Page 1 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 Insider Trading Policy BOD Policy Simplified The Board of Directors of United Fire Group, Inc. (“UFG” or “Company”) has adopted this Insider Trading Policy (“Policy”) to provide guidelines to all directors, officers, employees, consultants and contractors of UFG with respect to trading in UFG securities, as well as the securities of publicly traded companies with whom UFG has a business relationship. This Policy has been designed to prevent insider trading or even allegations of insider trading. Your strict adherence to this Policy will help safeguard UFG’s reputation and will further ensure that UFG conducts its business with the highest level of integrity and in accordance with the highest ethical standards. Each UFG officer, director, employees and consultant is responsible for the consequences of his or her actions, and for understanding and complying with this Policy. Federal and state securities laws prohibit the purchase or sale of a company’s securities by anyone who is aware of material information about that company that is not generally known or available to the public. These laws also prohibit anyone who is aware of material non-public information from disclosing this information to others who may trade. Companies and their controlling persons may also be subject to liability if they fail to take reasonable steps to prevent insider trading by Company personnel. Covered Parties The Policy covers officers, directors, employees, consultants and contractors of UFG, as well as their immediate family members and members of their households (“Insider(s)”), regardless of the country in which they reside. This Policy also applies to any entities controlled by Insiders, including any corporations, partnerships or trusts, and transactions by these entities should be treated for the purposes of this Policy and applicable securities laws as if they were for the Insider’s own account. This Policy extends to all activities of an Insider, either within or outside such Insider’s duties at UFG. Covered Transactions This Policy applies to all transactions involving UFG’s securities, including ordinary shares, options for ordinary shares, warrants, debt securities or any other securities that UFG may issue from time to time, and derivative securities relating to the Company’s securities, whether or not issued by the Company, such as publicly-traded options. This Policy also applies to all transactions involving the securities of other companies if you possess material non-public information about that company that was obtained in the course of your involvement with UFG.

Insider Trading Policy v2.0 Page 2 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 Material Non-public Information “Material non-public information” is information about a company that is not known to the general public and is likely to influence a typical investor’s decision to buy, sell or hold the company’s securities. Material non-public information can include information that something is likely to happen—or just that it might happen. Examples of material non-public information with respect to UFG include, among other things, non-public information about: • Operating or financial results, known or projected future earnings or losses; • Financial results; • Projections of future earnings or losses; • Significant developments in products or services; • Changes in business strategies; • News of a pending or proposed acquisition or merger; • Impending bankruptcy or financial liquidity problems; • Gain or loss, or change in status, of a significant customer or contract; • Stock splits; • New equity or debt offerings; • Significant exposure due to actual or threatened litigation; • Significant governmental regulatory activities; • Changes in senior management; • Changes in dividend policy; or • Significant pricing changes. It