WASHINGTON, D. C. 20549

Stocks may decline in value. Various factors, including costs, cash flows and security selection, may cause the Fund’s performance to differ from that of the index. Smaller company stocks tend to be more volatile than medium-sized or large company stocks. The Fund may lend securities to approved institutions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. See the prospectus for details.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

Deutsche AM Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

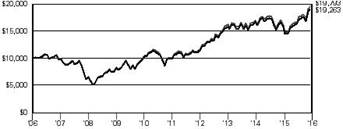

The growth of $10,000 is cumulative.

For the 12 months ended December 31, 2016, the Fund returned 21.03% (Class A shares, unadjusted for contract charges), compared with the 21.31% return of the Russell 2000® Index.1

The 12-month period began on a negative note, with China’s accelerated yuan depreciation rekindling worries regarding capital outflows and weaker growth there. Investor anxiety further dampened enthusiasm in January and February amid concerns regarding anemic fourth-quarter U.S. GDP growth, stemming from slower auto sales. However, the market staged a solid rally beginning on February 12 after China’s economic growth and currency outlook improved, oil prices rallied almost 50%, and enthusiasm built regarding an oil supply "freeze" proposal between several oil-producing countries. Equity markets then rallied through much of the spring and summer as better-than-expected economic data improved investor sentiment. In the fall of 2016, markets demonstrated anxiety leading up to the November presidential election, then rallied strongly post-election as investors were energized by the prospects for above-trend economic growth, lower corporate taxes and reduced regulation under a Republican-controlled federal government. In December, the U.S. Federal Reserve Board (the Fed) raised short-term interest rates as anticipated and projected additional rate increases in 2017 due to concerns that an acceleration in U.S. economic growth might lead to higher inflation.

To attempt to match the risk and return characteristics of the Russell 2000 Index as closely as possible, the Fund invests in a statistically selected sample of the securities found in the Russell 2000 Index, using a process known as "optimization." This process selects stocks for the Fund so that industry weightings, market capitalizations and fundamental characteristics closely match those of the securities in the Russell 2000 Index without purchasing all of the stocks in the index. Going forward, we will continue to seek returns that approximate those of the index.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future fund holdings are subject to risk.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund's current prospectus for more information.

