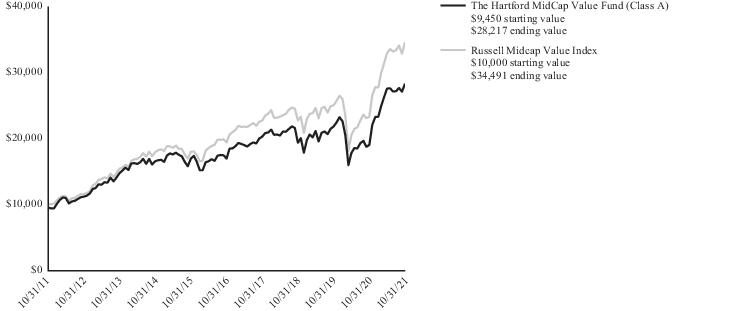

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07589

THE HARTFORD MUTUAL FUNDS, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Hartford Domestic

Equity Funds

Annual Report

October 31, 2021

| ■ The Hartford Capital Appreciation Fund |

| ■ Hartford Core Equity Fund |

| ■ The Hartford Dividend and Growth Fund |

| ■ The Hartford Equity Income Fund |

| ■ The Hartford Growth Opportunities Fund |

| ■ The Hartford Healthcare Fund |

| ■ The Hartford MidCap Fund |

| ■ The Hartford MidCap Value Fund |

| ■ Hartford Quality Value Fund |

| ■ The Hartford Small Cap Growth Fund |

| ■ Hartford Small Cap Value Fund |

| ■ The Hartford Small Company Fund |

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford Mutual Funds. The following is the Funds’ Annual Report covering the period from November 1, 2020 through October 31, 2021.

Market Review

During the 12 months ended October 31, 2021, U.S. stocks, as measured by the S&P 500 Index,1 gained 42.9%, a number that reflects one of the most remarkable market rebounds in recent memory, particularly when measured against the March 2020 sell-off at the start of the coronavirus (COVID-19) pandemic.

That said, the market’s extraordinary performance occurred against a backdrop of uncertain and sometimes contradictory economic signals: inflation fears; global supply-chain bottlenecks; tightened labor markets; political gridlock; a stubbornly persistent pandemic and a U.S. Federal Reserve (Fed) methodically signaling its intention to cut back on the monetary stimulus that helped fuel the recovery.

A year ago, markets had already bounced back from their March 2020 lows, yet the economy still faced considerable turbulence from a fiercely divisive U.S. presidential election and a resurgence of COVID-19 infections. Once the election was settled in November 2020, the emergence of safe and effective vaccines provided a significant lift to equity markets, as did a major $900 billion economic relief package passed by the U.S. Congress in late December 2020.

In March 2021, the U.S. Congress fast-tracked approval of the Biden administration’s $1.9 trillion economic stimulus package. In August 2021, a $1.2 trillion proposal for an infrastructure spending package received U.S. Senate approval. However, by the period’s end, the outcome for the administration’s $1.75 trillion “Build Back Better” proposal, focused on social-safety-net improvements and climate-change mitigation, remained uncertain.

Inflation headlines dominated the spring and summer of 2021. In July 2021, the Fed’s preferred measure of inflation had risen to levels not seen since 1991.2 The supply-chain disruptions spawned in part by the economic recovery helped drive up prices for gasoline, used cars, airfare tickets, durable goods, and a host of other items toward the end of the period. The Fed's previous assurances that inflation would be mostly transitory were being sorely tested.

Throughout the period, the Fed continued to maintain its ongoing policy of near-zero interest rates in support of the recovery. However, in September 2021, Fed Chairman Jerome Powell rattled markets when he announced preparations for having the Fed gradually cut back the $120 billion in bonds it had been purchasing each month since the start of the pandemic. By period’s end, markets had recovered.

As of the end of the period, the economic recovery appears durable. Yet, inflation remains a wildcard and market volatility may persist. Nowadays, it’s more important than ever to maintain a strong relationship with your financial professional.

Thank you again for investing in Hartford Mutual Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. The index is unmanaged and not available for direct investment. Past performance does not guarantee future results. |

| 2 | The Personal Consumption Expenditures Price Index, which excludes food and energy prices, rose 3.6% in July 2021. Source: U.S. Bureau of Economic Analysis and the St. Louis Fed, as of September 2021. |

Hartford Domestic Equity Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s portfolio manager(s) through the end of the period and are subject to change based on market and other conditions, and we disclaim any responsibility to update the views contained herein. These views may contain statements that are “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking�� statements. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in each Fund’s Manager Discussion reflects the returns of such Fund’s Class A shares, before sales charges. Returns for such Fund’s other classes differ only to the extent that the classes do not have the same expenses.

The Hartford Capital Appreciation Fund

Fund Overview

October 31, 2021 (Unaudited)

Inception 07/22/1996

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks growth of capital. |

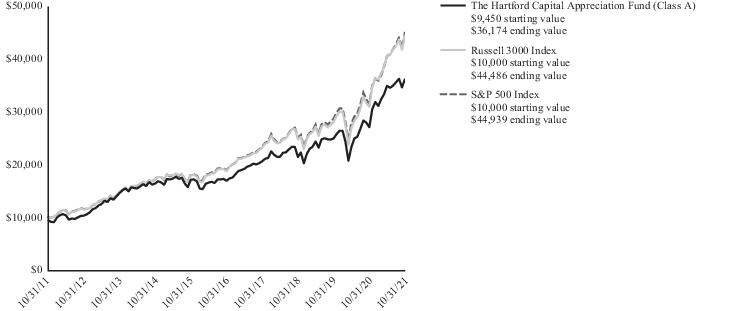

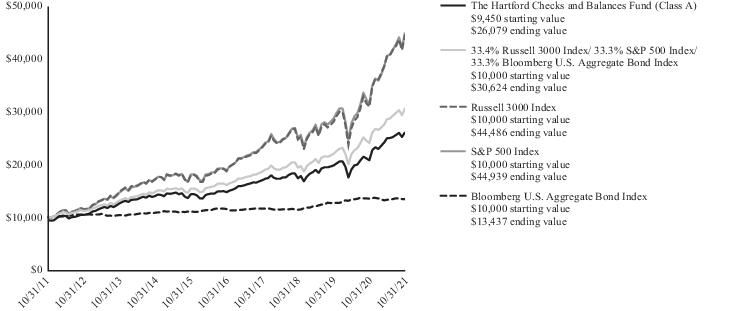

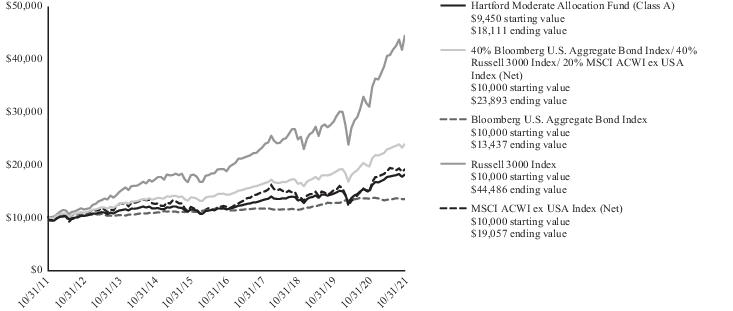

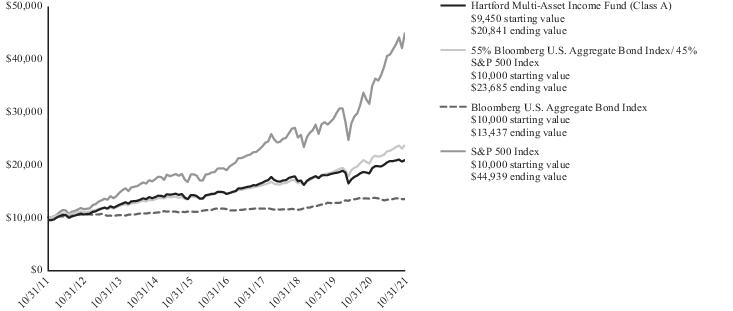

Comparison of Change in Value of $10,000 Investment (10/31/2011 - 10/31/2021)

