UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

Polycom, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF 2004 ANNUAL MEETING OF STOCKHOLDERS

June 2, 2004

To Polycom Stockholders:

Notice is hereby given that the 2004 Annual Meeting of Stockholders of Polycom, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, June 2, 2004, at 10:00 a.m., Pacific time, at the Company’s corporate headquarters located at 4750 Willow Road, Pleasanton, California 94588, for the following purposes:

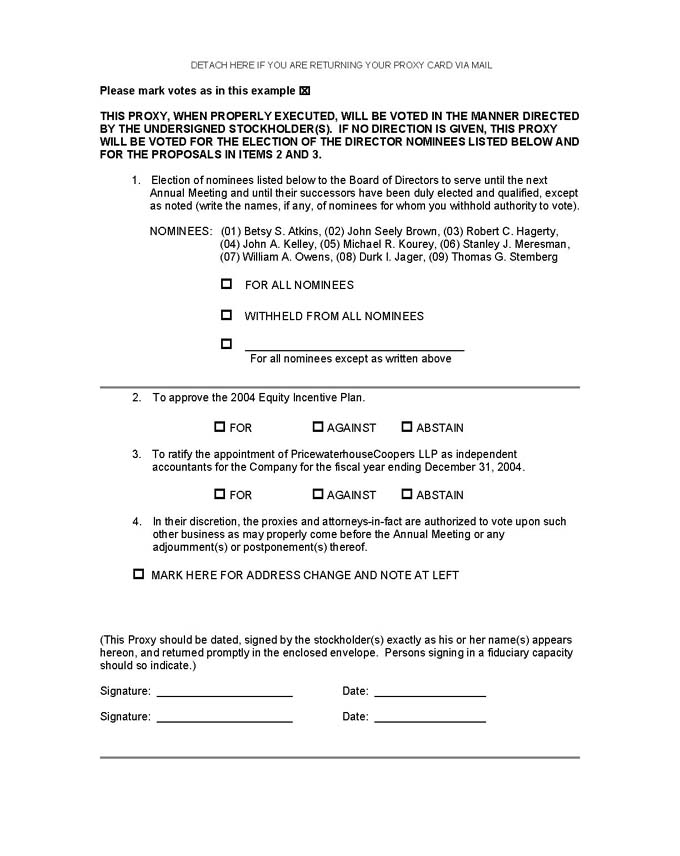

| | 1. | To elect directors to serve for the ensuing year and until their successors are duly elected and qualified. |

| | 2. | To approve the 2004 Equity Incentive Plan. |

| | 3. | To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants for the Company for the fiscal year ending December 31, 2004. |

| | 4. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The preceding items of business are more fully described in the proxy statement accompanying this Notice. Only stockholders of record at the close of business on April 9, 2004, are entitled to notice of and to vote at the 2004 Annual Meeting.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the envelope enclosed. Should you receive more than one proxy because your shares are registered in different names or addresses, please sign and return each proxy to assure that all your shares will be voted. You may revoke your proxy at any time prior to the 2004 Annual Meeting. If you attend the 2004 Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the 2004 Annual Meeting will be counted.

|

| By Order of the Board of Directors of Polycom, Inc. |

|

|

|

| Robert C. Hagerty |

| Chairman of the Board of Directors, Chief Executive Officer and President |

Pleasanton, California

April 26, 2004

YOUR VOTE IS IMPORTANT TO THE COMPANY. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENVELOPE PROVIDED.

POLYCOM, INC.

4750 Willow Road

Pleasanton, California 94588

PROXY STATEMENT

FOR 2004 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

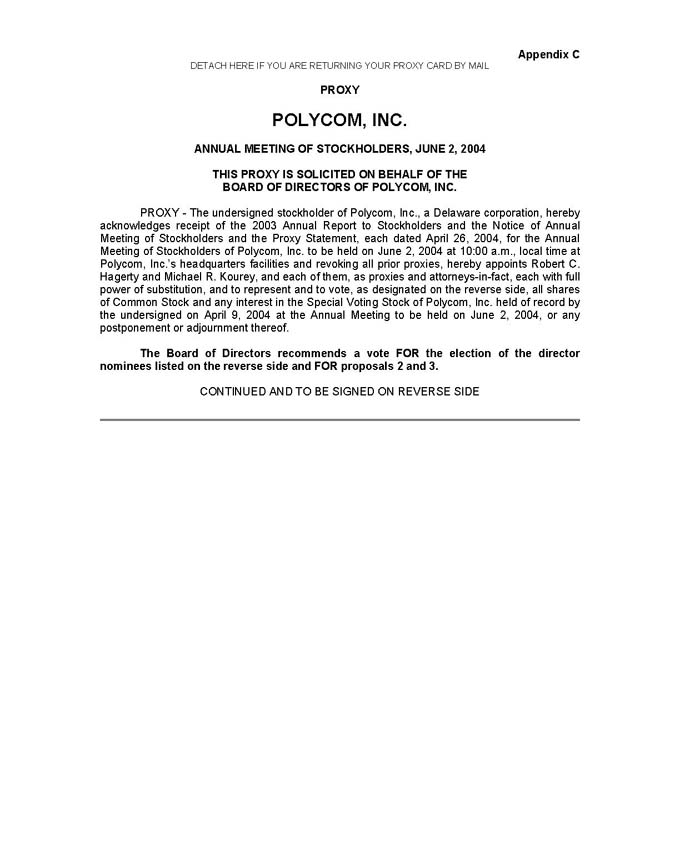

The enclosed proxy is solicited on behalf of the Board of Directors of Polycom, Inc., a Delaware corporation (the “Company”), for use at the 2004 Annual Meeting of Stockholders to be held on June 2, 2004, at 10:00 a.m., Pacific time, and at any adjournment thereof (the “2004 Annual Meeting”), for the purposes set forth herein and in the accompanying Notice of 2004 Annual Meeting of Stockholders. The 2004 Annual Meeting will be held at the Company’s corporate headquarters located at 4750 Willow Road, Pleasanton, California 94588. The Company’s telephone number at that location is (925) 924-6000.

These proxy solicitation materials were mailed to all stockholders entitled to vote at the 2004 Annual Meeting on or about April 26, 2004, together with the Company’s 2003 Annual Report to Stockholders.

You may request a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, at no charge, by writing to the Company’s corporate headquarters at the following address: Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attn: Investor Relations.

Stockholders Entitled to Vote; Record Date

Stockholders of record at the close of business on April 9, 2004 (the “Record Date”) are entitled to notice of and to vote at the 2004 Annual Meeting. As of the Record Date, 99,845,310 shares of the Company’s Common Stock were issued and outstanding and entitled to be voted at the 2004 Annual Meeting. Each holder of the Company’s Common Stock entitled to vote at the 2004 Annual Meeting is entitled to one vote for each share of Common Stock held as of the Record Date on all matters presented at the 2004 Annual Meeting. For information regarding security ownership by management and by the beneficial owners of more than 5% of the Common Stock, see “Management—Ownership of Securities.”

