SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

GENSYM CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

$

| | (2) | | Form, Schedule or Registration Statement No.: |

GENSYM CORPORATION

Notice of 2003 Annual Meeting of Stockholders

to be Held May 12, 2003

You are hereby notified that the 2003 annual meeting of stockholders of Gensym Corporation will be held on Monday, May 12, 2003 at 10:00 a.m., at our offices, 52 Second Avenue, Burlington, Massachusetts, for the purpose of considering and voting upon the following matters:

| | 1. | | To elect two members of our board of directors to serve as Class I directors, each for a term of three years; |

| | 2. | | To ratify the appointment by the board of directors of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending December 31, 2003; and |

| | 3. | | To transact such other business as may properly come before the meeting. |

These items of business are more fully described in the proxy statement accompanying this notice. The board of directors does not know of any other business to be transacted at the annual meeting.

The board of directors has fixed the close of business on Tuesday, April 1, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. A list of our stockholders entitled to notice of and to vote at the meeting will be available for examination by any stockholder, for any purpose germane to the meeting, during ordinary business hours for ten days prior to the meeting at our principal executive offices, 52 Second Avenue, Burlington, Massachusetts, 01803, telephone (781) 265-7100, and at the time and place of the annual meeting.

A copy of our annual report to stockholders for the year ended December 31, 2002 accompanies this notice of meeting and the enclosed proxy statement. Our annual report contains consolidated financial statements and other information of interest to stockholders

By Order of the Board of Directors,

Lowell B. Hawkinson

Chairman and Chief Executive Officer

April 18, 2003

Burlington, Massachusetts

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE.

NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

GENSYM CORPORATION

52 Second Avenue

Burlington, MA 01803

PROXY STATEMENT

2003 Annual Meeting of Stockholders

To Be Held May 12, 2003

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors for use at the 2003 annual meeting of stockholders to be held on Monday, May 12, 2003 at 10:00 a.m., local time, at our offices, 52 Second Avenue, Burlington, Massachusetts 01803.

All proxies will be voted in accordance with the instructions of the stockholder. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying notice of meeting. A stockholder may revoke any proxy at any time before its exercise by delivery of a written revocation to the Secretary of the Company. Attendance at the meeting will not by itself constitute revocation of a proxy unless the stockholder affirmatively revokes the proxy or votes at the meeting.

On April 1, 2003, the record date for determination of stockholders entitled to notice of and to vote at the annual meeting, there were 7,319,284 shares of common stock issued and outstanding and entitled to vote. Each share of common stock entitles the record holder to one vote on each of the matters to be voted upon at the meeting.

The notice of meeting, this proxy statement, the enclosed proxy and our annual report to stockholders for the year ended December 31, 2002 are being mailed to stockholders on or about April 18, 2003.

We will furnish to any stockholder, upon written request, a copy of our annual report on Form 10-K for the year ended December 31, 2002, as filed with the Securities and Exchange Commission, excluding exhibits. Please address requests to Gensym Corporation, 52 Second Avenue, Burlington, Massachusetts 01803, Attention: Corporate Secretary. Exhibits will be provided upon written request and payment of an appropriate processing fee.

Votes Required

The holders of a majority of the shares of our outstanding common stock will constitute a quorum for the transaction of business at the annual meeting. Shares of common stock present in person or represented by proxy, including shares that abstain or do not vote with respect to one or more of the matters presented at the annual meeting, will be counted for purposes of determining whether a quorum exists at the annual meeting.

The affirmative vote of the holders of a plurality of the shares voting on the matter is required to elect directors (Proposal 1). The affirmative vote of the holders of a majority of the shares voting on the matter is required to ratify the selection of PricewaterhouseCoopers LLP as our independent accountants for the year ending December 31, 2003 (Proposal 2).

Shares held by stockholders who abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as shares voted in favor of such matter and will not be counted as shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on the election of directors (Proposal 1) or the ratification of our independent accountants (Proposal 2) because they each require the affirmative vote of a plurality or majority of the shares voting on that matter.

1

Security Ownership of Certain Beneficial Owners and Management

The following table, except as otherwise noted, sets forth information about the beneficial ownership of our common stock as of January 31, 2003 by:

| • | | the stockholders we know to beneficially own more than 5% of our outstanding common stock; |

| • | | each of our current directors; |

| • | | our chief executive officer and the other named executive officers; and |

| • | | all of our current directors, director nominees and executive officers as a group. |

Name and Address of Beneficial Owner (1)

| | Amount and Nature of Beneficial Ownership(2)

| | Percent of Common Stock Outstanding

| |

5% Stockholders: | | | | | |

Johan H. Magnusson (3) Rocket Software, Inc. | | 953,000 | | 13.90 | % |

Two Apple Hill Drive, Natick, MA 01760 | | | | | |

|

David M. Greenhouse (4) Austin W. Marxe Special Situations Fund | | 719,400 | | 10.50 | % |