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

| Average Annual Total Returns |

| for the Periods Ending 10/31/2021 |

| | 1 Year | 5 Years | 10 Years |

| Class A1 | 33.83% | 16.44% | 14.37% |

| Class A2 | 26.47% | 15.13% | 13.72% |

| Class C1 | 32.78% | 15.56% | 13.54% |

| Class C3 | 31.78% | 15.56% | 13.54% |

| Class I1 | 34.18% | 16.76% | 14.71% |

| Class R31 | 33.32% | 16.03% | 14.01% |

| Class R41 | 33.72% | 16.39% | 14.36% |

| Class R51 | 34.13% | 16.74% | 14.70% |

| Class R61 | 34.27% | 16.86% | 14.81% |

| Class Y1 | 34.16% | 16.81% | 14.79% |

| Class F1 | 34.28% | 16.85% | 14.75% |

| Russell 3000 Index | 43.90% | 18.91% | 16.10% |

| S&P 500 Index | 42.91% | 18.93% | 16.21% |

| 1 | Without sales charge |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2021, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain

adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower.

| Operating Expenses* | Gross | Net |

| Class A | 1.07% | 1.07% |

| Class C | 1.84% | 1.84% |

| Class I | 0.78% | 0.78% |

| Class R3 | 1.41% | 1.41% |

| Class R4 | 1.10% | 1.10% |

| Class R5 | 0.80% | 0.80% |

| Class R6 | 0.70% | 0.70% |

| Class Y | 0.80% | 0.80% |

| Class F | 0.70% | 0.70% |

| * | Expenses as shown in the Fund’s most recent prospectus. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2021. |

The Hartford Capital Appreciation Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

Portfolio Managers

Gregg R. Thomas, CFA

Senior Managing Director and Director, Investment Strategy

Wellington Management Company LLP

Thomas S. Simon, CFA, FRM

Senior Managing Director and Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Capital Appreciation Fund returned 33.83%, before sales charges, for the twelve-month period ended October 31, 2021, underperforming the Fund’s benchmarks, the Russell 3000 Index, which returned 43.90% for the same period, and the S&P 500 Index, which returned 42.91% for the same period. For the same period, the Class A shares of the Fund, before sales charges, underperformed the 41.19% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2021. Towards the end of 2020, a sharp escalation in COVID-19 infections across the country and renewed restrictions to curb the spread of the virus were overshadowed by highly encouraging vaccine developments, despite the significant logistical challenges and uncertain timeline for distributing and administering vaccines on a broad scale. In December 2020, the government unveiled a long-awaited fifth stimulus package, worth approximately $900 billion.

Joe Biden was elected president in November 2020 after a closely contested election, removing a key element of uncertainty for the market. In the first quarter of 2021, U.S. equities rallied, bolstered by an accelerating vaccine rollout, substantial fiscal and monetary policy support, and upbeat forecasts for economic growth and earnings. Expectations for a strong rebound in the U.S. economy sparked inflationary fears, contributing to a pro-cyclical rotation. The Democrats secured slim majorities in both houses of Congress after winning control of the Senate, bolstering President Biden’s prospects of advancing his legislative agenda. In the second quarter of 2021, U.S. equities rallied for the fifth consecutive quarter amid a backdrop of improving vaccination rates, accelerating economic growth, and a broader reopening of the economy. Inflation rose sharply during the quarter, as robust demand for goods and services, along with significant global supply-chain disruptions, drove consumer and producer prices sharply higher. In the third quarter of 2021, U.S. equities rose against a backdrop of accommodative monetary policy, robust corporate earnings, and strong demand for goods and services. Growth equities outperformed their value counterparts for the quarter; however, surging U.S. Treasury yields sparked a sharp sell-off in shares of large technology companies at the end of September, triggering a powerful rotation into value equities. In the final month of

the period, U.S. equities registered their largest monthly gain of the year, as inflation anxiety was outweighed by improving coronavirus pandemic conditions, higher-than-expected corporate earnings, strong U.S. equity inflows, and improved prospects for additional fiscal stimulus. Markets were bolstered by a rapid decline in the number of U.S. COVID-19 cases, which fell nearly 60% from their latest peak in September 2021.

Returns varied by market cap during the period, as mid- and small-cap equities, as measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively, both outperformed large-cap equities, as measured by the S&P 500 Index.

All eleven sectors in the Russell 3000 Index posted positive returns during the period. Strong performers included the Energy (+116.4%), Financials (+71.0%), and Real Estate (+47.6%) sectors. The Utilities (+12.0%), Consumer Staples (+19.6%), and Health Care (+31.6%) sectors posted the smallest gains for the period.

During the period, the Fund underperformed the Russell 3000 Index, primarily due to weak stock selection within the Consumer Discretionary, Information Technology, and Healthcare sectors. Conversely, stronger selection within the Energy, Consumer Staples, and Financials sectors contributed positively to relative returns during the period. Sector allocation, a result of bottom-up stock selection, detracted during the period primarily due to the Fund’s underweight exposure to the Energy sector and overweight exposure to the Consumer Staples sector. An underweight to the Utilities sector relative to the Russell 3000 Index contributed positively to performance.

Our decision to not own Tesla (Consumer Discretionary) within the Fund and the Fund’s underweight exposures, relative to the Russell 3000 Index, to Microsoft (Information Technology) and NVIDIA (Information Technology) were the top relative detractors from Fund performance during the period. Tesla, a constituent of the Russell 3000 Index, engages in the design, development, manufacture, and sale of fully electric vehicles, energy generation and storage systems. Shares of Tesla rose after the company reported third-quarter earnings that beat consensus estimates after Hertz announced it would be adding 100,000 Tesla vehicles to its rental-car fleet. The Fund did not hold the stock as of the end of the period. Microsoft develops and supports software, services, devices, and solutions. Shares of Microsoft rose after the company delivered strong first quarter fiscal year 2022 results with balanced performance across the product set and good margin expansion in all three reporting segments. We maintained the Fund’s underweight exposure to the

The Hartford Capital Appreciation Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

stock as of the end of the period. NVIDIA is a leading producer of graphics processing units (GPUs). Shares of NVIDIA rose after Facebook (now named Meta) announced a significant increase in its capital spending plans for 2022. The majority of these investments will be aimed at developing the company's data center network and technology infrastructure, which is expected to benefit NVIDIA. We eliminated the Fund’s position earlier in the period on share-price strength.