In connection with the Company’s April 2001 acquisition of Circa Communications Ltd., a Canadian company (“Circa”), the Company caused to be issued 1,087,434 shares (the “Exchangeable Shares”) of Polycom Nova Scotia Ltd. (formerly 3048685 Nova Scotia Limited), a wholly-owned subsidiary of the Company, in exchange for all of the outstanding shares of capital stock of Circa. The Exchangeable Shares are exchangeable for shares of the Company’s Common Stock on a one-for-one basis. The Company issued the Exchangeable Shares so that the holders of the outstanding capital stock of Circa at the time of the acquisition could defer the imposition of certain taxes under Canadian law until such time as they elected to exchange their Exchangeable Shares for shares of the Company’s Common Stock. In order to provide the holders of the Exchangeable Shares the ability to vote on matters which may be voted on by the Company’s stockholders during the period prior to when they exchange their Exchangeable Shares for shares of the Company’s Common Stock, the Company has issued one share of the Company’s Preferred Stock, designated as Special Voting Stock, which is issued and outstanding as of the Record Date. Each of the current holders of Exchangeable Shares holds a fractional interest in the Special Voting Stock, which entitles them to a number of votes at the 2004 Annual Meeting equal to the number of Exchangeable Shares they hold. Therefore, each holder of a fractional interest in the Company’s Special Voting Stock entitled to vote at the 2004 Annual Meeting is entitled to one vote for each Exchangeable Share held by that holder as of the Record Date. As of the Record Date, 660,864 Exchangeable Shares were

1

issued and outstanding; therefore, through their interests in the Special Voting Stock, the holders of Exchangeable Shares may cast an aggregate of 660,864 votes at the 2004 Annual Meeting.

As of the Record Date, holders of Common Stock and holders of Exchangeable Shares are eligible to cast 100,506,174 votes at the 2004 Annual Meeting.

Quorum; Required Vote

The presence of the holders of a majority of the shares of Common Stock entitled to vote generally at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such stockholders are counted as present at the meeting if they (1) are present in person at the Annual Meeting or (2) have properly submitted a proxy card.

A plurality of the votes duly cast is required for the election of directors. The affirmative vote of a majority of the votes duly cast is required to (1) approve the 2004 Equity Incentive Plan and (2) ratify the appointment of PricewaterhouseCoopers LLP as independent accountants.

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting; however, broker “non-votes” are not deemed to be “votes cast.” As a result, broker “non-votes” are not included in the tabulation of the voting results on the election of directors or issues requiring approval of a majority of the votes cast and, therefore, do not have the effect of votes in opposition in such tabulations. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Voting; Revocability of Proxies

Whether or not you are able to attend the 2004 Annual Meeting, the Company urges you to submit your proxy, which when properly completed will be voted as you direct. In the event no directions are specified, such proxies will be voted “FOR” each of the nominees of the Board of Directors (Proposal One), “FOR” all of the other proposals and in the discretion of the proxy holders as to any other matters that may properly come before the Annual Meeting. You are urged to give direction as to how to vote your shares.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by:

| | • | Filing with the Secretary of the Company at or before the taking of the vote at the 2004 Annual Meeting a written notice of revocation bearing a later date than the proxy; |

| | • | Duly executing a later-dated proxy relating to the same shares and delivering it to the Secretary of the Company at or before the taking of the vote at the 2004 Annual Meeting; or |

| | • | Attending the 2004 Annual Meetingand voting in person. Please bring proof of identification if you decide to vote in person at the 2004 Annual Meeting. Please note that attendance at the 2004 Annual Meeting will not in and of itself constitute a revocation of a proxy. |

Any written notice of revocation or subsequent proxy should be delivered to Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attention: Corporate Secretary, or hand-delivered to the Secretary of the Company at or before the taking of the vote at the 2004 Annual Meeting.

2

Solicitation of Proxies

The Company will bear the cost of soliciting proxies for the 2004 Annual Meeting. In addition, the Company may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of shares for their reasonable expenses in forwarding solicitation materials to such beneficial owners. The Company’s directors, officers and regular employees may also solicit proxies personally or by telephone, letter, facsimile, email or other means of communication. No additional compensation will be paid to directors, officers and employees who make these solicitations, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. The Company may engage the services of a professional proxy solicitation firm to aid in soliciting proxies from certain brokers, bank nominees and other institutional holders. The Company’s costs for such services, if retained, will not be significant.

Procedure for Submitting Stockholder Proposals

Requirements for stockholder proposals to be considered for inclusion in the Company’s proxy material. Stockholders may present proper proposals for inclusion in the Company’s proxy statement and for consideration at the next annual meeting of its stockholders by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the proxy statement for the 2005 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than December 27, 2004, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Requirements for stockholder proposals to be brought before an annual meeting. The Company’s bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders, although such matters were not included in the Company’s proxy statement. In general, nominations for the election of directors may be made by (1) the Board of Directors, (2) the Corporate Governance and Nominating Committee, or (3) any stockholder entitled to vote who has delivered written notice to the Secretary of the Company no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. However, if a stockholder wishes only to recommend a candidate for consideration by the Corporate Governance and Nominating Committee as a potential nominee for the Company’s Board of Directors, see the procedures described in “Proposal One—Corporate Governance Matters” below.

The Company’s bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors, or (3) properly brought before the meeting by a stockholder who has delivered written notice to the Secretary of the Company no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

The “Notice Deadline” is defined as that date which is 120 days prior to the one year anniversary of the date on which the Company first mailed its proxy materials to stockholders for the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2004 annual stockholder meeting is December 27, 2004.

If a stockholder who has notified the Company of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, the Company need not present the proposal for vote at such meeting.

A copy of the full text of the bylaw provisions discussed above may be obtained by writing to the Secretary of the Company. All notices of proposals by stockholders, whether or not included in the Company’s proxy materials, should be sent to Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attention: Corporate Secretary.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Board of Directors has selected nine nominees for election to the Company’s Board of Directors, all of whom have been recommended for nomination by the Corporate Governance and Nominating Committee of the Board of Directors and all of whom are currently serving as directors of the Company. The names of the nominees for director, their ages and their positions with the Company as of April 9, 2004, are set forth in the table below. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. In the event any nominee is unable or declines to serve as a director at the time of the 2004 Annual Meeting, the proxies will be voted for any nominee who may be proposed by the Corporate Governance and Nominating Committee of the Board of Directors and designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees named below.

| | | | |

Name

| | Age

| | Position

|

Robert C. Hagerty | | 52 | | Chairman of the Board of Directors, Chief Executive Officer and President |

Michael R. Kourey | | 44 | | Senior Vice President, Finance and Administration, Chief Financial Officer, Treasurer and Director |

Betsy S. Atkins (2)(3)(4) | | 49 | | Director |

John Seely Brown (2)(3) | | 63 | | Director |

Durk I. Jager (1) | | 60 | | Director |

John A. Kelley (1)(3) | | 54 | | Director |

Stanley J. Meresman (1) | | 57 | | Director |

William A. Owens (1)(3) | | 63 | | Director |

Thomas G. Stemberg (2) | | 55 | | Director |

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of Corporate Governance and Nominating Committee |

Robert C. Hagerty joined the Company in January 1997 as President and Chief Operating Officer and as a member of the Board of Directors. In July 1998, Mr. Hagerty was named Chief Executive Officer. In March 2000, Mr. Hagerty was named Chairman of the Board of Directors. Prior to joining the Company, Mr. Hagerty served as President of Stylus Assets, Ltd., a developer of software and hardware products for fax, document management and Internet communications. He also held several key management positions with Logitech, Inc., including Operating Committee Member to the Office of the President, and Senior Vice President/General Manager of Logitech’s retail division and worldwide operations. In addition, Mr. Hagerty’s career history includes positions as Vice President, High Performance Products for Conner Peripherals, Director of Manufacturing Operations and General Manager for Signal Corporation, and Operations Manager for Digital Equipment Corporation. Mr. Hagerty holds a B.S. in Operations Research and Industrial Engineering from the University of Massachusetts, and an M.A. in Management from St. Mary’s College of California.