| |

Shares | Value ($) |

| | | |

| Common Stocks 97.8% |

| Consumer Discretionary 12.3% |

| Auto Components 1.2% |

| American Axle & Manufacturing Holdings, Inc.* | 14,499 | 279,831 |

| Cooper Tire & Rubber Co. | 10,731 | 416,899 |

| Cooper-Standard Holdings, Inc.* | 2,880 | 297,734 |

| Dana, Inc. | 28,934 | 549,167 |

| Dorman Products, Inc.* | 5,141 | 375,601 |

| Federal-Mogul Holdings Corp.* | 6,321 | 65,170 |

| Fox Factory Holding Corp.* | 4,223 | 117,188 |

| Gentherm, Inc.* | 7,166 | 242,569 |

| Horizon Global Corp.* | 3,657 | 87,768 |

| LCI Industries | 4,604 | 496,081 |

| Metaldyne Performance Group, Inc. | 2,829 | 64,926 |

| Modine Manufacturing Co.* | 9,305 | 138,645 |

| Motorcar Parts of America, Inc.* | 3,426 | 92,228 |

| Spartan Motors, Inc. | 6,267 | 57,970 |

| Standard Motor Products, Inc. | 4,074 | 216,818 |

| Stoneridge, Inc.* | 5,309 | 93,916 |

| Strattec Security Corp. | 682 | 27,485 |

| Superior Industries International, Inc. | 5,023 | 132,356 |

| Tenneco, Inc.* | 10,936 | 683,172 |

| Tower International, Inc. | 3,896 | 110,452 |

| Unique Fabricating, Inc. | 1,234 | 18,016 |

| Workhorse Group, Inc.* (a) | 2,167 | 15,299 |

| | 4,579,291 |

| Automobiles 0.1% |

| Winnebago Industries, Inc. | 5,130 | 162,364 |

| Distributors 0.1% |

| Core-Mark Holding Co., Inc. | 8,880 | 382,462 |

| Weyco Group, Inc. | 1,254 | 39,250 |

| | 421,712 |

| Diversified Consumer Services 1.0% |

| American Public Education, Inc.* | 2,869 | 70,434 |

| Apollo Education Group, Inc.* | 16,202 | 160,400 |

| Ascent Capital Group, Inc. "A"* | 1,939 | 31,528 |

| Bridgepoint Education, Inc.* | 3,215 | 32,568 |

| Bright Horizons Family Solutions, Inc.* | 8,397 | 587,958 |

| Cambium Learning Group, Inc.* | 2,305 | 11,502 |

| Capella Education Co. | 2,166 | 190,175 |

| Career Education Corp.* | 12,609 | 127,225 |

| Carriage Services, Inc. | 2,890 | 82,770 |

| Chegg, Inc.* | 15,391 | 113,585 |

| Collectors Universe, Inc. | 1,342 | 28,491 |

| DeVry Education Group, Inc. | 12,177 | 379,922 |

| Grand Canyon Education, Inc.* | 8,639 | 504,949 |

| Houghton Mifflin Harcourt Co.* | 24,173 | 262,277 |

| K12, Inc.* | 6,857 | 117,666 |

| Liberty Tax, Inc. | 1,055 | 14,137 |

| LifeLock, Inc.* | 16,464 | 393,819 |

| Regis Corp.* | 7,073 | 102,700 |

| Sotheby's | 9,582 | 381,938 |

| Strayer Education, Inc.* | 2,095 | 168,920 |

| Weight Watchers International, Inc.* (a) | 5,062 | 57,960 |

| | 3,820,924 |

| |

Shares | Value ($) |

| | | |

| Hotels, Restaurants & Leisure 3.0% |

| Belmond Ltd. "A"* | 15,911 | 212,412 |

| Biglari Holdings, Inc.* | 196 | 92,747 |

| BJ's Restaurants, Inc.* | 4,544 | 178,579 |

| Bloomin' Brands, Inc. | 19,766 | 356,381 |

| Bob Evans Farms, Inc. | 3,763 | 200,229 |

| Bojangles', Inc.* | 1,870 | 34,876 |

| Boyd Gaming Corp.* | 16,006 | 322,841 |

| Buffalo Wild Wings, Inc.* | 3,678 | 567,883 |

| Caesars Acquisition Co. "A"* | 9,023 | 121,811 |

| Caesars Entertainment Corp.* | 10,770 | 91,545 |

| Carrols Restaurant Group, Inc.* | 6,649 | 101,397 |

| Century Casinos, Inc.* | 4,055 | 33,373 |

| Churchill Downs, Inc. | 2,620 | 394,179 |

| Chuy's Holdings, Inc.* | 3,064 | 99,427 |

| ClubCorp Holdings, Inc. | 12,716 | 182,475 |

| Cracker Barrel Old Country Store, Inc. (a) | 3,725 | 622,000 |

| Dave & Buster's Entertainment, Inc.* | 7,361 | 414,424 |

| Del Frisco's Restaurant Group, Inc.* | 4,618 | 78,506 |

| Del Taco Restaurants, Inc.* | 4,391 | 62,001 |

| Denny's Corp.* | 14,809 | 189,999 |

| DineEquity, Inc. | 3,391 | 261,107 |

| El Pollo Loco Holdings, Inc.* | 3,848 | 47,330 |

| Eldorado Resorts, Inc.* | 5,428 | 92,005 |

| Empire Resorts, Inc.* (a) | 587 | 13,354 |

| Fiesta Restaurant Group, Inc.* | 5,272 | 157,369 |

| Fogo De Chao, Inc.* | 867 | 12,441 |

| Golden Entertainment, Inc. | 1,959 | 23,723 |

| ILG, Inc. | 21,964 | 399,086 |

| International Speedway Corp. "A" | 5,202 | 191,434 |

| Intrawest Resorts Holdings, Inc.* | 3,334 | 59,512 |

| Isle of Capri Casinos, Inc.* | 4,746 | 117,179 |

| J. Alexander's Holdings, Inc.* | 2,340 | 25,155 |

| Jack in the Box, Inc. | 6,259 | 698,755 |

| Jamba, Inc.* (a) | 2,526 | 26,018 |

| Kona Grill, Inc.* (a) | 1,504 | 18,875 |

| La Quinta Holdings, Inc.* | 16,618 | 236,142 |

| Lindblad Expeditions Holdings, Inc.* | 2,797 | 26,432 |

| Luby's, Inc.* | 3,683 | 15,763 |

| Marcus Corp. | 3,504 | 110,376 |

| Marriott Vacations Worldwide Corp. | 4,355 | 369,522 |

| Monarch Casino & Resort, Inc.* | 2,125 | 54,783 |

| Nathan's Famous, Inc.* | 579 | 37,577 |

| Noodles & Co.* | 2,106 | 8,635 |

| Papa John's International, Inc. | 5,278 | 451,691 |

| Penn National Gaming, Inc.* | 13,974 | 192,701 |

| Pinnacle Entertainment, Inc.* | 10,636 | 154,222 |

| Planet Fitness, Inc. "A" | 4,879 | 98,068 |

| Popeyes Louisiana Kitchen, Inc.* | 3,933 | 237,868 |

| Potbelly Corp.* | 4,513 | 58,218 |

| Red Lion Hotels Corp.* | 2,685 | 22,420 |

| Red Robin Gourmet Burgers, Inc.* | 2,433 | 137,221 |

| Red Rock Resorts, Inc. "A" | 5,702 | 132,229 |

| Ruby Tuesday, Inc.* | 11,518 | 37,203 |

| Ruth's Hospitality Group, Inc. | 6,029 | 110,331 |

| Scientific Games Corp. "A"* | 9,958 | 139,412 |

| SeaWorld Entertainment, Inc. | 12,736 | 241,092 |

| Shake Shack, Inc. "A"* | 2,978 | 106,583 |

| Sonic Corp. | 8,424 | 223,320 |

| |

Shares | Value ($) |

| | | |

| Speedway Motorsports, Inc. | 2,192 | 47,501 |

| Texas Roadhouse, Inc. | 12,875 | 621,090 |

| The Cheesecake Factory, Inc. | 8,807 | 527,363 |

| The Habit Restaurants, Inc. "A"* | 2,560 | 44,160 |

| Wingstop, Inc. | 2,989 | 88,445 |

| Zoe's Kitchen, Inc.* (a) | 3,851 | 92,385 |

| | 11,123,181 |

| Household Durables 1.2% |

| Bassett Furniture Industries, Inc. | 1,910 | 58,064 |

| Beazer Homes U.S.A., Inc.* | 5,966 | 79,348 |

| Cavco Industries, Inc.* | 1,602 | 159,960 |

| Century Communities, Inc.* | 3,134 | 65,814 |

| CSS Industries, Inc. | 1,699 | 45,992 |

| Ethan Allen Interiors, Inc. | 4,910 | 180,933 |

| Flexsteel Industries, Inc. | 1,230 | 75,854 |

| GoPro, Inc. "A"* (a) | 19,713 | 171,700 |

| Green Brick Partners, Inc.* | 4,496 | 45,185 |

| Helen of Troy Ltd.* | 5,446 | 459,915 |

| Hooker Furniture Corp. | 2,186 | 82,959 |

| Hovnanian Enterprises, Inc. "A"* | 22,782 | 62,195 |

| Installed Building Products, Inc.* | 3,814 | 157,518 |

| iRobot Corp.* | 5,131 | 299,907 |

| KB HOME | 16,157 | 255,442 |

| La-Z-Boy, Inc. | 9,540 | 296,217 |

| LGI Homes, Inc.* (a) | 2,929 | 84,150 |

| Libbey, Inc. | 4,384 | 85,313 |

| Lifetime Brands, Inc. | 2,058 | 36,529 |

| M.D.C. Holdings, Inc. | 8,132 | 208,667 |

| M/I Homes, Inc.* | 4,467 | 112,479 |

| Meritage Homes Corp.* | 7,451 | 259,295 |

| NACCO Industries, Inc. "A" | 709 | 64,200 |

| New Home Co., Inc.* | 2,265 | 26,523 |

| Taylor Morrison Home Corp. "A"* | 5,811 | 111,920 |

| TopBuild Corp.* | 7,500 | 267,000 |

| TRI Pointe Group, Inc.* | 28,889 | 331,646 |

| UCP, Inc. "A"* | 1,541 | 18,569 |

| Universal Electronics, Inc.* | 2,767 | 178,610 |

| WCI Communities, Inc.* | 4,103 | 96,215 |

| William Lyon Homes "A"* | 4,529 | 86,187 |

| ZAGG, Inc.* | 5,246 | 37,246 |

| | 4,501,552 |

| Internet & Direct Marketing Retail 0.5% |

| 1-800 FLOWERS.COM, Inc. "A"* | 5,129 | 54,880 |

| Blue Nile, Inc. | 2,103 | 85,445 |

| Duluth Holdings, Inc. "B"* (a) | 1,818 | 46,177 |

| Etsy, Inc.* | 20,488 | 241,349 |

| FTD Companies, Inc.* | 3,169 | 75,549 |

| Gaia, Inc.* | 1,184 | 10,242 |

| HSN, Inc. | 6,072 | 208,270 |

| Lands' End, Inc.* (a) | 2,693 | 40,799 |

| Liberty TripAdvisor Holdings, Inc. "A"* | 14,079 | 211,889 |

| NutriSystem, Inc. | 5,521 | 191,303 |

| Overstock.com, Inc.* | 2,597 | 45,447 |

| PetMed Express, Inc. | 3,985 | 91,934 |

| Shutterfly, Inc.* | 6,692 | 335,804 |

| Wayfair, Inc. "A"* (a) | 6,172 | 216,328 |

| | 1,855,416 |

| Leisure Products 0.3% |

| Acushnet Holdings Corp.* | 4,230 | 83,373 |

| American Outdoor Brands Corp.* | 10,683 | 225,198 |

| Arctic Cat, Inc. | 2,372 | 35,627 |

| Callaway Golf Co. | 18,592 | 203,768 |

| |

Shares | Value ($) |

| | | |

| Escalade, Inc. | 1,919 | 25,331 |

| JAKKS Pacific, Inc.* | 2,688 | 13,843 |

| Johnson Outdoors, Inc. "A" | 976 | 38,738 |

| Malibu Boats, Inc. "A"* | 3,743 | 71,417 |

| Marine Products Corp. | 1,901 | 26,367 |

| MCBC Holdings, Inc. | 1,200 | 17,496 |

| Nautilus, Inc.* | 6,120 | 113,220 |

| Sturm, Ruger & Co., Inc. (a) | 3,622 | 190,879 |

| | 1,045,257 |

| Media 1.5% |

| AMC Entertainment Holdings, Inc. "A" | 5,671 | 190,829 |

| Central European Media Enterprises Ltd. "A"* | 13,726 | 35,001 |

| Daily Journal Corp.* | 204 | 49,327 |

| Entercom Communications Corp. "A" | 4,793 | 73,333 |

| Entravision Communications Corp. "A" | 12,382 | 86,674 |

| Eros International PLC* (a) | 5,608 | 73,184 |

| Gannett Co., Inc. | 22,890 | 222,262 |

| Global Eagle Entertainment, Inc.* | 9,108 | 58,838 |

| Gray Television, Inc.* | 12,814 | 139,032 |

| Hemisphere Media Group, Inc.* | 1,151 | 12,891 |

| IMAX Corp.* | 11,451 | 359,561 |

| Liberty Media Corp.-Liberty Braves "A"* | 1,744 | 35,735 |

| Liberty Media Corp.-Liberty Braves "C"* | 5,972 | 122,963 |

| Liberty Media Corp.-Liberty Media "A"* | 4,348 | 136,310 |

| Liberty Media Corp.-Liberty Media "C"* | 9,047 | 283,443 |

| Loral Space & Communications, Inc.* | 2,406 | 98,766 |

| MDC Partners, Inc. "A" | 9,720 | 63,666 |

| Media General, Inc.* | 21,095 | 397,219 |

| Meredith Corp. | 7,286 | 430,967 |

| MSG Networks, Inc. "A"* | 11,263 | 242,155 |

