Marketing Our

Products and Services

As Never Before

2004 Analyst Conference

November 11-12, 2004

Georgia Natural Gas

Mike Braswell

President, Georgia Natural Gas

Marketing Initiatives

Overall Branding Goal

Strengthen and differentiate GNG brand versus

competition, in a manner that builds awareness

and leverages brand advantages

Advertising Initiatives

Radio, billboard & magazine ads deploying Gas

Guy to enhance communication of market

leadership and superior customer satisfaction

messages

High Value Customer Prospecting

Ongoing direct mail to acquire “high value”

prospects

Targeted Channel Marketing

Programs targeted to agents/movers to influence

selection of GNG at natural decision points

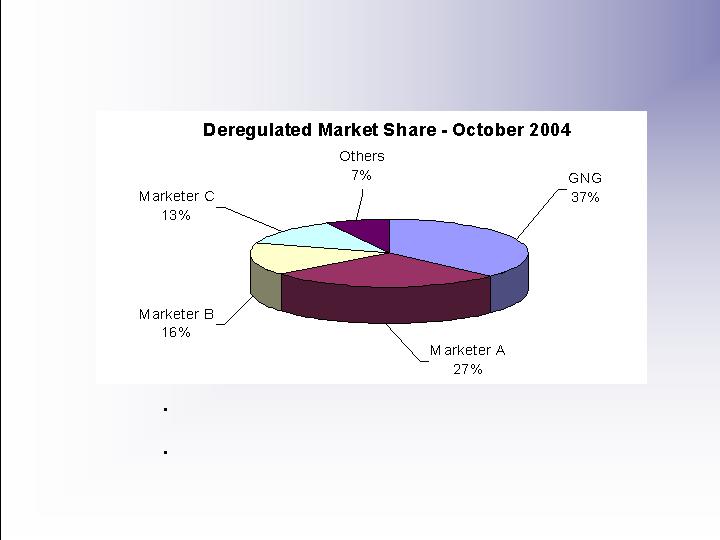

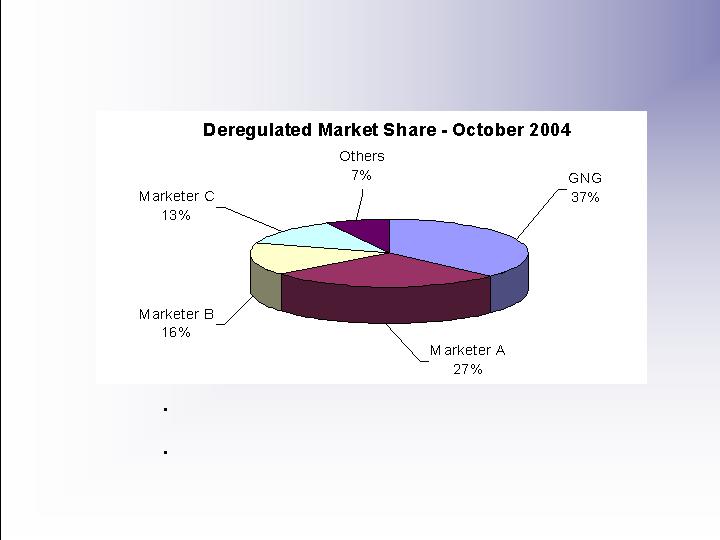

Largest Retail Marketer

in Georgia

SouthStar markets natural gas in Georgia under

the trade name Georgia Natural Gas (GNG)

SouthStar has a 10% lead over second-largest

marketer (based on deregulated customer count)

