UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2007

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-14160

PAINCARE HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Florida | | 06-1110906 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1030 N. Orange Avenue, Suite 105, Orlando, Florida 32801

(Address of Principal Executive Offices)

(407) 367-0944

(Registrant’s Telephone Number)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of May 18, 2007 there were 67,470,158 outstanding shares of the Registrant’s common stock, $0.0001 par value.

PAINCARE HOLDINGS, INC.

INDEX

2

PAINCARE HOLDINGS, INC.

Consolidated Balance Sheets

As of March 31, 2007 and December 31, 2006

| | | | | | | | |

| | | March 31, 2007 | | | December 31,

2006 | |

| | | (unaudited) | | | | |

| Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 2,623,725 | | | $ | 3,180,542 | |

Accounts receivable, net | | | 11,382,743 | | | | 10,744,604 | |

Deposits and prepaid expenses | | | 808,979 | | | | 1,541,540 | |

Current deferred tax asset | | | 2,141,299 | | | | 1,785,386 | |

Income tax receivable | | | 5,156,712 | | | | 4,135,375 | |

Current assets of discontinued operations | | | 9,327,261 | | | | 9,732,008 | |

| | | | | | | | |

Total current assets | | | 31,440,719 | | | | 31,119,455 | |

Property and equipment, net | | | 9,457,675 | | | | 9,579,704 | |

Goodwill, net | | | 87,490,877 | | | | 88,263,819 | |

Other assets | | | 3,872,372 | | | | 4,016,010 | |

Non-current assets of discontinued operations | | | 29,029,513 | | | | 30,262,937 | |

| | | | | | | | |

Total assets | | $ | 161,291,156 | | | $ | 163,241,925 | |

| | | | | | | | |

| | |

| Liabilities and Stockholders’ Equity | | | | | | | | |

Liabilities: | | | | | | | | |

Accounts payable and accrued expenses | | $ | 6,442,330 | | | $ | 5,634,124 | |

Derivative liabilities | | | 600,000 | | | | 600,000 | |

Acquisition consideration payable | | | 3,103,095 | | | | 4,026,209 | |

Current portion of notes payable | | | 34,195,868 | | | | 34,053,378 | |

Current portion of convertible debentures | | | 12,676,613 | | | | 12,415,480 | |

Current portion of capital lease obligations | | | 1,311,545 | | | | 1,383,790 | |

Current liabilities of discontinued operations | | | 1,566,951 | | | | 1,485,464 | |

| | | | | | | | |

Total current liabilities | | | 59,896,402 | | | | 59,598,445 | |

Capital lease obligations, less current portion | | | 1,657,510 | | | | 1,717,138 | |

Deferred tax liability non-current | | | 2,901,595 | | | | 2,336,704 | |

Non-current liabilities of discontinued operations | | | 11,250 | | | | 46,859 | |

| | | | | | | | |

Total liabilities | | | 64,466,757 | | | | 63,699,146 | |

| | | | | | | | |

Minority interests related to discontinued operations | | | 2,275,490 | | | | 2,191,797 | |

Commitments and contingencies | | | — | | | | — | |

Stockholders’ equity: | | | | | | | | |

| | |

Common stock, $.0001 par value. Authorized 200,000,000 shares; issued and outstanding 66,849,164 and 66,292,721 shares, respectively | | | 6,685 | | | | 6,629 | |

| | |

Preferred stock, $.0001 par value. Authorized 10,000,000 shares; issued and outstanding -0- shares | | | — | | | | — | |

Additional paid in capital | | | 143,124,782 | | | | 142,763,156 | |

Accumulated deficit | | | (48,640,692 | ) | | | (45,465,595 | ) |

Accumulated other comprehensive income | | | 58,134 | | | | 46,792 | |

| | | | | | | | |

Total stockholders’ equity | | | 94,548,909 | | | | 97,350,982 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 161,291,156 | | | $ | 163,241,925 | |

| | | | | | | | |

See accompanying notes to consolidated financial statements.

3

PAINCARE HOLDINGS, INC.

Consolidated Statements of Operations

For the Three Months Ended March 31, 2007 and 2006 (Unaudited)

| | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | | 2007 | | | 2006 | |

| | | | | | (as restated) | |

Revenues: | | | | | | | | |

Pain management | | $ | 9,622,598 | | | $ | 10,649,878 | |

Surgeries | | | 1,342,193 | | | | 1,881,030 | |

Ancillary services | | | 2,860,769 | | | | 3,828,377 | |

| | | | | | | | |

Total revenues | | | 13,825,560 | | | | 16,359,285 | |

Cost of revenues | | | 3,944,257 | | | | 2,865,889 | |

| | | | | | | | |

Gross profit | | | 9,881,303 | | | | 13,493,396 | |

General and administrative expense | | | 11,521,356 | | | | 1,345,734 | |

Impairment of goodwill | | | 229,745 | | | | — | |

Amortization expense | | | 148,745 | | | | 469,062 | |

Depreciation expense | | | 481,560 | | | | 487,996 | |

| | | | | | | | |

Operating income (loss) | | | (2,500,103 | ) | | | 11,190,604 | |

Interest income (expense) | | | (1,652,674 | ) | | | (618,094 | ) |

Derivative benefit (expense) | | | — | | | | 10,394,555 | |

Other income | | | 25,426 | | | | 87,531 | |

| | | | | | | | |

Income (loss) from continuing operations before income taxes | | | (4,127,351 | ) | | | 21,054,596 | |

Benefit (provision) for income taxes | | | 1,437,174 | | | | (3,920,837 | ) |

| | | | | | | | |

Income (loss) from continuing operations | | | (2,690,177 | ) | | | 17,133,759 | |

| | | | | | | | |

Discontinued operations: | | | | | | | | |

Income (loss) from discontinued operations (less applicable income tax (expense) benefit of $111,630 and ($794,878)) | | | (241,570 | ) | | | 91,682 | |

Loss on disposal of discontinued operations (less applicable income tax benefit of $125,362) | | | (243,350 | ) | | | — | |

| | | | | | | | |

Income (loss) from discontinued operations, net of tax | | | (484,920 | ) | | | 91,682 | |

Income (loss) from operations before a cumulative effect of a change in accounting principle | | | (3,175,097 | ) | | | 17,225,441 | |

| | | | | | | | |

Cumulative effect of a change in accounting principle (net of tax of $661,283) | | | — | | | | 991,925 | |

| | | | | | | | |

Net income (loss) | | $ | (3,175,097 | ) | | $ | 18,217,366 | |

| | | | | | | | |

Basic income (loss) per common share: | | | | | | | | |

Income (loss) from continuing operations before cumulative effect of a change in accounting principle | | $ | (.04 | ) | | $ | .28 | |

| | | | | | | | |

Income (loss) from discontinued operations | | $ | (.01 | ) | | $ | — | |

| | | | | | | | |

Cumulative effect of a change in accounting principle | | $ | — | | | $ | .02 | |

| | | | | | | | |

Net income (loss) | | $ | (.05 | ) | | $ | .30 | |

| | | | | | | | |

Diluted income (loss) per common share: | | | | | | | | |

Income (loss) from continuing operations before cumulative effect of a change in accounting principle | | $ | (.04 | ) | | $ | .24 | |

| | | | | | | | |

Income (loss) from discontinued operations | | $ | (.01 | ) | | $ | — | |

| | | | | | | | |

Cumulative effect of a change in accounting principle | | $ | — | | | $ | .01 | |

| | | | | | | | |

Net income (loss) | | $ | (.05 | ) | | $ | .25 | |

| | | | | | | | |

See accompanying notes to consolidated financial statements.

4

PAINCARE HOLDINGS, INC.

