UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2003

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-28296

GOLDBELT RESOURCES LTD.

(Exact name of registrant as specified in its charter)

Yukon, Canada

(Jurisdiction of incorporation or organization)

Sterling Tower, 372 Bay Street, Suite 1201

Toronto, Ontario, Canada, M5H 2W9

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares without par Value

(Title of class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

4,655,137

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ![]() No

No ![]()

If this report is an annual or transaction report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ![]() No

No ![]()

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ![]() No

No ![]()

Indicate by a check mark which financial statement item the registrant has elected to follow. Item 17 ![]() Item 18

Item 18 ![]()

If this report is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ![]() No

No ![]()

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Not Applicable

2

Table of Contents

| FORWARD-LOOKING STATEMENTS | 5 | |

| GLOSSARY OF TERMS AND DEFINITIONS | 6 | |

| PART 1 | 9 | |

| Item 1. Identity of Directors, Senior Management and Advisers | 9 | |

| Item 2. Offer Statistics and Expected Timetable | 9 | |

| Item 3. Key Information | 9 | |

| A. | Selected financial data | 9 |

| B. | Capitalization and Indebtedness | 11 |

| C. | Reasons for the offer and use of proceeds | 11 |

| D. | Risk factors | 11 |

| Item 4. Information on the Company | 15 | |

| A. | History and Development of Goldbelt Resources | 15 |

| B. | Business Overview | 18 |

| C. | Organizational Structure | 21 |

| D. | Property, Plants and Equipment | 21 |

| Item 4A. Unresolved Staff Comments | 31 | |

| Item 5. Operating and Financial Review and Prospects | 32 | |

| A. | Operating results | 32 |

| B. | Liquidity and capital resources | 33 |

| C. | Research and development, patents and licenses, etc | 33 |

| D. | Trend information | 33 |

| E. | Off-balance sheet arrangements | 33 |

| F. | Tabular disclosure of contractual obligations | 33 |

| Item 6. Directors, Senior Management and Employees | 34 | |

| A. | Directors and senior management | 34 |

| B. | Compensation | 35 |

| C. | Board practices | 36 |

| D. | Employees | 42 |

| E. | Share Ownership | 42 |

| Item 7. Major Shareholders and Related Party Transactions | 43 | |

| A. | Major shareholders | 43 |

| B. | Related Party Transactions | 44 |

| C. | Interests of experts and counsel | 45 |

| Item 8. Financial Information | 45 | |

| A. | Consolidated Statements and Other Financial Information | 45 |

| B. | Significant Changes | 45 |

| Item 9. The Offer and Listing | 46 | |

| A. | Offer and listing details | 46 |

| B. | Plan of distribution | 47 |

| C. | Markets | 47 |

| D. | Selling shareholders | 47 |

| E. | Dilution | 48 |

| F. | Expenses of the issue | 48 |

| Item 10. Additional Information | 48 | |

A. | Share capital | 48 |

3

| B. | Memorandum and articles of association | 48 |

| C. | Material Contracts | 50 |

| D. | Exchange controls | 50 |

| E. | Taxation | 50 |

| F. | Dividends and paying agents | 51 |

| G. | Statement by experts | 51 |

| H. | Documents on display | 51 |

| I. | Subsidiary Information | 51 |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 52 | |

| Item 12. Description of Securities Other than Equity Securities | 52 | |

| PART 2 | 52 | |

| Item 13. Defaults, Dividend Arrearages and Delinquencies | 52 | |

| Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 52 | |

| Item 15. Controls and Procedures | 52 | |

| Item 16A. Audit Committee Financial Expert | 52 | |

| Item 16B. Code of Ethics | 52 | |

| Item 16C. Principal Accountant Fees and Services | 53 | |

| Item 16D. Exemptions from the Listing Standards for Audit Committees | 53 | |

| Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 53 | |

| PART 3 | 53 | |

| Item 17. Financial Statements | 53 | |

| Item 18. Financial Statements | 53 | |

| Item 19. Exhibits | 53 | |

| A. | Financial Statements | 53 |

| B. | Exhibits | 54 |

4

FORWARD-LOOKING STATEMENTS

Certain statements in this annual report under Item 4: Information on the Company and Item 5: Operating and Financial Review and Prospects and elsewhere in this annual report are "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but, rather, on our current expectations and our projections about future events, including our current expectations regarding:

- estimates of the mineral resources with respect to lands in which we have an interest;

- our exploration and development plans with respect to lands in which we have an interest;

- our future stability and growth prospects;

- our business strategies, the measures to implement those strategies and the benefits to be derived therefrom;

- our future profitability and capital needs, including capita expenditures;

- the outlook for and other future developments in our affairs or in the industries in which we participate; and

- the effect on us of new accounting releases.

These forward-looking statements generally can be identified by the use of statements that include words such as "believe", "expect", "anticipate", "intend", "plan", "likely", "will", "predicts", "estimates", "forecasts" or other similar words or phrases. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements are subject to risks, uncertainties and other factors that could cause our actual results to differ materially from the future results expressed or implied by the forward-looking statements. These risks and uncertainties are described under "Risk Factors".

Any written or oral forward-looking statements made by us or on our behalf are subject to these factors. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this annual report on Form 20-F may not occur. Actual results could differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our future results. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this annual report on Form 20-F are made only as at the date of this annual report on Form 20-F. We do not intend, and do not assume any obligation, to update these forward- looking statements, except as required by law.

5

GLOSSARY OF TERMS AND DEFINITIONS

The following is a glossary of technical terms, which are used in this registration statement to describe Goldbelt Resources' business.

"Au" means gold

"diamond drill" means a type of rotary drill, the bit of which is set with diamonds that cut by abrasion rather than percussion. The hollow-centered cutting bit is attached to the end of long hollow drill rods that are rotated and through which water is pumped to the cutting face of the bit. The drill cuts a circle, the rock core of which is recovered in long cylindrical sections, an inch or more in diameter.

"dilution" means the incorporation of waste or low grade rock with ore during the mining process resulting in lower grade

"disseminated ore" means a scattered distribution of generally fine-grained metal bearing minerals throughout a rock body, in sufficient quantity to make the deposit an ore

"dollars" or "$" means Canadian currency unless otherwise indicated

"exploration" means prospecting, diamond drilling and other work involved in searching for ore bodies

"grade" the weight of valuable minerals in each tonne of ore

"g/t" means grams per tonne

"Indicated Mineral Resource" is a term defined by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") and adopted in Canadian National Instrument NI 43-101 Standards for Disclosure of Mineral Projects as meaning that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

"Inferred Mineral Resource" is a term defined by the CIM and adopted in NI 43-101 as meaning that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

6

"Measured Mineral Resource" is a term defined by the CIM and adopted in NI 43-101 as meaning that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics, are so well established that they can be estimated with sufficient confidence to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of economic viability of the deposit. The estimate is based on detailed and reliable exploration sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that spaced closely enough for geological and grade continuity.

