QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

SILICON IMAGE, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 11, 2002

To Our Stockholders:

You are cordially invited to attend the 2002 Annual Meeting of Stockholders of Silicon Image, Inc. to be held at our headquarters located at 1060 East Arques Ave., Sunnyvale, California, on Tuesday, May 21, 2002, at 2:00 p.m., local time.

The matters expected to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

It is important that you use this opportunity to take part in the affairs of Silicon Image by voting on the business to come before this meeting.Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

| | | Sincerely, |

|

|

|

|

|

David D. Lee

President and Chief Executive Officer |

SILICON IMAGE, INC.

1060 East Arques Ave.

Sunnyvale, California 94086

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Stockholders of Silicon Image, Inc. will be held at our headquarters located at 1060 East Arques Ave., Sunnyvale, California, on Tuesday, May 21, 2002, at 2:00 p.m., local time for the following purposes:

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 25, 2002 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof.

| | | By Order of the Board of Directors |

|

|

|

|

|

David D. Lee

President and Chief Executive Officer |

Sunnyvale, California

April 11, 2002

Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

SILICON IMAGE, INC.

1060 East Arques Ave.

Sunnyvale, California 94086

PROXY STATEMENT

April 11, 2002

The accompanying proxy is solicited on behalf of the Board of Directors of Silicon Image, Inc., a Delaware corporation, for use at the 2002 Annual Meeting of Stockholders to be held at our headquarters located at 1060 East Arques Ave., Sunnyvale, California, on Tuesday, May 21, 2002, at 2:00 p.m., local time. Only holders of record of our common stock at the close of business on March 25, 2002, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on March 25, 2002, we had 64,827,107 shares of common stock outstanding and entitled to vote. A majority of such shares, present in person or represented by proxy, will constitute a quorum for the transaction of business. This Proxy Statement and the accompanying form of proxy were first mailed to stockholders on or about April 11, 2002. An annual report for the year ended December 31, 2001 is enclosed with this Proxy Statement.

Voting Rights and Required Vote

Holders of Silicon Image common stock are entitled to one vote for each share held as of the above record date.

For Proposal No. 1, directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors, which means that the two nominees receiving the highest number of "for" votes will be elected. Proposal No. 2 requires for approval the affirmative vote of the majority of shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will tabulate affirmative and negative votes and abstentions. Abstentions will be counted towards a quorum and have the same effect as negative votes with regard to Proposal No. 2. In the event that a broker indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, such broker non-votes will also be counted towards a quorum, but will not be counted in determining whether Proposal No. 2 is approved.

Voting of Proxies

The proxy accompanying this Proxy Statement is solicited on behalf of the Board of Directors of Silicon Image for use at the Annual Meeting. Stockholders are requested to complete, date and sign the accompanying proxy and promptly return it in the enclosed envelope. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. However, returned signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted as votes "for" such proposal, or in the case of the election of Class III directors, as a vote "for" election to Class III of the Board of all the nominees presented by the Board. In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment would require the affirmative vote of the majority of the outstanding shares present in person or represented by proxy at the Annual Meeting.

Expenses of Solicitation

The expenses of soliciting proxies to be voted at the Annual Meeting will be paid by Silicon Image. Following the original mailing of the proxies and other soliciting materials, Silicon Image and/or its agents may also solicit proxies by mail, telephone, telegraph or in person. Following the original mailing of the proxies and other soliciting materials, Silicon Image will request that brokers, custodians, nominees and other record holders of its common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In such cases, Silicon Image, upon the request of the record holders, will reimburse such holders for their reasonable expenses. Georgeson Shareholder Communications, Inc. will assist Silicon Image in obtaining the return of proxies at an estimated cost to Silicon Image of $7,500.

Revocability of Proxies

Any person signing a proxy in the form accompanying this Proxy Statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote pursuant to the proxy. A proxy may be revoked by a writing delivered to Silicon Image stating that the proxy is revoked, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, or by attendance at the Annual Meeting and voting in person. Please note, however, that if a stockholder's shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming that stockholder's beneficial ownership of the shares.

Telephone or Internet Voting

For stockholders with shares registered in the name of a brokerage firm or bank, a number of brokerage firms and banks are participating in a program for shares held in "street name" that offers telephone and Internet voting options. If your shares are held in an account at a brokerage firm or bank participating in this program, you may vote those shares by calling the telephone number specified on your proxy or accessing the Internet website address specified on your proxy instead of completing and signing the proxy itself. The giving of such a telephonic or Internet proxy will not affect your right to vote in person should you decide to attend the Annual Meeting. Stockholders with shares registered directly in their names with Mellon Investor Services, Silicon Image's transfer agent, will not be able to vote using the telephone or Internet.

The telephone and Internet voting procedures are designed to authenticate stockholders' identities, to allow stockholders to give their voting instructions and to confirm that stockholders' instructions have been recorded properly. Stockholders voting via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Silicon Image's Board of Directors is presently comprised of six members, who are divided into three classes of two members each, designated as Class I, Class II and Class III. One class of directors is elected by the stockholders at each annual meeting to serve until the third succeeding annual meeting and until their successors are duly elected and qualified. Keith McAuliffe and Douglas C. Spreng have been designated as Class I directors, David A. Hodges and Ronald V. Schmidt have been designated as Class II directors, and David D. Lee and Andrew S. Rappaport have been designated as Class III directors. The Class III directors will stand for reelection or election at the Annual Meeting, the Class I directors will stand for reelection or election at the 2003 annual meeting of stockholders and the Class II directors will stand for reelection or election at the 2004 annual meeting of stockholders. Unless otherwise provided by law, any vacancy on the Board, including a vacancy created

2

by an increase in the authorized number of directors, may only be filled by the affirmative vote of a majority of the directors then in office or by a sole remaining director. Any director so elected to fill a vacancy shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and qualified, or until his or her earlier death, resignation or removal.

Each of the nominees for election to Class III is currently a director of Silicon Image and was previously elected by the stockholders. If elected at the Annual Meeting, each of the nominees would serve until the 2005 annual meeting of stockholders and until his successor is elected and qualified, or until such director's earlier death, resignation or removal. Directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. Shares represented by an executed proxy will be voted "for" the election of the two nominees recommended by the Board unless the proxy is marked in such a manner as to withhold authority so to vote. In the event that any nominee for any reason is unable to serve, or for good cause will not serve, the proxies will be voted for such substitute nominee as the present Board may determine. Silicon Image is not aware of any nominee who will be unable to serve, or for good cause will not serve, as a director.

The names of the nominees for election as Class III directors at the Annual Meeting and of the incumbent Class I and Class II directors, and certain information about them, including their ages as of February 28, 2002, are included below.

