UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-07507

Deutsche Investments VIT Funds

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

345 Park Avenue

New York, NY 10154-0004

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2017 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

December 31, 2017

Annual Report

Deutsche Investments VIT Funds

Deutsche Equity 500 Index VIP

Contents

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Stocks may decline in value. Various factors, including costs, cash flows and security selection, may cause the Fund’s performance to differ from that of the index. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The Fund may lend securities to approved institutions. Please read the prospectus for details.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

Deutsche AM Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | | | | | |

| | 2 | | | | | | Deutsche Equity 500 Index VIP |

| | |

| Performance Summary | | December 31, 2017 (Unaudited) |

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund’s most recent month-end performance. Performance figures for Classes A, B and B2 differ because each class maintains a distinct expense structure. Performance doesn’t reflect charges and fees (“contract charges”) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2017 are 0.34%, 0.69% and 0.74% for Class A, Class B and Class B2 shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

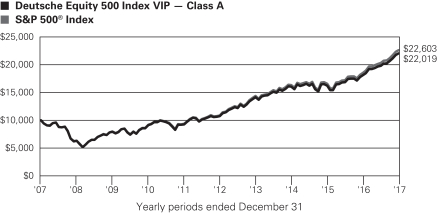

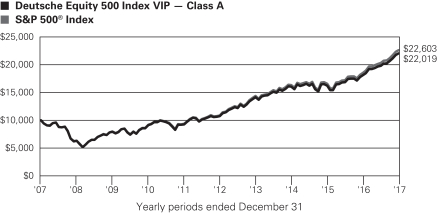

Growth of an Assumed $10,000 Investment

| | |

| | The Standard & Poor’s 500® (S&P 500) Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| | | | | | | | | | |

| Comparative Results (as of December 31, 2017) |

| | | | | |

| Deutsche Equity 500 Index VIP | | | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class A | | Growth of $10,000 | | $12,153 | | $13,718 | | $20,521 | | $22,019 |

| | | Average annual total return | | 21.53% | | 11.11% | | 15.46% | | 8.21% |

| S&P 500 Index | | Growth of $10,000 | | $12,183 | | $13,829 | | $20,814 | | $22,603 |

| | | Average annual total return | | 21.83% | | 11.41% | | 15.79% | | 8.50% |

| | | | | |

| Deutsche Equity 500 Index VIP | | | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class B | | Growth of $10,000 | | $12,107 | | $13,600 | | $20,245 | | $21,449 |

| | | Average annual total return | | 21.07% | | 10.79% | | 15.15% | | 7.93% |

| S&P 500 Index | | Growth of $10,000 | | $12,183 | | $13,829 | | $20,814 | | $22,603 |

| | | Average annual total return | | 21.83% | | 11.41% | | 15.79% | | 8.50% |

| | | | | |

| Deutsche Equity 500 Index VIP | | | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class B2 | | Growth of $10,000 | | $12,106 | | $13,564 | | $20,146 | | $21,209 |

| | | Average annual total return | | 21.06% | | 10.70% | | 15.04% | | 7.81% |

| S&P 500 Index | | Growth of $10,000 | | $12,183 | | $13,829 | | $20,814 | | $22,603 |

| | | Average annual total return | | 21.83% | | 11.41% | | 15.79% | | 8.50% |

The growth of $10,000 is cumulative.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 3 |

| | |

| Management Summary | | December 31, 2017 (Unaudited) |

The Fund returned 21.53% in 2017 (Class A shares, unadjusted for contract charges), which compares with a return of 21.83% for the Standard & Poor’s 500® (S&P 500) Index. Since the Fund’s strategy is to replicate the performance of the Standard & Poor’s 500® (S&P 500) Index before the deduction of expenses, the Fund’s return is normally close to that of the index.

Stocks performed unusually well in 2017, with above-average total returns and a remarkably low degree of volatility. In a year characterized by a pronounced lack of negative financial headlines, the S&P 500 Index experienced few large single-day moves and no peak-to-trough downturns of more than 3%. In fact, the index posted a gain in each of the 12 months of the year — the first time in history that has occurred. The strong showing for the index represented its ninth consecutive year of positive performance, as well as the fourteenth positive year of the past 15. The year also market the best return for the S&P 500 Index since 2013 and its fourth-highest gain since 2000.

The combination of healthy economic growth, rising corporate profits and a stable outlook for U.S. Federal Reserve (Fed) policy was the primary reason for U.S. equities’ hearty advance in 2017.

Looking first at growth, the U.S. Bureau of Economic Analysis reported that U.S. gross domestic product rose 3.1% and 3.2% in the second and third quarters, respectively, its strongest showing over a two-quarter interval since mid 2014. In addition, the unemployment rate fell to 4.1% — its lowest level since December 2000, according to the U.S. Bureau of Labor Statistics. Economic growth came from a variety of sources, including rising industrial production, surging housing prices and a strong holiday retail season at year-end.

The strength in the economy, in turn, fed through to corporate earnings. According to FactSet, U.S. corporations posted earnings growth of nearly 10% in 2017, the highest level since 2011. All sectors produced positive profit growth, led by energy, materials and information technology.

These favorable conditions provided the Fed with the latitude to tighten monetary policy. The central bank hiked interest rates three times in quarter-point increments in 2017, bringing the benchmark federal funds rate to a range of 1.25% to 1.50%. In addition, it announced that it would begin to reverse the quantitative easing policy it put in place following the financial crisis by reducing the size of its balance sheet. Although these moves removed monetary accommodation from the economy, the markets appeared confident that the low inflation-environment would enable the Fed to maintain its deliberate and well-communicated approach to raising interest rates.

The market also gained a significant benefit from the passage of a long-anticipated tax reform bill that reduced the U.S. corporate tax rate to 21% from its previous level of 35%. After an initial stretch of optimism in the wake of the November 2016 elections, investors gradually lost confidence that the Republican-led government would enact meaningful legislative changes. The mood shifted in mid-August, however, when a series of public statements by lawmakers indicated Republicans’ intention to pass a tax plan by year-end. Stocks embarked on a protracted rally in response to the news, as investors discounted the prospect of stronger bottom-line earnings into equity valuations.

The performance of sectors and individual stocks largely reflected investors’ preference for faster-growing companies. This tendency led to outsized gains for the technology sector, which registered a total return more than 17 points above the index. The sector was home to many of the leading performance contributors for the year, including Apple Inc., Microsoft Corp., Facebook, Inc. and Alphabet, Inc. (formerly known as Google). The consumer discretionary, financial and health care sectors also delivered market-beating returns.

On the other end of the spectrum, energy stocks finished in negative territory and were the worst performer among the 11 major sectors. The year’s other underperforming sectors were largely those featuring the types of defensive, higher-dividend companies that lagged at a time in which investors embraced risk and favored stocks with above-average economic sensitivity. This trend contributed to underperformance for the utilities, consumer staples, telecommunications services and real estate sectors, although all posted double-digit gains in absolute terms. Industrials stocks also finished slightly behind the index.

| | | | | | |

| | 4 | | | | | | Deutsche Equity 500 Index VIP |

Brent Reeder

Senior Vice President, Northern Trust Investments, Inc., Subadvisor to the Fund

Portfolio Manager

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

The Standard & Poor’s 500 (S&P 500) Index is an unmanaged, capitalization weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns assume reinvested dividends, do not reflect any fees or expenses and it is not possible to invest directly into an index.

Gross domestic product (GDP) is the monetary value of goods and services produced within a country’s borders in a specific time frame.

Quantitative easing entails the Fed’s purchase of government and other securities from the market in an effort to increase money supply.

Contribution and detraction incorporate both a stock’s total return and its weighting in the index.

The consumer discretionary sector represents industries that produce goods and services that are not necessities in everyday life.

Consumer staples are the industries that manufacture and sell products such as food and beverages, prescription drugs, and household products.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 5 |

| | |

| Portfolio Summary | | (Unaudited) |

| | | | | | | | |

| Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | | 12/31/17 | | | 12/31/16 | |

| Common Stocks | | | 99% | | | | 100% | |

| Cash Equivalents | | | 1% | | | | 0% | |

| Government & Agency Obligations | | | 0% | | | | 0% | |

| | | | 100% | | | | 100% | |

| | |

| Sector Diversification (As a % of Common Stocks) | | 12/31/17 | | | 12/31/16 | |

| Information Technology | | | 24% | | | | 21% | |

| Financials | | | 15% | | | | 15% | |

| Health Care | | | 14% | | | | 14% | |

| Consumer Discretionary | | | 12% | | | | 12% | |

| Industrials | | | 10% | | | | 10% | |

| Consumer Staples | | | 8% | | | | 9% | |

| Energy | | | 6% | | | | 7% | |

| Materials | | | 3% | | | | 3% | |

| Utilities | | | 3% | | | | 3% | |

| Real Estate | | | 3% | | | | 3% | |

| Telecommunication Services | | | 2% | | | | 3% | |

| | | | 100% | | | | 100% | |

| | | | | | |

| Ten Largest Equity Holdings (20.6% of Net Assets) | | |

| | 1. | | | Apple, Inc. | | |

| | | | | Designs, manufactures and markets personal computers and related computing and mobile communication devices | | 3.7% |

| | 2. | | | Microsoft Corp. | | |

| | | | | Develops, manufactures, licenses, sells and supports software products | | 2.8% |

| | 3. | | | Alphabet, Inc. | | |

| | | | | Holding company with subsidiaries that provide web-based search, advertisements, maps, software applications, mobile operating systems and a variety of other products | | 2.7% |

| | 4. | | | Amazon.com, Inc. | | |

| | | | | Online retailer that offers a wide range of products, including books, music, videotapes, computers, electronics, home and garden, and numerous products | | 2.0% |

| | 5. | | | Facebook, Inc. | | |

| | | | | Operates a social networking Web site | | 1.8% |

| | 6. | | | Berkshire Hathaway, Inc. | | |

| | | | | Holding company of insurance business and a variety of other businesses | | 1.7% |

| | 7. | | | Johnson & Johnson | | |

| | | | | Provider of health care products | | 1.6% |

| | 8. | | | JPMorgan Chase & Co. | | |

| | | | | Provider of global financial services | | 1.6% |

| | 9. | | | Exxon Mobil Corp. | | |

| | | | | Explorer and producer of oil and gas | | 1.5% |

| | 10. | | | Bank of America Corp. | | |

| | | | | Provider of commercial banking services | | 1.2% |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 7.

