SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under Rule 14a-12

COTELLIGENT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

COTELLIGENT, INC.

100 THEORY, SUITE 200

IRVINE, CALIFORNIA 92612

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 30, 2004

To the Stockholders:

The Annual Meeting of Stockholders of Cotelligent, Inc. (“Cotelligent” or the “Company”) will be held at the Canyon Gate Country Club, 2001 Canyon Gate Drive, Las Vegas, Nevada on the 30th day of June, 2004 at 9 a.m., Pacific Daylight Saving Time, for the following purposes:

| 1. | To elect one director to serve for the term specified in the attached Proxy Statement and until his successor is elected and qualified. |

| 2. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Only stockholders of record as of the close of business on May 25, 2004 are entitled to receive notice of and to vote at the meeting. A list of such stockholders shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of ten days prior to the meeting, at the operating location of the Company, located at 5275 South Arville Street, Suite 104, Las Vegas, NV 89118.

By Order of the Board of Directors

Curtis J. Parker

Executive Vice President, Chief Financial Officer,

Treasurer & Secretary

Irvine, California

May 26, 2004

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, YOU ARE URGED TO FILL IN, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE YOUR SHARES OF COMMON STOCK PERSONALLY EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY.

COTELLIGENT, INC.

100 THEORY, SUITE 200

IRVINE, CALIFORNIA 92612

PROXY STATEMENT

INTRODUCTION

The accompanying Proxy is solicited by and on behalf of the Board of Directors of Cotelligent, Inc., a Delaware corporation (the “Company” or “Cotelligent”), for use only at the 2004 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Canyon Gate Country Club, 2001 Canyon Gate Drive, Las Vegas, Nevada on the 30th day of June, 2004 at 9 a.m., Pacific Daylight Saving Time, and at any adjournment thereof. The approximate date on which this Proxy Statement and accompanying Proxy will first be given or sent to stockholders is June 1, 2004.

Each Proxy executed and returned by a stockholder may be revoked at any time thereafter by written notice to that effect to the Company, attention of the Secretary, before the Annual Meeting, or to the Secretary or the Inspector of Election at the Annual Meeting, or by execution and return of a later-dated Proxy, except as to any matter voted upon before such revocation.

A proxy card is enclosed for your use. The proxy card contains instructions for responding by mail. Any Proxy, if received in time, properly signed and not revoked, will be voted in accordance with the specifications made and, where no specifications are given, in the discretion of the proxy holders, such Proxies will be voted:

| • | For the election of one director to serve for the term specified in the attached Proxy Statement or until his or her successor is duly elected or qualified. |

In the discretion of the proxy holders, the Proxies will also be voted FOR or AGAINST such other matters as may properly come before the meeting. Management of the Company is not aware of any other matters to be presented for action at the meeting.

RECORD DATE AND VOTING SECURITIES

The Board of Directors has fixed the close of business on May 25, 2004 as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting. The outstanding stock of the Company on May 25, 2004 consisted of 24,861,620 shares of Common Stock, each of which is entitled to one vote. Shares of Common Stock held by the Company are not voted.

The presence, in person or by Proxy, of the holders of a majority of the shares of Common Stock of the Company entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at such meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Assuming a quorum, the nominees receiving a plurality of the votes of the shares of the Common Stock present in person or by Proxy at the Annual Meeting and entitled to vote on the election of directors will be elected as directors.

With regard to the election of the directors, only shares that are voted in favor of the director nominee will be counted towards the achievement of a plurality. Votes that are withheld and broker non-votes, if any, will have no effect on the outcome of the election of the directors.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of May 25, 2004 information regarding the beneficial ownership of the Common Stock of the Company by (i) each person known to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) each of the Company’s directors, (iii) each named executive officer and each officer named in the Summary Compensation Table and (iv) all executive officers and directors as a group. Unless otherwise indicated, all persons listed have an address c/o the Company’s principal executive offices and have sole voting and investment power with respect to their shares unless otherwise indicated.

| Shares Beneficially Owned | |||||

Name | Number | Percent | |||

Loren W. Willman(1) | 4,543,853 | 17.2 | % | ||

Kenneth L. Maul(2) | 2,230,858 | 8.8 | % | ||

James R. Lavelle(3) | 1,305,308 | 5.2 | % | ||

Curtis J. Parker(4) | 305,992 | 1.2 | % | ||

Anthony M. Frank(5) | 189,656 | * | |||

Debra J. Richardson(6) | 15,000 | * | |||

Harlan P. Kleiman(7) | 5,000 | * | |||

Tony C. Vickers(8) | 5,000 | * | |||

All executive officers and directors as a group (5 persons)(9) | 1,825,956 | 7.1 | % | ||

| * | Less than 1% |

| (1) | Includes 1,514,581 shares issuable upon exercise of warrants exercisable within 60 days of May 25, 2004. |

| (2) | Includes (i) 1,153,424 shares owned directly by Mr. Maul, (ii) 235,000 shares owned in Mr. Maul’s individual retirement account, (iii) 272,148 shares owned by the Las Vegas Venture Fund in which Mr. Maul is the managing partner, (iv) 40,000 shares owned by M&S Investments in which Mr. Maul is a managing partner, (v) 31,074 shares issuable upon exercise of warrants held by the Las Vegas Venture Fund exercisable within 60 days of May 25, 2004 and (vi) 489,212 shares issuable upon exercise of warrants held by Mr. Maul exercisable within 60 days of May 25, 2004. Mr. Maul has 50% voting and investment power with respect to the Las Vegas Venture Fund and M&S Investments. Mr. Maul’s business address is 1613 Night Wind Drive, Las Vegas, Nevada 89117. |

| (3) | Includes 400,000 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

| (4) | Includes 193,125 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

| (5) | Includes 117,500 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

| (6) | Includes 15,000 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

| (7) | Includes 5,000 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

| (8) | Includes 5,000 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

| (9) | Includes 842,500 shares issuable upon exercise of options exercisable within 60 days of May 25, 2004. |

2

ELECTION OF DIRECTORS

The number of directors on the Board of Directors is currently fixed at five. Pursuant to the Company’s Certificate of Incorporation and By-laws, the Board of Directors is divided into three classes, Class I, Class II and Class III, serving staggered three-year terms. One class of directors is elected at each annual meeting of stockholders to serve for the following three years. Currently there are two Class I directors whose term expires in 2005, two Class II directors whose term expires in 2006, and one Class III director whose term will expire at the Annual Meeting in 2004. Anthony M. Frank was elected as a Class III director and Mr. Frank has been nominated for election to the Board of Directors to serve for a term expiring at the Annual Meeting in 2007 and until his successor has been duly elected and qualified.

