UMB Financial Fourth Quarter 2016 January 24, 2017 Exhibit 99.2

Cautionary Notice about Forward-Looking Statements This presentation contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements about expected cost savings and other results of efficiency initiatives and our statements about reduced regulation, tax reform and our ability to capitalize on changes. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2015, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the Securities and Exchange Commission (SEC). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except to the extent required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

4Q 2016 Performance Highlights

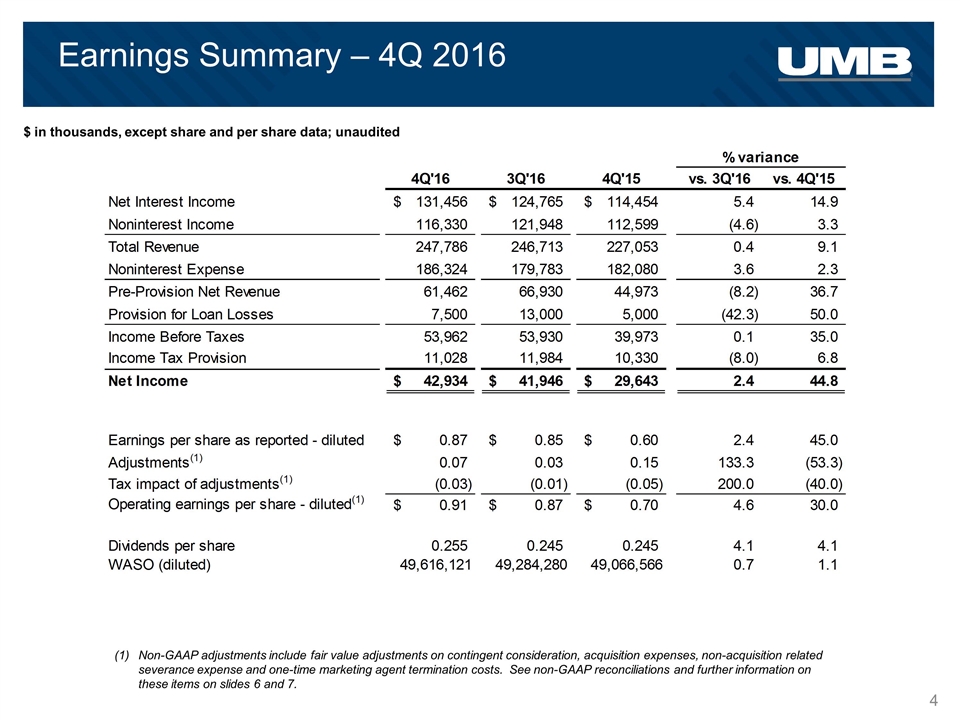

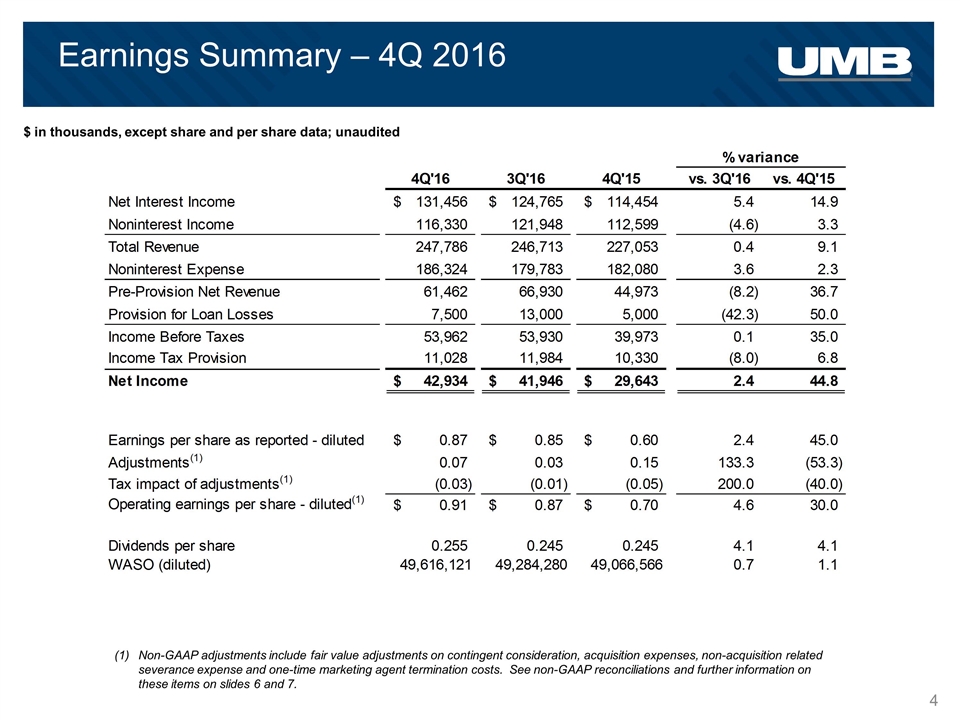

Earnings Summary – 4Q 2016 $ in thousands, except share and per share data; unaudited Non-GAAP adjustments include fair value adjustments on contingent consideration, acquisition expenses, non-acquisition related severance expense and one-time marketing agent termination costs. See non-GAAP reconciliations and further information on these items on slides 6 and 7.

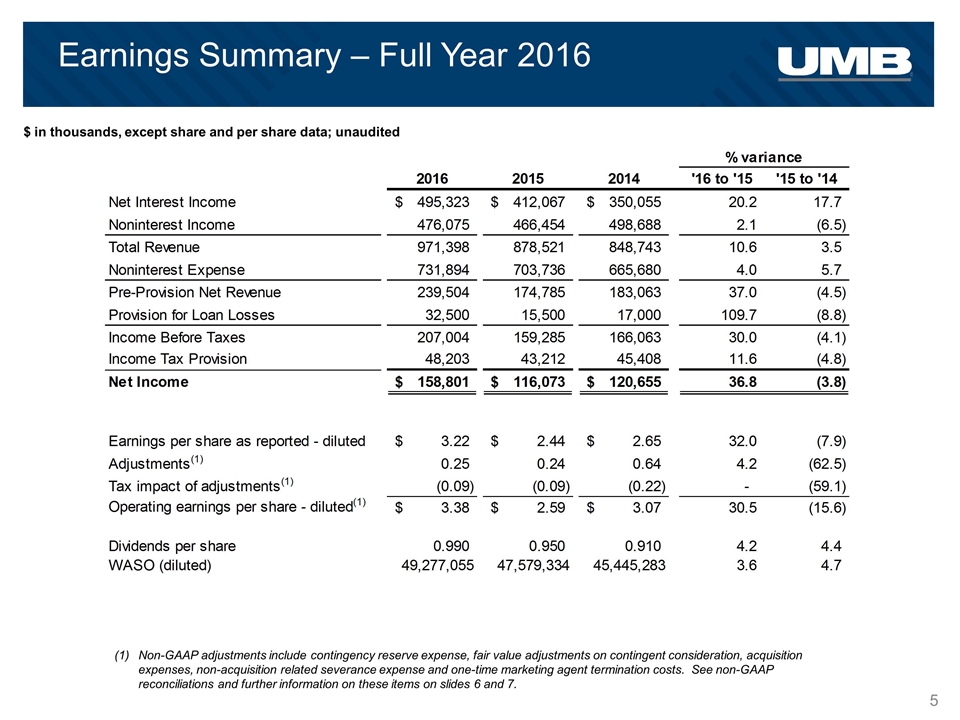

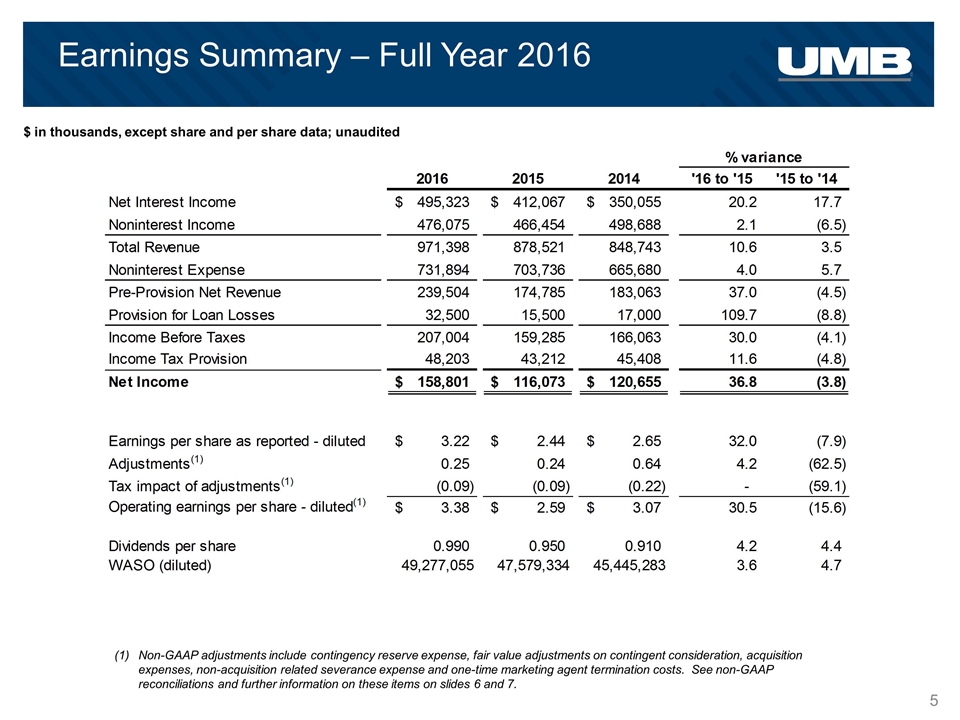

Earnings Summary – Full Year 2016 $ in thousands, except share and per share data; unaudited Non-GAAP adjustments include contingency reserve expense, fair value adjustments on contingent consideration, acquisition expenses, non-acquisition related severance expense and one-time marketing agent termination costs. See non-GAAP reconciliations and further information on these items on slides 6 and 7.

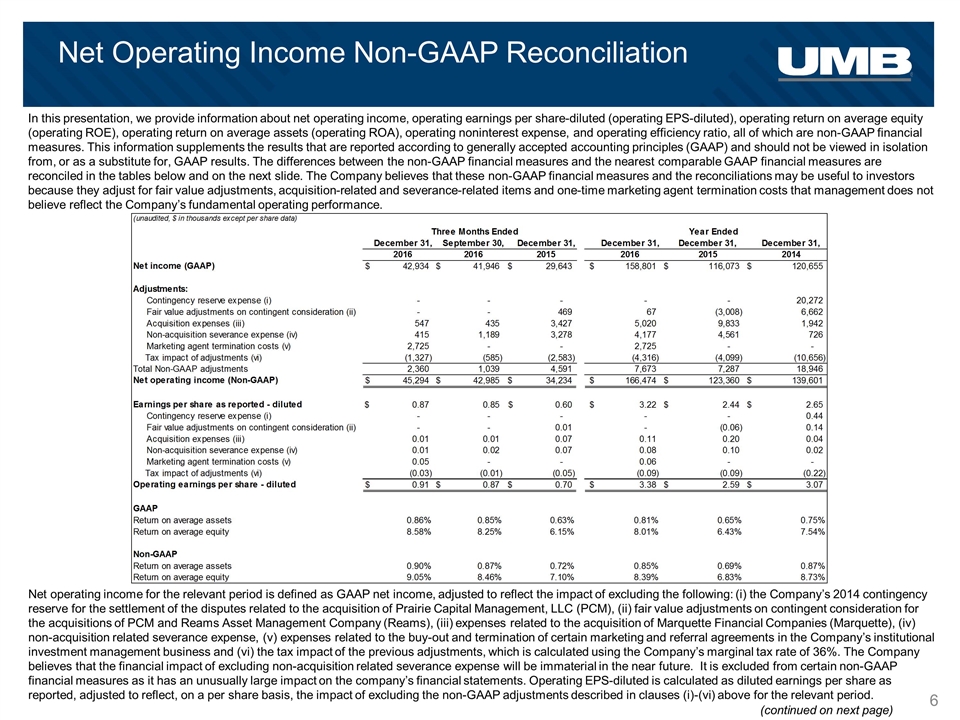

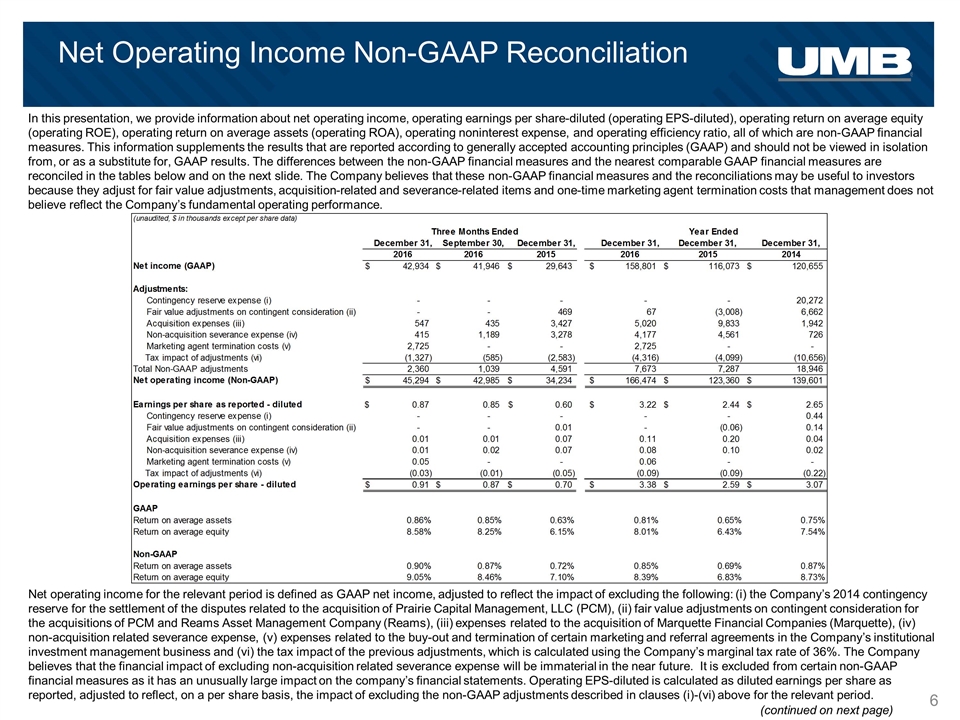

Net operating income for the relevant period is defined as GAAP net income, adjusted to reflect the impact of excluding the following: (i) the Company’s 2014 contingency reserve for the settlement of the disputes related to the acquisition of Prairie Capital Management, LLC (PCM), (ii) fair value adjustments on contingent consideration for the acquisitions of PCM and Reams Asset Management Company (Reams), (iii) expenses related to the acquisition of Marquette Financial Companies (Marquette), (iv) non-acquisition related severance expense, (v) expenses related to the buy-out and termination of certain marketing and referral agreements in the Company’s institutional investment management business and (vi) the tax impact of the previous adjustments, which is calculated using the Company’s marginal tax rate of 36%. The Company believes that the financial impact of excluding non-acquisition related severance expense will be immaterial in the near future. It is excluded from certain non-GAAP financial measures as it has an unusually large impact on the company’s financial statements. Operating EPS-diluted is calculated as diluted earnings per share as reported, adjusted to reflect, on a per share basis, the impact of excluding the non-GAAP adjustments described in clauses (i)-(vi) above for the relevant period. Net Operating Income Non-GAAP Reconciliation In this presentation, we provide information about net operating income, operating earnings per share-diluted (operating EPS-diluted), operating return on average equity (operating ROE), operating return on average assets (operating ROA), operating noninterest expense, and operating efficiency ratio, all of which are non-GAAP financial measures. This information supplements the results that are reported according to generally accepted accounting principles (GAAP) and should not be viewed in isolation from, or as a substitute for, GAAP results. The differences between the non-GAAP financial measures and the nearest comparable GAAP financial measures are reconciled in the tables below and on the next slide. The Company believes that these non-GAAP financial measures and the reconciliations may be useful to investors because they adjust for fair value adjustments, acquisition-related and severance-related items and one-time marketing agent termination costs that management does not believe reflect the Company’s fundamental operating performance. (continued on next page)

Operating Noninterest Expense & Efficiency Ratio Non-GAAP Reconciliation Operating ROE is calculated as net operating income, divided by the Company’s average total shareholders’ equity for the relevant period. Operating ROA is calculated as net operating income, divided by the Company’s average assets for the relevant period. Operating noninterest expense for the relevant period is defined as GAAP noninterest expense, adjusted to reflect the pre-tax impact of non-GAAP adjustments described in clauses i-v on slide 6. Operating efficiency ratio is calculated as the Company’s operating noninterest expense, net of amortization of other intangibles, divided by the Company’s total revenue (tax equivalent net interest income, plus noninterest income, less gains on sales of securities available for sale, net). Represents the Company’s 2014 contingency reserve for the settlement of disputes related to the acquisition of PCM. Represents fair value adjustments to contingent consideration for the acquisitions of PCM and Reams. Represents expenses related to the acquisition of Marquette. Represents non-acquisition severance expense related to UMB-legacy employees as management excludes severance expense from its internal evaluation of Company performance. Severance expense for Marquette-legacy employees is included in item (iii). Represents expenses related to the buy-out and termination of certain marketing and referral agreements in the Company’s institutional investment management business. Tax-exempt interest income has been adjusted to a tax equivalent basis. The amount of such adjustment was an addition to net interest income of $8.7 million, $8.0 million and $6.5 million for the three months ended December 31, 2016, September 30, 2016 and December 31, 2015, respectively, and $31.0 million, $23.8 million and $21.2 million for the years ended December 31, 2016, 2015 and 2014, respectively.

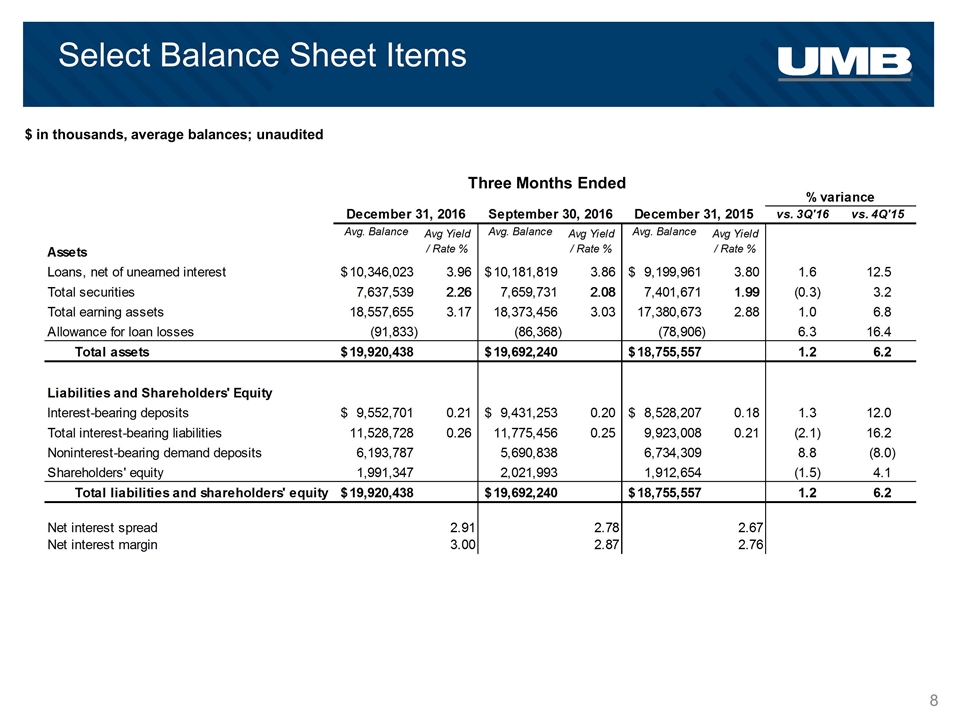

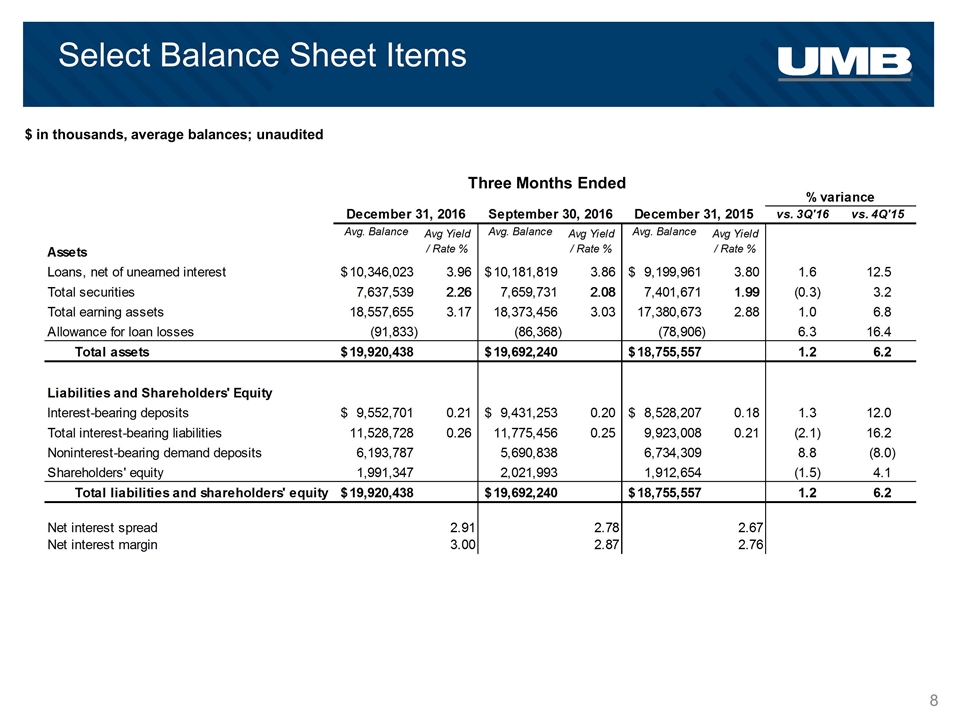

Select Balance Sheet Items $ in thousands, average balances; unaudited Three Months Ended

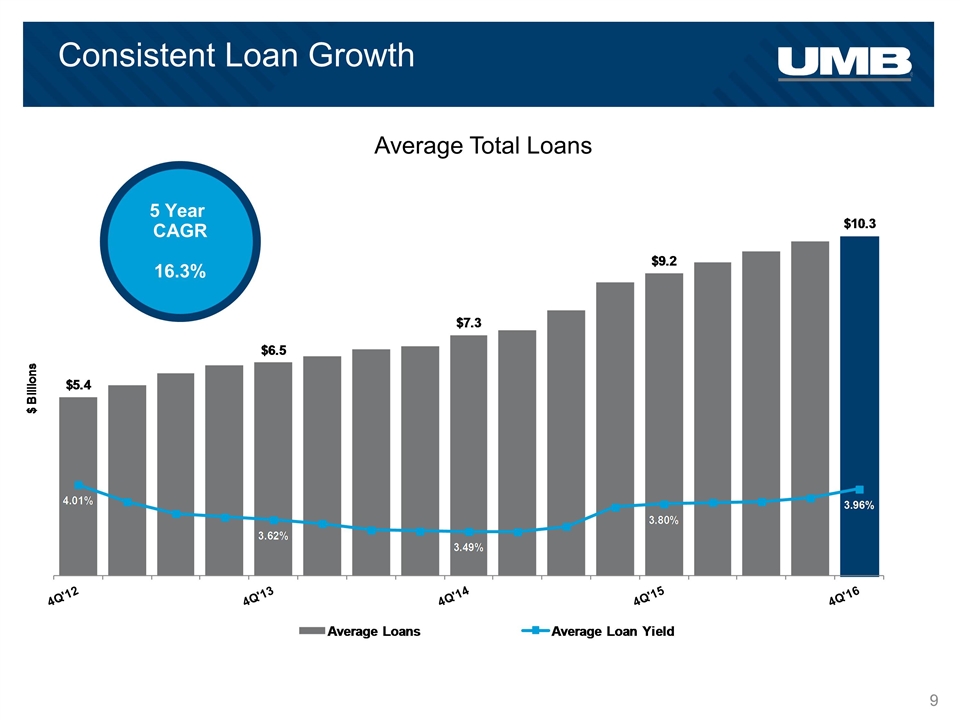

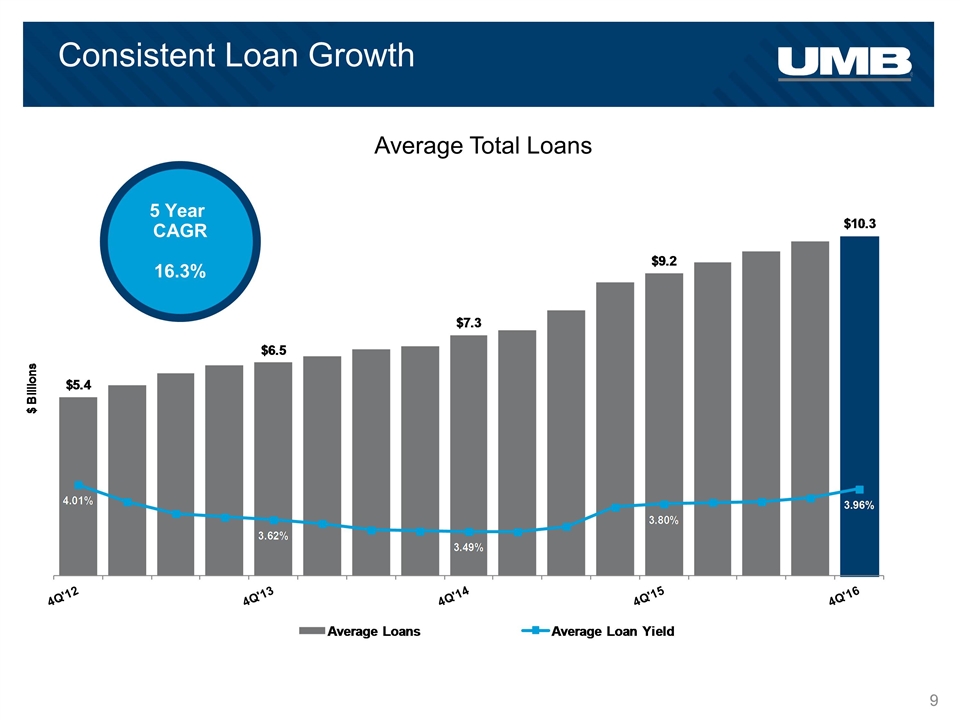

Consistent Loan Growth Average Total Loans 5 Year CAGR 16.3%

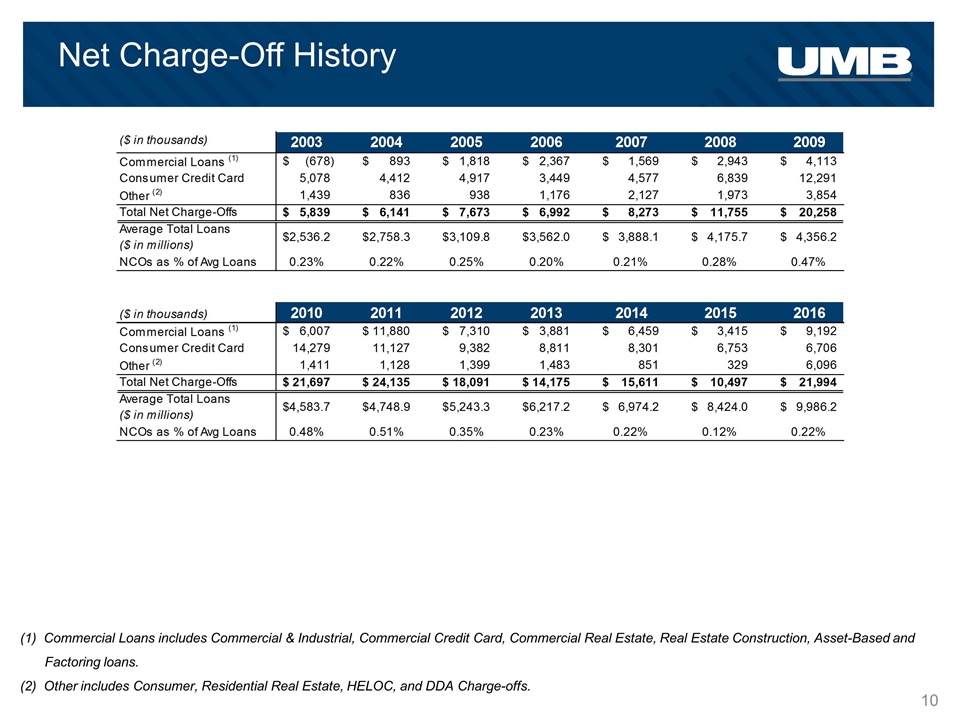

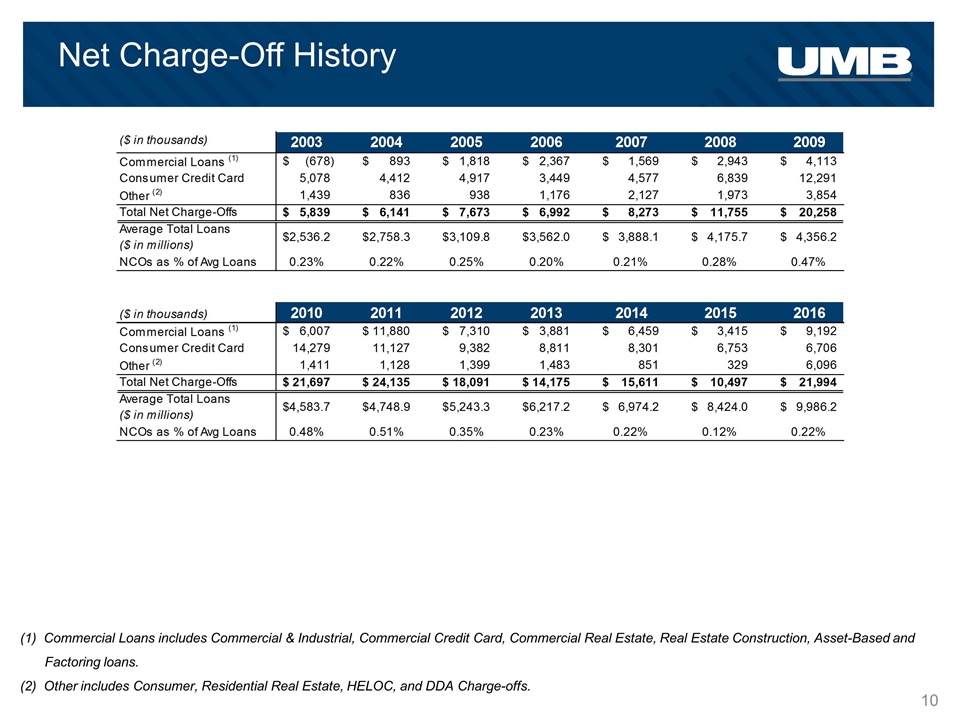

Net Charge-Off History (1) Commercial Loans includes Commercial & Industrial, Commercial Credit Card, Commercial Real Estate, Real Estate Construction, Asset-Based and Factoring loans. (2) Other includes Consumer, Residential Real Estate, HELOC, and DDA Charge-offs.

