INNOVATE Corp. ™ 2024 INNOVATE Corp. Q3 2024 Earnings Release Supplement November 6, 2024

INNOVATE Corp. ™ 2024 Safe Harbor Disclaimers 2 Cautionary Statement Regarding Forward-Looking Statements Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements made by our representatives from time to time may contain, "forward-looking statements." Generally, forward-looking statements include information describing actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Such forward-looking statements are based on current expectations and inherently involve certain risks, assumptions and uncertainties. The forward-looking statements in this presentation include, without limitation, any statements regarding INNOVATE’s plans and expectations for future growth and ability to capitalize on potential opportunities, the achievement of INNOVATE’s strategic objectives, expectations for performance of new projects and realization of revenue from the backlog at DBM Global, anticipated success from the continued sale of new products in the Life Sciences segment, possible developments regarding the FDA approval process at MediBeacon, anticipated performance of new channels and LPTV frequencies, expanded uses for LPTV channels in the Spectrum segment and the potential deployment of datacasting, anticipated agreements in the Spectrum segment with public broadcast networks, anticipated 5G broadcasting opportunities in the Spectrum segment, anticipated developments regarding Federal Communications Commission approval to convert existing station to 5G broadcast, our ability to remain in compliance with the NYSE's continued listing standards, and changes in macroeconomic and market conditions and market volatility, including interest rates, the value of securities and other financial assets, and the impact of such changes and volatility on INNOVATE’s financial position. Such statements are based on the beliefs and assumptions of INNOVATE’s management and the management of INNOVATE’s subsidiaries and portfolio companies. The Company believes these judgments are reasonable, but these statements are not guarantees of performance, results or the creation of stockholder value and the Company’s actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of important factors, both positive and negative, including those that may be identified in subsequent statements and reports filed with the Securities and Exchange Commission (“SEC”), including in our reports on Forms 10-K, 10-Q, and 8-K. Such important factors include, without limitation: our dependence on distributions from our subsidiaries to fund our operations and payments on our obligations; our ability to continue operating as a going concern; the impact on our business and financial condition of our substantial indebtedness and any significant additional indebtedness and other financing obligations we may incur; our dependence on the retaining and recruitment of key personnel; volatility in the trading price of our common stock; the impact of potential supply chain disruptions, labor shortages and increases in overall price levels, including in transportation costs; interest rate environment; developments relating to the ongoing hostilities in Ukraine and Israel; increased competition in the markets in which our operating segments conduct their businesses; our ability to successfully identify any strategic acquisitions or business opportunities; uncertain global economic conditions in the markets in which our operating segments conduct their businesses; changes in regulations and tax laws; covenant noncompliance risk; tax consequences associated with our acquisition, holding and disposition of target companies and assets; the ability of our operating segments to attract and retain customers; our expectations regarding the timing, extent and effectiveness of our cost reduction initiatives and management’s ability to moderate or control discretionary spending; our expectations and timing with respect to any strategic dispositions and sales of our operating subsidiaries, or businesses; the possibility of indemnification claims arising out of divestitures of businesses; and our possible inability to raise additional capital when needed or refinance our existing debt, on attractive terms, or at all. Although INNOVATE believes its expectations and assumptions regarding its future operating performance are reasonable, there can be no assurance that the expectations reflected herein will be achieved. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC, and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to INNOVATE or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and unless legally required, INNOVATE undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

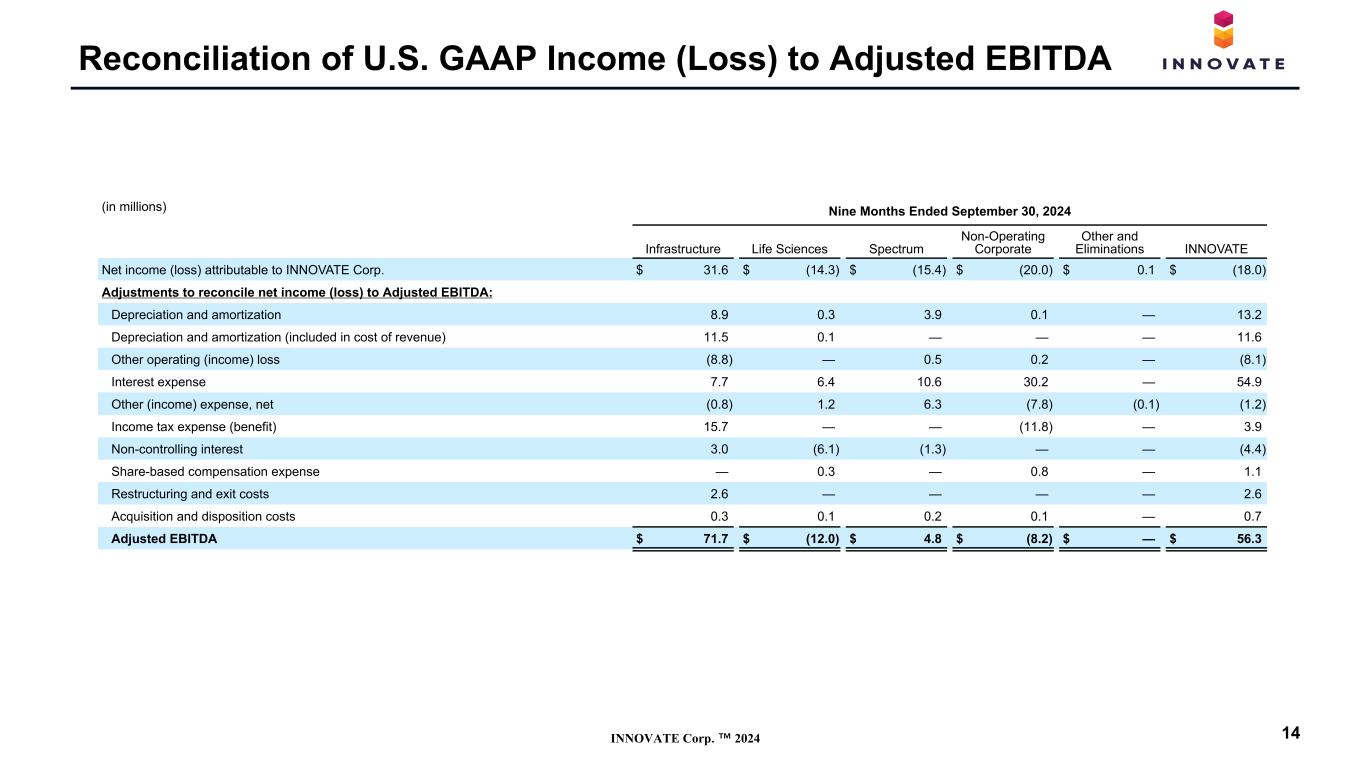

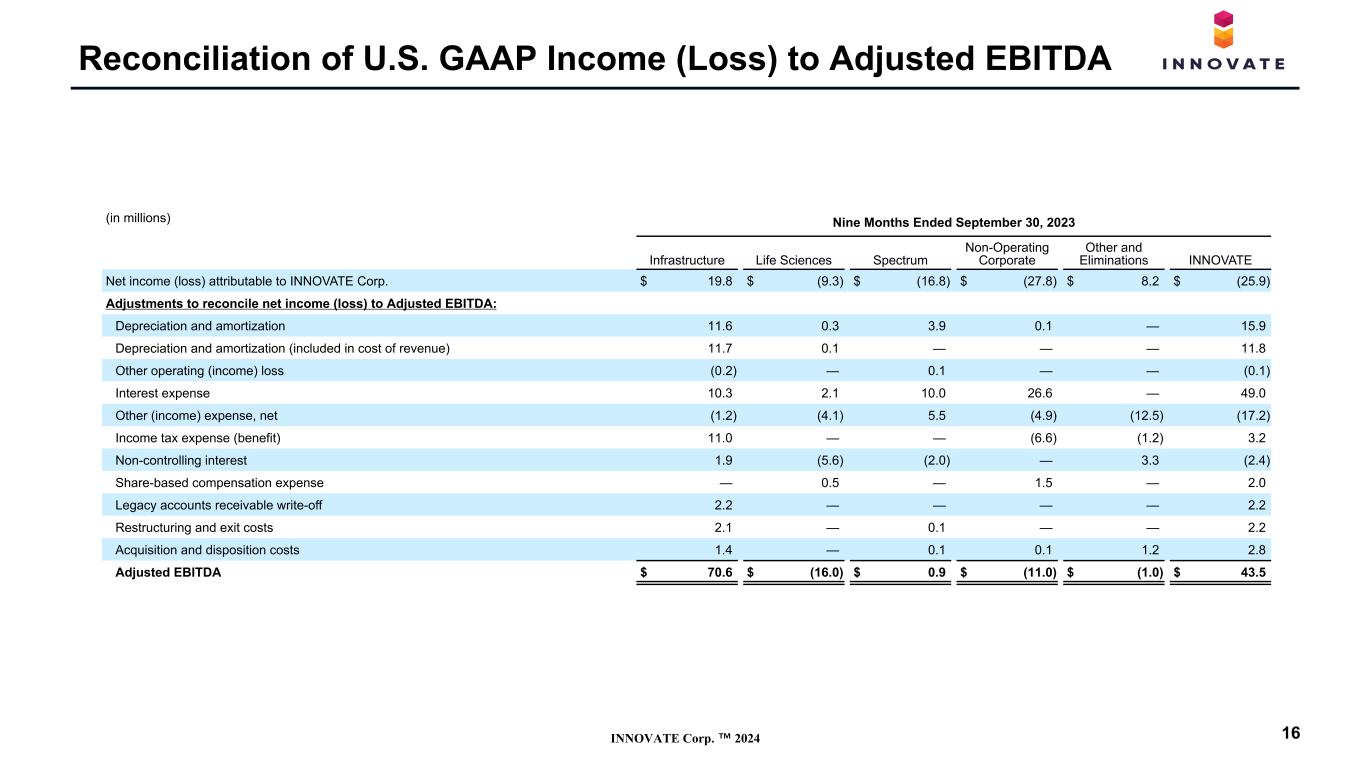

INNOVATE Corp. ™ 2024 Safe Harbor Disclaimers 3 Non-GAAP Financial Measures In this earnings release supplement, INNOVATE refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Total Adjusted EBITDA (excluding discontinued operations, if applicable) and Adjusted EBITDA for its operating segments. In addition, other companies may define Adjusted EBITDA differently than we do, which could limit its usefulness. Adjusted EBITDA Management believes that Adjusted EBITDA provides investors with meaningful information for gaining an understanding of our results as it is frequently used by the financial community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation, amortization and the other items listed in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. While management believes that non-U.S. GAAP measurements are useful supplemental information, such adjusted results are not intended to replace our U.S. GAAP financial results. Using Adjusted EBITDA as a performance measure has inherent limitations as an analytical tool as compared to net income (loss) or other U.S. GAAP financial measures, as this non-GAAP measure excludes certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA should not be considered in isolation and does not purport to be an alternative to net income (loss) or other U.S. GAAP financial measures as a measure of our operating performance. The calculation of Adjusted EBITDA, as defined by us, consists of Net income (loss) attributable to INNOVATE Corp., excluding: discontinued operations, if applicable; depreciation and amortization; other operating (income) loss, which is inclusive of (gain) loss on sale or disposal of assets, lease termination costs, (gains) losses on lease modifications, asset impairment expense and FCC reimbursements; interest expense; other (income) expense, net; income tax expense (benefit); non-controlling interest; share-based compensation expense; legacy accounts receivable write-offs; restructuring and exit costs; and acquisition and disposition costs. Third Party Sources Third party information presented in this earnings release supplement is based on sources we believe to be reliable; however, there can be no assurance information so presented will prove accurate in whole or in part.

