Other income for the year ended December 31, 2016 totaled $5,179,000 compared to $4,699,000 in the prior year, an increase of $480,000. Gains on the sale of loans and investment securities decreased $392,000 in the aggregate, while all other items of other income increased $872,000, net. Service charges and fees collected from the expanded customer base contributed to this increase.

Other expenses were $23,124,000 in 2016 compared to $17,100,000 for the similar period in 2015, an increase of $6,024,000. Salaries and benefits costs increased $2,393,000 in 2016 while occupancy and furniture and equipment costs increased $543,000 and all other operating expenses increased $3,088,000, net, due to costs related to the acquisition and the operation of twelve new community offices. Included in the increased expenses are $1.8 million of one-time merger related expenses. Income tax expense for the year totaled $1,884,000 which was an increase of $252,000 from the prior year. The effective tax rate in 2016 was 21.9% compared to 21.6% in 2015.

The following table sets forth changes in net income (in thousands):

| | | | |

| | | | |

| Net income 2015 | | $ | 5,908 | |

| Net interest income | | | 4,069 | |

| Provision for loan losses | | | 2,530 | |

| Net gains on sales of loans and securities | | | (392 | ) |

| Other income | | | 872 | |

| Salaries and employee benefits | | | (2,393 | ) |

| Occupancy, furniture and equipment | | | (543 | ) |

| Foreclosed real estate owned | | | 231 | |

| Merger related | | | (1,806 | ) |

| Other expenses | | | (1,513 | ) |

| Income tax expense | | | (252 | ) |

| Net income for 2016 | | $ | 6,711 | |

Net income for the year ended December 31, 2015 was $5,908,000 which was $1,749,000 lower than the $7,657,000 earned in 2014. Basic and diluted earnings per share were $1.60 in 2015 compared to $2.10 per share in 2014. The return on average assets (ROA) for the year ended December 31, 2015 was 0.80% and the return on average equity (ROE) was 5.83% compared to an ROA of 1.08% and an ROE of 7.92% in the prior year. The reduction in earnings from the prior year was the result of increased provision for loan losses and a decrease in net gains recognized on the sale of loans and securities which was partially offset by a decrease in expenses related to foreclosed properties.

Net interest income (fte) totaled $25,882,000 which was an increase of $64,000 from the 2014 total. Average loans outstanding increased $29.0 million in 2015 but a 21 basis point decrease in the yield earned limited the increase in fte interest income to $288,000. The reduced yield was due to loan production at current market rates. Total average securities decreased $4.9 million in 2015 which contributed to a $178,000 decrease in fte interest income. Average interest-bearing deposits with banks were $3.5 million higher in 2015 and interest income in this area increased $9,000. Growth of the funding base led to a $50,000 increase in interest expense. A 2 basis point reduction in the cost of interest-bearing deposits lead to reduced interest expense on deposits of $42,000 despite a $19.1 million increase in average total deposits. The cost of borrowed funds increased $92,000 compared to the prior year due primarily to a $5.8 million increase in average long-term borrowings. The resulting fte net interest margin decreased 15 basis points to 3.75% in 2015 as a 16 basis point reduction in the yield earned was only partially offset by a 1 basis point decrease in the cost of funds.

Loans receivable increased $58.8 million from the prior year-end due primarily to a $28.6 million increase in commercial loans which includes a $21.3 million increase in municipal financing. Commercial real estate loans also increased $17.2 million in 2015. Residential mortgage loans and construction loans increased $3.4 million, net, after the sale of $4.3 million of fixed-rate residential mortgage loans for the purpose of interest rate risk management. Consumer loans increased $9.5 million in 2015 due primarily to a $9.2 million increase in indirect auto and marine financing. Total non-performing loans increased from $5.6 million and 1.12% of total loans at the end of 2014 to $7.1 million, or 1.27% of total loans on December 31, 2015. Net charge-offs totaled $3,157,000 in 2015 which was an increase from the $1,513,000 recorded in 2014. Based on the level of charge-offs and non-performing loans, the Company determined that it would be appropriate to allocate $4,580,000 to the allowance for loan losses to reserve for potential future losses which resulted in an increase in the ratio of the allowance for loan losses to total loans outstanding to 1.30% compared to 1.17% on December 31, 2014.

Other income for the year ended December 31, 2015 totaled $4,699,000 compared to $5,110,000 in the prior year, a decrease of $411,000. Gains on the sale of loans and investment securities decreased $572,000 in the aggregate, while all other items of other income increased $161,000, net.

Other expenses were $17,100,000 in 2015 compared to $17,727,000 for the similar period in 2014, a decrease of $627,000. Salaries and benefits costs decreased $81,000 in 2015 due primarily to reduced incentive compensation. Occupancy and furniture and equipment costs decreased $35,000. Foreclosed real estate costs decreased $644,000 from the prior period. All other operating expenses increased $133,000, net. Income tax expense for the year totaled $1,632,000 which was a decrease of $974,000 from the prior year. The effective tax rate in 2015 was 21.6% compared to 25.4% in 2014 due primarily to a higher proportion of tax-exempt income.

The following table sets forth changes in net income (in thousands):

