UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Zoran Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

May 8, 2009

Dear Stockholder:

This year’s annual meeting of stockholders will be held on June 26, 2009, at 9:00 a.m. local time, at our headquarters located at 1390 Kifer Road, Sunnyvale, California. You are cordially invited to attend.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describes the formal business to be conducted at the meeting, follow this letter.

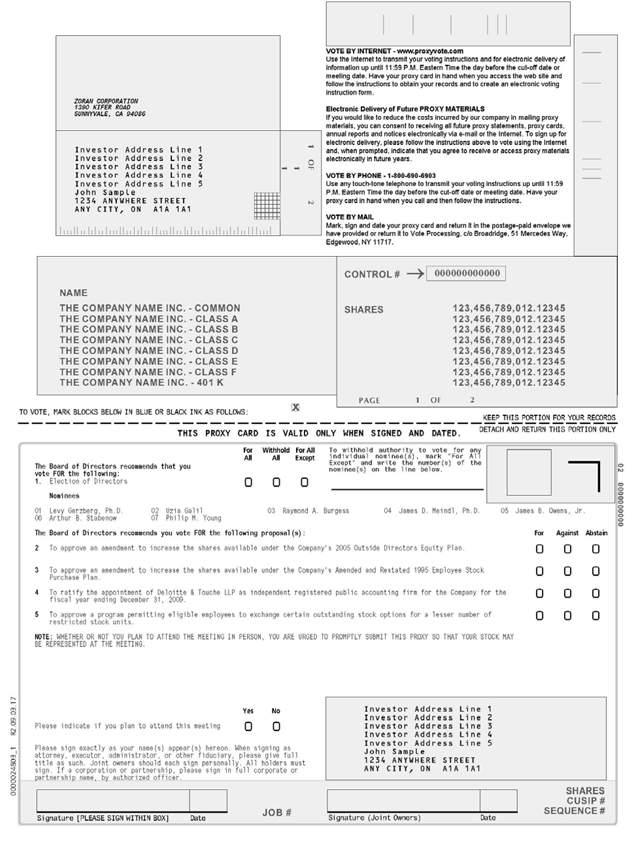

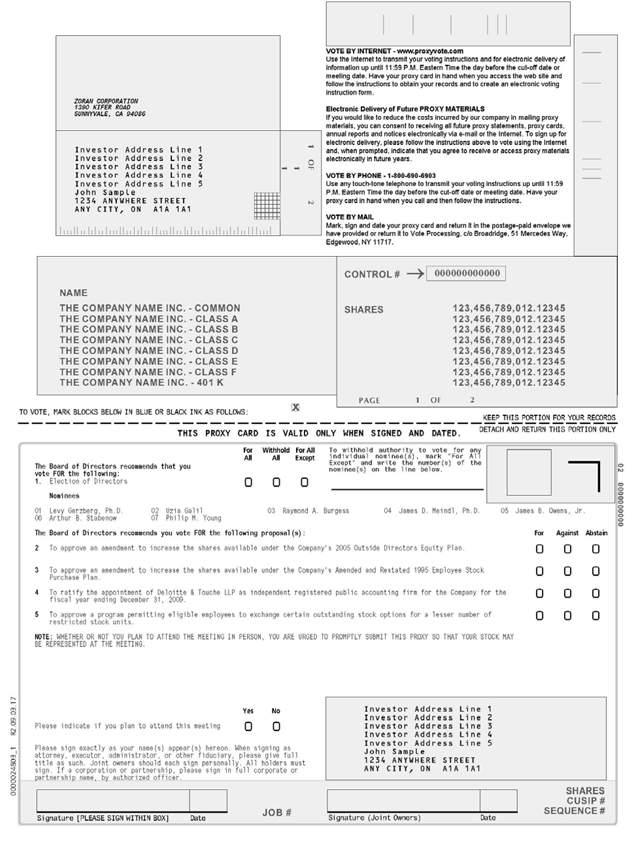

It is important that you use this opportunity to take part in the meeting by voting on the business to come before this meeting. After reading the Proxy Statement, refer to the instructions in the Notice of Internet Availability of Proxy Materials for information on how to access, execute and send the form of proxy. If you have requested and received a paper copy of this Proxy Statement, please promptly mark, sign, date and return the enclosed proxy card in the prepaid envelope to assure that your shares will be represented. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our stockholders is important.

A copy of our Annual Report to Stockholders is also provided for your information. At the annual meeting, we will review our activities over the past year and our plans for the future. The Board of Directors and management look forward to seeing you at the annual meeting.

Sincerely yours,

Levy Gerzberg, Ph.D.

President and Chief Executive Officer

ZORAN CORPORATION

1390 Kifer Road

Sunnyvale, California 94086

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 26, 2009

TO THE STOCKHOLDERS:

Notice is hereby given that the annual meeting of our stockholders will be held on June 26, 2009, at 9:00 a.m. local time, at our headquarters located at 1390 Kifer Road, Sunnyvale, California, for the following purposes:

1. To elect seven persons to serve on our Board of Directors.

2. To approve an amendment to increase the shares available under the 2005 Outside Directors Equity Plan.

3. To approve an amendment to increase the shares available under the Amended and Restated 1995 Employee Stock Purchase Plan.

4. To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2009.

5. To approve a program permitting eligible employees to exchange certain outstanding stock options for a lesser number of restricted stock units.

6. To transact such other business as may properly come before the meeting.

Stockholders of record at the close of business on April 27, 2009 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For 10 days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 1390 Kifer Road, Sunnyvale, California.

By order of the Board of Directors,

Levy Gerzberg, Ph.D

President and Chief Executive Officer

Sunnyvale, California

May 8, 2009

IMPORTANT: Please, refer to the instructions in the Notice of Internet Availability of Proxy Materials for information on how to access, execute and send the form of proxy. If you have received a paper copy of the proxy materials by mail, please fill in, date, sign and promptly mail the enclosed proxy card in the accompanying postage-paid envelope to assure that your shares are represented at the meeting. If you attend the meeting, you may choose to vote in person even if you have previously submitted your proxy card.

ZORAN CORPORATION

1390 Kifer Road

Sunnyvale, California 94086

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 26, 2009

Why did I receive a Notice of Internet Availability of Proxy Materials?

In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy statement, proxy card and annual report to stockholders, we elected to send a Notice of Internet Availability of Proxy Materials (“Notice”) to our stockholders. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice, or to request a printed set of these materials at no charge. You will not receive a printed copy of the proxy materials unless you specifically request one. Instead, the Notice instructs you as to how you may access and review the proxy materials via the Internet.

How do I request paper copies of the proxy materials?

You may request paper copies of the 2009 proxy materials by following the instructions listed atwww.proxyvote.com, by telephoning 1-800-579-1639 or by sending an e-mail to sendmaterial@proxyvote.com and following the instructions in the Notice.

What is the purpose of these proxy materials?

We provided you this proxy statement and the accompanying proxy card because our Board of Directors (“Board”) is soliciting your proxy to vote at our 2009 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may follow the instructions in the Notice regarding how to submit your vote electronically or telephonically.

