UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-9114 |

|

The Needham Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

445 Park Avenue New York, New York | | 10022 |

(Address of principal executive offices) | | (Zip code) |

|

The Corporation Trust Company 300 E. Lombard Street Baltimore, Maryland 21202 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 371-8300 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2005 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

Semiannual Report

Needham Funds

Seeking to build wealth for long-term investors.

Six Months Ended June 30, 2005

(Unaudited)

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

445 Park Avenue

New York, New York 10022-2606

1-800-625-7071

www.needhamfunds.com

Semiannual Report

For the Six Months Ended June 30, 2005

(Unaudited)

Contents

| Letter from the Adviser | | | 1 | | |

|

| Portfolio Characteristics | | | |

|

| Needham Growth Fund | | | 3 | | |

|

| Needham Aggressive Growth Fund | | | 4 | | |

|

| Needham Small Cap Growth Fund | | | 5 | | |

|

| Disclosure of Fund Expenses | | | 6 | | |

|

| Schedule of Investments | | | |

|

| Needham Growth Fund | | | 7 | | |

|

| Needham Aggressive Growth Fund | | | 10 | | |

|

| Needham Small Cap Growth Fund | | | 13 | | |

|

| Schedule of Securities Sold Short | | | |

|

| Needham Growth Fund | | | 9 | | |

|

| Needham Aggressive Growth Fund | | | 12 | | |

|

| Needham Small Cap Growth Fund | | | 15 | | |

|

| Statements of Assets and Liabilities | | | 16 | | |

|

| Statements of Operations | | | 17 | | |

|

| Statements of Changes in Net Assets | | | 18 | | |

|

| Financial Highlights | | | |

|

| Needham Growth Fund | | | 19 | | |

|

| Needham Aggressive Growth Fund | | | 20 | | |

|

| Needham Small Cap Growth Fund | | | 21 | | |

|

| Notes to Financial Statements | | | 22 | | |

|

| Supplemental Data | | | 25 | | |

|

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus of the Needham Funds, Inc. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus, please call 1-800-625-7071.

The Needham Funds, Inc., like all mutual funds:

• Are NOT FDIC insured

• Have no bank guarantee

• May lose value

Needham Funds Semiannual Report 2005

Dear Shareholders,

We at The Needham Funds, Inc. focus on buying growth stocks at reasonable prices. In the volatile six-month period we have just experienced, we are pleased that each of the funds performed reasonably well for our investors. During the six months ended June 30, 2005, the Growth Fund was down 0.67%, the Aggressive Growth Fund was down 1.17% and the Small Cap Growth Fund was down 2.75%. By comparison, the S&P 500 Index was down 0.81%, the NASDAQ Composite was down 5.12% and the Russell 2000 Index was down 1.21%.

The Needham Growth Fund (the "Growth Fund") seeks to create long-term, tax-efficient capital appreciation for its investors. To this end, the Growth Fund targets companies with products or services that are selling or marketing into growth markets. These companies normally have earnings growth of at least 15-20%, product and market dominance, and the ability to consolidate their market positions. They may also have a competitive advantage by acquiring and retaining more customers or driving costs down and profits up. The Growth Fund also looks for seasoned and motivated managements with records of building shareholder value. Companies with these characteristics sometimes find themselves in a temporary earnings downturn or shortfall or may be in a product transition. This often causes aggressive growth or dynamic growth investors to sell. At this point, the Growth Fund may deem the stock to be reasonably priced and purchase it for long-term capital appreciation. Hence, the discipline called "Growth At a Reasonable Price," or "GARP."

The Growth Fund was down 0.67% for the six months ended June 30, up 2.31% for the 1 year, up 10.91% for the 3 years, up 1.45% for the 5 years, and up 18.64% since inception, compounded annually. Our cash (5.32%) and short positions (7.34%) were not enough to offset the pressure on our long portfolio. One of our key sectors, technology, was not treated well in these markets. Our concentration in technology at 31.91% is down considerably from a year ago (42.79%). That conscious policy of reducing tech holdings did moderate our decline. Our best performing stocks were Talisman Energy, Inc., National Semiconductor Corp., Chesapeake Energy Corp. and Photronics, Inc.

The Needham Aggressive Growth Fund (the "Aggressive Growth Fund") seeks to create long-term, capital appreciation for its investors. To this end, the Aggressive Growth Fund targets the equities of companies with strong, above-average prospective growth rates. The Aggressive Growth Fund invests, in general, in markets and industries with strong growth rates, focusing on the market leaders in these areas. These market leaders, especially as they break away from their competitors, tend to garner a disproportionate share of the positive financial returns. Also important is the long-term sustainability of the companies' leadership positions. Thus, the Aggressive Growth Fund looks for companies with strong management teams, superior balance sheets, above-average margins that can generate excess cash, and strong R&D and brand spending in industries with high barriers to entry.

The Aggressive Growth Fund was down 1.17% for the six months ended June 30, up 7.45% for the 1 year, up 9.03% for the 3 years, and up 7.11% since inception, compounded annually. Hedging activities slightly benefited the Aggressive Growth Fund, but were unable to fully offset the market softness. The technology segment was the weakest for the first half of the period, but recovered strongly in the last two months. No segment significantly underperformed the others; however, the business services holdings lagged the other groups modestly and healthcare was the most positive contributor to the Aggressive Growth Fund's performance for the past six months. The Aggressive Growth Fund particularly benefited from its holdings in Community Health Systems, Inc., Express Scripts, Inc., Kyphon, Inc. and American Eagle Outfitters, Inc.

1

Needham Funds

The Needham Small Cap Growth Fund (the "Small Cap Growth Fund") seeks long-term, tax-efficient capital appreciation by investing primarily in equity securities of smaller growth companies that the Small Cap Growth Fund believes are trading at a discount to their underlying value yet have the potential for superior long-term growth. Under normal conditions, the Small Cap Growth Fund invests at least 80% of its total assets in equity securities of domestic issuers that have market capitalizations of $2 billion or less and that are listed on a nationally recognized securities exchange or traded on the NASDAQ system. Central to the Small Cap Growth Fund's investment strategy is a sound valuation discipline that seeks to acquire growth companies at reasonable prices. The Small Cap Growth Fund seeks tax efficiency by holding securities for a period of 12 months or more to obtain long-term capital ga in treatment and by offsetting capital gains on the sale of securities with capital losses.

The Small Cap Growth Fund was down 2.75% for the six months ended June 30, up 0.28% for the 1 year, up 24.92% for the 3 years, and up 20.98% since inception, compounded annually. We were able to do better in the second quarter than the first, mainly due to a rally that began around mid-April. As the market improved, we increased our shorts up to 2.48%, but still would like to add more in the second half. Cash was reduced to 6.02% by the end of June. The Small Cap Growth Fund benefited from several good performers: Bright Horizons Family Solutions, Inc., Advisory Board Co., Immucor, Inc. and Eon Labs, Inc.

The portfolio turnover rate was 5.90% for the Growth Fund, 36.72% for the Aggressive Growth Fund and 59.20% for the Small Cap Growth Fund for the six months ended June 30, 2005. The expense ratios for the three funds were 1.92% for the Growth Fund, 2.50% for the Aggressive Growth Fund and 2.49% for the Small Cap Growth Fund for the six months ended June 30, 2005.

The market remains volatile and uncertain. We believe that there will be an even greater premium on picking the right stocks in the second half of 2005. The problems in Iraq, the price of oil, the Fed's continuing policy to increase interest rates and the "housing bubble" fears are all tugging at investors' decision processes. We do not see any major improvements in these issues in the near term and, thus, we need to find the right stocks on the long side, add to our shorts during rallies and keep some powder dry for the unusual opportunity when it appears.

Sincerely,

| |  | |

|

| Vincent E. Gallagher | | James K. Kloppenburg | |

|

| Portfolio Manager | | Portfolio Manager | |

|

2

Semiannual Report 2005

NEEDHAM GROWTH FUND TICKER: NEEGX

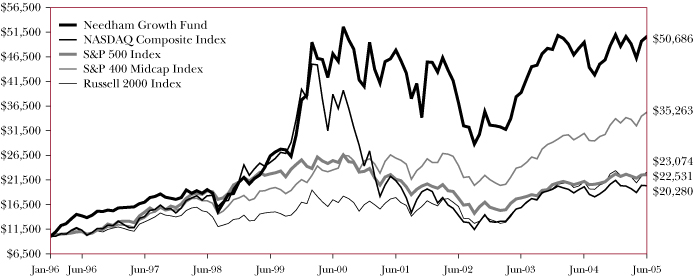

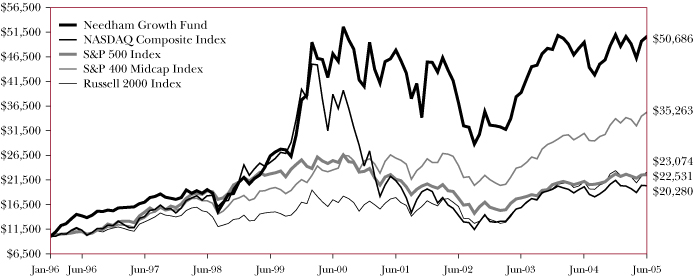

Comparative Performance Statistics as of June 30, 2005

| | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | Since Inception(7)(10) | |

| Needham Growth Fund(1) | | | (0.67 | )% | | | 2.31 | % | | | 10.91 | %(8) | | | 1.45 | %(9) | | | 18.64 | %(11) | |

| NASDAQ Composite Index(2) | | | (5.12 | )% | | | 1.10 | % | | | 12.58 | % | | | (11.91 | )% | | | 7.72 | % | |

| S&P 500 Index(3) | | | (0.81 | )% | | | 6.32 | % | | | 8.25 | % | | | (2.37 | )% | | | 8.92 | % | |

| S&P 400 Midcap Index(4) | | | 3.85 | % | | | 14.03 | % | | | 13.11 | % | | | 8.48 | % | | | 14.17 | % | |

| Russell 2000 Index(5) | | | (1.21 | )% | | | 9.55 | % | | | 12.82 | % | | | 5.78 | % | | | 9.19 | % | |

The average annual returns shown in the above table and accompanying footnotes are historical, reflect changes in share price and are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment results and the principal value of an investment will vary. Past performance noted above do es not guarantee future results. When shares are redeemed, they may be worth more or less than their original cost. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

1. Investment results calculated after reinvestment of dividends.

2. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks.

