Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

COTELLIGENT, INC.

(Name of Registrant as Specified in its charter)

COTELLIGENT, INC.

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. |

| x | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

Table of Contents

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

$2,800,000

| (5) | Total fee paid: |

$329.56

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

COTELLIGENT, INC.

655 Montgomery Street, Suite 1000

San Francisco, California 94111

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

, 2005

Notice is hereby given that the Special Meeting of Stockholders of Cotelligent, Inc. (“Cotelligent”) will be held on , 2005 commencing at 10:00 a.m., local time, at the offices of Morgan, Lewis & Bockius LLP, One Market, Spear Street Tower, San Francisco, California 94105 for the following purposes:

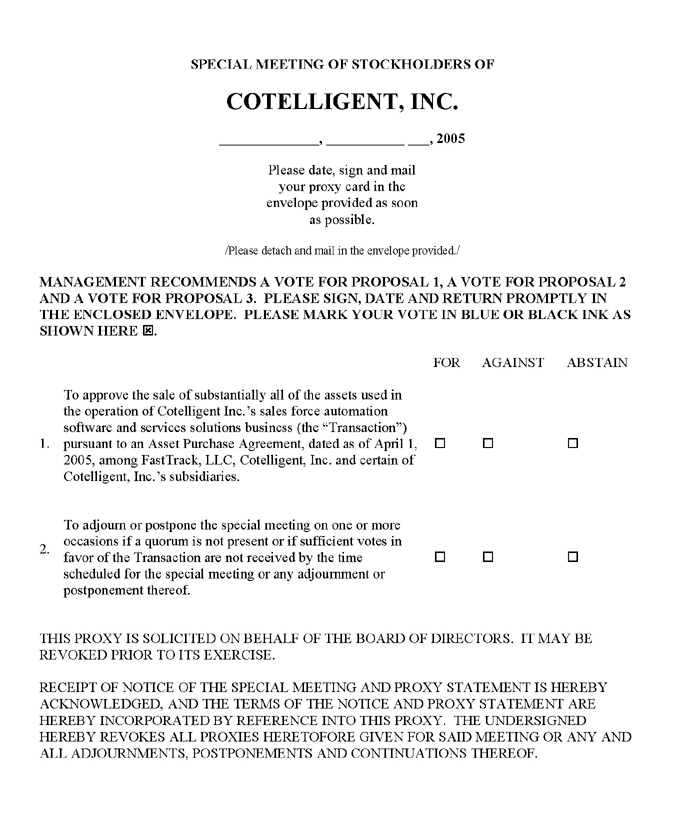

| 1. | To approve the sale of substantially all of the assets related to Cotelligent’s sales force automation software and services solutions business (the “Transaction”) pursuant to an Asset Purchase Agreement, dated as of April 1, 2005, by and among FastTrack, LLC, Cotelligent and certain of Cotelligent’s subsidiaries, as more fully described in the accompanying proxy statement. |

| 2. | To adjourn or postpone the special meeting on one or more occasions if a quorum is not present or if sufficient votes in favor of the Transaction are not received by the time scheduled for the special meeting or any adjournment or postponement thereof. |

| 3. | To address any procedural matters that may properly come before the special meeting or any adjournment thereof. |

The stock transfer books will not be closed but only stockholders of record at the close of business on , 2005, will be entitled to notice of and to vote at the meeting.

By order of the Board of Directors, |

James R. Lavelle Chairman and Chief Executive Officer |

San Francisco, California

, 2005

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING AND VOTE YOUR SHARES. IN THE EVENT THAT YOU CANNOT ATTEND, PLEASE DATE, SIGN AND MAIL THE ENCLOSED PROXY IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. A STOCKHOLDER WHO EXECUTES AND RETURNS A PROXY IN THE ACCOMPANYING FORM HAS THE POWER TO REVOKE SUCH PROXY AT ANY TIME PRIOR TO THE EXERCISE THEREOF.

Table of Contents

COTELLIGENT, INC.

655 Montgomery Street, Suite 1000

San Francisco, California 94111

PROXY STATEMENT

PROXY SOLICITATION AND EXPENSE

The accompanying proxy is solicited by the Board of Directors of Cotelligent, Inc. (“Cotelligent”), for use at the Special Meeting of Stockholders to be held on , 2005 at 10:00 a.m., local time, at the offices of Morgan, Lewis & Bockius LLP, One Market, Spear Street Tower, San Francisco, California 94105. The purpose of the meeting is to approve the sale of substantially all of the assets related to Cotelligent’s sales force automation software and services solutions business (the “Transaction”). Proxies in the accompanying form, properly executed and received prior to the meeting and not revoked, will be voted. A stockholder who executes and returns a proxy in the accompanying form has the power to revoke such proxy at any time prior to exercise thereof by notice in writing received by the Secretary of Cotelligent, by executing a later dated proxy, or by attending the meeting and voting in person. It is expected that proxy solicitation materials will be mailed to stockholders on or about , 2005.

The expense of soliciting proxies in the accompanying form will be borne by Cotelligent. Cotelligent has engaged to assist in the solicitation of proxies from stockholders, at a fee of $ plus reimbursement of usual and customary expenses. In addition, directors, officers and employees of Cotelligent may make some solicitations by mail, telephone or personal interview. No additional compensation will be paid to these directors, officers and employees for the time so employed but they may be reimbursed for out-of-pocket expenses incurred in connection with the solicitation of proxies.

RECORD DATE AND VOTING SECURITIES

Only holders of record at the close of business on , 2005 (the “Record Date”) will be entitled to vote at the meeting. On the Record Date there were shares of Cotelligent’s common stock, par value $.01 per share, outstanding, each of which is entitled to one (1) vote.

The presence, either in person or by proxy, of the holders of a majority of outstanding shares of common stock is necessary to constitute a quorum for the transaction of business at the Special Meeting. Abstentions and broker non-votes (as defined below) will be counted for purposes of determining the presence or absence of a quorum, but will not be counted for the purposes of determining whether the Transaction has been approved. Accordingly, abstentions and broker non-votes will therefore have the effect of a vote against the Transaction.

Table of Contents

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 5 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 17 | ||

| 19 | ||

| 19 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 21 | ||

i

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||

| 21 | ||

Risk Factors You Should Take into Account in Deciding How to Vote | 21 | |

| 26 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| 33 | ||

| 33 | ||

| 33 | ||

| 33 | ||

| 34 | ||

| 34 | ||

| 35 | ||

| 36 | ||

| 37 | ||

PROPOSAL TWO: ADJOURNMENT OR POSTPONEMENT OF THE SPECIAL MEETING | 38 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 39 | |

| 40 | ||

| 41 | ||

| 41 | ||

Appendices

| Appendix A | Asset Purchase Agreement | |

| Appendix B | Annual Report On Form 10-K For The Year Ended December 31, 2004 |

ii

Table of Contents

This Summary highlights selected information in this Proxy Statement and may not contain all of the information that is important to you. To understand the Transaction fully, and for a more complete description of the legal terms of the Transaction, you should read carefully this entire Proxy Statement and the documents to which we have referred you. See “Where You Can Find More Information” on page 41 of this Proxy Statement. Each item in this Summary includes a page reference directing you to a more complete description of that item. (“We”, “us” and “our” as used in this Proxy Statement refer to Cotelligent and its consolidated subsidiaries. “You” and “your” as used in this Proxy Statement refer to stockholders of Cotelligent).

We have entered into an Asset Purchase Agreement, dated as of April 1, 2005 (the “Agreement”), by and among FastTrack, LLC (“FastTrack”), Cotelligent, Inc., Cotelligent USA, Inc., CZG Mobile Ventures, Inc., bSmart.to LLC and JAS Concepts, Inc. pursuant to which we will sell substantially all of the assets related to our sales force automation software and services solutions business (the “Business”).

