Item 1: Report to Shareholders

|

| Health Sciences Fund | June 30, 2005 |

The views and opinions in this report were current as of June 30, 2005. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act of 2002, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Fellow Shareholders

Stocks generally declined in the first half of 2005, as modest second-quarter gains failed to offset first-quarter losses. The market’s attempts to advance were hindered by concerns about the pace of economic growth amid surging oil prices—which reached $60 per barrel in late June—and rising short-term interest rates.

Large-cap shares held up slightly better than small-caps, but mid-cap stocks decisively outperformed both segments. As measured by various Russell indexes, value stocks outperformed their growth counterparts across all market capitalizations. As a group, health care shares outperformed the more broadly based S&P 500 and Russell 2000 indexes.

| PERFORMANCE COMPARISON | ||

| Period Ended 6/30/05 | 6 Months | 12 Months |

| Health Sciences Fund | -2.64% | 1.49% |

| S&P 500 Index | -0.81 | 6.32 |

| Lipper Health/Biotechnology | ||

| Funds Index | 1.20 | 5.88 |

Your fund fell 2.64% and increased a modest 1.49% in the 6- and 12-month periods ended June 30, 2005, respectively. As shown in the Performance Comparison table, the fund underperformed its Lipper benchmark and the S&P 500 Index for both periods. Service firms (managed care, services, facilities, and distributors) significantly outperformed all other health care industries. Therapeutic companies (biotechnology, pharmaceuticals, and medical equipment) lagged. Approximately three-quarters of your fund’s assets are invested in the latter category.

MARKET ENVIRONMENT

Over the last six months, services industry companies posted sharp gains, and life sciences shares increased modestly. All other health care industries declined, and biotechnology shares fared the worst. The biotech segment was hit particularly hard when Elan and Biogen Idec voluntarily suspended marketing of their multiple sclerosis drug Tysabri, which was thought to have multibillion dollar sales potential. (Elan and Biogen Idec fell significantly on this news, which will be discussed more fully in the portfolio review section.) Helped by new drug approvals and positive developments at this April’s American Society of Clinical Oncology (ASCO) meeting, biotechnology shares staged a second-quarter rally.

The pharmaceutical industry was pressured on several fronts, as possible increased regulatory burdens, the imbalance between patent expirations for currently marketed drugs and important new drugs coming onto the market, and the threat of generic competition weighed on the group. In April, Eli Lilly received a favorable lower-court ruling in a patent challenge against Zyprexa, one of its top-selling drugs. This was the first of three critical rulings on pharmaceutical industry patent challenges—Plavix (Bristol-Myers) and Lipitor (Pfizer) are the others—that should be resolved over the next 12 months. It is likely that the stock market will react negatively if a pharmaceutical company loses any one of these patent challenges.

Over the last few years, therapeutic firms have been increasingly pressured by safety issues. In products and devices, Boston Scientific and Guidant recalled stents and defibrillators, respectively. Pharmaceutical firms have been affected by ongoing safety concerns related to COX-2 inhibitors—Merck’s Vioxx and Pfizer’s Celebrex and Bextra—and other drugs. Elan and Biogen Idec’s withdrawal of Tysabri earlier this year showed that biotechnology-generated drugs are not immune to safety concerns. In general, concerns over drug safety have pushed valuations lower. However, in our opinion, the pendulum has swung too far in the direction of safety concerns. In most instances, the risk that comes with not treating disease with modern pharmaceuticals is far greater than the safety risk associated with a new drug. If it becomes too difficult for new drugs to enter the market, then there is a real danger that innovative drugs needed to treat the many grievous illnesses for which good therapies currently do not exist will not be developed. Recent Food and Drug Administration (FDA) Advisory Panel meetings have served as a voice of reason, pointing out that all regulatory decisions must weigh the clinical benefit versus the safety concerns.

In an important recent development, Pfizer and Wyeth announced significant spending cuts—$4 billion and $750 million, respectively. Overall, this should benefit the industry, as the cost cutting indicates that the businesses are trying to better align their expenses with their revenues.

Our relative underweight in U.S. pharmaceutical stocks is not due to the negative publicity surrounding the industry over the last few months; it has been in place for a considerable period. However, because the industry’s troubles are well known and seem to be reflected in current valuations that are below the market’s average, opportunities to increase our exposure to the group may develop over the next 12 to 18 months. We are closely monitoring pharmaceutical industry developments and will act accordingly.

PORTFOLIO REVIEW

Biotechnology and Pharmaceuticals

The therapeutic business model (the discovery, development, manufacture, and commercialization of medicines or therapeutic devices) is the primary driver of long-term value in the health care sector. Moreover, a therapeutic-based business model in a smaller company can lead to significantly greater leverage from successful new product introductions. In fact, one important new medicine can transform a smaller therapeutic-based company and the value of its stock.

In many instances, Wall Street refers to these smaller, therapeutic-based companies as biotechs; however, because the major distinction between biotechs and large-cap pharmaceuticals is often size, the label lacks a meaningful distinction. As a result, we view smaller biotechs as emerging pharmaceuticals. The fund owns a number of these companies that have a leveraged bet on the pharmaceutical business model.

However, this strategy also encompasses more risk since a firm that is highly leveraged to the success or failure of a single drug can decline meaningfully on bad news. In our last report we wrote about the bright prospects for Tysabri, a new multiple sclerosis (MS) drug jointly developed by Elan and Biogen Idec that received unprecedented fast track FDA approval in November of 2004 after compelling one-year clinical data that showed benefit to sufferers of MS. Tysabri appeared to have all the characteristics of a mega-blockbuster drug. Unfortunately, on February 28, Biogen Idec and Elan announced a voluntary marketing suspension of Tysabri after it was linked to a very rare and potentially fatal disease that affects the central nervous system. The condition was confirmed in one patient (and was fatal) and suspected (and subsequently confirmed) in another patient. Both patients used the medication for at least two years.

Both stocks fell sharply when this news was released and have only recovered a fraction of their earlier losses in the second quarter. Tysabri could yet return to the market, but how well the stocks perform in the long term will be heavily influenced by Tysabri’s safety profile over the next several years. (Please refer to the portfolio of investments for a complete list of the fund’s holdings and the amount each represents of the portfolio.)

Our fourth-largest holding, Genentech (protein-based products for serious or life-threatening medical conditions), is an example of a company that is referred to as a “biotech” but has scale and dominance greater than most large pharmaceutical firms. Our best contributor for the past six months, Genentech delivered strong earnings and revenues behind strong sales of its portfolio of cancer drugs, including Avastin and Herceptin. Importantly, Genentech announced positive news about several of its drugs, including expanded use for its colon-cancer drug, Avastin, in lung cancer and breast cancer. The drug’s efficacy as a treatment for other cancers is also being tested. Herceptin’s data in adjuvant breast cancer positions it as the standard of care for that disease. Together, Herceptin and Avastin are the key drugs that should fuel Genentech’s earnings for years to come.