3. The S&P 500 Index is a broad unmanaged measure of the U.S. stock market.

4. The S&P 400 Midcap Index is a broad unmanaged measure of the U.S. stock market.

5. The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index.

6. Not annualized.

7. Compound annual growth rate. Assumes all dividends are reinvested in shares of the Fund (annualized return).

8. Cumulative return for the three years was 36.45%, assuming all dividends were reinvested in shares of the Fund.

9. Cumulative return for the five years was 7.45%, assuming all dividends were reinvested in shares of the Fund.

10. The inception date of the Fund was 1/1/96.

11. Cumulative return since inception was 406.86%, assuming all dividends were reinvested in shares of the Fund.

Top Ten Holdings*

(as a % of total investments, as of June 30, 2005)

| Security | |

| | % of Total

Investments† | |

| 1) Motorola, Inc. | | MOT | | | 5.59 | % | |

| 2) Ceradyne, Inc. | | CRDN | | | 4.02 | % | |

| 3) National Semiconductor Corp. | | NSM | | | 3.68 | % | |

| 4) Talisman Energy, Inc. | | TLM | | | 3.66 | % | |

| 5) Chesapeake Energy Corp. | | CHK | | | 3.43 | % | |

| 6) Seagate Technology | | STX | | | 3.32 | % | |

| 7) GlobalSantaFe Corp. | | GSF | | | 3.18 | % | |

| 8) Lucent Technologies, Inc. (bond) | | LU | | | 3.16 | % | |

| 9) Scientific-Atlanta, Inc. | | SFA | | | 2.78 | % | |

| 10) Johnson & Johnson | | JNJ | | | 2.72 | % | |

Top Ten Holdings = 35.54% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments includes all stocks, fixed income securities and options plus cash minus all short positions.

Sector Weightings*

(as a % of total investments, as of June 30, 2005)

| Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

Healthcare/Medical Devices/

Pharmaceuticals | | | 18.09 | % | | | (0.46 | )% | | | 17.63 | % | |

Cable/Entertainment/Media/

Software | | | 9.03 | % | | | (0.35 | )% | | | 8.68 | % | |

| Energy/Industrial/Metals | | | 21.42 | % | | | - | | | | 21.42 | % | |

Business Services/Consumer/

Financial | | | 6.68 | % | | | (1.97 | )% | | | 4.71 | % | |

| Technology | | | 32.92 | % | | | (1.01 | )% | | | 31.91 | % | |

| Telecommunications | | | 11.29 | % | | | (3.55 | )% | | | 7.74 | % | |

| Miscellaneous & Options | | | 2.59 | % | | | - | | | | 2.59 | % | |

| Cash & Fixed Income Investments | | | 5.32 | % | | | - | | | | 5.32 | % | |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, fixed income securities and options plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

Comparison of Change in Value of a $10,000 Investment

The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment results and the principal value of an investment will vary. Past performance noted above does not guarantee future results. When shares are redeemed, they may be worth more or less than their original cost. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

3

Needham Funds

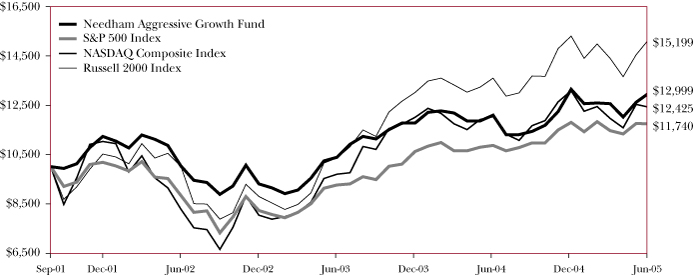

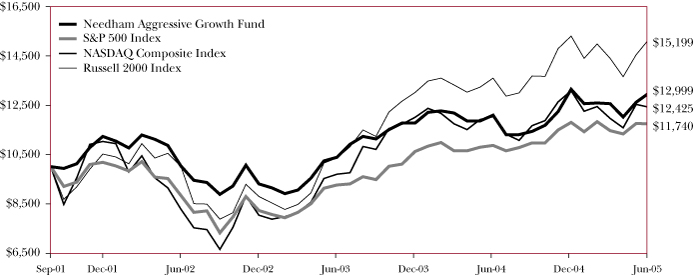

NEEDHAM AGGRESSIVE GROWTH FUND TICKER: NEAGX

Comparative Performance Statistics as of June 30, 2005

| Benchmarks | | 6 Months(5) | | 1 Year | | 3 Years(6) | | Since Inception(6)(8) | |

| Needham Aggressive Growth Fund(1) | | | (1.17 | )% | | | 7.45 | % | | | 9.03 | %(7) | | | 7.11 | %(9) | |

| S&P 500 Index(2) | | | (0.81 | )% | | | 6.32 | % | | | 8.25 | % | | | 4.29 | % | |

| NASDAQ Composite Index(3) | | | (5.12 | )% | | | 1.10 | % | | | 12.58 | % | | | 5.85 | % | |

| Russell 2000 Index(4) | | | (1.21 | )% | | | 9.55 | % | | | 12.82 | % | | | 11.59 | % | |

The average annual returns shown in the above table and accompanying footnotes are historical, reflect changes in share price and are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment results and the principal value of an investment will vary. Past performance noted above does not guarantee future results. When shares are redeemed, they may be worth more or less than their original cost. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

1. Investment results calculated after reinvestment of dividends.

2. The S&P 500 Index is a broad unmanaged measure of the U.S. stock market.

3. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks.

4. The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index.

5. Not annualized.

6. Compound annual growth rate. Assumes all dividends are reinvested in shares of the Fund (annualized return).

7. Cumulative return for the three years was 29.60%, assuming all dividends were reinvested in shares of the Fund.

8. The inception date of the Fund was 9/4/01.

9. Cumulative return since inception was 29.99%, assuming all dividends were reinvested in shares of the Fund.

Top Ten Holdings*

(as a % of total investments, as of June 30, 2005)

| Security | |

| | % of Total

Investments† | |

| 1) Precision Castparts Corp. | | PCP | | | 3.85 | % | |

| 2) Express Scripts, Inc. | | ESRX | | | 3.71 | % | |

| 3) Community Health Systems, Inc. | | CYH | | | 3.50 | % | |

| 4) Alliance Data Systems Corp. | | ADS | | | 3.13 | % | |

| 5) Iron Mountain, Inc. | | IRM | | | 2.88 | % | |

| 6) Animas Corp. | | PUMP | | | 2.80 | % | |

| 7) Getty Images, Inc. | | GYI | | | 2.75 | % | |

| 8) Gilead Sciences, Inc. | | GILD | | | 2.72 | % | |

| 9) Kyphon, Inc. | | KYPH | | | 2.69 | % | |

| 10) American Eagle Outfitters, Inc. | | AEOS | | | 2.65 | % | |

Top Ten Holdings = 30.68% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments includes all stocks, fixed income securities and options plus cash minus all short positions.

Sector Weightings*

(as a % of total investments, as of June 30, 2005)

| Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

Healthcare/Medical Devices/

Pharmaceuticals | | | 21.68 | % | | | (0.51 | )% | | | 21.17 | % | |

| Energy/Industrial | | | 5.78 | % | | | - | | | | 5.78 | % | |

| Business Services/Financial | | | 22.14 | % | | | - | | | | 22.14 | % | |

| Consumer | | | 13.57 | % | | | (0.49 | )% | | | 13.08 | % | |

Technology &

Telecommunications | | | 28.37 | % | | | (0.95 | )% | | | 27.42 | % | |

| Miscellaneous & Options | | | 0.01 | % | | | - | | | | 0.01 | % | |

| Cash & Fixed Income Investments | | | 10.40 | % | | | - | | | | 10.40 | % | |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, fixed income securities and options plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

Comparison of Change in Value of a $10,000 Investment

The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment results and the principal value of an investment will vary. Past performance noted above does not guarantee future results. When shares are redeemed, they may be worth more or less than their original cost. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

4

Semiannual Report 2005

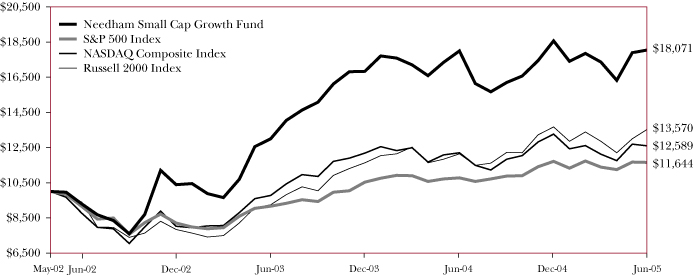

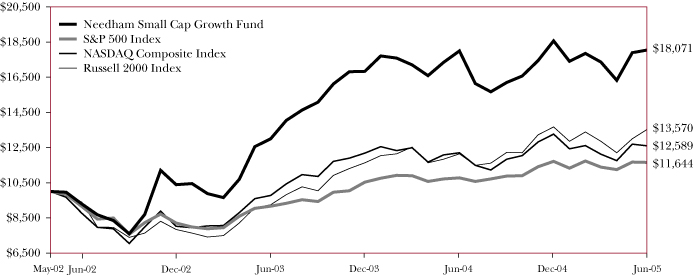

NEEDHAM SMALL CAP GROWTH FUND TICKER: NESGX

Comparative Performance Statistics as of June 30, 2005

| Benchmarks | | 6 Months(5) | | 1 Year | | 3 Years(6) | | Since Inception(6)(8) | |

| Needham Small Cap Growth Fund(1) | | | (2.75 | )% | | | 0.28 | % | | | 24.92 | %(7) | | | 20.98 | %(9) | |

| S&P 500 Index(2) | | | (0.81 | )% | | | 6.32 | % | | | 8.25 | % | | | 5.02 | % | |

| NASDAQ Composite Index(3) | | | (5.12 | )% | | | 1.10 | % | | | 12.58 | % | | | 7.69 | % | |

| Russell 2000 Index(4) | | | (1.21 | )% | | | 9.55 | % | | | 12.82 | % | | | 10.33 | % | |

The average annual returns shown in the above table and accompanying footnotes are historical, reflect changes in share price and are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment results and the principal value of an investment will vary. Past performance noted above does not guarantee future results. When shares are redeemed, they may be worth more or less than their original cost. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

1. Investment results calculated after reinvestment of dividends.

2. The S&P 500 Index is a broad unmanaged measure of the U.S. stock market.

3. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks.

