QuickLinks -- Click here to rapidly navigate through this documentSECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For |

|

THE FOURTH QUARTER AND YEAR ENDED DECEMBER 31, 2003 FINANCIAL RESULTS |

|

|

|

|

|

QUEBECOR WORLD INC. |

|

|

|

| | | (Translation of Registrant's Name into English) | | |

|

|

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8 |

|

|

|

| | | (Address of Principal Executive Office) | | |

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

QUEBECOR WORLD INC.

Filed in this Form 6-K

Documents index

| 1. | Press Release dated February 6, 2004; Financial Highlights, Consolidated Statements of Income and Retained Earnings and Consolidated Statements of Cash Flows |

| 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

| 3. | Consolidated Financial Statements |

| 4. | Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

1

| February 6, 2004 | | | | 02/04 |

For immediate release |

|

|

|

Page 1 of 8 |

QUEBECOR WORLD ANNOUNCES 2003 FOURTH QUARTER

AND FULL-YEAR RESULTS

HIGHLIGHTS FOR 2003

• Consolidated revenues increase to $6.39 billion

• Global workforce reduced by 2,272 employee positions

• Annualized cost savings from restructuring estimated

to be in excess of $90 million

• Free cash flow from operations is $183 million

Montréal, Canada — Quebecor World Inc. (NYSE;TSX:IQW) announced that for the fourth quarter 2003 the Company recorded a net loss of $54 million or $0.48 per share, after impairment of assets, restructuring and other charges, certain specific charges and others relating to finance and tax. This compares to net income of $71 million or $0.44 per diluted share in the fourth quarter of 2002. Operating income, before the impairment of assets, restructuring and other charges was $90 million in the fourth quarter, compared to $160 million in the fourth quarter of 2002. Consolidated revenues for the quarter increased 2% to $1.74 billion compared to $1.70 billion the same quarter last year.

"Our decreased operating income for the quarter is the result of significant price declines in our industry. This is in spite of the fact that we increased volumes in most of our business groups. As a result, we have taken additional measures in the quarter to address the current difficult industry and market environments," said Jean Neveu, President and CEO Quebecor World Inc.

In the fourth quarter Quebecor World incurred a $22 million charge for the impairment of assets, restructuring and other charges. The bulk of this charge is applied to a new reduction-in-force initiative of 878 employee positions. In total, the 2003 restructuring initiatives will involve the elimination of 2,272 employee positions, 1,769 as of December 31, 2003 and 503 by the end of the first quarter 2004. The reductions are taking place in all regions where the Company operates. These initiatives are expected to produce annualized cost savings in excess of $90 million.

2

| For immediate release | | Page 2 of 8 |

Also in the fourth quarter the Company took specific charges of $23 million of which, $13.9 million was related to North America, $3.4 million to Europe and the balance to Latin America and other provisions. Most of the charge, or $18.2 million, was included in selling, general and administrative expenses. Of the $13.9 million related to North America, there was $6.3 million for lease provisions and a $5.0 million provision for doubtful accounts.

For the full-year 2003, excluding specific charges and the effect of currency translation, SG&A decreased by $32 million or 6%. This is due to workforce reductions and other cost containment initiatives and was realized despite increases in medical and pension benefits.

To reduce interest expense going forward Quebecor World refinanced a portion of its long-term debt in the fourth quarter to take advantage of lower interest rates. This transaction is expected to lower interest expense by approximately $12 million per year. In completing the transaction the Company incurred a charge to financial expenses of $30 million.

"We firmly believe these measures are necessary to maintain and enhance our competitive position," said Mr. Neveu. "These initiatives will lower our cost base, reduce financial expense and improve efficiencies across our global platform."

In 2003 the reported income tax expense of $39 million includes the impact of two specific tax charges of $46 million in the fourth quarter and $53 million for the full-year. These charges are related to an adjustment of the average tax rate applied on cumulative temporary differences within states in the U.S. and the revised expectations of tax asset recoveries and liabilities from prior years.

For the-full year 2003, after impairment of assets restructuring and other charges, certain specific charges and others related to tax and finance Quebecor World reported a net loss of $31 million or $0.50 per share. This compares to net income of $279 million or $1.76 per diluted share for the full-year 2002. Operating income before impairment of assets, restructuring and other charges was $330 million compared to $563 million in 2002 and on the same basis, operating margin was 5.2% compared to 9.0% last year.

For the full-year 2003, Quebecor World generated $183 million of free cash flow compared to $320 million in 2002. "One of the strengths of Quebecor World is its ability to generative free cash flow. Through a disciplined management of working capital the Company produced significant free cash flow despite the tough environment and reduced operating income," added Mr. Neveu.

3

| For immediate release | | Page 3 of 8 |

Before impairment of assets, restructuring and other charges, certain specific charges and others relating to finance and tax, Quebecor World earned $0.27 per share in the fourth quarter of 2003 and $1.01 per share for the full-year.

The following table is a summary of previously discussed specific items and their impact on 2003 earnings per share on a full year basis.

Charge

| | Amount

| | EPS Impact

|

|---|

| IAROC* | | $ | 98 million | | $ | 0.53 |

| Specific Charges | | $ | 79 million | | $ | 0.42 |

| Tax Adjustment | | $ | 53 million | | $ | 0.39 |

| Refinancing Costs | | $ | 30 million | | $ | 0.13 |

| Currency Translation Adj. | | $ | 5 million | | $ | 0.04 |

- *

- Impairment of assets, restructuring and other charges

North America

In North America revenue for the quarter was $1.35 billion compared to $1.37 billion in the 4th quarter of 2002. For the full-year, revenue was $5.06 billion compared to $5.09 billion in 2002. In the quarter revenue was lower in all business segments with the exception of commercial/direct that registered an increase. Before impairment of assets, restructuring and other charges operating margin was 5.4% for the quarter and 6.1% for the full-year. Some business groups including retail and commercial, registered year over year increases in volume and revenue but not enough to offset lower prices. The magazine business continues to be hampered by sluggish ad spending while catalog volume increased. Our logistics business which primarily serves magazine and catalog customers, increased revenues 31% in 2003 to $245 million. Our directory business is also coping with pricing pressures and the book segment was adversely affected throughout the year by a weak market and significant price competition as publishers reduced inventories.

Europe

In Europe, revenues increased by 18% in the fourth quarter to $340 million and 15% for the full-year to $1.15 billion. The increase was due to favourable currency translation and acquisitions. Our French operations registered negative margins for the year but the trend improved in the later half of 2003. As the result of earlier cost containment initiatives and operational efficiencies, we recorded positive results in the fourth quarter. Revenue for the quarter increased 19% to $155 million and operating income increased to $7 million. All European countries are experiencing price pressure and overcapacity. In our operations outside of France, facilities in Austria, the U.K and Belgium performed well. Plants in Sweden, Finland and Spain were more adversely affected by pricing. Europe, as a whole, posted margins in the fourth quarter that were accretive to the consolidated margin.

4

| For immediate release | | Page 4 of 8 |

Latin America

In Latin America fierce competition and currency devaluations adversely affected results. Volumes increased in the quarter and for the full-year but lower prices resulted in a 3% decrease in revenues to $177 million in 2003 compared to $184 million in 2002. In an effort to improve margins, management introduced cost containment and restructuring initiatives that resulted in the reduction of its workforce by 18% or 548 employee positions compared to December 2002.

Management Discussion and Analysis

Please refer to the MD&A for the reconciliation to Canadian generally accepted accounting principles of certain figures used to explain these results. The MD&A can be found on the Company's website atwww.quebecorworld.com and through the SEDAR and SEC filings.

The Board of Directors declared a dividend of $0.13 per share on Multiple Voting Shares and Subordinate Voting Shares. The Board also declared a dividend of CDN$0.3845 per share on Series 3 Preferred Shares, CDN$0.4219 per share on Series 4 Preferred Shares and CDN$0.43125 on Series 5 Preferred Shares. The dividends are payable on March 1st, 2004 to shareholders of record at the close of business February 13, 2004.

Quebecor World Inc. also announced today that it has filed its quarterly report for the quarter ended December 31, 2003 with the Securities and Exchange Commission. The report contains certifications from Jean Neveu, President and Chief Executive Officer and Claude Hélie, Executive Vice President and Chief Financial Officer, that the periodic report fully complies with the Securities. Exchange Act of 1934 and that the information contained in the report fairly presents, in all material respects, the financial condition and results of operations of the Company. These certifications are in accordance with the requirements of the Sarbanes-Oxley Act.

Financial statements are available on the Company's website and through the SEDAR and SEC filings.

Sedar web address:www.sedar.com

SEC web address:www.sec.gov

Quebecor World To Webcast Investor Conference Call on February 6, 2004

Quebecor World Inc. will broadcast its Fourth Quarter and full-year results conference call live over the Internet on February 6, 2004 at 2:00 PM (Eastern Time).