| National CineMedia, Inc. | 12,070 | 177,791 |

| New Media Investment Group, Inc. | 8,452 | 135,148 |

| New York Times Co. "A" | 24,204 | 321,913 |

| Nexstar Broadcasting Group, Inc. "A" (a) | 5,797 | 366,950 |

| Radio One, Inc. "D"* | 4,708 | 13,653 |

| Reading International, Inc. "A"* | 3,089 | 51,277 |

| Saga Communications, Inc. "A" | 704 | 35,411 |

| Salem Media Group, Inc. | 2,108 | 13,175 |

| Scholastic Corp. | 5,277 | 250,605 |

| Sinclair Broadcast Group, Inc. "A" | 12,850 | 428,548 |

| The E.W. Scripps Co. "A"* | 11,621 | 224,634 |

| Time, Inc. | 19,979 | 356,625 |

| Townsquare Media, Inc. "A"* | 1,342 | 13,970 |

| tronc, Inc. | 5,120 | 71,014 |

| World Wrestling Entertainment, Inc. "A" | 6,872 | 126,445 |

| | 5,699,315 |

| Multiline Retail 0.2% |

| Big Lots, Inc. | 8,659 | 434,768 |

| Fred's, Inc. "A" (a) | 6,514 | 120,900 |

| Ollie's Bargain Outlet Holdings, Inc.* | 3,822 | 108,736 |

| Sears Holdings Corp.* (a) | 2,132 | 19,806 |

| Tuesday Morning Corp.* | 8,091 | 43,692 |

| | 727,902 |

| |

Shares | Value ($) |

| | | |

| Specialty Retail 2.4% |

| Aaron's, Inc. | 12,784 | 408,960 |

| Abercrombie & Fitch Co. "A" | 13,369 | 160,428 |

| America's Car-Mart, Inc.* | 1,543 | 67,506 |

| American Eagle Outfitters, Inc. | 31,828 | 482,831 |

| Asbury Automotive Group, Inc.* | 3,947 | 243,530 |

| Ascena Retail Group, Inc.* | 33,088 | 204,815 |

| At Home Group, Inc.* | 1,619 | 23,686 |

| Barnes & Noble Education, Inc.* | 7,595 | 87,115 |

| Barnes & Noble, Inc. | 11,969 | 133,454 |

| Big 5 Sporting Goods Corp. | 3,337 | 57,897 |

| Boot Barn Holdings, Inc.* (a) | 2,366 | 29,622 |

| Build-A-Bear Workshop, Inc.* | 2,399 | 32,986 |

| Caleres, Inc. | 8,356 | 274,244 |

| Camping World Holdings, Inc. "A" | 2,280 | 74,305 |

| Cato Corp. "A" | 5,008 | 150,641 |

| Chico's FAS, Inc. | 25,346 | 364,729 |

| Citi Trends, Inc. | 2,773 | 52,243 |

| Conn's, Inc.* | 3,657 | 46,261 |

| Destination XL Group, Inc.* | 6,863 | 29,168 |

| DSW, Inc. "A" | 13,081 | 296,285 |

| Express, Inc.* | 14,101 | 151,727 |

| Five Below, Inc.* | 10,412 | 416,063 |

| Francesca's Holdings Corp.* | 7,330 | 132,160 |

| Genesco, Inc.* | 3,903 | 242,376 |

| GNC Holdings, Inc. "A" | 13,339 | 147,263 |

| Group 1 Automotive, Inc. | 3,963 | 308,876 |

| Guess?, Inc. | 11,908 | 144,087 |

| Haverty Furniture Companies, Inc. | 3,810 | 90,297 |

| Hibbett Sports, Inc.* | 4,544 | 169,491 |

| Kirkland's, Inc.* | 2,658 | 41,226 |

| Lithia Motors, Inc. "A" | 4,613 | 446,677 |

| Lumber Liquidators Holdings, Inc.* | 5,290 | 83,265 |

| MarineMax, Inc.* | 4,667 | 90,306 |

| Monro Muffler Brake, Inc. | 6,110 | 349,492 |

| Office Depot, Inc. | 107,597 | 486,338 |

| Party City Holdco, Inc.* | 5,105 | 72,491 |

| Pier 1 Imports, Inc. | 15,042 | 128,459 |

| Rent-A-Center, Inc. | 10,164 | 114,345 |

| RH* | 7,587 | 232,921 |

| Sears Hometown & Outlet Stores, Inc.* | 2,140 | 10,058 |

| Select Comfort Corp.* | 9,017 | 203,964 |

| Shoe Carnival, Inc. | 2,744 | 74,033 |

| Sonic Automotive, Inc. "A" | 5,544 | 126,958 |

| Sportsman's Warehouse Holdings, Inc.* | 4,900 | 46,011 |

| Stage Stores, Inc. | 4,531 | 19,800 |

| Stein Mart, Inc. | 5,972 | 32,727 |

| Tailored Brands, Inc. | 9,287 | 237,283 |

| The Buckle, Inc. (a) | 5,631 | 128,387 |

| The Children's Place, Inc. | 3,641 | 367,559 |

| The Container Store Group, Inc.* (a) | 2,885 | 18,320 |

| The Finish Line, Inc. "A" | 8,177 | 153,809 |

| Tile Shop Holdings, Inc.* | 6,176 | 120,741 |

| Tilly's, Inc. "A"* | 1,996 | 26,327 |

| Vitamin Shoppe, Inc.* | 4,811 | 114,261 |

| West Marine, Inc.* | 3,410 | 35,703 |

| Winmark Corp. | 449 | 56,641 |

| Zumiez, Inc.* | 3,648 | 79,709 |

| | 8,920,857 |

| |

Shares | Value ($) |

| | | |

| Textiles, Apparel & Luxury Goods 0.8% |

| Columbia Sportswear Co. | 5,254 | 306,308 |

| Crocs, Inc.* | 14,789 | 101,453 |

| Culp, Inc. | 2,036 | 75,637 |

| Deckers Outdoor Corp.* | 6,297 | 348,791 |

| Delta Apparel, Inc.* | 1,344 | 27,861 |

| Fossil Group, Inc.* | 7,920 | 204,811 |

| G-III Apparel Group Ltd.* | 8,356 | 247,003 |

| Iconix Brand Group, Inc.* | 8,004 | 74,757 |

| Movado Group, Inc. | 2,851 | 81,966 |

| Oxford Industries, Inc. | 2,851 | 171,431 |

| Perry Ellis International, Inc.* | 2,456 | 61,179 |

| Sequential Brands Group, Inc.* (a) | 7,443 | 34,833 |

| Steven Madden Ltd.* | 11,962 | 427,642 |

| Superior Uniform Group, Inc. | 1,638 | 32,138 |

| Unifi, Inc.* | 2,970 | 96,911 |

| Vera Bradley, Inc.* | 4,130 | 48,404 |

| Vince Holding Corp.* (a) | 3,621 | 14,665 |

| Wolverine World Wide, Inc. | 18,825 | 413,209 |

| | 2,768,999 |

| Consumer Staples 2.9% |

| Beverages 0.2% |

| Boston Beer Co., Inc. "A"* | 1,715 | 291,293 |

| Coca-Cola Bottling Co. Consolidated | 889 | 158,998 |

| Craft Brew Alliance, Inc.* | 2,560 | 43,264 |

| MGP Ingredients, Inc. | 2,378 | 118,852 |

| National Beverage Corp. | 2,204 | 112,580 |

| Primo Water Corp.* | 3,995 | 49,059 |

| | 774,046 |

| Food & Staples Retailing 0.6% |

| Ingles Markets, Inc. "A" | 2,813 | 135,305 |

| Natural Grocers by Vitamin Cottage, Inc.* | 1,700 | 20,213 |

| Performance Food Group Co.* | 7,039 | 168,936 |

| PriceSmart, Inc. | 3,901 | 325,734 |

| Smart & Final Stores, Inc.* | 4,309 | 60,757 |

| SpartanNash Co. | 7,252 | 286,744 |

| SUPERVALU, Inc.* | 51,705 | 241,462 |

| The Andersons, Inc. | 5,292 | 236,553 |

| The Chefs' Warehouse, Inc.* | 3,784 | 59,787 |

| United Natural Foods, Inc.* | 9,644 | 460,212 |

| Village Super Market, Inc. "A" | 1,478 | 45,670 |

| Weis Markets, Inc. | 1,813 | 121,181 |

| | 2,162,554 |

| Food Products 1.4% |

| AdvancePierre Foods Holdings, Inc. | 4,206 | 125,255 |

| Alico, Inc. | 689 | 18,706 |

| Amplify Snack Brands, Inc.* (a) | 5,541 | 48,816 |

| B&G Foods, Inc. | 12,773 | 559,457 |

| Cal-Maine Foods, Inc. (a) | 6,046 | 267,082 |

| Calavo Growers, Inc. | 3,057 | 187,700 |

| Darling Ingredients, Inc.* | 31,853 | 411,222 |

| Dean Foods Co. | 17,794 | 387,553 |

| Farmer Brothers Co.* | 1,669 | 61,252 |

| Fresh Del Monte Produce, Inc. | 6,264 | 379,786 |

| Freshpet, Inc.* (a) | 4,347 | 44,122 |

| Inventure Foods, Inc.* | 4,145 | 40,828 |

| J & J Snack Foods Corp. | 2,894 | 386,146 |

| John B. Sanfilippo & Son, Inc. | 1,695 | 119,311 |

| Lancaster Colony Corp. | 3,640 | 514,660 |

| Landec Corp.* | 5,479 | 75,610 |

| Lifeway Foods, Inc.* | 911 | 10,486 |

| |

Shares | Value ($) |

| | | |

| Limoneira Co. | 2,309 | 49,667 |

| Omega Protein Corp.* | 4,212 | 105,511 |

| Sanderson Farms, Inc. | 3,882 | 365,840 |

| Seaboard Corp.* | 52 | 205,504 |

| Seneca Foods Corp. "A"* | 1,199 | 48,020 |

| Snyder's-Lance, Inc. | 15,274 | 585,605 |

| Tootsie Roll Industries, Inc. (a) | 3,249 | 129,148 |

| | 5,127,287 |

| Household Products 0.3% |

| Central Garden & Pet Co.* | 1,917 | 63,434 |

| Central Garden & Pet Co. "A"* | 6,335 | 195,751 |

| HRG Group, Inc.* | 23,066 | 358,907 |

| Oil-Dri Corp. of America | 930 | 35,535 |

| Orchids Paper Products Co. (a) | 1,743 | 45,632 |

| WD-40 Co. | 2,727 | 318,786 |

| | 1,018,045 |

| Personal Products 0.2% |

| Avon Products, Inc. | 85,641 | 431,631 |

| elf Beauty, Inc.* | 1,771 | 51,253 |

| Inter Parfums, Inc. | 3,507 | 114,854 |

| Lifevantage Corp.* | 2,599 | 21,182 |

| Medifast, Inc. | 1,882 | 78,348 |

| Natural Health Trends Corp. | 1,400 | 34,790 |

| Nature's Sunshine Products, Inc. | 1,450 | 21,750 |

| Nutraceutical International Corp. | 1,508 | 52,704 |

| Revlon, Inc. "A"* | 2,276 | 66,345 |

| Synutra International, Inc.* (a) | 3,372 | 18,040 |

| USANA Health Sciences, Inc.* | 2,040 | 124,848 |

| | 1,015,745 |

| Tobacco 0.2% |

| Alliance One International, Inc.* | 1,581 | 30,355 |

| Turning Point Brands, Inc.* | 1,127 | 13,806 |

| Universal Corp. | 4,326 | 275,782 |

| Vector Group Ltd. (a) | 17,932 | 407,774 |

| | 727,717 |

| Energy 3.7% |

| Energy Equipment & Services 1.3% |

| Archrock, Inc. | 13,278 | 175,269 |

| Atwood Oceanics, Inc. | 11,616 | 152,518 |

| Bristow Group, Inc. | 6,436 | 131,809 |

| CARBO Ceramics, Inc.* (a) | 4,518 | 47,258 |

| Dawson Geophysical Co.* | 3,836 | 30,841 |

| Era Group, Inc.* | 3,545 | 60,159 |

| Exterran Corp.* | 6,355 | 151,884 |

| Fairmount Santrol Holdings, Inc.* | 17,300 | 203,967 |

| Forum Energy Technologies, Inc.* | 11,723 | 257,906 |

| Geospace Technologies Corp.* | 2,477 | 50,432 |

| Helix Energy Solutions Group, Inc.* | 21,936 | 193,475 |

| Hornbeck Offshore Services, Inc.* | 6,291 | 45,421 |

| Independence Contract Drilling, Inc.* | 5,722 | 38,337 |

| Mammoth Energy Services, Inc.* | 1,403 | 21,326 |

| Matrix Service Co.* | 5,300 | 120,310 |

| McDermott International, Inc.* | 46,982 | 347,197 |

| Natural Gas Services Group* | 2,293 | 73,720 |

| Newpark Resources, Inc.* | 16,624 | 124,680 |

| Oil States International, Inc.* | 9,981 | 389,259 |

| Parker Drilling Co.* | 22,098 | 57,455 |

| PHI, Inc. (Non Voting)* | 2,151 | 38,761 |

| Pioneer Energy Services Corp.* | 14,307 | 98,003 |

| RigNet, Inc.* | 2,305 | 53,361 |

| SEACOR Holdings, Inc.* | 3,043 | 216,905 |

| |

Shares | Value ($) |

| | | |

| Seadrill Ltd.* (a) | 72,697 | 247,897 |

| Smart Sand, Inc.* | 2,194 | 36,311 |

| Tesco Corp. | 8,651 | 71,371 |

| TETRA Technologies, Inc.* | 18,384 | 92,288 |

| Tidewater, Inc. (a) | 8,960 | 30,554 |

| U.S. Silica Holdings, Inc. | 14,355 | 813,641 |

| Unit Corp.* | 9,984 | 268,270 |

| Willbros Group, Inc.* | 8,232 | 26,672 |

| | 4,667,257 |