The persons named as proxies in the accompanying proxy, or their substitutes, will vote for such nominees at the Annual Meeting. If, for any reason not currently known, the nominees are not available for election, another person or persons who may be nominated will be voted for in the discretion of the proxy holders.

The following sets forth information concerning the nominees for election to the Board of Directors, including his name, age, principal occupation or employment during at least the past five years and the period during which such person has served as a director of the Company.

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

For a Three-Year Term Expiring at the Annual Meeting in 2007:

Anthony M. Frank is 73 years old and is a director of the Company. He joined the Company in that capacity in March 1993. In September 1994, Mr. Frank became co-founding General Partner and Chairman of Belvedere Capital Partners, the general partner of the California Community Financial Institutions Fund, the primary purpose of which is investing in California community banks. From 1992 to 1994, Mr. Frank was an independent financial consultant and venture capitalist. From March 1988 to March 1992, Mr. Frank served as the Postmaster General of the United States. From 1971 until 1988, he served as Chairman and Chief Executive Officer of First Nationwide Bank. Mr. Frank is a graduate of Dartmouth College and the Tuck School of Business and was an overseer of the Tuck School of Business. He is also a director of several companies, including The Charles Schwab Corporation, Crescent Real Estate Equities Ltd., Temple Inland Corporation and Bedford Properties Investors.

The Board of Directors unanimously recommends that you vote FOR the election of Anthony M. Frank as director of the Company.

3

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Members whose terms expire at the Annual Meeting in 2005:

Debra J. Richardson is 49 years old, and joined the Company as a director in August 2001. Dr. Richardson is Dean of the School of Information and Computer Science and Professor of Informatics at the University of California, Irvine and she holds the Ted and Janice Smith Family Foundation Dean’s Endowed Chair. Dr. Richardson joined the faculty at UC Irvine in 1987, and was appointed department chair in 2000. Her research interests include formal software quality analysis and testing methods; she has developed leading edge software tools and worked with several companies in adopting technology to improve the quality of critical software systems. Dr. Richardson also serves as director of the Ada Byron Research Center on Diversity in Computing and Information Technology, director of the MICRO (Microelectronics Innovation and Computer Research Opportunities) program (one of the University of California’s Industry-Cooperative Research Programs) and is a founding member of the UC Institute for Software Research. Dr. Richardson serves on the Boards of the Orange County chapters of Girls Inc. and Achievement Rewards for College Scientists (ARCS), on strategic advisory boards of several academic institutions, and on the executive advisory board of the Association of Women in Technology. Dr. Richardson earned a Doctor of Philosophy and a Master of Science in computer and information science from the University of Massachusetts, Amherst, and received a Bachelor of Arts degree in mathematics from Revelle College of the University of California, San Diego.

Tony C. Vickers is 54 years old and is a director of the Company. He joined the Company in that capacity in January 2004. Mr. Vickers is also Principal of IT Services Development (ITSD), a results oriented management consulting firm that he established in 1998 that specializes in helping its clients to maximize profitable growth with the effective execution of projects ranging from strategic planning to mergers and acquisitions, and customer satisfaction surveys. Previously, Mr. Vickers was CEO, President and a Director of Computer People, a $400 million international IT professional services organization he founded in 1972, and took public in 1987. In addition, Mr. Vickers was Chairman of the IT Services Division of the Information Technology Association of America (ITAA)—the leading association for all aspects of the IT industry including software, services, system integration and Internet companies. Further, Mr. Vickers is a Director of Allin Corporation; a member of the Board of Advisors of Bluecrane, Inc., and Make Corp.; a member of the National Association of Corporate Directors; and a member of the University of Southern California’s Integrated Media Systems Center’s (IMSC) Board of Councilors. IMSC, which is sponsored by the National Science Foundation, is engaged in research, education programs and industry collaboration in multimedia and Internet technologies.

Member whose term expires at the Annual Meeting in 2006:

James R. Lavelle is 53 years old and is the founder, Chairman of the Board and Chief Executive Officer of the Company. Mr. Lavelle has served as Chief Executive Officer since he founded the Company in 1993. From inception of the Company until August 1995, Mr. Lavelle was also Chairman of the Board of the Company, a position that he reassumed in April 1996. From 1985 to 1993, he was a business consultant specializing in strategic marketing and organization development. From 1983 to 1985, Mr. Lavelle was Senior Manager and Director of Management Consulting Services for the San Francisco office of KMG Main Hurdman, an international accounting firm. Prior to that, he was Manager of Management Consulting Services in the San Francisco office of Price Waterhouse LLP, an international accounting firm. Mr. Lavelle has a bachelor’s degree from University of California at Santa Barbara and a Master of Business Administration degree from Santa Clara University.

Harlan P. Kleiman is 63 years old and is a director of the Company. He joined the Company in that capacity in May 2004. Mr. Kleiman has been a senior managing director of C. E. Unterberg, Towbin, an investment bank. In 1992, Mr. Kleiman founded Shoreline Pacific L.L.C. Since its founding, Shoreline Pacific has raised over $1.8 billion for public companies utilizing PIPES or other related financing structures. For the 20 years prior to

4

Shoreline Pacific, Mr. Kleiman designed and implemented business and financing strategies for new communication technologies, principally pay television and home video. He founded The Kleiman Company in 1979, one of the leading packagers of pay-television programming in the U.S. Earlier, he was Vice President, Programming for Home Box Office, where he developed and negotiated the initial feature film package with the major U.S. film studios; Senior Vice President, Cable Division of Warner Communications, Inc.; and, Chairman/Chief Executive Officer, Filmstar, Inc., arranging financing for film and television projects with foreign corporations, overseas funds, and commercial and merchant banks. Mr. Kleiman holds a Master’s Degree in Industrial Administration from Yale University. He was co-founder and Executive Director of New Haven’s Long Wharf Theater. He was on the Faculty of New York University’s School of the Arts where he taught television/film production and management and served as a special consultant to the Ford Foundation and the National Endowment for the Arts. He is a member of the Board of Trustees of National Public Radio and a Director of C.E. Unterberg, Towbin.