5

| For immediate release | | Page 5 of 8 |

The conference call, which will last approximately one hour, will be webcast live and can be accessed on the Quebecor World web site:

http://www.quebecorworld.com/en/investors/webcasts/Q403

Prior to the call please ensure that you have the appropriate software. The Quebecor World web address listed above has instructions and a direct link to download the necessary software, free of charge.

Anyone unable to attend this conference call may listen to the replay tape by phoning (416) 695-5275 or (888) 509-0082, available from February 6th, 2004 to February 13th, 2004.

Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company's actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customers' demand for the Company's products, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by the Company's competitors, and general changes in economic conditions.

Quebecor World Inc. (NYSE; TSX: IQW) is one of the largest commercial printers in the world. It is a market leader in most of its major product categories which include Magazines, inserts and circulars, books, catalogs, specialty printing and direct mail, directories, digital pre-media, logistics, mail list technologies and other value added services. The Company has approximately 37,000 employees working in more than 160 printing and related facilities in the United States, Canada, Brazil, France, the United Kingdom, Belgium, Spain, Austria, Sweden, Switzerland, Finland, Chile, Argentina, Peru, Colombia, Mexico and India.

Web address:www.quebecorworld.com

– 30 –

For further Information contact:

Jeremy Roberts

Vice-President,

Corporate Finance and

Investor Relations

Quebecor World Inc.

(514) 877-5118

(800) 567-7070 | | Tony Ross

Director, Communications

Quebecor World Inc.

(514) 877-5317

(800) 567-7070 |

6

FINANCIAL HIGHLIGHTS

Periods ended December 31

(In millions of US dollars, except per share data)

(Unaudited)

| | Three months

| | Twelve months

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| Consolidated Results | | | | | | | | | | | | | |

| Revenues | | $ | 1,741.6 | | $ | 1,701.5 | | $ | 6,391.5 | | $ | 6,271.7 | |

Operating income before depreciation and amortization

and before IAROC | | | 182.8 | | | 246.2 | | | 689.8 | | | 898.4 | |

| Operating income before IAROC | | | 90.1 | | | 160.3 | | | 330.4 | | | 562.8 | |

| IAROC | | | 21.5 | | | 19.6 | | | 98.3 | | | 19.6 | |

| Operating income | | | 68.6 | | | 140.7 | | | 232.1 | | | 543.2 | |

| Net income (loss) | | | (53.9 | ) | | 70.6 | | | (31.4 | ) | | 279.3 | |

| Cash provided by operating activities | | | 395.8 | | | 300.8 | | | 461.3 | | | 513.4 | |

| Free cash flow from operations* | | | 347.1 | | | 262.4 | | | 183.3 | | | 319.8 | |

Operating margin before depreciation and amortization

and before IAROC** | | | 10.5 | % | | 14.5 | % | | 10.8 | % | | 14.3 | % |

| Operating margin before IAROC** | | | 5.2 | % | | 9.4 | % | | 5.2 | % | | 9.0 | % |

| Operating margin** | | | 3.9 | % | | 8.3 | % | | 3.6 | % | | 8.7 | % |

| | |

| |

| |

| |

| |

Segmented Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | | | | | | | | | | | | |

| | North America | | $ | 1,354.9 | | $ | 1,366.3 | | $ | 5,062.9 | | $ | 5,087.6 | |

| | Europe | | | 340.3 | | | 288.5 | | | 1,151.4 | | | 1,002.5 | |

| | Latin America | | | 47.9 | | | 47.9 | | | 177.3 | | | 183.5 | |

Operating income (loss) before IAROC |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | $ | 72.7 | | $ | 138.2 | | $ | 311.1 | | $ | 527.3 | |

| | Europe | | | 19.6 | | | 12.3 | | | 30.3 | | | 38.9 | |

| | Latin America | | | 0.9 | | | 4.0 | | | (3.7 | ) | | 14.2 | |

Operating margins before IAROC ** |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | | 5.4 | % | | 10.1 | % | | 6.1 | % | | 10.4 | % |

| | Europe | | | 5.8 | % | | 4.3 | % | | 2.6 | % | | 3.9 | % |

| | Latin America | | | 1.9 | % | | 8.4 | % | | (2.1 | )% | | 7.8 | % |

Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Working capital | | | | | | | | $ | (193.0 | ) | $ | (213.8 | ) |

| Total assets | | | | | | | | | 6,213.8 | | | 6,207.4 | |

| Long-term debt (including convertible notes) | | | | | | | | | 2,009.0 | | | 1,822.1 | |

| Shareholders' equity | | | | | | | | | 2,503.4 | | | 2,703.8 | |

| Debt-to-capitalization | | | | | | | | | 44:56 | | | 40:60 | |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (losses) | | | | | | | | | | | | | |

| | Diluted | | $ | (0.48 | ) | $ | 0.44 | | $ | (0.50 | ) | $ | 1.76 | |

| | Diluted before IAROC | | $ | (0.36 | ) | $ | 0.61 | | $ | 0.03 | | $ | 1.92 | |

| Dividends on equity shares | | $ | 0.13 | | $ | 0.13 | | $ | 0.52 | | $ | 0.49 | |

| Book value | | | | | | | | $ | 15.51 | | $ | 15.92 | |

IAROC: Impairment of assets, restructuring and other charges.

- *

- Cash provided by operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

- **

- Margins calculated on revenues.

7

CONSOLIDATED STATEMENTS OF INCOME AND RETAINED EARNINGS

Periods ended December 31

(In millions of US dollars, except for earnings per share amounts)

| | Three months

| | Twelve months

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| | (Unaudited)

| | (Unaudited)

| | (Audited)

| | (Audited)

| |

|---|

| Revenues | | $ | 1,741.6 | | $ | 1,701.5 | | $ | 6,391.5 | | $ | 6,271.7 | |

| Operating expenses: | | | | | | | | | | | | | |

| | Cost of sales | | | 1,413.5 | | | 1,334.9 | | | 5,188.8 | | | 4,885.9 | |

| | Selling, general and administrative | | | 151.9 | | | 124.9 | | | 536.4 | | | 507.0 | |

| | Depreciation and amortization | | | 86.1 | | | 81.4 | | | 335.9 | | | 316.0 | |

| | Impairment of assets, restructuring and other charges | | | 21.5 | | | 19.6 | | | 98.3 | | | 19.6 | |

| | |

| |

| |

| |

| |

| | | | 1,673.0 | | | 1,560.8 | | | 6,159.4 | | | 5,728.5 | |

| | |

| |

| |

| |

| |

| Operating income | | | 68.6 | | | 140.7 | | | 232.1 | | | 543.2 | |

| Financial expenses | | | 84.1 | | | 42.7 | | | 221.3 | | | 170.2 | |

| | |

| |

| |

| |

| |

| Income (loss) before income taxes | | | (15.5 | ) | | 98.0 | | | 10.8 | | | 373.0 | |

| Income taxes | | | 36.7 | | | 26.3 | | | 39.1 | | | 90.9 | |

| | |

| |

| |

| |

| |

| Income (loss) before minority interest | | | (52.2 | ) | | 71.7 | | | (28.3 | ) | | 282.1 | |

| Minority interest | | | 1.7 | | | 1.1 | | | 3.1 | | | 2.8 | |

| | |

| |

| |

| |

| |

| Net income (loss) | | $ | (53.9 | ) | $ | 70.6 | | $ | (31.4 | ) | $ | 279.3 | |

| Net income available to holders of preferred shares | | | 9.7 | | | 7.3 | | | 36.5 | | | 28.9 | |

| | |

| |

| |

| |

| |

| Net income (loss) available to holders of equity shares | | $ | (63.6 | ) | $ | 63.3 | | $ | (67.9 | ) | $ | 250.4 | |

| | |

| |

| |

| |

| |

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Basic | | $ | (0.48 | ) | $ | 0.45 | | $ | (0.50 | ) | $ | 1.78 | |

| | Diluted | | $ | (0.48 | ) | $ | 0.44 | | $ | (0.50 | ) | $ | 1.76 | |

| | |

| |

| |

| |

| |

Average number of equity shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) | | | | | | | | | | | | | |

| | Basic | | | 131.9 | | | 141.1 | | | 136.0 | | | 140.7 | |

| | Diluted | | | 131.9 | | | 145.4 | | | 136.0 | | | 145.4 | |

| | |

| |

| |

| |

| |

Retained Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, beginning of period | | $ | 804.4 | | $ | 856.9 | | $ | 901.9 | | $ | 721.8 | |