Consolidated Statements of Cash Flows

For the Three Months Ended March 31, 2007 and 2006 (Unaudited)

| | | | | | | | |

| | | 2007 | | | 2006 | |

| | | | | | (as restated) | |

Cash flows from operating activities: | | | | | | | | |

Net income (loss) | | $ | (3,175,097 | ) | | $ | 18,217,366 | |

Income (loss) from discontinued operations, net of tax | | | 484,920 | | | | (91,682 | ) |

Cumulative effect of a change in accounting principle, net of tax | | | — | | | | (991,925 | ) |

| | | | | | | | |

Income (loss) from continuing operations | | | (2,690,177 | ) | | | 17,133,759 | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 630,305 | | | | 957,058 | |

Impairment of goodwill | | | 229,745 | | | | — | |

Non-cash compensation | | | 66,234 | | | | (9,249,269 | ) |

Loss on disposal of property and equipment | | | 21,790 | | | | — | |

Amortization of debt discount | | | 570,737 | | | | 376,384 | |

Stock issued for interest payments | | | 194,140 | | | | 196,050 | |

Mark to market derivatives | | | — | | | | (10,394,555 | ) |

Non-cash interest for forbearance fees | | | 832,500 | | | | — | |

Other comprehensive income | | | 11,342 | | | | (489 | ) |

Change in operating assets and liabilities, net of assets acquired: | | | | | | | | |

Accounts receivable | | | (1,044,455 | ) | | | (1,404,643 | ) |

Deposits and prepaid expenses | | | 478,951 | | | | 135,314 | |

Other assets | | | 109,721 | | | | 41,318 | |

Deferred income taxes | | | 589,050 | | | | 4,466,508 | |

Income tax payable | | | (1,021,336 | ) | | | (746,388 | ) |

Accounts payable and accrued expenses | | | (141,317 | ) | | | (421,641 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities from continuing operations | | | (1,162,770 | ) | | | 1,089,406 | |

Net cash used in operating activities attributable to discontinued operations | | | (467,099 | ) | | | (641,983 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | (1,629,869 | ) | | | 447,423 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Purchase of property and equipment | | | (103,816 | ) | | | (377,072 | ) |

Cash paid for earnouts | | | (25,000 | ) | | | (5,808,668 | ) |

Cash used for acquisitions | | | (118,414 | ) | | | (9,664,286 | ) |

Cash from disposition | | | 1,064,411 | | | | 105,250 | |

| | | | | | | | |

Net cash provided by (used in) investing activities from continuing operations | | | 817,181 | | | | (15,744,776 | ) |

Net cash provided by (used in) investing activities attributable to discontinued operations | | | (83,071 | ) | | | 506,838 | |

| | | | | | | | |

Net cash provided by (used in) investing activities | | | 734,110 | | | | (15,237,938 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance of convertible debentures, net of offering costs | | | — | | | | 4,090,707 | |

Payments of capital lease obligations | | | (341,202 | ) | | | (364,964 | ) |

Due from stockholders | | | — | | | | (2,170,722 | ) |

| | | | | | | | |

Net cash provided by (used in) financing activities from continuing operations | | | (341,202 | ) | | | 1,555,021 | |

| | | | | | | | |

Net cash provided by (used in) financing activities attributed to discontinued operations | | | 190,322 | | | | (491,192 | ) |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | (150,880 | ) | | | 1,063,829 | |

| | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | (1,046,639 | ) | | | (13,726,686 | ) |

Cash and cash equivalents at beginning of period includes cash from discontinued operations of $807,077 and $662,415 | | | 3,987,619 | | | | 22,713,165 | |

| | | | | | | | |

Cash and cash equivalents at end of period includes cash from discontinued operations of $317,254 and $1,305,379 | | $ | 2,940,980 | | | $ | 8,986,479 | |

| | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | |

Cash paid during the period for interest | | | 1,170,230 | | | | 1,082,816 | |

Cash received (paid) for taxes | | | 1,005,779 | | | | (1,767,500 | ) |

Non-cash investing and financing transactions: | | | | | | | | |

Common stock issued for acquisitions | | | — | | | | 9,624,459 | |

Common stock issued for contingent consideration | | | 101,308 | | | | 6,196,358 | |

Acquisition consideration payable | | | 3,103,095 | | | | 257,400 | |

Common stock issued for common stock payable | | | — | | | | 5,405,601 | |

Equipment financed with capital lease obligations | | | 229,363 | | | | — | |

See accompanying notes to consolidated financial statements.

5

PAINCARE HOLDINGS, INC.

Consolidated Statements of Stockholders’ Equity

For the Three Months Ended March 31, 2007 (Unaudited)

| | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | Additional Paid in Capital | | Accumulated Deficit | | | Accumulated Other Comprehensive Income | | Total Stockholders’ Equity | |

| | | Shares | | Amount | | | | |

Balances at December 31, 2006 | | 66,292,721 | | $ | 6,629 | | $ | 142,763,156 | | $ | (45,465,595 | ) | | $ | 46,792 | | $ | 97,350,982 | |

Common stock issued for earnouts- RMG | | 56,822 | | | 6 | | | 38,633 | | | | | | | | | | 38,639 | |

Common stock issued for earnouts- SOPC | | 169,376 | | | 17 | | | 62,652 | | | | | | | | | | 62,669 | |

Common stock options issued to employees | | | | | | | | 66,234 | | | | | | | | | | 66,234 | |

Common stock issued for debenture interest payments | | 330,245 | | | 33 | | | 194,107 | | | | | | | | | | 194,140 | |

Components of comprehensive loss: | | | | | | | | | | | | | | | | | | | |

Translation adjustment | | | | | | | | | | | | | | | 11,342 | | | 11,342 | |

Net income (loss) | | | | | | | | | | | (3,175,097 | ) | | | | | | (3,175,097 | ) |

| | | | | | | | | | | | | | | | | | | |

Comprehensive income (loss) | | | | | | | | | | | | | | | | | | (3,163,755 | ) |

| | | | | | | | | | | | | | | | | | | |

Balances at March 31, 2007 | | 66,849,164 | | | 6,685 | | | 143,124,782 | | | (48,640,692 | ) | | | 58,134 | | | 94,548,909 | |

| | | | | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

6

(1) Organization and Basis of Presentation

Basis of Presentation

PainCare Holdings, Inc. (“the Company”) is a provider of pain-focused medical and surgical solutions. Through its proprietary network of acquired or managed physician practices and ambulatory surgery centers, and in partnership with independent physician practices and medical institutions throughout the United States and Canada, PainCare is committed to utilizing the most advanced science and technologies to diagnose and treat pain stemming from neurological and musculoskeletal conditions and disorders.

The accompanying unaudited condensed consolidated financial statement of the Company and its subsidiaries should be read in conjunction with the consolidated financial statements and accompanying notes filed with the U.S. Securities and Exchange Commission (the “SEC”) in PainCare’s 2006 Annual Report on Form-10-K (the “2006 Form 10-K”). The unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the SEC applicable to interim financial information. Certain information and note disclosures included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) have been omitted in these interim statements, as allowed by such SEC rules and regulations. The balance sheet as of March 31, 2007 has been derived from unaudited financial statements, but it does not include all disclosures required by GAAP. However, we believe the disclosures are adequate to make the information presented not misleading.

The unaudited results of operations for the interim periods shown in these financial statements are not necessarily indicative of operating results for the entire year. In our opinion, the accompanying condensed financial statements recognize all adjustments for a normal recurring nature considered necessary to fairly state the financial position, results of operations, and cash flows for each interim period presented.

Reclassifications

Certain financial results have been reclassified to conform to the current period presentations. Such reclassifications primarily relate to subsidiaries we sold or have listed as available for sale in the three months ended March 31, 2007 that qualify under Financial Accounting Standards Board (“FASB”) Statement No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets, to be reported as discontinued operations. We reclassified our condensed consolidated balance sheet for the year ended December 31, 2006 and our condensed statement of operations’ comprehensive income and statement of cash flows for the three months ended March 31, 2006 to show the results of those qualifying subsidiaries. The Company also reclassified these subsidiaries for the three months ended March 31, 2007 as discontinued operations.

Use of Estimates

The preparation of financial statements in conformity with United States generally accepted accounting principles requires the Company to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. The more significant estimates relate to revenue recognition, contractual allowances and uncollectible accounts, intangible assets, accrued liabilities, derivative liabilities, income taxes, litigation and contingencies. Estimates are based on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances, the results of which form the basis for judgments about results and the carrying values of assets and liabilities. Actual results and values may differ significantly from these estimates.

Cash and Cash Equivalents

The Company has a qualified cash requirement from the HBK Investments credit facility. This requires the Company to maintain a minimum consolidated balance of $2,000,000 in cash and cash equivalents at all times.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are depreciated over the shorter of the term of the lease, including renewal periods when appropriate, or the estimated useful lives of the improvements. Expenditures for repairs and maintenance are charged to expense as incurred. Expenditures for betterments and major improvements are capitalized and depreciated over the remaining useful life of the asset. The carrying amounts of assets sold or retired and related accumulated depreciation are eliminated in the year of disposal and the resulting gains and losses are included in other income or expense. The useful lives of operating equipment range from five to ten years, and the depreciation period for leasehold improvements ranges from three to ten years.