Several biotech firms are good examples of the type of therapeutic company favored by the fund and help explain why approximately 45% of our assets are invested in this industry. The fund holds significant stakes in established firms such as Gilead Sciences (drugs for infectious diseases) and Amgen (drugs based on advances in cellular and molecular biology), both of which are early in what should be a strong cycle of earnings growth. Gilead, one of the period’s top contributors, continues to benefit from strong sales of its HIV drugs Viread, Emtriva, and Truvada, a single pill combining Viread and Emtriva.

Emerging biotech holdings Sepracor (drugs for respiratory and central nervous system disorders) and Celgene (products to treat cancer and debilitating inflammatory diseases) were top contributors over the last six and 12 months. Sepracor benefited from strong early sales of Lunesta, the first new sleep aid approved in more than five years. The drug, which can be used to treat sleep induction and maintenance, was launched in the first quarter. The prospects look good for Revlimid, Celgene’s treatment for the common blood disorder, myelodysplastic syndrome, or MDS.

On the other hand, Eyetech Pharmaceuticals’ stock performance was extremely disappointing. The company’s age-related macular degeneration drug, Macugen, continues to be pressured by concerns that its future will be severely impacted by competition from Genentech’s experimental drug, Lucentis. ImClone Systems was hurt by disappointing sales of its colorectal cancer drug, Erbitux.

The fund owns several emerging pharmaceutical companies to reduce overall portfolio risk. Our bias toward owning small- and medium-sized companies should continue. In fact, the investment-weighted median market cap of our holdings is $6.6 billion versus $13.2 billion for the peer group.

We have been very selective in our large-cap pharmaceutical investments, and the fund’s exposure to the largest industry segment within the health care universe remains lower than its peer group. As a result, if these companies perform particularly well, and your fund does not make corresponding changes, it could hinder our ability to outperform our peers.

| INDUSTRY DIVERSIFICATION | ||

| Percent of Net Assets | ||

| Periods Ended | 12/31/04 | 6/30/05 |

| Biotechnology | 46.6% | 45.1% |

| Services | 19.3 | 25.7 |

| Pharmaceuticals | 19.5 | 17.0 |

| Products and Devices | 10.7 | 9.1 |

| Life Sciences | 4.8 | 4.8 |

| Options | -2.0 | -1.8 |

| Other and Reserves | 1.1 | 0.1 |

| Total | 100.0% | 100.0% |

| Historical weightings reflect current industry/sector classifications. | ||

Currently, large-cap pharmaceutical companies trade at low valuations, reflective of the problems these companies are facing. Our holdings in the industry are focused on firms such as Wyeth that appear to be attractively valued and have a secure earnings outlook. Several European pharmaceuticals are better positioned for long-term growth than their U.S. counterparts. The group faces fewer patent expirations and has more advanced pipelines. Our exposure to Roche Holding, which owns a significant stake in Genentech, increased. Roche should benefit from its rights to manufacture and sell many of Genentech’s products outside the U.S.

Services

Selected managed health care services companies such as WellPoint and UnitedHealth Group were key contributors to our six-month performance. While the market believes rising health care costs will squeeze margins, as long as the increase in medical costs remains in line with historical norms, these companies should be able to keep profit margins at current levels. Under that premise, the growth rate of these companies relative to their valuation remains attractive. Our allocation to drug distributor Cardinal Health increased. The Medicare Act should increase the usage of pharmaceuticals, benefiting distributors. In addition to improvement in its core distribution business, Cardinal has some under-performing divisions that are also likely to improve.

OUTLOOK

Our goal is to deliver above-average returns with below-average risk. In order to achieve this objective, we seek the strongest companies in each of the four main areas of health care—the pharmaceutical, biotechnology, services, and medical devices industries. Although each subsector offers attractive growth opportunities, we will continue to favor therapeutic companies leveraged to novel products for unmet medical needs.

Over the next six to 12 months, pharmaceutical firms are likely to be hampered by concerns about their inability to deliver above-average growth. As a result, a strong move up or down from the group is not anticipated. Biotechnology shares were strong second-quarter performers. The group, which benefited from several positive product-related developments, should marginally outperform other health care industries over the course of the year. Services companies delivered strong results. Many investors anticipate that changes to Medicare will result in increased drug utilization, benefiting the industry. While this could be true, we will also keep a watchful eye. If prices rise too rapidly, it is likely that the group will correct.

While large-cap companies (both pharmaceuticals and biotechs) may face significant challenges, many smaller biotechnology firms can be transformed if they are able to gain approval for a product that wins significant market share. Positive news flow often drives the shares of such companies, and more good news is likely. So long as society continues to desire new therapies to soften the impact of disease, and price controls are not imposed, health care should remain an area of significant growth for the long term.

We appreciate your continued confidence and support.

Respectfully submitted,

Kris H. Jenner

President of the fund and chairman of its Investment Advisory Committee

July 20, 2005

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISK OF GROWTH INVESTING

Growth stocks can be volatile for several reasons. Since these companies usually invest a high portion of earnings in their businesses, they may lack the dividends of value stocks that can cushion stock prices in a falling market. Also, earnings disappointments often lead to sharply falling prices because investors buy growth stocks in anticipation of superior earnings growth.

RISK OF HEALTH SCIENCES FUND INVESTING

Funds that invest only in specific industries will experience greater volatility than funds investing in a broad range of industries. Companies in the health sciences field are subject to special risks such as increased competition within the health care industry, changes in legislation or government regulations, reductions in government funding, product liability or other litigation, and the obsolescence of popular products.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

S&P 500 Index: An index consisting of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index, with each stock’s weight in the index proportionate to its market value.