| | | | |

| | | | |

| Net income 2014 | | $ | 7,657 | |

| Net interest income | | | (39 | ) |

| Provision for loan losses | | | (2,900 | ) |

| Net gains on sales of loans and securities | | | (572 | ) |

| Other income | | | 161 | |

| Salaries and employee benefits | | | 81 | |

| Occupancy, furniture and equipment | | | 35 | |

| Foreclosed real estate owned | | | 644 | |

| Other expenses | | | (133 | ) |

| Income tax expense | | | 974 | |

| Net income for 2015 | | $ | 5,908 | |

| | | | | |

Total Assets

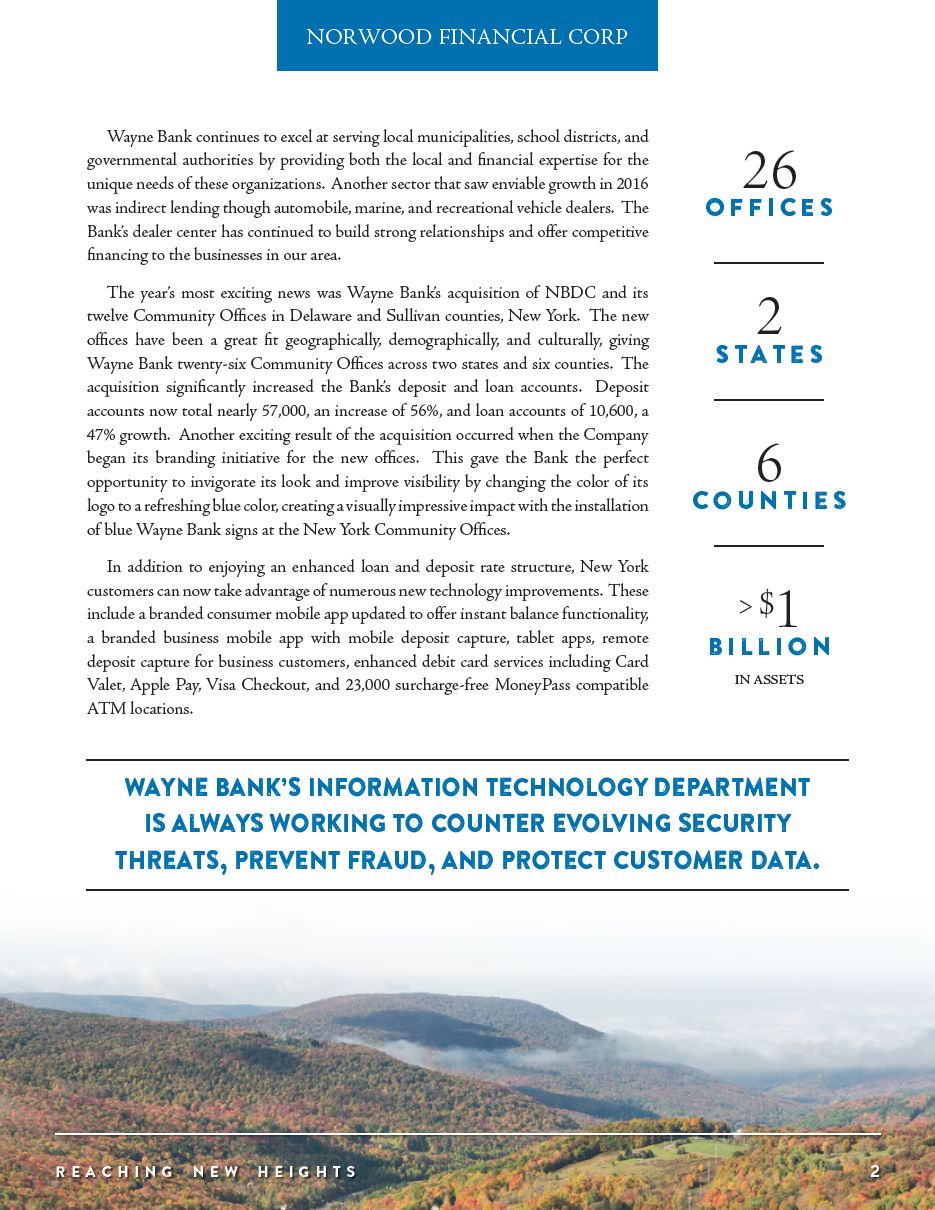

Total assets as of December 31, 2016, were $1.1 billion compared to $750.5 million as of year-end 2015, an increase of $360.6 million. Growth related to the acquisition of Delaware Bancshares was $368.6 million.

Loans Receivable

As of December 31, 2016, loans receivable totaled $713.9 million compared to $559.9 million as of year-end 2015, an increase of $154.0 million. Growth related to the acquisition totaled $112.1 million. Commercial loans grew $55.5 million, while retail loans increased $98.5 million during the year.

Residential real estate loans, which include home equity lending, totaled $237.2 million as of December 31, 2016, compared to $161.8 million as of year-end 2015, an increase of $75.4 million. The Company does not originate any non-traditional mortgage products such as interest-only loans or option adjustable rate mortgages and has no sub-prime mortgage exposure. The Company evaluates sales of its long-term, fixed-rate residential loan production for interest rate risk management, with $1.7 million of long-term, fixed-rate loans sold into the secondary market during 2016. In the current interest rate environment, the Company expects to continue selling mortgage loans in 2017. The Company's home equity loan portfolio, which is included in residential real estate loans, increased $9.1 million in 2016.

Commercial loans consist principally of loans made to small businesses within the Company's market and are usually secured by real estate or other assets of the borrower. Commercial real estate loans totaled $320.2 million as of December 31, 2016, increasing from $279.1 million as of December 31, 2015. The terms for commercial real estate loans are typically 15 to 20 years, with adjustable rates based on a spread to the prime rate or fixed for the initial three to five year period then adjusting to a spread to the prime rate. The majority of the Company's commercial real estate portfolio is owner occupied and includes the personal guarantees of the principals. Commercial loans consisting principally of lines of credit and term loans secured by equipment or other assets increased $14.4 million to $85.5 million as of December 31, 2016.

The Company's indirect lending portfolio (included in consumer loans to individuals) increased $17.9 million to $41.5 million as of December 31, 2016.

Allowance for Loan Losses and Non-Performing Assets

The allowance for loan losses totaled $6,463,000 as of December 31, 2016 and represented 0.91% of total loans receivable compared to $7,298,000 and 1.30% of total loans as of year-end 2015. The decrease in the ratio of the allowance for loan losses to total loans outstanding reflects the impact of the loans acquired from Delaware with no allowance. Net charge-offs for 2016 totaled $2,885,000 and represented 0.46% of average loans compared to $3,157,000 and 0.60% of average loans in 2015.

Non-performing assets consist of non-performing loans and real estate owned as a result of foreclosure, which is held for sale. Loans are placed on non-accrual status when management believes that a borrower's financial condition is such that collection of interest is doubtful. Commercial and real estate related loans are generally placed on non-accrual when interest is 90 days delinquent. When loans are placed on non-accrual, accrued interest is reversed from current earnings.

As of December 31, 2016, non-performing loans totaled $1,927,000 and represented 0.25% of total loans compared to $7,132,000 or 1.27% as of December 31, 2015. The significant decrease in the level of non-performing loans is due to the transfer of one loan relationship with a balance of $5.0 million on December 31, 2015 to foreclosed real estate owned in 2016. Based on management's analysis, the Company added $2,050,000 to the allowance for loan losses for the year ended December 31, 2016 compared to $4,580,000 in 2015.

Foreclosed real estate owned totaled $5,302,000 as of December 31, 2016 and $2,847,000 as of December 31, 2015. The increase is due primarily to the transfer of one loan relationship with a carrying value of $5.0 million as of December 31, 2015 which was partially offset by a subsequent write down of $2.4 million. During 2016, eight properties with a carrying value of $595,000 were disposed of through sales. The Company recorded a net gain of $61,000 from the sale of the properties.

Management assesses the adequacy of the allowance for loan losses on a quarterly basis. The process includes a review of the risks inherent in the loan portfolio. It includes an analysis of impaired loans and a historical review of losses. Other factors considered in the analysis include: concentrations of credit in specific industries in the commercial portfolio, the local and regional economic condition, trends in delinquencies, internal risk rating classifications, and growth in the portfolio. For loans acquired, including those that are not deemed impaired at acquisition, credit discounts representing the principal losses expected over the life of the loan are a component of the initial fair value. Subsequent to the purchase date, the methods utilized to estimate the required allowance for credit losses for these loans is similar to originated loans; however, the Company records a provision for loan losses only when the required allowance exceeds any remaining credit discounts.

The Company has limited exposure to higher-risk loans. The Company does not originate option ARM products, interest only loans, sub-prime loans or loans with initial teaser rates in its residential real estate portfolio. The Company has $8.3 million of junior lien home equity loans. For 2016, net charge-offs for this portfolio totaled $43,000.

