- SYKE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Sykes Enterprises (SYKE) DEF 14ADefinitive proxy

Filed: 15 Apr 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Sykes Enterprises, Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No Fee Required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| SYKES ENTERPRISES, INCORPORATED |

April 15, 2016

Dear Shareholder:

I am pleased to invite you to attend the Sykes Enterprises, Incorporated 2016 Annual Meeting of Shareholders. The meeting will be held at Rivergate Tower, 400 North Ashley Drive, 20th Floor, Suite 2000, Tampa, Florida, 33602, on Tuesday, May 17, 2016, at 8:00 a.m., Eastern Daylight Saving Time. In the following pages, you will find the Notice of Annual Meeting of Shareholders as well as a proxy statement which describes the items of business to be conducted at the meeting.

Your vote is important, so to assure your representation at the Annual Meeting, please vote on the matters described in this proxy statement by completing the enclosed proxy card and mailing it promptly in the enclosed envelope. If your shares are held in street name by a brokerage firm, bank or other nominee, the nominee will supply you with a proxy card to be returned to it. It is important that you return the proxy card as quickly as possible so that the nominee may vote your shares. If your shares are held in street name by a nominee, you may not vote those shares in person at the Annual Meeting unless you obtain a power of attorney or legal proxy from that nominee authorizing you to vote the shares, and you present that power of attorney or proxy at the Annual Meeting.

Sincerely,

|

| James T. Holder |

| Secretary |

Important notice regarding the availability of proxy materials

for the Shareholders Meeting To Be Held On May 17, 2016

This proxy statement and our 2015 Annual Report to Shareholders are available at:

https://materials.proxyvote.com/871237

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 9 | ||||

| 14 | ||||

| 16 | ||||

| 30 | ||||

| 31 | ||||

| 46 | ||||

| 47 | ||||

Proposal 4: Ratification of the Appointment of Independent Registered Public Accounting Firm | 52 | |||

| 53 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

Requirements, Including Deadlines, for Submission of Proxy Proposals and Nomination of Directors | 58 | |||

| 58 | ||||

SYKES ENTERPRISES, INCORPORATED

400 North Ashley Drive

Tampa, Florida 33602

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Date and Time: | 8:00 a.m. Eastern Daylight Saving Time on May 17, 2016 | |

| Place: | Rivergate Tower 400 N. Ashley Drive, 20th Floor, Suite 2000, Tampa, FL 33602 | |

| Items of Business: | 1. To elect four directors, three to hold office until the 2019 Annual Meeting of Shareholders and one to hold office until the 2018 Annual Meeting of Shareholders; | |

2. To hold a shareholder advisory vote on executive compensation; | ||

3. To vote on the approval of the material terms of the performance goals specified in the 2011 Equity Incentive Plan; | ||

4. To ratify the appointment of Deloitte & Touche LLP as independent auditors of the Company; and | ||

5. To transact any other business as may properly come before the Annual Meeting. | ||

Only shareholders of record as of the close of business on March 18, 2016, will be entitled to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. Information relating to the matters to be considered and voted on at the Annual Meeting is set forth in the proxy statement accompanying this Notice.

Tampa, Florida

April 15, 2016

| By Order of the Board of Directors, |

|

| James T. Holder |

| Secretary |

| GENERAL INFORMATION |

SYKES ENTERPRISES, INCORPORATED

400 North Ashley Drive

Tampa, Florida 33602

PROXY STATEMENT

2016 ANNUAL MEETING OF SHAREHOLDERS

Tuesday, May 17, 2016

This proxy statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Sykes Enterprises, Incorporated (the “Company”) for the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at Rivergate Tower, 400 North Ashley Drive, 20th Floor, Suite 2000, Tampa, Florida, 33602, on Tuesday, May 17,

2016, at 8:00 a.m., Eastern Daylight Saving Time, and any adjournment or postponement of the Annual Meeting.

This proxy statement and the annual report to shareholders of the Company for the year ended December 31, 2015 are first being mailed on or about April 15, 2016 to shareholders entitled to vote at the Annual Meeting.

Shareholders Entitled To Vote

The record date for the Annual Meeting is March 18, 2016. Only shareholders of record as of the close of business on the record date are entitled to notice of the Annual Meeting and to vote at the Annual Meeting. As of the record date, 42,782,509 shares of common stock were outstanding and entitled to vote at the Annual Meeting.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of elections appointed for the Annual Meeting, who will also determine whether a quorum is present for the transaction of business. The Company’s Bylaws provide that a quorum is present if the holders of a majority of the issued and outstanding shares of common stock entitled to vote at the meeting are present in person or represented by proxy. Abstentions will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. Shares held by nominees for beneficial owners will also be counted for purposes of determining whether a quorum is present if the nominee has the discretion to vote on at least one of the matters presented, even though the nominee may not exercise discretionary voting power with respect to other matters and even though voting instructions have not been received from the beneficial owner (a “broker non-vote”). At the Annual Meeting, if a quorum exists, directors will be elected by a majority vote, as more fully described under Proposal 1 – Election of Directors below. Approval of the other proposals will require the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting. Broker non-votes will not be counted as votes cast in determining whether a Proposal has been approved.

Shareholders are requested to vote by completing the enclosed Proxy and returning it signed and dated in the

enclosed postage-paid envelope. Shareholders are urged to indicate their votes in the spaces provided on the Proxy. Proxies solicited by the Board of Directors of the Company will be voted in accordance with the directions given in the Proxy. Where no instructions are indicated, signed Proxies will be voted FOR each of the proposals listed in the Notice of Annual Meeting of Shareholders. Returning your completed Proxy will not prevent you from voting in person at the Annual Meeting, should you be present and wish to do so.

Any shareholder giving a Proxy has the power to revoke it at any time before it is exercised by:

| • | filing with the Secretary of the Company written notice of revocation, |

| • | submitting a duly executed Proxy bearing a later date than the previous Proxy, or |

| • | appearing at the Annual Meeting and voting in person. |

Proxies solicited by this proxy statement may be exercised only at the Annual Meeting and any adjournment of the Annual Meeting and will not be used for any other meeting.

The cost of solicitation of Proxies by mail on behalf of the Board of Directors will be borne by the Company. Proxies also may be solicited by personal interview or by telephone by directors, officers, and other employees of the Company without additional compensation. The Company also has made arrangements with brokerage firms, banks, nominees, and other fiduciaries that hold shares on behalf of others to forward proxy solicitation materials to the beneficial owners of such shares. The Company will reimburse such record holders for their reasonable out-of-pocket expenses.

2 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| PROPOSAL 1: ELECTION OF DIRECTORS |

PROPOSAL 1: ELECTION OF DIRECTORS

The Company’s Board of Directors (the “Board”) currently is comprised of eight individuals, and is divided into three classes (designated “CLASS I,” “CLASS II,” and “CLASS III”), as nearly equal in number as possible, with each class serving a three-year term expiring at the third annual meeting of shareholders after its election. The term of the two current CLASS II directors will expire at the Annual Meeting. Mr. Ian A. Macdonald, whose term is expiring at this meeting, and who has served on the Board for 11 years, has notified the Board that he will retire and not stand for re-election this year. In addition, James K. Murray, Jr., a Class III director, resigned from the Board effective January 1, 2016. On March 15, 2016, the Company’s Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee, appointed Vanessa C.L. Chang as a director to fill the vacancy created by Mr. Murray’s resignation. The Company’s Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated Mr. Paul L. Whiting, Lt. General Michael DeLong (Ret.), and Carlos E. Evans to stand for election as CLASS II directors, whose terms will all expire at the 2019 Annual Meeting of Shareholders. The Company’s Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee, nominated Ms. Chang to stand for election as a CLASS III director, whose term will expire at the 2018 Annual Meeting of Shareholders.