Following the Fund’s fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC’s Web site at sec.gov, and it also may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) SEC-0330. The Fund’s portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund’s current prospectus for more information.

| | | | | | |

| | 6 | | | | | | Deutsche Equity 500 Index VIP |

| | |

| Investment Portfolio | | December 31, 2017 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| Common Stocks 97.5% | |

| Consumer Discretionary 11.9% | |

Auto Components 0.2% | |

Aptiv PLC | | | 6,633 | | | | 562,677 | |

BorgWarner, Inc. | | | 4,909 | | | | 250,801 | |

Goodyear Tire & Rubber Co. | | | 6,057 | | | | 195,702 | |

| | | | | | | | |

| | | | | | | 1,009,180 | |

|

Automobiles 0.5% | |

Ford Motor Co. | | | 97,274 | | | | 1,214,952 | |

General Motors Co. | | | 31,868 | | | | 1,306,269 | |

Harley-Davidson, Inc. (a) | | | 4,196 | | | | 213,493 | |

| | | | | | | | |

| | | | | | | 2,734,714 | |

|

Distributors 0.1% | |

Genuine Parts Co. | | | 3,657 | | | | 347,452 | |

LKQ Corp.* | | | 7,720 | | | | 313,972 | |

| | | | | | | | |

| | | | | | | 661,424 | |

|

Diversified Consumer Services 0.0% | |

H&R Block, Inc. | | | 5,178 | | | | 135,767 | |

|

Hotels, Restaurants & Leisure 1.8% | |

Carnival Corp. | | | 10,163 | | | | 674,518 | |

Chipotle Mexican Grill, Inc.* | | | 614 | | | | 177,464 | |

Darden Restaurants, Inc. | | | 3,060 | | | | 293,821 | |

Hilton Worldwide Holdings, Inc. | | | 5,039 | | | | 402,415 | |

Marriott International, Inc. “A” | | | 7,631 | | | | 1,035,756 | |

McDonald’s Corp. | | | 19,864 | | | | 3,418,992 | |

MGM Resorts International | | | 12,660 | | | | 422,717 | |

Norwegian Cruise Line Holdings Ltd.* | | | 4,465 | | | | 237,761 | |

Royal Caribbean Cruises Ltd. | | | 4,268 | | | | 509,087 | |

Starbucks Corp. | | | 35,453 | | | | 2,036,066 | |

Wyndham Worldwide Corp. | | | 2,549 | | | | 295,353 | |

Wynn Resorts Ltd. | | | 2,010 | | | | 338,866 | |

Yum! Brands, Inc. | | | 8,398 | | | | 685,361 | |

| | | | | | | | |

| | | | | | | 10,528,177 | |

|

Household Durables 0.4% | |

D.R. Horton, Inc. | | | 8,458 | | | | 431,950 | |

Garmin Ltd. | | | 2,762 | | | | 164,532 | |

Leggett & Platt, Inc. | | | 3,259 | | | | 155,552 | |

Lennar Corp. “A” | | | 5,107 | | | | 322,967 | |

Mohawk Industries, Inc.* | | | 1,578 | | | | 435,370 | |

Newell Brands, Inc. | | | 12,220 | | | | 377,598 | |

PulteGroup, Inc. | | | 6,743 | | | | 224,205 | |

Whirlpool Corp. | | | 1,796 | | | | 302,878 | |

| | | | | | | | |

| | | | | | | 2,415,052 | |

|

Internet & Direct Marketing Retail 2.8% | |

Amazon.com, Inc.* | | | 9,966 | | | | 11,654,938 | |

Expedia, Inc. | | | 3,085 | | | | 369,490 | |

Netflix, Inc.* | | | 10,782 | | | | 2,069,713 | |

The Priceline Group, Inc.* | | | 1,215 | | | | 2,111,354 | |

TripAdvisor, Inc.* | | | 2,702 | | | | 93,111 | |

| | | | | | | | |

| | | | | | | 16,298,606 | |

|

Leisure Products 0.1% | |

Hasbro, Inc. | | | 2,830 | | | | 257,219 | |

Mattel, Inc. (a) | | | 8,557 | | | | 131,606 | |

| | | | | | | | |

| | | | | | | 388,825 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Media 2.7% | |

CBS Corp. “B” | | | 9,034 | | | | 533,006 | |

Charter Communications, Inc. “A”* | | | 4,832 | | | | 1,623,359 | |

Comcast Corp. “A” | | | 116,223 | | | | 4,654,731 | |

Discovery Communications, Inc. “A”* (a) | | | 3,841 | | | | 85,962 | |

Discovery Communications, Inc. “C”* | | | 5,068 | | | | 107,290 | |

DISH Network Corp. “A”* | | | 5,672 | | | | 270,838 | |

Interpublic Group of Companies, Inc. | | | 9,687 | | | | 195,290 | |

News Corp. “A” | | | 9,421 | | | | 152,714 | |

News Corp. “B” | | | 3,121 | | | | 51,809 | |

Omnicom Group, Inc. | | | 5,744 | | | | 418,335 | |

Scripps Networks Interactive, Inc. “A” | | | 2,411 | | | | 205,851 | |

Time Warner, Inc. | | | 19,399 | | | | 1,774,426 | |

Twenty-First Century Fox, Inc. “A” | | | 26,262 | | | | 906,827 | |

Twenty-First Century Fox, Inc. “B” | | | 10,959 | | | | 373,921 | |

Viacom, Inc. “B” | | | 8,795 | | | | 270,974 | |

Walt Disney Co. | | | 37,632 | | | | 4,045,816 | |

| | | | | | | | |

| | | | | | | 15,671,149 | |

|

Multiline Retail 0.4% | |

Dollar General Corp. | | | 6,497 | | | | 604,286 | |

Dollar Tree, Inc.* | | | 5,909 | | | | 634,095 | |

Kohl’s Corp. | | | 4,203 | | | | 227,929 | |

Macy’s, Inc. | | | 7,535 | | | | 189,806 | |

Nordstrom, Inc. | | | 2,913 | | | | 138,018 | |

Target Corp. | | | 13,551 | | | | 884,203 | |

| | | | | | | | |

| | | | | | | 2,678,337 | |

|

Specialty Retail 2.2% | |

Advance Auto Parts, Inc. | | | 1,858 | | | | 185,224 | |

AutoZone, Inc.* | | | 686 | | | | 488,000 | |

Best Buy Co., Inc. | | | 6,341 | | | | 434,168 | |

CarMax, Inc.* | | | 4,515 | | | | 289,547 | |

Foot Locker, Inc. | | | 2,998 | | | | 140,546 | |

Home Depot, Inc. | | | 29,103 | | | | 5,515,892 | |

L Brands, Inc. | | | 6,117 | | | | 368,366 | |

Lowe’s Companies, Inc. | | | 20,758 | | | | 1,929,249 | |

O’Reilly Automotive, Inc.* | | | 2,120 | | | | 509,945 | |

Ross Stores, Inc. | | | 9,618 | | | | 771,844 | |

Signet Jewelers Ltd. | | | 1,509 | | | | 85,334 | |

The Gap, Inc. | | | 5,490 | | | | 186,989 | |

Tiffany & Co. | | | 2,547 | | | | 264,761 | |

TJX Companies, Inc. | | | 15,867 | | | | 1,213,191 | |

Tractor Supply Co. | | | 3,127 | | | | 233,743 | |

Ulta Salon, Cosmetics & Fragrance, Inc.* | | | 1,450 | | | | 324,307 | |

| | | | | | | | |

| | | | | | | 12,941,106 | |

|

Textiles, Apparel & Luxury Goods 0.7% | |

Hanesbrands, Inc. | | | 9,039 | | | | 189,005 | |

Michael Kors Holdings Ltd.* | | | 3,797 | | | | 239,021 | |

NIKE, Inc. “B” | | | 32,754 | | | | 2,048,763 | |

PVH Corp. | | | 1,931 | | | | 264,952 | |

Ralph Lauren Corp. | | | 1,364 | | | | 141,433 | |

Tapestry, Inc. | | | 7,103 | | | | 314,166 | |

Under Armour, Inc. “A”* (a) | | | 4,604 | | | | 66,436 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 7 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Under Armour, Inc. “C”* (a) | | | 4,609 | | | | 61,392 | |

