UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement | o Confidential, for Use of the Commission |

| | Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | |

o Definitive Additional Materials | |

o Soliciting Material Pursuant to Sec.240.14a-12 | |

| 99¢ Only Stores |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

| | 99¢ ONLY STORES | |

| | | |

| | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | |

| | | |

| TIME | | 9:00 a.m. Pacific Daylight Savings Time on Tuesday, October 18, 2005 |

| | | |

| PLACE | | City of Commerce Community Center |

| | | Rosewood Park Meeting Room |

| | | 5600 Harbor Street |

| | | City of Commerce, California 90040 |

| | | |

| ITEMS OF BUSINESS | | (1) To elect a Board of seven directors, each to hold office until the next annual meeting of shareholders and until his or her successor is elected. |

| | | |

| | | (2) To consider and act upon a shareholder proposal, if properly presented at this meeting. |

| | | |

| | | (3) To transact such other business as may properly come before the annual meeting and any adjournments or postponements thereof. |

| | | |

| RECORD DATE | | You can vote if at the close of business on September 13, 2005 you were a shareholder of 99¢ Only Stores. |

| | | |

| PROXY VOTING | | All shareholders are cordially invited to attend the annual meeting in person. However, to ensure your representation at the annual meeting, you are urged to complete and return the enclosed proxy as promptly as possible. If you receive more than one proxy card because you own shares registered in different names or at different addresses, each card should be completed and returned. |

| | | |

| | | |

| | | /s/ Eric Schiffer |

| September 14, 2005 | | Eric Schiffer |

| | | Chief Executive Officer and Assistant Corporate Secretary |

99¢ ONLY STORES

PROXY STATEMENT

FOR THE 2005 ANNUAL MEETING OF SHAREHOLDERS ON

October 18, 2005

This proxy statement is furnished in connection with the solicitation by the Board of Directors of 99¢ Only Stores, a California corporation, of proxies to be voted at our 2005 annual meeting of shareholders and at any adjournments or postponements thereof.

You are invited to attend our annual meeting of shareholders on Tuesday, October 18, 2005, beginning at 9:00 a.m. Pacific Daylight Savings Time. The meeting will be held at the City of Commerce Community Center, Rosewood Park Meeting Room, 5600 Harbor Street, City of Commerce, California 90040.

It is anticipated that this proxy statement and the accompanying proxy will be mailed to shareholders on or about September 19, 2005.

Shareholders Entitled to Vote. The close of business on September 13, 2005 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any postponements or adjournments thereof. At the record date, 69,552,150 shares of our common stock, no par value, were outstanding. Our common stock is the only outstanding class of securities entitled to vote at the annual meeting. At the record date, we had approximately 25,159 shareholders, which includes 485 shareholders of record.

Proxies. Your vote is important. If your shares are registered in your name, you are a shareholder of record. If your shares are in the name of your broker or bank, your shares are held in street name. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting even if you cannot attend. Your submission of the enclosed proxy will not limit your right to vote at the annual meeting if you later decide to attend in person. If your shares are held in a street name, however, you must direct the holder of record as to how to vote your shares, or you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the meeting. If you are a record holder, you may revoke your proxy at any time before the meeting either by filing with our Secretary, at our principal executive offices, a written notice of revocation or a duly executed proxy bearing a later date, or by attending the annual meeting and voting your shares in person. If no instruction is specified on the enclosed proxy with respect to a matter to be acted upon, the shares represented by the proxy will be voted (i) in favor of the election of the nominees for director set forth herein, (ii) against the shareholder proposal, and (iii) if any other business is properly presented at the annual meeting, in accordance with the best judgment of the proxyholders.

Quorum. The presence, in person or by proxy, of a majority of the votes entitled to be cast by the shareholders entitled to vote at the annual meeting is necessary to constitute a quorum. Abstentions and broker non-votes will be included in the number of shares present at the annual meeting for determining the presence of a quorum. Broker non-votes occur when a broker holding customer securities in street name has not received voting instructions from the customer on certain non-routine matters and, therefore, is barred by the rules of the applicable securities exchange from exercising discretionary authority to vote those securities.

Voting. A shareholder is entitled to cast one vote for each share held of record on the record date on all matters to be considered at the annual meeting. Abstentions will be counted toward the tabulation of votes cast on proposals submitted to shareholders and will have the same effect as negative votes, while broker non-votes will not be counted as votes cast against such matters.

Election of Directors. The seven nominees for director receiving the highest number of votes at the annual meeting will be elected. If any nominee is unable or unwilling to serve as a director at the time of the annual meeting, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.

Shareholder Proposal. Approval of the shareholder proposal will require the affirmative vote of a majority of the shares of common stock present or represented and voting at the annual meeting.

ITEM 1: | ELECTION OF DIRECTORS |

Item 1 is the election of seven members of the Board of Directors. In accordance with our bylaws, 99¢ Only Stores’ directors are elected at each annual meeting and hold office until the next annual meeting and until their successors are elected and qualified. Our bylaws provide that the Board of Directors shall consist of no less than seven and no more than eleven directors as determined from time to time by the board of directors. The Board of Directors currently consists of seven directors.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unable or unwilling to serve as a director at the time of the annual meeting or any adjournments thereof, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominees will be unable or unwilling to serve if elected as a director.

The Board of Directors proposes the election of the following nominees as directors:

| Eric G. Flamholtz | Marvin Holen |

| Lawrence Glascott | Eric Schiffer |

| David Gold | Thomas Unterman |

| Jeff Gold | |

If elected, each of the nominees is expected to serve until the 2006 annual meeting of shareholders and thereafter until his or her successor is duly elected and qualified.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE LISTED NOMINEES.

ITEM 2: | SHAREHOLDER PROPOSAL - REDEEM OR VOTE POISON PILL |

RESOLVED: Redeem or Vote Poison Pill. The shareholders of our company ask our Board of Directors to redeem any poison pill, unless such poison pill is approved by the affirmative vote of holders of a majority of shares present and voting as a separate ballot item, to be held as soon as may be practicable.

John Chevedden, 2215 Nelson Ave., No. 205, Redondo Beach, Calif. 90278 submitted this proposal.

61% Yes - Vote

This topic also won an impressive 61% yes - vote at 50 major companies in 2004. The Council of Institutional Investors www.cii.org, whose members have invested $3 trillion, recommends adoption of this proposal topic.

Pills Entrench Current Management

“They [poison pills] entrench the current management, even when it’s doing a poor job. They water down shareholders’ votes and deprive them of a meaningful voice in corporate affairs.”

