QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /x/

|

Filed by a Party other than the Registrant / / |

Check the appropriate box: |

/ / |

|

Preliminary Proxy Statement |

/ / |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

/x/ |

|

Definitive Proxy Statement |

/ / |

|

Definitive Additional Materials |

/ / |

|

Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

SILICON IMAGE, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

/x/ |

|

No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 19, 2004

To Our Stockholders:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of Silicon Image, Inc. to be held at our headquarters located at 1060 East Arques Ave., Sunnyvale, California, on Tuesday, May 25, 2004, at 2:00 p.m., local time.

The matters expected to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

It is important that you use this opportunity to take part in the affairs of Silicon Image by voting on the business to come before this meeting.Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

| | | Sincerely, |

|

|

|

|

|

David D. Lee

Chief Executive Officer |

SILICON IMAGE, INC.

1060 East Arques Ave.

Sunnyvale, California 94085

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2004 Annual Meeting of Stockholders of Silicon Image, Inc. will be held at our headquarters located at 1060 East Arques Ave., Sunnyvale, California 94085, on Tuesday, May 25, 2004, at 2:00 p.m., Pacific Time, for the following purposes:

- 1.

- To elect two Class II directors of Silicon Image, each to serve until the 2007 annual meeting of stockholders and until his successor has been elected and qualified, or until his earlier death, resignation or removal. Silicon Image's Board of Directors intends to present the following nominees for election as Class II directors:

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 29, 2004 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof.

| | | By Order of the Board of Directors |

|

|

|

|

|

David D. Lee

Chief Executive Officer |

Sunnyvale, California

April 19, 2004

Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

TABLE OF CONTENTS

| Proposal No. 1—Election of Directors | | 3 |

| | | Board of Directors Meetings and Committees | | 6 |

| | | Director Compensation | | 7 |

| | | Compensation Committee Interlocks and Insider Participation | | 8 |

| Proposal No. 2—Ratification of Appointment of Independent Accountants | | 9 |

| | | Audit and Related Fees | | 9 |

| | | Policy on Audit Committee Pre-Approval of Services Performed by Independent Accountants | | 9 |

| Security Ownership of Certain Beneficial Owners and Management | | 10 |

| | | Equity Compensation Plans | | 11 |

| Executive Officers | | 15 |

| Executive Compensation | | 18 |

| | | Officer Compensation | | 18 |

| | | Summary Compensation Table | | 18 |

| | | Option Grants in Last Fiscal Year | | 19 |

| | | Aggregated Option Exercises in 2003 and Year End Option Values | | 20 |

| | | Employment Contracts and Change of Control Arrangements | | 20 |

| Report of the Compensation Committee | | 22 |

| | | General Compensation Policy | | 22 |

| | | 2003 Executive Compensation | | 23 |

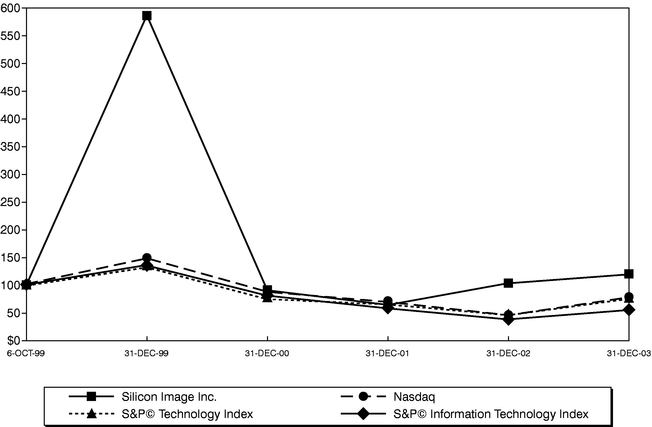

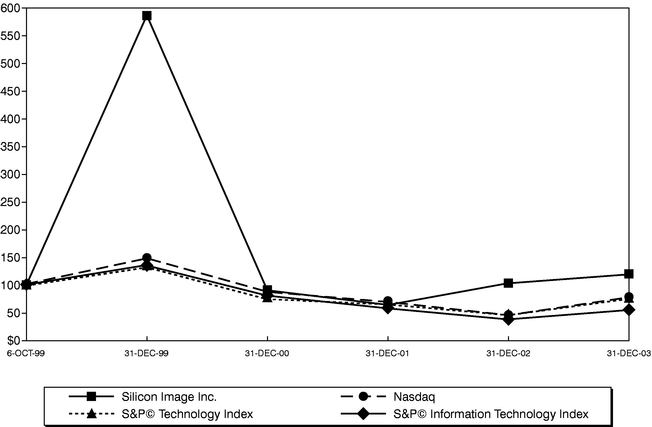

| Performance Graph | | 25 |

| Report of the Audit Committee | | 26 |

| Certain Relationships and Related Transactions | | 28 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 29 |

| Stockholder Proposals | | 29 |

| Directors' Attendance at Annual Stockholder Meetings | | 29 |

| Securityholder Communications | | 29 |

| Code of Conduct and Ethics | | 29 |

| Other Business | | 29 |

| Appendix—Charter of the Audit Committee of the Board of Directors | | A-1 |

SILICON IMAGE, INC.

1060 East Arques Ave.

Sunnyvale, California 94085

PROXY STATEMENT

April 19, 2004

The accompanying proxy is solicited on behalf of the Board of Directors of Silicon Image, Inc., a Delaware corporation, for use at the 2004 Annual Meeting of Stockholders to be held at our headquarters located at 1060 East Arques Ave., Sunnyvale, California 94085, on Tuesday, May 25, 2004, at 2:00 p.m., local time. Only holders of record of our common stock at the close of business on March 29, 2004, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on March 29, 2004, we had 73,584,373 shares of common stock outstanding and entitled to vote. A majority of such shares, present in person or represented by proxy, will constitute a quorum for the transaction of business. This Proxy Statement and the accompanying form of proxy were first mailed to stockholders on or about April 19, 2004. An annual report for the year ended December 31, 2003 is enclosed with this Proxy Statement.

Voting Rights, Quorum and Required Vote

Holders of Silicon Image common stock are entitled to one vote for each share held as of the above record date. A quorum is required for our stockholders to conduct business at the Annual Meeting. The holders of a majority of the shares of our common stock entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business.

For Proposal No. 1, directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors, which means that the two nominees receiving the highest number of "for" votes will be elected. Proposal No. 2 requires for approval the affirmative vote of the majority of shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. If stockholders abstain from voting, including brokers holding their clients' shares of record who cause abstentions to be recorded, these shares will be considered present and entitled to vote at the Annual Meeting and will be counted towards determining whether or not a quorum is present. Abstentions will have no effect with regard to Proposal No. 1, since approval of a percentage of shares present or outstanding is not required for this proposal, but will have the same effect as negative votes with regard to Proposal No. 2. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will tabulate affirmative and negative votes and abstentions.

Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients or in the absence of such direction, in their own discretion if permitted by the stock exchange or other organization of which they are members. Members of the New York Stock Exchange are permitted to vote their clients' proxies in their own discretion as to certain "routine" proposals, such as all of the proposals to be voted on at the Annual Meeting. If a broker votes shares that are not voted by its clients for or against a proposal, those shares are considered present and entitled to vote at the Annual Meeting. Those shares will be counted towards determining whether or not a quorum is present. Those shares will also be taken into account in determining the outcome of all of the proposals. Although all of the proposals to be voted on at the Annual Meeting are considered "routine," where a proposal is not "routine," a broker who has received no instructions from its clients generally does not have discretion to vote its clients' unvoted shares on that proposal. When a broker

indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, the missing votes are referred to as "broker non-votes." Those shares would be considered present for purposes of determining whether or not a quorum is present, but would not be considered entitled to vote on the proposal. Those shares would not be taken into account in determining the outcome of the non-routine proposal.

