UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-00816 | |||||

| AMERICAN CENTURY MUTUAL FUNDS, INC. | ||||||

| (Exact name of registrant as specified in charter) | ||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||

| (Address of principal executive offices) | (Zip Code) | |||||

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||

| (Name and address of agent for service) | ||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||

| Date of fiscal year end: | 10-31 | |||||

| Date of reporting period: | 04-30-2009 | |||||

ITEM 1. REPORTS TO STOCKHOLDERS.

| American Century Investments |

Ultra® Fund

| President’s Letter |

Dear Investor:

Thank you for investing with us during the financial reporting period ended April 30, 2009. We appreciate your trust in American Century Investments® during these challenging times.

The U.S. economy remained in recession at the close of the reporting period, part of the lingering fallout from the subprime-initiated credit and financial crises that shook the global capital markets during the past two years. The recession has affected everyone—from first-time individual investors to hundred-year-old financial institutions.

However, as we mark the second anniversary of the start of the subprime mortgage meltdown, the worst of the economic and financial market obstacles appear to be behind us. The rate of U.S. economic decline has slowed, as have the drop-offs in housing prices and jobs. Risk appetites returned to the markets in recent months, evidenced by the strong stock rebound since early March.

Risk was a predominant theme during the reporting period, as the investment pendulum swung from risk avoidance to risk acceptance. We believe, however, that caution and risk management are still advisable. We don’t think we’re out of the economic woods yet, not with mortgage and corporate default rates on the rise, housing prices still declining, and job losses still mounting.

Effective risk management requires a commitment to disciplined investment approaches that balance risk and reward, with the goal of setting and maintaining risk levels that are appropriate for portfolio objectives. At American Century Investments, we’ve stayed true to the principles that have guided us for over 50 years, including our commitment to delivering superior investment performance and helping investors reach their financial goals. Risk management is part of that commitment—we offer portfolios that can help diversify and stabilize investment returns.

The coming months will likely present additional challenges, but I’m certain that we have the investment professionals and processes in place to provide competitive and compelling long-term results for you. Thank you for your continued confidence in us.

Sincerely,

Jonathan S. Thomas

President and Chief Executive Officer

American Century Investments

President and Chief Executive Officer

American Century Investments

| Independent Chairman’s Letter |

I am Don Pratt, an independent director and chairman of the mutual fund board responsible for the U.S. Growth Equity, U.S. Value Equity, International Equity and Asset Allocation funds managed by American Century Investments. The board consists of seven independent directors and two directors who are affiliated with the investment advisor.

As one of your independent shareholder representatives on the fund board, I plan to write you from time to time with updates on board activities and news about your funds. My co-independent directors and I are committed to putting your interests first. We work closely with American Century Investments on maintaining strong fund performance, providing quality service to shareholders at competitive fees and ensuring ethical business practices and compliance with all applicable fund regulations.

Last year, the board welcomed its newest independent director, John R. Whitten He is a great addition to an experienced board where, collectively, the indepen dent directors have served the funds for more than 76 years. This continuity served shareholders well as the investment advisor initiated a successful management transition, creating a strong senior leadership team consisting of well-tenured company executives and experienced industry veterans. Under the leadership of President and Chief Executive Officer Jonathan Thomas and Chief Investment Officer Enrique Chang, the firm has made the achievement of superior investment performance its primary focus and the key driver of its success going forward. This focus helped the company generate strong relative performance against the backdrop of 2008’s unprecedented market volatility.

As investors in the American Century funds, my fellow directors and I share your investing experience. We know firsthand how decisions made at the board level affect all shareholders. To further guide our efforts on your behalf, I invite you to send me your comments, questions or suggestions by email to dhpratt@fundboardchair.com. Thank you for allowing me to serve as your advocate on our board.

| Table of Contents |

| Market Perspective | 2 |

| U.S. Stock Index Returns | 2 |

| Ultra | |

| Performance | 3 |

| Portfolio Commentary | 5 |

| Top Ten Holdings | 7 |

| Top Five Industries | 7 |

| Types of Investments in Portfolio | 7 |

| Shareholder Fee Example | 8 |

| Financial Statements | |

| Schedule of Investments | 10 |

| Statement of Assets and Liabilities | 13 |

| Statement of Operations | 15 |

| Statement of Changes in Net Assets | 16 |

| Notes to Financial Statements | 17 |

| Financial Highlights | 23 |

| Other Information | |

| Additional Information | 29 |

| Index Definitions | 30 |

The opinions expressed in the Market Perspective and the Portfolio Commentary reflect those of the portfolio management team as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| Market Perspective |

By Greg Woodhams, Chief Investment Officer, U.S. Growth Equity—Large Cap

Riding the Stock Market Roller Coaster

A dramatic shift in market sentiment buffeted the U.S. stock market during the six months ended April 30, 2009. The extreme pessimism that sent the equity market down sharply during the first four months of the period gave way to renewed optimism and a powerful market rally during the last seven weeks.

The pessimism that sank the stock market in late 2008 and early 2009 was brought on by a worsening economic downturn and continued distress in the financial sector. The U.S. economy sank into recession, contracting at an annual rate of more than 6% in both the fourth quarter of 2008 and the first quarter of 2009 as the unemployment rate hit a 26-year high and consumer spending slumped. In addition, the credit markets remained frozen, which contributed to growing losses and deteriorating balance sheets for many financial companies. As a result, the major stock indices finished 2008 with their worst quarter in 21 years and continued on a downward trajectory in the first two months of 2009.

However, the market bottomed in early March and staged a sharp rebound through the end of April as investor sentiment changed abruptly. Early signs of economic stabilization generated optimism about a possible recovery, and investors also grew more confident about the federal government’s actions to stimulate economic activity and restore liquidity in the credit markets. Despite their recent resurgence, though, most stocks still declined overall for the six-month period (see the table below).

Growth Stocks Outperformed

In this turbulent environment, growth stocks outpaced value issues by a considerable margin across all market capitalizations. Although it is not clear whether we are in the early stages of a growth-led market, we have conviction in the consistent execution of our investment strategies. Our portfolio managers and analysts continue to seek out the stocks of companies that possess improving fundamentals, reflecting our belief that long-term stock price movements follow growth in earnings, revenues, and cash flow.

| U.S. Stock Index Returns | ||||

| For the six months ended April 30, 2009* | ||||

| Russell 1000 Index (Large-Cap) | –7.39% | Russell 2000 Index (Small-Cap) | –8.40% | |

| Russell 1000 Growth Index | –1.52% | Russell 2000 Growth Index | –3.77% | |

| Russell 1000 Value Index | –13.27% | Russell 2000 Value Index | –12.60% | |

| Russell Midcap Index | –1.64% | * Total returns for periods less than one year are not annualized. | ||