4. The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index.

5. Not annualized.

6. Compound annual growth rate. Assumes all dividends are reinvested in shares of the Fund (annualized return).

7. Cumulative return for the three years was 94.94%, assuming all dividends were reinvested in shares of the Fund.

8. The inception date of the Fund was 5/22/02.

9. Cumulative return since inception was 80.71%, assuming all dividends were reinvested in shares of the Fund.

Top Ten Holdings*

(as a % of total investments, as of June 30, 2005)

| Security | |

| | % of Total

Investments† | |

| 1) Bright Horizons Family Solutions, Inc. | | BFAM | | | 8.30 | % | |

| 2) Advisory Board Co. | | ABCO | | | 5.71 | % | |

| 3) ARGON ST, Inc. | | STST | | | 3.26 | % | |

| 4) FactSet Research Systems, Inc. | | FRC | | | 3.10 | % | |

| 5) Innovative Solutions & Support, Inc. | | ISSC | | | 2.82 | % | |

| 6) Mobile Mini, Inc. | | MINI | | | 2.63 | % | |

| 7) Immucor, Inc. | | BLUD | | | 2.58 | % | |

| 8) Integral Systems, Inc. | | ISYS | | | 2.54 | % | |

| 9) Genesee & Wyoming, Inc. | | GWR | | | 2.50 | % | |

| 10) Ceradyne, Inc. | | CRDN | | | 2.45 | % | |

Top Ten Holdings = 35.89% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments includes all stocks, fixed income securities and options plus cash minus all short positions.

Sector Weightings*

(as a % of total investments, as of June 30, 2005)

| Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

Healthcare/Medical Devices/

Pharmaceuticals | | | 21.62 | % | | | (0.21 | )% | | | 21.41 | % | |

Cable/Entertainment/Media/

Software | | | 2.67 | % | | | - | | | | 2.67 | % | |

| Energy/Industrial/Metals | | | 15.78 | % | | | - | | | | 15.78 | % | |

Business Services/Consumer/

Financial | | | 30.19 | % | | | (0.49 | )% | | | 29.70 | % | |

| Technology | | | 22.54 | % | | | (0.75 | )% | | | 21.79 | % | |

| Telecommunications | | | 3.66 | % | | | (1.03 | )% | | | 2.63 | % | |

| Miscellaneous & Options | | | - | | | | - | | | | - | | |

| Cash & Fixed Income Investments | | | 6.02 | % | | | - | | | | 6.02 | % | |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, fixed income securities and options plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

Comparison of Change in Value of a $10,000 Investment

The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment results and the principal value of an investment will vary. Past performance noted above does not guarantee future results. When shares are redeemed, they may be worth more or less than their original cost. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

5

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A fund's expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The expense example table below illustrates your fund's costs in two ways:

• Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The "Ending Account Value" shown is derived from the fund's actual return, and "Expenses Paid During Period" shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, a $7,500 account value divided by $1,000 = 7.5), then multiply the result by the number given for your fund under the heading ent itled "Expenses Paid During Period."

• Hypothetical Expenses on a 5% Return. This section is intended to help you compare your fund's costs with those of other mutual funds. It assumes that the fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case - because the return used is not the fund's actual return - the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund's cost by comparing this hypothetical example with the hypothetical examples that appea r in shareholders reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs (if any). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

For the Period January 1, 2005 to June 30, 2005

Expense Example Table

| | |

Beginning

Account

Value

1/1/05 | |

Ending

Account

Value

6/30/05 | | Expenses

Paid During

Period*

1/1/05-

6/30/05 | | Expense Ratio

During

Period

1/1/05-

6/30/05 | |

| Needham Growth Fund | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 993.30 | | | $ | 9.49 | | | | 1.92 | % | |

| Hypothetical Expenses on a 5% Return | | $ | 1,000.00 | | | $ | 1,015.27 | | | $ | 9.59 | | | | 1.92 | % | |

| Needham Aggressive Growth Fund | | | |

| Actual Expense | | $ | 1,000.00 | | | $ | 988.30 | | | $ | 12.32 | | | | 2.50 | % | |

| Hypothetical Expenses on a 5% Return | | $ | 1,000.00 | | | $ | 1,012.40 | | | $ | 12.47 | | | | 2.50 | % | |

| Needham Small Cap Growth Fund | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 972.50 | | | $ | 12.18 | | | | 2.49 | % | |

| Hypothetical Expenses on a 5% Return | | $ | 1,000.00 | | | $ | 1,012.45 | | | $ | 12.42 | | | | 2.49 | % | |

* Expenses are equal to the average account value multiplied by the Fund's annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.

