Second Quarter 2020 July 28, 2020 UMB Financial Corporation Exhibit 99.2

Cautionary Notice about Forward-Looking Statements This presentation of UMB Financial Corporation (the “company,” “our,” “us,” or “we”) contains, and our other communications may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “outlook,” “forecast,” “target,” “trend,” “plan,” “goal,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, results, or aspirations. All forward-looking statements are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects, performance, condition, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking statements are described in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (SEC). In addition to such factors that have been disclosed previously, the COVID-19 pandemic (the “pandemic”) may also cause actual results or other future events, circumstances, or aspirations to differ from our forward-looking statements. The pandemic has created a global public-health crisis that has resulted in widespread volatility and deteriorations in household, business, economic, and market conditions. It is currently adversely affecting the company and its customers, counterparties, employees, and third-party service providers, and the continued adverse impacts on our business, financial position, results of operations, and prospects could be significant. We are not able to accurately predict the extent of the impact of the pandemic on our capital, liquidity, and other financial positions and on our business, results of operations, and prospects at this time, and we believe it will depend on a number of evolving factors, including: (i) the duration, extent and severity of the pandemic; (ii) the response of governmental and non-governmental authorities to the pandemic, which is rapidly changing and not always coordinated or consistent across jurisdictions; (iii) the effect of the pandemic on our customers, counterparties, employees and third-party service providers, which may vary widely, and which is generally expected to increase our credit, operational, and other risks and (iv) the effect of the pandemic on economies and markets, which in turn could adversely affect, among other things, the origination of new loans and the performance of our existing loans. The pandemic is also expected to have a significant impact on our current expected credit loss (CECL) calculation and related provision under a new accounting standard that we were required to phase in beginning January 2020. The CECL calculation includes periodic estimates of the net amount expected to be collected over the contractual term of certain financial assets, and requires us to take into account, among other things, economic conditions forecasted over the life of the financial asset, including the current and anticipated effects of the pandemic. Any forward-looking statement should be evaluated in light of these considerations. Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except to the extent required by applicable securities laws. You, however, should consult disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document that is filed or furnished with the SEC.

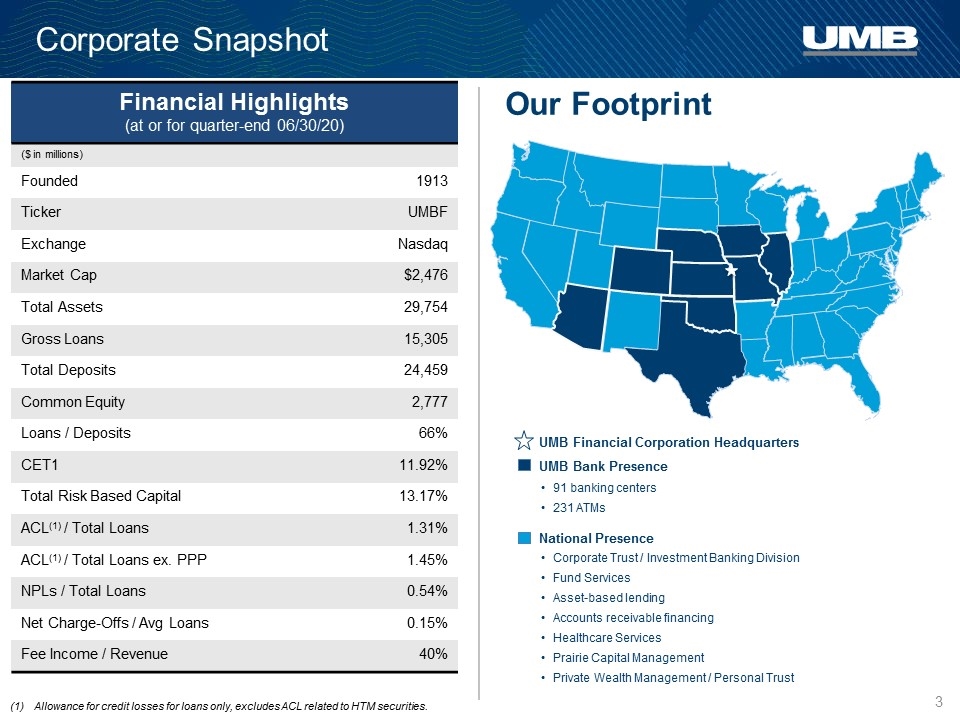

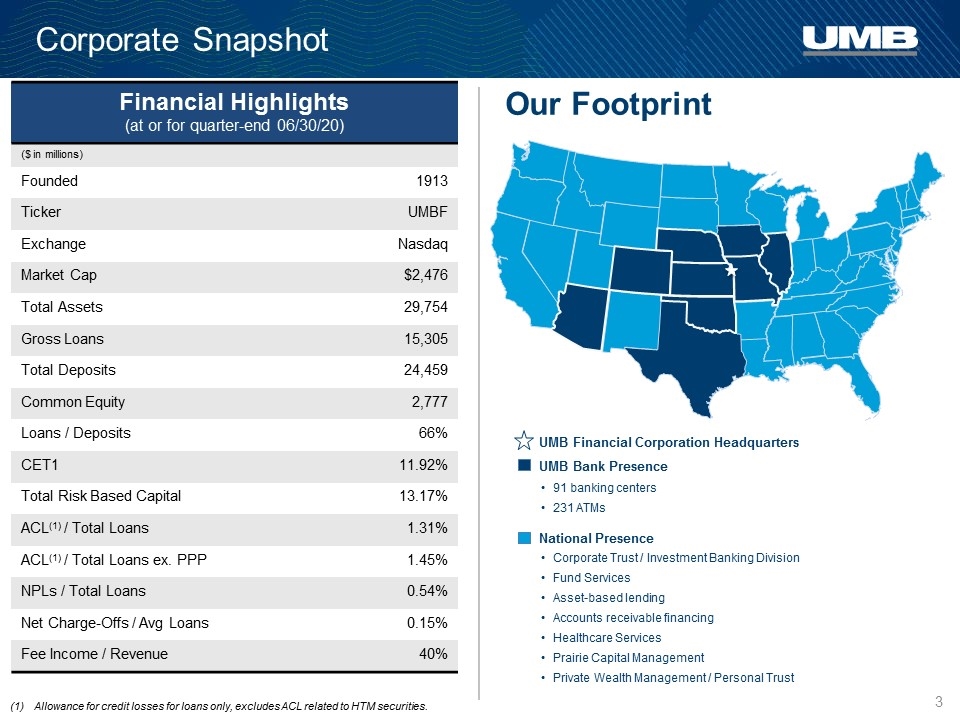

Corporate Snapshot Corporate Trust / Investment Banking Division Fund Services Asset-based lending Accounts receivable financing Healthcare Services Prairie Capital Management Private Wealth Management / Personal Trust 91 banking centers 231 ATMs Our Footprint National Presence UMB Financial Corporation Headquarters UMB Bank Presence Allowance for credit losses for loans only, excludes ACL related to HTM securities. Financial Highlights (at or for quarter-end 06/30/20) ($ in millions) Founded 1913 Ticker UMBF Exchange Nasdaq Market Cap $2,476 Total Assets 29,754 Gross Loans 15,305 Total Deposits 24,459 Common Equity 2,777 Loans / Deposits 66% CET1 11.92% Total Risk Based Capital 13.17% ACL(1) / Total Loans 1.31% ACL(1) / Total Loans ex. PPP 1.45% NPLs / Total Loans 0.54% Net Charge-Offs / Avg Loans 0.15% Fee Income / Revenue 40%

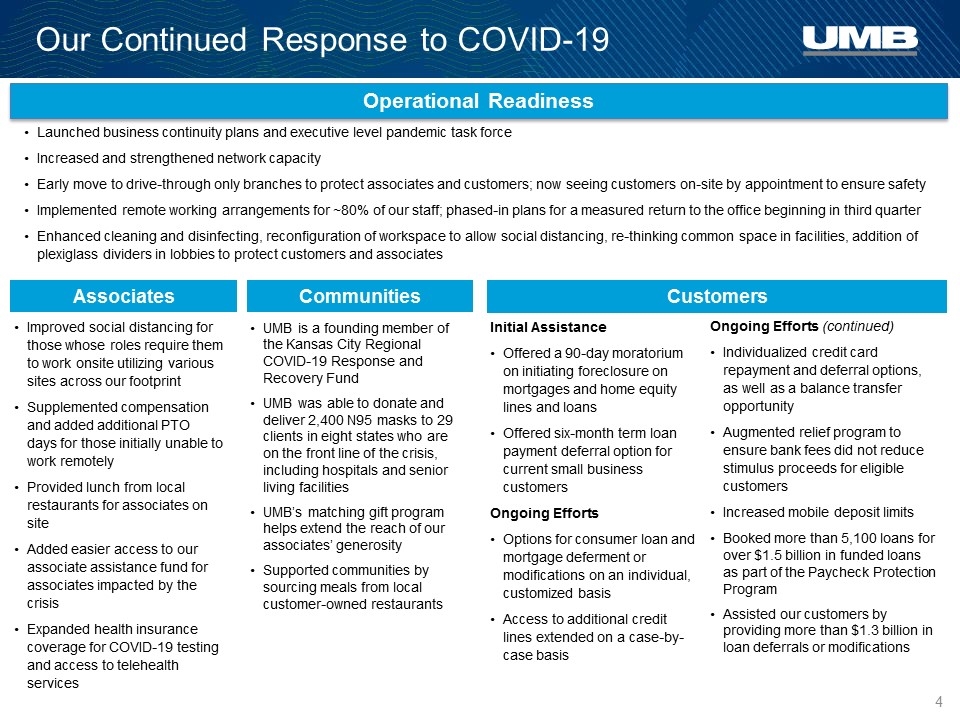

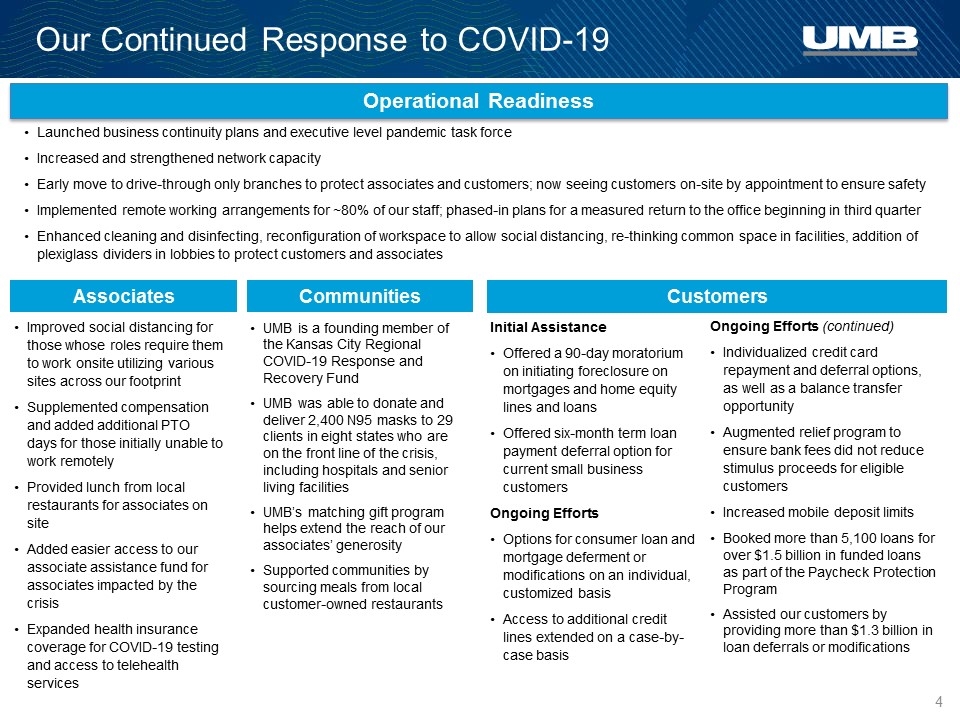

Our Continued Response to COVID-19 Operational Readiness Launched business continuity plans and executive level pandemic task force Increased and strengthened network capacity Early move to drive-through only branches to protect associates and customers; now seeing customers on-site by appointment to ensure safety Implemented remote working arrangements for ~80% of our staff; phased-in plans for a measured return to the office beginning in third quarter Enhanced cleaning and disinfecting, reconfiguration of workspace to allow social distancing, re-thinking common space in facilities, addition of plexiglass dividers in lobbies to protect customers and associates Associates Communities Customers UMB is a founding member of the Kansas City Regional COVID-19 Response and Recovery Fund UMB was able to donate and deliver 2,400 N95 masks to 29 clients in eight states who are on the front line of the crisis, including hospitals and senior living facilities UMB’s matching gift program helps extend the reach of our associates’ generosity Supported communities by sourcing meals from local customer-owned restaurants Improved social distancing for those whose roles require them to work onsite utilizing various sites across our footprint Supplemented compensation and added additional PTO days for those initially unable to work remotely Provided lunch from local restaurants for associates on site Added easier access to our associate assistance fund for associates impacted by the crisis Expanded health insurance coverage for COVID-19 testing and access to telehealth services Initial Assistance Offered a 90-day moratorium on initiating foreclosure on mortgages and home equity lines and loans Offered six-month term loan payment deferral option for current small business customers Ongoing Efforts Options for consumer loan and mortgage deferment or modifications on an individual, customized basis Access to additional credit lines extended on a case-by-case basis Ongoing Efforts (continued) Individualized credit card repayment and deferral options, as well as a balance transfer opportunity Augmented relief program to ensure bank fees did not reduce stimulus proceeds for eligible customers Increased mobile deposit limits Booked more than 5,100 loans for over $1.5 billion in funded loans as part of the Paycheck Protection Program Assisted our customers by providing more than $1.3 billion in loan deferrals or modifications

