| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206361-14 |

| | | |

| May [15], 2018 | JPMDB 2018-C8 |

Free Writing Prospectus Structural and Collateral Term Sheet |

JPMDB 2018-C8 |

| |

| |

| |

| |

| |

| |

| |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Deutsche Bank Securities Inc., Drexel Hamilton, LLC and Academy Securities, Inc., (each individually, an “Underwriter”, and together, the ’‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-206361) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk atabs_synd@jpmorgan.com. THE SECURITIES TO WHICH THIS INFORMATION RELATES WILL BE MORE FULLY DESCRIBED IN A PROSPECTUS (THE “PROSPECTUS”), WHICH IS NOT YET AVAILABLE. THEPROSPECTUS WILL CONTAIN MATERIAL INFORMATION THAT IS NOT CONTAINED IN THESE MATERIALS (INCLUDING WITHOUT LIMITATION A DETAILED DISCUSSION OF RISKS ASSOCIATED WITH AN INVESTMENT IN THE CERTIFICATES, UNDER THE HEADING“RISK FACTORS”IN THEPROSPECTUS). Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS. |

| | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| May [15], 2018 | JPMDB 2018-C8 |

THE REPUBLIC OF KOREA

THIS PROSPECTUS IS NOT, AND UNDER NO CIRCUMSTANCES IS THIS PROSPECTUS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 2 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $713,137,655 |

| | Number of Mortgage Loans: | 41 |

| | Number of Mortgaged Properties: | 69 |

| | Average Cut-off Date Balance per Mortgage Loan: | $17,393,601 |

| | Weighted Average Current Mortgage Rate: | 4.77046% |

| | 10 Largest Mortgage Loans as % of IPB: | 50.9% |

| | Weighted Average Remaining Term to Maturity(1): | 107 months |

| | Weighted Average Seasoning: | 2 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(2)(3): | 1.99x |

| | Weighted Average UW NOI Debt Yield(2): | 11.1% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(4): | 59.7% |

| | Weighted Average Maturity Date LTV(1)(2)(4): | 54.5% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 10.7% |

| | % of Mortgaged Properties with Single Tenants: | 5.3% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(5): | 350 months |

| | Weighted Average Remaining Amortization Term(5): | 349 months |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 35.8% |

| | % of Mortgage Loans with Interest-Only: | 26.1% |

| | % of Mortgage Loans with Amortizing Balloon: | 22.9% |

| | % of Mortgage Loans with Interest-Only followed by ARD structure: | 11.2% |

| | % of Mortgage Loans with Amortization followed by ARD structure: | 4.0% |

| | | |

| Lockbox / Cash Management(6) | |

| | % of Mortgage Loans with Springing Lockboxes: | 50.3% |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 37.1% |

| | % of Mortgage Loans with No Lockboxes: | 7.0% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 5.6% |

| | % of Mortgage Loans with Springing Cash Management: | 83.4% |

| | % of Mortgage Loans with In-Place Cash Management: | 9.5% |

| | | |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 79.6% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 48.7% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(7): | 73.1% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 61.1% |

| | | |

| (1) | In the case of Loan Nos. 1, 8 and 12, each with an anticipated repayment date, Remaining Term to Maturity and Maturity Date LTV are calculated as of the related anticipated repayment date |

| (2) | In the case of Loan Nos. 1, 3, 4, 8, 9, 10, 11, 16, 19 and 27, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 11 and 16, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided on Annex F and Annex G, respectively, to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 5, 9, 13, 21 and 27, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Excludes 8 mortgage loans that are interest-only for the entire term. |

| (6) | For a more detailed description of Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (7) | CapEx Reserves include FF&E reserves for hotel properties. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, mixed use and industrial properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 3 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | |

| GACC(1) | 11 | 11 | $211,770,968 | 29.7% |

| SMF VI | 16 | 20 | 208,141,380 | 29.2% |

| JPMCB(2) | 8 | 25 | 194,191,782 | 27.2% |

| BSP | 6 | 13 | 99,033,525 | 13.9 |

| Total: | 41 | 69 | $713,137,655 | 100.0% |

| (1) | With the exception of Loan Nos. 1, 8, 19, all of the loans for which GACC is the Mortgage Loan Seller were originated by Deutsche Bank, AG, New York Branch (“DBNY”) (an affiliate of GACC). In the case of Loan No. 1, the whole loan was originated by Goldman Sachs Mortgage Company (“GSMC”), which sold the Marina Heights State Farm mortgage loan to DBNY. In the case of Loan No. 8, the whole loan was originated by Cantor Commercial Real Estate Lending, L.P. (“CCRE”) and Prima Mortgage Investment Trust, LLC. CCRE sold the DreamWorks Campus mortgage loan to DBNY. In the case of Loan No. 19, the whole loan was originated by Column Financial, Inc., JPMCB and CCRE. CCRE sold the Lehigh Valley Mall mortgage loan DBNY. |

| (2) | In the case of Loan No. 16, the whole loan was co-originated by JPMCB, GSMC and Wells Fargo Bank, National Association. |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | Mortgage

Loan Seller | No.

of

Prop. | Cut-off Date Balance | % of

IPB | SF/Units/ Rooms/Beds | Property Type | UW

NCF

DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date LTV(1)(2)(3) |

| 1 | Marina Heights State Farm | GACC | 1 | $50,000,000 | 7.0% | 2,031,293 | Office | 3.12x | 11.3% | 58.3% | 58.3% |

| 2 | 1875 Atlantic Avenue | SMF VI | 1 | $42,000,000 | 5.9% | 118 | Multifamily | 1.43x | 7.1% | 60.7% | 60.7% |