| Russell Midcap Growth Index | 2.71% | |||

| Russell Midcap Value Index | –6.14% | |||

2

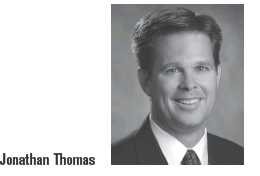

| Performance | ||||||

| Ultra | ||||||

| Total Returns as of April 30, 2009 | ||||||

| Average Annual Returns | ||||||

| Since | Inception | |||||

| 6 months(1) | 1 year | 5 years | 10 years | Inception | Date | |

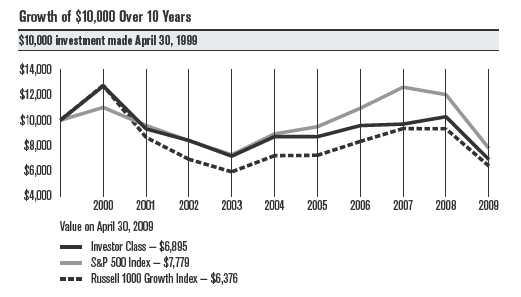

| Investor Class | -3.36% | -32.90% | -4.55% | -3.65% | 10.22% | 11/2/81 |

| Russell 1000 Growth Index(2) | -1.52% | -31.57% | -2.39% | -4.40% | 9.13%(3) | — |

| S&P 500 Index(2) | -8.53% | -35.31% | -2.70% | -2.48% | 10.39%(3) | — |

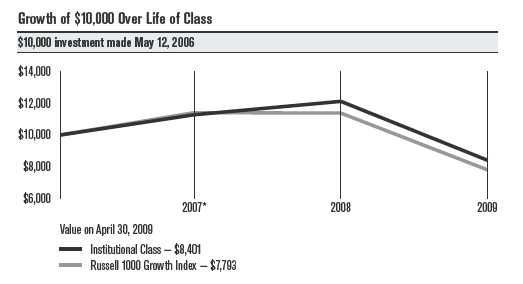

| Institutional Class | -3.28% | -32.78% | -4.36% | -3.46% | 1.74% | 11/14/96 |

| A Class(4) | 10/2/96 | |||||

| No sales charge* | -3.44% | -33.06% | -4.79% | -3.88% | 1.61% | |

| With sales charge* | -9.00% | -36.91% | -5.91% | -4.45% | 1.14% | |

| B Class | 9/28/07 | |||||

| No sales charge* | -3.81% | -33.57% | — | — | -25.67% | |

| With sales charge* | -8.81% | -37.57% | — | — | -28.70% | |

| C Class | 10/29/01 | |||||

| No sales charge* | -3.84% | -33.57% | -5.51% | — | -3.17% | |

| With sales charge* | -4.80% | -33.57% | -5.51% | — | -3.17% | |

| R Class | -3.57% | -33.24% | -5.02% | — | -2.97% | 8/29/03 |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. |

| The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. | |

| (1) | Total returns for periods less than one year are not annualized. |

| (2) | Data provided by Lipper Inc. — A Reuters Company. © 2009 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. |

| The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or sell any of the securities herein is being made by Lipper. | |

| (3) | Since 10/31/81, the date nearest the Investor Class’s inception for which data are available. |

| (4) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. Performance, with sales charge, prior to that date has been adjusted to reflect the A Class’s current sales charge. |

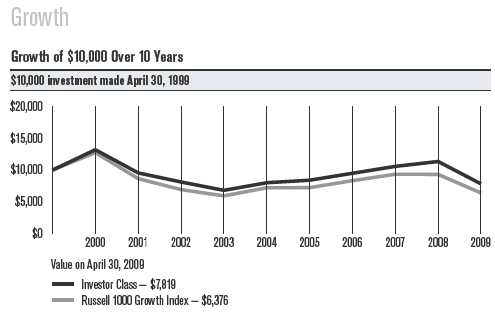

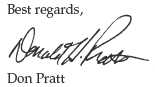

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

3

Ultra

| One-Year Returns Over 10 Years | ||||||||||

| Periods ended April 30 | ||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |

| Investor Class | 27.06% | -26.70% | -9.83% | -14.79% | 21.64% | -0.07% | 10.09% | 1.24% | 5.99% | -32.90% |

| Russell 1000 | ||||||||||

| Growth Index | 27.58% | -32.25% | -20.10% | -14.35% | 21.65% | 0.40% | 15.18% | 12.25% | -0.23% | -31.57% |

| S&P 500 Index | 10.13% | -12.97% | -12.63% | -13.31% | 22.88% | 6.34% | 15.42% | 15.24% | -4.68% | -35.31% |

| Total Annual Fund Operating Expenses | |||||

| Institutional | |||||

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 0.99% | 0.79% | 1.24% | 1.99% | 1.99% | 1.49% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

4

| Portfolio Commentary |

Ultra

Portfolio Managers: Keith Lee and Michael Li

In December 2008, portfolio manager Tom Telford left American Century Investments to pursue another career opportunity. Following Mr. Telford’s departure, Keith Lee and Michael Li, portfolio managers for the Select fund, joined the Ultra management team with co-manager Steve Lurito. In April 2009, Mr. Lurito also left American Century Investments. Messrs. Lee and Li are experienced investment professionals who have managed Select since 2003 and 2006, respectively, and they will continue to follow Ultra’s mandate of investing in large-cap growth companies demonstrating accelerating growth and share price momentum.

Performance Summary

Ultra returned –3.36%* for the six months ended April 30, 2009, trailing the –1.52% return of the fund’s benchmark, the Russell 1000 Growth Index, but outpacing the –8.53% return of the broad S&P 500 Index.

The six-month period was marked by dramatic swings in market sentiment. For much of the period, stocks fell significantly as increasingly fearful investors reacted to a worsening economic downturn and a deteriorating financial sector. In March, however, investors grew more optimistic as the economy showed signs of stabilization and the frozen credit markets began to thaw, leading to a sharp stock market rebound during the last six weeks of the period.

In this environment, Ultra held up better than the broader equity market but lagged its benchmark index. One factor contributing to the under-performance of the benchmark was our emphasis on stocks with price momentum, which were generally out of favor during the period. In addition, our bias toward larger companies weighed on relative results as the mid-cap stocks in the Russell 1000 Growth Index outperformed, especially during the market rally late in the period.

Health Care Detracted

Stock selection also detracted from performance compared with the Russell 1000 Growth Index, most notably in the health care sector. Stock choices among biotechnology firms and pharmaceutical companies were responsible for the bulk of the underperformance in the health care sector.

Genzyme and Celgene were the most significant detractors among biotech-nology stocks. Concerns about the potential for generic competition in the biotechnology industry, which could lead to slower growth prospects, weighed on biotech stocks in general. Genzyme, which makes medications that treat rare genetic diseases, also faced a regulatory setback on one of its new products, while Celgene, which focuses on cancer-related drugs, reported weaker-than-expected sales for its flagship medication.

Among pharmaceutical stocks, the biggest detractor was a missed opportunity. The portfolio did not own drug maker Schering-Plough, which rallied sharply during the six-month period thanks to a takeover offer from competitor Merck.

*All fund returns referenced in this commentary are for Investor Class shares. Total returns for periods less than one year are not annualized.

5

Ultra

Consumer Staples and Industrials Also Lagged

The portfolio’s consumer staples and industrials holdings underperformed their counterparts in the benchmark index. Stock selection among food retailers and food products makers contributed virtually all of the under-performance in the consumer staples sector. Grocery chain Kroger tumbled as the company recalled several of its private-label products because of a salmonella outbreak at one of its suppliers. General Mills, which makes cereal and other packaged foods, fell amid rising input costs and increased consumer demand for cheaper private-label brands.

In the industrials sector, overweight positions in railroad operators Norfolk Southern and Union Pacific had the biggest negative impact on relative results. Rail traffic slumped by more than 18% through the first four months of 2009 as reduced production in the manufacturing sector led to lower shipping volumes of both raw materials and finished goods.