Michael R. Kourey has been a member of the Board of Directors since January 1999. Mr. Kourey has served as our Senior Vice President, Finance and Administration since January 1999 and as our Chief Financial Officer since January 1995. He also served as Vice President, Finance and Administration from January 1995 to January 1999, Vice President, Finance and Operations from July 1991 to January 1995 and serves as our Treasurer. Mr. Kourey currently serves as a member of the Board of Directors of WatchGuard Technologies, Inc. and

4

2Wire, Inc. and serves on the Advisory Board of the Business School at Santa Clara University. Prior to joining us, he was Vice President, Operations of Verilink Corporation. Mr. Kourey holds a B.S. in Managerial Economics from the University of California, Davis, and an M.B.A. from Santa Clara University.

Betsy S. Atkinshas been a director of the Company since April 1999. Ms. Atkins is the Chief Executive Officer of Baja LLC, an early stage venture capital company investing in technology and life sciences. Ms. Atkins served as Chairman and Chief Executive Officer of NCI, Inc., a nutraceutical manufacturing company, from 1991 to 1993. Ms. Atkins was a founder and director of Ascend Communications Corporation, and from 1989 to 1999, she was its Vice President of Marketing and Sales. Ms. Atkins is also a director of McDATA Corporation, UTStarcom, Inc., and a number of private companies. Ms. Atkins is a Presidential Appointee to the Pension Benefit Guaranty Trust Corp. and is a Trustee of Florida International University. Ms. Atkins holds a B.A. from the University of Massachusetts.

John Seely Brownhas been a director of the Company since August 1999. Mr. Brown has been the Chief Scientist at Xerox Corporation since 1992. Mr. Brown was the director of Xerox’s Palo Alto Research Center from 1990 to May 2000. In addition, Mr. Brown is a co-founder of the Institute for Research on Learning, a member of the National Academy of Education and a fellow of the American Association for Artificial Intelligence. Mr. Brown is also a director of Varian Medical Systems, Inc. and Corning Incorporated. Mr. Brown received a B.A. in mathematics and physics from Brown University, a M.S. in mathematics from the University of Michigan, and a Ph.D. in computer and communications sciences from the University of Michigan.

Durk I. Jagerhas been a director of the Company since January 2003. Mr. Jager is the former Chairman of the Board, President and Chief Executive Officer of The Procter & Gamble Company. He left these positions in July 2000. He was elected to the position of Chief Executive Officer in January 1999 and Chairman of the Board effective September 1999, while continuing to serve as President since 1995. He served as Executive Vice President from 1990-1995. Mr. Jager joined The Procter & Gamble Company in 1970 and was named Vice President in 1987. Mr. Jager is also a director of Chiquita Brands International, Inc., Eastman Kodak Company and Royal KPN N.V. He graduated from Erasmus Universiteit, Rotterdam, The Netherlands.

John A. Kelley, Jr. has been a director of the Company since March 2000. Mr. Kelley has been the President and Chief Executive Officer of McDATA Corporation since August 2002 and from August 2001 was the President and Chief Operating Officer. Prior to joining McDATA, Mr. Kelley served as Executive Vice President of Networks at Qwest Communications from August 2000 to December 2000. He served as President of Wholesale Markets for U S West from May 1998 to July 2000. From 1995 to April 1998, Mr. Kelley served as Vice President and General Manager of Large Business and Government Accounts and President of Federal Services for U S West. Prior to joining U S West, Mr. Kelley was the Area President for Mead Corporation’s Zellerbach Southwest Business Unit from 1991 to 1995, and has held senior positions at Xerox and NBI. Mr. Kelley is also a director of Captaris, Inc., Colorado Women’s Vision Foundation, and InRoads of Colorado. Mr. Kelley holds a B.S. in business from the University of Missouri, St. Louis.

Stanley J. Meresmanhas been a director of the Company since January 1995. Mr. Meresman has been a Venture Partner with Technology Crossover Ventures, a venture capital firm, since January 2004. Previously he was General Partner and Chief Operating Officer of Technology Crossover Ventures from November 2001 to December 2003. During the four years prior to joining Technology Crossover Ventures, Mr. Meresman was a private investor and board member of a number of companies. Mr. Meresman served as the Senior Vice President, Finance and Chief Financial Officer of Silicon Graphics, Inc. from May 1989 to May 1997. Prior to joining Silicon Graphics, Mr. Meresman was Vice President, Finance and Administration, and Chief Financial Officer of Cypress Semiconductor Corporation. Mr. Meresman is also a director of several private companies. Mr. Meresman holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and a M.B.A. from Stanford University.

5

William A. Owenshas been a director of the Company since August 1999. Mr. Owens has been Co-Chief Executive Officer of Teledesic LLC, a satellite communications company, since February 1999 and Vice Chairman since 1998. He is also the Chairman and Chief Executive Officer of the affiliated Teledesic Holdings Ltd. From 1996 to 1998, Mr. Owens was President, Chief Operating Officer and Vice Chairman of Science Applications International Corporation (SAIC), an information technology systems integrator. From 1994 to 1996, he was Vice Chairman of the Joint Chiefs of Staff. Mr. Owens is also a member of the Board of Directors of Cray, Inc., IDT Corp., Microvision, Inc., Nortel Networks Inc., Symantec, Inc., TIBCO, Inc., ViaSat Inc., and Wireless Facilities, Inc. Mr. Owens holds a B.A. in mathematics from the U.S. Naval Academy, Bachelor’s and Master’s degrees in politics, philosophy, and economics from Oxford University, and a Master’s in Management from George Washington University.

Thomas G. Stemberg has been a director of the Company since December 2002. Mr. Stemberg has served as Chairman of the Board of Directors of Staples, Inc., an office supply superstore retailer, since February 1988, and as an executive officer of Staples with the title of Chairman since February 2002. Mr. Stemberg was Chief Executive Officer of Staples from January 1986 to February 2002. Mr. Stemberg is also a director of The Nasdaq Stock Market, Inc. and PETsMART, Inc.

There are no family relationships among any of the directors or executive officers of the Company. The Company’s bylaws authorize the Board of Directors to fix the number of directors by resolution. The Company currently has nine authorized directors. Each director holds office until the next annual meeting of stockholders or until that director’s successor is duly elected and qualified. The Company’s officers serve at the discretion of the Board of Directors.

Board of Directors’ Recommendation

THE BOARDOF DIRECTORS RECOMMENDSA VOTE

FORTHE ELECTIONOFTHE NOMINEES LISTED ABOVE.

Board and Committee Meetings

During the fiscal year ended December 31, 2003, the Board of Directors held seven meetings. Each of the directors attended or participated in 75% or more of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which he or she served during the past fiscal year. The Board of Directors of the Company has three standing committees: an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee.

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, consists of Messrs. Meresman, Jager, Kelley and Owens, each of whom is “independent” as such term is defined for audit committee members by the listing standards of The Nasdaq Stock Market. The Board of Directors has determined that Mr. Meresman is an “audit committee financial expert” as defined in rules of the Securities and Exchange Commission (the “SEC”).

The Audit Committee is responsible for overseeing the Company’s accounting and financial reporting processes and the audit of the Company’s financial statements, and assisting the Board of Directors in oversight of (1) the integrity of the Company’s financial statements, (2) the Company’s internal accounting and financial controls, (3) the Company’s compliance with legal and regulatory requirements, (4) the organization and performance of the Company’s internal audit function, and (5) the independent auditor’s qualifications, independence and performance.

6

The Audit Committee held four meetings during the last fiscal year. The Audit Committee acts pursuant to a written charter adopted by the Board of Directors, which is included asAppendix A to this proxy statement. The Audit Committee Charter is also available on the Company’s website athttp://www.polycom.com—“Investor Relations”—“Corporate Governance.”

