UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Rule 14a-101)

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| x | Soliciting Material Pursuant to §240.14a-12 | |

SIGMA-ALDRICH CORPORATION

(Name of Registrant as Specified In Its Charter)

MERCK KGaA

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Filed by: Merck KGaA

Pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Sigma-Aldrich Corporation

Commission File No. 000-08135

The following materials are available to shareholders of Sigma-Aldrich Corporation in connection with the previously announced transaction between Sigma-Aldrich Corporation and Merck KGaA on the transaction website hosted by Merck KGaA located at http://www.emdgroup.com/emd/media/topics/001.html:

1) Press Release

2) Investor Presentation

3) Ad Hoc Release

4) Factsheet

5) MerckNet Report

6) Script of CEO/CFO Video

7) Townhall Presentation

News Release | Your Contact | |||||

Nicole Mommsen |

+49 151 1454 2005 | |||||

| Markus Talanow | +49 6151 72-7144 | |||||

| Investor Relations | +49 6151 72-3321 |

September 22, 2014

Merck KGaA to Acquire Sigma-Aldrich to Enhance Position in Attractive Life Science Industry

| • | Merck KGaA to acquire Sigma-Aldrich for $140 per share in cash, valuing company at approx. $17 billion (€13.1 billion) |

| • | Acquisition expands EMD Millipore’s global reach, increasing the company’s presence in North America and adding exposure to fast-growing Asian markets |

| • | Customers benefit from broader offering of complementary products and capabilities and leading e-commerce platform in the industry |

| • | Merck KGaA plans to maintain significant presence in St. Louis, MO, and Billerica, MA |

| • | Life Science contribution to Merck KGaA earnings more than doubles |

| • | Transaction expected to be immediately accretive to EPS pre and EBITDA margin |

| • | Merck KGaA to host media conference call today at 8:00 AM EDT / 2:00 PM CET |

Darmstadt, Germany and St. Louis, MO, September 22, 2014 – Merck KGaA, a leading company for innovative and top-quality high-tech products in the pharmaceutical, chemical and life science sectors, and Sigma-Aldrich today announced that they have entered into a definitive agreement under which Merck KGaA, Darmstadt, Germany, will acquire Sigma-Aldrich for $17.0 billion (€13.1 billion), establishing one of the leading players in the $130 billion global life science industry.

Merck KGaA, Darmstadt, Germany, will acquire all of the outstanding shares of Sigma-Aldrich for $140 per share in cash. The agreed price represents a 37% premium to the latest closing price of $102.37 on September 19, 2014, and a 36% premium to the one-month average closing price. The transaction is expected to be immediately accretive to Merck KGaA, Darmstadt,

| Merck KGaA | ||||

Frankfurter Strasse 250 64293 Darmstadt Hotline +49 6151 72-5000 www.emdgroup.com | Head Media Relations -62445 Spokesperson: -9591 / -7144 / -6328 Fax +49 6151 72-3138 media.relations@merckgroup.com | |||

Page 1 of 7

News Release

Germany’s EPS pre and EBITDA margin. Merck KGaA, Darmstadt, Germany, expects to achieve annual synergies of approximately €260 million (approximately $340 million), which should be fully realized within three years after closing.

“This transaction marks a milestone on our transformation journey aimed at turning our three businesses into sustainable growth platforms”, said Karl-Ludwig Kley, Chairman of Merck KGaA, Darmstadt, Germany’s Executive Board. “For our life science business it’s even more than that: it’s a quantum leap. In one of the world’s key industries two companies that fit perfectly together have found each other to present a much broader product offering to our global customers in research, pharma and biopharma manufacturing and diagnostic and testing labs. As such, the combination of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich will secure stable growth and profitability in an industry that is driven by trends such as the globalization of research and manufacturing. What’s more, the combination gives us the possibility to invest even more in innovation going forward. We are delighted to make this compelling proposition to Sigma-Aldrich’s shareholders, who will obtain full and certain cash value for their shares.”

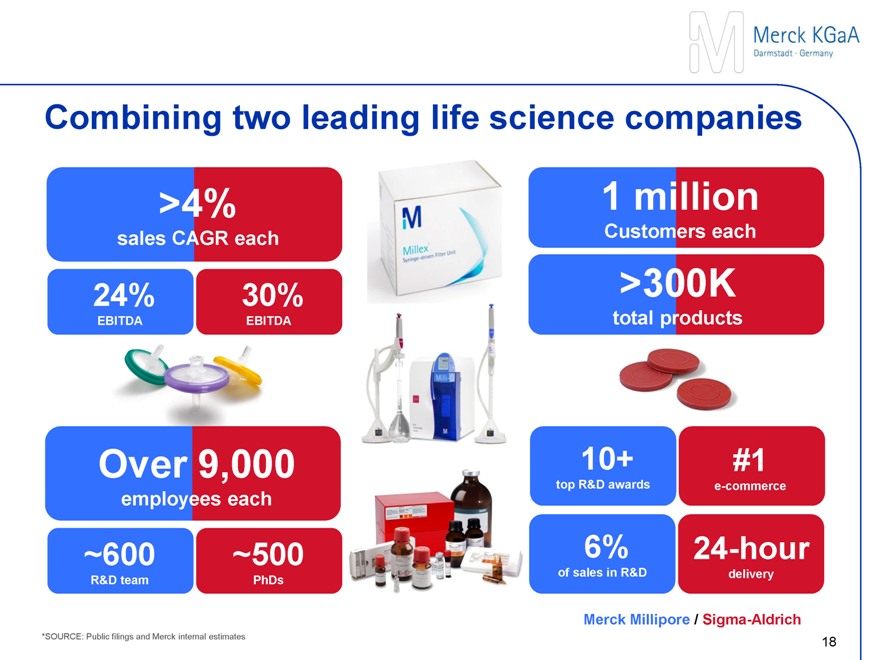

Rakesh Sachdev, President and Chief Executive Officer of Sigma-Aldrich, said, “We are excited to join forces with Merck KGaA, Darmstadt, Germany, a distinguished industry leader. The combined company will be well-positioned to deliver significant customer benefits, including a broader, complementary range of products and capabilities, greater investment in breakthrough innovations, enhanced customer service, and a leading e-commerce and distribution platform in the industry. This transaction is a clear validation of our success in transforming Sigma-Aldrich into a customer-focused and solutions-oriented global organization. This is a testament to the strength of the Sigma-Aldrich brand and the accomplishments of our 9,000 employees worldwide. We believe this is a very positive outcome for our shareholders, who will receive a significant premium, and our employees, who will benefit from enhanced opportunities as part of a larger, more global organization.”

The combined company will be able to serve life science customers around the world with a highly attractive set of established brands and an efficient supply chain that can support the delivery of more than 300,000 products. In the Laboratory & Academia business, together EMD

Page 2 of 7

News Release

Millipore and Sigma-Aldrich will offer their customers a complementary range of products across laboratory chemicals, biologics and reagents. In pharma and biopharma production, Sigma-Aldrich will complement EMD Millipore’s existing products and capabilities with additions along the entire value chain of drug production and validation.

Shaped over almost 350 years by a family of owners, Merck today is known as a successful and values-driven business and a well-respected employer in the life science industry. With a common focus on employees, customers and communities, the combination represents a strong operational and cultural fit. Merck KGaA, Darmstadt, Germany, has great respect for Sigma-Aldrich’s rich history, customer-centric culture and commitment to corporate social responsibility and believes that the combination will afford new opportunities to employees at both companies. Merck KGaA, Darmstadt, Germany, plans to maintain a significant presence in St. Louis, and in Billerica, following completion of the transaction, as well as in important EMD Millipore sites such as Darmstadt and Molsheim, France.

Merck KGaA, Darmstadt, Germany, has successfully integrated a number of life science businesses in recent years, evaluating each company and combining the strongest operations, most efficient processes and most innovative programs that best support the future growth of the combined company. Merck KGaA, Darmstadt, Germany, intends to apply the same principles to the acquisition of Sigma-Aldrich in order to ensure a seamless integration. An integration team, which will include representatives from both companies, will be established to oversee and facilitate the integration process.

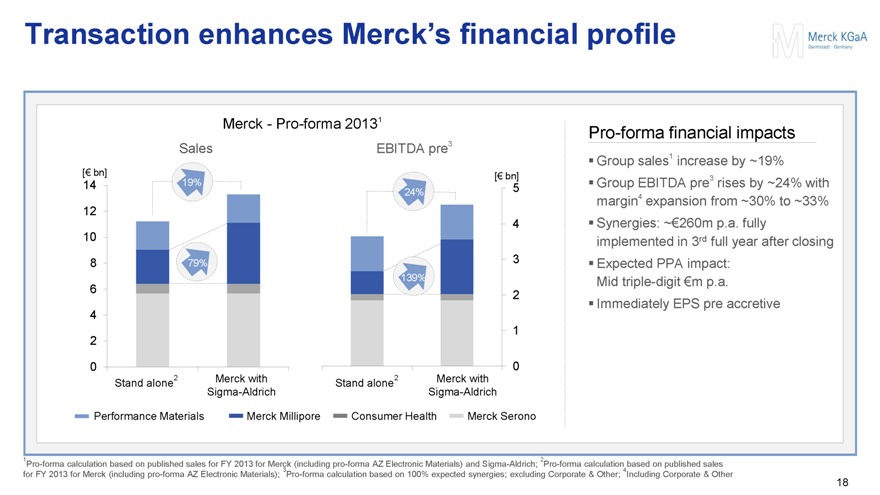

The combined life science business will have solid growth potential, strong and sustainable cash flow, and meaningful efficiency potential on an operational level. Based on fiscal year 2013 financials, the business would have had combined sales of €4.7 billion ($6.1 billion), an increase of 79% and combined EBITDA pre (earnings before interest, taxes, depreciation and amortization before one-time items) of €1.5 billion ($2.0 billion), which is an increase of 139%. Merck KGaA, Darmstadt, Germany, Group’s sales would have increased by approximately 19%. For the same period, the acquisition would have increased Merck KGaA, Darmstadt, Germany, Group’s EBITDA pre by approximately 24% and improved Group EBITDA pre margin from approximately 30% to approximately 33% including expected synergies.

Page 3 of 7

News Release

The transaction has been unanimously approved by Sigma-Aldrich’s Board of Directors. A merger agreement will be presented to Sigma-Aldrich shareholders for approval at a special meeting of shareholders.

The transaction has the full support of Merck KGaA, Darmstadt, Germany’s Executive Board and E. Merck KG including its Board of Partners, and a Merck KGaA, Darmstadt, Germany, shareholder vote will not be required. Bridge financing has been secured for the all-cash transaction, and Merck KGaA, Darmstadt, Germany, expects the final financing structure will comprise a combination of cash on Merck KGaA, Darmstadt, Germany’s balance sheet, bank loans and bonds. Closing is expected in mid-year 2015, subject to regulatory approvals and other customary closing conditions.

Guggenheim Securities and J.P. Morgan are acting as financial advisers to Merck KGaA, Darmstadt, Germany. Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal adviser to Merck KGaA, Darmstadt, Germany. Morgan Stanley & Co. LLC is acting as financial adviser to Sigma-Aldrich and Sidley Austin LLP is acting as legal adviser.

