Table of Contents

U.S. Securities and Exchange Commission

Washington, D.C. 20549

FORM 40-F

o Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

x Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2007 | | Commission file number 1-14118 |

QUEBECOR WORLD INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English (if applicable))

CANADA

(Province or other jurisdiction of incorporation or organization)

2572

(Primary Standard Industrial Classification Code Number (if applicable))

N/A

(I.R.S. Employer Identification Number (if applicable))

999 de Maisonneuve Blvd. West - Suite 1100, Montreal, Quebec, Canada, H3A 3L4

Tel: (514) 954-0101

(Address and telephone number of Registrant’s principal executive offices)

QUEBECOR WORLD (USA) INC.

291 State Street, North Haven, CT 06473

Telephone: (203) 288-2468

(Name, address (including zip code) and telephone number (including area code) of agent for

service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Subordinate voting shares | | |

Title of each class | | |

Securities Registered or to be registered pursuant to Section 12(g) of the Act

N/A

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

x Annual Information form | | x Audited financial statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| 85,584,924 Subordinate Voting shares Outstanding |

| 46,987,120 Multiple Voting Shares Outstanding |

| 12,000,000 First Preferred Shares Series 3 Outstanding |

| 7,000,000 First Preferred Shares Series 5 Outstanding |

Indicate by check mark whether the Registrant by filing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934 (the “Exchange Act”). If “Yes” is marked, indicate the filing number assigned to the Registrant in connection with such Rule.

Yes o 82- No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Table of Contents

Material included in this annual report on Form 40-F:

1. The Annual Information Form for the year ended December 31, 2007 of Quebecor World Inc. (the “Registrant”) dated October 17, 2008.

2. Management’s Discussion and Analysis of Financial Condition and Results of Operation of the Registrant for the year ended December 31, 2007 (the “Management’s Discussion and Analysis”) and the Audited Consolidated Financial Statements of the Registrant for the year ended December 31, 2007, as amended.

*************

Disclosure Controls and Procedures

As of December 31, 2007, an evaluation was carried out under the supervision of and with the participation of management, including the President and Chief Executive Officer and Senior Vice President and Chief Accounting Officer, of the effectiveness of the Registrant’s disclosure controls and procedures as defined in Rule 13a-15(e) under the Exchange Act and in Multilateral Instrument 52-109 under the Canadian Securities Administrators Rules and Policies. Based on that evaluation, the President and Chief Executive Officer and the Senior Vice President and Chief Accounting Officer concluded that as a result of material weaknesses in the Registrant’s internal control over financial reporting discussed on pages 33 to 36 of the Management’s Discussion and Analysis included in this annual report on Form 40-F, the disclosure controls and procedures were not effective as of December 31, 2007.

Management’s Annual Report on Internal Control over Financial Reporting

The report of management on the Registrant’s internal control over financial reporting is located under the heading “Management’s Report on Internal Control Over Financial Reporting” on pages 34 and 35 of the Management’s Discussion and Analysis included in this annual report on Form 40-F and is incorporated herein by this reference.

Attestation Report of the Registered Public Accounting Firm

The attestation report on the Registrant’s internal control over financial reporting is located under the heading “Report of Independent Registered Public Accounting Firm” on pages 5 and 6 of the Registrant’s Audited Consolidated Financial Statements for the year ended December 31, 2007 included in this annual report on Form 40-F and is incorporated herein by this reference. This attestation report expresses an opinion that the Registrant did not maintain effective internal control over financial reporting as of December 31, 2007.

Changes in Internal Controls Over Financial Reporting

Based on the evaluation described under the heading “Disclosure Controls and Procedures” in this annual report on Form 40-F, the Registrant identified a change that occurred during the period covered by this annual report on Form 40-F that materially affected or is reasonably likely to materially affect the Registrant’s internal control over financial reporting. This change related to the implementation of new application software (Taxware) for the plants in the U.S. and is described under the heading “Changes in Internal Control over Financial Reporting” on page 35.

Table of Contents

of the Management’s Discussion and Analysis included in this annual report on Form 40-F and is incorporated herein by this reference.

Audit Committee

The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Registrant’s audit committee are Messrs. Alain Rhéaume (Chairman), Douglas G. Bassett and André Caillé.

Audit Committee Financial Expert

The Board of Directors of the Registrant has reviewed the definition of “audit committee financial expert” under paragraph 8(b) of General Instruction B to Form 40-F and determined that the Registrant has at least one audit committee financial expert. As of December 17, 2008 the name of the audit committee financial expert of the Registrant is Mr. Alain Rhéaume. All members of the Audit Committee are “independent” within the meaning of Section 303A(6) of the New York Exchange Standards.

The Commission has indicated that the designation of Mr. Alain Rhéaume as the audit committee financial expert of the Registrant does not (i) make Mr. Alain Rhéaume an “expert” for any purpose, including without limitation for purposes of Section 11 of the Securities Act of 1933, as amended, as a result of this designation; (ii) impose any duties, obligations or liability on Mr. Alain Rhéaume that are greater than those imposed on him as a member of the audit committee and the Board of Directors in the absence of such designation; or (iii) affect the duties, obligations or liability of any other member of the audit committee or the Board of Directors.

Principal Accountant Fees and Services

Fees payable to the Registrant’s external auditor, KPMG LLP, for the years ended December 31, 2007 and December 31, 2006, totalled $12,216,000 and $13,630,000, respectively, as detailed in the following table:

FEES | | FINANCIAL YEAR

ENDED

DECEMBER 31, 2007 | | FINANCIAL YEAR

ENDED

DECEMBER 31, 2006 | |

Audit Fees(1) | | US$ | 7,637,000 | | US$ | 11,370,000 | |

Audit-Related Fees(2) | | US$ | 2,176,000 | | US$ | 369,000 | |

Tax Fees(3) | | US$ | 2,125,000 | | US$ | 1,212,000 | |

All other Fees(4) | | US$ | 278,000 | | US$ | 679,000 | |

TOTAL FEES: | | US$ | 12,216,000 | | US$ | 13,630,000 | |

(1) | | Audit Fees consist of fees billed for the annual integrated audit and quarterly reviews of our annual and quarterly consolidated financial statements or services that are normally provided by the external auditors in connection with statutory and regulatory filings or engagements. They also include fees billed for other audit services, which are those services that only the external auditors reasonably can provide, and include the provision of comfort letters and consents, the consultation concerning financial accounting and reporting of specific issues, the review of documents filed with regulatory authorities. |

| | |

(2) | | Audit-related Fees consist of fees billed for assurance and related services that are traditionally performed by |

Table of Contents

| | the external auditors, and include consultations concerning financial accounting and reporting standards on proposed transactions; due diligence or accounting work related to acquisitions; and employee benefit plan audits. |

| | |

(3) | | Tax Fees include fees billed for tax compliance services, including the preparation of original and amended tax returns and claims for refund; tax consultations, such as assistance and representation in connection with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from taxing authorities; tax planning services; and consultation and planning services. |

| | |

(4) | | All Other Fees include fees billed for advice with respect to our internal controls over financial reporting and disclosure controls and procedures and assistance provided to obtain grants and subsidies. |

Pre-approval policies and procedures

The Registrant’s audit committee has adopted a pre-approval policy pursuant to which the Registrant may not engage the Registrant’s external auditor to carry out certain non-audit services that are deemed inconsistent with the independence of auditors under U.S. and Canadian applicable laws. The Audit Committee must pre-approve all audit services as well as permitted non-audit services. This Policy also provides that, subject to certain limitations, the Chief Financial Officer of the Corporation and Chairman of the Audit Committee may retain the Registrant’s external auditors for certain audit and non-audit services that have been pre-approved by the Audit Committee (the ¨Pre-Approved Services¨), provided, however, that the external auditors’ estimated fees for the Pre-Approved Services may not exceed $150,000 when they are retained by the Chief Financial Officer, and $250,000 when they are retained by the Chairman of the Audit Committee. All other projects must be submitted for approval to the Audit Committee. The Chief Financial Officer and Chairman of the Audit Committee report to the Audit Committee, on a quarterly basis, on all projects approved under the Pre-Approval Policy. This Policy and the list of Pre-Approved Services are reviewed by the Audit Committee on an annual basis.

