QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

POLYCOM, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

May 21, 2002

To the Stockholders of Polycom:

Notice is hereby given that the 2002 Annual Meeting of Stockholders of Polycom, Inc., a Delaware corporation (the "Company") will be held on Tuesday, May 21, 2002 at 10:00 a.m., local time, at the Company's facilities located at 1565 Barber Lane, Milpitas, California 95035, for the following purposes:

- 1.

- To elect directors to serve for the ensuing year and until their successors are duly elected and qualified.

- 2.

- To consider and approve an amendment to the Company's 1996 Stock Incentive Plan increasing the number of shares of Common Stock reserved for issuance thereunder by 4,000,000 shares.

- 3.

- To consider and approve an amendment to the Company's Employee Stock Purchase Plan increasing the number of shares of Common Stock reserved for issuance thereunder by 500,000 shares.

- 4.

- To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants for the Company for the fiscal year ending December 29, 2002.

- 5.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The preceding items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on March 22, 2002 are entitled to notice of and to vote at the 2002 Annual Meeting.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the envelope enclosed. Should you receive more than one proxy because your shares are registered in different names or addresses, please sign and return each proxy to assure that all your shares will be voted. You may revoke your proxy at any time prior to the 2002 Annual Meeting. If you attend the 2002 Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the 2002 Annual Meeting will be counted.

| | | By Order of the Board of Directors of Polycom, Inc. |

|

|

Robert C. Hagerty

President and Chief Executive Officer |

Milpitas, California

April 15, 2002 | | |

YOUR VOTE IS IMPORTANT TO THE COMPANY. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENVELOPE PROVIDED.

POLYCOM, INC.

1565 Barber Lane

Milpitas, California 95035

PROXY STATEMENT

FOR 2002 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

The enclosed Proxy is solicited on behalf of the Board of Directors of Polycom, Inc., a Delaware corporation (the "Company"), for use at the 2002 Annual Meeting of Stockholders to be held on Tuesday, May 21, 2002 at 10:00 a.m., local time, and at any adjournment thereof (the "2002 Annual Meeting"), for the purposes set forth herein and in the accompanying Notice of 2002 Annual Meeting of Stockholders. The 2002 Annual Meeting will be held at the Company's facilities located at 1565 Barber Lane, Milpitas, CA 95035. The Company's telephone number is (408) 526-9000.

These proxy solicitation materials were mailed to all stockholders entitled to vote at the 2002 Annual Meeting on or about April 15, 2002, together with the Company's 2001 Annual Report to Stockholders.

You may request a copy of the Company's Annual Report on Form 10-K for the fiscal year ended December 30, 2001 at no charge, by writing to the Company at the following address: Investor Relations, Polycom, Inc., 1565 Barber Lane, Milpitas, California 95035.

Record Date and Shares Outstanding

Stockholders of record at the close of business on March 22, 2002 (the "Record Date") are entitled to notice of and to vote at the 2002 Annual Meeting. As of the Record Date, 99,575,250 shares of the Company's Common Stock were issued and outstanding and entitled to be voted at the 2002 Annual Meeting. For information regarding security ownership by management and by the beneficial owners of more than 5% of the Company's Common Stock, see "Management—Ownership of Securities," beginning on page 21.

In connection with the Company's acquisition of Circa Communications Ltd., a Canadian company ("Circa") in April of 2001, the Company issued 1,087,434 shares of 3048685 Nova Scotia Limited, a wholly-owned subsidiary of the Company, in exchange for all of the outstanding shares of capital stock of Circa. These shares are exchangeable for shares of the Company's Common Stock. The Company issued these shares so that the holders of the outstanding capital stock of Circa at the time of the acquisition could defer the imposition of certain taxes under Canadian law until such time as they elect to exchange their exchangeable shares for shares of Polycom Common Stock. In order to give the holders of these exchangeable shares the ability to vote on matters which may be voted on by the Company's stockholders during the period prior to when they exchange their exchangeable shares for shares of the Company's Common Stock, the Company has issued one share of the Company's Preferred Stock, designated as Special Voting Stock, which is issued and outstanding as of the Record Date. Each of the holders of exchangeable shares holds a fractional interest in the Special Voting Stock, which entitles them to a number of votes at the 2002 Annual Meeting equal to the number of exchangeable shares they hold. As of the Record Date, the holders of exchangeable shares and Special Voting Stock may cast an aggregate of 1,007,434 votes at the 2002 Annual Meeting.

A total of 100,582,684 shares of Common Stock issued and outstanding and entitled to vote and votes which may be cast by the holders of Special Voting Stock are eligible to vote as of the Record Date at the 2002 Annual Meeting.

1

Voting

Each holder of the Company's Common Stock entitled to vote at the 2002 Annual Meeting is entitled to one vote for each share of Common Stock held as of the Record Date on all matters presented at the 2002 Annual Meeting. Each holder of a fractional interest in the Company's Special Voting Stock entitled to vote at the 2002 Annual Meeting is entitled to a number of votes equal to the number of non-voting exchangeable shares of a wholly-owned subsidiary of the Company held by that holder.

Quorum; Abstentions; Broker Non-Votes

The required quorum for the transaction of business at the 2002 Annual Meeting is a majority of shares of Common Stock outstanding on the Record Date plus votes then held by holders of fractional interests in the Special Voting Stock, which are entitled to vote and present in person or represented by proxy.

Shares or votes that are voted "FOR," "AGAINST" or "WITHHELD" are treated as being present at the meeting for purposes of establishing a quorum. Shares or votes that are voted "FOR," "AGAINST" or "ABSTAIN" with respect to a matter will also be treated as shares or votes entitled to vote (the "Votes Cast") with respect to such matter.

While the statutory and case law authority in Delaware is uncertain as to the proper treatment of abstentions, the Company believes that abstentions should be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the number of Votes Cast with respect to a proposal (other than the election of directors). In the absence of controlling precedent to the contrary, the Company intends to treat abstentions in this manner.

A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions on how to vote from the beneficial owner. Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but will not be counted for purposes of determining the number of Votes Cast with respect to the particular proposal on which the broker has expressly not voted.

Vote Required

A plurality of Votes Cast is required for the election of directors. A plurality of Votes Cast means that only affirmative votes will affect the outcome of the election. Therefore, neither abstentions nor broker non-votes will have any impact on the election of directors.

The affirmative vote of a majority of Votes Cast is required to amend the Company's 1996 Stock Incentive Plan (the "1996 Plan") and Employee Stock Purchase Plan (the "ESPP"), and to ratify the appointment of auditors. Abstentions will have the effect of votes in opposition of the proposals to amend the 1996 Plan and the ESPP, and to ratify the appointment of auditors. However, broker "non-votes" will not be included in the tabulation of the voting results on the proposals to amend the 1996 Plan or the ESPP, or to ratify the appointment of auditors. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Proxies Generally; Revocability of Proxies

Whether or not you are able to attend the 2002 Annual Meeting, the Company urges you to submit your proxy, which when properly completed will be voted as you direct. In the event no directions are specified, such proxies will be voted "FOR" each of the nominees of the Board of Directors (Proposal No. 1), "FOR" all of the other proposals and in the discretion of the proxy holders

2

as to any other matters that may properly come before the Annual Meeting. You are urged to give direction as to how to vote your shares.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by:

- •

- filing with the Secretary of the Company at or before the taking of the vote at the 2002 Annual Meeting a written notice of revocation bearing a later date than the proxy;

- •

- duly executing a later-dated proxy relating to the same shares and delivering it to the Secretary of the Company at or before the taking of the vote at the 2002 Annual Meeting; or

- •

- attending the 2002 Annual Meetingand voting in person. Please note that attendance at the 2002 Annual Meeting will not in and of itself constitute a revocation of a proxy.

