With respect to each of the master servicer and special servicer, the Excess Modification Fees collected and earned by such person from the related borrower (taken in the aggregate with any other Excess Modification Fees collected and earned by such person from the related borrower within the prior

12-months of the collection of the current Excess Modification Fees) will be subject to a cap of [1.0]% of the outstanding principal balance of the related Mortgage Loan or Serviced Whole Loan on the closing date of the related modification, extension, waiver or amendment (after giving effect to such modification, extension, waiver or amendment) with respect to any Mortgage Loan or Serviced Whole Loan.

The Servicing Fee is calculated on the Stated Principal Balance of each Mortgage Loan (including the Non-Serviced Mortgage Loan) and each related Serviced Companion Loan in the same manner as interest is calculated on such Mortgage Loans and Serviced Companion Loans. The Servicing Fee for each Mortgage Loan is included in the Administrative Cost Rate listed for that Mortgage Loan on Annex A-1. Any Servicing Fee Rate calculated on an Actual/360 Basis will be recomputed on the basis of twelve 30-day months, assuming a 360-day year ("30/360 Basis") for purposes of calculating the Net Mortgage Rate.

[Pursuant to the terms of the PSA, [NAME OF MASTER SERVICER] will be entitled to retain a portion of the Servicing Fee with respect to each Mortgage Loan (other than the Non-Serviced Mortgage Loan) and, to the extent provided for in the related Intercreditor Agreement, each Serviced Companion Loan notwithstanding any termination or resignation of [NAME OF MASTER SERVICER] as master servicer; provided that [NAME OF MASTER SERVICER] may not retain any portion of the Servicing Fee to the extent that portion of the Servicing Fee is required to appoint a successor master servicer. In addition, [NAME OF MASTER SERVICER] will have the right to assign and transfer its rights to receive that retained portion of its Servicing Fee to another party.]

The master servicer will be required to pay its overhead and any general and administrative expenses incurred by it in connection with its servicing activities under the PSA. The master servicer will be entitled to reimbursement for any expenses incurred by it except as expressly provided in the PSA. The master servicer will be responsible for all fees payable to any sub-servicers. See "Description of the Certificates—Distributions—Method, Timing and Amount".

[With respect to the Non-Serviced Mortgage Loan, the master servicer (or primary servicer) will be entitled to a primary servicing fee accruing at a rate equal to [ [_____] % per annum with respect to the Non-Serviced Mortgage Loan][LIST PRIMARY SERVICING FEE RATE FOR NON-SERVICED MORTGAGE LOAN].]

The principal compensation to be paid to the special servicer in respect of its special servicing activities will be the Special Servicing Fee, the Workout Fee and the Liquidation Fee.

The Workout Fee with respect to any Corrected Loan will cease to be payable if the Corrected Loan again becomes a Specially Serviced Loan but will become payable again if and when the Mortgage Loan (including a Serviced Companion Loan again becomes a Corrected Loan. The Workout Fee with respect to any Specially Serviced Loan that becomes a Corrected Loan will be reduced by any Excess Modification Fees paid by or on behalf of the related borrower with respect to a related Mortgage Loan or REO Loan and received by the special servicer as compensation within the prior [18] months, but only to the extent those fees have not previously been deducted from a Workout Fee or Liquidation Fee [INSERT MAXIMUM/MINIMUM FEES].

If the special servicer is terminated (other than for cause) or resigns, it will retain the right to receive any and all Workout Fees payable with respect to a Mortgage Loan, Serviced Companion Loan that became a Corrected Loan during the period that it acted as special servicer and remained a Corrected Loan at the time of that termination or resignation, except that such Workout Fees will cease to be payable if the Corrected Loan again becomes a Specially Serviced Loan. The successor special servicer will not be entitled to any portion of those Workout Fees. If the special servicer resigns or is terminated (other than for cause), it will receive any Workout Fees payable on Specially Serviced Loans for which the resigning or terminated special servicer had determined to grant a forbearance or cured the event of default through a modification, restructuring or workout negotiated by the special servicer and evidenced by a signed writing, but which had not as of the time the special servicer resigned or was terminated become a Corrected Loan solely because the borrower had not made three consecutive timely Periodic Payments and which subsequently becomes a Corrected Loan as a result of the borrower making such three consecutive timely Periodic Payments.

The special servicer will also be entitled to late payment charges and default interest paid by the borrowers and accrued while the related Mortgage Loans (including the related Companion Loan, if applicable, and to the extent not prohibited by the related Intercreditor Agreement) and Subordinate Companion Loan were Specially Serviced Loans and that are not needed to pay interest on Advances or certain additional trust fund expenses with respect to the related Mortgage Loan (including the related Companion Loan, if applicable, to the extent not prohibited by the related Intercreditor Agreement) and Subordinate Companion Loan since the Closing Date. The special servicer also is authorized but not required to invest or direct the investment of funds held in the REO Account in Permitted Investments, and the special servicer will be entitled to retain any interest or other income earned on those funds and will bear any losses resulting from the investment of these funds, except as set forth in the PSA.

The Non-Serviced Mortgage Loan is serviced under the Non-Serviced PSA (including those occasions under the Non-Serviced PSA when the servicing of the Non-Serviced Mortgage Loan has been transferred from the Non-Serviced Master Servicer to the Non-Serviced Special Servicer). Accordingly, in its capacity as the special servicer under the PSA, the special servicer will not be entitled to receive any special servicing compensation for the Non-Serviced Mortgage Loan. Only the Non-Serviced Special Servicer will be entitled to special servicing compensation on the Non-Serviced Mortgage Loan and only the Non-Serviced Special Servicer will be entitled to special servicing compensation on the Non-Serviced Whole Loan.

The PSA will provide that the special servicer and its affiliates will be prohibited from receiving or retaining any Disclosable Special Servicer Fees in connection with the disposition, workout or foreclosure of any Mortgage Loan and Serviced Companion Loan, the management or disposition of any REO Property, or the performance of any other special servicing duties under the PSA. The PSA will also provide that, with respect to each Distribution Date, the special servicer must deliver or cause to be delivered to the master servicer within two (2) business days following the Determination Date, and the master servicer must deliver, to the extent it has received, to the certificate administrator, without charge and on the same day as the master servicer is required to deliver the CREFC® investor reporting package for such Distribution Date, an electronic report which discloses and contains an itemized listing of any Disclosable Special Servicer Fees received by the special servicer or any of its affiliates with respect to such Distribution Date, provided that no such report will be due in any month during which no Disclosable Special Servicer Fees were received.

The special servicer will be required to pay its overhead and any general and administrative expenses incurred by it in connection with its servicing activities under the PSA. The special servicer will

not be entitled to reimbursement for any expenses incurred by it except as expressly provided in the PSA. See "Description of the Certificates—Distributions—Method, Timing and Amount.

As compensation for the performance of its routine duties, the trustee and the certificate administrator will be paid a fee (collectively, the "Certificate Administrator/Trustee Fee"); provided that the Certificate Administrator/Trustee Fee includes the trustee fee, and the certificate administrator will pay the trustee fee to the trustee in an amount equal to $[____] per month. The Certificate Administrator/Trustee Fee will be payable monthly from amounts received in respect of the mortgage loans and will be equal to the product of a rate equal to [______]% per annum (the "Certificate Administrator/Trustee Fee Rate") and the Stated Principal Balance of the Mortgage Loans and any REO Loans and will be calculated in the same manner as interest is calculated on such Mortgage Loans. The Certificate Administrator/Trustee Fee includes the trustee fee.