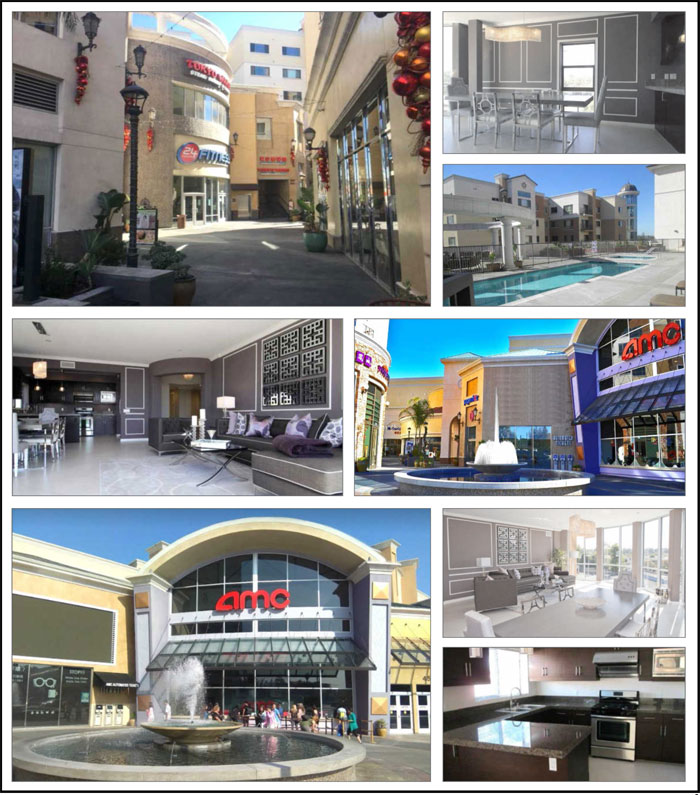

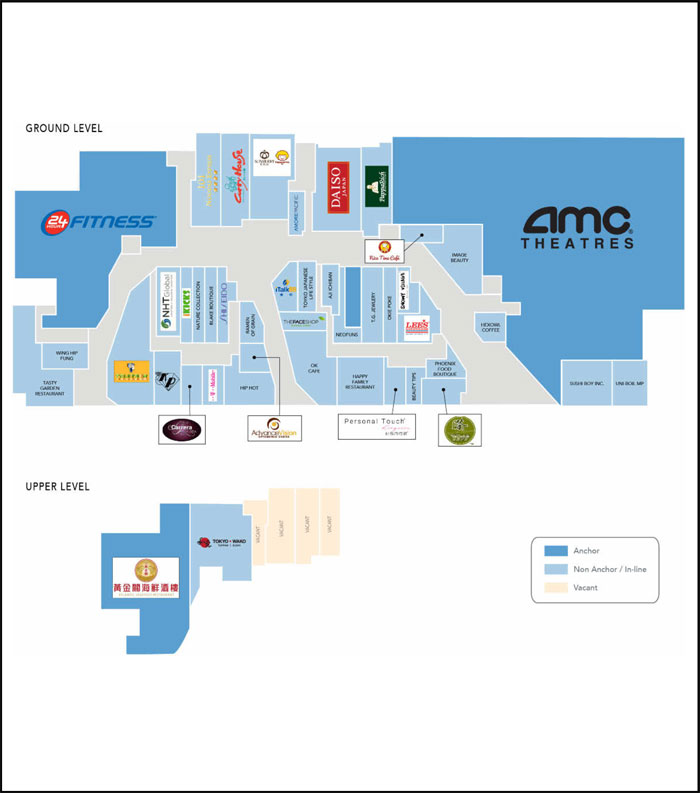

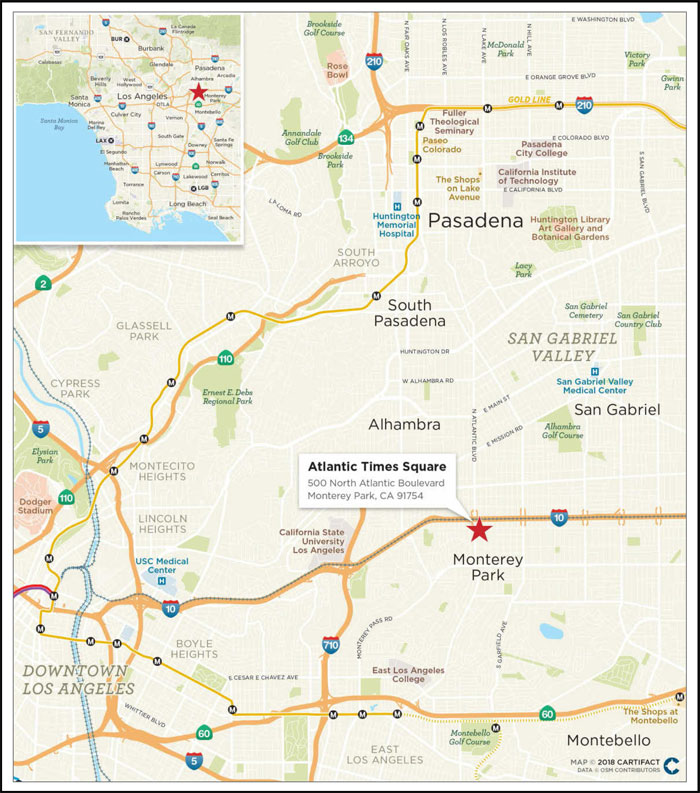

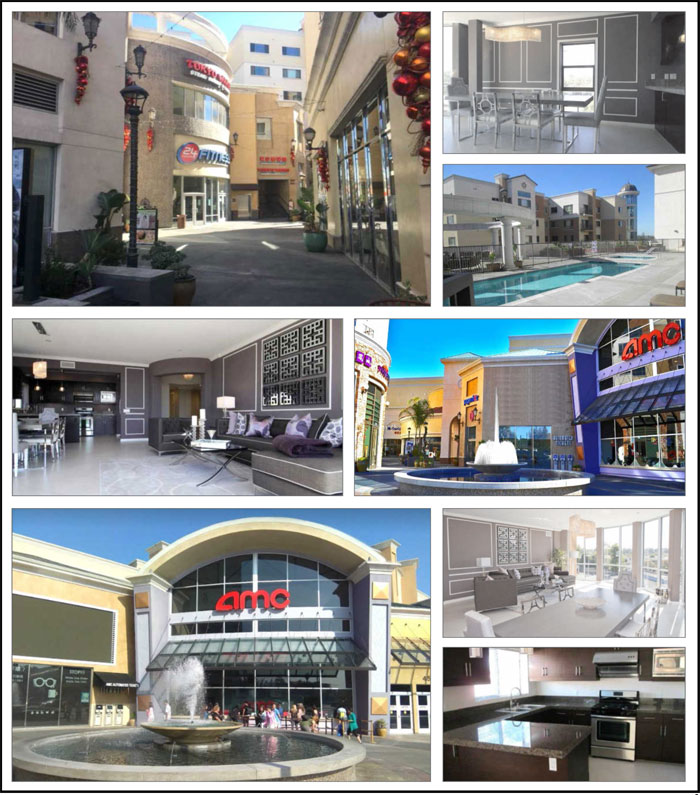

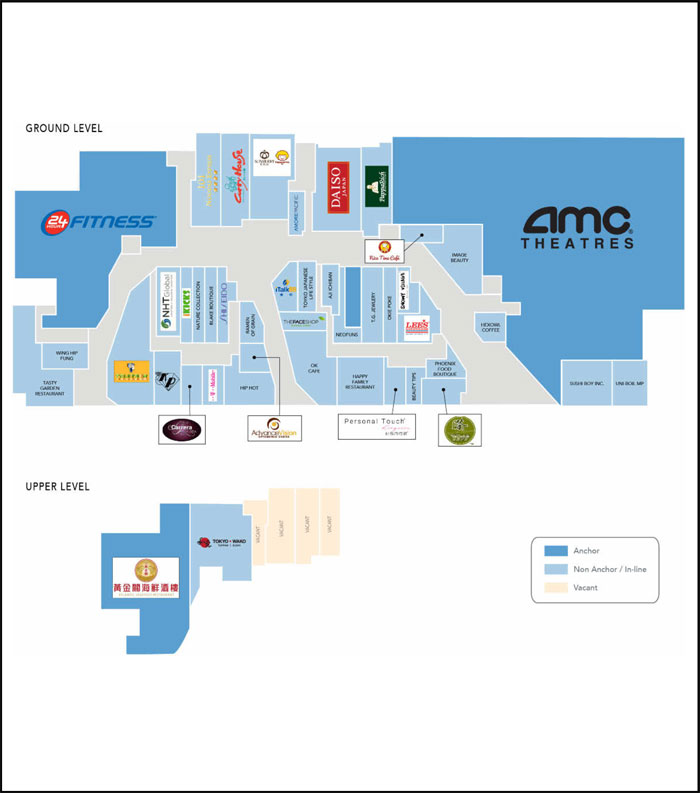

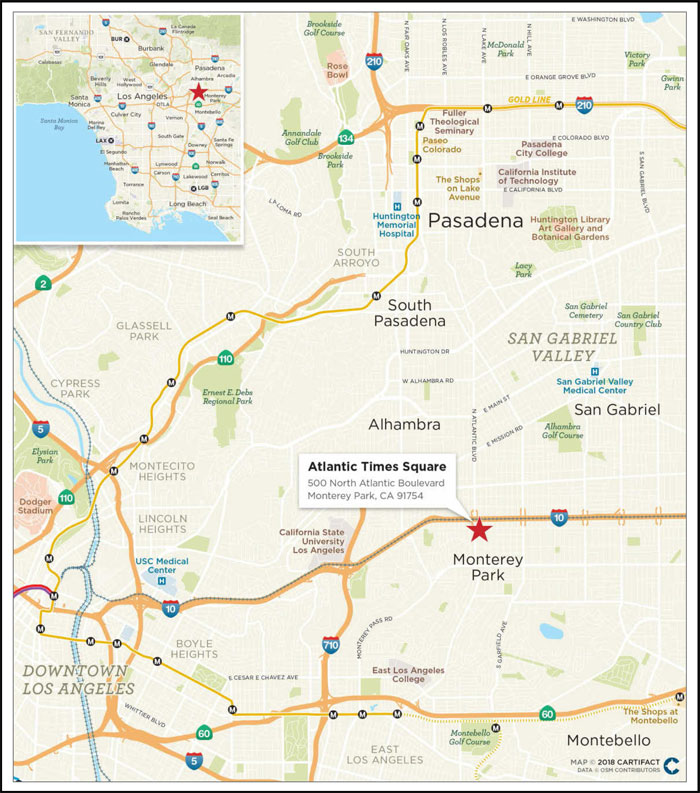

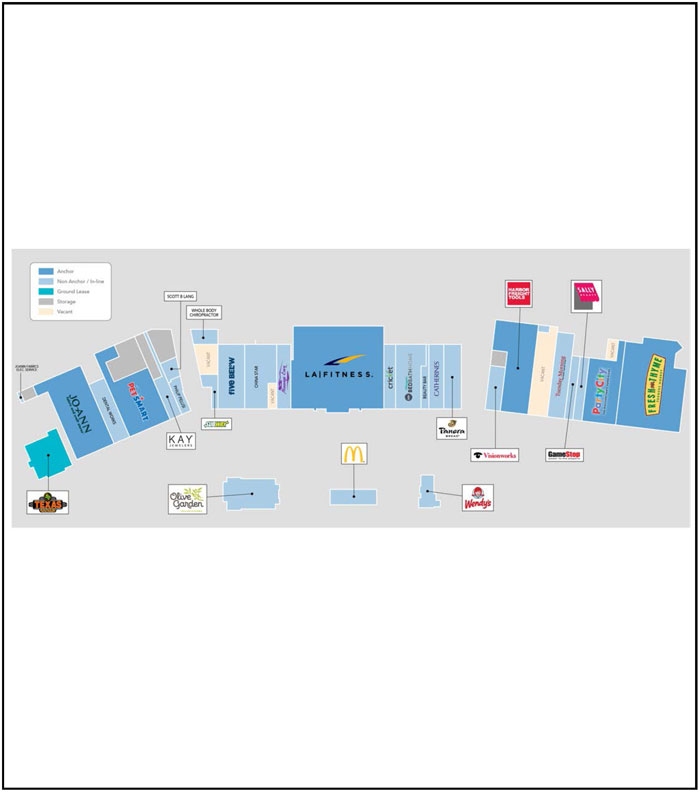

| 3 | Atlantic Times Square | JPMCB | 1 | $40,000,000 | 5.6% | 379,376 | Mixed Use | 1.86x | 9.5% | 59.8% | 59.8% |

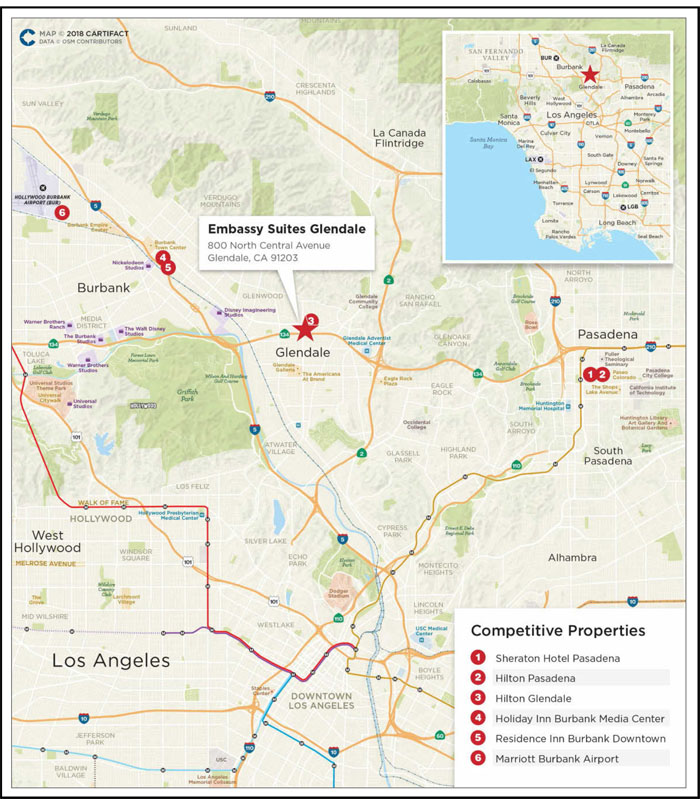

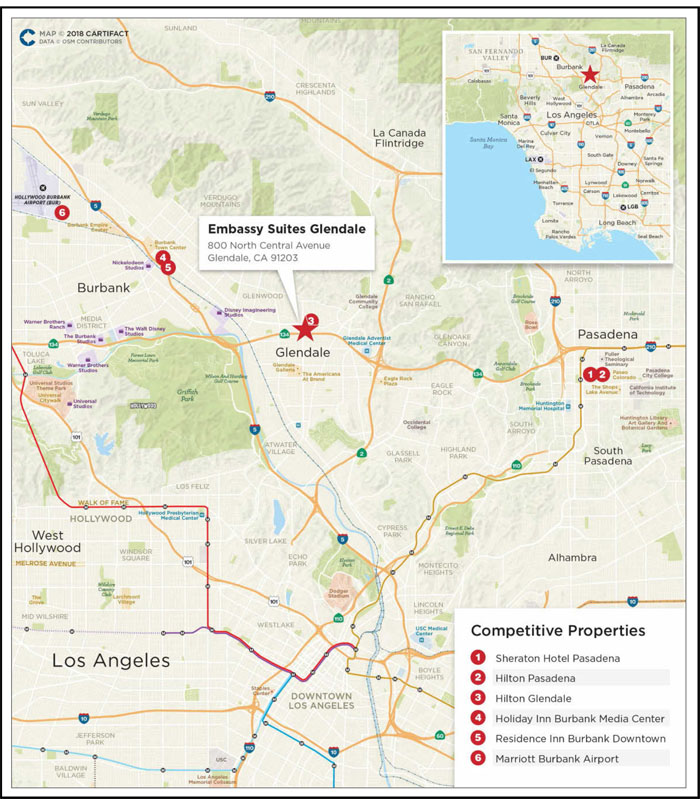

| 4 | Embassy Suites Glendale | JPMCB | 1 | $37,000,000 | 5.2% | 272 | Hotel | 2.04x | 11.3% | 59.6% | 59.6% |

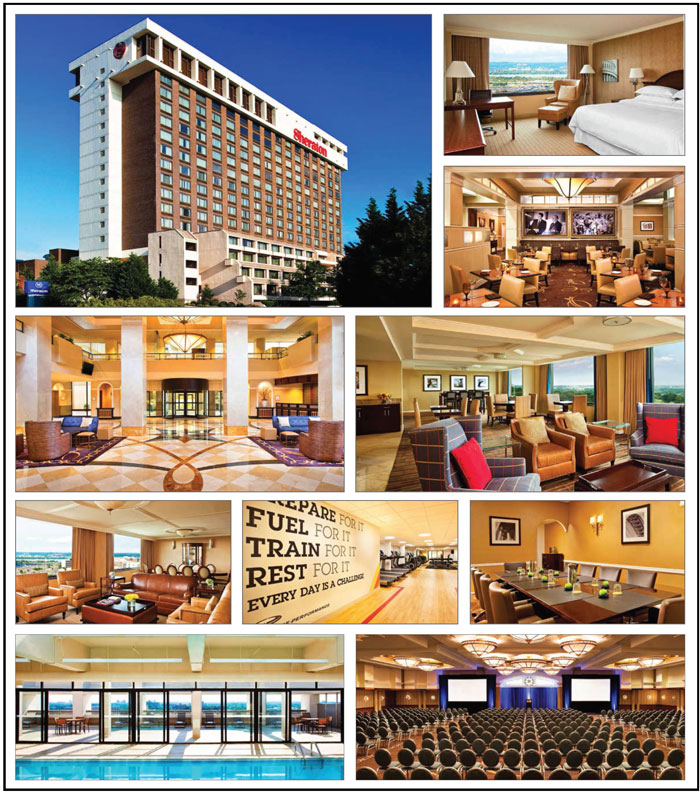

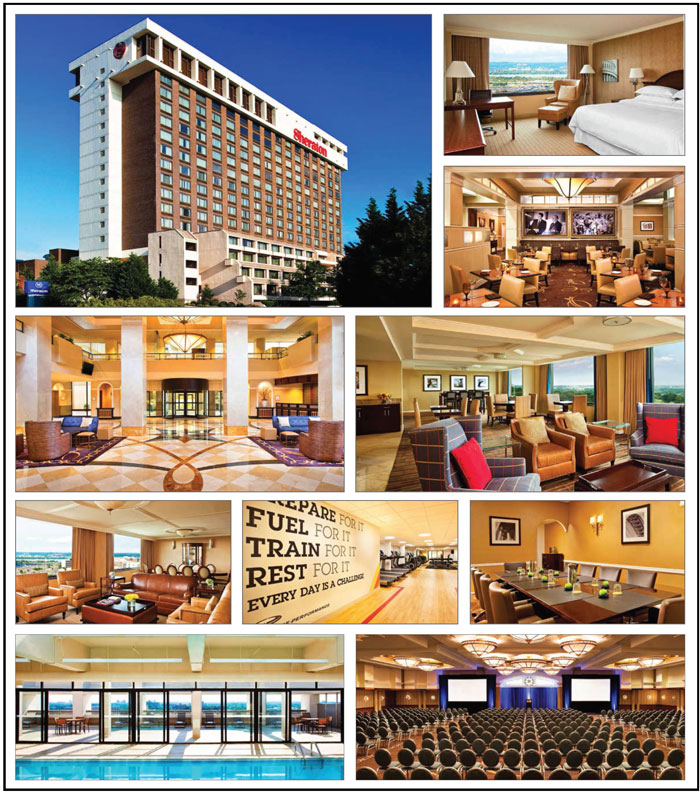

| 5 | Sheraton Hotel Arlington | GACC | 1 | $36,193,886 | 5.1% | 311 | Hotel | 1.82x | 14.1% | 60.8% | 56.6% |

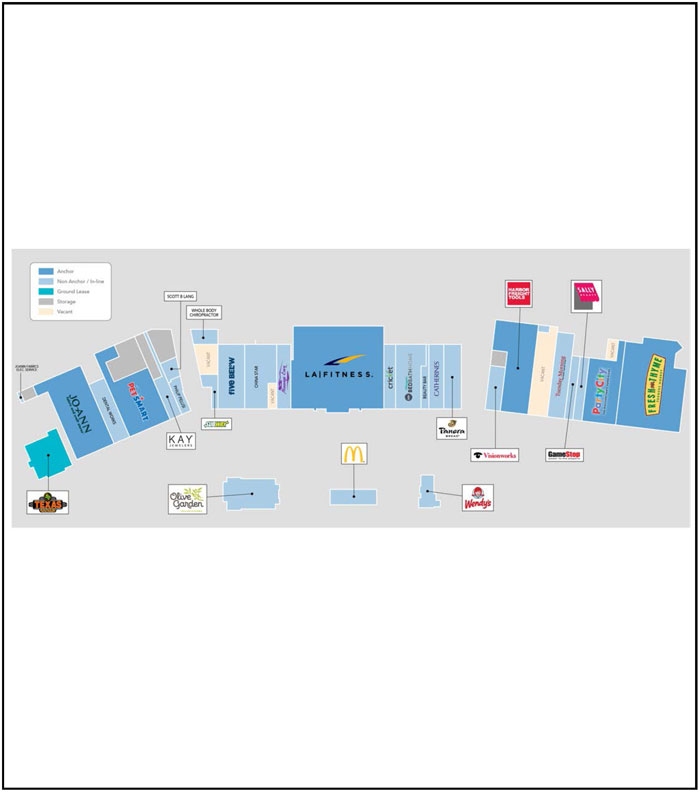

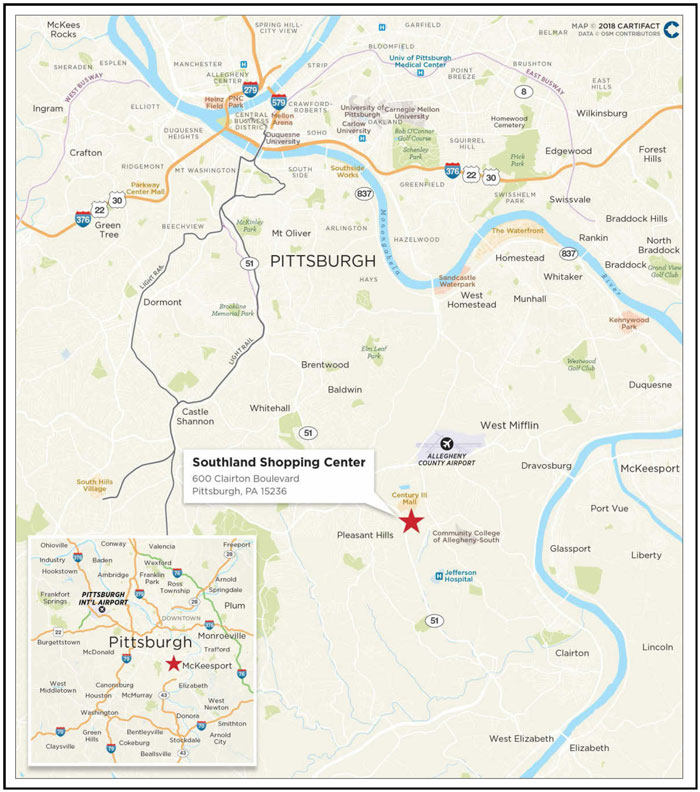

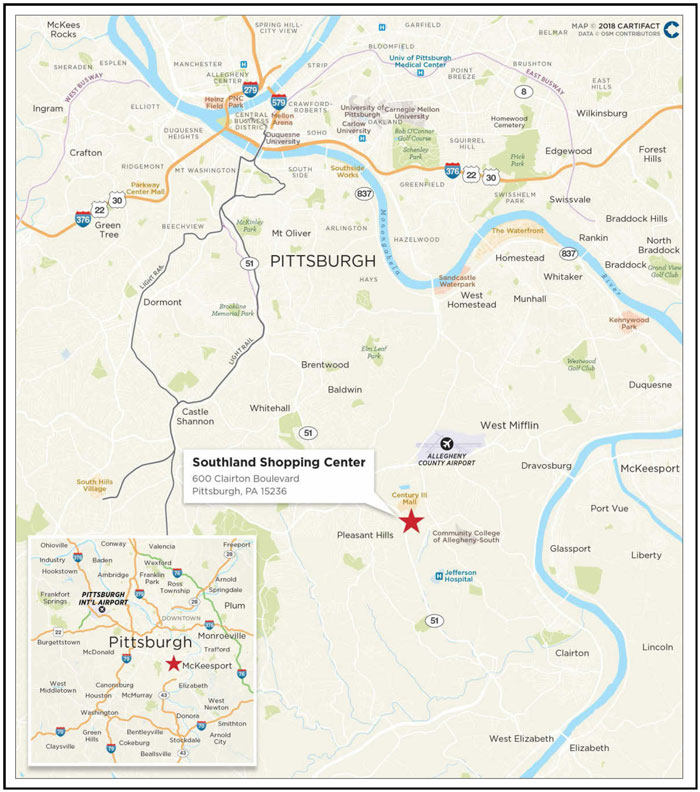

| 6 | Southland Shopping Center | SMF VI | 1 | $34,000,000 | 4.8% | 260,862 | Retail | 1.47x | 10.3% | 58.4% | 52.8% |

