UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07527 |

|

Turner Funds |

(Exact name of registrant as specified in charter) |

|

1205 Westlakes Drive, Suite 100 Berwyn, PA | | 19312 |

(Address of principal executive offices) | | (Zip code) |

|

Michael P. Malloy Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-224-6312 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | September 30, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Long/short equity funds

Turner Medical Sciences Long/Short Fund

Turner Titan II Fund

U.S. growth equity funds

Turner Emerging Growth Fund

Turner Midcap Growth Fund

Turner Small Cap Growth Fund

Contents

| | 2 | | | Letter to shareholders | |

| | 4 | | | Total returns of the Turner Funds | |

| 6

| | | Investment review:

Turner Medical Sciences Long/Short Fund | |

| 7

| | | Investment review:

Turner Titan II Fund | |

| 8

| | | Investment review:

Turner Emerging Growth Fund | |

| 9

| | | Investment review:

Turner Midcap Growth Fund | |

| 10

| | | Investment review:

Turner Small Cap Growth Fund | |

| | 11 | | | Schedules of investments | |

| | 24 | | | Financial statements | |

| | 36 | | | Notes to financial statements | |

| 45

| | | Report of independent registered public

accounting firm | |

| | 46 | | | Notice to shareholders | |

| | 47 | | | Disclosure of fund expenses | |

| | 48 | | | Trustees and officers of the Trust | |

Turner Funds

As of September 30, 2015, the Turner Funds offered a series of five mutual funds to individual and institutional investors. The minimum initial investment for Institutional Class Shares in a Turner Fund is $250,000 (except for $100,000 for the Turner Medical Sciences Long/Short Fund and the Turner Titan II Fund, formerly the Turner Spectrum Fund) for regular accounts and $100,000 for individual retirement accounts. The minimum initial investment for Investor Class Shares, Retirement Class Shares and Class C Shares is $2,500 for regular accounts and $2,000 for individual retirement accounts.

Turner Investments, L.P., based in Berwyn, Pennsylvania, serves as the investment adviser for the Turner Funds. Turner Investments, L.P., founded in 1990, manages more than $589 million in equity investments as of September 30, 2015.

Shareholder services

Turner Funds shareholders receive annual and semiannual reports, quarterly account statements, and a quarterly newsletter. Shareholders who have questions about their accounts may call a toll-free telephone number, 1.800.224.6312, may visit our website, www.turnerinvestments.com, or may write to Turner Funds, P.O. Box 219805, Kansas City, Missouri 64121-9805.

TURNER FUNDS 2015 ANNUAL REPORT 1

LETTER TO SHAREHOLDERS (Unaudited)

To our shareholders

Over the last decade global economies have grown by 6%; however, recently that rate has slowed considerably with the consensus for global gross domestic product (GDP) for 2016 at around 3%. Correlating to the slower growth is very low inflation — the U.S. is now at 0%, other developed countries are at about 0.5%, and the bigger developing countries (China and India) are at 4.2%. Discussions abound on China's slowing growth, India or Brazil's accelerating growth, moderate U.S. growth, and no growth out of Europe or Japan. While the alarmists continue to see inflation around every corner due to easy money, one overriding fact remains. In a world that is aging rapidly with technological advances that are hugely disinflationary, we believe that we are destined to experience more of the same — moderate global growth with low inflation.

While this is generally good for the global population overall, it creates a difficult backdrop for corporations to grow profits meaningfully. If top-line global GDP is 3% and inflation is 1.5%, the best you can hope to achieve is to grow your top line at around 5%. Through efficiencies and share buybacks, perhaps a company can raise its bottom line by 7 to 9% (not bad, particularly if you have a nice dividend yield). The problem is most big global corporations are not good stewards of capital and instead of seeking out efficiencies and buying back shares, they continue to see themselves as growth companies and make bad investments in both capital and mergers & acquisitions.

This is why stocks have generally performed modestly for the last couple of years (the MSCI World Index returned 24% over the last three years). While we do not foresee a big collapse in equity markets, we really do not see the scenario changing from very moderate returns for equities overall.

We do, however, believe that something very interesting and exciting is occurring beneath the surface of the market in general. Companies that are innovative, accelerating growth, disrupting others, and leading their respective market segments are doing very well and we seek to identify these types of companies and form high-conviction portfolios around them.

Innovative industries like cybersecurity have spawned winners like Palo Alto Networks (Palo Alto). Because of the threats of hacking and intrusion to corporations, governments and other entities, this innovative industry has boomed with Palo Alto establishing a leadership position. Since it became public in 2012, its stock price

has advanced significantly and has continued to outpace over the last two years as the market has stagnated.

After a company establishes itself as an Innovator, its business growth can accelerate. Mobileye, an innovator in safe and smart automobile systems, entered its Accelerator phase with rapid revenue growth over the last few quarters. Mobileye is now one of the largest companies of its type in the world.

A good example of a Disruptor that has shown outsized gains is Netflix. Clearly the company was innovative with its delivery of both physical and on-line entertainment content. Its production of "original content" programs showed even more innovation. Growth accelerated as their online business boomed, their original programming won rave reviews, and they expanded internationally. Netflix is truly a Disruptor — sharply altering the business of traditional media companies — you only have to look at the price advance to see that. Its stock price has appreciated substantially while CBS shares have fallen, the other networks such as Comcast (NBC) and Disney (ABC), have fared a bit better; however, most of their growth is from the non-broadcast businesses.

Ultimately, the Innovators, Accelerators and Disruptors become Market Leaders, and often they do this quickly. A prime example of this is Facebook. Social media has transformed how the world communicates. I venture to say Facebook users interact with friends on far greater levels than those achieved from face-to-face meetings, phone calls and even emails. And of course, we have all seen puppy videos and delicious recipes that we are supposed to "like". Facebook has performed very well since it became public in May of 2012 and now has a market capitalization of $255 billion. By that measure, Facebook is now the 9th biggest stock in the world.

In a moderate-growth, low-inflation world, we believe that excess returns in stocks will come from the Innovators, the Accelerators, the Disruptors and the Market Leaders. And that is what we seek to achieve for shareholders of Turner Funds. Our small cap portfolios focus on the Innovators and Accelerators. Our mid and larger cap portfolios focus on the Disruptors and Market Leaders. Our long/short portfolios tend to be long the Innovators, Accelerators, Disruptors, and Market Leaders while shorting those companies that struggle to grow in a moderate-growth, low-inflation world.

We believe that equities should continue to be appealing investments and that our active management strategy of constructing high-conviction portfolios comprising companies that are innovative, accelerating growth,

2 TURNER FUNDS 2015 ANNUAL REPORT

disrupting others, and leading their respective market segments offer shareholders the opportunity to achieve moderate returns in a low-inflation, low-growth global economy. As always, we appreciate your faith and continued support.

Sincerely,

Bob Turner

Chairman, Chief Investment Officer and Chief Executive Officer

Turner Investments

President and Trustee

Turner Funds

Past performance is no guarantee of future results. The views expressed are those of Turner Investments as of September 30, 2015, and are not intended as a forecast or investment recommendations. The indexes mentioned are not available for investment.

TURNER FUNDS 2015 ANNUAL REPORT 3

Total returns of the Turner Funds

Through September 30, 2015

Current performance may be lower or higher than the performance data quoted. Please call 1.800.224.6312 or visit our Web site at www.turnerinvestments.com for the most recent month-end performance information.

The performance data quoted represents past performance and the principal value and investment return will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown, unless otherwise indicated, are total returns, with dividends and income reinvested. Returns spanning more than one year are annualized. Fee waivers are in effect; if they had not been in effect, performance would have been lower. The indices mentioned are unmanaged statistical composites of stock-market performance. Investing in an index is not possible.

The holdings and sector weightings of the Turner Funds are subject to change. Forward-earnings projections are not predictors of stock price or investment performance, and do not represent past performance. There is no guarantee that the forward-earnings projections will accurately predict the actual earnings experience of any of the companies involved, and there is no guarantee that owning securities of companies with relatively high price-to-earnings ratios will cause the portfolio to outperform its benchmark or index.

The Turner Funds are distributed by Foreside Fund Services, LLC, Portland, Maine. The investor should consider the investment objectives, risks, charges, and expenses carefully before investing. This and other information can be found in the prospectus. A free prospectus, which contains detailed information, including fees and expenses, and the risks associated with investing in these Funds, can be obtained by calling 1.800.224.6312. Read the prospectus carefully before investing.

