UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07489

Oppenheimer International Growth Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: November 30

Date of reporting period: 5/29/2015

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 5/29/15*

| | | | | | | | | | | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | MSCI AC World ex-U.S.

Index |

6-Month | | | | 7.02 % | | | | | 0.87 % | | | | | 3.16 % | |

1-Year | | | | -0.92 | | | | | -6.61 | | | | | -0.90 | |

5-Year | | | | 12.31 | | | | | 10.99 | | | | | 8.09 | |

10-Year | | | | 8.56 | | | | | 7.92 | | | | | 6.04 | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

*May 29, 2015, was the last business day of the Fund’s semiannual period. See Note 2 of the accompanying Notes to Financial Statements. Index returns are calculated through May 31, 2015.

2 OPPENHEIMER INTERNATIONAL GROWTH FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) generated a cumulative total return of 7.02% during the reporting period. On a relative basis, the Fund outperformed the MSCI AC World ex-U.S. Index (the “Index”), which returned 3.16%. The Fund outperformed the Index in seven out of ten sectors, led by stock selection in the information technology, materials, financials and telecommunication services sectors. The Fund underperformed in the consumer staples and industrials sectors due to less favorable stock selection.

MARKET OVERVIEW

In 2014, the U.S. Federal Reserve (the “Fed”) began reducing its monthly purchases of U.S. government Treasuries and mortgage-backed securities (“MBS”) in steady $10 billion increments, and completed the process at the end of October, thereby ending the quantitative easing (“QE”) program’s purchases. While economic growth in the U.S. remained largely on track in 2014, it slowed in other areas, including Europe, and parts of both Latin America and Asia. Interest rates in core Europe dropped significantly, and turned negative in many cases. The U.S. dollar rallied strongly against most currencies, including the euro, and Japanese yen. The U.S. dollar appreciated due to a positive economic outlook compared to weakening growth prospects elsewhere, in addition to anticipated higher rates in the U.S. Against this backdrop, U.S. equities outperformed international equities in 2014.

The market environment shifted in 2015. The dollar continued to strengthen, which acted as a drag on growth. Businesses, especially U.S. firms with revenues dependent on exporting goods and services, cited this as a

headwind. European Central Bank (“ECB”) President Mario Draghi announced the purchase of €60 billion a month in sovereign bonds from Eurozone countries for at least 19 months, a form of QE that is projected to increase the ECB’s balance sheet by over €1 trillion. The announcement and implementation of these extraordinary monetary policies had a significant impact on financial markets. European markets rallied and the euro fell against the currencies of most major trading partners. Fed Chairwoman, Janet Yellen, reaffirmed plans to raise U.S. rates during 2015 despite any near-term weakness in first quarter Gross Domestic Product and employment growth. The Fed has made it clear, however, that it will remain flexible on the timing and extent of rate hikes for the remainder of 2015. European and emerging market equities have outperformed U.S. equities so far in 2015.

FUND REVIEW

Top performing holdings for the Fund this reporting period included Syngenta AG, Valeo SA and Infineon Technologies AG. Syngenta AG, a Swiss producer of crop chemicals and

3 OPPENHEIMER INTERNATIONAL GROWTH FUND

seeds, received an unsolicited takeover offer from Monsanto. Syngenta’s board rejected the bid, claiming the offer undervalued the growth prospects of the company and underestimated execution risks. Our exposure to France-based Valeo and Germany-based Infineon Technologies reflects our interest in the auto components supply industry. Since the global financial crisis, car manufacturers have concentrated more on their strengths: marketing and distribution. They have shifted more of the engineering expertise to their suppliers. As a result, there has been a marked change in the value added by suppliers. They own the intellectual property, and control more and more of the research and development. We expect higher returns on capital from suppliers in the future, particularly as the electronification of the car continues, and stricter emissions standards are introduced. Both of these companies performed well during the reporting period.

Top detractors for the Fund included Aryzta AG, Swatch Group AG and Boskalis Westminster NV. Aryzta is a Swiss manufacturer of baked goods. During the reporting period, the company announced weaker-than-expected results from its U.S. operations. A shift from lower margin customers to larger contracts had a negative impact on sales and margins, but we believe it has the potential to ultimately benefit the company. Aryzta also announced the acquisition of a 49% stake in Picard, a premium frozen food company in France. Picard moves Aryzta into the retail channel, which is unfamiliar territory. While there are

some concerns about the strategic fit of this deal, the underlying growth story behind Aryzta’s core baked goods continues to be a good one, in our opinion. Switzerland-based Swatch Group is one of the largest watchmakers in the world. The company, along with other Swiss-based exporters, has suffered from the strengthening of the Swiss Franc. Boskalis Westminster, based in the Netherlands, is a dredging and marine company. The company’s offshore energy business, which includes transportation and subsea services, faces a challenging outlook given the significant fall in oil prices. However, Boskalis has a healthy order book in its dredging business and sees a good tender pipeline for capital dredging projects, expansion of ports, and land reclamation.

STRATEGY & OUTLOOK

Our philosophy remains unchanged. We take a bottom-up approach, seeking high quality companies that are exposed to, and able to monetize durable, secular growth trends. We are long-term investors with an average holding period in excess of five years.

Europe continues to remain a cause of great trepidation for investors. Even as European equities are off to one of the strongest starts to the year in almost a decade, they face one of the longest periods in history of underperformance in relation to the United States. We think this bodes well for the region in the future. European stocks look compelling to us for a few key reasons. First, there is still significant pessimism reflected in overall low valuations. Second, companies

4 OPPENHEIMER INTERNATIONAL GROWTH FUND

there have gained earnings momentum because of the significant decline in the euro. Finally, European companies hold dominant positions in fast growing regions of the world, and often have high, defensible returns on capital. We believe these are the right ingredients for finding long-term growth at compelling prices.

| | |

| |  |

| | George R. Evans, CFA |

| | Portfolio Manager |

| | |

| |

|

| | Robert B. Dunphy, CFA |

| | Portfolio Manager |

5 OPPENHEIMER INTERNATIONAL GROWTH FUND

Top Holdings and Allocations*

| | | | |

TOP TEN COMMON STOCK HOLDINGS | |

Continental AG | | | 1.6% | |

Novo Nordisk AS, Cl. B | | | 1.6 | |

Valeo SA | | | 1.6 | |

Infineon Technologies AG | | | 1.6 | |

Syngenta AG | | | 1.6 | |

Dollarama, Inc. | | | 1.6 | |

Vodafone Group plc | | | 1.5 | |

Roche Holding AG | | | 1.5 | |

ICAP plc | | | 1.5 | |

Airbus Group NV | | | 1.5 | |

Portfolio holdings and allocations are subject to change. Percentages are as of May 29, 2015, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

| | | | |

TOP TEN GEOGRAPHICAL HOLDINGS | |

United Kingdom | | | 26.7% | |

France | | | 13.0 | |

Switzerland | | | 12.7 | |

Germany | | | 8.1 | |

Netherlands | | | 6.9 | |

Japan | | | 5.7 | |

Spain | | | 4.2 | |

United States | | | 3.5 | |

Canada | | | 3.3 | |

Sweden | | | 2.9 | |

Portfolio holdings and allocation are subject to change. Percentages are as of May 29, 2015, and are based on total market value of investments.

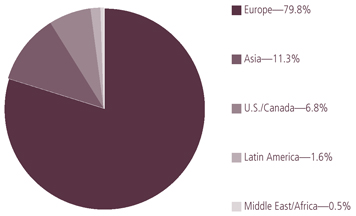

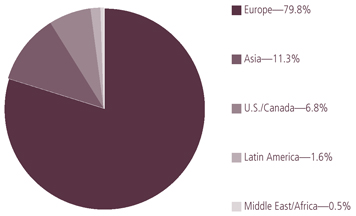

REGIONAL ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of May 29, 2015, and are based on the total market value of investments.