“Take on the Street” by Author Levitt, SEC Chairman, 1993-2001

Progress Begins with a First Step

If our Board takes the above RESOLVED step I believe it will then improve our Board’s ability to focus on other corporate governance issues of concern such as:

| | · | The Corporate Library, an independent investment research firm in Portland, Maine rated our company: |

| | | “D” in Board Composition. |

| | | “D” in Takeover Defenses. |

| | · | Of our 7 directors, 3 were over age 70. |

| | · | Three directors owned from zero to 3,000 shares each - commitment concern. |

| | · | 57% of our Board were insiders and another director. |

| | · | Our Board had no formal governance policy. |

A Very Powerful Family

According to The Corporate Library, “Fully half the board members at 99 Cents Only are Golds or married to one. Add to that a director who leases real estate to 99 Cents Only, and whose son received $576,000 in commissions and fees from the company, and what you are left with is just three fully independent directors overseeing a very powerful family running a company that is only one-third theirs - a tall order for just $18,000 and 3,000 options a year.”

Potential 56% Non-Family Shareholder Approval

According to The Corporate Library we own stock in a family firm with 31% ownership by a dominant shareholder. Based on the 2004 vote tabulation and 31% dominate shareholder ownership, I believe this proposal won 56% of the independent votes. This 56% vote could translate into a higher percentage in 2005 due to increased institutional investor emphasis on good governance.

The Enron implosion taught both boards and shareholders the importance of good governance. Also the increased refinement in professional corporate governance analysis and the increased circulation of this information through the internet make it all the more difficult for companies to hide inferior or conflicted corporate governance.

Stock value

I believe that if a poison pill makes our stock difficult to sell - that our stock has less value.

Redeem or Vote Poison Pill

Yes on 2

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE AGAINST THIS PROPOSAL FOR THE FOLLOWING REASONS:

The Company does not have a shareholder rights plan, or “poison pill,” in place and therefore has no poison pill to redeem or submit to a shareholder vote.

Further, the Board of Directors believes that it is in the best interests of the Company and its shareholders that we retain the flexibility to adopt and maintain such an anti-takeover provision if and when necessary, without obtaining shareholder approval. The purpose of a shareholder rights plan is to force a potential acquirer to negotiate directly with the corporation’s board of directors. A corporation’s board of directors is in the best position to negotiate on behalf of all shareholders, evaluate the adequacy of any potential offer and seek a higher price if there is to be a sale of the corporation. A study by Georgeson Shareholder Communications Inc. showed that between 1992 and 1996, stockholders of companies with shareholder rights plans received significantly higher value in acquisitions than companies without them. (Georgeson Shareholder Communications Inc., “Mergers & Acquisitions: Poison Pills and Shareholder Value/1992-1996,” 1997). To the extent that this proposal is intended to limit our flexibility to adopt and maintain a shareholder rights plan in the future, we believe any such limitation could prevent us from appropriately responding to a takeover attempt, which could jeopardize our ability to negotiate effectively, protect shareholders’ interests and maximize shareholder value.

We are committed to acting in the best interests of the Company and its shareholders in all matters of corporate governance, including any decision to adopt and maintain a shareholder rights plan. In response to statements included in the above proposal, shareholders should also recognize that a majority of the Company’s directors are independent in accordance with the standards of the New York Stock Exchange, and that, as described elsewhere in this Proxy Statement, the Company has adopted corporate governance guidelines to promote the effective governance of the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE AGAINST THE ADOPTION OF THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED AGAINST THIS PROPOSAL UNLESS OTHERWISE SPECIFIED BY THE SHAREHOLDER IN THE PROXY.

INFORMATION WITH RESPECT TO NOMINEES AND EXECUTIVE OFFICERS

The following table sets forth information with respect to the director nominees and our executive officers as of August 31, 2005:

Director Nominees:

Name: | Age at August 31, 2005 | Year First Elected or Appointed Director | Principal Occupation |

| | | | |

| David Gold | 73 | 1965 | David Gold has been Chairman of the Board since the founding of the Company in 1965. Mr. Gold has over 50 years of retail experience. |

| Jeff Gold | 37 | 1991 | Jeff Gold joined us in 1984 and has served in various managerial capacities. From 1991 to 2004 he served as Senior Vice President of Real Estate and Information Systems. In January 2005, he was promoted to President and Chief Operating Officer. |

Eric Schiffer | 44 | 1991 | Eric Schiffer joined us in 1991 and has served in various managerial capacities. In March 2000, he was promoted to President and in January 2005 to Chief Executive Officer. From 1987 to 1991, he was employed by Oxford Partners, a venture capital firm. Mr. Schiffer is a graduate of the Harvard Business School. |

| Lawrence Glascott | 71 | 1996 | Lawrence Glascott serves on our Audit, Compensation and Nominating and Corporate Governance Committees. From 1991 to 1996 he was the Vice President - Finance of Waste Management International, an environmental services company. Prior thereto, Mr. Glascott was a partner at Arthur Andersen LLP and was the Arthur Andersen LLP partner in charge of the 99¢ Only Stores account for six years. Additionally, Mr. Glascott was in charge of the Los Angeles based Arthur Andersen LLP Enterprise Group practice for over 15 years. |

| Marvin Holen | 76 | 1991 | Marvin Holen serves on our Audit, Compensation and Nominating and Corporate Governance Committees. He is an attorney and in 1960 founded the law firm of Van Petten & Holen. He served on the Board of the Southern California Rapid Transit District from 1976 to 1993 (six of those years as the Board’s President). He served on the Board of Trustees of California Blue Shield from 1972 to 1978, on the Board of United California Savings Bank from 1992 to 1994 and on several other corporate, financial institution and philanthropic boards of directors. |

| Eric G. Flamholtz | 62 | 2004 | Eric G. Flamholtz, Ph.D., serves on our Compensation and Nominating and Corporate Governance Committees. He has been a professor of management at the Anderson Graduate School of Management, University of California at Los Angeles since 1973 and President of Management Systems Consulting Corporation, which he founded in 1978. He is the author of several books including Growing Pains: Transitioning from an Entrepreneurship to a Professionally Managed Firm. As a consultant he has extensive experience with firms ranging from entrepreneurships to Fortune 500 companies, including Starbucks, Countrywide Financial Corporation, Baskin Robins, Jamba Juice and Grocery Outlets. |

| Thomas Unterman | 60 | 2004 | Thomas Unterman serves on our Audit, Compensation and Nominating and Corporate Governance Committees. Mr. Unterman is the Founder and Managing Partner of Rustic Canyon Partners, a sponsor of venture capital and private equity investment funds. Previously, from 1992 through 1997, he was employed by the Times Mirror Company (since acquired by the Tribune Company) most recently as Executive Vice President and Chief Financial Officer of The Times Mirror Company, a diversified media company. Mr. Unterman also serves on the boards of several of privately held companies in which Rustic Canyon has an investment and several charitable organizations. |