6

Semiannual Report 2005

Needham Growth Fund

Schedule of Investments

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

| Common Stocks - (91.5%) | |

| Business Services - (4.5%) | |

Affiliated Computer Services,

Inc. - Class A (L)* | | | 45,000 | | | $ | 2,299,500 | | |

| First Data Corp. (L) | | | 75,000 | | | | 3,010,500 | | |

| Iron Mountain, Inc. (L)*† | | | 110,000 | | | | 3,412,200 | | |

| | | | 8,722,200 | | |

Cable Television &

Equipment - (4.6%) | | | |

| Comcast Corp. - Class A*† | | | 130,000 | | | | 3,991,000 | | |

| Scientific-Atlanta, Inc. (L) | | | 150,000 | | | | 4,990,500 | | |

| | | | 8,981,500 | | |

Computers - Integrated

Systems - (2.1%) | | | |

| Kronos, Inc. (L)*† | | | 100,000 | | | | 4,039,000 | | |

| Computers - Storage - (4.9%) | |

| Datalink Corp. (PP)* | | | 400,000 | | | | 1,236,000 | | |

| Datalink Corp. (L)* | | | 280,000 | | | | 865,200 | | |

| Komag, Inc.* | | | 55,000 | | | | 1,560,350 | | |

| Seagate Technology | | | 340,000 | | | | 5,967,000 | | |

| | | | 9,628,550 | | |

Contract Manufacturing &

Materials - (2.9%) | | | |

| Merix Corp. (L)* | | | 200,000 | | | | 1,170,000 | | |

| Park Electrochemical Corp. | | | 150,000 | | | | 3,780,000 | | |

| Pemstar, Inc. (L)* | | | 640,000 | | | | 640,000 | | |

| | | | 5,590,000 | | |

Electronic Components &

Equipment - (11.3%) | | | |

| Actel Corp.* | | | 125,000 | | | | 1,737,500 | | |

| Agere Systems, Inc. (L)* | | | 200,000 | | | | 2,400,000 | | |

| Atmel Corp.* | | | 750,000 | | | | 1,777,500 | | |

| AXT, Inc.* | | | 367,202 | | | | 477,363 | | |

| CEVA, Inc.* | | | 145,090 | | | | 850,227 | | |

MEMC Electronic

Materials, Inc.* | | | 200,000 | | | | 3,154,000 | | |

| Newport Corp. (L)* | | | 250,000 | | | | 3,465,001 | | |

| Orbotech Ltd.* | | | 148,600 | | | | 3,193,414 | | |

| Parlex Corp. (L)* | | | 200,000 | | | | 1,160,000 | | |

| Planar Systems, Inc.* | | | 300,000 | | | | 2,205,000 | | |

| Vishay Intertechnology, Inc.* | | | 150,000 | | | | 1,780,500 | | |

| | | | 22,200,505 | | |

| Enabling Technology - (0.5%) | | | |

Dolby Laboratories, Inc. -

Class A (L)* | | | 40,000 | | | | 882,400 | | |

| Healthcare Services - (2.4%) | |

| HCA, Inc. | | | 50,000 | | | | 2,833,500 | | |

| Phase Forward, Inc. (L)* | | | 265,250 | | | | 1,803,700 | | |

| | | | 4,637,200 | | |

| Insurance - (0.1%) | | | |

American International

Group, Inc. | | | 5,000 | | | | 290,500 | | |

| | | Shares | | Value | |

Lasers - Systems & Components -

(0.2%) | |

Electro Scientific Industries,

Inc.* | | | 20,000 | | | $ | 357,600 | | |

Manufacturing & Industrial

Equipment - (7.4%) | |

| Ceradyne, Inc. (PP)* | | | 300,000 | | | | 7,221,000 | | |

| Intevac, Inc.* | | | 242,500 | | | | 2,538,975 | | |

Southwall Technologies,

Inc. (L)* | | | 728,000 | | | | 946,400 | | |

| Sypris Solutions, Inc. (L)† | | | 300,000 | | | | 3,711,000 | | |

| | | | 14,417,375 | | |

Medical Devices & Supplies -

(8.6%) | | | |

| Analogic Corp. | | | 80,000 | | | | 4,025,600 | | |

| CONMED Corp. (L)* | | | 100,000 | | | | 3,077,000 | | |

| Cutera, Inc.* | | | 85,000 | | | | 1,474,750 | | |

| Thermo Electron Corp.* | | | 180,000 | | | | 4,836,600 | | |

| Viasys Healthcare, Inc.* | | | 150,000 | | | | 3,388,500 | | |

| | | | 16,802,450 | | |

Oil & Gas - Exploration &

Production - (9.5%) | | | |

| Chesapeake Energy Corp. | | | 270,000 | | | | 6,156,000 | | |

| GlobalSantaFe Corp. | | | 140,000 | | | | 5,712,000 | | |

| Talisman Energy, Inc. (L) | | | 175,000 | | | | 6,574,750 | | |

| | | | 18,442,750 | | |

Pharmaceuticals &

Biotechnology - (5.7%) | | | |

| Johnson & Johnson | | | 75,000 | | | | 4,875,000 | | |

| Merck & Co., Inc. | | | 100,000 | | | | 3,080,000 | | |

| Schering-Plough Corp. | | | 162,000 | | | | 3,087,720 | | |

| | | | 11,042,720 | | |

| Semiconductors - (11.2%) | | | |

| Brooks Automation, Inc.* | | | 213,400 | | | | 3,168,990 | | |

| FSI International, Inc. (PP)* | | | 150,000 | | | | 558,000 | | |

| FSI International, Inc.* | | | 331,000 | | | | 1,231,320 | | |

| Helix Technology Corp. (L) | | | 175,341 | | | | 2,328,528 | | |

| MKS Instruments, Inc.* | | | 134,100 | | | | 2,264,949 | | |

National Semiconductor

Corp. | | | 300,000 | | | | 6,609,000 | | |

| Photronics, Inc. (L)* | | | 150,000 | | | | 3,501,000 | | |

Standard Microsystems

Corp. (L)* | | | 100,000 | | | | 2,338,000 | | |

| | | | 21,999,787 | | |

| Software - (3.7%) | | | |

| Aspen Technology, Inc. (L)* | | | 300,000 | | | | 1,560,000 | | |

| Hyperion Solutions Corp.* | | | 85,000 | | | | 3,420,400 | | |

| Phoenix Technologies Ltd.* | | | 290,000 | | | | 2,256,200 | | |

| | | | 7,236,600 | | |

Specialty Retailing &

Manufacturing - (1.5%) | | | |

| CarMax, Inc. (L)* | | | 75,000 | | | | 1,998,750 | | |

| DSW, Inc. - Class A* | | | 2,116 | | | | 52,794 | | |

Pacific Sunwear of California,

Inc.* | | | 40,000 | | | | 919,600 | | |

| | | | 2,971,144 | | |

See accompanying notes to financial statements.

7

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

Wireless Communications &

Equipment - (10.4%) | |

| Anaren, Inc. (L)*† | | | 250,000 | | | $ | 3,287,500 | | |

| EMS Technologies, Inc. (PP)* | | | 100,000 | | | | 1,495,000 | | |

| EMS Technologies, Inc.* | | | 76,900 | | | | 1,149,655 | | |

| Motorola, Inc.† | | | 550,000 | | | | 10,043,000 | | |

| REMEC, Inc. (L)* | | | 133,800 | | | | 856,320 | | |

| ViaSat, Inc. (L)* | | | 169,000 | | | | 3,435,770 | | |

| | | | 20,267,245 | | |

Total Common Stocks (Cost

$138,418,860) | | | | | | | 178,509,526 | | |

Convertible Preferred Stock -

(0.0%) | |

Cable Television & Equipment -

(0.0%) | |

Adelphia Communications

Corp., 7.50%, 11/15/49,

Series E** | | | 182,000 | | | | 9,100 | | |

Total Convertible Preferred

Stock (Cost $2,554,580) | | | | | | | 9,100 | | |

| Investment Trusts - (2.4%) | |

| H&Q Healthcare Investors | | | 154,515 | | | | 2,719,464 | | |

H&Q Life Sciences

Investors (L) | | | 118,374 | | | | 1,878,595 | | |

Total Investment Trusts (Cost

$4,535,132) | | | | | | | 4,598,059 | | |

| | | Principal

Amount | | | |

| Convertible Bonds - (4.4%) | |

Telecommunication Services &

Equipment - (4.4%) | |

Lucent Technologies, Inc.,

8.00%, 8/1/31 | | $ | 5,500,000 | | | | 5,678,750 | | |

Nortel Networks Corp.,

4.25%, 9/1/08 (L) | | | 3,000,000 | | | | 2,812,500 | | |

Total Convertible Bonds (Cost

$8,365,743) | | | | | | | 8,491,250 | | |

| | | Principal

Amount | | Value | |

| Repurchase Agreements - (8.2%) | |

Bear Stearns Companies,

Inc., 2.80%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$1,058,106, collateralized

by a U.S. Treasury

Obligation, 2/15/17,

value $1,087,574) | | $ | 1,058,024 | | | $ | 1,058,024 | | |

Bear Stearns Companies,

Inc., 3.375%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$12,239,865, collateralized

by U.S. Treasury Obligations,

8/15/16-2/15/17, value

$12,595,502) (Held as

Collateral for Securities

Lending) | | | 12,238,718 | | | | 12,238,718 | | |

Bear Stearns Companies,

Inc., 1.6875%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$2,695,133, collateralized

by a U.S. Treasury

Obligation, 2/15/17,

value $2,774,551) (Held

as Collateral for Securities

Lending) | | | 2,695,006 | | | | 2,695,006 | | |

Total Repurchase Agreements

(Cost $15,991,748) | | | | | | | 15,991,748 | | |

Total Investments - (106.5%)

(Cost $169,866,063) | | | | | | | 207,599,683 | | |

| | | Shares | | | |

| Warrants - (0.0%) | |

| Computers - Storage - (0.0%) | |

Datalink Corp., Expiring

May 07, Strike Price $4.50* | | | 68,000 | | | | 34,680 | | |

| Total Warrants (Cost $35,360) | | | | | | | 34,680 | | |

Total Investments and Warrants -

(106.5%) (Cost $169,901,423)(a) | | | | | | | 207,634,363 | | |

Total Securities Sold Short -

(-6.8%) | | | | | | | (13,182,575 | ) | |

Other Assets in Excess of

Liabilities - (0.3%) | | | | | | | 601,664 | | |

| Net Assets - (100.0%) | | | | | | $ | 195,053,452 | | |

(a) Represents cost for financial reporting purposes and differs from cost basis for federal income tax purposes by the amount of losses recognized for financial reporting in excess of federal income tax reporting of $238,972 due to wash sales. Cost for federal income tax purposes differs from value by net unrealized appreciation of securities as follows:

| Unrealized appreciation | | $ | 57,721,278 | | |

| Unrealized depreciation | | | (20,227,310 | ) | |

| Net unrealized appreciation | | $ | 37,493,968 | | |

* Represents non-income producing securities.

** Represents defaulted securities.

† Security position is either entirely or partially held in a segregated account as collateral for securities sold short.

L All or a portion of security is on loan as of June 30, 2005.

PP Private placement. Securities are exempt from registration under Rule 144 of the Securities Act of 1933. Such securities may be resold, normally to institutional buyers, in transactions exempt from registration. At June 30, 2005, the aggregate value of Rule 144 securities amounted to $10,510,000, which represents approximately 5.4% of net assets as of that date.

See accompanying notes to financial statements.

8

Semiannual Report 2005

Needham Growth Fund

Schedule of Securities Sold Short

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

| Securities Sold Short - (-6.8%) | | | |

| Financial Services - (-1.0%) | | | |

Lehman Brothers Holdings,

Inc. | | | 20,000 | | | $ | 1,985,600 | | |

Medical Devices & Supplies -

(-0.4%) | | | |

| Laserscope* | | | 20,000 | | | | 828,800 | | |

| Networking Products - (-2.6%) | | | |

| Juniper Networks, Inc.* | | | 200,000 | | | | 5,036,000 | | |

| Recreational Vehicles - (-0.6%) | | | |

| Polaris Industries, Inc. | | | 20,000 | | | | 1,080,000 | | |

| Semiconductors - (-0.9%) | | | |

| FormFactor, Inc.* | | | 40,000 | | | | 1,056,800 | | |

Marvell Technology Group

Ltd.* | | | 20,000 | | | | 760,800 | | |

| | | | 1,817,600 | | |

| Software - (-0.3%) | | | |

| ANSYS, Inc.* | | | 17,500 | | | | 621,425 | | |

| | | Shares | | Value | |

Specialty Retailing &

Manufacturing - (-0.3%) | |

A.C. Moore Arts & Crafts,

Inc.* | | | 15,000 | | | $ | 474,150 | | |

Telecommunication Services &

Equipment - (-0.7%) | |

Comtech Telecommunications

Corp.* | | | 20,000 | | | | 652,600 | | |

| Essex Corp.* | | | 30,000 | | | | 686,400 | | |

| | | | 1,339,000 | | |

Total Securities Sold Short

(Proceeds $9,609,169) | | | | | | | 13,182,575 | | |

Total Securities Sold Short -

(-6.8%) | | | | | | | (13,182,575 | ) | |

Total Investments and

Warrants - (106.5%) | | | | | | | 207,634,363 | | |

Other Assets in Excess of

Liabilities - (0.3%) | | | | | | | 601,664 | | |

| Net Assets - (100.0%) | | | | | | $ | 195,053,452 | | |

* Represents non-income producing securities.

See accompanying notes to financial statements.