We made available via the Internet this proxy statement, the accompanying proxy card and our annual report on or about May 8, 2009 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 27, 2009, the record date for the annual meeting, will be entitled to vote at the annual meeting. At the close of business on the record date, there were 51,183,007 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on the record date, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company (“AST”), then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the accompanying proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If at the close of business on the record date, your shares were not issued directly in your name, but rather were held in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares that are held in “street name” by your broker, banker or other agent and these proxy materials are being forwarded to you by your broker, bank or agent. The broker, bank or other agent holding your shares in that account is considered to be the stockholder of record for purposes of voting at the annual meeting.

1

As a beneficial owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy issued in your name from your broker, bank or agent.

What am I being asked to vote on?

There are five matters scheduled for a vote at the annual meeting:

| | • | | the election of seven members of the Board to hold office until our 2010 Annual Meeting of Stockholders; |

| | • | | the approval of an amendment to increase the shares available under the 2005 Outside Directors Equity Plan; |

| | • | | the approval of an amendment to increase the shares available under the Amended and Restated 1995 Employee Stock Purchase Plan; |

| | • | | the ratification of the appointment by the Audit Committee of our Board of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2009; and |

| | • | | the approval of a program permitting eligible employees to exchange certain outstanding stock options for a lesser number of restricted stock units. |

How do I vote?

For the election of directors, you may either vote “For” the seven nominees or you may “Withhold” your vote for any nominee you specify. For any other matter to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting. Alternatively, you may vote by proxy by using the accompanying proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | • | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | | To vote by proxy, simply complete, sign and date the accompanying proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

How many votes do I have?

On each matter to be voted on, you have one vote for each share of common stock you owned as of the close of business on April 27, 2009, the record date for the annual meeting.

2

What if I submit a proxy card but do not make specific choices?

If you submit a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of the seven nominees for director, “For” the amendment to increase the shares available under our 2005 Outside Directors Equity Plan, “For” the amendment to increase the shares available under our Amended and Restated 1995 Employee Stock Purchase Plan, “For” the ratification of the appointment of Deloitte as our independent registered public accounting firm and “For” the approval of a program permitting eligible employees to exchange certain outstanding stock options for a lesser number of restricted stock units. If any other matter is properly presented at the meeting, then one of the individuals named on your proxy card as your proxy will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. Our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I access via the Internet or receive by mail more than one proxy card?

If you access via the Internet or receive by mail more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the applicable vote at the meeting. If you are the stockholder of record, you may revoke your proxy in any one of three ways:

| | • | | you may submit another properly completed proxy with a later date; |

| | • | | you may send a written notice that you are revoking your proxy to our Secretary at 1390 Kifer Road, Sunnyvale, California 94086; or |

| | • | | you may attend the annual meeting and vote in person (however, simply attending the meeting will not, by itself, revoke your proxy). |

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them if you wish to change your vote.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For” and “Withhold” votes with respect to the election of directors and, with respect to the proposals other than the election of directors, “For” and “Against” votes, abstentions and broker non-votes. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner, despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions. Abstentions will have no effect on the outcome of the election of directors and will be counted as “Against” votes with respect to any proposals other than the election of directors. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker, bank or other agent as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included

3

on that form regarding how to instruct your broker, bank or other agent to vote your shares. If you do not give instructions, then your broker, bank or agent may vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange, such as the vote for directors and ratification of our independent registered public accounting firm. Non-discretionary items include adoption of or amendments to stock plans.

How many votes are needed to approve each proposal?

| | • | | For the election of directors, the seven nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. |

| | • | | To be approved, the amendment to increase the shares available under the 2005 Outside Directors Equity Plan must receive a “For” vote from a majority of shares present and entitled to vote either in person or by proxy. |

| | • | | To be approved, the amendment to increase the shares available under the Amended and Restated 1995 Employee Stock Purchase Plan must receive a “For” vote from a majority of shares present and entitled to vote either in person or by proxy. |

| | • | | To be approved, the ratification of the selection of Deloitte as our independent registered public accounting firm must receive a “For” vote from a majority of shares present and entitled to vote either in person or by proxy. |

| | • | | To be approved, the program permitting eligible employees to exchange certain outstanding stock options for a lesser number of restricted stock units must receive a “For” vote from a majority of shares present and entitled to vote either in person or by proxy. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares as of the close of business on the record date are represented by stockholders present at the meeting or by proxy. At the close of business on the record date, there were 51,183,007 shares outstanding and entitled to vote. Therefore, in order for a quorum to exist, 25,591,504 shares must be represented by stockholders present at the meeting or by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our Quarterly Report on Form 10-Q for the quarter ending June 30, 2009.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a Board consisting of eight directors who will serve until the next annual meeting of stockholders and until their respective successors are duly elected and qualified. David Rynne will not stand for re-election at the annual meeting. Therefore, by action of the Board and effective as of the annual meeting of stockholders, the authorized number of directors will be decreased to seven. The Board’s nominees for election at the annual meeting are Levy Gerzberg, Ph.D., Uzia Galil, Raymond A. Burgess, James D. Meindl, Ph.D, James B. Owens, Jr., Arthur B. Stabenow and Philip M. Young, each of whom has indicated his willingness to serve if elected. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate. If elected, the nominees will serve as directors until our 2010 annual meeting of stockholders and until their successors are elected and qualified.

If a quorum is present and voting, the seven nominees for director receiving the highest number of votes will be elected as directors. Abstentions and broker non-votes have no effect on the vote.

The Board recommends a vote “FOR” the nominees named above.

The following table sets forth, for the nominees for election at the annual meeting, information with respect to their ages and background.

| | | | | | |

Name | | Principal Occupation | | Age | | Director

Since |

Levy Gerzberg, Ph.D. | | Our President and Chief Executive Officer | | 64 | | 1981 |

Uzia Galil | | Chairman and Chief Executive Officer of Uzia Initiative and Management Ltd.; our Chairman of Board | | 84 | | 1983 |

Raymond A. Burgess | | Consultant | | 50 | | 2005 |

James D. Meindl, Ph.D. | | Professor of Microelectronics, Georgia Institute of Technology | | 76 | | 1986 |

James B. Owens, Jr. | | Consultant | | 59 | | 2003 |

Arthur B. Stabenow | | Private Investor | | 70 | | 1990 |

Philip M. Young | | Managing Member, USVP Management Company LLC | | 69 | | 1986 |

Levy Gerzbergwas our co-founder in 1981 and has served as our President and Chief Executive Officer since December 1988 and as a director since 1981. Dr. Gerzberg also served as our President from 1981 to 1984 and as our Executive Vice President and Chief Technical Officer from 1985 to 1988. Prior to our co-founding, Dr. Gerzberg was Associate Director of Stanford University’s Electronics Laboratory. Dr. Gerzberg has over 25 years of experience in the high technology industry in the areas related to integrated circuits, software and systems utilizing digital signal processing in communication, consumer electronics and PC markets. Dr. Gerzberg holds a Ph.D. in Electrical Engineering from Stanford University and an M.S. in Medical Electronics and a B.S. in Electrical Engineering from the Technion-Israel Institute of Technology in Haifa, Israel (“Technion”).