*May 29, 2015, was the last business day of the Fund’s semiannual period. See Note 2 of the accompanying Notes to Financial Statements.

6 OPPENHEIMER INTERNATIONAL GROWTH FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 5/29/15

| | | | | | | | | | |

| | | Inception Date | | 6-Month | | 1-Year | | 5-Year | | 10-Year |

Class A (OIGAX) | | 3/25/96 | | 7.02% | | -0.92% | | 12.31% | | 8.56% |

Class B (IGRWX) | | 3/25/96 | | 6.64% | | -1.65% | | 11.45% | | 8.06% |

Class C (OIGCX) | | 3/25/96 | | 6.64% | | -1.66% | | 11.49% | | 7.76% |

Class I (OIGIX) | | 3/29/12 | | 7.25% | | -0.48% | | 11.15% * | | N/A |

Class R (OIGNX) | | 3/1/01 | | 6.91% | | -1.15% | | 12.03% | | 8.27% |

Class Y (OIGYX) | | 9/7/05 | | 7.16% | | -0.66% | | 12.73% | | 7.98% * |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 5/29/15

| | | | | | | | | | |

| | | Inception Date | | 6-Month | | 1-Year | | 5-Year | | 10-Year |

Class A (OIGAX) | | 3/25/96 | | 0.87% | | -6.61% | | 10.99% | | 7.92% |

Class B (IGRWX) | | 3/25/96 | | 1.64% | | -6.57% | | 11.19% | | 8.06% |

Class C (OIGCX) | | 3/25/96 | | 5.64% | | -2.64% | | 11.49% | | 7.76% |

Class I (OIGIX) | | 3/29/12 | | 7.25% | | -0.48% | | 11.15% * | | N/A |

Class R (OIGNX) | | 3/1/01 | | 5.91% | | -2.13% | | 12.03% | | 8.27% |

Class Y (OIGYX) | | 9/7/05 | | 7.16% | | -0.66% | | 12.73% | | 7.98% * |

* Shows performance since inception.

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C shares, the contingent deferred sales charge (“CDSC”) of 1% for the 1-year period. Prior to 7/1/14, Class R shares were named Class N shares. Beginning 7/1/14, new purchases of Class R shares will no longer be subject to a CDSC upon redemption (any CDSC will remain in effect for purchases prior to 7/1/14). There is no sales charge for Class I and Class Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the 10-year return for Class B shares uses Class A performance for the period after conversion. Returns for periods of less than one year are cumulative and not annualized.

The Fund’s performance is compared to the performance of the MSCI AC World ex-U.S. Index. The MSCI AC World ex-U.S. Index is designed to measure the equity market performance of developed and emerging markets and excludes the U.S. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not

7 OPPENHEIMER INTERNATIONAL GROWTH FUND

predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

8 OPPENHEIMER INTERNATIONAL GROWTH FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended May 29, 2015.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended May 29, 2015” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9 OPPENHEIMER INTERNATIONAL GROWTH FUND

| | | | | | |

| Actual | | Beginning

Account Value

December 1, 2014 | | Ending

Account

Value

May 29, 2015 | | Expenses Paid During

6 Months Ended

May 29, 2015 |

|

Class A | | $ 1,000.00 | | $ 1,070.20 | | $ 5.84 |

|

Class B | | 1,000.00 | | 1,066.40 | | 9.67 |

|

Class C | | 1,000.00 | | 1,066.40 | | 9.67 |

|

Class I | | 1,000.00 | | 1,072.50 | | 3.58 |

|

Class R | | 1,000.00 | | 1,069.10 | | 7.12 |

|

Class Y | | 1,000.00 | | 1,071.60 | | 4.56 |

| | | |

| Hypothetical | | | | | | |

| (5% return before expenses) | | | | | | |

|

Class A | | 1,000.00 | | 1,019.04 | | 5.69 |

|

Class B | | 1,000.00 | | 1,015.34 | | 9.44 |

|

Class C | | 1,000.00 | | 1,015.34 | | 9.44 |

|

Class I | | 1,000.00 | | 1,021.21 | | 3.49 |

|

Class R | | 1,000.00 | | 1,017.80 | | 6.94 |

|

Class Y | | 1,000.00 | | 1,020.27 | | 4.44 |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 180/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended May 29, 2015 are as follows:

| | | | | | |

| Class | | Expense Ratios | |

| |

Class A | | | | | 1.14% | |

| |

Class B | | | | | 1.89 | |

| |

Class C | | | | | 1.89 | |

| |

Class I | | | | | 0.70 | |

| |

Class R | | | | | 1.39 | |

| |

Class Y | | | | | 0.89 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

10 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF INVESTMENTS May 29, 2015* Unaudited

| | | | | | | | | | |

| | | | | | | | | |

| | | Shares | | | Value | | | |

|

Common Stocks—97.4% | | | | | | | | | | |

|

Consumer Discretionary—23.6% | | | |

|

| Auto Components—3.2% | | | | | | | |

| Continental AG | | | 1,469,619 | | | $ | 339,415,151 | | | |

|

| Valeo SA | | | 2,065,261 | | | | 331,471,646 | | | |

| | | | | | | |

| | | | | | | 670,886,797 | | | |

| |

|

| Automobiles—1.4% | | | | | | | | | | |

| Bayerische Motoren | | | | | | | | | | |

| Werke AG | | | 1,627,588 | | | | 180,044,036 | | | |

|

| Hero MotoCorp Ltd. | | | 2,623,051 | | | | 110,476,118 | | | |

| | | | | | | |

| | | | | | | 290,520,154 | | | |

| |

|

| Diversified Consumer Services—0.7% | | | |

| Dignity plc1 | | | 4,756,330 | | | | 154,308,346 | | | |

| |

|

| Hotels, Restaurants & Leisure—3.7% | | | |

| Carnival Corp. | | | 5,957,010 | | | | 275,988,273 | | | |

|

| Domino’s Pizza Group plc1 | | | 16,433,847 | | | | 200,072,599 | | | |

|

| William Hill plc | | | 43,460,198 | | | | 280,162,277 | | | |

| | | | | | | |

| |

| | | | | | | 756,223,149 | | | |

| |

|

| Household Durables—1.0% | | | |

| SEB SA | | | 2,284,347 | | | | 203,056,810 | | | |

| |

|

| Internet & Catalog Retail—0.3% | | | |

| Yoox SpA1,2 | | | 1,807,644 | | | | 58,731,389 | | | |

| |

|

| Media—4.2% | | | | | | | | | | |

| Grupo Televisa SAB, Sponsored ADR | | | 5,810,320 | | | | 219,920,612 | | | |

|

| ProSiebenSat.1 Media AG | | | 4,810,132 | | | | 230,031,692 | | | |

|

| SES SA | | | 5,653,460 | | | | 200,642,669 | | | |

|

| Sky plc | | | 13,577,445 | | | | 219,173,933 | | | |

| | | | | | | |

| | | | | | | 869,768,906 | | | |

| |

|

| Multiline Retail—2.5% | | | | | | | | | | |

| Dollarama, Inc. | | | 5,918,757 | | | | 327,825,653 | | | |

|

| Hudson’s Bay Co.1 | | | 9,153,300 | | | | 187,467,474 | | | |

| | | | | | | |

| | | | | | | 515,293,127 | | | |

| |

|

| Specialty Retail—1.0% | | | | | | | | | | |

| Inditex SA | | | 6,511,551 | | | | 215,806,593 | | | |

| |

|

| Textiles, Apparel & Luxury Goods—5.6% | | | |

| Burberry Group plc | | | 10,713,461 | | | | 277,984,676 | | | |

|

| Cie Financiere Richemont SA | | | 2,398,294 | | | | 207,788,126 | | | |

|

| Hermes International | | | 327,027 | | | | 128,051,192 | | | |

|

| Kering | | | 671,750 | | | | 118,052,529 | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | | Shares | | | Value | | | |

