As filed with the Securities and Exchange Commission on October 14, 2014.

Registration No. 333-

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Celulosa Arauco y Constitución S.A.

(Exact name of Registrant as specified in its charter)

Arauco and Constitution Pulp Inc.

(Translation of Registrant’s name into English)

| | |

| Republic of Chile | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

Avenida El Golf 150, 14th Floor

Santiago, Chile

+56-2-2461-7200

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address and telephone number of agent for service)

Copies of communications to:

David L. Williams

Simpson Thacher & Bartlett, LLP

425 Lexington Avenue

New York, New York, 10017

(212) 455-2000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement and the satisfaction or waiver of all other conditions to the exchange offer described in the accompanying prospectus.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of each class of

Securities to be Registered | | Amount to be

Registered | | Proposed

Aggregate

Offering Price

Per Note | | Proposed

Maximum

Aggregate

Offering Price (1) | | Amount of

Registration Fee |

4.500% Notes due 2024 | | $500,000,000 | | 98.863% | | $500,000,000 | | $58,100 |

|

|

| (1) | The securities being registered are offered (i) in exchange for 4.500% Notes due 2024 previously sold in transactions exempt from registration under the Securities Act of 1933 and (ii) upon certain resales of the notes by broker-dealers. The registration fee has been computed based on the face value of the notes solely for the purpose of calculating the amount of the registration fee, pursuant to Rule 457 under the Securities Act of 1933. |

The Registration hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The Information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated October 14, 2014

Prospectus

Celulosa Arauco y Constitución S.A.

US$500,000,000

Offer to Exchange All Outstanding

4.500% Notes due 2024

For an Equal Principal Amount of

4.500% Notes due 2024

Which Have Been Registered Under the Securities Act of 1933

The Exchange Offer

| | • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradeable. |

| | • | | You may withdraw tenders of outstanding notes at any time prior to the expiration of the exchange offer. |

| | • | | The exchange offer expires at midnight, New York City time, on , 2014, unless extended. We do not currently intend to extend the expiration date. |

| | • | | The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for United States federal income tax or Chilean tax law purposes. |

| | • | | We will not receive any proceeds from the exchange offer. |

The Exchange Notes

| | • | | The exchange notes are being offered in order to satisfy our obligations under the registration rights agreement entered into in connection with the placement of the outstanding notes. |

| | • | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradeable. |

Resales of Exchange Notes

| | • | | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

If you are a broker-dealer and you receive exchange notes for your own account, you must acknowledge that you will deliver a prospectus in connection with any resale of such exchange notes. By making such acknowledgment, you will not be deemed to admit that you are an underwriter under the U.S. Securities Act of 1933, as amended, or the “Securities Act.” Broker-dealers may use this prospectus in connection with any resale of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by the broker-dealer as a result of market-making activities or trading activities. We have agreed that, for a period of 180 days after the expiration of the exchange offer or until any broker-dealer has sold all registered notes held by it, we will make this prospectus available to such broker-dealer for use in connection with any such resale. A broker dealer may not participate in the exchange offer with respect to outstanding notes acquired other than as a result of market-making activities or trading activities. See “Plan of Distribution.”

If you are an affiliate of ours or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, you cannot rely on the applicable interpretations of the U.S. Securities and Exchange Commission, or the “SEC,” and you must comply with the registration requirements of the Securities Act in connection with any resale transaction.

You should consider carefully the risk factors beginning on page 10 of this prospectus before participating in the exchange offer.

Neither the SEC nor any state securities commission has approved or disapproved of the exchange notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

TABLE OF CONTENTS

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any exchange notes offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation. The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies. No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained or incorporated by reference in this prospectus in connection with the offer contained herein and, if given or made, such information or representations must not be relied upon as having been authorized by us. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances create an implication that there has been no change in our affairs or that of our subsidiaries since the date hereof.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information reporting requirements of Section 13(a) Exchange Act and, in accordance therewith, file reports and other information with the SEC. We file annual reports on Form 20-F, which commencing with our annual report on Form 20-F for the year ended December 31, 2002, included annual audited consolidated financial statements prepared in accordance with US GAAP with transition to International Financial Reporting Standard issued by International Accounting Standard Board (“IFRS”) under SEC requirements as of January 1, 2009, as well as reports on Form 6-K containing our quarterly unaudited consolidated financial statements prepared in accordance with IFRS and certain other information. These reports and other information can be inspected and copied at the Public Reference Section of the SEC at 100 F Street, NE, Washington, D.C. 20549 and at the regional office of the SEC located at 500 West Madison Street, Chicago, Illinois 60661. Copies of these materials can also be obtained at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, NE, Washington, D.C. 20549, and its public reference facility in Chicago, Illinois. Such material may also be accessed electronically by means of the SEC’s home page on the Internet (http://www.sec.gov). As a foreign private issuer, we are exempt from certain provisions of the Exchange Act, including those prescribing the furnishing and content of proxy and information statements and certain periodic reports.

We have filed with the SEC a registration statement on FormF-4 under the Securities Act with respect to the exchange notes offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all the information contained in the registration statement. We have omitted certain items from the

i

prospectus as permitted by the rules and regulations of the SEC. For more information with respect to us and the exchange notes, refer to the registration statement, including the accompanying exhibits, financial statements, schedules and notes. You may inspect the registration statement without charge at the principal office of the SEC in Washington, D.C. and copies of all or part of it may be obtained from the SEC upon payment of the prescribed fee. Statements made in this prospectus concerning the contents of any document referred to herein are not necessarily complete. The exhibits accompanying any document referred to in this prospectus are essential for a more complete description of the matter involved.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are incorporating by reference certain information we filed with the SEC, which means that we are disclosing important information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus, and certain information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference herein the following documents:

| | • | | our annual report on Form 20-F for the year ended December 31, 2013, or the “2013 Form 20-F”, as filed with the SEC on April 29, 2014 (SEC file number 033-99720); |

| | • | | our 6-K report relating to the permits granted by the Uruguayan authorities to Celulosa y Energía Punta Pereira (CEPP), a company belonging to the Montes del Plata group, a joint venture between Arauco and Stora Enso, to initiate the start-up process and operation of its pulp mill located in the area of Conchillas, in Uruguay, as filed with the SEC on June 13, 2014. |

| | • | | our 6-K report relating to our unaudited interim consolidated financial statements for the three months ended March 31, 2014, as filed with the SEC on June 13, 2014; |

| | • | | our 6-K report relating to our management’s discussion and analysis of our results of operations for the three-month period ended March 31, 2013 and 2014, as filed with the SEC on July 8, 2014. |

| | • | | our 6-K report relating to the placement of US$500 million of 4.500% notes due 2024 in the international market pursuant to Rule 144A and Regulation S of the Securities Act, as filed with the SEC on July 23, 2014. |

| | • | | our 6-K report relating to our unaudited interim consolidated financial statements for the six months ended June 30, 2014, as filed with the SEC on September 12, 2014. |

| | • | | our 6-K report relating to the termination of the asset purchase agreement entered into among us and SierraPine, as filed with the SEC on October 3, 2014. |

| | • | | our 6-K report relating to the enactment of Law No. 20,780, introducing various amendments to the current regime of income tax and other taxes, as filed with the SEC on October 9, 2014. |

| | • | | our 6-K report relating to our management’s discussion and analysis of our results of operations for the six-month period ended June 30, 2013 and 2014, as filed with the SEC on October 9, 2014. |

In addition, all reports on Form 20-F filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act and, to the extent expressly stated therein, certain reports on Form6-K subsequent to the date of this prospectus and prior to the termination of the offering of the exchange notes, shall also be deemed to be incorporated by reference into this prospectus from the date of filing of such documents. Any statements contained herein or in a document incorporated or deemed to be incorporated by reference herein or attached as an annex hereto shall be deemed to be modified or superseded for purposes of this prospectus, to the extent that a statement contained herein or in any other subsequently filed document and deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement or document so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

ii

We will provide without charge to you, upon your written or oral request, a copy of any or all the documents we incorporate by reference (other than exhibits, unless such exhibits are specifically incorporated by reference in such documents). Written requests for such copies should be directed to:

Celulosa Arauco y Constitución S.A.