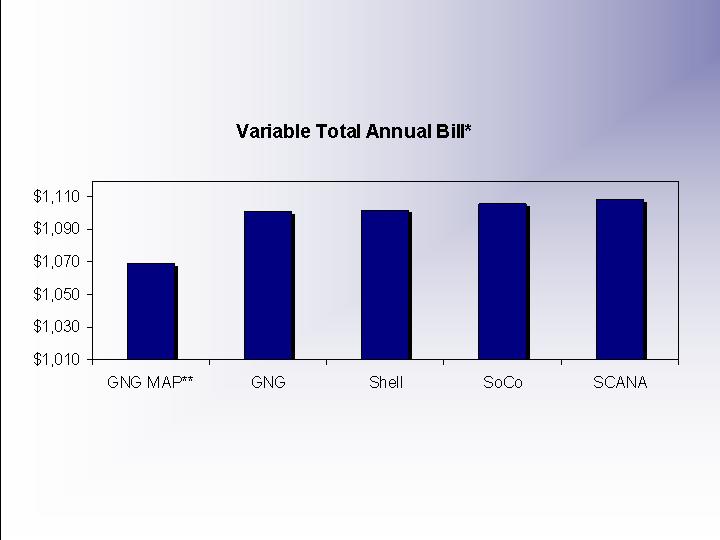

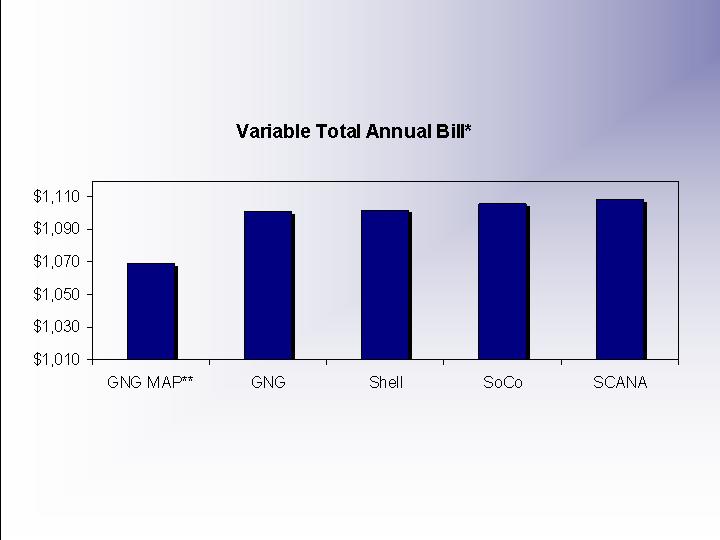

Variable Price Comparison of Top

Four Marketers

* Comparison of GNG’s variable price plans to other marketers’ standard published

prices in effect for past 12 months (November 2003 to October 2004). Assumes

typical AGLC customer using 880 therms per year with a 1.29 DDDC.

** GNG’s Market Advantage Plan (MAP) provides a guaranteed discount of at least 5

cents per therm.

