SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

_ Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934(Fee Required)

or

X Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934(Fee Required)

For the fiscal year ended June 30, 2002

or

_ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934(No Fee Required)

For the transition period from ______________ to _________________________

Commission file number: 0-28296

GOLDBELT RESOURCES LTD.

(Exact Name of Registrant as Specified in its Charter)

GOLDBELT RESOURCES LTD.

(Translation of Registrant's Name into English)

British Columbia, Canada

(Jurisdiction of Incorporation or Organization)

595 Howe Street, 10th Floor

Vancouver B.C., Canada V6C 2T5

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | Name on Each Exchange |

Title of Each Class | on which Registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of November 15, 2002.

4,655,137 Common Shares without par value.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES _____ NO _____

Indicate by check mark which financial statement item the registrant has elected to follow.

ITEM 17 __X__ ITEM 18 ______

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12,13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

NOT APPLICABLE

CURRENCY AND EXCHANGE RATES

All dollar amounts set forth in this report are in Canadian dollars, except where otherwise indicated. The following table sets forth (i) the rates of exchange for the Canadian dollar, expressed in U.S. dollars, in effect at the end of each of the periods indicated; (ii) the average exchange rates in effect on the last day of each month during such periods; (iii) the high and low exchange rate during such periods, in each case based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York.

For the period ending

June 30, | 2002 | 2001 | 2000 | 1999 | 1998 |

| Rate at end of Period | $.6590 | $.6590 | $.6805 | $.6787 | $.6843 |

| Average Rate During Period | .6375 | .6589 | .6788 | .6622 | .7054 |

| High Rate | .6622 | .6833 | .6925 | .6891 | .7305 |

| Low Rate | .6200 | .6316 | .6677 | .6431 | .6784 |

On November 15, 2001 the noon buying rate in New York City for cable transfer in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York was U.S.$0.6323 per $1.00 Canadian

| TABLE OF CONTENTS |

| PART I | | PAGE | |

| | | | |

| ITEM I | Description of Business | 1 | |

| | | | |

| ITEM 2 | Description of Property | 3 | |

| | | | |

| ITEM 3 | Legal Proceedings | 3 | |

| | | | |

| ITEM 4 | Control of Registrant | 4 | |

| | | | |

| ITEM 5 | Nature of Trading Market | 4 | |

| | | | |

| ITEM 6 | Exchange Controls and Other Limitations Affecting | | |

| | Security Holders | 5 | |

| | | | |

| ITEM 7 | Taxation | 7 | |

| | | | |

| ITEM 8 | Selected Financial Data | 12 | |

| | | | |

| ITEM 9 | Management's Discussion and Analysis of Financial | | |

| | Condition and Results of Operations | 13 | |

| | | | |

| ITEM 10 | Directors and Officers of Registrant | 15 | |

| | | | |

| ITEM 11 | Compensation of Directors and Officers | 16 | |

| | | | |

| ITEM 12 | Options to Purchase Securities from Registrant or | | |

| | Subsidiaries | 16 | |

| | | | |

| ITEM 13 | Interest of Management in Certain Transactions | 17 | |

| | | | |

| PART II | | | |

| | | | |

| ITEM 14 | Description of Securities to be Registered | 18 | |

| | | | |

| PART III | | | |

| | | | |

| ITEM 15 | Defaults upon Senior Securities | 19 | |

| | | | |

| ITEM 16 | Changes in Securities and Changes in Security for | | |

| | Registered Securities | 19 | |

| PART IV | | | |

| | | | |

| ITEM 17 | Financial Statements | F-1 | |

| | | | |

| ITEM 18 | N/A | F-1 | |

| | | | |

| ITEM 19 | Financial Statements and Exhibits | F-1 | |

i

PART I

ITEM I DESCRIPTION OF BUSINESS

1. (a) General

Goldbelt Resources Ltd. ("Goldbelt" or the "Company") was incorporated under the laws of the Province of British Columbia on July 23, 1976, under the name Goldbelt Mines Inc. The Company's name was changed to Goldbelt Resources Ltd. on July 15, 1991. The principal place of business of Goldbelt is located at 595 Howe Street, 10th Floor, Vancouver B.C., Canada, V6C 2T5. The Company on July 1, 1996 organized a wholly owned subsidiary, Goldbelt Management Services Inc., a Colorado corporation, as a management services corporation responsible for handling Goldbelt's worldwide activities and is based in Denver, Colorado. In August 2001 the Company continued its corporate jurisdiction into Yukon Territory.

The chart below presents the Company's legal corporate structure and the jurisdictions of incorporation.

(b) Transition

Goldbelt is designated “Inactive” by the TSX Venture Exchange. The Company was involved in exploration and development of precious and base mineral deposits in the Republic of Kazakhstan from 1992 to 1998. The Company did not undertake any activity in Kazakhstan from March 1998 until the final disposition of its Kazakhstan mineral interests in March 2001. For the period from December 1998 until July 2000, the Company pursued the acquisition of Regal Petroleum Corporation (“Regal”) and its oil and gas interests in the Ukraine and Romania. The acquisition was never completed as financing could not be arranged. Goldbelt and Regal dissolved plans to merge in July 2000. Goldbelt is continuing to pursue other opportunities with the intention of acquiring a project of merit with its principal focus in the area of natural resource exploration and development.

1

On December 8, 1998, the Company’s shares were halted from trading on the Vancouver Stock Exchange pending an announcement. In February 1999, the Company announced a proposed acquisition of Regal, which would have resulted in a reverse takeover. On April 2, 2001, trading in the shares of the Company resumed under the Inactive designation upon the Company announcing that its proposed reverse takeover and acquisition had terminated. As such, the Company is prohibited from granting stock options and principals are prohibited from exercising previously granted stock options. In accordance with Exchange policy, the Company was expected to initiate its reorganization within twelve months of being designated Inactive and was required to achieve Tier 2 Maintenance Requirements no later than October 3, 2002, failing which trading in the securities of the Company may be suspended. The Company was granted an extension until November 16, 2002. Effective as of November 20, 2002 the Company’s shares were halted from further trading by the TSX Venture Exchange for failing to maintain tier maintenance requirements and after being designated as inactive for more than 18 months. Upon achieving active status the shares of the Company will be reinstated for trading.

(c) Re-Organization Steps

The Company has initiated the following steps in its reactivation plans:

| 1 | . | In March 2001, the Company sold its last remaining interest in Kazakhstan to Celtic Resources Holdings, the successor company to Dabney Industries. The Company sold its 60% interest in the Abyz deposit owned by Karagai Gold, its 25% interest in Dostyk Minerals, an exploration company with two mineral licenses in Kazakhstan, and its 50% interest in Kazgold and any claim Kazgold may have to the Leninogorsk tailings deposits. In exchange for which Celtic Resources Holding granted Goldbelt 1.2 million unrestricted, ordinary shares in Celtic Resources Holding, a public company traded in the United Kingdom. As of the transaction the marketable securities in Celtic Resources Holding had a value of $240,870. (Effective October 10, 2002, the shares of Celtic Resources Holdings Plc were consolidated on a 1:10 basis leaving Goldbelt with 120,000 shares.) |

| 2 | . | Subsequent to shareholder approval received at the Company’s Extraordinary General Meeting held on May 19, 1998, the Company enacted the following: a) Consolidation of its authorized and issued share capital on a 1:10 basis and a subsequent increase in authorized capital to 100,000,000 common shares without par value; and b) Continuance from the jurisdiction of British Columbia to Yukon. On August 22, 2001, the Canadian Venture Exchange granted approval for the share consolidation and continuance to the Yukon Territory. |

The Company needs to complete the following steps in order to complete its reactivation:

| 1 | . | Reach an agreement with the Company’s major creditor to settle $287,610 of indebtedness by issuance of post-consolidation shares. |

| 2 | . | Acquire a property or business of merit. |

| 3 | . | Proceed with an equity financing to raise capital to fund its expenditure commitments on a property or business of merit and for working capital purposes. |

2

The Company is actively pursuing the matters described above.

