UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07391

AB UNCONSTRAINED BOND FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2018

Date of reporting period: April 30, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

APR 04.30.18

SEMI-ANNUAL REPORT

AB UNCONSTRAINED BOND FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We are pleased to provide this report for AB Unconstrained Bond Fund (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

As always, AB strives to keep clients ahead of what’s next by:

| + | | Transforming uncommon insights into uncommon knowledge with a global research scope |

| + | | Navigating markets with seasoned investment experience and sophisticated solutions |

| + | | Providing thoughtful investment insights and actionable ideas |

Whether you’re an individual investor or a multi-billion-dollar institution, we put knowledge and experience to work for you.

AB’s global research organization connects and collaborates across platforms and teams to deliver impactful insights and innovative products. Better insights lead to better opportunities—anywhere in the world.

For additional information about AB’s range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in the AB Mutual Funds.

Sincerely,

Robert M. Keith

President and Chief Executive Officer, AB Mutual Funds

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 1 |

SEMI-ANNUAL REPORT

June 8, 2018

This report provides management’s discussion of fund performance for AB Unconstrained Bond Fund for the semi-annual reporting period ended April 30, 2018.

The Fund’s investment objective is to generate current income consistent with preservation of capital.

NAV RETURNS AS OF APRIL 30, 2018 (unaudited)

| | | | | | | | |

| | | 6 Months | | | 12 Months | |

| AB UNCONSTRAINED BOND FUND1 | | | | | | | | |

| Class A Shares | | | -0.27% | | | | 0.22% | |

| Class B Shares2 | | | -0.54% | | | | -0.57% | |

| Class C Shares | | | -0.64% | | | | -0.54% | |

| Advisor Class Shares3 | | | -0.04% | | | | 0.47% | |

| Class R Shares3 | | | -0.37% | | | | -0.11% | |

| Class K Shares3 | | | -0.22% | | | | 0.10% | |

| Class I Shares3 | | | -0.13% | | | | 0.41% | |

| Class Z Shares3 | | | -0.13% | | | | 0.41% | |

| Primary benchmark: ICE BofA ML 3-Month US T-Bill Index | | | 0.68% | | | | 1.17% | |

Bloomberg Barclays Global Aggregate Bond Index

(USD hedged) | | | -0.11% | | | | 1.39% | |

| 1 | Includes the impact of proceeds received and credited to the Fund resulting from class-action settlements, which enhanced the performance of the Fund for the six- and 12-month periods ended April 30, 2018, by 0.02% and 0.02%, respectively. |

| 2 | Effective January 31, 2009, Class B shares are no longer available for purchase to new investors. Please see Note A for more information. |

| 3 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared with its primary benchmark, the Intercontinental Exchange Bank of America Merrill Lynch (“ICE BofA ML”) 3-Month US Treasury Bill (“T-Bill”) Index, and the Bloomberg Barclays Global Aggregate Bond Index (USD hedged) for the six- and 12-month periods ended April 30, 2018.

During the six-month period, all share classes of the Fund underperformed the primary benchmark, before sales charges. Country allocation (a result of bottom-up security analysis combined with fundamental research) and

| | |

| 2 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

yield-curve positioning detracted from relative performance, primarily because of the Fund’s positioning in the US and Canada. Currency allocation was also negative. Losses from short positions in the euro and South African rand more than offset gains from long positions in the Czech koruna and Polish zloty. Sector and security selection contributed to performance, as a result of beneficial positioning in high-yield corporates, non-agency mortgages, inflation-linked securities and agency credit risk-sharing transactions. However, a lack of exposure to equities and a position in sovereign bonds detracted.

During the 12-month period, all share classes of the Fund underperformed the primary benchmark, before sales charges. Country and yield-curve positioning detracted from returns, due to positions in the US, Canada and the eurozone. Currency investments were also negative, as gains from long positions in the Czech koruna and Polish zloty were outweighed by losses from short positions in the euro, South African rand and British pound. Sector and security selection contributed due to positions in high-yield corporates, non-agency mortgages and agency credit risk-sharing transactions. The absence of equities exposure detracted, as did a position in sovereign bonds.

During both periods, the Fund utilized derivatives in the form of interest rate swaps, futures and interest rate swaptions to manage and hedge duration risk and/or take active yield-curve positioning. The Fund also utilized currency forwards and currency options, both written and purchased, to hedge foreign currency exposure and to take active currency risk. Purchased and written equity options were used in an effort to add alpha (a measure of how the Fund is performing on a risk-adjusted basis versus its benchmark) through different strategies, including but not limited to, relative value, put spreads and call spreads. Credit default swaps, both single name and index, were used to manage and hedge investment-grade and high-yield credit risk taken through cash bonds. Total return swaps and variance swaps were used to take active risk and as hedging tools against other active equity-like risks in the Fund.

MARKET REVIEW AND INVESTMENT STRATEGY

Fixed-income markets were volatile during the six-month period. Emerging-market debt had mixed returns, with some segments of the market helped by increasing oil prices and an improving global growth story, while the rise in global rates weighed on others. Investment-grade credit and high-yield markets fell in the period, trailing the positive returns of emerging-market local-currency government bonds and developed-market treasuries. US, Canadian, Australian and German treasury yields rose, while the UK and Japanese curves flattened and treasury yields in other developed markets moved in different directions. The passage of US tax reform buoyed market sentiment, while in Europe, despite some formal progress on Brexit, investor anxiety increased around a bifurcated outlook

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 3 |

for the negotiation process. The US Federal Reserve (the “Fed”) raised interest rates twice in the period, and began to formally reduce its balance sheet, as universally anticipated by markets. The European Central Bank confirmed that its newly reduced pace of asset purchases would continue through September 2018, and further if necessary. At the end of the period, a severe spike in volatility shook a broad swath of capital markets. US Treasury yields rose dramatically, driven by higher inflation forecasts and expectations for continued rate increases from the Fed. Additionally, President Trump’s announcement of tariffs on Chinese imports weighed on capital markets worldwide, as investors feared the possible onset of a global trade war.

The Fund’s Senior Investment Management Team (the “Team”) continues to seek to generate attractive total returns while preserving capital by investing across a broad range of global fixed-income sectors. The Team’s approach is an alternative to traditional “core” fixed income that is unconstrained in its investable universe, flexible to allow for dynamic asset allocation, but well-defined in its structure.

INVESTMENT POLICIES

The Fund invests, under normal circumstances, at least 80% of its net assets in fixed-income securities and derivatives related to fixed-income securities. The Fund employs a dynamic risk allocation, meaning that the Fund’s risk profile may vary significantly over time based upon market conditions. The Fund invests in a portfolio that includes fixed-income securities of US and non-US companies and US and non-US government securities and supranational entities, including lower-rated securities.

The Fund may invest in debt securities with a range of maturities from short- to long-term. The Fund expects that its average portfolio duration will vary normally from negative three years to positive seven years, depending upon the Adviser’s forecast of interest rates and assessment of market risks generally. Duration is a measure of a fixed-income security’s sensitivity to changes in interest rates. The value of a fixed-income security with positive duration will decline if interest rates increase. Conversely, the value of a fixed-income security with negative duration will increase as interest rates increase. The Fund will seek to achieve negative duration through the use of derivatives, such as futures and total return swaps.

The Fund typically maintains at least 50% of its net assets in investment-grade securities. The Fund may invest up to 50% of its net assets in below investment-grade securities, such as corporate high-yield fixed-income securities, sovereign debt obligations and

| | |

| 4 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

(continued on next page)

fixed-income securities of issuers located in emerging markets.

The Fund may also invest in mortgage-related and other asset-backed securities, loan participations, inflation-indexed securities, structured securities, variable, floating, and inverse floating-rate instruments and preferred stock, and may use other investment techniques. The Fund may make short sales of securities or currencies or maintain a short position. The Fund may use borrowings or other leverage for investment purposes. The Fund intends, among other things, to enter into transactions such as reverse repurchase agreements and dollar rolls. The Fund may utilize, without limit, derivatives, such as options, futures contracts, forwards or swaps, including those on fixed-income and equity securities and foreign currencies.

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 5 |

DISCLOSURES AND RISKS

Benchmark Disclosure

The ICE BofA ML® 3-Month US T-Bill Index and the Bloomberg Barclays Global Aggregate Bond Index (USD hedged) are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The ICE BofA ML 3-Month US T-Bill Index measures the performance of Treasury securities maturing in 90 days. The Bloomberg Barclays Global Aggregate Bond Index represents the performance of the global investment-grade developed fixed-income markets. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Interest Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. The Fund may be subject to heightened interest rate risk due to rising rates as the current period of historically low interest rates may be ending. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Below Investment Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments, negative perceptions of the junk bond market generally and less secondary market liquidity.

Duration Risk: Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of a fixed-income security may be shorter than or equal to the full maturity of

| | |

| 6 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise. For example, a fixed-income security with a duration of three years will decrease in value by approximately 3% if interest rates increase by 1%.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater if the Fund invests a significant portion of its assets in fixed-income securities with longer maturities.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be less liquid due to adverse market, economic, political, regulatory or other factors.