153 East 53rd Street, 55th Floor, New York, NY 10022 | | | | | |

|

Directors and Executive Officers: | | | | | |

Lowell B. Hawkinson (5) | | 583,667 | | 8.29 | % |

Frank Cianciotta (6) | | 3,000 | | * | |

Robert A. Degan (7) | | 56,083 | | * | |

Barry R. Gorsun (8) | | 51,772 | | * | |

John A. Shane (9) | | 87,899 | | * | |

Thomas E. Swithenbank (10) | | 68,553 | | * | |

John M. Belchers | | 768 | | * | |

Carl D. Schultz (11) | | 21,320 | | * | |

All directors and executive officers as a group (10 persons) (12) | | 883,862 | | 12.15 | % |

| * | | Less than 1% of outstanding shares of common stock |

| (1) | | Unless otherwise indicated, the address of each beneficial owner is c/o Gensym Corporation, 52 Second Avenue, Burlington, MA 01803. |

| (2) | | The number of shares beneficially owned by each director and executive officer is determined under rules promulgated by the Securities and Exchange Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days after January 31, 2003 through the exercise of any stock option or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with his or her spouse) with respect to all shares of capital stock listed as owned by such person or entity. |

| (3) | | Johan Magnusson is the direct beneficial owner of 310,600 shares and may be deemed to be an indirect owner of the 642,400 shares held by Rocket Software, Inc. (“Rocket”). Rocket, Mr. Magnusson, Andrew Youniss and Matthew Kelly share voting and investment power with respect to 642,400 shares. Rocket is the beneficial owner of the 642,400 shares. Mr. Youniss is the direct beneficial owner of 1,500 shares and may be deemed to be an indirect owner of the 642,400 shares held by Rocket. Mr. Kelly is the direct |

2

| | beneficial owner of no shares and may be deemed to be an indirect owner of the 642,400 shares held by Rocket. Mr. Magnusson expressly disclaims beneficial ownership of any shares held by Rocket or Mr. Youniss. Rocket expressly disclaims beneficial ownership of any shares held by Messrs. Magnusson or Youniss. Mr. Youniss expressly disclaims beneficial ownership of any shares held by Rocket or Mr. Magnusson. Mr. Kelly expressly disclaims beneficial ownership of any shares held by Rocket, Mr. Youniss or Mr. Magnusson. The foregoing information is based solely on a Schedule 13D/A, dated January 17, 2002, filed with the Securities and Exchange Commission by Rocket and Messrs. Youniss, Magnusson and Kelly. |

| (4) | | AWM Investment Company, Inc., a Delaware corporation (“AWM”), is the general partner of MGP Advisers Limited Partnership, a Delaware limited partnership (“MGP”) and the general partner of and investment adviser to Special Situations Cayman Fund, L.P., a Cayman Islands limited partnership (the “Cayman Fund”). MGP is the general partner of and investment adviser to Special Situations Fund III, L.P., a Delaware limited partnership (“SSF III”). Austin W. Marxe and David M. Greenhouse are officers, directors and members or principal shareholders of MGP and AWM. SSF III and MGP beneficially own 532,100 shares, and the Cayman Fund and AWM beneficially own 187,300 shares. Messrs. Marxe and Greenhouse have sole voting power and sole dispositive power over an aggregate of 719,400 shares, comprised of the 532,100 shares beneficially owned by SSF III and MGP and the 187,300 shares beneficially owned by the Cayman Fund and AWM. The foregoing information is based on a Schedule 13D/A, dated November 30, 2001, filed with the Securities and Exchange Commission collectively by SSF III, the Cayman Fund, MGP, AWM and Messrs. Marxe and Greenhouse. |

| (5) | | Includes 12,000 shares held by trust for the benefit of Mr. Hawkinson’s children, as to which shares Mr. Hawkinson disclaims beneficial ownership, and shares held by Mr. Hawkinson’s spouse, as to which shares Mr. Hawkinson disclaims beneficial ownership. Also includes 186,667 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

| (6) | | Consists of shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

| (7) | | Includes 51,334 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

| (8) | | Includes 43,000 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

| (9) | | Includes 3,405 shares held by Palmer Service Corporation, of which Mr. Shane is the President and sole stockholder. Mr. Shane disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. Also includes 63,900 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

| (10) | | Includes 13,153 shares of common stock held in joint title with Mr. Swithenbank’s spouse and 55,400 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

| (11) | | Includes 20,201 shares of common stock subject to outstanding stock options exercisable within the 60-day period following January 31, 2003. |

| (12) | | Includes an aggregate of 423,502 of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2003. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and the holders of more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. Directors, executive officers and 10% stockholders are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of our records and written representations by the persons required to file these reports, we believe that during 2002 our reporting persons complied with all section 16(a) filing requirements, except that Mr. Michael J. Hoey, Vice President of Sales, filed two late reports, a late initial statement of beneficial ownership on Form 3 in September 2002 and a late statement of change of beneficial ownership on Form 4 reporting a transaction consummated in December 2002, and Mr. Carl D. Schultz, Vice President of Operations, filed a late annual statement of change in beneficial ownership on Form 5 for the fiscal year ended December 31, 2002.

3

PROPOSAL I —ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with members of each class holding office for a staggered three-year term. Pursuant to our by-laws, the board of directors has fixed the size of the board at six members. The terms of Messrs. Shane and Swithenbank (Class I directors) will expire at this annual meeting of stockholders; the terms of Messrs. Cianciotta and Hawkinson (Class II directors) will expire at the 2004 annual meeting of stockholders; and the terms of Messrs. Degan and Gorsun (Class III directors) will expire at the 2005 annual meeting of stockholders. Upon the expiration of the term of a class of directors at an annual meeting of stockholders, directors will be elected, or reelected, to serve within such class for a succeeding three-year term.