Other Executive Officers: | | |

| Howard Gold | 45 | | Howard Gold joined us in 1982 and has served in various managerial capacities. In 1991 he was named Senior Vice President of Distribution, and in January 2005 he was named Executive Vice President of Special Projects. |

| Jeffrey Kniffin | 52 | | Jeffrey Kniffin serves as the interim Chief Financial Officer. Mr. Kniffin is a financial expert with 27 years of professional experience, including six years as the CFO of a mid-sized company. Mr. Kniffin has been a financial consultant since 1994 and for approximately four of the past five years has been engaged by numerous small and mid-sized public and private corporations. Mr. Kniffin is a CPA with six years experience with Arthur Andersen LLP, and is a graduate of the UCLA Anderson School of Management. |

| Michael Zelkind | 36 | | Michael Zelkind was elected to the newly created position of Executive Vice President of Supply Chain and Merchandizing in October 2004. Prior to joining 99¢ Only Stores, Mr. Zelkind served as a Vice President with ConAgra Foods Grocery Products Division from June 2001 to October 2004. Mr. Zelkind has also held a variety of operational and management positions with ICG Commerce, AT Kearney, General Mills and Honeywell from December 1989 to June 2001. |

Jeff Gold and Howard Gold are the sons of David Gold, and Eric Schiffer is the son-in-law of David Gold.

We would like to sincerely thank Ben Schwartz and Howard Gold, both of whom stepped down from the Board earlier this year for reasons of ensuring the Board will be composed of a majority of independent directors. We greatly appreciate Mr. Schwartz’ and Mr. Gold’s years of valuable contribution to our Company.

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Independence

The Board of Directors has concluded that Lawrence Glascott, Marvin Holen, Eric Flamholtz, Ph.D. and Tom Unterman are independent in accordance with the director independence standards of the New York Stock Exchange, and it has determined that none of them has a material relationship with the Company which would impair his independence from management or otherwise compromise his ability to act as an independent director.

Meetings and Committees

The Board of Directors held a total of 11 meetings during the fiscal year ended December 31, 2004. During the fiscal year ended December 31, 2004, each director attended all meetings of the Board of Directors held. Directors are encouraged but not required to attend annual meetings of shareholders. All of our directors at the date of the 2004 annual meeting of shareholders attended that meeting.

The Board of Directors has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee currently consists of Messrs. Glascott (Chairman), Holen and Unterman, each of whom meets the criteria for independence set forth in the New York Stock Exchange’s rules and in Rule 10A-3 under the Securities Exchange Act. The Board of Directors has determined that Mr. Glascott is an “audit committee financial expert” as that term is used in Item 401(h) of Regulation S-K promulgated under the Securities Exchange Act. The Audit Committee selects the independent registered public accountants to perform the Company’s audit and periodically meets with the independent registered public accountants and our management to review matters relating to our financial statements, our accounting principles and our system of internal accounting controls, and reports its recommendations as to the approval of our financial statements to the Board of Directors. The role and responsibilities of the Audit Committee are more fully set forth in a written charter adopted by the Board of Directors, which is available on our website at www.99only.com. The Audit Committee held nine meetings during fiscal 2004, at which each member of the Audit Committee was present.

The Board of Directors also has a Compensation Committee. The Compensation Committee currently consists of Messrs. Flamholtz (Chairman), Glascott, Unterman, and Holen, each of whom is independent in accordance with New York Stock Exchange rules. This Committee is responsible for considering and making recommendations to the Board of Directors regarding executive compensation and is responsible for administering our stock option plan. The Compensation Committee held three meetings during fiscal 2004, at which each member of the Compensation Committee was present. A copy of the charter of the Compensation Committee is available on our website at www.99only.com.

In addition, the Board of Directors has a Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Messrs. Holen (Chairman), Flamholtz, Glascott and Unterman, each of whom is independent in accordance with New York Stock Exchange rules. The role of the Nominating and Corporate Governance Committee is to assist the Board of Directors by identifying, evaluating and recommending director nominees and recommending and monitoring corporate governance guidelines applicable to the Company. In identifying director nominees, the Nominating and Corporate Governance Committee looks for independent individuals with business and professional experience, relevant industry knowledge or experience, an ability to read and understand financial statements and other relevant qualifications. Each nominee for election as a director is standing for reelection after being elected by the shareholders at the 2004 annual meeting of shareholders with the exception of Mr. Unterman, who was elected to the Board in July 2004. Mr. Unterman was recommended to the Board by Eric Schiffer. There is not a formal policy by which shareholders may recommend director candidates, but the members of the Nominating and Corporate Governance Committee will certainly consider candidates recommended by shareholders. A shareholder wishing to submit such a recommendation should send a letter to the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the shareholder. At a minimum, candidates for election to the Board should meet the independence requirements of the New York Stock Exchange and Rule 10A-3 under the Securities Exchange Act, as well as the criteria identified above. Candidates recommended by shareholders will be evaluated in the same manner as candidates recommended by anyone else. The Nominating and Corporate Governance Committee held six meetings during fiscal 2004, at which each member of the Nominating and Corporate Governance Committee was present. A copy of the charter of the Nominating and Corporate Governance Committee is available on our website at www.99only.com.

Executive Sessions

The Board has adopted a procedure for executive sessions of non-management directors whereby a presiding non-management director for each session is determined on a rotating basis, proceeding in alphabetical order. Interested parties with concerns regarding the Company may contact the non-management directors by sending a letter in care of the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023; the mailing envelope must contain a clear notation that it is confidential and for the non-management directors.

Compensation of Directors

Each director who is not an officer of or otherwise employed by us receives $2,500 per month, plus $750 for each board meeting attended. Such non-employee directors also receive $250 for each committee meeting attended or $350 for each committee meeting attended as committee chairperson ($700 for the audit committee chairperson). In addition, each non-employee director receives an automatic annual grant of a non-qualified option to purchase 3,000 shares of our common stock with a per share exercise price equal to the fair market value of a share of our common stock on the date of grant.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of our Board of Directors currently consists of Messrs. Flamholtz, Glascott, Unterman, and Holen. None of these individuals has at any time been an officer or employee of the Company. During 2004, none of our executive officers served as a member of the board of directors or compensation committee of any entity for which a member of our Board of Directors or Compensation Committee has served as an executive officer.

Corporate Governance Guidelines

The Board of Directors has adopted corporate governance guidelines to serve as a flexible framework within which the Board may conduct its business, subject to occasional deviations. A copy of the corporate governance guidelines is available on our website at www.99only.com.