Emerging-Market Risk: Investments in emerging-market countries may have more risk because the markets are less developed and less liquid, and because these investments may be subject to increased economic, political, regulatory or other uncertainties.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Leverage Risk: To the extent the Fund uses leveraging techniques, its net asset value (“NAV”) may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Mortgage-Related and/or Other Asset-Backed Securities Risk: Investments in mortgage-related and other asset-backed securities are subject to certain additional risks. The value of these securities may be particularly sensitive to changes in interest rates. These risks include “extension risk”, which is the risk that, in periods of rising interest rates, issuers may delay the payment of principal, and “prepayment risk”, which is the risk that in periods of falling interest rates, issuers may pay principal sooner than expected, exposing the Fund to a lower rate of return upon reinvestment of principal. Mortgage-backed securities offered by non-governmental issuers and other asset-backed securities may be subject to other risks, such as higher rates of default in the mortgages or assets backing the securities or risks associated with the nature and servicing of mortgages or assets backing the securities.

Derivatives Risk: Derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 7 |

DISCLOSURES AND RISKS (continued)

Fund, and may be subject to counterparty risk to a greater degree than more traditional investments.

Liquidity Risk: Liquidity risk occurs when certain investments become difficult to purchase or sell. Difficulty in selling less liquid securities may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of liquidity risk may include low trading volumes, large positions and heavy redemptions of Fund shares. Over recent years liquidity risk has also increased because the capacity of dealers in the secondary market for fixed-income securities to make markets in these securities has decreased, even as the overall bond market has grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories. Liquidity risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares; the applicable contingent deferred sales charge for Class B shares (4% year 1, 3% year 2, 2% year 3, 1% year 4) and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| 8 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF APRIL 30, 2018 (unaudited)

| | | | | | | | | | | | |

| | | NAV Returns | | | SEC Returns

(reflects applicable

sales charges) | | | SEC

Yields1 | |

| CLASS A SHARES | | | | | | | | | | | 2.55% | |

| 1 Year | | | 0.22% | | | | -4.07% | | | | | |

| 5 Years | | | 1.48% | | | | 0.61% | | | | | |

| 10 Years | | | 2.89% | | | | 2.45% | | | | | |

| CLASS B SHARES | | | | | | | | | | | 1.89% | |

| 1 Year | | | -0.57% | | | | -4.51% | | | | | |

| 5 Years | | | 0.76% | | | | 0.76% | | | | | |

| 10 Years2 | | | 2.33% | | | | 2.33% | | | | | |

| CLASS C SHARES | | | | | | | | | | | 1.92% | |

| 1 Year | | | -0.54% | | | | -1.52% | | | | | |

| 5 Years | | | 0.76% | | | | 0.76% | | | | | |

| 10 Years | | | 2.17% | | | | 2.17% | | | | | |

| ADVISOR CLASS SHARES3 | | | | | | | | | | | 2.90% | |

| 1 Year | | | 0.47% | | | | 0.47% | | | | | |

| 5 Years | | | 1.76% | | | | 1.76% | | | | | |

| 10 Years | | | 3.18% | | | | 3.18% | | | | | |

| CLASS R SHARES3 | | | | | | | | | | | 2.21% | |

| 1 Year | | | -0.11% | | | | -0.11% | | | | | |

| 5 Years | | | 1.26% | | | | 1.26% | | | | | |

| 10 Years | | | 2.68% | | | | 2.68% | | | | | |

| CLASS K SHARES3 | | | | | | | | | | | 2.52% | |

| 1 Year | | | 0.10% | | | | 0.10% | | | | | |

| 5 Years | | | 1.49% | | | | 1.49% | | | | | |

| 10 Years | | | 2.96% | | | | 2.96% | | | | | |

| CLASS I SHARES3 | | | | | | | | | | | 2.97% | |

| 1 Year | | | 0.41% | | | | 0.41% | | | | | |

| 5 Years | | | 1.76% | | | | 1.76% | | | | | |

| 10 Years | | | 3.20% | | | | 3.20% | | | | | |

| CLASS Z SHARES3 | | | | | | | | | | | 2.97% | |

| 1 Year | | | 0.41% | | | | 0.41% | | | | | |

| Since Inception4 | | | 2.63% | | | | 2.63% | | | | | |

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 1.10%, 1.88%, 1.85%, 0.85%, 1.54%, 1.22%, 0.82% and 0.82% for Class A, Class B, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Fund’s annual operating expenses (exclusive of interest expense) to 0.90%, 1.65%, 1.65%, 0.65%, 1.15%, 0.90%, 0.65% and 0.65% for Class A, Class B, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively. These

(footnotes continued on next page)

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 9 |

HISTORICAL PERFORMANCE (continued)

waivers/reimbursements may not be terminated before January 31, 2019 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights sections since they are based on different time periods.

| 1 | SEC yields are calculated based on SEC guidelines for the 30-day period ended April 30, 2018. |

| 2 | Assumes conversion of Class B shares into Class A shares after eight years. |

| 3 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 4 | Inception date: 11/4/2014. |

| | |

| 10 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

MARCH 31, 2018 (unaudited)

| | | | |

| | | SEC Returns

(reflects applicable

sales charges) | |

| CLASS A SHARES | | | | |

| 1 Year | | | -3.66% | |

| 5 Years | | | 0.73% | |

| 10 Years | | | 2.49% | |

| CLASS B SHARES | | | | |

| 1 Year | | | -4.17% | |

| 5 Years | | | 0.87% | |

| 10 Years1 | | | 2.37% | |

| CLASS C SHARES | | | | |

| 1 Year | | | -1.17% | |

| 5 Years | | | 0.89% | |

| 10 Years | | | 2.21% | |

| ADVISOR CLASS SHARES2 | | | | |

| 1 Year | | | 0.83% | |

| 5 Years | | | 1.90% | |

| 10 Years | | | 3.22% | |

| CLASS R SHARES2 | | | | |

| 1 Year | | | 0.24% | |

| 5 Years | | | 1.40% | |

| 10 Years | | | 2.72% | |

| CLASS K SHARES2 | | | | |

| 1 Year | | | 0.45% | |

| 5 Years | | | 1.63% | |

| 10 Years | | | 3.01% | |

| CLASS I SHARES2 | | | | |

| 1 Year | | | 0.76% | |

| 5 Years | | | 1.90% | |

| 10 Years | | | 3.24% | |

| CLASS Z SHARES2 | | | | |

| 1 Year | | | 0.76% | |

| Since Inception3 | | | 2.47% | |

| 1 | Assumes conversion of Class B shares into Class A shares after eight years. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 3 | Inception date: 11/4/2014. |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 11 |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| 12 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

EXPENSE EXAMPLE (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

11/1/2017 | | | Ending

Account

Value

4/30/2018 | | | Expenses

Paid

During

Period* | | | Annualized

Expense

Ratio* | | | Total

Expenses

Paid

During

Period+ | | | Total

Annualized

Expense

Ratio+ | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 997.30 | | | $ | 4.41 | | | | 0.89 | % | | $ | 4.46 | | | | 0.90 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.38 | | | $ | 4.46 | | | | 0.89 | % | | $ | 4.51 | | | | 0.90 | % |

| Class B | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 994.60 | | | $ | 8.11 | | | | 1.64 | % | | $ | 8.21 | | | | 1.66 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,016.66 | | | $ | 8.20 | | | | 1.64 | % | | $ | 8.30 | | | | 1.66 | % |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 993.60 | | | $ | 8.11 | | | | 1.64 | % | | $ | 8.21 | | | | 1.66 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,016.66 | | | $ | 8.20 | | | | 1.64 | % | | $ | 8.30 | | | | 1.66 | % |

| Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 999.60 | | | $ | 3.17 | | | | 0.64 | % | | $ | 3.22 | | | | 0.65 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.62 | | | $ | 3.21 | | | | 0.64 | % | | $ | 3.26 | | | | 0.65 | % |

| Class R | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 996.30 | | | $ | 5.64 | | | | 1.14 | % | | $ | 5.69 | | | | 1.15 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.14 | | | $ | 5.71 | | | | 1.14 | % | | $ | 5.76 | | | | 1.15 | % |

| Class K | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 997.80 | | | $ | 4.41 | | | | 0.89 | % | | $ | 4.46 | | | | 0.90 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.38 | | | $ | 4.46 | | | | 0.89 | % | | $ | 4.51 | | | | 0.90 | % |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 998.70 | | | $ | 3.17 | | | | 0.64 | % | | $ | 3.22 | | | | 0.65 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.62 | | | $ | 3.21 | | | | 0.64 | % | | $ | 3.26 | | | | 0.65 | % |

| Class Z | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 998.70 | | | $ | 3.12 | | | | 0.63 | % | | $ | 3.22 | | | | 0.65 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.67 | | | $ | 3.16 | | | | 0.63 | % | | $ | 3.26 | | | | 0.65 | % |

| * | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| + | In connection with the Fund’s investments in affiliated/unaffiliated underlying portfolios, the Fund incurs no direct expenses, but bears proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Fund in an amount equal to the Fund’s pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Fund’s total expenses are equal to the classes’ annualized expense ratio plus the Fund’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 13 |