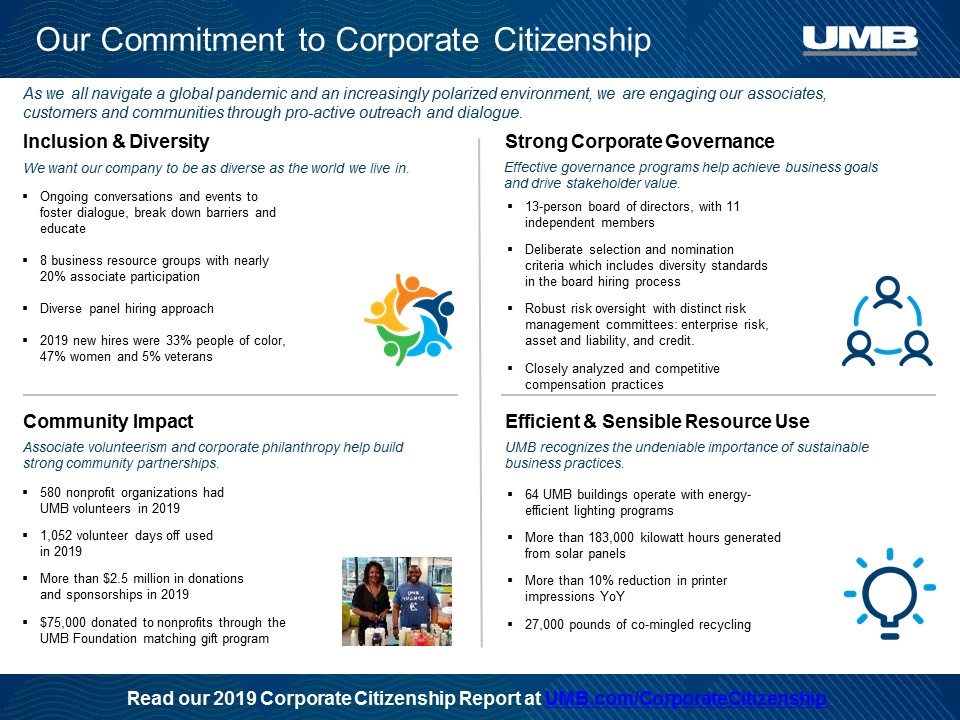

Our Commitment to Corporate Citizenship Inclusion & Diversity Community Impact Efficient & Sensible Resource Use Strong Corporate Governance As we all navigate a global pandemic and an increasingly polarized environment, we are engaging our associates, customers and communities through pro-active outreach and dialogue. Associate volunteerism and corporate philanthropy help build strong community partnerships. 580 nonprofit organizations had UMB volunteers in 2019 1,052 volunteer days off used in 2019 More than $2.5 million in donations and sponsorships in 2019 $75,000 donated to nonprofits through the UMB Foundation matching gift program Ongoing conversations and events to foster dialogue, break down barriers and educate 8 business resource groups with nearly 20% associate participation Diverse panel hiring approach 2019 new hires were 33% people of color, 47% women and 5% veterans We want our company to be as diverse as the world we live in. UMB recognizes the undeniable importance of sustainable business practices. Effective governance programs help achieve business goals and drive stakeholder value. 13-person board of directors, with 11 independent members Deliberate selection and nomination criteria which includes diversity standards in the board hiring process Robust risk oversight with distinct risk management committees: enterprise risk, asset and liability, and credit. Closely analyzed and competitive compensation practices 64 UMB buildings operate with energy-efficient lighting programs More than 183,000 kilowatt hours generated from solar panels More than 10% reduction in printer impressions YoY 27,000 pounds of co-mingled recycling Read our 2019 Corporate Citizenship Report at UMB.com/CorporateCitizenship

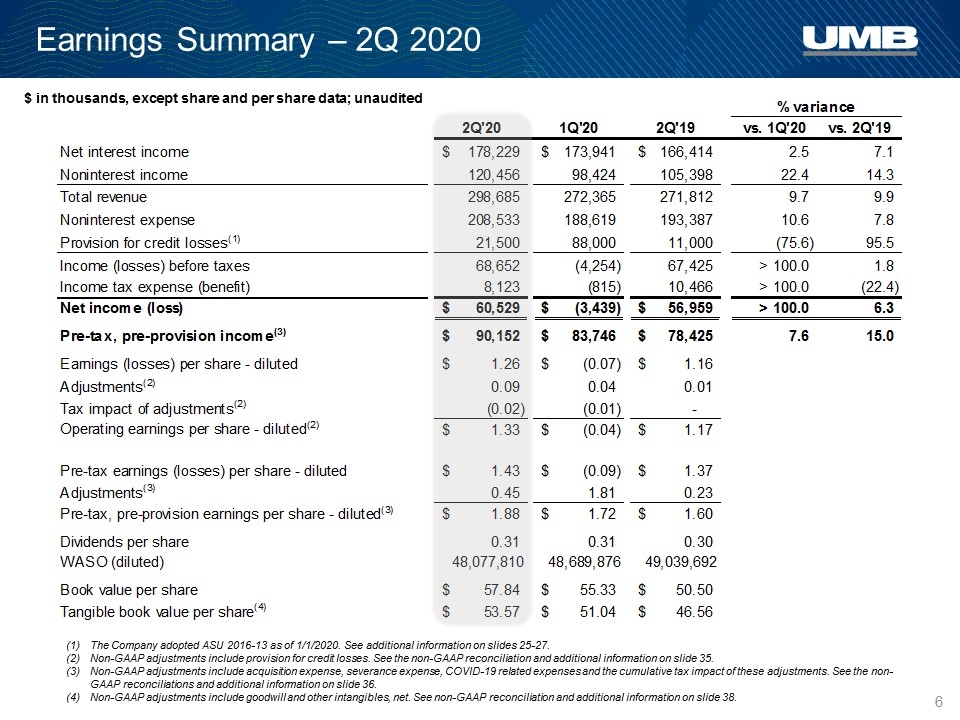

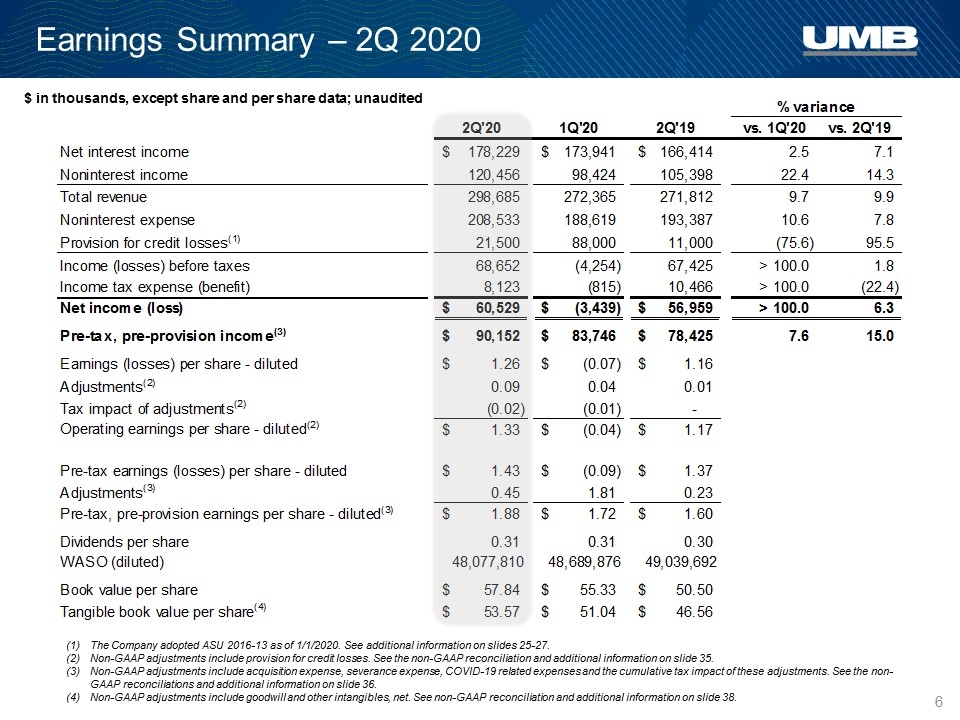

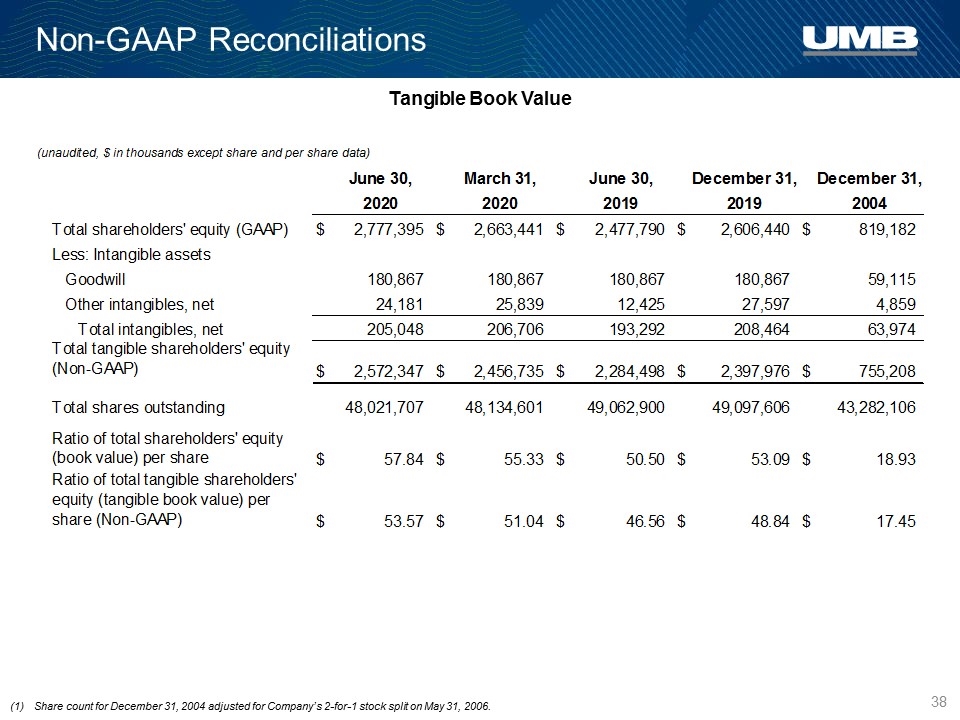

Earnings Summary – 2Q 2020 The Company adopted ASU 2016-13 as of 1/1/2020. See additional information on slides 25-27. Non-GAAP adjustments include provision for credit losses. See the non-GAAP reconciliation and additional information on slide 35. Non-GAAP adjustments include acquisition expense, severance expense, COVID-19 related expenses and the cumulative tax impact of these adjustments. See the non-GAAP reconciliations and additional information on slide 36. Non-GAAP adjustments include goodwill and other intangibles, net. See non-GAAP reconciliation and additional information on slide 38. $ in thousands, except share and per share data; unaudited

