| |

PRECISION DRILLING ANNUAL INFORMATION FORM |

| |

Throughout this Annual Information Form (AIF), the terms, we, us, our, Corporation, Company, Precision and Precision Drilling mean Precision Drilling Corporation and, where indicated, all our consolidated subsidiaries and any partnerships of which we and/or our Subsidiaries are a part.

Information in the AIF is as of December 31, 2023 unless specified otherwise. All amounts are in Canadian dollars unless specified otherwise.

| | | |

| | TABLE OF CONTENTS |

| 1 | About Precision |

| 1 | Corporate Governance |

| 2 | Corporate Structure |

| 3 | Recent Developments and Three-Year History |

| 3 | 2023 Accomplishments and Highlights |

| 5 | 2022 Accomplishments and Highlights |

| 6 | 2021 Accomplishments and Highlights |

| 8 | Our Business |

| 8 | Business Segments Overview |

| 9 | Contract Drilling Services |

| 12 | Completion and Production Services |

| 14 | Corporate Responsibility |

| 15 | Environmental |

| 16 | Social |

| 18 | Governance |

| 21 | Capital Structure |

| 21 | Common Shares |

| 24 | Preferred Shares |

| 25 | Material Debt |

| 29 | Risks in Our Business |

| 42 | Our Directors and Officers |

| 42 | Board of Directors |

| 44 | Our Board Committees |

| 46 | Our Executive Officers |

| 47 | Other Material Information |

| 47 | Interests of Experts |

| 47 | Materials Contracts |

| 47 | Legal Proceedings and Regulatory Actions |

| 47 | Management’s Discussion and Analysis |

| 47 | Transfer Agent and Registrar |

| 47 | Additional Information About Precision |

| 47 | About Registered Trademarks |

| 48 | Financial Measures and Ratios |

| 48 | Cautionary Statement About Forward-Looking Information and Statements |

| 50 | Appendix |

| 50 | Audit Committee Charter |

Precision is a leading provider of safe and environmentally responsible High Performance, High Value services to the energy industry, offering customers access to an extensive fleet of Super Series drilling rigs. Precision has commercialized an industry-leading digital technology portfolio known as AlphaTM technologies that utilizes advanced automation software and analytics to generate efficient, predictable, and repeatable results for energy customers. Additionally, Precision offers well service rigs, camps and rental equipment all backed by a comprehensive mix of technical support services and skilled, experienced personnel. Our drilling services are enhanced by our EverGreenTM suite of environmental solutions, which bolsters our commitment to reducing the environmental impact on our operations.

From our founding as a private drilling contractor in 1951, Precision has grown to become one of the most active drillers in North America. Our High Performance, High Value competitive advantage is underpinned by four distinguishing features:

▪a high-quality land drilling rig fleet, with AC Super Triple rigs enabled with our AlphaTM technologies and supported by our EverGreenTM suite of environmental solutions to deliver consistent, repeatable, high-quality wellbores while improving safety, performance, operational efficiency and reducing environmental impact

▪size and scale of our vertically integrated operations that provide higher margins and better service capabilities

▪a diverse culture focused on operational excellence, which includes corporate responsibility, safety and field performance, and

▪a capital structure that provides long-term stability, flexibility and liquidity, allowing us to take advantage of business cycle opportunities.

CORPORATE GOVERNANCE

At Precision, we integrate financial, environmental, and social responsibility seamlessly into our operations, adhering closely to our core values and corporate governance principles. Guided by these principles and with the support and oversight of our Board of Directors (Board), we are committed to upholding our elevated standards of ethics and integrity. We recognize that governance practices such as board independence, proactive shareholder engagement and risk management help us sustain the trust we have built with our stakeholders.

To deliver results, we focus on operational excellence, top-tier environmental, social and governance (ESG) performance and productive stakeholder engagement. We integrate our health, safety and environmental (HSE) commitment into our operations and incorporate HSE and ESG performance goals in our compensation program.

In 2023, we transitioned our ESG performance data to our interactive web page, which serves as the primary platform that highlights the Company’s ESG progress, and provides recurring updates on our ESG performance. We also expanded our reporting to include additional elements from the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. We invite you to review some of our ESG highlights beginning on page 14 or, for more fulsome information, you can explore our ESG initiatives by visiting our website at www.precisiondrilling.com/esg/.

We remain committed to achieving and maintaining at least 30% of female representation on our Board. We are actively working to incorporate another female nominee candidate to the Board at the 2024 Annual Meeting of Shareholders and we anticipate that this new member will enhance the Board's existing skill set, if elected. To learn more about our diversity efforts, please read our Management Information Circular for our 2024 Annual Meeting of Shareholders, which will be released in April 2024, or visit our website.

Our directors have a history of achievement and an effective mix of skills, knowledge and business experience. The directors continue to provide oversight in support of future operations and monitor regulatory developments and governance best practices in Canada, the United States (U.S.) and internationally. As part of their oversight, our Board has established three standing committees, comprised of independent directors, to help carry out its responsibilities effectively:

▪Corporate Governance, Nominating and Risk Committee (CGNRC), and

▪Human Resources and Compensation Committee (HRCC).

The Board may also create special ad hoc committees from time to time to deal with important matters that arise.

Management has also established internal committees, including the Enterprise Risk Management Committee, the Compliance Committee, the Disclosure Committee and the Health, Safety, Environment and Corporate Responsibility Council (HSE and Corporate Responsibility Council). Two of our directors, Mr. Culbert and Mr. Williams, are active members of the HSE and Corporate Responsibility Council and attend quarterly meetings.

Precision Drilling Corporation 2023 Annual Information Form 1

CORPORATE STRUCTURE

Precision was formed by amalgamation under the Business Corporations Act (Alberta). We previously operated as an income trust, known as Precision Drilling Trust, and converted to a corporate entity on June 1, 2010, under a statutory plan of arrangement.

On March 8, 2013, we repealed our old by-laws and adopted new by-laws to provide for, among other things, an advance notice requirement for Precision shareholders nominating directors for election to the Board and an increase in the quorum requirement for our shareholder meetings to 25% from 5%. The amendments were confirmed by our shareholders on May 8, 2013.

Our common shares trade on the Toronto Stock Exchange (TSX), under the symbol PD, and on the New York Stock Exchange (NYSE), under the symbol PDS.

Our principal corporate and registered office is at:

| | |

Suite 800, 525 – 8th Avenue SW Calgary, Alberta Canada T2P 1G1 | Phone: Email: Website: | 403.716.4500 info@precisiondrilling.com www.precisiondrilling.com |

