Precision is a leading provider of safe and environmentally responsible High Performance, High Value services to the energy industry, offering customers access to an extensive fleet of Super Series drilling rigs. Precision has commercialized an industry-leading digital technology portfolio known as AlphaTM technologies that utilizes advanced automation software and analytics to generate efficient, predictable, and repeatable results for energy customers. Additionally, Precision offers well service rigs, camps and rental equipment all backed by a comprehensive mix of technical support services and skilled, experienced personnel. Our drilling services are enhanced by our EverGreenTM suite of environmental solutions, which bolsters our commitment to reducing the environmental impact on our operations.

From our founding as a private drilling contractor in 1951, Precision has grown to become one of the most active drillers in North America. Our High Performance, High Value competitive advantage is underpinned by four distinguishing features:

▪a high-quality land drilling rig fleet, with AC Super Triple rigs enabled with our AlphaTM technologies and supported by our EverGreenTM suite of environmental solutions to deliver consistent, repeatable, high-quality wellbores while improving safety, performance, operational efficiency and reducing environmental impact

▪size and scale of our vertically integrated operations that provide higher margins and better service capabilities

▪a diverse culture focused on operational excellence, which includes corporate responsibility, safety and field performance, and

▪a capital structure that provides long-term stability, flexibility and liquidity, allowing us to take advantage of business cycle opportunities.

CORPORATE RESPONSIBILITY

Corporate Responsibility is a fundamental element of Precision’s High Performance, High Value strategy and critical to our long-term success. Our foundation was shaped by a commitment to operate with the highest ethical standards, prioritize the health, safety, and diversity of our workforce, and the protection of the environment and the communities where we operate. Our employees, investors and customers reward our commitment to Corporate Responsibility and recognize that it provides us the ability to attract talent, capital, and a premium for our services.

To learn more about Precision’s commitment to Corporate Responsibility, we invite you to review our interactive web page, which serves as the primary platform that highlights the Company’s progress in Environmental, Social and Governance (ESG) efforts, and provides recurring updates on our ESG efforts and performance. The information on our website represents not just a single snapshot of the year, but portrays a frequently updated view of our continuing ESG efforts.

OUR VISION AND DELIVERING ON OUR 2023 STRATEGIC PRIORITIES

Precision’s vision is to be globally recognized as the High Performance, High Value provider of land drilling services. We work toward this vision by defining and measuring our results against strategic priorities established at the beginning of each year.

In 2023, Precision focused on three strategic priorities:

▪Delivering High Performance, High Value service through operational excellence;

▪Maximizing free cash flow by increasing Adjusted EBITDA(1) margins, revenue efficiency and growing revenue from AlphaTM technologies and EverGreenTM suite of environmental solutions; and

▪Reducing debt by at least $150 million and allocating 10% to 20% of free cash flow before debt repayments for shareholder returns. We also increased our long-term debt reduction target to $500 million between 2022 and 2025 and sustained Net Debt to Adjusted EBITDA ratio(1) of below 1.0 times by the end of 2025.

(1) See Financial Measures and Ratios on page 40 of this report.

We successfully delivered on each of these priorities in 2023, reported one of our most profitable years in the past decade and exceeded our cash flow expectations. During the year, we not only met our debt reduction and shareholder capital return targets, but also funded two accretive acquisitions. Our High Performance, High Value strategy along with our Super Series rigs, AlphaTM technologies, and EverGreenTM suite of environmental solutions continue to differentiate our services.

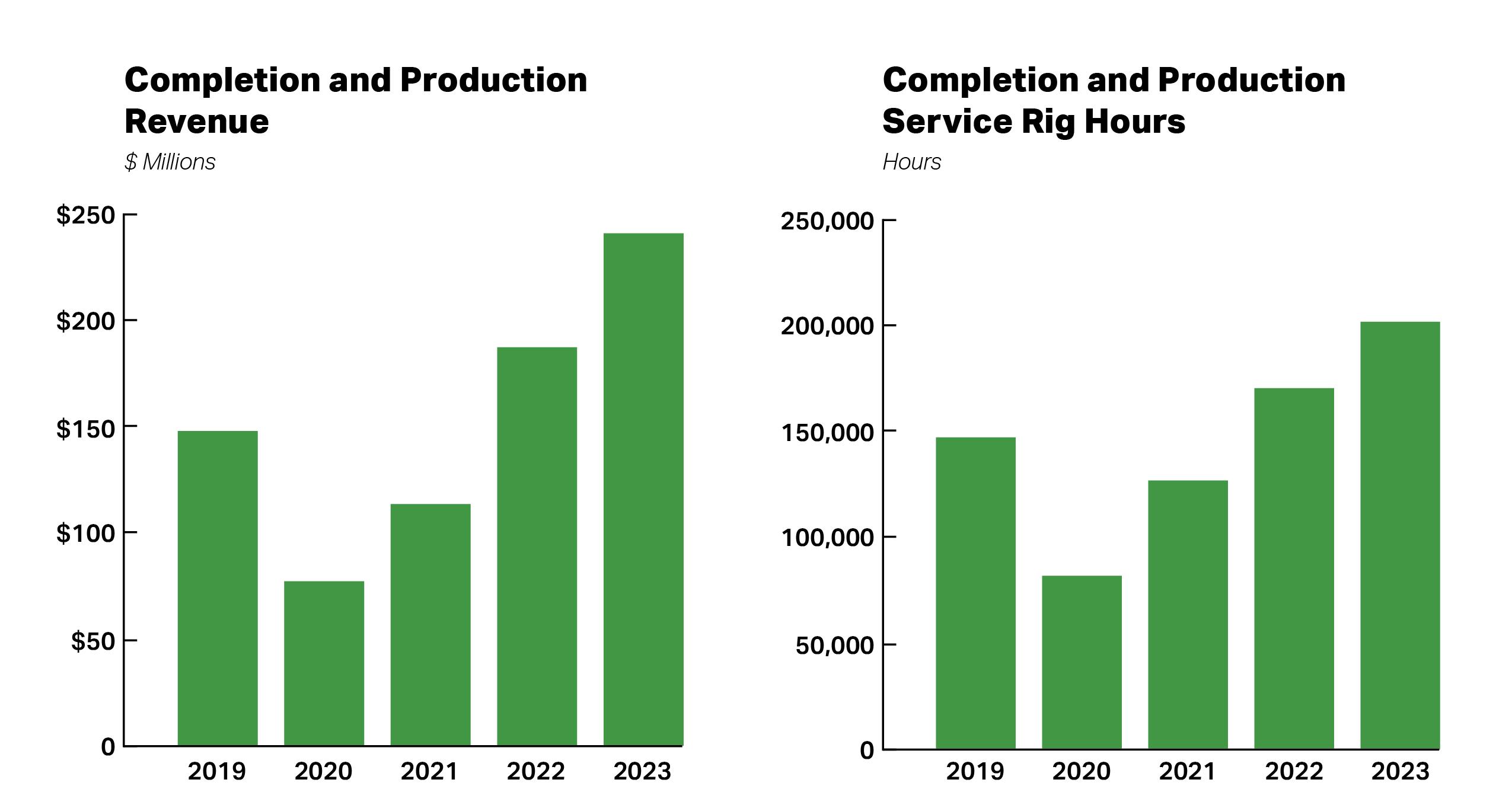

In Canada, we increased our drilling utilization days and well servicing rig operating hours over 2022 levels, maintaining our position as the leading Canadian service provider of oilfield services. In the fourth quarter of 2023, we acquired CWC Energy Services Corp. (CWC), which increased our marketed service rig count by 36% year over year and enhanced our North America drilling operations. Internationally, we recertified and reactivated four rigs, exiting 2023 with eight active rigs under five-year term contracts that extend into 2027 and 2028. We also completed integrating our 2022 acquisition of High Arctic Energy Services Inc.'s (High Arctic) assets, which helped contribute to increase our year over year Completion and Productions Services' Adjusted EBITDA by 34%.

We generated cash provided by operations of $501 million, a 111% increase over 2022 due to the higher activity in Canada and improved North America day rates and daily operating margins. We continued to scale our AlphaTM technologies and EverGreenTM suite of environmental solutions across our Super Triple rig fleet, increasing revenue from these offerings year over year. Approximately 75% of our Super Triple fleet is equipped with AlphaTM and the majority of the fleet has at least one EverGreenTM product.

Precision Drilling Corporation 2023 Annual Report 1

With robust cash flow in 2023, we reduced debt by $152 million and increased direct returns to shareholders, allocating 15% of our free cash flow before debt repayments to share repurchases. In 2024, we plan to increase this allocation to 25% to 35% and reduce debt by another $150 million to $200 million. This positions us to achieve our sustained Net Debt to Adjusted EBITDA ratio of below 1.0 times by the end of 2025 and meet our long-term debt reduction target of $500 million between 2022 and 2025. In 2026, we plan to reduce debt by another $100 million and move our direct shareholder capital returns towards 50% of free cash flow.

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

This Management’s Discussion and Analysis (MD&A) contains information to help you understand our business and financial performance. Information is as at March 4, 2024, unless otherwise stated. This MD&A focuses on our Consolidated Financial Statements and Notes and includes a discussion of known risks and uncertainties relating to our business and the oilfield services sector.

You should read this MD&A with the accompanying audited Consolidated Financial Statements and Notes, which have been prepared in accordance with International Financial Reporting Standards (IFRS) and with information contained in the Cautionary Statement About Forward-Looking Information and Statements on page 39. In this MD&A, we reference certain Non-Generally Accepted Accounting Principles (Non-GAAP) financial measures and ratios that are not defined terms under IFRS to assess our performance as we believe they provide useful supplemental information to investors. Our Non-GAAP financial measures and ratios are defined on page 40.

The terms we, us, our, Corporation, Company, Precision and Precision Drilling mean Precision Drilling Corporation and our subsidiaries and include any partnerships of which we are a part.

All amounts are in Canadian dollars unless otherwise stated.

OUR STRATEGY

Our High Performance, High Value competitive advantage is underpinned by four distinguishing features:

▪a high-quality land drilling rig fleet, with AC Super Triple rigs enabled with our AlphaTM technologies and supported by our EverGreenTM suite of environmental solutions to deliver consistent, repeatable, high-quality wellbores while improving safety, performance, operational efficiency and reducing environmental impact;

▪size and scale of our vertically integrated operations that provide higher margins and better service capabilities;

▪a diverse culture focused on operational excellence, which includes corporate responsibility, safety and field performance; and

▪a capital structure that provides long-term stability, flexibility and liquidity, allowing us to take advantage of business cycle opportunities.