is not possible to define all categories of material information, and you should recognize that the public, the media and the courts may use hindsight in judging what is material. Therefore, it is important to err on the side of caution and assume information is material if there is any doubt. Information is “non-public” if it is not generally known or available to the public. Additionally, information may still be non-public even though it is widely known within UFG. If you possess any material non-public information, the law and this Policy require that you refrain from buying or selling UFG’s securities until after the information has been fully disclosed and absorbed by the market or is no longer material. Generally, “full disclosure” to the public results when the company issues a press release followed by publication in the print media having general circulation. A speech to an audience, a TV or radio appearance, or an article in an obscure magazine does not qualify as full disclosure. Full disclosure means that the securities markets have received and had the opportunity to digest the news. Generally, a full day following publication in print media having general circulation (or release to national wire services) is regarded as sufficient for dissemination and interpretation of

Insider Trading Policy v2.0 Page 3 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 material information. As an Insider, you must refrain from trading prior to the full disclosure of material non-public information, even if you do not trade such securities for your own benefit. It is also a violation of the securities law if such trading is done by another person to whom you disclosed the inside information prior to full disclosure. In addition, it is also a violation of this Policy if you communicate any material non-public information about UFG to any other person, including family and friends. For purposes of this Policy, a “trading day” means a day on which Nasdaq is generally open for trading and trading in the stock of the Company has not been suspended for any reason. Requirements Applicable to All Employees, Executive Officers and Directors 1. Trading on Material Non-public Information: You are prohibited from engaging in any transaction in UFG securities while aware of material non-public information about UFG. It makes no difference whether or not you relied upon or used material non-public information in deciding to trade – if you are aware of material non-public information about UFG, the prohibition applies. You should avoid even the appearance of an improper transaction to preserve UFG’s reputation for adhering to the highest ethical standards of conduct. 2. Tipping: No insider shall disclose ("tip") material non-public information to any other person (including family members) where such information may be used by such person to his or her profit by trading in the securities of companies to which such information relates, nor shall such insider or related person make recommendations or express opinions on the basis of material non-public information as to trading in the company’s securities. 3. Confidentiality of Non-Public Information: It is very important that any information which reasonably could be expected to affect the market for UFG’s securities be kept strictly confidential until full disclosure of such information is proper. Consequently, all such information may be publicly disclosed only with the approval of the chief executive officer, chief financial officer or chief legal officer of UFG. You should not discuss or disclose confidential, inside information with or in the presence of any person outside of UFG. In addition, you should also refrain from commenting on our competitors’ and customers’ business. If you have knowledge of any such information, you must preserve its confidentiality until full disclosure of such information by UFG to the public. 