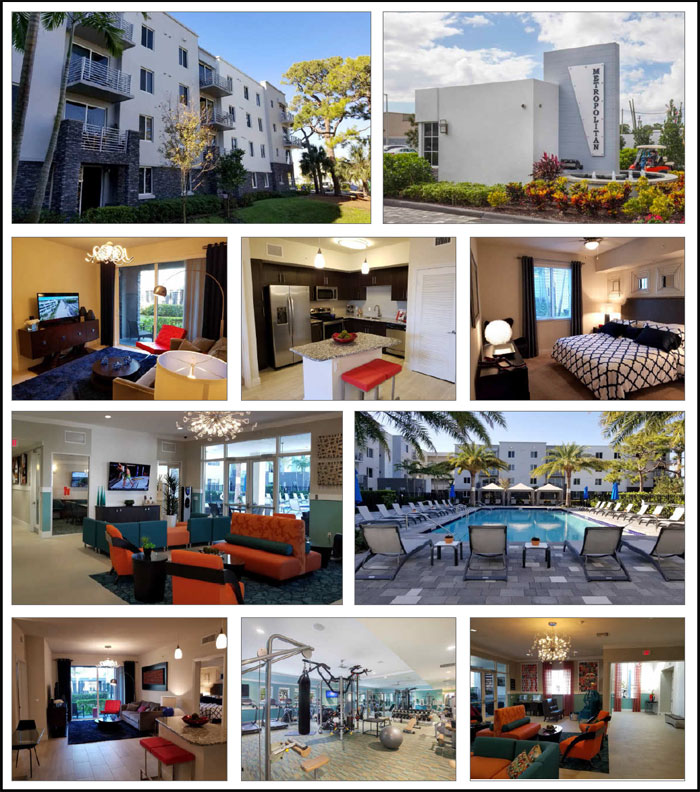

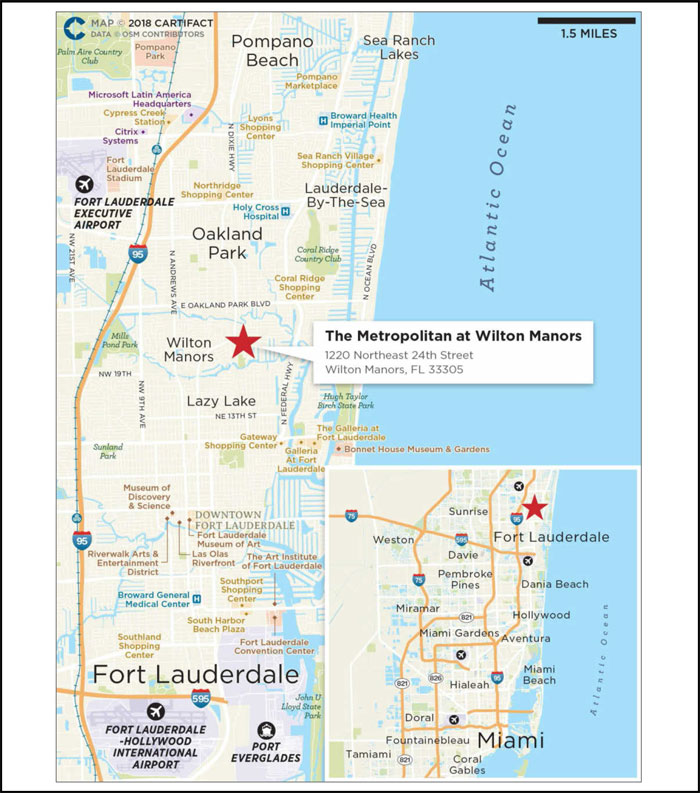

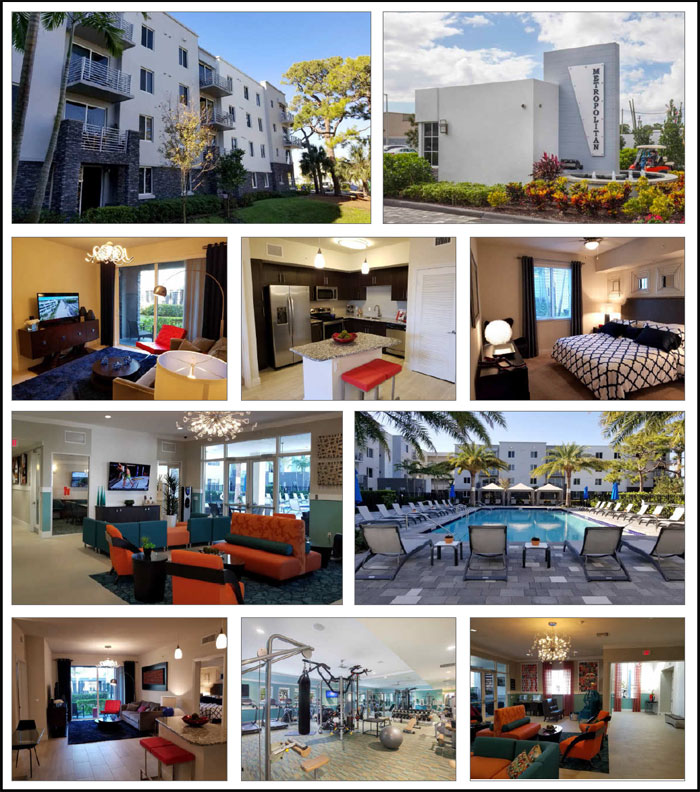

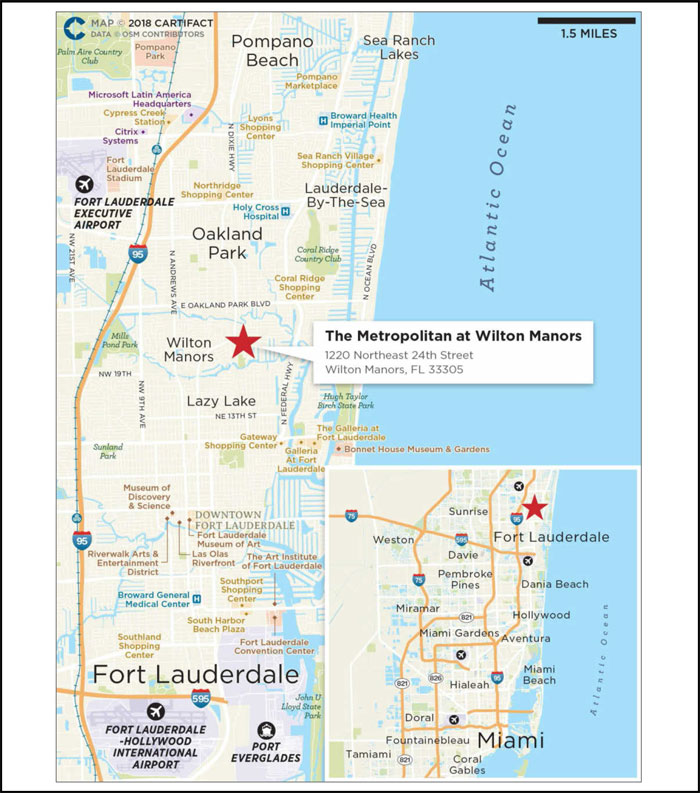

| 7 | The Metropolitan at Wilton Manors | BSP | 1 | $33,500,000 | 4.7% | 179 | Multifamily | 1.48x | 7.8% | 62.0% | 62.0% |

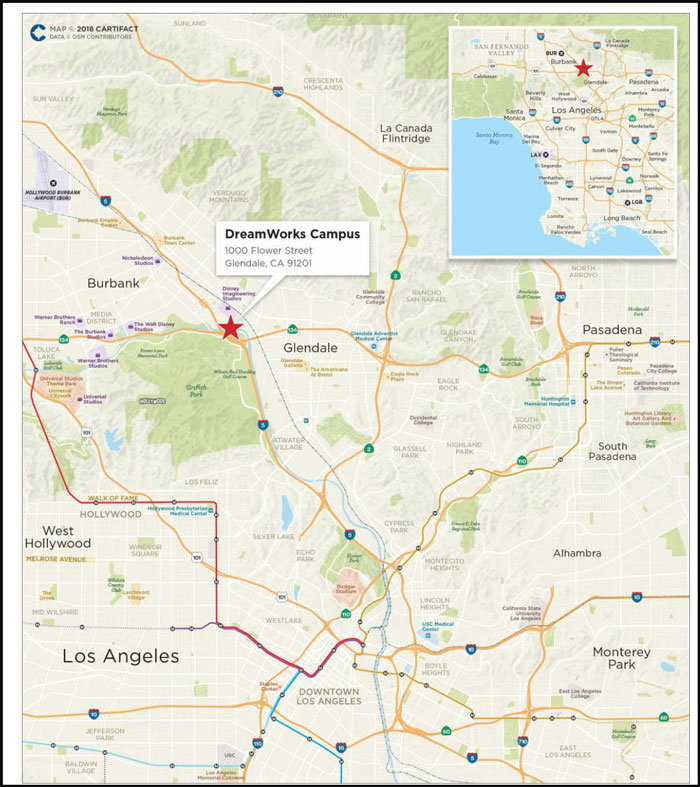

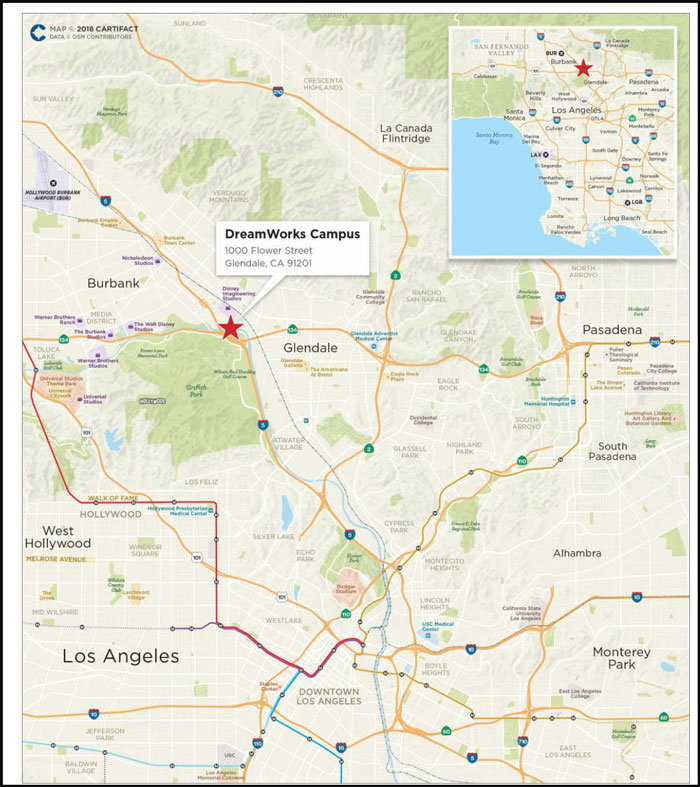

| 8 | DreamWorks Campus | GACC | 1 | $30,000,000 | 4.2% | 497,404 | Office | 6.31x | 14.8% | 31.0% | 31.0% |