ChemoCentryx (Health Care), Splunk (Information Technology), and Alibaba (Consumer Discretionary) were among the largest detractors from Fund performance on an absolute basis over the period.

Top contributors to the Fund’s performance relative to the Russell 3000 Index included the Fund’s out-of-benchmark exposure to Diamondback Energy (Energy), an overweight exposure to American Express (Financials), as well as an underweight exposure to Amazon (Consumer Discretionary). Diamondback Energy is an oil and gas exploration and production company. Shares rose over the period alongside surging global oil prices. The company also reported earnings for the first quarter that surprised to the upside, with investors focusing on strong free cash flow generation. The Fund maintained an overweight in the stock as of the end of the period. American Express is a credit card payments company. Shares rose during the period after the company announced better-than-expected first quarter earnings. Results were helped by a $1.1 billion release of reserves that were previously set aside to cover soured loans during the pandemic. Management also raised its outlook for fiscal year 2021. We trimmed the Fund’s position on share-price strength during the period. Amazon is a technology company with a focus on e-commerce and cloud computing. Shares of Amazon rose during the period but lagged the Russell 3000 Index. The company’s share price lost ground later in the period when management stated that sales growth was expected to slow over the next several quarters, as consumers continue to venture outside of their homes and away from their pandemic-induced online shopping habits. We increased the Fund’s underweight to Amazon during the period.

Alphabet (Communication Services), American Express (Financials), and TJX Companies (Consumer Discretionary) were among the largest contributors to the Fund’s performance on an absolute basis over the period.

Our investment process includes the use of factor-based strategies, which involve targeting certain company characteristics, or factors, that we believe impact returns across asset classes. Factor impact overall on the Fund was negative during the period. The Fund’s slight underweight exposure to higher-beta equities and overweight exposure to mid-cap equities detracted from performance, while the Fund’s slight underweight exposure to higher-volatility equities and slight overweight exposure to higher liquidity names contributed positively to performance.

During the period, the Fund, at times, used equity index futures to equitize cash or to seek to efficiently manage risks. During the period, the use of equity index futures contributed positively to relative performance.

What is the outlook as of the end of the period?

While company earnings have been improving relative to 2020 as of the end of the period, risks continue to evolve. This includes the potential economic ramifications following the spread of the COVID-19 Delta variant and the reemergence of pandemic-related restrictions in some regions, potential broad market disruption from political gridlock surrounding publicly listed equities in China and the government debt ceiling in the U.S., and the potential impact to company fundamentals as central banks begin to roll back stimulus programs. Against this backdrop, we expect continued volatility as investors balance long-term opportunities and nearer-term risks. As ever, we remain vigilant in managing risks in the Fund and seek to deliver performance that is driven by security selection.

Looking across markets, we are mindful of the ever-evolving risks of different equity factors and seek to create a fund that includes differentiated investment styles and philosophies. We maintain exposure to cyclical areas of the market through our allocations to mean-reversion (e.g. value and contrarian) underlying portfolio managers. These underlying portfolio managers look to invest in undervalued companies and use their security selection expertise to seek to identify companies with solid fundamentals and to avoid businesses that they believe are unlikely to mean-revert in the future. We look to our trend-following (e.g. growth and momentum) underlying portfolio managers to seek to provide capital appreciation by seeking attractive companies with favorable growth prospects. As with value equities, we look for the underlying portfolio managers' fundamental security selection processes to help differentiate companies with better long-term growth fundamentals versus those that are more speculative and driven by investor exuberance. We seek to balance these exposures with risk-aversion (e.g. quality and low volatility) allocations, which seek to provide a more defensive weight to the Fund by investing in companies with more stable businesses in our view. These characteristics are expected to add beneficial exposure to the Fund in the event of an unexpected shock to the economy or markets in our view. As of the end of the period, we also note that these equities continued to trade at attractive valuations relative to history in our view. To that end, we expect the market backdrop to benefit fundamental portfolio managers looking to differentiate between companies that can succeed in the current climate from those that cannot.

At the end of the period, the Fund’s largest overweights were to the Industrials and Consumer Staples sectors, while the Fund’s largest underweights were to the Information Technology and Utilities sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. The Fund’s strategy for allocating assets among portfolio management teams may not work as intended. • Mid-cap securities can have greater risks and volatility than large-cap securities. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks are generally greater, and include additional risks, for investments in emerging markets. • To the

The Hartford Capital Appreciation Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse development occur.

| Composition by Sector(1) |

| as of 10/31/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 7.7% |

| Consumer Discretionary | 14.9 |

| Consumer Staples | 7.5 |

| Energy | 1.0 |

| Financials | 11.5 |

| Health Care | 13.1 |

| Industrials | 12.2 |

| Information Technology | 22.3 |

| Materials | 3.1 |

| Real Estate | 4.1 |

| Utilities | 0.2 |

| Total | 97.6% |

| Short-Term Investments | 3.1 |

| Other Assets & Liabilities | (0.7) |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Core Equity Fund

Fund Overview

October 31, 2021 (Unaudited)

Inception 04/30/1998

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks growth of capital. |

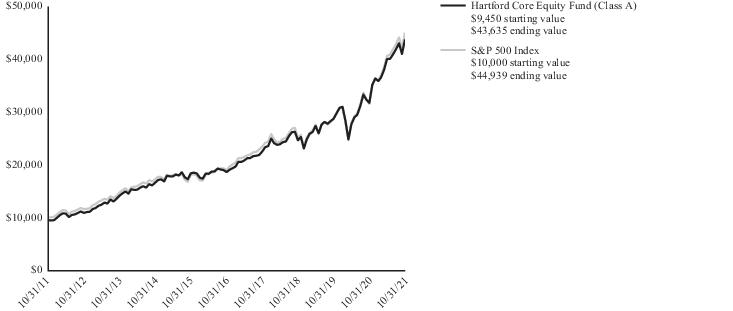

Comparison of Change in Value of $10,000 Investment (10/31/2011 - 10/31/2021)

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

| Average Annual Total Returns |

| for the Periods Ending 10/31/2021 |

| | 1 Year | 5 Years | 10 Years |

| Class A1 | 37.85% | 18.68% | 16.53% |

| Class A2 | 30.27% | 17.34% | 15.87% |

| Class C1 | 36.86% | 17.81% | 15.69% |

| Class C3 | 35.86% | 17.81% | 15.69% |

| Class I1 | 38.19% | 18.99% | 16.73% |

| Class R31 | 37.38% | 18.27% | 16.20% |

| Class R41 | 37.82% | 18.66% | 16.57% |

| Class R51 | 38.17% | 18.98% | 16.90% |

| Class R61 | 38.31% | 19.10% | 16.97% |

| Class Y1 | 38.20% | 19.03% | 16.95% |

| Class F1 | 38.33% | 19.09% | 16.78% |

| S&P 500 Index | 42.91% | 18.93% | 16.21% |

| 1 | Without sales charge |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2021, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain

adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class I shares commenced operations on 03/31/2015. Performance prior to that date is that of the Fund’s Class A shares (excluding sales charges). Class R6 shares commenced operations on 03/31/2015 and performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance for Class F shares prior to 02/28/2017 reflects the performance of Class I shares from 03/31/2015 through 02/27/2017 and Class A shares (excluding sales charges) prior to 03/31/2015.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

