SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to Rule 14a-12 | | |

GENSYM CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

$

| | (2) | | Form, Schedule or Registration Statement No.: |

GENSYM CORPORATION

Notice of 2004 Annual Meeting of Stockholders

to be Held May 27, 2004

You are hereby notified that the 2004 annual meeting of stockholders of Gensym Corporation will be held on Thursday, May 27, 2004 at 10:00 a.m., local time, at our offices, 52 Second Avenue, Burlington, Massachusetts, for the purpose of considering and voting upon the following matters:

| | 1. | | To elect two members of the board of directors to serve as Class II directors, each for a term of three years; |

| | 2. | | To approve the amendment of our 2000 stock incentive plan to increase the number of shares of common stock authorized for issuance from 800,000 to 1,050,000 shares; and |

| | 3. | | To transact such other business as may properly come before the meeting. |

These items of business are more fully described in the proxy statement accompanying this notice. The board of directors does not know of any other business to be transacted at the annual meeting.

The board of directors has fixed the close of business on Monday, April 5, 2004 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting. A list of the stockholders entitled to notice of and to vote at the meeting will be available for examination by any stockholder, for any purpose germane to the meeting, during ordinary business hours for ten days prior to the meeting at our offices at 52 Second Avenue, Burlington, Massachusetts 01803, telephone: (781) 265-7100, and at the time and place of the annual meeting.

A copy of our annual report to stockholders for the year ended December 31, 2003 accompanies this notice of meeting and the enclosed proxy statement. The annual report contains consolidated financial statements and other information of interest to stockholders.

By Order of the Board of Directors,

Lowell B. Hawkinson

Chairman, President and Chief Executive Officer

April 29, 2004

Burlington, Massachusetts

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

GENSYM CORPORATION

52 Second Avenue

Burlington, MA 01803

PROXY STATEMENT

2004 Annual Meeting of Stockholders

To Be Held May 27, 2004

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors for use at the 2004 annual meeting of stockholders to be held on Thursday, May 27, 2004 at 10:00 a.m., local time, at our offices, 52 Second Avenue, Burlington, Massachusetts 01803.

All proxies will be voted in accordance with the instructions of the stockholder. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying notice of meeting. A stockholder may revoke any proxy at any time before its exercise by delivery of a written revocation to the Secretary of the Company. Attendance at the meeting will not by itself constitute revocation of a proxy unless the stockholder affirmatively revokes the proxy or votes at the meeting.

On April 5, 2004, the record date for determination of stockholders entitled to notice of and to vote at the annual meeting, there were 7,513,131 shares of common stock issued and outstanding and entitled to vote. Each share of common stock entitles the record holder to one vote on each of the matters to be voted upon at the meeting.

The notice of meeting, this proxy statement, the enclosed proxy and our annual report to stockholders for the year ended December 31, 2003 are being mailed to stockholders on or about April 29, 2004.

A copy of our annual report on Form 10-K for the year ended December 31, 2003, as filed with the Securities and Exchange Commission, excluding exhibits, is being mailed to stockholders with this notice and proxy statement. Exhibits to the Form 10-K will be provided to stockholders upon written request and payment of an appropriate processing fee. Please address requests to Gensym Corporation, 52 Second Avenue, Burlington, Massachusetts 01803, Attention: Corporate Secretary.

Votes Required

The holders of a majority of the shares of the outstanding common stock will constitute a quorum for the transaction of business at the annual meeting. Shares of common stock present in person or represented by proxy, including shares that abstain or do not vote with respect to one or more of the matters presented at the annual meeting, will be counted for purposes of determining whether a quorum exists at the annual meeting.

The affirmative vote of the holders of a plurality of the shares voting on the matter is required to elect directors. The affirmative vote of the holders of a majority of the shares of common stock present or represented and voting on the matter is required for the approval of the amendment to our 2000 stock incentive plan.

Shares held by stockholders who abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as shares voted in favor of such matters and will not be counted as shares voting on such matters. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on matters that require the affirmative vote of a certain percentage of the votes cast or shares voting on those matters.

Security Ownership of Certain Beneficial Owners and Management

The following table, except as otherwise noted, sets forth information about the beneficial ownership of our common stock as of January 31, 2004 by:

| | • | | the stockholders we know to beneficially own more than 5% of our outstanding common stock; |

| | • | | each of our current directors; |

| | • | | our chief executive officer and the other named executive officers; and |

| | • | | all of our current directors, director nominees and executive officers as a group. |

| | | | |

Name and Address of Beneficial Owner

| | Amount and Nature

of Beneficial

Ownership(1)

| | Percent of

Common Stock

Outstanding(%)

|

5% Stockholders: | | | | |

Johan H. Magnusson (2) | | 953,000 | | 13.39 |

275 Grove Street, Newton, MA 02460 | | | | |

| | |

Robert B. Ashton (3) | | 851,400 | | 11.96 |

6 Occum Ridge, Hanover, NH 03755 | | | | |

| | |

Directors and Executive Officers (4): | | | | |

Lowell B. Hawkinson (5) | | 666,287 | | 9.02 |

Frank Cianciotta (6) | | 25,744 | | * |

Robert A. Degan (7) | | 89,079 | | 1.24 |

Barry R. Gorsun (8) | | 70,696 | | * |

John A. Shane (9) | | 123,040 | | 1.71 |

Thomas E. Swithenbank (10) | | 86,696 | | 1.21 |

Philippe C. Printz(11) | | 29,796 | | * |

Carl D. Schultz (12) | | 44,773 | | * |

John M. Belchers | | — | | * |

Michael J. Hoey | | — | | * |

All current directors and executive officers as a group (8 persons) (13) | | 1,136,111 | | 14.66 |

| * | | Less than 1% of outstanding shares of common stock |

| (1) | | The number of shares beneficially owned by each director and executive officer is determined under rules promulgated by the Securities and Exchange Commission (the “Commission”), and the information is not necessarily indicative of beneficial ownership for any other purpose. Under the Commission’s rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days after January 31, 2004 through the exercise of any stock option or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with his or her spouse) with respect to all shares of capital stock listed as owned by such person or entity. |

| (2) | | Beneficial ownership, as of October 31, 2003, as reported on Amendment No. 8 to the Schedule 13D as filed with the Commission on October 13, 2003. |

| (3) | | Beneficial ownership, as of December 3, 2003, as reported in Amendment No. 1 to the Schedule 13D as filed with the Commission on December 4, 2003. |

| (4) | | Unless otherwise indicated, the address of each beneficial owner is c/o Gensym Corporation, 52 Second Avenue, Burlington, MA 01803. |

| (5) | | Includes 12,000 shares of common stock held by Mr. Hawkinson’s adult children and 8,000 shares of common stock held by Mr. Hawkinson’s spouse, as to which shares Mr. Hawkinson disclaims beneficial ownership. Also includes 270,000 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