"mineralization" means rock containing an undetermined amount of minerals or metals

"Mineral Reserve" is a term defined by the CIM and adopted in NI 43-101 as meaning the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. (Note below the definition of "Reserve" found in the U.S. Securities and Exchange Commission Industry Guide 7)

"Mineral Resource" is a term defined by the CIM and adopted in NI 43-101 as meaning a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

"mineral zone" means a mineral-bearing belt or area

"Ore" is a natural aggregate of one or more minerals which, at a specified time and place, may be mined, processed and sold at a profit, or from which some part may profitably be separated

"oz/t" means Troy ounces per short ton

"percussion drill" means a drill that operates by having the drill bit fall with force onto the rock

"preliminary assessment" means an assessment that may be disclosed under NI 43-101 if made by a qualified person, notwithstanding that it includes an economic evaluation which uses inferred mineral resources, provided that such disclosure includes a proximate statement that the assessment is preliminary in nature, that it includes inferred mineral resources that are too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the preliminary assessment will be realized; a preliminary assessment is sometimes referred to as a "scoping study"

7

"Reserve" is a term defined by Industry Guide 7 of the U.S. Securities and Exchange Commission (SEC) as meaning that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Industry Guide 7 classifies reserves as either "Proven (Measured)" or "Probable (Indicated)". Proven (measured) reserves are those for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. Probable (indicated) reserves are those for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. Note: SEC staff has traditionally required a "bankable" or "final" feasibility study before reserves may be designed for purposes of meeting the requirements of Industry Guide 7.

"resource" or "Mineral Resource" is a term defined by the CIM and adopted in NI 43-101 as meaning a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

"tonne" means metric tonne (2,204 pounds)

Measurements stated in metric units covert to imperial equivalents as follows:

| Metric Units | Multiplied by | =Imperial Units |

| hectares | 2.471 | =acres |

| metres | 3.281 | =feet |

| kilometres | 0.621 | =miles (5,280 feet) |

| grams | 0.032 | =ounces (troy; 12 troy ozs/lb) |

| tonnes | 1.102 | =tons (short or 2,000 lbs) |

| grams/tonne | 0.029 | =ounces (troy)/ton |

8

PART 1

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable.

Item 2. Offer Statistics and Expected Timetable

Not Applicable.

Item 3. Key Information

A. Selected financial data.

The selected financial data appearing below for the fiscal years ended June 30, 2003, 2002, 2001, 2000 and 1999 are set forth in Canadian dollars and extracted from the audited Consolidated Financial Statements of Goldbelt Resources that appear elsewhere herein.

Goldbelt Resources' financial statements are prepared in accordance with generally accepted accounting principles (GAAP) that apply in Canada. The selected financial data appearing in the table below is presented in accordance with Canadian GAAP. For the years ended June 30, 2003, 2002 and 2001 the reconciliation of the Net Loss and Net Loss Per Share to a U.S. GAAP basis is presented in Note 12 of the June 30, 2003 financial statements. The principal differences between Canadian GAAP and US GAAP that affect Goldbelt Resources' income and shareholders' equity relate to those items described in Note 12 of Goldbelt Resources' June 30, 2003 financial statements appearing elsewhere herein.

The following selected financial data should be read in conjunction with, and is qualified in its entirety by reference to Goldbelt Resources' audited Consolidated Financial Statements appearing elsewhere in this registration statement. The differences between US GAAP and Canadian GAAP are described in Note 12 to the accompanying June 30, 2003 audited financial statements. Significant accounting policies applied in preparing Goldbelt Resources' financial statements are set out in Note 2 to the accompanying audited financial statements.

SELECTED FINANCIAL DATA UNDER CANADIAN GAAP

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended |

| June 30, | June 30, | June 30, | June 30, | June 30, |

| 2003 | 2002 | 2001 | 2000 | 1999 |

|

|

|

|

|

|

Operating Revenues | Nil | Nil | Nil | Nil | Nil |

|

|

|

|

|

|

Expenses | (164,986) | (113,494) | (200,720) | (108,838) | (628,388) |

9

Other income (loss) | 6,928 | 6,949 | 62,531 | 80,883 | (321,362) |

|

|

|

|

|

|

Write off of interests in | - | - | - | - | (909,349) |

mineral properties |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations | (158,058) | (106,545) | (138,189) | (27,955) | (1,859,099) |

|

|

|

|

|

|

Loss from continuing | (158,058) | (106,545) | (138,189) | (27,955) | (1,859,099) |

operations |

|

|

|

|

|

|

|

|

|

|

|

Loss | (158,058) | (106,545) | (138,189) | (27,955) | (1,859,099) |

|

|

|

|

|

|

Loss per share | (0.03) | (0.02) | (0.03) | (0.01) | (0.39) |

|

|

|

|

|

|

Loss from operations | (0.03) | (0.02) | (0.03) | (0.01) | (0.39) |

per share |

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing | (0.03) | (0.02) | (0.03) | (0.01) | (0.39) |

operations per share |

|

|

|

|

|

|

|

|

|

|

|

Total Assets | 361,565 | 479,301 | 600,290 | 490,061 | 568,019 |

|

|

|

|

|

|

Net Assets | 24,366 | 182,424 | 288,969 | 427,158 | 455,112 |

|

|

|

|

|

|

Dividends per share | - | - | - | - | - |

|

|

|

|

|

|

Deficit | (158,058) | (48,194,465) | (48,087,920) | (47,949,731) | (47,921,176) |

|

|

|

|

|

|

Capital Stock | 182,424 | 48,124,162 | 48,124,162 | 48,124,162 | 48,124,161 |

|

|

|

|

|

|

Weighted Average | 4,655,137 | 4,655,137 | 4,655,137 | 4,655,137 | 4,731,762 |

Number of Shares |

|

|

|

|

|

All dollar amounts set forth in this report are in Canadian dollars, except where otherwise indicated. On December 31, 2005 a Canadian dollar (C$1.00) was exchangeable for US$0.8569 on the basis applied in the following table, which sets forth (i) the rates of exchange for the Canadian dollar, expressed in U.S. dollars, in effect at the end of each of the periods indicated; (ii) the average exchange rates in effect on the last day of each month during such periods; (iii) the high and low exchange rate during such periods, in each case based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York.

Period | At Period End | Average Rate | High | Low |

| (all figures in US$ per C$) | |||

Month ended December 31, 2005 | 0.8579 | 0.8610 | 0.8690 | 0.8521 |

Month ended November 30, 2005 | 0.8569 | 0.8463 | 0.8579 | 0.8361 |

Month ended October 31, 2005 | 0.8477 | 0.8493 | 0.8795 | 0.8413 |

Month ended September 30, 2005 | 0.8615 | 0.8491 | 0.8615 | 0.8418 |

10

Month ended August 31, 2005 | 0.8408 | 0.8304 | 0.8412 | 0.8207 |

Month ended July 31, 2005 | 0.8159 | 0.8178 | 0.8300 | 0.8041 |

Month ended June 30, 2005 | 0.8159 | 0.8063 | 0.8159 | 0.7950 |

|

|

|

|

|

Year ended June 30, 2005 | 0.8159 | 0.8000 | 0.8493 | 0.7489 |

Year ended June 30, 2004 | 0.7459 | 0.7441 | 0.7880 | 0.7085 |

Year ended June 30, 2003 | 0.7376 | 0.6620 | 0.7492 | 0.6264 |

Year ended June 30, 2002 | 0.6583 | 0.6375 | 0.6622 | 0.6200 |

Year ended June 30, 2001 | 0.6590 | 0.6581 | 0.6831 | 0.6333 |

Year ended June 30, 2000 | 0.6758 | 0.6786 | 0.6969 | 0.6607 |

Year ended June 30, 1999 | 0.6787 | 0.6622 | 0.6891 | 0.6341 |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

This section describes some of the risks and uncertainties faced by Goldbelt Resources. The factors below should be considered in connection with any forward-looking statements in this registration statement. The risks described below are considered to be the significant or material ones, but they are not the only risks faced by Goldbelt Resources. Some risks may not be known to Goldbelt Resources and others that are not considered significant or material may turn out to be material. Investment in the common shares of Goldbelt Resources must be considered speculative and risky, since any one or more of the risks could materially impact Goldbelt Resources' business, its revenues, income, ability to raise required capital and the market price of its common shares.