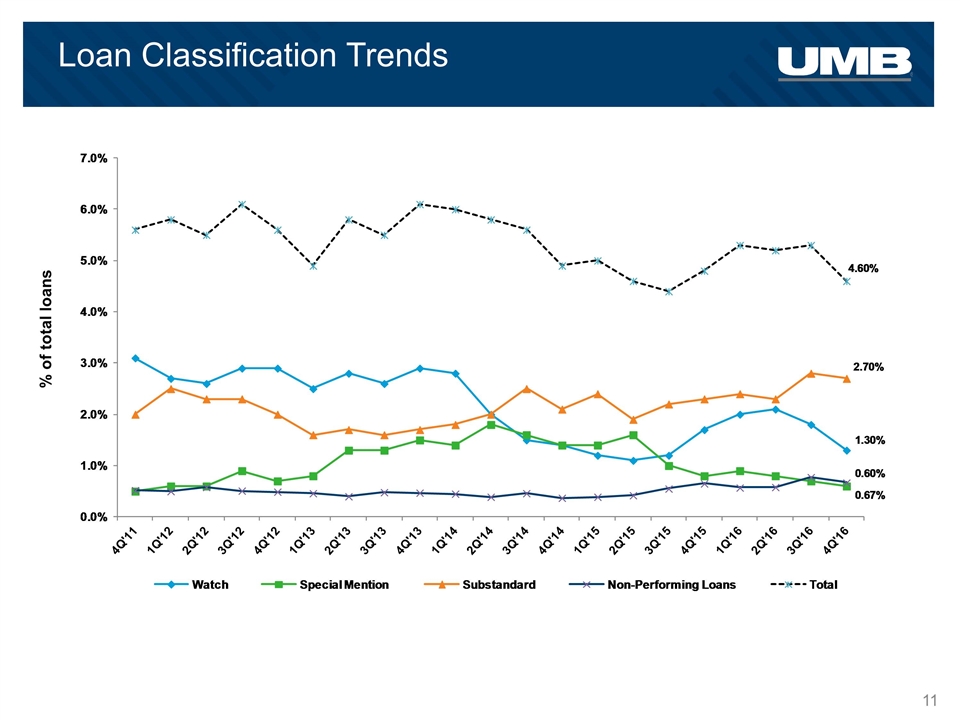

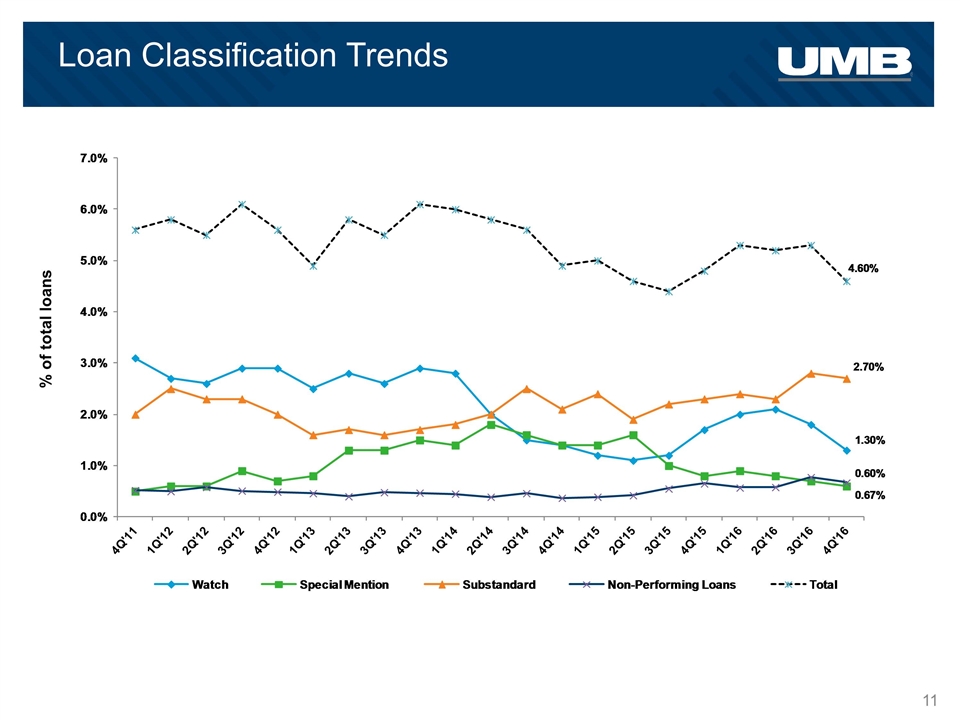

Loan Classification Trends % of total loans

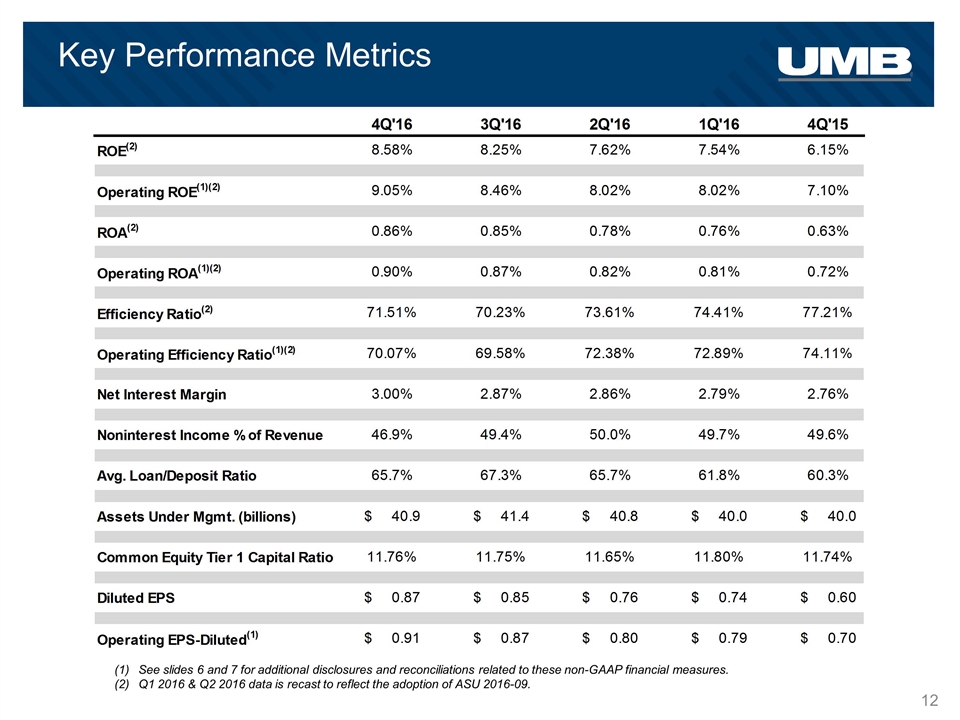

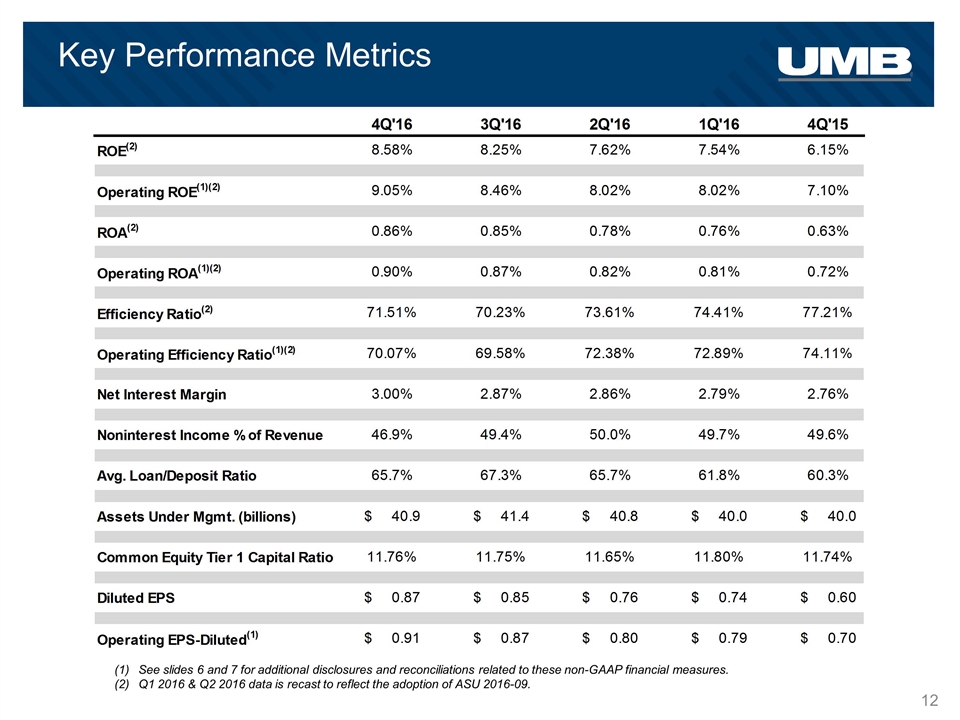

Key Performance Metrics See slides 6 and 7 for additional disclosures and reconciliations related to these non-GAAP financial measures. Q1 2016 & Q2 2016 data is recast to reflect the adoption of ASU 2016-09.

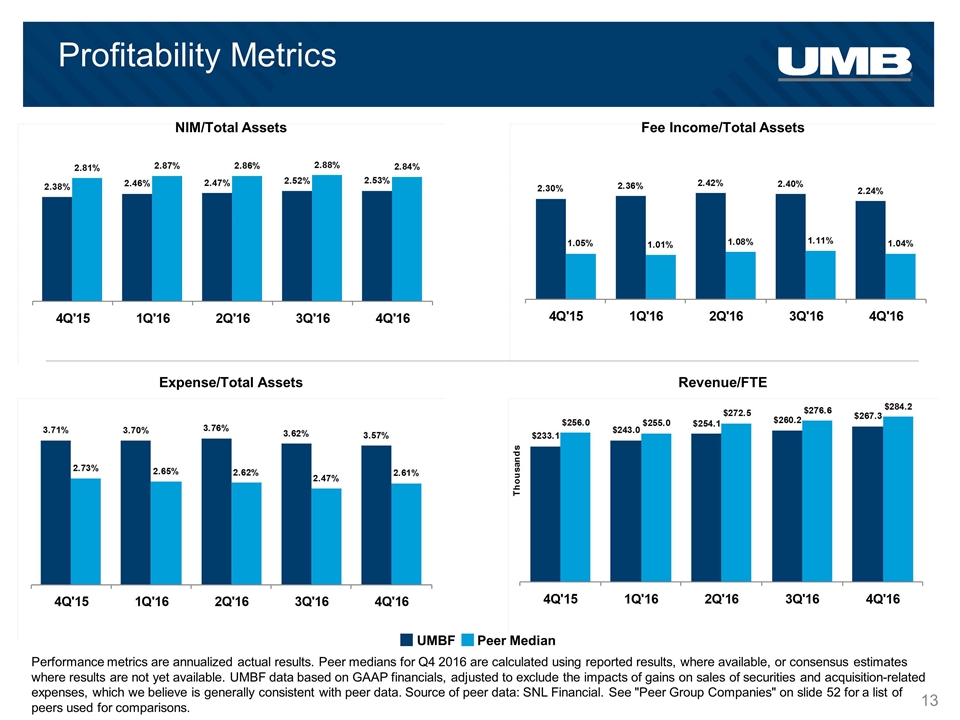

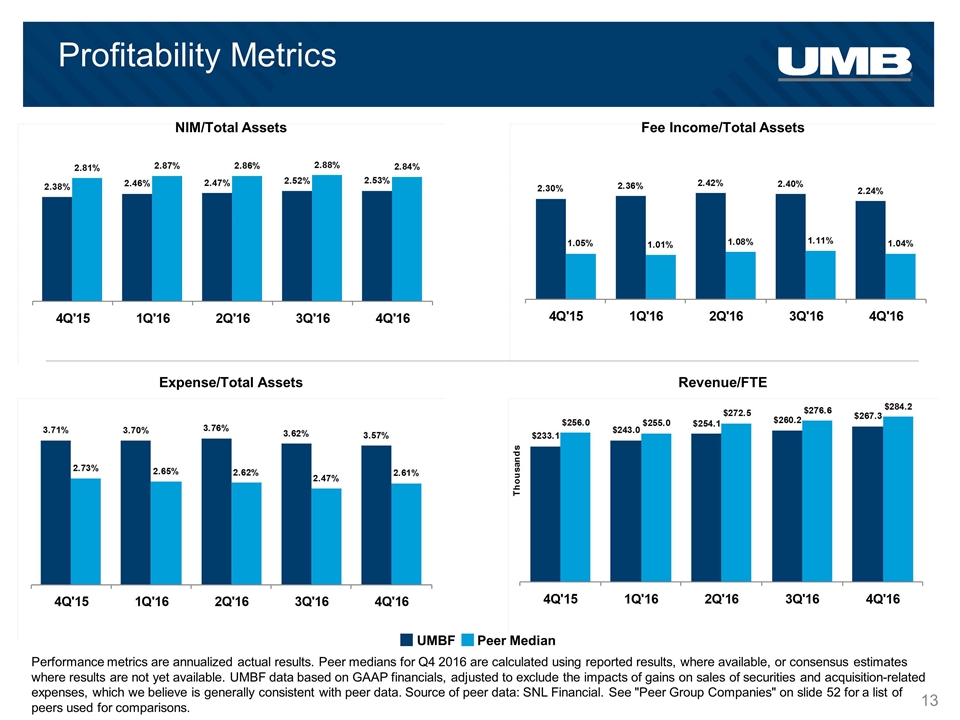

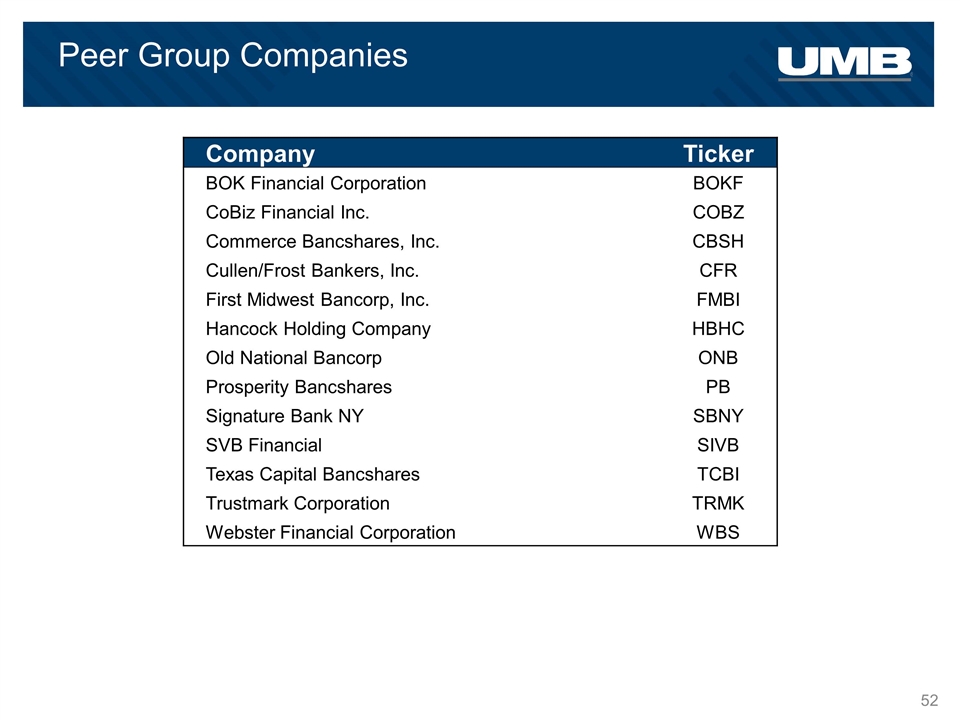

Profitability Metrics NIM/Total Assets Fee Income/Total Assets Expense/Total Assets Revenue/FTE UMBF Peer Median Performance metrics are annualized actual results. Peer medians for Q4 2016 are calculated using reported results, where available, or consensus estimates where results are not yet available. UMBF data based on GAAP financials, adjusted to exclude the impacts of gains on sales of securities and acquisition-related expenses, which we believe is generally consistent with peer data. Source of peer data: SNL Financial. See "Peer Group Companies" on slide 52 for a list of peers used for comparisons.

4Q 2016 Financials

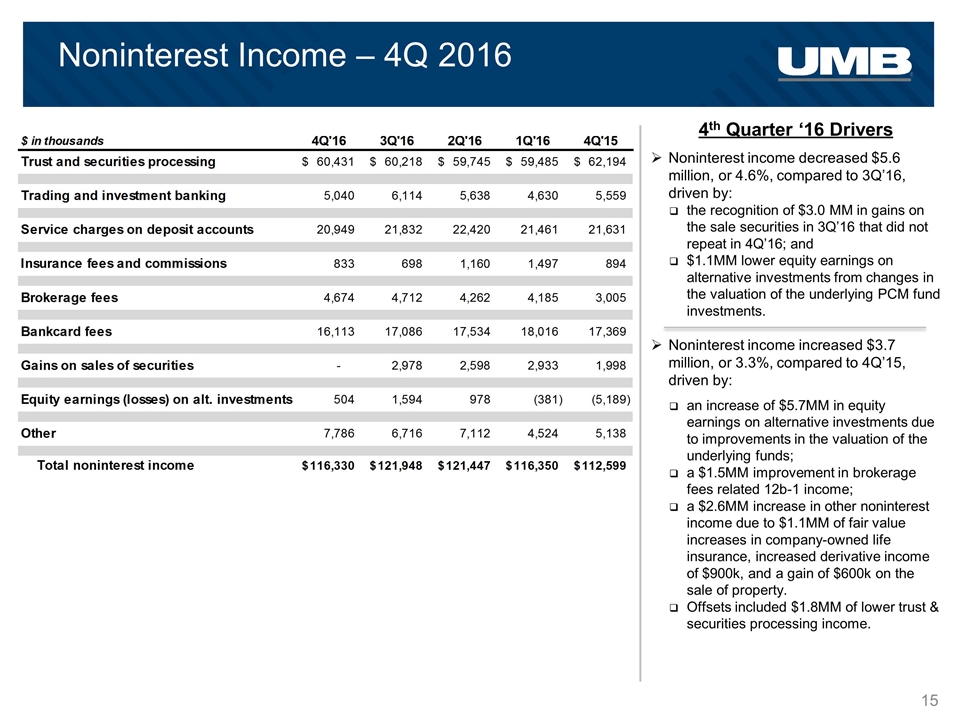

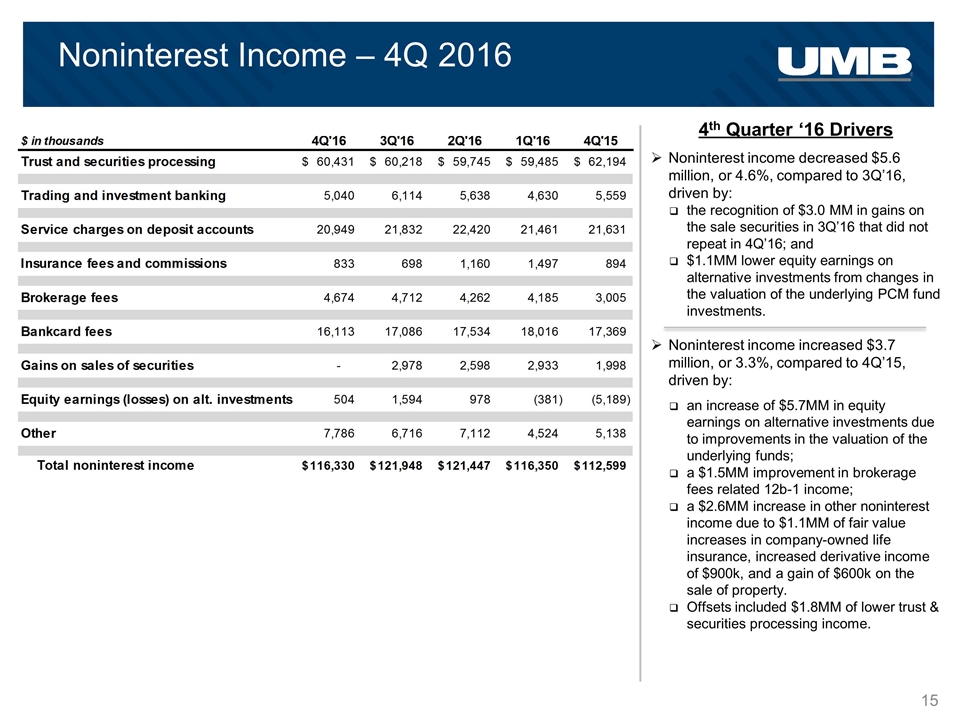

Noninterest Income – 4Q 2016 Noninterest income decreased $5.6 million, or 4.6%, compared to 3Q’16, driven by: the recognition of $3.0 MM in gains on the sale securities in 3Q’16 that did not repeat in 4Q’16; and $1.1MM lower equity earnings on alternative investments from changes in the valuation of the underlying PCM fund investments. Noninterest income increased $3.7 million, or 3.3%, compared to 4Q’15, driven by: an increase of $5.7MM in equity earnings on alternative investments due to improvements in the valuation of the underlying funds; a $1.5MM improvement in brokerage fees related 12b-1 income; a $2.6MM increase in other noninterest income due to $1.1MM of fair value increases in company-owned life insurance, increased derivative income of $900k, and a gain of $600k on the sale of property. Offsets included $1.8MM of lower trust & securities processing income. 4th Quarter ‘16 Drivers

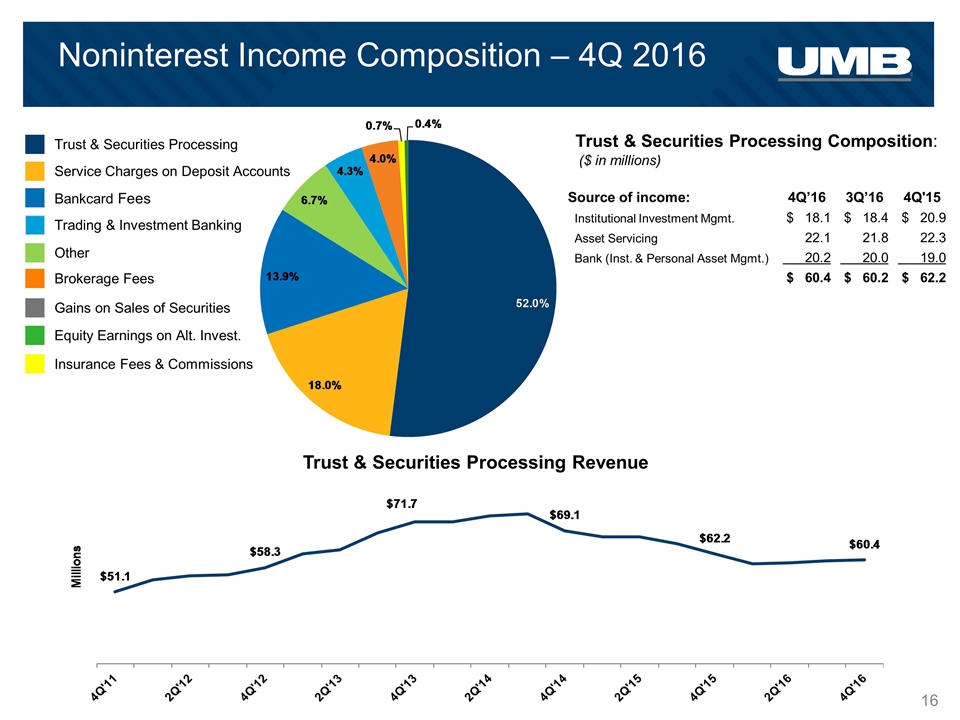

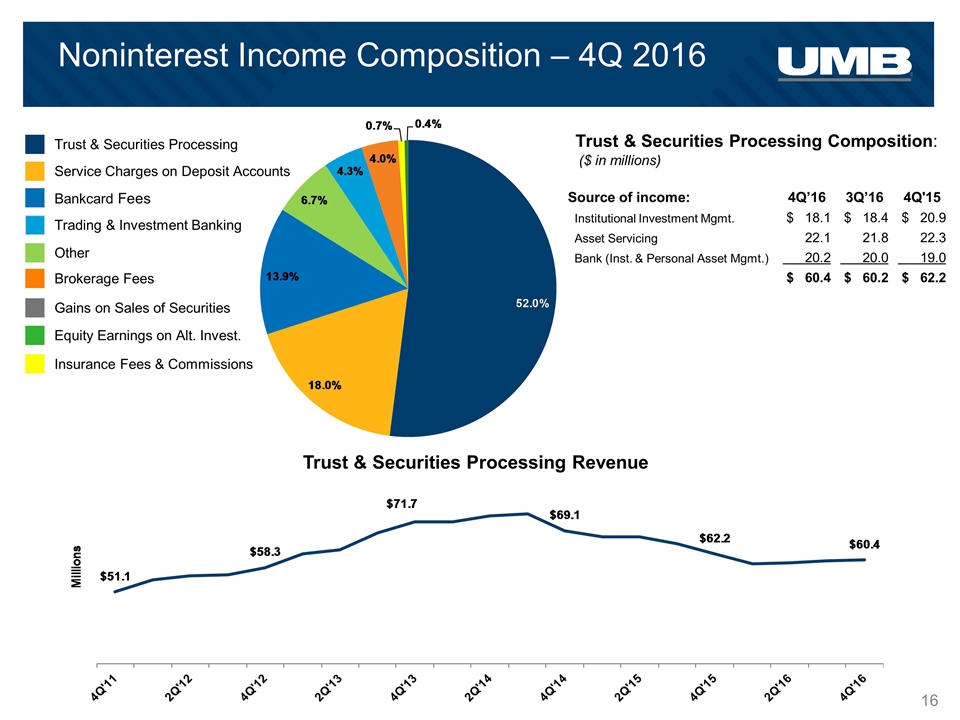

Bankcard Fees Noninterest Income Composition – 4Q 2016 Trust & Securities Processing Revenue Trust & Securities Processing Composition: Service Charges on Deposit Accounts Trust & Securities Processing Gains on Sales of Securities Other Brokerage Fees Trading & Investment Banking ($ in millions) Insurance Fees & Commissions Equity Earnings on Alt. Invest. Source of income: 4Q’16 3Q’16 4Q'15 Institutional Investment Mgmt. $ 18.1 $ 18.4 $ 20.9 Asset Servicing 22.1 21.8 22.3 Bank (Inst. & Personal Asset Mgmt.) 20.2 20.0 19.0 $ 60.4 $ 60.2 $ 62.2