2

| (6) | | Includes 18,000 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (7) | | Includes 74,667 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (8) | | Includes 58,000 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (9) | | Includes 3,405 shares held by Palmer Service Corporation, of which Mr. Shane is the President and sole stockholder. Mr. Shane disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. Also includes 79,500 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (10) | | Includes 17,077 shares of common stock held in joint title with Mr. Swithenbank’s spouse and 71,000 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (11) | | Includes 19,167 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (12) | | Includes 40,601 shares of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

| (13) | | Includes an aggregate of 630,935 of common stock subject to outstanding stock options that are exercisable within the 60-day period following January 31, 2004. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and the holders of more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the Commission. Directors, executive officers and 10% stockholders are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of our records and written representations by the persons required to file these reports, we believe that during 2003, with two exceptions, our reporting persons complied with all Section 16(a) filing requirements. Mr. Hoey failed to file timely a Form 4 with respect to two transactions, each on December 31, 2002, which were required to be reported by January 2, 2003. Upon discovery of this error, these transactions were reported on a Form 4 on January 10, 2003. Mr. Printz failed to file timely Forms 4 with respect to two transactions pursuant to our employee stock purchase plan on May 30, 2003 and November 28, 2003. Upon discovery of this error, these transactions were reported on Forms 4, which were both filed on February 11, 2004.

PROPOSAL I—ELECTION OF DIRECTORS

The board of directors is divided into three classes, with members of each class holding office for a staggered three-year term. Pursuant to our by-laws, the board of directors has fixed the size of the board at six members. The terms of Messrs. Cianciotta and Hawkinson (Class II directors) will expire at this annual meeting of stockholders; the terms of Messrs. Degan and Gorsun (Class III directors) will expire at the 2005 annual meeting of stockholders; and the terms of Messrs. Shane and Swithenbank (Class I directors) will expire at the 2006 annual meeting of stockholders. Upon the expiration of the term of a class of directors at an annual meeting of stockholders, directors will be elected, or reelected, to serve within such class for a succeeding three-year term.

The board of directors, based on the recommendation of the corporate governance committee, proposed the election of Frank Cianciotta and Lowell B. Hawkinson as Class II directors. Mr. Cianciotta was originally designated as a director by MinnovEX Technologies, Inc. pursuant to the terms of the Bridge Loan, Standby Stock Purchase and Debt Reduction Agreement, dated as of September 12, 2001, by and among us, MinnovEX and certain other parties. According to the terms of that agreement, MinnovEX and one other group of investors

3

each have the right to designate one person for election to the board of directors, subject to the review and approval of the corporate governance committee. Upon approval of the designee by the corporate governance committee, we must increase the size of the board and elect the designee to fill the new vacancy. Mr. Cianciotta was originally elected to the board in accordance with this right in February 2003. The other group of investors has recently exercised its right to designate a candidate for election, and the corporate governance committee is in the process of evaluating such candidacy.

The persons named in the enclosed proxy will vote to elect Messrs. Cianciotta and Hawkinson as Class II directors, unless the proxy is marked otherwise. Messrs. Cianciotta and Hawkinson currently serve as directors. Each Class II director will be elected to hold office until the annual meeting of stockholders held in 2007 and until his successor is elected and qualified. Each nominee has indicated his willingness to serve, if elected, however, if either nominee should be unable to serve, the persons acting under the proxy may, in their discretion, vote for a substitute nominee. The board of directors believes each of the nominees will be able to serve if elected.

Set forth below are the names of each nominee for director and each current director, their ages, the year in which they first became directors, their principal occupations and employment during at least the past five years and the names of the other public companies of which they serve as a director.

Nominees for Terms Expiring in 2007 (Class II Directors)

| | | | |

Name and Period of Service as a Director

| | Age

| | Principal Occupation, Other Business Experience During The Past Five Years and Other Directorships

|

Frank Cianciotta (1) Director since 2003 | | 49 | | Mr. Cianciotta has served as a sales and marketing consultant for Groveware Technologies, Inc., a start-up company specializing in document management, since March 2004. From June 2003 to February 2004, he served as a consultant at Audienceview Software Inc. From March 2002 to May 2003, he served as the vice president of international business development of Market-Partners, a provider of consulting and technology solutions. From August 2001 to March 2002, Mr. Cianciotta acted as a private investor. From August 2000 to August 2001, he served as general manager of E.piphany Canada, a supplier of intelligent customer interaction software. From November 1999 to August 2000, he served as director of sales of Deloitte Consulting Canada, a consulting service organization; and from September 1996 to September 1999, he served as the general manager of Siebel Systems Canada, a producer of eBusiness application software. |

| | |

Lowell B. Hawkinson Director since 1986 | | 61 | | Mr. Hawkinson has served as chairman, president, chief executive officer and secretary since August 2001. Mr. Hawkinson had previously served as chairman, chief executive officer, treasurer and secretary from September 1986 to October 1999. From November 1999 to August 2001, Mr. Hawkinson was an independent consultant. |

4

Directors Whose Terms Expire in 2005 (Class III Directors)

| | | | |

Name and Period of Service as a Director

| | Age

| | Principal Occupation, Other Business Experience During The Past Five Years and Other Directorships

|

Robert A. Degan (2) (3) Director since 1999 | | 65 | | Mr. Degan has been a private investor since January 2000. From November 1998 to December 1999, Mr. Degan served as general manager of the Enhanced Services & Migration Unit (formerly, Summa Four, Inc.) of Cisco Systems, Inc., a provider of networking solutions. From July 1998 to November 1998, Mr. Degan was chairman, president and chief executive office of Summa Four, Inc. From January 1997 to July 1998, Mr. Degan was president, chief executive officer, and a director of Summa Four, Inc., a provider of programmable switches. Mr. Degan is also a director of FlexiInternational Software, Inc., a producer of accounting and financial management software, CaminoSoft Corp., a provider of date storage and management solutions, and Overland Storage, Inc., a supplier of storage solutions for computer networks. |

| | |

Barry R. Gorsun (1) (3) Director since 1998 | | 61 | | Mr. Gorsun has been a private investor since July 1998. Previously, Mr. Gorsun served with Summa Four, Inc. from 1983 until July 1998, including as chairman from July 1993 until July 1998 and chief executive officer from July 1990 until July 1993. |

Directors Whose Terms Expire in 2006 (Class I Directors)

| | | | |

Name and Period of Service as a Director

| | Age

| | Principal Occupation, Other Business Experience During The Past Five Years and Other Directorships

|

John A. Shane (1) (2) (3) Director since 1995 | | 71 | | Mr. Shane has been president of Palmer Service Corporation, a venture capital management company, since 1972. Mr. Shane is also a director of Overland Storage, Inc., a supplier of storage solutions for computer networks. |

| | |

Thomas E. Swithenbank (1)(2) Director since 1997 | | 59 | | Mr. Swithenbank has been a private investor since December 2001. Mr. Swithenbank served as interim chief financial officer from March 25, 2002 until May 16, 2002. Mr. Swithenbank served as an executive vice president and chief financial officer of Techmar Communications, Inc., a business processing outsourcing firm, from April 1999 to December 2001. Mr. Swithenbank served as an executive vice president of Pegasystems, Inc., a developer of communications software products, from August 1998 to April 1999. From 1990 until August 1998, Mr. Swithenbank served as president and chief executive officer of Harte-Hanks Data Technologies, a computer software and service company specializing in database marketing systems. |

| (1) | | Member of the corporate governance committee. |

| (2) | | Member of the audit committee. |

| (3) | | Member of the compensation committee. |

The board of directors unanimously recommends a vote FOR the election of each of the nominees for director named above.