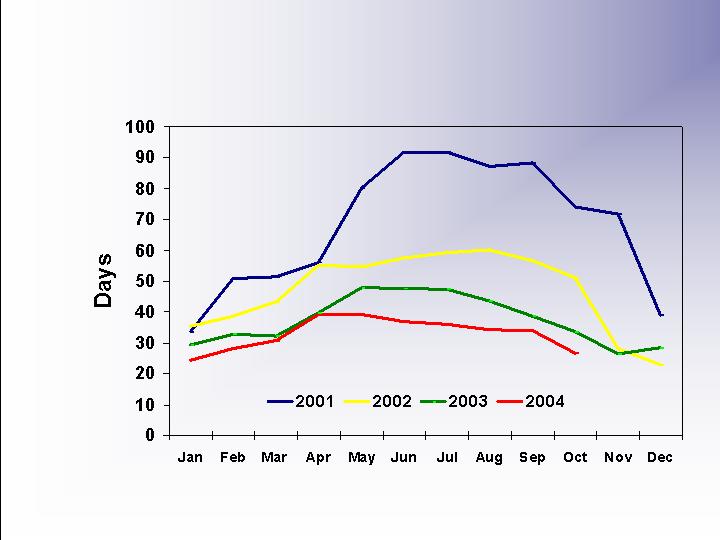

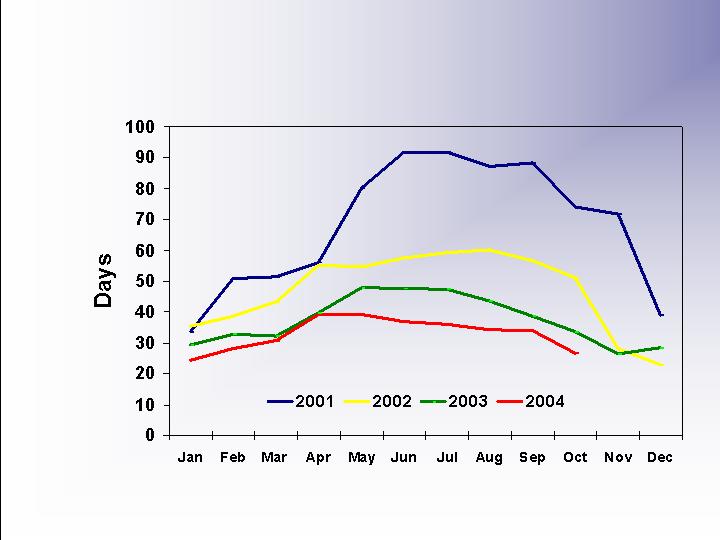

DSO (Days Sales

Outstanding) Tracking

30-Day DSO

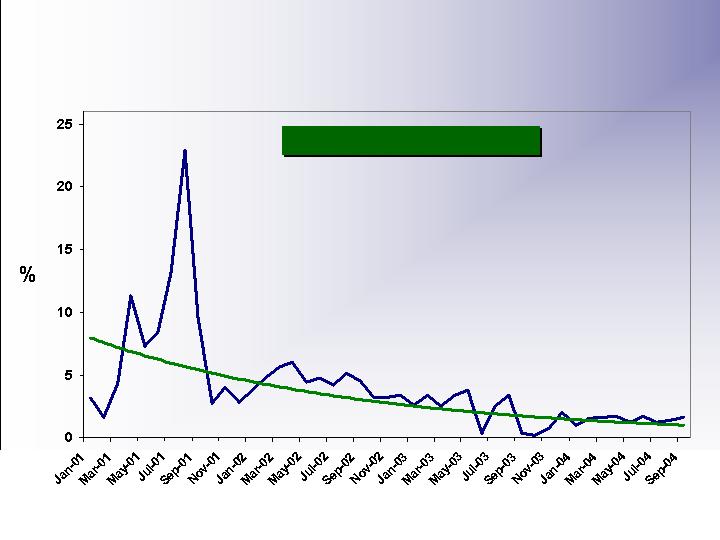

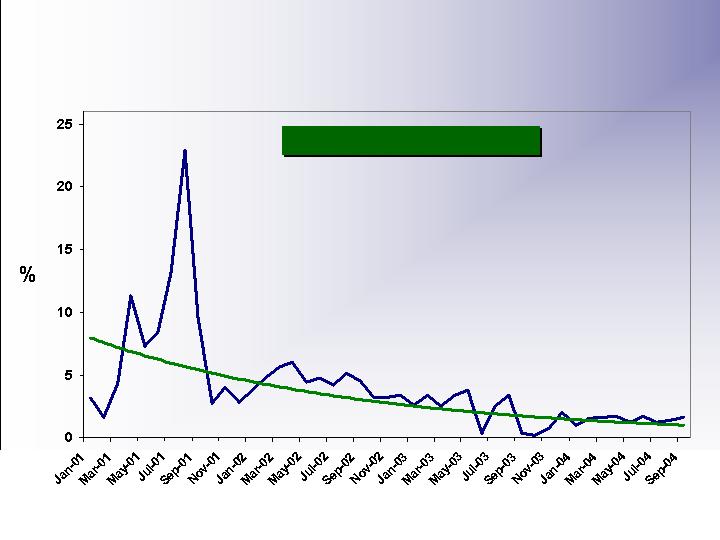

Significantly Reduced Bad Debt

Bad Debt as % of Revenue

Risk Management Philosophy

Identify and control the risk that is inherent in the retail gas marketing

business. SouthStar accomplishes this by:

identifying and isolating each exposure independently;

evaluating the entire portfolio to determine whether natural hedges exist;

and

utilizing financial derivatives to hedge residual exposures where natural

hedges do not exist

Key exposures that are inherent in the retail gas marketing business

include:

Commodity price risk (Fixed Price, Inventory, etc.)

Basis risk (Pipeline)

Throughput risk (Weather)

Credit risk (Retail Customers and Commercial Counterparties)

Sequent Energy

Management

Douglas N. Schantz

President, Sequent Energy Management

Sequent responds and caters to customers needs on an intra-day, day

ahead, monthly, and seasonal basis.

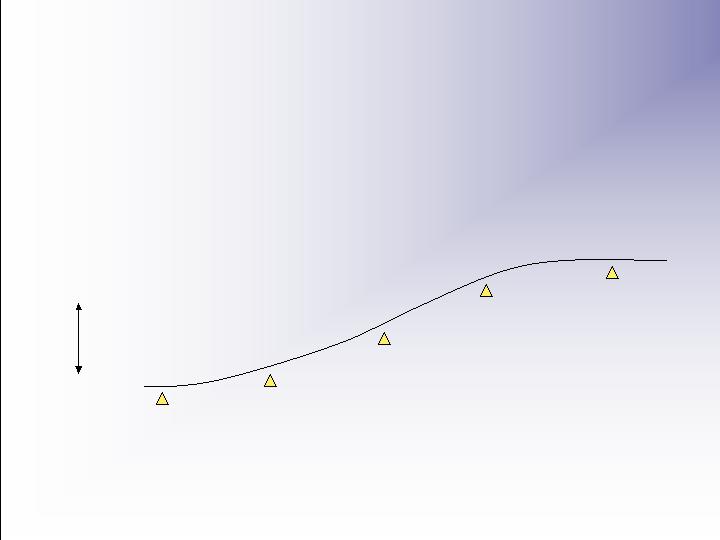

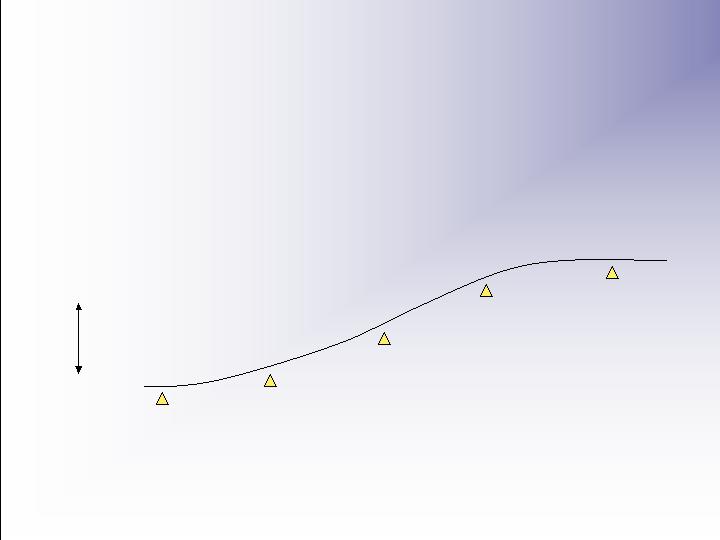

Typical progression of business activity typically follows this path:

Complex or

Structured

Low level of

complexity

Daily

Monthly

Seasonal

Peaking

Load Following

Full

Outsource

Wholesale Marketing

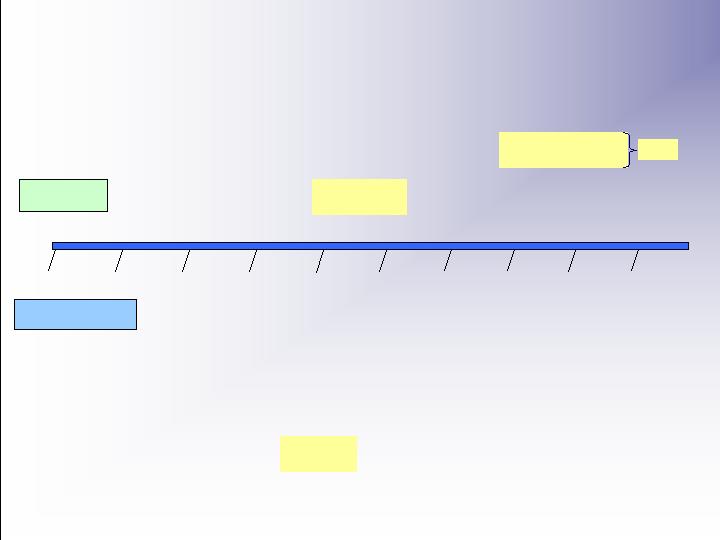

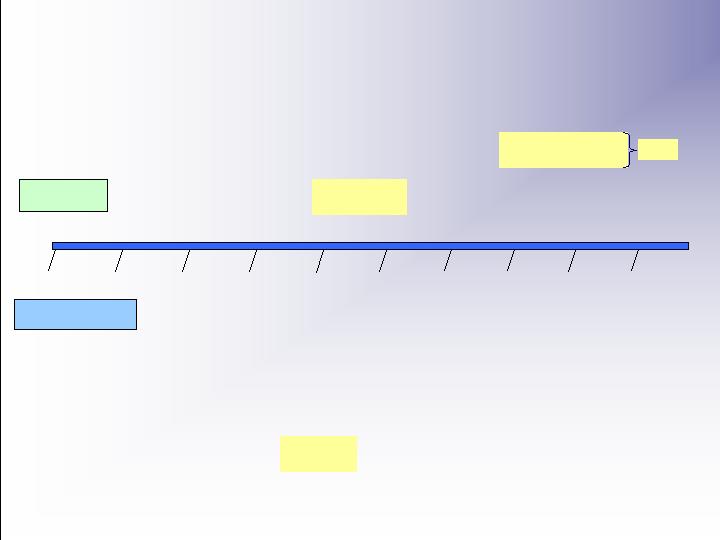

Key Structured Transactions

Under Contract

Final Development

Key Structured Transactions Duration

2004

2005

2006

2007

2008

2009

2010

2011

2012

Affiliate

Non-Affiliate

Northeast

LDC

Northeast

Power Gen

Northeast

Municipal AM

Southeast

Power Gen 1

Mid-Atlantic

LDC 2 AM

Mid-Atlantic

LDC 1 AM

Southeast

Power Gen 2

NUI City Gas of Fla.