Provided that a quorum is present at the Annual Meeting, each nominee shall be elected by the affirmative vote of a majority of the votes cast with respect to that nominee’s election. A majority of votes cast means that the number of

shares voted “for” a director’s election exceeds 50% of the number of votes cast with respect to that director’s election. Votes cast shall include (i) votes for the election of such director and (ii) votes against the election of such director, and shall exclude abstentions with respect to that director’s election and broker non-votes.

Incumbent directors Whiting, DeLong and Chang have provided to the Company contingent letters of resignation from the Board which shall become effective only if such director fails to receive a sufficient number of votes for re-election at the Annual Meeting and the Board determines to accept the resignation. The Board will consider and act upon the letter of resignation of a director who fails to receive the affirmative vote of a majority of the votes cast on his election within ninety (90) days after the date on which the election results were certified and will promptly make public disclosure of the results of its decision. The Board, in making its decision, may consider any factors or other information that it considers appropriate and relevant. The director who has tendered his resignation shall not participate in the decision of the Board with respect to his resignation. If such incumbent director’s resignation is not accepted by the Board, such director shall continue to serve until his successor is duly elected, or his earlier resignation or removal.

In the event any nominee is unable to serve, the persons designated as proxies will cast votes for such other person in their discretion as a substitute nominee. The Board of Directors has no reason to believe that the nominees named herein will be unavailable or, if elected, will decline to serve.

THE BOARD OF DIRECTORS RECOMMENDS THE FOLLOWING NOMINEES FOR ELECTION AS DIRECTORS IN THE CLASS SPECIFIED AND URGES EACH SHAREHOLDER TO VOTE “FOR” THE NOMINEES. EXECUTED PROXIES IN THE ACCOMPANYING FORM THAT ARE NOT OTHERWISE MARKED WILL BE VOTED AT THE ANNUAL MEETING “FOR” THE ELECTION AS DIRECTORS OF THE NOMINEES NAMED BELOW.

Directors Standing for Election at the 2016 Annual Meeting

CLASS II — TERM EXPIRES AT THE 2019 ANNUAL MEETING.

| Name | Age | Position(s) with the Company | Director Since | |||||||

Paul L. Whiting(1)(4) | 72 | Director & Non-Executive Chairman | 2003 | |||||||

Lt. General Michael DeLong (Ret.) (2)(3) | 70 | Director | 2003 | |||||||

Carlos E. Evans | 64 | Nominee for director | ||||||||

CLASS III — TERM EXPIRES AT THE 2018 ANNUAL MEETING.

| Name | Age | Position(s) with the Company | Director Since | |||||||

Vanessa C.L. Chang(4) | 63 | Director | 2016 | |||||||

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 3

| PROPOSAL 1: ELECTION OF DIRECTORS |

Directors Whose Term of Office Continues

CLASS I — TERM EXPIRES AT THE 2017 ANNUAL MEETING.

| Name | Age | Position(s) with the Company | Director Since | |||||||

James S. MacLeod (2)(4)(5) | 68 | Director | 2005 | |||||||

William D. Muir, Jr. (2)(5) | 47 | Director | 2014 | |||||||

Lorraine L. Lutton (3)(4) | 50 | Director | 2014 | |||||||

CLASS III — TERM EXPIRES AT THE 2018 ANNUAL MEETING.

| Name | Age | Position(s) with the Company | Director Since | |||||||

Charles E. Sykes | 53 | Director, President & Chief Executive Officer | 2004 | |||||||

William J. Meurer(3)(4)(5) | 72 | Director & Chairman of the Audit Committee | 2000 | |||||||

| (1) | Chairman of the Board |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

| (4) | Member of the Audit Committee |

| (5) | Member of the Finance Committee |

4 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| PROPOSAL 1: ELECTION OF DIRECTORS |

Director Qualifications and Biographical Information

Biographical information for each of the director nominees is set forth below, including the key qualifications, experience, attributes, and skills that led our Board to the conclusion that each of the director nominees should serve as a director.

Our Board includes individuals with strong backgrounds in executive leadership and management, accounting and finance, and Company and industry knowledge, and we believe that, as a group, they work effectively together in overseeing our business. We believe that our directors hold themselves to the highest standards of integrity and that they are committed to representing the long-term best interests of our shareholders. While we do not have a formal diversity policy, we believe that our directors’ diversity of backgrounds and experiences, which include public accounting, military, aerospace, manufacturing, banking, technology, healthcare, telecommunications, finance and retail, results in different ideas and varying viewpoints that contribute to effective oversight of our business.

Mr. Whiting

Director Since December 2003

Paul L. Whiting was elected to the Board of Directors in December 2003 and was elected Non-Executive Chairman in August 2004. He is also a member of the Board’s Audit Committee. Since 1997, Mr. Whiting has been President of Seabreeze Holdings, Inc., a privately held investment company. Previously, Mr. Whiting held various positions within Spalding & Evenflo Companies, Inc., including Chairman, Chief Executive Officer and Chief Financial Officer. Presently, Mr. Whiting sits on the boards of TECO Energy, Inc. (a public company) and Tampa Electric Company, New Mexico Gas Company, The Bank of Tampa and its holding company, The Tampa Bay Banking Co. Mr. Whiting also serves on the boards of various civic organizations, including, among others, the Academy Prep Center of Tampa, Inc., a full scholarship, private, college preparatory middle school for low-income children, where he is a Trustee and past Board President.

Qualifications:

| • | Mr. Whiting’s public company CEO, CFO and director experience as well as his private investment company business experience provides a unique combination of leadership, financial and business analytical skills, business judgment and investment banking knowledge to the Board as the Company’s non-executive Chairman. |

Lt. Gen. DeLong

Director Since September 2003

Lt. General Michael DeLong (USMC Retired) was elected to the Board of Directors in September 2003 and is Chairman of the Nominating and Corporate Governance Committee and a member the Compensation Committee. From October 2003 to February 2008, Lt. Gen. DeLong served as Vice Chairman of Shaw Arabia Limited, President of Shaw CentCom Services, LLC, and Senior Vice President of the Shaw Group, Inc. From February, 2008 through February 2013, Lt. Gen. DeLong served as Vice President of Boeing International Corporation. On March 1, 2013, Lt. Gen. DeLong was named President and CEO and General Manager of Gulf to Gulf Contractors International and serves as an advocate for several companies in Kuwait and Saudi Arabia in transactions with Boeing. From 1967 until his retirement on November 1, 2003, Lt. Gen. DeLong led a distinguished military career, most recently serving as the Deputy Commander, United States Central Command at MacDill Air Force Base, Tampa, Florida. He holds a Master’s Degree in Industrial Management from Central Michigan University and an honorary Doctorate in Strategic Intelligence from the Joint Military Intelligence College and graduated from the Naval Academy as an Aeronautical Engineer.