Each of the Operating Advisor Fee and the Operating Advisor Consulting Fee will be payable from funds on deposit in the Collection Account out of amounts otherwise available to make distributions on the Offered Certificates as described in "Description of the Certificates—Distributions", but with respect to the Operating Advisor Consulting Fee, only as and to the extent that such fee is actually received from the related borrower. If the operating advisor has consultation rights with respect to a Major Decision, the PSA will require the master servicer or the special servicer, as applicable, to use commercially reasonable efforts consistent with the Servicing Standard to collect the applicable Operating Advisor Consulting Fee from the related borrower in connection with such Major Decision, but only to the extent not prohibited by the related Mortgage Loan documents. The master servicer or special servicer, as applicable, will each be permitted to waive or reduce the amount of any such Operating Advisor Consulting Fee payable by the related borrower if it determines that such full or partial waiver is in accordance with the Servicing Standard but in no event will it take any enforcement action with respect to the collection of such Operating Advisor Consulting Fee other than requests for collection; provided that the master servicer or the special servicer, as applicable, will be required to consult, on a non-binding basis, with the operating advisor prior to any such waiver or reduction.

In addition to the Operating Advisor Fee and the Operating Advisor Consulting Fee, the operating advisor will be entitled to reimbursement of Operating Advisor Expenses in accordance with the terms of the PSA. "Operating Advisor Expenses" for each Distribution Date will equal any unreimbursed indemnification amounts or additional trust fund expenses payable to the operating advisor pursuant to the PSA (other than the Operating Advisor Fee and the Operating Advisor Consulting Fee).

After an Appraisal Reduction Event has occurred with respect to a Mortgage Loan (other than the Non-Serviced Mortgage Loan) or a Serviced Whole Loan, an Appraisal Reduction Amount is required to be calculated. An "Appraisal Reduction Event" will occur on the earliest of:

No Appraisal Reduction Event may occur at any time when the Certificate Balances of all classes of Subordinate Certificates have been reduced to zero.

[Each Serviced Whole Loan will be treated as a single Mortgage Loan for purposes of calculating an Appraisal Reduction Amount with respect to the Mortgage Loan and Companion Loan, as applicable, that comprise such Serviced Whole Loan. Any Appraisal Reduction Amount in respect of any Serviced Pari Passu Mortgage Loan will be allocated, pro rata, between the related Serviced Pari Passu Mortgage Loan and the related Serviced Pari Passu Companion Loan based upon their respective Stated Principal Balances. Any Appraisal Reduction Amount in respect of an AB Whole Loan will be allocated, first, to the Subordinate Companion Loan (until its principal balance is notionally reduced to zero by such related Appraisal Reduction Amounts) and second, to the related Mortgage Loan. For a summary of the provisions in the Non‑Serviced PSA relating to appraisal reductions, see “—Servicing of the Non‑Serviced Mortgage Loan” below.

The special servicer will be required to order an appraisal or conduct a valuation, promptly upon the occurrence of an Appraisal Reduction Event (other than with respect to the Non-Serviced Whole Loan). On the first Determination Date occurring on or after the tenth business day following the receipt of the MAI appraisal or the completion of the valuation, the special servicer will be required to calculate and report to the master servicer, the trustee, the certificate administrator, the operating advisor and, prior to the occurrence of any Consultation Termination Event, the Directing Certificateholder, the Appraisal Reduction Amount, taking into account the results of such appraisal or valuation and receipt of information requested by the special servicer from the master servicer reasonably necessary to calculate the Appraisal Reduction Amount. Such report will also be forwarded by the master servicer (or the special servicer if the related Mortgage Loan is a Specially Serviced Loan), to the extent the related Serviced Companion Loan has been included in a securitization transaction, to the master servicer of such securitization into which the related Serviced Companion Loan has been sold, or to the holder of any related Serviced Companion Loan by the master servicer (or the special servicer if the related Mortgage Loan is a Specially Serviced Loan).

In the event that the special servicer has not received any required MAI appraisal within 60 days after the Appraisal Reduction Event (or, in the case of an appraisal in connection with an Appraisal Reduction Event described in clauses (1) and (6) of the definition of Appraisal Reduction Event above, within 120 days (in the case of clause (1)) or 90 or 120 days (in the case of clause (6)), respectively, after the initial delinquency for the related Appraisal Reduction Event), the Appraisal Reduction Amount will be deemed to be an amount equal to 25% of the current Stated Principal Balance of the related Mortgage Loan (or Serviced Whole Loan) until an MAI appraisal is received by the special servicer. The Appraisal Reduction Amount is calculated as of the first Determination Date that is at least ten (10) business days after the special servicer's receipt of such MAI appraisal. The master servicer will provide (via electronic delivery) the special servicer with any information in its possession that is reasonably required to determine, redetermine, calculate or recalculate any Appraisal Reduction Amount pursuant to its definition using reasonable efforts to deliver such information within four business days of the special servicer's reasonable request (which request is required to be made promptly, but in no event later than

ten (10) business days, after the special servicer's receipt of the applicable appraisal or preparation of the applicable internal valuation); provided, however, that the special servicer's failure to timely make such a request will not relieve the master servicer of its obligation to use reasonable efforts to provide such information to the special servicer within four (4) business days following the special servicer's reasonable request. The master servicer will not calculate Appraisal Reduction Amounts.

With respect to each Mortgage Loan (other than the Non-Serviced Mortgage Loan) and each Serviced Whole Loan as to which an Appraisal Reduction Event has occurred (unless the Mortgage Loan or Serviced Whole Loan has remained current for three consecutive Periodic Payments, and with respect to which no other Appraisal Reduction Event has occurred with respect to that Mortgage Loan during the preceding three months (for such purposes taking into account any amendment or modification of such Mortgage Loan, any related Serviced Companion Loan or Serviced Whole Loan)), the special servicer is required (i) within 30 days of each anniversary of the related Appraisal Reduction Event and (ii) upon its determination that the value of the related Mortgaged Property has materially changed, to notify the master servicer of the occurrence of such anniversary or determination and to order an appraisal (which may be an update of a prior appraisal), the cost of which will be paid by the master servicer as a Servicing Advance (or to the extent it would be a Nonrecoverable Advance, an expense of the issuing entity paid out of the Collection Account), or to conduct an internal valuation, as applicable. Based upon the appraisal or valuation and receipt of information reasonably requested by the special servicer from the master servicer necessary to calculate the Appraisal Reduction Amount, the special servicer is required to determine or redetermine, as applicable, and report to the master servicer, the trustee, the certificate administrator, the operating advisor and, prior to the occurrence of a Consultation Termination Event, the Directing Certificateholder, the calculated or recalculated amount of the Appraisal Reduction Amount with respect to the Mortgage Loan or Serviced Whole Loan, as applicable. Such report will also be forwarded to the holder of any related Companion Loan by the master servicer (or the special servicer if the related Mortgage Loan is a Specially Serviced Loan). Prior to the occurrence of a Consultation Termination Event, the special servicer will consult with the Directing Certificateholder, with respect to any appraisal, valuation or downward adjustment in connection with an Appraisal Reduction Amount. Notwithstanding the foregoing, the special servicer will not be required to obtain an appraisal or valuation with respect to a Mortgage Loan or Serviced Whole Loan that is the subject of an Appraisal Reduction Event to the extent the special servicer has obtained an appraisal or valuation with respect to the related Mortgaged Property within the 12-month period prior to the occurrence of the Appraisal Reduction Event. Instead, the special servicer may use the prior appraisal or valuation in calculating any Appraisal Reduction Amount with respect to the Mortgage Loan or Serviced Whole Loan, provided that the special servicer is not aware of any material change to the Mortgaged Property that has occurred that would affect the validity of the appraisal or valuation.

The Non-Serviced Mortgage Loan is subject to provisions in the Non-Serviced PSA relating to appraisal reductions that are similar, but not necessarily identical, to the provisions described above. The existence of an appraisal reduction under the Non-Serviced PSA in respect of the Non-Serviced Mortgage Loan will proportionately reduce the master servicer's or the trustee's, as the case may be, obligation to make P&I Advances on the Non-Serviced Mortgage Loan and will generally have the effect of reducing the amount otherwise available for distributions to the Certificateholders. Pursuant to the Non-Serviced PSA, the Non-Serviced Mortgage Loan will be treated, together with each related Non-Serviced Companion Loan, as a single mortgage loan for purposes of calculating an appraisal reduction amount with respect to the loans that comprise the Non-Serviced Whole Loan. Any appraisal reduction calculated with respect to the Non-Serviced Whole Loan will generally be allocated to the Non-Serviced Mortgage Loan and the Non-Serviced Pari Passu Companion Loan, on a pro rata basis based upon their respective Stated Principal Balances.