5

The Board of Directors and Board Committees

The board of directors has established three primary standing committees—audit, compensation and corporate governance—each of which operates under a charter that has been approved by the board. Current copies of each committee’s charter, as well as the corporate governance guidelines that have been adopted by the board, are posted on the Investors/Corporate Governance section of our website,www.gensym.com. In addition, a copy of the audit committee charter, as in effect on the date of this proxy statement, is attached to this proxy statement as Exhibit A.

The board of directors held thirteen meetings during 2003, including regular, special and telephonic meetings. During 2003, each director attended at least 75% of the meetings of the board of directors and of the committees on which he served held while he was a director. Our corporate governance guidelines provide that all directors are expected to attend the annual meeting of stockholders. All directors attended the 2003 annual meeting of stockholders.

The board of directors has determined that, except as described below with respect to Mr. Swithenbank’s service on the audit committee, all of the members of each of the board’s three standing committees are independent as defined under the current rules of the Nasdaq Stock Market, including, in the case of all members of the audit committee except for Mr. Swithenbank, the independence requirements contemplated by Rule 10A-3 under the Exchange Act.

Audit Committee

The audit committee’s responsibilities include:

| | • | | appointing, approving the compensation of, and assessing the independence of our independent auditor; |

| | • | | overseeing the work of our independent auditor, including through the receipt and consideration of certain reports from independent auditors; |

| | • | | reviewing and discussing with management and the independent auditors our annual and quarterly financial statements and related disclosures; |

| | • | | overseeing our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| | • | | overseeing our internal audit function; |

| | • | | establishing policies regarding hiring employees from the independent auditor and procedures for the receipt and retention of accounting related complaints and concerns; |

| | • | | meeting independently with independent auditors and management; and |

| | • | | preparing the audit committee report required by SEC rules (which begins on page 8 of this proxy statement). |

In addition, the audit committee has adopted policies regarding the pre-approval of all audit and non-audit services to be performed by our independent auditors. These policies are described in more detail in the section entitled “Pre-Approval Policy and Procedures”.

The members of the audit committee are Messrs. Degan, Shane and Swithenbank. The audit committee met six times during 2003, including regular, special and telephonic meetings.

The board of directors has determined that Mr. Swithenbank is an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K. Because of his prior service as our interim chief financial officer from March 25, 2002 to May 16, 2002, Mr. Swithenbank does not qualify as an “independent director” as defined by the rules of the Nasdaq National Market. The board has determined that such prior service does not interfere with

6

Mr. Swithenbank’s ability to exercise independent judgment as a director or member of the audit committee. As such, the board has determined that Mr. Swithenbank is not precluded from serving on the audit committee.

Compensation Committee

The compensation committee’s responsibilities include:

| | • | | annually reviewing and approving corporate goals and objectives relevant to chief executive officer compensation; |

| | • | | reviewing and making recommendations to the board with respect to the compensation of our chief executive officer and chairman (if the chairman is an employee); |

| | • | | reviewing and approving the compensation of our other executive officers; |

| | • | | overseeing an evaluation of our senior executives other than our chief executive officer, whose evaluation is overseen by the corporate governance committee; |

| | • | | overseeing and administering our cash and equity incentive plans; and |

| | • | | reviewing and making recommendations to the board with respect to director compensation. |

The members of the compensation committee are Messrs. Degan, Gorsun and Shane. The compensation committee met thirteen times during 2003, including regular, special and telephonic meetings.

Corporate Governance Committee

The corporate governance committee’s responsibilities include:

| | • | | identifying individuals qualified to become board members; |

| | • | | selecting the persons to be nominated for election as directors and recommending to the board of directors the directors to be appointed to each of the board’s committees; |

| | • | | reviewing and making recommendations to the board with respect to management succession planning; |

| | • | | developing and recommending to the board corporate governance principles; and |

| | • | | overseeing an annual evaluation of our chief executive officer and the board. |

The members of the corporate governance committee are Messrs. Cianciotta, Gorsun, Shane and Swithenbank. The corporate governance committee met ten times during 2003, including regular, special and telephonic meetings.

Director Candidates

The process followed by the corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and the board.

In considering whether to recommend any particular candidate for inclusion in the board’s slate of recommended director nominees, the corporate governance committee applies the criteria set forth in our corporate governance guidelines. These criteria include issues of diversity, experience, judgment, ability and willingness to devote the necessary time, and familiarity with domestic and/or international markets, all in the context of an assessment of our perceived needs. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the board to fulfill its responsibilities.

7

Stockholders may recommend individuals to the corporate governance committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the corporate governance committee, c/o Corporate Secretary, Gensym Corporation, 52 Second Avenue, Burlington, MA 01803. Assuming the foregoing requirements have been met, the corporate governance committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for other candidates.

At the annual meeting, stockholders will be asked to consider the election of Mr. Cianciotta, who has been nominated for election as director for the first time. Mr. Cianciotta originally was appointed to the board in February 2003 as a result of his designation by MinnovEX, as discussed in the second paragraph of the section entitled “Election of Directors” above. The corporate governance committee approved his original appointment to the board and the board has determined to include him among the nominees for election this year.

In addition, as discussed in the second paragraph of the section entitled “Election of Directors” above, one additional group of investors has the contractual right, comparable to the one exercised by MinnovEX, to designate a person for election to the board of directors, subject to the review and approval of the corporate governance committee. The other group of investors has recently exercised its right to designate a candidate for election, and the corporate governance committee is in the process of evaluating such candidacy.

Communicating with the Independent Directors

The board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. The chairman of the corporate governance committee, with the assistance of the Company’s outside counsel, is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the other directors as he or she considers appropriate.

Under procedures approved by a majority of the independent directors, communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the chief executive officer considers to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which Gensym may receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to the board should address such communications to the Board of Directors c/o Corporate Secretary, Gensym Corporation, 52 Second Avenue, Burlington, Massachusetts 01803.

Report of the Audit Committee

The audit committee has reviewed Gensym’s audited financial statements for the fiscal year ended December 31, 2003 and has discussed these financial statements with Gensym’s management and Gensym’s independent auditors.

The audit committee has also received from, and discussed with Gensym’s independent auditors, various communications that Gensym’s independent auditors are required to provide to the audit committee, including the matters required to be discussed by Statement on Auditing Standards 61 (Communication with Audit Committees).

Gensym’s independent auditors also provided the audit committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The audit committee has discussed with the independent auditors their independence from Gensym.

8

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the audit committee recommended to Gensym’s board of directors that the audited financial statements be included in Gensym’s Annual Report on Form 10-K for the year ended December 31, 2003.