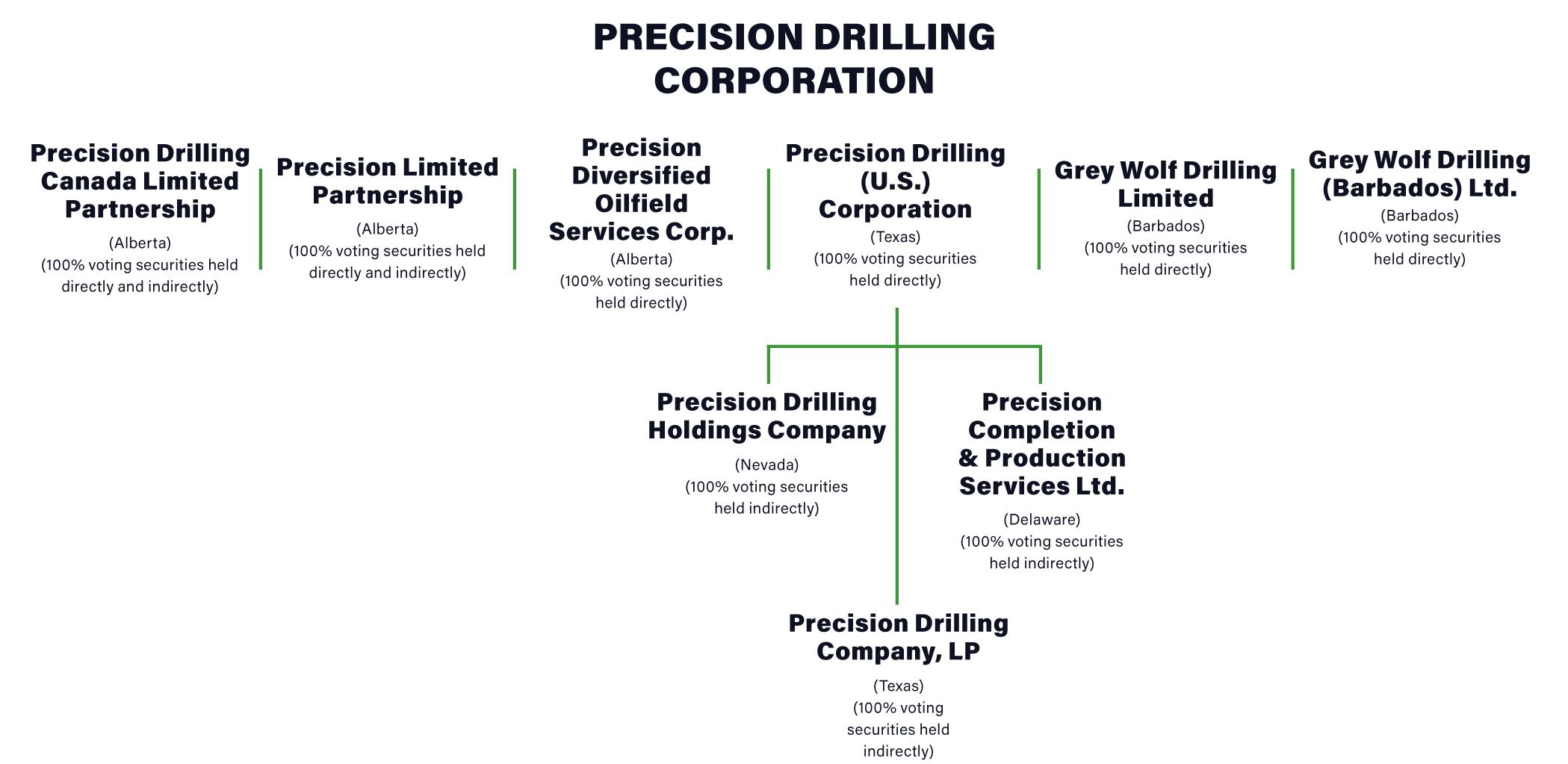

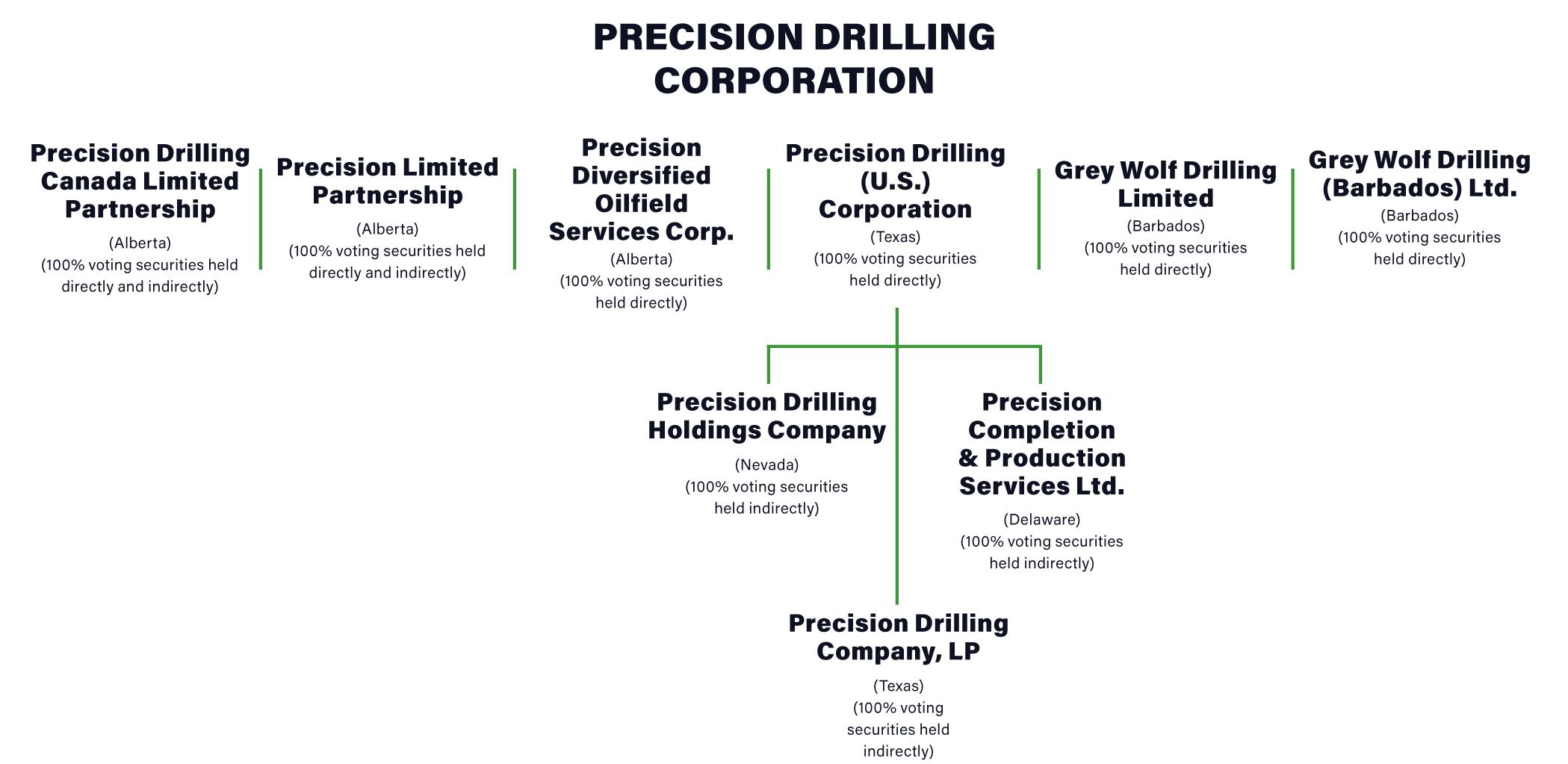

The chart below shows our organizational structure and material subsidiaries or partnerships, including the jurisdiction where each was incorporated, formed or continued and whether we hold the voting securities directly or indirectly. For simplification, non-material subsidiaries are excluded.

2 Precision Drilling Corporation 2023 Annual Information Form

RECENT DEVELOPMENTS AND THREE-YEAR HISTORY

In recent years, North American crude oil and and natural gas producers have undergone a noteworthy shift in priorities, transitioning from a primary focus on production growth to a heightened emphasis on delivering value and returning capital to shareholders. We have strategically aligned with this priority by maintaining strict capital discipline. Even with strong customer demand and high utilization of Super Series rigs, we only allocate capital to the most attractive investment opportunities. We are focused on increasing our margins and growing capital returns to shareholders versus gaining market share. This strategic orientation underscores our leadership and commitment to delivering sustained value to Precision's shareholders.

In 2023, Precision delivered one of our most profitable years in the past decade and exceeded our cash flow expectations. During the year, we not only met our debt reduction and shareholder capital return targets but also funded two accretive acquisitions. Our High Performance, High Value strategy along with our Super Series rigs, AlphaTM technologies, and EvergreenTM suite of environmental solutions continue to differentiate our services.

During the year, we reduced our debt by $152 million and allocated 15% of our free cash flow to share repurchases. In 2024, we plan to increase our shareholder capital return program by allocating 25% to 35% of our free cash flow, before debt repayments, to share repurchases. Our focus on our debt reduction strategy remains firmly in place and in 2024, we plan to reduce debt by another $150 million to $200 million. This positions us to achieve our sustained Net Debt to Adjusted EBITDA ratio(1) target of below 1.0 times by the end of 2025 and meet our long-term debt reduction target of $500 million between 2022 and 2025. In 2026, we plan to reduce debt by an additional $100 million and increase our shareholder capital return program towards 50% of free cash flow.

Notes:

(1)Non-GAAP measure - see Financial Measures and Ratios on page 48.

Accomplishments and Highlights

We consistently establish annual strategic priorities. As part of our management approach, we hold ourselves accountable by preparing quarterly updates on the progress made towards these priorities, culminating in a comprehensive year-end report highlighting the achieved results. Our enduring commitment is underscored by a robust multi-year track record, showcasing our ability to deliver tangible outcomes in alignment with our stated priorities.

2023 Accomplishments

| |

2023 Strategic Priorities | 2023 Results |

Deliver High Performance, High Value service through operational excellence | ▪Increased our Canadian drilling rig utilization days and well servicing rig operating hours over 2022, maintaining our position as the leading provider of high-quality and reliable services in Canada. ▪Recertified and reactivated a total of four rigs in the Middle East, exiting 2023 with eight active rigs that represent approximately US$475 million in backlog revenue that stretches into 2028. ▪Acquired CWC Energy Services Corp. (CWC), expanding our Canadian well servicing business and drilling fleets in both Canada and the U.S. ▪Upgraded and added the industry's most advanced AC Super Triple rig to our Canadian fleet, equipped with AlphaTM, EverGreenTM, and rig floor robotics. ▪Coached over 900 rig-based employees through our New Employee Orientation focused on industry-leading safety and performance training at our world-class facilities in Nisku, Alberta and Houston, Texas. |

Maximize free cash flow by increasing Adjusted EBITDA(1) margins, revenue efficiency, and growing revenue from AlphaTM technologies and EverGreenTM suite of environmental solutions | ▪Generated cash provided by operations of $501 million, a 111% increase over 2022. ▪Increased our daily operating margins(2) by approximately 39% in Canada and 69% in the U.S. year over year. ▪Grew combined Alpha™ and EverGreenTM revenue by over 10% compared to 2022. ▪Ended the year with 75 AC Super Triple Alpha™ rigs compared to 70 at the beginning of the year. ▪Scaled our EverGreenTM suite of environmental solutions, ending the year with approximately 65% of our AC Super Triple rigs equipped with at least one EverGreenTM product, including 13 EverGreenTM Battery Energy Storage Systems (BESS) versus seven a year ago. ▪Integrated the well servicing assets from our 2022 acquisition of High Arctic Energy Services Inc. (High Arctic), which helped increase our Completion and Production Services’ Adjusted EBITDA(1) 34% in 2023. |

Reduce debt by at least $150 million and allocate 10% to 20% of free cash flow before debt repayments for share repurchases. Long-term debt reduction target of $500 million between 2022 and 2025 and sustained Net Debt to Adjusted EBITDA ratio(1) of below 1.0 times by the end of 2025 | ▪Reduced debt by $152 million and ended the year with more than $600 million of available liquidity(3). ▪Returned $30 million of capital to shareholders through share repurchases. ▪Renewed our Normal Course Issuer Bid (NCIB), allowing purchases of up to 10% of the public float. ▪Ended the year with a Net Debt to Adjusted EBITDA ratio(1) of approximately 1.4 times and remain committed to reaching a sustained Net Debt to Adjusted EBITDA ratio of below 1.0 times by end of 2025. |

Notes:

(1)Non-GAAP measure – see Financial Measures and Ratios on page 48.

(2)Revenue per utilization day less operating costs per utilization day.

(3)Available liquidity is defined as cash plus unused credit facility capacity.