Our board of directors, based on the recommendation of the corporate governance committee, proposed the election of John A. Shane and Thomas E. Swithenbank as Class I directors. The persons named in the enclosed proxy will vote to elect Messrs. Shane and Swithenbank as Class I directors, unless the proxy is marked otherwise. In accordance with our board guidelines on significant corporate governance issues adopted on March 25, 2002, we expect each of directors to retire from service on the board at the annual meeting following their 70th birthday. Notwithstanding these guidelines, our board has requested that Mr. Shane stand for election in 2003 for one additional three-year term.

Messrs. Shane and Swithenbank currently serve as our directors. Each Class I director will be elected to hold office until the annual meeting of stockholders held in 2006 and until his successor is elected and qualified. The nominees have indicated their willingness to serve, if elected; however, if any nominee should be unable to serve, the persons acting under the proxy may, in their discretion, vote for a substitute nominee. Our board of directors believes each of the nominees will be able to serve if elected.

Set forth below are the names of each nominee for director and each of our current directors, their ages, the year in which they first became one of our directors, their principal occupations and employment during the past five years and the names of the other public companies of which they serve as a director.

Nominees For Terms Expiring in 2006 (Class I Directors)

Name and Period of Service as a Director

| | Age

| | Principal Occupation, Other Business Experience During The Past Five Years and Other Directorships

|

John A. Shane (1) (2) (3) Director since 1995 | | 70 | | Mr. Shane has been president of Palmer Service Corporation, a venture capital management company, since 1972. Mr. Shane is also a director of Overland Storage, Inc., a supplier of storage solutions for computer networks. |

|

Thomas E. Swithenbank (1) Director since 1997 | | 58 | | Mr. Swithenbank served as our interim chief financial officer from March 25, 2002 until May 16, 2002. From 1990 until August 1998, Mr. Swithenbank served as president and chief executive officer of Harte-Hanks Data Technologies, a computer software and service company specializing in database marketing systems. Mr. Swithenbank served as an executive vice president of Pegasystems, Inc., a developer of communications software products, from August 1998 to April 1999. Mr. Swithenbank served as an executive vice president and chief financial officer of Techmar Communications, Inc., a business processing outsourcing firm, from April 1999 to December 2001. Since December 2001, he has been a private investor. |

4

Directors Whose Terms Expire in 2004 (Class II Directors)

Name and Period of Service as a Director

| | Age

| | Principal Occupation, Other Business Experience During The Past Five Years and Other Directorships

|

Frank Cianciotta Director since 2003 | | 48 | | Mr. Cianciotta has served as the vice president of international business development of Market-Partners, a provider of consulting and technology solutions, since March 2002. From August 2001 to March 2002, Mr. Cianciotta acted as a private investor. From August 2000 to August 2001, he served as general manager of E.piphany Canada, a supplier of intelligent customer interaction software. From November 1999 to August 2000, he served as director of sales of Deloitte Consulting Canada, a consulting service organization; and from September 1996 to September 1999, he served as the general manager of Siebel Systems Canada, a producer of eBusiness application software. |

|

Lowell B. Hawkinson Director since 1986 | | 60 | | Mr. Hawkinson has served as our chairman, president, chief executive officer and secretary since August 2001. Mr. Hawkinson had previously served as our chairman, chief executive officer, treasurer and secretary from September 1986 to October 1999. From November 1999 to August 2001, Mr. Hawkinson was an independent consultant. |

Directors Whose Terms Expire in 2005 (Class III Directors)

Name and Period of Service as a Director

| | Age

| | Principal Occupation, Other Business Experience During The Past Five Years and Other Directorships

|

Robert A. Degan (1) (2) Director since 1999 | | 64 | | Mr. Degan has been a private investor since January 2000. From November 1998 to December 1999, Mr. Degan served as general manager of the Enhanced Services & Migration Unit (formerly, Summa Four, Inc.) of Cisco Systems, Inc., a provider of networking solutions. From January 1997 to November 1998, Mr. Degan was president, chief executive officer and a director of Summa Four, Inc., a provider of programmable switches. In addition, from July 1998 until November 1998, Mr. Degan served as the chairman of the board of Summa Four, Inc. Mr. Degan is also a director of FlexiInternational Software, Inc., a producer of accounting and financial management software, CaminoSoft Corp., a provider of date storage and management solutions, and Overland Storage, Inc., a supplier of storage solutions for computer networks. |

|

Barry R. Gorsun (2) (3) Director since 1998 | | 60 | | Mr. Gorsun has been a private investor since July 1998. Previously, Mr. Gorsun served as president of Summa Four, Inc. from July 1988 through July 1993, chief executive officer from July 1990 until July 1993, and chairman from July 1993 until July 1998. |

| (1) | | Member of our audit committee. |

| (2) | | Member of our compensation committee. |

| (3) | | Member of our corporate governance committee. |

The board of directors recommends a vote FOR the election of each of the nominees for director named above.

For information relating to shares of common stock owned by each of our directors, see “Security Ownership of Certain Beneficial Owners and Management” above.

5

Board and Committee Meetings

The board of directors held 10 meetings during 2002, including regular, special and telephonic meetings. During 2002, each director attended at least 75% of the meetings of the board of directors and of the committees on which he served.

The board of directors has an audit committee, a compensation committee and a corporate governance committee.