Risks and Uncertainties

The Company's business is subject to a number of risks related to its exploration and development projects as well as risks related to the mining industry generally.

Political and Economic Risks of Doing Business in Burkina Faso

All of Goldbelt's mineral properties are currently located in Burkina Faso, which is a politically stable country with newly developed mining and environmental legislation in place. The fiscal laws and practices are well established and generally consistent with Western rules and regulations. However, there is no assurance that future political and economic conditions in this country will not result in its government adopting different policies respecting foreign development and ownership of mineral properties. Any changes in laws, regulations or shifts in political attitudes regarding foreign direct

11

investment in the Burkina Faso mining industry are beyond Goldbelt's control and may adversely affect its business. Goldbelt's exploration and development activities may be affected in varying degrees by a variety of economic and political risks, including cancellation or renegotiation of contracts, changes in Burkina Faso domestic laws or regulations, changes in tax laws, royalty and tax increases, restrictions on production, price controls, expropriation of property, fluctuations in foreign currency, foreign exchange controls, import and export regulations, restrictions on the export of gold, restrictions on the ability to repatriate earnings and pay dividends offshore, restrictions on the ability to hold foreign currencies in offshore bank accounts, environmental legislation, employment practices and mine safety. In the event of a dispute regarding any of these matters, Goldbelt may be subject to the jurisdiction of courts outside of Canada, which could have adverse implications on the outcome.

Funding Requirements

Goldbelt has limited financial resources, no source of operating cash flow and no assurance that additional funding will be available for further exploration and development of its projects. Goldbelt will require additional financing from external sources to meet its operating and capital requirements. Although Goldbelt has been successful in the past in obtaining financing through the sale of equity securities, there can be no assurance that it will obtain adequate financing in the future or that the terms of such financing will be favorable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of Goldbelt's projects with the possible forfeiture of all or parts of its properties.

Risk Associated with Title

Title to mineral properties involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mineral properties. The Company has investigated title to all of its mineral properties and, to the best of its knowledge, title to all of its properties, except for the Kari permit, are in good standing. However, the foregoing should not be construed as a guarantee of title to those properties. Title to those properties may be affected by undisclosed and undetected defects.

Competition

Goldbelt competes with other mining companies that have substantially greater financial and technical resources in the search for and the acquisition of mineral concessions as well as for the recruitment and retention of qualified employees with technical skills and experience in the mining industry. There can be no assurance that Goldbelt will be able to compete successfully with others in acquiring mineral concessions and continue to attract and retain skilled and experienced employees.

Management and dependence on key personnel

12

Goldbelt currently has a small executive management group, which is sufficient for the Company's present stage of development. Goldbelt has relied, and will continue to rely, upon a number of consultants and others for operating expertise. Goldbelt may need to recruit additional personnel to supplement existing management. Goldbelt's development to date has largely depended and in the future will continue to depend on the efforts of the current executive management group and the loss of a significant number of the members of this group could have a material adverse effect on Goldbelt, its business and its ability to develop its mineral properties.

Enforcement of Civil Liabilities

As substantially all of the assets of Goldbelt and its subsidiaries are located outside of Canada, and certain of its directors and officers are resident outside of Canada, it may not be possible for investors to enforce judgments granted by a court in Canada against the assets of Goldbelt or its subsidiaries or its directors and officers residing outside of Canada.

Dividends

All of Goldbelt's available funds will be invested to finance the growth of its business and, therefore, investors cannot expect to receive a dividend on its common shares in the foreseeable future.

Risks Related to the Gold Mining Industry Generally

The following risks apply to the gold mining industry generally:

Exploration and Mining Risks

The business of exploring for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. At present, none of Goldbelt's properties have proven and probable reserves. Fires, power outages, labour disruptions, flooding, explosions, cave-ins, land slides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis. The economics of developing gold and other mineral properties is affected by many factors including the cost of operations, variations of the grade of ore mined, fluctuations in the price of gold or other minerals produced, fluctuations in exchange rates, costs of development, infrastructure and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. In addition, the grade of mineralization ultimately mined may differ from that indicated by drilling results and such differences could be

13

material. Depending on the price of gold or other minerals produced, Goldbelt may determine that it is impractical to commence or continue commercial production.

Estimates of Mineral Reserves and Resources and Production Risks

The mineral resource estimates are estimates only and no assurance can be given that any particular level of recovery of minerals will in fact be realized or that an identified resource will ever qualify as a commercially mineable (or viable) deposit, which can be legally and economically exploited. In addition, the grade of mineralization ultimately mined may differ from that indicated by drilling results and such differences could be material. Production can be affected by such factors as permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations, inaccurate or incorrect geologic, metallurgical or engineering work, and work interruptions, among other things. Short term factors, such as the need for orderly development of deposits or the processing of new or different grades, may have an adverse effect on mining operations and on the results of operations. There can be no assurance that minerals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site conditions or in production scale operations. Material changes in reserves or resources, grades, stripping ratios or recovery rates may affect the economic viability of projects. The estimated resources described herein should not be interpreted as assurances of mine life or of the profitability of future operations.

Goldbelt has engaged expert independent technical consultants to advise it with respect to mineral resources among other things. Goldbelt believes that those experts are competent and that they have carried out their work in accordance with all internationally recognized industry standards.

Gold Prices

Over the years, the price of gold has fluctuated widely. The marketability of gold is also affected by numerous other factors beyond Goldbelt's control, including government regulations relating to price, royalties, allowable production and importing and exporting of gold, the effect of which cannot accurately be predicted. Depending on the price of gold or other minerals produced, Goldbelt may determine that it is impractical to commence or continue commercial production.

Environmental and other Regulatory Requirements

Goldbelt's activities are subject to environmental regulations, which are enacted by government agencies from time to time. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner, which means standards for enforcement, fines and penalties for non-compliance are more stringent. Environmental

14

assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Goldbelt's current exploration activities, including any development activities and commencement of production on its properties, require permits from various governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities generally experience increased costs, and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. There can be no assurance that all permits which may be required for exploration, construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any mining project that Goldbelt may undertake. Management of Goldbelt believes that the Company is in substantial compliance with all material laws and regulations, which currently apply to its activities.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on Goldbelt and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Item 4. Information on the Company

A. History and Development of Goldbelt Resources

1. Name of the Company

The Company's legal and commercial name is: GOLDBELT RESOURCES LTD.

