Financial Overview

and 2005 Outlook

Richard T. O’Brien

Executive Vice President and Chief Financial Officer

Forward-Looking Statements

Statements in this presentation that are not historical facts, including statements

regarding our estimates, beliefs, expectations, intentions, strategies or

projections, may be “forward-looking statements” as defined in the Private

Securities Litigation Reform Act of 1995. All forward-looking statements involve a

number of risks and uncertainties that could cause actual results to differ

materially from the estimates, beliefs, expectations, intentions, strategies and

projections reflected in or suggested by the forward-looking statements.

Information concerning risks and uncertainties that could cause differences

between actual results and forward-looking statements is contained in our filings

with the Securities and Exchange Commission, including our Form 10-Q for the

quarter ended September 30, 2004, filed with the commission on October 27,

2004 and its Form 8-K filed with the commission on October 27, 2004. Caution

should be taken for you not to place undue reliance on our forward-looking

statements, which represent our views only as of the date of this presentation,

and which we have no current intention to update.

GAAP Reconciliation

During this presentation references to our financial measures will include

references to core earnings per share data. We provide a complete

reconciliation between GAAP basic and diluted earnings per share to core

earnings per share data in our 2003 Annual Report to Shareholders

available at www.aglresources.com under "Investor Relations - SEC

Filings."

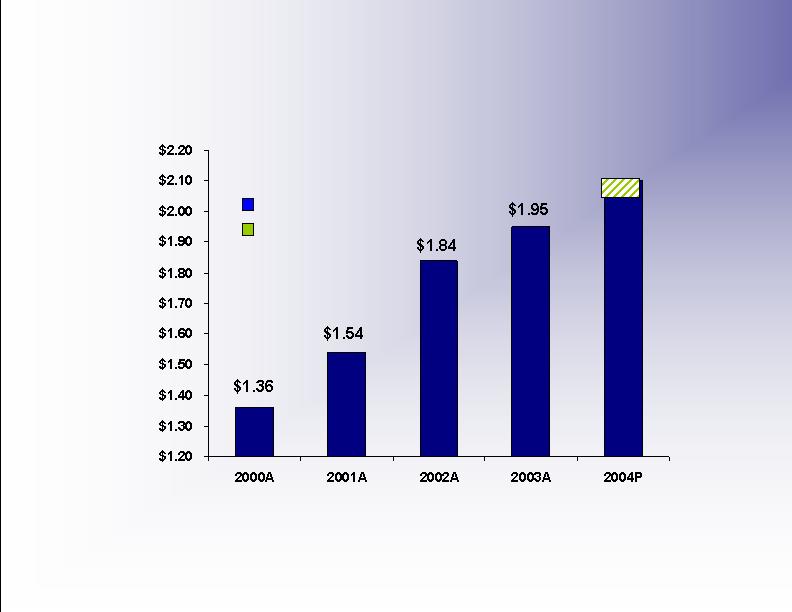

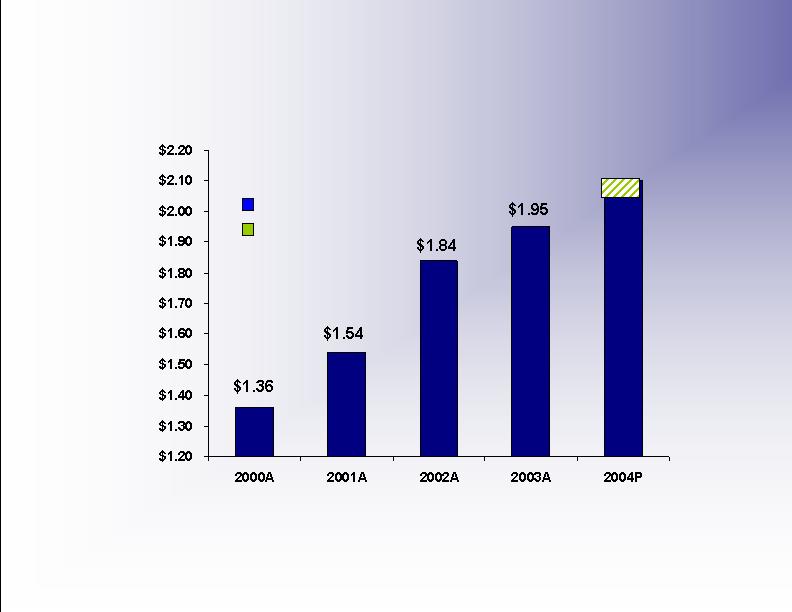

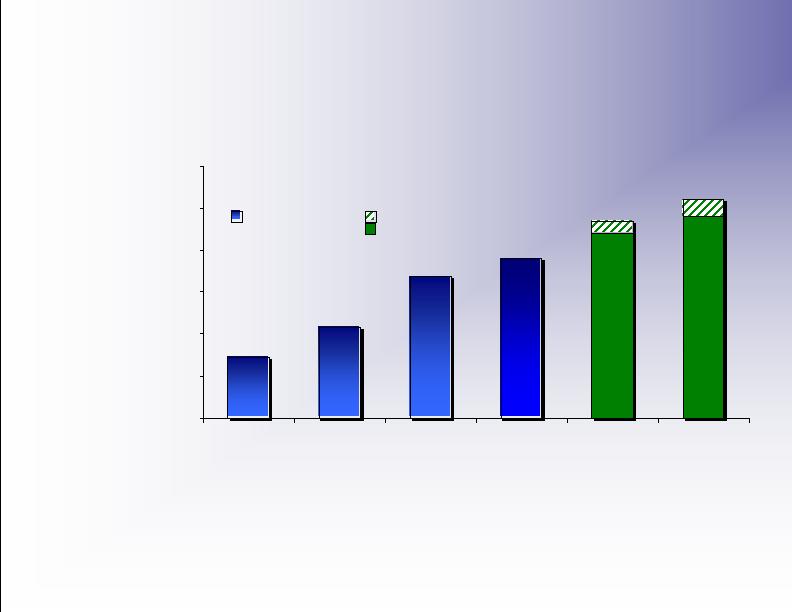

AGL Resources Core EPS*

2000-2004

EPS Actual

EPS Projected

$2.10

$2.17

*Basic earnings per share excluding an 8-cent gain on the sale of the Caroline Street campus, net of the donation

of the proceeds to a charitable organization in 2003; a 13-cent gain on the sale of Utilipro in 2001; and a 4-cent

gain on certain items in 2000. Our basic earnings per share was $2.03 in 2003, $1.67 in 2001 and $1.40 in 2000.