| Oil, Gas & Consumable Fuels 2.4% |

| Abraxas Petroleum Corp.* | 23,549 | 60,521 |

| Adams Resources & Energy, Inc. | 426 | 16,891 |

| Alon U.S.A. Energy, Inc. | 5,782 | 65,799 |

| Ardmore Shipping Corp. (a) | 5,580 | 41,292 |

| Bill Barrett Corp.* | 9,623 | 67,265 |

| California Resources Corp.* | 6,010 | 127,953 |

| Callon Petroleum Co.* | 28,245 | 434,126 |

| Carrizo Oil & Gas, Inc.* | 11,836 | 442,075 |

| Clayton Williams Energy, Inc.* | 1,164 | 138,819 |

| Clean Energy Fuels Corp.* | 17,216 | 49,238 |

| Cobalt International Energy, Inc.* | 77,446 | 94,484 |

| Contango Oil & Gas Co.* | 4,447 | 41,535 |

| CVR Energy, Inc. (a) | 3,024 | 76,779 |

| Delek U.S. Holdings, Inc. | 11,804 | 284,122 |

| Denbury Resources, Inc.* | 67,276 | 247,576 |

| DHT Holdings, Inc. | 19,040 | 78,826 |

| Dorian LPG Ltd.* | 4,452 | 36,551 |

| Earthstone Energy, Inc.* | 367 | 5,043 |

| Eclipse Resources Corp.* | 11,183 | 29,859 |

| EP Energy Corp. "A"* (a) | 7,346 | 48,116 |

| Erin Energy Corp.* (a) | 2,469 | 7,530 |

| Evolution Petroleum Corp. | 4,661 | 46,610 |

| EXCO Resources, Inc.* (a) | 24,978 | 21,823 |

| Frontline Ltd. (a) | 12,355 | 87,844 |

| GasLog Ltd. | 7,670 | 123,487 |

| Gener8 Maritime, Inc.* | 7,478 | 33,501 |

| Golar LNG Ltd. | 18,382 | 421,683 |

| Green Plains, Inc. | 6,883 | 191,692 |

| International Seaways, Inc.* | 3,197 | 44,886 |

| Isramco, Inc.* | 166 | 20,634 |

| Jones Energy, Inc. "A"* (a) | 11,073 | 55,365 |

| Matador Resources Co.* | 16,157 | 416,204 |

| Navios Maritime Acquisition Corp. | 15,053 | 25,590 |

| Nordic American Tankers Ltd. (a) | 19,172 | 161,045 |

| Northern Oil & Gas, Inc.* (a) | 8,912 | 24,508 |

| Oasis Petroleum, Inc.* | 45,316 | 686,084 |

| Overseas Shipholding Group, Inc. "A" | 7,618 | 29,177 |

| Pacific Ethanol, Inc.* | 5,209 | 49,485 |

| Panhandle Oil & Gas, Inc. "A" | 3,085 | 72,652 |

| Par Pacific Holdings, Inc.* | 5,860 | 85,204 |

| PDC Energy, Inc.* | 10,882 | 789,816 |

| Renewable Energy Group, Inc.* | 7,073 | 68,608 |

| REX American Resources Corp.* | 1,055 | 104,181 |

| Ring Energy, Inc.* | 7,887 | 102,452 |

| RSP Permian, Inc.* | 19,094 | 851,974 |

| Sanchez Energy Corp.* | 10,615 | 95,853 |

| Scorpio Tankers, Inc. | 31,071 | 140,752 |

| SemGroup Corp. "A" | 12,857 | 536,780 |

| Ship Finance International Ltd. | 11,752 | 174,517 |

| Synergy Resources Corp.* | 36,193 | 322,480 |

| Teekay Corp. | 9,506 | 76,333 |

| Teekay Tankers Ltd. "A" | 22,175 | 50,115 |

| |

Shares | Value ($) |

| | | |

| W&T Offshore, Inc.* (a) | 5,618 | 15,562 |

| Western Refining, Inc. | 15,678 | 593,412 |

| Westmoreland Coal Co.* | 3,686 | 65,132 |

| | 8,979,841 |

| Financials 19.4% |

| Banks 11.6% |

| 1st Source Corp. | 2,950 | 131,747 |

| Access National Corp. (a) | 1,597 | 44,333 |

| ACNB Corp. | 1,136 | 35,500 |

| Allegiance Bancshares, Inc.* | 2,080 | 75,192 |

| American National Bankshares, Inc. | 1,484 | 51,643 |

| Ameris Bancorp. | 6,675 | 291,030 |

| Ames National Corp. | 1,604 | 52,932 |

| Arrow Financial Corp. | 2,222 | 89,991 |

| Atlantic Capital Bancshares, Inc.* | 3,285 | 62,415 |

| Banc of California, Inc. (a) | 9,723 | 168,694 |

| BancFirst Corp. | 1,488 | 138,458 |

| Banco Latinoamericano de Comercio Exterior SA "E" | 5,732 | 168,750 |

| BancorpSouth, Inc. | 16,826 | 522,447 |

| Bank of Marin Bancorp. | 1,221 | 85,165 |

| Bank of NT Butterfield & Son Ltd. | 2,440 | 76,714 |

| Bank of the Ozarks, Inc. | 17,016 | 894,871 |

| Bankwell Financial Group, Inc. | 1,086 | 35,295 |

| Banner Corp. | 5,881 | 328,219 |

| Bar Harbor Bankshares | 1,063 | 50,312 |

| Berkshire Hills Bancorp., Inc. | 6,507 | 239,783 |

| Blue Hills Bancorp., Inc. | 4,561 | 85,519 |

| BNC Bancorp. | 7,952 | 253,669 |

| Boston Private Financial Holdings, Inc. | 16,064 | 265,859 |

| Bridge Bancorp., Inc. | 3,764 | 142,656 |

| Brookline Bancorp., Inc. | 13,222 | 216,841 |

| Bryn Mawr Bank Corp. | 3,166 | 133,447 |

| C&F Financial Corp. | 613 | 30,558 |

| California First National Bancorp. | 451 | 7,058 |

| Camden National Corp. | 2,895 | 128,683 |

| Capital Bank Financial Corp. "A" | 4,794 | 188,164 |

| Capital City Bank Group, Inc. | 2,067 | 42,332 |

| Capstar Financial Holdings, Inc.* | 687 | 15,087 |

| Cardinal Financial Corp. | 6,148 | 201,593 |

| Carolina Financial Corp. | 1,938 | 59,671 |

| Cascade Bancorp.* | 5,898 | 47,892 |

| Cathay General Bancorp. | 14,433 | 548,887 |

| Centerstate Banks, Inc. | 9,171 | 230,834 |

| Central Pacific Financial Corp. | 5,792 | 181,985 |

| Central Valley Community Bancorp. | 1,655 | 33,034 |

| Century Bancorp., Inc. "A" | 543 | 32,580 |

| Chemical Financial Corp. | 12,754 | 690,884 |

| Chemung Financial Corp. | 597 | 21,701 |

| Citizens & Northern Corp. | 2,448 | 64,138 |

| City Holding Co. | 2,776 | 187,658 |

| CNB Financial Corp. | 2,623 | 70,139 |

| CoBiz Financial, Inc. | 7,096 | 119,851 |

| Codorus Valley Bancorp., Inc. | 1,539 | 44,015 |

| Columbia Banking System, Inc. | 11,296 | 504,705 |

| Community Bank System, Inc. | 8,279 | 511,559 |

| Community Trust Bancorp., Inc. | 3,148 | 156,141 |

| ConnectOne Bancorp., Inc. | 5,403 | 140,208 |

| County Bancorp., Inc. | 914 | 24,651 |

| CU Bancorp.* | 3,061 | 109,584 |

| Customers Bancorp., Inc.* | 4,611 | 165,166 |

| CVB Financial Corp. | 19,722 | 452,225 |

| |

Shares | Value ($) |

| | | |

| Eagle Bancorp., Inc.* | 5,976 | 364,237 |

| Enterprise Bancorp., Inc. | 1,828 | 68,660 |

| Enterprise Financial Services Corp. | 3,819 | 164,217 |

| Equity Bancshares, Inc. "A"* | 968 | 32,564 |

| Farmers Capital Bank Corp. | 1,334 | 56,095 |

| Farmers National Banc Corp. | 4,719 | 67,010 |

| FB Financial Corp.* | 1,337 | 34,695 |

| FCB Financial Holdings, Inc. "A"* | 5,891 | 281,001 |

| Fidelity Southern Corp. | 4,172 | 98,751 |

| Financial Institutions, Inc. | 2,744 | 93,845 |

| First BanCorp.* | 22,522 | 148,870 |

| First BanCorp. — North Carolina | 3,815 | 103,539 |

| First Bancorp., Inc. | 1,889 | 62,526 |

| First Busey Corp. | 5,934 | 182,649 |

| First Business Financial Services, Inc. | 1,532 | 36,339 |

| First Citizens BancShares, Inc. "A" | 1,456 | 516,880 |

| First Commonwealth Financial Corp. | 17,122 | 242,790 |

| First Community Bancshares, Inc. | 3,056 | 92,108 |

| First Community Financial Partners, Inc.* | 2,567 | 30,034 |

| First Connecticut Bancorp, Inc. | 2,586 | 58,573 |

| First Financial Bancorp. | 11,759 | 334,544 |

| First Financial Bankshares, Inc. | 12,186 | 550,807 |

| First Financial Corp. — Indiana | 1,873 | 98,894 |

| First Financial Northwest, Inc. | 1,207 | 23,826 |

| First Foundation, Inc.* | 2,506 | 71,421 |

| First Internet Bancorp. | 985 | 31,520 |

| First Interstate BancSystem, Inc. "A" | 3,743 | 159,265 |

| First Merchants Corp. | 7,988 | 300,748 |

| First Mid-Illinois Bancshares, Inc. | 1,605 | 54,570 |

| First Midwest Bancorp., Inc. | 15,651 | 394,875 |

| First NBC Bank Holding Co.* (a) | 2,842 | 20,747 |

| First Northwest Bancorp.* | 2,109 | 32,900 |

| First of Long Island Corp. | 4,096 | 116,941 |

| Flushing Financial Corp. | 5,275 | 155,032 |

| FNB Corp. | 40,766 | 653,479 |

| Franklin Financial Network, Inc.* | 2,199 | 92,028 |

| Fulton Financial Corp. | 33,380 | 627,544 |

| German American Bancorp., Inc. | 2,709 | 142,520 |

| Glacier Bancorp., Inc. | 14,645 | 530,588 |

| Great Southern Bancorp., Inc. | 2,035 | 111,213 |

| Great Western Bancorp., Inc. | 11,498 | 501,198 |

| Green Bancorp., Inc.* | 3,938 | 59,858 |

| Guaranty Bancorp. | 3,450 | 83,490 |

| Hancock Holding Co. | 15,038 | 648,138 |

| Hanmi Financial Corp. | 6,174 | 215,473 |

| HarborOne Bancorp., Inc.* | 2,842 | 54,964 |

| Heartland Financial U.S.A., Inc. | 4,601 | 220,848 |

| Heritage Commerce Corp. | 4,931 | 71,154 |

| Heritage Financial Corp. | 5,975 | 153,856 |

| Heritage Oaks Bancorp. | 5,048 | 62,242 |

| Hilltop Holdings, Inc. | 14,633 | 436,063 |

| Home Bancshares, Inc. | 23,183 | 643,792 |

| HomeTrust Bancshares, Inc.* | 3,166 | 81,999 |

| Hope Bancorp., Inc. | 24,573 | 537,903 |

| Horizon Bancorp. | 3,948 | 110,544 |

| IBERIABANK Corp. | 8,519 | 713,466 |

| Independent Bank Corp. | 3,777 | 81,961 |

| Independent Bank Corp. | 4,953 | 348,939 |

| Independent Bank Group, Inc. | 2,109 | 131,602 |

| International Bancshares Corp. | 10,668 | 435,254 |

| |

Shares | Value ($) |

| | | |

| Investors Bancorp., Inc. | 57,401 | 800,744 |

| Lakeland Bancorp., Inc. | 7,330 | 142,935 |

| Lakeland Financial Corp. | 4,599 | 217,809 |

| LCNB Corp. | 1,677 | 38,990 |

| LegacyTexas Financial Group, Inc. | 8,623 | 371,306 |

| Live Oak Bancshares, Inc. | 3,705 | 68,542 |

| Macatawa Bank Corp. | 4,982 | 51,863 |

| MainSource Financial Group, Inc. | 4,453 | 153,183 |

| MB Financial, Inc. | 14,535 | 686,488 |

| MBT Financial Corp. | 3,340 | 37,909 |

| Mercantile Bank Corp. | 2,998 | 113,025 |

| Merchants Bancshares, Inc. | 1,102 | 59,728 |

| Middleburg Financial Corp. | 884 | 30,719 |

| Midland States Bancorp., Inc. | 700 | 25,326 |

| MidWestOne Financial Group, Inc. | 1,611 | 60,574 |

| MutualFirst Financial, Inc. | 1,032 | 34,159 |

| National Bank Holdings Corp. "A" | 4,550 | 145,099 |

| National Bankshares, Inc. | 1,314 | 57,093 |

| National Commerce Corp.* | 1,608 | 59,737 |

| NBT Bancorp., Inc. | 8,241 | 345,133 |

| Nicolet Bankshares, Inc.* | 1,466 | 69,914 |

| Northrim BanCorp., Inc. | 1,276 | 40,322 |

| OFG Bancorp. | 8,090 | 105,979 |

| Old Line Bancshares, Inc. | 1,592 | 38,176 |