OTHER EXECUTIVE OFFICERS OF THE COMPANY

Name | Age | Position | ||

Curtis J. Parker | 49 | Executive Vice President, Chief Financial Officer, Treasurer & Secretary |

Curtis J. Parker is 49 years old and is Executive Vice President, Chief Financial Officer, Treasurer & Secretary of the Company. From November 1996 until December 2000, Mr. Parker served as Vice President and Chief Accounting Officer. From January 1996 until March 1996, he served as a consultant to the Company and was appointed Corporate Controller in March 1996. From 1988 through 1995, Mr. Parker was employed by Burns Philp Food Inc., a manufacturer of food products, where he rose to the position of Vice President—Finance for the Industrial Products Division. Mr. Parker has a Bachelor of Commerce degree from the University of British Columbia and is a Certified Public Accountant licensed in Washington State.

5

BOARD ORGANIZATION AND COMMITTEES

During the fiscal year ended December 31, 2003, the Board held thirteen meetings. Each of the directors attended at least 92% of the meetings of the Board and the committees on which he or she served during the fiscal year ended December 31, 2003.

The Company does not have an audit committee of its Board of Directors. Rather, the customary duties and responsibilities of an audit committee are performed by the Board of Directors itself with Mr. Lavelle participating in his capacity as a member of management and not as a member of the Board of Directors. The Board of Directors has established committees to perform certain of its functions, including the Compensation Committee, the Executive Committee, and the Nominating Committee that was formed on July 10, 2003. The functions of each of these committees, and its members, are set forth below.

Audit Committee

During 2003, the Audit Committee responsibilities were performed by the Board of Directors, with Mr. Lavelle participating in his capacity as a member of management and not as a member of the Board of Directors. Management is responsible for the Company’s internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted accounting practices and to issue a report thereon. The Board of Director’s responsibility is to monitor and oversee these processes. The Board of Directors adopted a written charter for the Company’s audit and accounting matters on May 3, 1999, which was revised on October 6, 2000. During the fiscal year ended December 31, 2003, four meetings of the Board of Directors included matters of discussion normally relevant to an Audit Committee. The Board of Directors has determined that each of Mr. Frank, Dr. Richardson and Mr. Vickers are independent, in accordance with the listing standards of the New York Stock Exchange.

The Board has also determined that Anthony M. Frank and Tony C. Vickers meet the definition of Audit Committee Financial Expert, as specified by the rules of the United States Securities and Exchange Commission (“SEC”) and is independent in accordance with listing standards established by the New York Stock Exchange.

Compensation Committee

The Compensation Committee advises and makes recommendations to the Board with respect to salaries and bonuses to be paid to officers and other employees of the Company. The Compensation Committee also administers the Company’s 1998 Long-Term Incentive Plan, the 2000 Long Term Incentive Plan and the 1999 Leveraged Stock Purchase Plan. During the fiscal year ended December 31, 2003, the Compensation Committee met four times. The Compensation Committee currently consists of Anthony M. Frank and Debra J. Richardson.

Executive Committee

The Executive Committee generally handles matters that are time critical and cannot be handled in a reasonable manner by the entire Board. During the year ended December 31, 2003, this committee did not meet. The full Board acted upon all actions within the authority of the Executive Committee.

Nominating Committee

The Nominating Committee was formed on July 10, 2003 to serve as the nominating committee of the Board. The Nominating Committee reviews the size and composition of the Board of Directors, apportions the directors into classes and makes recommendations with respect to nominations for election of directors. The Nominating Committee does not currently operate pursuant to a charter.

6

The Nominating Committee currently consists of Anthony M. Frank, Debra J. Richardson and Tony C. Vickers. During the year ended December 31, 2003, this committee did not formally meet, although one Board of Directors meeting during 2003 included matters relevant to the Nominating Committee, which the Nominating Committee members addressed to the Board of Directors.

Qualifications to serve on the Board of Directors include among other things, independence, character, judgment and business experience as well as an appreciation for the Company’s core purpose, core values and mission, and whether each person has the time available to devote to the Company. At all times during the fiscal year ended December 31, 2003, the members of the Nominating Committee qualified as independent under the listing standards of the New York Stock Exchange.

The Nominating Committee will consider recommendations from stockholders for nominees to serve as directors if such proposals are submitted in writing in accordance with the advance notice provisions of our By-laws to the Company, 100 Theory, Suite 200, Irvine, California, 92612, and Attention: Nominating Committee. Letters of recommendation should include name, biographical data and qualification, accompanied by the written consent of the recommended nominee to serve as a director, if elected. Nominees proposed by persons owning Common Stock of the Company are not evaluated in any different manner from other potential nominees. The Nominating Committee has not paid a fee to any third party in connection with the search for a director. The Nominating Committee did not receive any recommendations from stockholders proposing candidates for election at the 2004 Annual Meeting.

CORPORATE GOVERNANCE MATTERS

Code of Business Conduct and Ethics

The Board has adopted a code of business conduct and ethics that applies not only to the Company’s CEO and senior financial officers, as required by the SEC, but also to its directors and employees. The current version of such code of business conduct and ethics can be found on the Company’s Internet website atwww.cotelligent.com and is available in print free of charge to the Company’s stockholders upon request.

Communications with the Board

Stockholders may communicate with the Board of Directors care of the Secretary, Cotelligent, Inc., 100 Theory, Suite 200, Irvine, CA 92612. The Secretary will relay all such correspondence to the entire Board of Directors.

DIRECTOR COMPENSATION

Each director who is not an employee of the Company receives an annual retainer fee of $20,000. Directors serving on a committee receive an annual fee of $2,000 per committee membership, while directors serving on a committee as chairperson receive an annual fee of $2,500 per committee chaired.

Each non-employee director receives an automatic annual option grant under the 1998 Long-Term Incentive Plan to acquire 5,000 shares of Common Stock on the date of each of the Company’s annual meetings held after September 9, 1998. All of such options have or will have an exercise price equal to the fair market value of the Common Stock on the date of grant, are or will be exercisable immediately except as limited by the rules and regulations of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will expire ten years from the date of grant. Directors are also reimbursed for out-of-pocket expenses incurred for attending meetings of the Board of Directors or committees thereof, and for other expenses incurred in their capacity as directors.

7

AUDIT & ACCOUNTING MATTERS

During 2003, the Board of Directors performed the responsibilities of the Audit Committee. The following is a report of the audit and accounting matters discussed by the Board of Directors for the fiscal year ended December 31, 2003.