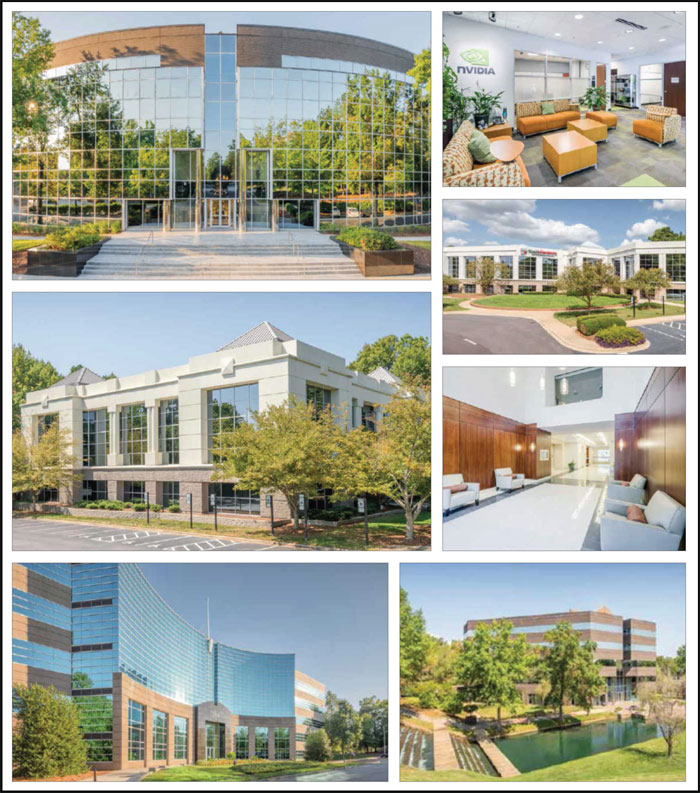

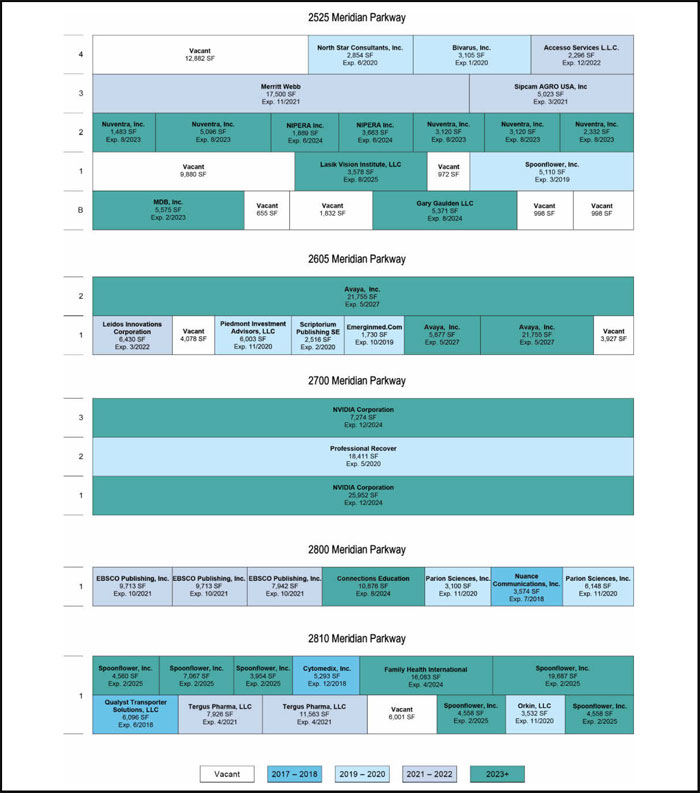

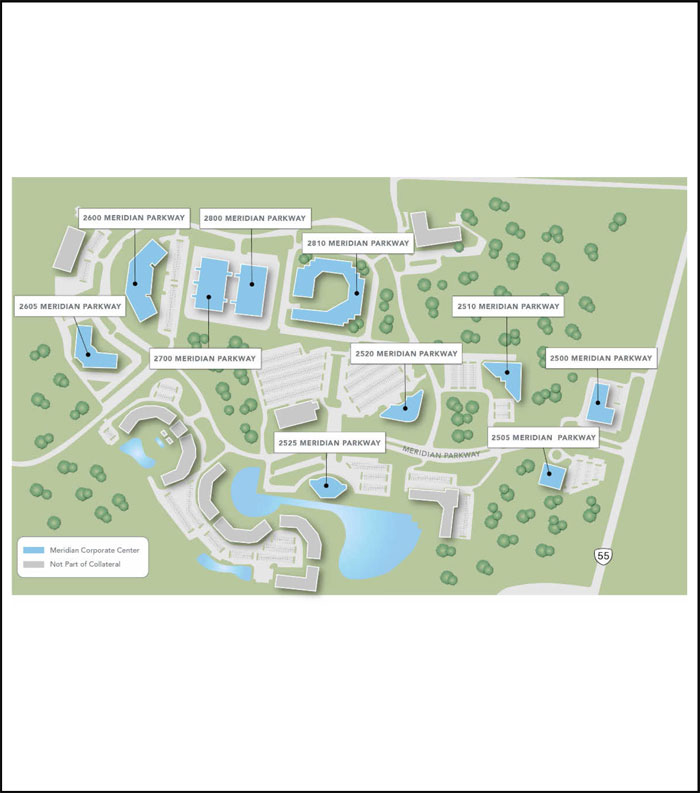

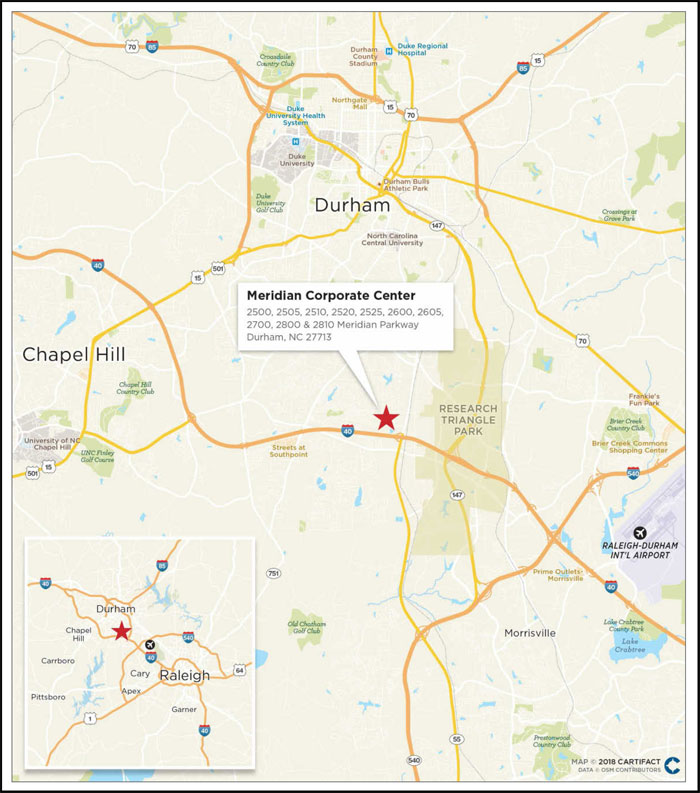

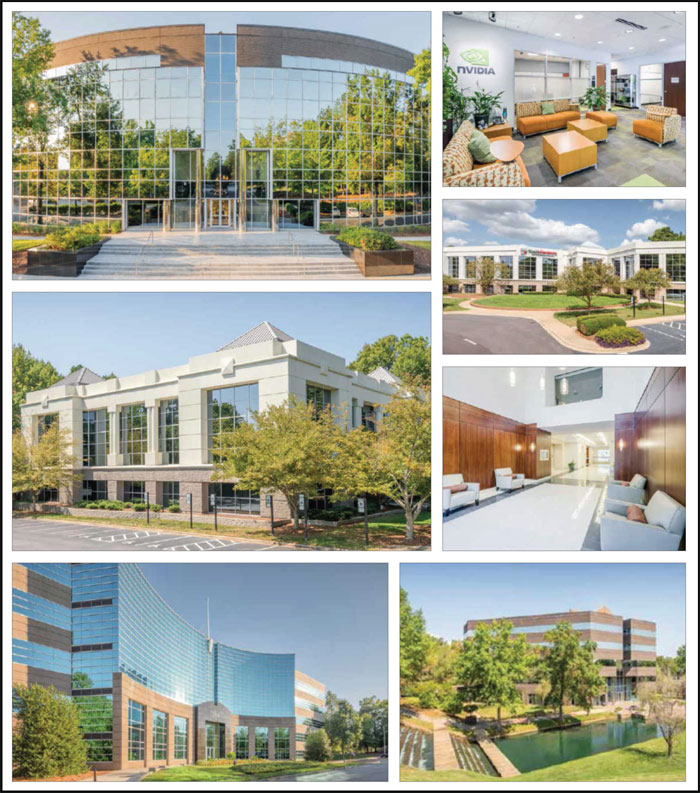

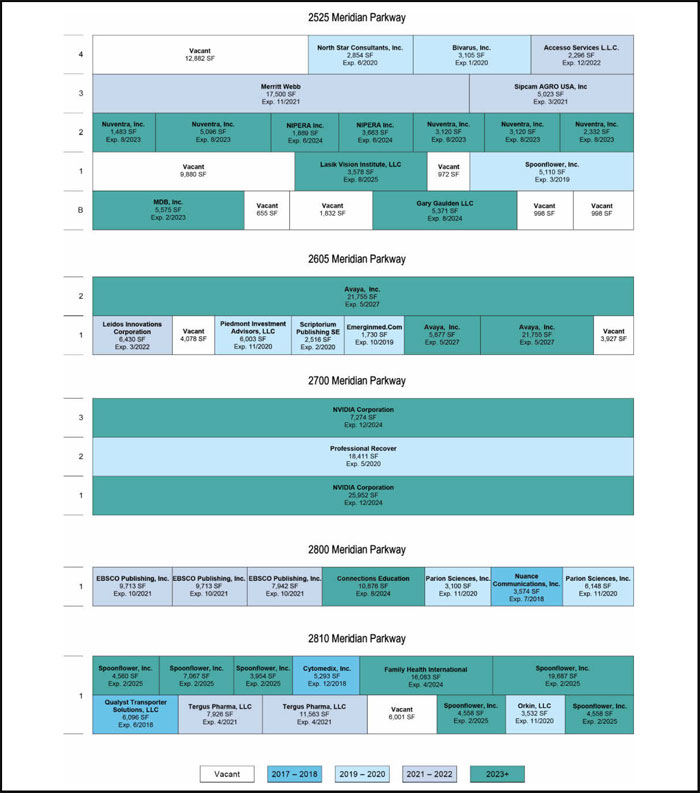

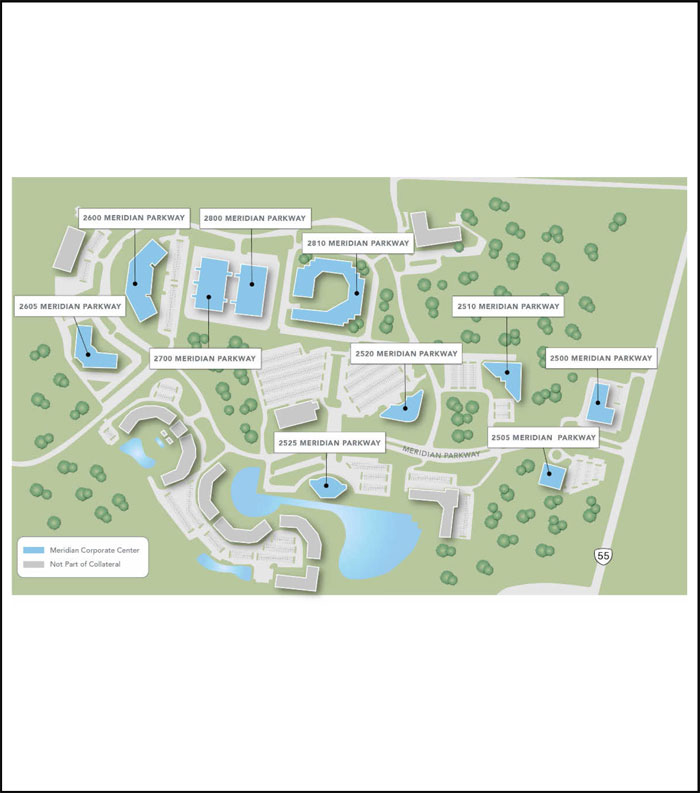

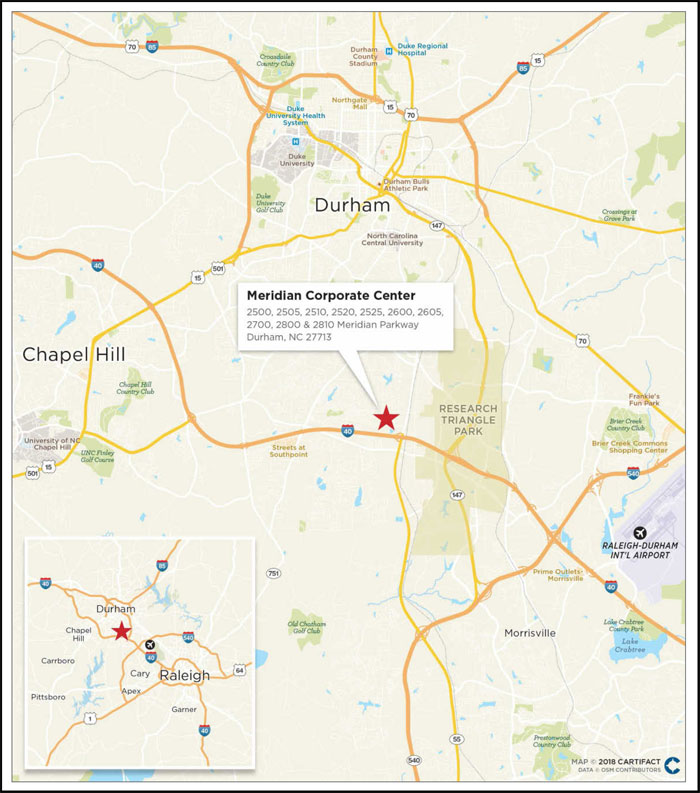

| 9 | Meridian Corporate Center | JPMCB | 10 | $30,000,000 | 4.2% | 691,705 | Office | 1.63x | 11.0% | 69.9% | 64.1% |

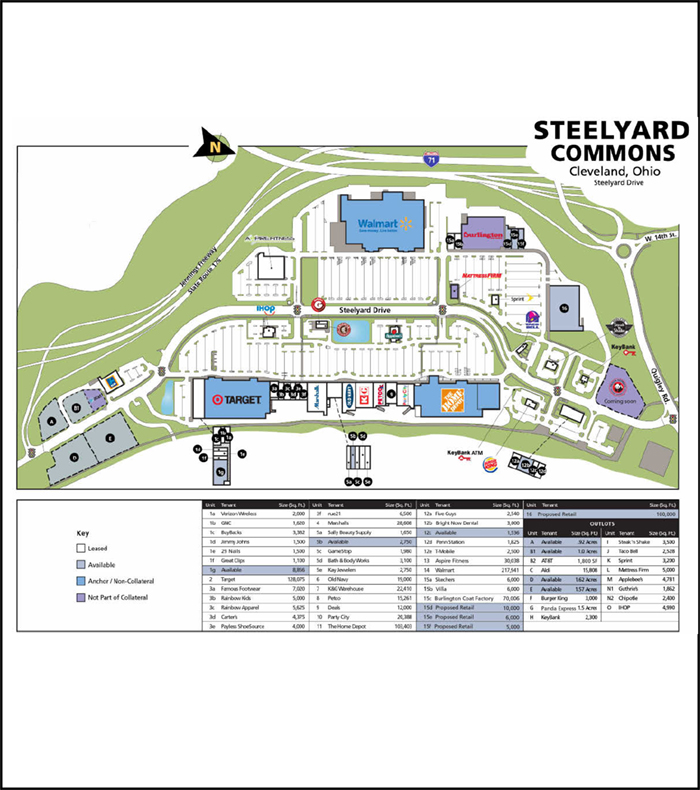

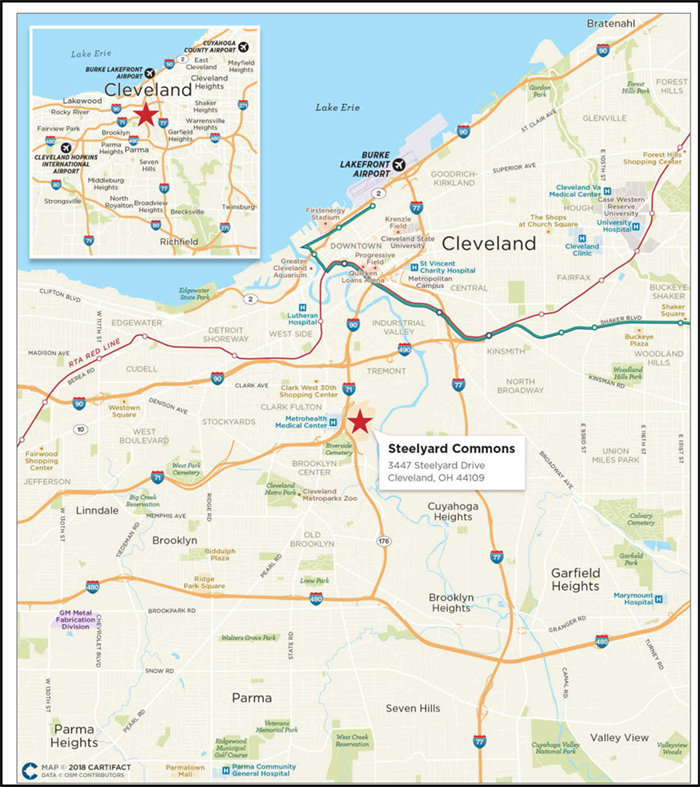

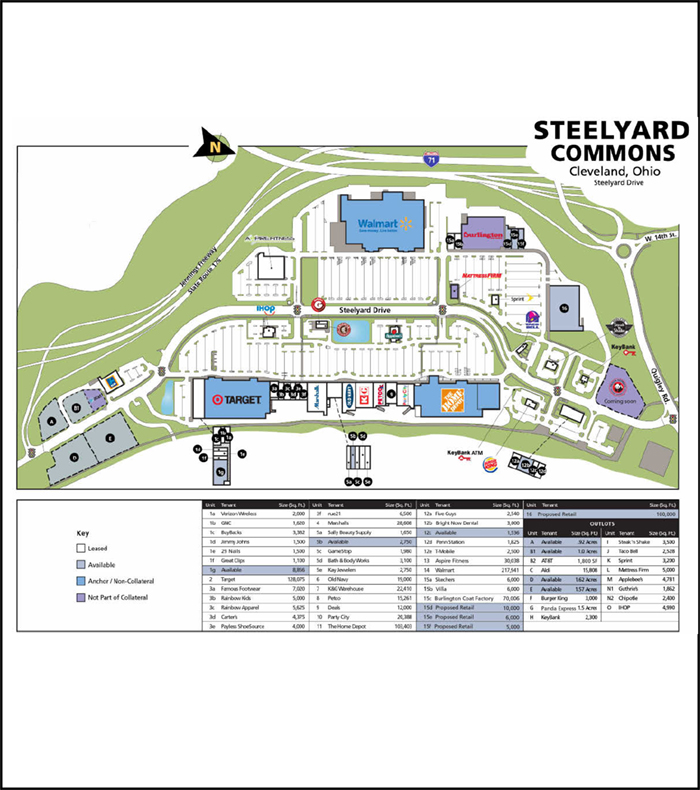

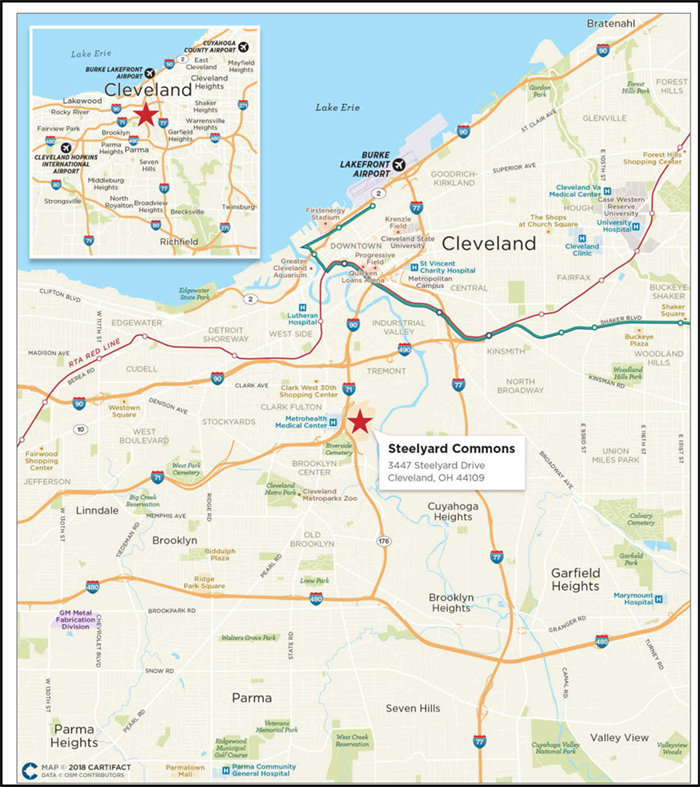

| 10 | Steelyard Commons | GACC | 1 | $30,000,000 | 4.2% | 265,386 | Retail | 1.39x | 9.4% | 74.5% | 64.2% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 3 | $132,000,000 | 18.5% | | | 2.20x | 9.4% | 59.5% | 59.5% |