Qualifications:

| • | Gen. DeLong’s military career, together with his international business executive experience, allows him to bring to the Board leadership and skills in strategic analysis and judgment as well as a knowledge of international business and political environments. |

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 5

| PROPOSAL 1: ELECTION OF DIRECTORS |

Mr. Sykes

Director Since August 2004

Charles E. Sykes was elected to the Board of Directors in August 2004 to fill the vacancy created by the retirement of the Company’s founder and former Chairman, John H. Sykes. Mr. Charles Sykes joined the Company in September 1986 and has served in numerous capacities throughout his years with the Company. Mr. Sykes was appointed as Vice President of Sales, North America in 1999 and between the years of 2000 to 2003 served as Group Executive, Senior Vice President of Marketing and Global Alliances, and Senior Vice President of Global Operations. Mr. Sykes was appointed President and Chief Operating Officer in July, 2003 and was named President and Chief Executive Officer in August 2004. Mr. Sykes received his Bachelor of Science degree in mechanical engineering from North Carolina State University in 1985. He currently serves on the boards of the Greater Tampa Chamber of Commerce, the Tampa Bay Partnership and the Tampa Bay Metro Board of the American Heart Association, as a director of Feeding America of Tampa Bay, Inc. and Junior Achievement of Tampa Bay, serves on the Board of Visitors for North Carolina State University, and is a member of the Florida Council of 100.

Qualifications:

| • | As the Chief Executive Officer of the Company, Mr. Sykes provides the Board with information gained from hands-on management of Company operations, identifying near-term and long-term goals, challenges and opportunities. As the son of the Company’s founder and having worked for the Company for his full career, he brings a continuity of mission and values on which the Company was established. |

Mr. MacLeod

Director Since May 2005

James S. MacLeod was elected to the Board of Directors in May 2005 and is Chairman of the Compensation Committee and is a member of the Audit Committee and the Finance Committee. Mr. MacLeod has served in various positions at CoastalStates Bank in Hilton Head Island, South Carolina since February 2004 and is currently its President. He also serves as Senior Managing Director and CEO of Homeowners Mortgage Enterprises, Inc. a subsidiary of CoastalStates Bank. Mr. MacLeod serves on the Board of Directors of CoastalStates Bank and has served as Chairman of the Board and Chief Executive Officer of CoastalSouth Bancshares, its holding company, since 2011. From June 1982 to February 2004, he held various positions at Mortgage Guaranty Insurance Corp in Milwaukee, Wisconsin, the last 7 years serving as its Executive Vice President. Mr. MacLeod has a Bachelor of Science degree in Economics from the University of Tampa, a Master of Science in Real Estate and Urban Affairs from Georgia State University and a Masters in City Planning from the Georgia Institute of Technology. Mr. MacLeod is also a Trustee of the Allianz Global Investors Funds and serves as Chairman of their Governance Committee.

Qualifications:

| • | As a result of his extensive financial services background, Mr. MacLeod brings to the Board valuable financial analytical skills and experience, a deep understanding of cash transaction and management issues, as well as business acumen and judgment. |

6 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| PROPOSAL 1: ELECTION OF DIRECTORS |

Mr. Meurer

Director Since October 2000

William J. Meurer was elected to the Board of Directors in October 2000 and is Chairman of the Audit Committee and a member of the Nominating and Corporate Governance Committee. Previously, Mr. Meurer was employed for 35 years with Arthur Andersen LLP where he served most recently as the Managing Partner for Arthur Andersen’s Central Florida operations. Since retiring from Arthur Andersen in 2000, Mr. Meurer has been a private investor and consultant. Mr. Meurer also serves on the Board of Trustees for Lifelink Foundation, Inc. and as a member of the Board of Directors of the Eagle Family of Funds and Walter Investment Management Corporation.

Qualifications:

| • | As former managing partner of an international public accounting firm, Mr. Meurer brings to our Board relevant experience with financial accounting, audit and reporting issues, SEC filings and complex corporate transactions. |

Ms. Lutton

Director Since May 2014

Lorraine L. Lutton was elected to the Board of Directors in 2014 and is a member of the Audit and Nominating and Corporate Governance Committees. Ms. Lutton serves as the President of St. Joseph’s Hospital, a 529 bed tertiary acute care facility in Tampa, Florida and member of the BayCare Health System. Ms. Lutton has been employed by St. Joseph’s in a variety of roles since 1992, serving most recently as Chief Operating Officer from 2004 to 2013, when she was named as President. Ms. Lutton received her bachelor’s degree in public health, health policy and administration from the University of North Carolina at Chapel Hill, and her master’s degree in business administration from the Anderson Graduate School of Management at UCLA. Ms. Lutton is a Fellow of the American College of Healthcare Executives.

Qualifications:

| • | Ms. Lutton brings to our Board substantial business experience in the healthcare arena, as well as communication, planning, organizational and management skills. |

Mr. Muir

Director Since May 2014

William D. Muir, Jr. was elected to the Board of Directors in 2014 and is Chairman of the Finance Committee and a member of the Compensation Committee. Mr. Muir serves as the Chief Operating Officer of Jabil Circuit, Inc. (NYSE: JBL), having been promoted to this position in 2013. From 2009 to 2013, Mr. Muir served as Jabil’s Executive Vice President and Chief Executive Officer, Global Manufacturing Services, responsible for $14B of annual revenue with commercial leadership across diversified markets, including Healthcare & Life Sciences, Enterprise & Infrastructure, High Velocity and Industrial & Clean-tech. Additionally, Mr. Muir led the global, integrated capabilities in Operations, Supply Chain and Design which underpin these diversified businesses. Previously, Mr. Muir served as Regional President for Asia, responsible for Jabil’s Operations and Business Development efforts across China, India, Vietnam, Malaysia, Singapore and Japan. In this capacity, he resided in Shanghai from 2004 through 2007 and subsequently in Singapore until 2009. Prior to his leadership role in Asia, Mr. Muir led Global Business Development efforts for Jabil across large-scale customer relationships and has also held roles leading Operations across the Americas.

Qualifications:

| • | Mr. Muir brings to our Board a diverse background spanning engineering, manufacturing, supply chain, business development, and operations. He has been a leader in information technology, supply chain, security, quality, engineering innovation, and global, strategic accounts. Mr. Muir’s decade long global and domestic profit and loss responsibility also brings valuable business financial acumen to the Board. |

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 7

| PROPOSAL 1: ELECTION OF DIRECTORS |

Ms. Chang

Director Since March 2016

Vanessa C.L. Chang was elected to the Board of Directors in 2016 and is a member of the Audit Committee. Ms. Chang has been a director of EL & EL Investments, a private real estate investment business, since 1999. She served as chief executive officer and president of ResolveItNow.com, an online dispute resolution service from 2000 to 2002, was senior vice president of Secured Capital Corporation, a real estate investment bank in 1998, and from 1986 until 1997 she was a partner in the accounting firm KPMG Peat Marwick LLP. Ms. Chang serves as a director of Edison International and its wholly-owned subsidiary, Southern California Edison Company, a director of Transocean Ltd., and a director or trustee of sixteen funds advised by the Capital Group’s subsidiaries in the American Funds and Capital Group Private Client Services families. She is a graduate of the University of British Columbia and a Certified Public Accountant (inactive).

Qualifications:

| • | Ms. Chang brings to the Board experience in accounting and financial reporting and oversight matters. She also brings experience as a director of public, private, and non-profit organizations, as well as knowledge of securities regulation and corporate governance. |

Mr. Evans

Nominee for Director

Carlos E. Evans has been nominated for election as a director at the Annual Meeting. Mr. Evans retired from Wells Fargo Bank in May 2014, where he served as executive vice president and group head of the eastern division of Wells Fargo commercial banking. Mr. Evans was also responsible for the bank’s government and institutional banking group and he served on Wells Fargo’s management committee. Mr. Evans joined First Union National Bank in 2000 as the wholesale banking executive for the commercial segment prior to its merger with Wachovia Corporation in 2001. From 2006 until Wachovia’s merger with Wells Fargo in 2009, Mr. Evans was the wholesale banking executive and an executive vice president for the Wachovia general banking group, overseeing the commercial, business and community banking segments, the dealer financial services business and the government, tax exempt and not-for-profit healthcare groups. Before joining First Union, Mr. Evans served in a variety of roles at Bank of America and its predecessors including NationsBank, North Carolina National Bank and Bankers Trust of South Carolina, which he joined in 1973. Mr. Evans received his B.A. in economics from Newberry College. He is also a graduate of the Commercial Lending School in Oklahoma and the Colgate Darden Commercial Lending School at the University of Virginia. Mr. Evans is chairman emeritus of the board of the Spoleto Festival USA and chairman of the board of the Medical University of South Carolina Foundation. He is also on the boards of Queens University of Charlotte and three private companies, National Coatings and Supplies Inc., American Welding & Gas Inc. and Johnson Management.