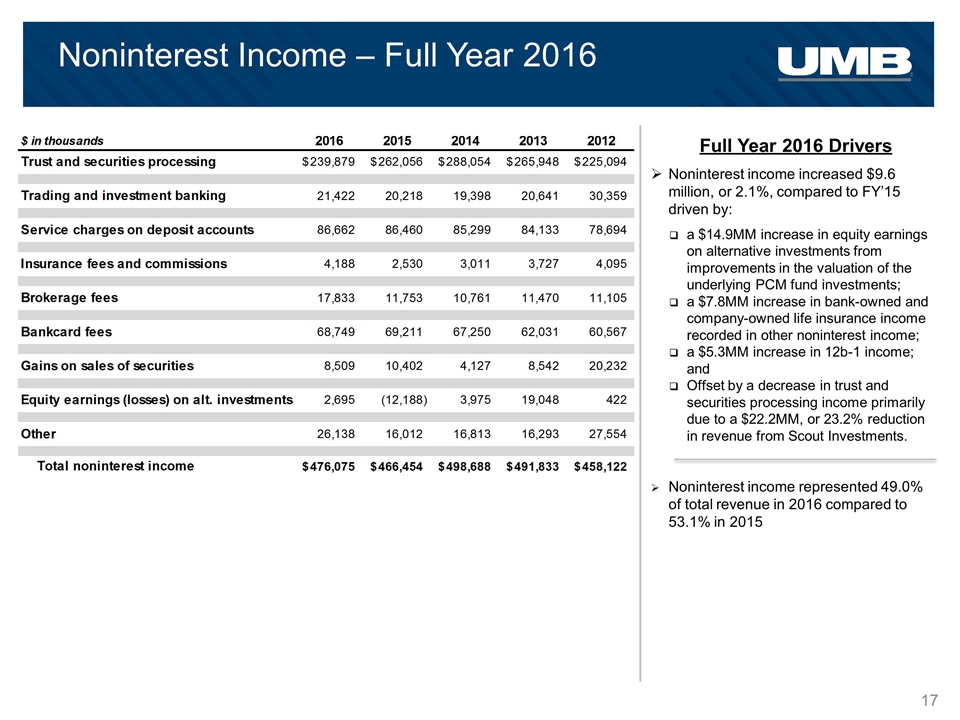

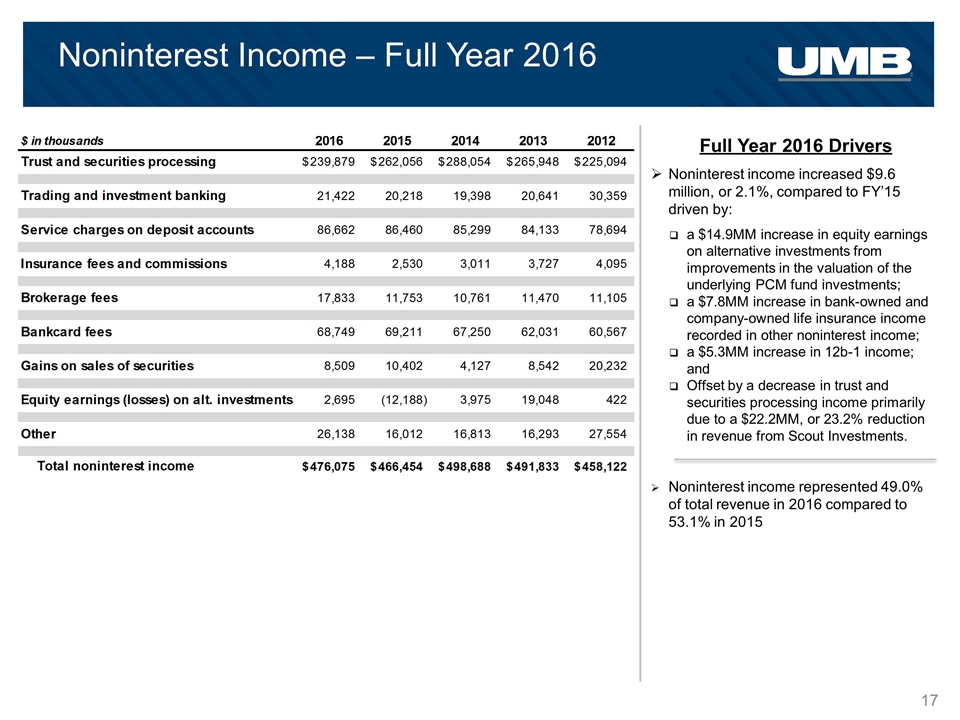

Noninterest Income – Full Year 2016 Noninterest income increased $9.6 million, or 2.1%, compared to FY’15 driven by: a $14.9MM increase in equity earnings on alternative investments from improvements in the valuation of the underlying PCM fund investments; a $7.8MM increase in bank-owned and company-owned life insurance income recorded in other noninterest income; a $5.3MM increase in 12b-1 income; and Offset by a decrease in trust and securities processing income primarily due to a $22.2MM, or 23.2% reduction in revenue from Scout Investments. Noninterest income represented 49.0% of total revenue in 2016 compared to 53.1% in 2015 Full Year 2016 Drivers

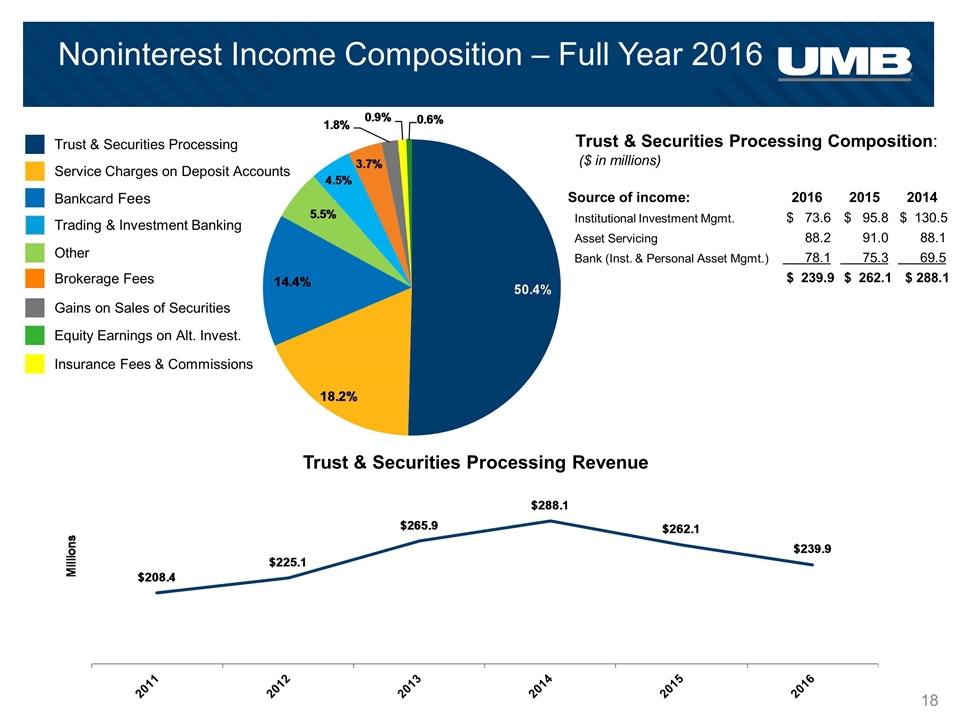

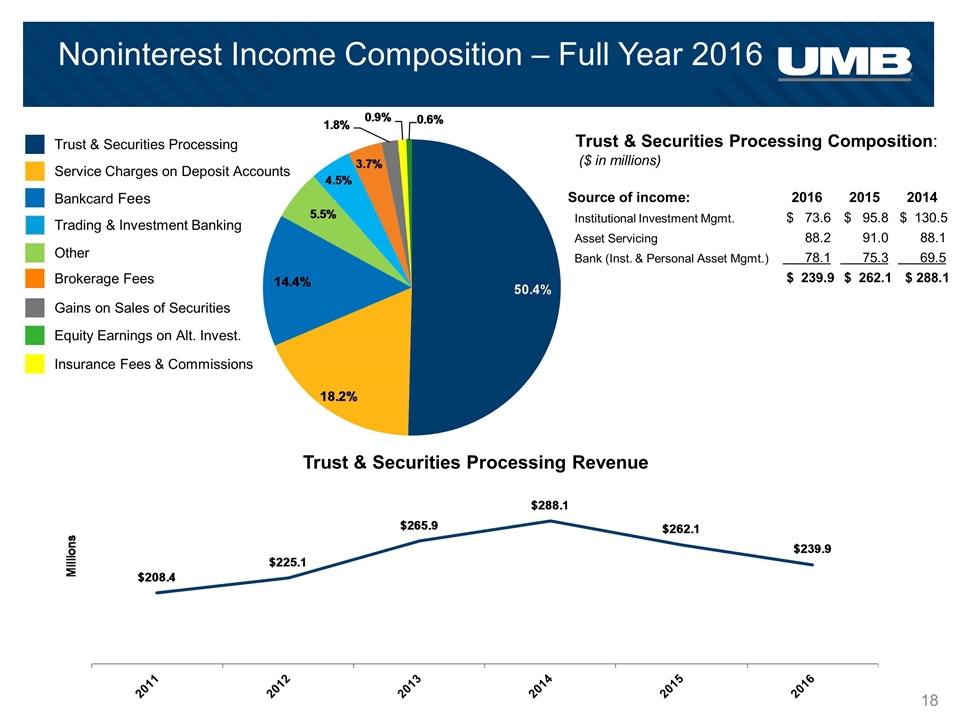

Bankcard Fees Noninterest Income Composition – Full Year 2016 Trust & Securities Processing Revenue Trust & Securities Processing Composition: Service Charges on Deposit Accounts Trust & Securities Processing Gains on Sales of Securities Other Brokerage Fees Trading & Investment Banking ($ in millions) Insurance Fees & Commissions Equity Earnings on Alt. Invest. Source of income: 2016 2015 2014 Institutional Investment Mgmt. $ 73.6 $ 95.8 $ 130.5 Asset Servicing 88.2 91.0 88.1 Bank (Inst. & Personal Asset Mgmt.) 78.1 75.3 69.5 $ 239.9 $ 262.1 $ 288.1

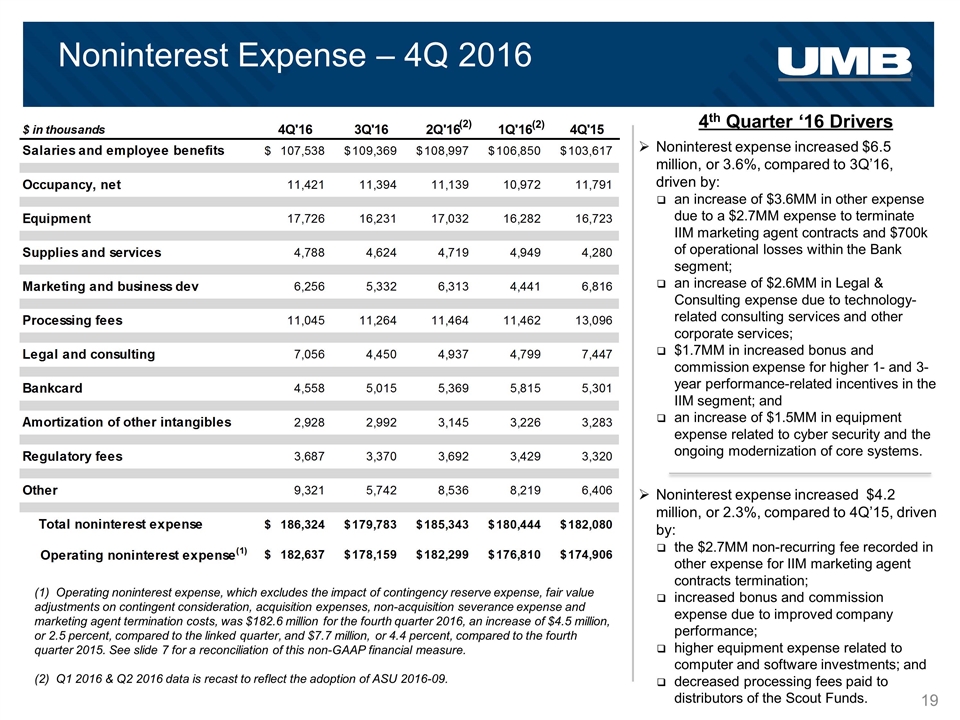

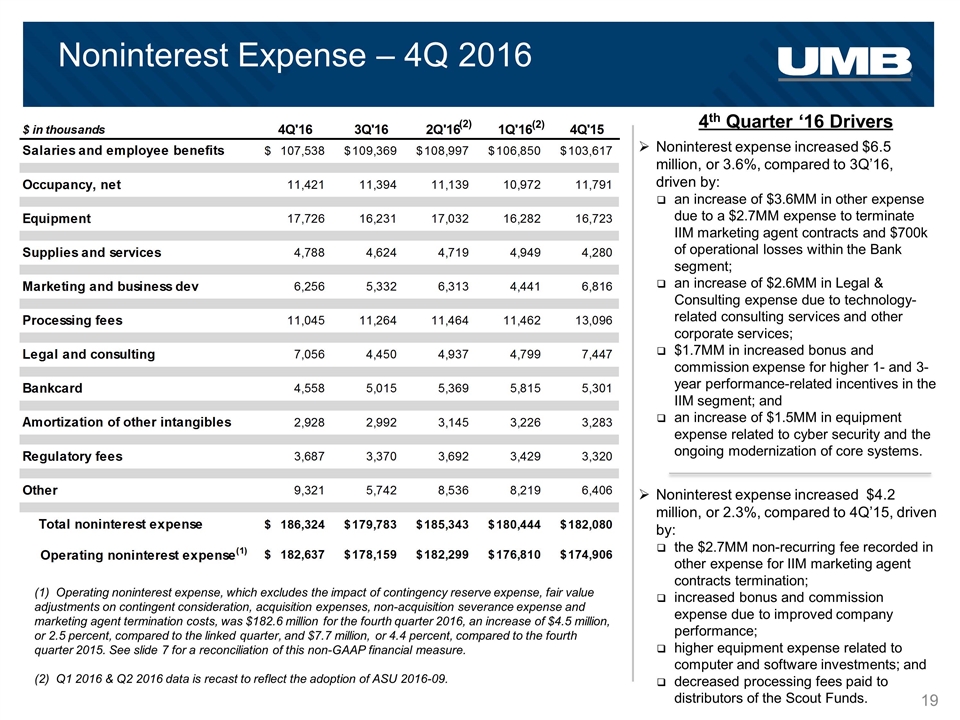

Noninterest expense increased $6.5 million, or 3.6%, compared to 3Q’16, driven by: an increase of $3.6MM in other expense due to a $2.7MM expense to terminate IIM marketing agent contracts and $700k of operational losses within the Bank segment; an increase of $2.6MM in Legal & Consulting expense due to technology-related consulting services and other corporate services; $1.7MM in increased bonus and commission expense for higher 1- and 3-year performance-related incentives in the IIM segment; and an increase of $1.5MM in equipment expense related to cyber security and the ongoing modernization of core systems. Noninterest Expense – 4Q 2016 4th Quarter ‘16 Drivers (1) Operating noninterest expense, which excludes the impact of contingency reserve expense, fair value adjustments on contingent consideration, acquisition expenses, non-acquisition severance expense and marketing agent termination costs, was $182.6 million for the fourth quarter 2016, an increase of $4.5 million, or 2.5 percent, compared to the linked quarter, and $7.7 million, or 4.4 percent, compared to the fourth quarter 2015. See slide 7 for a reconciliation of this non-GAAP financial measure. (2) Q1 2016 & Q2 2016 data is recast to reflect the adoption of ASU 2016-09. (2) (2) Noninterest expense increased $4.2 million, or 2.3%, compared to 4Q’15, driven by: the $2.7MM non-recurring fee recorded in other expense for IIM marketing agent contracts termination; increased bonus and commission expense due to improved company performance; higher equipment expense related to computer and software investments; and decreased processing fees paid to distributors of the Scout Funds.

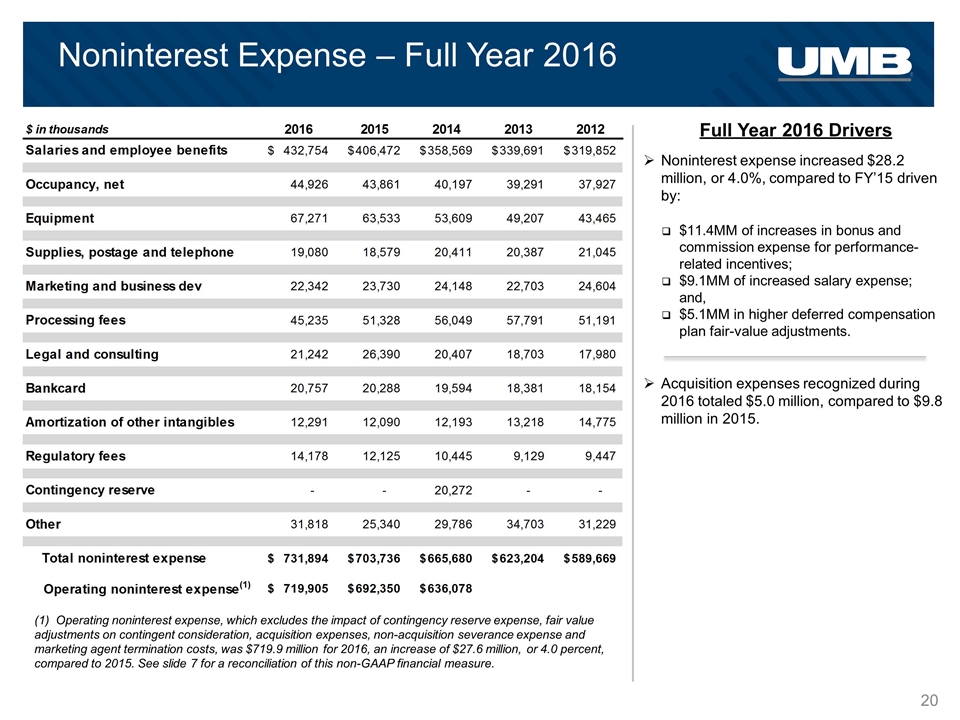

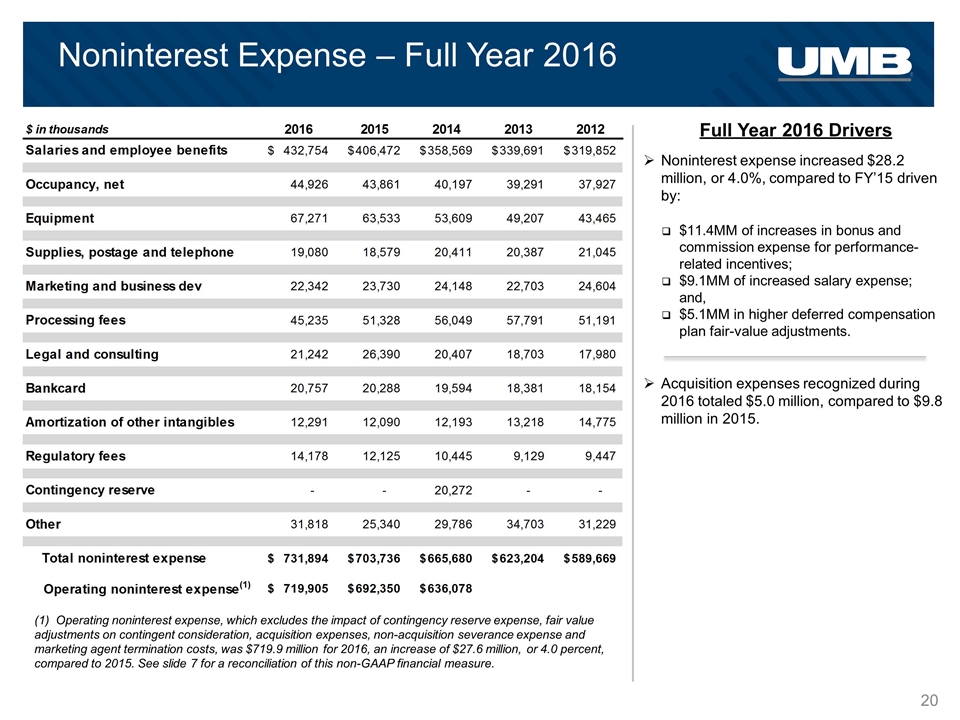

Noninterest expense increased $28.2 million, or 4.0%, compared to FY’15 driven by: $11.4MM of increases in bonus and commission expense for performance-related incentives; $9.1MM of increased salary expense; and, $5.1MM in higher deferred compensation plan fair-value adjustments. Acquisition expenses recognized during 2016 totaled $5.0 million, compared to $9.8 million in 2015. Noninterest Expense – Full Year 2016 Full Year 2016 Drivers (1) Operating noninterest expense, which excludes the impact of contingency reserve expense, fair value adjustments on contingent consideration, acquisition expenses, non-acquisition severance expense and marketing agent termination costs, was $719.9 million for 2016, an increase of $27.6 million, or 4.0 percent, compared to 2015. See slide 7 for a reconciliation of this non-GAAP financial measure.

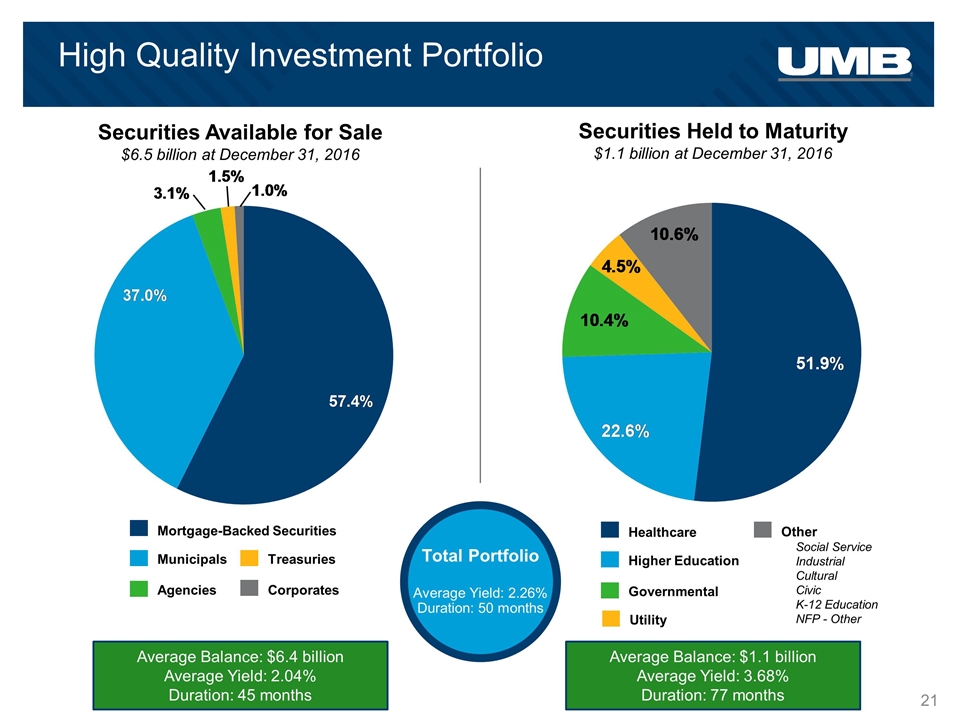

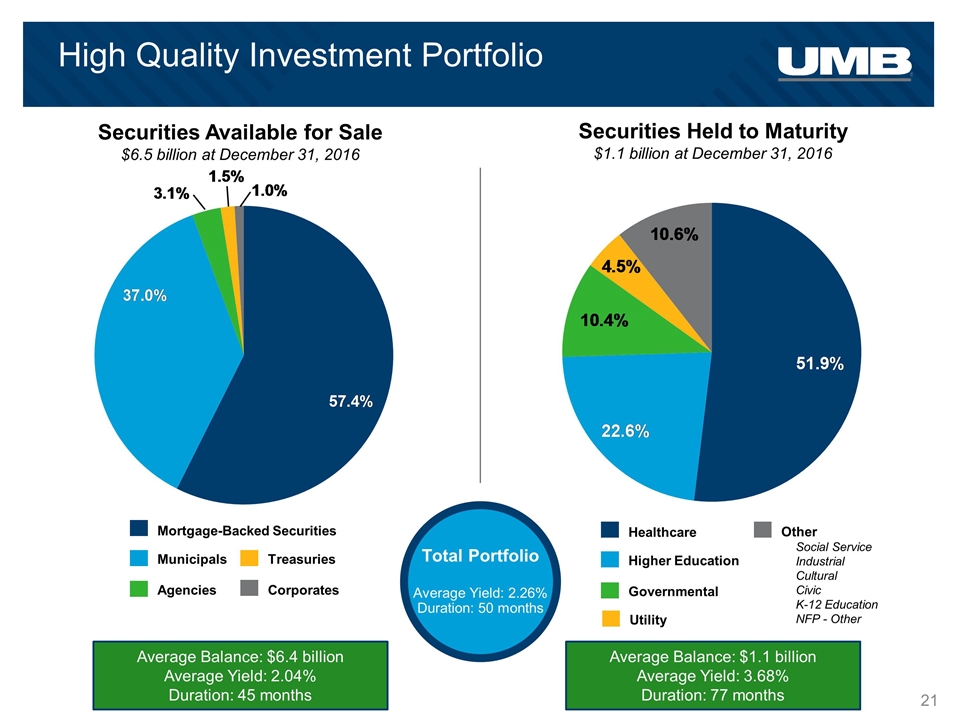

Securities Available for Sale $6.5 billion at December 31, 2016 High Quality Investment Portfolio Agencies Corporates Municipals Mortgage-Backed Securities Treasuries (2) (1) Securities Held to Maturity $1.1 billion at December 31, 2016 Governmental Other Higher Education Healthcare Utility Social Service Industrial Cultural Civic K-12 Education NFP - Other Average Balance: $6.4 billion Average Yield: 2.04% Duration: 45 months Average Balance: $1.1 billion Average Yield: 3.68% Duration: 77 months Total Portfolio Average Yield: 2.26% Duration: 50 months

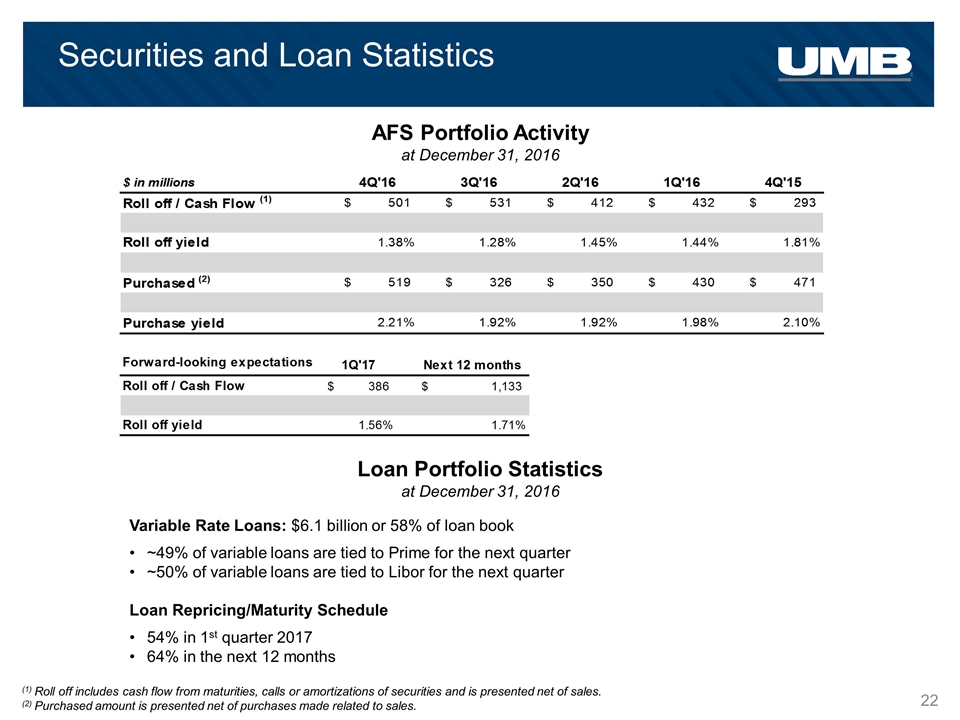

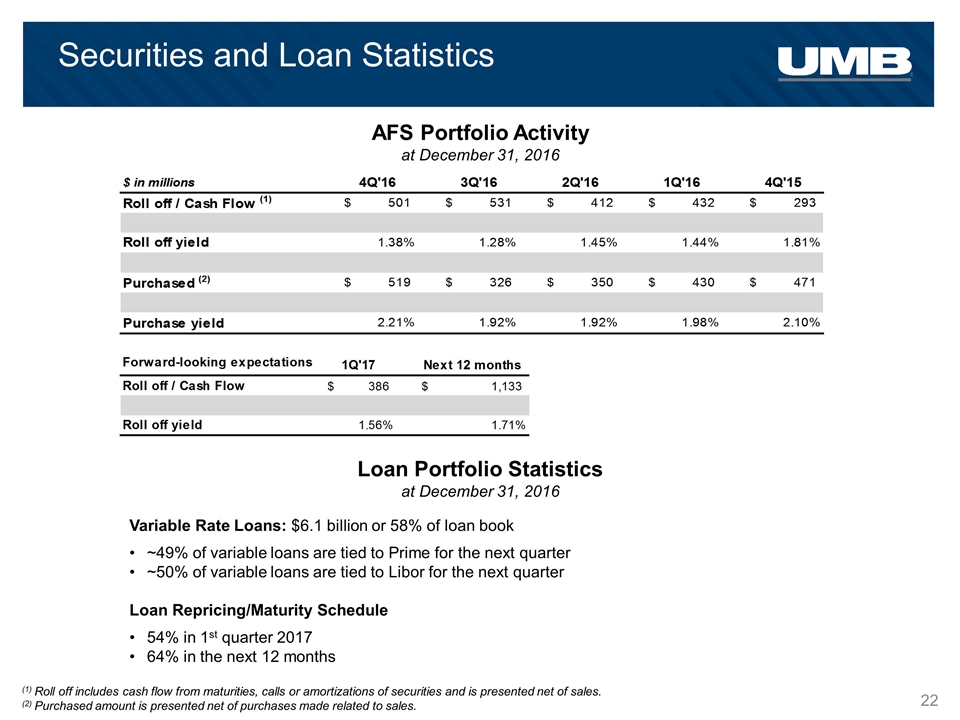

Securities and Loan Statistics AFS Portfolio Activity at December 31, 2016 (1) Roll off includes cash flow from maturities, calls or amortizations of securities and is presented net of sales. (2) Purchased amount is presented net of purchases made related to sales. Loan Portfolio Statistics at December 31, 2016 Variable Rate Loans: $6.1 billion or 58% of loan book ~49% of variable loans are tied to Prime for the next quarter ~50% of variable loans are tied to Libor for the next quarter Loan Repricing/Maturity Schedule 54% in 1st quarter 2017 64% in the next 12 months