As of December 31, 2016, the Company considered its concentration of credit risk profile to be acceptable. The highest concentrations are in commercial rentals and the hospitality lodging industry.

During 2016, the Company recognized a decrease in its adversely classified loans. The Company assesses a loss factor against the classified loans, which is based on prior experience. Classified loans which are considered impaired are measured on a loan by loan basis. The Company values such loans by either the present value of expected cash flows, the loan's obtainable market price or the fair value of collateral if the loan is collateral dependent.

At December 31, 2016, the recorded investment in impaired loans, not requiring an allowance for loan losses was $2,624,000 (net of charge-offs against the allowance for loan losses of $831,000). There were no loans requiring an allowance. The recorded investment in impaired loans not requiring an allowance for loan losses was $2,855,000 (net of charge-offs of $1,971,000) and $6,373,000 for impaired loans requiring an allowance for loan losses as of December 31, 2015.

As a result of its analysis, after applying these factors, management considers the allowance as of December 31, 2016, adequate. However, there can be no assurance that the allowance for loan losses will be adequate to cover significant losses, that might be incurred in the future.

The following table sets forth information with respect to the Company's allowance for loan losses at the dates indicated:

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Year ended December 31, | |

| | (dollars in thousands) | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | | | | |

| Allowance balance at beginning of period | $ | 7,298 | | $ | 5,875 | | $ | 5,708 | | $ | 5,502 | | $ | 5,458 | |

| Charge-offs: | | | | | | | | | | | | | | | |

| Real Estate loans | | | | | | | | | | | | | | | |

| Residential | | (123) | | | (224) | | | (270) | | | (603) | | | (541) | |

| Commercial | | (2,711) | | | (2,883) | | | (1,196) | | | (1,488) | | | (1,632) | |

| Construction | | - | | | - | | | - | | | (40) | | | (181) | |

| Commercial loans | | (15) | | | - | | | - | | | (4) | | | (24) | |

| Consumer loans | | (102) | | | (91) | | | (80) | | | (90) | | | (59) | |

| Total | | (2,951) | | | (3,198) | | | (1,546) | | | (2,225) | | | (2,437) | |

| Recoveries: | | | | | | | | | | | | | | | |

| Real Estate loans | | | | | | | | | | | | | | | |

| Residential | | 6 | | | 20 | | | - | | | 9 | | | 7 | |

| Commercial | | 15 | | | - | | | 2 | | | - | | | - | |

| Construction | | - | | | - | | | - | | | - | | | - | |

| Commercial loans | | - | | | - | | | - | | | - | | | - | |

| Consumer loans | | 45 | | | 21 | | | 31 | | | 22 | | | 24 | |

| Total | | 66 | | | 41 | | | 33 | | | 31 | | | 31 | |

| Provision expense | | 2,050 | | | 4,580 | | | 1,680 | | | 2,400 | | | 2,450 | |

| Allowance balance at end of period | $ | 6,463 | | $ | 7,298 | | $ | 5,875 | | $ | 5,708 | | $ | 5,502 | |

| Allowance for loan losses as a percent | | | | | | | | | | | | | | | |

| of total loans outstanding | | 0.91 | % | | 1.30 | % | | 1.17 | % | | 1.13 | % | | 1.15 | % |

| Net loans charged off as a percent of | | | | | | | | | | | | | | | |

| average loans outstanding | | 0.46 | % | | 0.60 | % | | 0.30 | % | | 0.45 | % | | 0.50 | % |

| Allowance coverage of non-performing loans | | 3.4 | x | | 1.0 | x | | 1.1 | x | | 0.6 | x | | 0.4 | x |

The following table sets forth information regarding non-performing assets.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | December 31, |

| | (dollars in thousands) |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Non-accrual loans: | | | | | | | | | | | | | | | |

| Real Estate loans | | | | | | | | | | | | | | | |

| Residential | $ | 1,136 | | $ | 440 | | $ | 1,675 | | $ | 1,704 | | $ | 2,846 | |

| Commercial | | 762 | | | 6,649 | | | 3,921 | | | 7,843 | | | 10,026 | |

| Construction | | 28 | | | — | | | — | | | — | | | — | |

| Commercial loans | | — | | | 43 | | | — | | | — | | | 328 | |

| Consumer loans | | — | | | — | | | 4 | | | — | | | — | |

| Total | | 1,926 | | | 7,132 | | | 5,600 | | | 9,547 | | | 13,200 | |

| | | | | | | | | | | | | | | | |

| Accruing loans which are contractually | | | | | | | | | | | | | | | |

| past due 90 days or more | | 1 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| Total non-performing loans | | 1,927 | | | 7,132 | | | 5,600 | | | 9,547 | | | 13,200 | |

| Foreclosed real estate | | 5,302 | | | 2,847 | | | 3,726 | | | 1,009 | | | 852 | |

| Total non-performing assets | $ | 7,229 | | $ | 9,979 | | $ | 9,326 | | $ | 10,556 | | $ | 14,052 | |

| | | | | | | | | | | | | | | | |

| Non-performing loans to total loans | | 0.25 | % | | 1.27 | % | | 1.12 | % | | 1.90 | % | | 2.77 | % |

| | | | | | | | | | | | | | | | |

| Non-performing loans to total assets | | 0.17 | % | | 0.95 | % | | 0.79 | % | | 1.34 | % | | 1.96 | % |

| | | | | | | | | | | | | | | | |

| Non-performing assets to total assets | | 0.64 | % | | 1.33 | % | | 1.31 | % | | 1.48 | % | | 2.09 | % |

Securities

The securities portfolio consists of issues of United States Treasury securities, United States Government agencies, including mortgage-backed securities, municipal obligations, and corporate debt. The Company classifies its investments into two categories: held to maturity (HTM) and available for sale (AFS). The Company does not have trading securities. Securities classified as HTM are those in which the Company has the ability and the intent to hold the security until contractual maturity. As of December 31, 2016, there were no securities carried in the HTM portfolio. Securities classified as AFS are eligible to be sold due to liquidity needs or interest rate risk management. These securities are adjusted to and carried at their fair value with any unrealized gains or losses recorded net of deferred income taxes, as an adjustment to capital and reported in the equity section of the Consolidated Balance Sheet as other comprehensive income. As of December 31, 2016, $302.6 million of securities were so classified and carried at their fair value, with unrealized losses, net of tax, of $4,438,000 included in accumulated other comprehensive income as a component of stockholders' equity.

As of December 31, 2016, the average life of the portfolio was 5.5 years. The Company has maintained a relatively short average life in the portfolio in order to generate cash flow to support loan growth and maintain liquidity levels. During 2016, the portfolio increased $163.7 million as a result of the acquisition of Delaware. Purchases for the year totaled $101.0 million, while maturities and cash flow totaled $26.2 million and proceeds from sales were $110.7 million. The purchases were funded principally by cash flow generated from the portfolio and excess overnight liquidity. The sales include securities that were acquired from Delaware which were sold immediately for a variety of factors, including non-conformance with Company policies.

