UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

Polycom, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

May 25, 2006

To Polycom Stockholders:

Notice is hereby given that the 2006 Annual Meeting of Stockholders of Polycom, Inc., a Delaware corporation (the “Company”), will be held on Thursday, May 25, 2006, at 12:00 p.m., Pacific time, at the Company’s corporate headquarters located at 4750 Willow Road, Pleasanton, California 94588, for the following purposes:

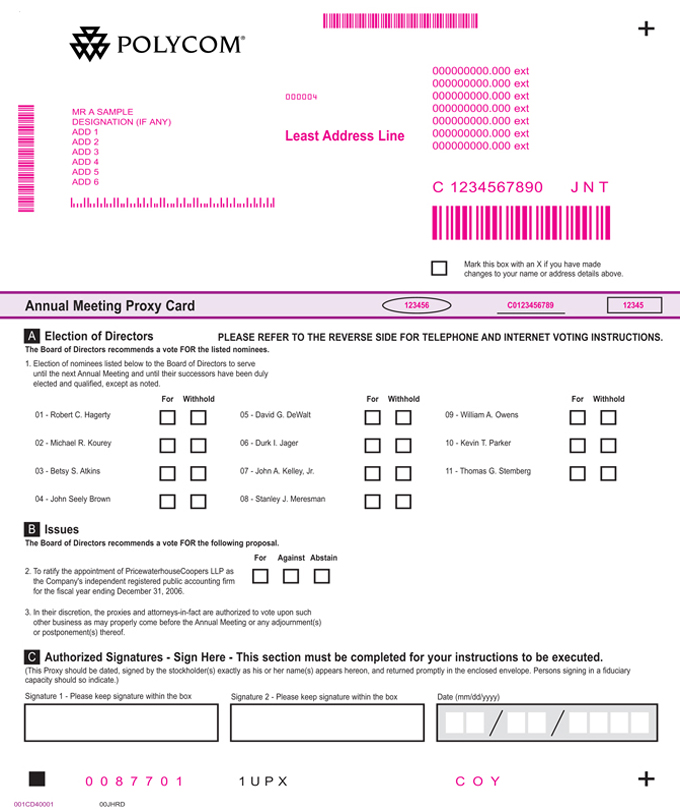

| | 1. | To elect eleven directors to serve for the ensuing year and until their successors are duly elected and qualified. |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006. |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The preceding items of business are more fully described in the proxy statement accompanying this Notice. Only stockholders of record at the close of business on April 5, 2006, are entitled to notice of and to vote at the 2006 Annual Meeting.

All stockholders are cordially invited to attend the 2006 Annual Meeting in person. However, to ensure your representation at the Annual Meeting, please vote as soon as possible using one of the following methods: (1) if applicable, by telephone by calling the toll-free number as instructed on the enclosed proxy card, (2) if applicable, by using the Internet as instructed on the enclosed proxy card or (3) by mail by completing, signing, dating and returning the enclosed paper proxy card in the postage-prepaid envelope enclosed for such purpose. For further details, please see the section entitled “Voting” on page 2 of the accompanying Proxy Statement. Any stockholder attending the 2006 Annual Meeting may vote in person even if he or she has voted using the Internet, telephone or proxy card.

|

| By Order of the Board of Directors of Polycom, Inc. |

|

|

|

Robert C. Hagerty |

| Chairman of the Board of Directors, Chief Executive Officer and President |

Pleasanton, California

April 20, 2006

YOUR VOTE IS IMPORTANT TO THE COMPANY. WHETHER OR NOT YOU PLAN TO ATTEND THE 2006 ANNUAL MEETING, PLEASE VOTE BY (1) TELEPHONE (IF APPLICABLE), (2) USING THE INTERNET (IF APPLICABLE) OR (3) COMPLETING AND RETURNING THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE.

POLYCOM, INC.

4750 Willow Road

Pleasanton, California 94588

PROXY STATEMENT

FOR 2006 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

The enclosed proxy is solicited on behalf of the Board of Directors of Polycom, Inc., a Delaware corporation (“Polycom,” or the “Company”), for use at the 2006 Annual Meeting of Stockholders to be held on May 25, 2006, at 12:00 p.m., Pacific time, and at any adjournment thereof (the “2006 Annual Meeting”), for the purposes set forth herein and in the accompanying Notice of 2006 Annual Meeting of Stockholders. The 2006 Annual Meeting will be held at the Company’s corporate headquarters located at 4750 Willow Road, Pleasanton, California 94588. The Company’s telephone number at that location is (925) 924-6000.

These proxy solicitation materials were mailed to all stockholders entitled to vote at the 2006 Annual Meeting on or about April 20, 2006, together with the Company’s 2005 Annual Report to Stockholders.

You may request a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, at no charge, by writing to the Company’s corporate headquarters at the following address: Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attn: Investor Relations.

Stockholders Entitled to Vote; Record Date

Stockholders of record at the close of business on April 5, 2006 (the “Record Date”) are entitled to notice of and to vote at the 2006 Annual Meeting. As of the Record Date, 87,215,752 shares of the Company’s Common Stock were issued and outstanding and entitled to be voted at the 2006 Annual Meeting. Each holder of the Company’s Common Stock entitled to vote at the 2006 Annual Meeting is entitled to one vote for each share of Common Stock held as of the Record Date on all matters presented at the 2006 Annual Meeting. For information regarding security ownership by management and by the beneficial owners of more than 5% of the Common Stock, see “Management—Ownership of Securities.”

In connection with the Company’s April 2001 acquisition of Circa Communications Ltd., a Canadian company (“Circa”), the Company caused to be issued 1,087,434 shares (the “Exchangeable Shares”) of Polycom Nova Scotia Ltd. (formerly 3048685 Nova Scotia Limited), a subsidiary of the Company, in exchange for all of the outstanding shares of capital stock of Circa. The Exchangeable Shares are exchangeable for shares of the Company’s Common Stock on a one-for-one basis. The Company issued the Exchangeable Shares so that the holders of the outstanding capital stock of Circa at the time of the acquisition could defer the imposition of certain taxes under Canadian law until such time as they elected to exchange their Exchangeable Shares for shares of the Company’s Common Stock. In order to provide the holders of the Exchangeable Shares the ability to vote on matters that may be voted on by the Company’s stockholders during the period prior to when they exchange their Exchangeable Shares for shares of the Company’s Common Stock, the Company has issued one share of the Company’s Preferred Stock, designated as Special Voting Stock, which is issued and outstanding as of the Record Date. Each of the current holders of Exchangeable Shares holds a fractional interest in the Special Voting Stock, which entitles them to a number of votes at the 2006 Annual Meeting equal to the number of Exchangeable Shares they hold. Therefore, each holder of a fractional interest in the Company’s Special Voting Stock entitled to vote at the 2006 Annual Meeting is entitled to one vote for each Exchangeable Share held by that holder as of the Record Date. As of the Record Date, 492,242 Exchangeable Shares were issued and outstanding; therefore, through their interests in the Special Voting Stock, the holders of Exchangeable Shares may cast an aggregate of 492,242 votes at the 2006 Annual Meeting.

1

As of the Record Date, holders of Common Stock and holders of Exchangeable Shares are eligible to cast an aggregate of 87,707,994 votes at the 2006 Annual Meeting.

Quorum; Required Vote

The presence of the holders of a majority of the shares entitled to vote at the 2006 Annual Meeting is necessary to constitute a quorum at the 2006 Annual Meeting. Such stockholders are counted as present at the meeting if they (1) are present in person at the 2006 Annual Meeting or (2) have properly submitted a proxy card or voted by telephone or using the Internet. Under the General Corporation Law of the State of Delaware, abstentions and “broker non-votes” are counted as present and entitled to vote and are, therefore, included for the purposes of determining whether a quorum is present at the 2006 Annual Meeting.