2 Management's Discussion and Analysis

BUSINESS SEGMENTS

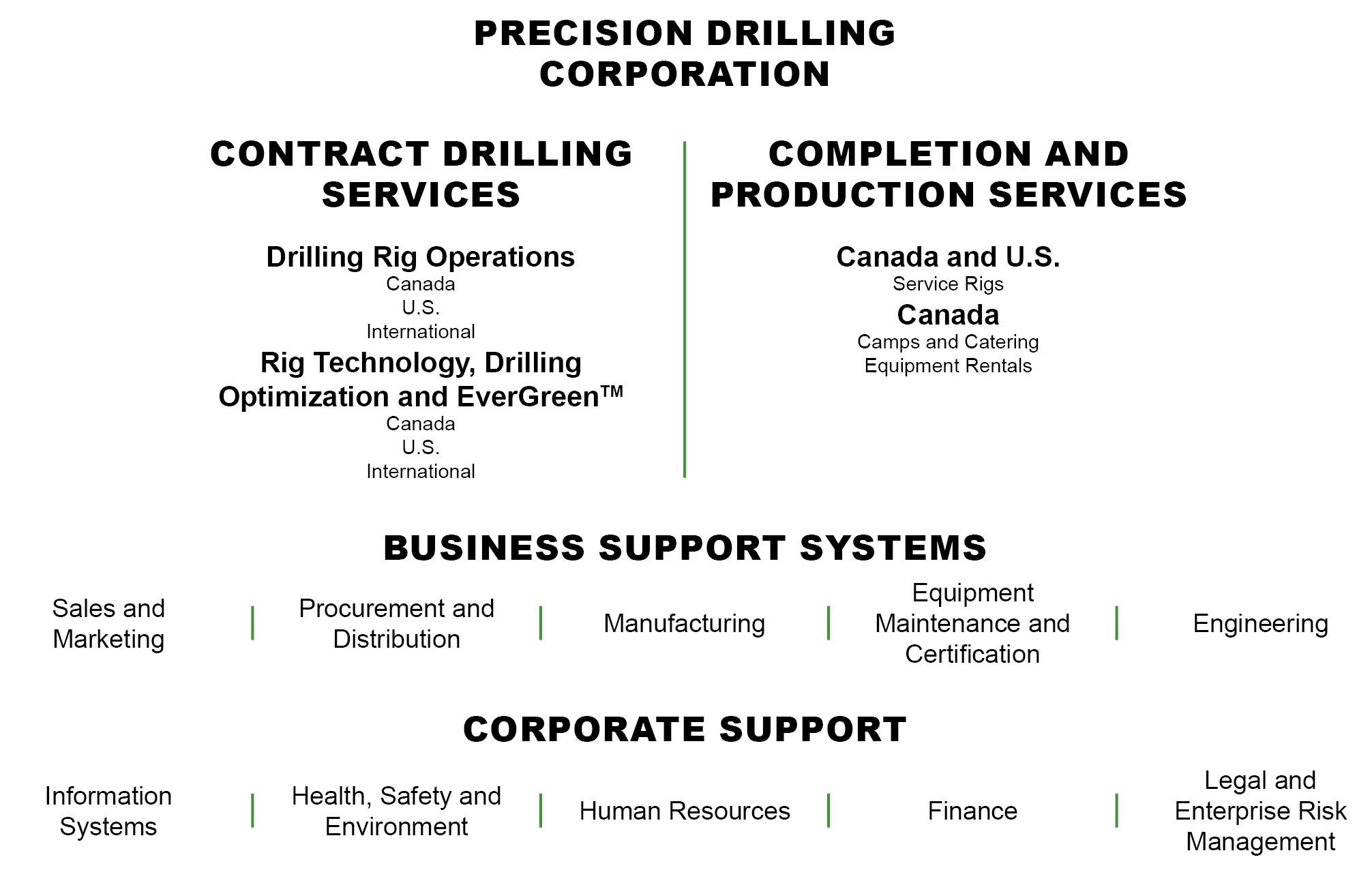

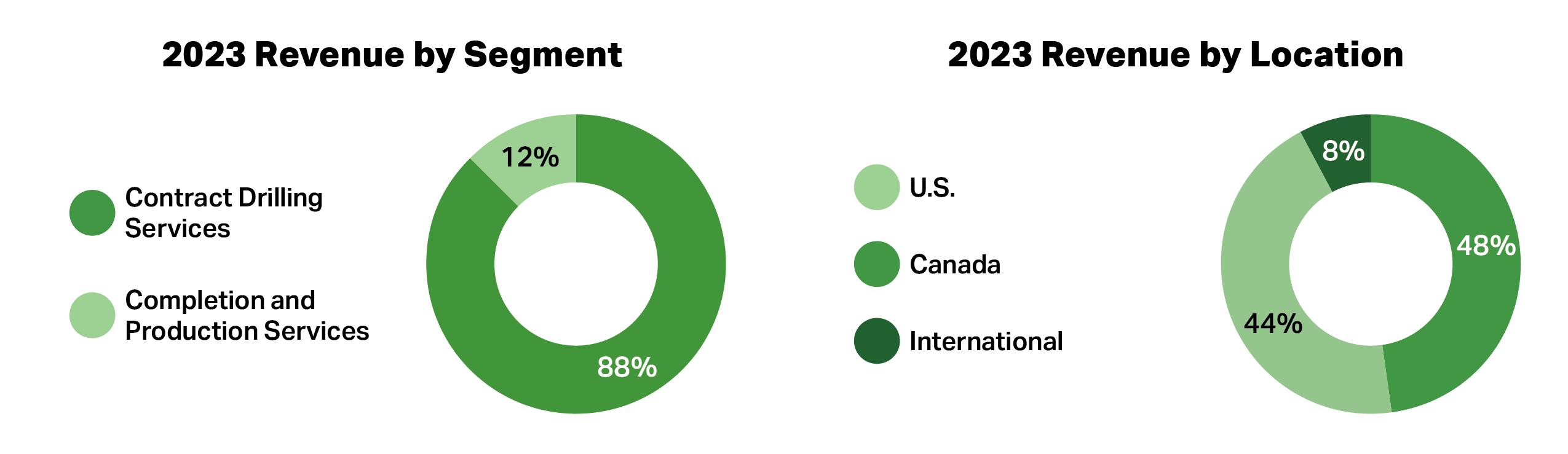

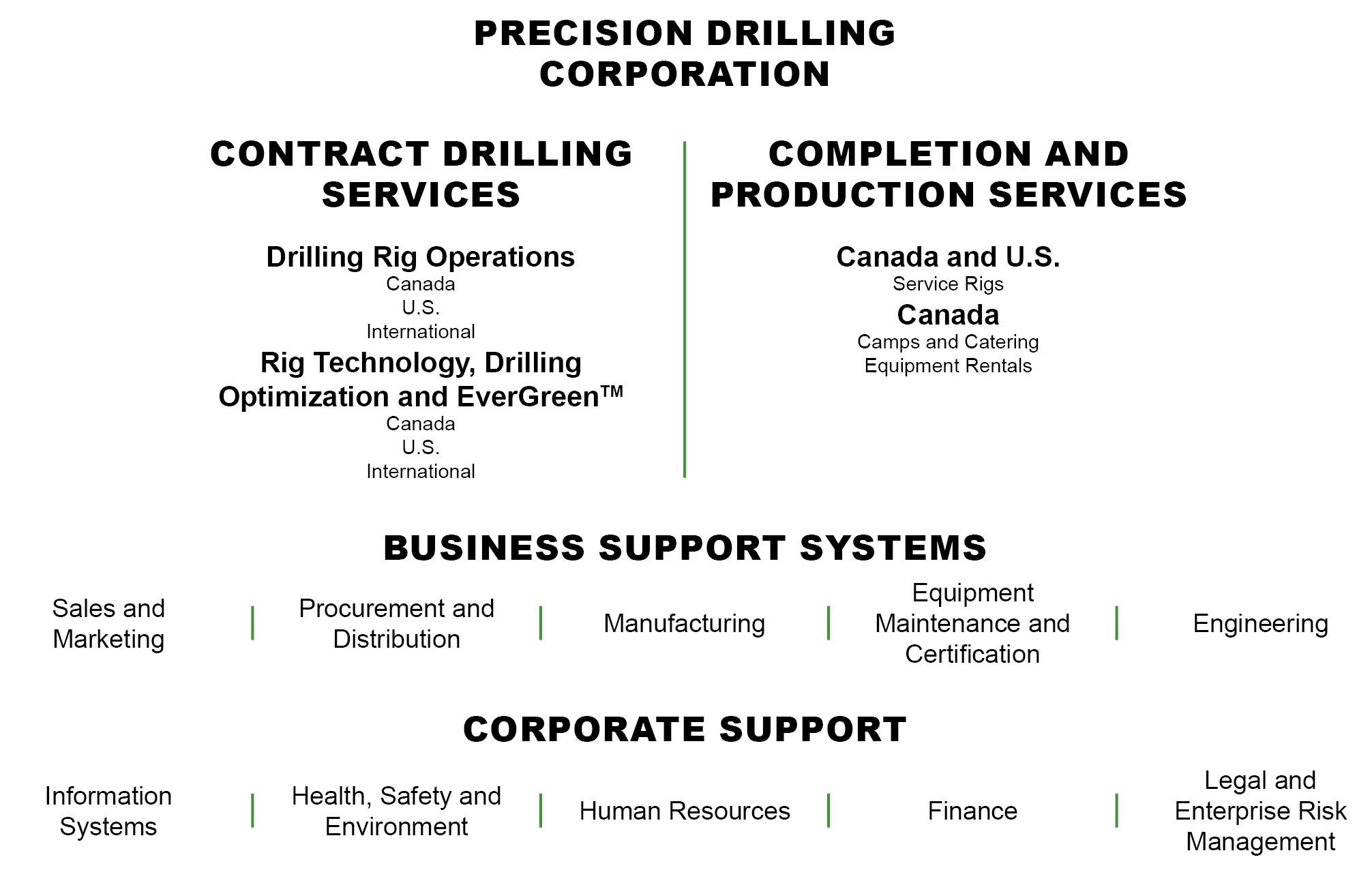

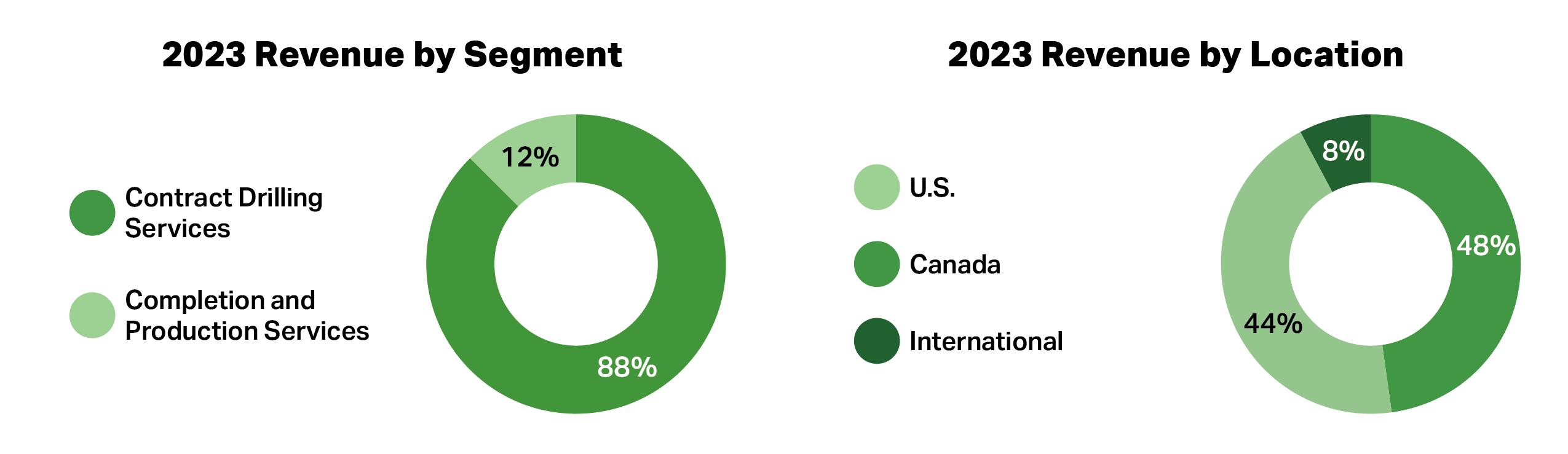

We have two business segments, Contract Drilling Services and Completion and Production Services, which share business support systems and corporate and administrative services.

Precision Drilling Corporation Contract Drilling Services Drilling Rig Operations Canada U.S. International Directional Drilling Operations Canada Completion and Production Services Canada and U.S. Service Rigs Canada Camps and Catering Equipment Rentals Business Support Systems Sales and Marketing Procurement and Distribution Manufacturing Equipment Maintenance and Certification Engineering Corporate Support Information Systems Health, Safety and Environment Human Resources Finance Legal and Enterprise Risk Management

Precision Drilling Corporation 2023 Annual Report 3

Contract Drilling Services

We provide onshore drilling services to exploration and production companies in the oil and natural gas and geothermal industries, operating in Canada, the U.S., and internationally. In Canada, we are the largest onshore drilling company, marketing approximately 25% of the industry's land rig fleet. In the U.S., our fleet is the fifth largest and accounts for approximately 9% of the country's Super-Spec land drilling rigs. We also have an international presence with operations in the Middle East.

We offer customers access to an extensive fleet of high-efficiency Super Series drilling rigs ideally suited for development drilling. Our rigs are strategically deployed across the most active drilling regions in North America, including all major unconventional oil and natural gas basins.

At December 31, 2023, our Contract Drilling Services segment consisted of 214 land drilling rigs, including 97 in Canada, 104 in the U.S. and 13 in the Middle East.

During the year, our acquisition of CWC added seven Canadian and 11 U.S. drilling rigs to our fleet. In addition, we decommissioned 20 and seven legacy drilling rigs in Canada and the U.S., respectively.

Our Super Series drilling rigs are further enhanced by our AlphaTM technologies and EverGreenTM suite of environmental solutions. Our AlphaTM technologies drive performance by integrating data insights, human ingenuity, automation consistency and smart algorithms, increasing drilling performance and cost efficiencies for our customers. Our EverGreenTM suite of environmental solutions bolsters our commitment to reduce the environmental impact of oilfield operations and offers customers products and applications to measure and reduce their Greenhouse Gas (GHG) emissions during drilling operations. Precision exited the year with 75 AC Super Triple rigs equipped with AlphaTM and the majority equipped with at least one EverGreenTM product.