9

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

| Common Stocks - (89.6%) | | | |

| Business Services - (21.7%) | | | |

Affiliated Computer Services,

Inc. - Class A* | | | 8,000 | | | $ | 408,800 | | |

| Alliance Data Systems Corp.* | | | 12,500 | | | | 507,001 | | |

| ChoicePoint, Inc. (L)* | | | 10,000 | | | | 400,500 | | |

| Digitas, Inc.* | | | 30,000 | | | | 342,300 | | |

| Euronet Worldwide, Inc.* | | | 10,000 | | | | 290,700 | | |

| First Data Corp. (L) | | | 7,500 | | | | 301,050 | | |

| Getty Images, Inc.* | | | 6,000 | | | | 445,560 | | |

| Iron Mountain, Inc. (L)* | | | 15,000 | | | | 465,300 | | |

Portfolio Recovery Associates,

Inc.* | | | 10,000 | | | | 420,200 | | |

| | | | 3,581,411 | | |

Cable Television & Equipment -

(3.6%) | | | |

Comcast Corp. - Special

Class A* | | | 9,000 | | | | 269,550 | | |

| Scientific-Atlanta, Inc. (L) | | | 10,000 | | | | 332,700 | | |

| | | | 602,250 | | |

Computers - Integrated

Systems - (1.8%) | | | |

| Kronos, Inc.* | | | 7,500 | | | | 302,925 | | |

| Computers - Storage - (0.5%) | | | |

| Datalink Corp. (PP)* | | | 25,000 | | | | 77,250 | | |

Electronic Components &

Equipment - (5.7%) | | | |

| CEVA, Inc.* | | | 50,000 | | | | 293,000 | | |

MEMC Electronic Materials,

Inc.* | | | 25,000 | | | | 394,250 | | |

| Orbotech Ltd.*† | | | 12,000 | | | | 257,880 | | |

| | | | 945,130 | | |

| Enabling Technology - (4.3%) | | | |

Dolby Laboratories, Inc. -

Class A (L)* | | | 15,000 | | | | 330,900 | | |

| NAVTEQ Corp.* | | | 10,000 | | | | 371,800 | | |

| | | | 702,700 | | |

| Healthcare Services - (9.7%) | | | |

Community Health Systems,

Inc.* | | | 15,000 | | | | 566,850 | | |

| Express Scripts, Inc. (L)* | | | 12,000 | | | | 599,760 | | |

| Phase Forward, Inc.* | | | 25,000 | | | | 170,000 | | |

United Surgical Partners

International, Inc.* | | | 5,000 | | | | 260,400 | | |

| | | | 1,597,010 | | |

Manufacturing & Industrial

Equipment - (3.8%) | | | |

| Precision Castparts Corp. (L) | | | 8,000 | | | | 623,200 | | |

| | | Shares | | Value | |

Medical Devices & Supplies -

(7.4%) | | | |

| Animas Corp. (L)* | | | 22,500 | | | $ | 453,375 | | |

Foxhollow Technologies,

Inc. (L)* | | | 7,500 | | | | 287,025 | | |

| Kyphon, Inc.* | | | 12,500 | | | | 434,875 | | |

Micrus Endovascular

Corp. (L)* | | | 5,000 | | | | 55,000 | | |

| | | | 1,230,275 | | |

Oil & Gas - Exploration &

Production - (1.9%) | | | |

| XTO Energy, Inc. | | | 9,166 | | | | 311,552 | | |

Pharmaceuticals &

Biotechnology - (4.1%) | | | |

| Gilead Sciences, Inc.* | | | 10,000 | | | | 439,900 | | |

| Sepracor, Inc.* | | | 4,000 | | | | 240,040 | | |

| | | | 679,940 | | |

| Semiconductors - (2.4%) | | | |

| FSI International, Inc.* | | | 35,000 | | | | 130,200 | | |

| Helix Technology Corp. | | | 20,000 | | | | 265,600 | | |

| | | | 395,800 | | |

| Software - (11.0%) | | | |

| Avid Technology, Inc.* | | | 3,500 | | | | 186,480 | | |

| Callidus Software, Inc.* | | | 25,000 | | | | 91,000 | | |

| Hyperion Solutions Corp.* | | | 10,000 | | | | 402,400 | | |

| Plumtree Software, Inc.* | | | 75,000 | | | | 365,250 | | |

RightNow Technologies,

Inc. (L)* | | | 20,000 | | | | 240,400 | | |

| TIBCO Software, Inc.* | | | 40,000 | | | | 261,600 | | |

WebEx Communications,

Inc. (L)* | | | 10,000 | | | | 264,100 | | |

| | | | 1,811,230 | | |

Specialty Retailing &

Manufacturing - (9.6%) | | | |

American Eagle Outfitters,

Inc. | | | 14,000 | | | | 429,100 | | |

| CarMax, Inc.* | | | 10,000 | | | | 266,500 | | |

| DSW, Inc. - Class A* | | | 172 | | | | 4,291 | | |

Pacific Sunwear of

California, Inc.* | | | 5,000 | | | | 114,950 | | |

PETCO Animal Supplies,

Inc.* | | | 12,000 | | | | 351,840 | | |

| Urban Outfitters, Inc. (L)*† | | | 7,500 | | | | 425,175 | | |

| | | | 1,591,856 | | |

Wireless Communications &

Equipment - (2.1%) | | | |

| EMS Technologies, Inc.* | | | 10,000 | | | | 149,500 | | |

| ViaSat, Inc.* | | | 10,000 | | | | 203,300 | | |

| | | | 352,800 | | |

Total Common Stocks (Cost

$11,632,551) | | | | | | | 14,805,329 | | |

See accompanying notes to financial statements.

10

Semiannual Report 2005

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2005 (Unaudited)

| | | Principal

Amount | | Value | |

| Repurchase Agreements - (18.3%) | | | |

Bear Stearns Companies,

Inc., 2.80%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$1,681,991, collateralized

by a U.S. Treasury

Obligation, 8/15/16,

value $1,732,886) | | $ | 1,681,860 | | | $ | 1,681,860 | | |

Bear Stearns Companies,

Inc., 3.375%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$1,205,480, collateralized

by a U.S. Treasury

Obligation, 8/15/16,

value $1,242,745) (Held

as Collateral for Securities

Lending) | | | 1,205,367 | | | | 1,205,367 | | |

Bear Stearns Companies,

Inc., 1.6875%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$138,299, collateralized

by a U.S. Treasury

Obligation, 8/15/16,

value $145,461) (Held as

Collateral for Securities

Lending) | | | 138,293 | | | | 138,293 | | |

Total Repurchase Agreements

(Cost $3,025,520) | | | | | | | 3,025,520 | | |

Total Investments - (107.9%)

(Cost $14,658,071) | | | | | | | 17,830,849 | | |

| | | Shares | | Value | |

| Warrants - (0.0%) | |

| Computers - Storage - (0.0%) | |

Datalink Corp., Expiring

May 07, Strike Price $4.50* | | 4,000 | | $ | 2,040 | | |

| Total Warrants (Cost $2,080) | | | | | 2,040 | | |

Total Investments and Warrants -

(107.9%) (Cost $14,660,151)(a) | | | | | 17,832,889 | | |

Total Securities Sold Short -

(-1.9%) | | | | | (315,200 | ) | |

Liabilities in Excess of

Other Assets - (-6.0%) | | | | | (995,956 | ) | |

| Net Assets - (100.0%) | | | | $ | 16,521,733 | | |

(a) Represents cost for financial reporting purposes and federal income tax purposes and differs from value by net unrealized appreciation of securities as follows:

| Unrealized appreciation | | $ | 3,491,910 | | |

| Unrealized depreciation | | | (319,172 | ) | |

| Net unrealized appreciation | | $ | 3,172,738 | | |

* Represents non-income producing securities.

† Security is either entirely or partially held in a segregated account as collateral for securities sold short.

L All or a portion of security is on loan as of June 30, 2005.

PP Private placement. Securities are exempt from registration under Rule 144 of the Securities Act of 1933. Such securities may be resold, normally to institutional buyers, in transactions exempt from registration. At June 30, 2005, the aggregate value of Rule 144 securities amounted to $77,250, which represents approximately 0.5% of net assets as of that date.

See accompanying notes to financial statements.

11

Needham Funds

Needham Aggressive Growth Fund

Schedule of Securities Sold Short

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

| Securities Sold Short - (-1.9%) | |

Medical Devices & Supplies -

(-0.5%) | |

| Laserscope* | | | 2,000 | | | $ | 82,880 | | |

| Semiconductors - (-0.4%) | |

| FormFactor, Inc.* | | | 2,500 | | | | 66,050 | | |

| SpatiaLight, Inc.* | | | 1,000 | | | | 5,670 | | |

| | | | 71,720 | | |

Specialty Retailing &

Manufacturing - (-0.5%) | | | |

A.C. Moore Arts & Crafts,

Inc.* | | | 2,500 | | | | 79,025 | | |

| | | Shares | | Value | |

Telecommunication Services &

Equipment - (-0.5%) | | | |

Comtech Telecommunications

Corp.* | | | 2,500 | | | $ | 81,575 | | |

Total Securities Sold Short

(Proceeds $297,322) | | | | | 315,200 | | |

Total Securities Sold Short -

(-1.9%) | | | | | (315,200 | ) | |

Total Investments and

Warrants - (107.9%) | | | | | 17,832,889 | | |

Liabilities in Excess of

Other Assets - (-6.0%) | | | | | (995,956 | ) | |

| Net Assets - (100.0%) | | | | $ | 16,521,733 | | |

* Represents non-income producing securities.

See accompanying notes to financial statements.