By the audit committee of the board of directors.

Thomas E. Swithenbank, Chairman

Robert A. Degan

John A. Shane

Director Compensation

We pay our non-employee directors $12,000 annually, plus $1,000 for physical attendance at each meeting of the board of directors or $500 for participation in a board meeting telephonically. Non-employee directors also receive a $1,500 quarterly retainer for each committee on which the director serves. Non-employee directors are also eligible to receive stock options.

In July 2003, the board of directors approved the temporary reduction of the board’s cash compensation by 10% in conjunction with the temporary reduction of the salaries of senior management. The board has indicated that the board’s cash compensation will be restored to pre-reduction levels at the same time that the salaries of our executive officers are restored.

Since January 1, 2003, each of our non-employee directors must receive 10%, and may elect to receive up to 100%, of his board compensation in shares of our common stock in lieu of cash. Each director must make his election in increments of 10% and may only change his election effective as of two specified times each year.

Prior to January 1, 2004, upon initial election as a director, each non-employee director was granted a nonstatutory option for the purchase of 3,000 shares of our common stock. In June of each year, each non-employee director was entitled to receive a nonstatutory option for the purchase of 10,000 shares of our common stock. Commencing January 1, 2004, upon initial election, each non-employee director is entitled to receive a nonstatutory option to purchase 10,000 shares of our common stock and on the first day of each calendar quarter each non-employee director is entitled to receive an option to purchase 5,000 shares. All options granted to directors are granted at an exercise price equal to the fair market value of our common stock on the date of the grant, are immediately exercisable and are exercisable for up to 10 years from the date of grant.

INFORMATION ABOUT EXECUTIVE COMPENSATION

Executive Officers

Our current executive officers are:

| | | | |

Name

| | Age

| | Position

|

Lowell B. Hawkinson | | 61 | | Chairman, President and Chief Executive Officer |

Stephen D. Allison | | 58 | | Vice President, Finance, Chief Financial Officer and Treasurer |

Carl D. Schultz | | 42 | | Vice President, Operations |

Philippe C. Printz | | 40 | | Vice President, Engineering |

Lowell B. Hawkinsonhas served as chairman, president, chief executive officer and secretary since August 2001. Mr. Hawkinson had previously served as chairman, chief executive officer, treasurer and secretary from September 1986 to October 1999. From November 1999 to August 2001, Mr. Hawkinson was an independent consultant.

9

Stephen D. Allison has served as vice president, finance, chief financial officer and treasurer since April 2004. From 2000 to 2003, Mr. Allison served as chief financial officer for Webhire, an Internet-based provider of solutions for human resources professionals. From 1997 to 2000, he served as chief financial officer of PRI Automation, a supplier of automation systems for the semiconductor industry. Previously, Mr. Allison held senior financial and operations management positions at Helix Technology from 1995 to 1997, Behring Diagnostics from 1991 to 1995, and at Teradyne from 1974 to 1989.

Carl D. Schultz joined us in January 1995 and has served as vice president, operations since January 1999. From 1991 to 1995 he worked as director of software operations at Computervision Corporation, an international supplier of electronic product definition solutions. From 1983 to 1991, Mr. Schultz held a number of management positions at Prime Computer.

Philippe C. Printz has served us in a variety of roles since joining us December 1996, including as vice president, engineering since April 2003, senior director, engineering from November 2002 through April 2003, director of application development from November 2001 to November 2002, and manager of product development from December 1999 to November 2001. From January 1989 to December 1996, Mr. Printz held a number of management positions in business development and engineering at the Bruker Companies, an international supplier of products for life science, biotechnical and process analytical applications.

Summary Compensation

The following table sets forth certain information required under applicable rules of the Securities and Exchange Commission about the compensation, for each of the last three fiscal years, of our chief executive officer, our two other current executive officers whose total annual salary and bonus for fiscal year 2003 exceeded $100,000 and who were serving as our executive officers on December 31, 2003, and two executive officers who would have been among the top four most highly compensated officers if they were serving as executive officers at December 31, 2003 and who earned at least $100,000. We refer to the individuals listed in the following table as our named executive officers.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | |

| | | Annual Compensation(1)

| | Long-Term

Compensation

Awards

| | All Other

Compensation

($)(2)

|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options(#)

| |

Lowell B. Hawkinson (3) | | 2003 | | 261,250 | | 20,000 | | — | | 10,169 |

Chairman, President, Chief Executive Officer

and Secretary | | 2002 | | 260,401 | | 78,750 | | — | | 12,627 |

| | | 2001 | | 102,404 | | 98,702 | | 260,000 | | 139,375 |

| | | | | |

Carl D. Schultz (4) | | 2003 | | 131,294 | | 15,600 | | 21,200 | | 12,604 |

Vice President, Operations | | 2002 | | 126,512 | | 28,432 | | 30,000 | | 11,330 |

| | | | | |

Philippe C. Printz (5) | | 2003 | | 127,671 | | 3,375 | | 22,800 | | 13,475 |

Vice President, Engineering | | | | | | | | | | |

| | | | | |

Michael J. Hoey (6) | | 2003 | | 175,070 | | — | | — | | 12,238 |

Former Vice President, Sales | | 2002 | | 98,942 | | — | | — | | 3,730 |

| | | | | |

John M. Belchers (7) | | 2003 | | 156,114 | | — | | — | | 11,012 |

Former Chief Financial Officer | | 2002 | | 112,067 | | 18,221 | | 70,000 | | 10,210 |

| (1) | | In accordance with the Commission’s rules, we have omitted Other Annual Compensation in the form of perquisites and other personal benefits because the aggregate amount of such perquisites and other personal benefits constituted less than the lesser of $50,000 or 10% of the total amount of annual salary and bonus for each executive officer for each fiscal year indicated. |

10

| (2) | | In fiscal year 2003, All Other Compensation included the following amounts: (A) contributions we made under our 401(k) Plan for Messrs. Printz and Schultz in the amounts of $3,638 and $3,632, respectively; and (B) payments we made for health and dental benefits, life insurance, and long and short term disability insurance for Messrs. Hawkinson, Printz and Schultz in the amounts of $10,169, $9,837 and $8,972, respectively. |

In fiscal year 2002, All Other Compensation included the following amounts: (A) contributions we made under our 401(k) Plan for Messrs. Schultz, Hoey and Belchers in the amounts of $706, $750 and $2,297, respectively; and (B) payments we made for health and dental benefits, life insurance, and long and short term disability insurance for Messrs. Hawkinson, Schultz, Hoey and Belchers in the amounts of $12,627, $10,624, $2,980 and $7,913, respectively.