Avenida El Golf 150, 14th Floor

Santiago, Chile

Attention: Gianfranco Truffello

Telephone requests may be directed to Mr. Gianfranco Truffello at +56-2-2461-7200.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation(sociedad anónima) organized under the laws of Chile and subject to certain rules applicable to Chilean public corporations(sociedades anónimas abiertas). Most of our directors and executive officers, and certain experts named or mentioned in this prospectus or other documents incorporated by reference herein, reside outside the United States. A substantial portion of our assets and the assets of these persons are located outside the United States. As a result, except as described below, it may not be possible for investors to effect service of process within the United States upon such persons or us, or to enforce against them or against us in United States courts a judgment obtained in United States courts based upon the civil liability provisions of the federal securities laws of the United States. We have been advised by our Chilean counsel, Portaluppi, Guzmán y Bezanilla, that no treaty exists between the United States and Chile for the reciprocal enforcement of foreign judgments. Chilean courts, however, have enforced judgments rendered by courts in the United States by virtue of the legal principles of reciprocity and comity, subject to review in Chile of such judgment in order to determine whether certain basic principles of due process and public policy have been respected, without reviewing the merits of the subject matter of the case. Nevertheless, we have been advised by our Chilean counsel that there is doubt as to the enforceability, in original actions in Chilean courts, of liabilities predicated solely upon the federal securities laws of the United States and as to the enforceability in Chilean courts of judgments of United States courts obtained in actions based upon the civil liability provisions of the federal securities laws of the United States. In addition, it will be necessary for investors to comply, or show evidence of compliance, with certain procedures, including payment of stamp taxes (currently assessed at a rate of 0.4% of the face value of a debt security), if applicable, in order to file a lawsuit with respect to the exchange notes in a Chilean court.

We have appointed CT Corporation System as our authorized agent upon whom process may be served in any action arising out of or based upon the indenture or the issuance of the exchange notes. With respect to such actions, we have submitted to the jurisdiction of any federal or state court having subject matter jurisdiction in the Borough of Manhattan, the City of New York, New York. See “Description of the Exchange Notes.”

iii

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein, contain words, such as “believe,” “intend,” “estimate,” “project,” “expect” and “anticipate” and similar expressions, that identify forward-looking statements which reflect our views about future events and financial performance. Statements that are not historical facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements are not guarantees of future performance and involve inherent risks and uncertainties. These forward-looking statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Actual results could differ materially and adversely from those projected in the forward-looking statements as a result of various factors that may be beyond our control, including but not limited to:

| | • | | our ability to service our debt, fund our working capital requirements and comply with financial covenants in certain of our debt instruments; |

| | • | | our ability to fund and implement our capital expenditure programs; |

| | • | | the maintenance of relationships with customers; |

| | • | | future demand for forestry and wood products in our export markets; |

| | • | | international prices for forestry and wood products; |

| | • | | the condition of our forests; |

| | • | | possible shortages of energy, including electricity; |

| | • | | the state of the Chilean, Argentine, Brazilian, Uruguayan, United States and world economies and manufacturing industries; |

| | • | | the relative value of the Chilean peso, Argentine peso, Brazilian real, Uruguayan peso and U.S. dollar compared to other currencies; |

| | • | | the effects of earthquakes, floods, tsunamis or other catastrophic events; |

| | • | | the effects from competition; |

| | • | | increases in interest rates; and |

| | • | | changes in our regulatory environment, including our ability to comply with new or stricter environmental regulations and to resolve environmental liabilities. |

In any event, these statements speak only as of their dates, and we do not undertake any obligation to update or revise any of them as a result of new information, future events or otherwise.

iv

PRESENTATION OF FINANCIAL DATA

Unless otherwise specified, all references to “US$”, “U.S. dollars” or “dollars” are to United States dollars; references to “Chilean pesos” or “Ch$” are to Chilean pesos; references to “Argentine pesos” or “AR$” are to Argentine pesos; references to “Brazilian reals” or “R$” are to Brazilian reals; references to “Uruguayan pesos” or “Uy$” are to Uruguayan pesos; references to “€” or “euro” are to the euro, the single European currency established pursuant to the European Economic and Monetary Union; and references to “UF” are toUnidades de Fomento. The UF is a unit of account that is linked to, and adjusted daily to reflect changes in, the Chilean consumer price index reported by the Chilean National Institute of Statistics (Instituto Nacional de Estadísticas). As of June 30, 2014, one UF equaled US$43.5 and Ch$ 24,024.

For your convenience, this prospectus contains certain translations of Chilean peso amounts into U.S. dollars at specified rates. Unless otherwise indicated, the U.S. dollar equivalent for information in Chilean pesos is based on the observed exchange rate reported by Banco Central de Chile, the Central Bank of Chile, which we refer to as the “Central Bank of Chile.” The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos. On June 30, 2014, the observed exchange rate for Chilean pesos was Ch$552.72 to US$1.00, and on October 13, 2014, the observed exchange rate was Ch$590.01 to US$1.00. You should not construe these translations as representations that the Chilean peso amounts actually represent such dollar amounts or could be converted into U.S. dollars at the rates indicated or at any other rate. See “Exchange Rates.” Unless otherwise specified, references to the devaluation or the appreciation of the Chilean peso against the U.S. dollar are in nominal terms (without adjusting for inflation) based on the observed exchange rates published by the Central Bank of Chile for the relevant period.

All references to “tons” are to metric tons (1,000 kilograms), which equal 2,204.7 pounds. One “hectare” equals 10,000 square meters or 2.471 acres. Percentages and certain amounts in this prospectus and the documents incorporated by reference herein have been rounded for ease of presentation. Discrepancies in any table between totals and the sums of the amounts listed are due to rounding.

v

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere or incorporated by reference in this prospectus and may not contain all of the information you need to consider. Please read the following summary, together with the information in this prospectus set forth under the heading “Risk Factors,” our interim consolidated financial statements for the six months ended June 30, 2014, our audited financial statements for the year ended December 31, 2013 prepared in accordance with IFRS and our audited financial statements and accompanying notes included in our 2013 Form 20-F, as filed with the SEC on April 29, 2014 and incorporated by reference in this prospectus. “Arauco,” “we,” “us” and words of similar effect refer, depending upon the context, to Celulosa Arauco y Constitución S.A., to one or more of its consolidated subsidiaries or to all of them taken as a whole, unless the context otherwise requires. References herein to the “notes” refer collectively to the outstanding notes and the exchange notes.

About Arauco

We believe that, as of June 30, 2014, we were one of Latin America’s largest forest plantation owners, and that we were Chile’s largest exporter of forestry and wood products in terms of sales revenue. We have industrial operations in Chile, Argentina, Brazil, the United States, Canada and Uruguay (via our 50% share in Montes del Plata). As of June 30, 2014, we had approximately 1.0 million hectares of plantations in Chile, Argentina, Brazil and Uruguay. We believe that in the year ended December 31, 2013, we were one of the world’s largest producers of bleached and unbleached softwood kraft market pulp measured by volume, based on information published by Resource Information Systems, Inc., an independent research company for the pulp and paper industry.