VF Corp. | | | 8,146 | | | | 602,804 | |

| | | | | | | | |

| | | | | | | 3,927,972 | |

|

| Consumer Staples 8.0% | |

Beverages 1.9% | |

Brown-Forman Corp. “B” | | | 4,881 | | | | 335,178 | |

Coca-Cola Co. | | | 95,551 | | | | 4,383,880 | |

Constellation Brands, Inc. “A” | | | 4,293 | | | | 981,251 | |

Dr. Pepper Snapple Group, Inc. | | | 4,500 | | | | 436,770 | |

Molson Coors Brewing Co. “B” | | | 4,591 | | | | 376,784 | |

Monster Beverage Corp.* | | | 10,259 | | | | 649,292 | |

PepsiCo, Inc. | | | 35,438 | | | | 4,249,725 | |

| | | | | | | | |

| | | | | | | 11,412,880 | |

|

Food & Staples Retailing 1.8% | |

Costco Wholesale Corp. | | | 10,889 | | | | 2,026,661 | |

CVS Health Corp. | | | 25,243 | | | | 1,830,117 | |

Kroger Co. | | | 22,168 | | | | 608,512 | |

Sysco Corp. | | | 11,946 | | | | 725,480 | |

Wal-Mart Stores, Inc. | | | 36,473 | | | | 3,601,709 | |

Walgreens Boots Alliance, Inc. | | | 21,636 | | | | 1,571,206 | |

| | | | | | | | |

| | | | | | | 10,363,685 | |

|

Food Products 1.2% | |

Archer-Daniels-Midland Co. | | | 13,940 | | | | 558,715 | |

Campbell Soup Co. | | | 4,797 | | | | 230,784 | |

Conagra Brands, Inc. | | | 10,188 | | | | 383,782 | |

General Mills, Inc. | | | 14,168 | | | | 840,021 | |

Hormel Foods Corp. | | | 6,655 | | | | 242,175 | |

Kellogg Co. | | | 6,202 | | | | 421,612 | |

Kraft Heinz Co. | | | 14,881 | | | | 1,157,147 | |

McCormick & Co., Inc. | | | 2,968 | | | | 302,469 | |

Mondelez International, Inc. “A” | | | 37,244 | | | | 1,594,043 | |

The Hershey Co. | | | 3,518 | | | | 399,328 | |

The JM Smucker Co. | | | 2,839 | | | | 352,717 | |

Tyson Foods, Inc. “A” | | | 7,418 | | | | 601,377 | |

| | | | | | | | |

| | | | | | | 7,084,170 | |

|

Household Products 1.6% | |

Church & Dwight Co., Inc. | | | 6,232 | | | | 312,659 | |

Clorox Co. | | | 3,213 | | | | 477,902 | |

Colgate-Palmolive Co. | | | 21,880 | | | | 1,650,846 | |

Kimberly-Clark Corp. | | | 8,766 | | | | 1,057,705 | |

Procter & Gamble Co. | | | 63,492 | | | | 5,833,645 | |

| | | | | | | | |

| | | | | | | 9,332,757 | |

|

Personal Products 0.2% | |

Coty, Inc. “A” | | | 11,799 | | | | 234,682 | |

Estee Lauder Companies, Inc. “A” | | | 5,577 | | | | 709,618 | |

| | | | | | | | |

| | | | | | | 944,300 | |

|

Tobacco 1.3% | |

Altria Group, Inc. | | | 47,550 | | | | 3,395,546 | |

Philip Morris International, Inc. | | | 38,702 | | | | 4,088,866 | |

| | | | | | | | |

| | | | | | | 7,484,412 | |

|

| Energy 5.9% | |

Energy Equipment & Services 0.8% | |

Baker Hughes a GE Co. | | | 10,634 | | | | 336,460 | |

Halliburton Co. | | | 21,762 | | | | 1,063,509 | |

Helmerich & Payne, Inc. (a) | | | 2,671 | | | | 172,653 | |

National Oilwell Varco, Inc. | | | 9,483 | | | | 341,578 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Schlumberger Ltd. | | | 34,528 | | | | 2,326,842 | |

TechnipFMC PLC | | | 10,930 | | | | 342,218 | |

| | | | | | | | |

| | | | | | | 4,583,260 | |

|

Oil, Gas & Consumable Fuels 5.1% | |

Anadarko Petroleum Corp. | | | 13,639 | | | | 731,596 | |

Andeavor | | | 3,578 | | | | 409,109 | |

Apache Corp. | | | 9,497 | | | | 400,963 | |

Cabot Oil & Gas Corp. | | | 11,528 | | | | 329,701 | |

Chesapeake Energy Corp.* | | | 22,687 | | | | 89,841 | |

Chevron Corp. | | | 47,331 | | | | 5,925,368 | |

Cimarex Energy Co. | | | 2,377 | | | | 290,018 | |

Concho Resources, Inc.* | | | 3,691 | | | | 554,462 | |

ConocoPhillips | | | 29,796 | | | | 1,635,502 | |

Devon Energy Corp. | | | 13,134 | | | | 543,748 | |

EOG Resources, Inc. | | | 14,414 | | | | 1,555,415 | |

EQT Corp. | | | 6,091 | | | | 346,700 | |

Exxon Mobil Corp. | | | 105,588 | | | | 8,831,380 | |

Hess Corp. | | | 6,739 | | | | 319,900 | |

Kinder Morgan, Inc. | | | 47,869 | | | | 864,993 | |

Marathon Oil Corp. | | | 21,180 | | | | 358,577 | |

Marathon Petroleum Corp. | | | 12,174 | | | | 803,241 | |

Newfield Exploration Co.* | | | 4,910 | | | | 154,812 | |

Noble Energy, Inc. | | | 12,180 | | | | 354,925 | |

Occidental Petroleum Corp. | | | 19,073 | | | | 1,404,917 | |

ONEOK, Inc. | | | 9,559 | | | | 510,929 | |

Phillips 66 | | | 10,709 | | | | 1,083,215 | |

Pioneer Natural Resources Co. | | | 4,241 | | | | 733,057 | |

Range Resources Corp. | | | 5,415 | | | | 92,380 | |

Valero Energy Corp. | | | 10,906 | | | | 1,002,370 | |

Williams Companies, Inc. | | | 20,609 | | | | 628,368 | |

| | | | | | | | |

| | | | | | | 29,955,487 | |

|

| Financials 14.4% | |

Banks 6.4% | |

Bank of America Corp. | | | 241,721 | | | | 7,135,604 | |

BB&T Corp. | | | 19,661 | | | | 977,545 | |

Citigroup, Inc. | | | 65,884 | | | | 4,902,428 | |

Citizens Financial Group, Inc. | | | 12,263 | | | | 514,801 | |

Comerica, Inc. | | | 4,336 | | | | 376,408 | |

Fifth Third Bancorp. | | | 17,591 | | | | 533,711 | |

Huntington Bancshares, Inc. | | | 26,954 | | | | 392,450 | |

JPMorgan Chase & Co. | | | 86,459 | | | | 9,245,925 | |

KeyCorp | | | 26,807 | | | | 540,697 | |

M&T Bank Corp. | | | 3,738 | | | | 639,161 | |

People’s United Financial, Inc. | | | 8,585 | | | | 160,539 | |

PNC Financial Services Group, Inc. | | | 11,857 | | | | 1,710,847 | |

Regions Financial Corp. | | | 28,915 | | | | 499,651 | |

SunTrust Banks, Inc. | | | 11,862 | | | | 766,167 | |

U.S. Bancorp. | | | 39,286 | | | | 2,104,944 | |

Wells Fargo & Co. | | | 110,434 | | | | 6,700,031 | |

Zions Bancorp. | | | 4,987 | | | | 253,489 | |

| | | | | | | | |

| | | | | | | 37,454,398 | |

|

Capital Markets 3.0% | |

Affiliated Managers Group, Inc. | | | 1,381 | | | | 283,450 | |

Ameriprise Financial, Inc. | | | 3,686 | | | | 624,667 | |

Bank of New York Mellon Corp. | | | 25,513 | | | | 1,374,130 | |

BlackRock, Inc. | | | 3,076 | | | | 1,580,172 | |

Cboe Global Markets, Inc. | | | 2,822 | | | | 351,593 | |

Charles Schwab Corp. | | | 29,728 | | | | 1,527,127 | |

CME Group, Inc. | | | 8,478 | | | | 1,238,212 | |

E*TRADE Financial Corp.* | | | 6,744 | | | | 334,300 | |

Franklin Resources, Inc. | | | 8,142 | | | | 352,793 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 8 | | | | | | Deutsche Equity 500 Index VIP |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Intercontinental Exchange, Inc. | | | 14,576 | | | | 1,028,483 | |