If any Mortgage Loan (other than the Non-Serviced Mortgage Loan) or any Serviced Whole Loan previously subject to an Appraisal Reduction Amount that becomes a Corrected Loan, and with respect to which no other Appraisal Reduction Event has occurred and is continuing, the Appraisal Reduction Amount and the related Appraisal Reduction Event will cease to exist.

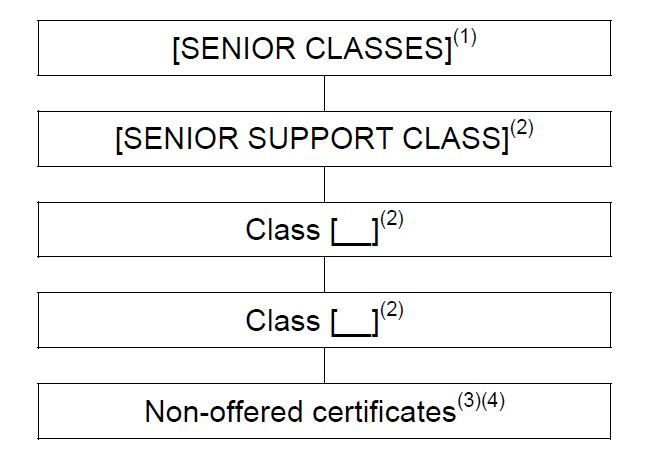

As a result of calculating one or more Appraisal Reduction Amounts (and, in the case of any Whole Loan, to the extent allocated in the related Mortgage Loan), the amount of any required P&I Advance will be reduced, which will have the effect of reducing the amount of interest available to the most subordinate class of certificates or Trust Components then-outstanding (i.e., first, to Class [__] certificates, second, to the Class [__] certificates, third, to the Class [__] certificates, fourth, to the Class [A] Trust Component (and correspondingly, to the Class [A] certificates and the Class [EC] certificates, pro rata based on their respective percentage interests in the Class [A] Trust Component), fifth, to the Class [B] Trust Component (and correspondingly, to the Class [B] certificates and the Class [EC] certificates, pro rata based on their respective percentage interests in the Class [B] Trust Component), sixth, to the Class [C] Trust Component (and correspondingly, to the Class [C] certificates and the Class [EC] certificates, pro rata based on their respective percentage interests in the Class [C] Trust Component), and finally, pro rata based on their respective interest entitlements, to the Senior Certificates). See "—Advances".

For purposes of determining the Controlling Class, Appraisal Reduction Amounts allocated to a related Mortgage Loan will be allocated to each class of Principal Balance Certificates and each Trust Component in reverse sequential order to notionally reduce their Certificate Balances until the Certificate Balances of each such class and Trust Component is notionally reduced to zero (i.e., first, to Class [__] certificates, second, to the Class [__] certificates, third, to the Class [__] certificates, fourth, to the Class [A] Trust Component (and correspondingly, to the Class [A] certificates and the Class [EC] certificates, pro rata based on their respective percentage interests in the Class [A] Trust Component), fifth, to the Class [B] Trust Component (and correspondingly, to the Class [B] certificates and the Class [EC] certificates, pro rata based on their respective percentage interests in the Class [B] Trust Component), sixth, to the Class [C] Trust Component (and correspondingly, to the Class [C] certificates and the Class [EC] certificates, pro rata based on their respective percentage interests in the Class [C] Trust Component), and finally, pro rata based on their respective interest entitlements, to the Senior Certificates). With respect to any Appraisal Reduction Amount calculated for purposes of determining the Controlling Class, the appraised value of the related Mortgaged Property will be determined on an “as‑is” basis.

Any class of Control Eligible Certificates, the Certificate Balance of which (taking into account the application of any Appraisal Reduction Amounts to notionally reduce the Certificate Balance of such class) has been reduced to less than 25% of its initial Certificate Balance, is referred to as an "Appraised-Out Class". The holders of the majority (by Certificate Balance) of an Appraised-Out Class will have the right, at their sole expense, to require the special servicer to order a second appraisal of any Mortgage Loan (or Serviced Whole Loan) for which an Appraisal Reduction Event has occurred (such holders, the "Requesting Holders"). The special servicer will use its reasonable best efforts to ensure that such appraisal is delivered within 30 days from receipt of the Requesting Holders' written request and will ensure that such appraisal is prepared on an "as-is" basis by an MAI appraiser. Upon receipt of such supplemental appraisal, the special servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of such supplemental appraisal, any recalculation of the applicable Appraisal Reduction Amount is warranted and, if so warranted will recalculate such Appraisal Reduction Amount based upon such supplemental appraisal and receipt of information requested by the special servicer from the master servicer as described above. If required by any such recalculation, the applicable Appraised-Out Class will be reinstated as the Controlling Class and each other Appraised-Out Class will, if applicable, have its related Certificate Balance notionally restored to the extent required by such recalculation of the Appraisal Reduction Amount.

Any Appraised-Out Class for which the Requesting Holders are challenging the special servicer's Appraisal Reduction Amount determination may not exercise any direction, control, consent and/or similar rights of the Controlling Class until such time, if any, as such class is reinstated as the Controlling Class; the rights of the Controlling Class will be exercised by the most senior Control Eligible Certificates, if any, during such period.

[With respect to the Non-Serviced Mortgage Loan, the Non-Serviced Directing Certificateholder will be subject to provisions similar to those described above. See "Description of the Mortgage Pool—The

[With respect to an AB Whole Loan, the holder of the related Subordinate Companion Loan (or, in the case of the Trust Subordinate Companion Loan, the Loan Specific Directing Certificateholder) may in certain circumstances post collateral to avoid a change of control as described in "Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loan".]

To the extent permitted by the related Mortgage Loan and required by the Servicing Standard, the master servicer (with respect to the Mortgage Loans and any related Serviced Companion Loan, but excluding the Non-Serviced Mortgage Loan) will be required to use efforts consistent with the Servicing Standard to cause each borrower to maintain, and the special servicer (with respect to REO Properties other than the Mortgaged Property securing the Non-Serviced Whole Loan and subject to the conditions set forth in the following sentence) will maintain, for the related Mortgaged Property all insurance coverage required by the terms of the related Mortgage Loan documents; provided, however, that the master servicer (with respect to Mortgage Loans and Serviced Companion Loans) will not be required to cause the borrower to maintain and the special servicer (with respect to REO Properties) will not be required to maintain terrorism insurance to the extent that the failure of the related borrower to do so is an Acceptable Insurance Default (as defined below) or if the trustee does not have an insurable interest. Insurance coverage is required to be in the amounts (which, in the case of casualty insurance, is generally equal to the lesser of the outstanding principal balance of the related Mortgage Loan and the replacement cost of the related Mortgaged Property), and from an insurer meeting the requirements, set forth in the related Mortgage Loan documents. If the borrower does not maintain such coverage, the master servicer (with respect to such Mortgage Loans and any related Serviced Companion Loan) or the special servicer (with respect to REO Properties other than a Mortgaged Property securing the Non-Serviced Whole Loan), as the case may be, will be required to maintain such coverage to the extent such coverage is available at commercially reasonable rates and the trustee has an insurable interest, as determined by the master servicer (with respect to the Mortgage Loans and any related Serviced Companion Loan) or special servicer (with respect to REO Properties other than a Mortgaged Property securing the Non-Serviced Whole Loan), as applicable, in accordance with the Servicing Standard; provided that the master servicer will be obligated to use efforts consistent with the Servicing Standard to cause the borrower to maintain (or to itself maintain) insurance against property damage resulting from terrorist or similar acts unless the borrower's failure is an Acceptable Insurance Default as determined by the special servicer with (unless a Control Termination Event has occurred and is continuing) the consent of the Directing Certificateholder. See "Description of the Mortgage Pool—Certain Terms of the Mortgage Loans" and "Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties".