2. Incorporation

Goldbelt Resources Ltd. ("Goldbelt", "Goldbelt Resources" or the "Company") was incorporated under the Company Act (British Columbia) on July 23, 1976 as a specially limited company with the name of Goldbelt Mines Inc. (Non-Personal Liability),

15

converted to a limited company pursuant to the Company Act (British Columbia) with the name Goldbelt Mines Inc. on October 5, 1984, amalgamated with North American Metal Corporation on October 22, 1984 as one company with the name Goldbelt Mines Inc., changed its name to Goldbelt Resources Ltd. on July 15, 1991 and amalgamated with Comptoir International du Commerce Ltee on July 9, 1997 as one company with the name Goldbelt Resources Ltd. In August 2001 the Company continued its corporate jurisdiction into Yukon Territory. On December 7, 2005, the Company received approval from its shareholders to continue its corporate jurisdiction into the Province of British Columbia. This application is pending.

3. Domicile and legal form of Company

Goldbelt Resources exists as a limited liability corporation as indicated above.

Goldbelt Resources' registered office in Canada is located at 200-204 Lambert St. Whitehorse, Yukon Territory, Canada, Y1A 3T2. Its executive office is located at Sterling Tower, 372 Bay Street, Suite 1201, Toronto, Ontario, Canada, M5H 2W9; telephone – (416) 364-0557.

Goldbelt Resources is a reporting issuer in British Columbia, Alberta, Ontario and the United States, and is a multiple jurisdiction filer with SEDAR and an EDGAR filer. The Company's common shares are listed on the TSX Venture Exchange (the TSXV) under the symbol "GLD:V".

4. Important events in development of Company's Business

The Company was involved in exploration and development of precious and base mineral deposits in the Republic of Kazakhstan from 1992 to 1998. The Company did not undertake any activity in Kazakhstan from March 1998 until the final disposition of its Kazakhstan mineral interests in March 2001. For the period from December 1998 until July 2000, the Company pursued the acquisition of Regal Petroleum Corporation ("Regal") and its oil and gas interests in the Ukraine and Romania. The acquisition was never completed, as financing could not be arranged. Goldbelt and Regal dissolved plans to merge in July 2000. In March 2001, the Company sold its last remaining interest in Kazakhstan to Celtic Resources Holdings PLC ("Celtic Holdings"), a public company traded in the United Kingdom and the successor company to Dabney Industries. The Company sold its 60% interest in the Abyz deposit owned by Karagai Gold, its 25% interest in Dostyk Minerals, an exploration company with two mineral licenses in Kazakhstan, and its 50% interest in Kazgold and any claim Kazgold may have to the Leninogorsk tailings deposits. In exchange for which Celtic Resources Holdings granted Goldbelt 1.2 (pre-consolidation) million unrestricted, ordinary shares in Celtic Resources Holding, a public company traded in the United Kingdom. In fiscal 2004, the Company disposed of its remaining investments in the shares of Celtic Resources Holdings and Regal for proceeds of $1,217,743 resulting in a gain of $872,239. On March 3, 2005, the Company completed the acquisition of mineral exploration properties in Burkina Faso in western Africa and raised $8,000,000 by way of private placement. The Company has undertaken a detailed evaluation of the mineralization of the Inata Project portion of the

16

Belahouro License and partial work on its additional exploration licenses in Burkina Faso. The Company is in the process of completing technical studies of the Inata Project prior to embarking on a feasibility study and in anticipation of applying for an exploitation permit to mine this property.

On December 8, 1998, the Company's shares were halted from trading on the Vancouver Stock Exchange pending an announcement. In February 1999, the Company announced a proposed acquisition of Regal, which would have resulted in a reverse takeover. On April 2, 2001, trading in the shares of the Company resumed under the Inactive designation upon the Company announcing that its proposed reverse takeover and acquisition had terminated. Effective as of November 20, 2002 the Company's shares were halted from further trading by the TSX Venture Exchange for failing to maintain Tier 2 Maintenance Requirements and resumed trading on September 25, 2003 on the NEX board. On March 3, 2005 the Company resumed trading on the TSX Venture Exchange after achieving Tier 2 Maintenance and Minimum Listing Requirements through the acquisition of its Burkina Faso properties and a simultaneous $8,000,000 private placement.

The Company entered into an agreement dated January 30, 2004 and amended and restated November 19, 2004, with Resolute Mining Limited ("Resolute") of Perth, Australia, an Australian Stock Exchange listed company, to acquire Resolute's 100% owned subsidiaries, Resolute (West Africa) Limited ("RWA") and Resolute (West Africa) Mining Company SA ("RWASA"). The primary assets of RWA and RWASA are exploration properties in Burkina Faso in western Africa. These permits consist of the Belahourou exploration permit and ten additional exploration permits in the rest of the country. The Belahourou exploration permit covers a 1,187 km2 area in northern Burkina Faso, close to the Mali-Burkina Faso border. The Company has identified a number of deposits and gold showings along the Inata, Minfo, Souma and Fete Kole gold trends. In addition to the Belahouro exploration permit, Goldbelt has been issued ten exploration licenses covering an area of approximately 2,216 km2. The Houndé area licenses located in southwestern Burkina Faso cover an area of approximately 1,155 km2. The five licenses (Bouhaoun, Karba, Kopoi, Lamou and Wakui) in this area are immediately south of Semafo's Mana Project and immediately north of Orezone's Bondi Project. The Mandiasso and Diosso licenses cover a 500 km2 area immediately south of the Houndé area licenses. The Oka Gakinde and Guesselnay licenses cover a 496 km2 area immediately north of the Belahouro Exploration Permit. The Ouedogo license, located in southeastern Burkina Faso, covers a 65 km2 area. The Kari License Application, also located in the Houndé area, is currently in dispute. The Company is currently in discussions with Resolute relating to the Kari permit within the Houndé area, which was not held by Resolute at the time of acquisition.

On March 3, 2005, the Company completed the acquisition (the "Acquisition") of the subsidiaries of Resolute and a concurrent private placement of 16,000,000 units at $0.50 per unit for gross proceeds of $8,000,000 (Note 6).

The subsidiaries were acquired in consideration for $1,873,350 (US$1,500,000) on closing, $1,951,056 (US$1,573,686) on or before January 31, 2006, 7,529,412 common shares of the Company and 7,529,412 common share purchase warrants valued at

17

$3,764,706. Included in the warrants are 1,882,353 exercisable at $0.50 until March 3, 2007, 1,882,353 exercisable at $0.65 until March 3, 2007 and 3,764,706 exercisable at $0.65 until September 3, 2006. The Company also paid due diligence costs $330,035 (US$250,000) and issued 250,000 units valued at $125,000 consisting of one common share and one-half of one common share purchase warrant. Each whole warrant entitles the holder to acquire an additional common share at $1.00 until March 3, 2007.

The amount due to Resolute Mining Limited as at June 30, 2005 of $1,933,588 (US$1,573,686) is non interest bearing and due on January 31, 2006.

In accordance with the acquisition agreement, the Company is required to raise, by January 31, 2006, a minimum of $10,625,000 by way of one or more private placements of which $8,000,000 was raised in fiscal 2005. Contemporaneously with the private placements, the Company will also be required to issue additional common shares and common share purchase warrants to Resolute.