The Company does not own any patents, trademarks, licenses or franchises that may materially affect its business.

2. Risk Factors

On-Going Concern

The Company has incurred significant operating losses and has not generated positive cash flow from operations. At June 30, 2002 the Company had no operations. The Company has sold assets for net losses and written down substantially all of its remaining mining and mining related assets. Those factors create an uncertainty about the Company’s ability to continue as a going concern. Management’s plans to continue in operation is dependent upon the Company’s ability to raise additional funding either as a result of acquiring some other asset or company. The ability of the Company to continue as a going concern is dependent on the success of these plans, and ultimately upon achieving profitability.

Market Factors and Volatility

The marketability of natural resource deposits, which may be acquired or discovered by the Company, will be affected by numerous factors beyond the control of the Company. These factors include market fluctuations in the prices of resources sought, which are highly volatile, the proximity of the resource to markets, and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of the natural resources and environmental protection. The effect of these factors cannot be accurately predicted, but may result in the Company not receiving an adequate return on invested capital.

Dividends Unlikely

The Company has not paid any dividends since the date of its incorporation, and it is not anticipated that dividends will be declared in the short or medium term. The Company is not prohibited by its charter documents or other agreements it has entered into from paying a dividend. The Company intends, however, to reinvest earnings, if any, in the development and expansion of its business. See Item 8, "Selected Financial Data" and Item 14, "Description of Securities to be Registered."

ITEM 2 DESCRIPTION OF PROPERTY

The Company has no properties. See Item 1.

ITEM 3 LEGAL PROCEEDINGS

No legal proceedings are pending to which the Company is a party or of which any of its properties is the subject.

3

ITEM 4 CONTROL OF REGISTRANT

Goldbelt securities are recorded on the books of its transfer agent in registered form. The majority of such shares are, however, registered in the name of intermediaries such as brokerage houses and clearinghouses on behalf of their respective clients. Goldbelt does not have knowledge of the beneficial owners thereof. To the best of its knowledge, Goldbelt is not directly or indirectly controlled by a foreign government, nor does any one person, own more than 10% of any class of the Company's voting securities. The total amount of any class of the Company's voting securities owned by the Company's officers and directors as a group as of November 15, 2002 is set forth below.

| | | Percentage of |

| | | Issued and |

| | Amount and Nature of | Outstanding |

| Group | Beneficial ownership (1) | Common Shares (2) |

| | | |

| All Officers and Directors as a | | |

| Group (3 persons) | 741,800(3) | 15.9%(3) |

| |

| (1 | ) | Shares beneficially owned, directly or indirectly, or over which control or direction is exercised. |

| (2 | ) | Percentage of issued and outstanding common shares, calculated on issued common shares only as of November 15, 2002. |

| (3 | ) | One director is owed $287,610 which the board has proposed be exchanged for 2,963,000 shares in the company stock, subject to approval of the TSX Venture Exchange. If granted the total shares owned or controlled by Officers and Directors would be 3,704,800, or 48.6% of the total. |

ITEM 5 NATURE OF TRADING MARKET

Common shares of the Company are traded in Canada on the Canadian Venture Stock Exchange and have traded since in January 1978. The shares were halted from trading from December 1998 through March 2001 and resumed trading on April 2, 2001 (See Item 1). The following table sets out the high and low prices of the Common Shares and the volume of trades for the periods indicated:

| | HIGH | LOW | CLOSE | VOLUME |

| July 1999 - September 1999 | Did not trade | Did not trade | Did not trade | Did not trade |

| October 1999 - December 1999 | Did not trade | Did not trade | Did not trade | Did not trade |

| January 2000 - March 2000 | Did not trade | Did not trade | Did not trade | Did not trade |

| April 2000 - June 2000 | Did not trade | Did not trade | Did not trade | Did not trade |

| July 2000 - September 2000 | Did not trade | Did not trade | Did not trade | Did not trade |

| October 2000 - December 2000 | Did not trade | Did not trade | Did not trade | Did not trade |

| January 2001 - March 2001 | Did not trade | Did not trade | Did not trade | Did not trade |

| April 2001 – June 2001 | 0.30 | 0.20 | 0.30 | 110,882 |

| July 2001 - September 2001 | 0.20 | 0.07 | 0.07 | 60,328 |

| October 2001 - December 2001 | 0.10 | .05 | 0.05 | 139,137 |

| January 2002 - March 2001 | 0.10 | 0.06 | 0.07 | 86,026 |

| April 2002 - June 2002 | 0.15 | 0.07 | 0.09 | 114,803 |

| July 2002 - September 2002 | 0.09 | 0.03 | 0.06 | 210,544 |

4

* The Company completed a 1:10 share consolidation as of August 27, 2001. The data shown is presented on a post-consolidated basis as though the consolidation occurred as of April 1, 2001.

The Company’s share price was halted from further trading as of November 20, 2002. When the shares last traded on November 13, 2002 the closing price was $0.05 per share.

To the best of the Company's knowledge, as of November 15, 2002, 126 registered shareholders lived in the United States, out of a total of 215, and held 2,152,116 common shares in the Company. The Company is not listed for trading on any securities exchange in the United States. There has been no active market in the United States for the common shares.

ITEM 6 EXCHANGE CONTROLS AND OTHER LIMITATIONS AFFECTING SECURITY HOLDERS

There are no governmental laws, decrees or regulations in Canada relating to restrictions on the import/export of capital affecting the remittance of interest, dividends or other payments to non-residential holders of the Company's shares. Any such remittances to United States residents, however, subject to a maximum withholding tax rate of 15% and a minimum rate that will be 5% beginning in 1997, pursuant to Article X of the reciprocal tax treaty between Canada and the United States. The applicable rate is dependent on the type of entity receiving the dividends. See Item 7, "Taxation."

Except as provided in theInvestment CanadaAct (the "Act"), there are no limitations under the laws of Canada, the Province of British Columbia or in the charter or any other constituent documents of the Company on the right of foreigners to hold and/or vote the shares of the Company.

The Act requires a non-Canadian making an investment to acquire control of a Canadian business, the gross assets of which exceed certain defined threshold levels, to file an application for review with Investment Canada, the federal agency created by the Act.

As a result of the Canada-U.S. Free Trade Agreement, the Act was amended in January 1989 to provide distinct threshold levels for Americans who acquire control of a Canadian business. The threshold levels for Americans were gradually raised between 1989 and 1992. A Canadian business is defined in the Act as a business carried on in Canada that has a place of business in Canada, an individual or individuals in Canada who are employed or self-employed in connection with the business, and assets in Canada used in carrying on the business.

An American, as defined in the Act, includes: an individual who is an American national or a lawful permanent resident of the United States; a government or government agency of the United States; and American-controlled entity, corporation or limited partnership; and a corporation, limited partnership or trust which is not controlled in fact through ownership of its voting interests of which two-thirds of its board of directors, general partners or trustees, as the case may be, are any combination of Canadians and Americans.

5

The following investments by a non-Canadian are subject to review by Investment Canada:

| (a) | all direct acquisitions of control of Canadian businesses with assets of $5 million or more; |

| (b) | all indirect acquisitions of control of Canadian businesses with assets of $50 million or more if such assets represent less than 50% of the value of the assets of the entities, the control of which is being acquired; and |

| (c) | all indirect acquisitions of control of Canadian businesses with assets of $5 million or more if such assets represent more than 50% of the value of the assets of the entities, the control of which is being acquired. |

Review by Investment Canada is required when investments by Americans for direct acquisitions of control exceed $150,000,000.