Shareholder Communication with the Board of Directors

Shareholders who wish to communicate with the Board of Directors or a particular director may send a letter to the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Corporate Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all directors, officers and employees of the Company. A copy of the Code of Business Conduct and Ethics is available on our website at www.99only.com.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth, as to the Chief Executive Officer, the other four most highly compensated executive officers during fiscal 2004, and one former executive officer (the “Named Executive Officers”), information concerning all compensation paid for services to us in all capacities during the last three fiscal years.

| | | | | | | | | | | Long-Term | | | |

| | | Fiscal | | | | | | | | Compensation | | | |

Name and | | Year | | | | | | | | Number of | | | |

Principal | | Ended | | Annual Compensation | | Securities | | All Other | |

Position During | | December | | | | | | Other Annual | | Underlying | | Compensation | |

2004 | | 31 | | Salary | | Bonus | | Compensation | | Options | | ($) | |

| | | | | | | | | | | | | | |

| David Gold | | | 2004 | | $ | 114,423 | | | - | | | - | | | - | | | - | |

| Chairman of the Board & Chief Executive Officer | | | 2003 | | | 158,173 | | | - | | | - | | | - | | | - | |

| | | | 2002 | | | 167,596 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Eric Schiffer (a) | | | 2004 | | $ | 124,615 | | | - | | | - | | | - | | | - | |

| President | | | 2003 | | | 117,692 | | | - | | | - | | | - | | | - | |

| | | | 2002 | | | 120,615 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Jeff Gold (b) | | | 2004 | | $ | 124,615 | | | - | | | - | | | - | | | - | |

| Senior Vice President of Real Estate and Information Systems | | | 2003 | | | 123,231 | | | - | | | - | | | - | | | - | |

| | | | 2002 | | | 118,615 | | | - | | | - | | | - | | | - | |

| Howard Gold (c) | | | 2004 | | $ | 124,615 | | | - | | | - | | | - | | | - | |

| Executive Vice President of Special Projects and Director | | | 2003 | | | 124,615 | | | - | | | - | | | - | | | - | |

| | | | 2002 | | | 123,231 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Andrew Farina | | | 2004 | | $ | 177,500 | | $ | 25,000 | | | - | | | 13,500 | | | - | |

| Former Chief Financial Officer | | | 2003 | | | 172,100 | | | 25,000 | | | - | | | 13,500 | | | - | |

| | | | 2002 | | | 163,400 | | | 25,000 | | | - | | | 13,500 | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Jose Gomez (d | | | 2004 | | $ | 174,450 | | $ | 25,000 | | | - | | | 13,500 | | | - | |

| Vice President of Retail | | | 2003 | | | 171,800 | | | 25,000 | | | - | | | 13,500 | | | - | |

| Operations | | | 2002 | | | 169,600 | | | 25,000 | | | - | | | 13,500 | | | - | |

| | (a) | It includes $92,723, $92,308, $99,692 discretionary contributions made to a deferred compensation plan for the year ended December 31, 2002, 2003, and 2004, respectively. |

| | (b) | It includes $90,528, $94,892, $99,692 discretionary contributions made to a deferred compensation plan for the year ended December 31, 2002, 2003, and 2004, respectively. |

| | (c) | It includes $90,538, $96,000, $99,692 discretionary contributions made to a deferred compensation plan for the year ended December 31, 2002, 2003, and 2004, respectively. |

| | (d) | It includes $18,400, $20,400, $20,400 discretionary contributions made to a deferred compensation plan for the year ended December 31, 2002, 2003, and 2004, respectively. |

Option Grants in Last Fiscal Year

The following table sets forth certain information regarding the grant of stock options made during the fiscal year ended December 31, 2004 to the Named Executive Officers.

| | | Number Of Securities Underlying Option | | Percent Of Total Options Granted To Employees in | | Exercise Or | | Expiration | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term | |

Name | | Granted (a) | | Fiscal Year (b) | | Base Price | | Date | | 5% | | 10% | |

| David Gold | | | - | | | - | | | - | | | - | | | - | | | - | |

| Eric Schiffer | | | - | | | - | | | - | | | - | | | - | | | - | |

| Jeff Gold | | | - | | | - | | | - | | | - | | | - | | | - | |

| Howard Gold | | | - | | | - | | | - | | | - | | | - | | | - | |

| Andrew Farina | | | 13,500 | | | 1.1 | % | $ | 17.92 | | | 5/21/2014 | | $ | 152,142 | | $ | 385,558 | |

| Jose Gomez | | | 13,500 | | | 1.1 | % | $ | 17.92 | | | 5/21/2014 | | $ | 152,142 | | $ | 385,558 | |

| (a) | The option grants set forth on this chart vest in three equal annual installments beginning on May 21, 2005 or on the first anniversary of the option grant. |

| (b) | Options covering an aggregate of 1,268,991 shares were granted to eligible persons during the fiscal year ended December 31, 2004. |

Stock Options Held at Fiscal Year End

The following table sets forth, for each of the Named Executive Officers, information regarding the number of shares of common stock underlying stock options held at fiscal year end and the value of options held at fiscal year end. None of the Named Executive Officers exercised any options in 2004.

| | | | | Number of Securities Underlying Unexercised Options at December 31, 2004 | | Value of Unexercised In-the-Money Options At December 31, 2004(a) | |

Name | | Shares Acquired Upon Exercise | | Value Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| | | | | | | | | | | | | | |

| David Gold | | | - | | | - | | | - | | �� | - | | | - | | | - | |

| Eric Schiffer | | | - | | | - | | | 75,006 | | | - | | $ | 915,073 | | | - | |

| Jeff Gold | | | - | | | - | | | 75,006 | | | - | | $ | 915,073 | | | - | |

| Howard Gold | | | - | | | - | | | 75,006 | | | - | | $ | 915,073 | | | - | |

| Andrew Farina | | | - | | | - | | | 100,300 | | | 27,000 | | $ | 48,350 | | | - | |

| Jose Gomez | | | - | | | - | | | 176,506 | | | 27,000 | | $ | 546,823 | | | - | |

(a) Based on the last reported sale price of the common stock on the New York Stock Exchange on December 31, 2004 ($16.16) less the option exercise price.

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee is charged with the responsibility of administering all aspects of the Company’s executive compensation programs. The committee, which currently is comprised of four independent, non-employee directors and no employee directors, also grants all stock options and otherwise generally administers the Company’s 1996 Stock Option Plan. Following review and approval by the committee, determinations pertaining to executive compensation are submitted to the full Board of Directors for approval.

Compensation Philosophy. The Company’s executive compensation program is designed to (1) provide levels of compensation that integrate pay and incentive plans with the Company’s strategic goals, so as to align the interests of executive management with the long-term interests of the Company’s shareholders, (2) attract, motivate and retain executives of outstanding abilities and experience capable of achieving the strategic business goals of the Company, (3) recognize outstanding individual contributions, and (4) provide compensation opportunities which are competitive to those offered by other retail companies of similar size and performance. To achieve these goals, the Company’s executive compensation program consists of three main elements: (i) base salary, (ii) annual cash bonus and (iii) long-term incentives. Each element of compensation has an integral role in the total executive compensation program. Given the current share ownership of Messrs. David Gold, Howard Gold, Jeff Gold and Eric Schiffer, these members of management have chosen not to receive bonuses or stock option awards.