Precision Drilling Corporation 2023 Annual Information Form 3

2023 Highlights

|

Industry Conditions In 2023, even though demand for global energy increased, economic uncertainty and geopolitical instability caused energy prices to compress. In the U.S., WTI averaged US$77.62 per barrel, a decrease of 18% from the prior year, and Henry Hub natural gas prices decreased 59% to average US$2.67 per MMBtu. U.S. producers continued to show capital discipline and, with lower prices, moderating but continued-inflation, and climbing interest rates, reduced their drilling activity 21% throughout the year. In Canada, drilling activity was relatively flat year-over-year as imminent hydrocarbon export capacity and favorable oil pricing, due to a weaker Canadian dollar exchange rate and improving heavy oil differentials, supported activity. |

Capital Expenditures and Asset Decommissioning Our capital spending for the year totaled $227 million, including $164 million for maintenance and infrastructure and $63 million for expansion and upgrades. We decommissioned 20 Canadian and seven U.S. legacy drilling rigs, recognizing an asset decommissioning charge of $10 million. See Financial Measures and Ratios on page 48. |

CWC Energy Services Corp. Acquisition On November 8, 2023, Precision acquired all of the issued and outstanding common shares of CWC for consideration of $14 million in cash and the issuance of 947,807 Precision common shares. Precision expects to deliver approximately $20 million in annual operating synergies. As of March 4, 2024, Precision has achieved headcount and operational annual run-rate synergies of approximately $13 million. |

International Drilling Contracts In 2023, Precision recertified and reactivated a total of four rigs in the Middle East, exited the year with eight active rigs, three in the Kingdom of Saudi Arabia and five in Kuwait. The majority of these rigs are under five-year term contracts that stretch into 2027 and 2028. |

Technology Initiatives As of December 31, 2023, Precision had 75 AlphaTM rigs throughout North America compared to 70 at the beginning of the year. Our AlphaTM rigs are fully digitally-enabled, pad-walking AC Super Triples equipped with AlphaAutomationTM and a platform to deploy AlphaAppsTM and AlphaAnalyticsTM. To date, Precision’s AlphaTM rigs have drilled over 3,800 wells in the U.S. and Canada and have been fully commercialized in numerous basins since November 2019. ▪Predictive Maintenance: In 2023, Precision developed, piloted and scaled an industry-leading asset health platform with the first phase focused on mud pump health. This platform leverages operational digital twin technology and Machine Learning models to support field operations. ▪Rig Floor Robotics: The incorporation of a modular fully automated pipe handling system represents a pioneering achievement in the industry, positioning our land drilling rig at the forefront of technological advancement. By collaborating with AlphaAutomationTM, our rig floor robotics offer a comprehensive and seamless automation solution, optimizing operational efficiency and increasing safety standards. |

EverGreenTM Suite of Environmental Solutions Precision’s EverGreenTM suite of environmental solutions encompasses the development and implementation of multiple technologies aimed at quantifying and reducing greenhouse gas emissions at the wellsite. As of December 31, 2023, approximately 65% of our AC Super Triple rigs were equipped with at least one EverGreenTM product, including 13 BESS compared to seven at the beginning of the year. As of December 31, 2023, Precision also had over 60 rigs equipped with dual-fuel engines, natural gas engines and/or grid tie-in technology. See Environmental - EverGreenTM Suite of Environmental Solutions on page 15. |

Debt Repayments In 2023, we repaid $152 million of debt, meeting our debt reduction target of at least $150 million for the year. In 2023, we agreed with the lenders of our Senior Credit Facility to remove certain non-extending lenders from our facility, thereby reducing the total commitment from US$500 million to US$447 million. See Capital Structure – Material Debt on page 25. |

Normal Course Issuer Bid On September 19, 2023, we renewed our NCIB through the facilities of the TSX and NYSE. The NCIB allows us to buyback up to 1,326,321 common shares, or approximately 10% of the public float as of September 5, 2023 for cancellation. For the year ended December 31, 2023, we repurchased and cancelled 412,623 common shares for approximately $30 million. These repurchases were funded from cash flow and accounted for approximately 3% of our available public float. |

Board of Directors In 2023, the Board initiated a search to nominate a third female director to achieve 30% female representation on the Board, as set out in our Diversity Policy. We believe this is an important step to increasing diversity on our Board. |

4 Precision Drilling Corporation 2023 Annual Information Form

2022 Accomplishments

| |

2022 Strategic Priorities | 2022 Results |

Grow revenue through scaling AlphaTM technologies and EverGreenTM suite of environmental solutions across Precision's Super Series rig fleet and further competitive differentiation through ESG initiatives | ▪Grew AlphaTM revenue by over 60% compared to 2021. ▪Increased total paid days for AlphaAutomationTM by over 50% from 2021. ▪Ended the year with 70 AlphaTM rigs, a 49% increase from the beginning of the year. ▪Expanded our commercial AlphaAppsTM to 21 versus 16 a year ago and increased AlphaAppsTM paid days by 15% from 2021. ▪Exited 2022 with seven field deployed EverGreenTM BESS, 15 EverGreenTM Integrated Power and Emissions Monitoring Systems and 21 high mast LED lighting systems. |

Grow free cash flow by maximizing operating leverage as demand for our High Performance, High Value services continues to rebound | ▪Generated cash provided by operations of $237 million, representing a 70% increase over the prior year. ▪Grew our active rig count by 40% in the U.S. and 30% in Canada as compared with 2021. ▪Increased our daily operating margins 41% in the U.S. and 36% in Canada. ▪Acquired High Arctic’s well servicing business and associated rental assets and increased our Completion and Production Services’ Adjusted EBITDA to $38 million versus $6 million in 2021 ▪Awarded four five-year drilling contracts in Kuwait. Our eight long-term contracts will generate steady and reliable cash flow into 2028. |

Utilize free cash flow to continue strengthening our balance sheet while investing in our people, equipment, and returning capital to shareholders | ▪Reduced debt by $106 million. ▪Returned $10 million of capital to shareholders through share repurchases. ▪Reinvested $184 million into our equipment and infrastructure and disposed of non-core and underutilized assets for proceeds of $37 million. ▪Hired and trained over 1,300 people new to the industry and increased our number of field coaches who conducted 155 site visits and provide over 10,000 hours of training. |

2022 Highlights

|

Industry Conditions With positive supply-demand fundamentals for energy, oil and natural gas commodity prices were strong in 2022 but dynamic as geopolitical issues, supply chain disruptions, inflation and climbing interest rates increased economic uncertainty. In the U.S., WTI averaged US$94.23 per barrel, an increase of 39% from 2021, and Henry Hub natural gas prices increased 75% to average US$6.51 per MMBtu. |

Capital Expenditures Our capital spending for 2022 totaled $184 million and by spend category included $121 million for maintenance and infrastructure and $63 million for expansion and upgrades. |

High Arctic Energy Services, Inc. Acquisition On July 27, 2022, we acquired the well servicing business and associated rental assets of High Arctic for an aggregate purchase price of $38 million, payable in cash. The transaction provided Precision with well servicing rigs, related rental assets, ancillary support equipment, inventories and spares, and six additional operating facilities in key basins, four of which are owned. |

International Drilling Contracts On October 19, 2022, we announced Precision was awarded four drilling contracts in Kuwait, each with a five-year term and an optional one-year renewal. The contract awards are for our AC Super Triple 3000 HP rigs. During the year, Precision also signed three rig contracts in the Kingdom of Saudi Arabia to five-year contract extensions. |

Technology Initiatives As of December 31, 2022, Precision had 70 AlphaTM rigs throughout North America, a 49% increase from the beginning of 2022. Our AlphaTM rigs are fully digitally-enabled, pad-walking AC Super Triples equipped with AlphaAutomationTM and a platform to deploy AlphaAppsTM and AlphaAnalyticsTM. Up to December 31, 2022, Precision’s AlphaTM rigs drilled over 2,600 wells in the U.S. and Canada and have been fully commercialized in numerous basins since November 2019. |

EverGreenTM Suite of Environmental Solutions Precision’s EverGreenTM suite of environmental solutions encompasses the development and implementation of multiple technologies aimed at quantifying and reducing greenhouse gas emissions at the wellsite. As of December 31, 2022, Precision had seven BESS, 15 Integrated Power and Emissions Monitoring Systems and 21 high mast LED lighting systems deployed throughout North America. As of December 31, 2022, Precision also had over 60 rigs equipped with dual-fuel engines, natural gas engines and/or grid tie-in technology. |

Precision Drilling Corporation 2023 Annual Information Form 5

|

Debt Repayments In 2022, we repaid $106 million of debt, exceeding our debt reduction target of $75 million for the year. There were no changes to our Senior Credit Facility in 2022, with the covenant relief period for the Senior Credit Facility ceasing September 30, 2022. |

Normal Course Issuer Bid On August 29, 2022, we renewed our normal course issuer bid through the facilities of the TSX and NYSE. For the year ended December 31, 2022, we repurchased and cancelled 130,395 common shares for approximately $10 million. These repurchases were funded from cash flow and accounted for approximately 1.1% of our available public float. |

Board of Directors On October 4, 2022, Lori A. Lancaster was appointed to the Board of Directors. |

2021 Accomplishments

| |

2021 Strategic Priorities | 2021 Results |

Grow revenue and market share through our digital leadership position | ▪Increased revenue by 6% as compared with 2020 as we achieved an average market share of 33% in Canada and 9% in the U.S. ▪Ended the year with 47 AlphaTM rigs, a 21% increase from the beginning of the year. ▪Increased our paid AlphaAutomationTM days by 123% versus the prior year. ▪Expanded our commercial AlphaAppsTM to 16 versus six in 2020 and increased AlphaAppsTM paid days by more than 600% year over year. ▪Negotiated a long-term supply agreement to outfit the balance of the Super Triple rig fleet with AlphaAutomationTM kits, mitigating inflationary pressures and supply chain risk. |