For each of the years ended December 31, 2007 and 2006, none of the non-audit services described above were approved by the Audit Committee pursuant to the “de minimis exception” to the pre-approval requirement for non-audit services.

Off-Balance Sheet Arrangements

The Registrant and its subsidiaries have certain arrangements and commitments that have financial implications. These arrangements are described in Note 25 to the Registrant’s Audited Consolidated Financial Statements for the year ended December 31, 2007 included in this annual report on Form 40-F. A discussion of the Registrant’s off-balance sheet arrangements can also be found on page 27 of the Management’s Discussion and Analysis for the year ended December 31, 2007 included in this annual report on Form 40-F.

Table of Contents

Tabular Disclosure of Contractual Obligations

The following table sets forth the Registrant’s contractual obligations as at December 31, 2007:

Contractual Obligations

(in millions)

| | Payment due by period | |

Contractual Obligations | | Total | | Less than

1 year | | 1 to 3

years | | 4 to 5

years | | More than

5 years | |

| | | | | | | | | | | |

Long-term debt | | $ | 2,292.7 | | $ | 1,016.6 | | $ | 5.6 | | $ | 6.1 | | $ | 1,264.4 | |

| | | | | | | | | | | |

Capital leases | | 62.5 | | 7.1 | | 15.6 | | 18.3 | | 21.5 | |

| | | | | | | | | | | |

Interest payments on long-term debt and capital leases (1) | | 810.4 | | 150.6 | | 214.7 | | 211.9 | | 233.2 | |

| | | | | | | | | | | |

Operating leases | | 339.2 | | 95.9 | | 101.5 | | 50.6 | | 91.2 | |

| | | | | | | | | | | |

Capital asset purchase commitments | | 29.1 | | 27.1 | | 2.0 | | — | | — | |

| | | | | | | | | | | |

Total contractual cash obligations | | $ | 3,533.9 | | $ | 1,297.3 | | $ | 339.4 | | $ | 286.9 | | $ | 1,610.3 | |

(1) Interest payments were calculated using the interest rate that would prevail should the debt be reimbursed as planned, and the outstanding balance as at December 31, 2007.

For more information about the Registrant’s contractual obligations as at December 31, 2007, see pages 26 and 27 of the Management’s Discussion and Analysis included in this annual report on Form 40-F and incorporated by reference herein.

Code of Ethics

The Registrant has adopted a Code of Business Conduct, which is a code of ethics (as defined in paragraph 9(b) of General Instruction B of Form 40-F) that applies to all of the Registrant’s employees, directors and officers, including the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The text of the Code of Business Conduct of the Registrant is available on the Registrant’s website at www.quebecorworld.com in Investors Center under Corporate Governance.

Undertaking

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities

Table of Contents

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

Registrant: | QUEBECOR WORLD INC. |

| |

| |

By: | /s/ Marie-É. Chlumecky |

| Marie-É. Chlumecky |

| Corporate Secretary |

| |

| |

Date | December 15, 2008 |

Table of Contents

QUEBECOR WORLD INC.

ANNUAL INFORMATION FORM

For the Year Ended

December 31, 2007

October 17, 2008

Table of Contents

INTRODUCTORY NOTE

In this Annual Information Form, unless the context otherwise requires, the terms “we”, “us”, “our”, “Quebecor World” and the “Corporation” refer to Quebecor World Inc. on a consolidated basis, including its partnerships, subsidiaries and divisions and their respective predecessors. Unless otherwise indicated, (i) all references to “dollars,” “Cdn$” and “$” are to Canadian dollars, and (ii) the information presented in this Annual Information Form is given as at September 30, 2008.

ITEM 1 — INCORPORATION

1.1 INCORPORATION OF QUEBECOR WORLD INC.

We were incorporated on February 23, 1989 pursuant to the Canada Business Corporations Act under the name “Quebecor Printing Inc.” (“Quebecor Printing”). On January 1, 1990, our predecessor, Quebecor Printing, Quebecor Printing Group Inc., Quebecor Printing (Canada) Inc., 166599 Canada Inc., Ronalds Printing Atlantic Limited and 148461 Canada Inc. amalgamated under the name “Quebecor Printing Inc.” pursuant to the Canada Business Corporations Act. This corporate reorganization was undertaken in order to consolidate the assets of the printing sector of Quebecor Inc., our parent company, which, prior to such reorganization, consisted of a number of divisions and subsidiaries. Our Articles were amended:

(a) on December 7, 1990, in order to subdivide each outstanding share into five shares;

(b) on December 14, 1990, in order to create Series 1 Preferred Shares;

(c) on February 24, 1992, in order to delete private company restrictions;

(d) on April 10, 1992, in order to:

(i) create three new classes of shares, namely Subordinate Voting Shares, Multiple Voting Shares and First Preferred Shares, issuable in series,

(ii) reclassify and change the 39,965,005 outstanding Common Shares into 39,965,005 Multiple Voting Shares,

(iii) reclassify and change the 5,360 outstanding Series 1 Preferred Shares into 5,360 Series 1 First Preferred Shares, and

(iv) cancel the unissued Preferred Shares and Common Shares;

(e) on April 25, 1994, in order to split the Subordinate Voting Shares and the Multiple Voting Shares, so that each shareholder would receive three shares for each two shares held;

(f) on April 25, 1996, in order to permit the appointment of one or more directors during the course of the year;

(g) on November 5, 1997, in order to create Series 2 First Preferred Shares and Series 3 First Preferred Shares;

(h) on April 25, 2000, in order to change our name to “Quebecor World Inc.”;

(i) on February 21, 2001, in order to create Series 4 First Preferred Shares; and

(j) on August 10, 2001, in order to create Series 5 First Preferred Shares.

In October 2008, we moved our head office to 999 de Maisonneuve Boulevard West, Montreal, Quebec, Canada, H3A 3L4. Our telephone number at our head office is (514) 954-0101. Our fax number is (514) 954-9624 and our web site is www.quebecorworld.com. Any information or documents on our website are not, however, included in, nor shall any of such information or documents be deemed to be incorporated by reference into, this Annual Information Form.

Table of Contents

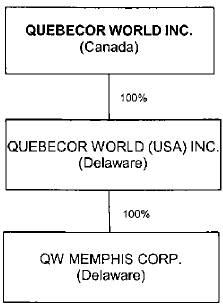

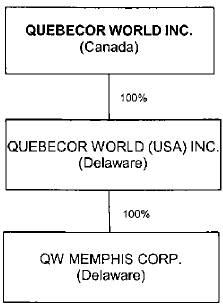

1.2 SUBSIDIARIES

Corporate Structure

The following organizational chart shows our principal subsidiaries, along with their governing jurisdiction and our ownership interest in each such subsidiary. Subsidiaries whose total assets and revenues represented (a) individually, less than 10% of our consolidated assets and revenues as at and for the financial year ended December 31, 2007 and (b) in the aggregate, less than 20% of our consolidated assets and revenues as at and for the financial year ended December 31, 2007, have not been included. We completed the sale of our European operations on June 26, 2008 (see Item 2.2 of this Annual Information Form — Sale of our European Operations) and, consequently, our European holding company, Quebecor World European Holding S.A., is not presented in the corporate chart below.