| PORTFOLIO HIGHLIGHTS | |

| TWENTY-FIVE LARGEST HOLDINGS | |

| Percent of | |

| Net Assets | |

| 6/30/05 | |

| WellPoint | 6.7% |

| Gilead Sciences | 6.3 |

| UnitedHealth Group | 5.8 |

| Genentech | 4.9 |

| Sepracor | 3.4 |

| Amgen | 2.9 |

| Wyeth | 2.4 |

| Cephalon | 2.4 |

| ImClone Systems | 2.0 |

| Community Health System | 1.8 |

| Celgene | 1.6 |

| Neurocrine Biosciences | 1.6 |

| Roche Holding | 1.5 |

| DaVita | 1.4 |

| Alkermes | 1.3 |

| CIGNA | 1.3 |

| Invitrogen | 1.3 |

| Eli Lilly | 1.2 |

| Pfizer | 1.2 |

| Cardinal Health | 1.1 |

| OSI Pharmaceuticals | 1.1 |

| Biogen Idec | 1.1 |

| Alcon | 1.1 |

| Johnson & Johnson | 1.0 |

| IVAX | 1.0 |

| Total | 57.4% |

| PORTFOLIO HIGHLIGHTS | ||||

| CONTRIBUTIONS TO THE CHANGE IN NET ASSET VALUE PER SHARE | ||||

| 6 Months Ended 6/30/05 | ||||

| Best Contributors | Worst Contributors | |||

| Genentech | 31¢ | Elan | -60¢ | |

| Gilead Sciences | 30 | Eyetech Pharmaceuticals | 33 | |

| WellPoint | 28 | Biogen Idec | 26 | |

| UnitedHealth Group | 25 | ImClone Systems | 16 | |

| Celgene | 9 | Cephalon | 14 | |

| Community Health System | 9 | OSI Pharmaceuticals | 12 | |

| Vertex Pharmaceuticals | 8 | Medicines Company | 9 | |

| Invitrogen | 7 | MGI Pharma | 7 | |

| Coventry Health Care | 6 | NPS Pharmaceuticals | 7 | |

| Alcon | 5 | Able Laboratories * | 6 | |

| Total | 158¢ | Total | -190¢ | |

| 12 Months Ended 6/30/05 | ||||

| Best Contributors | Worst Contributors | |||

| UnitedHealth Group | 69¢ | ImClone Systems | -61¢ | |

| WellPoint ** | 53 | Elan | 47 | |

| Gilead Sciences | 36 | Eyetech Pharmaceuticals | 25 | |

| Genentech | 30 | Biogen Idec | 22 | |

| Community Health System | 10 | Cephalon | 17 | |

| Wyeth | 10 | Omnicare | 12 | |

| Sepracor | 9 | Pfizer | 11 | |

| Invitrogen | 9 | OSI Pharmaceuticals | 11 | |

| Celgene | 9 | NPS Pharmaceuticals | 9 | |

| Amgen | 8 | ONYX Pharmaceuticals | 8 | |

| Total | 243¢ | Total | -223¢ | |

| * Position eliminated | ||||

| ** Merger | ||||

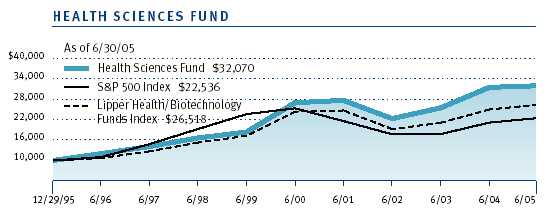

| GROWTH OF $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund and its benchmarks would have performed if their actual (or

cumulative) returns for the periods shown had been earned at a constant rate.

| Since | |||

| Inception | |||

| Periods Ended 6/30/05 | 1 Year | 5 Years | 12/29/95 |

| Health Sciences Fund | 1.49% | 3.44% | 13.05% |

| S&P 500 Index | 6.32 | -2.37 | 8.93 |

| Lipper Health/Biotechnology Funds Index | 5.88 | 1.65 | 10.81 |

| Current performance may be higher or lower than the quoted past performance, which can- | |||

| not guarantee future results. Share price, principal value, and return will vary, and you may | |||

| have a gain or loss when you sell your shares. For the most recent month-end performance | |||

| information, please visit our Web site (troweprice.com) or contact a T. Rowe Price representa- | |||

| tive at 1-800-225-5132. | |||

| Average annual total return figures include changes in principal value, reinvested dividends, and capital | |||

| gain distributions. Returns do not reflect taxes that the shareholder may pay on fund distributions or the | |||

| redemption of fund shares. When assessing performance, investors should consider both short- and | |||

| long-term returns. | |||

| FUND EXPENSE EXAMPLE |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs such as redemption fees or sales loads and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

| T. ROWE PRICE HEALTH SCIENCES FUND | |||

| Beginning | Ending | Expenses Paid | |

| Account Value | Account Value | During Period* | |

| 1/1/05 | 6/30/05 | 1/1/05 to 6/30/05 | |

| Actual | $1,000.00 | $973.60 | $4.60 |

| Hypothetical (assumes 5% | |||

| return before expenses) | 1,000.00 | 1,020.13 | 4.71 |

| * Expenses are equal to the fund’s annualized expense ratio for the six-month period (0.94%), multiplied | |||

| by the average account value over the period, multiplied by the number of days in the most recent fis- | |||

| cal half year (181) divided by the days in the year (365) to reflect the half-year period. | |||

Unaudited

| FINANCIAL HIGHLIGHTS | For a share outstanding throughout each period | |||||||||||

| 6 Months | Year | |||||||||||

| Ended | Ended | |||||||||||

| 6/30/05** | 12/31/04 | 12/31/03 | 12/31/02 | 12/31/01 | 12/31/00 | |||||||

| NET ASSET VALUE | ||||||||||||

| Beginning of period | $ | 23.11 | $ | 19.95 | $ | 14.51 | $ | 20.08 | $ | 21.70 | $ | 15.93 |

| Investment activities | ||||||||||||

| Net investment | ||||||||||||

| income (loss) | (0.07) | (0.12) | (0.11) | (0.11) | (0.11) | (0.03) | ||||||

| Net realized and | ||||||||||||

| unrealized gain (loss) | (0.54) | 3.28 | 5.55 | (5.46) | (1.20) | 8.28 | ||||||

| Total from | ||||||||||||

| investment activities | (0.61) | 3.16 | 5.44 | (5.57) | (1.31) | 8.25 | ||||||

| Distributions | ||||||||||||

| Net realized gain | – | – | – | – | (0.31) | (2.48) | ||||||

| NET ASSET VALUE | ||||||||||||

| End of period | $ | 22.50 | $ | 23.11 | $ | 19.95 | $ | 14.51 | $ | 20.08 | $ | 21.70 |

| Ratios/Supplemental Data | ||||||||||||

| Total return^ | (2.64)% | 15.84% | 37.49% | (27.74)% | (5.97)% | 52.19% | ||||||

| Ratio of total expenses to | ||||||||||||

| average net assets | 0.94%† | 0.93% | 1.00% | 1.04% | 1.02% | 0.98% | ||||||

| Ratio of net investment | ||||||||||||

| income (loss) to average | ||||||||||||

| net assets | (0.61)%† | (0.58)% | (0.64)% | (0.64)% | (0.60)% | (0.22)% | ||||||

| Portfolio turnover rate | 55.8%† | 44.1% | 44.8% | 62.7% | 74.6% | 110.6% | ||||||

| Net assets, end of period | ||||||||||||

| (in thousands) | $ | 1,252,998 | $ | 1,329,391 | $ | 1,027,367 | $ | 677,956 | $ | 960,787 | $ | 971,867 |

| ^ | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, |

| assuming reinvestment of all distributions. | |

| ** Per share amounts calculated using average shares outstanding method. | |

| † | Annualized |

The accompanying notes are an integral part of these financial statements.