Any written notice of revocation or subsequent proxy should be delivered to Polycom, Inc., 1565 Barber Lane, Milpitas, CA 95035, Attention: Secretary, or hand-delivered to the Secretary of the Company at or before the taking of the vote at the 2002 Annual Meeting.

Solicitation of Proxies

The cost of soliciting proxies for the 2002 Annual Meeting will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and regular employees, personally or by telephone, letter facsimile or other means of communication. No additional compensation will be paid to directors, officers and employees who make these solicitations.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Board of Directors has selected seven nominees for election to the Company's Board of Directors, all of whom have been recommended for nomination by the Nominating Committee of the Board of Directors and all of whom are currently serving as directors of the Company. The names of the nominees for director, their ages and their positions with the Company as of March 22, 2002 are set forth in the table below. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. In the event any nominee is unable or declines to serve as a director at the time of the 2002 Annual Meeting, the proxies will be voted for any nominee who may be proposed by the Nominating Committee of the Board of Directors and designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees named below.

Name

| | Age

| | Position

|

|---|

| Robert C. Hagerty | | 50 | | Chairman of the Board, President and Chief Executive Officer |

| Michael R. Kourey | | 42 | | Senior Vice President, Finance and Administration, Chief Financial Officer, Secretary and Director |

| Betsy S. Atkins(2)(3) | | 47 | | Director |

| John Seely Brown(2) | | 61 | | Director |

| John A. Kelley(1)(3) | | 52 | | Director |

| Stanley J. Meresman(1) | | 55 | | Director |

| William A. Owens(1) | | 61 | | Director |

- (1)

- Member of Audit Committee

- (2)

- Member of Compensation Committee

- (3)

- Member of Nominating Committee

Robert C. Hagerty joined the Company in January 1997 as President and Chief Operating Officer and as a member of the Board of Directors. In July 1998, Mr. Hagerty was named the Company's Chief Executive Officer. In March 2000, Mr. Hagerty was named Chairman of the Company's Board of Directors. Prior to joining Polycom, Mr. Hagerty served as President of Stylus Assets, Ltd., a developer of software and hardware products for fax, document management and Internet communications. He also held several key management positions with Logitech, Inc., including Operating Committee Member to the Office of the President, and Senior Vice President/General Manager of Logitech's retail division and worldwide operations. In addition, Mr. Hagerty's career history includes positions as Vice President, High Performance Products for Conner Peripherals, Director of Manufacturing Operations and General Manager for Signal Corporation, and Operations Manager for Digital Equipment Corporation. Mr. Hagerty holds a B.S. in Operations Research and Industrial Engineering from the University of Massachusetts, and an M.A. in Management from St. Mary's College of California.

Michael R. Kourey has been a director of the Company since January 1999. Mr. Kourey has served as Senior Vice President, Finance and Administration since January 1999 and as Chief Financial Officer of the Company since January 1995. Mr. Kourey has served as the Secretary of the Company since June 1993. He also served as Vice President, Finance and Administration from January 1995 to January 1999, as Vice President, Finance and Operations from July 1991 to January 1995 and as the Treasurer of the Company from June 1993 to March 1997. Mr. Kourey currently serves on the Advisory Board of the Business School at Santa Clara University. Prior to joining the Company, he was Vice

4

President, Operations of Verilink Corporation. Mr. Kourey holds a B.S. in Managerial Economics from the University of California, Davis, and an M.B.A. from Santa Clara University.

Betsy S. Atkins has been a director of the Company since April 1999. Ms. Atkins has been a private investor since August 1994. Ms. Atkins served as President and Chief Executive Officer of NCI, Inc. from 1991 to 1993. Ms. Atkins was a founder and director of Ascend Communications Corporation, and from 1989 to 1999, she was its Vice President of Marketing and Sales. Ms. Atkins is also a director of Lucent Technologies, webMethods, Wilmington Trust, and a number of private companies. Ms. Atkins is a Presidential Appointee to the Pension Benefit Guaranty Trust Corp. and is a Trustee of Florida International University. Ms. Atkins holds a B.A. from the University of Massachusetts.

John Seely Brown has been a director of the Company since August 1999. Mr. Brown has been the Chief Scientist at Xerox Corporation since 1992. Mr. Brown was the director of Xerox's Palo Alto Research Center from 1990 to May 2000. In addition, Mr. Brown is a co-founder of the Institute for Research on Learning, a member of the National Academy of Education and a fellow of the American Association for Artificial Intelligence. Mr. Brown serves on the boards of Varian Medical Systems and Corning Incorporated. Mr. Brown received a B.A. in mathematics and physics from Brown University, a M.S. in mathematics from the University of Michigan, and a Ph.D. in computer and communications sciences from the University of Michigan.

John A. Kelley has been a director of the Company since March 2000. Mr. Kelley has been the President and Chief Operating Officer of McDATA, Inc. since August 2001. Prior to joining McDATA, Mr. Kelley served as Executive Vice President of Networks at Qwest Communications from August 2000 to December 2000. He served as President of Wholesale Markets for U S West from May 1998 to July 2000. From 1995 to April 1998, Mr. Kelley served as Vice President and General Manager of Large Business and Government Accounts and President of Federal Services for U S West. Prior to joining U S West, Mr. Kelley was the Area President for Mead Corporation's Zellerbach Southwest Business Unit and Vice President and General Manager for the Zellerbach Industrial Business Unit during 1991 to 1995. Mr. Kelley is also a director of AVT, Inc., HRZ, Inc., Colorado Women's Vision Foundation, and InRoads of Colorado. Mr. Kelley holds a B.S. in business from the University of Missouri.

Stanley J. Meresman has been a director of the Company since January 1995. Mr. Meresman has been General Partner and Chief Operating Officer of Technology Crossover Ventures, a venture capital firm, since November 2001. Mr. Meresman has been a private investor since August 1997. Mr. Meresman served as the Senior Vice President, Finance and Chief Financial Officer of Silicon Graphics, Inc. from May 1989 to May 1997. Prior to joining Silicon Graphics, Mr. Meresman was Vice President, Finance and Administration, and Chief Financial Officer of Cypress Semiconductor Corporation. Mr. Meresman is also a director of a number of private companies. Mr. Meresman holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and an M.B.A. from Stanford University.

William A. Owens has been a director of the Company since August 1999. Mr. Owens has been Co-Chief Executive Officer of Teledesic LLC, a satellite communications company, since February 1999 and Vice Chairman since 1998. He is also the Chairman and Chief Executive Officer of the affiliated Teledesic Holdings Ltd. From 1996 to 1998, Mr. Owens was President, Chief Operating Officer and Vice Chairman of Science Applications International Corporation (SAIC), an information technology systems integrator. From 1994 to 1996, he was Vice Chairman of the Joint Chiefs of Staff. Mr. Owens holds a B.A. in mathematics from the U.S. Naval Academy, Bachelor's and Master's degrees in politics, philosophy, and economics from Oxford University, and a Master's in management from George Washington University.

5

There are no family relationships among any of the directors or executive officers of the Company. The Company's bylaws authorize the Board of Directors to fix the number of directors by resolution. The Company currently has seven authorized directors. Each director holds office until the next annual meeting of stockholders or until that director's successor is duly elected and qualified. The Company's officers serve at the discretion of the Board of Directors.