Page 4 of 7

News Release

Notes to editors

| • | Documents regarding the transaction are accessiblehere. |

| • | For the media, aconference call will be held with the Merck KGaA, Darmstadt, Germany management |

at 8:00 AM EDT / 2:00 PM CET

| +1 (888)424-8151 | Audience US Toll Free | |

| +1 (847)585-4422 | Audience US Toll | |

| 0800 222 2013 | Audience Germany Freephone | |

| 069 222 215 20 | Audience Germany-Frankfurt Local | |

| Audience Passcode | 9203 983 |

| • | For analysts and investors, aconference call with the Merck KGaA, Darmstadt, Germany management will be held 9:00 AM EDT / 3:00 PM CET |

| +1 (888) 424-8151 | Audience US Toll Free | |

| +1 (847)585-4422 | Audience US Toll | |

| 0800 222 2013 | Audience Germany Freephone | |

| 069 222 215 20 | Audience Germany-Frankfurt Local | |

| Audience Passcode | 6411 816 |

| • | Merck onFacebook,Twitter,Linkedin |

| • | Merck KGaA, Darmstadt, Germany photos and video footage can be foundhere |

| • | Merck KGaA, Darmstadt, Germany stock symbols |

Reuters: MRCG,Bloomberg: MRK GY,Dow Jones: MRK.DE

Frankfurt Stock Exchange:ISIN: DE 000 659 9905 – WKN: 659 990

| • | Sigma-Aldrich stock symbols |

Reuters: SIAL.O, Bloomberg: SIAL:US

Contacts Sigma-Aldrich

Karen Miller

Senior Vice President, Corporate Development & Corporate Communications

Karen.Miller@sial.com

+1-314-286-7996

Quintin Lai

Vice President - Investor Relations and Strategy

investorrelations@sial.com

+1-314-898-4643

Page 5 of 7

News Release

All Merck KGaA, Darmstadt, Germany, press releases are distributed by e-mail at the same time they become available on the EMD Group Website. In case you are a resident of the USA or Canada please go towww.emdgroup.com/subscribe to register again for your online subscription of this service as our newly introduced geo-targeting requires new links in the email. You may later change your selection or discontinue this service.

About Merck KGaA, Darmstadt, Germany

Merck KGaA of Darmstadt, Germany, is a leading company for innovative and top-quality high-tech products in the pharmaceutical and chemical sectors. Its subsidiaries in Canada and the United States operate under the umbrella brand EMD. Around 39,000 employees work in 66 countries to improve the quality of life for patients, to further the success of customers and to help meet global challenges. The company generated total revenues of € 11.1 billion in 2013 with its four divisions: Biopharmaceuticals, Consumer Health, Performance Materials and Life Science Tools. Merck KGaA of Darmstadt, Germany is the world’s oldest pharmaceutical and chemical company – since 1668, the name has stood for innovation, business success and responsible entrepreneurship. Holding an approximately 70 percent interest, the founding family remains the majority owner of the company to this day.

About Sigma-Aldrich

Sigma-Aldrich, a leading Life Science and Technology company focused on enhancing human health and safety, manufactures and distributes more than 230,000 chemicals, biochemicals and other essential products to more than 1.4 million customers globally in research and applied labs as well as in industrial and commercial markets. With three distinct business units - Research, Applied and SAFC Commercial - Sigma-Aldrich is committed to enabling science to improve the quality of life. The Company operates in 37 countries, has approximately 9,000 employees worldwide and had sales of $2.7 billion in 2013. For more information about Sigma-Aldrich, please visit its website at www.Sigma-Aldrich.com.

Cautionary Note Regarding Forward-Looking Statements

This communication may include “forward-looking statements.” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward-looking statements. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements.

Risks and uncertainties relating to the proposed transaction with Sigma-Aldrich Corporation (“Sigma-Aldrich”) include, but are not limited to: the risk Sigma-Aldrich’s shareholders do not approve the transaction; uncertainties as to the timing of the transaction; the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated; competitive responses to the transaction; litigation relating to the transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability of Merck KGaA, Darmstadt, Germany, to achieve the cost-savings and synergies contemplated by the proposed transaction within the expected time frame; the ability of Merck KGaA, Darmstadt, Germany, to promptly and effectively integrate the businesses of Sigma-Aldrich and Merck KGaA, Darmstadt, Germany; the effects of the business combination of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich, including the combined company’s future financial condition, operating results, strategy and plans; the implications of the proposed transaction on certain employee benefit plans of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich; and disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers.

Additional risks and uncertainties include, but are not limited to: the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval; the risk of stricter regulations for the manufacture, testing and

Page 6 of 7

News Release

marketing of products; the risk of destabilization of political systems and the establishment of trade barriers; the risk of a changing marketing environment for multiple sclerosis products in the European Union; the risk of greater competitive pressure due to biosimilars; the risks of research and development; the risks of discontinuing development projects and regulatory approval of developed medicines; the risk of a temporary ban on products/production facilities or of non-registration of products due to non-compliance with quality standards; the risk of an import ban on products to the United States due to an FDA warning letter; the risks of dependency on suppliers; risks due to product-related crime and espionage; risks in relation to the use of financial instruments; liquidity risks; counterparty risks; market risks; risks of impairment on balance sheet items; risks from pension obligations; risks from product-related and patent law disputes; risks from antitrust law proceedings; risks from drug pricing by the divested Generics Group; risks in human resources; risks from e-crime and cyber attacks; risks due to failure of business-critical information technology applications or to failure of data center capacity; environmental and safety risks; unanticipated contract or regulatory issues; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich and its impact on goodwill impairment evaluations; the impact of future regulatory or legislative actions; and the risks and uncertainties detailed by Sigma-Aldrich with respect to its business as described in its reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”).

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany, and the Risk Factors section of Sigma-Aldrich’s most recent reports on Form 10-K and Form 10-Q. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Important Additional Information

This communication is being made in respect of the proposed merger transaction involving Sigma-Aldrich and Merck KGaA, Darmstadt, Germany. The proposed merger will be submitted to the stockholders of Sigma-Aldrich for their consideration. In connection therewith, Sigma-Aldrich intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to the stockholders of Sigma-Aldrich. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement, any amendments or supplements thereto and other documents containing important information about Sigma-Aldrich, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Sigma-Aldrich will be available free of charge on Sigma-Aldrich’s website at www.sigmaaldrich.com under the heading “SEC Documents” within the “Investor Info” section in the “Investors” portion of Sigma-Aldrich’s website. Shareholders of Sigma-Aldrich may also obtain a free copy of the definitive proxy statement by contacting Sigma-Aldrich’s Investor Relations Department at (314) 898-4643.

Sigma-Aldrich and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Sigma-Aldrich is set forth in its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 21, 2014, its annual report on Form 10-K for the fiscal year ended December 31, 2013, which was filed with the SEC on February 6, 2014, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation of the stockholders of Sigma-Aldrich and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC when they become available.

Page 7 of 7

Acquisition of Sigma-Aldrich

Taking Merck’s life science business to the next level

Karl-Ludwig Kley, CEO

Marcus Kuhnert, CFO

M

September 22, 2014

M

Disclaimer Publication of Merck KGaA, Darmstadt, Germany. In the United States and Canada the subsidiaries of Merck KGaA, Darmstadt, Germany operate under the umbrella brand EMD.

M

Merck KGaA

Darmstadt · Germany

Disclaimer

Cautionary Note Regarding Forward-Looking Statements

This communication may include “forward-looking statements.” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward-looking statements. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements.

Risks and uncertainties relating to the proposed transaction with Sigma-Aldrich Corporation (“Sigma-Aldrich”) include, but are not limited to: the risk Sigma-Aldrich’s shareholders do not approve the transaction; uncertainties as to the timing of the transaction; the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated; competitive responses to the transaction; litigation relating to the transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability of Merck KGaA, Darmstadt, Germany, to achieve the cost-savings and synergies contemplated by the proposed transaction within the expected time frame; the ability of Merck KGaA, Darmstadt, Germany, to promptly and effectively integrate the businesses of Sigma-Aldrich and Merck KGaA, Darmstadt, Germany; the effects of the business combination of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich, including the combined company’s future financial condition, operating results, strategy and plans; the implications of the proposed transaction on certain employee benefit plans of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich; and disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers.

Additional risks and uncertainties include, but are not limited to: the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval; the risk of stricter regulations for the manufacture, testing and marketing of products; the risk of destabilization of political systems and the establishment of trade barriers; the risk of a changing marketing environment for multiple sclerosis products in the European Union; the risk of greater competitive pressure due to biosimilars; the risks of research and development; the risks of discontinuing development projects and regulatory approval of developed medicines; the risk of a temporary ban on products/production facilities or of non-registration of products due to non-compliance with quality standards; the risk of an import ban on products to the United States due to an FDA warning letter; the risks of dependency on suppliers; risks due to product-related crime and espionage; risks in relation to the use of financial instruments; liquidity risks; counterparty risks; market risks; risks of impairment on balance sheet items; risks from pension obligations; risks from product-related and patent law disputes; risks from antitrust law proceedings; risks from drug pricing by the divested Generics Group; risks in human resources; risks from e-crime and cyber attacks; risks due to failure of business-critical information technology applications or to failure of data center capacity; environmental and safety risks; unanticipated contract or regulatory issues; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich and its impact on goodwill impairment evaluations; the impact of future regulatory or legislative actions; and the risks and uncertainties detailed by Sigma-Aldrich with respect to its business as described in its reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”).

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany, and the Risk Factors section of Sigma-Aldrich’s most recent reports on Form 10-K and Form 10-Q. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Important Additional Information

This communication is being made in respect of the proposed merger transaction involving Sigma-Aldrich and Merck KGaA, Darmstadt, Germany. The proposed merger will be submitted to the stockholders of Sigma-Aldrich for their consideration. In connection therewith, Sigma-Aldrich intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to the stockholders of Sigma-Aldrich. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement, any amendments or supplements thereto and other documents containing important information about Sigma-Aldrich, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Sigma-Aldrich will be available free of charge on Sigma-Aldrich’s website at www.sigmaaldrich.com under the heading “SEC Documents” within the “Investor Info” section in the “Investors” portion of Sigma-Aldrich’s website. Shareholders of Sigma-Aldrich may also obtain a free copy of the definitive proxy statement by contacting Sigma-Aldrich’s Investor Relations Department at +1 (314) 898 4643.

Sigma-Aldrich and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Sigma-Aldrich is set forth in its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 21, 2014, its annual report on Form 10-K for the fiscal year ended December 31, 2013, which was filed with the SEC on February 6, 2014, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation of the stockholders of Sigma-Aldrich and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC when they become available.