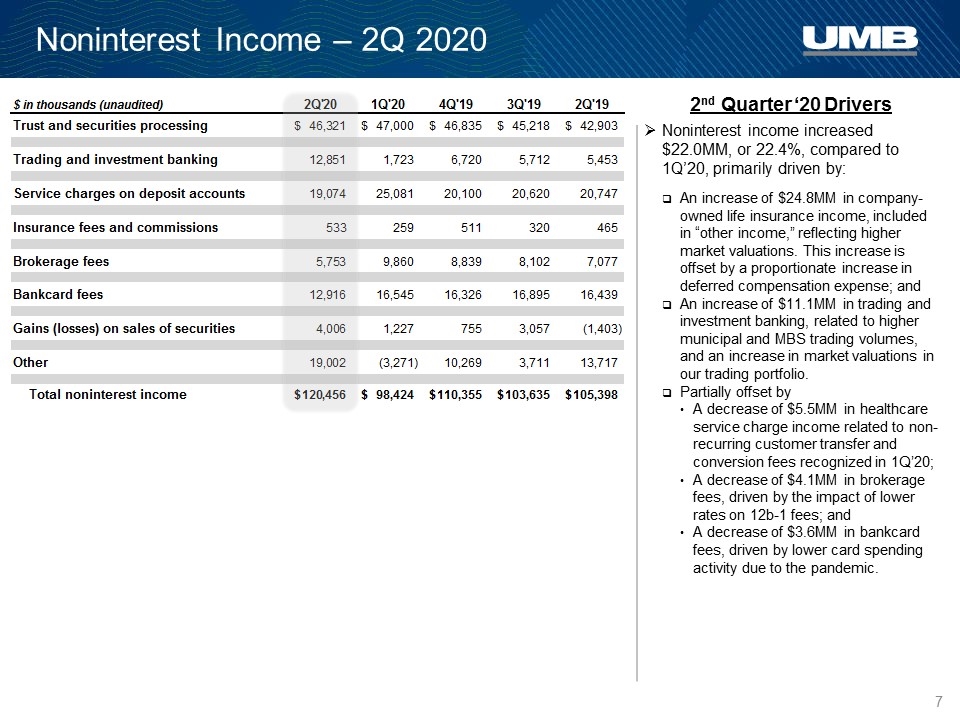

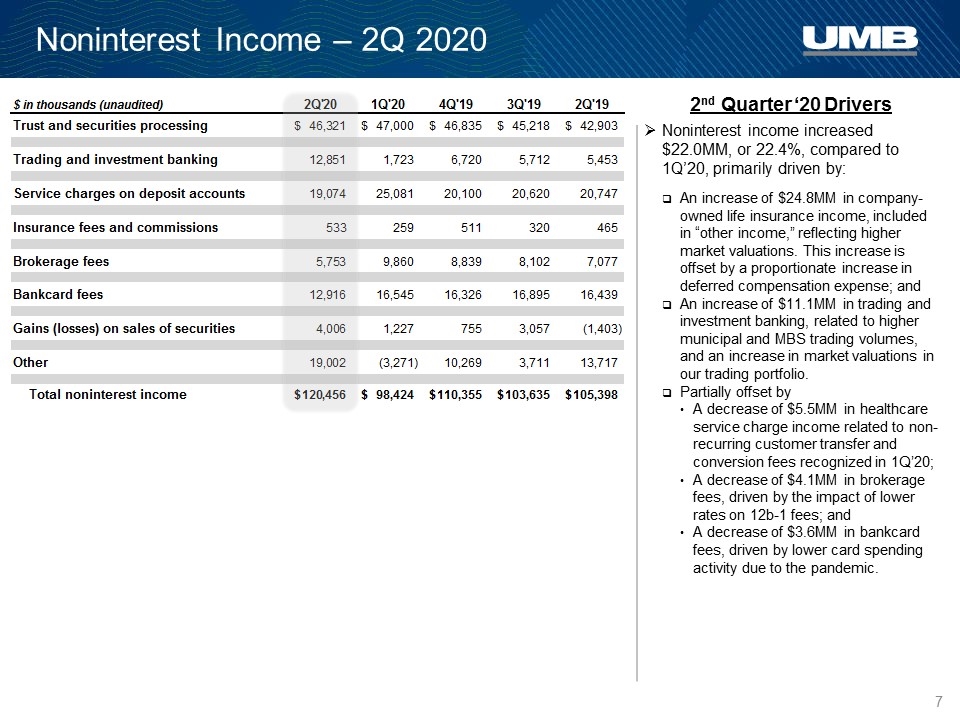

Noninterest Income – 2Q 2020 2nd Quarter ‘20 Drivers Noninterest income increased $22.0MM, or 22.4%, compared to 1Q’20, primarily driven by: An increase of $24.8MM in company-owned life insurance income, included in “other income,” reflecting higher market valuations. This increase is offset by a proportionate increase in deferred compensation expense; and An increase of $11.1MM in trading and investment banking, related to higher municipal and MBS trading volumes, and an increase in market valuations in our trading portfolio. Partially offset by A decrease of $5.5MM in healthcare service charge income related to non-recurring customer transfer and conversion fees recognized in 1Q’20; A decrease of $4.1MM in brokerage fees, driven by the impact of lower rates on 12b-1 fees; and A decrease of $3.6MM in bankcard fees, driven by lower card spending activity due to the pandemic.

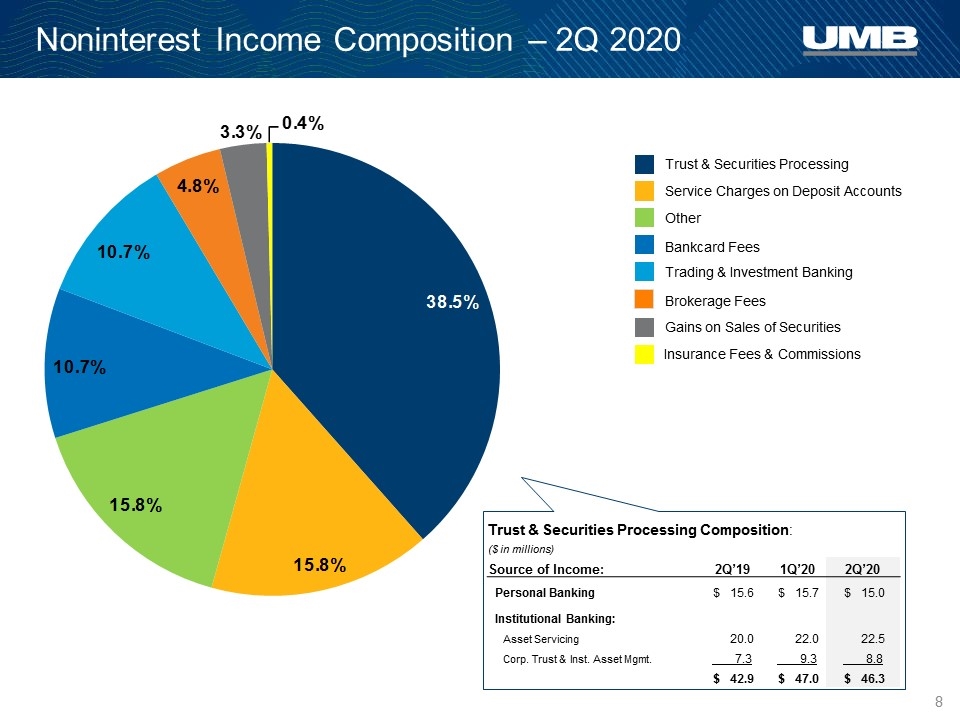

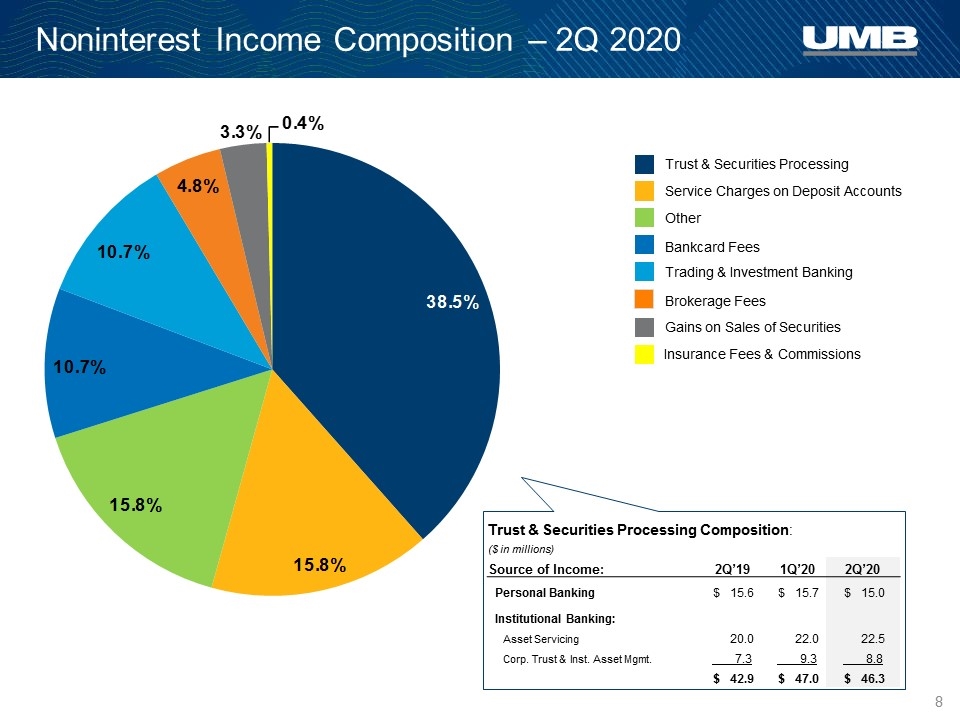

Noninterest Income Composition – 2Q 2020 Trust & Securities Processing Composition: ($ in millions) Source of Income: 2Q’19 1Q’20 2Q’20 Personal Banking $ 15.6 $ 15.7 $ 15.0 Institutional Banking: Asset Servicing 20.0 22.0 22.5 Corp. Trust & Inst. Asset Mgmt. 7.3 9.3 8.8 $ 42.9 $ 47.0 $ 46.3 Bankcard Fees Service Charges on Deposit Accounts Trust & Securities Processing Gains on Sales of Securities Trading & Investment Banking Other Brokerage Fees Insurance Fees & Commissions