12

Semiannual Report 2005

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

| Common Stocks - (92.9%) | |

| Aerospace & Satellite - (5.2%) | |

Innovative Solutions and

Support, Inc. (L)* | | | 16,500 | | | $ | 553,905 | | |

| Integral Systems, Inc. (L) | | | 22,000 | | | | 497,860 | | |

| | | | 1,051,765 | | |

| Business Services - (21.4%) | | | |

Bright Horizons Family

Solutions, Inc. (L)* | | | 40,000 | | | | 1,628,801 | | |

| Copart, Inc.* | | | 15,000 | | | | 357,000 | | |

Corporate Executive Board

Co. (L) | | | 5,000 | | | | 391,650 | | |

| Digitas, Inc.* | | | 30,000 | | | | 342,300 | | |

| Euronet Worldwide, Inc.* | | | 10,000 | | | | 290,700 | | |

FactSet Research Systems,

Inc. | | | 17,000 | | | | 609,280 | | |

| Mobile Mini, Inc.* | | | 15,000 | | | | 517,200 | | |

SRA International, Inc. -

Class A* | | | 7,000 | | | | 243,040 | | |

| | | | 4,379,971 | | |

Computers - Integrated

Systems - (2.5%) | | | |

| Kronos, Inc.* | | | 5,000 | | | | 201,950 | | |

| MICROS Systems, Inc.* | | | 7,000 | | | | 313,250 | | |

| | | | 515,200 | | |

| Computers - Storage - (0.9%) | | | |

| Datalink Corp. (L) | | | 57,000 | | | | 176,130 | | |

Contract Manufacturing &

Materials - (1.1%) | |

| Pemstar, Inc.* | | | 217,300 | | | | 217,300 | | |

| Defense - (4.5%) | |

| ARGON ST, Inc. (L)* | | | 18,000 | | | | 639,000 | | |

Esterline Technologies

Corp.* | | | 7,000 | | | | 280,560 | | |

| | | | 919,560 | | |

Electronic Components &

Equipment - (1.9%) | | | |

| LeCroy Corp. (L)* | | | 15,000 | | | | 206,250 | | |

| Planar Systems, Inc.* | | | 25,000 | | | | 183,750 | | |

| | | | 390,000 | | |

Enabling Technology -

(1.4%) | | | |

| NAVTEQ Corp.* | | | 7,500 | | | | 278,850 | | |

Entertainment &

Leisure - (1.8%) | |

Penn National Gaming,

Inc. (L)* | | | 10,000 | | | | 365,000 | | |

| | | Shares | | Value | |

| Financial Services - (2.1%) | |

Asset Acceptance Capital

Corp.* | | | 8,000 | | | $ | 207,280 | | |

| First Republic Bank | | | 6,000 | | | | 211,980 | | |

| | | | 419,260 | | |

| Healthcare Services - (10.1%) | | | |

| Advisory Board Co.* | | | 23,000 | | | | 1,121,020 | | |

DataTRAK International,

Inc. (L)* | | | 11,500 | | | | 197,800 | | |

Healthcare Services Group,

Inc. (L) | | | 7,500 | | | | 150,600 | | |

| HealthExtras, Inc.*† | | | 17,000 | | | | 341,190 | | |

| Phase Forward, Inc.* | | | 36,740 | | | | 249,832 | | |

| | | | 2,060,442 | | |

| Insurance - (3.3%) | | | |

Philadelphia Consolidated

Holding Corp.* | | | 2,500 | | | | 211,900 | | |

Universal American

Financial Corp.* | | | 8,500 | | | | 192,270 | | |

| W.R. Berkley Corp. | | | 7,500 | | | | 267,600 | | |

| | | | 671,770 | | |

Manufacturing & Industrial

Equipment - (6.7%) | | | |

| Actuant Corp. - Class A* | | | 7,500 | | | | 359,550 | | |

| Ceradyne, Inc. (PP)* | | | 20,000 | | | | 481,400 | | |

| Intevac, Inc.* | | | 30,000 | | | | 314,100 | | |

| Sypris Solutions, Inc. (L) | | | 17,000 | | | | 210,290 | | |

| | | | 1,365,340 | | |

| Marketing Services - (2.2%) | | | |

| aQuantive, Inc. (L)* | | | 13,500 | | | | 239,220 | | |

| SITEL Corp.* | | | 100,000 | | | | 211,000 | | |

| | | | 450,220 | | |

Medical Devices &

Supplies - (9.3%) | | | |

| Animas Corp. (L)* | | | 12,000 | | | | 241,800 | | |

| Atrion Corp. | | | 900 | | | | 67,095 | | |

| Cantel Medical Corp. (L)* | | | 24,000 | | | | 392,640 | | |

| Immucor, Inc.* | | | 17,500 | | | | 506,625 | | |

Intermagnetics General

Corp.* | | | 15,000 | | | | 461,400 | | |

| IRIS International, Inc.* | | | 12,800 | | | | 227,840 | | |

| | | | 1,897.400 | | |

Oil & Gas - Equipment &

Services - (1.7%) | | | |

Superior Energy Services,

Inc.* | | | 20,000 | | | | 356,000 | | |

Oil & Gas - Exploration &

Production - (3.3%) | |

| Encore Acquisition Co.* | | | 10,000 | | | | 410,000 | | |

| Grey Wolf, Inc.* | | | 35,000 | | | | 259,350 | | |

| | | | 669,350 | | |

See accompanying notes to financial statements.

13

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments (Continued)

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

Pharmaceuticals &

Biotechnology - (1.4%) | |

First Horizon Pharmaceutical

Corp.*† | | | 15,000 | | | $ | 285,600 | | |

| Semiconductors - (5.4%) | |

| FSI International, Inc.* | | | 44,568 | | | | 165,793 | | |

| MKS Instruments, Inc.* | | | 27,500 | | | | 464,475 | | |

| Standard Microsystems Corp.*† | | | 10,000 | | | | 233,800 | | |

| Therma-Wave, Inc.* | | | 5,100 | | | | 12,240 | | |

| Therma-Wave, Inc. (PP)* | | | 90,000 | | | | 216,000 | | |

| | | | 1,092,308 | | |

| Software - (0.8%) | | | |

| Avid Technology, Inc.* | | | 3,000 | | | | 159,840 | | |

Specialty Retailing &

Manufacturing - (0.0%) | |

| DSW, Inc. - Class A* | | | 212 | | | | 5,288 | | |

| Transportation - (2.4%) | |

Genesee & Wyoming, Inc. -

Class A* | | | 18,000 | | | | 489,780 | | |

Wireless Communications &

Equipment - (3.5%) | |

| Anaren, Inc. (L)* | | | 15,000 | | | | 197,250 | | |

| REMEC, Inc. (L)* | | | 17,840 | | | | 114,176 | | |

| ViaSat, Inc.* | | | 20,000 | | | | 406,600 | | |

| | | | 718,026 | | |

Total Common Stocks (Cost

$14,484,649) | | | | | | | 18,934,400 | | |

| | | Principal

Amount | | Value | |

Repurchase Agreements -

(15.6%) | | | |

Bear Stearns Companies,

Inc., 2.80%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$1,181,524, collateralized

by a U.S. Treasury

Obligation, 8/15/16,

value $1,217,447) | | $ | 1,181,432 | | | $ | 1,181,432 | | |

Bear Stearns Companies,

Inc., 3.375%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$1,858,600, collateralized

by a U.S. Treasury

Obligation, 8/15/16,

value $1,913,131) (Held

as Collateral for Securities

Lending) | | | 1,858,426 | | | | 1,858,426 | | |

Bear Stearns Companies,

Inc., 1.6875%, 7/1/05

(Purchased on 6/30/05,

proceeds at maturity

$133,639, collateralized by

a U.S. Treasury Obligation,

8/15/16, value $139,137)

(Held as Collateral for

Securities Lending) | | | 133,632 | | | | 133,632 | | |

Total Repurchase Agreements

(Cost $3,173,490) | | | | | | | 3,173,490 | | |

Total Investments - (108.5%)

(Cost $17,658,139)(a) | | | | | | | 22,107,890 | | |

Total Securities Sold Short -

(-2.4%) | | | | | | | (486,470 | ) | |

Liabilities in Excess of

Other Assets - (-6.1%) | | | | | | | (1,243,447 | ) | |

| Net Assets - (100.0%) | | | | | | $ | 20,377,973 | | |

(a) Represents cost for financial reporting purposes and differs from cost basis for federal income tax purposes by the amount of losses recognized for financial reporting in excess of federal income tax reporting of $123,278 due to wash sales. Cost for federal income tax purposes differs from value by net unrealized appreciation of securities as follows:

| Unrealized appreciation | | $ | 4,816,190 | | |

| Unrealized depreciation | | | (489,717 | ) | |

| Net unrealized appreciation | | $ | 4,326,473 | | |

* Represents non-income producing securities.

† Security position is either entirely or partially held in a segregated account as collateral for securities sold short.

L All or a portion of security is on loan as of June 30, 2005.

PP Private placement. Securities are exempt from registration under Rule 144 of the Securities Act of 1933. Such securities may be resold, normally to institutional buyers, in transactions exempt from registration. At June 30, 2005, the aggregate value of Rule 144 securities amounted to $697,400, which represents approximately 3.4% of net assets as of that date.

See accompanying notes to financial statements.

14

Semiannual Report 2005

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

June 30, 2005 (Unaudited)

| | | Shares | | Value | |

| Securities Sold Short - (-2.4%) | | | |

Computers - Integrated

Systems - (-0.3%) | | | |

| Radiant Systems, Inc.* | | | 6,000 | | | $ | 68,400 | | |

Medical Devices & Supplies -

(-0.2%) | | | |

| Laserscope* | | | 1,000 | | | | 41,440 | | |

| Semiconductors - (-0.4%) | | | |

| FormFactor, Inc.* | | | 3,000 | | | | 79,260 | | |

Specialty Retailing &

Manufacturing - (-0.5%) | | | |

A.C. Moore Arts & Crafts,

Inc.* | | | 3,000 | | | | 94,830 | | |

| | | Shares | | Value | |

Telecommunication Services &

Equipment - (-1.0%) | |

Comtech Telecommunications

Corp.* | | | 2,000 | | | $ | 65,260 | | |

| Essex Corp.* | | | 6,000 | | | | 137,280 | | |

| | | | 202,540 | | |

Total Securities Sold Short

(Proceeds $459,334) | | | | | 486,470 | | |

Total Securities Sold Short -

(-2.4%) | | | | | (486,470 | ) | |

| Total Investments - (108.5%) | | | | | 22,107,890 | | |

Liabilities in Excess of

Other Assets - (-6.1%) | | | | | (1,243,447 | ) | |

| Net Assets - (100.0%) | | | | $ | 20,377,973 | | |

* Represents non-income producing securities.

See accompanying notes to financial statements.