The Audit Committee Report is included in this proxy statement on page 29.

Compensation Committee

The Compensation Committee consists of Messrs. Stemberg and Brown and Ms. Atkins, each of whom qualifies as an independent director under the listing standards of The Nasdaq Stock Market.

The Compensation Committee is primarily responsible for reviewing and approving the Company’s compensation policies and establishing salaries, incentives and other forms of compensation for the Company’s executive officers. The Compensation Committee also administers the Company’s 1996 Stock Incentive Plan and 2001 Nonstatutory Stock Option Plan, makes option grants thereunder, and administers the other benefit plans of the Company.

The Compensation Committee held four meetings during the last fiscal year. The Compensation Committee acts pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website athttp://www.polycom.com—“Investor Relations”—“Corporate Governance.”

The Compensation Committee Report is included in this proxy statement on page 22.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of Ms. Atkins and Messrs. Brown, Kelley and Owens, each of whom qualifies as an independent director under the listing standards of The Nasdaq Stock Market.

The Corporate Governance and Nominating Committee is responsible for the development of general criteria regarding the qualifications and selection of board members and recommending candidates for election to the Board. The Corporate Governance and Nominating Committee is also responsible for developing overall governance guidelines, overseeing the performance of the Board and reviewing and making recommendations regarding the composition and mandate of Board committees. The Corporate Governance and Nominating Committee will consider recommendations of candidates for the Board of Directors submitted by stockholders of the Company; for more information, see “Corporate Governance Matters” below.

The Corporate Governance and Nominating Committee held one meeting during the last fiscal year, and conducted a board self evaluation under the direction of the committee chairperson, who communicated the results to the Board of Directors. The Corporate Governance and Nominating Committee also met in January 2004. The Corporate Governance and Nominating Committee acts pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website athttp://www.polycom.com—“Investor Relations”—“Corporate Governance.”

Compensation of Directors

The Company currently compensates each of its non-employee directors as follows:

| | • | An annual cash payment for Board membership of $35,000; |

| | • | An annual cash payment for Board committee membership of $5,000, or $10,000 for serving as committee chair; |

7

| | • | An annual cash payment for serving as Lead Director of $20,000; |

| | • | The one-time grant of options to purchase 60,000 shares of Common Stock under the Automatic Option Grant Program of the Company’s 1996 Stock Incentive Plan upon a non-employee director joining the board, which vest in four equal annual installments; and |

| | • | An annual grant of options to purchase 25,000 shares of Common Stock, under the Automatic Option Grant Program of the Company’s 1996 Stock Incentive Plan, which vest in full one year from the grant date. |

During fiscal 2003, non-employee directors received the following stock option grants:

| | | | | | | | | |

Name

| | Shares

| | Exercise

Price ($)

| | Vesting

| | Term

|

Betsy S. Atkins | | 25,000 | | $ | 11.99 | | 1 year | | 7 years |

John Seely Brown | | 25,000 | | $ | 11.99 | | 1 year | | 7 years |

Durk I. Jager | | 60,000

25,000 | | $

$ | 11.35

11.99 | | 4 years 1 year | | 7 years 7 years |

John A. Kelley | | 25,000 | | $ | 11.99 | | 1 year | | 7 years |

Stanley J. Meresman | | 25,000 | | $ | 11.99 | | 1 year | | 7 years |

William A. Owens | | 25,000 | | $ | 11.99 | | 1 year | | 7 years |

Thomas G. Stemberg | | 25,000 | | $ | 11.99 | | 1 year | | 7 years |

Corporate Governance Matters

Code of Ethics

The Company has adopted a Code of Ethics for Principal Executive and Senior Financial Officers, which is applicable to our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. The Code of Ethics for Principal Executive and Senior Financial Officers is available on the Company’s website athttp://www.polycom.com—“Investor Relations”—“Corporate Governance.” The Company will disclose any amendment to the Code or waiver of a provision of the Code, including the name of the officer to whom the waiver was granted, on the Company’s website athttp://www.polycom.com—“Investor Relations”.

Independence of the Board of Directors

The Board of Directors has determined that, with the exception of Robert C. Hagerty and Michael R. Kourey, who are executive officers of the Company, all of its members are “independent directors” as that term is defined in the listing standards of The Nasdaq Stock Market.

Contacting the Board of Directors

Any stockholder who desires to contact our non-employee directors may do so electronically by sending an e-mail to the following address: directorcom@polycom.com. The emails go unfiltered to our Lead Director who monitors these communications and forwards communication to the appropriate committee of the Board of Directors or non-employee director.

Attendance at Annual Stockholder Meetings by the Board of Directors

Although the Company does not have a formal policy regarding attendance by members of the Board of Directors at the Company’s annual meeting of stockholders, the Company encourages, but does not require, directors to attend. Messrs. Hagerty and Kourey attended the Company’s 2003 annual meeting of stockholders; the other directors did not attend.

8

Nominating Process for Recommending Candidates for Election to the Board of Directors

The Corporate Governance and Nominating Committee is responsible for, among other things, determining the criteria for membership to the Board of Directors and recommending candidates for election to the Board of Directors. It is the policy of the Corporate Governance and Nominating Committee to consider recommendations for candidates to the Board of Directors from stockholders. Stockholder recommendations for candidates to the Board of Directors must be directed in writing to Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attention: Secretary and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the nominating person’s ownership of Company stock.

The Corporate Governance and Nominating Committee’s criteria and process for evaluating and identifying the candidates that it selects, or recommends to the full Board for selection, as director nominees, are as follows:

| | • | The Corporate Governance and Nominating Committee regularly reviews the current composition and size of the Board. |

| | • | The Corporate Governance and Nominating Committee oversees an annual evaluation of the performance of the Board of Directors as a whole and evaluates the performance of individual members of the Board of Directors eligible for re-election at the annual meeting of stockholders. |

| | • | In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Corporate Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers (1) the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board, (2) such factors as issues of character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and (3) such other factors as the Corporate Governance and Nominating Committee may consider appropriate. |

| | • | While the Corporate Governance and Nominating Committee has not established specific minimum qualifications for Director candidates, the Corporate Governance and Nominating Committee believes that candidates and nominees must reflect a Board that is comprised of directors who (1) are predominantly independent, (2) are of high integrity, (3) have broad, business-related knowledge and experience at the policy-making level in business or technology, including their understanding of the telecommunications industry and the Company’s business in particular, (4) have qualifications that will increase overall Board effectiveness and (5) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members. |

| | • | With regard to candidates who are properly recommended by stockholders or by other means, the Corporate Governance and Nominating Committee will review the qualifications of any such candidate, which review may, in the Corporate Governance and Nominating Committee’s discretion, include interviewing references for the candidate, direct interviews with the candidate, or other actions that the Corporate Governance and Nominating Committee deems necessary or proper. |

| | • | In evaluating and identifying candidates, the Corporate Governance and Nominating Committee has the authority to retain and terminate any third party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm. |

| | • | The Corporate Governance and Nominating Committee will apply these same principles when evaluating Board candidates who may be elected initially by the full Board to fill vacancies or add additional directors prior to the annual meeting of stockholders at which directors are elected. |

| | • | After completing its review and evaluation of director candidates, the Corporate Governance and Nominating Committee selects, or recommends to the full Board of Directors for selection, the director nominees. |

9

PROPOSAL TWO

APPROVAL OF THE 2004 EQUITY INCENTIVE PLAN

We are asking stockholders to approve the 2004 Equity Incentive Plan (the “Plan”) so that we can use the Plan to achieve the Company’s employee performance, recruiting, retention and incentive goals, as well as receive a federal income tax deduction for certain compensation paid under the Plan. The Board of Directors has approved the Plan, subject to stockholder approval at the Annual Meeting. If stockholders approve the Plan, it will replace the Company’s current 1996 Stock Incentive Plan (the “1996 Plan”).