In fiscal year 2001, All Other Compensation included the following amounts: (A) payments we made for health and dental benefits, life insurance, and long and short term disability insurance for Messrs. Hawkinson in the amount of $12,305 and (B) amounts we paid in connection with the resignation or termination of employment comprising severance payments to Mr. Hawkinson in the amount of $127,070.

| (3) | | Mr. Hawkinson rejoined Gensym Corporation as president and chief executive officer on August 3, 2001. Mr. Hawkinson had previously served as chief executive officer from September 1986 through October 1999. |

| (4) | | Mr. Schultz became an executive officer in April 2002. |

| (5) | | Mr. Printz became vice president, engineering in April 2003. |

| (6) | | Mr. Hoey became vice president, sales in September 2002 and ceased to be so in August 2003. Mr. Hoey’s salary in 2003 includes $41,358 in severance payments. |

| (7) | | Mr. Belchers became chief financial officer in May 2002 and ceased to be so in August 2003. Mr. Belchers’ salary in 2003 includes $51,066 in severance payments. |

Option Grants in 2003

We granted our employees options representing a total of 296,000 shares of our common stock in fiscal year 2003. The following table sets forth information regarding options granted during the fiscal year ended December 31, 2003 to our named executive officers.

Option Grants in 2003

| | | | | | | | | | | | |

| | | Number of

Shares

Underlying

Options Granted

| | Percent of Total Options Granted

to Employees in 2003(%)

| | Exercise

Price ($/Share)(1)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price

Appreciation for Option Term(2)

|

| | | | | | | 5%($)

| | 10%($)

|

Lowell B. Hawkinson | | — | | — | | — | | — | | — | | — |

Carl D. Schultz | | 6,000 | | 2.03 | | 0.60 | | 7/9/13 | | 2,264 | | 5,737 |

| | | 5,200 | | 1.76 | | 0.60 | | 7/29/13 | | 1,962 | | 4,972 |

| | | 10,000 | | 3.38 | | 0.65 | | 10/27/13 | | 4,088 | | 10,359 |

Philippe C. Printz | | 22,800 | | 7.70 | | 0.60 | | 7/29/13 | | 8,602 | | 21,801 |

Michael J. Hoey | | — | | — | | — | | — | | — | | — |

John M. Belchers | | — | | — | | — | | — | | — | | — |

| (1) | | The exercise price is equal to the fair market value of our common stock on the date of the grant. |

| (2) | | Potential realizable value is based on an assumption that the market price of our common stock will appreciate at the stated rates (5% and 10%), compounded annually, from the date of grant until the end of the 10-year term. These values are calculated based on rules promulgated by the Securities and Exchange Commission and do not reflect our estimate or projection of future stock prices. Actual gains, if any, on stock option exercises will be dependent upon the future performance of the price of our common stock and the timing of exercises. |

11

Option Exercises During 2003 and Fiscal Year-End Option Values

None of our named executive officers exercised stock options during the fiscal year ended December 31, 2003. The following table sets forth information regarding the number and value of unexercised options to purchase our common stock held by each of the named executive officers as of December 31, 2003.

Fiscal Year-End Option Values

| | | | | | | | |

Name

| | Number of Shares Underlying Unexercised Options at Fiscal Year-End(#)

| | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(1)

|

| | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Lowell B. Hawkinson | | 270,000 | | — | | 194,200 | | — |

Carl D. Schultz | | 32,801 | | 49,599 | | 19,115 | | 25,823 |

Philippe C. Printz | | 13,667 | | 30,133 | | 8,215 | | 16,772 |

Michael J. Hoey | | — | | — | | — | | — |

John M. Belchers | | — | | — | | — | | — |

| (1) | | The value of the unexercised in-the-money options is calculated by multiplying the number of shares of common stock underlying the option by the difference between $1.14, which was the closing price per share of our common stock on the OTC Bulletin Board on December 31, 2003, and the applicable per share exercise price of the option. |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets for information about the securities authorized for issuance under our equity compensation plans as of December 31, 2003:

Equity Compensation Plan Information

| | | | | | |

| | | (a)

| | (b)

| | (c)

|

Plan category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected in

column (a))(1)

|

Equity compensation plans approved by stockholders | | 1,413,902 | | 1.19 | | 380,640 |

| (1) | | Includes 94,433 shares of common stock available for grant under our 1995 Employee Stock Purchase Plan, which includes approximately 54,000 shares of common stock which may be issued in connection with the offering period ending on May 28, 2004. |

Executive Employment and Severance Agreements

Carl D. Schultz, our vice president, operations, is party to a severance benefit agreement, which provides that he is entitled to receive severance payments equal to six months of his annual base salary if he is terminated without cause. We currently do not have employment or severance agreements with any other executive officers.

Report of the Compensation Committee

The compensation committee is responsible for establishing compensation policies with respect to the executive officers, including the president and chief executive officer, and setting the compensation for these individuals.

12

The compensation committee seeks to achieve three broad goals in connection with our executive compensation programs and decisions regarding individual compensation. First, the compensation committee structures executive compensation programs in a manner that the committee believes will enable us to attract and retain key executives. Second, the compensation committee establishes compensation programs that are designed to reward executives for our achievement of specified operating income goals and the executive’s achievement of certain assigned objectives. The compensation committee believes that tying compensation, in part, to particular goals creates a performance-oriented environment for our executives. Finally, our executive compensation programs are intended to link a portion of the compensation of our executives with the performance of our common stock.

Based on the objectives described above, our executive compensation programs generally consist of three components: (1) base salary, (2) annual cash bonus and (3) stock-based, equity incentives. In establishing base salaries for our executive officers, including our chairman, president and chief executive officer, the compensation committee monitors salaries at other companies, particularly those that are in the same or related industries as us, and/or are located in our general geographic area. In addition, the compensation committee considers historic salary levels of the officer and the nature of the officer’s responsibilities, and compares the officer’s base salary with those of our other executives.

The compensation committee links cash bonuses to annual profitability goals and the achievement by the executives of certain assigned objectives. The specified objectives for our executive officers are generally both objective and subjective and include such goals as bookings, revenue, profit and departmental goals. The compensation committee believes that these arrangements closely link the executives’ performance to our or the respective business unit’s key drivers of success.

Stock-based equity incentives, such as stock option grants, are designed to tie a portion of the overall compensation of the executive officers receiving such awards to our long range performance. Furthermore, we stagger the vesting schedule of options to create an incentive for the executives to remain with us and to allow all of their options to vest. This serves as an additional means for us to retain the services of key executives.

The compensation committee applies the same compensation philosophy in establishing the compensation for our chief executive officer as is applied for the other executive officers. The compensation committee believes that the compensation of the chief executive officer is consistent with our general policies concerning executive compensation and is appropriate in light of our financial objectives and performance. Awards of long-term incentive compensation to the chief executive officer are considered concurrently with awards to other executive officers and follow the same general policies as such other long-term incentive awards.

Mr. Hawkinson’s base salary for 2003 was $261,250. Mr. Hawkinson did not receive options to acquire shares of the Company’s common stock during the 2003 fiscal year. For fiscal year 2003, Mr. Hawkinson earned an annual performance bonus of $20,000 based upon his achievement of performance objectives determined by the board of directors, paid in February 2004. Mr. Hawkinson’s compensation was designed to align his interest with those of our stockholders by tying eligibility for bonuses to the success of his efforts toward our restructuring, and returning our company to operational profitability. The compensation committee believes that Mr. Hawkinson’s compensation has been consistent with the compensation committee’s compensation philosophy.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for compensation over $1,000,000 paid to its chief executive officer and its four other most highly compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. In this regard, we have structured the stock options granted to our employees in a manner that qualifies such options as performance-based compensation under Section 162(m).