ITEM 2 — RECENT DEVELOPMENTS

2.1 CREDITOR PROTECTION AND RESTRUCTURING

On January 21, 2008 (the “Filing Date”), we obtained an order (the “Initial Order”) from the Quebec Superior Court (the “Court”) granting creditor protection under the Companies’ Creditors Arrangement Act (the “CCAA”) for ourselves and for 53 U.S. subsidiaries (the “U.S. Subsidiaries” and, collectively with the Corporation, the “Applicants”). On the same date, the U.S. Subsidiaries filed a petition under Chapter 11 of the U.S. Bankruptcy Code (“Chapter 11”) in the U.S. Bankruptcy Court for the Southern District of New York (the “U.S. Bankruptcy Court”). The proceedings under the CCAA are referred to as the “Canadian Proceedings”, the proceedings under Chapter 11 are referred to as the “U.S. Proceedings” and the Canadian Proceedings and the U.S. Proceedings are collectively referred to as the “Insolvency Proceedings”. Our Latin American subsidiaries are not subject to the Insolvency Proceedings and prior to their disposition, as discussed below in Item 2.2 of this Annual Information Form — Sale of our European Operations, nor were our European subsidiaries. Pursuant to the Insolvency Proceedings, the Applicants are provided with the authority to, among other things, continue operating the Applicants’ business (subject to court approval for certain activities), file with the Court and submit to creditors a plan of compromise or arrangement under the CCAA (the “Plan”) and operate an orderly restructuring of the Applicants’ business and financial affairs, in accordance with the terms of the Initial Order. Ernst & Young Inc. (the “Monitor”) has been appointed by the Court as Monitor in the Canadian Proceedings. Pursuant to the terms of the orders made in the Insolvency Proceedings, as amended, the Monitor was appointed to monitor the business and financial affairs of the Applicants and, in connection with such role, the Initial Order imposes a number of duties and functions on the Monitor, including, but not limited to, assisting the Applicants in connection with their restructuring and reporting to the Court on the state of the business and financial affairs of the Applicants and on developments in the Insolvency Proceedings, as the Monitor

2

Table of Contents

considers appropriate. Reference should be made to the Initial Order (available on Quebecor World’s website at www.quebecorworld.com) for a more complete description of the duties and functions of the Monitor.

Chapter 11 provides for all actions and proceedings against the U.S. Subsidiaries to be stayed during the continuation of the U.S. Proceedings. The Initial Order also provides for a general stay and, pursuant to subsequent orders of the Court rendered on February 19, 2008, May 9, 2008, July 18, 2008 and September 29, 2008 respectively, this stay period was extended first to May 12, 2008 and then subsequently to July 25, 2008, September 30, 2008 and December 14, 2008 in Canada. The stay period is subject to further extensions as the Court may deem appropriate. The applicable stays generally preclude parties from taking any actions against the Applicants. The purpose of the stay period and the Insolvency Proceedings is to provide the Applicants the opportunity to stabilize their operations and businesses and to develop a business plan, all with a view to proposing a final Plan. Any such Plan will be subject to approval by affected creditors, as well as court approval.

As discussed in Note 16 to our Audited Consolidated Financial Statements for the financial year ended December 31, 2007, we became in default under our revolving bank facility, our equipment financing credit facility and our North American securitization program on January 16, 2008. On January 24, 2008, pursuant to the Insolvency Proceedings entered into by the Corporation, an amount of US$417.6 million, including fees, was paid in order to terminate the North American securitization program. The Insolvency Proceedings also triggered defaults under substantially all other debt obligations of the Applicants. Generally, the Insolvency Proceedings have stayed actions against the Applicants, including actions to collect pre-filing indebtedness or to exercise control over any of the Applicants’ property. As a result of the stay, the Applicants have ceased making payments of interest and principal on substantially all of their pre-petition debt obligations (i.e. debt obligations that pre-date the Insolvency Proceedings). The orders granted in the Insolvency Proceedings have provided the Applicants with the authority, among other things: (a) to pay outstanding and future employee wages, salaries and benefits; (b) to make rent payments under existing arrangements payable after the Filing Date; and (c) to honour obligations to customers.

The Applicants are in the process of developing comprehensive business and financial plans, which will serve as a basis for discussions with stakeholders, with the advice and guidance of their financial advisors and the Monitor. The Applicants presented their business plan to the Ad Hoc Bondholder Group, the Bank Syndicate and the Official Committee of Unsecured Creditors (collectively, the “Committees”) at the beginning of June 2008. An overview of the Applicants five-year business plan was presented as well as details related to each of the major business segments. The business plan that was presented will serve as a basis for discussions with the creditor constituencies in anticipation of the formulation of a Plan or Plans of reorganization and, subject to receipt of necessary approvals from affected creditors, the Court and the U.S. Bankruptcy Court, the Applicants will implement one or more Plans. There can be no assurance, however, that a successful Plan or Plans of reorganization will be proposed by the Applicants, supported by the Applicants’ creditors or confirmed by the Court and the U.S. Bankruptcy Court, or that any such Plan or Plans will be consummated.

On September 29, 2008, the Court authorized us to conduct a claims procedure for the identification, resolution and barring of claims against us in Canada. The Canadian claims procedure contemplates that any person with any claim against us of any kind or nature, with the exception of certain excluded claims, must file its claim with the Monitor on or prior to December 5, 2008.

Pursuant to orders entered by the U.S. Bankruptcy Court, the U.S. Subsidiaries filed their schedule of assets and liabilities and a statement of financial affairs on July 18, 2008. On September 29, 2008, concurrently with the order granted by the Court with respect to the Canadian claims procedure, the U.S. Bankruptcy Court authorized the U.S. Subsidiaries to conduct a claims procedure with December 5, 2008 as the bar date by which all creditors of the U.S. Subsidiaries must file proofs of their respective claims and interests against the U.S. Subsidiaries.

At this time, it is not possible to determine the extent of the claims that may be filed, whether or not such claims will be disputed, or whether or not such claims will be subject to discharge in the Insolvency Proceedings. It is also not possible at this time to determine whether to establish any additional liabilities in respect of claims. Once all claims against the Applicants have been filed, the Applicants will review all claims filed and begin the claims reconciliation process. In connection with the review and reconciliation

3

Table of Contents

process, the Applicants will also determine the additional liabilities, if any, that should appropriately be established in respect of such claims.

Another important step in our restructuring activities has been the sale of our European operations to a subsidiary of Hombergh Holdings B.V. (“HHBV”), a Netherlands-based investment group. On June 17, 2008, the Court and the U.S. Bankruptcy Court approved the proposed sale transaction, which closed on June 26, 2008. Under the terms of the agreement, the Corporation received €52.2 million in cash at closing and HHBV issued a €21.5 million five-year note bearing interest at 7% per year payable to Quebecor World. The sale was made substantially on an “as is, where is” basis (see Item 2.2 of this Annual Information Form — Sale of our European Operations).

Should the stay period and any subsequent extensions, if granted, not be sufficient to develop and present a Plan or should the Plan not be accepted by affected creditors and, in any such case, the Applicants lose the protection of the stay of proceedings, substantially all debt obligations of the Applicants will then become due and payable immediately, creating an immediate liquidity crisis which would in all likelihood lead to the liquidation of the Applicants’ assets. Failure to implement a Plan and obtain sufficient exit financing within the time granted by the Court and the U.S. Bankruptcy Court will also result in substantially all of the Applicants’ debt obligations becoming due and payable immediately, which would in all likelihood lead to the liquidation of the Applicants’ assets.

As detailed in Note 29 to our Audited Consolidated Financial Statements for the financial year ended December 31, 2007, our UK subsidiary was placed into administration on January 28, 2008.

On September 29, 2008, the Court granted an order lifting the stay of proceedings for the sole purpose of permitting certain of our noteholders to file a paulian action (namely, an action by which a creditor who suffers prejudice through a juridical act made by its debtor in fraud of its rights seeks to obtain a declaration that the act may not be set up against it) against, inter alia, us, contesting the opposability of security granted by Quebecor World and certain of our subsidiaries in September and October 2007 to the lenders under our credit facility at such time. The order expressly provides that, immediately following the issuance and service of the paulian action, all further proceedings with respect to such paulian action be immediately stayed until further order of the Court.