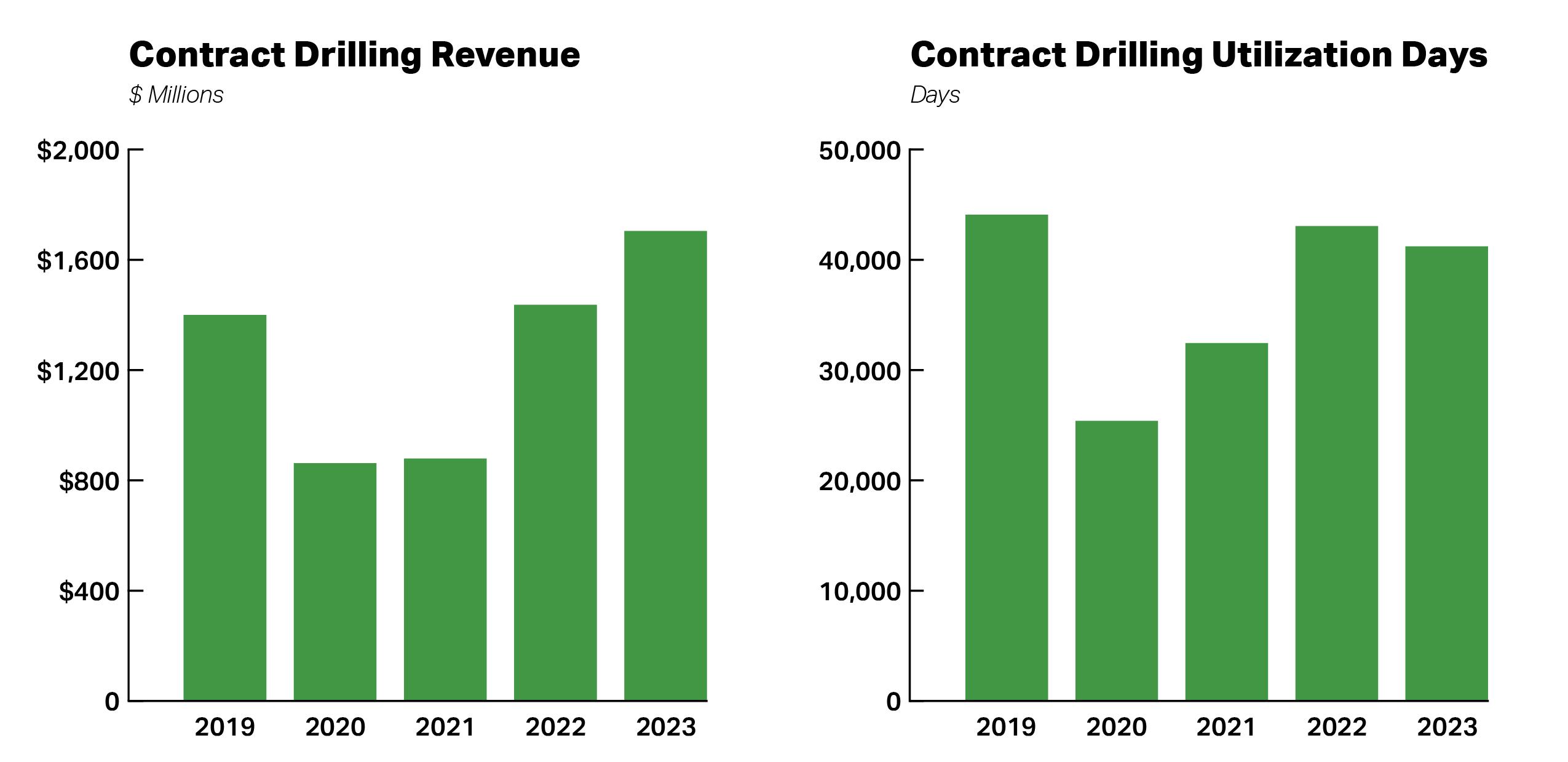

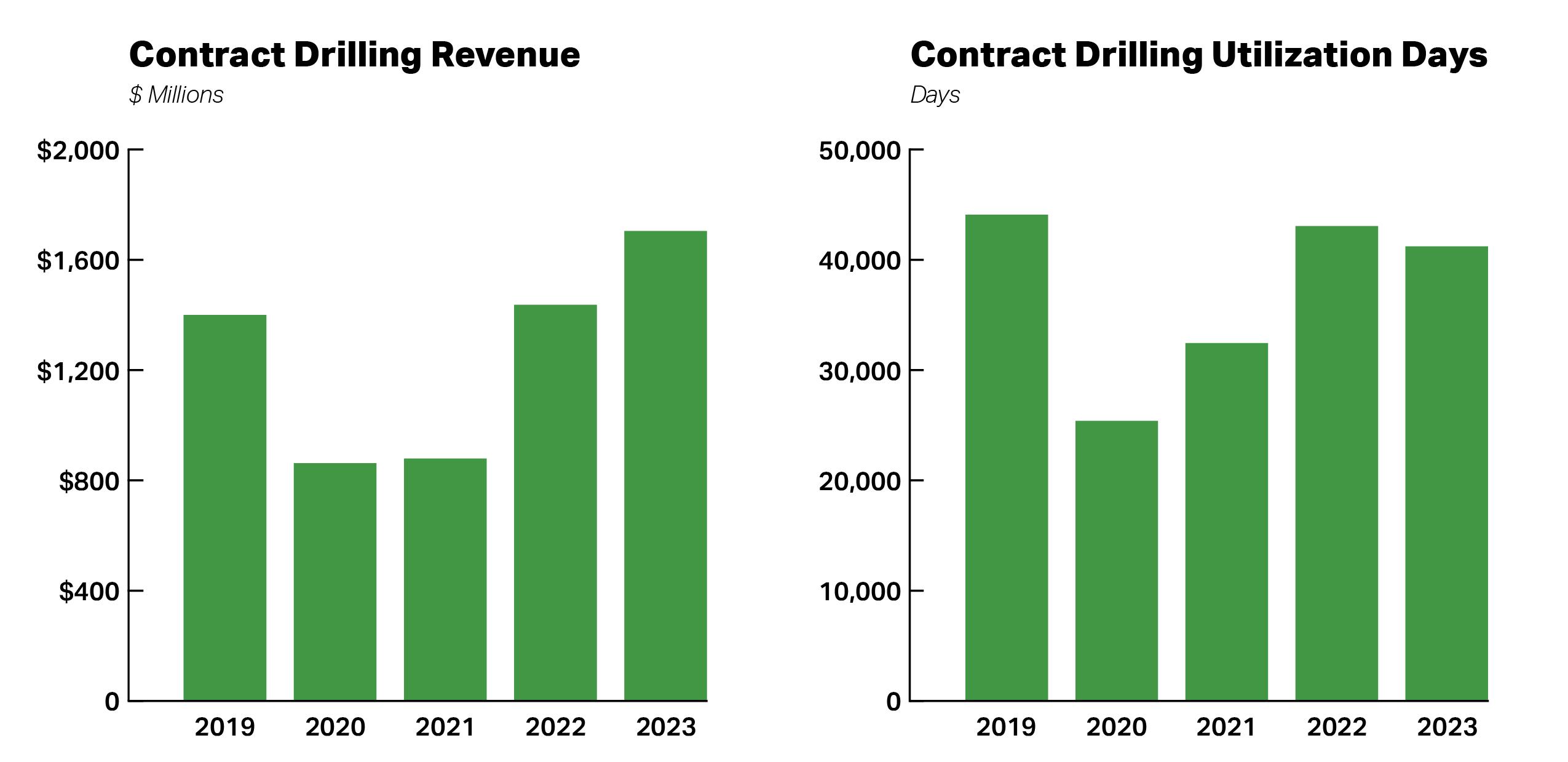

The below graphs summarize our revenue and utilization days for the last five financial years.

4 Management's Discussion and Analysis

Completion and Production Services

We provide well completion, workover, abandonment, and re-entry preparation services to oil and natural gas exploration and production companies in Canada and the U.S. In addition, we provide equipment rentals and camp and catering services in Canada.

In 2023, through the acquisition of CWC, we added 62 marketable Canadian service rigs to our fleet as well as ancillary equipment, inventories, spares and operating facilities in key basins in complementary geographic regions supported by skilled and experienced personnel and strong customer relationships.

At December 31, 2023, our Completion and Production Services segment consisted of 183 registered well completion and workover service rigs, including 173 in Canada and 10 in the U.S.

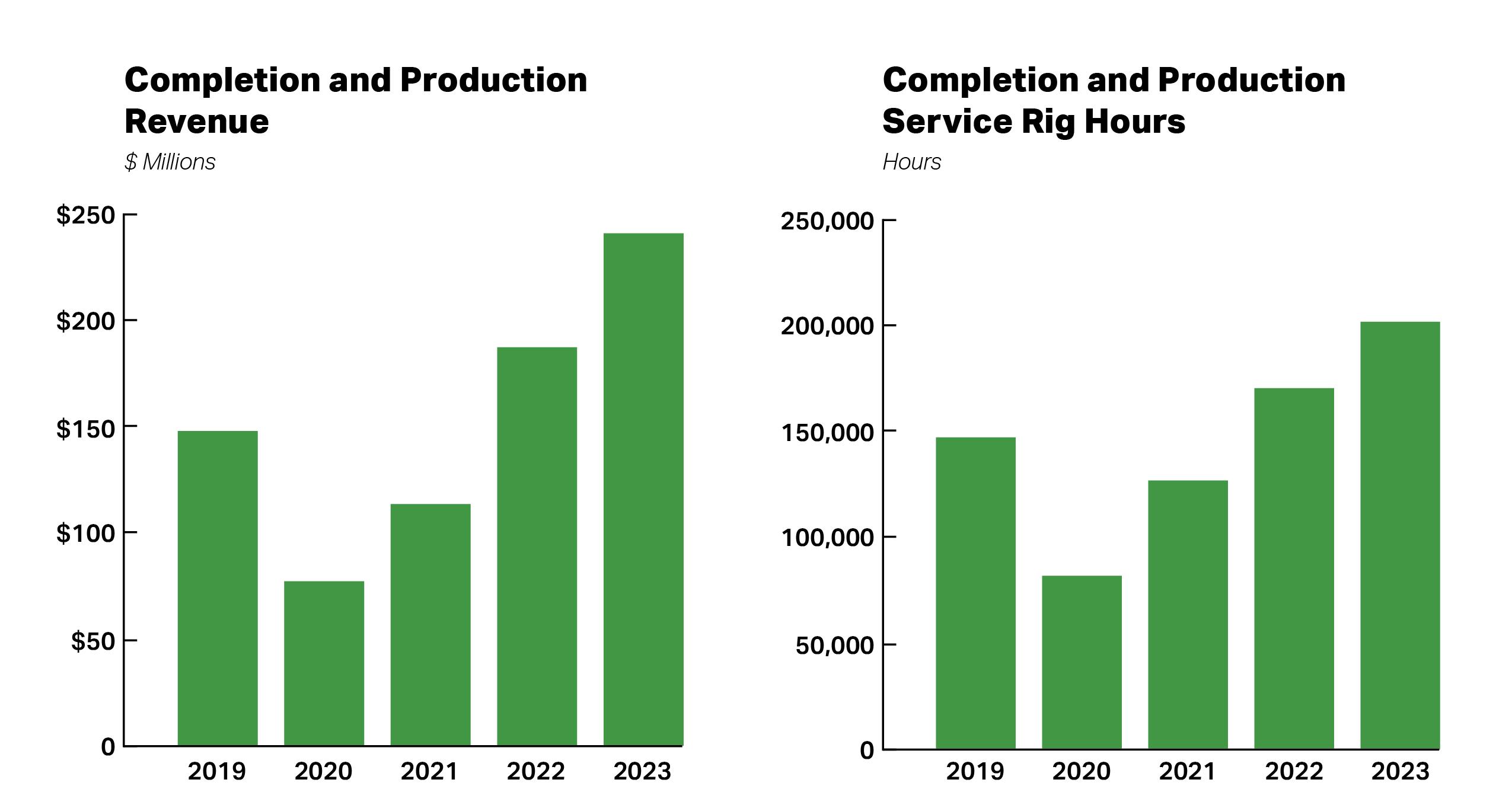

The below graphs summarize our revenue and utilization days for the last five financial years.

and Production Revenue $ Millions $200 $150 $100 $50 0 2016 2017 2018 2019 2020 Completion and Production Adjusted EBITDA $ Millions $25 $20 $15 $10 $5 0 -$5 2016 2017 2018 2019 2020 Completion and Production Service Rig Hours Hou0,000 0 2016 2017 2018 2019 2020

Precision Drilling Corporation 2023 Annual Report 5

strategic priorities

Our 2023 strategic priorities focused on delivering High Performance, High Value services, maximizing free cash flow, and continuing to strengthen our financial position with debt repayments. We successfully delivered on each of these priorities in 2023 and our results are summarized in the table below.

| |

2023 Strategic Priorities | 2023 Results |

Deliver High Performance, High Value service through operational excellence | ▪Increased our Canadian drilling rig utilization days and well servicing rig operating hours over 2022, maintaining our position as the leading provider of high-quality and reliable services in Canada. ▪Recertified and reactivated a total of four rigs in the Middle East, exiting 2023 with eight active rigs that represent approximately US$475 million in backlog revenue that stretches into 2028. ▪Acquired CWC, expanding our Canadian well servicing business and drilling fleets in both Canada and the U.S. ▪Upgraded and added the industry's most advanced AC Super Triple rig to our Canadian fleet, equipped with AlphaTM, EverGreenTM, and rig floor robotics. ▪Coached over 900 rig-based employees through our New Employee Orientation focused on industry-leading safety and performance training at our world-class facilities in Nisku, Alberta and Houston, Texas. |

Maximize free cash flow by increasing Adjusted EBITDA(1) margins, revenue efficiency, and growing revenue from AlphaTM technologies and EverGreenTM suite of environmental solutions | ▪Generated cash provided by operations of $501 million, a 111% increase over 2022. ▪Increased our daily operating margins(2) by approximately 39% in Canada and 69% in the U.S. year over year. ▪Grew combined Alpha™ and EverGreenTM revenue by over 10% compared to 2022. ▪Ended the year with 75 AC Super Triple Alpha™ rigs compared to 70 at the beginning of the year. ▪Scaled our EverGreenTM suite of environmental solutions, ending the year with approximately 65% of our AC Super Triple rigs equipped with at least one EverGreenTM product, including 13 EverGreenTM Battery Energy Storage Systems (BESS) versus seven a year ago. ▪Integrated the well servicing assets from our 2022 acquisition of High Arctic, which helped increase our Completion and Production Services’ Adjusted EBITDA(1) 34% in 2023. |

Reduce debt by at least $150 million and allocate 10% to 20% of free cash flow before debt repayments for share repurchases. Long-term debt reduction target of $500 million between 2022 and 2025 and sustained Net Debt to Adjusted EBITDA ratio(1) of below 1.0 times by the end of 2025 | ▪Reduced debt by $152 million and ended the year with more than $600 million of available liquidity(3). ▪Returned $30 million of capital to shareholders through share repurchases. ▪Renewed our Normal Course Issuer Bid (NCIB), allowing purchases of up to 10% of the public float. ▪Ended the year with a Net Debt to Adjusted EBITDA ratio(1) of approximately 1.4 times and remain committed to reaching a sustained Net Debt to Adjust EBITDA ratio of below 1.0 times by the end of 2025. |

Notes:

(1) See Financial Measures and Ratios on page 40 of this report.