| | Top 5 Total/Weighted Average | 5 | $205,193,886 | 28.8% | | | 2.10x | 10.6% | 59.8% | 59.0% |

| | Top 10 Total/Weighted Average | 19 | $362,693,886 | 50.9% | | | 2.24x | 10.6% | 59.5% | 57.2% |

| | | | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 1, 3, 4, 8, 9 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan No. 5 and 9, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (3) | In the case of Loan Nos. 1 and 8, each with an anticipated repayment date, Maturity Date LTV are calculated as of the related anticipated repayment date |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| | |

No. | Loan Name | Trust Cut-off Date Balance | Pari Passu Loan(s) Cut-off Date Balance | Total Mortgage Loan Cut-off Date Balance(1) | Controlling Pooling & Servicing Agreement | Master Servicer | Special Servicer | Voting Rights |

| 1 | Marina Heights State Farm | $50,000,000 | $510,000,000 | $560,000,000 | GSMS 2017-FARM | KeyBank | AEGON | GSMS 2017-FARM |

| 3 | Atlantic Times Square | $40,000,000 | $58,000,000 | $98,000,000 | JPMDB 2018-C8 | Wells Fargo | LNR | JPMDB 2018-C8 |

| 4 | Embassy Suites Glendale | $37,000,000 | $31,000,000 | $68,000,000 | JPMDB 2018-C8 | Wells Fargo | LNR | JPMDB 2018-C8 |

| 8 | DreamWorks HQ | $30,000,000 | $62,000,000 | $92,000,000 | UBS 2018-C9 | Midland | Rialto | (2) |

| 9 | Meridian Corporate Center | $30,000,000 | $45,705,000 | $75,705,000 | (3) | (3) | (3) | (3) |

| 10 | Steelyard Commons | $30,000,000 | $14,250,000 | $44,250,000 | JPMDB 2018-C8 | Wells Fargo | LNR | JPMDB 2018-C8 |

| 11 | Constitution Plaza | $29,975,491 | $24,979,576 | $54,955,068 | JPMDB 2018-C8 | Wells Fargo | LNR | JPMDB 2018-C8 |

| 16 | Twelve Oaks Mall | $16,609,144 | $182,700,601 | $199,309,746 | GSMS 2018-GS9 | Wells Fargo | Rialto | (2) |

| 19 | Lehigh Valley Mall | $14,852,082 | $183,175,679 | $198,027,762 | Benchmark 2018-B1 | Wells Fargo | Midland | Benchmark 2018-B1 |

| 27 | Fort Knox Executive Park | $7,962,419 | $26,873,166 | $34,835,585 | CGCMT 2018-B2 | Midland | LNR | CGCMT 2018-B2 |

| | | | | | | | | | |

| (1) | In the case of Loan Nos. 8 and 16, the Total Mortgage Loan Cut-off Date Balance excludes the related Subordinate Companion Loan(s). |

| (2) | The initial controlling noteholder is a third party investor, as holder of the related controlling subordinate companion loan. Upon the occurrence and during the continuance of a control appraisal period, the trust governed by the related lead servicing agreement will be the controlling noteholder. |

| (3) | In the case of Loan 9, the whole loan is serviced under the JPMDB 2018-C8 Pooling and Servicing Agreement until such time that the controllingpari passu companion loan has been securitized, at which point the whole loan will be serviced under the related pooling and servicing agreement. |

No. | Loan Name | Trust

Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(1)(2) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2)(3) | Total Debt UW NCF DSCR(3) | Mortgage Loan

Cut-off Date LTV(2) | Total Debt Cut-off Date LTV | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield |

| 8 | DreamWorks Campus | $30,000,000 | $108,000,000 | $200,000,000 | 6.31x | 2.07x | 31.0% | 67.3% | 14.8% | 6.8% |

| 11 | Constitution Plaza | $29,975,491 | $10,000,000 | $64,955,068 | 1.43x | 1.13x | 58.2% | 68.8% | 11.9% | 10.1% |

| 16 | Twelve Oaks Mall | $16,609,145 | $99,654,873 | $298,964,619 | 2.55x | 1.58x | 36.0% | 54.1% | 15.4% | 10.2% |

| (1) | In the case of Loan Nos. 8 and 16, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans. In the case of Loan No. 11, Subordinate Debt Cut-off Date Balance represents a mezzanine loan. |

| (2) | In the case of Loan Nos. 8, 11 and 16, Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans, where applicable, but exclude the related Subordinate Companion Loan(s) or mezzanine loan(s), as applicable. |

| (3) | In the case of Loan Nos. 11 and 16, the UW NCF DSCR and Total Debt UW NCF DSCR are calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided in Annex F and Annex G, respectively, to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW

NCF DSCR(2)(3) | UW

NOI Debt Yield(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(4)(5) |

| Office | Suburban | 16 | $153,862,419 | 21.6% | 96.9% | 3.01x | 11.8% | 56.3% | 52.5% |

| | CBD | 1 | 29,975,491 | 4.2 | 82.8% | 1.43x | 11.9% | 58.2% | 54.4% |

| | Medical | 1 | 8,350,000 | 1.2 | 85.3% | 1.74x | 9.3% | 63.5% | 63.5% |

| | Subtotal: | 18 | $192,187,911 | 26.9% | 94.2% | 2.71x | 11.7% | 56.9% | 53.3% |

| | | | | | | | | | |

| Retail | Anchored | 5 | $101,657,882 | 14.3% | 93.2% | 1.45x | 10.1% | 65.6% | 57.3% |

| | Super Regional Mall | 2 | 31,461,227 | 4.4 | 88.1% | 2.32x | 14.1% | 40.0% | 32.5% |

| | Shadow Anchored | 1 | 13,310,000 | 1.9 | 87.3% | 1.40x | 9.2% | 65.6% | 60.3% |

| | Freestanding | 7 | 5,830,000 | 0.8 | 100.0% | 2.50x | 12.7% | 50.0% | 50.0% |

| | Unanchored | 2 | 3,905,508 | 0.5 | 100.0% | 1.57x | 10.1% | 67.5% | 58.1% |

| | Single Tenant | 1 | 2,294,492 | 0.3 | 100.0% | 1.57x | 10.1% | 67.5% | 58.1% |

| | Subtotal: | 18 | $158,459,109 | 22.2% | 92.2% | 1.67x | 10.9% | 60.0% | 52.4% |

| | | | | | | | | | |

| Hotel | Full Service | 3 | $87,896,552 | 12.3% | 79.8% | 1.96x | 13.0% | 59.0% | 55.1% |

| | Limited Service | 3 | 21,602,204 | 3.0 | 73.9% | 2.00x | 14.7% | 58.3% | 45.7% |

| | Extended Stay | 1 | 8,574,092 | 1.2 | 76.9% | 2.22x | 17.4% | 57.0% | 43.0% |

| | Subtotal: | 7 | $118,072,847 | 16.6% | 78.5% | 1.99x | 13.7% | 58.7% | 52.5% |

| | | | | | | | | | |

| Multifamily | Mid-Rise | 2 | $75,500,000 | 10.6% | 95.9% | 1.45x | 7.4% | 61.3% | 61.3% |

| | Garden | 3 | $23,375,000 | 3.3% | 97.7% | 1.58x | 10.6% | 66.6% | 59.5% |

| | Subtotal: | 5 | $98,875,000 | 13.9% | 96.3% | 1.48x | 8.2% | 62.5% | 60.9% |

| | | | | | | | | | |

| Mixed Use | Retail/Multifamily | 1 | $40,000,000 | 5.6% | 96.9% | 1.86x | 9.5% | 59.8% | 59.8% |

| | Retail/Office | 2 | $12,900,000 | 1.8% | 96.7% | 1.77x | 10.5% | 60.2% | 56.9% |

| | Multifamily/Office | 1 | $6,300,000 | 0.9% | 95.6% | 1.24x | 8.4% | 66.3% | 59.0% |

| | Subtotal: | 4 | $59,200,000 | 8.3% | 96.7% | 1.77x | 9.6% | 60.6% | 59.1% |

| | | | | | | | | | |

| Self Storage | Self Storage | 13 | $48,897,637 | 6.9% | 89.4% | 1.79x | 10.8% | 61.7% | 51.0% |

| | Subtotal: | 13 | $48,897,637 | 6.9% | 89.4% | 1.79x | 10.8% | 61.7% | 51.0% |

| | | | | | | | | | |

| Industrial | Flex | 2 | $28,000,000 | 3.9% | 92.4% | 1.62x | 12.1% | 65.3% | 59.5% |

| | Warehouse | 1 | $4,745,152 | 0.7% | 100.0% | 1.68x | 12.1% | 62.4% | 51.7% |

| | Subtotal: | 3 | $32,745,152 | 4.6% | 93.5% | 1.63x | 12.1% | 64.9% | 58.4% |

| | | | | | | | | | |

| Manufactured Housing | Manufactured Housing | 1 | $4,700,000 | 0.7% | 96.3% | 1.52x | 9.9% | 58.0% | 50.2% |

| | Subtotal: | 1 | $4,700,000 | 0.7% | 96.3% | 1.52x | 9.9% | 58.0% | 50.2% |

| | | | | | | | | | |

| Total / Weighted Average: | 69 | 713,137,655 | 100.0% | 91.3% | 1.99x | 11.1% | 59.7% | 54.5% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 3, 4, 8, 9, 10, 11, 16, 19 and 27, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 11 and 16, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided on Annex F and Annex G, respectively, to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 5, 9, 13, 21 and 27, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | In the case of Loan Nos. 1, 8 and 12, each with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

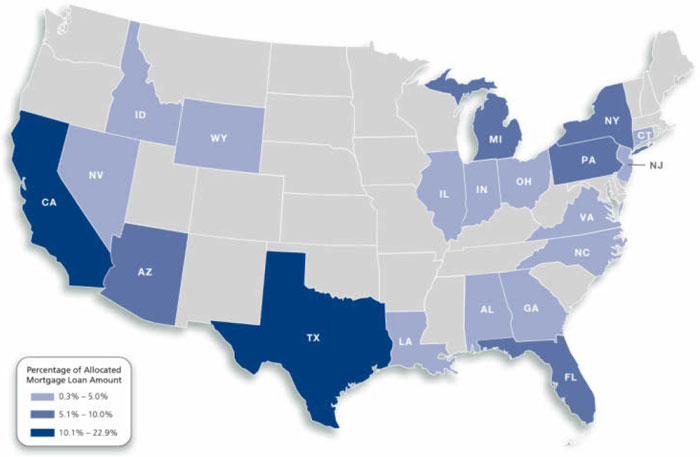

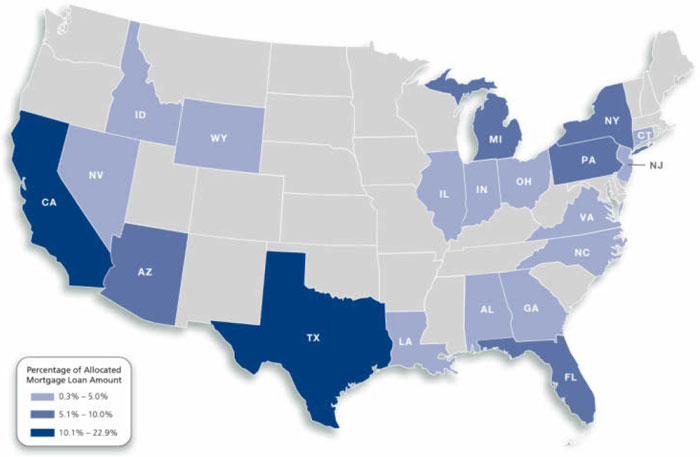

Mortgaged Properties by Location(1) |

|

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW

NCF DSCR(2)(3) | UW

NOI Debt Yield(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(4)(5) |

| California | 9 | $163,250,000 | 22.9% | 95.4% | 2.64x | 11.1% | 54.8% | 52.8% |

| Texas | 10 | 113,655,401 | 15.9 | 83.3% | 1.76x | 12.5% | 61.8% | 54.4% |

| Pennsylvania | 7 | 69,529,733 | 9.7 | 90.1% | 1.76x | 10.9% | 56.4% | 50.8% |

| Arizona | 2 | 59,416,059 | 8.3 | 98.3% | 2.89x | 11.3% | 59.0% | 56.4% |

| New York | 2 | 49,185,396 | 6.9 | 92.1% | 1.47x | 7.7% | 61.2% | 59.7% |

| Michigan | 5 | 44,462,280 | 6.2 | 87.5% | 2.21x | 15.2% | 50.5% | 39.3% |

| Florida | 2 | 41,462,419 | 5.8 | 93.7% | 1.50x | 8.6% | 61.9% | 59.0% |

| Ohio | 4 | 35,484,133 | 5.0 | 94.8% | 1.45x | 9.7% | 72.4% | 62.1% |

| North Carolina | 11 | 30,971,390 | 4.3 | 91.0% | 1.65x | 11.1% | 69.3% | 63.7% |

| Connecticut | 1 | 29,975,491 | 4.2 | 82.8% | 1.43x | 11.9% | 58.2% | 54.4% |

| Georgia | 1 | 22,750,000 | 3.2 | 90.6% | 1.66x | 12.5% | 66.5% | 60.4% |

| Virginia | 2 | 13,232,882 | 1.9 | 91.3% | 1.40x | 10.2% | 58.8% | 51.1% |

| Indiana | 2 | 12,300,000 | 1.7 | 96.6% | 1.30x | 8.8% | 66.5% | 58.4% |

| Nevada | 3 | 6,200,000 | 0.9 | 100.0% | 1.57x | 10.1% | 67.5% | 58.1% |

| Wyoming | 1 | 6,000,000 | 0.8 | 100.0% | 1.34x | 8.7% | 68.2% | 62.9% |

| Illinois | 2 | 5,850,000 | 0.8 | 84.1% | 1.62x | 10.5% | 62.1% | 57.2% |

| New Jersey | 1 | 3,218,399 | 0.5 | 90.7% | 1.65x | 11.2% | 62.8% | 46.0% |

| Alabama | 2 | 2,497,397 | 0.4 | 95.4% | 1.88x | 11.6% | 59.3% | 47.1% |

| Louisiana | 1 | 1,873,248 | 0.3 | 78.6% | 1.65x | 11.2% | 62.8% | 46.0% |

| Idaho | 1 | 1,823,427 | 0.3 | 89.9% | 1.65x | 11.2% | 62.8% | 46.0% |

| Total / Weighted Average: | 69 | $713,137,655 | 100.0% | 91.3% | 1.99x | 11.1% | 59.7% | 54.5% |

| | | | | | | | | | | | | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 3, 4, 8, 9, 10, 11, 16, 19 and 27, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan Nos. 11 and 16, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided on Annex F and Annex G to the Preliminary Prospectus, respectively. |

| (4) | In the case of Loan Nos. 5, 9, 13, 21 and 27, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | In the case of Loan Nos. 1, 8 and 12, each with an anticipated repayment date, Maturity Date LTV is calculated as of the related anticipated repayment date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | | Weighted Average |