| Old National Bancorp. | 25,579 | 464,259 |

| Old Second Bancorp., Inc. | 5,261 | 58,134 |

| Opus Bank | 3,253 | 97,753 |

| Orrstown Financial Services, Inc. | 1,404 | 31,450 |

| Pacific Continental Corp. | 4,009 | 87,597 |

| Pacific Mercantile Bancorp.* | 2,922 | 21,331 |

| Pacific Premier Bancorp., Inc.* | 5,339 | 188,734 |

| Paragon Commercial Corp.* | 238 | 10,405 |

| Park National Corp. | 2,610 | 312,313 |

| Park Sterling Corp. | 9,638 | 103,994 |

| Peapack-Gladstone Financial Corp. | 2,985 | 92,177 |

| Penns Woods Bancorp., Inc. | 859 | 43,379 |

| People's Utah Bancorp. | 2,466 | 66,212 |

| Peoples Bancorp., Inc. | 2,989 | 97,023 |

| Peoples Financial Services Corp. | 1,347 | 65,599 |

| Pinnacle Financial Partners, Inc. | 8,375 | 580,387 |

| Preferred Bank | 2,442 | 128,010 |

| Premier Financial Bancorp., Inc. | 1,768 | 35,537 |

| PrivateBancorp., Inc. | 15,074 | 816,860 |

| Prosperity Bancshares, Inc. | 12,774 | 916,918 |

| QCR Holdings, Inc. | 2,317 | 100,326 |

| Renasant Corp. | 7,979 | 336,873 |

| Republic Bancorp., Inc. "A" | 1,886 | 74,572 |

| Republic First Bancorp., Inc.* | 9,781 | 81,671 |

| S&T Bancorp., Inc. | 6,533 | 255,048 |

| Sandy Spring Bancorp., Inc. | 4,705 | 188,153 |

| Seacoast Banking Corp. of Florida* | 5,606 | 123,668 |

| ServisFirst Bancshares, Inc. | 8,788 | 329,023 |

| Shore Bancshares, Inc. | 2,371 | 36,158 |

| Sierra Bancorp. | 2,278 | 60,572 |

| Simmons First National Corp. "A" | 5,751 | 357,425 |

| South State Corp. | 4,621 | 403,875 |

| Southern First Bancshares, Inc.* | 1,082 | 38,952 |

| Southern National Bancorp. of Virginia, Inc. | 2,142 | 35,000 |

| Southside Bancshares, Inc. | 5,158 | 194,302 |

| Southwest Bancorp., Inc. | 3,401 | 98,629 |

| State Bank Financial Corp. | 6,687 | 179,613 |

| Sterling Bancorp. | 24,456 | 572,270 |

| |

Shares | Value ($) |

| | | |

| Stock Yards Bancorp., Inc. | 4,083 | 191,697 |

| Stonegate Bank | 2,516 | 104,993 |

| Suffolk Bancorp. | 2,130 | 91,207 |

| Summit Financial Group, Inc. (a) | 1,567 | 43,139 |

| Sun Bancorp, Inc. | 2,044 | 53,144 |

| Texas Capital Bancshares, Inc.* | 9,517 | 746,133 |

| The Bancorp., Inc.* | 9,761 | 76,721 |

| Tompkins Financial Corp. | 2,773 | 262,159 |

| TowneBank | 10,926 | 363,289 |

| TriCo Bancshares | 3,845 | 131,422 |

| TriState Capital Holdings, Inc.* | 4,308 | 95,207 |

| Triumph Bancorp., Inc.* | 3,020 | 78,973 |

| Trustmark Corp. | 13,081 | 466,338 |

| UMB Financial Corp. | 8,704 | 671,252 |

| Umpqua Holdings Corp. | 42,839 | 804,516 |

| Union Bankshares Corp. | 8,500 | 303,790 |

| Union Bankshares, Inc. (a) | 740 | 33,633 |

| United Bankshares, Inc. | 12,694 | 587,097 |

| United Community Banks, Inc. | 13,711 | 406,120 |

| Univest Corp. of Pennsylvania | 4,961 | 153,295 |

| Valley National Bancorp. | 47,946 | 558,091 |

| Veritex Holdings, Inc.* | 1,566 | 41,828 |

| Washington Trust Bancorp., Inc. | 2,840 | 159,182 |

| WashingtonFirst Bankshares, Inc. | 1,601 | 46,413 |

| Webster Financial Corp. | 17,585 | 954,514 |

| WesBanco, Inc. | 7,890 | 339,743 |

| West Bancorp. | 3,159 | 78,027 |

| Westamerica Bancorp. | 4,839 | 304,518 |

| Wintrust Financial Corp. | 9,970 | 723,523 |

| Xenith Bankshares, Inc.* | 1,523 | 42,949 |

| Yadkin Financial Corp. | 9,687 | 331,877 |

| | 43,167,799 |

| Capital Markets 1.4% |

| Arlington Asset Investment Corp. "A" | 4,146 | 61,444 |

| Associated Capital Group, Inc. "A" | 852 | 27,988 |

| B. Riley Financial, Inc. | 1,765 | 32,564 |

| BGC Partners, Inc. "A" | 42,190 | 431,604 |

| Calamos Asset Management, Inc. "A" | 3,223 | 27,557 |

| Cohen & Steers, Inc. | 4,156 | 139,642 |

| Cowen Group, Inc. "A"* (a) | 4,963 | 76,927 |

| Diamond Hill Investment Group | 576 | 121,179 |

| Evercore Partners, Inc. "A" | 7,573 | 520,265 |

| FBR & Co. | 1,180 | 15,340 |

| Fifth Street Asset Management, Inc. | 1,129 | 7,564 |

| Financial Engines, Inc. | 10,410 | 382,567 |

| Gain Capital Holdings, Inc. | 7,086 | 46,626 |

| GAMCO Investors, Inc. "A" | 830 | 25,639 |

| Greenhill & Co., Inc. | 5,339 | 147,890 |

| Hennessy Advisors, Inc. | 544 | 17,272 |

| Houlihan Lokey, Inc. | 2,287 | 71,171 |

| INTL. FCStone, Inc.* | 2,959 | 117,176 |

| Investment Technology Group, Inc. | 6,140 | 121,204 |

| Janus Capital Group, Inc. | 27,902 | 370,260 |

| KCG Holdings, Inc. "A"* | 9,945 | 131,771 |

| Ladenburg Thalmann Financial Services, Inc.* (a) | 18,811 | 45,899 |

| Manning & Napier, Inc. | 2,817 | 21,268 |

| Medley Management, Inc. "A" | 1,036 | 10,256 |

| Moelis & Co. "A" | 3,514 | 119,125 |

| OM Asset Management PLC | 7,597 | 110,157 |

| Oppenheimer Holdings, Inc. "A" | 1,955 | 36,363 |

| |

Shares | Value ($) |

| | | |

| Piper Jaffray Companies, Inc.* | 2,770 | 200,825 |

| PJT Partners, Inc. "A" | 3,359 | 103,726 |

| Pzena Investment Management, Inc. "A" | 2,886 | 32,063 |

| Safeguard Scientifics, Inc.* | 3,689 | 49,617 |

| Silvercrest Asset Management Group, Inc. "A" | 1,334 | 17,542 |

| Stifel Financial Corp.* | 12,460 | 622,377 |

| Value Line, Inc. | 416 | 8,112 |

| Virtu Financial, Inc. "A" | 4,784 | 76,305 |

| Virtus Investment Partners, Inc. | 827 | 97,627 |

| Waddell & Reed Financial, Inc. "A" | 15,522 | 302,834 |

| Westwood Holdings Group, Inc. | 1,511 | 90,645 |

| Wins Finance Holdings, Inc.* | 289 | 52,020 |

| WisdomTree Investments, Inc. (a) | 22,343 | 248,901 |

| | 5,139,312 |

| Consumer Finance 0.5% |

| Encore Capital Group, Inc.* (a) | 4,511 | 129,240 |

| Enova International, Inc.* | 5,470 | 68,649 |

| EZCORP, Inc. "A"* | 10,100 | 107,565 |

| FirstCash, Inc. | 9,270 | 435,690 |

| Green Dot Corp. "A"* | 8,345 | 196,525 |

| LendingClub Corp.* | 63,955 | 335,764 |

| Nelnet, Inc. "A" | 3,855 | 195,641 |

| PRA Group, Inc.* | 8,983 | 351,235 |

| Regional Management Corp.* | 1,955 | 51,377 |

| World Acceptance Corp.* | 1,120 | 71,994 |

| | 1,943,680 |

| Diversified Financial Services 0.1% |

| FNFV Group* | 12,438 | 170,400 |

| Marlin Business Services Corp. | 1,665 | 34,798 |

| NewStar Financial, Inc.* | 4,395 | 40,654 |

| On Deck Capital, Inc.* | 9,094 | 42,105 |

| PICO Holdings, Inc.* | 4,104 | 62,176 |

| Tiptree Financial, Inc. "A", | 3,945 | 24,262 |

| | 374,395 |

| Insurance 2.4% |

| Ambac Financial Group, Inc.* | 8,616 | 193,860 |

| American Equity Investment Life Holding Co. | 16,646 | 375,201 |

| AMERISAFE, Inc. | 3,591 | 223,899 |

| Argo Group International Holdings Ltd. | 5,578 | 367,590 |

| Atlas Financial Holdings, Inc.* | 1,891 | 34,132 |

| Baldwin & Lyons, Inc. "B" | 1,582 | 39,866 |

| Blue Capital Reinsurance Holdings Ltd. | 1,162 | 21,439 |

| Citizens, Inc.* | 8,810 | 86,514 |

| CNO Financial Group, Inc. | 34,772 | 665,884 |

| Crawford & Co. "B" | 2,268 | 28,486 |

| Donegal Group, Inc. "A" | 1,585 | 27,706 |

| eHealth, Inc.* | 3,363 | 35,816 |

| EMC Insurance Group, Inc. | 1,473 | 44,205 |

| Employers Holdings, Inc. | 6,252 | 247,579 |

| Enstar Group Ltd.* | 2,214 | 437,708 |

| FBL Financial Group, Inc. "A" | 1,965 | 153,565 |

| Federated National Holding Co. | 2,309 | 43,155 |

| Fidelity & Guaranty Life | 2,307 | 54,676 |

| Genworth Financial, Inc. "A"* | 97,812 | 372,664 |

| Global Indemnity Ltd.* | 1,546 | 59,073 |

| Greenlight Capital Re Ltd. "A"* | 5,550 | 126,540 |

| Hallmark Financial Services, Inc.* | 2,633 | 30,622 |

| HCI Group, Inc. | 1,579 | 62,339 |

| |

Shares | Value ($) |

| | | |

| Heritage Insurance Holdings, Inc. | 5,048 | 79,102 |

| Horace Mann Educators Corp. | 7,848 | 335,894 |

| Independence Holding Co. | 1,493 | 29,188 |

| Infinity Property & Casualty Corp. | 2,123 | 186,612 |

| Investors Title Co. | 271 | 42,867 |

| James River Group Holdings Ltd. | 2,708 | 112,517 |

| Kemper Corp. | 7,743 | 343,015 |

| Kinsale Capital Group, Inc. | 1,298 | 44,145 |

| Maiden Holdings Ltd. | 13,087 | 228,368 |

| MBIA, Inc.* | 25,201 | 269,651 |

| National General Holdings Corp. | 9,194 | 229,758 |

| National Western Life Group, Inc. "A" | 445 | 138,306 |

| Navigators Group, Inc. | 2,182 | 256,930 |

| OneBeacon Insurance Group Ltd. "A" | 4,117 | 66,078 |

| Patriot National, Inc.* | 2,264 | 10,528 |

| Primerica, Inc. | 9,125 | 630,994 |

| RLI Corp. | 7,338 | 463,248 |

| Safety Insurance Group, Inc. | 2,790 | 205,623 |

| Selective Insurance Group, Inc. | 11,010 | 473,980 |

| State Auto Financial Corp. | 2,960 | 79,358 |

| State National Companies, Inc. | 5,660 | 78,448 |

| Stewart Information Services Corp. | 4,516 | 208,097 |

| Third Point Reinsurance Ltd.* | 12,562 | 145,091 |

| Trupanion, Inc.* (a) | 2,904 | 45,070 |

| United Fire Group, Inc. | 4,289 | 210,890 |

| United Insurance Holdings Corp. | 3,186 | 48,236 |

| Universal Insurance Holdings, Inc. | 6,158 | 174,887 |

| WMIH Corp.* | 38,548 | 59,749 |

| | 8,929,149 |

| Mortgage Real Estate Investment Trusts (REITs) 1.1% |

| AG Mortgage Investment Trust, Inc. | 5,628 | 96,295 |

| Altisource Residential Corp. | 9,914 | 109,451 |

| Anworth Mortgage Asset Corp. | 18,565 | 95,981 |

| Apollo Commercial Real Estate Finance, Inc. | 14,026 | 233,112 |

| Ares Commercial Real Estate Corp. | 5,435 | 74,622 |

| ARMOUR Residential REIT, Inc. | 6,972 | 151,223 |

| Capstead Mortgage Corp. | 18,178 | 185,234 |

| Colony Capital, Inc. "A", | 21,817 | 441,794 |

| CYS Investments, Inc. | 29,319 | 226,636 |

| Dynex Capital, Inc. | 8,496 | 57,943 |

| Great Ajax Corp. | 3,063 | 40,646 |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 8,444 | 160,351 |