Unaudited

| PORTFOLIO OF INVESTMENTS (1) | Shares | Value |

| (Cost and value in $ 000s) | ||

| COMMON STOCKS AND WARRANTS 101.2% | ||

| BIOTECHNOLOGY 44.1% | ||

| Major Biotechnology 36.6% | ||

| Abgenix * | 800,000 | 6,864 |

| Alkermes * | 1,235,000 | 16,327 |

| American Pharmaceutical * | 25,000 | 1,031 |

| Amgen *^ | 600,000 | 36,276 |

| Array BioPharma * | 100,000 | 630 |

| Atherogenics * | 275,000 | 4,395 |

| Biogen Idec *^ | 400,000 | 13,780 |

| Celgene * | 505,000 | 20,589 |

| Cephalon *^ | 750,000 | 29,857 |

| Chiron * | 30,000 | 1,047 |

| CV Therapeutics *^ | 350,000 | 7,847 |

| Eyetech Pharmaceuticals *^ | 325,000 | 4,108 |

| Genentech *^ | 765,000 | 61,414 |

| Gilead Sciences *^ | 1,800,000 | 79,182 |

| Human Genome Sciences * | 425,000 | 4,922 |

| ICOS * | 125,300 | 2,653 |

| ImClone Systems *^ | 800,000 | 24,776 |

| Kosan Biosciences * | 225,000 | 1,188 |

| Martek Biosciences *^ | 225,000 | 8,539 |

| Medicines Company *^ | 375,000 | 8,771 |

| MedImmune * | 300,000 | 8,016 |

| Neurocrine Biosciences *^ | 475,000 | 19,978 |

| NPS Pharmaceuticals * | 550,000 | 6,243 |

| OSI Pharmaceuticals *^ | 350,000 | 14,304 |

| Protein Design Labs * | 625,000 | 12,631 |

| Seattle Genetics, Warrants, 12/31/11 *‡ | 50,000 | 0 |

| Sepracor *^ | 700,000 | 42,007 |

| Trimeris * | 725,000 | 7,235 |

| United Therapeutics *^ | 50,000 | 2,410 |

| Vertex Pharmaceuticals * | 700,000 | 11,788 |

| 458,808 | ||

| Other Biotechnology 7.5% | ||

| Alexion Pharmaceutical * | 250,000 | 5,760 |

| Amylin Pharmaceuticals * | 425,000 | 8,895 |

| BioCryst Pharmaceuticals * | 600,000 | 3,048 |

| Cubist Pharmaceuticals * | 975,000 | 12,841 |

| Cytokinetics * | 75,000 | 521 |

| deCode genetics * | 550,000 | 5,164 |

| Discovery Laboratories * | 100,000 | 729 |

| Dynavax Technologies * | 50,000 | 240 |

| Encysive Pharmaceuticals * | 726,800 | 7,857 |

| Exelixis * | 750,000 | 5,572 |

| Favrille * | 105,210 | 447 |

| Idenix Pharmaceuticals * | 237,400 | 5,147 |

| Incyte Genomics * | 400,000 | 2,860 |

| Inspire Pharmaceuticals *^ | 175,000 | 1,474 |

| Keryx Biopharmaceuticals * | 250,000 | 3,300 |

| Myogen * | 325,000 | 2,272 |

| Myogen, Warrants, 9/29/09 *‡ | 20,000 | 0 |

| Nektar Therapeutics * | 275,000 | 4,631 |

| NeoRX * | 175,000 | 105 |

| NeoRX, Warrants, 12/31/08 *‡ | 18,000 | 0 |

| ONYX Pharmaceuticals *^ | 175,000 | 4,179 |

| Pharmion * | 100,000 | 2,321 |

| Rigel Pharmaceuticals * | 200,000 | 3,984 |

| Theravance * | 295,000 | 5,015 |

| Vicuron Pharmaceuticals * | 75,000 | 2,092 |

| Vion Pharmaceuticals * | 950,000 | 2,062 |

| ViroLogic * | 125,000 | 310 |

| ViroPharma * | 400,000 | 2,780 |

| 93,606 | ||

| Total Biotechnology | 552,414 | |

| LIFE SCIENCES 4.8% | ||

| Life Sciences 4.8% | ||

| Dade Behring Holdings ^ | 175,000 | 11,377 |

| Gen-Probe * | 276,000 | 9,999 |

| Immucor *^ | 185,000 | 5,356 |

| Invitrogen * | 190,000 | 15,825 |

| OraSure Technologies * | 225,000 | 2,248 |

| Serologicals * | 140,000 | 2,975 |

| Symyx Technologies * | 450,000 | 12,591 |

| Total Life Sciences | 60,371 | |

| PHARMACEUTICALS 16.7% | ||

| International Pharmaceuticals 0.8% | ||

| Schwarz Pharma AG (EUR) | 100,000 | 4,533 |

| Solvay (EUR) | 40,000 | 4,106 |

| UCB (EUR) | 25,000 | 1,215 |

| 9,854 | ||

| Major Pharmaceuticals 15.9% | ||

| Alcon | 125,000 | 13,669 |

| Andrx * | 300,000 | 6,093 |

| Astellas Pharmaceutical (JPY) | 300,000 | 10,238 |

| Elan ADR * | 1,253,800 | 8,551 |

| Eli Lilly | 260,000 | 14,485 |

| Indevus Pharmaceuticals * | 325,000 | 832 |

| IVAX * | 600,000 | 12,900 |

| Johnson & Johnson | 200,000 | 13,000 |

| MGI Pharma * | 550,000 | 11,968 |

| Novartis ADR | 110,000 | 5,218 |

| Noven Pharmaceuticals * | 188,500 | 3,295 |

| Novo Nordisk, Series B (DKK) | 30,000 | 1,526 |

| Penwest Pharmaceuticals * | 100,000 | 1,182 |

| Pfizer ^ | 525,000 | 14,479 |

| Roche Holding (CHF) | 150,000 | 18,899 |

| Salix Pharmaceuticals * | 50,000 | 883 |

| Sanofi-Aventis (EUR) | 100,000 | 8,185 |

| Schering-Plough | 375,000 | 7,147 |

| Shire Pharmaceuticals ADR ^ | 175,700 | 5,763 |

| Teva Pharmaceutical ADR | 262,500 | 8,174 |

| Valeant Pharmaceuticals | 150,000 | 2,645 |

| Wyeth ^ | 675,000 | 30,037 |

| 199,169 | ||

| Total Pharmaceuticals | 209,023 | |

| PRODUCTS & DEVICES 9.0% | ||

| Implants 8.4% | ||

| Aspect Medical Systems * | 100,000 | 2,974 |

| Baxter International | 50,000 | 1,855 |

| Biomet | 125,300 | 4,340 |

| BioSphere Medical * | 600,000 | 2,700 |

| Boston Scientific *^ | 340,100 | 9,183 |

| C R Bard | 5,000 | 333 |

| CONMED * | 70,000 | 2,154 |

| CryoLife * | 310,500 | 2,409 |

| Edwards Lifesciences *^ | 209,100 | 8,996 |

| Endologix * | 375,000 | 1,691 |

| Fischer Imaging *† | 590,000 | 1,180 |

| Guidant | 60,000 | 4,038 |

| Integra LifeSciences * | 100,000 | 2,920 |

| Kinetic Concepts *^ | 160,000 | 9,600 |

| Medtronic | 150,000 | 7,769 |

| Regeneration Technologies * | 400,000 | 2,504 |

| ResMed * | 155,000 | 10,228 |

| Respironics * | 26,800 | 968 |

| St. Jude Medical *^ | 200,100 | 8,726 |

| Stryker ^ | 250,000 | 11,890 |

| Zimmer Holdings * | 110,000 | 8,379 |

| 104,837 | ||

| Other Products & Devices 0.6% | ||

| Bausch & Lomb | 98,100 | 8,142 |

| 8,142 | ||

| Total Products & Devices | 112,979 | |