Demonstrate operational leverage to generate free cash flow and reduce debt | ▪Reduced debt by $115 million, exceeding the midpoint of our targeted range. ▪Ended the year with more than $530 million in available liquidity. ▪Returned $4 million of capital to shareholders through share repurchases. ▪Extended our debt maturities with our earliest maturity date now in 2025 as we: ▪issued US$400 million of unsecured senior notes due in 2029, ▪redeemed our 2023 and 2024 unsecured senior notes, and ▪extended the maturity of our Senior Credit Facility to June 18, 2025. ▪Disposed of non-core and underutilized assets for proceeds of $13 million, which included divesting the directional drilling assets for an ownership stake in Cathedral Energy Services Ltd. (Cathedral). |

Deliver leading ESG performance to strengthen customer and stakeholder positioning | ▪Published our second annual Corporate Responsibility Report. ▪Formed our ‘E-Team’ and ‘S-Team’ to develop and implement certain ESG strategies and tactics. ▪Launched Precision’s EverGreenTM suite of environmental solutions during the year. ▪Secured customer commitments to deploy three BESS in the first quarter of 2022 and expect several additional commitments by mid-2022. |

2021 Highlights

|

Industry Conditions In 2021, the return of global energy demand, sustained periods of strong commodity prices and the multi-year period of upstream underinvestment provided a positive backdrop for the oilfield services industry. In Canada, industry activity surpassed pre-pandemic levels as takeaway capacity continued to improve, price differentials shrank and the startup of liquified natural gas (LNG) exports progressed. In the U.S., the active rig count steadily rose throughout the year as producers looked to replenish declining drilled but uncompleted well inventories. |

Environmental, Social and Governance On July 14, 2021, we published our second annual Corporate Responsibility Report that documented our progress in ESG efforts and provided an outline of our ESG strategies, focus areas and performance. |

EverGreenTM Suite of Environmental Solutions On July 14, 2021, we announced the brand launch of our EverGreenTM suite of environmental solutions, bolstering our commitment to reduce the environmental impact of oilfield operations. |

Technology Initiatives As of December 31, 2021, Precision had 47 AlphaTM rigs throughout North America, a 21% increase from the beginning of 2021. |

Capital Expenditures Our capital spending for 2021 totaled $76 million. Our capital spending by spend category included $57 million for maintenance and infrastructure and $19 million for expansion and upgrades. |

6 Precision Drilling Corporation 2023 Annual Information Form

|

Debt Repayment and U.S. Senior Note Offering Our 2021 targeted debt reduction range was $100 million to $125 million. We ended 2021 with a total of $115 million of debt reduction. During 2021, we redeemed and retired the outstanding amounts of our 7.75% senior notes due 2023 (2023 Notes) and 5.25% senior notes due 2024 (2024 Notes) using net proceeds from our 2029 Notes that were issued in June 2021 along with drawings on our syndicated senior credit facility (Senior Credit Facility). In June 2021, we completed a US$400 million offering of 6.875% senior unsecured notes due in 2029 (2029 Notes) in a private placement. |

Directional Drilling On July 23, 2021, we divested our directional drilling business to Cathedral for $6 million. The transaction included the sale of operating assets and personnel from our directional drilling business, including our operations facility in Nisku, Alberta. |

Normal Course Issuer Bid On August 27, 2021, we renewed our NCIB through the facilities of the TSX and NYSE. For the year ended December 31, 2021, we repurchased and cancelled 155,168 common shares for $4 million. These repurchases were funded from cash flow and accounted for approximately 1.2% of our available public float. |

Canadian Emergency Wage Subsidy On April 1, 2020, the Government of Canada announced the Canadian Emergency Wage Subsidy (CEWS) program, which subsidized a portion of employee wages for Canadian employers whose businesses had been adversely affected by the COVID-19 pandemic. The CEWS program benefited Precision and our employees throughout 2021 as it allowed us to retain a higher employment level for Canadian positions within our organization. In 2021, we recognized $24 million of CEWS program assistance that was presented as a reduction to operating and general and administrative expense of $21 million and $3 million, respectively. |

Extensions and Amendments to the Senior Credit Facility On June 18, 2021, we extended the maturity of our Senior Credit Facility’s to June 18, 2025, with US$53 million expiring on November 21, 2023. We also extended and amended certain financial covenants during the covenant relief period for the Senior Credit Facility. |