Fund name/index | | Six

months* | | Year

to

date* | | One

year | | Three

years | | Five

years | | Ten

years | | (Annualized)

Since

inception | | Total

net assets

($mil) | |

Turner Medical Sciences

Long/Short Fund(1) —

Institutional Class Shares | | | -3.31 | % | | | 20.76 | % | | | 12.60 | % | | | 14.94 | % | | | n/a | | | | n/a | | | | 9.85 | % | | $ | 40.57 | | |

Investor Class Shares | | | -3.41 | | | | 20.50 | | | | 12.30 | | | | 14.67 | | | | n/a | | | | n/a | | | | 9.61 | | | | 90.98 | | |

Class C Shares | | | -3.82 | | | | 19.82 | | | | 11.43 | | | | 13.80 | | | | n/a | | | | n/a | | | | 8.80 | | | | 5.47 | | |

S&P 500 Health Care Index | | | -8.13 | | | | -2.13 | | | | 5.19 | | | | 20.20 | | | | n/a | | | | n/a | | | | 19.07 | | | | | | |

Barclays Capital U.S. Aggregate

Bond Index | | | -0.47 | | | | 1.13 | | | | 2.94 | | | | 1.71 | | | | n/a | | | | n/a | | | | 3.81 | | | | | | |

Lipper Long/Short Equity Funds

Average | | | -4.80 | | | | -3.20 | | | | -1.59 | | | | 4.86 | | | | n/a | | | | n/a | | | | 3.99 | | | | | | |

Inception date: 2/7/11 | |

Turner Titan II Fund(1) —

Institutional Class Shares | | | 0.11 | | | | 6.72 | | | | 2.13 | | | | 3.87 | | | | 3.31 | % | | | n/a | | | | 3.96 | | | | 34.18 | | |

Investor Class Shares | | | 0.00 | | | | 6.50 | | | | 1.86 | | | | 3.57 | | | | 3.04 | | | | n/a | | | | 3.69 | | | | 25.65 | | |

Class C Shares(2) | | | -0.34 | | | | 5.98 | | | | 1.17 | | | | 2.83 | | | | 2.29 | | | | n/a | | | | 3.12 | | | | 1.55 | | |

S&P 500 Index | | | -6.18 | | | | -5.29 | | | | -0.61 | | | | 12.40 | | | | 13.34 | | | | n/a | | | | 14.83 | | | | | | |

Barclays Capital U.S. Aggregate

Bond Index | | | -0.47 | | | | 1.13 | | | | 2.94 | | | | 1.71 | | | | 3.10 | | | | n/a | | | | 4.48 | | | | | | |

Lipper Long/Short Equity Funds

Average | | | -4.80 | | | | -3.20 | | | | -1.59 | | | | 4.86 | | | | 5.45 | | | | n/a | | | | 6.88 | | | | | | |

Inception date: 5/7/09 | |

Turner Emerging

Growth Fund(1) —

Institutional Class Shares(3) | | | -3.81 | | | | 1.23 | | | | 7.28 | | | | 12.29 | | | | 13.95 | | | | n/a | | | | 17.14 | | | | 15.81 | | |

Investor Class Shares | | | -3.92 | | | | 1.04 | | | | 7.01 | | | | 12.00 | | | | 13.67 | | | | 7.07 | % | | | 16.88 | | | | 71.69 | | |

Russell 2000® Growth Index | | | -11.34 | | | | -5.47 | | | | 4.04 | | | | 12.85 | | | | 13.26 | | | | 7.67 | | | | 17.87 | | | | | | |

Inception date: 2/27/98 | |

4 TURNER FUNDS 2015 ANNUAL REPORT

PERFORMANCE (continued) (Unaudited)

Fund name/index | | Six

months* | | Year

to

date* | | One

year | | Three

years | | Five

years | | Ten

years | | (Annualized)

Since

inception | | Total

net assets

($mil) | |

Turner Midcap Growth Fund(1) —

Institutional Class Shares(4) | | | -12.71 | % | | | -8.12 | % | | | -4.63 | % | | | 10.10 | % | | | 9.58 | % | | | n/a | | | | 4.33 | % | | $ | 35.70 | | |

Investor Class Shares | | | -12.80 | | | | -8.28 | | | | -4.88 | | | | 9.80 | | | | 9.30 | | | | 5.80 | % | | | 9.67 | | | | 133.54 | | |

Retirement Class Shares(5) | | | -12.91 | | | | -8.43 | | | | -5.11 | | | | 9.58 | | | | 9.05 | | | | 5.51 | | | | 6.94 | | | | 2.74 | | |

Russell Midcap® Growth Index | | | -9.04 | | | | -4.15 | | | | 1.45 | | | | 13.98 | | | | 13.58 | | | | 8.09 | | | | 8.23 | | | | | | |

Inception date: 10/1/96 | |

Turner Small Cap Growth Fund(1) | | | -3.78 | | | | 3.55 | | | | 6.55 | | | | 12.91 | | | | 12.31 | | | | 7.69 | | | | 11.13 | | | | 70.84 | | |

Russell 2000® Growth Index | | | -11.34 | | | | -5.47 | | | | 4.04 | | | | 12.85 | | | | 13.26 | | | | 7.67 | | | | 6.79 | | | | | | |

Inception date: 2/7/94 | |

* Returns of less than one year are cumulative, and not annualized.

(1) Investing in technology and science companies and small- and mid-capitalization companies may subject the Funds to specific inherent risks, including above-average price fluctuations.

(2) Commenced operations on July 14, 2009.

(3) Commenced operations on February 1, 2009.

(4) Commenced operations on June 16, 2008.

(5) Commenced operations on September 24, 2001.

Expense Ratio†

| | | Gross

expense

ratio | | Net

expense

ratio†† | |

Turner Medical Sciences

Long/Short Fund | |

Institutional Class Shares | | | 3.54 | % | | | 3.35 | % | |

Investor Class Shares | | | 3.79 | % | | | 3.60 | % | |

Class C Shares | | | 4.54 | % | | | 4.35 | % | |

Turner Titan II Fund | |

Institutional Class Shares | | | 2.84 | % | | | 2.76 | % | |

Investor Class Shares | | | 3.09 | % | | | 3.01 | % | |

Class C Shares | | | 3.84 | % | | | 3.76 | % | |

| | | Gross

expense

ratio | | Net

expense

ratio†† | |

Turner Emerging Growth Fund | |

Institutional Class Shares | | | 1.42 | % | | | 1.15 | % | |

Investor Class Shares | | | 1.67 | % | | | 1.40 | % | |

Turner Midcap Growth Fund | |

Institutional Class Shares | | | 1.17 | % | | | 0.93 | % | |

Investor Class Shares | | | 1.42 | % | | | 1.18 | % | |

Retirement Class Shares | | | 1.67 | % | | | 1.43 | % | |

Turner Small Cap Growth Fund | |

Investor Class Shares | | | 1.66 | % | | | 1.25 | % | |

† These expense ratios are based on the most recent prospectus and may differ from those shown in the financial highlights.

†† Net expense ratio reflects contractual waivers of certain fees and/or expense reimbursements. Turner may discontinue this arrangement at any time after January 31, 2016.

TURNER FUNDS 2015 ANNUAL REPORT 5

INVESTMENT REVIEW (Unaudited)

Turner Medical Sciences Long/Short Fund

Fund profile

September 30, 2015

n Ticker symbol TMSFX

Investor Class Shares

n CUSIP #900297557

Investor Class Shares

n Top five holdings1

(1) Horizon Pharma

(2) Eli Lily

(3) Prothena

(4) Cardiome Pharma

(5) IGI Laboratories

n % in five largest holdings 26.4%1,2

n Number of holdings 761

n Net assets $90.98 million, Investor Class Shares

Growth of a $10,000 investment in the

Turner Medical Sciences Long/Short Fund,

Investor Class Shares:

February 7, 2011-September 30, 20153,4

Average annual total returns (Periods ended September 30, 2015)3

| | | One

year | | Three

years | | Since

inception4 | |

Turner Medical Sciences Long/Short Fund, Institutional Class Shares5 | | | 12.60 | % | | | 14.94 | % | | | 9.85 | % | |

Turner Medical Sciences Long/Short Fund, Investor Class Shares5 | | | 12.30 | % | | | 14.67 | % | | | 9.61 | % | |

Turner Medical Sciences Long/Short Fund, Class C Shares5 | | | 11.43 | % | | | 13.80 | % | | | 8.80 | % | |

S&P 500 Health Care Index6 | | | 5.19 | % | | | 20.20 | % | | | 19.07 | % | |

Barclays Capital U.S. Aggregate Bond Index7 | | | 2.94 | % | | | 1.71 | % | | | 3.81 | % | |

Lipper Long/Short Equity Funds Average8 | | | -1.59 | % | | | 4.86 | % | | | 3.99 | % | |

Sector weightings2:

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. Top five holdings are based on long positions. The fund composition is subject to change.

2 Percentages based on total investments of long positions.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Medical Sciences Long/Short Fund was February 7, 2011.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Health Care Index is an unmanaged index which includes the stocks in the health-care sector of the S&P 500 Index.

7 The Barclays Capital U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

8 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

The Turner Medical Sciences Long/Short Fund is subject to the risks associated with selling securities short. A short sale involves a finite opportunity for appreciation, but a theoretically unlimited risk of loss. The fund is subject to the risks associated with health care-related companies. Many health care-related companies are smaller and less seasoned than companies in other sectors. Health care-related companies may also be strongly affected by scientific or technological developments and their products may quickly become obsolete. The fund is subject to risks due to its foreign investments. The fund is also subject to taxable income and realized capital gains. Shareholder redemptions may force the fund to sell securities at an inappropriate time, also resulting in realized gains.

Manager's discussion of fund performance

The Turner Medical Sciences Long/Short Fund generated a positive absolute return for the 12-month period ended September 30, 2015. During the reporting period, the Fund outperformed the S&P 500 Health Care Index, Barclays Capital U.S. Aggregate Bond Index and the Lipper Long/Short Equity Funds Average. The Fund focuses on investment opportunities within the healthcare sector using a long/short growth strategy to capture alpha, reduce volatility, and preserve capital in declining markets.

Over this reporting period, top contributors to the Fund were long and short positions within the specialty pharma and biotechnology industries. Over the same period, detractors to performance were long and short positions that also came from the specialty pharma and biotechnology industry groups.