During 2013 and the six-month period ended June 30, 2014, we sold 2.5 million and 1.3 million cubic meters of sawlogs and pulplogs and sold 7.9 million and 3.9 million cubic meters of wood products, including sawn timber (green, kiln-dried lumber and flitches), remanufactured wood products and panels (plywood, medium-density fiberboard, particleboard and high-density fiberboard) in each of such periods respectively. In 2013, and the six-month period ended June 30, 2014, export sales constituted approximately 59.9% and 61.4% of our sales revenue, respectively, making us Chile’s largest non-mining exporter in terms of sales revenue. Our main export markets during each of 2013 and the six-month period ended June 30, 2014 were Asia, North America and Europe.

As of June 30, 2014, our planted forests consisted of approximately 73.2% radiata and taeda pine with the balance being primarily eucalyptus. We seek to manage our resources so that the annual growth rates of our forests equal or exceed the volume harvested each year. In 2013 and the six-month period ended June 30, 2014, we planted approximately 53,089 and 17,703 hectares, respectively, and harvested approximately 49,417 and 25,998 hectares, respectively, in Chile, Argentina, Brazil and Uruguay. We operate our forestry business through four main divisions: pulp, plywood and fiberboard panels, wood products, and forestry products, each as described below.

Pulp. We own and operate five pulp mills in Chile, one in Argentina and 50% of one in Uruguay through our Montes del Plata joint venture with Stora Enso Oyj. Our aggregate installed annual production capacity (including our 50% share of the Montes del Plata mill’s 1.3 million metric ton capacity) is approximately 3.88 million metric tons. During 2013 and the six-month period ended June 30, 2014, our pulp mills produced 2,619.0 and 1,304.2 million tons of unbleached pulp and 461.0 and 236.4 thousand tons of bleached pulp, respectively. During 2013 and the six-month period ended June 30, 2014, our pulp sales were US$2,030.2 million and US$1,057.6 million, respectively, representing 39.5% and 40.7% of our consolidated revenue for such respective periods.

Panels. We own and operate two plywood mills, one hardboard and medium-density fiberboard mill and one medium-density fiberboard mill in Chile, one medium-density fiberboard mill and one particleboard mill in Argentina, one medium-density fiberboard mill and one medium-density fiberboard and particleboard mill in Brazil, one medium-density fiberboard and particleboard mill, two particleboard mills and three medium-density fiberboard in the United States, and one medium-density fiberboard mill and one medium-density fiberboard and particleboard mill in Canada. The total annual production capacity of these mills is approximately 6.63 million cubic meters of plywood and fiberboard panels.

In Chile, during 2013 and the six-month period ended June 30, 2014, we produced 282,346 and 144,995 cubic meters of plywood, 55,181 and 24,045 cubic meters of hardboard panels, 473,755 and 230,110 cubic meters of

1

medium-density fiberboard panels, and 254,924 and 126,116, cubic meters of fiber board panels respectively. In Argentina, during 2013 and the six-month period ended June 30, 2014 our particleboard mill produced 194,545 and 78,981 cubic meters of panels, and our medium-density fiberboard mill produced 282,065 and 138,264 cubic meters of fiberboard panels, respectively. In Brazil, during 2013 and the six-month period ended june 30, 2014, our particleboard mill produced 297,686 and 125,208 cubic meters of panels, and our medium-density fiberboard mill produced 998,482 and 446,559 cubic meters of fiberboard panels, respectively. In the United States and Canada, during 2013 and the six-month period ended June 30, 2014, our particleboard mills produced 1,079,880 and 567,546 cubic meters of panels, and our medium-density fiberboard mills produced 1,185,113 and 611,321 cubic meters of fiberboard panels, respectively. During 2013 and the six-month period ended June 30, 2014, our plywood and fiberboard panel sales were US$1,927.3 million and US$890.8 million, respectively, representing 37.5% and 34.3% of our consolidated revenue for such respective periods.

Sawn Timber. We have eight sawmills in operation in Chile and one in Argentina with an aggregate installed annual production capacity of approximately 2.9 million cubic meters of lumber. We also own five remanufacturing facilities in Chile that reprocess sawn timber into remanufactured wood products such as moldings, jams and pre-cut pieces for doors, furniture and door and window frames. In 2013 and the six-month period ended June 30, 2014, we produced 2,865.7 and 1,466.9 thousand cubic meters of wood and remanufactured wood products, respectively. During 2013 and the six-month period ended June 30, 2014, our sawn timber sales were US829.9 million and US$454.8 million, respectively, representing 16.1% and 17.5% of our consolidated revenue for such respective periods.

Forestry Products. Our forestry products are sawlogs, pulplogs, posts and chips in Chile, Argentina and Brazil. During 2013 and the six-month period ended June 30, 2014, our forestry products sales to third parties were US$145.6 million and US$73.3 million, respectively, representing 2.8% and 2.8% of our consolidated revenue for such respective periods.

Business Strategy

Our business strategy is to maximize the value of our forest plantations by pursuing sustainable growth opportunities in our core businesses and expanding into new markets and products. We seek to implement our business strategy through the following initiatives:

| | • | | Improving the growth rate and quality of our plantations through advanced forest management techniques; |

| | • | | Executing a capital expenditure plan designed to reinforce our competitive advantages through economies of scale and scope, improving the efficiency and productivity of our industrial activities and optimizing the use of our forests through biomass energy generation; |

| | • | | Continuing to develop our facilities, transportation, shipping, storage and product distribution network that allows us to reach over 70 countries worldwide; and |

| | • | | Expanding internationally into new regions that we believe have comparative advantages in the forestry sector. |

2

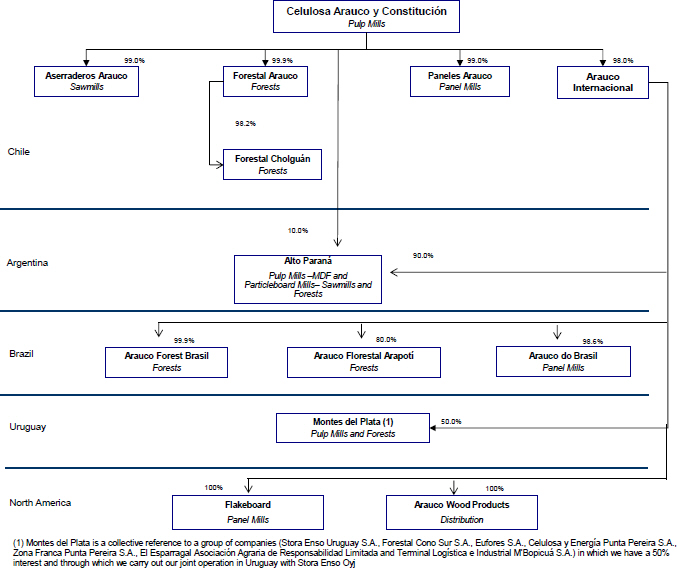

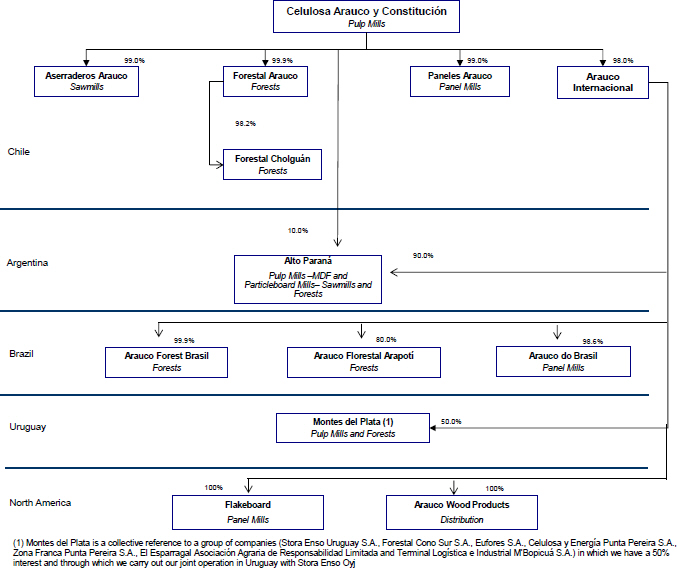

Corporate Structure

Set forth below is a diagram summarizing our corporate structure and our principal subsidiaries:

Our principal executive offices are located at Avenida El Golf 150, 14th Floor, Las Condes, Santiago, Chile. Our telephone number is +562-2461-7200, and our facsimile number is +562-2461-7541.