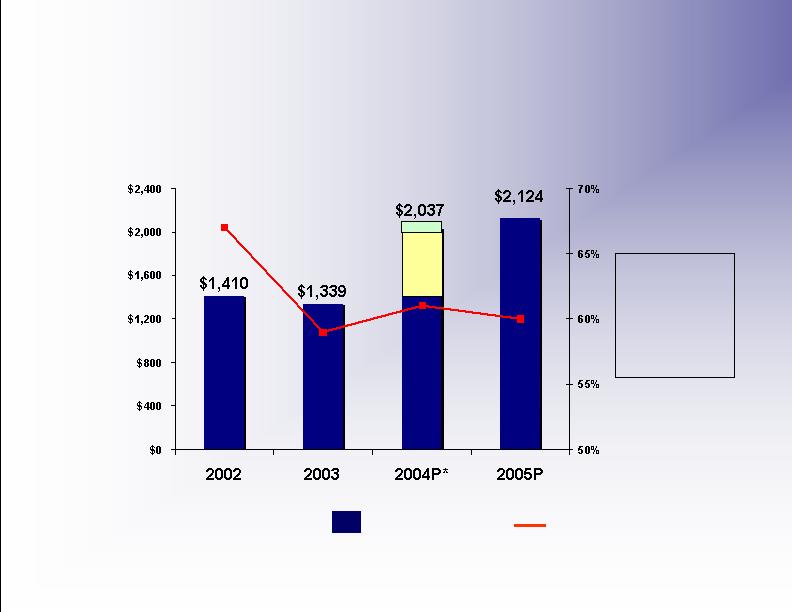

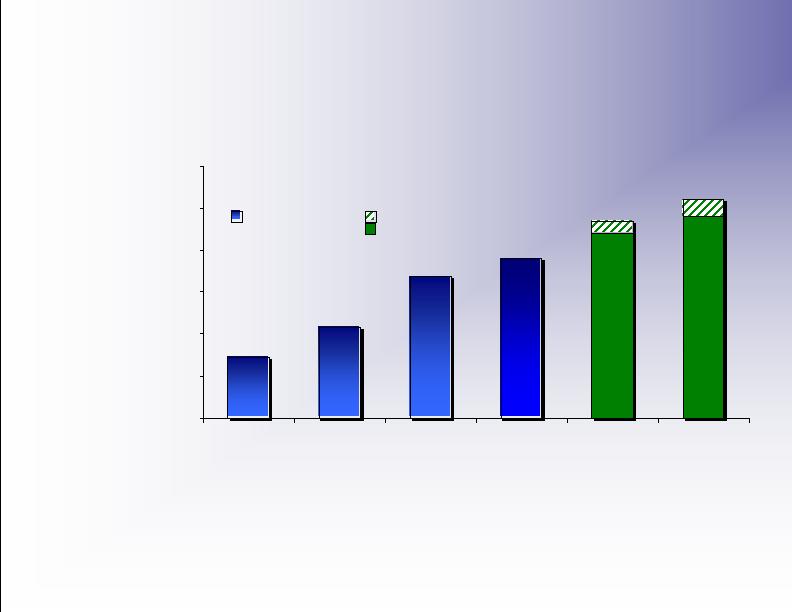

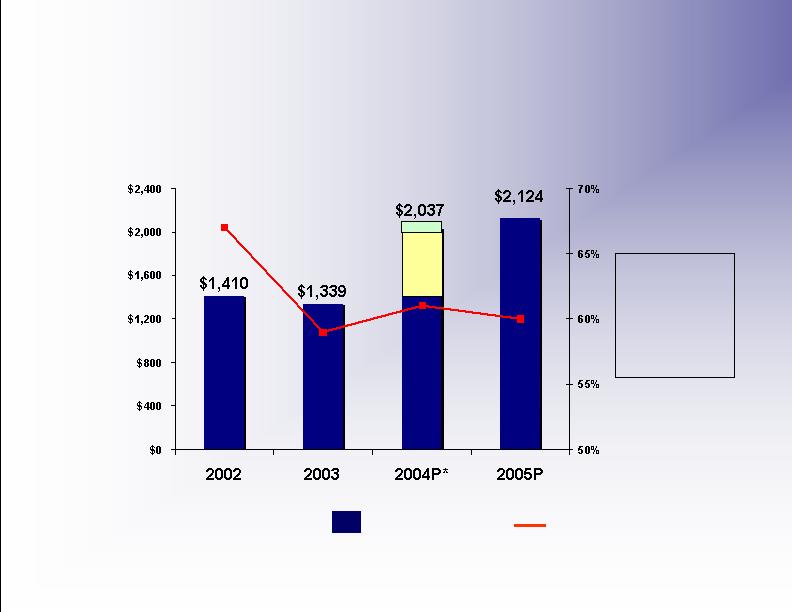

We Have Significantly Improved

The Balance Sheet in 2003 & 2004

Debt/Cap

Ratio (%)

Total Debt

($ Millions)

Debt/Cap Ratio

Total Debt

(including trust

preferred securities)