For purposes of the Act,

direct acquisition of control means:

a purchase of the voting interest on a corporation, partnership, joint venture or trust carrying on a Canadian business, or any purchase of all or substantially all of the assets used in carrying on a Canadian business; and

indirect acquisition of control means:

a purchase of the voting interest of a corporation, partnership, joint review or trust, whether a Canadian or foreign entity, which controls a corporation, partnership, joint venture or trust company carrying on a Canadian business in Canada.

The acquisition of certain Canadian businesses is excluded from the higher threshold set out for Americans. These excluded businesses include oil, gas, uranium, financial services (except insurance); transportation services and cultural services (i.e., the publication, distribution or sale of books, magazines, periodicals (other than printing or typesetting businesses), music in print or machine readable form, radio, television, cable and satellite services; the publication, distribution, sale or exhibitions of film or video recordings or audio or video music recordings).

Direct or indirect acquisitions of control of these excluded business are reviewable at the $5 and $50 million thresholds.

A non-Canadian shall not implement an investment reviewable under the Act unless the investment has been reviewed and the Minister responsible for Investment Canada is satisfied or is deemed to be satisfied that the investment is likely to be of net benefit to Canada, If the Minister is not satisfied that the investment is likely to be a net benefit to Canada, the non-Canadian shall not implement the investment or, if the investment has been implemented, shall divest himself of control of the business that is the subject of the investment.

A non-Canadian or American making the following investments:

6

| | (i) | an investment to establish a new Canadian business; and |

| | (ii) | an investment to acquire control of a Canadian business which investment is not subject to review under the Act must notify Investment Canada, within prescribed time limits, of such investments. |

ITEM 7 TAXATION

The following is a summary of the principal Canadian federal income tax considerations generally applicable in respect of the Common Shares. The tax consequences to any particular holder of Common Shares will vary according to the status of that holder as an individual, trust, corporation, or member of a partnership, the jurisdiction in which that holder is subject to taxation, the place where that holder is resident and, generally, according to that holder's particular circumstances. This summary is applicable only to holders who are resident in the United States, have never been resident in Canada, hold their Common Shares as capital property and will not use or hold the Common Shares in carrying on business in Canada.

Generally, dividends paid by Canadian corporations to non-resident shareholders are subject to a withholding tax of 25% of the gross amount of such dividends. However, Article X of the reciprocal tax treaty between Canada and the United States reduces to 15% the withholding tax on the gross amount of dividends paid to residents of the United States. The withholding tax rate on the gross amount of dividends is reduced to 5% if the beneficial owner of the dividend is a U.S. corporation, which owns at least 10% of the voting stock of the Canadian corporation paying the dividends.

A non-resident who holds shares of the Company as capital property will not be subject to tax on capital gains realized on the disposition of such shares unless such shares are "taxable Canadian property" within the meaning of theIncome Tax Act (Canada) and no relief is afforded under any applicable tax treaty. The shares of the Company would be taxable Canadian property of a non-resident if at any time during the five year period immediately preceding a disposition by the non-resident of such shares not less than 25% of the issued shares of any class of the Company belonged to the non-resident, persons with whom the non-resident did not deal at arm's length, or to the non-resident and persons with whom the non-resident did not deal at arm's length.

Certain United States Federal Income Tax Consequences

The following summary is a general discussion of the material United States Federal income tax considerations to U.S. holders of shares of the Company under current law. It does not discuss all the tax consequences that may be relevant to particular holders in light of their circumstances or to holders subject to special rules, such as tax-exempt organizations, qualified retirement plans, financial institutions, insurance companies, real estate investment trusts, regulated investment companies, broker-dealers, non-resident alien individuals or foreign corporations whose ownership of shares of the Company is not effectively connected with the conduct of a trade or business in the United States, shareholders who acquired their stock through the exercise of employee stock options or otherwise as compensation, shareholders who hold their stock as ordinary assets and not capital assets and any other non-U.S. holders. In addition, U.S. holders may be subject to state, local or foreign tax consequences. This discussion is not intended to be,

7

nor should it be construed to be, legal or tax advice to any holder or prospective holder of shares of the Company and no opinion or representation with respect to the United States Federal income tax consequences to any such holder or prospective holder is made. Holders and prospective holders should therefore consult with their own tax advisors with respect to their particular circumstances. This discussion covers all material tax consequences.

The following discussion is based upon the sections of the Internal Revenue Code of 1986, as amended (the "Code”), Treasury Regulations, published Internal Revenue Service ("IRS") rulings, published administrative positions of the IRS and court decisions that are currently applicable, any or all of which could be materially and adversely changed, possibly on a retroactive basis, at any time. This discussion does not consider the potential effects, both adverse and beneficial, of any recently proposed legislation that, if enacted, could be applied, possibly on a retroactive basis, at any time. The following discussion is for general information only and it is not intended to be, nor should it be construed to be, legal or tax advice to any holder or prospective holder of shares of the Company and no opinion or representation with respect to the United States Federal income tax consequences to any such holder or prospective holder is made. Accordingly, holders and prospective holders of shares of the Company should consult their own tax advisors about the Federal, state, local, estate, and foreign tax consequences of purchasing, owning and disposing of shares of the Company.

U.S. Holders

As used herein, a "U.S. Holder" includes a holder of shares of the Company who is a citizen or resident of the United States, a corporation created or organized in or under the laws of the United States or of any political subdivision thereof, any entity that is taxable as a corporation for U.S. tax purposes and any other person or entity whose ownership of shares of the Company is effectively connected with the conduct of a trade or business in the United States. A U.S. Holder does not include persons subject to special provisions of Federal income tax law such as tax exempt organizations, qualified retirement plans, financial institutions, insurance companies, real estate investment trusts, regulated investment companies, broker-dealers, nonresident alien individuals or foreign corporations whose ownership of shares of the Company is not effectively connected with conduct of trade or business in the United States, shareholders who acquired their stock through the exercise of employee stock options or otherwise as compensation and shareholders who hold their stock as ordinary assets and not as capital assets.

Distributions on Shares of the Company

U.S. Holders receiving dividend distributions (including constructive dividends) with respect to shares of the Company are required to include in gross income for United States Federal income tax purposes the gross amount of such distributions to the extent that the Company has current or accumulated earnings and profits as defined under U.S. Federal tax law, without reduction for any Canadian income tax withheld from such distributions. Such Canadian tax withheld may be credited, subject to certain limitations, against the U.S. Holder's United States Federal income tax liability or, alternatively, may be deducted in computing the U.S. Holder's United States Federal taxable income by those who itemize deductions. (See more detailed discussion at "Foreign Tax Credit" below). To the extent that distributions exceed current or accumulated earnings and

8

profits of the Company, they will be treated first as a return of capital up to the U.S. Holder's adjusted basis in the shares and thereafter as gain from the sale or exchange of the shares. Preferential tax rates for net capital gains are applicable to a U.S. Holder that is an individual, estate or trust. There are currently no preferential tax rates for long-term capital gains for a U.S. Holder that is a corporation.

Dividends paid on the shares of the Company will not generally be eligible for the dividends received deduction provided to corporations receiving dividends from certain United States corporations. A U.S. Holder that is a corporation may, under certain circumstances, be entitled to a 70% deduction of the United States source portion of dividends received from the Company (unless the Company qualifies as a "foreign personal holding company" or a "passive foreign investment company", as defined below) if such U.S. Holder owns shares representing at least 10% of the voting power and value of the Company. The availability of this deduction is subject to several complex limitations that are beyond the scope of this discussion.

In the case of foreign currency received as a dividend that is not converted by the recipient into U.S. dollars on the date of receipt, a U.S. Holder will have a tax basis in the foreign currency equal to its U.S. dollar value on the date of receipt. Generally, any gain or loss recognized upon a subsequent sale or other disposition of the foreign currency, including the exchange for U.S. dollars, will be ordinary income or loss. However, for tax years after 1997, an individual whose realized foreign exchange gain does not exceed U.S. $200 will not recognize that gain, to the extent that there are not expenses associated with the transaction that meet the requirement for deductibility as a trade or business expense (other than travel expenses in connection with a business trip or as an expense for the production of income).