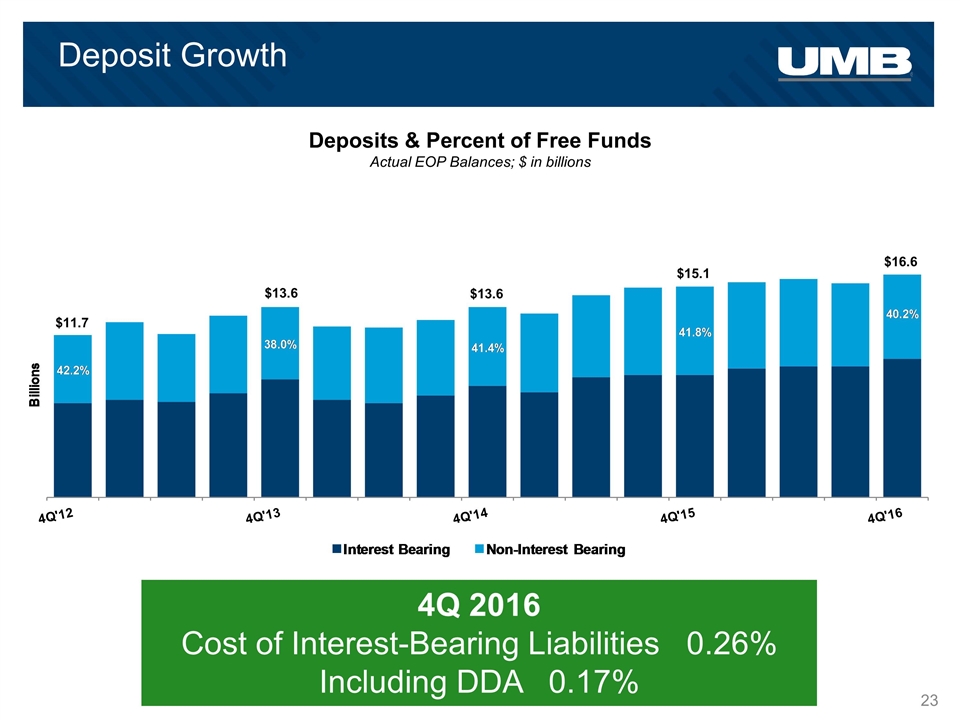

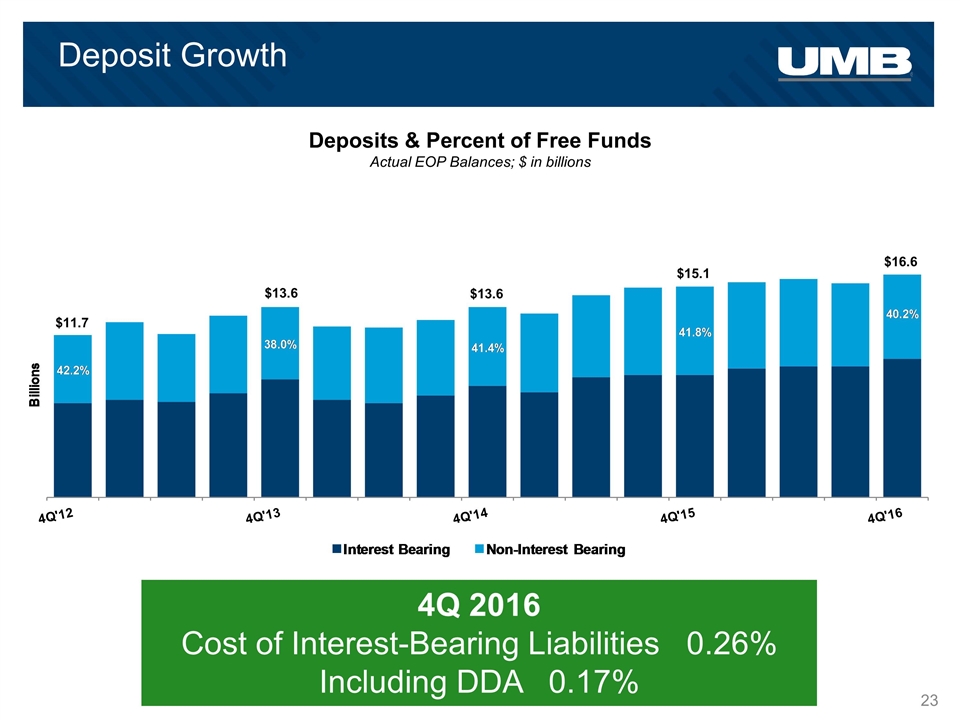

Deposit Growth Deposits & Percent of Free Funds Actual EOP Balances; $ in billions 4Q 2016 Cost of Interest-Bearing Liabilities 0.26% Including DDA 0.17% $11.7 $13.6 $13.6 $15.1 $16.6

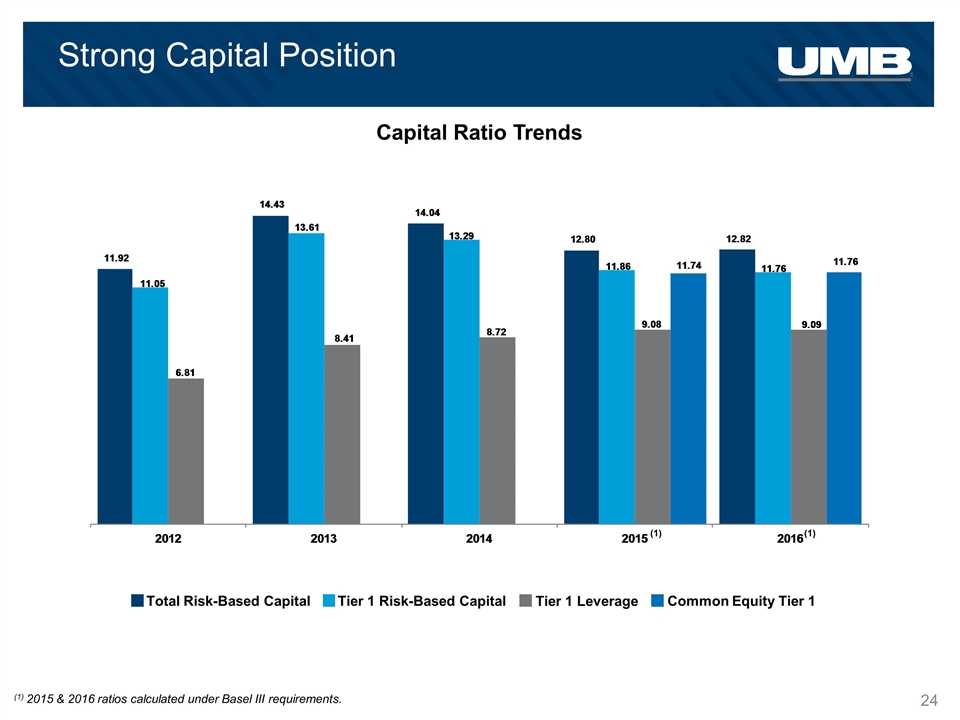

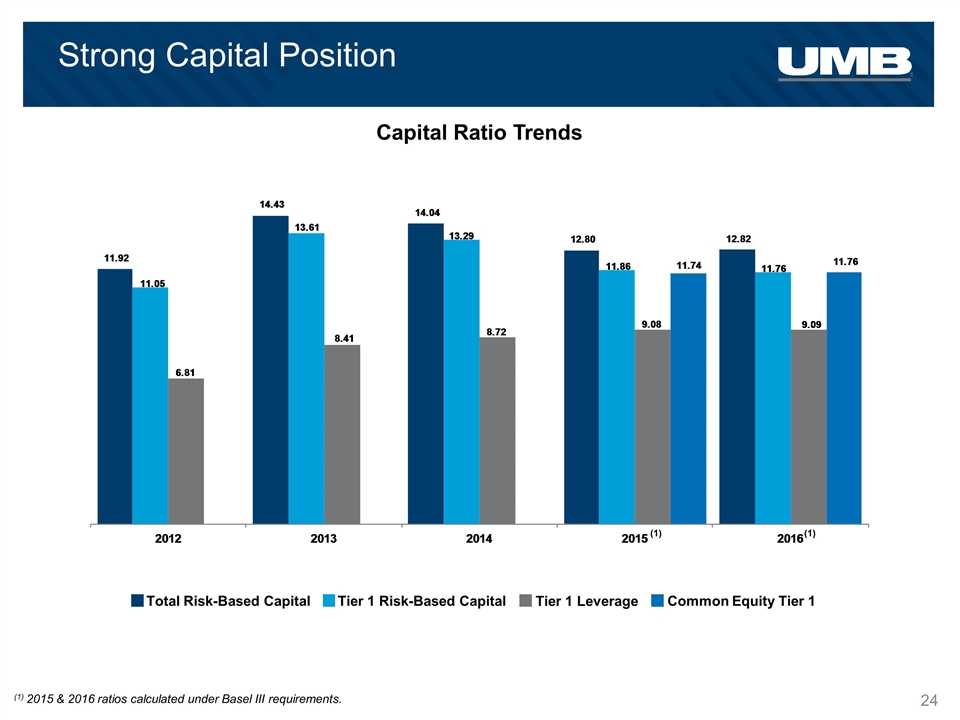

Strong Capital Position Capital Ratio Trends (1) 2015 & 2016 ratios calculated under Basel III requirements. Total Risk-Based Capital Tier 1 Risk-Based Capital Tier 1 Leverage Common Equity Tier 1 (1) (1)

Business Segment Updates

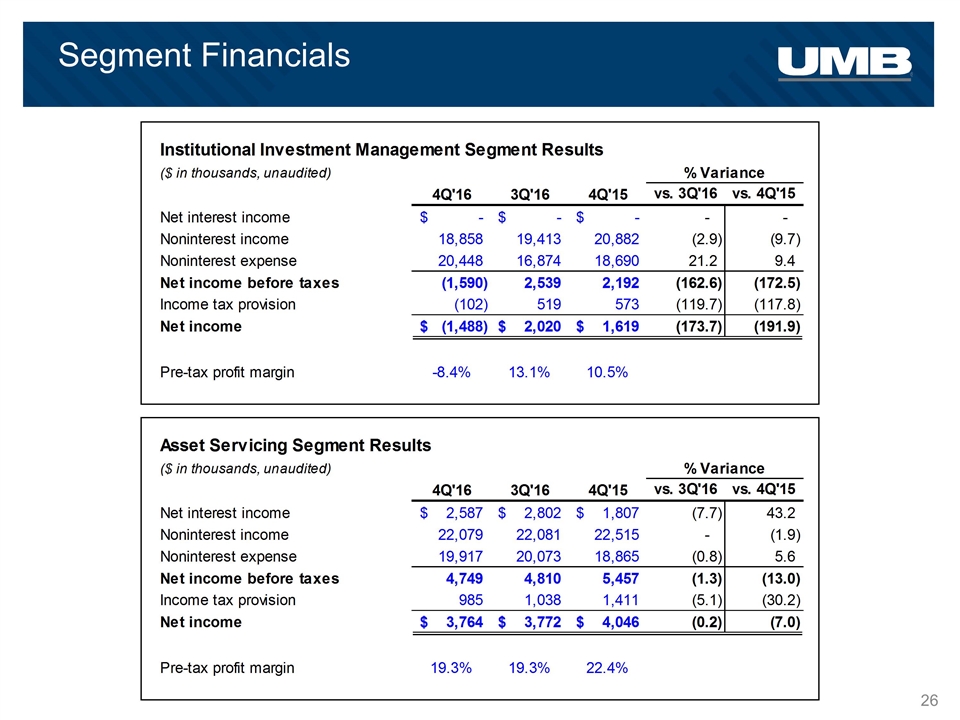

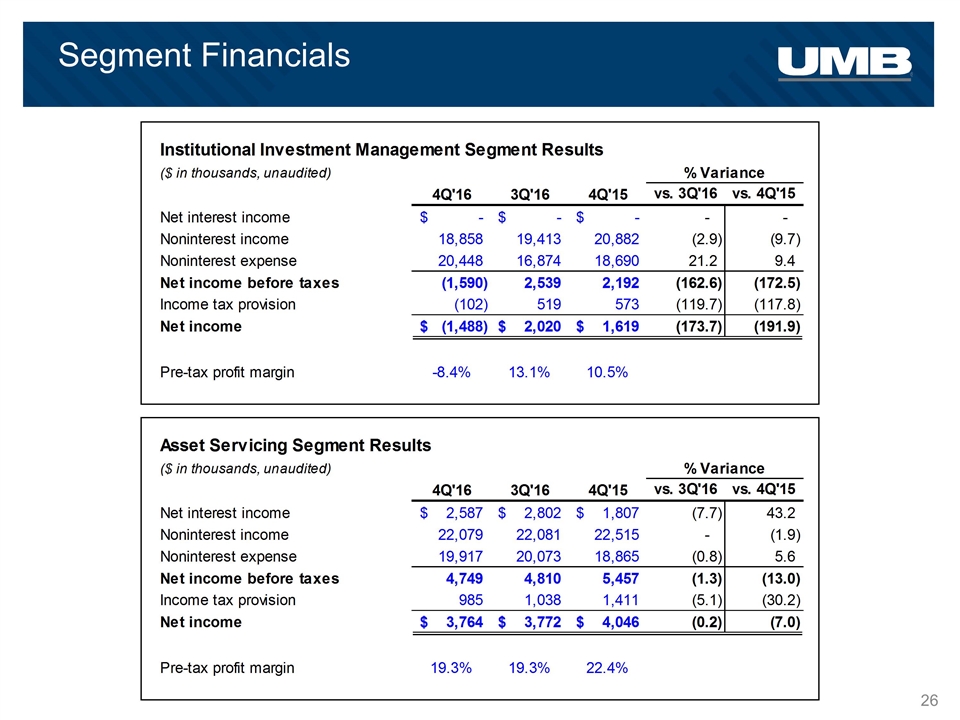

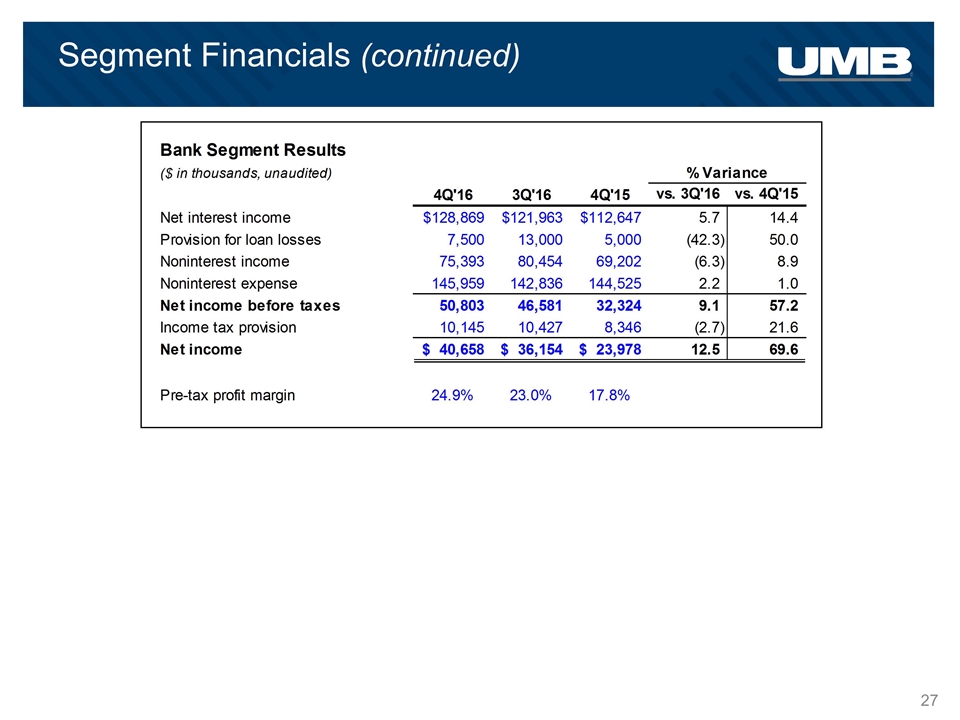

Segment Financials

Segment Financials (continued)

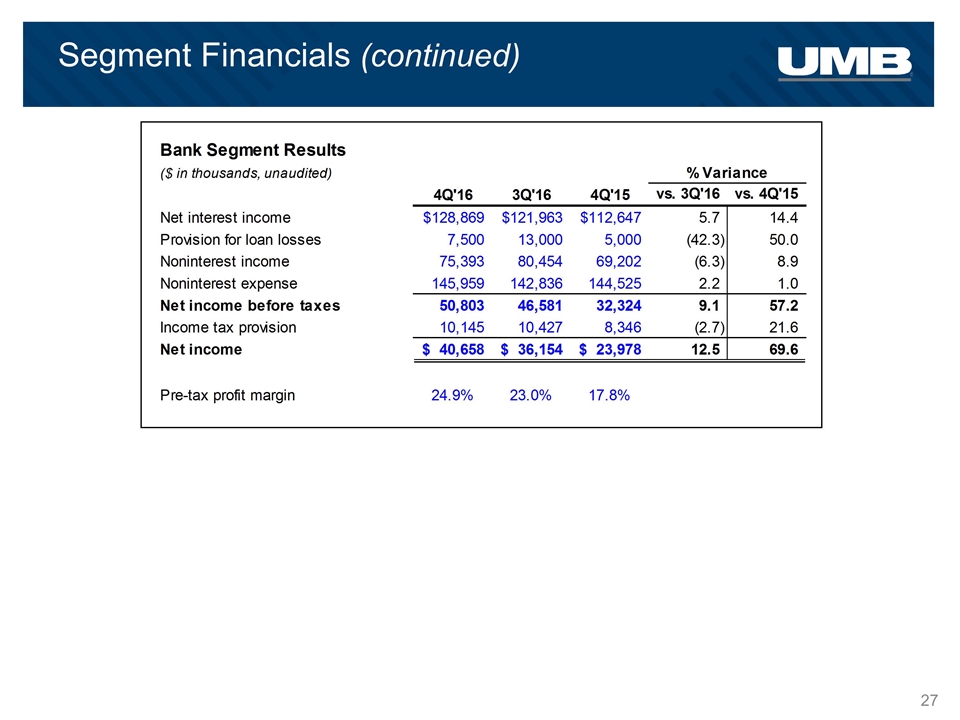

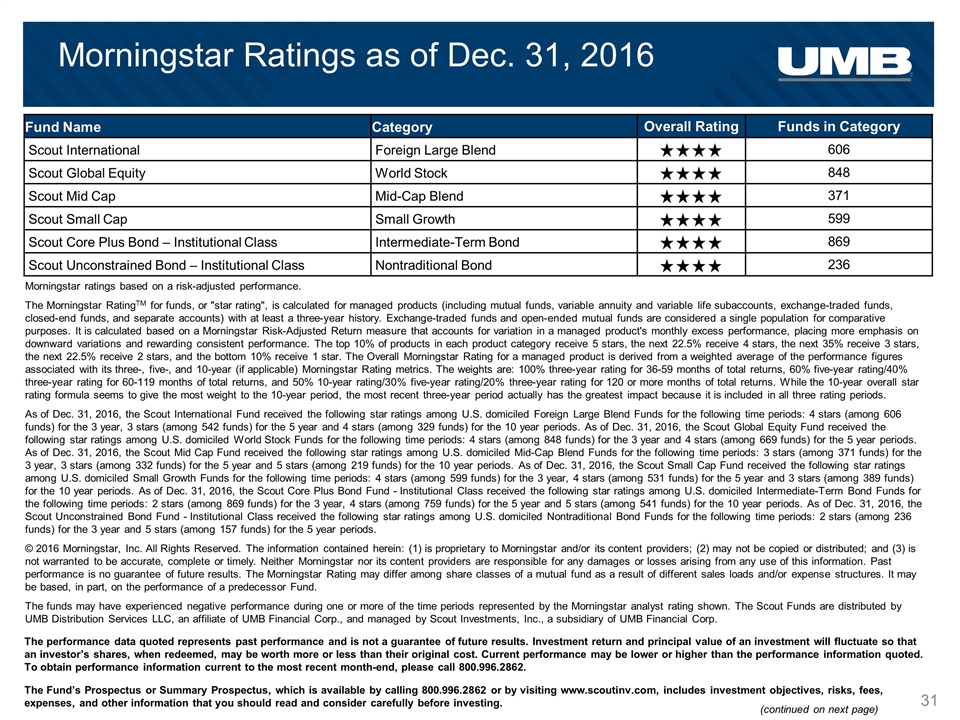

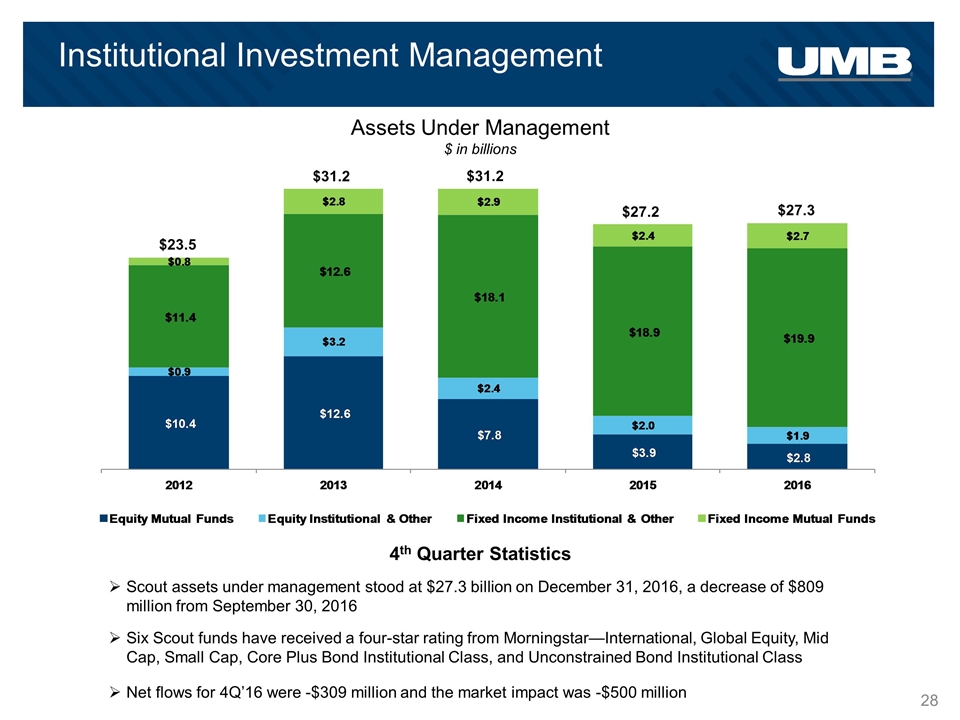

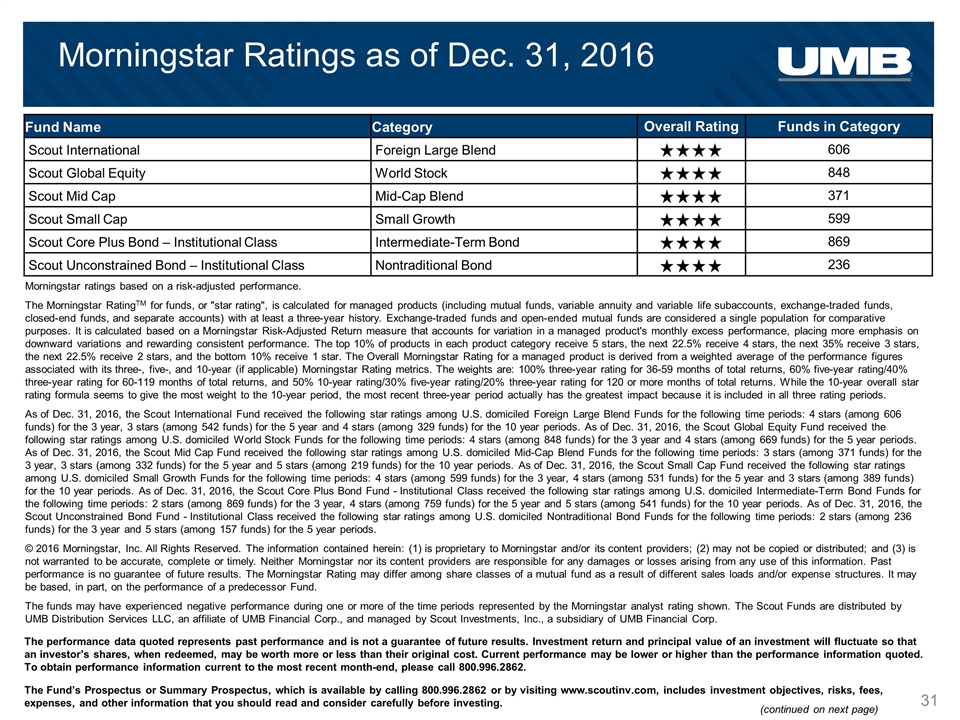

$27.3 $23.5 $31.2 Institutional Investment Management $31.2 $27.2 Assets Under Management $ in billions Scout assets under management stood at $27.3 billion on December 31, 2016, a decrease of $809 million from September 30, 2016 Six Scout funds have received a four-star rating from Morningstar—International, Global Equity, Mid Cap, Small Cap, Core Plus Bond Institutional Class, and Unconstrained Bond Institutional Class Net flows for 4Q’16 were -$309 million and the market impact was -$500 million 4th Quarter Statistics

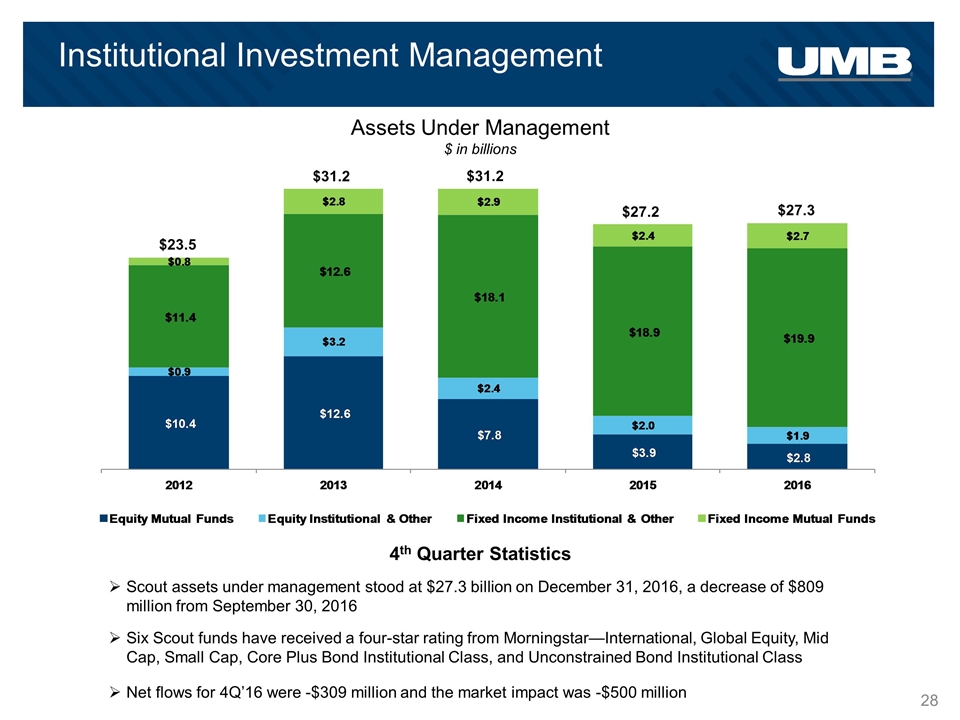

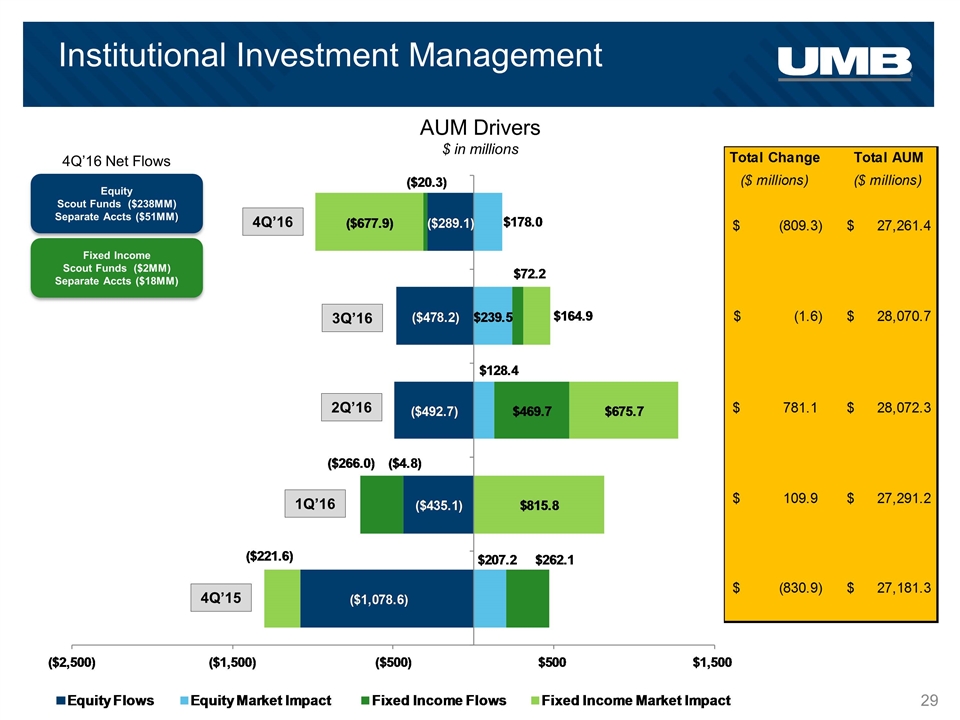

AUM Drivers $ in millions Institutional Investment Management 4Q’16 3Q’16 2Q’16 1Q’16 4Q’15 Equity Scout Funds ($238MM) Separate Accts ($51MM) Fixed Income Scout Funds ($2MM) Separate Accts ($18MM) 4Q’16 Net Flows