RATINGS

S&P: BBB+

Moody’s: Baa1

Fitch: A-

*Assumes $275mm equity offering

$622

NUI

$54 JISH

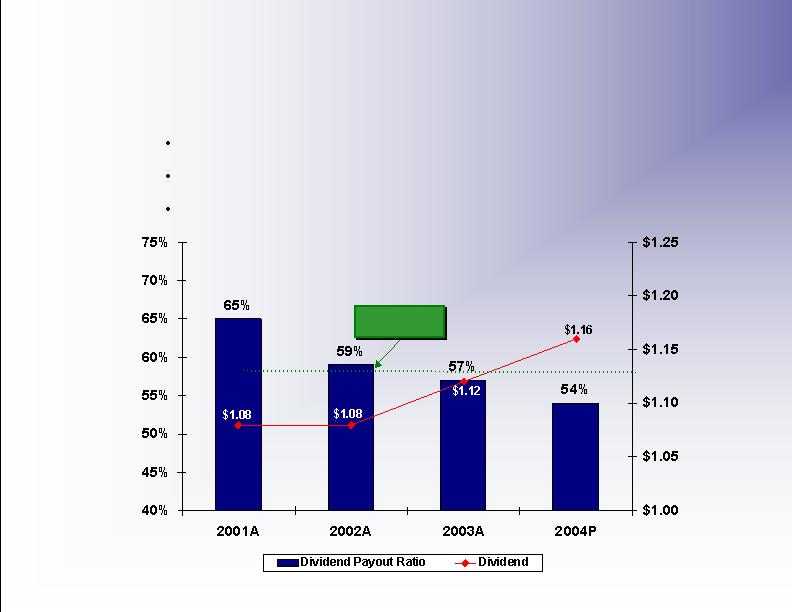

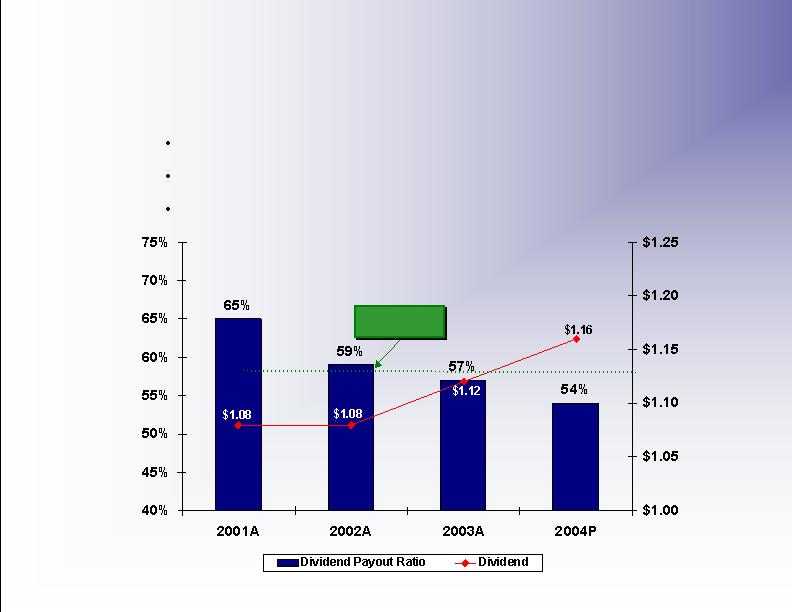

Dividend increased 3.5% to $1.16 annually in April 2004

Low dividend payout ratio relative to industry peers

Current dividend yield of 3.7%

Dividend Payout Continues to

Improve

Dividend Payout Ratio

LDC average

payout ratio

Reduced Cost of Debt

and Improved Interest Coverage

Our overall cost of debt and interest coverage ratios have

improved as a result of our debt and equity offerings

Average Debt ($MM) - $1,401$1,412 $1,255$1,290 $1,965

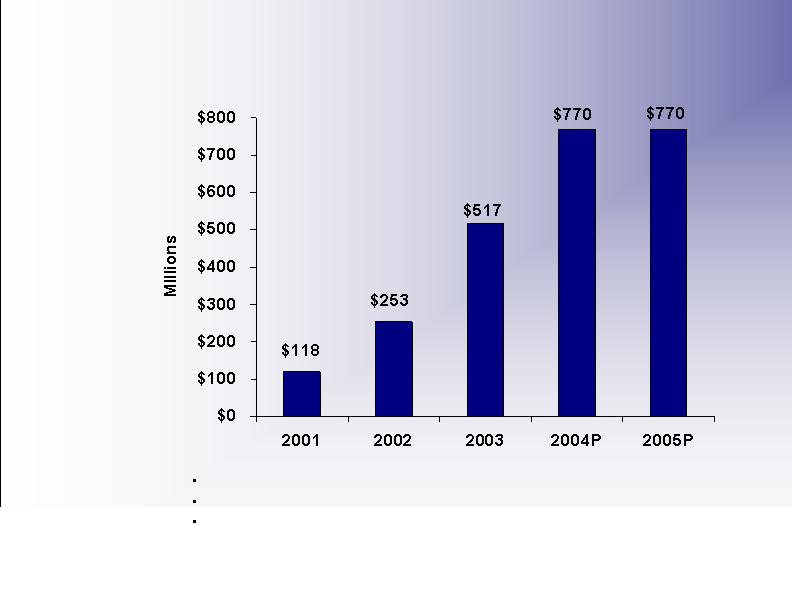

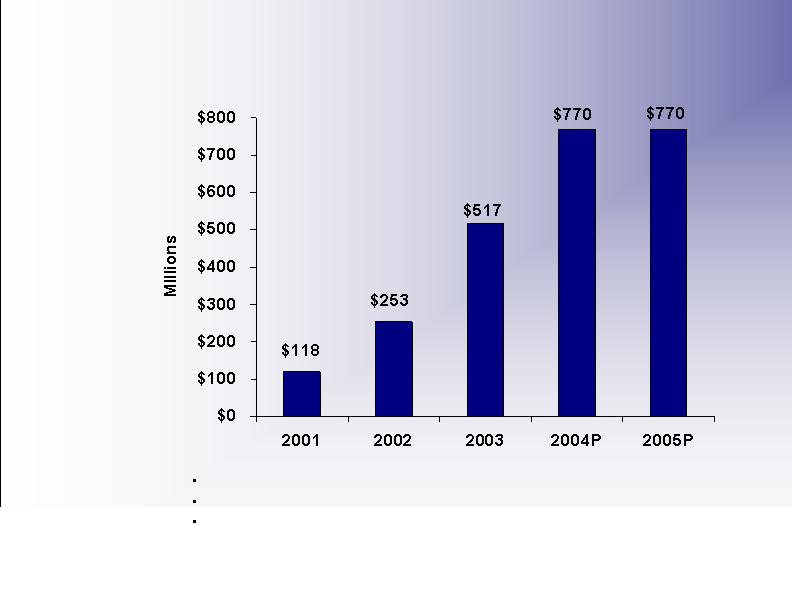

Significant Improvement

in Liquidity

(as of December 31)