3

M

Merck KGaA

Darmstadt · Germany

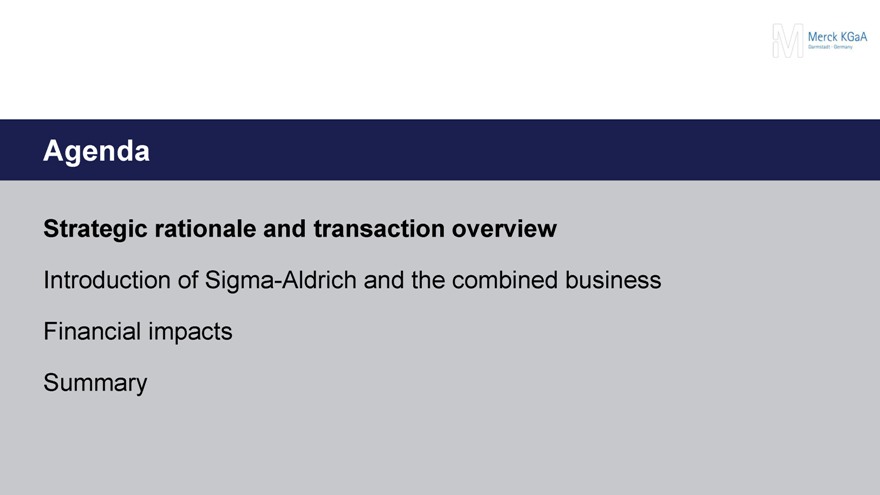

Agenda

Strategic rationale and transaction overview

Introduction of Sigma-Aldrich and the combined business

Financial impacts

Summary

M

Merck KGaA

Darmstadt · Germany

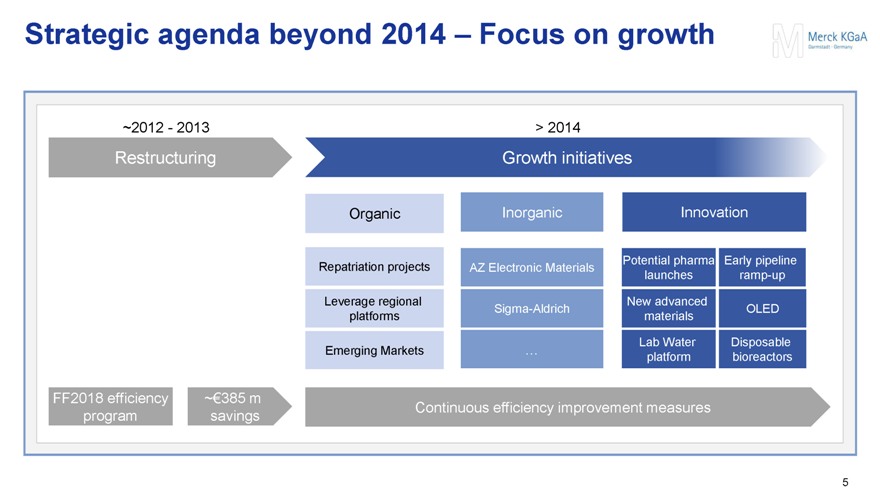

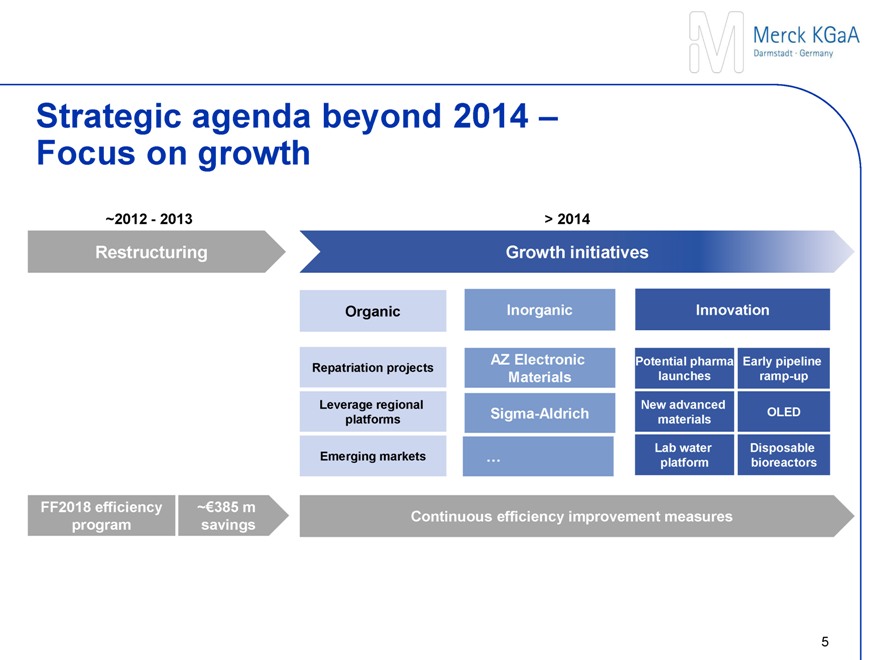

Strategic agenda beyond 2014 – Focus on growth

~2012 - 2013 > 2014

Restructuring Growth initiatives

Organic Inorganic Innovation

Repatriation projects AZ Electronic Materials Potential pharma launches Early pipeline ramp-up

Leverage regional platforms Sigma-Aldrich New advanced materials OLED

Emerging Markets … Lab Water platform Disposable bioreactors

FF2018 efficiency program ~€385 m savings Continuous efficiency improvement measures

5

M

Merck KGaA

Darmstadt · Germany

Sigma-Aldrich – Next step to enhance

Merck Millipore, a leading life sciences company

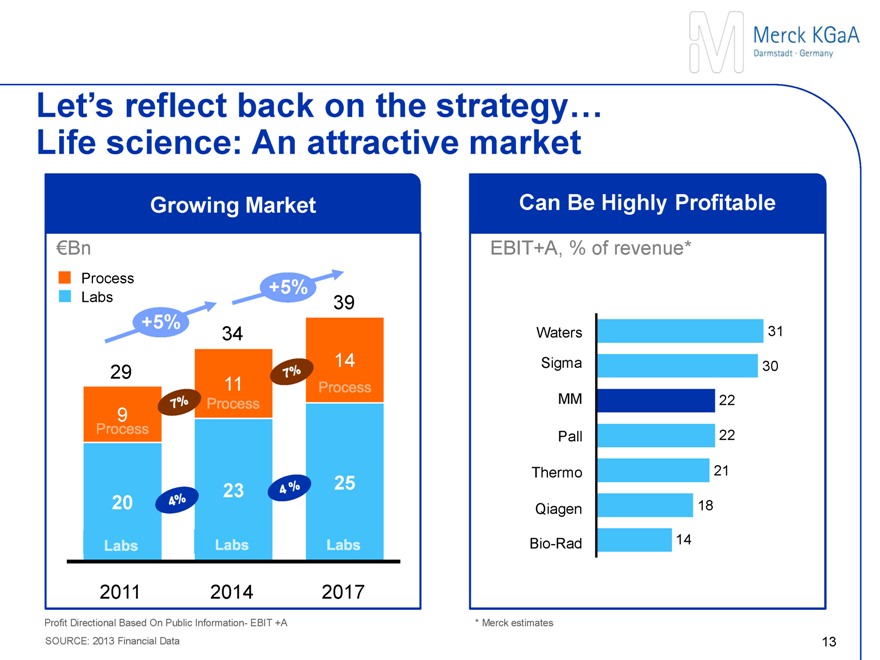

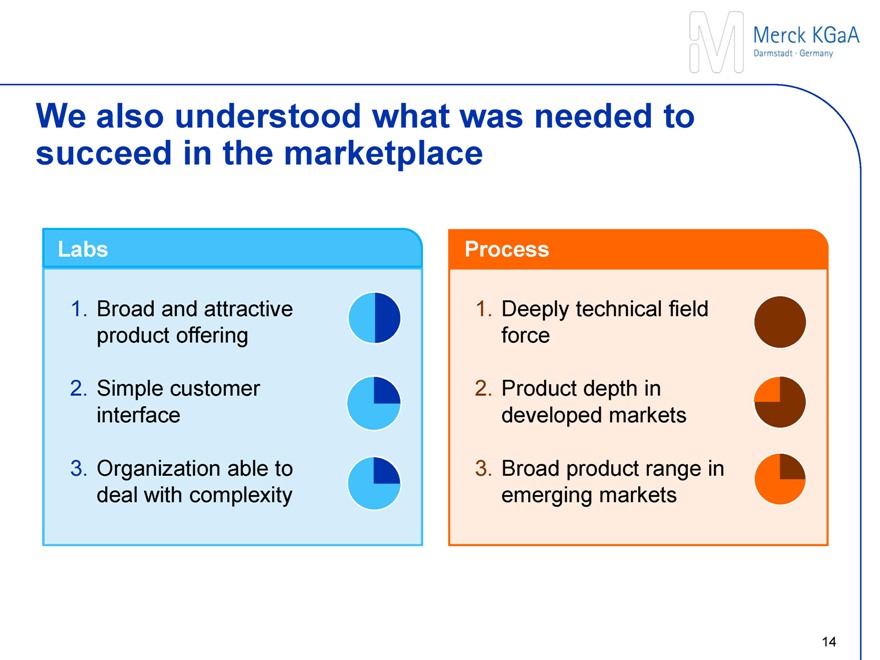

Attractive life science industry

Attractive industry driven by sustainable underlying market trends

Stable growth pattern, offering additional growth opportunities

Strong companies with healthy margins

Taking Merck’s life science business to the next level

Strong track record of delivering profitable growth

Adding scale with step change acquisition

6

M

Merck KGaA

Darmstadt · Germany

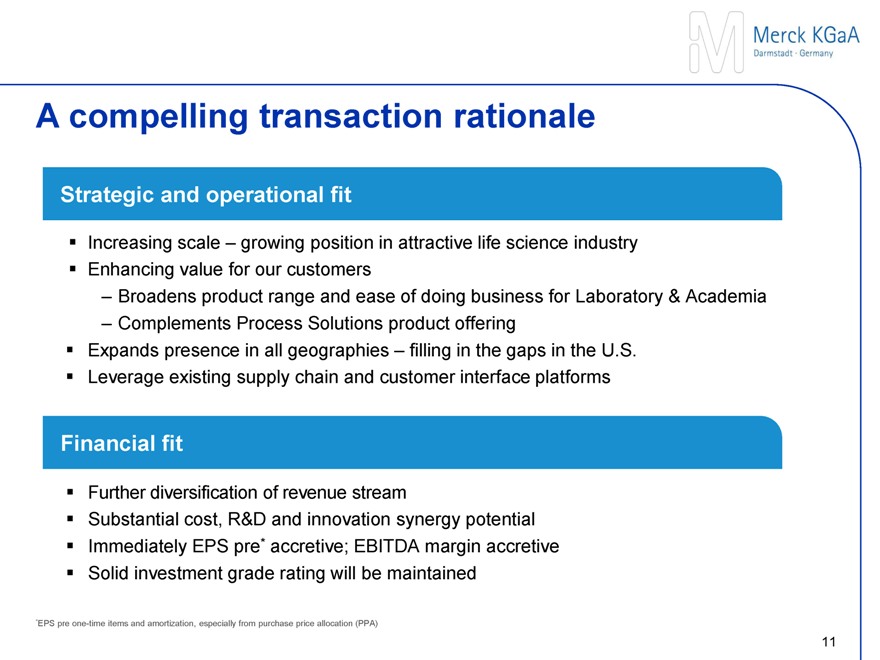

A compelling transaction rationale

Increasing scale – expanding position in attractive life science industry

Enhancing value for our customers

Strategic and operational fit

Broadens product range and ease of doing business for Laboratories & Academia

Complements Process Solutions product offering

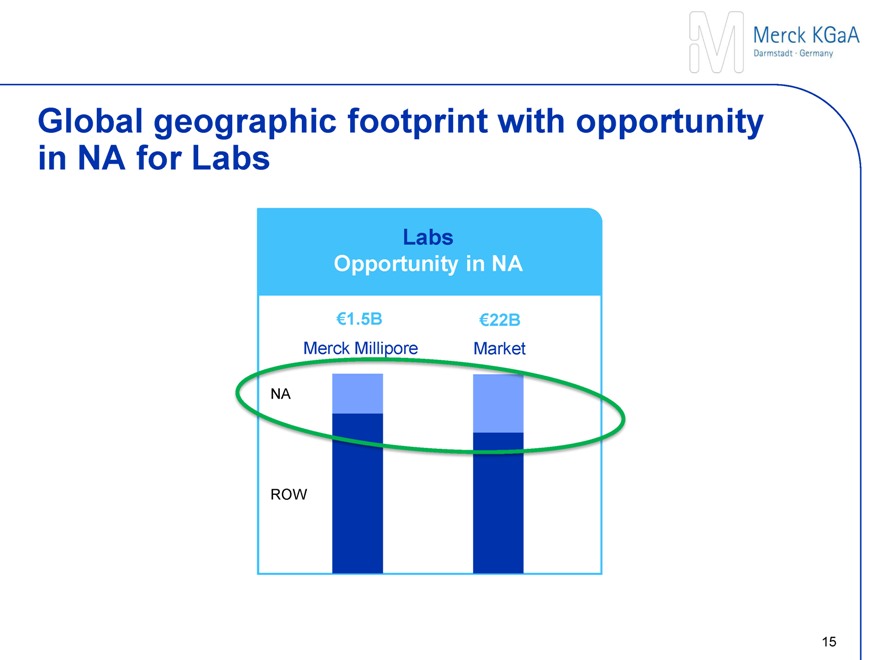

Closing the gap in U.S. – adequate presence in all geographies

Leveraging existing platforms for global innovation rollout

Financial fit

Further diversification of revenue stream

Substantial synergy potential

Immediately accretive to EPS pre* and EBITDA margin

Solid investment grade rating will be maintained

*EPS pre one-time items and amortization, especially from purchase price allocation (PPA)

