UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

oo Preliminary Proxy Statement | o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

x Definitive Proxy Statement | |

o Definitive Additional Materials | |

o Soliciting Material Pursuant to Sec.240.14a-12 | |

99¢ Only Stores

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

99¢ ONLY STORES

_____________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

_____________________________________________________

| TIME | 9:00 a.m. Pacific Time on Friday, May 11, 2007 |

| | |

| PLACE | City of Commerce Community Center Rosewood Park Meeting Room 5600 Harbor Street City of Commerce, California 90040 |

| | |

| ITEMS OF BUSINESS | (1) To elect a Board of nine directors, each to hold office until the next annual meeting of shareholders and until his or her successor is elected. |

| | |

| | (2) To consider and act upon a shareholder proposal, if properly presented at this meeting. |

| | |

| | (3) To transact such other business as may properly come before the annual meeting and any adjournments or postponements thereof. |

| | |

| RECORD DATE | You can vote if at the close of business on March 12, 2007 you were a shareholder of 99¢ Only Stores. |

| | |

| PROXY VOTING | All shareholders are cordially invited to attend the annual meeting in person. However, to ensure your representation at the annual meeting, you are urged to complete and return the enclosed proxy as promptly as possible. If you receive more than one proxy card because you own shares registered in different names or at different addresses, each card should be completed and returned. |

| | |

| | /s/ Eric Schiffer |

| April 4, 2007 | Eric Schiffer |

| | Chief Executive Officer |

99¢ ONLY STORES

PROXY STATEMENT

FOR THE 2006 ANNUAL MEETING OF SHAREHOLDERS ON

May 11, 2007

This proxy statement is furnished in connection with the solicitation by the Board of Directors of 99¢ Only Stores (“the Company”), a California corporation, of proxies to be voted at the Company’s 2006 annual meeting of shareholders and at any adjournments or postponements thereof.

You are invited to attend the Company’s annual meeting of shareholders on Friday, May 11, 2007, beginning at 9:00 a.m. Pacific Time. The meeting will be held at the City of Commerce Community Center, Rosewood Park Meeting Room, 5600 Harbor Street, City of Commerce, California 90040.

It is anticipated that this proxy statement and the accompanying proxy will be mailed to shareholders on or about April 11, 2007.

Shareholders Entitled to Vote. The close of business on March 12, 2007 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any postponements or adjournments thereof. At the record date, 69,937,297 shares of the Company’s common stock, no par value, were outstanding. The Company’s common stock is the only outstanding class of securities entitled to vote at the annual meeting. At the record date, the Company had approximately 15,282 shareholders, which includes 418 shareholders of record.

Proxies. Your vote is important. If your shares are registered in your name, you are a shareholder of record. If your shares are in the name of your broker or bank, your shares are held in street name. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting even if you cannot attend. Your submission of the enclosed proxy will not limit your right to vote at the annual meeting if you later decide to attend in person. If your shares are held in a street name, however, you must direct the holder of record as to how to vote your shares, or you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the meeting. If you are a record holder, you may revoke your proxy at any time before the meeting either by filing with the Company’s Secretary, at the Company’s principal executive offices, a written notice of revocation or a duly executed proxy bearing a later date, or by attending the annual meeting and voting your shares in person. If no instruction is specified on the enclosed proxy with respect to a matter to be acted upon, the shares represented by the proxy will be voted (i) in favor of the election of the nominees for director set forth herein, (ii) against the shareholder proposal, and (iii) if any other business is properly presented at the annual meeting, in accordance with the best judgment of the proxyholders.

Quorum. The presence, in person or by proxy, of a majority of the votes entitled to be cast by the shareholders entitled to vote at the annual meeting is necessary to constitute a quorum. Abstentions and broker non-votes will be included in the number of shares present at the annual meeting for determining the presence of a quorum. Broker non-votes occur when a broker holding customer securities in street name has not received voting instructions from the customer on certain non-routine matters and, therefore, is barred by the rules of the applicable securities exchange from exercising discretionary authority to vote those securities on those matters.

Voting. A shareholder is entitled to cast one vote for each share held of record on the record date on all matters to be considered at the annual meeting. Abstentions will be counted toward the tabulation of votes cast on proposals submitted to shareholders and will have the same effect as negative votes, while broker non-votes will not be counted as votes cast against such matters.

Election of Directors. The nine nominees for director receiving the highest number of votes at the annual meeting will be elected. If any nominee is unable or unwilling to serve as a director at the time of the annual meeting, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.

Shareholder Proposal. Approval of the shareholder proposal will require the affirmative vote of a majority of the shares of common stock present or represented and voting at the annual meeting.

Change in Fiscal Year. In December 2005, the Company changed its fiscal year end from December 31 to March 31. As a result, certain information in this proxy statement is presented for both the Company’s fiscal year ended March 31, 2006 (also referred to herein as “fiscal 2006”) and its transition period of January 1, 2005 through March 31, 2005.

ITEM 1: | ELECTION OF DIRECTORS |

Item 1 is the election of nine members of the Board of Directors. In accordance with the Company’s bylaws, 99¢ Only Stores’ directors are elected at each annual meeting and hold office until the next annual meeting and until their successors are elected and qualified. The Company’s bylaws provide that the Board of Directors shall consist of no less than seven and no more than eleven directors as determined from time to time by the board of directors. The Board of Directors currently consists of ten directors, but the size will be reduced to nine members as of the date of the annual meeting.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unable or unwilling to serve as a director at the time of the annual meeting or any adjournments thereof, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominees will be unable or unwilling to serve if elected as a director.

The Board of Directors proposes the election of the following nominees as directors:

| Eric Flamholtz | Marvin Holen |

| Lawrence Glascott | Eric Schiffer |

| Howard Gold | Jennifer Holden Dunbar |

| Jeff Gold | Peter Woo |

| David Gold | |

If elected, each of the nominees is expected to serve until the 2007 annual meeting of shareholders and thereafter until his or her successor is duly elected and qualified.

REGARDING ITEM 1: ELECTION OF DIRECTORS, THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE ABOVE LISTED NOMINEES.

ITEM 2: | SHAREHOLDER PROPOSAL - REDEEM OR VOTE POISON PILL |

RESOLVED, Shareholders request that our Board redeem any future or current poison pill, unless such poison pill is subject to a shareholder vote as a separate ballot item, to be held as soon as may be practicable. Charter or bylaw inclusion if practicable.

Thus there would be no loophole to allow exceptions to override the implementation of a shareholder vote as soon as may be practicable. Since a vote would be as soon as may be practicable, it accordingly could take place within 4-months of the adoption of a new poison pill. To give our board valuable insight on our views of their poison pill, a vote would occur even if our board had promptly terminated a new poison pill because our board could turnaround and readopt their poison pill.

58% yes - vote

Twenty (20) shareholder proposals on this topic won an impressive 58% average yes-vote in 2005 through late-September. The Council of Institutional Investors www.cii.org formally recommends adoption of this proposal topic.

Progress Begins with One Step

It is important to take one forward step in our corporate governance and adopt the above RESOLVED statement since our 2005 governance was not impeccable. For instance in 2005 it was reported (and certain concerns are noted):

• The Corporate Library (TCL) http://www.thecorporatelibrary.com/ a pro-investor research firm rated our company:

“D” in Overall Board Effectiveness.

“D” in Board Composition.

“D” in Litigation and Regulatory Problems.

“D” in Accounting.

Overall Governance Risk Assessment = High

• Our current CEO had a tenure of less than two years, while the former CEO remains Chairman, which can undermine and weaken the CEO’s leadership.