Voting of Proxies

The proxy accompanying this Proxy Statement is solicited on behalf of the Board of Directors of Silicon Image for use at the Annual Meeting. Stockholders are requested to complete, date and sign the accompanying proxy and promptly return it in the enclosed envelope. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. However, returned signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted as votes "for" such proposal, or in the case of the election of Class II directors, as a vote "for" election to Class II of the Board of all the nominees presented by the Board. In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment would require the affirmative vote of the majority of the outstanding shares present in person or represented by proxy at the Annual Meeting.

Expenses of Solicitation

The expenses of soliciting proxies to be voted at the Annual Meeting will be paid by Silicon Image. Following the original mailing of the proxies and other soliciting materials, Silicon Image and/or its agents may also solicit proxies by mail, telephone, telegraph or in person. Following the original mailing of the proxies and other soliciting materials, Silicon Image will request that brokers, custodians, nominees and other record holders of its common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In such cases, Silicon Image, upon the request of the record holders, will reimburse such holders for their reasonable expenses. Georgeson Shareholder Communications, Inc. will assist Silicon Image in obtaining the return of proxies at an estimated cost to Silicon Image of $7,500.

Revocability of Proxies

Any person signing a proxy in the form accompanying this Proxy Statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote pursuant to the proxy. A proxy may be revoked by a writing delivered to Silicon Image stating that the proxy is revoked, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, or by attendance at the Annual Meeting and voting in person. Please note, however, that if a stockholder's shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming that stockholder's beneficial ownership of the shares.

Telephone or Internet Voting

For stockholders with shares registered in the name of a brokerage firm or bank, a number of brokerage firms and banks are participating in a program for shares held in "street name" that offers telephone and Internet voting options. Stockholders with shares registered directly in their names with Mellon Investor Services, Silicon Image's transfer agent, will also be able to vote using the telephone and Internet. If your shares are held in an account at a brokerage firm or bank participating in this

2

program or registered directly in your name with Mellon Investor Services, you may vote those shares by calling the telephone number specified on your proxy or accessing the Internet website address specified on your proxy instead of completing and signing the proxy itself. The giving of such a telephonic or Internet proxy will not affect your right to vote in person should you decide to attend the Annual Meeting.

The telephone and Internet voting procedures are designed to authenticate stockholders' identities, to allow stockholders to give their voting instructions and to confirm that stockholders' instructions have been recorded properly. Stockholders voting via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Silicon Image's Board of Directors is presently comprised of seven members, who are divided into three classes of two members each, designated as Class I, Class II and Class III. One class of directors is elected by the stockholders at each annual meeting to serve until the third succeeding annual meeting and until their successors are duly elected and qualified. Keith McAuliffe and Douglas Spreng have been designated as Class I directors, David Hodges and Christopher Paisley have been designated as Class II directors, and David Courtney, David Lee and Andrew Rappaport have been designated as Class III directors. The Class II directors will stand for reelection or election at the Annual Meeting, the Class III directors will stand for reelection or election at the 2005 annual meeting of stockholders and the Class I directors will stand for reelection or election at the 2006 annual meeting of stockholders. Unless otherwise provided by law, any vacancy on the Board, including a vacancy created by an increase in the authorized number of directors, may only be filled by the affirmative vote of a majority of the directors then in office or by a sole remaining director. Any director so elected to fill a vacancy shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and qualified, or until his or her earlier death, resignation or removal.

Each of the nominees for election to Class II is currently a director of Silicon Image. If elected at the Annual Meeting, each of the nominees would serve until the 2007 annual meeting of stockholders and until his successor is elected and qualified, or until such director's earlier death, resignation or removal. Directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. Shares represented by an executed proxy will be voted "for" the election of the two nominees recommended by the Board unless the proxy is marked in such a manner as to withhold authority so to vote. In the event that any nominee for any reason is unable to serve, or for good cause will not serve, the proxies will be voted for such substitute nominee as the present Board may determine. Silicon Image is not aware of any nominee who will be unable to serve, or for good cause will not serve, as a director.

3

The names of the nominees for election as Class II directors at the Annual Meeting and of the incumbent Class I and Class III directors, and certain information about them, including their ages as of February 28, 2004, are included below.

Name

| | Age

| | Principal Occupation

| | Director Since

|

|---|

| Nominees for election as Class II directors for terms expiring in 2007: | | | | | | |

| | David Hodges (3) | | 66 | | Professor, University of California at Berkeley | | 1997 |

| | Christopher Paisley (1) | | 51 | | Professor, Santa Clara University | | 2004 |

| Incumbent Class III directors with terms expiring in 2005: | | | | | | |

| | David Courtney (1) | | 45 | | Executive Vice President, Worldwide Operations and Administration and Chief Financial Officer of TiVo Inc. | | 2003 |

| | David Lee | | 47 | | Chairman of the Board and Chief Executive Officer of Silicon Image | | 1995 |

| | Andrew Rappaport (2) | | 46 | | Partner of August Capital, LLC | | 1997 |

| Incumbent Class I directors with terms expiring in 2006: | | | | | | |

| | Keith McAuliffe (1) | | 46 | | Technology Consultant and Private Investor | | 2000 |

| | Douglas Spreng (2)(3) | | 60 | | Chairman and Chief Executive Officer of Ubicom, Inc. | | 2001 |

- (1)

- Member of the audit committee

- (2)

- Member of the compensation committee

- (3)

- Member of the governance and nominating committee

David Hodges has served as a director of Silicon Image since February 1997. Dr. Hodges is the Daniel M. Tellep Distinguished Professor Emeritus at the University of California at Berkeley, where he has been a member of the faculty in the department of Electrical Engineering and Computer Sciences since 1970. From 1995 to 2002, Dr. Hodges served as a director of Mentor Graphics Corporation, an electronic design automation company. From 1990 to 1996, Dr. Hodges served as Dean of the College of Engineering at the University of California at Berkeley. From 1966 to 1970, Dr. Hodges worked at Bell Telephone Laboratories, the research and development division of the American Telephone and Telegraph Company. Dr. Hodges serves as a director of Mentor Graphics Corporation, an electronic design automation company. Dr. Hodges holds a Bachelor of Electrical Engineering degree from Cornell University and Master of Science and Ph.D. degrees in Electrical Engineering from the University of California at Berkeley.

Christopher Paisley has served as a director of Silicon Image since April 2004. Mr. Paisley has been the Dean's Executive Professor of Accounting and Finance in the Leavey School of Business at Santa Clara University since January 2001. From September 1985 until May 2000, Mr. Paisley was the Senior Vice President of Finance and Chief Financial Officer of 3Com Corporation. Mr. Paisley is also a director of Brocade Communications Systems, Inc., Riverstone Networks, Inc. and two private companies. Mr. Paisley received a B.A. degree in Economics from the University of California, Santa Barbara and an M.B.A. degree from the University of California, Los Angeles.

4

David Courtney has served as a director of Silicon Image since March 2003. Mr. Courtney has served as Executive Vice President, Worldwide Operations & Administration of TiVo, Inc., a developer of digital video recorders, since October 2001, and has served as TiVo's Chief Financial Officer since March 1999. Mr. Courtney previously served as TiVo's Senior Vice President for Finance and Administration from March 2000 to October 2001 and as Vice President from March 1999 to March 2000. Mr. Courtney has served on the board of directors of TiVo since May 2002. From May 1995 to July 1998, Mr. Courtney served as a Managing Director in the high technology investment banking group at J.P. Morgan & Co., an investment banking firm. From 1986 to 1995, Mr. Courtney was a member of the high technology investment banking group at Goldman, Sachs & Co., an investment banking firm, most recently serving as Vice President. Mr. Courtney currently serves as vice-chairman of the Board of KQED Television, a non-profit affiliate of the Public Broadcasting System in San Francisco, California. Mr. Courtney holds a B.A. degree in Economics from Dartmouth College and a Master of Business Administration degree from Stanford University.