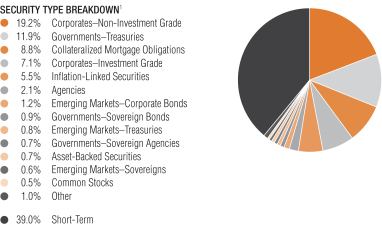

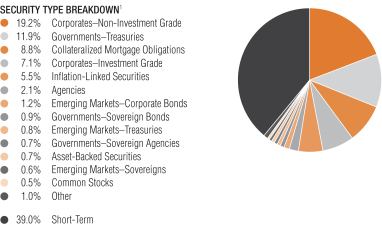

PORTFOLIO SUMMARY

April 30, 2018 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $322.9

| 1 | All data are as of April 30, 2018. The Fund’s sector type breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” security type weightings represent 0.4% or less in the following security types: Bank Loans, Commercial Mortgage-Backed Securities, Local Governments–Regional Bonds, Local Governments–US Municipal Bonds, Options Purchased–Calls, Options Purchased–Puts, Preferred Stocks, Warrants and Whole Loan Trusts. |

| | |

| 14 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

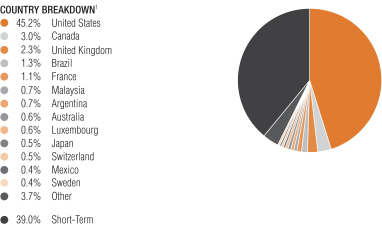

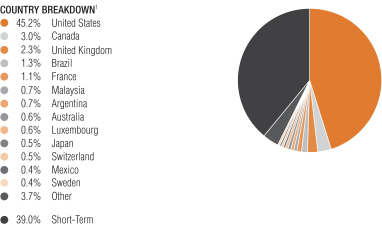

PORTFOLIO SUMMARY (continued)

April 30, 2018 (unaudited)

| 1 | All data are as of April 30, 2018. The Fund’s country breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.4% or less in the following countries or regions: Chile, Costa Rica, Denmark, Dominican Republic, Ecuador, Eurozone, Gabon, Germany, Hungary, Ireland, Israel, Italy, Ivory Coast, Jamaica, Kuwait, Netherlands, Norway, Qatar, South Africa, Spain, Trinidad & Tobago, Uruguay and Zambia. |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 15 |

PORTFOLIO OF INVESTMENTS

April 30, 2018 (unaudited)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CORPORATES – NON-INVESTMENT GRADE – 19.4% | | | | | | | | | | | | |

Industrial – 15.2% | | | | | | | | | | | | |

Basic – 1.5% | |

AK Steel Corp.

7.625%, 10/01/21 | | | U.S.$ | | | | 29 | | | $ | 29,600 | |

Allegheny Technologies, Inc.

5.95%, 1/15/21 | | | | | | | 29 | | | | 29,510 | |

ArcelorMittal

5.50%, 8/05/20 | | | | | | | 150 | | | | 155,736 | |

7.00%, 3/01/41 | | | | | | | 204 | | | | 234,453 | |

7.25%, 10/15/39 | | | | | | | 120 | | | | 141,897 | |

Cleveland-Cliffs, Inc.

5.75%, 3/01/25(a) | | | | | | | 65 | | | | 62,720 | |

Constellium NV

6.625%, 3/01/25(a) | | | | | | | 250 | | | | 254,212 | |

Crown Americas LLC/Crown Americas Capital Corp. VI

4.75%, 2/01/26(a) | | | | | | | 97 | | | | 93,612 | |

Eldorado Gold Corp.

6.125%, 12/15/20(a) | | | | | | | 13 | | | | 12,024 | |

Flex Acquisition Co., Inc.

6.875%, 1/15/25(a) | | | | | | | 16 | | | | 16,108 | |

FMG Resources (August 2006) Pty Ltd.

4.75%, 5/15/22(a) | | | | | | | 49 | | | | 48,651 | |

5.125%, 5/15/24(a) | | | | | | | 127 | | | | 125,915 | |

Foresight Energy LLC/Foresight Energy Finance Corp.

11.50%, 4/01/23(a) | | | | | | | 11 | | | | 9,281 | |

Freeport-McMoRan, Inc.

3.55%, 3/01/22 | | | | | | | 469 | | | | 454,166 | |

Graphic Packaging International LLC

4.75%, 4/15/21 | | | | | | | 60 | | | | 60,908 | |

Grinding Media, Inc./Moly-Cop AltaSteel Ltd.

7.375%, 12/15/23(a) | | | | | | | 94 | | | | 99,184 | |

Hexion, Inc.

6.625%, 4/15/20 | | | | | | | 168 | | | | 157,710 | |

Huntsman International LLC

4.875%, 11/15/20 | | | | | | | 100 | | | | 102,090 | |

Joseph T Ryerson & Son, Inc.

11.00%, 5/15/22(a) | | | | | | | 209 | | | | 231,477 | |

Lecta SA

6.50%, 8/01/23(a) | | | EUR | | | | 104 | | | | 128,536 | |

Momentive Performance Materials, Inc.

3.88%, 10/24/21 | | | U.S.$ | | | | 650 | | | | 686,685 | |

8.875%, 10/15/20(b)(c)(d)(e) | | | | | | | 650 | | | | – 0 | – |

Multi-Color Corp.

4.875%, 11/01/25(a) | | | | | | | 57 | | | | 53,311 | |

| | |

| 16 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

NOVA Chemicals Corp.

5.25%, 8/01/23(a) | | | U.S.$ | | | | 12 | | | $ | 12,036 | |

Novelis Corp.

6.25%, 8/15/24(a) | | | | | | | 50 | | | | 50,993 | |

Nufarm Australia Ltd./Nufarm Americas, Inc.

5.75%, 4/30/26(a) | | | | | | | 67 | | | | 66,715 | |

OCI NV

5.00%, 4/15/23(a) | | | EUR | | | | 100 | | | | 123,121 | |

Peabody Energy Corp.

6.00%, 11/15/18(b)(d)(e)(f) | | | U.S.$ | | | | 396 | | | | – 0 | – |

Plastipak Holdings, Inc.

6.25%, 10/15/25(a) | | | | | | | 86 | | | | 83,594 | |

PQ Corp.

5.75%, 12/15/25(a) | | | | | | | 17 | | | | 16,853 | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Lu

5.125%, 7/15/23(a) | | | | | | | 176 | | | | 176,846 | |

7.00%, 7/15/24(a) | | | | | | | 87 | | | | 90,537 | |

Sealed Air Corp.

6.875%, 7/15/33(a) | | | | | | | 442 | | | | 492,813 | |

Steel Dynamics, Inc.

5.125%, 10/01/21 | | | | | | | 90 | | | | 91,669 | |

Teck Resources Ltd.

5.40%, 2/01/43 | | | | | | | 213 | | | | 204,584 | |

8.50%, 6/01/24(a) | | | | | | | 22 | | | | 24,518 | |

United States Steel Corp.

6.25%, 3/15/26 | | | | | | | 65 | | | | 64,486 | |

W.R. Grace & Co.-Conn

5.125%, 10/01/21(a) | | | | | | | 56 | | | | 57,636 | |

5.625%, 10/01/24(a) | | | | | | | 60 | | | | 62,293 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,806,480 | |

| | | | | | | | | | | | |

Capital Goods – 0.6% | | | | | | | | | | | | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc.

6.75%, 5/15/24(a) | | | EUR | | | | 280 | | | | 368,719 | |

BBA US Holdings, Inc.

5.375%, 5/01/26(a) | | | U.S.$ | | | | 35 | | | | 35,149 | |

Bombardier, Inc.

5.75%, 3/15/22(a) | | | | | | | 447 | | | | 448,722 | |

6.00%, 10/15/22(a) | | | | | | | 59 | | | | 58,897 | |

6.125%, 1/15/23(a) | | | | | | | 11 | | | | 11,073 | |

8.75%, 12/01/21(a) | | | | | | | 24 | | | | 26,655 | |

Cleaver-Brooks, Inc.

7.875%, 3/01/23(a) | | | | | | | 32 | | | | 33,233 | |

Gates Global LLC/Gates Global Co.

6.00%, 7/15/22(a) | | | | | | | 20 | | | | 20,251 | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 17 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

GFL Environmental, Inc.

5.375%, 3/01/23(a) | | | U.S.$ | | | | 120 | | | $ | 118,852 | |

5.625%, 5/01/22(a) | | | | | | | 22 | | | | 22,018 | |

9.875%, 2/01/21(a) | | | | | | | 86 | | | | 90,506 | |

Jeld-Wen, Inc.

4.625%, 12/15/25(a) | | | | | | | 13 | | | | 12,502 | |

4.875%, 12/15/27(a) | | | | | | | 17 | | | | 16,112 | |

RBS Global, Inc./Rexnord LLC

4.875%, 12/15/25(a) | | | | | | | 132 | | | | 127,798 | |

TransDigm, Inc.

6.00%, 7/15/22 | | | | | | | 234 | | | | 237,600 | |

6.50%, 7/15/24 | | | | | | | 67 | | | | 68,209 | |

Triumph Group, Inc.