Hartford Core Equity Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

| Operating Expenses* | Gross | Net |

| Class A | 0.73% | 0.73% |

| Class C | 1.47% | 1.47% |

| Class I | 0.46% | 0.46% |

| Class R3 | 1.07% | 1.07% |

| Class R4 | 0.78% | 0.78% |

| Class R5 | 0.48% | 0.48% |

| Class R6 | 0.38% | 0.38% |

| Class Y | 0.48% | 0.46% |

| Class F | 0.38% | 0.38% |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2022 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2021. |

Portfolio Managers

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Douglas W. McLane, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of the Hartford Core Equity Fund returned 37.85%, before sales charges, for the twelve-month period ended October 31, 2021, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 42.91% for the same period. For the same period, the Class A shares of the Fund, before sales charges, also underperformed the 41.18% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2021. Towards the end of 2020, a sharp escalation in COVID-19 infections across the country and renewed restrictions to curb the spread of the virus were overshadowed by highly encouraging vaccine developments, despite the significant logistical challenges and uncertain timeline for distributing and administering vaccines on a broad scale. In December 2020, the government unveiled a long-awaited fifth stimulus package, worth approximately $900 billion.

Joe Biden was elected president in November 2020 after a closely contested election, removing a key element of uncertainty for the market. In the first quarter of 2021, U.S. equities rallied, bolstered by an accelerating vaccine rollout, substantial fiscal and monetary policy support, and upbeat forecasts for economic growth and earnings. Expectations for a strong rebound in the U.S. economy sparked inflationary fears, contributing to a pro-cyclical rotation. The Democrats secured slim majorities in both houses of Congress after winning control of the Senate, bolstering President Biden’s prospects of advancing his legislative agenda. In the second quarter of 2021, U.S. equities rallied for the fifth consecutive quarter amid a backdrop of improving vaccination rates, accelerating economic growth, and a broader reopening of the economy. Inflation rose sharply during the quarter, as robust demand for goods and services, along with significant global supply-chain disruptions, drove consumer and producer prices sharply higher. In the third quarter of 2021, U.S. equities rose against a backdrop of accommodative monetary policy, robust corporate earnings, and strong demand for goods and services. Growth equities outperformed their value counterparts for the quarter; however, surging U.S. Treasury yields sparked a sharp sell-off in shares of large technology companies at the end of September, triggering a powerful rotation into value equities. In the final month of the period, U.S. equities registered their largest monthly gain of the year, as inflation anxiety was outweighed by improving coronavirus pandemic conditions, higher-than-expected corporate earnings, strong

Hartford Core Equity Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

U.S. equity inflows, and improved prospects for additional fiscal stimulus. Markets were bolstered by a rapid decline in the number of U.S. COVID-19 cases, which fell nearly 60% from their latest peak in September 2021.

Returns varied by market cap during the period, as large-cap equities, as measured by the S&P 500 Index, underperformed small-cap and mid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively.

All eleven sectors in the S&P 500 Index rose during the period, with the Energy (+111%) and Financials (+72%) sectors performing best. Conversely, the Utilities (+11%) and Consumer Staples (+19%) sectors were the worst performers during the period.

Overall, the Fund’s underperformance relative to the S&P 500 Index during the period was driven by weak security selection, primarily within the Information Technology, Consumer Discretionary, and Consumer Staples sectors. This was partially offset by stronger stock selection within the Financials, Communication Services, and Energy sectors, which contributed positively to performance over the same period. Sector allocation, a result of the bottom-up stock selection process, also detracted from relative performance, primarily driven by the Fund’s underweight to the Energy sector and overweight allocation to the Consumer Staples sector. This was partially offset by the Fund’s underweight positions in the Consumer Discretionary and Utilities sectors, which contributed positively to performance over the period.

The top contributors to relative performance over the period were overweight positions in EOG Resources (Energy), Morgan Stanley (Financials) and Bank of America (Financials). Shares of oil and gas exploration and production company EOG Resources surged over the period after reporting both fourth quarter 2020 and calendar year 2020 earnings that beat consensus expectations. An unusually tight supply-demand balance in European gas heading into the winter added further price pressure to a market already at record highs while increased demand for crude oil continued to push prices higher, lifting share prices during the period. The Fund remained overweight in the stock at the end of period. Shares of Morgan Stanley rose over the period as well. This was driven by strong earnings throughout the period, where the company beat consensus earnings expectations each quarter. The Fund remained overweight in the stock at the end of period. Shares of Bank of America rose over the period. The company reported strong earnings during the same period, beating estimates, as the bank regained losses seen from the early onset of the pandemic. The Fund remained overweight the stock at the end of period. Top absolute contributors to Fund performance over the period included Alphabet (Communication Services) and Microsoft (Information Technology).

The top detractors from the Fund’s relative performance over the period included overweight positions in FedEx (Industrials) and American Electric Power (Utilities), as well as not owning NVIDIA (Information Technology). Shares of FedEx fell over the period after the company announced weak fiscal first quarter 2022 earnings, missing expectations in September 2021. High wage inflation and substantial inefficiencies from COVID-19 disruptions in the same quarter resulted in an estimated $450 million negative impact to operating results. The company also had mixed earnings in varying

quarters earlier in 2021. As of the end of the period, the Fund was overweight the stock, which performed poorly during the period. Shares of American Electric Power, a company that specializes in the provision of electricity, also fell during the period due to concerns stemming from President Biden’s continued remarks regarding the switch to clean energy. While the company has high exposures to coal currently, we believe the company is aligned with the energy transition since renewables are expected to be their dominant power source by 2030. As of the end of the period, the Fund was overweight the stock. Shares of NVIDIA, a leading producer of graphics processing units (GPUs), rose during the period. For the same period, Facebook (now renamed Meta) announced a significant increase in its capital spending plans for 2022. The majority of these investments will be aimed at developing the company's data center network and technology infrastructure, which is expected to benefit NVIDIA. Not owning the stock during the period was a detractor from the Fund’s relative performance due to the stock’s strong performance. The Fund’s absolute detractors for the period included American Electric Power (Utilities) and FedEx (Industrials).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

As of the end of the period, we believe several issues are emerging that will have near- and intermediate-term impacts. Infrastructure spending remains a key area of discussion and, while the negotiations around the large democratic bill and the Senate approved bipartisan bill remain stalled, our expectation remains that Congress will approve both bills with a total size of around $2.5 trillion. We also expect the U.S. debt ceiling will be extended. We believe this may provide some cushion for growth into 2022 with the caveat that a higher corporate tax rate may be included in the bills. Depending on the revenue required to offset the spending, we believe it could pose a challenge to future earnings growth.