Furthermore, on September 29, 2008, we were authorized by the Court to enter into a share purchase agreement providing for the sale to Bandhu Industrial Resources Private Limited of our interest in TEJ Quebecor Printing Limited (“TQPL”), which operates a printing facility located in Gurgaon, India. If completed, the transaction would also include a loan settlement agreement with respect to certain loans owing by TPQL to the Corporation and master release and indemnity agreement(s) between the purchaser and TQPL concerning certain of our liabilities in relation to TQPL and the printing facility. It is currently estimated that the total net consideration payable to us would be US$150,000. The transaction is not conditional on obtaining any further approval of the Court.

Contributing Factors

Quebecor World’s financial performance has suffered in the past few years, especially with respect to our European operations, which were funded, in part, with cash flows generated by our North American operations, as a result of a combination of factors, including declining prices and sales volume, and temporary disturbances and inefficiencies caused by a major retooling and restructuring of our printing operations initiated in 2004. The combination of significant capital investments and continued operating losses, principally incurred in connection with our European operations, resulted in increased financing needs. During the last quarter of 2007, it was also necessary for us to repurchase certain senior notes (see Item 9.3 of this Annual Information Form — Senior Notes, and Note 16(c) to our Audited Consolidated Financial Statements for the financial year ended December 31, 2007) in order to avoid breaching certain financial ratios, while also facing reduction in amounts available under our revolving bank facility.

More recent events further hindered our efforts to improve our balance sheet and financial position. First, on November 20, 2007, we announced the withdrawal of a refinancing plan previously announced on November 13, 2007 due to adverse financial market conditions. Second, on December 13, 2007, we

4

Table of Contents

announced that we would not be able to consummate a previously announced transaction to sell/merge our European operations, which otherwise would have resulted in proceeds being paid to us.

On December 31, 2007, we obtained a waiver from our bank syndicate lenders and from the sponsors of our North American securitization program, subject to the satisfaction of certain conditions and refinancing milestones, including obtaining $125 million in new financing by January 15, 2008. On January 16, 2008, we failed to satisfy the conditions and refinancing milestones set by the bank syndicate lenders, which resulted in the Corporation and certain of our subsidiaries being in default of our obligations under our revolving bank facility, our equipment financing credit facility and our North American securitization program (see Item 9 of this Annual Information Form — Description of Certain Indebtedness, and Note 16 to our Audited Consolidated Financial Statements for the financial year ended December 31, 2007).

As a result of our unsuccessful efforts to obtain new financing, the inability at the time to conclude the proposed sale of our European operations and our operational demands, by mid-January 2008, we were experiencing a severe lack of liquidity and concluded we no longer had the ability to meet obligations which were falling due.

2.2 SALE OF OUR EUROPEAN OPERATIONS

On June 26, 2008 we announced the completion of the previously announced sale of our European operations to a subsidiary of HHBV, a Netherlands-based investment group. The transaction is valued at approximately €135 million.

Upon closing of the transaction, we received €52 million in net cash proceeds, less certain customary deductions and expenses permitted by our DIP Credit Agreement (as defined in Item 4 of this Annual Information Form — Highlights for the Last Three Financial Years), which we used to partially reimburse indebtedness under such credit facility. HHBV also assumed approximately €61 million of net debt, and it issued a €21.5 million five-year note bearing interest at 7% per year payable to us. The sale was made substantially on an “as is, where is” basis and was not subject to the approval of either Quebecor World’s or HHBV’s shareholders. The only condition to closing was its approval by the Court and the U.S. Bankruptcy Court pursuant to the Insolvency Proceedings, which was obtained on June 17, 2008.

At the time we sold our European operations, they consisted of 16 printing and related facilities employing approximately 3,500 people in Austria, Belgium, Finland, France, Spain and Sweden producing magazines, catalogs, retail inserts, direct mail products, books and directories.

2.3 CREATION OF THE MARKETING SOLUTIONS GROUP AND THE PUBLISHING SERVICES GROUP

On June 16, 2008, we announced the merging of our U.S. Retail Insert, Catalog, Sunday Magazine and Direct Mail divisions into a new integrated Marketing Solutions Group to better serve the marketing and advertising needs of our customers in multiple markets including retail, direct marketing, Sunday magazine, agency and financial services. The Marketing Solutions Group produces direct mail products, retail inserts, catalogs and Sunday Magazines in a coast-to-coast integrated network of more than 20 facilities in the United States. We expect that this operating and sales structure will allow us to improve our operational efficiency and enhance our integrated product offering to all our customers.

Subsequently, on June 17, 2008, we announced the integration of our U.S. Magazine, Book and Directory Divisions into the Publishing Services Group, as well as the merging of our U.S. Pre-Media and Logistics divisions into a single operating structure. The new Publishing Services Group is intended to streamline our operations, improve services, and better serve existing and new publishing customers.

We expect that this enhanced operating structure, comprising three U.S. divisions — Marketing Solutions Group, Publishing Services Group and Pre-Media and Logistics Group — instead of six, will result in greater synergies, shared resources and faster decision-making with a focus on delivering complete value-added solutions to two principal customer bases, multi-channel marketers and publishers. Our two other business groups are Canada and Latin America.

5

Table of Contents

ITEM 3 — NARRATIVE DESCRIPTION OF THE BUSINESS

The description of our current business, including the number of our facilities, presses and equipment, contained in this Annual Information Form takes into account and reflects the completion of the sale of our European operations, which occurred on June 26, 2008. For more information on the sale of our European operations, please refer to Item 2.2 of this Annual Information Form — Sale of our European Operations.

3.1 BUSINESS OVERVIEW

3.1.1 Our Business

We are a leader in providing high-value, complete market solutions, including pre-print, print and post-print services to leading retailers, branded goods companies, catalogers as well as to leading publishers of magazines, books, directories and other printed media. We are also one of the few commercial printers able to serve customers on a regional, national and international basis. We are a leader in most of the services that we offer in our principal geographic markets. Our market-leading positions have been established through a combination of building long-term partnerships with the world’s leading print media customers, investing in key strategic technologies and expanding operations through acquisitions.

We have 99 printing and related facilities located in North America, Latin America and Asia. In the United States, we are the second largest commercial printer with 76 facilities in 28 states, and we are a leader in the printing of books, magazines, directories, retail inserts, catalogs and direct mail. We are the second largest commercial printer in Canada with 15 facilities in five provinces through which we offer a diversified mix of printed products and related value-added services to the Canadian market and internationally. We are also the largest commercial printer in Latin America, with seven facilities operating in Argentina, Brazil, Chile, Colombia, Mexico and Peru, and we have one facility in India. We operate both rotogravure and web offset presses in our various facilities, which provide our customers long-run, short-run and multi-versioning options as well as a variety of other value-added services, and which also enable us to print simultaneously for our customers in multiple facilities reducing cycle time and transportation costs.

The table below summarizes the location of our printing and related facilities and the services offered by such facilities:

LOCATION | | # OF

FACILITIES | |

| | | |

UNITED STATES (Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Utah, Virginia, West Virginia and Wisconsin) | | 76 | |

| | | |

CANADA (Alberta, British Columbia, Nova Scotia, Ontario and Quebec) | | 15 | |

| | | |

LATIN AMERICA (Argentina, Brazil, Chile, Colombia, Mexico and Peru) | | 7 | |

| | | |

ASIA (India) | | 1 | |

| | | |

TOTAL: | | 99 | |

6

Table of Contents

Our primary print services groups in the United States are the Marketing Solutions Group and the Publishing Services Group. We also offer to our customers various services in our Pre-Media and Logistics Group. Our customers include many of the largest publishers, retailers and catalogers in the geographic areas in which we operate and for the services that we offer. Our Marketing Solutions Group integrates all our activities related to U.S. retail inserts, catalogs, Sunday magazines and direct mail. With respect to retail inserts, our customers include Sears, JC Penney, Kohl’s, Albertson’s, Comp USA, Wal-Mart, RONA and Petco. We print catalogs for customers such as Williams-Sonoma, Blair Corporation, Bass Pro, Redcats and Victoria’s Secret. Our Publishing Services Group comprises our book, magazine and directory print services. Our book publishing customers include Reader’s Digest Association, McGraw-Hill, Scholastic, Harlequin Enterprises, Thomas Nelson, Simon & Schuster and Imagitas, Inc. We print magazines for publishers including Time, Hearst, Hachette, Primedia, Wenner Media, Meister Media Worldwide, Stamats Business Media Amos Publishing, Reader’s Digest Association and Affinity Group Inc. Our directories customers include Dex Media, Yellow Book USA and Yellow Pages Group (Canada).

Our two other business groups are Canada and Latin America, which both offer a variety of print, pre-media and logistics services to marketers, retailers and publishers in their respective geographical areas.

3.1.2 Industry Overview

Commercial printing is a highly fragmented, capital-intensive industry. The North American and Latin American printing industries are very competitive in most product categories and geographic regions. We believe that the ten largest competitors in the North American commercial printing market have less than 25% of the total share of each of their respective markets. In 2006, in the United States alone, there were approximately 30,700 commercial printers.

Commercial printers tend to compete within each product category based on price, quality, range of services offered, distribution capabilities, customer service, availability of printing time on appropriate equipment and state-of-the-art technology. Small competitors are generally limited to servicing customers for a specific product category within a regional market. Larger and more diversified commercial printers with greater geographic coverage, such as us, have the ability to serve national and international customers across multiple print service categories.

We believe that the trend towards consolidation will continue as larger commercial printers displace medium-size printers and regional competitors. Industry trends in Latin America, which are mirroring historical developments in North America, indicate that this market may also undergo consolidation.

In addition, technological changes continue to increase the accessibility and quality of electronic alternatives to traditional delivery of printed documents through the increased use of the Internet and the electronic distribution of media content, documents and data. While the acceleration of consumer acceptance of such electronic media will probably continue to increase, we believe that the value and role of printed media should continue to play a strong role in marketing, advertising and publishing because, in our view, print media is an efficient and effective vehicle to market and advertise products. We believe that in a multichannel marketing strategy, print should continue to play a key and important role. We further believe that a significant percentage of the purchases over the Internet are based upon a buying decision based upon a catalog or retail insert, and that print plays a synergistic role with many of the new technologies.

3.2 DESCRIPTION OF SEGMENTS AND PRINT SERVICES

We operate in the commercial print media segment of the printing industry and our business segments are located in two main geographical regions: North America and Latin America. In the United States, our print services are offered by three business groups: the Marketing Solutions Group, the Publishing Services Group and the Pre-Media and Logistics Group.

Our two other business groups are Canada and Latin America. The Canadian and Latin American business groups both offer the same broad range of print services as our three U.S. business groups, such as retail inserts, magazines, catalogues, books, directories and, in the case of Canada only, direct mail products, as well as before and after print services such as complete pre-media solutions.

7

Table of Contents

3.2.1 Marketing Solutions Group

Our Marketing Solutions Group was created on June 16, 2008. Through our Marketing Solutions Group, we offer and provide print services related to retail inserts, catalogs, Sunday magazines and direct mail (see Item 2.3 of this Annual Information Form — Creation of the Marketing Solutions Group and the Publishing Services Group).

· Retail Inserts

Our major retail insert customers include some of the largest retailers in North America and Latin America, such as CVS (Consumer Value Stores), JC Penney, Kohl’s, Sears, RONA, Comp USA, Wal-Mart, Petco and Walgreens. We believe that we are the leading retail insert printer in North America, where our unique coast-to-coast rotogravure and web offset network provides retailers with a dual-process option for long-run and multi-versioned advertising campaigns.

· Catalogs

We are one of the largest printers of catalogs in North America. Our catalog customer base includes Williams-Sonoma, Oriental Trading Company, Victoria’s Secret, IKEA, Cabellas, Bass Pro, Blair Corporation, Redcats and many others. We offer special catalog services, such as list services, to help customers compile effective lists for distribution, co-mailing, co-stitching and selective-binding capacity, as well as providing ink-jet addressing and messaging to personalize messages for each recipient. These and other value-added services allow our customers to vary catalog content to meet their customers’ demographic and purchase patterns. Our geographic reach also allows us to offer our customers one-stop shopping for all of their catalog needs.

· Sunday Magazines

We believe that we are the industry leader in the production of the major weekend newspaper magazines, Parade and USA Weekend, as well as locally edited and distributed titles. These are four-color magazines inserted in major-market weekend newspapers. We also print comic books for leading companies.

· Direct Mail

We are a North American industry leader in direct mail production. Two of our facilities, located in Atlanta, GA and Effingham, IL, are direct mail mega-facilities that provide complete direct mail production services from the data programming stages through to bulk mailing. We can produce everything from traditional direct mail packages to complex personalized in-line finished packages. Approximately 90% of the manufacturing (except for conventional envelopes) is done in-house thereby streamlining the production process and reducing cycle time and transportation costs. Our sophisticated inkjet imaging technology allows us to apply variable messages in up to sixteen different locations on a single printed piece and in virtually any font or color with resolutions of up to 240 dpi.

Furthermore, we have the capability to combine and co-ordinate all the pieces of multi-component marketing materials in virtually one pass through the press. By combining these features with our highly complex in-line imaging capability, we can provide clients with more targeted and personalized marketing vehicles.

3.2.2 Publishing Services Group

Our Publishing Services Group was created on June 17, 2008 and integrates our books, magazines and directories print services (see Item 2.3 of this Annual Information Form — Creation of the Marketing Solutions Group and the Publishing Services Group).

· Books

We are a North American industry leader in book manufacturing. We print books for many of the world’s leading publishers, including McGraw-Hill, Scholastic, Harlequin Enterprises, Simon & Schuster, Thomas Nelson, Time-Warner, Reader’s Digest Association, Imagitas and Pearson Education. We are an industry leader in the application of new technologies for book production, including electronic pre-media,

8

Table of Contents

information networking and digital printing. With facilities in North America and Latin America, we serve more than 750 book publishing customers internationally.

Our Latin American platform serves as a competitive alternative to Asia in the printing of books. It is also well positioned to service North American book publishers in the printing of books for which time-to-market is not as significant a factor.

In keeping with our full-service approach, we also provide on-demand digital printing services for small quantities of books, brochures, technical documents and similar products to be produced quickly and at a relatively low cost.

In April 2006, we announced that we were significantly enhancing service to our international book customers through the implementation of our three-year strategic investment plan and through improved integration of our book platform. This investment plan forms part of our long-term strategic plan to meet the changing needs of the publishing industry, and we believe that it will permit our U.S. book facilities to become more focused on specializing in specific product lines. This specialization, combined with new equipment, including two new wide-web MAN presses (Fairfield, PA) and the installation of new computer-to-plate systems and casing in equipment (Fairfield, PA and Martinsburg, WV), will permit these facilities to improve efficiencies and better serve our book customers. In the mass-market segment, we completed the installation of two Timson presses in July 2007. These new presses are designed to deliver faster set-up and greater throughput than other wide-web presses in the market today. In the reference and educational book segment, in addition to new, more efficient presses, we will be offering our customers improved binding capacity with the installation of new state-of-the-art, highly automated bindery equipment. We have also enhanced our capabilities in the rapidly growing market for digitally printed books and related products with the addition of new digital presses at facilities in Dubuque, IA and Leominster, MA.

· Magazines

We are one of the leading printers of consumer magazines in the United States. We print more than 1,000 magazine titles, including industry leading titles such as Elle for Hachette-Fillipachi Magazines US, Cosmopolitan and Good housekeeping for Hearst Corp., Maxim for Alpha Media Publishing, Forbes for Forbes Inc., ESPN The Magazine for Walt Disney Corp., In Touch Weekly for Bauer Publishing USA, Family Handyman and Weekly Reader for Reader’s Digest Association and Rolling Stone, US Weekly and Men’s Journal for Wenner Media. We operate an international print platform with operations in the United States, Canada and Latin America. As the industry leader in weekly publishing, we produce more than 15 magazine titles for Time, Inc., including Time, Sports Illustrated, People, Entertainment Weekly, Time For Kids as well as Fortune, Money, Southern Living, Cooking Light, Coastal Living, Southern Accents and People en Español.

We have invested in pre-media and post-press technology to enhance our ability to service this market by providing publishers with before and after print services. Our co-mailing and other logistics services help publishers reduce costs and improve distribution. For the production of medium to long-run magazines, we believe that we are at an advantage because our facilities have selective-binding and ink-jet-imaging capabilities and can utilize our mail analysis system.

· Directories

We are the largest directory printer in Canada and one of the leading directory printers in the United States and Latin America. We print directories for some of the largest directory publishers in the world, including Dex Media, Yellow Book USA, RH Donnelley, Windstream and Frontier in the United States, the Yellow Pages Group in Canada, as well as Telmex and Telefonica in Latin America.

3.2.3 Pre-Media and Logistics Group

We are a leader in the transition from conventional pre-press to an all-digital workflow, providing a complete spectrum of film and digital preparation services, from traditional creative services and colour separation to state-of-the-art, all-digital pre-media, as well as digital photography and digital archiving. Such pre-media services include the color electronic pre-media system, which takes art work from concept to final product, and desktop publishing, giving the customer greater control over the finished

9

Table of Contents

product. These pre-media services are especially helpful to smaller customers, who may not have the capital to employ such equipment or who may have to rely on third-party vendors, which may result in coordination and delay problems. Our specialized digital and pre-media facilities, which are strategically located close to and, in certain cases, onsite at, customers’ facilities, provide our customers high-quality, 24-hour preparatory services linked directly to our various printing facilities. In addition, our computer systems enable us to electronically exchange both images and textual material directly between us and our customers’ business locations. We believe that our integrated pre-media operations provide us with competitive advantages over traditional prepress shops that are not able to provide the same level of integrated services. Our pre-media services bring together the full range of digital technologies and pre-media assets within our corporate group that allows us to focus on providing a more comprehensive range of solutions to our customer base.

Other value-added services, including mail list, shipping and distribution expertise, ink-jet personalizing, customer-targeted binding and creative services, are increasingly demanded by our customers.

Quebecor World Logistics (“QWL”) provides logistics and mail list services for both Quebecor World as well as third-party customers, managing distribution and mailing services for catalogs, direct mail, magazine (subscriber copies and newsstand), newspaper inserts, books and bulk printed products. QWL uses scale to consolidate volume and a comprehensive menu of electronic tracking options to efficiently plan all deliveries. QWL provides customized, flexible mailing strategies based on customers’ specific in-home delivery requirements.

3.3 MANUFACTURING AND TECHNOLOGY

3.3.1 Description of Manufacturing Processes and Equipment

We use principally two types of printing processes, rotogravure and offset, which are the most commonly used commercial printing processes. Both processes have undergone substantial technological advances over the past decade, resulting in significant improvements in both speed and print quality.

· Rotogravure

The rotogravure process uses a copper-coated printing cylinder that is mechanically engraved using high-precision, computer-controlled and diamond-cutting heads. Although the engraving of the printing cylinder is relatively expensive, the printing cylinder itself is extremely durable and cost-effective per long run. The rotogravure process has an excellent reputation for the quality of its four-color reproductions on various grades of paper and the very high speed at which it is capable of running. Rotogravure also provides the advantage of offering multiple cut-off sizes. With 65 rotogravure presses, we are one of the largest world-wide printers using the rotogravure process.

The rotogravure process is well suited to long-run printing of retail inserts and circulars, weekend newspaper magazines and other high-circulation magazines and catalogs. We believe that our coast-to-coast network of rotogravure facilities in North America offers both the capacity and broad geographic presence required by large retailers and publishers. Our advanced ability in rotogravure digital pre-media also ensures more efficient and accurate production of the same insert simultaneously in multiple locations, thereby offering the customer the efficiency and cost savings of manufacturing and distribution closer to its end-use markets in reduced time frames.

· Offset

In the offset process, an inked impression from a thin metal plate is first made on a rubber cylinder, after which it is offset to paper. There are several types of offset printing processes: sheetfed and web; and heatset and coldset. Sheetfed presses print on sheets of paper, whereas web presses print on rolls of paper. Short-run printing is generally best served by sheetfed offset, whereas web offset is generally the best process for longer runs.

Heatset web offset involves a press which uses an oven to instantly set or dry the oil-based inks. This permits high speed and better quality and is best suited for printing on glossier papers (coated paper). Heatset web offset is used to print retail inserts, magazines, catalogs and books. We operate 282 heatset web offset presses.

10

Table of Contents

Coldset web offset involves a press that does not use an oven to dry the ink, instead using oil-based inks that are absorbed into the paper and dried by oxidation. Coldset web offset is used mainly to print newspapers, books, directories and some retail inserts. We operate 39 coldset web offset presses.

We also operate 60 sheetfed offset presses, which print books, promotional material, covers and direct-mail products.

3.3.2 Technology

We cooperate with large suppliers in the area of research and development of new printing technologies, materials and processes. Our capital-improvement programs include adding, replacing and upgrading existing equipment.

In the past several years, we have invested in faster, more efficient and higher quality presses. In July 2004, we announced, as part of our retooling program, our intention to purchase latest generation web offset presses targeted for the magazine, catalog, retail and book platforms of our U.S. operations. This allowed us to further improve efficiency and meet the needs of both publishers and retailers. Since July 2004, we have installed 19 new presses, due mainly to our retooling program. During this period, we permanently de-commissioned or sold over 70 presses and relocated nearly 40 presses, excluding the European operations.

Pre-media has continued to adapt to ever changing technology advancements and embrace web-enabled digital workflows as part of our offerings to customers. The latest hardware and software solutions help drive the services upstream in the creative process and downstream to print and web media options. We have deployed content management systems and services to bridge the information to multiple media channels. We have been an industry leader in bringing new on-line imaging services in conjunction with traditional pre-media services and color management, which streamline the production of pages for print. We have pioneered the digital engraving process for gravure and early adoption to computer-to-plate process for offset printing to optimize the color quality and consistency on our presses. Migration to a complete PDF workflow simplifies and standardizes the process. We also believe that we have established one of the industry’s most efficient data communications (VPN) network, capable of transmitting customer files from our pre-media centers to multiple print facility locations. Virtual Soft Proofing technology has allowed viewing of images and pages across the Internet that will ultimately improve schedules and enable last-minute changes.

We have also upgraded our U.S. rotogravure network with a view to improving efficiency and service to our magazine, catalog, retail insert and weekend newspaper magazine customers. We were one of the first commercial printers in North America to install short cut-off tabloid offset presses. These presses print more pages at faster speeds and use less paper than do conventional tabloid presses. We have also invested in new and emerging digital and web-based technologies to improve services, reduce costs and expand our range of products.

We operate a North American-wide telecommunications network, which enhances our ability to move digital files between our facilities and customers quickly, share work among facilities, and expand distribution and printing operations.

3.4 SALES AND MARKETING

Our sales and marketing activities are highly integrated and reflect an increasingly international approach to meeting customers’ needs that are complemented by product-specific sales efforts. Sales representatives are located in facilities or in regional offices throughout North America and Latin America, generally close to their customers and prospects. Each sales representative has the ability to sell into any facility in our network. This enables the customer to coordinate simultaneous printing throughout our network through one sales representative. Some larger customers prefer to centralize the purchase of printing services and, in this regard, our ability to provide broad geographical services is clearly an advantage over smaller regional competitors.

11

Table of Contents

3.5 PURCHASING AND RAW MATERIALS

The principal raw materials used in our products are paper and ink. In 2007, we spent approximately US$2.1 billion on raw materials. We exercise our purchasing power to obtain pricing, terms, quality, quality control and service in line with our status as one of the largest industry customers.