The Company provides stock options to the Company’s employees as an incentive to employees to increase long-term stockholder value. The Company currently grants stock options to each employee upon initial hire in all countries with an approved sub-plan, and periodically thereafter in recognition of achievement of certain performance criteria and/or as a retention and incentive device. The Plan includes a variety of forms of equity awards, including stock options, stock purchase rights, restricted stock, performance units, and performance shares to allow the Company to adapt its equity compensation program to meet the needs of the Company in the changing business environment in which the Company operates.

We strongly believe that the approval of the Plan is essential to our continued success. The Board of Directors and management believe that equity awards motivate high levels of performance, align the interests of employees and stockholders by giving employees the perspective of an owner with an equity stake in the Company, and provide an effective means of recognizing employee contributions to the success of the Company. The Board of Directors and management believe that equity awards are a competitive necessity in our high-technology industry, and are essential to recruiting and retaining the highly qualified technical and other key personnel who help the Company meet its goals, as well as rewarding and encouraging current employees. The Board of Directors and management believe that the ability to grant equity awards will be important to the future success of the Company.

Description of the Plan

The following paragraphs provide a summary of the principal features of the Plan and its operation. The Plan is set forth in its entirety asAppendix B to this Proxy Statement. The following summary is qualified in its entirety by reference to the Plan.

Background and Purpose of the Plan.

The Plan permits the grant of the following types of incentive awards: (1) stock options, (2) stock appreciation rights, (3) restricted stock, (4) performance units, and (5) performance shares (individually, an “Award”). The Plan is intended to attract, motivate, and retain (1) employees of the Company and its subsidiaries, (2) consultants who provide significant services to the Company and its subsidiaries, and (3) directors of the Company who are employees of neither the Company nor any subsidiary. The Plan also is designed to encourage stock ownership by employees, directors, and consultants, thereby aligning their interests with those of the Company’s stockholders and to permit the payment of compensation that qualifies as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”).

Administration of the Plan.

The Plan provides that it will be administered by a committee (the “Committee”) appointed by the Board of Directors. The Compensation Committee of the Board will administer the Plan from its inception and currently is expected to do so throughout the life of the Plan. The Plan requires that the Committee consist of at least two directors who qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, and

10

as “outside directors” under Section 162(m) (so that the Company is entitled to a federal tax deduction for certain compensation paid under the Plan).

Subject to the terms of the Plan, the Committee has the sole discretion to select the employees, consultants, and directors who will receive Awards, determine the terms and conditions of Awards (for example, the exercise price and vesting schedule), and interpret the provisions of the Plan and outstanding Awards. The Committee may delegate any part of its authority and powers under the Plan to one or more directors and/or officers of the Company; provided, however, the Committee may not delegate its authority and powers with respect to Awards intended to qualify as performance-based compensation under Section 162(m) if the delegation would cause the Awards to fail to so qualify.

Assuming stockholder approval, the Plan will be effective June 2, 2004 and the 1996 Plan will terminate on the same day (except with respect to awards previously granted under the 1996 Plan that remain outstanding). The number of shares of Company common stock (“Shares”) initially reserved for issuance under the Plan will equal (1) 12,500,000 Shares, plus (2) up to 2,700,000 Shares still available for issuance under the 1996 Plan as of the date that the 1996 Plan is terminated. Thus, the actual increase in Shares available for grant under the Company’s equity incentive plans is only 12,500,000 (given that 2,700,000 of the Shares already were approved for grant under the 1996 Plan). If stockholders approve the Plan, the Company currently expects that it will not ask stockholders to approve additional shares for the Plan until at least the 2007 Annual Meeting of Stockholders, depending on business conditions. To the extent any Shares otherwise would have returned to the 1996 Plan as a result of the expiration, cancellation, or forfeiture of awards granted under the 1996 Plan, those Shares instead will go into the reserve of shares available under the Plan. The maximum number of Shares that could be returned in this manner is 11,991,366, which is the number of options outstanding under the 1996 Plan as of April 9, 2004. However, the number of Shares that actually are added to the Plan on account of these expirations or forfeitures likely will be substantially smaller because it is unlikely that all of the outstanding 1996 Plan options will expire or terminate without being exercised. For example, as of April 9, 2004, only 7,538,680 options under the 1996 Plan were unvested or had exercise prices above the fair market value of the Company’s shares.

No more than 50% of the Shares available under the Plan may be issued pursuant to Awards of restricted stock, performance shares, or performance units. If an Award is settled in cash, is cancelled, terminates, expires, or lapses for any reason without having been fully exercised or vested, the unvested or cancelled Shares generally will be returned to the available pool of Shares reserved for issuance under the Plan. Also, if the Company experiences a stock dividend, reorganization, or other change in capital structure, the Committee has the discretion to adjust the number of Shares available for issuance under the Plan, the outstanding Awards, and the per-person limits on Awards, as appropriate to reflect the stock dividend or other change.

Eligibility to Receive Awards.

The Committee selects the employees, consultants, and directors who will be granted Awards under the Plan. The actual number of individuals who will receive Awards cannot be determined in advance because the Committee has the discretion to select the participants.

Stock Options.

A stock option is the right to acquire Shares at a fixed exercise price for a fixed period of time. Under the Plan, the Committee may grant nonqualified stock options and/or incentive stock options (which entitle employees, but not the Company, to more favorable tax treatment). The Committee will determine the number of Shares covered by each option, but during any fiscal year of the Company, no participant may be granted options (and/or stock appreciation rights) covering more than 750,000 Shares. Notwithstanding the foregoing, during the fiscal year in which the participant first becomes an employee, he or she may be granted options (and/or stock appreciation rights) covering up to an additional 750,000 Shares.

11

The exercise price of the Shares subject to each option is set by the Committee but cannot be less than 100% of the fair market value (on the date of grant) of the Shares covered by the option. An exception would be made for any options that the Committee grants in substitution for options held by employees of companies that the Company acquires (in which case the exercise price preserves the economic value of the employee’s cancelled option from his or her former employer).

In addition, the exercise price of an incentive stock option must be at least 110% of fair market value if (on the grant date) the participant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any of its subsidiaries. The aggregate fair market value of the Shares (determined on the grant date) covered by incentive stock options which first become exercisable by any participant during any calendar year also may not exceed $100,000.

Options become exercisable at the times and on the terms established by the Committee. The Committee also establishes the time at which options expire, but the expiration may not be later than 10 years after the grant date (except in certain cases of death, in which case a participant’s option may remain exercisable for three years after the date of death).

The exercise price of each option must be paid in full in cash (or cash equivalent) at the time of exercise. The Committee also may permit payment through the tender of Shares that are already owned by the participant, or by any other means that the Committee determines to be consistent with the purpose of the Plan. At the time of exercise, a participant must pay any taxes that the Company is required to withhold.

Stock Appreciation Rights.

Stock appreciation rights (“SARs”) are awards that grant the participant the right to receive an amount (in the form of cash, Shares of equal value, or a combination thereof, as determined by the Committee) equal to (1) the number of shares exercised, times (2) the amount by which the Company’s stock price exceeds the exercise price. The exercise price is set by the Committee but cannot be less than 100% of the fair market value of the covered Shares on the grant date. An SAR may be exercised only if it becomes vested based on the vesting schedule established by the Committee. SARs expire under the same rules that apply to options and are subject to the same per-person limits (750,000 covered Shares for SARs and/or options in any fiscal year plus an additional 750,000 Shares for SARs and/or options in the fiscal year in which the participant first becomes an employee.)