Uzia Galilhas been one of our directors since 1983 and has served as Chairman of the Board since October 1993. Mr. Galil currently serves as Chairman and Chief Executive Officer of Uzia Initiative and Management Ltd., a company specializing in the promotion and nurturing of new businesses associated with mobile communication, electronic commerce and medical informatics, which he founded in November 1999. From 1962 until November 1999, Mr. Galil served as President and Chief Executive Officer of Elron Electronic Industries Ltd. (“Elron”), an Israeli high technology holding company, where he also served as Chairman of the Board of Directors. From January 1981 until leaving Elron, Mr. Galil also served as Chairman of the Board of Directors of Elbit Ltd., an electronic communication affiliate of Elron, and as a member of the Board of Directors of Elbit Systems Ltd., a defense electronics affiliate of Elron and all other private companies held in the Elron portfolio.

5

Mr. Galil currently serves as a director of Orbotech Ltd. and Partner Communications Ltd. From 1980 to 1990, Mr. Galil served as Chairman of the International Board of Governors of the Technion. Mr. Galil holds an M.S. in Electrical Engineering from Purdue University and a B.S. from the Technion. Mr. Galil has also been awarded an honorary doctorate in technical sciences by the Technion in recognition of his contribution to the development of science-based industries in Israel, an honorary doctorate in philosophy by the Weizmann Institute of Science, an honorary doctorate in engineering by Polytechnic University, New York, an honorary doctorate from the Ben-Gurion University of the Negev in Israel and the Solomon Bublick Prize Laureate from the Hebrew University of Jerusalem. Mr. Galil is also a recipient of the Israel Prize.

Raymond A. Burgesshas been one of our directors since April 2005. Since February 2008, he has been a business consultant. From November 2006 to February 2008, Mr. Burgess served as President and Chief Executive Officer of TeraVicta Technologies Inc. (“TeraVicta”), a provider of broadband MEMS switches and modules. On February 25, 2008, TeraVicta filed a petition for bankruptcy under Chapter 7 of Title 11 of the United States Code. From November 2005 to September 2006, Mr. Burgess was Chief Executive Officer of Tao Group, a private software company engaged in the development and sale of embedded software to enable multimedia in consumer and mobile communications devices. From July 2004 to November 2005, Mr. Burgess was engaged as a consultant to companies in the semiconductor industry and related fields. From April 2004 to July 2004, Mr. Burgess served as Senior Vice President, Strategy, Marketing and Communications of Freescale Semiconductor, Inc. From September 2000 to March 2004, Mr. Burgess served as Corporate Vice President, Strategy, Marketing and Communications for the Semiconductor Products Sector of Motorola , Inc. (“Motorola”) and he held a variety of other executive positions during a 20 year career at Motorola.

James D. Meindlhas been one of our directors since March 1986. Dr. Meindl has been the Joseph M. Pettit Chair Professor in microelectronics at Georgia Institute of Technology since November 1993. From September 1986 to November 1993, Dr. Meindl served as Provost and Senior Vice President of Academic Affairs at Renssalaer Polytechnic Institute. Prior to September 1986, Dr. Meindl was a professor of electrical engineering and Director of the Stanford Electronics Laboratory and Center for Integrated Systems at Stanford University. Dr. Meindl is also a director of SanDisk Corporation.

James B. Owens, Jr.has been one of our directors since May 2003. Since January 2005, Mr. Owens has been principally engaged as a consultant to companies in the semiconductor industry. From January 2002 to January 2005, Mr. Owens served as President and Chief Executive Officer and a director of Strasbaugh, a provider of semiconductor manufacturing equipment. From December 1999 to August 2001, Mr. Owens served as President and Chief Executive Officer of Surface Interface, a supplier of high-end metrology equipment to the semiconductor and hard disk markets. From August 1998 to December 1999, Mr. Owens served as President of Verdant Technologies, a division of Ultratech Stepper. Mr. Owens holds a B.S. in Physics from Stetson University, an M.S. in Management from the University of Arkansas and an M.S.E.E. from Georgia Institute of Technology.

Arthur B. Stabenowhas been one of our directors since November 1990. Mr. Stabenow has been principally engaged as a private investor since January 1999. From March 1986 to January 1999, Mr. Stabenow was Chief Executive Officer of Micro Linear Corporation, a semiconductor company. Mr. Stabenow also serves as a director of Applied Micro Circuits Corporation.

Philip M. Younghas been one of our directors since January 1986. Mr. Young has been a managing member of USVP Management Company LLC, a venture capital management company, since April 1990, and a general partner or managing member of the general partners of various venture capital funds managed by that company. Mr. Young is also a director of several private companies.

Current Director Not Standing for Re-Election

David Rynne, age 68, has been one of our directors since August 2003 but will not stand for re-election at the annual meeting. Mr. Rynne is a retired senior financial executive with more than 35 years of experience in growing technology companies. Most recently, Mr. Rynne served as Chief Executive Officer of Receipt.com

6

from July to December 1999 and as Vice President of Nortel Networks from August 1998 to June 1999. He served as Chief Financial Officer of Bay Networks from January 1997 to August 1998. Prior to joining Bay Networks, Mr. Rynne served as Chief Financial Officer at Tandem Computers from June 1983 to December 1996 and held a variety of financial management positions during an 18 year career at Burroughs Corporation. He is currently Chairman of the Board of Directors of Netfuel, Inc., a programmable network company, and serves on the Board of Directors of PD-LD, Inc., a fiber optic component company, and Synnex Corporation, an IT product distribution company.

Independence of the Board and its Committees

The Board has determined that Dr. Meindl and Messrs. Galil, Burgess, Owens, Rynne, Stabenow and Young are “independent directors” as defined under the rules of the Nasdaq Stock Market (“Nasdaq”), as currently in effect.

Board Meetings and Committees

The Board held eight meetings during the year ended December 31, 2008. The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. In 2008, no director attended fewer than 75% of the total number of meetings of the Board and the total number of meetings of committees of the Board on which such director served.

Audit Committee.The members of the Audit Committee are Messrs. Burgess, Owens, Rynne and Stabenow. Because Mr. Rynne will not stand for re-election at the annual meeting, the members of the Audit Committee, effective as of the annual meeting will be Messrs. Burgess, Owens and Stabenow. Mr. Stabenow is Chairman of the committee. The Board has determined that each of the members of the Audit Committee is independent for purposes of the applicable rules of Nasdaq and the SEC. The Board has also determined that Messrs. Burgess, Owens and Stabenow qualify as audit committee financial experts, as defined in the rules of the SEC. The functions of the Audit Committee include overseeing the quality of our financial reports and other financial information, retaining our independent registered public accounting firm, reviewing their independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our independent registered public accounting firm, overseeing their audit work, reviewing and pre-approving any non-audit services that may be performed by them, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies and reviewing and approving any related party transactions. The Audit Committee held ten meetings during 2008.

Compensation Committee.The members of the Compensation Committee are Mr. Galil, Dr. Meindl and Mr. Stabenow. Mr. Galil is Chairman of the committee. The Board has determined that each of the members of the Compensation Committee is independent for purposes of the applicable rules of Nasdaq. The Compensation Committee reviews the performance of our executive officers and approves their salaries and incentive compensation. For a description of the Compensation Committee’s processes and procedures for determining executive compensation, please see the “Compensation Discussion and Analysis” section below. The Compensation Committee held six meetings during 2008.