Base Salary. Base salaries are negotiated at the commencement of an executive’s employment with the Company and are reviewed annually. Base salaries are designed to reflect the position, duties and responsibilities of each executive officer, the cost of living in the area in which the officer is located, the market for base salaries of similarly situated executives at other companies engaged in businesses similar to that of the Company and the Company’s performance against its financial and strategic goals. Base salaries are generally designed to be at the mid-range of salaries of comparable companies. During the year ended December 31, 2004, David Gold served as the Company’s Chief Executive Officer. Mr. Gold’s base salary of $114,423 was determined based upon his service to the Company, the financial performance of the Company in the year ended December 31, 2004, his stock ownership position in the Company, and the salaries received by similarly situated executives at other companies. See “Executive Compensation -- Summary Compensation Table.”

Annual Cash Bonuses. All officers are eligible to receive annual incentive bonuses from an executive bonus pool in amounts approved at the discretion of the Board of Directors. The executive bonus pool is calculated based on the Company’s annual performance against a business plan developed each year by senior management and reviewed and approved by the Board of Directors. The executive bonus pool is capped at 3% of the Company’s operating profit. The amount of the bonus pool is determined based on a performance matrix consisting of three variables: (i) the increase in store sales during the subject year over store sales during the immediately preceding year; (ii) operating income; and (iii) the individual performance of the executives. Messrs. David Gold, Howard Gold, Jeff Gold and Eric Schiffer have chosen not to receive an annual incentive bonus for 2004.

Long-Term Incentives. The Company provides its executive officers with long-term incentive compensation through grants of awards under the Company’s 1996 Stock Option Plan. Under the 1996 Stock Option Plan, the Board of Directors is authorized to grant any type of award which might involve the issuance of shares of Common Stock, an option, warrant, convertible security, stock appreciation right or similar right or any other security or benefit with a value derived from the value of the Common Stock. The Compensation Committee of the Board of Directors is currently responsible for selecting the individuals to whom grants of awards will be made, the timing of grants, the determination of the per share exercise price and the number of shares subject to each award. All awards granted by the Compensation Committee pursuant to the 1996 Stock Option Plan have been in the form of stock options. The Compensation Committee believes that stock options provide the Company’s executive officers with the opportunity to purchase and maintain an equity interest in the Company and to share in the appreciation of the value of the Common Stock. The Compensation Committee believes that stock options directly motivate an executive to maximize long-term shareholder value. The options incorporate vesting periods in order to encourage key employees to continue in the employ of the Company. All options granted in 2004 were granted at the fair market value of the Company’s Common Stock on the date of grant. The Compensation Committee considers the grant of each option subjectively, considering factors such as the individual performance of executive officers and competitive compensation packages in the industry. Messrs. David Gold, Howard Gold, Jeff Gold and Eric Schiffer have chosen not to receive bonuses or stock option awards.

Compensation Deferral Plan. Effective January 1, 2000 the Company established a compensation deferral plan for highly compensated employees. Under the compensation deferral plan participants may defer up to 80% of base pay.

Omnibus Budget Reconciliation Act Implications for Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to the Chief Executive Officer and each of the Company’s four most highly paid executive officers other than the Chief Executive Officer. Certain “performance-based” compensation that has been approved by the Company’s shareholders is not subject to the deduction limit. The Company’s 1996 Stock Option Plan is intended to qualify so that awards under the plan constitute performance-based compensation not subject to Section 162(m) of the Code. All compensation paid to the Company’s employees in fiscal 2002 is fully deductible.

Summary. The Compensation Committee believes that its executive compensation philosophy of paying the Company’s executive officers by means of base salaries, annual cash bonuses and long-term incentives (other than Messrs. David Gold, Howard Gold, Jeff Gold and Eric Schiffer), as described in this report, serves the interests of the Company and its shareholders.

| | COMPENSATION COMMITTEE |

| | |

| | Eric Flamholtz (Chairman) |

| | Marvin Holen |

| | Lawrence Glascott |

| | Thomas Unterman |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors, which consists entirely of directors who meet the independence requirements of the New York Stock Exchange and Rule 10A-3 under the Securities Exchange Act, has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written Charter adopted by the Board. The Audit Committee reviews and reassesses the Charter annually and recommends any changes to the Board for approval.

The Audit Committee is responsible for overseeing the Company’s overall financial reporting process. In fulfilling its responsibilities for the financial statements for fiscal year 2004 the Audit Committee:

| | 1. | Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2004 with management and Deloitte & Touche LLP, the Company’s independent registered accounting firm; |

| | 2. | Discussed with Deloitte & Touche LLP the matters required to be discussed by Statement on Auditing Standards 61, 89 and 90 relating to the conduct of the audit; and |

| | 3. | Received written disclosures and the letter from Deloitte & Touche LLP regarding its independence as required by Independence Standards Board Standard Number 1. The Audit Committee also discussed with Deloitte & Touche LLP the firms’ independence. |

The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the Committee determined appropriate.

Based on the Audit Committee’s review of the audited financial statements and discussions with management and Deloitte & Touche, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004 for filing with the Securities and Exchange Commission.

| | AUDIT COMMITTEE |

| | |

| | Lawrence Glascott (Chairman) |

| | Marvin Holen |

| | Thomas Unterman |

EQUITY COMPENSATION PLAN INFORMATION

Plan category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted-average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders | 5,179,170 | $20.05 | 4,440,000 |

Equity compensation plans not approved by security holders | - | - | - |

Total | 5,179,170 | $20.05 | 4,440,000 |

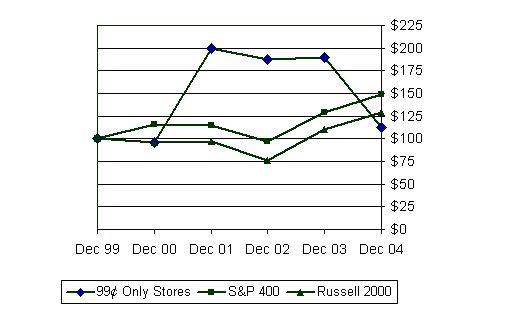

PERFORMANCE GRAPH

The following graph sets forth the percentage change in cumulative total shareholder return of our common stock during the period from December 31, 1999 to December 31, 2004, compared with the cumulative returns of the S&P Mid Cap 400 Index and the Russell 2000 Index. The comparison assumes $100 was invested on December 31, 1999 in the common stock and in each of the foregoing indices shown. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