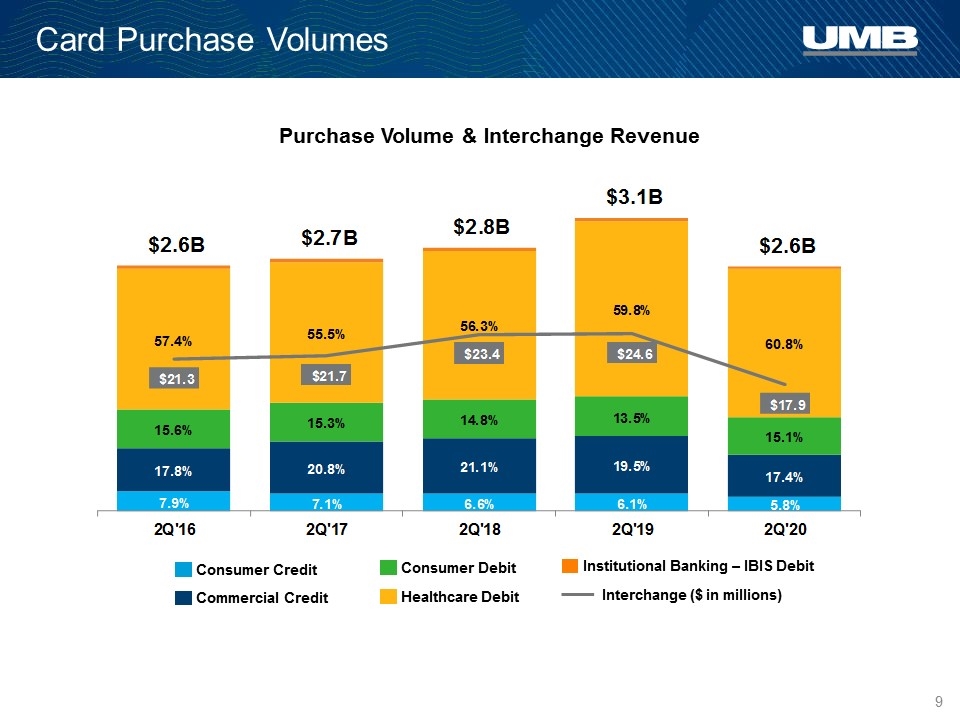

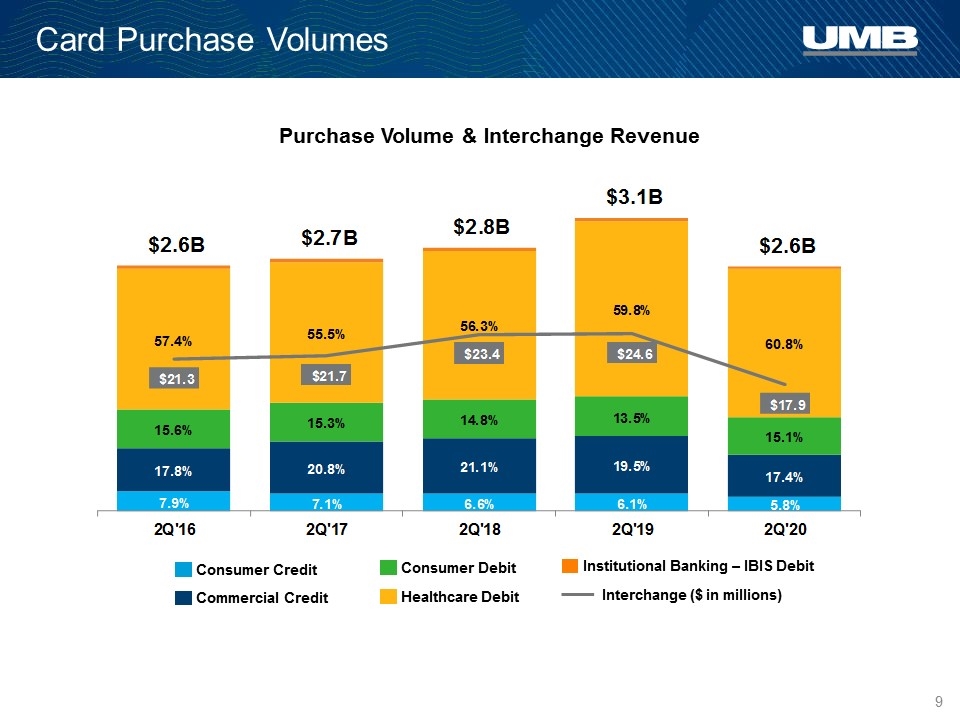

Card Purchase Volumes Purchase Volume & Interchange Revenue Commercial Credit Consumer Credit Consumer Debit Healthcare Debit Institutional Banking – IBIS Debit Interchange ($ in millions)

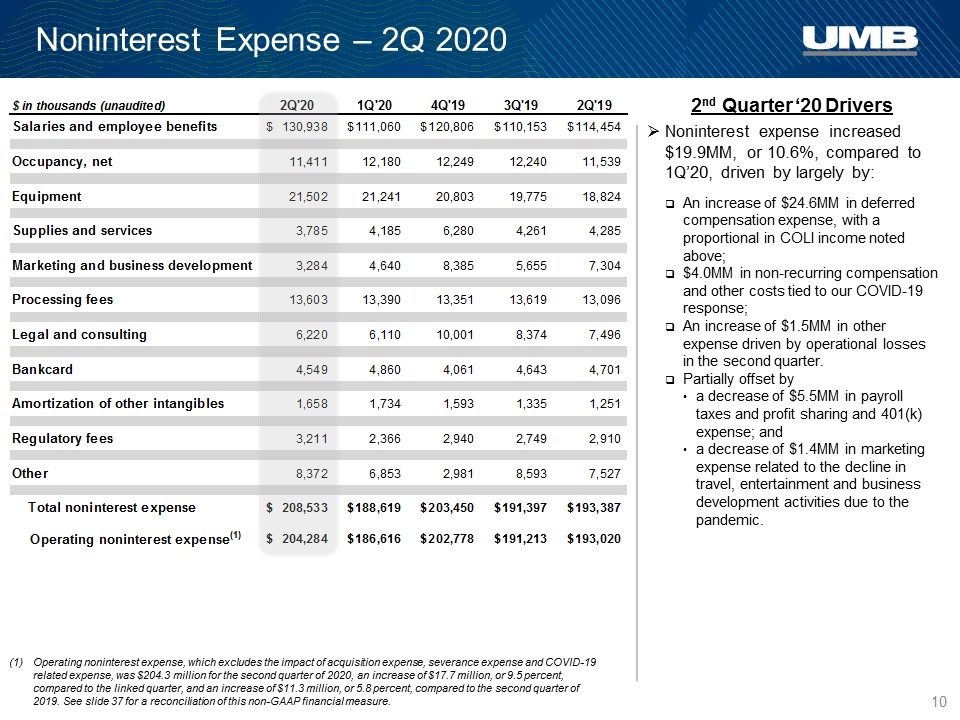

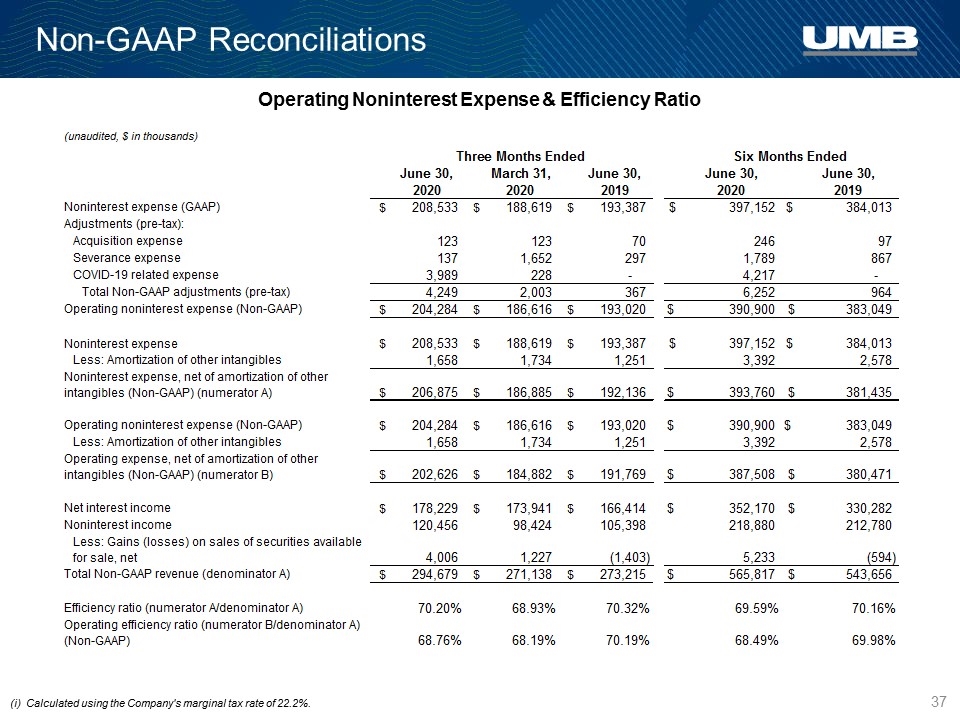

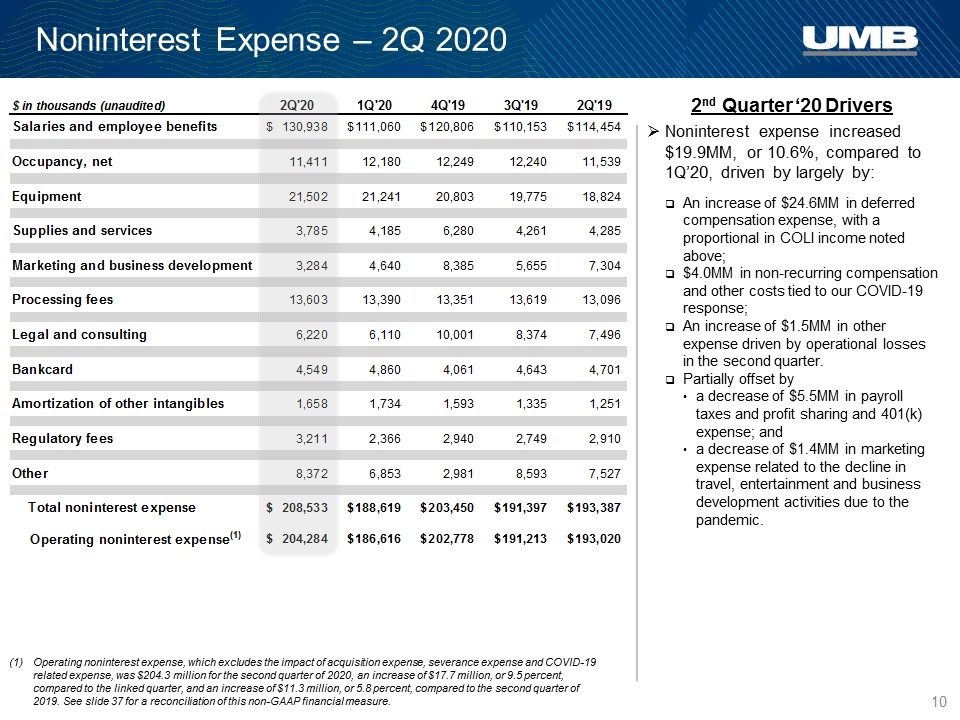

Noninterest Expense – 2Q 2020 Operating noninterest expense, which excludes the impact of acquisition expense, severance expense and COVID-19 related expense, was $204.3 million for the second quarter of 2020, an increase of $17.7 million, or 9.5 percent, compared to the linked quarter, and an increase of $11.3 million, or 5.8 percent, compared to the second quarter of 2019. See slide 37 for a reconciliation of this non-GAAP financial measure. Noninterest expense increased $19.9MM, or 10.6%, compared to 1Q’20, driven by largely by: An increase of $24.6MM in deferred compensation expense, with a proportional in COLI income noted above; $4.0MM in non-recurring compensation and other costs tied to our COVID-19 response; An increase of $1.5MM in other expense driven by operational losses in the second quarter. Partially offset by a decrease of $5.5MM in payroll taxes and profit sharing and 401(k) expense; and a decrease of $1.4MM in marketing expense related to the decline in travel, entertainment and business development activities due to the pandemic. 2nd Quarter ‘20 Drivers