The carrying value of the securities portfolio at December 31 is as follows:

| | | | | | | | | |

| | | | | | | | | |

| | 2016 | | 2015 | |

| | (dollars in thousands) | |

| | Carrying | | % of | | Carrying | | % of | |

| | Value | | portfolio | | Value | | portfolio | |

| | | | | | | | | |

| U.S. Treasury securities | | $ | 1,997 | | | | 0.7 | % | | $ | — | | | | — | % |

| U.S. Government agencies | | | — | | | | — | % | | | 9,169 | | | | 6.6 | % |

| States and political subdivisions | | | 125,101 | | | | 41.4 | % | | | 60,755 | | | | 43.8 | % |

| Corporate obligations | | | 10,112 | | | | 3.3 | % | | | 4,974 | | | | 3.5 | % |

| Mortgage-backed securities – government sponsored entities | | | 164,930 | | | | 54.5 | % | | | 63,569 | | | | 45.8 | % |

| Equity securities – financial services | | | 424 | | | | 0.1 | % | | | 384 | | | | 0.3 | % |

| | | | | | | | | | | | | | | | | |

| Total | | $ | 302,564 | | | | 100.0 | % | | $ | 138,851 | | | | 100.0 | % |

The portfolio had no adjustable-rate instruments as of December 31, 2016 and 2015. The portfolio contained no private label mortgage backed securities, collateralized debt obligations (CDOs), or trust preferred securities, and no off-balance sheet derivatives were in use. As of December 31, 2016, the portfolio did not contain any step-up bonds. The mortgage-backed securities portfolio includes pass-through bonds and collateralized mortgage obligations (CMO's) with Fannie Mae, Freddie Mac and the Government National Mortgage Association (GNMA).

The Company evaluates the securities in its portfolio for other-than-temporary-impairment (OTTI) as fair value declines below cost. In estimating OTTI management considers (1) the length of time and the extent of the decline in fair value and (2) the financial condition and near-term prospects of the issuer. As of December 31, 2016, the Company held 247 investment securities in a loss position which had a combined unrealized loss of $7.8 million. Management believes that these losses are principally due to changes in interest rates and represent temporary impairment as the Company does not have the intent to sell these securities and it is more likely than

not that it will not have to sell the securities before recovery of their cost basis. The Company also holds a small portfolio of equity securities of other financial institutions. As of December 31, 2016, none of these equity securities were in an unrealized loss position. No impairment charges have been recognized in 2016, 2015 and 2014.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company uses fair value measurements to record fair value adjustments to certain financial instruments and determine fair value disclosures (see Note 14 of Notes to the Consolidated Financial Statements).

Approximately $302.6 million, which represents 27.2% of total assets at December 31, 2016, consisted of financial instruments recorded at fair value on a recurring basis. This amount consists entirely of the Company's available for sale securities portfolio. The Company uses valuation methodologies involving market-based or market-derived information, collectively Level 1 and 2 measurements, to measure fair value. There were no transfers into or out of Level 3 for any instruments for the years ending December 31, 2016 and 2015.

The Company utilizes a third party provider to perform valuations of the investments. Methods used to perform the valuations include: pricing models that vary based on asset class, available trade and bid information, actual transacted prices, and proprietary models for valuations of state and municipal obligations. In addition, the Company has a sample of fixed-income securities valued by another independent source. The Company does not adjust values received from its providers, unless it is evident that fair value measurement is not consistent with the Company's policies.

The Company also utilizes a third party provider to provide the fair value of certain loan servicing rights. Fair value for the purpose of this measurement is defined as the amount at which the asset could be exchanged in a current transaction between willing parties, other than in a forced liquidation. The fair value of mortgage servicing rights as of December 31, 2016 and 2015 was $250,000 and $291,000, respectively.

DEPOSITS

The Company, through the community offices of the Bank, provides a full range of deposit products to its retail and business customers. These products include interest-bearing and non-interest bearing transaction accounts, statement savings and money market accounts. Time deposits consist of certificates of deposit (CDs) with terms of up to five years and include Individual Retirement Accounts. The Bank participates in the Jumbo CD ($100,000 and over) markets with local municipalities and school districts, which are typically awarded on a competitive bid basis. The Company has no brokered deposits nor does it participate in the Certificate of Deposit Account Registry Service (CDARS).

Total deposits as of December 31, 2016, totaled $925.4 million, increasing $374.5 million from year-end 2015. The increase included $327.3 million of deposits which were acquired from Delaware. Organic growth included a $17.0 million increase in non-interest bearing demand balances and a $27.5 million increase in certificates of deposit. The large increase in certificates of deposit includes deposits of local municipalities and school districts which were held in more liquid accounts at year-end 2015.

Time deposits of $250,000 or more, which consist principally of school district funds, other public funds and short-term deposits from large commercial customers with maturities generally less than one year, totaled $59.0 million as of December 31, 2016, compared to $22.0 million at year-end 2015. These deposits are subject to competitive bid and the Company bases its bid on current interest rates, loan demand, investment portfolio structure and the relative cost of other funding sources.

As of December 31, 2016, non-interest bearing demand deposits totaled $191.5 million compared to $107.8 million at year-end 2015. Cash management accounts in the form of securities sold under agreements to repurchase included in short-term borrowings, totaled $32.8 million at year end 2016 compared to $33.6 million as of December 31, 2015. These balances represent commercial and municipal customers' funds invested in overnight securities. The Company considers these accounts as a source of core funding.

MARKET RISK

Interest rate sensitivity and the repricing characteristics of assets and liabilities are managed by the Asset and Liability Management Committee (ALCO). The principal objective of the ALCO is to maximize net interest income within acceptable levels of risk, which are established by policy. Interest rate risk is monitored and managed by using financial modeling techniques to measure the impact of changes in interest rates.

Net interest income, which is the primary source of the Company's earnings, is impacted by changes in interest rates and the relationship of different interest rates. To manage the impact of the rate changes, the balance sheet should be structured so that repricing opportunities exist for both assets and liabilities at approximately the same time intervals. The Company uses net interest simulation to assist in interest rate risk management. The process includes simulating various interest rate environments and their impact on net interest income. As of December 31, 2016, the level of net interest income at risk in a ± 200 basis points increase was within the Company's policy limit of a decline less than 8% of net interest income.

Imbalances in repricing opportunities at a given point in time reflect interest-sensitivity gaps measured as the difference between rate-sensitive assets and rate-sensitive liabilities. These are static gap measurements that do not take into account any future activity, and as such are principally used as early indicators of potential interest rate exposures over specific intervals.

At December 31, 2016, the Bank had a positive 90-day interest sensitivity gap of $34.7 million or 3.1% of total assets. A positive gap indicates that the balance sheet has a higher level of rate-sensitive assets (RSA) than rate-sensitive liabilities (RSL) at the specific time interval. This would indicate that in an increasing rate environment, the yield on interest-earning assets would increase faster than the cost of interest-bearing liabilities in the 90 day time frame. The level of RSA and RSL for an interval is managed by ALCO strategies, including adjusting the average life of the investment portfolio through purchases and sales, pricing of deposit liabilities to attract long or short term time deposits, utilizing borrowings to fund loan growth, loan pricing to encourage variable rate products and evaluation of loan sales of long term fixed rate mortgages.