The Board of Directors has:

| • | Reviewed and discussed the Company’s financial statements for the quarters ended March 31, 2003, June 30, 2003 and September 30, 2003 with management; |

| • | Agreed with management’s recommendation to amend and restate its Annual Report on Form 10K/A for the fiscal year ended December 31, 2002; |

| • | Reviewed and discussed the Company’s audited financial statements for the year ended December 31, 2003 with management; |

| • | Discussed with KPMG LLP, the Company’s independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61, as may be modified or supplemented; and |

| • | Received from KPMG LLP the written disclosures and the letter regarding its independence as required by Independence Standards Board Standard No. 1, as may be modified or supplemented, and discussed the auditors’ independence with them. |

Based on the review and discussions referred to above, the Board of Directors recommended the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003 for filing with the Securities and Exchange Commission.

Audit and Other Service Fees Incurred In 2003:

| • | Audit Fees—The aggregate fees billed by KPMG LLP for the audit of the Company’s annual financial statements (including all the Company’s subsidiaries) for the year ended December 31, 2003 as included on Form 10-K, and the reviews of the financial statements as included on Forms 10-Q for that fiscal year were $192,521. The aggregate fees billed by KPMG LLP for services rendered for the amendment of the Company’s annual financial statements (including all the Company’s subsidiaries) for the year ended December 31, 2002 as included on Form 10-K/A were $20,740. The aggregate fees billed by KPMG LLP for services rendered in connection the registration statement as included on Form S-4 dated December 24, 2003 were $61,161; |

| • | Audit-Related Fees—None.; |

| • | Tax Fees—None; |

| • | All Other Fees—None. |

The Board of directors is required to pre-approve the rendering by our independent auditor of audit or permitted non-audit services.

Outside Board Members

Anthony M. Frank

Debra J. Richardson

8

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The following report of the Compensation Committee of the Board of Directors of Cotelligent shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement by reference into any filing under the Securities Act, or under the Exchange Act, and shall not be deemed filed under either the Securities Act or the Exchange Act except to the extent that Cotelligent specifically incorporates this information by reference.

Overview

The key components of executive officer compensation are salary, bonus and equity-based awards.

The members of the Compensation Committee hold primary responsibility for determining executive officer compensation levels, subject to the terms of executive employment agreements. The Compensation Committee is composed entirely of independent outside directors of Cotelligent, none of whom are or have been officers or employees of Cotelligent. The Compensation Committee has adopted a compensation philosophy intended to align compensation with Cotelligent’s overall business strategy. The philosophy guiding the executive compensation program is designed to link executive compensation and stockholder value. The goals of the program are to:

| • | Compensate executive employees in a manner that aligns the employees’ interests with the interests of the stockholders; |

| • | Encourage continuation of Cotelligent’s entrepreneurial spirit; |

| • | Reward executives for successful long-term strategic management; |

| • | Recognize outstanding performance; and |

| • | Attract and retain highly qualified and motivated executives. |

The Compensation Committee believes that Cotelligent’s executive compensation program should consist primarily of base salaries, performance bonuses and equity-based awards. The Compensation Committee has structured these compensation elements to motivate and reward executive management for performance that builds long-term stockholder value. In particular, base salaries and discretionary bonuses have been designed to give Cotelligent’s executives the potential to earn in excess of competitive industry compensation if certain subjective and objective operating and performance goals for Cotelligent are achieved. Moreover, the Compensation Committee will continue granting Cotelligent’s executives and other key employees stock options and/or other equity-based awards at current market value. Such options have no monetary value to the executives unless and until the market price of Cotelligent’s Common Stock increases. In this manner, Cotelligent’s executives will be compensated as stockholder value increases. The Compensation Committee anticipates that discretionary bonus payments and option grants made during the fiscal year ended December 31, 2003 and thereafter were and will be based on multiple subjective and objective measurements and criteria linked to building long-term stockholder value.

The cash compensation paid to Cotelligent’s executive officers during the fiscal year ended December 31, 2003 was in accordance with arms-length negotiations between Cotelligent and such executive officers.

Chief Executive Officer’s Compensation

Mr. James R. Lavelle, the Company’s Chairman and Chief Executive Officer, is a party to a three-year employment agreement which was negotiated at arms-length and became effective on January 5, 2000 which, unless terminated or not renewed by him, continues thereafter on a year-to-year basis on the same terms and conditions. This employment agreement supercedes prior employment agreements that the Company had entered

9

into with Mr. Lavelle. Mr. Lavelle’s employment agreement provides for a minimum base salary of $450,000 (subject to increase by the Compensation Committee) and the right to receive annually discretionary incentive bonuses provided by the Compensation Committee and to receive stock option grants at the discretion of the Compensation Committee. Mr. Lavelle may also participate in Cotelligent’s Long-Range Incentive Bonus Plan.

Mr. Lavelle was eligible for, and did receive, a $598,519 bonus during the fiscal year ended December 31, 2003 based upon the signing of a definitive agreement related to the acquisition of OnSite Media, Inc, on November 25, 2003.

This report is submitted by the members of the Compensation Committee.

Compensation Committee

Anthony M. Frank (Chair)

Debra J. Richardson

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

All of the members of the Compensation Committee are non-employee directors of the Company and are not former officers of the Company or its subsidiaries. No executive officer of the Company serves as a member of the board of directors or on the compensation committee of a corporation for which any of the Company’s directors serving on the Compensation Committee or on the Board of Directors of the Company is an executive officer.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information regarding the compensation earned by or awarded to the Chief Executive Officer and the other executive officers of the Company for the fiscal year ended December 31, 2003, the fiscal year ended December 31, 2002, and the twelve month period ended December 31, 2001.