INNOVATE Corp. ™ 2024 ■ DBM Global Inc. ("DBM Global") delivered solid results in the third quarter, achieving net income attributable to INNOVATE Corp. of $6.2 million and Adjusted EBITDA of $20.9 million. Adjusted EBITDA margin improved by 70 basis points, year-over-year. ■ R2 Technologies once again broke sales and revenue records in North America. ■ MediBeacon remains focused on working with the U.S. Food and Drug Administration ("FDA") as they conduct their substantive review of the kidney monitoring system. ■ New network launches and expanded coverage with existing customers drove Spectrum's revenue growth of 18.5% year-over-year in the third quarter. Third Quarter 2024 and Recent Highlights 4 DBM results highlighted by margin performance; R2 experiences strong unit sales growth; Spectrum delivers strong top and bottom line results

INNOVATE Corp. ™ 2024 ■ New network launches and expanded coverage with existing customers drove top line growth in the quarter. ■ Progress on discussions with prospective strategic partners in pursuit of new spectrum-related revenue opportunities in ATSC 3.0, datacasting and 5G Broadcasting. ■ Reported backlog of $0.9B and total adjusted backlog(1) of $1.1B. ■ Sequential increase in total adjusted backlog. ■ Gross margin and Adjusted EBITDA margin expanded again in the third quarter over the prior year period to 18.8% and 9.0%, respectively. ■ Remain active from a project bidding perspective. Segment Highlights Infrastructure Highlights Life Sciences Highlights Spectrum Highlights 5(1) Adjusted Backlog takes into consideration awarded, but not yet signed contracts. ■ Achieved a 247% increase in system unit sales growth year- over-year and record high system sales in North America in the third quarter. ■ Working through the substantive review of the kidney monitoring program with the FDA.