Name

| | Age

| | Principal Occupation

| | Director Since

|

|---|

| Nominees for election as Class III directors for terms expiring in 2005: | | | | | | |

| | David D. Lee | | 45 | | Chairman of the Board, Chief Executive Officer and President of Silicon Image | | 1995 |

| | Andrew S. Rappaport (1) (2) | | 44 | | Partner of August Capital, LLC | | 1997 |

| Incumbent Class I directors with terms expiring in 2003: | | | | | | |

| | Keith McAuliffe (1) | | 44 | | Private Investor | | 2000 |

| | Douglas C. Spreng (2) | | 58 | | President and Chief Operating Officer of Applied Micro Circuits Corp. | | 2001 |

| Incumbent Class II directors with terms expiring in 2004: | | | | | | |

| | David A. Hodges (1) | | 64 | | Professor in the Graduate School, University of California at Berkeley | | 1997 |

| | Ronald V. Schmidt (2) | | 57 | | Private Investor | | 1997 |

- (1)

- Member of the audit committee

- (2)

- Member of the compensation committee

David D. Lee has served as Chairman of the Board and Chief Executive Officer of Silicon Image since its inception on January 1, 1995, and in addition served as President from inception until October 1996 and since June 1999. Prior to founding Silicon Image, Dr. Lee was a principal investigator at Sun Microsystems, Inc., a computer networking company, where he led advanced development projects from 1993 to 1995, as a Visiting Scientist at Sun's Technology Development Group and as Senior Staff Engineer at Sun Labs. Before joining Sun, Dr. Lee was a member of the research staff at Xerox Corporation's Palo Alto Research Center, from 1989 to 1994. Dr. Lee holds Bachelor of Science, Master of Science and Ph.D. degrees in Electrical Engineering and Computer Sciences from the University of California at Berkeley.

3

Andrew S. Rappaport has served as a director of Silicon Image since June 1997. Mr. Rappaport has been a partner of August Capital, LLC, a venture capital firm, since July 1996. Prior to that time, Mr. Rappaport was President of The Technology Research Group, Inc., a Boston-based strategic management consulting firm that he founded in August 1984. Mr. Rappaport serves as a director of several private companies. Mr. Rappaport attended Princeton University.

Keith McAuliffe has served as a director of Silicon Image since November 2000. Previously, Mr. McAuliffe served as Vice President, Product Development of RLX Technologies, Inc., a server platform company from December 2000 to October 2001. Mr. McAuliffe served with Compaq Computer Corporation, a computer systems company, as Vice President and General Manager of the Service Provider and dotCOM Business Unit from December 1999 to December 2000, as Vice President of Mainstream Servers of the Industry Standard Server Division from 1998 to 1999, as Vice President of Engineering in the Systems Division from 1997 to 1998, and as Director of Hardware Engineering in the Systems Division from 1995 to 1997. Mr. McAuliffe holds a Bachelor of Science degree in Electrical Engineering Technology from Texas Tech University.

Douglas C. Spreng has served as a director of Silicon Image since February 2001. Mr. Spreng has served as President and Chief Operating Officer of Applied Micro Circuits Corp., a supplier of processors for optical networks, since July 2001, and previously served as Senior Vice President of that company's Switching and Network Processing Group from January 2001 to July 2001. From April 1999 to December 2000, Mr. Spreng served as the President and Chief Executive Officer of MMC Networks, Inc., a developer and supplier of network processors which became a subsidiary of Applied Micro Circuits Corp. in October 2000. Prior to that time, Mr. Spreng was the Executive Vice President of the Client Access Business Unit of 3Com Corporation, a networking company, from June 1995 to April 1999. Mr. Spreng is also a director of Applied Micro Circuits Corp. Mr. Spreng holds a Bachelor of Science degree in Electrical Engineering from the Massachusetts Institute of Technology and a Master of Business Administration degree from Harvard Business School.

David A. Hodges has served as a director of Silicon Image since February 1997. Dr. Hodges is a Professor in the Graduate School and the Daniel M. Tellep Distinguished Professor Emeritus at the University of California at Berkeley, where he has been a member of the faculty in the department of Electrical Engineering and Computer Sciences since 1970. From 1990 to 1996, Dr. Hodges served as Dean of the College of Engineering at the University of California at Berkeley. From 1966 to 1970, Dr. Hodges worked at Bell Telephone Laboratories, the research and development division of the American Telephone and Telegraph Company. Dr. Hodges serves as a director of Mentor Graphics Corporation, an electronic design automation company. Dr. Hodges holds a Bachelor of Electrical Engineering degree from Cornell University and Master of Science and Ph.D. degrees in Electrical Engineering from the University of California at Berkeley.

Ronald V. Schmidt has served as a director of Silicon Image since April 1997. From 1997 to February 2000, he held the position of Research Vice President at Lucent Bell Laboratories Research Silicon Valley, a division of Lucent Technologies, Inc., a global communications company. From 1994 to 1997, he served as Executive Vice President and Chief Technical Officer and a director of Bay Networks, Inc., a data networking products and services company formed by the merger of SynOptics Communications, Inc., and Wellfleet Communications, Inc. Dr. Schmidt was a co-founder of Synoptics in 1985, and served as Senior Vice President, Chief Technical Officer and a director of Synoptics until the merger. From 1981 to 1985, Dr. Schmidt was a research fellow at Xerox Corporation's Palo Alto Research Center. Dr. Schmidt serves as a director of several private companies. Dr. Schmidt holds Bachelor of Science, Master of Science and Ph.D. degrees in Electrical Engineering and Computer Science from the University of California at Berkeley.

The Board of Directors recommends a vote FOR the election

of each of the nominated directors

4

Board of Directors Meetings and Committees

Board of Directors. During fiscal year 2001, the Board met fourteen times, including six telephone conference meetings, and acted by written consent three times. Except for Douglas Spreng, no director attended fewer than 75% of the aggregate of the total number of meetings of the Board (held during the period for which he was a director) and the total number of meetings held by all committees of the Board on which such director served (held during the period that such director served).

Standing committees of the Board include an audit committee and a compensation committee. The Board does not have a nominating committee or committee performing similar functions.

Audit Committee. The audit committee consists of Dr. Hodges and Mr. Rappaport, as well as Mr. McAuliffe, who was appointed to the committee in March 2001. The audit committee met five times during fiscal year 2001, including four telephone conference meetings. The audit committee reviews our financial reporting process, our system of internal controls and the audit process. The audit committee also reviews the performance and independence of our external auditors and recommends to the Board the appointment or discharge of our external auditors.

Compensation Committee. The compensation committee consists of Mr. Rappaport and Dr. Schmidt, as well as Mr. Spreng, who was appointed to the committee in February 2001. The compensation committee did not meet during fiscal year 2001, but acted by written consent two times. The compensation committee reviews and recommends to the Board of Directors the compensation and benefits of officers, directors and consultants of Silicon Image and reviews general policy relating to compensation and benefits. Although the Compensation Committee has the authority to approve the issuance of stock options and other equity awards, the Board of Directors has generally continued to administer the issuance of stock options and other equity awards. The Board of Directors has also delegated to Dr. Lee the authority to grant stock options to non-officer employees, subject to certain limitations.

Director Compensation

Directors of Silicon Image do not receive cash compensation for their services as directors, but are reimbursed for their reasonable and necessary expenses for attending board and board committee meetings. All board members are eligible to receive stock options pursuant to the discretionary option grant program in effect under our 1999 Equity Incentive Plan.

Immediately following each annual meeting of our stockholders, each director who is not an employee and whose direct pecuniary interest in our common stock is less than 5% will automatically be granted an option under our 1999 Equity Incentive Plan to purchase 20,000 shares if the director has served continuously as a member of the board of directors for a period of at least one year, an additional option for 10,000 shares if the director has served continuously on the audit committee for a period of at least one year, and an additional option for 10,000 shares if the director has served continuously on the compensation committee for a period of at least one year. Each option will have an exercise price equal to the fair market value of our common stock on the date of grant. So long as the option holder continues to provide services to us, these annual grants will vest with respect to 4.167% of the shares each month following the date of grant until fully vested; provided, that these grants will become fully vested if we undergo a change in control. These annual grants will have a five-year term, but will generally terminate three months following the date the option holder ceases to provide services to us.