FastTrack will acquire substantially all of the assets of the Business for the sum of Two Million Eight Hundred Thousand Dollars ($2,800,000) to be paid in cash at closing, plus an earn-out amount of up to $950,000 if certain future revenue targets are attained over the three (3) years following completion of the sale, minus a possible post-closing refund of up to $700,000 if certain specified business conditions are not satisfied. FastTrack will also assume certain liabilities related to the Business.

The Companies (See Pages 11-13)

Cotelligent, Inc.

655 Montgomery Street, Suite 1000

San Francisco, California 94111

Telephone: 415-477-9900

Website: www.cotelligent.com

Cotelligent, Inc. operates two distinct business units: Information Technology (“IT”) services and narrowcasting. Cotelligent’s IT services provide sales force automation services and solutions to extend information technology beyond the desktop all the way to the mobile enterprise to businesses in the United States of America. Our mobility business solutions keep mobile workforces connected to their companies’ business applications. In addition, we provide custom software development services. We also provide maintenance and support on software products licensed to our clients in connection with solutions we develop.

Through our wholly-owned subsidiary, Watchit Media, Inc., we provide narrowcasting services and digital motion media content to Private Video Networks™. Our narrowcasting services, utilizing digital video and Internet Protocol “IP” technology, gives us the ability to create television programming rapidly, change that content on demand and schedule the presentation of that content on Private Video Networks anywhere in the world from our creative media and television center in Las Vegas, Nevada.

Table of Contents

FastTrack, LLC

c/o Skyview Capital, LLC

468 North Camden Drive, Suite 2000

Beverly Hills, California 90210

Telephone: 310-860-7466

FastTrack is an affiliate of Beverly Hills, California-based private equity firm Skyview Capital, LLC. Skyview specializes in the acquisition and continuous strategic management of “systems-critical” enterprises in the areas of technology and telecommunications.

The Special Meeting (See Pages 8 and 9)

The special meeting of Cotelligent stockholders (including any adjournments or postponements thereof, the “Special Meeting”) will be held on , 2005, at 10:00 a.m., local time, at the offices of Morgan, Lewis & Bockius LLP, One Market, Spear Street Tower, San Francisco, California 94105. At the Special Meeting, we will ask you to vote upon a proposal to approve the Transaction pursuant to the Agreement. Approval of the Transaction requires the affirmative vote of at least a majority of the outstanding shares of Cotelligent common stock. Only Cotelligent stockholders at the close of business on the record date, , 2005, will be entitled to notice of the Special Meeting and will be entitled to vote at the Special Meeting. At the close of business on , 2005, there were shares of Cotelligent common stock outstanding, with each share entitled to one (1) vote.

Reasons for the Transaction (See Pages 17-19)

We are proposing to sell the Business to FastTrack because we believe that the Transaction and the terms of the related Agreement are in the best interests of our company and our stockholders. You should review the factors that the Cotelligent Board of Directors considered when deciding whether to approve the Transaction.

Proceeds from the Transaction (See Page 19)

We plan to retain the proceeds from the Transaction. We do not intend to distribute any of the proceeds to our stockholders, but plan to use the proceeds for working capital and general corporate purposes, including possible acquisitions of businesses or technologies, in order to focus on our narrowcasting business.

Terms of the Agreement (See Pages 26-34)

Assets to be Sold (See Page 26)

We are selling to FastTrack substantially all of the assets used in the operation of our sales force automation software and services solutions business.

Consideration (See Page 27)

FastTrack will acquire substantially all of the assets of the Business for the sum of Two Million Eight Hundred Thousand Dollars ($2,800,000) to be paid in cash at closing, plus an earn-out amount of up to $950,000 if certain future revenue targets are attained over the three (3) years following completion of the sale, minus a possible post-closing refund of up to $700,000 if certain specified business conditions are not satisfied. FastTrack will also assume certain liabilities related to the Business.

2

Table of Contents

We believe that the source of funds with which FastTrack plans to use to pay the cash consideration would be from FastTrack’s working capital. FastTrack has advised us that it has sufficient funds available on hand, and has existing, committed financing facilities.

Agreement Not To Compete (See Page 33)

As part of the Transaction, we have agreed with FastTrack, for a period of three (3) years after the date of the closing of the Transaction, not to, anywhere in the United States, directly or indirectly invest in, own, manage, operate, or control any entity engaged in or planning to become engaged in the business of manufacturing, distributing, selling, operating or maintaining sales force automation software and services solutions,provided,however, that we may purchase or otherwise acquire up to (but not more than) five percent (5%) of any class of the securities of any entity (but may not otherwise participate in the activities of such entity) if such securities are listed on any national or regional securities exchange or have been registered under Section 12(g) of the Exchange Act.

Agreement to Change Corporate Name (See Page 33)

We have agreed that after the closing of the Transaction we will change our corporate name from Cotelligent to a name that is not similar to or in any manner subject to confusion with the name “Cotelligent”. We intend to change our name to Watchit Media, Inc. after the closing of the Transaction.

Representations and Warranties (See Pages 28 and 29)

The Agreement contains representations and warranties by Cotelligent similar to those that are customarily included in asset purchase agreements. The representations and warranties will generally survive the closing of the Transaction for a period of one (1) year.

Termination (See Page 34)

The Agreement may be terminated under certain circumstances, including the following:

| • | by either Cotelligent or FastTrack if the other party materially breaches any provision of the Agreement and such breach has not been waived or cured within the time periods prescribed in the Agreement; |

| • | if Cotelligent and FastTrack mutually agree to terminate the Agreement; or |

| • | by either Cotelligent or FastTrack if the closing has not occurred by June 30, 2005, subject to an automatic thirty (30) day extension if the Securities and Exchange Commission undertakes to review our proxy statement. |

Conditions to Completion of Transaction (See Pages 30 and 31)

Each party’s obligation to complete the Transaction is subject to the prior satisfaction or waiver of certain conditions. We have to comply with the following material closing conditions that must be satisfied or waived before completion of the Transaction:

| • | customary conditions relating to compliance with the Agreement, including the accuracy of our representations and warranties, performance in all material respects of all obligations required to be performed prior to the closing, obtaining all necessary governmental and third party consents and delivery of closing certificates; |

3

Table of Contents

| • | all documents and instruments required by the Agreement are delivered to FastTrack; |

| • | assign or renew certain material contracts; |

| • | no action or proceeding by or before any court or other governmental body shall have been instituted or, to our best knowledge, threatened seeking to restrain, prohibit or invalidate the Transaction or which might affect the right of FastTrack to own or operate the Business after the closing; |

| • | the consummation nor performance of any part of the Transaction will not directly or indirectly, contravene or conflict with or result in a violation by FastTrack of any applicable legal requirement or order that has been introduced or otherwise proposed by or before any governmental body, excluding bulk sales laws; and |

| • | provide FastTrack with such governmental authorizations as are reasonably necessary to allow FastTrack to operate the assets after the closing. |

4

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Q: WHAT PROPOSALS WILL I BE VOTING ON AT THE SPECIAL MEETING?

A: You will be asked to consider and vote upon a proposal to approve the sale of substantially all of the assets related to Cotelligent’s sales force automation software and services solutions business (the “Business”), pursuant to the Asset Purchase Agreement, dated as of April 1, 2005, by and among FastTrack, LLC, Cotelligent and certain of Cotelligent’s subsidiaries (the “Agreement”). The Agreement is attached to this proxy statement asAppendix A. You may also be asked to vote to adjourn or postpone the Special Meeting to a later time, if deemed necessary, in order to solicit additional proxies, or upon procedural matters that may come before the Special Meeting.