Balance Sheet

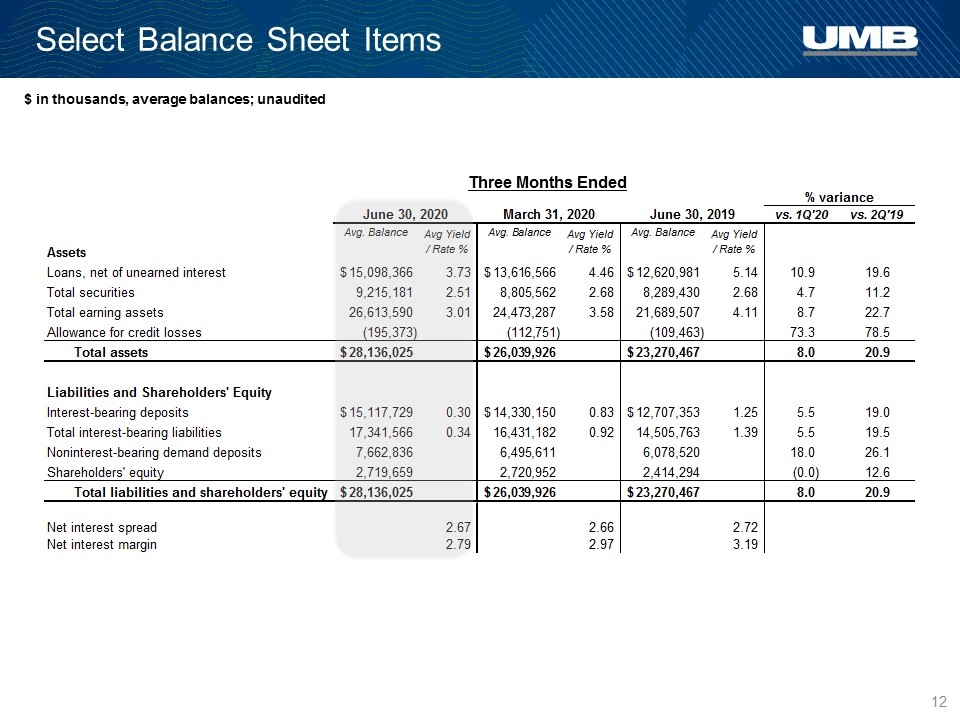

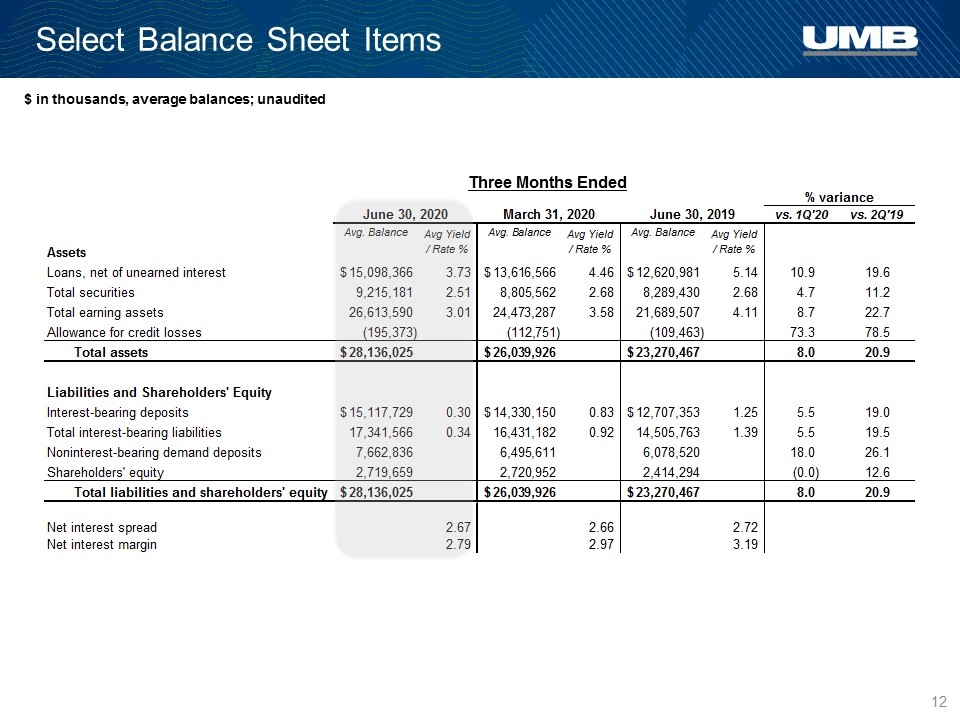

Select Balance Sheet Items $ in thousands, average balances; unaudited Three Months Ended

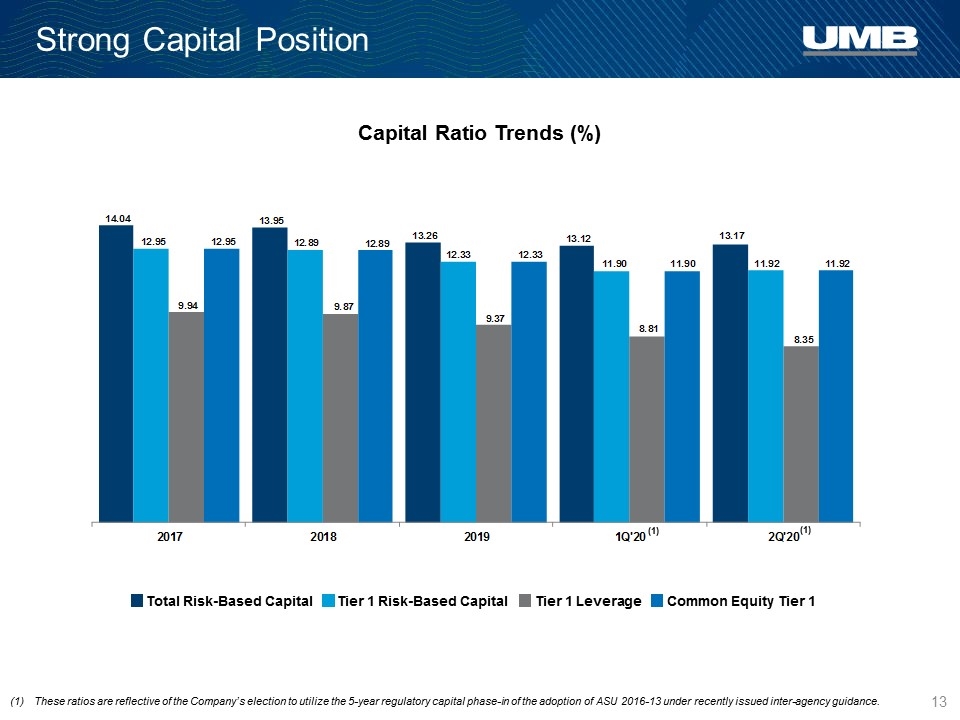

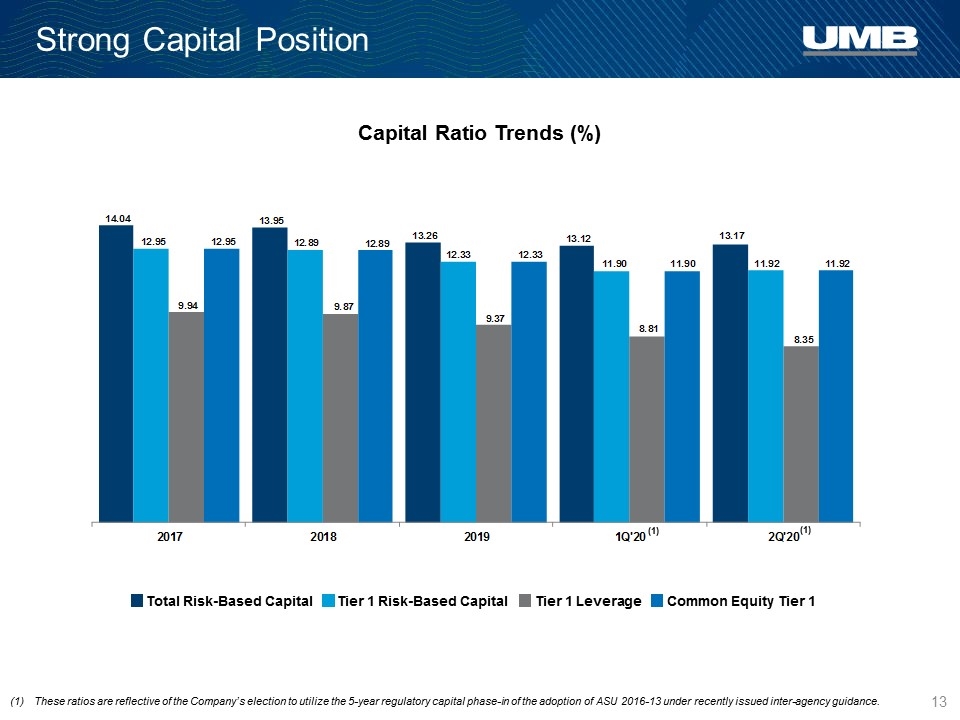

Strong Capital Position Capital Ratio Trends (%) Total Risk-Based Capital Tier 1 Risk-Based Capital Tier 1 Leverage Common Equity Tier 1 (1) These ratios are reflective of the Company’s election to utilize the 5-year regulatory capital phase-in of the adoption of ASU 2016-13 under recently issued inter-agency guidance. (1) (1)

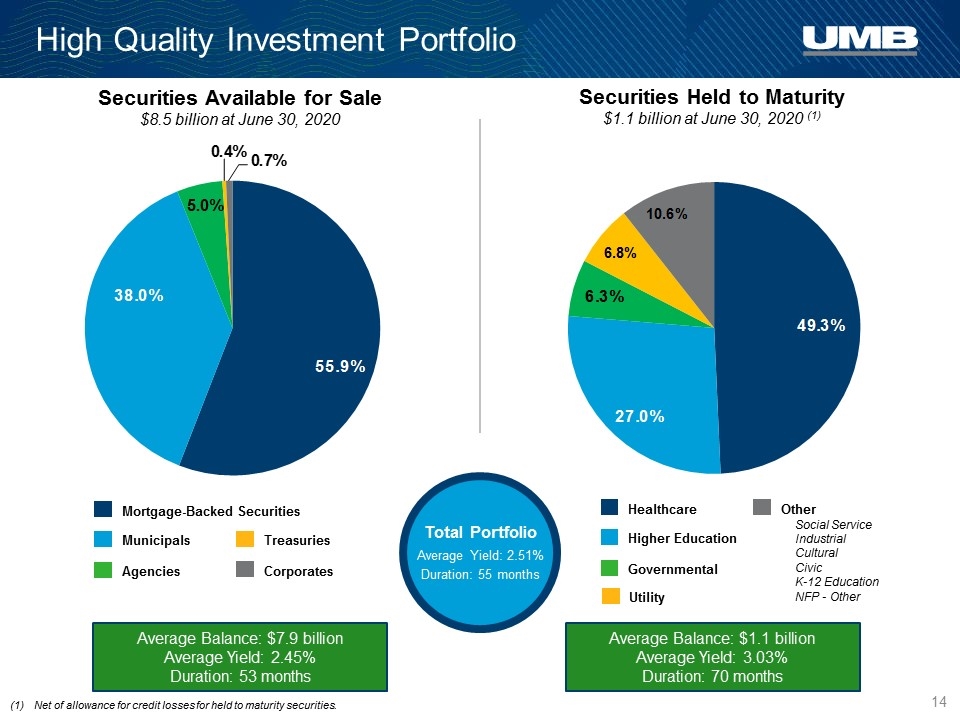

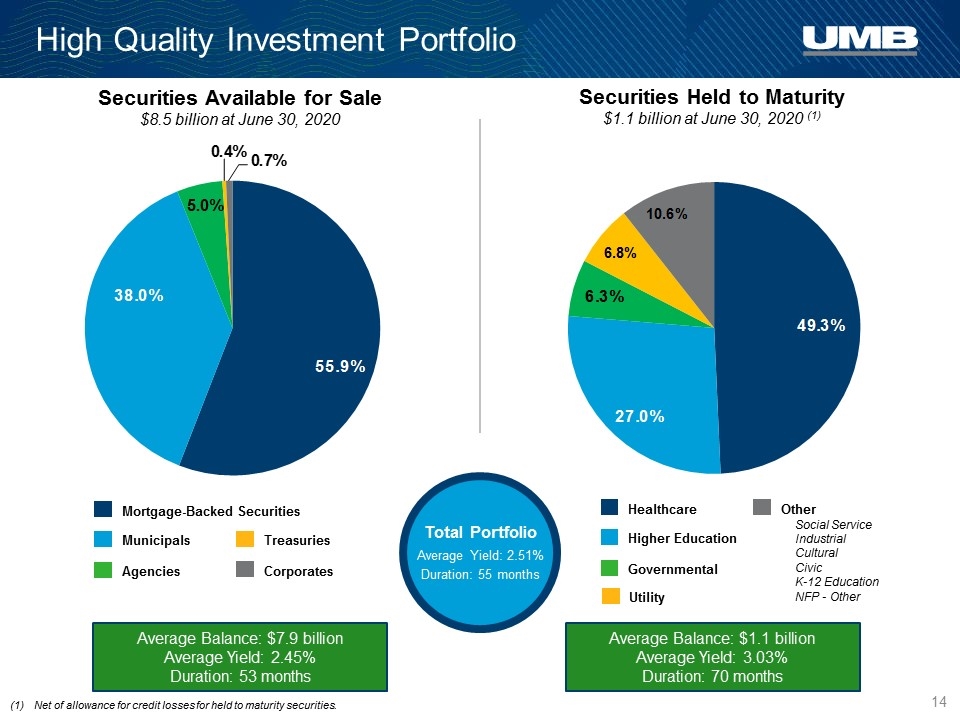

High Quality Investment Portfolio Securities Held to Maturity $1.1 billion at June 30, 2020 (1) Securities Available for Sale $8.5 billion at June 30, 2020 Governmental Other Higher Education Healthcare Utility Social Service Industrial Cultural Civic K-12 Education NFP - Other Average Balance: $7.9 billion Average Yield: 2.45% Duration: 53 months Average Balance: $1.1 billion Average Yield: 3.03% Duration: 70 months Total Portfolio Average Yield: 2.51% Duration: 55 months Agencies Corporates Municipals Mortgage-Backed Securities Treasuries Net of allowance for credit losses for held to maturity securities.