7

M

Merck KGaA

Darmstadt · Germany

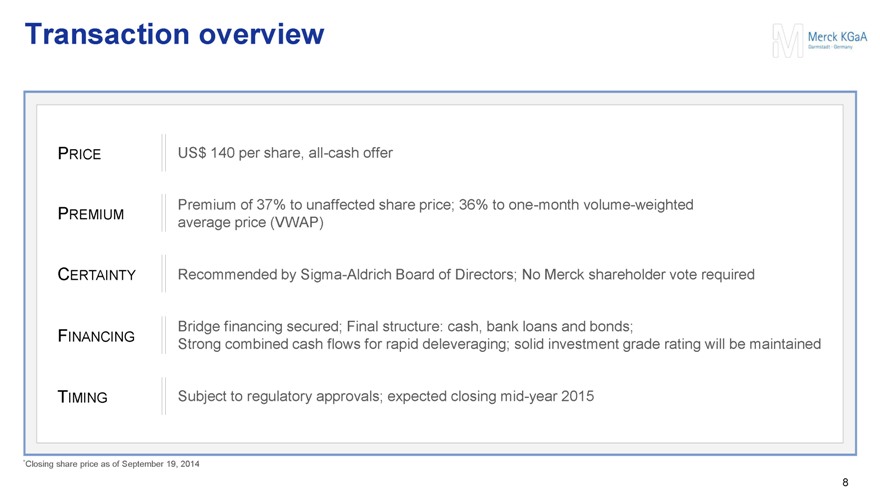

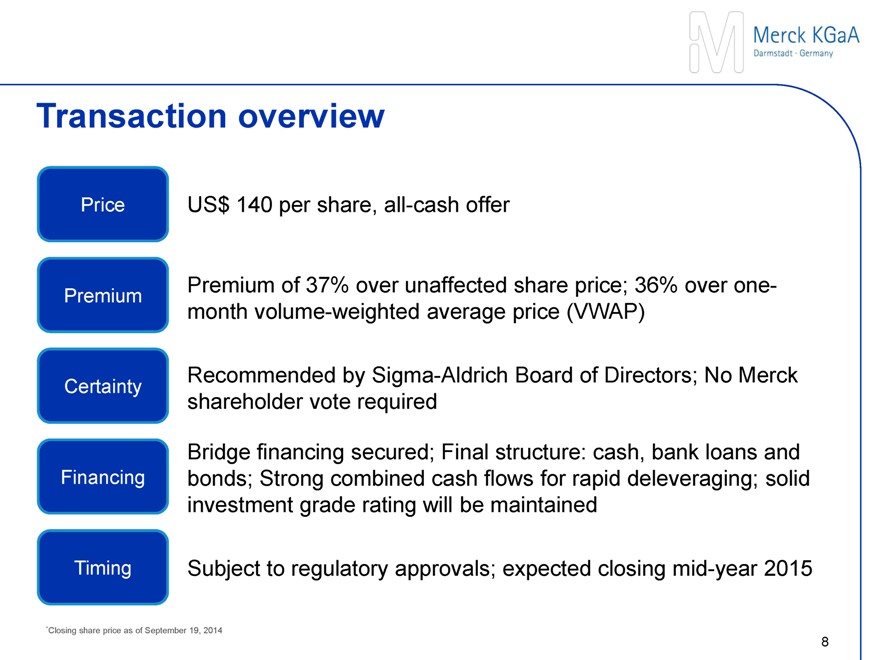

Transaction overview

PRICE

US$ 140 per share, all-cash offer

PREMIUM

Premium of 37% to unaffected share price; 36% to one-month volume-weighted average price (VWAP)

CERTAINTY

Recommended by Sigma-Aldrich Board of Directors; No Merck shareholder vote required

FINANCING

Bridge financing secured; Final structure: cash, bank loans and bonds; Strong combined cash flows for rapid deleveraging; solid investment grade rating will be maintained

TIMING

Subject to regulatory approvals; expected closing mid-year 2015

*Closing share price as of September 19, 2014

8

M

Merck KGaA

Darmstadt · Germany

Agenda

Strategic rationale and transaction overview

Introduction of Sigma-Aldrich and the combined business

Financial impacts

Summary

M

Merck KGaA

Darmstadt · Germany

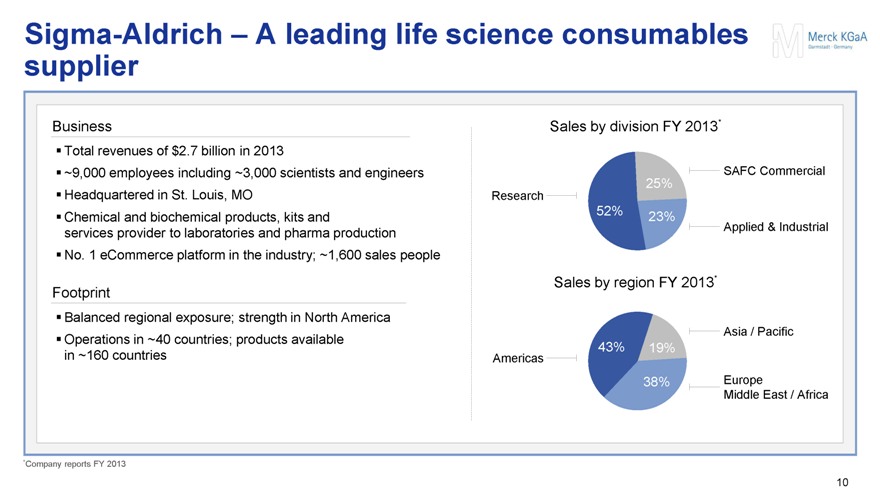

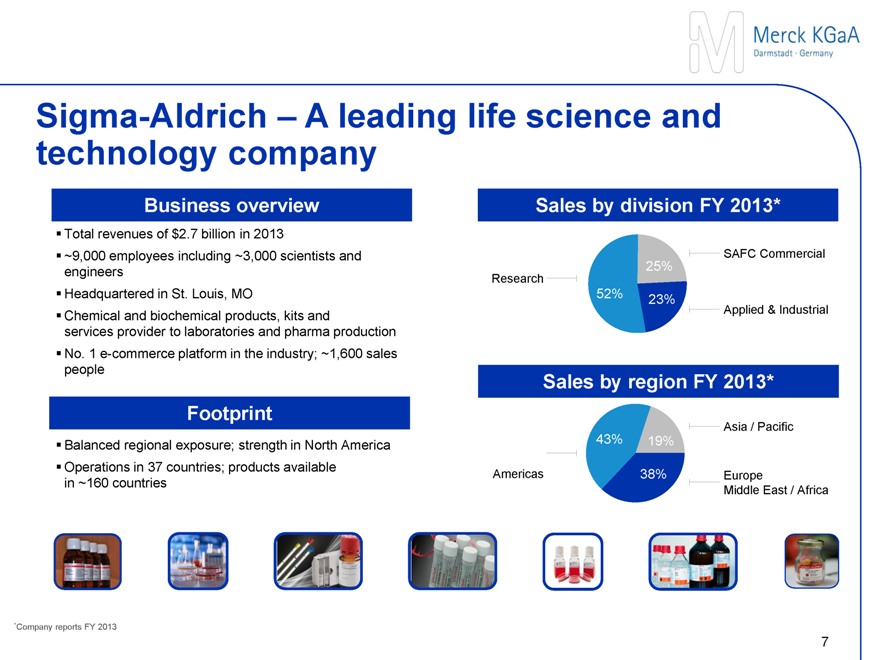

Sigma-Aldrich – A leading life science consumables supplier

Business

Total revenues of $2.7 billion in 2013

~9,000 employees including ~3,000 scientists and engineers

Headquartered in St. Louis, MO

Chemical and biochemical products, kits and services provider to laboratories and pharma production

No. 1 eCommerce platform in the industry; ~1,600 sales people

Footprint

Balanced regional exposure; strength in North America

Operations in ~40 countries; products available in ~160 countries

Sales by division FY 2013*

SAFC Commercial

25%

Research

52% 23%

Applied & Industrial

Sales by region FY 2013*

Asia / Pacific

Americas 43% 19%

38% Europe

Middle East / Africa

*Company reports FY 2013

10

M

Merck KGaA

Darmstadt · Germany

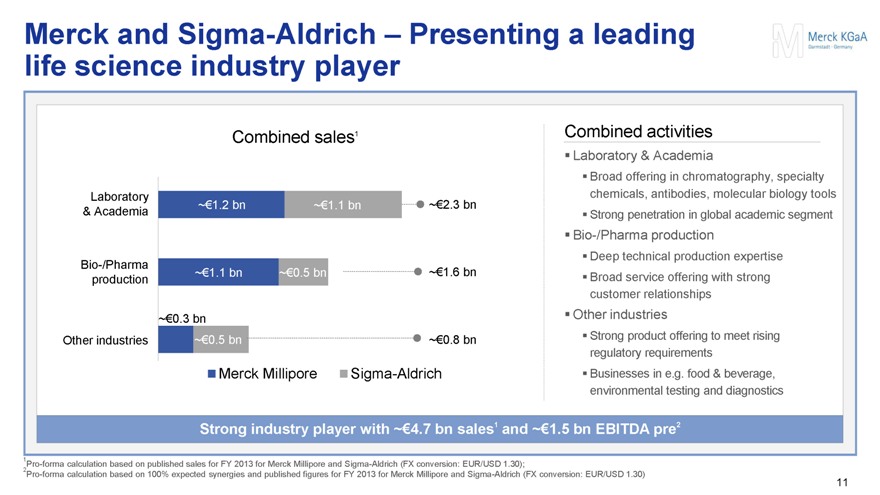

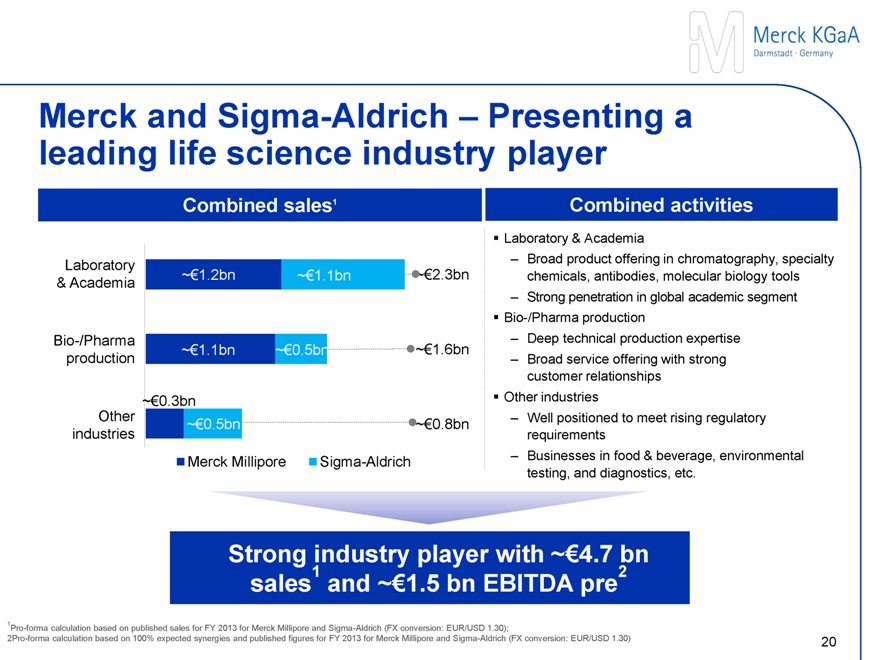

Merck and Sigma-Aldrich – Presenting a leading life science industry player

Combined sales1

Laboratory & Academia ~€1.2 bn ~€1.1 bn ~€2.3 bn

Bio-/Pharma production ~€1.1 bn ~€0.5 bn ~€1.6 bn

~€0.3 bn Other industries ~€0.5 bn ~€0.8 bn

Merck Millipore Sigma-Aldrich

Combined activities

Laboratory & Academia

Broad offering in chromatography, specialty chemicals, antibodies, molecular biology tools