Notwithstanding any contrary provision above, the master servicer will not be required to maintain, and will not be in default for failing to obtain, any earthquake or environmental insurance on any Mortgaged Property unless (other than with respect to a Mortgaged Property securing the Non-Serviced Mortgage Loan) such insurance was required at the time of origination of the related Mortgage Loan, the trustee has an insurable interest and is currently available at commercially reasonable rates. In addition, the master servicer and special servicer will be entitled to rely on insurance consultants (at the applicable servicer's expense) in determining whether any insurance is available at commercially reasonable rates. After the master servicer determines that a Mortgaged Property other than the Mortgaged Property securing the Non-Serviced Mortgage Loan is located in an area identified as a federally designated special flood hazard area (and flood insurance has been made available), the master servicer will be required to use efforts consistent with the Servicing Standard to (1) cause each borrower to maintain (to the extent required by the related Mortgage Loan documents), and if the borrower does not so maintain, will be required to (2) itself maintain to the extent the trustee, as mortgagee, has an insurable interest in the Mortgaged Property and is available at commercially reasonable rates (as determined by the master servicer in accordance with the Servicing Standard) a flood insurance policy in an amount representing coverage not less than the lesser of (x) the outstanding principal balance of the related Mortgage Loan

(and any related Serviced Companion Loan) and (y) the maximum amount of insurance which is available under the National Flood Insurance Act of 1968, as amended, plus such additional excess flood coverage with respect to the Mortgaged Property, if any, in an amount consistent with the Servicing Standard, but only to the extent that the related Mortgage Loan permits the lender to require the coverage and maintaining coverage is consistent with the Servicing Standard.

Notwithstanding the foregoing, with respect to the Mortgage Loans (other than the Non-Serviced Mortgage Loan) and any related Serviced Companion Loan, that either (x) require the borrower to maintain "all-risk" property insurance (and do not expressly permit an exclusion for terrorism) or (y) contain provisions generally requiring the applicable borrower to maintain insurance in types and against such risks as the holder of such Mortgage Loan and any related Serviced Companion Loan reasonably requires from time to time in order to protect its interests, the master servicer will be required to, consistent with the Servicing Standard, (A) monitor in accordance with the Servicing Standard whether the insurance policies for the related Mortgaged Property contain exclusions in addition to those customarily found in insurance policies for mortgaged properties similar to the Mortgaged Properties on or prior to September 11, 2001 ("Additional Exclusions"), (B) request the borrower to either purchase insurance against the risks specified in the Additional Exclusions or provide an explanation as to its reasons for failing to purchase such insurance, and (C) notify the special servicer if it has knowledge that any insurance policy contains Additional Exclusions or if it has knowledge that any borrower fails to purchase the insurance requested to be purchased by the master servicer pursuant to clause (B) above. If the special servicer determines in accordance with the Servicing Standard that such failure is not an Acceptable Insurance Default, the special servicer will be required to notify the master servicer and the master servicer will be required to use efforts consistent with the Servicing Standard to cause such insurance to be maintained. If the special servicer determines that such failure is an Acceptable Insurance Default, it will be required to promptly deliver such conclusions in writing to the 17g-5 Information Provider for posting to the 17g-5 Information Provider's website for those Mortgage Loans that (i) have one of the ten (10) highest outstanding principal balances of the Mortgage Loans then included in the issuing entity or (ii) comprise more than 5% of the outstanding principal balance of the Mortgage Loans then included in the issuing entity.

During the period that the special servicer is evaluating the availability of such insurance, or waiting for a response from the Directing Certificateholder, neither the master servicer nor the special servicer will be liable for any loss related to its failure to require the borrower to maintain such insurance and neither will be in default of its obligations as a result of such failure unless the master servicer or the special servicer is required to take any immediate action pursuant to the Servicing Standard and other servicing requirements under the PSA as described under "—The Directing Certificateholder—Control Termination Event and Consultation Termination Event" and "—The Directing Certificateholder—Servicing Override".

The special servicer will be required to maintain (or cause to be maintained), fire and hazard insurance on each REO Property (other than any REO Property with respect to the Non-Serviced Mortgage Loan), to the extent obtainable at commercially reasonable rates and the trustee has an insurable interest, in an amount that is at least equal to the lesser of (1) the full replacement cost of the improvements on the REO Property, and (2) the outstanding principal balance owing on the related Mortgage Loan and any related Serviced Companion Loan or REO Loan, as applicable, and in any event, the amount necessary to avoid the operation of any co-insurance provisions. In addition, if the REO

Property is located in an area identified as a federally designated special flood hazard area, the special servicer will be required to cause to be maintained, to the extent available at commercially reasonable rates (as determined by the special servicer (prior to the occurrence and continuance of a Control Termination Event, with the consent of the Directing Certificateholder) in accordance with the Servicing Standard), a flood insurance policy meeting the requirements of the current guidelines of the Federal Insurance Administration in an amount representing coverage not less than the maximum amount of insurance that is available under the National Flood Insurance Act of 1968, as amended.

The PSA provides that the master servicer may satisfy its obligation to cause each borrower to maintain a hazard insurance policy and the master servicer or special servicer may satisfy their respective obligation to maintain hazard insurance by maintaining a blanket or master single interest or force-placed policy insuring against hazard losses on the Mortgage Loans and related Serviced Companion Loan and REO Properties (other than the Mortgaged Property securing the Non-Serviced Whole Loan), as applicable. Any losses incurred with respect to Mortgage Loans (and any related Serviced Companion Loan) or REO Properties due to uninsured risks (including earthquakes, mudflows and floods) or insufficient hazard insurance proceeds may adversely affect payments to Certificateholders. Any cost incurred by the master servicer or special servicer in maintaining a hazard insurance policy, if the borrower defaults on its obligation to do so, will be advanced by the master servicer as a Servicing Advance and will be charged to the related borrower. Generally, no borrower is required by the Mortgage Loan documents to maintain earthquake insurance on any Mortgaged Property and the special servicer will not be required to maintain earthquake insurance on any REO Properties. Any cost of maintaining that kind of required insurance or other earthquake insurance obtained by the special servicer will be paid out of the REO Account or advanced by the master servicer as a Servicing Advance.

The costs of the insurance may be recovered by the master servicer or the trustee, as the case may be, from reimbursements received from the borrower or, if the borrower does not pay those amounts, as a Servicing Advance as set forth in the PSA. All costs and expenses incurred by the special servicer in maintaining the insurance described above on REO Properties will be paid out of the related REO Account or, if the amount in such account is insufficient, such costs and expenses will be advanced by the master servicer to the special servicer as a Servicing Advance to the extent that such Servicing Advance is not determined to be a Nonrecoverable Advance.

No pool insurance policy, special hazard insurance policy, bankruptcy bond, repurchase bond or certificate guarantee insurance will be maintained with respect to the Mortgage Loans, nor will any Mortgage Loan be subject to FHA insurance.

The master servicer may amend any term (other than a Money Term) of a mortgage loan (other than a Non-Serviced Mortgage Loan) or Serviced Companion Loan that is not a Specially Serviced Mortgage Loan and may extend the maturity date of any Balloon Loan, other than a Specially Serviced Mortgage Loan or a Non-Serviced Mortgage Loan, to a date not more than sixty (60) days beyond the original maturity date, if in the master servicer's sole judgment exercised in good faith, a default in the payment of the Balloon Payment is reasonably foreseeable and such extension is reasonably likely to produce a greater recovery to the Certificateholders and the holder of the related Companion Loan, as applicable (as a collective whole), on a net present value basis than liquidation of such mortgage loan, and the borrower has obtained an executed written commitment (subject only to satisfaction of conditions set forth therein) for refinancing of the mortgage loan or purchase of the related mortgaged property. "Money Term" means, with respect to any mortgage loan or Serviced Companion Loan, the stated maturity date, mortgage rate, principal balance, amortization term or payment frequency or any provision of such mortgage loan or Serviced Companion Loan requiring the payment of a Prepayment Premium or Yield Maintenance Charge (but does not include late fee or default interest provisions).

