| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226123-06 |

| | | |

| November 6, 2019 | | JPMDB 2019-COR6 |

Free Writing Prospectus Structural and Collateral Term Sheet |

JPMDB 2019-COR6 |

$807,180,797 (Approximate Mortgage Pool Balance) |

| |

$696,193,000 (Approximate Offered Certificates) |

| |

J.P. Morgan Chase Commercial Mortgage Securities Corp. Depositor |

|

| |

JPMDB Commercial Mortgage Securities Trust 2019-COR6, Commercial Mortgage Pass-Through Certificates Series 2019-COR6 |

|

| |

JPMorgan Chase Bank, National Association

LoanCore Capital Markets LLC

German American Capital Corporation Sponsors and Mortgage Loan Sellers |

| |

| J.P. Morgan | | Deutsche Bank Securities |

| | Co-Lead Managers and

Joint Bookrunners | |

| | | |

| Jefferies | | Drexel Hamilton |

| | Co-Managers | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| November 6, 2019 | | JPMDB 2019-COR6 |

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Deutsche Bank Securities Inc. (“DBSI”), Jefferies LLC (“Jefferies”) or Drexel Hamilton, LLC (“Drexel”) (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-226123) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, the Depositor or any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request itby calling (800) 408-1016 or by emailing the ABS Syndicate Desk at abs_synd@jpmorgan.com.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE. Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG, acting through its New York Branch.

Capitalized terms used in this material but not defined herein shall have the meanings ascribed to them in the Preliminary Prospectus (as defined below).

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 2 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Indicative Capital Structure |

Publicly Offered Certificates

| Class | Expected Ratings

(S&P / Fitch / KBRA) | Approximate

Initial Certificate

Balance or

Notional

Amount(1) | Approximate

Initial Available

Certificate

Balance or

Notional

Amount(1) | Approximate

Initial Retained

Certificate

Balance or

Notional

Amount(1)(2) | Approximate

Initial Credit

Support(3) | Expected

Weighted

Avg. Life

(years)(4) | Expected

Principal

Window(4) | Certificate

Principal

to Value

Ratio(5) | Underwritten

NOI Debt

Yield(6) |

| A-1 | AAA(sf) / AAAsf / AAA(sf) | $15,090,000 | $14,753,000 | $337,000 | 30.000% | 2.58 | 12/2019 – 10/2024 | 42.8% | 13.9% |

| A-2 | AAA(sf) / AAAsf / AAA(sf) | $33,100,000 | $32,361,000 | $739,000 | 30.000% | 4.92 | 10/2024 – 11/2024 | 42.8% | 13.9% |

| A-3 | AAA(sf) / AAAsf / AAA(sf) | (7) | (7) | (7) | 30.000% | (7) | (7) | 42.8% | 13.9% |

| A-4 | AAA(sf) / AAAsf / AAA(sf) | (7) | (7) | (7) | 30.000% | (7) | (7) | 42.8% | 13.9% |

| A-SB | AAA(sf) / AAAsf / AAA(sf) | $19,610,000 | $19,172,000 | $438,000 | 30.000% | 7.28 | 11/2024 – 4/2029 | 42.8% | 13.9% |

| X-A | AA-(sf) / AAAsf / AAA(sf) | $622,538,000(8) | $608,652,000(8) | $13,886,000(8) | N/A | N/A | N/A | N/A | N/A |

| X-B | NR / A-sf / AAA(sf) | $73,655,000(8) | $72,011,000(8) | $1,644,000(8) | N/A | N/A | N/A | N/A | N/A |

| A-S | AA-(sf) / AAAsf / AAA(sf) | $57,512,000 | $56,229,000 | $1,283,000 | 22.875% | 9.92 | 10/2029 – 11/2029 | 47.2% | 12.6% |

| B | NR / AA-sf / AA(sf) | $34,305,000 | $33,539,000 | $766,000 | 18.625% | 9.96 | 11/2029 – 11/2029 | 49.8% | 11.9% |

| C | NR / A-sf / A(sf) | $39,350,000 | $38,472,000 | $878,000 | 13.750% | 9.96 | 11/2029 – 11/2029 | 52.8% | 11.2% |

Privately Offered Certificates(9)

| Class | Expected Ratings

(S&P / Fitch / KBRA) | Approximate

Initial Certificate

Balance or

Notional

Amount(1)(10) | Approximate

Initial Available

Certificate

Balance or

Notional

Amount(1)(10) | Approximate

Initial Retained

Certificate

Balance or

Notional

Amount(1)(2)(10) | Approximate

Initial Credit

Support | Expected

Weighted

Avg. Life

(years)(4) | Expected

Principal

Window(4) | Certificate

Principal

to Value

Ratio(5) | Underwritten

NOI Debt

Yield(6) |

| X-D | NR / BBB-sf / BBB-(sf) | $45,404,000(8) | $44,391,000(8) | $1,013,000(8) | N/A | N/A | N/A | N/A | N/A |

| X-F | NR / NR / BBB-(sf) | $9,081,000(8) | $8,878,000(8) | $203,000(8) | N/A | N/A | N/A | N/A | N/A |

| D | NR / BBBsf / BBB+(sf) | $24,215,000 | $23,675,000 | $540,000 | 10.750% | 9.96 | 11/2029 – 11/2029 | 54.6% | 10.9% |

| E | NR / BBB-sf / BBB-(sf) | $21,189,000 | $20,716,000 | $473,000 | 8.125% | 9.96 | 11/2029 – 11/2029 | 56.2% | 10.6% |

| F | NR / NR / BBB-(sf) | $9,081,000 | $8,878,000 | $203,000 | 7.000% | 9.96 | 11/2029 – 11/2029 | 56.9% | 10.4% |

| G-RR | NR / NR / BB-(sf) | $17,152,000 | $16,769,000 | $383,000 | 4.875% | 9.96 | 11/2029 – 11/2029 | 58.2% | 10.2% |

| H-RR | NR / NR / B-(sf) | $8,072,000 | $7,891,000 | $181,000 | 3.875% | 9.96 | 11/2029 – 11/2029 | 58.8% | 10.1% |

| NR-RR | NR / NR / NR | $31,278,797 | $30,580,797 | $698,000 | 0.000% | 9.96 | 11/2029 – 11/2029 | 61.2% | 9.7% |

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%, including in connection with any variation in the certificate balances and notional amounts of the classes comprising the VRR Interest following the calculation of the actual fair value of the ABS interests (as such term is defined in Regulation RR) issued by the issuing entity. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D and Class X-F Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates whose Certificate Balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any Class of the Class X-A, Class X-B, Class X-D and Class X-F Certificates, as applicable, would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (2) | On the Closing Date, LoanCore Capital Markets LLC or a majority-owned affiliate of LCM is expected to satisfy the U.S. risk retention requirements of LCM, as retaining sponsor, through the purchase and retention of (i) approximately 2.230% of the certificate balance or notional amount, as applicable, of each class of certificates (other than the Class R certificates) (collectively, the “VRR Interest”) and (ii) the Class G-RR, Class H-RR and Class NR-RR certificates (collectively, excluding the portion of each such class comprising the VRR Interest, the “HRR Certificates”). The certificate balance or notional amount of each class of certificates is subject to change based on the final pricing of all certificates and the final determination of the VRR Interest and the HRR Certificates that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the VRR Interest and the HRR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (3) | The credit support percentages set forth for Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates in the aggregate. |

| (4) | Assumes 0% CPR / 0% CDR and a November 26, 2019 closing date. Based on modeling assumptions as described in the Preliminary Prospectus dated November 6, 2019 (the “Preliminary Prospectus”). |

| (5) | The “Certificate Principal to Value Ratio” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV for the mortgage loans, and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The “Underwritten NOI Debt Yield” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI DY for the mortgage loans and (b) the total initial Certificate Balance of all of the Classes of Principal Balance Certificates divided by the total initial Certificate Balance for such Class and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 3 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Indicative Capital Structure |

| (7) | The exact initial certificate balances of the Class A-3 and Class A-4 Certificates are unknown and will be determined based on the final pricing of those Classes of Certificates. However, the respective initial Certificate Balances (and corresponding available and retained portions thereof), weighted average lives and principal windows of the Class A-3 and Class A-4 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-3 and Class A-4 Certificates is expected to be approximately $497,226,000 subject to a variance of plus or minus 5%. |

| | Class of

Certificates | Expected Range of Initial

Certificate Balance | Expected Range of Initial

Available Certificate Balance | Expected Range of Initial

Retained Certificate

Balance | Expected

Range of

Weighted

Avg. Life (Yrs) | Expected Range of Principal

Window |

| | Class A-3 | $51,141,000 – $178,992,000 | $50,000,000 – $175,000,000 | $1,141,000 – $3,992,000 | 9.15 – 9.38 | 12/2028–2/2029 / 12/2028–8/2029 |

| | Class A-4 | $318,234,000 – $446,085,000 | $311,137,000 – $436,137,000 | $7,097,000 – $9,948,000 | 9.82 – 9.72 | 8/2029–10/2029 / 2/2029–10/2029 |

| (8) | The Class X-A, Class X-B, Class X-D and Class X-F Notional Amounts are defined in the Preliminary Prospectus. |

| (9) | The Class X-D, Class X-F, Class D, Class E, Class F, Class G-RR, Class H-RR and Class NR-RR Certificates are not being offered by the Preliminary Prospectus or this Term Sheet. The Class R Certificates are not shown above. |

| (10) | The initial Certificate Balance or Notional Amount of each of the Class X-F, Class F, Class G-RR, Class H-RR and Class NR-RR Certificates is subject to change based on final pricing of all certificates and the final determination of the Class G-RR, Class H-RR and Class NR-RR Certificates and the VRR Interest that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus to satisfy the U.S. risk retention requirements of LoanCore Capital Markets LLC, as retaining sponsor. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the Class G-RR, Class H-RR and Class NR-RR certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 4 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Summary of Transaction Terms |

| Securities Offered: | $696,193,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | J.P. Morgan Securities LLC and Deutsche Bank Securities Inc. |

| Co-Managers: | Jefferies LLC and Drexel Hamilton, LLC. |

| Mortgage Loan Sellers: | JPMorgan Chase Bank, National Association (“JPMCB”) (32.1%), LoanCore Capital Markets LLC (“LCM”) (60.1%) and German American Capital Corporation (“GACC”) (7.7%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association. |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association. |

| Directing Certificateholder: | LoanCore Capital Markets LLC or its affiliate. |

| Trustee: | Wells Fargo Bank, National Association. |

| Certificate Administrator: | Wells Fargo Bank, National Association. |

| Operating Advisor: | Pentalpha Surveillance LLC. |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC. |

| Rating Agencies: | S&P Global Ratings, a Standard & Poor’s Financial Services LLC business (“S&P”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency Inc. (“KBRA”). |

| U.S. Credit Risk Retention: | LCM is expected to act as the “retaining sponsor” for this securitization and intends to satisfy the U.S. credit risk retention requirement through the purchase by LCM or its “majority-owned affiliate” (as defined in Regulation RR), on the Closing Date, of (i) an “eligible vertical interest”, which will consist of approximately 2.230% of the certificate balance or notional amount of each class of certificates (other than the Class R Certificates) issued by the issuing entity and (ii) an “eligible horizontal residual interest”, which will consist (excluding the portion thereof that comprises a part of the VRR Interest) of the Class G-RR, Class H-RR and Class NR-RR Certificates. The restrictions on hedging and transfer under the credit risk retention rules as in effect on the closing date of this transaction will expire on and after the date that is the latest of (i) the date on which the aggregate principal balance of the mortgage loans has been reduced to 33% of the aggregate principal balance of the mortgage loans as of the Cut-off Date; (ii) the date on which the total unpaid principal obligations under the Certificates has been reduced to 33% of the aggregate total unpaid principal obligations under the Certificates as of the Closing Date; or (iii) two years after the Closing Date. Notwithstanding any references in this term sheet to the credit risk retention rules, Regulation RR, the retaining sponsor and other risk retention related matters, in the event the credit risk retention rules and/or Regulation RR (or any relevant portion thereof) are repealed or determined by applicable regulatory agencies to be no longer applicable to this securitization transaction, none of the retaining sponsor or any other party will be required to comply with or act in accordance with the credit risk retention rules and/or Regulation RR (or such relevant portion thereof). For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Pricing Date: | On or about November 12, 2019. |

| Closing Date: | On or about November 26, 2019. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in November 2019, or with respect to any mortgage loan that has its first due date in December 2019, the date that would otherwise have been the related due date in November 2019. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in December 2019. |

| Determination Date: | 9thday of each month, or if the 9th day is not a business day, the next succeeding business day, commencing in December 2019. |

| Assumed Final Distribution Date: | The Distribution Date in November 2029, which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in November 2052. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 5 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Summary of Transaction Terms |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class X-F, Class D, Class E, Class F, Class G-RR, Class H-RR, Class NR-RR and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors (other than the Class R Certificates) and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the Cut-off Date, certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., Blackrock Financial Management, Inc., Interactive Data Corporation, CMBS.com, Inc., Markit Group Limited, Moody’s Analytics, MBS Data, LLC, RealInsight and Thomson Reuters Corporation. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO “RISK FACTORS” IN THE PRELIMINARY PROSPECTUS. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 6 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $807,180,797 |

| | Number of Mortgage Loans: | 32 |

| | Number of Mortgaged Properties: | 117 |

| | Average Cut-off Date Balance per Mortgage Loan: | $25,224,400 |

| | Weighted Average Current Mortgage Rate: | 3.94484% |

| | 10 Largest Mortgage Loans as % of IPB: | 57.5% |

| | Weighted Average Remaining Term to Maturity: | 115 months |

| | Weighted Average Seasoning: | 2 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR(1)(2): | 2.18x |

| | Weighted Average UW NOI Debt Yield(1): | 9.7% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(3): | 61.2% |

| | Weighted Average Maturity Date LTV(1)(3): | 58.2% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 20.9% |

| | % of Mortgaged Properties with Single Tenants: | 14.6% |

| | | |

| Amortization | |

| | Weighted Average Original Amortization Term(4): | 359 months |

| | Weighted Average Remaining Amortization Term(4): | 357 months |

| | % of Mortgage Loans with Interest-Only: | 68.8% |

| | % of Mortgage Loans with Amortizing Balloon: | 21.2% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 9.9% |

| | | |

| Lockbox / Cash Management(5) | |

| | % of Mortgage Loans with In-Place, Hard Lockboxes: | 76.0% |

| | % of Mortgage Loans with Springing Lockboxes: | 12.2% |

| | % of Mortgage Loans with In-Place, Soft Lockboxes: | 11.8% |

| | % of Mortgage Loans with In-Place Cash Management: | 10.6% |

| | % of Mortgage Loans with Springing Cash Management: | 89.4% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 65.8% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 34.9% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves(6): | 65.3% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(7): | 56.3% |

| | | |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7, 9, 11, 14, 16, 17, 18, 20 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | In the case of Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 mortgage loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 3, 17 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to“Description of the Mortgage Pool—Assessments of Property Value and Condition” and“—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes 20 mortgage loans that are interest-only for the entire term. |

| (5) | For a more detailed description of Lockbox / Cash Management, refer to“Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (6) | CapEx Reserves include FF&E reserves for hotel properties. |

| (7) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by retail, office, industrial and mixed use properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 7 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | |

| LCM | 22 | 100 | $485,460,797 | 60.1% |

| JPMCB(1) | 9 | 16 | 259,220,000 | 32.1 |

| GACC(2) | 1 | 1 | 62,500,000 | 7.7 |

| Total | 32 | 117 | $807,180,797 | 100.0% |

| (1) | In the case of Loan No. 16, the whole loan was co-originated by JPMCB, Morgan Stanley Bank, N.A., Wells Fargo Bank, National Association and Goldman Sachs Bank USA. In the case of Loan Nos. 17 and 18, the whole loan was co-originated by JPMCB and Wells Fargo Bank, National Association. |