• Our directors can be elected with one yes-vote from our 62 million shares under plurality voting.

• Two of our director held zero-shares - Lack of confidence concern.

• Three directors on our small board were 70 to 74 years of age.

The Corporate Library’s 2005 “Analyst Comments” said 99 Cents dismissed its auditor, PricewaterhouseCoopers, in April 2004. This is not a signal of impending restatements, unless it is followed by:

1. Resignation of an audit committee member, like William Christy’s September 10, 2004 departure.

2. Resignation of the CFO, or worse still, a reassignment to a non-executive position, which is what happened on December 16, 2004, when Andrew Farina, then CFO, was reassigned as treasurer.

3. The replacement CFO resigning as Jim Ritter, Mr. Farina’s replacement, did, 3-months into the job.

99 Cents took away some surprise on March 7, 2005, when it announced its SOX non-compliance, the possibility of earnings restatements, and that its 2005 10-K would be delayed.

Pills Entrench Current Management

“Poison pills … prevent shareholders, and the overall market, from exercising their right to discipline management by turning it out. They entrench the current management, even when it’s doing a poor job. They water down shareholders’ votes.”

“Take on the Street” by Author Levitt, SEC Chairman, 1993-2001

John Chevedden, 2215 Nelson Ave., No. 205, Redondo Beach, Calif. 90278 submitted this proposal.

Redeem or Vote Poison Pill

Yes on 2

REGARDING ITEM 2: SHAREHOLDER PROPOSAL - REDEEM OR VOTE POISON PILL, THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE AGAINST THE ABOVE PROPOSAL FOR THE FOLLOWING REASONS:

The Company does not have a shareholder rights plan, or “poison pill,” in place and therefore has no poison pill to redeem or submit to a shareholder vote.

Further, the Board of Directors believes that it is in the best interests of the Company and its shareholders that we retain the flexibility to adopt and maintain such an anti-takeover provision if and when necessary, without obtaining shareholder approval. The purpose of a shareholder rights plan is to force a potential acquirer to negotiate directly with the corporation’s board of directors. A corporation’s board of directors is in the best position to negotiate on behalf of all shareholders, evaluate the adequacy of any potential offer and seek a higher price if there is to be a sale of the corporation. A study by Georgeson Shareholder Communications Inc. showed that between 1992 and 1996, stockholders of companies with shareholder rights plans received significantly higher value in acquisitions than companies without them. (Georgeson Shareholder Communications Inc., “Mergers & Acquisitions: Poison Pills and Shareholder Value/1992-1996,” 1997). To the extent that this proposal is intended to limit our flexibility to adopt and maintain a shareholder rights plan in the future, we believe any such limitation could prevent us from appropriately responding to a takeover attempt, which could jeopardize our ability to negotiate effectively, protect shareholders’ interests and maximize shareholder value.

We are committed to acting in the best interests of the Company and its shareholders in all matters of corporate governance, including any decision to adopt and maintain a shareholder rights plan. In response to statements included in the above proposal, shareholders should also recognize that a majority of the Company’s directors are independent in accordance with the standards of the New York Stock Exchange, and that, as described elsewhere in this Proxy Statement, the Company has adopted corporate governance guidelines to promote the effective governance of the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE AGAINST THE ADOPTION OF THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED AGAINST THIS PROPOSAL UNLESS OTHERWISE SPECIFIED BY THE SHAREHOLDER IN THE PROXY.

INFORMATION WITH RESPECT TO NOMINEES AND EXECUTIVE OFFICERS

The following table sets forth information with respect to the Company’s directors and executive officers as of February 28, 2007 and information with respect to Peter Woo, Jennifer Holden Dunbar and Howard Gold who became directors on April 3, 2007:

Directors:

Name: | | Age at February 28, 2007 | | Year First Elected or Appointed Director | | Principal Occupation |

| | | | | | | |

| David Gold | | 74 | | 1965 | | David Gold has been Chairman of the Board since the founding of the Company in 1965. Mr. Gold has over 50 years of retail experience. |

| Jeff Gold | | 39 | | 1991 | | Jeff Gold joined the Company in 1984 and has served in various managerial capacities. From 1991 to 2004 he served as Senior Vice President of Real Estate and Information Systems. In January 2005, he was promoted to President and Chief Operating Officer. |

| Eric Schiffer | | 46 | | 1991 | | Eric Schiffer joined the Company in 1991 and has served in various managerial capacities. In March 2000, he was promoted to President and in January 2005 to Chief Executive Officer. From 1987 to 1991, he was employed by Oxford Partners, a venture capital firm. Mr. Schiffer is a graduate of the Harvard Business School. |

| Lawrence Glascott | | 72 | | 1996 | | Lawrence Glascott serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. Mr. Glascott has also served as Chairman of the Board of Directors of General Finance Corporation since November 2005. Before Mr. Glascott retired in 1996, he had been Vice President - Finance of Waste Management International, an environmental services company, since 1991. Prior thereto, Mr. Glascott was a partner at Arthur Andersen LLP and was the Arthur Andersen LLP partner in charge of the 99¢ Only Stores account for six years. Additionally, Mr. Glascott was in charge of the Los Angeles based Arthur Andersen LLP Enterprise Group practice for over 15 years. |

| Marvin Holen | | 77 | | 1991 | | Marvin Holen serves on the Company’s Audit, Compensation and Nominating and Corporate Governance Committees. He is an attorney and in 1960 founded the law firm of Van Petten & Holen. He served on the Board of the Southern California Rapid Transit District from 1976 to 1993 (six of those years as the Board’s President). He served on the Board of Trustees of California Blue Shield from 1972 to 1978, on the Board of United California Savings Bank from 1992 to 1994 and on several other corporate, financial institution and philanthropic boards of directors; he currently serves on the Board of United Pacific Bank. |

| Eric G. Flamholtz | | 64 | | 2004 | | Eric G. Flamholtz, Ph.D., serves on the Company’s Compensation and Nominating and Corporate Governance Committees. He has been a professor of management at the Anderson Graduate School of Management, University of California at Los Angeles since 1973 and in 2006 became Professor Emeritus. He is President of Management Systems Consulting Corporation, which he founded in 1978. He is the author of several books including Growing Pains: Transitioning from an Entrepreneurship to a Professionally Managed Firm. As a consultant he has extensive experience with firms ranging from entrepreneurships to Fortune 500 companies, including Starbucks, Countrywide Financial Corporation, Baskin Robbins, Jamba Juice and Grocery Outlets. |

| Thomas Unterman | | 62 | | 2004 | | Thomas Unterman serves on the Company’s Audit and Nominating and Corporate Governance Committees. Mr. Unterman is the Founder and Managing Partner of Rustic Canyon Partners, a sponsor of venture capital and private equity investment funds. Previously, from 1992 through 1997, he was employed by the Times Mirror Company (since acquired by the Tribune Company) most recently as Executive Vice President and Chief Financial Officer of The Times Mirror Company, a diversified media company. Mr. Unterman also serves on the boards of several privately held companies in which Rustic Canyon has an investment and several charitable organizations. As previously disclosed, Mr. Unterman is not standing for re-election at the Company’s annual meeting. |

| Jennifer Holden Dunbar | | 44 | | 2007 | | Jennifer Holden Dunbar has served as a director of Big 5 Sporting Goods Corp. since February 2004, as well as from 1992 to 1997. Ms. Dunbar has served as Principal and Managing Director of Dunbar Partners, LLC, an investment/advisory firm since 2005. From 1994 to 1998, she was a partner of Leonard Green & Partners, L.P., a private equity firm, which she joined in 1989. During the 1990s, she served as a director of several public and private companies including Thrifty Payless, Inc., Kash N’ Karry Food Stores, Inc. and Gart Sports Company. Ms. Dunbar received her MBA from the Stanford Graduate School of Business in 1989. |

