| Company: | Merck KGaA |

| Conference Title: | Merck/Millipore Conference |

| Presenters: | Dr. Karl-Ludwig Kley, Dr. Michael Becker |

| Date: | Monday 1st March 2010 – 09h00 CET |

| Company: | Merck KGaA |

| Conference Title: | Merck Acquires Millipore Conference |

| Presenters: | Dr. Karl-Ludwig Kley, Dr. Michael Becker |

| Date: | Monday 1st March 2010 – 14h30 CET |

creation calculation which proves in our opinion that the transaction will create significant value for shareholders. The acquisition is accretive to core EPS right away. 2009 overall product sales of the combined group amounted to €8.9 billion on the pro forma basis with earnings per share of €4.87, an increase of 10% compared with Merck standalone. We expect annual cost synergies of around $100 million or €75 million and they will be fully realised within three years from now.

A bit on integration. The integration of course is still a bit down the road but it is a very important aspect for us because this is a complementary acquisition and not a synergy acquisition although we will lift the synergies that we will find – and I repeat that was $100 million. Our integration principles are what we call the best of both worlds. We know Millipore for many years of working together in the same industry and also exploring possibilities to work together. We have great respect for what Millipore stands for, for its vision, its innovative spirit, its people and management and its culture. In order to ensure seamless integration of the two businesses we plan to build on Millipore’s workforce and retain its senior management. We also plan to maintain Millipore’s headquarters in Billerica and combine it with Merck’s existing US Chemicals headquarters. All this reflects what we call best of both worlds for integrating these two businesses.

| Companies |  |  | |

| Ticker | Frankfurt Stock Exchange: MRK | NYSE: MIL | |

| Description | Merck is the world’s oldest pharmaceutical and chemical company – its roots date back to 1668. The Pharmaceuticals Business Sector comprises innovative prescription drugs as well as over-the-counter products. The Chemicals Business Sector offers specialty products for the electronics, printing, coatings, cosmetics, food, pharmaceutical and biotech industries. The operational business is managed under the umbrella of Merck KGaA headquartered in Darmstadt (Germany). In the U.S. Merck is called EMD. Since 1917 the former U.S. subsidiary Merck & Co has been an independent company. www.merck.de | Millipore is a Life Science leader providing cutting-edge technologies, tools and services for pharma and biotech companies as well as for academia to improve laboratory productivity and to develop and optimize manufacturing processes – founded in 1954. Millipore offers an extensive range of products and services in: Life Sciences, Drug Discovery and Development, Lab Filtration, Lab Water, Upstream Bioprocessing, Downstream Bioprocessing and Process Monitoring. Millipore is headquartered in Billerica, Massachusetts (USA). www.millipore.com | |

| Employees | Around 33,000 | Around 6,000 | |

| 2009 Revenue | € 7.7 billion | US$ 1.7 billion (€ 1.2 billion) | |

Combined Company (pro forma 2009) | Group Revenues: € 8.9 billion Merck Millipore Revenues: € 2.1 billion (USD 2.9 billion) | ||

Strategic Rationale | · Contributes complementary high-margin specialty products with an attractive growth profile · Creates a € 2.1bn (USD 2.9bn) world class partner for the Life Science sector – Significant scale in high-growth bioscience and bioproduction segments – Comprehensive product offering and cutting-edge technologies for pharma and biopharma customers – Strong global presence and enhanced distribution capabilities – Combined R&D capabilities create powerful innovation platform · Generates significant value for shareholders · Fully in line with Merck's acquisition strategy | ||

Transaction Terms | Offer | · Definitive agreement to acquire all outstanding Millipore shares for US$107 per share in cash, or a total transaction value (including net debt) of approximately US$ 7.2 billion | |

| Condition | · Closing subject to Millipore shareholder approval, antitrust clearance and other customary closing conditions · Closing expected in 2H 2010 | ||

| Financing | · The acquisition will be funded through available cash and a term loan provided by Bank of America Merrill Lynch, BNP Paribas and Commerzbank Aktiengesellschaft · Merck plans to replace part of the facility through the issuance of bonds. Merck is committed to retaining a solid investment-grade rating | |