The master servicer's power to amend a mortgage loan is subject to any restrictions applicable to REMICs, and to limitations imposed by the Pooling Agreement and any applicable Intercreditor Agreement or co-lender agreement (including the consent rights of the Directing Certificateholder prior to

the occurrence and continuance of a Control Termination Event, the consultation rights of the Directing Certificateholder during the occurrence and continuance of a Control Termination Event but prior to the occurrence of a Consultation Termination Event, the rights of the Operating Advisor during the occurrence and continuance of a Control Termination Event or following the occurrence of a Consultation Termination Event and the rights of the holder of any Companion Loan, as applicable).

Subject to any restrictions applicable to REMICs, the special servicer will be permitted to enter into a modification, waiver or amendment of the terms of any Specially Serviced Mortgage Loan, including any modification, waiver or amendment to:

The consent of the special servicer is required to any modification, waiver or amendment with regard to any mortgage loan that is not a Specially Serviced Mortgage Loan or a Non-Serviced Mortgage Loan (other than certain non-material modifications, waivers or amendments). When the special servicer's consent is required, the master servicer will be required to promptly provide the special servicer with written notice of any request for modification, waiver or amendment accompanied by the master servicer's recommendation and analysis and any and all information in the master servicer's possession that the special servicer may reasonably request to grant or withhold its consent to such action. Such consent will be deemed given fifteen (15) Business Days after receipt (unless earlier objected to) by the special servicer from the master servicer of the master servicer's written analysis and recommendation with respect to such proposed action together with such other information reasonably required by the special servicer.

With respect to any Mortgage Loan (other than with respect to any Non-Serviced Mortgage Loans), the special servicer will be required, prior to consenting to such a proposed action of the master servicer,

and prior to itself taking such an action, either to obtain the written consent of (if no Control Termination Event has occurred and is continuing) or to consult with (if during the occurrence and continuance of a Control Termination Event but prior to the occurrence of a Consultation Termination Event), the Directing Certificateholder. Any such consent (if consent is required) will be deemed given ten (10) Business Days after receipt (unless earlier objected to) by the Directing Certificateholder of the master servicer's and/or special servicer's written analysis and recommendation with respect to such waiver together with such other information reasonably required by the Directing Certificateholder. See "—The Directing Certificateholder" in this prospectus.

Modifications that forgive principal or interest of a mortgage loan will result in realized losses on such mortgage loan and such realized losses will be allocated among the various classes of Certificates in the manner described under "Description of the Offered Certificates—Subordination; Allocation of Realized Losses" in this prospectus.

The modification of a mortgage loan may tend to reduce prepayments by avoiding liquidations and therefore may extend the weighted average life of the Certificates beyond that which might otherwise be the case. See "Yield and Maturity Considerations" in this prospectus.

The special servicer will determine, in a manner consistent with the Servicing Standard, whether (a) to exercise any right it may have with respect to a Mortgage Loan (other than the Non-Serviced Mortgage Loan) and any related Serviced Companion Loan containing a "due-on-sale" clause (1) to accelerate the payments on that Mortgage Loan and any related Companion Loan, as applicable, or (2) to withhold its consent to any sale or transfer, consistent with the Servicing Standard or (b) to waive its right to exercise such rights; provided, however, (i) that with respect to such waiver of rights prior to the occurrence and continuance of any Control Termination Event, the special servicer has obtained the prior written consent (or deemed consent) of the Directing Certificateholder (or the Loan Specific Directing Certificateholder prior to the occurrence and continuance of an AB Control Appraisal Period, as applicable) (or after the occurrence and continuance of a Control Termination Event, but prior to a Consultation Termination Event, upon consultation with the Directing Certificateholder) and (ii) with respect to any Mortgage Loan [that is [DESCRIBE CRITERIA FOR A RATING AGENCY [CONFIRMATION][COMMUNICATION] REQUIREMENT], [a Rating Agency Confirmation is received by the master servicer or the special servicer, as the case may be, from each Rating Agency and a confirmation of any applicable rating agency that such action will not result in the downgrade, withdrawal or qualification of its then-current ratings of any class of securities backed, wholly or partially, by any Serviced Pari Passu Companion Loan (if any)][a Rating Agency Communication is provided by the master servicer or the special servicer, as the case may be, to each Rating Agency].

With respect to a Mortgage Loan (other than the Non-Serviced Mortgage Loan) and any related Serviced Companion Loan with a "due-on-encumbrance" clause, the special servicer will determine, in a manner consistent with the Servicing Standard, whether (a) to exercise any right it may have with respect to a Mortgage Loan containing a "due-on-encumbrance" clause (1) to accelerate the payments thereon, or (2) to withhold its consent to the creation of any additional lien or other encumbrance, consistent with the Servicing Standard or (b) to waive its right to exercise such rights, provided, however, (i) that, with respect to such waiver of rights prior to the occurrence and continuance of a Control Termination Event, the special servicer has obtained the consent of the Directing Certificateholder [(or, with respect to the AB Whole Loan prior to the occurrence and continuance of an AB Control Appraisal Period, the prior consent of the Loan Specific Directing Certificateholder, to the extent required by the terms of the related Intercreditor Agreement)] (or after the occurrence and continuance of a Control Termination Event, but prior to a Consultation Termination Event, has consulted with the Directing Certificateholder) and (ii) the special servicer has received a Rating Agency Confirmation from each Rating Agency and a confirmation of any applicable rating agency that such action will not result in the downgrade, withdrawal or qualification of its then-current ratings of any class of securities backed, wholly or partially, by any Serviced Pari Passu Companion Loan (if any) if such Mortgage Loan is [INSERT CRITERIA FOR RATING AGENCY [CONFIRMATION][COMMUNICATION] REQUIREMENT].

Any modification, extension, waiver or amendment of the payment terms of the Non-Serviced Whole Loan will be required to be structured so as to be consistent with the Servicing Standard and the allocation and payment priorities in the related loan documents and the related Intercreditor Agreement, such that neither the issuing entity as holder of such Non-Serviced Mortgage Loan nor any holder of the related Companion Loan gains a priority over the other holder that is not reflected in the related loan documents and the related Intercreditor Agreement.

The master servicer will be required to perform (at its own expense) or cause to be performed (at its own expense), physical inspections of each Mortgaged Property relating to a Mortgage Loan (other than the Mortgaged Property securing the Non-Serviced Mortgage Loan, which is subject to inspection pursuant to the Non-Serviced PSA, and other than a Specially Serviced Loan) with a Stated Principal Balance of (A) $[2,000,000] or more at least once every 12 months and (B) less than $[2,000,000] at least once every [24] months, in each case commencing in the calendar year 20[__] unless a physical inspection has been performed by the special servicer within the previous [12] months and the master servicer has no knowledge of a material change in the Mortgaged Property since such physical inspection; provided, further, however, that if any scheduled payment becomes more than [60] days delinquent on the related Mortgage Loan, the special servicer is required to inspect or cause to be inspected the related Mortgaged Property as soon as practicable after the Mortgage Loan becomes a Specially Serviced Loan and annually thereafter for so long as the Mortgage Loan remains a Specially Serviced Loan (the cost of which inspection, to the extent not paid by the related borrower, will be reimbursed first from default interest and late charges constituting additional compensation of the special servicer on the related Mortgage Loan (but with respect to a Serviced Whole Loan, only amounts available for such purpose under the related Intercreditor Agreement) and then from the Collection Account as an expense of the issuing entity, and in the case of a Serviced Whole Loan, as an expense of the holders of the related Serviced Pari Passu Mortgage Loan and Serviced Pari Passu Companion Loan, pro rata and pari passu, to the extent provided in the related Intercreditor Agreement. With respect to an AB Whole Loan, the costs will be allocated, first, as an expense of the holder of the Subordinate Companion Loan, and second, as an expense of the holders of the related Mortgage Loan to the extent provided in the related Intercreditor Agreement. The special servicer or the master servicer, as applicable, will be required to prepare or cause to be prepared a written report of the inspection describing, among other things, the condition of and any damage to the Mortgaged Property to the extent evident from the inspection and specifying the existence of any vacancies in the Mortgaged Property of which it has knowledge and deems material, of any sale, transfer or abandonment of the Mortgaged Property of which it has knowledge or that is evident from the inspection, of any adverse change in the condition of the Mortgaged Property of which the preparer of such report has knowledge or that is evident from the inspection, and that the preparer of such report deems material, or of any material waste committed on the Mortgaged Property to the extent evident from the inspection.