| | Net income (loss) | | | (53.9 | ) | | 70.6 | | | (31.4 | ) | | 279.3 | |

| | Shares repurchased | | | (0.1 | ) | | — | | | (39.3 | ) | | (1.4 | ) |

| | Dividends: | | | | | | | | | | | | | |

| | | Equity shares | | | (17.2 | ) | | (18.4 | ) | | (71.1 | ) | | (69.0 | ) |

| | | Preferred shares | | | (9.6 | ) | | (7.2 | ) | | (36.5 | ) | | (28.8 | ) |

| | |

| |

| |

| |

| |

| Balance, end of period | | $ | 723.6 | | $ | 901.9 | | $ | 723.6 | | $ | 901.9 | |

| | |

| |

| |

| |

| |

8

CONSOLIDATED STATEMENTS OF CASH FLOWS

Periods ended December 31

(In millions of US dollars)

| | Three months

| | Twelve months

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| | (Unaudited)

| | (Unaudited)

| | (Audited)

| | (Audited)

| |

|---|

| Operating activities: | | | | | | | | | | | | | |

| | Net income (loss) | | $ | (53.9 | ) | $ | 70.6 | | $ | (31.4 | ) | $ | 279.3 | |

| | Non-cash items in net income (loss): | | | | | | | | | | | | | |

| | | Depreciation of property, plant and equipment | | | 85.3 | | | 79.9 | | | 333.2 | | | 313.2 | |

| | | Future income taxes | | | 33.6 | | | 16.5 | | | 15.1 | | | 56.7 | |

| | | Amortization of deferred charges | | | 7.4 | | | 6.0 | | | 26.2 | | | 22.4 | |

| | | Impairment of assets and non-cash portion of restructuring and other charges | | | 7.0 | | | (0.5 | ) | | 60.4 | | | (0.5 | ) |

| | | Gain on sale of investments | | | — | | | (1.2 | ) | | — | | | (3.9 | ) |

| | | Loss on extinguishment of long-term debt | | | 30.2 | | | — | | | 30.2 | | | — | |

| | | Other | | | 10.2 | | | 6.5 | | | 16.0 | | | 12.2 | |

| | Changes in non-cash balances related to operations: | | | | | | | | | | | | | |

| | | Trade receivables | | | 206.6 | | | 76.1 | | | 157.0 | | | (91.0 | ) |

| | | Inventories | | | 34.2 | | | 30.0 | | | 30.8 | | | (21.0 | ) |

| | | Trade payables and accrued liabilities | | | 34.5 | | | 33.0 | | | (121.4 | ) | | (18.4 | ) |

| | | Other current assets and liabilities | | | (58.7 | ) | | 35.3 | | | (56.3 | ) | | 43.7 | |

| | | Other non-current assets and liabilities | | | 59.4 | | | (51.4 | ) | | 1.5 | | | (79.3 | ) |

| | |

| |

| |

| |

| |

| | Cash provided by operating activities | | | 395.8 | | | 300.8 | | | 461.3 | | | 513.4 | |

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Net change in bank indebtedness | | | 0.1 | | | 0.2 | | | 1.0 | | | 0.2 | |

| | Net proceeds from issuance of equity shares | | | 2.9 | | | 3.5 | | | 13.5 | | | 22.7 | |

| | Repurchases of shares for cancellation | | | — | | | — | | | (173.6 | ) | | (3.5 | ) |

| | Issuance of long-term debt | | | 592.0 | | | — | | | 592.0 | | | — | |

| | Repayments of long-term debt | | | (562.5 | ) | | (22.1 | ) | | (582.4 | ) | | (96.9 | ) |

| | Net (repayments) borrowings under revolving bank facility

and commercial paper | | | (339.6 | ) | | (237.0 | ) | | 108.9 | | | (283.6 | ) |

| | Dividends on equity shares | | | (17.2 | ) | | (18.4 | ) | | (71.1 | ) | | (69.0 | ) |

| | Dividends on preferred shares | | | (11.8 | ) | | (14.6 | ) | | (37.7 | ) | | (36.2 | ) |

| | Dividends to minority shareholders | | | — | | | (0.1 | ) | | (0.4 | ) | | (2.0 | ) |

| | Other | | | 5.7 | | | — | | | 5.7 | | | — | |

| | |

| |

| |

| |

| |

| | Cash used in financing activities | | | (330.4 | ) | | (288.5 | ) | | (144.1 | ) | | (468.3 | ) |

Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Business acquisitions, net of cash and cash equivalents | | | — | | | — | | | (7.5 | ) | | (0.3 | ) |

| | Additions to property, plant and equipment | | | (37.5 | ) | | (43.6 | ) | | (243.1 | ) | | (184.5 | ) |

| | Net proceeds from disposal of assets | | | 0.6 | | | 19.8 | | | 2.8 | | | 27.1 | |

| | Other | | | — | | | 9.6 | | | (0.8 | ) | | 19.6 | |

| | |

| |

| |

| |

| |

| | Cash used in investing activities | | | (36.9 | ) | | (14.2 | ) | | (248.6 | ) | | (138.1 | ) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(30.7 |

) |

|

3.2 |

|

|

(56.2 |

) |

|

10.2 |

|

| | |

| |

| |

| |

| |

| Net increase (decrease) in cash and cash equivalents | | | (2.2 | ) | | 1.3 | | | 12.4 | | | (82.8 | ) |

| Cash and cash equivalents, beginning of period | | | 17.3 | | | 1.4 | | | 2.7 | | | 85.5 | |

| | |

| |

| |

| |

| |

| Cash and cash equivalents, end of period | | $ | 15.1 | | $ | 2.7 | | $ | 15.1 | | $ | 2.7 | |

| | |

| |

| |

| |

| |

9

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Quebecor World Inc. is one of the largest commercial print media services company in the world. Quebecor World is the market leader in most of its product categories and geographies. This market-leading position has been built through a combination of integrating acquisitions, investment in key strategic technologies and a commitment to build long-term partnerships with the world's leading print media customers.

Quebecor World has facilities in the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

Certain measures used in this discussion and analysis do not have any standardized meaning under Canadian Generally Accepted Accounting Principles (GAAP). When used, these measures are defined in such terms to allow the reconciliation to the closest GAAP measure. Numerical reconciliations are provided in figures 9 and 10. It is not likely that these measures could be compared to similar measures presented by other companies.

The Company's 2003 results were deeply affected by a very difficult economic environment in the print media industry. Weak advertising spending and global overcapacity in the industry resulted in a significant price erosion. This environment negatively impacted results in all the Company's markets.

To face these challenges, management's approach has been to secure and increase new and existing volume and to adopt an uncompromising focus on costs.

The Company competed aggressively and this is reflected in the volume increase in most markets as a result of contract extensions and new gains at market prices.

To mitigate the pricing decline, the Company continued to focus on cost reduction and cost containment. Early in 2003 and throughout the year, new management performed a detailed review of the Company's operations. Through this review, management identified additional restructuring initiatives to address the competitive environment. This involved a general workforce reduction across the platform, the closure of four smaller facilities in North America and the decommissioning of underperforming assets. In addition, progress was made in terms of streamlining the workforce and cutting overhead expenses, achieved through consolidation of corporate functions and relocation of certain sales offices into plants. To further reduce costs, the Company took advantage of lower interest rates to refinance debt with the proceeds of a new $600 million issuance of long-term debt.

Ultimately, all of these cost reduction measures will lower the cost base and allow the Company to harvest the benefits when markets recover.

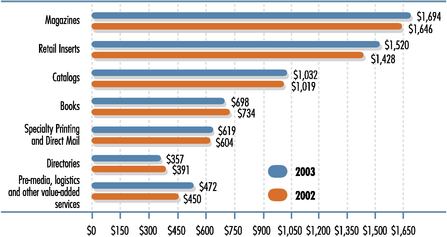

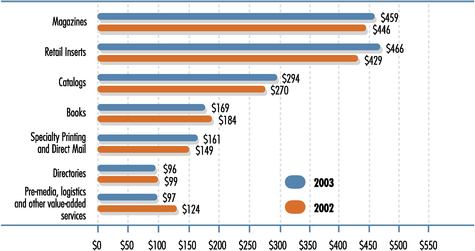

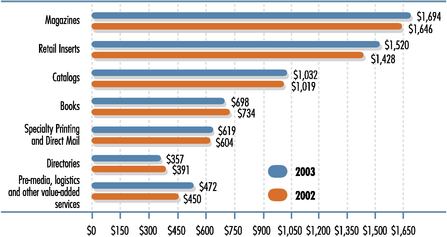

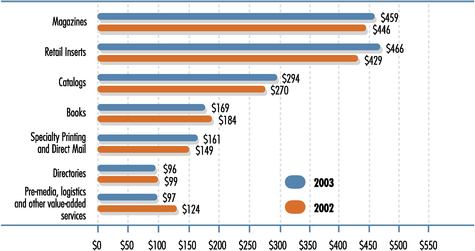

Revenue by Product($ millions)

For the year ended December 31

Figure 1

FOURTH QUARTER IN REVIEW

In the fourth quarter of 2003, the Company continued to face challenges in difficult markets and overcapacity in the print industry. The Company's consolidated revenues increased from $1,701 million in 2002 to $1,742 million in 2003, an increase of 2%, essentially explained by the favourable impact of currency translation of $95 million. Excluding this impact, revenues for the fourth quarter followed the same trend as in the third quarter, decreasing 3% compared to the same period last year (5% decrease in the third quarter of 2003). Despite this decrease, volume was up in virtually all of the Company's business groups. Lower prices were the main factor for the decrease in revenues.