15

Needham Funds

Statements of Assets and Liabilities (Unaudited)

June 30, 2005

| | | Needham

Growth Fund | | Needham

Aggressive

Growth Fund | | Needham

Small Cap

Growth Fund | |

| Assets: | |

Investments, at Value* (Cost $153,874,315, $11,632,551 and

$14,484,649, respectively) | | $ | 191,607,935 | | | $ | 14,805,329 | | | $ | 18,934,400 | | |

| Warrants, at Value (Cost $35,360, $2,080 and $0, respectively) | | | 34,680 | | | | 2,040 | | | | - | | |

| Repurchase Agreements, at Cost | | | 15,991,748 | | | | 3,025,520 | | | | 3,173,490 | | |

| Cash | | | 77,664 | | | | - | | | | - | | |

| Receivables: | |

| Due from Broker | | | 13,092,180 | | | | 324,722 | | | | 489,318 | | |

| Dividends and Interest | | | 372,069 | | | | 6,318 | | | | 4,402 | | |

| Fund Shares Sold | | | 35,408 | | | | - | | | | 3,531 | | |

| Investment Securities Sold | | | 3,582,092 | | | | 68,416 | | | | 553,164 | | |

| Prepaid Expenses and Other Assets | | | 36,848 | | | | 14,687 | | | | 11,518 | | |

| Total Assets | | | 224,830,624 | | | | 18,247,032 | | | | 23,169,823 | | |

| Liabilities: | |

Securities Sold Short, at Value (Proceeds $9,609,169, $297,322 and

$459,334, respectively) | | | 13,182,575 | | | | 315,200 | | | | 486,470 | | |

| Payable for Collateral Received on Securities Loaned | | | 14,933,724 | | | | 1,343,660 | | | | 1,992,058 | | |

| Payables: | |

| Investment Securities Purchased | | | 1,196,365 | | | | 3,268 | | | | 223,523 | | |

| Fund Shares Redeemed | | | 131,522 | | | | - | | | | 20,668 | | |

| Due to Adviser | | | 210,571 | | | | 14,604 | | | | 19,679 | | |

| Distribution Fees | | | 42,114 | | | | 3,348 | | | | 4,128 | | |

| Accrued Expenses and Other Liabilities | | | 80,301 | | | | 45,219 | | | | 45,324 | | |

| Total Liabilities | | | 29,777,172 | | | | 1,725,299 | | | | 2,791,850 | | |

| Net Assets | | $ | 195,053,452 | | | $ | 16,521,733 | | | $ | 20,377,973 | | |

Shares Issued and Outstanding $.001 Par Value

(Authorized 800,000,000, 100,000,000 and 100,000,000,

respectively) | | | 6,300,414 | | | | 1,301,211 | | | | 1,130,830 | | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 30.96 | | | $ | 12.70 | | | $ | 18.02 | | |

| Components of Net Assets | |

| Paid-in Capital | | | 179,857,007 | | | | 12,964,224 | | | | 13,635,959 | | |

| Undistributed Net Investment Income | | | (1,124,299 | ) | | | (166,030 | ) | | | (140,792 | ) | |

| Accumulated Net Realized Gain (Loss) | | | (17,838,790 | ) | | | 568,679 | | | | 2,460,191 | | |

Net Unrealized Appreciation of Investment Securities,

Warrants and Securities Sold Short | | | 34,159,534 | | | | 3,154,860 | | | | 4,422,615 | | |

| Total Net Assets | | $ | 195,053,452 | | | $ | 16,521,733 | | | $ | 20,377,973 | | |

* Includes securities on loan with total values of $14,447,574, $1,310,077 and $1,896,446, respectively.

See accompanying notes to financial statements.

16

Semiannual Report 2005

Statements of Operations (Unaudited)

For the Six Months Ended June 30, 2005

| | | Needham

Growth Fund | | Needham

Aggressive

Growth Fund | | Needham

Small Cap

Growth Fund | |

| Investment Income | |

| Dividends | | $ | 631,831 | | | $ | 13,804 | | | $ | 104,580 | | |

| Interest | | | 365,415 | | | | 19,697 | | | | 16,194 | | |

| Total Investment Income | | | 997,246 | | | | 33,501 | | | | 120,774 | | |

| Expenses | |

| Investment Advisory Fees | | | 1,383,210 | | | | 99,750 | | | | 131,551 | | |

| Distribution Fees | | | 276,642 | | | | 19,881 | | | | 26,323 | | |

| Administration and Accounting Fees | | | 110,444 | | | | 37,707 | | | | 38,010 | | |

| Audit Fees | | | 23,273 | | | | 17,158 | | | | 16,960 | | |

| Custodian Fees | | | 19,007 | | | | 8,664 | | | | 10,978 | | |

| Dividend Expense | | | 22,000 | | | | - | | | | - | | |

| Insurance Expense | | | 15,527 | | | | 942 | | | | 1,010 | | |

| Interest Expense | | | 14,739 | | | | 157 | | | | 246 | | |

| Legal Fees | | | 48,556 | | | | 18,449 | | | | 18,964 | | |

| Filing Fees | | | 10,078 | | | | 7,264 | | | | 7,543 | | |

| Shareholders' Reports | | | 53,308 | | | | 6,171 | | | | 8,382 | | |

| Transfer Agent Fees | | | 14,928 | | | | 14,927 | | | | 14,927 | | |

| Directors' Fees | | | 20,885 | | | | 1,150 | | | | 1,495 | | |

| Other Expenses | | | 108,948 | | | | 11,858 | | | | 13,002 | | |

| Total Expenses | | | 2,121,545 | | | | 244,078 | | | | 289,391 | | |

| Less: Fees Waived and/or Expenses Reimbursed (Note 3) | | | - | | | | (44,547 | ) | | | (27,825 | ) | |

| Net Expenses | | | 2,121,545 | | | | 199,531 | | | | 261,566 | | |

| Net Investment Loss | | | (1,124,299 | ) | | | (166,030 | ) | | | (140,792 | ) | |

Realized and Unrealized Gain (Loss) on Investment

Securities, Warrants and Securities Sold Short | |

Net Realized Gain on Investment Securities, Warrants and

Securities Sold Short | | | 23,518,679 | | | | 736,556 | | | | 3,117,122 | | |

Change in Unrealized Appreciation (Depreciation) of

Investment Securities, Warrants and Securities Sold Short | | | (27,406,649 | ) | | | (786,325 | ) | | | (3,882,026 | ) | |

Net Realized and Unrealized Loss on Investment Securities,

Warrants and Securities Sold Short | | | (3,887,970 | ) | | | (49,769 | ) | | | (764,904 | ) | |

| Change in Net Assets Resulting from Operations | | $ | (5,012,269 | ) | | $ | (215,799 | ) | | $ | (905,696 | ) | |

See accompanying notes to financial statements.

17

Needham Funds

Statements of Changes in Net Assets

| | | Needham Growth Fund | | Needham Aggressive

Growth Fund | | Needham

Small Cap

Growth Fund | |

| | | Six Months

Ended

June 30,

2005

(Unaudited) | | Year Ended

December 31,

2004 | | Six Months

Ended

June 30,

2005

(Unaudited) | | Year Ended

December 31,

2004 | | Six Months

Ended

June 30,

2005

(Unaudited) | | Year Ended

December 31,

2004 | |

| Change in Net Assets | |

| Operations: | |

| Net Investment Loss | | $ | (1,124,299 | ) | | $ | (4,897,093 | ) | | $ | (166,030 | ) | | $ | (378,269 | ) | | $ | (140,792 | ) | | $ | (482,187 | ) | |

Net Realized Loss on

Option Contracts | | | - | | | | (1,322,357 | ) | | | - | | | | - | | | | - | | | | - | | |

Net Realized Gain (Loss) on

Investment Securities, Warrants

and Securities Sold Short | | | 23,518,679 | | | | 13,637,854 | | | | 736,556 | | | | 489,748 | | | | 3,117,122 | | | | (612,078 | ) | |

Change in Unrealized Appreciation

(Depreciation) of Investment

Securities, Warrants and

Securities Sold Short | | | (27,406,649 | ) | | | 5,600,561 | | | | (786,325 | ) | | | 1,639,704 | | | | (3,882,026 | ) | | | 3,227,072 | | |

Change in Net Assets Resulting

from Operations | | | (5,012,269 | ) | | | 13,018,965 | | | | (215,799 | ) | | | 1,751,183 | | | | (905,696 | ) | | | 2,132,807 | | |

| Distributions to Shareholders from: | |

| Net Long-Term Gains | | | - | | | | - | | | | - | | | | - | | | | - | | | | (68,474 | ) | |

| Total Distributions to Shareholders | | | - | | | | - | | | | - | | | | - | | | | - | | | | (68,474 | ) | |

| Capital Transactions: | |

| Shares Issued | | | 6,946,196 | | | | 58,898,114 | | | | 420,458 | | | | 1,013,413 | | | | 1,720,950 | | | | 19,549,157 | | |

| Contribution by Adviser | | | - | | | | 417,668 | | | | - | | | | - | | | | - | | | | - | | |

Shares Issued in Reinvestment of

Distributions | | | - | | | | - | | | | - | | | | - | | | | - | | | | 67,806 | | |

| Shares Redeemed | | | (94,252,535 | ) | | | (149,282,839 | ) | | | (683,411 | ) | | | (3,482,785 | ) | | | (6,332,602 | ) | | | (23,401,507 | ) | |

Change in Net Assets from

Capital Transactions | | | (87,306,339 | ) | | | (89,967,057 | ) | | | (262,953 | ) | | | (2,469,372 | ) | | | (4,611,652 | ) | | | (3,784,544 | ) | |

| Change in Net Assets | | | (92,318,608 | ) | | | (76,948,092 | ) | | | (478,752 | ) | | | (718,189 | ) | | | (5,517,348 | ) | | | (1,720,211 | ) | |

| Net Assets | |

| Beginning of Period | | | 287,372,060 | | | | 364,320,152 | | | | 17,000,485 | | | | 17,718,674 | | | | 25,895,321 | | | | 27,615,532 | | |

| End of Period | | $ | 195,053,452 | | | $ | 287,372,060 | | | $ | 16,521,733 | | | $ | 17,000,485 | | | $ | 20,377,973 | | | $ | 25,895,321 | | |

| Undistributed Net Investment Income | | | (1,124,299 | ) | | | - | | | | (166,030 | ) | | | - | | | | (140,792 | ) | | | - | | |

| Share Transactions: | |

| Number of Shares Issued | | | 231,491 | | | | 1,976,467 | | | | 33,617 | | | | 85,122 | | | | 96,232 | | | | 1,129,912 | | |

| Number of Shares Reinvested | | | - | | | | - | | | | - | | | | - | | | | - | | | | 3,938 | | |

| Number of Shares Redeemed | | | (3,151,314 | ) | | | (5,170,870 | ) | | | (55,386 | ) | | | (301,518 | ) | | | (362,638 | ) | | | (1,376,108 | ) | |

| Change in Shares | | | (2,919,823 | ) | | | (3,194,403 | ) | | | (21,769 | ) | | | (216,396 | ) | | | (266,406 | ) | | | (242,258 | ) | |

See accompanying notes to financial statements.