| | | Cumulative Total Return | |

| | | | 12/99 | | | 12/00 | | | 12/01 | | | 12/02 | | | 12/03 | | | 12/04 | |

| 99¢ ONLY STORES | | | 100.00 | | | 95.47 | | | 200.07 | | | 187.31 | | | 189.89 | | | 112.69 | |

| S & P MID CAP 400 | | | 100.00 | | | 116.21 | | | 114.31 | | | 96.65 | | | 129.54 | | | 149.17 | |

| RUSSELL 2000 | | | 100.00 | | | 95.80 | | | 96.78 | | | 75. 90 | | | 110.33 | | | 129.09 | |

CERTAIN TRANSACTIONS WITH DIRECTORS AND EXECUTIVE OFFICERS

The Company currently leases 13 store locations and a parking lot associated with one of these stores from the Gold family and their affiliates. Rental expense for these facilities was approximately $2.2 million, $2.1 million, and $2.1 million in 2002, 2003, and 2004, respectively. The Company believes that lease terms are as favorable to the Company as they would be for an unrelated party. The Company enters into real estate transactions with affiliates only for the renewal or modification of existing leases and on occasions where it determines that such transactions are in the Company’s best interests. Moreover, the independent members of the Board of Directors must unanimously approve all real estate transactions between the Company and its affiliates. They must also determine that such transactions are equivalent to a negotiated arm’s-length transaction with a third party. The Company cannot guarantee that it will reach agreements with the Gold family on renewal terms for the properties the Company currently leases from them. In addition, even if the Company agrees to such terms, it cannot be certain that the independent directors will approve them. If the Company fails to renew one of these leases, it could be forced to relocate or close the leased store.

In addition, one of the Company’s directors, Ben Schwartz, who resigned in the first quarter of 2005 was a trustee of a trust that owns a property on which a single 99¢ Only Store is located. Rent expense on this store amounted to $0.3 million in 2002, 2003, and 2004.

In 2004, the Company engaged Boris Zelkind, a partner in the law firm of Zelkind and Schakelford LLP and the brother of Michael Zelkind, the Company's Executive Vice President of Supply Chain and Merchandising, to perform various legal services. Boris Zelkind continues to be engaged by the Company. Although the Company did not pay Zelkind and Schakelford LLP more than $60,000 during 2004, the Company expects to pay his firm in excess of $60,000 for such services in 2005.

PRINCIPAL SHAREHOLDERS

The following table sets forth as of August 31, 2005, certain information relating to the ownership of our common stock by (i) each person known by us to be the beneficial owner of more than five percent of the outstanding shares of our common stock, (ii) each of our directors, (iii) each of the Named Executive Officers, and (iv) all of our executive officers and directors as a group. Except as may be indicated in the footnotes to the table and subject to applicable community property laws, each such person has the sole voting and investment power with respect to the shares owned. Unless otherwise noted, the address of each person listed is in care of 99¢ Only Stores, 4000 Union Pacific Avenue, City of Commerce, California 90023.

Names and Addresses | | Number of Shares(a) | | Percent Of Class (a) |

| David Gold (b)(e) | | 15,864,212 | | 22.6% |

| Sherry Gold (c)(e) | | 15,864,212 | | 22.6% |

| Howard Gold (d)(e) | | 9,225,600 | | 13.1% |

| Jeff Gold (d)(e) | | 9,225,600 | | 13.1% |

| Eric and Karen Schiffer (e)(f) | | 9,300,606 | | 13.3% |

| Au Zone Investments #3, LLC (e) | | 6,860,124 | | 9.8% |

| Kayne Anderson Rudnick (g) | | 5,461,199 | | 7.8% |

| Goldman Sachs Asset Management, L.P. (h) | | 4,223,843 | | 6.0% |

| Massachusetts Financial Services Company “MFS”(i) | | 3,613,270 | | 5.1% |

| Thomas Unterman (j) | | 1,000 | | * |

| Marvin Holen (k) | | 60,000 | | * |

| Lawrence Glascott (l) | | 51,772 | | * |

| Eric Flamholtz (m) | | 1,000 | | * |

| Jose Gomez (n) | | 190,006 | | * |

| Andrew Farina (o) | | 113,800 | | * |

| All of the Company’s current executive officers and directors as a group, 10 persons (p) | | 23,162,752 | | 33.0% |

| | (a) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission that deem shares to be beneficially owned by any person who has or shares voting or investment power with respect to such shares. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that currently are exercisable or exercisable within 60 days of August 31, 2005 are deemed outstanding. Unless otherwise indicated, the persons named in this table have sole voting and sole investment power for all shares shown as beneficially owned, subject to community property laws where applicable. |

| | (b) | Includes 4,502,044 shares owned by Sherry Gold, David Gold’s spouse, and 6,860,124 shares controlled through Au Zone Investments #3, LLC, a California limited liability company. |

| | (c) | Includes 4,502,044 shares owned by David Gold, Sherry Gold’s spouse, and 6,860,124 shares controlled through Au Zone Investments #3, LLC. |

| | (d) | Includes 6,860,124 shares controlled through Au Zone Investments #3, LLC, and 75,006 shares reserved for issuance upon exercise of stock options, which are exercisable. |

| | (e) | Au Zone Investments #3, LLC, is the general partner of Au Zone Investments #2, L.P., a California limited partnership (the “Partnership”). The Partnership is the registered owner of 6,860,124 shares of common stock. The limited partners of the Partnership are David Gold, Sherry Gold, Howard Gold, Jeff Gold and Karen Schiffer. Each of the limited partners of the Partnership owns a 20% interest in Au Zone Investments #3, LLC. |

| | (f) | Includes 6,860,124 shares controlled through Au Zone Investments #3, LLC, and 150,012 shares reserved for issuance upon exercise of stock options, which are exercisable. |

| | (g) | This information is based on a Schedule 13G amendment filed by Kayne Anderson Rudnick Investment Management, LLC, 1800 Avenue of the Stars 2nd Floor, Los Angeles, California 90067, on February 7, 2005. |

| | (h) | This information is based on a Schedule13G amendment filed by Goldman Sachs Asset Management, L.P., 32 Old Slip, New York, NY 10005 on February 9, 2005. |

| | (i) | This information is based on a Schedule13G amendment filed by Massachusetts Financial Services, Company, 500 Boylston Street, Ma. 02116, on January 10, 2005. |

| | (j) | Includes 1,000 shares of common stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before October 31, 2005. |

| | (k) | Includes 47,503 shares of common stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before October 31, 2005. |

| | (l) | Includes 49,754 shares of common stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before October 31, 2005. |

| | (m) | Includes 1,000 shares of common stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before October 31, 2005. |

| | (n) | Includes 190,006 shares of common stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before October 31, 2005. |

| | (o) | Includes 113,800 shares of common stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before October 31, 2005. |

| | (p) | Includes (i) 4,502,044 shares owned by Sherry Gold, the spouse of David Gold, (ii) 6,860,124 shares controlled through Au Zone Investments #3, LLC, and (iii) 412,615 shares of common stock reserved for issuance upon exercise of stock options, which are exercisable. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our officers, directors, and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the Commission. Officers, directors and greater-than-ten percent shareholders are required by the Commission’s regulations to furnish us with all Section 16(a) forms they file. Based solely on our review of the copies of the forms received by us and written representations from certain reporting persons that they have complied with the relevant filing requirements, we believe that, during the year ended December 31, 2004, except for Form 4s (reporting a grant of options on May 21, 2004) filed on May 28, 2004 by each of William Christy (former Director), Andrew Farina (former CFO), Lawrence Glascott, Jose Gomez, Marvin Holen, Helen Pipkin, Ben Schwartz (former Director) and John Shields (former Director), all of our officers, directors and greater-than-ten percent shareholders complied with all Section 16(a) filing requirements.