SUMMARY COMPENSATION TABLE

| Annual Compensation | Long Term Compensation Awards | ||||||||||

Name and Principal Position | Fiscal Year | Salary($)(1) | Bonus($) | Other($) | Options/ SARs(#) | ||||||

James R. Lavelle Chairman and Chief Executive Officer | 2003

2002 | 440,441

335,207 | 598,519

0 | 1,997 136,590 18,000 1,700 18,000 1,700 18,000 | (2) (3) (4) (2) (4) (2) (4) | 0

0 | |||||

Curtis J. Parker Executive Vice President, Chief Financial Officer, Treasurer and Secretary | 2003 2002 2001 | 154,045 142,489 166,500 | 0 0 0 | 1,123 18,773 1,425 1,665 | (2) (5) (2) (2) | 0 0 275,000 | |||||

| (1) | Base salary earned. |

| (2) | Represents matching contributions by the Company under the Company’s 401(k) Plan. |

| (3) | Represents $91,260 for duplicate housing expenses and $45,330 for a gross-up of payroll taxes (incurred in connection with the inclusion of the duplicate living expenses in W-2 wages) paid for by the Company for such employee’s southern California residence. These expenses were incurred in connection with a cost cutting measure after the Company closed its northern California corporate office and required the employee to commute and live during the business week near the southern California office. |

| (4) | Represents auto allowance. |

| (5) | Represents $11,600 for duplicate housing expenses and $7,173 for a gross-up of payroll taxes (incurred in connection with the inclusion of the duplicate living expenses in W-2 wages) paid for by the Company for such employee’s southern California residence. These expenses were incurred in connection with a cost cutting measure after the Company closed its northern California corporate office and required the employee to commute and live during the business week near the southern California office. |

Stock Option Grants Table

The following table sets forth, as to the executive officers named in the Summary Compensation Table, information related to the grant of stock options pursuant to the Company’s 1998 Long-Term Incentive Plan during the fiscal year ended December 31, 2003.

OPTIONS GRANTED IN THE FISCAL YEAR ENDED DECEMBER 31, 2003

| Individual Grants | |||||||||||

| Number of Securities Underlying Options Granted | Percentage of Total Options Granted to Employees in the fiscal year ended December 31, 2003 | Exercise or Base Price Per Share ($/Share) | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term ($) | ||||||||

Name | 5% | 10% | |||||||||

James R. Lavelle | 0 | 0 | $ | 0 | 0 | 0 | |||||

Curtis J. Parker | 0 | 0 | $ | 0 | 0 | 0 | |||||

11

Stock Option Exercises and Year End Values Table

The following table shows, as to the executive officers named in the Summary Compensation Table, information with respect to the unexercised options to purchase Common Stock granted under the 1995 and 1998 Long-Term Incentive Plans and held as of December 31, 2003.

VALUE OF OPTIONS AT DECEMBER 31, 2003

Number of Shares Acquired On Exercise | Value Realized ($) | Number of Securities at December 31, 2003 | Value of Unexercised In-the-Money Options at December 31, 2003 ($)(1) | |||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

James R. Lavelle | 0 | 0 | 400,000 | 0 | 0 | 0 | ||||||||

Curtis J. Parker | 0 | 0 | 186,250 | 113,750 | $ | 5,000 | $ | 5,000 | ||||||

| (1) | Options are “in-the-money” if the closing market price of the Company’s Common Stock exceeds the exercise price of the options. The value of the unexercised options represents the difference between the exercise price of such options and the closing market price ($0.22) of the Company’s Common Stock on the OTC Bulletin Board on December 31, 2003. |

Equity Compensation

The following table sets forth, as of December 31, 2003, outstanding awards and shares remaining available for future issuance under the Company’s compensation plans under which equity securities are authorized for issuance (excluding 401(k) plans and similar tax-qualified plans).

Plan Category | (a) Number of securities to | (b) Weighted-average exercise price of outstanding options, warrants and rights | (c) Number of securities | |||||

Equity compensation plans approved by security holders | 1,204,393 | $ | 0.36 | 1,348,369 | (1) | |||

Equity compensation plans not approved by security holders(2) | 1,303,921 | $ | 0.28 | not determinable | ||||

Total | 2,508,314 | $ | 0.32 | not determinable | ||||

| (1) | Includes 1,348,369 shares of Common Stock remaining available for future issuance under the Company’s 1998 Long-Term Incentive Plan (“1998 Plan”). Under the 1998 Plan, an aggregate of 18% of the then outstanding shares of Common Stock are available for awards under such plan. Unless otherwise provided by the Compensation Committee in an award agreement, all outstanding awards under the 1998 Plan will generally become exercisable or vested upon a “change in control” of the Company. The acquisition by the Company of OnSite Media, Inc. on March 2, 2004 constituted a “change in control” of the Company under the 1998 Plan. As a result, all outstanding awards under the 1998 Plan became fully exercisable and vested as of March 2, 2004. This amount excludes the number of securities of Common Stock remaining available for future issuance under the Company’s 1999 Leveraged Stock Purchase Plan. |

| (2) | The 2000 Long-Term Incentive Plan (the “2000 Plan”) was adopted by the Company’s Board of Directors on August 11, 2000, but was not approved by stockholders. Awards under the 2000 Plan may be granted by the Compensation Committee of the Board of Directors (or such other committee designated by the Board of Directors to administer the 2000 Plan) and may include: (i) non-qualified options to purchase shares of Common Stock; (ii) stock appreciation rights (“SARs”), whether in conjunction with the grant of stock options or independent of such grant, or stock appreciation rights that are only exercisable in the event of a change in control of the Company or upon other events; (iii) restricted stock, consisting of shares that are |

12

subject to forfeiture based on the failure to satisfy employment-related restrictions; (iv) deferred stock, representing the right to receive shares of stock in the future; (v) bonus stock and awards in lieu of cash compensation; (vi) dividend equivalents, consisting of a right to receive cash, other awards, or other property equal in value to dividends paid with respect to a specified number of shares of Common Stock, or other periodic payments; or (vii) other awards not otherwise provided for, the value of which are based in whole or in part upon the value of the Common Stock. Unless otherwise determined by the Compensation Committee, all outstanding awards under the 2000 Plan will generally become fully exercisable or vested upon a “change in control” of the Company. The acquisition by the Company of OnSite Media Inc. on March 2, 2004 constituted a “change in control” of the Company under the 200 Plan. As a result, all outstanding awards under the 2000 Plan became fully exercisable and vested as of March 2, 2004. The Compensation Committee has the discretion to establish all of the terms and conditions of awards under the 2000 Plan and to interpret the terms of the 2000 Plan. There is no limit on the maximum number of shares of Common Stock that may be awarded under the 2000 Plan. The 2000 Plan may be amended, altered, suspended, discontinued, or terminated by the Board of Directors at any time. |

13

EMPLOYMENT AGREEMENTS; COVENANTS-NOT-TO-COMPETE

Mr. James R. Lavelle, Cotelligent’s Chairman and Chief Executive Officer, is a party to a three-year employment agreement effective January 5, 2000 which, unless terminated or not renewed by him, continues thereafter on a year-to-year basis on the same terms and conditions. Mr. Lavelle’s employment agreement provides that, in the event of termination of employment by the Company without cause, he shall be entitled to receive from the Company an amount equal to (i) three times the minimum base salary, as defined in the employment agreement, plus (ii) three times his most recent annual bonus (not including any payments made under Cotelligent’s Long-Range Bonus Incentive Plan), without regard to whether he obtains subsequent employment. Mr. Lavelle shall be deemed to have been terminated without cause by Cotelligent, if, among other things, Cotelligent fails to elect and continue Mr. Lavelle as Chief Executive Officer or Chairman or to nominate him for re-election as a member of the board of directors unless Mr. Lavelle is terminated for good cause. In addition, his employment agreement provides that, in the event of a change in control of the Company where he has not received at least five days’ notice of such change in control, he will be deemed to have been terminated without cause and shall be entitled to compensation as described in the preceding sentence. Additionally, in such event he will not be bound by any non-compete terms in his employment agreement, as discussed below. If given at least five days notice of such change in control, he may elect to terminate his employment agreement and collect the respective compensation provided above.