David Lee has served as Chairman of the Board and Chief Executive Officer of Silicon Image since its inception on January 1, 1995, and in addition served as President from inception until October 1996 and from June 1999 until January 2003. Prior to founding Silicon Image, Dr. Lee was a principal investigator at Sun Microsystems, Inc., a computer networking company, where he led advanced development projects from 1993 to 1995, as a Visiting Scientist at Sun's Technology Development Group and as Senior Staff Engineer at Sun Labs. Before joining Sun, Dr. Lee was a member of the research staff at Xerox Corporation's Palo Alto Research Center, from 1989 to 1994. Dr. Lee holds Bachelor of Science, Master of Science and Ph.D. degrees in Electrical Engineering and Computer Sciences from the University of California at Berkeley.

Andrew Rappaport has served as a director of Silicon Image since June 1997. Mr. Rappaport has been a partner of August Capital, LLC, a venture capital firm, since July 1996. Prior to that time, Mr. Rappaport was President of The Technology Research Group, Inc., a Boston-based strategic management consulting firm that he founded in August 1984. Mr. Rappaport serves as a director of several private companies. Mr. Rappaport attended Princeton University.

Keith McAuliffe has served as a director of Silicon Image since November 2000. From May 2003 to the present, Mr. McAuliffe has served as a consultant for, and an investor in, technology startups, which included interim senior management positions. From October 2002 to April 2003, Mr. McAuliffe served as Vice President of Engineering for Surgient Networks, Inc., a data center management software company. Previously, Mr. McAuliffe served as Vice President, Product Development of RLX Technologies, Inc., a server platform company from December 2000 to October 2001. Mr. McAuliffe served with Compaq Computer Corporation, a computer systems company, as Vice President and General Manager of the Service Provider and dotCOM Business Unit from December 1999 to December 2000, as Vice President of Mainstream Servers of the Industry Standard Server Division from 1998 to 1999, as Vice President of Engineering in the Systems Division from 1997 to 1998, and as Director of Hardware Engineering in the Systems Division from 1995 to 1997. Mr. McAuliffe holds a Bachelor of Science degree in Electrical Engineering Technology from Texas Tech University.

Douglas Spreng has served as a director of Silicon Image since February 2001. Since August 2003, Mr. Spreng has served as Chief Executive Officer of Ubicom, Inc., a supplier of wireless network processor and software platforms. Mr. Spreng served as President and Chief Operating Officer of Applied Micro Circuits Corp., a supplier of processors for optical networks, from July 2001 to September 2002, and previously served as Senior Vice President of that company's Switching and Network Processing Group from January 2001 to July 2001. From April 1999 to December 2000, Mr. Spreng served as the President and Chief Executive Officer of MMC Networks, Inc., a developer and supplier of network processors which became a subsidiary of Applied Micro Circuits Corp. in October 2000. Prior to that time, Mr. Spreng was the Executive Vice President of the Client Access

5

Business Unit of 3Com Corporation, a networking company, from June 1995 to April 1999. Mr. Spreng is also a director at two private companies. Mr. Spreng holds a Bachelor of Science degree in Electrical Engineering from the Massachusetts Institute of Technology and a Master of Business Administration degree from Harvard Business School.

The Board of Directors recommends a vote FOR the election

of each of the nominated directors

Board of Directors Meetings and Committees

Board of Directors. During fiscal year 2003, the board met fourteen times and acted by written consent four times. None of the directors attended fewer than 75% of the aggregate of the total number of meetings of the board (held during the period for which he was a director) and the total number of meetings held by all committees of the board on which such director served (held during the period that such director served), except for Douglas Spreng, who attended in excess of 70% of such meetings.

With the exception of Dr. Lee, Silicon Image's Chief Executive Officer, the board of directors has determined that each of its members including each of the nominees is independent under the rules of the NASDAQ Stock Market.

Standing committees of the board include an audit committee, a compensation committee and a governance and nominating committee.

Audit Committee. The audit committee consists of Mr. McAuliffe, Mr. Courtney, who joined the committee as its chairman in March 2003 and Mr. Paisley, who joined the committee in April 2004. Mr. Rappaport served on the committee during 2003 and in 2004 until Mr. Paisley was appointed to the committee in April 2004. During fiscal year 2003, the audit committee met nineteen times. Each member of the audit committee is an independent director. The board of directors has also determined that Mr. Courtney is an "audit committee financial expert" within the meaning of the rules of the Securities and Exchange Commission and meets the financial sophistication requirement of the rules of the NASDAQ Stock Market. The audit committee reviews our financial reporting process, our system of internal controls and the audit process. The audit committee also reviews the performance and independence of our external auditors and recommends to the board the appointment or discharge of our external auditors.

Compensation Committee. The compensation committee consists of Messrs. Rappaport and Spreng. Ronald Schmidt, a former director, served on the committee during 2003 and in 2004 until his resignation in April 2004. During fiscal year 2003, the compensation committee met three times and acted by written consent one time. Each member of the compensation committee is an independent director. The compensation committee has the authority to approve the form and amount of compensation to be paid or awarded to all employees of Silicon Image. The compensation committee administers the issuance of stock options and other equity awards. The board also has the authority to approve the issuance of stock options and other equity awards and has delegated to Dr. Lee the authority to grant stock options to non-officer employees, subject to certain limitations.

Governance and Nominating Committee. The governance and nominating committee consists of Messrs. Hodges and Spreng. The nominating committee was formed in February 2003 and was reconstituted as the governance and nominating committee in July 2003. The governance and nominating committee met once during fiscal year 2003. Each member of the governance and nominating committee is an independent director. The governance and nominating committee is responsible for interviewing, evaluating, nominating and recommending individuals for membership on the board.

6

The governance and nominating committee charter was adopted in July 2003. The governance and nominating committee charter is available on Silicon Image's website atwww.siliconimage.com.

The goal of the governance and nominating committee is to ensure that our board possesses a variety of perspectives and skills derived from high-quality business and professional experience. The committee seeks to achieve a balance of knowledge, experience and capability on our board. To this end, the committee seeks nominees with high professional and personal ethics and values, an understanding of our business lines and industry, diversity of business experience and expertise, broad-based business acumen, and the ability to think strategically. In addition, the committee considers the level of the candidate's commitment to active participation as a director, both at board and committee meetings and otherwise. Although the committee uses these and other criteria to evaluate potential nominees, we have no stated minimum criteria for nominees. The committee does not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our stockholders.

Policy regarding Stockholder Nominations. The governance and nominating committee considers stockholder recommendations for director candidates. The committee has established the following procedure for stockholders to submit director nominee recommendations:

- •

- If a stockholder would like to recommend a director candidate for the next proxy meeting, he or she must submit the recommendations by mail to Silicon Image's Secretary at Silicon Image's principal executive offices, no later than the 120th calendar before the date that Silicon Image last mailed its proxy statement to stockholders in connection with the previous year's annual meeting.

- •

- Recommendations for candidates must be accompanied by personal information of the candidate, including a list of the candidate's references, the candidate's resume or curriculum vitae and such other information as determined by the Secretary and as necessary to satisfy Securities Exchange Commission rules and Silicon Image's Bylaws, together with a letter signed by the proposed candidate consenting to serve on the Board if nominated and elected.

- •

- The committee considers nominees based on Silicon Image's need to fill vacancies or to expand the Board, and also considers Silicon Image's need to fill particular roles on the Board or committees thereof (e.g. independent director, audit committee financial expert, etc.).