Board of Directors' Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FORTHE ELECTION OF THE NOMINEES LISTED ABOVE.

Board and Committees Meetings

During the fiscal year ended December 30, 2001, the Board of Directors held ten meetings. Each of the directors attended or participated in 75% or more of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which he or she served during the past fiscal year with the exception of Mr. Brown, who attended or participated in 73% of those meetings. The Board of Directors of the Company has three standing committees: an Audit Committee, a Compensation Committee and a Nominating Committee.

The Audit Committee, which currently consists of Messrs. Meresman, Kelley and Owens, is responsible for monitoring and overseeing (1) the independence and performance of the Company's internal auditors and independent accountants, (2) the integrity of the Company's financial statements, and (3) the Company's compliance with legal and regulatory requirements.

The Compensation Committee, which currently consists of Ms. Atkins and Mr. Brown, is primarily responsible for reviewing and approving the Company's general compensation policies and establishing salaries, incentives and other forms of compensation for the Company's executive officers and other employees. The Compensation Committee also administers the Company's 1996 Stock Incentive Plan and makes option grants thereunder, and administers the other benefit plans of the Company. The Compensation Committee held one meeting during the last fiscal year.

The Nominating Committee, which currently consists of Ms. Atkins and Mr. Kelley, is responsible for recommending nominees for election to the Board of Directors. The Nominating Committee will not consider nominees for the Board of Directors submitted by stockholders of the Company. The Nominating Committee was established in March 2001, and its first meeting was held in February 2002 to recommend the nominees for the Board of Directors at the 2002 Annual Meeting.

6

PROPOSAL TWO

APPROVAL OF AN AMENDMENT TO THE 1996 STOCK INCENTIVE PLAN TO

INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE THEREUNDER

Since 1991, the Company has provided stock options as an incentive to its employees to promote increased stockholder value. The Board of Directors and Management believe that stock options are one of the primary ways to attract and retain key personnel responsible for the continued development and growth of the Company's business, and to motivate all employees to increase stockholder value. In addition, stock options are considered a competitive necessity in the high technology sector in which the Company competes.

The Company currently grants options to all employees upon initial hire, and periodically to key employees or in recognition of achievement of certain performance criteria. As a result of acquisitions and internal growth, the number of our employees during fiscal 2001 grew from 543 to 1,269 at fiscal year end. In October 1998, January 2000 and June 2000, the Company rewarded each employee below the director management level with a special option grant of 1,000 shares, 500 shares and 500 shares, respectively. In August 2001, the Company made a special option grant of 250 shares to each employee excluding executive officers. Certain of those grants were delayed to December 2001.

As a result of the increase in number of employees during fiscal 2001, and the desire to give further incentive to and retain current employees and officers, options to purchase 4,528,405 shares were granted from the 1996 Plan during fiscal 2001. Consequently, as of December 30, 2001, there were 433,173 shares available for issuance under the 1996 Plan, not including the 4,000,000 shares subject to stockholder approval at this 2002 Annual Meeting. Also, as of December 30, 2001, options to purchase 198,945 shares were granted under the 2001 Nonstatutory Stock Option Plan, all of which were granted during fiscal 2001, and there were 558,405 shares available for issuance under the 2001 Nonstatutory Stock Option Plan. The Company cannot grant options to its executive officers from the 2001 Nonstatutory Stock Option Plan.

As of March 22, 2002, 230,973 shares were available for issuance under the 1996 Plan, not including the 4,000,000 shares subject to stockholder approval at the 2002 Annual Meeting, and 13,073,825 options were outstanding that were granted under the 1996 Plan and its predecessor plan, the 2001 Plan and the assumed stock option plans of ViaVideo Communications, Inc., Atlas Communication Engines, Inc., Accord Networks Ltd., PictureTel Corporation, Circa Communications, Ltd. and Atlanta Signal Processors, Incorporated.

Proposed Amendment

At the 2002 Annual Meeting, the Company requests that its stockholders approve an amendment to the 1996 Plan to increase the number of shares reserved for issuance under the 1996 Plan by 4,000,000 shares, for an aggregate of 21,250,000 shares reserved for issuance thereunder. The Board of Directors previously approved the proposed amendment to the 1996 Plan in February of 2002, subject to stockholder approval at the 2002 Annual Meeting. The amendment to increase the number of shares reserved under the 1996 Plan is proposed in order to give the Board of Directors and the Compensation Committee of the Board of Directors greater flexibility to grant stock options. The Board of Directors and Management believe that granting stock options motivates high levels of performance and provides an effective means of recognizing employee contributions to the success of the Company. The Board of Directors and Management believe that stock options are of great value in recruiting and retaining highly qualified technical and other key personnel who are in great demand, as well as rewarding and encouraging current employees. The Board of Directors and Management believe that the ability to grant options will be important to the future success of the Company by allowing it to accomplish these objectives.

7

Board of Directors' Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFORTHE AMENDMENT TO

THE 1996 STOCK INCENTIVE PLAN INCREASING THE NUMBER OF SHARES

RESERVED FOR ISSUANCE THEREUNDER.

Description of the 1996 Stock Incentive Plan

The following is a summary of the principal features of the 1996 Plan. However, this summary is not a complete description of all of the provisions of the 1996 Plan, and is qualified in its entirety by the specific language of the 1996 Plan. A copy of the 1996 Plan is available to any stockholder upon written request to the Company's Secretary.

Equity Incentive Programs

The 1996 Plan contains three separate equity incentive programs:

- •

- a Discretionary Option Grant Program;

- •

- an Automatic Option Grant Program; and

- •

- a Stock Issuance Program.

The principal features of these programs are described below. The 1996 Plan (other than the Automatic Option Grant Program) is administered by the Compensation Committee of the Board of Directors. The Compensation Committee acting in this administrative capacity (the "Plan Administrator") has complete discretion, subject to the provisions of the 1996 Plan, to authorize option grants and direct stock issuances under the 1996 Plan. Pursuant to provisions in the 1996 Plan, the Board may appoint a secondary committee of one or more Board members, including employee directors, to authorize option grants and direct stock issuances to eligible persons other than Board members and executive officers subject to the short-swing liability provisions of the federal securities laws. In April 1999, the Board appointed a secondary committee composed of Michael R. Kourey, the Company's Chief Financial Officer, to grant options in amounts pre-approved by the Board to newly hired employees other than executive officers. All grants under the Automatic Option Grant Program are to be made in strict compliance with the provisions of that program, and no administrative discretion will be exercised by the Plan Administrator with respect to the grants made under such program. Options granted through either the Discretionary or Automatic Option Grant Program do not give the holder of the options any stockholder rights until that person has exercised the option, paid the exercise price and become a holder of record of the purchased shares. In connection with the 1996 Plan, the Company has adopted subplans to allow for the grant of options with more favorable tax consequences to employees, consultants and directors in some of the Company's foreign subsidiaries in the United Kingdom, France, the Netherlands, Israel and Thailand.