In our opinion, the bigger question concerns expectations around inflation with companies struggling to offset higher input costs with higher pricing of their own goods and services, leading to margin compression. We believe that labor force participation rates may continue to increase as stimulus effects wane, and some supply chain disruptions may ease with the increased availability of vaccines globally, limiting the risk of runaway inflation. Still, we believe some of these higher costs are likely here to stay, and many companies have announced further price increases to offset cost pressures. Hence, we do expect some of the inflation to be sustained into the next year.

Lastly, we believe there are some lurking risks that are difficult to handicap, such as the deteriorating financial condition of Chinese real estate developers such as Evergrande and the high gas prices translating to increased power costs in Europe. Increased geopolitical tension is bringing increased attention to strategic industries such as semiconductors, electric vehicles, and robotics. We believe these industries are likely to see increased investment in local economies as each country tries to reduce reliance on imports. Given these factors, we believe it will be important to keep an eye on the U.S. Federal Reserve and other global central banks, as the manner in which the

Hartford Core Equity Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

abundant liquidity is withdrawn from global economies will likely impact exchange rates and interest rates around the world and, in turn, affect prices of risk assets.

At the end of the period, the Fund’s largest overweights relative to the S&P 500 Index were to the Communication Services and Industrials sectors, while the Fund’s largest underweights were to the Information Technology and Energy sectors.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

| Composition by Sector(1) |

| as of 10/31/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 12.7% |

| Consumer Discretionary | 11.9 |

| Consumer Staples | 5.9 |

| Energy | 1.3 |

| Financials | 12.6 |

| Health Care | 14.4 |

| Industrials | 9.4 |

| Information Technology | 26.1 |

| Materials | 1.1 |

| Real Estate | 1.7 |

| Utilities | 2.0 |

| Total | 99.1% |

| Short-Term Investments | 0.6 |

| Other Assets & Liabilities | 0.3 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

The Hartford Dividend and Growth Fund

Fund Overview

October 31, 2021 (Unaudited)

Inception 07/22/1996

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

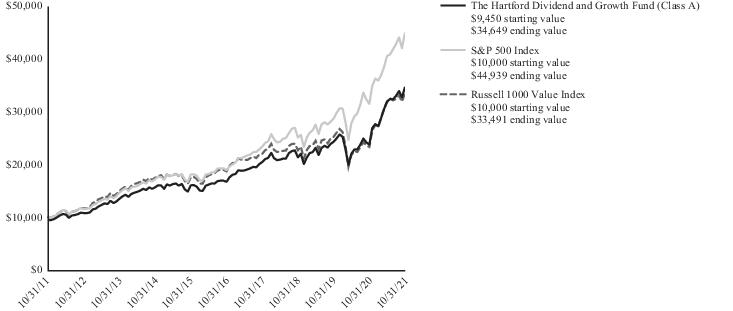

Comparison of Change in Value of $10,000 Investment (10/31/2011 - 10/31/2021)

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

| Average Annual Total Returns |

| for the Periods Ending 10/31/2021 |

| | 1 Year | 5 Years | 10 Years |

| Class A1 | 46.01% | 15.72% | 13.87% |

| Class A2 | 37.98% | 14.42% | 13.23% |

| Class C1 | 44.92% | 14.85% | 13.02% |

| Class C3 | 43.92% | 14.85% | 13.02% |

| Class I1 | 46.39% | 16.02% | 14.14% |

| Class R31 | 45.43% | 15.31% | 13.49% |

| Class R41 | 45.92% | 15.66% | 13.84% |

| Class R51 | 46.35% | 16.01% | 14.18% |

| Class R61 | 46.52% | 16.13% | 14.29% |

| Class Y1 | 46.47% | 16.09% | 14.27% |

| Class F1 | 46.55% | 16.13% | 14.19% |

| S&P 500 Index | 42.91% | 18.93% | 16.21% |

| Russell 1000 Value Index | 43.76% | 12.39% | 12.85% |

| 1 | Without sales charge |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2021, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain

adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

The Hartford Dividend and Growth Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

| Operating Expenses* | Gross | Net |

| Class A | 1.00% | 1.00% |

| Class C | 1.78% | 1.78% |

| Class I | 0.74% | 0.74% |

| Class R3 | 1.36% | 1.36% |

| Class R4 | 1.05% | 1.05% |

| Class R5 | 0.75% | 0.75% |

| Class R6 | 0.65% | 0.65% |

| Class Y | 0.74% | 0.69% |

| Class F | 0.65% | 0.65% |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements only with respect to Class Y. These arrangements remain in effect until 02/28/2022 unless the Fund’s Board of Directors approves an earlier termination. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2021. |

Portfolio Managers

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Nataliya Kofman

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Dividend and Growth Fund returned 46.01%, before sales charges, for the twelve-month period ended October 31, 2021, outperforming the Fund’s primary benchmark, the S&P 500 Index, which returned 42.91% for the same period, and also outperforming the Fund’s secondary benchmark, the Russell 1000 Value Index, which returned 43.76% for the same period. For the same period, the Class A shares of the Fund, before sales charges, outperformed the 39.88% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2021. Towards the end of 2020, a sharp escalation in COVID-19 infections across the country and renewed restrictions to curb the spread of the virus were overshadowed by highly encouraging vaccine developments, despite the significant logistical challenges and uncertain timeline for distributing and administering vaccines on a broad scale. In December 2020, the government unveiled a long-awaited fifth stimulus package, worth approximately $900 billion.

Joe Biden was elected president in November 2020 after a closely contested election, removing a key element of uncertainty for the market. In the first quarter of 2021, U.S. equities rallied, bolstered by an accelerating vaccine rollout, substantial fiscal and monetary policy support, and upbeat forecasts for economic growth and earnings. Expectations for a strong rebound in the U.S. economy sparked inflationary fears, contributing to a pro-cyclical rotation. The Democrats secured slim majorities in both houses of Congress after winning control of the Senate, bolstering President Biden’s prospects of advancing his legislative agenda. In the second quarter of 2021, U.S. equities rallied for the fifth consecutive quarter amid a backdrop of improving vaccination rates, accelerating economic growth, and a broader reopening of the economy. Inflation rose sharply during the quarter, as robust demand for goods and services, along with significant global supply-chain disruptions, drove consumer and producer prices sharply higher. In the third quarter of 2021, U.S. equities rose against a backdrop of accommodative monetary policy, robust corporate earnings, and strong demand for goods and services. Growth equities outperformed their value counterparts for the quarter; however, surging U.S. Treasury yields sparked a sharp sell-off in shares of large technology companies at the end of September, triggering a powerful rotation into value equities. In the final month of the period, U.S. equities registered their largest monthly gain of the year, as inflation anxiety was outweighed by improving coronavirus pandemic conditions, higher-than-expected corporate earnings, strong U.S. equity inflows, and improved prospects for additional fiscal stimulus. Markets were bolstered by a rapid decline in the number of U.S. COVID-19 cases, which fell nearly 60% from their latest peak in September 2021.

The Hartford Dividend and Growth Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

Returns varied by market cap during the period, as mid- and small-cap equities, as measured by the S&P MidCap 400 Index and Russell 2000 Index, respectively, both outperformed large-cap equities, as measured by the S&P 500 Index.