- •

- The committee evaluates candidates in accordance with the committee's charter and the committee's policies regarding director qualifications, qualities and skills.

Director Compensation

Directors of Silicon Image do not receive cash compensation for their services as directors, but are reimbursed for their reasonable and necessary expenses for attending board and board committee meetings. All board members are eligible to receive discretionary grants of stock options under our 1999 Equity Incentive Plan, and we have previously made discretionary grants of stock options to new directors upon their appointment to the board.

In addition, immediately following each annual meeting of our stockholders, each director who is not an employee and whose direct pecuniary interest in our common stock is less than 5% will automatically be granted an option under our 1999 Equity Incentive Plan to purchase 30,000 shares of our common stock if the director has served continuously as a member of the board of directors for a period of at least one year and an additional option for 10,000 shares of our common stock for each committee of the board of directors on which the director has served continuously for a period of at least one year. Each option will have an exercise price equal to the fair market value of our common stock on the date of grant. So long as the option holder continues to provide services to us, these annual grants will vest with respect to 4.167% of the shares each month following the date of grant

7

until fully vested; provided, that these grants will become fully vested if we undergo a change in control. These annual grants will have a five-year term, but will generally terminate three months following the date the option holder ceases to provide services to us.

On May 20, 2003, following the 2003 annual meeting of our stockholders, the following option grants were made to our directors at that time pursuant to our automatic annual grant program: Keith McAuliffe—an option for 30,000 shares and an option for 10,000 shares; Douglas Spreng—an option for 30,000 shares and an option for 10,000 shares; David Hodges—an option for 30,000 shares; Ronald Schmidt—an option for 30,000 shares and an option for 10,000 shares; and Andrew Rappaport—an option for 30,000 shares and two options for 10,000 shares each. Each of these options has an exercise price of $5.37, the closing price per share of our common stock on the NASDAQ National Market on that date.

Upon the appointment of David Courtney to the board of directors and to the audit committee as its chairman on March 20, 2003, Mr. Courtney was granted a discretionary non-plan option for 40,000 shares, which is the customary grant for newly-appointed board members. In addition, Mr. Courtney was granted a discretionary non-plan option for 20,000 shares in recognition of the additional time and responsibility that would be required of him in his role as chairman of the audit committee. Each of these options has an exercise price of $4.52, the closing price per share of our common stock on the NASDAQ National Market on that date, and will vest with respect to 2.083% of the shares each month following the date of grant until fully vested; provided, that these grants will become fully vested if we undergo a change in control.

Upon the appointment of Christopher Paisley to the board of directors and to the audit committee on April 9, 2004, Mr. Paisley was granted a discretionary non-plan option for 40,000 shares. This option has an exercise price of $12.44, the closing price per share of our common stock on the NASDAQ National Market on April 8, 2004, and will vest with respect to 2.083% of the shares each month following the date of grant until fully vested; provided, that this grant will become fully vested if we undergo a change in control.

Compensation Committee Interlocks and Insider Participation

The compensation committee of Silicon Image's board of directors is currently comprised of Messrs. Rappaport, Spreng and Dr. Schmidt. None of these individuals has at any time been an officer or employee of Silicon Image. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

8

PROPOSAL NO. 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Board of Directors has selected PricewaterhouseCoopers LLP, independent accountants, to audit the financial statements of Silicon Image for the year ending December 31, 2004, and recommends that the stockholders vote for ratification of such appointment. In the event of a negative vote on such ratification, the Board of Directors will reconsider its selection. Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting, will have the opportunity to make a statement at the Annual Meeting if they desire to do so, and will be available to respond to appropriate questions.

Audit and Related Fees

Audit Fees. The aggregate fees billed or to be billed by PricewaterhouseCoopers LLP for professional services rendered for (i) the audit of Silicon Image's annual financial statements set forth in Silicon Image's Annual Report for the fiscal years ended December 31, 2003 and December 31, 2002, (ii) the review of Silicon Image's quarterly financial statements set forth in Silicon Image's Quarterly Reports on Form 10-Q and (iii) the issuances of consents and review of documents filed with the SEC were $407,750 for the fiscal year ended December 31, 2003 and $307,069 for the fiscal year ended December 31, 2002.

Audit-Related Fees. The aggregate fees billed or to be billed by PricewaterhouseCoopers LLP for professional services rendered related to the performance of the aforementioned audits or reviews of Silicon Image's financial statements and not reported above under "Audit Fees" were $450,500 for the fiscal year ended December 31, 2003 and $10,610 for the fiscal year ended December 31, 2002. Audit related services include work associated with auditing and accounting consultations regarding new accounting standards, procedures performed in connection with the examination conducted by Silicon Image's Audit Committee related to the recognition of revenue associated with certain licensing transactions recorded in 2002 and 2003, advisory procedures under Section 404 of the Sarbanes-Oxley Act of 2002 and acquisitions-related accounting assistance.

Tax Fees. The aggregate fees billed or to be billed by PricewaterhouseCoopers LLP for professional services rendered for tax consulting and compliance were $12,610 for the fiscal year ended December 31, 2003 and $0 for the fiscal year ended December 31, 2002.

All Other Fees. The aggregate fees billed by PricewaterhouseCoopers LLP for services other than those described above were $97,959 for the fiscal year ended December 31, 2003 and $0 for the fiscal year ended December 31, 2002. These services consisted of a security control review following the implementation of a new enterprise resource planning system during 2003.

All of PricewaterhouseCoopers LLP's fees for the fiscal years ended December 31, 2002 and 2003, described above, were pre-approved by the audit committee.

Policy on Audit Committee Pre-Approval of Services Performed by Independent Accountants

The audit committee's policy is to pre-approve all audit and permissible non-audit services provided by the independent accountants. These services may include audit services, audit-related services, tax services and other services. The Audit Committee generally pre-approves particular services or categories of services on a case-by-case basis. The independent accountants and management are required to periodically report to the audit committee regarding the extent of services provided by the independent accountants in accordance with these pre-approvals, and the fees for the services performed to date.

The Board of Directors recommends a vote FOR the ratification

of the appointment of PricewaterhouseCoopers LLP

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information as to the beneficial ownership of our common stock as of February 29, 2004 by:

- •

- each stockholder known by us to be the beneficial owner of more than 5% of our common stock;

- •

- each of our directors;

- •

- our Chief Executive Officer, the four other most highly compensated executive officers who were executive officers as of December 31, 2003 and earned more than $100,000 in 2003; and

- •

- all current directors and executive officers as a group.

The percentage ownership is based on 73,303,994 shares of common stock outstanding as of February 29, 2004. Shares of common stock that are subject to options or other convertible securities currently exercisable or exercisable within 60 days of February 29, 2004, are deemed outstanding for the purposes of computing the percentage ownership of the person holding these options or convertible securities, but are not deemed outstanding for computing the percentage ownership of any other person. Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. To our knowledge, unless otherwise indicated below, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. The table does not include executive officers or directors who were not serving in those capacities as of February 29, 2004. Unless otherwise indicated, the address for each listed stockholder is c/o Silicon Image, Inc., 1060 East Arques Ave., Sunnyvale, California 94085.

| | Shares Beneficially Owned

| |

|---|

Name of Beneficial Owner

| | Number of Shares

| | Percent of Class

| |

|---|

| FMR Corp. (1) | | 10,496,839 | | 14.3 | % |

| Sang-Chul Han (2) | | 3,684,650 | | 5.0 | |

| David Lee (3) | | 2,793,310 | | 3.8 | |

| Steve Tirado (4) | | 988,098 | | 1.3 | |

| Andrew Rappaport (5) | | 486,601 | | * | |

| Parviz Khodi (6) | | 371,930 | | * | |

| David Hodges (7) | | 168,350 | | * | |

| John LeMoncheck (8) | | 103,553 | | * | |

| Keith McAuliffe (9) | | 93,250 | | * | |

| Douglas Spreng (10) | | 78,750 | | * | |

| David Courtney (11) | | 16,250 | | * | |

| Christopher Paisley | | 0 | | * | |

| All current executive officers and directors as a group (14 persons) (12) | | 5,531,558 | | 7.3 | |

- *

- Less than 1%.