13

Based on the compensation awarded to our executive officers, it does not appear that the Section 162(m) limitation will have a significant impact on us in the near term. While the committee does not currently intend to qualify compensation paid to executive officers, other than stock options, as a performance-based compensation, the committee will continue to monitor the impact of Section 162(m) on us.

By the compensation committee of the board of directors.

John A. Shane, Chairman

Robert A. Degan

Barry R. Gorsun

Compensation Committee Interlocks and Insider Participation

The current members of the compensation committee are Messrs. Degan, Gorsun and Shane. During the fiscal year ended December 31, 2003, none of our executive officers has served as a director or member of the compensation committee, or other committee serving an equivalent function, of any other entity that had executive officers serving as a member of our board of directors or compensation committee.

PROPOSAL II — APPROVAL OF THE AMENDMENT OF

OUR 2000 STOCK INCENTIVE PLAN

Our board of directors believes that our future success depends, in large part, upon our ability to attract, retain and motivate personnel who are expected to make important contributions to our business. Our 2000 stock incentive plan was approved by the board of directors in April 2000 and our stockholders in May 2000. There currently are 800,000 shares of common stock reserved for issuance under the plan. As of April 5, 2004, options to purchase 658,333 shares of common stock were outstanding and 126,525 shares of common stock had been issued upon the exercise of stock options and issuance of stock awards under our 2000 stock incentive plan. As a result, as of April 5, 2004, only 15,142 shares were available for future option grants under the 2000 stock incentive plan. For additional information regarding the number of shares of common stock available for grant under all of our equity incentive plans, please see the section titled “Securities Authorized for Issuance Under Equity Compensation Plans.” We believe that such number of shares will be insufficient to satisfy our incentive compensation needs in the future.

To ensure that sufficient shares are available for grant under our 2000 stock incentive plan in the future, our board of directors adopted on April 21, 2004, subject to stockholder approval, an increase in the number of shares of common stock available for issuance under the 2000 stock incentive plan from 800,000 to 1,050,000 shares.

The board of directors believes that this increase in the number of shares available for issuance under the 2000 Stock Incentive Plan is in Gensym’s best interests and unanimously recommends a vote FOR this proposal.

Description of the 2000 Stock Incentive Plan

The following is a brief summary of the 2000 stock incentive plan, a copy of which is attached asExhibit B to this proxy statement. The following summary is qualified in its entirety by reference to the 2000 stock incentive plan.

Types of Awards

The 2000 stock incentive plan provides for the grant of incentive stock options intended to qualify under section 422 of the Internal Revenue Code, non-statutory stock options, restricted stock awards and other

14

stock-based awards, including the grant of shares based upon certain conditions, the grant of securities convertible into common stock and the grant of stock appreciation rights.

Incentive Stock Options and Non-Statutory Stock Options. Optionees receive the right to purchase a specified number of shares of common stock at a specified option price and subject to such other terms and conditions as are specified in connection with the option grant. Options may be granted at an exercise price which may be less than, equal to or greater than the fair market value of the common stock on the date of grant. Incentive stock options may not be granted at an exercise price less than 100% of the fair market value of the common stock on the date of grant. Options intended to be incentive stock options, but which fail to meet the requirements for incentive stock option treatment, will be treated as non-statutory stock options. No option shall have a term in excess of 10 years and shall be exercisable by delivery to us of a written notice. The 2000 stock incentive plan permits the following forms of payment of the exercise price of options:

| | • | | payment by cash or check, |

| | • | | except as the board of directors may otherwise provide in an option agreement, payment in connection with a “cashless exercise” through a broker, |

| | • | | by surrender of shares of common stock that have been owned by the optionee for at least six months, |

| | • | | to the extent permitted by the board of directors, by delivery of a promissory note or any other lawful consideration, or |

| | • | | by any combination of these forms of payment. |

Restricted Stock Awards. Under the 2000 stock incentive plan, the board of directors is entitled to grant restricted stock awards. Restricted stock awards entitle recipients to acquire shares of common stock, subject to our right to repurchase all or part of such shares from the recipient in the event that the conditions specified in the applicable award are not satisfied prior to the end of the applicable restriction period.

Other Stock-Based Awards. Under the 2000 stock incentive plan, the board of directors has the right to grant other awards based upon the common stock having such terms and conditions as it may determine, including the grant of shares based upon certain conditions, the grant of securities convertible into common stock and the grant of stock appreciation rights.

Eligibility to Receive Awards

Our employees, officers, directors, consultants and advisors, and any individuals who have accepted an offer for employment, are eligible to be granted awards under the 2000 stock incentive plan. Incentive stock options may only be granted to our employees. The maximum number of shares with respect to which awards may be granted to any participant under the 2000 stock incentive plan may not exceed 150,000 shares per calendar year.

Administration

The board of directors administers the 2000 stock incentive plan. The board of directors has the authority to adopt, amend and repeal the administrative rules, guidelines and practices relating to the 2000 stock incentive plan and to interpret the provisions of the 2000 stock incentive plan. Pursuant to the terms of the 2000 stock incentive plan, our board of directors may delegate authority under the 2000 stock incentive plan to one or more committees or subcommittees of the board of directors. The board of directors has authorized the compensation committee to administer all rights, authority and function of the board with respect to the 2000 stock incentive plan.

15

Subject to any applicable limitations contained in the 2000 stock incentive plan, the board of directors, the compensation committee, or any other committee to whom the board of directors delegates authority, as the case may be, selects the recipients of awards and determines:

| | • | | the number of shares of common stock covered by options and the dates upon which such options become exercisable; |

| | • | | the exercise price of options, which cannot be less than the fair market value of the common stock; |

| | • | | the duration of options; and |

| | • | | the number of shares of common stock subject to any restricted stock or other stock-based awards and the terms and conditions of such awards, including conditions for repurchase, issue price and repurchase price. |

We are required to make those adjustments that the board of directors deems to be necessary and appropriate to the 2000 stock incentive plan and any outstanding awards under that plan to reflect stock splits, stock dividends, recapitalizations, spin-offs and other similar changes in capitalization. The 2000 stock incentive plan also contains provisions addressing the consequences of an acquisition event. Upon the occurrence of an acquisition event, our board of directors will provide that all outstanding options will be assumed, or equivalent options will be substituted, by the acquiring or succeeding corporation. If the acquiring or succeeding corporation does not agree to assume, or substitute for, options outstanding under the 2000 stock incentive plan, then our board of directors will provide:

| | • | | that all unexercised options will become exercisable in full at a specified time prior to the acquisition event and will terminate immediately prior to the consummation of such acquisition event, or |

| | • | | for cash payment in the amount of the spread between the per share acquisition price and the exercise price of such options. |

An acquisition event is defined as:

| | • | | any merger or consolidation of us with or into another entity a result of which our common stock is converted into or exchanged for the right to receive cash, securities or other property, or |

| | • | | any exchange of shares of our common stock for cash, securities or other property pursuant to a statutory share exchange transaction. |

If any award expires or is terminated, surrendered, canceled or forfeited, the unused shares of common stock covered by such award will again be available for grant under the 2000 stock incentive plan, subject, however, in the case of incentive stock options, to any limitations under the Internal Revenue Code.