Audit Committee

Messrs. Degan, Shane and Swithenbank currently serve on our audit committee. The audit committee assists the board in fulfilling its oversight responsibilities by reviewing the financial information that will be provided to our stockholders, the systems of internal controls that management and the board of directors have established, the independence of our auditors and all audit processes. The audit committee:

| | • | | consults with our independent accountants to review our annual financial statements and related footnotes prior to their submission to the board of directors; |

| | • | | discusses with the independent accountants our internal financial controls, the audit scope and procedural plans, and recommendations by the auditors; |

| | • | | assesses and confirms the independence of the independent accountants selected as auditor; and |

| | • | | coordinates our audit activities. |

The audit committee has the sole authority and responsibility to select, evaluate and, where appropriate, replace the independent accountants. In addition, the audit committee reviews all services provided by the independent accountants and all fees paid to them.

The audit committee held eight meetings during 2002, including regular, special and telephonic meetings. The audit committee has recommended that PricewaterhouseCoopers LLP be selected as our independent accountants for the year ending December 31, 2003.

Compensation Committee

Messrs. Cianciotta, Degan, Gorsun, Shane and Swithenbank currently serve on our compensation committee. The compensation committee makes recommendations concerning salaries and incentive compensation for our employees and consultants and administers stock option grants pursuant to our stock plans. The compensation committee held nine meetings during 2002, including regular, special and telephonic meetings.

Corporate Governance Committee

Messrs. Gorsun and Shane currently serve on our corporate governance committee. The corporate governance committee is responsible for making recommendations as to the number of members of the board of directors and composition of the board and its committees and periodically evaluating the board’s performance. The duties of the corporate governance committee include the nomination of new board members after consultation with the chief executive officer and an annual written evaluation of the board of directors and its committees. The corporate governance committee will consider nominees recommended to the committee by stockholders in accordance with the procedures described below under the caption “Stockholder Proposals for 2004 Annual Meeting.” The corporate governance committee held eight meetings during 2002, including regular, special and telephonic meetings.

6

Report of the Audit Committee

Messrs. Degan, Shane and Swithenbank comprised the audit committee for the fiscal year ended December 31, 2002. However, for the period March 25, 2002, the date of the auditor’s report relating to our audited financial statements for the year ended December 31, 2001, until May 16, 2002, Mr. Gorsun replaced Mr. Swithenbank on our Audit Committee while Mr. Swithenbank served as our interim chief financial officer.

Our Audit Committee acts under a written charter first adopted and approved on April 28, 2000.

Our Audit Committee reviewed our audited financial statements for the fiscal year ended December 31, 2002 and discussed these financial statements with our management. Our Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with PricewaterhouseCoopers LLP, our independent accountants.

Our independent accountants also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Our Audit Committee discussed with the independent accountants the matters disclosed in this letter and their independence from the Company. Our Audit Committee also considered whether the independent accountants’ provision of the other, non-audit related services to us which are referred to below in the discussion relating to Proposal III is compatible with maintaining such auditors’ independence.

Based on its discussions with management and the independent accountants, and its review of the representations and information provided by management and the independent accountants, our Audit Committee recommended to our Board of Directors that the audited financial statements be included in the our Annual Report on Form 10-K for the year ended December 31, 2002.

By our Audit Committee of the Board of Directors.

Thomas E. Swithenbank

Robert A. Degan

John A. Shane

Director Compensation

We pay our non-employee directors $12,000 annually, plus $1,000 for physical attendance at each meeting of the board of directors or $500 for participation in a board meeting telephonically. Non-employee directors also receive a $1,500 quarterly retainer for each committee on which the director serves. Non-employee directors are eligible to receive stock options under our 2000 Stock Incentive Plan and our 1995 director stock option plan, and all directors are eligible to receive stock options under our 1994 stock option plan and our 1997 stock incentive plan.

Beginning January 1, 2003, each of our non-employee directors may elect to receive up to 100% of his board compensation in shares of our common stock granted pursuant to our 2000 Stock Incentive Plan in lieu of cash. Each director must make his election in increments of 10% and may only change his election effective as of two specified times each year.

Upon their initial election as a director, each non-employee director is granted a nonstatutory option for the purchase of 3,000 shares of our common stock. In June of each year, each non-employee director receives a nonstatutory option for the purchase of 10,000 shares of our common stock. All options granted to directors are granted at an exercise price equal to the fair market value of our common stock on the date of the grant, are immediately exercisable and are exercisable for up to 10 years from the date of grant.

7

INFORMATION ABOUT EXECUTIVE COMPENSATION

Summary Compensation

The following table sets forth certain information required under applicable rules of the Securities and Exchange Commission about the compensation, for each of the last three fiscal years, of our chief executive officer and our two other executive officers whose total annual salary and bonus for fiscal year 2002 exceeded $100,000 and who were serving as our executive officers on December 31, 2002.