All eleven sectors in the S&P 500 Index rose during the period, with the Energy (+111%), Financials (+72%), and Information Technology (+47%) sectors performing the best. The Utilities (+11%), Consumer Staples (+19%), and Healthcare (+34%) sectors were the worst performers during the period.

Security selection was the main driver of the Fund’s returns relative outperformance versus the S&P 500 Index over the period. Stock selection was strongest within the Financials, Industrials, and Healthcare sectors. This was partially offset by weaker selection within the Materials and Communication Services sectors, which detracted from relative performance over the same period. Sector allocation, a result of the bottom-up stock selection process, also contributed positively to the Fund’s performance relative to the S&P 500 Index over the period. An overweight to the Financials and Energy sectors added the most to returns relative to the S&P 500 Index during the period. This was partially offset by an underweight allocation to the Information Technology sector over the same period.

The Fund’s top positive contributors to performance relative to the S&P 500 Index during the period were not owning Amazon.com (Consumer Discretionary) and overweight positions in Bank of America (Financials) and ConocoPhilips (Energy). Not holding S&P 500 Index constituent Amazon.com was a top relative positive contributor to performance during the period as shares of the company rose yet underperformed the S&P 500 Index. The Fund did not hold a position in the company during the period as it did not align with our philosophy and process. Shares of Bank of America rose during the period as banking equities benefited from the vaccine-led rally and subsequent rotation towards value sectors. The U.S. Federal Reserve’s (Fed’s) decision in September 2021 to roll back its bond-buying program but leave short-term interest rates unchanged, sent share prices higher at the end of the period. We trimmed the Fund’s position on share-price strength during the period, but as of the end of the period, we continued to hold the stock. Shares of oil and gas conglomerate ConocoPhillips rose strongly over the period on news that the company had purchased the entirety of Royal Dutch Shell’s Permian Basin assets. The all-cash purchase has made ConocoPhillips one of the largest producers in the world’s top shale basin. The company continued to execute on acquisition opportunities after buying Concho Resources earlier in 2021. Rising global crude oil prices also buoyed share prices during the period. As of the end of the period, we continued to hold the stock.

The Fund’s top detractors from performance relative to the S&P 500 Index during the period included Verizon (Communication Services) and not owning Tesla (Consumer Discretionary) and NVIDIA (Information Technology). Shares of Verizon fell during the period. After releasing fourth-quarter 2020 results, investors were disappointed by weak subscriber growth that fell short of analyst estimates, sending share prices lower. As of the end of the period, we continued to hold Verizon in the Fund. Not owning Tesla also detracted from relative performance during the period. Shares of Telsa were

added to the S&P 500 Index in late 2020, which along with positive sentiment around electric vehicles led to a soaring share price. Since then, shares have reached all-time highs after the company reported third quarter 2021 earnings with increased revenue growth led by a 73% increase in vehicle deliveries. The Fund does not hold a position in the company as of the end of the period, as it does not align with our philosophy and process. Not owning NVIDIA also detracted from relative performance during the period. The company consecutively announced better-than expected results and continued to show strong growth across categories, particularly within gaming and datacenter categories over the period. In addition to strong growth in hardware, the company's software offerings also grew in importance during the same period, with management introducing the company's artificial intelligence (AI) as a service and its Omniverse platform as a foundation for the future metaverse. The Fund did not hold a position in the company during the period as it does not align with our philosophy and process.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

Despite high stock price correlations within industries, as of the end of the period we believe there is meaningful dissent in the market regarding the economic outlook and the path of the economic recovery from here. Our view is that inflation is likely to endure going forward due to the significant supply constraints (e.g., commodities, labor, etc.). We believe that persistent inflation, which we have not seen for years, will put downward pressure on margins and likely lead to higher interest rates. Given this outlook, we believe a market regime shift is likely and we are seeking to identify consistent compounders (high-quality businesses with strong recurring revenues) with strong competitive advantages and the ability to pass price inflation through to customers. We are also evaluating which end markets we believe are poised to benefit from continued supply tightness - such as metals and mining, for example.

We remain focused on seeking to limit downside risk in the Fund, so we are seeking to avoid companies that we would expect to struggle in an inflationary environment with rising interest rates. Such companies include those that we believe to have rich valuations amid increasing discount rates and companies with margins that we believe are vulnerable to inflation due to an inability to pass on price increases to their customers. We remain focused on seeking to identify quality companies with a positive risk/reward skew and a narrow range of outcomes.

At the end of the period, the Fund had its largest overweights in the Financials and Healthcare sectors, and the largest underweights in the Information Technology and Consumer Discretionary sectors, relative to the S&P 500 Index.

We continue to apply our valuation discipline within the Fund to seek to maintain a Fund of resilient businesses that in our opinion are reasonably valued and have favorable industry and competitive dynamics.

The Hartford Dividend and Growth Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. • To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur. • Integration of environmental, social, and/or governance (ESG) factors into the investment process may not work as intended.

| Composition by Sector(1) |

| as of 10/31/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 8.2% |

| Consumer Discretionary | 6.2 |

| Consumer Staples | 5.8 |

| Energy | 4.2 |

| Financials | 20.0 |

| Health Care | 14.9 |

| Industrials | 8.1 |

| Information Technology | 19.0 |

| Materials | 3.4 |

| Real Estate | 3.2 |

| Utilities | 3.8 |

| Total | 96.8% |

| Short-Term Investments | 2.5 |

| Other Assets & Liabilities | 0.7 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

The Hartford Equity Income Fund

Fund Overview

October 31, 2021 (Unaudited)

Inception 08/28/2003

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

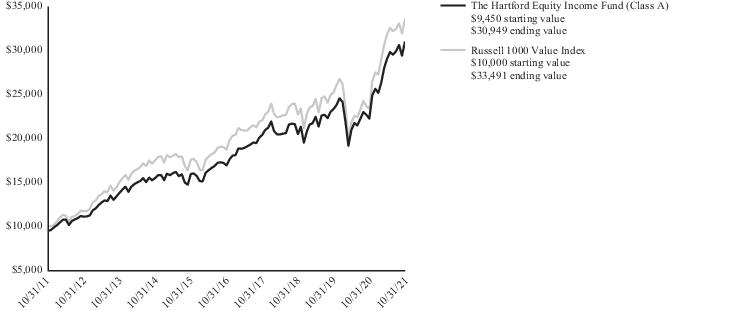

Comparison of Change in Value of $10,000 Investment (10/31/2011 - 10/31/2021)

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

| Average Annual Total Returns |

| for the Periods Ending 10/31/2021 |

| | 1 Year | 5 Years | 10 Years |

| Class A1 | 39.45% | 12.89% | 12.60% |

| Class A2 | 31.78% | 11.62% | 11.96% |

| Class C1 | 38.31% | 12.02% | 11.76% |

| Class C3 | 37.31% | 12.02% | 11.76% |

| Class I1 | 39.69% | 13.15% | 12.88% |

| Class R31 | 38.83% | 12.47% | 12.20% |

| Class R41 | 39.25% | 12.80% | 12.54% |

| Class R51 | 39.75% | 13.15% | 12.89% |

| Class R61 | 39.82% | 13.26% | 13.00% |

| Class Y1 | 39.77% | 13.21% | 12.97% |

| Class F1 | 39.81% | 13.25% | 12.93% |

| Russell 1000 Value Index | 43.76% | 12.39% | 12.85% |

| 1 | Without sales charge |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2021, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the report are calculated in the same manner, but also take into account certain

adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower.