Q: WHY IS OUR COMPANY PROPOSING TO SELL ITS SALES FORCE AUTOMATION SOFTWARE AND SERVICES SOLUTIONS BUSINESS?

A: In November 2004, we announced our plan to divest our entire IT services business in order to focus all of our attention on narrowcasting. In deciding to divest our IT services business and to sell our sales force automation software and services solutions business, the Cotelligent Board of Directors considered a number of factors, including:

| • | that Cotelligent has incurred net losses and negative operating cash flows in each of the past three years and that Cotelligent’s working capital and available cash has also decreased in each of the past three years; |

| • | the previous decision by the Board of Directors to focus on narrowcasting; |

| • | that, based on market research, Cotelligent expects there to be significantly higher growth in the market for narrowcasting than in the market for IT services; and |

| • | the need to generate positive cash flow and return to profitability or obtain additional equity financing before the end of the second quarter of 2005 to avoid the risk of exhausting our capital. |

We are proposing to sell the Business to FastTrack because we believe that the Transaction and the terms of the related Agreement are in the best interests of our company and our stockholders. The potential benefits of the sale of the Business to FastTrack include:

| • | the fact that the transaction will significantly increase our cash holdings, which were approximately $526,000 as of December 31, 2004, by approximately $2.3 million at closing, which represents the cash portion of the purchase price less our estimated expenses for the Transaction, and this cash will provide us with a greater ability to pursue our strategy of developing our narrowcasting business; and |

| • | the $2.8 million cash consideration payable at closing exceeds our market capitalization of approximately $2.7 million as of March 31, 2005, the last full day of trading prior to execution of the Agreement, based on the closing prices of our common stock as quoted on the Over-the-Counter Bulletin Board. |

5

Table of Contents

Q: ARE THERE RISKS THAT STOCKHOLDERS OF COTELLIGENT SHOULD CONSIDER IN CONNECTION WITH THE TRANSACTION?

A: Yes. The sale of the Business may not achieve the expected benefits for Cotelligent because of the risks and uncertainties discussed in the section entitled “Risk Factors You Should Take into Account in Deciding How to Vote.” Cotelligent urges you to carefully read and consider the information contained in the section entitled “Risk Factors You Should Take into Account in Deciding How to Vote.”

Q: WILL ANY OF THE PROCEEDS FROM THE TRANSACTION BE DISTRIBUTED TO ME AS A STOCKHOLDER?

A: No. We intend to retain the proceeds and use them for working capital and general corporate purposes, including possible acquisitions of businesses or technologies, in order to focus on our narrowcasting business.

Q: WHO IS SOLICITING MY PROXY?

A: The Cotelligent Board of Directors.

Q: HOW DOES THE BOARD RECOMMEND THAT I VOTE ON THE MATTERS PROPOSED?

A: The Cotelligent Board of Directors recommends that stockholders vote “FOR” each of the proposals submitted at the Special Meeting.

Q: CAN I STILL SELL MY SHARES?

A: Yes. Neither the Agreement nor the Transaction will affect your right to sell or otherwise transfer your shares of our common stock.

Q: WHAT WILL HAPPEN IF THE TRANSACTION IS NOT APPROVED?

A: If the Transaction is not approved, we will not complete the proposed sale, we will retain and continue to operate the Business and may continue to pursue other buyers; however, the market price of our common stock could decline and, if we are unable to generate positive cash flow or if we do not obtain additional equity financing before the end of the second quarter of 2005, we may exhaust our capital.

Q: WHO IS ENTITLED TO VOTE AT THE SPECIAL MEETING?

A: Only holders of record of common stock as of the close of business on , 2005 will be entitled to notice of the Special Meeting and will be entitled to vote at the Special Meeting.

Q: WHEN AND WHERE IS THE SPECIAL MEETING?

A: The Special Meeting will be held at the offices of Morgan, Lewis & Bockius LLP, One Market, Spear Street Tower, San Francisco, California 94105, on , 2005, at 10:00 a.m., local time.

Q: WHERE CAN I VOTE MY SHARES?

A: You can vote your shares where indicated by the instructions set forth on the proxy card, or you can attend and vote your shares at the Special Meeting of Stockholders of Cotelligent to be held on , 2005, at 10:00 a.m., local time, at the offices of Morgan, Lewis & Bockius LLP, One Market, Spear Street Tower, San Francisco, California 94105.

6

Table of Contents

Q: IF MY SHARES ARE HELD IN “STREET NAME” BY MY BROKER, WILL MY BROKER VOTE MY SHARES FOR ME?

A: Your broker may not be permitted to exercise voting discretion with respect to the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters, and will not be counted in determining the number of shares necessary for approval. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares.

Q: MAY I CHANGE MY VOTE AFTER I HAVE MAILED MY SIGNED PROXY CARD?

A: Yes. Just send in a written revocation or a later dated, signed proxy card before the Special Meeting or attend the Special Meeting and vote in person. Simply attending the Special Meeting, however, will not revoke your proxy; you must vote at the Special Meeting.

Q: WHAT DO I NEED TO DO NOW?

A:Please vote your shares as soon as possible, so that your shares may be represented at the Special Meeting. You may vote by signing and dating your proxy card and mailing it in the enclosed return envelope, or you may vote in person at the Special Meeting. A vote of at least a majority of the outstanding shares of Cotelligent common stock entitled to vote at the Special Meeting is required to approve the Transaction.

Q: WHAT ARE THE UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTION TO THE STOCKHOLDERS?

A: The Transaction will not result in any United States federal income tax consequences to our stockholders.

Q: WHAT ARE THE UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTION TO COTELLIGENT?

A: The Transaction will result in a taxable gain to us; however, it is anticipated that our 2005 operating losses and our currently available income tax net operating loss carryforwards will substantially offset the estimated amount of the gain.

Q: WILL STOCKHOLDERS HAVE DISSENTERS’ OR APPRAISAL RIGHTS?

A: No. The Delaware General Corporation Law governs stockholders’ rights in connection with the proposed sale. Under the applicable provisions of the Delaware General Corporation Law, our stockholders will have no right to seek appraisal of their shares of common stock in connection with the Transaction.

Q: WHOM SHOULD I CALL IF I HAVE QUESTIONS?

A: If you have questions about any of the proposals on which you are voting, you may call or write to:

James R. Lavelle

Chairman and Chief Executive Officer

655 Montgomery Street, Suite 1000

San Francisco, California 94111

Telephone: 415-477-9900

Fax: 415-399-1366

7

Table of Contents

The Cotelligent Board of Directors is soliciting proxies for use at the special meeting of Cotelligent stockholders including any adjournments or postponements thereof (the “Special Meeting”). The Special Meeting will be held at the offices of Morgan, Lewis & Bockius LLP, One Market, Spear Street Tower, San Francisco, California 94105, on , 2005, at 10:00 a.m., local time.

At the Special Meeting, Cotelligent stockholders as of the record date will be asked to consider and vote on a proposal to approve the Transaction.

Record Date, Voting Power and Vote Required

The Cotelligent Board of Directors has fixed the close of business on , 2005 as the record date for determining the Cotelligent stockholders entitled to notice of the Special Meeting, and entitled to vote at the Special Meeting. Only Cotelligent stockholders of record at the close of business on the record date will be entitled to notice of, and to vote at, the Special Meeting.

At the close of business on the record date, shares of Cotelligent common stock were issued and outstanding and entitled to vote at the Special Meeting. Cotelligent stockholders of record are entitled to one (1) vote per share on any matter that may properly come before the Special Meeting. Votes may be cast at the Special Meeting in person or by proxy. See “The Special Meeting—Voting of Proxies” below.