Qualifications:

| • | Mr Evans brings to the Board a vast array of experiences in commercial banking, including financial aspects of governmental, tax exempt and not-for-profit healthcare groups. Mr. Evans’ decades of experience in various management roles provides a significant level of business acumen and judgment. |

8 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| CORPORATE GOVERNANCE |

The Company maintains a corporate governance page on its website which includes key information about its corporate governance initiatives, including its Corporate Governance Guidelines, Code of Ethics, and charters for the committees of the Board of Directors. The corporate governance page can be found atwww.sykes.com, by clicking on “Company,” then “Investor Relations” and then on the links under the heading “Corporate Governance.”

The Company’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of the NASDAQ Stock Market and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

| • | the Board of Directors has adopted clear corporate governance policies; |

| • | a majority of the board members are independent of the Company and its management; |

| • | all members of the key board committees — the Audit Committee, the Compensation Committee, the Nominating |

and Corporate Governance Committee and the Finance Committee — are independent; |

| • | the independent members of the Board of Directors meet regularly without the presence of management; |

| • | the Company has adopted a code of ethics that applies to all directors, officers and employees which is monitored by its Nominating and Corporate Governance Committee; |

| • | the charters of the Board committees clearly establish their respective roles and responsibilities; and |

| • | the Company’s Audit Committee has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received by the Company, including the Board and the Audit Committee, regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters. These procedures are described under “Communications With Our Board” below. |

Certain Relationships and Related Person Transactions

Review and Approval of Related Person Transactions. In order to ensure that material transactions and relationships involving a potential conflict of interest for any executive officer or director of the Company are in the best interests of the Company, under the Code of Ethics adopted by the Board of Directors for all of our employees and directors, all such conflicts of interest are required to be reported to the Board of Directors, and the approval of the Board of Directors must be obtained in advance for the Company to enter into any such transaction or relationship. Pursuant to the Code of Ethics, no officer or employee of the Company may, on behalf of the Company, authorize or approve any transaction or relationship, or enter into any agreement, in which such officer, director or any member of his or her immediate family, may have a personal interest without such Board approval. Further, no officer or employee of the Company may, on behalf of the Company, authorize or approve any transaction or relationship, or enter into any agreement, if they are aware that an executive officer or a director of the Company, or any member of any such person’s family, may have a personal interest in such transaction or relationship, without such Board approval.

The Company’s Audit Committee reviews all conflict of interest transactions involving executive officers and directors of the Company, pursuant to its charter.

In the course of their review of a related party transaction, the Board and the Audit Committee considers:

| • | the nature of the related person’s interest in the transaction; |

| • | the material terms of the transaction, including, without limitation, the amount and type of transaction; |

| • | the importance of the transaction to the Company; |

| • | the importance of the transaction to the related person; |

| • | whether the transaction would impair the judgment of the director or executive officer to act in the best interests of the Company; and |

| • | any other matters the Board or Audit Committee deems appropriate. |

Any member of the Board or the Audit Committee who has a conflict of interest with respect to a transaction under review may not participate in the deliberations or vote respecting approval of the transaction, provided, however, that such director may be counted in determining the presence of a quorum.

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 9

| CORPORATE GOVERNANCE |

Related Party Transactions. On January 25, 2008, the Company entered into a real estate lease with Kingstree Office I, LLC, an entity controlled by Mr. John Sykes, the founder, former Chairman and Chief Executive Officer of the Company, relating to the Company’s call center in Kingstree, South Carolina. On May 21, 2008, the Audit

Committee of the Board reviewed this transaction and recommended approval to the full Board, which also approved the transaction. During the year ended December 31, 2015, the Company paid $428,264 to Kingstree Office I, LLC as rent on the Kingstree facility.

Leadership Structure

In 2005, our Board of Directors separated the positions of Chairman of the Board and Chief Executive Officer, believing that an independent non-employee Chairman could provide a diversity of view and experience in

consultation with the Chief Executive Officer. The Board continues to believe that the Company is best served by having this bifurcated leadership structure.

Risk Oversight

The Board has determined that the role of risk oversight will currently remain with the full Board as opposed to having responsibility delegated to a specific committee. Management has created an enterprise risk management

committee which is primarily responsible for identifying and assessing enterprise risks, developing risk responses and evaluating residual risks. The chairperson of this committee reports directly to the full Board.

Director Independence

In accordance with NASDAQ rules, the Board affirmatively determines the independence of each director and nominee for election as a director in accordance with guidelines it has adopted, which include all elements of independence set forth in the Nasdaq listing standards. Based upon these standards, at its meeting held on March 16, 2016, the Board determined that each of the following non-employee directors was independent and had no relationship with the Company, except as a director and shareholder of the Company:

| (1) | Paul L. Whiting | (5) | James S. MacLeod | |||

| (2) | Lt. General Michael DeLong (Ret.) | (6) | Vanessa C.L. Chang | |||

| (3) | William J. Meurer | (7) | Lorraine L. Lutton | |||

| (4) | Iain A. Macdonald | (8) | William D. Muir, Jr. |

In connection with its decision to nominate Mr. Carlos E. Evans to stand for election at the Annual Meeting, the Board has affirmatively determined that he is independent and has no previous or current relationship with the Company.

Nominations for Directors

The Nominating and Corporate Governance Committee (the “Nominating Committee”) is responsible for screening potential director candidates and recommending qualified candidates to the Board for nomination. The Nominating Committee considers all relevant criteria including, age, skill, integrity, experience, education, time availability, stock exchange listing standards, and applicable federal and state laws and regulations. The Nominating Committee has a specific goal of creating and maintaining a board with the heterogeneity, skills, experience and personality that lend to open, honest and vibrant discussion, consideration and analysis of Company

issues, and accordingly the Nominating Committee also considers individual qualities and attributes that will help create the desired heterogeneity.

The Nominating Committee may use various sources for identifying and evaluating nominees for directors including referrals from our current directors, management and shareholders, as well as input from third party executive search firms retained at the Company’s expense. If the Nominating Committee retains one or more search firms, such firms may be asked to identify possible nominees, interview and screen such nominees and act as a liaison between the Nominating Committee and each nominee

10 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| CORPORATE GOVERNANCE |

during the screening and evaluation process. The Nominating Committee will review the resume and qualifications of each candidate identified through any of the sources referenced above, and determine whether the candidate would add value to the Board. With respect to candidates that are determined by the Nominating Committee to be potential nominees, one or more members of the Nominating Committee will contact such candidates to determine the candidate’s general availability and interest in serving. Once it is determined that a candidate is a good prospect, the candidate will be invited to meet the full Nominating Committee which will conduct a personal interview with the candidate. During the interview, the Nominating Committee will evaluate whether the candidate meets the guidelines and criteria adopted by the Board, as well as exploring any special or unique qualifications, expertise and experience offered by the candidate and how such qualifications, expertise and/or experience may complement that of existing Board members. If the candidate is approved by the Nominating Committee, as a result of the Nominating Committee’s determination that the candidate will be able to add value to the Board and the candidate expresses his or her interest in serving on the Board, the Nominating Committee will then review its conclusions with the Board and recommend that the candidate be selected by the Board to stand for election by the shareholders or fill a vacancy or newly created position on the Board.