5. Principal Business and Capital Investment in the Last Five Years

Since the disposition of its properties in Kazakhstan in fiscal 1998 and prior to the acquisition of its mineral properties in Burkina Faso in March 3, 2005, the Company did not incur expenditures on other properties. In fiscal 2004, the Company disposed of its remaining investments in the shares of Celtic Resources Holdings and Regal for proceeds of $1,217,743 resulting in a gain of $872,239. In fiscal 2005, Goldbelt Resources' principal capital expenditures have been on or in connection with its properties in Burkina Faso.

From 1999 to 2004 there were no financings. In fiscal 2005 the Company raised $8,000,000 via private placement of which $2.9 million was spent on its Burkina Faso properties. The Company acquired these properties for approximately $8 million of which $3.9 million was in the form of shares.

As of December 31 2005, approximately $11.7 million have been invested on these properties.

6. Principal Capital Expenditures in Progress

The Belahouro and other exploration programs in Burkina Faso are the only significant expenditures in progress. All exploration has been funded by external financing through issue of securities of Goldbelt Resources.

7. Takeover Offers

There has been no indication of public takeover offers in respect of Goldbelt Resources' shares.

B. Business Overview

1. The Business of the Company

18

Cautionary Note to U.S. Investors concerning estimates of Measured and Indicated Resources

This section uses the terms "measured" and "indicated resources." We advise U.S. investors that, while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Goldbelt is a Canadian based resource company with mineral properties in Burkina Faso, West Africa. The common shares of Goldbelt trade on the TSX Venture Exchange under the symbol GLD.

Goldbelt Resources has been exclusively in the business of acquiring and exploring resource properties. The Company is committed to establishing Goldbelt as a significant and profitable mining company in West Africa by exploring and developing known gold prospects that will create long-life mines. The Company is also focused on maximizing its opportunities for growth through acquisitions and mergers and return on its shareholders' investment, while being safety conscious and environmentally responsible.

Goldbelt acquired Resolute Limited, assets on March 3, 2005 and completed the detailed evaluation of the mineralization of the Inata Project, Belahouro License. The Company has upgraded and increased its National Instrument 43-101 estimated resource of the Inata Project of the Company's Belahouro Project. Total measured and indicated resources using a cut off grade of 0.5 g/t, have increased to 933,000 ounces of gold and inferred resources have increased to 226,000 ounces of gold, more than doubling the resources since acquiring the project. The current planned work program is to make a production decision in early 2006 by completing feasibility and environmental studies and to make application for an Exploitation License while advancing defined projects in the Belahouro license area. Goldbelt has acquired an additional 1,100 square kilometres of new exploration tenements at Gusselnay and Oka Gakinde (north of Belahouro); Bouhaoun, Karba, Kopoi, Lamou, Wakui, Mandiasso and Diosso within the Houndé greenstone belt and Ouedogo within the Koupela greenstone belt.

The climate in Burkina Faso permits the Company to conduct its exploration work year round with some interruptions during the rainy season in May to July. Goldbelt Resources has not encountered difficulties in complying with regulations regarding environmental protection.

The Company does not own any patents, trademarks or franchises that may materially affect its business. The Company, through its subsidiary, is the registered owner of the 11 exploration permits described above.

The Company has not earned any revenues in the past three years and is currently focused on the development of its mineral properties in Burkina Faso

19

2. Effect of Government Regulation

All of Goldbelt's mineral properties are currently located in Burkina Faso, which is a politically stable country with newly developed mining and environmental legislation in place. The fiscal laws and practices are well established and generally consistent with Western rules and regulations. However, there is no assurance that future political and economic conditions in this country will not result in its government adopting different policies respecting foreign development and ownership of mineral properties. Any changes in laws, regulations or shifts in political attitudes regarding foreign direct investment in the Burkina Faso mining industry are beyond its control and may adversely affect its business. Goldbelt's exploration and development activities may be affected in varying degrees by a variety of economic and political risks, including cancellation or renegotiation of contracts, changes in Burkina Faso domestic laws or regulations, changes in tax laws, royalty and tax increases, restrictions on production, price controls, expropriation of property, fluctuations in foreign currency, foreign exchange controls, import and export regulations, restrictions on the export of gold, restrictions on the ability to repatriate earnings and pay dividends offshore, restrictions on the ability to hold foreign currencies in offshore bank accounts, environmental legislation, employment practices and mine safety. In the event of a dispute regarding any of these matters, Goldbelt may be subject to the jurisdiction of courts outside of Canada, which could have adverse implications on the outcome.

20

C. Organizational Structure

The following chart presents the Company's legal corporate structure and the jurisdictions of incorporation.

Percentage values indicate percentage ownership.

D. Property, Plants and Equipment

Burkina Faso

All of Goldbelt's current exploration permits are in Burkina Faso, West Africa. Burkina Faso has a land area of 1,200,000 square miles, with a population of 12 million people and borders Ghana, Cote D'Ivoire, Mali, Niger, Benin and Togo. Its major industry is agriculture and its principal export commodity is cotton. The emergence of mining in Burkina Faso is seen by the Burkinabe government as its best opportunity to develop a new industry and garner much needed foreign currency, consequently there is significant support in Burkina Faso for foreign investment in mining. Burkina Faso is a politically stable country with a democratically elected government and newly developed mining and environmental legislation in place.

21

The Geology

Burkina Faso, West Africa is situated on the Birimian greenstone belt, which is contained within the West African Shield. The Birimian Series of West Africa host some of the largest gold deposits in the world, including Sadiola, Yatela, Morila and Syama in Mali, Siguiri in Guinea, and Obuasi, Bogosu, Prestea, Bibiani and the recent Newmont discovery (Akyem and Ahafo) in Ghana, and is comparable to other Archean and Proterozoic shields in Canada, Australia and Southern Africa.

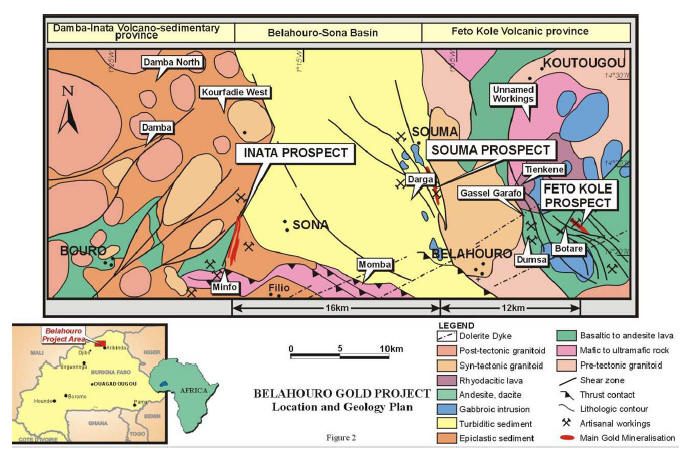

Goldbelt tenement holdings in Burkina total 3,403 square kilometres contained within eleven exploration licenses these being Belahouro, Gusselnay and Oka Gakinde within the Belahouro region; Karba, Kopoi, Wakui, Bouhaoun, Lamou, Mandiasso and Diosso within the Houndé region and Ouedogo within the Koupela region. The Belahouro tenement (1,187 square kilometres) is the most advanced exploration license and contains a number of projects which can be separated into three principal geological domains as indicated on the Belahouro Project map.