- (1)

- Based upon a Schedule 13G/A filed with the Securities and Exchange Commission on February 17, 2004 which indicates sole voting power over 286,700 of these shares and sole investment power over all of these shares. FMR Corp.'s address is 82 Devonshire Street, Boston, Massachusetts 02109.

- (2)

- Based upon a Schedule 13G/A filed with the Securities and Exchange Commission on February 13, 2004 which indicates sole voting and investment power over all of these shares. Mr. Han's address

10

is c/o Kang Nam Cable, Ryukyung Building 239-1, Bonhyun-dong, Kangnam-ku, Seoul, Korea 135-010.

- (3)

- Includes 1,689,100 shares held by Dr. Lee and Joanne W. Lee, trustees of the David D. Lee and Joanne W. Lee Trust Agreement dated March 15, 2000. Includes 1,103,210 shares subject to options held by Dr. Lee that are exercisable within 60 days of February 29, 2004.

- (4)

- Includes 900 shares held by the Tirado Family Trust, of which Mr. Tirado is a trustee. Includes 401,761 shares subject to options held by Mr. Tirado that are exercisable within 60 days of February 29, 2004.

- (5)

- Includes 8,000 shares held by a trust of which Mr. Rappaport is a trustee and 30,000 shares held in Mr. Rappaport's retirement plan account. Includes 101,249 shares subject to options held by Mr. Rappaport that are exercisable within 60 days of February 29, 2004. Mr. Rappaport's address is c/o August Capital, L.P., 2480 Sand Hill Road, Suite 101, Menlo Park, CA 94025.

- (6)

- Includes 199,036 shares held by the Khodi Family Trust U/A/D 2/19/00. Includes 140,521 shares subject to options held by Mr. Khodi that are exercisable within 60 days of February 29, 2004.

- (7)

- Includes 123,600 shares held by the Hodges Family Trust 5/16/90, of which Dr. Hodges and Susan A. Hodges are trustees. Includes 44,750 shares subject to options held by Dr. Hodges that are exercisable within 60 days of February 29, 2004.

- (8)

- Includes 103,230 shares subject to options held by Mr. LeMoncheck that are exercisable within 60 days of February 29, 2004.

- (9)

- Includes 81,250 shares subject to options held by Mr. McAuliffe that are exercisable within 60 days of February 29, 2004.

- (10)

- Includes 78,750 shares subject to options held by Mr. Spreng that are exercisable within 60 days of February 29, 2004.

- (11)

- Includes 16,250 shares subject to options held by Mr. Courtney that are exercisable within 60 days of February 29, 2004.

- (12)

- Includes 2,484,259 shares subject to options that are exercisable within 60 days of February 29, 2004.

Equity Compensation Plans

As of December 31, 2003, we maintained our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan, both of which were approved by our stockholders. Our 1995 Equity Incentive Plan that was terminated in connection with our initial public offering but had options outstanding under it as of December 31, 2003, was also approved by our stockholders. As of December 31, 2003, we also maintained the CMD Technology Inc. 1999 Stock Incentive Plan, Silicon Communication Lab, Inc. 1999 Stock Option Plan and TransWarp Networks, Inc. 2002 Stock Option/Stock Issuance Plan, which we assumed in connection with our acquisition of those companies, as well as non-plan stock options. The

11

following table gives information about equity awards under these plans and options as of December 31, 2003.

Plan category

| | (a)

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | (b)

Weighted-average

exercise price of

outstanding options,

warrants and rights

| | (c)

Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected

in column (a))

| |

|---|

| Equity compensation plans approved by security holders | | 13,223,041 | | $ | 5.46 | | 3,094,524 | (1) |

| Equity compensation plans not approved by security holders (2) | | 6,938,408 | | | 3.06 | | 398,128 | |

| Total | | 20,161,449 | | | 4.63 | | 3,492,652 | |

- (1)

- Of these, 1,979,561 shares remained available for grant under the 1999 Equity Incentive Plan and 1,114,963 shares remained available for grant under the 1999 Employee Stock Purchase Plan. All of the shares available for grant under the 1999 Equity Incentive Plan may be issued in the form of stock options, restricted stock or stock bonuses. Under the terms of our 1999 Equity Incentive Plan, on the first business day of each calendar year, the aggregate number of shares reserved and available for grant and issuance pursuant to the plan is automatically increased by a number of shares equal to 5% of the total outstanding shares as of the immediately preceding December 31, provided that our board of directors or compensation committee may in its sole discretion reduce the amount of the increase in any particular year. Under the terms of our 1999 Employee Stock Purchase Plan, on January 1 of each year, the aggregate number of shares reserved for issuance under the plan is automatically increased by a number of shares equal to 1% of the total outstanding shares as of the immediately preceding December 31, provided that our board of directors or compensation committee may in its sole discretion reduce the amount of the increase in any particular year and, provided further, that the aggregate number of shares issued over the term of the plan shall not exceed 8,000,000 shares.

- (2)

- In June 2001, we assumed the CMD Technology Inc. 1999 Stock Incentive Plan, all outstanding stock options under this plan and all shares then remaining available for future issuance under this plan. In September 2001, our board amended this plan to conform the material terms so that they are substantially similar to those of our 1999 Equity Incentive Plan; however, this plan does not allow for the award of stock bonuses and does not provide for an automatic annual increase in the amount of shares reserved for issuance thereunder. As of December 31, 2003, 3,024,486 shares were subject to outstanding stock options under this plan at a weighted-average exercise price of $3.21, and in addition, 151,459 shares remained available for future issuance under this plan. Shares subject to any option or right to purchase restricted stock granted under this plan that can no longer be exercised and shares reacquired by us pursuant to an option agreement or restricted stock purchase agreement will again be available for grant or issuance under this plan. Our directors, employees and consultants are eligible to receive stock options and rights to purchase restricted stock under this plan. Incentive stock options may be granted only to our employees. The compensation committee or board determines the exercise or purchase price and vesting schedule of options and restricted stock awards. The exercise price of incentive stock options must be at least equal to the fair market value of our common stock on the date of grant. The exercise price of non-statutory stock options must be at least equal to 85% of the fair market value of our common stock on the date of grant. The maximum term of options granted under this plan is 10 years. If we undergo a change in control (such as a merger, sale of assets or tender offer), outstanding options may be assumed or substituted for by the successor corporation. In the discretion of the compensation committee or board, the vesting of these options may accelerate

12

upon one of these transactions. The board may from time to time amend, suspend or terminate this plan. Unless earlier terminated pursuant to its terms, this plan shall terminate on August 9, 2009.

In July 2001, we assumed the Silicon Communication Lab, Inc. 1999 Stock Option Plan, all outstanding stock options under this plan and all shares then remaining available for future issuance under this plan. In September 2001, our board amended this plan to conform the material terms so that they are substantially similar to those of our 1999 Equity Incentive Plan (as described above); however, this plan does not allow for the award of restricted stock or stock bonuses and does not provide for an automatic annual increase in the amount of shares reserved for issuance thereunder. As of December 31, 2003, 1,186,510 shares were subject to outstanding stock options under this plan at a weighted-average exercise price of $2.16, and in addition, 149,030 shares remained available for future issuance under this plan. Shares subject to an option granted under this plan which expires or becomes exercisable for any reason shall become available for future grant under this plan. Our directors, employees and consultants are eligible to receive stock options under this plan. The compensation committee or board determines the exercise price and vesting schedule of options. The exercise price of incentive stock options must be at least equal to the fair market value of our common stock on the date of grant. The exercise price of non-statutory stock options must be at least equal to 85% of the fair market value of our common stock on the date of grant. The maximum term of options granted under this plan is 10 years. If we undergo a change in control (such as a merger, sale of assets or tender offer), outstanding options may be assumed or substituted for by the successor corporation. In the discretion of the compensation committee or board, the vesting of these options may accelerate upon one of these transactions. The board may at any time amend, suspend or discontinue this plan. Unless earlier terminated pursuant to its terms, this plan shall terminate 10 years from its initial adoption.