NUI Elkton

TBD

VNG

AGLC

CGC

NUI

Elizabethtown

Mid-Atlantic LDC

Peaking

Northeast

Industrial

Mid-Atlantic

Retail

Aggregator

Florida

Power Gen

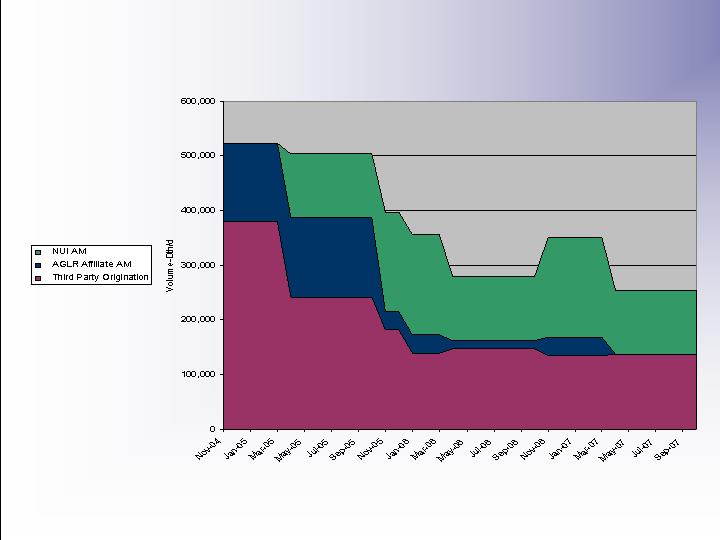

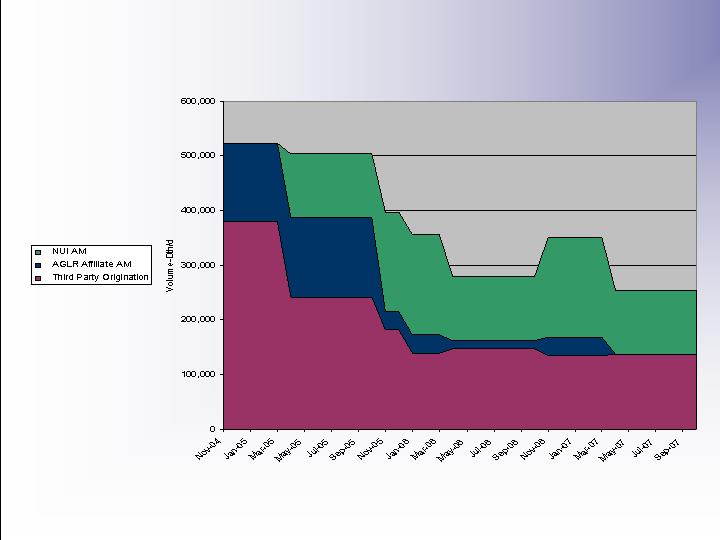

Key Structured Transaction Volumes

Sample Origination Deal

Southeast Power Generator

Term: 4 years

Transaction: Full requirements delivered fuel supply

Customer: 1200+MW combined style power generator

Benefits

Increased use of CGC and AGLC firm transportation at decent

margin levels

Potential use of Saltville and other Sequent high cycle storage

Sequent shares in the value created through using affiliates firm

transportation

Large savings to power generator by not holding firm upstream

transportation and storage

Georgia, Tennessee and

Virginia

Hank Linginfelter

President, Virginia Natural Gas

Donna Peeples

Managing Director, Sales and Marketing

Our Customer

Growth Is Not

Spectacular

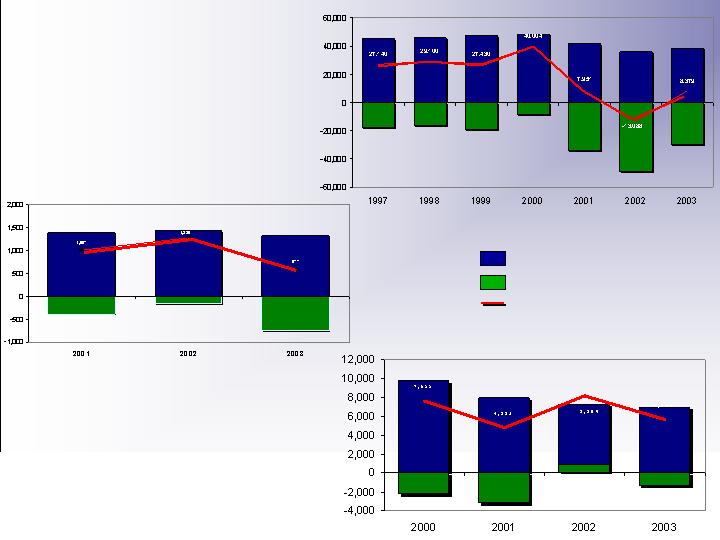

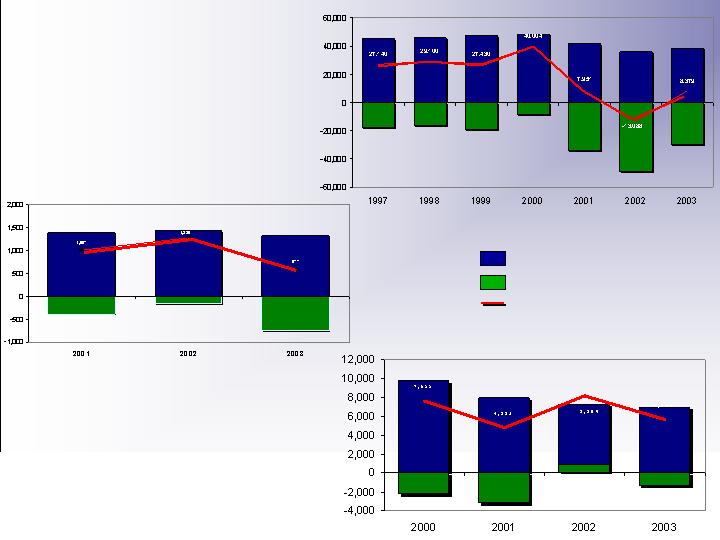

New Customers

Customers Lost