Belahouro Project Map

22

Belahouro Project License

The Belahouro license is located 220 kilometres north of the capital Ouagadougou and approximately 45 kilometres south of the Mali border. The license covers an area of 1,187 square kilometres and contains 10 known exploration projects. A resource estimate has been established on 4 of these exploration projects: Inata, Minfo, BSF1 and BSF16.

Belahouro Geology

The Belahouro permit is located in the western part of the Djibo greenstone belt, part of the Birimian greenstone belt. The age of these formations is estimated to be from 1.6 to 2.3 billion years old. The weathering profile in the region is extensive and persists down to 100 metres depth and has a well developed laterite profile.

The geological interpretation of the Belahouro Project area initially relied on the interpretation of geophysical data and geological mapping of very limited weathered outcrop. This has been significantly enhanced by the results obtained from a number of exploration drilling programs employing different drilling techniques such as rotary air-blast, reverse circulation and diamond core drill holes.

Deposit Types

Gold within the Belahouro Project is exclusively associated with deep crustal deformation, regional metamorphism and mesothermal vein style mineralization. This is entirely consistent with the majority of Archaean and Proterozoic terrains worldwide, including the Birimian Series of West Africa.

The main deposits are:

- Inata trend gold deposits (Inata North, Central and South, Sayouba and Minfo) in the Damba-Inata volcano-sedimentary Province.

- Souma-N'Darga trend deposits (Souma Village, BSF1, BSF16 and N'Darga) in the eastern margin of Sona-Belahouro Basin.

- Fete Kole deposit in Fete Kole volcanic Province.

Damba-Inata Volcano Sedimentary Province

The Damba-Inata domain occurs in the westernmost portion of the project area and is dominated by metasediments, intermediate to mafic volcanics and volcanoclastics. To the west of the Inata trend, strong magnetic signatures are present in aeromagnetic data, which correspond to mafic volcanics and their sedimentary derivatives, such as pillow breccias. The trend varies over the strike of the prospect, from north-northwest in the south to north in the central area and north-northeast in the northern area.

Inata Trend Deposits

The principal gold mineralization is confined to the Inata and Souma trends. The three Inata deposits (North, Central and South) are located over a strike length of 4 kilometres.

23

The deposits are interpreted to be related to the same structural regional shear along the western margin of the Sona-Belahouro Basin. The Inata Central and Inata South represent the same mineralized trend, separated by lower grade mineralization and cross-cutting faults. Inata North lies some 300 metres west of the Inata Central-South trend. The Inata shear trends north-northeast and dips steeply to the west-northwest.

Gold mineralization is present as free grains and is generally associated with carbonate-pyrite alteration within quartz veins.

Sayouba is a small zone (strike 100 metres) of north-northwest trending gold mineralization with a dip of 60° to 70° west. It occurs in shale, siltstone, minor intermediate volcanics, and felsic porphyry.

Minfo lies on the Minfo-Filio east-west shear zone. The shear zone can be traced over a distance of 20 kilometres and is characterized by a wide zone of shearing (up to 400 metres) associated with a strong aeromagnetic trend. Mineralization is associated with massive and stringer quartz veining in black shales within an intermediate volcanic shale/siltstone package.

Souma-N'Darga Trend Deposits

Belahouro-Sona Basin lies in the centre of the Belahouro property. It is a rift basin with deep crustal fault margins gently plunging north with rocks consisting of turburbitic meta-sediments and minor volcanoclastics. The basin forming structures have later been reactivated in subsequent phases of compression deformation. Late stage north-east to south-west faults crosscut the basin and provide channel ways for mineralizing events along the rift margins.

The Souma-N'Darga trend is located along the eastern structural margin of the Belahouro -Sona Basin, immediately west of the contact with the deformed Belahouro granite.

Mineralization comprises laminated quartz ± tourmaline veins that outcrop sporadically along the entire trend, and has been separated into several separate prospects: BEF2, BSF1, BSF16 and Souma Village. The western trend comprises N'Darga and Boulili deposits.

Fete Kole Province Deposits

The Fete Kole province occurs to the east of the Belahouro-Sona Basin and is a near vent complex of felsic to mafic volcanics and basin type sediments cross cut by various pre-, syn- and post deformation granitoid intrusions recently dated at 2.1 to 4.0 billion years old. The final phase of intrusion in the Fete Kole province is gabbroic, which is also associated with minor volcanic ultramafic sequences.The Fete Kole volcano-plutonic province is marked by the dominant northwest-southeast trend of foliation and quartz tourmaline veins. Dip is generally to the west. Two structural sectors are distinguished from aeromagnetic analytical signal image. They are divided by a well defined major

24

structure, which separates predominantly intermediate volcanic rock in the south from predominantly mafic and ultramafic rocks in the north.

A table of the Belahouro projects resources is summarized below:

Belahouro Projects Resource Table (at a cutoff grade of 1.0g/t)

| Measured & Indicated | Inferred | |||||

| Tonnage | Tonnage | |||||

| Deposit | (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs |

| Inata | 10.297 | 2.5 | 818,000 | 2.811 | 2.0 | 177,000 |

| Minfo | 0.604 | 2.4 | 46,000 | |||

| BSF1 | 0.463 | 3.0 | 44,600 | |||

| BSF16 | 0.170 | 2.0 | 10,900 | |||

| Total | 10.297 | 2.5 | 818,000 | 4.048 | 2.2 | 278,500 |

Project Development

Inata Project

Goldbelt and the previous owners of the Project (BHP and Resolute Resources) have, to date, expended approximately $27 million on geological and technical studies within the Belahouro license area with the majority of these funds being focused on the Inata project.

This has provided Goldbelt with an exceptional opportunity through the establishment of an extensive historical database involving geophysical and geochemical exploration results, geotechnical and metallurgical testwork studies and environmental study reports.

The Inata Project database consists of 3,312 metres of diamond core drilling and 78,618 metres of reverse circulation drilling. Additionally, drilling has also been completed at other project areas within the Belahouro license where zones of mineralization have been determined. These are Minfo, Folio, Souma Village, BSF1, BSF16, Fete Kole and Pali.

In March 2005, immediately after completing the acquisition, Goldbelt successfully designed and instigated a new drilling program at Inata to increase the level of resource confidence, to test continuity of the mineralization along strike and down dip extensions. All holes drilled in the resource definition program were restricted to the Inata North, Central and South mineralized areas.

The drill program also provided additional mineral samples for a new metallurgical testwork program of the oxide mineralization and for the analysis of rock strengths (geotechnical) for the preparation of a feasibility study.

In total, 183 reverse circulation and 13 diamond core drill holes were completed with a total of 21,750 metres being drilled.

25

The drilling program involved 179 reverse circulation holes designed to better define the mineralized boundaries, 3 diamond core holes and 4 reverse circulation holes from surface for the collection of metallurgical samples, 8 diamond core holes from surface for collection of geotechnical and structural samples for rock strength and structural integrity evaluation, and 2 deep diamond drill holes to test the depth extensions of high grade ore zones at Inata, which will enhance the geotechnical drilling.