| Peter Woo | | 57 | | 2007 | | Peter Woo is a founder, co-owner and President of Megatoys, Inc., a toy and general merchandise manufacturer and import/export company headquartered in Los Angeles that he founded in 1989. Megatoys operates buying, logistics and export facilities in Hong Kong and mainland China, as well as warehouse and distribution facilities in the U.S. Mr. Woo was instrumental in the redevelopment of the downtown Los Angeles area now known as the “toy district”, and has served as an advisor on international trade to the City of Los Angeles. |

| Howard Gold | | 47 | | 2007 | | Howard Gold joined the Company in 1982 and has served in various managerial capacities. In 1991 Mr. Gold was named Senior Vice President of Distribution, and in January 2005 he was named Executive Vice President of Special Projects. He has been an executive with the Company for over 20 years. He previously served as a director of the Company from 1991 until March 2005. |

Other Executive Officers: | | | | |

| | | | | | | |

| Robert Kautz | | 48 | | | | Robert Kautz joined the Company in November 2005 as Executive Vice President and Chief Financial Officer. He was the CEO/CFO of Taste Good LLC, a private start-up in food production and distribution, from September 2004 until he joined the Company. He was CFO and subsequently CEO for Wolfgang Puck Casual Dining and Wolfgang Puck Worldwide where he was employed from 1998 until July 2004. Mr. Kautz is a graduate of the Harvard Business School. |

Jeff Gold and Howard Gold are the sons of David Gold, and Eric Schiffer is the son-in-law of David Gold.

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Independence

The Board of Directors has concluded that the following directors are independent in accordance with the director independence standards of the New York Stock Exchange, and it has determined that none of them has a material relationship with the Company which would impair his or her independence from management or otherwise compromise his or her ability to act as an independent director: Lawrence Glascott, Marvin Holen, Eric Flamholtz, Tom Unterman, Jennifer Holden Dunbar and Peter Woo.

Meetings and Committees

The Board of Directors held a total of 10 meetings during the fiscal year ended March 31, 2006 and two meetings during the transition period of January 1, 2005 through March 31, 2005. The number of Board committee meetings is set forth below. During the fiscal year ended March 31, 2006 and the three month period ended March 31, 2005, each incumbent director attended 75 percent or more of the aggregate of (i) the total number of board meetings (held during the period for which he or she has been a director) and (ii) the total number of meetings held by all committees of the board on which he or she served (during the periods that he or she served). Directors are encouraged but not required to attend annual meetings of shareholders. All of the Company’s directors at the date of the 2005 annual meeting of shareholders attended that meeting.

The Board of Directors has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee during the three month transition period ended March 31, 2005 and during fiscal 2006 consisted of Messrs. Glascott (Chairman), Holen and Unterman, each of whom meets the criteria for independence set forth in the New York Stock Exchange’s rules and in Rule 10A-3 under the Securities Exchange Act. The Board of Directors has determined that Mr. Glascott is an “audit committee financial expert” as that term is used in Item 401(h) of Regulation S-K promulgated under the Securities Exchange Act. The Audit Committee selects the independent registered public accountants to perform the Company’s audit and periodically meets with the independent registered public accountants and the Company’s management to review matters relating to the Company’s financial statements, accounting principles and system of internal accounting controls, and reports its recommendations as to the approval of the Company’s financial statements to the Board of Directors. The role and responsibilities of the Audit Committee are more fully set forth in a written charter adopted by the Board of Directors, which is available on the Company’s website at www.99only.com. The Audit Committee held ten meetings during the fiscal year ended March 31, 2006. There were two meetings held during the transition period ended March 31, 2005. Following the date of the annual meeting, Jennifer Holden Dunbar will become a member of the Audit Committee.

The Board of Directors also has a Compensation Committee. The Compensation Committee currently consists of Messrs. Flamholtz (Chairman), Glascott and Holen, each of whom is independent in accordance with New York Stock Exchange rules. This Committee is responsible for considering and making recommendations to the Board of Directors regarding executive compensation and is responsible for administering the Company’s stock option plan. The Compensation Committee held five meetings during the fiscal year ended March 31, 2006. There was one meeting held during the transition period ended March 31, 2005. A copy of the charter of the Compensation Committee is available on the Company’s website at www.99only.com. Following the date of the annual meeting, Jennifer Holden Dunbar and Peter Woo will become members of the Compensation Committee.

In addition, the Board of Directors has a Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee during fiscal 2006 consisted of Messrs. Holen (Chairman), Flamholtz, Glascott and Unterman, each of whom is independent in accordance with New York Stock Exchange rules. The role of the Nominating and Corporate Governance Committee is to assist the Board of Directors by identifying, evaluating and recommending director nominees and recommending and monitoring corporate governance guidelines applicable to the Company. In identifying director nominees, the Nominating and Corporate Governance Committee looks for independent individuals with business and professional experience, relevant industry knowledge or experience, an ability to read and understand financial statements and other relevant qualifications. Each nominee for election as a director is standing for reelection after being elected by the shareholders at the 2004 annual meeting of shareholders with the exception of Ms. Dunbar and Messrs. Woo and Howard Gold. Ms. Dunbar and Mr. Woo were recommended to the nominating committee by Eric Schiffer. Howard Gold is a former director and executive officer of the Company. There is not a formal policy by which shareholders may recommend director candidates, but the members of the Nominating and Corporate Governance Committee will certainly consider candidates recommended by shareholders. A shareholder wishing to submit such a recommendation should send a letter to the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the shareholder. At a minimum, candidates for election to the Board should meet the independence requirements of the New York Stock Exchange and Rule 10A-3 under the Securities Exchange Act, as well as the criteria identified above. Candidates recommended by shareholders will be evaluated in the same manner as candidates recommended by anyone else. The Nominating and Corporate Governance Committee held three meetings during the fiscal year ended March 31, 2006. There were no meetings during the transition period ended March 31, 2005. A copy of the charter of the Nominating and Corporate Governance Committee is available on the Company’s website at www.99only.com. Following the date of the annual meeting, Jennifer Holden Dunbar and Peter Woo will become members of the Nominating and Corporate Governance Committee.

Executive Sessions

The Board has adopted a procedure for executive sessions of non-management directors whereby a presiding non-management director for each session is determined on a rotating basis, proceeding in alphabetical order. Interested parties with concerns regarding the Company may contact the non-management directors by sending a letter in care of the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023; the mailing envelope must contain a clear notation that it is confidential and for the non-management directors.

Compensation of Directors

Each director who is not an officer of or otherwise employed by us receives $2,500 per month, plus $750 for each board meeting attended. Such non-employee directors also receive $250 ($350 for audit committee members) for each committee meeting attended or $350 for each committee meeting attended as committee chairperson ($700 for the audit committee chairperson). In addition, the Company’s stock option plan provides that each non-employee director receives an annual grant of a non-qualified option to purchase 3,000 shares of the Company’s Common Stock with a per share exercise price equal to the fair market value (as determined pursuant to the stock option plan).

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Company’s Board of Directors currently consists of Messrs. Flamholtz, Glascott and Holen. None of these individuals has at any time been an officer or employee of the Company. During fiscal 2006 and the transition period ended March 31, 2005, none of the Company’s executive officers served as a member of the board of directors or compensation committee of any entity for which a member of the Company’s Board of Directors or Compensation Committee has served as an executive officer.