Commitment to the U.S. | Millipore Integration | · Merck to apply “best of both worlds” integration approach across all operating functions, similar to strategy used in successful Serono transaction · Merck plans to build on Millipore’s talented workforce and retain its senior management · Merck also plans to maintain Millipore’s headquarters in Billerica, Massachusetts and to combine it with Merck’s U.S. headquarters · Millipore’s well-recognized brand will be maintained · Commitment to invest in Millipore’s operations · Commitment to maintain and build upon Millipore’s and Merck’s existing community initiatives, corporate giving and sustainability programs |

| History | · Merck has a century-long history as a responsible employer · Merck Serono today is rated one of the most desirable biopharma companies to work for in the U.S. · Merck is already an active participant and committed corporate citizen in business communities in and around the Boston area. · Merck operates in North America under the umbrella brand EMD, formed from the initials of Emanuel Merck, Darmstadt · Merck employs around 2,200 employees in North America · Merck generates around € 1.2 billion in revenue in North America in 2009 · Approximately 15% of total revenues are generated in North America |

Investor Presentation, March 1, 2010

Acquisition of Millipore

Investing in Life Sciences – Transforming Merck’s Chemicals Business

Disclaimer

Merck does not assume any responsibility with respect to the completeness and the accuracy of the information contained in this document (the

"Information"). The Information is selective and does not purport to contain all information the addressee may require. This document should

exclusively be viewed together with the oral presentation provided by Merck. The addressees of this document should conduct their own investigation

and analysis of Millipore’s and Merck’s business, the proposed transaction and the Information.

The Information in this document may contain “forward-looking statements”. Forward-looking statements may be identified by words such as

“expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “will” or words of similar meaning and include, but are not limited to,

statements about the expected future businesses of Merck KGaA (Merck) and Millipore Corporation (Millipore) resulting from and following the

proposed acquisition. These statements are based on the current expectations of Merck and Millipore and are inherently subject to uncertainties and

changes in circumstances. Among the factors that could cause actual results to differ materially from those described in the forward-looking statements

are factors relating to the fulfillment of certain closing conditions to the proposed transaction, and changes in global, political, economic, business,

competitive, market and regulatory forces. Merck and Millipore do not undertake any obligation to update the forward-looking statements to reflect

actual results, or any change in events, conditions, assumptions or other factors.

This communication may be deemed to be solicitation material in respect of the proposed acquisition of Millipore by Merck. In connection with the

proposed acquisition, Merck and Millipore intend to file relevant materials with the SEC, including Millipore's proxy statement on Schedule 14A.

INVESTORS AND SECURITYHOLDERS OF MILLIPORE ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC,

INCLUDING MILLIPORE'S PROXY STATEMENT, WHEN IT BECOMES AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED ACQUISITION.

Investors and security holders will be able to obtain all such documents, when they become available, free of charge through the website

maintained by the SEC at www.sec.gov, or by directing a request to Joshua S. Young, Director of Investor Relations for Millipore at +1-978-715-1527.

Such documents are not currently available.

Merck and certain of its directors and executive officers and other persons, and Millipore and its directors and certain executive officers, may be

deemed to be participants in the solicitation of proxies from the holders of Millipore common stock in respect of the proposed acquisition. Information

regarding such persons and a description of their interests in the transaction will be contained in the proxy statement when it is filed.

Page 2

Contents

1

2

3

Transaction highlights

Millipore overview and strategic rationale

Impact on Merck

4

Summary

Page 3

A compelling investment opportunity to unlock

value in Merck’s chemicals business

Contributes complementary high-margin specialty products with an

attractive growth profile

Creates a EUR 2.1bn world class partner for the Life Science sector

Significant scale in high-growth bioscience and bioproduction segments

Comprehensive product offering and cutting-edge technologies for pharma

and biopharma customers

Strong global presence and enhanced distribution capabilities

Combined R&D capacity creates powerful innovation platform

Generates significant value for shareholders

Fully in line with Merck's acquisition strategy

Page 4

Transaction details

USD 107 per share in cash

USD 7.2bn transaction value (EUR 5.3bn)(1)

15.1x 2010E EBITDA

12.5x 2010E EBITDA including steady-state synergies of USD 100m

The transaction will be funded through available cash and term loan

Closing subject to Millipore shareholder approval, antitrust clearance and

other customary closing conditions

Closing expected in 2H 2010

Note: (1) At an exchange rate EUR/USD of 1.36 as of February 26, 2010 and including net debt