Restricted Stock.

Awards of restricted stock are Shares that vest in accordance with the terms and conditions established by the Committee. The Committee determines the number of Shares of restricted stock granted to any participant, but during any fiscal year of the Company, no participant may be granted more than 375,000 Shares of restricted stock (and/or performance shares). Notwithstanding the foregoing, a participant may be granted an additional 375,000 Shares of restricted stock (and/or performance shares) in the fiscal year in which he or she first becomes an employee.

In determining whether an Award of restricted stock should be made, and/or the vesting schedule for any such Award, the Committee may impose whatever conditions to vesting it determines to be appropriate. Notwithstanding the foregoing, if the Committee desires that the Award qualify as performance-based compensation under Section 162(m), any restrictions will be based on a specified list of performance goals (see “Performance Goals” below for more information).

A holder of restricted stock will have full voting rights, unless determined otherwise by the Committee. A holder of restricted stock also generally will be entitled to receive all dividends and other distributions paid with respect to Shares; provided, however, that dividends and distributions generally will be subject to the same vesting criteria as the Shares upon which the dividend or distribution was paid.

12

Performance Units and Performance Shares.

Performance units and performance shares are Awards that result in a payment to a participant (in the form of cash, Shares of equal value, or a combination thereof, as determined by the Committee) only if performance goals and/or other vesting criteria established by the Committee are achieved or the Awards otherwise vest. The applicable performance goals (which may be solely continued employment) will be determined by the Committee, and may be applied on a company-wide, business unit or individual basis, as deemed appropriate in light of the participant’s specific responsibilities (see “Performance Goals” below for more information).

During any fiscal year of the Company, no participant may receive performance units having an initial value greater than $3,000,000. The Committee establishes the initial value of each performance unit on the date grant. Additionally, grants of performance stock are subject to the same per-person limits as restricted stock (375,000 Shares in any fiscal year plus an additional 375,000 Shares in the fiscal year in which the participant first becomes an employee.)

Non-Employee Director Awards.

In addition to discretionary Awards granted by the Committee, if any, each non-employee director receives automatic, non-discretionary stock option grants under the Plan.

All non-employee directors of the Company who are first appointed or elected to the Board of Directors on or after the date of the 2004 Annual Meeting, one grant of a nonqualified stock option to purchase 60,000 Shares. These initial grants vest in four equal annual installments commencing one year following the date of grant, provided that the individual remains a director on each vesting date. The terms of these initial grants are substantially the same as those of the initial grants made to non-employee directors under the 1996 Plan.

On the date of each annual meeting of stockholders beginning in 2004, each individual who is reelected to serve as a non-employee director automatically is granted a nonqualified stock option to purchase 25,000 Shares. These reoccurring grants vest as to 1/12th of the covered Shares each month following the date of grant, provided that the individual remains a director on each vesting date. The terms of these recurring grants are substantially the same as the recurring grants made to non-employee directors under the 1996 Plan, except that recurring grants under the Plan vest monthly over twelve months. Under the 1996 Plan, the recurring grants vest on the one-year anniversary of grant.

Both the initial grants and the reoccurring grants have an exercise price equal to the fair market value of the covered Shares on the date of grant. Additionally, both types of grants have a maximum term of seven years, subject to an extension of up to one year in the event of certain deaths. In the event of the directors termination as a result of death or disability, or in the event of a change of control where the director is not asked to be a member of the board of directors of the acquiring or combined company, the director’s initial and reoccurring grants immediately shall vest as to all of the covered Shares.

Performance Goals.

The Committee (in its discretion) may make performance goals applicable to a participant with respect to an Award. If the Committee desires that an Award qualify as performance-based compensation under Section 162(m) (discussed below), then at the Committee’s discretion, one or more of the following performance goals may apply:

| | • | Total shareholder return. |

13

Each of these goals is defined in the Plan. Any criteria used may be measured, as applicable (1) in absolute terms, (2) in relative terms (including, but not limited to, passage of time and/or against another company or companies), (3) on a per-share basis, (4) against the performance of the Company as a whole or a business unit of the Company, and/or (5) on a pre-tax or after-tax basis.

By granting awards that vest upon achievement of performance goals, the Committee may be able to preserve the Company’s deduction for certain compensation in excess of $1,000,000. Section 162(m) limits the Company’s ability to deduct annual compensation paid to the Company’s Chief Executive Officer or any other of the Company’s four most highly compensated executive officers to $1,000,000 per individual. However, the Company can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include stockholder approval of the Plan, setting limits on the number of Awards that any individual may receive, and for Awards other than stock options and stock appreciation rights, establishing performance criteria that must be met before the Award actually will vest or be paid. The performance goals listed above, as well as the per-person limits on shares covered by Awards, permit the Committee to grant Awards that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting the Company to receive a federal income tax deduction in connection with such Awards.

Awards to be Granted to Certain Individuals and Groups.

The number of Awards (if any) that an employee, consultant, or director may receive under the Plan is in the discretion of the Committee and therefore cannot be determined in advance. Our executive officers and directors have an interest in this proposal because they are eligible to receive Awards under the Plan. The following table sets forth (a) the total number of Shares subject to options granted under the 1996 Plan during the last fiscal year and (b) the weighted average per Share exercise price of such options. No other type of Award was granted under the 1996 Plan during the last fiscal year. The last reported trade price for Shares on December 31, 2003, was $19.52.

| | | | | |

Name of Individual or Group

| | Number of Securities Underlying Options Granted

| | Weighted Average

Per Share Exercise Price

|

Robert C. Hagerty Chairman of the Board of Directors, Chief Executive Officer and President | | 150,000 | | $ | 16.70 |

| | |

Michael R. Kourey Senior Vice President, Finance and Administration, Chief Financial Officer, Treasurer and Director | | 100,000 | | $ | 16.70 |

| | |

Pierre-Francois Catte Senior Vice President, Corporate Operations | | 100,000 | | $ | 16.70 |

| | |

James E. Ellett Senior Vice President and General Manager, Video Communications | | 215,000 | | $ | 11.24 |

| | |

Philip B. Keenan Senior Vice President and General Manager, Network Systems | | 50,000 | | $ | 16.70 |

| | |

All executive officers, as a group (8 persons) | | 915,000 | | $ | 14.31 |

| | |

All directors who are not executive officers, as a group (1) | | 235,000 | | $ | 11.83 |

| | |

All employees who are not executive officers, as a group | | 3,947,637 | | $ | 17.73 |

| (1) | Pursuant to the 1996 Plan’s automatic, non-discretionary formula, each non-employee director received a nonqualified stock option for 25,000 Shares and Durk I. Jager received a one-time stock option to purchase 60,000 Shares upon joining the board. |

14

Limited Transferability of Awards.

Awards granted under the Plan generally may not be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the applicable laws of descent and distribution. Notwithstanding the foregoing, the Committee may permit an individual to transfer an Award to an individual or entity. Any transfer shall be made in accordance with procedures established by the Committee.

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and the Company of Awards granted under the Plan. Tax consequences for any particular individual may be different.

Nonqualified Stock Options and Stock Appreciation Rights.

No taxable income is recognized when a nonqualified stock option or a stock appreciation right is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value of the Shares on the exercise date over the exercise price. Any additional gain or loss recognized upon later disposition of the Shares is capital gain or loss.