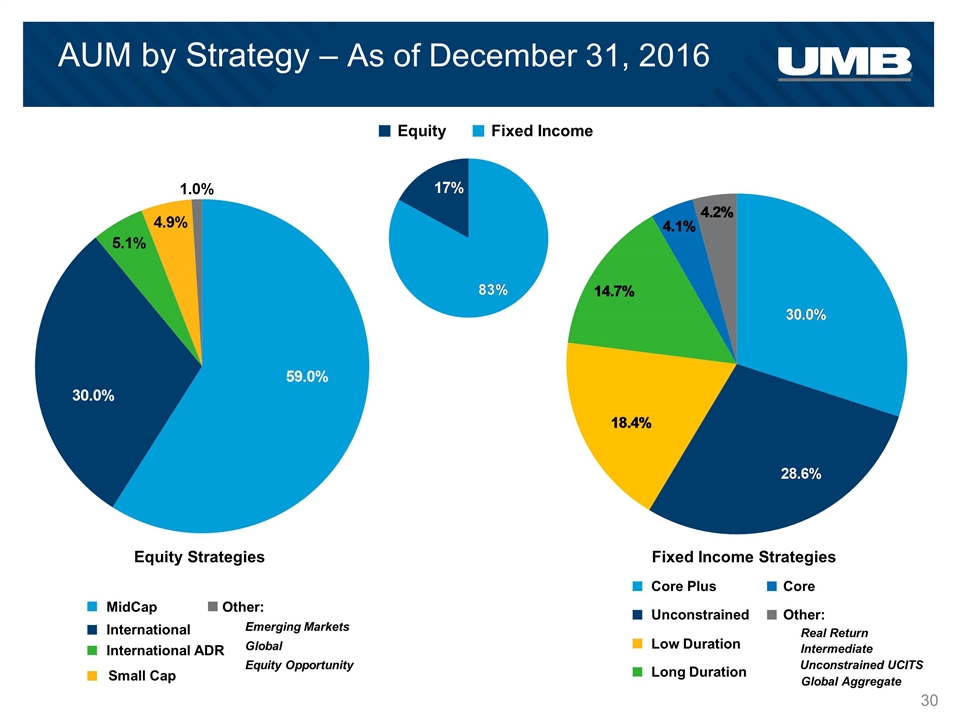

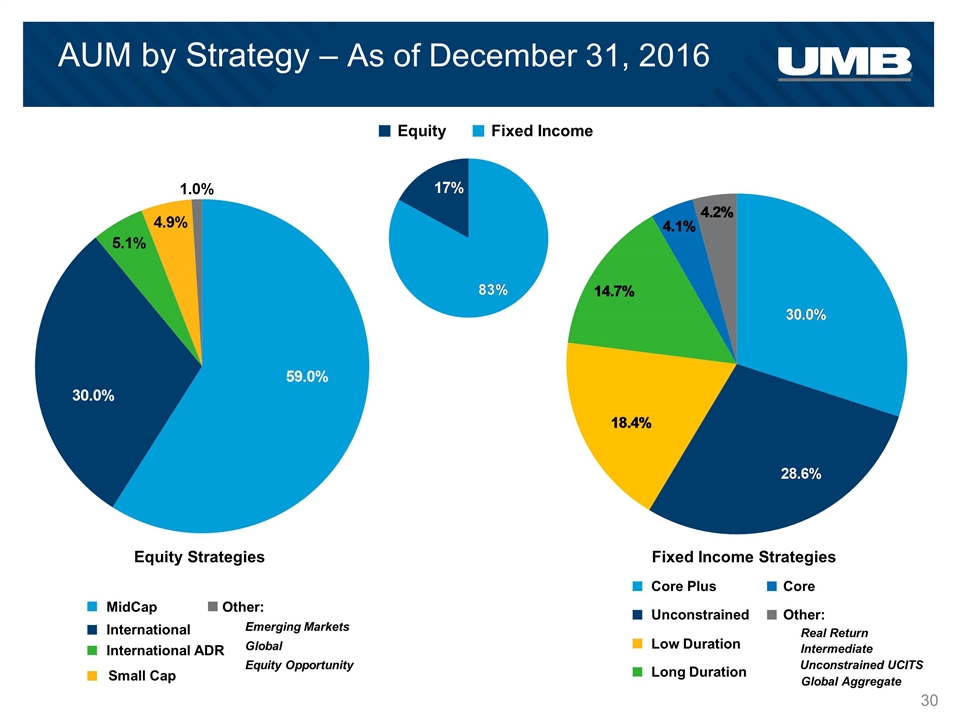

AUM by Strategy – As of December 31, 2016 Equity Fixed Income Equity Strategies International MidCap International ADR Emerging Markets Global Small Cap Other: Equity Opportunity Fixed Income Strategies Core Plus Low Duration Long Duration Core Real Return Unconstrained Intermediate Other: Global Aggregate Unconstrained UCITS

Morningstar Ratings as of Dec. 31, 2016 Fund Name Category Overall Rating Funds in Category Scout International Foreign Large Blend 606 Scout Global Equity World Stock 848 Scout Mid Cap Mid-Cap Blend 371 Scout Small Cap Small Growth 599 Scout Core Plus Bond – Institutional Class Intermediate-Term Bond 869 Scout Unconstrained Bond – Institutional Class Nontraditional Bond 236 Morningstar ratings based on a risk-adjusted performance. The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. As of Dec. 31, 2016, the Scout International Fund received the following star ratings among U.S. domiciled Foreign Large Blend Funds for the following time periods: 4 stars (among 606 funds) for the 3 year, 3 stars (among 542 funds) for the 5 year and 4 stars (among 329 funds) for the 10 year periods. As of Dec. 31, 2016, the Scout Global Equity Fund received the following star ratings among U.S. domiciled World Stock Funds for the following time periods: 4 stars (among 848 funds) for the 3 year and 4 stars (among 669 funds) for the 5 year periods. As of Dec. 31, 2016, the Scout Mid Cap Fund received the following star ratings among U.S. domiciled Mid-Cap Blend Funds for the following time periods: 3 stars (among 371 funds) for the 3 year, 3 stars (among 332 funds) for the 5 year and 5 stars (among 219 funds) for the 10 year periods. As of Dec. 31, 2016, the Scout Small Cap Fund received the following star ratings among U.S. domiciled Small Growth Funds for the following time periods: 4 stars (among 599 funds) for the 3 year, 4 stars (among 531 funds) for the 5 year and 3 stars (among 389 funds) for the 10 year periods. As of Dec. 31, 2016, the Scout Core Plus Bond Fund - Institutional Class received the following star ratings among U.S. domiciled Intermediate-Term Bond Funds for the following time periods: 2 stars (among 869 funds) for the 3 year, 4 stars (among 759 funds) for the 5 year and 5 stars (among 541 funds) for the 10 year periods. As of Dec. 31, 2016, the Scout Unconstrained Bond Fund - Institutional Class received the following star ratings among U.S. domiciled Nontraditional Bond Funds for the following time periods: 2 stars (among 236 funds) for the 3 year and 5 stars (among 157 funds) for the 5 year periods. © 2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The Morningstar Rating may differ among share classes of a mutual fund as a result of different sales loads and/or expense structures. It may be based, in part, on the performance of a predecessor Fund. The funds may have experienced negative performance during one or more of the time periods represented by the Morningstar analyst rating shown. The Scout Funds are distributed by UMB Distribution Services LLC, an affiliate of UMB Financial Corp., and managed by Scout Investments, Inc., a subsidiary of UMB Financial Corp. The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 800.996.2862. The Fund’s Prospectus or Summary Prospectus, which is available by calling 800.996.2862 or by visiting www.scoutinv.com, includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. (continued on next page)

Important Disclosures 1. The returns for periods prior to April 1, 2005 do not reflect the fees and expenses in effect as of April 1, 2005. If the new fees and expenses and the Advisor’s agreement to limit total Fund expenses were in effect for the periods shown, returns would have been lower. 2. The Fund’s inception date is December 18, 1986. Prior to July 2, 2001, the Fund was known as the UMB Scout Regional Fund and was managed in accordance with a different investment objective and strategy. As a result of the objective and strategy change, the since inception performance shown represents the period beginning July 2, 2001. 3. The performance of the Scout Core Bond Fund Institutional Class Shares reflects the historical performance of the Frontegra Columbus Core Fund Institutional Class Shares (the “Predecessor Fund”). Effective as of the close of business on April 21, 2011, the Predecessor Fund was reorganized into the Fund. The Predecessor Fund and the Fund have substantially similar principal investment strategies. The Predecessor Fund’s original Institutional Class Shares returns reflect the total annual operating fees and expenses, net of any fee and expense waivers, of the Scout Core Bond Fund Institutional Class Shares. 4. The performance of the Scout Core Plus Bond Fund Institutional Class Shares and Class Y Shares reflects the historical performance of the Frontegra Columbus Core Plus Fund Institutional Class Shares and Class Y Shares (the “Predecessor Fund”). Effective as of the close of business on April 21, 2011, the Predecessor Fund was reorganized into the Fund. The Predecessor Fund and the Fund have substantially similar principal investment strategies. The Predecessor Fund’s original Institutional Class Shares and Class Y Shares returns reflect the total annual operating fees and expenses, net of any fee and expense waivers, of the Scout Core Plus Bond Fund Institutional Class Shares and Class Y Shares. 5. The performance returns for the funds’ reflects a fee waiver in effect. In absence of such waiver, the returns would be reduced. The Advisor has contractually agreed to waive fees/certain fund expenses through Oct. 30, 2016, and may recoup previously waived expenses that it assumed during the previous three fiscal years. †Because the fund’s inception predates the benchmark’s inception, a comparison is not available. Risk considerations: Stock fund values fluctuate and investors may lose principal value. Small-cap and mid-cap stocks are more susceptible to market volatility due to risks such as lack of management experience, product diversification, financial resources, competitive strength and liquidity. Real Estate Investment Trusts (REITS) may be affected by economic conditions including credit risk, interest rate risk and other factors that affect property values, rents or occupancies of real estate. Certain funds invest in highly leveraged companies which tend to be more sensitive to issuer, political, market and economic developments especially during economic downturns or periods of rising interest rates. Groups of stocks, such as value and growth, go in and out of favor which may cause certain funds to underperform other equity funds. Foreign investments present additional risk due to currency fluctuations, economic and political factors, government regulations, differences in accounting standards, and other factors. Investments in emerging markets involve even greater risks. Focusing on particular countries, regions, industries, sectors or types of investments may cause greater risk of adverse developments in certain funds. The return of principal in a fixed income fund is not guaranteed. Fixed income funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying fixed income securities owned by the fund. Mortgage- and Asset-Backed Securities are subject to prepayment risk and the risk of default on the underlying mortgages or other assets. High yield securities involve greater risk than investment grade securities and tend to be more sensitive to economic conditions and credit risk. An unconstrained investment approach can create considerable exposure to certain types of securities, such as derivatives, that present significant volatility, particularly over short periods of time. Derivatives such as options, futures contracts, currency forwards or swap agreements may involve greater risks than if the Fund invested in the referenced obligation directly. Derivatives are subject to risks such as market risk, liquidity risk, interest rate risk, credit risk and management risk. Derivative investments could lose more than the principal amount invested. Certain funds may use derivatives for hedging purposes or as part of the fund’s investment strategy. The use of leverage, derivatives and short sales could accelerate losses to the fund. These losses could exceed the original amount invested. Certain funds may, at times, experience higher-than-average portfolio turnover, which may generate significant taxable gains and increased trading expenses, which, in turn, may lower the fund’s return. The Scout Funds are distributed by UMB Distribution Services, LLC, an affiliate of UMB Financial Corporation, and managed by Scout Investments, Inc., a subsidiary of UMB Financial Corporation. SCOUT, SCOUT INVESTMENTS – Reg. U.S. Tm. Off NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

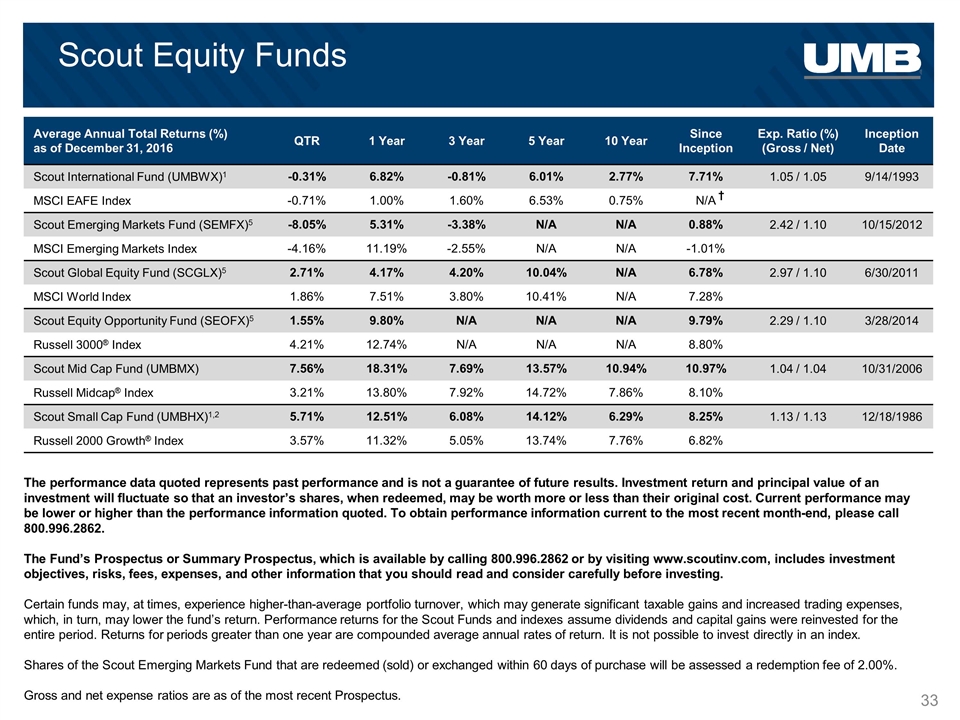

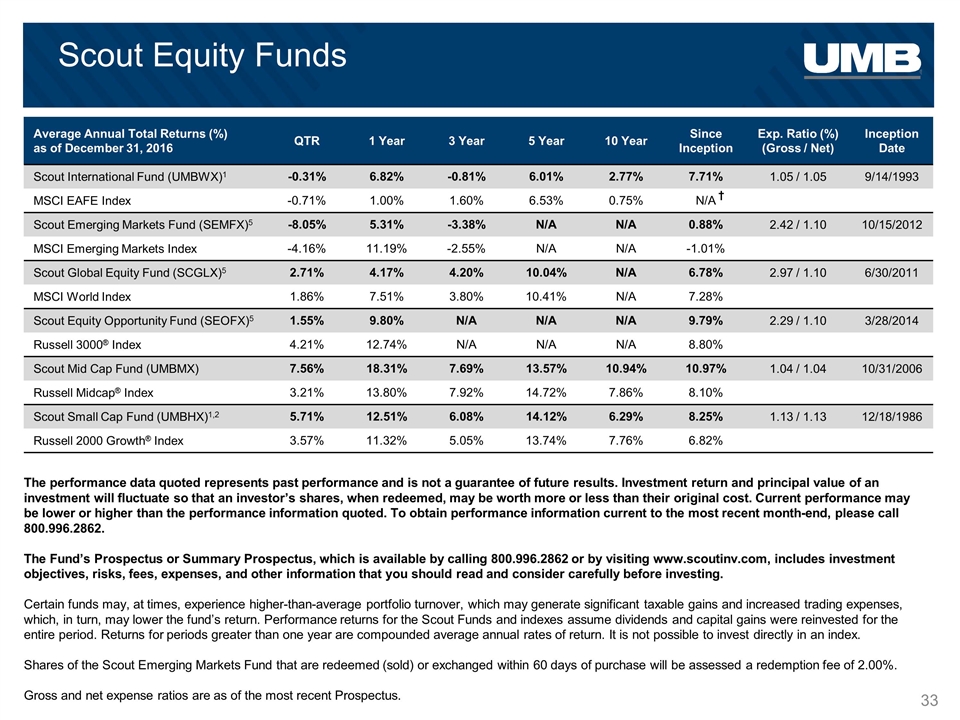

Scout Equity Funds Average Annual Total Returns (%) as of December 31, 2016 QTR 1 Year 3 Year 5 Year 10 Year Since Inception Exp. Ratio (%) (Gross / Net) Inception Date Scout International Fund (UMBWX)1 -0.31% 6.82% -0.81% 6.01% 2.77% 7.71% 1.05 / 1.05 9/14/1993 MSCI EAFE Index -0.71% 1.00% 1.60% 6.53% 0.75% N/A Scout Emerging Markets Fund (SEMFX)5 -8.05% 5.31% -3.38% N/A N/A 0.88% 2.42 / 1.10 10/15/2012 MSCI Emerging Markets Index -4.16% 11.19% -2.55% N/A N/A -1.01% Scout Global Equity Fund (SCGLX)5 2.71% 4.17% 4.20% 10.04% N/A 6.78% 2.97 / 1.10 6/30/2011 MSCI World Index 1.86% 7.51% 3.80% 10.41% N/A 7.28% Scout Equity Opportunity Fund (SEOFX)5 1.55% 9.80% N/A N/A N/A 9.79% 2.29 / 1.10 3/28/2014 Russell 3000® Index 4.21% 12.74% N/A N/A N/A 8.80% Scout Mid Cap Fund (UMBMX) 7.56% 18.31% 7.69% 13.57% 10.94% 10.97% 1.04 / 1.04 10/31/2006 Russell Midcap® Index 3.21% 13.80% 7.92% 14.72% 7.86% 8.10% Scout Small Cap Fund (UMBHX)1,2 5.71% 12.51% 6.08% 14.12% 6.29% 8.25% 1.13 / 1.13 12/18/1986 Russell 2000 Growth® Index 3.57% 11.32% 5.05% 13.74% 7.76% 6.82% The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 800.996.2862. The Fund’s Prospectus or Summary Prospectus, which is available by calling 800.996.2862 or by visiting www.scoutinv.com, includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. Certain funds may, at times, experience higher-than-average portfolio turnover, which may generate significant taxable gains and increased trading expenses, which, in turn, may lower the fund’s return. Performance returns for the Scout Funds and indexes assume dividends and capital gains were reinvested for the entire period. Returns for periods greater than one year are compounded average annual rates of return. It is not possible to invest directly in an index. Shares of the Scout Emerging Markets Fund that are redeemed (sold) or exchanged within 60 days of purchase will be assessed a redemption fee of 2.00%. Gross and net expense ratios are as of the most recent Prospectus. †

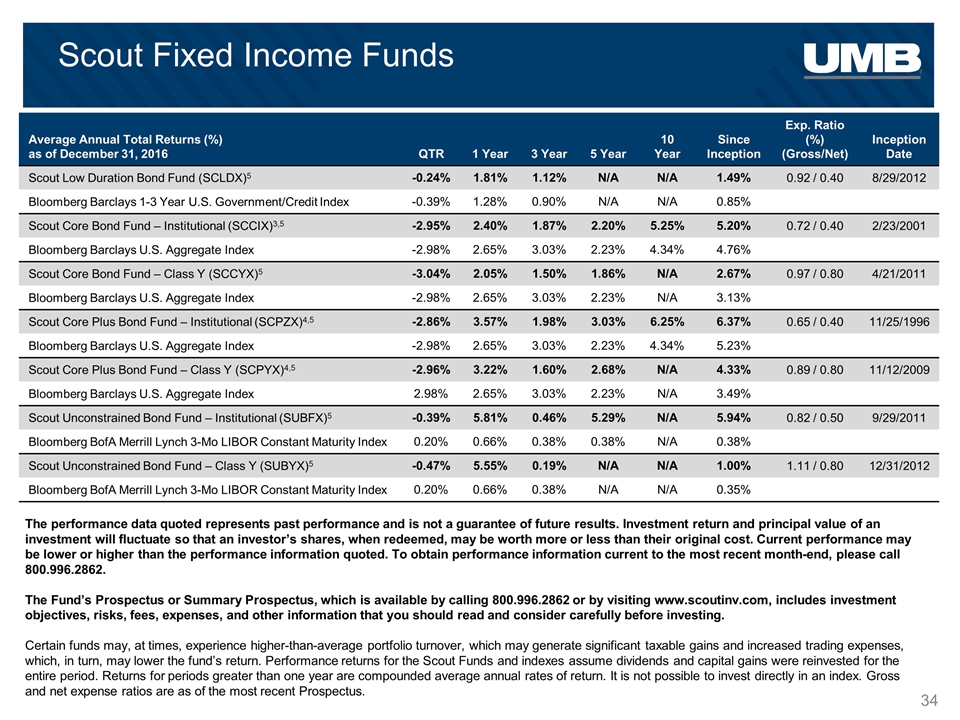

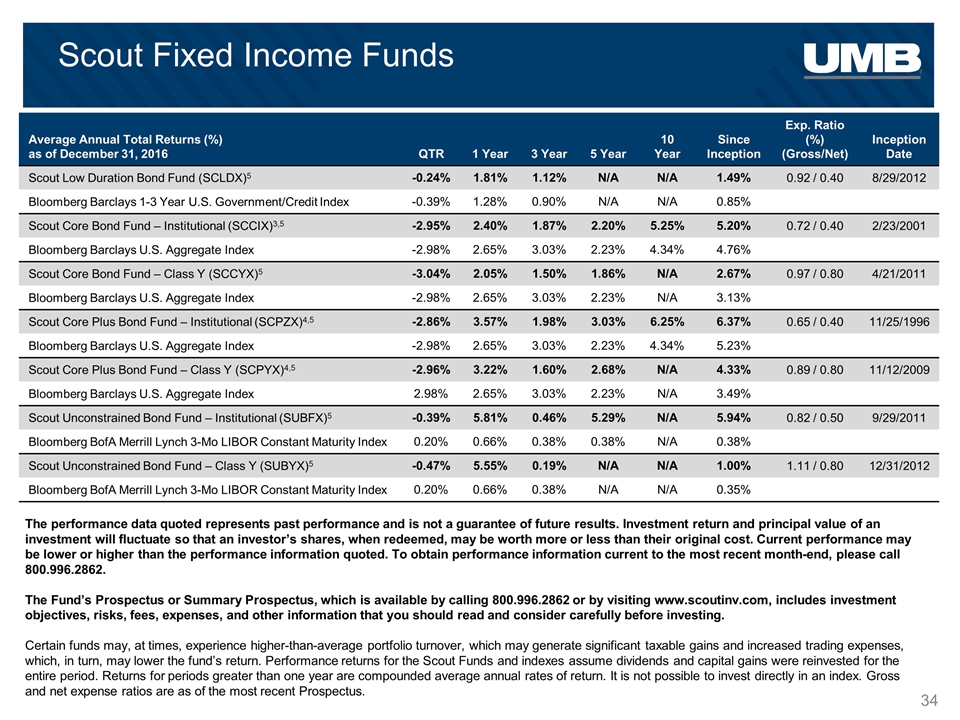

Scout Fixed Income Funds Average Annual Total Returns (%) as of December 31, 2016 QTR 1 Year 3 Year 5 Year 10 Year Since Inception Exp. Ratio (%) (Gross/Net) Inception Date Scout Low Duration Bond Fund (SCLDX)5 -0.24% 1.81% 1.12% N/A N/A 1.49% 0.92 / 0.40 8/29/2012 Bloomberg Barclays 1-3 Year U.S. Government/Credit Index -0.39% 1.28% 0.90% N/A N/A 0.85% Scout Core Bond Fund – Institutional (SCCIX)3,5 -2.95% 2.40% 1.87% 2.20% 5.25% 5.20% 0.72 / 0.40 2/23/2001 Bloomberg Barclays U.S. Aggregate Index -2.98% 2.65% 3.03% 2.23% 4.34% 4.76% Scout Core Bond Fund – Class Y (SCCYX)5 -3.04% 2.05% 1.50% 1.86% N/A 2.67% 0.97 / 0.80 4/21/2011 Bloomberg Barclays U.S. Aggregate Index -2.98% 2.65% 3.03% 2.23% N/A 3.13% Scout Core Plus Bond Fund – Institutional (SCPZX)4,5 -2.86% 3.57% 1.98% 3.03% 6.25% 6.37% 0.65 / 0.40 11/25/1996 Bloomberg Barclays U.S. Aggregate Index -2.98% 2.65% 3.03% 2.23% 4.34% 5.23% Scout Core Plus Bond Fund – Class Y (SCPYX)4,5 -2.96% 3.22% 1.60% 2.68% N/A 4.33% 0.89 / 0.80 11/12/2009 Bloomberg Barclays U.S. Aggregate Index 2.98% 2.65% 3.03% 2.23% N/A 3.49% Scout Unconstrained Bond Fund – Institutional (SUBFX)5 -0.39% 5.81% 0.46% 5.29% N/A 5.94% 0.82 / 0.50 9/29/2011 Bloomberg BofA Merrill Lynch 3-Mo LIBOR Constant Maturity Index 0.20% 0.66% 0.38% 0.38% N/A 0.38% Scout Unconstrained Bond Fund – Class Y (SUBYX)5 -0.47% 5.55% 0.19% N/A N/A 1.00% 1.11 / 0.80 12/31/2012 Bloomberg BofA Merrill Lynch 3-Mo LIBOR Constant Maturity Index 0.20% 0.66% 0.38% N/A N/A 0.35% The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 800.996.2862. The Fund’s Prospectus or Summary Prospectus, which is available by calling 800.996.2862 or by visiting www.scoutinv.com, includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. Certain funds may, at times, experience higher-than-average portfolio turnover, which may generate significant taxable gains and increased trading expenses, which, in turn, may lower the fund’s return. Performance returns for the Scout Funds and indexes assume dividends and capital gains were reinvested for the entire period. Returns for periods greater than one year are compounded average annual rates of return. It is not possible to invest directly in an index. Gross and net expense ratios are as of the most recent Prospectus.