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| $2,350,000 | - | $9,999,999 | 17 | $103,205,849 | 14.5 | % | 5.04756% | 118 | 1.62x | 10.4% | 62.4% | 55.6% |

| $10,000,000 | - | $19,999,999 | 10 | 145,421,227 | 20.4 | | 4.78844% | 118 | 1.85x | 12.1% | 57.7% | 49.9% |

| $20,000,000 | - | $24,999,999 | 2 | 43,443,565 | 6.1 | | 5.16093% | 119 | 1.86x | 13.6% | 60.1% | 50.6% |

| $25,000,000 | - | $49,999,999 | 11 | 371,067,015 | 52.0 | | 4.80381% | 96 | 2.01x | 10.6% | 59.8% | 56.0% |

| $50,000,000 | - | $50,000,000 | 1 | 50,000,000 | 7.0 | | 3.55950% | 115 | 3.12x | 11.3% | 58.3% | 58.3% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| | | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| 2.29783% | - | 3.99999% | 2 | $80,000,000 | 11.2 | % | 3.08637% | 92 | 4.32x | 12.6% | 48.1% | 48.1% |

| 4.00000% | - | 4.49999% | 4 | 72,158,864 | 10.1 | | 4.31350% | 117 | 2.04x | 12.3% | 52.2% | 42.3% |

| 4.50000% | - | 4.99999% | 17 | 282,365,000 | 39.6 | | 4.81866% | 118 | 1.59x | 9.7% | 63.2% | 58.6% |

| 5.00000% | - | 5.99000% | 18 | 278,613,791 | 39.1 | | 5.32353% | 96 | 1.71x | 11.9% | 61.4% | 55.5% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| Original Term to Maturity/ARD in Months(1) |

| | | | | | Weighted Average |

Original Term to

Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2)) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| 60 | 4 | $133,169,378 | 18.7 | % | 4.80109% | 57 | 2.80x | 13.0% | 53.2% | 51.2% |

| 120 | 37 | 579,968,278 | 81.3 | | 4.76343% | 118 | 1.80x | 10.7% | 61.2% | 55.3% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| Remaining Term to Maturity/ARD in Months(1) |

| | | | | | | | | | | | | |

| | | | | Weighted Average |

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| 54 | - | 84 | 4 | $133,169,378 | 18.7 | % | 4.80109% | 57 | 2.80x | 13.0% | 53.2% | 51.2% |

| 85 | - | 119 | 33 | 543,368,278 | 76.2 | | 4.73904% | 118 | 1.80x | 10.6% | 61.3% | 55.6% |

| 120 | - | 120 | 4 | 36,600,000 | 5.1 | | 5.12546% | 120 | 1.83x | 12.8% | 59.6% | 51.0% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| (1) | In the case of Loan Nos. 1, 8 and 12, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 3, 4, 8, 9, 10, 11, 16, 19 and 27, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan Nos. 11 and 16, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided on Annex F and Annex G to the Preliminary Prospectus, respectively. |

| (4) | In the case of Loan Nos. 5, 9, 13, 21 and 27, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | | Weighted Average |

Original

Amortization

Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| Interest Only | 10 | $266,280,000 | 37.3 | % | 4.42703% | 103 | 2.53x | 10.2% | 56.3% | 56.3% |

| 300 | 4 | 74,053,622 | 10.4 | | 4.83032% | 119 | 1.90x | 13.7% | 58.6% | 43.6% |

| 357 | 1 | 29,975,491 | 4.2 | | 5.99000% | 59 | 1.43x | 11.9% | 58.2% | 54.4% |

| 360 | 26 | 342,828,543 | 48.1 | | 4.91765% | 112 | 1.63x | 11.2% | 62.7% | 55.5% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| Remaining Amortization Term in Months |

| | | | | | Weighted Average |

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| Interest Only | 10 | $266,280,000 | 37.3 | % | 4.42703% | 103 | 2.53x | 10.2% | 56.3% | 56.3% |

| 297 | - | 356 | 7 | 155,075,081 | 21.7 | | 5.07361% | 92 | 1.80x | 13.3% | 57.7% | 48.0% |

| 357 | - | 360 | 24 | 291,782,574 | 40.9 | | 4.92276% | 118 | 1.59x | 10.8% | 63.8% | 56.4% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| | | | | | Weighted Average |

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| IO-Balloon | 20 | $255,260,000 | 35.8 | % | 4.92401% | 119 | 1.53x | 10.5% | 65.8% | 58.6% |

| Interest Only | 8 | 186,280,000 | 26.1 | | 5.00280% | 107 | 1.77x | 9.1% | 59.9% | 59.9% |

| Balloon | 10 | 163,200,018 | 22.9 | | 5.16641% | 93 | 1.88x | 13.6% | 55.0% | 46.8% |

| ARD-Interest Only | 2 | 80,000,000 | 11.2 | | 3.08637% | 92 | 4.32x | 12.6% | 48.1% | 48.1% |

| ARD-Balloon | 1 | 28,397,637 | 4.0 | | 4.33500% | 118 | 1.65x | 11.2% | 62.8% | 46.0% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(2)(3) |

| | | | | | Weighted Average |

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| 1.24x | - | 1.49x | 12 | $227,418,373 | 31.9 | % | 5.13013% | 111 | 1.43x | 9.2% | 63.2% | 58.6% |

| 1.50x | - | 1.74x | 16 | 186,565,605 | 26.2 | | 4.80967% | 118 | 1.62x | 11.1% | 64.7% | 55.9% |

| 1.75x | - | 1.99x | 4 | 94,868,886 | 13.3 | | 5.04715% | 94 | 1.84x | 11.6% | 60.4% | 57.9% |

| 2.00x | - | 2.24x | 5 | 101,845,647 | 14.3 | | 5.01387% | 97 | 2.10x | 13.1% | 55.5% | 49.2% |

| 2.25x | - | 6.31x | 4 | 102,439,145 | 14.4 | | 3.40233% | 98 | 3.93x | 13.1% | 46.2% | 45.2% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| (1) | In the case of Loan Nos. 1, 8 and 12, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 3, 4, 8, 9, 10, 11, 16, 19 and 27, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan Nos. 11 and 16, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided on Annex F and Annex G to the Preliminary Prospectus, respectively. |

| (4) | In the case of Loan Nos. 5, 9, 13, 21 and 27, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(2)(4) |

| | | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| 31.0% | - | 49.9% | 3 | $61,461,227 | 8.6 | % | 3.29037% | 85 | 4.27x | 14.4% | 35.6% | 31.8% |

| 50.0% | - | 59.9% | 12 | 266,781,938 | 37.4 | | 4.87068% | 103 | 2.07x | 11.5% | 57.9% | 54.4% |

| 60.0% | - | 64.9% | 13 | 212,084,491 | 29.7 | | 4.93920% | 108 | 1.59x | 10.2% | 61.6% | 55.9% |

| 65.0% | - | 69.9% | 11 | 137,210,000 | 19.2 | | 4.94011% | 119 | 1.56x | 10.8% | 67.4% | 60.4% |

| 70.0% | - | 74.5% | 2 | 35,600,000 | 5.0 | | 4.91556% | 118 | 1.43x | 9.8% | 73.8% | 63.9% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| LTV Ratios as of the Maturity/ARD Date(1)(2)(4) |

| | | | | | Weighted Average |

Range of

Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| 29.6% | - | 44.9% | 5 | $99,154,792 | 13.9 | % | 3.99574% | 98 | 3.46x | 15.0% | 42.9% | 35.4% |

| 45.0% | - | 49.9% | 3 | 44,342,939 | 6.2 | | 4.64303% | 118 | 1.58x | 11.1% | 61.6% | 46.4% |

| 50.0% | - | 54.9% | 9 | 124,036,039 | 17.4 | | 5.20763% | 104 | 1.57x | 10.9% | 58.7% | 52.9% |

| 55.0% | - | 59.9% | 14 | 248,493,886 | 34.8 | | 4.77368% | 100 | 2.06x | 11.1% | 61.3% | 58.4% |

| 60.0% | - | 64.2% | 10 | 197,110,000 | 27.6 | | 4.90970% | 119 | 1.51x | 9.3% | 66.3% | 62.2% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| | | | | | Weighted Average |

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| Defeasance(5) | 30 | $534,802,655 | 75.0 | % | 4.87626% | 103 | 1.96x | 11.2% | 58.5% | 52.8% |

| Yield Maintenance | 9 | 165,185,000 | 23.2 | | 4.41601% | 117 | 2.10x | 10.9% | 63.8% | 60.1% |

| Defeasance or Yield Maintenance | 2 | 13,150,000 | 1.8 | | 4.91998% | 119 | 1.75x | 9.9% | 56.9% | 54.7% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| | | | | | Weighted Average |

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW

NCF DSCR(2)(3) | UW NOI

Debt Yield(2) | Cut-off

Date LTV(2)(4) | Maturity Date LTV(1)(2)(4) |

| Refinance | 29 | $499,810,721 | 70.1 | % | 5.04569% | 106 | 1.68x | 10.7% | 60.9% | 55.8% |

| Acquisition | 10 | 168,320,152 | 23.6 | | 4.06337% | 106 | 2.91x | 12.0% | 57.8% | 54.6% |

| Recapitalization | 2 | 45,006,782 | 6.3 | | 4.35843% | 118 | 1.98x | 12.7% | 52.9% | 39.9% |

| Total / Weighted Average: | 41 | $713,137,655 | 100.0 | % | 4.77046% | 107 | 1.99x | 11.1% | 59.7% | 54.5% |

| (1) | In the case of Loan Nos. 1, 8 and 12, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are calculated as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 1, 3, 4, 8, 9, 10, 11, 16, 19 and 27, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan Nos. 11 and 16, the UW NCF DSCR is calculated using the sum of principal and interest payments over the first 12 payments allocable to the Mortgage Loan following the Cut-off Date based on the assumed principal payment schedule provided on Annex F and Annex G to the Preliminary Prospectus, respectively. |

| (4) | In the case of Loan Nos. 5, 9, 13, 21 and 27, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | In the case of Loan Nos. 3, 4 and 19, the loan documents permit the borrowers to prepay the related loan with yield maintenance premium in the event the defeasance lockout period has not expired after certain dates. See the “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Defeasance; Collateral Substitution” in the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Loan Name | Cut-off Date Principal Balance | % of IBP | Location | Property Type | Previous Securitization |

| 3 | Atlantic Times Square | $40,000,000 | | 5.6 | % | Monterey Park, CA | Mixed Use | JPMCC 2013-C13 |

| 4 | Embassy Suites Glendale | 37,000,000 | | 5.2 | | Glendale, CA | Hotel | JPMBB 2013-C14 |

| 5 | Sheraton Hotel Arlington | 36,193,886 | | 5.1 | | Arlington, TX | Hotel | RSO 2015-CRE3 |

| 9 | Meridian Corporate Center | 30,000,000 | | 4.2 | | Durham, NC | Office | JPMBB 2014-C24 |

| 10 | Steelyard Commons | 30,000,000 | | 4.2 | | Cleveland, OH | Retail | JPMBB 2013-C12 |

| 11 | Constitution Plaza | 29,975,491 | | 4.2 | | Hartford, CT | Office | FORT CRE 2016-1 |

| 17 | Lakewood Forest Plaza | 16,575,000 | | 2.3 | | Houston, TX | Retail | GSMS 2010-C1 |

| 25 | Northridge Medical Tower | 8,350,000 | | 1.2 | | Northridge, CA | Office | DBUBS 2011-LC3 |

| 37 | Shoppes at Schoolhouse Crossing | 5,600,000 | | 0.8 | | Kennett Square, PA | Mixed Use | MSC 2008-T29 |

| 40 | Sunrise Pass Estates MHC | 4,700,000 | | 0.7 | | Barstow, CA | Manufactured Housing | WFRBS 2013-C14 |

| Total | | $238,394,378 | | 33.4 | % | | | |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

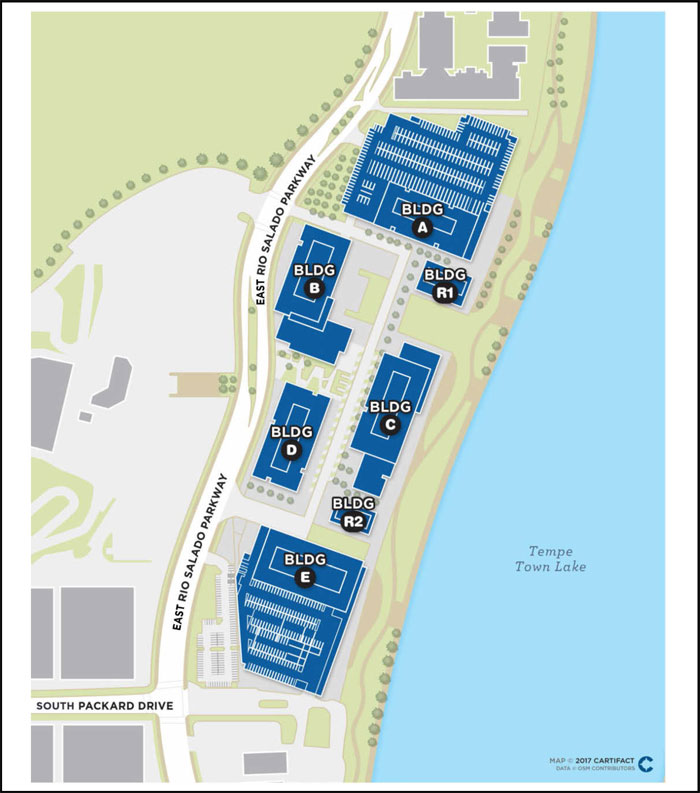

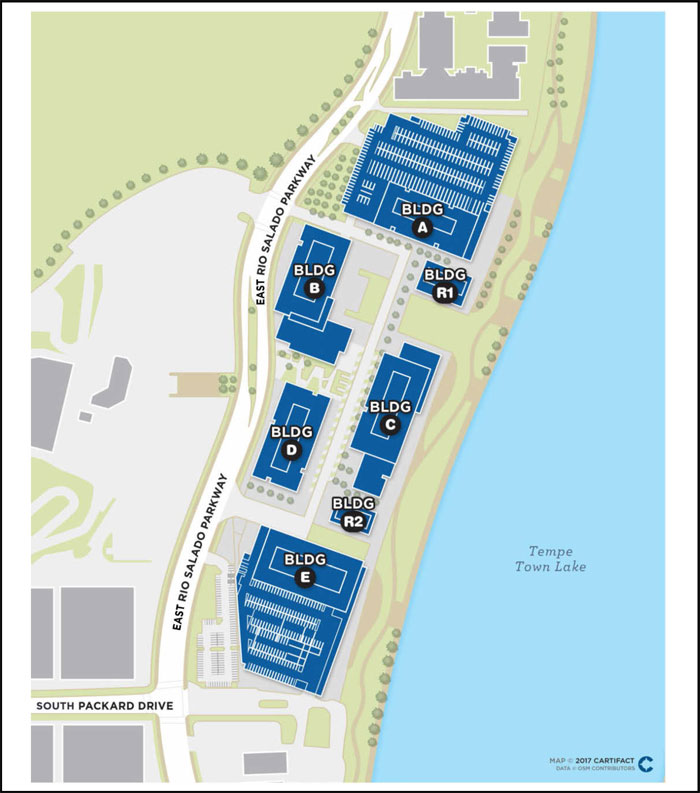

| Marina Heights State Farm |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller(1): | GACC | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(2): | $50,000,000 | | Title: | Leasehold |