Nominating and Corporate Governance Committee.The members of the Nominating and Corporate Governance Committee are Messrs. Owens, Stabenow and Young. Mr. Young is Chairman of the committee. The Board has determined that each of the members of the Nominating and Corporate Governance Committee is independent for purposes of the Nasdaq rules. The Nominating and Corporate Governance Committee is responsible for identifying and considering qualified candidates for appointment and nomination for election to the Board and for making recommendations concerning such candidates, recommending corporate governance principles, codes of conduct and compliance mechanisms for us and providing oversight in the evaluation of the Board and its committees. The Nominating and Corporate Governance Committee held six meetings during 2008.

7

Director Nominations

The Nominating and Corporate Governance Committee is responsible for the selection, and recommendation to the Board, of nominees for election as director. When considering the nomination of directors for election at an annual meeting, the Nominating and Corporate Governance Committee reviews the needs of the Board for various skills, background, experience, expected contributions and the qualification standards established from time to time by the Nominating and Corporate Governance Committee. When reviewing potential nominees, including incumbents, the Nominating and Corporate Governance Committee considers the perceived needs of the Board, the candidate’s relevant background, experience, skills and expected contributions to the Board, as well as the following factors:

| | • | | the appropriate size of our Board and its committees; |

| | • | | diversity, age and skills, such as understanding of relevant technology, manufacturing operations, finance, marketing and international business operation, in the context of our perceived needs and the perceived needs of the Board at the time; |

| | • | | the relevant skills, background, reputation and business experience of nominees compared to the skills, background, reputation and business experience already possessed by other members of the Board; |

| | • | | nominees’ independence from management; |

| | • | | applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance; |

| | • | | the benefits of a constructive working relationship among directors; and |

| | • | | the desire to balance the benefits associated with continuity with the benefits of the fresh perspective provided by new members. |

The Nominating and Corporate Governance Committee also seeks appropriate input from the Chief Executive Officer from time to time in assessing the needs of the Board for relevant background, experience and skills of its members.

The Nominating and Corporate Governance Committee’s goal is to assemble a Board with a diversity of experience at policy-making levels in business, technology and in areas relevant to our global activities. Directors should possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of our stockholders. They must have an inquisitive and objective outlook and mature judgment. They must also have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Director candidates must have sufficient time available in the judgment of the Nominating and Corporate Governance Committee to perform all Board and committee responsibilities that will be expected of them. Members of the Board are expected to rigorously prepare for, attend and participate in all meetings of the Board and applicable committees. Other than the foregoing, there are no specific minimum criteria for director nominees, although the Nominating and Corporate Governance Committee believes that it is preferable that at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by SEC rules. Under applicable Nasdaq listing requirements, at least a majority of the members of the Board must meet the definition of “independent director” set forth in such requirements and our Corporate Governance Guidelines. The Nominating and Corporate Governance Committee also believes it appropriate for one or more key members of our management, including the Chief Executive Officer, to serve on the Board.

The Nominating and Corporate Governance Committee will consider candidates for director proposed by directors or management, and will evaluate any such candidates against the criteria and pursuant to the policies and procedures set forth above. If the Nominating and Corporate Governance Committee believes that the Board requires additional candidates for nomination, the Nominating and Corporate Governance Committee may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. All incumbent

8

directors and nominees will be required to submit a completed directors’ and officers’ questionnaire as part of the nominating process. The process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee will also consider candidates for director recommended by a stockholder, provided that any such recommendation is sent in writing to General Counsel, Zoran Corporation, 1390 Kifer Road, Sunnyvale, CA 94086, at least 120 days prior to the anniversary of the date definitive proxy materials were mailed to stockholders in connection with the prior year’s annual meeting of stockholders and contains the following information:

| | • | | the candidate’s name, age, contact information and present principal occupation or employment; and |

| | • | | a description of the candidate’s qualifications, skills, background and business experience during at least the last five years, including his or her principal occupation and employment and the name and principal business of any company or other organization where the candidate has been employed or has served as a director. |

The Nominating and Corporate Governance Committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

In addition, stockholders may make direct nominations of directors for election at an annual meeting, provided the advance notice requirements set forth in our Bylaws have been met. Under our Bylaws, written notice of such nomination, including certain information and representations specified in the Bylaws, must be delivered to our principal executive offices, addressed to the General Counsel, at least 120 days prior to the anniversary of the date definitive proxy materials were mailed to stockholders in connection with the prior year’s annual meeting of stockholders, except that if no annual meeting was held in the previous year or the date of the annual meeting has been advanced by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, such notice must be received not later than the close of business on the 10th day following the day on which the public announcement of the date of such meeting is first made.

9

DIRECTOR COMPENSATION

Cash Compensation

For serving as a member of our Board of Directors, each of our directors that is not employed by us or one of our subsidiaries (a “non-employee director”) receives an annual retainer of $20,000 and a fee of $2,000 for each Board meeting attended. Board committee chairs receive $2,500 per quarter, and other committee members receive $1,500 per quarter, and all committee members receive $750 for each committee meeting attended.

Stock Options

Upon appointment or election to the Board of Directors, each non-employee director receives an option to purchase 30,000 shares of our common stock, vesting in four equal annual installments. Thereafter, on the date following each annual meeting of stockholders, each incumbent non-employee director who was not appointed or elected in the previous year receives an option to purchase 15,000 shares of our common stock, vesting in full on the day preceding the next annual meeting of stockholders, subject to the director’s continued service through that date. The exercise price of each such option is the closing price of our common stock on the date of grant. These options expire after 10 years.

The following table provides information regarding all compensation for 2008 for each of our non-employee directors. The compensation paid to Dr. Gerzberg, who is also one of our employees, is presented below in the Summary Compensation Table and the related explanatory tables. Dr. Gerzberg is not entitled to receive additional compensation for his service as a director.

| | | | | | | | | | | |

Name | | Fees

Earned or

Paid in

Cash | | Option

Awards(1)(2) | | All Other

Compensation | | Total |

Uzia Galil | | $ | 48,500 | | $ | 149,705 | | — | | $ | 198,205 |

Raymond A. Burgess | | $ | 47,500 | | $ | 165,085 | | — | | $ | 212,585 |

James D. Meindl, Ph.D. | | $ | 44,500 | | $ | 149,705 | | — | | $ | 194,205 |

James B. Owens, Jr. | | $ | 58,000 | | $ | 149,705 | | — | | $ | 207,705 |

David Rynne | | $ | 44,000 | | $ | 149,705 | | — | | $ | 193,705 |

Arthur B. Stabenow | | $ | 72,500 | | $ | 149,705 | | — | | $ | 222,205 |

Philip M. Young | | $ | 48,500 | | $ | 149,705 | | — | | $ | 198,205 |

| (1) | These amounts reflect the dollar amount of expense recognized for financial statement reporting purposes for the year ended December 31, 2008 in accordance with FAS 123(R), with the exception that estimated forfeitures related to service-based vesting were disregarded in these amounts. No equity awards granted to our non-employee directors were forfeited during 2008. Assumptions used in the calculation of these amounts for purposes of our financial statements for the years ended December 31, 2006, 2007 and 2008 are included in Note 10 of Notes to Consolidated Financial Statements for the year ended December 31, 2008 included in our Annual Report on Form 10-K filed with the SEC. |

| (2) | As described above, we granted each of our non-employee directors an option to purchase 15,000 shares of our common stock on June 13, 2008. Each of these options had a per-share exercise price of $13.50 and a grant date fair value (as determined under FAS 123R), of $104,485. At December 31, 2008, the following directors had outstanding options to purchase the number of shares of our common stock set forth following their respective names: Mr. Galil, 126,600 shares; Mr. Burgess, 75,000 shares; Dr. Meindl, 126,600 shares; Mr. Owens, 105,000 shares; Mr. Rynne, 131,733 shares; Mr. Stabenow, 152,850 shares; Mr. Young, 126,600 shares. |