Copies of the inspection reports referred to above that are delivered to the certificate administrator will be posted to the certificate administrator's website for review by Privileged Persons pursuant to the PSA. See "Description of the Certificates—Reports to Certificateholders; Certain Available Information".

With respect to each Mortgage Loan that requires the borrower to deliver operating statements, the special servicer or the master servicer, as applicable, is also required to use reasonable efforts to collect and review the annual operating statements beginning with calendar year end 20[__] of the related Mortgaged Property. Most of the Mortgage Loan documents obligate the related borrower to deliver annual property operating statements. However, we cannot assure you that any operating statements required to be delivered will in fact be delivered, nor is the special servicer or the master servicer likely to have any practical means of compelling the delivery in the case of an otherwise performing Mortgage Loan.

If the related Mortgaged Property is acquired in respect of any Mortgage Loan (and any related Serviced Companion Loan) (upon acquisition, an "REO Property") whether through foreclosure, deed-in-lieu of foreclosure or otherwise, the special servicer will continue to be responsible for its operation and management. If any Serviced Companion Loan becomes specially serviced, then the related Mortgage Loan will also become a Specially Serviced Loan. If any Mortgage Loan becomes a Specially Serviced Loan, then the related Serviced Companion Loan will also become a Specially Serviced Loan. The master servicer will have no responsibility for the performance by the special servicer of its duties under the PSA. Any Mortgage Loan (excluding the Non-Serviced Mortgage Loan), that is or becomes a cross-collateralized Mortgage Loan and is cross-collateralized with a Specially Serviced Loan will become a Specially Serviced Loan.

If any Specially Serviced Loan, in accordance with its original terms or as modified in accordance with the PSA, becomes performing for at least three consecutive Periodic Payments (provided that no additional event of default is foreseeable in the reasonable judgment of the special servicer and no other event or circumstance exists that causes such Mortgage Loan or related Companion Loan to otherwise constitute a Specially Serviced Loan), the special servicer will be required to transfer servicing of such Specially Serviced Loan (a "Corrected Loan") to the master servicer.

An Asset Status Report prepared for each Specially Serviced Loan will be required to include, among other things, the following information:

If no Control Termination Event has occurred and is continuing, the Directing Certificateholder will have the right to disapprove the Asset Status Report prepared by the special servicer with respect to a Specially Serviced Loan within 10 business days after receipt of the Asset Status Report. If the Directing Certificateholder does not disapprove an Asset Status Report within 10 business days or if the special servicer makes a determination, in accordance with the Servicing Standard, that the disapproval by the Directing Certificateholder (communicated to the special servicer within ten business days) is not in the best interest of all the Certificateholders, the special servicer will be required to implement the recommended action as outlined in the Asset Status Report. If the Directing Certificateholder disapproves the Asset Status Report within the 10 business day period and the special servicer has not made the affirmative determination described above, the special servicer will be required to revise the Asset Status Report as soon as practicable thereafter, but in no event later than 30 days after the disapproval. The special servicer will be required to continue to revise the Asset Status Report until the Directing Certificateholder fails to disapprove the revised Asset Status Report or until the special servicer makes a determination, in accordance with the Servicing Standard, that the disapproval is not in the best interests of the Certificateholders; provided that, if the Directing Certificateholder has not approved the Asset Status Report for a period of 60 business days following the first submission of an Asset Status Report, the special servicer may act upon the most recently submitted form of Asset Status Report, if consistent with the Servicing Standard.

[If a Control Termination Event [(or, with respect to the AB Whole Loan, if both a Control Termination Event has occurred and is continuing and an AB Control Appraisal Period is in effect)]] [EXCLUDE FOR TRANSACTIONS THAT CLOSE ON OR AFTER DECEMBER 24, 2016 THAT SATISFY RISK RETENTION REQUIREMENTS THROUGH THIRD PARTY PURCHASER OF HORIZONTAL RESIDUAL INTEREST], the special servicer will be required to promptly deliver each Asset Status Report prepared in connection with a Specially Serviced Loan to the operating advisor (and so long as no Consultation Termination Event has occurred, the Directing Certificateholder). The operating advisor will be required to provide comments to the special servicer in respect of the Asset Status Report, if any, within ten (10) business days following the later of (i) receipt of such Asset Status Report or (ii) such related additional information reasonably requested by the operating advisor, and propose possible alternative courses of action to the extent it determines such alternatives to be in the best interest of the Certificateholders (including any Certificateholders that are holders of the Control Eligible Certificates), as a collective whole. The special servicer will be obligated to consider such alternative courses of action and any other feedback provided by the operating advisor (and so long as no Consultation Termination Event has occurred, the Directing Certificateholder) in connection with the special servicer's preparation of any Asset Status Report. The special servicer will revise the Asset Status Report as it deems necessary to take into account any input and/or comments from the operating advisor (and so long as no Consultation Termination Event has occurred, the Directing Certificateholder), to the extent the special servicer determines that the operating advisor's and/or Directing Certificateholder's input and/or recommendations are consistent with the Servicing Standard and in the best interest of the Certificateholders as a collective whole (or, with respect to a Serviced Whole Loan, the best interest of the Certificateholders and the holders of the related Companion Loan, as a collective whole (taking into account the pari passu or subordinate nature of such Companion Loan)).

The special servicer will not be required to take or to refrain from taking any action because of an objection or comment by the operating advisor or a recommendation of the operating advisor.

[After the occurrence and during the continuance of a Control Termination Event but prior to the occurrence of a Consultation Termination Event, each of the Directing Certificateholder and the operating advisor will be entitled to consult with the special servicer and propose alternative courses of action and

provide other feedback in respect of any Asset Status Report. After the occurrence of a Consultation Termination Event, the Directing Certificateholder will have no right to consult with the special servicer with respect to Asset Status Reports and the special servicer will only be obligated to consult with the operating advisor with respect to any Asset Status Report as described above. The special servicer may choose to revise the Asset Status Report as it deems reasonably necessary in accordance with the Servicing Standard to take into account any input and/or recommendations of the operating advisor or the Directing Certificateholder during the applicable periods described above, but is under no obligation to follow any particular recommendation of the operating advisor or the Directing Certificateholder.] [APPLICABLE TO OFFERINGS PRIOR TO DECEMBER 24, 2016]

[After the occurrence and during the continuance of a Control Termination Event but prior to the occurrence of a Consultation Termination Event, the Directing Certificateholder, and after the occurrence and during the continuance of an Operating Advisor Consultation Event, the operating advisor, will be entitled to consult with the special servicer and propose alternative courses of action and provide other feedback in respect of any Asset Status Report. After the occurrence of a Consultation Termination Event, the Directing Certificateholder will have no right to consult with the special servicer with respect to Asset Status Reports and the special servicer will only be obligated to consult with the operating advisor with respect to any Asset Status Report as described above. The special servicer may choose to revise the Asset Status Report as it deems reasonably necessary in accordance with the Servicing Standard to take into account any input and/or recommendations of the operating advisor or the Directing Certificateholder during the applicable periods described above, but is under no obligation to follow any particular recommendation of the operating advisor or the Directing Certificateholder.] [APPLICABLE TO OFFERINGS CLOSING ON OR AFTER DECEMBER 24, 2016 THAT SATISFY RISK RETENTION REQUIREMENTS THROUGH THIRD PARTY PURCHASER OF HORIZONTAL RESIDUAL INTEREST]

[Notwithstanding the foregoing, with respect to a Subordinate Companion Loan and prior to the occurrence and continuance of an AB Control Appraisal Period, the special servicer will prepare an Asset Status Report for an AB Whole Loan within [60] days after it becomes a Specially Serviced Loan in accordance with the terms of the PSA and any applicable provisions of the related Intercreditor Agreement and the Directing Certificateholder will have no approval rights over any such Asset Status Report. See "Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loan".]