| Cut-off Date Principal Balance(2): | $50,000,000 | | Property Type - Subtype: | Office – Suburban |

| % of Pool by IPB: | 7.0% | | Net Rentable Area (SF): | 2,031,293 |

| Loan Purpose: | Acquisition | | Location: | Tempe, AZ |

| Borrower: | Corporate Properties Tempe SPE, | | Year Built / Renovated: | 2015-2017 / N/A |

| | L.L.C. | | Occupancy: | 99.5% |

| Sponsors(3): | Transwestern Investment Group, | | Occupancy Date: | 12/7/2017 |

| | Corporate Properties Trust III, L.P. | | Number of Tenants: | 4 |

| Interest Rate(4): | 3.55950% | | 2015 NOI(5): | N/A |

| Note Date: | 12/7/2017 | | 2016 NOI(5): | N/A |

| Anticipated Repayment Date(4): | 1/6/2028 | | 2017 NOI(5): | N/A |

| Final Maturity Date(4): | 1/6/2033 | | TTM NOI(5): | N/A |

| Interest-only Period: | 120 months | | UW Economic Occupancy: | 98.7% |

| Original Term(4): | 120 months | | UW Revenues: | $83,160,015 |

| Original Amortization: | None | | UW Expenses: | $19,826,859 |

| Amortization Type: | ARD-Interest Only | | UW NOI(6): | $63,333,156 |

| Call Protection: | L(11),Gtr1%orYM(102),O(7) | | UW NCF(6): | $63,137,233 |

| Lockbox / Cash Management: | Hard / Springing | | Appraised Value / Per SF: | $960,000,000 / $473 |

| Additional Debt(2): | Yes | | Appraisal Date: | 11/20/2017 |

| Additional Debt Balance(2): | $510,000,000 | | | |

| Additional Debt Type: | Pari Passu | | | |

| | | | | |

| Escrows and Reserves(7) | | Financial Information(2) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | $276 | |

| Taxes: | $0 | Springing | N/A | | Maturity Date Loan / SF(4): | $276 | |

| Insurance: | $0 | Springing | N/A | | Cut-off Date LTV: | 58.3% | |

| Replacement Reserves: | $0 | Springing | N/A | | Maturity Date LTV(4): | 58.3% | |

| TI/LC: | $0 | Springing | N/A | | UW NCF DSCR(6): | 3.12x | |

| Other: | $0 | Springing | N/A | | UW NOI Debt Yield(6): | 11.3% | |

| | | | | | | |

| Sources and Uses(8) |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Mortgage Loan | $560,000,000 | 58.4% | | Purchase Price(10) | $930,000,000 | 97.1% |

| Principal Cash Equity Contribution | 375,736,548 | 39.2% | | Imputed Equity Purchase(9) | 22,500,000 | 2.3% |

| Imputed Equity Contribution(9) | 22,500,000 | 2.3% | | Closing Costs(11) | 5,736,548 | 0.6% |

| Total Sources | $958,236,548 | 100.0% | | Total Uses | $958,236,548 | 100.0% |

| (1) | The Marina Heights State Farm Whole Loan (as defined in “The Loan” below) was originated by Goldman Sachs Mortgage Company (“GSMC”) on December 7, 2017. Subsequent to the origination date, notes representing 35% of the Marina Heights State Farm Whole Loan were transferred to Deutsche Bank AG, acting through its New York Branch (“DBNY”), an affiliate of GACC, which has re-underwritten such mortgage loan in accordance with the procedures described under “Transaction Parties—The Sponsors and Mortgage Loan Sellers—German American Capital Corporation—DBNY’s Underwriting Guidelines and Processes”in the Preliminary Prospectus. |

| (2) | The Marina Heights State Farm loan is part of a whole loan evidenced by eightpari passunotes with an aggregate outstanding principal balance of $560.0 million. The Financial Information presented in the chart above reflects the $560.0 million aggregate Cut-off Date balance of the Marina Heights State Farm Whole Loan. |

| (3) | There is no nonrecourse carve-out guarantor or environmental indemnitor, other than the borrower, for the Marina Heights State Farm Whole Loan. |

| (4) | The Marina Heights State Farm Whole Loan has an anticipated repayment date of January 6, 2028 (the “Anticipated Repayment Date” or “ARD”) and a final maturity date of January 6, 2033. From and after the Anticipated Repayment Date, the Marina Heights State Farm Whole Loan (a) accrues interest at a fixed rate that is equal to the greater of (i) 3.55950% plus 3.00000% and (ii) the then 10-year swap rate plus 3.00000% and (b) on each payment date after the ARD, requires principal payments based on a 30-year amortization schedule assuming the initial interest rate. The Maturity Date Loan / SF and Maturity Date LTV are based on the maturity balance as of the ARD. |

| (5) | Historical net operating income is not available because the property was constructed between 2015 and 2017. |

| (6) | The UW NCF DSCR and UW NOI Debt Yield are based on the adjusted UW NOI and UW NCF (as set forth under the “Underwritten Net Cash Flow” chart below), and include the net present value of future contractual rent increases in the amount of $11,242,393, as well as other adjustments. The UW NCF DSCR and UW NOI Debt Yield absent such adjustments are 2.62x and 9.4%, respectively. |

| (7) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. |

| (8) | The Marina Heights State Farm Whole Loan was used to finance the purchase of the Marina Heights State Farm property by a wholly-owned subsidiary of a joint venture between JDM Partners, LLC (“JDM”) and Transwestern Investment Group, LLC (“Transwestern”) in a sale lease-back transaction from State Farm Mutual Automobile Insurance Company and its affiliates (collectively, “State Farm”). |

| (9) | Represents the value of Transwestern’s equity interest in partnership based on borrower’s purchase price. |

| (10) | Represents the contractual purchase price. |

| (11) | Closing Costs includes costs associated with the purchase and sale transaction.

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 15 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

The Loan.The Marina Heights State Farm loan is secured by a first mortgage lien on the borrower’s leasehold interest in a five building office complex with retail space. The whole loan has an outstanding principal balance as of the Cut-off Date of $560.0 million (the “Marina Heights State Farm Whole Loan”), and is comprised of eightpari passu notes, each as described below. The non-controlling Note A-2-C3 with an outstanding principal balance as of the Cut-off Date of $50.0 million, will be contributed to the JPMDB 2018-C8 Trust. The remaining notes are currently held by the parties described in the “Whole Loan Summary” chart below and have been or are expected to be contributed to one or more securitization trusts. The relationship between the holders of the Marina Heights State Farm Whole Loan will be governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” in the Preliminary Prospectus. The Marina Heights State Farm Whole Loan is structured with an ARD of January 6, 2028, a final maturity date of January 6, 2033 and will be interest-only for the entire term until the ARD. From the first payment date after the ARD until the final maturity date, the Marina Heights State Farm Whole Loan will amortize on a 30-year schedule. At any time on or after the due date in January 2019, the borrower will have the right to prepay the Marina Heights State Farm Whole Loan in whole or in part. Any voluntary prepayments prior to the due date in July 2027 require a yield maintenance premium, which may be no less than 1% of the amount prepaid.

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | | Note Holder | Controlling Piece |

| A-2-C3 | $50,000,000 | $50,000,000 | | JPMDB 2018-C8 | No |

| A-1-S | $264,000,000 | $264,000,000 | | GSMS 2017-FARM | Yes |

| A-2-C4, A-2-C5 | $41,000,000 | $41,000,000 | | Benchmark 2018-B2 | No |

| A-1-C1 | $72,500,000 | $72,500,000 | | GSMS 2018-GS9 | No |

| A-2-C1 | $45,000,000 | $45,000,000 | | Benchmark 2018-B3 | No |

| A-1-C2 | $27,500,000 | $27,500,000 | | GSMC | No |

| A-2-C2 | $60,000,000 | $60,000,000 | | DBNY | No |

| Total | $560,000,000 | $560,000,000 | | | |

The Borrower.The borrowing entity for the Marina Heights State Farm Whole Loan is Corporate Properties Tempe SPE, L.L.C., a Delaware limited liability company. There is no nonrecourse carve-out guarantor or environmental indemnitor, other than the borrower, for the Marina Heights State Farm Whole Loan.

The Loan Sponsors.The loan sponsors are Transwestern Investment Group and Corporate Properties Trust III, L.P. (a joint venture between JDM and Transwestern). JDM is a Phoenix-based real estate development and equity fund management firm. JDM sponsors multiple real estate funds with approximately $1.2 billion in assets under management as of December 31, 2016. As of December 31, 2016, JDM’s fund assets consist of office, commercial, and resort assets, including 23 commercial and office buildings in 16 states, totaling over six million square feet (not including the Marina Heights State Farm property). JDM has an existing relationship with State Farm as State Farm is the tenant in 20 of the 23 commercial and office buildings referenced above and accounts for over 4.8 million of the over six million square feet. Transwestern, an investment advisor, is the general partner and a minority equity holder of the joint venture. Transwestern has an existing relationship with State Farm, including acting as general partner, minority equity holder and property manager of State Farm’s two other super-regional headquarters in Richardson, Texas and Dunwoody, Georgia. There is no nonrecourse carve-out guarantor or environmental indemnitor, other than the borrower, for the Marina Heights State Farm Whole Loan.

The Property.The Marina Heights State Farm property is an approximately 2.03 million square foot office campus consisting of (i) approximately 1.97 million square feet of office space, (ii) approximately 58,000 square feet of dining, retail, and wellness space and (iii) approximately 8,000 square feet of management office space, located on an approximately 20-acre site. The Marina Heights State Farm property consists of five regional headquarters office buildings and was delivered to State Farm in 2015 through 2017 to meet the company’s need for a campus to accommodate the consolidation of approximately 10,000 employees from across the southwest region. As part of this strategy, the Marina Heights State Farm property was developed as a Class A, office campus offering modern finishes and flexible office configurations for office, conference and training needs. The Marina Heights State Farm property also offers 7,991 parking spaces (approximately 3.9 spaces per 1,000 square feet). The Marina Heights State Farm property has large, raised floor plates, raised ceilings, modern building systems, along with marble and natural hardwood lobby accents and ground floor café and restaurant tenants. Furthermore, the campus offers access to Loop 202 and is approximately four miles from the Phoenix Sky Harbor International Airport. The Marina Heights State Farm property is also expected to be a future stop for the Tempe Streetcar (which is in an initial construction phase and is not expected to be completed prior to 2020), which is anticipated to provide access to the airport, downtown and central Phoenix, and west Mesa via the Valley Metro Light Rail.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 16 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

State Farm is the largest tenant at the Marina Heights State Farm property, occupying 97.1% of the total square feet, 100.0% of the office space and accounts for 98.8% of UW total rent. In addition to State Farm, the Marina Heights State Farm property is leased to Mountainside Fitness, Compass, Honor Health, and Transwestern’s management office (in the aggregate representing 2.3% of the total square feet and 1.2% of UW total rent). Founded in 1922 and based in Bloomington, Illinois, State Farm has approximately $148 billion in total assets as of December 2016. State Farm generated a net loss of $2.6 billion in 2016, with net written premiums of $39.6 billion and net investment income of $3.4 billion. A.M. Best Co. gives an A++ rating to State Farm Mutual Automobile Insurance Company. State Farm operates in every state and Washington, D.C. through its independent field agents that operate through localized offices. In January 2015, State Farm sold all of its Canadian businesses to the Desjardins Group.

The Marina Heights State Farm property represents an operations center that houses approximately 10,000 employees in various roles including regional managers, claims processing and field agents serving State Farm’s Southwestern markets. The five office buildings are leased to State Farm pursuant to five separate long-term leases averaging more than 20 years across the five buildings, with the option to renew each lease for up to 20 additional years. The State Farm leases are triple net, allowing the pass through of Marina Heights State Farm property operating expenses, and provide for annual rent escalations of 2.0%. There are two additional buildings on the campus for retail and wellness facilities.

The Marina Heights State Farm property is located in Tempe, Arizona. The Tempe office submarket had a vacancy rate of 6.7% for Class A office properties as of third quarter 2017, which has remained near or below the historical average since 2013. The gross market rents for Class A office leases were $34.46 per square foot as of the third quarter of 2017. Seven office lease comparables have asking rents ranging from $21.06 per square foot to $27.56 per square foot on a triple-net basis and $31.50 per square foot to $44.00 per square foot on a gross rent basis.

| Historical and Current Occupancy(1) |

| 2014 | 2015 | 2016 | Current(2) |

| N/A | N/A | N/A | 99.5% |

| (1) | Historical occupancy is not available because the Marina Heights State Farm property was constructed between 2015 and 2017. |

| (2) | Current occupancy is as of December 7, 2017. |

| Tenant Summary(1) |

| Tenant | Ratings(2)