| Invesco Mortgage Capital, Inc. | 21,838 | 318,835 |

| Ladder Capital Corp. | 7,261 | 99,621 |

| MTGE Investment Corp. | 9,114 | 143,090 |

| New Residential Investment Corp. | 46,528 | 731,420 |

| New York Mortgage Trust, Inc. (a) | 20,847 | 137,590 |

| Orchid Island Capital, Inc. (a) | 4,930 | 53,392 |

| Owens Realty Mortgage, Inc. | 1,889 | 34,984 |

| PennyMac Mortgage Investment Trust | 13,382 | 219,063 |

| Redwood Trust, Inc. | 14,827 | 225,519 |

| Resource Capital Corp. | 5,725 | 47,689 |

| Western Asset Mortgage Capital Corp. | 8,323 | 83,813 |

| | 3,968,304 |

| Thrifts & Mortgage Finance 2.3% |

| Astoria Financial Corp. | 17,936 | 334,506 |

| Bank Mutual Corp. | 7,515 | 71,017 |

| |

Shares | Value ($) |

| | | |

| BankFinancial Corp. | 2,859 | 42,370 |

| Bear State Financial, Inc. | 3,400 | 34,510 |

| Beneficial Bancorp., Inc. | 13,835 | 254,564 |

| BofI Holding, Inc.* (a) | 11,668 | 333,121 |

| BSB Bancorp., Inc.* | 1,447 | 41,891 |

| Capitol Federal Financial, Inc. | 24,851 | 409,047 |

| Charter Financial Corp. | 2,568 | 42,809 |

| Clifton Bancorp., Inc. | 4,139 | 70,032 |

| Dime Community Bancshares | 5,942 | 119,434 |

| ESSA Bancorp., Inc. | 1,563 | 24,570 |

| Essent Group Ltd.* | 14,530 | 470,336 |

| EverBank Financial Corp. | 19,518 | 379,625 |

| Federal Agricultural Mortgage Corp. "C" | 1,626 | 93,121 |

| First Defiance Financial Corp. | 1,647 | 83,569 |

| Flagstar Bancorp., Inc.* | 4,138 | 111,478 |

| Greene County Bancorp., Inc. (a) | 571 | 13,076 |

| Hingham Institution for Savings | 235 | 46,243 |

| Home Bancorp., Inc. | 1,083 | 41,815 |

| HomeStreet, Inc.* | 4,634 | 146,434 |

| Impac Mortgage Holdings, Inc.* | 2,173 | 30,465 |

| Kearny Financial Corp. | 16,804 | 261,302 |

| Lake Sunapee Bank Group | 1,496 | 35,291 |

| LendingTree, Inc.* | 1,185 | 120,100 |

| Meridian Bancorp., Inc. | 9,128 | 172,519 |

| Meta Financial Group, Inc. | 1,559 | 160,421 |

| MGIC Investment Corp.* | 65,411 | 666,538 |

| Nationstar Mortgage Holdings, Inc.* (a) | 6,442 | 116,343 |

| NMI Holdings, Inc. "A"* | 10,010 | 106,606 |

| Northfield Bancorp., Inc. | 7,945 | 158,662 |

| Northwest Bancshares, Inc. | 18,705 | 337,251 |

| OceanFirst Financial Corp. | 5,002 | 150,210 |

| Ocwen Financial Corp.* | 19,223 | 103,612 |

| Oritani Financial Corp. | 7,302 | 136,912 |

| PennyMac Financial Services, Inc. "A"* | 2,471 | 41,142 |

| PHH Corp.* | 9,997 | 151,555 |

| Provident Bancorp., Inc.* | 835 | 14,946 |

| Provident Financial Holdings, Inc. | 1,251 | 25,295 |

| Provident Financial Services, Inc. | 12,012 | 339,940 |

| Radian Group, Inc. | 41,307 | 742,700 |

| SI Financial Group, Inc. | 2,097 | 32,294 |

| Southern Missouri Bancorp., Inc. | 1,091 | 38,600 |

| Territorial Bancorp., Inc. | 1,340 | 44,006 |

| TrustCo Bank Corp. | 18,381 | 160,834 |

| United Community Financial Corp. | 9,151 | 81,810 |

| United Financial Bancorp., Inc. | 9,518 | 172,847 |

| Walker & Dunlop, Inc.* | 5,250 | 163,800 |

| Walter Investment Management Corp.* | 3,540 | 16,815 |

| Washington Federal, Inc. | 17,645 | 606,106 |

| Waterstone Financial, Inc. | 4,904 | 90,234 |

| Western New England Bancorp, Inc. | 4,871 | 45,544 |

| WSFS Financial Corp. | 5,644 | 261,599 |

| | 8,749,867 |

| Health Care 11.9% |

| Biotechnology 4.2% |

| Acceleron Pharma, Inc.* | 5,365 | 136,915 |

| Achillion Pharmaceuticals, Inc.* | 22,969 | 94,862 |

| Acorda Therapeutics, Inc.* | 8,459 | 159,029 |

| Adamas Pharmaceuticals, Inc.* (a) | 3,166 | 53,505 |

| Aduro Biotech, Inc.* (a) | 6,721 | 76,619 |

| |

Shares | Value ($) |

| | | |

| Advaxis, Inc.* (a) | 7,096 | 50,807 |

| Adverum Biotechnologies, Inc.* | 5,537 | 16,057 |

| Aevi Genomic Medicine, Inc.* | 5,663 | 29,334 |

| Agenus, Inc.* (a) | 14,043 | 57,857 |

| Aimmune Therapeutics, Inc.* | 4,978 | 101,800 |

| Akebia Therapeutics, Inc.* | 6,796 | 70,746 |

| Alder Biopharmaceuticals, Inc.* | 9,131 | 189,925 |

| AMAG Pharmaceuticals, Inc.* | 6,842 | 238,102 |

| Amicus Therapeutics, Inc.* (a) | 27,813 | 138,231 |

| Anavex Life Sciences Corp.* (a) | 6,186 | 24,497 |

| Anthera Pharmaceuticals, Inc.* (a) | 7,316 | 4,749 |

| Applied Genetic Technologies Corp.* | 2,397 | 22,412 |

| Aptevo Therapeutics, Inc.* | 3,072 | 7,496 |

| Ardelyx, Inc.* | 5,842 | 82,956 |

| Arena Pharmaceuticals, Inc.* | 47,040 | 66,797 |

| Argos Therapeutics, Inc.* | 2,022 | 9,908 |

| ARIAD Pharmaceuticals, Inc.* | 34,424 | 428,235 |

| Array BioPharma, Inc.* | 32,515 | 285,807 |

| Arrowhead Pharmaceuticals, Inc.* (a) | 12,160 | 18,848 |

| Asterias Biotherapeutics, Inc.* (a) | 4,293 | 19,748 |

| Atara Biotherapeutics, Inc.* (a) | 4,402 | 62,508 |

| Athersys, Inc.* (a) | 14,404 | 22,038 |

| Audentes Therapeutics, Inc.* (a) | 1,116 | 20,389 |

| Avexis, Inc.* | 1,195 | 57,037 |

| Axovant Sciences Ltd.* (a) | 4,630 | 57,505 |

| Bellicum Pharmaceuticals, Inc.* (a) | 3,972 | 54,099 |

| BioCryst Pharmaceuticals, Inc.* | 14,928 | 94,494 |

| BioSpecifics Technologies Corp.* | 1,041 | 57,984 |

| BioTime, Inc.* (a) | 12,665 | 45,721 |

| Bluebird Bio, Inc.* | 7,794 | 480,890 |

| Blueprint Medicines Corp.* | 3,789 | 106,281 |

| Cara Therapeutics, Inc.* (a) | 3,745 | 34,791 |

| Celldex Therapeutics, Inc.* | 17,942 | 63,515 |

| Cellular Biomedicine Group, Inc.* | 2,303 | 30,169 |

| ChemoCentryx, Inc.* | 5,074 | 37,548 |

| Chimerix, Inc.* | 8,328 | 38,309 |

| Cidara Therapeutics, Inc.* (a) | 2,924 | 30,410 |

| Clovis Oncology, Inc.* (a) | 6,257 | 277,936 |

| Coherus Biosciences, Inc.* | 5,862 | 165,015 |

| Concert Pharmaceuticals, Inc.* | 3,312 | 34,080 |

| Corvus Pharmaceuticals, Inc.* | 626 | 8,952 |

| Curis, Inc.* | 23,326 | 71,844 |

| Cytokinetics, Inc.* | 6,204 | 75,379 |

| CytomX Therapeutics, Inc.* | 3,864 | 42,465 |

| CytRx Corp.* | 12,477 | 4,644 |

| Dimension Therapeutics, Inc.* | 2,312 | 10,057 |

| Dynavax Technologies Corp.* (a) | 7,361 | 29,076 |

| Eagle Pharmaceuticals, Inc.* (a) | 1,693 | 134,323 |

| Edge Therapeutics, Inc.* | 3,076 | 38,450 |

| Editas Medicine, Inc.* | 1,230 | 19,963 |

| Eiger BioPharmaceuticals, Inc.* | 657 | 7,654 |

| Emergent Biosolutions, Inc.* | 6,126 | 201,178 |

| Enanta Pharmaceuticals, Inc.* | 2,961 | 99,193 |

| Epizyme, Inc.* | 8,125 | 98,312 |

| Esperion Therapeutics, Inc.* (a) | 2,714 | 33,979 |

| Exact Sciences Corp.* (a) | 20,562 | 274,708 |

| Exelixis, Inc.* | 44,219 | 659,305 |

| FibroGen, Inc.* | 10,301 | 220,441 |

| Five Prime Therapeutics, Inc.* | 5,271 | 264,130 |

| Flexion Therapeutics, Inc.* | 4,824 | 91,752 |

| Fortress Biotech, Inc.* | 6,467 | 17,461 |

| Foundation Medicine, Inc.* (a) | 2,548 | 45,100 |

| |

Shares | Value ($) |

| | | |

| Galena Biopharma, Inc.* | 1,699 | 3,296 |

| Genomic Health, Inc.* | 3,540 | 104,041 |

| Geron Corp.* (a) | 28,914 | 59,852 |

| Global Blood Therapeutics, Inc.* (a) | 3,236 | 46,760 |

| GlycoMimetics, Inc.* | 1,936 | 11,810 |

| Halozyme Therapeutics, Inc.* | 21,320 | 210,642 |

| Heron Therapeutics, Inc.* (a) | 6,019 | 78,849 |

| Idera Pharmaceuticals, Inc.* (a) | 18,194 | 27,291 |

| Ignyta, Inc.* | 5,572 | 29,532 |

| Immune Design Corp.* | 3,312 | 18,216 |

| ImmunoGen, Inc.* (a) | 16,609 | 33,882 |

| Immunomedics, Inc.* (a) | 19,584 | 71,873 |

| Infinity Pharmaceuticals, Inc.* | 8,997 | 12,146 |

| Inotek Pharmaceuticals Corp.* (a) | 3,302 | 20,142 |

| Inovio Pharmaceuticals, Inc.* (a) | 12,567 | 87,215 |

| Insmed, Inc.* | 12,171 | 161,022 |

| Insys Therapeutics, Inc.* (a) | 4,843 | 44,556 |

| Intellia Therapeutics, Inc.* (a) | 1,321 | 17,318 |

| Invitae Corp.* (a) | 5,539 | 43,980 |

| Ironwood Pharmaceuticals, Inc.* | 25,260 | 386,225 |

| Kadmon Holdings, Inc.* (a) | 1,577 | 8,437 |

| Karyopharm Therapeutics, Inc.* (a) | 4,982 | 46,831 |

| Keryx Biopharmaceuticals, Inc.* (a) | 14,951 | 87,613 |

| Kite Pharma, Inc.* (a) | 7,637 | 342,443 |

| La Jolla Pharmaceutical Co.* (a) | 2,864 | 50,206 |

| Lexicon Pharmaceuticals, Inc.* | 8,404 | 116,227 |

| Ligand Pharmaceuticals, Inc.* | 3,716 | 377,583 |

| Lion Biotechnologies, Inc.* | 10,962 | 76,186 |

| Loxo Oncology, Inc.* | 2,522 | 80,994 |

| MacroGenics, Inc.* | 6,309 | 128,956 |

| MannKind Corp.* (a) | 61,455 | 39,128 |

| MediciNova, Inc.* | 5,623 | 33,907 |

| Merrimack Pharmaceuticals, Inc.* (a) | 23,120 | 94,330 |

| MiMedx Group, Inc.* (a) | 20,280 | 179,681 |

| Minerva Neurosciences, Inc.* | 3,730 | 43,827 |

| Mirati Therapeutics, Inc.* | 2,114 | 10,042 |

| Momenta Pharmaceuticals, Inc.* | 11,971 | 180,164 |

| Myovant Sciences Ltd.* | 1,717 | 21,359 |

| Myriad Genetics, Inc.* | 13,157 | 219,327 |

| NantKwest, Inc.* (a) | 3,156 | 18,052 |

| Natera, Inc.* | 4,942 | 57,871 |

| NewLink Genetics Corp.* (a) | 4,301 | 44,214 |

| Novavax, Inc.* (a) | 54,701 | 68,923 |

| OncoMed Pharmaceuticals, Inc.* | 4,217 | 32,513 |

| Ophthotech Corp.* | 5,949 | 28,734 |

| Organovo Holdings, Inc.* (a) | 19,047 | 64,569 |

| Osiris Therapeutics, Inc.* (a) | 3,347 | 16,434 |

| Otonomy, Inc.* | 4,554 | 72,409 |

| OvaScience, Inc.* | 5,946 | 9,097 |

| PDL BioPharma, Inc. | 31,644 | 67,085 |

| Pfenex, Inc.* | 3,672 | 33,305 |

| PharmAthene, Inc.* | 11,812 | 38,389 |

| Portola Pharmaceuticals, Inc.* | 9,604 | 215,514 |

| Progenics Pharmaceuticals, Inc.* | 13,781 | 119,068 |

| Protagonist Therapeutics, Inc.* (a) | 1,475 | 32,435 |

| Proteostasis Therapeutics, Inc.* (a) | 1,202 | 14,737 |

| Prothena Corp. PLC* (a) | 6,767 | 332,869 |

| PTC Therapeutics, Inc.* | 6,126 | 66,835 |

| Puma Biotechnology, Inc.* | 5,434 | 166,824 |

| Ra Pharmaceuticals, Inc.* | 993 | 15,084 |

| Radius Health, Inc.* (a) | 6,147 | 233,770 |

| REGENXBIO, Inc.* (a) | 3,833 | 71,102 |

| |

Shares | Value ($) |

| | | |

| Regulus Therapeutics, Inc.* (a) | 7,348 | 16,533 |

| Repligen Corp.* | 6,609 | 203,689 |

| Retrophin, Inc.* | 7,129 | 134,952 |

| Rigel Pharmaceuticals, Inc.* | 18,077 | 43,023 |