4. Hedging Transactions: Certain forms of hedging or monetization transactions may offset a decrease, or limit your ability to profit from an increase, in the value of UFG securities you hold, enabling you to continue to own UFG securities without the full risks and rewards of ownership. UFG believes that such transactions separate the holder's interests from those of other stockholders. Therefore, you and any person acting on your behalf are prohibited from purchasing any financial instruments (such as prepaid variable forward contracts, equity swaps, collars or exchange funds) or otherwise engaging in any transactions that hedge or offset any

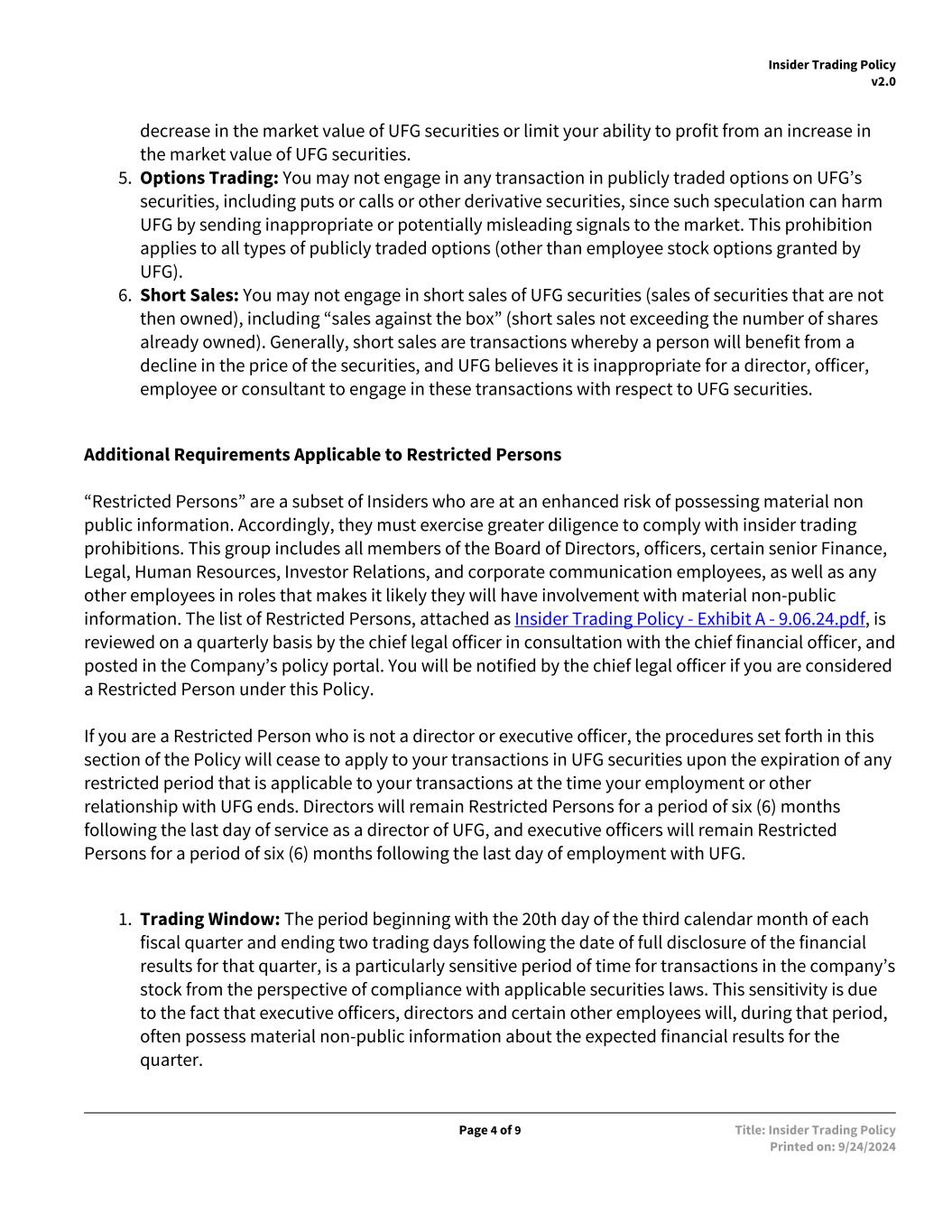

Insider Trading Policy v2.0 Page 4 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 decrease in the market value of UFG securities or limit your ability to profit from an increase in the market value of UFG securities. 5. Options Trading: You may not engage in any transaction in publicly traded options on UFG’s securities, including puts or calls or other derivative securities, since such speculation can harm UFG by sending inappropriate or potentially misleading signals to the market. This prohibition applies to all types of publicly traded options (other than employee stock options granted by UFG). 6. Short Sales: You may not engage in short sales of UFG securities (sales of securities that are not then owned), including “sales against the box” (short sales not exceeding the number of shares already owned). Generally, short sales are transactions whereby a person will benefit from a decline in the price of the securities, and UFG believes it is inappropriate for a director, officer, employee or consultant to engage in these transactions with respect to UFG securities. Additional Requirements Applicable to Restricted Persons “Restricted Persons” are a subset of Insiders who are at an enhanced risk of possessing material non public information. Accordingly, they must exercise greater diligence to comply with insider trading prohibitions. This group includes all members of the Board of Directors, officers, certain senior Finance, Legal, Human Resources, Investor Relations, and corporate communication employees, as well as any other employees in roles that makes it likely they will have involvement with material non-public information. The list of Restricted Persons, attached as Insider Trading Policy - Exhibit A - 9.06.24.pdf, is reviewed on a quarterly basis by the chief legal officer in consultation with the chief financial officer, and posted in the Company’s policy portal. You will be notified by the chief legal officer if you are considered a Restricted Person under this Policy. If you are a Restricted Person who is not a director or executive officer, the procedures set forth in this section of the Policy will cease to apply to your transactions in UFG securities upon the expiration of any restricted period that is applicable to your transactions at the time your employment or other relationship with UFG ends. Directors will remain Restricted Persons for a period of six (6) months following the last day of service as a director of UFG, and executive officers will remain Restricted Persons for a period of six (6) months following the last day of employment with UFG. 1. Trading Window: The period beginning with the 20th day of the third calendar month of each fiscal quarter and ending two trading days following the date of full disclosure of the financial results for that quarter, is a particularly sensitive period of time for transactions in the company’s stock from the perspective of compliance with applicable securities laws. This sensitivity is due to the fact that executive officers, directors and certain other employees will, during that period, often possess material non-public information about the expected financial results for the quarter.