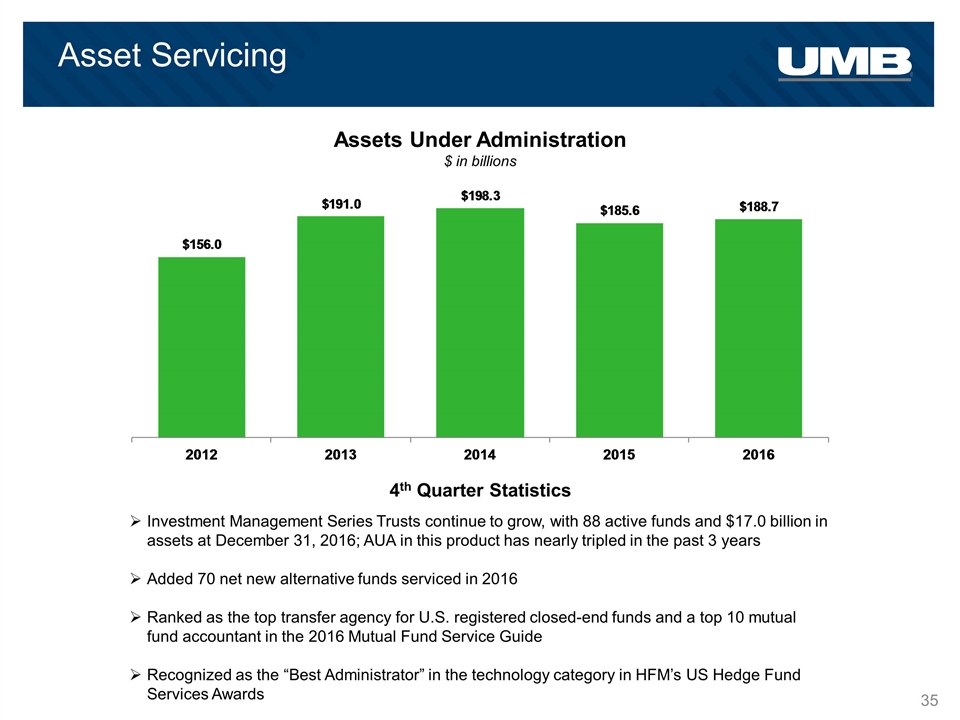

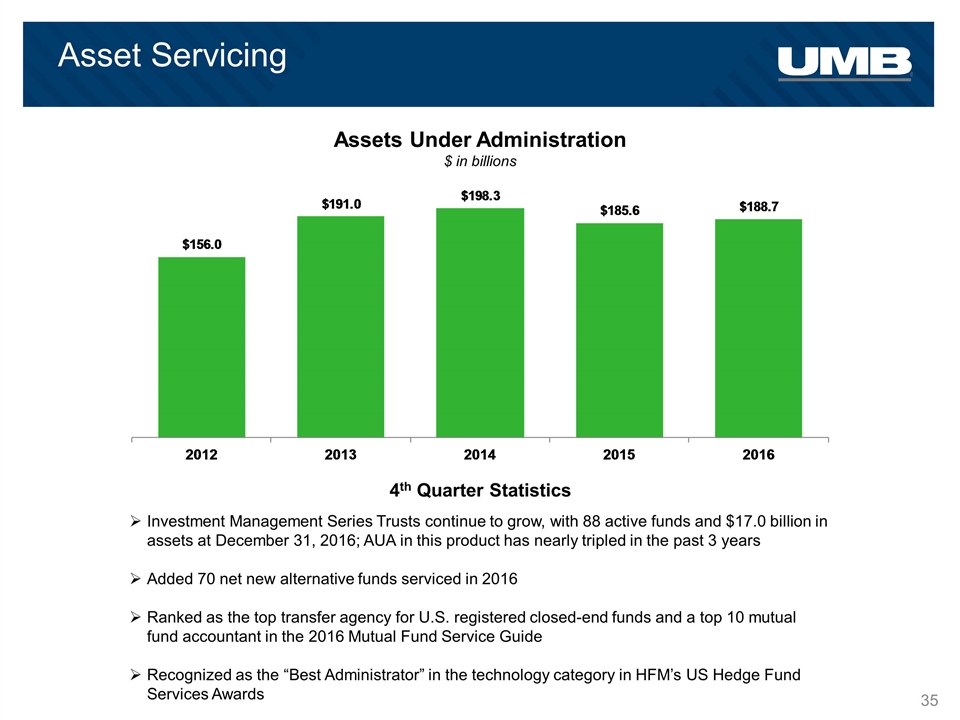

Asset Servicing Assets Under Administration $ in billions Investment Management Series Trusts continue to grow, with 88 active funds and $17.0 billion in assets at December 31, 2016; AUA in this product has nearly tripled in the past 3 years Added 70 net new alternative funds serviced in 2016 Ranked as the top transfer agency for U.S. registered closed-end funds and a top 10 mutual fund accountant in the 2016 Mutual Fund Service Guide Recognized as the “Best Administrator” in the technology category in HFM’s US Hedge Fund Services Awards 4th Quarter Statistics

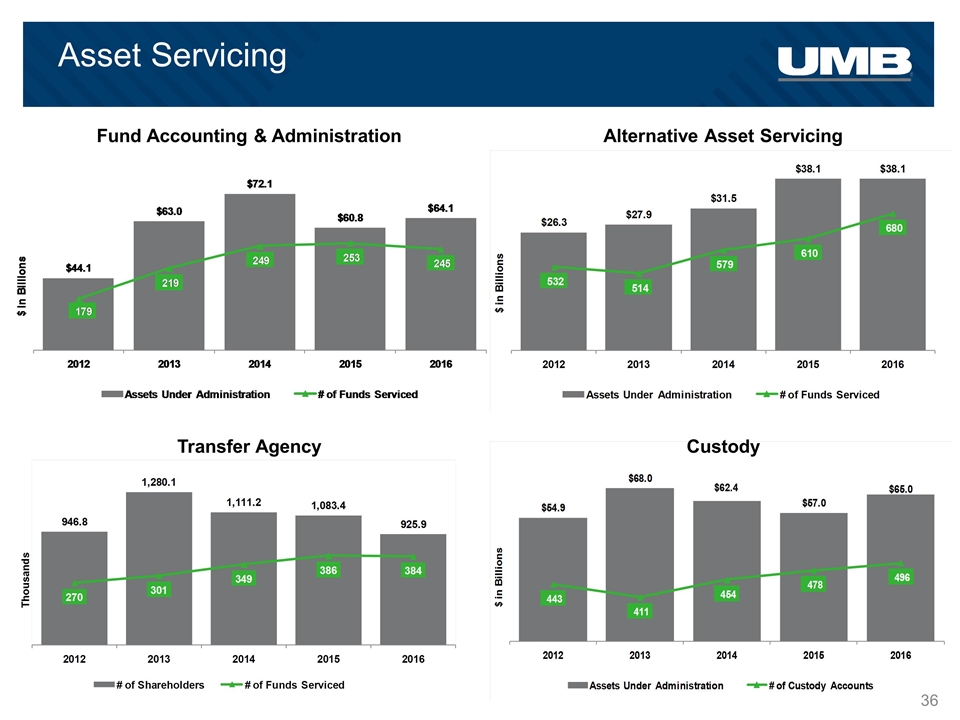

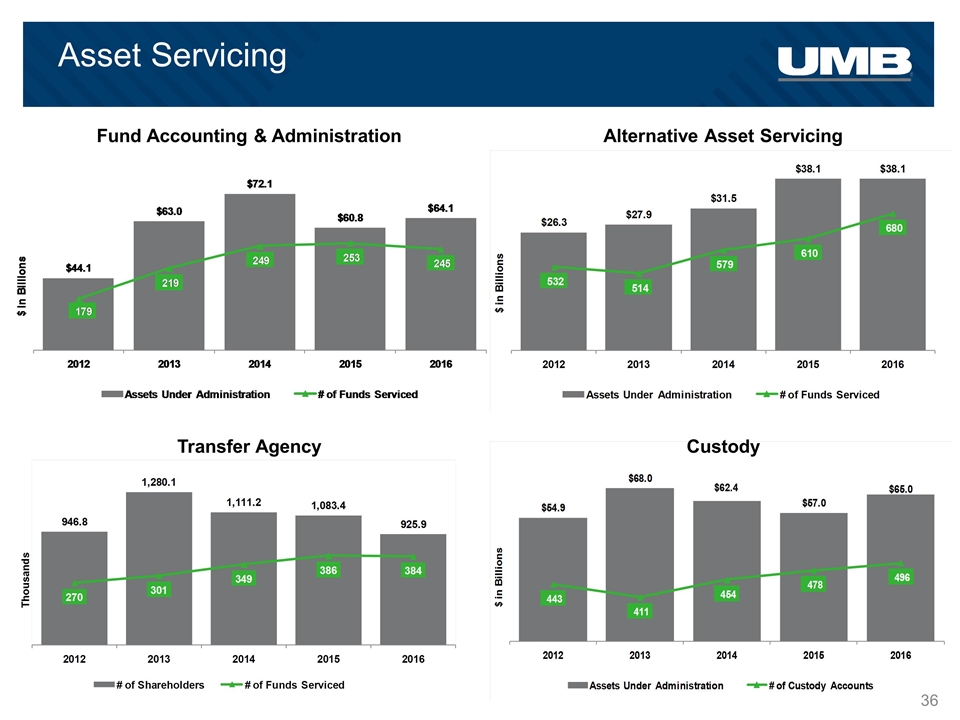

Asset Servicing Fund Accounting & Administration Alternative Asset Servicing Custody Transfer Agency

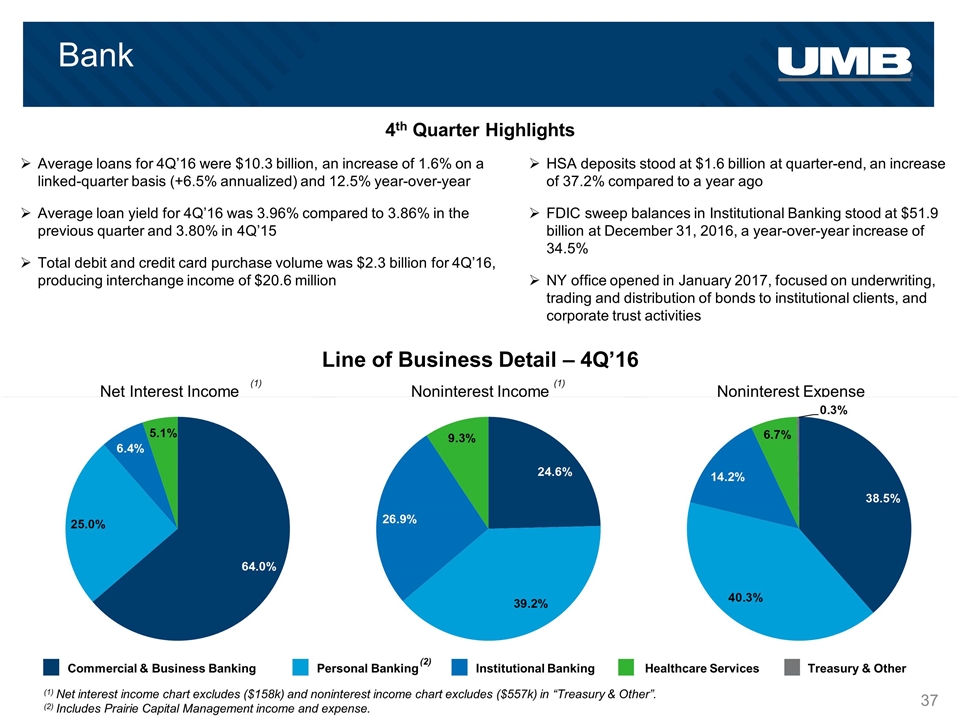

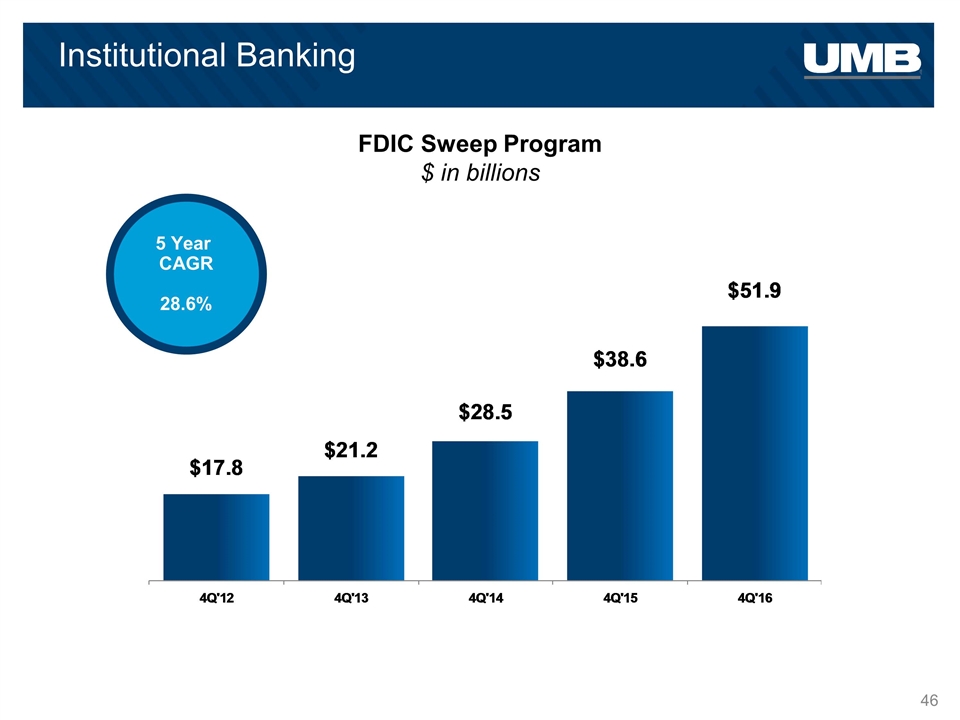

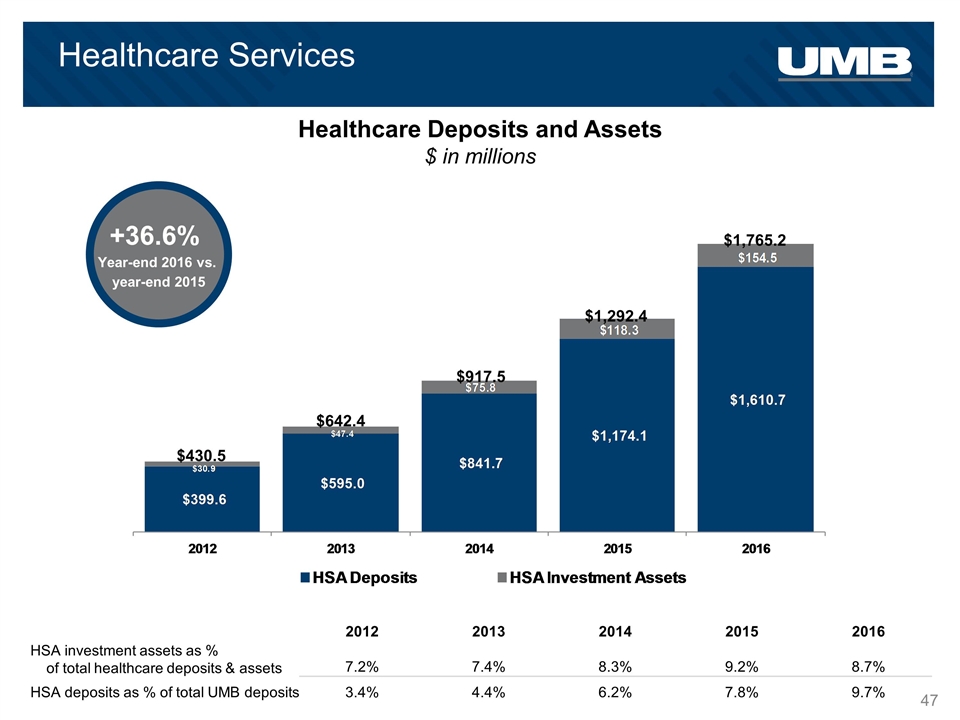

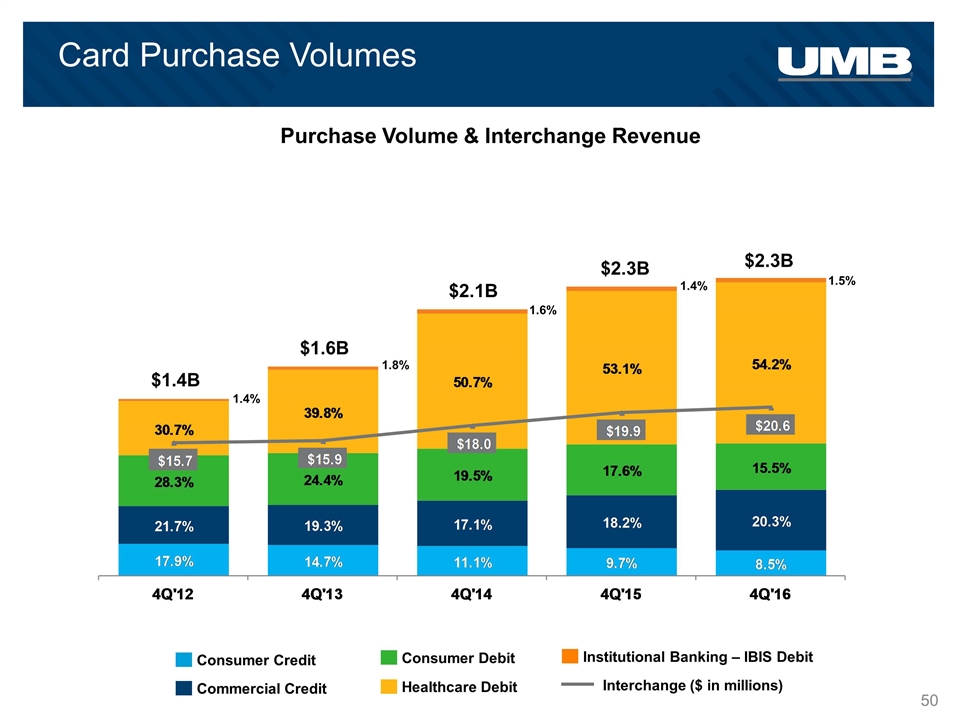

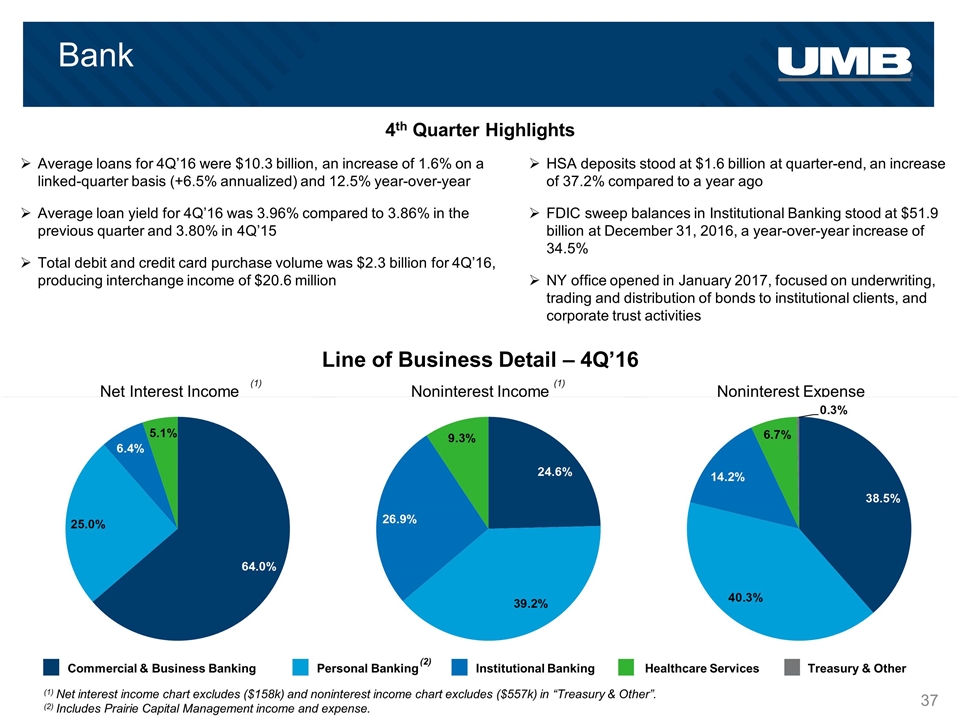

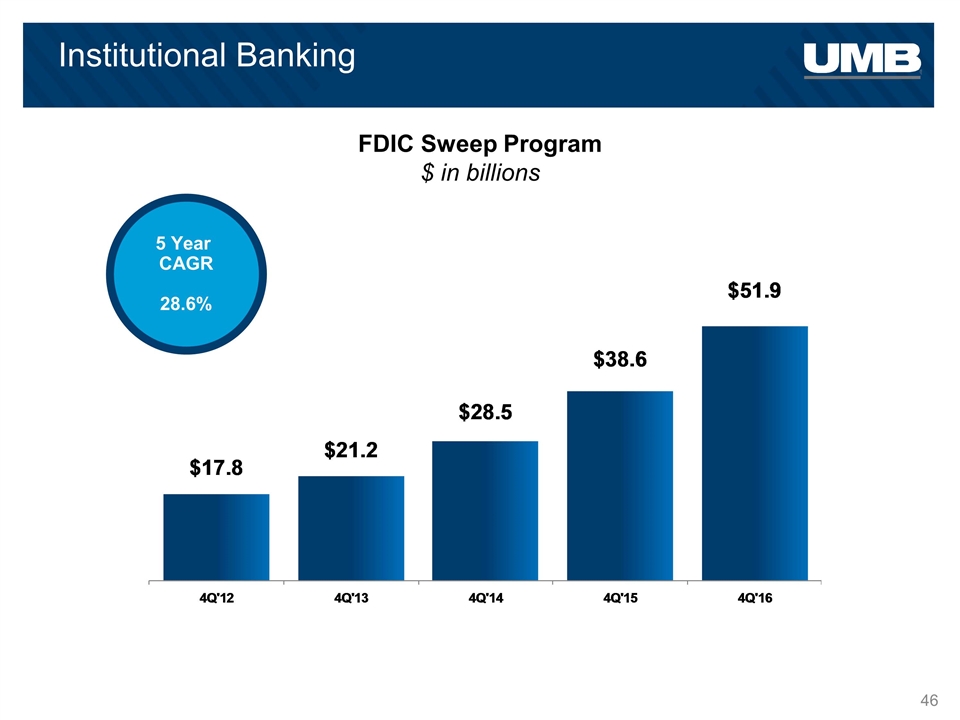

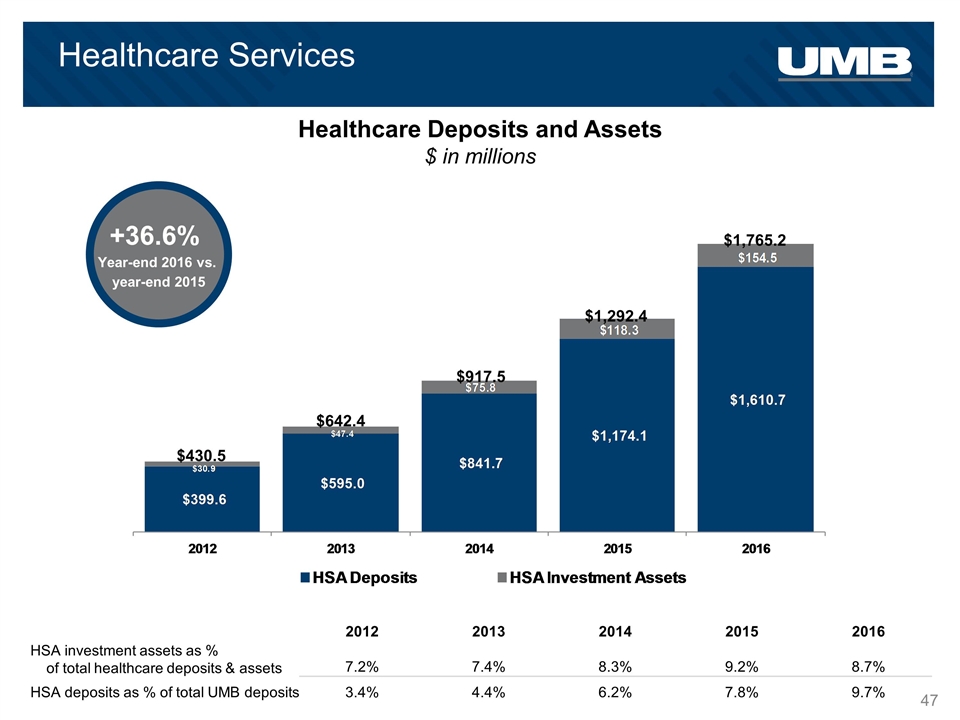

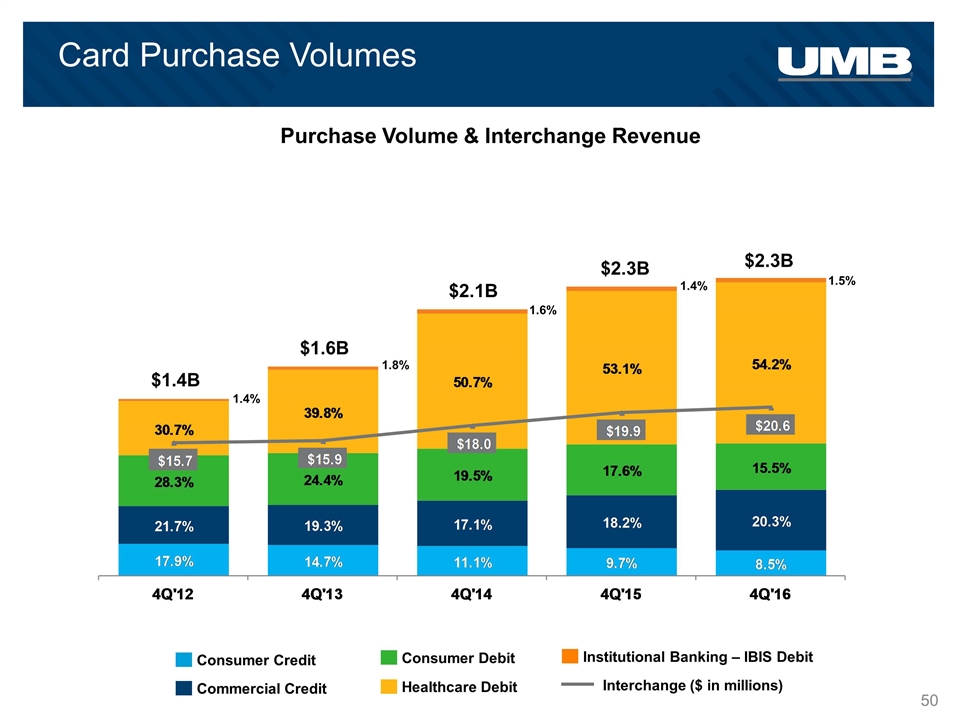

Bank Personal Banking Commercial & Business Banking Institutional Banking Healthcare Services Treasury & Other (2) (1) Net interest income chart excludes ($158k) and noninterest income chart excludes ($557k) in “Treasury & Other”. (2) Includes Prairie Capital Management income and expense. Net Interest Income Noninterest Income Noninterest Expense (1) Line of Business Detail – 4Q’16 Average loans for 4Q’16 were $10.3 billion, an increase of 1.6% on a linked-quarter basis (+6.5% annualized) and 12.5% year-over-year Average loan yield for 4Q’16 was 3.96% compared to 3.86% in the previous quarter and 3.80% in 4Q’15 Total debit and credit card purchase volume was $2.3 billion for 4Q’16, producing interchange income of $20.6 million HSA deposits stood at $1.6 billion at quarter-end, an increase of 37.2% compared to a year ago FDIC sweep balances in Institutional Banking stood at $51.9 billion at December 31, 2016, a year-over-year increase of 34.5% NY office opened in January 2017, focused on underwriting, trading and distribution of bonds to institutional clients, and corporate trust activities 4th Quarter Highlights (1)

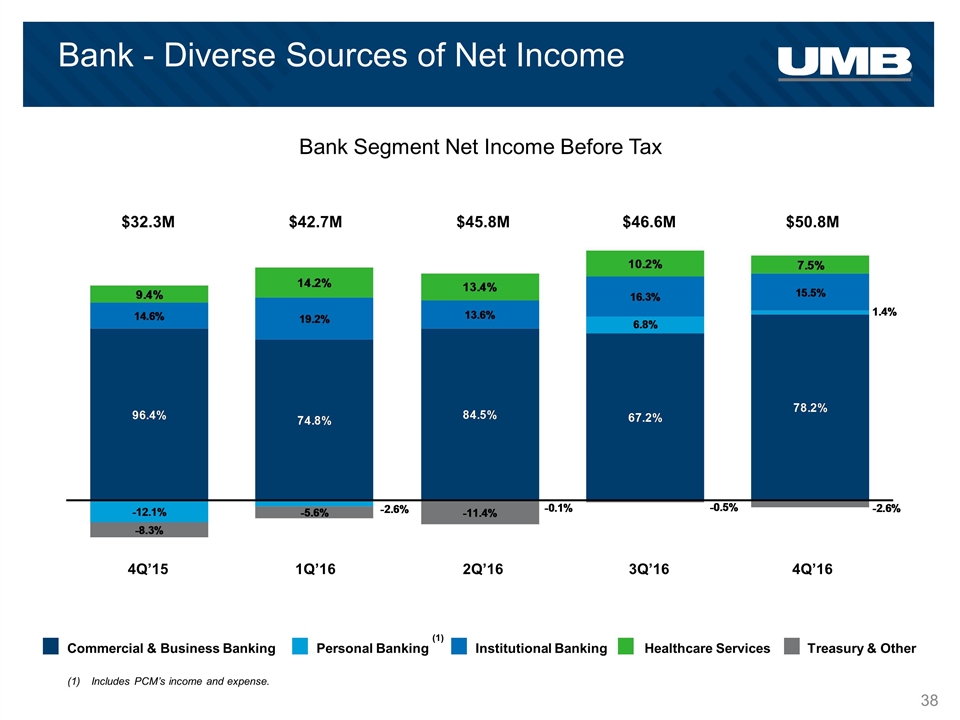

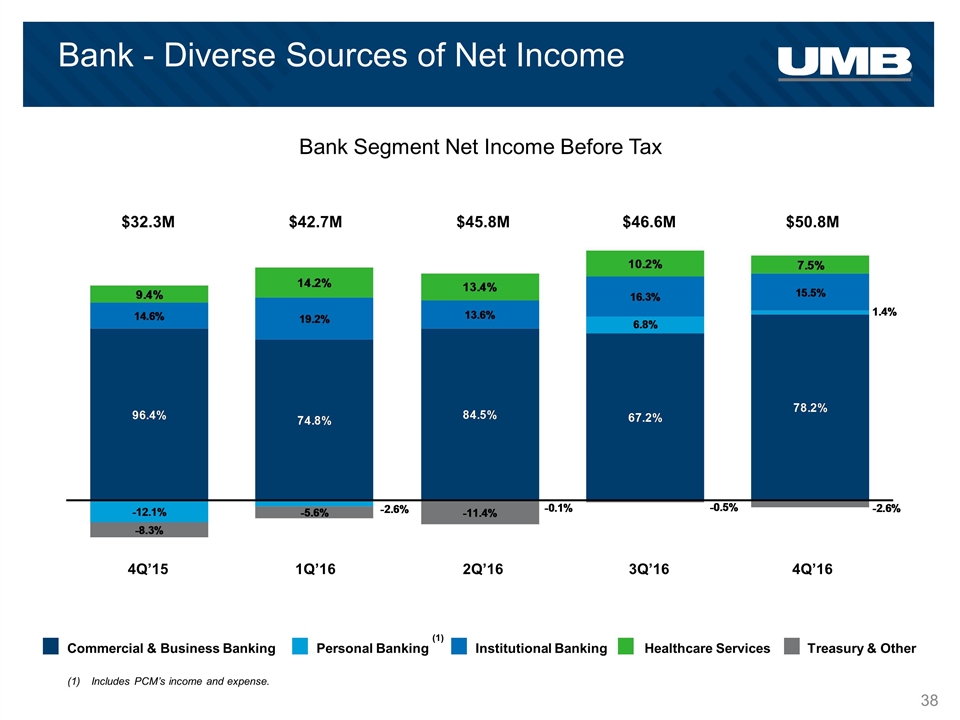

Bank - Diverse Sources of Net Income Includes PCM’s income and expense. Personal Banking Commercial & Business Banking Institutional Banking Healthcare Services Treasury & Other (1) Bank Segment Net Income Before Tax 4Q’16 4Q’15 1Q’16 3Q’16 2Q’16 $32.3M $42.7M $45.8M $50.8M $46.6M

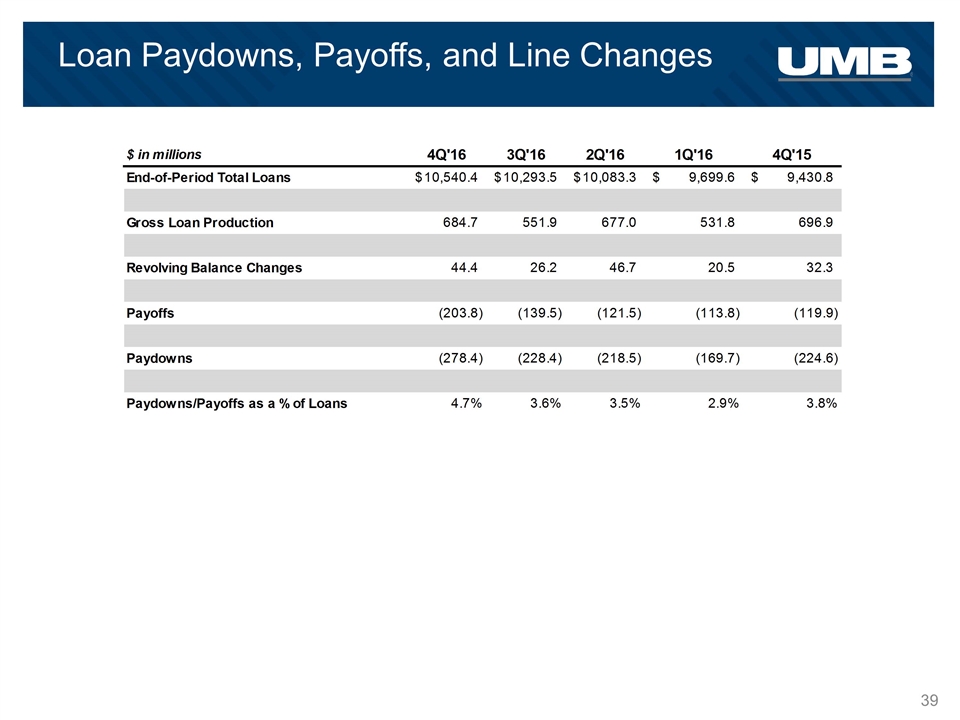

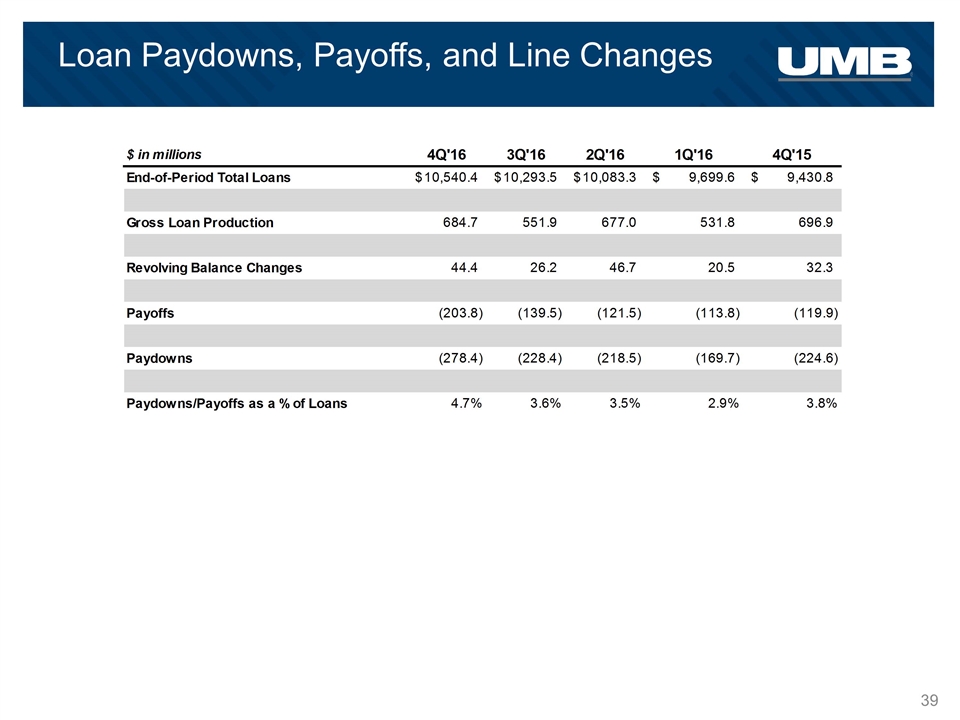

Loan Paydowns, Payoffs, and Line Changes

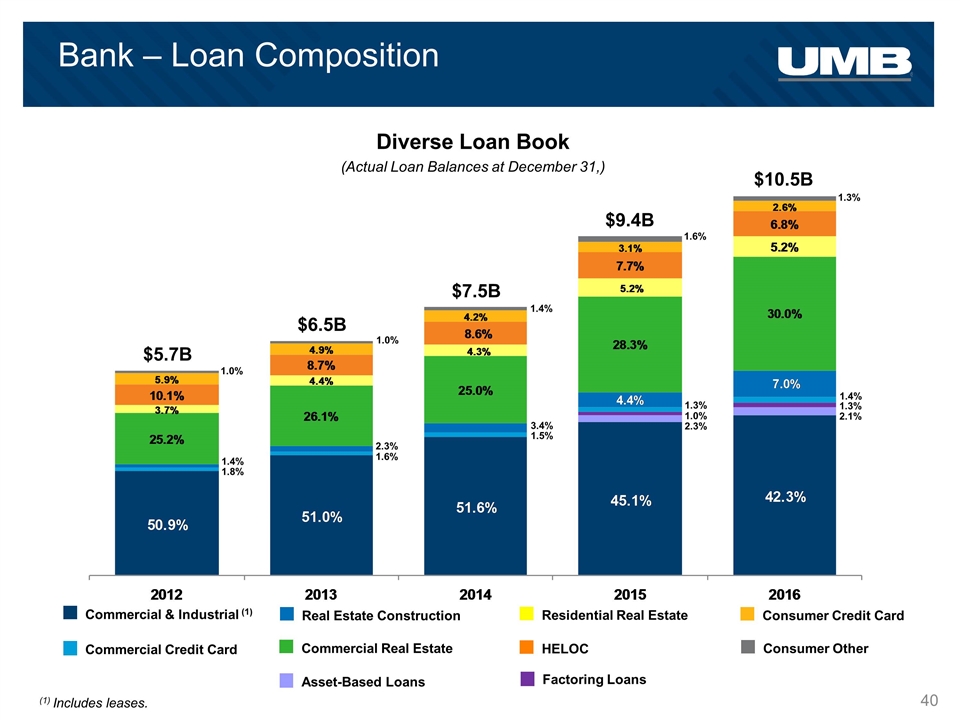

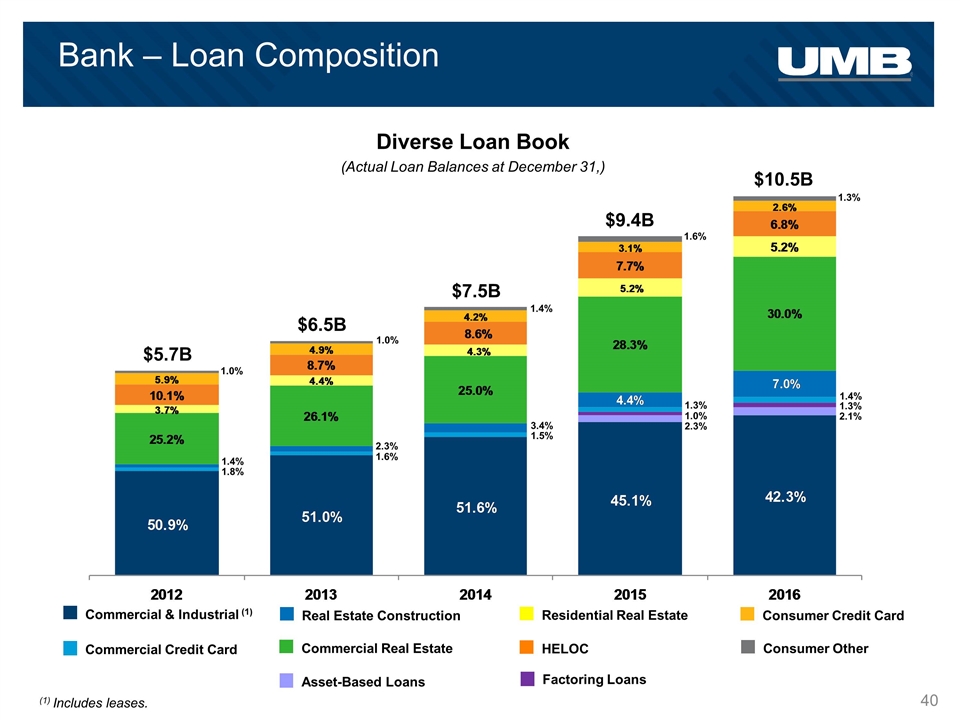

Bank – Loan Composition Diverse Loan Book (Actual Loan Balances at December 31,) Commercial Credit Card Commercial & Industrial (1) HELOC Residential Real Estate Real Estate Construction Commercial Real Estate Consumer Credit Card Consumer Other $5.7B $6.5B $7.5B $9.4B $10.5B 1.3% 2.3% 3.4% 1.5% 2.3% 1.6% 1.4% 1.8% Factoring Loans Asset-Based Loans (1) Includes leases. 1.0% 1.0% 1.4% 1.0% 1.3% 1.6% 2.1% 1.3% 1.4%

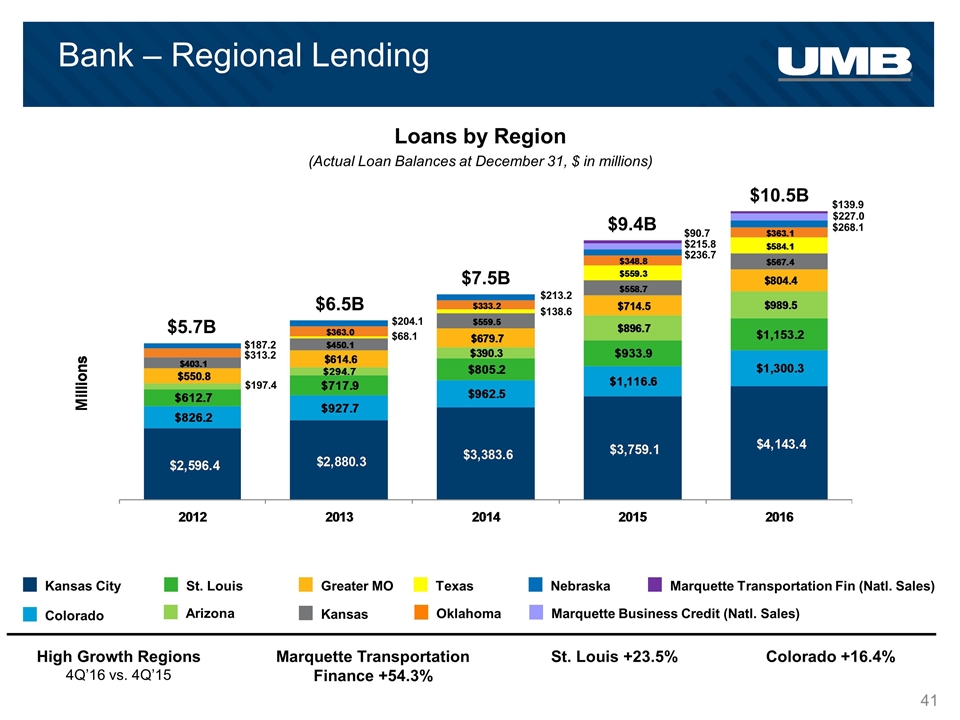

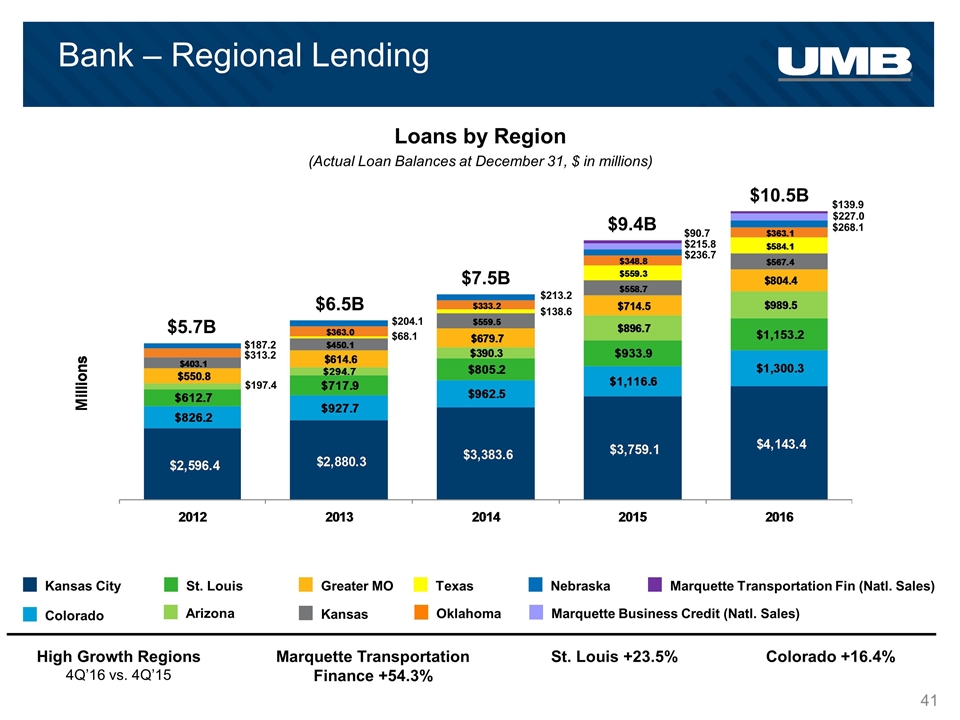

Colorado Kansas City Kansas Greater MO St. Louis Arizona Texas Oklahoma Marquette Transportation Fin (Natl. Sales) Nebraska Marquette Business Credit (Natl. Sales) Bank – Regional Lending $187.2 $313.2 $197.4 $204.1 $68.1 $213.2 $268.1 $5.7B $6.5B $7.5B $9.4B $10.5B $227.0 $139.9 $138.6 Loans by Region (Actual Loan Balances at December 31, $ in millions) High Growth Regions 4Q’16 vs. 4Q’15 St. Louis +23.5% Colorado +16.4% Marquette Transportation Finance +54.3% $236.7 $215.8 $90.7

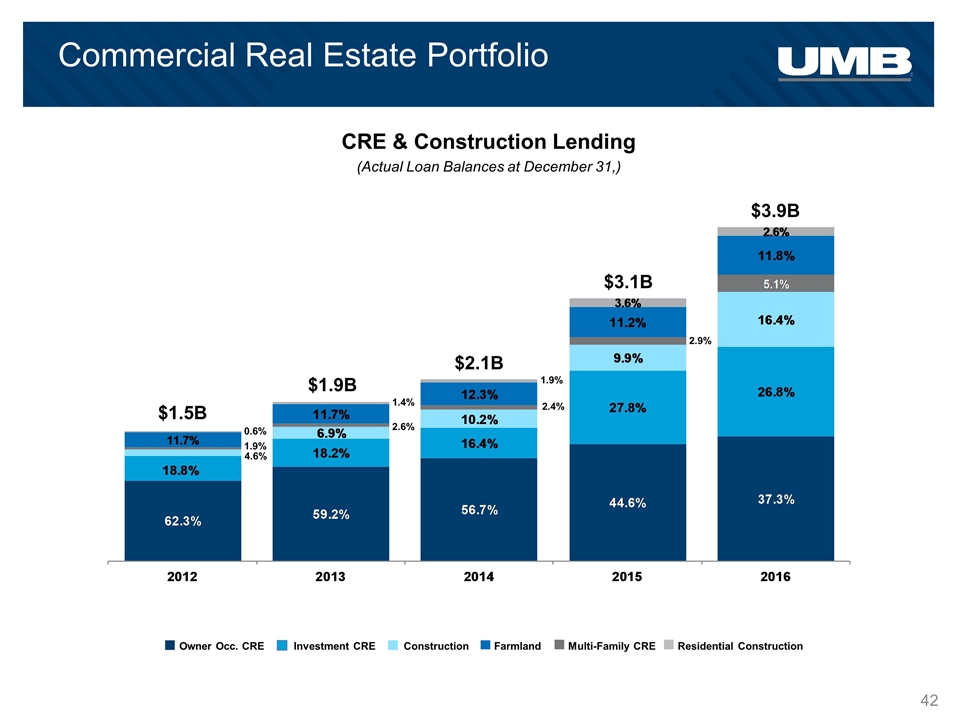

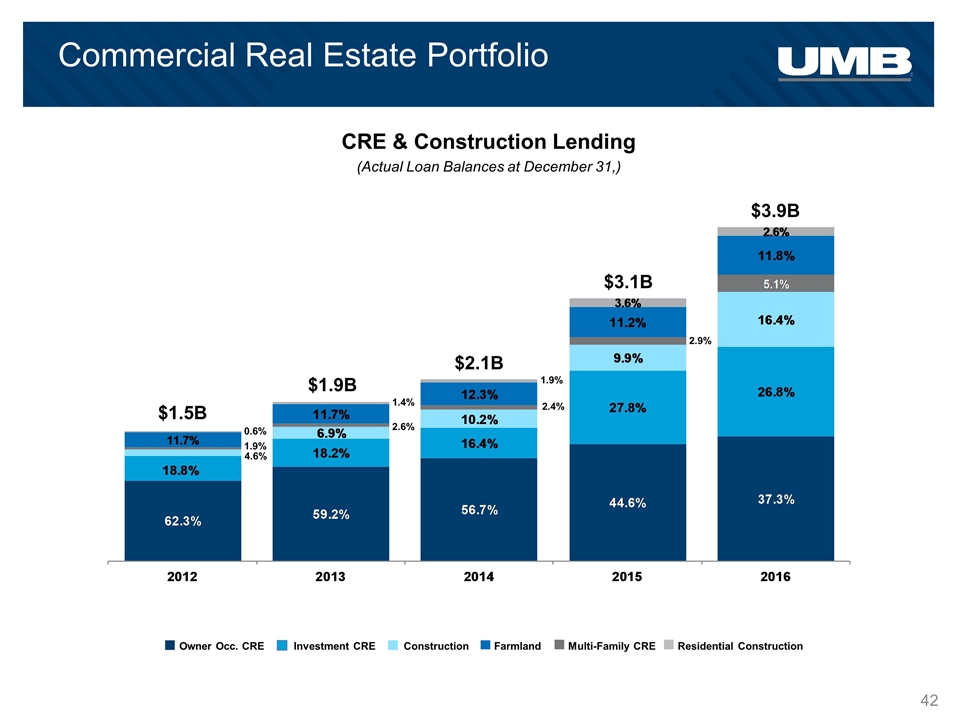

Commercial Real Estate Portfolio CRE & Construction Lending (Actual Loan Balances at December 31,) $3.9B $3.1B $2.1B $1.9B $1.5B 4.6% 1.9% 0.6% 2.6% 1.4% 2.4% 1.9% 2.9% Investment CRE Owner Occ. CRE Construction Farmland Multi-Family CRE Residential Construction

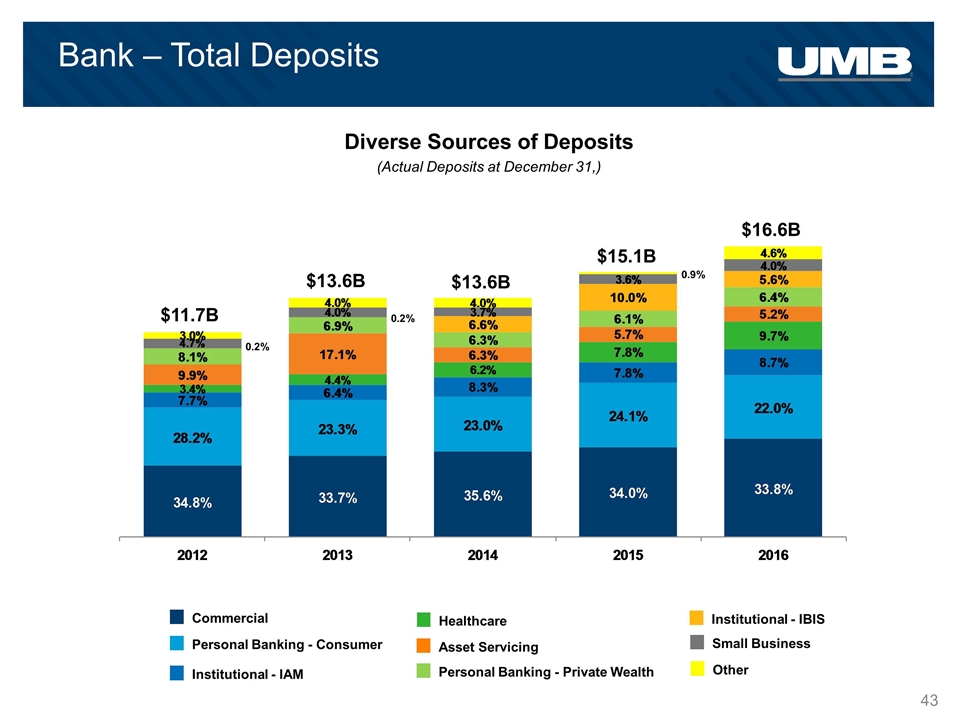

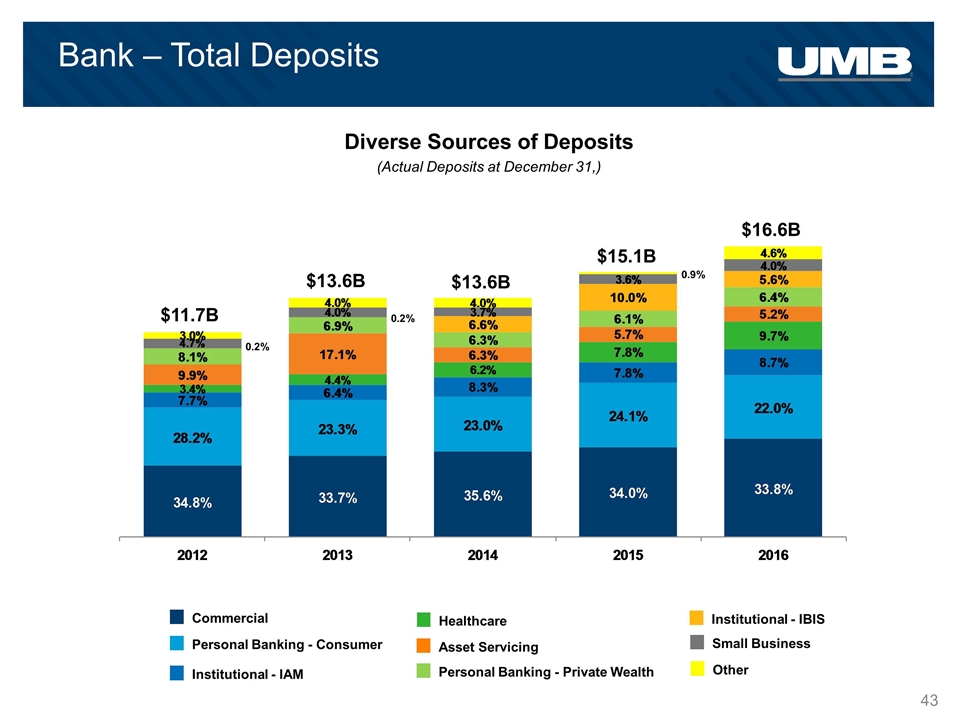

Bank – Total Deposits Diverse Sources of Deposits (Actual Deposits at December 31,) $11.7B $13.6B $13.6B $15.1B $16.6B Personal Banking - Consumer Commercial Institutional - IAM Personal Banking - Private Wealth Asset Servicing Healthcare Institutional - IBIS Small Business Other 0.2% 0.2% 0.9%

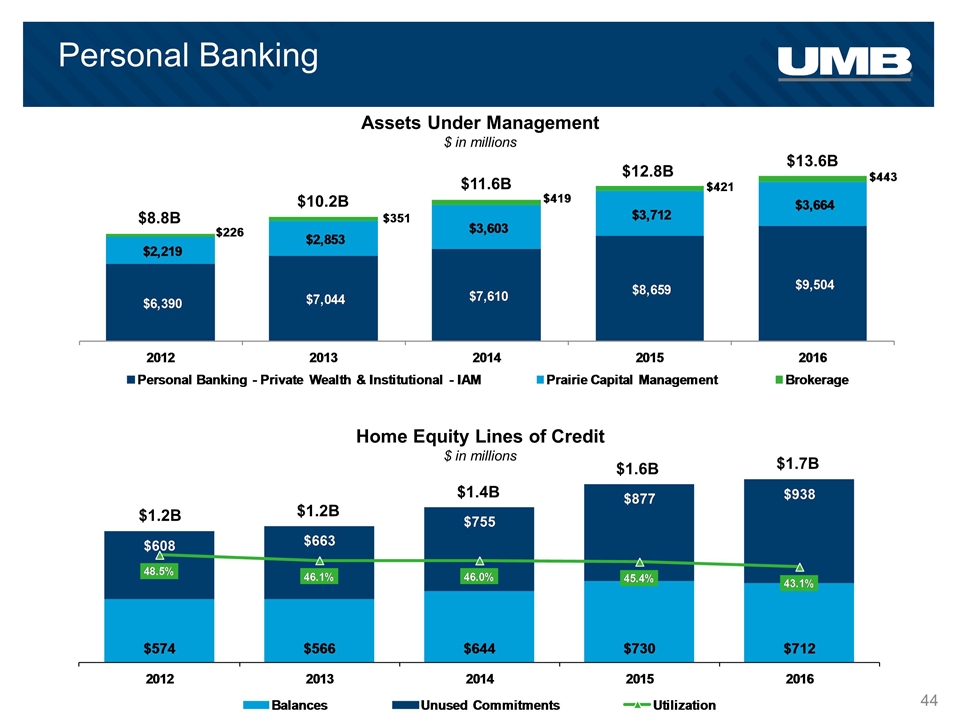

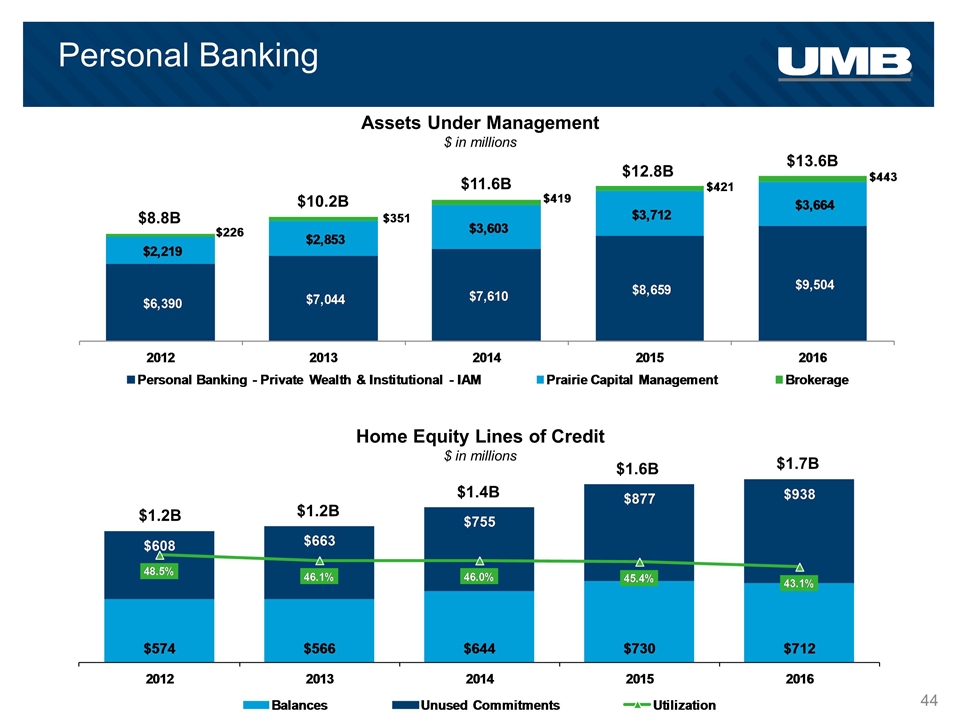

$8.8B $10.2B $11.6B $12.8B $13.6B $1.2B $1.2B $1.4B $1.6B $1.7B Home Equity Lines of Credit $ in millions Assets Under Management $ in millions Personal Banking