(2) Revenue per utilization day less operating costs per utilization day.

(3) Available liquidity is defined as cash plus unused credit facility capacity.

We have established the following strategic priorities for 2024:

| | |

2024 Strategic Priorities | | |

▪Concentrate organizational efforts on leveraging our scale and generating free cash flow. ▪Reduce debt by $150 million to $200 million and allocate 25% to 35% of free cash flow before debt repayments for share repurchases, while remaining committed to achieving a sustained Net Debt to Adjusted EBITDA ratio of below 1.0 times by the end of 2025. Increase long-term debt reduction target to $600 million between 2022 and 2026 and continue to move direct shareholder capital returns towards 50% of free cash flow. ▪Continue to deliver operational excellence in drilling and service rig operations to strengthen our competitive position and extend market penetration of our AlphaTM and EverGreenTM products. |

6 Management's Discussion and Analysis

| |

UNDERSTANDING OUR BUSINESS DRIVERS |

| |

ENERGY INDUSTRY OVERVIEW

Precision operates in the energy services business. Our primary customers are oil and natural gas exploration and production companies, who contract our services as part of their exploration and development activities. The economics of their businesses are dictated by the current and expected future margin between their finding and development costs and the eventual market price for the commodities they produce: crude oil, natural gas, and Natural Gas Liquids (NGLs).

Commodity Prices

Our customers’ capital expenditures for exploration and development are largely dependent on current and expected future prices of crude oil and natural gas. Crude oil is generally priced in a global market which is influenced by an array of economic and political factors. Natural gas is priced more regionally and, in North America, largely depends on the weather. Colder winter temperatures, and to a lesser extent, warmer summer temperatures, result in greater natural gas demand. Both commodities have historically been, and we expect them to continue to be cyclical and highly volatile.

Historically, there has been a strong correlation between crude oil and natural gas prices and the demand for drilling rigs with the rig count increasing and decreasing with movements in commodity prices. However, beginning in 2021, rig activity has not moved in tandem with crude oil prices to the same extent it has historically, as a large portion of our customers instituted and adhered to a more disciplined approach to their operations and capital spending in order to enhance their own financial returns.

Average Oil and Natural Gas Prices

| | | | | | | | | | | | |

| | 2023 | | | 2022 | | | 2021 | |

Oil | | | | | | | | | |

West Texas Intermediate (per barrel) (US$) | | | 77.62 | | | | 94.23 | | | | 67.91 | |

Western Canadian Select (per barrel) (US$) | | | 58.96 | | | | 78.15 | | | | 54.84 | |

| | | | | | | | | |

Natural gas | | | | | | | | | |

U.S. | | | | | | | | | |

Henry Hub (per MMBtu) (US$) | | | 2.67 | | | | 6.51 | | | | 3.72 | |

Canada | | | | | | | | | |

AECO (per MMBtu) (Cdn$) | | | 2.64 | | | | 5.43 | | | | 3.64 | |

Source: WTI and Henry; Hub Energy Information Administration, AECO; Gas Alberta Inc. | | | | | | | | | |

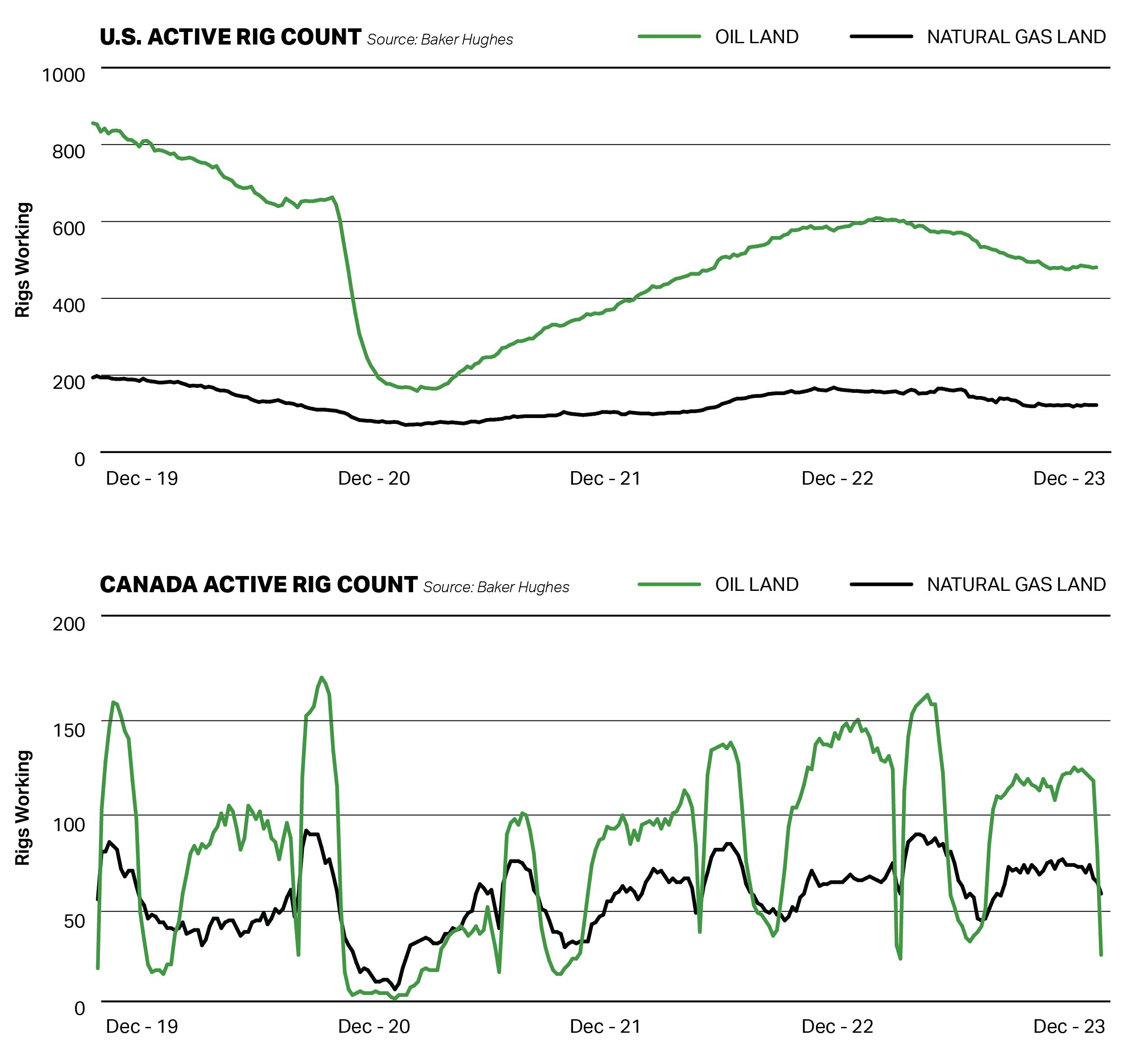

Drilling Activity

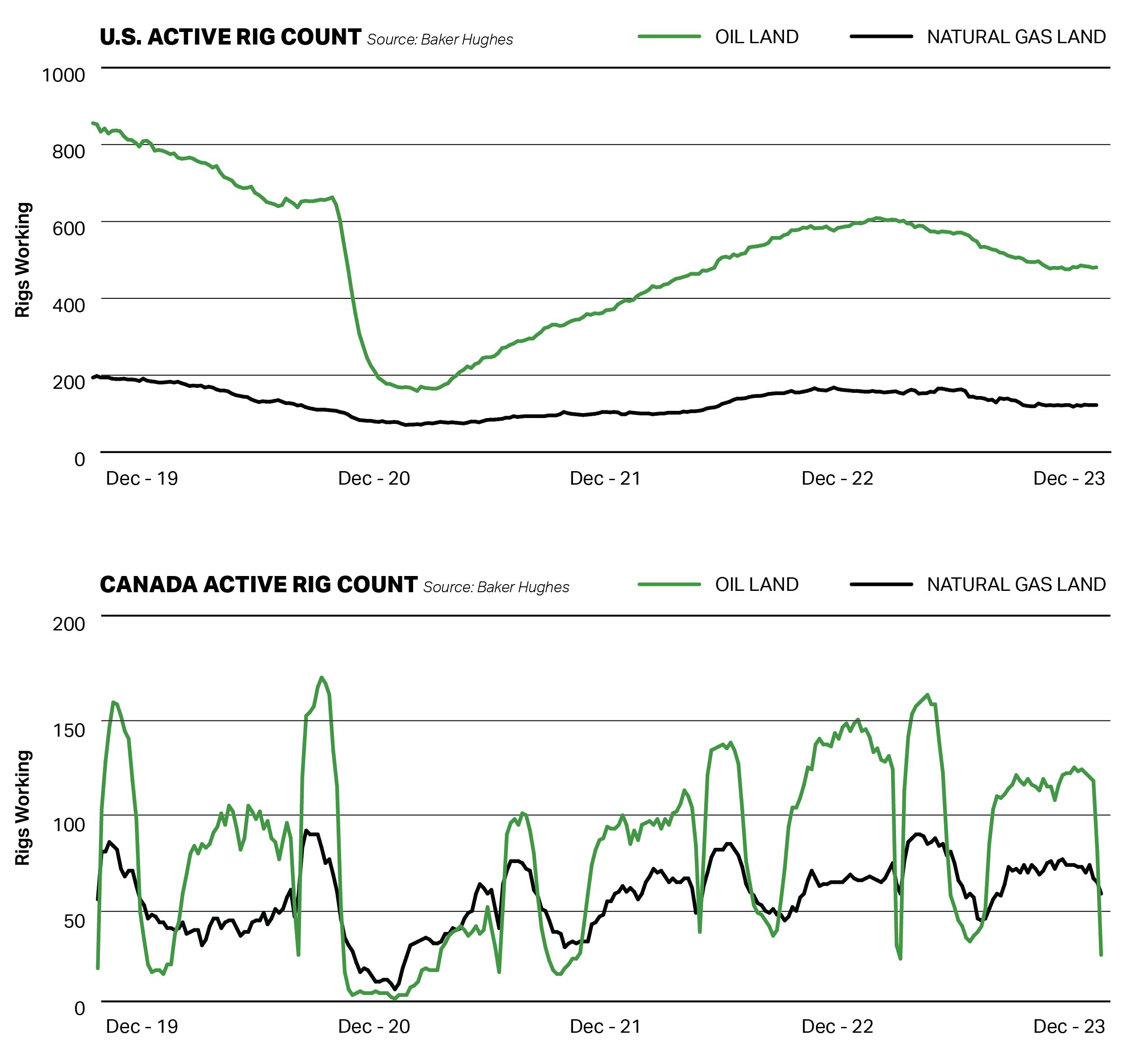

According to Baker Hughes, the Canadian average active rig count in 2023 was nearly flat year over year, while the U.S. average active land drilling rig count declined slightly. In Canada, the Canadian Association of Energy Contractors (CAOEC) reported approximately 5,700 wells were drilled in 2023, compared with 5,500 in 2022 and 4,600 in 2021. For the U.S., Enverus reported approximately 15,600 wells were started onshore in the U.S., compared with approximately 17,600 in 2022 and 14,400 in 2021. Drilling activity began to weaken in early 2023 due to lower natural gas prices and oil price volatility and was exacerbated by drilling and completion efficiencies, consolidation among producers, and continued capital discipline. The bias towards oil-directed drilling in the U.S. continues with approximately 80% of the active industry rig count drilling for oil targets during 2023.

In Canada, drilling activity was supported by strong fundamentals as additional takeaway capacity for oil and natural gas becomes available in 2024. Approximately 60% of the industry’s active rigs were drilling for oil targets in 2023 as producers remained active in the traditional heavy oil regions of Canada, such as the oil sands and the Clearwater. The start-up of the Trans Mountain oil pipeline expansion is expected in the first half of 2024, improving pricing for producers and encouraging additional drilling. Natural gas drilling occurs in the deeper basins of northwestern Alberta and northeastern British Columbia, supporting the production of NGLs required for oil sands development. Natural gas drilling in Canada continues to gain momentum as producers develop drilling programs to support LNG Canada, which is expected to begin start-up operations in 2024.