SHAREHOLDER PROPOSALS

Any shareholder who intends to present a proposal at the next annual meeting for inclusion in our proxy statement and proxy relating to such annual meeting must submit such proposal to us at our principal executive offices by May 22, 2005. In addition, in the event a stockholder proposal is not received by us by August 5, 2005, the proxy to be solicited by the Board of Directors for the 2006 annual meeting will confer discretionary authority on the holders of the proxy to vote the shares if the proposal is presented at the 2006 Annual Meeting without any discussion of the proposal in the proxy statement for such meeting.

SEC rules and regulations provide that if the date of our 2006 Annual Meeting is advanced or delayed more than 30 days from the date of our 2005 Annual Meeting, stockholder proposals intended to be included in the proxy materials for the 2004 annual meeting must be received by us within a reasonable time before we begin to print and mail the proxy materials for the 2006 annual meeting. Upon determination by us that the date of the 2006 annual meeting will be advanced or delayed by more than 30 days from the date of the 2005 annual meeting, we will disclose such change in the earliest possible Quarterly Report on Form 10-Q.

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

On April 6, 2004, the Company’s audit committee dismissed PricewaterhouseCoopers LLP (“PWC”) as the Company’s independent registered public accounting firm but retained them for tax services. The decision to change independent registered public accounting firms was not the result of any disagreement between the Company and PWC on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure. The audit reports of PWC with respect to the consolidated financial statements as of and for the fiscal years ended December 31, 2003 and 2002 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty or audit scope.

On April 19, 2004, the Company’s audit committee engaged Deloitte & Touche LLP (“D&T”) as its independent registered public accounting firm to audit its financial statements for the year ended December 31, 2004. During the Company’s two most recent years ended December 31, 2003 and subsequent interim period through April 19, 2004, the Company did not consult with D&T with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements or any other matters or reportable events as set forth in Items 304 (a) (2) (i) and (ii) of Regulation S-K.

Representatives of Deloitte are expected to be present at the Annual Meeting and will be afforded the opportunity to make a statement if they desire and will be available to respond to appropriate questions from shareholders. Representatives of PWC are not expected to be present at the Annual Meeting.

For the fiscal years ended December 31, 2004 and December 31, 2003, Deloitte & Touche LLP and PricewaterhouseCoopers LLP billed the fees set forth below for work performed for the years indicated.

| | | 2004 | | 2003 | |

| Audit Fees | | $ | 2,346,000 | (a) | $ | 263,000 | |

| Audit Related Fees (b) | | | 410,000 | | | - | |

| Tax Fees(c) | | | 95,000 | | $ | 230,000 | |

| All Other Fees | | | - | | | - | |

| | (a) | The 2004 amount include fees necessary to perform an audit or quarterly review in accordance with Generally Accepted Auditing Standards and services that generally only the independent registered public accounting firm can reasonable provide, such as attest services, consents and assistance with, and review of, documents filed with the Securities and Exchange Commission (“SEC”). The amount also includes fees related to Deloitte’s attestation of the Company’s internal controls over financial reporting as of December 31, 2004. |

| | (b) | Fees paid to PWC for consultation on a SEC comment letter related to the 2003 10-K and other consultation related to the 2004 10-K. |

| | (c) | Tax fees paid to PWC primarily include fees for services performed in connection with IRS and California Franchise Tax Board audits in 2003 and preparation of tax provision in 2004. |

The Audit Committee has considered whether the provision of non-audit services by our principal accountant is compatible with maintaining auditor independence and determined that it is. Pursuant to the rules of the Securities and Exchange Commission, before our independent registered accounting firm is engaged to render audit or non-audit services, the engagement must be approved by the Audit Committee or entered into pursuant to the Audit Committee’s pre-approval policies and procedures. The Audit Committee has adopted a policy, attached hereto as Appendix A, granting pre-approval to certain specific audit and audit-related services and specifying the procedures for pre-approving other services.

SOLICITATION OF PROXIES

The expenses of preparing, assembling, printing and mailing this Proxy Statement and the materials used in the solicitation of proxies will be borne by us. It is contemplated that the proxies will be solicited through the mails, but our officers, directors and regular employees may solicit proxies personally. Although there is no formal agreement to do so, we may reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding the proxy materials to shareholders whose stock in us is held of record by such entities. In addition, we may use the services of individuals or companies we do not regularly employ in connection with the solicitation of proxies if management determines it advisable.

ANNUAL REPORT ON FORM 10-K

OUR ANNUAL REPORT ON FORM 10-K, WHICH HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE YEAR ENDED DECEMBER 31, 2004, WILL BE MADE AVAILABLE TO SHAREHOLDERS WITHOUT CHARGE UPON WRITTEN REQUEST TO 99¢ ONLY STORES, 4000 UNION PACIFIC AVENUE, CITY OF COMMERCE, CALIFORNIA 90023, ATTENTION: CHIEF FINANCIAL OFFICER. THE EXHIBITS OF THIS REPORT WILL ALSO BE PROVIDED UPON REQUEST AND PAYMENT OF COPYING CHARGES.

| | ON BEHALF OF THE BOARD OF DIRECTORS |

| | |

| | /s/ Eric Schiffer |

| | Eric Schiffer, CEO |

| | 4000 Union Pacific Avenue |

| | City of Commerce, California 90023 |

| | |

| | September 14, 2005 |

Appendix A

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF

99¢ ONLY STORES

PRE-APPROVAL POLICY

| I. | STATEMENT OF PRINCIPLES |

The Audit Committee of the Board of Directors (the “Board”) of 99¢ Only Stores (the “Corporation”) is required to pre-approve the audit and non-audit services performed by the independent auditor in order to assure that the provision of such services does not impair the auditor's independence. Unless a type of service to be provided by the independent auditor has received pre-approval pursuant to this policy, it will require specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved cost levels will require specific pre-approval by the Audit Committee.

The term of any pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different period. The Audit Committee will periodically review previously pre-approved services, based on subsequent determinations.

To ensure prompt handling of unexpected matters, the Audit Committee delegates to the Chair of the Audit Committee the authority to amend or modify the list of pre-approved non-audit services and fees. The Chair will report action taken to the Audit Committee at its next scheduled meeting. The Audit Committee may also delegate pre-approval authority to one or more of its members who shall report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent auditor to management or to the Board generally.