Net Growth

Atlanta Gas Light

Chattanooga Gas

Virginia Natural Gas

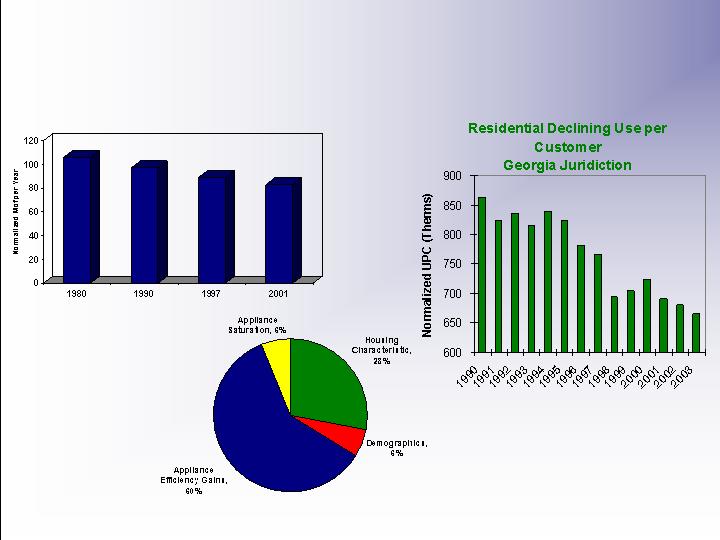

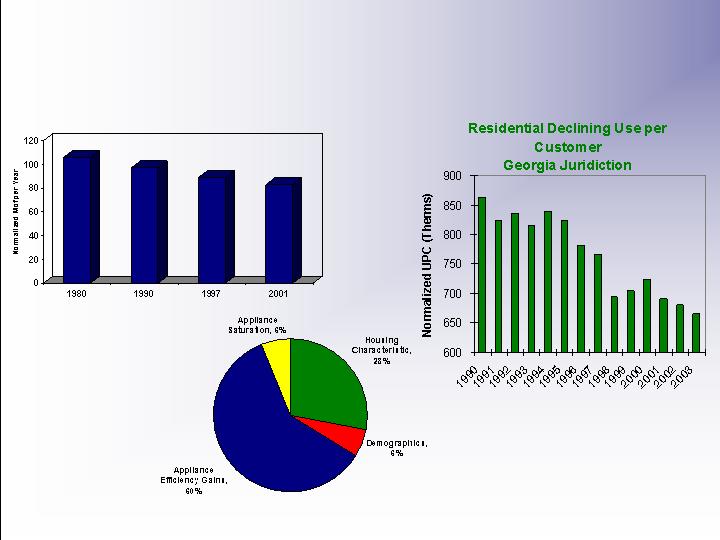

Declining Use Per Customer Is

Nothing New

Declining Use per Customer

Factors Contributing to

Declining U.S. Natural Gas

Use per Residential Customer

1997-2001

Source: AGA and internal data

Heat Pumps Remain A Problem

20

Percentage Growth of Heat Pump Sales

19.8%

9.9%

10.8%

27.9%

Growth Initiatives Fall Into Two

Major Categories

Increased billing unit growth

Increasing new additions

Reducing defections

Appliance programs

Consumer programs

Rate related programs

Marketing programs

Builder programs

Line extension policy

Legislative initiatives

Continue to explore regulatory mechanisms

to dampen impact of lost billing units

Enterprise-Wide Marketing

Initiatives

Targeted advertising

Dedicated Sales Representatives

“Gas Loyal” Dealer Network

Custom Designed Incentive Programs

Extensive Builder Relationships

Strategic Partnerships

22

We don’t sell gas – appliances do!