|

| Textiles, Apparel & Luxury Goods (Continued) | | | |

|

| LVMH Moet Hennessy | | | | | | | | | | |

| Louis Vuitton SE | | | 1,053,010 | | | $ | 188,424,189 | | | |

|

| Prada SpA | | | 13,878,300 | | | | 76,161,237 | | | |

|

| Swatch Group AG (The)2 | | | 393,902 | | | | 156,653,935 | | | |

| | | | | | | |

| | | | | | | 1,153,115,884 | | | |

|

|

| Consumer Staples—10.5% | | | | | | | | | | |

|

| Beverages—2.6% | | | | | | | | | | |

| Diageo plc | | | 4,027,760 | | | | 111,952,244 | | | |

|

| Heineken NV | | | 3,406,852 | | | | 267,502,562 | | | |

|

| Pernod Ricard SA | | | 1,316,092 | | | | 162,777,245 | | | |

| | | | | | | |

| | | | | | | 542,232,051 | | | |

|

|

| Food & Staples Retailing—1.6% | | | |

| CP ALL PCL | | | 172,378,600 | | | | 234,080,495 | | | |

|

| Spar Group Ltd. (The) | | | 6,718,496 | | | | 103,007,799 | | | |

| | | | | | | |

| | | | | | | 337,088,294 | | | |

|

|

| Food Products—4.6% | | | | | | | | | | |

| Aryzta AG2 | | | 4,249,773 | | | | 269,810,932 | | | |

|

| Barry Callebaut AG2 | | | 149,798 | | | | 168,922,091 | | | |

|

| Danone SA | | | 2,182,975 | | | | 149,979,783 | | | |

|

| Saputo, Inc. | | | 5,928,778 | | | | 161,282,213 | | | |

|

| Unilever plc | | | 4,620,682 | | | | 204,181,173 | | | |

| | | | | | | |

| | | | | | | 954,176,192 | | | |

|

|

| Household Products—1.2% | | | | | | | | | | |

| Reckitt Benckiser Group plc | | | 2,624,324 | | | | 237,192,786 | | | |

|

|

| Tobacco—0.5% | | | | | | | | | | |

| Swedish Match AB | | | 3,704,903 | | | | 110,408,190 | | | |

|

|

| Energy—1.5% | | | | | | | | | | |

|

| Energy Equipment & Services—0.5% | | | |

| Technip SA | | | 1,522,122 | | | | 100,540,337 | | | |

|

|

| Oil, Gas & Consumable Fuels—1.0% | | | |

| Koninklijke Vopak NV | | | 4,186,582 | | | | 208,495,353 | | | |

|

|

| Financials—4.6% | | | | | | | | | | |

|

| Capital Markets—2.8% | | | | | | | | | | |

| ICAP plc1 | | | 35,654,567 | | | | 301,527,814 | | | |

|

| Tullett Prebon plc | | | 12,156,254 | | | | 73,572,910 | | | |

|

| UBS Group AG2 | | | 9,288,913 | | | | 199,849,928 | | | |

| | | | | | | |

| | | | | | | 574,950,652 | | | |

11 OPPENHEIMER INTERNATIONAL GROWTH FUND

| | | | | | | | | | |

| | | | | | | | | |

| | | Shares | | | Value | | | |

|

| Commercial Banks—0.8% | | | | | | | |

| ICICI Bank Ltd., | | | | | | | | | | |

| Sponsored ADR | | | 15,751,320 | | | $ | 166,333,939 | | | |

| |

|

| Insurance—1.0% | | | | | | | |

| Prudential plc | | | 8,850,112 | | | | 220,508,343 | | | |

| |

|

| Health Care—9.4% | | | | | | | | | | |

|

| Biotechnology—2.0% | | | | | | | |

| CSL Ltd. | | | 3,314,100 | | | | 235,877,385 | | | |

|

| Grifols SA | | | 4,399,757 | | | | 175,510,166 | | | |

| | | | | | | |

| | | | | | | 411,387,551 | | | |

| |

|

| Health Care Equipment & Supplies—3.1% | | | |

| DiaSorin SpA1 | | | 2,582,787 | | | | 116,906,038 | | | |

|

| Essilor International SA | | | 1,357,406 | | | | 165,809,989 | | | |

|

| Sonova Holding AG | | | 1,461,027 | | | | 220,332,048 | | | |

|

| William Demant Holding AS2 | | | 1,620,004 | | | | 133,444,582 | | | |

| | | | | | | |

| | | | | | | 636,492,657 | | | |

| |

|

| Health Care Providers & Services—0.4% | | | |

| Sonic Healthcare Ltd. | | | 5,698,906 | | | | 87,030,775 | | | |

| |

|

| Pharmaceuticals—3.9% | | | | | | | |

| Galenica AG | | | 164,775 | | | | 165,206,761 | | | |

|

| Novo Nordisk AS, Cl. B | | | 5,938,225 | | | | 336,493,661 | | | |

|

| Oxagen Ltd.2,3 | | | 214,287 | | | | 3,275 | | | |

|

| Roche Holding AG | | | 1,045,938 | | | | 307,954,351 | | | |

| | | | | | | |

| | | | | | | 809,658,048 | | | |

| |

|

| Industrials—21.3% | | | | | | | |

|

| Aerospace & Defense—3.3% | | | |

| Airbus Group NV2 | | | 4,395,073 | | | | 299,460,004 | | | |

|

| Embraer SA | | | 14,584,046 | | | | 109,209,848 | | | |

|

| Rolls-Royce Holdings plc2 | | | 17,307,856 | | | | 264,390,445 | | | |

| | | | | | | |

| | | | | | | 673,060,297 | | | |

| |

|

| Air Freight & Couriers—0.8% | | | |

| Royal Mail plc | | | 21,510,809 | | | | 172,376,877 | | | |

| |

|

| Commercial Services & Supplies—2.6% | | | |

| Aggreko plc | | | 7,507,803 | | | | 184,625,120 | | | |

|

| Edenred | | | 6,611,612 | | | | 167,046,500 | | | |

|

| Prosegur Cia de Seguridad SA1 | | | 35,117,286 | | | | 192,901,729 | | | |

| | | | | | | |

| | | | | | | 544,573,349 | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | Shares | | | Value | | | |

|

| Construction & Engineering—1.5% | | | |

| Boskalis Westminster NV | | | 3,273,657 | | | $ | 162,472,653 | | | |

|

| CIMIC Group Ltd. | | | 6,231,098 | | | | 114,940,886 | | | |

| | | | | | | | | |

|

| Trevi Finanziaria | | | | | | | | | | |

| Industriale SpA1 | | | 15,868,642 | | | | 39,579,336 | | | |

| | | | | | | |

| | | | | | | 316,992,875 | | | |

| |

|

| Electrical Equipment—3.6% | | | |

| ABB Ltd.2 | | | 4,596,593 | | | | 100,773,600 | | | |

|

| Legrand SA2 | | | 3,496,820 | | | | 196,935,391 | | | |

|

| Nidec Corp. | | | 3,261,670 | | | | 237,209,065 | | | |

|

| Schneider Electric SE | | | 2,620,250 | | | | 198,738,537 | | | |

| | | | | | | |

| | | | | | | 733,656,593 | | | |

| |

|

| Machinery—3.1% | | | |

| Aalberts Industries NV1 | | | 8,811,865 | | | | 272,607,624 | | | |

|

| Atlas Copco AB, Cl. A | | | 8,454,842 | | | | 255,789,090 | | | |

|

| Atlas Copco AB, Cl. A2 | | | 8,454,842 | | | | 5,899,995 | | | |

|

| Weir Group plc (The) | | | 3,705,110 | | | | 114,723,373 | | | |

| | | | | | | |

| | | | | | | 649,020,082 | | | |

| |

|

| Professional Services—2.8% | | | |

| Experian plc | | | 11,597,908 | | | | 221,120,107 | | | |

|

| Intertek Group plc | | | 5,683,390 | | | | 217,372,593 | | | |

|

| SGS SA | | | 71,441 | | | | 137,487,944 | | | |

| | | | | | | |

| | | | | | | 575,980,644 | | | |

| |

|

| Trading Companies & Distributors—3.6% | | | |

| Brenntag AG | | | 3,439,212 | | | | 207,665,625 | | | |

|

| Bunzl plc | | | 9,961,590 | | | | 288,778,667 | | | |

|

| Wolseley plc | | | 3,960,431 | | | | 244,743,178 | | | |

| | | | | | | |

| | | | | | | 741,187,470 | | | |

| |

|

| Information Technology—16.0% | | | |

|

| Communications Equipment—1.5% | | | |

| Nokia OYJ | | | 11,981,181 | | | | 87,569,633 | | | |

|

| Telefonaktiebolaget LM Ericsson, Cl. B | | | 19,387,235 | | | | 217,764,654 | | | |