A plurality of the votes duly cast is required for the election of directors. The eleven nominees for director receiving the highest number of affirmative votes shall be elected as directors. Therefore, abstentions or broker non-votes will not affect the outcome of the election.

The affirmative vote of a majority of the votes duly cast is required to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm. Abstentions are deemed to be votes cast, and have the same effect as a vote against this proposal. However, broker non-votes are not deemed to be votes cast, and therefore are not included in the tabulation of the voting results on this proposal.

A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Voting

Voting by telephone or the Internet. If applicable, a stockholder may vote his or her shares by calling the toll-free number indicated on the enclosed proxy card and following the recorded instructions or by accessing the website indicated on the enclosed proxy card and following the instructions provided. When a stockholder votes via the Internet or by telephone, his or her vote is recorded immediately. Polycom encourages its stockholders to vote using these methods whenever possible.

Voting by proxy card. All shares entitled to vote and represented by properly executed proxy cards received prior to the 2006 Annual Meeting, and not revoked, will be voted at the 2006 Annual Meeting in accordance with the instructions indicated on those proxy cards. If no instructions are indicated on a properly executed proxy card, the shares represented by that proxy card will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the 2006 Annual Meeting, including, among other things, consideration of a motion to adjourn the 2006 Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxies in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the 2006 Annual Meeting.

Voting by attending the meeting. A stockholder may also vote his or her shares in person at the 2006 Annual Meeting. A stockholder planning to attend the 2006 Annual Meeting should bring proof of identification for entrance to the 2006 Annual Meeting. If a stockholder attends the 2006 Annual Meeting, he or she may also submit his or her vote in person, and any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the 2006 Annual Meeting.

Changing vote; revocability of proxy. If a stockholder has voted by telephone or the Internet or by sending a proxy card, such stockholder may change his or her vote before the 2006 Annual Meeting.

2

A stockholder that has voted by telephone or the Internet may change his or her vote by making a timely and valid later telephone or Internet vote, as the case may be.

Any proxy card given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. A proxy card may be revoked by (1) filing with the Secretary of the Company, at or before the taking of the vote at the 2006 Annual Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy card relating to the same shares, or (2) attending the 2006 Annual Meeting and voting in person (although attendance at the 2006 Annual Meeting will not of itself revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the taking of the vote at the 2006 Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or should be sent so as to be delivered to Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attention: Corporate Secretary.

Solicitation of Proxies

The Company will bear the cost of soliciting proxies for the 2006 Annual Meeting. In addition, the Company may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of shares for their reasonable expenses in forwarding solicitation materials to such beneficial owners. The Company’s directors, officers and regular employees may also solicit proxies personally or by telephone, letter, facsimile, email or other means of communication. No additional compensation will be paid to directors, officers and employees who make these solicitations, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. The Company has retained The Altman Group, Inc. to aid in soliciting proxies from certain brokers, bank nominees and other institutional holders. The Company’s costs for such services will not be significant.

Procedure for Submitting Stockholder Proposals

Requirements for stockholder proposals to be considered for inclusion in the Company’s proxy materials. Stockholders may present proper proposals for inclusion in the Company’s proxy statement and for consideration at the next annual meeting of its stockholders by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the proxy statement for the 2007 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than December 21, 2006, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Requirements for stockholder proposals to be brought before an annual meeting. In addition, the Company’s bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by (1) the Board of Directors, (2) the Corporate Governance and Nominating Committee, or (3) any stockholder entitled to vote who has delivered written notice to the Secretary of the Company no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. However, if a stockholder wishes only to recommend a candidate for consideration by the Corporate Governance and Nominating Committee as a potential nominee for the Company’s Board of Directors, see the procedures described in “Proposal One—Election of Directors—Corporate Governance Matters—Process for Recommending Candidates for Election to the Board of Directors” below.

The Company’s bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors, or (3) properly brought before the meeting by a stockholder who has delivered written notice to the Secretary of the Company no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

3

The “Notice Deadline” is defined as that date which is 120 days prior to the one year anniversary of the date on which the Company released its proxy materials to stockholders in connection with the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2007 annual stockholder meeting is December 21, 2006. If a stockholder who has notified the Company of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, the Company need not present the proposal for vote at such meeting.

A copy of the full text of the bylaw provisions discussed above may be obtained by writing to the Secretary of the Company. All notices of proposals by stockholders, whether or not included in the Company’s proxy materials, should be sent to Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attention: Corporate Secretary.

4

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Board of Directors has selected eleven nominees for election to the Company’s Board of Directors, all of whom have been recommended for nomination by the Corporate Governance and Nominating Committee of the Board of Directors and all of whom are currently serving as directors of the Company. All nominees were elected by the stockholders at last year’s annual meeting with the exception of David G. DeWalt and William A. Owens. Mr. DeWalt was elected to the Board of Directors in November 2005 upon the recommendation of the Corporate Governance and Nominating Committee. Mr. DeWalt was recommended to the Corporate Governance and Nominating Committee by a third-party search firm engaged by the Company. After conducting its evaluation, including interviews with Mr. DeWalt, the Corporate Governance and Nominating Committee recommended his election to the Board of Directors. Mr. Owens was elected to the Board of Directors in December 2005 upon the recommendation of the Corporate Governance and Nominating Committee. Mr. Owens was recommended to the Corporate Governance and Nominating Committee by the Board of Directors. Mr. Owens was previously a director of the Company from August 1999 to May 2004. The names of the nominees for director, their ages, their positions with the Company and other biographical information as of April 5, 2006, are set forth below.

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. In the event any nominee is unable or declines to serve as a director at the time of the 2006 Annual Meeting, the proxies will be voted for any nominee who may be proposed by the Corporate Governance and Nominating Committee and designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees named below.

| | | | |

Name

| | Age

| | Position

|

Robert C. Hagerty | | 54 | | Chairman of the Board of Directors, Chief Executive Officer and President |

Michael R. Kourey | | 46 | | Senior Vice President, Finance and Administration, Chief Financial Officer, and Director |

Betsy S. Atkins (2)(3) | | 50 | | Director |

John Seely Brown(3) | | 65 | | Director |

David G. DeWalt (2) | | 41 | | Director |

Durk I. Jager (2)(3) | | 62 | | Director |

John A. Kelley, Jr. (1)(3) | | 56 | | Director |

Stanley J. Meresman (1) | | 59 | | Director |

William A. Owens (1)(4) | | 65 | | Director |

Kevin T. Parker (1) | | 46 | | Director |

Thomas G. Stemberg (2) | | 57 | | Director |

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of Corporate Governance and Nominating Committee |

| (4) | Lead Independent Director |

Robert C. Hagerty joined the Company in January 1997 as President and Chief Operating Officer and as a member of the Board of Directors. In July 1998, Mr. Hagerty was named Chief Executive Officer. In March 2000, Mr. Hagerty was named Chairman of the Board of Directors. Prior to joining the Company, Mr. Hagerty served as President of Stylus Assets, Ltd., a developer of software and hardware products for fax, document management and Internet communications. He also held several key management positions with Logitech, Inc.,

5

including Operating Committee Member to the Office of the President, and Senior Vice President/General Manager of Logitech’s retail division and worldwide operations. In addition, Mr. Hagerty’s career history includes positions as Vice President, High Performance Products for Conner Peripherals, Director of Manufacturing Operations and General Manager for Signal Corporation, and Operations Manager for Digital Equipment Corporation. Mr. Hagerty currently serves as a member of the Board of Directors of Palm, Inc. and privately-held Modulus Video, Inc. Mr. Hagerty holds a B.S. in Operations Research and Industrial Engineering from the University of Massachusetts, and an M.A. in Management from St. Mary’s College of California.