18

Semiannual Report 2005

Needham Growth Fund

Financial Highlights

(For a Share Outstanding | | Six Months

Ended

June 30, | | Year Ended December 31, | |

| Throughout each Period) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| | | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 31.17 | | | $ | 29.35 | | | $ | 19.92 | | | $ | 27.78 | | | $ | 24.77 | | | $ | 26.47 | | |

| Investment Operations | | | |

| Net Investment Loss | | | (0.18 | ) | | | (0.84 | ) | | | (0.38 | ) | | | (0.25 | ) | | | (0.29 | ) | | | (0.12 | ) | |

Net Realized and Unrealized Gains (Losses)

on Investments | | | (0.03 | ) | | | 2.62 | | | | 9.81 | | | | (7.61 | ) | | | 3.30 | | | | 2.57 | | |

| Total from Investment Operations | | | (0.21 | ) | | | 1.78 | | | | 9.43 | | | | (7.86 | ) | | | 3.01 | | | | 2.45 | | |

| Contribution by Adviser | | | - | | | | 0.04 | | | | - | | | | - | | | | - | | | | - | | |

| Less Distributions | | | |

| Net Realized Gains | | | - | | | | - | | | | - | | | | - | | | | - | | | | (4.15 | ) | |

| Total Distributions | | | - | | | | - | | | | - | | | | - | | | | - | | | | (4.15 | ) | |

| Net Asset Value, End of Period | | $ | 30.96 | | | $ | 31.17 | | | $ | 29.35 | | | $ | 19.92 | | | $ | 27.78 | | | $ | 24.77 | | |

| Total Return | | | (0.67 | )%(b) | | | 6.20 | % | | | 47.34 | % | | | (28.29 | )% | | | 12.15 | % | | | 7.40 | % | |

| Net Assets, End of Period (000's) | | $ | 195,053 | | | $ | 287,372 | | | $ | 364,320 | | | $ | 264,575 | | | $ | 348,387 | | | $ | 76,070 | | |

| Ratios/Supplemental Data | | | |

| Ratio of Expenses to Average Net Assets | | | 1.92 | %(a) | | | 2.21 | % | | | 2.16 | % | | | 1.92 | % | | | 1.94 | % | | | 2.19 | % | |

Ratio of Expenses to Average Net Assets

(excluding interest and dividend expense) | | | 1.88 | %(a) | | | 1.78 | % | | | 1.77 | % | | | 1.75 | % | | | 1.87 | % | | | 2.19 | % | |

Ratio of Net Investment Loss to Average

Net Assets | | | (1.02 | )%(a) | | | (1.51 | )% | | | (1.38 | )% | | | (1.01 | )% | | | (1.04 | )% | | | (1.07 | )% | |

| Portfolio Turnover Rate | | | 6 | %(b) | | | 15 | % | | | 42 | % | | | 78 | % | | | 150 | % | | | 187 | % | |

(a) Annualized.

(b) Not Annualized.

See accompanying notes to financial statements.

19

Needham Funds

Needham Aggressive Growth Fund

Financial Highlights

| (For a Share Outstanding | | Six Months

Ended

June 30, | | Year Ended December 31, | | September 4,

2001 to

December 31, | |

| Throughout each Period) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001* | |

| | | | (Unaudited) | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 12.85 | | | $ | 11.51 | | | $ | 9.09 | | | $ | 11.23 | | | $ | 10.00 | | |

| Investment Operations | | | |

| Net Investment Loss | | | (0.13 | ) | | | (0.36 | ) | | | (0.23 | ) | | | (0.17 | ) | | | (0.03 | ) | |

Net Realized and Unrealized Gains (Losses)

on Investments | | | (0.02 | ) | | | 1.70 | | | | 2.65 | | | | (1.76 | ) | | | 1.26 | | |

| Total from Investment Operations | | | (0.15 | ) | | | 1.34 | | | | 2.42 | | | | (1.93 | ) | | | 1.23 | | |

| Less Distributions | | | |

| Net Realized Gains | | | - | | | | - | | | | - | | | | (0.21 | ) | | | - | | |

| Total Distributions | | | - | | | | - | | | | - | | | | (0.21 | ) | | | - | | |

| Net Asset Value, End of Period | | $ | 12.70 | | | $ | 12.85 | | | $ | 11.51 | | | $ | 9.09 | | | $ | 11.23 | | |

| Total Return | | | (1.17 | )%(b) | | | 11.64 | % | | | 26.62 | % | | | (17.15 | )% | | | 12.30 | %(b) | |

| Net Assets, End of Period (000's) | | $ | 16,522 | | | $ | 17,000 | | | $ | 17,719 | | | $ | 14,273 | | | $ | 13,178 | | |

| Ratios/Supplemental Data | | | |

| Ratio of Expenses to Average Net Assets | | | 2.50 | %(a) | | | 2.61 | % | | | 2.52 | % | | | 2.51 | % | | | 2.57 | %(a) | |

Ratio of Expenses to Average Net Assets

(excluding interest and dividend expense) | | | 2.50 | %(a) | | | 2.50 | % | | | 2.50 | % | | | 2.50 | % | | | 2.50 | %(a) | |

Ratio of Expenses to Average Net Assets

(excluding waivers and reimbursement of expenses) | | | 3.06 | %(a) | | | 3.15 | % | | | 3.22 | % | | | 2.78 | % | | | 4.12 | %(a) | |

| Ratio of Net Investment Loss to Average Net Assets | | | (2.08 | )%(a) | | | (2.25 | )% | | | (2.24 | )% | | | (1.76 | )% | | | (1.23 | )%(a) | |

Ratio of Net Investment Loss to Average Net Assets

(excluding waivers and reimbursement of expenses) | | | (2.64 | )%(a) | | | (2.79 | )% | | | (2.94 | )% | | | (2.03 | )% | | | (2.78 | )%(a) | |

| Portfolio Turnover Rate | | | 37 | %(b) | | | 64 | % | | | 87 | % | | | 58 | % | | | 45 | %(a) | |

* The Needham Aggressive Growth Fund commenced operations on September 4, 2001.

(a) Annualized.

(b) Not Annualized.

See accompanying notes to financial statements.

20

Semiannual Report 2005

Needham Small Cap Growth Fund

Financial Highlights

| (For a Share Outstanding | | Six Months

Ended

June 30, | | Year Ended December 31, | | May 22,

2002 to

December 31, | |

| Throughout each Period) | | 2005 | | 2004 | | 2003 | | 2002* | |

| | | | (Unaudited) | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 18.53 | | | $ | 16.84 | | | $ | 10.38 | | | $ | 10.00 | | |

| Investment Operations | | | |

| Net Investment Loss | | | (0.12 | ) | | | (0.37 | ) | | | (0.06 | ) | | | (0.10 | ) | |

Net Realized and Unrealized Gains (Losses)

on Investments | | | (0.39 | ) | | | 2.11 | | | | 6.52 | | | | 0.48 | | |

| Total from Investment Operations | | | (0.51 | ) | | | 1.74 | | | | 6.46 | | | | 0.38 | | |

| Less Distributions | | | |

| Net Realized Gains | | | - | | | | (0.05 | ) | | | - | | | | - | | |

| Total Distributions | | | - | | | | (0.05 | ) | | | - | | | | - | | |

| Net Asset Value, End of Period | | $ | 18.02 | | | $ | 18.53 | | | $ | 16.84 | | | $ | 10.38 | | |

| Total Return | | | (2.75 | )%(b) | | | 10.34 | % | | | 62.24 | % | | | 3.80 | %(b) | |

| Net Assets, End of Period (000's) | | $ | 20,378 | | | $ | 25,895 | | | $ | 27,616 | | | $ | 4,569 | | |

| Ratios/Supplemental Data | | | |

| Ratio of Expenses to Average Net Assets | | | 2.49 | %(a) | | | 2.52 | % | | | 2.27 | % | | | 2.50 | %(a) | |

Ratio of Expenses to Average Net Assets

(excluding interest and dividend expense) | | | 2.48 | %(a) | | | 2.50 | % | | | 2.26 | % | | | 2.50 | %(a) | |

Ratio of Expenses to Average Net Assets

(excluding waivers and reimbursement of expenses) | | | 2.75 | %(a) | | | 2.63 | % | | | 3.25 | % | | | 6.06 | %(a) | |

| Ratio of Net Investment Loss to Average Net Assets | | | (1.34 | )%(a) | | | (1.91 | )% | | | (1.68 | )% | | | (2.04 | )%(a) | |

Ratio of Net Investment Loss to Average Net Assets

(excluding waivers and reimbursement of expenses) | | | (1.60 | )%(a) | | | (2.02 | )% | | | (2.66 | )% | | | (5.60 | )%(a) | |

| Portfolio Turnover Rate | | | 59 | %(b) | | | 68 | % | | | 67 | % | | | 107 | %(a) | |

* The Needham Small Cap Growth Fund commenced operations on May 22, 2002.

(a) Annualized.

(b) Not Annualized.

See accompanying notes to financial statements.

21

Needham Funds

Notes To Financial Statements

(Unaudited)

1. Organization

Needham Growth Fund ("NGF"), Needham Aggressive Growth Fund ("NAGF'') and Needham Small Cap Growth Fund ("NSCGF'') or (the "Portfolios''), are portfolios of The Needham Funds, Inc. (the "Fund''), which is registered under the Investment Company Act of 1940 as a non-diversified, open-end management investment company. The Fund was organized as a Maryland corporation on October 12, 1995.

2. Significant Accounting Policies