SUMMARY COMPENSATION TABLE

| | | Annual Compensation(1)

| | Long-Term Compensation Awards

| | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities Underlying Options(#)

| | All Other Compensation ($)(2)

|

Lowell B. Hawkinson (3) President and Chief Executive Officer | | 2002 2001 | | 260,401 102,404 | | 102,313 98,702 | | — 260,000 | | 12,627 139,375 |

| | | | | | | | | | | |

John M. Belchers (4) Chief Financial Officer | | 2002 | | 112,067 | | 23,691 | | 70,000 | | 10,210 |

| | | | | | | | | | | |

Carl D. Schultz (5) Vice President of Operations | | 2002 | | 126,512 | | 27,040 | | 30,000 | | 11,329 |

| (1) | | In accordance with the rules of the Securities and Exchange Commission, we have omitted Other Annual Compensation in the form of perquisites and other personal benefits because the aggregate amount of such perquisites and other personal benefits constituted less than the lesser of $50,000 or 10% of the total amount of annual salary and bonus for each executive officer for each fiscal year indicated. |

| (2) | | In fiscal year 2002, All Other Compensation included the following amounts: (A) contributions we made under our 401(k) Plan for Messrs. Belchers and Schultz in the amounts of $2,297 and $706, respectively; and (B) payments we made for health and dental benefits, life insurance, and long and short term disability insurance for Messrs. Hawkinson, Belchers and Schultz in the amounts of $12,627, $7,913 and $10,624, respectively. |

In fiscal year 2001, All Other Compensation included the following amounts: (A) payments we made for health and dental benefits, life insurance, and long and short term disability insurance for Messrs. Hawkinson in the amount of $12,305 and (B) amounts we paid in connection with the resignation or termination of employment comprising severance payments to Mr. Hawkinson in the amount of $127,070.

| (3) | | Mr. Hawkinson rejoined Gensym Corporation as our president and chief executive officer on August 3, 2001. Mr. Hawkinson had previously served as our president and chief executive officer from September 1986 through October 1999. Mr. Hawkinson did not serve as one of our executive officers during fiscal year 2000. During fiscal year 2000, we paid Mr. Hawkinson severance payments totaling $215,000. Mr. Hawkinson also received options to purchase 10,000 shares of common stock in June 2000 as a non-employee director. |

| (4) | | Mr. Belchers became our chief financial officer on May 10, 2002. |

| (5) | | Mr. Schultz became our vice president of operations on April 16, 2002. |

8

Option Grants in 2002

Options representing a total of 237,000 shares of our common stock were granted in fiscal year 2002. The following table sets forth information regarding options granted during the fiscal year ended December 31, 2002 to our named executive officers. No stock appreciation rights were granted during 2002.

Option Grants in 2002

| | | Number of Shares Underlying Options Granted

| | Percent of Total Options Granted to Employees in 2002

| | | Exercise Price ($/Share)(1)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

| | | | | | | 5%($)

| | 10%($)

|

John M. Belchers | | 70,000 | | 29.53 | % | | 0.72 | | 5/16/12 | | 31,696 | | 103,180 |

Carl D. Schultz | | 30,000 | | 12.65 | % | | 0.72 | | 5/16/12 | | 13,584 | | 44,220 |

| (1) | | The exercise price is equal to the fair market value of our common stock on the date of the grant. |

| (2) | | Potential realizable value is based on an assumption that the market price of our common stock will appreciate at the stated rates (5% and 10%), compounded annually, from the date of grant until the end of the 10-year term. These values are calculated based on rules promulgated by the Securities and Exchange Commission and do not reflect our estimate or projection of future stock prices. Actual gains, if any, on stock option exercises will be dependent upon the future performance of the price of our common stock and the timing of exercises. |

Option Exercises During 2002 and Fiscal Year-End Option Values

None of our named executive officers exercised stock options during the fiscal year ended December 31, 2002. The following table sets forth information regarding the number and value of unexercised options to purchase our common stock held by each of the named executive officers as of December 31, 2002.

Fiscal Year-End Option Values

| | | Number of Shares Underlying Unexercised Options at Fiscal Year-End

| | Value of Unexercised In-the-Money Options at Fiscal Year-End (1)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Lowell B. Hawkinson | | 186,667 | | 83,333 | | 25,000 | | 12,500 |

John M. Belchers | | — | | 70,000 | | — | | — |

Carl D. Schultz | | 19,535 | | 49,465 | | 1,667 | | 3,333 |

| (1) | | The value of the unexercised in-the-money options is calculated by multiplying the number of shares of common stock underlying the option by the difference between $0.52, which was the closing price per share of our common stock on the OTC Bulletin Board on December 31, 2002, and the applicable per share exercise price of the option. |

9

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets for information about the securities authorized for issuance under our equity compensation plans as of December 31, 2002:

Equity Compensation Plan Information

| | | (a)

| | (b)

| | (c)

| |

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(1)

| |

Equity compensation plans approved by stockholders | | 1,344,944 | | $ | 1.43 | | 711,875 | (2) |

| (1) | | In addition to being available for future issuance upon the exercise of options that may be granted after December 31, 2002, 42,727, 264,787 and 118,641 shares under the 1994 Stock Option Plan, 1997 Stock Incentive Plan and 2000 Stock Option Plan, respectively, may instead be issued in the form of restricted stock, stock appreciation rights, performance shares or other equity-based awards and 18,000 shares under the 1995 Director Stock Option Plan may instead be issued in the form of restricted stock. |

| (2) | | Includes 267,720 shares of common stock available for grant under our 1995 Employee Stock Purchase Plan which may be issued in connection with the offering period ending on May 31, 2003. |

Executive Employment and Severance Agreements

In August 2001, we entered into an employment agreement with Lowell B. Hawkinson, relating to his employment as our president and chief executive officer. Under the terms of that agreement, Mr. Hawkinson received an annual base salary of $250,000 and was eligible to receive an annual bonus of up to 50% of his annual base salary based on the Company’s achievement. Mr. Hawkinson’s employment agreement expired on October 31, 2002 and has not been replaced. Also pursuant to the employment agreement, Mr. Hawkinson was granted options to purchase 250,000 shares of the Company’s common stock. The options vest in three equal annual installments commencing on August 3, 2001.