Page 5

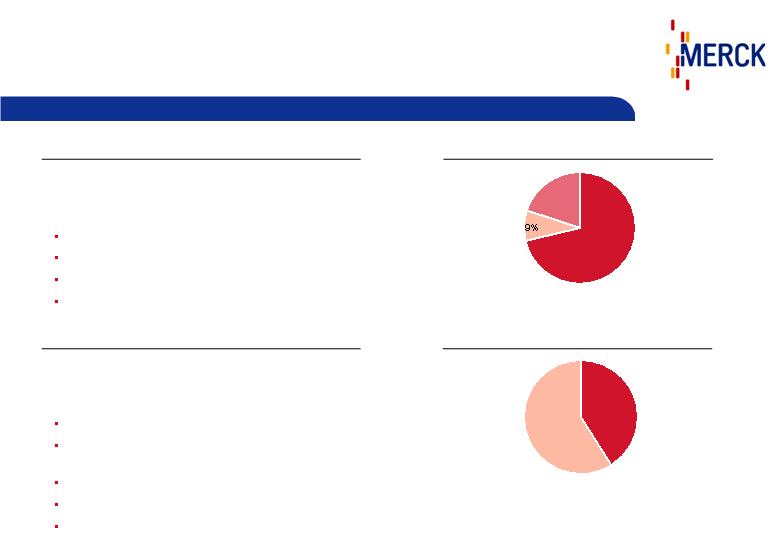

Millipore at a glance

Founded in 1954

Headquarter: Billerica, MA

Around 6,000 employees in more than 30 countries

Serving needs of life science researchers and

biopharmaceutical manufacturers in the life science

tools market

Two divisions: bioscience & bioprocess

Customers: pharma, biopharma and academia

Operates 11 manufacturing sites and 10 R&D

centers

2009 USD 1.7bn sales / 2009 USD 341m operating

profit(1) (margin 20.6%)

Sales by Division (FY09)

Sales by Region (FY09)

Asia

20%

Europe

40%

Company Description

56%

Bioprocess

44%

Bioscience

Total: USD 1.7bn

Total: USD 1.7bn

North & Latin America

40%

Note: (1) Non-GAAP figure as reported by Millipore

Page 6

Transaction fully in line with Merck’s acquisition

strategy

Capitalizes on Merck‘s strong expertise in

pharma and biopharma sectors

Build on Merck’s in-depth sector

knowledge

Adds well-recognized global brand and doubles

sales of Merck’s chemicals business in the

Americas

Expand geographical reach and

strengthen presence in U.S.

Adds USD 1.7bn sales to Merck’s chemicals

business

Balance Merck’s business portfolio

Millipore’s contribution

Criteria

Cutting-edge technologies for one of the most

innovative industries, Life Sciences

Concentrate on innovative businesses

Strong position in bioscience research and

biopharmaceutical manufacturing

Focus on high-margin specialty

products in growth markets

Page 7

Contents

1

2

3

Transaction highlights

Millipore overview and strategic rationale

Impact on Merck

4

Summary

Page 8

Products, technologies and services to improve

laboratory productivity and work flows for life science

research:

Reagents, kits, antibodies

Molecular biology tools for purifying, preparing, or

screening biological samples

Filtration devices, customized antibodies, kits, etc.

Lab water solutions

Advanced instruments

Millipore business overview

Bioprocess Sales (FY09)

Bioscience Sales (FY09)

Life Science

59%

Lab Water

41%

Process Monitoring

20%

Upstream

Downstream

71%

Bioprocess Division

Products for pharma and biotech companies to

develop and optimize manufacturing processes and

ensure drug quality:

Cell culture media supplements

Chromatography media

Broad range of filtration consumables and devices

Process monitoring tools

Bioscience Division

Total: USD 926m

Total: USD 729m

Page 9

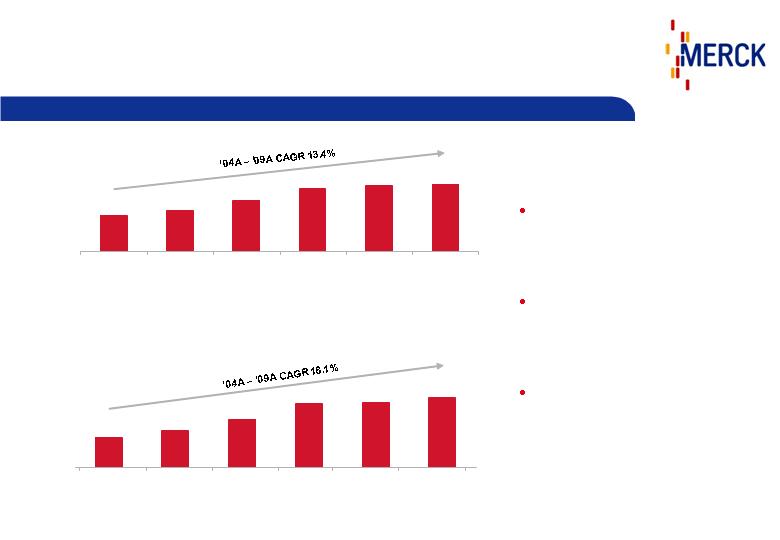

Consistently strong

revenue growth

Strong growth in

operating profit

Attractive operating

margins

Millipore: consistent track record of profitable growth

3.3%

4.6%

22.0%

26.7%

12.2%

10.0%

Total

(2.7%)

3.6%

5.0%

0.3%

0.3%

5.0%

Currency

1.0%

0.0%

11.0%

17.8%

1.7%

0.0%

Acquisition

Growth

Organic

5.0%

10.2%

8.6%

6.0%

1.0%

5.0%

Reported Sales (USDm)

883

991

1,255

1,532

1,602

1,654

2004

2005

2006

2007

2008

2009

2005

16.8% 18.1% 18.7% 20.3% 19.8% 20.6%

Margin

149

179

235

311

317

341

2004

2006

2007

2008

2009

Operating Profit(1) (USDm)

Note: (1) Non-GAAP figure as reported by Millipore

Page 10

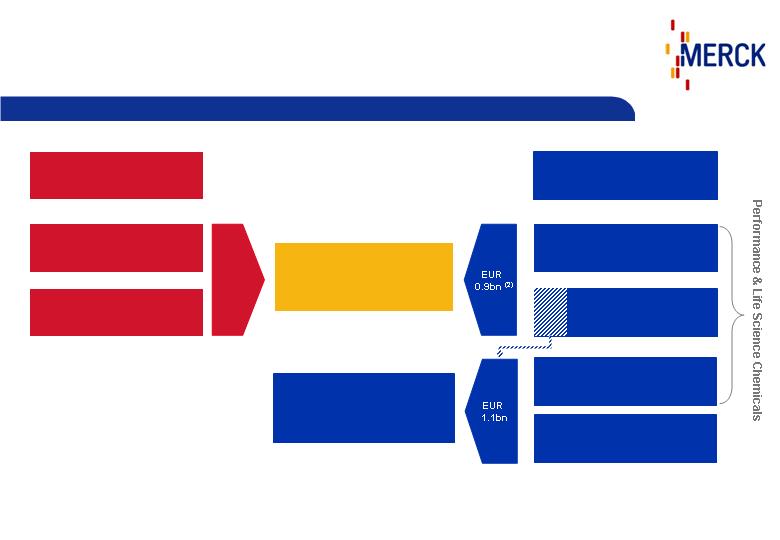

Merck Millipore

Pro-forma FY09 Sales

EUR 2.1bn

Transforming Merck’s chemicals business

MILLIPORE

Total FY09 Sales: EUR 1.2bn

MERCK CHEMICALS

Total FY09 Sales: EUR 1.9bn(1)

Bioscience

Bioprocess

Laboratory

Business

Life Science

Solutions

Pigments

Liquid

Crystals

EUR

1.2bn

Performance Chemicals

Pro-forma FY09 Sales:

EUR 1.1bn

Note: (1) Figures do not add up due to rounding

(2) Relevant Merck business for Merck Millipore

Exchange Rate EUR/USD: 1.39 for Millipore’s figures

Page 11

Scale in high-growth market segments

2-6%

6-10%

4-8%

Note: (1) Exchange Rate EUR/USD: 1.39 for Millipore’s figures

(2) Research reports

(3) Figures do not add up due to rounding

Research Customers

Production Customers

Bioscience customers: Critical mass,

broad product portfolio and strong

specialized sales force

Lab customers: High-quality chemicals

and water purification technologies for

laboratories in industry and academia

Pharma & biotech production:

Complementary product offering

for pharma and biotech customers

667

453

214

386

77

310

667

345

1,012

FY09 sales in EURm(1)

Lab

Business

Bioscience

Pharma &

Biotech

Production

Millipore

Merck

(3)