Property and equipment, net at March 31, 2007 and December 31, 2006, consisted of:

| | | | | | | | |

| | | March 31,

2007 | | | December 31,

2006 | |

Furniture, fixtures equipment | | $ | 7,045,660 | | | $ | 6,576,926 | |

Medical equipment | | | 9,316,584 | | | | 9,425,787 | |

| | | | | | | | |

Total cost | | | 16,362,244 | | | | 16,002,713 | |

Less accumulated depreciation | | | (6,904,569 | ) | | | (6,423,009 | ) |

| | | | | | | | |

Property and equipment, net | | $ | 9,457,675 | | | $ | 9,579,704 | |

| | | | | | | | |

Accounts Receivable

This table provides the accounts receivable for the three months ended March 31, 2007 and 2006:

| | | | | | |

| | | March 31,

2007 | | December 31,

2006 |

Accounts receivable | | $ | 13,554,288 | | $ | 12,296,436 |

Less allowance for doubtful accounts | | | 2,171,545 | | | 1,551,832 |

| | | | | | |

Accounts receivable, net | | $ | 11,382,743 | | $ | 10,744,604 |

| | | | | | |

Accounts Payable and Accrued Expenses

This table provides the accounts payable and accrued expenses for the three months ended March 31, 2007:

| | | |

| | | March 31, 2007 |

Accounts payable | | $ | 2,212,673 |

Accrued interest | | | 790,405 |

Accrued salaries | | | 834,829 |

Accrued forbearance fees included in interest expense | | | 832,500 |

Accrued interest and penalties on ineffective registration statements | | | 1,314,248 |

Accrued management bonuses | | | 235,000 |

Other payable and accrued expenses | | | 222,675 |

| | | |

Accounts payable and accrued expenses | | $ | 6,442,330 |

| | | |

8

Advertising Costs

Advertising expenditures relating to marketing efforts consisting primarily of marketing material, brochure preparation, printing and trade show expenses are expensed as incurred. Advertising expense was $404,768 and $412,840 for the three months ended March 31, 2007 and 2006, respectively, and is included in general and administrative expense in the accompanying consolidated statements of operations.

Recent Accounting Pronouncements

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, “The Fair Value Option for Financial Assets and Liabilities” (“SFAS 159”). SFAS 159 provided entities the one-time election to measure financial instruments and certain other assets and liabilities at fair value on an instrument-by-instrument basis under a fair value option. SFAS 159 is effective for financial statements as of the beginning of the first fiscal year that begins after November 15, 2007. Its provision may be applied to an earlier period only if the following conditions are met: (1) the decision to adopt is made after the issuance of SFAS 159 but within 120 days after the first day of the fiscal year of adoption, and no financial statements, including footnotes, for any interim period of the adoption year have yet been issued and (2) the requirement of SFAS 157 are adopted concurrently with or prior to the adoption of SFAS 159. We are currently evaluating the provisions of SFAS 159.

In December 2006, the FASB approved EITF 00-19-2, “Accounting for Registration Payment Arrangements.” which establishes the standard that contingent obligations to make future payments under a registration rights arrangement shall be recognized and measured separately in accordance with Statement 5 and FASB Interpretation No. 14,Reasonable Estimation of the Amount of a Loss. Early adoption of EITF 00-19-2 is permitted, and the Company has elected such early adoption.

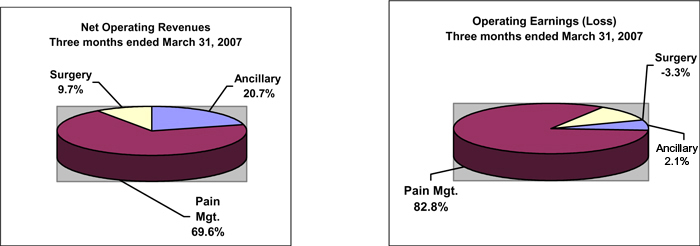

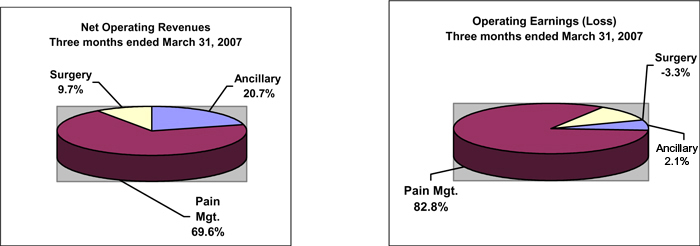

(2) Categories of Revenue

We present three categories of revenue in our statement of operations: pain management, surgeries and ancillary services. Pain management revenue is derived from our owned and managed practices, which provide pain management services. Surgery revenue is derived from our owned and managed practices, which primarily provide surgical services. Ancillary service revenue is derived from our owned and managed practices and limited management practices, which provide one or more of our ancillary services, including: orthopedic rehabilitation, electro-diagnostic medicine, intra-articular joint treatment and diagnostic imagery. Our cost of revenue is primarily physicians’ salaries and medical supplies.

We have set forth below our revenues, and operating income (loss) for continuing operations classified by the type of service we perform as well as the expenses allocated to our corporate office.

| | | | | | | | | | | | | | | | | | |

For the Three Months Ended March 31, 2007 | |

| | | Pain Management | | Surgery | | | Ancillary Services | | Corporate | | | Totals | |

Revenues | | $ | 9,622,598 | | $ | 1,342,193 | | | $ | 2,860,769 | | $ | — | | | $ | 13,825,560 | |

Operating income (loss) | | | 1,394,612 | | | (177,664 | ) | | | 112,060 | | | (3,829,111 | ) | | | (2,500,103 | ) |

|

For the Three Months Ended March 31, 2006 | |

| | | Pain Management | | Surgery | | | Ancillary Services | | Corporate | | | Totals | |

Revenues | | $ | 10,649,878 | | $ | 1,881,030 | | | $ | 3,828,377 | | $ | — | | | $ | 16,359,285 | |

Operating income (loss) | | | 2,998,534 | | | 484,923 | | | | 969,183 | | | 6,737,964 | | | | 11,190,604 | |

Pain management revenue, expense and income are attributable to one owned and ten managed practices that primarily offer physician services for pain management and physiatry. With respect to one of our managed practices, we only include the revenue recognized from management fees earned. Surgery revenue, expense and income are attributable to one owned and two managed physician practices that offer surgical physician services, including minimally invasive spine surgery. Ancillary service revenue, expense and income are attributable to two owned and three managed practices that primarily offer orthopedic rehabilitation services. We have 19 practices under limited management agreements, including orthopedic rehabilitation, electro-diagnostic medicine and real estate services.

9

(3) Income Per Common Share

Basic income per common share is computed by dividing income available to common shareholders by the weighted average number of common shares outstanding. The weighted average shares used in computing diluted income per common share include the dilutive effect of stock options, warrants, convertible debt, and other common stock equivalents using the treasury stock method, and income is adjusted for the diluted computation for the assumed non-payment of interest, etc., upon conversion. The shares used in the computation of the Company’s basic and diluted income per common share are reconciled as follows:

| | | | | | | |

| | | For the Three Months Ended

March 31, |

| | | 2007 | | | 2006 |

| Basic earnings per common share | | | | | | | |

Income from continuing operations | | $ | (2,690,177 | ) | | $ | 17,133,759 |

Income from discontinued operations | | | (484,920 | ) | | | 91,682 |

Cumulative effect of a change in accounting principle | | | — | | | | 991,925 |

| | | | | | | |

Net income available to common shareholders | | $ | (3,175,097 | ) | | $ | 18,217,366 |

| | | | | | | |

Weighted average shares | | | 66,421,742 | | | | 61,598,932 |

Basic earnings per share: | | | | | | | |

Income from continuing operations | | $ | (0.04 | ) | | $ | 0.28 |

Income from discontinued operations | | $ | (0.01 | ) | | $ | 0.00 |

Cumulative effect of a change in accounting principle | | $ | — | | | $ | 0.02 |

Net income | | $ | (0.05 | ) | | $ | 0.30 |

| Diluted earnings per common share | | | | | | | |

Net income available to common shareholders | | $ | (3,175,097 | ) | | $ | 18,217,366 |

| | | | | | | |

Plus impact of assumed conversions | | | | | | | |

Interest expense on 7.5% convertible note due 2006, net of tax | | | — | | | | 112,500 |

Interest expense on 7.5% convertible note due 2007, net of tax | | | — | | | | 16,875 |

| | | | | | | |

Net income available to common shareholders plus assumed conversions | | $ | (3,175,097 | ) | | $ | 18,346,741 |

| | | | | | | |

Weighted average shares | | | 66,421,742 | | | | 61,598,932 |

Plus incremental shares from assumed conversions | | | | | | | |

7.5% convertible note due 2006 | | | — | | | | 4,713,242 |

7.5% convertible note due 2007 | | | — | | | | 789,474 |

Employee stock option plan for vested, in the money options | | | — | | | | 3,709,895 |

Warrants issued, outstanding, and in the money | | | — | | | | 842,784 |

Adjusted weighted average shares | | | 66,421,742 | | | | 71,654,327 |

Diluted earnings per share: | | | | | | | |

Income from continuing operations | | $ | (0.04 | ) | | $ | 0.24 |

Income from discontinued operations | | $ | (0.01 | ) | | $ | 0.00 |

Cumulative effect of a change in accounting principle | | $ | — | | | $ | 0.01 |

Net income | | $ | (0.05 | ) | | $ | 0.25 |

10

Potentially dilutive shares excluded from the calculation:

Potential shares where the exercise price is greater than the average market price of common shares:

| | | | |

| | | 2007 | | 2006 |

Stock options | | 9,561,667 | | 1,405,000 |

Stock warrants | | 1,979,884 | | 2,679,884 |

Convertible debenture, issued December 17, 2003 | | 4,713,242 | | — |

Convertible debentures, issued July 1, 2004 | | 789,474 | | — |

Convertible debenture, issued August 2, 2006 | | 1,578,947 | | — |

| | | | |

Total | | 18,623,214 | | 4,084,884 |

| | | | |

| | |

Potential shares excluded in the computation of diluted shares outstanding that are anti-dilutive: | | | | |

| | |

| | | 2007 | | 2006 |

Stock options | | 228,817 | | — |

Stock warrants | | 156 | | — |

Contingent shares for acquisitions | | 506,938 | | — |

| | | | |

Total | | 735,911 | | — |

| | | | |

| | |

Total potentially dilutive shares excluded from the calculation | | 19,359,125 | | 4,084,884 |

| | | | |

(4) Income Taxes

The income tax provision (benefit) three months ended March 31, 2007 and 2006 from continuing operations consists of the following:

| | | | | | | | |

| | | 2007 | | | 2006 | |

Computed “expected” tax expense (benefit) | | $ | (1,403,299 | ) | | $ | 7,158,563 | |

Increase (reduction) in income tax expense resulting from: | | | | | | | | |

Valuation allowance on deferred tax asset | | | 2,948 | | | | 2,068,961 | |

Derivative (benefit) expense | | | | | | | (3,534,149 | ) |

Derivative interest expense | | | | | | | 133,105 | |

Compensation- incentive stock options | | | 19,570 | | | | (2,234,955 | ) |

State income taxes, net of federal income tax benefit | | | (158,551 | ) | | | | |

Other, net | | | 102,158 | | | | 329,312 | |

| | | | | | | | |

Total | | $ | (1,437,174 | ) | | $ | 3,920,837 | |

| | | | | | | | |

11

(5) Goodwill

The Company continually evaluates the performance of our individual practices. Any practice that is deemed to be underperforming will become subject to more direct oversight by our management team. To the extent additional oversight fails to improve the practice’s performance over a period of time, the practice will become subject to additional company imposed actions, but not limited to, potential restructuring or divestiture. Due to this analysis, the company took an additional $229,745 charge to Health Care Center of Tampa.

(6) Dispositions

On February 28, 2007, the PainCare Holdings Inc. parties and Centeno Shultz, Inc. (“CSI”) entered into a Settlement Agreement pursuant to which said parties rescinded the Purchase Transaction and terminated agreements among them. To effectuate the rescission of the Purchase Transaction, (i) the PainCare Sub sold, and the Original Practice purchased, substantially all of the assets of the PainCare Sub for purchase price of the lesser of $250,000 or the total amount of proceeds generated from the sale of certain shares of common stock of PainCare ( the “PainCare Shares”) issued to the Centeno Parties in the Purchase Transaction, and (ii) in exchange for the PainCare parties to terminate the Management Agreement and any and all other agreements between CSI and the PainCare Parties, CSI paid the PainCare Parties $750,000 plus all remaining proceeds in excess of $250,000 from the sale of the PainCare shares. In connection with the termination of the Management Agreement, CSI entered into a promissory note with a principal balance of $375,000 with imputed interest of 8.25% payable by June 1, 2008.

As of March 31, 2007, PainCare has received $1,064,411 from the Centeno Parties, in cash payments for the sale of the “Original Practice”, with a receivable balance of $357,953 on the promissory note. The note includes imputed interest recorded as a discount of $17,047 at March 31, 2007.

(7) Related Party Transactions

During the three months ended March 31, 2007 and 2006 the Company had transactions with companies owned by certain shareholders of the Company. The following is a summary of transactions with these entities for the three months ended March 31, 2007 and 2006:

12

| | | | | | | | | | | | |

Practice Name | | Type of Practice | | Type of Related Party Transaction | | Expense related to the three months

ended March 31; |

| | | | 2007 | | 2006 | | Reported

As |

Associated Physicians Group, Ltd. | | Managed Practice | | The Company leases its office space from a limited liability company partially owned by a certain shareholder of the Company. The lease commenced January 1, 2005, for an initial term of ten years with the option to renew for two five year periods. The limited liability company sold the property during the second quarter of 2006. | | $ | 0 | | $ | 36,795 | | G&A |

| | | | | |

The Center for Pain Management, LLC | | Managed Practice | | The Company leases certain employees from a limited liability company owned by certain shareholders of the Company. The Company also charged this entity for the use of its equipment and certain services. | | $ | 570,677 | | $ | 571,265 | | G&A |

| | | | | |

| | | | The Company has an agreement to outsource its billing and collections function to a limited liability company owned by certain shareholders of the Company. The Company is charged a fee of 8% of net collections under this arrangement. | | $ | 171,742 | | $ | 191,889 | | G&A |

| | | | | |

| | | | * (A) | | | | | | | | |

| | | | | |

| | | | * (B) | | | | | | | | |

| | | | | |

Dynamic Rehabilitation Centers, Inc. | | Managed Practice | | The Company leases its office space from a limited liability company partially owned by certain shareholders of the Company. The lease associated with the Redford location has a ten year term commencing January 1, 2000, with no option to renew. The lease associated with the Clinton Township location commenced October 8, 2004 and expires December 31, 2014. The lease was amended in July 2005, for the occupancy of additional space by the Company. | | $ | 44,954 | | $ | 42,222 | | G&A |

| | | | | |

| | | | The Company provides services for billing, accounting and management oversight to a limited liability company owned by certain shareholders of the Company. | | $ | 0 | | $ | 217,387 | | G&A |

| | | | | |

| | | | * (C) | | | | | | | | |

| | | | | |

Health Care Center of Tampa, Inc. | | Owned Practice | | The Company has an agreement to outsource its billing and collections function to a limited liability company owned by a certain shareholder of the Company. The Company is charged a fee of 10% of net collections under this arrangement. | | $ | 63,412 | | $ | 101,431 | | G&A |

| | | | | |

Rick Taylor, D.O., P.A. | | Managed Practice | | The Company has an agreement to lease an aircraft from a limited liability company owned by a certain shareholder of the Company. The lease agreement was entered into in June 2003 for a period of 60 months. Effective January 1, 2005, the lease payment was lowered to a nominal amount of $1 per year; the Company will continue to pay a third party provider for the related fuel and maintenance cost. Effective January 1, 2004 the lease fee was reduced from the original amount of $12,000 per month to $7,000 per month; maintenance, fuel, insurance recurring training, hangar rental and any other fees required to maintain the aircraft were the responsibility of the Company. | | $ | 1.00 | | $ | 1.00 | | G&A |

| | | | | |

| Spine and Pain Center, P.C. | | Managed Practice | | The Company leases its office space from a limited liability company partially owned by certain shareholders of the Company. The lease commenced December 23, 2003 and expires December 31, 2008, with no option to renew. | | $ | 36,748 | | $ | 31,674 | | G&A |

13

| | | | | | | | | | | | |

Lake Worth Surgical Center | | Managed Practice | | The Company, through a subsidiary, is the majority partner of the PSHS Alpha Partners, Ltd. Partnership Dr. Merrill Reuter , the Company’s chairman, is a minority partner of partnership. The Company owns 67.5% and Dr. Reuter owns 9.75% of the partnership. Dr. Reuter receives distributions from the partnership. These distributions are reported as minority interest on the balance sheet. | | $ | 45,825 | | $ | 29,250 | | G&A |

| | | | | |

The Center for Pain Management ASC, LLC | | Managed Practice | | The Company leases certain employees from a limited liability company owned by certain stockholders of the Company. The Company also charged this entity for the use of its equipment and certain services. | | $ | 315,903 | | $ | 307,216 | | G&A |

| | | | | |

The Center for Pain Management ASC, LLC | | Managed Practice | | The Company has an agreement to outsource its billing and collections functions to a limited liability company owned by certain stockholders of the Company. The Company is charged a flat fee of $40,000 per month under the arrangement. | | $ | 120,000 | | $ | 120,000 | | G&A |

| | | | | |

The Center for Pain Management ASC, LLC | | Managed Practice | | The Company has an agreement to outsource its non-clinical management and administrative services and support for health care providers to a limited liability company owned by certain stockholders of the Company. The Company is charged a flat fee of $52,500 per month under this arrangement. | | $ | 157,500 | | $ | 157,500 | | G&A |

| | | | | |

Georgia Pain Physicians, P.C. | | Managed Practice | | The Company has agreements to lease equipment from a limited partnership wholly owned by Dr. Windsor. The lease commenced February 1, 2006, with no expiration date. | | $ | 8,050 | | $ | 10,250 | | G&A |

| | | | | |

| Piedmont | | Managed Practice | | The Company has an agreement to lease property from a limited liability properties company which is owned by Dr. Cohen. The lease commenced November 1, 2002 and will expire October 31, 2007. | | $ | 38,920 | | $ | 16,425 | | G&A |