Corporate Governance Guidelines

The Board of Directors has adopted corporate governance guidelines to serve as a flexible framework within which the Board may conduct its business, subject to occasional deviations. A copy of the corporate governance guidelines is available on the Company’s website at www.99only.com.

Shareholder Communication with the Board of Directors

Shareholders who wish to communicate with the Board of Directors or a particular director may send a letter to the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Corporate Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all directors, officers and employees of the Company. A copy of the Code of Business Conduct and Ethics is available on the Company’s website at www.99only.com.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth, as to the Chief Executive Officer and the other four most highly compensated executive officers during fiscal 2006 (the “Named Executive Officers”), information concerning all compensation paid for services to the Company in all capacities during the periods indicated.

Name and Principal Position | | Fiscal Year Ended (except 2005, which is a three month fiscal period) (1) | | Annual Compensation (except 2005, which is a three month fiscal period) (1) | | Other Annual Compensation | | Long-Term Compensation (Number of Securities Underlying Options((#) | | All Other Compensation ($) | |

| | | | | Salary | | Bonus | | | | | | | |

| | | | | | | | | | | | | | |

| Eric Schiffer (a) | | | 3/31/2006 | | $ | 120,000 | | | - | | | - | | | - | | | - | |

| Chief Executive | | | 3/31/2005 | | | 32,308 | | | - | | | - | | | - | | | - | |

| Officer | | | 12/31/2004 | | | 124,615 | | | - | | | - | | | - | | | - | |

| | | | 12/31/2003 | | | 117,692 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Jeff Gold (b) | | | 3/31/2006 | | $ | 122,308 | | | - | | | - | | | - | | | - | |

| President and Chief | | | 3/31/2005 | | | 34,615 | | | - | | | - | | | - | | | - | |

| Operating Officer | | | 12/31/2004 | | | 124,615 | | | - | | | - | | | - | | | - | |

| | | | 12/31/2003 | | | 123,231 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Howard Gold (c) | | | 3/31/2006 | | $ | 122,308 | | | - | | | - | | | - | | | - | |

| Executive Vice | | | 3/31/2005 | | | 34,615 | | | - | | | - | | | - | | | - | |

| President Of | | | 12/31/2004 | | | 124,615 | | | - | | | - | | | - | | | - | |

| Special Projects | | | 12/31/2003 | | | 124,615 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Michael Zelkind | | | 3/31/2006 | | $ | 240,000 | | $ | 26,250 | | | - | | | - | | | - | |

| Former Executive | | | 3/31/2005 | | | 50,000 | | | 8,750 | | | - | | | - | | | - | |

| Vice President | | | 12/31/2004 | | | 35,000 | | | 25,000 | | | - | | | 40,002 | | | - | |

| Of Supply Chain and Merchandising | | | 12/31/2003 | | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Robert Kautz | | | 3/31/2006 | | $ | 129,500 | | $ | 20,000 | | | - | | | 150,000 | | | - | |

| Chief Financial | | | 3/31/2005 | | | - | | | - | | | - | | | - | | | - | |

| Officer | | | 12/31/2004 | | | - | | | - | | | - | | | - | | | - | |

| | | | 12/31/2003 | | | - | | | - | | | - | | | - | | | | |

| | (a) | Includes $92,308, $99,692, $25,846, and $96,000 in discretionary contributions made to a deferred compensation plan for the year ended December 31, 2003, the year ended December 31, 2004, the three month period ended March 31, 2005, and the fiscal year ended March 31, 2006, respectively. |

| | (b) | Includes $94,892, $99,692, $27,692, and $97,846 in discretionary contributions made to a deferred compensation plan for the year ended December 31, 2003, the year ended December 31, 2004, the three month period ended March 31, 2005, and the fiscal year ended March 31, 2006, respectively. |

| | (c) | Includes $96,000, $99,692, $27,692, and $97,846 in discretionary contributions made to a deferred compensation plan for the year ended December 31, 2003, the year ended December 31, 2004, the three month period ended March 31, 2005, and the year ended March 31, 2006, respectively. |

| (1) | The 2005 period reflected in this table is the transition period of January 1, 2005 through March 31, 2005 due to the change from the calendar year-end December 31 reporting to fiscal year-end March 31 reporting. |

Option Grants in Last Fiscal Year

The following table sets forth certain information regarding the grant of stock options made during the fiscal year ended March 31, 2006 to the Named Executive Officers. No grants were made to the Named Executive Officers during the three months ended March 31, 2005.

| Name | | Number Of Securities Underlying Option Granted (a) | | Percent Of Total Options Granted To Employees in Fiscal Year (b) | | Exercise Or Base Price | | Expiration Date | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term | |

| | | | | | | | | | | 5% | | 10% | |

| Eric Schiffer | | | - | | | - | | | - | | | - | | | - | | | - | |

| Jeff Gold | | | - | | | - | | | - | | | - | | | - | | | - | |

| Howard Gold | | | - | | | - | | | - | | | - | | | - | | | - | |

| Michael Zelkind | | | - | | | - | | | - | | | - | | | - | | | - | |

| Robert Kautz | | | 150,000 | | | 85.7 | % | $ | 9.54 | | | 11/11/2015 | | $ | 899,948 | | $ | 2,280,645 | |

| (a) | The option grant set forth on this chart vests in three equal annual installments beginning on November 11, 2006. |

| (b) | Options covering an aggregate of 175,000 shares were granted to eligible persons during the fiscal year ended March 31, 2006. |

Stock Options Held at Fiscal Year End

The following table sets forth, for each of the Named Executive Officers, information regarding the number of shares of Common Stock underlying stock options held at fiscal 2006 year end and the value of options held at fiscal 2006 year end. None of the Named Executive Officers exercised any options during the fiscal year ending March 31, 2006 or during the three month period ended March 31, 2005.

| | | | | Number of Securities Underlying Unexercised Options at March 31, 2006 | | Value of Unexercised In-the-Money Options At March 31, 2006(a) | |

Name | | Shares Acquired Upon Exercise | | Value Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| | | | | | | | | | | | | | |

| Eric Schiffer | | | - | | | - | | | 75,006 | | | - | | $ | 720,058 | | | - | |

| Jeff Gold | | | - | | | - | | | 75,006 | | | - | | $ | 720,058 | | | - | |

| Howard Gold | | | - | | | - | | | 75,006 | | | - | | $ | 720,058 | | | - | |

| Michael Zelkind | | | - | | | - | | | 13,334 | | | 26,666 | | $ | 4,467 | | $ | 8,934 | |

| Robert Kautz | | | - | | | - | | | - | | | 150,000 | | | - | | $ | 603,000 | |

| (a) | Based on the last reported sale price of the Company’s Common Stock on the New York Stock Exchange on March 31, 2006 ($13.56) less the option exercise price. |

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee is charged with the responsibility of administering the Company’s compensation program pertaining to executive officers. The committee, which currently is comprised of three independent, non-employee directors and no employee directors, also grants all stock options and otherwise generally administers the Company’s 1996 Stock Option Plan. Following review and approval by the committee, determinations pertaining to executive officer compensation are submitted to the full Board of Directors for approval.