| Operating Expenses* | Gross | Net |

| Class A | 1.01% | 1.01% |

| Class C | 1.76% | 1.76% |

| Class I | 0.74% | 0.74% |

| Class R3 | 1.36% | 1.36% |

| Class R4 | 1.06% | 1.06% |

| Class R5 | 0.77% | 0.77% |

| Class R6 | 0.66% | 0.66% |

| Class Y | 0.76% | 0.76% |

| Class F | 0.66% | 0.66% |

| * | Expenses as shown in the Fund’s most recent prospectus. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2021. |

The Hartford Equity Income Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

Portfolio Managers

W. Michael Reckmeyer, III, CFA*

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Adam H. Illfelder, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew C. Hand, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

| * | Michael Reckmeyer, III, CFA announced his plan to retire and withdraw from the partnership of Wellington Management Company LLP’s parent company, and effective June 30, 2022, he will no longer serve as a portfolio manager for the Fund. Mr. Reckmeyer’s portfolio management responsibilities will transition to Matthew C. Hand, CFA in the months leading up to his departure. |

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Equity Income Fund returned 39.45%, before sales charges, for the twelve-month period ended October 31, 2021, underperforming the Fund’s benchmark, the Russell 1000 Value Index, which returned 43.76% for the same period. For the same period, the Class A shares of the Fund, before sales charges, also underperformed the 39.88% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to that of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2021. In the first half of 2021, U.S. equities gained amid a backdrop of improving vaccination rates, accelerating economic growth, and a broader reopening of the economy. Inflation rose sharply, as robust demand for goods and services, along with significant global supply-chain disruptions, drove consumer and producer prices sharply higher. The U.S. Federal Reserve (Fed) maintained its view that elevated price pressures may prove transitory, but the Fed rattled markets by considerably raising its inflation forecast for 2021 and signaling the potential for two interest-rate increases in 2023. This shift in expectations toward tighter monetary policy triggered a rotation from value and cyclically sensitive equities to growth equities. U.S. equities continued to climb in the third quarter of 2021 against a backdrop of accommodative monetary policy, robust corporate earnings, and strong demand for goods and services, while risk sentiment was pressured by anxiety about rising inflation, imminent monetary tightening by the Fed, moderating economic growth, and uncertainty about fiscal stimulus and the federal debt ceiling. Growth equities outperformed their value counterparts for the quarter; however, surging U.S. Treasury yields sparked a sharp sell-off in shares of large technology companies at the end of September 2021, triggering a powerful rotation into value equities. COVID-19 cases fell sharply in September, although the proliferation of the Delta variant in July and August 2021 weighed on consumer confidence and

dampened momentum from businesses reopening. The Fed trimmed its 2021 gross domestic product (GDP) growth forecast to 5.9%, from 7%, and delivered a clearer signal that it would begin to taper asset purchases later this year if economic conditions remain stable.

During the period, all of the eleven sectors within the Russell 1000 Value Index posted positive absolute returns, with the Energy (+113%), Financials (+74%), and Real Estate (+53%) sectors performing the best. Conversely, the Utilities (+11%), Consumer Staples (+18%), and Communication Services (+26%) sectors lagged over the period.

The Fund’s underperformance relative to the Russell 1000 Value Index during the period was driven by sector allocation, a result of our bottom-up stock selection process, due primarily to overweight allocations to the Consumer Staples and Healthcare sectors (which are two sectors that are more defensively oriented and therefore did not benefit as materially from the re-opening economy), as well as an underweight allocation to the Energy sector (which experienced broad-based strength given the sharp rise in oil prices during the period). This was partially offset by underweight allocations to the Communication Services and Information Technology sectors. Security selection also detracted from relative results during the period. Selection within the Real Estate, Communication Services, and Energy sectors detracted the most from performance but was partially offset by positive selection within the Information Technology, Healthcare, and Industrials sectors.

Top detractors from relative results included Lockheed Martin (Industrials), Progressive (Financials), and not holding Exxon Mobil (Energy). Shares of Lockheed Martin, a United States (U.S.) based aerospace and defense company, declined after third-quarter 2021 sales missed estimates and management released 2022 guidance that was below expectations due to the withdrawal of the U.S. military presence in Afghanistan, re-basing of F-35 related revenue, and accelerated payments to suppliers to ensure supply-chain health.

The Hartford Equity Income Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

Shares of insurance provider Progressive were pressured as catastrophe losses from Hurricane Ida eroded already lackluster underwriting results and growth slowed in the third quarter of 2021.

Top contributors to relative returns included an out-of-benchmark position in Blackstone (Financials), Morgan Stanley (Financials), and Bank of America (Financials). Shares of alternative investments manager Blackstone advanced over the period, driven by higher fee-related earnings and performance net revenues. Net accrued carried interest grew significantly over the prior year on the back of strong investment performance. Morgan Stanley, a diversified financial services company, reported third quarter earnings ahead of consensus estimates, benefiting from strong core performance as well as contributions from subsidiaries, E*TRADE and Eaton Vance. Finally, financial services provider Bank of America reported third-quarter 2021 results that beat consensus estimates on strong fees and rising net interest income.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

As of the end of the period, as the market’s concern shifts among inflation, stagnating growth, supply chain disruptions, the Delta variant of the coronavirus, and labor market tightness—to name several—we have continued to focus on high-quality businesses with strong balance sheets and sustainable dividends. While these issues are topical and worth monitoring, they have not been the driver of our decision-making. We stress-test the Fund’s portfolio across a number of scenarios and feel comfortable with the Fund’s balanced posturing relative to the Russell 1000 Value Index.

At the end of the period, the Consumer Staples, Healthcare, and Industrials sectors represented the Fund’s largest overweights relative to the Russell 1000 Value Index, while the Communication Services, Real Estate, and Financials sectors were the Fund’s largest underweights.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. • Different investment styles may go in and out favor, which may cause the Fund to underperform the broader stock market. • To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur.

| Composition by Sector(1) |

| as of 10/31/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 3.6% |

| Consumer Discretionary | 4.6 |

| Consumer Staples | 11.7 |

| Energy | 5.3 |

| Financials | 20.6 |

| Health Care | 19.1 |

| Industrials | 12.7 |

| Information Technology | 9.3 |

| Materials | 4.3 |

| Real Estate | 2.0 |

| Utilities | 5.7 |

| Total | 98.9% |

| Short-Term Investments | 1.4 |

| Other Assets & Liabilities | (0.3) |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

The Hartford Growth Opportunities Fund

Fund Overview

October 31, 2021 (Unaudited)

Inception 03/31/1963

Sub-advised by Wellington Management Company LLP | Investment objective – The Fund seeks capital appreciation. |