Precision Drilling Corporation 2023 Annual Information Form 7

BUSINESS SEGMENTS OVERVIEW

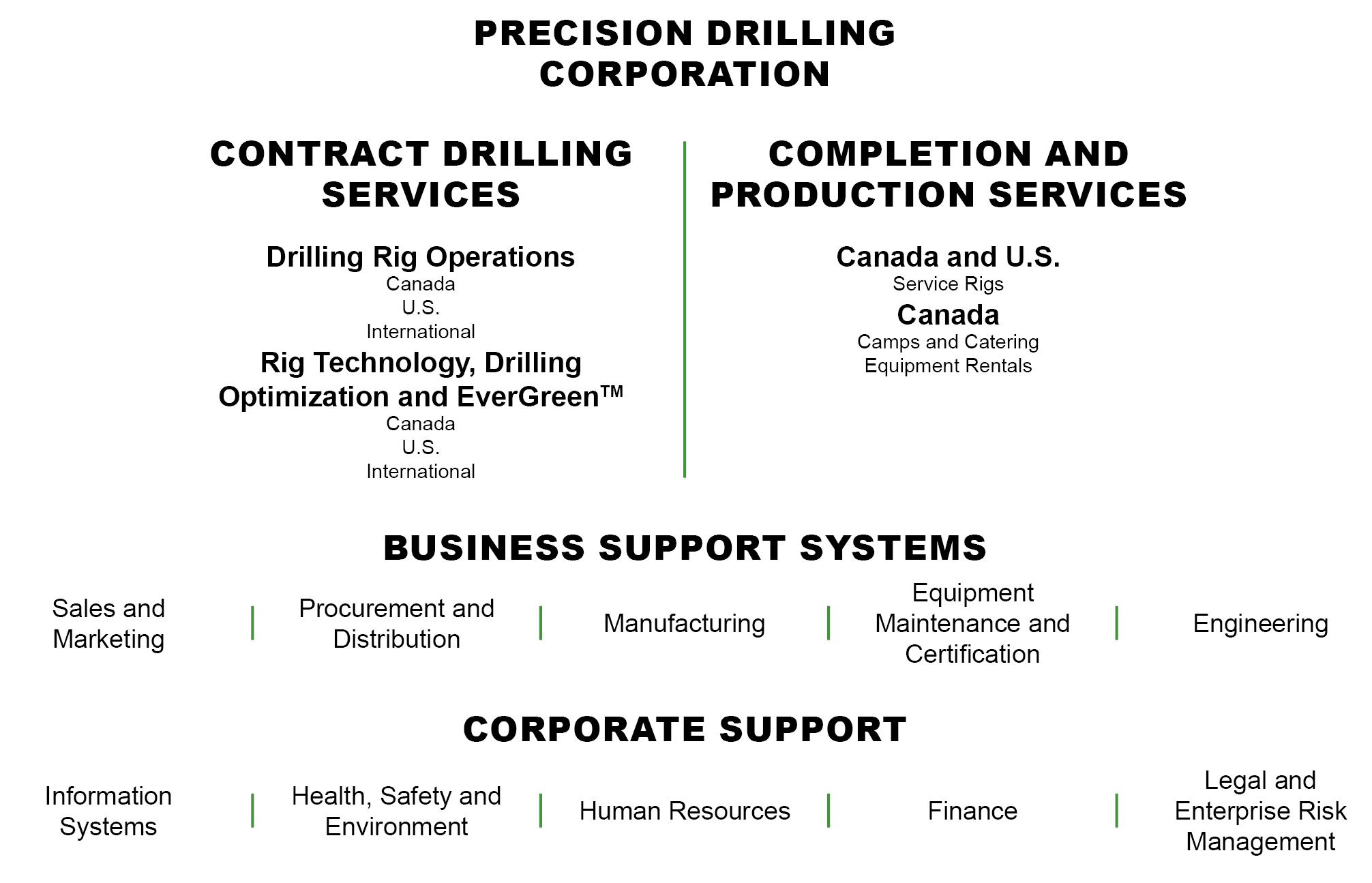

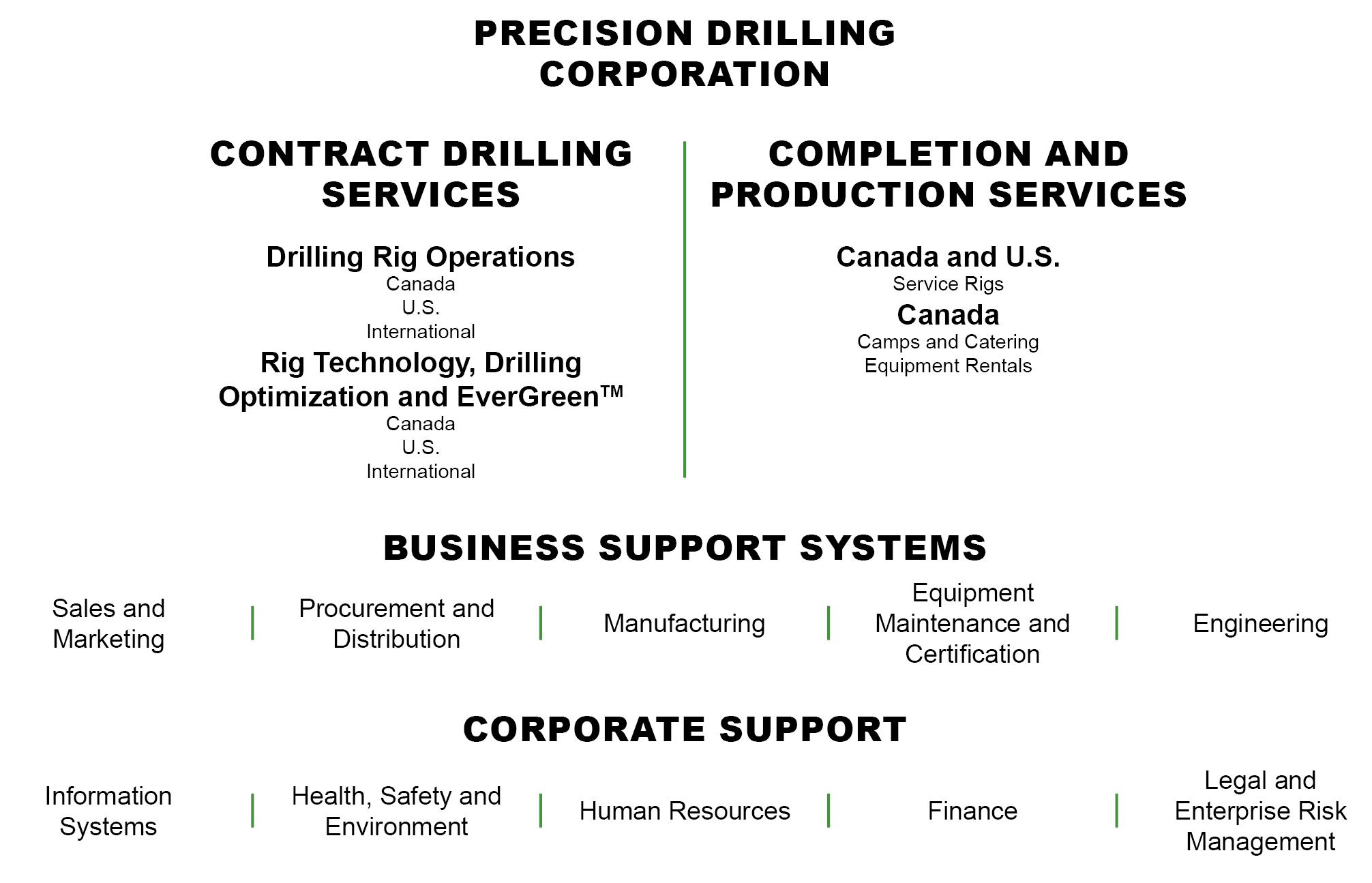

We have two business segments – Contract Drilling Services and Completion and Production Services, which share business support systems and corporate and administrative services.

The following tables summarize our two business segments and the scope of our services:

| | |

CONTRACT DRILLING SERVICES |

Operates our drilling rigs in Canada, the U.S. and internationally and provides onshore well drilling services to exploration and production companies in the oil, natural gas and geothermal industries. At December 31, 2023, the segment consisted of: ▪214 land drilling rigs, including: ▪engineering, manufacturing and repair services, primarily for Precision’s operations ▪centralized procurement, inventory, and distribution of consumable supplies for our global operations ▪diverse offerings from our AlphaTM technologies including: ▪wide array of offerings from our EverGreenTM suite of environmental solutions: – 97 in Canada – 104 in the U.S. – 6 in Kuwait – 4 in Kingdom of Saudi Arabia – 2 in the Kurdistan region of Iraq – 1 in the country of Georgia – 75 AlphaTM rigs with commercial AlphaAutomationTM – 26 commercial AlphaAppsTM – deployed commercial AlphaAnalyticsTM offering – Battery Energy Storage System (BESS) and real-time fuel/emissions monitoring capabilities currently offered across North America – 63 rigs equipped with dual-fuel engines, natural gas engines and/or power grid tie-in technology | Canada | ▪procurement and distribution of oilfield supplies ▪manufacture and refurbishment of drilling and service rig equipment |

U.S. | ▪turnkey drilling services ▪procurement and distribution of oilfield supplies ▪manufacture and refurbishment of drilling and service rig equipment |

International | |

8 Precision Drilling Corporation 2023 Annual Information Form

| | |

COMPLETION AND PRODUCTION SERVICES | | |

Providing completion, workover, and ancillary services to oil and natural gas exploration and production companies in Canada and the U.S. At December 31, 2023, the segment consisted of: ▪183 registered well completion and workover service rigs, including: ▪more than 1,900 oilfield rental items, including surface storage, power generation, and solids control equipment, primarily in Canada ▪102 wellsite accommodation units in Canada ▪736 drill camp beds, 654 base camp beds and 3 kitchen diners in Canada – 173 in Canada – 10 in the U.S. | Canada | ▪well completion and workover service rigs ▪camp and catering services ▪oilfield surface equipment rental |

U.S. | ▪well completion and workover service rigs |

Revenue

| | | | | | | |

Year ended December 31 (thousands of Canadian dollars) | | 2023 | | | 2022 |

Contract Drilling Services | | $ | 1,704,265 | | | $ | 1,436,134 |

Completion and Production Services | | | 240,716 | | | | 187,171 |

Inter-segment eliminations | | | (7,127) | | | | (6,111) |

Total revenue | | $ | 1,937,854 | | | $ | 1,617,194 |

CONTRACT DRILLING SERVICES

Precision Drilling

At the end of 2023, we had a large fleet of land drilling rigs deployed in Canada, the U.S. and internationally:

▪Canada – We operate the largest fleet of land drilling rigs in the country. At year end, we were marketing 97 drilling rigs located throughout western Canada, accounting for approximately 25% of the industry’s estimated fleet of 386 land drilling rigs.

▪United States – At year end, we were marketing 104 land drilling rigs, including 66 AC Super Triple rigs. Our fleet is the fifth largest in the U.S. and accounts for approximately 9% of the country’s Super-Spec land drilling rigs.

▪Internationally – At year end, we were marketing 6 land drilling rigs in Kuwait, 4 in the Kingdom of Saudi Arabia, 2 in the Kurdistan region of Iraq, and 1 in the country of Georgia.

Drilling Contracts

Our contract terms are generally based on the complexity and risk of operations, on-site drilling conditions, the type of equipment used and anticipated duration of work to be performed.

Drilling contracts can be for single or multiple wells and can vary in length from a few days on shallow single-well applications to multiple-year, multiple-well drilling programs for more complex applications. Term drilling contracts typically have fixed utilization rates for a minimum of six months and usually include early termination penalties, escalating costs provisions and contract renewal options. Short-term contracts that provide drilling rigs on a well-to-well basis are typically subject to termination by the customer on short notice or with little or no penalty.

In 2023, we had an average of 62 drilling rigs (34 in the U.S., 22 in Canada and 6 internationally) working under term contracts. Utilization days from term contracts was approximately 50% of our total contract drilling utilization days for the year.

We market our drilling rigs mainly on a regional basis through sales and marketing personnel. We secure contracts to drill wells either through competitive bidding or as a result of business development efforts and negotiations with customers.

Our contracts have been carried out almost exclusively on a daywork basis. Under a daywork contract, we:

▪provide a drilling rig with required personnel, and the customer supervises the drilling of the well

▪charge the customer a fixed rate per day regardless of the number of days needed to drill the well

▪charge the customer a fixed rate per day or a lump sum amount to mobilize the rig to the well site location, rig-up,

rig-down and demobilize the rig to a secure site, and

▪generally, we do not bear any of the costs arising from downhole risks, underground pollution or loss of reserves.

Seasonality

Drilling and well servicing activity is affected by seasonal weather patterns and ground conditions. In Canada and the northern U.S., wet weather and the spring thaw make the ground unstable, resulting in road restrictions that may limit the movement of heavy oilfield equipment and reduce the level of drilling and well servicing activity primarily during the second quarter of the year.

In northern Canada, some drilling sites can only be accessed in the winter once the terrain is frozen, which usually begins late in the fourth quarter. Our business activity depends, in part, on the severity and duration of the winter drilling season. See Risks in our Business, starting on page 29.

Precision Drilling Corporation 2023 Annual Information Form 9

Competition

The land drilling industry is highly competitive with technology increasingly differentiating the market, as customers have transitioned away from vertical wells to more complex directional and horizontal drilling programs. These wells require higher capacity rigs, which typically include AC power, digital control systems, integrated top drives, pad walking systems, highly mechanized pipe handling, and high capacity mud pumps. These rigs have recently been referred to as Super-Spec. Consequently, the rig market has been shedding older, low-technology rigs in favour of Super-Spec rigs as they are more powerful, efficient, and better suited for horizontal wells and resource development programs. Increasingly, digital technologies and rig-based software are becoming enablers of efficiency, and as a result, are in demand from our customers.

In the U.S., the top five land drillers own approximately 85% of the rigs referred to as Super-Spec. In Canada, the top four land drillers own virtually all of these rigs.

Competitive Strategy

The core of our competitive strategy lies in our commitment to provide High Performance, High Value services to our customers. We deliver High Performance through the dedication of our passionate people bolstered by our robust business systems, cutting-edge drilling technology, quality equipment and infrastructure designed to optimize results and mitigate risks. We create High Value by prioritizing safety and sustainability, thereby reducing risks and costs to our customers while enhancing efficiency, developing our people and striving to generate superior financial returns for our investors.

In the early 1990s Precision designed and branded its Super Single rig that is ideally suited for long-term conventional heavy oil development in the oil sands and other heavy oil plays. In 2010, Precision introduced and branded its Super Triple rig, which is well suited for large pad horizontal drilling. Our Super Series fleet meets or exceeds the industry term Super-Spec that was recently adopted.

We keep customer well costs down by maximizing operating efficiency and minimizing environmental impact in several ways:

▪using innovative and advanced drilling technology, including our AlphaTM and EverGreenTM offerings, that is efficient, reduces costs and minimizes impact on the environment

▪having equipment that is geographically dispersed, reliable and well maintained

▪monitoring our equipment to minimize mechanical downtime

▪managing operations effectively to keep non-productive time to a minimum

▪staffing well trained crews, with performance measured against defined competencies

▪incentivizing our executives and eligible employees based on performance against safety, operational, employee retention, strategic, ESG and financial measures, and

▪employing industry-leading alternative rig energy sources and fuel monitoring to reduce emissions and cost.

We have a footprint in all of the most active North American resource plays, including the Deep Basin, Bakken, Cardium, Duvernay, Montney, Viking, Clearwater, and other heavy oil formations in Canada and Cana Woodford, Eagle Ford, Granite Wash, Haynesville, Marcellus, Mid-Continent, Niobrara, Permian, Powder River, Rocky Mountains, Utica and Williston in the U.S.