Amendment or Termination

No award may be made under the 2000 stock incentive plan after April 5, 2010, but awards previously granted may extend beyond that date. Our board of directors may at any time amend, suspend or terminate the 2000 stock incentive plan, except that no award designated as subject to Section 162(m) of the Internal Revenue Code by our board of directors after the date of such amendment will become exercisable, realizable or vested, to the extent such amendment was required to grant such award, unless and until such amendment shall have been approved by the our stockholders.

Plan Benefits

As of April 5, 2004, approximately 81 persons were eligible to receive awards under the 2000 stock incentive plan, including three executive officers and five non-employee directors. The granting of awards under the 2000 stock incentive plan is discretionary, and we cannot now determine the number or type of awards to be

16

granted in the future to any particular person or group. The following table summarizes options awarded under the 2000 stock incentive plan through April 5, 2004 to the five named executive officers, all current executive officers as a group, all current non-employee directors as a group and all non-executive employees as a group since the adoption of the 2000 stock incentive plan.

| | | |

Name and Position

| | Number of Options

Granted

| |

Lowell B. Hawkinson | | 160,000 | |

Director, President and Chief Executive Officer | | | |

Carl D. Schultz | | 51,200 | |

Vice President, Operations | | | |

Phillippe C. Printz | | 21,000 | |

Vice President, Engineering | | | |

Michael J. Hoey | | 50,000 | * |

Former Vice President, Sales | | | |

John M. Belchers | | 70,000 | * |

Former Chief Financial Officer | | | |

All current executive officers, as a group (3 persons) | | 232,200 | |

| All current directors who are not executive officers, as a group (5 persons) | | 183,000 | |

| All employees who are not executive officers, as a group (188 persons) | | 623,150 | * |

| * | | The options granted to Messrs. Hoey and Belchers and options representing the right to acquire 387,684 shares of our common stock granted to all employees who are not executive officers, have terminated as a result of the applicable recipient ceasing to be our employee. |

On April 22, 2004, the last reported sale price of our common stock on the OTC.BB was $1.75 per share.

Federal Income Tax Consequences

The following generally summarizes the United States federal income tax consequences that generally will arise with respect to awards granted under the 2000 stock incentive plan. This summary is based on the tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below.

Incentive Stock Options. A participant will not have income upon the grant of an incentive stock option. Also, except as described below, a participant will not have income upon exercise of an incentive stock option if the participant has been employed by us or any corporate parent or majority-owned corporate subsidiary of us at all times beginning with the option grant date and ending three months before the date the participant exercises the option. If the participant has not been so employed during that time, then the participant will be taxed as described below under “Nonstatutory Stock Options.” The exercise of an incentive stock option may subject the participant to the alternative minimum tax.

A participant will have income upon the sale of the stock acquired under an incentive stock option at a profit (if sales proceeds exceed the exercise price). The type of income will depend on when the participant sells the stock. If a participant sells the stock more than two years after the option was granted and more than one year after the option was exercised, then all of the profit will be long-term capital gain. If a participant sells the stock prior to satisfying these waiting periods, then the participant will have engaged in a disqualifying disposition and a portion of the profit will be ordinary income and a portion may be capital gain. This capital gain will be long-term if the participant has held the stock for more than one year and otherwise will be short-term. If a participant sells the stock at a loss (sales proceeds are less than the exercise price), then the loss will be a capital loss. This capital loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Nonstatutory Stock Options. A participant will not have income upon the grant of a nonstatutory stock option. A participant will have compensation income upon the exercise of a nonstatutory stock option equal to the value of the stock on the day the participant exercised the option less the exercise price. Upon sale of the stock, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the day the option was exercised. This capital gain or loss will be long-term if the participant has held the stock for more than one year and otherwise will be short-term.

17

Restricted Stock. A participant will not have income upon the grant of restricted stock unless an election under Section 83(b) of the Internal Revenue Code is made within 30 days of the date of grant. If a timely 83(b) election is made, then a participant will have compensation income equal to the value of the stock less the purchase price. When the stock is sold, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the date of grant. If the participant does not make an 83(b) election, then when the stock vests the participant will have compensation income equal to the value of the stock on the vesting date less the purchase price. When the stock is sold, the participant will have capital gain or loss equal to the sales proceeds less the value of the stock on the vesting date. Any capital gain or loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Tax Consequences to Us. There will be no tax consequences to us except that we will be entitled to a deduction when a participant has compensation income. Any such deduction will be subject to the limitations of Section 162(m) of the Internal Revenue Code.

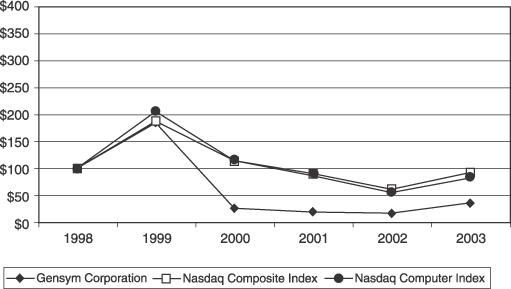

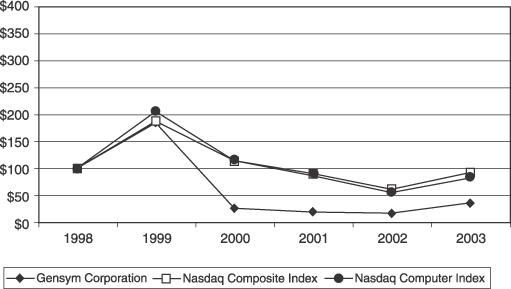

Comparative Stock Performance

The following graph compares the cumulative total stockholder return on our common stock since December 31, 1998 with the cumulative total return for the Nasdaq Composite Index and the Nasdaq Computer Index. The comparison assumes the investment of $100 on December 31, 1998 in our common stock, the Nasdaq Composite Index and the Nasdaq Computer Index and assumes all dividends are reinvested. Measurement points are the last trading day for each respective fiscal year.

Comparison of 5-year Cumulative Return Among Gensym Corporation,

Nasdaq Composite Index and Nasdaq Computer Index

| | | | | | | | | | | | | | | | | | |

| | | Year ended December 31,

|

| | | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

Gensym Corporation | | $ | 100 | | $ | 184 | | $ | 26 | | $ | 19 | | $ | 17 | | $ | 36 |

Nasdaq Composite Index | | $ | 100 | | $ | 187 | | $ | 114 | | $ | 90 | | $ | 61 | | $ | 92 |

Nasdaq Computer Index | | $ | 100 | | $ | 205 | | $ | 114 | | $ | 86 | | $ | 55 | | $ | 82 |

18

Change in Accountants

The audit committee annually considers and recommends to our board the selection of our independent accountants. As recommended by the audit committee, our board of directors on March 27, 2002 dismissed Arthur Andersen LLP as our independent accountants and, on April 8, 2002, engaged PricewaterhouseCoopers LLP to serve as our independent accountants for the fiscal year ended December 31, 2002.