Strong penetration in global academic segment

Bio-/Pharma production

Deep technical production expertise

Broad service offering with strong customer relationships

Other industries

Strong product offering to meet rising regulatory requirements

Businesses in e.g. food & beverage, environmental testing and diagnostics

Strong industry player with ~€4.7 bn sales1 and ~€1.5 bn EBITDA pre2

1Pro-forma calculation based on published sales for FY 2013 for Merck Millipore and Sigma-Aldrich (FX conversion: EUR/USD 1.30);

2Pro-forma calculation based on 100% expected synergies and published figures for FY 2013 for Merck Millipore and Sigma-Aldrich (FX conversion: EUR/USD 1.30)

11

M

Merck KGaA

Darmstadt · Germany

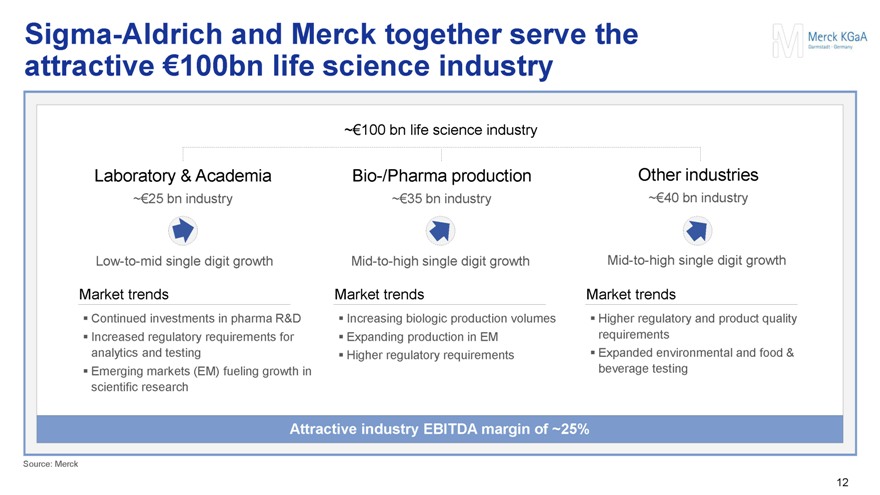

Sigma-Aldrich and Merck together serve the attractive €100bn life science industry

Laboratory & Academia

~€25 bn industry

Low-to-mid single digit growth

Market trends

Continued investments in pharma R&D

Increased regulatory requirements for analytics and testing

Emerging markets (EM) fueling growth in scientific research

~€100 bn life science industry

Bio-/Pharma production

~€35 bn industry

Mid-to-high single digit growth

Market trends

Increasing biologic production volumes

Expanding production in EM

Higher regulatory requirements

Other industries

~€40 bn industry

Mid-to-high single digit growth

Market trends

Higher regulatory and product quality requirements

Expanded environmental and food & beverage testing

Attractive industry EBITDA margin of ~25%

Source: Merck

12

M

Merck KGaA

Darmstadt · Germany

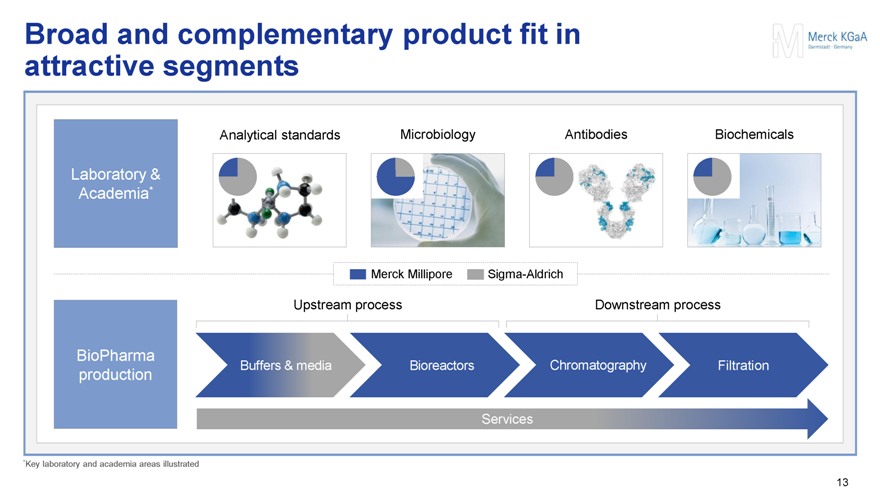

Broad and complementary product fit in attractive segments

Laboratory & Academia*

Analytical standards Microbiology Antibodies Biochemicals

Merck Millipore Sigma-Aldrich

BioPharma production

Upstream process Downstream process

Buffers & media Bioreactors Chromatography Filtration

Services

*Key laboratory and academia areas illustrated

13

M

Merck KGaA

Darmstadt · Germany

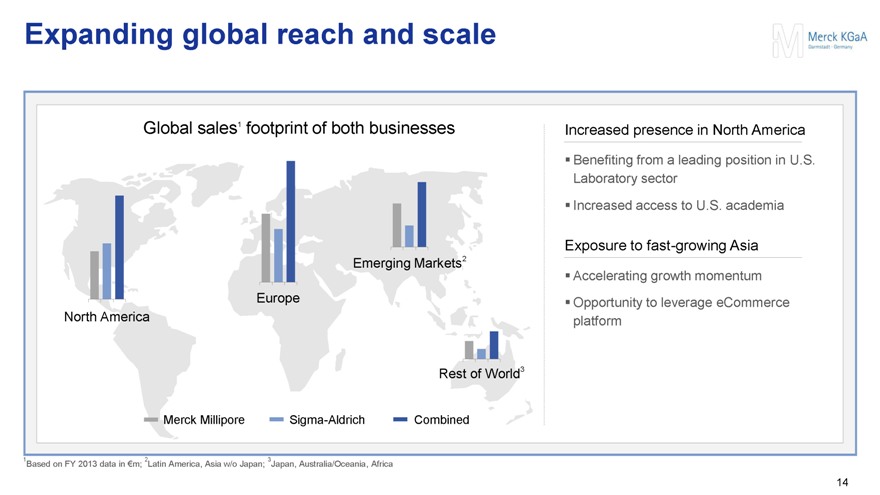

Expanding global reach and scale

Global sales1 footprint of both businesses

Emerging Markets2

Europe

North America

Rest of World3

Merck Millipore

Sigma-Aldrich

Combined

Increased presence in North America

Benefiting from a leading position in U.S. Laboratory sector

Increased access to U.S. academia

Exposure to fast-growing Asia

Accelerating growth momentum

Opportunity to leverage eCommerce platform

1Based on FY 2013 data in €m; 2Latin America, Asia w/o Japan; 3Japan, Australia/Oceania, Africa