The Company assesses performance based on operating income before impairment of assets, restructuring and other charges. The following operating analyses are before impairment of assets, restructuring and other charges.

During the fourth quarter of 2003, the Company incurred specific charges that reduced operating income totalling $22.7 million of which $13.9 million was related to North America, $3.4 million to Europe and the balance to Latin America and other provisions. Most of the charge, or $18.2 million, was included in selling, general and administrative expenses. Of the $13.9 million related to North America, there was $6.3 million for lease provisions and a $5.0 million provision for doubtful accounts.

In the fourth quarter of 2003, operating income, before impairment of assets, restructuring and other charges, fell by 44% to $90 million, from $160 million in 2002. Operating margin, on the same basis, declined to 5.2% from 9.4% in 2002. Depreciation and amortization were $86 million in the fourth quarter of 2003, compared to $81 million in 2002.

Selling, general and administrative expenses were $152 million compared with $125 million in 2002, an increase of $27 million. Excluding the specific charges of $18.2 million, of which $8.2 million was for bad debts and $6.3 million was for lease provisions, and the impact of currency translation of $8.9 million, selling, general and administrative expenses were flat with the fourth quarter of last year. The savings from the workforce reduction and other cost containment measures were offset by the increasing employee benefit expenses, such as medical, pension and accounting for stock-based compensation. However, as explained in section "Year 2003 in Review", on a full year basis, selling, general and administrative expenses were down by $32 million when compared to 2002.

10

Impact of Foreign Currency and Business Acquisition

($ millions)

| | Periods ended December 31, 2003

| |

|---|

| | Three months

| | Twelve months

| |

|---|

| Revenues | | | | | | | |

| | Foreign currency impact | | $ | 95.2 | | $ | 260.8 | |

| | Business acquisition | | | — | | | 24.1 | |

| | |

| |

| |

| Total | | $ | 95.2 | | $ | 284.9 | |

| | |

| |

| |

| Operating income | | | | | | | |

| | Foreign currency impact | | $ | 2.7 | | $ | 5.0 | |

| | Business acquisition | | | — | | | (0.2 | ) |

| | |

| |

| |

| Total | | $ | 2.7 | | $ | 4.8 | |

| | |

| |

| |

Figure 2

During the fourth quarter, the Company continued its restructuring initiatives and recorded a net restructuring charge of $21.5 million, which reflected further work-force reduction and additional impairment of assets. These measures are described in section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $84 million in the fourth quarter of 2003, compared to $43 million in 2002. The 2003 results included a $30 million charge on extinguishment of long-term debt related to the redemption of the 8.375% senior notes and the repurchase of 89.6% of the 7.75% senior notes. The effect of this transaction is expected to lower interest expense by approximately $12 million per year. This quarter's financial expenses also included an exchange loss of $5 million from the currency translation adjustment account due to the reduction of a net investment in Latin America. Excluding these two events, financial expenses increased by $6 million from last year. The higher expenses were mainly due to a higher level of debt in the fourth quarter of 2003 combined with the net impact of the currency mix of the debt portfolio and losses on foreign exchange related to the weaker U.S. dollar.

Income taxes were $37 million in the fourth quarter of 2003 compared with $26 million in 2002. The increase in income taxes was due to two items, namely an adjustment of the average tax rate applied on cumulative temporary differences within different states in the United States for $28 million and an additional charge of $18 million reflecting a revised expectation of tax asset recovery and liabilities from prior years. When excluding these items, the income tax would be a recovery, since earnings before taxes were generated in jurisdictions with lower tax rates whereas income taxes on restructuring and other charges were recovered in jurisdictions with higher tax rates.

For the fourth quarter ended December 31, 2003, the Company reported a diluted loss per share of $0.48 compared to a diluted earnings per share of $0.44 in 2002. These results incorporated impairment of assets, restructuring and other charges of $21.5 million ($15.7 million net of taxes) or $0.12 per share compared with $19.6 million ($24.1 million net of taxes) or $0.17 per share in 2002. Excluding the effect of impairment of assets, restructuring and other charges, the fourth quarter of 2003 resulted in loss per share of $0.36 compared with earnings per share of $0.61 in the same period of 2002. The specific charges of $22.7 million ($13.7 million net of taxes) also negatively impacted earnings per share by $0.10. The refinancing of the long-term debt which generated a charge on extinguishment of long-term debt of $30 million ($18 million net of taxes) and a $5 million loss from the currency translation adjustment further lowered earnings per share by $0.18.

The combined effect of the items affecting the tax expense described above was $0.35 on earnings per share ($46 million reduction of net income) for the fourth quarter.

YEAR 2003 IN REVIEW

In 2003, the difficult economic environment and the global overcapacity in the print media industry resulted in increased competition and severe pressure on prices. In reaction to this environment, the Company's approach was to secure and increase new and existing volume and to contain and reduce costs. These measures were implemented across the platform, on the operational side as well as in the administrative functions.

Revenue increased from $6,272 million in 2002 to $6,392 million in 2003, an increase of 2%, explained by the favourable impact of currency translation and the aquisition of the printing assets of Hachette Filipacchi Medias (see figure 2). The reduction in revenues when excluding these factors, was a reflection of the pricing pressure in all business segments, despite the overall volume increase.

On a full year basis, the Company incurred specific charges that reduced operating income totalling $78.8 million of which $58.4 million related to North America, and included a $15.0 million adjustment caused by the rapid growth and systems issues in the North American Logistics business, a $16.0 million provision for doubtful accounts and $9.3 million for lease provisions. In Latin America and Europe, specific charges amounted to $8.0 million and $6.1 million, respectively. From the total specific charges, a portion of $37.9 million increased selling, general and administrative expenses.

Operating income, before impairment of assets, restructuring and other charges, fell by 41% to $330 million in 2003, from $563 million in 2002. Operating margin, on the same basis, declined to 5.2% in 2003 from 9.0% in 2002. Reduced capacity utilization and pricing pressures were largely responsible for the lower operating margin. Operating margin was also negatively affected by increases in pension, utilities and medical expenses (see figure 3)

Depreciation and amortization were $336 million in 2003, compared to $316 million in 2002. This increase was primarily due to new capital expenditures including the purchase of presses that were previously under operating leases.

Impact of Selected Expenses on Operating Income and EPS

| | Year ended December 31, 2003

|

|---|

| | Operating Income Increase on 2002

| | Impact on EPS Net of Taxes

|

|---|

| | ($ millions)

| |

|

|---|

| Selected expenses(1) | | | | | | |

| | Pension | | $ | 11.2 | | $ | 0.05 |

| | Utilities | | | 16.2 | | | 0.08 |

| | Medical | | | 7.2 | | | 0.03 |

| | |

| |

|

| Total | | $ | 34.6 | | $ | 0.16 |

| | |

| |

|

- (1)

- Excluding the impact of foreign currency and business acquisition.

Figure 3

11

Selling, general and administrative expenses were $536 million compared with $507 million in 2002, an increase of $29 million. Excluding specific charges totalling $37.9 million, as well as the impact of currency translation of $23 million, selling, general and administrative expenses improved by $32 million or 6%. This resulted from the work-force reduction and other cost containment measures despite increases in employee benefit expenses, such as medical, pension and accounting for stock-based compensation.

In 2003, impairment of assets, restructuring and other charges of $98.3 million were recorded following management's detailed review of the Company's operations and administrative functions.

Financial expenses were $221 million in 2003, compared to $170 million in 2002. The 2003 results included a $30 million charge on extinguishment of long-term debt related to the redemption of the 8.375% senior notes and the repurchase of 89.6% of the 7.75% senior notes in the fourth quarter of 2003. This year's financial expenses also included an exchange loss of $5 million from the currency translation adjustment account for the reduction of a net investment in Latin America. Excluding these two events, financial expenses increased by $16 million from last year. Despite the higher level of debt at year-end, the average volume for the year was similar to the previous year. The higher expenses were mainly due to the net impact of the currency mix of the debt portfolio, the higher fixed component of the debt denominated in U.S. dollars and losses on foreign exchange due to the weaker U.S. dollar.