| SERVICES 24.0% | ||

| Distribution 3.0% | ||

| AmerisourceBergen | 50,000 | 3,457 |

| Cardinal Health | 250,000 | 14,395 |

| Caremark RX * | 175,000 | 7,791 |

| NeighborCare * | 200,000 | 6,634 |

| Omnicare | 50,000 | 2,122 |

| Patterson Companies * | 75,000 | 3,381 |

| 37,780 | ||

| Other Services 0.4% | ||

| LabOne * | 115,000 | 4,578 |

| 4,578 | ||

| Payors 14.4% | ||

| CIGNA | 150,000 | 16,055 |

| Coventry Health Care * | 120,000 | 8,490 |

| UnitedHealth Group | 1,400,000 | 72,996 |

| WellPoint * | 1,200,000 | 83,568 |

| 181,109 | ||

| Providers 6.2% | ||

| Community Health System * | 600,000 | 22,674 |

| DaVita * | 391,000 | 17,783 |

| HCA | 125,000 | 7,084 |

| HealthSouth * | 600,000 | 3,360 |

| Manor Care | 10,000 | 397 |

| Sunrise Senior Living * | 175,000 | 9,446 |

| Symbion * | 250,000 | 5,963 |

| Triad Hospitals * | 155,000 | 8,469 |

| Vencor, REIT | 75,000 | 2,265 |

| 77,441 | ||

| Total Services | 300,908 | |

| Total Miscellaneous Common Stocks 2.6% ∞ | 31,697 | |

| Total Common Stocks and Warrants (Cost $1,025,779) | 1,267,392 |

| CONVERTIBLE PREFERRED STOCKS 0.2% | ||

| Control Delivery Systems, Series A *‡ | 37,216 | 500 |

| Corus Pharma *‡ | 1,724,138 | 1,944 |

| NeoRx, Series B *‡ | 45 | 59 |

| Total Convertible Preferred Stocks (Cost $4,450) | 2,503 | |

| PREFERRED STOCKS 0.4% | ||

| Alexza Molecular Delivery, Series D *‡ | 1,555,210 | 1,800 |

| Fibrogen, Series F *‡ | 659,341 | 2,700 |

| Total Preferred Stocks (Cost $5,000) | 4,500 | |

| OPTIONS WRITTEN (1.8%) | ||

| Abbott Laboratories, Put, 1/21/06 @ $55.00 * | (40,000) | (252) |

| Alkermes, Put, 11/19/05 @ $15.00 * | (50,000) | (145) |

| Allergan, Put, 1/21/06 @ $80.00 * | (15,000) | (42) |

| Amgen | ||

| Call, 1/21/06 @ $65.00 * | (100,000) | (195) |

| Put | ||

| 1/21/06 @ $60.00 * | (30,000) | (86) |

| 1/21/06 @ $65.00 * | (100,000) | (550) |

| Amylin Pharmaceuticals | ||

| Put | ||

| 1/21/06 @ $15.00 * | (20,000) | (16) |

| 1/21/06 @ $20.00 * | (35,000) | (87) |

| 1/21/06 @ $22.50 * | (55,000) | (209) |

| Bausch & Lomb | ||

| Put | ||

| 1/21/06 @ $65.00 * | (30,000) | (23) |

| 1/21/06 @ $70.00 * | (25,000) | (37) |

| 1/21/06 @ $75.00 * | (25,000) | (63) |

| 1/21/06 @ $80.00 * | (25,000) | (105) |

| Baxter International | ||

| Put | ||

| 1/21/06 @ $35.00 * | (50,000) | (61) |

| 1/21/06 @ $40.00 * | (25,000) | (91) |

| Biogen Idec | ||

| Call, 10/22/05 @ $45.00 * | (75,000) | (30) |

| Put, 10/22/05 @ $35.00 * | (40,000) | (116) |

| Biomet, Put, 7/16/05 @ $45.00 * | (23,200) | (245) |

| Boston Scientific | ||

| Call | ||

| 1/21/06 @ $35.00 * | (50,000) | (21) |

| 11/19/05 @ $30.00 * | (75,000) | (68) |

| Put, 1/21/06 @ $40.00 * | (4,900) | (63) |

| Cardinal Health, Put, 1/21/06 @ $60.00 * | (10,000) | (46) |

| Caremark RX | ||

| Put | ||

| 1/21/06 @ $45.00 * | (35,000) | (112) |

| 1/21/06 @ $50.00 * | (25,000) | (155) |

| Celgene | ||

| Put | ||

| 1/21/06 @ $35.00 * | (50,000) | (123) |

| 1/21/06 @ $40.00 * | (30,000) | (129) |

| 1/21/06 @ $45.00 * | (25,000) | (172) |

| 1/21/06 @ $50.00 * | (50,000) | (520) |

| 7/16/05 @ $40.00 * | (25,000) | (19) |

| Cephalon | ||

| Call | ||

| 8/20/05 @ $35.00 * | (100,000) | (540) |

| 8/20/05 @ $40.00 * | (100,000) | (175) |

| Put | ||

| 1/21/06 @ $40.00 * | (25,000) | (84) |

| 8/20/05 @ $40.00 * | (50,000) | (91) |

| CIGNA, Put, 1/21/06 @ $110.00 * | (25,000) | (207) |

| Community Health System, Put, 9/17/05 @ $35.00 * | (50,000) | (25) |

| Coventry Health Care | ||

| Put | ||

| 1/21/06 @ $60.00 * | (25,000) | (45) |

| 1/21/06 @ $65.00 * | (25,000) | (76) |

| 1/21/06 @ $70.00 * | (35,000) | (168) |

| CV Therapeutics, Call, 10/22/05 @ $22.50 * | (50,000) | (126) |

| Dade Behring Holdings, Call, 11/19/05 @ $70.00 * | (75,000) | (169) |

| DaVita, Put, 1/21/06 @ $50.00 * | (35,000) | (191) |

| Edwards Lifesciences | ||

| Call, 11/19/05 @ $45.00 * | (37,500) | (55) |

| Put, 8/22/05 @ $50.00 * | (20,900) | (145) |

| Elan | ||

| Put | ||

| 1/21/06 @ $25.00 * | (18,500) | (336) |

| 1/21/06 @ $30.00 * | (29,500) | (683) |

| 1/21/06 @ $35.00 * | (5,700) | (161) |

| 7/16/05 @ $30.00 * | (5,200) | (120) |

| Encysive Pharmaceuticals, Put, 10/22/05 @ $15.00 * | (23,200) | (97) |

| Eyetech Pharmaceuticals | ||

| Call | ||

| 12/17/05 @ $15.00 * | (100,000) | (140) |

| 9/17/05 @ $17.50 * | (100,000) | (42) |

| Forest Labs, Put, 1/21/06 @ $40.00 * | (50,000) | (195) |

| Gen-Probe | ||

| Put | ||

| 11/19/05 @ $50.00 * | (20,000) | (280) |

| 8/20/05 @ $50.00 * | (39,000) | (542) |

| Genentech | ||

| Call | ||

| 1/21/06 @ $100.00 * | (50,000) | (119) |

| 9/17/05 @ $70.00 * | (175,000) | (2,170) |

| 9/17/05 @ $90.00 * | (100,000) | (182) |

| Put | ||

| 1/21/06 @ $65.00 * | (120,000) | (288) |

| 1/21/06 @ $80.00 * | (50,000) | (367) |

| 9/17/05 @ $70.00 * | (50,000) | (73) |

| 9/17/05 @ $75.00 * | (20,000) | (54) |

| 9/17/05 @ $80.00 * | (60,000) | (276) |

| Gilead Sciences | ||

| Call, 8/20/05 @ $40.00 * | (150,000) | (720) |

| Put | ||

| 1/21/06 @ $45.00 * | (50,000) | (200) |

| 1/21/06 @ 47.50 * | (30,000) | (162) |

| 11/19/05 @ $42.50 * | (35,000) | (83) |

| 8/20/05 @ $40.00 * | (50,000) | (32) |

| 8/20/05 @ $45.00 * | (85,000) | (200) |

| Guidant, Put, 1/21/06 @ $70.00 * | (25,000) | (127) |