| | | | | |

| CareFirst | | Managed Practice | | The Company has an agreement to lease property from REC, Inc., in which Dr. Carpenter is the President. The lease commenced on January 4, 2006 and will expire on January 3, 2011. | | $ | 14,188 | | $ | 6,500 | | G&A |

| | | | | |

Northeast Pain Management | | Owned Practice | | The Company has an agreement to lease property from a limited liability company in which the Zolper family is the sole proprietor. The lease commenced on October 1, 2005 and will expire on September 30, 2007. | | $ | 41,092 | | $ | 30,819 | | G&A |

| | | | | |

| Bone and Joint Clinic | | Owned Practice | | The Company has an agreement to lease property from Dr. Cenac, the sole owner of such property. The lease commenced on January 1, 2004 and will expire on December 31, 2008. | | $ | 15,798 | | $ | 0 | | G&A |

| | | | | |

The Center for Pain Management/Care First Practice | | Managed Practice | | The Center for Pain Management entered into an agreement, through its limited liability company, to handle all billing services for CareFirst Medical Associates and Pain Rehabilitation. The agreement commenced on June 12, 2006 and will expire on June 11, 2011. | | $ | 21,695.63 | | $ | 0 | | G&A |

| | | | | |

Georgia Pain Physicians, P.C. | | Owned Practice | | The Company entered into property lease agreements with Windsor Family Limited Partnership leasing both a storage unit and office space with commencement dates of September 30, 2003 and June 1, 2006 respectively. These leases expire September 30, 2008 and June 1, 2011, respectively. | | $ | 10,390 | | $ | 3,600 | | G&A |

| | | | | |

| Bone and Joint Clinic | | Owned Practice | | Dr. Cenac entered into an agreement to lease office space to his son. The lease commenced on September 1, 2005 and expired on December 31, 2006. | | $ | 0 | | $ | 0 | | G&A |

| | | | | |

Health Care Center of Tampa, Inc. | | Owned Practice | | The Company entered into a property leasing agreement with Dr. Khan leasing office space with a commencement date of January 1, 2004. The lease expires on December 31, 2008. | | $ | 32,701 | | $ | 29,149 | | G&A |

14

| (A) | The Company has the option to purchase a “Competitive Business Opportunity” (CBO) from shareholders of the Company who are currently operating a competitive physician practice that fall outside a ten mile radius from the Center for Pain Management, LLC clinics. The Company has an option to purchase the CBO at market rates similar to the original acquisition. There is no guarantee that the option will be exercised by the Company, nor is the purchase price discounted for the Company should they choose to execute the option to purchase. |

| (B) | The Company has the option to purchase a “Competitive Business Opportunity” (CBO) from shareholders of the Company who are currently operating a competitive surgery center that fall outside a ten mile radius from the Center for Pain Management, LLC clinics. The Company has an option to purchase the CBO at market rates similar to the original acquisition. There is no guarantee that the option will be exercised by the Company, nor is the purchase price discounted for the Company should they choose to execute the option to purchase. |

| (C) | The Company has the option to purchase a “Competitive Business Opportunity” (CBO) from shareholders of the Company who are currently operating competitive rehabilitation clinics that fall outside a ten mile radius from the Dynamic Rehabilitation Centers, Inc. The Company has an option to purchase the CBO at market rates similar to the original acquisition. There is no guarantee that the option will be exercised by the Company, nor is the purchase price discounted for the Company should they chose to execute the option to purchase. |

(8) Acquisition Payable

Acquisition payable for the three months ended March 31, 2007:

| | | | | | | | | |

| | | Cash | | Stock | | Total |

Advanced Physicians Group | | $ | 97,789 | | $ | 22,900 | | $ | 120,689 |

Spine and Orthopedic Pain Center | | | 208,333 | | | — | | | 208,333 |

HealthCare Center of Tampa | | | — | | | 229,769 | | | 229,769 |

Center for Pain Management | | | 1,961,931 | | | 414,808 | | | 2,376,739 |

RMG | | | 102,720 | | | — | | | 102,720 |

CareFirst Medical Assoc. | | | 55,686 | | | 9,159 | | | 64,845 |

| | | | | | | | | |

Total | | $ | 2,426,459 | | $ | 676,636 | | $ | 3,103,095 |

| | | | | | | | | |

(9) Other Assets

Other assets for the three months ended March 31, 2007:

| | | | | | | | | | |

| | | Cost | | Amortization | | | Net |

MedX Distribution Right | | $ | 2,212,673 | | $ | (1,647,916 | ) | | $ | 564,757 |

Contract Right-APG | | | 482,673 | | | (246,072 | ) | | | 236,601 |

Contract Right-SPA | | | 1,419,471 | | | (286,058 | ) | | | 1,133,413 |

Contract Right-SCPI | | | 1,041,546 | | | (254,734 | ) | | | 786,812 |

Physician’s referral network | | | 1,823,935 | | | (786,626 | ) | | | 1,037,309 |

Patient list | | | 118,414 | | | (4,934 | ) | | | 113,480 |

| | | | | | | | | | |

Totals | | $ | 7,098,712 | | $ | (3,226,340 | ) | | $ | 3,872,372 |

| | | | | | | | | | |

15

(10) Long-Term Debt

Long-term debt consists of the following at March 31:

| | | |

| | | 2007 |

HBK Investments (a) | | $ | 26,744,717 |

CPM ASC acquisition promissory note (b) | | | 7,451,151 |

| | | |

Total | | | 34,195,868 |

Less current installments | | | 34,195,868 |

| | | |

Long-term portion | | $ | — |

At March 31, 2007, the aggregate annual principal payments with respect to the obligations existing at that date as described above, are as follows:

| | | |

| Three Months Ending March 31: | | | |

2007 | | | 35,250,000 |

2008 | | | |

2009 | | | |

Thereafter | | | |

Less unamortized discount | | | 1,054,132 |

| | | |

| | $ | 34,195,868 |

| | | |

| (a) | Note payable to HBK Investments due on May 10, 2009. Interest is either LIBOR + 7.25% or Prime + 4.5% at the discretion of the Company. On March 21, 2007, the Agent provided the Company with notice that the Agent would be charging interest at the default rate until all existing events of default have been met or waived in accordance with the loan agreement. The default rate is LIBOR plus 10.25% or approximately 15.57% as of March 21, 2007. Interest payments are due monthly with quarterly principal repayments beginning on April 1, 2006. Certain mandatory prepayments must be made upon the occurrence of any sale or disposition of property or assets, upon the receipt of any extraordinary receipts, and upon issuance of any indebtedness other than indebtedness permitted by the agreement, including equipment leases and notes. The agreement requires compliance with various financial and non-financial covenants for the Company starting in the second quarter of 2005. The primary financial covenants pertain to, among other things, minimum EBITDA, minimum Free Cash Flow, Leverage ratio, and Market Capitalization. The Company for the quarter ended March 31, 2007 has failed to comply with certain covenants set forth in the original loan agreement and the forebearance agreement dated January 1, 2007. On May 2, 2006, June 20, 2006, August 9, 2006 and November 8, 2006 we entered into letter agreements with the lenders under the credit facility in consideration for which we paid $300,000, $150,000, $100,000 and $150,000 in waiver fees, respectively, to the lenders. The Face value of the Note is $27,750,000 with unamortized discount of $1,005,283. The total amount amortized to interest expense for the quarter ended March 31, 2007 was $191,323. On March 21, 2007, we received a notice of default from the Agent. We are currently engaged in negotiations with the Agent in an effort to enter into a forbearance agreement. |

16

| (b) | Note payable for acquisition of CPM, ASC LLC. Originally due on January 3, 2007 with a stated interest rate of 3.45%. Interest is imputed at 6.75% over the period. The face value is $7,500,000. In December 2006, the due date of the note was extended until April 2, 2007 with an additional $300,000 promissory note with a $300,000 issuance cost which was accreted to interest expense in 2007. With this extension an additional interest was imputed at 8.25% until April 30, 2007. The total amount amortized to interest expense in 2007 was $146,546 with an unamortized discount of $48,849. The note is secured by the Company’s interest in PainCare Surgery Center III, Inc. The Company’s carrying amount of the entity is $12,748,390 and it is accounted for in discontinued operations. On March 15, 2007, the Company received a notice of breach and default (the “CPM Notice”) from The Center for Pain Management, LLC (“CPM”) with respect to that certain Asset Acquisition Agreement dated December 1, 2004 (the “APA”) entered into by the Company, PainCare Acquisition Company XV, Inc. (the “Subsidiary”), CPM, and the owners of CPM (the “Members”). The CPM Notice further provides that unless the alleged events of default set forth in the CPM Notice are cured by the Company, (i) certain non-competition and non-solicitation provisions binding the Members will cease as of April 24, 2007, and (ii) CPM and the Members will have, as of April 12, 2007, certain rights under that certain Stock Pledge Agreement dated December 1, 2004 (the “Pledge Agreement”) entered into by the Company and the Members, including, but not limited to, the right to foreclose on the issued and outstanding shares of stock of the Subsidiary. Since receipt of the CPM Notice we have been actively engaged in negotiations with CPM in an effort to resolve the disputes between us. We have, as a result of the foregoing negotiations, reached an agreement in principal providing for our sale of CPM and the related surgery center operations to those individuals from whom we originally purchased the operations. The completion of the transactions remains subject to the negotiation and execution of definitive transaction documents. |