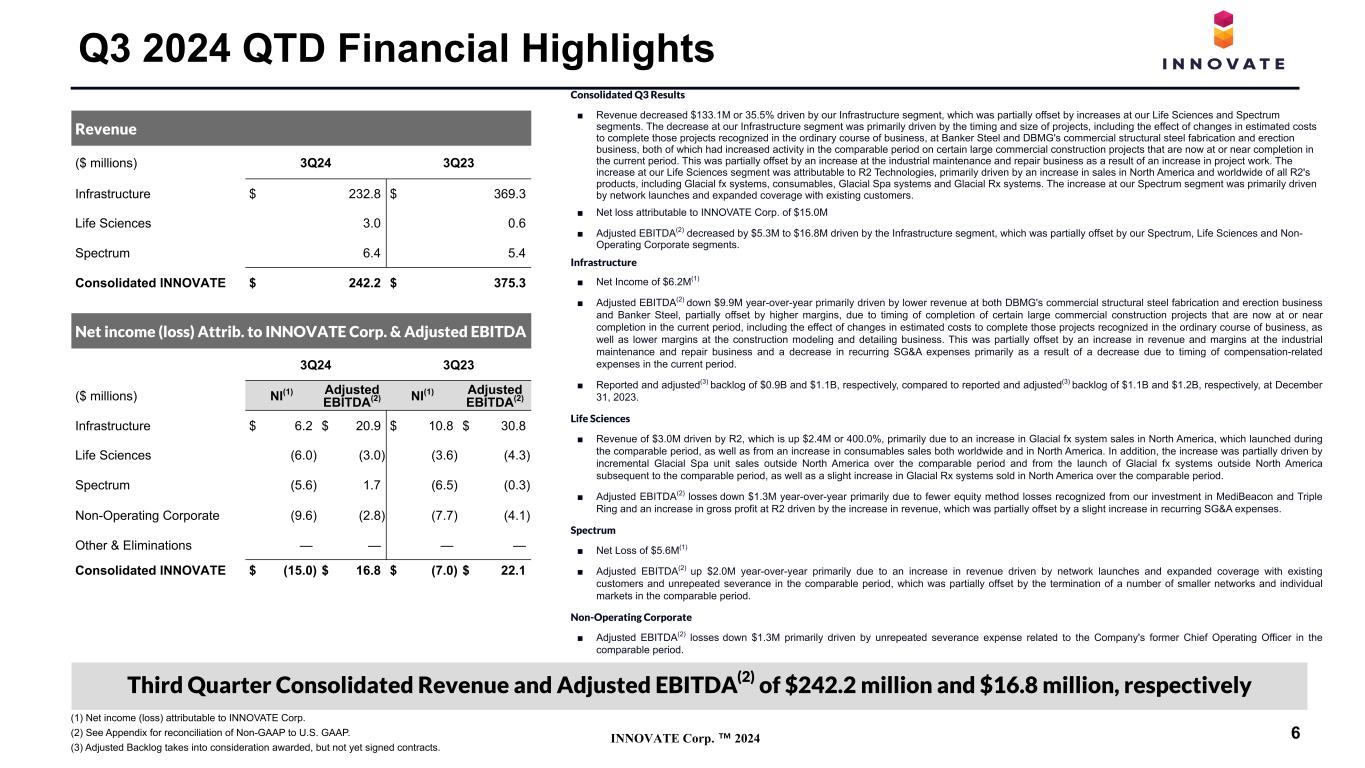

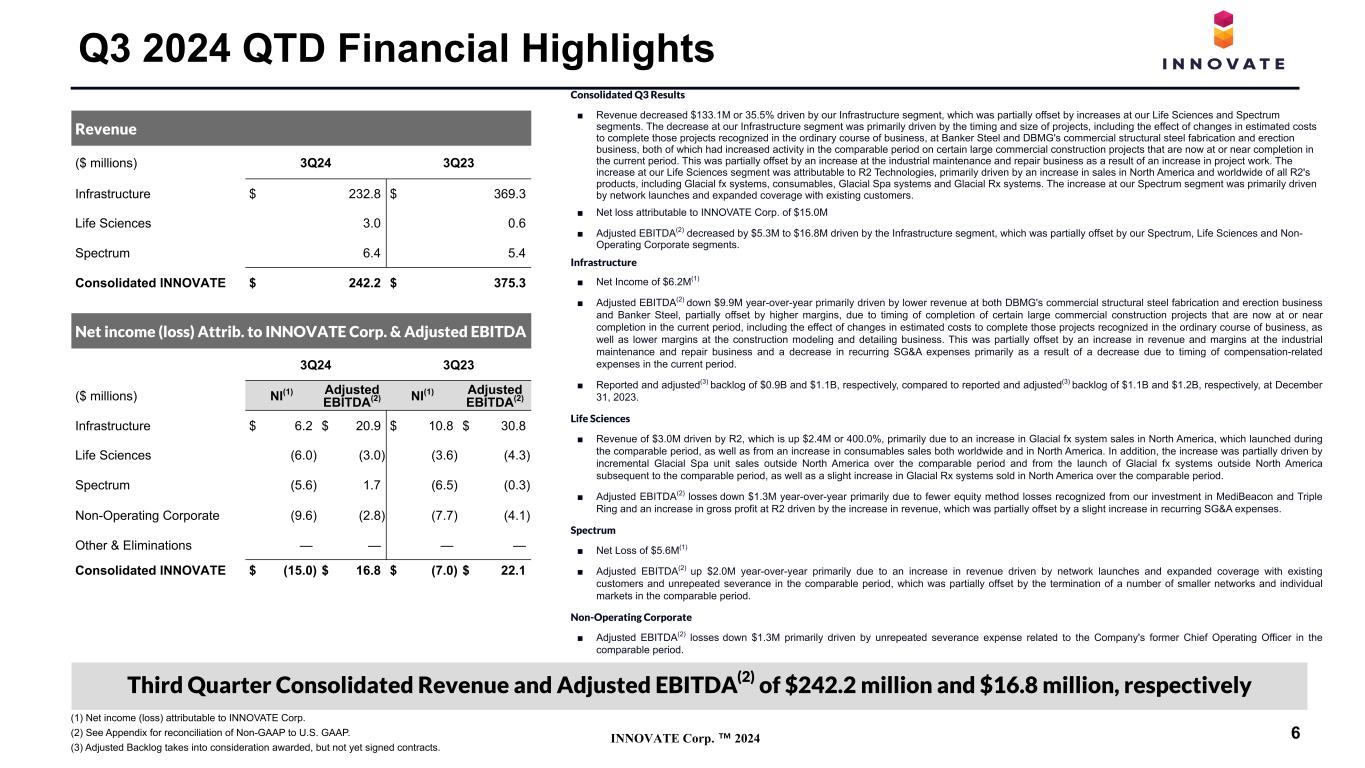

INNOVATE Corp. ™ 2024 Consolidated Q3 Results ■ Revenue decreased $133.1M or 35.5% driven by our Infrastructure segment, which was partially offset by increases at our Life Sciences and Spectrum segments. The decrease at our Infrastructure segment was primarily driven by the timing and size of projects, including the effect of changes in estimated costs to complete those projects recognized in the ordinary course of business, at Banker Steel and DBMG's commercial structural steel fabrication and erection business, both of which had increased activity in the comparable period on certain large commercial construction projects that are now at or near completion in the current period. This was partially offset by an increase at the industrial maintenance and repair business as a result of an increase in project work. The increase at our Life Sciences segment was attributable to R2 Technologies, primarily driven by an increase in sales in North America and worldwide of all R2's products, including Glacial fx systems, consumables, Glacial Spa systems and Glacial Rx systems. The increase at our Spectrum segment was primarily driven by network launches and expanded coverage with existing customers. ■ Net loss attributable to INNOVATE Corp. of $15.0M ■ Adjusted EBITDA(2) decreased by $5.3M to $16.8M driven by the Infrastructure segment, which was partially offset by our Spectrum, Life Sciences and Non- Operating Corporate segments. Infrastructure ■ Net Income of $6.2M(1) ■ Adjusted EBITDA(2) down $9.9M year-over-year primarily driven by lower revenue at both DBMG's commercial structural steel fabrication and erection business and Banker Steel, partially offset by higher margins, due to timing of completion of certain large commercial construction projects that are now at or near completion in the current period, including the effect of changes in estimated costs to complete those projects recognized in the ordinary course of business, as well as lower margins at the construction modeling and detailing business. This was partially offset by an increase in revenue and margins at the industrial maintenance and repair business and a decrease in recurring SG&A expenses primarily as a result of a decrease due to timing of compensation-related expenses in the current period. ■ Reported and adjusted(3) backlog of $0.9B and $1.1B, respectively, compared to reported and adjusted(3) backlog of $1.1B and $1.2B, respectively, at December 31, 2023. Life Sciences ■ Revenue of $3.0M driven by R2, which is up $2.4M or 400.0%, primarily due to an increase in Glacial fx system sales in North America, which launched during the comparable period, as well as from an increase in consumables sales both worldwide and in North America. In addition, the increase was partially driven by incremental Glacial Spa unit sales outside North America over the comparable period and from the launch of Glacial fx systems outside North America subsequent to the comparable period, as well as a slight increase in Glacial Rx systems sold in North America over the comparable period. ■ Adjusted EBITDA(2) losses down $1.3M year-over-year primarily due to fewer equity method losses recognized from our investment in MediBeacon and Triple Ring and an increase in gross profit at R2 driven by the increase in revenue, which was partially offset by a slight increase in recurring SG&A expenses. Spectrum ■ Net Loss of $5.6M(1) ■ Adjusted EBITDA(2) up $2.0M year-over-year primarily due to an increase in revenue driven by network launches and expanded coverage with existing customers and unrepeated severance in the comparable period, which was partially offset by the termination of a number of smaller networks and individual markets in the comparable period. Non-Operating Corporate ■ Adjusted EBITDA(2) losses down $1.3M primarily driven by unrepeated severance expense related to the Company's former Chief Operating Officer in the comparable period. Q3 2024 QTD Financial Highlights Revenue ($ millions) 3Q24 3Q23 Infrastructure $ 232.8 $ 369.3 Life Sciences 3.0 0.6 Spectrum 6.4 5.4 Consolidated INNOVATE $ 242.2 $ 375.3 Net income (loss) Attrib. to INNOVATE Corp. & Adjusted EBITDA 3Q24 3Q23 ($ millions) NI(1) Adjusted EBITDA(2) NI(1) Adjusted EBITDA(2) Infrastructure $ 6.2 $ 20.9 $ 10.8 $ 30.8 Life Sciences (6.0) (3.0) (3.6) (4.3) Spectrum (5.6) 1.7 (6.5) (0.3) Non-Operating Corporate (9.6) (2.8) (7.7) (4.1) Other & Eliminations — — — — Consolidated INNOVATE $ (15.0) $ 16.8 $ (7.0) $ 22.1 (1) Net income (loss) attributable to INNOVATE Corp. (2) See Appendix for reconciliation of Non-GAAP to U.S. GAAP. (3) Adjusted Backlog takes into consideration awarded, but not yet signed contracts. 6 Third Quarter Consolidated Revenue and Adjusted EBITDA(2) of $242.2 million and $16.8 million, respectively