On May 22, 2001, following the 2001 annual meeting or our stockholders, the following option grants were made to our directors at that time pursuant to our automatic annual grant program: Andrew Rappaport—an option for 20,000 shares and two options for 10,000 shares each; David Hodges—an option for 20,000 shares and an option for 10,000 shares; and Ronald Schmidt—an option

5

for 20,000 shares and an option for 10,000 shares. Each of these options has an exercise price of $5.39, the closing price per share of our common stock on the Nasdaq National Market on that date.

Compensation Committee Interlocks and Insider Participation

The compensation committee of Silicon Image's board of directors is currently comprised of Messrs. Rappaport and Spreng and Dr. Schmidt. None of these individuals has at any time been an officer or employee of Silicon Image. None of our executive officers serves as a member of the board of directors or compensation committee of any entity which has one or more executive officers serving as a member of our board of directors or compensation committee.

6

PROPOSAL NO. 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Board of Directors has selected PricewaterhouseCoopers LLP, independent accountants, to audit the financial statements of Silicon Image for the year ending December 31, 2002, and recommends that the stockholders vote for ratification of such appointment. In the event of a negative vote on such ratification, the Board of Directors will reconsider its selection. Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting, will have the opportunity to make a statement at the Annual Meeting if they desire to do so, and will be available to respond to appropriate questions.

For the fiscal year ended December 31, 2001, PricewaterhouseCoopers LLP, Silicon Image's independent accountant, billed the approximate fees set forth below:

| Audit Fees | | $ | 189,000 |

| Financial Information System Design and Implementation Fees | | | — |

| All Other Fees | | | 254,000 |

The Board of Directors recommends a vote FOR the ratification

of the appointment of PricewaterhouseCoopers LLP

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information as to the beneficial ownership of our common stock as of February 28, 2002 by:

- •

- each stockholder known by us to be the beneficial owner of more than 5% of our common stock;

- •

- each of our directors;

- •

- our chief executive officer, the four other most highly compensated executive officers who were executive officers as of December 31, 2001 and earned more than $100,000 in 2001; and

- •

- all current directors and executive officers as a group.

The percentage ownership is based on 64,605,018 shares of common stock outstanding as of February 28, 2002. Shares of common stock that are subject to options or other convertible securities currently exercisable or exercisable within 60 days of February 28, 2002, are deemed outstanding for the purposes of computing the percentage ownership of the person holding these options or convertible securities, but are not deemed outstanding for computing the percentage ownership of any other person. Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. To our knowledge, unless otherwise indicated below, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise indicated, the address for each listed stockholder is c/o Silicon Image, Inc., 1060 East Arques Ave., Sunnyvale, California 94086.

| | Shares Beneficially Owned

| |

|---|

Name of Beneficial Owner

| | Number of Shares

| | Percent of Class

| |

|---|

| Sang-Chul Han (1) | | 3,981,600 | | 6.2 | % |

| David D. Lee (2) | | 3,229,209 | | 5.0 | |

| Steve Tirado (3) | | 909,121 | | 1.4 | |

| Andrew Rappaport (4) | | 492,677 | | * | |

| Parviz Khodi (5) | | 356,140 | | * | |

| Ronald V. Schmidt (6) | | 315,886 | | * | |

| David A. Hodges (7) | | 187,350 | | * | |

| Badar Baqai (8) | | 164,949 | | * | |

| Michael Kelley (9) | | 129,517 | | * | |

| Keith McAuliffe (10) | | 26,167 | | * | |

| Douglas C. Spreng (11) | | 11,667 | | * | |

| All current executive officers and directors as a group (14 persons) (12) | | 7,185,485 | | 10.8 | |

- *

- Less than 1%.

- (1)

- Based upon a Schedule 13G filed with the Securities and Exchange Commission on February 12, 2002 which indicates sole voting and investment power over these shares. Mr. Han's address is c/o Kang Nam Cable, Ryukyung Building 239-1, Bonhyun-dong, Kangnam-ku, Seoul, Korea 135-010.

- (2)

- Includes 2,690,350 shares held by Dr. Lee and Joanne W. Lee, trustees of the David D. Lee and Joanne W. Lee Trust Agreement dated March 15, 2000. Includes 481,609 shares subject to options held by Dr. Lee that are exercisable within 60 days of February 28, 2002. Includes 50,000 shares held by Dr. Lee subject to our right of repurchase as of February 28, 2002.

8

- (3)

- Includes 900 shares held by the Tirado Family Trust, of which Mr. Tirado is a trustee. Includes 107,568 shares subject to options held by Mr. Tirado that are exercisable within 60 days of February 28, 2002. Includes 313,450 shares held by Mr. Tirado subject to our right of repurchase as of February 28, 2002.

- (4)

- Includes 8,000 shares held by a trust of which Mr. Rappaport is a trustee and 30,000 shares held in Mr. Rappaport's retirement plan account. Includes 58,333 shares subject to options held by Mr. Rappaport that are exercisable within 60 days of February 28, 2002. Mr. Rappaport's address is c/o August Capital, L.P., 2480 Sand Hill Road, Suite 101, Menlo Park, CA 94025.

- (5)

- Includes 102,500 shares held by the Khodi Family Trust U/A/D 2/19/00. Includes 51,147 shares subject to options held by Mr. Khodi that are exercisable within 60 days of February 28, 2002. Includes 80,000 shares held by Mr. Khodi subject to our right of repurchase as of February 28, 2002.

- (6)

- Includes 203,750 shares subject to options held by Dr. Schmidt that are exercisable within 60 days of February 28, 2002.

- (7)

- Includes 143,600 shares held by the Hodges Family Trust 5/16/90, of which Dr. Hodges and Susan A. Hodges are trustees. Includes 43,750 shares subject to options held by Dr. Hodges that are exercisable within 60 days of February 28, 2002. Includes 20,000 shares held by the trust subject to our right of repurchase as of February 28, 2002.

- (8)

- Includes 160,237 shares subject to options held by Mr. Baqai that are exercisable within 60 days of February 28, 2002.

- (9)

- Includes 114,026 shares subject to options held by Mr. Kelley that are exercisable within 60 days of February 28, 2002.

- (10)

- Includes 14,167 shares subject to an option held by Mr. McAuliffe that is exercisable within 60 days of February 28, 2002.

- (11)

- Includes 11,667 shares subject to an option held by Mr. Spreng that is exercisable within 60 days of February 28, 2002. Mr. Spreng's address is c/o Applied Micro Circuits Corp., 6290 Sequence Drive, San Diego, CA 92121.

- (12)

- Includes 1,864,369 shares subject to options that are exercisable within 60 days of February 28, 2002, of which 375,000 shares would be subject to our right of repurchase as of April 29, 2002. Includes 583,450 shares subject to our right of repurchase as of February 28, 2002.