Available Liquidity*

Liquidity = unused available Credit Facility and Cash and Cash Equivalents

*Restricted by 70% debt to cap ratio

Bank facility increased to $750mm with 5 year term in September 2004

Additional $700mm bridge facility in place for NUI financing if needed

Executed in October 2004 $250mm 30-year senior note offering at 6.00%

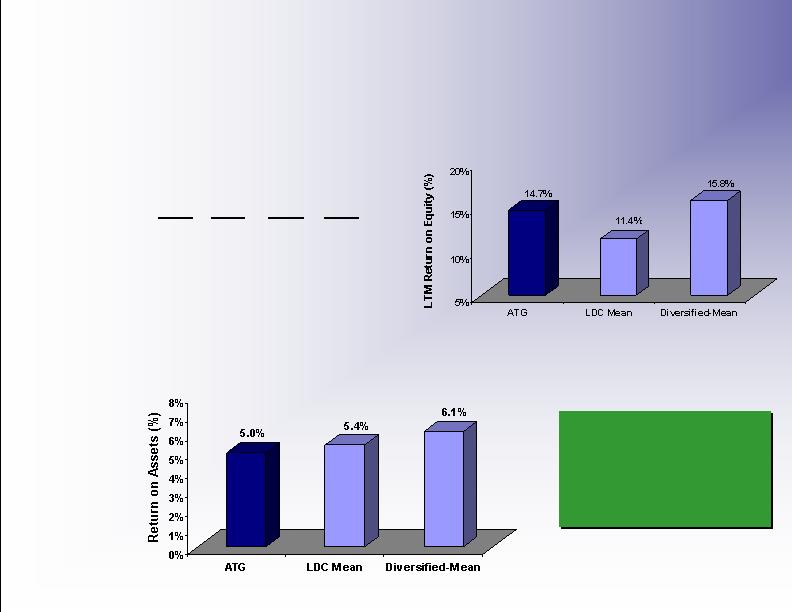

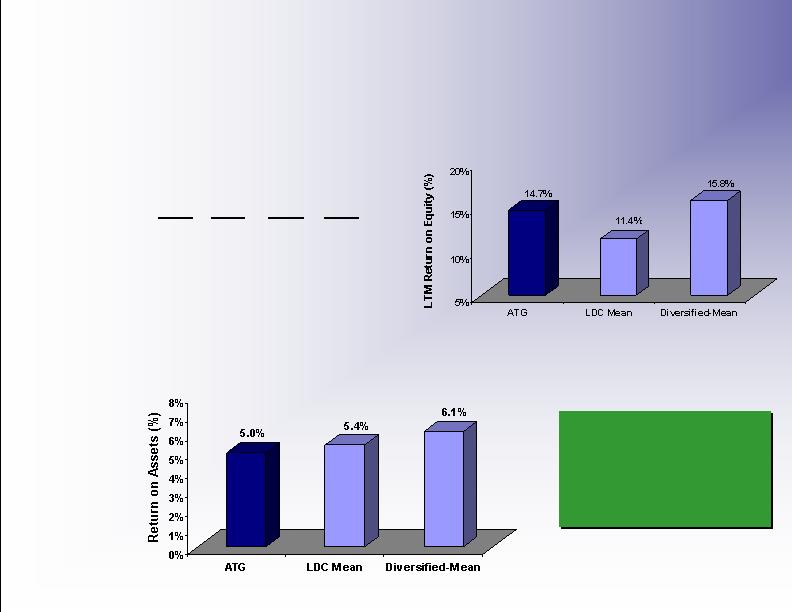

Returns Have Improved, But

We Still Have Work To Do

Must continue to

focus on capital

deployment and

maximizing return on

our asset base

Return on Equity (LTM)

Return on Assets (LTM)

ROIC - AGL Resources

2002A

2003A

2004E

2005E

Average Debt

1,453

$

1,376

$

1,350

$

1,965

$

Total Capital

2,153

$

2,204

$

2,333

$

3,346

$

ROIC

7.3%

7.9%

8.0%

7.3%

9

Return on Invested Capital

(ROIC)