| | | | | | | |

| | | | | | | 305,334,287 | | | |

| |

|

| Electronic Equipment, Instruments, & Components—2.8% | | | |

| Hoya Corp. | | | 5,902,510 | | | | 216,948,956 | | | |

|

| Keyence Corp. | | | 409,121 | | | | 219,684,277 | | | |

|

| Spectris plc | | | 4,264,756 | | | | 152,508,764 | | | |

| | | | | | | |

| | | | | | | 589,141,997 | | | |

| | | | | | | | | |

12 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | | | |

| | | Shares | | | Value | | | |

|

| Internet Software & Services—2.4% | | | | | | | |

| Telecity Group plc | | | 7,350,880 | | | $ | 121,171,142 | | | |

|

| United Internet AG | | | 3,595,514 | | | | 168,016,273 | | | |

|

| Yahoo Japan Corp. | | | 45,949,300 | | | | 204,979,834 | | | |

| | | | | | | |

| | | | | | | 494,167,249 | | | |

| | | | | | | | | |

|

| IT Services—1.4% | | | | | | | | | | |

| Amadeus IT Holding SA, Cl. A | | | 6,382,684 | | | | 290,621,582 | | | |

| |

|

| Semiconductors & Semiconductor Equipment—2.1% | | | |

| ARM Holdings plc | | | 6,259,940 | | | | 110,769,516 | | | |

|

| Infineon Technologies AG | | | 25,391,816 | | | | 331,028,557 | | | |

| | | | | | | |

| | | | | | | 441,798,073 | | | |

| |

|

| Software—4.5% | | | | | | | | | | |

| AVEVA Group plc | | | 3,016,724 | | | | 89,718,039 | | | |

|

| Dassault Systemes2 | | | 2,968,096 | | | | 232,043,201 | | | |

|

| Gemalto NV | | | 2,421,027 | | | | 212,102,056 | | | |

|

| SAP SE | | | 2,882,279 | | | | 213,430,520 | | | |

|

| Temenos Group AG1 | | | 4,878,182 | | | | 178,113,472 | | | |

| | | | | | | |

| | | | | | | 925,407,288 | | | |

| |

|

| Technology Hardware, Storage & Peripherals—1.3% | | | |

| Lenovo Group Ltd. | | | 163,844,000 | | | | 261,126,381 | | | |

| |

|

| Materials—4.8% | | | | | | | | | | |

|

| Chemicals—3.9% | | | | | | | | | | |

| Essentra plc1 | | | 19,344,992 | | | | 296,276,452 | | | |

|

| Sika AG | | | 51,844 | | | | 178,174,898 | | | |

|

| Syngenta AG | | | 717,015 | | | | 328,382,669 | | | |

| | | | | | | |

| | | | | | | 802,834,019 | | | |

| |

|

| Construction Materials—0.9% | | | |

| James Hardie Industries plc | | | 14,437,500 | | | | 194,651,982 | | | |

| |

|

| Telecommunication Services—5.7% | | | | | | | |

|

| Diversified Telecommunication Services—4.2% | | | |

| BT Group plc | | | 38,582,393 | | | | 263,775,821 | | | |

|

| Iliad SA | | | 637,690 | | | | 144,569,623 | | | |

|

| Inmarsat plc | | | 10,908,887 | | | | 165,770,936 | | | |

|

| Nippon Telegraph & Telephone Corp. | | | 4,289,500 | | | | 298,071,435 | | | |

| | | | | | | |

| | | | | | | 872,187,815 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Shares | | | Value | | | |

|

| Wireless Telecommunication Services—1.5% | | | |

| Vodafone Group plc | | | 78,891,100 | | | $ | 308,496,049 | | | |

| | | | | | | |

Total Common Stocks (Cost $16,105,076,598) | | | | | | | 20,176,821,232 | | | |

| |

|

Preferred Stock—0.0% | | | | | | | | | | |

Zee Entertainment Enterprises Ltd., 6% Cum. Non-Cv. (Cost

$843,860) | | | 172,139,289 | | | | 2,264,060 | | | |

| | | | | | | | | | |

| | | |

| | | Units | | | | | | |

|

Rights, Warrants and Certificates—0.0% | | | |

|

| Ceres, Inc., Series F Wts., Strike Price $19.50, Exp. 9/6/152,3 | | | 126,666 | | | | — | | | |

|

| MEI Pharma, Inc. Wts., Strike Price $1.19, Exp. 5/10/172 | | | 1,118,385 | | | | 60,728 | | | |

| | | | | | | |

Total Rights, Warrants and Certificates

(Cost $264,716) | | | | | | | 60,728 | | | |

| | | |

| | | Shares | | | | | | |

|

Investment Company—2.2% | | | |

|

| Oppenheimer Institutional Money Market Fund, Cl. E, 0.14%1,4 (Cost $453,503,515) | | | 453,503,515 | | | | 453,503,515 | | | |

|

| Total Investments, at Value (Cost $16,559,688,689) | | | 99.6% | | | | 20,632,649,535 | | | |

|

| Net Other Assets (Liabilities) | | | 0.4 | | | | 76,325,679 | | | |

| | | |

| Net Assets | | | 100.0% | | | $ | 20,708,975,214 | | | |

| | | |

13 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF INVESTMENTS May 29, 2015 / Unaudited

Footnotes to Statement of Investments

* May 29, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

1. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the period ended May 29, 2015, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares

November 28,

2014 a | | | Gross Additions | | | Gross Reductions | | | Shares May 29, 2015 | |

| |

| Aalberts Industries NV | | | 8,282,724 | | | | 529,141 | | | | — | | | | 8,811,865 | |

| DiaSorin SpAb | | | 3,272,661 | | | | — | | | | 689,874 | | | | 2,582,787 | |

| Dignity plc | | | 4,534,461 | | | | 221,869 | | | | — | | | | 4,756,330 | |

| Domino’s Pizza Group plc | | | 16,433,847 | | | | — | | | | — | | | | 16,433,847 | |

| Essentra plc | | | 18,215,196 | | | | 1,129,796c | | | | — | | | | 19,344,992 | |

| Hudson’s Bay Co. | | | 6,929,700 | | | | 2,223,600 | | | | — | | | | 9,153,300 | |

| ICAP plc | | | 33,506,054 | | | | 2,148,513c | | | | — | | | | 35,654,567 | |

| Oppenheimer Institutional Money Market | | | | | | | | | | | | | | | | |

| Fund, Cl. E | | | 413,638,127 | | | | 1,875,455,515 | | | | 1,835,590,127 | | | | 453,503,515 | |

| Prosegur Cia de Seguridad SA | | | 33,462,250 | | | | 1,655,036 | | | | — | | | | 35,117,286 | |