Invesco Ltd. | | | 10,144 | | | | 370,662 | |

Moody’s Corp. | | | 4,142 | | | | 611,401 | |

Morgan Stanley | | | 34,688 | | | | 1,820,079 | |

Nasdaq, Inc. | | | 2,898 | | | | 222,653 | |

Northern Trust Corp. | | | 5,405 | | | | 539,906 | |

Raymond James Financial, Inc. | | | 3,202 | | | | 285,939 | |

S&P Global, Inc. | | | 6,353 | | | | 1,076,198 | |

State Street Corp. | | | 9,240 | | | | 901,916 | |

T. Rowe Price Group, Inc. | | | 6,037 | | | | 633,462 | |

The Goldman Sachs Group, Inc. | | | 8,741 | | | | 2,226,857 | |

| | | | | | | | |

| | | | | | | 17,384,000 | |

|

Consumer Finance 0.8% | |

American Express Co. | | | 17,953 | | | | 1,782,912 | |

Capital One Financial Corp. | | | 12,082 | | | | 1,203,126 | |

Discover Financial Services | | | 9,059 | | | | 696,818 | |

Navient Corp. | | | 6,472 | | | | 86,207 | |

Synchrony Financial | | | 18,335 | | | | 707,914 | |

| | | | | | | | |

| | | | | | | 4,476,977 | |

|

Diversified Financial Services 1.6% | |

Berkshire Hathaway, Inc. “B”* | | | 47,947 | | | | 9,504,055 | |

Leucadia National Corp. | | | 7,817 | | | | 207,072 | |

| | | | | | | | |

| | | | | | | 9,711,127 | |

|

Insurance 2.6% | |

Aflac, Inc. | | | 9,793 | | | | 859,630 | |

Allstate Corp. | | | 8,939 | | | | 936,003 | |

American International Group, Inc. | | | 22,395 | | | | 1,334,294 | |

Aon PLC | | | 6,226 | | | | 834,284 | |

Arthur J. Gallagher & Co. | | | 4,506 | | | | 285,140 | |

Assurant, Inc. | | | 1,341 | | | | 135,226 | |

Brighthouse Financial, Inc.* | | | 2,399 | | | | 140,677 | |

Chubb Ltd. | | | 11,565 | | | | 1,689,993 | |

Cincinnati Financial Corp. | | | 3,696 | | | | 277,089 | |

Everest Re Group Ltd. | | | 1,023 | | | | 226,349 | |

Hartford Financial Services Group, Inc. | | | 8,923 | | | | 502,186 | |

Lincoln National Corp. | | | 5,461 | | | | 419,787 | |

Loews Corp. | | | 6,868 | | | | 343,606 | |

Marsh & McLennan Companies, Inc. | | | 12,714 | | | | 1,034,793 | |

MetLife, Inc. | | | 26,219 | | | | 1,325,633 | |

Principal Financial Group, Inc. | | | 6,690 | | | | 472,046 | |

Progressive Corp. | | | 14,488 | | | | 815,964 | |

Prudential Financial, Inc. | | | 10,564 | | | | 1,214,649 | |

The Travelers Companies, Inc. | | | 6,818 | | | | 924,794 | |

Torchmark Corp. | | | 2,677 | | | | 242,831 | |

Unum Group | | | 5,605 | | | | 307,658 | |

Willis Towers Watson PLC | | | 3,304 | | | | 497,880 | |

XL Group Ltd. | | | 6,382 | | | | 224,391 | |

| | | | | | | | |

| | | | | | | 15,044,903 | |

|

| Health Care 13.5% | |

Biotechnology 2.7% | |

AbbVie, Inc. | | | 39,720 | | | | 3,841,321 | |

Alexion Pharmaceuticals, Inc.* | | | 5,566 | | | | 665,638 | |

Amgen, Inc. | | | 18,086 | | | | 3,145,155 | |

Biogen, Inc.* | | | 5,268 | | | | 1,678,227 | |

Celgene Corp.* | | | 19,617 | | | | 2,047,230 | |

Gilead Sciences, Inc. | | | 32,548 | | | | 2,331,739 | |

Incyte Corp.* | | | 4,364 | | | | 413,315 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Regeneron Pharmaceuticals, Inc.* | | | 1,919 | | | | 721,467 | |

Vertex Pharmaceuticals, Inc.* | | | 6,301 | | | | 944,268 | |

| | | | | | | | |

| | | | | | | 15,788,360 | |

|

Health Care Equipment & Supplies 2.7% | |

Abbott Laboratories | | | 43,370 | | | | 2,475,126 | |

Align Technology, Inc.* | | | 1,798 | | | | 399,498 | |

Baxter International, Inc. | | | 12,488 | | | | 807,224 | |

Becton, Dickinson & Co. | | | 6,608 | | | | 1,414,525 | |

Boston Scientific Corp.* | | | 34,214 | | | | 848,165 | |

Danaher Corp. | | | 15,252 | | | | 1,415,691 | |

DENTSPLY SIRONA, Inc. | | | 5,721 | | | | 376,613 | |

Edwards Lifesciences Corp.* | | | 5,273 | | | | 594,320 | |

Hologic, Inc.* | | | 6,933 | | | | 296,386 | |

IDEXX Laboratories, Inc.* | | | 2,187 | | | | 342,003 | |

Intuitive Surgical, Inc.* | | | 2,792 | | | | 1,018,912 | |

Medtronic PLC | | | 33,728 | | | | 2,723,536 | |

ResMed, Inc. | | | 3,533 | | | | 299,210 | |

Stryker Corp. | | | 8,019 | | | | 1,241,662 | |

The Cooper Companies, Inc. | | | 1,216 | | | | 264,942 | |

Varian Medical Systems, Inc.* | | | 2,284 | | | | 253,867 | |

Zimmer Biomet Holdings, Inc. | | | 5,045 | | | | 608,780 | |

| | | | | | | | |

| | | | | | | 15,380,460 | |

|

Health Care Providers & Services 2.7% | |

Aetna, Inc. | | | 8,127 | | | | 1,466,030 | |

AmerisourceBergen Corp. | | | 4,016 | | | | 368,749 | |

Anthem, Inc. | | | 6,399 | | | | 1,439,839 | |

Cardinal Health, Inc. | | | 7,842 | | | | 480,479 | |

Centene Corp.* | | | 4,299 | | | | 433,683 | |

Cigna Corp. | | | 6,145 | | | | 1,247,988 | |

DaVita, Inc.* | | | 3,774 | | | | 272,672 | |

Envision Healthcare Corp.* | | | 3,013 | | | | 104,129 | |

Express Scripts Holding Co.* | | | 14,116 | | | | 1,053,618 | |

HCA Healthcare, Inc.* | | | 7,062 | | | | 620,326 | |

Henry Schein, Inc.* | | | 3,903 | | | | 272,742 | |

Humana, Inc. | | | 3,561 | | | | 883,377 | |

Laboratory Corp. of America Holdings* | | | 2,539 | | | | 404,996 | |

McKesson Corp. | | | 5,196 | | | | 810,316 | |

Patterson Companies, Inc. | | | 2,041 | | | | 73,741 | |

Quest Diagnostics, Inc. | | | 3,400 | | | | 334,866 | |

UnitedHealth Group, Inc. | | | 24,149 | | | | 5,323,889 | |

Universal Health Services, Inc. “B” | | | 2,165 | | | | 245,403 | |

| | | | | | | | |

| | | | | | | 15,836,843 | |

|

Health Care Technology 0.1% | |

Cerner Corp.* | | | 7,853 | | | | 529,213 | |

|

Life Sciences Tools & Services 0.8% | |

Agilent Technologies, Inc. | | | 7,987 | | | | 534,890 | |

Illumina, Inc.* | | | 3,638 | | | | 794,867 | |

IQVIA Holdings, Inc.* | | | 3,627 | | | | 355,083 | |

Mettler-Toledo International, Inc.* | | | 639 | | | | 395,873 | |

PerkinElmer, Inc. | | | 2,773 | | | | 202,762 | |

Thermo Fisher Scientific, Inc. | | | 9,991 | | | | 1,897,091 | |

Waters Corp.* | | | 1,981 | | | | 382,709 | |

| | | | | | | | |

| | | | | | | 4,563,275 | |

|

Pharmaceuticals 4.5% | |

Allergan PLC | | | 8,286 | | | | 1,355,424 | |

Bristol-Myers Squibb Co. | | | 40,779 | | | | 2,498,937 | |

Eli Lilly & Co. | | | 24,137 | | | | 2,038,611 | |

Johnson & Johnson | | | 66,939 | | | | 9,352,717 | |

Merck & Co., Inc. | | | 68,149 | | | | 3,834,744 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 9 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Mylan NV* | | | 13,407 | | | | 567,250 | |