In the event of a change in control, Mr. Lavelle is entitled to reimbursement for any excise taxes the employee incurs under Section 4999 of the Internal Revenue Code, as well as any interest or penalties related to the excise tax and any entitlements outside of the employment agreement that are described in Section 280G(b)(2)(A)(i) of the Internal Revenue Code. In the employment agreement, a “Change in Control” is deemed to occur if: (1) any person or entity, other than the Company, a corporation owned directly or indirectly by the stockholders of the Company in substantially the same proportions as their ownership of the Common Stock of the Company, or an employee benefit plan of Company or a subsidiary of Company, acquires directly or indirectly Beneficial Ownership (as defined in Rule 13d-3 of the Exchange Act) of any voting security of the Company and immediately after such acquisition such person or entity is, directly or indirectly, the Beneficial Owner of voting securities representing 30% or more of the total voting power of all of the then-outstanding voting securities of the Company; (2) a change in the composition of the individuals on the Board of Directors as a result of which fewer than one-half of the incumbent directors are directors who either (a) had been directors of Company on the date 24 months prior to the date of the event that constitutes a change in control (the “original directors”) or (b) were elected, or nominated with the affirmative votes of at least a majority of the aggregate of the original directors who were still in office at the time of the election or nomination and the directors whose election or nomination was previously so approved; (3) the consummation of a merger or consolidation of Company with or into another entity or any other corporate reorganization, if more than 50% of the combined voting power of the continuing or surviving entity’s securities outstanding immediately after such merger, consolidation or other reorganization is owned by persons who were not stockholders of Company immediately prior to such merger, consolidation or other reorganization; or (4) the sale, transfer or other disposition of all or substantially all of the Company’s assets. Mr. Lavelle agreed that the purchase of OnSite Media, Inc., including the issuance by the Company of shares of Common Stock and Warrants in connection therewith, would not result in a “Change in Control” as that term is defined in Mr. Lavelle’s employment agreement and that certain provisions of Mr. Lavelle’s employment agreement will not apply in connection with such purchase.

The employment agreement of Mr. Lavelle contains a covenant-not-to-compete with the Company for a period of two years immediately following the termination of employment; or, in the case of a termination without cause, for a period of one year following the termination of his employment; or, in the case of a Change in Control in which he is not given at least five days’ notice of such Change in Control, the covenant not-to-compete does not apply for any period of time. If any court of competent jurisdiction determines that the scope, time or territorial restrictions contained in the covenant are unreasonable, the covenant-not-to-compete shall be reduced to the maximum period permitted by such court. The compensation to which Mr. Lavelle is entitled, as the case may be, shall nonetheless be paid to him.

14

Mr. Lavelle’s employment agreement calls for a minimum base salary of $450,000. Mr. Lavelle’s annual base salary paid for the fiscal year ended December 31, 2003 was $440,441. For the fiscal year ended December 31, 2003, he was eligible for, and did receive, a $598,519 bonus based upon the signing of a definitive agreement related to the acquisition of OnSite Media, Inc. on November 25, 2003. Pursuant to the Long-Range Bonus Incentive Plan, Mr. Lavelle is eligible for bonuses in fiscal years 2003 and 2006 based upon the operating results of the Company.

Mr. Curtis J. Parker, as Cotelligent’s Executive Vice President, Chief Financial Officer, Treasurer and Secretary, is a party to a one-year employment agreement effective December 19, 2000 which was extended for a two-year period as of December 19, 2001 and then, unless terminated by either party or not renewed by him, continues thereafter on a year-to-year basis, in each case on the same terms and conditions. Mr. Parker’s employment agreement provides that, in the event of termination of employment by the Company without cause, he shall be entitled to receive from the Company an amount equal to (i) one times the Market Based Salary, as defined in the employment agreement, plus (ii) one times his most recent annual bonus, without regard to whether he obtains subsequent employment. His employment agreement provides that, in the event of a Change in Control of the Company where he has not received at least five days’ notice of such change in control, he will be deemed to have been terminated without cause and shall be entitled to compensation as described in the preceding sentence. Additionally, in such event he will not be bound by any non-compete terms in his employment agreement, as discussed below. If given at least five days’ notice of such change in control, he may elect to terminate his employment agreement and collect the respective compensation provided above.

The employment agreement of Mr. Parker contains a covenant-not-to-compete with the Company for a period of one year immediately following the termination of employment; or, in the case of a termination without cause, for a period of six months following the termination of his employment; or, in the case of a Change in Control in which the he is not given at least five days’ notice of such Change in Control, the covenant not-to-compete does not apply for any period of time. If any court of competent jurisdiction determines that the scope, time or territorial restrictions contained in the covenant are unreasonable, the covenant-not-to-compete shall be reduced to the maximum period permitted by such court. The compensation to which Mr. Parker is entitled shall nonetheless be paid to him.

Mr. Parker’s employment agreement provides for a minimum base salary of $180,000 per year. With Mr. Parker’s consent, annual base salary paid for the fiscal year ended December 31, 2003 was $154,045. For the fiscal year ended December 31, 2003, he was eligible for, but did not receive, a discretionary bonus of up to fifty percent (50%) of the amount of his base salary provided by the Compensation Committee.