The presence at the Special Meeting, either in person or by proxy, of the holders of a majority of the outstanding shares of Cotelligent common stock entitled to vote is necessary to constitute a quorum. If a quorum is not present at the Special Meeting, management will adjourn or postpone the meeting in order to solicit additional proxies.

The affirmative vote of the holders of at least a majority of the outstanding shares of Cotelligent common stock entitled to vote at the Special Meeting is required to approve the Transaction. Broker non-votes (that is, shares represented by properly signed and dated proxies held by brokers as nominees as to which instructions have not been received from the beneficial owners and the broker or nominee does not have discretionary voting power on that proposal) will be counted as present for purposes of establishing a quorum, but will not be counted for the purposes of determining whether the Transaction has been approved. Broker non-votes will therefore have the effect of a vote against the Transaction.

Cotelligent shares represented by properly signed and dated proxies received in time for the Special Meeting will be voted at the Special Meeting in the manner specified by the proxies. If you sign, date and mail your proxy without indicating how you want to vote, your proxy will be counted in favor of the Transaction. We do not expect that any matter other than the approval of the Transaction and possibly procedural items relating to the conduct of the Special Meeting will be brought before the Special Meeting.

If you have Cotelligent shares registered in different names, you will receive a separate proxy card for each registration. All these shares will be voted in accordance with the instructions on the proxy card. If your shares are held by a broker as nominee, you will receive a voter information form from your broker.

8

Table of Contents

The appointment of a proxy on the enclosed proxy card does not preclude you from voting in person.

If the Special Meeting is adjourned, we do not expect any such adjournment to be for a period of time long enough to require the setting of a new record date for the Special Meeting. If an adjournment occurs, it will have no effect on the ability of the Cotelligent stockholders of record as of the record date either to exercise their voting rights or to revoke any previously delivered proxies.

You may revoke a proxy at any time before its exercise by (i) notifying in writing Cutis J. Parker, Executive Vice President, Chief Financial Officer, Treasurer & Secretary of Cotelligent, Inc., 655 Montgomery Street, Suite 1000, San Francisco, California 94111, (ii) completing a later-dated proxy and returning it to Cotelligent’s stockholder services representative, EquiServe Trust Company, 66 Brooks Drive, Braintree, Massachusetts 02184, if you sent your original proxy there, or to your broker if your shares are held by a broker or (iii) attending the Special Meeting and voting in person. Attendance at the Special Meeting will not by itself constitute revocation of a proxy. A Cotelligent stockholder of record attending the Special Meeting may revoke his or her proxy and vote in person by informing the Secretary before the vote is taken at the Special Meeting that he or she desires to revoke a previously submitted proxy.

Cotelligent will bear the costs of soliciting proxies from Cotelligent stockholders. In addition to solicitation by mail, our directors, officers and employees may solicit proxies from Cotelligent stockholders by telephone or in person. These directors, officers and employees will not receive additional compensation but may be reimbursed for out-of-pocket expenses incurred in connection with the solicitation of proxies. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of Cotelligent shares held of record by these persons, and Cotelligent will reimburse such brokerage houses, custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses.

Cotelligent has retained to help solicit proxies. will receive a fee of $ as compensation for its basic solicitation services, plus reimbursement of usual and customary expenses.

NO VOTE REQUIRED FOR FASTTRACK MEMBERS

Under California law, the members of FastTrack need not approve the Agreement or the Transaction. Thus, no one is soliciting proxies from the members of FastTrack.

9

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING INFORMATION

This Proxy Statement contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Our actual results may differ materially from those contemplated by the forward-looking statements. These forward-looking statement reflect management’s current expectations, are based on many assumptions and are subject to certain risks and uncertainties, including among other things: our ability to satisfy all closing conditions to the sale of our sales force automation software and services solutions business and to complete the sale; and other risk factors that are described in the sections “Risk Factors Regarding the Transaction” and “Risk Factors Relating to Our Company if Our Sales Force Automation Software and Services Solutions Business is Sold”. These factors should be considered in conjunction with any discussion of our operations or results, including any forward-looking statements as well as comments contained in press releases, presentations to securities analysts or investors and all other communications made by us or our representatives. We intend to use the following words or variations of the following words to identify forward-looking statements: anticipates, believes, expects, estimates, intends, plans, projects and seeks. Stockholders are cautioned not to place undue reliance on the forward-looking statements, which appear elsewhere in this Proxy Statement. We do not intend to update or publicly release any revisions to the forward-looking statements.

10

Table of Contents

SALE OF SUBSTANTIALLY ALL OF THE ASSETS RELATED TO OUR SALES FORCE

AUTOMATION SOFTWARE AND SERVICES SOLUTIONS BUSINESS

This section of the Proxy Statement describes certain aspects of the sale of substantially all of the assets related to our sales force automation software and services solutions business (the “Business”). However, we recommend that you read carefully the complete Agreement for the precise legal terms of the Agreement and other information that may be important to you. The Agreement is included in this proxy statement asAppendix A.

Cotelligent, Inc.

Cotelligent was incorporated under the laws of the State of California in February 1993 as TSX, a California corporation. In November 1995, we changed our jurisdiction of incorporation to Delaware and our name to Cotelligent Group, Inc. In September 1998, we changed our name to Cotelligent, Inc. Cotelligent operates two distinct business units: Information Technology (“IT”) services and narrowcasting. Our IT services provide sales force automation services and solutions to extend information technology beyond the desktop all the way to the mobile enterprise to businesses in the United States of America. Our mobility business solutions keep mobile workforces connected to their companies’ business applications. In addition, we provide custom software development services. We also provide maintenance and support on software products licensed to our clients in connection with solutions we develop.

Through our wholly-owned subsidiary, Watchit Media, Inc., we provide narrowcasting services and digital motion media content to Private Video Networks™. Our narrowcasting services, utilizing digital video and Internet Protocol “IP” technology, gives us the ability to create television programming rapidly, change that content on demand and schedule the presentation of that content on Private Video Networks anywhere in the world from our creative media and television center in Las Vegas, Nevada.

Certain of Cotelligent’s subsidiaries, including Cotelligent USA, Inc., CZG Mobile Ventures, Inc., bSmart.to LLC and JAS Concepts, Inc., are also parties to the Agreement.

Cotelligent’s principal executive office is located at 655 Montgomery Street, Suite 1000, San Francisco, California 94111, and our telephone number is 415-477-9900. Our website is www.cotelligent.com and our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any other amendments to those reports are made available to the public free of charge, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC, by contacting us via telephone, mail or through our website.

Recent Developments

On February 1, 2005, we sold, in a private placement to accredited investors, an aggregate of 1,550,000 shares of our common stock and warrants to purchase up to an additional 1,550,000 shares of our common stock, at an offering price of $0.10 per share, for a total consideration of $155,000. We paid an aggregate finders fee of $11,500 in connection with such sale. On April 11, 2005, we sold, in a private placement to an accredited investor, an aggregate of 1,000,000 shares of our common stock and warrants to purchase up to an additional 1,000,000 shares of our common stock, at an offering price of $0.10 per share, for a total consideration of $100,000. On April 27, 2005, we sold, in a private placement to James R. Lavelle, our Chairman and Chief Executive Officer, an aggregate of 1,000,000 shares of our common

11

Table of Contents

stock and warrants to purchase up to an additional 1,000,000 shares of our common stock, at an offering price of $0.10 per share, for a total consideration of $100,000. Each warrant is exercisable for the purchase of one share of our common stock at an exercise price of $0.30 per share. The warrants are immediately exercisable and expire three years from their date of issuance. We have the right to redeem all or any portion of the warrants at any time at a price of $0.05 per share. For more information about these sales, please see the section entitled “Where You Can Find More Information.”