10

Director Stock Ownership Guidelines

The Board of Directors adopted stock ownership guidelines recommending minimum stock ownership levels for our non-employee directors. Holdings include our shares from all sources, including personal and trust holdings, restricted stock, restricted stock units, stock options and stock appreciation rights. The current members of the Board of Directors are each encouraged to own a number of shares of our common stock that have a value at least equal to three times the annual cash retainer paid for Board service. We recommend that new members of the Board of Directors comply with this guideline within three years of their initial election or appointment.

Director Training

Each of our directors attended an eight-hour training to aid them in effectively discharging their duties and familiarize them with the issues facing all boards of directors of publicly traded corporations, including best boardroom practices, compliance with the Sarbanes-Oxley Act, compensation, audit committee practices, litigation, director and officer insurance coverage and ethical concerns.

Communications with Directors; Attendance at Annual Meetings

Stockholders may communicate with the Board, or any individual director, by mail addressed to the intended recipient c/o General Counsel, Zoran Corporation, 1390 Kifer Road, Sunnyvale, CA 94086, by facsimile to (408) 523-6501 or by email to board.directors@zoran.com. The General Counsel will maintain a log of such communications and transmit them promptly to the identified recipient except in the case of communications that are in bad taste or present security concerns, or communications that relate primarily to commercial matters unrelated to the sender’s interests as a stockholder. The intended recipient will be advised of any communication withheld for such reasons.

We do not have a policy regarding directors’ attendance at annual meetings. None of our directors attended the 2008 annual meeting of stockholders.

Committee Charters and Other Corporate Governance Materials

The Board has adopted a charter for each of the committees described above. Copies of the charters of the Audit Committee, the Compensation Committee and Nominating and Corporate Governance Committee are available on our website at http://www.zoran.com/Corporate-Governance.

The Board has also adopted Corporate Governance Guidelines that address the composition of the Board, criteria for Board membership, director stock ownership guidelines and other Board governance matters. Links to these materials are available on our website at http://www.zoran.com/Corporate-Governance.

Code of Business Conduct and Ethics

We have in place a Code of Business Conduct and Ethics that applies to all of our officers, directors and employees, including our Chief Executive Officer, Chief Financial Officer and Controller. This code is available on our website at http://www.zoran.com/Corporate-Governance.If we make any substantive amendments to the code or grant any waiver from a provision of the code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website, as well as via any other means then required by Nasdaq listing standards or applicable law.

11

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO

INCREASE THE SHARES AVAILABLE UNDER THE

2005 OUTSIDE DIRECTORS EQUITY PLAN

At the annual meeting, the stockholders will be asked to approve an amendment to the Zoran Corporation 2005 Outside Directors Equity Plan (the “2005 Directors Plan”) that would increase the number of shares available for award grant purposes under the 2005 Directors Plan by 600,000 shares. The Board of Directors approved the amendment, subject to stockholder approval, on April 22, 2009.

As of March 31, 2009, a total of 405,000 shares of our common stock were subject to outstanding awards granted under the 2005 Directors Plan and an additional 195,000 shares of our common stock were then available for new award grants under the 2005 Directors Plan.

We are requesting that the stockholders approve the amendment to increase the shares available under the 2005 Directors Plan in order to assist us in attracting and retaining highly qualified individuals to serve as our independent directors and to provide an incentive toward increasing our value for our stockholders. The Board of Directors believes that attracting and retaining qualified members has become more challenging in the past few years in light of recent changes in the business and regulatory environment that require public companies to have more independent directors on their boards and require their board members to make increasing time commitments. Having a competitive equity incentive program for non-employee directors is an important factor in recruiting and retaining the caliber of directors essential to our success. In addition, the Board of Directors believes that equity ownership by directors is important in aligning the interests of management and our stockholders.

The Board of Directors believes that the proposed amendment of the 2005 Directors Plan is in our best interests and the best interests of our stockholders in order to provide a competitive equity incentive program that will enable us to continue to recruit and retain the capable directors essential to our long-term success. Therefore, the Board urges you to vote to approve the proposed amendment of the 2005 Directors Plan.

Summary of the 2005 Directors Plan

The following summary of the 2005 Directors Plan is qualified in its entirety by the full text of the 2005 Directors Plan, which has been filed as an exhibit to the copy of this Proxy Statement that was filed electronically with the SEC and can be reviewed on the SEC’s website athttp://www.sec.gov. You may also obtain, free of charge, a copy of the 2005 Directors Plan by writing to the Corporate Secretary, Zoran Corporation, 1390 Kifer Road, Sunnyvale, California 94086, or by facsimile to (408) 523-6541 or by e-mail tolegal@zoran.com.

General.The purpose of the 2005 Directors Plan is to advance our interests by providing an incentive to attract and retain qualified individuals to serve on our Board of Directors and to provide them with a personal stake in our success. These incentives will be provided through the grant of stock options, stock appreciation rights, restricted stock units and deferred compensation awards.

Authorized Shares.A total of 600,000 shares of our common stock is currently authorized for issuance under the 2005 Directors Plan. If stockholders approve the 2005 Directors Plan proposal, the share limit for the 2005 Director Plan will be increased by an additional 600,000 shares.

Share Accounting and Adjustments.Each share subject to a stock option, stock appreciation right or deferred compensation award will reduce the number of shares remaining available for grant under the 2005 Directors Plan by one share. However, each share subject to a “full value” award (i.e.,an award settled in stock, other than an option, stock appreciation right or deferred compensation award) will reduce the number of shares remaining available for grant under the 2005 Directors Plan by 1.3 shares.

12

If any award granted under the 2005 Directors Plan expires or otherwise terminates for any reason without having been exercised or settled in full, or if we forfeit or repurchase shares subject to forfeiture or repurchase are forfeited or repurchased by us for not more than the participant��s purchase price, any such shares reacquired or subject to a terminated award will again become available for issuance under the 2005 Directors Plan. Shares withheld or reacquired by us in satisfaction of a tax withholding obligation will not again become available under the 2005 Directors Plan. The number of shares available under the 2005 Directors Plan will be reduced upon the exercise of a stock appreciation right by the gross number of shares for which the award is exercised. If shares are tendered in payment of the exercise price of an option or the option is exercised by means of a net-exercise procedure, the number of shares available under the 2005 Directors Plan will be reduced by the gross number of shares for which the option is exercised. Appropriate adjustments will be made to the number of shares authorized under the 2005 Directors Plan, to the numerical limits on awards described below, and to outstanding awards in the event of any change in our common stock through merger, consolidation, reorganization, reincorporation, recapitalization, reclassification, stock dividend, stock split, reverse stock split, split-up, split-off, spin-off, combination of shares, exchange of shares or similar change in our capital structure, or if we make a distribution to our stockholders in a form other than common stock (excluding normal cash dividends) that has a material effect on the fair market value of our common stock. In such circumstances, the Board of Directors also has the discretion under the 2005 Directors Plan to adjust the terms of outstanding awards as it deems appropriate.