Michael R. Kourey has been a member of the Board of Directors since January 1999. Mr. Kourey has served as our Senior Vice President, Finance and Administration since January 1999 and as our Chief Financial Officer since January 1995. He also served as Vice President, Finance and Administration from January 1995 to January 1999, Vice President, Finance and Operations from July 1991 to January 1995, Secretary from June 1993 to May 2003, and Treasurer from May 2003 to May 2004. Mr. Kourey currently serves as a member of the Board of Directors of WatchGuard Technologies, Inc. and privately-held Riverbed Technology, Inc. Mr. Kourey also serves on the Advisory Board of the Business School at Santa Clara University. Prior to joining us, he was Vice President, Operations of Verilink Corporation. Mr. Kourey holds a B.S. in Managerial Economics from the University of California, Davis, and an M.B.A. from Santa Clara University.

Betsy S. Atkinshas been a director of the Company since April 1999. Ms. Atkins is the Chief Executive Officer of Baja Corporation LLC, an early stage venture capital company investing in technology and life sciences. Ms. Atkins served as Chairman and Chief Executive Officer of NCI, Inc., a nutraceutical manufacturing company, from 1991 to 1993. Ms. Atkins was a founder and director of Ascend Communications Corporation, and from 1989 to 1999, she was its Vice President of Marketing and Sales. Ms. Atkins is also a director of Chico’s FAS, Inc., Reynolds American Inc., SunPower Corporation, and a number of private companies. Ms. Atkins was a Presidential Appointee to the Pension Benefit Guaranty Trust Corp. and is a Trustee of Florida International University. Ms. Atkins holds a B.A. from the University of Massachusetts.

John Seely Brownhas been a director of the Company since August 1999. Dr. Brown was the Chief Scientist at Xerox Corporation from 1992 to April 2002. Dr. Brown was the director of Xerox’s Palo Alto Research Center from 1990 to May 2000. In addition, Dr. Brown is a co-founder of the Institute for Research on Learning, a member of the National Academy of Education and a fellow of the American Association for Artificial Intelligence. Dr. Brown is also a director of Amazon.com, Inc., Corning Incorporated, Varian Medical Systems, Inc., and certain private companies. Dr. Brown received a B.A. in mathematics and physics from Brown University, a M.S. in mathematics from the University of Michigan, and a Ph.D. in computer and communications sciences from the University of Michigan.

David G. DeWalthas been a director of the Company since November 2005. Mr. DeWalt currently serves as Executive Vice President, EMC Software Group, EMC Corporation, and the President of EMC’s Documentum and Legato Software divisions, positions which he has held since July 2004. Prior to joining EMC, Mr. DeWalt served as President and Chief Executive Officer of Documentum, Inc. from July 2001 to December 2003, Executive Vice President and Chief Operating Officer of Documentum from October 2000 to July 2001, and Executive Vice President and General Manager, eBusiness Unit, of Documentum from August 1999 to October 2000. Prior to joining Documentum in 1999, Mr. DeWalt was the Founding Principal and Vice President of Eventus Software, a web content software company, from August 1997 to December 1998. Following the 1998 acquisition of Eventus by Segue Software, an e-business software company, Mr. DeWalt served as Segue’s Vice President, North American sales. Mr. DeWalt is also a director of MatrixOne, Inc. Mr. DeWalt holds a B.S. in Computer Science and Electrical Engineering from The University of Delaware.

Durk I. Jagerhas been a director of the Company since January 2003. Mr. Jager is the former Chairman of the Board, President and Chief Executive Officer of The Procter & Gamble Company. He left these positions in July 2000. He was elected to the position of Chief Executive Officer in January 1999 and Chairman of the Board effective September 1999, while continuing to serve as President since 1995. He served as Executive Vice

6

President from 1990 to 1995. Mr. Jager joined The Procter & Gamble Company in 1970 and was named Vice President in 1987. Mr. Jager is also a director of Chiquita Brands International, Inc. and Eastman Kodak Company and sits on the supervisory boards of Royal KPN N.V. and Royal Wessanen nv. He graduated from Erasmus Universiteit, Rotterdam, The Netherlands.

John A. Kelley, Jr. has been a director of the Company since March 2000. Mr. Kelley has been the Chairman of McDATA Corporation, a data infrastructure solutions provider, since February 2004 and, from August 2001 to July 2002, he served as its President and Chief Operating Officer. Prior to joining McDATA, Mr. Kelley served as Executive Vice President of Networks at Qwest Communications from August 2000 to December 2000. He served as President of Wholesale Markets for U S West from May 1998 to July 2000. From 1995 to April 1998, Mr. Kelley served as Vice President and General Manager of Large Business and Government Accounts and President of Federal Services for U S West. Prior to joining U S West, Mr. Kelley was the Area President for Mead Corporation’s Zellerbach Southwest Business Unit from 1991 to 1995, and has held senior positions at Xerox and NBI. Mr. Kelley is also a director of Colorado Women’s Vision Foundation, a not-for-profit organization, and INROADS of Colorado, a not-for-profit mentoring program. Mr. Kelley holds a B.S. in business from the University of Missouri, St. Louis.

Stanley J. Meresmanhas been a director of the Company since January 1995. Mr. Meresman was a Venture Partner with Technology Crossover Ventures, a venture capital firm, from January through December 2004. He was General Partner and Chief Operating Officer of Technology Crossover Ventures from November 2001 to December 2003. During the four years prior to joining Technology Crossover Ventures, Mr. Meresman was a private investor and board member and advisor to several technology companies. Mr. Meresman served as the Senior Vice President, Finance and Chief Financial Officer of Silicon Graphics, Inc. from May 1989 to May 1997. Prior to joining Silicon Graphics, Mr. Meresman was Vice President, Finance and Administration, and Chief Financial Officer of Cypress Semiconductor Corporation. Mr. Meresman is also a director of several private companies. Mr. Meresman holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and a M.B.A. from the Stanford Graduate School of Business.

William A. Owenshas been a director of the Company since December 2005 and was previously a director of the Company from August 1999 to May 2004. Mr. Owens joined AEA Holdings and AEA Investors, a New York private equity company, on April 1, 2006. He served as Vice Chairman, Chief Executive Officer and President of Nortel Networks Corporation from May 2004 to November 2005. Prior to that, he served as Chairman and Chief Executive Officer of Teledesic LLC, a satellite communications company, from February 1999 to May 2004. During that same period, he also served as Chairman and Chief Executive Officer of Teledesic’s affiliated company, Teledesic Holdings Ltd. From 1996 to 1998, Mr. Owens was President, Chief Executive Officer and Vice Chairman of Science Applications International Corporation (SAIC), an information technology systems integrator. From 1994 to 1996, he was Vice Chairman of the Joint Chiefs of Staff. Mr. Owens is also a member of the Board of Directors of Daimler Chrysler AG, private company boards, and several philanthropic boards. Mr. Owens holds a B.A. in mathematics from the U.S. Naval Academy, Bachelor’s and Master’s degrees in politics, philosophy, and economics from Oxford University, and a Master’s in Management from George Washington University.