The Company analyzes and measures the time periods in which RSA and RSL will mature or reprice in accordance with their contractual terms and assumptions. Management believes that the assumptions used are reasonable. The interest rate sensitivity of assets and liabilities could vary substantially if differing assumptions were used or if actual experience differs from the assumptions used in the analysis. For example, although certain assets and liabilities may have similar maturities or periods to repricing, they may react in differing degrees to changes in market interest rates. The interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types may lag behind changes in market rates. Interest rates may change at different rates changing the shape of the yield curve. The level of rates on the investment securities may also be affected by the spread relationship between different investments. Further, in the event of a significant change in interest rates, prepayment and early withdrawal levels would likely deviate significantly from those assumed. Finally, the ability of borrowers to service their adjustable-rate debt may decrease in the event of an interest rate increase. It should be noted that the operating results of the Company are not subject to foreign currency exchange or commodity price risk.

The following table displays interest-sensitivity as of December 31, 2016 (in thousands):

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 3 Months | | 3-12 | | | | Over | | |

| | Or Less | | Months | | 1-3 Years | | 3 Years | | Total |

| Federal funds sold and | | | | | | | | | | | | | | |

| interest-bearing deposits | $ | 2,174 | | $ | — | | $ | 100 | | $ | — | | $ | 2,274 |

| Securities | | 7,476 | | | 21,583 | | | 59,163 | | | 214,342 | | | 302,564 |

| Loans Receivable | | 158,060 | | | 165,189 | | | 199,137 | | | 191,503 | | | 713,889 |

| Total Rate Sensitive Assets (RSA) | $ | 167,710 | | $ | 186,772 | | $ | 258,400 | | $ | 405,845 | | $ | 1,018,727 |

| | | | | | | | | | | | | | | |

| Non-maturity interest-bearing deposits | $ | 65,059 | | $ | 64,050 | | $ | 170,069 | | $ | 139,206 | | $ | 438,384 |

| Time Deposits | | 48,730 | | | 126,075 | | | 88,233 | | | 32,518 | | | 295,556 |

| Borrowings | | 19,252 | | | 18,092 | | | 23,391 | | | 4,077 | | | 64,812 |

| Total Rate Sensitive Liabilities (RSL) | $ | 133,041 | | $ | 208,217 | | $ | 281,693 | | $ | 175,801 | | $ | 798,752 |

| | | | | | | | | | | | | | | |

| Interest sensitivity gap | $ | 34,669 | | $ | (21,445) | | $ | (23,293) | | $ | 230,044 | | $ | 219,975 |

| Cumulative gap | | 34,669 | | | 13,224 | | | (10,069) | | | 219,975 | | | |

| RSA/RSL-cumulative | | 126.1 | % | | 103.9 | % | | 98.4 | % | | 127.5 | % | | |

| | | | | | | | | | | | | | | |

| As of December 31, 2015 | | | | | | | | | | | | | | |

| Interest sensitivity gap | $ | 38,817 | | $ | 11,614 | | $ | (57,114) | | $ | 168,269 | | $ | 161,586 |

| Cumulative gap | | 38,817 | | | 50,431 | | | (6,683) | | | 161,586 | | | |

| RSA/RSL-cumulative | | 140.9 | % | | 122.8 | % | | 98.5 | % | | 130.1 | % | | |

Certain interest-bearing deposits with no stated maturity dates are included in the interest-sensitivity table above. The balances allocated to the respective time periods represent an estimate of the total outstanding balance that has the potential to migrate either through withdrawal or transfer to time deposits, thereby impacting the interest-sensitivity position of the Company. The estimates were derived from a non-maturity deposit study which was prepared by an independent third party provider in 2016. The purpose of the study was to estimate the average lives of various deposit types and their pricing sensitivity to movements in market interest rates.

LIQUIDITY

Liquidity is the ability to fund customers' borrowing needs and their deposit withdrawal requests while supporting asset growth. The Company's primary sources of liquidity include deposit generation, asset maturities, cash flow from payments on loans and securities and access to borrowing from the Federal Home Loan Bank and other correspondent banks.

As of December 31, 2016, the Company had cash and cash equivalents of $17.2 million in the form of cash, due from banks, balances with the Federal Reserve Bank, and short-term deposits with other institutions. In addition, the Company had total securities available for sale of $302.6 million, which could be used for liquidity needs. This totals $319.8 million and represents 28.8% of total assets compared to $148.9 million and 19.8% of total assets as of December 31, 2015. The Company also monitors other liquidity measures, all of which were within the Company's policy guidelines as of December 31, 2016. Based upon these measures, the Company believes its liquidity position is adequate.

The Company maintains established lines of credit with the Federal Home Loan Bank of Pittsburgh (FHLB), the Atlantic Community Bankers Bank (ACBB) and other correspondent banks, which support liquidity needs. The total available under all the lines was $356.8 million, with $0 outstanding at December 31, 2016 and $19.7

million outstanding at December 31, 2015. The maximum borrowing capacity from FHLB was $316.8 million. As of December 31, 2016, the Company had $32.0 million in term borrowings from the FHLB, compared to $41.1 million at December 31, 2015.

OFF-BALANCE SHEET ARRANGEMENTS

The Company's financial statements do not reflect various commitments that are made in the normal course of business, which may involve some liquidity risk. These commitments consist mainly of unfunded loans and letters of credit made under the same standards as on-balance sheet instruments. Unused commitments, as of December 31, 2016 totaled $82.6 million. They consisted of $22.2 million of commitments for residential and commercial real estate, construction and land developments loans, $24.7 million in unused home equity lines of credit, $5.6 million in performance and standby letters of credit and $30.1 million in other unused commitments, principally commercial lines of credit. Because these instruments have fixed maturity dates and many of them will expire without being drawn upon, they do not represent any significant liquidity risk.

Management believes that any amounts actually drawn upon can be funded in the normal course of operations. The Company has no investment in or financial relationship with any unconsolidated entities that are reasonably likely to have a material effect on liquidity or the availability of capital resources.

The following table represents the aggregate of on and off-balance sheet contractual obligations to make future payments (in thousands):

CONTRACTUAL OBLIGATIONS

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | December 31, 2016 | |

| | | Total | | | Less than 1 year | | | 1-3 years | | | 4-5 years | | | Over 5 years | |

| | | | | | | | | | | | | | | | |

| Time deposits | | $ | 295,557 | | | $ | 174,814 | | | $ | 88,233 | | | $ | 32,331 | | | $ | 179 | |

| Long-term debt | | | 32,001 | | | | 14,025 | | | | 2,296 | | | | 11,112 | | | | 4,568 | |

| Operating leases | | | 3,470 | | | | 381 | | | | 767 | | | | 705 | | | | 1,617 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 331,028 | | | $ | 189,220 | | | $ | 91,296 | | | $ | 44,148 | | | $ | 6,364 | |

RESULTS OF OPERATIONS

NET INTEREST INCOME

Net interest income is the most significant source of revenue for the Company and represented 84.7% of total revenue for the year ended December 31, 2016. Net interest income (fte) totaled $30,339,000 for the year ended December 31, 2016 compared to $25,882,000 for 2015, an increase of $4,457,000. The resulting fte net interest spread and net interest margin were 3.46% and 3.60%, respectively, in 2016 compared to 3.61% and 3.75%, respectively, in 2015.