3

The Exchange Offer

On July 22, 2014, we completed the private offering of the outstanding notes. References to the “notes” in this prospectus are references to both the outstanding notes and the exchange notes. This prospectus is part of a registration statement covering the exchange of the outstanding notes for the exchange notes.

We entered into a registration rights agreement with the initial purchasers in the private offering in which we agreed to deliver to you this prospectus as part of the exchange offer and we agreed to use our reasonable best efforts to complete the exchange offer within 360 days after the date of original issuance of the outstanding notes. In the exchange offer, you are entitled to exchange your outstanding notes for exchange notes that are identical in all material respects to the outstanding notes except the exchange notes have been registered under the Securities Act. In addition, the exchange notes will not be entitled to registration rights and liquidated damages that are applicable to the outstanding notes under the registration rights agreement.

| | | | |

| | The Exchange Offer | | We are offering to exchange up to US$500 million aggregate principal amount of our 4.500% Notes due 2024, which we refer to in this prospectus as the “exchange notes”, for up to US$500 million aggregate principal amount of our 4.500% Notes due 2024, which we refer to in this prospectus as the “outstanding notes”. The exchange offer is being made with respect to all of the outstanding notes. Outstanding notes may only be exchanged in integral multiples of US$1,000. |

| | |

| | Resale of the Exchange Notes | | Based on an interpretation of the staff of the SEC set forth in no action letters issued to unrelated third parties, we believe that exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are an affiliate of ours, within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that the exchange notes are acquired in the ordinary course of your business and you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

| | |

| | | | Each participating broker-dealer that receives exchange notes for its own account pursuant to the exchange offer in exchange for outstanding notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. |

| | |

| | | | Any holder of outstanding notes who: |

| | |

| | | | • is an affiliate of ours; |

| | |

| | | | • does not acquire exchange notes in the ordinary course of business; or |

| | |

| | | | • tenders in the exchange offer with the intention to participate, or for the purpose of participating, in the distribution of the exchange notes; |

4

| | | | |

| | | | cannot rely on the position of the staff of the SEC enunciated in Exxon Capital Holdings Corporation, Morgan Stanley & Co. Incorporated or similar interpretive letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with the resale of the exchange notes. See “The Exchange Offer—Resales of the Exchange Notes.” |

| | |

| | Expiration Date; Withdrawal of Tender | | The exchange offer will expire at midnight, New York City time, on , 2014, unless we extend it. We do not currently intend to extend the expiration date. We refer to this date (as it may be extended) as the “expiration date.” Tenders of outstanding notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date. Any outstanding notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of the exchange offer. See “The Exchange Offer––Expiration Date; Extensions; Amendments” and “The Exchange Offer––Withdrawal of Tenders.” |

| | |

| | Conditions to the Exchange Offer | | The exchange offer is subject to customary conditions, which we may waive in our sole discretion. See “The Exchange Offer––Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

| | |

| | Procedures for Tendering Outstanding Notes | | If you wish to accept the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal according to the instructions contained in this prospectus and the letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal, together with any physical certificates requesting the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. If you hold outstanding notes through The Depository Trust Company, or DTC, and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC, which we refer to as “ATOP,” by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: |

| | |

| | | | • any exchange notes that you receive will be acquired in the ordinary course of your business; |

| | |

| | | | • you have no arrangement or understanding with any person or entity to participate in a distribution of the exchange notes; |

| | |

| | | | • if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of the exchange notes; and |

5

| | |

| | • you are not an affiliate, as defined in Rule 405 of the Securities Act, of ours or, if you are an affiliate of ours, you will comply with any applicable registration and prospectus delivery requirements of the Securities Act. |

| | See “The Exchange Offer—Procedures for Tendering” and “Plan of Distribution.” |

Special Procedures for Beneficial Owners | | If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender the outstanding notes in the exchange offer, you should contact that registered holder promptly and instruct that registered holder to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. See “The Exchange Offer—Procedures for Tendering.” |

Guaranteed Delivery Procedures | | If you wish to tender your outstanding notes and they are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other documents required by the letter of transmittal, or comply with the applicable procedures under DTC’s ATOP, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

Effect on Holders of Outstanding Notes | | As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offer, we will have fulfilled a covenant contained in the registration rights agreement and, accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you are a holder of outstanding notes and you do not tender your outstanding notes in the exchange offer, you will continue to hold the outstanding notes, and you will be entitled to all the rights and limitations applicable to the outstanding notes in the indenture, except for any rights under the registration rights agreement that by their terms terminate upon the consummation of the exchange offer. |

| | To the extent outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes could be adversely affected. |

6

| | |

Consequence of Failure to Exchange | | All untendered outstanding notes will continue to be subject to the restrictions on transfer provided for in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act. See “The Exchange Offer — Consequences of Failure to Exchange.” |

Taxation | | The exchange of the outstanding notes for the exchange notes pursuant to the exchange offer will not be a taxable event for United States federal income tax or Chilean tax law purposes. See “Taxation.” |

Use of Proceeds | | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. |

Exchange Agent | | The Bank of New York Mellon is serving as exchange agent in connection with the exchange offer. The contact information for the exchange agent is set forth in the section captioned “The Exchange Offer—Exchange Agent” of this prospectus. |

7

The Exchange Notes

| | |

Issuer | | Celulosa Arauco y Constitución S.A. |

Notes Offered | | US$500 million in an aggregate principal amount of 4.500% Notes due 2024. |

Maturity | | August 1, 2024. |

Interest Payment Dates | | February 1 and August 1 of each year, commencing on February 1, 2015. |

Optional Redemption | | We may redeem the exchange notes in whole or in part, at our option, at any time and from time to time at a redemption price equal to the greater of (i) 100% of the principal amount of the exchange notes to be redeemed and (ii) the sum of the present values of the Remaining Scheduled Payments (as defined herein) discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate (as defined herein) plus 30 basis points, together with, in each case, accrued and unpaid interest, if any, on the principal amount of the exchange notes to be redeemed to the date of redemption. In addition, we may redeem the exchange notes in whole or in part, any time and from time to time, beginning on the date that is three months prior to the scheduled maturity of the exchange notes, at our option at a redemption price equal to 100% of the principal amount of the exchange notes to be redeemed, plus accrued and unpaid interest, if any, on the principal amount of the exchange notes being redeemed to the date of redemption. See “Description of the Exchange Notes—Optional Redemption.” |

Tax Redemption | | We may redeem the exchange notes in whole, but not in part, at any time at par if certain changes related to Chilean tax law occur. See “Description of the Exchange Notes—Redemption for Taxation Reasons.” |

Certain Covenants | | The indenture under which the exchange notes will be issued contains certain covenants, including limitations on liens and limitations on sale and leaseback transactions. |

Ranking | | The exchange notes will be our unsecured obligations and will, other than with respect to certain obligations given preferential treatment pursuant to the laws of Chile, rankpari passu in right of payment with all of our other unsecured and unsubordinated indebtedness. The exchange notes will not have the benefit of any collateral securing any of our existing and future secured indebtedness and will be structurally subordinated to all existing and future indebtedness of any of our subsidiaries. The exchange notes do not restrict our ability or the ability of our subsidiaries to incur additional indebtedness in the future. At June 30, 2014, the aggregate principal amount of outstanding indebtedness of our subsidiaries was US$1,326.0 million or 26.5 % of our consolidated indebtedness at such date. |