9

EXECUTIVE OFFICERS

The following sets forth certain information with regard to executive officers of Silicon Image, including their ages as of February 28, 2002:

Name

| | Age

| | Position

|

|---|

| David D. Lee | | 45 | | Chairman of the Board, Chief Executive Officer and President |

| Steve Tirado | | 47 | | Chief Operating Officer |

| Robert Gargus | | 50 | | Vice President, Finance and Administration and Chief Financial Officer |

| Daniel K. Atler | | 42 | | Executive Vice President, Strategic Business Development |

| Badar Baqai | | 53 | | Executive Vice President, Engineering |

| Jalil Shaikh | | 47 | | Executive Vice President, Operations and Information Technology |

| Jaime Garcia-Meza | | 39 | | Vice President, Worldwide Sales |

| Parviz Khodi | | 42 | | Vice President, Marketing |

| Michael Kelley | | 54 | | Vice President of Sales and Marketing, Storage Systems |

David D. Lee has served as Silicon Image's Chairman of the Board and Chief Executive Officer since our inception on January 1, 1995, and in addition served as President from inception until October 1996 and since June 1999. Prior to founding Silicon Image, Dr. Lee was a principal investigator at Sun Microsystems, Inc., a computer networking company, where he led advanced development projects from 1993 to 1995, as a Visiting Scientist at Sun's Technology Development Group and as Senior Staff Engineer at Sun Labs. Before joining Sun, Dr. Lee was a member of the research staff at Xerox Corporation's Palo Alto Research Center, from 1989 to 1994. Dr. Lee holds Bachelor of Science, Master of Science and Ph.D. degrees in Electrical Engineering and Computer Sciences from the University of California at Berkeley.

Steve Tirado has served as Silicon Image's Chief Operating Officer since November 2000 and previously served as Silicon Image's Executive Vice President of Marketing and Business Development from August 1999 to November 2000. From April 1986 to July 1999, Mr. Tirado held various marketing and management positions at Sun Microsystems, Inc., a computer networking company, serving most recently as Vice President of Marketing and Business Development for the NC Systems Group. From 1985 to 1986, Mr. Tirado was President of Tirado, Sorrentino Associates, a consulting firm. From 1984 to 1985, Mr. Tirado held the position of Marketing Administration Manager at Qualogy, a mass storage disk drive and controller company. From 1976 to 1984, Mr. Tirado was a public program administrator and policy analyst within various government agencies. Mr. Tirado holds a Bachelor of Arts degree in Psychology from the University of California at Santa Barbara, a Master of Arts Degree in Organizational Planning and Consultation from Boston University and a Master of Business Administration degree from the University of California at Berkeley.

Robert Gargus has served as Silicon Image's Chief Financial Officer and Vice President, Finance and Administration since October 2001. From December 1999 to April 2001, Mr. Gargus served as President of Telcom Semiconductor, Inc., a supplier of semiconductor products for the wireless market, and prior to that time served as Vice President, Financial and Administration and Chief Financial Officer of the company from April 1998 to December 1999. From 1984 to May 1998, Mr. Gargus held a number of financial and management positions at Tandem Computers Inc., a computer systems company, serving most recently as President and General Manager of the Atalla Security Products Division and as Corporate Controller. From 1973 to 1984, Mr. Gargus held various financial positions at Unisys Corporation, an information technology services company. Mr. Gargus holds a Bachelor of Science degree in Accounting and a Master of Business Administration degree from the University of Detroit.

10

Daniel K. Atler has served as Silicon Image's Executive Vice President, Strategic Business Development since October 2001. Mr. Atler previously served as Silicon Image's Chief Financial Officer and Vice President, Finance and Administration from June 1998 to October 2001. Mr. Atler served as Chief Financial Officer and Vice President of Finance and Administration for Wireless Access, Inc., a two-way wireless communication systems company, from January 1995 to November 1997, when Wireless Access, Inc., was acquired by Glenayre Technologies, Inc., a wireless personal communication systems company. After the merger, Mr. Atler continued in the same position at Wireless Access Group, a division of Glenayre Technologies, Inc., from November 1997 to June 1998. From July 1992 to December 1994, Mr. Atler served as Corporate Controller for Global Village Communication, Inc., a designer, developer and marketer of communication products for personal computers. From July 1982 to July 1992, Mr. Atler was with Ernst & Young, a financial accounting firm, most recently as a Senior Manager. Mr. Atler holds a Bachelor of Science degree in Business Administration from Colorado State University.

Badar Baqai has served as Silicon Image's Executive Vice President, Engineering since November 2000. Prior to that time, Mr. Baqai served with Fujitsu Microelectronics, Inc., a supplier of semiconductors and electronics, as Executive Vice President of the Systems Solutions Group from September 1998 to November 2000, as Vice President of the ASIC business unit of the Systems Solutions Group from September 1997 to September 1998, and as Vice President of Engineering of the Processor Product Group from September 1994 to September 1997. Mr. Baqai holds a Master of Science degree in electrical engineering from the University of California at Los Angeles and a Master of Business Administration degree from the University of Phoenix.

Jalil Shaikh has served as Silicon Image's Executive Vice President, Operations and Information Technology since May 2000 and previously served as Silicon Image's Vice President, Operations from September 1996 to May 2000. From August 1994 to August 1996, he served as Director of Engineering Operations for graphics and multimedia products at Trident Microsystems, a designer, developer and marketer of digital media. From July 1991 to August 1994, he served as Product Engineering Manager at Micro Linear Corporation, an analog and mixed signal semiconductor company. Mr. Shaikh holds a Master of Science degree in Electrical Engineering from Rutgers, The State University of New Jersey and a Master of Business Administration degree from the University of Phoenix.

Jaime Garcia-Meza has served as Silicon Image's Vice President, Worldwide Sales since April 2001. From January 2001 to March 2001, he was a general partner at The Corporate Finance Group, a venture capital firm. From August 1999 to December 2000, he served as Venture Director at Index Ventures Management, a venture capital firm. Prior to that time, he served with Sun Microsystems Inc., a computer networking company, as Director, Integrated Operations and Business Support Systems Solutions, Worldwide Telecommunications from July 1998 to July 1999, as Director, Telecommunications Industry Sales Development, International from July 1997 to June 1998, as Director, Telecommunications Industry Sales Development, Europe from April 1996 to June 1997, and as Regional Sales Manager, Mexico from October 1992 to March 1996. Mr. Garcia-Meza holds a Bachelor of Science degree in electrical engineering and a Master of Science degree in telecommunications and computer networks from the University of Kansas.

Parviz Khodi has served as Silicon Image's Vice President, Marketing since April 2001 and previously served as Silicon Image's Vice President, Worldwide Sales from August 1998 to April 2001. Mr. Khodi joined Silicon Image in July 1998 as Director of Asia Pacific Sales. From November 1987 to July 1998, Mr. Khodi worked at Chips and Technologies, Inc., a maker of semiconductor chips principally for the graphics market, where he held various sales management positions, most recently Director, Asia Pacific Sales. From 1986 to 1987, Mr. Khodi was responsible for worldwide field applications at Touch Communications, Inc., a client/server software company. From 1984 to 1986, Mr. Khodi held engineering positions in the microprocessor and microcontroller divisions of Intel

11

corporation, a computer processor company. Mr. Khodi holds Bachelor of Science and Master of Science degrees in electrical engineering from the University of Kansas.