Page 12

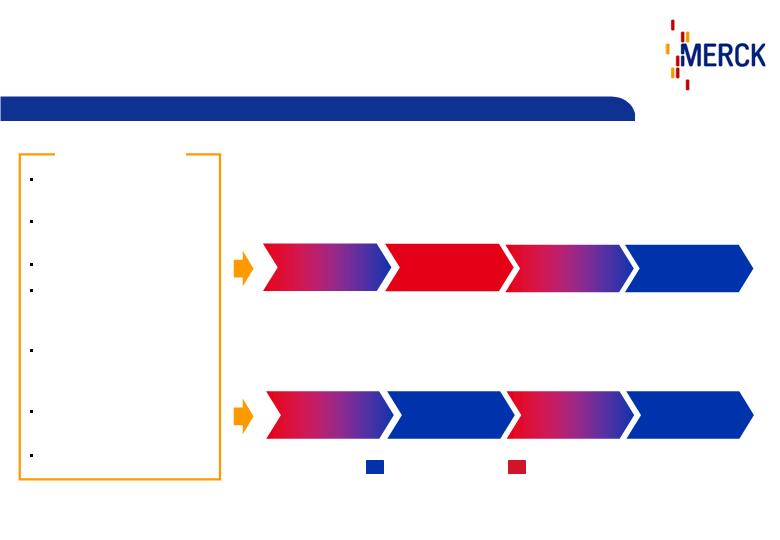

Beyond Chemicals – Covering the entire value

chain for biopharma and pharma customers

Biopharma Value Chain

Creating an integrated solutions offering to biopharma customers

Biodiscovery

Upstream-

Processing

Downstream-

Processing

Formulation

Pharma Value Chain

Enhancing Merck‘s strong product offering to pharma customers

Pharma

Research

Formulation

Synthesis

Purification

Pharma raw materials

Services

Advanced lab

instruments &

consumables

Disposable

manufacturing

solutions

Chromatography

media

Bioscience kits and

reagents

Process monitoring

tools

Merck Millipore

Millipore

Merck

Page 13

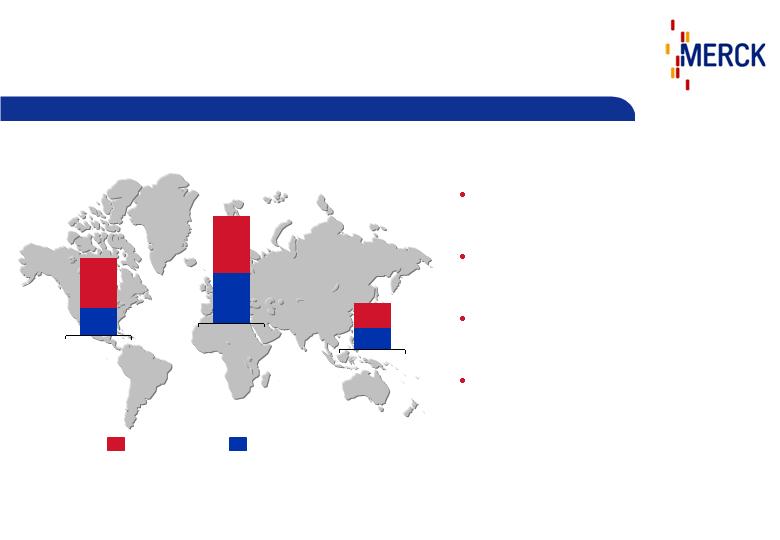

Strong global market presence

Sales by region in EURm(1) for FY09

Enhanced presence in U.S.