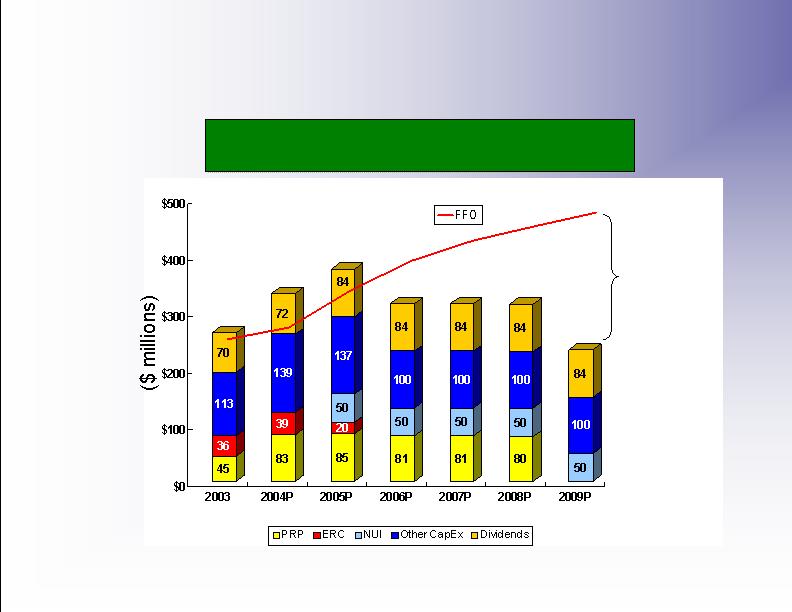

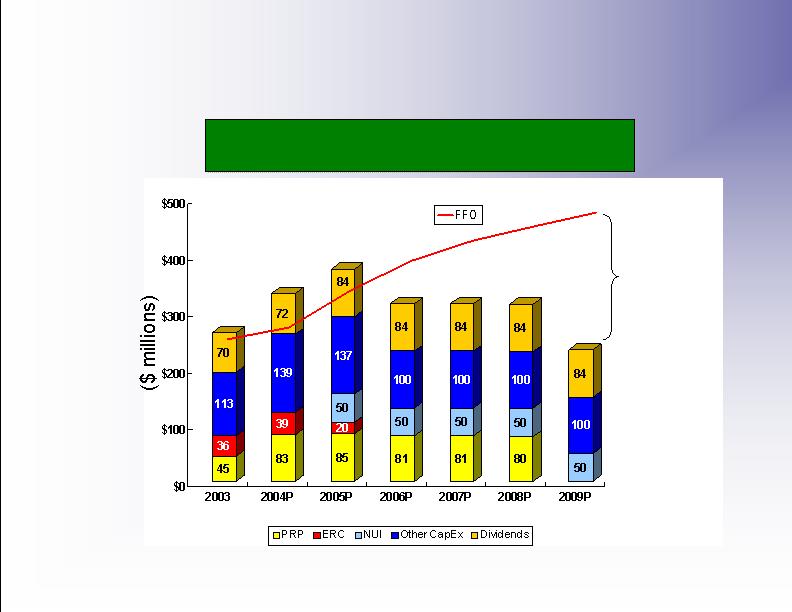

Cash Flow Projections

A Strong Long-term Outlook Due to the

Completion of PRP and ERC Rider Programs

Cash Outflows

‘05-’09 FFO

CAGR = 8%

Excess cash

available for debt

pay-down, dividend

increases or stock

repurchase

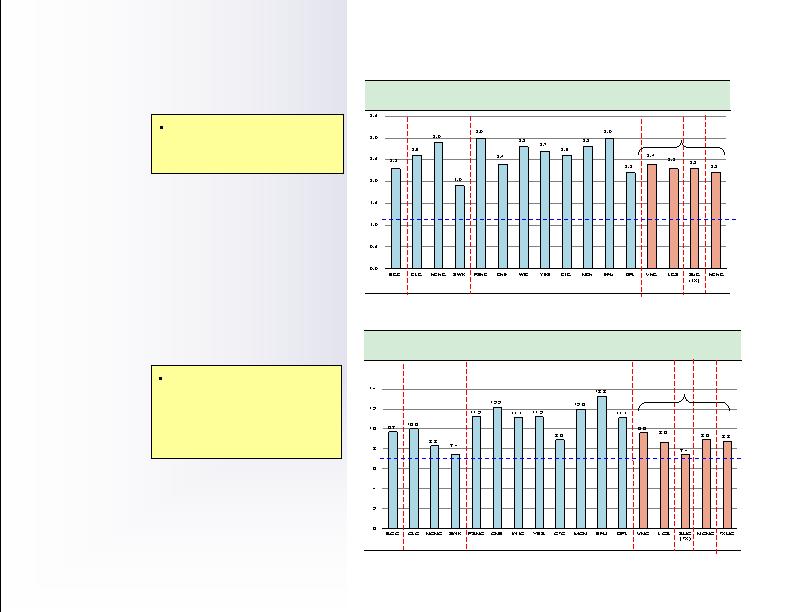

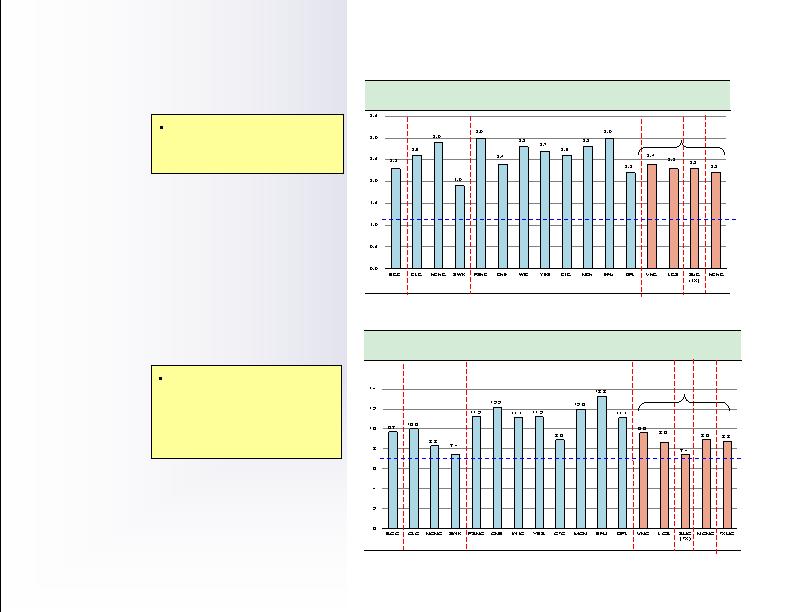

NUI - A Compelling Valuation

Equity Value / Book Value (1)

x

1997

1998

1999

2000

2002

2003

Recent

Transactions

Note

1.

BGC = Bay State Gas/NIPSCO; CLG = Colonial Gas/Eastern Enterprises; NCG = North Carolina Natural Gas/Carolina Power and Light; SWK = Southwest Gas/Oneok; PSNC = Public Service Company of North

Carolina/SCANA; CNE = Connecticut Energy/Energy East; WIC = Wicor/Wisconsin Energy; YES = Yankee Energy/Northeast Utilities; MCN = MCN Energy/DTE Energy; EFU = Eastern Enterprises/KeySpan; DPL = DPL/Indiana

Energy; VNG = VNG/AGL Resources; LGS = LGS/Atmos Energy; SUG = SUG Texas/Oneok; NCNG = NCNG (subsidiary of Progress)/Piedmont

Note

1.

BGC = Bay State Gas/NIPSCO; CLG = Colonial Gas/Eastern Enterprises; NCG = North Carolina Natural Gas/Carolina Power and Light; SWK = Southwest Gas/Oneok; PSNC = Public Service Company of North Carolina/SCANA; CNE =

Connecticut Energy/Energy East; WIC = Wicor/Wisconsin Energy; YES = Yankee Energy/Northeast Utilities; MCN = MCN Energy/DTE Energy; EFU = Eastern Enterprises/KeySpan; DPL = DPL/Indiana Energy; VNG = VNG/AGL

Resources; LGS = LGS/Atmos Energy; SUG = SUG Texas/Oneok; NCNG = NCNG/Piedmont; TXUG = TXU Gas/Atmos Energy (Atmos’ estimate of EBITDA)

Aggregate Value/EBITDA (1)