We currently do not have employment agreements with Mr. Hawkinson nor with any of our other executive officers.

Report of the Compensation Committee

Our compensation committee is responsible for establishing compensation policies with respect to the our executive officers, including the president and chief executive officer, and setting the compensation for these individuals.

Our compensation committee seeks to achieve three broad goals in connection with our executive compensation programs and decisions regarding individual compensation. First, our compensation committee structures executive compensation programs in a manner that our committee believes will enable us to attract and retain key executives. Second, our compensation committee establishes compensation programs that are designed to reward executives for our achievement of specified operating income goals and the executive’s achievement of certain assigned objectives. Our compensation committee believes that tying compensation, in part, to particular goals creates a performance-oriented environment for our executives. Finally, our executive compensation programs are intended to link a portion of the compensation of our executives with the performance of our common stock.

10

Based on the objectives described above, our executive compensation programs generally consist of three components: (1) base salary, (2) annual cash bonus and (3) stock-based, equity incentives. In establishing base salaries for our executive officers, including our chairman, president and chief executive officer, our compensation committee monitors salaries at other companies, particularly those that are in the same or related industries as us, and/or are located in our general geographic area. In addition, our compensation committee considers historic salary levels of the officer and the nature of the officer’s responsibilities, and compares the officer’s base salary with those of our other executives.

Our compensation committee links cash bonuses to annual profitability goals and the achievement by the executives of certain assigned objectives. The specified objectives for our executive officers are generally both objective and subjective and include such goals as bookings, revenue, profit and departmental goals. The compensation committee believes that these arrangements closely link the executives’ performance to our or the respective business unit’s key drivers of success.

Stock-based equity incentives, such as stock option grants, are designed to tie a portion of the overall compensation of the executive officers receiving such awards to our long range performance. Furthermore, we stagger the vesting schedule of options to create an incentive for the executives to remain with us and to allow all of their options to vest. This serves as an additional means for us to retain the services of key executives.

The compensation committee applies the same compensation philosophy in establishing the compensation for our chief executive officer as is applied for the other executive officers. The compensation committee believes that the compensation of the chief executive officer is consistent with our general policies concerning executive compensation and is appropriate in light of our financial objectives and performance. Awards of long-term incentive compensation to the chief executive officer are considered concurrently with awards to other executive officers and follow the same general policies as such other long-term incentive awards.

Mr. Hawkinson’s base salary for 2002 was $275,000. Mr. Hawkinson did not receive options to acquire shares of the Company’s common stock during the 2002 fiscal year. In fiscal year 2002, Mr. Hawkinson received an annual performance bonus of $102,313 based upon his achievement of performance objectives determined by the board of directors. Mr. Hawkinson’s compensation was designed to align his interest with those of our stockholders by tying the value of the stock option award and his eligibility for bonuses to the success of his efforts toward our restructuring, and returning our company to operational profitability. The compensation committee believes that Mr. Hawkinson’s compensation has been consistent with the compensation committee’s compensation philosophy.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for compensation over $1,000,000 paid to its chief executive officer and its four other most highly compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. In this regard, we have structured the stock options granted to our employees in a manner that qualifies such options as performance-based compensation under Section 162(m). Based on the compensation awarded to our executive officers, it does not appear that the Section 162(m) limitation will have a significant impact on us in the near term. While the committee does not currently intend to qualify compensation paid to executive officers, other than stock options, as a performance-based compensation, the committee will continue to monitor the impact of Section 162(m) on us.

Compensation Committee

John A. Shane, Chairman

Robert A. Degan

Barry R. Gorsun

11

Compensation Committee Interlocks and Insider Participation

The current members of our compensation committee are Messrs. Degan, Gorsun and Shane. During the fiscal year ended December 31, 2002, none of our executive officers has served as a director or member of the compensation committee, or other committee serving an equivalent function, of any other entity that had executive officers serving as a member of our board of directors or compensation committee.

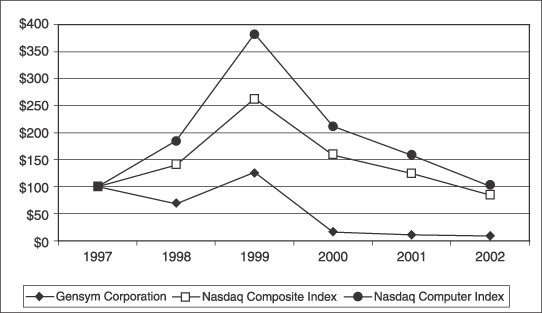

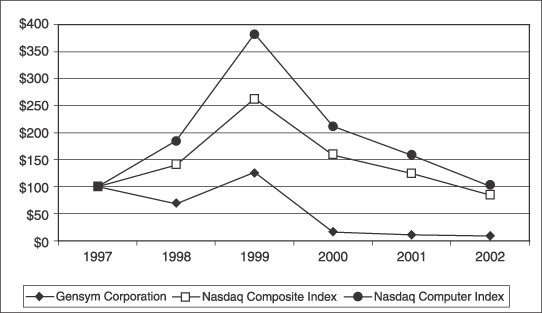

Comparative Stock Performance

The following graph compares the cumulative total stockholder return on our common stock since December 31, 1997 with the cumulative total return for the Nasdaq Composite Index and the Nasdaq Computer Index. The comparison assumes the investment of $100 on December 31, 1997 in our common stock, the Nasdaq Composite Index and the Nasdaq Computer Index and assumes all dividends are reinvested. Measurement points are the last trading day for each respective fiscal year.