[With respect to the Non-Serviced Mortgage Loan, the Non-Serviced Directing Certificateholder will have approval and consultation rights with respect to any asset status report prepared by the Non-Serviced Special Servicer with respect to the Non-Serviced Whole Loan under the Non-Serviced PSA that are substantially similar to the approval and consultation rights of the Directing Certificateholder with respect to the Mortgage Loans and the Serviced Whole Loans. See "—Servicing of the Non-Serviced Mortgage Loan".]

Such requirement precludes enforcement of the security for the related Mortgage Loan until a satisfactory environmental site assessment is obtained (or until any required remedial action is taken), but will decrease the likelihood that the issuing entity will become liable for a material adverse environmental condition at the Mortgaged Property. However, we cannot assure you that the requirements of the PSA will effectively insulate the issuing entity from potential liability for a materially adverse environmental condition at any Mortgaged Property.

If title to any Mortgaged Property is acquired by the issuing entity (directly or through a single member limited liability company established for that purpose), the special servicer will be required to sell the Mortgaged Property prior to the close of the third calendar year beginning after the year of acquisition, unless (1) the IRS grants (or does not deny) an extension of time to sell the property or (2) the special servicer, the certificate administrator and the trustee receive an opinion of independent counsel to the effect that the holding of the property by the related Lower-Tier REMIC longer than the above-referenced three year period will not result in the imposition of a tax on any Trust REMIC or cause any Trust REMIC to fail to qualify as a REMIC under the Code at any time that any certificate is outstanding. Subject to the foregoing and any other tax-related limitations, pursuant to the PSA, the special servicer will generally be required to attempt to sell any Mortgaged Property so acquired in accordance with the Servicing Standard. The special servicer will also be required to ensure that any Mortgaged Property acquired by the issuing entity is administered so that it constitutes "foreclosure property" within the meaning of Code Section 860G(a)(8) at all times, and that the sale of the property does not result in the receipt by the issuing entity of any income from nonpermitted assets as described in Code Section 860F(a)(2)(B). If any Lower-Tier REMIC acquires title to any Mortgaged Property, the special servicer, on behalf of such Lower-Tier REMIC, will retain, at the expense of the issuing entity, an independent contractor to manage and operate the property. The independent contractor generally will be permitted to perform construction (including renovation) on a foreclosed property only if the construction was more than 10% completed at the time default on the related Mortgage Loan became imminent. The retention of an independent contractor, however, will not relieve the special servicer of its obligation to manage the Mortgaged Property as required under the PSA.

In general, the special servicer will be obligated to cause any Mortgaged Property acquired as an REO Property to be operated and managed in a manner that would, in its good faith and reasonable judgment and to the extent commercially feasible, maximize the issuing entity's net after-tax proceeds from such property. Generally, no Trust REMIC will be taxable on income received with respect to a Mortgaged Property acquired by the issuing entity to the extent that it constitutes "rents from real property", within the meaning of Code Section 856(c)(3)(A) and Treasury regulations under the Code. Rents from real property include fixed rents and rents based on the gross receipts or sales of a tenant but do not include the portion of any rental based on the net income or profit of any tenant or sub-tenant. No determination has been made whether rent on any of the Mortgaged Properties meets this requirement. Rents from real property include charges for services customarily furnished or rendered in connection

with the rental of real property, whether or not the charges are separately stated. Services furnished to the tenants of a particular building will be considered as customary if, in the geographic market in which the building is located, tenants in buildings which are of similar class are customarily provided with the service. No determination has been made whether the services furnished to the tenants of the Mortgaged Properties are "customary" within the meaning of applicable regulations. It is therefore possible that a portion of the rental income with respect to a Mortgaged Property owned by the issuing entity would not constitute rents from real property, or that none of such income would qualify if a separate charge is not stated for such non-customary services or they are not performed by an independent contractor. Rents from real property also do not include income from the operation of a trade or business on the Mortgaged Property, such as a hotel property, or rental income attributable to personal property leased in connection with a lease of real property if the rent attributable to personal property exceeds 15% of the total net rent for the taxable year. Any of the foregoing types of income may instead constitute "net income from foreclosure property", which would be taxable to the related Lower-Tier REMIC at the highest marginal federal corporate rate (currently 35%) and may also be subject to state or local taxes. The PSA provides that the special servicer will be permitted to cause the related Lower-Tier REMIC to earn "net income from foreclosure property" that is subject to tax if it determines that the net after-tax benefit to Certificateholders is greater than another method of operating or net leasing the Mortgaged Property. Because these sources of income, if they exist, are already in place with respect to the Mortgaged Properties, it is generally viewed as beneficial to Certificateholders to permit the issuing entity to continue to earn them if it acquires a Mortgaged Property, even at the cost of this tax. These taxes would be chargeable against the related income for purposes of determining the proceeds available for distribution to holders of certificates. See "Material Federal Income Tax Considerations—Taxes That May Be Imposed on a REMIC—Prohibited Transactions".

Under the PSA, the special servicer is required to establish and maintain one or more REO Accounts, to be held on behalf of the trustee for the benefit of the Certificateholders and with respect to a Serviced Whole Loan, the Serviced Companion Loan Holder, for the retention of revenues and insurance proceeds derived from each REO Property. The special servicer is required to use the funds in the REO Account to pay for the proper operation, management, maintenance and disposition of any REO Property, but only to the extent of amounts on deposit in the REO Account relate to such REO Property. To the extent that amounts in the REO Account in respect of any REO Property are insufficient to make such payments, the master servicer is required to make a Servicing Advance, unless it determines such Servicing Advance would be nonrecoverable. Within one business day following the end of each Collection Period, the special servicer is required to deposit all amounts received in respect of each REO Property during such Collection Period, net of any amounts withdrawn to make any permitted disbursements, to the Collection Account; provided, that the special servicer may retain in the REO Account permitted reserves.

If the special servicer determines in accordance with the Servicing Standard that it would be in the best economic interests of the Certificateholders or, in the case of a Serviced Whole Loan, Certificateholders and any holder of the related Serviced Companion Loan (as a collective whole as if such Certificateholders and Serviced Companion Loan Holder constituted a single lender) to attempt to sell a Defaulted Loan (other than the Non-Serviced Mortgage Loan) and any related Serviced Companion Loan as described below, the special servicer will be required to use reasonable efforts to solicit offers for each Defaulted Loan on behalf of the Certificateholders and the holder of any related Serviced Companion Loan in such manner as will be reasonably likely to realize a fair price. [In the case of the Non-Serviced Mortgage Loan, under certain limited circumstances permitted under the related Intercreditor Agreement, to the extent that such Non-Serviced Mortgage Loan is not sold together with the Non-Serviced Companion Loan by the special servicer for the Non-Serviced Whole Loan, the special servicer will be entitled to sell (with the consent of the Directing Certificateholder if no Control Termination Event has occurred and is continuing) such Non-Serviced Mortgage Loan if it determines in accordance with the Servicing Standard that such action would be in the best interests of the Certificateholders.] The special

servicer is required to accept the first cash offer received from any person that constitutes a fair price for the Defaulted Loan. If multiple offers are received during the period designated by the special servicer for receipt of offers, the special servicer is required to select the highest offer. The special servicer is required to give the trustee, the certificate administrator, the master servicer, the operating advisor and the Directing Certificateholder 10 business days' prior written notice of its intention to sell any such Defaulted Loan. Neither the trustee nor any of its affiliates may make an offer for or purchase any Defaulted Loan. ["Defaulted Loan" means a Mortgage Loan (other than the Non-Serviced Mortgage Loan) or Serviced Whole Loan (A) (i) that is delinquent at least 60 days in respect of its Periodic Payments or delinquent in respect of its balloon payment, if any, in either case such delinquency to be determined without giving effect to any grace period permitted by the related Mortgage or Mortgage Note and without regard to any acceleration of payments under the related Mortgage and Mortgage Note or (ii) as to which the master servicer or special servicer has, by written notice to the related borrower, accelerated the maturity of the indebtedness evidenced by the related Mortgage Note.]