Mr. Ian A. Macdonald, who has served on the Board for a total of 11 years, and whose term is expiring at this meeting, has notified the Board that he will retire and not stand for re-election this year. The remaining two Class II directors whose terms expire at the Annual Meeting have each been recommended to the Board by the Committee, and nominated by the Board to stand for re-election. The Committee also recommended to the Board, and the Board has nominated, Carlos E. Evans for election as a new director. Mr. Evans was recommended to the Committee for consideration by non-management members of our Board of Directors.

The Committee will consider qualified nominees recommended by shareholders who may submit recommendations to the Nominating Committee in care of our Corporate Secretary, 400 North Ashley Drive, Suite 2800, Tampa, Florida 33602. Any shareholder nominating an individual for election as a director at an annual meeting must provide written notice to the Secretary of the Company, along

with the information specified below, which notice must be received at the principal business office of the Company no later than the date designated for receipt of shareholders’ proposals as set forth in the Company’s proxy statement for its annual shareholders’ meeting. If there has been no such prior public disclosure, then to be timely, a shareholder’s nomination must be delivered to or mailed and received at the principal business office of the Company not less than 60 days nor more than 90 days prior to the annual meeting of shareholders; provided, however, that in the event that less than 70 days’ notice of the date of the meeting is given to the shareholders or prior public disclosure of the date of the meeting is made, notice by the shareholder to be timely must be so received not later than the close of business on the tenth day following the day on which such notice of the annual meeting was mailed or such public disclosure was made.

To be considered by the Nominating Committee, shareholder nominations must be accompanied by: (1) the name, age, business and residence address of the nominee; (2) the principal occupation or employment of the nominee for at least the last ten years and a description of the qualifications of the nominee; (3) the number of shares of our stock that are beneficially owned by the nominee; (4) any legal proceedings involving the nominee during the previous ten years and (5) any other information relating to the nominee that is required to be disclosed in solicitations for proxies for election of directors under Regulation 14A of the Exchange Act, together with a written statement from the nominee that he or she is willing to be nominated and desires to serve, if elected. Also, the shareholder making the nomination should include: (1) his or her name and record address, together with the name and address of any other shareholder known to be supporting the nominee; and (2) the number of shares of our stock that are beneficially owned by the shareholder making the nomination and by any other supporting shareholders. Nominees for director who are recommended by our shareholders will be evaluated in the same manner as any other nominee for director.

We may require that the proposed nominee furnish us with other information as we may reasonably request to assist us in determining the eligibility of the proposed nominee to serve as a director. At any meeting of shareholders, the Chairman of the Board may disregard the purported nomination of any person not made in compliance with these procedures.

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 11

| CORPORATE GOVERNANCE |

Communications with our Board

Shareholders and other parties interested in communicating with our Board of Directors may do so by writing to the Board of Directors, Sykes Enterprises, Incorporated, 400 North Ashley Drive, Suite 2800, Tampa, Florida 33602. Under the process for such communications established by the Board of Directors, the Executive Vice President and General Counsel of the Company reviews all such correspondence and regularly forwards to all members of the Board a summary of the correspondence. Directors may at any time review a log of all correspondence received by the Company that is addressed to the Board or any member of the Board and request copies of any such correspondence. Correspondence that, in the opinion of the Executive Vice

President and General Counsel, relates to concerns or complaints regarding accounting, internal accounting controls and auditing matters is summarized and the summary and a copy of the correspondence is forwarded to the Chairman of the Audit Committee. Additionally, at the direction of the Audit Committee, the Company has established a worldwide toll free hotline administered by an independent third party through which employees may make anonymous submissions regarding questionable accounting or auditing matters. Reports of any anonymous submissions are sent to the Chairman of the Audit Committee as well as the Executive Vice President and General Counsel of the Company.

Meetings and Committees of the Board

The Board. Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of his or her duties and to attend all Board, committee and shareholders’ meetings. The Board met five times during 2015, of which four were regularly scheduled meetings and one was an unscheduled meeting. The Board also acted

once by unanimous written action in 2015. All directors attended at least 75% of the meetings of the Board and of the committees on which they served during the fiscal year ended December 31, 2015. All of the directors attended the 2015 Annual Meeting of Shareholders on May 19, 2015.

Committees of the Board

The Board has four standing committees to facilitate and assist the Board in the execution of its responsibilities. The Board may also establish special committees as needed to assist the Board with review and consideration of non-routine matters. The standing committees are the Audit Committee, Finance Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. All the committees are comprised solely of non-employee,

independent directors. Charters for each committee are available on the Company’s website atwww.sykes.com by first clicking on “Company,” then “Investor Relations” and then on “Documents and Charters” under the heading “Corporate Governance.” The charter of each committee is also available in print to any shareholder who requests it. The table below shows the current membership and membership for the entire year 2015 for each of the standing Board committees.

| Non-employee Directors | Audit Committee | Finance Committee | Nominating and Corporate Governance Committee | Compensation Committee | ||||

Paul L. Whiting (Chairman of the Board) | ü | |||||||

Lt. General Michael P. DeLong (Ret.) | Chair | ü | ||||||

Iain A. Macdonald | ü | ü | ||||||

James S. MacLeod | ü | ü | Chair | |||||

William J. Meurer | Chair | ü | ||||||

James K. Murray(1) | Chair | ü | ||||||

Lorraine L. Lutton | ü | ü | ||||||

William D. Muir, Jr.(2) | Chair | ü | ||||||

Vanessa C.L. Chang(3) | ü | |||||||

Employee Director | ||||||||

Charles E. Sykes | ||||||||

No. of Meetings in 2015 | 7 | 6 | 4 | 5 | ||||

| (1) | Mr. Murray resigned from the Board effective January 1, 2016. |

12 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| CORPORATE GOVERNANCE |

| (2) | Mr. Muir became Chairman of the Finance Committee on March 15, 2016. |

| (3) | Ms. Chang joined the Board and was appointed to the Audit Committee on March 15, 2016. |

Audit Committee. The Audit Committee serves as an independent and objective party to monitor the Company’s financial reporting process and internal control system. The Committee’s responsibilities, which are discussed in detail in its charter, include, among other things, the appointment, compensation, and oversight of the work of the Company’s independent auditing firm, as well as reviewing the independence, qualifications, and activities of the auditing firm. The Company’s independent auditing firm reports directly to the Committee. All proposed transactions between the Company and the Company’s officers and directors, or an entity in which a Company officer or director has a material interest, are reviewed by the Committee, and the approval of the Committee is required for such transactions. The Board has determined that Mr. Meurer is an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission. The Committee is governed by a written charter, which is reviewed on an annual basis.

Additional information about the Audit Committee is included under the heading “Audit Committee Disclosure” later in this proxy statement.

Finance Committee. The principal purpose of the Finance Committee is to assist the Board of Directors in evaluating significant investments and other financial commitments by the Company. The Committee has the authority to review and make recommendations to the Board with respect to debt and equity limits, equity issuances, repurchases of Company stock or debt, policies relating to the use of derivatives, and proposed mergers, acquisitions, divestitures or investments by the Company that require approval by the full Board. The Committee also has authority to approve capital expenditures not previously approved by the Board of Directors. The level of authority applies to capital expenditures in excess of

$2 million but less than $5 million. This authority is used, and the Committee convened only, when management recommends a decision prior to the next Board meeting. The Committee is governed by a written charter, which is reviewed on an annual basis.