Share Reserve

A total of 17,250,000 shares of Common Stock has been reserved for issuance over the term of the 1996 Plan. However, Proposal Two, if approved, will raise the number of shares reserved by 4,000,000 shares, to 21,250,000 shares. Should an option expire or terminate for any reason prior to exercise in full or be canceled in accordance with the provisions of the 1996 Plan, the shares subject to the portion of the option not so exercised or canceled will be available for subsequent issuance under the 1996 Plan. Unvested shares issued under the 1996 Plan and subsequently repurchased by the Company at the original option exercise or direct issue price paid per share will also be added back to the share reserve and will accordingly be available for subsequent issuance under the 1996 Plan. In the event any change is made to the outstanding shares of Common Stock by reason of any recapitalization, stock dividend,

8

stock split, combination of shares, exchange of shares or other change in corporate structure effected without the Company's receipt of consideration, appropriate adjustments will be made to (i) the maximum number and class of securities issuable under the 1996 Plan, (ii) the maximum number and class of securities for which any one participant may be granted stock options and direct stock issuances under the 1996 Plan, (iii) the number and class of securities for which option grants will subsequently be made under the Automatic Option Grant Program to each continuing non-employee Board member, and (iv) the number and class of securities and the exercise price per share in effect under each outstanding option.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") places limits on the deductibility for federal income tax purposes on compensation paid to certain executive officers of the Company. In order to qualify the compensation income associated with options granted to such persons as "performance-based" compensation under Section 162(m) of the Code, thereby preserving the Company's ability to deduct such compensation income, the 1996 Plan provides that in no event may any one participant in the 1996 Plan be granted stock options, separately exercisable stock appreciation rights, and direct stock issuances for more than 600,000 shares in the aggregate per calendar year under the 1996 Plan.

Eligibility

Employees of the Company or any parent or subsidiary, non-employee members of the Board or the board of directors of any parent or subsidiary corporation, and consultants and other independent advisors in the service of the Company or its parent or subsidiary corporations are eligible to participate in the Discretionary Option Grant and Stock Issuance Programs. Non-employee members of the Board are also eligible to participate in the Automatic Option Grant Program.

As of December 30, 2001, eight executive officers, five non-employee Board members and approximately 1,261 other employees were eligible to participate in the Discretionary Option Grant and Stock Issuance Programs, and the five non-employee Board members were also eligible to participate in the Automatic Option Grant Program.

Discretionary Option Grant Program

Options granted under the Discretionary Option Grant Program must have an exercise price per share not less than the fair market value per share of Common Stock on the option grant date. No option can have a term in excess of seven years.

Since December 1998, granted options will become vested and exercisable in a series of installments over four years so long as the optionees remain in service to the Company. Periodically, the Company grants options to all employees below a certain management level as a special incentive to retain them and/or as a special reward for past performance. These options generally vest and become exercisable fully within one year so long as the employee remains employed with the Company. During October 1998, January 2000 and June 2000, the Company granted each employee below the director management level, option grants of 1,000 shares, 500 shares and 500 shares, respectively. In August 2001, the Company made a special option grant of 250 shares to each employee excluding executive officers. Certain of those grants were delayed to December of 2001.

Upon cessation of service, the optionee will generally have a limited period of time in which to exercise his or her outstanding options which are vested at that time. The Plan Administrator has complete discretion to extend the period following the optionee's cessation of service during which his or her outstanding options may be exercised and to accelerate the exercisability or vesting of such options in whole or in part. This discretion may be exercised at any time while the options remain outstanding, whether before or after the optionee's actual cessation of service.

9

The shares of Common Stock acquired upon the exercise of one or more options may be unvested and subject to repurchase by the Company, at the original exercise price paid per share, if the optionee ceases service with the Company prior to vesting in those shares. The Plan Administrator has complete discretion to establish the vesting schedule to be in effect for any such unvested shares and, in certain circumstances, may accelerate the vesting of those shares, thereby the Company's outstanding repurchase rights with respect to those shares.

Limited Transferability of Options. During the lifetime of the optionee, the options granted under the Discretionary Option Grant Program are exercisable only by the optionee. In addition, the options are not assignable or transferable other than by will or the laws of descent and distribution. However, non-statutory options may, in connection with an optionee's estate plan, be assigned to members of the optionee's family or a trust established exclusively for such family members (unless the Plan Administrator determines that the non-statutory options are not transferable for certain optionees employed by the Company's European subsidiaries).

Cancellation and Regrant of Options. The Plan Administrator also has the authority to effect the cancellation of outstanding options under the Discretionary Option Grant Program and to issue replacement options with an exercise price based on the fair market price of Common Stock at the time of the new grant. However, any such repricing of stock options, effected either by reducing the exercise price of outstanding options or canceling outstanding options and granting replacement options with a lower exercise price, requires the approval of the holders of a majority of the Company's voting shares.

Stock Appreciation Rights. The Plan Administrator is authorized to issue two types of stock appreciation rights in connection with option grants made under the Discretionary Option Grant Program:

Tandem Stock Appreciation rights provide the holders with the right to surrender their options for an appreciation distribution from the Company equal in amount to the excess of (a) the fair market value on the option surrender date of the vested shares of Common Stock subject to the surrendered option over (b) the aggregate exercise price payable for those shares. Such appreciation distribution may, at the discretion of the Plan Administrator, be made in cash, shares of Common Stock or a combination of both.

Limited Stock Appreciation rights may be provided to one or more non-employee directors or executive officers of the Company as part of their option grants. Any such vested option may be surrendered to the Company upon the successful completion of a hostile tender offer for more than 50% of the Company's outstanding voting stock. In return for the surrendered option, the officer or non-employee director would be entitled to a cash distribution from the Company.

To date, the Company has not issued any Tandem or Limited Stock Appreciation Rights.

Automatic Option Grant Program

Beginning after May 17, 2001, all non-employee directors of the Company are granted, as of the date they first join the Board of Directors, an option to purchase 60,000 shares of Company common stock (the "Initial Grant"); provided that they have not previously worked for the Company or received a prior stock option grant from the Company. Each Initial Grant vests in four equal annual installments commencing one year following the date of grant of such option, provided the optionee remains a Board member on each such vesting date. Each Initial Grant has a term of seven (7) years.

Beginning after October 26, 1999, on the date of every annual meeting of stockholders, each individual who is serving as a non-employee Board member is automatically granted a non-statutory option to purchase 30,000 shares of the Company's Common Stock (a "Recurring Grant"). There is no

10

limit on the number of such Recurring Grants that any one non-employee Board member may receive over his or her period of Board service. Each Recurring Grant has an exercise price per share equal to 100% of the fair market value per share of Common Stock on the option grant date and a maximum term of seven years measured from the grant date. Each Recurring Grant vests in four equal annual installments commencing one year following the date of grant of such option, provided the optionee remains a Board member on each such vesting date. Each Recurring Grant granted on or after May 17, 2001 has a maximum term of seven (7) years, while each Recurring Grant granted between October 26, 1999 and May 17, 2001 has a maximum term of five (5) years.

Should the optionee cease to serve as a Board member, the optionee generally has until the earlier of the 12 month period following such cessation of service or the expiration date of the option term, in which to exercise the option for the number of shares that are vested at the time of that individual's cessation of Board service. The shares subject to each automatic option grant immediately vest in full upon:

- •

- the optionee's death or permanent disability while a Board member;

- •

- an acquisition of the Company by merger or asset sale;

- •

- the successful completion of a tender offer for more than 50% of the Company's outstanding voting stock; or

- •

- a change in the majority of the Board effected through one or more proxy contests for Board membership.

In addition, upon the successful completion of a hostile tender offer for more than 50% of the Company's outstanding voting stock, each option granted under the Automatic Option Grant Program may be surrendered to the Company for a cash payment in an amount equal to the excess of the highest price per share of Common Stock paid in connection with such tender offer over the per share exercise price multiplied by the number of shares subject to that option.