Energy and Materials Added Value

The only two sectors of the portfolio that contributed positively to performance versus the Russell 1000 Growth Index were energy and materials. Security selection and an underweight position in energy equipment and services stocks was the key behind the outperformance in the energy sector. Drilling products and services supplier National Oilwell Varco and oil and gas producer Noble Energy were among the top contributors in this sector.

In the materials sector, outperformance was driven primarily by an overweight in metals and mining stocks. Metals producers BHP Billiton, headquartered in Australia, and U.S. based Freeport McMoRan Copper & Gold were the best contributors, benefiting from a rebound in copper prices during the six-month period.

Other noteworthy positive contributors included investment bank Goldman Sachs Group and department store chain Kohl’s. Goldman Sachs successfully raised capital and indicated that it may pay back the cash infusion it received from the federal government sooner than expected. Kohl’s gained market share from its competitors thanks to improving sales of its private-label and exclusive brands.

A Look Ahead

Despite the recent market rebound, we expect stocks to remain volatile in the coming months. We seek to take advantage of this uncertain period by opportunistically investing in high-growth companies, as dictated by our investment discipline. We remain confident in our belief that high-quality, high-growth stocks which exhibit accelerating fundamentals, positive relative strength, and reasonable valuations will outperform over the long term.

6

| Ultra | ||

| Top Ten Holdings as of April 30, 2009 | ||

| % of net assets | % of net assets | |

| as of 4/30/09 | as of 10/31/08 | |

| Google, Inc., Class A | 3.2% | 1.8% |

| Wal-Mart Stores, Inc. | 3.0% | 5.0% |

| Apple, Inc. | 3.0% | 3.3% |

| Cisco Systems, Inc. | 2.8% | 2.3% |

| Microsoft Corp. | 2.8% | 1.7% |

| QUALCOMM, Inc. | 2.4% | 2.8% |

| Express Scripts, Inc. | 2.3% | 2.0% |

| Hewlett-Packard Co. | 2.3% | 0.9% |

| Oracle Corp. | 2.0% | 0.7% |

| Philip Morris International, Inc. | 2.0% | 1.9% |

| Top Five Industries as of April 30, 2009 | ||

| % of net assets | % of net assets | |

| as of 4/30/09 | as of 10/31/08 | |

| Software | 7.0% | 5.9% |

| Computers & Peripherals | 6.3% | 4.6% |

| Semiconductors & Semiconductor Equipment | 5.8% | 4.6% |

| Oil, Gas & Consumable Fuels | 5.7% | 5.2% |

| Communications Equipment | 5.2% | 5.8% |

| Types of Investments in Portfolio | ||

| % of net assets | % of net assets | |

| as of 4/30/09 | as of 10/31/08 | |

| Domestic Common Stocks | 94.2% | 94.8% |

| Foreign Common Stocks(1) | 5.4% | 3.5% |

| Total Common Stocks | 99.6% | 98.3% |

| Temporary Cash Investments | 0.8% | 1.7% |

| Other Assets and Liabilities | (0.4)% | —(2) |

| (1) | Includes depositary shares, dual listed securities and foreign ordinary shares. |

| (2) | Category is less than 0.05%. |

7

| Shareholder Fee Example (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from November 1, 2008 to April 30, 2009.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

8

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending | Expenses Paid | ||

| Account Value | Account Value | During Period* | Annualized | |

| 11/1/08 | 4/30/09 | 11/1/08 – 4/30/09 | Expense Ratio* | |

| Actual | ||||

| Investor Class | $1,000 | $966.40 | $4.88 | 1.00% |

| Institutional Class | $1,000 | $967.20 | $3.90 | 0.80% |

| A Class | $1,000 | $965.60 | $6.09 | 1.25% |

| B Class | $1,000 | $961.90 | $9.73 | 2.00% |

| C Class | $1,000 | $961.60 | $9.73 | 2.00% |

| R Class | $1,000 | $964.30 | $7.31 | 1.50% |

| Hypothetical | ||||

| Investor Class | $1,000 | $1,019.84 | $5.01 | 1.00% |

| Institutional Class | $1,000 | $1,020.83 | $4.01 | 0.80% |

| A Class | $1,000 | $1,018.60 | $6.26 | 1.25% |

| B Class | $1,000 | $1,014.88 | $9.99 | 2.00% |

| C Class | $1,000 | $1,014.88 | $9.99 | 2.00% |

| R Class | $1,000 | $1,017.36 | $7.50 | 1.50% |

| * | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

9

| Schedule of Investments |

| Ultra |

| APRIL 30, 2009 (UNAUDITED) | ||||||

| Shares | Value | Shares | Value | |||

| Common Stocks — 99.6% | ELECTRICAL EQUIPMENT — 2.5% | |||||

| ABB Ltd.(1) | 1,085,000 | $ 15,561,791 | ||||

| AEROSPACE & DEFENSE — 2.9% | ||||||

| General Dynamics Corp. | 1,388,000 | $ 71,717,960 | ABB Ltd. ADR | 2,130,000 | 30,288,600 | |

| Lockheed Martin Corp. | 901,000 | 70,755,530 | Emerson Electric Co. | 2,266,000 | 77,134,640 | |

| 142,473,490 | 122,985,031 | |||||

| BEVERAGES — 2.3% | ENERGY EQUIPMENT & SERVICES — 2.5% | |||||

| Coca-Cola Co. (The) | 1,918,000 | 82,569,900 | National Oilwell Varco, Inc.(1) | 1,402,000 | 42,452,560 | |

| PepsiCo, Inc. | 638,000 | 31,746,880 | Schlumberger Ltd. | 1,633,000 | 80,000,670 | |

| 114,316,780 | 122,453,230 | |||||

| BIOTECHNOLOGY — 3.2% | FOOD & STAPLES RETAILING — 4.1% | |||||

| Celgene Corp.(1) | 853,000 | 36,440,160 | Costco Wholesale Corp. | 1,132,000 | 55,015,200 | |

| Genzyme Corp.(1) | 1,033,000 | 55,089,890 | Wal-Mart Stores, Inc. | 2,977,000 | 150,040,800 | |

| Gilead Sciences, Inc.(1) | 1,485,000 | 68,013,000 | 205,056,000 | |||

| 159,543,050 | FOOD PRODUCTS — 1.3% | |||||

| CAPITAL MARKETS — 2.8% | General Mills, Inc. | 864,000 | 43,796,160 | |||

| BlackRock, Inc. | 174,000 | 25,494,480 | Nestle SA | 661,000 | 21,636,623 | |

| Charles Schwab Corp. (The) | 3,285,000 | 60,706,800 | 65,432,783 | |||

| Goldman Sachs | HEALTH CARE EQUIPMENT & SUPPLIES — 2.3% | |||||

| Group, Inc. (The) | 410,000 | 52,685,000 | Baxter International, Inc. | 1,556,000 | 75,466,000 | |

| 138,886,280 | Medtronic, Inc. | 796,000 | 25,472,000 | |||

| CHEMICALS — 2.5% | Varian Medical | |||||

| Systems, Inc.(1) | 411,000 | 13,715,070 | ||||

| Air Products | ||||||

| & Chemicals, Inc. | 311,000 | 20,494,900 | 114,653,070 | |||

| Monsanto Co. | 1,098,000 | 93,209,220 | HEALTH CARE PROVIDERS & SERVICES — 4.2% | |||