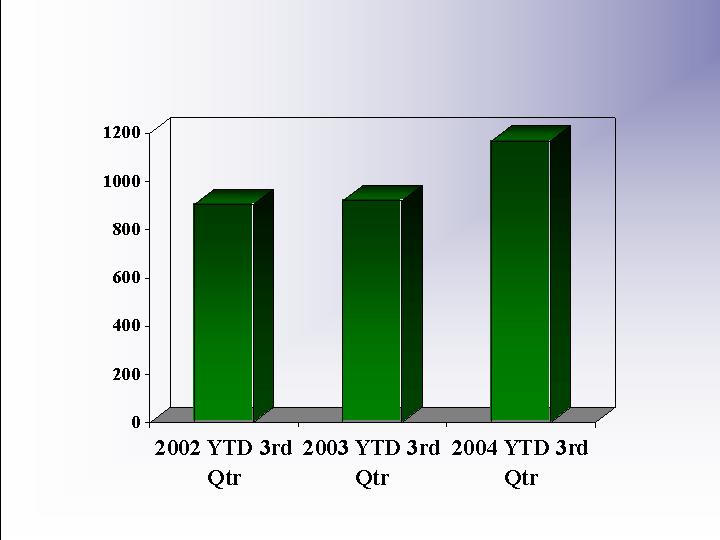

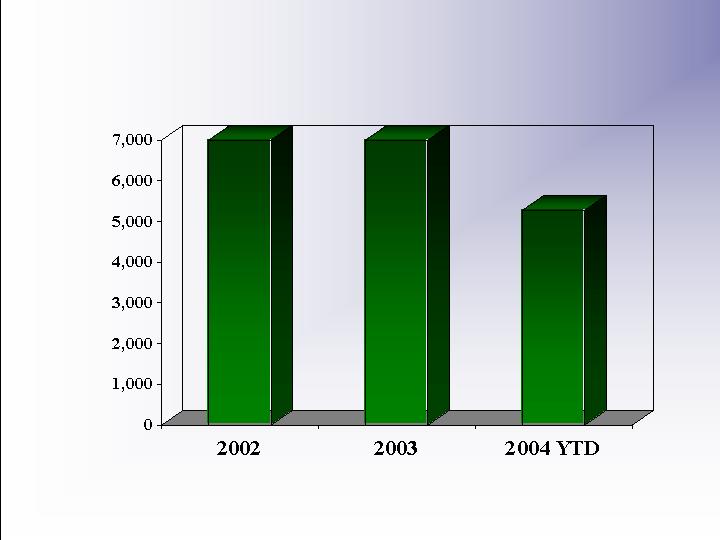

Atlanta Gas Light

Installed Meters

9 months ending September 30

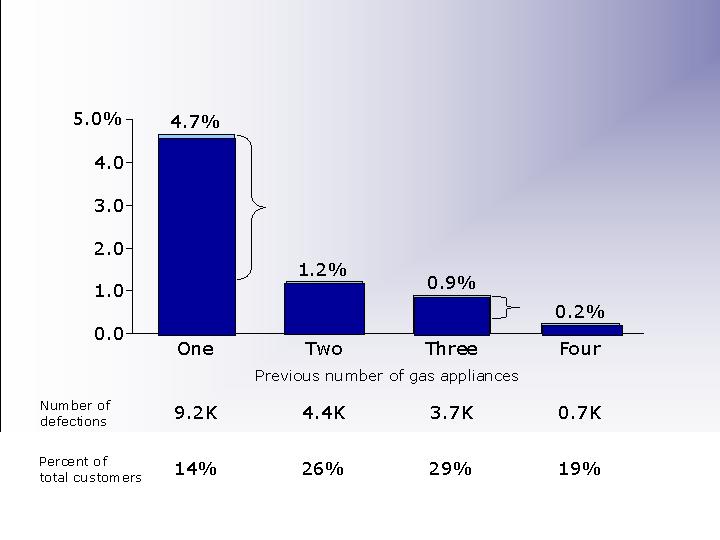

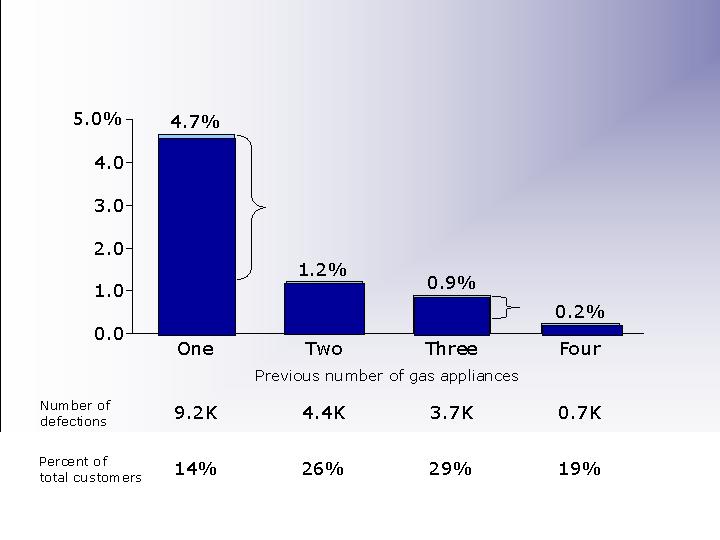

Defection Rates Decrease

Dramatically With Increased Gas Appliances

Note: There were 19,065 permanent defectors of 1.43M total residential customers in 2003