Perrigo Co. PLC | | | 3,289 | | | | 286,669 | |

Pfizer, Inc. | | | 148,509 | | | | 5,378,996 | |

Zoetis, Inc. | | | 12,138 | | | | 874,422 | |

| | | | | | | | |

| | | | | | | 26,187,770 | |

|

| Industrials 10.0% | |

Aerospace & Defense 2.6% | |

Arconic, Inc. | | | 10,640 | | | | 289,940 | |

Boeing Co. | | | 13,950 | | | | 4,113,994 | |

General Dynamics Corp. | | | 6,918 | | | | 1,407,467 | |

Harris Corp. | | | 2,970 | | | | 420,700 | |

L3 Technologies, Inc. | | | 1,947 | | | | 385,214 | |

Lockheed Martin Corp. | | | 6,214 | | | | 1,995,005 | |

Northrop Grumman Corp. | | | 4,336 | | | | 1,330,762 | |

Raytheon Co. | | | 7,202 | | | | 1,352,896 | |

Rockwell Collins, Inc. | | | 4,053 | | | | 549,668 | |

Textron, Inc. | | | 6,563 | | | | 371,400 | |

TransDigm Group, Inc. | | | 1,201 | | | | 329,819 | |

United Technologies Corp. | | | 18,505 | | | | 2,360,683 | |

| | | | | | | | |

| | | | | | | 14,907,548 | |

|

Air Freight & Logistics 0.7% | |

C.H. Robinson Worldwide, Inc. | | | 3,488 | | | | 310,746 | |

Expeditors International of Washington, Inc. | | | 4,433 | | | | 286,771 | |

FedEx Corp. | | | 6,147 | | | | 1,533,922 | |

United Parcel Service, Inc. “B” | | | 17,119 | | | | 2,039,729 | |

| | | | | | | | |

| | | | | | | 4,171,168 | |

|

Airlines 0.5% | |

Alaska Air Group, Inc. | | | 3,070 | | | | 225,676 | |

American Airlines Group, Inc. | | | 10,566 | | | | 549,749 | |

Delta Air Lines, Inc. | | | 16,357 | | | | 915,992 | |

Southwest Airlines Co. | | | 13,610 | | | | 890,774 | |

United Continental Holdings, Inc.* | | | 6,279 | | | | 423,205 | |

| | | | | | | | |

| | | | | | | 3,005,396 | |

|

Building Products 0.3% | |

A.O. Smith Corp. | | | 3,637 | | | | 222,875 | |

Allegion PLC | | | 2,373 | | | | 188,796 | |

Fortune Brands Home & Security, Inc. | | | 3,842 | | | | 262,946 | |

Johnson Controls International PLC | | | 23,061 | | | | 878,855 | |

Masco Corp. | | | 7,840 | | | | 344,490 | |

| | | | | | | | |

| | | | | | | 1,897,962 | |

|

Commercial Services & Supplies 0.3% | |

Cintas Corp. | | | 2,145 | | | | 334,255 | |

Republic Services, Inc. | | | 5,661 | | | | 382,740 | |

Stericycle, Inc.* | | | 2,164 | | | | 147,130 | |

Waste Management, Inc. | | | 9,952 | | | | 858,858 | |

| | | | | | | | |

| | | | | | | 1,722,983 | |

|

Construction & Engineering 0.1% | |

Fluor Corp. | | | 3,501 | | | | 180,827 | |

Jacobs Engineering Group, Inc. | | | 3,049 | | | | 201,112 | |

Quanta Services, Inc.* | | | 3,766 | | | | 147,288 | |

| | | | | | | | |

| | | | | | | 529,227 | |

|

Electrical Equipment 0.5% | |

Acuity Brands, Inc. | | | 1,057 | | | | 186,032 | |

AMETEK, Inc. | | | 5,755 | | | | 417,065 | |

Eaton Corp. PLC | | | 10,978 | | | | 867,372 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Emerson Electric Co. | | | 15,990 | | | | 1,114,343 | |

Rockwell Automation, Inc. | | | 3,201 | | | | 628,516 | |

| | | | | | | | |

| | | | | | | 3,213,328 | |

|

Industrial Conglomerates 1.9% | |

3M Co. | | | 14,870 | | | | 3,499,952 | |

General Electric Co. | | | 216,095 | | | | 3,770,857 | |

Honeywell International, Inc. | | | 18,983 | | | | 2,911,233 | |

Roper Technologies, Inc. | | | 2,551 | | | | 660,709 | |

| | | | | | | | |

| | | | | | | 10,842,751 | |

|

Machinery 1.7% | |

Caterpillar, Inc. | | | 14,824 | | | | 2,335,966 | |

Cummins, Inc. | | | 3,888 | | | | 686,776 | |

Deere & Co. | | | 7,971 | | | | 1,247,541 | |

Dover Corp. | | | 3,867 | | | | 390,528 | |

Flowserve Corp. | | | 3,187 | | | | 134,268 | |

Fortive Corp. | | | 7,614 | | | | 550,873 | |

Illinois Tool Works, Inc. | | | 7,683 | | | | 1,281,909 | |

Ingersoll-Rand PLC | | | 6,256 | | | | 557,973 | |

PACCAR, Inc. | | | 8,762 | | | | 622,803 | |

Parker-Hannifin Corp. | | | 3,320 | | | | 662,606 | |

Pentair PLC | | | 4,116 | | | | 290,672 | |

Snap-on, Inc. | | | 1,422 | | | | 247,855 | |

Stanley Black & Decker, Inc. | | | 3,821 | | | | 648,385 | |

Xylem, Inc. | | | 4,476 | | | | 305,263 | |

| | | | | | | | |

| | | | | | | 9,963,418 | |

|

Professional Services 0.3% | |

Equifax, Inc. | | | 2,993 | | | | 352,935 | |

IHS Markit Ltd.* | | | 9,051 | | | | 408,653 | |

Nielsen Holdings PLC | | | 8,416 | | | | 306,342 | |

Robert Half International, Inc. | | | 3,141 | | | | 174,451 | |

Verisk Analytics, Inc.* | | | 3,860 | | | | 370,560 | |

| | | | | | | | |

| | | | | | | 1,612,941 | |

|

Road & Rail 0.9% | |

CSX Corp. | | | 22,269 | | | | 1,225,018 | |

J.B. Hunt Transport Services, Inc. | | | 2,133 | | | | 245,252 | |

Kansas City Southern | | | 2,584 | | | | 271,889 | |

Norfolk Southern Corp. | | | 7,129 | | | | 1,032,992 | |

Union Pacific Corp. | | | 19,613 | | | | 2,630,103 | |

| | | | | | | | |

| | | | | | | 5,405,254 | |

|

Trading Companies & Distributors 0.2% | |

Fastenal Co. | | | 7,153 | | | | 391,198 | |

United Rentals, Inc.* | | | 2,106 | | | | 362,042 | |

W.W. Grainger, Inc. | | | 1,292 | | | | 305,235 | |

| | | | | | | | |

| | | | | | | 1,058,475 | |

|

| Information Technology 23.2% | |

Communications Equipment 1.0% | |

Cisco Systems, Inc. | | | 123,193 | | | | 4,718,292 | |

F5 Networks, Inc.* | | | 1,551 | | | | 203,522 | |

Juniper Networks, Inc. | | | 9,316 | | | | 265,506 | |

Motorola Solutions, Inc. | | | 4,040 | | | | 364,974 | |

| | | | | | | | |

| | | | | | | 5,552,294 | |

|

Electronic Equipment, Instruments & Components 0.4% | |

Amphenol Corp. “A” | | | 7,607 | | | | 667,895 | |

Corning, Inc. | | | 21,657 | | | | 692,807 | |

FLIR Systems, Inc. | | | 3,446 | | | | 160,653 | |

TE Connectivity Ltd. | | | 8,763 | | | | 832,835 | |

| | | | | | | | |

| | | | | | | 2,354,190 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 10 | | | | | | Deutsche Equity 500 Index VIP |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Internet Software & Services 4.7% | |

Akamai Technologies, Inc.* | | | 4,213 | | | | 274,014 | |

Alphabet, Inc. “A”* | | | 7,427 | | | | 7,823,602 | |

Alphabet, Inc. “C”* | | | 7,522 | | | | 7,871,021 | |

eBay, Inc.* | | | 24,211 | | | | 913,723 | |

Facebook, Inc. “A”* | | | 59,424 | | | | 10,485,959 | |

VeriSign, Inc.* | | | 2,096 | | | | 239,866 | |

| | | | | | | | |

| | | | | | | 27,608,185 | |

|

IT Services 4.0% | |

Accenture PLC “A” | | | 15,400 | | | | 2,357,586 | |

Alliance Data Systems Corp. | | | 1,198 | | | | 303,669 | |

Automatic Data Processing, Inc. | | | 11,052 | | | | 1,295,184 | |

Cognizant Technology Solutions Corp. “A” | | | 14,695 | | | | 1,043,639 | |

CSRA, Inc. | | | 4,031 | | | | 120,608 | |

DXC Technology Co. | | | 7,109 | | | | 674,644 | |

Fidelity National Information Services, Inc. | | | 8,321 | | | | 782,923 | |

Fiserv, Inc.* | | | 5,195 | | | | 681,220 | |

Gartner, Inc.* | | | 2,261 | | | | 278,442 | |

Global Payments, Inc. | | | 3,967 | | | | 397,652 | |

International Business Machines Corp. | | | 21,455 | | | | 3,291,626 | |

Mastercard, Inc. “A” | | | 23,145 | | | | 3,503,227 | |

Paychex, Inc. | | | 7,940 | | | | 540,555 | |

PayPal Holdings, Inc.* | | | 28,154 | | | | 2,072,697 | |

Total System Services, Inc. | | | 4,142 | | | | 327,591 | |

Visa, Inc. “A” | | | 45,190 | | | | 5,152,564 | |

Western Union Co. | | | 11,465 | | | | 217,950 | |

| | | | | | | | |

| | | | | | | 23,041,777 | |

|

Semiconductors & Semiconductor Equipment 3.8% | |

Advanced Micro Devices, Inc.* (a) | | | 20,647 | | | | 212,251 | |

Analog Devices, Inc. | | | 9,180 | | | | 817,295 | |

Applied Materials, Inc. | | | 26,566 | | | | 1,358,054 | |

Broadcom Ltd. | | | 10,130 | | | | 2,602,397 | |

Intel Corp. | | | 116,610 | | | | 5,382,718 | |

KLA-Tencor Corp. | | | 3,902 | | | | 409,983 | |

Lam Research Corp. | | | 4,034 | | | | 742,538 | |

Microchip Technology, Inc. | | | 5,853 | | | | 514,362 | |

Micron Technology, Inc.* | | | 28,735 | | | | 1,181,583 | |

NVIDIA Corp. | | | 15,099 | | | | 2,921,657 | |

Qorvo, Inc.* | | | 3,169 | | | | 211,055 | |

QUALCOMM, Inc. | | | 36,730 | | | | 2,351,455 | |

Skyworks Solutions, Inc. | | | 4,598 | | | | 436,580 | |

Texas Instruments, Inc. | | | 24,548 | | | | 2,563,793 | |

Xilinx, Inc. | | | 6,247 | | | | 421,173 | |

| | | | | | | | |

| | | | | | | 22,126,894 | |

|

Software 5.1% | |

Activision Blizzard, Inc. | | | 18,841 | | | | 1,193,012 | |

Adobe Systems, Inc.* | | | 12,283 | | | | 2,152,473 | |

ANSYS, Inc.* | | | 2,114 | | | | 312,005 | |

Autodesk, Inc.* | | | 5,462 | | | | 572,581 | |

CA, Inc. | | | 7,782 | | | | 258,985 | |

Cadence Design Systems, Inc.* | | | 7,037 | | | | 294,287 | |

Citrix Systems, Inc.* | | | 3,574 | | | | 314,512 | |

Electronic Arts, Inc.* | | | 7,673 | | | | 806,125 | |

Intuit, Inc. | | | 6,051 | | | | 954,727 | |

Microsoft Corp. | | | 192,231 | | | | 16,443,440 | |

Oracle Corp. | | | 75,916 | | | | 3,589,309 | |

Red Hat, Inc.* | | | 4,409 | | | | 529,521 | |

salesforce.com, Inc.* | | | 17,096 | | | | 1,747,724 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Symantec Corp. | | | 15,450 | | | | 433,527 | |

