The accompanying notes are an integral part of these financial statements.

MANOR INVESTMENT FUNDS, INC.

ADDITIONAL INFORMATION

Proxy Voting Procedures and Accord

The Company’s Board of Directors has approved proxy voting procedures setting forth guidelines and procedures for the voting of proxies relating to securities held by the Fund. Records of the Fund’s proxy voting records are maintained and are available for inspection without charge by calling 1-800-787-3334 and on the SEC’s website at http://www.sec.gov. The Board is responsible for overseeing the implementation of the procedures. The proxy voting record of the Fund can be reviewed on the web site of the Fund at www.ManorFunds.com. The Proxy voting history is located under Fund Information, Proxy Voting.

Quarterly Portfolio Schedule

The Company now files a complete schedule of investments with the SEC for the first and third quarters of each fiscal year on Form N-Q. These forms are available on the SEC’S website at http://www.sec.gov. They may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-723-0330.

Compensation of Board of Directors

The members of the Board of Directors serve without compensation. Daniel A. Morris, President of Manor Investment Funds, Inc. (“the Funds”), and President of Morris Capital Advisors, Inc., adviser to the Funds, and an Interested Director of the Funds, receives no compensation directly from the Funds. He is compensated through the management fee paid to the adviser to the Funds.

Investment Advisor Review

At its regularly scheduled in-person meeting on April 26, 2006, the Board of Directors unanimously approved the continuance of the investment advisory contract with MCA. Prior to approving the contract, the Board discussed the services performed by MCA (as described herein), performance of the funds, fees and profits accruing to MCA, and economies of scale from which the funds could benefit as the funds grow. In conducting its review, the Board reviewed the fees and services incurred by other mutual funds.

Morris Capital Advisors, Inc. (MCA) provides ongoing investment management for the portfolio of each Fund. In the execution of these duties MCA performs securities research, trading, and accounting for Fund portfolios. MCA also reconciles each portfolio with the Fund custodian to prevent errors in purchase and sale transactions, dividends, interest, and shareholder transactions.

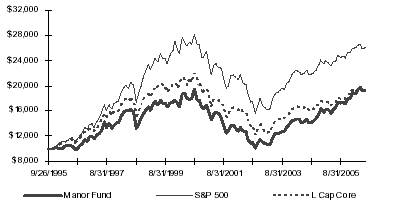

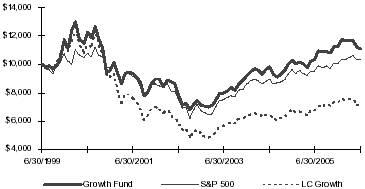

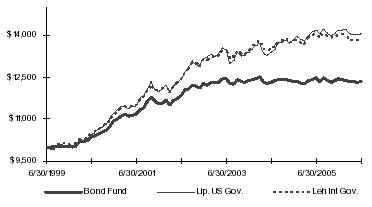

The investment performance of each Fund is compared to a broad market index and comparable mutual funds. As of December 31, 2005 the Manor Fund outperformed its benchmarks for the trailing quarter, 1-year, 3-year, and 5-year periods. The Growth Fund also outperformed its benchmarks for the trailing quarter, 1-year, 3-year, and 5-year periods ending December 31, 2005. The Bond Fund underperformed its benchmarks because the Fund is invested 100% in U.S. Treasury securities, with short maturities. This portfolio structure is designed to protect principal in periods of rising interest rates, and underperformed during the recent period of declining yields.

In addition to investment management functions, MCA provides ongoing shareholder accounting, acts as transfer agent for shares of the Fund, prepares and distributes all shareholder reports, prepares and submits all filings required by SEC rules and regulations, negotiates agreements with outside service providers, and processes all shareholder questions and requests. MCA provides these services, over and above the typical responsibilities of investment management, without compensation from the Fund. The cost of providing these services substantially reduce the net profit attributable to MCA from the sole execution of its duties under its investment advisory agreement with the Fund.