Income tax expenses were $39 million in 2003 compared with $91 million in 2002. The income taxes in 2003 include the following two items; an adjustment of the average tax rate applied on cumulative temporary differences within different states in the United States for $28 million; and an additional charge of $25 million reflecting a revised expectation of tax asset recovery and liabilities from prior years. When excluding these items, the income tax would be a recovery, since earnings before taxes were generated in jurisdictions with lower tax rates, whereas income tax on restructuring and other charges were recovered in jurisdictions with higher tax rates.

For the year ended December 31, 2003, the Company reported a diluted loss per share of $0.50 compared to a diluted earnings per share of $1.76 in 2002. These results incorporated impairment of assets, restructuring and other charges of $98.3 million ($71.3 million net of taxes) or $0.53 per share compared with $19.6 million ($24.1 million net of taxes) or $0.16 per share in 2002. Excluding the effect of impairment of assets, restructuring and other charges, 2003 resulted in diluted earnings per share of $0.03 compared with $1.92 in 2002. The specific charges of $78.8 million ($56.9 million net of taxes) also negatively impacted earnings per share by $0.42. The refinancing of the long-term debt, which generated a charge on extinguishment of long-term debt of $30 million ($18 million net of taxes) and a $5 million loss from the currency translation adjustment further lowered earnings per share by $0.17. The impact of the special tax items as described above also reduced earnings per share by $0.39 ($53 million reduction of net income).

YEAR 2002 IN REVIEW

Year 2002 was also impacted by a difficult economic environment with declines in volumes and pressures on prices. However, restructuring activities and cost reduction initiatives mitigated the negative impact on the Company's results and resulted in increased operating margins for most of the North American and European (other than France) groups.

Revenue decreased from $6,443 million in 2001 to $6,272 million in 2002, a decrease of 3%, despite the impact of business acquisitions of $184 million. Operating income, before restructuring and other special charges, fell by 9% to $563 million in 2002, from $618 million in 2001. Operating margin, on the same basis, declined to 9.0% in 2002 from 9.6% in 2001. Reduced capacity utilization and pricing pressures were largely responsible for the lower margin.

Depreciation and amortization were $316 million in 2002, compared to $317 million in 2001. This slight decrease was primarily due to the closure of facilities and the disposal of equipment following the 2001 restructuring initiatives.

Selling, general and administrative expenses were $507 million compared with $489 million in 2001. The increase of $18 million was primarily due to business acquisitions and reduction in suppliers' cash discounts related to the cash management strategy. However, this strategy allowed us to reduce our financial expenses.

In 2002, restructuring and other charges of $20 million were recorded due to difficult market conditions in France, further integration of administrative functions in North America and the write-down of impaired or idle assets.

Segmented Results of Operations($ millions)

Selected Performance Indicators

| | North America

| | Europe

| | Latin America

| | Inter-Segment and Others

| | Total

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| | 2003

| | 2002

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| Year ended December 31 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 5,062.9 | | $ | 5,087.6 | | $ | 1,151.4 | | $ | 1,002.5 | | $ | 177.3 | | $ | 183.5 | | $ | (0.1 | ) | $ | (1.9 | ) $ | 6,391.5 | | $ | 6,271.7 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 595.4 | | | 797.0 | | | 93.5 | | | 96.3 | | | 6.9 | | | 21.7 | | | (6.0 | ) | | (16.6 | ) | 689.8 | | | 898.4 | |

| Operating income (loss) before IAROC | | | 311.1 | | | 527.3 | | | 30.3 | | | 38.9 | | | (3.7 | ) | | 14.2 | | | (7.3 | ) | | (17.6 | ) | 330.4 | | | 562.8 | |

| IAROC | | | 78.5 | | | (9.0) | | | 6.8 | | | 22.1 | | | 11.8 | | | 1.0 | | | 1.2 | | | 5.5 | | 98.3 | | | 19.6 | |

| Operating income (loss) | | | 232.6 | | | 536.3 | | | 23.5 | | | 16.8 | | | (15.5 | ) | | 13.2 | | | (8.5 | ) | | (23.1 | ) | 232.1 | | | 543.2 | |

| Operating margin before depreciation and amortization and before IAROC | | | 11.8 | % | | 15.7 | % | | 8.1 | % | | 9.7 | % | | 3.9 | % | | 11.8 | % | | | | | | | 10.8 | % | | 14.3 | % |

| Operating margin before IAROC | | | 6.1 | % | | 10.4 | % | | 2.6 | % | | 3.9 | % | | (2.1 | )% | | 7.7 | % | | | | | | | 5.2 | % | | 9.0 | % |

| Operating margin | | | 4.6 | % | | 10.5 | % | | 2.0 | % | | 1.7 | % | | (8.7 | )% | | 7.2 | % | | | | | | | 3.6 | % | | 8.7 | % |

Figure 4

12

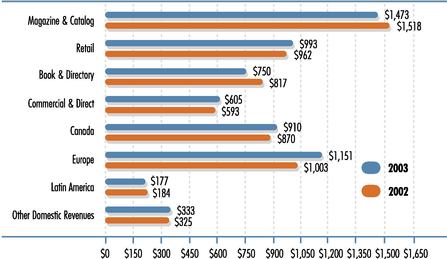

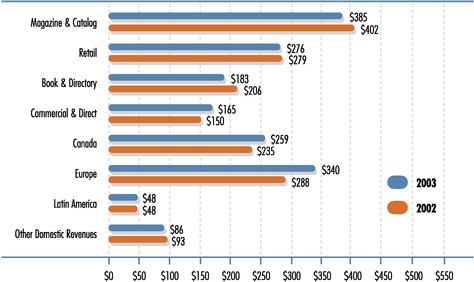

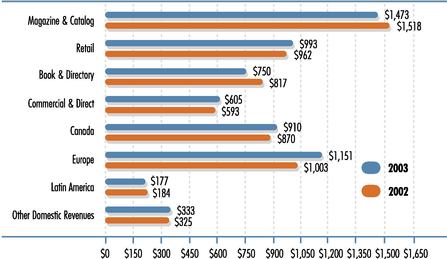

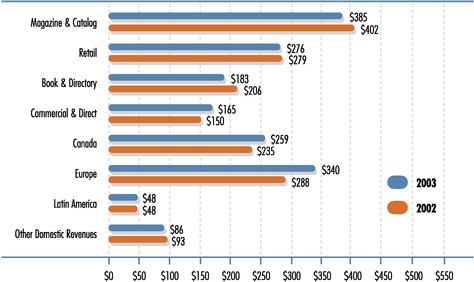

Revenue by Business Group($ millions)

For the year ended December 31

Figure 5

Financial expenses were $170 million in 2002, compared to $209 million in 2001. The significant decrease was due to lower levels of debt, together with reduced interest rates on long-term debt and on securitization programs.

Income taxes were $91 million in 2002 compared with $52 million in 2001. Before restructuring and other special charges, income taxes were $86 million or 22.0% compared to $96 million or 23.4% in 2001. The decrease in income taxes is due to lower profitability and an increase in profits generated in countries with a lower overall tax rate.

SEGMENT REVIEW

The following is a review of activity by business group and the operating analysis is before impairment of assets, restructuring and other charges.

North America

North American revenues for the fourth quarter of 2003 were $1,355 million, down 1% from $1,366 million in 2002. On a full year basis, revenues slightly decreased to $5,063 million in 2003, from $5,088 million in 2002. Excluding the effect of currency translation, revenues decreased by 4% in the fourth quarter and 2% for the year. The following is a review of the North American activities by business group.

Magazine & Catalog

Magazine & Catalog revenues for the fourth quarter of 2003 were $385 million, down 4% from $402 million in 2002. On a full year basis, revenues fell by 3% to $1,473 million in 2003, from $1,518 million in 2002. The decrease was a direct result of price erosion and lower volume due to weaknesses in the Magazine business. However, in the fourth quarter, volume was stable. Magazine advertising pages, as measured by the Publishers Information Bureau were down 1% from last year. On the other hand, the Catalog business has been experiencing year-over-year growth from renewals and new contracts.

The Magazine & Catalog Group is the Company's largest business platform and contributed in securing market share by extending current contracts and attracting new customers, such as: Viacom, Dennis Publishing, Bauer, Viking, Office Depot, Avon, Williams-Sonoma and Ethan Allen.

In an effort to contain costs, headcount was reduced by 401 employees or approximatively 4% when compared to December 2002.

Retail

Retail revenues for the fourth quarter of 2003 were $276 million, down 1% from $279 million in 2002. On a full year basis, revenues increased by 3% to $993 million in 2003, from $962 million in 2002. In the fourth quarter, volume was up 4% (3% for the year) but was offset by a significant price erosion hurting revenues and operating margins.