In April 2003, we assumed the TransWarp Networks, Inc. 2002 Stock Option/Stock Issuance Plan, all outstanding stock options under this plan and all shares then remaining available for future issuance under this plan. The material terms of this plan are substantially similar to those of our 1999 Equity Incentive Plan (as described above); however, this plan does not provide for an automatic annual increase in the amount of shares reserved for issuance thereunder. Following our acquisition of TransWarp Networks, we amended the form of stock option agreement under this plan to conform the material terms so that they are substantially similar to those of stock option agreements under our 1999 Equity Incentive Plan. As of December 31, 2003, 772,437 shares were subject to outstanding stock options under this plan at a weighted-average exercise price of $1.79, and in addition, 97,639 shares remained available for future issuance under this plan. Shares subject to an option granted under this plan which expires or becomes exercisable for any reason and unvested shares of common stock granted under this plan which are repurchased by us shall become available for future grant under this plan. Our directors, employees and consultants are eligible to receive stock options and awards of common stock under this plan. Incentive stock options may be granted only to our employees. The compensation committee or board determines the exercise price and vesting schedule of options. The exercise price of non-statutory stock options must be at least equal to 85% of the fair market value of our common stock on the date of grant. The maximum term of options granted under this plan is 10 years. If we undergo a change in control (such as a merger, sale of assets or tender offer), with respect to outstanding options and unvested shares granted by prior to our acquisition of TransWarp Networks, vesting of such options and unvested shares will automatically accelerate in full unless such options are assumed or replaced by a cash incentive program by the successor corporation, repurchase rights with respect to unvested shares are assigned to the successor corporation, or acceleration is subject to or precluded by limitations imposed by the compensation committee or board. If we undergo a change in control (such as a merger, sale of assets or tender offer), with respect to outstanding options granted following our acquisition of TransWarp Networks, vesting of such options may be

13

assumed or substituted for by the successor corporation and in the discretion of the compensation committee or board, the vesting of such options may accelerate upon one of these transactions. The board may at any time amend or modify this plan. Unless earlier terminated pursuant to its terms, this plan shall terminate 10 years from its initial adoption.

As of December 31, 2003, 1,954,975 shares were subject to nine outstanding non-plan stock options at a weighted-average exercise price of $3.86.

On August 19, 1999, Daniel Atler was granted a non-plan option to purchase 60,000 shares at an exercise price of $2.875, which equaled 85% of the fair market value of our common stock on that date. As of December 31, 2003, Mr. Atler had exercised this option with respect to 56,600 shares and this option remained outstanding and exercisable with respect to 3,400 shares.

On August 19, 1999, Parviz Khodi was granted a non-plan option to purchase 60,000 shares at an exercise price of $2.875, which equaled 85% of the fair market value of our common stock on that date. As of December 31, 2003, this option remained outstanding and exercisable with respect to 60,000 shares.

On November 22, 2000, Badar Baqai was granted two non-plan options for 350,000 shares and 150,000 shares, respectively, each with an exercise price of $6.5625, which equaled the fair market value of our common stock on that date. Each of these options becomes vested and exercisable with respect to 25% of the shares on November 22, 2001 and 2.083% of the shares on December 22, 2001 and each of the 35 months thereafter. On April 4, 2001, as part of our option repricing program for executives, Mr. Baqai exchanged the option for 350,000 shares for an option for 350,000 shares with an exercise price of $5.625, which exceeded the fair market value of our common stock on that date. This option becomes vested and exercisable with respect to 12.5% of the shares on October 4, 2001 and 2.083% of the shares on November 4, 2001 and the 41 months thereafter. This option expires six years from the date of grant. As of December 31, 2003, Mr. Baqai had exercised this option with respect to 271,050 shares and this option remained outstanding with respect to 78,950 shares and Mr. Baqai had exercised the other option with respect to 59,375 shares and the other option remained outstanding with respect to 90,625 shares.

On April 5, 2001, Jaime Garcia-Meza was granted a non-plan option for 500,000 shares at $3.4375, which equaled the fair market value of our common stock on that date. This option is immediately exercisable and the shares subject thereto become vested with respect to 12.5% of the shares on October 5, 2001 and 2.083% of the shares on November 5, 2001 and the 41 months thereafter. As of December 31, 2003, Mr. Garcia-Meza had exercised this option with respect to 30,000 shares and this option remained outstanding with respect to 470,000 shares.

On October 31, 2001, Robert Gargus was granted a non-plan option for 400,000 shares at an exercise price of $1.14, which equaled the fair market value of our common stock on that date. This option becomes vested and exercisable with respect to 25% of the shares on October 31, 2002 and 2.083% of the shares on November 31, 2002 and each of the 35 months thereafter. As of December 31, 2003, Mr. Gargus had exercised this option with respect to 83,000 shares and this option remained outstanding with respect to 317,000 shares.

On November 6, 2001, Hyun-Jong Shin was granted a non-plan option for 350,000 shares at an exercise price of $1.65, which equaled the fair market value of our common stock on that date. This option becomes vested and exercisable with respect to 25% of the shares on November 6, 2002 and 2.083% of the shares on December 6, 2002 and each of the 35 months thereafter. As of December 31, 2003, this option remained outstanding with respect to 310,000 shares.

On January 6, 2003, John LeMoncheck was granted a non-plan option for 325,000 shares at an exercise price of $6.35, which equaled the fair market value of our common stock on that date. This option becomes vested and exercisable with respect to 25% of the shares on January 6, 2004

14

and 2.083% of the shares on February 6, 2004 and each of the 35 months thereafter. As of December 31, 2003, this option remained outstanding with respect to 325,000 shares.

On February 20, 2004, Robert Bagheri was granted a non-plan option for 300,000 shares at an exercise price of $5.90, which equaled the fair market value of our common stock on that date. This option becomes vested and exercisable with respect to 25% of the shares on February 20, 2004 and 2.083% of the shares on March 20, 2004 and each of the 35 months thereafter. As of December 31, 2003, this option remained outstanding with respect to 300,000 shares.

Unless noted otherwise above, all outstanding non-plan options expire 10 years from the date of grant. However, if an optionee ceases to provide services to us, his non-plan option will generally expire three months from the date of termination, unless the termination is for cause, in which case the option will expire on the date of termination, or the termination is for death or disability, in which case the option will expire 12 months from the date of termination.

EXECUTIVE OFFICERS

The following sets forth certain information with regard to executive officers of Silicon Image, including their ages as of February 28, 2004:

Name

| | Age

| | Position

|

|---|

| David Lee | | 47 | | Chairman of the Board and Chief Executive Officer |

| Steve Tirado | | 49 | | Division President, Storage Group |

| Robert Gargus | | 52 | | Vice President, Finance and Administration and Chief Financial Officer |

| Robert Bagheri | | 47 | | Executive Vice President, Operations |

| Parviz Khodi | | 45 | | Vice President, PC/Display Products |

| John LeMoncheck | | 38 | | Vice President, Consumer Electronics Products |

| J. Duane Northcutt | | 46 | | Chief Technology Officer |

| Robert Valiton | | 39 | | Vice President, Worldwide Sales |

David Lee has served as Silicon Image's Chairman of the Board and Chief Executive Officer since our inception on January 1, 1995, and in addition served as President from inception until October 1996 and from June 1999 until January 2003. Prior to founding Silicon Image, Dr. Lee was a principal investigator at Sun Microsystems, Inc., a computer networking company, where he led advanced development projects from 1993 to 1995, as a Visiting Scientist at Sun's Technology Development Group and as Senior Staff Engineer at Sun Labs. Before joining Sun, Dr. Lee was a member of the research staff at Xerox Corporation's Palo Alto Research Center, from 1989 to 1994. Dr. Lee holds Bachelor of Science, Master of Science and Ph.D. degrees in Electrical Engineering and Computer Sciences from the University of California at Berkeley.