Sales Force Automation Software and Services Solutions

Cotelligent’s sales force automation software and services solutions business is designed to serve niche grocery and consumer packaged good industries. The Business is comprised of two main software components known as “FastTrack”, which is divided into two sections, field application and data server, and “Exchange Lynx”, which consists of proprietary data communications management product.

The Business also includes:

| • | sales and field force automation solutions (FastTrack™); |

| • | mobile middleware products (JASware™); |

| • | hardware and software products; |

| • | application hosting and vertical solution; |

| • | provider services; |

| • | remote support services; and |

| • | help desk and education services. |

Set forth below is a summary of certain audited consolidated financial data that gives effect to the sale of our IT services business, including the Business. The audited consolidated financial data set forth below is derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2004, a copy of which is attached asAppendix B to this proxy statement. Please see “Unaudited Pro Forma Financial Statements” beginning on page 36 and the financial statements and notes thereto in our Annual Report on Form 10-K for the year ended December 31, 2004, attached asAppendix B to this proxy statement, for further details.

Year Ended December 31, 2004 | ||||

| (in thousands) | ||||

Statement of Operations Data: | ||||

Revenues | $ | 862 | ||

Operating Loss | $ | (1,388 | ) | |

Loss from Continuing Operations | $ | (1,278 | ) | |

Loss from Discontinued Operations | $ | (2,927 | ) | |

12

Table of Contents

FastTrack, LLC

FastTrack, LLC, a California limited liability company, was organized on March 30, 2005. FastTrack is an affiliate of Beverly Hills, California-based private equity firm Skyview Capital, LLC. Skyview specializes in the acquisition and continuous strategic management of “systems-critical” enterprises in the areas of technology and telecommunications.

The current principal executive offices of FastTrack are c/o Skyview Capital, LLC, which is located at 468 North Camden Drive, Suite 2000, Beverly Hills, California 90210 and Skyview Capital’s telephone number is 310-860-7466.

Background and Negotiation of the Transaction

In the years leading up to 2003, we strategically shifted from providing general IT services to a targeted approach to offering mobile workforce management and Web services. We changed our go-to-market strategy to better focus our resources and leverage our experience and solid client base in these areas. Our decision to do this was reinforced at the time by market research, financial research and our own research and analysis indicating that mobile workforce management and Web services were the next emerging growth markets. Our solutions utilized broadly accepted as well as cutting edge technologies. We spent considerable time on the development of these core competencies after divesting the majority of our IT staffing business in 2000. In addition, we carefully assessed and exited a number of solutions and service offerings that were not core to the principal service offerings outlined above.

While executing this strategy we believed we were focused on offering services that would help us increase revenue in the near term. From 2001 through the third quarter of 2003 we continued to invest heavily in a large scale sales, marketing and business development organization working to capture new business. In September 2002, we hired a marketing executive to develop and implement a more formalized and systematic marketing program for us because of the difficulty we were having in selling new business to clients. Marketing programs re-designed and put in place by early 2003 offered promising results when measured against prior year sales opportunity pipeline and business backlog. By the second quarter of 2003, we gained more confidence in our marketing program and saw an unprecedented number of prospect and client proposals.

Nevertheless, throughout 2003 we continued to be disappointed by prospects and clients either delaying decisions to initiate projects or pursuing lower cost off-shore technical resources to execute their projects. Notwithstanding our investments in our selling organization, we were not successful in signing new business with companies we had not done business with before. We did, however, continue to sign new contracts with existing clients.

In August of 2003, it became clear to us that a number of opportunities that only a few months before looked promising were not going to close. We performed an in-depth review of each opportunity and concluded that businesses were reticent to use discretionary expenditures to invest in mobile workforce and Web service technologies (other new projects) given the fact that their current IT environments operated satisfactorily. In addition, fearful of continuing poor economic conditions and market pressures, we observed that many of the prospects that decided to pursue projects did so with larger, better capitalized firms than Cotelligent.

It became evident that the outlook for spending in IT services would continue to be uncertain without any clear indication of when a turnaround could be expected. Accordingly, in August 2003, we terminated the majority of our senior executive staff along with most of the sales and business development organization. At the same time we aggressively engaged our existing clients and committed

13

Table of Contents

ourselves to supporting their project requirements. In some cases we have been successful in securing longer term commitments. By scaling back expense and focusing intensely on generating business from our long term clients, we began to stabilize our revenue trend allowing us to move forward in our attempt to restore profitability and positive cash flow. Throughout the remainder of 2003, we continued to reduce headcount and looked closely at expense activity to scale back and streamline operating costs in line with revenue. The Philadelphia-based operation that supports Cotelligent’s sales force automation application FastTrack has achieved stable revenue over the past several years and our clients continue to give us high marks for performance and client service. In addition, the core team responsible for our custom software development activities is helping us to take advantage of recurring projects with existing clients. By keeping only the top sales account executives and account managers, we have lowered our selling cost and improved our client relationships and retention.

In April 2003, our Chief Executive Officer, James Lavelle, sent a letter to our stockholders indicating our intention to engage in merger and acquisition activities in order to help improve Cotelligent’s prospects for the future and increase our scale. As a matter of course since we started our company in 1996 and successfully executed an aggressive merger and acquisition strategy through early 1999, we believed this strategy would help us improve our prospects. We researched and analyzed a variety of vertical markets that could provide new growth opportunities for us through merger or acquisitions. In mid-2003 Cotelligent signed a letter of intent to acquire a field force automation firm. After 90 days of due diligence, we decided not to consummate the transaction.

In September 2003, Cotelligent engaged in a dialog with a Las Vegas based narrowcasting company, OnSite Media, Inc. The combination of Cotelligent’s deep history in Internet, media and wireless technologies and OnSite’s strength in driving video content to high growth venues in the gaming and hospitality industries looked promising. Cotelligent entered into a definitive agreement to acquire OnSite Media, Inc. on November 24, 2003, and closed the acquisition transaction on March 2, 2004. By integrating OnSite’s business with Cotelligent’s infrastructure, and by utilizing our public company know how to position us for the future, we have set about executing a strategy that we believe will allow us to play an important role in the convergence of Internet, video and mobile technology. This is a growing, fast paced market in which we believe the ability to integrate these technologies will help to differentiate us from many other companies.

Upon completion of the acquisition, OnSite Media was renamed Watchit Media, Inc., and is now a wholly-owned subsidiary of ours. The newly acquired business was immediately integrated into the Cotelligent infrastructure from March through October 2004. Our Board of Directors carefully followed and evaluated the financial and operating performance of our two business segments. While the IT services business continued to struggle, Watchit Media performed well and experienced significant revenue growth, together with increased gross margin performance, up to 63% in the fourth quarter of 2004. In addition, Watchit’s near and longer term business opportunities appeared to indicate the strong possibility of future revenue growth.

On July 26, 2004, during a telephonic meeting of the Board of Directors, Mr. Lavelle reviewed Cotelligent’s operating results for the second quarter of 2004. Mr. Lavelle commented about the growth opportunities on the Watchit Media side of the business. As he had done previously, he commented that the future of the company looked more and more to be in narrowcasting. He also suggested the idea of selling the IT services business and using the proceeds of a sale to invest in Watchit Media. The Board of Directors authorized Mr. Lavelle to pursue strategic alternatives for the company.

At the beginning of August 2004, Mr. Lavelle met with Bill Santo of Sanders Morris Harris to discuss the landscape for selling Cotelligent’s sales force automation software and services solutions business which is based at Cotelligent’s Broomall, Pennsylvania office.

14

Table of Contents

At a telephonic meeting of the Board of Directors on August 12, 2004, the Board agreed that the sales force automation software and services solutions business should be divested and that an investment bank should be engaged to solicit offers so that Cotelligent could better determine whether this business could be sold and the consideration that could be expected to be received.