The special servicer will be required to determine whether any cash offer constitutes a fair price for any Defaulted Loan if the highest offeror is a person other than an Interested Person. In determining whether any offer from a person other than an Interested Person constitutes a fair price for any Defaulted Loan, the special servicer will be required to take into account (in addition to the results of any appraisal, updated appraisal or narrative appraisal that it may have obtained pursuant to the PSA within the prior 9 months), among other factors, the period and amount of the occupancy level and physical condition of the related Mortgaged Property and the state of the local economy.

If the offeror is an Interested Person (provided that the trustee may not be a offeror), then the trustee will be required to determine whether the cash offer constitutes a fair price [unless (i) the offer is equal to or greater than the applicable Purchase Price and (ii) the offer is the highest offer received. Absent an offer at least equal to the Purchase Price, no offer from an Interested Person will constitute a fair price unless (A) it is the highest offer received and (B) at least two other offers are received from independent third parties]. In determining whether any offer received from an Interested Person represents a fair price for any such Defaulted Loan, the trustee will be supplied with and will be required to rely on the most recent appraisal or updated appraisal conducted in accordance with the PSA within the preceding 9‑month period or, in the absence of any such appraisal, on a new appraisal. Except as provided in the following paragraph, the cost of any appraisal will be covered by, and will be reimbursable as, a Servicing Advance.

Notwithstanding anything contained in the preceding paragraph to the contrary, if the trustee is required to determine whether a cash offer by an Interested Person constitutes a fair price, the trustee shall (at the expense of the Interested Person) designate an independent third party expert in real estate or commercial mortgage loan matters with at least 5 years’ experience in valuing or investing in loans similar to the subject Mortgage Loan or Serviced Whole Loan, as the case may be, that has been selected with reasonable care by the trustee to determine if such cash offer constitutes a fair price for such Mortgage Loan or Serviced Whole Loan. If the trustee designates such a third party to make such determination, the trustee will be entitled to rely conclusively upon such third party’s determination. The reasonable costs of all appraisals, inspection reports and broker opinions of value incurred by any such third party pursuant to this paragraph will be covered by, and will be reimbursable by the Interested Person; provided that the trustee will not engage a third party expert whose fees exceed a commercially reasonable amount as determined by the trustee.

The special servicer is required to use reasonable efforts to solicit offers for each REO Property on behalf of the Certificateholders and the related Companion Loan Holder(s) (if applicable) and to sell each REO Property in the same manner as with respect to a Defaulted Loan.

Notwithstanding any of the foregoing paragraphs, the special servicer will not be required to accept the highest cash offer for a Defaulted Loan or REO Property if the special servicer determines (in consultation with the Directing Certificateholder (unless a Consultation Termination Event exists) and, in the case of a Serviced Whole Loan or an REO Property related to a Serviced Whole Loan, the related Companion Loan Holder(s)), in accordance with the Servicing Standard, that rejection of such offer would be in the best interests of the Certificateholders and, in the case of a sale of a Serviced Whole Loan or an REO Property related to a Serviced Whole Loan, the related Companion Loan Holder(s) (as a collective whole as if such Certificateholders and, if applicable, the related Companion Loan Holder(s) constituted a single lender (and with respect to any AB Whole Loan, taking into account the subordinate nature of the

related Trust Subordinate Companion Loan)), and the special servicer may accept a lower offer (from any person other than itself or an affiliate) if it determines, in its reasonable and good faith judgment, that acceptance of such offer would be in the best interests of the Certificateholders and, in the case of a Serviced Whole Loan or an REO Property related to a Serviced Whole Loan, the related Companion Loan Holder(s) (as a collective whole as if such Certificateholders and, if applicable, the related Companion Loan Holder(s) constituted a single lender and with respect to any AB Whole Loan, taking into account the subordinate nature of the related Trust Subordinate Companion Loan)).

[In connection with any such sale involving an AB Whole Loan, the special servicer will also have the right, but not the obligation, to sell the related Trust Subordinate Companion Loan, provided that such sale will require the consent of the Loan Specific Directing Certificateholder. A related Companion Loan Holder (or its representative) or a holder of any mezzanine debt relating to a Defaulted Loan will be permitted to submit an offer at any sale of such Defaulted Loan or related REO Property or may have the option to purchase such Defaulted Loan or related REO Property, as applicable, under the related Intercreditor Agreement (and such purchase price is subject to the terms of such Intercreditor Agreement).] See "Description of the Mortgage Pool—Additional Indebtedness—Mezzanine Indebtedness" and "—The Whole Loans—The Serviced AB Whole Loan".

In addition, with respect to the Non-Serviced Mortgage Loan, if such Mortgage Loan has become a defaulted Mortgage Loan under the related Non-Serviced PSA, the Non-Serviced Special Servicer will generally have the right to sell such Mortgage Loan together with the related Companion Loan as notes evidencing one whole loan. [The issuing entity, as the holder of the Non-Serviced Mortgage Loan, will have the right to consent to such sale if the required notices and information regarding such sale are not provided to the special servicer in accordance with the related Intercreditor Agreement. The Directing Certificateholder will be entitled to exercise such consent right so long as a Control Termination Event has not occurred and is continuing, and if a Control Termination Event has occurred and is continuing, the special servicer will exercise such consent rights.] See "Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Whole Loan".

To the extent that Liquidation Proceeds collected with respect to any Mortgage Loan are less than the sum of (1) the outstanding principal balance of the Mortgage Loan, (2) interest accrued on the Mortgage Loan and (3) the aggregate amount of outstanding reimbursable expenses (including any (i) unpaid servicing compensation, (ii) unreimbursed Servicing Advances, (iii) accrued and unpaid interest on all Advances and (iv) additional expenses of the issuing entity) incurred with respect to the Mortgage Loan, the issuing entity will realize a loss in the amount of the shortfall. The trustee, the master servicer and/or the special servicer will be entitled to reimbursement out of the Liquidation Proceeds recovered on any

(iii) that is (and is not affiliated with) not the depositor, the trustee, the certificate administrator, the master servicer, the special servicer, a mortgage loan seller, the Directing Certificateholder, a depositor, a trustee, a certificate administrator, a master servicer or special servicer with respect to the securitization of a Companion Loan, or any of their respective affiliates;

(iv) that has not been paid by any special servicer or successor special servicer any fees, compensation or other remuneration (x) in respect of its obligations under the PSA or (y) for the appointment or recommendation for replacement of a successor special servicer to become the special servicer[; and

(v) that does not directly or indirectly, through one or more affiliates or otherwise, own any interest in any certificates, any Mortgage Loans, any Companion Loan or any securities backed by a Companion Loan or otherwise have any financial interest in the securitization transaction to which the PSA relates, other than in fees from its role as operating advisor and except as set forth in the PSA.] [APPLICABLE TO OFFERINGS WITH CLOSING DATES ON AND AFTER DECEMBER 24, 2016 THAT SATISFY RISK RETENTION REQUIREMENTS THROUGH THIRD PARTY PURCHASER OF HORIZONTAL RESIDUAL INTEREST]

Other Obligations of Operating Advisor