| Nalco Holding Co. | 500,000 | 8,160,000 | Express Scripts, Inc.(1) | 1,759,000 | 112,523,230 | |

| 121,864,120 | Medco Health | |||||

| Solutions, Inc.(1) | 576,000 | 25,084,800 | ||||

| COMMUNICATIONS EQUIPMENT — 5.2% | ||||||

| Cisco Systems, Inc.(1) | 7,172,000 | 138,563,040 | UnitedHealth Group, Inc. | 3,059,000 | 71,947,680 | |

| QUALCOMM, Inc. | 2,793,000 | 118,199,760 | 209,555,710 | |||

| 256,762,800 | HOTELS, RESTAURANTS & LEISURE — 2.8% | |||||

| COMPUTERS & PERIPHERALS — 6.3% | McDonald’s Corp. | 1,696,000 | 90,379,840 | |||

| Yum! Brands, Inc. | 1,486,000 | 49,558,100 | ||||

| Apple, Inc.(1) | 1,167,000 | 146,843,610 | ||||

| 139,937,940 | ||||||

| EMC Corp.(1) | 4,315,000 | 54,066,950 | ||||

| HOUSEHOLD PRODUCTS — 0.9% | ||||||

| Hewlett-Packard Co. | 3,105,000 | 111,717,900 | Colgate-Palmolive Co. | 745,000 | 43,955,000 | |

| 312,628,460 | INSURANCE — 1.3% | |||||

| CONSTRUCTION & ENGINEERING — 0.5% | Aon Corp. | 253,000 | 10,676,600 | |||

| Fluor Corp. | 661,000 | 25,032,070 | MetLife, Inc. | 1,764,000 | 52,479,000 | |

| DIVERSIFIED FINANCIAL SERVICES — 0.9% | 63,155,600 | |||||

| JPMorgan Chase & Co. | 1,292,000 | 42,636,000 | INTERNET & CATALOG RETAIL — 1.0% | |||

| DIVERSIFIED TELECOMMUNICATION | Amazon.com, Inc.(1) | 623,000 | 50,163,960 | |||

| SERVICES — 0.2% | ||||||

| Telefonica SA | 575,000 | 10,962,876 | INTERNET SOFTWARE & SERVICES — 4.3% | |||

| ELECTRIC UTILITIES — 1.1% | Baidu.com, Inc. ADR(1) | 148,000 | 34,469,200 | |||

| Progress Energy, Inc. | 791,000 | 26,988,920 | Google, Inc., Class A(1) | 403,000 | 159,575,910 | |

| Southern Co. (The) | 915,000 | 26,425,200 | Tencent Holdings Ltd. | 2,024,000 | 18,020,013 | |

| 53,414,120 | 212,065,123 | |||||

10

| Ultra | ||||||

| Shares | Value | Shares | Value | |||

| IT SERVICES — 4.4% | SEMICONDUCTORS & SEMICONDUCTOR | |||||

| International Business | EQUIPMENT — 5.8% | |||||

| Machines Corp. | 726,000 | $ 74,930,460 | Altera Corp. | 2,063,000 | $ 33,647,530 | |

| MasterCard, Inc., Class A | 471,000 | 86,404,950 | Applied Materials, Inc. | 5,933,000 | 72,441,930 | |

| Visa, Inc., Class A | 852,000 | 55,345,920 | ASML Holding NV | 1,859,000 | 38,272,043 | |

| 216,681,330 | Intel Corp. | 3,097,000 | 48,870,660 | |||

| LEISURE EQUIPMENT & PRODUCTS — 0.8% | Lam Research Corp.(1) | 520,000 | 14,497,600 | |||

| Hasbro, Inc. | 1,436,000 | 38,283,760 | Linear Technology Corp. | 1,722,000 | 37,505,160 | |

| LIFE SCIENCES TOOLS & SERVICES — 0.6% | MEMC Electronic | |||||

| Thermo Fisher | Materials, Inc.(1) | 237,000 | 3,839,400 | |||

| Scientific, Inc.(1) | 868,000 | 30,449,440 | Microchip Technology, Inc. | 1,695,000 | 38,985,000 | |

| MACHINERY — 3.7% | 288,059,323 | |||||

| Cummins, Inc. | 1,293,000 | 43,962,000 | SOFTWARE — 7.0% | |||

| Deere & Co. | 1,869,000 | 77,114,940 | Adobe Systems, Inc.(1) | 3,216,000 | 87,957,600 | |

| Eaton Corp. | 458,000 | 20,060,400 | Microsoft Corp. | 6,744,000 | 136,633,440 | |

| Parker-Hannifin Corp. | 953,000 | 43,218,550 | Oracle Corp. | 5,212,000 | 100,800,080 | |

| 184,355,890 | VMware, Inc., Class A(1) | 784,000 | 20,446,720 | |||

| MEDIA — 0.4% | 345,837,840 | |||||

| Marvel Entertainment, Inc.(1) | 689,000 | 20,559,760 | SPECIALTY RETAIL — 3.5% | |||

| METALS & MINING — 2.7% | Lowe’s Cos., Inc. | 3,146,000 | 67,639,000 | |||

| BHP Billiton Ltd. ADR | 1,055,000 | 50,787,700 | Staples, Inc. | 2,705,000 | 55,777,100 | |

| Freeport-McMoRan | TJX Cos., Inc. (The) | 1,758,000 | 49,171,260 | |||

| Copper & Gold, Inc. | 144,000 | 6,141,600 | 172,587,360 | |||

| Newmont Mining Corp. | 823,000 | 33,117,520 | TEXTILES, APPAREL & LUXURY GOODS — 1.1% | |||

| Nucor Corp. | 1,119,000 | 45,532,110 | NIKE, Inc., Class B | 1,010,000 | 52,994,700 | |

| 135,578,930 | TOBACCO — 2.0% | |||||

| MULTILINE RETAIL — 1.0% | Philip Morris | |||||

| Kohl’s Corp.(1) | 1,065,000 | 48,297,750 | International, Inc. | 2,702,000 | 97,812,400 | |

| OIL, GAS & CONSUMABLE FUELS — 5.7% | TRADING COMPANIES & DISTRIBUTORS — 1.0% | |||||

| Apache Corp. | 386,000 | 28,123,960 | W.W. Grainger, Inc. | 587,000 | 49,237,560 | |

| EOG Resources, Inc. | 882,000 | 55,989,360 | TOTAL COMMON STOCKS | |||

| Exxon Mobil Corp. | 596,000 | 39,735,320 | (Cost $4,933,081,119) | 4,927,012,796 | ||

| Hess Corp. | 788,000 | 43,174,520 | Temporary Cash Investments — 0.8% | |||

| Noble Energy, Inc. | 745,000 | 42,278,750 | Repurchase Agreement, Deutsche Bank | |||

| Occidental Petroleum Corp. | 929,000 | 52,293,410 | Securities, Inc., (collateralized by various | |||

| Southwestern Energy Co.(1) | 621,000 | 22,269,060 | U.S. Treasury obligations, 3.75%, 11/15/18, | |||

| valued at $39,713,009), in a joint trading | ||||||

| 283,864,380 | account at 0.14%, dated 4/30/09, due | |||||

| PHARMACEUTICALS — 3.3% | 5/1/09 (Delivery value $38,900,151) | |||||

| Abbott Laboratories | 2,057,000 | 86,085,450 | (Cost $38,900,000) | 38,900,000 | ||