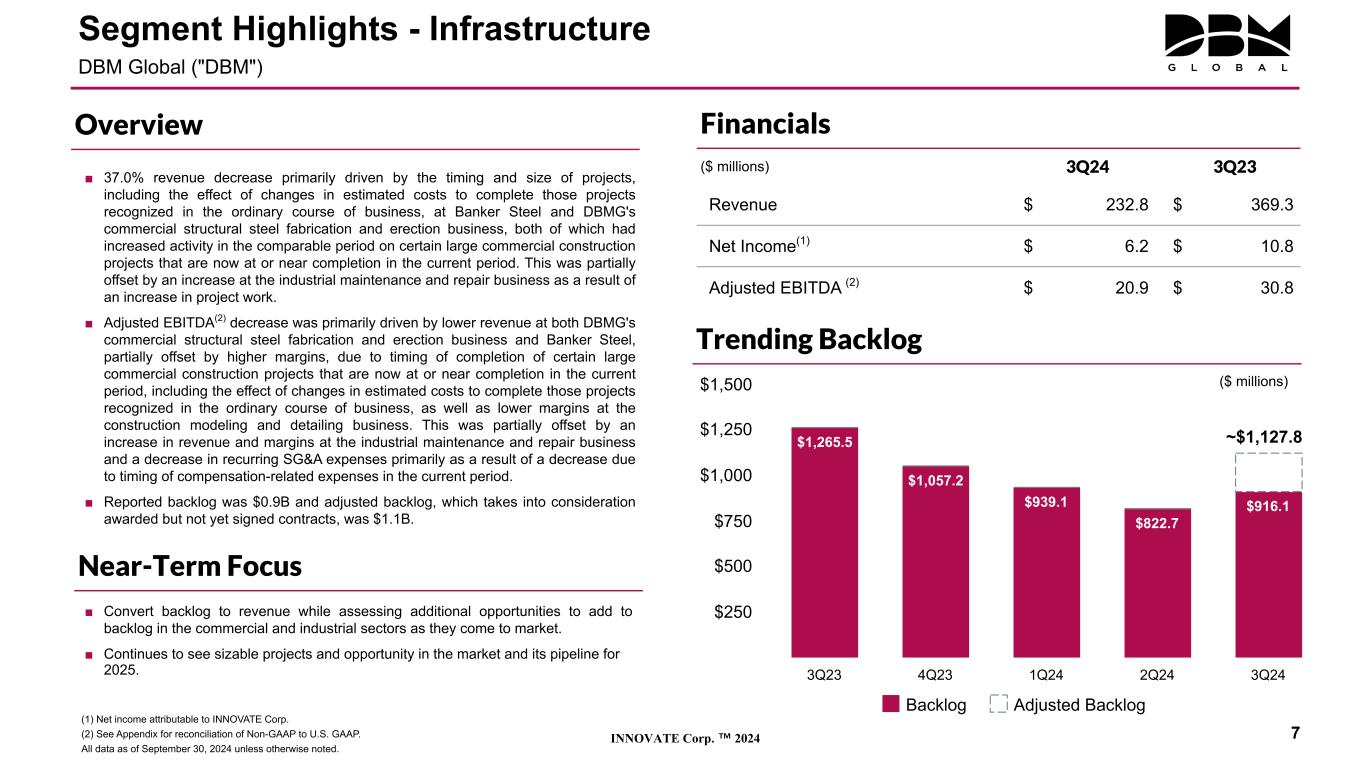

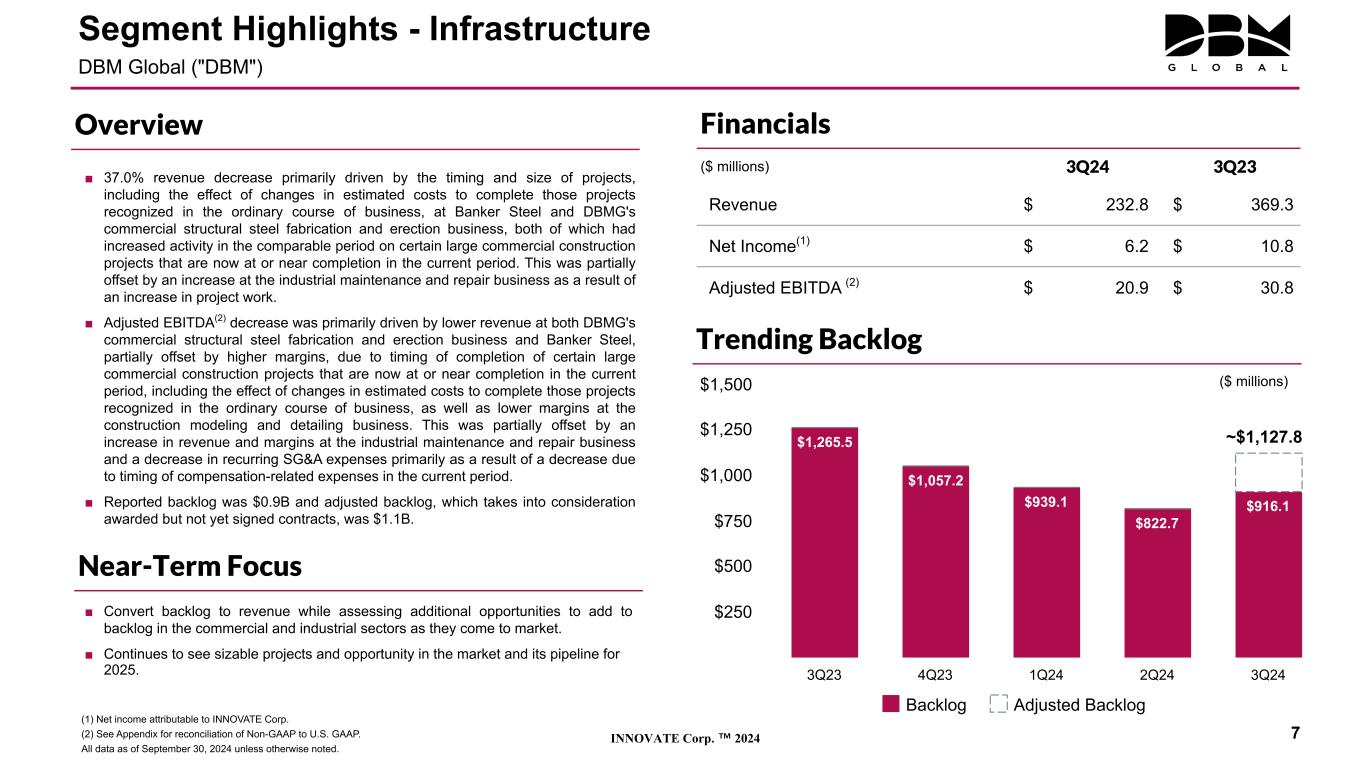

INNOVATE Corp. ™ 2024 ■ Convert backlog to revenue while assessing additional opportunities to add to backlog in the commercial and industrial sectors as they come to market. ■ Continues to see sizable projects and opportunity in the market and its pipeline for 2025. ■ 37.0% revenue decrease primarily driven by the timing and size of projects, including the effect of changes in estimated costs to complete those projects recognized in the ordinary course of business, at Banker Steel and DBMG's commercial structural steel fabrication and erection business, both of which had increased activity in the comparable period on certain large commercial construction projects that are now at or near completion in the current period. This was partially offset by an increase at the industrial maintenance and repair business as a result of an increase in project work. ■ Adjusted EBITDA(2) decrease was primarily driven by lower revenue at both DBMG's commercial structural steel fabrication and erection business and Banker Steel, partially offset by higher margins, due to timing of completion of certain large commercial construction projects that are now at or near completion in the current period, including the effect of changes in estimated costs to complete those projects recognized in the ordinary course of business, as well as lower margins at the construction modeling and detailing business. This was partially offset by an increase in revenue and margins at the industrial maintenance and repair business and a decrease in recurring SG&A expenses primarily as a result of a decrease due to timing of compensation-related expenses in the current period. ■ Reported backlog was $0.9B and adjusted backlog, which takes into consideration awarded but not yet signed contracts, was $1.1B. Financials ($ millions) 3Q24 3Q23 Revenue $ 232.8 $ 369.3 Net Income(1) $ 6.2 $ 10.8 Adjusted EBITDA (2) $ 20.9 $ 30.8 (1) Net income attributable to INNOVATE Corp. (2) See Appendix for reconciliation of Non-GAAP to U.S. GAAP. All data as of September 30, 2024 unless otherwise noted. Segment Highlights - Infrastructure DBM Global ("DBM") 7 $1,265.5 $1,057.2 $939.1 $822.7 $916.1 Backlog Adjusted Backlog 3Q23 4Q23 1Q24 2Q24 3Q24 $250 $500 $750 $1,000 $1,250 $1,500 ~$1,127.8 Trending Backlog Overview Near-Term Focus ($ millions)

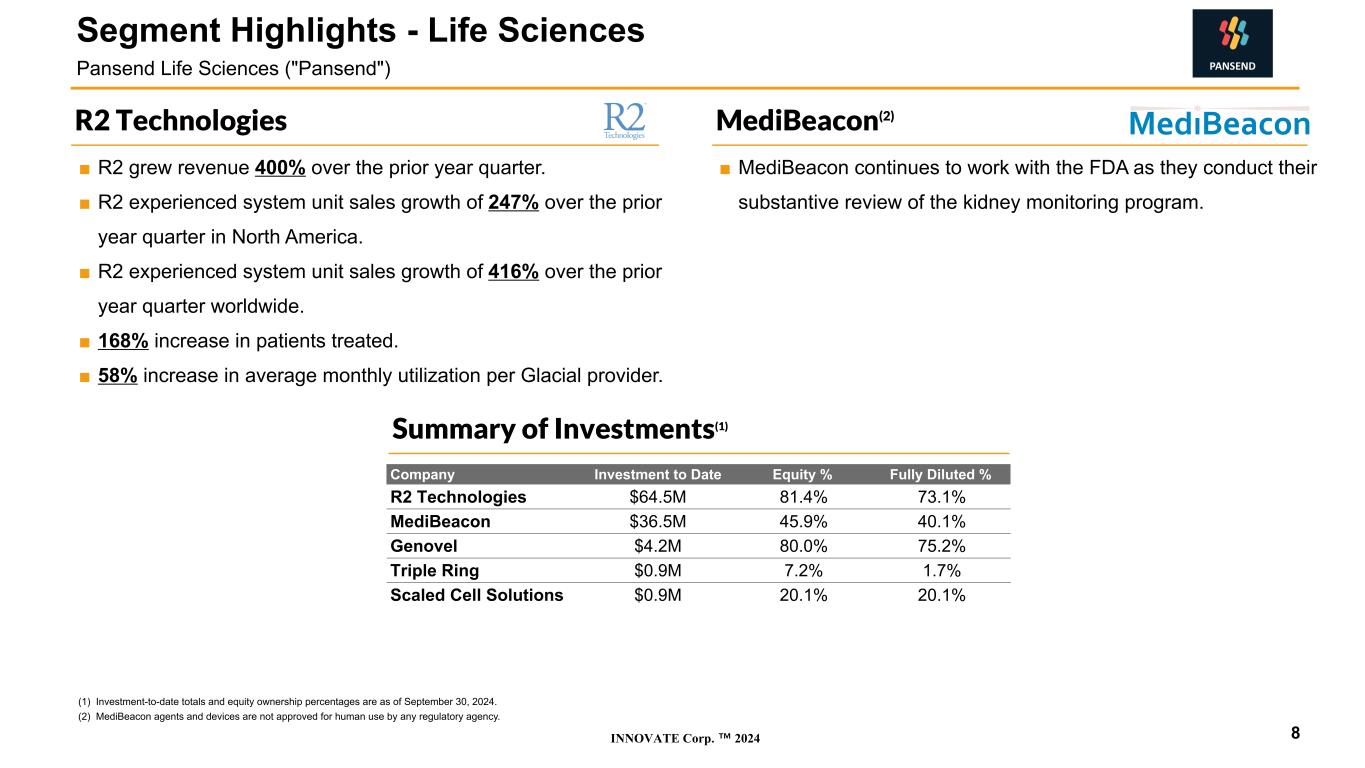

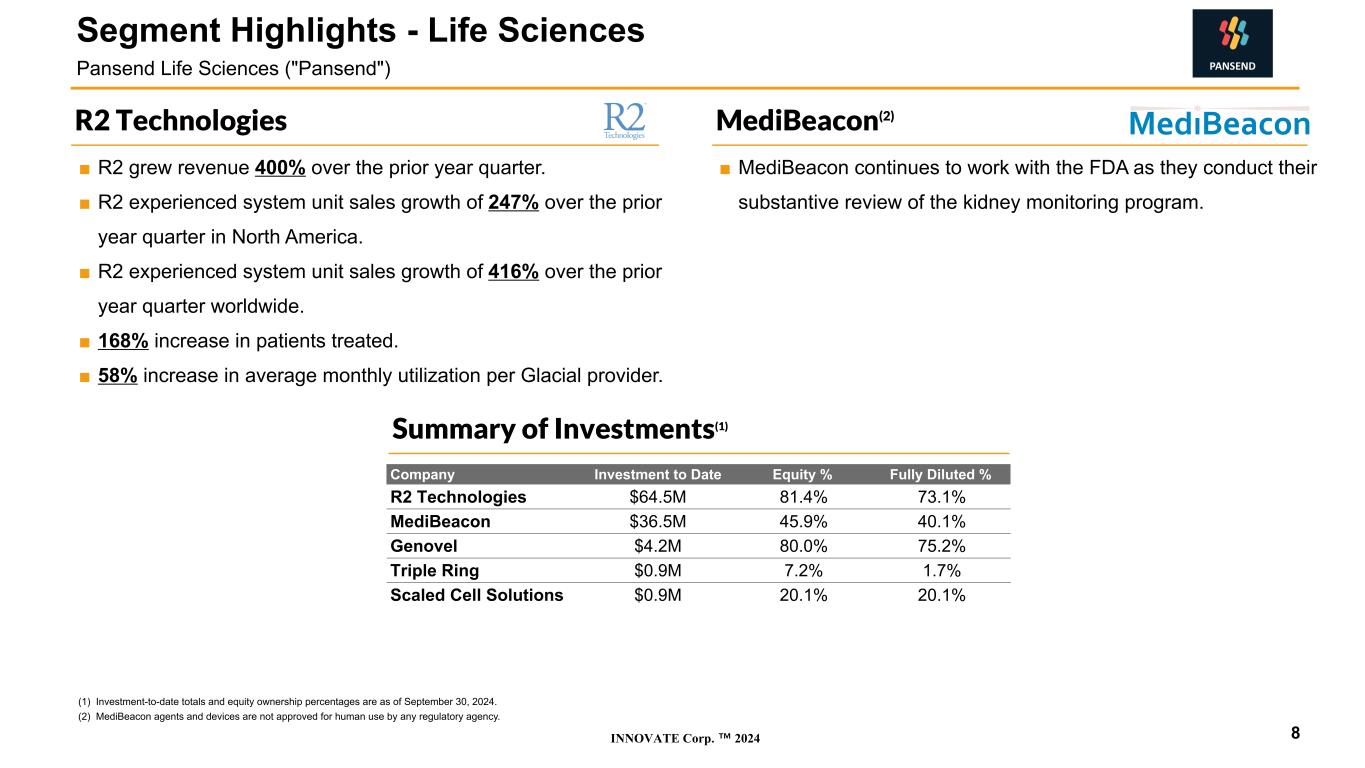

INNOVATE Corp. ™ 2024 ■ MediBeacon continues to work with the FDA as they conduct their substantive review of the kidney monitoring program. ■ R2 grew revenue 400% over the prior year quarter. ■ R2 experienced system unit sales growth of 247% over the prior year quarter in North America. ■ R2 experienced system unit sales growth of 416% over the prior year quarter worldwide. ■ 168% increase in patients treated. ■ 58% increase in average monthly utilization per Glacial provider. MediBeacon(2)R2 Technologies (1) Investment-to-date totals and equity ownership percentages are as of September 30, 2024. (2) MediBeacon agents and devices are not approved for human use by any regulatory agency. Company Investment to Date Equity % Fully Diluted % R2 Technologies $64.5M 81.4% 73.1% MediBeacon $36.5M 45.9% 40.1% Genovel $4.2M 80.0% 75.2% Triple Ring $0.9M 7.2% 1.7% Scaled Cell Solutions $0.9M 20.1% 20.1% 8 Segment Highlights - Life Sciences Pansend Life Sciences ("Pansend") Summary of Investments(1)