(11) Convertible Debentures

Convertible Debentures consist of the following on March 31:

| | | | |

| | | March 31,

2007 | |

Midsummer/Islandia (a) | | $ | 8,622,879 | |

Midsummer (b) | | | 1,429,078 | |

Midsummer/Islandia (c) | | | 2,624,656 | |

Total | | | 12,676,613 | |

| | | | |

Less current installments | | | 12,676,613 | |

Long-term portion | | $ | — | |

| |

Maturities of the convertible debentures for future years ending March 31, are as follows: | | | | |

2007 | | $ | 13,455,160 | (d) |

2008 | | | — | |

2009 | | | — | |

2010 | | | — | |

2011 | | | — | |

Less unamortized discount | | | 778,547 | |

| | | | |

Total | | $ | 12,676,613 | |

| | | | |

| (a) | Convertible debenture to Midsummer Investment Ltd. in the original amount of $5,000,000 and Islandia, LP in the original amount of $5,000,000. The Company combines these debentures since they are of identical terms. On July 1, 2004, Midsummer Investment, Ltd. converted $1,044,840 of their debenture into 400,000 Company shares. Their face value is currently $3,955,160. The Islandia, LP debenture has a face value currently of $5,000,000. These two debentures were completed on the same date of December 17, 2003 with an original maturity date of December 17, 2006. On August 2, 2006, the Company extended the term of these debentures to August 2, 2009. The extension did not change the face value or the interest rate. The stated interest rate is 7.5%. The interest expense for the three months ending March 31, 2007, was $203,510. The debentures are convertible into common stock of the Company at the price of $1.90 per share. The Company has the right to pay the interest in common stock providing certain equity conditions are met. The equity conditions must all be met for the twenty trading days preceding the interest payment date. Interest only is payable quarterly. As of March 31, 2007, the Company does not meet the equity requirements and is required to make payments in cash; however, Midsummer and Islandia have permitted the Company to make payment in common shares subject to a 10% discount. There are no assets pledged as collateral, sinking fund requirements, or restrictive covenants associated with these debentures. The amount of amortized discount accreted to interest expense in the three months ending March 31, 2007 was $35,600. The March 31, 2007 unamortized discount balance is $332,281. |

17

| (b) | Convertible debenture to Midsummer Investment Ltd. in the face amount of $1,500,000. The debenture was completed on July 1, 2004 with an original maturity date of June 30, 2007. On August 2, 2006 the Company extended the term of this debenture to August 2, 2009. The extension did not change the face value or the interest rate. The stated interest rate is 7.5%. The interest expense for the three months ending March 31, 2007 was $163,835. The debentures are convertible into common stock of the Company at the price of $1.90 per share. The Company has the right to pay the interest in common stock providing certain equity conditions are met. The equity conditions must all be met for the twenty trading days preceding the interest payment date. Interest only is payable quarterly. All interest payments were made in cash because not all of the equity conditions have been met. As of March 31, 2007 the company does not meet the equity requirements and is required to make payments in cash; however, Midsummer and Islandia have permitted the Company to make payment in common shares subject to a 10% discount. There are no assets pledged as collateral, sinking fund requirements, or restrictive covenants associated with this debenture. The amount of amortized discount accreted to interest expense in the three months ending March 31, 2007 was $129,379. The March 31, 2007 unamortized discount balance is $70,922. |

| (c) | Convertible debenture to Midsummer Investment Ltd. with a face value of $1,500,000 and Islandia, LP with a face value of $1,500,000. The Company combines these debentures since they are of identical terms. These two debentures were completed on the same date of August 2, 2006 with an original maturity date of August 2, 2009. The stated interest rate is 8.5%. The interest expense for the three months ending March 31, 2007 was $159,907. The debentures are convertible into common stock of the Company at the price of $1.90 per share. The Company has the right to pay the interest in common stock providing certain equity conditions are met. The equity conditions must all be met for the twenty trading days preceding the interest payment date. Interest only is payable quarterly beginning on October 1, 2006. As of March 31, 2007 the company does not meet the equity requirements and is required to make payments in cash; however Midsummer and Islandia have permitted the Company to pay interest in common shares during the quarter at a 10% discount to the twenty trading days volume weighted average price. There are no assets pledged as collateral, sinking fund requirements, or restrictive covenants associated with these debentures. The amount of amortized discount accreted to interest expense in the three months ending March 31, 2007 was $96,156. The March 31, 2007 unamortized discount balance is $375,344. The convertible debentures issued to Midsummer Investments, Ltd and Islandia LP. We are currently in technical default because the Company is in default with it’s primary lender. As of May 15, 2007, the Company has not received formal notification of default. |

| (d) | As a result of certain technical defaults under the terms of the convertible debentures issued to Midsummer Investments, Ltd and Islandia LP, we have elected to treat all amounts outstanding under the convertible debentures as current liabilities. |

(12) Recent Accounting Pronouncements

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, “The Fair Value Option for Financial Assets and Liabilities” (“SFAS 159”). SFAS 159 provided entities the one-time election to measure financial instruments and certain other assets and liabilities at fair value on an instrument-by-instrument basis under a fair value option. SFAS 159 is effective for financial statements as of the beginning of the first fiscal year that begins after November 15, 2007. Its provision may be applied to an earlier period only if the following conditions are met: (1) the decision to adopt is made after the issuance of SFAS 159 but within 120 days after the first day of the fiscal year of adoption, and no financial statements, including footnotes, for any interim period of the adoption year have yet been issued and (2) the requirement of SFAS 157 are adopted concurrently with or prior to the adoption of SFAS 159. We are currently evaluating the provisions of SFAS 159.

In December 2006, the FASB approved EITF 00-19-2, “Accounting for Registration Payment Arrangements.” which establishes the standard that contingent obligations to make future payments under a registration rights arrangement shall be recognized and measured separately in accordance with Statement 5 and FASB Interpretation No. 14,Reasonable Estimation of the Amount of a Loss. Early adoption of EITF 00-19-2 is permitted, and the Company has elected such early adoption.

18

(13) Litigation

Class Action

On March 21, 2006, Roy Thomas Mould filed a complaint under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 against the Company, as well as the Company’s chief executive officer and chief financial officer, before the United States District Court for the Middle District of Florida. The complaint is entitledMould v. PainCare Holdings, Inc., et al. , Case No. 06-CV-00362-JA-DAB. Mr. Mould alleged material misrepresentations and omissions in connection with the Company’s financial statements which appear to relate principally to the Company’s previously announced intention to restate certain past financial statements. Ten additional complaints were filed shortly afterward before the same court which recite similar allegations. (Collectively, these cases will be referred to as the “Securities Litigation.”) Lead counsel was selected and a consolidated complaint was filed. On September 20, 2006, the Company filed a motion to dismiss the pending securities class action with the Federal District Court. Subsequently, the District Court referred the matter to a Federal Magistrate for a hearing, report and recommendation. On January 17, 2007, the Magistrate held a hearing and took the matter under submission. On March 26, 2007, the Magistrate issued a report which recommended that the District Court dismiss all outstanding claims with leave to amend. On April 25, 2007, the District Court signed an order adopting the Magistrate’s report and dismissed the Securities Litigation, with leave to amend.

Derivative Action

On April 7, 2006, Kenneth R. Cope filed a derivative complaint against the directors of the Company before the United States District Court for the Middle District of Florida. The complaint is entitledCope v. Reuter, et al. , Case No. 06-CV-00449-JA-DAB. Mr. Cope alleges that the directors breached their fiduciary duties by failing to supervise and manage the operations of the company, among other claims. (This litigation is referred to as the “Derivative Action.”). In November of 2006, the Company and the plaintiff entered into a Stipulation and Agreement of Compromise, Settlement and Release, filed on November 30, 2006, and conditioned upon court approval. Concurrently with the filing of the foregoing agreement, the parties jointly moved for preliminary court approval, and thereafter, for final approval following notice to the Company’s shareholders. The Stipulation and Agreement was preliminarily approved by the court on January 12, 2007, and finally approved on April 20, 2007, at which time the Derivative Action was dismissed.

Other Matters

The Company and one of its subsidiaries are defendants in a lawsuit arising from business operations. It is the opinion of management that the final outcome of this matter will not materially affect the consolidated financial position of the Company.

Additional disclosure regarding the foregoing litigation and other litigation involving the Company is set forth in the Company’s annual report on Form 10-K for the year ended December 31, 2006.