The Company's North American Retail network, built through strategic investments in both gravure and offset technologies, provides customers with a unique coast-to-coast platform allowing for large-run national campaigns or shorter-run multi-versioned ones. Competition is fierce but the Group reported significant wins with customers such as: Staples, Office Depot, Home Depot and JC Penny, an indication of increased market share.

Year-over-year headcount was reduced by 131 employees or approximatively 3% when compared to 2002. This improvement was reflected in selling, general and administrative costs.

Book & Directory

Book & Directory revenues for the fourth quarter of 2003 were $183 million, down 11% from $206 million in 2002. On a full year basis, revenues fell by 8% to $750 million in 2003, from $817 million in 2002. The drop in revenues was directly related to negative price pressures in both businesses. The Book group was hit hard by the price competition in a soft market combined with overcapacity in the United States and strong competition from Asia. Volume was down by 1% in the fourth quarter. The demand was weak for high-value added products such as bibles, fine-edition books, encyclopedias, and industrial catalogs. Educational publishers focused on cash management in this difficult market, reducing inventories which resulted in smaller orders and fewer new titles.

In Directories, while competition for market share for the major telecom business remained fierce, volume was higher in 2003 as the Company's orders from emerging independent publishers increased. However, this caused a negative price impact on the overall product mix.

As part of the cost reduction efforts, Book & Directory were combined to maximize efficiencies due to the similarities of their operations.

The Group's focus continued to be on cost containment. Headcount was reduced by 510 employees or approximatively 9% when compared to 2002. In addition, detailed action plans were implemented in every plant to reduce waste and improve operational efficiency. Also, a capital investment to improve the efficiency of equipment and complete the expansion for school books was made at the Dubuque facility.

Commercial & Direct

Commercial & Direct revenues for the fourth quarter of 2003 were $165 million, up 10% from $150 million in 2002. On a full year basis, revenues increased by 2% to $605 million in 2003, from $593 million in 2002. Volume increased close to 4% during the fourth quarter, following the same trend for the full year. Headcount was reduced by 197 employees which represented approximatively a 6% year-over-year decrease with a significant impact on administrative expenses.

13

Canada

Canadian revenues for the fourth quarter of 2003 were $259 million, up 11% from $235 million in 2002. On a full year basis, revenues increased by 5% to $910 million in 2003 from $870 million in 2002. Excluding the effect of currency translation, revenues decreased by 7% in both the fourth quarter and for the year. Similar to the US market, pricing was very competitive. In Eastern Canada, despite eroding prices and excluding currency translation, revenues for the year were up 3% from 2002, explained by an increase in volume. This trend was reversed in the fourth quarter with a decrease of more than 3%.

During the year, the Group reported contract renewals including, Rogers Publications, Sears Retail, Shoppers Drug Mart, Verizon, and Canada Wide Magazines.

Other Revenues

Other sources of revenues in North America included Que-Net Media™ (pre-media services) and Logistics. The Que-Net Media™ Group's revenues for the fourth quarter of 2003 were $18 million, down 8% from $19 million in 2002. On a full year basis, revenues fell by 10% to $75 million in 2003, from $84 million in 2002, despite a significant volume increase (8% for 2003 and 13% in the fourth quarter). This business offers services to the Company's main print media businesses and has suffered from the decline in volume and price pressures experienced elsewhere in the platform. The economic environment also impacted customers who continued to focus on cutting costs, many of whom are turning towards self-service and in-house production.

Logistics revenues for the fourth quarter of 2003 were $69 million, up 17% from $59 million in 2002. On a full year basis, revenues increased to $245 million in 2003, from $187 million in 2002, a 31% increase.

Europe

European revenues for the fourth quarter of 2003 were $340 million, up 18% from $288 million in 2002. On a full year basis, revenues increased by 15% to $1,151 million in 2003, from $1,003 million in 2002. The increase in revenues in the last quarter and for the year was largely due to the positive impact of currency translation. The purchase of the printing assets of Hachette Filipacchi was also a factor in the annual increase in revenues for 2003. Excluding these factors, revenues were flat for the last quarter and down $49 million for the year 2003.

The European market is still suffering from overcapacity and pressures on price. Operations excluding France performed well, particularly in the facilities in the United Kingdom, Austria and Belgium, where results were higher or comparable to last year. Volume was up 7% for the year (11% in the fourth quarter). Despite this, the book export business in Spain experienced volume declines due to the strengthening of the Euro. Sweden and Finland were also severely hit by a price erosion.

French revenues for the fourth quarter of 2003 were $155 million, up 19% from $131 million in 2002. Operating income in the fourth quarter of 2003 was $7 million, up from $1 million in 2002. On a full year basis, revenues were $529 million, an increase of 18% from $447 million in 2002. Operating loss for the year 2003 was $3 million, as compared to a loss of $2 million in 2002.

The French operations, excluding the effect of the currency translation, reported a negative operating margin and a revenue decline of 1%. However, the trend was reversed in the fourth quarter with flat revenues and positive margins. Its operations were especially hard hit by negative price pressures due to the over-capacity in the industry.

Overall, headcount in Europe was reduced by 269 employees which represented approximatively a 5% decrease, with a particular focus on France where general administrative expense reductions were effected.

Latin America

Latin America's revenues for the fourth quarter of 2003 were $48 million, stable compared to 2002. On a full year basis, revenues decreased by 3% to $177 million in 2003, from $184 million in 2002. Overcapacity coupled with economic pressure within the region and currency devaluation all had a negative impact on prices. As a result, management's plan of action was to secure volume at market prices and focus on reducing headcount in addition to significant overhead cost reductions. Volume was up in all countries except for the Recife facility in Brazil. Overall volume was up 13% (10% in the fourth quarter) and headcounts reduced by 548 employees or approximatively an 18% reduction.

PENSION AND OTHER POSTRETIREMENT BENEFITS

As at December 2003, the pension and other post-retirement benefit costs were $67 million compared with $55 million in 2002 and the funded status decreased by $93 million over last year. Calculations of pension and other postretirement benefit costs and obligations are based on various assumptions (see figure 6). Management is continuously assessing those assumptions for its funding exposure. In 2002 and 2001, difficult capital market conditions affected pension asset returns. The year 2003 returns were marked by a slight recovery. However, Generally Accepted Accounting Principles recommend an accounting treatment to reduce the volatility of the pension plan expense in order to reflect the long-term nature of these obligations and any actuarial gains or losses resulting from a turbulent capital market environment are amortized over a period of 15 years.

The Company is monitoring the funding of the pension plans very closely and made contributions above the minimum legal requirements. A total of $68 million of cash contributions were made to the pension plans in 2003 compared to $40 million in 2002.

Weighted average assumptions used in the

measurement of the Company's pension benefits

| | 2003

| | 2002

| |

| |

|---|

| Discount rate | | 6.0 | % | 6.7 | % | | |

| Expected return on plan assets | | 8.2 | % | 8.2 | % | | |

| Rate of compensation increase | | 3.5 | % | 3.4 | % | | |

Figure 6

14

Total Debt and Accounts Receivable Securitization($ millions)

| | December 31, 2003

| | December 31, 2002

|

|---|

| Bank indebtedness | | $ | 1.3 | | $ | 0.3 |

| Current portion of long-term debt | | | 23.9 | | | 38.5 |

| Long-term debt | | | 1,874.4 | | | 1,668.6 |

| Convertible notes | | | 110.7 | | | 115.0 |

| | |

| |

|

| Total debt | | $ | 2,010.3 | | $ | 1,822.4 |

Accounts receivable securitization |

|

|

766.6 |

|

|

649.7 |

| | |

| |

|

| Total debt and accounts receivable securitization | | $ | 2,776.9 | | $ | 2,472.1 |

| | |

| |

|

Figure 7

STOCK OPTION PLANS

During the year, the Company issued a total of 916,911 options. Shares reserved for issuance total 7.6 million as at December 31, 2003, of which 3.7 million were outstanding.

In 2003, the Company changed its method of accounting for stock-based compensation and decided to adopt the fair value based method of accounting for all of its stock-based compensation. The Company adopted these changes using the prospective application transitional alternative. Accordingly, the fair value based method was applied to awards granted, modified or settled on or after January 1, 2003. The compensation cost charged against income for those plans was $2 million for the year 2003.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

The Company measures its liquidity performance using the calculation of free cash flow as described in figure 9. Free cash flow reflects liquidity available for business acquisitions, dividends on equity shares and repayments of long-term debt. In 2003, free cash flow from operations was $183 million, compared to $320 million in 2002. The decrease in free cash flow was due to lower earnings and higher capital expenditures in 2003.