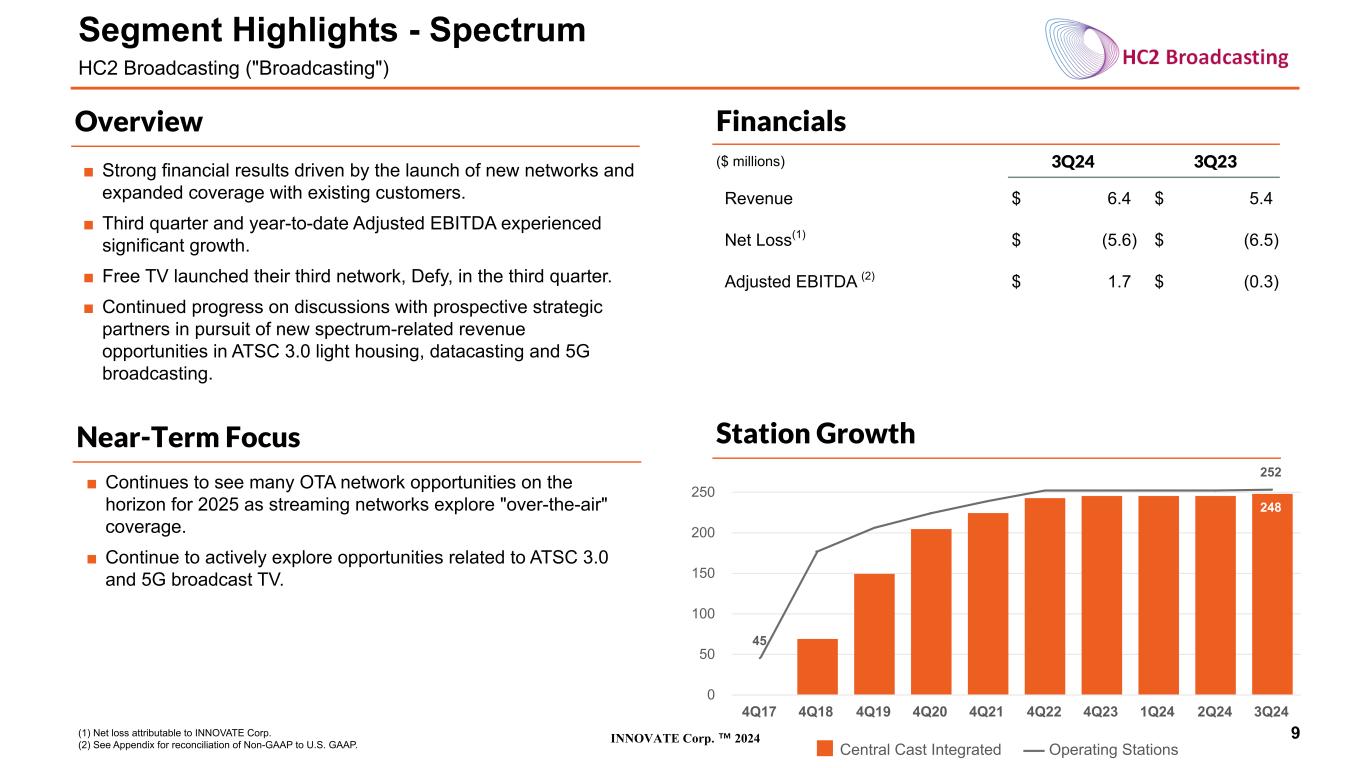

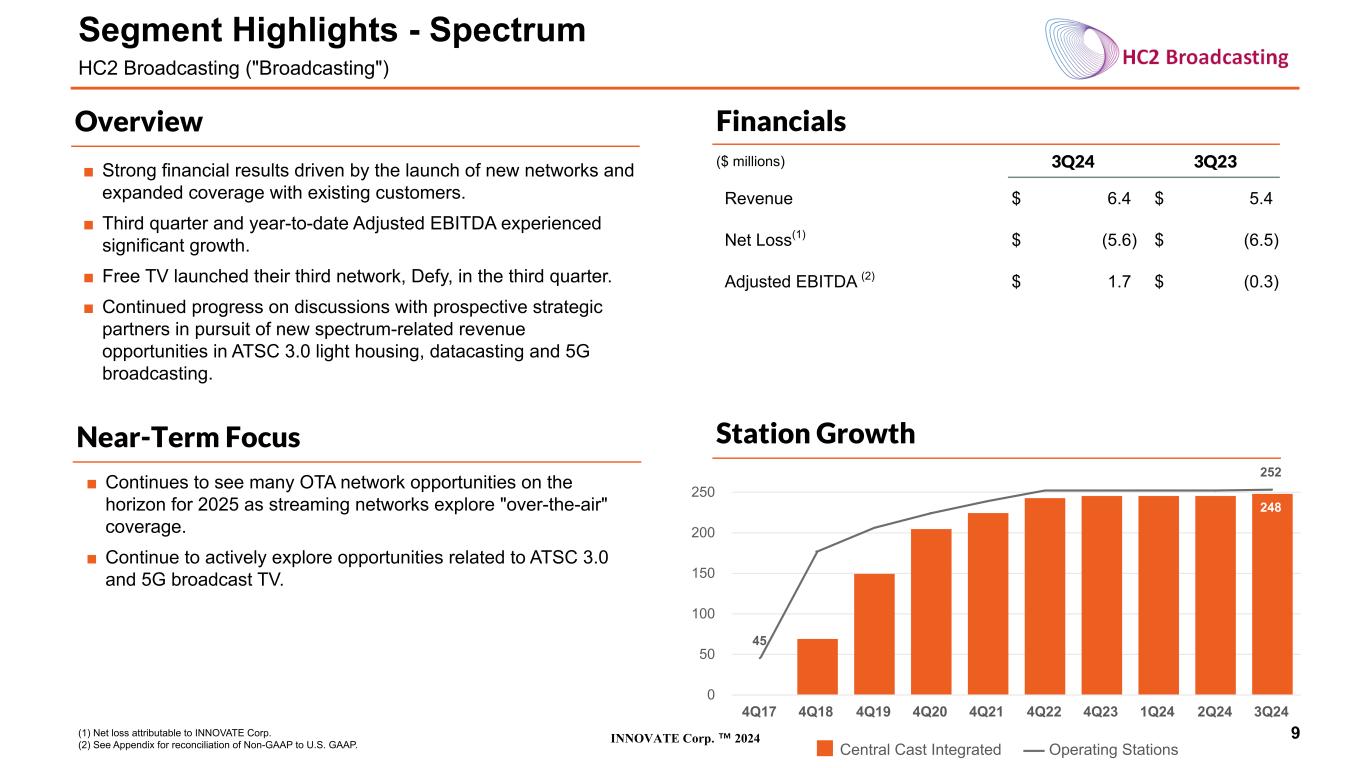

INNOVATE Corp. ™ 2024 Financials ($ millions) 3Q24 3Q23 Revenue $ 6.4 $ 5.4 Net Loss(1) $ (5.6) $ (6.5) Adjusted EBITDA (2) $ 1.7 $ (0.3) 9 Segment Highlights - Spectrum HC2 Broadcasting ("Broadcasting") 248 45 252 Central Cast Integrated Operating Stations 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 1Q24 2Q24 3Q24 0 50 100 150 200 250 Overview Near-Term Focus ■ Continues to see many OTA network opportunities on the horizon for 2025 as streaming networks explore "over-the-air" coverage. ■ Continue to actively explore opportunities related to ATSC 3.0 and 5G broadcast TV. Station Growth (1) Net loss attributable to INNOVATE Corp. (2) See Appendix for reconciliation of Non-GAAP to U.S. GAAP. ■ Strong financial results driven by the launch of new networks and expanded coverage with existing customers. ■ Third quarter and year-to-date Adjusted EBITDA experienced significant growth. ■ Free TV launched their third network, Defy, in the third quarter. ■ Continued progress on discussions with prospective strategic partners in pursuit of new spectrum-related revenue opportunities in ATSC 3.0 light housing, datacasting and 5G broadcasting.