Steve Tirado has served as Silicon Image's Division President of the Storage Group since April 2004. Mr. Tirado served as Silicon Image's President from January 2003 until March 2004, has also served as Silicon Image's Chief Operating Officer from November 2000 to March 2004, and previously served as Silicon Image's Executive Vice President of Marketing and Business Development from August 1999 to November 2000. From April 1986 to July 1999, Mr. Tirado held various marketing and management positions at Sun Microsystems, Inc., a computer networking company, serving most recently as Vice President of Marketing and Business Development for the NC Systems Group. From 1985 to 1986, Mr. Tirado was President of Tirado, Sorrentino Associates, a consulting firm. From 1984 to 1985, Mr. Tirado held the position of Marketing Administration Manager at Qualogy, a mass storage disk drive and controller company. From 1976 to 1984, Mr. Tirado was a public program administrator and policy analyst within various government agencies. Mr. Tirado holds a Bachelor of Arts degree in Psychology from the University of California at Santa Barbara, a Master of Arts Degree in Organizational Planning and Consultation from Boston University and a Master of Business Administration degree from the University of California at Berkeley.

15

Robert Gargus has served as Silicon Image's Chief Financial Officer and Vice President, Finance and Administration since October 2001. From April 2000 to April 2001, Mr. Gargus served as Chief Executive Officer of Telcom Semiconductor, Inc., a supplier of semiconductor products for the wireless market, and prior to that time served as President from December 1999 to April 2000 and as Vice President, Financial and Administration and Chief Financial Officer from April 1998 to December 1999. From 1984 to May 1998, Mr. Gargus held a number of financial and management positions at Tandem Computers Inc., a computer systems company, serving most recently as President and General Manager of the Atalla Security Products Division and as Corporate Controller. From 1973 to 1984, Mr. Gargus held various financial positions at Unisys Corporation, an information technology services company. Mr. Gargus holds a Bachelor of Science degree in Accounting and a Master of Business Administration degree from the University of Detroit.

Robert Bagheri has served as Silicon Image's Executive Vice President of Operations since February 2003. From January 1997 to January 2003, Mr. Bagheri served as Vice President of Operations and Quality Reliability at SiRF Technology, Inc., a developer of software and semiconductor products designed to provide location awareness capabilities. Prior to that time, Mr. Bagheri served as Director of Product and Test Engineering Operations at S3 Incorporated, a supplier of multimedia acceleration hardware and software, from April 1995 to January 1997. From December 1989 to March 1995 Mr. Bagheri held various product engineering and management positions at Zoran Corporation, IMP Inc., Microchip Technology Inc. and Monolithic Memories Inc. Mr. Bagheri holds a Bachelor of Science in electrical engineering from the Cleveland Institute of Technology.

Parviz Khodi has served as Silicon Image's Vice President, PC/Display Products since March 2003 and previously served as Silicon Image's Vice President, Marketing from April 2001 to March 2003 and Vice President, Worldwide Sales from August 1998 to April 2001. Mr. Khodi joined Silicon Image in July 1998 as Director of Asia Pacific Sales. From November 1987 to July 1998, Mr. Khodi worked at Chips and Technologies, Inc., a maker of semiconductor chips principally for the graphics market, where he held various sales management positions, most recently Director, Asia Pacific Sales. From 1986 to 1987, Mr. Khodi was responsible for worldwide field applications at Touch Communications, Inc., a client/server software company. From 1984 to 1986, Mr. Khodi held engineering positions in the microprocessor and microcontroller divisions of Intel corporation, a computer processor company. Mr. Khodi holds Bachelor of Science and Master of Science degrees in electrical engineering from the University of Kansas.

John LeMoncheck has served as Silicon Image's Vice President, Consumer Electronics Products since January 2003. From January 2001 to January 2003 Mr. LeMoncheck served as Vice President, Software and Systems Engineering at Oak Technology's TeraLogic Group, a developer of integrated circuits, software and platforms for digital television. Prior to that time, Mr. LeMoncheck directed the LEGO Company's West Coast design center, which was focused on high technology toys from September 1999 to January 2001. From November 1993 to June 1999, Mr. LeMoncheck was Vice President of Engineering at Arithmos, Inc., a developer of flat panel display products. Before joining Arithmos, Mr. LeMoncheck was an engineer at Synaptics, Inc., a developer of interface devices for portable electronic devices, from May 1991 through October 1993 and an engineer at NCR Corporation, a financial information processing company, from June 1987 through June 1989. Mr. LeMoncheck holds a Bachelor of Science degree in electrical engineering from the University of California at San Diego.

J. Duane Northcutt has served as Silicon Image's Chief Technology Officer since July 22, 2003. Prior to joining Silicon Image in early 2002, Dr. Northcutt held the title of Distinguished Engineer and Chief Technologist of the Desktop and Workgroup Servers Group at Sun Microsystems, where he worked in a technical capacity for twelve years. Previously, Mr. Northcutt was a member of the research faculty at Carnegie Mellon University's School of Computer Science. Dr. Northcutt holds both

16

a bachelor's and a master's degree in electrical engineering, and a Ph.D. in computer and electrical engineering from Carnegie-Mellon University.

Robert Valiton has served as Silicon Image's Vice President of Worldwide Sales since April 2004 and previously served as Silicon Image's Senior Director of Sales, NAE and EMEA from August 2003 to April 2004 and Director of Sales, NAE from October 2000 to August 2003. Mr. Valiton joined Silicon Image in July 1999 as Eastern Region Sales Manager. From 1998 to 1999, Mr. Valiton served as Eastern Area Sales and Applications Manager at Summit Microelectronics, a start-up designer and fabless manufacturer of programmable analog and mixed-signal semiconductors. From 1996 to 1998, Mr. Valiton was Eastern Area Sales Manager for Benchmarq Microelectronics, a designer and fabless semiconductor manufacturer of mixed-signal and analog semiconductors. From 1986 to 1996, Mr. Valiton held various strategic account management, sales and marketing management and account specialist positions with Rayovac Corporation's OEM Division, Power Convertibles Corporation's Power Management Division and Dow Chemical Company. Mr. Valiton holds a Bachelor of Science degree in plastics engineering with a minor in chemistry from the University of Massachusetts.

17

EXECUTIVE COMPENSATION

Officer Compensation

The following table sets forth all compensation awarded to, earned by or paid for services rendered to Silicon Image in all capacities during the years ended December 31, 2003, 2002 and 2001 by (i) our Chief Executive Officer and (ii) the four other most highly compensated executive officers other than the Chief Executive Officer who were serving as executive officers as of December 31, 2003 and whose salary and bonus for 2003 exceeded $100,000 (collectively, the "Named Executive Officers").