6 TURNER FUNDS 2015 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Fund profile

September 30, 2015

n Ticker symbol TSPEX

Institutional Class Shares

n CUSIP #900297664

Institutional Class Shares

n Top five holdings1

(1) CME Group

(2) Allergan

(3) Monster Beverage

(4) Amazon.com

(5) VF

n % in five largest holdings 20.3%1,2

n Number of holdings 1001

n Net assets $34.18 million, Institutional Class Shares

Growth of a $100,000 investment in the

Turner Titan II Fund, Institutional Class Shares:

May 7, 2009-September 30, 20153,4

Average annual total returns (Periods ended September 30, 2015)3

| | | One

year | | Three

years | | Five

years | | Since

inception | |

Turner Titan II Fund, Institutional Class Shares5 | | | 2.13 | % | | | 3.87 | % | | | 3.31 | % | | | 3.96 | %4 | |

Turner Titan II Fund, Investor Class Shares5 | | | 1.86 | % | | | 3.57 | % | | | 3.04 | % | | | 3.69 | %4 | |

Turner Titan II Fund, Class C Shares5 | | | 1.17 | % | | | 2.83 | % | | | 2.29 | % | | | 3.12 | %6 | |

S&P 500 Index7 | | | -0.61 | % | | | 12.40 | % | | | 13.34 | % | | | 14.83 | %4 | |

Barclays Capital U.S. Aggregate Bond Index8 | | | 2.94 | % | | | 1.71 | % | | | 3.10 | % | | | 4.48 | %4 | |

Lipper Long/Short Equity Funds Average9 | | | -1.59 | % | | | 4.86 | % | | | 5.45 | % | | | 6.88 | %4 | |

Sector weightings2:

Manager's discussion of fund performance

The Turner Titan II Fund generated a positive absolute return for the 12-month period ended September 30, 2015. During the reporting period, the Fund outperformed the S&P 500 Index and Lipper Long/Short Equity Fund Average but trailed the Barclays Capital U.S. Aggregate Bond Index. The Turner Titan II Fund invests in stocks of companies with primarily large capitalization ranges across all major industry sectors using a long/short strategy in seeking to capture alpha, reduce volatility, and preserve capital in declining markets.

During the reporting period, most sectors contributed to performance. The top contributors to performance were long and short positions in consumer discretionary, technology and health care sectors. Materials and energy slightly detracted performance but were not drags compared to the S&P 500 benchmark for the 12-month period ended September 30, 2015.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. Top five holdings are based on long positions. The fund composition is subject to change.

2 Percentages based on total investments of long positions.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Titan II Fund (Institutional Class Shares and Investor Class Shares) was May 7, 2009. Index returns are based on Institutional Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Titan II Fund (Class C Shares) was July 14, 2009.

7 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

8 The Barclays Capital U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

9 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

The Turner Titan II Fund may focus its investments from time to time on one or more economic sectors. To the extent that it does so, developments affecting companies in that sector or sectors will likely have a magnified effect on the fund's net asset value and total return. The fund is subject to the risks associated with selling securities short. A short sale involves a finite opportunity for appreciation, but a theoretically unlimited risk of loss. The fund is also subject to taxable income and realized capital gains. Shareholder redemptions may force the fund to sell securities at an inappropriate time, also resulting in realized gains.

TURNER FUNDS 2015 ANNUAL REPORT 7

INVESTMENT REVIEW (Unaudited)

Turner Emerging Growth Fund

Fund profile

September 30, 2015

n Ticker symbol TMCGX

Investor Class Shares

n CUSIP #872524301

Investor Class Shares

n Top five holdings1

(1) Fortune Brands Home & Security

(2) Virtusa

(3) Inphi

(4) CDW Corp. of Delaware

(5) Inogen

n % in five largest holdings 16.0%1,2

n Number of holdings 491

n Net assets $71.69 million, Investor Class Shares

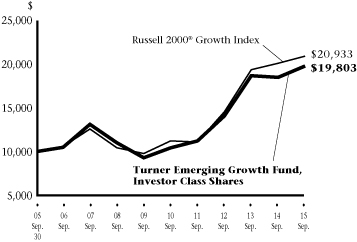

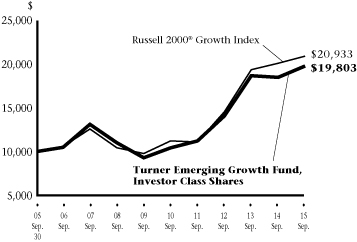

Growth of a $10,000 investment in the

Turner Emerging Growth Fund, Investor Class Shares:

September 30, 2005-September 30, 20153,4

Average annual total returns (Periods ended September 30, 2015)3

| | | One

year | | Three

years | | Five

years | | Ten

years | | Since

inception | |

Turner Emerging Growth Fund, Institutional Class Shares5 | | | 7.28 | % | | | 12.29 | % | | | 13.95 | % | | | — | | | | 17.14 | %6 | |

Turner Emerging Growth Fund, Investor Class Shares5 | | | 7.01 | % | | | 12.00 | % | | | 13.67 | % | | | 7.07 | % | | | 16.88 | %4 | |

Russell 2000® Growth Index7 | | | 4.04 | % | | | 12.85 | % | | | 13.26 | % | | | 7.67 | % | | | 17.87 | %4 | |

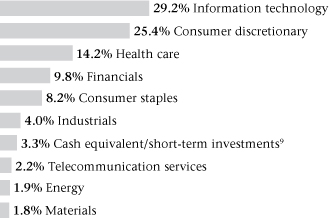

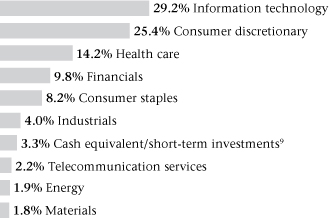

Sector weightings2:

Manager's discussion of fund performance

During the 12-month period ended September 30, 2015, the Turner Emerging Growth Fund handily beat the return of its benchmark, the Russell 2000® Growth Index.

The strongest returning sectors were health care and technology with those sectors outperforming their corresponding index sectors. Within those sectors, pharmaceuticals, medical specialties, semiconductors and information technology performed the best. Consumer discretionary and consumer staple stocks detracted the most from relative returns. In those sectors, food producers, apparel and restaurants posted the worst returns for the fiscal year.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional and Investor Class Shares will differ due to differences in fees.

4 The inception date of the Turner Emerging Growth Fund (Investor Class Shares) was February 27, 1998. Index returns are based on Investor Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Emerging Growth Fund (Institutional Class Shares) was February 1, 2009.

7 The Russell 2000® Growth Index is a widely-recognized, capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 2,000 smallest U.S. companies out of the 3,000 largest U.S. companies with higher growth rates and price-to-book ratios.

8 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

The Turner Emerging Growth Fund may buy and sell securities frequently as part of its investment strategy. The smaller capitalization companies the fund invests in may be more vulnerable to adverse business or economic events than larger, more established companies. The fund is subject to risks due to its foreign investments. The fund is also subject to taxable income and realized capital gains. Shareholder redemptions may force the fund to sell securities at an inappropriate time, also resulting in realized gains.

8 TURNER FUNDS 2015 ANNUAL REPORT

INVESTMENT REVIEW (Unaudited)

Turner Midcap Growth Fund

Fund profile

September 30, 2015

n Ticker symbol TMGFX

Investor Class Shares

n CUSIP #900297409

Investor Class Shares

n Top five holdings1

(1) NXP Semiconductors

(2) Avago Technologies

(3) Monster Beverage

(4) Signature Bank

(5) AMETEK

n % in five largest holdings 15.7%1,2

n Number of holdings 441

n Net assets $133.54 million, Investor Class Shares

Growth of a $10,000 investment in the

Turner Midcap Growth Fund, Investor Class Shares:

September 30, 2005-September 30, 20153,4

Average annual total returns (Periods ended September 30, 2015)3

| | | One

year | | Three

years | | Five

years | | Ten

years | | Since

inception | |

Turner Midcap Growth Fund, Institutional Class Shares5 | | | -4.63 | % | | | 10.10 | % | | | 9.58 | % | | | — | | | | 4.33 | %6 | |

Turner Midcap Growth Fund, Investor Class Shares5 | | | -4.88 | % | | | 9.80 | % | | | 9.30 | % | | | 5.80 | % | | | 9.67 | %4 | |

Turner Midcap Growth Fund, Retirement Class Shares5 | | | -5.11 | % | | | 9.58 | % | | | 9.05 | % | | | 5.51 | % | | | 6.94 | %7 | |

Russell Midcap® Growth Index8 | | | 1.45 | % | | | 13.98 | % | | | 13.58 | % | | | 8.09 | % | | | 8.23 | %4 | |

Sector weightings2:

Manager's discussion of fund performance

For the 12-month period ended September 30, 2015, the Turner Midcap Growth Fund trailed the return of its benchmark, the Russell Midcap® Growth Index. The technology and energy sectors provided the greatest contribution to the fund's performance with solid stock performance in semiconductors and software as a service sub industries. Lower exposure to oil services and natural gas also benefitted the portfolio as oil prices collapsed in the first half of 2015.

The main detractors from performance were in the health care and consumer discretionary sectors. Within these sectors, specialty pharmaceuticals and biotechnology had the greatest negative impact to returns as concerns around higher drug pricing came into focus during the political campaign season and weighed heavily on these industries. In consumer discretionary, results in the recreational products and leisure goods industries were the worst performers.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Retirement Class Shares will differ due to differences in fees.