OPERATING ACTIVITIES

Cash flow from operating activities was $461 million in 2003, compared with $513 million in 2002. This reduction was mainly attributable to the lower earnings in 2003. The deficiency in working capital was $193 million in 2003, compared to $214 million in 2002. The variance was due to lower trade payables partly offset by a higher level of securitization in 2003. Favourable currency impact on Canadian and European programs and the amendment to the U.S. program allowed for greater drawings under these securitization programs. The Company has also renegotiated certain terms and conditions of the U.S. and European programs to substitute the previous credit rating termination event with a termination event which mirrors the financial covenants in the bank facility.

FINANCING ACTIVITIES

In June 2003, the Company repurchased for cancellation a total of 10,000,000 Subordinate Voting Shares pursuant to its Substantial Issuer Bid dated April 24, 2003 for a net cash consideration, including redemption fees, of Cdn $241 million ($174 million). The Substantial Issuer Bid expired at midnight (Montreal time) on the evening of June 2,2003. The excess of the price paid over the book value of the shares repurchased was charged to retained earnings.

In November 2003, the Company issued senior notes for a principal amount of $600 million, comprised of two tranches. The first tranche of $200 million matures on November 15, 2008 and the second tranche of $400 million matures on November 15, 2013. The notes were issued at a discount for a total net proceeds of $597 million. The proceeds from the sale of these notes were used to repay outstanding indebtedness.

In November 2003, following a tender offer to purchase all of the $300 million principal amount of the 7.75% senior notes due February 15, 2009, the Company repurchased 89.6% of the notes at a premium for a cash consideration of $283 million.

In December 2003, the Company exercised its option and redeemed all of the $258 million principal amount of the 8.375% senior notes at a premium for a total cash consideration of $268 million.

The Company also restructured its $1 billion bank facility in November 2003 in three tranches, the first tranche of $250 million matures in 2004, while the second tranche of $250 million and the third tranche of $500 million mature in 2006. All three tranches can be extended on a yearly basis. The financial covenants remain unchanged and the facility can be used for general corporate purposes. All of these new agreements were part of the Company's 2003 financial plan and will contribute to substantial annual savings.

Dividends paid to shareholders of Multiple Voting Shares and Subordinate Voting Shares totaled $0.52 per share, compared to $0.49 per share in 2002 and $0.46 per share in 2001, an increase of 6% over 2002 and 13% from 2001.

No dividends were paid on the First Preferred Shares, Series 2 in 2003 as all First Preferred Shares, Series 2 were converted into First Preferred Shares, Series 3 in December 2002. The Company paid dividends of Cdn $1.54 per share on the First Preferred Shares, Series 3 in 2003. Dividends of Cdn $1.25 per share were paid in 2002 and in 2001 on First Preferred Shares, Series 2. The Company paid dividends of Cdn $1.69 per share on the First Preferred Shares, Series 4 in 2003 (Cdn $1.69 per share in 2002 and Cdn $1.27 in 2001), and Cdn $1.73 per share on the First Preferred Shares, Series 5, in 2003 (Cdn $1.73 per share in 2002 and Cdn $0.51 in 2001).

Contractual Cash Obligations($ millions)

| | 2004

| | 2005

| | 2006

| | 2007

| | 2008

| | 2009 and thereafter

|

|---|

| Long-term debt and convertible notes | | $ | 8 | | $ | — | | $ | 530 | | $ | 261 | | $ | 202 | | $ | 949 |

| Capital leases | | | 16 | | | 11 | | | 8 | | | 4 | | | 3 | | | 17 |

| Operating leases | | | 101 | | | 84 | | | 68 | | | 52 | | | 36 | | | 108 |

| | |

| |

| |

| |

| |

| |

|

| Total contractual cash obligations | | $ | 125 | | $ | 95 | | $ | 606 | | $ | 317 | | $ | 241 | | $ | 1,074 |

| | |

| |

| |

| |

| |

| |

|

Figure 8

15

INVESTING ACTIVITIES

In 2003, capital expenditures were targeted to improve the Company's cost structure and for customer-driven projects. The Company invested $243 million on capital expenditure projects, compared to $185 million in 2002. Key expenditures included the following items:

- •

- North America

The expansion and improvement of the Magazine & Catalog platform included the purchase of new gravure presses in the Augusta, Georgia, and Franklin, Kentucky facilities to service L.L. Bean and other retail customers, and the acquisition of a 48-page short cut-off offset press in the Elk Grove Village, Illinois facility for additional press capacity to service Williams-Sonoma.

In the Retail platform, the Company completed the expansion of the Riverside, California facility, including the relocation of the Ontario, California facility to a new 196,000 square foot facility nearby Riverside.

Phase 2 of the educational book market expansion has been initiated in the Dubuque, Iowa facility.

A new 4 unit Goss press was added at the Web Press facility in Vancouver to increase capacity.

In addition, the Company concluded the buyout of leased presses installed in 8 facilities for $71 million.

- •

- Europe

The addition of a 48-page commercial press was completed in the Spanish platform to increase overall capacity and to replace an older press.

Other capital investments were dedicated to normal replacement of assets as well as environmental compliance and systems development and implementation.

During 2003, the Company acquired some minority interests in Spain and North America.

FINANCIAL POSITION

For the year ended December 31, 2003, the debt-to-capitalization ratio was 44:56, compared to 40:60 in 2002. As at December 31, 2003, total debt plus accounts receivable securitization was $2,777 million, $305 million higher than last year (see figure 7).

In February 2004, the Company expects to finalize the redemption of the remaining nominal amount of $31 million of the 7.75% senior notes.

The holders of the 6.50% senior debentures have the option to tender the $150 million aggregate principal amount for redemption in August 2004. Their decision will depend on prevailing market conditions at such time.

The Company believes that the liquidity, capital resources and cash flows from operations are sufficient to fund planned capital expenditures, working capital requirements, pension contributions, interest and principal payment obligations for the foreseeable future. The total mandatory principal payments on long-term debt, convertible notes and capital leases are $24 million in 2004 and $11 million in 2005. Minimum pension contributions are estimated at $75 million for 2004.

IMPAIRMENT OF ASSETS AND RESTRUCTURING INITIATIVES

In early 2003, as a result of changes in management, a detailed review of the Company's operations and administrative functions has been undertaken to further reduce the cost base and improve efficiencies. This resulted in additional impairment of assets and restructuring initiatives.

In 2003, the Company recorded an impairment of assets, restructuring and other charges of $98.3 million. Non-cash items amounted to $60.4 million and cash items to $37.9 million. The non-cash portion included an impairment of assets of $54.4 million and other charges of $2.8 million for the 2003 initiatives and $3.2 million related to previous years' initiatives.

Impairment of Assets

During 2003, the Company recorded an impairment of assets of $54.4 million for write-downs of certain under-performing assets resulting from the over capacity in the industry and the decision not to redeploy the assets. An amount of $47.4 million has been recorded in the second quarter and $7.0 million in the fourth quarter.

Restructuring and Other Charges

During the fourth quarter of 2003, the Company continued its restructuring initiatives and recorded net restructuring charges of $21.5 million. The charges included $15.8 million, consisting of new initiatives of $16.1 million, net of a reversal of $0.3 million related to second quarter and third quarter initiatives, $7.0 million for impairment of assets and a reversal of $1.3 million related to 2001-2002 initiatives. The cash charge of $16.1 million was related to a workforce reduction of 878 employee positions, of which $12.8 million was for North America, $1.9 million for Europe and $1.4 million for Latin America. Under these initiatives, 393 employee positions have been eliminated and 485 will be eliminated in the first quarter of 2004.

In the third quarter of 2003, the Company initiated new restructuring initiatives. A net cash reversal of $0.3 million was recorded. This was composed of two items: a reversal of $2.2 million of which $1.9 million was for Europe and $0.3 million was for Latin America, and a charge of $1.9 million for work-force reduction, of which $1.4 million was for North America and $0.5 million for Latin America. Under these initiatives, 260 employee positions were eliminated. The reversal of the provision of $2.2 million was recorded after the Company completed most of its June initiatives and re-evaluated the remaining costs.

In the second quarter of 2003, the Company initiated restructuring initiatives and other charges following the continued volume declines in certain business segments. A cash charge of $23.4 million was taken consisting of $17.6 million in workforce reduction and $5.8 million of additional closure costs of four smaller facilities. The amount of $17.6 million in workforce reduction included $5.8 million for Europe and $10.0 million for North America. Related to this, an asset write-down of $2.8 million was also recorded. Under these initiatives,1,134 employee positions were eliminated.

In summary, as of December 31, 2003, 1,769 employee positions were eliminated under the 2003 restructuring initiatives and 503 will be completed in 2004. The workforce reductions affected all fixed cost areas of the Company, both at plant and corporate levels.