Foreign Tax Credit

A U.S. Holder who pays (or has withheld from distributions) Canadian income tax with respect to the ownership of shares of the Company may be entitled, at the option of the U.S. Holder, to either a deduction or a tax credit for such foreign tax paid or withheld. Generally, it will be more advantageous to claim a credit because a credit reduces United States Federal income taxes on a dollar4or-dollar basis, while a deduction merely reduces the taxpayer's income subject to tax. This election is made on a year-by-year basis and applies to all foreign taxes paid by (or withheld from) the U.S. Holder during that year. There are significant and complex limitations that apply to the credit; among which is the general limitation that the credit cannot exceed the proportionate share of the U.S. Holder's United States Federal income tax liability that the U.S. Holder's foreign source income bears to his or its worldwide taxable income. In the determination of the application of this limitation, the various items of income and deduction must be classified into foreign and domestic sources. Complex rules govern this classification process. There are further limitations on the foreign tax credit for certain types of income such as "passive income", "high withholding tax interest", "financial services income", "shipping income", and certain other classifications of income. The availability of the foreign tax credit and the application of the limitations on the credit are fact specific and holders and prospective holders of shares of the Company should consult their own tax advisors regarding their individual circumstances.

9

Disposition of Shares of the Company

A U.S. Holder will recognize a gain or loss upon the sale of shares of the Company equal to the difference, if any, between (i) the amount of cash plus the fair market value of any property received, and (ii) the shareholder's tax basis in the shares of the Company. This gain or loss will be a capital gain or toss if the shares are a capital asset in the hands of the U.S. Holder, and will be a short-term or long-term capital gain or loss depending upon the holding period of the U.S. Holder. Gains and losses are netted and combined according to special rules in arriving at the overall capital gain or loss for a particular tax year. Deductions for net capital losses are subject to significant limitations. Corporate capital losses (other than losses of corporations electing under Subchapter S or the Code) are deductible to the extent of capital gains. Non-corporate taxpayers may deduct net capital losses, whether short-term or tong-term, up to U.S. $3,000 a year (U.S. $1,500in the case of a married individual filing separately). For U.S. Holders who are individuals, any unused portion of such net capital loss may be carried over to be used in later tax years until such net capital loss is thereby exhausted. For U.S. Holders which are corporations (other than corporations subject to Subchapter S of the Code), an unused net capital loss may be carried back three years from the loss year and carried forward five years from the loss year to be offset against capital gains until such net capital loss is thereby exhausted.

Other Considerations

In the following circumstances, the above sections of this discussion may not describe the United States Federal income tax consequences resulting from the holding and disposition of shares of the Company:

Foreign Personal Holding Company

If at any time during a taxable year more than 50% of the total combined voting power or the total value of the Company's outstanding shares is owned, directly or indirectly, by five or fewer individuals who are citizens or residents of the United States and 60% (50% in subsequent years) or more of the Company's gross income for such year was derived from certain passive sources (e.g., from dividends received from its subsidiaries), the Company would be treated as a "foreign personal holding company". In that event, U.S. Holders that hold shares of the Company (on the earlier of the last day of the Company's tax year or the last date in which the Company was a foreign personal holding company) would be required to include in gross income for such year their allocable portions of such passive income to the extent the Company does not actually distribute such income.

Foreign Investment Company

If 50% or more of the combined voting power or total value of the Company's outstanding shares are held, directly or indirectly, by citizens or residents of the United States, United States domestic partnerships or corporations, or estates or trusts other than foreign estates or trusts (as defined by the Code Section 7701 (a)(31)), and the Company is found to be engaged primarily in the business of investing, reinvesting, or trading in securities, commodities, or any interest therein, it is possible that the Company might be treated as a "foreign investment company" as defined in Section 1246 of the Code, causing all or part of any gain realized by a U.S. Holder selling or exchanging shares of the Company to be treated as ordinary income rather than capital gain.

10

Passive Foreign Investment Company

As a foreign corporation with U.S. Holders, the Company could potentially be treated as a passive foreign investment company ("PFIC"), as defined in Section 1296 of the Code, if 75% or more of its gross income in a taxable year is passive income, or the average percentage of the Company's assets (by value) during the taxable year which produce passive income or which are held for production of same are at least 50%. Passive income is generally defined to include gross income in the nature of dividends, interest, royalties, rents and annuities; excess of gains over losses from certain transactions in any commodities not arisinginter alia from a PFIC whose business is actively involved in such commodities; certain foreign currency gains; and other similar types of income. U.S. Holders owning shares of a PFIC are subject to an additional tax and to an interest charge based on the value of deferral of tax for the period during which the shares of the PFIC are owned, in addition to treatment of any gain realized on the disposition of shares of the PFIC as ordinary income rather than as a capital gain. However, if the U.S. Holder makes a timely election to treat a PFIC as a qualified electing fund ("QEF") with respect to such shareholder's interest therein, the above-described rules generally will not apply. Instead, the electing U.S. Holder would include annually in his gross income his pro rata share of the PFIC's ordinary earnings and any net capital gain regardless of whether such income or gain was actually distributed. A U.S. Holder of a QEF can, however, elect to defer the payment of United States Federal income tax on such income inclusions. Special rules apply to U.S. Holders who own their interests in a PFIC through intermediate entities or persons.

Effective for tax years of U.S. Holders beginning after December 31,1997, U.S. Holders who hold, actually or constructively, marketable stock of a foreign corporation that qualifies as a PFIC may elect to mark such stock to the market (a "mark-to-market election"). If such an election is made, such U.S. Holder will not be subject to the special taxation rules of PFIC described above for the taxable years for which the mark-to-market election is made. A U.S. Holder who makes such an election will include in income for the taxable year an amount equal to the excess, if any, of the fair market value of the shares of the Company as of the close of such tax year over such U.S. Holder's adjusted basis in such shares. In addition, the U.S. Holder is allowed a deduction for the lesser of (i) the excess, if any, of such U.S. Holder's adjusted tax basis in the shares over the fair market value of such shares as of the close of the tax year, or (ii) the excess, if any of (A) the mark4o-market gains for the shares in the Company included by such U.S. Holder for prior tax years, including any amount which would have been included for any prior year but for Section 1291 interest on tax deferral rules discussed above with respect to a U.S. Holder, who has not made a timely QEF election during the year in which he holds (or is deemed to have held) shares in the Company and the Company is a PFIC ("Non-Electing U.S. Holder"), over (B) the mark-to-market losses for shares that were allowed as deductions for prior tax years. A U.S. Holder's adjusted tax basis in the shares of the Company will be increased or decreased to reflect the amount included or deducted as a result of mark-to-market election. A mark-to-market election will apply to the tax year for which the election is made and to all later tax years, unless the PFIC stock ceases to be marketable or the IRS consents to the revocation of the election.

The IRS has issued proposed regulations that, subject to certain exceptions, would treat as taxable certain transfers of PFIC stock by a Non-Electing U.S. Holder that are generally not otherwise taxed, such as gifts, exchanges pursuant to corporate

11

reorganizations, and transfers at death. Generally, in such cases, the basis of the Company's shares in the hands of the transferee and the basis of any property received in the exchange for those shares would be increased by the amount of gain recognized. A U.S. Holder who has made a timely QEF election (as discussed below) will not be taxed on certain transfers of PFIC stock, such as gifts, exchanges pursuant to corporate reorganizations, and transfers at death. The transferee's basis in this case will depend on the manner of the transfer. The specific tax effect to the U.S. Holder and the transferee may vary based on the manner in which the shares of the Company are transferred. Each U.S. Holder should consult a tax advisor with respect to how the PFIC rules affect their tax situation.

The PFIC and QEF election rules are complex. U.S. Holders should consult a tax advisor regarding the availability and procedure for making the QEF election as well as the applicable method for recognizing gains or earnings and profits under the foregoing rules.