Drilling Fleet

Our primary focus revolves around delivering efficient and cost-reducing drilling technologies that are designed to minimize environmental impact. Design innovations and technology improvements, such as multi-well pad capability and rapid mobility between wells, capture incremental time savings during the drilling process. Precision has invested over $3 billion in its drilling rig fleet since 2010, adding over 125 Super Single and Super Triple drilling rigs during the period. With one of the newest and most technically capable fleets in North America and the Middle East, Precision’s Super Series rigs have been designed for industrial-style drilling: highly efficient, mobile, safe, controllable, upgradable, and able to act as a platform for digital and emission-reducing technology delivery to the well location. Precision has completed relatively low-dollar cost upgrades over the past several years, including additions of walking systems, higher pressure and capacity mud pumps, increased torque and setback capacity, AlphaAutomationTM and AlphaAppsTM technology, EverGreenTM solutions, and most recently rig floor robotics. Precision’s Super Series drilling rig fleet meets the industrial-style drilling requirements of our customers in North America and deep, high-pressure/high-temperature drilling projects internationally. On November 8, 2023, we acquired CWC, adding seven marketed drilling rigs in Canada and 11 marketed drilling rigs in the U.S., including seven AC triple rigs. As of December 31, 2023, we had 214 rigs in our fleet including 48 Super Singles and 101 AC Super Triples.

AlphaTM Technologies

Precision is a leading provider of digital technologies that automate key processes of the drilling cycle and significantly improves the efficiency of the downhole function. We partner with various industry leaders to develop a widespread portfolio of technology offerings which include: AlphaAutomationTM, AlphaAppsTM and AlphaAnalyticsTM. To date, Precision has drilled over 3,800 wells with AlphaAutomationTM, which includes approximately 1,200 wells drilled in 2023, enhancing the performance and value of our Super Triple drilling rig fleet. As at December 31, 2023, the Company had 75 AlphaAutomationTM systems commercialized across various basins in the U.S. and Canada, which support an open platform to host multiple in-house, customer-developed or third-party applications. Precision currently has 26 commercial AlphaAppsTM and offers our AlphaAnalyticsTM data services to further enhance the value proposition of our digital offering.

10 Precision Drilling Corporation 2023 Annual Information Form

EverGreenTM Suite of Environmental Solutions

In 2021, we launched our EverGreenTM suite of environmental solutions, bolstering our commitment to reduce the environmental impact of oilfield operations. Our EverGreenTM suite of environmental solutions is comprised of EverGreenMonitoringTM, EverGreenEnergyTM and EverGreenTM Fuel Cell. We aim to provide the cleanest, most efficient and most cost-effective rig power sources for our customers through our EverGreenEnergyTM offerings, and our EverGreenMonitoringTM systems, which deliver the fuel and emissions data that allow our customers to monitor their gains in real time and track their emissions. We tested, field hardened, and implemented our BESS and fuel monitoring system in 2022. We have multiple commercial agreements in place for our EverGreenTM products as approximately 65% of our Super Triple rigs are equipped with at least one EverGreenTM solution, including 13 BESS and 26 field monitoring systems as of December 31, 2023.

International

Grey Wolf International (Grey Wolf) is our platform and market brand for our international oil and natural gas drilling market. Grey Wolf is currently active in Kuwait and the Kingdom of Saudi Arabia and continues to explore opportunities in various additional international markets. International oilfield service operations involve relatively long sales cycles with bidding periods, contract award periods and rig mobilization periods measured in months. Grey Wolf has a regional office in Dubai, United Arab Emirates.

Manufacturing

Based in Calgary, Alberta, Rostel Industries manufactures drilling rigs and equipment and refurbishes components for our drilling and service rigs as well as third-party equipment. Rostel Industries supports our vertical integration, and approximately 76% of its revenue in 2023 was related to Precision business. Having the in-house ability to repair and provide new components for our drilling and service rigs improves the efficiency and reliability of our fleets.

Oilfield Supply

Columbia Oilfield Supply in Canada and Precision Drilling Oilfield Supply in the U.S. utilize general oilfield supply warehouses that procure, package and distribute large volumes of consumable oilfield supplies for our rig sites. Our supply warehouses achieve economies of scale through bulk purchasing and standardized product selection as well as coordinated distribution to Precision rig sites. Columbia Oilfield Supply and Precision Drilling Oilfield Supply play a key role in our supply chain management. In 2023, 99% of Columbia Oilfield Supply and 100% of Precision Drilling Oilfield Supply activities supported Precision operations. These operations leverage our procurement volumes to lower costs and reduce the administrative workload for field personnel, enhancing our competitiveness.

Employees

In the oilfield services industry, the market for experienced personnel is inherently competitive due to the cyclical nature of the work, uncertainty of continuing employment, and generally higher employment rates during periods of high oil and natural gas prices and drilling activities. Our unwavering commitment to safety performance and our established reputation plays a crucial role in attracting and retaining experienced, well-trained employees, including when the industry experiences crew shortages during peak operating periods, ensuring our sustained success in a competitive landscape.

Throughout the year, we conducted ongoing assessments of our workforce, placing a strategic emphasis on the recruitment of skilled personnel to fulfill technical roles essential for advancing our drilling optimization initiatives and AlphaTM suite of technologies. In 2023, our workforce averaged 5,000 employees, reaching a peak of 5,560.

These efforts reflect our commitment to assembling a capable and proficient team to drive innovation and excellence in the deployment of cutting-edge technologies within our operations.

Bench Strength and Recruiting

We utilize proven formal procedures to retain key drilling personnel (including drillers, rig managers, and field superintendents) during reduced drilling activity periods. Drillers are often temporarily repositioned to lower positions and return as a driller once drilling activity increases. This practice allows us to meet drilling demand and retain qualified employees. We also rely on our industry-leading recruiting programs to attract new drilling personnel. Our initial recruiting focus for entry-level positions is outreach to our extensive alumni network, supplemented by job postings and other recruiting efforts that attract industry personnel as well as new people to the oilfield services industry. New drilling personnel receive intensive onboarding and training.

Technical Support Centres

We operate two contract drilling technical centres, one in Nisku, Alberta and one in Houston, Texas, and one completion and production technical centre in Red Deer, Alberta. These centres accommodate our technical service and field training groups and consolidate field support and training for our operations. The Houston and Nisku facilities have fully-functioning training rigs with the latest drilling technologies. Also, our Houston facility accommodates our rig manufacturing group. In 2023, we trained more than 4,300 people at our technical centres.

Precision Drilling Corporation 2023 Annual Information Form 11

Our Global Field Competency Program ensures that our field operations employees obtain competency levels for their current position and potential future positions. The program defines specific skills and learning pathways for certain jobs and identifies any skill gaps that an individual employee is required to remedy. The Global Field Competency Program supports our broader corporate vision and strategy by ensuring our drilling personnel provide High Performance, High Value services to our customers. In 2023, we completed over 2,000 competency assessments throughout North America.

COMPLETION AND PRODUCTION SERVICES

Precision Completion and Production Services

Precision offers a versatile fleet of service rigs for well completion, workover, abandonment, maintenance and re-entry preparation services. The fleet is strategically positioned throughout western Canada and in the northern U.S.

Well Servicing Activities

Well servicing jobs are typically of short duration and generally conducted during daylight hours, so it is important for a service rig to be close to customer demand and be able to move quickly from one site to another. Well servicing requires a unique skill set as crews must deal with the potential dangers and safety concerns of working with pressurized wellbores. Completion and workover services can take a few days to several weeks to complete depending on the depth of the well and the complexity of the completion or workover.

On November 8, 2023, we acquired CWC Energy Services Corp. The acquisition further increased the size and scale of our Canadian well servicing operations, adding 62 marketable well service rigs to our service rig fleet along with ancillary and spare equipment and operating facilities in complimentary operating basins.

At the end of 2023, Precision Well Servicing had an industry leading market share in Canada, based on operating hours, of approximately 25% of total industry operating hours. The total Canadian industry well servicing fleet average is approximately 455 service rigs. Our fleet of 173 service rigs is the largest in western Canada. Precision has an additional 231 well completion and workover service rigs in Canada that are not registered with the industry association.

In 2023, Precision Completion and Production Services operated 10 service rigs in the United States.

Service Rig Fleet

The table below shows the configuration of Precision’s marketed well servicing fleet in Canada, as at December 31, 2023. The fleet’s operating features are detailed on our website.

| | | | | | | |

Type of Service Rig | | | Size/Capability | | Total | |

Mobile Rigs | | | | | | | |

▪Highly mobile, efficient rig up and rig down, minimal surface disturbance, freestanding design eliminates anchoring | | | Single | | | 96 | |

| | Double | | | 67 | |

| | | Slant | | | 10 | |

Total1 | | | | | | 173 | |

1Does not include 231 additional service rigs in Canada that are not registered with the Canadian Association of Energy Contractors (CAOEC).

Service Rig Activities

Well servicing operations have two distinct functions – workovers and abandonments, and completions. The demand for completion services is generally more volatile than for workover services.

Of our total oil and natural gas well service rig activity in Canada in 2023:

▪workovers and abandonments accounted for approximately 89%, and

▪completions accounted for approximately 11%.

Workovers and Abandonments – Workover services are generally provided according to customer preventive maintenance schedules or on a call-out basis when a well needs major repairs or modifications. Workover services generally involve remedial work such as repairing or replacing equipment in the well, enhancing production, re-completing a new producing zone, recovering lost equipment or abandoning the well.

Producing oil and natural gas wells generally require some type of workover or maintenance during their life cycle. The demand for production or workover services is based on the total number of existing active wells and their age and producing characteristics.