15

PERFORMANCE GRAPH

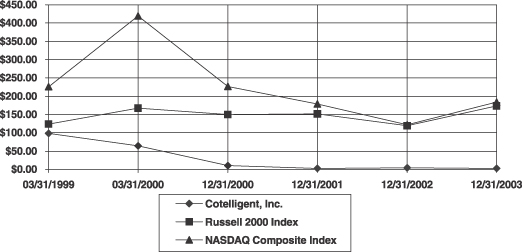

The following chart compares the yearly percentage change in the cumulative total stockholder return on the Company’s Common Stock from March 31, 1999 through December 31, 2003, with the cumulative total return on the Russell 2000 Index and the NASDAQ Composite Index. The comparison assumes $100, as of February 14, 1996, the date of the Company’s initial public offering (the “Offering”) was invested in the Company’s Common Stock and in each of the foregoing indices and assumes reinvestment of dividends, as applicable. Cotelligent’s Offering price of $9.00 was used as the beginning price of the Common Stock. Dates on the following chart represent the last day of the indicatedfiscal year. Cotelligent has paid no dividends during the periods shown.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

Company/Index | March 31, 1999 | March 31, 2000 | December 31, 2000 | December 31, 2001 | December 31, 2002 | December 31, 2003 | ||||||||||||

Cotelligent, Inc. | $ | 98.61 | $ | 64.59 | $ | 10.42 | $ | 2.89 | $ | 4.11 | $ | 2.44 | ||||||

Russell 2000 Index | $ | 123.65 | $ | 167.63 | $ | 150.36 | $ | 151.90 | $ | 119.12 | $ | 173.17 | ||||||

NASDAQ Composite Index | $ | 225.67 | $ | 419.26 | $ | 226.51 | $ | 178.82 | $ | 122.45 | $ | 183.68 | ||||||

16

CERTAIN TRANSACTIONS

From May 1996 through early July 1996, the Company advanced to Daniel E. Jackson, President and Chief Operating Officer, $250,000 to facilitate relocation of his residence to northern California. Prior to his termination discussed below, there was a remaining balance of $82,500 evidenced by a demand note. The note is non-interest bearing and the principal balance was originally due July 15, 2001 or upon termination of employment if prior to the due date. The note to cover relocation was extended by a vote of the Compensation Committee of the Board of Directors on October 29, 2000 for three years to July 15, 2004. Since the beginning of the 2000 fiscal year, the Company has also advanced to Mr. Jackson an aggregate amount of approximately $480,000, evidenced by five separate unsecured demand promissory notes, three dated August 11, 1999, one dated September 30, 1999, and one dated November 23, 1999. The purpose of such advances was to cover margin calls made on brokerage accounts held by Mr. Jackson. On May 5, 2000, Mr. Jackson repaid $68,270 of principal and $31,730 of interest. The notes, although due on demand, were issued with original due dates in 2001. These notes were also extended by a vote of the Compensation Committee of the Board of Directors on October 29, 2001 for three years to October 29, 2004. The interest rates on these notes remained unchanged at rates between 7.75% and 8.75%. Payment of the notes is accelerated if the Company’s Common Stock reaches certain sustained target levels. During the year ended December 31, 2003, Mr. Jackson was terminated from the Company. The Company paid severance and other termination benefits to Mr. Jackson which were used, in part, to repay the entire balance of demand notes receivable, including interest, due the Company from Mr. Jackson.

On March 31, 1996, the Company advanced to James R. Lavelle, Chairman of the Board and Chief Executive Officer of the Company, $37,902, evidenced by an unsecured demand promissory note bearing interest annually at a rate of 6%. The entire amount of such advance remains outstanding. Since the beginning of the 2000 fiscal year, the Company has also advanced to Mr. Lavelle an aggregate amount of $619,000, evidenced by seven separate unsecured demand promissory notes. The purpose of such advances was to cover margin calls made on brokerage accounts held by Mr. Lavelle. On May 1, 2000, Mr. Lavelle repaid $15,330 of principal and $34,670 of interest. The notes, although due on demand, were issued with original due dates in 2001. The notes were extended by a vote of the Compensation Committee of the Board of Directors on October 29, 2001 for three years to October 29, 2004. The interest rates on these notes remain unchanged at rates between 7.75% and 8.25%. Payment of the notes is accelerated if the Company’s Common Stock reaches certain sustained target levels.

During the year ended December 31, 2003, the Chief Executive Officer repaid a portion of notes receivable due the Company. In prior years the Chief Executive Officer had voluntarily reduced his base compensation from its authorized level. Upon restoration of base compensation close to its authorized level in 2003, the Chief Executive Officer used the increase in compensation of $106,363 to repay the notes receivable due the Company. In addition, prior to December 31, 2003, the Compensation Committee of the Board of Directors authorized a bonus to the Chief Executive Officer of $598,918 upon the signing of a definitive agreement for the purchase of OnSite Media, Inc. The amount of bonus remaining, after tax was withheld by the Company, was used to repay $354,816 of the notes receivable and accrued interest. Subsequent to December 31, 2003, the Compensation Committee of the Board of Directors authorized a further bonus of $639,597 upon the closing of the purchase of Onsite Media, Inc. The amount of the bonus remaining, after tax was withheld by the Company, was used to repay $364,527 of the notes receivable and accrued interest. Upon payment of the second bonus in 2004, Mr. Lavelle satisfied the entire principal and accrued interest on all demand loans due the Company.

On September 8, 1999, the stockholders approved the Cotelligent, Inc. 1999 Leveraged Stock Purchase Plan (the “LSPP”), which authorizes the purchase of shares of Common Stock by eligible employees who are selected by the Compensation Committee of the Board to participate in the LSPP on terms and conditions determined by the Compensation Committee. Since the LSPP’s inception through March 31, 2000, Mr. Lavelle has been issued 750,000 shares of Common Stock and Mr. Jackson has been issued 736,842 shares of Common Stock. Shares issued under the LSPP resulted in notes receivable from Mr. Lavelle for $2,671,875 at 5.93% interest, and from Mr. Jackson for $2,625,000 at 5.93% interest. Mr. Lavelle’s notes remain outstanding. The notes (1) are secured

17

by the pledge of Common Stock issued; (2) are full recourse as to the employee, except that in the case of death, disability, termination by the Company without cause or a change of control of the Company, recourse against the employees is limited to the pledged stock; and (3) have a term of five years from date of issuance, provided that if the stock is sold, the loan shall be prepaid, and if the stock is not sold, the loan may not be prepaid. The Common Stock issued under the LSPP is restricted from sale in the open market for a period of two years from the date of issuance, provided, however, that in the case of death, disability, termination by the Company without cause or change of control of the Company, the Common Stock may be sold and the proceeds used to repay the loan. During the year ended December 31, 2003, Mr. Jackson was terminated from the Company. Accordingly, upon termination, the notes due from Mr. Jackson became non-recourse. Sixty days following termination when the notes became due, Mr. Jackson satisfied the notes by returning the underlying shares of Common Stock to the Company. On March 2, 2004, the Company closed the acquisition of OnSite Media, Inc. This acquisition constituted a change in control under the LSPP. Accordingly, on March 2, 2004, the notes due from Mr. Lavelle became non-recourse.