| Bristol-Myers Squibb Co. | 1,455,000 | 27,936,000 | TOTAL INVESTMENT | |||

| Teva Pharmaceutical | SECURITIES — 100.4% | |||||

| Industries Ltd. ADR | 1,077,000 | 47,269,530 | (Cost $4,971,981,119) | 4,965,912,796 | ||

| 161,290,980 | OTHER ASSETS | |||||

| AND LIABILITIES — (0.4)% | (17,488,727) | |||||

| ROAD & RAIL — 1.5% | TOTAL NET ASSETS — 100.0% | $4,948,424,069 | ||||

| Norfolk Southern Corp. | 758,000 | 27,045,440 | ||||

| Union Pacific Corp. | 939,000 | 46,142,460 | ||||

| 73,187,900 | ||||||

11

| Ultra | ||||

| Forward Foreign Currency Exchange Contracts | ||||

| Contracts to Sell | Settlement Date | Value | Unrealized Gain (Loss) | |

| 21,746,765 | CHF for USD | 5/29/09 | $19,059,113 | $ (52,527) |

| 18,389,345 | EUR for USD | 5/29/09 | 24,329,410 | (271,550) |

| $43,388,523 | $(324,077) | |||

| (Value on Settlement Date $43,064,446) |

| Notes to Schedule of Investments |

| ADR = American Depositary Receipt |

| CHF = Swiss Franc |

| EUR = Euro |

| USD = United States Dollar |

| (1) Non-income producing. |

| See Notes to Financial Statements. |

12

| Statement of Assets and Liabilities |

| APRIL 30, 2009 (UNAUDITED) | |

| Assets | |

| Investment securities, at value (cost of $4,971,981,119) | $4,965,912,796 |

| Receivable for investments sold | 24,457,300 |

| Receivable for capital shares sold | 1,142,852 |

| Dividends and interest receivable | 7,089,512 |

| 4,998,602,460 | |

| Liabilities | |

| Disbursements in excess of demand deposit cash | 14,678 |

| Payable for investments purchased | 39,865,008 |

| Payable for capital shares redeemed | 6,006,876 |

| Payable for forward foreign currency exchange contracts | 324,077 |

| Accrued management fees | 3,951,565 |

| Service fees (and distribution fees – A Class and R Class) payable | 15,690 |

| Distribution fees payable | 497 |

| 50,178,391 | |

| Net Assets | $4,948,424,069 |

| See Notes to Financial Statements. | |

13

| APRIL 30, 2009 (UNAUDITED) | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $5,873,160,353 |

| Undistributed net investment income | 21,651,762 |

| Accumulated net realized loss on investment and foreign currency transactions | (939,879,801) |

| Net unrealized depreciation on investments and translation of assets and liabilities in foreign currencies | (6,508,245) |

| $4,948,424,069 | |

| Investor Class, $0.01 Par Value | |

| Net assets | $4,806,834,272 |

| Shares outstanding | 319,105,204 |

| Net asset value per share | $15.06 |

| Institutional Class, $0.01 Par Value | |

| Net assets | $66,021,445 |

| Shares outstanding | 4,291,466 |

| Net asset value per share | $15.38 |

| A Class, $0.01 Par Value | |

| Net assets | $71,615,644 |

| Shares outstanding | 4,884,790 |

| Net asset value per share | $14.66 |

| Maximum offering price (net asset value divided by 0.9425) | $15.55 |

| B Class, $0.01 Par Value | |

| Net assets | $48,993 |

| Shares outstanding | 3,288 |

| Net asset value per share | $14.90 |

| C Class, $0.01 Par Value | |

| Net assets | $827,880 |

| Shares outstanding | 60,108 |

| Net asset value per share | $13.77 |

| R Class, $0.01 Par Value | |

| Net assets | $3,075,835 |

| Shares outstanding | 210,327 |

| Net asset value per share | $14.62 |

| See Notes to Financial Statements. | |

14

| Statement of Operations |

| FOR THE SIX MONTHS ENDED APRIL 30, 2009 (UNAUDITED) | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $182,572) | $ 45,773,251 |

| Interest | 35,040 |

| 45,808,291 | |

| Expenses: | |

| Management fees | 23,347,138 |

| Distribution fees: | |

| B Class | 157 |

| C Class | 2,814 |

| Service fees: | |

| B Class | 52 |

| C Class | 938 |

| Distribution and service fees: | |

| A Class | 87,581 |

| R Class | 7,026 |

| Directors’ fees and expenses | 87,269 |

| Other expenses | 7,389 |

| 23,540,364 | |

| Net investment income (loss) | 22,267,927 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investment and foreign currency transactions | (564,367,830) |

| Change in net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currency | 335,794,044 |

| Net realized and unrealized gain (loss) | (228,573,786) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $(206,305,859) |

| See Notes to Financial Statements. | |

15

| Statement of Changes in Net Assets |

| SIX MONTHS ENDED APRIL 30, 2009 (UNAUDITED) AND YEAR ENDED OCTOBER 31, 2008 | |||

| Increase (Decrease) in Net Assets | 2009 | 2008 | |

| Operations | |||

| Net investment income (loss) | $ 22,267,927 | $ 29,064,990 | |

| Net realized gain (loss) | (564,367,830) | (368,571,720) | |

| Change in net unrealized appreciation (depreciation) | 335,794,044 | (3,217,056,037) | |

| Net increase (decrease) in net assets resulting from operations | (206,305,859) | (3,556,562,767) | |

| Distributions to Shareholders | |||

| From net investment income: | |||

| Investor Class | (25,630,860) | — | |

| Institutional Class | (491,887) | — | |

| A Class | (226,924) | — | |

| B Class | — | — | |

| C Class | — | — | |

| R Class | (1,496) | — | |

| From net realized gains: | |||

| Investor Class | — | (2,312,270,157) | |

| Institutional Class | — | (65,091,994) | |

| A Class | — | (50,919,711) | |

| B Class | — | (11,669) | |

| C Class | — | (533,319) | |

| R Class | — | (1,501,522) | |

| Decrease in net assets from distributions | (26,351,167) | (2,430,328,372) | |

| Capital Share Transactions | |||

| Net increase (decrease) in net assets from capital share transactions | (261,023,812) | 794,859,566 | |

| Net increase (decrease) in net assets | (493,680,838) | (5,192,031,573) | |

| Net Assets | |||

| Beginning of period | 5,442,104,907 | 10,634,136,480 | |

| End of period | $4,948,424,069 | $ 5,442,104,907 | |

| Undistributed net investment income | $21,651,762 | $25,735,002 | |

| See Notes to Financial Statements. | |||

16

| Notes to Financial Statements |

APRIL 30, 2009 (UNAUDITED)

1. Organization and Summary of Significant Accounting Policies

Organization — American Century Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company. Ultra Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified under the 1940 Act. The fund’s investment objective is to seek long-term capital growth. The fund pursues this objective by investing primarily in equity securities of large companies, but may invest in companies of any size. The following is a summary of the fund’s significant accounting policies.