Nominating and Corporate Governance Committee. The purpose of the Nominating and Corporate Governance Committee is to: (a) identify individuals qualified to become members of the Board of Directors of the Company and its subsidiaries; (b) recommend to the Board of Directors director nominees for election at the annual meeting of shareholders or for election by the Board of Directors to fill open seats between annual meetings; (c) recommend to the Board of Directors committee appointments for directors; (d) develop and recommend to the Board of Directors corporate governance guidelines applicable to the Company; and (e) monitor the Company’s compliance with good corporate governance standards. The Committee is governed by a written charter, which is reviewed on an annual basis.

Compensation Committee. The Compensation Committee’s responsibilities, which are discussed in detail in its charter, include, among other things, the establishment of the base salary, incentive compensation and any other compensation for the Company’s President and Chief Executive Officer, and to review and approve the President and Chief Executive Officer’s recommendations for the compensation of certain executive officers reporting to him. This Committee also monitors the Company’s management incentive cash and equity based bonus compensation arrangements and other executive officer benefits, and evaluates and recommends the compensation policy for the directors to the full Board for consideration. The Committee also determines compensation and benefits of the Company’s non-employee directors. This Committee is also responsible for providing oversight and direction regarding the Company’s employee health and welfare benefit programs. The Committee is governed by a written charter, which is reviewed on an annual basis.

Compensation Committee Interlocks and Insider Participation

None.

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 13

| DIRECTOR COMPENSATION |

On May 17, 2012, the shareholders approved the Fifth Amended and Restated 2004 Non-Employee Director Fee Plan (the “2004 Fee Plan”), which provided that the annual cash and equity retainer compensation amounts payable to directors under the 2004 Fee Plan would be determined by the Board of Directors on an annual basis. The 2004 Fee Plan expired pursuant to its terms in May, 2014. Prior to the expiration of the 2004 Fee Plan, at the meeting held on March 19, 2014, the Board of Directors determined to continue to pay non-employee directors the same cash compensation, and under the same terms, as was provided for in the 2004 Fee Plan, without the adoption of a new, formal compensation plan, subject to changes in the amount of the cash compensation on an annual basis as was the case under the 2004 Fee Plan. Similarly, the Board determined to continue to pay the non-employee directors the same equity compensation, but now under the Company’s 2011 Equity Incentive Plan, with each grant having the same terms as the previous grant under the 2004 Fee Plan, subject to changes in the amount of the equity compensation on an annual basis as was the case under the 2004 Fee Plan.

At the Board meeting on December 10, 2014, upon the recommendation of the Compensation Committee, the Board determined that its cash and equity compensation for the next fiscal year beginning on the date of the 2015 Annual Meeting would be increased by $5,000 (to $55,000 per year) and

$25,000 (to $100,000 per year) per member, respectively. So for 2015, all new non-employee directors joining the Board after the 2015 Annual Meeting would receive an initial grant of shares of common stock on the date the new director is elected or appointed, the number of which was determined by dividing $60,000 by the closing price of the Company’s common stock on the trading day immediately preceding the date a new director is elected or appointed, rounded to the nearest whole number of shares. The initial grant of shares vests in twelve equal quarterly installments, one-twelfth on the date of grant and an additional one-twelfth on each successive third monthly anniversary of the date of grant. The award lapses with respect to all unvested shares in the event the non-employee director ceases to be a director of the Company, and any unvested shares are forfeited.

Also, each non-employee director would receive, on the day after the annual shareholders’ meeting, an annual retainer for service as a non-employee director (the “Annual Retainer”). The Annual Retainer consisted of shares of the Company’s common stock and cash. For 2015, the total value of the Annual Retainer was $155,000, payable $55,000 in cash and the remainder paid in stock, the amount of which was determined by dividing $100,000 by the closing price of the Company’s common stock on the date of 2015 Annual Meeting, rounded to the nearest whole number of shares.

In addition to the Annual Retainer award, for 2015 the non-employee Chairman of the Board receives an additional annual cash award of $100,000, and each non-employee director serving on a committee of the Board to receive an additional annual cash award in the following amounts:

| Position | Amount | |||

Audit Committee | ||||

Chairperson | $ | 20,000 | ||

Member | $ | 10,000 | ||

Compensation Committee | ||||

Chairperson | $ | 15,000 | ||

Member | $ | 7,500 | ||

Finance Committee | ||||

Chairperson | $ | 12,500 | ||

Member | $ | 7,500 | ||

Nominating and Corporate Governance Committee | ||||

Chairperson | $ | 12,500 | ||

Member | $ | 7,500 | ||

The annual grant of shares vests in four equal quarterly installments, one-fourth on the day following the annual meeting of shareholders, and an additional one-fourth on each successive third monthly anniversary of the date of grant. The annual grant of cash, including all amounts paid to

a non-employee Chairman of the Board and all amounts paid to non-employee directors serving on committees of the Board, vests in four equal quarterly installments, one-fourth on the day following the annual meeting of shareholders, and an additional one-fourth on each successive third monthly

14 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| DIRECTOR COMPENSATION |

anniversary of the date of grant. The award lapses with respect to all unpaid cash and unvested shares in the event the non-employee director ceases to be a director of the Company, and any unvested shares and unpaid cash are forfeited.

At the Board’s regularly scheduled meeting on December 9, 2015, upon the recommendation of the Compensation Committee, the Board determined that the amount of the cash and equity compensation payable to non-employee

directors beginning on the date of the 2016 annual shareholders’ meeting would remain unchanged.

The Board may pay additional cash compensation to any non-employee director for services on behalf of the Board over and above those typically expected of directors, including but not limited to service on a special committee of the Board. Directors who are executive officers of the Company receive no compensation for service as members of either the Board of Directors or any committees of the Board.

The following table contains information regarding compensation paid to the non-employee directors during fiscal year ending December 31, 2015, including cash and shares of the Company’s common stock.

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||

| Name | Fees Earned ($)(1) | Stock ($)(2) | Option ($) | Non-Equity ($) | Change in Value and ($) | All Other ($) | Total ($) | |||||||||||||

Lt. General Michael DeLong (Ret.) | 73,750 | 100,010 | 173,760 | |||||||||||||||||

Lorraine L. Lutton | 71,250 | 100,010 | 171,260 | |||||||||||||||||

Iain A. Macdonald | 71,250 | 100,010 | 171,260 | |||||||||||||||||

James S. MacLeod | 86,250 | 100,010 | 186,260 | |||||||||||||||||

William J. Meurer | 81,250 | 100,010 | 181,260 | |||||||||||||||||

William D. Muir, Jr. | 68,750 | 100,010 | 168,760 | |||||||||||||||||

James K. Murray, Jr. | 73,750 | 100,010 | 173,760 | |||||||||||||||||

Paul L. Whiting | 163,750 | 100,010 | 263,760 | |||||||||||||||||

| (1) | Amounts shown include the cash portion of the annual retainers and amounts paid for services on Board committees paid to each non-employee director in 2015. The fees earned by Mr. Whiting include $100,000 for service as non-employee Chairman of the Board. |

| (2) | The amounts shown in column (c) represent the Annual Retainer amounts paid in shares of the Company’s common stock. The amounts are valued based on the aggregate grant date fair value of the awards in accordance with FASB ASC Topic 718 (formerly FAS 123(R)). See Notes 1 and 24 to the Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 filed on February 29, 2016 for a discussion of the relevant assumptions used in calculating the grant date fair value in accordance with FASB ASC Topic 718. |