Stock Issuance Program

Shares of Common Stock may be sold under the Stock Issuance Program at a price per share not less than the fair market value on the issuance date, payable in cash, by check or by means of a promissory note issued in favor of the Company. Shares may also be issued solely as a bonus for past services.

The issued shares may either be immediately vested upon issuance or subject to a vesting schedule tied to the period of service with the Company or the attainment of performance goals. However, the Purchaser has full stockholder rights with respect to any shares of Common Stock issued under the Stock Issuance Program, whether or not the interest in those shares is vested. The Plan Administrator also has the discretionary authority at any time to accelerate the vesting of any and all unvested shares outstanding under the 1996 Plan.

Upon cessation of service, any unvested shares of Common Stock issued under the Stock Issuance Program shall be immediately surrendered to the Corporation for cancellation. However, the Plan Administrator may, in its discretion, waive the surrender and cancellation of one or more unvested shares.

Change of Control Provisions

Discretionary Option Grant and Stock Issuance Programs. In the event that the Company is acquired by merger or asset sale, the vesting of each outstanding option under the Discretionary Option Grant Program which is not to be assumed by the successor corporation, including options held by the Company's executive officers, will automatically accelerate in full, and all unvested shares issued

11

under the Discretionary Option Grant and Stock Issuance Programs will immediately vest, except to the extent the Company's repurchase rights with respect to those shares are to be assigned to the successor corporation. Any options assumed in connection with such acquisition may, in the Plan Administrator's discretion, be subject to immediate acceleration of vesting, and any unvested shares which do not vest at the time of such acquisition may be subject to full and immediate vesting, in the event the individual's service with the successor entity is subsequently terminated within a specified period following the acquisition. In connection with a change in control of the Company other than by merger or asset sale (whether such change of control is by successful tender offer for more than 50% of the outstanding voting stock or a change in the majority of the Board by one or more contested elections for Board membership), the Plan Administrator will have the discretionary authority to provide for automatic acceleration of vesting of outstanding options under the Discretionary Option Grant Program and the automatic vesting of all unvested shares issued under the Discretionary Option Grant and Stock Issuance Programs, with such acceleration of vesting to occur either at the time of such change in control or upon the subsequent termination of the individual's service. Any options accelerated upon termination within the designated period following the change in control remain exercisable for up to one year following the transaction.

Automatic Grant Program. The shares subject to each automatic option grant immediately vest in full upon:

- •

- an acquisition of the Company by merger or asset sale;

- •

- the successful completion of a tender offer for more than 50% of the Company's outstanding voting stock; or

- •

- a change in the majority of the Board effected through one or more proxy contests for Board membership.

In addition, upon the successful completion of a hostile tender offer for more than 50% of the Company's outstanding voting stock, each option granted under the Automatic Option Grant Program may be surrendered to the Company for a cash payment in an amount equal to (i) the excess of the greater of (A) the fair market value of the Common Stock on the date the option is surrendered, or (B) the highest price per share of Common Stock paid in connection with such tender offer over (ii) the per share exercise price multiplied by the number of shares subject to that option.

The acceleration of vesting upon a change in the ownership or control of the Company may have the effect of discouraging a merger proposal, a takeover attempt or other efforts to gain control of the Company.

Special Tax Election

The Plan Administrator may provide one or more holders of non-statutory options or unvested shares (other than the options granted or the shares issued under the Automatic Option Grant Program) with the right to have the Company withhold a portion of the shares otherwise issuable to such individuals in satisfaction of the tax liability incurred by such individuals in connection with the exercise of those options or the vesting of those shares. Alternatively, the Plan Administrator may allow such individuals to deliver previously acquired shares of Common Stock in payment of such tax liability.

Amendment and Termination

The Board may amend or modify the 1996 Plan in any or all respects whatsoever, subject to any stockholder approval required under the 1996 Plan or applicable laws or regulations. The 1996 Plan requires stockholder approval of amendments to the 1996 Plan which take the following actions:

- •

- materially modify the requirements for eligibility under the 1996 Plan;

12

- •

- materially increase the number of shares of the Company's Common Stock which may be issued over the term of the 1996 Plan; or

- •

- materially increase the benefits accruing to participants under the 1996 Plan.

The Board may terminate the 1996 Plan at any time, and the 1996 Plan will terminate no later than December 31, 2005.

Summary of United States Federal Income Tax Consequences

The following is only a brief summary of the effect of United States federal income taxation on the recipient of an award and the Company under the 1996 Plan. This summary is not exhaustive and does not discuss the income tax laws of any municipality, state or country outside the United States in which a recipient of an award may reside.

Option Grants

Options granted under the 1996 Plan may be either incentive stock options which satisfy the requirements of Section 422 of the Internal Revenue Code or non-statutory options which are not intended to meet such requirements. The Federal income tax treatment for the two types of options differs as follows:

Incentive Options. An optionee who is granted an incentive stock option does not recognize taxable income at the time the option is granted or upon its exercise, although the exercise is an adjustment item for alternative minimum tax purposes and may subject the optionee to the alternative minimum tax. Upon a disposition of the shares more than two (2) years after grant of the option and one (1) year after exercise of the option, any gain or loss is treated as long-term capital gain or loss. Net capital gains on shares held more than twelve (12) months may be taxed at a maximum federal rate of 20%. Capital losses are allowed in full against capital gains and up to $3,000 against other income. If these holding periods are not satisfied, the optionee recognizes ordinary income at the time of disposition equal to the difference between the exercise price and the lower of (i) the fair market value of the shares at the date of the option exercise, or (ii) the sale price of the shares. Any gain or loss recognized on such a premature disposition of the shares in excess of the amount treated as ordinary income is treated as long-term or short-term capital gain or loss, depending on the holding period. A different rule for measuring ordinary income upon such a premature disposition may apply if the optionee is also an officer, director, or 10% shareholder of the Company. Unless limited by Section 162(m) of the Code, the Company is entitled to a deduction in the same amount as any ordinary income recognized by the optionee.

Non-Statutory Options. An optionee does not recognize any taxable income at the time he or she is granted a nonstatutory stock option. Upon exercise, the optionee recognizes taxable income generally measured by the excess of the then fair market value of the shares over the exercise price. Any taxable income recognized in connection with an option exercise by the Company's employee is subject to tax withholding by the Company. Unless limited by Section 162(m) of the Code, the Company is entitled to a deduction in the same amount as the ordinary income recognized by the optionee. Upon a disposition of such shares by the optionee, any difference between the sale price and the optionee's exercise price, to the extent not recognized as taxable income as provided above, is treated as long-term or short-term capital gain or loss, depending on the holding period. Net capital gains on shares held more than 12 months may be taxed at a maximum federal rate of 20%. Capital losses are allowed in full against capital gains and up to $3,000 against other income.

13

Stock Appreciation Rights

An optionee who is granted a stock appreciation right will recognize ordinary income in the year of exercise equal to the amount of the appreciation distribution. The Company will be entitled to an income tax deduction equal to such distribution for the taxable year in which the ordinary income is recognized by the optionee.

Stock Issuance

The tax principles applicable to stock issuances under the 1996 Plan will be substantially the same as those summarized above for the exercise of non-statutory option grants.

Deductibility of Executive Compensation

The Company anticipates that any compensation deemed paid by it in connection with disqualifying dispositions of incentive stock option shares or exercises of non-statutory options will qualify as performance-based compensation for purposes of Internal Revenue Code Section 162(m) and will not have to be taken into account for purposes of the $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company. Accordingly, all compensation deemed paid with respect to those options will remain deductible by the Company without limitation under Internal Revenue Code Section 162(m).