The drilling program provided the necessary additional information on the extension and continuity of the Inata mineralization for the purpose of upgrading the Inata resource model. Additional sample material was also obtained for utilization in a metallurgical testwork program of the oxide mineralization and for geotechnical analysis of the adjacent lithologies in preparation for the development of a feasibility study.

Inata Resources Estimate:

A resource estimate carried out by RSG Global of Perth, Australia has incorporated all of the historical and current drilling prior to October 2005. RSG Global recommended that a 0.5 grams per tonne cutoff be used for the resource statement, the results of which are summarized below.

INATA Resource Table

Subdivided by CNI 43-101 Resource categories @ 0.5 g/t cutoff

| Measured | Indicated | Measured & Indicated | Inferred | ||||||||

| Tonnage | Tonnage | Tonnage | Tonnage | ||||||||

| (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs |

| 1.396 | 3.0 | 132,500 | 13.647 | 1.8 | 800,500 | 15.043 | 1.9 | 933,000 | 4.869 | 1.4 | 226,000 |

The low volume of measured resources was due to insufficient bulk density measurements. This issue will be addressed within the feasibility study and prior to our reserve statement.

The current resource, using a cut-off grade of 1.0 grams per tonne, is estimated by RSG Global of Perth, Australia, as follows:

INATA Resource Table

Subdivided by CNI 43-101 Resource categories @ 1.0 g/t cutoff

| Measured | Indicated | Measured & Indicated | Inferred | ||||||||

| Tonnage | Tonnage | Tonnage | Tonnage | ||||||||

| (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs | (Million t) | Au g/t | ozs |

| 1.270 | 3.2 | 129,000 | 9.027 | 2.4 | 689,000 | 10.297 | 2.5 | 818,000 | 2.811 | 2.0 | 177,000 |

26

It is recognized that there are a number of high grade zones contained within each of the three Inata deposit areas (North, Central and South). These high grade zones carry a significant proportion of the resource ounces and will be the focus of the future resource assessment and development process.

Inata Technical Studies

The Inata project has a wealth of information generated over 9 years, previously by BHP and Resolute, and more recently by Goldbelt. This database includes metallurgical and geotechnical testwork as well as environmental and sociological evaluations. The results of the earlier studies form the foundation of the current study work being undertaken. Hence, a feasibility study will provides the additional detailed assessment and optimization of the previously completed technical areas of metallurgical, environmental, sociological and financial evaluation.

Scoping Study

A Scoping Study is expected to be completed in early 2006 and will evaluate a number of process flowsheet designs and production rate options. These include conventional carbon-in-leach, heap leach or a combination of the two technologies at annual production rates ranging from 1.0 million tonnes per annum to 2.0 million tonnes per annum. Capital and operating costs will be estimated for each option.

The Inata mineralization appears to be favorably situated for the establishment of an open pit mining operation.

It is anticipated that a number of shallow open pits will be developed within a short haulage distance from a centrally located process plant.

It is also recognized that there are a number of high grade mineralized zones within each of the deposits which, due to their grade and extent, have the potential to be later exploited from an underground operation.

The study additionally will evaluate the infrastructural requirements and assess the environmental impact of each processing option. The results of the scoping study will form the basis for the Inata Project feasibility study scope of work.

Feasibility

The sociological aspects of the feasibility study will contain the environmental impact assessment, sociological evaluation and environmental management plan A new environmental baseline, sociological and environmental impact study commenced in early September and is expected to be completed by the end of 2005. The initial study was carried out by SRK consultants from South Africa. A more detailed study is

27

presently being conducted by Socrege SARL, a Burkina Faso environmental group. Socrege is the only registered environmental group operating in Burkina Faso and has provided similar consultation for Orezone, Semafo and High River Gold.

Inata Exploitation License Project Study

The Belahouro exploration license is to be converted to a 20 year Exploitation license (mining permit) for the Inata deposit before April 2006. An application for the Exploitation license, supported by a study report (referred to as a 'Feasibility Report' in Burkina Faso), will be completed and submitted before the end of 2005.

This is four months in advance of the expiry of the Belahouro exploration license. The approval process may take a maximum of three months to complete.

After award of the Exploitation license a new project company will be established within Burkina Faso to hold the Inata mining rights and for the management of the future mining operation. Goldbelt will own ninety per cent of this new company and the government of Burkina Faso will hold ten per cent.

Exploration Projects

Inata North - Northern Extension

After a review of the data, RSG Global provided comment on the potential to define additional resources to the north, along strike (approximately 650 metres), of Inata North. Based on the available information significant potential exists to define additional mineralization in this region, however, it is considered probable the tenor of the mineralization is lower and the mineralization widths will be reduced in comparison to Inata North.

Inata North – Sayouba

The footwall zones at Inata North are considered to have oxide resource potential and are therefore considered a high priority target. Optimistically, potential exists to define a zone of strike extending 350 metres.

Inata North and Inata Central Deposits - Infill drilling

RSG Global considers the most likely outcome of infill drilling between the Inata North and Central is to close off the mineralized zones. Little potential exists in this region to convert large oxide ounces into mining reserve.

Inata South Deposit

Drilling in this region indicates some narrowing of the mineralized zones. However, due to the boudinage nature of the mineralization, some pinching of the mineralized zone may

28

have occurred and potential exists for the zone to flex and widen. A 1,350 metre strike length remains to be adequately drill tested.

Inata North Potential Underground Resource

RSG Global considers that potential exists for developing the high grade central Inata North mineralization down dip, and this zone should be tested by strategically placed diamond drill holes in the future. It is noted however, that mineralization widths and grade tenor at depth appear to be reduced, although some pinching of the mineralized zone may have occurred. A detailed review of structural and mineralization data in this area is recommended prior to proceeding with expensive deep diamond drilling.

Minfo Prospect

Resolute estimated a resource at Minfo of 600,000 tonnes at 2.5 grams per tonne Au for 40,000 ounces. The previous reports were not prepared in accordance with standards set out in NI43-101 and therefore are provided for reference purposes only. The current drilling has adequately defined the known mineralization, including the identified cross cutting structure. Relatively few infill drill holes should enable an upgrade in resource confidence with limited potential existing to define significant addition contained ounces.

Inata East-Pali Prospect

It is considered that the poor understanding of the geological controls and the narrow nature of the intersected mineralization at Pali do not make a high priority target. Infill drilling of anomalous RAB and RC intercepts by diamond drilling is recommended for this area. A significant intersection BRB846 - 11 metres at 6.6 grams per tonne Au should be investigated at depth. The potential for a significant oxide resource, however, is considered limited based on the current geological interpretation.

Inata West - Filio Prospect

Similar to the Pali prospect, the Filio prospect is considered a lower priority target, which requires systematic further exploration, due to the poor understanding of the geological controls on mineralization and the relatively narrow anomalous intercepts. Infill drilling on anomalous RAB and RC intercepts by oriented diamond drilling is recommended for this area. A significant intersection BRB134 - 24 metres at 2.6 grams per tonne Au was obtained through earlier drilling and is to be investigated at depth.

Souma Village Prospect

It is considered that the Souma trend, consisting of the advanced exploration prospects of the Souma Village, BSF1 and BSF16, has the potential to yield a large oxide resource. The Souma trend is considered a mineralized structural corridor of at least 11 kilometres from BSF1 to the Tabassi surface sampling. The structural behavior and mineralization characteristics appear similar to Inata. As such, the Souma trend is considered a high priority target.