| | | Year ended December 31,

|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

Gensym Corporation | | $ | 100 | | $ | 69 | | $ | 126 | | $ | 18 | | $ | 13 | | $ | 11 |

Nasdaq Composite Index | | $ | 100 | | $ | 139 | | $ | 259 | | $ | 157 | | $ | 124 | | $ | 85 |

Nasdaq Computer Index | | $ | 100 | | $ | 183 | | $ | 376 | | $ | 209 | | $ | 158 | | $ | 101 |

12

PROPOSAL II—RATIFICATION OF THE APPOINTMENT OF AUDITORS

As recommended by the audit committee, our board of directors has selected the firm of PricewaterhouseCoopers LLP to be our independent accountants for the fiscal year ending December 31, 2003 and recommends to our stockholders that they vote for ratification of that selection. PricewaterhouseCoopers LLP has served as our independent accountants since April 2002.

A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting to respond to appropriate questions, and to make a statement if he or she desires.

The selection of independent accountants is approved annually by our board of directors and subsequently submitted to the stockholders for ratification. Although stockholder ratification of the board of directors’ selection of PricewaterhouseCoopers LLP is not required by law, the board of directors believes that it is advisable to give stockholders the opportunity to ratify this selection. If this proposal is not approved at the annual meeting, the board of directors will reconsider its selection of PricewaterhouseCoopers LLP.

The Board of Directors recommends a vote FOR of the ratification of PricewaterhouseCoopers LLP as independent accountants for 2003.

Change in Accountants

Our audit committee annually considers and recommends to our board the selection of our independent accountants. As recommended by the audit committee, our board of directors on March 27, 2002 dismissed Arthur Andersen LLP as our independent accountants and, on April 8, 2002, PricewaterhouseCoopers LLP was engaged to serve as our independent accountants for the fiscal year ended December 31, 2002.

Arthur Andersen LLP’s audit report on our consolidated financial statements for the fiscal year ended December 31, 2000 contained an explanatory paragraph regarding our ability to continue as a going concern. Except as stated above, Arthur Andersen LLP’s audit reports on our consolidated financial statements for the fiscal years ended December 31, 2001 and 2000 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2001 and 2000 and through March 27, 2002, there were no disagreements with Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen LLP’s satisfaction, would have caused it to make reference to the subject matter of the disagreement in connection with its audit reports on our consolidated financial statements for such years.

During the fiscal years ended December 31, 2001 and 2000 and through March 27, 2002, there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K, except that in connection with its work on our consolidated financial statements for the fiscal year ended December 31, 2001, Arthur Andersen LLP noted what it considered to be deficiencies in the design and implementation of our company’s internal financial controls relating to the financial closing and review process, the consolidation process, foreign operations and control, reconciliation of sub-ledgers and trial balances to the general ledger, and account analysis supporting recorded amounts. Arthur Andersen LLP advised us that the noted deficiencies constituted a reportable event under Item 304(a)(1)(v)(A) of Regulation S-K. Our audit committee discussed the subject matter of this reportable event with Arthur Andersen LLP. Additionally, we authorized Arthur Andersen LLP to respond fully to inquiries of PricewaterhouseCoopers LLP concerning the subject matter of the reportable event.

We requested Arthur Andersen LLP to furnish to us a letter addressed to the Securities and Exchange Commission stating whether or not it agreed with the above statements. A copy of that letter, dated May 16, 2002, was included with our current report on Form 8-K, filed with the Securities and Exchange Commission on May 16, 2002.

13

Prior to their engagement, neither we, nor anyone acting on our behalf, consulted PricewaterhouseCoopers LLP with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our consolidated financial statements, or any other matters or reportable events as set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K.

Independent Auditor Fees and Other Matters

The following is a description of the audit and non-audit services performed by PricewaterhouseCoopers LLP for us during fiscal year 2002 and the fees associated with such services.

Audit Fees

PricewaterhouseCoopers LLP billed us an aggregate of $299,000 in fees for professional services rendered in connection with the audit of our financial statements for the most recent fiscal year and the reviews of the financial statements included in each of our quarterly reports on Form 10-Q during the fiscal year ended December 31, 2002.

Financial Information Systems Design and Implementation Fees

PricewaterhouseCoopers LLP has not billed us for any professional services rendered to us and our affiliates for the fiscal year ended December 31, 2002 in connection with the design and implementation of financial information systems, the operation of information systems and the management of local area networks.

All Other Fees

PricewaterhouseCoopers LLP billed us an aggregate of $105,000 in fees for other services rendered to us and our affiliates for the fiscal year ended December 31, 2002. These services included the review of and assistance with Securities and Exchange Commission filings and tax compliance.

STOCKHOLDER PROPOSALS FOR 2004 ANNUAL MEETING

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 and intended to be presented in the proxy material for the 2004 annual meeting of stockholders must be received by us at our offices, 52 Second Avenue, Burlington, MA 01803, no later than December 22, 2003 in order to be considered for inclusion in the proxy statement relating to that meeting. We suggest that proponents submit their proposals by certified mail, return receipt requested, addressed to our corporate secretary.