APPOINTMENT OF AUDITORS

The Board of Directors is currently reviewing bids from firms of certified public accountants. The Board of Directors seeks to appoint a firm more suitable to the Company’s present size and with a lower fee structure. KPMG LLP, the Company’s current certified public accountant, has reported on the Company’s consolidated financial statements at and for the fiscal periods ended December 31, 2003, 2002, 2001 and 2000. The Company does not expect representatives of KPMG LLP to be present at the Annual Meeting.

On July 10, 2002, the Company dismissed its independent auditors, Arthur Andersen LLP, and engaged the services of KPMG, as its new independent auditors for its fiscal year ended December 31, 2002. The Audit Committee of the Board of Directors authorized the dismissal of Arthur Andersen and the immediate engagement of KPMG. Arthur Andersen’s report on the Company’s consolidated financial statements for the year ended December 31, 2001 did not contain an adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles. During the year ended December 31, 2001, and the subsequent interim period through July 10, 2002, there were no disagreements with Arthur Andersen on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which disagreement, if not resolved to Arthur Andersen’s satisfaction, would have caused it to make reference to the subject matter of the disagreement in connection with its report on the Company’s consolidated financial statements for such years; and there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K. During the years ended December 31, 2001 and December 31, 2002, the Company did not consult with KPMG regarding any of the matters or events set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K.

COMPLIANCE WITH SECTION 16 (a) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (the “SEC”). Such persons are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms received by the Company with respect to the fiscal year ended December 31, 2003. Anthony M. Frank and Debra J. Richardson each filed a late Form 5 reporting one transaction each relating to the grant of stock options. Tony C. Vickers filed a late Form 3 reporting his appointment as a director of the Company and the grant of stock options in connection with such appointment. Daniel E. Jackson, a former executive officer of the Company, who was terminated in August 2003, has not yet filed a Form 5 reporting the termination of his reporting responsibilities under Section 16(a). Except for these late filings, to the best of the Company’s knowledge, all other Section 16(a) filing requirements have been satisfied.

18

STOCKHOLDER PROPOSALS

Stockholders who intend to present proposals at the 2005 Annual Meeting under SEC Rule 14a-8 must insure that such proposals are received by the Secretary of the Company not later than February 1, 2005. Such proposals must meet the requirements of the SEC to be eligible for inclusion in the Company’s 2005 proxy materials. In order for a proposal submitted outside of Rule 14a-8 to be considered “timely” within the meaning of SEC Rule 14a-4 (c), such proposal must comply with the advance notice provisions of our By-laws.

The advance notice provisions of our By-laws require that, in order to be properly brought before the 2005 Annual Meeting, a stockholder’s notice of the matter the shareholder wishes to present must be delivered to the Secretary of the Company not less than 90 nor more than 120 days prior to the first anniversary of the date of this year’s Annual Meeting. As a result, any notice given by or on behalf of a stockholder pursuant to these provisions of our By-laws must be received no earlier than March 2, 2005 nor later than April 1, 2005.

GENERAL

Management does not intend to bring any business before the meeting other than the matters referred to in the accompanying notice. If, however, any other matters properly come before the meeting, it is intended that the persons named in the accompanying proxy will vote pursuant to the proxy in accordance with their best judgment on such matters.

A copy of the Company’s most recent Annual Report on Form 10-K is available on the Company’s web site atwww.cotelligent.com or can be made available without charge upon written request to: Cotelligent, Inc., 100 Theory, Suite 200, Irvine, California, 92612, Attention: Investor Relations Administrator.

OTHER INFORMATION

The cost of solicitation of proxies will be borne by the Company. In addition to solicitation by mail, proxies may be solicited in person, by telephone, telecopy or other means, or by Directors, officers and regular employees of the Company who will not receive additional compensation for such solicitations. Proxy cards and materials will also be distributed to beneficial owners of Common Stock through brokers, custodians, nominees and other like parties, and the Company expects to reimburse such parties for their charges and expenses.

By Order of the Board of Directors

Curtis J. Parker

Executive Vice President, Chief Financial Officer,

Treasurer & Secretary

Irvine, California

May 26, 2004

19

DETACH HERE

PROXY

COTELLIGENT, INC.

100 THEORY, SUITE 200

IRVINE, CALIFORNIA 92612

This Proxy is solicited on behalf of the Board of Directors of Cotelligent, Inc., a Delaware corporation (the “Company” or “Cotelligent”). The undersigned hereby appoints James R. Lavelle and Curtis J. Parker and each of them, proxies, with full power of substitution in each of them, for and on behalf of the undersigned to vote as proxies, as directed and permitted herein to vote your shares of Cotelligent, Inc. Common Stock at the Annual Meeting of Stockholders of Cotelligent, Inc. to be held on Wednesday, June 30, 2004, at 9:00 a.m., Pacific Daylight Savings Time at the Canyon Gate Country Club, 2001 Canyon Gate Drive, Las Vegas, Nevada, and at any adjournments thereof upon matters set forth in the Proxy Statement and, in their judgment and discretion, upon such other business as may properly come before the meeting.

This proxy when properly executed will be voted in the manner directed on the reverse hereof by the Stockholder.IF NO DIRECTION IS MADE ON THIS MATTER, THIS PROXY WILL BE VOTED FOR THE NOMINEE LISTED.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, YOU ARE URGED TO FILL IN, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE YOUR SHARES OF COMMON STOCK PERSONALLY EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY.

SEE REVERSE SIDE | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | SEE REVERSE SIDE |

COTELLIGENT, INC.

C/O EQUISERVE TRUST COMPANY N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

x | Please mark votes as in this example | L | 1482

|

| 1. | Election of Director. |

NOMINEE:(01) Anthony M. Frank

FOR NOMINEE

| ¨ | ¨ | WITHHELD FROM NOMINEE | |||||||||||

| MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT | ¨ | |||

| Please sign this proxy exactly as name appears hereon. When shares | ||||

| are held by joint tenants, both should sign. When signing as attorney, | ||||

| administrator, trustee or guardian, please give full title as such. | ||||

Signature: | Date: | Signature: | Date: |