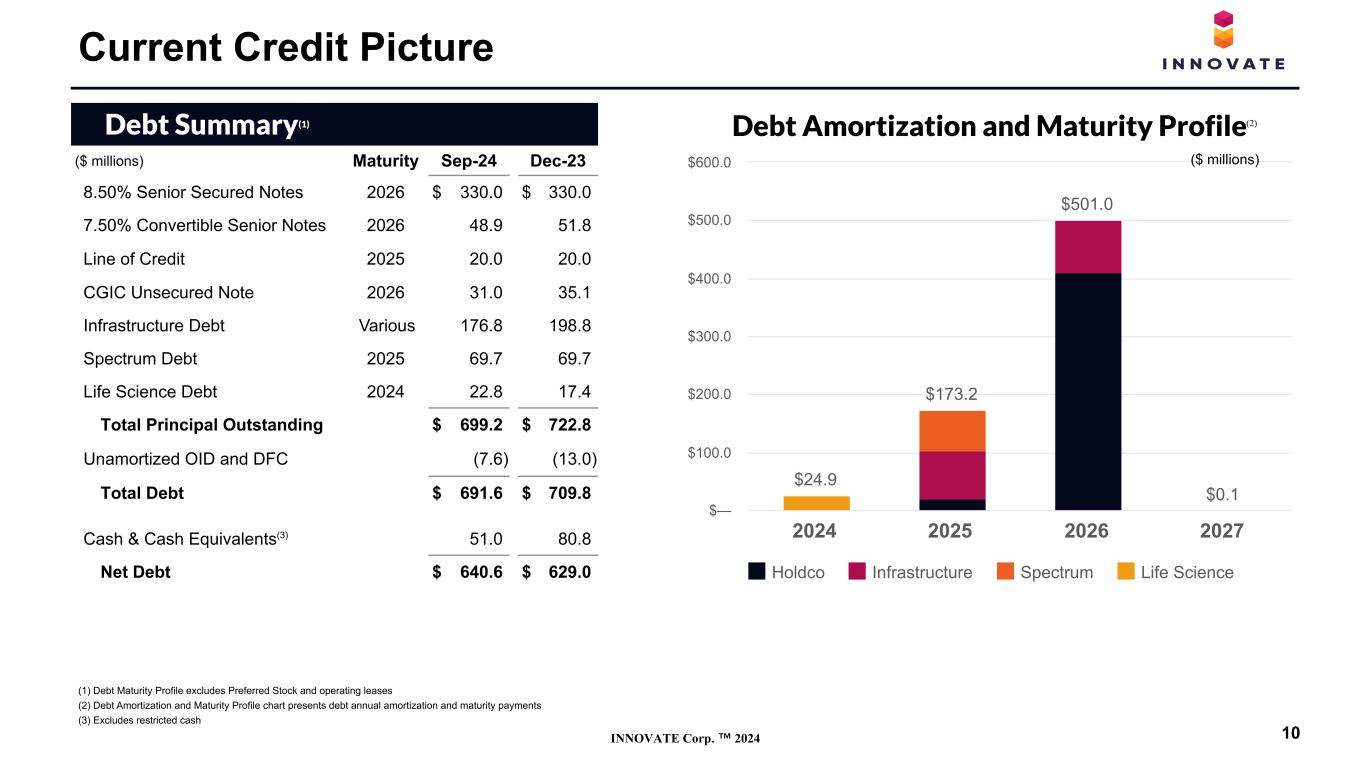

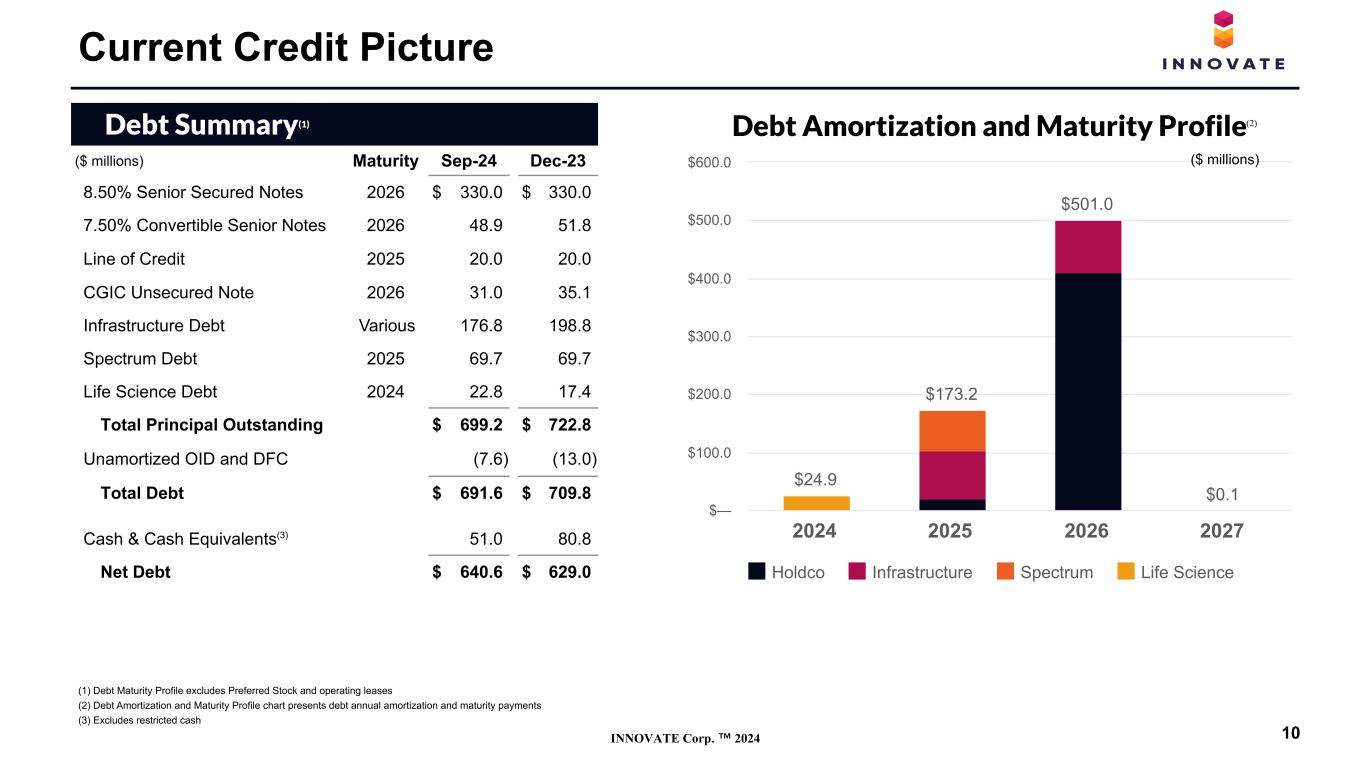

INNOVATE Corp. ™ 2024 (1) Debt Maturity Profile excludes Preferred Stock and operating leases (2) Debt Amortization and Maturity Profile chart presents debt annual amortization and maturity payments (3) Excludes restricted cash Debt Summary(1) ($ millions) Maturity Sep-24 Dec-23 8.50% Senior Secured Notes 2026 $ 330.0 $ 330.0 7.50% Convertible Senior Notes 2026 48.9 51.8 Line of Credit 2025 20.0 20.0 CGIC Unsecured Note 2026 31.0 35.1 Infrastructure Debt Various 176.8 198.8 Spectrum Debt 2025 69.7 69.7 Life Science Debt 2024 22.8 17.4 Total Principal Outstanding $ 699.2 $ 722.8 Unamortized OID and DFC (7.6) (13.0) Total Debt $ 691.6 $ 709.8 Cash & Cash Equivalents(3) 51.0 80.8 Net Debt $ 640.6 $ 629.0 Current Credit Picture 10 Debt Amortization and Maturity Profile $24.9 $173.2 $501.0 $0.1 Holdco Infrastructure Spectrum Life Science 2024 2025 2026 2027 $— $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 ($ millions) (2)