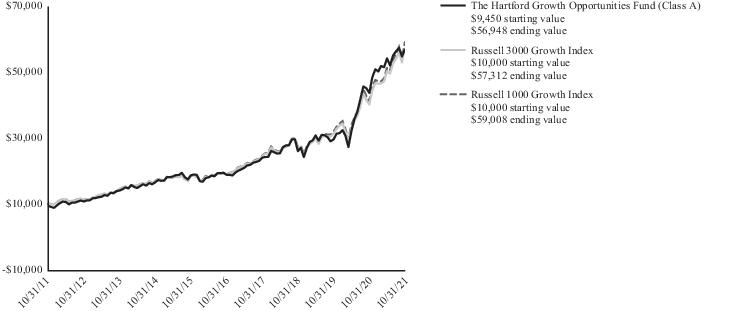

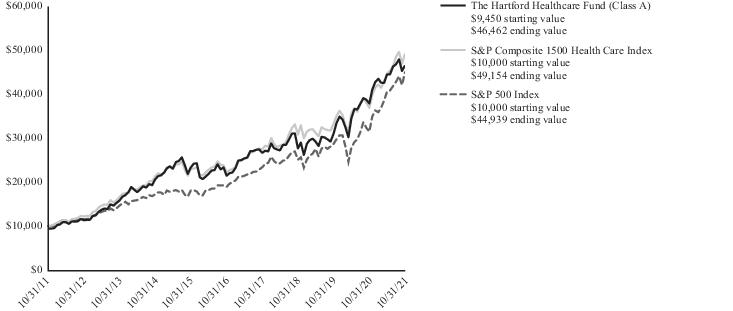

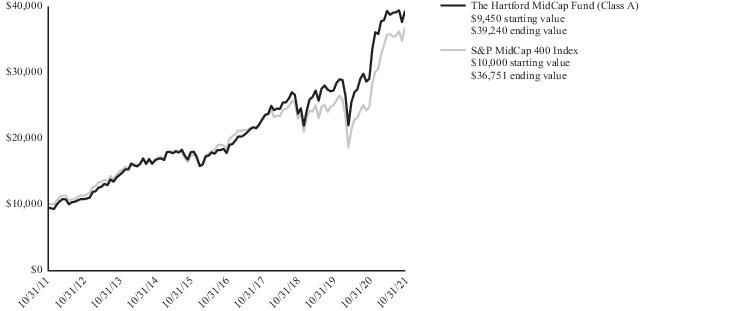

Comparison of Change in Value of $10,000 Investment (10/31/2011 - 10/31/2021)

The chart above represents the hypothetical growth of a $10,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

| Average Annual Total Returns |

| for the Periods Ending 10/31/2021 |

| | 1 Year | 5 Years | 10 Years |

| Class A1 | 30.45% | 24.75% | 19.68% |

| Class A2 | 23.28% | 23.34% | 19.00% |

| Class C1 | 29.47% | 23.82% | 18.80% |

| Class C3 | 28.47% | 23.82% | 18.80% |

| Class I1 | 30.75% | 25.07% | 19.97% |

| Class R31 | 29.96% | 24.31% | 19.29% |

| Class R41 | 30.36% | 24.69% | 19.65% |

| Class R51 | 30.74% | 25.07% | 20.01% |

| Class R61 | 30.87% | 25.19% | 20.12% |

| Class Y1 | 30.74% | 25.14% | 20.10% |

| Class F1 | 30.87% | 25.18% | 20.03% |

| Russell 3000 Growth Index | 42.81% | 24.96% | 19.08% |

| Russell 1000 Growth Index | 43.21% | 25.49% | 19.42% |

| 1 | Without sales charge |

| 2 | Reflects maximum sales charge of 5.50% |

| 3 | Reflects a contingent deferred sales charge of 1.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale or redemption of Fund shares on 10/31/2021, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses. The total returns presented in the Financial Highlights section of the

report are calculated in the same manner, but also take into account certain adjustments that are necessary under generally accepted accounting principles. As a result, the total returns in the Financial Highlights section may differ from the total returns presented above.

Class R6 shares commenced operations on 11/07/2014. Performance prior to that date is that of the Fund’s Class Y shares. Class F shares commenced operations on 02/28/2017. Performance prior to that date is that of the Fund’s Class I shares.

To the extent a share class has adopted the prior performance of another share class that had different operating expenses, such performance has not been adjusted to reflect the different operating expenses. If the performance were adjusted, it may have been higher or lower.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower.

| Operating Expenses* | Gross | Net |

| Class A | 1.10% | 1.10% |

| Class C | 1.85% | 1.85% |

| Class I | 0.82% | 0.82% |

| Class R3 | 1.43% | 1.43% |

| Class R4 | 1.13% | 1.13% |

| Class R5 | 0.84% | 0.84% |

| Class R6 | 0.74% | 0.74% |

| Class Y | 0.82% | 0.82% |

| Class F | 0.74% | 0.74% |

| * | Expenses as shown in the Fund’s most recent prospectus. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 10/31/2021. |

The Hartford Growth Opportunities Fund

Fund Overview – (continued)

October 31, 2021 (Unaudited)

Portfolio Managers

Stephen Mortimer

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mario E. Abularach, CFA, CMT

Senior Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class A shares of The Hartford Growth Opportunities Fund returned 30.45%, before sales charges, for the twelve-month period ended October 31, 2021, underperforming the Fund’s primary benchmark, the Russell 3000 Growth Index, which returned 42.81% for the same period, and underperforming the Fund’s secondary benchmark, the Russell 1000 Growth Index, which returned 43.21% for the same period. For the same period, the Class A shares of the Fund, before sales charges, also underperformed the 39.88% average return of the Lipper Multi-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

United States (U.S.) equities, as measured by the S&P 500 Index, posted positive results over the trailing twelve-month period ending October 31, 2021. In the first half of 2021, U.S. equities gained amid a backdrop of improving vaccination rates, accelerating economic growth, and a broader reopening of the economy. Inflation rose sharply, as robust demand for goods and services, along with significant global supply-chain disruptions, drove consumer and producer prices sharply higher. The U.S. Federal Reserve (Fed) maintained its view that elevated price pressures may prove transitory, but the Fed rattled markets by considerably raising its inflation forecast for 2021 and signaling the potential for two interest-rate increases in 2023. This shift in expectations toward tighter monetary policy triggered a rotation from value and cyclically sensitive equities to growth equities. U.S. equities continued to climb in the third quarter of 2021 against a backdrop of accommodative monetary policy, robust corporate earnings, and strong demand for goods and services, while risk sentiment was pressured by anxiety about rising inflation, imminent monetary tightening by the Fed, moderating economic growth, and uncertainty about fiscal stimulus and the federal debt ceiling. Growth equities outperformed their value counterparts for the quarter; however, surging U.S. Treasury yields sparked a sharp sell-off in shares of large technology companies at the end of September 2021, triggering a powerful rotation into value equities. COVID-19 cases fell sharply in September, although the proliferation of the Delta variant in July and August 2021 weighed on consumer confidence and dampened momentum from businesses reopening. The Fed trimmed its 2021 gross domestic product (GDP) growth forecast to 5.9%, from 7%, and delivered a clearer signal that it would begin to taper asset purchases later this year if economic conditions remain stable.