Kevin T. Parker has been a director of the Company since January 2005 and was appointed as Chairman of our Audit Committee in March 2005. Mr. Parker is President and Chief Executive Officer of Deltek Systems, Inc., a Herndon, Virginia based provider of enterprise software applications to project oriented businesses. Prior to joining Deltek, Mr. Parker served as Co-President of PeopleSoft, Inc. from October 2004 to December 2004, as Executive Vice President of Finance and Administration and Chief Financial Officer of PeopleSoft from January 2002 to October 2004, and as Senior Vice President and Chief Financial Officer of PeopleSoft from October 2000 to December 2001. Mr. Parker served as Senior Vice President and Chief Financial Officer from 1999 to 2000 at Aspect Communications Corporation, a customer relationship management software company. From 1996 to 1999, Mr. Parker was Senior Vice President of Finance and Administration at Fujitsu Computer Products of America. Mr. Parker holds a B.S. in Accounting from Clarkson University and sits on its Board of Trustees.

7

Thomas G. Stemberg has been a director of the Company since December 2002. Mr. Stemberg has been a Venture Partner of Highland Capital Ventures, a venture capital firm, since February 2005, and has served as Chairman Emeritus of Staples, Inc., an office supply superstore retailer which he founded, since March 2005. Mr. Stemberg served as Chairman of the Board of Directors of Staples from February 1988 to March 2005, and as an executive officer of Staples with the title of Chairman from February 2002 to March 2005. Mr. Stemberg was Chief Executive Officer of Staples from January 1986 to February 2002. Mr. Stemberg is also a director of CarMax, Inc., The Nasdaq Stock Market, Inc., PETsMART, Inc. and several private companies. Mr. Stemberg holds an A.B. from Harvard College and a M.B.A. from Harvard Business School.

There are no family relationships among any of the directors or executive officers of the Company. The Company’s bylaws authorize the Board of Directors to fix the number of directors by resolution. The Company currently has eleven authorized directors. Each director holds office until the next annual meeting of stockholders or until that director’s successor is duly elected and qualified. The Company’s officers serve at the discretion of the Board of Directors.

Board of Directors’ Recommendation

THE BOARDOF DIRECTORS RECOMMENDSA VOTEFORTHE ELECTIONOFTHE NOMINEES LISTED ABOVE.

Board and Committee Meetings

During the fiscal year ended December 31, 2005, the Board of Directors held six meetings. Other than Dr. Brown, each of the directors attended or participated in 75% or more of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which he or she served during the past fiscal year. The Board of Directors of the Company has three standing committees: an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee.

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, consists of Messrs. Parker, Kelley, Meresman, and Owens, each of whom is “independent” as such term is defined for audit committee members by the listing standards of The Nasdaq Stock Market. The Board of Directors has determined that Messrs. Meresman and Parker are “audit committee financial experts” as defined in the rules of the Securities and Exchange Commission (the “SEC”).

The Audit Committee is responsible for overseeing the Company’s accounting and financial reporting processes and the audit of the Company’s financial statements, and assisting the Board of Directors in oversight of (1) the integrity of the Company’s financial statements, (2) the Company’s internal accounting and financial controls, (3) the Company’s compliance with legal and regulatory requirements, (4) the organization and performance of the Company’s internal audit function, and (5) the independent registered public accounting firm’s qualifications, independence and performance.

The Audit Committee held five meetings during the last fiscal year. The Audit Committee has adopted a written charter approved by the Board of Directors, which is included asAppendix A to this proxy statement. The Audit Committee Charter is also available on the Company’s website at http://www.polycom.com—“Investor Relations”—“Corporate Governance.”

The Audit Committee Report is included in this proxy statement on page 28.

8

Compensation Committee

The Compensation Committee consists of Messrs. DeWalt, Jager and Stemberg and Ms. Atkins, each of whom qualifies as an independent director under the listing standards of The Nasdaq Stock Market.

The Compensation Committee assists the Board of Directors in overseeing the compensation of the Company’s Chief Executive Officer and other executive officers, approving and evaluating the Company’s executive officer compensation plans, policies and programs, and administering the Company’s equity compensation plans. The Compensation Committee also provides oversight of the Company’s compensation policies, plans and benefit programs. The Compensation Committee has delegated to the Secondary Committee, comprised of our Chief Financial Officer and Chief Executive Officer, the authority to grant stock options and to make new hire, retention and promotion stock option grants within certain guidelines to employees below the level of Vice President.

The Compensation Committee held seven meetings during the last fiscal year. The Compensation Committee has adopted a written charter approved by the Board of Directors, which is available on the Company’s website at http://www.polycom.com—“Investor Relations”—“Corporate Governance.”

The Compensation Committee Report is included in this proxy statement on page 25.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of Ms. Atkins, Dr. Brown, and Messrs. Jager and Kelley, each of whom qualifies as an independent director under the listing standards of The Nasdaq Stock Market.

The Corporate Governance and Nominating Committee reviews and makes recommendations to the Board of Directors on matters concerning: corporate governance generally; conflicts of interest, including reviews of the Company’s Code of Business Ethics and Conduct; the composition, evaluation of and nominations to the Board of Directors; the committees of the Board of Directors; director compensation; and succession planning for the Company’s Chief Executive Officer and other executive officers. The Corporate Governance and Nominating Committee will consider recommendations of candidates for the Board of Directors submitted by stockholders of the Company; for more information, see “Corporate Governance Matters” below.

The Corporate Governance and Nominating Committee held three meetings during the last fiscal year, and conducted a board self evaluation under the direction of the committee chairperson, who communicated the results to the Board of Directors. The Corporate Governance and Nominating Committee has adopted a written charter approved by the Board of Directors, which is available on the Company’s website at http://www.polycom.com—“Investor Relations”—“Corporate Governance.”

Compensation of Directors

The Company currently compensates each of its non-employee directors as follows:

| | • | | An annual cash retainer of $45,000 for Board membership; |

| | • | | An annual cash payment of $5,000 for membership on each of the Compensation and Corporate Governance and Nominating Committees or $10,000 for serving as the chair of these committees; |

| | • | | An annual cash payment of $10,000 for membership on the Audit Committee or $20,000 for serving as the chair of the Audit Committee; |

| | • | | An annual cash payment of $20,000 for serving as Lead Independent Director; |

| | • | | The one-time grant of options to purchase 60,000 shares of Common Stock upon a non-employee director joining the board, which vest in four equal annual installments commencing one year following the date of grant; and |

9

| | • | | An annual grant of options to purchase 25,000 shares of Common Stock, which vest monthly over twelve months. |

Board members also have their travel, lodging and related expenses associated with attending Board and Committee meetings and for participating in Board-related activities paid or reimbursed by the Company.

During fiscal 2005, non-employee directors received the following stock option grants:

| | | | | | | | | |

Name

| | Shares

| | Exercise

Price ($)

| | Vesting

| | Term

|

Betsy S. Atkins | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

John Seely Brown | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

David G. DeWalt | | 60,000 | | $ | 15.21 | | 4 year | | 7 year |

Durk I. Jager | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

John A. Kelley, Jr. | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

Stanley J. Meresman | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

William A. Owens | | 60,000 | | $ | 15.67 | | 4 year | | 7 year |

Kevin T. Parker | | 60,000 | | $ | 18.55 | | 4 year | | 7 year |

| | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

Thomas G. Stemberg | | 25,000 | | $ | 16.92 | | 1 year | | 7 year |

Corporate Governance Matters

Corporate Governance Principles and Code of Business Conduct and Ethics

The Company believes that strong corporate governance practices are the foundation of a successful, well-run company. The Company is committed to establishing an operating framework that exercises appropriate oversight of responsibilities at all levels throughout the Company and managing its affairs consistent with high principles of business ethics. The Board of Directors has adopted Corporate Governance Principles to establish the corporate governance policies pursuant to which the Board intends to conduct its oversight of the Company’s business in accordance with its fiduciary duties. The Board of Directors first adopted these Corporate Governance Principles in 2003 and has refined them from time to time. The Corporate Governance Principles are available on the Company’s website at http://www.polycom.com—“Investor Relations”—“Corporate Governance.”