INNOVATE Corp. ™ 2024 Appendix Select GAAP Financials & Non-GAAP Reconciliations

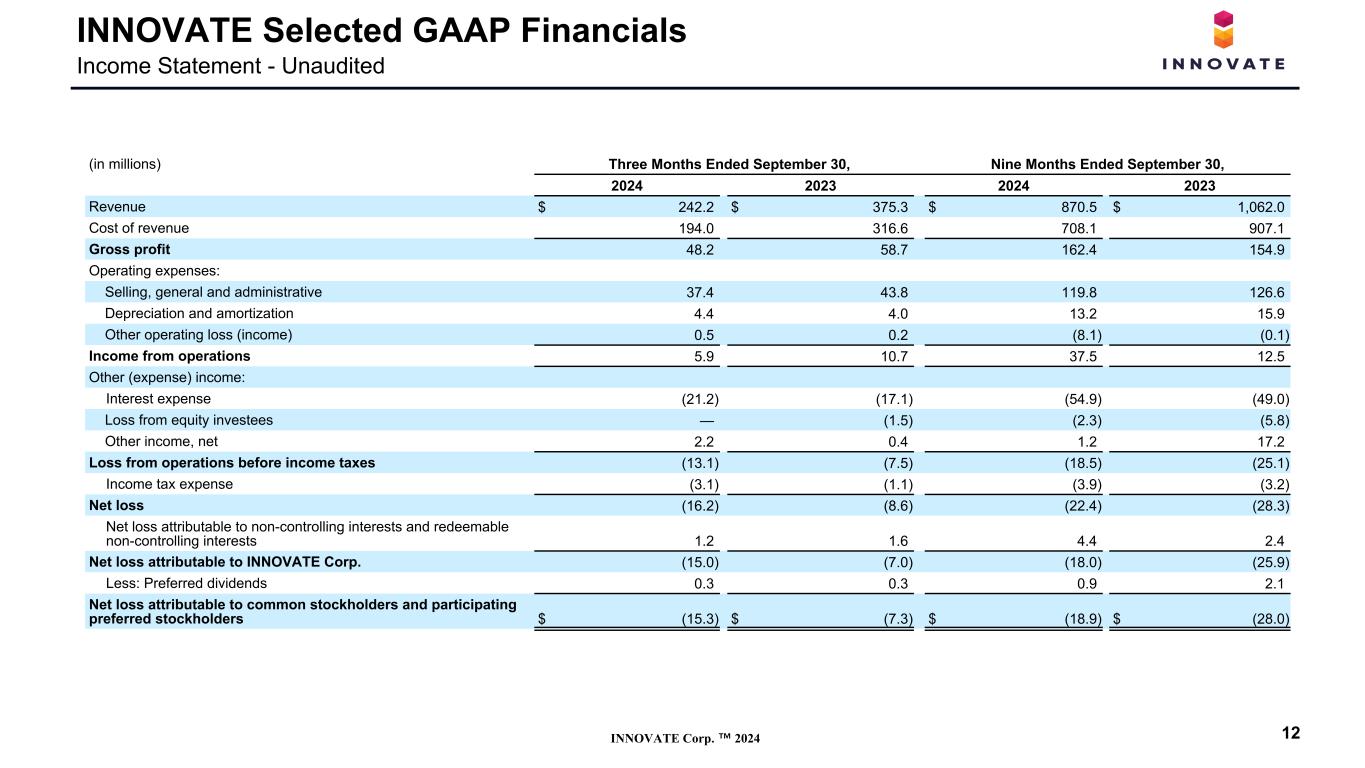

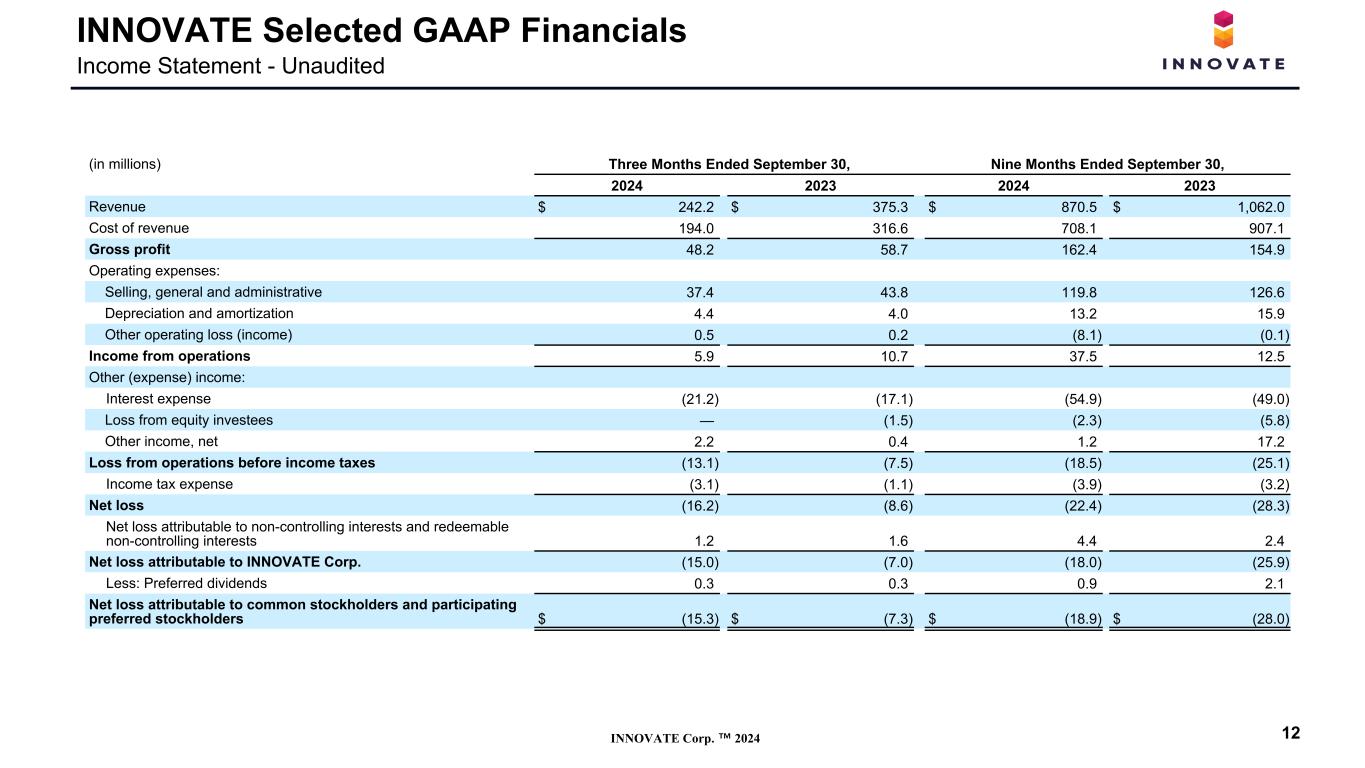

INNOVATE Corp. ™ 2024 INNOVATE Selected GAAP Financials Income Statement - Unaudited (in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenue $ 242.2 $ 375.3 $ 870.5 $ 1,062.0 Cost of revenue 194.0 316.6 708.1 907.1 Gross profit 48.2 58.7 162.4 154.9 Operating expenses: Selling, general and administrative 37.4 43.8 119.8 126.6 Depreciation and amortization 4.4 4.0 13.2 15.9 Other operating loss (income) 0.5 0.2 (8.1) (0.1) Income from operations 5.9 10.7 37.5 12.5 Other (expense) income: Interest expense (21.2) (17.1) (54.9) (49.0) Loss from equity investees — (1.5) (2.3) (5.8) Other income, net 2.2 0.4 1.2 17.2 Loss from operations before income taxes (13.1) (7.5) (18.5) (25.1) Income tax expense (3.1) (1.1) (3.9) (3.2) Net loss (16.2) (8.6) (22.4) (28.3) Net loss attributable to non-controlling interests and redeemable non-controlling interests 1.2 1.6 4.4 2.4 Net loss attributable to INNOVATE Corp. (15.0) (7.0) (18.0) (25.9) Less: Preferred dividends 0.3 0.3 0.9 2.1 Net loss attributable to common stockholders and participating preferred stockholders $ (15.3) $ (7.3) $ (18.9) $ (28.0) 12

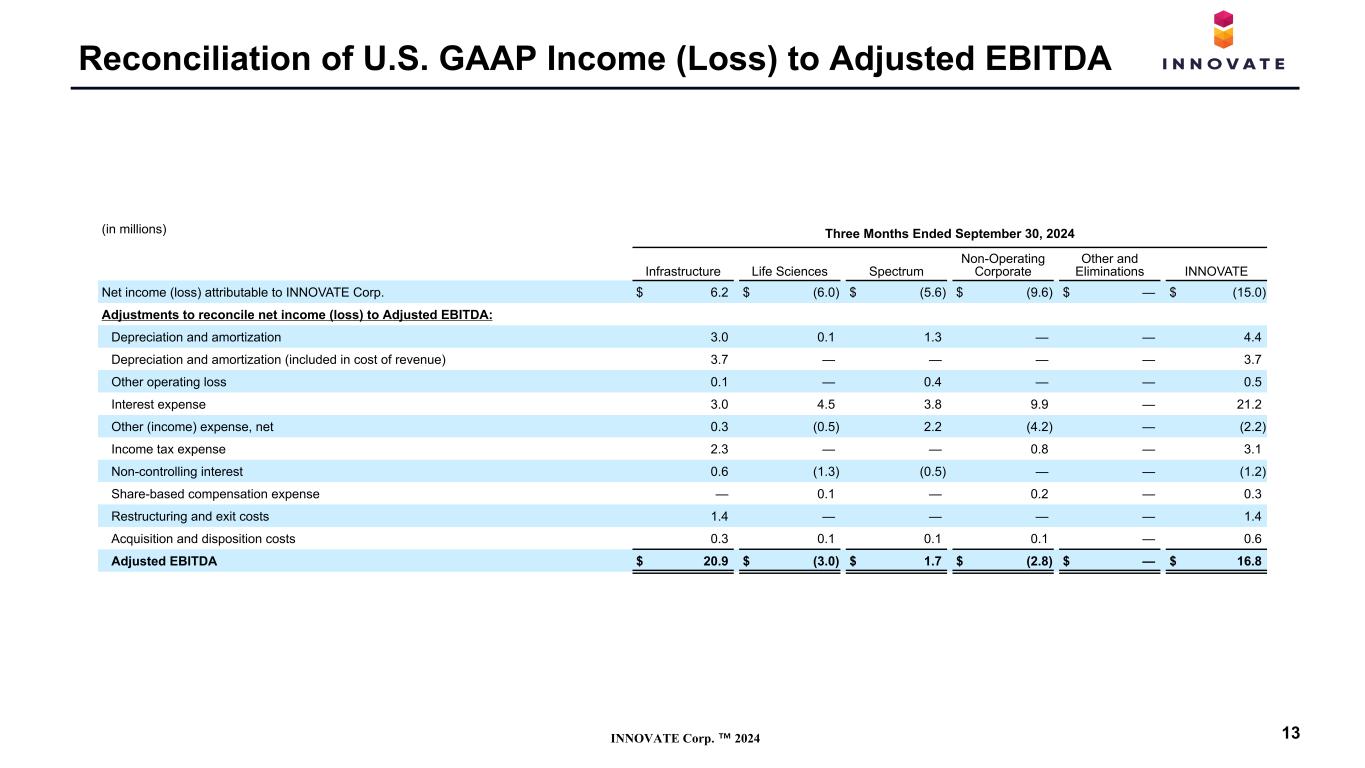

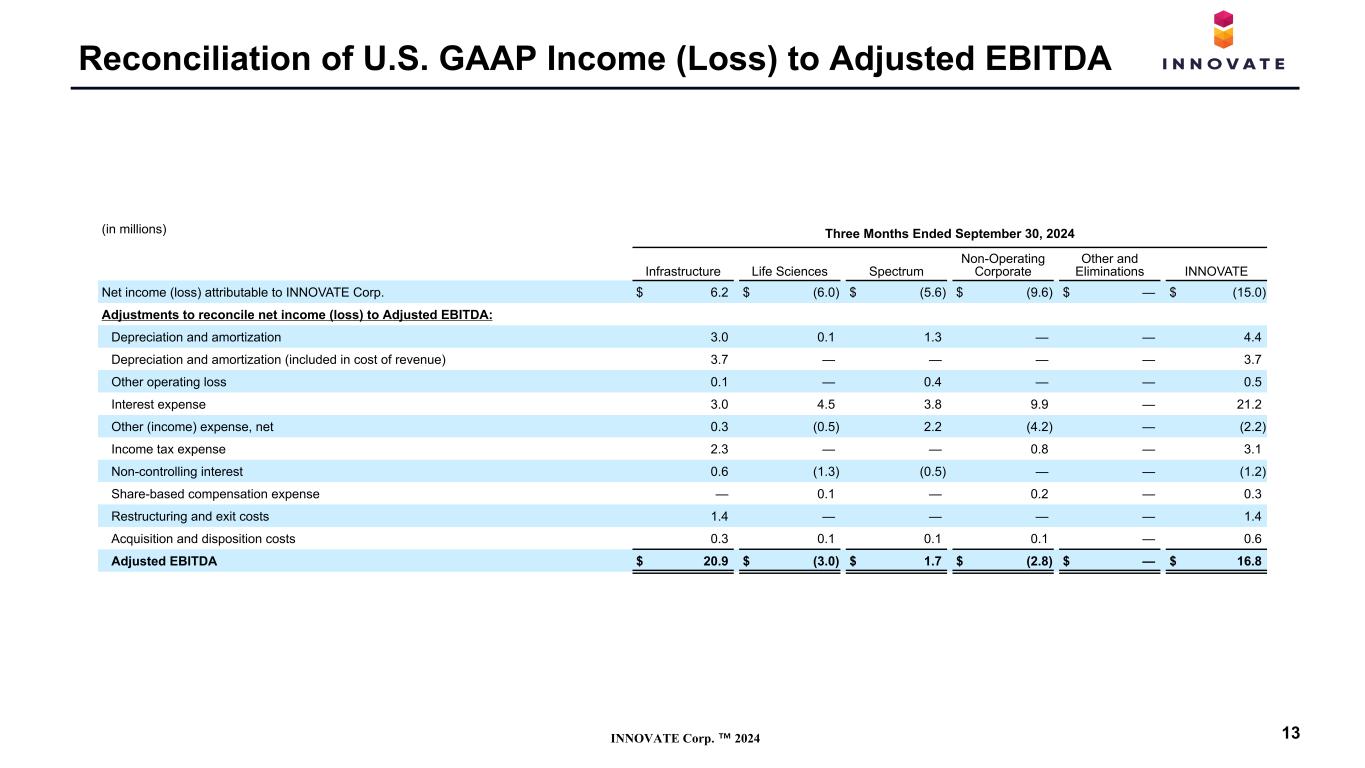

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 13 (in millions) Three Months Ended September 30, 2024 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 6.2 $ (6.0) $ (5.6) $ (9.6) $ — $ (15.0) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 3.0 0.1 1.3 — — 4.4 Depreciation and amortization (included in cost of revenue) 3.7 — — — — 3.7 Other operating loss 0.1 — 0.4 — — 0.5 Interest expense 3.0 4.5 3.8 9.9 — 21.2 Other (income) expense, net 0.3 (0.5) 2.2 (4.2) — (2.2) Income tax expense 2.3 — — 0.8 — 3.1 Non-controlling interest 0.6 (1.3) (0.5) — — (1.2) Share-based compensation expense — 0.1 — 0.2 — 0.3 Restructuring and exit costs 1.4 — — — — 1.4 Acquisition and disposition costs 0.3 0.1 0.1 0.1 — 0.6 Adjusted EBITDA $ 20.9 $ (3.0) $ 1.7 $ (2.8) $ — $ 16.8

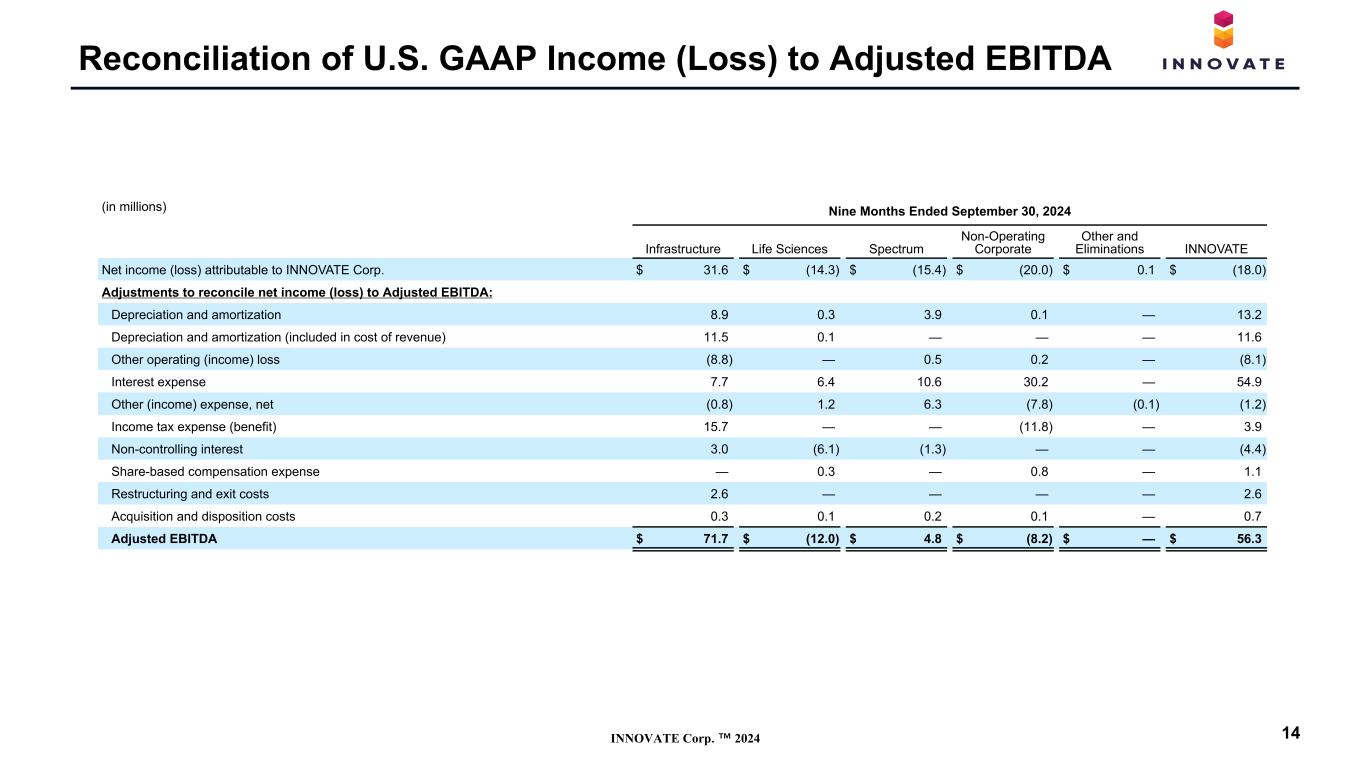

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 14 (in millions) Nine Months Ended September 30, 2024 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 31.6 $ (14.3) $ (15.4) $ (20.0) $ 0.1 $ (18.0) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 8.9 0.3 3.9 0.1 — 13.2 Depreciation and amortization (included in cost of revenue) 11.5 0.1 — — — 11.6 Other operating (income) loss (8.8) — 0.5 0.2 — (8.1) Interest expense 7.7 6.4 10.6 30.2 — 54.9 Other (income) expense, net (0.8) 1.2 6.3 (7.8) (0.1) (1.2) Income tax expense (benefit) 15.7 — — (11.8) — 3.9 Non-controlling interest 3.0 (6.1) (1.3) — — (4.4) Share-based compensation expense — 0.3 — 0.8 — 1.1 Restructuring and exit costs 2.6 — — — — 2.6 Acquisition and disposition costs 0.3 0.1 0.2 0.1 — 0.7 Adjusted EBITDA $ 71.7 $ (12.0) $ 4.8 $ (8.2) $ — $ 56.3

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 15 (in millions) Three Months Ended September 30, 2023 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 10.8 $ (3.6) $ (6.5) $ (7.7) $ — $ (7.0) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 2.6 0.1 1.3 — — 4.0 Depreciation and amortization (included in cost of revenue) 3.8 — — — — 3.8 Other operating (income) loss (0.2) — 0.4 — — 0.2 Interest expense 3.5 0.9 3.4 9.3 — 17.1 Other (income) expense, net (0.7) (0.1) 1.8 (1.4) — (0.4) Income tax expense (benefit) 6.1 — — (5.0) — 1.1 Non-controlling interest 1.0 (1.8) (0.8) — — (1.6) Share-based compensation expense — 0.2 — 0.6 — 0.8 Legacy accounts receivable write-off 2.2 — — — — 2.2 Restructuring and exit costs 1.1 — 0.1 — — 1.2 Acquisition and disposition costs 0.6 — — 0.1 — 0.7 Adjusted EBITDA $ 30.8 $ (4.3) $ (0.3) $ (4.1) $ — $ 22.1

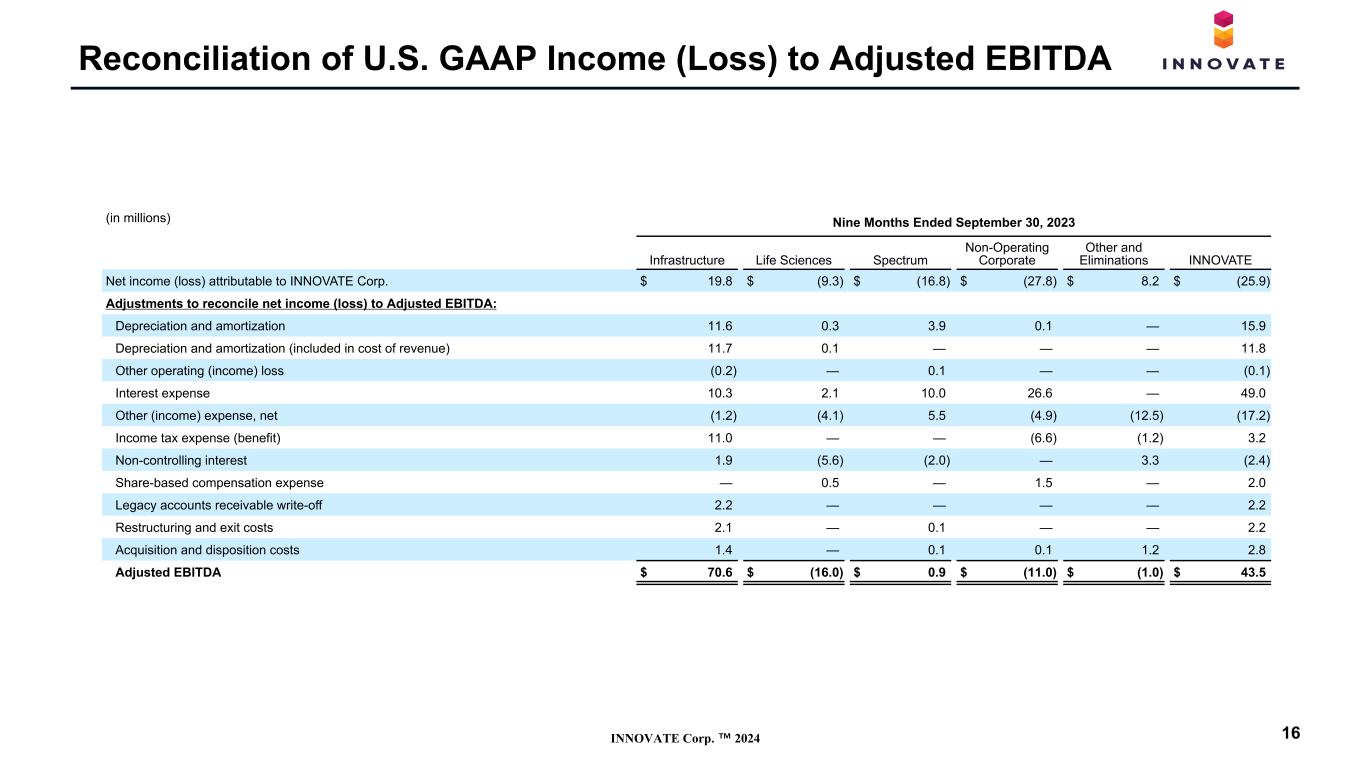

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 16 (in millions) Nine Months Ended September 30, 2023 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 19.8 $ (9.3) $ (16.8) $ (27.8) $ 8.2 $ (25.9) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 11.6 0.3 3.9 0.1 — 15.9 Depreciation and amortization (included in cost of revenue) 11.7 0.1 — — — 11.8 Other operating (income) loss (0.2) — 0.1 — — (0.1) Interest expense 10.3 2.1 10.0 26.6 — 49.0 Other (income) expense, net (1.2) (4.1) 5.5 (4.9) (12.5) (17.2) Income tax expense (benefit) 11.0 — — (6.6) (1.2) 3.2 Non-controlling interest 1.9 (5.6) (2.0) — 3.3 (2.4) Share-based compensation expense — 0.5 — 1.5 — 2.0 Legacy accounts receivable write-off 2.2 — — — — 2.2 Restructuring and exit costs 2.1 — 0.1 — — 2.2 Acquisition and disposition costs 1.4 — 0.1 0.1 1.2 2.8 Adjusted EBITDA $ 70.6 $ (16.0) $ 0.9 $ (11.0) $ (1.0) $ 43.5