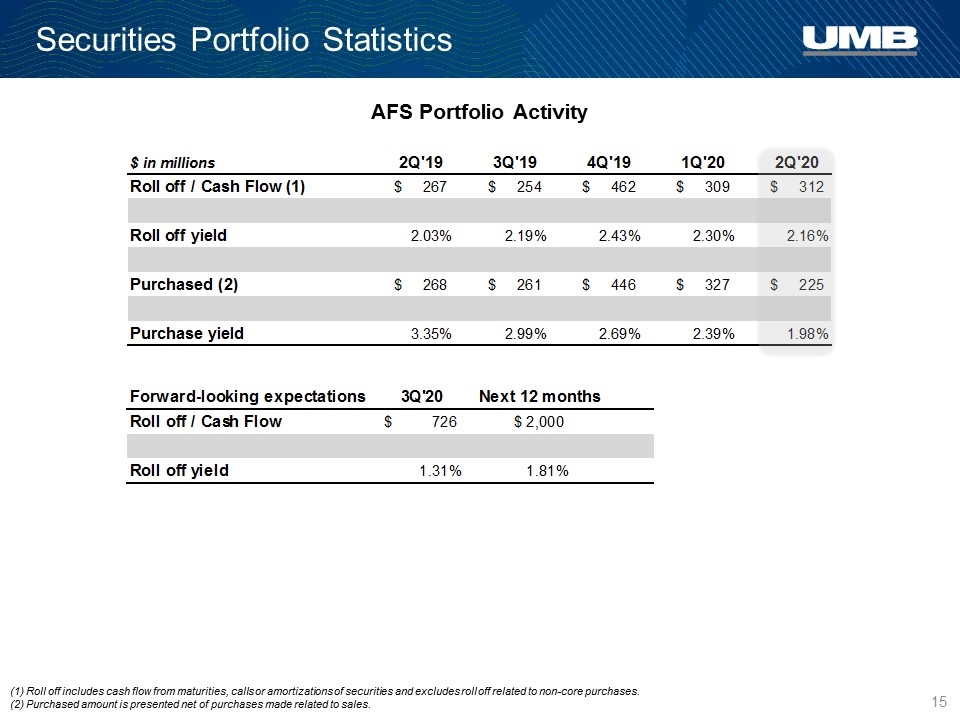

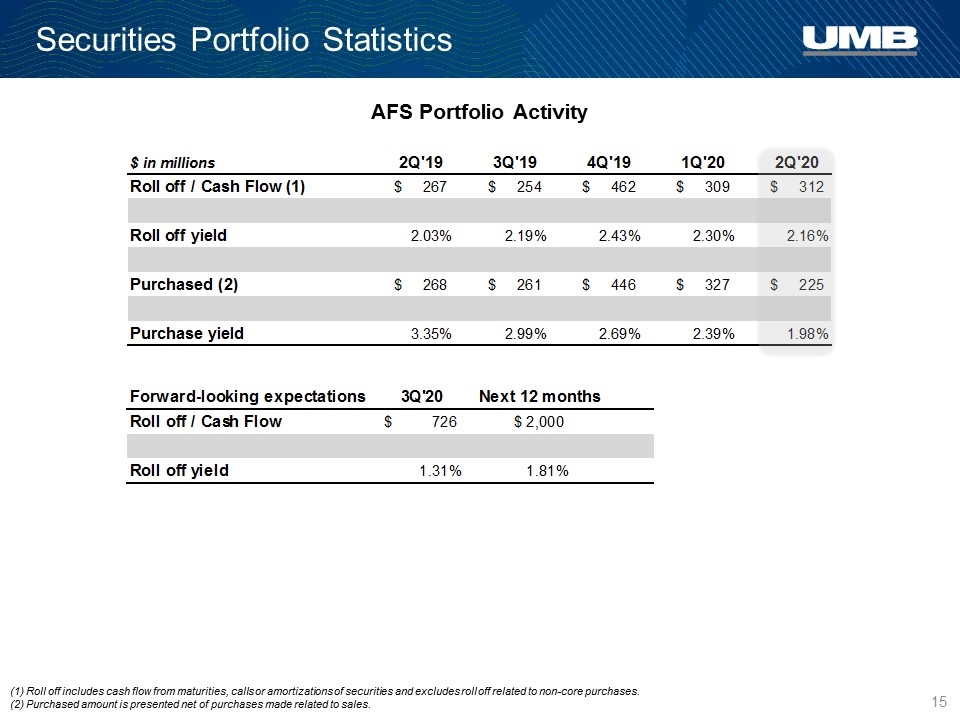

Securities Portfolio Statistics AFS Portfolio Activity (1) Roll off includes cash flow from maturities, calls or amortizations of securities and excludes roll off related to non-core purchases. (2) Purchased amount is presented net of purchases made related to sales.

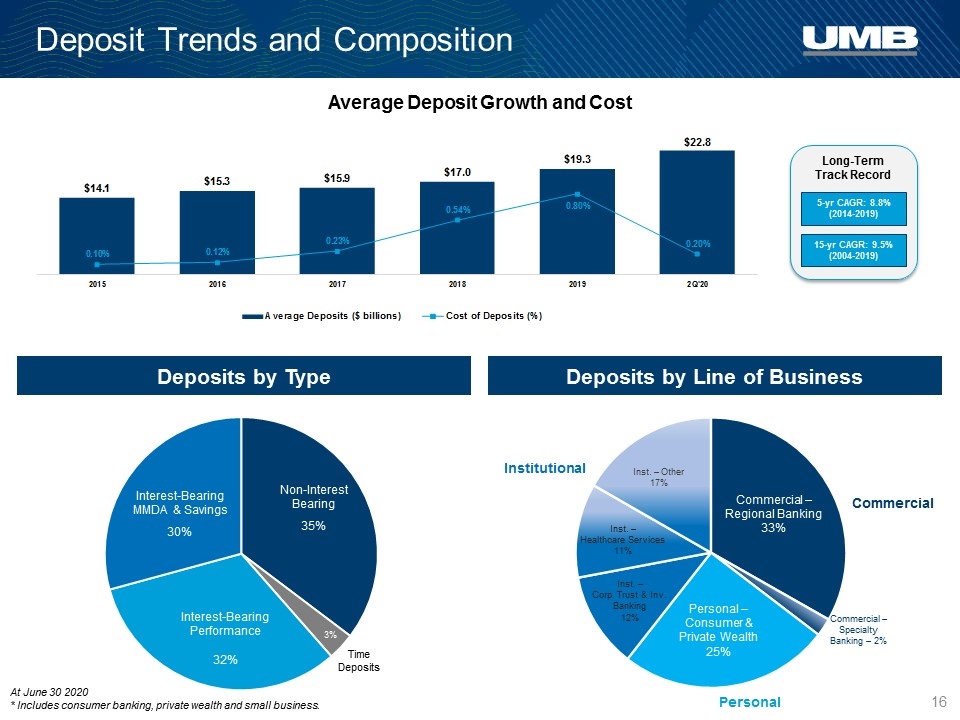

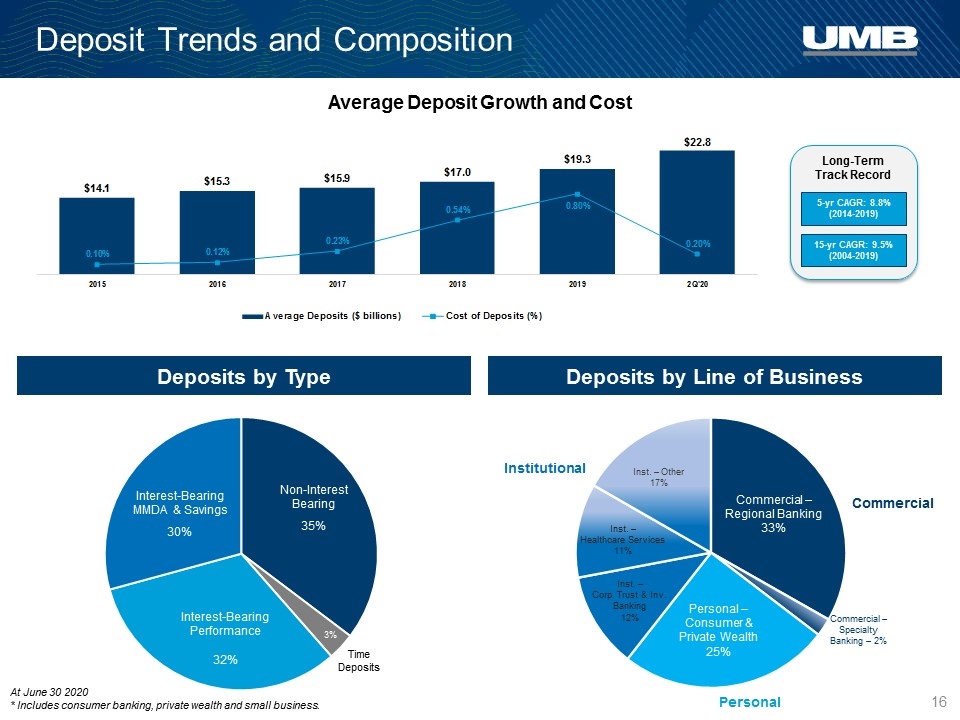

Deposit Trends and Composition Average Deposit Growth and Cost 5-yr CAGR: 8.8% (2014-2019) 15-yr CAGR: 9.5% (2004-2019) Long-Term Track Record At June 30 2020 * Includes consumer banking, private wealth and small business. Deposits by Type Deposits by Line of Business Non-Interest Bearing Interest-Bearing MMDA & Savings Time Deposits Interest-Bearing Performance Commercial Personal Institutional Commercial – Regional Banking 33% Personal – Consumer & Private Wealth 25% Commercial – Specialty Banking – 2% Inst. – Corp. Trust & Inv. Banking 12% Inst. – Healthcare Services 11% Inst. – Other 17%