5.25%, 6/01/22 | | | | | | | 20 | | | | 19,395 | |

Waste Pro USA, Inc.

5.50%, 2/15/26(a) | | | | | | | 91 | | | | 90,075 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,805,766 | |

| | | | | | | | | | | | |

Communications - Media – 2.2% | | | | | | | | | | | | |

Altice Financing SA

6.625%, 2/15/23(a) | | | | | | | 420 | | | | 419,711 | |

Altice France SA/France

6.00%, 5/15/22(a) | | | | | | | 200 | | | | 197,959 | |

7.375%, 5/01/26(a) | | | | | | | 450 | | | | 436,910 | |

Altice Luxembourg SA

7.75%, 5/15/22(a) | | | | | | | 240 | | | | 229,564 | |

Altice US Finance I Corp.

5.375%, 7/15/23(a) | | | | | | | 200 | | | | 201,005 | |

AMC Networks, Inc.

5.00%, 4/01/24 | | | | | | | 21 | | | | 20,525 | |

CCO Holdings LLC/CCO Holdings Capital Corp.

4.00%, 3/01/23(a) | | | | | | | 218 | | | | 209,848 | |

5.00%, 2/01/28(a) | | | | | | | 285 | | | | 262,282 | |

5.125%, 2/15/23 | | | | | | | 244 | | | | 244,905 | |

5.75%, 2/15/26(a) | | | | | | | 24 | | | | 23,794 | |

5.875%, 5/01/27(a) | | | | | | | 91 | | | | 89,378 | |

Cequel Communications Holdings I LLC/Cequel Capital Corp.

7.75%, 7/15/25(a) | | | | | | | 204 | | | | 214,874 | |

Clear Channel Worldwide Holdings, Inc.

Series A

6.50%, 11/15/22 | | | | | | | 41 | | | | 41,896 | |

Series B

6.50%, 11/15/22 | | | | | | | 353 | | | | 360,920 | |

7.625%, 3/15/20 | | | | | | | 34 | | | | 34,086 | |

CSC Holdings LLC

5.25%, 6/01/24 | | | | | | | 195 | | | | 182,660 | |

5.375%, 2/01/28(a) | | | | | | | 298 | | | | 278,902 | |

| | |

| 18 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

6.75%, 11/15/21 | | | U.S.$ | | | | 116 | | | $ | 122,095 | |

10.875%, 10/15/25(a) | | | | | | | 173 | | | | 202,868 | |

DISH DBS Corp.

5.875%, 7/15/22 | | | | | | | 520 | | | | 478,653 | |

6.75%, 6/01/21 | | | | | | | 173 | | | | 172,314 | |

7.75%, 7/01/26 | | | | | | | 7 | | | | 6,379 | |

iHeartCommunications, Inc.

9.00%, 12/15/19(e)(g) | | | | | | | 251 | | | | 200,803 | |

Liberty Interactive LLC

8.25%, 2/01/30 | | | | | | | 11 | | | | 11,824 | |

McGraw-Hill Global Education Holdings LLC/McGraw-Hill Global Education Finance

7.875%, 5/15/24(a) | | | | | | | 361 | | | | 340,612 | |

Meredith Corp.

6.875%, 2/01/26(a) | | | | | | | 89 | | | | 90,098 | |

Netflix, Inc.

4.375%, 11/15/26 | | | | | | | 77 | | | | 72,085 | |

5.875%, 11/15/28(a) | | | | | | | 180 | | | | 179,595 | |

Radiate Holdco LLC/Radiate Finance, Inc.

6.625%, 2/15/25(a) | | | | | | | 43 | | | | 39,882 | |

6.875%, 2/15/23(a) | | | | | | | 32 | | | | 30,996 | |

RR Donnelley & Sons Co.

7.875%, 3/15/21 | | | | | | | 63 | | | | 65,919 | |

Sinclair Television Group, Inc.

5.625%, 8/01/24(a) | | | | | | | 76 | | | | 74,955 | |

Sirius XM Radio, Inc.

3.875%, 8/01/22(a) | | | | | | | 185 | | | | 179,780 | |

4.625%, 5/15/23(a) | | | | | | | 13 | | | | 12,829 | |

6.00%, 7/15/24(a) | | | | | | | 85 | | | | 87,354 | |

TEGNA, Inc.

6.375%, 10/15/23 | | | | | | | 247 | | | | 255,334 | |

Townsquare Media, Inc.

6.50%, 4/01/23(a) | | | | | | | 119 | | | | 111,253 | |

Univision Communications, Inc.

5.125%, 5/15/23-2/15/25(a) | | | | | | | 184 | | | | 173,267 | |

Urban One, Inc.

7.375%, 4/15/22(a) | | | | | | | 37 | | | | 36,445 | |

9.25%, 2/15/20(a) | | | | | | | 135 | | | | 128,294 | |

Virgin Media Receivables Financing Notes I DAC

5.50%, 9/15/24(a) | | | GBP | | | | 100 | | | | 136,426 | |

Virgin Media Secured Finance PLC

4.875%, 1/15/27(a) | | | | | | | 166 | | | | 224,927 | |

Ziggo Bond Finance BV

5.875%, 1/15/25(a) | | | U.S.$ | | | | 220 | | | | 208,790 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,092,996 | |

| | | | | | | | | | | | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 19 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Communications - Telecommunications – 1.5% | | | | | | | | | | | | |

CenturyLink, Inc.

Series S

6.45%, 6/15/21 | | | U.S.$ | | | | 55 | | | $ | 56,284 | |

Series T

5.80%, 3/15/22 | | | | | | | 361 | | | | 359,209 | |

Cincinnati Bell, Inc.

7.00%, 7/15/24(a) | | | | | | | 118 | | | | 108,253 | |

Consolidated Communications, Inc.

6.50%, 10/01/22 | | | | | | | 11 | | | | 10,125 | |

Embarq Corp.

7.995%, 6/01/36 | | | | | | | 220 | | | | 209,466 | |

Frontier Communications Corp.

7.125%, 1/15/23 | | | | | | | 70 | | | | 50,040 | |

7.625%, 4/15/24 | | | | | | | 365 | | | | 239,930 | |

8.75%, 4/15/22 | | | | | | | 134 | | | | 111,834 | |

GTT Communications, Inc.

7.875%, 12/31/24(a) | | | | | | | 16 | | | | 16,358 | |

Intelsat Jackson Holdings SA

5.50%, 8/01/23 | | | | | | | 88 | | | | 74,022 | |

7.25%, 10/15/20 | | | | | | | 93 | | | | 90,768 | |

7.50%, 4/01/21 | | | | | | | 335 | | | | 318,618 | |

9.50%, 9/30/22(a) | | | | | | | 239 | | | | 273,974 | |

9.75%, 7/15/25(a) | | | | | | | 129 | | | | 126,602 | |

Level 3 Financing, Inc.

5.25%, 3/15/26 | | | | | | | 24 | | | | 23,161 | |

5.375%, 8/15/22 | | | | | | | 195 | | | | 195,762 | |

Qwest Corp.

6.75%, 12/01/21 | | | | | | | 67 | | | | 72,122 | |

SoftBank Group Corp.

4.50%, 4/15/20, TBA(a) | | | | | | | 200 | | | | 205,538 | |

Sprint Capital Corp.

6.875%, 11/15/28 | | | | | | | 74 | | | | 75,445 | |

8.75%, 3/15/32 | | | | | | | 159 | | | | 182,594 | |

Sprint Communications, Inc.

7.00%, 3/01/20(a) | | | | | | | 521 | | | | 550,441 | |

Sprint Corp.

7.875%, 9/15/23 | | | | | | | 252 | | | | 269,752 | |

T-Mobile USA, Inc.

4.50%, 2/01/26 | | | | | | | 290 | | | | 279,003 | |

6.00%, 4/15/24 | | | | | | | 128 | | | | 134,034 | |

6.375%, 3/01/25 | | | | | | | 153 | | | | 160,341 | |

Telecom Italia Capital SA

7.20%, 7/18/36 | | | | | | | 313 | | | | 359,462 | |

Zayo Group LLC/Zayo Capital, Inc.

6.00%, 4/01/23 | | | | | | | 206 | | | | 212,151 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,765,289 | |

| | | | | | | | | | | | |

| | |

| 20 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Consumer Cyclical - Automotive – 0.4% | | | | | | | | | | | | |

Adient Global Holdings Ltd.

4.875%, 8/15/26(a) | | | U.S.$ | | | | 200 | | | $ | 187,365 | |

American Axle & Manufacturing, Inc.

6.25%, 3/15/26 | | | | | | | 60 | | | | 59,387 | |

BCD Acquisition, Inc.

9.625%, 9/15/23(a) | | | | | | | 154 | | | | 167,110 | |

Dana Financing Luxembourg SARL

6.50%, 6/01/26(a) | | | | | | | 89 | | | | 92,547 | |

Exide Technologies

7.00%, 4/30/25(b)(h)(i)(j) | | | | | | | 260 | | | | 163,948 | |

11.00%, 4/30/22(b)(c)(i) | | | | | | | 114 | | | | 102,029 | |

Meritor, Inc.