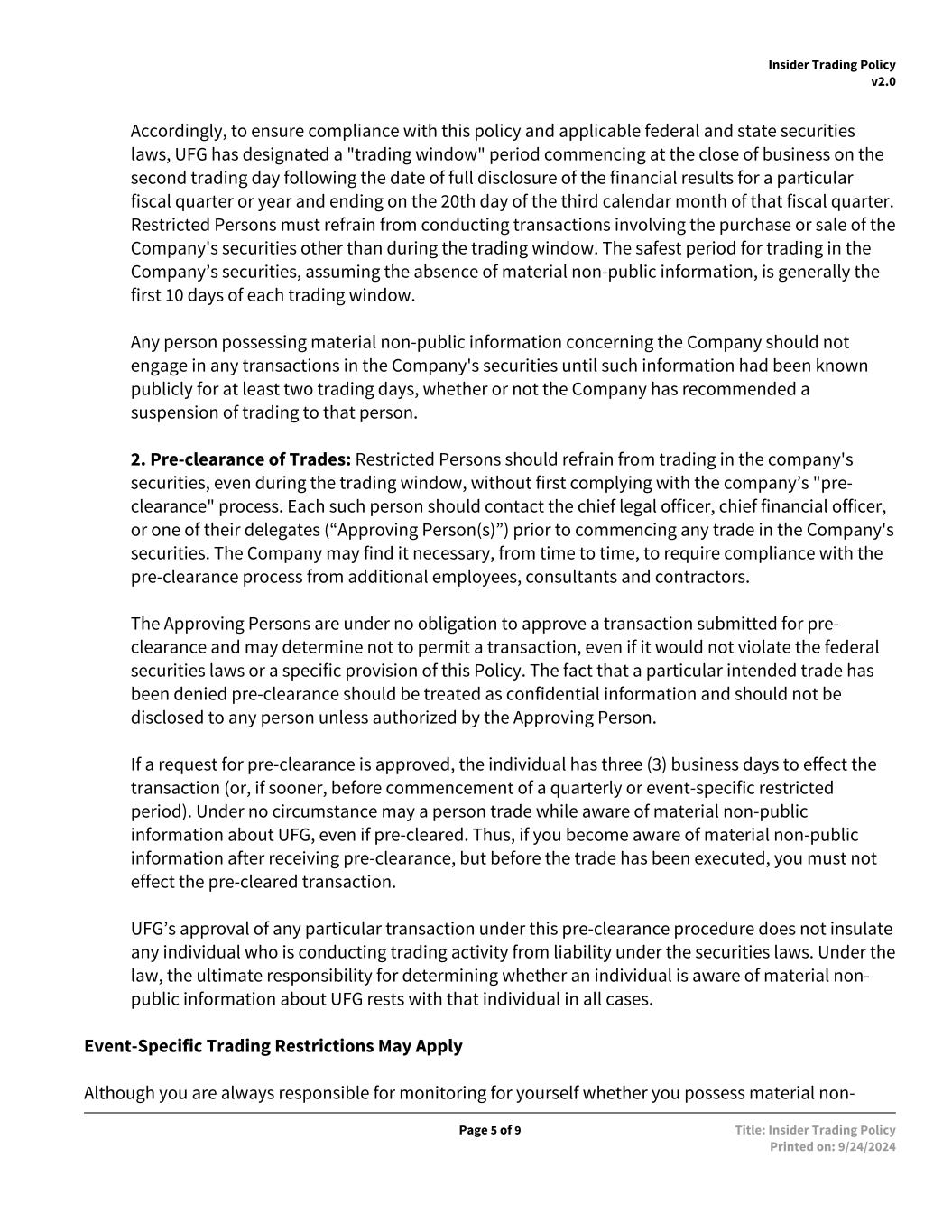

Insider Trading Policy v2.0 Page 5 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 Accordingly, to ensure compliance with this policy and applicable federal and state securities laws, UFG has designated a "trading window" period commencing at the close of business on the second trading day following the date of full disclosure of the financial results for a particular fiscal quarter or year and ending on the 20th day of the third calendar month of that fiscal quarter. Restricted Persons must refrain from conducting transactions involving the purchase or sale of the Company's securities other than during the trading window. The safest period for trading in the Company’s securities, assuming the absence of material non-public information, is generally the first 10 days of each trading window. Any person possessing material non-public information concerning the Company should not engage in any transactions in the Company's securities until such information had been known publicly for at least two trading days, whether or not the Company has recommended a suspension of trading to that person. 2. Pre-clearance of Trades: Restricted Persons should refrain from trading in the company's securities, even during the trading window, without first complying with the company’s "pre- clearance" process. Each such person should contact the chief legal officer, chief financial officer, or one of their delegates (“Approving Person(s)”) prior to commencing any trade in the Company's securities. The Company may find it necessary, from time to time, to require compliance with the pre-clearance process from additional employees, consultants and contractors. The Approving Persons are under no obligation to approve a transaction submitted for pre- clearance and may determine not to permit a transaction, even if it would not violate the federal securities laws or a specific provision of this Policy. The fact that a particular intended trade has been denied pre-clearance should be treated as confidential information and should not be disclosed to any person unless authorized by the Approving Person. If a request for pre-clearance is approved, the individual has three (3) business days to effect the transaction (or, if sooner, before commencement of a quarterly or event-specific restricted period). Under no circumstance may a person trade while aware of material non-public information about UFG, even if pre-cleared. Thus, if you become aware of material non-public information after receiving pre-clearance, but before the trade has been executed, you must not effect the pre-cleared transaction. UFG’s approval of any particular transaction under this pre-clearance procedure does not insulate any individual who is conducting trading activity from liability under the securities laws. Under the law, the ultimate responsibility for determining whether an individual is aware of material non- public information about UFG rests with that individual in all cases. Event-Specific Trading Restrictions May Apply Although you are always responsible for monitoring for yourself whether you possess material non-