| HCA | ||

| Put | ||

| 1/21/06 @ $50.00 * | (50,000) | (73) |

| 1/21/06 @ $55.00 * | (75,000) | (212) |

| 1/21/06 @ $60.00 * | (30,000) | (156) |

| 1/21/06 @ $65.00 * | (25,000) | (221) |

| ICOS, Put, 1/21/06 @ $30.00 * | (29,700) | (264) |

| ImClone Systems | ||

| Call | ||

| 1/21/06 @ $45.00 * | (75,000) | (103) |

| 1/21/06 @ $50.00 * | (100,000) | (88) |

| 11/19/05 @ $40.00 * | (100,000) | (140) |

| 8/20/05 @ $40.00 * | (75,000) | (30) |

| Put | ||

| 1/21/06 @ $30.00 * | (35,000) | (136) |

| 1/21/06 @ $35.00 * | (25,000) | (170) |

| Immucor, Call, 9/17/05 @ $35.00 * | (50,000) | (36) |

| Inspire Pharmaceuticals, Call, 12/17/05 @ $12.50 * | (50,000) | (63) |

| Invitrogen, Put, 1/21/06 @ $75.00 * | (30,000) | (76) |

| Kinetic Concepts | ||

| Call | ||

| 9/17/05 @ $65.00 * | (125,000) | (197) |

| 9/17/05 @ $70.00 * | (30,000) | (16) |

| Martek Biosciences | ||

| Call | ||

| 9/17/05 @ $45.00 * | (50,000) | (59) |

| 9/17/05 @ $50.00 * | (25,000) | (14) |

| Put, 12/17/05 @ $30.00 * | (60,000) | (91) |

| Medicines Company | ||

| Call | ||

| 1/21/06 @ $25.00 * | (100,000) | (225) |

| 10/15/05 @ $25.00 * | (175,000) | (232) |

| 10/22/05 @ $22.50 * | (100,000) | (247) |

| Medtronic, Put, 1/21/06 @ $55.00 * | (25,000) | (108) |

| Merck, Put, 1/26/06 @ $30.00 * | (40,000) | (74) |

| MGI Pharma, Put, 1/21/06 @ $20.00 * | (25,000) | (53) |

| Neurocrine Biosciences, Call, 11/19/05 @ $50.00 * | (50,000) | (64) |

| Omnicare, Put, 1/21/06 @ $45.00 * | (35,000) | (156) |

| ONYX Pharmaceuticals | ||

| Call, 1/21/06 @ $45.00 * | (25,000) | (6) |

| Put, 1/21/06 @ $25.00 * | (50,000) | (205) |

| OSI Pharmaceuticals | ||

| Call | ||

| 1/21/06 @ $50.00 * | (25,000) | (73) |

| 1/21/06 @ $55.00 * | (50,000) | (95) |

| 10/22/05 @ $50.00 * | (50,000) | (72) |

| 7/16/05 @ $45.00 * | (50,000) | (21) |

| Put | ||

| 1/21/06 @ $40.00 * | (25,000) | (121) |

| 7/16/05 @ $50.00 * | (40,000) | (362) |

| Patterson Companies, Put, 1/21/06 @ $50.00 * | (25,000) | (137) |

| Pfizer | ||

| Call, 1/21/06 @ $30.00 * | (100,000) | (77) |

| Put, 9/17/05 @ $27.50 * | (75,000) | (75) |

| Pharmaceutical Holdings Trust, Put, 1/21/06 @ $80.00 * | (25,000) | (176) |

| ResMed, Put, 10/22/05 @ $65.00 * | (40,000) | (100) |

| Respironics, Put, 10/22/05 @ $32.50 * | (70,000) | (7) |

| Sepracor | ||

| Call | ||

| 1/21/06 @ $70.00 * | (75,000) | (191) |

| 10/22/05 @ $70.00 * | (75,000) | (94) |

| Put | ||

| 1/21/06 @ $65.00 * | (80,000) | (656) |

| 10/22/05 @ $60.00 * | (25,000) | (106) |

| 7/16/05 @ $65.00 * | (25,000) | (134) |

| Shire Pharmaceuticals | ||

| Call, 10/22/05 @ $37.50 * | (50,000) | (26) |

| Put | ||

| 1/21/06 @ $40.00 * | (55,000) | (410) |

| 7/16/05 @ $40.00 * | (14,700) | (107) |

| St. Jude Medical | ||

| Call, 7/16/05 @ $40.00 * | (45,000) | (167) |

| Put | ||

| 1/21/06 @ $40.00 * | (30,000) | (50) |

| 1/21/06 @ $45.00 * | (60,000) | (222) |

| 7/16/05 @ $40.00 * | (29,900) | (3) |

| Stryker | ||

| Call, 1/21/06 @ $52.50 * | (73,800) | (100) |

| Put | ||

| 1/21/06 @ $50.00 * | (30,000) | (120) |

| 1/21/06 @ $55.00 * | (30,000) | (226) |

| Triad Hospitals | ||

| Put | ||

| 1/21/06 @ $50.00 * | (25,000) | (50) |

| 1/21/06 @ $55.00 * | (25,000) | (96) |

| 1/21/06 @ $60.00 * | (25,000) | (171) |

| United Therapeutics, Call, 8/20/05 @ $55.00 * | (25,000) | (13) |

| UnitedHealth Group, Put, 1/21/06 @ $50.00 * | (50,000) | (119) |

| WellChoice, Put, 10/22/05 @ $65.00 * | (10,000) | (18) |

| Wyeth | ||

| Call | ||

| 1/21/06 @ $45.00 * | (150,000) | (383) |

| 1/21/06 @ $50.00 * | (100,000) | (75) |

| 7/16/05 @ $40.00 * | (75,000) | (341) |

| Zimmer Holdings, Put, 1/21/06 @ $80.00 * | (10,000) | (69) |

| Total Options Written (Cost $(26,907)) | (22,305) |

| SHORT-TERM INVESTMENTS 0.1% | ||

| Money Market Fund 0.1% | ||

| T. Rowe Price Reserve Investment Fund, 3.14% #† | 1,660,847 | 1,661 |

| Total Short-Term Investments (Cost $1,661) | 1,661 | |

| Total Investments in Securities | ||

| 100.1% of Net Assets (Cost $1,009,983) | $ | 1,253,751 |

| (1) | Denominated in U.S. dollars unless other- |

| wise noted | |

| # | Seven-day yield |

| * | Non-income producing |

| ∞ | The identity of certain securities has been |

| concealed to protect the fund while it com- | |

| pletes a purchase or selling program for | |

| the securities | |

| ^ | All or a portion of this security is pledged to |

| cover written call options at June 30, 2005 | |

| ADR | American Depository Receipts |

| CHF | Swiss franc |

| DKK | Danish krone |

| EUR | Euro |

| JPY | Japanese yen |

| REIT | Real Estate Investment Trust |

| †Affiliated Companies | ||||||||||

| ($ 000s) | ||||||||||

| The fund may invest in certain securities that are considered affiliated companies. As defined | ||||||||||

| by the 1940 Act, an affiliated company is one in which the fund owns 5% or more of the | ||||||||||

| outstanding voting securities, or a company which is under common ownership or control. | ||||||||||

| Purchase | Sales | Investment | Value | |||||||

| Affiliate | Cost | Cost | Income | 6/30/05 | 12/31/04 | |||||

| Endologix | $ | - | $ | - | $ | - | $ | * | $ | 2,561 |

| Fischer Imaging | - | - | - | 1,180 | 2,301 | |||||

| T. Rowe Price Reserve | ||||||||||

