| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226123-04 |

| | | |

| June [3], 2019 | JPMCC 2019-COR5 |

Free Writing Prospectus Structural and Collateral Term Sheet |

JPMCC 2019-COR5 This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Jefferies LLC and Drexel Hamilton, LLC, (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-226123) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk atabs_synd@jpmorgan.com. THE SECURITIES TO WHICH THIS INFORMATION RELATES WILL BE MORE FULLY DESCRIBED IN A PROSPECTUS (THE “PROSPECTUS”), WHICH IS NOT YET AVAILABLE. THE PROSPECTUS WILL CONTAIN MATERIAL INFORMATION THAT IS NOT CONTAINED IN THESE MATERIALS (INCLUDING WITHOUT LIMITATION A DETAILED DISCUSSION OF RISKS ASSOCIATED WITH AN INVESTMENT IN THE CERTIFICATES, UNDER THE HEADING“RISK FACTORS”IN THE PROSPECTUS). Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

1 of 116

| June [3], 2019 | JPMCC 2019-COR5 |

THE REPUBLIC OF KOREA

IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $698,637,121 |

| | Number of Mortgage Loans: | 46 |

| | Number of Mortgaged Properties: | 135 |

| | Average Cut-off Date Balance per Mortgage Loan: | $15,187,764 |

| | Weighted Average Current Mortgage Rate: | 4.79423% |

| | 10 Largest Mortgage Loans as % of IPB: | 63.1% |

| | Weighted Average Remaining Term to Maturity: | 112 months |

| | Weighted Average Seasoning: | 3 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(1)(2): | 1.79x |

| | Weighted Average UW NOI Debt Yield(1): | 10.0% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(3): | 58.6% |

| | Weighted Average Maturity Date LTV(1)(3): | 54.5% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 39.3% |

| | % of Mortgaged Properties with Single Tenants: | 8.2% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(4): | 355 months |

| | Weighted Average Remaining Amortization Term(4): | 354 months |

| | % of Mortgage Loans with Interest-Only: | 57.1% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 21.9% |

| | % of Mortgage Loans with Amortizing Balloon: | 21.0% |

| | | |

| Lockbox / Cash Management(5) | |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 80.9% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 9.8% |

| | % of Mortgage Loans with Springing Lockboxes: | 9.3% |

| | % of Mortgage Loans with In-Place Cash Management: | 50.3% |

| | % of Mortgage Loans with Springing Cash Management: | 49.7% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 90.0% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 52.2% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(6): | 79.6% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(7): | 77.9% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 9, 13, 14, 20, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 6, 11, 20 and 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes 30 mortgage loans that are interest-only for the entire term. |

| (5) | For a more detailed description of Lockbox / Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (6) | CapEx Reserves include FF&E reserves for hotel properties. |

| (7) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by retail, office and mixed use properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | % of IPB |

| LCM | 18 | 81 | $438,826,733 | 62.8% |

| JPMCB(1) | 28 | 54 | 259,810,388 | 37.2 |

| Total | 46 | 135 | $698,637,121 | 100.0% |

| (1) | In the case of Loan No. 6, the whole loan was co-originated by JPMCB and Société Générale Financial Corporation. JPMCB will contribute promissory note A-9 with a Cut-off Date Balance of $35.0 million to this securitization. |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | Mortgage

Loan Seller | No.

of Prop. | Cut-off

Date

Balance | % of

IPB | SF / Units/

Rooms /

Beds | Property

Type | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 1 | Brooklyn Renaissance Plaza | LCM | 1 | $64,920,607 | 9.3% | 289,180 | Office | 1.43x | 8.9% | 48.6% | 39.2% |

| 2 | Hyde Park Multifamily Portfolio | LCM | 42 | $60,000,000 | 8.6% | 839 | Multifamily | 1.84x | 8.8% | 60.5% | 60.5% |

| 3 | The Avenue | LCM | 1 | $60,000,000 | 8.6% | 394 | Multifamily | 1.82x | 9.4% | 50.0% | 50.0% |

| 4 | 3 Columbus Circle | JPMCB | 1 | $50,000,000 | 7.2% | 753,713 | Office | 2.91x | 12.3% | 45.4% | 45.4% |

| 5 | Hampton Roads Office Portfolio | LCM | 22 | $49,901,186 | 7.1% | 1,322,003 | Office | 1.34x | 10.4% | 71.7% | 60.3% |

| 6 | SWVP Portfolio | JPMCB | 4 | $35,000,000 | 5.0% | 1,192 | Hotel | 2.04x | 11.9% | 59.6% | 59.6% |

| 7 | Terrace at Traverse Mountain | LCM | 1 | $32,000,000 | 4.6% | 117,097 | Retail | 1.75x | 9.2% | 58.2% | 58.2% |

| 8 | Peppertree Plaza | LCM | 1 | $31,850,000 | 4.6% | 248,901 | Retail | 1.57x | 10.7% | 68.3% | 61.7% |

| 9 | Vie Portfolio | JPMCB | 6 | $29,000,000 | 4.2% | 1,799 | Multifamily | 1.90x | 9.9% | 62.5% | 62.5% |

| 10 | Gateway Center | JPMCB | 1 | $28,350,000 | 4.1% | 310,745 | Office | 1.70x | 9.3% | 69.7% | 69.7% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 44 | $184,920,607 | 26.5% | | | 1.69x | 9.0% | 52.9% | 49.6% |

| | Top 5 Total/Weighted Average | 67 | $284,821,793 | 40.8% | | | 1.84x | 9.8% | 54.9% | 50.7% |

| | Top 10 Total/Weighted Average | 80 | $441,021,793 | 63.1% | | | 1.83x | 10.0% | 57.9% | 54.8% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6 and 9, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4 and 5, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (3) | In the case of Loan No. 6, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| Loan No. | Mortgage

Loan | Note(s) | Original

Balance ($) | Cut-off Date

Balance ($) | Holder of Note | Lead

Servicer

for Whole

Loan (Y/N) | Master

Servicer

Under Lead Securitization | Special

Servicer Under Lead

Securitization |

| 1 | Brooklyn Renaissance Plaza | Note A-1 | $65,000,000 | $64,920,607 | JPMCC 2019-COR5 | Y | Midland | Midland |

| | Note A-2 | $25,000,000 | $24,969,464 | LCM | N | | |

| | Total | $90,000,000 | $89,890,072 | | | | |

2 | Hyde Park Multifamily Portfolio | Note A-1 | $60,000,000 | $60,000,000 | JPMCC 2019-COR5 | Y | Midland | Midland |

| | Note A-2 | $46,750,000 | $46,750,000 | LCM | N | | |

| | Total | $106,750,000 | $106,750,000 | | | | |

| 4 | 3 Columbus Circle | NoteA-1-1, A-2-1 | $75,000,000 | $75,000,000 | Benchmark 2019-B10 | Y(2) | | |

| | | Note A-1-2-A | $50,000,000 | $50,000,000 | JPMCC 2019-COR5 | N | | |

| | | Note A-1-3, A-2-4 | $100,000,000 | $100,000,000 | Benchmark 2019-B11(3) | N | | |

| | | Note A-1-2-B, A-1-4, A-1-6, A-1-7, A-1-8 | $142,500,000 | $142,500,000 | JPMCB | N | | |

| | | Note A-1-5 | $50,000,000 | $50,000,000 | CS | N | | |

| | | Note A-2-2, A-2-3 | $50,000,000 | $50,000,000 | CF 2019-CF1 | N | | |

| | | Note A-2-5-A | $12,500,000 | $12,500,000 | DBNY | N | | |

| | | Note A-2-5-B | $10,000,000 | $10,000,000 | CCRE | N | | |

| | | Note B-1(1) | $51,450,000 | $51,450,000 | Benchmark 2019-B10 | Y(2) | KeyBank | LNR |

| | | Note B-2(1) | $53,550,000 | $53,550,000 | Benchmark 2019-B10 | N | | |

| | | Total | $595,000,000 | $595,000,000 | | | | |

5 | Hampton Roads Office Portfolio | Note A-1, A-5 | $50,000,000 | $49,901,186 | JPMCC 2019-COR5 | Y | Midland | Midland |

| | Note A-2, A-3, A-4, A-6 | $83,000,000 | $82,835,969 | LCM | N | | |

| | | Total | $133,000,000 | $132,737,155 | | | | |

6 | SWVP Portfolio | Note A-1, A-3 | $45,000,000 | $45,000,000 | BBCMS 2019-C3(4) | Y | Midland | Midland |

| | | Note A-2, A-4, A-5, A-6 | $55,000,000 | $55,000,000 | Société Générale | N | | |

| | | Note A-7, A-8 | $50,000,000 | $50,000,000 | Benchmark 2019-B11(3) | N | | |

| | | Note A-9 | $35,000,000 | $35,000,000 | JPMCC 2019-COR5 | N | | |

| | | Note A-10 | $15,000,000 | $15,000,000 | JPMCB | N | | |

| | | Total | $200,000,000 | $200,000,000 | | | | |

9 | Vie Portfolio | Note A-1 | $29,000,000 | $29,000,000 | JPMCC 2019-COR5 | Y | Midland | Midland |

| | | Note A-2 | $17,500,000 | $17,500,000 | Benchmark 2019-B10 | N | | |

| | | Note A-3 | $28,885,000 | $28,885,000 | JPMCB | N | | |

| | | Total | $75,385,000 | $75,385,000 | | | | |

13 | ICON Upper Side East Portfolio | Note A-1 | $8,500,000 | $8,500,000 | JPMCC 2019-ICON UES | Y | Midland | CWCapital |

| | Note A-2 | $25,000,000 | $25,000,000 | JPMCC 2019-COR5 | N | | |

| | | Note A-3 | $25,000,000 | $25,000,000 | JPMCB | N | | |

| | | Note B(1) | $57,200,000 | $57,200,000 | JPMCC 2019-ICON UES | N | | |

| | | Total | $115,700,000 | $115,700,000 | | | | |

14 | NOV Headquarters | Note A-1 | $20,000,000 | $20,000,000 | JPMCC 2019-COR5 | Y | Midland | Midland |

| | | Note A-2 | $19,200,000 | $19,200,000 | LCM | N | | |

| | | Total | $39,200,000 | $39,200,000 | | | | |

20 | Greenleaf at Howell | Note A-1-A | $10,000,000 | $10,000,000 | JPMCC 2019-COR5 | N | | |

| | Note A-1-B | $10,000,000 | $10,000,000 | JPMCB | N | | |

| | Note A-2 | $26,500,000 | $26,500,000 | Benchmark 2019-B11(3) | Y | Midland | Rialto |

| | | Total | $46,500,000 | $46,500,000 | | | | |

Various(5) | ICON 18 Mortgage Loans(5) | Notes A-1 | $30,000,000 | $30,000,000 | JPMCC 2019-COR5 | Y | Midland | Situs |

| | Notes A-2 | $60,771,256 | $60,771,256 | JPMCC 2019-ICON | N | | |

| | | Notes B(1) | $83,928,744 | $83,928,744 | JPMCC 2019-ICON | N | | |

| | | Total | $174,700,000 | $174,700,000 | | | | |

| (1) | Each note represents a subordinate companion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| (2) | With respect to the 3 Columbus Circle Whole Loan, the initial controlling note is Note B-1, so long as no 3 Columbus Circle Control Appraisal Period has occurred and is continuing. If and for so long as a 3 Columbus Circle Control Termination Eventhas occurred and is continuing, then the controlling note will be the Note A-1-1. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loans—The 3 Columbus Circle Whole Loan” in the Preliminary Prospectus. The 3 Columbus Circle Whole Loan is serviced pursuant to the Benchmark 2019-B10 Pooling and Servicing Agreement. |

| (3) | With respect to Loan Nos. 4, 6 and 20, Notes A-1-3, A-2-4, Notes A-7, A-8 and Note A-1, respectively, are expected to be contributed to the Benchmark 2019-B11 trust. |

| (4) | With respect to Loan No. 6, Notes A-1 and A-3 are expected to be contributed to the BBCMS 2019-C3 trust. |

| (5) | The ICON 18 mortgage loans are comprised of 18 separate uncrossed mortgage loans with the same borrower sponsor. Each of these mortgage loans are collectively referred to from time to time as the “ICON 18 Mortgage Loans”, and the related whole loans as the “ICON 18 Whole Loans”. Each ICON 18 mortgage loan is serviced pursuant to the JPMCC 2019-ICON trust and servicing agreement. The Master Servicer Under Lead Securitization and the Special Servicer Under Lead Securitization applicable to each ICON 18 mortgage loan is Midland Loan Services, a Division of PNC Bank, National Association and Situs Holdings, LLC, respectively. In addition, the Original Balance ($) and Cut-off Date Balance ($) represents the related ICON 18 mortgage loan notes in the aggregate. The Holder of Note set forth above reflects the current holder of each ICON mortgage loan Note A-1, Note A-2 and Note B, as applicable. Please see “Additional Debt Summary” below for more information. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off Date

Balance | Subordinate

Debt Cut-off

Date

Balance(1) | Total Debt

Cut-off

Date

Balance | Mortgage

Loan UW

NCF

DSCR(2)(3) | Total

Debt

UW

NCF

DSCR(3) | Mortgage

Loan

Cut-off

Date

LTV(2) | Total

Debt

Cut-off

Date

LTV | Mortgage

Loan UW

NOI Debt

Yield(2) | Total

Debt

UW NOI Debt

Yield |

| 2 | Hyde Park Multifamily Portfolio | $60,000,000 | $15,250,000 | $122,000,000 | 1.84x | 1.49x | 60.5% | 69.2% | 8.8% | 7.7% |

| 3 | The Avenue | $60,000,000 | $25,680,000 | $85,680,000 | 1.82x | 1.11x | 50.0% | 71.4% | 9.4% | 6.6% |

| 4 | 3 Columbus Circle | $50,000,000 | $105,000,000 | $595,000,000 | 2.91x | 2.40x | 45.4% | 55.1% | 12.3% | 10.2% |

| 5 | Hampton Roads Office Portfolio | $49,901,186 | $19,960,474 | $152,697,629 | 1.34x | 1.11x | 71.7% | 82.5% | 10.4% | 9.0% |

| 13 | ICON Upper East Side Portfolio | $25,000,000 | $57,200,000 | $115,700,000 | 2.63x | 1.33x | 29.1% | 57.5% | 12.2% | 6.2% |

| 28 | ICON 18 - 320-324 West 14th Street | $3,819,049 | $8,644,670 | $20,200,000 | 2.35x | 1.34x | 37.2% | 65.0% | 12.6% | 7.2% |

| 29 | ICON 18 - 446-450 West 19th Street | $3,170,508 | $9,706,968 | $19,300,000 | 2.32x | 1.15x | 30.6% | 61.7% | 12.4% | 6.2% |

| 30 | ICON 18 - 57-59 Second Avenue | $3,042,033 | $8,955,696 | $18,160,000 | 2.33x | 1.18x | 28.5% | 56.2% | 12.6% | 6.4% |

| 31 | ICON 18 - 43 West 27th Street | $2,972,307 | $8,506,667 | $17,500,000 | 2.34x | 1.20x | 28.2% | 54.9% | 12.6% | 6.5% |

| 32 | ICON 18 - 59-61 East 3rd Street | $2,266,072 | $6,408,526 | $13,265,000 | 2.28x | 1.18x | 27.4% | 53.1% | 12.3% | 6.4% |

| 34 | ICON 18 - 808 Lexington Avenue | $1,742,703 | $4,052,089 | $9,325,000 | 2.35x | 1.33x | 37.1% | 65.7% | 12.6% | 7.1% |

| 35 | ICON 18 - 1384 First Avenue | $1,623,750 | $4,687,006 | $9,600,000 | 2.49x | 1.28x | 29.1% | 56.8% | 13.5% | 6.9% |

| 36 | ICON 18 - 329 Union Street | $1,385,894 | $3,931,689 | $8,125,000 | 2.39x | 1.23x | 34.9% | 67.7% | 12.9% | 6.6% |

| 37 | ICON 18 - 350 East 13th Street | $1,349,016 | $4,003,272 | $8,085,000 | 2.36x | 1.19x | 32.7% | 64.7% | 12.6% | 6.4% |

| 38 | ICON 18 - 358 & 362 11th Street | $1,318,637 | $3,835,187 | $7,825,000 | 2.38x | 1.21x | 30.0% | 58.8% | 12.8% | 6.5% |

| 39 | ICON 18 - 610 East 9th Street | $1,249,447 | $3,719,537 | $7,500,000 | 2.35x | 1.18x | 28.6% | 56.8% | 12.7% | 6.4% |

| 40 | ICON 18 - 316 West 14th Street | $1,228,744 | $3,582,180 | $7,300,000 | 2.25x | 1.15x | 34.4% | 67.6% | 12.2% | 6.2% |

| 41 | ICON 18 - 402 East 12th Street | $1,207,464 | $3,571,565 | $7,225,000 | 2.34x | 1.18x | 30.7% | 60.7% | 12.7% | 6.4% |

| 42 | ICON 18 - 42 Sidney Place | $1,055,674 | $3,205,837 | $6,400,000 | 2.38x | 1.19x | 30.4% | 61.0% | 12.8% | 6.4% |

| 43 | ICON 18 - 522 East 5th Street | $815,544 | $2,432,401 | $4,900,000 | 2.37x | 1.19x | 27.1% | 53.8% | 12.9% | 6.5% |

| 44 | ICON 18 - 106 Bedford Avenue | $698,956 | $1,935,164 | $4,050,000 | 2.48x | 1.30x | 34.1% | 65.3% | 13.3% | 7.0% |

| 45 | ICON 18 - 295 DeGraw Street | $548,322 | $1,615,936 | $3,275,000 | 2.46x | 1.25x | 29.6% | 58.5% | 13.3% | 6.7% |

| 46 | ICON 18 - 413 South 5th Street | $505,879 | $1,134,356 | $2,665,000 | 2.33x | 1.34x | 35.6% | 62.0% | 12.5% | 7.2% |

| (1) | In the case of Loan Nos. 2, 3 and 5, Subordinate Debt Cut-off Date Balance represents one or more mezzanine loans. In the case of Loan Nos. 4, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans. |

| (2) | In the case of Loan Nos. 2, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield and Cut-off Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield and Cut-off Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number

of

Properties | Cut-off Date

Principal

Balance | % of IPB | Occupancy | UW

NCF

DSCR(2)(3) | UW

NOI Debt

Yield(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(2)(4) |

| Office | CBD | 3 | $143,270,607 | 20.5% | 92.0% | 2.00x | 10.2% | 51.7% | 47.4% |

| | Suburban | 26 | 124,901,186 | 17.9 | 93.5% | 1.45x | 9.5% | 69.5% | 61.4% |

| | Subtotal: | 29 | $268,171,793 | 38.4% | 92.7% | 1.75x | 9.9% | 60.0% | 53.9% |

| | | | | | | | | | |

| Multifamily | Garden | 35 | $112,284,976 | 16.1% | 94.2% | 1.81x | 9.2% | 55.3% | 55.2% |

| | Mid-Rise | 34 | 47,294,443 | 6.8 | 98.4% | 2.30x | 11.2% | 40.0% | 40.0% |

| | Student Housing | 6 | 39,078,891 | 5.6 | 91.2% | 1.72x | 9.7% | 66.2% | 61.7% |

| | Subtotal: | 75 | $198,658,310 | 28.4% | 94.6% | 1.91x | 9.8% | 53.8% | 52.8% |

| | | | | | | | | | |

| Retail | Anchored | 5 | $112,650,000 | 16.1% | 93.0% | 1.54x | 9.8% | 67.6% | 61.5% |

| | Freestanding | 1 | 7,600,000 | 1.1 | 100.0% | 1.72x | 9.2% | 62.3% | 62.3% |

| | Subtotal: | 6 | $120,250,000 | 17.2% | 93.5% | 1.56x | 9.8% | 67.2% | 61.5% |

| | | | | | | | | | |

| Mixed Use | Retail/Office | 3 | $29,300,000 | 4.2% | 91.0% | 1.45x | 9.6% | 69.2% | 62.9% |

| | Multifamily/Retail | 11 | 22,149,118 | 3.2 | 97.1% | 2.40x | 12.5% | 31.3% | 31.3% |

| | Multifamily/Office | 1 | 1,296,456 | 0.2 | 100.0% | 2.63x | 12.2% | 29.1% | 29.1% |

| | Subtotal: | 15 | $52,745,574 | 7.5% | 93.8% | 1.88x | 10.9% | 52.3% | 48.8% |

| | | | | | | | | | |

| Hotel | Full Service | 4 | $35,000,000 | 5.0% | 80.2% | 2.04x | 11.9% | 59.6% | 59.6% |

| | Subtotal: | 4 | $35,000,000 | 5.0% | 80.2% | 2.04x | 11.9% | 59.6% | 59.6% |

| | | | | | | | | | |

| Manufactured Housing | Manufactured Housing | 3 | $18,029,940 | 2.6% | 98.1% | 1.56x | 10.2% | 55.3% | 45.6% |

| | Subtotal: | 3 | $18,029,940 | 2.6% | 98.1% | 1.56x | 10.2% | 55.3% | 45.6% |

| | | | | | | | | | |

| Other | Parking | 3 | $5,781,504 | 0.8% | 100.0% | 2.61x | 14.3% | 43.2% | 43.2% |

| | Subtotal: | 3 | $5,781,504 | 0.8% | 100.0% | 2.61x | 14.3% | 43.2% | 43.2% |

| | Total / Weighted Average: | 135 | $698,637,121 | 100.0% | 93.0% | 1.79x | 10.0% | 58.6% | 54.5% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 6, 9, 13, 14, 20, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 6, 11, 20 and 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

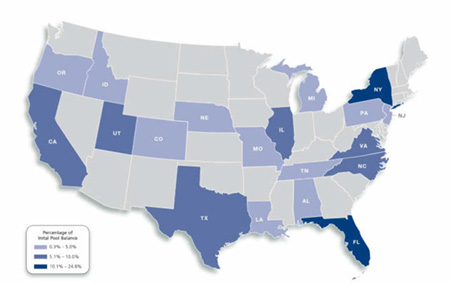

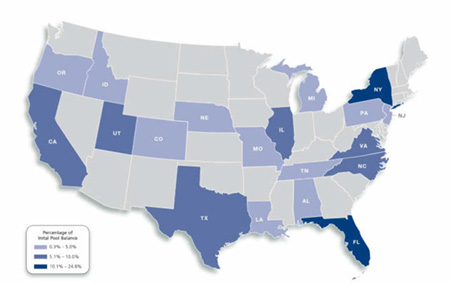

| Mortgaged Properties by Location(1) |

| |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date

Principal

Balance | % of

IPB | Occupancy | UW

NCF DSCR(2)(3) | UW

NOI Debt

Yield(2) | Cut-off Date

LTV(2)(4) | Maturity Date

LTV(2)(4) |

| New York | 40 | $173,577,104 | 24.8% | 94.2% | 2.20x | 11.0% | 42.2% | 38.7% |

| Florida | 6 | 119,020,329 | 17.0 | 94.0% | 1.75x | 10.0% | 58.3% | 56.0% |

| Illinois | 43 | 66,500,000 | 9.5 | 94.5% | 1.79x | 8.9% | 60.8% | 60.3% |

| Utah | 2 | 57,750,000 | 8.3 | 89.7% | 1.50x | 9.1% | 65.5% | 59.2% |

| Virginia | 22 | 49,901,186 | 7.1 | 91.9% | 1.34x | 10.4% | 71.7% | 60.3% |

| California | 4 | 41,100,655 | 5.9 | 96.6% | 1.65x | 9.7% | 59.8% | 55.3% |

| Texas | 3 | 39,521,154 | 5.7 | 96.5% | 1.63x | 8.8% | 69.4% | 64.9% |

| North Carolina | 3 | 38,272,500 | 5.5 | 87.7% | 1.79x | 10.0% | 67.1% | 67.1% |

| Nebraska | 1 | 26,500,000 | 3.8 | 91.2% | 1.43x | 9.9% | 73.8% | 64.9% |

| Oregon | 2 | 21,404,285 | 3.1 | 93.6% | 1.49x | 9.5% | 65.3% | 58.3% |

| Louisiana | 1 | 18,602,500 | 2.7 | 78.7% | 2.04x | 11.9% | 59.6% | 59.6% |

| Idaho | 1 | 12,300,000 | 1.8 | 93.8% | 1.47x | 10.3% | 75.0% | 63.1% |

| New Jersey | 1 | 10,000,000 | 1.4 | 100.0% | 1.20x | 8.3% | 69.5% | 60.3% |

| Alabama | 1 | 7,890,031 | 1.1 | 86.0% | 1.90x | 9.9% | 62.5% | 62.5% |

| Colorado | 1 | 4,650,000 | 0.7 | 96.5% | 1.36x | 9.3% | 69.9% | 65.8% |

| Missouri | 1 | 3,700,000 | 0.5 | 100.0% | 2.65x | 14.6% | 42.3% | 42.3% |

| Michigan | 1 | 3,623,798 | 0.5 | 85.1% | 1.90x | 9.9% | 62.5% | 62.5% |

| Pennsylvania | 1 | 2,523,579 | 0.4 | 92.1% | 1.90x | 9.9% | 62.5% | 62.5% |

| Tennessee | 1 | 1,800,000 | 0.3 | 100.0% | 2.65x | 14.6% | 42.3% | 42.3% |

| Total / Weighted Average | 135 | $698,637,121 | 100.0% | 93.0% | 1.79x | 10.0% | 58.6% | 54.5% |

| (1) | Because this table represents information relating to the mortgaged properties and not mortgage loans, the information for the mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 5, 6, 9, 13, 14, 20, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 6, 11, 20 and 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

Range of Cut-off Date

Principal Balances | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| $505,879 | - | $9,999,999 | 26 | $79,854,940 | 11.4% | 5.17572% | 86 | 1.92x | 11.3% | 49.3% | 45.7% |

| $10,000,000 | - | $19,999,999 | 6 | 80,510,388 | 11.5 | 4.74542% | 119 | 1.50x | 9.4% | 68.1% | 60.9% |

| $20,000,000 | - | $24,999,999 | 1 | 20,000,000 | 2.9 | 4.63000% | 118 | 1.71x | 8.2% | 68.8% | 68.8% |

| $25,000,000 | - | $49,999,999 | 9 | 283,351,186 | 40.6 | 4.96901% | 112 | 1.70x | 10.3% | 63.9% | 59.0% |

| $50,000,000 | - | $64,920,607 | 4 | 234,920,607 | 33.6 | 4.48444% | 117 | 1.95x | 9.7% | 51.3% | 48.7% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 3.91400% | - | 4.41400% | 3 | $127,420,607 | 18.2% | 4.19733% | 118 | 2.04x | 10.4% | 48.7% | 43.4% |

| 4.41401% | - | 4.91400% | 9 | 239,625,000 | 34.3 | 4.69070% | 111 | 1.76x | 9.6% | 61.5% | 58.6% |

| 4.91401% | - | 5.38200% | 34 | 331,591,514 | 47.5 | 5.09841% | 110 | 1.71x | 10.2% | 60.4% | 55.9% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date LTV(1)(3) |

| 60 | 21 | $65,150,000 | 9.3% | 4.97182% | 57 | 2.41x | 12.4% | 34.2% | 33.9% |

| 120 | 24 | 607,737,121 | 87.0 | 4.76380% | 117 | 1.74x | 9.8% | 60.5% | 56.5% |

| 123 | 1 | 25,750,000 | 3.7 | 5.06300% | 118 | 1.20x | 8.9% | 74.6% | 60.4% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

Range of Remaining Term to

Maturity in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date LTV(1)(3) |

| 55 | - | 84 | 21 | $65,150,000 | 9.3% | 4.97182% | 57 | 2.41x | 12.4% | 34.2% | 33.9% |

| 85 | - | 119 | 23 | 604,237,121 | 86.5 | 4.78452% | 117 | 1.72x | 9.8% | 61.1% | 56.5% |

| 120 | - | 120 | 2 | 29,250,000 | 4.2 | 4.59915% | 120 | 1.70x | 9.6% | 61.6% | 59.2% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 9, 13, 14, 20, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 6, 11, 20 and 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 30 | $399,200,000 | 57.1% | 4.76201% | 108 | 2.06x | 10.3% | 53.6% | 53.6% |

| 300 | 1 | 25,750,000 | 3.7 | 5.06300% | 118 | 1.20x | 8.9% | 74.6% | 60.4% |

| 360 | 15 | 273,687,121 | 39.2 | 4.81593% | 117 | 1.45x | 9.8% | 64.4% | 55.3% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

Range of Remaining

Amortization Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 30 | $399,200,000 | 57.1% | 4.76201% | 108 | 2.06x | 10.3% | 53.6% | 53.6% |

| 300 | - | 359 | 7 | 172,337,121 | 24.7 | 4.86958% | 118 | 1.38x | 9.5% | 61.8% | 50.8% |

| 360 | - | 360 | 9 | 127,100,000 | 18.2 | 4.79323% | 116 | 1.49x | 10.0% | 69.9% | 62.4% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| | | | | | | | | | | | |

| | | | | Weighted Average |

| Amortization Types | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 30 | $399,200,000 | 57.1% | 4.76201% | 108 | 2.06x | 10.3% | 53.6% | 53.6% |

| IO-Balloon | 10 | 152,850,000 | 21.9 | 4.83868% | 116 | 1.44x | 9.8% | 70.7% | 62.0% |

| Balloon | 6 | 146,587,121 | 21.0 | 4.83561% | 118 | 1.41x | 9.6% | 59.6% | 49.1% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| | | | | Weighted Average |

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 1.20x | - | 1.49x | 10 | $229,482,181 | 32.8% | 4.83064% | 117 | 1.37x | 9.4% | 65.5% | 55.3% |

| 1.50x | - | 1.75x | 10 | 162,154,940 | 23.2 | 4.90676% | 117 | 1.66x | 9.5% | 64.4% | 61.6% |

| 1.76x | | 2.00x | 4 | 161,500,000 | 23.1 | 4.80657% | 116 | 1.84x | 9.4% | 57.1% | 56.7% |

| 2.01x | | 2.25x | 2 | 36,228,744 | 5.2 | 4.96824% | 117 | 2.05x | 11.9% | 58.7% | 58.7% |

| 2.26x | - | 2.50x | 17 | 28,771,256 | 4.1 | 5.25420% | 55 | 2.36x | 12.7% | 31.3% | 31.3% |

| 2.51x | - | 2.75x | 2 | 30,500,000 | 4.4 | 4.65905% | 59 | 2.63x | 12.6% | 31.5% | 31.5% |

| 2.76x | - | 2.91x | 1 | 50,000,000 | 7.2 | 3.91400% | 117 | 2.91x | 12.3% | 45.4% | 45.4% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 9, 13, 14, 20, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 6, 11, 20 and 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(1)(3) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number

of Loans | Cut-off Date

Principal

Balance | % of IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 27.1% | - | 37.1% | 18 | $51,180,951 | 7.3% | 4.88551% | 57 | 2.49x | 12.4% | 29.9% | 29.9% |

| 37.2% | - | 47.1% | 3 | 59,319,049 | 8.5 | 4.13677% | 107 | 2.85x | 12.5% | 44.6% | 44.6% |

| 47.2% | - | 69.9% | 19 | 452,375,547 | 64.8 | 4.79017% | 117 | 1.70x | 9.5% | 59.3% | 56.5% |

| 70.0% | - | 75.0% | 6 | 135,761,574 | 19.4 | 5.06061% | 118 | 1.36x | 9.9% | 73.2% | 61.7% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| LTV Ratios as of the Maturity Date(1)(3) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 27.1% | - | 49.9% | 25 | $193,450,547 | 27.7% | 4.50306% | 99 | 2.16x | 11.1% | 43.0% | 39.0% |

| 50.0% | - | 54.9% | 1 | 60,000,000 | 8.6 | 4.99243% | 115 | 1.82x | 9.4% | 50.0% | 50.0% |

| 55.0% | - | 59.9% | 4 | 86,000,000 | 12.3 | 4.84756% | 118 | 1.84x | 10.6% | 59.8% | 58.6% |

| 60.0% | - | 69.7% | 16 | 359,186,574 | 51.4 | 4.90517% | 117 | 1.57x | 9.5% | 68.2% | 62.7% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| | | | | Weighted Average |

| Prepayment Protection | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Defeasance | 20 | $502,275,547 | 71.9% | 4.69473% | 117 | 1.80x | 9.8% | 58.4% | 55.0% |

| Yield Maintenance | 25 | 169,861,574 | 24.3 | 5.10314% | 96 | 1.81x | 10.7% | 56.8% | 51.4% |

| Defeasance or Yield Maintenance | 1 | 26,500,000 | 3.8 | 4.70000% | 119 | 1.43x | 9.9% | 73.8% | 64.9% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| | | | | | | | | | |

| | | | | Weighted Average |

| Loan Purpose | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Refinance | 35 | $424,335,935 | 60.7% | 4.68097% | 109 | 1.88x | 10.2% | 54.8% | 50.7% |

| Acquisition | 11 | 274,301,186 | 39.3 | 4.96944% | 117 | 1.64x | 9.8% | 64.6% | 60.4% |

| Total / Weighted Average: | 46 | $698,637,121 | 100.0% | 4.79423% | 112 | 1.79x | 10.0% | 58.6% | 54.5% |

| (1) | In the case of Loan Nos. 1, 2, 4, 5, 6, 9, 13, 14, 20, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 2, 3, 4, 5, 13, 28, 29, 30, 31, 32, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45 and 46, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 5, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex G of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 6, 11, 20 and 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Loan Name | Cut-off Date Principal

Balance | % of IPB | Location | Property Type | Previous Securitization |

| 4 | 3 Columbus Circle | $50,000,000 | 7.2% | New York, NY | Office | CGCMT 2015-GC29 |

| 9.03 | University View | $5,520,329 | 0.8% | Boca Raton, FL | Multifamily | UBSC 2011-C1 |

| 9.04 | Colonie | $3,656,497 | 0.5% | Amherst, NY | Multifamily | JPMBB 2015-C30 |

| 9.05 | Hillcrest Oakwood | $3,623,798 | 0.5% | Big Rapids, MI | Multifamily | JPMBB 2015-C30 |

| 9.06 | Southgate | $2,523,579 | 0.4% | State College, PA | Multifamily | JPMBB 2015-C30 |

| 26.01 | St. Louis Shoe Surface Lot | $3,700,000 | 0.5% | St. Louis, MO | Other | COMM 2014-UBS2 |

| 26.02 | Memphis Poplar Surface Lot | $1,800,000 | 0.3% | Memphis, TN | Other | COMM 2014-UBS2 |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance Plaza |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | LCM | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $65,000,000 | | Title: | Leasehold |

| Cut-off Date Principal Balance(1): | $64,920,607 | | Property Type - Subtype: | Office – CBD |

| % of Pool by IPB: | 9.3% | | Net Rentable Area (SF): | 289,180 |

| Loan Purpose: | Refinance | | Location: | Brooklyn, NY |

| Borrower: | Brooklyn Renaissance Plaza II LLC | | Year Built / Renovated: | 1998 / 2019 |

| Sponsor: | Joshua L. Muss | | Occupancy(3): | 88.5% |

| Interest Rate: | 4.39000% | | Occupancy Date(3): | 1/28/2019 |

| Note Date: | 4/11/2019 | | Number of Tenants(3): | 10 |

| Maturity Date: | 5/6/2029 | | 2016 NOI: | $6,770,519 |

| Interest-only Period: | None | | 2017 NOI: | $6,528,395 |

| Original Term: | 120 months | | 2018 NOI: | $7,356,524 |

| Original Amortization: | 360 months | | TTM NOI: | N/A |

| Amortization Type: | Balloon | | UW Economic Occupancy: | 88.4% |

| Call Protection(2): | L(25),Def(91),O(4) | | UW Revenues: | $14,691,541 |

| Lockbox / Cash Management: | Hard / In Place | | UW Expenses: | $6,697,245 |

| Additional Debt: | Yes | | UW NOI: | $7,994,296 |

| Additional Debt Balance(1): | $24,969,464 | | UW NCF: | $7,745,455 |

| Additional Debt Type(1): | Pari Passu | | Appraised Value / Per SF: | $185,000,000 / $640 |

| | | | Appraisal Date: | 12/11/2018 |

| | | | | |

| Escrows and Reserves(4) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | $311 | |

| Taxes: | $850,000 | $150,000 | N/A | | Maturity Date Loan / SF: | $251 | |

| Insurance: | $95,000 | $12,000 | N/A | | Cut-off Date LTV: | 48.6% | |

| Replacement Reserves: | $0 | $6,017 | $216,612 | | Maturity Date LTV: | 39.2% | |

| TI/LC: | $3,360,261 | $36,102 | $1,299,672 | | UW NCF DSCR: | 1.43x | |

| Other: | $39,128 | 1/12 of | N/A | | UW NOI Debt Yield: | 8.9% | |

| | | Ground Rent | | | | | |

| | | | | | | |

|

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Whole Loan(1) | $90,000,000 | 100.0% | | Return of Equity(5) | $73,068,982 | 81.2% |

| | | | | Closing Costs | 12,586,629 | 14.0 |

| | | | | Upfront Reserves | 4,344,389 | 4.8 |

| Total Sources | $90,000,000 | 100.0% | | Total Uses | $90,000,000 | 100.0% |

| | | | | | | | | |

| (1) | The Brooklyn Renaissance Plaza Loan (as defined below) is part of a whole loan evidence by twopari passu notes, with an aggregate outstanding principal balance as of the Cut-off Date of approximately $89.9 million. The Financial Information presented in the chart above reflects the Cut-off Date balance of the approximately $89.9 million Brooklyn Renaissance Plaza Whole Loan (as defined below). |

| (2) | The lockout period will be at least 25 payment dates beginning with and including the first payment date of June 6, 2019. Defeasance of the full Brooklyn Renaissance Plaza Whole Loan is permitted after the date that is the earlier to occur of the payment date that is (i) two years after the closing date of the securitization that includes the lastpari passu note to be securitized and (ii) November 2022. The assumed lockout period of 25 payments is based on the expected JPMCC 2019-COR5 securitization closing date in June 2019. The actual lockout period may be longer. |

| (3) | Occupancy excludes Amerigroup Community Care, which currently occupies 33,285 square feet (11.5% of net rentable area) but recently gave notice that it would be vacating its space at lease expiration on June 30, 2019. |

| (4) | For a full description of Escrows and Reserves, please refer to“Escrows and Reserves”below. |

| (5) | The Brooklyn Renaissance Plaza Property (as defined below) was previously unencumbered by debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance Plaza |

The Loan.The Brooklyn Renaissance Plaza loan, with an original principal balance of $65.0 million (the “Brooklyn Renaissance Plaza Loan”), is secured by a first mortgage lien on the borrower’s leasehold interest in a Class A office condominium unit comprised of 289,180 square feet of net rentable area located on floors 24 through 32 of the north tower (the “Brooklyn Renaissance Plaza Property”), which is within the Brooklyn Renaissance Plaza mixed use development (the “Brooklyn Renaissance Plaza Development”) located in downtown Brooklyn, New York. The Brooklyn Renaissance Plaza Loan is part of a whole loan that has an aggregate original principal balance as of the Cut-off Date of approximately $89.9 million (the “Brooklyn Renaissance Plaza Whole Loan”) and is comprised of twopari passu notes, each as described in the “Whole Loan Summary” chart below. The controlling Note A-1, with an outstanding principal balance as of the Cut-off Date of approximately $64.9 million, is being contributed to the JPMCC 2019-COR5 Trust. The non-controlling Note A-2, with an original principal balance of $25.0 million is held by LCM or an affiliate and expected to be contributed to one or more future securitizations or may otherwise be transferred at any time. The relationship between the holders of the Brooklyn Renaissance Plaza Whole Loan will be governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the Preliminary Prospectus. The Brooklyn Renaissance Plaza Whole Loan has a 10-year term and amortizes on a 30-year schedule.The most recent prior financing of theBrooklyn RenaissancePlaza Property was not included in a securitization.

| Whole Loan Summary |

| Notes | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| A-1 | $65,000,000 | $64,920,607 | JPMCC 2019-COR5 | Yes |

| A-2 | 25,000,000 | 24,969,464 | LCM | No |

| Total | $90,000,000 | $89,890,072 | | |

The Borrower.The borrowing entity is Brooklyn Renaissance Plaza II LLC, a Delaware limited liability company structured to be bankruptcy remote with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Brooklyn Renaissance Plaza Whole Loan.

The Loan Sponsor.The loan sponsor and nonrecourse carve-out guarantor is Joshua L. Muss, a principal of Muss Development LLC (“Muss Development”). Founded in 1906 by Isaac Muss, Muss Development is a family-owned and operated, full-service real estate development and investment company that is currently led by Joshua Muss and his son, Jason Muss. Since its founding, Muss Development has developed more than 15.0 million square feet of commercial, residential, industrial and retail space throughout the five boroughs.

The Property.The Brooklyn Renaissance Plaza Property is a Class A office condominium unit comprised of 289,180 square feet of net rentable area located on floors 24 through 32 of the north tower that is within the Brooklyn Renaissance Plaza Development. Built in 1998 by the loan sponsor, the Brooklyn Renaissance Plaza Development is a mixed-use development comprised of five individual condominium units across two towers containing a total of approximately 1.5 million square feet. The north tower within the Brooklyn Renaissance Plaza Development (the “North Tower”) is a 32-story, mixed-use tower with office and retail space, and the south tower within the Brooklyn Renaissance Plaza Development is comprised of a 386-room Marriott hotel and a parking garage located on three lower levels and the ground floor. The Brooklyn Renaissance Plaza Development is comprised of five individual condominium units, all of which are owned by affiliates of the loan sponsor.

The Brooklyn Renaissance Plaza Property has unobstructed views of Staten Island, the East River, Manhattan and other parts of New York City. The loan sponsor recently completed an approximately $1.0 million comprehensive renovation of the lobby in the North Tower which features new ceilings, lighting, heightened security with the installation of turnstiles and a newly remodeled interior retail component.

The Brooklyn Renaissance Plaza Property is currently 88.5% occupied by 10 tenants and has reported an average historical occupancy of 100.0% since opening in 1998. Amerigroup Community Care which currently occupies 33,285 square feet (11.5% of net rentable area) recently gave notice that it would be vacating its space at lease expiration on June 30, 2019. Amerigroup Community Care was not included in the underwriting of the Brooklyn Renaissance Plaza Whole Loan. At origination, the borrower deposited $3.0 million for future leasing costs associated with the re-tenanting of this space at the Brooklyn Renaissance Plaza Property. Approximately 60.5% of net rentable area and 74.8% of underwritten base rent is attributable to investment grade tenants which include the USA GSA – Secret Service (“GSA”) (30.8% of net rentable area; rated Aaa/AAA/AA+ by Moody’s/Fitch/S&P), the NYC Department of Education (22.2% of net rentable area; rated Aa1/AA/AA by Moody’s/Fitch/S&P) and the NYC Department of Citywide Administration (7.5% of net rentable area; rated Aa1/AA/AA by Moody’s/Fitch/S&P).

The largest tenant at the Brooklyn Renaissance Plaza Property, the USA GSA – Secret Service (89,030 square feet; 30.8% of net rentable area; 41.7% of underwritten base rent; rated Aaa/AAA/AA+ by Moody’s/Fitch/S&P), is one of the oldest federal law enforcement agencies in the country and ranks among the most elite in the world. The Secret Service protects both national leaders and visiting foreign dignitaries while helping to secure the nation’s financial infrastructure through financial and cybercrime investigations.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance Plaza |

The GSA has been a tenant at the Brooklyn Renaissance Plaza Property since October 2001, originally pursuant to a lease with Empire Insurance Company, the original tenant of the Brooklyn Renaissance Plaza Property (which lease was assigned to BRP Leasing, LLC (“BRP Leasing”), an affiliate of the borrower). At the expiration of the initial lease term in 2018, the GSA extended its lease for an additional five years through October 2023. According to the loan sponsor, the GSA is in the process of approving the attornment to the borrower of BRP Leasing’s rights under the lease which will permit the GSA to enter into a direct lease with the borrower. The GSA utilizes its space as a New York field office and currently pays base rent equal to $59.78 per square foot gross. The tenant has no termination options and no renewal options remaining.

The second largest tenant at the Brooklyn Renaissance Plaza Property, the NYC Department of Education (64,340 square feet; 22.2% of net rentable area; 25.7% of underwritten base rent;rated Aa1/AA/AA by Moody’s/Fitch/S&P), is the branch of municipal government in New York City that manages New York City's public school system. New York City’s public school system is the largest school system in the United States, with over 1.1 million students taught in more than 1,400 separate schools. The NYC Department of Education covers all five boroughs of New York City. Approximately 135,000 people work full-time in New York City’s public-school system.

The NYC Department of Education originally took occupancy at the Brooklyn Renaissance Plaza Property in 2017. The NYC Department of Education leases the entire 28th and 29th floors and currently pays base rent equal to $48.00 per square foot modified gross on a direct lease which commenced in November 2018 and extends for 15 years through October 2033. The NYC Department of Education has no termination options and no renewal options remaining.

The third largest tenant at the Brooklyn Renaissance Plaza Property is the United Federation of Teachers (“UFT”) (44,945 square feet; 15.5% of net rentable area; 13.6% of underwritten base rent). With over 200,000 members predominantly made up of education and healthcare professionals, the UFT is a federation of teachers, nurses and other similar professionals working in New York City’s five boroughs that negotiates and advocates on their behalf for fair and competitive salaries, enhanced professionalism and improved working condition. UFT supports policies, legislation and programs that promote attaining educational equity, closing the achievement gap and assuring parent and community voice in school governance. The UFT works to raise academic standards and strengthen instruction; reduce class size and overcrowding; create safer, more orderly schools; improve school facilities; and increase parent involvement in schools. The UFT offers a full spectrum of workshops and graduate-level courses to approximately 30,000 members annually. The UFT partners with institutions such as Mt. Saint Vincent, Baruch, NYIT and Adelphi, and offers master’s degrees in programs ranging from Literacy and Early Childhood Education to Teaching English as a Second Language and Special Education.

The UFT originally took occupancy at the Brooklyn Renaissance Plaza Property in October 1998 on a 15-year lease term and extended its lease in April 2014 for an additional 15 years through June 2029. The UFT leases the entire 25th floor and a portion of the 24th floor, and currently pays base rent equal to $38.78 per square foot modified gross. The UFT has no termination options and no renewal options remaining.

The Market.The Brooklyn Renaissance Plaza Property is located in the Downtown Brooklyn neighborhood of Brooklyn, New York. Since 2004, the neighborhood has experienced an increase in retail corridors such as the Fulton Street Mall, Atlantic Avenue and the transformation of DUMBO Heights. Downtown Brooklyn is also the site of the 18,100 seat Barclays Center, home to the NBA’s Brooklyn Nets, NCAA Men's Basketball tournaments and a number of concerts, conventions and other events throughout the year. Additional notable eateries and attractions in the area include the Brooklyn Bridge Park, Dekalb Market, Rocco’s Tacos & Tequila Bar (at the base of the Brooklyn Renaissance Plaza Development), Brooklyn Fare, Borough Hall, TKTS Downtown Brooklyn, Gotham Market and Fort Greene Park.

According to a market report, the Brooklyn Renaissance Plaza Property is located within the Downtown Brooklyn office submarket. For the full-year 2018, the Downtown Brooklyn office submarket contained approximately 23.9 million square feet, representing 43.9% of the total Brooklyn market. Overall average vacancy for the Downtown Brooklyn office market was 8.2% for the full-year 2018.

The appraisal included 12 rent comparables. Of the 12 comparables, one was triple net (“NNN”) with the remaining 11 full service gross (“FSG”). The one NNN rent comparable was equal to $50.00 per square foot while the 11 FSG rent comparables ranged from $43.00 to $70.00 per square foot with a weighted average of approximately $51.90 per square foot FSG. According to the appraisal, the in-place rents for tenants at the Brooklyn Renaissance Plaza Property are approximately 18.1% below market.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

19 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance Plaza |

| Historical and Current Occupancy(1) |

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Current(2) |

| 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 88.5% |

| (1) | Historical Occupancies are as of December 31 of eachrespective year. |

| (2) | Current Occupancy is as of January 28, 2019 and excludes Amerigroup Community Care which currently occupies 33,285 square feet (11.5% of net rentable area) and recently gave notice that it would be vacating its space at lease expiration on June 30, 2019. |

| Tenant Summary(1) |

| Tenant | Ratings

Moody’s/Fitch/S&P | Net Rentable Area (SF) | % of

Total NRA | Base Rent PSF(2) | % of Total

Base Rent(2) | Lease

Expiration Date |

| USA GSA - Secret Service | Aaa / AAA / AA+ | 89,030 | 30.8% | $59.78 | 41.7% | 10/31/2023 |

| NYC Department of Education | Aa1 / AA / AA | 64,340 | 22.2 | $50.99 | 25.7 | 10/31/2033 |

| United Federation of Teachers | NR / NR / NR | 44,945 | 15.5 | $38.78 | 13.6 | 6/30/2029 |

| NYC Department of Citywide Administration(3) | Aa1 / AA / AA | 21,625 | 7.5 | $44.23 | 7.5 | 4/30/2021 |

| Motorola Solutions Inc.(4) | NR / NR / NR | 9,975 | 3.4 | $48.50 | 3.8 | 1/31/2022 |

| LTK Consulting Services Inc. | NR / NR / NR | 7,874 | 2.7 | $43.59 | 2.7 | 6/30/2026 |

| Brooklyn Chamber of Commerce | NR / NR / NR | 7,640 | 2.6 | $29.71 | 1.8 | 5/31/2023 |

| MetLife Services & Solutions(4)(5) | NR / NR / NR | 4,995 | 1.7 | $47.00 | 1.8 | 8/31/2021 |

| Black, Inc. | NR / NR / NR | 3,608 | 1.2 | $34.00 | 1.0 | 5/31/2021 |

| Epstein & Conroy(4) | NR / NR / NR | 1,863 | 0.6 | $33.21 | 0.5 | 1/31/2023 |

| Top 10 Total / Wtd. Avg. | | 255,895 | 88.5% | $49.93 | 100.0% | |

| Other Tenants | | 0 | 0.0 | $0.00 | 0.0 | |

| Total Occupied Space | | 255,895 | 88.5% | $49.93 | 100.0% | |

| Vacant | | 33,285 | 11.5 | | | |

| Total | | 289,180 | 100.0% | | | |

| | | | | | | |

| (1) | Based on the underwritten rent roll dated as of January 28, 2019. |

| (2) | Base Rent includes average rent over the lease term for investment grade tenant the NYC Department of Education ($192,248). |

| (3) | NYC Department of Citywide Administration has the right to terminate its lease at any time by providing at least 12 months’ notice and payment of a termination fee. |

| (4) | Motorola Solutions Inc. has one, five-year renewal option remaining, MetLife Services & Solutions has one, five-year renewal option remaining, and Epstein & Conroy has one, five-year renewal option remaining. |

| (5) | MetLife Services & Solutions has a free rent period in the months of September 2019 and September 2020, each for approximately $19,564. At origination, the borrower deposited approximately $39,128 into a free rent reserve. |

Lease Rollover Schedule(1) |

| Year | Number of Leases Expiring | Net Rentable Area Expiring | % of NRA Expiring | Base Rent Expiring(2) | % of Base Rent Expiring(2) | Cumulative Net Rentable Area Expiring | Cumulative % of NRA Expiring | Cumulative Base Rent Expiring(2) | Cumulative % of Base Rent Expiring(2) |

| Vacant | NAP | 33,285 | 11.5% | NAP | NAP | 33,285 | 11.5% | NAP | NAP |

| 2019 & MTM | 0 | 0 | 0.0% | $0 | 0.0% | 33,285 | 11.5% | $0 | 0.0% |

| 2020 | 0 | 0 | 0.0% | 0 | 0.0% | 33,285 | 11.5% | $0 | 0.0% |

| 2021 | 3 | 30,228 | 10.5% | 1,313,902 | 10.3% | 63,513 | 22.0% | $1,313,902 | 10.3% |

| 2022 | 1 | 9,975 | 3.4% | 483,788 | 3.8% | 73,488 | 25.4% | $1,797,690 | 14.1% |

| 2023 | 3 | 98,533 | 34.1% | 5,611,377 | 43.9% | 172,021 | 59.5% | $7,409,066 | 58.0% |

| 2024 | 0 | 0 | 0.0% | 0 | 0.0% | 172,021 | 59.5% | $7,409,066 | 58.0% |

| 2025 | 0 | 0 | 0.0% | 0 | 0.0% | 172,021 | 59.5% | $7,409,066 | 58.0% |

| 2026 | 1 | 7,874 | 2.7% | 343,193 | 2.7% | 179,895 | 62.2% | $7,752,260 | 60.7% |

| 2027 | 0 | 0 | 0.0% | 0 | 0.0% | 179,895 | 62.2% | $7,752,260 | 60.7% |

| 2028 | 0 | 0 | 0.0% | 0 | 0.0% | 179,895 | 62.2% | $7,752,260 | 60.7% |

| 2029 | 1 | 44,945 | 15.5% | 1,742,783 | 13.6% | 224,840 | 77.8% | $9,495,042 | 74.3% |

| 2030 & Beyond | 1 | 64,340 | 22.2% | 3,280,568 | 25.7% | 289,180 | 100.0% | $12,775,610 | 100.0% |

| Total | 10 | 289,180 | 100.0% | $12,775,610 | 100.0% | | | | |

| | | | | | | | | | |

| (1) | Based on the underwritten rent roll dated January 28, 2019. |

| (2) | Base Rent Expiring includes $192,248 of average rent over the lease term for the NYC Department of Education. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

20 of 116

| Structural and Collateral Term Sheet | | JPMCC 2019-COR5 |

| |

| Brooklyn Renaissance Plaza |

| Operating History and Underwritten Net Cash Flow |

| | 2016 | | 2017 | | 2018 | | Underwritten | | Per Square Foot | | %(1) |

| Rents in Place(2) | $7,462,946 | | $7,462,946 | | $8,502,569 | | $12,583,362 | | $43.51 | | 75.7 | % |

| Straight Line Rent(3) | 0 | | 0 | | 0 | | 192,248 | | 0.66 | | 1.2 | |

| Vacant Income | 0 | | 0 | | 0 | | 1,930,530 | | 6.68 | | 11.6 | |

| Gross Potential Rent | $7,462,946 | | $7,462,946 | | $8,502,569 | | $14,706,140 | | $50.85 | | 88.5 | % |

| Total Reimbursements(2) | 3,568,169 | | 3,785,081 | | 3,999,970 | | 1,912,225 | | 6.61 | | 11.5 | |

| Total Other Income | 6,785 | | 0 | | 3,706 | | 3,706 | | 0.01 | | 0.0 | |

| Net Rental Income | $11,037,900 | | $11,248,027 | | $12,506,245 | | $16,622,071 | | $57.48 | | 100.0 | % |

| (Vacancy/Credit Loss) | 0 | | 0 | | 0 | | (1,930,530) | | (6.68) | | (11.6 | ) |

| Effective Gross Income | $11,037,900 | | $11,248,027 | | $12,506,245 | | $14,691,541 | | $50.80 | | 88.4 | % |

| Total Expenses | $4,267,381 | | $4,719,632 | | $5,149,721 | | $6,697,245 | | $23.16 | | 45.6 | % |

| Net Operating Income | $6,770,519 | | $6,528,395 | | $7,356,524 | | $7,994,296 | | $27.64 | | 54.4 | % |

| Total TI/LC, CapEx/RR | 0 | | 0 | | 0 | | 248,841 | | 0.86 | | 1.7 | |

| Net Cash Flow | $6,770,519 | | $6,528,395 | | $7,356,524 | | $7,745,455 | | $26.78 | | 52.7 | % |

| (1) | % column represents percent of Net Rental Income for all revenue lines and represents percent of Effective Gross Income for the remainder of the fields. |

| (2) | The increase in Underwritten Rents in Place and the decrease in Underwritten Total Reimbursements over the historical periods is primarily attributable to the GSA renewal in October 2018 which converted the base rent from modified gross to gross as well as the new direct lease with the NYC Department of Education which commenced in November 2018. |

| (3) | Based on the average rent over the lease term for the NYC Department of Education. |

Property Management.The Brooklyn Renaissance Plaza Property is managed by Renaissance Property Managers LLC, an affiliate of the borrower.

Escrows and Reserves. At origination, the borrower deposited into escrow $3,000,000 for tenant improvements and leasing commissions (related to leasing the Amerigroup Community Care space), $850,000 for real estate taxes, $200,000 for outstanding leasing expenses, approximately $160,261 for a lease buyout required pursuant to the Amerigroup Community Care lease, $95,000 for insurance premiums and approximately $39,128 for outstanding free rent.

Tax Escrows– On a monthly basis,the borrower is required to escrow 1/12 of the annual estimated tax payments which currently equates to $150,000.

Insurance Escrows– On a monthly basis,the borrower is required to escrow 1/12 of the annual estimated insurance premiums which currently equates to $12,000.

Replacement Reserves –On a monthly basis, the borrower is required to escrow $6,017 for replacement reserves, subject to a cap of $216,612.

TI/LC Reserves – On a monthly basis, the borrower is required to escrow $36,102 for tenant improvements and leasing commissions, subject to a cap of $1,299,672 (which cap is exclusive of the initial $3.0 million deposit for tenant improvements and leasing commissions relating to leasing the Amerigroup Community Care space and $200,000 deposit for tenant improvements relating to the GSA space).

Ground Rent Reserves –On a monthly basis, the borrower is required to escrow 1/12 of the annual ground rent payments.

Lockbox / Cash Management.The Brooklyn Renaissance Plaza Whole Loan is structured with a hard lockbox and in-place cash management. All rents are required to be deposited directly by the tenants into a lockbox account controlled by the lender. All funds in the lockbox account are required to be swept to a lender-controlled cash management account every business day and applied on each payment date to the payment of debt service and the funding of required reserves. Provided no Cash Trap Period (as defined below) is continuing, all funds remaining in the cash management account after payment of the aforementioned items will be transferred into the borrower’s operating account. During a Cash Trap Period, all excess cash in the cash management account will be retained by the lender as additional collateral for the Brooklyn Renaissance Plaza Whole Loan.