6.25%, 2/15/24 | | | | | | | 70 | | | | 72,019 | |

Navistar International Corp.

6.625%, 11/01/25(a) | | | | | | | 146 | | | | 151,918 | |

Tesla, Inc.

5.30%, 8/15/25(a) | | | | | | | 23 | | | | 20,385 | |

Titan International, Inc.

6.50%, 11/30/23(a) | | | | | | | 118 | | | | 120,411 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,137,119 | |

| | | | | | | | | | | | |

Consumer Cyclical - Entertainment – 0.1% | | | | | | | | | | | | |

AMC Entertainment Holdings, Inc.

5.875%, 11/15/26 | | | | | | | 26 | | | | 25,312 | |

Constellation Merger Sub, Inc.

8.50%, 9/15/25(a) | | | | | | | 10 | | | | 9,741 | |

National CineMedia LLC

5.75%, 8/15/26 | | | | | | | 17 | | | | 15,669 | |

NCL Corp., Ltd.

4.75%, 12/15/21(a) | | | | | | | 72 | | | | 73,278 | |

Silversea Cruise Finance Ltd.

7.25%, 2/01/25(a) | | | | | | | 84 | | | | 89,005 | |

VOC Escrow Ltd.

5.00%, 2/15/28(a) | | | | | | | 163 | | | | 157,694 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 370,699 | |

| | | | | | | | | | | | |

Consumer Cyclical - Other – 1.1% | | | | | | | | | | | | |

Beazer Homes USA, Inc.

8.75%, 3/15/22 | | | | | | | 297 | | | | 320,611 | |

Cooperativa Muratori & Cementisti-CMC di Ravenna SC

6.00%, 2/15/23(a) | | | EUR | | | | 100 | | | | 115,662 | |

Diamond Resorts International, Inc.

10.75%, 9/01/24(a) | | | U.S.$ | | | | 115 | | | | 127,968 | |

Five Point Operating Co. LP/Five Point Capital Corp.

7.875%, 11/15/25(a) | | | | | | | 189 | | | | 192,717 | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 21 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Hilton Domestic Operating Co., Inc.

5.125%, 5/01/26(a) | | | U.S.$ | | | | 100 | | | $ | 99,857 | |

Jacobs Entertainment, Inc.

7.875%, 2/01/24(a) | | | | | | | 9 | | | | 9,388 | |

K. Hovnanian Enterprises, Inc.

10.00%, 7/15/22(a) | | | | | | | 108 | | | | 115,975 | |

10.50%, 7/15/24(a) | | | | | | | 108 | | | | 110,311 | |

Lennar Corp.

4.50%, 6/15/19 | | | | | | | 265 | | | | 267,692 | |

5.875%, 11/15/24(a) | | | | | | | 302 | | | | 311,535 | |

MDC Holdings, Inc.

6.00%, 1/15/43 | | | | | | | 361 | | | | 334,135 | |

MGM Resorts International

6.75%, 10/01/20 | | | | | | | 227 | | | | 241,211 | |

PulteGroup, Inc.

5.00%, 1/15/27 | | | | | | | 129 | | | | 126,104 | |

6.00%, 2/15/35 | | | | | | | 9 | | | | 8,976 | |

7.875%, 6/15/32 | | | | | | | 220 | | | | 259,847 | |

Rivers Pittsburgh Borrower LP/Rivers Pittsburgh Finance Corp.

6.125%, 8/15/21(a) | | | | | | | 10 | | | | 9,834 | |

Shea Homes LP/Shea Homes Funding Corp.

5.875%, 4/01/23(a) | | | | | | | 414 | | | | 418,172 | |

Standard Industries, Inc./NJ

5.375%, 11/15/24(a) | | | | | | | 65 | | | | 65,721 | |

5.50%, 2/15/23(a) | | | | | | | 180 | | | | 186,084 | |

Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp.

5.875%, 5/15/25(a) | | | | | | | 43 | | | | 41,227 | |

Taylor Morrison Communities, Inc./Taylor Morrison Holdings II, Inc.

5.625%, 3/01/24(a) | | | | | | | 165 | | | | 164,484 | |

Wyndham Hotels & Resorts, Inc.

5.375%, 4/15/26(a) | | | | | | | 100 | | | | 100,962 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,628,473 | |

| | | | | | | | | | | | |

Consumer Cyclical - Restaurants – 0.1% | | | | | | | | | | | | |

Golden Nugget, Inc.

8.75%, 10/01/25(a) | | | | | | | 25 | | | | 26,135 | |

IRB Holding Corp.

6.75%, 2/15/26(a) | | | | | | | 176 | | | | 170,711 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 196,846 | |

| | | | | | | | | | | | |

Consumer Cyclical - Retailers – 0.5% | | | | | | | | | | | | |

Dollar Tree, Inc.

5.75%, 3/01/23 | | | | | | | 60 | | | | 62,591 | |

FirstCash, Inc.

5.375%, 6/01/24(a) | | | | | | | 16 | | | | 16,242 | |

| | |

| 22 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Group 1 Automotive, Inc.

5.00%, 6/01/22 | | | U.S.$ | | | | 154 | | | $ | 154,678 | |

JC Penney Corp., Inc.

5.875%, 7/01/23(a) | | | | | | | 31 | | | | 29,818 | |

L Brands, Inc.

5.25%, 2/01/28 | | | | | | | 203 | | | | 190,763 | |

6.95%, 3/01/33 | | | | | | | 260 | | | | 247,971 | |

Neiman Marcus Group Ltd. LLC

8.00%, 10/15/21(a) | | | | | | | 191 | | | | 128,934 | |

8.75% (8.75% Cash or 9.50% PIK), 10/15/21(a)(i) | | | | | | | 162 | | | | 108,819 | |

Penske Automotive Group, Inc.

3.75%, 8/15/20 | | | | | | | 130 | | | | 129,550 | |

PetSmart, Inc.

7.125%, 3/15/23(a) | | | | | | | 67 | | | | 38,995 | |

PVH Corp.

3.125%, 12/15/27(a) | | | EUR | | | | 110 | | | | 132,130 | |

Rite Aid Corp.

6.75%, 6/15/21 | | | U.S.$ | | | | 31 | | | | 31,536 | |

Sonic Automotive, Inc.

5.00%, 5/15/23 | | | | | | | 139 | | | | 134,080 | |

6.125%, 3/15/27 | | | | | | | 48 | | | | 46,259 | |

Staples, Inc.

8.50%, 9/15/25(a) | | | | | | | 13 | | | | 12,139 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,464,505 | |

| | | | | | | | | | | | |

Consumer Non-Cyclical – 2.3% | | | | | | | | | | | | |

Acadia Healthcare Co., Inc.

5.625%, 2/15/23 | | | | | | | 71 | | | | 71,733 | |

Air Medical Group Holdings, Inc.

6.375%, 5/15/23(a) | | | | | | | 160 | | | | 153,159 | |

Albertsons Cos. LLC/Safeway, Inc./New Albertson’s, Inc./Albertson’s LLC

6.625%, 6/15/24 | | | | | | | 258 | | | | 240,672 | |

AMAG Pharmaceuticals, Inc.

7.875%, 9/01/23(a) | | | | | | | 7 | | | | 6,959 | |

Avantor, Inc.

9.00%, 10/01/25(a) | | | | | | | 46 | | | | 46,534 | |

Aveta, Inc.

10.50%, 3/01/21(b)(d)(e)(j) | | | | | | | 1,062 | | | | – 0 | – |

Avon Products, Inc.

6.60%, 3/15/20 | | | | | | | 30 | | | | 30,268 | |

Catalent Pharma Solutions, Inc.

4.875%, 1/15/26(a) | | | | | | | 25 | | | | 24,323 | |

Charles River Laboratories International, Inc.

5.50%, 4/01/26(a) | | | | | | | 32 | | | | 32,548 | |

Chobani LLC/Chobani Finance Corp., Inc.

7.50%, 4/15/25(a) | | | | | | | 13 | | | | 13,065 | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 23 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CHS/Community Health Systems, Inc.

5.125%, 8/01/21 | | U.S.$ | | | 140 | | | $ | 129,128 | |

6.875%, 2/01/22 | | | | | 188 | | | | 102,523 | |

7.125%, 7/15/20 | | | | | 359 | | | | 285,686 | |

DaVita, Inc.

5.00%, 5/01/25 | | | | | 130 | | | | 123,237 | |

5.75%, 8/15/22 | | | | | 32 | | | | 32,731 | |

Dean Foods Co.

6.50%, 3/15/23(a) | | | | | 17 | | | | 16,304 | |

Eagle Holding Co. II LLC

7.625% (7.625% Cash or 8.375% PIK), 5/15/22(a)(i) | | | | | 149 | | | | 151,116 | |

Endo Dac/Endo Finance LLC/Endo Finco, Inc.

6.00%, 7/15/23(a) | | | | | 498 | | | | 362,295 | |

Endo Finance LLC

5.75%, 1/15/22(a) | | | | | 18 | | | | 14,781 | |

Endo Finance LLC/Endo Finco, Inc.

5.375%, 1/15/23(a) | | | | | 40 | | | | 28,986 | |

Envision Healthcare Corp.