| Temenos Group AG | | | 3,515,715 | | | | 1,362,467 | | | | — | | | | 4,878,182 | |

| Trevi Finanziaria Industriale SpA | | | 20,097,065 | | | | — | | | | 4,228,423 | | | | 15,868,642 | |

| Yoox SpAb | | | 5,154,268 | | | | — | | | | 3,346,624 | | | | 1,807,644 | |

| | | | |

| | | | | | Value | | | Income | | | Realized Gain

(Loss) | |

| |

| Aalberts Industries NV | | | | | | $ | 272,607,624 | | | $ | 3,671,130 | | | $ | — | |

| DiaSorin SpA | | | | | | | — d | | | | 1,536,551 | | | | 620,739 | |

| Dignity plc | | | | | | | 154,308,346 | | | | 946,205 | | | | — | |

| Domino’s Pizza Group plc | | | | | | | 200,072,599 | | | | 2,425,923 | | | | — | |

| Essentra plc | | | | | | | 296,276,452 | | | | 3,572,570 | | | | — | |

| Hudson’s Bay Co. | | | | | | | 187,467,474 | | | | 575,175 | | | | — | |

| ICAP plc | | | | | | | 301,527,814 | | | | 3,499,845 e | | | | — | |

| Oppenheimer Institutional Money Market Fund, Cl. E | | | | | | | 453,503,515 | | | | 222,805 | | | | — | |

| Prosegur Cia de Seguridad SA | | | | | | | 192,901,729 | | | | 1,680,686 | | | | — | |

| Temenos Group AG | | | | | | | 178,113,473 | | | | 2,089,940 | | | | — | |

| Trevi Finanziaria Industriale SpA | | | | | | | 39,579,336 | | | | — | | | | (24,554,229) | |

| Yoox SpA | | | | | | | — d | | | | — | | | | 5,636,617 | |

| | | | | | | | |

| Total | | | | | | $ | 2,276,358,362 | | | $ | 20,220,830 | | | $ | (18,296,873) | |

| | | | | | | | |

a. November 28, 2014 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

b. No longer an affiliate as of May 29, 2015.

c. All or a portion are the result of a corporate action.

d. The security is no longer an affiliate; therefore, the value has been excluded from this table.

e. All or a portion of the transitions were the restult of non-cash dividends.

2. Non-income producing security.

14 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

3. Restricted security. The aggregate value of restricted securities as of May 29, 2015 was $3,275, which represents less than 0.005% of the Fund’s net assets. See Note 4 of the accompanying Notes. Information concerning restricted securities is as follows:

| | | | | | | | | | | | | | | | |

| Security | | Acquisition Dates | | | Cost | | | Value | | | Unrealized

Depreciation | |

| |

| Ceres, Inc., Series F Wts., Strike Price $19.50, Exp. 9/6/15 | | | 9/5/07 | | | $ | — | | | $ | — | | | $ | — | |

| Oxagen Ltd. | | | 12/20/00 | | | | 2,210,700 | | | | 3,275 | | | | 2,207,425 | |

| | | | | | | | |

| | | | | | $ | 2,210,700 | | | $ | 3,275 | | | $ | 2,207,425 | |

| | | | | | | | |

4. Rate shown is the 7-day yield as of May 29, 2015.

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| | | | | | | | |

| Geographic Holdings | | Value | | | Percent | |

| |

United Kingdom | | $ | 5,497,254,180 | | | | 26.7% | |

France | | | 2,688,139,642 | | | | 13.0 | |

Switzerland | | | 2,619,450,754 | | | | 12.7 | |

Germany | | | 1,669,631,854 | | | | 8.1 | |

Netherlands | | | 1,422,640,252 | | | | 6.9 | |

Japan | | | 1,176,893,566 | | | | 5.7 | |

Spain | | | 874,840,070 | | | | 4.2 | |

United States | | | 729,552,516 | | | | 3.5 | |

Canada | | | 676,575,340 | | | | 3.3 | |

Sweden | | | 589,861,929 | | | | 2.9 | |

Denmark | | | 469,938,243 | | | | 2.3 | |

Australia | | | 437,849,045 | | | | 2.1 | |

Italy | | | 291,378,000 | | | | 1.4 | |

India | | | 279,074,117 | | | | 1.4 | |

China | | | 261,126,382 | | | | 1.3 | |

Thailand | | | 234,080,495 | | | | 1.1 | |

Mexico | | | 219,920,612 | | | | 1.1 | |

Ireland | | | 194,651,983 | | | | 0.9 | |

Brazil | | | 109,209,848 | | | | 0.5 | |

South Africa | | | 103,007,799 | | | | 0.5 | |

Finland | | | 87,569,633 | | | | 0.4 | |

Hong Kong | | | 3,275 | | | | 0.0 | |

| | | | |

Total | | $ | 20,632,649,535 | | | | 100.0% | |

| | | | |

See accompanying Notes to Financial Statements.

15 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES May 29, 20151 Unaudited

| | | | | | |

|

Assets | | | | | | |

| Investments, at value—see accompanying statement of investments: | | | | | | |

| Unaffiliated companies (cost $14,868,306,026) | | $ | 18,356,291,173 | | | |

| Affiliated companies (cost $1,691,382,663) | | | 2,276,358,362 | | | |

| | | |

| | | 20,632,649,535 | | | |

|

| Cash | | | 15,224,610 | | | |

|

| Receivables and other assets: | | | | | | |

| Dividends | | | 76,708,207 | | | |

| Investments sold | | | 42,327,145 | | | |

| Shares of beneficial interest sold | | | 34,312,879 | | | |

| Other | | | 869,441 | | | |

| | | |

| Total assets | | | 20,802,091,817 | | | |

|

|

Liabilities | | | | | | |

| Bank overdraft-foreign | | | 51,255 | | | |

|

| Payables and other liabilities: | | | | | | |

| Investments purchased | | | 57,435,211 | | | |

| Shares of beneficial interest redeemed | | | 27,023,726 | | | |

| Foreign capital gains tax | | | 6,112,379 | | | |

| Distribution and service plan fees | | | 1,249,280 | | | |

| Trustees’ compensation | | | 552,980 | | | |

| Other | | | 691,772 | | | |

| | | |

| Total liabilities | | | 93,116,603 | | | |

|

|

| Net Assets | | $ | 20,708,975,214 | | | |

| | | |

|

|

Composition of Net Assets | | | | | | |

| Paid-in capital | | $ | 16,672,027,487 | | | |

|

| Accumulated net investment income | | | 153,150,947 | | | |

|

| Accumulated net realized loss on investments and foreign currency transactions | | | (181,208,614) | | | |

|

| Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 4,065,005,394 | | | |

| | | |

| Net Assets | | $ | 20,708,975,214 | | | |

| | | |

1. May 29, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

16 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES Continued

| | | | | | |

|

Net Asset Value Per Share | | | | | | |

Class A Shares: | | | | | | |

Net asset value and redemption price per share (based on net assets of $4,878,154,001 and 126,107,811 shares of beneficial interest outstanding) | | $ | 38.68 | | | |

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | $ | 41.04 | | | |

|

Class B Shares: | | | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $19,934,495 and 539,416 shares of beneficial interest outstanding) | | $ | 36.96 | | | |

|

Class C Shares: | | | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $554,921,143 and 15,121,407 shares of beneficial interest outstanding) | | $ | 36.70 | | | |

|

Class I Shares: | | | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $4,218,172,321 and 109,429,709 shares of beneficial interest outstanding) | | $ | 38.55 | | | |

|

Class R Shares: | | | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $409,879,749 and 10,784,917 shares of beneficial interest outstanding) | | $ | 38.00 | | | |

|

Class Y Shares: | | | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $10,627,913,505 and 276,009,339 shares of beneficial interest outstanding) | | $ | 38.51 | | | |

See accompanying Notes to Financial Statements.