In addition, the Company has adopted a Code of Business Conduct and Ethics, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Business Conduct and Ethics is available on the Company’s website at http://www.polycom.com—“Investor Relations”—“Corporate Governance.” The Company will disclose on its website any amendment to the Code of Business Conduct and Ethics, as well as any waivers of the Code of Business Conduct and Ethics, that are required to be disclosed by the rules of the SEC or The Nasdaq Stock Market.

Independence of the Board of Directors

The Board of Directors has determined that, with the exception of Messrs. Hagerty and Kourey, who are executive officers of the Company, all of its members are “independent directors” as that term is defined in the listing standards of The Nasdaq Stock Market.

Contacting the Board of Directors

Any stockholder who desires to contact our non-employee directors may do so electronically by sending an e-mail to the following address: directorcom@polycom.com. Our Lead Independent Director monitors these communications, which are not monitored by the Company, forwards communications to the appropriate committee of the Board of Directors or non-employee director, and facilitates an appropriate response.

10

Attendance at Annual Stockholder Meetings by the Board of Directors

Although the Company does not have a formal policy regarding attendance by members of the Board of Directors at the Company’s annual meeting of stockholders, the Company encourages, but does not require, directors to attend. Messrs. Hagerty, Jager, Kourey and Parker and Ms. Atkins attended the Company’s 2005 annual meeting of stockholders.

Process for Recommending Candidates for Election to the Board of Directors

The Corporate Governance and Nominating Committee is responsible for, among other things, determining the criteria for membership to the Board of Directors and recommending candidates for election to the Board of Directors. It is the policy of the Corporate Governance and Nominating Committee to consider recommendations for candidates to the Board of Directors from stockholders. Stockholder recommendations for candidates to the Board of Directors must be received by December 31 of the year prior to the year in which the recommended candidates will be considered for nomination, must be directed in writing to Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the nominating person’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like, personal references, and an indication of the candidate’s willingness to serve.

The Corporate Governance and Nominating Committee’s criteria and process for evaluating and identifying the candidates that it selects, or recommends to the full Board for selection, as director nominees, are as follows:

| | • | | The Corporate Governance and Nominating Committee regularly reviews the current composition and size of the Board. |

| | • | | The Corporate Governance and Nominating Committee oversees an annual evaluation of the performance of the Board of Directors as a whole and evaluates the performance of individual members of the Board of Directors eligible for re-election at the annual meeting of stockholders. |

| | • | | In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Corporate Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers (1) the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board, (2) such factors as issues of character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and (3) such other factors as the Corporate Governance and Nominating Committee may consider appropriate. |

| | • | | While the Corporate Governance and Nominating Committee has not established specific minimum qualifications for Director candidates, the Corporate Governance and Nominating Committee believes that candidates and nominees must reflect a Board that is comprised of directors who (1) are predominantly independent, (2) are of high integrity, (3) have broad, business-related knowledge and experience at the policy-making level in business or technology, including their understanding of the telecommunications industry and the Company’s business in particular, (4) have qualifications that will increase overall Board effectiveness and (5) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members. |

| | • | | With regard to candidates who are properly recommended by stockholders or by other means, the Corporate Governance and Nominating Committee will review the qualifications of any such candidate, which review may, in the Corporate Governance and Nominating Committee’s discretion, include |

11

| | interviewing references for the candidate, direct interviews with the candidate, or other actions that the Corporate Governance and Nominating Committee deems necessary or proper. |

| | • | | In evaluating and identifying candidates, the Corporate Governance and Nominating Committee has the authority to retain and terminate any third party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm. |

| | • | | The Corporate Governance and Nominating Committee will apply these same principles when evaluating Board candidates who may be elected initially by the full Board to fill vacancies or add additional directors prior to the annual meeting of stockholders at which directors are elected. |

| | • | | After completing its review and evaluation of director candidates, the Corporate Governance and Nominating Committee selects, or recommends to the full Board of Directors for selection, the director nominees. |

In 2005, the Company retained a third-party search firm to assist in identifying and evaluating potential director nominees. Mr. DeWalt was recommended by the search firm. The Corporate Governance and Nominating Committee conducted an evaluation of Mr. DeWalt, including interviews, and recommended his selection to the Board of Directors.

Director Resignation

Pursuant to the Company’s Corporate Governance Principles, a director whose primary employment status changes materially from the most recent annual meeting of stockholders when such director was elected is expected to submit a letter of resignation to the Board. The Board does not believe that a director in this circumstance should necessarily leave the Board, but that the director’s continued service should be re-evaluated under the established Board membership criteria. Accordingly, the Corporate Governance and Nominating Committee will review and recommend to the Board of Directors whether the director’s continued service is appropriate, and the Board of Directors will then determine whether to accept such resignation. In addition, a director who reaches the age of 72 will submit a letter of resignation to the Board of Directors, which will be accepted by the Board unless the Corporate Governance and Nominating Committee determines, after weighing the benefits of such director’s continued contributions against the benefits of fresh viewpoints and experience, to nominate the director for another term.

12

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm to audit the financial statements of the Company for the fiscal year ending December 31, 2006, which will include an audit of the effectiveness of the Company’s internal control over financial reporting. PricewaterhouseCoopers LLP and its predecessor entities have audited the Company’s financial statements since fiscal 1991. A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting, will have the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP is not required by our bylaws or other applicable legal requirements. However, the Board of Directors is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. In the event that this selection of an independent registered public accounting firm is not ratified by the affirmative vote of a majority of the shares present and voting at the meeting in person or by proxy, the appointment of the independent registered public accounting firm will be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

Principal Accounting Fees and Services

The following table presents fees billed for professional audit services and other services rendered to the Company by PricewaterhouseCoopers LLP for the years ended December 31, 2005 and December 31, 2004.

| | | | | | |

| (in thousands) | | 2005

| | 2004

|

Audit Fees (1) | | $ | 1,596 | | $ | 2,051 |

Audit-Related Fees (2) | | | 23 | | | 193 |

Tax Fees (3) | | | 111 | | | 283 |

All Other Fees (4) | | | — | | | 10 |

| | |

|

| |

|

|

Total | | $ | 1,730 | | $ | 2,537 |

| | |

|

| |

|

|

| (1) | Audit Fees consists of fees billed for professional services rendered for the audit of the Company’s annual financial statements included in the Company’s Annual Reports on Form 10-K and for the review of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, as well as services that generally only the Company’s independent registered public accounting firm can reasonably provide, including statutory audits and services rendered in connection with SEC filings. Audit Fees for fiscal years 2005 and 2004 also includes the audit of management’s assessment of the effectiveness of the Company’s internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002. |

| (2) | Audit-Related Fees consists of fees billed for assurance and related services that are traditionally performed by the Company’s independent registered public accounting firm. |

| (3) | Tax Fees for fiscal 2005 consists entirely of tax compliance fees. Tax Fees for fiscal 2004 consists of tax compliance fees of $250,000 and tax consulting and planning fees of $33,000. |

| (4) | All Other Fees for fiscal 2004 consists of fees billed for advisory services for one of the Company’s Israeli subsidiaries. |

Pre-Approval of Audit and Non-Audit Services

The Company’s Audit Committee is responsible for appointing, setting compensation for and overseeing the work of the Company’s independent registered public accounting firm. In connection with these responsibilities,

13

the Company’s Audit Committee adopted a policy for pre-approving the services and associated fees of the Company’s independent registered public accounting firm. Under this policy, the Audit Committee must pre-approve all services and associated fees provided to the Company by its independent registered public accounting firm, with certain exceptions described in the policy. The Policy for Preapproving Services and Fees of the Company’s Independent Auditor is available on the Company’s website athttp://www.polycom.com— “Investor Relations”—“Corporate Governance.”