x

1997

1998

1999

00

02

03

Recent Transactions

04

No other recent LDC

purchase has been done

at or near book value

At 7x* EBITDA, we paid

the lowest Aggregate

value/ EBITDA multiple

of 17 LDC transactions

from 1997 to current

* net of assumed cash

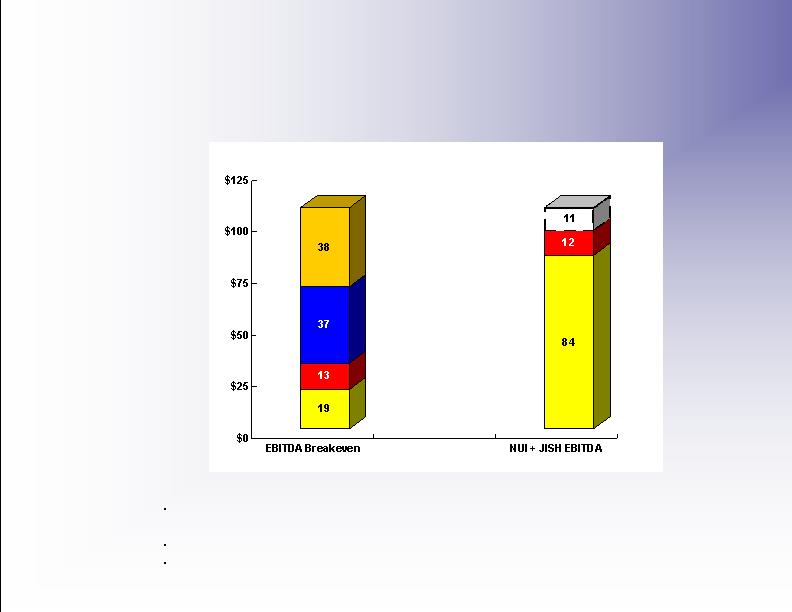

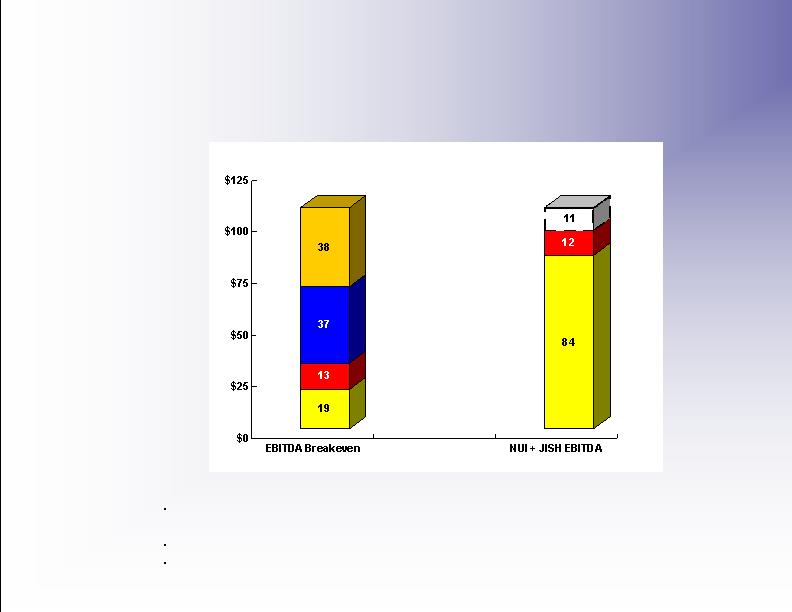

2005 Breakeven EBITDA

From Acquisitions

*EBITDA Breakeven Assumes:

$951MM combined enterprise value; includes regulatory settlement cost but no

transaction expenses

$275MM of equity issued at current market

Target of $2.20 ’05 EPS (low side of ’05 guidance)

Depreciation

Interest

Taxes

Net Income

$107*

($MM)