17 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF OPERATIONS For the Six Months Ended May 29, 20151 Unaudited

| | | | | | |

|

Investment Income | | | | | | |

| Dividends: | | | | | | |

| Unaffiliated companies (net of foreign withholding taxes of $21,862,117) | | $ | 231,355,217 | | | |

| Affiliated companies (net of foreign withholding taxes of $1,440,677) | | | 20,220,830 | | | |

|

| Portfolio lending fees | | | 1,336,409 | | | |

|

| Interest | | | 186 | | | |

| | | |

| Total investment income | | | 252,912,642 | | | |

|

|

Expenses | | | | | | |

| Management fees | | | 63,344,264 | | | |

|

| Distribution and service plan fees: | | | | | | |

| Class A | | | 5,856,507 | | | |

| Class B | | | 102,776 | | | |

| Class C | | | 2,548,043 | | | |

| Class R | | | 947,232 | | | |

|

| Transfer and shareholder servicing agent fees: | | | | | | |

| Class A | | | 5,182,878 | | | |

| Class B | | | 22,693 | | | |

| Class C | | | 560,927 | | | |

| Class I | | | 601,077 | | | |

| Class R | | | 417,649 | | | |

| Class Y | | | 10,807,120 | | | |

|

| Shareholder communications: | | | | | | |

| Class A | | | 20,741 | | | |

| Class B | | | 639 | | | |

| Class C | | | 1,870 | | | |

| Class I | | | 3,057 | | | |

| Class R | | | 702 | | | |

| Class Y | | | 22,221 | | | |

|

| Custodian fees and expenses | | | 880,935 | | | |

|

| Trustees’ compensation | | | 152,692 | | | |

|

| Other | | | 434,503 | | | |

| | | |

| Total expenses | | | 91,908,526 | | | |

| Less reduction to custodian expenses | | | (4,142) | | | |

| Less waivers and reimbursements of expenses | | | (199,730) | | | |

| | | |

| Net expenses | | | 91,704,654 | | | |

|

| Net Investment Income | | | 161,207,988 | | | |

1. May 29, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

18 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENT OF OPERATIONS Continued

| | | | | | |

|

Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investments from: | | | | | | |

Unaffiliated companies (net of foreign capital gains tax of $1,063) | | $ | (9,801,295) | | | |

Affiliated companies | | | (18,296,873) | | | |

| Foreign currency transactions | | | (797,426) | | | |

| | | |

| | | |

| Net realized loss | | | (28,895,594) | | | |

|

| Net change in unrealized appreciation/depreciation on: | | | | | | |

| Investments (net of foreign capital gains tax of $5,840,218) | | | 1,969,301,488 | | | |

| Translation of assets and liabilities denominated in foreign currencies | | | (728,252,336) | | | |

| | | |

Net change in unrealized appreciation/depreciation | | | 1,241,049,152 | | | |

|

| Net Increase in Net Assets Resulting from Operations | | $ | 1,373,361,546 | | | |

| | | |

See accompanying Notes to Financial Statements.

19 OPPENHEIMER INTERNATIONAL GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

May 29, 20151 (Unaudited) | | | Year Ended

November 28, 20141 | |

| |

Operations | | | | | | | | |

| Net investment income | | $ | 161,207,988 | | | $ | 198,868,908 | |

| |

| Net realized gain (loss) | | | (28,895,594) | | | | 11,154,618 | |

| |

| Net change in unrealized appreciation/depreciation | | | 1,241,049,152 | | | | (682,462,279) | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 1,373,361,546 | | | | (472,438,753) | |

| |

Dividends and/or Distributions to Shareholders | | | | | | | | |

| Dividends from net investment income: | | | | | | | | |

| Class A | | | (38,397,404) | | | | (29,041,523) | |

| Class B | | | — | | | | — | |

| Class C | | | (1,025,238) | | | | (1,063,895) | |

| Class I | | | (49,175,131) | | | | (23,738,945) | |

| Class R2 | | | (2,483,145) | | | | (1,548,448) | |

| Class Y | | | (108,362,701) | | | | (63,514,365) | |

| | | | |

| | | (199,443,619) | | | | (118,907,176) | |

| |

Beneficial Interest Transactions | | | | | | | | |

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| Class A | | | (130,812,633) | | | | 996,017,308 | |

| Class B | | | (4,377,477) | | | | (7,643,153) | |

| Class C | | | 24,645,441 | | | | 147,973,437 | |

| Class I | | | 210,239,241 | | | | 2,005,118,031 | |

| Class R2 | | | 16,999,775 | | | | 108,745,192 | |

| Class Y | | | 1,263,218,826 | | | | 2,358,107,607 | |

| | | | | | | | |

| | | 1,379,913,173 | | | | 5,608,318,422 | |

| |

Net Assets | | | | | | | | |

| Total increase | | | 2,553,831,100 | | | | 5,016,972,493 | |

| |

| Beginning of period | | | 18,155,144,114 | | | | 13,138,171,621 | |

| | | | | | | | |

| | |

| End of period (including accumulated net investment income of $153,150,947 and $191,386,578, respectively) | | $ | 20,708,975,214 | | | $ | 18,155,144,114 | |

| | | | |

1. May 29, 2015 and November 28, 2014 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. Effective July 1, 2014, Class N shares were renamed Class R. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

20 OPPENHEIMER INTERNATIONAL GROWTH FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | Six Months

Ended

May 29, 20151

(Unaudited) | | | Year Ended

November 28,

20141 | | | Year Ended

November 29,

20131 | | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | | | Year Ended

November 30,

2010 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 36.45 | | | $ | 37.45 | | | $ | 30.43 | | | $ | 26.43 | | | $ | 25.75 | | | $ | 24.27 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.26 | | | | 0.38 | | | | 0.36 | | | | 0.35 | | | | 0.23 | | | | 0.18 | |

| Net realized and unrealized gain (loss) | | | 2.27 | | | | (1.11) | | | | 7.02 | | | | 3.85 | | | | 0.59 | | | | 1.45 | |

| | | | |

| Total from investment operations | | | 2.53 | | | | (0.73) | | | | 7.38 | | | | 4.20 | | | | 0.82 | | | | 1.63 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.30) | | | | (0.27) | | | | (0.36) | | | | (0.20) | | | | (0.14) | | | | (0.15) | |

| |

| Net asset value, end of period | | $ | 38.68 | | | $ | 36.45 | | | $ | 37.45 | | | $ | 30.43 | | | $ | 26.43 | | | $ | 25.75 | |

| | | | |

| | | | | | | | | |

| |

Total Return, at Net Asset Value3 | | | 7.02% | | | | (1.95)% | | | | 24.52% | | | | 16.06% | | | | 3.16% | | | | 6.77% | |

| |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 4,878,154 | | | $ | 4,726,302 | | | $ | 3,903,102 | | | $ | 2,388,159 | | | $ | 1,663,354 | | | $ | 1,554,785 | |

| |

| Average net assets (in thousands) | | $ | 4,723,084 | | | $ | 4,897,214 | | | $ | 3,048,384 | | | $ | 1,762,405 | | | $ | 1,730,811 | | | $ | 1,474,415 | |

| |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.43% | | | | 1.02% | | | | 1.05% | | | | 1.25% | | | | 0.83% | | | | 0.73% | |

| Total expenses5 | | | 1.14% | | | | 1.14% | | | | 1.21% | | | | 1.45% | | | | 1.36% | | | | 1.39% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.14% | | | | 1.14% | | | | 1.20% | | | | 1.28% | | | | 1.32% | | | | 1.34% | |

| |

| Portfolio turnover rate | | | 7% | | | | 12% | | | | 12% | | | | 15% | | | | 19% | | | | 23% | |