8

| | |

Further Issues | | We may, from time to time without the consent of holders of the notes, issue additional notes on substantially the same terms and conditions as the notes, which additional notes will increase the aggregate principal amount of, and will be consolidated and form a single series with, the notes; provided that no additional notes may be issued with original issue discount for United States federal income tax purposes. |

Taxation | | Under Chile’s income tax law, our payments of interest made from Chile in respect of the exchange notes to a Foreign Holder (as defined herein) will generally be subject to a Chilean withholding tax assessed at a rate of 4.0%. Subject to certain exceptions, we will pay Additional Amounts (as defined herein) as may be necessary to ensure that the net amounts received by the Foreign Holders (including Additional Amounts) after such Chilean withholding tax shall equal the amounts which would have been receivable in respect of the exchange notes in the absence of such Chilean withholding tax. See “Description of the Exchange Notes—Payment of Additional Amounts” and “Taxation.” |

Governing Law | | Our contractual rights and obligations and the rights of the holders of the exchange notes arising out of, or in connection with, the indenture and the exchange notes are governed by, and will be construed in accordance with, the laws of the State of New York. |

Absence of a Public Market for the Exchange Notes | | The exchange notes generally will be freely transferable but will also be new securities for which there will not initially be an established trading market. Accordingly, we cannot assure you as to the development or liquidity of any market for the exchange notes. We do not intend to apply for a listing of the exchange notes on any securities exchange or automated dealer quotation system. |

Exchange Controls in Chile | | The issuance of the exchange notes does not require prior authorization by the Central Bank of Chile. Nevertheless, certain financial terms of the outstanding notes have been registered with the Central Bank of Chile after the issuance of the outstanding notes. |

Trustee | | The Bank of New York Mellon is the trustee under the indenture. |

For a discussion of risks that should be considered in connection with an investment in the exchange notes, see “Risk Factors.”

9

RISK FACTORS

We are subject to various changing economic, political, social and competitive conditions, particularly in our principal markets. Any of the following risks, if they occur, could materially and adversely affect our business, financial condition and results of operations and, as a result, the exchange notes. You should consider these risks, in addition to the other information presented or incorporated by reference into this prospectus, before making an investment decision in respect of the exchange notes.

Risks Relating to the Exchange Offer and Notes

If you choose not to exchange your outstanding notes, the present transfer restrictions will remain in force and the market price of your outstanding notes could decline.

If you do not exchange your outstanding notes for exchange notes under the exchange offer, then you will continue to be subject to the transfer restrictions on the outstanding notes as set forth in the offering memorandum distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to the section of the prospectus entitled “The Exchange Offer” for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offer will reduce the principal amount of the outstanding notes, which may have an adverse effect upon, and increase the volatility of, the market price of the outstanding notes due to reduction in liquidity.

You must comply with the exchange offer procedures in order to receive freely tradable exchange notes.

Delivery of the exchange notes in exchange for the outstanding notes tendered and accepted for exchange pursuant to the exchange offer will be made only after timely receipt by the exchange agent of the following:

| | • | | Certificates for the outstanding notes or a book-entry confirmation of a book-entry transfer of the outstanding notes into the exchange agent’s account at DTC, as a depository, including an agent’s message, as defined in this prospectus, if the tendering holder does not deliver a letter of transmittal; |

| | • | | A completed and signed letter of transmittal, or facsimile copy, with any required signature guarantees, or, in the case of a book-entry transfer, an agent’s message in place of the letter of transmittal; and |

| | • | | Any other documents required by the letter of transmittal. |

Therefore, holders of the outstanding notes who would like to tender the outstanding notes in exchange for exchange notes should be sure to allow enough time for the outstanding notes to be delivered on time. We are not required to notify you of defects or irregularities in tenders of outstanding notes for exchange. Outstanding notes that are not tendered or that are tendered but we do not accept for exchange will, following consummation of the exchange offer, continue to be subject to the existing transfer restrictions under the Securities Act and will no longer have the registration and other rights under the registration rights agreement. See “The Exchange Offer—Procedures for Tendering.”

Some holders who exchange their outstanding notes may be deemed to be underwriters and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your outstanding notes in the exchange offer for the purpose of participating in a distribution of the exchange notes, you may be deemed to have received restricted securities. If you are deemed to have received restricted securities, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

10

The non-payment of funds by our subsidiaries could have a material and adverse effect on our business, financial condition, results of operations and ability to service our debt, including the exchange notes.

Our cash flow and our ability to service debt is dependent, in part, on the cash flow and earnings of our subsidiaries and the transfer of funds by those subsidiaries to us, in the form of loans, interest, dividends or otherwise. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due under the terms of the exchange notes or to make any funds available for such purpose. Furthermore, claims of creditors of our subsidiaries, including trade creditors, will have priority over our creditors, including holders of our securities, with respect to the assets and cash flow of our subsidiaries. The indenture governing the notes does not limit the ability of our subsidiaries to incur additional indebtedness. Our right to receive assets of any of our subsidiaries upon their liquidation or reorganization (and the consequent right of the holders of the exchange notes to participate in those assets) will be effectively subordinated to the claims of that subsidiary’s creditors.

Changes in Chilean tax laws could lead to the redemption of the exchange notes.

Payments of interest in respect of the exchange notes made by us to holders who are not domiciled or resident in Chile will generally be subject to Chilean interest withholding tax at a rate of 4.0%. Subject to certain exceptions, we will pay Additional Amounts so that the amount received by the holder after Chilean withholding tax will equal the amount that would have been received if no such taxes had been applicable. Under the indenture, the exchange notes are redeemable at our option, subject to applicable Chilean law, in whole (but not in part) at any time at the principal amount thereof plus accrued and unpaid interest and any Additional Amounts due thereon if, as a result of changes in the laws, regulations or rulings affecting Chilean taxation (or the official application, administration or interpretation thereof), we become obligated to pay Additional Amounts on the exchange notes (in excess of Additional Amounts payable in respect of the 4.0% withholding tax payable on payments of interest on the exchange notes). Although no proposal to increase the withholding tax rate in Chile is currently pending, we cannot assure you that an increase in withholding tax rate will not be presented to or enacted by the Chilean Congress. See “Description of the Exchange Notes—Redemption for Taxation Reasons.”

The exchange notes are a new issue of securities for which there is currently no public market, and you may be unable to sell your exchange notes if a trading market for the exchange notes does not develop.

We cannot assure you that an active trading market for the exchange notes will develop or, if a market develops, as to the liquidity of the market. The liquidity of any market for the exchange notes will depend on the number of holders of the exchange notes, the interest of securities dealers in making a market in the exchange notes and other factors. If an active trading market does not develop, the market price and liquidity of the exchange notes may be adversely affected. If the exchange notes are traded, they may trade at a discount from their initial offering price depending upon prevailing interest rates, the market for similar securities, general economic conditions, our performance and business prospects and other factors.

We may incur additional indebtedness ranking equally to the exchange notes.

The indenture does not impose any limitation on our ability to issue additional debt that ranks on an equal and ratable basis with the exchange notes. If we incur any additional debt that ranks on an equal and ratable basis with the exchange notes, the holders of that debt will be entitled to share ratably with the holders of the exchange notes in any proceeds distributed in connection with an insolvency, liquidation, reorganization, dissolution or other winding-up of us subject to satisfaction of certain debt limitations. This may have the effect of reducing the amount of proceeds paid to you. Subject to certain limitations, we also have the ability to incur secured debt and such debt would be effectively senior to the exchange notes to the extent of such collateral.