Incentive Stock Options.

No taxable income is recognized when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax, in which case taxation is the same as for nonqualified stock options). If the participant exercises the option and then later sells or otherwise disposes of the Shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the Shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the Shares on the exercise date (or the sale price, if less) minus the exercise price of the option. Any additional gain or loss will be capital gain or loss.

Restricted Stock, Performance Units, and Performance Shares.

A participant will not have taxable income upon grant of restricted stock, performance units, or performance shares. Instead, the participant will recognize ordinary income at the time of vesting or payout equal to the fair market value of the Shares on that date or the cash received minus any amount paid. For restricted stock only, a participant instead may elect to be taxed at the time of grant.

Tax Effect for the Company.

The Company generally will be entitled to a tax deduction in connection with an Award under the Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonqualified stock option). As discussed above, special rules limit the deductibility of compensation paid to our Chief Executive Officer and to each of our four most highly compensated executive officers. However, the Plan has been designed to permit the Committee to grant Awards that qualify as performance-based compensation under Section 162(m), thereby permitting the Company to receive a federal income tax deduction in connection with such Awards.

15

Amendment and Termination of the Plan

The Board generally may amend or terminate the Plan at any time and for any reason. However, no amendment, suspension, or termination may impair the rights of any participant without his or her consent. Also, stockholder approval will be required for certain material amendments to the Plan, as provided under Nasdaq rules.

Summary

We believe strongly that the approval of the Plan is essential to our continued success. Awards such as those provided under the Plan constitute an important incentive and help us to attract and retain people whose skills and performance are critical to our success. Our employees and directors are our most important asset. The Plan is vital to our ability to attract and retain outstanding and highly skilled individuals to work for the Company and serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDSA VOTEFOR THE PROPOSALTO

APPROVETHE 2004 EQUITY INCENTIVE PLAN

16

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Audit Committee has selected PricewaterhouseCoopers LLP as the independent accountants to audit the financial statements of the Company for the fiscal year ending December 31, 2004. PricewaterhouseCoopers LLP and its predecessor entities have audited the Company’s financial statements since fiscal 1991. A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting, will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions.

Board of Directors’ Recommendation

THE BOARDOF DIRECTORS RECOMMENDSA VOTEFORTHE RATIFICATIONOFTHE

APPOINTMENTOF PRICEWATERHOUSECOOPERS, LLPAS INDEPENDENT ACCOUNTANTS

FORTHE COMPANY’S FISCAL YEAR ENDING DECEMBER 31, 2004.

Principal Accountant Fees and Services

The following table presents fees billed for professional audit services and other services rendered to the Company by PricewaterhouseCoopers, LLP for the years ended December 31, 2003 and December 31, 2002.

| | | | | | |

| ($ Thousands) | | 2003

| | 2002

|

Audit Fees (1) | | $ | 819 | | $ | 1,000 |

Audit-Related Fees (2) | | | 237 | | | 478 |

Tax Fees (3) | | | 472 | | | 916 |

All Other Fees (4) | | | 12 | | | 85 |

| | |

|

| |

|

|

Total | | $ | 1,540 | | $ | 2,479 |

| | |

|

| |

|

|

| (1) | Audit Fees consisted of fees billed for professional services rendered for the audit of the Company’s annual financial statements included in the Company’s Annual Reports on Form 10-K and for the review of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, as well as services that generally only the Company’s independent auditor can reasonably provide, including statutory audits and services rendered in connection with securities exchange commission filings. |

| (2) | Audit-Related Fees consisted of fees billed for assurance and related services that are traditionally performed by the Company’s independent auditor, including, in 2002, accounting research, review of the Company’s internal controls, and services rendered in connection with mergers and acquisitions. |

| (3) | Tax Fees consisted of fees billed for tax compliance, consultation and planning services. |

| (4) | All Other Fees consisted of fees billed for legal and administrative services for certain of the Company’s international subsidiaries. |

Pre-Approval of Audit and Non-Audit Services

The Company’s Audit Committee is responsible for appointing, setting compensation for and overseeing the work of the Company’s independent auditor. In connection with these responsibilities, the Company’s Audit Committee adopted a policy for pre-approving the services and associated fees of the Company’s independent auditor. Under this policy, the Audit Committee must pre-approve all services and associated fees provided to the Company by its independent auditor, with certain exceptions described in the policy. The Policy for Preapproving Services and Fees of the Company’s Independent Auditor is available on the Company’s website athttp://www.polycom.com—“Investor Relations”—“Corporate Governance.”

17

MANAGEMENT

Ownership of Securities

The table below shows the beneficial ownership of the Company’s Common Stock as of April 9, 2004, for the following persons:

| | • | Each person (or group of affiliated persons) who is known by the Company to beneficially own 5% of the outstanding shares of the Company’s Common Stock; |

| | • | Each of the Company’s non-employee directors; |

| | • | Each of the Company’s officers named in the Summary Compensation Table on page 20 of this proxy statement; and |

| | • | All directors and executive officers of the Company as a group. |

| | | | | |

5% Stockholders, Directors and Officers (1)

| | Shares Beneficially Owned (2)

| | Percentage Beneficially Owned (2)

| |

Principal Stockholders | | | | | |

Capital Group International, Inc. and Capital Guardian Trust Company (3) | | 6,985,460 | | 7.0 | % |

Mazama Capital Management, Inc. (4) | | 5,362,443 | | 5.4 | % |

| | |

Non-Employee Directors | | | | | |

Betsy S. Atkins (5) | | 144,063 | | * | |

John Seely Brown (6) | | 160,000 | | * | |

Durk I. Jager (7) | | 50,000 | | * | |

John A. Kelley (8) | | 160,000 | | * | |

Stanley J. Meresman (9) | | 165,000 | | * | |

William A. Owens (10) | | 145,000 | | * | |

Thomas G. Stemberg (11) | | 50,000 | | * | |

| | |

Named Executive Officers | | | | | |

Robert C. Hagerty (12) | | 1,093,698 | | * | |

Michael R. Kourey (13) | | 475,312 | | * | |

Pierre-Francois Catte (14) | | 135,454 | | * | |

James E. Ellett (15) | | 80,437 | | * | |

Philip B. Keenan (16) | | 177,824 | | * | |

| | |

All directors and current executive officers as a group | | | | | |

(15 persons) (17) | | 3,292,767 | | 3.3 | % |

| (1) | Unless otherwise indicated in their respective footnote, the address for each listed person is c/o Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588. |

| (2) | Beneficial ownership is determined in accordance with the rules of the Commission, and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options which are currently exercisable or which will become exercisable within 60 days after April 9, 2004, are deemed outstanding for purposes of computing the beneficial ownership of the person holding these options but are not deemed outstanding for purposes of computing the beneficial ownership of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. Percentage of ownership is based on 99,845,310 shares of the Company’s Common Stock outstanding on April 9, 2004, and is calculated in accordance with the rules of the SEC. |

| (3) | The address of Capital Group International, Inc. and Capital Guardian Trust Company is 11100 Santa Monica Blvd., Los Angeles, CA 90025. This information was obtained from filings made with the SEC pursuant to Section 13(g) of the Exchange Act. |