The following graphs shows oil and natural gas drilling activity since 2019, in both the U.S. and Canada. The Canadian drilling rig activity graph also shows the seasonality of the Canadian drilling activity which fluctuates with spring breakup, a market dynamic that generally is not present in the U.S.

Precision Drilling Corporation 2023 Annual Report 7

Competition and Competitive Strategy

The land drilling industry is highly competitive with technology increasingly differentiating the market, as customers have transitioned away from vertical wells to more complex directional and horizontal drilling programs. These wells require higher capacity rigs, which typically include AC power, digital control systems, integrated top drives, pad walking systems, highly mechanized pipe handling, and high capacity mud pumps. These rigs have recently been referred to as Super Specification (Super-Spec). Consequently, the rig market has been shedding older, low-technology rigs in favour of Super-Spec rigs as they are more powerful, efficient, and better suited for horizontal wells and resource development programs. Increasingly, digital technologies and rig-based software are becoming enablers of efficiency, and as a result, are in demand from our customers.

In the U.S., the top five land drillers own approximately 85% of the rigs referred to as Super-Spec, while in Canada, the top four land drillers own virtually all of these rigs.

In the early 1990s Precision designed and branded its Super Single rigs that are ideally suited for long-term conventional heavy oil development in the oil sands and other heavy oil plays. In 2010, Precision introduced and branded its Super Triple rigs, which are well suited for large pad horizontal drilling. Our Super Series fleet meets or exceeds the industry term Super-Spec that was recently adopted and as of December 31, 2023, our fleet of 214 rigs included 48 Super Single rigs and 101 AC Super Triple rigs.

8 Management's Discussion and Analysis

Drilling Contracts

We market our drilling rigs mainly on a regional basis through sales and marketing personnel. Our drilling contracts provide for payment on a daywork basis, pursuant to which we provide the drilling rig and crew to the customer. The customer provides the drilling program and is responsible for managing the downhole operation. Our compensation is based on a contracted rate per day (day rate) during the period the drilling rig is utilized. Generally, we do not bear any of the costs arising from downhole risks or loss of oil and natural gas reserves.

Products and services provided by our Alpha™ technologies and EverGreen™ suite of environmental solutions earn revenue that is incremental to the contracted day rate.

Seasonality

Drilling and well servicing activity is affected by seasonal weather patterns and ground conditions. In Canada and the northern U.S., wet weather and the spring thaw make the ground unstable resulting in road restrictions that may limit the movement of heavy oilfield equipment and reduce the level of drilling and well servicing activity primarily during the second quarter of the year. In Canada, some drilling sites can only be accessed in the winter once the terrain is frozen, which usually begins late in the fourth quarter. Our business activity depends, in part, on the severity and duration of the winter drilling season.

COMPETITIVE OPERATING MODEL

Providing High Performance, High Value services to our customers represents the core of our competitive strategy. Our competitive advantages include:

▪High Performance standardized rig fleet that is strategically deployed across the most active drilling regions in North America,

▪Alpha™ technologies that increase drilling performance and reduce costs,

▪EverGreen™ suite of environmental solutions which includes industry-leading alternative rig energy sources and fuel monitoring to reduce emissions and costs,

▪systems and scale to deliver highly disciplined, consistent, reliable, and safe operations,

▪experienced, High Performance crews as we focus on training, development and retaining key leaders, and

▪culture of teamwork, safety, integrity and desire to be the top tier service provider.

Employees

Our people strategies focus on initiatives that provide a safe and productive work environment, opportunity for advancement, and added wage security. In 2023, we had an average of approximately 5,000 employees, with a high of 5,560.

The market for experienced personnel in the oilfield services industry can be competitive due to the cyclical nature of the work, the uncertainty of continuing employment, and generally higher employment rates during periods of high oil and natural gas prices and drilling activities. We strive to position ourselves for increased activity while maintaining performance excellence through our safety performance and reputation. These factors help us attract and retain experienced, well-trained employees when the industry experiences crew shortages during peak operating periods.

Employee Safety and Training

Employee safety is embedded in all that we do at Precision, from job planning and change management to the critical task assessments and safety observations our employees perform every day. We deliver High Performance, High Value service to our customers without compromising the health and safety of our employees or those in the communities where we work.

Precision’s commitment to providing industry-leading comprehensive training and development to our employees can be seen through the extensive instructor-led and virtual courses, as well as face-to-face coaching. In 2023, over 63,600 employee training hours were focused on Precision’s culture, rig roles and responsibilities, well control, tools, and equipment, HSE standards, leadership and communication at one of our world-class training facilities, located in Nisku, Alberta and Houston, Texas. Additionally, in 2023, we continued our focus on rig-site training with over 18,000 employee training hours during more than 370 rig visits.

A specific focus on new employee development is driven through our Short-Service Employee (SSE) program, which is catered to rig-based employees with low levels of experience to ensure they are well-positioned for long-term success at Precision. During the first six months with Precision, these employees are paired with a mentor and put through various tasks under supervision to ensure they adapt to our culture, develop a safety-first mentality, and enable them to perform their duties to the best of their ability. In 2023, we dedicated over 15,000 SSE-specific training hours to approximately 990 employees who were new to the industry.

Technology and Innovation

In 2023, we upgraded and added the industry's most advanced AC Super Triple rig to our Canadian fleet, which is not only equipped with AlphaTM and EverGreenTM technologies but also includes rig floor robotics. The incorporation of a modular fully automated pipe handling system represents a pioneering achievement in the industry, positioning this land drilling rig at the forefront of technological advancement. By collaborating with AlphaAutomationTM, our rig floor robotics provides a comprehensive and seamless automation solution, optimizing operational efficiency and increasing safety standards.

Precision Drilling Corporation 2023 Annual Report 9

Diversity, Equity and Inclusion

Delivering strong operational and financial results in today’s environment requires the expertise and positive contributions of every Precision employee. We are committed to developing a diverse range of thoughts, experiences, and points of view to complement our strategy and decision-making processes. Precision is an inclusive workplace that strives to be free of discrimination, harassment, workplace violence, and retaliation. Our diversity, equity and inclusion policy prohibits discrimination of any kind and promotes diversity and inclusivity among our employees, management, and Board of Directors (Board).

Each year our employees are required to complete our Diversity, Equity, and Inclusion, and Discrimination and Harassment courses. In 2023, approximately 5,800 employees globally completed these courses.

Talent Management

As an industry leader, we are committed to recruiting and retaining high-performing, Passionate People at every level of our Company. Precision has developed a strong recruitment marketing strategy both in the field and for our corporate support roles. We ensure the value proposition we provide in the ways of pay and benefits remains competitive and engages our employees. We have implemented systems and processes that help us execute our talent management strategy to maintain a well-trained, highly competent and capable talent pool, both in the field and corporate positions with a broad range of business experience throughout market cycles. Our Talent Management and Field Training & Development departments have been successful implementing new and inventive technology platforms and internal learning systems to provide learning and development opportunities, leveraging our in-house technical expertise while maintaining the necessary in-person interactions to develop appropriate levels of understanding and strong professional networks.

10 Management's Discussion and Analysis

Contracts

Term customer contracts provide a base level of activity and revenue. In 2023, we had an average of 62 drilling rigs working under term contracts: 34 in the U.S., 22 in Canada and 6 internationally. Utilization days from these contracts was approximately 50% of our total contract drilling utilization days for the year. As at March 4, 2024, we had term contracts in place for an average of 44 rigs: 14 in the U.S., 22 in Canada and 8 internationally for 2024. In most regions in the U.S. and internationally, term contracts normally generate 365 utilization days per rig year. In Canada, term contracted rigs normally generate 250 utilization days per rig year because of the seasonal nature of wellsite access.

Pricing, Demand and Utilization

Energy industry fundamentals continue to support drilling activity for oil and natural gas despite economic uncertainty and the continued presence of global conflict. Today, oil prices are supported by increasing global demand and limited supply growth as OPEC+ continues to honor its lower production quotas and producers remain committed to returning capital to shareholders versus increasing production.

Natural gas has demonstrated price weaknesses since early 2023; however, this lower-carbon energy source is becoming increasingly favored as countries around the world stress the importance of sustainability, decarbonization and energy security. Even with the U.S. pausing approvals of new U.S. Liquefied Natural Gas (LNG) export terminals, we still expect North American LNG export capacity (including LNG Canada) to increase by more than 14 bcf/d over the next three years from projects currently under construction. We therefore anticipate a sustained period of elevated North America natural gas drilling activity.

In Canada, Precision’s drilling activity remained strong throughout 2023 and we expect high activity levels to continue into 2024 due to strong oil prices, tight supply of Super-Spec drilling rigs, and increases in hydrocarbon export capacity. The Trans Mountain oil pipeline expansion, which is expected to increase Canada’s tidewater takeaway capacity for crude oil by approximately 590,000 barrels per day, is expected to start-up in the first half of 2024. The Coastal GasLink pipeline achieved mechanical completion in late 2023 and will deliver gas to LNG Canada, which is expected to begin start-up activities in 2024. We expect near full utilization in the Canadian Super-Spec rig market in 2024, which should support high average day rates and demand for additional term contracts as customers secure rigs to ensure fulfillment of their development programs.

In the U.S., drilling activity began to weaken in early 2023 due to lower natural gas prices and oil price volatility and was exacerbated by drilling and completion efficiencies, consolidation among producers, and continued capital discipline. As a result, the U.S. active land rig count declined by approximately 21% throughout 2023, according to Baker Hughes. If oil prices remain stable and around today’s level, we expect drilling demand to begin to improve in the second quarter and gain momentum through the remainder of 2024 as customers embark on a new budget cycle, seek to maintain or possibly increase production levels, and replenish reserve inventories.

Internationally, as at March 4, 2024, we had eight rigs working on term contracts, five in Kuwait and three in the Kingdom of Saudi Arabia. During 2023, we recertified and reactivated four rigs, which is expected to increase our annual activity by approximately 40% in 2024. The majority of these rigs are under five-year term contracts that extend into 2027 and 2028, providing predictable cash flow for the next several years. We continue to bid our remaining idle rigs within the region and remain optimistic in our ability to secure rig reactivations.

High Performance Rig Fleet

The industry trend toward more complex drilling programs has accelerated the retirement of older generation, less capable drilling rigs. Over the past several years, we and some of our competitors have been upgrading our drilling rig fleets primarily through upgrading existing rigs and decommissioning lower capacity rigs. In more recent years, drilling rigs have been equipped with automation systems and emission reduction technologies to further drive time and cost efficiencies and environmental performance in the well construction process. We believe this retooling of the industry-wide fleet has made legacy rigs virtually obsolete in North America.

Capital Spending and Free Cash Flow Allocation

Capital spending in 2024 is expected to be $195 million and by spend category(1) includes $155 million for maintenance, infrastructure, and intangibles and $40 million for expansion and upgrades. We expect to spend $177 million in the Contract Drilling Services segment, $13 million in the Completion and Production Services segment and $5 million in the Corporate segment. At December 31, 2023, Precision had capital commitments of $175 million with payments expected through 2026.

We remain committed to our debt reduction plans and in 2024 expect to reduce debt by $150 million to $200 million and allocate 25% to 35% of free cash flow before debt repayments for share repurchases, while remaining committed to achieving a sustained Net Debt to Adjusted EBITDA ratio of below 1.0 times by the end of 2025. In 2026, we plan to reduce debt another $100 million and move our direct shareholder capital returns towards 50% of free cash flow.

(1) See Financial Measures and Ratios on page 40 of this report.