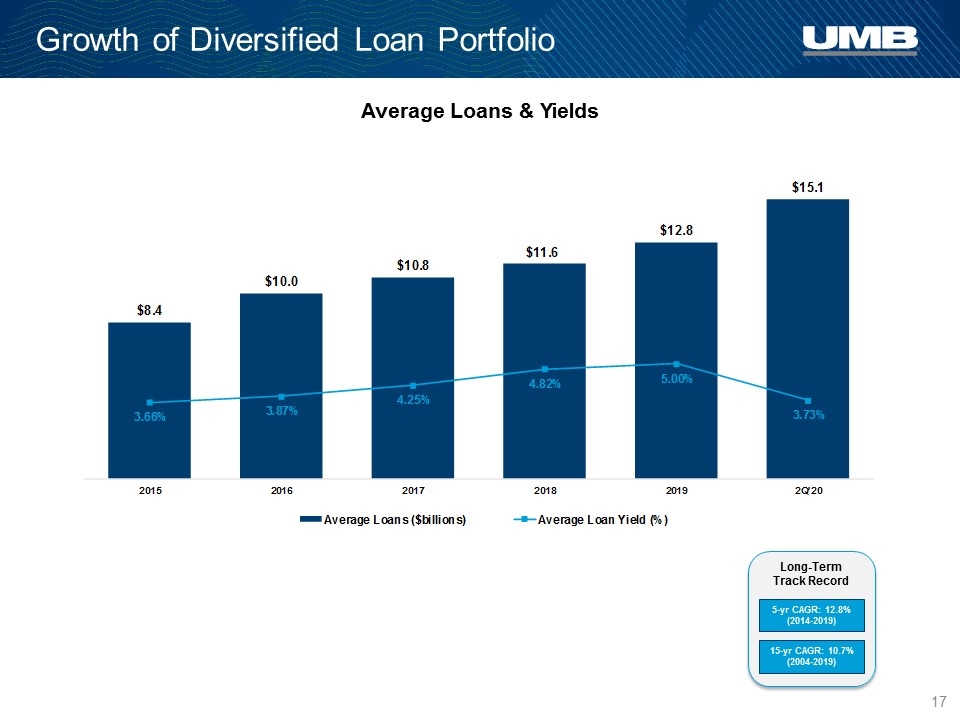

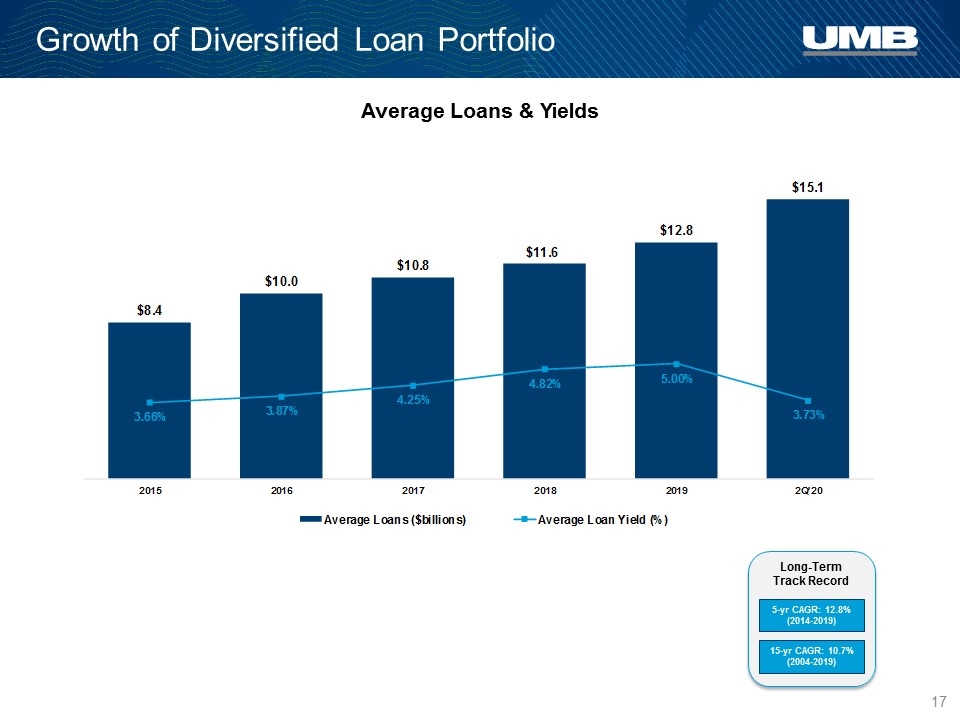

Growth of Diversified Loan Portfolio Average Loans & Yields 5-yr CAGR: 12.8% (2014-2019) 15-yr CAGR: 10.7% (2004-2019) Long-Term Track Record

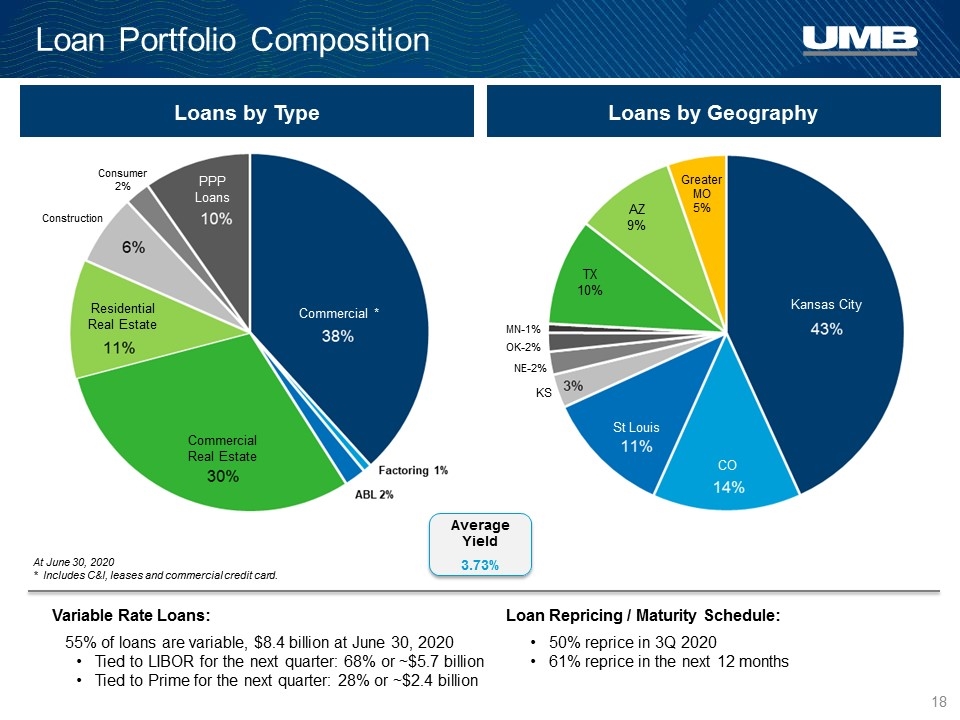

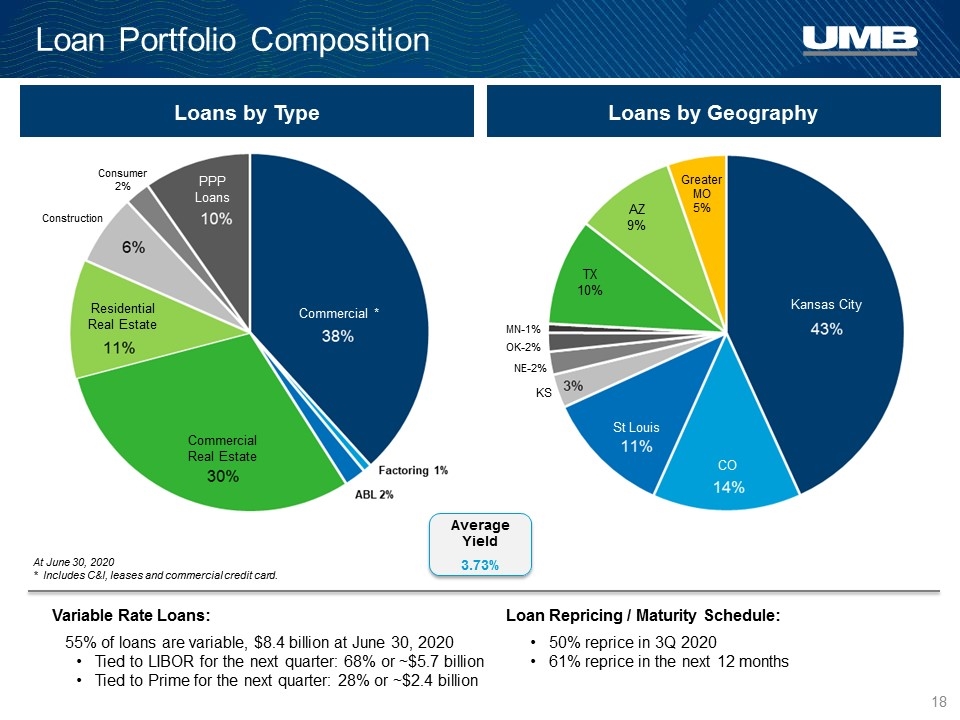

Loan Portfolio Composition Variable Rate Loans: 55% of loans are variable, $8.4 billion at June 30, 2020 Tied to LIBOR for the next quarter: 68% or ~$5.7 billion Tied to Prime for the next quarter: 28% or ~$2.4 billion Loan Repricing / Maturity Schedule: 50% reprice in 3Q 2020 61% reprice in the next 12 months At June 30, 2020 * Includes C&I, leases and commercial credit card. Loans by Type Loans by Geography Average Yield 3.73% Kansas City CO St Louis AZ 9% KS TX 10% Greater MO 5% NE-2% OK-2% Commercial * Commercial Real Estate Residential Real Estate Consumer 2% Construction PPP Loans MN-1%

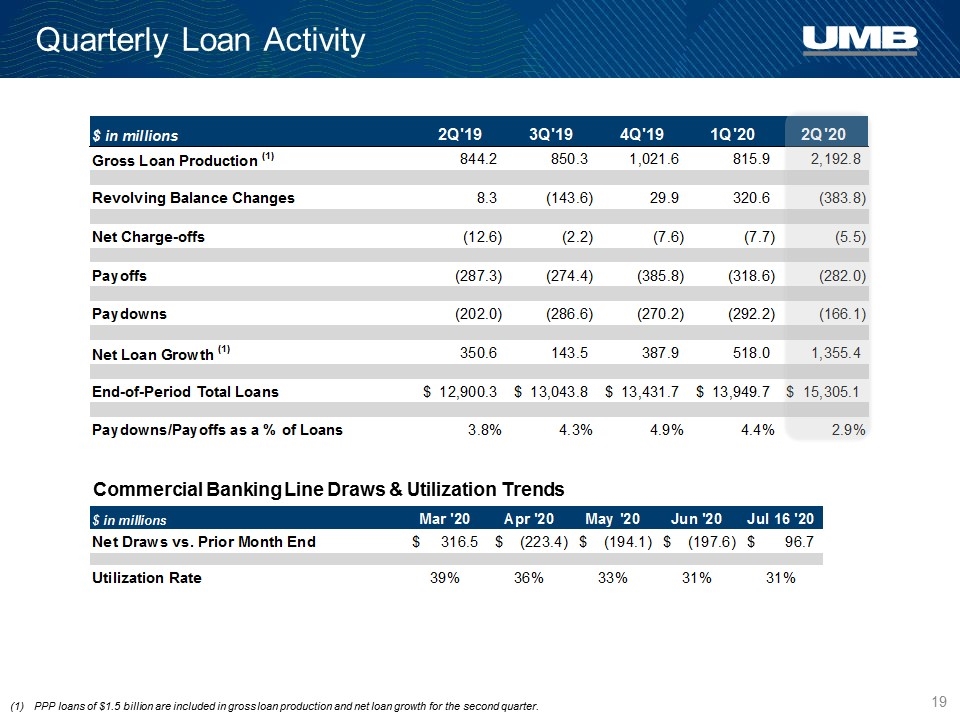

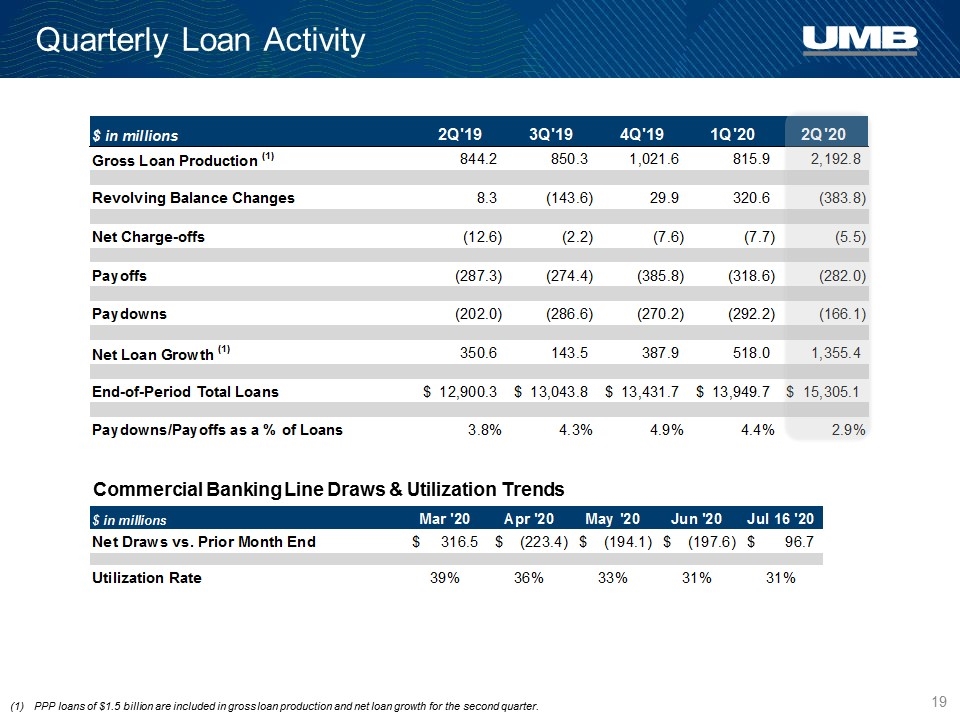

Quarterly Loan Activity Commercial Banking Line Draws & Utilization Trends PPP loans of $1.5 billion are included in gross loan production and net loan growth for the second quarter.