Controlled Foreign Corporation

If more than 50% of the voting power of all classes of stock or the total value of the stock of the Company is owned, directly or indirectly, by citizens or residents of the United States, United States domestic partnerships and corporations or estates or trusts other than foreign estates or trusts, each of whom own 10% or more of the total combined voting power of all classes of stock of the Company ("United States shareholder"), the Company could be treated as a "controlled foreign corporation" under Subpart F of the Code. This classification would effect many complex results including the required inclusion by such United States shareholders in income of their pro rata share of "Subpart F income" (as specially defined by the Code) of the Company. Subpart F requires current inclusions in the income of United States shareholders to the extent of a controlled foreign corporation's accumulated earnings invested in "excess passive" assets (as defined by the Code). In addition, under Section 1248 of the Code, a gain from the sale or exchange of shares by a U.S. Holder who is or was a United States shareholder at any time during the five year period ending with the sale or exchange is treated as ordinary dividend income to the extent of earnings and profits of the Company attributable to the stock sold or exchanged. Because of the complexity of Subpart F, and because it is not clear that Subpart F would apply to the U.S. Holders of shares of the Company, a more detailed review of these rules is outside of the scope of this discussion.

If the Company is both a PFIC and controlled foreign corporation. the Company will generally not be treated as a PFIC with respect to United States shareholders of the controlled foreign corporation. This rule generally will be effective for taxable years of the Company ending with or within such taxable years of United States shareholders.

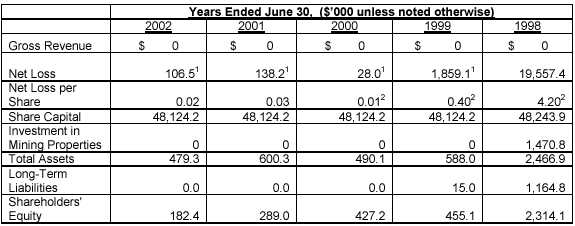

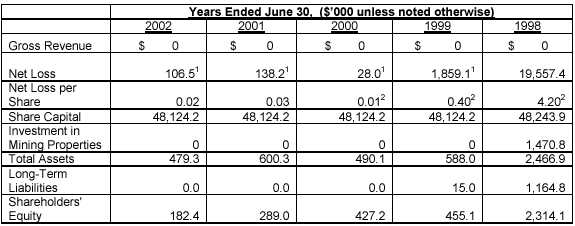

ITEM 8 SELECTED FINANCIAL DATA

The consolidated financial statements have been prepared in conformity with Canadian generally accepted accounting principles (“GAAP"). For United States GAAP reconciliation for years 2000, 2001 and 2002 see Note 11 of the attached financial statements.

12

The reader should also refer to Item 9, “Discussion and Analysis of Financial Condition and Results of Operations."

The following data is shown in thousands except for per share information:

| | 1 | . | For the years ended June 30, 2002, 2001 and 2000 the reconciliation of the Net Loss and Net Loss Per Share to a U.S. GAAP basis is presented in Note 11 of the financial statements. |

| | 2 | . | Restated to reflect the 1:10 share consolidation. |

ITEM 9 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Goldbelt Resources Ltd (“Goldbelt” or “Company”) is a Canadian corporation and is designated “Inactive” by the Canadian Venture Exchange. Goldbelt’s activity in the year ending June 30, 2002 was limited as there were no paid employees. The Board of Directors remained committed to identify a natural resource property of merit that can support the fund raising necessary to advance the property to be acquired.

The Company incurred a total of $113,494 in expenses for the year that are primarily composed of Legal, Accounting, and Shareholder Service fees related to the maintenance of a public company. Subsequent to year-end, the Company received 176,000 shares in Regal Petroleum Plc. The shares were delivered to the Company effective September 27, 2002 as payment related to the settlement of expenses related to the failed merger terminated in July 2000 and were made available to Goldbelt once Regal became a public company. Effective September 27, 2002, Regal is listed on the London Stock Exchange. The shares are restricted from trading until September 27, 2003. The face value of the shares as of their issuance was $260,885.

Also subsequent to year-end, Celtic Resource Holdings had a 1:10 share consolidation. The Company’s holding in Celtic, therefore, became 120,000 shares. Celtic is a public company incorporated in the Republic of Ireland and traded on the London stock exchange.

13

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2002, the Company had $233,796 in cash, and 120,000 shares of Celtic Resource Holdings with a market value of $486,276. The Company also had $296,877 of liabilities of which $287,610 was due to a Director. The Board has proposed exchanging the debt for 2,963,000 shares of Goldbelt stock, subject to approval by the TSX Venture Exchange. Subsequent to year-end, the Company received 176,000 shares of Regal Petroleum Plc, as part of its settlement with Regal Petroleum related to the termination of the proposed merger. These shares are restricted from trading until September 27, 2003. The face value of the shares as of the date of issue was $260,885.

Also subsequent to year-end, the Board of Directors proposed a reduction of capital subject to approval of both the shareholders and the court. Specifically, the Board proposed to reduce the Company’s capital by $48,194,465, the amount of its accumulated losses as of June 30, 2002, or a lesser amount as the directors may determine. The proposed reduction in capital was presented to shareholders in a proxy as of November 8, 2002 for approval at the Company’s December 18, 2002 Annual General Meeting.

As of June 30, 2002, the Company had 4,655,137 common shares and no options or warrants issued. Following the issuance of shares for debt, subject to shareholder and Exchange approval, there will be 7,618,137 shares issued.

RESULTS OF OPERATIONS

No operations were conducted during the fiscal year ending June 30, 2002 or June 30, 2001. Since March 1998, the Company has been inactive except to dispose of its assets and to seek to acquire additional assets sufficient to re-activate the Company.

Fiscal year ended June 30, 2002 compared with fiscal year ended June 30, 2001

For the twelve-month period ending June 30, 2002, the Company had a loss of $106,545 versus a loss of $138,189 for the prior period. In the prior fiscal year the Company had a gain of $240,870 on the disposition of its remaining mineral interests in Kazakhstan. Also benefiting the Company in the prior year were $30,293 in foreign exchange gain resulting from the weakening of the Canadian dollar versus the US dollar. There was a foreign exchange gain of $3,162 in the current fiscal year.

Administrative expenses totaled $113,494 in the current year down from $200,720 for the prior year. Expenses were primarily comprised of Legal ($27,366), Accounting and Auditing ($29,220), and Shareholder Services ($23,925). These expenses accounted for $80,511 of the $113,494 in costs and were down from $88,814 in 2001. Other costs resulted from management services ($12,784), health care benefits for the President / CEO ($10,704), and other office costs ($9,495). General management expenses were higher for the year ended June 30, 2001 primarily due to greater consulting fees ($67,009 versus $12,784 in 2002) related to increased activity of evaluating alternative acquisitions to the Regal acquisition. Legal expenses were also higher in the prior year for the same reason ($67,009 versus $27,366 in 2002). Travel expenses also contributed to the higher costs ($19,210 versus none in 2002) for the same reason. Accounting expense was essentially unchanged from the prior year ($27,035 in 2001

14

versus $29,220 in 2002) as also were other Rent, Salaries and Benefits ($6,139 and $9,398 in 2001, respectively versus $6,384 and $10,704 respectively, in 2002).

Fiscal year ended June 30, 2001 compared with fiscal year ended June 30, 2000

For the twelve-month period ending June 30, 2001 the Company had a loss of $138,189 versus a loss of $27,955 for the prior period. During the current fiscal year the Company had a gain of $240,870 on the disposition of its remaining mineral interests in Kazakhstan as the Company’s investment in Kazakhstan had been entirely written off in a prior period. Also benefiting the Company in the current year were $30,293 of foreign exchange gain resulting from the weakening of the Canadian dollar versus the US dollar and its impact on the US denominated Regal note receivable. This compares with an exchange loss of $4,263 in 2000.

Offsetting the one-time gains were settlement costs related to the termination of the Regal acquisition ($249,389). Also, general management expenses were higher for the year ended June 30, 2001 totaling $200,720 versus $108,838 for the prior year. The increase resulted primarily for greater consulting fees ($67,009 versus $16,059) related to increased activity of evaluating alternative acquisitions to the Regal acquisition. Travel expenses also contributed to the higher costs ($19,210 versus $155) for the same reason. Accounting expense was essentially unchanged from the prior year ($27,035 versus $28,001) as also were Rent and Salaries and Benefits ($6,139 and $9,398 in 2001, respectively versus $4,576 and $7,612 respectively, in 2000). Legal expenses were higher ($48,084 versus $33,071) due to the added expense of the Regal acquisition termination.

ITEM 10 DIRECTORS AND OFFICERS OF REGISTRANT

Each director holds office until the next annual meeting or until his successor is duly elected unless his office is earlier vacated in accordance with the by-laws. The board currently consists of five directors.

The following table and text sets forth the names and addresses of directors and officers of the Company, their position and offices with the Company, their principal occupations and the date of commencement of their terms:

| Name and Address | Offices | Date Tenure Began |

| | | |

| PAUL G. NAUGHTON | Chairman, Director | March 1992 |

| Perth, Australia | | |

| | | |

| PAUL J. MORGAN | Director, President | March 1992 |

| Denver, Colorado | Chief Executive Officer | |

| | | |

| BRIAN IRWIN | Director and Secretary | April 1998 |

| West Vancouver, British Columbia | | |

PAUL G. NAUGHTON (Chairman, Director) Mr. Naughton was appointed Chairman of the Board of the Company in 1992. Mr. Naughton is a Chartered Accountant and has over 25 years experience in the public company sector in mining and oil and gas.

15

PAUL J. MORGAN (Director, President, and CEO) Mr. Morgan was appointed a director of Goldbelt in March 1992. He served as President and CEO from 1992 until July 1997and resumed these offices as of March 1999. He has over 30 years of experience in exploration and mine development in the U.S., Australia, Southeast Asia and the C.l.S. countries.

BRIAN IRWIN (Director, Secretary) Mr. Irwin was elected a director and the Secretary of the Company in April 1996. He has been a practicing attorney since 1965, and has been a partner of DuMoulin Black, a Vancouver law firm, since 1983. His practice is in the areas of corporate and commercial law with an emphasis on securities and mining law.

ITEM 11 COMPENSATION OF DIRECTORS AND OFFICERS

During the twelve months ended June 30, 2002, the aggregate compensation paid by the Company to its officers and directors was $10,704 versus $9,398 in 2001.

The following table sets forth all annual and long term compensation for services in all capacities to the Company and its subsidiaries for the three most recently completed financial years in respect of each of the individuals who were, as of June 30, 2002, the Chief Executive Officer and the other four most highly compensated executive offices of the Company whose individual total compensation for the most recently completed financial year exceeded $100,000 and any individual who would have satisfied these criteria but for the fact that the individual was not serving as such an officer at the end of the most recently completed financial year.

SUMMARY COMPENSATION TABLE

Name and

Principal Position | Fiscal

Year | Annual Compensation | Long Term Compensation | All other

compen-

sation

($) |

Salary

($) | Bonus

($) | Other

Annual

compen-sation

($) | Awards | | Payouts |

Securities

Under

Options

Granted

| Restricted

Shares or

Restricted

Share

Units

| LTIP

Payouts

|

Paul J. Morgan

President & CEO | 2002

2001

2000 | $10,7041

9,3981

7,6121 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

(1) Medical and dental health coverage only.

ITEM 12 OPTIONS TO PURCHASE SECURITIES FROM REGISTRANT OR SUBSIDIARIES

Grants and Exercises of Options

16

As of November 15, 2002, the Company had no outstanding common share purchase options.

Purchase Warrants

The Company had no purchase warrants outstanding as of November 15, 2002.

ITEM 13 INTEREST OF MANAGEMENT IN CERTAIN TRANSACTIONS

During the year ended June 30, 2002, the amount incurred for management, consulting and legal fees to companies controlled by directors or officers of the Company and its subsidiaries was $25,891 (2001 - $368,962). At June 30, 2002, the Company owed $288,666 (2001 - $294,430) to a director related entity and a director. Included in the year-end balances for both 2001 and 2002 is $287,610 owed to a director.

During the year ended June 30, 2002, the Company advanced $5,000 ($2001 - $10,000) to a director related entity as a prepayment for disbursements to be made for compliance filings. At June 30, 2002, the prepaid expense amount was $2,311 (2001 - $8,506).

Some of the directors and senior officers of the Company are directors or officers of other corporations with businesses that may conflict with the proposed business of the Company. In accordance with the laws of British Columbia, the directors and officers of the Company are required to act honestly, in good faith and in the best interests of the Company. In determining whether or not the Company will take a proposed course of action, the directors will primarily consider the degree of risk to which the Company may be exposed and the Company's financial position at the time, after full disclosure of all direct or indirect conflicting interests. The directors of the Company are required by the Company's articles to declare the nature and extent of their interests in any contract or transaction in which a conflict or potential conflict of interest may arise. A director of the Company may not vote on any contract or transaction in which he has an interest.

Related party transactions for the fiscal years 2000-2002 are shown below. Payments made to DuMoulin Black, a private law firm, were made primarily as a result of legal services provided by Brian Irwin. Mr. Irwin is a partner in DuMoulin Black. Payments made to Paul Morgan and Paul Naughton, or to companies controlled by them, were for management services. Payments to Scott, Bisset, a law firm with Graham Scott as a partner, were made for legal services. Graham Scott’s term as a director ended as of December 2000.

| | | | 2000 | | | 2001 | | | 2002 | |

| | | |

| | |

| | |

| |

| Brian Irwin | Director | $ | 16,137 | | $ | 50,731 | | $ | 25,891 | |

| Paul Morgan | Director | | | | | 318,231 | | | | |

| Paul Naughton | Director | | | | | | | | | |

| Graham Scott | Director | | 15,476 | | | | | | | |

| | | |

| | |

| | |

| |

| Total | | $ | 31,613 | | $ | 368,962 | | $ | 25,891 | |

17

PART II

ITEM 14 DESCRIPTION OF SECURITIES TO BE REGISTERED

The securities of the Company to be registered are common shares without par value. The Company presently has 100,000,000 common shares authorized. As of November 15, 2002, 4,655,137 common shares were issued and outstanding.

All shares of the Company's common stock, both issued and unissued, are of the same class and rank equally as to dividends, voting powers and participation in the assets of the Company on a winding-up or dissolution. No shares have been issued subject to call or assessment. There are no preemptive or conversion rights attached to the Company's shares, and no provisions for redemption, purchase for cancellation surrender of, sinking funds or purchase funds. Each share of common stock is entitled to one vote with respect to the election of directors and other matters upon which shareholders are ordinarily entitled to vote. The Company has not paid any dividends on its common stock since its inception. Part 16 of the Company's Memorandum and Articles provides that the directors may declare payment of a dividend out of funds properly available therefor. There is no limitation on the Company's ability to pay dividends imposed by the terms of any of the Company's contracts or agreements. All references to '1shares" or “common shares" herein refer to common shares without par value of the Company.

18

PART III

ITEM 15 DEFAULTS UPON SENIOR SECURITIES

Not Applicable.

ITEM 16 CHANGES IN SECURITIES AND CHANGES IN SECURITY FOR REGISTERED SECURITIES

Not Applicable.