5.125%, 7/01/22(a) | | | | | 46 | | | | 45,385 | |

5.625%, 7/15/22 | | | | | 170 | | | | 170,517 | |

Fresh Market, Inc. (The)

9.75%, 5/01/23(a) | | | | | 13 | | | | 7,371 | |

Greatbatch Ltd.

9.125%, 11/01/23, TBA(a) | | | | | 9 | | | | 9,731 | |

Hadrian Merger Sub, Inc.

8.50%, 5/01/26(a) | | | | | 135 | | | | 135,328 | |

HCA Healthcare, Inc.

6.25%, 2/15/21 | | | | | 88 | | | | 92,554 | |

HCA, Inc.

4.75%, 5/01/23 | | | | | 170 | | | | 171,453 | |

5.875%, 3/15/22 | | | | | 655 | | | | 691,148 | |

6.50%, 2/15/20 | | | | | 230 | | | | 240,870 | |

7.58%, 9/15/25 | | | | | 65 | | | | 71,192 | |

Kinetic Concepts, Inc./KCI USA, Inc.

7.875%, 2/15/21(a) | | | | | 461 | | | | 477,702 | |

Kronos Acquisition Holdings, Inc.

9.00%, 8/15/23(a) | | | | | 8 | | | | 7,619 | |

LifePoint Health, Inc.

5.375%, 5/01/24 | | | | | 41 | | | | 39,017 | |

5.50%, 12/01/21 | | | | | 62 | | | | 62,520 | |

5.875%, 12/01/23 | | | | | 197 | | | | 194,965 | |

Mallinckrodt International Finance SA

4.75%, 4/15/23 | | | | | 113 | | | | 80,159 | |

Mallinckrodt International Finance SA/Mallinckrodt CB LLC

4.875%, 4/15/20(a) | | | | | 105 | | | | 100,202 | |

| | |

| 24 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

5.50%, 4/15/25(a) | | | U.S.$ | | | | 278 | | | $ | 208,732 | |

5.625%, 10/15/23(a) | | | | | | | 20 | | | | 15,737 | |

MEDNAX, Inc.

5.25%, 12/01/23(a) | | | | | | | 185 | | | | 182,639 | |

Ortho-Clinical Diagnostics, Inc./Ortho-Clinical Diagnostics SA

6.625%, 5/15/22(a) | | | | | | | 79 | | | | 77,656 | |

Post Holdings, Inc.

5.625%, 1/15/28(a) | | | | | | | 50 | | | | 47,750 | |

5.75%, 3/01/27(a) | | | | | | | 190 | | | | 186,113 | |

RegionalCare Hospital Partners Holdings, Inc.

8.25%, 5/01/23(a) | | | | | | | 134 | | | | 140,535 | |

Spectrum Brands, Inc.

5.75%, 7/15/25 | | | | | | | 99 | | | | 99,007 | |

6.625%, 11/15/22 | | | | | | | 90 | | | | 93,110 | |

Tenet Healthcare Corp.

4.50%, 4/01/21 | | | | | | | 313 | | | | 310,939 | |

6.00%, 10/01/20 | | | | | | | 148 | | | | 152,961 | |

6.75%, 6/15/23 | | | | | | | 227 | | | | 223,570 | |

8.125%, 4/01/22 | | | | | | | 130 | | | | 135,434 | |

Valeant Pharmaceuticals International

6.75%, 8/15/21(a) | | | | | | | 76 | | | | 76,603 | |

7.25%, 7/15/22(a) | | | | | | | 11 | | | | 11,110 | |

Valeant Pharmaceuticals International, Inc.

5.50%, 3/01/23-11/01/25(a) | | | | | | | 332 | | | | 312,242 | |

5.625%, 12/01/21(a) | | | | | | | 577 | | | | 560,861 | |

5.875%, 5/15/23(a) | | | | | | | 85 | | | | 78,094 | |

7.50%, 7/15/21(a) | | | | | | | 72 | | | | 73,144 | |

Vizient, Inc.

10.375%, 3/01/24(a) | | | | | | | 85 | | | | 94,086 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,544,104 | |

| | | | | | | | | | | | |

Energy – 3.0% | | | | | | | | | | | | |

American Midstream Partners LP/American Midstream Finance Corp.

8.50%, 12/15/21(a) | | | | | | | 10 | | | | 9,942 | |

Antero Resources Corp.

5.00%, 3/01/25 | | | | | | | 65 | | | | 64,986 | |

5.125%, 12/01/22 | | | | | | | 133 | | | | 133,916 | |

5.625%, 6/01/23 | | | | | | | 154 | | | | 157,277 | |

Berry Petroleum Co. LLC

7.00%, 2/15/26(a) | | | | | | | 200 | | | | 204,632 | |

Bristow Group, Inc.

8.75%, 3/01/23(a) | | | | | | | 230 | | | | 236,014 | |

Calfrac Holdings LP

7.50%, 12/01/20(a) | | | | | | | 13 | | | | 12,887 | |

��

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 25 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

California Resources Corp.

5.50%, 9/15/21 | | U.S.$ | | | 45 | | | $ | 36,737 | |

6.00%, 11/15/24 | | | | | 51 | | | | 37,049 | |

8.00%, 12/15/22(a) | | | | | 186 | | | | 159,924 | |

Carrizo Oil & Gas, Inc.

6.25%, 4/15/23 | | | | | 198 | | | | 202,906 | |

8.25%, 7/15/25 | | | | | 19 | | | | 20,371 | |

Cheniere Corpus Christi Holdings LLC

5.875%, 3/31/25 | | | | | 172 | | | | 177,185 | |

7.00%, 6/30/24 | | | | | 180 | | | | 196,745 | |

Cheniere Energy Partners LP

5.25%, 10/01/25(a) | | | | | 82 | | | | 80,112 | |

Cheniere Energy, Inc.

4.875%, 5/28/21(a)(b)(h)(i) | | | | | 62 | | | | 63,650 | |

Chesapeake Energy Corp.

4.875%, 4/15/22 | | | | | 25 | | | | 24,035 | |

5.75%, 3/15/23 | | | | | 10 | | | | 9,212 | |

6.125%, 2/15/21 | | | | | 242 | | | | 244,708 | |

8.00%, 6/15/27(a) | | | | | 240 | | | | 231,048 | |

Covey Park Energy LLC/Covey Park Finance Corp.

7.50%, 5/15/25(a) | | | | | 16 | | | | 16,160 | |

Denbury Resources, Inc.

9.00%, 5/15/21(a) | | | | | 77 | | | | 80,525 | |

9.25%, 3/31/22(a) | | | | | 96 | | | | 100,165 | |

Diamond Offshore Drilling, Inc.

4.875%, 11/01/43 | | | | | 154 | | | | 110,818 | |

5.70%, 10/15/39 | | | | | 212 | | | | 169,784 | |

7.875%, 8/15/25 | | | | | 23 | | | | 23,614 | |

Energy Transfer Equity LP

5.875%, 1/15/24 | | | | | 310 | | | | 316,372 | |

Ensco PLC

4.50%, 10/01/24 | | | | | 138 | | | | 112,246 | |

5.20%, 3/15/25 | | | | | 168 | | | | 138,404 | |

7.75%, 2/01/26 | | | | | 70 | | | | 65,644 | |

EP Energy LLC/Everest Acquisition Finance, Inc.

7.75%, 9/01/22 | | | | | 125 | | | | 85,221 | |

8.00%, 2/15/25(a) | | | | | 133 | | | | 94,240 | |

9.375%, 5/01/20 | | | | | 34 | | | | 32,275 | |

9.375%, 5/01/24(a) | | | | | 114 | | | | 87,205 | |

Genesis Energy LP/Genesis Energy Finance Corp.

5.625%, 6/15/24 | | | | | 103 | | | | 97,925 | |

6.25%, 5/15/26 | | | | | 69 | | | | 65,849 | |

6.50%, 10/01/25 | | | | | 8 | | | | 7,839 | |

6.75%, 8/01/22 | | | | | 22 | | | | 22,412 | |

| | |

| 26 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Gulfport Energy Corp.

6.00%, 10/15/24 | | U.S.$ | | | 70 | | | $ | 66,716 | |

6.375%, 5/15/25-1/15/26 | | | | | 155 | | | | 148,661 | |

Hess Infrastructure Partners LP/Hess Infrastructure Partners Finance Corp.

5.625%, 2/15/26(a) | | | | | 234 | | | | 236,285 | |

HighPoint Operating Corp.

7.00%, 10/15/22 | | | | | 138 | | | | 139,977 | |

8.75%, 6/15/25 | | | | | 2 | | | | 2,170 | |

Hilcorp Energy I LP/Hilcorp Finance Co.

5.00%, 12/01/24(a) | | | | | 15 | | | | 14,615 | |

Indigo Natural Resources LLC

6.875%, 2/15/26(a) | | | | | 235 | | | | 225,374 | |

Laredo Petroleum, Inc.

6.25%, 3/15/23 | | | | | 48 | | | | 48,612 | |

Murphy Oil USA, Inc.

5.625%, 5/01/27 | | | | | 5 | | | | 4,988 | |

Nabors Industries, Inc.