Synopsys, Inc.* | | | 3,763 | | | | 320,758 | |

| | | | | | | | |

| | | | | | | 29,922,986 | |

|

Technology Hardware, Storage & Peripherals 4.2% | |

Apple, Inc. | | | 127,939 | | | | 21,651,117 | |

Hewlett Packard Enterprise Co. | | | 39,757 | | | | 570,911 | |

HP, Inc. | | | 41,633 | | | | 874,709 | |

NetApp, Inc. | | | 6,685 | | | | 369,814 | |

Seagate Technology PLC | | | 7,213 | | | | 301,792 | |

Western Digital Corp. | | | 7,361 | | | | 585,420 | |

Xerox Corp. | | | 5,356 | | | | 156,128 | |

| | | | | | | | |

| | | | | | | 24,509,891 | |

|

| Materials 2.9% | |

Chemicals 2.1% | |

Air Products & Chemicals, Inc. | | | 5,431 | | | | 891,118 | |

Albemarle Corp. | | | 2,756 | | | | 352,465 | |

CF Industries Holdings, Inc. | | | 5,813 | | | | 247,285 | |

DowDuPont, Inc. | | | 58,308 | | | | 4,152,696 | |

Eastman Chemical Co. | | | 3,573 | | | | 331,003 | |

Ecolab, Inc. | | | 6,478 | | | | 869,218 | |

FMC Corp. | | | 3,346 | | | | 316,732 | |

International Flavors & Fragrances, Inc. | | | 1,959 | | | | 298,963 | |

LyondellBasell Industries NV “A” | | | 8,061 | | | | 889,290 | |

Monsanto Co. | | | 10,945 | | | | 1,278,157 | |

PPG Industries, Inc. | | | 6,341 | | | | 740,756 | |

Praxair, Inc. | | | 7,134 | | | | 1,103,487 | |

The Mosaic Co. | | | 8,830 | | | | 226,578 | |

The Sherwin-Williams Co. | | | 2,051 | | | | 840,992 | |

| | | | | | | | |

| | | | | | | 12,538,740 | |

|

Construction Materials 0.1% | |

Martin Marietta Materials, Inc. | | | 1,566 | | | | 346,149 | |

Vulcan Materials Co. | | | 3,284 | | | | 421,567 | |

| | | | | | | | |

| | | | | | | 767,716 | |

|

Containers & Packaging 0.4% | |

Avery Dennison Corp. | | | 2,207 | | | | 253,496 | |

Ball Corp. | | | 8,737 | | | | 330,695 | |

International Paper Co. | | | 10,293 | | | | 596,376 | |

Packaging Corp. of America | | | 2,330 | | | | 280,882 | |

Sealed Air Corp. | | | 4,507 | | | | 222,195 | |

WestRock Co. | | | 6,337 | | | | 400,562 | |

| | | | | | | | |

| | | | | | | 2,084,206 | |

|

Metals & Mining 0.3% | |

Freeport-McMoRan, Inc.* | | | 33,513 | | | | 635,406 | |

Newmont Mining Corp. | | | 13,354 | | | | 501,042 | |

Nucor Corp. | | | 7,958 | | | | 505,970 | |

| | | | | | | | |

| | | | | | | 1,642,418 | |

|

| Real Estate 2.8% | |

Equity Real Estate Investment Trusts (REITs) 2.7% | |

Alexandria Real Estate Equities, Inc. | | | 2,386 | | | | 311,588 | |

American Tower Corp. | | | 10,687 | | | | 1,524,714 | |

Apartment Investment & Management Co. “A” | | | 3,882 | | | | 169,682 | |

AvalonBay Communities, Inc. | | | 3,441 | | | | 613,909 | |

Boston Properties, Inc. | | | 3,861 | | | | 502,046 | |

Crown Castle International Corp. | | | 10,123 | | | | 1,123,754 | |

Digital Realty Trust, Inc. | | | 5,107 | | | | 581,687 | |

Duke Realty Corp. | | | 8,888 | | | | 241,842 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 11 |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Equinix, Inc. | | | 1,949 | | | | 883,326 | |

Equity Residential | | | 9,158 | | | | 584,006 | |

Essex Property Trust, Inc. | | | 1,643 | | | | 396,571 | |

Extra Space Storage, Inc. | | | 3,140 | | | | 274,593 | |

Federal Realty Investment Trust | | | 1,800 | | | | 239,058 | |

GGP, Inc. | | | 15,545 | | | | 363,598 | |

HCP, Inc. | | | 11,738 | | | | 306,127 | |

Host Hotels & Resorts, Inc. | | | 18,446 | | | | 366,153 | |

Iron Mountain, Inc. | | | 6,974 | | | | 263,129 | |

Kimco Realty Corp. | | | 10,684 | | | | 193,915 | |

Mid-America Apartment Communities, Inc. | | | 2,833 | | | | 284,886 | |

Prologis, Inc. | | | 13,261 | | | | 855,467 | |

Public Storage | | | 3,730 | | | | 779,570 | |

Realty Income Corp. | | | 7,024 | | | | 400,509 | |

Regency Centers Corp. | | | 3,678 | | | | 254,444 | |

SBA Communications Corp. * | | | 2,929 | | | | 478,481 | |

Simon Property Group, Inc. | | | 7,746 | | | | 1,330,298 | |

SL Green Realty Corp. | | | 2,437 | | | | 245,966 | |

The Macerich Co. | | | 2,726 | | | | 179,044 | |

UDR, Inc. | | | 6,679 | | | | 257,275 | |

Ventas, Inc. | | | 8,876 | | | | 532,649 | |

Vornado Realty Trust | | | 4,290 | | | | 335,392 | |

Welltower, Inc. | | | 9,214 | | | | 587,577 | |

Weyerhaeuser Co. | | | 18,810 | | | | 663,241 | |

| | | | | | | | |

| | | | | | | 16,124,497 | |

|

Real Estate Management & Development 0.1% | |

CBRE Group, Inc. “A”* | | | 7,536 | | | | 326,384 | |

|

| Telecommunication Services 2.0% | |

Diversified Telecommunication Services | |

AT&T, Inc. | | | 152,984 | | | | 5,948,018 | |

CenturyLink, Inc. | | | 24,360 | | | | 406,325 | |

Verizon Communications, Inc. | | | 101,639 | | | | 5,379,752 | |

| | | | | | | | |

| | | | | | | 11,734,095 | |

|

| Utilities 2.9% | |

Electric Utilities 1.7% | |

Alliant Energy Corp. | | | 5,795 | | | | 246,925 | |

American Electric Power Co., Inc. | | | 12,258 | | | | 901,821 | |

Duke Energy Corp. | | | 17,440 | | | | 1,466,879 | |

Edison International | | | 8,116 | | | | 513,256 | |

Entergy Corp. | | | 4,492 | | | | 365,604 | |

Eversource Energy | | | 7,879 | | | | 497,795 | |

Exelon Corp. | | | 23,926 | | | | 942,924 | |

FirstEnergy Corp. | | | 11,079 | | | | 339,239 | |

NextEra Energy, Inc. | | | 11,722 | | | | 1,830,859 | |

PG&E Corp. | | | 12,783 | | | | 573,062 | |

Pinnacle West Capital Corp. | | | 2,785 | | | | 237,226 | |

PPL Corp. | | | 17,032 | | | | 527,140 | |

Southern Co. | | | 25,009 | | | | 1,202,683 | |

Xcel Energy, Inc. | | | 12,657 | | | | 608,928 | |

| | | | | | | | |

| | | | | | | 10,254,341 | |

|

Independent Power & Renewable Electricity Producers 0.1% | |

AES Corp. | | | 16,425 | | | | 177,883 | |

NRG Energy, Inc. | | | 7,441 | | | | 211,920 | |

| | | | | | | | |

| | | | | | | 389,803 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

Multi-Utilities 1.0% | |

Ameren Corp. | | | 6,051 | | | | 356,948 | |

CenterPoint Energy, Inc. | | | 10,785 | | | | 305,863 | |

CMS Energy Corp. | | | 7,060 | | | | 333,938 | |

Consolidated Edison, Inc. | | | 7,730 | | | | 656,663 | |

Dominion Energy, Inc. | | | 16,037 | | | | 1,299,959 | |

DTE Energy Co. | | | 4,456 | | | | 487,754 | |

NiSource, Inc. | | | 8,389 | | | | 215,346 | |

Public Service Enterprise Group, Inc. | | | 12,611 | | | | 649,466 | |

SCANA Corp. | | | 3,533 | | | | 140,543 | |

Sempra Energy | | | 6,258 | | | | 669,105 | |

WEC Energy Group, Inc. | | | 7,850 | | | | 521,476 | |

| | | | | | | | |

| | | | | | | 5,637,061 | |

|

Water Utilities 0.1% | |

American Water Works Co., Inc. | | | 4,435 | | | | 405,758 | |

Total Common Stocks

(Cost $278,366,355) | | | | | | | 568,260,273 | |

| | |

| | | Principal

Amount ($) | | | Value ($) | |

| Government & Agency Obligation 0.1% | |

| U.S. Treasury Obligation | |

U.S. Treasury Bill, 1.07%**, 2/1/2018 (b) (Cost $584,461) | | | 585,000 | | | | 584,383 | |