Multiple Class — The fund is authorized to issue the Investor Class, the Institutional Class, the A Class, the B Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class, the B Class, and the C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Security Valuations — Securities traded primarily on a principal securities exchange are valued at the last reported sales price, or at the mean of the latest bid and asked prices where no last sales price is available. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official close price. Investments in open-end management investment companies are valued at the reported net asset value. Debt securities not traded on a principal securities exchange are valued through a commercial pricing service or at the mean of the most recent bid and asked prices. Discount notes may be valued through a commercial pricing service or at amortized cost, which approximates fair value. Securities traded on foreign securities exchanges and over-the-counter markets are normally completed before the close of business on days that the New York Stock Exchange (the Exchange) is open and may also take place on days when the Exchange is not open. If an event occurs after the value of a security was established but before the net asset value per share was determined that was likely to materially change the net asset value, that security would be valued as determined in accordance with procedures adopted by the Board of Directors. If the fund determines that the market price of a portfolio security is not readily available, or that the valuation methods mentioned above do not reflect the security’s fair value, such security is valued as determined by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors, if such determination would materially impact a fund’s net asset value. Certain other circumstances may cause the fund to use alternative procedures to value a security such as: a security has been declared in default; trading in a security has been halted during the trading day; or there is a foreign market holiday and no trading will commence.

Security Transactions — For financial reporting purposes, security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

17

Foreign Currency Transactions — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. Purchases and sales of investment securities, dividend and interest income, and certain expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. For assets and liabilities, other than investments in securities, net realized and unrealized gains and losses from foreign currency translations arise from changes in currency exchange rates.

Net realized and unrealized foreign currency exchange gains or losses occurring during the holding period of investment securities are a component of realized gain (loss) on investment transactions and unrealized appreciation (depreciation) on investments, respectively. Certain countries may impose taxes on the contract amount of purchases and sales of foreign currency contracts in their currency. The fund records the foreign tax expense, if any, as a reduction to the net realized gain (loss) on foreign currency transactions.

Forward Foreign Currency Exchange Contracts — The fund may enter into forward foreign currency exchange contracts to facilitate transactions of securities denominated in a foreign currency or to hedge the fund’s exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by the fund and the resulting unrealized appreciation or depreciation are determined daily using prevailing exchange rates. The fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses may arise if the counterparties do not perform under the contract terms.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. Each repurchase agreement is recorded at cost. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2005. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes. Interest and penalties associated with any federal or state income tax obligations, if any, are recorded as interest expense.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income and net realized gains, if any, are generally declared and paid annually.

18

Indemnifications — Under the corporation‘s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the fund. The risk of material loss from such claims is considered by management to be remote.

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

2. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a Management Agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The Agreement provides that all expenses of the fund, except brokerage commissions, taxes, interest, fees and expenses of those directors who are not considered “interested persons” as defined in the 1940 Act (including counsel fees) and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on the daily net assets of each specific class of shares of the fund and paid monthly in arrears. For funds with a stepped fee schedule, the rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account each fund’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 0.80% to 1.00% for the Investor Class, A Class, B Class, C Class and R Class. The Institutional Class is 0.20% less at each point within the range. The effective annual management fee for each class of the fund for the six months ended April 30, 2009 was 1.00% for the Investor Class, A Class, B Class, C Class and R Class, and 0.80% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, B Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the B Class and the C Class will each pay ACIS an annual distribution fee of 0.75% and service fee of 0.25%. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the six months ended April 30, 2009, are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors, and, as a group, controlling stockholders of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a Mutual Funds Services Agreement with J.P. Morgan Investor Services Co. (JPMIS) and a securities lending agreement with JPMorgan Chase Bank (JPMCB). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

19

3. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the six months ended April 30, 2009, were $1,735,408,472 and $1,891,933,148, respectively.

| 4. Capital Share Transactions | ||||

| Transactions in shares of the fund were as follows: | ||||

| Six months ended April 30, 2009 | Year ended October 31, 2008 | |||

| Shares | Amount | Shares | Amount | |

| Investor Class/Shares Authorized | 3,500,000,000 | 3,500,000,000 | ||

| Sold | 5,906,856 | $ 82,472,403 | 15,047,819 | $ 349,727,360 |

| Issued in reinvestment of distributions | 1,792,593 | 24,917,040 | 91,021,431 | 2,229,114,850 |

| Redeemed | (25,297,798) | (351,639,661) | (70,022,806) | (1,625,259,696) |

| (17,598,349) | (244,250,218) | 36,046,444 | 953,582,514 | |

| Institutional Class/Shares Authorized | 200,000,000 | 200,000,000 | ||

| Sold | 364,314 | 5,266,744 | 1,768,195 | 41,370,627 |

| Issued in reinvestment of distributions | 33,797 | 479,581 | 2,567,071 | 64,151,093 |

| Redeemed | (872,907) | (12,434,034) | (9,133,416) | (232,001,615) |

| (474,796) | (6,687,709) | (4,798,150) | (126,479,895) | |

| A Class/Shares Authorized | 100,000,000 | 100,000,000 | ||

| Sold | 439,698 | 5,980,671 | 1,495,972 | 34,046,242 |

| Issued in reinvestment of distributions | 16,176 | 219,026 | 2,076,111 | 49,536,018 |

| Redeemed | (1,198,954) | (16,201,031) | (5,107,987) | (116,870,252) |

| (743,080) | (10,001,334) | (1,535,904) | (33,287,992) | |

| B Class/Shares Authorized | 50,000,000 | 50,000,000 | ||

| Sold | 673 | 9,637 | 1,429 | 39,247 |

| Issued in reinvestment of distributions | — | — | 478 | 11,669 |

| Redeemed | — | — | (82) | (1,808) |

| 673 | 9,637 | 1,825 | 49,108 | |

| C Class/Shares Authorized | 50,000,000 | 50,000,000 | ||

| Sold | 5,158 | 69,313 | 18,798 | 403,824 |

| Issued in reinvestment of distributions | — | — | 22,734 | 513,343 |

| Redeemed | (7,288) | (90,538) | (46,798) | (965,829) |

| (2,130) | (21,225) | (5,266) | (48,662) | |

| R Class/Shares Authorized | 50,000,000 | 50,000,000 | ||

| Sold | 31,327 | 422,962 | 104,389 | 2,462,123 |

| Issued in reinvestment of distributions | 95 | 1,278 | 56,879 | 1,354,849 |

| Redeemed | (37,000) | (497,203) | (127,380) | (2,772,479) |

| (5,578) | (72,963) | 33,888 | 1,044,493 | |

| Net increase (decrease) | (18,823,260) | $(261,023,812) | 29,742,837 | $ 794,859,566 |

20

5. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• Level 1 valuation inputs consist of actual quoted prices based on an active market;

• Level 2 valuation inputs consist of significant direct or indirect observable market data; or

• Level 3 valuation inputs consist of significant unobservable inputs such as a fund’s own assumptions.

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the valuation inputs used to determine the fair value of the fund’s securities and other financial instruments as of April 30, 2009:

| Value of | Unrealized Gain (Loss) on | |

| Valuation Inputs | Investment Securities | Other Financial Instruments* |

| Level 1 — Quoted Prices | $4,822,559,450 | — |

| Level 2 — Other Significant Observable Inputs | 143,353,346 | $(324,077) |

| Level 3 — Significant Unobservable Inputs | — | — |

| $4,965,912,796 | $(324,077) | |

| *Includes forward foreign currency exchange contracts. |

6. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

7. Bank Line of Credit

The fund, along with certain other funds in the American Century Investments family of funds, had a $500,000,000 unsecured bank line of credit agreement with Bank of America, N.A. The line expired December 10, 2008, and was not renewed. The agreement allowed the fund to borrow money for temporary or emergency purposes to fund shareholder redemptions. Borrowings under the agreement were subject to interest at the Federal Funds rate plus 0.40%. The fund did not borrow from the line during the six months ended April 30, 2009.