PART IV

ITEM 17 FINANCIAL STATEMENTS

The following financial statements are attached and incorporated herein:

| | | Description of Document | Pages | |

| | | | | |

| (1 | ) | Management’s Responsibility for Financial Reporting | 1 | |

| (2 | ) | Independent Auditors' Report | 2 | |

| (3 | ) | Consolidated Balance Sheets as at June 30, 2002 and 2001 | 3 | |

| (4 | ) | Consolidated Statements of Loss and deficit for the Years Ended | 4 | |

| | | June 30, 2002, 2001 and 2000 | | |

| (5 | ) | Consolidated Statements of Changes in Financial Position for the | 5 | |

| | | Years Ended June 30, 2002, 2001 and 2000 | | |

| (6 | ) | Notes to Consolidated Financial Statements for the Years Ended | 6 | |

| | | June 30, 2001, 2000 and 1999 | | |

ITEM 18 FINANCIAL STATEMENTS

Not Applicable.

ITEM 19 FINANCIAL STATEMENTS AND EXHIBITS

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant certifies that it meets all of the requirements for filing on Form 20-F and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | GOLDBELT RESOURCES LTD. |

| | | (Registrant) |

| | | |

| DATE: | December 12, 2002 | By: /s/ Paul J. Morgan |

| | | |

| | | Name: Paul J. Morgan |

19

GOLDBELT RESOURCES LTD.

JUNE 30, 2002

SCHEDULE A

Reports and ConsolidatedFinancial Statements of

GOLDBELT RESOURCES LTD.

As at June 30, 2002 and 2001 and for the three year period ended June 30, 2002

Management's Responsibility for Financial Reporting

The accompanying consolidated financial statements of the Company have been prepared by management in accordance with Canadian generally accepted accounting principles, and contain estimates based on management's judgment. A system of internal control is maintained to provide reasonable assurance that financial information is accurate and reliable.

The Company's independent auditors, J.M. Tucker Inc., are appointed by its shareholders to conduct an audit in accordance with Canadian generally accepted auditing standards to allow them to express an opinion on the financial statements.

The Audit Committee of the Board of Directors, which is composed of a majority of independent directors, has met with the Company's independent auditor to review the scope and results of the annual audit, and to review the consolidated financial statements and related financial reporting matters prior to submitting the consolidated financial statements to the Board for approval.

| (signed) Paul J. Morgan | Director | (signed) Brian C. Irwin | Director |

| |

| |

Vancouver, British Columbia

November 8, 2002

1

| | | 3630 Triumph St., Vancouver, BC, |

| | CHARTERED ACCOUNTANT | Canada V5K 1V3 |

| | | Telephone (604) 299-3333 |

| | | Facsimile (604) 299-2212 |

| | | E-mail jacqueline_tucker@telus.net |

|

|

|

| J.M. TUCKER INC. | | |

AUDITORS’ REPORT TO THE SHAREHOLDERS

We have audited the consolidatedbalance sheets of Goldbelt Resources Ltd. as at June 30, 2002 and 2001 and the consolidatedstatements of operations and deficit and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards and United States generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidatedfinancial statements present fairly, in all material respects, the financial position of the Company as at June 30, 2001 and 2002 the results of its operations and its cash flows for the years then ended in accordance with Canadian generally accepted accounting principles.

The consolidatedstatements of operations and deficit and cash flows for the year ended June 30, 2000 were audited by other auditors who expressed an opinion without reservation on these statements in their report dated September 15, 2000.

(signed) J.M. Tucker Inc.

Chartered Accountant

Vancouver, British Columbia

October 15, 2002, except as to note 10 which is of October 22, 2002

COMMENTS BY AUDITORS FOR U.S. READERS ON CANADA-U.S. REPORTING CONFLICT

In the United States, reporting standards for auditors require the addition of an explanatory paragraph (following the opinion paragraph) when the financial statements are affected by conditions and events that cast substantial doubt on the Company’s ability to continue as a going concern, such as that referred to in the attached consolidated balance sheets as at June 30, 2002 and 2001 and described in note 1 of the consolidated financial statements. Our report to shareholders dated October 15, 2002, except as to note 10 which is of October 22, 2002, is expressed in accordance with Canadian reporting standards, which do not permit a reference to such events and conditions in the auditor’s report when the uncertainty is adequately disclosed in the financial statements.

(signed) J.M. Tucker Inc.

Chartered Accountant

Vancouver, British Columbia

October 15, 2002, except as to note 10 which is of October 22, 2002

2

GOLDBELT RESOURCES LTD.

Consolidated Balance Sheet

As at June 30,

|

|

|

|

|

| |

| | | 2002 | | | 2001 | |

|

|

|

|

|

| |

| | | | | | | |

| (Expressed in Canadian dollars) | | | | | | |

| | | | | | | |

| ASSETS | | | | | | |

| | | | | | | |

| Current | | | | | | |

| Cash and cash equivalents | $ | 233,796 | | $ | 349,126 | |

| Accounts receivable | | 388 | | | 1,765 | |

| Prepaid expense and other | | 4,247 | | | 8,529 | |

|

|

|

|

|

| |

| | | | | | | |

| | | 238,431 | | | 359,420 | |

| Investment(note 3) | | 240,870 | | | 240,870 | |

|

|

|

|

|

| |

| | | | | | | |

| | $ | 479,301 | | $ | 600,290 | |

|

|

|

|

|

| |

| | | | | | | |

| LIABILITIES | | | | | | |

| | | | | | | |

| Current | | | | | | |

| Accounts payable and accrued liabilities | $ | 296,877 | | $ | 311,321 | |

|

|

|

|

|

| |

| | | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | |

| | | | | | | |

| Capital stock(note 4) | | 48,124,162 | | | 48,124,162 | |

| Contributed surplus | | 252,727 | | | 252,727 | |

| Deficit | | (48,194,465 | ) | | (48,087,920 | ) |

|

|

|

|

|

| |

| | | | | | | |

| | | 182,424 | | | 288,969 | |

|

|

|

|

|

| |

| | | | | | | |

| | $ | 479,301 | | $ | 600,290 | |

|

|

|

|

|

| |

| Continuing operations (note 1) | | | |

| Significant and subsequent events (note 10) | | | |

| | | | |

| Approved on behalf of the Board: | | | |

| | | | |

| (signed) Paul J. Morgan | Director | (signed) Brian C. Irwin | Director |

| |

| |

| See notes to consolidated financial statements. | 3 |

GOLDBELT RESOURCES LTD.

Consolidated Statements of Operations and Deficit

For the years ended June 30, 2002, 2001 and 2000

|

|

|

|

|

|

|

|

| |

| | | 2002 | | | 2001 | | | 2000 | |

|

|

|

|

|

|

|

|

| |

| (Expressed in Canadian dollars) | | | | | | | | | |

| | | | | | | | | | |

| Expenses | | | | | | | | | |

| Audit, accounting and related services fees | $ | 29,220 | | $ | 27,035 | | $ | 28,001 | |

| Legal fees | | 27,366 | | | 48,084 | | | 33,071 | |

| Management and consulting fees | | 12,784 | | | 67,009 | | | 18,022 | |

| Occupancy costs | | 6,384 | | | 6,139 | | | 4,576 | |

| Office | | 1,617 | | | 8,601 | | | 1,267 | |

| Salaries and benefits | | 10,704 | | | 9,398 | | | 7,612 | |

| Shareholders relations | | 9,168 | | | 6,650 | | | 5,006 | |

| Telephone and facsimile | | 1,494 | | | 1,549 | | | 2,728 | |

| Transfer agent and filing fees | | 14,757 | | | 7,045 | | | 8,400 | |

| Travel and promotion | | - | | | 19,210 | | | 155 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Loss before the under noted items | | (113,494 | ) | | (200,720 | ) | | (108,838 | ) |

| Settlement costs, net of recoveries (note 5) | | - | | | (249,389 | ) | | - | |

| Foreign exchange gain (loss) | | 3,162 | | | 30,293 | | | (4,263 | ) |

| Gain on sale of interests in mineral properties (note 6) | | - | | | 240,870 | | | - | |

| Interest income | | 3,787 | | | 29,971 | | | 38,471 | |

| Other | | - | | | 10,786 | | | 46,675 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Loss for year | | (106,545 | ) | | (138,189 | ) | | (27,955 | ) |

| Deficit, beginning of year | | (48,087,920 | ) | | (47,949,731 | ) | | (47,921,776 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Deficit, end of year | $ | (48,194,465 | ) | $ | (48,087,920 | ) | $ | (47,949,731 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Earnings (loss) per share – basic and diluted | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.01 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Weighted average number of common shares used in | | | | | | | | | |

| the calculation of basic earnings (loss) per share | | 4,655,137 | | | 4,655,137 | | | 4,655,137 | |

|

|

|

|

|

|

|

|

| |

| See notes to consolidated financial statements. | 4 |

GOLDBELT RESOURCES LTD.