14

Participation in the 1996 Stock Incentive Plan

The grant of awards under the 1996 Plan to employees, including the executive officers named in the Summary Compensation Table below, is subject to the discretion of the Plan Administrator. As of the date of this proxy statement, there has been no determination by the Plan Administrator with respect to future awards under the 1996 Plan. Accordingly, future awards are not determinable. The following table sets forth information with respect to the grant of options under the 1996 Plan to the executive officers named in the Summary Compensation Table below, to all current executive officers as a group, to all nonemployee directors as a group and to all other employees as a group during the Company's last fiscal year:

Amended Plan Benefits

1996 Stock Incentive Plan

Name of Individual

Or

Identity of Group and Position

| | Number of

Securities Underlying

Options Granted

| | Weighted Average

Exercise Price

Per Share

|

|---|

Robert C. Hagerty

Chairman of the Board, President and Chief Executive Officer | | 250,000 | | 23.50 |

Michael R. Kourey

Senior Vice President, Finance and Administration, Chief Financial Officer, Secretary and Director | | 225,000 | | 23.50 |

Sunil K. Bhalla

Senior Vice President and General Manager, Voice Communications | | 200,000 | | 23.50 |

Jules L. DeVigne

Executive Vice President and General Manager, Network Systems | | 200,000 | | 23.50 |

Craig B. Malloy

Senior Vice President and General Manager, Video Communications | | 175,000 | | 23.50 |

Dale A. Bastian

Vice President, European Sales | | 75,000 | | 23.50 |

| All current executive officers as a group (8 persons) | | 1,475,000 | | 24.86 |

| All nonemployee directors as a group | | 508,125 | | 22.12 |

| All other employees (including all current officers who are not executive officers) as a group | | 2,545,280 | | 27.62 |

15

PROPOSAL THREE

AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN

TO INCREASE THE NUMBER OF SHARES

RESERVED FOR ISSUANCE THEREUNDER

Since 1996, the Company has provided an Employee Stock Purchase Plan ("ESPP") as an incentive to its employees to promote increased stockholder value. The ESPP provides the Company's employees with the opportunity to purchase shares of the Company's Common Stock through pre-tax payroll deductions at a discount of up to 15% from the trading price on certain dates specified in the ESPP. The Board of Directors and Management believe that the ESPP is a valuable way to attract and retain key personnel responsible for the continued development and growth of the Company's business, and to motivate all employees to increase stockholder value. In addition, an ESPP is considered a competitive necessity in the high technology sector in which the Company competes. As of December 30, 2001, there were 986,944 shares available for issuance under the ESPP.

Proposed Amendment

At the 2002 Annual Meeting, the Company requests that its stockholders approve an amendment to the ESPP to increase the number of shares of the Company's Common Stock reserved for issuance under the ESPP by 500,000 shares, for an aggregate of 2,500,000 shares reserved for issuance thereunder. The Board of Directors previously approved the proposed amendment to the ESPP in February of 2002, subject to stockholder approval at the 2002 Annual Meeting. The amendment to increase the number of shares reserved under the ESPP is proposed in order to allow the Company the ability to continue to offer its employees the incentive and flexibility provided by an ESPP. Management and the Board of Directors believe that the ESPP is a significant component of employee compensation, and is of great value in recruiting and retaining employees. Consequently, the Board of Directors believes that the ability of the Company to continue to offer its employees an ESPP is important to the future success of the Company.

Board of Directors' Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN INCREASING THE NUMBER OF SHARES RESERVED THEREUNDER.

Description of the Employee Stock Purchase Plan

The following is a summary of the principal features of the ESPP. However, this summary is not a complete description of all the provisions of the ESPP, and is qualified in its entirety by the specific language of the ESPP, a copy of which is available to any stockholder upon written request to the Company's Secretary.

Administration

The ESPP is administered by the Board of Directors or a committee appointed by the Board (the "Administrator"). All questions of interpretation or application of the ESPP are determined by the Board or its appointed committee, and its decisions are final, conclusive and binding upon all participants.

Eligibility

Each employee of the Company, including officers, whose customary employment with the Company is at least twenty hours per week and more than five months in any calendar year, is eligible to participate in the ESPP. However, no employee may be granted a purchase right under the ESPP to

16

the extent that, immediately after the grant, such employee would own 5% of either the voting power or value of the stock of the Company or any parent or subsidiary of the Company, or to the extent that his or her rights to purchase stock under all employee stock purchase plans of the Company accrues at a rate which exceeds $25,000 worth of stock (determined at the fair market value of the shares at the time the option is granted) for each calendar year.

Offering Period

The ESPP is implemented through offering periods, which may not exceed twenty-four months in duration. Each offering period is comprised of a series of successive six-month purchase intervals. To participate in the ESPP, each eligible employee must authorize payroll deductions for purchases under the ESPP. These payroll deductions may not exceed 15% of a participant's compensation. Compensation is defined as base straight time gross earnings and commissions and, to the extent they are paid in cash, payments for overtime, shift premiums, incentive compensation, bonuses and other compensation. Once an employee becomes a participant in the ESPP, Common Stock will automatically be purchased under the ESPP at the end of each six month purchase interval, unless the participant withdraws or terminates employment earlier. The participating employee will automatically continue to participate in each successive purchase interval until such time as the employee withdraws from the ESPP or the employee's employment terminates.

Purchase Price

The purchase price per share at which shares will be sold in an offering under the ESPP is the lower of 85% of the fair market value of a share of Common Stock on the day the participant enters the offering period, or 85% of the fair market value of a share of or that Common Stock on the last day of each purchase interval. The fair market value of the Common Stock on a given date is generally the closing sale price of the Company's Common Stock as reported on the Nasdaq National Market the Company's date.

Payment of Purchase Price; Payroll Deductions

The purchase price of the shares is accumulated by payroll deductions throughout each purchase interval during the offering period. The number of shares of Common Stock a participant may purchase in each offering period is determined by dividing the total amount of payroll deductions withheld from the participant's compensation during that offering period by the purchase price. However, a participant may not purchase more than 1,500 shares in each purchase interval. During the offering period, a participant may discontinue his or her participation in the ESPP, and may decrease or increase the rate of payroll deductions in an offering period within limits set by the Administrator.

All payroll deductions made for a participant are credited to the participant's account under the ESPP, are withheld in whole percentages only and are included with the general funds of the Company. A participant may not make any additional payments into his or her account other than through appropriate payroll deductions.

Withdrawal

A participant may terminate his or her participation in the ESPP at any time prior to the next scheduled purchase date in the offering period by giving the plan administrator a written notice of withdrawal on the appropriate form. In the event of withdrawal, the payroll deductions credited to the participant's account will either be returned, without interest, to the participant, or at the election of the participant, held for the purchase of shares on the next purchase date. Payroll deductions will not resume unless the participant delivers a new subscription agreement in connection with a subsequent offering period.

17

Termination of Employment; Loss of Eligibility

Termination of a participant's employment for any reason, including death, or any loss of eligibility to participate in the ESPP cancels his or her participation in the ESPP. In this event, the payroll deductions credited to the participant's account will be returned without interest to the participant, his or her designated beneficiaries or the executors or administrators of his or her estate.