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 15

| COMPENSATION DISCUSSION AND ANALYSIS |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (this “CD&A”) is intended to assist our shareholders in understanding our compensation philosophy, strategy, program design, policies, and practices, with a focus on our 2015 compensation decisions and results for our Named Executive Officers (NEOs). For 2015, our NEOs were as follows:

| Name | Title | |

Charles E. Sykes | President and Chief Executive Officer (“CEO”) | |

John Chapman | Executive Vice President and Chief Financial Officer | |

Lawrence R. Zingale | Executive Vice President and General Manager | |

Andrew J. Blanchard | Executive Vice President, Financial Services, Insurance and Healthcare | |

James T. Holder | Executive Vice President, General Counsel and Corporate Secretary |

Executive Summary

Sykes is a complex global business serving sophisticated and demanding clients. Our business and financial strategies require careful expense management while providing superior customer service and value. This requires experienced executive leadership with sound business judgment, a passion for service excellence, and the ability to understand and implement the Company’s strategic growth plan, including leveraging our proprietary technology and effectively managing our global customer response team.

Our compensation philosophy and strategy has been, and continues to be, focused on the following principles and objectives:

| • | Provide market competitive total compensation opportunities |

| • | Emphasize variable incentives (short-term and long-term) over fixed compensation (salary) |

| • | Establish performance measures and goals that will align pay and performance |

| • | Encourage long-term stock ownership to create strong shareholder alignment |

| • | Adopt appropriate governance practices, processes, and policies |

| • | Maintain a simple program that is easy to understand and communicate |

2015 Compensation Actions

Heading into 2015, the Compensation Committee was satisfied with the overall design of the executive compensation program and believed that it was accomplishing the objectives above. Accordingly, only minimal changes were made for 2015, as summarized below:

| • | Each NEO received a salary increase, with the size of the increase based on individual executive performance, changing roles and responsibilities, and external market pay data |

| • | No changes to short-term or long-term incentive opportunities, except for Mr. Chapman to reflect his appointment as Chief Financial Officer |

| • | No changes to the short-term incentive plan design, except for Mr. Zingale and Mr. Blanchard where additional measures of revenue and Plan Adjusted Operating Income1 for their respective areas of responsibilities were added to the consolidated Plan Adjusted Operating Income used for the other NEOs |

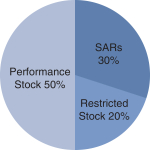

| • | No changes to the long-term incentive plan design, which remained a mix of Performance Shares (50%), Stock Appreciation Rights (SARs) (30%), and Restricted Stock (20%); with Performance Shares tied to 3-year Revenue and Plan Adjusted Operating Income goals |

| 1 | The additional measures of revenue are discussed and Plan Adjusted Operating Income is defined in the “Elements of Compensation” section under the heading “Performance-Based Annual Cash Incentive Compensation” on page 22. |

16 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement

| COMPENSATION DISCUSSION AND ANALYSIS |

2015 Company Performance Results

The Company achieved solid performance results in 2015, as evidenced by the following performance highlights on key measures used in our short-term and long-term incentive plans:

| • | Revenue increased 1.7% year over year, on a constant currency basis2 |

| • | Plan Adjusted Operating Income increased 28% year over year |

| • | EMEA and Major Market Client Revenue goals were achieved at 101.9% of target |

| • | EMEA Adjusted Operating Income goals were achieved at 115.1% of target |

| • | FHP Revenue goals were achieved at 109.5% of target |

| • | New Sales goals were achieved at 126.5% of target |

| • | 3 Year Cumulative Revenue for 2013 – 2015 was $3.877 billion, which was 100.5% of target |

| • | 3 Year Cumulative Adjusted Operating Income for 2013 – 2015 was $275.1 million, which was 113.2% of target |

2015 Executive Compensation Results

These strong financial results yielded the following strong executive compensation results for 2015:

| • | Short-term incentives for 2015 were earned at 124.5% of target for each NEO, except for Mr. Zingale who earned 122.9% of target and Mr. Blanchard who earned 130.7% of target which are blended percentages of the actual results discussed in detail on page 22 under the heading “Performance-Based Annual Incentive Compensation.” |

| • | Performance shares for the 2013 – 2015 period were earned at 168.2% of target |

The Committee believes that these pay results are aligned with the Company’s performance results, and are indicative of the intended linkage between pay and performance. Additionally, the SARs and Restricted Stock awards, in conjunction with our executive stock ownership guidelines, create further alignment between executive compensation and long-term shareholder value creation.

2016 Executive Compensation Actions

In considering changes for 2016, the Compensation Committee focused on the following observations:

| • | Strong shareholder support for the existing executive compensation structure, as expressed by the 2015 Say on Pay vote results where 94.7% of our shareholders voted FOR our program |

| • | Strong pay and performance alignment achieved with respect to 2015 and the 3-year period covering 2013 – 2015 |

| • | Strong executive support of the existing executive compensation structure and plan designs |

| • | Strong alignment with market practices and trends, based on information and analysis provided to the Committee by its independent consultant |

Accordingly, no changes were made to the executive compensation program for 2016, except for select salary increases based on individual executive performance, changing roles and responsibilities, and competitive market pay data.

| 2 | See the Company’s Current Report on Form 8-K filed with the SEC on February 29, 2016, for a reconciliation of the Non-GAAP (generally accepted accounting principles) financial measures to their most directly comparable GAAP financial measures. |

Compensation Philosophy and Objectives

The Committee believes that the most effective executive compensation program is one that is designed to enhance shareholder value by attracting and retaining the talent and experience best suited to manage, guide and build our business. This requires fair and competitive base salaries and benefits designed to attract qualified executives, as well as carefully designed incentive compensation programs to link the interests of the executives to the long-term interests of our shareholders.

In evaluating and determining the complete compensation packages for the Company’s executive officers generally, and the NEOs specifically, the Committee reviews relevant market data provided by its outside independent compensation

consultant, which includes an evaluation of the executive compensation packages paid to similarly situated executives of similarly situated companies. Although the market pay data is only one of many factors considered when making executive compensation determinations, the Committee generally seeks to position pay opportunities within a range of 80% to 120% of the 50th percentile pay level of similarly situated executives. However, variations from this objective may occur as dictated by the experience level of the individual executive.

A significant percentage of the target total compensation to our NEOs and other executive officers consists of performance-based incentives which align the interests of our

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 17

| COMPENSATION DISCUSSION AND ANALYSIS |

executives with those of our shareholders. Although there is no pre-established policy for the allocation between either cash and non-cash or short-term and long-term performance-based incentive compensation, in 2015 the Committee continued the basic structure utilized in recent years, which determined performance-based incentives as a percentage of base salary, which percentage was validated against current

market pay data. A significant percentage of the target total direct compensation to our executive officers is in the form of non-cash, long-term equity incentive awards. A chart showing the relative percentages between base salary and target short-term and long-term incentive compensation of the NEOs for 2015 is included below in the section of this CD&A entitled “Elements of Compensation.”