On October 15, 2004, Cotelligent signed an engagement letter pursuant to which Sanders Morris Harris was retained as a financial advisor to help Cotelligent identify strategic alternatives for the company, including the possibility of divesting Cotelligent’s sales force automation software and services solutions business.

In the Fall of 2004, Mr. Santo visited Cotelligent’s Broomall, Pennsylvania office and met with all operating principals to assess the functionality and operations of Cotelligent’s sales force automation software and services solutions business (the “Business”). In addition to this meeting, Mr. Santo participated in several conference calls with Dawn Gibbons, director of account management at Cotelligent, and Curt Parker, chief financial officer of Cotelligent, to review Cotelligent’s financial performance and client service agreements. Based on a review of Cotelligent’s operations, customer base and financial performance, Mr. Santo recommended to management that the Business should be marketed to companies and financial sponsors active in the sales force automation and customer relationship management software and service vertical markets. Beginning in October 2004, Mr. Santo distributed an executive summary of the Business offering to a list of over 100 strategic buyers and financial sponsors active in the targeted vertical markets.

At a telephonic meeting of the Board of Directors on October 25, 2004, Mr. Lavelle informed the Board that one of Cotelligent’s largest sales force automation clients, Handleman Company, transitioned to another platform on September 29, 2004. Due to this event as well as the Board’s assessment that Cotelligent’s IT services business would continue to decline for the foreseeable future, the Board of Directors decided to announce Cotelligent’s intention to divest Cotelligent’s remaining IT services business, change its name to Watchit Media, Inc., and transform itself into a media/narrowcasting company. On November 16, 2004, Cotelligent issued a press release announcing its plan to divest the entire IT services business and change its name to Watchit Media, Inc.

Over the course of November and early December 2004, Sanders Morris began receiving numerous inquiries regarding the Business that, after preliminary discussions, were filtered to seven strategic buyers and four financial sponsors expressing serious interest in the Business.

On December 10, 2004, Sanders Morris Harris solicited bids for the Business from the interested parties. On December 17, 2004, Sanders Morris Harris received a letter of intent from Skyview Capital, LLC, a Beverly Hills, California-based private equity firm, outlining proposed terms of an acquisition of the Business for $3.5 million in cash with a $1.0 million earn-out. The letter of intent included an exclusivity provision expiring upon the earlier of consummation of a transaction or January 31, 2005. Between December 17, 2004 and January 3, 2005, Mr. Santo negotiated the terms of the letter of intent with Michel Tamer, chief legal officer, and Alex Soltani, chief executive officer, of Skyview Capital. During that time, Mr. Santo consulted with Mr. Lavelle on numerous occasions regarding the letter of intent.

At a telephonic meeting of the Board of Directors on January 3, 2005, Mr. Lavelle and Mr. Santo provided an overview of Mr. Santo’s work on Cotelligent’s behalf. Mr. Santo indicated that he had identified 46 firms qualified to acquire the Business that met certain relevant criteria. After having discussions with each of these firms, Sanders Morris Harris identified seven strategic buyers and four financial sponsors that expressed serious interest in the Business. Mr. Santo indicated that bids were solicited from each of these parties and that as of January 3, 2005 only one offer had been received. At

15

Table of Contents

the January 3, 2005 Board meeting, Mr. Santo presented Skyview Capital and their letter of intent to acquire the Business. Mr. Lavelle and Mr. Santo advised the Board that Skyview Capital appeared to be able to consummate a transaction quickly while paying an appropriate level of consideration for the Business. The Board discussed the sales process and asked questions of Mr. Santo and Mr. Lavelle. At the January 3, 2005 Board meeting, the Board authorized Mr. Lavelle to execute the letter of intent with Skyview Capital and to begin negotiating a definitive agreement with Skyview Capital. Cotelligent signed the letter of intent with Skyview Capital on January 3, 2005.

In January and February 2005, a team of executives from Skyview Capital visited Cotelligent’s corporate offices in San Francisco, California and the Broomall, Pennsylvania office as part of their due diligence process.

On January 26, 2005, Sanders Morris Harris received a proposed draft of the definitive asset purchase agreement for the purchase of the assets of the Business. Contemporaneously, Skyview Capital delivered to Sanders Morris Harris a memorandum that outlined concerns that had arisen as a result of their due diligence. Skyview Capital also indicated that because of the concerns that had been identified as part of their due diligence review, Skyview Capital would only be willing to pursue a transaction if the proposed purchase price was reduced.

From January 2005 through February 2005, the parties negotiated the terms of a potential sale of the Business, with Mr. Santo participating in numerous conference calls with various individuals of Skyview Capital. During this period of negotiation, Skyview Capital’s exclusivity expired and Mr. Santo continued to generate interest in the Business among the other parties that had an expressed an interest during the sales process. In mid-February 2005, Sanders Morris Harris invited another bidder to conduct due diligence on the Business. The second bidder was an enterprise ERP provider. Based on its initial review of the Business, the second bidder indicated a willingness to pay $3.5 million for the Business.

On March 4, 2005, Cotelligent received a letter of intent for the Business from the second bidder. The letter of intent from the second bidder included a financing contingency that, in the opinion of management, made continuing negotiations with Skyview Capital a better course of action to pursue. Management of Cotelligent believed that pursuing a transaction with Skyview Capital, who had completed their due diligence and whose offer did not include a financing contingency, would result in a transaction that could be consummated before the end of the second quarter of 2005. Given Cotelligent’s liquidity position, Cotelligent was concerned that pursuing a transaction with another party that had not yet completed its due diligence and who did not have financing in place would result in a delay to the sales process and cast doubt on the ability to complete a sale by the end of the second quarter of 2005.

After receiving the letter of intent from the second bidder, Mr. Santo requested that Skyview Capital present a final proposal for the acquisition of the Business. On March 4, 2005, Skyview Capital presented a final offer to Sanders Morris Harris. Management believed that the terms of Skyview Capital’s final proposal warranted further negotiations with Skyview Capital to reach a definitive agreement. On March 18, 2005, Cotelligent granted Skyview Capital an extension of the exclusivity period until March 23, 2005.

Over the following two weeks, Cotelligent’s legal advisors, along with Mr. Lavelle, Mr. Parker and Mr. Santo of Sanders Morris Harris finalized negotiations with Skyview Capital and the definitive asset purchase agreement was finalized.

On March 25, 2005, the definitive asset purchase agreement and related documents were delivered to Cotelligent’s Board of Directors for their review and approval. On March 29, 2005,

16

Table of Contents

Mr. Lavelle convened a telephonic meeting of Cotelligent’s Board with legal counsel, and Mr. Parker on the call. Mr. Lavelle and legal counsel reviewed the documents and called for approval of the transaction. The Board of Directors asked questions of Mr. Lavelle and legal counsel. After discussing the definitive asset purchase agreement, the Cotelligent Board of Directors unanimously approved the transaction. The definitive asset purchase agreement was executed by Cotelligent and FastTrack on April 1, 2005 and Cotelligent issued a press release announcing the transaction on April 6, 2005.