19

(14) Stock Options and Warrants

The Company’s previously issued consolidated financial statements as of and for the quarters ending March 31, June 30, and September 30, 2006 have been restated to give effect to the correction of certain errors that were discovered subsequent to September 30, 2006. See Footnote 3Restatement and Reclassifications of Previously Issued Financial Statements in the Company’s 10-K for the year ended December 31, 2006 for further explanation.

The Company’s Board of Directors adopted the 2000 Stock Option Plan and the 2001 Stock Option Plan (the “Plans”) which authorize the issuance of up to 10,000,000 shares of the Company’s common stock to employees, non-employees and Directors. There are also option grants totaling 2,000,000 shares of common stock made to executive officers that were issued outside of the two Plans. Options granted under the Plans and to the executives are exercisable up to 10 years from the grant date at an exercise price of not less than the fair market value of the common stock on the date of grant.

Notwithstanding, the term of an incentive stock option granted under the Plan to a stockholder owning more than 10% of the voting rights may not exceed 5 years, and the exercise price of an incentive stock option granted to such stockholder may not be less than 110% of the fair market value of the common stock on the date of grant.

Warrants were issued for various capital raising purposes and for consulting fees.

The number of shares, terms, vesting and exercise period of options granted under the Plans are determined by the Company’s Board of Directors on a case-by-case basis.

20

Stock options and warrants granted, exercised and expired during the year ended December 31, 2006 and for the quarter ended March 31, 2007 are as follows:

| | | | | | | | | | | |

| | | Options | | Warrants |

| | | Number | | Weighted

Average

Exercise

Price | | Number | | | Weighted

Average

Exercise

Price |

Outstanding, December 31, 2005 | | 9,752,150 | | $ | 2.01 | | 3,179,316 | (a) | | $ | 2.61 |

Granted in 2006 | | 565,000 | | $ | 1.58 | | 1,399,884 | | | $ | 3.51 |

Exercised in 2006 | | — | | $ | — | | — | | | $ | — |

Forfeited in 2006 | | 520,000 | | $ | 2.35 | | 2,678,316 | | | $ | 2.84 |

| | | | | | | | | | | |

Outstanding, December 31, 2006 | | 9,797,150 | | $ | 1.94 | | 1,900,884 | | | $ | 2.96 |

| | | | | | | | | | | |

Granted in the first quarter of 2007 | | 200,000 | | $ | .73 | | — | | | | — |

Exercised in the first quarter of 2007 | | — | | | — | | — | | | | — |

Forfeited in the first quarter of 2007 | | 100,000 | | $ | 1.64 | | — | | | | — |

| | | | | | | | | | | |

Outstanding, March 31, 2007 | | 9,897,150 | | $ | 1.92 | | 1,900,884 | | | $ | 2.96 |

| | | | | | | | | | | |

Exercisable at December 31, 2006 | | 9,540,480 | | $ | 1.91 | | 1,900,884 | | | $ | 2.96 |

| (a) | includes 25,000 warrants issued to employees. |

The following table summarizes information for options and warrants outstanding and exercisable at March 31, 2007:

| | | | | | | | |

Exercise Price | | Number

Outstanding | | Weighted

Average

Remaining

Life | | Number

Outstanding

and

Exercisable | | Weighted

Average

Remaining

Life |

Stock Options: | | | | | | | | |

$0.25-$1.00 | | 3,392,150 | | .70years | | 3,325,480 | | .61years |

$1.01-$2.00 | | 3,250,000 | | 5.00years | | 3,130,000 | | 5.02years |

$2.01-$3.00 | | 1,665,000 | | 1.75years | | 1,495,000 | | 1.70years |

$3.01-$4.00 | | 1,410,000 | | 3.99years | | 1,410,000 | | 3.99years |

$4.01-$5.00 | | 155,000 | | 2.98years | | 155,000 | | 2.98years |

$5.01-$6.00 | | 25,000 | | 2.76years | | 25,000 | | 2.76years |

| | | | | | | | |

Total | | 9,897,150 | | 2.80years | | 9,540,480 | | 2.77years |

Warrants: | | | | | | | | |

$0.25-$1.00 | | 106,000 | | 2.00years | | 106,000 | | 2.00years |

$1.01-$2.00 | | 330,000 | | 1.81years | | 330,000 | | 1.81years |

$2.01-$3.00 | | — | | — years | | — | | — years |

$3.01-$4.00 | | 1,414,884 | | .51years | | 1,414,884 | | .51years |

$4.01-$5.00 | | 50,000 | | 3.75years | | 50,000 | | 3.75years |

$5.01-$6.00 | | — | | —years | | — | | —years |

| | | | | | | | |

Total | | 1,900,884 | | .90years | | 1,900,884 | | .90years |

The weighted-average grant-date fair value of options and warrants granted during the quarters ending March 31, 2006 and 2007 were $.81 and $.37, respectively. There were no options exercised in the quarters ending March 31, 2006 and 2007.

A summary of the status of the Company’s non-vested options as of March 31, 2007, and changes since the year ended December 31, 2006 is presented below:

| | | | | | |

| | | Number

of Options | | | Weighted Average

Grant Date Fair Value |

Outstanding, December 31, 2005 | | 2,891,733 | | | $ | 1.08 |

Granted in 2006 | | 204,167 | | | $ | .80 |

Vested in 2006 | | (2,666,731 | ) | | $ | 1.05 |

Forfeited in 2006 | | (54,999 | ) | | $ | 1.23 |

| | | | | | |

Outstanding, December 31, 2006 | | 374,170 | | | $ | 1.08 |

Granted in the first quarter of 2007 | | 66,667 | | | $ | .32 |

| | |

Vested in the first quarter of 2007 | | (17,500 | ) | | $ | .62 |

Forfeited in the first quarter of 2007 | | (66,667 | ) | | $ | 1.64 |

| | | | | | |

Outstanding, March 31, 2007 | | 356,670 | | | $ | .60 |

21

As of March 31, 2007, there was $161,919 of total unrecognized compensation cost related to non-vested share based compensation arrangements. The cost is expected to be recognized over a weighted-average period of .87 years.

During the second quarter of 2006, the Company fully vested options on 2,155,000 shares of common stock held by the CEO, CFO, and President. As a result of that modification, the Company recognized additional compensation expense of $1,125,250 for the year ended December 31, 2006.

(15) Segment Reporting

We define segment operating earnings as income before (1) interest income; (2) interest expense and amortization of debt discount and fees; (3) gain or loss from discontinued operations; and (4) income tax expense or benefits. We also do not allocate corporate to our operating segments. We use segment operating earnings as an analytical indicator for purposes of allocating resources to a particular segment and assessing segment performance. Revenues and expenses are measured in accordance with the policies and procedures described in Note 1,Summary of Significant Accounting Policies, to the consolidated financials statements accompanying our 2006 Form 10-K.

Selected financial information of our operating segments for each of the three months ended March 31, 2007 and 2006 is as follows:

| | | | | | | | | | | | | | | | | | |

| | | Pain

Management | | Surgery | | | Ancillary

Services | | Corporate and

Other | | | Total | |

Three Months ended March 31, 2007 | | | | | | | | | | | | | | | | | | |

Net operating revenues | | $ | 9,622,598 | | $ | 1,342,193 | | | $ | 2,860,769 | | $ | — | | | $ | 13,825,560 | |

Operating income (loss) | | | 1,394,612 | | | (177,664 | ) | | | 112,060 | | | (3,829,111 | ) | | | (2,500,103 | ) |

Total assets | | $ | 74,002,042 | | $ | 13,605,321 | | | $ | 13,814,678 | | $ | 21,139,384 | | | $ | 122,561,425 | |

Three Months ended March 31, 2006 | | | | | | | | | | | | | | | | | | |

Net operating revenues | | $ | 10,649,878 | | $ | 3,828,377 | | | $ | 1,881,030 | | $ | — | | | $ | 16,359,285 | |

Operating income (loss) | | | 2,998,534 | | | 484,923 | | | | 969,183 | | | 6,737,964 | | | | 11,190,604 | |

Total Assets | | $ | 91,336,337 | | $ | 14,761,448 | | | $ | 19,198,970 | | $ | 17,516,879 | | | $ | 142,813,634 | |

22

(16) Discontinued Operations

Physiom and the PainCare Surgery Centers, Inc are allocated in the ancillary operating segment. GSC/GPP and Centeno are allocated in the Pain Management operating segment. The results of the discontinued operations of Physiom, Centeno, GSC/GPP and the PainCare Surgery Centers, Inc, businesses, included in the accompanying consolidated statements of operations for the quarters ended March 31, 2007 and 2006 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | |

| | | Centeno | | | GSC/GPP | | | PCSI | | | Adjustments | | | Total | | | PhysIom | | Centeno | | | GSC/GPP | | PCSI | | Adjustments | | | Total | |

Net Revenue | | 371,347 | | | 1,017,084 | | | 3,810,954 | | | — | | | 5,199,385 | | | 783,826 | | 1,151,369 | | | 1,428,252 | | 3,585,742 | | — | | | 6,949,189 | |