21

8. Interfund Lending

The fund, along with certain other funds in the American Century Investments family of funds, may participate in an interfund lending program, pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC). This program provides an alternative credit facility allowing the fund to borrow from or lend to other funds in the American Century Investments family of funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. The interfund loan rate earned/paid on interfund lending transactions is determined daily based on the average of certain current market rates. Interfund lending transactions normally extend only overnight, but can have a maximum duration of seven days. The program is subject to annual approval by the Board of Directors. During the six months ended April 30, 2009, the fund did not utilize the program.

9. Federal Tax Information

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of April 30, 2009, the components of investments for federal income tax purposes were as follows:

| Federal tax cost of investments | $5,119,519,687 |

| Gross tax appreciation of investments | $ 471,205,649 |

| Gross tax depreciation of investments | (624,812,540) |

| Net tax appreciation (depreciation) of investments | $(153,606,891) |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

As of October 31, 2008, the fund had accumulated capital losses of $(201,210,564), which represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. The capital loss carryovers expire in 2016.

10. Recently Issued Accounting Standards

The Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (FAS 157), in September 2006, which is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishes a framework for measuring fair value and expands the required financial statement disclosures about fair value measurements. The adoption of FAS 157 did not materially impact the determination of fair value.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities — an amendment of FASB Statement No. 133” (FAS 161). FAS 161 is effective for interim periods beginning after November 15, 2008. FAS 161 amends and expands disclosures about derivative instruments and hedging activities. FAS 161 requires qualitative disclosures about the objectives and strategies of derivative instruments, quantitative disclosures about the fair value amounts of and gains and losses on derivative instruments, and disclosures of credit-risk-related contingent features in hedging activities. Management is currently evaluating the impact that adopting FAS 161 will have on the financial statement disclosures.

22

| Financial Highlights | ||||||

| Ultra | ||||||

| Investor Class | ||||||

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | ||||||

| 2009(1) | 2008 | 2007 | 2006 | 2005 | 2004 | |

| Per-Share Data | ||||||

| Net Asset Value, | ||||||

| Beginning of Period | $15.67 | $33.48 | $28.55 | $29.02 | $27.17 | $26.01 |

| Income From | ||||||

| Investment Operations | ||||||

| Net Investment | ||||||

| Income (Loss)(2) | 0.07 | 0.08 | (0.01) | (0.06) | 0.02 | (0.05) |

| Net Realized and | ||||||

| Unrealized Gain (Loss) | (0.60) | (9.95) | 6.95 | (0.37) | 1.83 | 1.21 |

| Total From | ||||||

| Investment Operations | (0.53) | (9.87) | 6.94 | (0.43) | 1.85 | 1.16 |

| Distributions | ||||||

| From Net | ||||||

| Investment Income | (0.08) | — | — | (0.04) | — | — |

| From Net Realized Gains | — | (7.94) | (2.01) | — | — | — |

| Total Distributions | (0.08) | (7.94) | (2.01) | (0.04) | — | — |

| Net Asset Value, | ||||||

| End of Period | $15.06 | $15.67 | $33.48 | $28.55 | $29.02 | $27.17 |

| Total Return(3) | (3.36)% | (38.02)% | 25.89% | (1.51)% | 6.81% | 4.46% |

| Ratios/Supplemental Data | ||||||

| Ratio of Operating | ||||||

| Expenses to Average | ||||||

| Net Assets | 1.00%(4) | 0.99% | 0.99% | 0.99% | 0.99% | 0.99% |

| Ratio of Net Investment | ||||||

| Income (Loss) to | ||||||

| Average Net Assets | 0.95%(4) | 0.36% | (0.04)% | (0.15)% | 0.09% | (0.20)% |

| Portfolio Turnover Rate | 36% | 152% | 93% | 62% | 33% | 34% |

| Net Assets, End of Period | ||||||

| (in millions) | $4,807 | $5,276 | $10,066 | $13,482 | $18,904 | $20,708 |

| (1) | Six months ended April 30, 2009 (unaudited). |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset value to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| (4) | Annualized. |

See Notes to Financial Statements.

23

| Ultra | ||||||

| Institutional Class | ||||||

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | ||||||

| 2009(1) | 2008 | 2007 | 2006 | 2005 | 2004 | |

| Per-Share Data | ||||||

| Net Asset Value, | ||||||

| Beginning of Period | $16.02 | $33.98 | $28.90 | $29.38 | $27.44 | $26.22 |

| Income From | ||||||

| Investment Operations | ||||||

| Net Investment | ||||||

| Income (Loss)(2) | 0.08 | 0.15 | 0.05 | —(3) | 0.07 | —(3) |

| Net Realized and | ||||||

| Unrealized Gain (Loss) | (0.61) | (10.17) | 7.04 | (0.38) | 1.87 | 1.22 |

| Total From | ||||||

| Investment Operations | (0.53) | (10.02) | 7.09 | (0.38) | 1.94 | 1.22 |

| Distributions | ||||||

| From Net | ||||||

| Investment Income | (0.11) | — | — | (0.10) | — | — |

| From Net Realized Gains | — | (7.94) | (2.01) | — | — | — |

| Total Distributions | (0.11) | (7.94) | (2.01) | (0.10) | — | — |

| Net Asset Value, | ||||||

| End of Period | $15.38 | $16.02 | $33.98 | $28.90 | $29.38 | $27.44 |

| Total Return(4) | (3.28)% | (37.89)% | 26.14% | (1.33)% | 7.07% | 4.65% |

| Ratios/Supplemental Data | ||||||

| Ratio of Operating | ||||||

| Expenses to Average | ||||||

| Net Assets | 0.80%(5) | 0.79% | 0.79% | 0.79% | 0.79% | 0.79% |

| Ratio of Net Investment | ||||||

| Income (Loss) to | ||||||

| Average Net Assets | 1.15%(5) | 0.56% | 0.16% | 0.05% | 0.29% | 0.00% |

| Portfolio Turnover Rate | 36% | 152% | 93% | 62% | 33% | 34% |

| Net Assets, End of Period | ||||||

| (in thousands) | $66,021 | $76,339 | $325,035 | $1,073,767 | $1,460,343 | $1,055,145 |

| (1) | Six months ended April 30, 2009 (unaudited). |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Per-share amount was less than $0.005. |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset value to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| (5) | Annualized. |

See Notes to Financial Statements.