All PricewaterhouseCoopers LLP services and fees in 2005 were pre-approved by the Audit Committee.

Board of Directors’ Recommendation

THE BOARDOF DIRECTORS RECOMMENDSA VOTEFORTHE RATIFICATIONOFTHE APPOINTMENTOF PRICEWATERHOUSECOOPERS LLPASTHE COMPANY’SINDEPENDENTREGISTEREDPUBLIC

ACCOUNTINGFIRMFORTHE FISCAL YEAR ENDING DECEMBER 31, 2006.

14

MANAGEMENT

Ownership of Securities

The table below shows the beneficial ownership of the Company’s Common Stock as of April 5, 2006, for the following persons:

| | • | | Each person (or group of affiliated persons) who is known by the Company to beneficially own 5% of the outstanding shares of the Company’s Common Stock; |

| | • | | Each of the Company’s non-employee directors; |

| | • | | Each of the Company’s officers named in the Summary Compensation Table on page 17 of this proxy statement; and |

| | • | | All directors and current executive officers of the Company as a group. |

| | | | | |

5% Stockholders, Directors and Officers (1)

| | Shares

Beneficially

Owned (2)

| | Percentage

Beneficially

Owned (2)

| |

5% Stockholders: | | | | | |

Barclays Global Investors, NA (3) | | 7,546,366 | | 8.6 | % |

Mazama Capital Management, Inc. (4) | | 15,602,513 | | 17.8 | % |

| | |

Non-Employee Directors: | | | | | |

Betsy S. Atkins (5) | | 198,125 | | * | |

John Seely Brown (6) | | 202,500 | | * | |

David G. DeWalt (7) | | — | | * | |

Durk I. Jager (8) | | 130,000 | | * | |

John A. Kelley, Jr. (9) | | 195,000 | | * | |

Stanley J. Meresman (10) | | 230,000 | | * | |

William A. Owens (11) | | — | | * | |

Kevin T. Parker (12) | | 40,000 | | * | |

Thomas G. Stemberg (13) | | 130,000 | | * | |

| | |

Named Executive Officers: | | | | | |

Robert C. Hagerty (14) | | 1,319,690 | | 1.5 | % |

Michael R. Kourey (15) | | 583,237 | | * | |

Sunil K. Bhalla (16) | | 476,796 | | * | |

James E. Ellett (17) | | 97,293 | | * | |

Kim Niederman (18) | | 23,542 | | * | |

| | |

All directors and current executive officers as a group | | | | | |

(17 persons) (19) | | 3,923,419 | | 4.5 | % |

| (1) | Unless otherwise indicated in their respective footnote, the address for each listed person is c/o Polycom, Inc., 4750 Willow Road, Pleasanton, California 94588. |

| (2) | Beneficial ownership is determined in accordance with the rules of the Commission, and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options which are currently exercisable or which will become exercisable within 60 days after April 5, 2006, are deemed outstanding for purposes of computing the beneficial ownership of the person holding these options but are not deemed outstanding for purposes of computing the beneficial ownership of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. Percentage of ownership is based on 87,707,994 shares of the Company’s Common Stock outstanding on April 5, 2006, and is calculated in accordance with the rules of the SEC. |

15

| (3) | Includes (i) 5,191,115 shares beneficially owned by Barclays Global Investors, NA, (ii) 1,923,146 shares beneficially owned by Barclays Global Fund Advisors, and (iii) 432,105 shares beneficially owned by Barclays Global Investors, Ltd. The address of Barclays Global Investors, NA and Barclays Global Fund Advisors is 45 Fremont Street, San Francisco, CA 94105, and the address of Barclays Global Investors, LTD is Murray House, 1 Royal Mint Court, London, EC3N 4HH. This information was obtained from a filing made with the SEC pursuant to Section 13(g) of the Exchange Act on January 26, 2006. |

| (4) | The address of Mazama Capital Management, Inc. is One S.W. Columbia, Suite 1500, Portland, OR 97258. This information was obtained from a filing made with the SEC pursuant to Section 13(g) of the Exchange Act on January 9, 2006. |

| (5) | Includes options held by Ms. Atkins to purchase 198,125 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (6) | Includes options held by Dr. Brown to purchase 202,500 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (7) | Mr. DeWalt was granted an option to purchase 60,000 shares on November 1, 2005 at an exercise price of $15.21 per share; however, no shares are exercisable within sixty (60) days of April 5, 2006. |

| (8) | Includes options held by Mr. Jager to purchase 120,000 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (9) | Includes options held by Mr. Kelley to purchase 195,000 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (10) | Includes options held by Mr. Meresman to purchase 230,000 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (11) | Mr. Owens was granted an option to purchase 60,000 shares on December 13, 2005 at an exercise price of $15.67 per share; however, no shares are exercisable within sixty (60) days of April 5, 2006. |

| (12) | Includes options held by Mr. Parker to purchase 40,000 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (13) | Includes options held by Mr. Stemberg to purchase 120,000 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (14) | Includes options held by Mr. Hagerty to purchase 1,237,499 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. Mr. Hagerty is also a director of the Company. |

| (15) | Includes (i) 27,342 shares held by a trust for which Mr. Kourey is a trustee and (ii) options held by Mr. Kourey to purchase 555,895 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. Mr. Kourey is also a director of the Company. |

| (16) | Includes options held by Mr. Bhalla to purchase 474,998 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (17) | Includes options held by Mr. Ellett to purchase 97,293 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (18) | Includes options held by Mr. Niederman to purchase 23,542 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

| (19) | Includes options to purchase 3,788,953 shares of Common Stock that are exercisable within sixty (60) days of April 5, 2006. |

16

Executive Officer Compensation

The table below shows, for the Chief Executive Officer and each of the four other most highly compensated executive officers whose salary plus bonus exceeded $100,000 during the last fiscal year, information concerning compensation paid for services to the Company in all capacities during the last three fiscal years. The individuals in the table are collectively referred to in this proxy statement as the “Named Executive Officers.”