In deciding to divest our IT services business and to sell our sales force automation software and services solutions business to FastTrack, the Cotelligent Board of Directors consulted with our senior management in approving the Agreement and considered a number of factors, including the following:

| • | the Board and management recognized that Cotelligent has incurred net losses and negative operating cash flows in each of the past three years and that Cotelligent’s working capital and available cash has also decreased in each of the past three years; |

| • | the Board and management’s previous decision to focus on our narrowcasting business and to use its experience in Internet, wireless and system integration technology to differentiate Cotelligent from competitors in the narrowcasting market; |

| • | that, based on market research, Cotelligent expects there to be significantly higher growth in the market for narrowcasting than in the market for IT services. According to CAP Ventures, a research firm, United States spending on narrowcasting in 2004 was approximately $600 million and is expected to increase to over $2.0 billion in 2009. This is in contrast to expected growth in IT services where, according to market research from Gartner, the compound annual growth rate for IT services over the next three years is expected to average 5%; and |

| • | the need to generate positive cash flow and return to profitability or obtain additional equity financing before the end of the second quarter of 2005 to avoid the risk of exhausting our capital and to permit Cotelligent to pursue its business strategy of focusing on the narrowcasting business. As of December 31, 2004, we had cash resources of approximately $526,000. |

For the reasons set forth above, the Cotelligent Board of Directors determined that if a fair price could be obtained, a sale of the Business would be in the best interest of the stockholders. As discussed in more detail in “Background and Negotiation of the Transaction” above, Cotelligent’s management explored a number of alternatives for such a sale. The Cotelligent Board of Directors determined to pursue a transaction with FastTrack for the following reasons:

| • | the Cotelligent Board of Directors believed that it was not likely that any party other than FastTrack would propose and complete a transaction on terms more favorable to our company and our stockholders with respect to the expected timing of the Transaction, as we expect to be able to complete the Transaction by the end of the second quarter of 2005; |

| • | the likelihood of completion of the sale, including an assessment that FastTrack has the financial capability to acquire the Business for the agreed consideration; |

| • | the transaction would significantly increase our cash holdings, which were approximately $526,000 as of December 31, 2004, by approximately $2.3 million at closing, which |

17

Table of Contents

represents the cash portion of the purchase price less our estimated expenses for the Transaction, and this cash would provide us with a greater ability to pursue our strategy of developing our narrowcasting business; |

| • | the $2.8 million cash consideration payable at closing exceeds our market capitalization of approximately $2.7 million as of March 31, 2005, the last full day of trading prior to execution of the Agreement, based on the closing prices of our common stock as quoted on the Over-the-Counter Bulletin Board; |

| • | the Board’s belief that the Agreement can be rapidly consummated after stockholder approval without significant regulatory obstacles; and |

| • | the fact that the sale of our sales force automation software and services solutions business must be approved by the holders of a majority of our company’s common stock, which ensures that the Board will not be taking action of which the stockholders disapprove. |

The Cotelligent Board of Directors also considered certain negative factors associated with the proposed transaction, including:

| • | by discontinuing the operations of our IT services segment and selling our sales force automation software and services solutions business, we will no longer have assets that historically generated the majority of our revenue stream. These segments represented 100% of our revenue in 2002 and 2003 and approximately 89% of our revenue (from both continuing and discontinued operations) in 2004; |

| • | our new business strategy is to focus on expanding our narrowcasting business, but we have only been operating our narrowcasting business since March 2004 when we acquired OnSite Media, Inc.; |

| • | the risk that we could be required to refund up to $700,000 of the purchase price if certain specified business conditions are not satisfied, even though we expect that these business conditions will be satisfied; |

| • | the risk that we could be exposed to future indemnification payments for a breach of the representations, warranties and covenants contained in the Agreement, which are generally capped at fifty percent (50%) of the purchase price; |

| • | we do not intend to distribute any portion of the proceeds from the Transaction to our stockholders, but currently intend to use the proceeds from the sale of the Business to fund development of our narrowcasting business; and |

| • | the failure to complete the sale and obtain the consideration for the Business may result in a decrease in the market value of our common stock and may create doubt as to our ability to grow and implement our current business strategies. |

The Agreement does not contain a fiduciary out provision that would allow the Board to consider unsolicited offers to purchase the Business. As discussed in the section “Background and Negotiation of the Transaction” above, Cotelligent’s financial advisor solicited offers for the Business as part of the sales process and we believe the sales process identified the likely potential purchasers of the Business. Our financial advisor had discussions with these potential purchasers regarding the terms of a sale of the Business. Based on this extensive canvassing of the market and the discussions we and our financial

18

Table of Contents

advisor had with potential purchasers, we did not believe it was necessary to include a fiduciary out provision in the Agreement and management believed that including one could adversely affect the terms offered by FastTrack.

The Cotelligent Board of Directors did not engage an independent financial advisor to determine the fairness of the Transaction to our stockholders and determined, based upon the factors set forth above, that the Transaction is fair to our stockholders. A fairness opinion from an independent financial advisor typically entails a substantial fee. In the context of an asset sale, the financial advisor would typically review our historical and projected revenues, operating earnings and net income of our sales force automation software and services solutions business and certain other publicly held companies in businesses it believed to be comparable to our sales force automation software and services solutions business, and make certain assumptions regarding the value, including the liquidation value, of our assets and liabilities associated with our sales force automation software and services solutions business, which may be difficult to predict, in order to render its opinion. In addition to the speculative nature of any such analyses, the Cotelligent Board of Directors believes undertaking these analyses would involve a significant unnecessary expense that would reduce the amount of net cash received in the proposed Transaction that could be used to develop the narrowcasting business. In electing not to obtain a fairness opinion the Cotelligent Board of Directors also considered that the cash portion of the $2.8 million purchase price was more than Cotelligent’s approximately $2.7 million market capitalization as of March 31, 2005 (the last full day of trading prior to execution of the Agreement, based on the closing prices of our common stock as quoted on the Over-the-Counter Bulletin Board). The Cotelligent Board of Directors also concluded that the approval of the Agreement by the stockholders provides a procedural safeguard to the stockholders in reaching its determination that the transactions contemplated by the Agreement are fair to our stockholders, in that if stockholders holding a majority of Cotelligent stock do not deem the Transaction to be fair, the Transaction will not occur.

The discussion above of the information and factors that the Cotelligent Board of Directors considered, while not exhaustive, addresses all of the material factors the Cotelligent Board of Directors considered. In view of the wide variety of factors considered, the Cotelligent Board of Directors did not quantify or assign relative weights to the factors above. Rather, the Cotelligent Board of Directors based its recommendation on the totality of the information presented to and considered by it.

Recommendation of the Board of Directors

THE COTELLIGENT BOARD OF DIRECTORS HAS DETERMINED THAT THE TRANSACTION IS IN THE BEST INTERESTS OF OUR COMPANY AND OUR STOCKHOLDERS. THE COTELLIGENT BOARD OF DIRECTORS HAS APPROVED THE AGREEMENT AND RECOMMENDS THAT THE STOCKHOLDERS VOTE IN FAVOR OF THE PROPOSAL TO APPROVE THE SALE OF SUBSTANTIALLY ALL OF THE ASSETS RELATED TO OUR SALES FORCE AUTOMATION SOFTWARE AND SERVICES SOLUTIONS BUSINESS TO FASTTRACK, LLC, PURSUANT TO THE AGREEMENT AND THE TRANSACTIONS CONTEMPLATED BY THE AGREEMENT.

Cotelligent plans to retain the proceeds of the Transaction. It is the intention of the Cotelligent Board of Directors to retain the proceeds and use them for working capital and general corporate purposes, including possible acquisitions of businesses and technologies, in order to focus on our narrowcasting business.

19

Table of Contents

Stockholder Approval of the Sale of Our Sales Force Automation Software and Services Solutions Business; Vote Required

Under Section 271 of the Delaware General Corporation Law, the sale of “all or substantially all” of our assets requires approval by the affirmative vote of the holders of a majority of the voting power of all outstanding shares of our common stock on the record date. We, in consultation with our legal counsel, have determined that the sale of substantially all of the assets related to our sales force automation software and services solutions to FastTrack might be deemed to constitute a sale of “all or substantially all” of our assets based on interpretations of that term as used in the statute. The Agreement provides that, as a condition to FastTrack’s obligation to consummate the transactions contemplated by the Agreement, we must obtain the consent of our stockholders pursuant to the Delaware General Corporation Law.Therefore, the affirmative vote of the holders of a majority of the voting power of all outstanding shares of our common stock on the record date must be obtained.