Consolidated Statements of Cash Flows

For the years ended June 30, 2002, 2001 and 2000

|

|

|

|

|

|

|

|

| |

| | | 2002 | | | 2001 | | | 2000 | |

|

|

|

|

|

|

|

|

| |

| (Expressed in Canadian dollars) | | | | | | | | | |

| | | | | | | | | | |

| Cash flows from operating activities | | | | | | | | | |

| Net loss | $ | (106,545 | ) | $ | (138,189 | ) | $ | (27,955 | ) |

| Items not involving cash | | | | | | | | | |

| Loss (gain) on sale of interests in mineral properties | | - | | | (240,870 | ) | | - | |

| Other | | - | | | - | | | 9,907 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| | | (106,545 | ) | | (379,059 | ) | | (18,048 | ) |

| Changes in operating assets and liabilities | | | | | | | | | |

| Accounts receivable | | 1,377 | | | (1,765 | ) | | - | |

| Interest receivable | | - | | | 62,239 | | | (17,553 | ) |

| Prepaid expenses and other | | 4,282 | | | (8,529 | ) | | - | |

| Accounts payable and accrued liabilities | | (14,444 | ) | | 263,425 | | | 4,778 | |

| Loan payable | | - | | | (15,007 | ) | | (27,436 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| | | (115,330 | ) | | (78,696 | ) | | (58,259 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | |

| Repayments on note receivable | | - | | | 424,734 | | | 83,682 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Cash flows from financing activities | | | | | | | | | |

| Long-term liabilities, net | | - | | | - | | | (27,346 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Increase (decrease) in cash | | (115,330 | ) | | 346,038 | | | (1,923 | ) |

| Cash and cash equivalents, beginning of year | | 349,126 | | | 3,088 | | | 5,011 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Cash and cash equivalents, end of year | $ | 233,796 | | $ | 349,126 | | $ | 3,088 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | | |

| Interest received | $ | 3,787 | | $ | 92,210 | | $ | 20,918 | |

| Interest paid | $ | - | | $ | 1,091 | | $ | 3,607 | |

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | |

| Supplemental disclosure of non-cash investing and | | | | | | | | | |

| financing activities | | | | | | | | | |

| Shares received on disposition of interests in mineral | | | | | | | | | |

| properties | $ | - | | $ | 240,870 | | $ | - | |

|

|

|

|

|

|

|

|

| |

| See notes to consolidated financial statements. | 5 |

GOLDBELT RESOURCES LTD.Notes to Consolidated Financial StatementsAs at June 30, 2002 and 2001 and for the three year period ended June 30, 2002

(Expressed in Canadian dollars)

| | | |

| | | |

| 1. | Continuing operations |

| | | |

| | The accompanying consolidated financial statements are prepared on a going-concern basis, which assumes the realization of assets and the settlement of liabilities in the normal course of business. From 1992 to 1998, the Company was engaged in the exploration and development of precious and base mineral deposits in the Republic of Kazakhstan. Since 1998, the Company has been an inactive public company. On April 2, 2001, the Company was designated as “Inactive” by the TSX Venture Exchange (the “Exchange”). The Company’s ability to continue in operations is dependent on its ability to evaluate and acquire a new business opportunity and, to secure new financing to develop an opportunity to complete its reactivation to meet the Exchange’s Tier 2 Maintenance Requirements to have the Inactive designation removed (note 10). |

| | | |

| | The consolidated financial statements do not include any adjustments, which might result from the outcome of these uncertainties. |

| | | |

| 2. | Significant accounting policies |

| | | |

| | These consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles. A reconciliation of amounts presented in accordance with United States generally accepted accounting principles is detailed in note 11. A summary of the significant policies are as follows: |

| | | |

| | a) | Principles of consolidation |

| | | These consolidated financial statements include the accounts of Goldbelt Resources Ltd. and its wholly owned subsidiaries, 521968 B.C. Ltd., Goldbelt Management Services, Inc. and Goldbelt International, LLC. (collectively, unless the context requires otherwise, referred to as the “Company”). All intercompany balances and transactions are eliminated. |

| | | |

| | b) | Use of estimates |

| | | The preparation of financial statements in conformity with Canadian generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Financial results as determined by actual events could differ from those estimates. |

| | | |

| | c) | Cash and cash equivalents |

| | | Cash and cash equivalents includes deposits at call and term deposits which are readily convertible to cash on hand and which are used in the cash management function on a day-to-day basis. |

| | | |

| | d) | Investments |

| | | Short-term investments that are considered temporary are carried at the lower of cost or market value. Long-term investments in which the Company does not exercise significant influence are recorded at cost. Long-term investments are written down if there is a permanent impairment in their carrying value. |

| | | |

| | e) | Interests in mineral properties |

| | | The Company follows the method of accounting for its mineral properties whereby all costs related to acquisition, exploration and development are capitalized by area of interest. These expenditures are carried forward where rights to tenure of the areas of interest are current, and it is expected the expenditure will be recovered through successful development and exploitation of the area of interest or alternatively by its sale and/or the activities are continuing in the area of interest but have not yet reached a stage of development which permits reasonable assessments of the existence or otherwise of economically recoverable reserves. Expenditures, which no longer satisfy the above criteria, are written off. The carrying value of each of its mineral properties is reviewed on a regular basis. |

| | | |

| | | On commencement of commercial production, net costs will be charged to operations on the unit-of-production method by property based upon estimated recoverable reserves. |

6

GOLDBELT RESOURCES LTD.Notes to Consolidated Financial StatementsAs at June 30, 2002 and 2001 and for the three year period ended June 30, 2002

(Expressed in Canadian dollars)

| | | | |

| 2 | . | Significant accounting policies(continued) |

| | | | |

| | | f) | Income tax |

| | | | Income taxes are accounted for under the asset and liability method. Under this method, future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statementand carrying value and the tax basis of assets and liabilities. |

| | | |

| | | |

| | | | |

| | | | Future tax assets and liabilities are measured using the enacted or substantively enacted tax rates expected to applyto taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on future tax assets and liabilities of a change in tax rates is recognized in income in the period during which the change in rates is considered to be substantially enacted. |

| | | | |

| | | g) | Share issuance costs |

| | | | Costs directly identifiable with the raising of capital are charged against the related share capital. Costs related to shares not yet issued are recorded as deferred financing costs. These costs are presented as other assets until the issuance of the shares to which the costs relate, at which time the costs are charged against the related share capital or charged to operations if the shares are not issued. |

| | | | |

| | | h) | Stock based compensation |

| | | | No compensation expense is recognized in the accounts at date of issue and any consideration paid by the directors, officers and others on exercise of the stock options is credited to share capital. |

| | | | |

| | | i) | Foreign currency translation |

| | | | Foreign currency transactions and balances and accounts of integrated foreign operations are translated into Canadian dollars as follows: |

| | | | i) | Revenues and expenses at average exchange rates for each period; |

| | | | ii) | Monetary items, non current assets and non current liabilities at the rates of exchange prevailing at balance sheet dates; |

| | | | iii) | Other non-monetary items at the historical exchange rates; and, |