4 The inception date of the Turner Midcap Growth Fund (Investor Class Shares) was October 1, 1996. Index returns are based on Investor Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Midcap Growth Fund (Institutional Class Shares) was June 16, 2008.

7 The inception date of the Turner Midcap Growth Fund (Retirement Class Shares) was September 24, 2001.

8 The Russell Midcap® Growth Index is a capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 800 smallest U.S. companies out of the 1,000 largest companies with higher growth rates and price-to-book ratios.

9 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

The Turner Midcap Growth Fund may buy and sell securities frequently as part of its investment strategy. The medium capitalization companies in which the fund invests may be more vulnerable to adverse business or economic events than larger, more established companies. The fund is subject to risks due to its foreign investments. The fund is also subject to taxable income and realized capital gains. Shareholder redemptions may force the fund to sell securities at an inappropriate time, also resulting in realized gains.

TURNER FUNDS 2015 ANNUAL REPORT 9

INVESTMENT REVIEW (Unaudited)

Turner Small Cap Growth Fund

Fund profile

September 30, 2015

n Ticker symbol TSCEX

n CUSIP #900297300

Investor Class Shares

n Top five holdings1

(1) Digimarc

(2) HubSpot

(3) Remark Media

(4) ABIOMED

(5) AmSurg

n % in five largest holdings 15.1%1,2

n Number of holdings 531

n Net assets $70.84 million

Growth of a $10,000 investment in the

Turner Small Cap Growth Fund:

September 30, 2005-September 30, 20153

Average annual total returns (Periods ended September 30, 2015)3

| | | One

year | | Three

years | | Five

years | | Ten

years | | Since

inception3 | |

Turner Small Cap Growth Fund4 | | | 6.55 | % | | | 12.91 | % | | | 12.31 | % | | | 7.69 | % | | | 11.13 | % | |

Russell 2000® Growth Index5 | | | 4.04 | % | | | 12.85 | % | | | 13.26 | % | | | 7.67 | % | | | 6.79 | % | |

Sector weightings2:

Manager's discussion of fund performance

During the 12-month period ended September 30, 2015, the Turner Small Cap Growth Fund outperformed its benchmark, the Russell 2000® Growth Index.

The strongest returning sectors were health care, technology, and consumer discretionary with those sectors outperforming their corresponding index sectors. Within those sectors, pharmaceuticals and biotechnology, semiconductors, and apparel/footwear industries performed the best. The producer durables and materials sectors were drags on the portfolio on relative and absolute returns.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. The inception date of the Turner Small Cap Growth Fund was February 7, 1994. Index returns are based on this inception date.

4 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

5 The Russell 2000® Growth Index is a widely-recognized, capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 2,000 smallest U.S. companies out of the 3,000 largest U.S. companies with higher growth rates and price-to-book ratios.

6 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in Notes to Financial Statements for more detailed information.

The Turner Small Cap Growth Fund may buy and sell securities frequently as part of its investment strategy. The smaller capitalization companies the fund invests in may be more vulnerable to adverse business or economic events than larger, more established companies. The fund is subject to risks due to its foreign investments. The fund is also subject to taxable income and realized capital gains. Shareholder redemptions may force the fund to sell securities at an inappropriate time, also resulting in realized gains.

10 TURNER FUNDS 2015 ANNUAL REPORT

Turner Medical Sciences Long/Short Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—76.7% | |

Biotechnology—27.6% | |

Acceleron Pharma*^ | | | 56,740 | | | $ | 1,413 | | |

Achillion Pharmaceuticals*^ | | | 596,550 | | | | 4,122 | | |

AMAG Pharmaceuticals*^ | | | 40,910 | | | | 1,625 | | |

Avalanche Biotechnologies* | | | 111,090 | | | | 915 | | |

Cancer Genetics (a)*^ | | | 92,730 | | | | 725 | | |

Catalyst Pharmaceuticals*^ | | | 356,490 | | | | 1,069 | | |

Emergent BioSolutions*^ | | | 65,220 | | | | 1,858 | | |

Epizyme*^ | | | 62,790 | | | | 807 | | |

Gilead Sciences^ | | | 24,350 | | | | 2,391 | | |

Heron Therapeutics*^ | | | 88,610 | | | | 2,162 | | |

Intercept Pharmaceuticals*^ | | | 6,460 | | | | 1,071 | | |

Ironwood Pharmaceuticals* | | | 104,850 | | | | 1,093 | | |

Juno Therapeutics* | | | 67,610 | | | | 2,751 | | |

NephroGenex (a)*^ | | | 360,388 | | | | 1,218 | | |

Progenics Pharmaceuticals*^ | | | 252,785 | | | | 1,446 | | |

Prothena*^ | | | 130,270 | | | | 5,907 | | |

Retrophin*^ | | | 238,040 | | | | 4,824 | | |

Rigel Pharmaceuticals*^ | | | 285,020 | | | | 704 | | |

Tonix Pharmaceuticals Holding*^ | | | 122,000 | | | | 645 | | |

Trovagene*^ | | | 183,630 | | | | 1,045 | | |

Total Biotechnology | | | | | 37,791 | | |

Health care equipment & supplies—1.6% | |

St. Jude Medical^ | | | 35,720 | | | | 2,254 | | |

Total Health care equipment & supplies | | | | | 2,254 | | |

Health care providers & services—4.4% | |

AmerisourceBergen, Cl A^ | | | 21,090 | | | | 2,003 | | |

Diplomat Pharmacy* | | | 82,220 | | | | 2,363 | | |

Universal Health Services, Cl B | | | 13,260 | | | | 1,655 | | |

Total Health care providers & services | | | | | 6,021 | | |

Pharmaceuticals—43.1% | |

Akari Therapeutics ADR (a)* | | | 41,101 | | | | 1,007 | | |

Allergan*^ | | | 16,530 | | | | 4,493 | | |

Amphastar Pharmaceuticals*^ | | | 89,750 | | | | 1,049 | | |

BioDelivery Sciences

International*^ | | | 579,540 | | | | 3,222 | | |

Bristol-Myers Squibb^ | | | 29,070 | | | | 1,721 | | |

Cardiome Pharma (a)*^ | | | 653,122 | | | | 5,512 | | |

Corium International* | | | 100,000 | | | | 935 | | |

Eli Lilly^ | | | 80,890 | | | | 6,770 | | |

| | | Shares | | Value

(000) | |

Flamel Technologies SA ADR*^ | | | 134,968 | | | $ | 2,201 | | |

GlaxoSmithKline ADR^ | | | 65,510 | | | | 2,519 | | |

Horizon Pharma*^ | | | 405,700 | | | | 8,040 | | |

IGI Laboratories (a)*^ | | | 830,532 | | | | 5,432 | | |

Intra-Cellular Therapies* | | | 24,400 | | | | 977 | | |

Mallinckrodt PLC* | | | 60,100 | | | | 3,843 | | |

Novartis ADR^ | | | 21,960 | | | | 2,019 | | |

Ocera Therapeutics (a)*^ | | | 503,457 | | | | 1,591 | | |

Paratek Pharmaceuticals | | | 52,720 | | | | 1,002 | | |

Pernix Therapeutics Holdings* | | | 325,990 | | | | 1,030 | | |

Pfizer^ | | | 104,130 | | | | 3,271 | | |

Sanofi ADR^ | | | 31,120 | | | | 1,477 | | |

SteadyMed (a)*^ | | | 297,267 | | | | 1,055 | | |

Total Pharmaceuticals | | | | | 59,166 | | |

Total Common stock

(Cost $114,721)** | | | | | 105,232 | | |

Warrant—0.0% | |

Biotechnology—0.0% | |

NephroGenex (a)* | | | 65,000 | | | | — | | |

Total Biotechnology | | | | | — | | |

Total Warrant

(Cost $—)** | | | | | — | | |

Cash equivalent—10.9% | |

BlackRock Liquidity Funds

TempCash Portfolio,

Dollar Shares, 0.030%‡ | | | 14,867,710 | | | | 14,868 | | |

Total Cash equivalent

(Cost $14,868)** | | | | | 14,868 | | |

Total Investments—87.6%

(Cost $129,589)** | | | | | 120,100 | | |

Segregated cash with brokers—83.1% | | | | | 113,796 | | |

Securities sold short—(65.2)%

(Proceeds $(103,280))** | | | | | (89,308 | ) | |

Net Other assets (liabilities)—(5.5)% | | | | | (7,578 | ) | |

Net Assets—100.0% | | | | $ | 137,010 | | |

TURNER FUNDS 2015 ANNUAL REPORT 11

Schedule of investments

Turner Medical Sciences Long/Short Fund

Amounts designated as "—" have been rounded to $0.