Insider Trading Policy v2.0 Page 6 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 public information, from time to time UFG may decide to impose a special restriction on trading (“special blackout period”) on those who are aware of particular material non-public information that UFG determines warrants specific protection. If you are subject to a special blackout period, you may not trade in any UFG securities, except pursuant to a 10b5-1 plan previously approved by UFG, until notified that the special blackout period has concluded. Individuals may be subject to more than one special blackout period at a time if they possess material non-public information related to multiple topics or events that independently necessitate the imposition of a special blackout period. The chief legal officer, in consultation with the chief executive officer, will determine whether a special blackout period should be imposed. The existence of a special blackout period will not be generally announced, and those subject to a special blackout period should not disclose the existence of the restricted period to anyone else. If you are covered by a special blackout period, you will be notified by the chief legal officer when the special blackout period both commences and concludes. Individual Responsibility of Each Officer, Director and Employee to Comply with Policy Every officer, director and employee has the individual responsibility to comply with this Policy against insider trading, regardless of whether the Company has recommended a trading window to that Insider or any other Insiders of the Company. Appropriate judgment should be exercised in connection with any trade in the Company's securities. An Insider may, from time to time, have to forego a proposed transaction in the company's securities even if he or she planned to make the transaction before learning of the material non-public information and even though the Insider believes he or she may suffer an economic loss or forego anticipated profit by not trading. Inside Information Regarding Other Companies This Policy also applies to material non-public information relating to other companies, including the company's "business partners," particularly when that information is obtained in the course of employment with, or other services performed on behalf of UFG. Civil and criminal penalties, and termination of employment, may result from trading on inside information regarding the Company’s business partners. All employees should treat material non-public information about the Company's business partners with the same care required with respect to information related directly to the Company. Exceptions In certain limited circumstances, a transaction otherwise prohibited by this Policy may be permitted if, prior to the transaction, the chief legal officer determines that the transaction is still consistent with the purposes of this Policy. The existence of a personal financial emergency does not excuse you from compliance with this Policy and will not be the basis for an exception to the Policy for a transaction that is inconsistent with the purposes of the Policy. The only exceptions to the Policy are as follows:

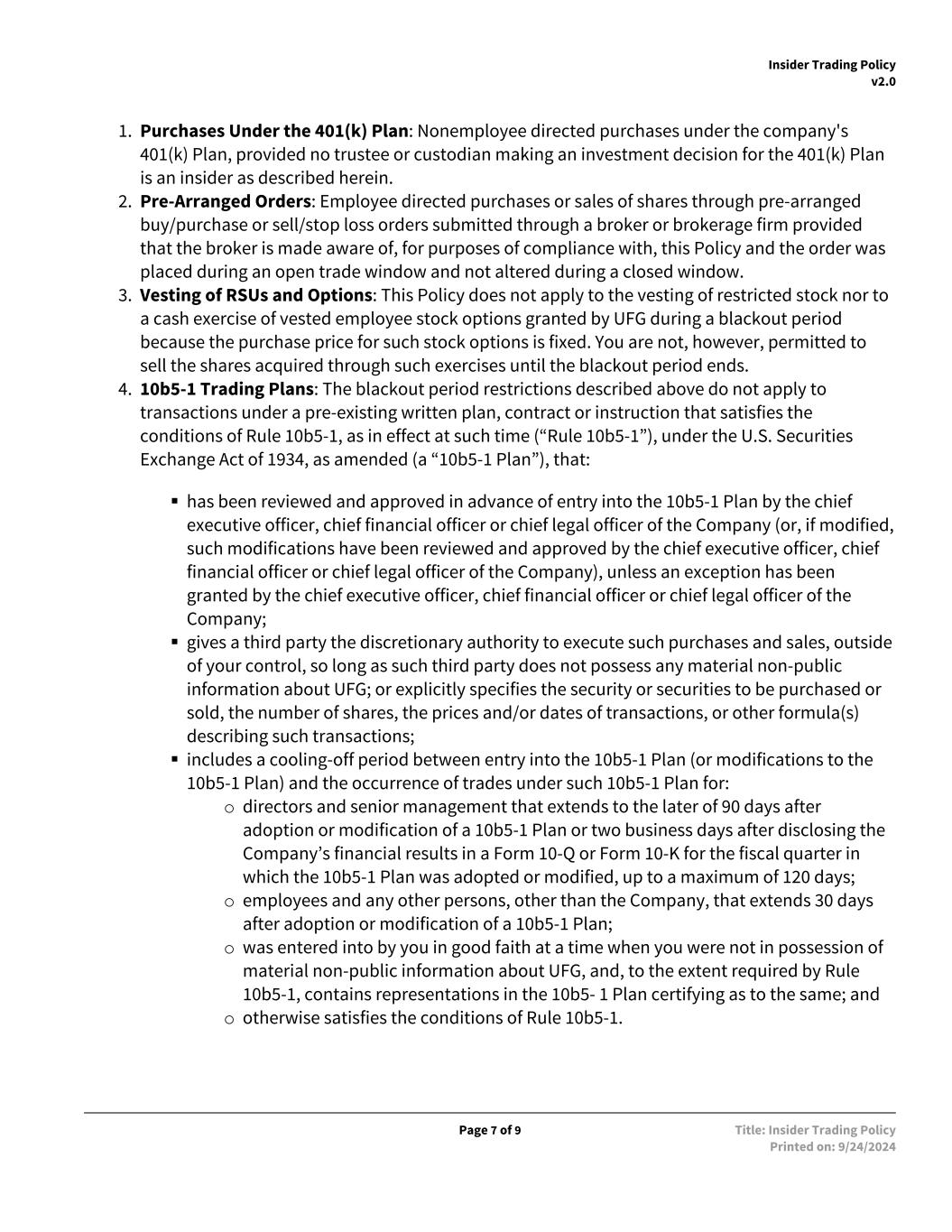

Insider Trading Policy v2.0 Page 7 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 1. Purchases Under the 401(k) Plan: Nonemployee directed purchases under the company's 401(k) Plan, provided no trustee or custodian making an investment decision for the 401(k) Plan is an insider as described herein. 2. Pre-Arranged Orders: Employee directed purchases or sales of shares through pre-arranged buy/purchase or sell/stop loss orders submitted through a broker or brokerage firm provided that the broker is made aware of, for purposes of compliance with, this Policy and the order was placed during an open trade window and not altered during a closed window. 3. Vesting of RSUs and Options: This Policy does not apply to the vesting of restricted stock nor to a cash exercise of vested employee stock options granted by UFG during a blackout period because the purchase price for such stock options is fixed. You are not, however, permitted to sell the shares acquired through such exercises until the blackout period ends. 4. 10b5-1 Trading Plans: The blackout period restrictions described above do not apply to transactions under a pre-existing written plan, contract or instruction that satisfies the conditions of Rule 10b5-1, as in effect at such time (“Rule 10b5-1”), under the U.S. Securities Exchange Act of 1934, as amended (a “10b5-1 Plan”), that: ▪ has been reviewed and approved in advance of entry into the 10b5-1 Plan by the chief executive officer, chief financial officer or chief legal officer of the Company (or, if modified, such modifications have been reviewed and approved by the chief executive officer, chief financial officer or chief legal officer of the Company), unless an exception has been granted by the chief executive officer, chief financial officer or chief legal officer of the Company; ▪ gives a third party the discretionary authority to execute such purchases and sales, outside of your control, so long as such third party does not possess any material non-public information about UFG; or explicitly specifies the security or securities to be purchased or sold, the number of shares, the prices and/or dates of transactions, or other formula(s) describing such transactions; ▪ includes a cooling-off period between entry into the 10b5-1 Plan (or modifications to the 10b5-1 Plan) and the occurrence of trades under such 10b5-1 Plan for: o directors and senior management that extends to the later of 90 days after adoption or modification of a 10b5-1 Plan or two business days after disclosing the Company’s financial results in a Form 10-Q or Form 10-K for the fiscal quarter in which the 10b5-1 Plan was adopted or modified, up to a maximum of 120 days; o employees and any other persons, other than the Company, that extends 30 days after adoption or modification of a 10b5-1 Plan; o was entered into by you in good faith at a time when you were not in possession of material non-public information about UFG, and, to the extent required by Rule 10b5-1, contains representations in the 10b5- 1 Plan certifying as to the same; and o otherwise satisfies the conditions of Rule 10b5-1.