| Sage Therapeutics, Inc.* | 5,857 | 299,058 |

| Sangamo BioSciences, Inc.* | 14,381 | 43,862 |

| Sarepta Therapeutics, Inc.* | 9,743 | 267,250 |

| Selecta Biosciences, Inc.* | 991 | 16,996 |

| Seres Therapeutics, Inc.* | 3,376 | 33,422 |

| Sorrento Therapeutics, Inc.* (a) | 5,039 | 24,691 |

| Spark Therapeutics, Inc.* | 3,724 | 185,828 |

| Spectrum Pharmaceuticals, Inc.* | 14,498 | 64,226 |

| Stemline Therapeutics, Inc.* | 3,618 | 38,713 |

| Syndax Pharmaceuticals, Inc.* | 892 | 6,396 |

| Synergy Pharmaceuticals, Inc.* (a) | 35,875 | 218,479 |

| Synthetic Biologics, Inc.* | 14,334 | 10,931 |

| Syros Pharmaceuticals, Inc.* (a) | 905 | 11,005 |

| T2 Biosystems, Inc.* (a) | 3,125 | 16,437 |

| TESARO, Inc.* | 5,485 | 737,623 |

| TG Therapeutics, Inc.* (a) | 7,408 | 34,447 |

| Tokai Pharmaceuticals, Inc.* (a) | 1,692 | 1,655 |

| Trevena, Inc.* | 8,476 | 49,839 |

| Trovagene, Inc.* (a) | 5,536 | 11,626 |

| Ultragenyx Pharmaceutical, Inc.* | 7,018 | 493,436 |

| Vanda Pharmaceuticals, Inc.* | 6,915 | 110,294 |

| Versartis, Inc.* | 6,089 | 90,726 |

| Vital Therapies, Inc.* (a) | 3,993 | 17,370 |

| Voyager Therapeutics, Inc.* (a) | 2,225 | 28,346 |

| vTv Therapeutics, Inc. "A"* | 1,054 | 5,091 |

| XBiotech, Inc.* (a) | 3,315 | 33,548 |

| Xencor, Inc.* | 6,788 | 178,660 |

| Zafgen, Inc.* | 4,325 | 13,753 |

| ZIOPHARM Oncology, Inc.* (a) | 23,023 | 123,173 |

| | 15,595,127 |

| Health Care Equipment & Supplies 3.0% |

| Abaxis, Inc. | 4,287 | 226,225 |

| Accuray, Inc.* | 15,816 | 72,754 |

| Analogic Corp. | 2,306 | 191,283 |

| AngioDynamics, Inc.* | 5,204 | 87,791 |

| Anika Therapeutics, Inc.* | 2,683 | 131,360 |

| AtriCure, Inc.* | 5,966 | 116,755 |

| Atrion Corp. | 259 | 131,365 |

| Avinger, Inc.* | 3,900 | 14,430 |

| AxoGen, Inc.* | 5,647 | 50,823 |

| Cantel Medical Corp. | 6,762 | 532,507 |

| Cardiovascular Systems, Inc.* | 6,212 | 150,392 |

| Cerus Corp.* | 19,212 | 83,572 |

| ConforMIS, Inc.* (a) | 6,779 | 54,910 |

| CONMED Corp. | 5,380 | 237,635 |

| Corindus Vascular Robotics, Inc.* | 10,458 | 7,304 |

| CryoLife, Inc. | 5,978 | 114,479 |

| Cutera, Inc.* | 2,544 | 44,138 |

| Cynosure, Inc. "A"* | 4,620 | 210,672 |

| Endologix, Inc.* | 16,005 | 91,549 |

| Entellus Medical, Inc.* | 1,426 | 27,051 |

| Exactech, Inc.* | 1,915 | 52,279 |

| GenMark Diagnostics, Inc.* | 8,175 | 100,062 |

| Glaukos Corp.* | 3,171 | 108,765 |

| Globus Medical, Inc. "A"* | 13,633 | 338,235 |

| Haemonetics Corp.* | 9,958 | 400,312 |

| Halyard Health, Inc.* | 9,111 | 336,925 |

| ICU Medical, Inc.* | 2,862 | 421,716 |

| Inogen, Inc.* | 3,183 | 213,802 |

| |

Shares | Value ($) |

| | | |

| Insulet Corp.* | 11,218 | 422,694 |

| Integer Holdings Corp.* | 5,798 | 170,751 |

| Integra LifeSciences Holdings Corp.* | 5,655 | 485,142 |

| Invacare Corp. | 5,966 | 77,856 |

| InVivo Therapeutics Holdings Corp.* (a) | 5,989 | 25,154 |

| iRadimed Corp.* (a) | 793 | 8,802 |

| iRhythm Technologies, Inc.* | 1,285 | 38,550 |

| IRIDEX Corp.* | 1,426 | 20,050 |

| K2M Group Holdings, Inc.* | 4,883 | 97,855 |

| LeMaitre Vascular, Inc. | 2,556 | 64,769 |

| Masimo Corp.* | 7,750 | 522,350 |

| Meridian Bioscience, Inc. | 8,321 | 147,282 |

| Merit Medical Systems, Inc.* | 8,431 | 223,421 |

| Natus Medical, Inc.* | 6,330 | 220,284 |

| Neogen Corp.* | 7,102 | 468,732 |

| Nevro Corp.* | 4,669 | 339,249 |

| Novocure Ltd.* (a) | 9,602 | 75,376 |

| NuVasive, Inc.* | 9,624 | 648,273 |

| NxStage Medical, Inc.* | 12,406 | 325,161 |

| Obalon Therapeutics, Inc.* | 947 | 8,381 |

| OraSure Technologies, Inc.* | 10,054 | 88,274 |

| Orthofix International NV* | 3,516 | 127,209 |

| Oxford Immunotec Global PLC* | 4,283 | 64,031 |

| Penumbra, Inc.* | 4,950 | 315,810 |

| Quidel Corp.* | 5,151 | 110,334 |

| Rockwell Medical, Inc.* (a) | 8,999 | 58,943 |

| RTI Surgical, Inc.* | 10,252 | 33,319 |

| Second Sight Medical Products, Inc.* | 2,450 | 4,826 |

| Senseonics Holdings, Inc.* | 5,285 | 14,111 |

| Spectranetics Corp.* | 8,440 | 206,780 |

| STAAR Surgical Co.* | 7,958 | 86,344 |

| SurModics, Inc.* | 2,464 | 62,586 |

| Tactile Systems Technology, Inc.* | 810 | 13,292 |

| Tandem Diabetes Care, Inc.* | 4,207 | 9,045 |

| TransEnterix, Inc.* (a) | 13,196 | 17,155 |

| Utah Medical Products, Inc. | 736 | 53,544 |

| Vascular Solutions, Inc.* | 3,309 | 185,635 |

| Veracyte, Inc.* | 3,643 | 28,197 |

| ViewRay, Inc.* | 1,322 | 4,138 |

| Wright Medical Group NV* | 20,067 | 461,140 |

| Zeltiq Aesthetics, Inc.* | 6,934 | 301,768 |

| | 11,185,704 |

| Health Care Providers & Services 2.0% |

| AAC Holdings, Inc.* | 1,879 | 13,604 |

| Aceto Corp. | 5,536 | 121,626 |

| Addus HomeCare Corp.* | 1,329 | 46,581 |

| Adeptus Health, Inc. "A"* (a) | 2,786 | 21,285 |

| Air Methods Corp.* | 6,430 | 204,796 |

| Almost Family, Inc.* | 1,535 | 67,694 |

| Amedisys, Inc.* | 5,448 | 232,248 |

| American Renal Associates Holdings, Inc.* (a) | 1,653 | 35,176 |

| AMN Healthcare Services, Inc.* | 9,210 | 354,124 |

| BioScrip, Inc.* | 21,040 | 21,882 |

| BioTelemetry, Inc.* | 5,042 | 112,689 |

| Capital Senior Living Corp.* | 5,327 | 85,498 |

| Chemed Corp. | 3,142 | 504,008 |

| Civitas Solutions, Inc.* | 2,856 | 56,834 |

| Community Health Systems, Inc.* | 21,471 | 120,023 |

| CorVel Corp.* | 1,868 | 68,369 |

| |

Shares | Value ($) |

| | | |

| Cross Country Healthcare, Inc.* | 5,952 | 92,911 |

| Diplomat Pharmacy, Inc.* | 8,904 | 112,190 |

| Fulgent Genetics, Inc.* | 972 | 11,246 |

| Genesis Healthcare, Inc.* | 6,503 | 27,638 |

| Healthequity, Inc.* | 8,391 | 340,003 |

| HealthSouth Corp. | 16,928 | 698,111 |

| Healthways, Inc.* | 6,048 | 137,592 |

| Kindred Healthcare, Inc. | 16,814 | 131,990 |

| Landauer, Inc. | 1,851 | 89,033 |

| LHC Group, Inc.* | 2,836 | 129,605 |

| Magellan Health, Inc.* | 4,480 | 337,120 |

| Molina Healthcare, Inc.* | 8,406 | 456,110 |

| National Healthcare Corp. | 2,120 | 160,675 |

| National Research Corp. "A" | 1,489 | 28,291 |

| Nobilis Health Corp.* (a) | 10,486 | 22,021 |

| Owens & Minor, Inc. | 12,121 | 427,750 |

| PharMerica Corp.* | 5,903 | 148,460 |

| Providence Service Corp.* | 2,623 | 99,805 |

| Quorum Health Corp.* | 5,617 | 40,836 |

| RadNet, Inc.* | 7,589 | 48,949 |

| Select Medical Holdings Corp.* | 20,798 | 275,574 |

| Surgery Partners, Inc.* | 3,532 | 55,982 |

| Surgical Care Affiliates, Inc.* | 5,236 | 242,270 |

| Team Health Holdings, Inc.* | 13,195 | 573,323 |

| Teladoc, Inc.* (a) | 3,934 | 64,911 |

| The Ensign Group, Inc. | 9,310 | 206,775 |

| Triple-S Management Corp. "B"* | 4,446 | 92,032 |

| U.S. Physical Therapy, Inc. | 2,407 | 168,971 |

| Universal American Corp.* | 7,672 | 76,336 |

| | 7,362,947 |

| Health Care Technology 0.4% |

| Castlight Health, Inc. "B"* (a) | 7,643 | 37,833 |

| Computer Programs & Systems, Inc. | 2,091 | 49,348 |

| Cotiviti Holdings, Inc.* | 2,396 | 82,422 |

| Evolent Health, Inc. "A"* | 2,885 | 42,698 |

| HealthStream, Inc.* | 4,831 | 121,017 |

| HMS Holdings Corp.* | 16,391 | 297,661 |

| Medidata Solutions, Inc.* | 10,686 | 530,774 |

| NantHealth, Inc.* | 1,287 | 12,793 |

| Omnicell, Inc.* | 6,936 | 235,130 |

| Quality Systems, Inc. | 9,475 | 124,596 |

| Tabula Rasa HealthCare, Inc.* | 875 | 13,107 |

| Vocera Communications, Inc.* | 4,905 | 90,693 |

| | 1,638,072 |

| Life Sciences Tools & Services 0.7% |

| Accelerate Diagnostics, Inc.* (a) | 4,467 | 92,690 |

| Albany Molecular Research, Inc.* | 4,940 | 92,674 |

| Cambrex Corp.* | 6,188 | 333,843 |

| ChromaDex Corp.* | 5,445 | 18,023 |

| Enzo Biochem, Inc.* | 7,495 | 52,015 |

| Fluidigm Corp.* | 6,205 | 45,172 |

| INC Research Holdings, Inc. "A"* | 8,033 | 422,536 |

| Luminex Corp.* | 7,170 | 145,049 |

| Medpace Holdings, Inc.* | 1,583 | 57,099 |

| NanoString Technologies, Inc.* | 2,844 | 63,421 |

| NeoGenomics, Inc.* | 9,735 | 83,429 |

| Pacific Biosciences of California, Inc.* | 15,627 | 59,383 |

| PAREXEL International Corp.* | 10,191 | 669,753 |

| PRA Health Sciences, Inc.* | 4,733 | 260,883 |

| | 2,395,970 |

| |

Shares | Value ($) |

| | | |

| Pharmaceuticals 1.6% |

| AcelRx Pharmaceuticals, Inc.* (a) | 6,717 | 17,464 |

| Aclaris Therapeutics, Inc.* | 2,057 | 55,827 |

| Aerie Pharmaceuticals, Inc.* | 5,486 | 207,645 |

| Agile Therapeutics, Inc.* | 2,158 | 12,301 |

| Amphastar Pharmaceuticals, Inc.* | 6,754 | 124,409 |

| Ampio Pharmaceuticals, Inc.* | 8,304 | 7,475 |

| ANI Pharmaceuticals, Inc.* | 1,612 | 97,719 |

| Aratana Therapeutics, Inc.* | 6,321 | 45,385 |

| Axsome Therapeutics, Inc.* | 2,107 | 14,222 |

| Bio-Path Holdings, Inc.* | 15,702 | 21,198 |

| Catalent, Inc.* | 19,365 | 522,080 |

| Cempra, Inc.* (a) | 8,694 | 24,343 |

| Clearside Biomedical, Inc.* (a) | 1,602 | 14,322 |

| Collegium Pharmaceutical, Inc.* (a) | 3,149 | 49,030 |

| Corcept Therapeutics, Inc.* (a) | 14,180 | 102,947 |

| DepoMed, Inc.* | 11,877 | 214,024 |

| Dermira, Inc.* | 4,847 | 147,010 |

| Durect Corp.* | 25,179 | 33,740 |

| Egalet Corp.* (a) | 4,216 | 32,252 |

| Endocyte, Inc.* | 7,143 | 18,215 |

| Flex Pharma, Inc.* | 2,021 | 10,671 |

| Heska Corp.* | 1,196 | 85,634 |

| Horizon Pharma PLC* | 31,369 | 507,550 |

| Impax Laboratories, Inc.* | 14,245 | 188,746 |

| Innoviva, Inc.* (a) | 16,019 | 171,403 |

| Intersect ENT, Inc.* | 4,843 | 58,600 |

| Intra-Cellular Therapies, Inc.* | 6,685 | 100,877 |

| Lannett Co., Inc.* (a) | 5,521 | 121,738 |

| Lipocine, Inc.* (a) | 3,145 | 11,574 |

| Medicines Co.* | 13,103 | 444,716 |

| MyoKardia, Inc.* | 2,814 | 36,441 |

| Nektar Therapeutics* | 27,647 | 339,229 |

| Neos Therapeutics, Inc.* (a) | 2,607 | 15,251 |

| Novan, Inc.* (a) | 829 | 22,400 |

| Ocular Therapeutix, Inc.* | 3,855 | 32,266 |

| Omeros Corp.* (a) | 7,923 | 78,596 |

| Pacira Pharmaceuticals, Inc.* | 7,099 | 229,298 |

| Paratek Pharmaceuticals, Inc.* | 3,631 | 55,917 |

| Phibro Animal Health Corp. "A" | 3,714 | 108,820 |