Precision Drilling Corporation 2023 Annual Report 11

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31

(in thousands of dollars, except where noted) | | 2023 | | | % increase/

(decrease) | | | 2022 | | | % increase/

(decrease) | | | 2021 | | | % increase/

(decrease) | | |

Revenue | | | 1,937,854 | | | | 19.8 | | | | 1,617,194 | | | | 63.9 | | | | 986,847 | | | | 5.5 | | |

Adjusted EBITDA(1) | | | 611,118 | | | | 96.1 | | | | 311,605 | | | | 61.6 | | | | 192,772 | | | | (26.8 | ) | |

Adjusted EBITDA % of revenue(1) | | | 31.5 | % | | | | | | 19.3 | % | | | | | | 19.5 | % | | | | |

Net earnings (loss) | | | 289,244 | | | | (943.4 | ) | | | (34,293 | ) | | | (80.7 | ) | | | (177,386 | ) | | | 47.7 | | |

Cash provided by operations | | | 500,571 | | | | 111.1 | | | | 237,104 | | | | 70.3 | | | | 139,225 | | | | (38.4 | ) | |

Funds provided by operations(1) | | | 533,409 | | | | 88.5 | | | | 282,994 | | | | 85.9 | | | | 152,243 | | | | (10.8 | ) | |

| | | | | | | | | | | | | | | | | | | |

Cash used in investing activities | | | 214,784 | | | | 48.7 | | | | 144,415 | | | | 155.1 | | | | 56,613 | | | | 39.7 | | |

Capital spending by spend category(1) | | | | | | | | | | | | | | | | | | | |

Expansion and upgrade | | | 63,898 | | | | 0.9 | | | | 63,305 | | | | 233.1 | | | | 19,006 | | | | (29.2 | ) | |

Maintenance, infrastructure and intangibles | | | 162,851 | | | | 34.6 | | | | 120,945 | | | | 112.4 | | | | 56,935 | | | | 64.2 | | |

Proceeds on sale of property, plant and

equipment | | | (23,841 | ) | | | (35.9 | ) | | | (37,198 | ) | | | 184.3 | | | | (13,086 | ) | | | (38.0 | ) | |

Net capital spending(1) | | | 202,908 | | | | 38.0 | | | | 147,052 | | | | 134.0 | | | | 62,855 | | | | 55.2 | | |

| | | | | | | | | | | | | | | | | | | |

Net earnings (loss) per share ($) | | | | | | | | | | | | | | | | | | | |

Basic | | | 21.03 | | | | (931.2 | ) | | | (2.53 | ) | | | (81.0 | ) | | | (13.32 | ) | | | 52.1 | | |

Diluted | | | 19.53 | | | | (871.9 | ) | | | (2.53 | ) | | | (81.0 | ) | | | (13.32 | ) | | | 52.1 | | |

(1) See Financial Measures and Ratios on page 40 of this report.

Operating Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31 | | 2023 | | | % increase/

(decrease) | | | 2022 | | | % increase/

(decrease) | | | 2021 | | | % increase/

(decrease) | |

Contract drilling rig fleet | | | 214 | | | | (4.9 | ) | | | 225 | | | | (0.9 | ) | | | 227 | | | | — | |

Drilling rig utilization days | | | | | | | | | | | | | | | | | | |

U.S. | | | 17,961 | | | | (11.9 | ) | | | 20,396 | | | | 40.7 | | | | 14,494 | | | | 20.0 | |

Canada | | | 21,156 | | | | 3.1 | | | | 20,519 | | | | 30.0 | | | | 15,782 | | | | 46.2 | |

International | | | 2,132 | | | | (2.6 | ) | | | 2,190 | | | | — | | | | 2,190 | | | | (13.3 | ) |

Revenue per utilization day | | | | | | | | | | | | | | | | | | |

U.S. (US$) | | | 35,040 | | | | 28.3 | | | | 27,309 | | | | 28.7 | | | | 21,213 | | | | (19.0 | ) |

Canada (Cdn$) | | | 33,151 | | | | 22.6 | | | | 27,037 | | | | 28.1 | | | | 21,105 | | | | (2.3 | ) |

International (US$) | | | 50,840 | | | | (0.8 | ) | | | 51,242 | | | | (3.0 | ) | | | 52,837 | | | | (3.6 | ) |

Operating cost per utilization day | | | | | | | | | | | | | | | | | | |

U.S. (US$) | | | 20,401 | | | | 9.5 | | | | 18,635 | | | | 23.8 | | | | 15,048 | | | | 2.6 | |

Canada (Cdn$) | | | 19,225 | | | | 13.0 | | | | 17,007 | | | | 23.8 | | | | 13,734 | | | | 1.4 | |

| | | | | | | | | | | | | | | | | | |

Service rig fleet | | | 183 | | | | 35.6 | | | | 135 | | | | 9.8 | | | | 123 | | | | — | |

Service rig operating hours | | | 201,627 | | | | 18.4 | | | | 170,362 | | | | 34.3 | | | | 126,840 | | | | 54.8 | |

Financial Position and Ratios

| | | | | | | | | | | | |

(in thousands of dollars, except ratios) | | December 31,

2023 | | | December 31,

2022 | | | December 31,

2021 | |

Working capital(1) | | | 145,239 | | | | 60,641 | | | | 81,637 | |

Working capital ratio(1) | | | 1.4 | | | | 1.1 | | | | 1.3 | |

Long-term debt(2) | | | 914,830 | | | | 1,085,970 | | | | 1,106,794 | |

Total long-term financial liabilities(3) | | | 1,004,216 | | | | 1,206,619 | | | | 1,185,858 | |

Total assets | | | 3,019,035 | | | | 2,876,123 | | | | 2,661,752 | |

Enterprise Value(1)(4) | | | 1,892,305 | | | | 2,470,538 | | | | 1,660,781 | |

Long-term debt to long-term debt plus equity | | | 0.4 | | | | 0.5 | | | | 0.5 | |

Long-term debt to cash provided by operations(1) | | | 1.8 | | | | 4.6 | | | | 7.9 | |

Net Debt to Adjusted EBITDA(1) | | | 1.4 | | | | 3.4 | | | | 5.5 | |

(1) See Financial Measures and Ratios on page 40 of this report.

(2) Net of unamortized debt issue costs.

(3) Non-current liabilities less deferred tax liabilities.

(4) See page 23 for more information.

12 Management's Discussion and Analysis

Consolidated Statements of Net Earnings (Loss) Summary

| | | | | | | | | | | | |

Year ended December 31 (in thousands of dollars) | | | 2023 | | | | 2022 | | | | 2021 | |

Revenue | | | | | | | | | |

Contract Drilling Services | | | 1,704,265 | | | | 1,436,134 | | | | 877,943 | |

Completion and Production Services | | | 240,716 | | | | 187,171 | | | | 113,488 | |

Inter-segment elimination | | | (7,127 | ) | | | (6,111 | ) | | | (4,584 | ) |

| | | 1,937,854 | | | | 1,617,194 | | | | 986,847 | |

Adjusted EBITDA(1) | | | | | | | | | |

Contract Drilling Services | | | 630,761 | | | | 397,753 | | | | 231,532 | |

Completion and Production Services | | | 51,224 | | | | 38,147 | | | | 23,807 | |

Corporate and Other | | | (70,867 | ) | | | (124,295 | ) | | | (62,567 | ) |

| | | 611,118 | | | | 311,605 | | | | 192,772 | |

Depreciation and amortization | | | 297,557 | | | | 279,035 | | | | 282,326 | |

Gain on asset disposals | | | (24,469 | ) | | | (29,926 | ) | | | (8,516 | ) |

Loss on asset decommissioning | | | 9,592 | | | | — | | | | — | |

Foreign exchange | | | (1,667 | ) | | | 1,278 | | | | 393 | |

Finance charges | | | 83,414 | | | | 87,813 | | | | 91,431 | |

Loss (gain) on investments and other assets | | | 6,810 | | | | (12,452 | ) | | | 400 | |

Gain on acquisition | | | (25,761 | ) | | | — | | | | — | |

Loss (gain) on redemption and repurchase of unsecured senior notes | | | (137 | ) | | | — | | | | 9,520 | |

Earnings (loss) before income tax | | | 265,779 | | | | (14,143 | ) | | | (182,782 | ) |

Income taxes | | | (23,465 | ) | | | 20,150 | | | | (5,396 | ) |

Net earnings (loss) | | | 289,244 | | | | (34,293 | ) | | | (177,386 | ) |

(1) See Financial Measures and Ratios on page 40 of this report.

Results by Geographic Segment

| | | | | | | | | | | | |

Year ended December 31 (in thousands of dollars) | | | 2023 | | | | 2022 | | | | 2021 | |

Revenue | | | | | | | | | |

U.S. | | | 861,915 | | | | 745,630 | | | | 398,024 | |

Canada | | | 929,639 | | | | 725,560 | | | | 443,772 | |

International | | | 146,300 | | | | 146,004 | | | | 145,051 | |

| | | 1,937,854 | | | | 1,617,194 | | | | 986,847 | |

Total assets | | | | | | | | | |

U.S. | | | 1,226,256 | | | | 1,376,413 | | | | 1,247,173 | |

Canada | | | 1,246,069 | | | | 1,056,093 | | | | 959,163 | |

International | | | 546,710 | | | | 443,617 | | | | 455,416 | |

| | | 3,019,035 | | | | 2,876,123 | | | | 2,661,752 | |

2023 COMPARED WITH 2022

In the U.S., West Texas Intermediate (WTI) oil prices averaged US$77.62 per barrel and Henry Hub natural gas prices averaged US$2.67 per MMBtu, representing an decreases of 18% and 59% from 2022, respectively. In Canada, Western Canadian Select (WCS) and AECO natural gas prices averaged US$58.96 and $2.64 in 2023, respectively. Average WCS pricing was 25% lower than 2022 while AECO decreased by 51%.

As compared with 2022, our revenue increased by 20% to $1,938 million. Our higher revenue was primarily the result of increased North American drilling revenue per utilization day rates and increased service rig activity and revenue rates, partially offset by lower U.S. drilling activity. We recognized Adjusted EBITDA in 2023 of $611 million, 96% higher than 2022. Our higher Adjusted EBITDA in 2023 was primarily due to increased drilling and well service revenue rates, stronger Canadian drilling and well service activity and lower share-based compensation, partially offset by lower U.S. drilling activity. As compared with 2022, our U.S. drilling activity decreased 12%, Canadian activity increased 3% and international activity decreased 3%. Our service rig operating hours increased 18% compared with 2022. Net earnings in 2023 were $289 million, or $21.03 per share, compared with a net loss of $34 million, or $2.53 per share, in 2022.

Debt Repayments and Shareholder Returns

In 2023, we reduced debt by $152 million through the full repayment of our Senior Credit Facility of $60 million, $100 million of repurchases and redemptions of our 2026 unsecured senior notes and $2 million of repayments of our Real Estate Credit Facilities, partially offset by the assumption of the $10 million CWC Real Estate Credit Facility. Pursuant to our NCIB, we repurchased and cancelled 412,623 common shares for $30 million.

In addition, we assumed a $51 million syndicated loan in connection with our CWC acquisition that was fully repaid and cancelled upon closing.

CWC Acquisition

We acquired CWC for cash of $14 million and the issuance of 947,807 common shares for total consideration of $89 million plus the assumption of $61 million of CWC long-term debt. The acquisition further increased the size and scale of our Canadian well

Precision Drilling Corporation 2023 Annual Report 13

servicing operations, adding 62 marketable well service rigs to our service rig fleet along with ancillary and spare equipment and operating facilities in complimentary operating basins. The acquisition also added seven Canadian and 11 U.S. drilling rigs to our drilling fleet. We recognized a gain on acquisition of $26 million.

Finance Charges

Finance charges were $83 million as compared with $88 million in 2022. Our decreased finance charges in 2023 were the result of our lower debt balance, partially offset by the impact of higher variable interest rates and higher translated U.S. dollar-denominated interest charges due to the weakening of the Canadian dollar.

Capital Spending and Long-Lived Assets

Capital expenditures for the purchase of property, plant and equipment were $227 million, an increase of $42 million from 2022. Capital spending by spend category included $64 million for expansion and upgrades and $163 million for the maintenance of existing assets, infrastructure and intangibles. Capital expenditures were $12 million higher than guidance due to the timing of equipment deliveries.

We decommissioned 20 and seven legacy drilling rigs in Canada and the U.S., respectively, recognizing an asset decommissioning charge of $10 million.

Through the completion of normal course business operations, we sold non-core assets for proceeds of $24 million resulting in a gain on asset disposal of $24 million. Included in the gain on asset disposal was a $7 million gain from the non-cash swap of drill pipe.

In accordance with IFRS, we review the carrying value of our long-lived assets for indications of impairment at the end of each reporting period. At December 31, 2023, we reviewed each of our cash-generating units (CGUs) and did not identify indications of impairment and, therefore, did not test our CGUs for impairment.

Investments and Other Assets

During 2023, we exercised 2 million warrants for $1 million in exchange for 2 million common shares of Cathedral Energy Services Ltd. (Cathedral). We subsequently divested 11 million Cathedral common shares for net proceeds of $10 million. In addition, we completed a $5 million equity investment in CleanDesign Income Corp. (CleanDesign). CleanDesign is a key supplier of Precision’s EverGreenTM BESS and this investment provides access to key BESS and power management technologies.

Income Taxes

In 2023, we recognized an income tax recovery of $23 million as compared with an income tax expense of $20 million in 2022. During the fourth quarter of 2023, we recorded a deferred income tax asset of $73 million for the expected future use of certain Canadian operating losses. We continue to not recognize deferred income tax assets for certain international locations.

2022 COMPARED WITH 2021

2022 was highlighted by increasing industry activity, supported by strengthening commodity prices, as global oil and natural gas demand approached pre-pandemic levels and customers sought to replenish depleted well inventories. In the U.S., the WTI oil price averaged US$94.23 per barrel and Henry Hub natural gas prices averaged US$6.51 per MMBtu, representing an increase of 39% and 75% from 2021, respectively. In Canada, the WCS oil price and AECO natural gas prices averaged US$78.15 and $5.43 in 2022, respectively. Average WCS pricing was 43% higher than 2021 while AECO increased by 49%.