Amendment and Termination

The Board may at any time and for any reason amend or terminate the ESPP, which amendment or termination would become effective immediately following the close of any offering period. Stockholder approval is required for several types of amendments to the ESPP, including an increase in the number of shares issuable under the ESPP. Any amendment to the ESPP must comply with all applicable laws or regulations. The ESPP will terminate in 2006 unless terminated earlier by the Board or otherwise in accordance with the ESPP.

Summary of United States Federal Income Tax Consequences

The following is only a brief summary of the effect of the United States federal income taxation on a participant in the ESPP and the Company with respect to the shares purchased under the ESPP. This summary is not exhaustive and does not discuss the income tax consequences of a participant's death, or the income tax laws of any municipality, state or country outside the United States in which a recipient of an award may reside.

The ESPP, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Sections 421 and 423 of the Code. Under these provisions, no income will be taxable to a participant until the shares purchased under the ESPP are sold or otherwise disposed of. Upon the sale or other disposition of the shares, the participant will generally be subject to tax in an amount that depends upon the holding period for the shares. If the shares are sold or otherwise disposed of more than two years from the participant's entry date into the applicable offering period and more than one year from the applicable date of purchase, the participant will recognize ordinary income measured as the lesser of (a) the excess of the fair market value of the shares at the time of such sale or disposition over the purchase price, or (b) an amount equal to 15% of the fair market value of the shares as of the participant's entry date into the applicable offering period. Any additional gain will be treated as long-term capital gain. If the shares are sold or otherwise disposed of before the expiration of these holding periods, the participant will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price. Any additional gain or loss on any such sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period for the shares. The Company generally is only entitled to a deduction for amounts taxed as ordinary income recognized by participants upon a sale or disposition of shares prior to the expiration of the holding periods described above.

18

Participation in the Employee Stock Purchase Plan

Participation in the ESPP is voluntary and is dependent on each eligible employee's election to participate and his or her determination as to the level of payroll deductions. Accordingly, future purchases under the ESPP are not determinable. Non-employee directors are not eligible to participate in the ESPP. The following table sets forth certain information regarding shares purchased under the ESPP during the Company's last fiscal year and the payroll deductions accumulated at the end of the Company's last fiscal year in accounts under the ESPP for each of the executive officers named in the Summary Compensation Table below, for all current executive officers as a group and for all other employees who participated in the ESPP as a group:

Amended Plan Benefits

Employee Stock Purchase Plan

Name of Individual or Identity of Group and Position

| | Number of

Shares

Purchased

| | Dollar

Value $(1)

| | Payroll

Deductions

as of Fiscal

Year End $

|

|---|

Robert C. Hagerty

Chairman of the Board, President and Chief Executive Officer | | 772 | | 21,572 | | 18,336 |

Michael R. Kourey

Senior Vice President, Finance and Administration, Chief Financial Officer, Secretary and Director | | 674 | | 17,791 | | 15,122 |

Sunil K. Bhalla

Senior Vice President and General Manager, Voice Communications | | — | | — | | — |

Jules L. DeVigne

Executive Vice President and General Manager, Network Systems | | 520 | | 13,234 | | 11,249 |

Craig B. Malloy

Senior Vice President and General Manager, Video Communications | | 764 | | 20,096 | | 17,081 |

Dale A. Bastian

Vice President, European Sales | | 782 | | 21,202 | | 18,022 |

| All current executive officers as a group (8 persons) | | 2,730 | | 72,693 | | 61,788 |

| All other employees (excluding executive officers) as a group | | 166,738 | | 4,460,574 | | 3,791,177 |

- (1)

- Represents the market value of the shares on the date of purchase.

19

PROPOSAL FOUR

RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Board of Directors has selected PricewaterhouseCoopers LLP as its independent accountants to audit the financial statements of the Company for the fiscal year ending December 29, 2002. PricewaterhouseCoopers LLP and its predecessor entities have audited the Company's financial statements since fiscal 1991. A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting, will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions.

Board of Directors' Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE RATIFICATION OF THE

APPOINTMENT OF PRICEWATERHOUSECOOPERS, LLP AS INDEPENDENT ACCOUNTANTS

FOR THE COMPANY'S FISCAL YEAR ENDING DECEMBER 29, 2002.

Fees Billed to Company by PricewaterhouseCoopers LLP during Fiscal 2001

Audit Fees

Audit fees billed to the Company by PricewaterhouseCoopers LLP during the Company's 2001 fiscal year for review of the Company's annual financial statements and those financial statements included in the Company's quarterly reports on Form 10-Q totaled approximately $525,000.

Financial Information Systems Design and Implementation Fees

The Company did not engage PricewaterhouseCoopers LLP to provide advice to the Company regarding financial information systems design and implementation during the fiscal year ended December 30, 2001.

All Other Fees

Fees billed to the Company by PricewaterhouseCoopers LLP during the Company's 2001 fiscal year for all other non-audit services rendered to the Company, including services for tax-related matters, stock offerings and mergers and acquisitions, totaled approximately $2,200,000. Of those fees, approximately $1,150,000 were billed for tax-related services, approximately $550,000 were billed for services related to mergers and acquisitions and approximately $500,000 were billed for services related to Securities and Exchange Commission filings and other services.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining PricewaterhouseCoopers LLP's independence.

20

MANAGEMENT

Ownership of Securities

The table below shows the beneficial ownership of the Company's Common Stock as of March 22, 2002 for the following persons:

- •

- each person (or group of affiliated persons) who is known by the Company to beneficially own 5% of the outstanding shares of the Company's Common Stock;

- •

- each of the Company's directors;

- •

- Each of the Company's officers named in the Summary Compensation Table on page 24 of this Proxy Statement; and

- •

- all directors and executive officers of the Company as a group.

5% Stockholders, Directors and Officers(1)

| | Shares Beneficially

Owned(2)

| | Percentage

Beneficially

Owned(2)

| |

|---|

| Principal Stockholders | | | | | |

| FMR Corp.(3) | | 6,551,860 | | 6.58 | % |

Directors |

|

|

|

|

|

| Betsy S. Atkins(4) | | 45,000 | | * | |

| John Seely Brown(5) | | 75,000 | | * | |

| John A. Kelley(6) | | 75,000 | | * | |

| Stanley J. Meresman(7) | | 65,000 | | * | |

| William A. Owens(8) | | 60,000 | | * | |

Named Executive Officers |

|

|

|

|

|

| Robert C. Hagerty(9) | | 579,883 | | * | |

| Michael R. Kourey(10) | | 345,003 | | * | |

| Sunil K. Bhalla(11) | | 137,499 | | * | |

| Jules L. DeVigne(12) | | 209,602 | | * | |

| Craig B. Malloy(13) | | 339,107 | | * | |

| Dale A. Bastian(14) | | 48,125 | | * | |

All current directors and executive officers as a group |

|

|

|

|

|

| (13 persons)(15) | | 2,130,482 | | 2.10 | % |

- *

- Less than 1%

- (1)

- Unless otherwise indicated in their respective footnote, the address for each listed stockholder is c/o Polycom, Inc., 1565 Barber Lane, Milpitas, California 95035.

- (2)

- Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the "SEC"), and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options which are currently exercisable or which will become exercisable within 60 days after March 22, 2002 are deemed outstanding for purposes of computing the beneficial ownership of the person holding these options but are not deemed outstanding for purposes of computing the beneficial ownership of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. Percentage of ownership is based on 99,575,250 shares of the Company's Common Stock outstanding on March 22, 2002, and is calculated in accordance with the rules of the Securities and Exchange Commission.