Moody’s/S&P/Fitch | Net Rentable Area (SF) | % of

Total NRA | Base Rent PSF | % of Base

Rent | Lease

Expiration Date |

| State Farm Building B | NA / AA / NA | 575,639 | 28.3% | $26.52 | 28.9% | 12/31/2042 |

| State Farm Building E | NA / AA / NA | 426,902 | 21.0% | $26.52 | 21.4% | 12/31/2032 |

| State Farm Building D | NA / AA / NA | 370,332 | 18.2% | $26.52 | 18.6% | 12/31/2035 |

| State Farm Building A | NA / AA / NA | 347,851 | 17.1% | $26.52 | 17.5% | 12/31/2037 |

| State Farm Building C | NA / AA / NA | 245,370 | 12.1% | $26.52 | 12.3% | 12/31/2039 |

| Mountainside Fitness | NA / NA / NA | 17,485 | 0.9% | $10.00 | 0.3% | 3/31/2027 |

| MarinaLink (State Farm) | NA / AA / NA | 7,154 | 0.4% | $25.50 | 0.3% | 3/31/2027 |

| Compass - Cafe 450 | NA / NA / NA | 6,610 | 0.3% | $10.51 | 0.1% | 12/31/2031 |

| Honor Health | NA / NA / NA | 5,736 | 0.3% | $21.53 | 0.2% | 7/31/2027 |

| Compass - Matt's Big Breakfast | NA / NA / NA | 5,007 | 0.2% | $10.51 | 0.1% | 12/31/2031 |

| | | | | | | | | |

| (1) | Based on the underwritten rent roll dated December 7, 2017. |

| (2) | Ratings for State Farm leases are those for State Farm Mutual Automobile Insurance Company, the tenant on each State Farm lease. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 17 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

| Lease Rollover Schedule(1) |

| Year | Number of Leases Expiring(2) | Net Rentable Area Expiring | % of NRA Expiring | Base Rent Expiring | % of Base Rent Expiring | Cumulative Net Rentable Area Expiring | Cumulative % of NRA Expiring | Cumulative Base Rent Expiring | Cumulative % of Base Rent Expiring |

| Vacant | NAP | 10,488 | 0.5% | NAP | NAP | 10,488 | 0.5% | NAP | NAP |

| 2018 & MTM | 0 | 0 | 0.0% | 0 | 0.0% | 10,488 | 0.5% | 0 | 0.0% |

| 2019 | 0 | 0 | 0.0% | 0 | 0.0 | 10,488 | 0.5% | 0 | 0.0% |

| 2020 | 0 | 0 | 0.0% | 0 | 0.0 | 10,488 | 0.5% | 0 | 0.0% |

| 2021 | 0 | 0 | 0.0% | 0 | 0.0 | 10,488 | 0.5% | 0 | 0.0% |

| 2022 | 0 | 0 | 0.0% | 0 | 0.0 | 10,488 | 0.5% | 0 | 0.0% |

| 2023 | 0 | 0 | 0.0% | 0 | 0.0 | 10,488 | 0.5% | 0 | 0.0% |

| 2024 | 0 | 0 | 0.0% | 0 | 0.0 | 10,488 | 0.5% | 0 | 0.0% |

| 2025(2) | 1 | 915 | 0.0% | 0 | 0.0 | 11,403 | 0.6% | 0 | 0.0% |

| 2026(2) | 3 | 6,621 | 0.3% | 0 | 0.0 | 18,024 | 0.9% | 0 | 0.0% |

| 2027(3)(4) | 3 | 30,375 | 1.5% | 480,773 | 0.9 | 48,399 | 2.4% | 480,773 | 0.9% |

| 2028 | 0 | 0 | 0.0 | 0 | 0.0 | 48,399 | 2.4% | 480,773 | 0.9% |

| 2029 & Beyond | 11 | 1,982,894 | 97.6% | 52,317,710 | 99.1 | 2,031,293 | 100.0% | 52,798,483 | 100.0% |

| Total(2) | 18 | 2,031,293 | 100.0% | $52,798,483 | 100.0% | | | | |

| (1) | Based on the underwritten rent roll dated December 7, 2017. |

| (2) | The Marina Heights State Farm property is occupied by four tenants under eighteen leases. |

| (3) | Includes a total of 7,536 square feet which pertains to the management office, which does not pay rent or reimbursements at the Marina Heights State Farm property. |

| (4) | Includes State Farm as the MarinaLink (State Farm) lease that expires in 2027. The other leases with State Farm expire in 2032, 2035, 2037, 2039 and 2042. |

| Underwritten Net Cash Flow(1) |

| | Underwritten In-Place | Adjusted Underwritten | Per Square Foot | %(2) |

| Rents in Place(3) | $52,798,483 | $52,798,483 | $25.99 | 62.7% |

| Credit Tenant Rent Steps(4) | 0 | 11,242,393 | 5.53 | 13.3% |

| Vacant Income | 0 | 300,493 | 0.15 | 0.4% |

| Gross Potential Rent | $52,798,483 | $64,341,369 | $31.68 | 76.4% |

| Total Reimbursements(5) | 17,819,370 | 19,919,069 | 9.81 | 23.6% |

| Net Rental Income | $70,617,853 | $84,260,438 | $41.48 | 100.0% |

| (Vacancy/Credit Loss)(6) | 0 | (1,100,423) | (0.54) | (1.3) |

| Effective Gross Income | $70,617,853 | $83,160,015 | $40.94 | 98.7% |

| Total Expenses(7) | $17,716,262 | $19,826,859 | $9.76 | 23.8% |

| Net Operating Income | $52,901,590 | $63,333,156 | $31.18 | 76.2% |

| Total TI/LC, Capex/RR | 0 | 195,923 | 0.10 | 0.2% |

| Net Cash Flow | $52,901,590 | $63,137,233 | $31.08 | 75.9% |

| (1) | Historical financial information is not available as the Marina Heights State Farm property was constructed between 2015 and 2017. |

| (2) | % column represents percent of Net Rental Income for all revenue lines and represents percent of Effective Gross Income for the remainder of the fields. |

| (3) | Rents in Place include rent steps through January 31, 2019. |

| (4) | Credit Tenant Rent Steps reflect the net present value of future contractual rent steps for State Farm leases (office and MarinaLink (State Farm) space) through the lease term (excluding any rent steps already captured in Rents in Place), using a discount rate of 7.0%. |

| (5) | Underwritten In-Place Total Reimbursements reflect contractual expense reimbursements for all tenants at the property, based on a pro-rata share of budgeted expenses and management office rent and reimbursements. Adjusted Underwritten Total Reimbursements are calculated the same as Underwritten In-Place, however the additional management fee and ground rent expense is passed through to occupied tenants. |

| (6) | Vacancy/Credit Loss reflects 1.0% vacancy for State Farm space, in-place economic vacancy for retail space of 21.2% and 0% vacancy on management office space. |

| (7) | Adjusted Underwritten Total Expenses includes the average of ground rent expense over the Marina Heights State Farm Whole Loan term, which is required to be reimbursed by the tenants (other than the tenant under the space used for management). |

Property Management.The property is managed by Transwestern Commercial Services Arizona, L.L.C., an affiliate of the borrower.

Escrows and Reserves.

Tax Escrows - On a monthly basis, during the continuance of a Trigger Period (as defined below) or after the ARD (or following any failure of State Farm to pay all required taxes, insurance, and ground rent payments when due), the borrower is required to escrow an amount equal to 1/12 of projected annual property tax payments.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 18 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

Insurance Escrows -On a monthly basis, during the continuance of a Trigger Period or after the ARD (or following any failure of State Farm to pay all required taxes, insurance, and ground rent payments when due), the borrower is required to escrow an amount equal to 1/12 of projected annual estimated insurance premiums.

Replacement Reserves- On a monthly basis, during the continuance of a Trigger Period or after the ARD, the borrower is required to escrow an amount equal to approximately $50,782 (approximately $0.30 per square foot per annum) into a capital expenditure reserve.

TI/LC Reserves- On a monthly basis, during the continuance of a Trigger Period or after the ARD the borrower is required to escrow (i) an amount equal to approximately $338,549 (approximately $2.00 per square foot per annum) into a tenant improvements and leasing commissions reserve.

Ground Rent Escrows- On a monthly basis, during the continuance of a Trigger Period or after the ARD (or following any failure of State Farm to pay all required taxes, insurance, and ground rent payments when due), the borrower is required to escrow an amount equal to 1/12 of projected annual ground rent.

Lockbox / Cash Management.The Marina Heights State Farm Whole Loan is structured with a hard lockbox and springing cash management. The tenants are required to pay rent directly to a lender-controlled lockbox account, and all other money received by the borrower with respect to the Marina Heights State Farm property (other than tenant security deposits required to be held in escrow accounts) is required to be promptly deposited into such lockbox account during the term of the Marina Heights State Farm Whole Loan. Prior to the ARD, for so long as no Trigger Period or event of default under the Marina Heights State Farm Whole Loan is continuing, funds in the lockbox account will be transferred daily at the direction of the borrower. After the occurrence of and during the continuance of a Trigger Period, after the ARD or during the continuance of an event of default under the Marina Heights State Farm Whole Loan, all amounts in the lockbox account are required to be swept to a lender-controlled cash management account on a daily basis and applied to payment of debt service and operating expenses and funding of required reserves, with the remainder deposited into an excess cash flow reserve and held by the lender as additional collateral for the Marina Heights State Farm Whole Loan; provided, however, that to the extent no event of default is then ongoing, funds in the excess cash flow account will be made available to the borrower for: (x) certain tenant improvement and/or leasing commission costs (to the extent there are, as of said date of disbursement, insufficient funds in the leasing reserve for payment of the same and, (y) certain operating expenses that are due and payable; provided that cash flow from the Marina Heights State Farm property is insufficient to make such payments.

A “Trigger Period” means any period during which (i) State Farm is in default under any lease beyond any applicable notice and cure period, (ii) State Farm is rated below Baa3 by Moody’s (to the extent that Moody’s is then rating State Farm) or BBB- by S&P, (iii) State Farm has surrendered, cancelled or terminated any of the State Farm leases or given written notice of its intent to surrender, cancel or terminate any of State Farm leases, (iv) State Farm fails to continuously occupy at least 50.0% of the aggregate space demised by all of the State Farm leases or (v) State Farm is the subject of a voluntary or involuntary bankruptcy proceeding or the subject of any other proceeding under any reorganization, arrangement, adjustment of debt, relief of creditors, dissolution, insolvency or similar law of any jurisdiction or State Farm has otherwise dissolved, been adjudicated insolvent or bankrupt or made a general assignment for the benefit of creditors. A Trigger Period will no longer be continuing if a replacement tenant or replacement tenants that are each rated Baa3 or better by Moody’s and BBB- or better by S&P and have assumed the obligations of State Farm under its leases or have entered into a replacement lease(s) for the State Farm space.

Condominium.The Marina Heights State Farm property has been divided into multiple condominium units, each of which is owned by the borrower and is part of the collateral by way of the condominium units being part of the ground leasehold interest in the Marina Heights State Farm property. The borrower also owns 100% of the undivided interests in the common elements of the condominium, and controls 100% of the condominium association. See “Description of the Mortgage Pool— Mortgage Pool Characteristics—Condominium Interests” in the Preliminary Prospectus.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 19 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

| Marina Heights State Farm |

Ground Lease.The borrower’s interest with respect to the property is through a ground lease with the Arizona Board of Regents, a body corporate, for and on behalf of Arizona State University (the “Ground Lessor”) that commenced on August 16, 2013 and expires on August 16, 2112 (the “Ground Lease”). The borrower has one option to renew for a period of no fewer than 25 and no more than 99 years. The ground lease is structured with seven separate phases corresponding to the seven buildings. No rent payments are due with respect to any phase under the ground lease until October 13, 2023 (the 8th anniversary of the day the first certificate of occupancy was issued for the first phase). The rent commencement dates for the phases begin on October 13, 2023 and the final phase rent commences March 3, 2025. The maximum ground rent expense once rent commences for all phases is $4,375,033per annum. There are no contractual ground lease increases. $30,905,569 of rent was prepaid to the Ground Lessor. In addition to ground rent, the Ground Lease requires the tenant to cover certain additional costs and expenses, including but not limited to (i) annual payments to the city of Tempe, which includes a set of annual payments calculated on gross building space and number of office floors (a portion of these payments fund K-12 city schools) and a $309,315 annual municipal services fee, (ii) annual payments to the Rio Salado Community Facilities District equal to the Ground Lessor’s proportionate share of maintaining the adjacent public lake and park and (iii) all taxes, assessments, utility fees or other charges imposed upon or that are a lien on the property or the improvements. For example, pending the execution of the Streetcar Development Agreement in order to develop the Streetcar project, the borrower will be required to pay annual payments of $210,125.30 for 20 years, totaling an aggregate payment of $4,202,506. The property is exempt from property taxes because the Ground Lessor is a tax exempt government agency. The Ground Lease prohibits the Ground Lessor from transferring the fee to any entity that is not the State of Arizona or a political subdivision thereof that is exempt from property taxes. The Marina Heights State Farm loan was underwritten assuming no property taxes are paid. The ground lease requires the consent of the Ground Lessor, to any transfer by the ground lessee of its ground leasehold interest, which consent may not be unreasonably withheld, delayed or conditioned. Such consent is not required in connection with a lender’s enforcement of its lien.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 20 of 108 |  |

| Structural and Collateral Term Sheet | | JPMDB 2018-C8 |

| |

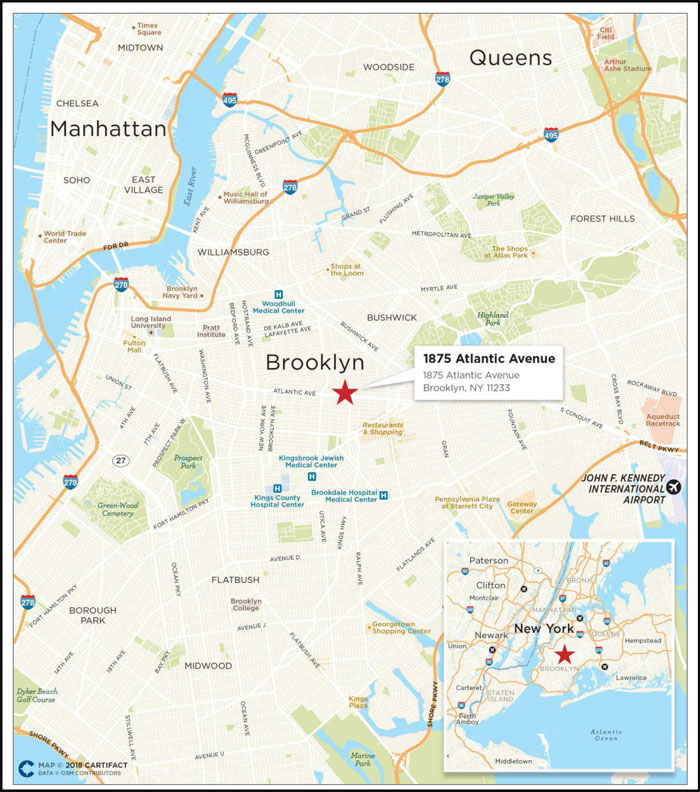

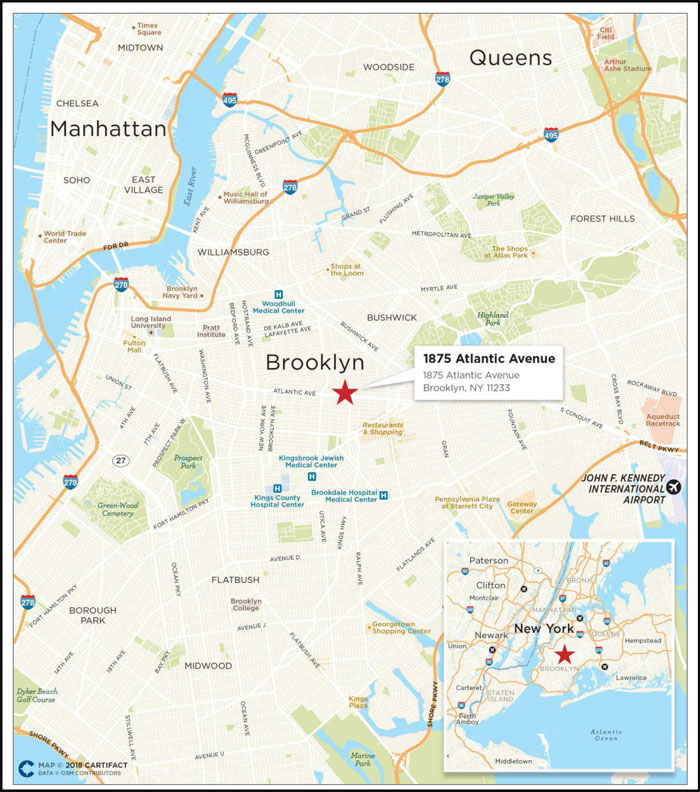

| 1875 Atlantic Avenue |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 21 of 108 |  |