16

In 2003, the review and the execution of the 2002 and 2001 initiatives resulted in a net reversal of $1.0 million comprised of a cash over-spending of $12.9 million and a $13.9 million reversal of prior year restructuring and other charges. The cash overspending is related to costs of closed facilities not yet disposed of, and office leases not yet subleased and other completed initiatives. Under these initiatives, 3,961 employee positions were eliminated as at December 31, 2003 and 23 will be eliminated in 2004, of which 18 terminations in Europe are to be completed when all the legal procedures and requirements are met.

In addition, during the second quarter of 2003, the Company also recorded an asset write-down of $3.2 million in relation with 2001 and 2002 initiatives.

In 2002, following the persistant difficult situation in France and the identification of other cost reduction opportunities in North America, the Company took additonal restructuring charges which also included asset and investment write-downs and overspending on its 2001 restructuring initiatives, net of the reversal of unused reserves from 2001.

Restructuring and other charges, as at December 31, 2002, were $19.6 million. This included $13.3 million required to complete the 2001 restructuring initiatives, mostly related to employee termination costs. In addition, it also included a reversal of $40.1 million, mainly related to the Company's decision not to close a plant. This reversal consisted of $18.4 million of asset impairments and $21.7 million for related restructuring. The new initiatives in 2002 were comprised of the following three basic components:

- •

- Cash costs relating to the severance of employees and other restructuring costs of $30.0 million;

- •

- Write-down of assets of $6.5 million associated with the impairment of assets that will no longer be used;

- •

- Other special charges of $9.9 million for the write-down of investments to their expected realizable value. The larger portion was related to equity shares in Q-Media Services Corporation that went into receivership at the end of December 2002.

In 2001, due to the economic fallout that was exacerbated following September 11th events, the Company announced that it would restructure its business with the aim of removing the least efficient equipment, without materially affecting the overall capacity of its platform. The restructuring and other charges required to achieve this goal totaled $273 million. The restructuring plan involved the closure of facilities, together with the rationalization of numerous other plants. The restructuring and other charges included the following three basic components:

- •

- Cash costs relating to the severance of employees, real estate and other costs associated with exiting facilities;

- •

- Non-cash costs of $114 million associated with the impairment of assets that will no longer be used in the business on an ongoing basis;

- •

- Non-cash costs of $29 million associated with exiting investments and non-core businesses, together with cash costs of $15 million required in order to complete the World Color integration.

RISK MANAGEMENT

In the normal course of business, the Company is exposed to changes in interest rates, foreign exchange rates and commodity prices.

The Company manages interest rate exposure by having a balanced schedule of debt maturities as well as a combination of fixed and floating rate obligations. In addition, the Company has entered into interest rate swap agreements to manage this exposure. Contracts outstanding at year-end have a notional value of $33 million. These contracts expire in March 2006.

The Company has also entered into foreign-exchange forward contracts and cross-currency swaps to set the exchange rate for cross-border sales and to manage the foreign exchange exposure on net investments and foreign denominated assets. Foreign-exchange forward contracts and cross-currency swap contracts outstanding at year-end have a notional value of $673 million and $212 million respectively, and expire between January 2004 and December 2007.

The Company has also entered into natural gas swap contracts to manage the exposure on this commodity. Contracts outstanding at year-end cover a notional quantity of 271,000 gigajoules in Canada and 2,237,000 MMBTU in the U.S. These contracts expire between January and December 2004.

While the counterparties of these agreements expose the Company to credit loss in the event of non-performance, the Company believes that the possibility of incurring such a loss is remote due to the creditworthiness of the counterparties. The Company does not hold or issue any derivative financial instruments for speculative or trading purposes.

Concentrations of credit risk with respect to trade receivables are limited due to the diverse operations and large customer base.

As of December 31, 2003, the Company has no significant concentrations of credit risk and believes that the product and geographic diversity of its customer base is instrumental in reducing credit risk, as well as having a positive impact on local markets or product-line demand. The Company has long-term contracts with most of its largest customers. These contracts generally include price-adjustment clauses based on the cost of paper, ink and labor. The Company does not believe that it is exposed to an unusual level of customer credit risk.

The primary raw materials used in the manufacturing process are paper and ink. The Company uses its purchasing power as one of the major buyers in the printing industry to obtain among the best prices, terms, quality control and service. To maximize its purchasing power, the Company negotiates with a limited number of suppliers.

In 2003, the Company had 71 collective bargaining agreements in North America. Of this total, 7 agreements expired in 2003 and 6 are still under negotiation. In addition, 15 collective bargaining agreements, covering 2,248 employees, will expire in 2004. The Company has approximately 10,509 unionized employees in North America. Moreover, 87 of the plants and related facilities in North America are non-unionized.

SEASONALITY

The operations of the Company's business are seasonal, with approximately two-thirds of operating income historically recognized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions.

ENVIRONMENTAL MATTERS

During 2003, the Company continued to strengthen its approach to environmental management. Twelve facilities have now received or are in the implementation phase of getting ISO-14001 certification, an internationally recognized environmental management system standard.

17

Reconciliation of non GAAP measures

($ millions)

| | Year ended December 31

| |

|---|

| | 2003

| | 2002

| | 2001

| |

|---|

Operating Income |

|

|

|

|

|

|

|

|

|

|

| | Operating income | | $ | 232.1 | | $ | 543.2 | | $ | 347.8 | |

| | Impairment of assets, restructuring and other charges ("IAROC") | | | 98.3 | | | 19.6 | | | 270.0 | |

| | |

| |

| |

| |

| | Operating income before IAROC | | $ | 330.4 | | $ | 562.8 | | $ | 617.8 | |

| | |

| |

| |

| |

| | Operating income | | $ | 232.1 | | $ | 543.2 | | $ | 347.8 | |

| | Depreciation of property, plant and equipment | | | 333.2 | | | 313.2 | | | 314.9 | |

| | Amortization of deferred charges(1) | | | 26.2 | | | 22.4 | | | 22.9 | |

| | |

| |

| |

| |

| | Operating income before depreciation and amortization | | $ | 591.5 | | $ | 878.8 | | $ | 685.6 | |

| |

IAROC |

|

|

98.3 |

|

|

19.6 |

|

|

270.0 |

|

| | |

| |

| |

| |

| | Operating income before depreciation and amortization and IAROC | | $ | 689.8 | | $ | 898.4 | | $ | 955.6 | |

| | |

| |

| |

| |

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

| | Net income (loss) available to holders of equity shares | | $ | (67.9 | ) | $ | 250.4 | | $ | 0.5 | |

| | IAROC (net of income taxes of $27.0 million in 2003,

$(4.5) million in 2002 and $43.8 million in 2001) | | | 71.3 | | | 24.1 | | | 226.3 | |

| | |

| |

| |

| |

| | Net income available to holders of equity shares before IAROC | | $ | 3.4 | | $ | 274.5 | | $ | 226.8 | |

| |

Diluted average number of equity shares outstanding (in millions) |

|

|

136.0 |

|

|

145.4 |

|

|

143.0 |

|

| |

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

| | | Diluted | | $ | (0.50 | ) | $ | 1.76 | | $ | — | |

| | | Diluted, before IAROC | | $ | 0.03 | | $ | 1.92 | | $ | 1.58 | |

| | |

| |

| |

| |

Free Cash Flow |

|

|

|

|

|

|

|

|

|

|

| | Cash provided by operating activities | | $ | 461.3 | | $ | 513.4 | | $ | 576.5 | |

| | Dividends on preferred shares | | | (37.7 | ) | | (36.2 | ) | | (20.5 | ) |

| | Additions to property, plant and equipment | | | (243.1 | ) | | (184.5 | ) | | (278.3 | ) |

| | Net proceeds from disposal of other assets | | | 2.8 | | | 27.1 | | | 9.5 | |

| | |

| |

| |

| |

| | Free cash flow from operations | | $ | 183.3 | | $ | 319.8 | | $ | 287.2 | |

| | |

| |

| |

| |

Debt-to-capitalization |

|

|

|

|

|

|

|

|

|

|

| | Bank indebtedness | | $ | 1.3 | | $ | 0.3 | | $ | 0.1 | |

| | Current portion of long-term debt and convertible notes | | | 23.9 | | | 38.5 | | | 57.0 | |

| | Long-term debt | | | 1,874.4 | | | 1,668.6 | | | 1,961.9 | |

| | Convertible notes | | | 110.7 | | | 115.0 | | | 113.3 | |

| | |

| |

| |

| |

| | Total debt | | $ | 2,010.3 | | $ | 1,822.4 | | $ | 2,132.3 | |

| |

Minority interest |

|

|

24.7 |

|

|

20.9 |

|

|

14.2 |

|

| | Shareholders' equity | | | 2,503.4 | | | 2,703.8 | | | 2,473.2 | |

| | |

| |

| |

| |

| | Capitalization | | $ | 4,538.4 | | $ | 4,547.1 | | $ | 4,619.7 | |

| | |