| Prestige Brands Holdings, Inc.* | 9,897 | 515,634 |

| Reata Pharmaceuticals, Inc. "A"* (a) | 1,082 | 23,620 |

| Revance Therapeutics, Inc.* (a) | 3,885 | 80,419 |

| Sciclone Pharmaceuticals, Inc.* | 9,526 | 102,881 |

| Sucampo Pharmaceuticals, Inc. "A"* | 4,384 | 59,403 |

| Supernus Pharmaceuticals, Inc.* | 9,214 | 232,653 |

| Teligent, Inc.* | 8,427 | 55,702 |

| Tetraphase Pharmaceuticals, Inc.* | 6,769 | 27,279 |

| TherapeuticsMD, Inc.* (a) | 29,350 | 169,349 |

| Theravance Biopharma, Inc.* (a) | 7,662 | 244,265 |

| Titan Pharmaceuticals, Inc.* | 3,560 | 14,240 |

| WaVe Life Sciences Ltd.* | 1,404 | 36,715 |

| Zogenix, Inc.* | 4,591 | 55,781 |

| | 5,999,276 |

| Industrials 14.3% |

| Aerospace & Defense 1.5% |

| AAR Corp. | 6,303 | 208,314 |

| Aerojet Rocketdyne Holdings, Inc.* | 11,562 | 207,538 |

| Aerovironment, Inc.* | 4,120 | 110,540 |

| Astronics Corp.* | 3,752 | 126,968 |

| Cubic Corp. | 4,949 | 237,304 |

| |

Shares | Value ($) |

| | | |

| Curtiss-Wright Corp. | 8,552 | 841,175 |

| DigitalGlobe, Inc.* | 12,276 | 351,707 |

| Ducommun, Inc.* | 2,027 | 51,810 |

| Engility Holdings, Inc.* | 3,485 | 117,444 |

| Esterline Technologies Corp.* | 5,740 | 512,008 |

| KLX, Inc.* | 10,253 | 462,513 |

| Kratos Defense & Security Solutions, Inc.* | 10,845 | 80,253 |

| Mercury Systems, Inc.* | 7,582 | 229,128 |

| Moog, Inc. "A"* | 6,212 | 408,004 |

| National Presto Industries, Inc. | 1,003 | 106,719 |

| Sparton Corp.* | 1,968 | 46,937 |

| Taser International, Inc.* | 10,128 | 245,503 |

| Teledyne Technologies, Inc.* | 6,613 | 813,399 |

| The Keyw Holding Corp.* | 6,811 | 80,302 |

| Triumph Group, Inc. | 9,584 | 253,976 |

| Vectrus, Inc.* | 2,198 | 52,422 |

| Wesco Aircraft Holdings, Inc.* | 10,549 | 157,708 |

| | 5,701,672 |

| Air Freight & Logistics 0.6% |

| Air Transport Services Group, Inc.* | 9,147 | 145,986 |

| Atlas Air Worldwide Holdings, Inc.* | 4,816 | 251,154 |

| Echo Global Logistics, Inc.* | 5,686 | 142,434 |

| Forward Air Corp. | 5,777 | 273,714 |

| Hub Group, Inc. "A"* | 6,488 | 283,850 |

| Park-Ohio Holdings Corp. | 1,557 | 66,328 |

| Radiant Logistics, Inc.* | 7,884 | 30,748 |

| XPO Logistics, Inc.* | 18,840 | 813,135 |

| | 2,007,349 |

| Airlines 0.4% |

| Allegiant Travel Co. | 2,560 | 425,984 |

| Hawaiian Holdings, Inc.* | 10,223 | 582,711 |

| SkyWest, Inc. | 9,813 | 357,684 |

| | 1,366,379 |

| Building Products 1.1% |

| AAON, Inc. | 7,847 | 259,343 |

| Advanced Drainage Systems, Inc. | 6,936 | 142,882 |

| American Woodmark Corp.* | 2,719 | 204,605 |

| Apogee Enterprises, Inc. | 5,549 | 297,204 |

| Armstrong Flooring, Inc.* | 4,428 | 88,161 |

| Builders FirstSource, Inc.* | 16,588 | 181,970 |

| Caesarstone Ltd.* | 4,727 | 135,429 |

| Continental Building Products, Inc.* | 6,556 | 151,444 |

| CSW Industrials, Inc.* | 2,729 | 100,564 |

| Gibraltar Industries, Inc.* | 6,127 | 255,189 |

| Griffon Corp. | 5,720 | 149,864 |

| Insteel Industries, Inc. | 3,479 | 123,992 |

| Masonite International Corp.* | 5,886 | 387,299 |

| NCI Building Systems, Inc.* | 5,255 | 82,241 |

| Patrick Industries, Inc.* | 2,747 | 209,596 |

| PGT Innovations, Inc.* | 9,587 | 109,771 |

| Ply Gem Holdings, Inc.* | 4,258 | 69,192 |

| Quanex Building Products Corp. | 6,480 | 131,544 |

| Simpson Manufacturing Co., Inc. | 7,965 | 348,469 |

| Trex Co., Inc.* | 5,724 | 368,626 |

| Universal Forest Products, Inc. | 3,844 | 392,780 |

| | 4,190,165 |

| Commercial Services & Supplies 2.4% |

| ABM Industries, Inc. | 10,818 | 441,807 |

| Acco Brands Corp.* | 20,209 | 263,727 |

| Advanced Disposal Services, Inc.* | 4,223 | 93,835 |

| Aqua Metals, Inc.* (a) | 2,028 | 26,587 |

| |

Shares | Value ($) |

| | | |

| ARC Document Solutions, Inc.* | 8,849 | 44,953 |

| Brady Corp. "A" | 8,877 | 333,331 |

| Casella Waste Systems, Inc. "A"* | 7,335 | 91,027 |

| CECO Environmental Corp. | 5,717 | 79,752 |

| CompX International, Inc. | 545 | 8,775 |

| Deluxe Corp. | 9,431 | 675,354 |

| Ennis, Inc. | 5,144 | 89,248 |

| Essendant, Inc. | 7,007 | 146,446 |

| G&K Services, Inc. "A" | 3,790 | 365,546 |

| Healthcare Services Group, Inc. | 13,668 | 535,376 |

| Heritage-Crystal Clean, Inc.* | 2,282 | 35,827 |

| Herman Miller, Inc. | 11,625 | 397,575 |

| HNI Corp. | 8,809 | 492,599 |

| Innerworkings, Inc.* | 7,455 | 73,432 |

| Interface, Inc. | 12,657 | 234,787 |

| Kimball International, Inc. "B" | 6,985 | 122,657 |

| Knoll, Inc. | 9,349 | 261,118 |

| Matthews International Corp. "A" | 6,189 | 475,625 |

| McGrath RentCorp. | 4,585 | 179,686 |

| Mobile Mini, Inc. | 8,624 | 260,876 |

| MSA Safety, Inc. | 6,055 | 419,793 |

| Multi-Color Corp. | 2,578 | 200,053 |

| NL Industries, Inc.* | 1,487 | 12,119 |

| Quad Graphics, Inc. | 5,718 | 153,700 |

| SP Plus Corp.* | 3,274 | 92,163 |

| Steelcase, Inc. "A" | 16,356 | 292,772 |

| Team, Inc.* | 5,470 | 214,698 |

| Tetra Tech, Inc. | 11,197 | 483,151 |

| The Brink's Co. | 8,760 | 361,350 |

| TRC Companies, Inc.* | 3,963 | 42,008 |

| U.S. Ecology, Inc. | 4,329 | 212,770 |

| UniFirst Corp. | 2,920 | 419,458 |

| Viad Corp. | 3,858 | 170,138 |

| VSE Corp. | 1,662 | 64,552 |

| West Corp. | 8,198 | 202,982 |

| | 9,071,653 |

| Construction & Engineering 1.0% |

| Aegion Corp.* | 6,528 | 154,714 |

| Ameresco, Inc. "A"* | 4,913 | 27,021 |

| Argan, Inc. | 2,569 | 181,243 |

| Comfort Systems U.S.A., Inc. | 7,307 | 243,323 |

| Dycom Industries, Inc.* | 5,940 | 476,923 |

| EMCOR Group, Inc. | 11,602 | 820,957 |

| Granite Construction, Inc. | 7,710 | 424,050 |

| Great Lakes Dredge & Dock Co.* | 12,467 | 52,361 |

| HC2 Holdings, Inc.* | 7,419 | 43,995 |

| IES Holdings, Inc.* | 1,464 | 28,036 |

| Layne Christensen Co.* | 3,399 | 36,947 |

| MasTec, Inc.* | 12,881 | 492,698 |

| MYR Group, Inc.* | 2,801 | 105,542 |

| NV5 Holdings, Inc.* | 1,384 | 46,226 |

| Orion Group Holdings, Inc.* | 4,962 | 49,372 |

| Primoris Services Corp. | 7,662 | 174,540 |

| Tutor Perini Corp.* | 7,165 | 200,620 |

| | 3,558,568 |

| Electrical Equipment 0.7% |

| Allied Motion Technologies, Inc. | 1,111 | 23,764 |

| American Superconductor Corp.* (a) | 2,217 | 16,339 |

| Atkore International Group, Inc.* | 2,360 | 56,428 |

| AZZ, Inc. | 5,011 | 320,203 |

| Babcock & Wilcox Enterprises, Inc.* | 8,649 | 143,487 |

| Encore Wire Corp. | 4,006 | 173,660 |

| Energous Corp.* (a) | 2,806 | 47,281 |

| |

Shares | Value ($) |

| | | |

| EnerSys | 8,452 | 660,101 |

| FuelCell Energy, Inc.* (a) | 6,229 | 10,901 |

| Generac Holdings, Inc.* | 12,693 | 517,113 |

| General Cable Corp. | 9,556 | 182,042 |

| LSI Industries, Inc. | 4,485 | 43,684 |

| Plug Power, Inc.* (a) | 36,975 | 44,370 |

| Powell Industries, Inc. | 1,624 | 63,336 |

| Power Solutions International, Inc.* | 777 | 5,827 |

| Preformed Line Products Co. | 538 | 31,268 |

| Sunrun, Inc.* (a) | 11,977 | 63,598 |

| Thermon Group Holdings, Inc.* | 6,398 | 122,138 |

| TPI Composites, Inc.* | 1,167 | 18,719 |

| Vicor Corp.* | 3,238 | 48,894 |

| | 2,593,153 |

| Industrial Conglomerates 0.1% |

| Raven Industries, Inc. | 7,056 | 177,811 |

| Machinery 3.5% |

| Actuant Corp. "A" | 11,391 | 295,596 |

| Alamo Group, Inc. | 1,890 | 143,829 |

| Albany International Corp. "A" | 5,617 | 260,067 |

| Altra Industrial Motion Corp. | 4,791 | 176,788 |

| American Railcar Industries, Inc. (a) | 1,462 | 66,214 |

| Astec Industries, Inc. | 3,805 | 256,685 |

| Barnes Group, Inc. | 9,753 | 462,487 |

| Blue Bird Corp.* | 913 | 14,106 |

| Briggs & Stratton Corp. | 8,043 | 179,037 |

| Chart Industries, Inc.* | 5,811 | 209,312 |

| CIRCOR International, Inc. | 3,129 | 203,010 |

| CLARCOR, Inc. | 9,171 | 756,332 |

| Columbus McKinnon Corp. | 3,663 | 99,048 |

| DMC Global, Inc. | 2,645 | 41,923 |

| Douglas Dynamics, Inc. | 4,349 | 146,344 |

| Energy Recovery, Inc.* | 6,508 | 67,358 |

| EnPro Industries, Inc. | 4,209 | 283,518 |

| ESCO Technologies, Inc. | 4,875 | 276,169 |

| Federal Signal Corp. | 11,651 | 181,872 |

| Franklin Electric Co., Inc. | 8,947 | 348,038 |

| FreightCar America, Inc. | 2,340 | 34,936 |

| Gencor Industries, Inc.* | 1,422 | 22,325 |

| Global Brass & Copper Holdings, Inc. | 4,011 | 137,577 |

| Gorman-Rupp Co. | 3,509 | 108,604 |

| Graham Corp. | 1,917 | 42,462 |

| Greenbrier Companies, Inc. (a) | 5,266 | 218,802 |

| Hardinge, Inc. | 2,186 | 24,221 |

| Harsco Corp. | 15,677 | 213,207 |

| Hillenbrand, Inc. | 11,405 | 437,382 |

| Hurco Companies, Inc. | 1,216 | 40,250 |

| Hyster-Yale Materials Handling, Inc. | 1,808 | 115,296 |

| John Bean Technologies Corp. | 5,657 | 486,219 |

| Joy Global, Inc. | 18,821 | 526,988 |

| Kadant, Inc. | 2,123 | 129,928 |

| Kennametal, Inc. | 15,328 | 479,153 |

| Lindsay Corp. (a) | 2,017 | 150,488 |

| Lydall, Inc.* | 3,140 | 194,209 |

| Manitowoc Co., Inc.* | 24,040 | 143,759 |

| Meritor, Inc.* | 16,168 | 200,807 |

| Milacron Holdings Corp.* | 2,904 | 54,102 |

| Miller Industries, Inc. | 2,077 | 54,937 |

| Mueller Industries, Inc. | 10,983 | 438,881 |

| Mueller Water Products, Inc. "A" | 30,175 | 401,629 |

| Navistar International Corp.* | 9,473 | 297,168 |

| NN, Inc. | 4,876 | 92,888 |

| |

Shares | Value ($) |

| | | |

| Omega Flex, Inc. | 496 | 27,657 |

| Proto Labs, Inc.* | 4,818 | 247,404 |

| RBC Bearings, Inc.* | 4,388 | 407,250 |

| Rexnord Corp.* | 16,020 | 313,832 |

| SPX Corp.* | 7,903 | 187,459 |

| SPX FLOW, Inc.* | 6,969 | 223,426 |

| Standex International Corp. | 2,461 | 216,199 |

| Sun Hydraulics Corp. | 4,414 | 176,428 |

| Supreme Industries, Inc. "A" | 2,455 | 38,543 |

| Tennant Co. | 3,399 | 242,009 |

| The ExOne Co.* | 1,931 | 18,036 |

| Titan International, Inc. | 8,353 | 93,637 |

| TriMas Corp.* | 8,555 | 201,042 |

| Wabash National Corp.* | 12,195 | 192,925 |

| Watts Water Technologies, Inc. "A" | 5,360 | 349,472 |

| Woodward, Inc. | 10,231 | 706,451 |

| | 13,155,721 |

| Marine 0.1% |