Insider Trading Policy v2.0 Page 8 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 Unless otherwise approved by the Chief Executive Officer, Chief Financial Officer or Chief Legal Officer of the Company in accordance with this Policy: ▪ You may not enter into, modify or terminate a 10b5-1 Plan during a blackout period; ▪ following the termination of a 10b5-1 Plan, you must wait at least fifteen (15) days before entering into a new 10b5-1 Plan; ▪ when a 10b5-1 Plan is in effect, you are prohibited from buying or selling UFG’s securities outside of your 10b5-1 Plan; ▪ you are not permitted to have multiple 10b5-1 Plans in operation simultaneously; and ▪ you are not permitted to enter into more than one 10b5-1 Plan designed to effect purchases or sales of the total amount of securities subject to the 10b5-1 Plan as a single transaction in any 12- month period. With respect to any purchase or sale under a 10b5-1 Plan, the third party effecting transactions on your behalf should be instructed to send duplicate confirmations of all such transactions to the Company’s Chief Legal Officer or his or her designee. Potential Criminal and Civil Liability and/or Disciplinary Action 1. Liability for Insider Trading: Violations of the insider trading laws can result in severe civil and criminal sanctions. For example, under U.S. securities laws, individuals may be subject to imprisonment for up to 20 years, criminal fines of up to $5 million and civil fines of up to three times the profit gained or loss avoided. 2. Liability for Tipping: Insiders may also be liable for improper transactions by any person (commonly referred to as "tippee") to whom they have disclosed non-public information regarding the company or to whom they have made recommendations or expressed opinions on the basis of such information as to trading in the Company’s securities. The Securities and Exchange Commission (SEC) has imposed large penalties even when the disclosing person did not profit financially from the trading. The SEC, the stock exchanges and the National Association of Securities Dealers, Inc. use sophisticated electronic surveillance techniques to uncover insider trading. 3. Possible Disciplinary Action: Individuals who violate this policy shall also be subject to disciplinary action by the Company, which may include ineligibility for future participation in the Company’s equity incentive plans or termination of employment. Inquiries Any questions about this Policy, its application to a proposed transaction, or the requirements of applicable laws should be directed to the Chief Legal Officer.