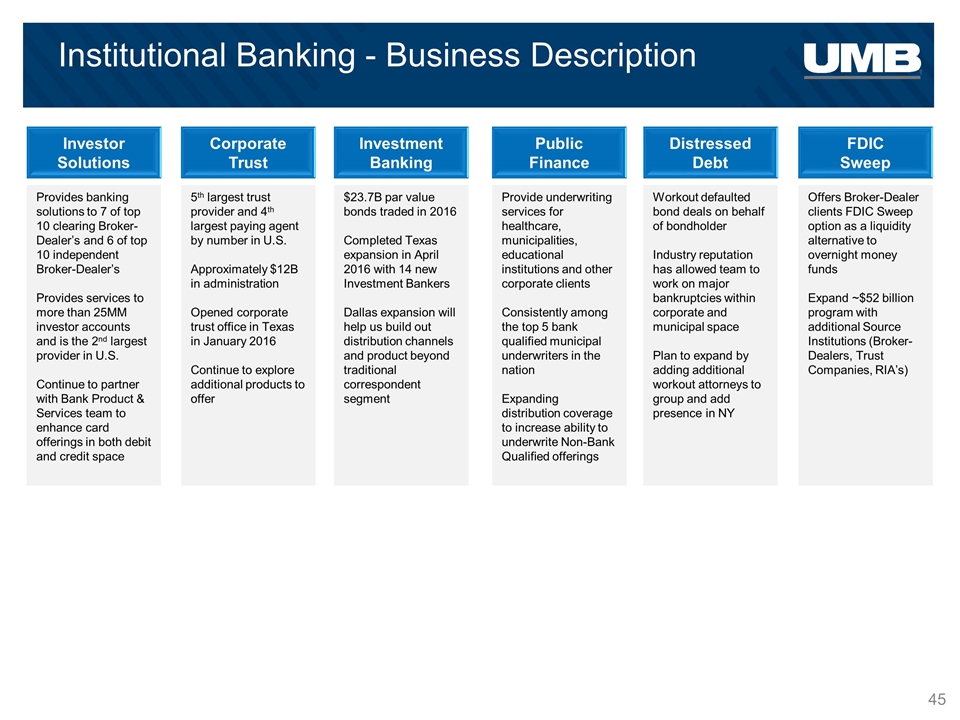

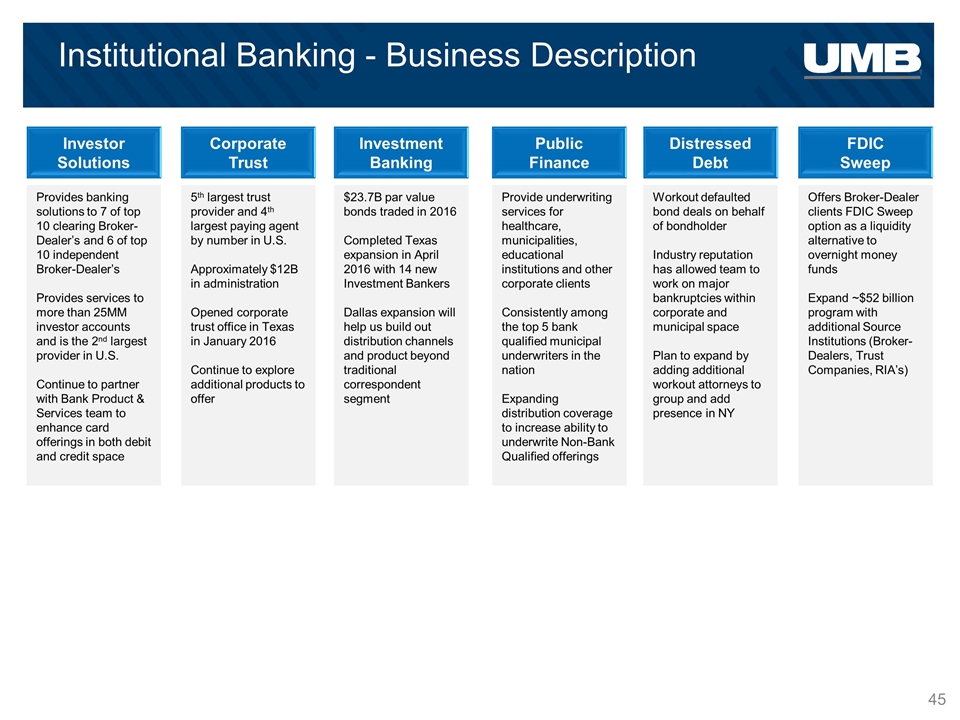

Institutional Banking - Business Description Investor Solutions Corporate Trust Investment Banking Public Finance Distressed Debt FDIC Sweep Provides banking solutions to 7 of top 10 clearing Broker-Dealer’s and 6 of top 10 independent Broker-Dealer’s Provides services to more than 25MM investor accounts and is the 2nd largest provider in U.S. Continue to partner with Bank Product & Services team to enhance card offerings in both debit and credit space 5th largest trust provider and 4th largest paying agent by number in U.S. Approximately $12B in administration Opened corporate trust office in Texas in January 2016 Continue to explore additional products to offer $23.7B par value bonds traded in 2016 Completed Texas expansion in April 2016 with 14 new Investment Bankers Dallas expansion will help us build out distribution channels and product beyond traditional correspondent segment Provide underwriting services for healthcare, municipalities, educational institutions and other corporate clients Consistently among the top 5 bank qualified municipal underwriters in the nation Expanding distribution coverage to increase ability to underwrite Non-Bank Qualified offerings Workout defaulted bond deals on behalf of bondholder Industry reputation has allowed team to work on major bankruptcies within corporate and municipal space Plan to expand by adding additional workout attorneys to group and add presence in NY Offers Broker-Dealer clients FDIC Sweep option as a liquidity alternative to overnight money funds Expand ~$52 billion program with additional Source Institutions (Broker-Dealers, Trust Companies, RIA’s)

Institutional Banking FDIC Sweep Program $ in billions 5 Year CAGR 28.6%

Healthcare Services 2012 2013 2014 2015 2016 HSA investment assets as % of total healthcare deposits & assets 7.2% 7.4% 8.3% 9.2% 8.7% HSA deposits as % of total UMB deposits 3.4% 4.4% 6.2% 7.8% 9.7% Healthcare Deposits and Assets $ in millions $430.5 $642.4 $917.5 $1,292.4 $1,765.2 +36.6% Year-end 2016 vs. year-end 2015

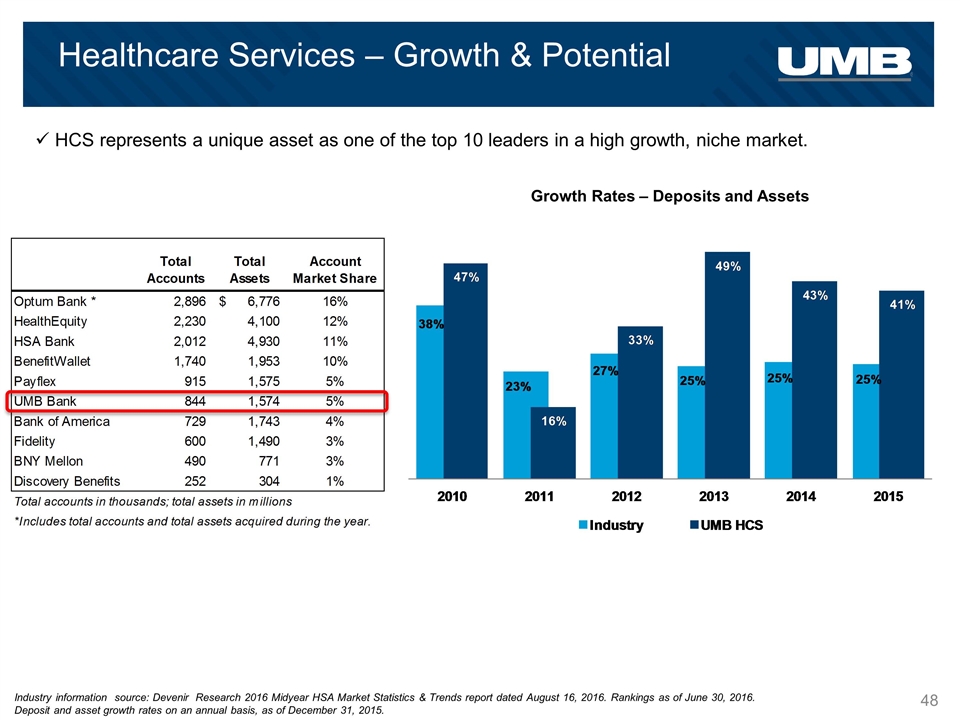

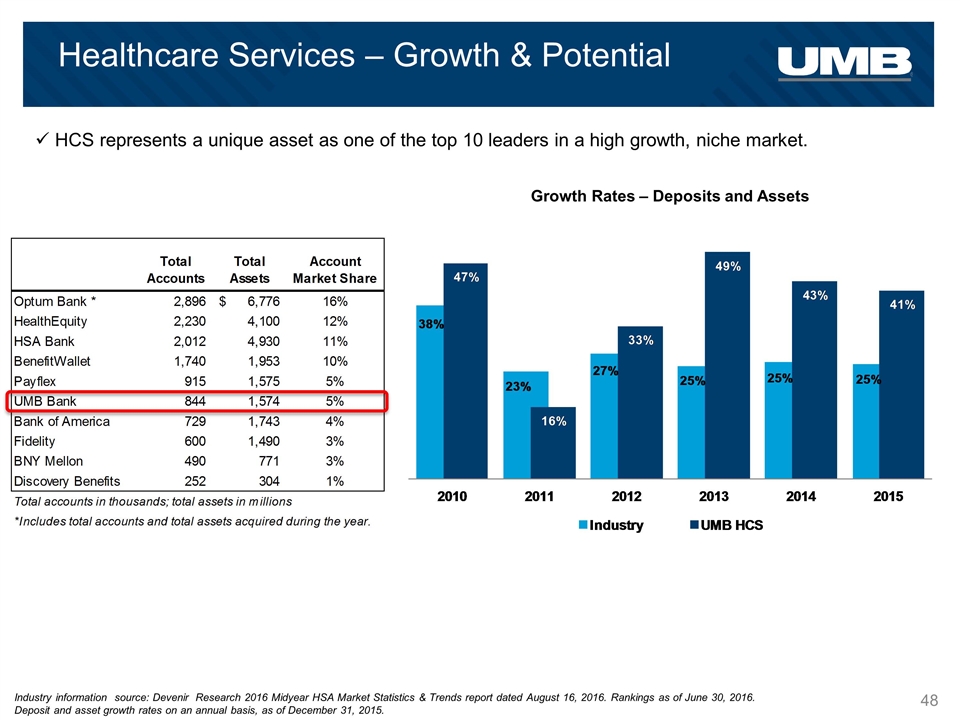

Industry information source: Devenir Research 2016 Midyear HSA Market Statistics & Trends report dated August 16, 2016. Rankings as of June 30, 2016. Deposit and asset growth rates on an annual basis, as of December 31, 2015. HCS represents a unique asset as one of the top 10 leaders in a high growth, niche market. Growth Rates – Deposits and Assets Healthcare Services – Growth & Potential

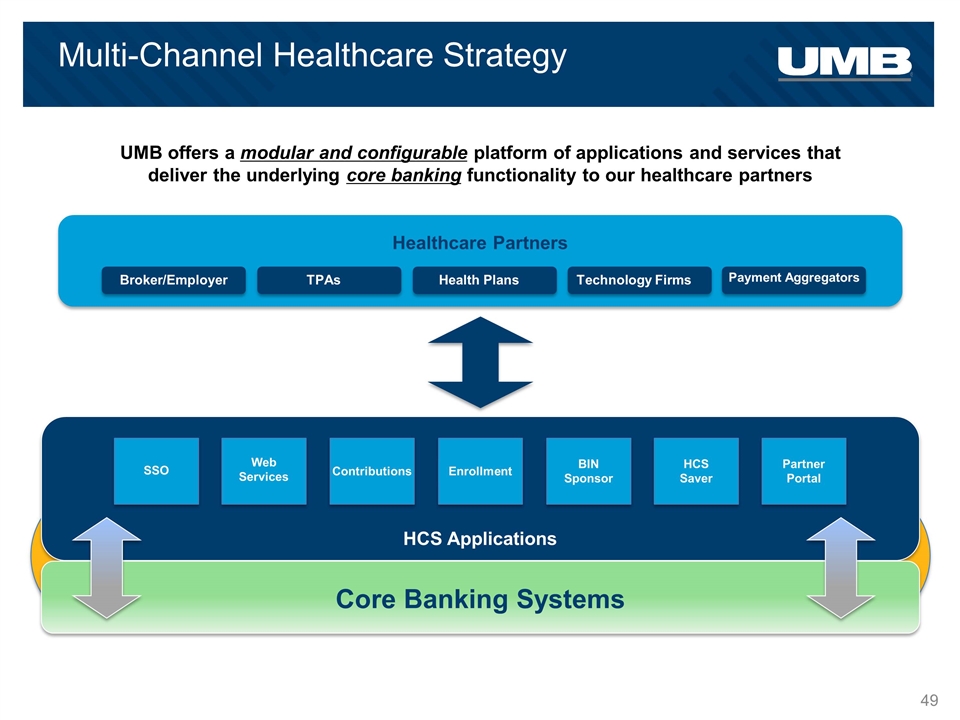

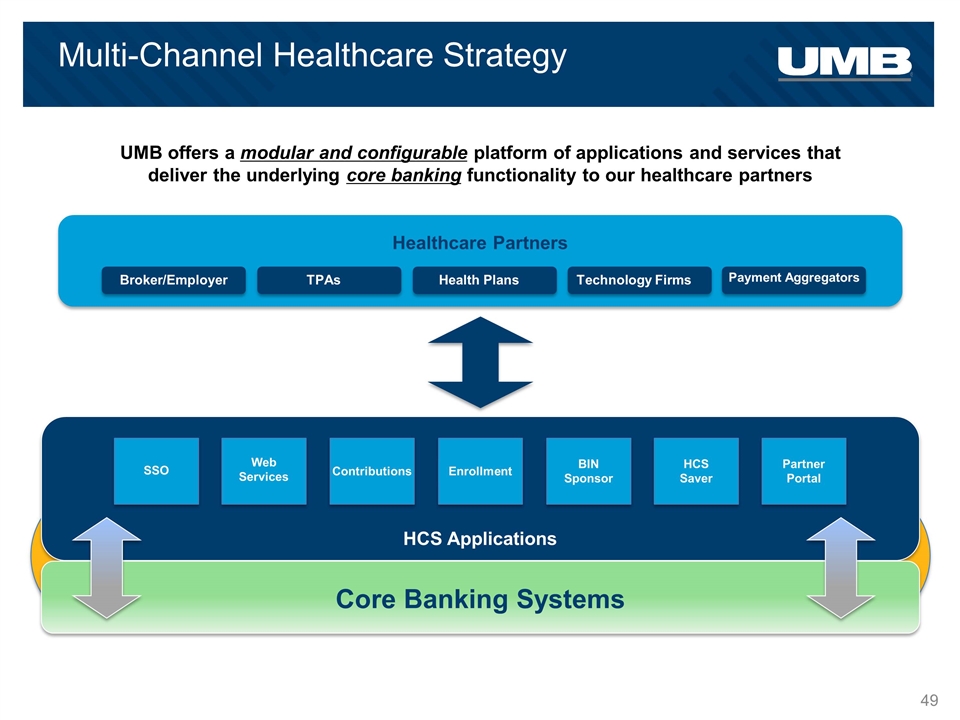

Multi-Channel Healthcare Strategy UMB offers a modular and configurable platform of applications and services that deliver the underlying core banking functionality to our healthcare partners Broker/Employer TPAs Health Plans Technology Firms Payment Aggregators Healthcare Partners HCS Applications SSO Web Services Contributions Enrollment BIN Sponsor HCS Saver Partner Portal Core Banking Systems

Card Purchase Volumes Purchase Volume & Interchange Revenue Commercial Credit Consumer Credit Consumer Debit Healthcare Debit Institutional Banking – IBIS Debit Interchange ($ in millions) $2.3B $1.4B $1.6B $2.1B $2.3B 1.4% 1.8% 1.6% 1.4% 1.5%

Appendix

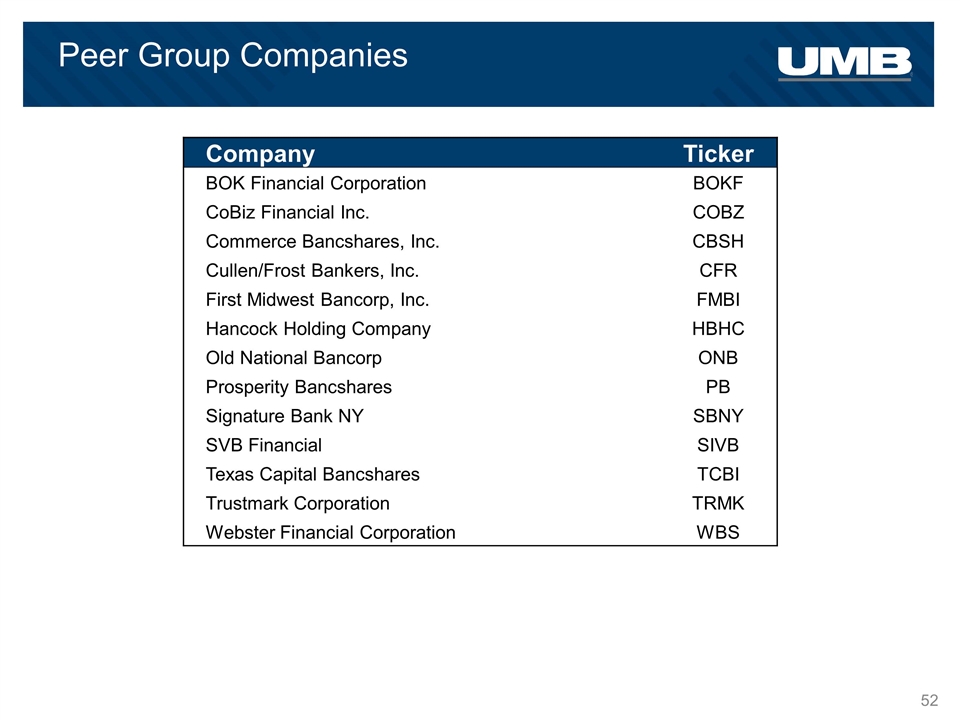

Peer Group Companies Company Ticker BOK Financial Corporation BOKF CoBiz Financial Inc. COBZ Commerce Bancshares, Inc. CBSH Cullen/Frost Bankers, Inc. CFR First Midwest Bancorp, Inc. FMBI Hancock Holding Company HBHC Old National Bancorp ONB Prosperity Bancshares PB Signature Bank NY SBNY SVB Financial SIVB Texas Capital Bancshares TCBI Trustmark Corporation TRMK Webster Financial Corporation WBS

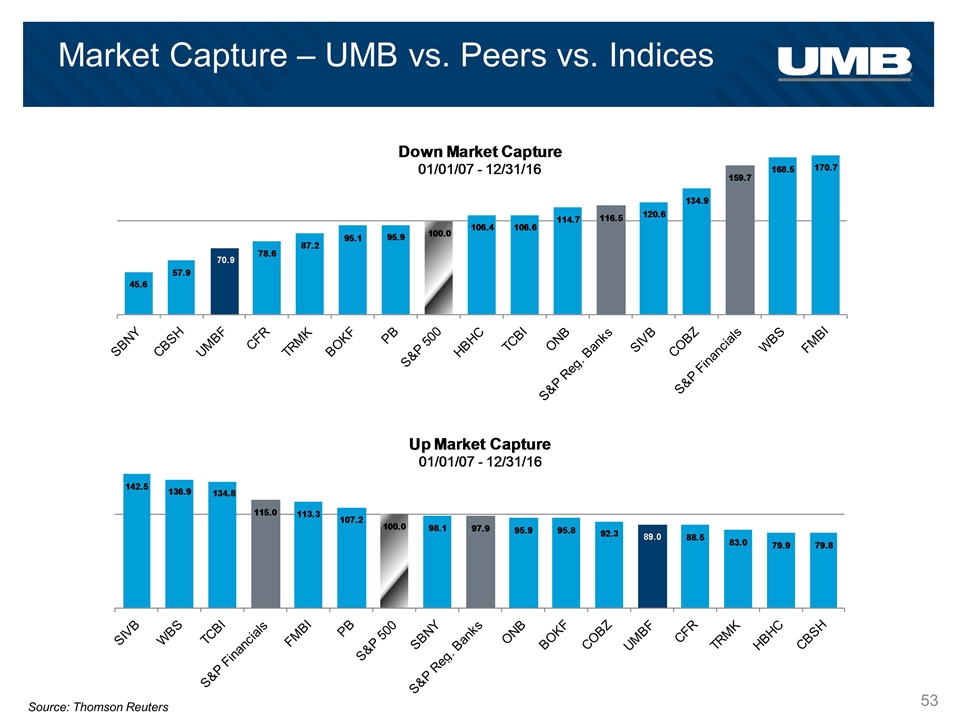

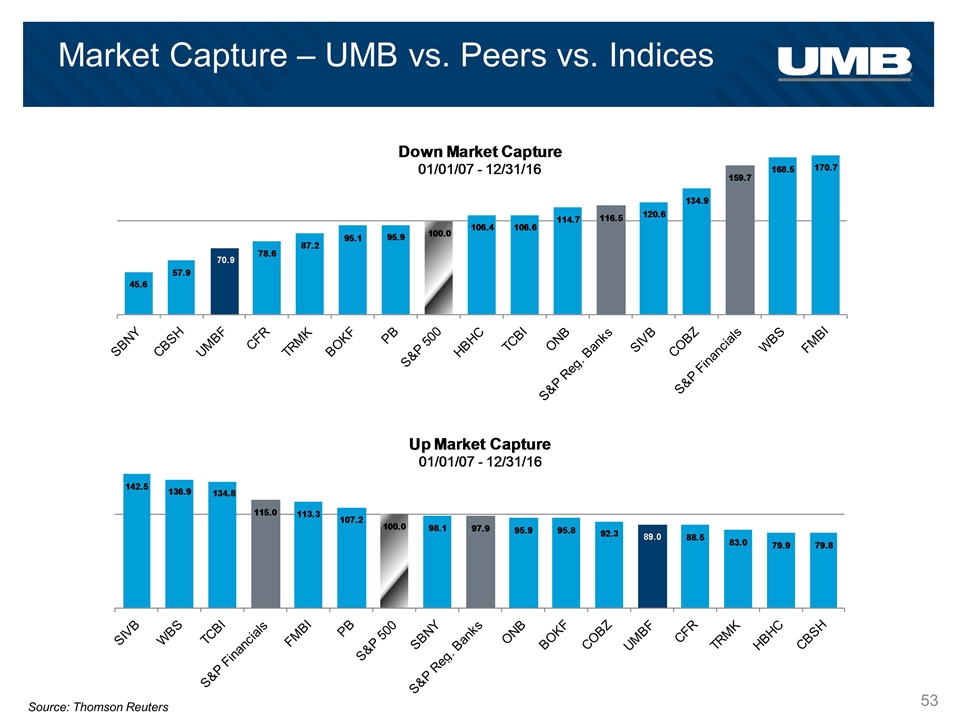

Market Capture – UMB vs. Peers vs. Indices Source: Thomson Reuters

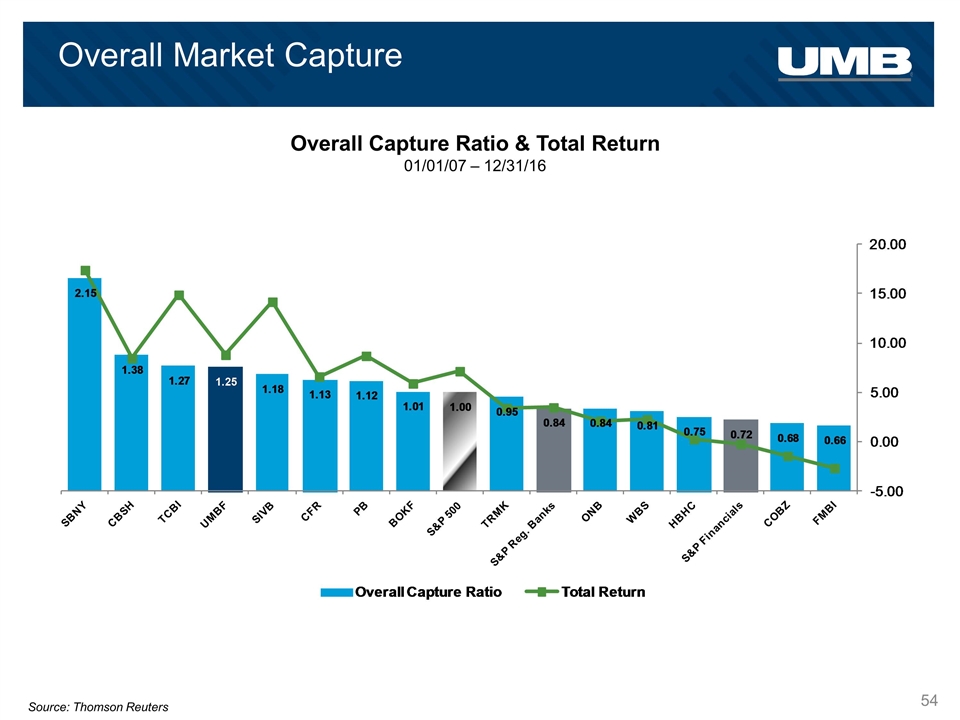

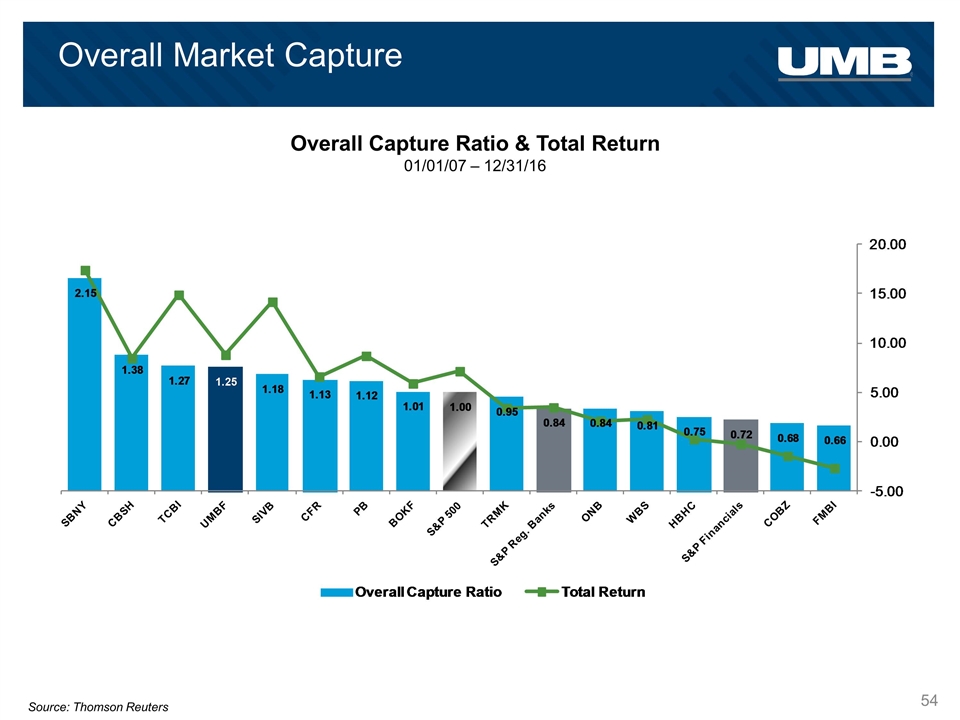

Overall Market Capture Overall Capture Ratio & Total Return 01/01/07 – 12/31/16 Source: Thomson Reuters

UMB Financial Fourth Quarter 2016 January 24, 2017