Interest income (fte) for the year ended December 31, 2016 totaled $33,993,000 compared to $29,140,000 in 2015. The fte yield on average earning assets was 4.03%, decreasing 20 basis points from the 4.23% reported last year. The low interest rate environment impacted the yield earned as new loan production was added at historically low rates. This impacted loan yields which earned 4.50% in 2016 compared to 4.61% in the prior year. The reduced yield was offset by a $96.9 million increase in average loans outstanding due primarily to loans acquired from Delaware, and interest income (fte) from loans increased $3.8 million. The yield on securities decreased 33 basis points in 2016 due primarily to the lower yielding portfolio acquired from Delaware. A $55.6 million increase in average securities outstanding offset the lower yield, and interest income (fte) from the portfolio improved $1.0 million.

Interest expense was $3,654,000 in 2016 which resulted in an average cost of interest-bearing liabilities of 0.57% compared to total interest expense of $3,258,000 in 2015 with an average cost of 0.62%. The continued low rate environment also impacted rates paid on deposits as the Company reduced rates paid on time deposits to market levels. Total interest-bearing deposits cost 0.46% in 2016 which was 6 basis points lower than the 0.52% cost in the prior year. Time certificates of deposit repriced to current market rates upon maturity and new growth was added at the reduced levels. Time deposits acquired from Delaware also impacted the cost of deposits. Long-term borrowings also repriced downward in 2016 reflecting a the impact from low-cost borrowings originated in recent years.

Net interest income represented 83.9% of total revenue for the year ended December 31, 2015. Net interest income (fte) totaled $25,882,000 for the year ended December 31, 2015 compared to $25,818,000 for 2014, an increase of $64,000. The resulting fte net interest spread and net interest margin were 3.61% and 3.75%, respectively, in 2015 compared to 3.76% and 3.90%, respectively, in 2014.

Interest income (fte) for the year ended December 31, 2015 totaled $29,140,000 compared to $29,026,000 in 2014. The fte yield on average earning assets was 4.23%, decreasing 16 basis points from the 4.39% reported last year. The continued low interest rate environment impacted the yield earned as new loan production was added at historically low rates. This impacted loan yields which earned 4.61% in 2015 compared to 4.82% in the prior year. The reduced yield was partially offset by a $29.0 million increase in average loans outstanding, resulting in a $288,000 increase in loan income. The yield on securities decreased 2 basis points in 2015, and combined with a $4.8 million decrease in the average balance, resulted in a $178,000 decrease in interest income.

Interest expense was $3,258,000 in 2015 which resulted in an average cost of interest-bearing liabilities of 0.62% compared to total interest expense of $3,208,000 in 2014 with an average cost of 0.63%. The continued low rate environment also impacted rates paid on deposits as the Company reduced rates paid on time deposits to market levels. Total interest-bearing deposits cost 0.52% in 2015 which was 2 basis points lower than the 0.54% cost in the prior year due primarily to a 14 basis point reduction in time deposits as certificates repriced to current market rates upon maturity and new growth was added at the reduced levels. Long-term borrowings also repriced downward in 2015 reflecting the impact from low-cost borrowings originated in recent years.

OTHER INCOME

Other income totaled $5,179,000 for the year ended December 31, 2016 compared to $4,699,000 in 2015, an increase of $480,000. Gains from the sales of loans and securities decreased $392,000 from the prior year, while all other items of other income increased $872,000, net. The increase reflects the increased fees related to the Delaware acquisition.

Other income totaled $4,699,000 for the year ended December 31, 2015 compared to $5,110,000 in 2014, a decrease of $411,000. Gains from the sales of loans and securities decreased $572,000 from the prior year, while all other items of other income increased $161,000, net.

Other Income (dollars in thousands)

For the year ended December 31

| | | | | | | | | | |

| | | | | | | | | | |

| | | 2016 | | | 2015 | | | 2014 | |

| Service charges on deposit accounts | | $ | 200 | | | $ | 168 | | | $ | 176 | |

| ATM Fees | | | 258 | | | | 220 | | | | 206 | |

| NSF Fees | | | 1,171 | | | | 850 | | | | 932 | |

| Safe deposit box rental | | | 66 | | | | 62 | | | | 63 | |

| Loan related service fees | | | 319 | | | | 451 | | | | 370 | |

| Debit card | | | 874 | | | | 660 | | | | 620 | |

| Fiduciary activities | | | 448 | | | | 439 | | | | 437 | |

| Commissions on mutual funds & annuities | | | 143 | | | | 143 | | | | 94 | |

| Gain on sales of mortgage loans | | | 54 | | | | 104 | | | | 132 | |

| Earnings on and proceeds from bank-owned life insurance | | | 888 | | | | 664 | | | | 685 | |

| Other income | | | 474 | | | | 312 | | | | 225 | |

| | | | 4,895 | | | | 4,073 | | | | 3,940 | |

| Net realized gains on sales of securities | | | 284 | | | | 626 | | | | 1,170 | |

| | | | | | | | | | | | | |

| Total | | $ | 5,179 | | | $ | 4,699 | | | $ | 5,110 | |

OTHER EXPENSES

Other expenses totaled $23,124,000 for the year ended December 31, 2016 compared to $17,100,000 in the prior year. The $6,024,000 increase in costs includes $1,806,000 of one-time merger expenses plus the costs of acquiring and operating twelve new community offices. Salaries and benefits costs increased $2,393,000 in 2016 while occupancy and equipment costs increased $543,000. All other operating expenses increased $3,088,000, net, which includes $1,806,000 of one-time merger expenses. The Company's efficiency ratio, which measures total other expenses as a percentage of net interest income (fte) plus other income, was 65.1% in 2016 compared to 55.9% in 2015. Merger costs contributed to the increased ratio.

Other expenses totaled $17,100,000 for the year ended December 31, 2015 compared to $17,727,000 in the prior year. The $627,000 decrease in costs includes a $644,000 decrease in expenses related to foreclosed real estate owned. Salaries and benefits costs decreased $81,000 in 2015 while occupancy and equipment costs decreased $35,000. All other operating expenses increased $133,000, net. The Company's efficiency ratio, which measures total other expenses as a percentage of net interest income (fte) plus other income, was 55.9% in 2015 compared to 57.3% in 2014.