As compared with 2021, our revenue increased by 64% to $1,617 million. Our higher revenue in the year was primarily the result of higher North American activity and revenue per utilization day. We recognized Adjusted EBITDA in 2022 of $312 million, 62% higher than in 2021. Our higher Adjusted EBITDA in 2022 was primarily due to increased activity and day rates, partially offset by higher share-based compensation. As compared with 2021, U.S. drilling activity increased 41%, Canadian activity increased 30% and international activity remained consistent. In addition, service rig operating hours increased 34% compared with the prior year. Our net loss in 2022 was $34 million, or $2.53 per diluted share, compared with a net loss of $177 million, or $13.32 per diluted share, in 2021.

Debt Repayments and Shareholder Returns

During 2022, we reduced debt by $106 million through repayments on our Senior Credit and Real Estate Credit Facilities. Pursuant to our NCIB, we repurchased and cancelled 130,395 common shares for $10 million.

Finance Charges

Finance charges were $88 million, a decrease of $4 million from 2021 due to lower debt issue costs, partially offset by the impact of higher variable interest rates on our Senior Credit and Real Estate Credit Facilities. In 2021, we accelerated the amortization of issue costs associated with fully redeemed unsecured senior notes.

14 Management's Discussion and Analysis

Capital Spending and Long-Lived Assets

Capital expenditures for the purchase of property, plant and equipment were $184 million in 2022, an increase of $108 million from 2021. Capital spending by spend category included $63 million for expansion and upgrades and $121 million for the maintenance of existing assets and infrastructure.

During 2022, we acquired the well servicing business and associated rental assets of High Arctic for consideration of $38 million. On the date of acquisition, we made a $10 million cash payment with the remaining balance of $28 million paid in 2023. The acquisition increased the size and scale of our operations within the Canadian well servicing industry, adding well-service rigs to our fleet along with related rental assets, ancillary support equipment, inventories, spares and operating facilities in key operating basins.

Under IFRS, we review the carrying value of our long-lived assets for indications of impairment at the end of each reporting period. At December 31, 2022, we reviewed each of our cash-generating units and did not identify indications of impairment and, therefore, did not test our CGUs for impairment.

Through the completion of normal course business operations, we sold non-core assets for proceeds of $37 million resulting in a gain on asset disposal of $30 million.

Income Taxes

In 2022, we recognized an income tax expense of $20 million as compared with an income tax recovery of $5 million in 2021. In 2022, we continued to not recognize the benefit of Canadian and certain international deferred tax assets resulting in a higher income tax expense as compared with 2021.

SEGMENTED RESULTS

Contract Drilling Services

Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31

(in thousands of dollars, except where noted) | | 2023 | | | % of

revenue | | | 2022 | | | % of

revenue | | | 2021 | | | % of

revenue | |

Revenue | | | 1,704,265 | | | | | | | 1,436,134 | | | | | | | 877,943 | | | | |

Expenses | | | | | | | | | | | | | | | | | | |

Operating | | | 1,030,053 | | | | 60.4 | | | | 988,885 | | | | 68.9 | | | | 618,327 | | | | 70.4 | |

General and administrative | | | 43,451 | | | | 2.5 | | | | 49,496 | | | | 3.4 | | | | 28,084 | | | | 3.2 | |

Adjusted EBITDA(1) | | | 630,761 | | | | 37.0 | | | | 397,753 | | | | 27.7 | | | | 231,532 | | | | 26.4 | |

(1) See Financial Measures and Ratios on page 40 of this report.

Operating Statistics

| | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31 | | 2023 | | | % increase/

(decrease) | | | 2022 | | | % increase/

(decrease) | | | 2021 | | | % increase/

(decrease) | |

Number of drilling rigs (year-end) | | | 214 | | | | (4.9 | ) | | | 225 | | | | (0.9 | ) | | | 227 | | | | — | |

Drilling utilization days (operating and moving) | | | | | | | | | | | | | | | | | | |

U.S. | | | 17,961 | | | | (11.9 | ) | | | 20,396 | | | | 40.7 | | | | 14,494 | | | | 20.0 | |

Canada | | | 21,156 | | | | 3.1 | | | | 20,519 | | | | 30.0 | | | | 15,782 | | | | 46.2 | |

International | | | 2,132 | | | | (2.6 | ) | | | 2,190 | | | | — | | | | 2,190 | | | | (13.3 | ) |

Drilling revenue per utilization day | | | | | | | | | | | | | | | | | | |

U.S. | | | 35,040 | | | | 28.3 | | | | 27,309 | | | | 28.7 | | | | 21,213 | | | | (19.0 | ) |

Canada | | | 33,151 | | | | 22.6 | | | | 27,037 | | | | 28.1 | | | | 21,105 | | | | (2.3 | ) |

International | | | 50,840 | | | | (0.8 | ) | | | 51,242 | | | | (3.0 | ) | | | 52,837 | | | | (3.6 | ) |

2023 Compared with 2022

Revenue from Contract Drilling Services was $1,704 million, 19% higher than 2022 due to higher North America revenue per utilization day rates, increased Canadian drilling activity, partially offset by lower U.S. and international activity. As compared to 2022, our drilling rig utilization days increased 3% in Canada while U.S. and international decreased by 12% and 3%, respectively.

Operating expenses in 2023 were 60% of revenue, 9% lower than the prior year, representing our revenue efficiency as our strengthening North American revenue per utilization day outpaced operating cost increases. On a per utilization day basis, in the U.S., operating costs were 10% higher than 2022 primarily due to higher rig operating expenses and repairs and maintenance and the impact of fixed operating overheads spread over fewer utilization days. Operating costs on a per day basis in our Canadian drilling rig division were 13% higher than in 2022, primarily due to higher rig operating expenses and repairs and maintenance. In both the U.S. and Canada, higher rig operating expenses primarily related to increased wages.

General and administrative expenses for 2023 decreased by 12% due to lower share-based compensation resulting from our lower share price. We recognized share-based compensation of $4 million as compared with $13 million in 2022.

Precision Drilling Corporation 2023 Annual Report 15

Our Adjusted EBITDA was $631 million as compared with $398 million in 2022. The increase was primarily due to the impact of stronger North America revenue per utilization day, higher Canadian drilling activity and lower share-based compensation, partially offset by decreased U.S. drilling activity.

U.S. Drilling

Revenue from U.S. drilling was US$629 million, 13% higher than 2022. Drilling rig activity, as measured by utilization days, was down 12% while average revenue per utilization day increased 28% compared with 2022. Adjusted EBITDA was US$242 million, 53% higher than 2022 and was the result of higher revenue per utilization day, partially offset by lower drilling and turnkey activity.

Our higher U.S. drilling revenue per utilization days was primarily due to higher average day rates spurred by the tightening of available Super-Spec rigs and revenue from idle but contracted rigs, partially offset by lower turnkey revenue. In 2023, we recognized turnkey revenue of US$7 million which accounted for 1% of our U.S. drilling revenue as compared with US$25 million and 4% in 2022, respectively. During the year, we recognized US$18 million of revenue from idle but contracted rigs as compared with $2 million in 2022.

Drilling Statistics – U.S.

We ended the year with a U.S. rig count of 104. We averaged 49 rigs working in 2023, 13% lower than 2022 due to lower industry activity. The average number of active land rigs for the industry was 670 as compared with 699 rigs in 2022.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | | 2022 | | | 2021 | |

| | Precision | | | Industry (1) | | | Precision | | | Industry (1) | | | Precision | | | Industry (1) | |

Average number of active land rigs

for quarters ended: | | | | | | | | | | | | | | | | | | |

March 31 | | | 60 | | | | 744 | | | | 51 | | | | 603 | | | | 33 | | | | 378 | |

June 30 | | | 51 | | | | 700 | | | | 55 | | | | 687 | | | | 39 | | | | 437 | |

September 30 | | | 41 | | | | 631 | | | | 57 | | | | 746 | | | | 41 | | | | 485 | |

December 31 | | | 45 | | | | 603 | | | | 60 | | | | 761 | | | | 45 | | | | 545 | |

Annual average | | | 49 | | | | 670 | | | | 56 | | | | 699 | | | | 40 | | | | 461 | |

(1) Source: Baker Hughes.

Canadian Drilling

Revenue from Canadian drilling was $701 million, 26% higher than 2022. Drilling rig activity, as measured by utilization days, was up by 3% while average revenue per utilization day increased 23% as compared with 2022.

Adjusted EBITDA was $279 million, 45% higher than 2022 and was the result of higher drilling activity and day rates.

Drilling Statistics – Canada

We ended the year with a Canadian rig count of 97. Our average active rig count increased to 58 rigs in 2023, up from 56 rigs in 2022, and was consistent with increased industry activity as the average active land rigs increased from 176 to 177.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | | 2022 | | | 2021 | |

| | Precision | | | Industry (1) | | | Precision | | | Industry (1) | | | Precision | | | Industry (1) | |

Average number of active land rigs

for quarters ended: | | | | | | | | | | | | | | | | | | |

March 31 | | | 69 | | | | 221 | | | | 63 | | | | 205 | | | | 42 | | | | 145 | |

June 30 | | | 42 | | | | 117 | | | | 37 | | | | 113 | | | | 27 | | | | 72 | |

September 30 | | | 57 | | | | 188 | | | | 59 | | | | 199 | | | | 51 | | | | 151 | |

December 31 | | | 64 | | | | 181 | | | | 66 | | | | 187 | | | | 52 | | | | 160 | |

Annual average | | | 58 | | | | 177 | | | | 56 | | | | 176 | | | | 43 | | | | 132 | |

(1) Source: Baker Hughes.

COMPLETION AND PRODUCTION SERVICES

Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31

(in thousands of dollars, except where noted) | | 2023 | | | % of

revenue | | | 2022 | | | % of

revenue | | | 2021 | | | % of

revenue | |

Revenue | | | 240,716 | | | | | | | 187,171 | | | | | | | 113,488 | | | | |

Expenses | | | | | | | | | | | | | | | | | | |

Operating | | | 181,622 | | | | 75.5 | | | | 141,827 | | | | 75.8 | | | | 84,401 | | | | 74.4 | |

General and administrative | | | 7,870 | | | | 3.3 | | | | 7,197 | | | | 3.8 | | | | 5,280 | | | | 4.7 | |

Adjusted EBITDA(1) | | | 51,224 | | | | 21.3 | | | | 38,147 | | | | 20.4 | | | | 23,807 | | | | 21.0 | |

(1) See Financial Measures and Ratios on page 40 of this report.

16 Management's Discussion and Analysis

Operating Statistics

| | | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31 | | 2023 | | | % increase/

(decrease) | | | 2022 | | | % increase/

(decrease) | | | 2021 | | | % increase/

(decrease) | |

Number of service rigs (end of year) | | | 183 | | | | 35.6 | | | | 135 | | | | 9.8 | | | | 123 | | | | — | |

Service rig operating hours | | | 201,627 | | | | 18.4 | | | | 170,362 | | | | 34.3 | | | | 126,840 | | | | 54.8 | |

2023 Compared with 2022

Revenue from Completion and Production Services was $241 million, 29% higher than 2022, resulting from increased well service activity and stronger hourly service rates. Our current year service rig operating hours rose by 18% versus 2022.

Operating expenses were 76% of segment revenue, largely consistent with 2022, as industry-wide wage increases were offset by increased hourly service rates. General and administrative expenses increased 9% due higher fixed overheads associated with our High Arctic and CWC acquisitions, partially offset by lower share-based compensation.

Adjusted EBITDA increased by 34% from 2022 as a result of increased activity and higher service rates.

CORPORATE AND OTHER

Financial Results

| | | | | | | | | | | | |

Year ended December 31

(in thousands of dollars, except where noted) | | | 2023 | | | | 2022 | | | | 2021 | |

Expenses | | | | | | | | | |

General and administrative | | | 70,867 | | | | 124,295 | | | | 62,567 | |

Adjusted EBITDA(1) | | | (70,867 | ) | | | (124,295 | ) | | | (62,567 | ) |

(1) See Financial Measures and Ratios on page 40 of this report.

2023 Compared with 2022

Our Corporate and Other segment contains support functions that provide assistance to our business segments. It includes costs incurred in corporate groups in both Canada and the U.S.

Corporate general and administrative expenses were $71 million, $53 million lower than 2022. The decrease was mainly related to lower share-based compensation resulting from our decreased share price in the current year. Corporate general and administrative costs were 4% of consolidated revenue as compared with 8% in 2022.