No Dissenters’ or Appraisal Rights

Our stockholders will not experience any change in their rights as stockholders as a result of the Transaction, and we will continue to operate our remaining business. Our shares will remain publicly traded on the Over-the-Counter Bulletin Board following the Transaction. Under the applicable provisions of the General Corporation Law of the State of Delaware, our stockholders will have no right to seek appraisal of their shares of common stock in connection with the Transaction.

No material regulatory approvals, filings or consents, other than filings in compliance with applicable SEC requirements, are required to complete the Transaction.

The proposed Transaction will be accounted for as a sale of certain assets and the assumption of liabilities. Upon consummation of the proposed Transaction, Cotelligent will recognize a financial reporting gain equal to the excess of cash received over the net book value of the assets and liabilities being assumed by FastTrack, less direct expenses of consummating the deal. Cotelligent expects to recognize a financial gain of approximately $2.1 million upon completion of the Transaction. The expected gain is based on the $2.8 million cash portion of the purchase price to be delivered on the closing date less the approximately $500,000 in estimated expenses of the Transaction and approximately $200,000 estimated net book value of the assets and liabilities being assumed by FastTrack.

Material United States Federal Income Tax Consequences

The following summarizes the material United States federal income tax consequences of the proposed Transaction that are generally applicable to our company and our stockholders. The following discussion is based on the current provisions of the Internal Revenue Code, existing, temporary, and proposed Treasury regulations thereunder, and current administrative rulings and court decisions. Future legislative, judicial or administrative actions or decisions, which may be retroactive in effect, may affect the accuracy of any statements in this summary with respect to the transactions entered into or contemplated prior to the effective date of those changes.

The proposed Transaction will be a taxable transaction to Cotelligent for United States federal income tax purposes. We will recognize a gain on the Transaction equal to the amount realized on the

20

Table of Contents

sale in excess of our tax basis in the assets sold. The amount realized on the sale will consist of the cash we receive in exchange for the assets sold plus the amount of related liabilities assumed by FastTrack.

Although the Transaction will result in a taxable gain to Cotelligent, our 2005 operating losses and our available federal income tax net operating loss carryforwards should be able to substantially offset the estimated amount of the gain. However, for purposes of computing our Alternative Minimum Tax liability, Internal Revenue Code Section 56(d) does not permit a corporation’s alternative minimum net operating loss carryforwards to offset more than 90% of the corporation’s alternative minimum taxable income. Due to this limitation and depending upon the operating results during the fiscal year ending December 31, 2005, we may incur an Alternative Minimum Tax, which, in general, will result in an effective tax liability of approximately two percent of alternative minimum taxable income. The availability and amount of tax loss carryforwards are subject to audit and adjustment by the Internal Revenue Service.

We may file income tax returns in more than one state. Because state income tax laws do not necessarily follow federal law, and because state laws themselves differ, the state income tax consequences of the Transaction will vary state by state. The tax loss carryforwards in a particular state may not completely offset state taxable income, and state income tax may be incurred on the sale. However, it is not anticipated that the sale will result in a material amount of state income taxes.

Our stockholders will experience no United States federal income tax consequences as a result of the consummation of the Transaction.

EACH HOLDER OF OUR COMMON STOCK IS URGED TO CONSULT HIS OR HER OWN TAX ADVISOR AS TO THE FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTION, AND ALSO AS TO ANY STATE, LOCAL, FOREIGN OR OTHER TAX CONSEQUENCES BASED ON HIS OR HER OWN PARTICULAR FACTS AND CIRCUMSTANCES.

Interests of Certain Persons in the Sale of Our Sales Force Automation Software and Services Solutions Business

The executive officers and directors of Cotelligent do not have interests in the Transaction that are different from or in addition to their interests as stockholders generally. Although some of our employees that are involved with the Business may be joining FastTrack following the sale, none of our executive officers would be transferring to FastTrack as part of the Transaction.

Our Operations Following the Sale of Our Sales Force Automation Software and Services Solutions Business

Following the sale of our sales force automation software and services solutions business, we will no longer engage in that business and, furthermore, we will be prohibited from engaging in a business competitive with the sales force automation software and services solutions business anywhere in the United States for three (3) years. Our remaining business operations will consist primarily of our narrowcasting business. The Transaction is a significant part of our plan to continue expanding our competitive advantage in the rapidly growing narrowcasting sector of the media industry.

Risk Factors You Should Take into Account in Deciding How to Vote

You should carefully consider the risk factors described below as well as other information provided to you in this document in deciding how to vote on the proposal to sell the Business. The risk

21

Table of Contents

factors described below are not the only ones facing Cotelligent. Additional considerations not presently known to us or that we currently believe are immaterial may also impair our business operations. If any of the following risk factors actually occur, our business, financial condition or results of operations could be materially adversely affected, the value of our common stock could decline, and you may lose all or part of your investment.

Risk Factors Regarding the Transaction

If we are not be able to complete the disposition of our sales force automation software and services solutions business, or are unable to generate positive cash flow and return to profitability, we may exhaust our capital.

We have experienced a general reduction in demand for our sales force automation software and services solutions business. At the same time, we have taken action to divest non-strategic operations and have used the cash proceeds from these divestitures to pay off debt obligations. As a result, we have had adequate working capital to fund our needs as we restructured the business. However, our business has incurred net losses and negative operating cash flows in each of the past three years and our working capital and available cash has also decreased in each of the past three years. We have decided to dispose of our sales force automation software and services solutions business and instead focus on our narrowcasting business. The sale of our sales force automation software and services solutions business is subject to the approval of our stockholders and we cannot assure you that such approval will be obtained. In addition, the sale is not expected to close until the end of the second quarter of 2005. Our cash resources are limited. As of December 31, 2004, we had a working capital deficiency in excess of $1.0 million and only had cash resources of approximately $526,000 to fund our working capital requirements. If we are unable to consummate the sale of our sales force automation software and services solutions business or otherwise dispose of it, if our business does not begin to generate revenue, a positive cash flow and return to profitability or if we do not obtain additional equity financing before the end of the second quarter of 2005, our on-going liquidity and financial viability would be materially and adversely affected and we may not be able to pursue our business strategy.

The failure to complete the Transaction may result in a decrease in the market value of our common stock and may create substantial doubt as to our ability to grow and implement our current business strategies.

The sale of the Business is subject to a number of contingencies and other customary closing conditions, including the requirement that we obtain the renewal of certain customer contracts and the approval of the Transaction by our stockholders, and we cannot predict whether we will succeed in obtaining these customer renewals and stockholder approval. In addition, the definitive agreement we have entered into with FastTrack may be terminated if the sale is not closed by June 30, 2005, subject to a 30 day extension in certain limited circumstances.

We cannot guarantee that we will be able to meet the closing conditions set forth in the Agreement or the events that would lead to termination of the Agreement will not happen. As a result, we cannot assure you that the Transaction will be completed. If our stockholders fail to approve the proposal at the Special Meeting or if the Transaction is not completed for any other reason, the market price of our common stock may decline. In addition, failure to complete the Transaction may substantially limit our ability to grow and implement our current business strategies. In the event sufficient additional funding cannot be secured on a timely basis, we may not be able to sustain our operations if our sales force automation software and services solutions business cannot be sold in the near future.

22

Table of Contents

The Agreement will expose us to contingent liabilities that could have a material affect on our financial condition.