Michael Kelley has served as Silicon Image's Vice President of Sales and Marketing, Storage Systems since March 2002. Mr. Kelley previously served as Vice President and General Manager of the Storage Systems Division of Silicon Image from June 2001 to March 2002, as Silicon Image's Vice President, Business Development from April 2001 to June 2001 and as Silicon Image's Vice President, Marketing from November 2000 to April 2001. Previously, Mr. Kelley served as senior director of marketing for Silicon Image from September 1999 to November 2000. From July 1996 to June 1999, Mr. Kelley served as president and general manager of Argentina, Paraguay and Uruguay operations for Sun Microsystems, Inc., a computer networking company, and from November 1992 to June 1996, Mr. Kelley served as regional director, Interamerica for Sun Microsystems, Inc. From 1977 to 1989, Mr. Kelley held various marketing and management positions at Wang Laboratories, Inc., a computer networking company, serving most recently as Area Director, Latin America. Mr. Kelley holds Bachelor of Science degrees in mathematics, physics and chemistry from Andrews University and a Master of Science degree in nuclear chemistry from the University of California at Berkeley.

12

EXECUTIVE COMPENSATION

Officer Compensation

The following table sets forth all compensation awarded to, earned by or paid for services rendered to Silicon Image in all capacities during the years ended December 31, 1999, 2000 and 2001 by (i) our chief executive officer and (ii) the four other most highly compensated executive officers other than the chief executive officer who were serving as executive officers as of December 31, 2001 and whose salary and bonus for 2001 exceeded $100,000 (collectively, the "Named Executive Officers"). The following table also sets forth the number of shares acquired on exercise of options by the Named Executive Officers during the years ended December 31, 1999, 2000 and 2001, the number of shares underlying options held by the Named Executive Officers which were canceled during the years ended December 31, 1999, 2000 and 2001 and the number of shares underlying unexercised options held by the Named Executive Officers as of December 31, 1999, 2000 and 2001. Although this information is not required to be presented in the table under the rules of the Securities and Exchange Commission, it is provided in order to facilitate understanding of option transactions involving the Named Executive Officers. Options previously granted to the Named Executive Officers were canceled in exchange for the issuance of replacement options to them on April 4, 2001 under our option repricing program for executives. Under this program, subject to certain limitations, each of our executive officers was allowed to exchange each of his options with an exercise price greater than $5.625 for a new option granted on April 4, 2001 with an exercise price of $5.625, which price exceeded the $3.0625 closing price of our common stock on that date. This program was modeled on our repricing program for non-executive employees, under which we previously allowed our non-executive employees to exchange each of their options with an exercise price greater than $5.625, the closing price of our common stock on December 22, 2000, for a new option granted on that date with an exercise price of $5.625. Subject to very limited exceptions, under both of these repricing programs, the vesting schedule for the new options was restarted, with the new options vesting as to 12.5% of the shares after six months and 2.083% of the shares each of the 42 months thereafter.

13

Summary Compensation Table

| |

| |

| |

| |

| | Supplemental Option Information

|

|---|

| |

| |

| |

| | Long-Term

Compensation

Awards

|

|---|

| |

| |

| |

| | Shares

Acquired on

Exercise of

Options

During Fiscal

Year (#)

| | Shares

Underlying

Options

Canceled

During

Fiscal

Year (#)

| | Shares

Underlying

Unexercised

Options at

Fiscal Year

End (#)

|

|---|

| |

| | Annual Compensation

| | Securities

Underlying

Options

Granted (#)

|

|---|

Name and Principal Positions

| |

|

|---|

| | Year

| | Salary ($)

| | Bonus ($)

|

|---|

David D. Lee (1)

Chairman of the Board,

Chief Executive Officer

and President | | 2001

2000

1999 | | $

| 192,500

256,248

189,446 | | $

| —

42,740

2,178 | | 500,000

—

1,000,000 | | —

—

— | | 431,724

—

— | | 1,068,276

1,000,000

1,000,000 |

Steve Tirado (2)

Chief Operating Officer | | 2001

2000

1999 | | | 239,150

233,923

93,750 | | | —

50,000

— | | 666,459

120,000

— | | —

—

— | | 370,000

—

— | | 416,459

120,000

— |

Badar Baqai (3)

Executive Vice

President, Engineering | | 2001

2000 | | | 226,042

21,795 | | | 50,000

— | | 562,184

500,000 | | —

— | | 350,000

— | | 712,184

500,000 |

Parviz Khodi (4)

Vice President, Marketing | | 2001

2000

1999 | | | 249,605

245,143

236,642 | | | —

37,565

10,000 | | 218,415

60,000

60,000 | | —

—

120,000 | | 60,000

—

— | | 278,415

120,000

60,000 |

Michael Kelley (5)

Vice President of Sales

and Marketing,

Storage Systems | | 2001

2000

1999 | | | 213,235

155,752

45,481 | | | —

—

25,000 | | 375,620

60,000

200,000 | | —

62,500

— | | 60,000

—

— | | 513,120

197,500

200,000 |

- (1)

- Of the stock options to purchase 500,000 shares of common stock granted to Dr. Lee in 2001, an option for 431,724 shares was received pursuant to our option repricing program for executives in exchange for cancellation of an option for 431,724 shares granted to Dr. Lee in 1999. We authorized the sale of 300,000 shares of common stock to Dr. Lee in October 1998, and the sale was completed in January 1999. The price per share was $0.175, which the board of directors determined was the fair market value of our common stock on the date of sale. We have a right to repurchase these shares upon termination of employment, which right lapses over a four-year period.

- (2)

- Of the stock options to purchase 416,459 shares of common stock granted to Mr. Tirado in 2001, an option for 250,000 shares and an option for 120,000 shares were received pursuant to our option repricing program for executives in exchange for cancellation of an option for 250,000 shares granted to Mr. Tirado earlier in 2001 and an option for 120,000 shares granted to Mr. Tirado in 2000, respectively. Mr. Tirado joined us in June 1999. We authorized the sale of 940,350 shares of common stock to Mr. Tirado in June 1999, and the sale was completed in June 1999. The price per share was $1.00, which the board of directors determined was the fair market value of our common stock on the date of sale. We have a right to repurchase these shares upon termination of employment, which right lapses over a four-year period.

- (3)

- Of the stock options to purchase 562,184 shares of common stock granted to Mr. Baqai in 2001, an option for 350,000 shares was received pursuant to our option repricing program for executives in exchange for cancellation of an option for 350,000 shares granted to Mr. Baqai in 2000.

- (4)

- Of the stock options to purchase 218,415 shares of common stock granted to Mr. Khodi in 2001, an option for 60,000 shares was received pursuant to our option repricing program for executives in exchange for cancellation of an option for 60,000 shares granted to Mr. Khodi in 2000. Salary figures include sales commissions of $68,672 in 1999.

- (5)

- Of the stock options to purchase 375,620 shares of common stock granted to Mr. Kelley in 2001, an option for 40,000 shares and an option for 20,000 shares were received pursuant to our option repricing program for executives in exchange for cancellation of an option for 40,000 shares and an option for 20,000 shares granted to Mr. Kelley in 2000, respectively. Salary figures include sales commissions of $20,318 in 2001.

In October 2001, we hired Robert Gargus as our Chief Financial Officer and Vice President, Finance and Administration. In connection with his hiring, Mr. Gargus' annual base salary was set at $225,000 and he was granted an option to purchase 400,000 shares of common stock with an exercise price per share of $1.14, which equaled the closing price per share of our common stock on the Nasdaq National Market on the date of grant.