QUARTERLY FINANCIAL RESULTS

| | | | | | | | | | | | | | | | |

2023 – Quarters Ended

(in thousands of dollars, except per share amounts) | | March 31 | | | June 30 | | | September 30 | | | December 31 | |

Revenue | | | 558,607 | | | | 425,622 | | | | 446,754 | | | | 506,871 | |

Adjusted EBITDA(1) | | | 203,219 | | | | 142,093 | | | | 114,575 | | | | 151,231 | |

Net earnings (loss) | | | 95,830 | | | | 26,900 | | | | 19,792 | | | | 146,722 | |

per basic share | | | 7.02 | | | | 1.97 | | | | 1.45 | | | | 10.42 | |

per diluted share | | | 5.57 | | | | 1.63 | | | | 1.45 | | | | 9.81 | |

Funds provided by operations(1) | | | 159,653 | | | | 136,959 | | | | 91,608 | | | | 145,189 | |

Cash provided by (used in) operations | | | 28,356 | | | | 213,460 | | | | 88,500 | | | | 170,255 | |

(1) See Financial Measures and Ratios on page 40 of this report.

| | | | | | | | | | | | | | | | |

2022 – Quarters Ended

(in thousands of dollars, except per share amounts) | | March 31 | | | June 30 | | | September 30 | | | December 31 | |

Revenue | | | 351,339 | | | | 326,016 | | | | 429,335 | | | | 510,504 | |

Adjusted EBITDA(1) | | | 36,855 | | | | 64,099 | | | | 119,561 | | | | 91,090 | |

Net earnings (loss) | | | (43,844 | ) | | | (24,611 | ) | | | 30,679 | | | | 3,483 | |

per basic share | | | (3.25 | ) | | | (1.81 | ) | | | 2.26 | | | | 0.27 | |

per diluted share | | | (3.25 | ) | | | (1.81 | ) | | | 2.03 | | | | 0.27 | |

Funds provided by operations(1) | | | 29,955 | | | | 60,373 | | | | 81,327 | | | | 111,339 | |

Cash provided by operations | | | (65,294 | ) | | | 135,174 | | | | 8,142 | | | | 159,082 | |

(1) See Financial Measures and Ratios on page 40 of this report.

Fourth Quarter 2023 Compared with Fourth Quarter 2022

We recorded net earnings of $147 million or $10.42 per share as compared with net earnings of $3 million or $0.27 per share in the fourth quarter of 2022.

Fourth quarter revenue of $507 million was largely consistent with 2022 as increased drilling and service revenue rates were offset by lower North America activity. Drilling rig utilization days decreased 25% and 3% in the U.S. and Canada, respectively, while international activity increased 26% as we reactivated rigs in the Middle East. Fourth quarter revenue from our Contract Drilling Services was largely consistent with 2022, whereas revenue from our Completion and Production Services segment increased 5%.

Precision Drilling Corporation 2023 Annual Report 17

Adjusted EBITDA for the quarter was $151 million, $60 million higher than 2022. Our increased Adjusted EBITDA in 2023 was primarily due to lower share-based compensation. Share-based compensation for the quarter was $13 million, $62 million lower than 2022 as a result of our lower share price appreciation during the current year quarter.

Contract Drilling Services

Revenue from Contract Drilling Services was $447 million, largely consistent with 2022, while Adjusted EBITDA increased 18% to $162 million. The increased Adjusted EBITDA was primarily due to higher daily operating margins and international activity, partially offset by lower North America drilling activity.

Drilling rig utilization days in the U.S. were 4,138, 25% lower than 2022. Drilling rig utilization days in Canada were 5,909, 3% lower than 2022. The movement in utilization days in both the U.S. and Canada was largely consistent with changes in industry activity. Drilling rig utilization days in our international business increased 26% to 693, as we reactivated rigs in Kuwait.

As compared with 2022, our U.S. fourth quarter revenue per utilization day increased 10% to US$34,452. The increase was primarily the result of higher fleet average day rates and idle but contracted rig revenue, partially offset by lower turnkey revenue. We recognized revenue from idle but contracted rigs and turnkey activity of US$7 million and nil, respectively, as compared with nil and US$4 million in 2022. Compared with the same quarter in 2022, drilling rig revenue per utilization day in Canada increased 16% to $34,616 due to higher average day rates and customer cost recoveries. Our international revenue per utilization day for the quarter was consistent with 2022.

In the U.S., operating costs per utilization day were $21,039, 9% higher than in 2022. The increase was primarily due to higher rig operating costs and repairs and maintenance and the impact of fixed costs being spread over fewer activity days. Our Canadian operating costs on a per day basis increased 9% to $19,191 and was due to higher field wages and recoverable costs, partially offset by lower repairs and maintenance.

Our general and administrative expenses decreased $5 million as compared with 2022 and was primarily the result of lower share-based compensation, partially offset by the impact of higher translated U.S. dollar-denominated costs.

Completion and Production Services

Completion and Production Services revenue increased to $62 million as compared with $59 million in 2022. The higher revenue was primarily due to increased average service rates and activity. Our fourth quarter service rig operating hours were 56,683 an increase of 15% from 2022.

Operating costs as a percentage of revenue were 77%, consistent with 2022. As compared to 2022, our fourth quarter general and administrative expenses increased 9%, primarily due to overhead charges associated with the CWC acquisition.

Adjusted EBITDA was $12 million, consistent with 2022.

Corporate and Other

Our Corporate and Other segment provides support functions to our operating segments. The Corporate and Other segment had negative Adjusted EBITDA of $23 million as compared with negative $58 million in 2022. Our improved Adjusted EBITDA was due to lower share-based compensation, partially offset by $4 million in transaction costs and severance.

18 Management's Discussion and Analysis

The oilfield services business is inherently cyclical. To manage this variability, we focus on maintaining a strong financial position to have the financial flexibility we need to continue to manage our capital expenditures and cash flows, no matter where we are in the business cycle.

We apply a disciplined approach to managing and tracking the results of our operations to keep costs down. We maintain a variable cost structure so we can respond to changing market demand. We also invest in our fleet to make sure we remain competitive. Our maintenance capital expenditures are tightly governed and highly responsive to activity levels with additional cost savings generated through the operating leverage provided by our internal manufacturing and supply divisions. Term contracts on expansion capital for new-build rig programs help provide more certainty of future revenues and return on our growth capital investments.

LIQUIDITY

During 2023, we maintained our strong liquidity position, exiting the year with a cash balance of $54 million and more than $600 million of available liquidity. We expect cash provided by operations and our sources of financing, including our Senior Credit Facility, to be sufficient to meet our unsecured senior note obligations and to fund future capital expenditures.

At December 31, 2023, excluding letters of credit, we had approximately $929 million (2022 – $1,103 million) outstanding under our secured and unsecured credit facilities and $11 million (2022 – $15 million) in unamortized debt issue costs. Our Senior Credit Facility and Real Estate Credit Facility include financial ratio covenants that are tested quarterly.

The current blended cash interest cost of our debt is approximately 7.0%.

Key Financial Indicators and Ratios

We evaluate the relative strength of our financial position by monitoring our working capital, debt ratios and liquidity. We also monitor returns on capital and link our executives’ incentive compensation to certain long-term strategic targets as well as the returns of our shareholders relative to the shareholder returns of our peers. Please refer to page 12 for our summary of Financial Position and Ratios.

Credit Rating

Credit ratings affect our ability to obtain short and long-term financing, the cost of this financing, and our ability to engage in certain business activities cost-effectively.

| | | | | | |

At March 4, 2024 | | Moody’s | | S&P | | Fitch |

Corporate credit rating | | Ba3 | | B+ | | B+ |

Senior Credit Facility rating | | Not rated | | Not rated | | BB+ |

Unsecured senior notes credit rating | | B1 | | B+ | | B+ |

CAPITAL MANAGEMENT

To maintain and grow our business, we invest in growth, upgrade and sustaining capital. We base expansion and upgrade capital decisions on return of capital employed and payback. We mitigate the risk that we may not be able to fully recover our capital, by requiring term contracts for new-build rigs.

We base our maintenance capital decisions on actual activity levels, using key financial indicators that we express as per operating day or per operating hour. Sourcing internally (through our manufacturing and supply divisions) helps keep our maintenance capital costs as low as possible.

Foreign Exchange Risk

Our U.S. and international operations have revenue, expenses, assets, and liabilities denominated in currencies other than the Canadian dollar (mostly in U.S. dollars and currencies that are pegged to the U.S. dollar). This means that changes in currency exchange rates can materially affect our income statement, statement of financial position and statement of cash flow. We manage this risk by matching the currency of our debt obligations with the currency of cash flows generated by the operations that the debt supports.

Hedge of Investments in Foreign Operations

We utilize foreign currency long-term debt to hedge our exposure to changes in the carrying values of our net investment in certain foreign operations as a result of changes in foreign exchange rates. During 2023, we continued to designate our U.S. dollar Senior Credit Facility and unsecured senior notes as a net investment hedge in our U.S. dollar denominated foreign operations. To be accounted for as a hedge, the foreign currency denominated long-term debt must be designated and documented as such and must be effective at inception and on an ongoing basis. We recognize the effective amount of this hedge (net of tax) in other comprehensive income. We recognize ineffective amounts in earnings.

Precision Drilling Corporation 2023 Annual Report 19

SOURCES AND USES OF CASH

| | | | | | | | | | | | |

At December 31 (in thousands of dollars) | | | 2023 | | | | 2022 | | | | 2021 | |

Cash provided by operations | | | 500,571 | | | | 237,104 | | | | 139,225 | |

Cash used in investing activities | | | (214,784 | ) | | | (144,415 | ) | | | (56,613 | ) |

Surplus | | | 285,787 | | | | 92,689 | | | | 82,612 | |

Cash used in financing activities | | | (251,966 | ) | | | (113,171 | ) | | | (149,913 | ) |

Effect of exchange rate changes on cash | | | (1,226 | ) | | | 1,481 | | | | (883 | ) |

Net cash movement | | | 32,595 | | | | (19,001 | ) | | | (68,184 | ) |

Cash Provided by Operations

In 2023, cash provided by operations was $501 million compared with $237 million in 2022. The increase was driven by our revenue efficiency, as average drilling and service revenue rate increases outpaced operating cost increases, and lower share-based compensation, partially offset by lower U.S. and international drilling activity.

Cash Used in Investing Activities

Our 2023 capital spending of $227 million by spend category was comprised of:

▪$64 million on upgrade and expansion capital, and

▪$163 million on maintenance and infrastructure capital.

The $227 million in capital expenditures in 2023 was split between our segments as follows:

▪$214 million in Contract Drilling Services,

▪$10 million in Completion and Production Services, and

▪$3 million in Corporate and Other.

Expansion and upgrade capital includes the cost of long-lead items purchased for our capital inventory, such as integrated top drives, drill pipe, control systems, engines, and other items we can use to complete new-build projects or upgrade our rigs in North America and internationally.

We sold underutilized capital assets for proceeds of $24 million in 2023 compared with $37 million in 2022.

Our business combination activities included:

▪The acquisition of CWC in which we made a cash payment of $14 million on November 8, 2023 which was offset by the acquired CWC cash balance of $13 million, and

▪The payment of $28 million in connection with our 2022 acquisition of High Arctic that was deferred until 2023.

Our investments and other assets activities included:

▪The sale of Cathedral common shares for proceeds of $10 million, and

▪Our investment in CleanDesign for $5 million.

Cash Used in Financing Activities

In 2023, cash used in financing activities was $252 million as compared with $113 million in 2022. Our 2023 financing activities were comprised of:

▪$213 million of long-term debt repayments, which included the repayment of CWC's $51 million syndicated loan that was assumed upon acquisition,

▪$30 million of NCIB share repurchases, and

▪$9 million of lease payments.

20 Management's Discussion and Analysis

CAPITAL STRUCTURE

Material Debt

| | | | | | |

Amount | | Availability | | Used for | | Maturity |

Senior Credit Facility (secured) | | | | | | |

US$447 million (extendible, revolving

term credit facility with US$353 million

accordion feature) | | Nil drawn and US$56 million in

outstanding letters of credit | | General corporate purposes | | June 18, 2025 |

Real estate credit facilities (secured) | | | | | | |

US$8 million | | Fully drawn | | General corporate purposes | | November 19, 2025 |

$16 million | | Fully drawn | | General corporate purposes | | March 16, 2026 |

$10 million | | Fully drawn | | General corporate purposes | | June 30, 2028 |

Operating facilities (secured) | | | | | | |

$40 million | | Undrawn, except $20 million

in outstanding letters of credit | | Letters of credit and general

corporate purposes | | |

US$15 million | | Undrawn | | Short term working capital

requirements | | |

Demand letter of credit facility (secured) | | | | | | |

US$40 million | | Undrawn, except US$28 million

in outstanding letters of credit | | Letters of credit | | |

Unsecured senior notes (unsecured) | | | | | | |

US$273 million – 7.125% | | Fully drawn | | Debt redemption and repurchases | | January 15, 2026 |

US$400 million – 6.875% | | Fully drawn | | Debt redemption and repurchases | | January 15, 2029 |

| | | | | | |

Covenants

At December 31, 2023, we were in compliance with the covenants of our Senior Credit Facility, Real Estate Credit Facility and unsecured senior notes.

| | | | | | |

| | Covenant | | At December 31, 2023 | |

Senior Credit Facility | | | | | |

Consolidated senior debt to consolidated covenant EBITDA(1) | | ≤ 2.50 | | | 0.07 | |

Consolidated covenant EBITDA to consolidated interest expense | | ≥ 2.50 | | | 6.92 | |

| | | | | |

Real Estate Credit Facility | | | | | |

Consolidated covenant EBITDA to consolidated interest expense | | ≥ 2.50 | | | 6.92 | |

| | | | | |

Unsecured Senior Notes | | | | | |

Consolidated interest coverage ratio | | ≥ 2.00 | | | 7.50 | |

(1) For purposes of calculating the leverage ratio consolidated senior debt only includes secured indebtedness.

Senior Credit Facility