18

| (4) | The address of Mazama Capital Management, Inc. is One S.W. Columbia, Suite 1500, Portland, OR 97258. This information was obtained from filings made with the SEC pursuant to Section 13(g) of the Exchange Act. |

| (5) | Includes options held by Ms. Atkins to purchase 144,063 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (6) | Includes options held by Dr. Brown to purchase 160,000 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (7) | Includes options held by Mr. Jager to purchase 40,000 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (8) | Includes options held by Mr. Kelley to purchase 160,000 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (9) | Includes options held by Mr. Meresman to purchase 165,000 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (10) | Includes options held by Mr. Owens to purchase 145,000 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (11) | Includes options held by Mr. Stemberg to purchase 40,000 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (12) | Includes options held by Mr. Hagerty to purchase 1,047,698 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. Mr. Hagerty is also a director of the Company. |

| (13) | Includes options held by Mr. Kourey to purchase 428,562 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. Mr. Kourey is also a director of the Company. |

| (14) | Includes options held by Mr. Catte to purchase 133,333 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (15) | Includes options held by Mr. Ellett to purchase 79,061 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (16) | Includes options held by Mr. Keenan to purchase 177,824 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

| (17) | Includes options to purchase 3,172,626 shares of Common Stock that are exercisable within sixty (60) days of April 9, 2004. |

19

Executive Officer Compensation

The table below shows, for the Chief Executive Officer and each of the four other most highly compensated executive officers whose salary plus bonus exceeded $100,000 during the last fiscal year, information concerning compensation paid for services to the Company in all capacities during the last three fiscal years. The individuals in the table are collectively referred to in this proxy statement as the “Named Executive Officers.”

Summary Compensation Table

| | | | | | | | | | | | |

| | | Year

| | Annual Compensation

| | Long-Term Compensation Awards

| | All Other Compensation ($) (3)

|

Name and Principal Position

| | | Salary

($)

| | Bonus

($) (1)

| | Other Annual

Compensation

($) (2)

| | Securities

Underlying

Options (#)

| |

Robert C. Hagerty Chairman of the Board of Directors, Chief Executive Officer and President | | 2003

2002

2001 | | 425,000

425,000

414,567 | | 152,310

39,421

102,605 | | —

92,415

— | | 150,000

400,000

250,000 | | 25,140

30,721

25,656 |

| | | | | | |

Michael R. Kourey Senior Vice President, Finance and Administration, Chief Financial Officer, Treasurer and Director | | 2003

2002

2001 | | 340,000

340,000

322,452 | | 85,294

25,972

63,846 | | —

—

— | | 100,000

100,000

225,000 | | 28,703

30,096

32,404 |

| | | | | | |

Pierre-Francois Catte (4) Senior Vice President, Corporate Operations | | 2003

2002

2001 | | 325,000

325,000

33,333 | | 70,471

11,066

5,500 | | —

—

— | | 100,000

100,000

200,000 | | 10,981

7,706

1,161 |

| | | | | | |

James E. Ellett (5) Senior Vice President and General Manager, Video Communications | | 2003

2002

2001 | | 290,625

—

— | | 133,369

—

— | | —

—

— | | 215,000

—

— | | 19,158

—

— |

| | | | | | |

Philip B. Keenan (6) Senior Vice President and General Manager, Network Systems | | 2003

2002

2001 | | 310,000

310,000

176,667 | | 58,185

25,040

98,665 | | —

—

— | | 50,000

150,000

150,000 | | 18,923

15,592

10,536 |

| (1) | Includes bonuses earned or accrued with respect to services rendered in the fiscal year indicated, whether or not such bonus was actually paid during such fiscal year. |

| (2) | For Mr. Hagerty, this amount includes the cost of the use of golf club facilities for business purposes. |

| (3) | Includes health, life, dental, vision and disability insurance premiums paid by the Company pursuant to employee benefit programs available to all employees, tax return preparation services and matching 401(k) plan contributions. |

| (4) | Mr. Catte joined the Company in November 2001. |

| (5) | Mr. Ellett joined the Company in February 2003. |

20

Option Grants in the Last Fiscal Year

The table below shows, as to each of the Named Executive Officers, information concerning stock options granted during the fiscal year ended December 31, 2003. No stock appreciation rights were granted to any of the Named Executive Officers during this fiscal year.

Option Grants in Fiscal 2003

| | | | | | | | | | | | | | |

| | | Individual Grants

| | | | |

| | | Number of Securities Underlying Options Granted (1)

| | Percent of Total Options Granted to Employees in Fiscal Year (2)

| | | Exercise Price (3)

| | Expiration Date (4)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($) (5)

|

Name

| | | | | | 5%

| | 10%

|

Robert C. Hagerty | | 150,000 | | 2.85 | % | | $ | 16.70 | | 07/30/10 | | 1,019,787 | | 2,376,536 |

Michael R. Kourey | | 100,000 | | 1.90 | % | | $ | 16.70 | | 07/30/10 | | 679,858 | | 1,584,358 |

Pierre-Francois Catte | | 100,000 | | 1.90 | % | | $ | 16.70 | | 07/30/10 | | 679,858 | | 1,584,358 |

James E. Ellett | | 165,000

50,000 | | 3.13

0.95 | %

% | | $

$ | 9.59

16.70 | | 02/09/10

07/30/10 | | 644,175

339,929 | | 1,501,203

792,179 |

Philip B. Keenan | | 50,000 | | 0.95 | % | | $ | 16.70 | | 07/30/10 | | 339,929 | | 792,179 |

| (1) | All options in this table are incentive stock options to the extent permissible by IRS limitations with the remainder being non-statutory options, were granted under the 1996 Stock Incentive Plan, and have exercise prices equal to the fair market value on the date of grant. All of these options have seven-year terms, subject to earlier termination upon the optionee’s cessation of service. All of these options vest over a four-year period at the rate of one-fourth of the shares subject to each option at the end of one year from the date of grant and 1/48th each month thereafter. The shares subject to each option will immediately vest in full in the event the Company is acquired by a merger or asset sale, unless the Company’s repurchase right with respect to the unvested shares is to be assigned to the acquiring entity or the option is to be assumed by such entity. |

| (2) | The Company granted options to purchase a total of 5,270,158 shares of Common Stock under the 1996 Stock Incentive Plan and the 2001 Nonstatutory Stock Option Plan to employees in fiscal 2003. |

| (3) | The exercise price may be paid in cash or in shares of the Company’s Common Stock valued at fair market value on the exercise date. |

| (4) | Options may terminate before their expiration upon the termination of the optionee’s status as an employee, the optionee’s death or disability or an acquisition of the Company. |

| (5) | Potential realizable value assumes that the stock price increases from the exercise price from the date of grant until the end of the option term of 7 years at the annual rates specified (5% and 10%). Annual compounding results in total appreciation of approximately 40.7% (at 5% per year) and 94.9% (at 10% per year). The assumed annual rates of appreciation are specified in SEC rules and do not represent the Company’s estimate or projection of future stock price growth. The Company does not necessarily agree that this method can properly determine the projected value of an option. |

21

Option Exercises and Holdings

The table below shows, for each of the Named Executive Officers, certain information concerning stock options exercised during the fiscal year ended December 31, 2003, and the number of shares subject to exercisable stock options as of December 31, 2003. Also reported are values for “in-the-money” options that represent the positive spread between the exercise prices of each outstanding stock option and the fair market value of the Company’s Common Stock as of December 31, 2003, the last trading day of fiscal 2003, which was $19.52 per share.

Aggregated Option Exercises in Fiscal 2003 and Fiscal 2003 Year-End Option Values

| | | | | | | | | | | | | | | |

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised In-The-Money Options at Fiscal Year End

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Robert C. Hagerty | | — | | | — | | 1,056,033 | | 335,417 | | $ | 6,999,135 | | $ | 1,335,563 |

Michael R. Kourey | | — | | | — | | 389,501 | | 253,645 | | $ | 2,034,218 | | $ | 890,372 |