(a) These securities have been deemed illiquid by the Adviser and represent 12.10% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

‡ Rate shown is the 7-day effective yield as of September 30, 2015.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

12 TURNER FUNDS 2015 ANNUAL REPORT

Schedule of securities sold short

Turner Medical Sciences Long/Short Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—33.1% | |

Biotechnology—9.3% | |

Alexion Pharmaceuticals | | | 12,460 | | | $ | 1,949 | | |

Amgen | | | 17,590 | | | | 2,433 | | |

Kite Pharma | | | 70,700 | | | | 3,936 | | |

Novavax | | | 120,260 | | | | 850 | | |

Spark Therapeutics | | | 28,200 | | | | 1,177 | | |

Synergy Pharmaceuticals | | | 173,270 | | | | 918 | | |

Vitae Pharmaceuticals | | | 118,242 | | | | 1,302 | | |

Total Biotechnology | | | | | 12,565 | | |

Health care equipment & supplies—6.5% | |

Anika Therapeutics | | | 74,860 | | | | 2,383 | | |

Hologic | | | 38,370 | | | | 1,501 | | |

Nevro | | | 58,100 | | | | 2,695 | | |

Stryker | | | 24,930 | | | | 2,346 | | |

Total Health care equipment & supplies | | | | | 8,925 | | |

Health care providers & services—8.4% | |

Aetna | | | 12,300 | | | | 1,346 | | |

Cardinal Health | | | 22,420 | | | | 1,722 | | |

DaVita HealthCare Partners | | | 22,000 | | | | 1,591 | | |

Express Scripts Holdings | | | 24,530 | | | | 1,986 | | |

HCA Holdings | | | 23,970 | | | | 1,854 | | |

LifePoint Health | | | 19,620 | | | | 1,391 | | |

UnitedHealth Group, Cl B | | | 14,220 | | | | 1,650 | | |

Total Health care providers & services | | | | | 11,540 | | |

Health care technology—1.1% | |

Cerner | | | 25,060 | | | | 1,503 | | |

Total Health care technology | | | | | 1,503 | | |

Life sciences tools & services—1.1% | |

ICON | | | 21,500 | | | | 1,526 | | |

Total Life Sciences Tools & Services | | | | | 1,526 | | |

| | | Shares | | Value

(000) | |

Pharmaceuticals—6.7% | |

ANI Pharmaceuticals | | | 25,980 | | | $ | 1,026 | | |

CVS Health | | | 30,390 | | | | 2,932 | | |

Lannett | | | 54,460 | | | | 2,261 | | |

Novo Nordisk A/S ADR | | | 55,640 | | | | 3,019 | | |

Total Pharmaceuticals | | | | | 9,238 | | |

Total Common stock

(Proceeds $53,611)* | | | | | 45,297 | | |

Exchange traded funds—32.1% | |

Health Care Select Sector

SPDR Fund | | | 153,570 | | | | 10,171 | | |

iShares NASDAQ

Biotechnology ETF | | | 35,890 | | | | 10,887 | | |

iShares Russell 2000 Growth ETF | | | 108,480 | | | | 11,846 | | |

SPDR S&P 500 ETF Trust | | | 12,510 | | | | 2,397 | | |

SPDR S&P Biotech ETF | | | 139,920 | | | | 8,710 | | |

Total Exchange traded funds

(Proceeds $49,669)* | | | | | 44,011 | | |

Total Securities sold short—65.2%

(Proceeds $103,280)* | | | | $ | 89,308 | | |

Percentages disclosed are based on total net assets of the Fund at September 30, 2015.

* This number is listed in thousands.

ADR — American Depositary Receipt

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 ANNUAL REPORT 13

Turner Titan II Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—85.8% | |

Consumer discretionary—20.9% | |

Advance Auto Parts | | | 4,500 | | | $ | 853 | | |

Amazon.com*^ | | | 3,930 | | | | 2,012 | | |

AMC Networks, Cl A* | | | 10,610 | | | | 776 | | |

Buffalo Wild Wings* | | | 4,100 | | | | 793 | | |

Delphi Automotive^ | | | 13,780 | | | | 1,048 | | |

Dollar General | | | 11,700 | | | | 848 | | |

Expedia^ | | | 5,000 | | | | 588 | | |

Mohawk Industries* | | | 3,200 | | | | 582 | | |

Newell Rubbermaid | | | 31,700 | | | | 1,259 | | |

Royal Caribbean Cruises | | | 8,600 | | | | 766 | | |

Target | | | 10,500 | | | | 826 | | |

Time Warner | | | 9,100 | | | | 626 | | |

VF^ | | | 28,380 | | | | 1,936 | | |

Total Consumer discretionary | | | | | 12,913 | | |

Consumer staples—9.8% | |

Constellation Brands, Cl A^ | | | 15,030 | | | | 1,882 | | |

Monster Beverage* | | | 15,100 | | | | 2,040 | | |

PepsiCo^ | | | 10,900 | | | | 1,028 | | |

Rite Aid*^ | | | 77,590 | | | | 471 | | |

The Kroger | | | 16,600 | | | | 599 | | |

Total Consumer staples | | | | | 6,020 | | |

Energy—4.6% | |

EOG Resources^ | | | 14,020 | | | | 1,021 | | |

Patterson-UTI Energy | | | 46,800 | | | | 615 | | |

Pioneer Natural Resources | | | 9,920 | | | | 1,206 | | |

Total Energy | | | | | 2,842 | | |

Financials—11.7% | |

Bank of New York Mellon | | | 32,800 | | | | 1,284 | | |

BlackRock | | | 2,640 | | | | 785 | | |

CME Group^ | | | 27,700 | | | | 2,568 | | |

Equinix | | | 4,680 | | | | 1,280 | | |

Signature Bank* | | | 3,400 | | | | 468 | | |

Zions Bancorp | | | 28,130 | | | | 775 | | |

Total Financials | | | | | 7,160 | | |

| | | Shares | | Value

(000) | |

Health care—10.9% | |

Allergan*^ | | | 7,900 | | | $ | 2,147 | | |

Boston Scientific* | | | 66,400 | | | | 1,090 | | |

Celgene* | | | 13,090 | | | | 1,416 | | |

McKesson^ | | | 5,890 | | | | 1,090 | | |

Pfizer^ | | | 29,800 | | | | 936 | | |

Total Health care | | | | | 6,679 | | |

Industrials—5.5% | |

Danaher^ | | | 9,930 | | | | 846 | | |

JetBlue Airways*^ | | | 34,420 | | | | 888 | | |

Northrop Grumman | | | 4,660 | | | | 773 | | |

Union Pacific | | | 9,650 | | | | 853 | | |

Total Industrials | | | | | 3,360 | | |

Information technology—19.9% | |

Alphabet, Cl A*^ | | | 1,670 | | | | 1,066 | | |

Apple^ | | | 11,430 | | | | 1,261 | | |

Avago Technologies | | | 7,940 | | | | 993 | | |

Facebook, Cl A*^ | | | 13,600 | | | | 1,223 | | |

Fortinet* | | | 20,400 | | | | 867 | | |

Global Payments^ | | | 5,980 | | | | 686 | | |

Microsoft | | | 18,910 | | | | 837 | | |

NXP Semiconductors*^ | | | 17,870 | | | | 1,555 | | |

Palo Alto Networks* | | | 3,520 | | | | 605 | | |

PayPal Holdings* | | | 39,800 | | | | 1,235 | | |

Salesforce.com*^ | | | 15,560 | | | | 1,080 | | |

Visa, Cl A^ | | | 11,150 | | | | 777 | | |

Total Information technology | | | | | 12,185 | | |

Materials—2.5% | |

Albemarle | | | 16,890 | | | | 745 | | |

PPG Industries | | | 8,900 | | | | 780 | | |

Total Materials | | | | | 1,525 | | |

Total Common stock

(Cost $52,839)** | | | | | 52,684 | | |

14 TURNER FUNDS 2015 ANNUAL REPORT

Schedule of investments

Turner Titan II Fund

| | | Shares | | Value

(000) | |

Warrant—0.1% | |

Financials—0.1% | |

Atlas Mara (a)* | | | 472,160 | | | $ | 47 | | |

Total Financials | | | | | 47 | | |

Total Warrant

(Cost $92)** | | | | | 47 | | |

Total Investments—85.9%

(Cost $52,931)** | | | | | 52,731 | | |

Segregated cash with brokers—59.9% | | | | | 36,748 | | |

Securities sold short—(50.5)%

(Proceeds $(32,868))** | | | | | (30,973 | ) | |

Net Other assets (liabilities)—4.7% | | | | | 2,878 | | |

Net Assets—100.0% | | | | $ | 61,384 | | |

(a) These securities have been deemed illiquid by the Adviser and represent 0.08% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 ANNUAL REPORT 15