NUI 03

Normalized

JISH

$107

Synergies Needed

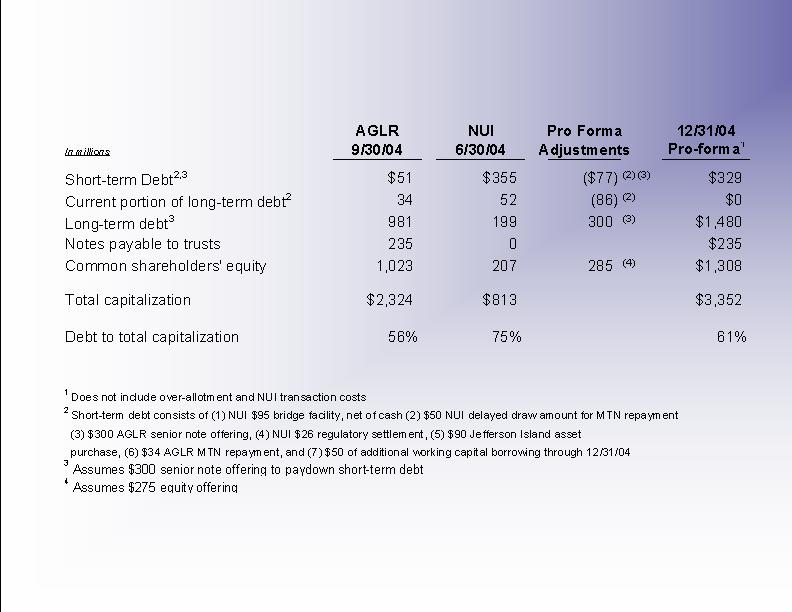

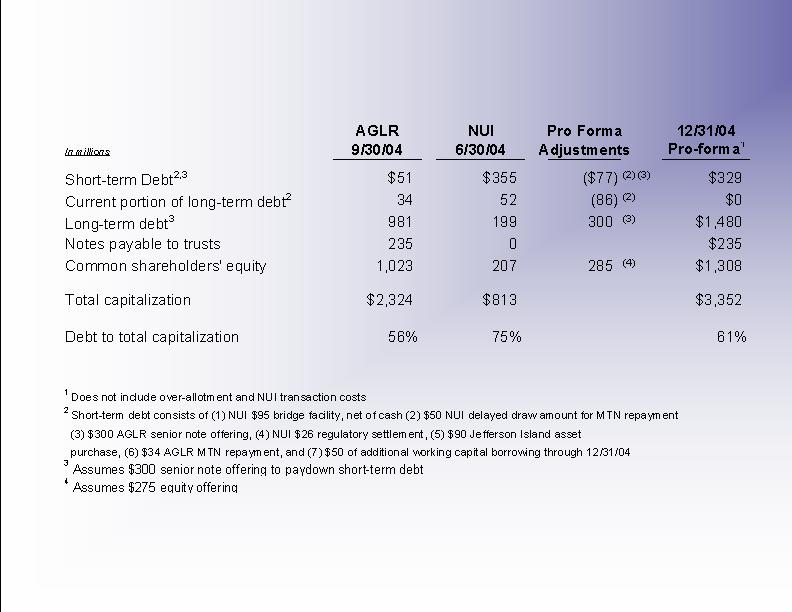

Pro-forma Capitalization

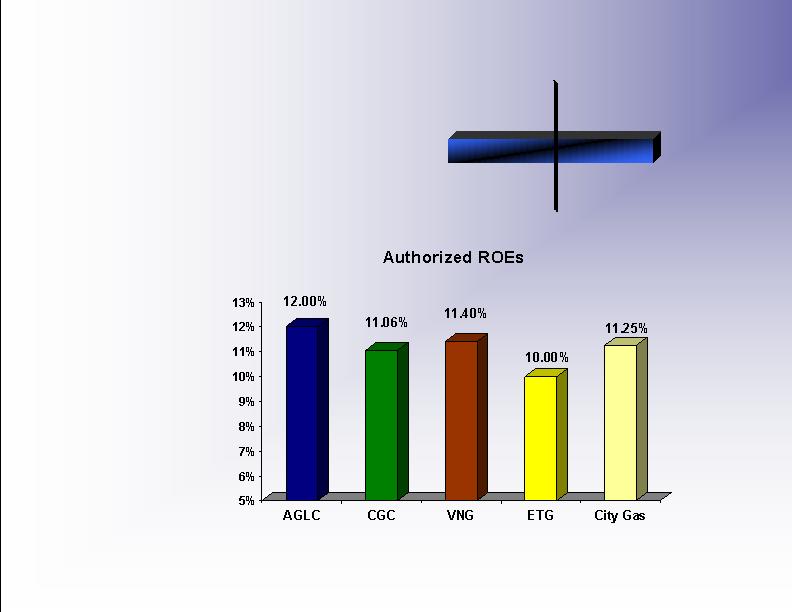

Regulatory Filings

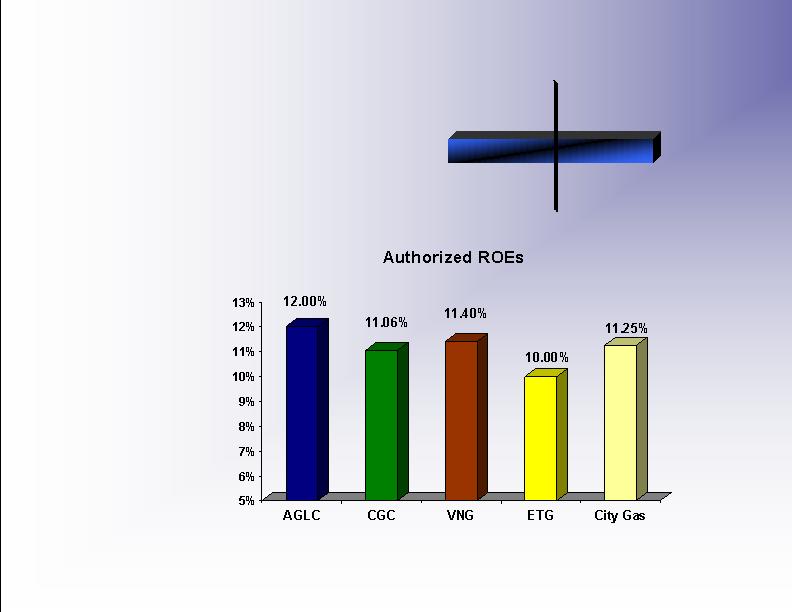

AGLC

Filing has been made with proposed rate increase of $24.6 MM or

approximately 5% of base rates or 1.5% of total bill

Capacity supply plan has been approved for 3 years

Pipeline replacement rider amount is being decided

Chattanooga

Reconsideration sought in Rate Case on ROR

VNG

Weather normalization extended for 2 years with minor modifications

Pivotal Air Propane plant ($27 million) should earn authorized ROE in

2005 and beyond

ETG

NJBPU approval received on November 9th

3 year rate freeze with PBR similar to GA in years 4 and 5 with Rate

Case in year 5

Sequent will be asset manager for 3 years at $4MM per year

City Gas

Base rate increase of $6.7 MM effective from 2/23/04

Future Regulatory Filings

1% Change in

Authorized ROE

-$10MM

+10MM

404 Compliance

Management will continue assessment process through December 31, 2004 by

completing documentation and performing testing of internal controls over

financial reporting

Currently no pervasive control deficiencies or deficiencies which can not be

remediated by December 31, 2004

NUI and Jefferson Island are exempted from SOX 404 Compliance in 2004

Sequent implemented a new Energy Trading and Risk Management System

(ETRM) in October 2004

Design and implementation began in November 2003 before finalization of SOX 404

requirements

Management believes that ETRM has enhanced internal controls

Timing of ETRM implementation may not enable management to gather sufficient

evidence to conclude our internal controls over financial reporting were designed and