29

Developing defined mineralization at the Souma Village is considered a high priority. The similar structure behavior, mineralization widths and continuity to that identified at Inata North, make the Souma Village prospect a high priority target. The potential also exists for multiple en echelon mineralized structures.

The Souma trend is untested at depth north of the Souma Village towards the Tabassi surface sampling. This area shows potential if the structural trend is continuous.

RSG Global considers that further exploration may identify significant additional mineralization

BSF16 Prospect

Resolute estimated the BSF16 resource as 170,000 tonnes at 2.0 grams per tonne Au for 11,000 ounces. The previous reports were not prepared in accordance with standards set out in NI43-101 and therefore are provided for reference purposes only. Potential depth extensions (below approximately 30 metres) remain untested and drill lines are limited to two holes per section.

BSF1 Prospect

Resolute estimated the resource for the BSF1 prospect to be 463,000 tonnes at 3.0 grams per tonne Au for 45,000 ounces. The previous reports were not prepared in accordance with standards set out in NI43-101 and therefore are provided for reference purposes only. Depth extensions of the mineralization are not well drilled. Section lines are limited to three holes intersecting mineralization to approximately 90 metres in down dip depth.

Fete Kole Prospect

Metamorphic Regime

Despite the extensive deformation observed in the Birimian volcano-sedimentary series, they seem to have been subject, during the Eburnean Orogeny, to low-grade regional metamorphism to greenschist facies. However, in the Belahouro-Souma area, kyanite bearing mica schist and pelite indicate higher grade metamorphic regime.

On a regional scale, the large granite intrusion emplacement developed contact metamorphism such as at Aribinda area.

The deposits occur in shear zones. The Gassel Garafo mineralized zone lies proximal to a major north to southeast trending shear zone, which has a known extent of 14 kilometres between Senakaye and Lybie. In the Gassel Garafo area, the shear traverses the contact between granitoids to the west and basaltic andesites to the east. The shear zone that controls the gold mineralization at Gassel Garafo has been tested at Dumsa and Senakaye. The shear zone is dominantly hosted in basaltic andesites and associated pyroclastics. Mineralization was confined to quartz veining within the main shear zone.

30

The Fete Kole mineralization is closely related to a volcanic centre along a regional north south complex shear. Stacked, flat lying structures pond hydrothermal solutions, which have significant high grade zones. Iron carbonate alteration is common throughout the project.

Fete Kole is the largest area of artisanal mining in the License. Approximately 1,000 miners are active, some digging shafts to at least 60 metres. The artisanal workings occupy an area of approximately 30 square kilometres. The prospect represents a structurally more complex area of the Belahouro Project. The structural and mineralization controls are poorly understood. RSG Global considers that a systematic approach to exploration is appropriate at Fete Kole to ensure a maximization of the exploration expenditure. Orientated diamond drilling core, selected for maximizing geological information as opposed to grade, is considered the logical first step in better understanding the Fete Kole prospect.

Other Exploration Licences

1. Houndé (Karba, Wakui, Kopoi, Bouhaoun and Lamou):

A 16,000 geochemical soil sampling program was carried out early in 2005. The analysis of these samples was completed in late July 2005. The evaluation of these results and development of a further geochemical soil sampling and/or a RAB drilling program is to be determined.

Other Houndé Area tenements (Mandiasso and Diosso):

These licenses have recently been awarded to Goldbelt and no exploration work has been carried out to date. An initial review of historical data is required for the development of an exploratory soil geochemical program.

2. Belahouro Area tenements (Guesselnay and Oka Gakinde):

These licenses have recently been awarded to Goldbelt and no exploration work has been carried out to date. An initial review of historical data is required for the development of an exploratory soil geochemical program.

3. Ouedogo tenement, Koupela Region (Central Burkina Faso):

A re-assessment of previous geological data will be conducted before developing a future exploration program. This project is situated in a massive sulphide province and its potential is not as a gold resource but for base metals.

The technical information contained in this document has been prepared under the direction of and has been reviewed by Collin Ellison, Chief Executive Officer of Goldbelt and a Qualified Person under NI 43-101.

Item 4A. Unresolved Staff Comments.

31

Not applicable.

Item 5. Operating and Financial Review and Prospects

A. Operating results.

The following discussion of Goldbelt Resources' operations and financial condition describes financial data prepared using Canadian GAAP. The differences between US GAAP and Canadian GAAP are described in Note 12 to the accompanying audited financial statements.

Significant accounting policies applied in preparing Goldbelt Resources' financial statements are set out in Note 2 to the accompanying audited financial statements.

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended |

| June | June | June | June | June |

| 30, 2003 | 30, 2002 | 30, 2001 | 30, 2000 | 30, 1999 |

Expenses | (164,986) | (113,494) | (200,720) | (108,838) | (628,388) |

Other income (loss) | 6,928 | 6,949 | 62,531 | 80,883 | (321,362) |

Write off of interests in | - | - | - | - | (909,349) |

mineral properties |

|

|

|

|

|

Loss for the year | (158,058) | (106,545) | (138,189) | (27,955) | (1,859,099) |

Loss per share | (0.03) | (0.02) | (0.03) | (0.01) | (0.39) |

Total Assets | 361,565 | 479,301 | 600,290 | 490,061 | 568,019 |

Net Assets | 24,366 | 182,424 | 288,969 | 427,158 | 455,112 |

Dividends per share | - | - | - | - | - |

Deficit | (158,058) | (48,194,465) | (48,087,920) | (47,949,731) | (47,921,776) |

Capital Stock | 182,424 | 48,124,162 | 48,124,162 | 48,124,162 | 48,124,161 |

Weighted Average | 4,655,137 | 4,655,137 | 4,655,137 | 4,655,137 | 4,731,762 |

Number of Shares |

|

|

|

|

|

For the year ended June 30, 2003, the Company's loss was $158,058 compared with a loss of $106,545 for the corresponding prior period. Included in the current year's results are a $30,928 foreign currency gain on debts denominated in US dollars and a $104,354 gain with respect to shares received as a result of the termination of the proposed acquisition of Regal Petroleum Corporation Limited in a prior year. In addition, the Company forfeited the deposit of $30,380 (US$20,000) made on entering into agreement with ORI and recorded a reserve of $98,735 (US$65,000) for advances made to ORI as there is significant uncertainty as to whether these amounts will be collected.

The net loss of $(158,058), $(106,545), $(138,189), $(27,955) and $(1,859,099); and net assets of $24,266, $182,424, $288,969, $427,158 and $455,112 in fiscal 2003, 2002, 2001, 2000,and 1999 respectively, reflect the fact that the company was on a continued

32

maintenance basis since the disposition of its exploration properties in Kazakhstan in 1998.

Inflation did not affect Goldbelt Resources' operating results.

Foreign currency fluctuations had a very limited negative effect on Goldbelt Resources other income and expenses. The impact of a rising Canadian dollar (or devaluing US dollar) could have significant effect on concentrate product sales in the future, since all such sales are conducted in US currency, while costs are incurred in Canadian dollars and CFA francs (Euro-based) giving rise to potential significant foreign currency transaction exposure which could have a significant impact on the Company's financial condition and results of operations.