21 OPPENHEIMER INTERNATIONAL GROWTH FUND

1. May 29, 2015, November 28, 2014 and November 29, 2013 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

| Six Months Ended May 29, 2015 | | | 1.14 | % |

| Year Ended November 28, 2014 | | | 1.14 | % |

| Year Ended November 29, 2013 | | | 1.21 | % |

| Year Ended November 30, 2012 | | | 1.45 | % |

| Year Ended November 30, 2011 | | | 1.36 | % |

| Year Ended November 30, 2010 | | | 1.39 | % |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER INTERNATIONAL GROWTH FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class B | | Six Months

Ended

May 29,

20151

(Unaudited) | | | Year Ended

November 28,

20141 | | | Year Ended

November 29,

20131 | | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | | | Year Ended

November 30,

2010 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 34.66 | | | $ | 35.62 | | | $ | 28.89 | | | $ | 25.09 | | | $ | 24.51 | | | $ | 23.14 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)2 | | | 0.11 | | | | 0.08 | | | | 0.10 | | | | 0.14 | | | | 0.01 | | | | (0.02) | |

| Net realized and unrealized gain (loss) | | | 2.19 | | | | (1.04) | | | | 6.69 | | | | 3.66 | | | | 0.57 | | | | 1.39 | |

| | | | |

| Total from investment operations | | | 2.30 | | | | (0.96) | | | | 6.79 | | | | 3.80 | | | | 0.58 | | | | 1.37 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | (0.06) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| |

| Net asset value, end of period | | $ | 36.96 | | | $ | 34.66 | | | $ | 35.62 | | | $ | 28.89 | | | $ | 25.09 | | | $ | 24.51 | |

| | | | |

| | | | | | | | | |

| |

Total Return, at Net Asset Value3 | | | 6.64% | | | | (2.70)% | | | | 23.56% | | | | 15.15% | | | | 2.37% | | | | 5.92% | |

| |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 19,934 | | | $ | 23,058 | | | $ | 31,300 | | | $ | 32,852 | | | $ | 39,319 | | | $ | 55,020 | |

| |

| Average net assets (in thousands) | | $ | 20,650 | | | $ | 27,680 | | | $ | 31,491 | | | $ | 35,472 | | | $ | 51,183 | | | $ | 67,453 | |

| |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.60% | | | | 0.22% | | | | 0.30% | | | | 0.53% | | | | 0.04% | | | | (0.07)% | |

| Total expenses5 | | | 1.89% | | | | 1.90% | | | | 2.04% | | | | 2.30% | | | | 2.35% | | | | 2.41% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.89% | | | | 1.90% | | | | 1.98% | | | | 2.07% | | | | 2.13% | | | | 2.13% | |

| |

| Portfolio turnover rate | | | 7% | | | | 12% | | | | 12% | | | | 15% | | | | 19% | | | | 23% | |

1. May 29, 2015, November 28, 2014 and November 29, 2013 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

| Six Months Ended May 29, 2015 | | | 1.89 | % |

| Year Ended November 28, 2014 | | | 1.90 | % |

| Year Ended November 29, 2013 | | | 2.04 | % |

| Year Ended November 30, 2012 | | | 2.30 | % |

| Year Ended November 30, 2011 | | | 2.35 | % |

| Year Ended November 30, 2010 | | | 2.41 | % |

See accompanying Notes to Financial Statements.

23 OPPENHEIMER INTERNATIONAL GROWTH FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | Six Months

Ended

May 29,

20151

(Unaudited) | | | Year Ended

November 28,

20141 | | | Year Ended

November 29,

20131 | | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | | | Year Ended

November 30,

2010 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 34.49 | | | $ | 35.54 | | | $ | 28.87 | | | $ | 25.07 | | | $ | 24.47 | | | $ | 23.10 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)2 | | | 0.13 | | | | 0.09 | | | | 0.09 | | | | 0.14 | | | | 0.03 | | | | (0.01) | |

| Net realized and unrealized gain (loss) | | | 2.15 | | | | (1.04) | | | | 6.71 | | | | 3.66 | | | | 0.57 | | | | 1.38 | |

| | | | |

| Total from investment operations | | | 2.28 | | | | (0.95) | | | | 6.80 | | | | 3.80 | | | | 0.60 | | | | 1.37 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.07) | | | | (0.10) | | | | (0.13) | | | | 0.00 | | | | 0.00 | | | | 0.003 | |

| |

| Net asset value, end of period | | $ | 36.70 | | | $ | 34.49 | | | $ | 35.54 | | | $ | 28.87 | | | $ | 25.07 | | | $ | 24.47 | |

| | | | |

| | | | | | | | | |

| |

Total Return, at Net Asset Value4 | | | 6.64% | | | | (2.68)% | | | | 23.64% | | | | 15.16% | | | | 2.45% | | | | 5.94% | |

| |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 554,921 | | | $ | 498,041 | | | $ | 368,340 | | | $ | 206,019 | | | $ | 189,147 | | | $ | 196,001 | |

| |

| Average net assets (in thousands) | | $ | 511,597 | | | $ | 471,895 | | | $ | 267,686 | | | $ | 194,518 | | | $ | 210,320 | | | $ | 198,031 | |

| |

| Ratios to average net assets:5 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.73% | | | | 0.25% | | | | 0.29% | | | | 0.53% | | | | 0.12% | | | | (0.04)% | |

| Total expenses6 | | | 1.89% | | | | 1.89% | | | | 1.93% | | | | 2.05% | | | | 2.04% | | | | 2.10% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.89% | | | | 1.89% | | | | 1.93% | | | | 2.05% | | | | 2.04% | | | | 2.09% | |

| |

| Portfolio turnover rate | | | 7% | | | | 12% | | | | 12% | | | | 15% | | | | 19% | | | | 23% | |

1. May 29, 2015, November 28, 2014 and November 29, 2013 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Less than $0.005 per share.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

| Six Months Ended May 29, 2015 | | | 1.89 | % |

| Year Ended November 28, 2014 | | | 1.89 | % |

| Year Ended November 29, 2013 | | | 1.93 | % |

| Year Ended November 30, 2012 | | | 2.05 | % |

| Year Ended November 30, 2011 | | | 2.04 | % |

| Year Ended November 30, 2010 | | | 2.10 | % |

See accompanying Notes to Financial Statements.

24 OPPENHEIMER INTERNATIONAL GROWTH FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | |

| Class I | | Six Months

Ended

May 29, 20151

(Unaudited) | | | Year Ended

November 28,

20141 | | | Year Ended

November 29,

20131 | | | Period Ended

November 30,

20122 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 36.43 | | | $ | 37.41 | | | $ | 30.37 | | | $ | 28.71 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income3 | | | 0.35 | | | | 0.55 | | | | 0.44 | | | | 0.21 | |

| Net realized and unrealized gain (loss) | | | 2.24 | | | | (1.11) | | | | 7.08 | | | | 1.45 | |

| | | | |

| Total from investment operations | | | 2.59 | | | | (0.56) | | | | 7.52 | | | | 1.66 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.47) | | | | (0.42) | | | | (0.48) | | | | 0.00 | |

| |

| Net asset value, end of period | | $ | 38.55 | | | $ | 36.43 | | | $ | 37.41 | | | $ | 30.37 | |

| | | | |

| |

| |

Total Return, at Net Asset Value4 | | | 7.25% | | | | (1.51)% | | | | 25.14% | | | | 5.78% | |

| |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 4,218,172 | | | $ | 3,763,546 | | | $ | 1,870,890 | | | $ | 108,917 | |

| |

| Average net assets (in thousands) | | $ | 4,019,435 | | | $ | 3,030,734 | | | $ | 961,530 | | | $ | 61,111 | |

| |

| Ratios to average net assets:5 | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.89% | | | | 1.47% | | | | 1.28% | | | | 1.10% | |

| Total expenses6 | | | 0.70% | | | | 0.70% | | | | 0.72% | | | | 0.74% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.70% | | | | 0.70% | | | | 0.72% | | | | 0.74% | |

| |

| Portfolio turnover rate | | | 7% | | | | 12% | | | | 12% | | | | 15% | |

1. May 29, 2015, November 28, 2014 and November 29, 2013 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. For the period from March 29, 2012 (inception of offering) to November 30, 2012.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

| Six Months Ended May 29, 2015 | | | 0.70 | % |

| Year Ended November 28, 2014 | | | 0.70 | % |

| Year Ended November 29, 2013 | | | 0.72 | % |

| Period Ended November 30, 2012 | | | 0.74 | % |

See accompanying Notes to Financial Statements.