Arthur Andersen LLP’s audit report on our consolidated financial statements for the fiscal year ended December 31, 2000 contained an explanatory paragraph regarding our ability to continue as a going concern. Except as stated above, Arthur Andersen LLP’s audit reports on our consolidated financial statements for the fiscal years ended December 31, 2001 and 2000 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2001 and 2000 and through March 27, 2002, there were no disagreements with Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen LLP’s satisfaction, would have caused it to make reference to the subject matter of the disagreement in connection with its audit reports on our consolidated financial statements for such years.

During the fiscal years ended December 31, 2001 and 2000 and through March 27, 2002, there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K, except that in connection with its work on our consolidated financial statements for the fiscal year ended December 31, 2001, Arthur Andersen LLP noted what it considered to be deficiencies in the design and implementation of our company’s internal financial controls relating to the financial closing and review process, the consolidation process, foreign operations and control, reconciliation of sub-ledgers and trial balances to the general ledger, and account analysis supporting recorded amounts. Arthur Andersen LLP advised us that the noted deficiencies constituted a reportable event under Item 304(a)(1)(v)(A) of Regulation S-K. The audit committee discussed the subject matter of this reportable event with Arthur Andersen LLP. Additionally, we authorized Arthur Andersen LLP to respond fully to inquiries of PricewaterhouseCoopers LLP concerning the subject matter of the reportable event.

At our request, Arthur Andersen LLP furnished us a letter addressed to the Securities and Exchange Commission stating whether or not it agreed with the above statements. A copy of that letter, dated May 16, 2002, was included with our current report on Form 8-K, filed with the Securities and Exchange Commission on May 16, 2002.

Prior to their engagement, neither we, nor anyone acting on our behalf, consulted PricewaterhouseCoopers LLP with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our consolidated financial statements, or any other matters or reportable events as set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K.

Independent Auditor Fees and Other Matters

The following table summarizes the fees of PricewaterhouseCoopers LLP, our independent auditor, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

| | | | | | |

Fee Category

| | 2003

| | 2002

|

Audit Fees (1) | | $ | 405,000 | | $ | 290,000 |

Audit-Related Fees (2) | | $ | — | | $ | 27,000 |

Tax Fees (3) | | $ | 52,000 | | $ | 70,000 |

All Other Fees | | $ | — | | $ | — |

| | |

|

| |

|

|

Total Fees | | $ | 457,000 | | $ | 387,000 |

| | |

|

| |

|

|

19

| | (1) | | Audit fees consist of fees for the audit of our financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements. |

| | (2) | | Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit and the review of our financial statements and which are not reported under “Audit Fees”. These services relate to financial accounting and reporting consultations during 2002. |

| | (3) | | Tax fees consist of fees for tax compliance, tax advice and tax planning services. Tax compliance services, which relate to the preparation of original and amended tax returns accounted for $52,000 of the total tax fees paid for 2003 and $65,000 of the total tax fees paid for 2002. Tax advice and tax planning services for $5,000 relate to international tax planning in 2002. |

Pre-Approval Policy and Procedures

The audit committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent auditor. This policy generally provides that we will not engage our independent auditor to render audit or non-audit services unless the service is specifically approved in advance by the audit committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the audit committee may pre-approve specified types of services that are expected to be provided to us by our independent auditor during the next 12 months. Any such pre-approval is detailed as to the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.

STOCKHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 and intended to be presented in the proxy material for the 2005 annual meeting of stockholders must be received by us at our offices, 52 Second Avenue, Burlington, Massachusetts 01803, no later than Thursday, December 23, 2004 in order to be considered for inclusion in the proxy statement relating to that meeting. We suggest that proponents submit their proposals by certified mail, return receipt requested, addressed to our corporate secretary.

Our amended and restated by-laws also establish advance notice procedures with respect to a stockholder nomination of candidates for election as directors and for the conduct of other business to be brought before an annual meeting by a stockholder not submitted pursuant to Rule 14a-8. A notice regarding a director nomination or a proposal for other business must be received by us not less than 60 days nor more than 90 days prior to the applicable stockholder meeting. However, in the event that less than 70 days’ notice or prior disclosure of the date of the meeting is given or made to our stockholders, the notice must be received by us not later than the tenth day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever occurs first. Any such notice must contain certain specified information concerning the persons to be nominated and/or the other business to be brought before the annual meeting and the stockholder submitting the director nomination or proposal for other business. We have not yet publicly announced the date of the 2005 annual meeting. The advance notice provisions of our by-laws supersede the notice requirements contained in Rule 14a-4. Director nominations or stockholder proposals for other business to be brought before the annual meeting should be mailed to: Corporate Secretary, Gensym Corporation, 52 Second Avenue, Burlington, Massachusetts 01803.

20

SOLICITATION OF PROXIES

We will bear the cost of soliciting proxies. In addition to solicitations by mail, our directors, officers and regular employees may, without additional remuneration, solicit proxies by telephone, facsimile and personal interviews. We will request brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares and request instructions for voting the proxies. We will reimburse such brokerage houses and other persons for their reasonable expenses in connection with this distribution.

We will provide free of charge to any stockholder from whom a proxy is solicited pursuant to this proxy statement, upon written request from such stockholder, a copy of our annual report filed with the Securities and Exchange Commission on Form 10-K for our fiscal year ended December 31, 2003, without exhibits. Requests for this report should be directed to Gensym Corporation, 52 Second Avenue, Burlington, Massachusetts 01803, Attention: Corporate Secretary. Exhibits will be provided upon request and payment of an appropriate processing fee.

OTHER MATTERS

The board of directors knows of no other business that will be presented for consideration at the annual meeting other than that described above. However, if any other business should come before the annual meeting, it is the intention of the persons named in the enclosed proxy to vote, or otherwise act, in accordance with their best judgment on such matters.

By order of the Board of Directors,

Lowell B. Hawkinson

Chairman and Chief Executive Officer

April 29, 2004

The board of directors hopes that stockholders will attend the meeting. Whether or not you plan to attend, you are urged to complete, date, sign and return the enclosed proxy in the accompanying envelope. Prompt response will greatly facilitate arrangements for the meeting and your cooperation is appreciated. Stockholders who attend the meeting may vote their stock personally even though they have sent in their proxies.

21

Exhibit A

GENSYM CORPORATION

AUDIT COMMITTEE CHARTER

April 13, 2004

The purpose of the Audit Committee is to assist the Board of Directors’ oversight of:

| | • | | the integrity of the Company’s financial statements; |

| | • | | the independent auditor’s qualifications and independence; and |

| | • | | the performance of the Company’s internal audit function, if any, and independent auditors. |

| B. | | Structure and Membership |