Completions – Customers often contract a specialized service rig to take over from a larger, more expensive drilling rig to prepare a newly drilled well for initial production. The service rig and crew work jointly with other services to open and stimulate the wellbore producing zones for initial production.

The demand for well completion services is generally related to the level of drilling activity in a region.

12 Precision Drilling Corporation 2023 Annual Information Form

Precision Rentals

Precision Rentals provides more than 1,900 pieces of oilfield rental equipment for rental to customers from three operating centres and 12 stocking points throughout western Canada, supported by a technical service centre in central Alberta.

Precision Rentals has four distinct product categories:

▪surface equipment (including environmental invert drilling mud storage, hydraulic fracturing fluid storage, production tanks and other fluid handling equipment)

▪wellsite accommodations (fully equipped units that provide on-site office and lodging for field personnel)

▪power generation equipment, and

▪solids control equipment.

Precision Camp Services

Precision Camp Services provides food and accommodation to personnel working at remote locations in western Canada. At the end of 2023, Precision Camp Services had 32 drill camps and base camp dormitories along with kitchen or diners to accommodate 614 people in western Canada. Each drill camp includes six building units that typically accommodate 20 to 25 rig crew members and other personnel.

Precision Camp Services has also configured several camps and dormitories to provide housing and meals for base camps with up to 500 personnel on separate major projects in western Canada. As the oil and natural gas industry searches for new reserves in more remote locations, crews need to stay near the worksite, often in camps, throughout the duration of a drilling program. Precision Camp Services serves Precision and other companies in the oil and natural gas sector and, from time to time, other industries operating in remote locations.

Precision Drilling Corporation 2023 Annual Information Form 13

ESG in All We Do

In 2023, we remained steadfast in our commitment to prioritize key Environmental, Social, and Governance (ESG) aspects identified as material to Precision through our 2020 materiality assessment. We remain dedicated to adopting proactive and sustainable means to ensure ESG is accounted for in all that we do. Our “E” (Environmental) and “S” (Social) teams, comprised of high-performing employees from throughout the organization, work collaboratively to drive environmental and social initiatives.

In 2023, we transitioned the ESG highlights shared in our annual Corporate Responsibility Report onto our website, where the information represents not just a single snapshot of the year, but portrays a frequently updated view of our ESG efforts.

The expansion of our Short-Term Incentive Plan (STIP) goals in 2021 to include ESG goals beyond health, safety, and environmental (HSE) targets, highlighted our focus on accelerating the evaluation, testing, implementation, and commercialization of several lower-carbon energy sources, monitoring systems, and energy-efficient equipment substitutions and modifications. In 2023, we expanded further on those goals, by including social and governance qualitative and initiative-based metrics, creating an even stronger incentive for our employees to contribute toward these efforts. We exceeded the targeted metrics in 2023, resulting in even greater environmental and associated financial gains for us and for our customers.

Our Board plays a pivotal role in overseeing the Corporation’s commitment to ESG. This oversight encompasses the formulation of approaches, strategic planning, performance evaluation, monitoring processes, and disclosure practices. Annually, the Board conducts a thorough review of both Board and committee charters, ensuring alignment with sustainability objectives. Additionally, the Board receives quarterly reports detailing ESG mapping, materiality assessments, and a comprehensive analysis of ESG-related risks.

In 2024, we will continue to share our Corporate Responsibility highlights on our website. We have maintained our alignment with Sustainability Accounting Standards Board (SASB) and Task Force on Climate Related Financial Disclosures (TCFD) frameworks and will continue to publish ESG performance data for the preceding year. For more detailed information on our ESG efforts, please visit our website.

Our Commitment to Corporate Responsibility

In 2023, we continued to deliver on our multi-year corporate responsibility strategy by developing and completing the following initiatives:

▪disclosing Greenhouse Gas (GHG) emissions data, including Scope 1 and Scope 2 emissions

▪expanded the impact of our “E” and “S” teams to drive intentional environmental and social efforts across the organization and with our customers

▪further expanded the ESG goals in our STIP scorecard to incentivize innovation within our own organization and with our customers

▪increased investment in the EverGreenTM product line, growing and differentiating our products and technologies aimed at reducing environmental impact

▪partnered with our customers to mobilize 11 additional independent emissions monitoring or reduction systems

▪conducted our search for a third female director for Precision's Board that will stand for election as a nominated director at Precision's 2024 Annual Meeting of Shareholders

▪continued expansion and development of relationships with Indigenous Groups, actively participating in collaborative initiatives and offering training opportunities

▪published our Human Rights Policy and strengthened our supply chain procedures to ensure full compliance with the Forced Labour and Child Labour Act in Canada

▪continued our long-term strategic alliance with Shock Trauma Air Rescue Services (STARS) in Canada and collaborated with multiple non-profit and industry organizations across North America

▪increased employee volunteer hours year over year

▪continued an ongoing formal remote work program for our office-based employees

▪conducted ransomware drills, identifying and mitigating potential challenges to our response processes, and

▪continued our summer internship program, employing 51 interns from 28 universities.

14 Precision Drilling Corporation 2023 Annual Information Form

ESG Materiality

In accordance with our 2020 materiality study, the following areas remain our focus for 2023.

ENVIRONMENTAL

Target Zero and Climate Change Stewardship

Our Health, Safety and Environmental strategy continues to guide us toward Target Zero – which is our commitment to minimize any occupational injuries, illnesses and environmental harm from our footprint while conducting business. We recognize climate change is an important global risk and we actively monitor developments that have the potential to impact our business, our customers, and the environment.

We publicly disclose emissions associated with our direct operations and those we conduct on behalf of our customers. This data is being used to identify opportunities to reduce emissions through efficiency gains, alternate forms of energy, and hydrocarbon fuel use reductions across all operations.

While many operational decisions are still within the control of our customers, we continue to commit a significant amount of our internal resources to develop technology to ensure that the safest and most environmentally friendly drilling options are also the best financial options for our customers. In 2023, this focus facilitated the continued increase in adoption of our AlphaTM technologies and our EverGreenTM suite of environmental solutions such as BESS and real-time fuel consumption and emissions monitoring equipment.

Environmental goals were expanded significantly for 2023, with challenging targets laid out for our operations, technical, and marketing teams. These included:

| |

STIP Target Area | Results |

Deploy GHG emission monitoring / quantification systems | 11 Integrated Power & Emissions Fuel Monitoring Systems (Monitoring Systems) deployed in the field, including real-time monitoring dashboards |

Implement lower carbon / premium green power systems or technologies | 50 lower carbon power systems and technologies deployed in the field, with additional systems contracted for deployment in 2024 |

Initiate environmental initiatives targeting Company facilities, fleet, or controlled operations | Currently in assessment phase of LED lighting projects for three facilities to reduce energy consumption |

Commercialize new low carbon / premium green power systems or technologies | 2 systems deployed in the field, Maestro Engine Management System and EverGreenTM Highline Power Package |

EverGreenTM Suite of Environmental Solutions

Precision’s EverGreenTM suite of environmental solutions was launched in 2021, differentiating new and existing products specifically aimed at quantifying and reducing the environmental impact of drilling operations at the wellsite.

As part of our EverGreenTM product line, our BESS has now been field hardened and proven to provide significant reductions in hydrocarbon fuel use, and in turn a similar reduction in emissions and fuel cost. A successful launch of this technology in 2021 quickly expanded and we had 13 BESS deployed as of December 31, 2023. Further BESS deployments are scheduled for customer implementation throughout 2024.

We also saw significant adoption of our Monitoring Systems, a part of our EverGreenTM product line, which is capable of measuring and communicating real-time wellsite GHG emissions. 11 Monitoring Systems were installed in 2023, with additional units scheduled to come online throughout 2024. These Monitoring Systems provide us and our customers with real-time insight into the correlation between power demand, fuel consumption, and resulting GHG emissions throughout the well construction process, and allow capture and analysis of this data across different rigs, well profiles, engine types, and geographic areas. This knowledge source is meaningful to help improve both our and our customers’ understanding of the variability of land drilling GHG emissions and help operate power generating equipment with optimal fuel consumption and carbon footprint efficiency.

Precision Drilling Corporation 2023 Annual Information Form 15

SOCIAL

Our Corporate Culture

We are committed to cultivating a work environment where employees feel safe, respected, and valued. We recognize the importance of building a culture that will provide us with a competitive advantage over not only our direct peers in the oilfield services industry but also other employers in the areas where we operate. To fortify our culture, the “S” Team which is comprised of a team of our employees from around the globe, surveys our population of employees and brings a wide range of ideas and perspectives for our senior management team and the Board to assess and take action, when necessary.

Our Board actively champions a collaborative and transparent culture fostering an atmosphere where employees are encouraged to express their thoughts freely, and management actively listens to feedback. To gauge and enhance our organizational culture, we regularly conduct focus groups and launch Leadership and Culture surveys with our employees in the field and in our corporate offices. The insights gathered from these surveys are invaluable in understanding our strengths and identifying areas for improvement. Subsequently, we synthesize this information, formulate action plans, and share the feedback with the Board, reinforcing our commitment to continuous improvement and an inclusive workplace.

Our Core Values and Key Beliefs

Our Core Values and Key Beliefs (which can be accessed on our website) successfully promote a culture of integrity and accountability. Our Core Values drive our culture, as they are foundational to how we approach our business. From the top down, the commitment to these values helps ensure we are moving in the right direction with a ‘Down to Earth’ common sense purpose among our employees. Our Key Beliefs are fundamental to how we operate our business every day. They are how we want our employees to act, interact, and be perceived. By creating a feeling of personal ownership and a culture of hard work, innovation and productivity, our Core Values and Key Beliefs encourage an environment that brings out the best in everyone.

Employee Safety and Training

Employee safety is embedded in all that we do at Precision, from job planning and change management to the critical task assessments and safety observations our employees perform every day. We deliver High Performance, High Value service to our customers without compromising the health and safety of our employees or those in the communities where we work.