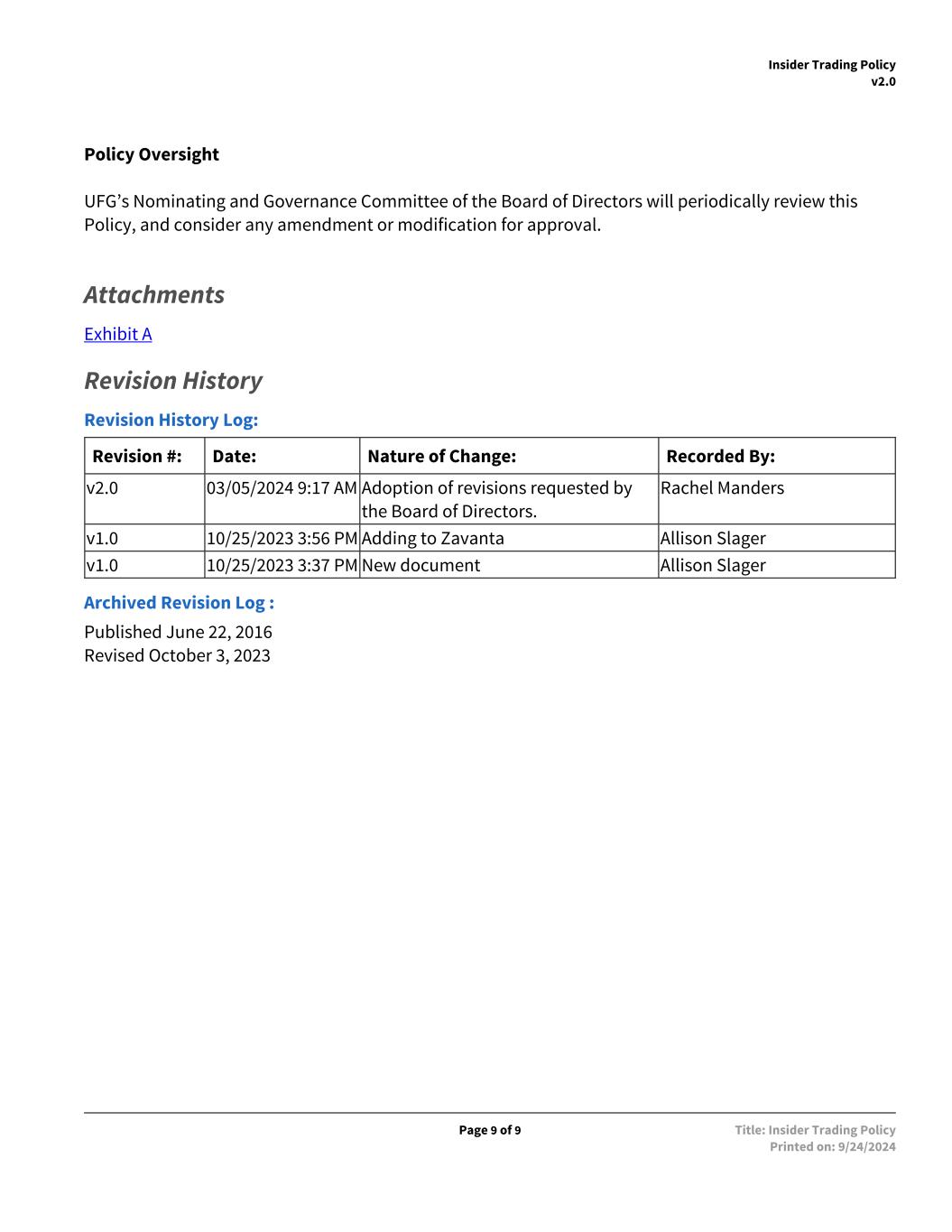

Insider Trading Policy v2.0 Page 9 of 9 Title: Insider Trading Policy Printed on: 9/24/2024 Policy Oversight UFG’s Nominating and Governance Committee of the Board of Directors will periodically review this Policy, and consider any amendment or modification for approval. Attachments Exhibit A Revision History Revision History Log: Revision #: Date: Nature of Change: Recorded By: v2.0 03/05/2024 9:17 AM Adoption of revisions requested by the Board of Directors. Rachel Manders v1.0 10/25/2023 3:56 PM Adding to Zavanta Allison Slager v1.0 10/25/2023 3:37 PM New document Allison Slager Archived Revision Log : Published June 22, 2016 Revised October 3, 2023