| | |

| | | Shares | | | Value ($) | |

| Securities Lending Collateral 0.1% | |

Deutsche Government & Agency Securities Portfolio “Deutsche Government Cash Institutional Shares”, 1.21% (c) (d) (Cost $870,253) | | | 870,253 | | | | 870,253 | |

|

| Cash Equivalents 1.0% | |

Deutsche Central Cash Management Government Fund, 1.30% (c) (Cost $5,621,694) | | | 5,621,694 | | | | 5,621,694 | |

| | |

| | | % of Net

Assets | | | Value ($) | |

Total Investment Portfolio

(Cost $285,442,763) | | | 98.7 | | | | 575,336,603 | |

| Other Assets and Liabilities, Net | | | 1.3 | | | | 7,745,805 | |

| Net Assets | | | 100.0 | | | | 583,082,408 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 12 | | | | | | Deutsche Equity 500 Index VIP |

| * | Non-income producing security. |

| ** | Annualized yield at time of purchase; not a coupon rate. |

| (a) | All or a portion of these securities were on loan. In addition, “Other Assets and Liabilities, Net” may include pending sales that are also on loan. The value of securities loaned at December 31, 2017 amounted to $826,429, which is 0.1% of net assets. |

| (b) | At December 31, 2017, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts. |

| (c) | Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end. |

| (d) | Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

S&P: Standard & Poor’s

At December 31, 2017, open futures contracts purchased were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Futures | | Currency | | | Expiration Date | | | Contracts | | | Notional Amount ($) | | | Notional Value ($) | | | Unrealized Appreciation ($) | |

| S&P 500 E-Mini Index | | | USD | | | | 3/16/2018 | | | | 50 | | | | 6,609,683 | | | | 6,690,000 | | | | 80,317 | |

Currency Abbreviation

For information on the Fund’s policy and additional disclosures regarding futures contracts, please refer to the Derivatives section of Note A in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2017 in valuing the Fund’s investments.

| | | | | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks (e) | | $ | 568,260,273 | | | $ | — | | | $ | — | | | $ | 568,260,273 | |

| Government & Agency Obligation (e) | | | — | | | | 584,383 | | | | — | | | | 584,383 | |

| Short-Term Investments (e) | | | 6,491,947 | | | | — | | | | — | | | | 6,491,947 | |

| Derivatives (f) | | | | | | | | | | | | | | | | |

Futures Contracts | | | 80,317 | | | | — | | | | — | | | | 80,317 | |

| Total | | $ | 574,832,537 | | | $ | 584,383 | | | $ | — | | | $ | 575,416,920 | |

There have been no transfers between fair value measurement levels during the year ended December 31, 2017.

| (e) | See Investment Portfolio for additional detailed categorizations. |

| (f) | Derivatives include unrealized appreciation (depreciation) on open futures contracts. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 13 |

Statement of Assets and Liabilities

| | | | |

| as of December 31, 2017 | | | | |

| |

| Assets | | | | |

| Investments in non-affiliated securities, at value (cost $278,950,816) — including $826,429 of securities loaned | | $ | 568,844,656 | |

| Investment in Deutsche Government & Agency Securities Portfolio (cost $870,253)* | | | 870,253 | |

| Investment in Deutsche Central Cash Management Government Fund (cost $5,621,694) | | | 5,621,694 | |

| Cash | | | 4,780 | |

| Receivable for investments sold | | | 7,960,915 | |

| Receivable for Fund shares sold | | | 547,179 | |

| Dividends receivable | | | 582,877 | |

| Interest receivable | | | 7,769 | |

| Other assets | | | 10,418 | |

| Total assets | | | 584,450,541 | |

| |

| Liabilities | | | | |

| Payable upon return of securities loaned | | | 870,253 | |

| Payable for Fund shares redeemed | | | 178,637 | |

| Payable for variation margin on futures contracts | | | 24,302 | |

| Accrued management fee | | | 94,524 | |

| Accrued Trustees’ fees | | | 7,471 | |

| Other accrued expenses and payables | | | 192,946 | |

| Total liabilities | | | 1,368,133 | |

| Net assets, at value | | $ | 583,082,408 | |

| |

| Net Assets Consist of | | | | |

| Undistributed net investment income | | | 9,463,423 | |

| Net unrealized appreciation (depreciation) on: | | | | |

Investments | | | 289,893,840 | |

Futures | | | 80,317 | |

| Accumulated net realized gain (loss) | | | 40,874,429 | |

| Paid-in capital | | | 242,770,399 | |

| Net assets, at value | | $ | 583,082,408 | |

Net Asset Value | | | | |

Class A | | | | |

| Net Asset Value, offering and redemption price per share ($540,610,325 ÷ 24,366,996 outstanding shares of beneficial interest, $.001 par value, unlimited number of shares authorized) | | $ | 22.19 | |

Class B | | | | |

| Net Asset Value, offering and redemption price per share ($25,244,880 ÷ 1,138,481 outstanding shares of beneficial interest, $.001 par value, unlimited number of shares authorized) | | $ | 22.17 | |

Class B2 | | | | |

| Net Asset Value, offering and redemption price per share ($17,227,203 ÷ 776,819 outstanding shares of beneficial interest, $.001 par value, unlimited number of shares authorized) | | $ | 22.18 | |

| * | Represents collateral on securities loaned. |

Statement of Operations

| | | | |

| for the year ended December 31, 2017 | | | | |

| |

| Investment Income | | | | |

| Income: | | | | |

| Dividends | | $ | 11,395,495 | |

| Interest | | | 4,814 | |

| Income distributions — Deutsche Central Cash Management Government Fund | | | 50,604 | |

| Securities lending income, net of borrower rebates | | | 12,164 | |

| Other income | | | 53,939 | |

| Total income | | | 11,517,016 | |

| Expenses: | | | | |

| Management fee | | | 1,155,097 | |

| Administration fee | | | 577,549 | |

| Services to shareholders | | | 3,453 | |

| Record keeping fee (Class B and Class B-2) | | | 50,008 | |

| Distribution service fees (Class B and Class B-2) | | | 94,521 | |

| Custodian fee | | | 16,858 | |

| Professional fees | | | 87,104 | |

| Reports to shareholders | | | 38,432 | |

| Trustees’ fees and expenses | | | 31,013 | |

| Other | | | 44,127 | |

| Total expenses before expense reductions | | | 2,098,162 | |

| Expense reductions | | | (85,152 | ) |

| Total expenses after expense reductions | | | 2,013,010 | |

| Net investment income (loss) | | | 9,504,006 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | 49,946,820 | |

| Futures | | | 1,343,561 | |

| | | | 51,290,381 | |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 50,986,271 | |

| Futures | | | 100,717 | |

| | | | 51,086,988 | |

| Net gain (loss) | | | 102,377,369 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 111,881,375 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 14 | | | | | | Deutsche Equity 500 Index VIP |

| | |

| Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | Years Ended December 31, | |

Increase (Decrease) in Net

Assets | | 2017 | | | 2016 | |

| Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 9,504,006 | | | $ | 9,929,415 | |

| Net realized gain (loss) | | | 51,290,381 | | | | 30,550,655 | |

| Change in net unrealized appreciation (depreciation) | | | 51,086,988 | | | | 17,492,004 | |

| Net increase (decrease) in net assets resulting from operations | | | 111,881,375 | | | | 57,972,074 | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income: | | | | | | | | |

Class A | | | (9,614,078 | ) | | | (10,160,013 | ) |

Class B | | | (291,291 | ) | | | (239,707 | ) |

Class B2 | | | (232,694 | ) | | | (284,387 | ) |

| Net realized gains: | | | | | | | | |

Class A | | | (27,007,783 | ) | | | (37,893,356 | ) |

Class B | | | (972,179 | ) | | | (1,020,192 | ) |

Class B2 | | | (832,427 | ) | | | (1,283,529 | ) |

| Total distributions | | | (38,950,452 | ) | | | (50,881,184 | ) |

| Fund share transactions: | | | | | | | | |

Class A | | | | | | | | |

| Proceeds from shares sold | | | 14,878,880 | | | | 19,113,656 | |

| Reinvestment of distributions | | | 36,621,861 | | | | 48,053,369 | |

| Cost of shares redeemed | | | (98,129,716 | ) | | | (84,799,336 | ) |

| Net increase (decrease) in net assets from Class A share transactions | | | (46,628,975 | ) | | | (17,632,311 | ) |

Class B | | | | | | | | |

| Proceeds from shares sold | | | 7,279,737 | | | | 6,018,267 | |

| Reinvestment of distributions | | | 1,263,470 | | | | 1,259,899 | |

| Cost of shares redeemed | | | (4,494,346 | ) | | | (1,576,659 | ) |

| Net increase (decrease) in net assets from Class B share transactions | | | 4,048,861 | | | | 5,701,507 | |