Compensation Philosophy. The Company’s compensation program pertaining to executive officers is designed to (1) provide levels of compensation that integrate pay and incentive plans with the Company’s strategic goals, so as to align the interests of executive management with the long-term interests of the Company’s shareholders, (2) attract, motivate and retain executives of outstanding abilities and experience capable of achieving the strategic business goals of the Company, (3) recognize outstanding individual contributions, and (4) provide compensation opportunities which are competitive to those offered by other retail companies of similar size and performance. To achieve these goals, the Company’s executive compensation program consists of three main elements: (i) base salary, (ii) annual cash bonus and (iii) long-term incentives. Each element of compensation has an integral role in the total executive compensation program. Given the current share ownership of Howard Gold, Jeff Gold and Eric Schiffer, these members of management have chosen not to receive bonuses or stock option awards.

Base Salary. Base salaries are negotiated at the commencement of an executive officer’s employment with the Company and are reviewed annually. Base salaries are designed to reflect the position, duties and responsibilities of each executive officer, the cost of living in the area in which the officer is located, the market for base salaries of similarly situated executives at other companies engaged in businesses similar to that of the Company and the Company’s performance against its financial and strategic goals. Base salaries are generally designed to be at the mid-range of salaries of comparable companies. During the fiscal year ended March 31, 2006 and the transition period ended March 31, 2005, Eric Schiffer served as the Company’s Chief Executive Officer. Mr. Schiffer’s base annual salary of $120,000 was determined based upon his service to the Company, the financial performance of the Company in the fiscal year ended March 31, 2006 and the transition period ended March 31, 2005, his stock ownership position in the Company. See “Executive Compensation -- Summary Compensation Table.”

Annual Cash Bonuses. All executive officers are eligible to receive annual incentive bonuses in amounts approved at the discretion of the Board of Directors. Executive officer bonuses are calculated based on the Company’s annual performance, individual performance, the executive’s position and compensation level. Messrs. Howard Gold, Jeff Gold and Eric Schiffer have chosen not to receive an annual incentive bonus for fiscal 2006 and the transition period ended March 31, 2005.

Long-Term Incentives. The Company provides its executive officers with long-term incentive compensation through stock option grant awards under the Company’s 1996 Stock Option Plan. Under the 1996 Stock Option Plan, the Board of Directors is authorized to grant any type of award which might involve the issuance of shares of Common Stock, an option, warrant, convertible security, stock appreciation right or similar right or any other security or benefit with a value derived from the value of the Common Stock. The Compensation Committee of the Board of Directors is currently responsible for selecting the individuals to whom grants of awards will be made, the timing of grants, the determination of the per share exercise price and the number of shares subject to each award. All awards granted by the Compensation Committee pursuant to the 1996 Stock Option Plan have been in the form of stock options. The Compensation Committee believes that stock options provide the Company’s executive officers with the opportunity to purchase and maintain an equity interest in the Company and to share in the appreciation of the value of the Common Stock. The Compensation Committee believes that stock options directly motivate an executive to maximize long-term shareholder value. The options incorporate vesting periods in order to encourage key employees to continue in the employ of the Company. As a result of the Company’s delay in filing its reports with the Securities and Exchange Commission (“SEC”) during the transition period ended March 31, 2005 and fiscal 2006, the Compensation Committee did not approve its traditional annual grant to employees that would ordinarily have been made in early fiscal 2006 until June 2006. All options granted in June 2006, as well as the small number of option grants made during fiscal 2006, were granted at the fair market value of the Company’s Common Stock on the date of grant. The Compensation Committee considers the grant of each option subjectively, considering factors such as the individual performance of executive officers and competitive compensation packages in the industry. Since 1997, Messrs. Howard Gold, Jeff Gold and Eric Schiffer have chosen not to receive bonuses or stock option awards.

Compensation Deferral Plan Effective January 1, 2000 the Company established a voluntary compensation deferral plan for highly compensated employees. Under the compensation deferral plan participants may defer up to 80% of base pay.

Omnibus Budget Reconciliation Act Implications for Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to the Chief Executive Officer and each of the Company’s four most highly paid executive officers other than the Chief Executive Officer. Certain “performance-based” compensation that has been approved by the Company’s shareholders is not subject to the deduction limit. The Company’s 1996 Stock Option Plan is intended to qualify so that awards under the plan constitute performance-based compensation not subject to Section 162(m) of the Code. All compensation paid to the Company’s employees in fiscal 2006 and the transition period ended March 31, 2005 is fully deductible.

Employment Agreements with Executive Officers On November 14, 2005, the Company announced the appointment of Robert Kautz as Executive Vice President and Chief Financial Officer of the Company. In connection with this appointment, the Company and Mr. Kautz entered into an employment agreement (the “Agreement”) dated November 11, 2005. The Agreement provides that Mr. Kautz’s salary is $400,000 per year, subject to increase at the discretion of the Company and the Compensation Committee of the Board of Directors, and that he is eligible for an annual bonus of up to 50% of his salary. Mr. Kautz received an initial grant of 150,000 nonqualified stock options. Upon a termination during the five-year term of the Agreement either by the Company without cause or by Mr. Kautz upon the Company failing to cure a material breach of the Agreement after notice, Mr. Kautz is entitled to a payment equal to 12 months of his salary and the vesting of any unvested options from his initial grant. Upon a termination during the term of the Agreement either by the Company for cause or by Mr. Kautz for any other reason, Mr. Kautz is not entitled to any termination payment and all of his unvested options shall be forfeited.

Summary. The Compensation Committee believes that its executive officer compensation philosophy of paying the Company’s executive officers by means of base salaries, annual cash bonuses and long-term incentives (other than Messrs. Howard Gold, Jeff Gold and Eric Schiffer), as described in this report, serves the interests of the Company and its shareholders.

COMPENSATION COMMITTEE

| | Eric G. Flamholtz (Chairman) |

| | Marvin Holen |

| | Lawrence Glascott |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors, which consists entirely of directors who meet the independence requirements of the New York Stock Exchange and Rule 10A-3 under the Securities Exchange Act, has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written Charter adopted by the Board. The Audit Committee reviews and reassesses the Charter annually and recommends any changes to the Board for approval.

The Audit Committee is responsible for overseeing the Company’s overall financial reporting process. In fulfilling its responsibilities for the financial statements for fiscal year 2006 and the transition period ended March 31, 2005, the Audit Committee:

| | 1. | Reviewed and discussed the audited financial statements for the fiscal year ended March 31, 2006 and the transition period ended March 31, 2005 with management and BDO Seidman, LLP, the Company��s independent registered accounting firm; |

| | 2. | Discussed with BDO Seidman, LLP the matters required to be discussed by Statement on Auditing Standards 61, 89 and 90 relating to the conduct of the audit; and |

| | 3. | Received written disclosures and a letter from BDO Seidman, LLP regarding its independence as required by Independence Standards Board Standard Number 1. The Audit Committee also discussed with BDO Seidman, LLP the firm’s independence. |

The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the Audit Committee determined appropriate.