The obligations under the exchange notes will be subordinated to certain statutory liabilities and structurally subordinated to any future indebtedness of our subsidiaries.

Under Chilean bankruptcy law, the obligations under the exchange notes are subordinated to certain statutory preferences. In the event of liquidation, such statutory preferences, including claims for salaries, wages, secured obligations, social security, taxes and certain court fees and expenses in the interest of the creditors, will have preference over any other claims, including claims by any investor in respect of the exchange notes.

11

Furthermore, the exchange notes will be structurally subordinated to any future indebtedness of our subsidiaries. In the event of a liquidation, winding-up, dissolution or a bankruptcy, administration, reorganization, insolvency, receivership, or similar proceeding, of any of these subsidiaries, the subsidiaries will pay the holders of their own debt, their trade creditors and any preferred shareholders before they would be able to distribute any of their assets to us. At June 30, 2014, the aggregate principal amount of outstanding indebtedness of our subsidiaries was US$1,326.0 million or 26.5% of our consolidated indebtedness at such date.

The exchange notes will be unsecured obligations of Arauco and will not have the benefit of any collateral securing any of our existing and future secured indebtedness. Pursuant to the indenture governing the exchange notes, we are permitted to incur a substantial amount of additional secured indebtedness. Holders of our secured debt will have claims that are effectively senior to your claims as holders of the exchange notes, to the extent of the value of the assets securing the secured debt. If we become insolvent or are liquidated, or if payment under any secured debt is accelerated, the lenders thereunder would be entitled to exercise the remedies available to a secured lender. Accordingly, such lenders will have priority over any claim for payment under the exchange notes to the extent of the value of the assets that constitute their collateral. If this were to occur, it is possible that there would be no assets remaining from which claims of the holders of the exchange notes could be satisfied.

Holders of the exchange notes may find it difficult to enforce civil liabilities against us or our directors, officers and controlling persons.

We are organized under the laws of Chile and our principal place of business (domicilio social) is in Santiago, Chile. Most of our directors, officers and controlling persons reside outside of the United States. In addition, a substantial portion of our assets is located outside of the United States. As a result, it may be difficult for holders of notes to effect service of process within the United States on such persons or to enforce judgments against them, including in any action based on civil liabilities under the U.S. federal securities laws. Based on the opinion of our Chilean counsel, there is doubt as to the enforceability against such persons in Chile, whether in original actions or in actions to enforce judgments of U.S. courts, of liabilities based solely on the U.S. federal securities laws. See “Enforceability of Civil Liabilities.”

We will not have guaranteed access to U.S. dollars for repayment of the exchange notes.

Under Chilean laws and regulations of the Banco Central de Chile (the “Central Bank of Chile”), we will not have guaranteed access to the formal exchange market (Mercado Cambiario Formal) for payment of interest and principal on the exchange notes in U.S. dollars. However, we are permitted to purchase U.S. dollars to make payments of interest and principal on the exchange notes. Future regulations of the Central Bank of Chile or legislative changes to the current foreign exchange control regime in Chile could restrict or prevent us from purchasing U.S. dollars for purposes of making payments under the exchange notes.

We cannot assure you that the credit ratings for the exchange notes will not be lowered, suspended or withdrawn by the rating agencies.

The credit ratings of the exchange notes may change after issuance. Such ratings are limited in scope, and do not address all material risks relating to an investment in the exchange notes, but rather reflect only the views of the rating agencies at the time the ratings are issued. An explanation of the significance of such ratings may be obtained from the rating agencies. We cannot assure you that such credit ratings will remain in effect for any given period of time or that such ratings will not be lowered, suspended or withdrawn entirely by the rating agencies, if, in the judgment of such rating agencies, circumstances so warrant. Any lowering, suspension or withdrawal of such ratings may have an adverse effect on the market price and marketability of the exchange notes.

The market value of the exchange notes may depend on economic conditions in Latin America or other parts of the world over which we have no control.

The market value of debt securities of Chilean companies, including ours, is affected to varying degrees by economic and market conditions in other Latin American countries and elsewhere in the world. Although economic conditions in such countries may differ significantly from economic conditions in Chile, investors’ reactions to developments in any of these other countries may have an adverse effect on the market value of securities of Chilean issuers. International financial markets have recently experienced volatility due to a combination of international

12

political and economic events. There can be no assurance that deterioration of the Argentine economy, economic or policy changes in Brazil or other events in these or other countries will not adversely affect the market value of the exchange notes.

13

USE OF PROCEEDS

We will not receive any cash proceeds from the issuance of the exchange notes. In consideration for issuing the exchange notes as contemplated in this prospectus, we will receive in exchange a like principal amount of outstanding notes, the terms of which are identical in all material respects to the exchange notes. The outstanding notes surrendered in exchange for the exchange notes will be retired and canceled and cannot be reissued. Accordingly, issuance of the exchange notes will not result in any change in our capitalization or result in any increase in our indebtedness.

The net proceeds to us from the issuance of the outstanding notes were approximately US$492,815,000 after deducting discounts and commissions. We used a portion of the net proceeds from the offering of the outstanding notes to refinance a US$200 million bank loan maturing in December 2014 outstanding pursuant to a credit facility among us, the lenders party thereto and Scotiabank & Trust (Cayman) Ltd., as administrative agent and arranger. Scotiabank & Trust (Cayman) Ltd. is an affiliate of Scotia Capital (USA) Inc., one of the initial purchasers of the outstanding notes. We also expect to use the net proceeds from the sale of the outstanding notes to refinance a portion of our outstanding 5.625% notes due April 2015.

14

SELECTED CONSOLIDATED FINANCIAL DATA

The following tables present our summary consolidated financial and operating information as of the dates and for each of the periods indicated. This information should be read in conjunction with, and is qualified in its entirety by reference to, our audited and unaudited consolidated financial statements, including the notes thereto, appearing in our 2013 Form 20-F and in our Form 6-K filed with the SEC on October 9, 2014, which have been incorporated by reference in this prospectus.

The consolidated financial information as of December 31, 2012 and 2013 and for each of the years ended on December 31, 2011, 2012 and 2013 has been derived from our audited consolidated financial statements which have been prepared in accordance with IFRS and are contained in our 2013 Form 20-F, incorporated by reference in this prospectus.

The consolidated financial information as of December 31, 2009, 2010 and 2011 and for each of the years ended on December 31, 2009 and 2010 has been derived from our audited consolidated financial statements which have been prepared in accordance with IFRS and are not contained in our 2013 Form 20-F.

The interim consolidated financial information has been derived from our unaudited interim consolidated financial statements as of December 31, 2013 and for the six months ended June 30, 2013 and 2014 which have been prepared in accordance with IFRS and were included in our report on Form 6-K filed with the SEC on September 12, 2014, incorporated by reference in this prospectus. Our results of operations for the six months ended June 30, 2014 are not necessarily indicative of our results to be expected for the year ended December 31, 2014 or for any other period.