For most of our purchases, we negotiate with a limited number of suppliers to maximize our purchasing power, but we do not rely on any single supplier. Purchasing activity at both the local plant and corporate level is coordinated in order to increase and benefit from economies of scale. Inventory-control operations are also integrated into our purchasing functions, which has resulted in improvements in inventory turnover. Inventories are also managed and tracked on a regional basis, increasing the utilization of existing inventories.

We take pride in offering world-wide procurement services to our customers. We believe that our procurement office, located in Fribourg, Switzerland, provides us with a competitive advantage. By consolidating the activities formerly carried out at four regional offices, we have been able to reduce administrative costs, standardize procurement and provide customers with assured supply at attractive prices.

3.6 COMPETITIVE ENVIRONMENT

The commercial printing business is highly competitive in most product categories and geographic segments. Industry analysts consider most of the industry’s markets to be currently oversupplied, and competition is significant. Competition is largely based on price, quality, range of services offered, distribution capabilities, customer service, availability of printing time on appropriate equipment and state-of-the-art technology.

3.7 SEASONALITY OF THE CORPORATION’S BUSINESS

Operations in the print business are seasonal, with the majority of our historical operating income during the past five financial years being realized in the second half of the financial year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions.

3.8 HUMAN RESOURCES

As at June 30, 2008, we employed approximately 20,000 people in North America, of whom approximately 5,900 are covered by 45 separate collective agreements. Nine collective agreements covering approximately 300 employees are currently in negotiation. Of these, two collective agreements covering approximately 130 employees expired in 2007, and five collective agreements covering approximately 60 employees expired in 2006. In addition, two collective agreements covering approximately 100 employees will expire in 2008 and are already in negotiation. These agreements are limited to single facilities and groups of employees within these facilities.

We also employed approximately 3,000 people in Latin America as at June 30, 2008. Of this number, the majority of our employees in Latin America are either governed by agreements that apply industry-wide or by a collective agreement.

3.9 ENVIRONMENTAL REGULATIONS

We are subject to various laws, regulations and government policies relating to the generation, storage, transportation, and disposal of solid waste, to air and water releases of various substances into the environment, and to the protection of the environment in general. We believe we are in compliance with applicable laws and requirements in all material respects.

We are also subject to various laws and regulations, which allow regulatory authorities to compel (or seek reimbursement for) the cleanup of environmental contamination at our own sites and at off-site facilities where waste is or has been disposed of. We have established a provision for expenses associated with environmental remediation obligations, as well as other environmental matters, when such amounts can

12

Table of Contents

be reasonably estimated. The amount of the provision is adjusted as new information is known. We believe the provision is adequate to cover the potential costs associated with the remediation of environmental contamination found on-site and off-site as well as other environmental matters.

We expect to incur ongoing capital and operating costs to maintain compliance with existing and future applicable environmental laws and requirements, as well as to address equipment and process upgrades over the next few years as part of an overall environmental compliance plan. Furthermore, we do not anticipate that maintaining compliance with existing environmental statutes will have a material adverse effect upon our competitive or consolidated financial position.

We believe we have internal controls and personnel dedicated to compliance with all applicable environmental laws and that we provide for adequate monitoring and management of the environmental risk related to our operations. For the 2008 calendar year, we believe that there are no new environmental matters (environmental incident, promulgation of new environmental laws and regulations, soil and groundwater contamination discovery, etc.) to be reported that could have a material impact on our operations.

ITEM 4 – HIGHLIGHTS FOR THE LAST THREE FINANCIAL YEARS

In light of the Insolvency Proceedings, we are of the view that the most relevant and significant developments concerning Quebecor World are the Insolvency Proceedings, certain events leading up to the Insolvency Proceedings and events that occurred subsequent thereto as described below. Quebecor World’s prior annual information forms provide detailed descriptions of other events and developments concerning Quebecor World in prior periods.

· On November 22, 2007, we entered into a factoring program for our accounts receivable in France. Under this program (the “Factoring Program”), we entered into agreements to sell up to €47.0 million (US$69.2 million) of selected receivables with limited recourse. As at December 31, 2007, we had sold accounts receivable of €27.7 million (US$40.7 million) under the Factoring Program. As at December 31, 2007, the accounts receivable pledged totaled US$40.7 million. This Factoring Program was sold in connection with the sale of our European operations (see Item 2.2 of this Annual Information Form — Sale of our European Operations).

· On January 20, 2008, we filed for Court protection under the CCAA and on January 21, 2008, we obtained an order from the Quebec Superior Court granting creditor protection under the CCAA for Quebecor World Inc. and for 53 U.S. Subsidiaries. On the same date, the U.S. Subsidiaries filed a petition under Chapter 11 in the U.S. Bankruptcy Court. For more information on our filing for credit protection, please refer to Item 2.1 of this Annual Information Form — Creditor Protection and Restructuring.

· On January 21, 2008, in connection with the Insolvency Proceedings, we concluded a senior secured super priority debtor-in-possession credit agreement (the “DIP Credit Agreement”) with Credit Suisse and Morgan Stanley Senior Funding, Inc., as joint lead arrangers and initial lenders, and a syndicate of lenders named later. The DIP Credit Agreement provides for a US$1 billion credit facility made available to Quebecor World and Quebecor World (USA) Inc. The credit facility will expire in July 2009 unless we complete a plan of reorganization under Chapter 11 or a plan of compromise or arrangement under the CCAA prior thereto. The DIP Credit Agreement contains certain restrictions, including the obligation to respect certain covenants and financial ratios, as well as certain events of default, all of which are customary for a debtor-in-possession credit agreement. The DIP Credit Agreement is fully secured by liens on substantially all of our North American assets and on certain of our assets located in Latin America (see Item 9.1 of this Annual Information Form — DIP Credit Agreement).

· Our pre-petition revolving credit agreement has been amended by amendments dated as of January 25, 2008, February 26, 2008, March 27, 2008 and August 5, 2008, which were concluded in order to facilitate the syndication of the credit facility and to provide us with additional flexibility regarding reporting requirements and certain other covenants contained in the DIP Credit Agreement.

13

Table of Contents

· On January 28, 2008, we also announced that Quebecor World PLC, our subsidiary based in Corby, United Kingdom, had been placed into administration. This facility had experienced economic difficulties mainly due to the overcapacity of the UK printing industry, challenging market conditions and reduced demand for printing in the United Kingdom. This decision was not related to our filing for credit protection in the United States and Canada.

· On March 1, 2008, 3,975,663 of our 6.90% Series 5 Cumulative Redeemable First Preferred Shares (the “Series 5 Preferred Shares”) were converted into 51,410,291 Subordinate Voting Shares in accordance with the rights, privileges, restrictions and conditions attaching to the Series 5 Preferred Shares (see Item 10.1.4 of this Annual Information Form — General Description of Capital Structure — Preferred Shares).

· On June 1, 2008, 517,184 of our Series 5 Preferred Shares were converted into 6,799,353 Subordinate Voting Shares in accordance with the rights, privileges, restrictions and conditions attaching to the Series 5 Preferred Shares (see Item 10.1.4 of this Annual Information Form — General Description of Capital Structure — Preferred Shares).

· On June 16 and 17, 2008, we announced the merging of our U.S. Retail Insert, Catalog, Sunday Magazine and Direct Mail divisions into our Marketing Solutions Group, our U.S. Magazine, Book and Directory divisions into our Publishing Services Group and our U.S. Pre-Media and Logistics divisions into the Pre-Media and Logistics Group (see Item 2.3 of this Annual Information Form — Creation of the Marketing Solutions Group and the Publishing Services Group).

· On June 26, 2008, we announced the completion of the sale of our European operations to a subsidiary of HHBV (see Item 2.2 of this Annual Information Form — Sale of our European Operations).