Roles and Responsibilities in Determining Executive Compensation

The Role of the Compensation Committee. The Committee has been charged with the responsibility for establishing, implementing and continually monitoring adherence with the Company’s compensation philosophy. The Committee’s goal is to ensure that the form and amount of compensation and benefits paid to our executive team, specifically including the NEOs, is fair, reasonable and sufficiently competitive to attract and retain high quality executives who can lead the Company to achieve the goals that the Board believes will maximize shareholder value. For executives other than the CEO, executive compensation matters are first considered by the Committee, which then makes recommendations to the Board. As it relates to the compensation of the Company’s CEO, the Committee meets first with the CEO to obtain information regarding performance, objectives and expectations, discusses the matter with the Board and then makes a final compensation determination. The CEO is not present during voting or any deliberations regarding his compensation.

The Role of the Chief Executive Officer. The Committee meets periodically with the CEO to discuss and review executive compensation. The CEO provides the Committee with the appropriate business context for executive compensation decisions as well as specific recommendations for each of the executives, including the NEOs. Additionally, the Chairman of the Committee meets periodically with the CEO to discuss the Committee’s views on the CEO’s compensation and proposals for adjustments to be considered by the Committee.

The Role of Senior Management. The Committee periodically meets with representatives of our Human Resources, Finance, and Legal departments. These individuals provide the Committee with requested data, information, and advice regarding our executive compensation program, specifically with regard to incentive plan designs, performance measures and goals, and disclosure. These representatives are not involved in conversations regarding their own compensation.

The Role of Outside Independent Consultants. In accordance with the Committee’s charter, the Committee has the authority to retain any outside counsel, consultants or other advisors to the extent deemed necessary and appropriate, including the sole authority to approve the terms of engagement and fees related to services provided. Since 2010, the Committee has utilized Pearl Meyer (“Pearl Meyer”) as its independent executive compensation consultant.

During 2015, at the Committee’s request, Pearl Meyer provided the following services:

| • | Attended all Committee meetings. When appropriate, the Committee has discussions with its consultant without management present to ensure candor and impartiality; |

| • | Provided research, market data, survey information and design expertise to assist the Company in evaluating executive and director compensation programs; |

| • | Advised the Committee on all principal aspects of executive and director compensation, including the competitiveness of program design and award values; and |

| • | Provided specific analyses with respect to the compensation of the Company’s executive officers. |

Pearl Meyer is directly engaged by, and its activities are dictated by, the Committee. Pearl Meyer and its affiliates provide services only to the Committee and are prohibited from providing services or products of any kind to the Company.

In 2015, the Committee assessed the independence of Pearl Meyer and considered whether its work raised any conflicts of interest, taking into consideration the independence factors set forth in the NASDAQ listing rules. Based on that assessment, the Committee determined that Pearl Meyer was independent and that its work did not raise any conflicts of interest.

The Role of Peer Group Data. In making its compensation decisions for 2015, the Committee compared the Company’s pay and performance levels against a peer group of twelve publicly traded companies which the Committee believes compete with the Company in the customer contact management industry for executive talent (the “Compensation Peer Group”). Pearl Meyer and the Committee annually review the composition of the Compensation Peer Group is to determine whether there are new companies which should be added, or existing companies which should be deleted. For its analysis in 2015, the Committee eliminated two companies from the 2014 Compensation Peer Group due to the fact that their market capitalization and enterprise values had decreased in relative size to an extent that comparisons to the Company were no longer deemed valid. Three companies, comparable to the Company, were added.

| 18 SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement |

| COMPENSATION DISCUSSION AND ANALYSIS |

The companies included in the Compensation Peer Group and used as the basis for comparison and analysis by the Committee with respect to 2015 compensation decisions were:

| • | Genpact Limited |

| • | Kforce Inc. |

| • | Convergys Corporation |

| • | FTI Consulting, Inc. |

| • | West Corporation |

| • | Ciber, Inc. |

| • | CDI Corp. |

| • | TeleTech Holdings, Inc. |

| • | Acxiom Corporation |

| • | Alliance Data Systems Corporation |

| • | Syntel, Inc. |

| • | ExlService Holdings, Inc. |

In addition to proxy-reported data from the above peer group companies, Pearl Meyer gathers survey-reported pay data from various reputable compensation surveys containing relevant pay data for comparable roles in comparable organizations. Neither Pearl Meyer nor the Committee are aware of the specific companies reporting pay data within the various surveys used, but the data is selected based on industry and revenue size comparability to the Company.

As in prior years, the competitive market analysis and data are one of many factors considered by the Committee and the Board in making its final pay determinations. Other important factors include the current and expected performance of the Company, the current and expected performance of the executive and ensuring that our executive compensation program is internally consistent and equitable.

Executive Compensation Analysis

As in prior years, the Committee requested, reviewed, and discussed an independent analysis of the Company’s executive compensation program provided by Pearl Meyer. The analysis included a review of compensation competitiveness, pay and performance alignment, our LTIP design, and an overall risk assessment of the executive compensation program. The following were the significant findings from this analysis:

| • | Base salaries were generally positioned slightly below the 50th percentile; |

| • | Target total cash compensation (salary plus target short-term incentive opportunity) was slightly below the 50th percentile; |

| • | Long-term incentive grant values were positioned near the 50th percentile and the aggregate equity grant rate (as a percent of shares outstanding) was at the 50th percentile; |

| • | Total direct compensation (target total cash compensation plus long-term incentive grant value) was positioned slightly below the 50th percentile; |

| • | Company performance (across a variety of financial and operating metrics) on a 1-year and 3-year basis was generally positioned at the 50th percentile; and |

| • | The overall program strikes a balance between risks and rewards, and is not believed to encourage executives to take undue risks that could materially harm the Company. |

The above analysis reflects our executive team in the aggregate. As expected, there is variation by executive (with regard to pay competitiveness) and by performance measure (with regard to relative performance). This analysis was

completed in August 2014 and was one of many inputs into the Committee’s decisions with regard to our 2015 executive compensation program.

Results of the 2015 Shareholder Advisory Vote to Approve Compensation of Our NEOs. At our 2015 Annual Meeting of Shareholders, our shareholders had the opportunity to cast an advisory vote to approve the compensation of our named executive officers as disclosed in our 2015 proxy statement. Approximately 97.4% of the votes cast on this proposal voted to approve, on an advisory basis, the 2014 compensation of our named executive officers. The Committee believes that the results of this vote indicate that our shareholders generally support our executive compensation program. The Committee considered that support when making executive compensation decisions for fiscal 2015. As a result, the Committee recommended that the executive compensation structure for 2015 remain substantially the same, utilizing a combination of base salary, short-term incentive andlong-term incentive compensation, with total compensation being weighted heavily toward equity-based compensation. The long-term equity incentive compensation program designs for performance cycles beginning in 2013, 2014 and 2015 are shown below in the tables under the heading “Performance-Based, Long-Term Equity Incentive Compensation” in this CD&A. The Committee will continue to monitor and consider the outcome of shareholder advisory votes when making future decisions regarding our executive compensation program.

SYKES ENTERPRISES, INCORPORATED ï 2016 Proxy Statement 19

| COMPENSATION DISCUSSION AND ANALYSIS |

Elements of Compensation

The compensation program for our executives includes several direct compensation components. Those components are base salary, annual cash incentive awards and equity-based incentive awards, which are

granted in the form of time-based restricted stock (or restricted stock units), performance–based restricted stock (or restricted stock units), and time-based SARs.

The relative percentages between base salary, annual cash incentive targets and long-term, equity-based incentive targets as compared to total target compensation for the NEOs for 2015 were as follows:

| Name | Total Direct Compensation | Base Salary | Annual Cash Incentive | Long-Term Equity Incentive | ||||||||||||

Charles E. Sykes | 100% | 16% | 18% | 66% | ||||||||||||

John Chapman | 100% | 31% | 22% | 47% | ||||||||||||