Certain Award Limits.In addition to the limitation described above on the total number of shares of our common stock that are authorized for issuance under the 2005 Directors Plan, the 2005 Directors Plan limits the numbers of shares that may be subject to awards granted to any director in any fiscal year, subject to adjustment as described under “Share Accounting and Adjustments” above. A director may not be granted an award for more than 20,000 shares in any fiscal year, except that this limit may be increased by up to an additional 40,000 shares in the fiscal year in which the individual is first appointed or elected to the Board of Directors, up to an additional 10,000 shares in any fiscal year in which the director is serving as the chairman or lead director of the Board of Directors, up to an additional 2,500 shares for each committee of the Board of Directors on which the director is serving other than as chairman, and up to an additional 5,000 shares for each committee of the Board of Directors on which the director is serving as chairman.

Administration.The 2005 Directors Plan is generally administered by the Board of Directors or by a committee or subcommittee of the Board of Directors appointed to administer the 2005 Directors Plan. For purposes of this summary, the term “Board” will refer to either such committee or the Board of Directors. Subject to the provisions of the 2005 Directors Plan, the Board determines in its discretion when and to whom awards are granted, the types and sizes of awards, the vesting and/or holding periods applicable to awards and all other terms and conditions of awards. The Board may, subject to the limitations in the 2005 Directors Plan, amend, cancel or renew any award, waive any restrictions or conditions applicable to any award, and accelerate, continue, extend or defer the vesting of any award. The 2005 Directors Plan provides, subject to certain limitations, for our indemnification of any director, officer or employee against all reasonable expenses, including attorneys’ fees, incurred in connection with any legal action arising from such person’s action or failure to act in administering the 2005 Directors Plan. All awards granted under the 2005 Directors Plan will be evidenced by a written agreement between us and the participant specifying the terms and conditions of the award, consistent with the requirements of the 2005 Directors Plan. The Board has the authority to interpret the 2005 Directors Plan and awards granted thereunder, and all determinations of the Board are final and binding on all persons having an interest in the 2005 Directors Plan or any award.

Prohibition of Option and SAR Repricing.The 2005 Directors Plan expressly provides that, without the approval of a majority of the votes cast in person or by proxy at a meeting of our stockholders, the Board may not provide for either the cancellation of outstanding options or stock appreciation rights in exchange for the grant of new options or stock appreciation rights at a lower exercise price or the amendment of outstanding options or stock appreciation rights to reduce the exercise price.

13

Eligibility.Awards may be granted under the 2005 Directors Plan only to persons who, at the time of grant, are serving as members of the Board of Directors and who are not our employees or employees of any of our parents, subsidiaries or other affiliates. As of March 31, 2009, all seven of our non-employee directors were eligible for award grants under the 2005 Directors Plan.

Awards Granted Under the 2005 Directors Plan.The Board may, from time to time, establish awards to be granted on a periodic, nondiscriminatory basis to non-employee members of the Board of Directors. Additional awards may be granted to non-employee directors in consideration of service on one or more committees of the Board, service as chairman of one or more committees of the Board, service as chairman or lead director of the Board or the individual’s initial appointment or election to the Board. Awards granted under the 2005 Directors Plan may be granted in the form of nonstatutory stock options, stock appreciation rights, restricted stock units and deferred compensation awards. Each of these types of awards is described in more detail below. Subject to the limits described above under “Certain Award Limits,” the Board will determine the amount(s) and type(s) of such awards.

Stock Options.The Board may grant nonstatutory stock options under the 2005 Directors Plan. The exercise price of each option may not be less than the fair market value of a share of our common stock on the date of grant. The 2005 Directors Plan provides that the option exercise price may be paid in cash or its equivalent; by means of a broker-assisted cashless exercise; by tender to us of shares of common stock owned by the participant having a fair market value not less than the exercise price (to the extent legally permitted); by means of a net-exercise procedure; by such other lawful consideration as approved by the Board; or by any combination of these. Nevertheless, the Board may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the participant has made adequate provision for federal, state, local and foreign taxes, if any, relating to the exercise of the option, including, if permitted or required by us, through the participant’s surrender of a portion of the option shares to us.

Options become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Board. The maximum term of any option granted under the 2005 Directors Plan is ten years. Unless otherwise provided by the Board, an option generally remains exercisable for three months following the participant’s termination of service, provided that if service terminates as a result of the participant’s death or disability, the option generally will remain exercisable for 12 months. However, if the director has served continuously on the board for at least two years as of the date of death or disability, or if the director’s service terminates due to his or her retirement, the option will generally remain exercisable until its expiration date. In all cases, the option may not be exercised at any time after its expiration date. Stock options may be assigned or transferred to certain family members to the extent permitted by the Board.

Stock Appreciation Rights.The Board may grant stock appreciation rights either in tandem with a related option (“Tandem SAR”) or independently of any option (“Freestanding SAR”). A Tandem SAR requires the option holder to elect between the exercise of the underlying option for shares of common stock or the surrender of the option and the exercise of the related stock appreciation right. A Tandem SAR is exercisable only at the time and to the extent that the related stock option is exercisable, while a Freestanding SAR is exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as may be specified by the Board. The exercise price of a Tandem SAR is the same as the exercise price of the related option, and the exercise price of a Freestanding SAR may not be less than the fair market value of a share of our common stock on the date of grant.

Upon the exercise of any stock appreciation right, the participant is entitled to receive an amount equal to the excess of the fair market value of the underlying shares of common stock as to which the right is exercised over the aggregate exercise price for such shares. Payment of this amount upon the exercise of a Tandem SAR may be made only in shares of common stock whose fair market value on the exercise date equals the payment amount. At the Board’s discretion, payment of this amount upon the exercise of a Freestanding SAR may be

14

made in cash or shares of common stock and may be paid in a lump sum or on a deferred basis in accordance with the terms of the participant’s award agreement. The maximum term of any stock appreciation right granted under the 2005 Directors Plan is ten years.

Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution, and are generally exercisable during the participant’s lifetime only by the participant. If permitted by the Board, a Tandem SAR related to a stock option and a Freestanding SAR may be assigned or transferred to certain family members to the extent permitted by the Board. Other terms of stock appreciation rights are generally similar to the terms of comparable stock options.

Restricted Stock Units.The Board may grant restricted stock units under the 2005 Directors Plan, which represent rights to receive shares of our common stock at a future date determined in accordance with the participant’s award agreement. No monetary payment is required for receipt of restricted stock units or the shares issued in settlement of the award, the consideration for which is furnished in the form of the participant’s services to us. The Board may grant restricted stock unit awards subject to such vesting requirements and other terms and conditions as established by the Board. Unless otherwise provided by the Board, a participant will forfeit any restricted stock units which have not vested prior to the participant’s termination of service. Participants have no voting rights or rights to receive cash dividends with respect to restricted stock unit awards until shares of common stock are issued in settlement of such awards. However, the Board may grant restricted stock units that entitle their holders to dividend equivalent rights, which are rights to receive additional restricted stock units for a number of shares whose value is equal to any cash dividends we pay.