25 OPPENHEIMER INTERNATIONAL GROWTH FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class R | | Six Months

Ended

May 29,

20151

(Unaudited) | | | Year Ended

November 28,

20141 | | | Year Ended

November 29,

20131 | | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | | | Year Ended

November 30,

2010 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 35.80 | | | $ | 36.81 | | | $ | 29.89 | | | $ | 25.98 | | | $ | 25.33 | | | $ | 23.89 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.22 | | | | 0.28 | | | | 0.26 | | | | 0.27 | | | | 0.17 | | | | 0.12 | |

| Net realized and unrealized gain (loss) | | | 2.22 | | | | (1.09) | | | | 6.92 | | | | 3.78 | | | | 0.57 | | | | 1.43 | |

| | | | |

| Total from investment operations | | | 2.44 | | | | (0.81) | | | | 7.18 | | | | 4.05 | | | | 0.74 | | | | 1.55 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.24) | | | | (0.20) | | | | (0.26) | | | | (0.14) | | | | (0.09) | | | | (0.11) | |

| |

| Net asset value, end of period | | $ | 38.00 | | | $ | 35.80 | | | $ | 36.81 | | | $ | 29.89 | | | $ | 25.98 | | | $ | 25.33 | |

| | | | |

| | | | | | | | | |

| |

Total Return, at Net Asset Value3 | | | 6.91% | | | | (2.19)% | | | | 24.23% | | | | 15.73% | | | | 2.90% | | | | 6.53% | |

| |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 409,880 | | | $ | 369,630 | | | $ | 272,619 | | | $ | 158,362 | | | $ | 113,905 | | | $ | 100,249 | |

| |

| Average net assets (in thousands) | | $ | 380,826 | | | $ | 341,419 | | | $ | 213,038 | | | $ | 137,418 | | | $ | 115,153 | | | $ | 92,184 | |

| |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.23% | | | | 0.74% | | | | 0.79% | | | | 0.97% | | | | 0.60% | | | | 0.48% | |

| Total expenses5 | | | 1.39% | | | | 1.39% | | | | 1.45% | | | | 1.70% | | | | 1.65% | | | | 1.73% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.39% | | | | 1.39% | | | | 1.44% | | | | 1.57% | | | | 1.56% | | | | 1.58% | |

| |

| Portfolio turnover rate | | | 7% | | | | 12% | | | | 12% | | | | 15% | | | | 19% | | | | 23% | |

1. May 29, 2015, November 28, 2014 and November 29, 2013 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

| Six Months Ended May 29, 2015 | | | 1.39 | % |

| Year Ended November 28, 2014 | | | 1.39 | % |

| Year Ended November 29, 2013 | | | 1.45 | % |

| Year Ended November 30, 2012 | | | 1.70 | % |

| Year Ended November 30, 2011 | | | 1.65 | % |

| Year Ended November 30, 2010 | | | 1.73 | % |

See accompanying Notes to Financial Statements.

26 OPPENHEIMER INTERNATIONAL GROWTH FUND

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class Y | | Six Months

Ended May 29, 20151

(Unaudited) | | | Year Ended

November 28,

20141 | | | Year Ended

November 29,

20131 | | | Year Ended

November 30,

2012 | | | Year Ended

November 30,

2011 | | | Year Ended

November 30,

2010 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 36.36 | | | $ | 37.35 | | | $ | 30.34 | | | $ | 26.38 | | | $ | 25.71 | | | $ | 24.20 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.32 | | | | 0.46 | | | | 0.46 | | | | 0.48 | | | | 0.36 | | | | 0.30 | |

| Net realized and unrealized gain (loss) | | | 2.24 | | | | (1.10) | | | | 6.99 | | | | 3.80 | | | | 0.58 | | | | 1.46 | |

| | | | |

| Total from investment operations | | | 2.56 | | | | (0.64) | | | | 7.45 | | | | 4.28 | | | | 0.94 | | | | 1.76 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.41) | | | | (0.35) | | | | (0.44) | | | | (0.32) | | | | (0.27) | | | | (0.25) | |

| |

| Net asset value, end of period | | $ | 38.51 | | | $ | 36.36 | | | $ | 37.35 | | | $ | 30.34 | | | $ | 26.38 | | | $ | 25.71 | |

| | | | |

| | | | | | | | | |

| |

Total Return, at Net Asset Value3 | | | 7.16% | | | | (1.71)% | | | | 24.91% | | | | 16.54% | | | | 3.63% | | | | 7.34% | |

| |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 10,627,914 | | | $ | 8,774,567 | | | $ | 6,691,921 | | | $ | 4,381,526 | | | $ | 2,996,792 | | | $ | 2,436,200 | |

| |

| Average net assets (in thousands) | | $ | 9,861,225 | | | $ | 8,185,239 | | | $ | 5,487,802 | | | $ | 3,865,270 | | | $ | 2,934,647 | | | $ | 2,042,580 | |

| |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.73% | | | | 1.23% | | | | 1.38% | | | | 1.72% | | | | 1.30% | | | | 1.22% | |

| Total expenses5 | | | 0.89% | | | | 0.89% | | | | 0.90% | | | | 0.87% | | | | 0.91% | | | | 0.81% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.89% | | | | 0.89% | | | | 0.90% | | | | 0.87% | | | | 0.87% | | | | 0.81% | |

| |

| Portfolio turnover rate | | | 7% | | | | 12% | | | | 12% | | | | 15% | | | | 19% | | | | 23% | |

27 OPPENHEIMER INTERNATIONAL GROWTH FUND

1. May 29, 2015, November 28, 2014 and November 29, 2013 represent the last business days of the Fund’s respective reporting periods. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | |

| Six Months Ended May 29, 2015 | | | 0.89 | % |

| Year Ended November 28, 2014 | | | 0.89 | % |

| Year Ended November 29, 2013 | | | 0.90 | % |

| Year Ended November 30, 2012 | | | 0.87 | % |

| Year Ended November 30, 2011 | | | 0.91 | % |

| Year Ended November 30, 2010 | | | 0.81 | % |

See accompanying Notes to Financial Statements.

28 OPPENHEIMER INTERNATIONAL GROWTH FUND

NOTES TO FINANCIAL STATEMENTS May 29, 2015 Unaudited

1. Organization

Oppenheimer International Growth Fund (the “Fund”) is registered under the Investment Company Act of 1940 (“1940 Act”), as amended, as a diversified open-end management investment company. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI.

The Fund offers Class A, Class C, Class I, Class R and Class Y shares, and previously offered Class B shares for new purchase through June 29, 2012. Subsequent to that date, no new purchases of Class B shares are permitted, however reinvestment of dividend and/or capital gain distributions and exchanges of Class B shares into and from other Oppenheimer funds will be allowed. As of July 1, 2014, Class N shares were renamed Class R shares. Class N shares subject to a contingent deferred sales charge (“CDSC”) on July 1, 2014, will continue to be subject to a CDSC after the shares are renamed. Purchases of Class R shares occurring on or after July 1, 2014, will not be subject to a CDSC upon redemption. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class R shares are sold, and Class B shares were sold, without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, B, C and R shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees. Class B shares will automatically convert to Class A shares 72 months after the date of purchase.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.