| Investment Fund, | ||||||||||

| 3.14% | ¤ | ¤ | 81 | 1,661 | 15,453 | |||||

| Totals | $ | 81 | $ | 2,841 | $ | 20,315 | ||||

| * The issuer was not considered an affiliated company at June 30, 2005. | ||||||||||

| ¤ Purchase and sale information not shown for cash management funds. | ||||||||||

The accompanying notes are an integral part of these financial statements.

| ‡Restricted Securities | |||

| Amounts in (000s) | |||

| The fund may invest in securities that cannot be offered for public resale without first being | |||

| registered under the Securities Act of 1933 and related rules. The total value of restricted securities | |||

| (excluding 144A issues) at period-end amounts to $7,003 and represents 0.6% of net assets. | |||

| Acquisition | Acquisition | ||

| Description | Date | Cost | |

| Alexza Molecular Delivery, Series D | 12/23/04 | $ | 2,000 |

| Control Delivery Systems, Series A | 8/9/00 | 2,000 | |

| Chorus Pharma | 4/21/04 | 2,000 | |

| Fibrogen, Series F | 12/30/04 | 3,000 | |

| Myogen, Warrants, 9/29/09 | 9/29/04 | 3 | |

| NeoRX, Series B | 12/5/03 | 450 | |

| NeoRX, Warrants, 12/31/08 | 12/5/03 | 0 | |

| Seattle Genetics, Warrants, 12/31/11 | 7/8/03 | 0 | |

| Totals | $ | 9,453 | |

| The fund has registration rights for certain restricted securities held as of June 30, 2005. Any costs | |||

| related to such registration are borne by the issuer. | |||

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF ASSETS AND LIABILITIES | ||

| (In thousands except shares and per share amounts) | ||

| Assets | ||

| Investments in securities, at value | ||

| Affiliated companies (cost $8,555) | $ | 2,841 |

| Non-affiliated companies (cost $1,001,428) | 1,250,910 | |

| Total investments in securities | 1,253,751 | |

| Dividends and interest receivable | 64 | |

| Receivable for investment securities sold | 12,518 | |

| Receivable for shares sold | 1,299 | |

| Other assets | 43 | |

| Total assets | 1,267,675 | |

| Liabilities | ||

| Investment management fees payable | 673 | |

| Payable for investment securities purchased | 12,105 | |

| Payable for shares redeemed | 1,511 | |

| Due to affiliates | 183 | |

| Other liabilities | 205 | |

| Total liabilities | 14,677 | |

| NET ASSETS | $ | 1,252,998 |

| Net Assets Consist of: | ||

| Undistributed net investment income (loss) | $ | (3,706) |

| Undistributed net realized gain (loss) | 14,325 | |

| Net unrealized gain (loss) | 243,767 | |

| Paid-in-capital applicable to 55,684,637 shares of | ||

| $0.0001 par value capital stock outstanding; | ||

| 1,000,000,000 shares authorized | 998,612 | |

| NET ASSETS | $ | 1,252,998 |

| NET ASSET VALUE PER SHARE | $ | 22.50 |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF OPERATIONS | ||

| ($ 000s) | ||

| 6 Months | ||

| Ended | ||

| 6/30/05 | ||

| Investment Income (Loss) | ||

| Income | ||

| Dividend | $ | 1,731 |

| Interest | 277 | |

| Total income | 2,008 | |

| Expenses | ||

| Investment management | 4,043 | |

| Shareholder servicing | 1,403 | |

| Custody and accounting | 122 | |

| Prospectus and shareholder reports | 98 | |

| Proxy and annual meeting | 20 | |

| Registration | 12 | |

| Legal and audit | 9 | |

| Directors | 5 | |

| Miscellaneous | 2 | |

| Total expenses | 5,714 | |

| Net investment income (loss) | (3,706) | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) | ||

| Securities | 8,305 | |

| Written options | 6,550 | |

| Foreign currency transactions | (31) | |

| Net realized gain (loss) | 14,824 | |

| Change in net unrealized gain (loss) | ||

| Securities | (58,017) | |

| Written options | 9,818 | |

| Other assets and liabilities | ||

| denominated in foreign currencies | (2) | |

| Change in net unrealized gain (loss) | (48,201) | |

| Net realized and unrealized gain (loss) | (33,377) | |

| INCREASE (DECREASE) IN NET | ||

| ASSETS FROM OPERATIONS | $ | (37,083) |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF CHANGES IN NET ASSETS | ||||

| ($ 000s) | ||||

| 6 Months | Year | |||

| Ended | Ended | |||

| 6/30/05 | 12/31/04 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | (3,706) | $ | (7,069) |

| Net realized gain (loss) | 14,824 | 86,615 | ||

| Change in net unrealized gain (loss) | (48,201) | 88,220 | ||

| Increase (decrease) in net assets from operations | (37,083) | 167,766 | ||

| Capital share transactions * | ||||

| Shares sold | 114,609 | 381,311 | ||

| Shares redeemed | (153,919) | (247,053) | ||

| Increase (decrease) in net assets from capital | ||||

| share transactions | (39,310) | 134,258 | ||

| Net Assets | ||||

| Increase (decrease) during period | (76,393) | 302,024 | ||

| Beginning of period | 1,329,391 | 1,027,367 | ||

| End of period | $ | 1,252,998 | $ | 1,329,391 |

| (Including undistributed net investment income (loss) of | ||||

| $(3,706) at 6/30/05 and $0 at 12/31/04) | ||||

| *Share information | ||||

| Shares sold | 5,250 | 17,677 | ||

| Shares redeemed | (7,085) | (11,654) | ||

| Increase (decrease) in shares outstanding | (1,835) | 6,023 | ||

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

T. Rowe Price Health Sciences, Inc. (the fund) is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on December 29, 1995. The fund seeks long-term capital appreciation.