Cost of revenue and operating expenses | | 398,455 | | | 1,222,508 | | | 2,078,804 | | | — | | | 3,699,767 | | | 487,535 | | 477,842 | | | 1,204,523 | | 2,270,628 | | (11,291 | ) | | 4,429,237 | |

Operating income (loss) | | (27,108 | ) | | (205,424 | ) | | 1,732,150 | | | — | | | 1,499,618 | | | 296,291 | | 673,527 | | | 223,729 | | 1,315,114 | | 11,291 | | | 2,519,952 | |

Interest (expense) | | (177 | ) | | (215 | ) | | (3,141 | ) | | (1,533,552 | ) | | (1,537,085 | ) | | — | | — | | | — | | — | | — | | | — | |

Other income (loss) | | — | | | 1,340 | | | 5,770 | | | — | | | 7,110 | | | — | | (502 | ) | | 1,773 | | 49,930 | | (1,310,723 | ) | | (1,259,522 | ) |

Income (loss) before provision for income taxes and minority interest | | (27,285 | ) | | (204,299 | ) | | 1,734,779 | | | (1,533,552 | ) | | (30,357 | ) | | 296,291 | | 673,025 | | | 225,502 | | 1,365,044 | | (1,299,432 | ) | | 1,260,430 | |

Provision (benefit) for income taxes | | (9,190 | ) | | (61,849 | ) | | (40,591 | ) | | — | | | (111,630 | ) | | 100,935 | | 229,952 | | | 85,614 | | 378,377 | | — | | | 794,878 | |

Income (loss) before minority interest | | (18,095 | ) | | (142,450 | ) | | 1,775,370 | | | (1,533,552 | ) | | 81,273 | | | 195,356 | | 443,073 | | | 139,888 | | 986,667 | | (1,299,432 | ) | | 465,552 | |

Minority interest in earnings of discontinued operations | | — | | | — | | | 322,843 | | | — | | | 322,843 | | | 118,516 | | — | | | — | | 255,354 | | — | | | 373,870 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income from discontinued operations | | (18,095 | ) | | (142,450 | ) | | 1,452,527 | | | (1,533,552 | ) | | (241,570 | ) | | 76,840 | | 443,073 | | | 139,888 | | 731,313 | | (1,299,432 | ) | | 91,682 | |

Loss from disposal of discontinued operations, net of tax | | — | | | — | | | — | | | 243,350 | | | 243,350 | | | — | | — | | | — | | — | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from discontinued operations | | (18,095 | ) | | (142,450 | ) | | 1,452,527 | | | (1,776,902 | ) | | (484,920 | ) | | 76,840 | | 443,073 | | | 139,888 | | 731,313 | | (1,299,432 | ) | | 91,682 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The assets and liabilities of the Centeno, GPP and PainCare Surgery Centers, Inc. businesses included in the consolidated balance sheets as of March 31, 2007 and December 31, 2006 were as follows:

| | | | | | |

| | | For the three months ended March 31, 2007 | | For the twelve months

ended December 31, 2006 |

Assets | | | | | | |

Cash | | $ | 317,254 | | $ | 807,077 |

Accounts receivable | | | 8,361,345 | | | 8,308,134 |

Deposits and prepaids | | | 648,662 | | | 384,491 |

Deferred taxes | | | — | | | 232,306 |

| | | | | | |

Current assets of discontinued operations | | | 9,327,261 | | | 9,732,008 |

| | | | | | |

Property and equipment, net | | | 1,400,772 | | | 1,572,004 |

Goodwill | | | 26,062,738 | | | 27,142,361 |

Other assets | | | 759,879 | | | 831,669 |

Non-current deferred tax asset | | | 806,124 | | | 716,903 |

| | | | | | |

Non-current assets of discontinued operations | | | 29,029,513 | | | 30,262,937 |

| | | | | | |

Total assets of discontinued operations | | $ | 38,356,774 | | $ | 39,994,945 |

Liabilities | | | | | | |

Accounts payable and accrued liabilities | | $ | 1,552,665 | | $ | 1,405,097 |

Current portion of capital lease obligations | | | 14,286 | | | 18,367 |

Current portion of notes payable | | | | | | 62,000 |

| | | | | | |

Current liabilities of discontinued operations | | | 1,566,951 | | | 1,485,464 |

| | | | | | |

Capital lease obligations | | | 11,250 | | | 46,859 |

Deferred taxes | | | — | | | — |

| | | | | | |

Long term liabilities of discontinued operations | | | 11,250 | | | 46,859 |

| | | | | | |

Total liabilities of discontinued operations | | $ | 1,578,201 | | $ | 1,532,323 |

Minority interest in discontinued operations | | | 2,275,490 | | | 2,191,797 |

Book value of net assets | | $ | 36,778,573 | | $ | 38,462,621 |

23

On February 28, 2007, the PainCare Holdings Inc. parties and Centeno Shultz, Inc. entered into a Settlement Agreement pursuant to which said parties rescinded the Purchase Transaction and terminated agreements among them. To effectuate the rescission of the Purchase Transaction, (i) the PainCare Sub sold, and the Original Practice purchased, substantially all of the assets of the PainCare Sub for purchase price of the lesser of $250,000 or the total amount of proceeds generated from the sale of certain shares of common stock of PainCare ( the “PainCare Shares”) issued to the Centeno Parties in the Purchase Transaction, and (ii) in exchange for the PainCare parties to terminate the Management Agreement and any and all other agreements between CSI and the PainCare Parties, CSI paid the PainCare Parties $750,000 plus all remaining proceeds in excess of $250,000 from the sale of the PainCare shares. In connection with the termination of the Management Agreement, CSI entered into a promissory note with a principal balance of $375,000 with imputed interest of 8.25% payable by June 1, 2008.

The discontinued operations of the PainCare Surgery Centers, Inc. were allocated interest because the Company is required by our senior lender HBK Investments to repay their note upon the sale of PainCare Surgery Centers, Inc. As a result interest expense of $1,533,552 and $1,354,350, respectively, has been included in the results of the discontinued operations recorded as held for sale.

The following table shows the components of the loss from sale of Centeno Shultz, Inc., net of taxes as of February 28, 2007:

| | | | |

Proceeds | | $ | 1,419,302 | |

Book value of net assets disposed | | | (1,769,108 | ) |

Cost of disposition | | | (18,906 | ) |

| | | | |

Loss on sale of discontinued operations | | | (368,712 | ) |

Income tax benefit | | | 125,362 | |

| | | | |

Loss on sale of discontinued operations, net | | $ | (243,350 | ) |

| | | | |

(17) Subsequent Events

On April 30, 2007, the PainCare Parties, PainCare, Inc., and the Windsor Parties (GSC/GPP) entered into a Mutual Settlement Agreement and General Release pursuant to which said parties rescinded the Purchase Transaction and terminated all agreements among them. To effectuate the rescission of the Purchase Transaction, (i) PainCare, Inc. sold, and Windsor purchased, all of the issued and outstanding shares of stock of GSC; (ii) the Management Agreement and all related agreements were terminated; (iii) GPP paid PainCare $50,000 at closing and entered into a promissory note under which it is obligated to pay PainCare a total of $75,000 over a three month period, said payment obligations being secured by a grant of a security interest in GPP’s and GSC’s accounts receivable; and (iv) the parties entered into general release agreements.

The Company has been faced with derivative and class action lawsuits related to financial restatements. The settlement for the derivative lawsuit received court approval and the case was dismissed on April 20, 2007.

24

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide the reader with information that will assist in understanding our consolidated financial statements, the changes in certain key items in those financial statements from year to year, and the primary factors that accounted for those changes, as well as how certain accounting principles affect our consolidated financial statements. The discussion also provides information about the financial results of the various segments of our business to provide a better understanding of how those segments and their results affect the financial condition and results of operations of PainCare as a whole.

Cautionary Statement Regarding Forward-Looking Statements

The terms “PainCare,” “Company,” “we,” “our,” and “us” refer to PainCare Holdings, Inc. and its consolidated subsidiaries unless the context suggests otherwise.

This quarterly report contains and may incorporate by reference “forward-looking” statements, including statements regarding our expectations, beliefs, intentions or strategies regarding the future. Such statements can be identified by the use of forward-looking terminology such as “may,” “will,” “believe,” “intend,” “expect,” “anticipate,” “estimate,” “continue,” or other similar words. Variations on those or similar words, or the negatives of such words, also may indicate forward-looking statements.

These forward-looking statements, which may include statements regarding our future financial performance or results of operations, including expected revenue growth, cash flow growth, future expenses, future operating margins and other future or expected performance, are subject to the following risks:

| • | | the acquisition of businesses or the launch of new lines of business, which could increase operating expenses and dilute operating margins; |

| • | | the inability to attract new patients by our owned practices, the managed practices and the limited management practices; |

| • | | increased competition, which could lead to negative pressure on our pricing and the need for increased marketing; |