15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | As of and for the six

months ended June 30, | |

| | | As of and for the year ended December 31, | | | (unaudited) | | | (unaudited) | |

| | | 2009 | | | 2010 | | | 2011 | | | 2012(1)(2) | | | 2013(2) | | | 2013(2)(3) | | | 2014(2) | |

| | | (in thousands of US$, except ratios and per share data) | |

INCOME STATEMENT DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pulp | | | 1,674,412 | | | | 1,866,517 | | | | 2,161,214 | | | | 1,996,739 | | | | 2,180,756 | | | | 1,092,576 | | | | 1,148,084 | |

Panels | | | 826,022 | | | | 1,102,360 | | | | 1,289,737 | | | | 1,331,981 | | | | 1,940,860 | | | | 964,784 | | | | 903,108 | |

Sawn timber | | | 493,379 | | | | 620,816 | | | | 734,889 | | | | 765,439 | | | | 829,924 | | | | 394,862 | | | | 454,760 | |

Forestry products | | | 89,488 | | | | 156,217 | | | | 164,079 | | | | 172,972 | | | | 160,490 | | | | 83,258 | | | | 76,540 | |

Other | | | 14,147 | | | | 21,474 | | | | 24,576 | | | | 31,532 | | | | 33,470 | | | | 16,455 | | | | 16,767 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue | | | 3,097,448 | | | | 3,767,384 | | | | 4,374,495 | | | | 4,298,663 | | | | 5,145,500 | | | | 2,551,935 | | | | 2,599,259 | |

Cost of sales | | | (2,152,535 | ) | | | (2,276,446 | ) | | | (2,882,455 | ) | | | (3,163,432 | ) | | | (3,557,210 | ) | | | (1,760,221 | ) | | | (1,726,254 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 944,913 | | | | 1,490,938 | | | | 1,492,040 | | | | 1,135,231 | | | | 1,588,290 | | | | 791,714 | | | | 873,005 | |

Other income | | | 181,383 | | | | 378,480 | | | | 475,014 | | | | 408,251 | | | | 385,055 | | | | 202,473 | | | | 154,124 | |

Distribution costs | | | (374,641 | ) | | | (381,933 | ) | | | (477,628 | ) | | | (452,760 | ) | | | (523,587 | ) | | | (258,837 | ) | | | (256,115 | ) |

Administrative expenses | | | (249,340 | ) | | | (323,916 | ) | | | (415,521 | ) | | | (479,625 | ) | | | (544,694 | ) | | | (267,283 | ) | | | (278,744 | ) |

Other expenses | | | (57,978 | ) | | | (49,063 | ) | | | (90,313 | ) | | | (105,325 | ) | | | (136,812 | ) | | | (43,183 | ) | | | (83,048 | ) |

Other gains (losses) | | | 64,102 | | | | — | | | | — | | | | 16,133 | | | | — | | | | | | | | | |

Financial income | | | 19,313 | | | | 15,761 | | | | 24,589 | | | | 23,476 | | | | 19,062 | | | | 11,512 | | | | 7,506 | |

Financial costs | | | (193,872 | ) | | | (207,519 | ) | | | (196,356 | ) | | | (236,741 | ) | | | (232,843 | ) | | | (115,031 | ) | | | (110,058 | ) |

Share of profit (loss) of associates and joint ventures accounted for using equity method | | | 6,621 | | | | (7,693 | ) | | | (11,897 | ) | | | 18,933 | | | | 6,260 | | | | (924 | ) | | | (99 | ) |

Exchange rate differences | | | 17,632 | | | | (16,288 | ) | | | (26,643 | ) | | | (17,245 | ) | | | (11,797 | ) | | | (7,609 | ) | | | 10,120 | |

Income before income tax | | | 358,133 | | | | 898,767 | | | | 773,285 | | | | 310,328 | | | | 548,934 | | | | 312,832 | | | | 316,691 | |

Income tax | | | (53,537 | ) | | | (198,018 | ) | | | (152,499 | ) | | | (166,787 | ) | | | (130,357 | ) | | | (55,170 | ) | | | (84,015 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 304,596 | | | | 700,749 | | | | 620,786 | | | | 143,541 | | | | 418,577 | | | | 257,662 | | | | 232,676 | |

| | | | | | | |

BALANCE SHEET DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current assets | | | 2,272,313 | | | | 3,152,116 | | | | 2,462,660 | | | | 2,785,517 | | | | 2,808,321 | | | | — | | | | 3,000,427 | |

Property, plant and equipment | | | 4,969,753 | | | | 5,088,745 | | | | 5,393,978 | | | | 6,816,742 | | | | 7,137,467 | | | | — | | | | 7,290,920 | |

Biological

assets(4) | | | 3,757,528 | | | | 3,790,958 | | | | 3,744,584 | | | | 3,610,572 | | | | 3,635,246 | | | | — | | | | 3,602,238 | |

Total assets | | | 11,413,827 | | | | 12,506,332 | | | | 12,552,178 | | | | 14,259,614 | | | | 14,493,395 | | | | — | | | | 14,795,611 | |

Total current liabilities | | | 951,413 | | | | 1,209,061 | | | | 1,031,945 | | | | 1,546,728 | | | | 1,682,016 | | | | — | | | | 1,822,057 | |

Total non-current liabilities | | | 4,079,981 | | | | 4,456,696 | | | | 4,490,083 | | | | 5,747,127 | | | | 5,766,839 | | | | — | | | | 5,713,630 | |

Total equity | | | 6,382,433 | | | | 6,840,575 | | | | 7,030,150 | | | | 6,965,759 | | | | 7,044,540 | | | | — | | | | 7,259,924 | |

| | | | | | | |

CASH FLOW DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash flow from operating activities | | | 751,025 | | | | 1,137,275 | | | | 980,517 | | | | 442,394 | | | | 897,720 | | | | 356,839 | | | | 414,611 | |

Net cash flow from investing activities | | | (717,291 | ) | | | (669,414 | ) | | | (1,207,137 | ) | | | (1,345,849 | ) | | | (687,620 | ) | | | (297,710 | ) | | | (351,288 | ) |

Net cash flow from financing activities | | | 302,372 | | | | 33,852 | | | | (481,184 | ) | | | 1,055,482 | | | | (7,776 | ) | | | 289,756 | | | | (92,687 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net change in cash | | | 336,106 | | | | 501,713 | | | | (707,804 | ) | | | 152,027 | | | | 202,324 | | | | 348,885 | | | | (29,364 | ) |

| | | | | | | |

OTHER FINANCIAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures(5) | | | 362,690 | | | | 595,520 | | | | 748,272 | | | | 1,186,374 | | | | 942,638 | | | | — | | | | 366,425 | |

Depreciation and amortization | | | 207,415 | | | | 233,655 | | | | 230,737 | | | | 252,381 | | | | 317,647 | | | | 144,402 | | | | 155,903 | |

Fair value cost of timber

harvested(6) | | | 198,675 | | | | 271,515 | | | | 335,142 | | | | 311,821 | | | | 320,894 | | | | 155,086 | | | | 147,530 | |

EBIT(6) | | | 532,692 | | | | 1,090,525 | | | | 945,052 | | | | 523,593 | | | | 762,715 | | | | 416,351 | | | | 419,243 | |

Adjusted

EBITDA(6) | | | 765,618 | | | | 1,390,482 | | | | 1,307,685 | | | | 861,745 | | | | 1,143,382 | | | | 586,805 | | | | 610,941 | |

Adjusted EBITDA/interest expense | | | 3.95 | | | | 6.70 | | | | 6.66 | | | | 3.64 | | | | 4.91 | | | | 5.10 | | | | 5.55 | |

Adjusted EBITDA/sales revenue | | | 24.7 | % | | | 36.9 | % | | | 29.9 | % | | | 20.0 | % | | | 22.2 | % | | | 23.0 | % | | | 23.5 | % |

Average

debt(7)/EBITDA | | | 3.82 | | | | 2.39 | | | | 2.55 | | | | 4.80 | | | | 4.37 | | | | — | | | | 4.11 | |

Total debt(8) | | | 3,202,919 | | | | 3,449,569 | | | | 3,283,107 | | | | 4,962,116 | | | | 5,026,494 | | | | — | | | | 5,012,776 | |

Total debt(8)/ capitalization(9) | | | 33.4 | % | | | 33.5 | % | | | 31.8 | % | | | 41.6 | % | | | 41.6 | % | | | — | | | | 40.8 | % |