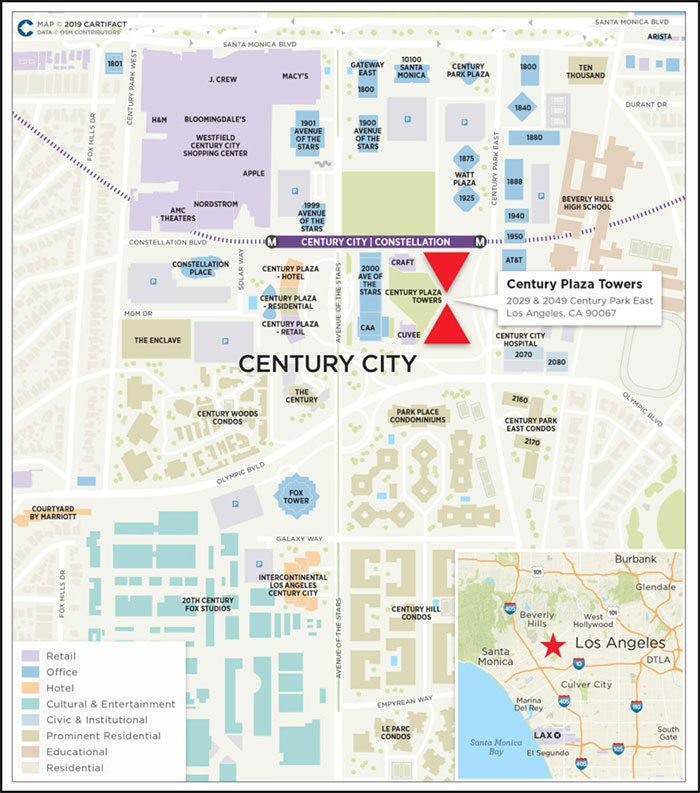

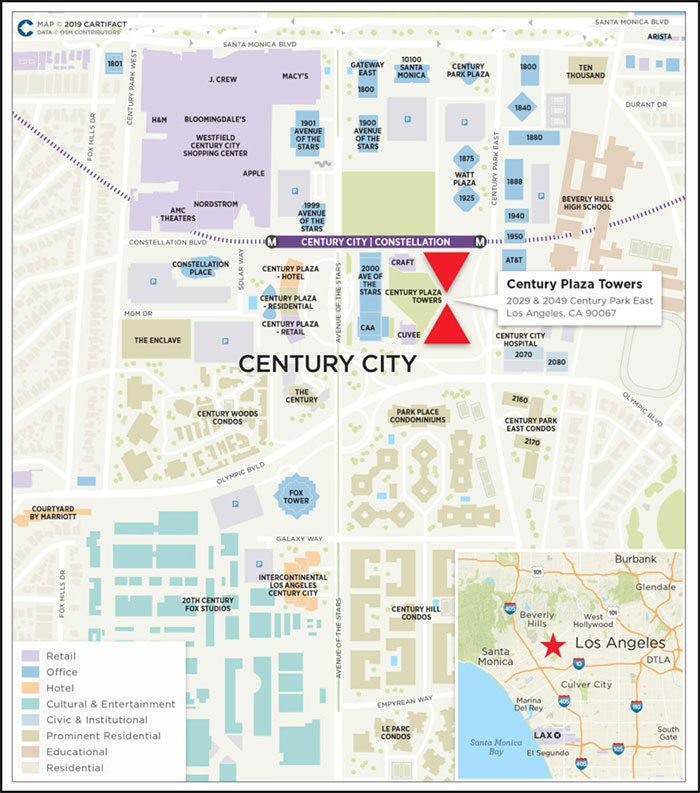

| (2) | In the case of Loan No. 1, such mortgage loan being sold by GACC was originated by an affiliate thereof, Deutsche Bank AG, New York Branch (“DBNY”). DBNY on the origination date transferred such mortgage loan to DBR Investments Co. Limited (“DBRI”), and DBRI will transfer such mortgage loan to GACC on or prior to the closing date. The Century Plaza Towers Whole Loan, with respect to which such mortgage loan is a part of, was co-originated by DBNY, Morgan Stanley Bank, N.A. and Wells Fargo Bank, National Association. |

| Ten Largest Mortgage Loans |

| |

| No. | Loan Name | Mortgage

Loan Seller | No.

of Prop. | Cut-off

Date

Balance | % of

IPB | SF / Units | Property

Type | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 1 | Century Plaza Towers | GACC | 1 | $62,500,000 | 7.7% | 2,401,641 | Office | 4.09x | 13.5% | 39.1% | 39.1% |

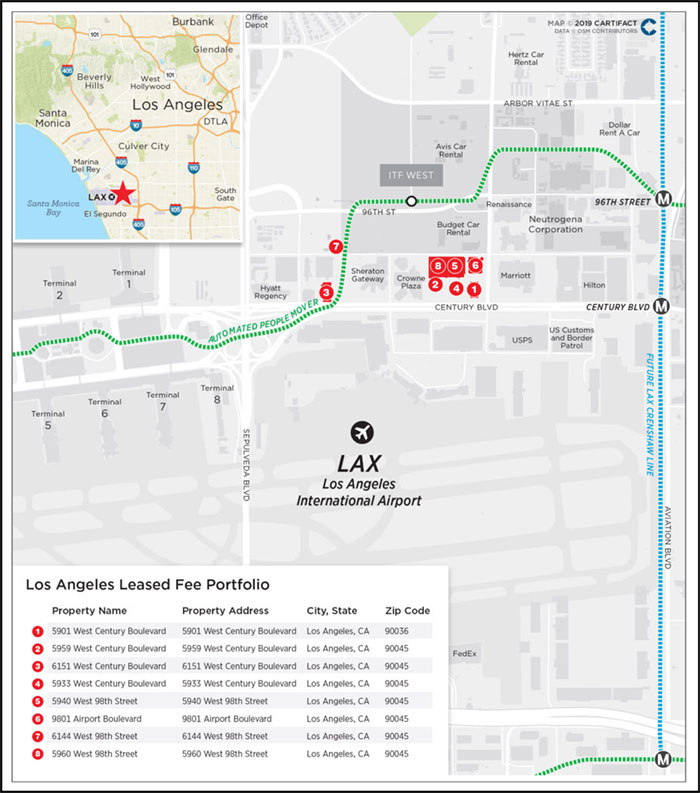

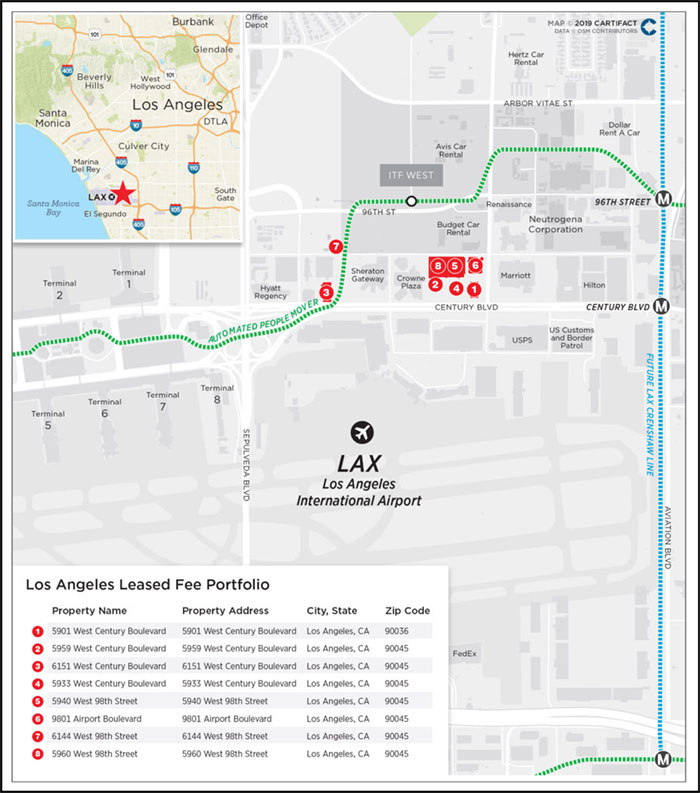

| 2 | Los Angeles Leased Fee Portfolio | LCM | 8 | $61,000,000 | 7.6% | 556,202 | Other | 1.75x | 6.2% | 63.0% | 63.0% |

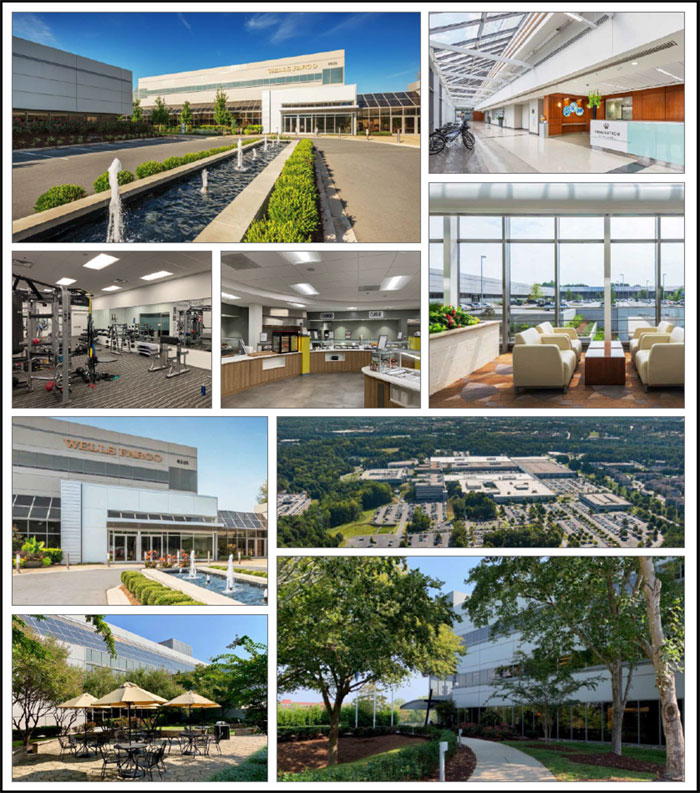

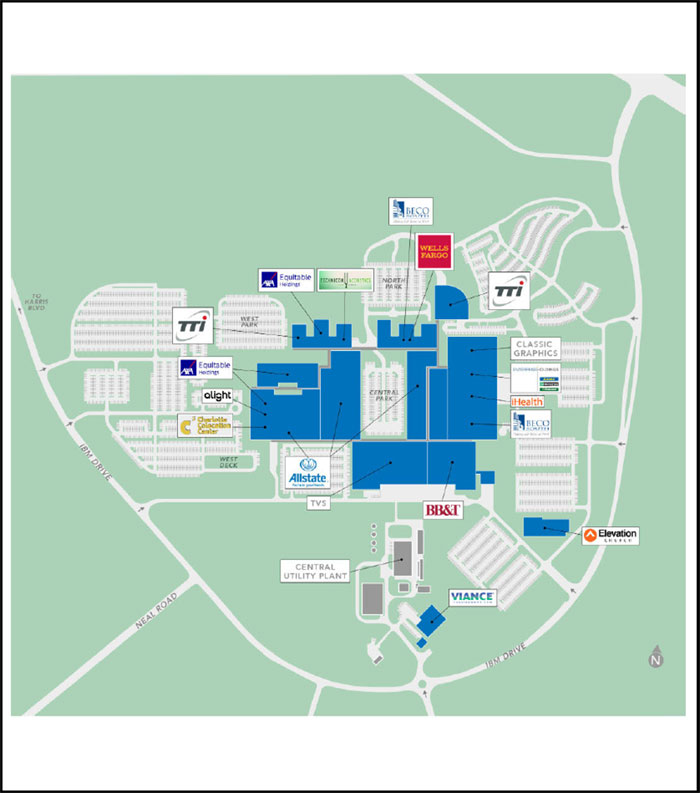

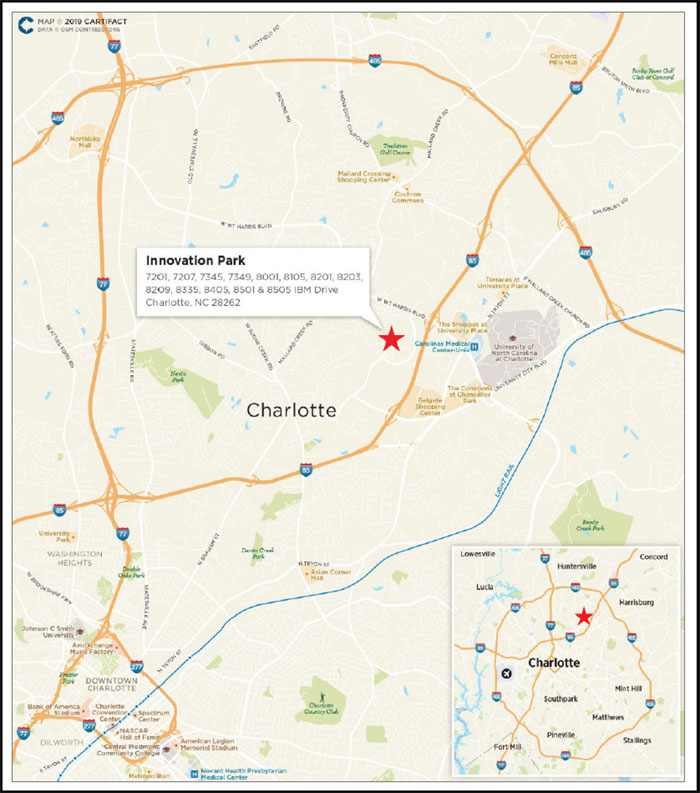

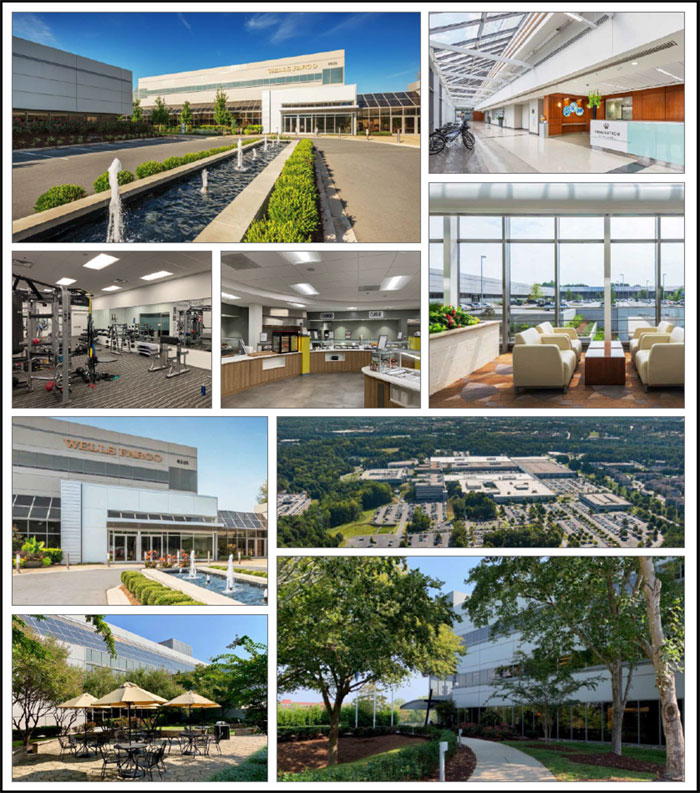

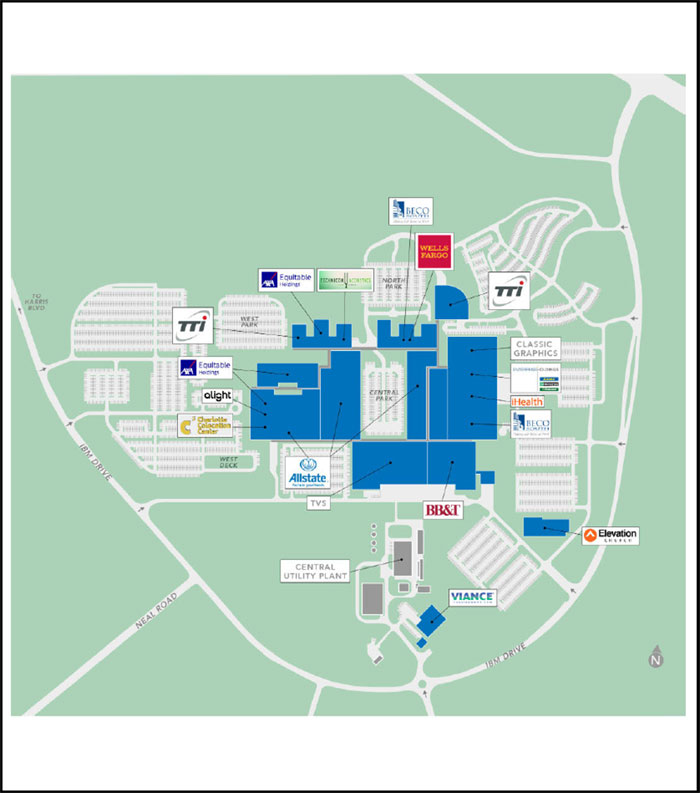

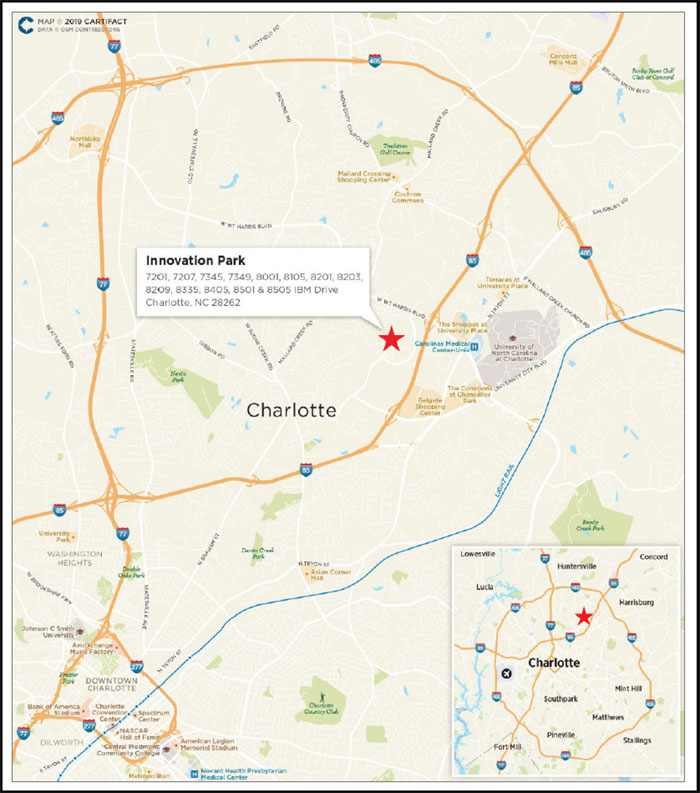

| 3 | Innovation Park | JPMCB | 1 | $55,000,000 | 6.8% | 1,854,729 | Office | 2.96x | 11.6% | 68.8% | 68.8% |

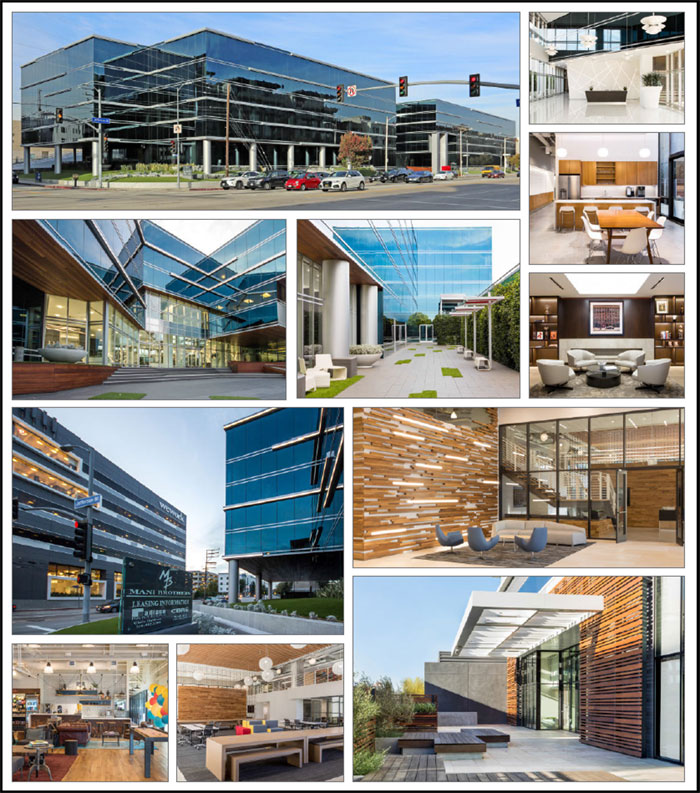

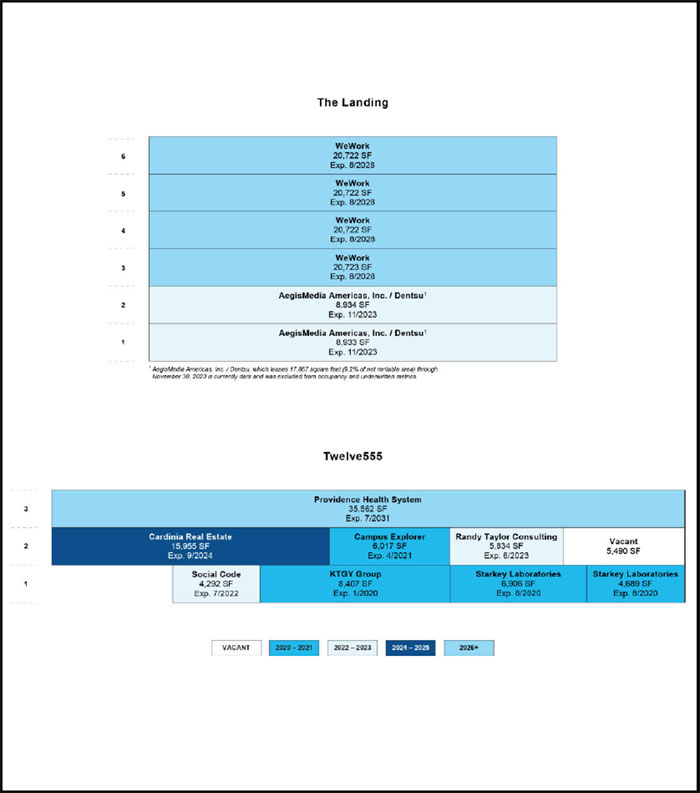

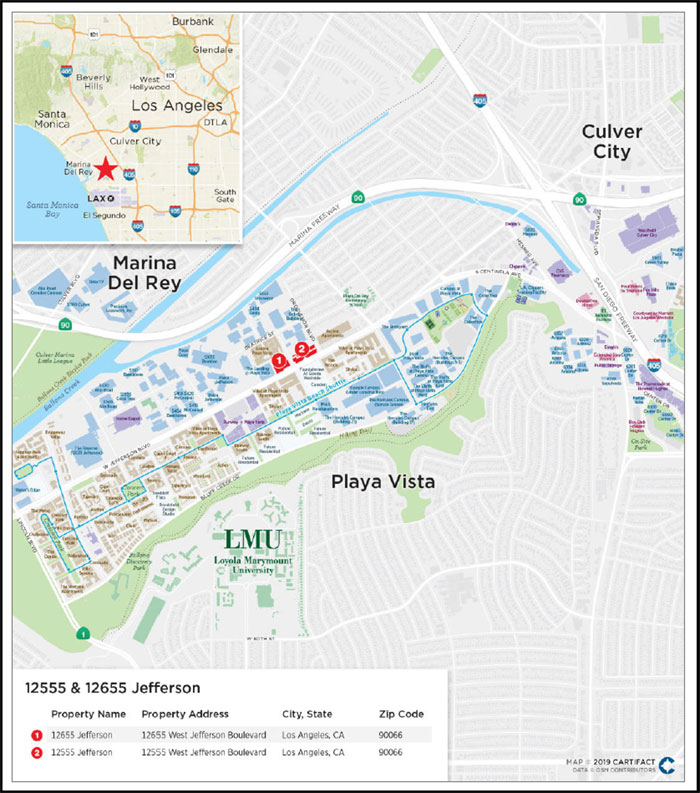

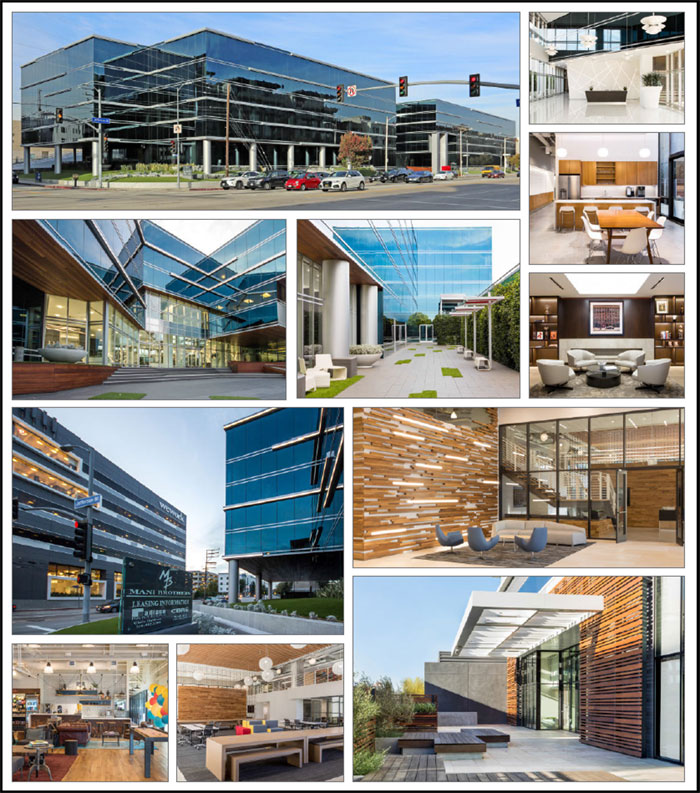

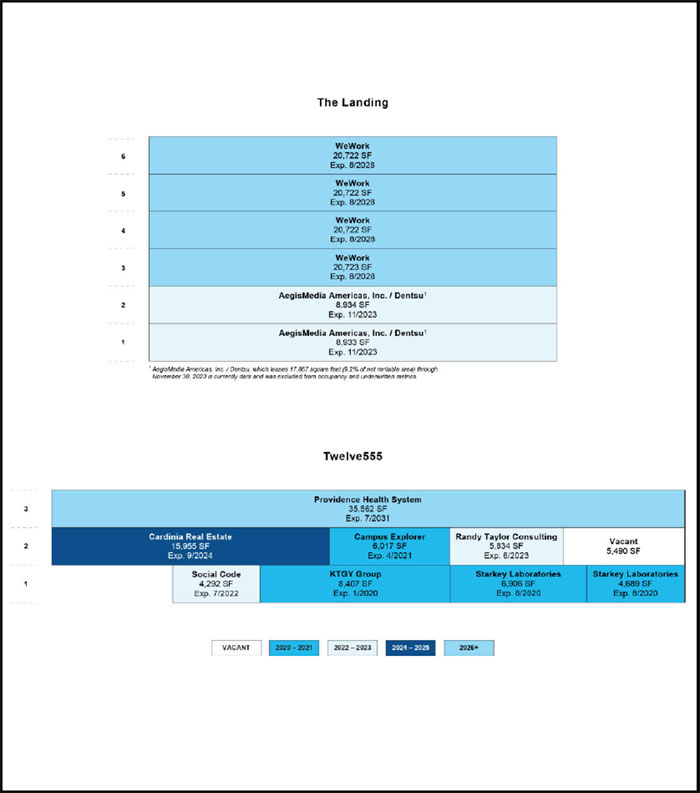

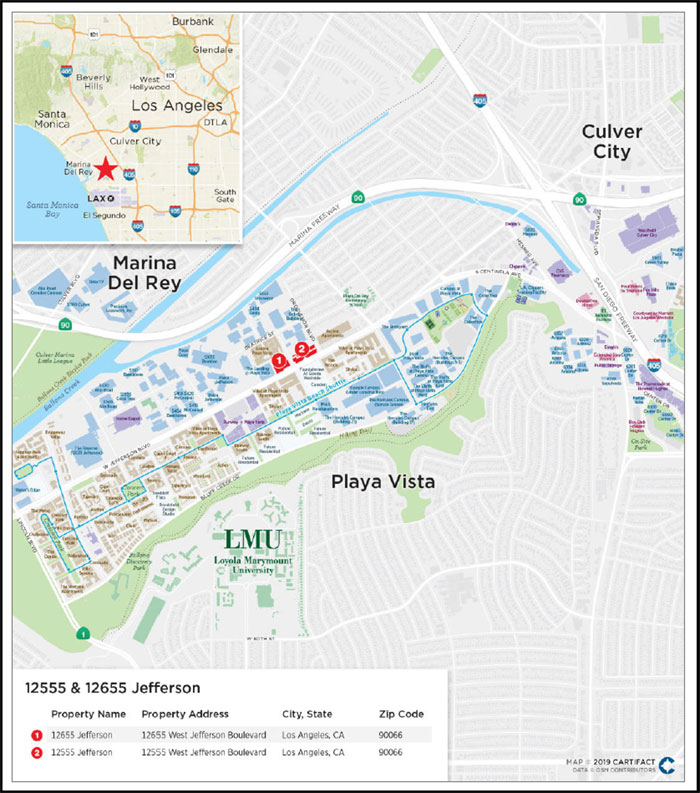

| 4 | 12555 & 12655 Jefferson | LCM | 2 | $54,000,000 | 6.7% | 193,908 | Office | 1.80x | 7.6% | 59.5% | 59.5% |

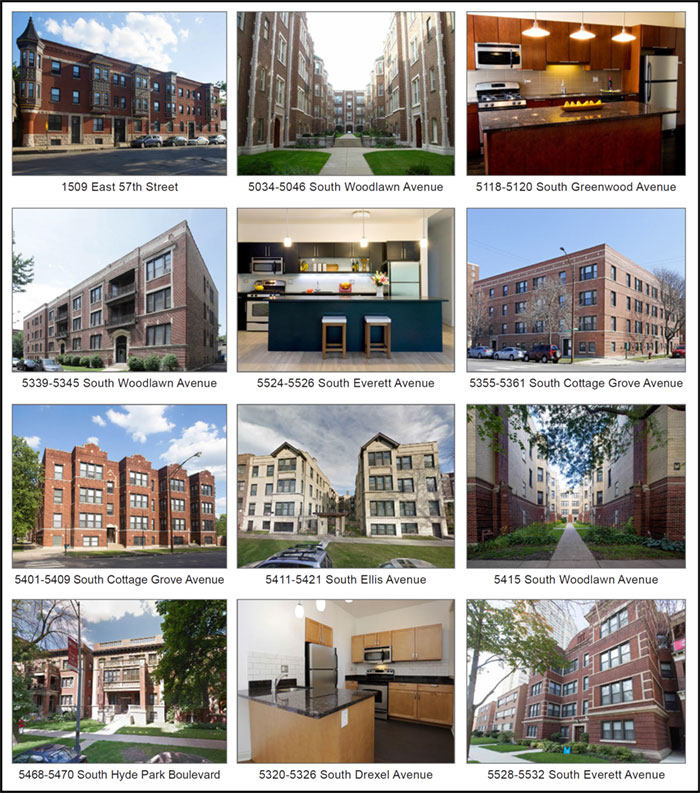

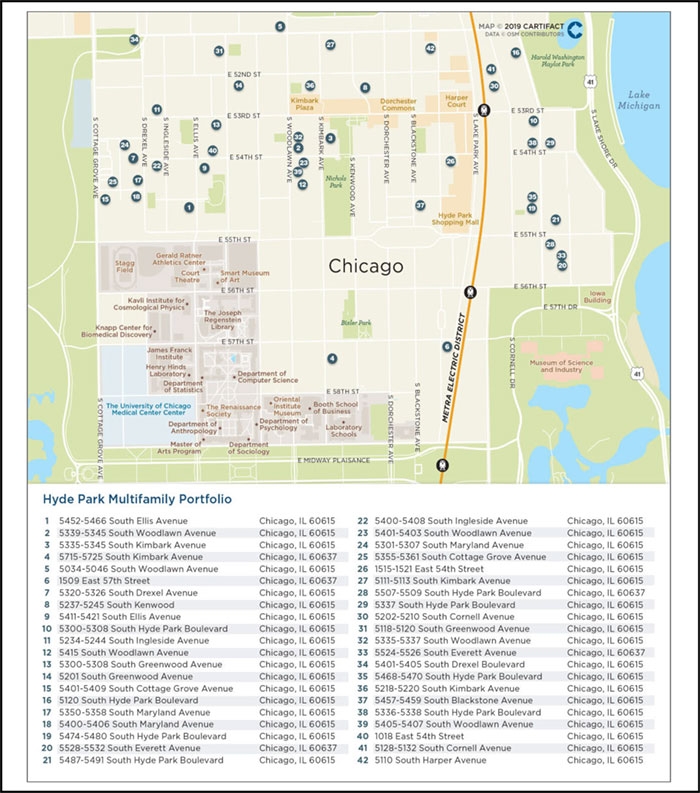

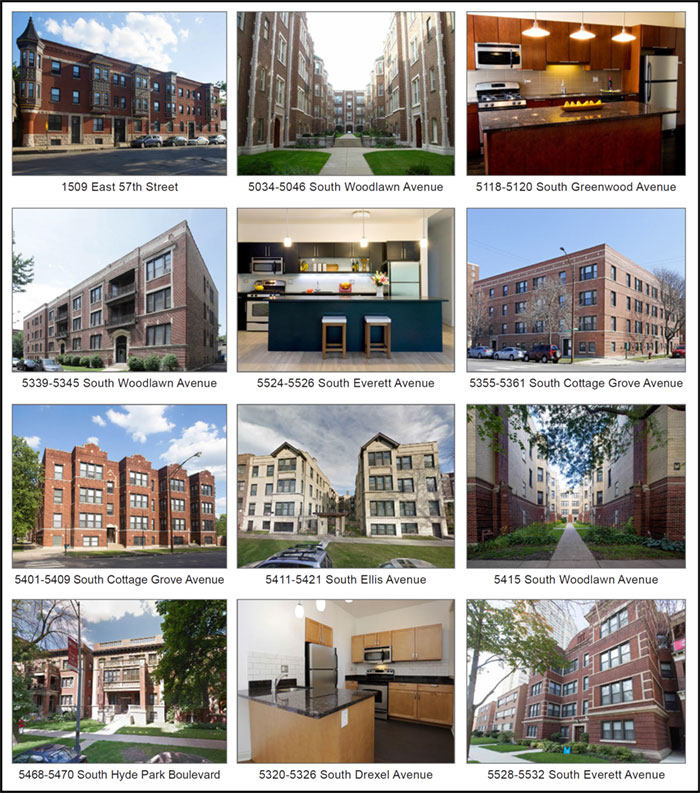

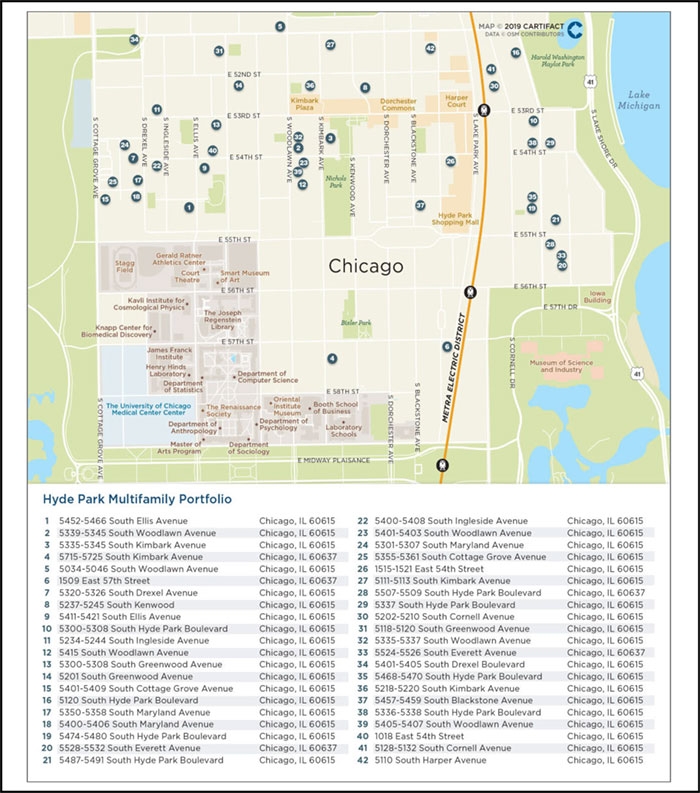

| 5 | Hyde Park Multifamily Portfolio | LCM | 42 | $46,750,000 | 5.8% | 839 | Multifamily | 1.82x | 8.7% | 60.5% | 60.5% |

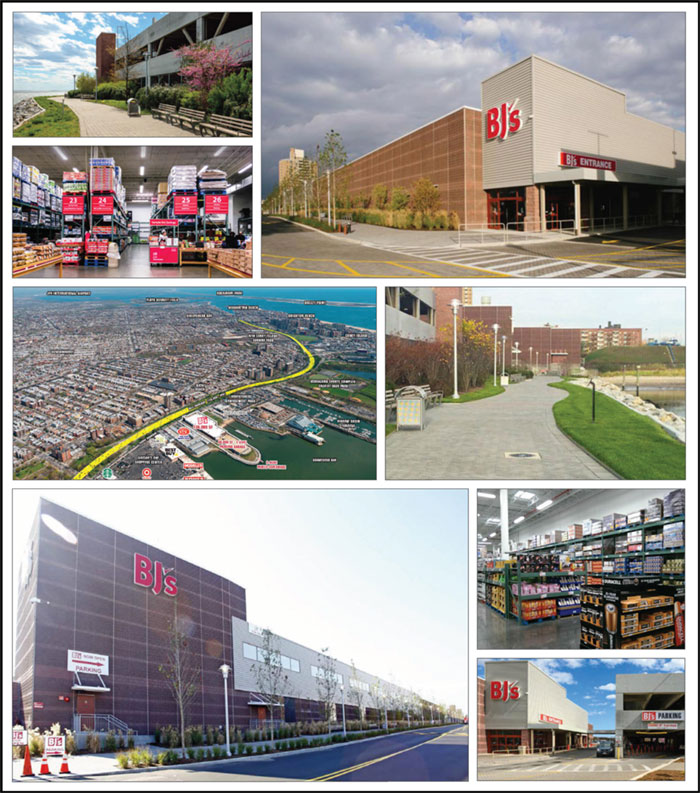

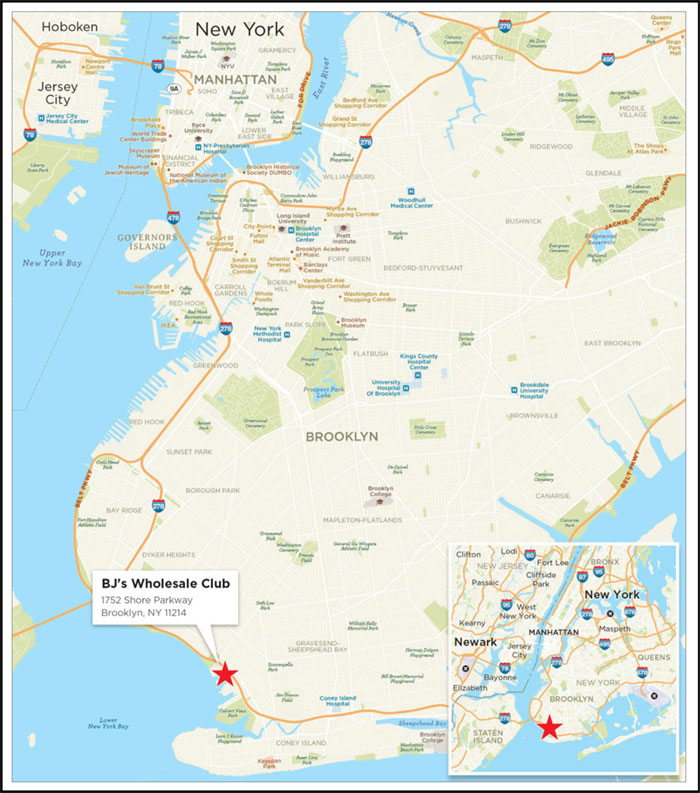

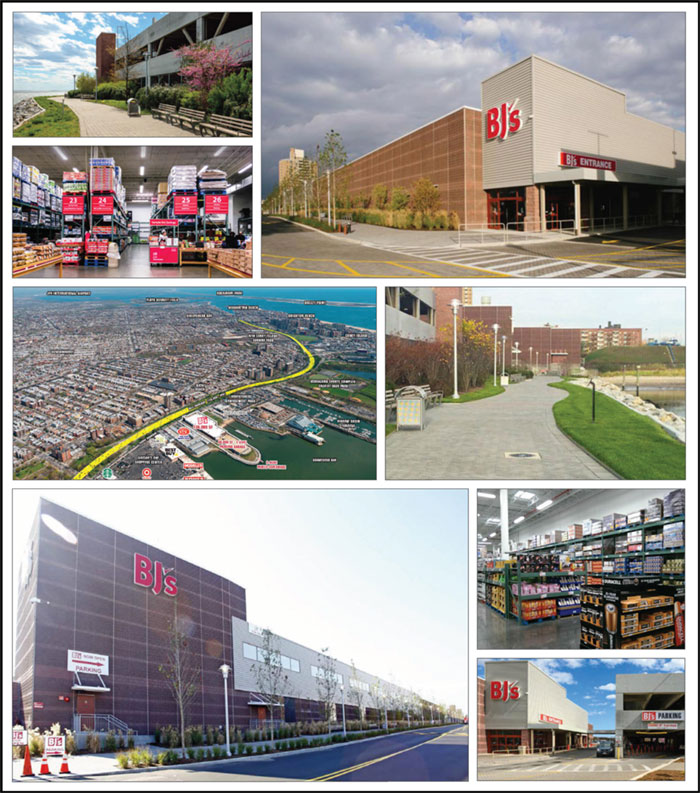

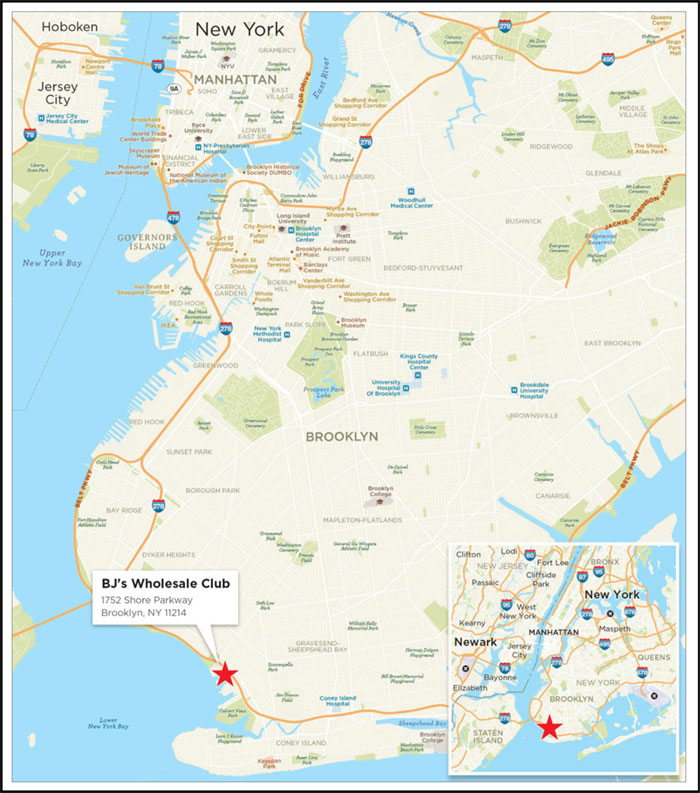

| 6 | BJ's Wholesale Club | JPMCB | 1 | $40,150,000 | 5.0% | 135,753 | Retail | 2.58x | 9.4% | 54.3% | 54.3% |

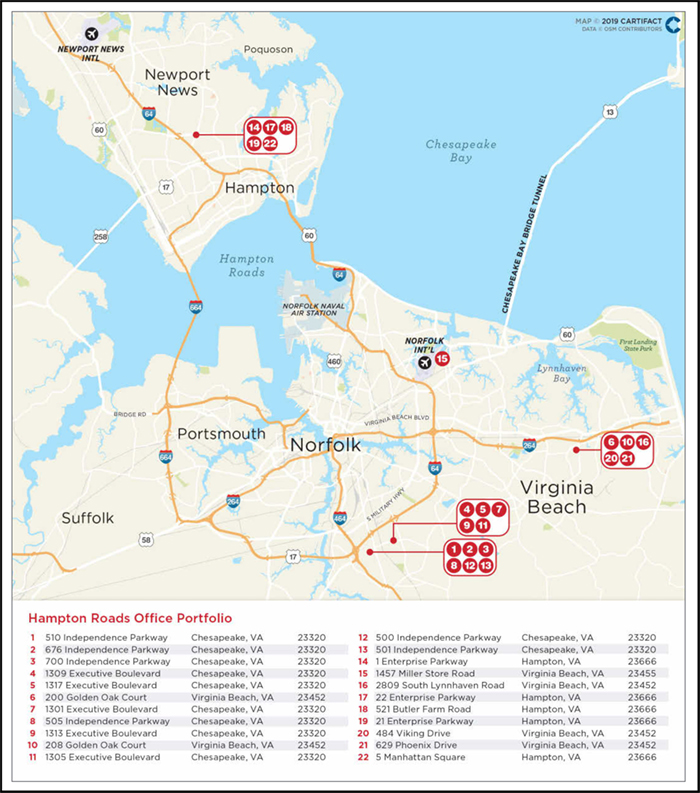

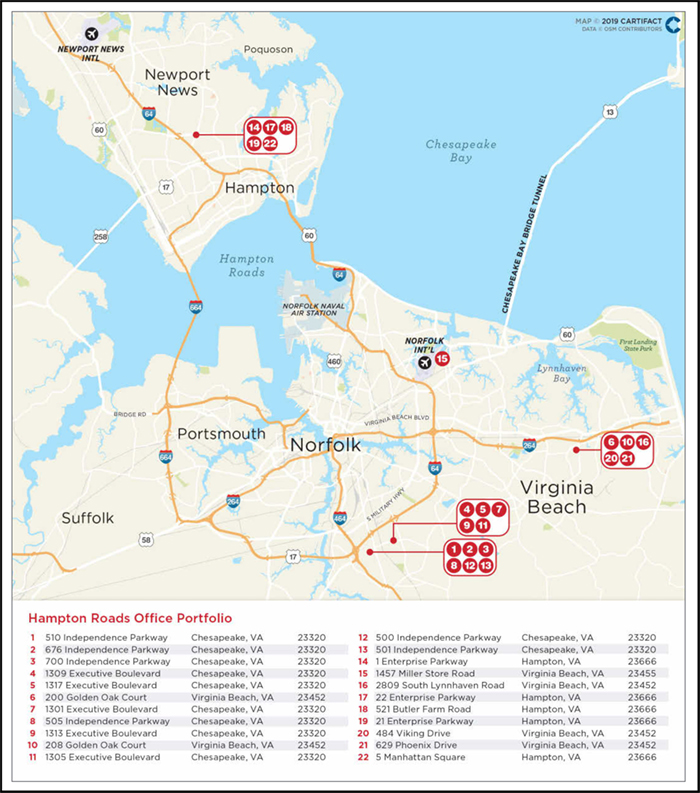

| 7 | Hampton Roads Office Portfolio | LCM | 22 | $39,723,151 | 4.9% | 1,322,003 | Office | 1.40x | 10.8% | 71.3% | 60.3% |

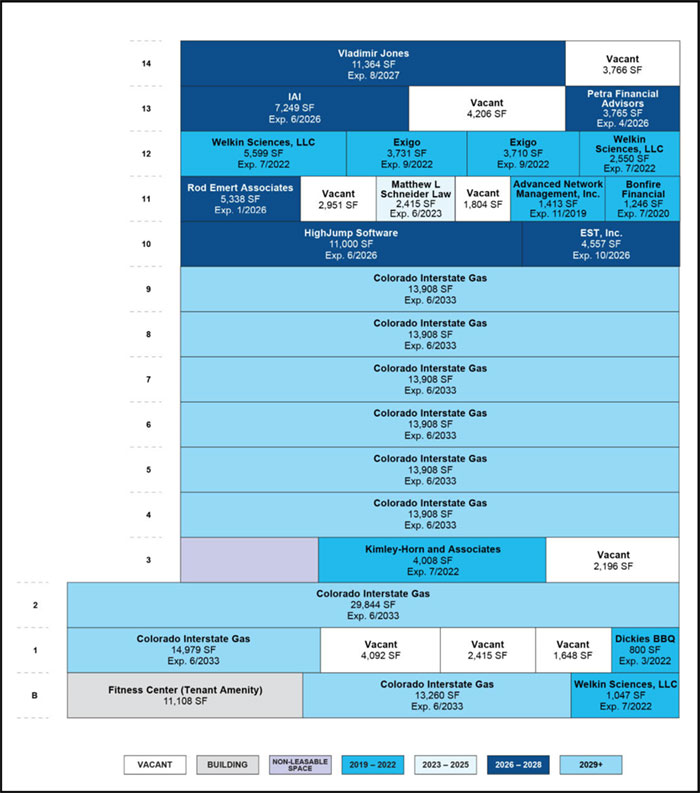

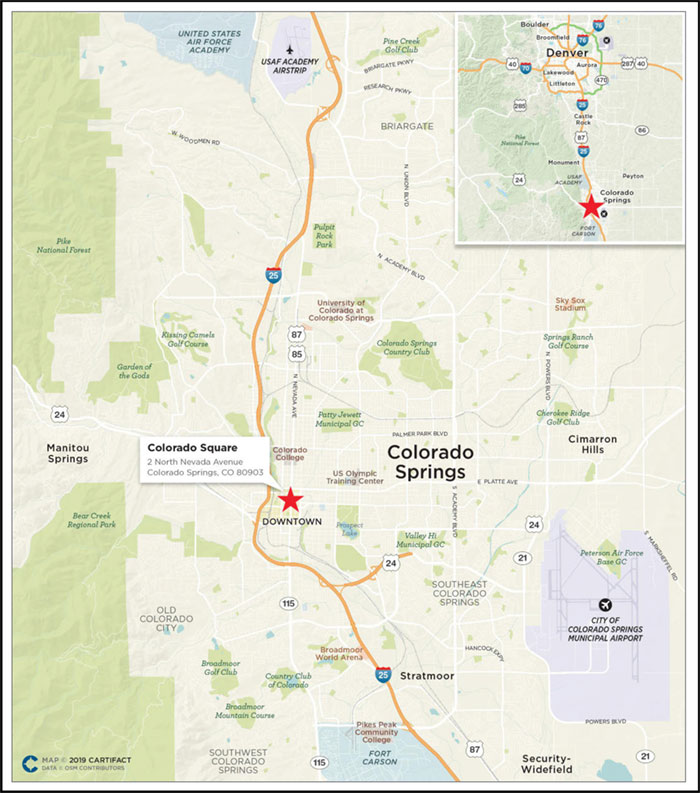

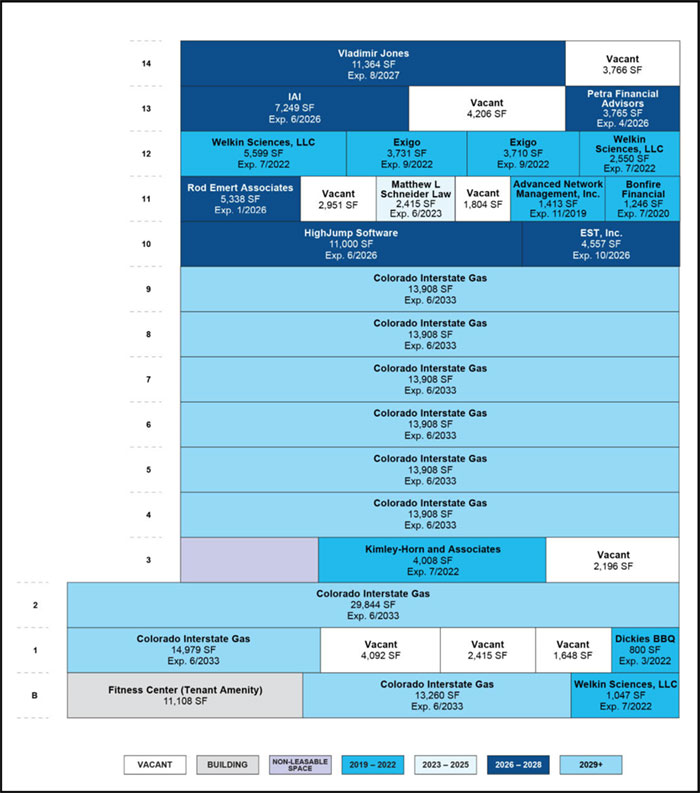

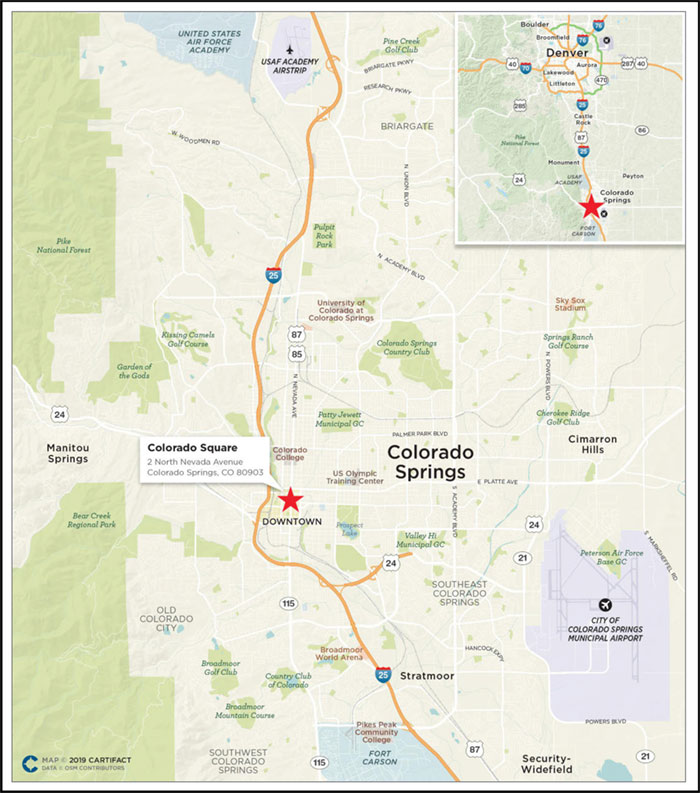

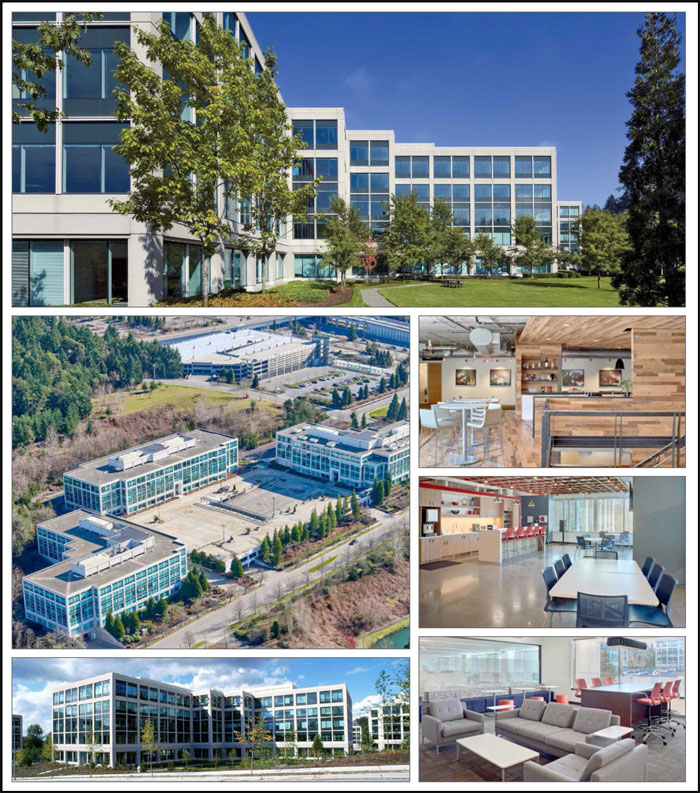

| 8 | Colorado Square | LCM | 1 | $37,050,001 | 4.6% | 245,509 | Office | 1.53x | 9.3% | 71.8% | 57.5% |

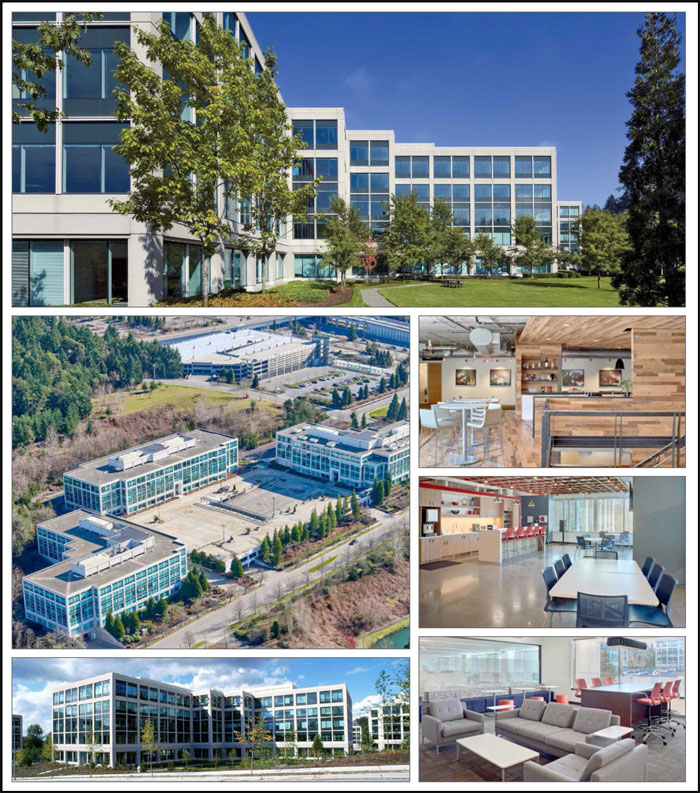

| 9 | Sunset North | JPMCB | 1 | $35,000,000 | 4.3% | 464,061 | Office | 2.63x | 9.1% | 66.1% | 66.1% |

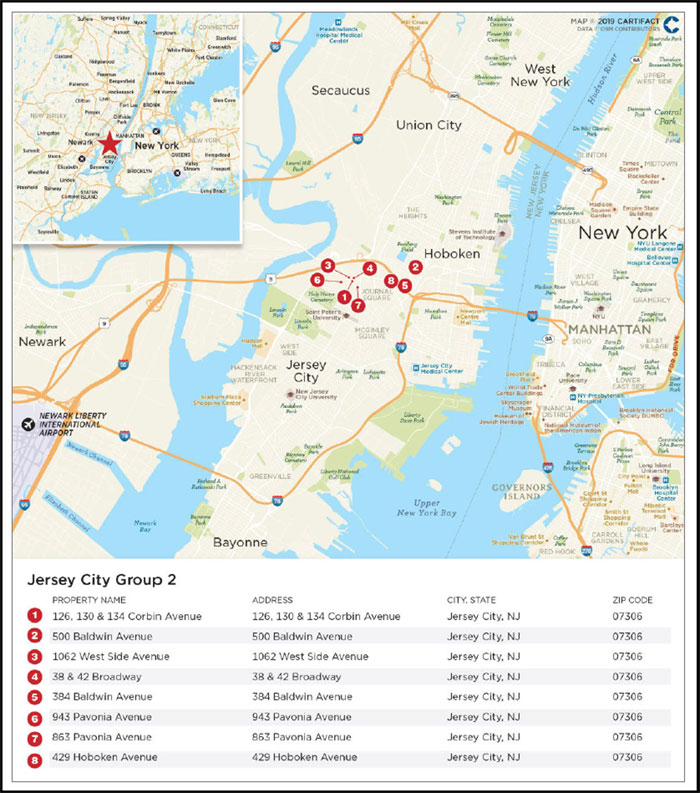

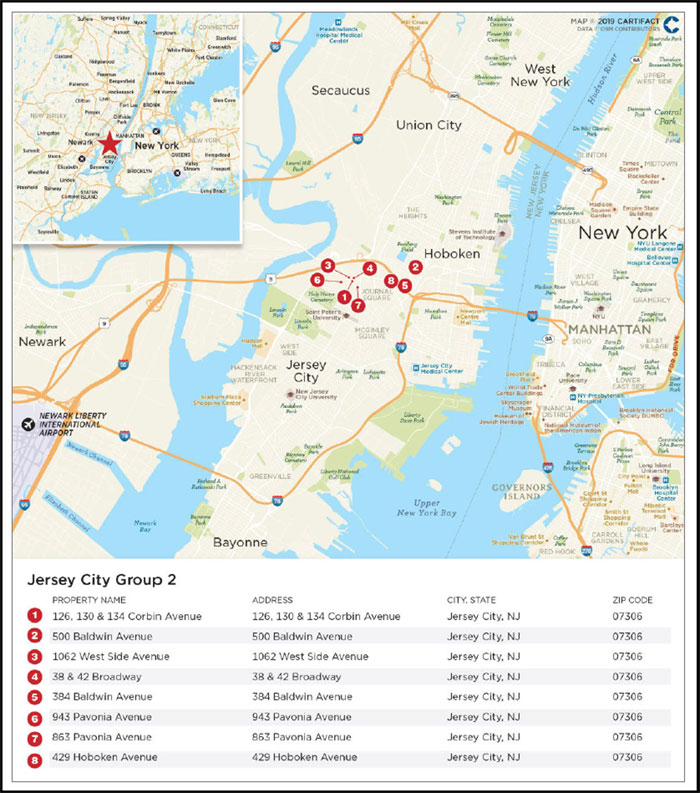

| 10 | Jersey City Group 2 | JPMCB | 8 | $32,840,000 | 4.1% | 201 | Multifamily | 1.04x | 6.6% | 78.6% | 72.0% |

| | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | 10 | $178,500,000 | 22.1% | | | 2.94x | 10.4% | 56.4% | 56.4% |

| | Top 5 Total/Weighted Average | 54 | $279,250,000 | 34.6% | | | 2.53x | 9.6% | 57.7% | 57.7% |

| | Top 10 Total/Weighted Average | 87 | $464,013,153 | 57.5% | | | 2.26x | 9.4% | 61.8% | 59.3% |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7 and 9, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5 and 7, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (3) | In the case of Loan No. 3, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 8 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| Loan No. | Mortgage Loan | Note(s) | Original Balance ($) | Cut-off Date

Balance ($) | Holder of Note | Lead

Servicer for

Whole Loan

(Y/N) | Master

Servicer

Under Lead

Securitization | Special Servicer

Under Lead

Securitization |

| 1 | Century Plaza Towers | A-1-S1, A-1-S2, A-1-S3, A-2-S1, A-2-S2, A-2-S3, A-2-C1, A-2-C3, A-2-C4, A-3-S1, A-3-S2, A-3-S3, A-3-C1, A-3-C3 | $525,000,000 | $525,000,000 | CPTS 2019-CPT | Yes | Wells | CWCapital |

| | A-1-C3, A-1-C8 | $62,500,000 | $62,500,000 | JPMDB 2019-COR6 | No | | |

| | A-1-C1, A-1-C2, A-1-C4, A-1-C5, A-1-C6, A-1-C7, | $187,500,000 | $187,500,000 | DBRI | No | | |

| | | A-2-C2, A-2-C5, A-2-C6, A-2-C7 | $62,500,000 | $62,500,000 | MSBNA | No | | |

| | | A-3-C2, A-3-C4, A-3-C5 | $62,500,000 | $62,500,000 | WFBNA | No | | |

| | | B-1, B-2, B-3(1) | $300,000,000 | $300,000,000 | CPTS 2019-CPT | No | | |

| | | Total | $1,200,000,000 | $1,200,000,000 | | | | |

| 2 | Los Angeles Leased Fee Portfolio | A-1 | $61,000,000 | $61,000,000 | JPMDB 2019-COR6 | Yes | Midland | Midland |

| | A-2 | $24,000,000 | $24,000,000 | LCM | No | | |

| | | Total | $85,000,000 | $85,000,000 | | | | |

| 3 | Innovation Park | A-1 | $60,000,000 | $60,000,000 | BMARK 2019-B14 | No(2) | | |

| | A-2 | $67,250,000 | $67,250,000 | JPMCB | Yes | (2) | (2) |

| | | A-3 | $55,000,000 | $55,000,000 | JPMDB 2019-COR6 | No | | |

| | | Total | $182,250,000 | $182,250,000 | | | | |

| 4 | 12555 &12655 Jefferson | A-1 | $54,000,000 | $54,000,000 | JPMDB 2019-COR6 | Yes | Midland | Midland |

| | A-2 | $30,000,000 | $30,000,000 | LCM | No | | |

| | | A-3 | $27,000,000 | $27,000,000 | LCM | No | | |

| | | Total | $111,000,000 | $111,000,000 | | | | |

5 | Hyde Park Multifamily Portfolio | A-1 | $60,000,000 | $60,000,000 | JPMCC 2019-COR5 | Yes | Midland | Midland |

| | A-2 | $46,750,000 | $46,750,000 | JPMDB 2019-COR6 | No | | |

| | | Total | $106,750,000 | $106,750,000 | | | | |

7 | Hampton Roads Office Portfolio | A-1, A-5 | $50,000,000 | $49,653,939 | JPMCC 2019-COR5 | Yes | Midland | Midland |

| | A-3, A-4 | $40,000,000 | $39,723,151 | JPMDB 2019-COR6 | No | | |

| | A-2 | $33,000,000 | $32,771,600 | LCM | No | | |

| | A-6 | $10,000,000 | $9,930,788 | LCM | No | | |

| | Total | $133,000,000 | $132,079,478 | | | | |

9 | Sunset North | A-1 | $75,000,000 | $75,000,000 | BMARK 2019-B13 | Yes | Midland | CWCapital |

| | | A-2 | $20,000,000 | $20,000,000 | BMARK 2019-B14 | No | | |

| | | A-3 | $35,000,000 | $35,000,000 | JPMDB 2019-COR6 | No | | |

| | | A-4 | $20,000,000 | $20,000,000 | JPMCB | No | | |

| | | Total | $150,000,000 | $150,000,000 | | | | |

| 11 | Belvedere Place | A-1 | $32,750,000 | $32,750,000 | JPMDB 2019-COR6 | Yes | Midland | Midland |

| | A-2 | $11,250,000 | $11,250,000 | LCM | No | | |

| | | Total | $44,000,000 | $44,000,000 | | | | |

14 | Brooklyn Renaissance Plaza | A-1 | $65,000,000 | $64,503,166 | JPMCC 2019-COR5 | Yes | Midland | Midland |

| | A-2 | $25,000,000 | $24,808,910 | JPMDB 2019-COR6 | No | | |

| | | Total | $90,000,000 | $89,312,076 | | | | |

| (1) | Each note represents a subordinate companion loan. |

| (2) | In the case of Loan No. 3, the whole loan is expected to be serviced under the BMARK 2019-B14 pooling and servicing agreement until such time the controlling note has been securitized, at which point such whole loan will be serviced under the pooling and servicing agreement related to such securitization. JPMCB holds the related controllingpari passucompanion loan and is entitled to exercise control rights until the securitization of such controllingpari passucompanion loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 9 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Loan No. | Mortgage Loan | Note(s) | Original

Balance ($) | Cut-off Date

Balance ($) | Holder of Note | Lead

Servicer for

Whole Loan

(Y/N) | Master

Servicer

Under Lead

Securitization | Special Servicer

Under Lead

Securitization |

| 16 | Grand Canal Shoppes | A-1-1, A-1-6 | $70,000,000 | $70,000,000 | MSC 2019-H7 | Yes(2) | Midland | LNR |

| | | A-1-2, A-2-1 | $100,000,000 | $100,000,000 | BANK 2019-BNK19 | No | | |

| | | A-3-1 | $50,000,000 | $50,000,000 | BMARK 2019-B12 | No | | |

| | | A-3-2 | $50,000,000 | $50,000,000 | BMARK 2019-B13 | No | | |

| | | A-4-1 | $60,000,000 | $60,000,000 | CGCMT 2019-GC41 | No | | |

| | | A-4-3 | $20,000,000 | $20,000,000 | GSMS 2019-GC42 | No | | |

| | | A-1-7, A-1-8, A-2-2-1 | $40,000,000 | $40,000,000 | BANK 2019-BNK20 | No | | |

| | | A-2-2-2 | $30,000,000 | $30,000,000 | CSAIL 2019-C17 | No | | |

| | | A-2-3, A-2-5 | $50,384,615 | $50,384,615 | UBS 2019-C17 | No | | |

| | | A-1-4 | $40,000,000 | $40,000,000 | BANK 2019-BNK21 | No | | |

| | | A-3-3-1, A-3-5 | $30,384,615 | $30,384,615 | BMARK 2019-B14 | No | | |

| | | A-1-3, A-1-5 | $53,846,154 | $53,846,154 | MSNBA | No | | |

| | | A-3-3-2 | $20,000,000 | $20,000,000 | JPMDB 2019-COR6 | No | | |

| | | A-3-4 | $25,000,000 | $25,000,000 | CCRE | No | | |

| | | A-4-2, A-4-4, A-4-5 | $95,384,615 | $95,384,615 | GSBI | No | | |

| | | A-2-4 | $25,000,000 | $25,000,000 | UBS AG | No | | |

| | | B-1(1) | $215,000,000 | $215,000,000 | CPPIB Credit Investment II Inc. | No(2) | | |

| | | Total | $975,000,000 | $975,000,000 | | | | |

17 | 600 & 620 National Avenue | A-1-1 | $38,950,000 | $38,950,000 | UBSCM 2019-C17 | Yes | Midland | CWCapital |

| | A-2-1-A | $20,000,000 | $20,000,000 | BMARK 2019-B14 | No | | |

| | | A-1-2 | $30,000,000 | $30,000,000 | WFCM 2019-C53 | No | | |

| | | A-2-2-A | $20,000,000 | $20,000,000 | JPMDB 2019-COR6 | No | | |

| | | A-2-1-B, A-2-2-B, A-2-3 | $28,950,000 | $28,950,000 | JPMCB | No | | |

| | | Total | $137,900,000 | $137,900,000 | | | | |

18 | Tysons Tower | A-1 | $50,000,000 | $50,000,000 | BANK 2019-BNK21 | Yes | Rialto | Wells |

| | A-2, A-3 | $45,000,000 | $45,000,000 | BANK 2019-BNK22 | No | | |

| | | A-4 | $40,000,000 | $40,000,000 | BMARK 2019-B14 | No | | |

| | | A-5, A-7 | $35,000,000 | $35,000,000 | JPMCB | No | | |

| | | A-6 | $20,000,000 | $20,000,000 | JPMDB 2019-COR6 | No | | |

| | | Total | $190,000,000 | $190,000,000 | | | | |

| 20 | Hilton Cincinnati Netherland Plaza | A-1 | $35,500,000 | $35,500,000 | BMARK 2019-B14 | Yes | Midland | Midland |

| | A-2 | $17,000,000 | $17,000,000 | JPMDB 2019-COR6 | No | | |

| | A-3 | $20,000,000 | $20,000,000 | JPMCB | No | | |

| | | Total | $72,500,000 | $72,500,000 | | | | |

| 26 | NOV Headquarters | A-1 | $20,000,000 | $20,000,000 | JPMCC 2019-COR5 | Yes | Midland | Midland |

| | A-2 | $9,200,000 | $9,200,000 | JPMDB 2019-COR6 | No | | |

| | | A-3 | $10,000,000 | $10,000,000 | LCM | No | | |

| | | Total | $39,200,000 | $39,200,000 | | | | |

| (1) | Each note represents a subordinate companion loan. |

| (2) | In the case of Loan No. 16, the initial control note is Note B-1. During the continuance of a Grand Canal Shoppes Control Appraisal Period, Note A-1-1 will be the Control Note. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loans—The Grand Canal Shoppes Whole Loan” in the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 10 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

No. | Loan Name | Trust

Cut-off Date

Balance | Subordinate

Debt Cut-off

Date

Balance(1) | Total Debt

Cut-off Date

Balance | Mortgage

Loan UW

NCF

DSCR(2)(3) | Total

Debt

UW

NCF

DSCR(3) | Mortgage

Loan

Cut-off

Date

LTV(2) | Total

Debt

Cut-off

Date

LTV | Mortgage

Loan UW

NOI Debt

Yield(2) | Total

Debt

UW NOI

Debt

Yield |

| 1 | Century Plaza Towers | $62,500,000 | $300,000,000 | $1,200,000,000 | 4.09x | 3.07x | 39.1% | 52.1% | 13.5% | 10.1% |

| 5 | Hyde Park Multifamily Portfolio | $46,750,000 | $15,250,000 | $122,000,000 | 1.82x | 1.48x | 60.5% | 69.2% | 8.7% | 7.6% |

| 7 | Hampton Roads Office Portfolio | $39,723,151 | $19,861,576 | $151,941,054 | 1.40x | 1.16x | 71.3% | 82.0% | 10.8% | 9.4% |

| 16 | Grand Canal Shoppes | $20,000,000 | $215,000,000 | $975,000,000 | 2.46x | 1.67x | 46.3% | 59.5% | 9.6% | 7.5% |

| (1) | In the case of Loan Nos. 5 and 7, Subordinate Debt Cut-off Date Balance represents one or more mezzanine loans. In the case of Loan Nos. 1 and 16, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans. |

| (2) | In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield and Cut-off Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield and Cut-off Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 mortgage loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. The Total Debt UW NCF DSCR is calculated using the sum of the first 12 total debt principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in the related mortgage and mezzanine loan agreements. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 11 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Mortgaged Properties by Type(1) |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number

of

Properties | Cut-off Date

Principal

Balance | % of IPB | Occupancy | UW

NCF

DSCR(2)(3) | UW

NOI Debt

Yield(2) | Cut-off

Date

LTV(2)(4) | Maturity

Date

LTV(2)(4) |

| Office | Suburban | 31 | $280,753,630 | 34.8% | 95.9% | 2.22x | 10.2% | 66.2% | 62.6% |

| | CBD | 5 | 178,358,911 | 22.1 | 93.1% | 2.49x | 10.2% | 53.3% | 49.1% |

| | Medical | 4 | 9,200,000 | 1.1 | 100.0% | 1.50x | 10.0% | 58.7% | 53.9% |

| | Subtotal: | 40 | $468,312,541 | 58.0% | 94.9% | 2.31x | 10.2% | 61.2% | 57.3% |

| | | | | | | | | | |

| Multifamily | Garden | 40 | $67,106,565 | 8.3% | 94.3% | 1.44x | 7.7% | 69.4% | 66.1% |

| | Mid-Rise | 11 | 34,064,097 | 4.2 | 97.2% | 1.91x | 8.2% | 61.2% | 61.2% |

| | Subtotal: | 51 | $101,170,662 | 12.5% | 95.2% | 1.60x | 7.9% | 66.6% | 64.5% |

| | | | | | | | | | |

| Retail | Freestanding | 2 | $44,350,000 | 5.5% | 100.0% | 2.51x | 9.3% | 55.1% | 55.1% |

| | Anchored | 2 | 25,553,256 | 3.2 | 94.1% | 2.13x | 11.0% | 60.2% | 56.2% |

| | Specialty Retail | 1 | 20,000,000 | 2.5 | 94.0% | 2.46x | 9.6% | 46.3% | 46.3% |

| | Shadow Anchored | 1 | 3,395,000 | 0.4 | 92.2% | 2.52x | 11.5% | 67.9% | 67.9% |

| | Subtotal: | 6 | $93,298,256 | 11.6% | 96.8% | 2.40x | 9.9% | 55.1% | 54.0% |

| | | | | | | | | | |

| Other | Leased Fee | 8 | $61,000,000 | 7.6% | 100.0% | 1.75x | 6.2% | 63.0% | 63.0% |

| | Parking | 1 | 219,338 | 0.0 | 100.0% | 1.82x | 8.7% | 60.5% | 60.5% |

| | Subtotal: | 9 | $61,219,338 | 7.6% | 100.0% | 1.75x | 6.2% | 63.0% | 63.0% |

| | | | | | | | | | |

| Hotel | Extended Stay | 1 | $25,250,000 | 3.1% | 88.1% | 2.99x | 12.3% | 52.6% | 52.6% |

| | Full Service | 1 | 17,000,000 | 2.1 | 74.8% | 1.62x | 10.9% | 68.7% | 63.7% |

| | Subtotal: | 2 | $42,250,000 | 5.2% | 82.7% | 2.44x | 11.7% | 59.1% | 57.1% |

| | | | | | | | | | |

| Self Storage | Self Storage | 2 | $28,330,000 | 3.5% | 90.5% | 1.81x | 8.9% | 64.2% | 64.2% |

| | Subtotal: | 2 | $28,330,000 | 3.5% | 90.5% | 1.81x | 8.9% | 64.2% | 64.2% |

| | | | | | | | | | |

| Industrial | Flex | 6 | $11,060,700 | 1.4% | 100.0% | 2.49x | 16.8% | 50.8% | 41.0% |

| | Warehouse/Distribution | 1 | 1,539,300 | 0.2 | 100.0% | 1.64x | 10.6% | 66.9% | 55.1% |

| | Subtotal: | 7 | $12,600,000 | 1.6% | 100.0% | 2.39x | 16.1% | 52.8% | 42.7% |

| | Total / Weighted Average: | 117 | $807,180,797 | 100.0% | 94.8% | 2.18x | 9.7% | 61.2% | 58.2% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7, 9, 11, 14, 16, 17, 18, 20 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 17 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 12 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

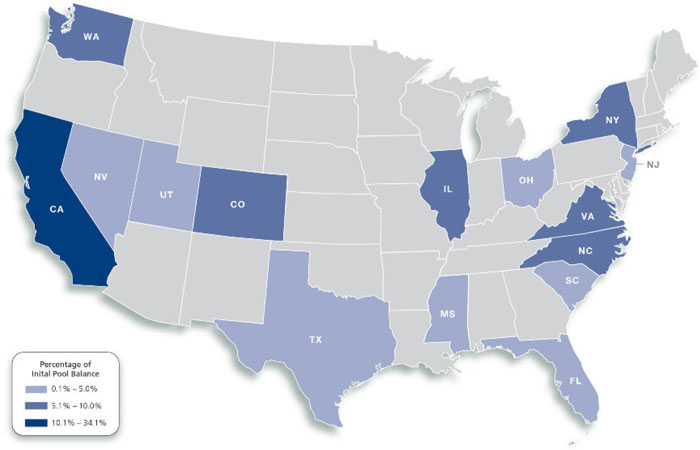

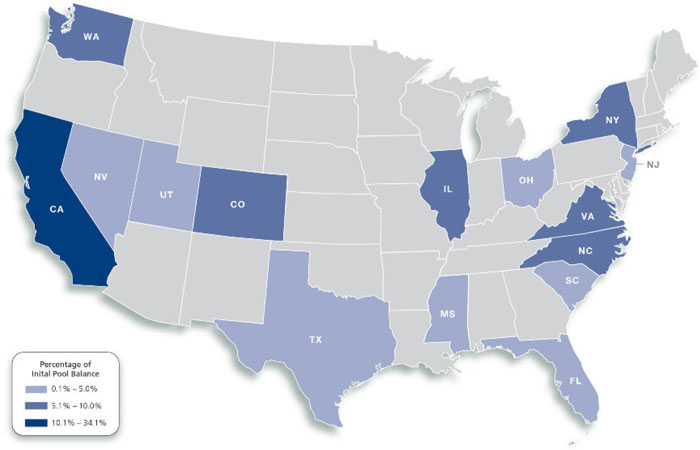

| Mortgaged Properties by Location(1) |

| |

| | | | | Weighted Average |

State | Number of Properties | Cut-off Date

Principal

Balance | % of

IPB | Occupancy | UW

NCF DSCR(2)(3) | UW

NOI Debt

Yield(2) | Cut-off Date

LTV(2)(4) | Maturity Date

LTV(2)(4) |

| California | 17 | $274,983,735 | 34.1% | 96.6% | 2.43x | 9.4% | 57.5% | 56.8% |

| Illinois | 44 | 68,550,000 | 8.5 | 95.4% | 1.86x | 8.5% | 60.9% | 60.9% |

| New York | 2 | 64,958,910 | 8.0 | 95.6% | 2.14x | 9.2% | 52.0% | 48.5% |

| North Carolina | 4 | 60,789,100 | 7.5 | 96.5% | 2.83x | 11.5% | 68.6% | 67.5% |

| Virginia | 24 | 60,258,551 | 7.5 | 93.9% | 1.96x | 10.9% | 64.9% | 57.5% |

| Colorado | 2 | 56,280,001 | 7.0 | 89.7% | 1.57x | 9.2% | 68.5% | 59.0% |

| Washington | 3 | 48,100,000 | 6.0 | 98.3% | 2.66x | 10.6% | 63.0% | 62.4% |

| New Jersey | 8 | 32,840,000 | 4.1 | 95.0% | 1.04x | 6.6% | 78.6% | 72.0% |

| Utah | 1 | 29,600,000 | 3.7 | 88.2% | 1.58x | 9.5% | 67.4% | 60.9% |

| South Carolina | 2 | 27,895,000 | 3.5 | 99.1% | 1.83x | 10.9% | 61.5% | 50.7% |

| Florida | 2 | 26,789,300 | 3.3 | 88.8% | 2.91x | 12.2% | 53.4% | 52.7% |

| Nevada | 1 | 20,000,000 | 2.5 | 94.0% | 2.46x | 9.6% | 46.3% | 46.3% |

| Texas | 5 | 18,400,000 | 2.3 | 100.0% | 1.61x | 9.1% | 63.8% | 61.4% |

| Ohio | 1 | 17,000,000 | 2.1 | 74.8% | 1.62x | 10.9% | 68.7% | 63.7% |

| Mississippi | 1 | 736,200 | 0.1 | 100.0% | 1.64x | 10.6% | 66.9% | 55.1% |

| Total / Weighted Average | 117 | $807,180,797 | 100.0% | 94.8% | 2.18x | 9.7% | 61.2% | 58.2% |

| (1) | Because this table represents information relating to the mortgaged properties and not mortgage loans, the information for the mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7, 9, 11, 14, 16, 17, 18, 20 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (3) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 3, 17 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 13 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Cut-off Date Principal Balance |

| | | | | Weighted Average |

Range of Cut-off Date

Principal Balances | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| $3,395,000 | - | $9,999,999 | 9 | $65,398,256 | 8.1% | 4.28717% | 114 | 1.93x | 10.5% | 62.0% | 57.8% |

| $10,000,000 | - | $19,999,999 | 5 | 80,860,479 | 10.0 | 4.61616% | 93 | 1.84x | 10.0% | 64.7% | 62.4% |

| $20,000,000 | - | $24,999,999 | 5 | 109,308,910 | 13.5 | 3.87262% | 117 | 2.08x | 9.5% | 55.4% | 50.5% |

| $25,000,000 | - | $49,999,999 | 9 | 319,113,153 | 39.5 | 4.07770% | 117 | 1.99x | 9.5% | 65.0% | 60.7% |

| $50,000,000 | - | $62,500,000 | 4 | 232,500,000 | 28.8 | 3.46669% | 119 | 2.68x | 9.8% | 57.1% | 57.1% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| | | | | Weighted Average |

Range of

Mortgage Interest Rates | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 3.00450% | - | 3.99999% | 16 | $490,150,000 | 60.7% | 3.53174% | 119 | 2.56x | 9.8% | 58.3% | 57.8% |

| 4.00000% | - | 4.49999% | 7 | 129,434,390 | 16.0 | 4.14426% | 109 | 1.70x | 10.1% | 63.6% | 53.9% |

| 4.50000% | - | 4.99999% | 6 | 111,643,256 | 13.8 | 4.58227% | 115 | 1.53x | 8.3% | 66.2% | 62.9% |

| 5.00000% | - | 5.39000% | 3 | 75,953,151 | 9.4 | 5.33398% | 100 | 1.51x | 10.4% | 68.4% | 61.5% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| | | | | | | | | | | | |

| Original Term to Maturity in Months |

| | | | | Weighted Average |

Original Term to

Maturity in Months | Number of

Loans | Cut-off Date Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date LTV(1)(3) |

| 60 | 3 | $35,375,479 | 4.4% | 4.71509% | 59 | 1.68x | 10.7% | 70.2% | 65.0% |

| 120 | 29 | 771,805,319 | 95.6 | 3.90954% | 117 | 2.20x | 9.7% | 60.7% | 57.9% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| Remaining Term to Maturity in Months |

| | | | | Weighted Average |

Range of Remaining Term

to Maturity in Months | Number of

Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date LTV(1)(3) | Maturity

Date LTV(1)(3) |

| 59 | - | 84 | 3 | $35,375,479 | 4.4% | 4.71509% | 59 | 1.68x | 10.7% | 70.2% | 65.0% |

| 85 | - | 119 | 21 | 554,415,319 | 68.7 | 4.01454% | 116 | 1.96x | 8.9% | 61.8% | 58.9% |

| 120 | 8 | 217,390,000 | 26.9 | 3.64175% | 120 | 2.82x | 11.5% | 58.0% | 55.5% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| | | | | | | | | | | | |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7, 9, 11, 14, 16, 17, 18, 20 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 3, 17 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 14 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Original Amortization Term in Months |

| | | | | Weighted Average |

Original

Amortization

Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 20 | $555,425,000 | 68.8% | 3.71279% | 117 | 2.48x | 9.6% | 58.7% | 58.7% |

| 300 | 1 | 4,000,000 | 0.5 | 3.80000% | 120 | 3.99x | 27.8% | 22.5% | 16.1% |

| 360 | 11 | 247,755,797 | 30.7 | 4.46742% | 109 | 1.47x | 9.6% | 67.2% | 57.8% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| Remaining Amortization Term in Months |

| | | | | Weighted Average |

Range of Remaining

Amortization Term in Months | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 20 | $555,425,000 | 68.8% | 3.71279% | 117 | 2.48x | 9.6% | 58.7% | 58.7% |

| 300 | - | 359 | 6 | 130,015,797 | 16.1 | 4.54182% | 109 | 1.55x | 10.5% | 64.7% | 53.8% |

| 360 | 6 | 121,740,000 | 15.1 | 4.36602% | 111 | 1.47x | 9.3% | 68.5% | 60.8% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| | | | | | | | | | | | |

| | | | | Weighted Average |

| Amortization Types | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Interest Only | 20 | $555,425,000 | 68.8% | 3.71279% | 117 | 2.48x | 9.6% | 58.7% | 58.7% |

| Balloon | 8 | 171,515,797 | 21.2 | 4.55167% | 105 | 1.58x | 10.6% | 64.5% | 54.0% |

| IO-Balloon | 4 | 80,240,000 | 9.9 | 4.25405% | 118 | 1.36x | 8.5% | 70.9% | 64.0% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| | | | | Weighted Average |

Range of Underwritten Net

Cash Flow Debt Service

Coverage Ratios | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 1.04x | - | 1.49x | 3 | $97,372,061 | 12.1% | 4.83881% | 116 | 1.29x | 8.9% | 67.9% | 58.9% |

| 1.50x | - | 1.74x | 10 | 178,813,736 | 22.2 | 4.37276% | 106 | 1.60x | 9.8% | 66.4% | 58.3% |

| 1.75x | - | 1.99x | 7 | 207,750,000 | 25.7 | 3.92996% | 117 | 1.82x | 7.5% | 62.1% | 62.1% |

| 2.00x | - | 2.24x | 1 | 9,100,000 | 1.1 | 3.90000% | 120 | 2.17x | 8.6% | 68.7% | 68.7% |

| 2.25x | - | 4.09x | 11 | 314,145,000 | 38.9 | 3.43532% | 118 | 3.03x | 11.4% | 55.3% | 55.2% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7, 9, 11, 14, 16, 17, 18, 20 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 3, 17 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 15 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| LTV Ratios as of the Cut-off Date(1)(3) |

| | | | | Weighted Average |

Range of

Cut-off Date LTVs | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 22.5% | - | 39.9% | 2 | $66,500,000 | 8.2% | 3.05235% | 120 | 4.08x | 14.4% | 38.1% | 37.7% |

| 40.0% | - | 49.9% | 2 | 44,808,910 | 5.6 | 4.10024% | 115 | 1.89x | 9.3% | 47.4% | 42.4% |

| 50.0% | - | 59.9% | 7 | 171,603,256 | 21.3 | 3.78747% | 119 | 2.29x | 9.4% | 56.1% | 55.3% |

| 60.0% | - | 69.9% | 16 | 379,675,000 | 47.0 | 3.94604% | 114 | 2.11x | 9.4% | 64.6% | 62.8% |

| 70.0% | - | 78.6% | 5 | 144,593,631 | 17.9 | 4.49078% | 111 | 1.44x | 8.9% | 73.0% | 64.2% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| LTV Ratios as of the Maturity Date(1)(3) |

| | | | | Weighted Average |

Range of

Maturity Date LTVs | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| 16.1% | - | 39.9% | 3 | $91,308,910 | 11.3% | 3.41579% | 118 | 3.36x | 12.9% | 40.9% | 38.1% |

| 40.0% | - | 49.9% | 3 | 53,953,256 | 6.7 | 4.01423% | 118 | 1.97x | 10.3% | 54.7% | 47.3% |

| 50.0% | - | 54.9% | 4 | 94,600,000 | 11.7 | 3.62164% | 119 | 2.69x | 10.6% | 53.8% | 53.3% |

| 55.0% | - | 59.9% | 4 | 113,200,001 | 14.0 | 4.00018% | 118 | 1.72x | 8.4% | 63.9% | 58.4% |

| 60.0% | - | 72.0% | 18 | 454,118,630 | 56.3 | 4.09651% | 112 | 1.98x | 9.1% | 66.8% | 64.6% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| | | | | Weighted Average |

| Prepayment Protection | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Defeasance | 26 | $570,577,646 | 70.7% | 3.99512% | 114 | 1.91x | 9.0% | 62.9% | 59.5% |

| Yield Maintenance | 5 | 174,103,151 | 21.6 | 4.11763% | 117 | 2.38x | 10.6% | 63.4% | 60.8% |

| YM, then Defeasance or YM | 1 | 62,500,000 | 7.7 | 3.00450% | 120 | 4.09x | 13.5% | 39.1% | 39.1% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| | | | | | | | | | |

| | | | | Weighted Average |

| Loan Purpose | Number

of Loans | Cut-off Date

Principal

Balance | % of

IPB | Mortgage

Rate | Remaining

Loan Term | UW

NCF

DSCR(1)(2) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1)(3) | Maturity

Date

LTV(1)(3) |

| Refinance | 19 | $507,482,167 | 62.9% | 3.98604% | 115 | 2.07x | 9.4% | 59.2% | 55.7% |

| Acquisition | 12 | 279,698,630 | 34.7 | 3.91406% | 114 | 2.31x | 10.1% | 65.4% | 63.3% |

| Recapitalization | 1 | 20,000,000 | 2.5 | 3.33000% | 119 | 3.07x | 11.0% | 52.1% | 52.1% |

| Total / Weighted Average: | 32 | $807,180,797 | 100.0% | 3.94484% | 115 | 2.18x | 9.7% | 61.2% | 58.2% |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5, 7, 9, 11, 14, 16, 17, 18, 20 and 26, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 5, 7 and 16, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s) and/or related mezzanine loan(s). |

| (2) | With respect to Loan No. 7, the UW NCF DSCR is calculated using the sum of the first 12 whole loan principal and interest payments after the Cut-off Date based on the assumed principal and interest payment schedule set forth in Annex H of the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 3, 17 and 20, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 16 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Collateral Characteristics |

| Previous Securitization History(1) |

| No. | Property Name | Cut-off Date Principal

Balance | % of IPB | Location | Property

Type | Previous

Securitization |

| 1 | Century Plaza Towers | $62,500,000 | 7.7% | Los Angeles, CA | Office | MSC 2014-CPT |

| 10 | Jersey City Group 2 | $32,840,000 | 4.1% | Jersey City, NJ | Multifamily | TRTX 2018-FL1 |

| 12 | Union Heights | $29,600,000 | 3.7% | Sandy, UT | Office | GSMS 2012-GCJ7 |

| 31 | Opus Seaway | $4,000,000 | 0.5% | Everett, WA | Industrial | COMM 2015-PC1 |

| (1) | The table above represents the properties for which the previously existing debt was securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 17 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Class A-2(1) |

No. | Loan Name | Location | Cut-off Date

Balance | % of IPB | Maturity Date Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR(1) | UW NOI

Debt

Yield(1) | Cut-off

Date

LTV(1) | Maturity Date

LTV(1) |

| 20 | Hilton Cincinnati Netherland Plaza | Cincinnati, OH | $17,000,000 | 2.1% | $15,761,725 | 47.6% | 60 | 60 | 1.62x | 10.9% | 68.7% | 63.7% |

| 22 | Prospect Park | Rancho Cordova, CA | 14,980,479 | 1.9 | 13,637,903 | 41.2% | 60 | 59 | 1.55x | 10.4% | 72.4% | 65.9% |

| 32 | Prince Creek Village Center | Murrells Inlet, SC | 3,395,000 | 0.4 | 3,395,000 | 10.3% | 60 | 59 | 2.52x | 11.5% | 67.9% | 67.9% |

| Total / Weighted Average: | | $35,375,479 | 4.4% | $32,794,628 | 99.1% | 60 | 59 | 1.68x | 10.7% | 70.2% | 65.0% |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the certificate balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Maturity Date Balance divided by the initial Class A-2 Certificate Balance. |

| (3) | In the case of Loan No. 20, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loans. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 18 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Structural Overview |

| ■ Accrual: | | Each Class of Certificates (other than the Class R Certificates) will accrue interest on a 30/360 basis. The Class R Certificates will not accrue interest. |

| ■ Distribution of Interest: | | On each Distribution Date, accrued interest for each Class of Certificates (other than the Class R) at the applicable pass-through rate will be distributed in the following order of priority to the extent of Available Funds: first, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-D and Class X-F Certificates (the “Senior Certificates”), on apro rata basis, based on the interest entitlement for each such Class on such date, and then to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G-RR, Class H-RR and Class NR-RR Certificates, in that order, in each case until the interest entitlement for such date payable to each such Class is paid in full. The pass-through rate applicable to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G-RR, Class H-RR and Class NR-RR Certificates on each Distribution Date, will be aper annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), (iii) the lesser of a specified fixed rate and the rate described in clause (ii) above, or (iv) the rate described in clause (ii) above less a specified percentage. The pass-through rate for the Class X-A Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB and Class A-S Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that Distribution Date. The pass-through rate for the Class X-B Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class B and Class C certificates for the related Distribution Date, weighted on the basis of their respective certificate balances outstanding immediately prior to that Distribution Date. The pass-through rate for the Class X-D Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class D and Class E Certificates for the related Distribution Date, weighted on the basis of their respective certificate balances outstanding immediately prior to that Distribution Date. The pass-through rate for the Class X-F Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class F Certificates for the related Distribution Date. See “Description of the Certificates—Distributions” in the Preliminary Prospectus. |

| ■ Distribution of Principal: | | On any Distribution Date prior to the Cross-Over Date, payments in respect of principal will be distributed, up to the Available Funds: first, to the Class A-SB Certificates until the Certificate Balance of the Class A-SB Certificates is reduced to the Class A-SB planned principal balance for the related Distribution Date set forth in Annex G to the Preliminary Prospectus,second, to the Class A-1 Certificates, until the Certificate Balance of such Class is reduced to zero,third, to the Class A-2 Certificates, until the Certificate Balance of such Class is reduced to zero,fourth, to the Class A-3 Certificates, until the Certificate Balance of such Class is reduced to zero,fifth, to the Class A-4 Certificates, until the Certificate Balance of such Class is reduced to zero,sixth, to the Class A-SB Certificates, until the Certificate Balance of such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G-RR, Class H-RR and Class NR-RR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. On any Distribution Date on or after the Cross-Over Date, payments in respect of principal will be distributed, up to the Available Funds, to the Class A-1, Class A-2, Class A-3, Class A-4 and |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 19 of 145 |  |

| Structural and Collateral Term Sheet | | JPMDB 2019-COR6 |

| |

| Structural Overview |