Schedule of securities sold short

Turner Titan II Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—36.4% | |

Consumer discretionary—5.3% | |

American Axle & Manufacturing

Holdings | | | 19,400 | | | $ | 387 | | |

Choice Hotels International | | | 9,700 | | | | 462 | | |

Hanesbrands | | | 15,710 | | | | 455 | | |

Mattress Firm Holding | | | 7,100 | | | | 296 | | |

Priceline Group | | | 400 | | | | 495 | | |

Tiffany | | | 7,900 | | | | 610 | | |

TripAdvisor | | | 3,700 | | | | 233 | | |

Twenty-First Century Fox, Cl A | | | 12,600 | | | | 340 | | |

Total Consumer discretionary | | | | | 3,278 | | |

Consumer staples—2.1% | |

Colgate-Palmolive | | | 10,800 | | | | 685 | | |

The Hain Celestial Group | | | 11,600 | | | | 599 | | |

Total Consumer staples | | | | | 1,284 | | |

Energy—4.2% | |

Exxon Mobil | | | 12,810 | | | | 953 | | |

Helmerich & Payne | | | 6,900 | | | | 326 | | |

National Oilwell Varco | | | 14,020 | | | | 528 | | |

Tesoro | | | 7,860 | | | | 764 | | |

Total Energy | | | | | 2,571 | | |

Financials—4.5% | |

Capital One Financial | | | 8,400 | | | | 609 | | |

Citigroup | | | 14,260 | | | | 708 | | |

Comerica | | | 11,600 | | | | 477 | | |

Eaton Vance | | | 10,000 | | | | 334 | | |

Franklin Resources | | | 8,370 | | | | 312 | | |

Regions Financial | | | 34,200 | | | | 308 | | |

Total Financials | | | | | 2,748 | | |

Health care—4.7% | |

Alexion Pharmaceuticals | | | 2,980 | | | | 466 | | |

Baxter International | | | 15,500 | | | | 509 | | |

CVS Health | | | 5,700 | | | | 550 | | |

Mettler-Toledo International | | | 3,300 | | | | 940 | | |

Theravance | | | 17,000 | | | | 122 | | |

Varian Medical Systems | | | 4,120 | | | | 304 | | |

Total Health care | | | | | 2,891 | | |

| | | Shares | | Value

(000) | |

Industrials—5.7% | |

| 3M | | | 6,630 | | | $ | 939 | | |

Applied Industrial Technologies | | | 15,800 | | | | 603 | | |

Deere | | | 6,340 | | | | 469 | | |

Dover | | | 4,000 | | | | 229 | | |

Emerson Electric | | | 8,800 | | | | 389 | | |

L-3 Communications Holdings | | | 4,100 | | | | 429 | | |

USG | | | 16,000 | | | | 426 | | |

Total Industrials | | | | | 3,484 | | |

Information technology—9.3% | |

Akamai Technologies | | | 6,600 | | | | 456 | | |

Alibaba Group Holding ADR | | | 12,780 | | | | 754 | | |

Analog Devices | | | 8,400 | | | | 474 | | |

Check Point Software Technologies | | | 9,330 | | | | 740 | | |

F5 Networks | | | 6,000 | | | | 695 | | |

Fairchild Semiconductor

International | | | 40,200 | | | | 564 | | |

International Business Machines | | | 2,200 | | | | 319 | | |

NetSuite | | | 10,430 | | | | 874 | | |

Tech Data | | | 6,760 | | | | 463 | | |

Workday, Cl A | | | 5,100 | | | | 351 | | |

Total Information technology | | | | | 5,690 | | |

Materials—0.6% | |

The Valspar | | | 4,900 | | | | 352 | | |

Total Materials | | | | | 352 | | |

Total Common stock

(Proceeds $23,547)* | | | | | 22,298 | | |

Exchange traded funds—14.1% | |

iShares Russell 1000 Growth ETF | | | 10,020 | | | | 932 | | |

Market Vectors Semiconductor ETF | | | 6,700 | | | | 334 | | |

SPDR S&P 500 ETF Trust | | | 24,140 | | | | 4,626 | | |

SPDR S&P Biotech ETF | | | 4,650 | | | | 289 | | |

SPDR S&P MidCap 400 ETF Trust | | | 10,020 | | | | 2,494 | | |

Total Exchange traded funds

(Proceeds $9,321)* | | | | | 8,675 | | |

Total Securities sold short—50.5%

(Proceeds $32,868)* | | | | $ | 30,973 | | |

16 TURNER FUNDS 2015 ANNUAL REPORT

Schedule of securities sold short

Turner Titan II Fund

Percentages disclosed are based on total net assets of the Fund at September 30, 2015.

* This number is listed in thousands.

ADR — American Depositary Receipt

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 ANNUAL REPORT 17

Turner Emerging Growth Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—67.5%† | |

Consumer discretionary—12.0% | |

Aaron's | | | 20,000 | | | $ | 722 | | |

Century Communities* | | | 60,000 | | | | 1,191 | | |

D.R. Horton | | | 60,000 | | | | 1,762 | | |

Installed Building Products* | | | 20,000 | | | | 506 | | |

Isle of Capri Casinos* | | | 30,000 | | | | 523 | | |

M/I Homes* | | | 35,000 | | | | 825 | | |

Metaldyne Performance Group | | | 55,000 | | | | 1,156 | | |

Motorcar Parts of America* | | | 28,000 | | | | 878 | | |

Papa John's International | | | 17,000 | | | | 1,164 | | |

Ulta Salon, Cosmetics &

Fragrance* | | | 11,000 | | | | 1,796 | | |

Total Consumer discretionary | | | | | 10,523 | | |

Consumer staples—2.4% | |

Prestige Brands Holdings* | | | 46,350 | | | | 2,093 | | |

Total Consumer staples | | | | | 2,093 | | |

Financials—5.2% | |

Blackhawk Network Holdings* | | | 35,380 | | | | 1,500 | | |

CoreSite Realty | | | 25,000 | | | | 1,286 | | |

Patriot National* | | | 112,480 | | | | 1,780 | | |

Total Financials | | | | | 4,566 | | |

Health care—13.4% | |

ABIOMED* | | | 12,000 | | | | 1,113 | | |

Acadia Healthcare* | | | 8,000 | | | | 530 | | |

Cross Country Healthcare* | | | 110,000 | | | | 1,497 | | |

Cyberonics* | | | 25,000 | | | | 1,520 | | |

Envision Healthcare Holdings* | | | 15,000 | | | | 552 | | |

HealthEquity* | | | 15,000 | | | | 443 | | |

Inogen* | | | 49,000 | | | | 2,380 | | |

Ligand Pharmaceuticals* | | | 5,000 | | | | 428 | | |

Molina Healthcare* | | | 25,000 | | | | 1,721 | | |

PRA Health Sciences* | | | 10,000 | | | | 388 | | |

Vascular Solutions* | | | 35,000 | | | | 1,134 | | |

Total Health care | | | | | 11,706 | | |

Industrials—4.7% | |

Avolon Holdings* | | | 20,000 | | | | 609 | | |

Dycom Industries* | | | 4,000 | | | | 289 | | |

| | | Shares | | Value

(000) | |

Fortune Brands Home & Security | | | 55,000 | | | $ | 2,611 | | |

Patrick Industries* | | | 15,000 | | | | 592 | | |

Total Industrials | | | | | 4,101 | | |

Information technology—29.8% | |

Autobytel* | | | 20,000 | | | | 335 | | |

CDW Corp. of Delaware | | | 60,000 | | | | 2,452 | | |

Cvent* | | | 20,000 | | | | 673 | | |

Digimarc*^ | | | 20,000 | | | | 611 | | |

Fleetmatics Group PLC* | | | 10,000 | | | | 491 | | |

Hortonworks* | | | 10,000 | | | | 219 | | |

HubSpot* | | | 40,000 | | | | 1,855 | | |

Imperva* | | | 5,000 | | | | 327 | | |

Inphi* | | | 105,000 | | | | 2,524 | | |

LogMeIn* | | | 30,000 | | | | 2,045 | | |

Luxoft Holding* | | | 15,000 | | | | 949 | | |

MaxLinear, Cl A* | | | 35,000 | | | | 435 | | |

New Relic* | | | 50,000 | | | | 1,906 | | |

Pandora Media* | | | 100,000 | | | | 2,134 | | |

Paycom Software*^ | | | 65,830 | | | | 2,364 | | |

Paylocity Holdings* | | | 15,000 | | | | 450 | | |

Proofpoint* | | | 34,000 | | | | 2,051 | | |

SPS Commerce* | | | 25,000 | | | | 1,697 | | |

Virtusa* | | | 50,000 | | | | 2,567 | | |

Total Information technology | | | | | 26,085 | | |

Total Common stock

(Cost $57,427)** | | | | | 59,074 | | |

Cash equivalent—22.2% | |

BlackRock Liquidity Funds

TempCash Portfolio,

Dollar Shares, 0.030%‡ (1) | | | 19,447,412 | | | | 19,447 | | |

Total Cash equivalent

(Cost $19,447)** | | | | | 19,447 | | |

Total Investments—89.7%

(Cost $76,874)** | | | | | 78,521 | | |

Net Other assets (liabilities)—10.3% | | | | | 8,981 | | |

Net Assets—100.0% | | | | $ | 87,502 | | |

18 TURNER FUNDS 2015 ANNUAL REPORT

Schedule of investments

Turner Emerging Growth Fund

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at September 30, 2015 was $1,399**.

^ Security fully or partially on loan at September 30, 2015. The total value of securities on loan at September 30, 2015 was $1,391**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of September 30, 2015.

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 ANNUAL REPORT 19

Turner Midcap Growth Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—98.0%† | |

Consumer discretionary—25.7% | |

| | 2 | U* | | | 77,120 | | | $ | 2,769 | | |

Advance Auto Parts | | | 23,950 | | | | 4,539 | | |

Chipotle Mexican Grill* | | | 6,130 | | | | 4,415 | | |

Criteo SA ADR* | | | 49,880 | | | | 1,872 | | |

Dollar Tree* | | | 75,930 | | | | 5,062 | | |

Expedia | | | 30,960 | | | | 3,643 | | |

Mohawk Industries* | | | 21,890 | | | | 3,979 | | |

Netflix* | | | 31,360 | | | | 3,238 | | |

Newell Rubbermaid | | | 77,720 | | | | 3,086 | | |

Starbucks | | | 84,480 | | | | 4,802 | | |

Under Armour, Cl A* | | | 45,730 | | | | 4,426 | | |

Wayfair*^ | | | 69,240 | | | | 2,428 | | |

Total Consumer discretionary | | | | | 44,259 | | |

Consumer staples—8.3% | |

Constellation Brands, Cl A | | | 35,650 | | | | 4,464 | | |

Monster Beverage* | | | 40,880 | | | | 5,524 | | |

WhiteWave Foods, Cl A* | | | 107,770 | | | | 4,327 | | |

Total Consumer staples | | | | | 14,315 | | |

Energy—2.0% | |

Nabors Industries | | | 355,950 | | | | 3,364 | | |

Total Energy | | | | | 3,364 | | |

Financials—9.9% | |

Intercontinental Exchange Group | | | 20,770 | | | | 4,881 | | |

Moody's | | | 33,630 | | | | 3,302 | | |

Signature Bank* | | | 38,320 | | | | 5,272 | | |

TD Ameritrade Holdings | | | 111,315 | | | | 3,544 | | |

Total Financials | | | | | 16,999 | | |

Health care—14.4% | |

Acadia Healthcare* | | | 73,340 | | | | 4,860 | | |

Achillion Pharmaceuticals* | | | 427,780 | | | | 2,956 | | |

Cooper | | | 14,850 | | | | 2,211 | | |

Horizon Pharma* | | | 161,260 | | | | 3,196 | | |

Jazz Pharmaceuticals* | | | 26,610 | | | | 3,534 | | |

LDR Holding* | | | 98,900 | | | | 3,415 | | |

Regeneron Pharmaceuticals* | | | 9,890 | | | | 4,600 | | |

Total Health care | | | | | 24,772 | | |

| | | Shares | | Value

(000) | |

Industrials—4.0% | |

AMETEK | | | 98,730 | | | $ | 5,165 | | |

Roper Technologies | | | 10,980 | | | | 1,721 | | |

Total Industrials | | | | | 6,886 | | |

Information technology—29.6% | |

Adobe Systems* | | | 51,920 | | | | 4,269 | | |

Alliance Data Systems* | | | 16,930 | | | | 4,385 | | |

Avago Technologies | | | 44,290 | | | | 5,537 | | |

Cavium*^ | | | 82,869 | | | | 5,086 | | |

Facebook, Cl A* | | | 49,620 | | | | 4,461 | | |

HubSpot* | | | 58,260 | | | | 2,702 | | |

Mobileye* | | | 62,490 | | | | 2,842 | | |

Monolithic Power Systems | | | 84,790 | | | | 4,341 | | |

NXP Semiconductors* | | | 67,580 | | | | 5,883 | | |

Palo Alto Networks* | | | 19,290 | | | | 3,318 | | |

Salesforce.com* | | | 58,900 | | | | 4,089 | | |

ServiceNow* | | | 55,530 | | | | 3,857 | | |

Total Information technology | | | | | 50,770 | | |

Materials—1.8% | |

PPG Industries | | | 36,090 | | | | 3,165 | | |

Total Materials | | | | | 3,165 | | |

Telecommunication services—2.3% | |

SBA Communications, Cl A* | | | 37,130 | | | | 3,889 | | |

Total Telecommunication services | | | | | 3,889 | | |

Total Common stock

(Cost $153,833)** | | | | | 168,419 | | |

Cash equivalent—3.3% | |

BlackRock Liquidity Funds

TempCash Portfolio,

Dollar Shares, 0.030%‡ (1) | | | 5,752,096 | | | | 5,752 | | |

Total Cash equivalent

(Cost $5,752)** | | | | | 5,752 | | |

Total Investments—101.3%

(Cost $159,585)** | | | | | 174,171 | | |

Net Other assets (liabilities)—(1.3)% | | | | | (2,184 | ) | |

Net Assets—100.0% | | | | $ | 171,987 | | |

20 TURNER FUNDS 2015 ANNUAL REPORT

Schedule of investments

Turner Midcap Growth Fund

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at September 30, 2015 was $538**.

^ Security fully or partially on loan at September 30, 2015. The total value of securities on loan at September 30, 2015 was $544**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of September 30, 2015.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 ANNUAL REPORT 21

Turner Small Cap Growth Fund

September 30, 2015

| | | Shares | | Value

(000) | |

Common stock—98.9%† | |

Consumer discretionary—15.3% | |

| | 2 | U*^ | | | 44,000 | | | $ | 1,580 | | |

Buffalo Wild Wings* | | | 9,000 | | | | 1,741 | | |

Lithia Motors, Cl A | | | 14,000 | | | | 1,514 | | |

Oxford Industries | | | 15,280 | | | | 1,129 | | |

Pool | | | 25,000 | | | | 1,807 | | |

Restoration Hardware Holdings* | | | 14,000 | | | | 1,306 | | |

Zoe's Kitchen*^ | | | 45,000 | | | | 1,777 | | |

Total Consumer discretionary | | | | | 10,854 | | |

Consumer staples—3.0% | |

Casey's General Stores | | | 10,000 | | | | 1,030 | | |

Smart & Final Stores* | | | 30,000 | | | | 471 | | |

TreeHouse Foods* | | | 8,000 | | | | 622 | | |

Total Consumer staples | | | | | 2,123 | | |

Energy—0.9% | |

Diamondback Energy* | | | 10,000 | | | | 646 | | |

Total Energy | | | | | 646 | | |

Financials—5.7% | |

Bank of the Ozarks | | | 28,000 | | | | 1,225 | | |

Blackhawk Network Holdings* | | | 20,000 | | | | 848 | | |

Essent Group* | | | 30,000 | | | | 746 | | |

Home BancShares | | | 30,000 | | | | 1,215 | | |

Total Financials | | | | | 4,034 | | |

Health care—25.6% | |

ABIOMED* | | | 23,000 | | | | 2,134 | | |

Amicus Therapeutics* | | | 90,000 | | | | 1,259 | | |

AMN Healthcare Services* | | | 35,000 | | | | 1,050 | | |

AmSurg*^ | | | 25,000 | | | | 1,943 | | |

Horizon Pharma* | | | 40,000 | | | | 793 | | |

Inogen* | | | 27,500 | | | | 1,335 | | |

LDR Holding*^ | | | 55,000 | | | | 1,899 | | |

Molina Healthcare* | | | 22,500 | | | | 1,549 | | |

Neurocrine Biosciences* | | | 38,000 | | | | 1,512 | | |

PRA Health Sciences* | | | 33,000 | | | �� | 1,281 | | |

Prothena* | | | 33,000 | | | | 1,496 | | |

| | | Shares | | Value

(000) | |

Repligen* | | | 68,000 | | | $ | 1,894 | | |

Total Health care | | | | | 18,145 | | |

Industrials—5.8% | |

Allegiant Travel | | | 6,000 | | | | 1,298 | | |

Energous*^ | | | 115,000 | | | | 794 | | |

Healthcare Services Group | | | 40,000 | | | | 1,347 | | |

Virgin America* | | | 20,000 | | | | 685 | | |

Total Industrials | | | | | 4,124 | | |

Information technology—38.5% | |

Cavium* | | | 30,000 | | | | 1,841 | | |

CoreLogic* | | | 17,000 | | | | 633 | | |

CUI Global (a)*^ | | | 220,000 | | | | 1,137 | | |

Demandware*^ | | | 17,000 | | | | 879 | | |

Digimarc*^ | | | 125,000 | | | | 3,819 | | |

Euronet Worldwide* | | | 24,000 | | | | 1,778 | | |

Guidewire Software* | | | 30,000 | | | | 1,577 | | |

Heartland Payment Systems | | | 18,000 | | | | 1,134 | | |

HubSpot* | | | 48,000 | | | | 2,226 | | |

LogMeIn* | | | 8,000 | | | | 545 | | |

MINDBODY, Cl A* | | | 40,000 | | | | 625 | | |

Pandora Media* | | | 65,000 | | | | 1,387 | | |

Proofpoint* | | | 32,000 | | | | 1,930 | | |

Remark Media (a)* | | | 490,000 | | | | 2,156 | | |

RingCentral, Cl A* | | | 35,000 | | | | 635 | | |

Shopify, Cl A* | | | 40,000 | | | | 1,408 | | |

SPS Commerce*^ | | | 25,000 | | | | 1,697 | | |

The Ultimate Software Group* | | | 5,500 | | | | 985 | | |

Tyler Technologies* | | | 5,500 | | | | 821 | | |

Total Information technology | | | | | 27,213 | | |

Materials—4.1% | |

Headwaters* | | | 90,000 | | | | 1,692 | | |

Senomyx*^ | | | 275,000 | | | | 1,227 | | |

Total Materials | | | | | 2,919 | | |

Total Common stock

(Cost $65,297)** | | | | | 70,058 | | |

22 TURNER FUNDS 2015 ANNUAL REPORT

Schedule of investments

Turner Small Cap Growth Fund

| | | Shares | | Value

(000) | |

Cash equivalent—16.1% | |

BlackRock Liquidity Funds

TempCash Portfolio,

Dollar Shares, 0.030%‡ (1) | | | 11,420,921 | | | $ | 11,421 | | |

Total Cash equivalent

(Cost $11,421)** | | | | | 11,421 | | |

Total Investments—115.0%

(Cost $76,718)** | | | | | 81,479 | | |

Net Other assets (liabilities)—(15.0)% | | | | | (10,637 | ) | |

Net Assets—100.0% | | | | $ | 70,842 | | |

(a) These securities have been deemed illiquid by the Adviser and represent 4.65% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at September 30, 2015 was $10,013**.

^ Security fully or partially on loan at September 30, 2015. The total value of securities on loan at September 30, 2015 was $9,897**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of September 30, 2015.

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 ANNUAL REPORT 23

Statements of assets and liabilities (000)

September 30, 2015

| | | Turner

Medical Sciences

Long/Short

Fund | | Turner

Titan II

Fund | | Turner

Emerging

Growth Fund | | Turner

Midcap

Growth Fund | | Turner

Small Cap

Growth Fund | |

Assets: | |

Investment securities, at cost | | $ | 129,589 | | | $ | 52,931 | | | $ | 76,874 | | | $ | 159,585 | | | $ | 76,718 | | |

Investment securities, at value | | $ | 120,100 | | | $ | 52,731 | | | $ | 78,521 | * | | $ | 174,171 | * | | $ | 81,479 | * | |

Cash | | | — | | | | 6,651 | | | | — | | | | — | | | | — | | |

Deposits with brokers for securities sold short | | | 113,796 | | | | 36,748 | | | | — | | | | — | | | | — | | |

Foreign currency, at value | | | — | | | | 3 | | | | — | | | | — | | | | — | | |

Receivable for investment securities sold | | | 10,556 | | | | 3,296 | | | | 11,975 | | | | 5,318 | | | | 6,753 | | |

Receivable for capital shares sold | | | 1,208 | | | | 154 | | | | 2 | | | | 45 | | | | 64 | | |

Prepaid expenses | | | 47 | | | | 31 | | | | 29 | | | | 76 | | | | 24 | | |

Receivable for dividend income | | | 78 | | | | 10 | | | | 83 | | | | 23 | | | | 23 | | |

Reclaim receivable | | | 1 | | | | 1 | | | | — | | | | — | | | | — | | |

Total assets | | | 245,786 | | | | 99,625 | | | | 90,610 | | | | 179,633 | | | | 88,343 | | |

Liabilities: | |

Securities sold short, at proceeds | | | 103,280 | | | | 32,868 | | | | — | | | | — | | | | — | | |

Securities sold short, at value | | | 89,308 | | | | 30,973 | | | | — | | | | — | | | | — | | |

Foreign currency overdraft, at value | | | 1 | | | | — | | | | — | | | | — | | | | — | | |

Payable for investment securities purchased | | | 18,612 | | | | 6,973 | | | | 1,640 | | | | 6,466 | | | | 5,720 | | |

Obligation to return securities lending collateral | | | — | | | | — | | | | 1,399 | | | | 538 | | | | 10,013 | | |

Payable for capital shares redeemed | | | 517 | | | | 187 | | | | 7 | | | | 418 | | | | 1,705 | | |

Dividends payable on securities sold short (Note 2) | | | 152 | | | | 55 | | | | — | | | | — | | | | — | | |

Payable due to investment adviser | | | 113 | | | | 13 | | | | 1 | | | | 77 | | | | 12 | | |

Payable due to administrator | | | 10 | | | | 4 | | | | 5 | | | | 22 | | | | 4 | | |

Payable due to shareholder servicing | | | 20 | | | | 3 | | | | 16 | | | | 29 | | | | 16 | | |

Payable due to distributor | | | 3 | | | | 1 | | | | — | | | | 1 | | | | — | | |

Payable due to transfer agent | | | 7 | | | | 7 | | | | 9 | | | | 25 | | | | 6 | | |

Payable due to custodian | | | 3 | | | | 8 | | | | 5 | | | | 4 | | | | 4 | | |

Payable due to compliance services | | | 2 | | | | 1 | | | | 2 | | | | 5 | | | | 1 | | |

Other accrued expenses | | | 28 | | | | 16 | | | | 24 | | | | 61 | | | | 20 | | |

Total liabilities | | | 108,776 | | | | 38,241 | | | | 3,108 | | | | 7,646 | | | | 17,501 | | |

Net assets | | $ | 137,010 | | | $ | 61,384 | | | $ | 87,502 | | | $ | 171,987 | | | $ | 70,842 | | |

*Includes market value of securities on loan | | $ | — | | | $ | — | | | $ | 1,391 | | | $ | 544 | | | $ | 9,897 | | |

Net assets: | |

Portfolio capital | | $ | 136,654 | | | $ | 58,305 | | | $ | 54,217 | | | $ | 140,407 | | | $ | 53,445 | | |

Accumulated net investment loss | | | (1,688 | ) | | | (825 | ) | | | (577 | ) | | | (1,010 | ) | | | (323 | ) | |

Accumulated net realized gain (loss) from investments, securities sold short and foreign

currency transactions | | | (2,439 | ) | | | 2,209 | | | | 32,215 | | | | 18,004 | | | | 12,959 | | |

Net unrealized appreciation on investments, securities sold short, foreign currencies and

translation of other assets and liabilities denominated in foreign currencies | | | 4,483 | | | | 1,695 | | | | 1,647 | | | | 14,586 | | | | 4,761 | | |

Net assets | | $ | 137,010 | | | $ | 61,384 | | | $ | 87,502 | | | $ | 171,987 | | | $ | 70,842 | | |

Outstanding shares of beneficial interest — Institutional Class Shares (1) | | | 2,893 | | | | 3,646 | | | | 506 | | | | 1,661 | | | | — | | |

Outstanding shares of beneficial interest — Investor Class Shares (1) | | | 6,560 | | | | 2,797 | | | | 2,381 | | | | 6,448 | | | | 3,922 | | |

Outstanding shares of beneficial interest — Class C Shares (1) | | | 409 | | | | 179 | | | | — | | | | — | | | | — | | |

Outstanding shares of beneficial interest — Retirement Class Shares (1) | | | — | | | | — | | | | — | | | | 147 | | | | — | | |

Net assets — Institutional Class Shares | | $ | 40,568 | | | $ | 34,179 | | | $ | 15,808 | | | $ | 35,704 | | | $ | — | | |

Net assets — Investor Class Shares | | $ | 90,976 | | | $ | 25,651 | | | $ | 71,694 | | | $ | 133,541 | | | $ | 70,842 | | |

Net assets — Class C Shares | | $ | 5,466 | | | $ | 1,554 | | | $ | — | | | $ | — | | | $ | — | | |

Net assets — Retirement Class Shares | | $ | — | | | $ | — | | | $ | — | | | $ | 2,742 | | | $ | — | | |

Net asset value, offering and redemption price per share — Institutional Class Shares | | $ | 14.02 | | | $ | 9.37 | | | $ | 31.27 | † | | $ | 21.49 | † | | $ | — | | |

Net asset value, offering and redemption price per share — Investor Class Shares | | $ | 13.87 | | | $ | 9.17 | | | $ | 30.11 | | | $ | 20.71 | | | $ | 18.06 | | |

Net asset value, offering and redemption price per share — Class C Shares | | $ | 13.36 | | | $ | 8.68 | | | $ | — | | | $ | — | | | $ | — | | |

Net asset value, offering and redemption price per share — Retirement Class Shares | | $ | — | | | $ | — | | | $ | — | | | $ | 18.69 | † | | $ | — | | |

(1) Unlimited authorization — par value $0.00001.

† Differences in net asset value recalculation and net asset value stated are caused by rounding differences.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

24 TURNER FUNDS 2015 ANNUAL REPORT

TURNER FUNDS 2015 ANNUAL REPORT 25

Statements of operations (000)

| | | Turner

Medical Sciences

Long/Short

Fund | | Turner

Titan II

Fund | | Turner

Emerging

Growth Fund | | Turner

Midcap

Growth Fund | | Turner

Small Cap

Growth Fund | |

| | | year ended

9/30/15 | | year ended

9/30/15 | | year ended

9/30/15 | | year ended

9/30/15 | | year ended

9/30/15 | |

Investment income: | |

Dividend | | $ | 279 | | | $ | 475 | | | $ | 141 | | | $ | 1,124 | | | $ | 149 | | |

Securities lending | | | — | | | | — | | | | 737 | | | | 42 | | | | 219 | | |

Foreign taxes withheld | | | — | | | | (7 | ) | | | — | | | | — | | | | — | | |

Total investment income | | | 279 | | | | 468 | | | | 878 | | | | 1,166 | | | | 368 | | |

Expenses: | |

Investment advisory fees | | | 1,059 | | | | 972 | | | | 1,080 | | | | 1,633 | | | | 771 | | |

Administration fees | | | 105 | | | | 97 | | | | 161 | | | | 325 | | | | 115 | | |

Shareholder service fees (1) | | | 92 | | | | 25 | | | | 223 | | | | 431 | | | | 193 | | |

Shareholder service fees (2) | | | 9 | | | | 5 | | | | — | | | | — | | | | — | | |

Shareholder service fees (3) | | | — | | | | — | | | | — | | | | 10 | | | | — | | |

Distribution fees (2) | | | 28 | | | | 15 | | | | — | | | | — | | | | — | | |

Distribution fees (3) | | | — | | | | — | | | | — | | | | 10 | | | | — | | |

Accounting agent fees | | | 1 | | | | 5 | | | | 2 | | | | 2 | | | | 2 | | |

Dividend expense | | | 314 | | | | 299 | | | | — | | | | — | | | | — | | |

Broker fees and charges on short sales | | | 610 | | | | 440 | | | | — | | | | — | | | | — | | |

Custodian fees | | | 18 | | | | 42 | | | | 22 | | | | 24 | | | | 25 | | |

Transfer agent fees | | | 72 | | | | 108 | | | | 118 | | | | 282 | | | | 82 | | |

Registration fees | | | 54 | | | | 47 | | | | 41 | | | | 68 | | | | 22 | | |

Professional fees | | | 58 | | | | 43 | | | | 75 | | | | 164 | | | | 54 | | |

Trustees' fees | | | 41 | | | | 44 | | | | 75 | | | | 160 | | | | 52 | | |

Compliance services fees | | | 27 | | | | 23 | | | | 41 | | | | 88 | | | | 29 | | |