4.625%, 9/15/21 | | | | | 82 | | | | 80,121 | |

5.00%, 9/15/20 | | | | | 20 | | | | 20,162 | |

5.50%, 1/15/23 | | | | | 183 | | | | 179,743 | |

Noble Holding International Ltd.

5.25%, 3/15/42 | | | | | 70 | | | | 46,022 | |

6.20%, 8/01/40 | | | | | 63 | | | | 44,100 | |

7.75%, 1/15/24 | | | | | 119 | | | | 111,123 | |

7.95%, 4/01/25 | | | | | 139 | | | | 124,759 | |

Oasis Petroleum, Inc.

6.875%, 3/15/22 | | | | | 122 | | | | 125,355 | |

Parkland Fuel Corp.

6.00%, 4/01/26(a) | | | | | 187 | | | | 188,193 | |

PBF Holding Co. LLC/PBF Finance Corp.

7.25%, 6/15/25 | | | | | 31 | | | | 32,228 | |

PDC Energy, Inc.

5.75%, 5/15/26(a) | | | | | 77 | | | | 77,568 | |

Precision Drilling Corp.

7.125%, 1/15/26(a) | | | | | 75 | | | | 75,788 | |

QEP Resources, Inc.

5.25%, 5/01/23 | | | | | 202 | | | | 196,911 | |

5.625%, 3/01/26 | | | | | 65 | | | | 62,633 | |

Range Resources Corp.

4.875%, 5/15/25 | | | | | 132 | | | | 122,349 | |

5.00%, 8/15/22-3/15/23 | | | | | 276 | | | | 269,123 | |

5.875%, 7/01/22 | | | | | 6 | | | | 6,082 | |

Rowan Cos., Inc.

7.375%, 6/15/25 | | | | | 240 | | | | 232,254 | |

Sable Permian Resources Land LLC/AEPB Finance Corp.

7.125%, 11/01/20(a) | | | | | 61 | | | | 44,599 | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 27 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Sanchez Energy Corp.

6.125%, 1/15/23 | | | U.S.$ | | | | 268 | | | $ | 193,642 | |

7.25%, 2/15/23(a) | | | | | | | 53 | | | | 53,542 | |

7.75%, 6/15/21 | | | | | | | 10 | | | | 9,294 | |

SandRidge Energy, Inc.

8.125%, 10/15/22(b)(d)(e)(f) | | | | | | | 665 | | | | – 0 | – |

SemGroup Corp.

6.375%, 3/15/25 | | | | | | | 35 | | | | 33,378 | |

7.25%, 3/15/26 | | | | | | | 88 | | | | 87,153 | |

SM Energy Co.

5.00%, 1/15/24 | | | | | | | 35 | | | | 33,351 | |

6.125%, 11/15/22 | | | | | | | 71 | | | | 71,762 | |

6.50%, 11/15/21-1/01/23 | | | | | | | 194 | | | | 196,540 | |

SRC Energy, Inc.

6.25%, 12/01/25(a) | | | | | | | 49 | | | | 49,682 | |

Sunoco LP/Sunoco Finance Corp.

5.50%, 2/15/26(a) | | | | | | | 154 | | | | 149,447 | |

5.875%, 3/15/28(a) | | | | | | | 116 | | | | 112,672 | |

Targa Resources Partners LP/Targa Resources Partners Finance Corp.

4.125%, 11/15/19 | | | | | | | 96 | | | | 96,482 | |

5.875%, 4/15/26(a) | | | | | | | 132 | | | | 131,042 | |

Transocean, Inc.

5.80%, 10/15/22 | | | | | | | 70 | | | | 68,794 | |

6.80%, 3/15/38 | | | | | | | 261 | | | | 219,545 | |

7.50%, 1/15/26(a) | | | | | | | 39 | | | | 39,571 | |

9.00%, 7/15/23(a) | | | | | | | 279 | | | | 301,107 | |

Vine Oil & Gas LP/Vine Oil & Gas Finance Corp.

8.75%, 4/15/23(a) | | | | | | | 122 | | | | 114,846 | |

Weatherford International LLC

9.875%, 3/01/25(a) | | | | | | | 171 | | | | 162,821 | |

Weatherford International Ltd.

5.875%, 7/01/21(h) | | | | | | | 77 | | | | 73,322 | |

7.75%, 6/15/21 | | | | | | | 232 | | | | 229,693 | |

9.875%, 2/15/24 | | | | | | | 23 | | | | 22,087 | |

Whiting Petroleum Corp.

5.75%, 3/15/21 | | | | | | | 67 | | | | 68,574 | |

6.25%, 4/01/23 | | | | | | | 20 | | | | 20,569 | |

6.625%, 1/15/26(a) | | | | | | | 172 | | | | 176,932 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,572,393 | |

| | | | | | | | | | | | |

Other Industrial – 0.2% | | | | | | | | | | | | |

American Tire Distributors, Inc.

10.25%, 3/01/22(a) | | | | | | | 145 | | | | 77,503 | |

Global Partners LP/GLP Finance Corp.

6.25%, 7/15/22 | | | | | | | 294 | | | | 293,139 | |

| | |

| 28 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

H&E Equipment Services, Inc.

5.625%, 9/01/25 | | | U.S.$ | | | | 27 | | | $ | 27,122 | |

KAR Auction Services, Inc.

5.125%, 6/01/25(a) | | | | | | | 28 | | | | 27,332 | |

Laureate Education, Inc.

8.25%, 5/01/25(a) | | | | | | | 210 | | | | 226,499 | |

Travis Perkins PLC

4.50%, 9/07/23(a) | | | GBP | | | | 100 | | | | 142,525 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 794,120 | |

| | | | | | | | | | | | |

Services – 0.4% | | | | | | | | | | | | |

ACE Cash Express, Inc.

12.00%, 12/15/22(a) | | | U.S.$ | | | | 10 | | | | 11,100 | |

APTIM Corp.

7.75%, 6/15/25(a) | | | | | | | 75 | | | | 65,395 | |

APX Group, Inc.

8.75%, 12/01/20 | | | | | | | 450 | | | | 443,338 | |

GEO Group, Inc. (The)

6.00%, 4/15/26 | | | | | | | 94 | | | | 92,730 | |

iPayment, Inc.

10.75%, 4/15/24(f) | | | | | | | 100 | | | | 111,096 | |

Monitronics International, Inc.

9.125%, 4/01/20 | | | | | | | 33 | | | | 23,382 | |

Nielsen Finance LLC/Nielsen Finance Co.

5.00%, 4/15/22(a) | | | | | | | 135 | | | | 135,862 | |

Prime Security Services Borrower LLC/Prime Finance, Inc.

9.25%, 5/15/23(a) | | | | | | | 282 | | | | 302,577 | |

Sabre GLBL, Inc.

5.25%, 11/15/23(a) | | | | | | | 66 | | | | 66,671 | |

Team Health Holdings, Inc.

6.375%, 2/01/25(a) | | | | | | | 207 | | | | 180,815 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,432,966 | |

| | | | | | | | | | | | |

Technology – 0.9% | | | | | | | | | | | | |

Ascend Learning LLC

6.875%, 8/01/25(a) | | | | | | | 18 | | | | 18,308 | |

BMC Software Finance, Inc.

8.125%, 7/15/21(a) | | | | | | | 612 | | | | 611,523 | |

Boxer Parent Co., Inc.

9.00% (9.00% Cash or 9.75% PIK), 10/15/19(a)(i) | | | | | | | 87 | | | | 86,959 | |

Change Healthcare Holdings LLC/Change Healthcare Finance, Inc.

5.75%, 3/01/25(a) | | | | | | | 13 | | | | 12,717 | |

Conduent Finance, Inc./Conduent Business Services LLC

10.50%, 12/15/24(a) | | | | | | | 194 | | | | 229,399 | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 29 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CURO Financial Technologies Corp.

12.00%, 3/01/22(a) | | | U.S.$ | | | | 94 | | | $ | 103,843 | |

Dell International LLC/EMC Corp.

5.875%, 6/15/21(a) | | | | | | | 62 | | | | 63,697 | |

7.125%, 6/15/24(a) | | | | | | | 234 | | | | 249,306 | |

EIG Investors Corp.

10.875%, 2/01/24 | | | | | | | 9 | | | | 9,746 | |

Exela Intermediate LLC/Exela Finance, Inc.

10.00%, 7/15/23(a) | | | | | | | 14 | | | | 14,057 | |

First Data Corp.

5.00%, 1/15/24(a) | | | | | | | 96 | | | | 96,709 | |

Genesys Telecommunications Laboratories, Inc./Greeneden Lux 3 SARL/Greeneden US Ho

10.00%, 11/30/24(a) | | | | | | | 18 | | | | 19,994 | |

Harland Clarke Holdings Corp.

9.25%, 3/01/21(a) | | | | | | | 45 | | | | 46,418 | |

Infor US, Inc.

6.50%, 5/15/22 | | | | | | | 470 | | | | 477,236 | |

Ingram Micro, Inc.

5.45%, 12/15/24 | | | | | | | 21 | | | | 20,397 | |

IQVIA, Inc.