Deferred Compensation Awards.The 2005 Directors Plan authorizes the Board to establish a deferred compensation award program. If such a program is implemented, directors would be able to elect to receive an award of deferred stock units in lieu of compensation otherwise payable in cash. Each such deferred stock unit represents a right to receive one share of our common stock at a future date determined in accordance with the participant’s award agreement. Deferred stock units are settled by distribution to the participant of a number of whole shares of common stock equal to the number of deferred stock units subject to the award as soon as practicable following the earlier of the date on which the participant’s service terminates or a settlement date elected by the participant at the time of his or her election to receive the deferred stock unit award in accordance with applicable tax laws. Participants are not required to pay any additional consideration in connection with the settlement of deferred stock units. A holder of deferred stock units has no voting rights or other rights as a stockholder until shares of common stock are issued to the participant in settlement of the deferred stock units. However, participants holding deferred stock units are entitled to dividend equivalent rights with respect to any payment of cash dividends on an equivalent number of shares of common stock. Such dividend equivalents are credited in the form of additional whole deferred stock units. Prior to settlement, deferred stock units may not be assigned or transferred other than by will or the laws of descent and distribution.

Change in Control.In the event of a Change in Control, the vesting of all awards granted under the 2005 Directors Plan and held by a participant whose service has not terminated prior to the date of the Change in Control will be accelerated in full. Restricted stock unit awards and deferred compensation awards granted under the 2005 Directors Plan will be settled on the date of the Change in Control. The 2005 Directors Plan provides that a “Change in Control” occurs upon (a) a person or entity (with certain exceptions described in the 2005 Plan) becoming the direct or indirect beneficial owner of more than 50% of our voting stock, (b) our liquidation or dissolution, or (c) the occurrence of any of the following events upon which our stockholders immediately before the event do not retain immediately after the event direct or indirect beneficial ownership of more than 50% of our voting securities, our successor or the entity to which our assets were transferred: (i) a sale or exchange by the stockholders in a single transaction or series of related transactions of more than 50% of our voting stock; (ii) a merger or consolidation in which we are a party; or (iii) the sale, exchange or transfer of all or substantially all of our assets (other than a sale, exchange or transfer to one or more of our subsidiaries).

If a Change in Control occurs, the surviving, continuing, successor or purchasing entity or its parent may, without the consent of the participant, either assume or continue outstanding awards or substitute substantially

15

equivalent awards for its stock. Stock-based awards will be deemed assumed if, for each share subject to the award prior to the Change in Control, its holder is given the right to receive the same amount of consideration that a stockholder would receive as a result of the Change in Control. Any awards which are not assumed or continued in connection with a Change in Control or exercised or settled prior to the Change in Control will terminate effective as of the time of the Change in Control. Subject to the restrictions of Section 409A of the Code, the Board may provide for the settlement of any or all outstanding awards upon such terms and to such extent as it determines. The 2005 Directors Plan also authorizes the Board, in its discretion and without the consent of any participant, to cancel each or any outstanding award denominated in shares of stock upon a Change in Control in exchange for a payment to the participant with respect each vested share subject to the cancelled award of an amount equal to the excess of the consideration to be paid per share of common stock in the Change in Control transaction over the exercise price per share, if any, under the award.

Awards Subject to Section 409A of the Code.Certain awards granted under the 2005 Directors Plan may be deemed to constitute “deferred compensation” within the meaning of Section 409A of the Code, providing rules regarding the taxation of nonqualified deferred compensation plans, and such regulations or other administrative guidance that may be issued pursuant to Section 409A. Any such awards will be required to comply with the requirements of Section 409A. Notwithstanding any provision of the 2005 Directors Plan to the contrary, the Board is authorized, in its sole discretion and without the consent of any participant, to amend the 2005 Directors Plan or any award agreement as it deems necessary or advisable to comply with Section 409A.

Termination or Amendment.The 2005 Directors Plan will continue in effect until its termination by the Board, provided that no awards may be granted under the 2005 Directors Plan following the tenth anniversary of the 2005 Directors Plan’s effective date, which will be the date on which it is approved by the stockholders. The Board may terminate or amend the 2005 Directors Plan at any time, provided that no amendment may be made without stockholder approval that would increase the maximum aggregate number of shares of stock authorized for issuance under the 2005 Directors Plan or require stockholder approval under any applicable law, regulation or rule. No termination or amendment may affect any outstanding award unless expressly provided by the Board, and, in any event, may not adversely affect an outstanding award without the consent of the participant unless necessary to comply with any applicable law, regulation or rule, including, but not limited to, Section 409A of the Code.

Summary of U.S. Federal Income Tax Consequences

The following summary is intended only as a general guide to the U.S. federal income tax consequences of participation in the 2005 Directors Plan and does not attempt to describe all possible federal or other tax consequences of such participation or tax consequences based on particular circumstances.

Nonstatutory Stock Options.Options granted under the 2005 Directors Plan are nonstatutory stock options and are not intended to qualify as “incentive stock options” for tax purposes. A participant generally recognizes no taxable income upon receipt of such an option. Upon exercising a nonstatutory stock option, the participant normally recognizes ordinary income equal to the difference between the exercise price paid and the fair market value of the shares on the date when the option is exercised. Upon the sale of stock acquired by the exercise of a nonstatutory stock option, any gain or loss, based on the difference between the sale price and the fair market value of the shares on the exercise date, is taxed as capital gain or loss. We generally are entitled to a tax deduction equal to the amount of ordinary income recognized by the participant as a result of the exercise of a nonstatutory stock option, except to the extent such deduction is limited by applicable provisions of the Code.

Stock Appreciation Rights.A participant recognizes no taxable income upon the receipt of a stock appreciation right. Upon the exercise of a stock appreciation right, the participant generally recognizes ordinary income in an amount equal to the excess of the fair market value of the underlying shares of common stock on the exercise date over the exercise price. If the participant is an employee, such ordinary income generally is subject to withholding of income and employment taxes. We generally are entitled to a deduction equal to the

16

amount of ordinary income recognized by the participant in connection with the exercise of the stock appreciation right, except to the extent such deduction is limited by applicable provisions of the Code.

Restricted Stock Unit Awards.A participant generally recognizes no income upon the grant of a restricted stock unit award. Upon the settlement of such awards, participants normally recognize ordinary income in the year of settlement in an amount equal to the cash received and the fair market value of any substantially vested shares of stock received. Upon the sale of any shares received, any further gain or loss is taxed as capital gain or loss. We generally should be entitled to a deduction equal to the amount of ordinary income recognized by the participant, except to the extent such deduction is limited by applicable provisions of the Code.