· Effective September 1, 2008, 744,124 of our issued and outstanding Series 5 Preferred Shares were converted into 9,943,356 Subordinate Voting Shares in accordance with the rights, privileges, restrictions and conditions attaching to the Series 5 Preferred Shares (see Item 10.1.4 of this Annual Information Form — General Description of Capital Structure — Preferred Shares).

· On September 26, 2008, we received notices in respect of 66,601 of our remaining issued and outstanding Series 5 Preferred Shares requesting conversion into our Subordinate Voting Shares as of December 1, 2008. On or after November 27, 2008, we will announce the final conversion rate applicable to the conversion of such 66,601 Series 5 Preferred Shares into Subordinate Voting Shares scheduled to occur as of December 1, 2008 (see Item 10.1.4 of this Annual Information Form — General Description of Capital Structure — Preferred Shares).

· Finally, on September 29, 2008, in the context of the Insolvency Proceedings, we were authorized by the Court to enter into a share purchase agreement providing for the sale to Bandhu Industrial Resources Private Limited of our interest in TEJ Quebecor Printing Limited (“TQPL”), which operates a printing facility located in Gurgaon, India for an estimated total net consideration of approximately US$150,000 (see Item 2.1 of this Annual Information Form — Creditor Protection and Restructuring).

ITEM 5 — OUR DIRECTORS AND OFFICERS

5.1 OUR DIRECTORS

Our Board of Directors is currently composed of ten members. The term of office of each director expires upon the election of his or her successor unless the director resigns from office or his or her office becomes vacant by death, removal or other cause. The following table sets forth, as at September 30, 2008, the names, places of residence and principal occupations of the directors, the year of their appointment, the committees on which each director serves as a member, as the case may be, the number of Subordinate Voting Shares held by each of them as well as the directorships they hold on other public companies.

14

Table of Contents

All the information in this Item has been provided to us by the persons concerned.

Name and Place of

Residence | | Principal Occupation | | Director

Since | | Number of

Subordinate

Voting

Shares Held | | Other Directorships |

| | | | | | | | |

DOUGLAS G. BASSETT, O.C., O.,

ONT.(AC)(PC)

Ontario, Canada | | Chairman and President of Windward Investments (private investment company) | | 2007 | | — | | · Rothmans Inc. · White Raven Capital Corporation |

| | | | | | | | |

ANDRÉ CAILLÉ(HRCC)(PC)(EC)(RC)(IC)

Quebec, Canada | | Corporate Director | | 2005 | | — | | · National Bank of

· Canada

· Junex Inc. |

| | | | | | | | |

MICHÈLE DESJARDINS(HRCC)(NCGC)(PC)(RC)(IC)

Quebec, Canada | | President, Koby Consulting Inc. (management consultant firm) | | 2007 | | — | | None. |

| | | | | | | | |

JEAN LA

COUTURE(AC)(HRCC)(EC)(RC)(1)

Quebec, Canada | | President, Huis Clos ltée (management and mediation firm) | | 2007 | | 1,000 | | · Quebecor Inc. · Innergex Power Trust · Immunotec Inc. |

| | | | | | | | |

JACQUES MALLETTE(RC)

Quebec, Canada | | President and Chief Executive Officer of Quebecor World Inc. | | 2008 | | — | (2) | None. |

| | | | | | | | |

THE RIGHT HONOURABLE BRIAN

MULRONEY(EC)(1)

Quebec, Canada | | Chairman of the Board of Quebecor World Inc. and Senior Partner of Ogilvy Renault LLP (law firm) | | 1997 | | — | (3) | · Quebecor Inc. · Archer-Daniels-Midland Company · Barrick Gold Corporation · Cendant Corporation · Trizec Properties Inc. |

| | | | | | | | |

JEAN NEVEU(NCGC)(RC)(1)

Quebec, Canada | | Chairman of the Board of Quebecor Inc. (communications company) and Chairman of the Board of TVA Group Inc. (television broadcasting company) | | 1989 | | 3,896 | (4) | · Quebecor Inc. · TVA Group Inc. |

| | | | | | | | |

ÉRIK PÉLADEAU(1)

Quebec, Canada | | Vice Chairman of the Board of Quebecor World Inc., Vice Chairman of the Board of Quebecor Media Inc. (communications company) and Vice Chairman of the Board of Quebecor Inc. (communications holding company) | | 1989 | | 504 | (5)(6) | · Quebecor Inc. · Le Groupe Jean Coutu (PJC) inc. |

| | | | | | | | |

PIERRE KARL PÉLADEAU(EC)(1)

Quebec, Canada | | President and Chief Executive Officer of Quebecor Inc. (communications holding company), Vice Chairman of the Board and Chief Executive Officer of Quebecor Media Inc. (communications company) | | 1989 | | 25,976 | (6)(7) | · Quebecor Inc. · TVA Group Inc. |

15

Table of Contents

Name and Place of

Residence | | Principal Occupation | | Director

Since | | Number of

Subordinate

Voting

Shares Held | | Other Directorships |

| | | | | | | | |

ALAIN RHÉAUME(AC)(NCGC)(EC)(IC)(8)

Quebec, Canada | | Lead Director of Quebecor World Inc. and Managing Partner of Trio Capital (private investment firm specialized in telecommunications) | | 1997 | | — | | · Boralex Income Fund · Kangourou Media Inc. · DiagnoCure Inc. |

(AC) | | Member of our Audit Committee. |

| | |

(HRCC) | | Member of our Human Resources and Compensation Committee. |

| | |

(NCGC) | | Member of our Nominating and Corporate Governance Committee. |

| | |

(PC) | | Member of our Pension Committee. |

| | |

(EC) | | Member of our Executive Committee. |

| | |

(RC) | | Member of our Restructuring Committee. |

| | |

(IC) | | Member of our Independent Committee. |

| | |

(1) | | Each of Messrs. La Couture, Mulroney, Neveu, Érik Péladeau and Pierre Karl Péladeau is also a director of Quebecor Inc. Between April 2 and June 12, 2008, Quebecor Inc.’s directors, senior officers and certain of its current and former employees were prohibited from trading in the securities of Quebecor Inc. pursuant to a management cease trade order issued by the Autorité des marchés financiers in connection with the delay in filing its 2007 annual financial statements, first quarter 2008 interim financial statements and related management’s discussion and analysis. |

| | |

(2) | | Mr. Mallette holds 224,000 options to purchase Subordinate Voting Shares. |

| | |

(3) | | On October 31, 2001, the Board granted The Right Honourable Brian Mulroney options to subscribe for 50,000 Subordinate Voting Shares at an exercise price of $33.50 per share. In addition, on February 3, 2003, the Board granted Mr. Mulroney options to subscribe for 100,000 Subordinate Voting Shares at an exercise price of US$23.746 per share. Mr. Mulroney also owns 1,000 Class A Multiple Voting Shares of Quebecor Inc. |

| | |

(4) | | Mr. Neveu also owns 65,614 Class B Subordinate Voting Shares of Quebecor Inc. |

| | |

(5) | | Érik Péladeau owns 140 Class B Subordinate Voting Shares of Quebecor Inc. and he controls Cie de Publication Alpha inc., which holds 5,200 Class B Subordinate Voting Shares of Quebecor Inc. On February 14, 2003, the Human Resources and Compensation Committee of the Corporation granted Mr. Péladeau options to subscribe for 100,000 Subordinate Voting Shares at an exercise price of $33.648 per share. |

| | |

(6) | | A trust established for the benefit of Érik Péladeau and Pierre Karl Péladeau has voting control of Quebecor Inc., the Corporation’s controlling shareholder, with 17,508,964 Class A Multiple Voting Shares and 19,800 Class B Subordinate Voting Shares of Quebecor Inc., representing 67.09% of all voting interests in Quebecor Inc. |

| | |

(7) | | Pierre Karl Péladeau also owns 3,200 Class A Multiple Voting Shares and 25,000 Class B Subordinate Voting Shares of Quebecor Inc. |

| | |