Class B2 | | | | | | | | |

| Proceeds from shares sold | | | 375,574 | | | | 343,915 | |

| Reinvestment of distributions | | | 1,065,121 | | | | 1,567,916 | |

| Cost of shares redeemed | | | (2,854,784 | ) | | | (2,587,120 | ) |

| Net increase (decrease) in net assets from Class C share transaction | | | (1,414,089 | ) | | | (675,289 | ) |

| Increase (decrease) in net assets | | | 28,936,720 | | | | (5,515,203 | ) |

| Net assets at beginning of year | | | 554,145,688 | | | | 559,660,891 | |

| Net assets at end of year (including undistributed net investment income of $9,463,423 and $9,879,009, respectively) | | $ | 583,082,408 | | | $ | 554,145,688 | |

| | | | | | | | |

| | | Years Ended December 31, | |

Other Information | | 2017 | | | 2016 | |

Class A | | | | | | | | |

| Shares outstanding at beginning of period | | | 26,513,791 | | | | 27,337,468 | |

| Shares sold | | | 724,657 | | | | 1,015,516 | |

| Shares issued to shareholders in reinvestment of distributions | | | 1,870,371 | | | | 2,660,762 | |

| Shares redeemed | | | (4,741,823 | ) | | | (4,499,955 | ) |

| Net increase (decrease) in Class A shares | | | (2,146,795 | ) | | | (823,677 | ) |

| Shares outstanding at end of period | | | 24,366,996 | | | | 26,513,791 | |

Class B | | | | | | | | |

| Shares outstanding at beginning of period | | | 940,533 | | | | 634,704 | |

| Shares sold | | | 355,052 | | | | 320,148 | |

| Shares issued to shareholders in reinvestment of distributions | | | 64,397 | | | | 69,646 | |

| Shares redeemed | | | (221,501 | ) | | | (83,965 | ) |

| Net increase (decrease) in Class B shares | | | 197,948 | | | | 305,829 | |

| Shares outstanding at end of period | | | 1,138,481 | | | | 940,533 | |

Class B2 | | | | | | | | |

| Shares outstanding at beginning of period | | | 843,125 | | | | 877,722 | |

| Shares sold | | | 18,378 | | | | 18,490 | |

| Shares issued to shareholders in reinvestment of distributions | | | 54,260 | | | | 86,625 | |

| Shares redeemed | | | (138,944 | ) | | | (139,712 | ) |

| Net increase (decrease) in Class C shares | | | (66,306 | ) | | | (34,597 | ) |

| Shares outstanding at end of period | | | 776,819 | | | | 843,125 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 15 |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| Class A | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 19.58 | | | $ | 19.40 | | | $ | 20.41 | | | $ | 19.01 | | | $ | 15.01 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)a | | | .34 | | | | .35 | | | | .35 | | | | .33 | | | | .30 | |

Net realized and unrealized gain (loss) | | | 3.69 | | | | 1.74 | | | | (.10 | ) | | | 2.10 | | | | 4.37 | |

Total from investment operations | | | 4.03 | | | | 2.09 | | | | .25 | | | | 2.43 | | | | 4.67 | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.37 | ) | | | (.40 | ) | | | (.33 | ) | | | (.37 | ) | | | (.31 | ) |

Net realized gains | | | (1.05 | ) | | | (1.51 | ) | | | (.93 | ) | | | (.66 | ) | | | (.36 | ) |

Total distributions | | | (1.42 | ) | | | (1.91 | ) | | | (1.26 | ) | | | (1.03 | ) | | | (.67 | ) |

Net asset value, end of period | | $ | 22.19 | | | $ | 19.58 | | | $ | 19.40 | | | $ | 20.41 | | | $ | 19.01 | |

Total Return (%)b | | | 21.53 | | | | 11.61 | | | | 1.13 | | | | 13.39 | | | | 31.93 | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period ($ millions) | | | 541 | | | | 519 | | | | 530 | | | | 610 | | | | 600 | |

Ratio of expenses before expense reductions (%)d | | | .34 | | | | .34 | | | | .34 | | | | .34 | | | | .34 | |

Ratio of expenses after expense reductions (%)d | | | .33 | | | | .33 | | | | .33 | | | | .33 | | | | .34 | |

Ratio of net investment income (%) | | | 1.67 | | | | 1.88 | | | | 1.77 | | | | 1.70 | | | | 1.76 | |

Portfolio turnover rate (%) | | | 3 | | | | 4 | | | | 3 | | | | 3 | | | | 4 | c |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Excludes portfolio securities delivered as a result of processing redemption in-kind transactions. |

| d | Expense ratio does not reflect charges and fees associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. |

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| Class B | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 19.58 | | | $ | 19.40 | | | $ | 20.40 | | | $ | 19.01 | | | $ | 15.00 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)a | | | .28 | | | | .30 | | | | .30 | | | | .28 | | | | .34 | |

Net realized and unrealized gain (loss) | | | 3.67 | | | | 1.74 | | | | (.09 | ) | | | 2.09 | | | | 4.29 | |

Total from investment operations | | | 3.95 | | | | 2.04 | | | | .21 | | | | 2.37 | | | | 4.63 | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.31 | ) | | | (.35 | ) | | | (.28 | ) | | | (.32 | ) | | | (.26 | ) |

Net realized gains | | | (1.05 | ) | | | (1.51 | ) | | | (.93 | ) | | | (.66 | ) | | | (.36 | ) |

Total distributions | | | (1.36 | ) | | | (1.86 | ) | | | (1.21 | ) | | | (.98 | ) | | | (.62 | ) |

Net asset value, end of period | | $ | 22.17 | | | $ | 19.58 | | | $ | 19.40 | | | $ | 20.40 | | | $ | 19.01 | |

Total Return (%)b | | | 21.07 | | | | 11.32 | | | | .92 | | | | 13.05 | | | | 31.68 | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period ($ millions) | | | 25 | | | | 18 | | | | 12 | | | | 7 | | | | 5 | |

Ratio of expenses before expense reductions (%)d | | | .71 | | | | .69 | | | | .67 | | | | .62 | | | | .59 | |

Ratio of expenses after expense reductions (%)d | | | .65 | | | | .61 | | | | .58 | | | | .58 | | | | .58 | |

Ratio of net investment income (%) | | | 1.35 | | | | 1.61 | | | | 1.53 | | | | 1.45 | | | | 2.11 | |

Portfolio turnover rate (%) | | | 3 | | | | 4 | | | | 3 | | | | 3 | | | | 4 | c |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Excludes portfolio securities delivered as a result of processing redemption in-kind transactions. |

| d | Expense ratio does not reflect charges and fees associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. |

| | | | | | |

| | 16 | | | | | | Deutsche Equity 500 Index VIP |

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| Class B2 | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 19.57 | | | $ | 19.39 | | | $ | 20.40 | | | $ | 18.99 | | | $ | 14.99 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)a | | | .26 | | | | .28 | | | | .28 | | | | .27 | | | | .23 | |

Net realized and unrealized gain (loss) | | | 3.69 | | | | 1.74 | | | | (.10 | ) | | | 2.09 | | | | 4.37 | |

Total from investment operations | | | 3.95 | | | | 2.02 | | | | .18 | | | | 2.36 | | | | 4.60 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (.29 | ) | | | (.33 | ) | | | (.26 | ) | | | (.29 | ) | | | (.24 | ) |

Net realized gains | | | (1.05 | ) | | | (1.51 | ) | | | (.93 | ) | | | (.66 | ) | | | (.36 | ) |

Total distributions | | | (1.34 | ) | | | (1.84 | ) | | �� | (1.19 | ) | | | (.95 | ) | | | (.60 | ) |

| Net asset value, end of period | | $ | 22.18 | | | $ | 19.57 | | | $ | 19.39 | | | $ | 20.40 | | | $ | 18.99 | |

| Total Return (%)b | | | 21.06 | | | | 11.20 | | | | .76 | | | | 13.00 | | | | 31.44 | |

| | | | | |

| Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | | 17 | | | | 17 | | | | 17 | | | | 19 | | | | 20 | |

| Ratio of expenses before expense reductions (%)d | | | .74 | | | | .74 | | | | .74 | | | | .74 | | | | .74 | |

| Ratio of expenses after expense reductions (%)d | | | .72 | | | | .71 | | | | .68 | | | | .68 | | | | .72 | |

| Ratio of net investment income (%) | | | 1.27 | | | | 1.50 | | | | 1.42 | | | | 1.35 | | | | 1.39 | |

| Portfolio turnover rate (%) | | | 3 | | | | 4 | | | | 3 | | | | 3 | | | | 4 | c |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Excludes portfolio securities delivered as a result of processing redemption in-kind transactions. |

| d | Expense ratio does not reflect charges and fees associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. |

| | | | |

| Deutsche Equity 500 Index VIP | | | | | 17 |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Deutsche Investments VIT Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust is organized as a Massachusetts business trust. Deutsche Equity 500 Index VIP (the “Fund”) is a diversified series of the Trust offered to investors. The Fund is an underlying investment vehicle for variable annuity contracts and variable life insurance policies to be offered by the separate accounts of certain life insurance companies (“Participating Insurance Companies”).

Multiple Classes of Shares of Beneficial Interest. The Fund offers three classes of shares to investors: Class A shares, Class B shares and Class B2 shares. Class B and Class B2 shares are subject to Rule 12b-1 distribution fees under the 1940 Act equal to an annual rate of 0.25% of Class B and Class B2 shares average daily net assets. In addition, Class B and Class B2 shares are subject to record keeping fees equal to an annual rate up to 0.15% of average daily net assets. Class A shares are not subject to such fees.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class (including the applicable 12b-1 distribution fees and record keeping fees). Differences in class-level expenses may result in payment of different per share dividends by class. All shares have equal rights with respect to voting subject to class-specific arrangements.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1.

Debt securities are valued at prices supplied by independent pricing services approved by the Fund’s Board. If the pricing services are unable to provide valuations, securities are valued at the most recent bid quotation or evaluated price, as applicable, obtained from one or more broker-dealers. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. These securities are generally categorized as Level 2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.