As the Funds grow economies of scale will reduce the cost of services to the Fund, for the benefit of all Fund shareholders. It is expected that these economies of scale will benefit shareholders when Fund assets exceed $25 million.

28

Board of Directors Information

Manor Investment Funds, Inc.

June 30, 2006

The business and affairs of the Fund are managed under the direction of the Funds’ Board of Directors. Information pertaining to the Directors of the Fund are set forth below. The Statement of Additional Information includes addition information about the Funds’ Directors, and is available without charge, by calling 1-800-787-3334. Each director may be contacted by writing to the director c/o Manor Investment Funds, Inc., 15 Chester Commons, Malvern, PA 19355.

Independent Directors

JAMES MCFADDEN

James McFadden is a Director of the Fund, and Chairman of the Audit Committee. He serves a one-year term, and stands for re-election annually. He has been a Director since 9/25/1995.

Mr. McFadden is Vice President of Marketing for MBNA Corporation. He is not a Director for any other public companies.

JOHN MCGINN

John McGinn is a Director of the Fund, and serves on the Audit Committee. He serves a one-year term, and stands for re-election annually. He has been a Director since 11/5/2002.

Mr. McGinn is head of Credit Review for Vertex, Inc. He is not a Director for any other public companies.

FRED MYERS

Fred Myers is a Director of the Fund. He serves a one-year term, and stands for re-election annually. He has been a Director since 9/25/1995.

Mr. Myers is founding Partner of the accounting firm of Myers & Associates, CPA’s. He is not a Director for any other public companies.

EDWARD SZKUDLAPSKI

Edward Szkudlapski is a Director of the Fund. He serves a one-year term, and stands for re-election annually. He has been a Director since 5/15/2000.

Mr. Szkudlapski is President of Eclipse Business Systems. He is not a Director for any other public companies.

DONALD THOMPSON

Donald Thompson is a Director of the Fund. He serves a one-year term, and stands for re-election annually. He has been a Director since 4/20/1999.

Mr. Thompson is a Network Administrator and Healthcare Consultant. He is not a Director for any other public companies.

ALAN WEINTRAUB

Alan Weintraub is a Director of the Fund. He serves a one-year term, and stands for re-election annually. He has been a Director since 9/25/1995.

Mr. Weintraub is a Chief Technical Officer with Qumas, Cork, Ireland. He is not a Director for any other public companies.

Interested Directors

DANIEL A. MORRIS

Daniel A. Morris is a Director of the Fund, and President of Morris Capital Advisors, Inc., advisor to the Fund. He serves a one-year term, and stands for re-election annually. He has been a Director since 9/25/1995.

Prior to founding Morris Capital Advisors, Inc., he was Senior Vice President of Consistent Asset Management Company, an investment adviser for separate accounts and registered investment companies. As President of the Fund, he is considered an Interested Director. He is not a Director for any other public companies.

BRUCE LAVERTY

Bruce Laverty is a Director of the Fund, and serves as legal counsel to the Fund. He serves a one-year term, and stands for re-election annually. He has been a Director since 9/25/1995.

Mr. Laverty is a Partner of the law firm Valocchi, Fischer & Laverty legal counsel to the Fund. He is not a Director for any other public companies.

29

Fund Office:

15 Chester County Commons

Malvern, PA 19355

610-722-0900 800-787-3334

www.manorfunds.com

Not applicable for semi-annual reports.

ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable for semi-annual reports.

ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable for semi-annual reports.

ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTAS. |

Not applicable for semi-annual reports.

ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

ITEM 9. | CONTROLS AND PROCEDURES. |

| (a) (1) | Code of Ethics - For annual reports. |

| (a) (2) | Certifications persuant to Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

| (b) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Manor Investment Funds, Inc. |

By |

/s/ Daniel A. Morris

|

|

|

| President |

Date | 6/30/2006 |

31