Summary Compensation Table

| |

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

|

|---|

| |

| | Annual

Compensation

| |

| |

|

|---|

| |

| |

| | Securities

Underlying

Options

Granted (#)

| |

|

|---|

Name and Principal Positions

| |

| | Other Annual Compensation ($)

| | All

Other

Compensation ($)(5)

|

|---|

| | Year

| | Salary ($)

| | Bonus ($)

|

|---|

David Lee

Chairman of the Board and Chief Executive Officer | | 2003

2002

2001 | | $

| 305,000

275,000

192,500 | | $

| —

15,687

— | | —

—

— | | 500,000

—

500,000 |

(1) | $

| 948

1,196

1,196 |

Steve Tirado

Division President,

Storage Group | | 2003

2002

2001 | | | 300,000

273,105

239,150 | | | —

—

— | | —

—

— | | 400,000

250,000

666,459 |

(2) | | 948

1,196

1,196 |

Jaime Garcia-Meza

Vice President, Worldwide Sales (former) (3) | | 2003

2002

2001 | | | 305,802

337,178

203,010 | (3)

(3)

(3) | | 20,000

20,595

— | | —

—

50,938 | | 150,000

50,000

660,000 | | | 948

1,196

897 |

Parviz Khodi

Vice President, PC/Display Products | | 2003

2002

2001 | | | 259,564

259,564

249,605 | | | —

—

— | | —

—

— | | 25,000

—

218,415 |

(4) | | 948

1,196

1,196 |

John LeMoncheck

Vice President,

Consumer Electronics

Products | | 2003 | | | 207,711 | | | 50,000 | | — | | 325,000 | | | 948 |

- (1)

- Of the stock options to purchase 500,000 shares of common stock granted to Dr. Lee in 2001, an option for 431,724 shares was received pursuant to our option repricing program for executives in exchange for cancellation of an option for 431,724 shares granted to Dr. Lee in 1999. Under this program, subject to certain limitations, each of our executive officers was allowed to exchange each of his options with an exercise price greater than $5.625 for a new option granted on April 4, 2001 with an exercise price of $5.625, which price exceeded the $3.0625 closing price of our common stock on that date. Subject to very limited exceptions, under this program, the vesting schedule for the new options was restarted, with the new options vesting as to 12.5% of the shares after six months and 2.083% of the shares each of the 42 months thereafter.

- (2)

- Of the stock options to purchase 666,459 shares of common stock granted to Mr. Tirado in 2001, an option for 250,000 shares and an option for 120,000 shares were received pursuant to our option repricing program for executives in exchange for cancellation of an option for 250,000 shares granted to Mr. Tirado earlier in 2001 and an option for 120,000 shares granted to Mr. Tirado in 2000, respectively.

- (3)

- Salary figures include sales commissions of $113,302 in 2003, $144,678 in 2002 and $21,264 in 2001. In 2001, Mr. Garcia-Meza received a payment of $50,938 to cover his relocation expenses incurred in connection with joining Silicon Image. In April 2004, Mr. Garcia-Meza's position changed from Vice President, Worldwide Sales to Vice President of Sales and Marketing, Storage Systems.

- (4)

- Of the stock options to purchase 218,415 shares of common stock granted to Mr. Khodi in 2001, an option for 60,000 shares was received pursuant to our option repricing program for executives in exchange for cancellation of an option for 60,000 shares granted to Mr. Khodi in 2000.

- (5)

- These figures represent life insurance premiums paid by Silicon Image for the benefit of the applicable executive.

18

Option Grants in Last Fiscal Year

The following table shows information about each stock option granted during 2003 to each of the Named Executive Officers. In accordance with the rules of the Securities and Exchange Commission, the table sets forth the hypothetical gains or "option spreads" that would exist for the options at the end of their respective ten-year terms. These gains are based on assumed rates of annual compound stock price appreciation of 5% and 10% from the closing price on the date an option was granted until the end of the option term. The 5% and 10% assumed annual rates of stock price appreciation are mandated by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of future common stock prices.

All options included in the following table are nonqualified stock options. Unless noted otherwise, the options were granted under our 1999 Equity Incentive Plan and the exercise price of each option granted equaled the closing price per share of our common stock on the NASDAQ National Market on the date of grant. Unless noted otherwise, the options expire on the earlier of ten years from the date of grant or three months after termination of employment. The percentage numbers are based on an aggregate of 4,534,585 options granted to our employees during fiscal 2003.

| |

| | Percentage

of Total

Options

Granted

to

Employees

in 2003

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term

|

|---|

| | Number of

Securities

Underlying Options

Granted (#)

| |

| |

|

|---|

Name

| | Exercise

Price

Per Share ($)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| David Lee | | 500,000 | (1) | 11.0 | % | $ | 6.16 | | 1/2/13 | | $ | 1,936,995 | | $ | 4,908,727 |

Steve Tirado

| | 200,000

200,000 | (2)

(3) | 4.4

4.4 | | | 6.16

6.16 | | 1/2/13

1/2/13 | | | 774,798

774,798 | | | 1,963,491

1,963,491 |

| Jaime Garcia-Meza | | 150,000 | (4) | 3.3 | | | 6.16 | | 1/2/13 | | | 581,099 | | | 1,472,618 |

| Parviz Khodi | | 25,000 | (5) | 0.6 | | | 6.16 | | 1/2/13 | | | 96,850 | | | 245,436 |

| John LeMoncheck | | 325,000 | (6) | 7.2 | | | 6.35 | | 1/6/13 | | | 1,297,881 | | | 3,289,086 |

- (1)

- This option becomes vested and exercisable with respect to 2.083% of the shares on January 2, 2003 and each of the 47 months thereafter.

- (2)

- This option becomes vested and exercisable with respect to 0.833% of the shares on January 2, 2004 and each of the 11 months thereafter, 1.25% of the shares on January 2, 2005 and each of the 11 months thereafter, 2.083% of the shares on January 2, 2006 and each of the 11 months thereafter, and 4.167% of the shares on January 2, 2007 and each of the 11 months thereafter.

- (3)

- This option becomes vested and exercisable with respect to 1.667% of the shares on January 2, 2003 and each of the 59 months thereafter.

- (4)

- This option becomes vested and exercisable with respect to 1.667% of the shares on January 2, 2005 and each of the 11 months thereafter, 2.777% of the shares on January 2, 2006 and each of the 11 months thereafter, and 3.888% of the shares on January 2, 2007 and each of the 11 months thereafter.

- (5)

- This option becomes vested and exercisable with respect to 100% of the shares on January 2, 2008.

- (6)

- This option becomes vested and exercisable with respect to 25% of the shares on January 6, 2004 and 2.083% of the shares each of the 36 months thereafter.

19

Aggregated Option Exercises in 2003 and Year End Option Values

The following table sets forth the number of shares acquired upon the exercise of stock options during 2003 and the number of shares covered by both exercisable and unexercisable stock options held by each of the Named Executive Officers at December 31, 2003. Also reported are values of unexercised "in-the-money" options, which represent the positive spread between the respective exercise prices of outstanding stock options and $7.16, the closing price per share of our common stock on December 31, 2003 on the NASDAQ National Market.

| |

| |

| | Number of Securities

Underlying

Unexercised Options at

Fiscal Year End (#)

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End ($)

|

|---|

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David Lee | | — | | $ | — | | 1,023,417 | | 544,859 | | $ | 639,702 | | $ | 640,599 |

| Steve Tirado | | — | | | — | | 334,566 | | 731,893 | | | 532,708 | | | 1,290,268 |

| Jaime Garcia-Meza | | 40,000 | | | 180,975 | | 471,667 | (1) | 348,333 | | | 1,759,610 | | | 1,178,965 |

| Parviz Khodi | | — | | | — | | 122,918 | | 180,497 | | | 383,044 | | | 801,214 |

| John LeMoncheck | | — | | | — | | — | | 325,000 | | | — | | | 263,250 |

- (1)

- 197,500 of the shares issuable upon exercise of these options were vested as of December 31, 2003.

Employment Contracts and Change of Control Arrangements