Summary Compensation Table

| | | | | | | | | | | | |

| | | Year

| | Annual

Compensation

| | | Long-Term

Compensation

Awards

| | All Other

Compensation

($) (2)

| |

Name and Principal Position

| | | Salary

($)

| | Bonus

($) (1)

| | | Securities

Underlying

Options (#)

| |

Robert C. Hagerty Chairman of the Board, Chief Executive Officer and President | | 2005

2004

2003 | | 491,667

458,333

425,000 | | —

479,417

152,310 |

| | 200,000

200,000

150,000 | | 20,111

19,362

17,740 | (3)

|

| | | | | |

Michael R. Kourey Senior Vice President, Finance and Administration, Chief Financial Officer and Director | | 2005

2004

2003 | | 361,333

348,000

340,000 | | —

254,806

85,294 |

| | 80,000

85,000

100,000 | | 31,429

25,982

23,434 | (4)

|

| | | | | |

Sunil K. Bhalla Senior Vice President and General Manager, Voice Communications | | 2005

2004

2003 | | 311,000

289,417

278,250 | | 82,104

246,149

57,714 |

(5) | | 80,000

70,000

75,000 | | 21,429

16,618

14,459 | (6)

|

| | | | | |

James E. Ellett (7) Senior Vice President and General Manager, Video Communications | | 2005

2004

2003 | | 348,000

335,000

290,625 | | 35,496

183,513

133,369 |

| | 60,000

70,000

215,000 | | 21,429

16,618

13,379 | (8)

|

| | | | | |

Kim Niederman (9) Senior Vice President, Worldwide Sales | | 2005

2004

2003 | | 296,667

286,667

276,769 | | 85,994

174,924

69,199 |

| | —

70,000

200,000 | | 17,626

12,342

9,825 | (10)

|

| (1) | Includes bonuses earned or accrued with respect to services rendered in the fiscal year indicated, whether or not such bonus was actually paid during such fiscal year. |

| (2) | Health, life, dental, vision, employee assistance program and disability insurance premiums (excluding employee-paid portions of the premiums) and matching 401(k) plan contributions are paid by the Company pursuant to employee benefit programs available to all employees. |

| (3) | Includes $16,126 in health, life, dental, vision, employee assistance program and disability insurance premiums, $1,500 in matching 401(k) plan contributions, and $2,485 for tax return preparation and planning services. |

| (4) | Includes $19,929 in health, life, dental, vision, employee assistance program and disability insurance premiums, $1,500 in matching 401(k) plan contributions, and $10,000 for tax return preparation and planning services. |

| (5) | Previously unreported in 2005 proxy statement. |

| (6) | Includes $19,929 in health, life, dental, vision, employee assistance program and disability insurance premiums and $1,500 in matching 401(k) plan contributions. |

| (7) | Mr. Ellett joined the Company in February 2003. |

17

| (8) | Includes $19,929 in health, life, dental, vision, employee assistance program and disability insurance premiums and $1,500 in matching 401(k) plan contributions. |

| (9) | The Company has entered into a Transition and Separation Agreement with Mr. Niederman, as described below. |

| (10) | Includes $16,126 in health, life, dental, vision, employee assistance program and disability insurance premiums and $1,500 in matching 401(k) plan contributions. |

Option Grants in the Last Fiscal Year

The table below shows, as to each of the Named Executive Officers, information concerning stock options granted during the fiscal year ended December 31, 2005. No stock appreciation rights were granted to any of the Named Executive Officers during this fiscal year.

Option Grants in Fiscal 2005

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | | | |

| | | Number of

Securities

Underlying

Options

Granted (1)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year (2)

| | | Exercise

Price (3)

| | Expiration

Date (4)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for

Option Term ($) (5)

|

Name

| | | | | |

| 5%

| |

| 10%

|

Robert C. Hagerty | | 200,000 | | 5.1 | % | | $ | 16.80 | | 8/2/2012 | | $ | 1,367,857 | | $ | 3,187,689 |

Michael R. Kourey | | 80,000 | | 2.1 | % | | $ | 16.80 | | 8/2/2012 | | $ | 547,143 | | $ | 1,275,076 |

Sunil K. Bhalla | | 80,000 | | 2.1 | % | | $ | 16.80 | | 8/2/2012 | | $ | 547,143 | | $ | 1,275,076 |

James E. Ellett | | 60,000 | | 1.5 | % | | $ | 16.80 | | 8/2/2012 | | $ | 410,357 | | $ | 956,307 |

Kim Niederman | | — | | — | | | | — | | — | | | — | | | — |

| (1) | All options in this table are non-statutory options, were granted under the 2004 Equity Incentive Plan, and have exercise prices equal to the fair market value on the date of grant. All of these options have seven-year terms, subject to earlier termination upon the optionee’s cessation of service. All of these options vest over a four-year period at the rate of one-fourth of the shares subject to each option vesting at the end of one year from the date of grant and 1/48th vesting each month thereafter. See “Employment Contracts, Change of Control Arrangements and Certain Transactions” for a further description of certain terms relating to these options. |

| (2) | The Company granted options to purchase a total of 3,896,720 shares of Common Stock under the 2004 Equity Incentive Plan, 1996 Stock Incentive Plan and the 2001 Nonstatutory Stock Option Plan to employees in fiscal 2005. |

| (3) | The exercise price may be paid in cash or in shares of the Company’s Common Stock valued at fair market value on the exercise date. |

| (4) | Options may terminate before their expiration upon the termination of the optionee’s status as an employee, the optionee’s death or disability or an acquisition of the Company. |

| (5) | Potential realizable value assumes that the stock price increases from the exercise price from the date of grant until the end of the option term of seven years at the annual rates specified (5% and 10%). Annual compounding results in total appreciation of approximately 40.7% (at 5% per year) and 94.9% (at 10% per year). The assumed annual rates of appreciation are specified in SEC rules and do not represent the Company’s estimate or projection of future stock price growth. The Company does not necessarily agree that this method can properly determine the projected value of an option. |

Option Exercises and Holdings

The table below shows, for each of the Named Executive Officers, certain information concerning stock options exercised during the fiscal year ended December 31, 2005, and the number of shares subject to

18

exercisable stock options as of December 31, 2005. Also reported are values for “in-the-money” options that represent the positive spread between the exercise prices of each outstanding stock option and the fair market value of the Company’s Common Stock as of December 30, 2005, the last trading day of fiscal 2005, which was $15.30 per share.

Aggregated Option Exercises in Fiscal 2005 and Fiscal 2005 Year-End Option Values

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End

| | Value of Unexercised

In-The-Money Options at Fiscal Year End

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Robert C. Hagerty | | — | | | — | | 1,185,417 | | 414,583 | | $ | 2,056,500 | | $ | 113,750 |

Michael R. Kourey | | 50,362 | | $ | 281,848 | | 546,208 | | 190,834 | | $ | 931,193 | | $ | 75,832 |

Sunil K. Bhalla | | — | | | — | | 473,968 | | 167,292 | | $ | 105,680 | | $ | 56,872 |

James E. Ellett | | — | | | — | | 71,773 | | 162,917 | | $ | 193,318 | | $ | 208,175 |

Kim Niederman | | 63,124 | | $ | 429,018 | | 59,792 | | 107,084 | | $ | 33,380 | | $ | 216,938 |

Equity Compensation Plan Information

The following table summarizes the number of outstanding options granted to employees and directors, as well as the number of securities remaining available for future issuance, under the Company’s equity compensation plans as of December 31, 2005.

| | | | | | | | |

| | | (a) | | (b) | | (c) | |

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities

remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

| |

Equity compensation plans approved by security holders (1) | | 15,252,400 | | $ | 18.12 | | 16,169,438 | (2) |

Equity compensation plans not approved by security holders (3) | | 520,023 | | $ | 15.77 | | — | |

Total | | 15,772,423 | | $ | 18.05 | | 16,169,438 | |

| (1) | Included in these amounts are 727,225 shares available to be issued upon exercise of outstanding options with a weighted-average exercise price of $18.88 related to equity compensation plans assumed in connection with previous business mergers and acquisitions. |

| (2) | Included in this amount are 5,228,013 shares available for future issuance under the Employee Stock Purchase Plan. |

| (3) | Amounts correspond to the Company’s 2001 Nonstatutory Stock Option Plan, which was not subject to shareholder approval. The 2001 Nonstatutory Stock Option Plan was terminated in February 2005. A description of the 2001 Nonstatutory Stock Option Plan follows below. |

