UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| x | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-12 |

Salix Pharmaceuticals, Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

Salix Pharmaceuticals, Ltd.

Presentation to Institutional Shareholder Services

June 4, 2003

Salix Pharmaceuticals, Ltd.

WHY SUPPORT THE INCUMBENT

BOARD OF DIRECTORS?

| | • | | Strong business execution |

| | - | | Salix’s Board has consistently made decisions that have enhanced stockholder value |

| | - | | Salix is at the cusp of realizing the benefit of our efforts and success in executing our business plan |

| | - | | Salix is poised for significant growth and profitability, and can better enhance stockholder value by continuing to execute its businessplan |

| | • | | Good Corporate Governance |

| | - | | Independent, experienced Board |

| | • | | Incumbent Board more aligned with stockholders |

| | - | | Salix’s D&O own 15.5% of outstanding common stock |

Salix Pharmaceuticals, Ltd. 2

CORPORATE PROFILE

| | • | | Specialty pharmaceutical company |

| | n | | Gastroenterology-focused |

| | • | | Headquarters: Raleigh, NC |

| | n | | 84-member sales and marketing team |

| | • | | COLAZAL® product revenues |

Salix Pharmaceuticals, Ltd. 3

MISSION STATEMENT

Salix Pharmaceuticals is dedicated

to being the leading specialty

pharmaceutical company providing

products to gastroenterologists

and their patients

Salix Pharmaceuticals, Ltd. 4

SALIX HAS A CLEAR, FOCUSED

STRATEGY

Enhance stockholder value:

| | • | | In-license selective late-stage/marketed product candidates |

| | - | | U.S. gastroenterology focus |

| | - | | Reduce risk and capital commitment |

| | • | | Complete any required development and secure FDA approval |

| | • | | Sell products through specialty sales force |

| | - | | Establish franchise with U.S. gastroenterologists |

| | - | | Sell products that serve unmet needs |

Salix Pharmaceuticals, Ltd. 5

SALIX HAS SUCCESSFULLY

EXECUTED ITS BUSINESS PLAN

| | • | | Premier Specialty Sales Force |

| | • | | COLAZAL® - approved and marketed |

| | • | | Rifaximin – FDA approvable letter |

| | • | | Granulated mesalamine – scheduled to enter Phase III |

Salix Pharmaceuticals, Ltd. 6

PREMIER

GASTROENTEROLOGY

SALES FORCE

| | • | | 84-member sales and marketing team |

| | • | | Experienced, incentivized professionals |

| | • | | Reputation for integrity and quality |

| | • | | Established franchise with gastroenterologists |

| | • | | Infrastructure in place to be leveraged with future products |

Salix Pharmaceuticals, Ltd. 7

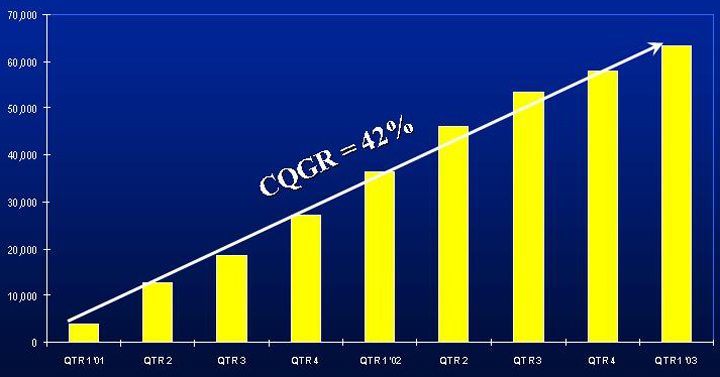

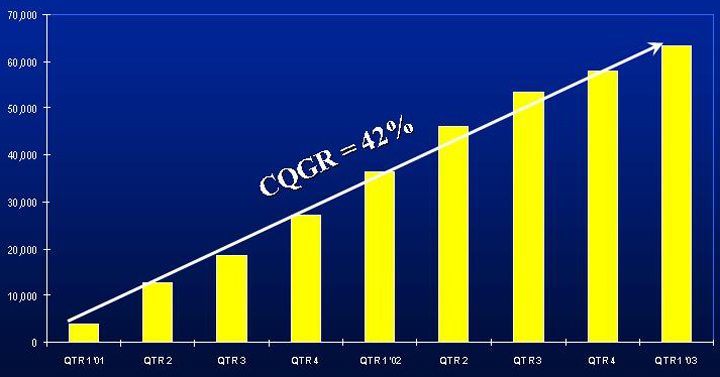

COLAZAL

| | • | | Approved for first-line treatment of mildly to moderately active ulcerative colitis (UC) |

| | • | | The fastest growing drug of its kind in the marketplace based upon 2002 prescriptions |

| | • | | COLAZAL revenue alone is expected to provide profitability in the second half of 2004 |

Salix Pharmaceuticals, Ltd. 8

COLAZAL

TOTAL PRESCRIPTIONS

Source: NDC

Salix Pharmaceuticals, Ltd. 9

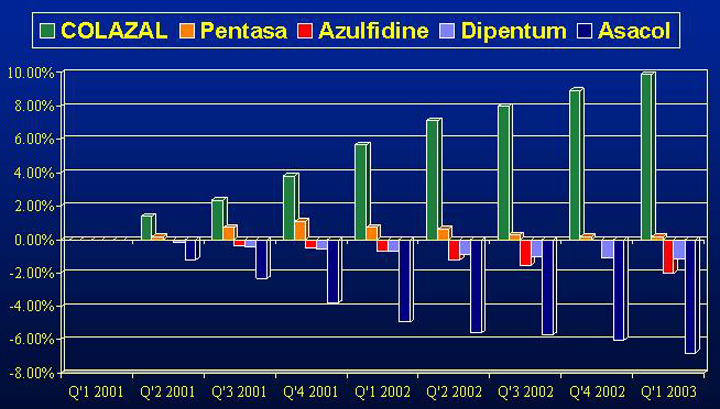

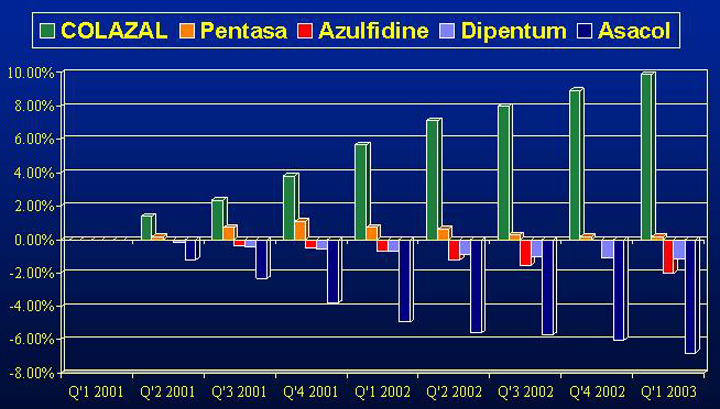

5-ASA MARKET SHARE CHANGE SINCE

COLAZAL LAUNCH

Source: NDC Health Called-On Physicians

Salix Pharmaceuticals, Ltd. 10

RIFAXIMIN

| | • | | A unique, broad-spectrum, gastrointestinal-specific, non-absorbed, oral antibiotic |

| | • | | FDA approvable letter received October 2002 |

| | • | | FDA approvable letter response – 4Q/2003 |

| | • | | Anticipated launch – mid-2004 |

| | • | | Approval in 2004 provides profitability for 2004 |

| | • | | Expected to be bigger than COLAZAL with a potential U.S. annual retail market in excess of 12 million patients and $2 billion |

Salix Pharmaceuticals, Ltd. 11

RIFAXIMIN

(CONTINUED)

| | • | | Travelers’ diarrhea – First indication |

| | • | | Over 100 clinical publications for a broad range of GI diseases |

| | • | | Clinical studies for additional potential uses |

| | n | | Hepatic encephalopathy, Crohn’s disease |

| | n | | Pouchitis,C. difficile-associated diarrhea |

| | n | | Small bowel overgrowth, TD prophylaxis |

| | • | | Salix intends to seek FDA approval for additional indications |

Salix Pharmaceuticals, Ltd. 12

GRANULATED MESALAMINE

| | • | | In-licensed from Dr. Falk Pharma, a leading European gastroenterology company |

| | • | | Given unique release mechanism, Salix intends to develop for: |

| | – | | expanded ulcerative colitis treatment options |

| | – | | improved dosing regimens |

| | • | | Patent protected to 2018 |

| | • | | First right of negotiation for certain other products |

Salix Pharmaceuticals, Ltd. 13

SALIX IS SUCCESSFULLY EXECUTING

ITS BUSINESS PLAN

| | • | | Salix has made tremendous progress over three years in building a thriving specialty pharmaceutical franchise |

| | • | | Salix has proven its ability to in-license, complete any required development, and launch and sell drugs through our focused specialty sales force |

| | • | | Salix is at the cusp of realizing the benefit of our efforts and success in executing our business plan |

| | • | | Salix is poised for significant growth and profitability, and can better enhance stockholder value by continuing to execute its business plan |

Salix Pharmaceuticals, Ltd. 14

CORPORATE GOVERNANCE

Salix Pharmaceuticals, Ltd. 15

SALIX IS GOVERNED BY AN

INDEPENDENT BOARD

John F. Chappell | | IO | | Former Chairman, Worldwide Pharmaceuticals, SmithKline Beecham plc (28 yrs pharmaceutical executive) |

|

Thomas W. D’Alonzo | | IO | | Former President, PPD, Inc. & Glaxo, Inc. (17 yrs pharmaceutical executive) |

|

Richard A. Franco | | IO | | Former Chairman and CEO, LipoScience, Inc. & Trimeris, Inc. (32 yrs health care and pharmaceutical executive) |

|

Carolyn J. Logan | | I | | President, CEO and Director (22 yrs pharmaceutical executive) |

|

Robert P. Ruscher | | I | | Executive Chairman (9 yrs pharmaceutical executive) |

IO = Independent outsider I = Insider

Salix Pharmaceuticals, Ltd. 16

KEY BOARD COMMITTEES ARE FULLY

INDEPENDENT

Audit, Compensation and Nominating Committee members

John F. Chappell

Chair, Compensation

Thomas W. D’Alonzo

Chair, Audit

Richard A. Franco

Chair, Nominating

Salix Pharmaceuticals, Ltd. 17

SALIX BOARD’S INTERESTS ARE

ALIGNED WITH ITS STOCKHOLDERS

| | | Shares Owned

| | % O.S.**

| |

Salix Directors* | | 1,624,396 | | 7.6 | % |

|

Axcan (Saule Holdings) | | 100 | | 0.0005 | % |

| * | | Salix Officers and Directors hold an aggregate of 3.3 million shares of SLXP common stock, representing 15.5 % of O.S. The aggregate market value of their equity holdings is25 times greater than their annual salaries. |

Salix Pharmaceuticals, Ltd. 18

SALIX PRACTICES GOOD

CORPORATE GOVERNANCE

| | • | | All directors elected annually |

| | • | | Stockholders can amend the bylaws by majority vote |

| | • | | Holders of 10% can call special meetings |

| | • | | Merger can be approved by simple majority vote |

| | • | | Original Rights Plan approved by stockholders |

Salix Pharmaceuticals, Ltd. 19

SALIX PRACTICES GOOD

CORPORATE GOVERNANCE

(CONTINUED)

| | • | | The CEO and Chairman roles are separated, and have been since 1999 |

| | • | | All directors have excellent meeting attendance |

| | • | | Non-audit fees consistently lower than audit fees |

| | • | | Auditor appointment ratified by stockholders annually |

| | • | | Active involvement of outside directors and advisors |

Salix Pharmaceuticals, Ltd. 20

SHAREHOLDER RIGHTS PLAN

| | • | | Approved by shareholders (94% of votes cast) in June 2000 |

| | • | | Updated January 2003 after Salix: |

| | – | | Reincorporated from a British Virgin Islands corporation to a Delaware corporation in 2002 |

| | – | | Changed from Toronto Stock Exchange listing to Nasdaq listing in 2000 |

| | • | | Plan was not updated or adopted in response to any discussions with Axcan |

| | • | | Rights plan before and after January 2003 update would have same practical effect with respect to Axcan tender |

| | • | | Rights plan periodically evaluated with respect to the best interests of stockholders |

Salix Pharmaceuticals, Ltd. 21

GOOD CORPORATE

GOVERNANCE IN ACTION

The Salix Board has a record of carefully considering indications of

interest and being advised of, understanding and complying

with, their fiduciary duties

AXCAN Tender Offer

| | • | | Board has met formally 6 times |

| | – | | over 17 hours of meetings/deliberations |

| | • | | Sought and utilized advice from independent advisors, including: |

| | – | | Leading medical authorities |

| | • | | Both decisions to reject Axcan’s offers were affirmed by independent Board members in closed meetings without insider directors |

Salix Pharmaceuticals, Ltd. 22

SALIX HAS ALWAYS BEEN WILLING TO

MEET WITH THIRD PARTIES AND

DISCUSS STRATEGIC ALTERNATIVES

CONTACTS WITH AXCAN

April 1999 – January 2003

During this period, Salix estimates that there were over 30 communications between Salix and Axcan in the form of meetings, telephone calls, letters and substantive e-mails. Salix never failed to respond to a telephone call or request for a meeting from Axcan.

Salix Pharmaceuticals, Ltd. 23

SALIX HAS ALWAYS BEEN WILLING TO

MEET WITH THIRD PARTIES AND

DISCUSS STRATEGIC ALTERNATIVES

(CONTINUED)

CONTACTS WITH AXCAN

January 2003 – April 2003

January 2003

Salix seeks to postpone meeting scheduled for January 30, 2003

February – March 2003

No communication between Salix and Axcan

April 2003

Axcan initiates hostile tender offer and related actions

Salix Pharmaceuticals, Ltd. 24

THE SALIX BOARD HAS A HISTORY OF MAKING STRATEGIC DECISIONS THAT ENHANCE STOCKHOLDER VALUE

| | • | | Axcan first sought to acquire Salix on Dec. 14, 1999 when SLXP stock was trading on the TSE at US$ 0.12 per share |

| | – | | The Salix Board determined that its stock at that time did not adequately reflect true value in light of potential for balsalazide (COLAZAL), and that Salix stockholders would best be served by Salix’s execution of its business plan |

| | – | | A 12/99 premiums paid analysis (similar to that currently used by Axcan to justify its current $10.50 offer) would have implied that an offer below $1.00 per share would have been “fair value” for Salix |

| | – | | Twelve months later, Salix announced US launch of COLAZAL (1/22/01), and Salix stock closed at $9.50 |

Salix Pharmaceuticals, Ltd. 25

SALIX HAS ADDED SIGNIFICANT STOCKHOLDER VALUE

SLXP and AXCA Relative Stock Price Performance

Between Axcan’s 12/14/99 Initial Inquiry and

one day prior to its 4/10/03 Offer

SLXP: 62-fold increase | | AXCA: 2.7-fold increase |

|

| | | |

Clearly, by successfully implementing its current business plan initiated in

1999, Salix has added significant stockholder value

Clearly, Salix stockholders were better served by the Salix Board’s

decision in late 1999 and 2000 to execute its business plan and launch

COLAZAL, rather than sell to Axcan when the Salix stock did not reflect

the true value of its first product

Salix Pharmaceuticals, Ltd. 26

THE SALIX BOARD BELIEVES STOCKHOLDERS WILL ONCE AGAIN BE BETTER SERVED BY EXECUTING THE BUSINESS PLAN

Now, 12 months prior to the projected launch of Salix’s second product, Rifaximin, Axcan is once again trying to acquire Salix at a time when Salix is poised for substantial growth, but when its stock is substantially undervalued

The Salix Board believes stockholders will once again be better served by executing Salix’s business plan and launching its second product, rather than selling to Axcan when the Salix stock does not reflect the true value of its gastroenterology franchise, its second product, Rifaximin, or its third product, granulated mesalamine

Salix Pharmaceuticals, Ltd. 27

VALUATION CONSIDERATIONS

Salix Pharmaceuticals, Ltd. 28

PEER GROUP VALUATION SHOWS SALIX IS

SIGNIFICANTLY UNDERVALUED

ENTERPRISE VALUE* / REVENUE

| | | | | Valuation Data

|

| | | 6/2/2003 | | Revenue (2)

| | Enterprise Value/ Revenue (3)

|

Comparable Company (1) | | Price

| | LTM

| | 2003E

| | 2004E

| | LTM

| | 2003E

| | 2004E

|

Alkermes | | $ | 13.11 | | $ | 15.5 | | $ | 52.0 | | $ | 67.2 | | 18.9x | | 17.3x | | 13.4x |

Connetics | | | 16.53 | | | 51.7 | | | 69.2 | | | 93.1 | | 8.7x | | 7.1x | | 5.3x |

Medicines Co. | | | 23.31 | | | 47.3 | | | 84.4 | | | 134.9 | | 20.3x | | 11.4x | | 7.1x |

MGI Pharma | | | 20.70 | | | 26.2 | | | 52.8 | | | 102.1 | | 17.0x | | 9.3x | | 4.8x |

| | | | | | | | | | | | | Mean | | 16.2x | | 11.3x | | 7.6x |

Salix | | $ | 11.80 | | $ | 38.8 | | $ | 52.3 | | $ | 81.8 | | 5.3x | | 3.9x | | 2.5x |

| (1) | | Peer group comprised of specialty pharma companies projected to be profitable in next 24 months |

| (2) | | LTM=Last twelve months |

| (3) | | Estimates obtained from equity research reports |

| *Enterprise | | value = market value of equity plus net debt |

$ in millions, except per share numbers

Salix Pharmaceuticals, Ltd. 29

INDEPENDENT RESEARCH ANALYSTS’ COMMENTS

AXCAN TENDER OFFER AND SALIX STRATEGIC PLAN

| | • | | “Axcan has raised its hostile offer for SLXP to $10.50 per share (from $8.75 per share)…We believe that the new bid does not fully reflect the potential of rifaximin…We believe SLXP shareholders could potentially derive more value from approval and launch of Rifaximin, rather than trading in the shares prematurely at $10.50.”(M Tong—Wachovia 5/20/03) |

| | • | | “We believe that the majority of SLXP shareholders are growth investors and own shares in anticipation of continued growth of COLAZAL and future product launches. The rifaximin launch in FY04 represents a pivotal point for Salix and will push the company towards profitability, in our opinion.”(D Ellis—Thomas Weisel Partners (TWP) 4/10/03) |

Salix Pharmaceuticals, Ltd. 30

INDEPENDENT RESEARCH ANALYSTS’ COMMENTS

(CONTINUED)

AXCAN TENDER OFFER AND SALIX STRATEGIC PLAN

| | • | | “We believe SLXP’s current share price does not fully reflect Rifaximin’s intrinsic value potential.”(M Tong—Wachovia 5/14/03) |

| | • | | “We believe the Company has sufficient financial flexibility to execute product acquisitions that could complement its existing sales and market efforts. The company expects to turn profitable in H2 2004, with or without Rifaximin. Our analysis supports management’s assertion…We believe the company has sufficient cash to fund its operations until it turns profitable.”(M Tong—Wachovia 5/14/03) |

| | • | | “Even if the deal is not completed, we see limited downside for SLXP based on the valuation exercise above.”(M Tong—Wachovia 4/10/03) |

Salix Pharmaceuticals, Ltd. 31

INDEPENDENT RESEARCH ANALYSTS’ COMMENTS

(CONTINUED)

COLAZAL

| | • | | “The company has raised its forecast for 2003 COLAZAL sales to $53 million from $50 million…Note that as of the week ending 5/2/03, COLAZAL had an annual run rate of almost $58 million…, which could indicate that the company’s expectations might prove conservative.”(CJ Sylvester—UBSW 5/15/03) |

| | • | | “Axcan suggests that COLAZAL’s growth is decelerating. We disagree again.”(M Tong—Wachovia 5/20/03) |

| | • | | “Sequentially, (Colazal) scripts increased 9.3% during the quarter (Q1 2003 over Q4 2002) and channel inventory levels at the end of Q1 (2003) stood at 1.1 months, vs. 1.5 months in Q4 2002.”(M Hearle—Leerink Swann 5/14/03) |

Salix Pharmaceuticals, Ltd. 32

INDEPENDENT RESEARCH ANALYSTS’

COMMENTS

(CONTINUED)

RIFAXIMIN

| | • | | “We continue to believe that the company will provide the FDA with all necessary data for a Rifaximin approval in mid-2004 and that this will drive company profitability.. We believe this (travelers’ diarrhea) represents the first of several indications Salix will seek for Rifaximin. Other indications for which we expect Salix to seek Rifaximin approval in the near-term include: hepatic encephalopathy, small bowel overgrowth, pouchitis, diverticulitis, andC. difficilediarrhea.”(D Ellis –TWP 5/14/03) |

| | • | | “We have raised our 2005 Rifaximin forecast to $40 million from $15 million to account for the product’s substantial market opportunities.”(CJ Sylvester – UBS Warburg (USBW) 5/15/03) |

| | • | | “Given Rifaximin’s low systemic absorption and resistance potential, it could be an ideal product for treatment of a broad range of GI infections, in our view… Management expects Rifaximin sales to exceed $550 million in its fifth year after launch (2009). This would equate to average market share of approximately 15% (in the sub-segments listed in Table 1).”(M Tong – Wachovia 5/14/03) |

Salix Pharmaceuticals, Ltd. 33

INDEPENDENT RESEARCH ANALYSTS’

COMMENTS

(CONTINUED)

GRANULATED MESALAMINE

| | • | | “Given the potential for improved dosing (qd or bid vs. current tid administration), we believe peak sales (of granulated mesalamine product) could be $250-300MM – addressing a market of roughly 500,000 adults in the U.S.”(M Hearle – Leerink Swann 5/14/03) |

Salix Pharmaceuticals, Ltd. 34

WHY SUPPORT THE INCUMBENT

BOARD OF DIRECTORS?

| | • | | Strong business execution |

| | – | | Salix’s Board has consistently made decisions that have enhanced stockholder value |

| | – | | Salix is at the cusp of realizing the benefit of our efforts and success in executing our business plan |

| | – | | Salix is poised for significant growth and profitability, and can better enhance stockholder value by continuing to execute its business plan |

| | • | | Good Corporate Governance |

| | – | | Independent, experienced Board |

| | • | | Incumbent Board more aligned with stockholders |

| | – | | Salix’s D&O own 15.5% of outstanding common stock |

Salix Pharmaceuticals, Ltd. 35

FORWARD-LOOKING

STATEMENTS

Statements presented in this overview which are not historical facts are forward looking statements that involve risks and uncertainties that could cause actual results to differ from projected results.

Factors that could cause actual results to differ materially include our dependence on balsalazide and rifaximin and their market acceptance, the risks of clinical trials and regulatory review, our limited sales and marketing experience and the need to acquire new products. These and other relevant risks are detailed in the Company’s Securities and Exchange Commission filings.

Salix Pharmaceuticals, Ltd. 36