Other Expenses (dollars in thousands)

For the year ended December 31

| | | | | | | | | | |

| | | | | | | | | | |

| | | 2016 | | | 2015 | | | 2014 | |

| Salaries | | $ | 7,054 | | | $ | 5,752 | | | $ | 5,744 | |

| Employee benefits | | | 3,874 | | | | 2,783 | | | | 2,872 | |

| Occupancy | | | 2,077 | | | | 1,660 | | | | 1,676 | |

| Furniture and equipment | | | 548 | | | | 422 | | | | 441 | |

| Data processing and related operations | | | 1,337 | | | | 943 | | | | 929 | |

| Federal Deposit Insurance Corporation insurance assessment | | | 412 | | | | 411 | | | | 420 | |

| Advertising | | | 283 | | | | 240 | | | | 224 | |

| Professional fees | | | 836 | | | | 730 | | | | 671 | |

| Postage and telephone | | | 566 | | | | 436 | | | | 414 | |

| Office supplies | | | 379 | | | | 255 | | | | 278 | |

| Taxes, other than income | | | 731 | | | | 711 | | | | 649 | |

| Foreclosed real estate | | | 680 | | | | 911 | | | | 1,555 | |

| Amortization of intangible assets | | | 122 | | | | 105 | | | | 121 | |

| Merger related | | | 1,806 | | | | - | | | | - | |

| Other | | | 2,419 | | | | 1,741 | | | | 1,733 | |

| Total | | $ | 23,124 | | | $ | 17,100 | | | $ | 17,727 | |

INCOME TAXES

Income tax expense for the year ended December 31, 2016 totaled $1,884,000 which resulted in an effective tax rate of 21.9% compared to $1,632,000 and 21.6% for 2015.

Income tax expense for the year ended December 31, 2015 totaled $1,632,000 which resulted in an effective tax rate of 21.6% compared to $2,606,000 and 25.4% for 2014. The decrease in the effective rate reflects a higher proportion of tax-exempt income.

CAPITAL AND DIVIDENDS

Total stockholders' equity as of December 31, 2016, was $111.1 million, compared to $101.0 million as of year-end 2015. The increase was due primarily to a $12.2 million increase resulting from additional common shares issued in connection with the Delaware acquisition. As of December 31, 2016 the Company had a leverage capital ratio of 9.16%, a Tier 1 risk-based capital ratio of 13.27%, a common equity Tier 1 risk-based capital ratio of 13.27% and a total risk-based capital ratio of 14.12% compared to 12.40%, 15.86%, 15.86% and 17.09%, respectively, at December 31, 2015. The reduced ratios reflect the impact from the acquisition of Delaware.

The Company's common stock is traded on the Nasdaq Global Market under the symbol, NWFL. As of December 31, 2016, there were approximately 2,700 shareholders based on transfer agent mailings.

The following table sets forth the price range and cash dividends declared per share regarding common stock for the periods indicated:

| | | | | | | | | |

| | | | | | | | | |

| | Closing Price Range | | Cash dividends |

| | High | | Low | | Declared per share |

| Year 2016 | | | | | | | |

| First Quarter | $ | 30.90 | | $ | 26.25 | | $ | 0.31 |

| Second Quarter | | 29.00 | | | 27.51 | | | 0.31 |

| Third Quarter | | 29.75 | | | 27.60 | | | 0.31 |

| Fourth Quarter | | 34.50 | | | 28.53 | | | 0.32 |

| | | | | | | | | |

| Year 2015 | | | | | | | | |

| First Quarter | $ | 30.00 | | $ | 27.69 | | $ | 0.31 |

| Second Quarter | | 30.90 | | | 27.88 | | | 0.31 |

| Third Quarter | | 30.64 | | | 28.01 | | | 0.31 |

| Fourth Quarter | | 29.30 | | | 27.69 | | | 0.31 |

The book value of the common stock was $26.15 per share as of December 31, 2016 compared to $27.39 as of December 31, 2015. As of year-end 2016, the closing stock price was $33.14 per share, compared to $28.75 as of December 31, 2015.

NON-GAAP FINANCIAL MEASURES

This annual report contains or references tax-equivalent interest income and net interest income, which are non-GAAP financial measures. Tax-equivalent interest income and net interest income are derived from GAAP interest income and net interest income using an assumed tax rate of 34%. We believe the presentation of interest income and net interest income on a tax-equivalent basis ensures comparability of interest income and net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. Tax-equivalent net interest income is reconciled to GAAP net interest income on page 25. Although the Company believes that these non-GAAP financial measures enhance investors' understanding of our business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP measures.

STOCK PERFORMANCE GRAPH

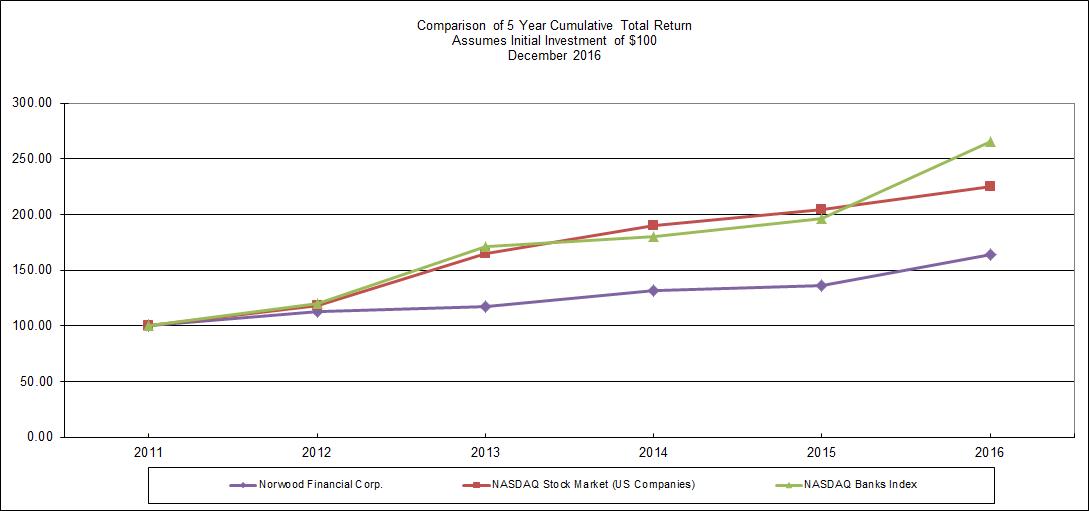

Set forth below is a stock performance graph comparing the cumulative total shareholder return on the Common Stock with (a) the cumulative total stockholder return on stocks included in the Nasdaq Stock Market index and (b) the cumulative total stockholder return on stocks included in the Nasdaq Bank index, as prepared by Zack's Investment Research, Inc. using data from the Center for Research in Securities Prices (CRSP) at the University of Chicago. All three investment comparisons assume the investment of $100 at the market close on December 31, 2011 and the reinvestment of dividends paid. The graph provides comparison at December 31, 2011 and each fiscal year through December 31, 2016.

There can be no assurance that the Company's future stock performance will be the same or similar to the historical performance shown in the above graph. The Company neither makes nor endorses any predictions as to stock performance.