Based on the Audit Committee’s review of the audited financial statements and discussions with management and BDO Seidman, LLP, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2006 for filing with the Securities and Exchange Commission.

| | AUDIT COMMITTEE |

| | |

| | Lawrence Glascott (Chairman) |

| | Marvin Holen |

| | Thomas Unterman |

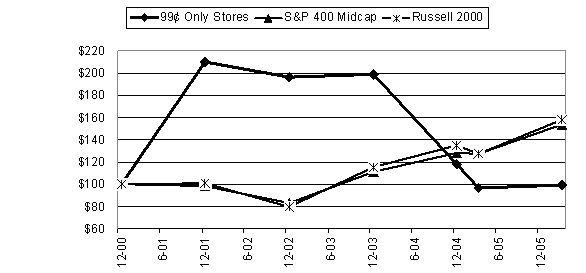

PERFORMANCE GRAPH

The following graph sets forth the percentage change in cumulative total shareholder return of the Company’s Common Stock during the period from December 31, 2000 to March 31, 2006, compared with the cumulative returns of the S&P Mid Cap 400 Index and the Russell 2000 Index. The comparison assumes $100 was invested on December 31, 2000 in the common stock and in each of the foregoing indices shown. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

| | | 12/2000 | | 12/2001 | | 12/2002 | | 12/2003 | | 12/2004 | | 3/2005 | | 3/2006 | |

| 99 Cents Only Stores | | $ | 100 | | $ | 210 | | $ | 196 | | $ | 199 | | $ | 118 | | $ | 96 | | $ | 99 | |

| S&P 400 | | $ | 100 | | $ | 98 | | $ | 83 | | $ | 111 | | $ | 128 | | $ | 128 | | $ | 153 | |

| Russell 2000 | | $ | 100 | | $ | 101 | | $ | 79 | | $ | 115 | | $ | 135 | | $ | 127 | | $ | 158 | |

CERTAIN TRANSACTIONS WITH DIRECTORS AND EXECUTIVE OFFICERS

The Company currently leases 13 store locations and a parking lot associated with one of these stores from the Gold family and their affiliates, of which 11 stores are leased on a month to month basis and are in negotiation for renewal. Rental expense for these facilities was approximately $2.1 million in calendar years 2003, 2004 and fiscal 2006. Rental expense for these facilities was approximately $0.5 million for the three months ended March 31, 2005. The Company enters into real estate transactions with affiliates only for the renewal or modification of existing leases and on occasions where it determines that such transactions are in the Company’s best interests. Moreover, the independent members of the Board of Directors must unanimously approve all real estate transactions between the Company and its affiliates. They must also determine that such transactions are equivalent to a negotiated arm’s-length transaction with a third party. The Company cannot guarantee that it will reach agreements with the Gold family on renewal terms for the properties the Company currently leases from them. In addition, even if the Company agrees to such terms, it cannot be certain that the independent directors will approve them. If the Company fails to renew one of these leases, it could be forced to relocate or close the leased store.

In addition, one of the Company’s former directors, Ben Schwartz, who resigned during the three months ended March 31, 2005, was a trustee of a trust that owns a property on which a single 99¢ Only Stores is located. Rent expense on this store amounted to $0.3 million in 2004. Rent expense on this store was $46,000 for the three months ended March 31, 2005 and $0.2 million for the year ended March 31, 2006.

In 2004, the Company engaged Boris Zelkind, a partner in the law firm of Zelkind and Schakelford LLP and the brother of Michael Zelkind, the Company's former Executive Vice President of Supply Chain and Merchandizing, to perform various legal services. The Company paid Zelkind and Schakelford LLP less than $60,000 in fiscal 2004 and $94,000 in the fiscal year ended March 31, 2006. No payments were made for the three months ended March 31, 2005.

Prior to the sale of Universal International, Inc. (a former subsidiary of the Company) in 2000, the Company signed documents purporting to guarantee certain obligations under leases in which Universal, or a subsidiary, was the lessee. Subsequent to the sale, Universal may have defaulted on these lease agreements. The Company was potentially contingently liable for lease payments totaling up to $1.1 million as of March 31, 2006, as well as additional costs for attorney fees, rent increases and common area maintenance charges, in connection with three lawsuits brought by the lessors under these leases. As part of the Universal sale in 2000, David and Sherry Gold agreed to indemnify the Company for any and all attorney fees, costs, judgments, settlements or other payments that the Company may make under its guarantees of these leases, which indemnity David and Sherry Gold confirmed in writing in April 2004 and re-executed on August 5, 2005. As of June 2006 one of the matters settled, and the Company has been fully reimbursed for the settlement pursuant to the guarantees by David and Sherry Gold. The Company and the plaintiffs in the two remaining cases have agreed on a tentative settlement of the cases, pursuant to which the Company would be responsible for an aggregate payment of $150,000. This settlement has not yet been reduced to writing or approved by the Court. The Company anticipates full reimbursement of any such settlement payment or other obligation in connection with these cases under the guarantees of David and Sherry Gold.

PRINCIPAL SHAREHOLDERS

The following table sets forth as of February 28, 2007, certain information relating to the ownership of the Company’s Common Stock by (i) each person known to be the beneficial owner of more than five percent of the outstanding shares of the Company’s Common Stock, (ii) each of the Company’s directors, (iii) each of the Named Executive Officers, and (iv) all of the Company’s executive officers and directors as a group. Except as may be indicated in the footnotes to the table and subject to applicable community property laws, each such person has the sole voting and investment power with respect to the shares owned. Unless otherwise noted, the address of each person listed is in care of 99¢ Only Stores, 4000 Union Pacific Avenue, City of Commerce, California 90023.

Names and Addresses | | Number of Shares(a) | | Percent Of Class (a) |

| David Gold (b)(d)(e) | | 15,864,832 | | 22.6% |

| Sherry Gold (c)(d)(e) | | 15,864,832 | | 22.6% |

| Howard Gold (d)(e) | | 9,225,600 | | 13.2% |

| Jeff Gold (d)(e) | | 9,225,600 | | 13.2% |

| Eric and Karen Schiffer (d)(e) | | 9,300,606 | | 13.3% |

| Au Zone Investments #3, LLC (e) | | 6,860,124 | | 9.8% |

| Akre Capital Management, LLC (f) | | 6,911,295 | | 9.9% |

| Primecap Management Company (g) | | 5,154,700 | | 7.4% |

| Dimensional Fund Advisors LP (h) | | 4,937,363 | | 7.1% |

| Marvin Holen (i) | | 62,000 | | * |

| Lawrence Glascott (j) | | 53,835 | | * |

| Eric Flamholtz (k) | | 2,000 | | * |

| Thomas Unterman (l) | | 2,000 | | * |

| Robert Kautz (m) | | 50,000 | | * |

| Jennifer Holden Dunbar | | - | | |

| Peter Woo | | 5,000 | | * |

All of the Company’s current executive officers and directors as a group, 11 persons (n) | | 23,211,101 | | 33.1 % |

| * | Less than 1% |

| (a) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission that deem shares to be beneficially owned by any person who has or shares voting or investment power with respect to such shares. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock subject to options held by that person that currently are exercisable or exercisable within 60 days of February 28, 2007 are deemed outstanding. |

| (b) | Includes 4,502,354 shares owned by Sherry Gold, David Gold’s spouse. |

| (c) | Includes 4,502,354 shares owned by David Gold, Sherry Gold’s spouse. |

| (d) | Includes 6,860,124 shares controlled through Au Zone Investments #3, LLC. |

| (e) | Au Zone Investments #3, LLC, is the general partner of Au Zone Investments #2, L.P., a California limited partnership (the “Partnership”). The Partnership is the registered owner of 6,860,124 shares of Common Stock. The limited partners of the Partnership are David Gold, Sherry Gold, Howard Gold, Jeff Gold and Karen Schiffer (the daughter of David and Sherry Gold). Each of the limited partners of the Partnership owns a 20% interest in Au Zone Investments #3, LLC. |

| (f) | This information is based on a Schedule 13G filed by Akre Capital Management, LLC, 2 West Marshall Street, Middleburg, Virginia 20118, on February 13, 2007. |

| (g) | This information is based on a Schedule13G/A filed by Primecap Management Company, 225 South Lake Avenue #400, Pasadena, CA 91101, on February 14, 2007. |