14

Option Grants in Last Fiscal Year

The following table shows information about each stock option granted during 2001 to each of the Named Executive Officers, including options granted under our option repricing program for executives in exchange for cancellation of options for a like amount of shares. Cancellations of options are not reflected in the table.

In accordance with the rules of the Securities and Exchange Commission, the table sets forth the hypothetical gains or "option spreads" that would exist for the options at the end of their respective ten-year terms. These gains are based on assumed rates of annual compound stock price appreciation of 5% and 10% from the closing price on the date an option was granted until the end of the option term. Where no gain is indicated, the foregoing formula yields a negative number due to the exercise price of the option exceeding the closing price on the date of grant. The 5% and 10% assumed annual rates of stock price appreciation are mandated by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of future common stock prices.

All options included in the following table are nonqualified stock options. Unless noted otherwise, the options were granted under our 1999 Equity Incentive Plan and the exercise price of each option granted equaled the closing price per share of our common stock on the Nasdaq National Market on the date of grant. Unless noted otherwise, the options expire on the earlier of ten years from the date of grant or three months after termination of employment. The percentage numbers are based on an aggregate of 10,171,929 options granted to our employees during fiscal 2001.

| |

| | Percentage

of Total

Options

Granted to

Employees

in 2001

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term

|

|---|

| | Number of

Securities

Underlying Options

Granted (#)

| |

| |

|

|---|

Name

| | Exercise

Price

Per Share ($)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| David D. Lee | | 37,931 (1

30,345 (2

431,724 (3 | )

)

) | 0.4

0.3

4.2 | %

| $

| 5.4375

5.4375

5.6250 | | 1/2/11

1/2/11

4/4/07 | | $

| 172,187

137,751

— | | $

| 396,348

317,080

— |

| Steve Tirado | | 31,391 (4

15,068 (5

250,000 (6

120,000 (7 | )

)

)

) | 0.3

0.1

2.5

1.2 | | | 5.4375

5.4375

5.6250

5.6250 | | 1/2/11

1/2/11

4/4/07

4/4/07 | | | 142,499

68,401

—

— | | | 328,010

157,448

—

— |

| Badar Baqai | | 22,989 (8

9,195 (9

350,000 (10

180,000 (11 | )

)

)

) | 0.2

0.1

3.4

1.8 | | | 5.4375

5.4375

5.6250

1.1400 | | 1/2/11

1/2/11

4/4/07

10/30/11 | | | 104,358

41,741

—

129,049 | | | 240,216

96,080

—

327,036 |

| Parviz Khodi | | 23,868 (12

9,547 (13

60,000 (14

125,000 (15 | )

)

)

) | 0.2

0.1

0.6

1.2 | | | 5.4375

5.4375

5.6250

1.1400 | | 1/2/11

1/2/11

4/4/07

10/30/11 | | | 108,348

43,338

—

89,617 | | | 249,401

99,758

—

227,108 |

| Michael Kelley | | 17,011 (16

13,609 (17

50,000 (18

40,000 (19

20,000 (20

25,000 (21

50,000 (22

160,000 (23 | )

)

)

)

)

)

)

) | 0.2

0.1

0.5

0.4

0.2

0.2

0.5

1.6 | | | 5.4375

5.4375

3.3125

5.6250

5.6250

4.9000

4.9000

1.1400 | | 1/2/11

1/2/11

3/29/11

4/4/07

4/4/07

6/6/11

6/6/11

10/30/11 | | | 77,221

61,778

104,161

—

—

77,040

154,079

114,710 | | | 177,751

142,203

263,964

—

—

195,233

390,467

290,699 |

- (1)

- This option becomes vested and exercisable with respect to 16% of the shares on January 2, 2003, an additional 1.417% of the shares each of the 24 months thereafter, and an additional 4.167% of the shares each of the 12 months thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

15

- (2)

- This option becomes vested and exercisable with respect to 8.333% of the shares on January 31, 2001 and an additional 8.333% of the shares at the end of each month thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (3)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (4)

- This option becomes vested and exercisable with respect to 16% of the shares on January 2, 2003, an additional 1.417% of the shares each of the 24 months thereafter, and an additional 4.167% of the shares each of the 12 months thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (5)

- This option becomes vested and exercisable with respect to 8.333% of the shares on January 31, 2001 and an additional 8.333% of the shares at the end of each month thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (6)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (7)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (8)

- This option becomes vested and exercisable with respect to 16% of the shares on January 2, 2003, an additional 1.417% of the shares each of the 24 months thereafter, and an additional 4.167% of the shares each of the 12 months thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (9)

- This option becomes vested and exercisable with respect to 8.333% of the shares on January 31, 2001 and an additional 8.333% of the shares at the end of each month thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (10)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (11)

- This option becomes vested and exercisable with respect to 1.157% of the shares on November 30, 2001 and an additional 1.157% of the shares each of the 11 months thereafter, 1.389% of the shares on November 30, 2002 and an additional 1.389% of the shares each of the 11 months thereafter, 1.62% of the shares on November 30, 2003 and an additional 1.62% of the shares each of the 11 months thereafter, 1.852% of the shares on November 30, 2004 and an additional 1.852% of the shares each of the 11 months thereafter, and 2.315% of the shares on November 30, 2005 and an additional 2.315% of the shares each of the 11 months thereafter.

- (12)

- This option becomes vested and exercisable with respect to 16% of the shares on January 2, 2003, an additional 1.417% of the shares each of the 24 months thereafter, and an additional 4.167% of the shares each of the 12 months thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (13)

- This option becomes vested and exercisable with respect to 8.333% of the shares on January 31, 2001 and an additional 8.333% of the shares at the end of each month thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (14)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with

16

respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (15)

- This option becomes vested and exercisable with respect to 2.333% of the shares on November 30, 2003 and an additional 2.333% of the shares each of the 23 months thereafter and 3.667% of the shares on November 30, 2005 and an additional 3.667% of the shares each of the 11 months thereafter.

- (16)

- This option becomes vested and exercisable with respect to 16% of the shares on January 2, 2003, an additional 1.417% of the shares each of the 24 months thereafter, and an additional 4.167% of the shares each of the 12 months thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (17)

- This option becomes vested and exercisable with respect to 8.333% of the shares on January 31, 2001 and an additional 8.333% of the shares at the end of each month thereafter. The exercise price for this option represents the opening price of our common stock on the date of grant. The closing price of our common stock on the date of grant was $6.125.

- (18)

- This option becomes vested and exercisable with respect to 2.083% of the shares on April 29, 2001 and an additional 2.083% of the shares each of the 47 months thereafter.

- (19)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (20)

- This option was issued pursuant to our option repricing program for executives in exchange for cancellation of a previously granted option for a like amount of shares. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter. The closing price of our common stock on the date of grant of this option was $3.0625.

- (21)

- This option becomes vested and exercisable with respect to 2.083% of the shares on July 6, 2001 and an additional 2.083% of the shares each of the 47 months thereafter.

- (22)

- This option becomes vested and exercisable with respect to 16% of the shares on June 6, 2003, an additional 1.417% of the shares each of the 24 months thereafter, and an additional 4.167% of the shares each of the 12 months thereafter.