14

M

Merck KGaA

Darmstadt · Germany

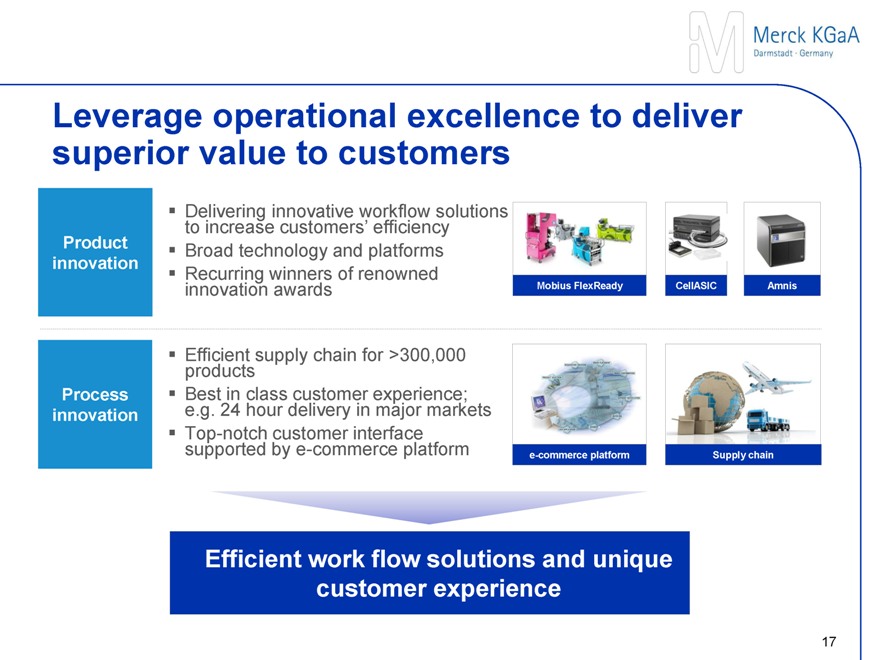

Leveraging operational excellence to deliver superior value to customers

Delivering innovative workflow solutions to increase customers’ efficiency

Product innovation

Broad technology and platforms

Recurring winners of renowned innovation awards

Mobius FlexReady

Duolink

Amnis

Efficient supply chain for >300,000 products

Process innovation

Best in class customer experience; e.g. 24 hour delivery in major markets

Top-notch customer interface supported by eCommerce platform

eCommerce platform

Supply chain

Efficient work flow solutions and unique customer experience

15

M

Merck KGaA

Darmstadt · Germany

Agenda

Strategic rationale and transaction overview

Introduction of Sigma-Aldrich and the combined business

Financial impacts

Summary

M

Merck KGaA

Darmstadt · Germany

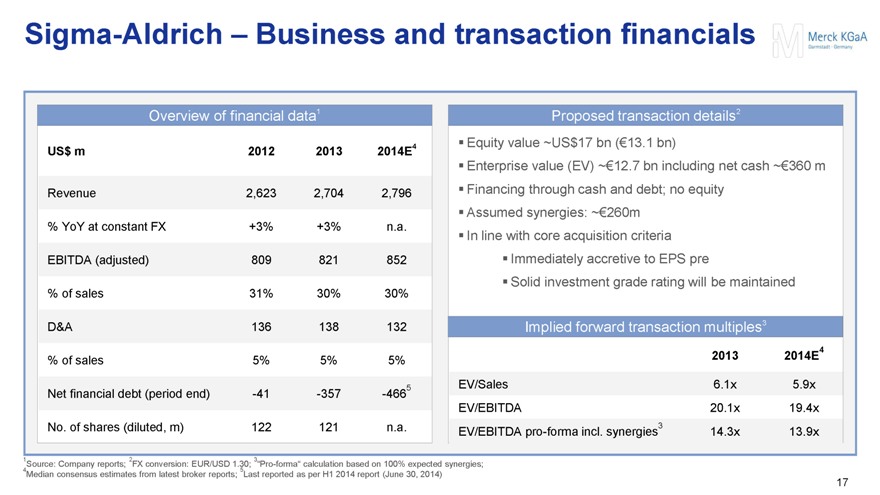

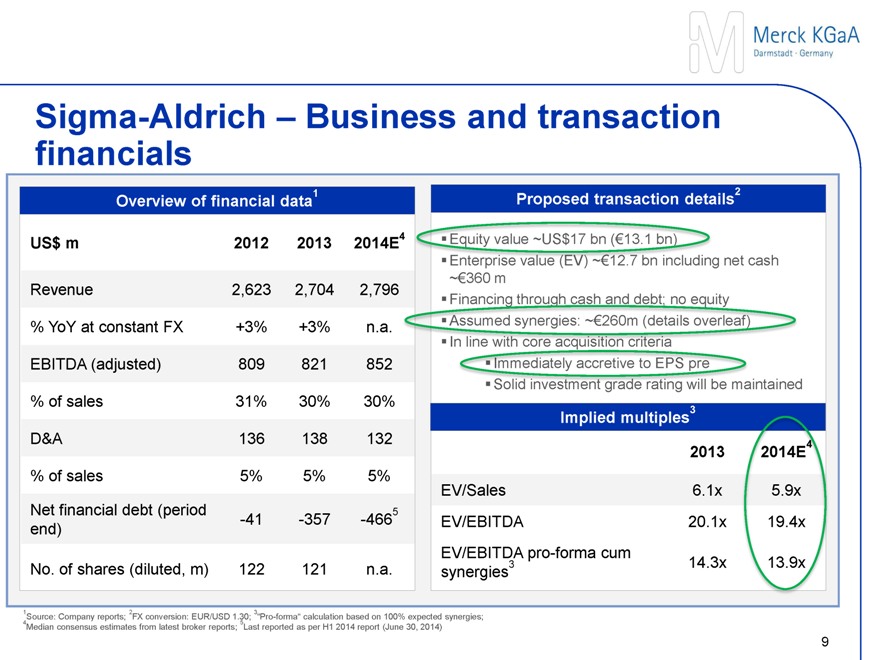

Sigma-Aldrich – Business and transaction financials

Overview of financial data1

US$ m 2012 2013 2014E4

Revenue 2,623 2,704 2,796

% YoY at constant FX +3% +3% n.a.

EBITDA (adjusted) 809 821 852

% of sales 31% 30% 30%

D&A 136 138 132

% of sales 5% 5% 5%

Net financial debt (period end) -41 -357 -4665

No. of shares (diluted, m) 122 121 n.a.

Proposed transaction details2

Equity value ~US$17 bn (€13.1 bn)

Enterprise value (EV) ~€12.7 bn including net cash ~€360 m

Financing through cash and debt; no equity

Assumed synergies: ~€260m

In line with core acquisition criteria

Immediately accretive to EPS pre

Solid investment grade rating will be maintained

Implied forward transaction multiples3

2013 2014E4

EV/Sales 6.1x 5.9x

EV/EBITDA 20.1x 19.4x

EV/EBITDA pro-forma incl. synergies3 14.3x 13.9x

1Source: Company reports; 2FX conversion: EUR/USD 1.30; 3“Pro-forma” calculation based on 100% expected synergies;

4Median consensus estimates from latest broker reports; 5Last reported as per H1 2014 report (June 30, 2014)

17

M

Merck KGaA

Darmstadt · Germany

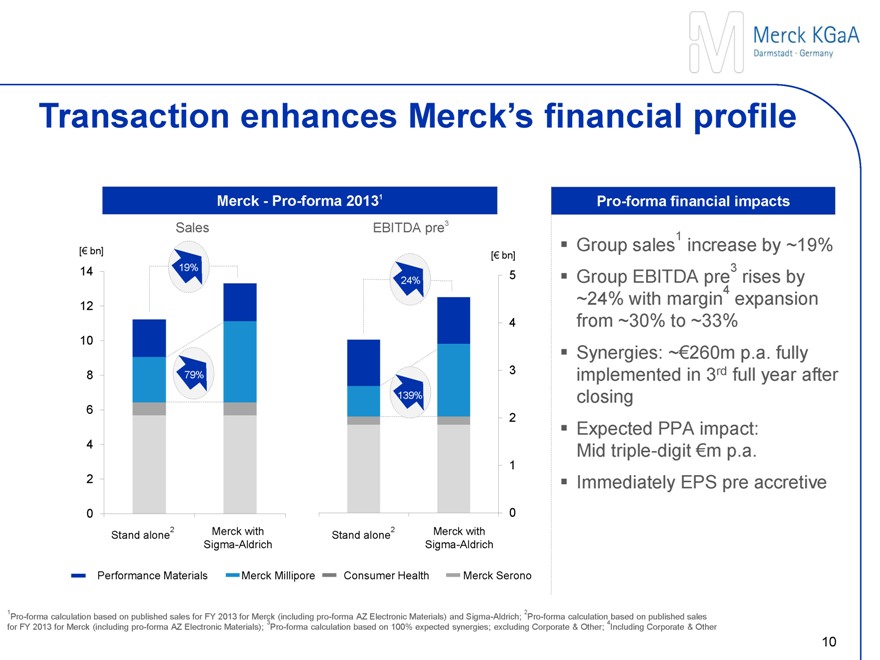

Transaction enhances Merck’s financial profile

Merck - Pro-forma 20131

Sales EBITDA pre3

[€ bn] [€ bn]

14 19%

24% 5 12 4 10 8 79% 3 139% 6 2 4 1 2 0 0

Stand alone2

Merck with Sigma-Aldrich

Stand alone2

Merck with Sigma-Aldrich

Performance Materials

Merck Millipore

Consumer Health

Merck Serono

Pro-forma financial impacts

Group sales1 increase by ~19%

Group EBITDA pre3 rises by ~24% with margin4 expansion from ~30% to ~33%

Synergies: ~€260m p.a. fully implemented in 3rd full year after closing

Expected PPA impact: Mid triple-digit €m p.a.

Immediately EPS pre accretive

1Pro-forma calculation based on published sales for FY 2013 for Merck (including pro-forma AZ Electronic Materials) and Sigma-Aldrich; 2Pro-forma calculation based on published sales for FY 2013 for Merck (including pro-forma AZ Electronic Materials); 3Pro-forma calculation based on 100% expected synergies; excluding Corporate & Other; 4Including Corporate & Other

18

M

Merck KGaA

Darmstadt · Germany

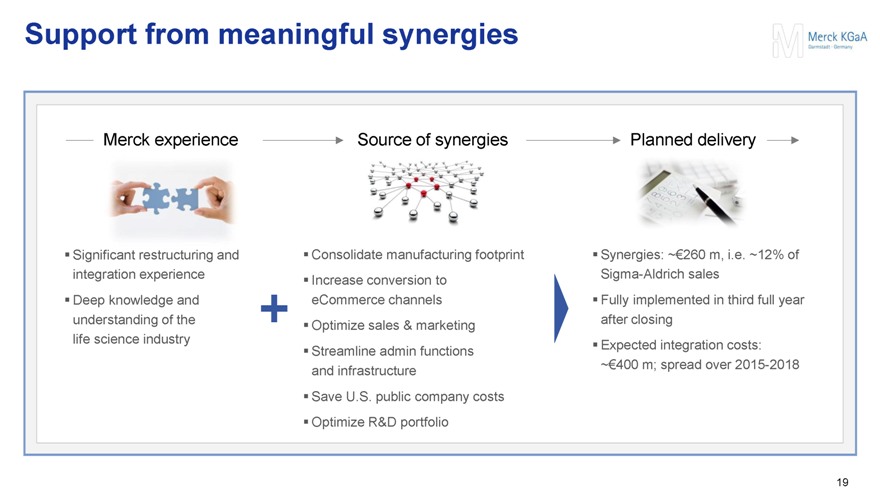

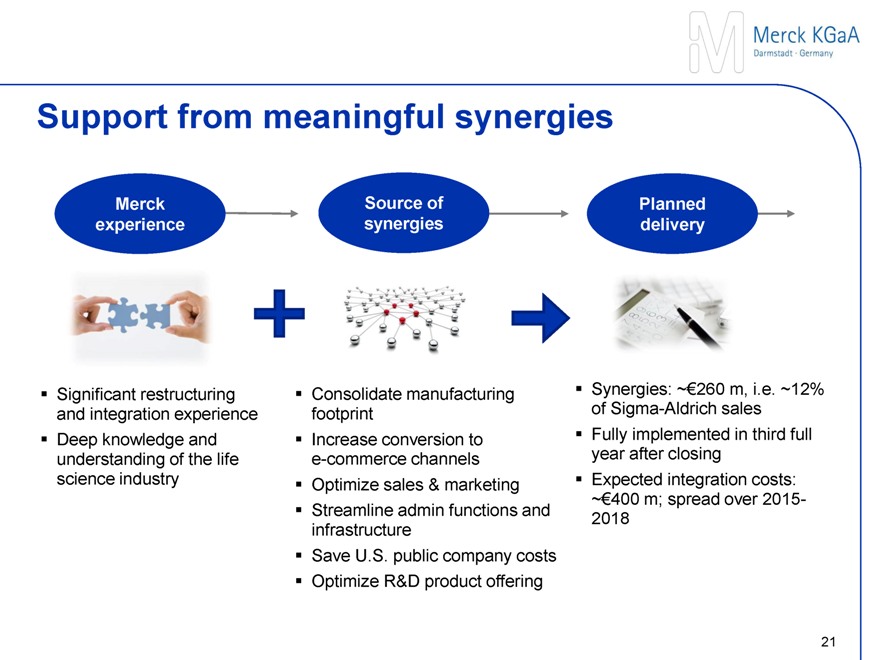

Support from meaningful synergies

Merck experience

Significant restructuring and integration experience

Deep knowledge and understanding of the life science industry

Source of synergies

Consolidate manufacturing footprint

Increase conversion to eCommerce channels

Optimize sales & marketing

Streamline admin functions and infrastructure

Save U.S. public company costs

Optimize R&D portfolio

Planned delivery

Synergies: ~€260 m, i.e. ~12% of Sigma-Aldrich sales

Fully implemented in third full year after closing

Expected integration costs:

~€400 m; spread over 2015-2018

19

M

Merck KGaA

Darmstadt · Germany

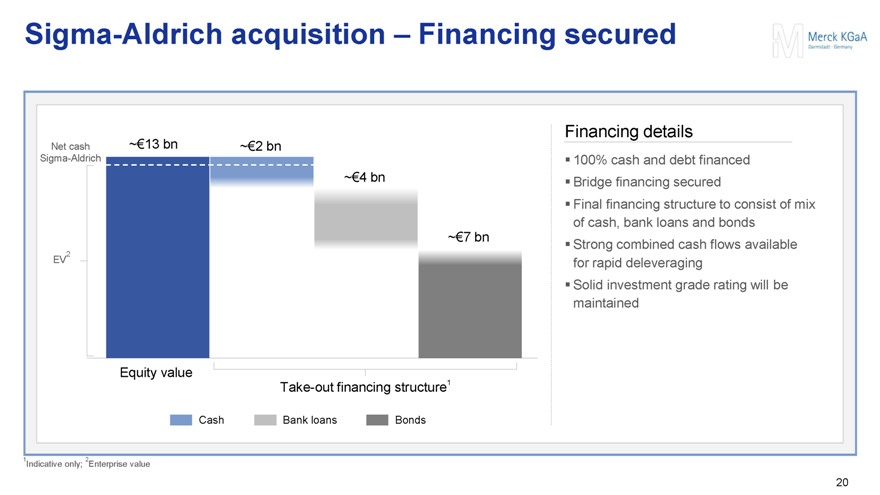

Sigma-Aldrich acquisition – Financing secured

Net cash ~€13 bn ~€2 bn

Sigma-Aldrich

~€4 bn

~€7 bn

EV2

Equity value

Take-out financing structure1

Cash

Bank loans

Bonds

Financing details

100% cash and debt financed

Bridge financing secured

Final financing structure to consist of mix of cash, bank loans and bonds

Strong combined cash flows available for rapid deleveraging

Solid investment grade rating will be maintained

1Indicative only; 2Enterprise value

20

M

Merck KGaA

Darmstadt · Germany

Agenda

Strategic rationale and transaction overview

Introduction of Sigma-Aldrich and the combined business

Financial impacts

Summary

M

Merck KGaA

Darmstadt · Germany

Sigma-Aldrich acquisition – Taking Merck Millipore to the next level

Expanding position in the attractive life science industry, poised for sustainable growth