| (h) | This information is based on a Schedule 13G/A filed by Dimensional Fund Advisors LP, 1299 Ocean Avenue, Santa Monica, California 90401, on February 09, 2007. |

| (i) | Includes 48,503 shares of Common Stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before April 29, 2007. |

| (j) | Includes 48,503 shares of Common Stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before April 29, 2007. |

| (k) | Includes 2,000 shares of Common Stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before April 29, 2007. |

| (l) | Includes 2,000 shares of Common Stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before April 29, 2007. |

| (m) | Includes 50,000 shares of Common Stock reserved for issuance upon exercise of stock options, which are or will become exercisable on or before April 29, 2007. |

| (n) | Includes (i) 4,502,354 shares owned by Sherry Gold, the spouse of David Gold, and (ii) 6,860,124 shares controlled through Au Zone Investments #3, LLC and (iii) 151,006 shares of Common Stock reserved upon exercise of stock option, which are exercisable. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors, and persons who own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Commission. Officers, directors and greater-than-ten percent shareholders are required by the Commission’s regulations to furnish us with all Section 16(a) forms they file. Based solely on the Company’s review of the copies of the forms received by the Company and written representations from certain reporting persons that they have complied with the relevant filing requirements, we believe that, during the fiscal year ended March 31, 2006 and the transition period ended March 31, 2005, all of the Company’s officers, directors and greater-than-ten percent shareholders complied with all Section 16(a) filing requirements.

SHAREHOLDER PROPOSALS

Any shareholder who intends to present a proposal at the next annual meeting for inclusion in the Company’s proxy statement and proxy relating to such annual meeting must submit such proposal to the Company at its principal executive offices within a reasonable time before it begins to print and mail the proxy materials for the 2007 annual meeting. Upon determination by the Company of the date of the 2007 annual meeting, the Company will disclose that date in the earliest possible Quarterly Report on Form 10-Q.

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

On April 6, 2004, the Audit Committee of the Company’s Board of Directors (the “Audit Committee”) dismissed PricewaterhouseCoopers LLP (“PWC”) as the Company’s independent registered public accounting firm but retained them for tax services. The decision to change independent registered public accounting firms was not the result of any disagreement between the Company and PWC on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure. The audit reports of PWC with respect to the consolidated financial statements as of and for the fiscal years ended December 31, 2003 and 2002 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

On April 19, 2004, the Audit Committee engaged Deloitte & Touche LLP (“D&T”) as the Company’s independent registered public accounting firm to audit its financial statements for the year ended December 31, 2004. During the Company’s two most recent years ended December 31, 2003 and subsequent interim period through April 19, 2004, the Company did not consult D&T with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements or any other matters or reportable events as set forth in Items 304 (a) (2) (i) and (ii) of Regulation S-K.

On September 14, 2005, the Company and the Chairman of the Audit Committee were advised by D&T, that D&T resigned as the Company’s independent registered public accounting firm. The Company was informed by D&T that its decision to resign was not the result of any disagreement between the Company and D&T on matters of accounting principles or practices, financial statement disclosure or auditing scope or procedures. The audit report of D&T on the Company’s financial statements for the fiscal year ended December 31, 2004 did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principle, but it did reference D&T’s report of August 30, 2005 which disclaimed an opinion on management’s assessment of the effectiveness of the Company’s internal control over financial reporting because of a scope limitation and expressed an adverse opinion on the effectiveness of the Company’s internal control over financial reporting because of material weaknesses and the effects of the scope limitation. The Audit Committee was informed of, but neither recommended nor approved, the termination of the client-auditor relationship with D&T.

From April 19, 2004, the date of D&T’s appointment as the Company’s independent registered public accounting firm, through September 14, 2005, there were no disagreements with D&T on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of D&T, would have caused D&T to make a reference thereto in connection with its report on the Company’s financial statements.

From April 19, 2004 through September 14, 2005, there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K, except that management was unable to complete its assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2004, based on the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, and therefore D&T was unable to perform auditing procedures necessary to form an opinion on management’s assessment in connection with its engagement to audit management’s assessment of the effectiveness of the Company’s internal control over financial reporting. Material weaknesses in internal control over financial reporting were identified by management and included in management’s assessment and in D&T’s report, all of which were listed in Item 4.01 of the Company’s Current Report on Form 8-K filed with the SEC on September 20, 2005, which is hereby incorporated herein by reference.

On October 31, 2005, the Company’s audit committee engaged BDO Seidman, LLP (“BDO”) to serve as the Company’s independent registered public accounting firm to audit its financial statements for the three months ended March 31, 2005 and the fiscal year ended March 31, 2006. During the Company’s two most recent years ended December 31, 2003 and 2004 and subsequent interim period through October 31, 2005, the Company did not consult BDO with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements or any other matters or reportable events as set forth in Items 304 (a) (2) (i) and (ii) of Regulation S-K.

Representatives of BDO are expected to be present at the Annual Meeting and will be afforded the opportunity to make a statement if they desire and will be available to respond to appropriate questions from shareholders. Representatives of D&T and PWC are not expected to be present at the Annual Meeting.

For the fiscal year ended March 31, 2006, the three months ended March 31, 2005 and the year ended December 31, 2004, the Company’s principal accountants billed the aggregate fees set forth below for work performed for the periods indicated.

| | | Year Ended March 31, 2006 | | Period Ended March 31, 2005 | | Year Ended December 31 2004 | |

| | | | | | | | |

| Audit Fees (a) | | $ | 2,760,000 | | $ | 829,000 | | $ | 2,346,000 | |

| Audit Related Fees | | | - | | | - | | | - | |

| Tax Fees | | | - | | | - | | | - | |

| | (a) | Includes fees necessary to perform an audit or quarterly review in accordance with Generally Accepted Auditing Standards and services that generally only the independent registered public accounting firm can reasonable provide, such as attest services, consents and assistance with, and review of, documents filed with the Securities and Exchange Commission. The amount also includes fees related to BDO Seidman, LLP’s attestation of the Company’s internal control over financial reporting as of March 31, 2006 and the Company’s former principal accountant, Deloitte & Touche, LLP, for its attestation of the Company’s internal control over financial reporting as of December 31, 2004. Three months ended March 31, 2006 is the “stub-period” due to the change from calendar year-end December 31 reporting to fiscal year-end March 31 reporting. Audit fees paid during the “stub-period” were paid to BDO Seidman LLP. |

The Audit Committee has considered whether the provision of non-audit services by the Company’s principal accountant is compatible with maintaining auditor independence and determined that it is. Pursuant to the rules of the Securities and Exchange Commission, before the Company’s independent registered accounting firm is engaged to render audit or non-audit services, the engagement must be approved by the Audit Committee or entered into pursuant to the Audit Committee’s pre-approval policies and procedures. The Audit Committee has adopted a policy filed as attached as Appendix A, granting pre-approval to certain specific audit and audit-related services and specifying the procedures for pre-approving other services.

SOLICITATION OF PROXIES

The expenses of preparing, assembling, printing and mailing this Proxy Statement and the materials used in the solicitation of proxies will be borne by us. It is contemplated that the proxies will be solicited through the mails, but the Company’s officers, directors and regular employees may solicit proxies personally. Although there is no formal agreement to do so, we may reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding the proxy materials to shareholders whose stock in us is held of record by such entities. In addition, we may use the services of individuals or companies we do not regularly employ in connection with the solicitation of proxies if management determines it advisable.