market

Adds scale to sales and

marketing

Stronger partner to global

customers

Critical mass in India and

China

737

475

262

Americas

897

418

479

Europe

Asia Pacific

431

195

236

Millipore

Merck

Note: (1) Exchange Rate EUR/USD: 1.39 for Millipore’s figures

Page 14

Enhanced distribution capabilities

Combined bioscience business to benefit from Millipore’s

strong e-commerce platform

Drives sales and profitability

Enhances operational efficiency and simplifies processes

Larger sales force leads to greater customer proximity

Strengthened specialty sales force

More efficient joint product development process for customers

and Merck Millipore

Increased scale allows higher direct sales to customers

Page 15

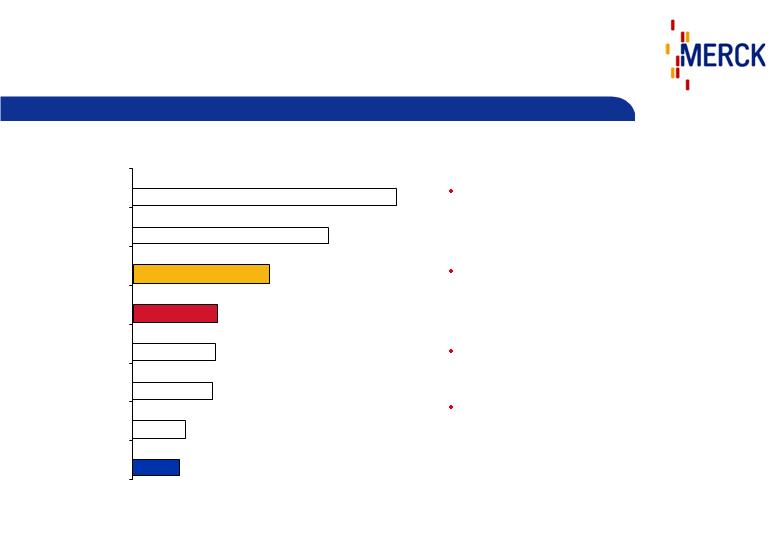

Combined R&D capacity creates powerful

innovation platform

Pro forma annual R&D budget of

EUR 123m focused on products for

pharma and biotech customers

Increased scale helps to improve

return on investment in new

technologies and diversifies risk

Leveraging existing biopharma

competence

Partner of choice for strategic

collaborations and licensing

relationships

Note: (1) All figures are based on FY09 except Lonza (FY08)

(2) Relevant Merck business for Merck Millipore

Exchange Rate EUR/USD: 1.390

Exchange Rate EUR/CHF: 1.587

R&D expenses (EURm and % sales)

41

45

69

78

82

123

177

240

4.7%

2.9%

3.7%

10.7%

6.9%

5.9%

10.1%

2.4%

Merck(2)

Sigma Aldrich

Lonza(1)

Qiagen

Millipore

Merck Millipore

Thermo Fisher

Scientific

Life Technologies

Page 16

Contents

1

2

3

Transaction highlights

Millipore overview and strategic rationale

Impact on Merck

4

Summary

Page 17

Pro forma impact on Merck – 2009

Merck

Millipore(1)

Steady-

State

Synergies

New

Merck

Group

Product Sales

7.7

1.2

8.9

EBITDA

1.7

0.3

0.1

2.0(2)

Margin

21%

25%

23%

Core EPS

4.44

2.88

4.87

Accretion

10%

EURbn, except per share data

Note: (1) Exchange rate EUR/USD: 1.39

(2) Figures do not add up due to rounding

(3) Including those Life Science Solutions businesses that will not be part of Merck Millipore

Significant value creation for shareholders

New Merck Group Sales in % (FY09)

12%

Pharma

65%

23%

Merck Millipore

Liquid Crystals, Pigments(3)

Total: EUR 8.9bn

Page 18

Details on financing

Acquisition will be funded through available cash and a term

loan provided by Bank of America Merrill Lynch, BNP Paribas

and Commerzbank Aktiengesellschaft

Merck plans to replace part of the facility through the issuance

of bonds.

Merck is committed to retaining a solid investment-grade

rating.

Page 19

Successful integration built on experience

Intention to retain the senior management team

Merck to build on successful acquisition and integration track record

Merck to apply “best of both worlds” integration approach across all

operating business functions, similar to strategy used in successful

Serono transaction

Seamless integration from customers’ point of view

Merck intends to retain Millipore’s existing headquarters in Billerica and

combine it with Merck’s existing U.S. chemicals headquarters

The well-recognized Millipore brand will be maintained

Proven commitment to Billerica and the region with significant investment in

last years

Page 20

Contents

1

2

3

Transaction highlights

Millipore overview and strategic rationale

Impact on Merck

4

Summary

Page 21

Illustrative process for share exchange

Merck and Millipore execute Share Exchange

Agreement

Preparatory actions for Millipore’s special meeting

Special meeting approving Share Exchange

(2/3 of all shareholders)

Closing after fulfillment of closing conditions such

as shareholder approval and regulatory clearance

Execution

~ 80

Days

2H 2010

Page 22

A compelling investment opportunity to unlock

value in Merck Chemicals

Contributes complementary high-margin specialty products

with an attractive growth profile

Creates a EUR 2.1 bn world class partner for the Life

Science sector

Generates significant value for shareholders

Fully in line with Merck’s acquisition criteria

Page 23