- (23)

- This option becomes vested and exercisable with respect to 1.563% of the shares on November 30, 2003 and an additional 1.563% of the shares each of the 11 months thereafter, 2.604% of the shares on November 30, 2004 and an additional 2.604% of the shares each of the 11 months thereafter, and 4.167% of the shares on November 30, 2005 and an additional 4.167% of the shares each of the 11 months thereafter.

17

2001 Year End Option Values

The following table sets forth the number of shares covered by both exercisable and unexercisable stock options held by each of the Named Executive Officers at December 31, 2001. Also reported are values of unexercised "in-the-money" options, which represent the positive spread between the respective exercise prices of outstanding stock options and $3.76, the closing price per share of our common stock on December 31, 2001 on the Nasdaq National Market. No stock options were exercised by any of the Named Executive Officers during 2001. All of the shares issuable upon exercise of exercisable options shown in the following table are vested.

| | Number of Securities Underlying

Unexercised Options at

Fiscal Year End (#)

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End ($)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David D. Lee | | 398,276 | | 670,000 | | $ | — | | $ | — |

| Steve Tirado | | 76,735 | | 339,724 | | | — | | | — |

| Badar Baqai | | 112,320 | | 599,864 | | | 10,918 | | | 460,682 |

| Parviz Khodi | | 42,747 | | 235,668 | | | 20,532 | | | 360,068 |

| Michael Kelley | | 86,109 | | 427,011 | | | 29,695 | | | 482,005 |

Employment Contracts and Change of Control Arrangements

Silicon Image entered into a severance agreement with David Lee on April 22, 1997, amended and restated this agreement on August 15, 1997, amended this agreement on January 24, 2000, and amended this agreement again on March 29, 2001. The agreement provides that if, on or before December 31, 2006, Dr. Lee is terminated by Silicon Image other than for cause, or if Dr. Lee resigns for good reason, Dr. Lee will continue to receive salary at his current rate for six months and vesting of his stock and options will accelerate, subject to limitations in the event of specified types of acquisitions of Silicon Image. In addition, if Dr. Lee is terminated for cause, or resigns without good reason, then Silicon Image may elect to continue his salary for six months. During any period in which Dr. Lee is receiving post-termination salary pursuant to the severance agreement, he will be available to consult with Silicon Image from time to time as Silicon Image may request, and he may not compete with Silicon Image in defined geographical areas.

Silicon Image entered into a letter agreement with Steve Tirado in June 1999. The agreement sets forth Mr. Tirado's title and provides for an initial salary of $225,000 per year and a bonus of up to $50,000 in the first year. Pursuant to the agreement, Silicon Image sold Mr. Tirado 940,350 shares of common stock at the price of $1.00 per share. All of the shares initially are subject to our right to repurchase them at cost if Mr. Tirado's employment terminates, and this right lapses over a four-year period. The agreement provides that Mr. Tirado will continue to receive salary at his current rate and benefits for six months in the event his employment terminates other than for cause. In November 1999, Silicon Image entered into an additional letter agreement with Mr. Tirado that provides that instead of the bonus provided for under the initial letter agreement, Mr. Tirado will be eligible for a bonus determined after June 30, 2000 equal to the greater of the amount due to him under the executive bonus plan adopted by Silicon Image or $45,833.

Silicon Image entered into a letter agreement with Badar Baqai in November 2000. The agreement sets forth Mr. Baqai's title and provides for an initial salary of $250,000 per year and a sign on bonus of $50,000 payable over the first nine months of employment. The agreement provides that Mr. Baqai will continue to receive salary at his current rate and benefits for six months in the event his employment terminates other than for cause. The agreement also indicates that management will recommend to the Board that Mr. Baqai be granted a 500,000 share stock option. On November 22, 2000, the Compensation Committee granted Mr. Baqai a 500,000 share non-plan option with an

18

exercise price per share equal to $6.5625, the closing price of our common stock on the Nasdaq National Market on that date. This option vests and becomes exercisable with respect to 25% of the shares on November 22, 2001 and an additional 2.083% of the shares each of the 36 months thereafter. On April 4, 2001, Mr. Baqai exchanged 350,000 shares subject to this option for a repriced option with an exercise price per share equal to $5.625 pursuant to our option repricing program for executives. This repriced option vests and becomes exercisable with respect to 12.5% of the shares on October 4, 2001 and an additional 2.083% of the shares each of the 42 months thereafter.

Silicon Image entered into an employment agreement with Parviz Khodi on June 10, 1999. In addition to describing Mr. Khodi's title and compensation, the agreement provides for continuation of salary and commission for six months in the event that there is a change in control of Silicon Image and Silicon Image terminates Mr. Khodi's employment other than for cause, disability or death. The agreement also provides that Mr. Khodi may purchase up to $10,000 of Silicon Image's common stock at the end of each of eight fiscal quarters, commencing with the fourth quarter of 1998, at the then current fair market value as determined by the board of directors. Mr. Khodi has exercised this right by purchasing a total of $40,000 of Silicon Image's stock. This stock purchase opportunity expired upon the closing of Silicon Image's initial public offering in October 1999.

Silicon Image entered into a letter agreement with Michael Kelley on August 19, 1999. The agreement sets forth Mr. Kelley's title and provides for an initial salary of $150,000 per year. The agreement also indicates that management will recommend to the Board that Mr. Kelley be granted a 200,000 share stock option. On September 23, 1999, the Board granted Mr. Kelley a 200,000 share option with an exercise price equal to $3.25, the fair market value of our common stock on that date, as determined by the Board. This option vests and becomes exercisable with respect to 25% of the shares on September 13, 2000 and an additional 2.083% of the shares each of the 36 months thereafter. Mr. Kelley has previously exercised this option with respect to 62,500 shares.

REPORT OF THE COMPENSATION COMMITTEE

This Report of the Compensation Committee is required by the Securities and Exchange Commission and, in accordance with the Commission's rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that Silicon Image specifically incorporates this information by reference, and will not otherwise be deemed "soliciting material" or "filed" under either the Securities Act of 1933 or the Securities Exchange Act of 1934.

The Compensation Committee of the Board of Directors (the "Committee"), in conjunction with the members of the Board of Directors other than David D. Lee, sets the base salaries of Silicon Image's executive officers, including the Chief Executive Officer ("CEO"), and approves bonus programs for the executive officers. Although the Committee has from time to time made stock option grants to Silicon Image's employees, including its executive officers, the Board of Directors has continued to administer the issuance of stock options and other equity awards under Silicon Image's 1999 Equity Incentive Plan, 1999 Employee Stock Purchase Plan, CMD Technology Inc. 1999 Stock Incentive Plan and Silicon Communication Lab, Inc. 1999 Stock Option Plan as well as non-plan options. The Committee has complete discretion in establishing the terms of stock option grants it makes. The Committee is comprised of three independent non-employee directors whose names appear below. None of these directors has interlocking relationships as defined by the Commission. The following is a summary of policies of Silicon Image that affect the compensation paid to executive officers, as reflected in the tables and text set forth elsewhere in this Proxy Statement.

19

General Compensation Policy

Silicon Image's overall policy is to offer its executive officers cash-based and equity-based compensation opportunities based on their personal performance and the financial performance of Silicon Image and their contribution to that performance. The principal factors taken into account in establishing each executive's compensation package are summarized below. Additional factors may be taken into account to a lesser degree and the relative weight given to each factor varies with each individual in the discretion of the Committee. The Committee may in its discretion apply entirely different factors, such as different measures of financial performance, for future years.