The annual audit services engagement terms and fees will be subject to the specific pre-approval of the Audit Committee. The independent auditor will provide the Audit Committee with an engagement letter and fee proposal outlining the scope and cost of the audit services proposed to be performed during the fiscal year. Once agreed to by the Audit Committee, the final engagement letter and fee proposal will be formally accepted. The Audit Committee will then approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope, Corporation structure or other matters.

In addition to the annual audit services engagement approved by the Audit Committee, the Audit Committee may grant pre-approval for other audit services that only the independent auditor reasonably can provide. The Audit Committee has pre-approved (i) statutory audits or financial audits for subsidiaries or affiliates of the Corporation, (ii) services associated with SEC registration statements, periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings (e.g., comfort letters, consents, etc.), and assistance in responding to SEC comment letters, and (iii) consultations by the Corporation’s management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB or other regulatory or standard setting body (other than services that are “audit-related” services under SEC rules which have been separately pre-approved). Other audit services that reasonably could be performed by someone other than the independent auditor must be separately pre-approved by the Audit Committee.

| IV. | AUDIT-RELATED SERVICES |

Audit-related services are assurance and related services that are reasonably related to the performance of the audit or review of the Corporation's financial statements and that are traditionally performed by the independent auditor. The Audit Committee believes that the provision of audit-related services does not impair the independence of the auditor, and has pre-approved audit-related services related to (i) internal control reviews and assistance with internal control reporting requirements, (ii) consultations by the Corporation’s management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB or other regulatory or standard setting body (other than services that are “audit” services under SEC rules which have been separately pre-approved), (iii) attest services not required by statute or regulation, and (iv) agreed-upon or expanded audit procedures relating to accounting and/or billing records required to respond to or comply with financial, accounting or regulatory reporting matters. All other audit-related services must be separately pre-approved by the Audit Committee.

It is the preference of the Audit Committee for tax services such as tax compliance, tax planning and tax advice to be performed by an accountant other than the independent auditor. However, if the Audit Committee believes that the independent auditor can provide tax services to the Corporation without impairing the auditor's independence, and the Audit Committee desires to retain the independent auditor for tax services, those services must be specifically pre-approved by the Audit Committee. In no event will the Audit Committee permit the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the purpose of which may be tax avoidance and the tax treatment of which may not be supported in the Internal Revenue Code and related regulations.

The Audit Committee may grant pre-approval to those permissible non-audit services classified as “all other” services that it believes are routine and recurring services, and would not impair the independence of the auditor.

A list of the SEC's prohibited non-audit services is attached to this policy as Exhibit 1. The SEC's rules and relevant guidance should be consulted to determine the precise definitions of these services and the applicability of exceptions to certain of the prohibitions.

| VII. | PRE-APPROVAL FEE LEVELS |

Pre-approval fee levels for all services to be provided by the independent auditor will be established periodically by the Audit Committee. Any proposed services exceeding these levels will require specific pre-approval by the Audit Committee. The initial pre-approval fee level shall be $30,000.

| VIII. | SUPPORTING DOCUMENTATION |

With respect to each proposed pre-approved service, the independent auditor will be required to provide detailed back-up documentation, which will be provided to the Audit Committee, regarding the specific services to be provided.

Except for the annual audit services engagement (the procedures for which are set forth in Section III above), all requests or applications to provide services that require separate approval by the Audit Committee will be submitted to the Audit Committee by both the independent auditor and the Chief Executive Officer, and must include a joint statement as to whether, in their view, the request or application is permissible under all legal requirements and consistent with the SEC's rules on auditor independence.

EXHIBIT 1

PROHIBITED NON-AUDIT SERVICES

| · | Bookkeeping or other services related to the accounting records or financial statements of the audit client* |

| · | Financial information systems design and implementation* |

| · | Appraisal or valuation services, fairness opinions or contribution-in-kind reports* |

| · | Internal audit outsourcing services* |

| · | Broker-dealer, investment adviser or investment banking services |

| · | Expert services unrelated to the audit |

* Provision of these non-audit services may be permitted if it is reasonable to conclude (without reference to materiality) that the results of these services will not be subject to audit procedures during the audit of the Corporation’s financial statements.

ANNUAL MEETING OF SHAREHOLDERS OF

99¢ ONLY STORES

October 18, 2005

PROXY

99¢ ONLY STORES

4000 UNION PACIFIC AVENUE

CITY OF COMMERCE, CALIFORNIA 90023

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

99¢ ONLY STORES

The undersigned, a shareholder of 99¢ ONLY STORES, a California corporation (the "Company") hereby appoints David Gold and Eric Schiffer, and each of them, the proxy of the undersigned, with full power of substitution, to attend, vote and act for the undersigned at the Company's Annual Meeting of Shareholders (the "Annual Meeting"), to be held on October 18, 2005, and at any postponements or adjournments thereof, to vote and represent all of the shares of the Company which the undersigned would be entitled to vote, as follows:

(PLEASE SIGN, DATE, AND RETURN PROPMTLY IN THE ENCLOSED ENVELOPE) |

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý. |

| | | |

1. ELECTION OF DIRECTORS, The Board of Directors recommends a vote for the election of the following nominees: | | 2. SHAREHOLDER PROPOSAL-REDEEM OR VOTE POISON PILL. |

¨ ¨ ¨ | FOR ALL NOMINEES WITHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instruction below) | | NOMINEES: m Eric Schiffer m Lawrence Glascott m David Gold m Jeff Gold m Marvin Holen m Thomas Unterman m Eric G. Flamholtz | | The Board of Directors recommends a vote AGAINST the adoption of this proposal. Proxies solicited by the Board of Directors will be voted against this proposal unless otherwise specified by the shareholder in the proxy. | FOR ¨ | AGAINST ¨ | ABSTAIN ¨ |

INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: l | | The undersigned hereby revokes any other proxy to vote at the Annual Meeting, and hereby ratifies and confirms all that the proxy holder may lawfully do by virtue hereof. As to any business that may properly come before the Annual Meeting and any of its postponement or adjournments, the proxy holder is authorized to vote in accordance with his best judgment. |

| | | This Proxy will be voted in accordance with the instructions set forth above. This Proxy will be treated as a GRANT OF AUTHORITY TO VOTE FOR the election of the directors named above and AGAINST the shareholder proposal and as the proxy holder shall deem advisable on such other business as may come before the Annual Meeting, unless otherwise directed. |

| | | The undersigned acknowledges receipt of a copy of the Notice of Annual Meeting and accompanying Proxy Statement dated September 14, 2005 relating to the Annual Meeting. |

______________________________________________ Signature(s) of Shareholder(s) (See Instructions Below) | | Date: |

______________________________________________ Signature(s) of Shareholder(s) (See Instructions Below) | | Date: |

The signature(s) hereon should correspond exactly with the name(s) of the shareholder(s) appearing on the Stock Certificate. If stock is jointly held, all joint owners should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If signer is a corporation, please sign the full corporation name and give title of signing officer.