21

- (3)

- The address of FMR Corp. is 82 Devonshire Street, Boston, MA 02109. This information was obtained from filings made with the Securities and Exchange Commission pursuant to Section 13(g) of the Exchange Act.

- (4)

- Includes options held by Ms. Atkins to purchase 45,000 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (5)

- Includes options held by Dr. Brown to purchase 75,000 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (6)

- Includes options held by Mr. Kelley to purchase 75,000 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (7)

- Includes options held by Mr. Meresman to purchase 65,000 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (8)

- Includes options held by Mr. Owens to purchase 60,000 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (9)

- Includes options held by Mr. Hagerty to purchase 500,615 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002. Mr. Hagerty is also a director of the Company.

- (10)

- Includes options held by Mr. Kourey to purchase 306,353 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002. Mr. Kourey is also a director of the Company.

- (11)

- Includes options held by Mr. Bhalla to purchase 137,499 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (12)

- Includes options held by Mr. DeVigne to purchase 143,386 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (13)

- Includes options held by Mr. Malloy to purchase 336,082 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

- (14)

- Includes options held by Mr. Bastian to purchase 48,125 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002. Mr. Bastian was an executive officer of the Company until July 2001.

- (15)

- Includes options to purchase 1,943,323 shares of Common Stock which are exercisable within sixty (60) days of March 22, 2002.

22

Compensation of Directors

In fiscal 2001, the Company did not pay any cash compensation to its directors who were not employees of the Company, other than for reimbursement of meeting expenses, if any. However, non-employee directors are eligible to receive periodic option grants under the Automatic Option Grant program of the 1996 Plan. During fiscal 2001, non-employee directors received the following stock option grants:

Name

| | Shares

| | Exercise Price

| | Vesting (1)

| | Term

|

|---|

| Betsy S. Atkins | | 60,000

58,125 | | $

$ | 23.50

20.12 | | 4 years

4 years | | 7 years

7 years |

| John Seely Brown | | 60,000

30,000 | | $

$ | 23.50

20.12 | | 4 years

4 years | | 7 years

7 years |

| John A. Kelley | | 60,000

30,000 | | $

$ | 23.50

20.12 | | 4 years

4 years | | 7 years

7 years |

| Stanley J. Meresman | | 60,000

60,000 | | $

$ | 23.50

20.12 | | 4 years

4 years | | 7 years

7 years |

| William A. Owens | | 60,000

30,000 | | $

$ | 23.50

20.12 | | 4 years

4 years | | 7 years

7 years |

- (1)

- Each option listed vests in four equal annual installments commencing one year following the grant date of such option.

23

Executive Officer Compensation

The table below shows, for the Chief Executive Officer and each of the four other most highly compensated executive officers whose salary plus bonus exceeded $100,000 during the last fiscal year, information concerning compensation paid for services to the Company in all capacities during the last three fiscal years. The individuals in the table are collectively referred to in this Proxy Statement as the "Named Executive Officers."

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($) (1)

| | Securities

Underlying

Options (#)

| | All Other

Compensation

($) (2)

| |

|---|

Robert C. Hagerty

Chairman of the Board, President, and

Chief Executive Officer | | 2001

2000

1999 | | 414,567

332,692

272,404 | | 102,605

127,588

141,650 | | 250,000

—

400,000 | | 25,656

16,164

13,428 | |

Michael R. Kourey

Senior Vice President, Finance and

Administration, Chief Financial Officer, Secretary and Director |

|

2001

2000

1999 |

|

322,452

273,077

223,789 |

|

63,846

72,502

93,096 |

|

225,000

50,000

— |

|

32,404

15,919

23,089 |

(4) |

Sunil K. Bhalla(3)

Senior Vice President, Voice

Communications |

|

2001

2000

1999 |

|

260,260

181,923

— |

|

51,531

35,000

— |

|

200,000

200,000

— |

|

13,172

12,061

— |

|

Jules L. DeVigne (5)

Executive Vice President and General

Manager, Network Systems |

|

2001

2000

1999 |

|

297,452

—

— |

|

32,289

—

— |

|

200,000

—

— |

|

8,868

—

— |

|

Craig B. Malloy

Senior Vice President and General Manager,

Videoconferencing |

|

2001

2000

1999 |

|

289,327

223,269

179,391 |

|

57,287

80,433

98,665 |

|

175,000

50,000

400,000 |

|

13,281

11,767

9,431 |

|

Dale A. Bastian

Vice President, European Sales |

|

2001

2000

1999 |

|

263,144

223,846

194,308 |

|

52,103

59,297

93,377 |

|

75,000

—

150,000 |

|

13,047

13,715

12,566 |

|

- (1)

- Includes bonuses earned or accrued with respect to services rendered in the fiscal year indicated, whether or not such bonus was actually paid during such fiscal year.

- (2)

- Includes health, life, dental, vision and disability insurance premiums paid by the Company pursuant to employee benefit programs available to all employees. Also includes tax return preparation services for 1999, 2000 and 2001, and matching 401(k) plan contributions for 2000 and 2001.

- (3)

- Mr. Bhalla joined the Company in February 2000.

- (4)

- Includes imputed interest of 5.44% on Mr. Kourey's interest free loan issued by the Company in 1997. The loan was paid in full in September 1999.

- (5)

- Mr. DeVigne joined the Company in February 2001 and became an executive officer of the Company in May 2001.

24

Option Grants in the Last Fiscal Year

The table below shows, as to each of the Named Executive Officers, information concerning stock options granted during the fiscal year ended December 30, 2001. No stock appreciation rights were granted to any of the Named Executive Officers during this fiscal year.

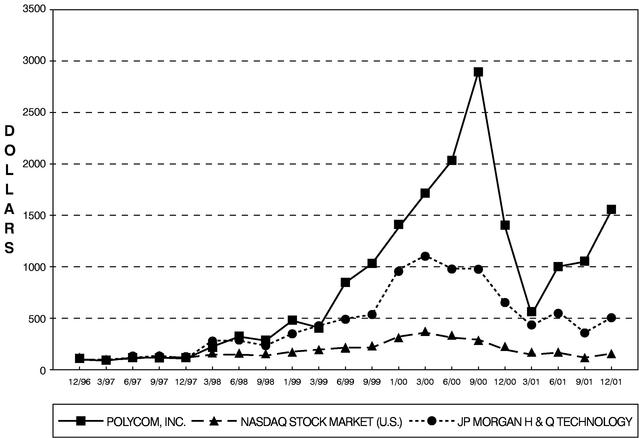

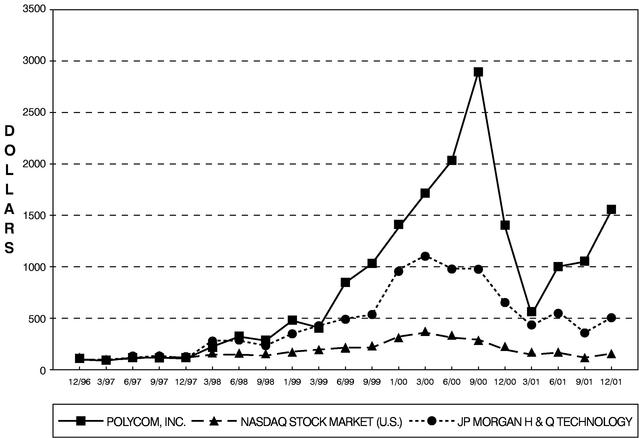

Option Grants in Fiscal 2001