LEGEND

| | | | | | | | |

| Symbol | CRSP Total Returns Index for: | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | 12/31/16 |

| ♦ | Norwood Financial Corp | $100.00 | $112.93 | $116.88 | $131.58 | $135.82 | $163.54 |

| ■ | CRSP Nasdaq U.S. Index | 100.00 | 118.26 | 164.83 | 190.07 | 204.70 | 224.75 |

| ▲ | Nasdaq Bank Index | 100.00 | 119.64 | 171.23 | 179.93 | 195.98 | 265.31 |

| | | | | | | | |

| Notes: A. Data complete through last fiscal year. B. Corporate Performance Graph with peer group only performance (excludes only company). C. Peer group indices use beginning of period market capitalization weighting. D. Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2017. E. Index Data: Calculated (or Derived) based from CRSP NASDAQ Stock Market (US Companies) and CRSP NASDAQ Banks Index, Center for Research in Security Prices (CRSP®), Graduate School of Business, The University of Chicago. Copyright 2017. Used with permission. All rights reserved. |

NORWOOD FINANCIAL CORP

SUMMARY OF QUARTERLY RESULTS (UNAUDITED)

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| 2016 | December 31 | | September 30 | | June 30 | | March 31 |

| | | | | | | | | | | | |

| Interest income | $ | 9,456 | | $ | 8,528 | | $ | 7,234 | | $ | 7,026 |

| Interest expense | | 1,005 | | | 958 | | | 840 | | | 851 |

| Net interest income | | 8,451 | | | 7,570 | | | 6,394 | | | 6,175 |

| Provision for loan losses | | 450 | | | 450 | | | 700 | | | 450 |

| Other income | | 1,475 | | | 1,399 | | | 1,018 | | | 1,003 |

| Net realized gains on sales of securities | | 15 | | | - | | | 205 | | | 64 |

| Other expense | | 6,568 | | | 7,679 | | | 4,528 | | | 4,349 |

| Income before income taxes | | 2,923 | | | 840 | | | 2,389 | | | 2,443 |

| Income tax expense | | 577 | | | 228 | | | 511 | | | 567 |

| NET INCOME | $ | 2,346 | | $ | 612 | | $ | 1,878 | | $ | 1,876 |

| Basic earnings per share | $ | 0.57 | | $ | 0.15 | | $ | 0.51 | | $ | 0.51 |

| Diluted earnings per share | $ | 0.56 | | $ | 0.15 | | $ | 0.51 | | $ | 0.51 |

| | | | | | | | | | | | |

| 2015 | | | | | | | | | | | |

| | December 31 | | September 30 | | June 30 | | March 31 |

| | | | | | | | | | | | |

| Interest income | $ | 6,936 | | $ | 6,872 | | $ | 6,882 | | $ | 7,088 |

| Interest expense | | 824 | | | 819 | | | 833 | | | 781 |

| Net interest income | | 6,112 | | | 6,053 | | | 6,049 | | | 6,307 |

| Provision for loan losses | | 2,820 | | | 720 | | | 420 | | | 620 |

| Other income | | 1,098 | | | 1,008 | | | 999 | | | 968 |

| Net realized gains on sales of securities | | 118 | | | 63 | | | 134 | | | 311 |

| Other expense | | 4,674 | | | 4,070 | | | 4,168 | | | 4,187 |

| Income (loss) before income taxes | | (166) | | | 2,334 | | | 2,594 | | | 2,779 |

| Income tax expense (benefit) | | (294) | | | 557 | | | 631 | | | 738 |

| NET INCOME | $ | 128 | | $ | 1,777 | | $ | 1,963 | | $ | 2,041 |

| Basic earnings per share | $ | 0.04 | | $ | 0.48 | | $ | 0.53 | | $ | 0.55 |

| Diluted earnings per share | $ | 0.04 | | $ | 0.48 | | $ | 0.53 | | $ | 0.55 |

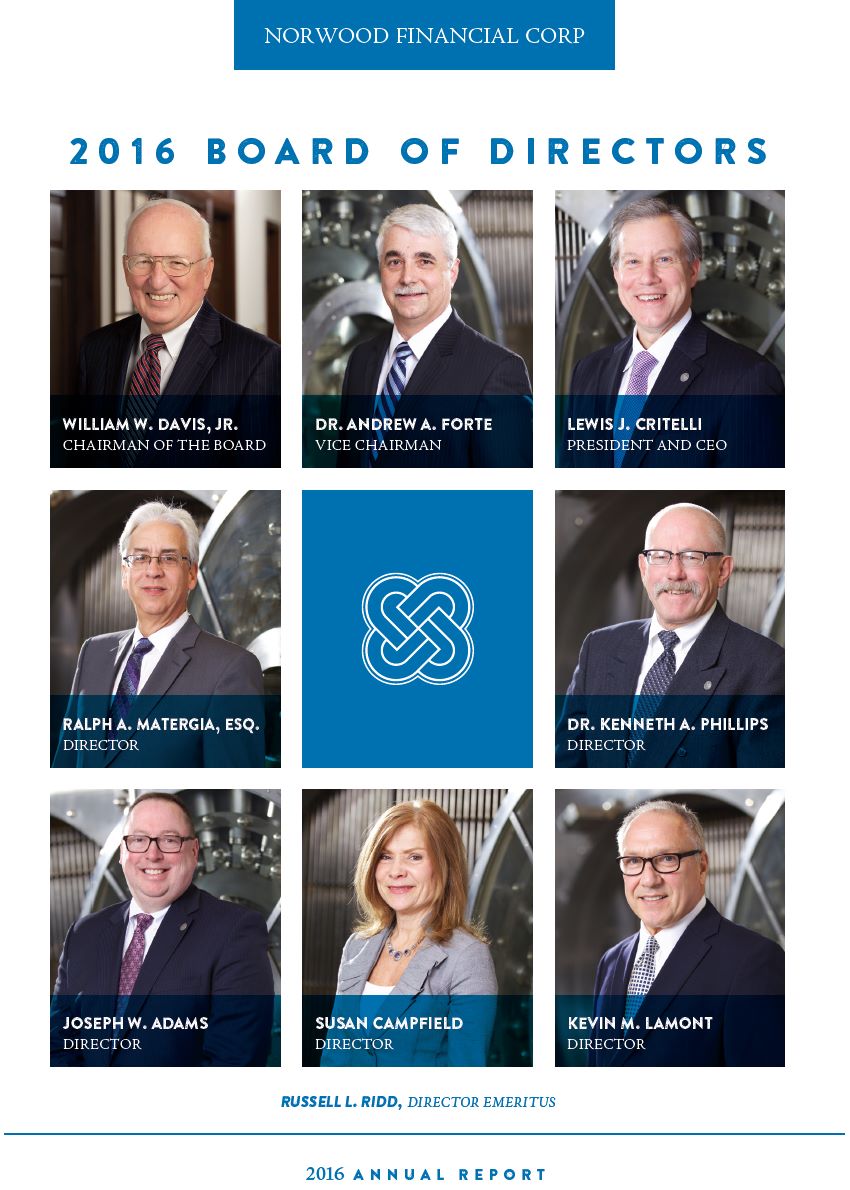

| | | | | | | | | | | | |