Cash-based Compensation. Silicon Image sets base salaries for executive officers on the basis of personal performance, the scope of an officer's particular job, the financial performance of Silicon Image and internal and industry comparability considerations.

Long-term Equity-based Compensation. Long-term equity incentives for executive officers are effected through the granting of stock options. The Committee believes that equity-based compensation in the form of stock options links the interests of management and stockholders by focusing management on increasing stockholder value. Stock options generally have value for the executive only if the price of Silicon Image's common stock increases above the exercise price determined on the option grant date and the executive remains employed by Silicon Image for the period required for the shares to vest. Stock options typically have been granted to executive officers when the executive first joins Silicon Image, in connection with a significant change in responsibilities, to achieve equity within a peer group, and to provide greater incentives to continue employment with Silicon Image and to strive to increase the value of Silicon Image's common stock. The Board of Directors or Committee may, however, grant stock options to executives for other reasons. The number of shares subject to each stock option granted is within the discretion of the Board of Directors or Committee and may be based on the executive's level of responsibility, anticipated future contribution and ability to impact corporate results, past performance, consistency within the executive's peer group, the number of existing option shares held by the executive at the time of the grant, or other considerations. The relative weight given to these factors varies with each executive in the sole discretion of the Board of Directors or Committee.

2001 Executive Compensation

Cash-based Compensation. The Committee was formed in October 1998. In October 1999, the Committee determined the base salaries of Silicon Image's CEO and vice presidents, effective as of October 1999. David D. Lee, Silicon Image's CEO, made recommendations with respect to the base salaries of the vice presidents after review of a salary survey prepared by the Radford Division of Aon Consulting, which provides compensation and benefits surveys to high-technology companies. Since October 1999, the Board of Directors has periodically reviewed and adjusted the base salaries of Silicon Image's executive officers in light of the factors and considerations for cash-based compensation described above and, except with respect to the CEO's compensation, the recommendations of the CEO. In addition, Silicon Image's CEO and Chief Operating Officer have periodically reviewed and adjusted the base salaries of executive officers in light of the factors and considerations for cash-based compensation described above. However, neither the CEO nor Chief Operating Officer has set or adjusted his own salary.

Upon the hiring of an executive officer, the Board of Directors or Committee will determine the officer's annual base salary. During 2001, the Board of Directors set Jaime Garcia-Meza's base salary in connection with his hiring as Vice President, Worldwide Sales and set Robert Gargus's base salary in connection with his hiring as Chief Financial Officer and Vice President, Finance and Administration. The Board of Directors also increased Michael Kelley's base salary in connection with his promotion to Vice President and General Manager of the Storage Systems Division. Although in prior years the

20

Board of Directors and Committee have adopted executive bonus plans under which executive officers were eligible to receive cash bonuses based on Silicon Image's revenue and income from operations, neither the Board of Directors nor the Committee adopted a cash-based executive bonus plan for executive officers for 2001. Instead, the Committee granted executive officers stock options as described below.

Long-term Equity-based Compensation. In December 2000, the Board of Directors approved a program allowing each of Silicon Image's executive officers to reduce his 2001 salary in exchange for a stock option for that number of shares equal to two times the amount of the salary reduction divided by the opening price of the company's common stock on the grant date, which would be January 2, 2001. On January 2, 2001, the Committee made option grants under this program to David D. Lee, Steve Tirado, Daniel K. Atler, Badar Baqai, Jalil Shaikh, Parviz Khodi and Michael Kelley. In December 2000, the Board of Directors also approved a program to grant options to Silicon Image's executive officers at the opening price of the company's common stock on the grant date, which would be January 2, 2001, with vesting commencing in 2001 upon the company's satisfaction of financial performance criteria for each quarter of the 2001 fiscal year, provided that if the specified financial performance criteria were not satisfied, the commencement of vesting would instead be deferred until January 2003. These options were to be granted in lieu of cash bonuses for 2001. On January 2, 2001, the Committee made option grants under this program to David D. Lee, Steve Tirado, Daniel K. Atler, Badar Baqai, Jalil Shaikh, Parviz Khodi and Michael Kelley.

During 2001, the Board of Directors also granted stock options in connection with the hiring of Jaime Garcia-Meza and Robert Gargus in order to induce them to join Silicon Image and granted stock options in connection with the promotions of Michael Kelley in order to recognize his increased job responsibilities. The Board of Directors also granted stock options to Daniel K. Atler, Badar Baqai, Jalil Shaikh, Jaime Garcia-Meza, Parviz Khodi and Michael Kelley in order to aid in the retention of these executive officers. The foregoing option grants were also made in order to align the interests of the grantees with those of the stockholders.

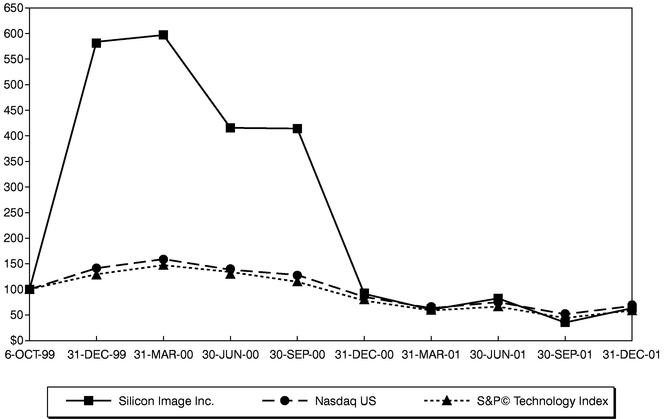

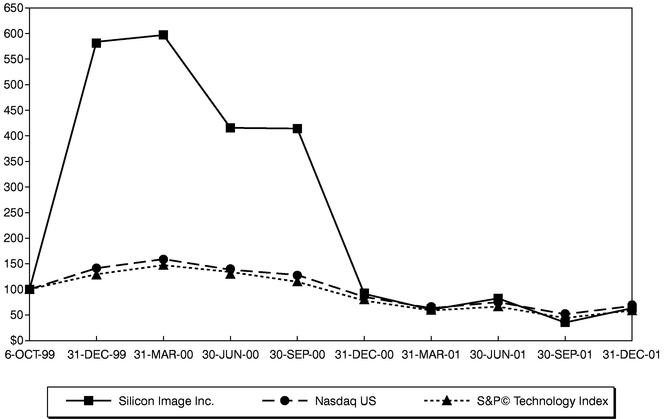

Company Performance and CEO Compensation. In October 1999, the Committee set the annual base salary for David D. Lee at $250,000 based on the criteria for cash-based compensation set forth above and taking into account the increases in base salaries awarded to Silicon Image's vice presidents at that time. In September 2000, the Board of Directors increased Dr. Lee's annual base salary by $25,000 to $275,000 based on the criteria for cash-based compensation set forth above. Dr. Lee elected to reduce his 2001 base salary by $82,500, to $192,500, pursuant to the salary reduction program described above. Vesting of a 37,391 share stock option granted to Dr. Lee on January 2, 2001 was scheduled to commence in 2001 upon Silicon Image satisfying specified financial performance criteria, specifically achieving revenue targets for each quarter specified in the 2001 operating plan and for the fourth quarter only, also achieving a pro forma net income target as well. Because the company did not satisfy any of these quarterly financial performance criteria during 2001, vesting under this option will instead commence in January 2003.