Our amended and restated by-laws also establish advance notice procedures with respect to a stockholder nomination of candidates for election as directors and for the conduct of other business to be brought before an annual meeting by a stockholder not submitted pursuant to Rule 14a-8. A notice regarding a director nomination or a proposal for other business must be received by us not less than 60 days nor more than 90 days prior to the applicable stockholder meeting. However, in the event that less than 70 days’ notice or prior disclosure of the date of the meeting is given or made to our stockholders, the notice must be received by us not later than the tenth day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever occurs first. Any such notice must contain certain specified information concerning the persons to be nominated and/or the other business to be brought before the annual meeting and the stockholder submitting the director nomination or proposal for other business. We have not yet publicly announced the date of the 2004 annual meeting. The advance notice provisions of our by-laws supersede the notice requirements contained in recent amendments to Rule 14a-4. Director nominations or stockholder proposals for other business to be brought before the annual meeting should be mailed to: Corporate Secretary, Gensym Corporation, 52 Second Avenue, Burlington, MA 01803.

14

SOLICITATION OF PROXIES

We will bear the cost of soliciting proxies. In addition to solicitations by mail, our directors, officers and regular employees may, without additional remuneration, solicit proxies by telephone, facsimile and personal interviews. We will request brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares and request instructions for voting the proxies. We will reimburse such brokerage houses and other persons for their reasonable expenses in connection with this distribution.

We will provide free of charge to any stockholder from whom a proxy is solicited pursuant to this proxy statement, upon written request from such stockholder, a copy of our annual report filed with the Securities and Exchange Commission on Form 10-K for our fiscal year ended December 31, 2002, without exhibits. Requests for this report should be directed to Gensym Corporation, 52 Second Avenue, Burlington, Massachusetts 01803, Attention: Corporate Secretary. Exhibits will be provided upon request and payment of an appropriate processing fee.

OTHER MATTERS

The Board of Directors knows of no other business that will be presented for consideration at the annual meeting other than that described above. However, if any other business should come before the annual meeting, it is the intention of the persons named in the enclosed proxy to vote, or otherwise act, in accordance with their best judgment on such matters.

By order of the Board of Directors,

Lowell B. Hawkinson

Chairman and Chief Executive Officer

April 18, 2003

The board of directors hopes that stockholders will attend the meeting. Whether or not you plan to attend, you are urged to complete, date, sign and return the enclosed proxy in the accompanying envelope. Prompt response will greatly facilitate arrangements for the meeting and your cooperation is appreciated. Stockholders who attend the meeting may vote their stock personally even though they have sent in their proxies.

15

DETACH HERE

PROXY

GENSYM CORPORATION

PROXY for Annual Meeting of Stockholders – May 12, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned, revoking all prior proxies, hereby appoint(s) Lowell B. Hawkinson and John M. Belchers, and each of them, with full power of substitution, as attorneys or attorney for the undersigned, for and in the name(s) of the undersigned to vote and act at the annual meeting of stockholders of Gensym Corporation to be held at the offices of the Company, 52 Second Avenue, Burlington, Massachusetts, on Monday, May 12, 2003 at 10:00 a.m., or any adjournment thereof, upon or in respect of all the shares of stock of Gensym Corporation upon or in respect of which the undersigned would be entitled to vote or act, and will all the powers the undersigned would possess, if personally present, upon all matters which may properly come before said meeting, as described in the Proxy Statement and Notice dated April 11, 2003, receipt of which is hereby acknowledged.

Unless a contrary direction is indicated, this Proxy will be voted FOR all nominees listed in Proposal 1 and FOR the ratification of the appointment of PricewaterhouseCoopers LLP as independent accountants in Proposal 2, in each case as more specifically set forth in the Proxy Statement. If specific instructions are indicated, this Proxy will be voted in accordance therewith.

The Board of Directors recommends a vote FOR all nominees named in Proposal 1 and a vote FOR Proposal 2.

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof.

Address Change: ________________________________________________________________

_______________________________________________________________________________

(If you noted any Address Change above, please mark corresponding box on the reverse side.)

SEE REVERSE SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE SIDE |

DETACH AND RETURN THIS PORTION ONLY

GENSYM CORPORATION

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ALL NOMINEES

NAMED IN PROPOSAL 1 AND FOR PROPOSAL 2.

Vote on Directors 1. Election of Class I Directors Nominees: (01) John A. Shane (02) Thomas E. Swithenbank | | Vote on Proposal 2. Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent accountants for the fiscal year 2003. |

For All Nominees | | Withhold From All Nominees | | For | | Against | | Abstain |

¨ | | ¨ | | ¨ | | ¨ | | ¨ |

For All Except | | | | | | | | |

¨ | | | | | | | | |

To withhold authority to vote for any individual nominee, mark “For All Except” and write the nominees name in the line below: | | | | | | |

|

| | |

| | |

| | | | | | | | | |

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY IN THE ENCLOSED POSTAGE PREPAID ENVELOPE.

NOTE: Signature should be exactly as name appears on imprint. If stock is registered in the names of two or more persons as joint owners, trustees or otherwise, this proxy should be personally signed by each of them or accompanied by proof of authority of less than all to act. In the case of executors, administrators, trustees, guardians and attorneys, unless the stock is registered in their names, proof of authority should accompany this proxy.

MARK HERE FOR ADDRESS ¨

CHANGE AND NOTE AT LEFT.

Signature:____________________________________ Signature:__________________________________

Date: __________________ Date:__________________________

2