24

| Ultra | ||||||

| A Class(1) | ||||||

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | ||||||

| 2009(2) | 2008 | 2007 | 2006 | 2005 | 2004 | |

| Per-Share Data | ||||||

| Net Asset Value, | ||||||

| Beginning of Period | $15.23 | $32.83 | $28.11 | $28.61 | $26.85 | $25.77 |

| Income From | ||||||

| Investment Operations | ||||||

| Net Investment | ||||||

| Income (Loss)(3) | 0.05 | 0.03 | (0.08) | (0.13) | (0.05) | (0.12) |

| Net Realized and | ||||||

| Unrealized Gain (Loss) | (0.58) | (9.69) | 6.81 | (0.37) | 1.81 | 1.20 |

| Total From | ||||||

| Investment Operations | (0.53) | (9.66) | 6.73 | (0.50) | 1.76 | 1.08 |

| Distributions | ||||||

| From Net | ||||||

| Investment Income | (0.04) | — | — | — | — | — |

| From Net Realized Gains | — | (7.94) | (2.01) | — | — | — |

| Total Distributions | (0.04) | (7.94) | (2.01) | — | — | — |

| Net Asset Value, | ||||||

| End of Period | $14.66 | $15.23 | $32.83 | $28.11 | $28.61 | $26.85 |

| Total Return(4) | (3.44)% | (38.19)% | 25.56% | (1.75)% | 6.55% | 4.19% |

| Ratios/Supplemental Data | ||||||

| Ratio of Operating | ||||||

| Expenses to Average | ||||||

| Net Assets | 1.25%(5) | 1.24% | 1.24% | 1.24% | 1.24% | 1.24% |

| Ratio of Net Investment | ||||||

| Income (Loss) to | ||||||

| Average Net Assets | 0.70%(5) | 0.11% | (0.29)% | (0.40)% | (0.16)% | (0.45)% |

| Portfolio Turnover Rate | 36% | 152% | 93% | 62% | 33% | 34% |

| Net Assets, End of Period | ||||||

| (in thousands) | $71,616 | $85,723 | $235,217 | $405,173 | $639,792 | $738,032 |

| (1) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. |

| (2) | Six months ended April 30, 2009 (unaudited). |

| (3) | Computed using average shares outstanding throughout the period. |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset value to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| (5) | Annualized. |

See Notes to Financial Statements.

25

| Ultra | |||

| B Class | |||

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | |||

| 2009(1) | 2008 | 2007(2) | |

| Per-Share Data | |||

| Net Asset Value, Beginning of Period | $15.49 | $33.45 | $31.63 |

| Income From Investment Operations | |||

| Net Investment Income (Loss)(3) | —(4) | (0.16) | (0.04) |

| Net Realized and Unrealized Gain (Loss) | (0.59) | (9.86) | 1.86 |

| Total From Investment Operations | (0.59) | (10.02) | 1.82 |

| Distributions | |||

| From Net Realized Gains | — | (7.94) | — |

| Net Asset Value, End of Period | $14.90 | $15.49 | $33.45 |

| Total Return(5) | (3.81)% | (38.64)% | 5.75% |

| Ratios/Supplemental Data | |||

| Ratio of Operating Expenses to Average Net Assets | 2.00%(6) | 1.99% | 1.99%(6) |

| Ratio of Net Investment Income (Loss) to Average Net Assets | (0.05)%(6) | (0.64)% | (1.53)%(6) |

| Portfolio Turnover Rate | 36% | 152% | 93%(7) |

| Net Assets, End of Period (in thousands) | $49 | $41 | $26 |

| (1) | Six months ended April 30, 2009 (unaudited). |

| (2) | September 28, 2007 (commencement of sale) through October 31, 2007. |

| (3) | Computed using average shares outstanding throughout the period. |

| (4) | Per-share amount was less than $0.005. |

| (5) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset value to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| (6) | Annualized. |

| (7) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2007. |

See Notes to Financial Statements.

26

| Ultra | ||||||

| C Class | ||||||

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | ||||||

| 2009(1) | 2008 | 2007 | 2006 | 2005 | 2004 | |

| Per-Share Data | ||||||

| Net Asset Value, | ||||||

| Beginning of Period | $14.32 | $31.54 | $27.26 | $27.96 | $26.44 | $25.57 |

| Income From Investment | ||||||

| Operations | ||||||

| Net Investment | ||||||

| Income (Loss)(2) | —(3) | (0.13) | (0.29) | (0.34) | (0.26) | (0.32) |

| Net Realized and | ||||||

| Unrealized Gain (Loss) | (0.55) | (9.15) | 6.58 | (0.36) | 1.78 | 1.19 |

| Total From | ||||||

| Investment Operations | (0.55) | (9.28) | 6.29 | (0.70) | 1.52 | 0.87 |

| Distributions | ||||||

| From Net Realized Gains | — | (7.94) | (2.01) | — | — | — |

| Net Asset Value, | ||||||

| End of Period | $13.77 | $14.32 | $31.54 | $27.26 | $27.96 | $26.44 |

| Total Return(4) | (3.84)% | (38.63)% | 24.64% | (2.50)% | 5.75% | 3.40% |

| Ratios/Supplemental Data | ||||||

| Ratio of Operating | ||||||

| Expenses to Average | ||||||

| Net Assets | 2.00%(5) | 1.99% | 1.99% | 1.99% | 1.99% | 1.99% |

| Ratio of Net Investment | ||||||

| Income (Loss) to | ||||||

| Average Net Assets | (0.05)%(5) | (0.64)% | (1.04)% | (1.15)% | (0.91)% | (1.20)% |

| Portfolio Turnover Rate | 36% | 152% | 93% | 62% | 33% | 34% |

| Net Assets, End of Period | ||||||

| (in thousands) | $828 | $891 | $2,129 | $3,342 | $5,601 | $4,836 |

| (1) | Six months ended April 30, 2009 (unaudited). |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Per-share amount was less than $0.005. |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset value to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| (5) | Annualized. |

See Notes to Financial Statements.

27

| Ultra | ||||||

| R Class | ||||||

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | ||||||

| 2009(1) | 2008 | 2007 | 2006 | 2005 | 2004 | |

| Per-Share Data | ||||||

| Net Asset Value, | ||||||

| Beginning of Period | $15.17 | $32.80 | $28.15 | $28.72 | $27.01 | $25.99 |

| Income From | ||||||

| Investment Operations | ||||||

| Net Investment | ||||||

| Income (Loss)(2) | 0.03 | (0.03) | (0.15) | (0.21) | (0.12) | (0.22) |

| Net Realized and | ||||||

| Unrealized Gain (Loss) | (0.57) | (9.66) | 6.81 | (0.36) | 1.83 | 1.24 |

| Total From | ||||||

| Investment Operations | (0.54) | (9.69) | 6.66 | (0.57) | 1.71 | 1.02 |

| Distributions | ||||||

| From Net | ||||||

| Investment Income | (0.01) | — | — | — | — | — |

| From Net Realized Gains | — | (7.94) | (2.01) | — | — | — |

| Total Distributions | (0.01) | (7.94) | (2.01) | — | — | — |

| Net Asset Value, | ||||||

| End of Period | $14.62 | $15.17 | $32.80 | $28.15 | $28.72 | $27.01 |

| Total Return(3) | (3.57)% | (38.35)% | 25.26% | (1.98)% | 6.33% | 3.92% |

| Ratios/Supplemental Data | ||||||

| Ratio of Operating | ||||||

| Expenses to Average | ||||||

| Net Assets | 1.50%(4) | 1.49% | 1.49% | 1.49% | 1.44%(5) | 1.49% |

| Ratio of Net Investment | ||||||

| Income (Loss) to | ||||||

| Average Net Assets | 0.45%(4) | (0.14)% | (0.54)% | (0.65)% | (0.36)%(5) | (0.70)% |

| Portfolio Turnover Rate | 36% | 152% | 93% | 62% | 33% | 34% |

| Net Assets, End of Period | ||||||

| (in thousands) | $3,076 | $3,276 | $5,971 | $8,922 | $8,367 | $4,545 |

| (1) | Six months ended April 30, 2009 (unaudited). |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset value to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| (4) | Annualized. |