ANNUAL REPORT ON FORM 10-K

THE COMPANY’S ANNUAL REPORT ON FORM 10-K, WHICH HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE FISCAL YEAR ENDED MARCH 31, 2006, WILL BE MADE AVAILABLE TO SHAREHOLDERS WITHOUT CHARGE UPON WRITTEN REQUEST TO 99¢ ONLY STORES, 4000 UNION PACIFIC AVENUE, CITY OF COMMERCE, CALIFORNIA 90023, ATTENTION: CHIEF FINANCIAL OFFICER. THE EXHIBITS OF THIS REPORT WILL ALSO BE PROVIDED UPON REQUEST AND PAYMENT OF COPYING CHARGES.

| | ON BEHALF OF THE BOARD OF DIRECTORS |

| | /s/ Eric Schiffer, CEO |

| | Eric Schiffer, CEO |

| | 4000 Union Pacific Avenue |

| | City of Commerce, California 90023 |

| | |

| | April 4, 2007 |

Appendix A

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF

99¢ ONLY STORES

PRE-APPROVAL POLICY

| I. | STATEMENT OF PRINCIPLES |

The Audit Committee of the Board of Directors (the “Board”) of 99¢ Only Stores (the “Corporation”) is required to pre-approve the audit and non-audit services performed by the independent auditor in order to assure that the provision of such services does not impair the auditor's independence. Unless a type of service to be provided by the independent auditor has received pre-approval pursuant to this policy, it will require specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved cost levels will require specific pre-approval by the Audit Committee.

The term of any pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different period. The Audit Committee will periodically review previously pre-approved services, based on subsequent determinations.

To ensure prompt handling of unexpected matters, the Audit Committee delegates to the Chair of the Audit Committee the authority to amend or modify the list of pre-approved non-audit services and fees. The Chair will report action taken to the Audit Committee at its next scheduled meeting. The Audit Committee may also delegate pre-approval authority to one or more of its members who shall report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent auditor to management or to the Board generally.

The annual audit services engagement terms and fees will be subject to the specific pre-approval of the Audit Committee. The independent auditor will provide the Audit Committee with an engagement letter and fee proposal outlining the scope and cost of the audit services proposed to be performed during the fiscal year. Once agreed to by the Audit Committee, the final engagement letter and fee proposal will be formally accepted. The Audit Committee will then approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope, Corporation structure or other matters.

In addition to the annual audit services engagement approved by the Audit Committee, the Audit Committee may grant pre-approval for other audit services that only the independent auditor reasonably can provide. The Audit Committee has pre-approved (i) statutory audits or financial audits for subsidiaries or affiliates of the Corporation, (ii) services associated with SEC registration statements, periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings (e.g., comfort letters, consents, etc.), and assistance in responding to SEC comment letters, and (iii) consultations by the Corporation’s management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB or other regulatory or standard setting body (other than services that are “audit-related” services under SEC rules which have been separately pre-approved). Other audit services that reasonably could be performed by someone other than the independent auditor must be separately pre-approved by the Audit Committee.

| IV. | AUDIT-RELATED SERVICES |

Audit-related services are assurance and related services that are reasonably related to the performance of the audit or review of the Corporation's financial statements and that are traditionally performed by the independent auditor. The Audit Committee believes that the provision of audit-related services does not impair the independence of the auditor, and has pre-approved audit-related services related to (i) internal control reviews and assistance with internal control reporting requirements, (ii) consultations by the Corporation’s management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB or other regulatory or standard setting body (other than services that are “audit” services under SEC rules which have been separately pre-approved), (iii) attest services not required by statute or regulation, and (iv) agreed-upon or expanded audit procedures relating to accounting and/or billing records required to respond to or comply with financial, accounting or regulatory reporting matters. All other audit-related services must be separately pre-approved by the Audit Committee.

It is the preference of the Audit Committee for tax services such as tax compliance, tax planning and tax advice to be performed by an accountant other than the independent auditor. However, if the Audit Committee believes that the independent auditor can provide tax services to the Corporation without impairing the auditor's independence, and the Audit Committee desires to retain the independent auditor for tax services, those services must be specifically pre-approved by the Audit Committee. In no event will the Audit Committee permit the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the purpose of which may be tax avoidance and the tax treatment of which may not be supported in the Internal Revenue Code and related regulations.

The Audit Committee may grant pre-approval to those permissible non-audit services classified as “all other” services that it believes are routine and recurring services, and would not impair the independence of the auditor.

A list of the SEC's prohibited non-audit services is attached to this policy as Exhibit 1. The SEC's rules and relevant guidance should be consulted to determine the precise definitions of these services and the applicability of exceptions to certain of the prohibitions.

| VII. | PRE-APPROVAL FEE LEVELS |

Pre-approval fee levels for all services to be provided by the independent auditor will be established periodically by the Audit Committee. Any proposed services exceeding these levels will require specific pre-approval by the Audit Committee. The initial pre-approval fee level shall be $30,000.

| VIII. | SUPPORTING DOCUMENTATION |

With respect to each proposed pre-approved service, the independent auditor will be required to provide detailed back-up documentation, which will be provided to the Audit Committee, regarding the specific services to be provided.

Except for the annual audit services engagement (the procedures for which are set forth in Section III above), all requests or applications to provide services that require separate approval by the Audit Committee will be submitted to the Audit Committee by both the independent auditor and the Chief Executive Officer, and must include a joint statement as to whether, in their view, the request or application is permissible under all legal requirements and consistent with the SEC's rules on auditor independence.

EXHIBIT 1

PROHIBITED NON-AUDIT SERVICES

| · | Bookkeeping or other services related to the accounting records or financial statements of the audit client* |

| · | Financial information systems design and implementation* |

| · | Appraisal or valuation services, fairness opinions or contribution-in-kind reports* |

| · | Internal audit outsourcing services* |

| · | Broker-dealer, investment adviser or investment banking services |

| · | Expert services unrelated to the audit |

* Provision of these non-audit services may be permitted if it is reasonable to conclude (without reference to materiality) that the results of these services will not be subject to audit procedures during the audit of the Corporation’s financial statements.

ANNUAL MEETING OF SHAREHOLDERS OF

99¢ ONLY STORES

May 11, 2007

PROXY

99¢ ONLY STORES

4000 UNION PACIFIC AVENUE

CITY OF COMMERCE, CALIFORNIA 90023

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

99¢ ONLY STORES

The undersigned, a shareholder of 99¢ ONLY STORES, a California corporation (the "Company"), hereby appoints David Gold and Eric Schiffer, and each of them, the proxy of the undersigned, with full power of substitution, to attend, vote and act for the undersigned at the Company's Annual Meeting of Shareholders (the "Annual Meeting"), to be held on May 11, 2007, and at any postponements or adjournments, to vote and represent all of the shares of the Company which the undersigned would be entitled to vote, as follows:

(PLEASE SIGN, DATE, AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE)

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý.

Item 1. ELECTION OF DIRECTORS. The Board of Directors recommends a vote FOR the election of the following nominees: | | Item 2. SHAREHOLDER PROPOSAL-REDEEM OR VOTE POISON PILL. |

| | | | | FOR | AGAINST | ABSTAIN |

¨ FOR ALL NOMINEES ¨ WITHOLD AUTHORITY FOR ALL NOMINEES ¨ FOR ALL EXCEPT (See instruction below) | NOMINEES: m Eric Schiffer m Lawrence Glascott m David Gold m Jeff Gold m Marvin Holen m Howard Gold m Eric G. Flamholtz m Jennifer Holden Dunbar m Peter Woo | | The Board of Directors recommends a vote AGAINST the adoption of this proposal. Proxies solicited by the Board of Directors will be voted against this proposal unless otherwise specified. | ¨ | ¨ | ¨ |