operating effectively

Independent auditors (PricewaterhouseCoopers) could also have a scope limitation

with respect to Sequent due to potential lack of sufficient evidence

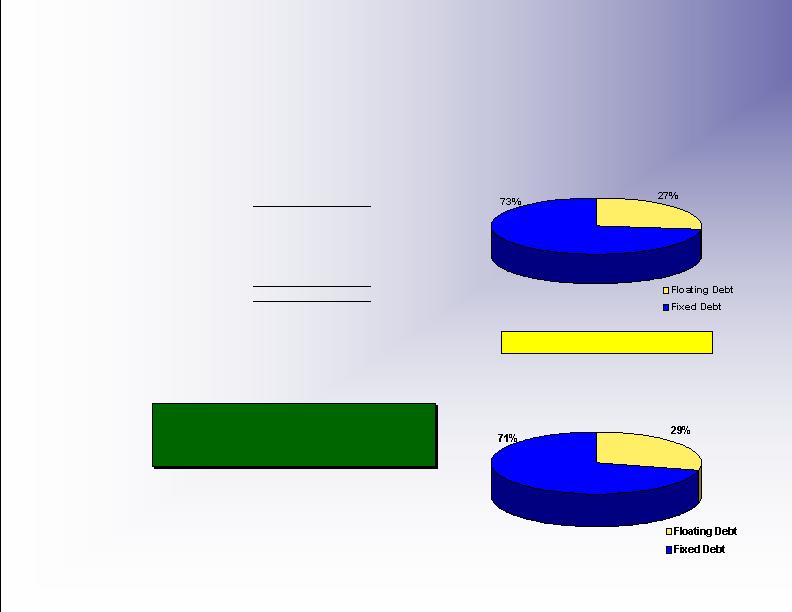

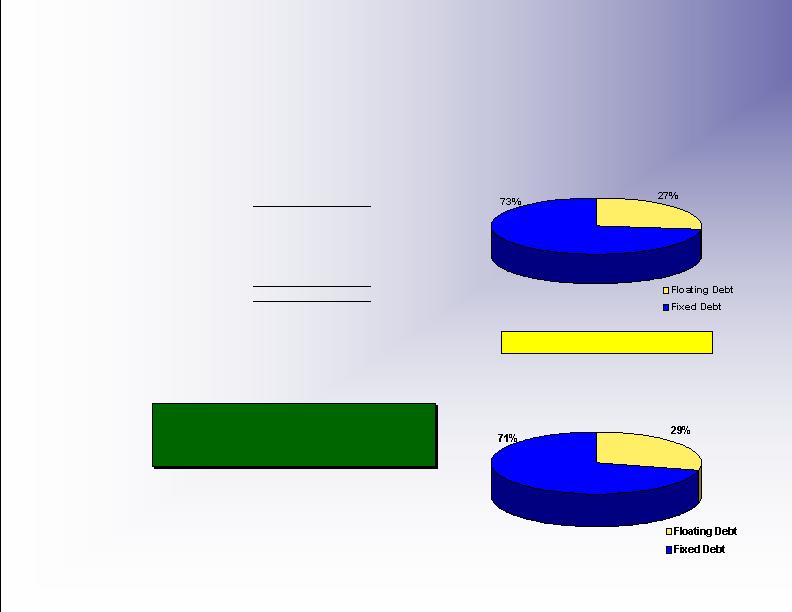

Projected Debt Profile

Projected As of December 31, 2004

Projected As of December 31, 2005

A 100 bps change in short-term interest

rates at 12/31/04 impacts interest

expense by $5 million annually

$543

$1,501

$1,501

$629

With NUI Financing and $275 Equity Offering

Includes $175 of interest rate swaps

December 31,

In millions

2004P

2005P

Short-term Debt

$329

$415

Medium Term Notes

208

208

Senior Notes

1,073

1,073

Revenue Bonds

199

199

Notes Payable to Trusts

235

235

Total Debt

$2,044

$2,130

Total Debt to Total Capitalization

61%

60%

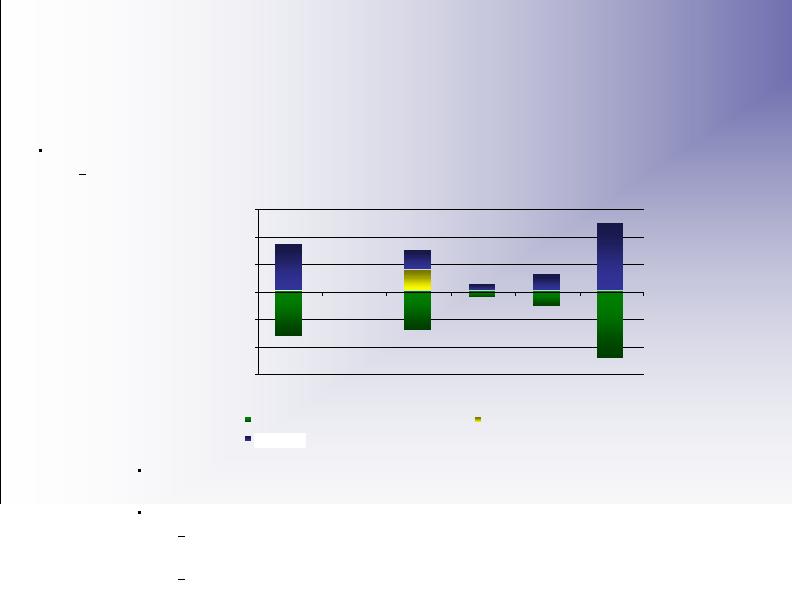

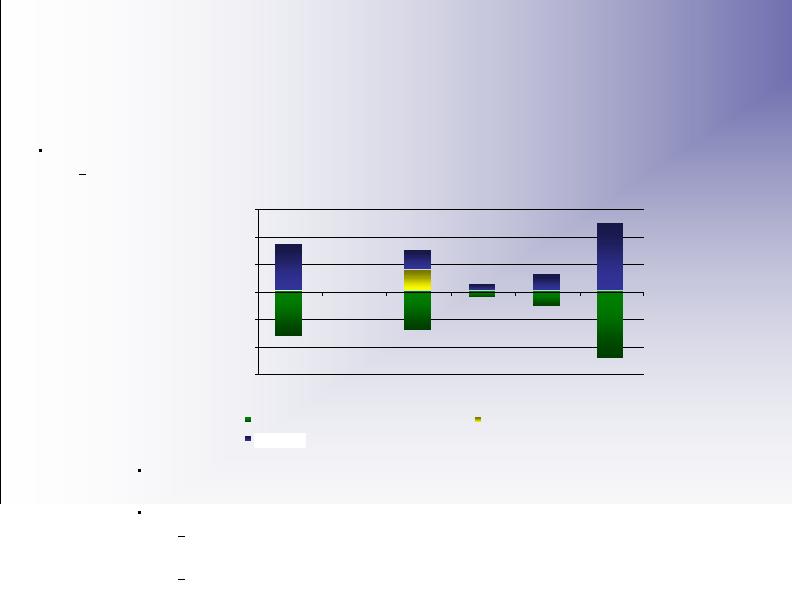

Impact of Price Fluctuations on

Sequent Positions at September 30,

2004

Sequent fully hedges storage inventory with futures thereby locking in margin:

$2MM Q4 2004 and $5MM Q1 2005 at Sep. 30

Fair Value (mark-to-market) accounting for hedges versus accrual accounting for

inventory may result in volatility in reported earnings

Inventory and Related Hedge Sensitivity

Hedges: at Sep. 30, a $0.10 price move results in $650,000 pre-tax and

pre-sharing impact to earnings

Physical Inventory: Sep. 30 = 6.5Bcf

Inventory Withdrawal Schedule and NYMEX Hedges

-169

-149

-61

-249

169

74

61

249

-25

75

25

-300

-200

-100

0

100

200

300

Oct-04

Nov-04

Dec-04

Jan-05

Feb-05

Mar-05

NYMEX Open Positions

Salt Dome - Physical Withdrawals

Resovoir - Physical Withdrawals

18

$1.95

$1.84

$1.54

$1.36

$1.00

$1.25

$1.50

$1.75

$2.00

$2.25

$2.50

2000A

2001A

2002A

2003A

2004P

2005P

EPS Actual

Projected

$2.10 - $2.17

$2.20 - $2.30

AGL Resources Core EPS*

2000-2005

*Basic earnings per share excluding an 8-cent gain on the sale of the Caroline Street campus, net of the donation

of the proceeds to a charitable organization in 2003; a 13-cent gain on the sale of Utilipro in 2001; and a 4-cent

gain on certain items in 2000. Our basic earnings per share was $2.03 in 2003, $1.67 in 2001 and $1.40 in 2000.