Enhancing value for customers via strengthened offering, reach, and operational excellence

Sigma-Aldrich and Merck Millipore will be core earnings contributor to Merck and generate sustainable and growing cash flow

Consistent with Merck’s core acquisition criteria and corporate transformation journey

22

M

Merck KGaA

Darmstadt · Germany

M

Merck KGaA

Darmstadt · Germany

Appendix

M

Merck KGaA

Darmstadt · Germany

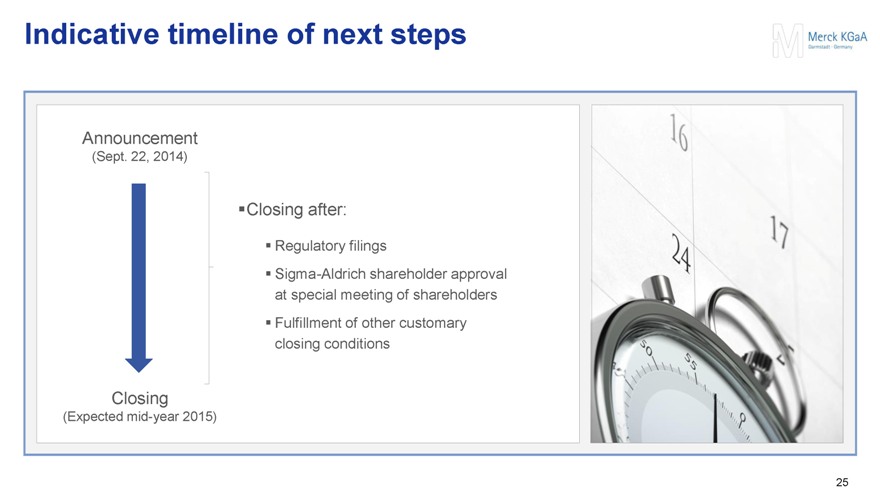

Indicative timeline of next steps

Announcement

(Sept. 22, 2014)

Closing after:

Regulatory filings

Sigma-Aldrich shareholder approval at special meeting of shareholders

Fulfillment of other customary closing conditions

Closing

(Expected mid-year 2015)

25

M

Merck KGaA

Darmstadt · Germany

Investor Relations contact details

Constantin Fest

Head of Investor Relations

+49 6151 72-5271

constantin.fest@merckgroup.com

Alessandra Heinz

Assistant Investor Relations

+49 6151 72-3321

alessandra.heinz@merckgroup.com

Svenja Bundschuh

Assistant Investor Relations

+49 6151 72-3744

svenja.bundschuh@merckgroup.com

Eva Sterzel

AGM, Capital Market Events, IR-Media

+49 6151 72-5355

eva.sterzel@merckgroup.com

Annett Weber

Institutional Investors / Analysts

+49 6151 72-63723

annett.weber@merckgroup.com

Julia Schwientek

Institutional Investors / Analysts

+49 6151 72-7434

julia.schwientek@merckgroup.com

Olliver Lettau

Analysts, Fixed Income, Private Investors

+49 6151 72-34409 olliver.lettau@merckgroup.com

Email: investor.relations@merckgroup.com Web: www.investors.merck.de Fax: +49 6151 72-913321

26

M

Merck KGaA

Darmstadt · Germany

Media Relations contact details

Dr. Walter Huber

Head of Group Communications

+49 6151 72-2287

walter.huber@merckgroup.com

Nicole Mommsen

Head of Media Relations

+49 6151 72-62445

nicole.mommsen@merckgroup.com

Silke Klotz

Assistant Media Relations

+49 6151 72-4342

silke.klotz@merckgroup.com

Markus Talanow

Financial Communications,

Chemicals

+49 6151 72-7144

markus.talanow@merckgroup.com

Dr. Gangolf Schrimpf

Pharma

+49 6151 72-9591

gangolf.schrimpf@merckgroup.com

Gerhard Lerch

HR, IT, Corporate Responsibility

+49 6151 72-6328

gerhard.lerch@merckgroup.com

Email: media.relations@merckgroup.com Web: www.media.merck.de Fax: +49 6151 72-5000

27

Merck KGaA: Merck to Acquire Sigma-Aldrich to Enhance Position in Attractive Life Science Industry

Merck KGaA / Key word(s): Offer

22.09.2014 11:56

Dissemination of an Ad hoc announcement according to § 15 WpHG, transmitted by DGAP - a service of EQS Group AG.

The issuer is solely responsible for the content of this announcement.

Merck, a leading company for innovative and top-quality high-tech products in the pharmaceutical, chemical and life science sectors, and Sigma-Aldrich Corporation (“Sigma-Aldrich”), today have entered into a definitive agreement under which Merck will acquire Sigma-Aldrich for $17.0 billion (EUR13.1 billion), establishing one of the leading players in the $130 billion global life science industry.

Merck will acquire all of the outstanding shares of Sigma-Aldrich for $140 per share in cash. The agreed price represents a 37% premium to the latest closing price of $102.37 on September 19, 2014, and a 36% premium to the one-month average closing price. The transaction is expected to be immediately accretive to Merck’s EPS pre and EBITDA margin. Merck expects to achieve annual synergies of approximately EUR260 million (approximately $340 million), which should be fully realized within three years after closing.

Bridge financing has been secured for the all-cash transaction, and Merck expects the final financing structure will comprise a combination of cash on Merck’s balance sheet, bank loans and bonds. Closing is expected mid-year 2015, subject to regulatory approvals, approval by a special meeting of the shareholders of Sigma-Aldrich and other customary closing conditions.

Information and Explanation of the Issuer to this News:

Cautionary Note Regarding Forward-Looking Statements

This communication may include “forward-looking statements.” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward-looking statements. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements.

Risks and uncertainties relating to the proposed transaction with Sigma-Aldrich Corporation (“Sigma-Aldrich”) include, but are not limited to: the risk Sigma-Aldrich’s shareholders do not approve the transaction; uncertainties as to the timing of the transaction; the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated; competitive responses to the transaction; litigation relating to the transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability of Merck KGaA, Darmstadt, Germany, to achieve the cost-savings and synergies contemplated by the proposed transaction within the expected time frame; the ability of Merck KGaA, Darmstadt, Germany, to promptly and effectively integrate the businesses of Sigma-Aldrich and Merck KGaA, Darmstadt, Germany; the effects of the business combination of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich, including the combined company’s future financial condition, operating results, strategy and plans; the implications of the proposed transaction on certain employee benefit plans of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich; and disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers.

Additional risks and uncertainties include, but are not limited to: the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval; the risk of stricter regulations for the manufacture, testing and marketing of products; the risk of destabilization of political systems and the establishment of trade barriers; the risk of a changing marketing environment for multiple sclerosis products in the European Union; the risk of greater competitive pressure due to biosimilars; the risks of research and development; the risks of discontinuing development projects and regulatory approval of developed medicines; the risk of a temporary ban on products/production facilities or of non-registration of products due to non-compliance with quality standards; the risk of an import ban on products to the United States due to an FDA warning letter; the risks of dependency on suppliers; risks due to product-related crime and espionage; risks in relation to the use of financial instruments; liquidity risks; counterparty risks; market risks; risks of impairment on balance sheet items; risks from pension obligations; risks from product-related and patent law disputes; risks from antitrust law proceedings; risks from drug pricing by the divested Generics Group; risks in human resources; risks from e-crime and cyber attacks; risks due to failure of business-critical information technology applications or to failure of data center capacity; environmental and safety risks; unanticipated contract or regulatory issues; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich and its impact on goodwill impairment evaluations; the impact of future regulatory or legislative actions; and the risks and uncertainties detailed by Sigma-Aldrich with respect to its business as described in its reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”).

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany, and the Risk Factors section of Sigma-Aldrich’s most recent reports on Form 10-K and Form 10-Q. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Important Additional Information

This communication is being made in respect of the proposed merger transaction involving Sigma-Aldrich and Merck KGaA, Darmstadt, Germany. The proposed merger will be submitted to the stockholders of Sigma-Aldrich for their consideration. In connection therewith, Sigma-Aldrich intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to the stockholders of Sigma-Aldrich. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement,

2

any amendments or supplements thereto and other documents containing important information about Sigma-Aldrich, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Sigma-Aldrich will be available free of charge on Sigma-Aldrich’s website at www.sigmaaldrich.com under the heading “SEC Documents” within the “Investor Info” section in the “Investors” portion of Sigma-Aldrich’s website. Shareholders of Sigma-Aldrich may also obtain a free copy of the definitive proxy statement by contacting Sigma-Aldrich’s Investor Relations Department at (314) 898-4643.

Sigma-Aldrich and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Sigma-Aldrich is set forth in its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 21, 2014, its annual report on Form 10-K for the fiscal year ended December 31, 2013, which was filed with the SEC on February 6, 2014, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation of the stockholders of Sigma-Aldrich and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC when they become available.

22.09.2014 The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases.

Media archive at www.dgap-medientreff.de and www.dgap.de

| Language: | English | |

| Company: | Merck KGaA | |

| Frankfurter Str. 250 | ||

| 64293 Darmstadt | ||

| Germany | ||

| Phone: | +49 (0) 6151 72 - 3321 | |

| Fax: | +49 (0) 6151 72 - 913321 | |

| E-mail: | investor.relations@merckgroup.com | |

| Internet: | www.merck.de | |

| ISIN: | DE0006599905 | |

| WKN: | 659990 | |

| Indices: | DAX | |

| Listed: | Regulierter Markt in Frankfurt (Prime Standard); Freiverkehr in Berlin, Düsseldorf, Hamburg, Hannover, München, Stuttgart; Terminbörse EUREX; London, SIX |

| End of Announcement | DGAP News-Service |

3

Factsheet

| Company |  |  | ||||

| Ticker | FWB: MRK | NASDAQ: SIAL | ||||

| Description | Merck KGaA of Darmstadt, Germany is a leading company for innovative and top-quality high-tech products in the pharmaceutical and chemical sectors. In Canada and the United States, Merck operates under the name EMD.

With its four divisions – Biopharmaceuticals, Consumer Health, Performance Materials, Life Science Tools – EMD generated total revenues of € 11.1 billion in 2013.

Around 39,000 EMD employees work in 66 countries to improve the quality of life for patients, to further the success of customers and to help meet global challenges.

EMD is the world’s oldest pharmaceutical and chemical company – since 1668, the company has stood for innovation, business success and responsible entrepreneurship. Holding an approximately 70 percent interest, the founding family remains the majority owner of the company to this day.

www.emdgroup.com | Sigma-Aldrich, a leading Life Science and Technology company focused on enhancing human health and safety, manufactures and distributes more than 230,000 chemicals, biochemicals and other essential products to more than 1.4 million customers globally in research and applied labs as well as in industrial and commercial markets.

With three distinct business units – Research, SAFC Commercial, Applied – Sigma-Aldrich is committed to enabling science to improve the quality of life.