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund receives upon sale of the securities.

Valuation The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Equity securities listed or regularly traded on a securities exchange or in the over-the-counter market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Debt securities are generally traded in the over-the-counter market. Securities with original maturities of one year or more are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with original maturities of less than one year are valued at amortized cost in local currency, which approximates fair value when combined with accrued interest.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Purchased and written options are valued at the mean of the closing bid and asked prices.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Most foreign markets close before the close of trading on the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, which in turn will affect the fund’s share price, the fund will adjust the previous closing prices to reflect the fair value of the securities as of the close of the NYSE, as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. In deciding whether to make fair value adjustments, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U. S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with closing market prices and information used for adjusting those prices. The fund cannot predict when and how often it will use closing prices and when it will adjust those prices to reflect fair value. As a means of evaluating its fair value process, the fund routinely compares closing market prices, the next day’s opening prices in the same markets, and adjusted prices.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are included in realized gain on securities in the accompanying financial statements and totaled $54,000 for the six months ended June 30, 2005.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid on an annual basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

NOTE 2 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Although certain of these securities may be readily sold, for example, under Rule 144A, others may be illiquid, their sale may involve substantial delays and additional costs, and prompt sale at an acceptable price may be difficult.

Options Call and put options give the holder the right to purchase or sell, respectively, a security at a specified price on a certain date. Risks arise from possible illiquidity of the options market and from movements in security values. Options are reflected in the accompanying Portfolio of Investments at market value. Transactions in options written and related premiums received during the six months ended June 30, 2005, were as follows:

| Number of | ||

| Contracts | Premiums | |

| Outstanding at beginning of period | 69,000 | $ 20,972,000 |

| Written | 130,000 | 44,135,000 |

| Exercised | (7,000) | (4,773,000) |

| Expired | (2,000) | (282,000) |

| Closed | (123,000) | (33,145,000) |

| Outstanding at end of period | 67,000 | $ 26,907,000 |

Other Purchases and sales of portfolio securities, other than short-term securities, aggregated $350,478,000 and $356,141,000, respectively, for the six months ended June 30, 2005.

NOTE 3 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Federal income tax regulations differ from generally accepted accounting principles; therefore, distributions determined in accordance with tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of June 30, 2005.

At June 30, 2005, the cost of investments for federal income tax purposes was $1,009,983,000. Net unrealized gain aggregated $243,767,000 at period-end, of which $347,722,000 related to appreciated investments and $103,955,000 related to depreciated investments.

NOTE 4 - FOREIGN TAXES

Gains realized upon disposition of certain Indian securities held by the fund are subject to capital gains tax in India, payable prior to repatriation of sale proceeds. The tax is computed on net realized gains, and realized losses in excess of gains may be carried forward eight years to offset future gains. In addition, the fund accrues a deferred tax liability for net unrealized gains on Indian securities when applicable. At June 30, 2005, the fund had no deferred tax liability.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.35% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.29% for assets in excess of $160 billion. Prior to May 1, 2005, the maximum group fee rate in the graduated fee schedule had been 0.295% for assets in excess of $120 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At June 3 0, 2005, the effective annual group fee rate was 0.31%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and maintains the financial records of the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the six months ended June 30, 2005, expenses incurred pursuant to these service agreements were $52,000 for Price Associates, $796,000 for T. Rowe Price Services, Inc., and $88,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period end pursuant to these service agreements is reflected as due to affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the six months ended June 30, 2005, the fund was charged $20,000 for shareholder servicing costs related to the college savings plans, of which $16,000 was for services provided by Price. The amount payable at period end pursuant to this agreement is included in due to affiliates in the accompanying financial statements. At June 30, 2005, approximately 0.8% of the outstanding shares of the fund were held by college savings plans.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the Reserve Funds), open-end management investment companies managed by Price Associates and affiliates of the fund. The Reserve Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates, and are not available for direct purchase by members of the public. The Reserve Funds pay no investment management fees.

As of June 30, 2005, T. Rowe Price Group, Inc. and/or its wholly owned subsidiaries owned 238,145 shares of the fund, representing less than 1% of the fund’s net assets.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 2, 2005, the fund’s Board of Directors unanimously approved the investment advisory contract (“Contract”) between the fund and its investment manager, T. Rowe Price Associates, Inc. (“Manager”). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Manager during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Manager. These services included, but were not limited to, management of the fund’s portfolio and a variety of activities related to portfolio management. The Board also reviewed the background and experience of the Manager’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Manager.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total return over the 1-, 3- and 5- year periods as well as the fund’s year-by-year returns and compared these returns to previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Manager under the Contract and other benefits that the Manager (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements. The Board also received information on the estimated costs incurred and profits realized by the Manager and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Manager’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Manager. Under the Contract, the fund pays a fee to the Manager composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels, and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that an additional breakpoint should be added to the group fee component of the fees paid by the fund under the Contract at a level of $160 billion. The Board further concluded that, with this change, the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio and compared them to fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate was above the median for certain groups of comparable funds but below the median for other groups of comparable funds. The information also indicated that the fund’s expense ratio was generally below the median for comparable funds. The Board also reviewed the fee schedules for comparable privately managed accounts of the Manager and its affiliates. Management informed the Board that the Manager’s responsibilities for privately managed accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract as amended to add an additional breakpoint to the group fee rate. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| SIGNATURES | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the | |

| undersigned, thereunto duly authorized. | |

| T. Rowe Price Health Sciences Fund, Inc. | |

| By | /s/ James S. Riepe |

| James S. Riepe | |

| Principal Executive Officer | |

| Date | August 18, 2005 |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, this report has been signed below by the following persons on behalf of | |

| the registrant and in the capacities and on the dates indicated. | |

| By | /s/ James S. Riepe |

| James S. Riepe | |

| Principal Executive Officer | |

| Date | August 18, 2005 |

| By | /s/ Joseph A. Carrier |

| Joseph A. Carrier | |

| Principal Financial Officer | |

| Date | August 18, 2005 |