Total debt(8)/ equity attributable to parent company | | | 51.1 | % | | | 51.2 | % | | | 47.3 | % | | | 72.0 | % | | | 71.9 | % | | | — | | | | 69.6 | % |

| | | | | | | |

Ratio of earnings to fixed

charges(10) | | | 2.7 | | | | 5.1 | | | | 4.8 | | | | 2.0 | | | | 3.0 | | | | 3.3 | | | | 3.4 | |

Working

capital(11) | | | 1,320,900 | | | | 1,943,055 | | | | 1,430,715 | | | | 1,238,789 | | | | 1,126,305 | | | | — | | | | 1,178,370 | |

Number of shares | | | 113,152,446 | | | | 113,152,446 | | | | 113,152,446 | | | | 113,152,446 | | | | 113,159,655 | | | | 113,152,446 | | | | 113,159,655 | |

Earnings per share (US$ per share) | | | 2.66 | | | | 6.14 | | | | 5.41 | | | | 1.2 | | | | 3.4 | | | | 2.1 | | | | 2.0 | |

Dividends paid by parent company | | | 135,175 | | | | 158,781 | | | | 291,512 | | | | 196,816 | | | | 140,054 | | | | 65,293 | | | | 77,759 | |

| | | | | | | |

Dividends per share (US$ per share) | | | 1.19 | | | | 1.40 | | | | 2.58 | | | | 1.74 | | | | 1.24 | | | | 0.6 | | | | 0.7 | |

| (1) | Numbers for year 2012 have been restated applying IFRS 11, see note 2 of our audited consolidated financial statements included in our 2013 Form 20-F. |

| (2) | Our investments in Uruguay are considered joint operations because of existing contracts that stipulate that both we and Stora Enso will maintain joint control over such investments, and since there is a contractual commitment of the sale of the entire pulp production to be generated from the future plant to us and Stora Enso in the proportion each party’s 50% ownership interest. Since January 1, 2012 we have recognized our 50% proportional share of the assets, liabilities, income and expenses of our joint Uruguayan operation, in accordance with IFRS. |

| (3) | For certain balance sheet data in the second quarter of 2013, we do not have data with Montes del Plata to provide comparable information. |

16

| (4) | Biological assets refer to our forests and standing trees. |

| (5) | Includes capital expenditures in respect of property, plant and equipment and biological assets accrued for the period. Excludes acquisition of companies. |

| (6) | We calculate Adjusted EBITDA by adding “fair value cost of timber harvested,” “exchange rate differences” and deducting “gain from changes in fair value of biological assets” to our EBITDA. “Fair value cost of timber harvested” is a non-cash expense included in our cost of sales (as a component of raw materials) that represents the fair value of the wood harvested and sold from our own plantations, which is commonly excluded from the non-generally accepted accounting principles (non-GAAP) measures used by analysts to compare participants in our industry as it is a non-cash item (purchases of wood from third parties are cash expenses that are not included in “fair value cost of timber harvested”) and therefore, as noted above, to exclude this non-cash expense, the amount is added back (along with other amounts mentioned above) to EBITDA. “Gain from changes in fair value of biological assets” is a gain that does not represent a cash flow. We believe that Adjusted EBITDA provides investors with a useful supplemental indicator of the performance of our core business because (i) it cancels out the effects of fair value that are independent of the cost efficiency of our operating facilities and (ii) it excludes the effect of exchange rate differences, which are mainly derived from our debt instruments, and the effect of local costs as our functional currency is the U.S. dollar. |

In evaluating our performance, we believe that each of these non-GAAP financial measures, EBIT, EBITDA and Adjusted-EBITDA, should be considered together with and should not be considered in isolation, or as a substitute for, the analysis of our results as reported under IFRS. Some of the limitations of our non-GAAP financial measures are that EBIT, EBITDA and Adjusted EBITDA do not reflect: (i) our cash expenditures, or future requirements, for capital expenditures or contractual commitments; (ii) changes in, or cash requirements for, working capital needs; (iii) the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our outstanding debt.

Because all companies do not calculate EBIT, EBITDA or Adjusted EBITDA in the same manner, such measures as calculated by us may differ significantly from such measures calculated by other companies. We compensate for these limitations by using EBIT, EBITDA and Adjusted EBITDA as supplemental measures of our performance and by relying primarily on our financial statements that have been prepared in accordance with IFRS.

The following table presents, for the periods indicated, the reconciliation of EBIT, EBITDA and Adjusted EBITDA to net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | For the six months

ended June 30, | |

| | | For the year ended December 31, | | | (unaudited) | | | (unaudited) | |

| | | 2009 | | | 2010 | | | 2011 | | | 2012(2) | | | 2013 | | | 2013 | | | 2014 | |

| | | (in thousands of US$) | |

Net income | | | 304,596 | | | | 700,749 | | | | 620,786 | | | | 143,541 | | | | 418,577 | | | | 257,662 | | | | 232,676 | |

(+) Financial costs | | | 193,872 | | | | 207,519 | | | | 196,356 | | | | 236,741 | | | | 232,843 | | | | 115,031 | | | | 110,058 | |

(-) Financial income | | | (19,313 | ) | | | (15,761 | ) | | | (24,589 | ) | | | (23,476 | ) | | | (19,062 | ) | | | (11,512 | ) | | | (7,506 | ) |

(+) Income tax | | | 53,537 | | | | 198,018 | | | | 152,499 | | | | 166,787 | | | | 130,357 | | | | 55,170 | | | | 84,015 | |

| | | | | | | |

EBIT | | | 532,692 | | | | 1,090,525 | | | | 945,052 | | | | 523,593 | | | | 762,715 | | | | 416,351 | | | | 419,243 | |

(+) Depreciation, amortization and others(12) | | | 207,415 | | | | 233,655 | | | | 230,737 | | | | 252,381 | | | | 317,647 | | | | 144,402 | | | | 187,932 | |

| | | | | | | |

EBITDA | | | 740,107 | | | | 1,324,180 | | | | 1,175,789 | | | | 775,974 | | | | 1,080,362 | | | | 560,753 | | | | 607,175 | |

(+) Fair value cost of timber harvested | | | 198,675 | | | | 271,515 | | | | 335,142 | | | | 311,821 | | | | 320,894 | | | | 155,086 | | | | 147,530 | |

(-) Gain from changes in fair value of biological assets | | | (155,532 | ) | | | (221,501 | ) | | | (229,889 | ) | | | (243,295 | ) | | | (269,671 | ) | | | (136,643 | ) | | | (133,644 | ) |

(+) Exchange rate differences | | | (17,632 | ) | | | 16,288 | | | | 26,643 | | | | 17,245 | | | | 11,797 | | | | 7,609 | | | | (10,120 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | | 765,618 | | | | 1,390,482 | | | | 1,307,685 | | | | 861,745 | | | | 1,143,382 | | | | 586,805 | | | | 610,941 | |

| (7) | We calculate average debt as the average of our outstanding debt at the beginning and at the end of the applicable period. |

| (8) | We calculate total debt as the sum of other current financial liabilities and other non-current financial liabilities, less hedging instruments. |

| (9) | We calculate capitalization as total debt, including accrued interest, plus equity attributable to the parent company. |

| (10) | For purposes of computing the ratio of earnings to fixed charges, earnings consist of income before income taxes plus fixed charges. Fixed charges consist of interest expense (including capitalized interest) and amortization of any discount and issuance costs related to our offerings of debt securities. |

| (11) | We calculate working capital by subtracting current liabilities from current assets. |

| (12) | Data for the six months ended June 30, 2014 includes a provision of US$32.0 million for forestry losses due to fire. |

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | | | For the six months

ended June 30, | |

| | | | (unaudited) | | | (unaudited) | |

| | | 2009 | | | 2010 | | | 2011 | | | 2012(1) | | | 2013(1) | | | 2013(1) | | | 2014(1) | |

| | | (in thousands of US$, except volume data) | |

OPERATING DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |