Exhibit 99.2

Salix Pharmaceuticals Investor Presentation

December 2013

We have a

One Tract

mind.

Table of Contents

Transaction Overview 5

Salix & Santarus Overview 7

Key Credit Highlights 12

Combined Company Overview 16

Historical Financial Overview 29

Appendix 33

2

Disclaimer

Forward-Looking Statements

This document contains forward-looking statements, which relate to matters such as the Company’s acquisition of Santarus, Inc. (“Santarus”) and the Company’s industry, business strategy, goals and expectations concerning its market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources, other financial and operating information and peak revenue potential. When used in this presentation, the words “will,” “believes,” “intends,” “anticipates,” “plans”, “projects”, “estimates”, “expects” and similar expressions (including negatives thereof) are intended to identify forward-looking statements. Such statements are based on management’s current expectations and assumptions regarding the Company’s business and performance, the economy and other future conditions and forecasts of future events, circumstances and results. As with any projection or forecast, forward-looking statements are inherently susceptible to uncertainty and changes in circumstances. Actual results could differ materially from those expressed in, or implied by, such forward-looking statements.

Factors that could cause our actual results to differ materially from the Company’s projected results include, among others, those set forth in the section entitled “Risk Factors” in the Company’s and Santarus’ filings with the Securities and Exchange Commission. The Company makes no representations or warranties as to the accuracy or completeness of such statements, estimates and projections and there can be no assurance that the third party or publicly available information on which the Company’s forward-looking statements are based is complete or accurate.

Non-GAAP Financial Measures

Some of the financial metrics presented in this document represent non-GAAP financial measures. A reconciliation of the non-GAAP financial metrics to GAAP is presented in the Appendix. However, these non-GAAP financial metrics should not be considered as an alternative to other performance or liquidity measures derived in accordance with GAAP.

Pro Forma Information

This document contains certain pro forma information that reflects our current expectations and assumptions regarding the effect that our pending acquisition of Santarus would have had if it has been completed at an earlier date. This pro forma information does not purport to present the results that would have actually occurred had the acquisition been completed on the assumed date, or which may be realized in the future.

Trademark Disclaimer

The following are trademarks or registered trademarks of Salix in the United States and/or other countries: APRISO®, COLAZAL®, FULYZAQ™, GIAZO®, OSMOPREP®, METOZOLV®, PROCTOCORT®, and RELISTOR®.

The following are registered trademarks of Santarus in the United States and/or other countries: FENOGLIDE®, UCERIS®, and ZEGERID®.

There may be other company names and products mentioned in this document, and such company names and/or products may be trademarks or registered trademarks of other companies. The use of these company names and/or products herein is not intended to imply a relationship or endorsement of Salix or Santarus by such company.

3

Management Presenters

Carolyn Logan

President & CEO

President and CEO of Salix since 2002

Approximately 35 years of specialty pharmaceutical sales and marketing experience, including extensive experience building and rebuilding specialty pharmaceutical sales forces Previously, served as Senior Vice President, Sales and Marketing for Salix from 2000 to 2002 Prior to joining Salix, served as Vice President, Sales and Marketing, of the Oclassen Dermatologics division of Watson Pharmaceuticals, Inc. from 1997 to 2000

Adam Derbyshire

EVP, Finance and Administration & CFO

Executive Vice President, Finance and Administration and CFO since 2000

Prior to joining Salix, served as Vice President, Corporate Controller, and Secretary of Medco Research, Inc. from 1999 to 2000 and Corporate Controller and Secretary from 1995 to 1999 and Assistant Controller from 1993 to 1995

4

Transaction Overview

5

Introduction

On November 7, 2013, Salix (NasdaqGS: SLXP) announced the acquisition of Santarus (NasdaqGS: SNTS) for $32.00 per share in an all-cash transaction valued at approximately $2.6 billion, a 36% premium over the November 6, 2013 closing price of $23.53 per share

The transaction creates a leader in the gastroenterology pharmaceuticals space, offering a highly complementary portfolio of well-known and profitable drugs, including Xifaxan, Apriso, Glumetza and Uceris, utilized primarily for chronic conditions

The acquisition will be immediately EBITDA accretive with opportunities for approximately $40 million in operational cost savings across R&D, G&A and marketing. Revenue synergies are expected to result from utilizing Santarus’ existing salesforce to promote Salix products

The combined company will retain the Salix name and be led by current Salix management

The companies expect to close the transaction in the first quarter of 2014

In connection with this acquisition, Salix is pursuing the following new financing:

$2,100 million in total debt financing

On a pro forma basis, the combined company would have generated LQA 9/30/13 combined Revenue and LQA combined Adjusted EBITDA of approximately $1,348 million and $577 million, respectively(1)(2)

LQA Adj. EBITDA is quickly ramping due to the contribution of Uceris and continued growth of Xifaxan, with LQA 9/30/2013 combined Adjusted EBITDA of $577 million(1)(2), compared to LTM 9/30/2013 PF Adjusted EBITDA of $467 million(1)(2)

Given the ongoing increase in prescription volume related to key products, this annualized information is useful in evaluating the Company’s recent performance

Total and net leverage of 5.2x and 4.9x, respectively, based on LQA 9/30/13 Adjusted EBITDA

(1) Pro forma Adjusted EBITDA figures are inclusive of approximately $40 million of operational cost savings.

(2) A reconciliation of LQA Adjusted EBITDA, PF Adjusted EBITDA and Adjusted EBITDA is contained in the Appendix.

6

Salix & Santarus Overview

7

Salix Overview

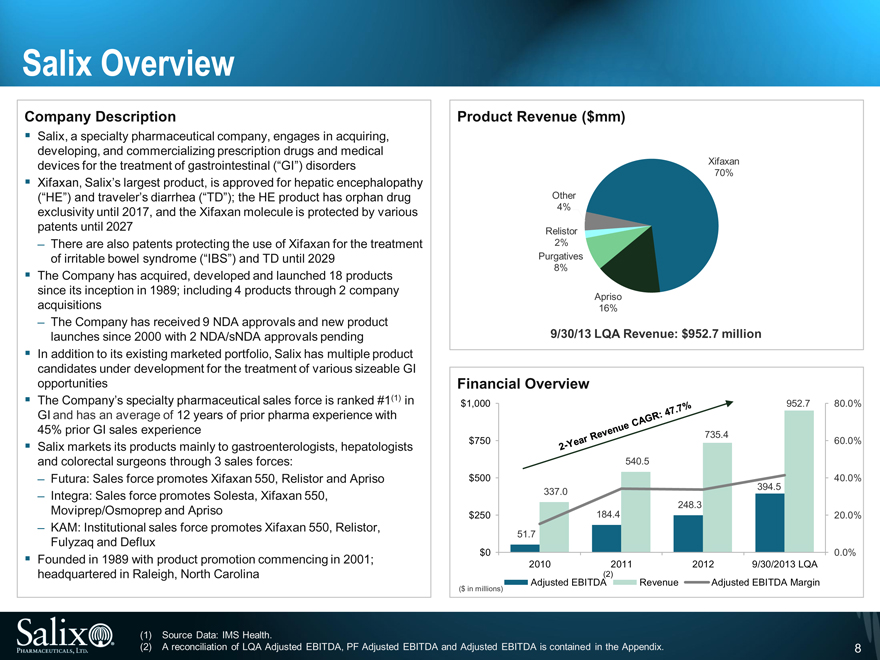

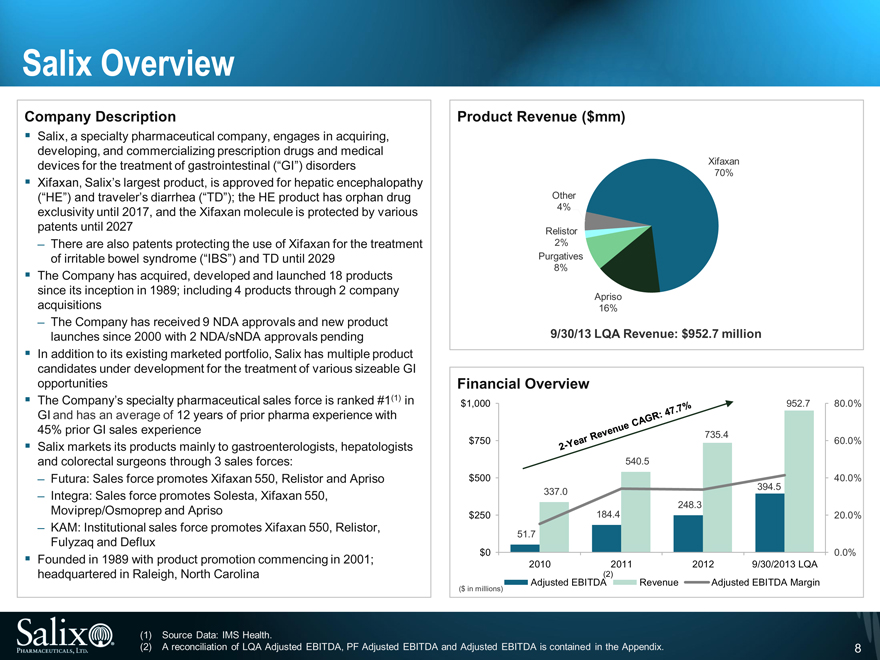

Company Description

Salix, a specialty pharmaceutical company, engages in acquiring, developing, and commercializing prescription drugs and medical devices for the treatment of gastrointestinal (“GI”) disorders

Xifaxan, Salix’s largest product, is approved for hepatic encephalopathy (“HE”) and traveler’s diarrhea (“TD”); the HE product has orphan drug exclusivity until 2017, and the Xifaxan molecule is protected by various patents until 2027

There are also patents protecting the use of Xifaxan for the treatment of irritable bowel syndrome (“IBS”) and TD until 2029

The Company has acquired, developed and launched 18 products since its inception in 1989; including 4 products through 2 company acquisitions

The Company has received 9 NDA approvals and new product launches since 2000 with 2 NDA/sNDA approvals pending

In addition to its existing marketed portfolio, Salix has multiple product candidates under development for the treatment of various sizeable GI opportunities

The Company’s specialty pharmaceutical sales force is ranked #1(1) in GI and has an average of 12 years of prior pharma experience with 45% prior GI sales experience

Salix markets its products mainly to gastroenterologists, hepatologists and colorectal surgeons through 3 sales forces:

Futura: Sales force promotes Xifaxan 550, Relistor and Apriso

Integra: Sales force promotes Solesta, Xifaxan 550,

Moviprep/Osmoprep and Apriso

KAM: Institutional sales force promotes Xifaxan 550, Relistor, Fulyzaq and Deflux

Founded in 1989 with product promotion commencing in 2001; headquartered in Raleigh, North Carolina

Product Revenue ($mm)

Xifaxan

70%

Other

4%

Relistor

2%

Purgatives

8%

Apriso

16%

9/30/13 LQA Revenue: $952.7 million

Financial Overview

$1,000

952.7

80.0%

735.4

$750

60.0%

540.5

$500

40.0%

337.0

394.5

248.3

$250

184.4

20.0%

51.7

$0

0.0%

2010

2011

2012

9/30/2013 LQA

2-Year Revenue CAGR: 47.7%

(2)

Adjusted EBITDA

Revenue

Adjusted EBITDA Margin

($ in millions)

(1)

Source Data: IMS Health.

(2)

A reconciliation of LQA Adjusted EBITDA, PF Adjusted EBITDA and Adjusted EBITDA is contained in the Appendix.

8

Santarus Overview

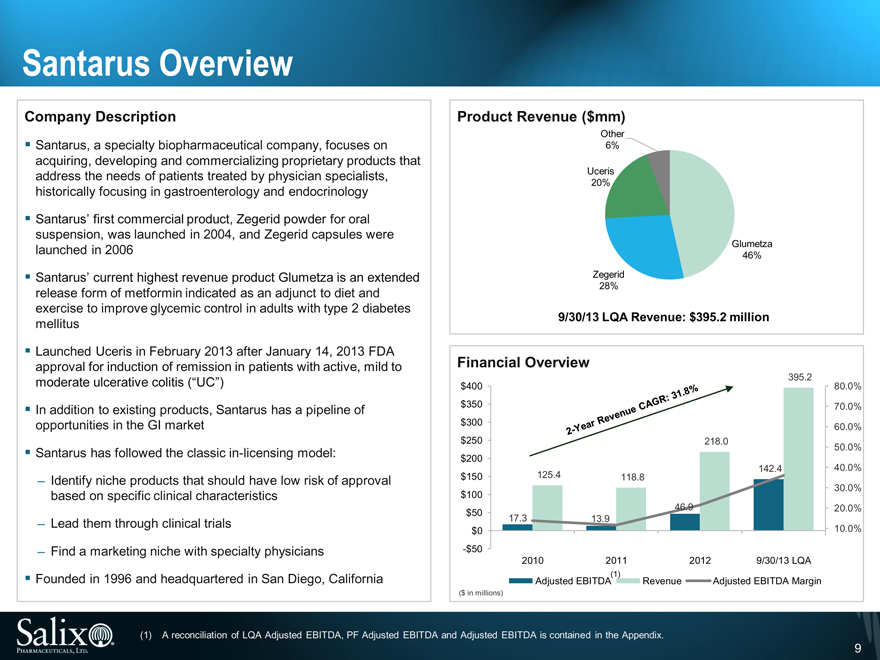

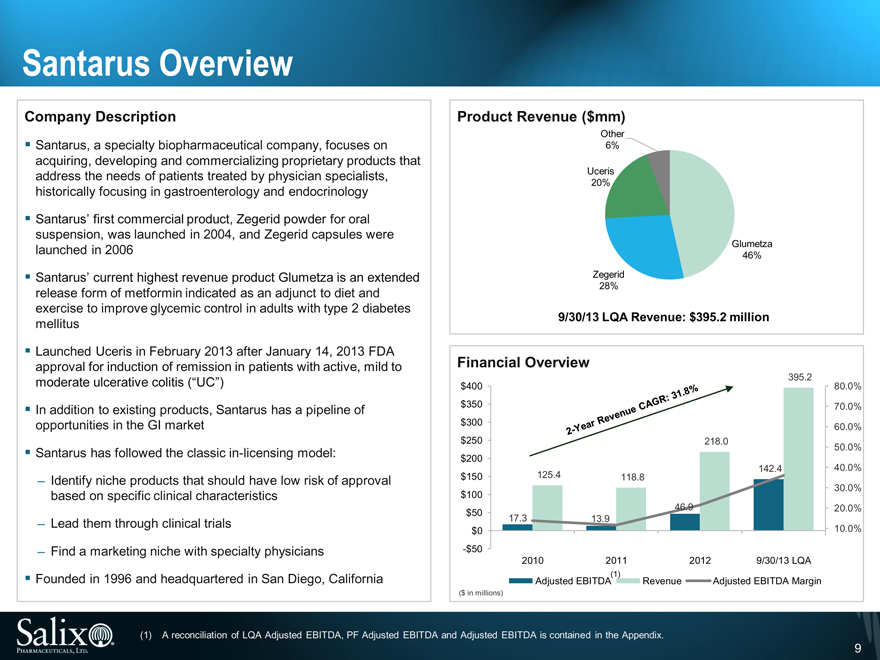

Company Description

Santarus, a specialty biopharmaceutical company, focuses on acquiring, developing and commercializing proprietary products that address the needs of patients treated by physician specialists, historically focusing in gastroenterology and endocrinology

Santarus’ first commercial product, Zegerid powder for oral suspension, was launched in 2004, and Zegerid capsules were launched in 2006

Santarus’ current highest revenue product Glumetza is an extended release form of metformin indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus

Launched Uceris in February 2013 after January 14, 2013 FDA approval for induction of remission in patients with active, mild to moderate ulcerative colitis (“UC”)

In addition to existing products, Santarus has a pipeline of opportunities in the GI market

Santarus has followed the classic in-licensing model:

Identify niche products that should have low risk of approval based on specific clinical characteristics

Lead them through clinical trials

Find a marketing niche with specialty physicians

Founded in 1996 and headquartered in San Diego, California

Product Revenue ($mm)

Other

6%

Uceris

20%

Glumetza

46%

Zegerid

28%

9/30/13 LQA Revenue: $395.2 million

Financial Overview

395.2

$400

80.0%

$350

70.0%

$300

60.0%

$250

218.0

50.0%

$200

142.4

40.0%

$150

125.4

118.8

30.0%

$100

$50

46.9

20.0%

17.3

13.9

$0

10.0%

-$50

2010

2011

2012

9/30/13 LQA

Adjusted EBITDA(1)

Revenue

Adjusted EBITDA Margin

($ in millions)

(1) A reconciliation of LQA Adjusted EBITDA, PF Adjusted EBITDA and Adjusted EBITDA is contained in the Appendix.

9

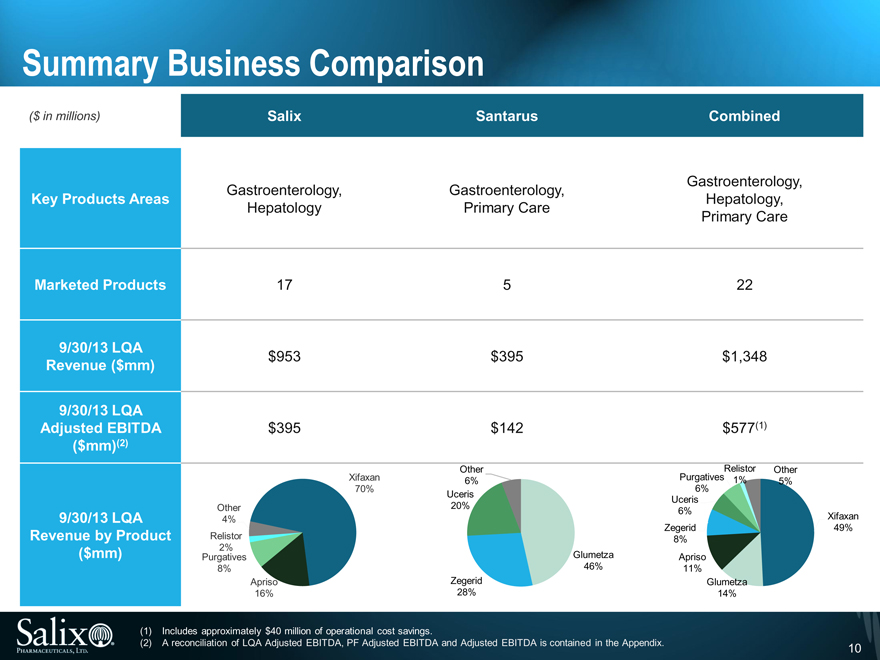

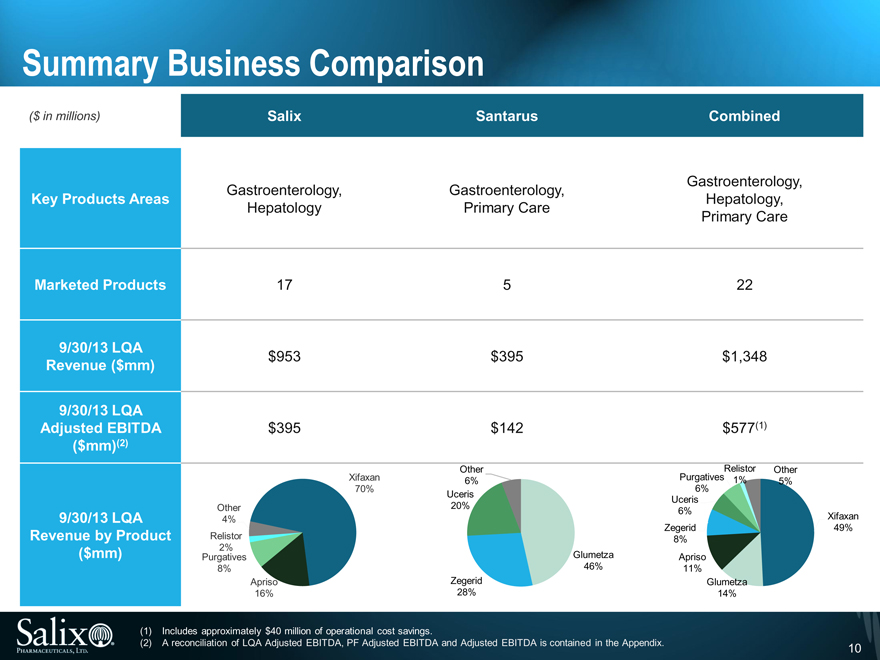

Summary Business Comparison

($ in millions) Salix Santarus Combined

Gastroenterology, Gastroenterology, Gastroenterology,

Key Products Areas Hepatology,

Hepatology Primary Care Primary Care

Marketed Products 17 5 22

9/30/13 LQA

Revenue ($mm) $953 $ 395 $1,348

9/30/13 LQA

Adjusted EBITDA $395 $ 142 $577(1)

($mm)(2)

Other Relistor Other

Xifaxan 6% Purgatives 1% 5%

70% 6%

Uceris Uceris

Other 20% 6%

9/30/13 LQA 4% Xifaxan

Zegerid 49%

Revenue by Product Relistor 8%

($mm) Purgatives 2% Glumetza Apriso

8% 46% 11%

Apriso Zegerid Glumetza

16% 28% 14%

(1) Includes approximately $40 million of operational cost savings.

(2) A reconciliation of LQA Adjusted EBITDA, PF Adjusted EBITDA and Adjusted EBITDA is contained in the Appendix. 10

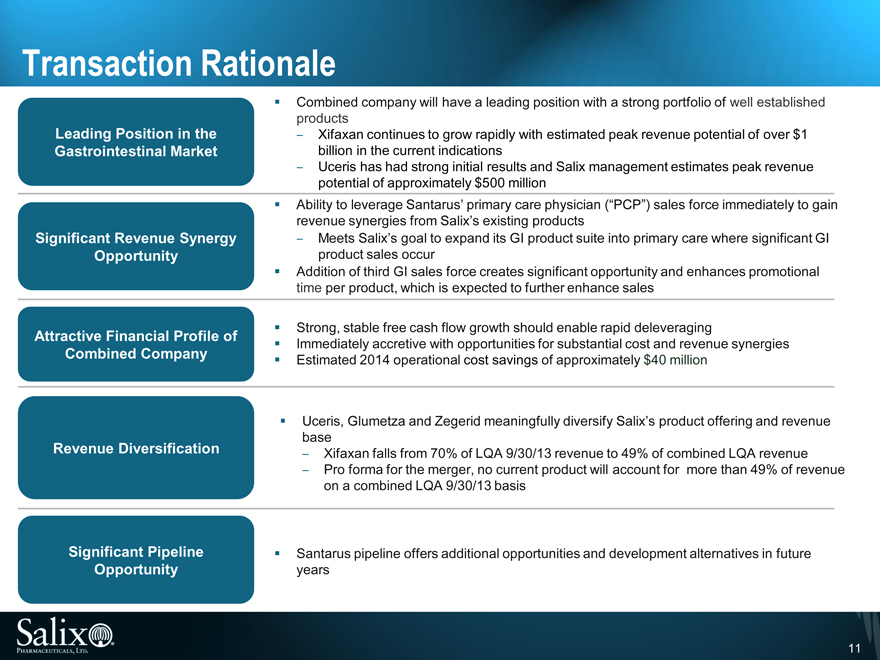

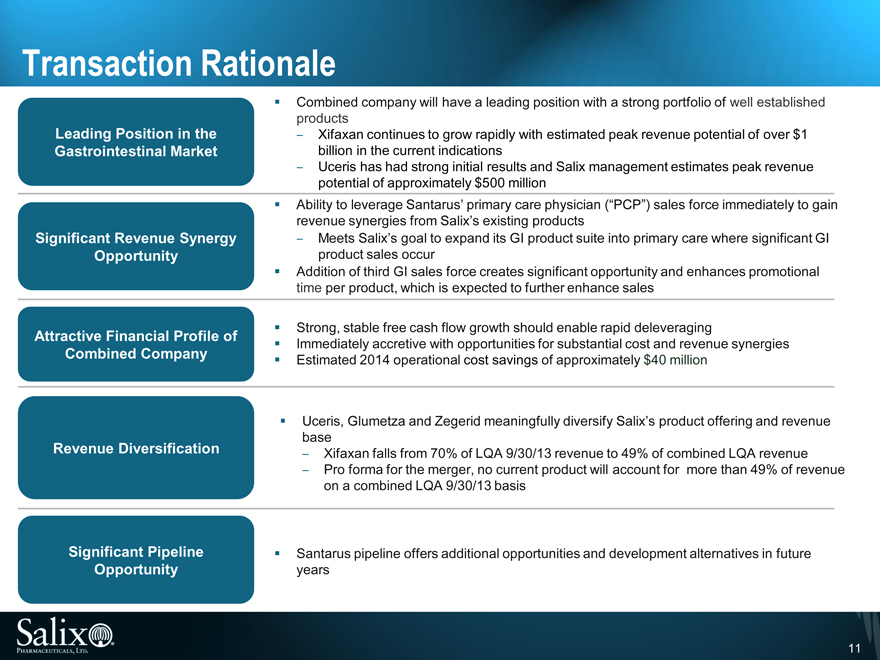

Transaction Rationale

Combined company will have a leading position with a strong portfolio of well established

products

Leading Position in the Xifaxan continues to grow rapidly with estimated peak revenue potential of over $1

Gastrointestinal Market billion in the current indications

Uceris has had strong initial results and Salix management estimates peak revenue

potential of approximately $500 million

Ability to leverage Santarus’ primary care physician (“PCP”) sales force immediately to gain

revenue synergies from Salix’s existing products

Significant Revenue Synergy Meets Salix’s goal to expand its GI product suite into primary care where significant GI

Opportunity product sales occur

Addition of third GI sales force creates significant opportunity and enhances promotional

time per product, which is expected to further enhance sales

Strong, stable free cash flow growth should enable rapid deleveraging

Attractive Financial Profile of Immediately accretive with opportunities for substantial cost and revenue synergies

Combined Company Estimated 2014 operational cost savings of approximately $40 million

Significant Pipeline Santarus pipeline offers additional opportunities and development alternatives in future

Opportunity years Uceris, Glumetza and Zegerid meaningfully diversify Salix’s product offering and revenue

base

Revenue Diversification Xifaxan falls from 70% of LQA 9/30/13 revenue to 49% of combined LQA revenue

Pro forma for the merger, no current product will account for more than 49% of revenue

on a combined LQA 9/30/13 basis

11

Key Credit Highlights

12

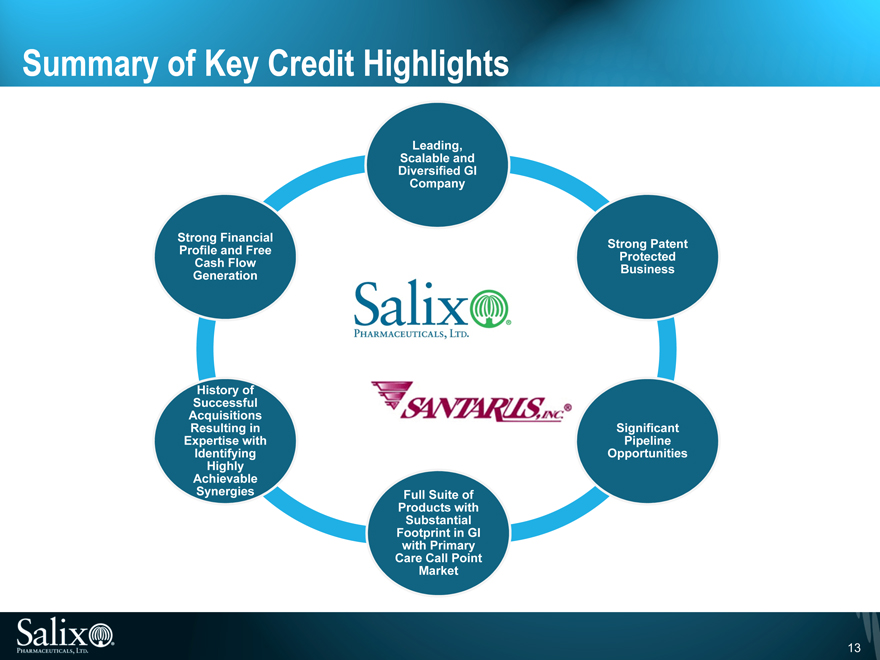

Summary of Key Credit Highlights

Leading, Scalable and Diversified GI

Company

Strong Patent Protected Business

Significant Pipeline Opportunities

Full Suite of Products with Substantial Footprint in GI with Primary Care Call Point Market

History of Successful Acquisitions Resulting in Expertise with Identifying Highly Achievable Synergies

Strong Financial Profile and Free Cash Flow Generation

13

Key Highlights

Combination of Salix and Santarus will establish the leading GI-focused company in the specialty pharmaceutical market with

significantly increased scale

Leading, Scalable Includes unique products with well-defined roles in the treatment of chronic conditions

and Diversified GI Xifaxan and Glumetza currently comprise approximately 70% and 46% of Salix’s and Santarus’ LQA 9/30/13 revenue, respectively

Company Pro forma for the combination, no current product expected to account for more than 49% of pro forma LQA 9/30/13 revenue

Significant growth potential from the successful recent launch of Uceris will diversify the company’s product offering within GI

Combined Company will own no manufacturing facilities and use third-party vendors to produce materials and product for maximum

flexibility

Various composition of matter patents for Xifaxan until 2027, leading to anticipated peak revenue potential of over $1 billion

Additionally, Xifaxan has method of use patents until 2029 for IBS and TD

Salix’s Apriso for UC, a chronic condition, has patent protection until 2018 with projected peak revenue potential of $150 – $200

million(1)

Growing Patent Uceris for UC, a chronic condition, has patent protection until 2020, leading to approximately $500 million in expected peak

revenue potential

Protected

Business Zegerid and Glumetza projected to achieve significant combined annual sales of approximately $350 million prior to expected

generic competition in 2016(2)

Salix has a history of extending the life of its products through proactive life cycle management

Strong pipeline of life cycle extension opportunities for Xifaxan; management expects to develop similar opportunities for

Uceris as well

Salix currently has a number of product candidates in late-stage development with strong anticipated peak revenue potential

Significant 6 pipeline opportunities in Phase II or later development with projected total peak revenue potential approaching $5 billion

Pipeline In addition to Santarus’ commercial products, the acquisition provides Salix with investigational drugs that may have commercial

Opportunities potential

2 new products in the pipeline and potential for an additional indication for Uceris

(1) Filed patent infringement lawsuit against Lupin on September 7, 2012.

(2) Under certain circumstances, both products could face generic competition at an earlier date, which could reduce the peak revenue

potential to be derived from these products. 14

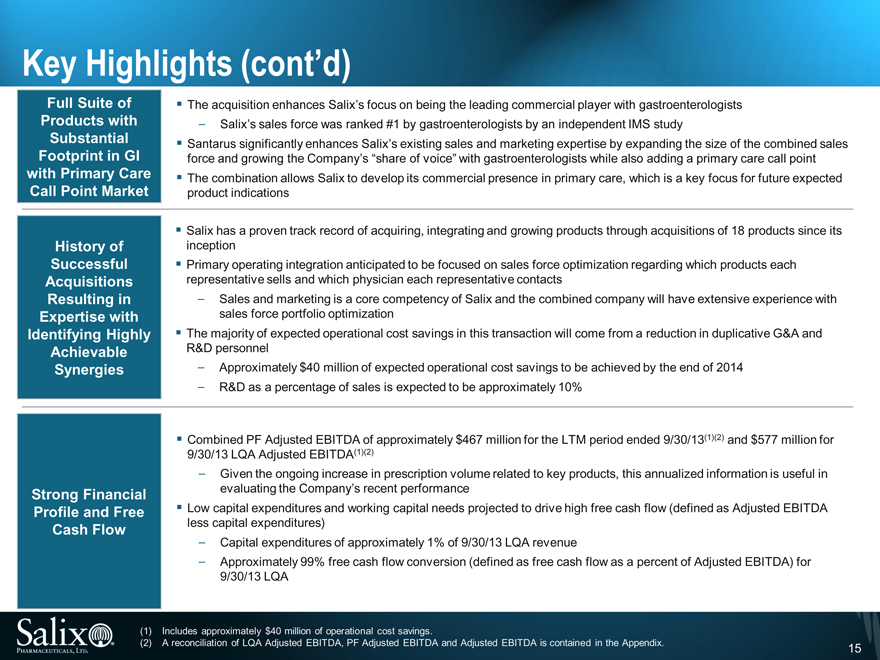

Key Highlights (cont’d)

Full Suite of The acquisition enhances Salix’s focus on being the leading commercial player with gastroenterologists

Products with Salix’s sales force was ranked #1 by gastroenterologists by an independent IMS study

Substantial Santarus significantly enhances Salix’s existing sales and marketing expertise by expanding the size of the combined sales

Footprint in GI force and growing the Company’s “share of voice” with gastroenterologists while also adding a primary care call point

with Primary Care The combination allows Salix to develop its commercial presence in primary care, which is a key focus for future expected

Call Point Market product indications

Salix has a proven track record of acquiring, integrating and growing products through acquisitions of 18 products since its

History of inception

Successful Primary operating integration anticipated to be focused on sales force optimization regarding which products each

Acquisitions representative sells and which physician each representative contacts

Resulting in Sales and marketing is a core competency of Salix and the combined company will have extensive experience with

Expertise with sales force portfolio optimization

Identifying Highly The majority of expected operational cost savings in this transaction will come from a reduction in duplicative G&A and

Achievable R&D personnel

Synergies Approximately $40 million of expected operational cost savings to be achieved by the end of 2014

R&D as a percentage of sales is expected to be approximately 10%

Combined PF Adjusted EBITDA of approximately $467 million for the LTM period ended 9/30/13(1)(2) and $577 million for

9/30/13 LQA Adjusted EBITDA(1)(2)

Given the ongoing increase in prescription volume related to key products, this annualized information is useful in

Strong Financial evaluating the Company’s recent performance

Profile and Free Low capital expenditures and working capital needs projected to drive high free cash flow (defined as Adjusted EBITDA

Cash Flow less capital expenditures)

Capital expenditures of approximately 1% of 9/30/13 LQA revenue

Approximately 99% free cash flow conversion (defined as free cash flow as a percent of Adjusted EBITDA) for

9/30/13 LQA

(1) Includes approximately $40 million of operational cost savings.

(2) A reconciliation of LQA Adjusted EBITDA, PF Adjusted EBITDA and Adjusted EBITDA is contained in the Appendix. 15

Combined Company Overview

16

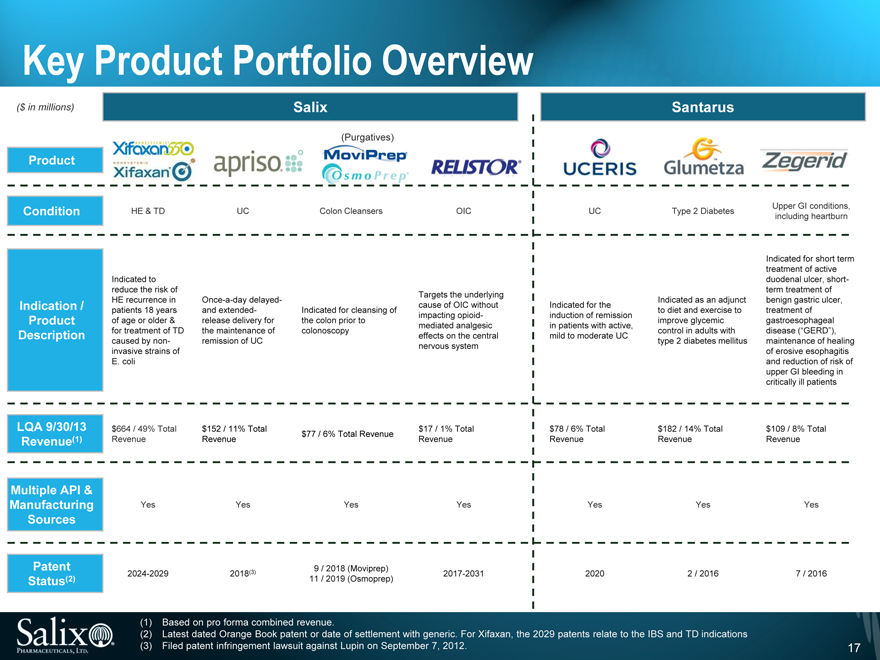

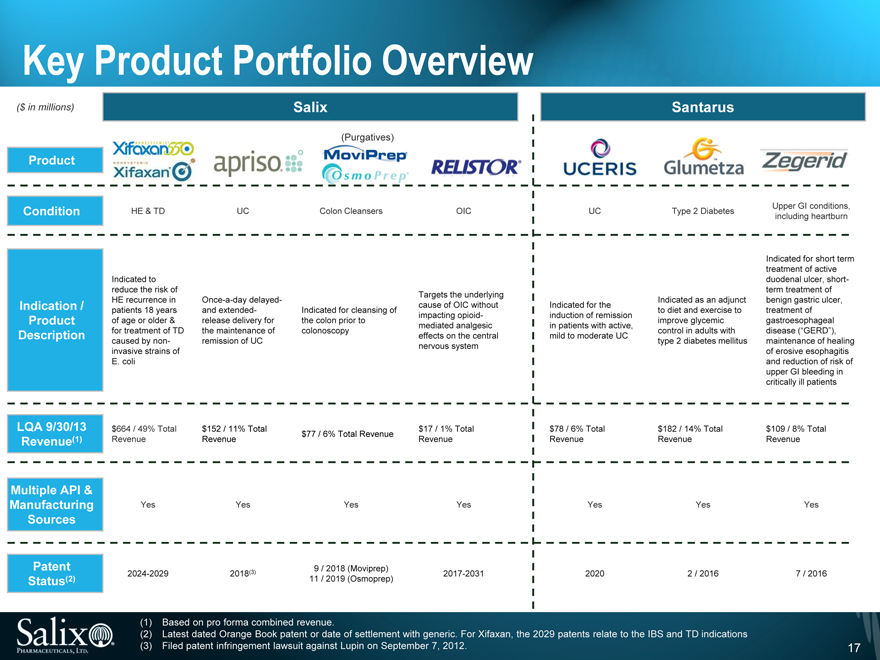

Key Product Portfolio Overview

($ in millions)

Product

Condition

Indication / Product Description

LQA 9/30/13 Revenue(1)

Multiple API & Manufacturing Sources

Patent Status(2)

Salix

Santarus

(Purgatives)

HE & TD UC Colon Cleansers OIC UC Type 2 Diabetes Upper GI conditions,

including heartburn

Indicated for short term

treatment of active

Indicated to duodenal ulcer, short-

reduce the risk of term treatment of

Targets the underlying

HE recurrence in Once-a-day delayed- Indicated as an adjunct benign gastric ulcer,

cause of OIC without Indicated for the

patients 18 years and extended- Indicated for cleansing of to diet and exercise to treatment of

impacting opioid- induction of remission

of age or older & release delivery for the colon prior to improve glycemic gastroesophageal

mediated analgesic in patients with active,

for treatment of TD the maintenance of colonoscopy control in adults with disease (“GERD”),

effects on the central mild to moderate UC

caused by non- remission of UC type 2 diabetes mellitus maintenance of healing

nervous system

invasive strains of of erosive esophagitis

E. coli and reduction of risk of

upper GI bleeding in

critically ill patients

$664 / 49% Total $152 / 11% Total $17 / 1% Total $78 / 6% Total $182 / 14% Total $109 / 8% Total

$77 / 6% Total Revenue

Revenue Revenue Revenue Revenue Revenue Revenue

Yes Yes Yes Yes Yes Yes Yes

9 / 2018 (Moviprep)

2024-2029 2018(3) 2017-2031 2020 2 / 2016 7 / 2016

11 / 2019 (Osmoprep)

(1) Based on pro forma combined revenue.

(2) Latest dated Orange Book patent or date of settlement with generic. For Xifaxan, the 2029 patents relate to the IBS and TD indications (3) Filed patent infringement lawsuit against Lupin on September 7, 2012.

17

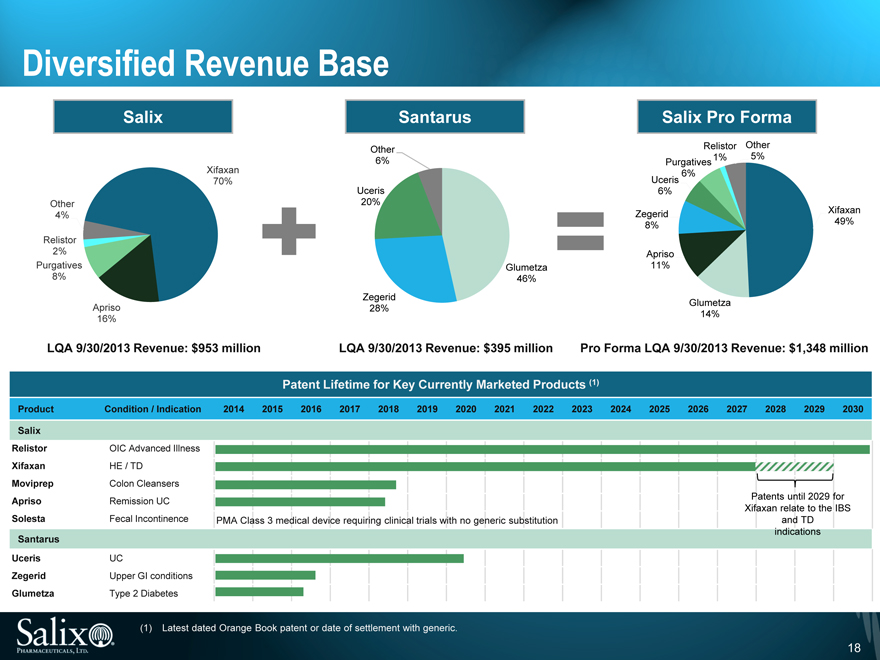

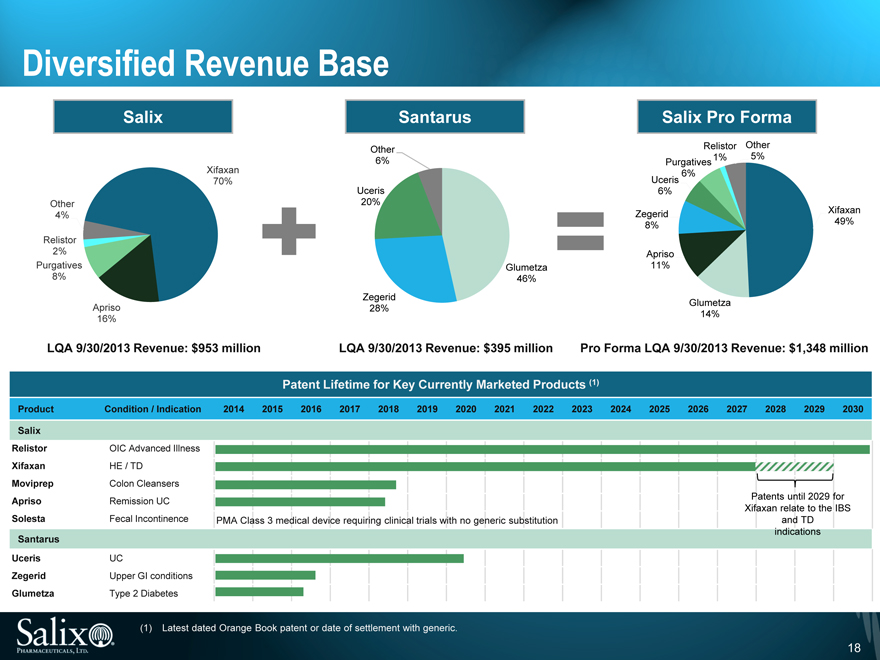

Diversified Revenue Base

Salix

Other 4%

Relistor 2%

Purgatives 8%

Apriso 16%

Xifaxan 70%

Santarus

Other 6%

Uceris 20%

Zegerid 28%

Glumetza 46%

Salix Pro Forma

Other 5%

Relistor 1%

Purgatives 6%

Uceris 6%

Zegerid 8%

Apriso 11%

Glumetza 14%

Xifaxan 49%

LQA 9/30/2013 Revenue: $953 million

LQA 9/30/2013 Revenue: $395 million

Pro Forma LQA 9/30/2013 Revenue: $1,348 million

Patent Lifetime for Key Currently Marketed Products (1)

Product Condition / Indication 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Salix

Relistor OIC Advanced Illness

Xifaxan HE / TD

Moviprep Colon Cleansers

Apriso Remission UC Patents until 2029 for

Xifaxan relate to the IBS

Solesta Fecal Incontinence PMA Class 3 medical device requiring clinical trials with no generic substitution and TD

indications

Santarus

Uceris UC

Zegerid Upper GI conditions

Glumetza Type 2 Diabetes

(1) Latest dated Orange Book patent or date of settlement with generic.

18

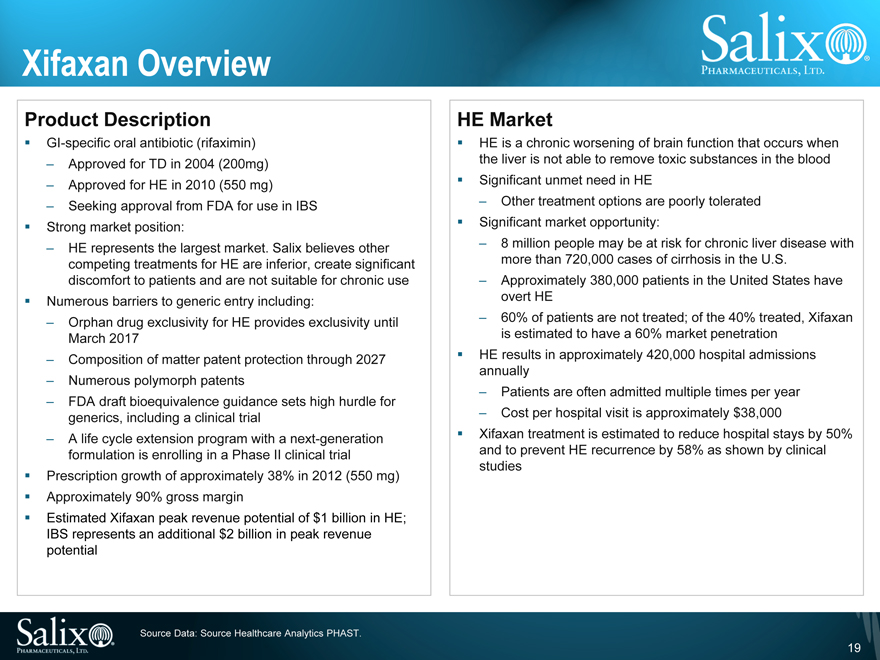

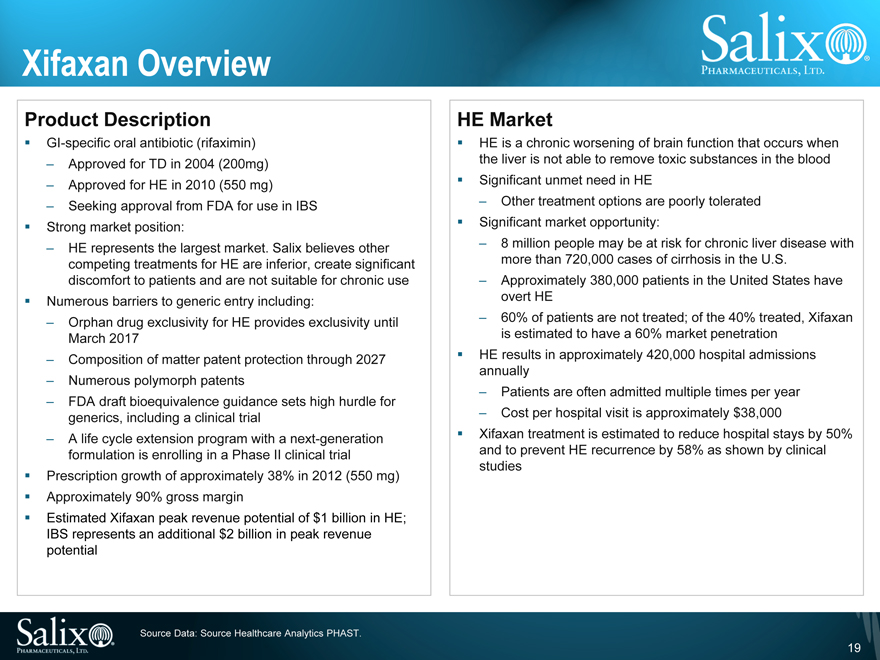

Xifaxan Overview

Product Description

GI-specific oral antibiotic (rifaximin)

Approved for TD in 2004 (200mg)

Approved for HE in 2010 (550 mg)

Seeking approval from FDA for use in IBS

Strong market position:

HE represents the largest market. Salix believes other

competing treatments for HE are inferior, create significant

discomfort to patients and are not suitable for chronic use

Numerous barriers to generic entry including:

Orphan drug exclusivity for HE provides exclusivity until

March 2017

Composition of matter patent protection through 2027

Numerous polymorph patents

FDA draft bioequivalence guidance sets high hurdle for

generics, including a clinical trial

A life cycle extension program with a next-generation

formulation is enrolling in a Phase II clinical trial

Prescription growth of approximately 38% in 2012 (550 mg)

Approximately 90% gross margin

Estimated Xifaxan peak revenue potential of $1 billion in HE;

IBS represents an additional $2 billion in peak revenue

potential

HE Market

HE is a chronic worsening of brain function that occurs when

the liver is not able to remove toxic substances in the blood

Significant unmet need in HE

Other treatment options are poorly tolerated

Significant market opportunity:

8 million people may be at risk for chronic liver disease with

more than 720,000 cases of cirrhosis in the U.S.

Approximately 380,000 patients in the United States have

overt HE

60% of patients are not treated; of the 40% treated, Xifaxan

is estimated to have a 60% market penetration

HE results in approximately 420,000 hospital admissions

annually

Patients are often admitted multiple times per year

Cost per hospital visit is approximately $38,000

Xifaxan treatment is estimated to reduce hospital stays by 50%

and to prevent HE recurrence by 58% as shown by clinical

studies

Source Data: Source Healthcare Analytics PHAST.

19

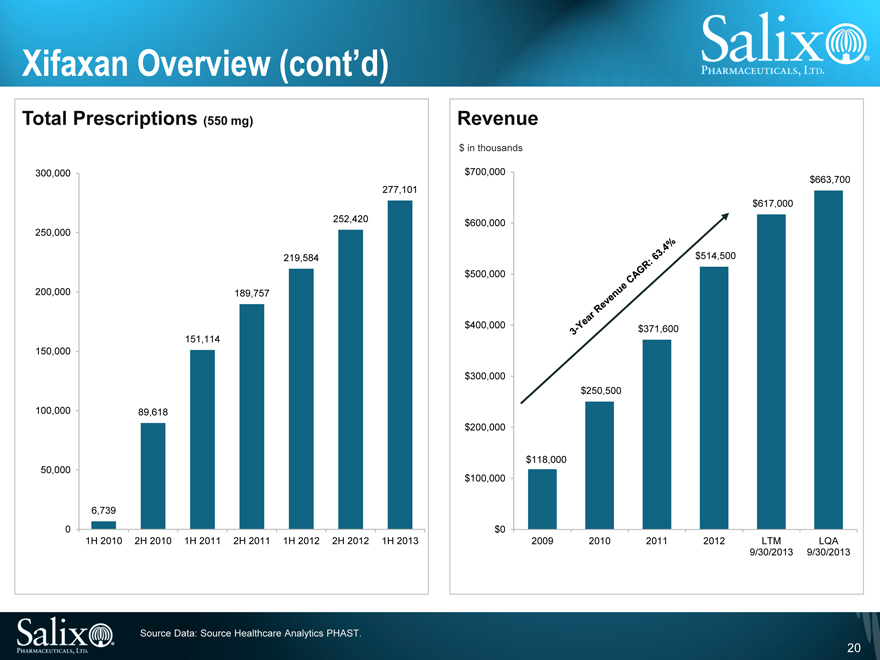

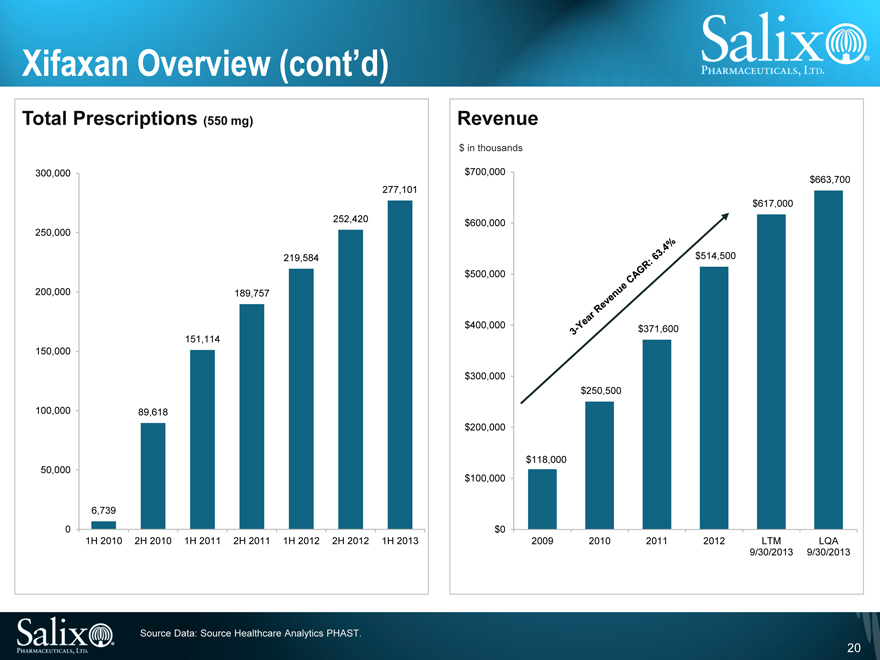

Xifaxan Overview (cont’d)

Total Prescriptions (550 mg)

300,000 250,000 200,000 150,000 100,000 50,000 0

6,739

89,618

151,114

189,757

219,584

252,420

277,101

1H 2010

2H 2010

1H 2011

2H 2011

1H 2012

2H 2012

1H 2013

Revenue

$ in thousands

$700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $0

$118,000

$250,500

$371,600

$514,500

$617,000

$663,700

2009

2010

2011

2012

LTM 9/30/2013

LQA 9/30/2013

3-Year Revenue CAGR: 63.4%

Source Data: Source Healthcare Analytics PHAST.

20

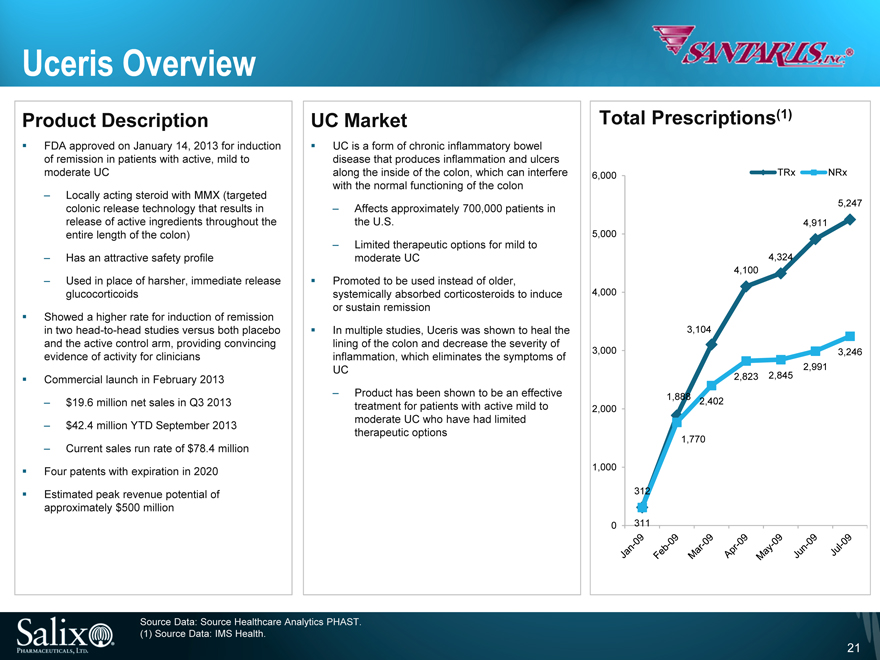

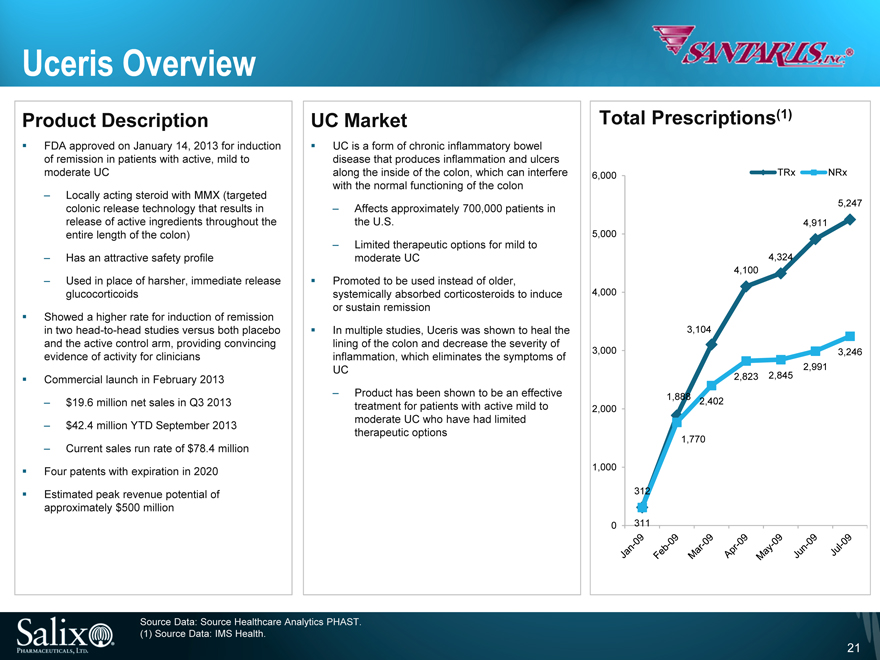

Uceris Overview

Product Description

FDA approved on January 14, 2013 for induction of remission in patients with active, mild to moderate UC

Locally acting steroid with MMX (targeted colonic release technology that results in release of active ingredients throughout the entire length of the colon)

Has an attractive safety profile

Used in place of harsher, immediate release glucocorticoids

Showed a higher rate for induction of remission in two head-to-head studies versus both placebo and the active control arm, providing convincing evidence of activity for clinicians

Commercial launch in February 2013

$19.6 million net sales in Q3 2013

$42.4 million YTD September 2013

Current sales run rate of $78.4 million

Four patents with expiration in 2020

Estimated peak revenue potential of approximately $500 million

UC Market

UC is a form of chronic inflammatory bowel disease that produces inflammation and ulcers along the inside of the colon, which can interfere with the normal functioning of the colon

Affects approximately 700,000 patients in the U.S.

Limited therapeutic options for mild to moderate UC

Promoted to be used instead of older, systemically absorbed corticosteroids to induce or sustain remission

In multiple studies, Uceris was shown to heal the lining of the colon and decrease the severity of inflammation, which eliminates the symptoms of UC

Product has been shown to be an effective treatment for patients with active mild to moderate UC who have had limited therapeutic options

Total Prescriptions(1)

6,000

5,000

4,000

3,000

2,000

1,000

0

TRx

NRx

311

312

1,770

2,402

1,888

2,845

2,823

3,104

2,991

3,246

4,100

4,324

4,911

5,247

Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09

Source Data: Source Healthcare Analytics PHAST. (1) Source Data: IMS Health.

21

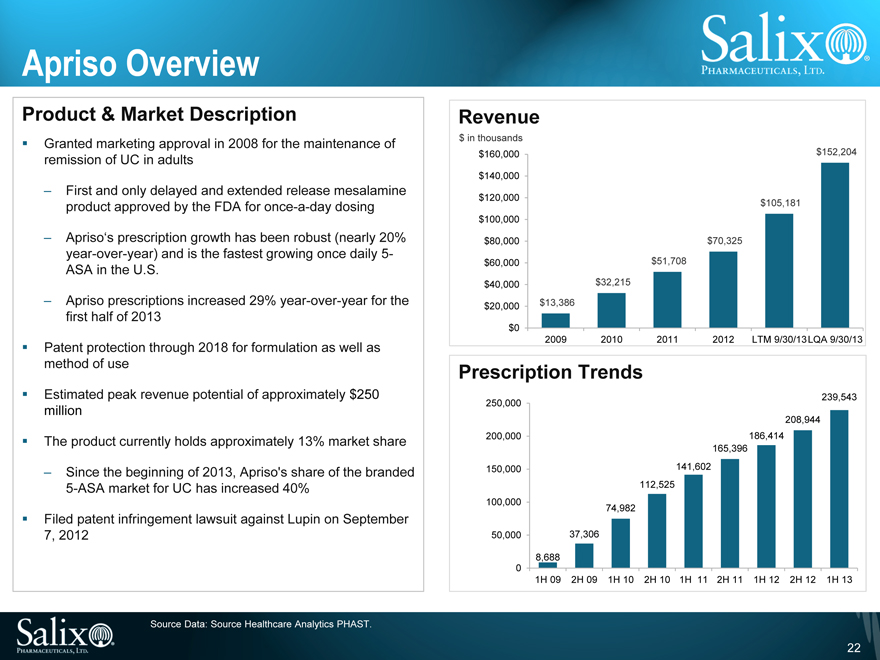

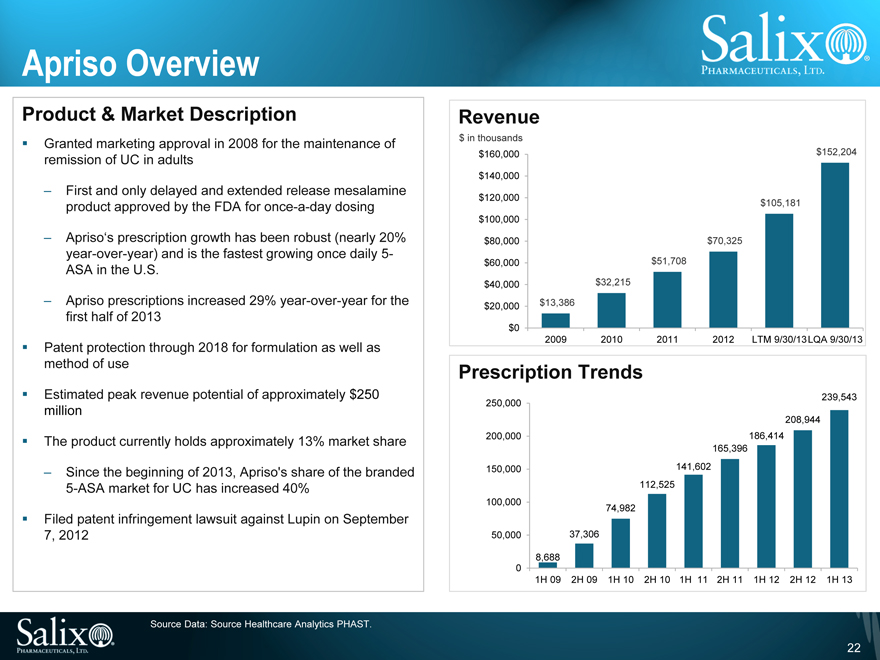

Apriso Overview

Product & Market Description

Granted marketing approval in 2008 for the maintenance of remission of UC in adults

First and only delayed and extended release mesalamine product approved by the FDA for once-a-day dosing

Apriso‘s prescription growth has been robust (nearly 20% year-over-year) and is the fastest growing once daily 5-ASA in the U.S.

Apriso prescriptions increased 29% year-over-year for the first half of 2013

Patent protection through 2018 for formulation as well as method of use

Estimated peak revenue potential of approximately $250 million

The product currently holds approximately 13% market share

Since the beginning of 2013, Apriso’s share of the branded

5-ASA market for UC has increased 40%

Filed patent infringement lawsuit against Lupin on September

7, 2012

Revenue

$ in thousands $160,000

$140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0

$13,386

$32,215

$51,708

$70,325

$105,181

$152,204

2009

2010

2011

2012

LTM

9/30/13

LQA

9/30/13

Prescription Trends

250,000

200,000

150,000

100,000 50,000

0

8,688

37,306

74,982

112,525

141,602

165,396

186,414

208,944

239,543

1H 09 2H 09 1H 10 2H 10 1H 11 2H 11 1H 12 2H 12 1H 13

Source Data: Source Healthcare Analytics PHAST.

22

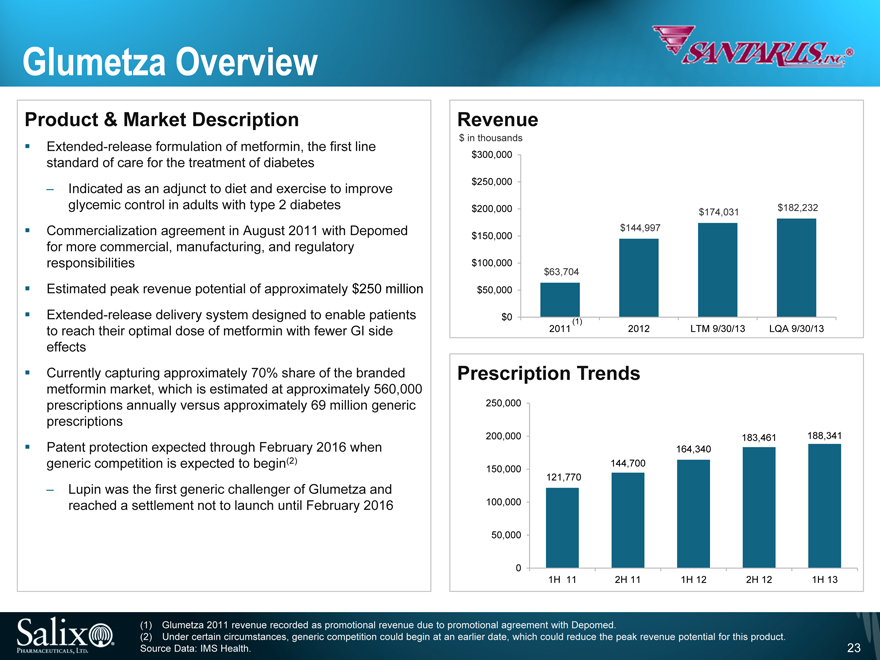

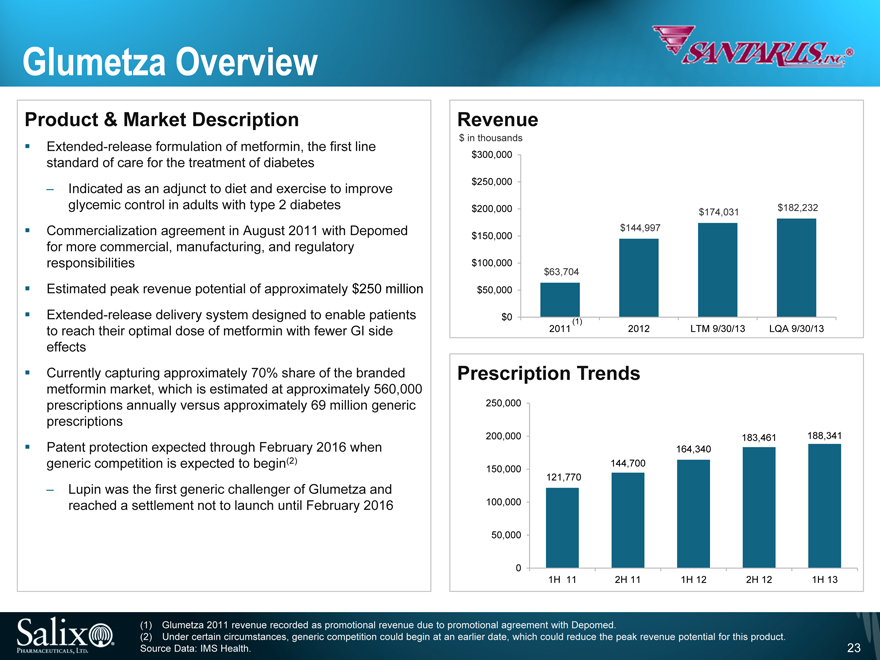

Glumetza Overview

Product & Market Description

Extended-release formulation of metformin, the first line standard of care for the treatment of diabetes

Indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes

Commercialization agreement in August 2011 with Depomed for more commercial, manufacturing, and regulatory responsibilities Estimated peak revenue potential of approximately $250 million Extended-release delivery system designed to enable patients to reach their optimal dose of metformin with fewer GI side effects Currently capturing approximately 70% share of the branded metformin market, which is estimated at approximately 560,000 prescriptions annually versus approximately 69 million generic prescriptions Patent protection expected through February 2016 when generic competition is expected to begin(2)

Lupin was the first generic challenger of Glumetza and reached a settlement not to launch until February 2016

Revenue

$ in thousands

$300,000

$250,000 $200,000

$150,000 $100,000

$50,000

$0

$63,704

$144,997

$174,031

$182,232

(1)

2011

LTM 9/30/13

2012

LQA 9/30/13

Prescription Trends

250,000

200,000

150,000

100,000

50,000

0

121,770

144,700

164,340

183,461

188,341

1H 11

2H 11

1H 12

2H 12

1H 13

(1) Glumetza 2011 revenue recorded as promotional revenue due to promotional agreement with Depomed.

(2) Under certain circumstances, generic competition could begin at an earlier date, which could reduce the peak revenue potential for this product. Source Data: IMS Health.

23

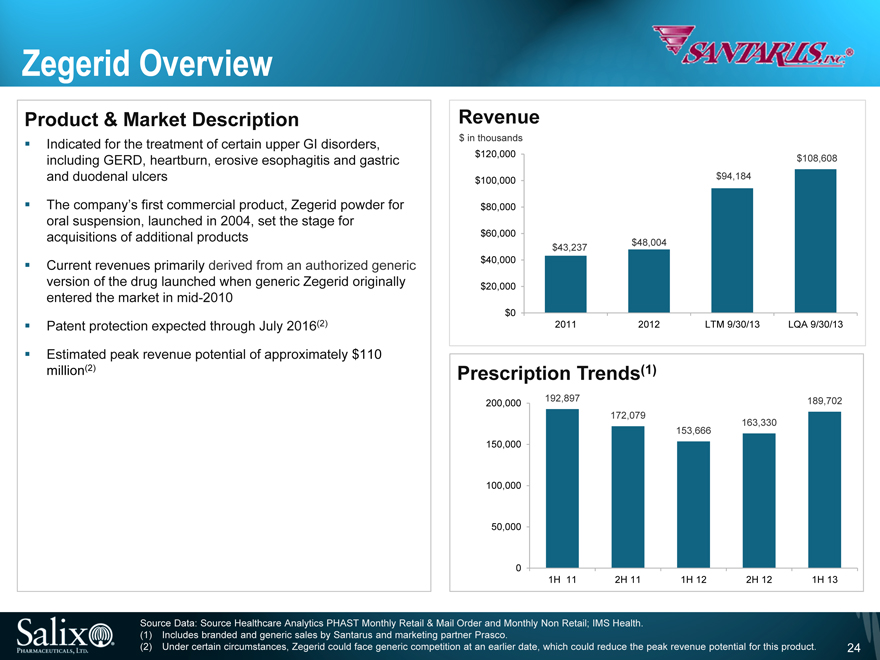

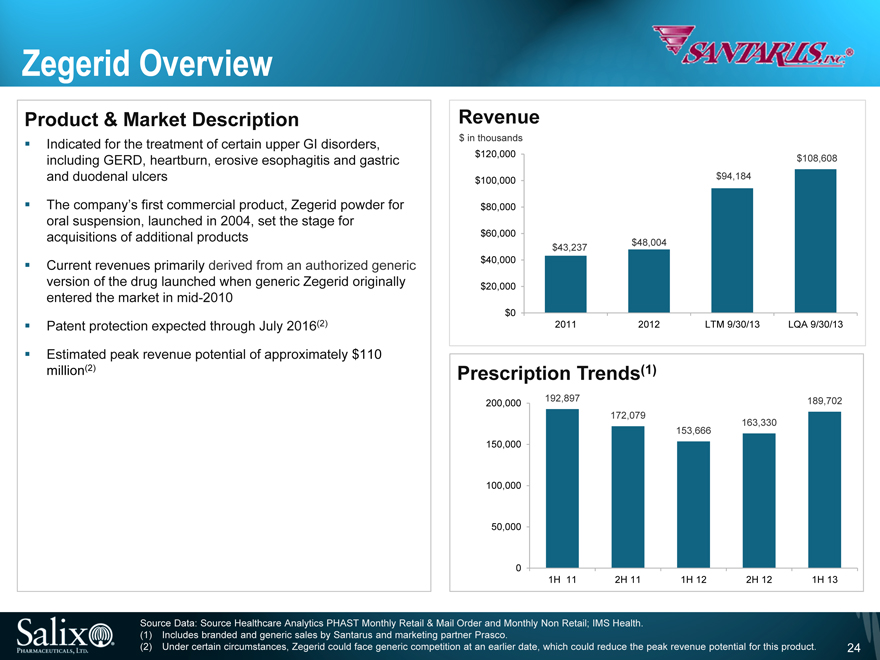

Zegerid Overview

Product & Market Description

Indicated for the treatment of certain upper GI disorders, including GERD, heartburn, erosive esophagitis and gastric and duodenal ulcers

The company’s first commercial product, Zegerid powder for oral suspension, launched in 2004, set the stage for acquisitions of additional products

Current revenues primarily derived from an authorized generic version of the drug launched when generic Zegerid originally entered the market in mid-2010

Patent protection expected through July 2016(2)

Estimated peak revenue potential of approximately $110 million(2)

Revenue

$ in thousands

$120,000

$100,000

$80,000

$60,000

$40,000

$20,000

$0

$43,237

$48,004

$94,184

$108,608

2011

2012

LTM 9/30/13

LQA 9/30/13

Prescription Trends(1)

200,000

150,000

100,000

50,000

0

192,897

172,079

153,666

163,330

189,702

1H 11

2H 11

1H 12

2H 12

1H 13

Source Data: Source Healthcare Analytics PHAST Monthly Retail & Mail Order and Monthly Non Retail; IMS Health. (1) Includes branded and generic sales by Santarus and marketing partner Prasco.

(2) Under certain circumstances, Zegerid could face generic competition at an earlier date, which could reduce the peak revenue potential for this product.

24

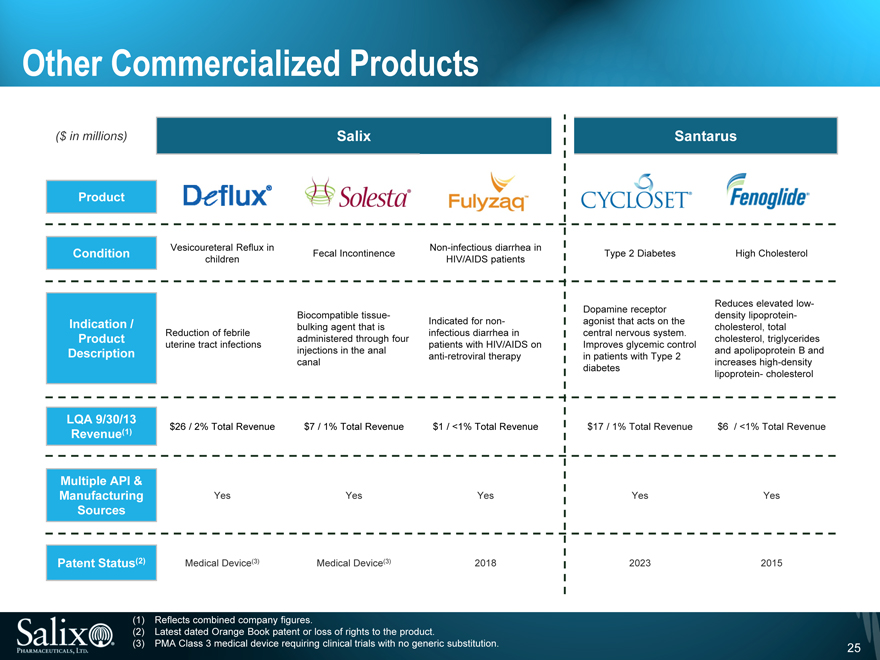

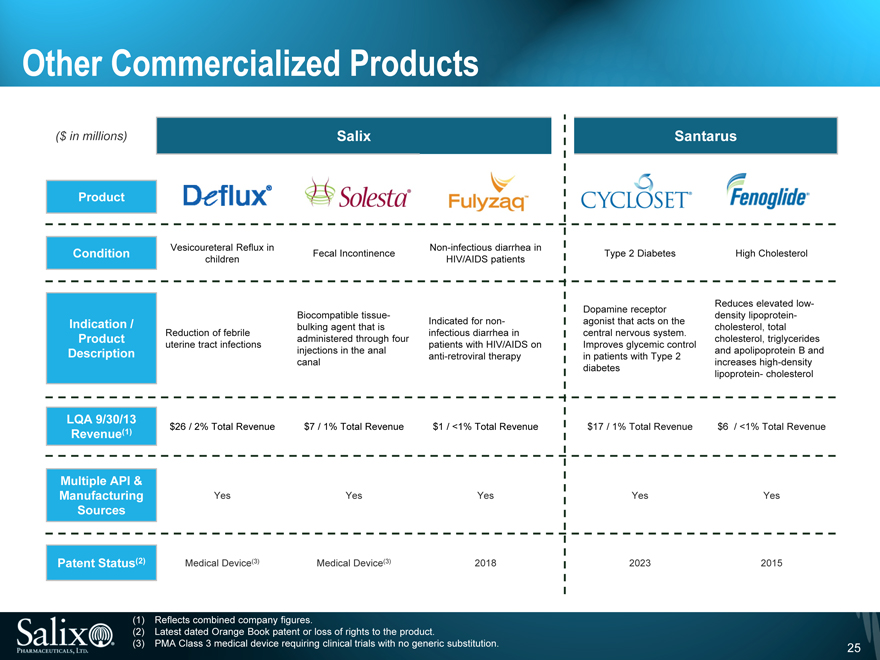

Other Commercialized Products

($ in millions) Salix Santarus

Product

Vesicoureteral Reflux in Non-infectious diarrhea in

Condition Fecal Incontinence Type 2 Diabetes High Cholesterol

children HIV/AIDS patients

Dopamine receptor Reduces elevated low-

Biocompatible tissue- density lipoprotein-

Indication / bulking agent that is Indicated for non- agonist that acts on the cholesterol, total

Reduction of febrile infectious diarrhea in central nervous system.

Product administered through four cholesterol, triglycerides

uterine tract infections patients with HIV/AIDS on Improves glycemic control

Description injections in the anal anti-retroviral therapy in patients with Type 2 and apolipoprotein B and

canal increases high-density

diabetes lipoprotein- cholesterol

LQA 9/30/13

Revenue(1) $26 / 2% Total Revenue $7 / 1% Total Revenue $1 / <1% Total Revenue $17 / 1% Total Revenue $6 / <1% Total Revenue

Multiple API &

Manufacturing Yes Yes Yes Yes Yes

Sources

Patent Status(2) Medical Device(3) Medical Device(3) 2018 2023 2015

(1) Reflects combined company figures.

(2) Latest dated Orange Book patent or loss of rights to the product.

(3) PMA Class 3 medical device requiring clinical trials with no generic substitution.

25

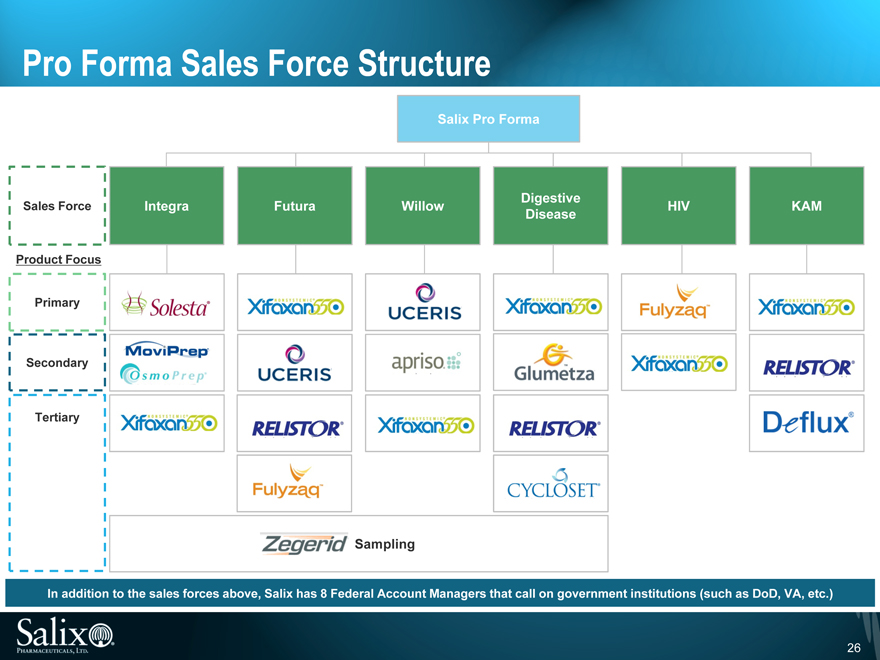

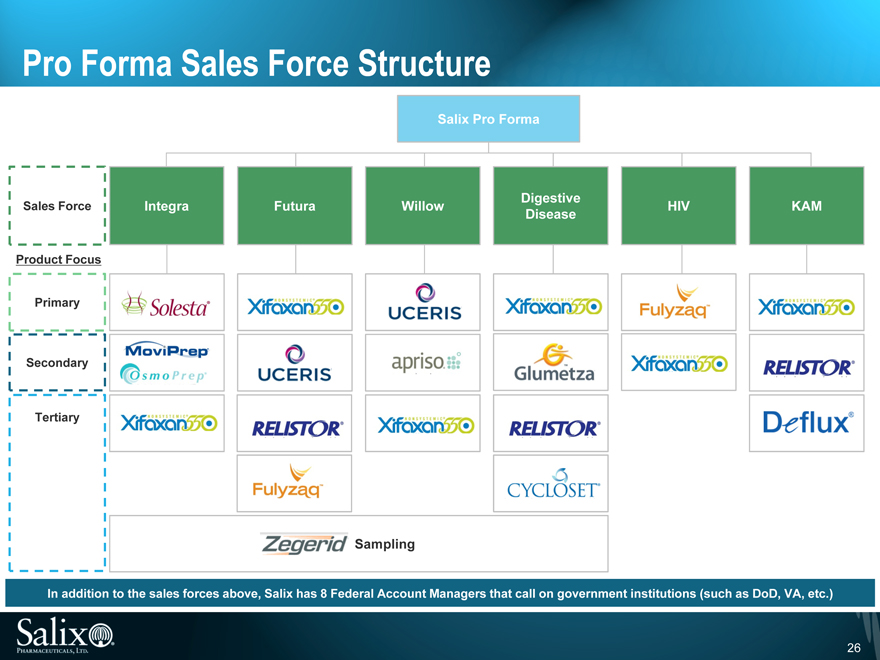

Pro Forma Sales Force Structure

Salix Pro Forma

Sales Force

Product Focus

Primary

Secondary

Tertiary

Integra

Futura

Willow

Digestive Disease

HIV

KAM

In addition to the sales forces above, Salix has 8 Federal Account Managers that call on government institutions (such as DoD, VA, etc.)

26

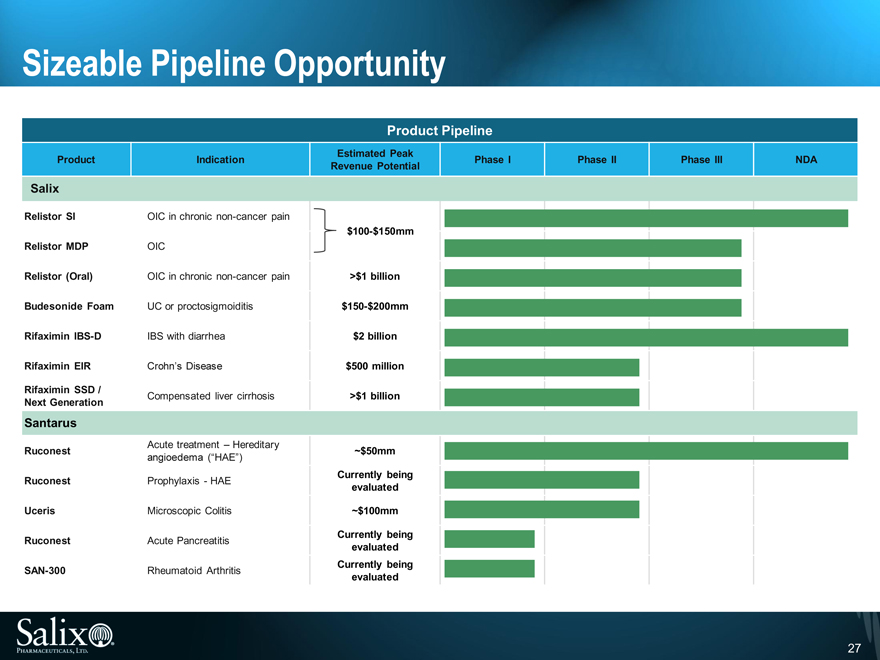

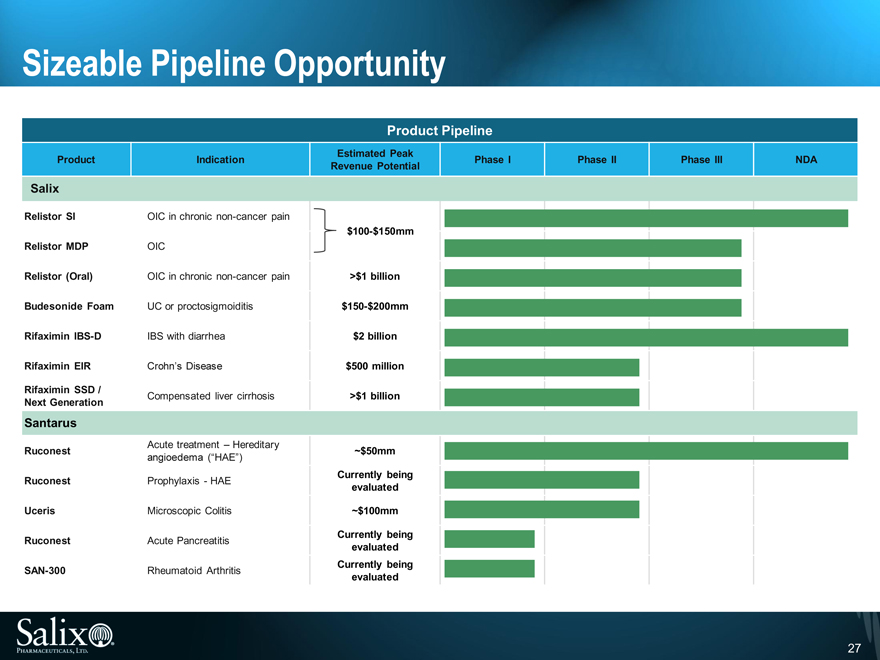

Sizeable Pipeline Opportunity

Product Pipeline

Estimated Peak

Product Indication Phase I Phase II Phase III NDA

Revenue Potential

Salix

Relistor SI OIC in chronic non-cancer pain

$100-$150mm

Relistor MDP OIC

Relistor (Oral) OIC in chronic non-cancer pain >$1 billion

Budesonide Foam UC or proctosigmoiditis $150-$200mm

Rifaximin IBS-D IBS with diarrhea $2 billion

Rifaximin EIR Crohn’s Disease $500 million

Rifaximin SSD / Compensated liver cirrhosis >$1 billion

Next Generation

Santarus

Acute treatment – Hereditary

Ruconest ~$50mm

angioedema (“HAE”)

Ruconest Prophylaxis - HAE Currently being

evaluated

Uceris Microscopic Colitis ~$100mm

Ruconest Acute Pancreatitis Currently being

evaluated

SAN-300 Rheumatoid Arthritis Currently being

evaluated

27

Strategy for Success

Company / Product Acquisitions

Successfully acquired 18 products since inception

4 product acquisitions since 2010

2 company acquisitions integrated historically

Product Development and Approval

History of progressing candidates through late-state development and approval

9 NDA approvals and launches since 2000

2 NDA/sNDA approvals pending

Successful Commercialization

Sales force has an average of 12 years of prior pharmaceutical experience

45% have prior experience in GI sales specifically

Sales force ranked #1 by gastroenterologists in independent study by IMS

28

Historical Financial Overview

29

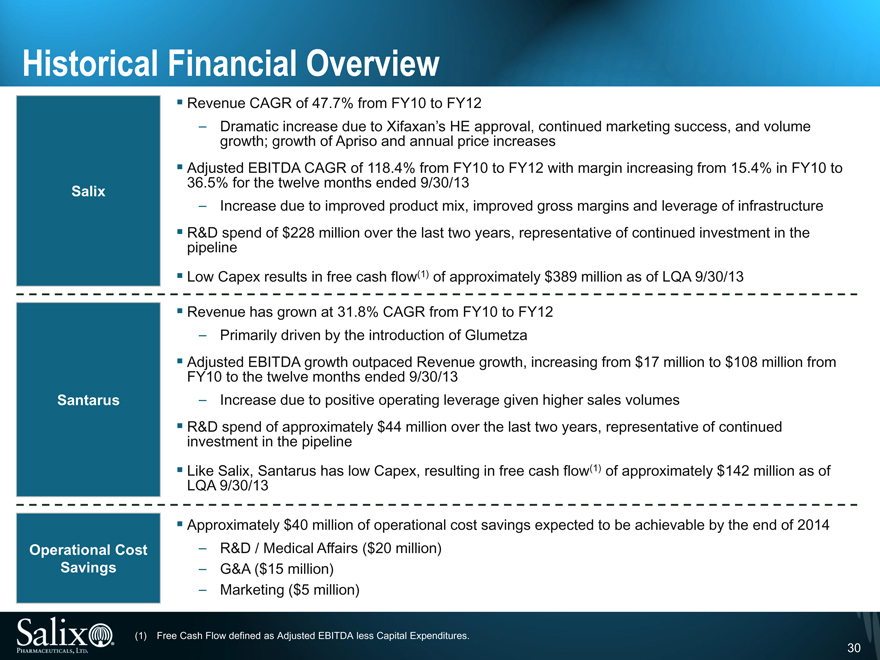

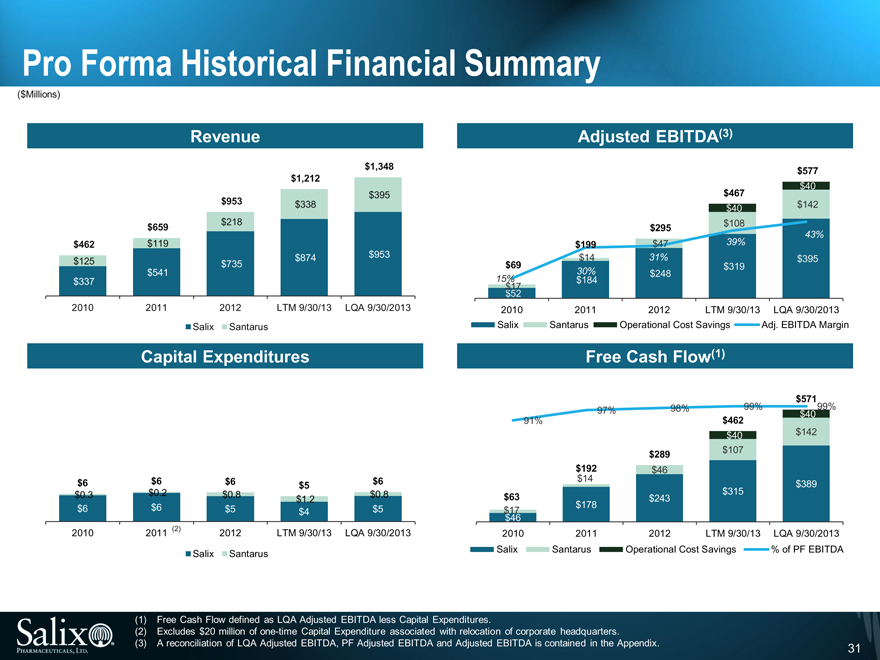

Historical Financial Overview

Salix

Revenue CAGR of 47.7% from FY10 to FY12

Dramatic increase due to Xifaxan’s HE approval, continued marketing success, and volume growth; growth of Apriso and annual price increases

Adjusted EBITDA CAGR of 118.4% from FY10 to FY12 with margin increasing from 15.4% in FY10 to 36.5% for the twelve months ended 9/30/13

Increase due to improved product mix, improved gross margins and leverage of infrastructure

R&D spend of $228 million over the last two years, representative of continued investment in the pipeline

Low Capex results in free cash flow(1) of approximately $389 million as of LQA 9/30/13

Santarus

Revenue has grown at 31.8% CAGR from FY10 to FY12

Primarily driven by the introduction of Glumetza

Adjusted EBITDA growth outpaced Revenue growth, increasing from $17 million to $108 million from FY10 to the twelve months ended 9/30/13

Increase due to positive operating leverage given higher sales volumes

R&D spend of approximately $44 million over the last two years, representative of continued investment in the pipeline

Like Salix, Santarus has low Capex, resulting in free cash flow(1) of approximately $142 million as of LQA 9/30/13

Operational Cost Savings

Approximately $40 million of operational cost savings expected to be achievable by the end of 2014

R&D / Medical Affairs ($20 million)

G&A ($15 million)

Marketing ($5 million)

(1) Free Cash Flow defined as Adjusted EBITDA less Capital Expenditures.

30

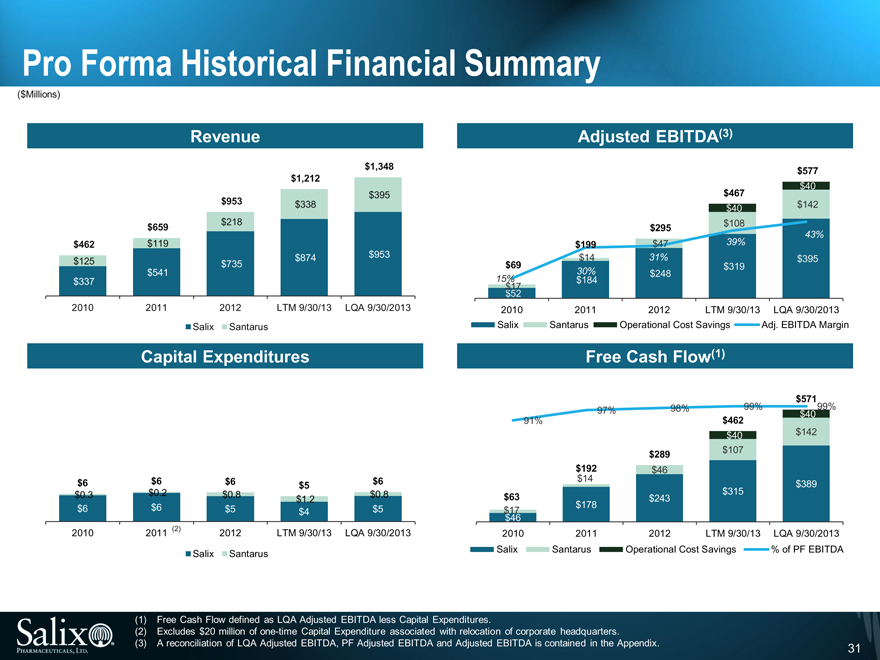

Pro Forma Historical Financial Summary

($Millions)

Revenue

$1,348

$1,212

$395

$953 $338

$659 $218

$462 $119

$953

$125 $735 $874

$541

$337

2010 2011 2012 LTM 9/30/13 LQA 9/30/2013

Salix Santarus

Capital Expenditures

$6 $6 $6 $5 $6

$0.3 $0.2 $0.8 $0.8

$1.2

$6 $6 $5 $4 $5

2010 2011 (2) 2012 LTM 9/30/13 LQA 9/30/2013

Salix Santarus

Adjusted EBITDA(3)

$577

$40

$467

$40 $142

$295 $108

43%

$199 $47 39%

$14 31% $395

$69 $319

30% $248

15% $184

$17

$52

2010 2011 2012 LTM 9/30/13 LQA 9/30/2013

Salix Santarus Operational Cost Savings Adj. EBITDA Margin

Free Cash Flow(1)

$571

97% 98% 99% $40 99%

91% $462

$40 $142

$289 $107

$192 $46

$14 $389

$63 $243 $315

$17 $178

$46

2010 2011 2012 LTM 9/30/13 LQA 9/30/2013

Salix Santarus Operational Cost Savings % of PF EBITDA

(1) Free Cash Flow defined as LQA Adjusted EBITDA less Capital Expenditures.

(2) Excludes $20 million of one-time Capital Expenditure associated with relocation of corporate headquarters.

(3) A reconciliation of LQA Adjusted EBITDA, PF Adjusted EBITDA and Adjusted EBITDA is contained in the Appendix.

31

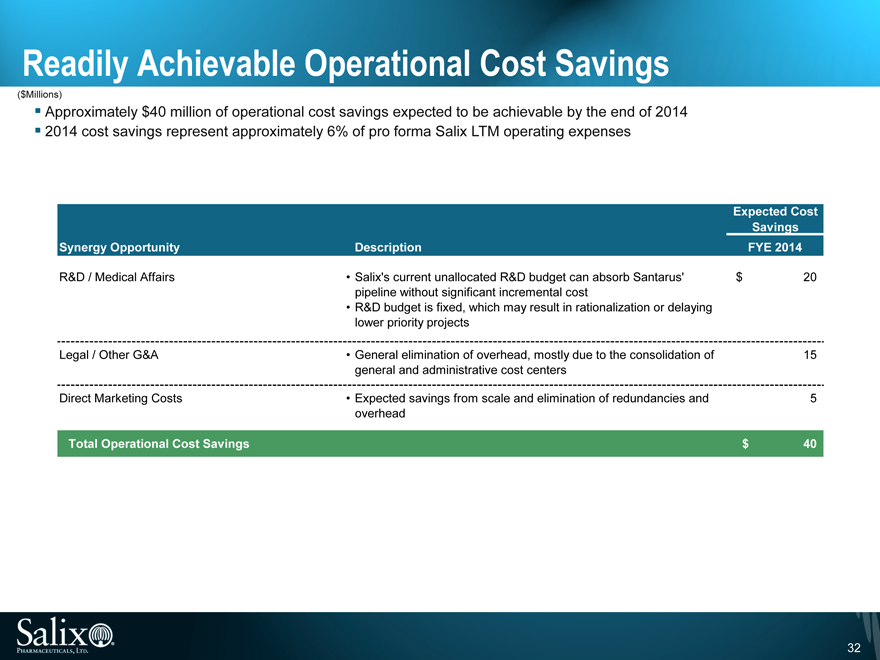

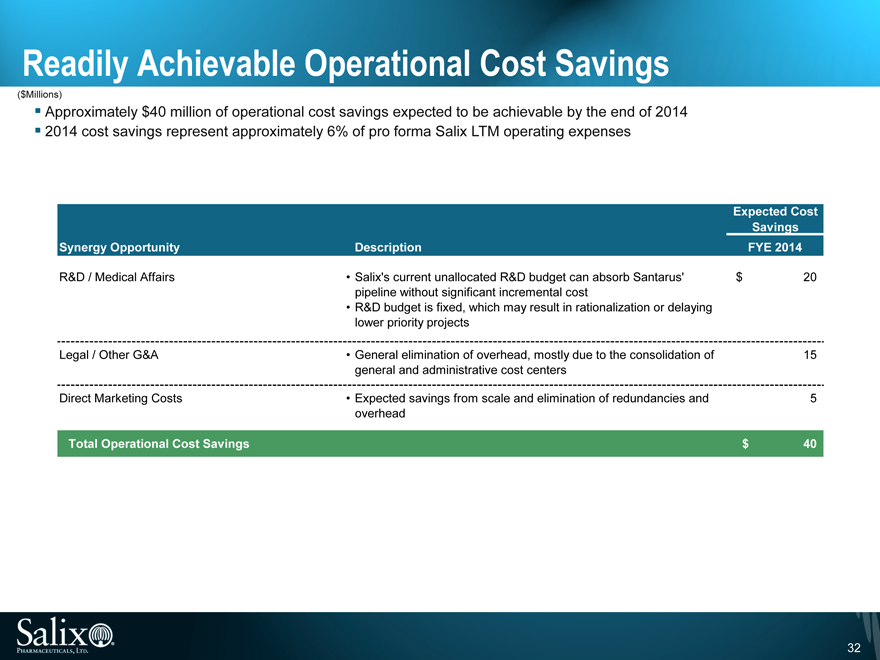

Readily Achievable Operational Cost Savings

($Millions)

Approximately $40 million of operational cost savings expected to be achievable by the end of 2014 2014 cost savings represent approximately 6% of pro forma Salix LTM operating expenses

Expected Cost

Savings

Synergy Opportunity Description FYE 2014

R&D / Medical Affairs Salix’s current unallocated R&D budget can absorb Santarus’ $ 20

pipeline without significant incremental cost

R&D budget is fixed, which may result in rationalization or delaying

lower priority projects

Legal / Other G&A General elimination of overhead, mostly due to the consolidation of 15

general and administrative cost centers

Direct Marketing Costs Expected savings from scale and elimination of redundancies and 5

overhead

Total Operational Cost Savings $ 40

32

Appendix

33

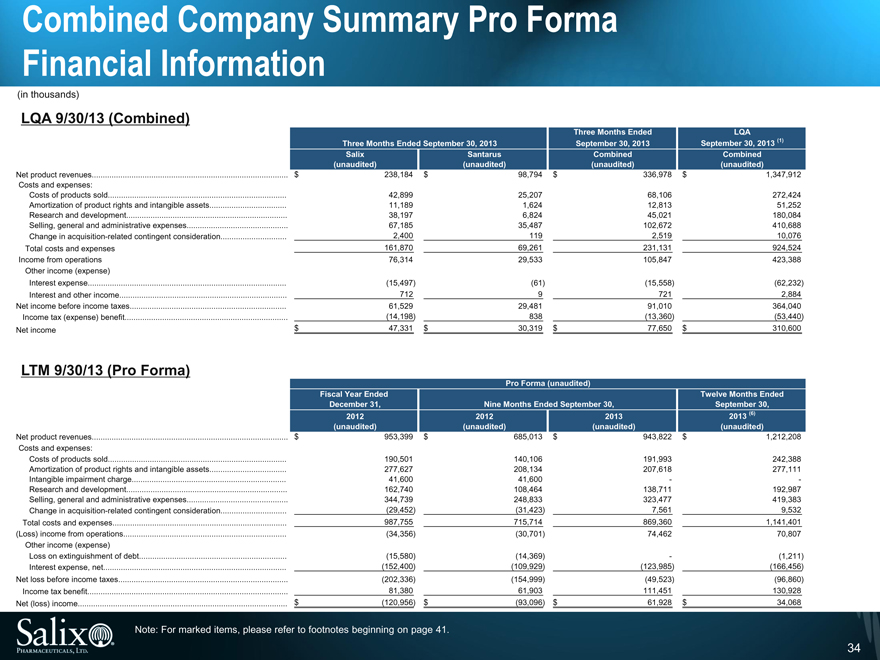

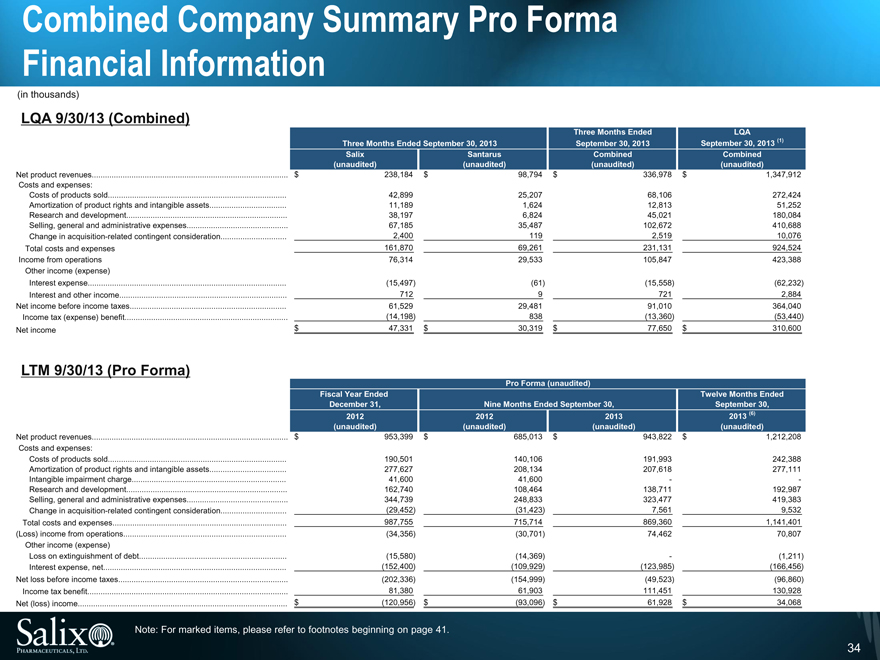

Combined Company Summary Pro Forma Financial Information

(in thousands)

LQA 9/30/13 (Combined)

Three Months Ended LQA

Three Months Ended September 30, 2013 September 30, 2013 September 30, 2013 (1)

Salix Santarus Combined Combined

(unaudited) (unaudited) (unaudited) (unaudited)

Net product revenues $ 238,184 $ 98,794 $ 336,978 $ 1,347,912

Costs and expenses:

Costs of products sold 42,899 25,207 68,106 272,424

Amortization of product rights and intangible assets 11,189 1,624 12,813 51,252

Research and development 38,197 6,824 45,021 180,084

Selling, general and administrative expenses 67,185 35,487 102,672 410,688

Change in acquisition-related contingent consideration 2,400 119 2,519 10,076

Total costs and expenses 161,870 69,261 231,131 924,524

Income from operations 76,314 29,533 105,847 423,388

Other income (expense)

Interest expense (15,497) (61) (15,558) (62,232)

Interest and other income 712 9 721 2,884

Net income before income taxes 61,529 29,481 91,010 364,040

Income tax (expense) benefit (14,198) 838 (13,360) (53,440)

Net income $ 47,331 $ 30,319 $ 77,650 $ 310,600

LTM 9/30/13 (Pro Forma)

Pro Forma (unaudited)

Fiscal Year Ended Twelve Months Ended

December 31, Nine Months Ended September 30, September 30,

2012 2012 2013 2013 (6)

(unaudited) (unaudited) (unaudited) (unaudited)

Net product revenues $ 953,399 $ 685,013 $ 943,822 $ 1,212,208

Costs and expenses:

Costs of products sold 190,501 140,106 191,993 242,388

Amortization of product rights and intangible assets 277,627 208,134 207,618 277,111

Intangible impairment charge 41,600 41,600 - -

Research and development 162,740 108,464 138,711 192,987

Selling, general and administrative expenses 344,739 248,833 323,477 419,383

Change in acquisition-related contingent consideration (29,452) (31,423) 7,561 9,532

Total costs and expenses 987,755 715,714 869,360 1,141,401

(Loss) income from operations (34,356) (30,701) 74,462 70,807

Other income (expense)

Loss on extinguishment of debt (15,580) (14,369) - (1,211)

Interest expense, net (152,400) (109,929) (123,985) (166,456)

Net loss before income taxes (202,336) (154,999) (49,523) (96,860)

Income tax benefit 81,380 61,903 111,451 130,928

Net (loss) income $ (120,956) $ (93,096) $ 61,928 $ 34,068

Note: For marked items, please refer to footnotes beginning on page 41.

34

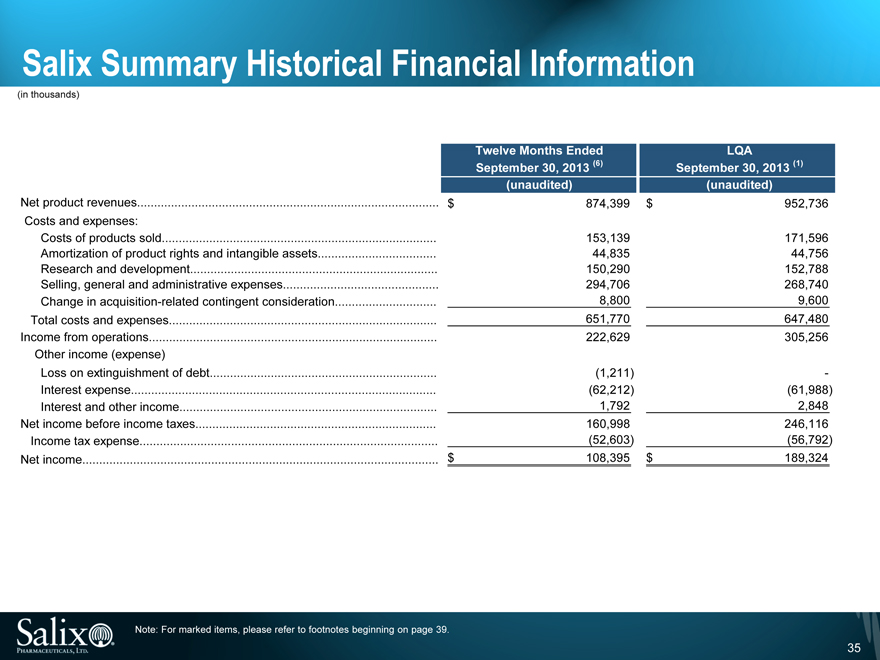

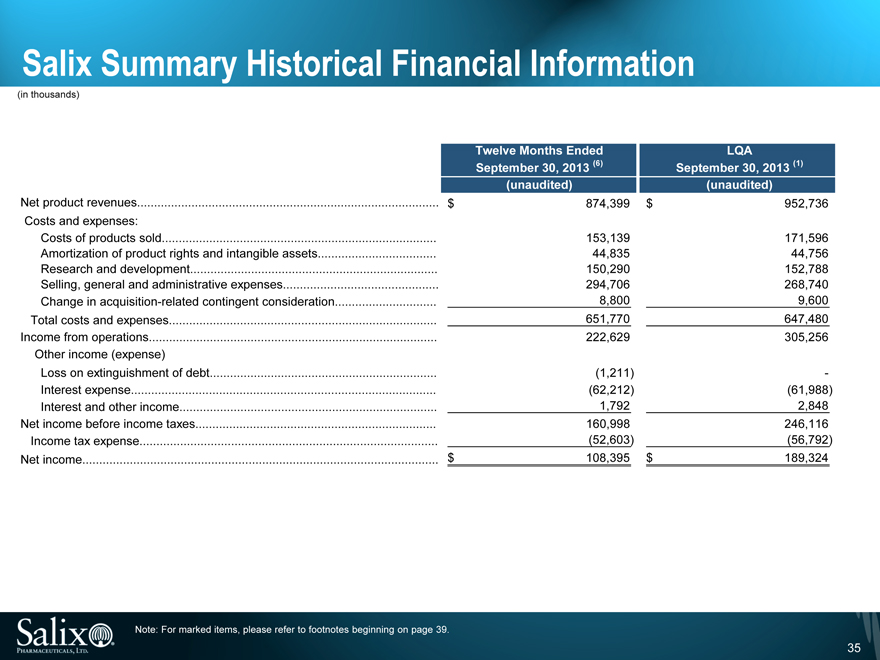

Salix Summary Historical Financial Information

(in thousands)

Twelve Months Ended LQA

September 30, 2013 (6) September 30, 2013(1)

(unaudited) (unaudited)

Net product revenues $ 874,399 $ 952,736

Costs and expenses:

Costs of products sold 153,139 171,596

Amortization of product rights and intangible assets 44,835 44,756

Research and development 150,290 152,788

Selling, general and administrative expenses 294,706 268,740

Change in acquisition-related contingent consideration 8,800 9,600

Total costs and expenses 651,770 647,480

Income from operations 222,629 305,256

Other income (expense)

Loss on extinguishment of debt (1,211) -

Interest expense (62,212) (61,988)

Interest and other income 1,792 2,848

Net income before income taxes 160,998 246,116

Income tax expense (52,603) (56,792)

Net income $ 108,395 $ 189,324

Note: For marked items, please refer to footnotes beginning on page 39.

35

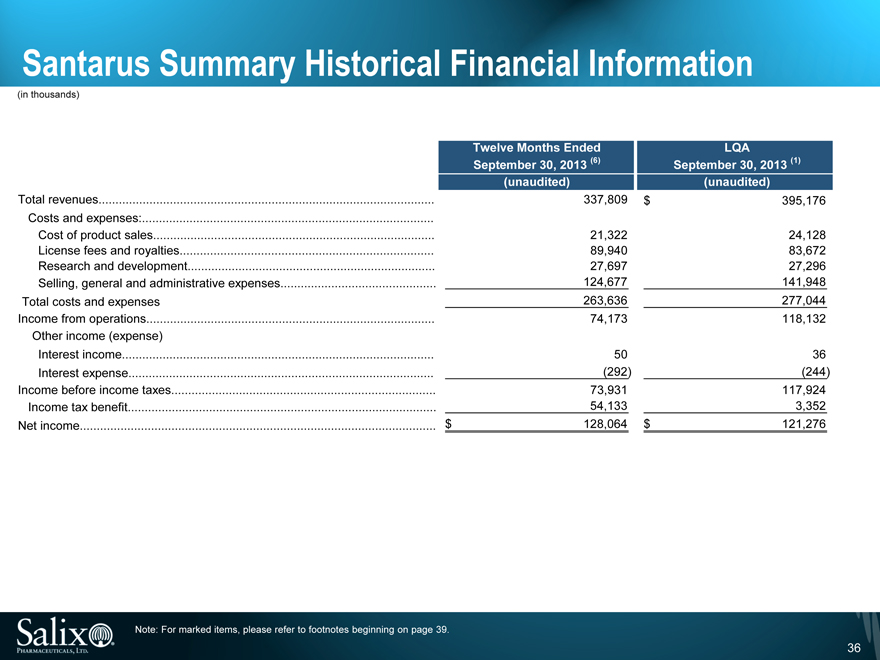

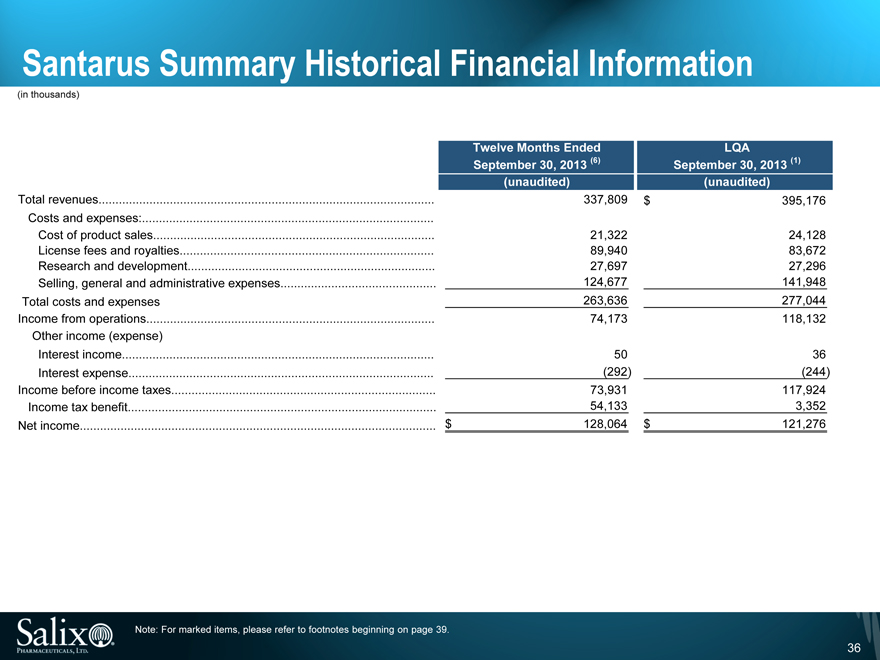

Santarus Summary Historical Financial Information

(in thousands)

Twelve Months Ended LQA

September 30, 2013 (6) September 30, 2013 (1)

(unaudited) (unaudited)

Total revenues 337,809 $ 395,176

Costs and expenses:

Cost of product sales 21,322 24,128

License fees and royalties 89,940 83,672

Research and development 27,697 27,296

Selling, general and administrative expenses 124,677 141,948

Total costs and expenses 263,636 277,044

Income from operations 74,173 118,132

Other income (expense)

Interest income 50 36

Interest expense (292) (244)

Income before income taxes 73,931 117,924

Income tax benefit 54,133 3,352

Net income $ 128,064 $ 121,276

Note: For marked items, please refer to footnotes beginning on page 39.

36

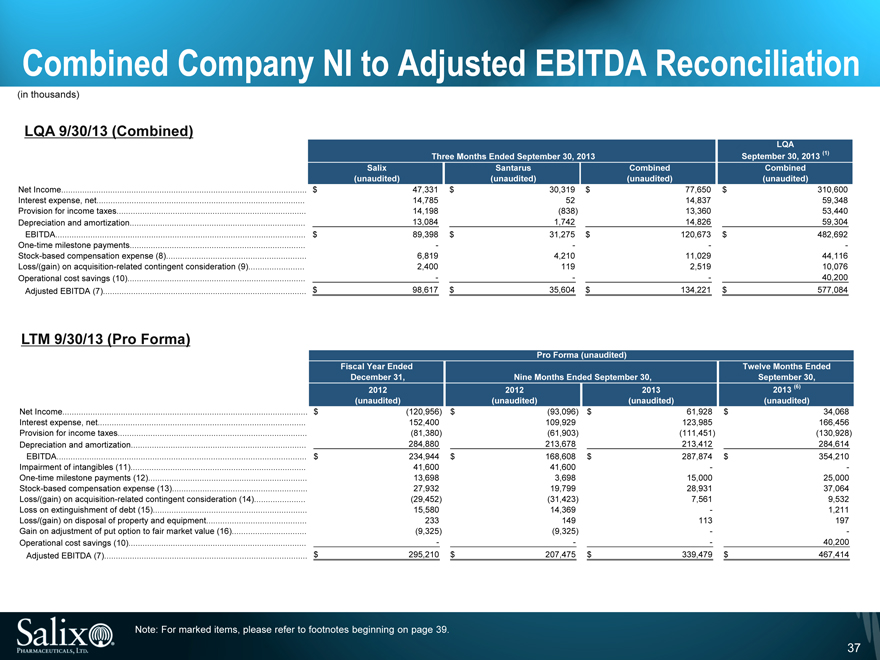

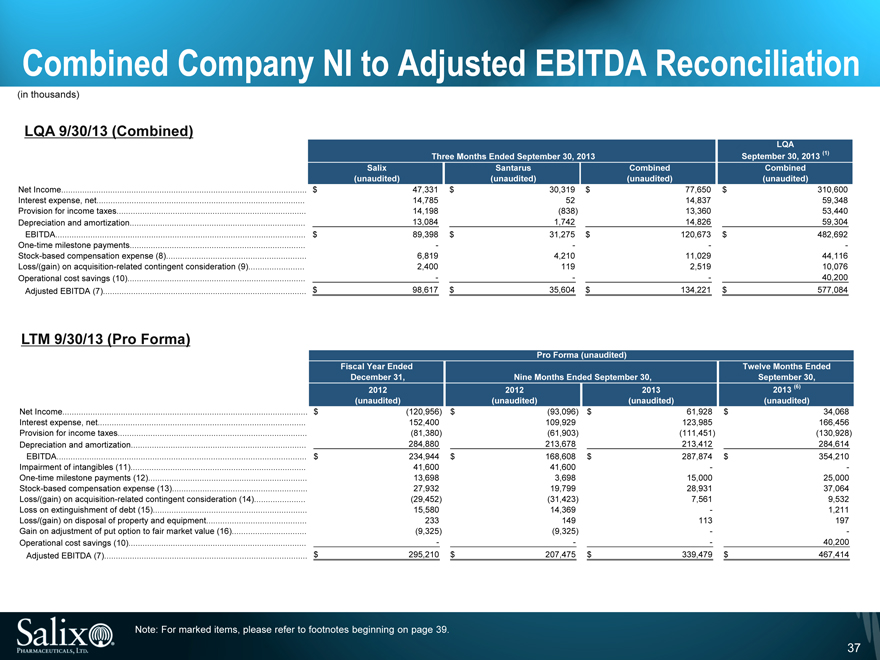

Combined Company NI to Adjusted EBITDA Reconciliation

(in thousands)

LQA 9/30/13 (Combined)

LQA

Three Months Ended September 30, 2013 September 30, 2013 (1)

Salix Santarus Combined Combined

(unaudited) (unaudited) (unaudited) (unaudited)

Net Income $ 47,331 $ 30,319 $ 77,650 $ 310,600

Interest expense, net 14,785 52 14,837 59,348

Provision for income taxes 14,198 (838) 13,360 53,440

Depreciation and amortization 13,084 1,742 14,826 59,304

EBITDA $ 89,398 $ 31,275 $ 120,673 $ 482,692

One-time milestone payments — — — -

Stock-based compensation expense (8) 6,819 4,210 11,029 44,116

Loss/(gain) on acquisition-related contingent consideration (9) 2,400 119 2,519 10,076

Operational cost savings (10) — — — 40,200

Adjusted EBITDA (7) $ 98,617 $ 35,604 $ 134,221 $ 577,084

LTM 9/30/13 (Pro Forma)

Pro Forma (unaudited)

Fiscal Year Ended Twelve Months Ended

December 31, Nine Months Ended September 30, September 30,

2012 2012 2013 2013 (6)

(unaudited) (unaudited) (unaudited) (unaudited)

Net Income $ (120,956) $ (93,096) $ 61,928 $ 34,068

Interest expense, net 152,400 109,929 123,985 166,456

Provision for income taxes (81,380) (61,903) (111,451) (130,928)

Depreciation and amortization 284,880 213,678 213,412 284,614

EBITDA $ 234,944 $ 168,608 $ 287,874 $ 354,210

Impairment of intangibles (11) 41,600 41,600 — -

One-time milestone payments (12) 13,698 3,698 15,000 25,000

Stock-based compensation expense (13) 27,932 19,799 28,931 37,064

Loss/(gain) on acquisition-related contingent consideration (14) (29,452) (31,423) 7,561 9,532

Loss on extinguishment of debt (15) 15,580 14,369 — 1,211

Loss/(gain) on disposal of property and equipment 233 149 113 197

Gain on adjustment of put option to fair market value (16) (9,325) (9,325) — -

Operational cost savings (10) — — — 40,200

Adjusted EBITDA (7) $ 295,210 $ 207,475 $ 339,479 $ 467,414

Note: For marked items, please refer to footnotes beginning on page 39.

37

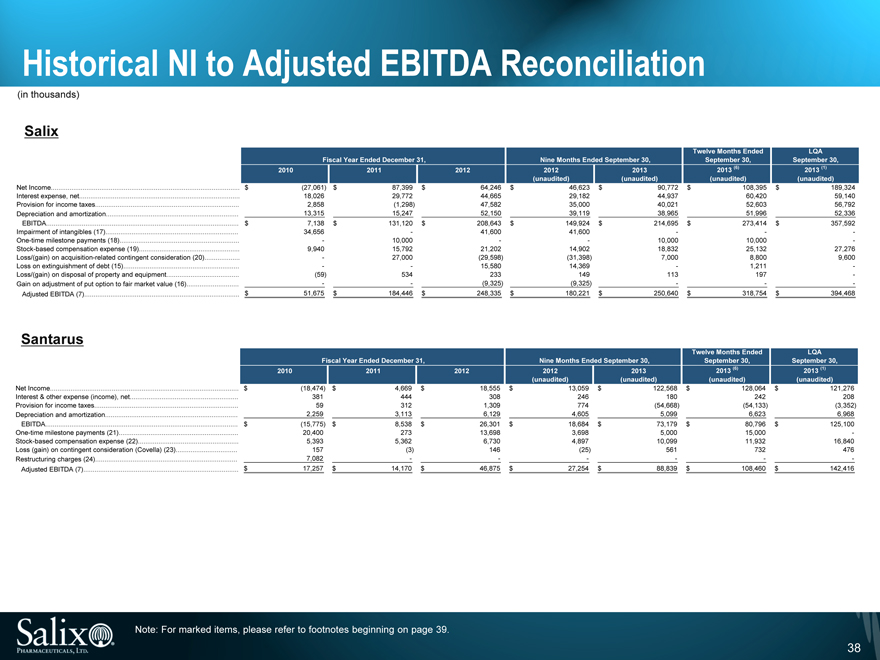

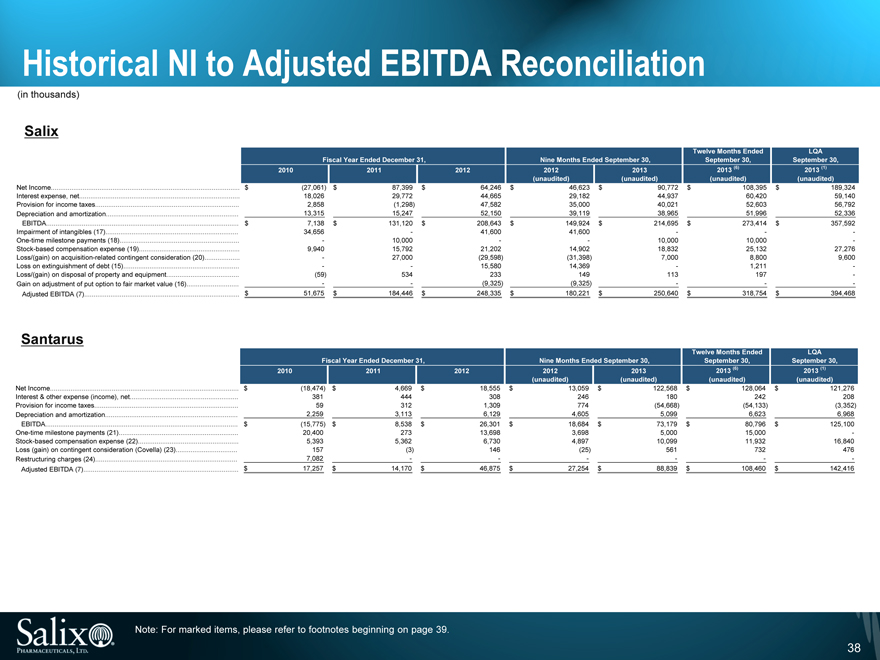

Historical NI to Adjusted EBITDA Reconciliation

(in thousands)

Salix

Twelve Months Ended LQA

Fiscal Year Ended December 31, Nine Months Ended September 30, September 30, September 30,

2010 2011 2012 2012 2013 2013 (6) 2013 (1)

(unaudited) (unaudited) (unaudited) (unaudited)

Net Income $ (27,061) $ 87,399 $ 64,246 $ 46,623 $ 90,772 $ 108,395 $ 189,324

Interest expense, net 18,026 29,772 44,665 29,182 44,937 60,420 59,140

Provision for income taxes 2,858 (1,298) 47,582 35,000 40,021 52,603 56,792

Depreciation and amortization 13,315 15,247 52,150 39,119 38,965 51,996 52,336

EBITDA $ 7,138 $ 131,120 $ 208,643 $ 149,924 $ 214,695 $ 273,414 $ 357,592

Impairment of intangibles (17) 34,656 — 41,600 41,600 — — -

One-time milestone payments (18) — 10,000 — — 10,000 10,000 -

Stock-based compensation expense (19) 9,940 15,792 21,202 14,902 18,832 25,132 27,276

Loss/(gain) on acquisition-related contingent consideration (20) — 27,000 (29,598) (31,398) 7,000 8,800 9,600

Loss on extinguishment of debt (15) —— 15,580 14,369 — 1,211 -

Loss/(gain) on disposal of property and equipment (59) 534 233 149 113 197 -

Gain on adjustment of put option to fair market value (16) —— (9,325) (9,325) — — -

Adjusted EBITDA (7) $ 51,675 $ 184,446 $ 248,335 $ 180,221 $ 250,640 $ 318,754 $ 394,468

Santarus

Twelve Months Ended LQA

Fiscal Year Ended December 31, Nine Months Ended September 30, September 30, September 30,

2010 2011 2012 2012 2013 2013 (6) 2013 (1)

(unaudited) (unaudited) (unaudited) (unaudited)

Net Income $ (18,474) $ 4,669 $ 18,555 $ 13,059 $ 122,568 $ 128,064 $ 121,276

Interest & other expense (income), net 381 444 308 246 180 242 208

Provision for income taxes 59 312 1,309 774 (54,668) (54,133) (3,352)

Depreciation and amortization 2,259 3,113 6,129 4,605 5,099 6,623 6,968

EBITDA $ (15,775) $ 8,538 $ 26,301 $ 18,684 $ 73,179 $ 80,796 $ 125,100

One-time milestone payments (21) 20,400 273 13,698 3,698 5,000 15,000 -

Stock-based compensation expense (22) 5,393 5,362 6,730 4,897 10,099 11,932 16,840

Loss (gain) on contingent consideration (Covella) (23) 157 (3) 146 (25) 561 732 476

Restructuring charges (24) 7,082 — — — — — -

Adjusted EBITDA (7) $ 17,257 $ 14,170 $ 46,875 $ 27,254 $ 88,839 $ 108,460 $ 142,416

Note: For marked items, please refer to footnotes beginning on page 39.

38

Footnotes

LQA September 30, 2013 for each of Salix and Santarus is derived by multiplying the respective unaudited financial results for the three months ended

September 30, 2013 by four. LQA September 30, 2013 for the combined company is derived by multiplying the combined unaudited financial results for the three months ended September 30, 2013 by four. The LQA September 30, 2013 is not necessarily indicative of results that may be expected for a full year or any future period.

(2) Reflects reclassification of $0.7 million of Santarus’ “Royalty revenue” to “Net product revenue” to conform to Salix’s financial statement presentation. (1)

Reflects reclassification of $19.2 million of royalty fees contained in Santarus’ “Licensing and royalty fees” to “Cost of products sold” to conform to Salix’s financial statement presentation. (3)

Reflects reclassification of $1.6 million of licensing fees contained in Santarus’ “Licensing and royalty fees” to “Amortization of product rights and intangibles” to conform to Salix’s financial statement presentation.

(4) Reflects reclassification of $0.1 million of licensing fees contained in Santarus’ “Licensing and royalty fees” to “Change in acquisition-related contingent consideration” to conform to Salix’s financial statement presentation.

LTM September 30, 2013 for each of Salix and Santarus is derived by adding the respective financial results for the year ended December 31, 2012 and the nine months ended September 30, 2013, and subtracting the respective financial results for the nine months ended September 30, 2012. LTM September 30, 2013 for the combined company is derived by adding the combined financial results for the year ended December 31, 2012 and the nine months ended September 30, 2013, and subtracting the combined financial results for the nine months ended September 30, 2012.

(5) Salix presents LQA Adjusted EBITDA and Pro Forma Adjusted EBITDA as supplemental measures of its performance. Salix defines Adjusted EBITDA as net income plus (i) income tax (benefit), (ii) interest expense (net) and (iii) depreciation and amortization, as further adjusted to eliminate the impact of certain items that the Company does not consider indicative of its ongoing operating performance. Salix defines Pro Forma Adjusted EBITDA as Adjusted EBITDA plus its estimated operational cost savings resulting from its pending acquisition of Santarus. You are encouraged to evaluate these adjustments and the reasons the

Company considers them appropriate for supplemental analysis. Adjusted EBITDA and Pro Forma Adjusted EBITDA should not be considered in isolation or as

(6)

a substitute for net income or other income statement data prepared in accordance with GAAP. In evaluating Adjusted EBITDA and Pro Forma Adjusted EBITDA, you should be aware that in the future Salix may incur expenses that are the same as or similar to some of the adjustments in this presentation. The Company’s presentation of Adjusted EBITDA and Pro Forma Adjusted EBITDA should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items.

(7) Represents the combined non-cash share-based compensation expense incurred by Salix and Santarus for the three months period ended September 30, 2013, on a combined basis and on an LQA basis.

(8) Represents non-cash charges that relate to the change in fair value of contingent milestone and royalty obligations recorded by Salix and Santarus. These contingent obligations are recorded as liabilities on the balance sheet and are reassessed at each period with changes recognized as non-cash charges in the statement of operations. For Salix these charges consist of acquisition agreements related to the acquisition of the Relistor and EIR licenses and the acquisition of Oceana and for Santarus these relate to contingent obligations for the Covella acquisition. The change in the fair value of the contingent consideration liability during the three-month ended September 30, 2013 was mainly as a result of the reduction of the discount period due to the passage of time.

(9) Salix expects the pending acquisition of Santarus to provide the opportunity to realize approximately $40 million of operational cost savings which represents among other things, (a) direct and indirect research and development costs (approximately $20 million in cost savings), stemming from, among other things, the absorption of Santarus’ pipeline into Salix’s current unallocated research and development budget without significant incremental cost and the elimination of redundancies related to research and development program employees and overhead, (b) general and administrative expenses (approximately $15 million in cost savings), stemming primarily from the consolidation of general and administrative cost centers, and (c) direct marketing expenses (approximately $5 million in cost savings), stemming from the elimination of redundancies and overhead. (10)

39

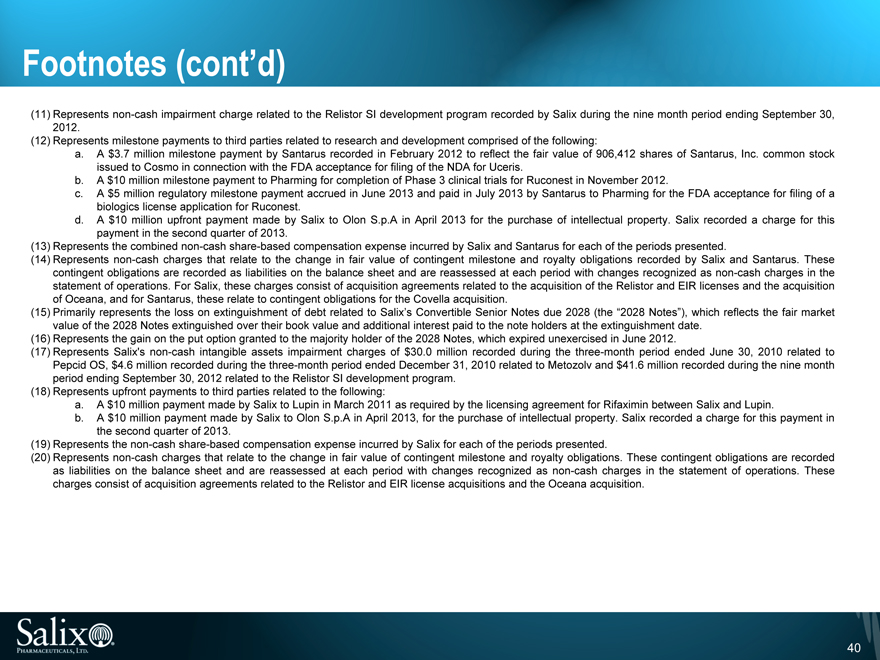

(11) Represents non-cash impairment charge related to the Relistor SI development program recorded by Salix during the nine month period ending September 30, 2012.

(12) Represents milestone payments to third parties related to research and development comprised of the following:

a. A $3.7 million milestone payment by Santarus recorded in February 2012 to reflect the fair value of 906,412 shares of Santarus, Inc. common stock

issued to Cosmo in connection with the FDA acceptance for filing of the NDA for Uceris.

b. A $10 million milestone payment to Pharming for completion of Phase 3 clinical trials for Ruconest in November 2012.

c. A $5 million regulatory milestone payment accrued in June 2013 and paid in July 2013 by Santarus to Pharming for the FDA acceptance for filing of a biologics license application for Ruconest.

d. A $10 million upfront payment made by Salix to Olon S.p.A in April 2013 for the purchase of intellectual property. Salix recorded a charge for this payment in the second quarter of 2013.

(13) Represents the combined non-cash share-based compensation expense incurred by Salix and Santarus for each of the periods presented.

(14) Represents non-cash charges that relate to the change in fair value of contingent milestone and royalty obligations recorded by Salix and Santarus. These contingent obligations are recorded as liabilities on the balance sheet and are reassessed at each period with changes recognized as non-cash charges in the statement of operations. For Salix, these charges consist of acquisition agreements related to the acquisition of the Relistor and EIR licenses and the acquisition of Oceana, and for Santarus, these relate to contingent obligations for the Covella acquisition.

(15) Primarily represents the loss on extinguishment of debt related to Salix’s Convertible Senior Notes due 2028 (the “2028 Notes”), which reflects the fair market value of the 2028 Notes extinguished over their book value and additional interest paid to the note holders at the extinguishment date.

(16) Represents the gain on the put option granted to the majority holder of the 2028 Notes, which expired unexercised in June 2012.

(17) Represents Salix’s non-cash intangible assets impairment charges of $30.0 million recorded during the three-month period ended June 30, 2010 related to Pepcid OS, $4.6 million recorded during the three-month period ended December 31, 2010 related to Metozolv and $41.6 million recorded during the nine month period ending September 30, 2012 related to the Relistor SI development program.

(18) Represents upfront payments to third parties related to the following:

a. A $10 million payment made by Salix to Lupin in March 2011 as required by the licensing agreement for Rifaximin between Salix and Lupin.

b. A $10 million payment made by Salix to Olon S.p.A in April 2013, for the purchase of intellectual property. Salix recorded a charge for this payment in the second quarter of 2013.

(19) Represents the non-cash share-based compensation expense incurred by Salix for each of the periods presented.

(20) Represents non-cash charges that relate to the change in fair value of contingent milestone and royalty obligations. These contingent obligations are recorded as liabilities on the balance sheet and are reassessed at each period with changes recognized as non-cash charges in the statement of operations. These charges consist of acquisition agreements related to the Relistor and EIR license acquisitions and the Oceana acquisition.

40

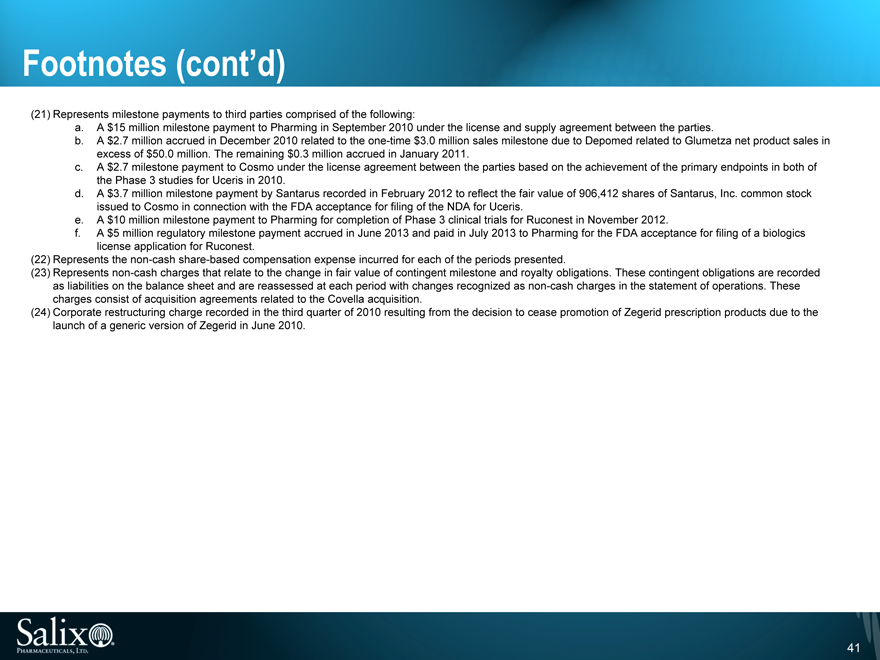

Footnotes (cont’d)

(21) Represents milestone payments to third parties comprised of the following:

a. A $15 million milestone payment to Pharming in September 2010 under the license and supply agreement between the parties.

b. A $2.7 million accrued in December 2010 related to the one-time $3.0 million sales milestone due to Depomed related to Glumetza net product sales in excess of $50.0 million. The remaining $0.3 million accrued in January 2011.

c. A $2.7 milestone payment to Cosmo under the license agreement between the parties based on the achievement of the primary endpoints in both of the Phase 3 studies for Uceris in 2010.

d. A $3.7 million milestone payment by Santarus recorded in February 2012 to reflect the fair value of 906,412 shares of Santarus, Inc. common stock issued to Cosmo in connection with the FDA acceptance for filing of the NDA for Uceris.

e. A $10 million milestone payment to Pharming for completion of Phase 3 clinical trials for Ruconest in November 2012.

f. A $5 million regulatory milestone payment accrued in June 2013 and paid in July 2013 to Pharming for the FDA acceptance for filing of a biologics license application for Ruconest.

(22) Represents the non-cash share-based compensation expense incurred for each of the periods presented.

(23) Represents non-cash charges that relate to the change in fair value of contingent milestone and royalty obligations. These contingent obligations are recorded as liabilities on the balance sheet and are reassessed at each period with changes recognized as non-cash charges in the statement of operations. These charges consist of acquisition agreements related to the Covella acquisition.

(24) Corporate restructuring charge recorded in the third quarter of 2010 resulting from the decision to cease promotion of Zegerid prescription products due to the launch of a generic version of Zegerid in June 2010.

41