3.25%, 3/15/25(a) | | | EUR | | | | 213 | | | | 261,199 | |

NXP BV/NXP Funding LLC

4.125%, 6/01/21(a) | | | U.S.$ | | | | 200 | | | | 200,764 | |

Rackspace Hosting, Inc.

8.625%, 11/15/24(a) | | | | | | | 32 | | | | 32,460 | |

Riverbed Technology, Inc.

8.875%, 3/01/23(a) | | | | | | | 14 | | | | 13,014 | |

Solera LLC/Solera Finance, Inc.

10.50%, 3/01/24(a) | | | | | | | 243 | | | | 270,474 | |

West Corp.

8.50%, 10/15/25(a) | | | | | | | 37 | | | | 35,797 | |

Western Digital Corp.

4.75%, 2/15/26 | | | | | | | 167 | | | | 164,750 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,038,767 | |

| | | | | | | | | | | | |

Transportation - Services – 0.4% | | | | | | | | | | | | |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc.

5.50%, 4/01/23 | | | | | | | 192 | | | | 190,138 | |

CEVA Group PLC

9.00%, 9/01/21(a) | | | | | | | 217 | | | | 219,844 | |

Herc Rentals, Inc.

7.50%, 6/01/22(a) | | | | | | | 72 | | | | 76,624 | |

7.75%, 6/01/24(a) | | | | | | | 134 | | | | 144,262 | |

| | |

| 30 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Hertz Corp. (The)

5.50%, 10/15/24(a) | | | U.S.$ | | | | 64 | | | $ | 53,699 | |

5.875%, 10/15/20 | | | | | | | 24 | | | | 23,760 | |

7.375%, 1/15/21 | | | | | | | 271 | | | | 268,730 | |

Loxam SAS

4.25%, 4/15/24(a) | | | EUR | | | | 100 | | | | 127,957 | |

Park Aerospace Holdings Ltd.

4.50%, 3/15/23(a) | | | U.S.$ | | | | 36 | | | | 34,472 | |

5.25%, 8/15/22(a) | | | | | | | 75 | | | | 74,756 | |

Rent-A-Center, Inc./TX

4.75%, 5/01/21 | | | | | | | 9 | | | | 8,493 | |

United Rentals North America, Inc.

5.50%, 5/15/27 | | | | | | | 184 | | | | 182,650 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,405,385 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 49,055,908 | |

| | | | | | | | | | | | |

| Financial Institutions – 3.7% | | | | | | | | | | | | |

Banking – 2.5% | | | | | | | | | | | | |

Allied Irish Banks PLC

Series E

7.375%, 12/03/20(a)(k) | | | EUR | | | | 200 | | | | 271,106 | |

Ally Financial, Inc.

8.00%, 11/01/31 | | | U.S.$ | | | | 270 | | | | 328,438 | |

Banco Bilbao Vizcaya Argentaria SA

5.875%, 5/24/22(a)(k) | | | EUR | | | | 200 | | | | 263,833 | |

Banco Santander SA

6.75%, 4/25/22(a)(k) | | | | | | | 200 | | | | 273,859 | |

Bank of America Corp.

Series DD

6.30%, 3/10/26(k) | | | U.S.$ | | | | 186 | | | | 197,512 | |

Series FF

5.875%, 3/15/28(k) | | | | | | | 7 | | | | 6,986 | |

Series Z

6.50%, 4/23/67 | | | | | | | 1 | | | | 1,060 | |

Barclays PLC

8.00%, 12/15/20(k) | | | EUR | | | | 200 | | | | 277,627 | |

CIT Group, Inc.

5.25%, 3/07/25 | | | U.S.$ | | | | 74 | | | | 75,573 | |

6.125%, 3/09/28 | | | | | | | 39 | | | | 40,413 | |

Credit Agricole SA

6.50%, 6/23/21(a)(k) | | | EUR | | | | 156 | | | | 212,169 | |

Credit Suisse Group AG

6.25%, 12/18/24(a)(k) | | | U.S.$ | | | | 208 | | | | 213,246 | |

Goldman Sachs Group, Inc. (The)

Series P

5.00%, 11/10/22(k) | | | | | | | 97 | | | | 93,063 | |

| | |

| abfunds.com | | AB UNCONSTRAINED BOND FUND | 31 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Intesa Sanpaolo SpA

7.75%, 1/11/27(a)(k) | | | EUR | | | | 200 | | | $ | 296,202 | |

National Westminster Bank PLC

1.822% (EURIBOR 3 Month + 2.15%), 7/05/18(k)(l) | | | | | | | 200 | | | | 240,080 | |

Royal Bank of Scotland Group PLC

2.001% (EURIBOR 3 Month + 2.33%), 6/30/18(a)(k)(l) | | | | | | | 50 | | | | 59,947 | |

Series U

4.622% (LIBOR 3 Month + 2.32%), 9/30/27(k)(l) | | | U.S.$ | | | | 3,400 | | | | 3,427,163 | |

Societe Generale SA

6.75%, 4/07/21(a)(k) | | | EUR | | | | 100 | | | | 134,202 | |

7.875%, 12/18/23(a)(k) | | | U.S.$ | | | | 200 | | | | 217,000 | |

Standard Chartered PLC

3.869% (LIBOR 3 Month + 1.51%), 1/30/27(a)(k)(l) | | | | | | | 600 | | | | 566,009 | |

7.50%, 4/02/22(a)(k) | | | | | | | 335 | | | | 354,279 | |

SunTrust Banks, Inc.

Series H

5.125%, 12/15/27(k) | | | | | | | 60 | | | | 57,511 | |

UBS Group AG

7.00%, 2/19/25(a)(k) | | | | | | | 200 | | | | 214,011 | |

UniCredit SpA

6.75%, 9/10/21(a)(k) | | | EUR | | | | 200 | | | | 260,837 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,082,126 | |

| | | | | | | | | | | | |

Brokerage – 0.1% | | | | | | | | | | | | |

Lehman Brothers Holdings, Inc.

0.00%, 5/25/10(b)(e)(m) | | | U.S.$ | | | | 435 | | | | 14,355 | |

0.00%, 1/12/12(b)(e)(m) | | | | | | | 440 | | | | 14,520 | |

LPL Holdings, Inc.

5.75%, 9/15/25(a) | | | | | | | 150 | | | | 145,368 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 174,243 | |

| | | | | | | | | | | | |

Finance – 0.7% | | | | | | | | | | | | |

ASP AMC Merger Sub, Inc.

8.00%, 5/15/25(a) | | | | | | | 7 | | | | 6,289 | |

Compass Diversified Holdings/Compass Group Diversified Holdings LLC

8.00%, 5/01/26(a) | | | | | | | 142 | | | | 140,929 | |

Enova International, Inc.

8.50%, 9/01/24(a) | | | | | | | 50 | | | | 53,117 | |

9.75%, 6/01/21 | | | | | | | 105 | | | | 110,619 | |

goeasy Ltd.

7.875%, 11/01/22(a) | | | | | | | 28 | | | | 29,772 | |

Lincoln Finance Ltd.

7.375%, 4/15/21(a) | | | | | | | 200 | | | | 206,809 | |

| | |

| 32 | AB UNCONSTRAINED BOND FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| | | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Navient Corp.

5.875%, 3/25/21 | | | U.S.$ | | | | 660 | | | $ | 675,351 | |

6.50%, 6/15/22 | | | | | | | 60 | | | | 61,662 | |

6.625%, 7/26/21 | | | | | | | 752 | | | | 780,884 | |

SLM Corp.

5.125%, 4/05/22 | | | | | | | 31 | | | | 31,013 | |

Springleaf Finance Corp.

6.875%, 3/15/25 | | | | | | | 146 | | | | 147,405 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,243,850 | |

| | | | | | | | | | | | |

Insurance – 0.2% | | | | | | | | | | | | |

Acrisure LLC/Acrisure Finance, Inc.

7.00%, 11/15/25(a) | | | | | | | 24 | | | | 22,658 | |

AssuredPartners, Inc.

7.00%, 8/15/25(a) | | | | | | | 13 | | | | 12,777 | |

Genworth Holdings, Inc.

7.20%, 2/15/21 | | | | | | | 66 | | | | 62,046 | |

Liberty Mutual Group, Inc.

7.80%, 3/15/37(a) | | | | | | | 156 | | | | 188,996 | |

Polaris Intermediate Corp.

8.50%, 12/01/22(a)(i) | | | | | | | 366 | | | | 371,212 | |

USIS Merger Sub, Inc.

6.875%, 5/01/25(a) | | | | | | | 16 | | | | 16,062 | |

WellCare Health Plans, Inc.

5.25%, 4/01/25 | | | | | | | 61 | | | | 61,419 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 735,170 | |

| | | | | | | | | | | | |

Other Finance – 0.1% | | | | | | | | | | | | |

Intrum Justitia AB

2.75%, 7/15/22(a) | | | EUR | | | | 200 | | | | 239,447 | |

NVA Holdings, Inc./United States

6.875%, 4/01/26(a) | | | U.S.$ | | | | 37 | | | | 37,260 | |

Oxford Finance LLC/Oxford Finance Co-Issuer II, Inc.