2001 Nonstatutory Stock Option Plan

In 2001, the Board of Directors reserved 750,000 shares of Common Stock under the 2001 Nonstatutory Stock Option Plan for issuance of nonqualified stock options to employees of acquired companies and foreign-based employees ineligible for incentive stock options. Under the terms of the 2001 Nonstatutory Stock Option Plan, options were granted at prices not lower than fair market value at date of grant as determined by the Board of Directors. Generally, options granted under the 2001 Nonstatutory Stock Option Plan expire seven years from the date of grant and are only exercisable upon vesting. Options granted under the 2001 Nonstatutory Stock

19

Option Plan generally vest over a four-year period at the rate of one-fourth of the shares subject to the option vesting at the end of one year from the date of grant and 1/48th vesting each month thereafter. Upon cessation of service to the Company, the optionee will generally have a limited period of time in which to exercise his or her outstanding options that are vested at that time; however, in the event of an optionee’s death or disability, the optionee or designated beneficiary will generally have 12 months to exercise vested outstanding options. In the event that the Company is acquired by merger or asset sale, the vesting of each outstanding option under the 2001 Nonstatutory Stock Option Plan that is not to be assumed by the successor corporation will automatically accelerate in full, and all unvested shares will immediately vest. The Board of Directors terminated the 2001 Nonstatutory Stock Option Plan in February 2005, and no further options will be granted thereunder.

Compensation Committee Interlocks and Insider Participation

The Company’s Compensation Committee was formed in January 1995 and is currently composed of Messrs. DeWalt, Jager and Stemberg and Ms. Atkins. No interlocking relationships exist between any member of the Company’s Board of Directors or Compensation Committee and any member of the board of directors or compensation committee of any other company, nor has any such interlocking relationship existed in the past. No member of the Compensation Committee is or was formerly an officer or an employee of the Company or its subsidiaries.

Employment Contracts, Change of Control Arrangements and Certain Transactions

2004 Equity Incentive Plan

Certain options to purchase shares of the Company’s Common Stock held by the Named Executive Officers and the Company’s non-employee directors were granted under the 2004 Equity Incentive Plan. In the event of a change in control of the Company, the successor corporation must assume the option, substitute an equivalent award, convert the option into an option to purchase the consideration received by the stockholders of the Company or cancel the option after payment to the optionee of the fair market value of the shares subject to the option, less the exercise price. If there is no assumption, substitution, conversion or payment, such options will become fully vested and exercisable prior to the change in control.

In the event that the officer is terminated by the Company for any reason other than cause or if such officer terminates for good reason within the 12 months following a change in control, each such officer’s options will become fully vested and exercisable. In the event that a non-employee director is not asked to be a member of the board of directors of the successor corporation following a change in control, each such director’s options will become fully vested and exercisable.

1996 Stock Incentive Plan

Certain options to purchase shares of the Company’s Common Stock held by the Named Executive Officers and the Company’s non-employee directors were granted under the 1996 Stock Incentive Plan. In the event that the Company is acquired by merger or asset sale, the vesting of each outstanding option that is not to be assumed by the successor corporation will automatically accelerate in full, and all unvested shares will immediately vest. In connection with a change in control of the Company other than by merger or asset sale, the plan administrator will have the discretionary authority to provide for automatic acceleration of vesting of outstanding options, with such acceleration of vesting to occur either at the time of such change in control or upon the subsequent termination of the individual’s service. Any options accelerated upon termination within the designated period following the change in control remain exercisable for up to one year following the transaction.

In addition, the shares subject to each automatic option grant to non-employee directors immediately vest in full upon an acquisition of the Company by merger or asset sale, the successful completion of a tender offer for

20

more than 50% of the Company’s outstanding voting stock, or a change in the majority of the Board effected through one or more proxy contests for Board membership.

Severance Agreement between the Company and Robert C. Hagerty

In July 2003, the Company entered into a Severance Agreement with Robert C. Hagerty, the Company’s Chief Executive Officer and President. In the event of Mr. Hagerty’s involuntary termination of employment other than for cause, death or disability, or his voluntary termination of employment for good reason, Mr. Hagerty will receive:

| | • | | Severance pay equal to his annual base salary and target bonus for a period of two years; |

| | • | | One year in which to exercise certain outstanding stock option grants and any stock options granted after the effective date of the Severance Agreement (to the extent exercisable on the date of termination); and |

| | • | | Continued coverage of employee benefits for up to one year from the date of termination or until he begins receiving comparable benefits from another employer, but only if Mr. Hagerty elects continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended. |

However, if Mr. Hagerty’s termination of employment would qualify him for payments and benefits under his Change of Control Severance Agreement, Mr. Hagerty will not receive any benefits under this Severance Agreement. Instead, Mr. Hagerty will receive the payments and benefits to which he is entitled under his Change of Control Severance Agreement. See “Management Change of Control Severance Agreements” below.

Transition and Separation Agreement between the Company and Kim Niederman

In 2005, the Company entered into a Transition and Separation Agreement (the “Transition Agreement”) with Kim Niederman, which was renewed in January 2006. Under the terms of the Transition Agreement, upon the resignation of Mr. Niederman effective on the last business day of the quarter in which the start date of his replacement occurs, or his earlier resignation with two weeks’ written notice to the Chief Executive Officer (the “Termination Date”), and upon Mr. Niederman’s signature of a legal release of claims, Mr. Niederman will receive:

| | • | | Separation pay equal to $150,000, less applicable withholdings; and |

| | • | | A lump sum amount equal to six months’ COBRA premiums for health insurance benefits, provided that Mr. Niederman elects to continue health insurance under COBRA. |

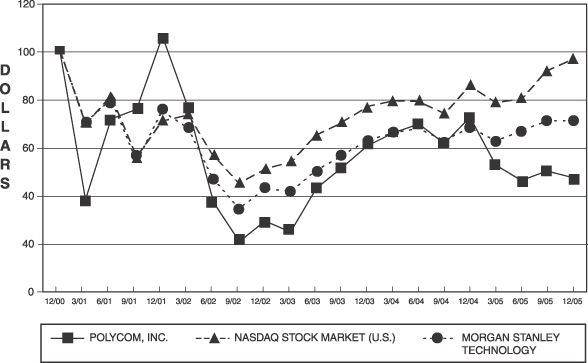

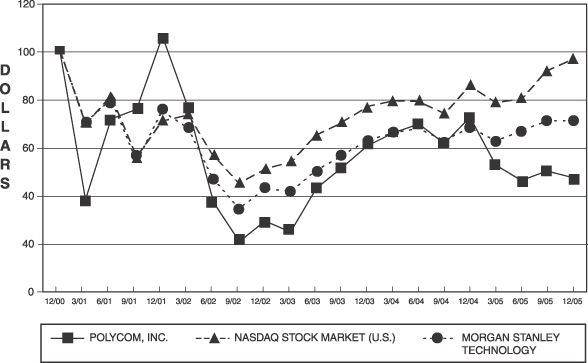

The Transition Agreement provides that Mr. Niederman will continue to receive compensation and benefits through the end of the quarter in which his employment with the Company ends, including any payments earned by him under the Company’s 2005 Performance Bonus Plan. The Transition Agreement also entitles Mr. Niederman to be eligible for quarterly bonuses in the amounts of $50,000 each, in the event that the Company meets certain predetermined financial targets in each of the third and fourth quarters of 2005 and the first and second quarters of 2006. Pursuant to the terms of the Transition Agreement, Mr. Niederman will also be permitted to keep certain Company-issued devices after the Termination Date.