Deferred Compensation Awards.A participant generally recognizes no income upon the receipt of deferred stock units. Upon the settlement of deferred stock units, the participant normally recognizes ordinary income in the year of settlement in an amount equal to the fair market value of the shares received. Upon the sale of the shares received, any gain or loss, based on the difference between the sale price and the fair market value of the shares on the date the shares were transferred to the participant, is taxed as capital gain or loss. We generally are entitled to a deduction equal to the amount of ordinary income recognized by the participant, except to the extent such deduction is limited by applicable provisions of the Code.

Specific Benefits under the 2005 Directors Plan

None of the Company’s officers and employees (including the named executive officers) is eligible to receive awards under the 2005 Directors Plan. As described above under “Director Compensation,” the Board has adopted a program under the 2005 Directors Plan that provides for grants of stock options to be made to non-employee directors upon their election or appointment to the Board and for grants of stock options to be made each year in conjunction with the annual meeting. The number of stock options that will be allocated, based on the following assumptions, to the Company’s six non-employee directors nominated for re-election at the annual meeting pursuant to the annual award grants under the current program is 630,000 (15,000 x 6 x 7) stock options. This represents the aggregate number of shares that would be subject to the annual grants to non-employee directors under the 2005 Directors Plan for calendar years 2009 through 2015 (the seven remaining years in the term of the plan), assuming, among other future variables, that there are no new eligible directors, there continue to be six eligible directors seated and there are no changes to the types of annual awards and the number of shares subject to each annual award (15,000 stock options) granted under the 2005 Directors Plan. The actual number of shares that will be subject to stock options for initial one-time grants to new directors under the plan and the number of other discretionary awards that may be made under the plan is not determinable.

The closing market price for a share of our common stock as of March 31, 2009 was $8.80 per share.

17

AGGREGATE PAST GRANTS UNDER THE 2005 DIRECTORS PLAN

As of March 31, 2009, awards covering 405,000 shares of the Company’s common stock had been granted under the 2005 Directors Plan. The following table shows information regarding the awards made to the Company’s non-employee directors under the plan as of that date. As noted above, none of the Company’s officers and employees (including the named executive officers) is eligible to receive awards under the 2005 Directors Plan.

| | | | | | | | |

Name and Position | | Number of

Shares

Subject to

Past Option

Grants | | Number

of Shares

Acquired

On

Exercise | | Number of Shares Underlying

Outstanding Options as of

March 31, 2009 |

| | | | Exercisable | | Unexercisable |

Uzia Galil | | 60,000 | | 0 | | 45,000 | | 15,000 |

Raymond A. Burgess | | 45,000 | | 0 | | 30,000 | | 15,000 |

James D. Meindl, Ph.D. | | 60,000 | | 0 | | 45,000 | | 15,000 |

James B. Owens, Jr. | | 60,000 | | 0 | | 45,000 | | 15,000 |

David Rynne | | 60,000 | | 0 | | 45,000 | | 15,000 |

Arthur B. Stabenow | | 60,000 | | 0 | | 45,000 | | 15,000 |

Philip M. Young | | 60,000 | | 0 | | 45,000 | | 15,000 |

| | | | | | | | |

Total for Non-Executive Director Group: | | 405,000 | | 0 | | 300,000 | | 105,000 |

| | | | | | | | |

Each of the non-employee directors identified above (other than Mr. Rynne) is a nominee for re-election as a director at the annual meeting.

Required Vote and Board of Directors’ Recommendation

The Board of Directors believes that the approval of the amendment to the 2005 Directors Plan will promote our interests and our stockholders’ interests and will help us continue to be able to attract, retain and reward persons important to our success.

All non-employee members of the Board of Directors are eligible for awards under the 2005 Directors Plan and thus have a personal interest in the approval of the amendment to the 2005 Directors Plan. The Company’s executive officers are not eligible to participate in the 2005 Directors Plan.

Approval of this proposal requires the affirmative vote of a majority of the shares voted affirmatively or negatively on this proposal at the annual meeting of stockholders, either in person or by proxy. Abstentions and broker non-votes will have no effect on the outcome of this vote.

Our Board of Directors recommends that you vote “FOR” approval of the amendment to increase the shares available under the 2005 Directors Plan as described above.

18

PROPOSAL NO. 3

APPROVAL OF AMENDMENT TO

INCREASE THE SHARES AVAILABLE UNDER THE AMENDED AND RESTATED

1995 EMPLOYEE STOCK PURCHASE PLAN

At the annual meeting, the stockholders are being asked to approve an amendment to Zoran’s Amended and Restated 1995 Employee Stock Purchase Plan (the “Purchase Plan”) to increase the maximum number of shares of common stock that may be issued under the Purchase Plan by 3,000,000 shares. Our stockholders have previously authorized 4,225,000 shares of our common stock for purchase by employees under the Purchase Plan. As of March 31, 2009, a total of 1,373,752 shares remained available for purchase under the Purchase Plan.

The Board of Directors believes that the Purchase Plan benefits us and our stockholders by helping to attract, retain and motivate valued employees by offering an opportunity to purchase shares of our common stock through payroll deductions. The Board of Directors approved this amendment, subject to stockholder approval, to permit us to continue offering this opportunity to our employees.

Summary of the 1995 Employee Stock Purchase Plan, as Amended

The following summary of the Purchase Plan is qualified in its entirety by the full text of the Purchase Plan, which has been filed as an exhibit to the copy of this Proxy Statement that was filed electronically with the SEC and can be reviewed on the SEC’s website athttp://www.sec.gov. You may also obtain, free of charge, a copy of the Purchase Plan by writing to the Corporate Secretary, Zoran Corporation, 1390 Kifer Road, Sunnyvale, California 94086, or by facsimile to (408) 523-6541 or by e-mail tolegal@zoran.com.

General.The Purchase Plan is intended to qualify as an “employee stock purchase plan” under Section 423 of the Code. Each participant in the Purchase Plan is granted, at the beginning of each offering period under the plan (an “Offering”), the right to purchase through accumulated payroll deductions up to a number of shares of common stock (a “Purchase Right”) determined on the first day of the Offering. The Purchase Right is automatically exercised on the last day of each purchase period within the Offering unless the participant has withdrawn from participation in the Offering or in the Purchase Plan prior to such date.

Authorized Shares.Currently, a maximum of 4,225,000 of our authorized but unissued or reacquired shares of common stock may be issued under the Purchase Plan, subject to appropriate adjustment in the event of a stock dividend, stock split, reverse stock split, recapitalization, combination, reclassification or similar change in our capital structure or in the event of any merger, sale of assets or other reorganization. The Board of Directors has amended the Purchase Plan, subject to stockholder approval, to authorize an additional 3,000,000 shares for issuance under the Purchase Plan, for a cumulative, aggregate maximum of 7,225,000 shares. If any Purchase Right expires or terminates, the shares subject to the unexercised portion of such Purchase Right will again be available for issuance under the Purchase Plan.

Administration.The Purchase Plan is administered by the Board of Directors or a duly appointed committee of the Board. (For the purposes of this discussion, the term “Board” refers to either the Board of Directors or such committee.) Subject to the provisions of the Purchase Plan, the Board determines the terms and conditions of Purchase Rights granted under the plan. The Board has the authority to interpret the Purchase Plan and Purchase Rights granted thereunder, and all determinations of the Board are final and binding on all persons having an interest in the Purchase Plan or any Purchase Rights.