The Company operates in 37 countries, has approximately 9,000 employees worldwide and had sales of $2.7 billion in 2013.

www.sigma-aldrich.com | ||||

Key Facts & Figures FY 2013 |

EMD Group |

• US$ 2,704 million revenue | ||||

• € 11,095 million revenue |

• US$ 821 million EBITDA (adjusted) | |||||

• € 3,253 million EBITDA-pre |

• ~230,000 products and solutions | |||||

• 39,000 employees | • One of the leading e-commerce and supply chain | |||||

platforms | ||||||

• ~ 9,000 employees (~500 Ph. Ds) | ||||||

| EMD Millipore | ||||||

• € 2,645 million revenue | ||||||

• € 643 million EBITDA pre | ||||||

• ~ 60,000 products and solutions | ||||||

• ~ 10,000 employees (600 R&D) | ||||||

Combined Business |

• ~€ 4.7 billion1 pro forma 2013 revenue | |||||

• ~€ 1.5 billion2 pro forma 2013 EBITDA pre | ||||||

• 2 million total customers | ||||||

• More than 300,000 total products | ||||||

| 1) | Pro forma calculation based on published sales for FY 2013 for EMD Millipore and Sigma-Aldrich (FX conversion: EUR/USD 1.30); 2) Pro forma calculation based on 100% expected synergies and published figures for FY 2013 for EMD Millipore and Sigma-Aldrich (FX conversion: EUR/USD 1.30) | |||||

Products |

|

| ||||

1

Factsheet

Strategic Rationale | • | Increasing scale – expanding position in attractive life science industry | ||

• |

Enhancing value for our customers | |||

| • | Broadens product range and ease of doing business for Laboratories & Academia | |||

| • | Complements Process Solutions product offering | |||

| • | Closing the gap in U.S. – adequate presence in all geographies | |||

| • | Leveraging existing platforms for global innovation rollout | |||

| Financial Fit | • | Further diversification of revenue stream | ||

| • | Substantial synergy potential | |||

| • | Immediately accretive to EPS pre* and EBITDA margin | |||

| • | Solid investment grade rating will be maintained | |||

Proposed acquisition |

• |

US$ 140 per share all-cash offer | ||

• |

Price represents 37% premium to the latest closing price of US$ 102.37 on September 19, 2014, and a 36% premium to the one-month volume-weighted average price (VWAP) | |||

Transaction details |

• |

Fully financed with cash, bank loans and bonds | ||

• |

Strong combined cash flows for rapid deleveraging; solid investment grade rating will be maintained | |||

| • | Expected synergies of € 260 million fully achieved in the third year after closing | |||

| • | Subject to regulatory approvals; expected closing mid-year 2015 | |||

| • | Recommended by Sigma-Aldrich Board of Directors; No EMD shareholder vote required | |||

| Commitment to the U.S. | • | EMD plans to maintain a significant presence in St. Louis, MO as well as in Billerica, MA following the transaction | ||

Cautionary Note Regarding Forward-Looking Statements

This communication may include “forward-looking statements.” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward-looking statements. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements.

Risks and uncertainties relating to the proposed transaction with Sigma-Aldrich Corporation (“Sigma-Aldrich”) include, but are not limited to: the risk Sigma-Aldrich’s shareholders do not approve the transaction; uncertainties as to the timing of the transaction; the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated; competitive responses to the transaction; litigation relating to the transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability of Merck KGaA, Darmstadt, Germany, to achieve the cost-savings and synergies contemplated by the proposed transaction within the expected time frame; the ability of Merck KGaA, Darmstadt, Germany, to promptly and effectively integrate the businesses of Sigma-Aldrich and Merck KGaA, Darmstadt, Germany; the effects of the business combination of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich, including the combined company’s future financial condition, operating results, strategy and plans; the implications of the proposed transaction on certain employee benefit plans of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich; and disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers.

Additional risks and uncertainties include, but are not limited to: the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval; the risk of stricter regulations for the manufacture, testing and marketing of products; the risk of destabilization of political systems and the establishment of trade barriers; the risk of a changing marketing environment for multiple sclerosis products in the European Union; the risk of greater competitive pressure due to biosimilars; the risks of research and development; the risks of discontinuing development projects and regulatory approval of developed medicines; the risk of a temporary ban on products/production facilities or of non-registration of products due to non-compliance with quality standards; the risk of an import ban on products to the United States due to an FDA warning letter; the risks of dependency on suppliers; risks due to product-related crime and espionage; risks in relation to the use of financial instruments; liquidity risks; counterparty risks; market risks; risks of impairment on balance sheet items; risks from pension obligations; risks from product-related and patent law disputes; risks from

2

Factsheet

antitrust law proceedings; risks from drug pricing by the divested Generics Group; risks in human resources; risks from e-crime and cyber attacks; risks due to failure of business-critical information technology applications or to failure of data center capacity; environmental and safety risks; unanticipated contract or regulatory issues; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich and its impact on goodwill impairment evaluations; the impact of future regulatory or legislative actions; and the risks and uncertainties detailed by Sigma-Aldrich with respect to its business as described in its reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”).

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany, and the Risk Factors section of Sigma-Aldrich’s most recent reports on Form 10-K and Form 10-Q. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Important Additional Information

This communication is being made in respect of the proposed merger transaction involving Sigma-Aldrich and Merck KGaA, Darmstadt, Germany. The proposed merger will be submitted to the stockholders of Sigma-Aldrich for their consideration. In connection therewith, Sigma-Aldrich intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to the stockholders of Sigma-Aldrich. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement, any amendments or supplements thereto and other documents containing important information about Sigma-Aldrich, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Sigma-Aldrich will be available free of charge on Sigma-Aldrich’s website at www.sigmaaldrich.com under the heading “SEC Documents” within the “Investor Info” section in the “Investors” portion of Sigma-Aldrich’s website. Shareholders of Sigma-Aldrich may also obtain a free copy of the definitive proxy statement by contacting Sigma-Aldrich’s Investor Relations Department at (314) 898-4643.

Sigma-Aldrich and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Sigma-Aldrich is set forth in its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 21, 2014, its annual report on Form 10-K for the fiscal year ended December 31, 2013, which was filed with the SEC on February 6, 2014, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation of the stockholders of Sigma-Aldrich and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC when they become available.

3

EN - MerckNet Report

Homepage teaser:Merck to Acquire Sigma-Aldrich to Enhance Position in Attractive Life Science Industry –Merck and Sigma-Aldrich, one of the leading US-based life science and technology companies, today announced that they have entered into a definitive agreement under which Merck will acquire Sigma-Aldrich for $17.0 billion (€13.1 billion), establishing one of the leading players in the $130 billion global life science industry.Read more

Text: Merck announced today that it has entered into a definitive agreement under which Merck will acquire all of the outstanding shares of Sigma-Aldrich for $140 per share in cash. The agreement values Sigma-Aldrich at $17.0 billion (€13.1 billion). The transaction is expected to close by mid-year 2015 subject to regulatory approvals and customary closing conditions. Merck’s Chairman of the Executive Board stated in today’spress release [link to release], that the combination of Merck and Sigma-Aldrich marks a quantum leap for Merck’s life science business.

With a common focus on employees, customers and communities, the combination represents a strong operational and cultural fit. Together, the two companies will be able to offer a much broader product offering to our global customers in research, pharma and biopharma manufacturing and diagnostic and testing labs. The combined company will invest more in innovation going forward, enhancing the customer benefits, and increasing the company’s presence in North America and adding exposure to fast-growing Asian markets.

In the Laboratory & Academia business, the combined company will offer their customers a complementary range of products across laboratory chemicals, biologics and reagents. In pharma and biopharma production, Sigma-Aldrich will complement Merck Millipore’s existing products and capabilities with additions along the entire value chain of drug production and validation.

Merck has great respect for Sigma-Aldrich’s rich history, customer-centric culture and commitment to corporate social responsibility and believes that the combination will afford new opportunities to employees at both companies. An integration team, which will include representatives from both companies, will be established to oversee and facilitate the integration process.

Learn more: Video interview with Karl-Ludwig Kley, the Chairman of the Executive Board, Marcus Kuhnert, Member of the Executive Board and Chief Financiel Officer and Rakesh Sachdev, Sigma-Aldrich’s CEO about why the transaction represents a compelling strategic and cultural fit.Link to video interview

Cautionary Note Regarding Forward-Looking Statements

This communication may include “forward-looking statements.” Statements that include words such as “anticipate,” “expect,” “should,” “would,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” and other words of similar meaning in connection with future events or future operating or financial performance are often used to identify forward-looking statements. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond control of Merck KGaA, Darmstadt, Germany, which could cause actual results to differ materially from such statements.

Risks and uncertainties relating to the proposed transaction with Sigma-Aldrich Corporation (“Sigma-Aldrich”) include, but are not limited to: the risk Sigma-Aldrich’s shareholders do not approve the transaction; uncertainties as to the timing of the transaction; the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated; competitive responses to the transaction; litigation relating to the transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability of Merck KGaA, Darmstadt, Germany, to achieve the cost-savings and synergies contemplated by the proposed transaction within the expected time frame; the ability of Merck KGaA, Darmstadt, Germany, to promptly and effectively integrate the businesses of Sigma-Aldrich and Merck KGaA, Darmstadt, Germany; the effects of the business combination of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich, including the combined company’s future financial condition, operating results, strategy and plans; the implications of the proposed transaction on certain employee benefit plans of Merck KGaA, Darmstadt, Germany, and Sigma-Aldrich; and disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers.

Additional risks and uncertainties include, but are not limited to: the risks of more restrictive regulatory requirements regarding drug pricing, reimbursement and approval; the risk of stricter regulations for the manufacture, testing and marketing of products; the risk of destabilization of political systems and the establishment of trade barriers; the risk of a changing marketing environment for multiple sclerosis products in the European Union; the risk of greater competitive pressure due to biosimilars; the risks of research and development; the risks of discontinuing development projects and regulatory approval of developed medicines; the risk of a temporary ban on products/production facilities or of non-registration of products due to non-compliance with quality standards; the risk of an import ban on products to the United States due to an FDA warning letter; the risks of dependency on suppliers; risks due to product-related crime and espionage; risks in relation to the use of financial instruments; liquidity risks; counterparty risks; market risks; risks of impairment on balance sheet items; risks from pension obligations; risks from product-related and patent law disputes; risks from antitrust law proceedings; risks from drug pricing by the divested Generics Group; risks in human resources; risks from e-crime and cyber attacks; risks due to failure of business-critical information technology applications or to failure of data center capacity; environmental and safety risks; unanticipated contract or regulatory issues; a potential downgrade in the rating of the indebtedness of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich; downward pressure on the common stock price of Merck KGaA, Darmstadt, Germany, or Sigma-Aldrich and its impact on goodwill impairment evaluations; the impact of future regulatory or legislative actions; and the risks and uncertainties detailed by Sigma-Aldrich with respect to its business as described in its reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”).

2

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere, including the Report on Risks and Opportunities Section of the most recent annual report and quarterly report of Merck KGaA, Darmstadt, Germany, and the Risk Factors section of Sigma-Aldrich’s most recent reports on Form 10-K and Form 10-Q. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Important Additional Information

This communication is being made in respect of the proposed merger transaction involving Sigma-Aldrich and Merck KGaA, Darmstadt, Germany. The proposed merger will be submitted to the stockholders of Sigma-Aldrich for their consideration. In connection therewith, Sigma-Aldrich intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to the stockholders of Sigma-Aldrich. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement, any amendments or supplements thereto and other documents containing important information about Sigma-Aldrich, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Sigma-Aldrich will be available free of charge on Sigma-Aldrich’s website at www.sigmaaldrich.com under the heading “SEC Documents” within the “Investor Info” section in the “Investors” portion of Sigma-Aldrich’s website. Shareholders of Sigma-Aldrich may also obtain a free copy of the definitive proxy statement by contacting Sigma-Aldrich’s Investor Relations Department at (314) 898-4643.