Source: AGL residential customer interviews, permanent defectors

4.8K

decrease

3.0K

decrease

Defection rate as percent of

total customer base with

same number of appliances

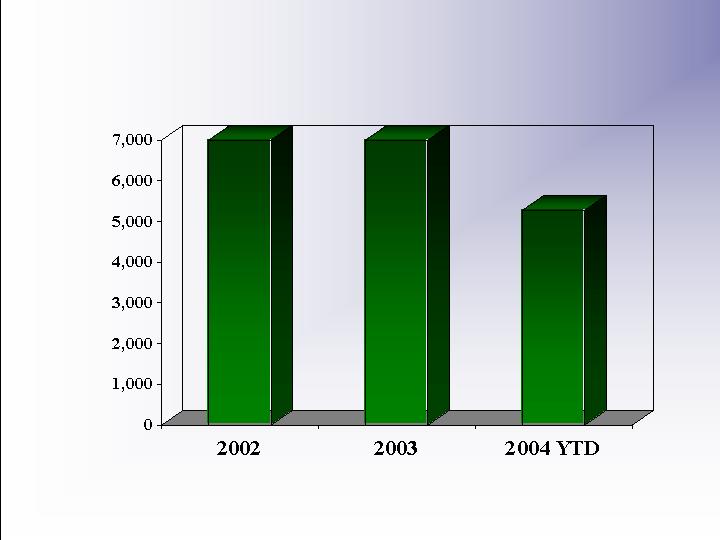

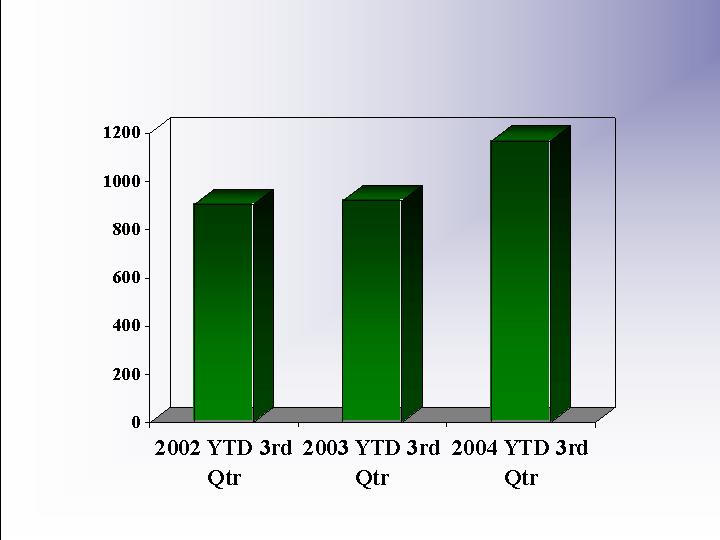

Chattanooga Gas Company

Installed Meters

Chattanooga Successes

Strategic pipeline expansion

Aggressive credit and collections program

Reengagement in community through

leadership in economic development

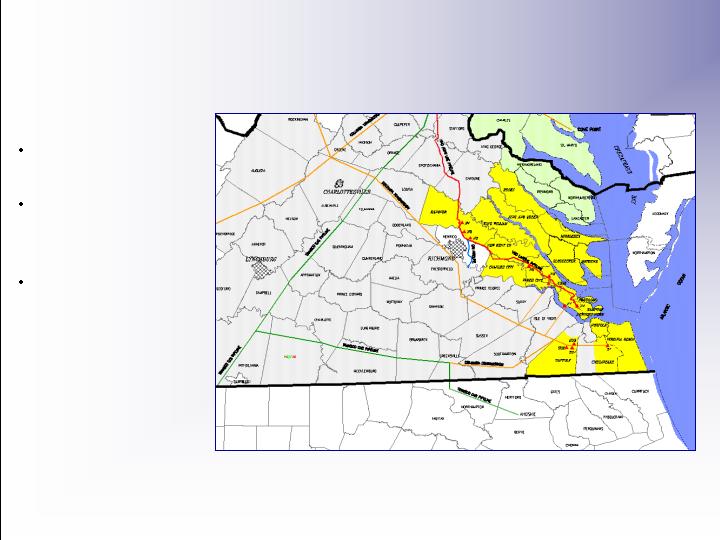

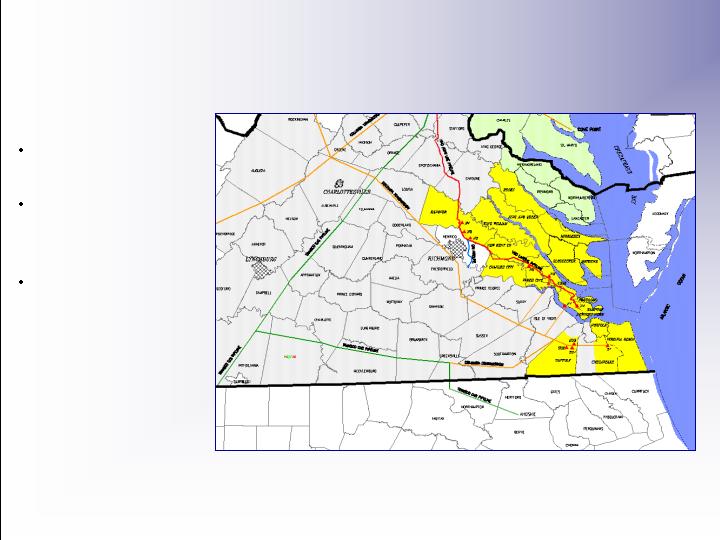

Virginia Natural Gas

New Customer Additions

Franchise Territory Is Important

Net Population

Growth 2000-2003

Counties Adjacent

to VNG Franchise:

+56,000

VNG Franchise:

+46,500