Precision’s commitment to providing industry-leading comprehensive training and development to our employees can be seen through the extensive instructor-led and virtual courses as well as face-to-face coaching. In 2023, over 63,000 employee training hours were focused on Precision’s culture, rig roles and responsibilities, well control, tools and equipment, HSE standards, leadership and communication at one of our two world-class training facilities, located in Nisku, Alberta and Houston, Texas. Additionally, we increased our rig-site training in the second half of 2023 with over 10,000 employee training hours during 372 rig visits.

A specific focus on new employee development is driven through our Short-Service Employee (SSE) program, which is catered to rig-based employees with low levels of experience to ensure they are well-positioned for long-term success at Precision. During the first six months with Precision, these employees are paired with a mentor and put through various tasks under supervision to ensure they adapt to our culture, develop a safety-first mentality, and enable them to perform their duties to the best of their ability. In 2023, we dedicated over 15,000 SSE-specific training hours to approximately 990 employees who were new to the industry.

Employee Wellness

At Precision, we prioritize the well-being of our employees by providing them with comprehensive tools and support to care for both their mental and physical health. Precision offers competitive benefit packages to all eligible employees throughout the organization, including health, vision, and dental plans. We also offer a multitude of formal programs to assist employees in achieving physical, mental, and financial well-being, including our Employee Assistance Program that provides confidential counseling for personal issues, financial planning resources, beneficiary financial counseling, will preparation, and legal assistance, and telemedicine services to support our employee population located in areas with lesser access to healthcare services.

Diversity, Equity and Inclusion

Employee Diversity, Equity and Inclusion

Delivering strong operational and financial results in today’s environment requires the expertise and positive contributions of every member of the Precision Team. Committed to harnessing a diverse range of thoughts, experiences, and points of view; we actively cultivate an inclusive workplace where every employee's unique perspective complements our strategy and decision-making processes. Precision is an inclusive workplace that strives to be free of discrimination, harassment, workplace violence, and retaliation. Our diversity, equity and inclusion policy (Diversity Policy) prohibits discrimination of any kind and promotes diversity and inclusivity among our employees, management, and the Board.

Each year our employees are required to participate in and complete our Diversity, Equity, and Inclusion, and Harassment, Discrimination and Workplace Violence courses. In 2023, approximately 4,800 employees across the globe completed these

16 Precision Drilling Corporation 2023 Annual Information Form

courses. This commitment underscores our dedication to creating a workplace where all individuals can thrive and contribute their best to our collective success.

Management Diversity

Recognizing the integral role that diversity plays in sustaining our competitive advantage, Precision places a strategic emphasis on increasing diversity at the management level.

The executive leadership team reviews the talent pool regularly and considers the individual’s development, industry experience, background and race and gender representation, as well as other factors before recommending executive appointments to the Board for approval. The Board also considers the representation of women and other diversity factors in executive positions when reviewing the management succession plan and approving executive appointments. We do not have specific gender targets for management as we believe the skills, qualifications and attributes of the candidate and the needs of the organization are paramount.

Currently, 20% (one out of five) of our executive officers are female and 60% (three out of five) of our executive team self-identify as a Diverse Persons(1).

Board Diversity

When recruiting new directors, the CGNRC meticulously evaluates our vision and business strategy, the skills and competencies of the current directors, gaps in Board skills, and the attributes, knowledge and experience new directors should have to enhance our business plan and strategies. The CGNRC also considers diversity as part of this process, including the level of female representation on the Board. When assessing Board composition or identifying suitable candidates for appointment to the Board, the CGNRC will include a slate of Diverse Persons(1) for all open Board seats.

Currently, 25% (two out of eight) of our Board members are female and 63% (five out of eight) of our Board members self-identify as a Diverse Persons(1).

| | | | | |

Position Title | Total Number | Number of Women | % of Women | Number of Diverse Persons(1) | % of Diverse Persons(1) |

Board of Directors(2) | 8 | 2 | 25% | 5 | 63% |

Executive Officers(3) | 5 | 1 | 20% | 3 | 60% |

Notes:

(1)A Diverse Persons includes directors or executives that have self-identified into one or more of the following categories: Racialized Person, Female, LGBTQ2S+, disability and indigenous people (First Nations, Inuit, or Metis). Racialized is derived by the Ontario Human Rights Commission from the concept of “visible minority” defined as person other than Aboriginal Peoples, who are non-Caucasian in race or non-white in color. We have defined 'Disability’ as a person with a physical or mental condition that is permanent, ongoing, episodic or of some persistence, and is a substantial or significant limit on an individual's ability to carry out some of life’s important functions or activities, such as employment.

(2)Board of Directors currently includes seven independent Board members and the President and Chief Executive Officer.

(3)Executive Officers includes the Chief Financial Officer, President, North American Drilling, Chief Administrative Officer, Chief Legal and Compliance Officer, and Chief Technology Officer.

|

The Board remains committed to recruiting a third female director to serve on Precision's Board and achieving 30% female representation on the Board as set out in our Diversity Policy. Upon Shareholders’ approval of our nominated slate of directors at our 2024 Annual Meeting of Shareholders, we will fulfill this commitment. To read more about our nominated slate of directors, please refer to our 2024 Management Information Circular. |

Reporting and Accountability

Our Human Resources department reviews the structure, size, pay equity and composition of our workforce annually and prepares a report for the Chief Administrative Officer and the Chief Executive Officer. Similarly, the executive leadership team meets regularly to assess its optimum composition, and annually provides a report to the CGNRC.

Talent Management

As an industry leader, we are committed to attracting, recruiting and retaining high-performing, Passionate People at every level of our Company. Precision has developed a strong recruitment marketing strategy both in the field and for our corporate support roles, using standard recruitment practices, grassroots efforts and social media applications. We believe that our pay and benefits remain competitive and engages our employees. We have implemented systems and processes that help us execute our talent management strategy to maintain a well-trained, highly competent, and capable talent pool, both in the field and corporate positions with a broad range of business experience throughout market cycles.

University Internship Programs

During 2023, Precision initiated industry exposure efforts by broadening students’ technical education and familiarity with our industry through Career Days. Every year, Precision hosts students from universities and trade schools in our Intern Program. In 2023, we hosted 51 interns from over 28 universities working in Canada and the U.S., with nationalities represented from North and South America, Western and Southern Africa, Southeast Asia, and Northern Europe. We believe our Intern Program provides an important talent pool for our future permanent hires and provides participants with practical experience that cannot be obtained in the classroom and is an excellent introduction to the industry in which we operate.

Precision Drilling Corporation 2023 Annual Information Form 17

Community and Industry Engagement

We are proud to invest in causes that are important to our employees, customers, and the communities where we operate. Throughout 2023, our “PD Cares” corporate giving program contributed to several exceptional health and human services organizations and youth programs.

For over 30 years, one of our proudest partnerships in Canada has been with the STARS Foundation which provides rapid and specialized emergency care and transportation for critically ill and injured patients. STARS operates 24/7 bases in Calgary, Edmonton, Grande Prairie, Regina, Saskatoon, and Winnipeg which are well aligned to provide critical support to remote field operations and employees both on and off the job residing across Western Canada.

In addition to this long-standing partnership, in 2023, Precision employees donated their time and resources to many great organizations, including Camp Kindle, Habitat for Humanity, AutismSpeaks, Alberta Cancer Foundation, City of Houston Parks, Houston Livestock Show and Rodeo, National MS Society, Texas Children’s Hospital, Inn from the Cold, and EvenStart Calgary.

Our commitment to the energy industry is evidenced by our participation in several non-profit organizations, such as the Canadian Association of Energy Contractors (CAOEC), International Association of Drilling Contractors (IADC), Business Council of Alberta, the Modern Miracle Network, the Fraser Institute and Enserva.

Indigenous Relationships

Precision recognizes the history and diversity of Indigenous peoples. Our relationships help create opportunities and deliver outcomes beneficial to our Indigenous partners, the communities in which we all live, and our customers. Precision strives to support local Indigenous communities through ongoing engagement, employment, and mutually beneficial business opportunities. Precision currently has several successful business relationships with Indigenous nations across Western Canada, including joint ventures, collaboration, and benefits agreements. In 2023, we also formalized our Indigenous Relations Policy to acknowledge Precision's commitment to upholding the rights of Indigenous Groups, both in our global operations and within our workplace.

GOVERNANCE

Corporate Governance, Ethics & Compliance

As we strive for sustainable operations, we actively pursue financial, environmental, and social responsibility. Our actions are consistently guided by our Core Values, Key Beliefs, and strong corporate governance principles. We remain committed to ethical behavior through our Code of Business Conduct and Ethics (the Code), along with our comprehensive employment policies and practices. The Board and our external and internal auditors provide oversight and ensure compliance throughout our organization. To maintain the trust of our stakeholders, we promote Board independence, proactively engage with shareholders, assess risk management and uphold principles of ethics and integrity.

Governance Guidelines

Our Corporate Governance Guidelines outline the composition, structure, procedures, and policies that guide our Board. These guidelines undergo an annual review and serve as a guidepost for the Board. Topics pertaining to corporate citizenship, governance and sustainability are also routinely reviewed at meetings of the Board and its committees.

Our Code of Business Conduct and Ethics

At the core of our business practices lies a commitment to ethical behavior. Our Code ensures every director, executive officer, manager, employee, and contractor is aware of Precision’s values. The full text of the Code is available on the Corporate Governance section of our website.

We have a robust, proven corporate governance system that is effective in ensuring a transparent culture. It allows for ethical issues to be reported, assessed, and resolved in a timely manner. This system employs a strong body of policies, enforcement mechanisms and a closed-loop resolution process of issues that are reported.

The Code addresses the following key areas, among others:

| |

▪financial reporting and accountability ▪maintaining confidentiality ▪avoiding conflicts of interest ▪complying with laws and regulations ▪safeguarding corporate assets ▪reporting illegal or unethical behavior | ▪data and privacy security ▪bribery and corruption, and ▪harassment and discrimination |