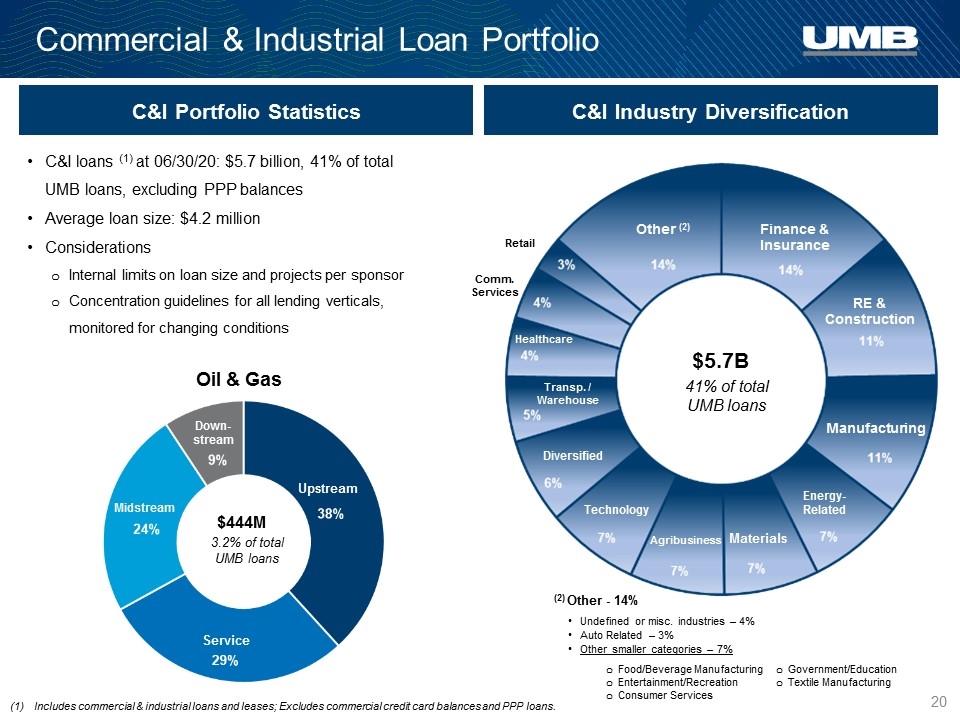

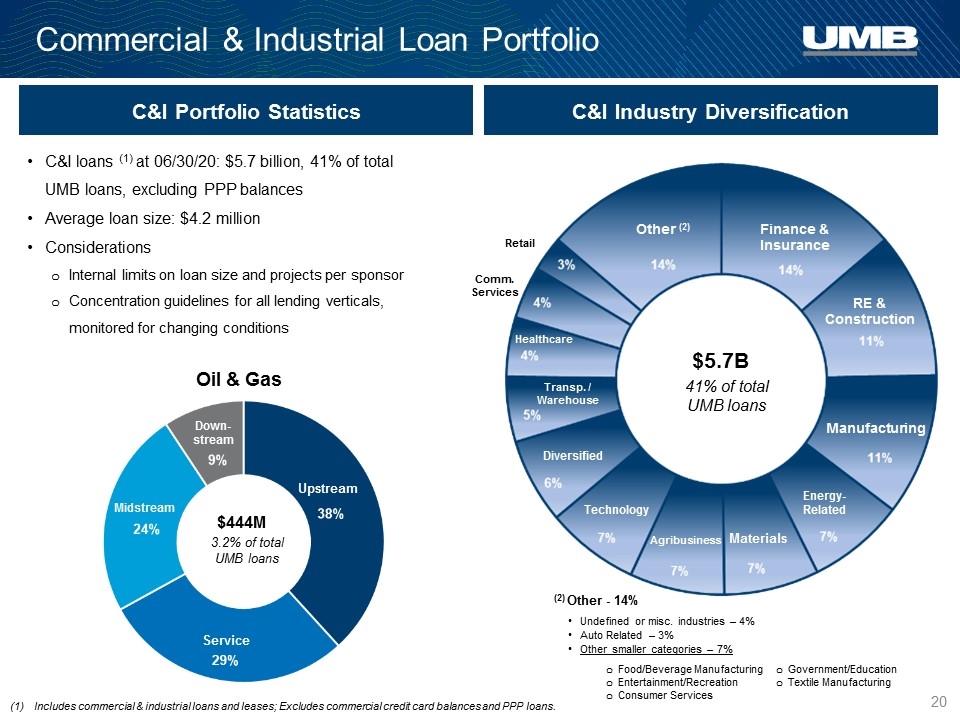

Commercial & Industrial Loan Portfolio (2) Other - 14% Undefined or misc. industries – 4% Auto Related – 3% Other smaller categories – 7% Transp. / Warehouse Diversified Technology Materials Manufacturing Retail Healthcare Comm. Services Other (2) Agribusiness RE & Construction Finance & Insurance Energy-Related C&I Portfolio Statistics C&I Industry Diversification $5.7B 41% of total UMB loans Oil & Gas $444M 3.2% of total UMB loans Upstream Service Midstream Down- stream C&I loans (1) at 06/30/20: $5.7 billion, 41% of total UMB loans, excluding PPP balances Average loan size: $4.2 million Considerations Internal limits on loan size and projects per sponsor Concentration guidelines for all lending verticals, monitored for changing conditions Includes commercial & industrial loans and leases; Excludes commercial credit card balances and PPP loans. Food/Beverage Manufacturing Entertainment/Recreation Consumer Services Government/Education Textile Manufacturing

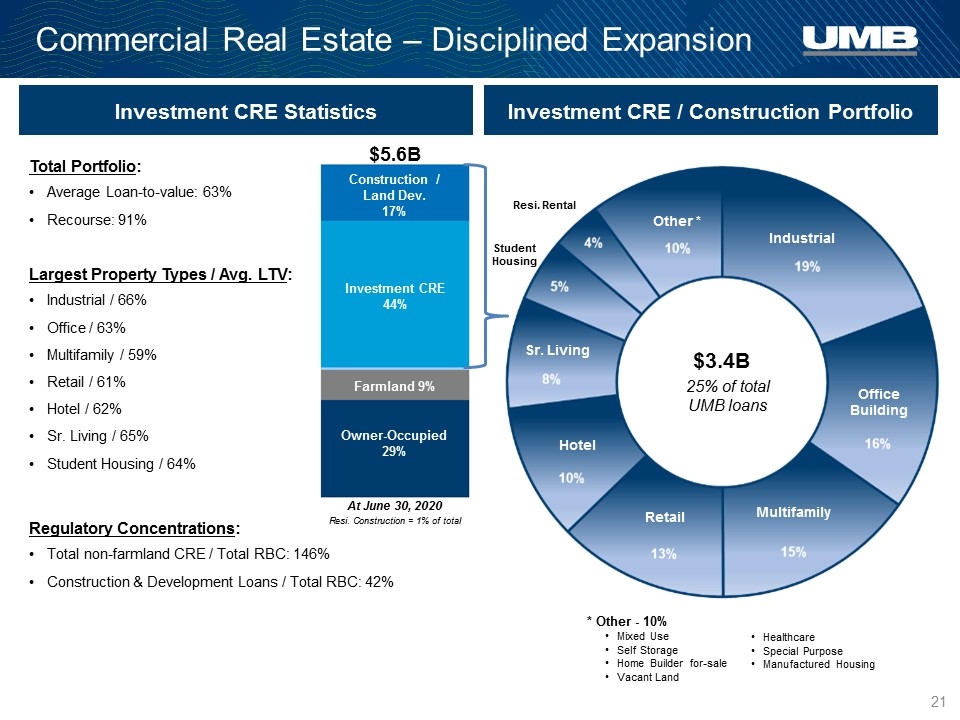

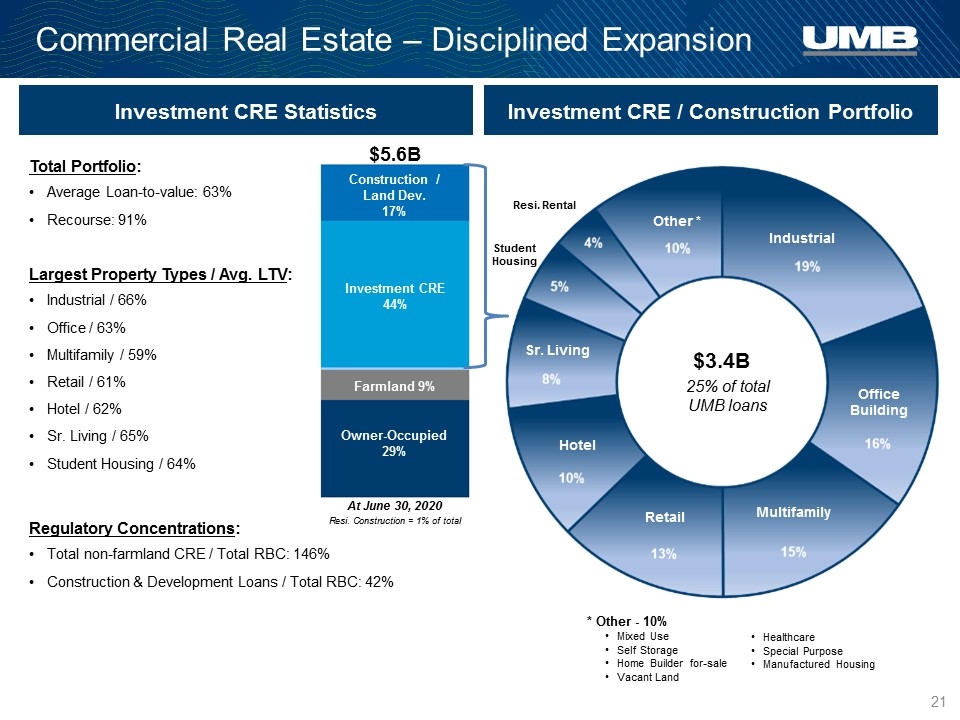

Commercial Real Estate – Disciplined Expansion Construction / Land Dev. 17% Owner-Occupied 29% Investment CRE 44% $5.6B At June 30, 2020 Resi. Construction = 1% of total Farmland 9% * Other - 10% Mixed Use Self Storage Home Builder for-sale Vacant Land Healthcare Special Purpose Manufactured Housing Total Portfolio: Average Loan-to-value: 63% Recourse: 91% Regulatory Concentrations: Total non-farmland CRE / Total RBC: 146% Construction & Development Loans / Total RBC: 42% Largest Property Types / Avg. LTV: Industrial / 66% Office / 63% Multifamily / 59% Retail / 61% Hotel / 62% Sr. Living / 65% Student Housing / 64% Investment CRE Statistics Investment CRE / Construction Portfolio Retail Multifamily Other * Office Building Hotel Industrial Sr. Living Student Housing Resi. Rental $3.4B 25% of total UMB loans

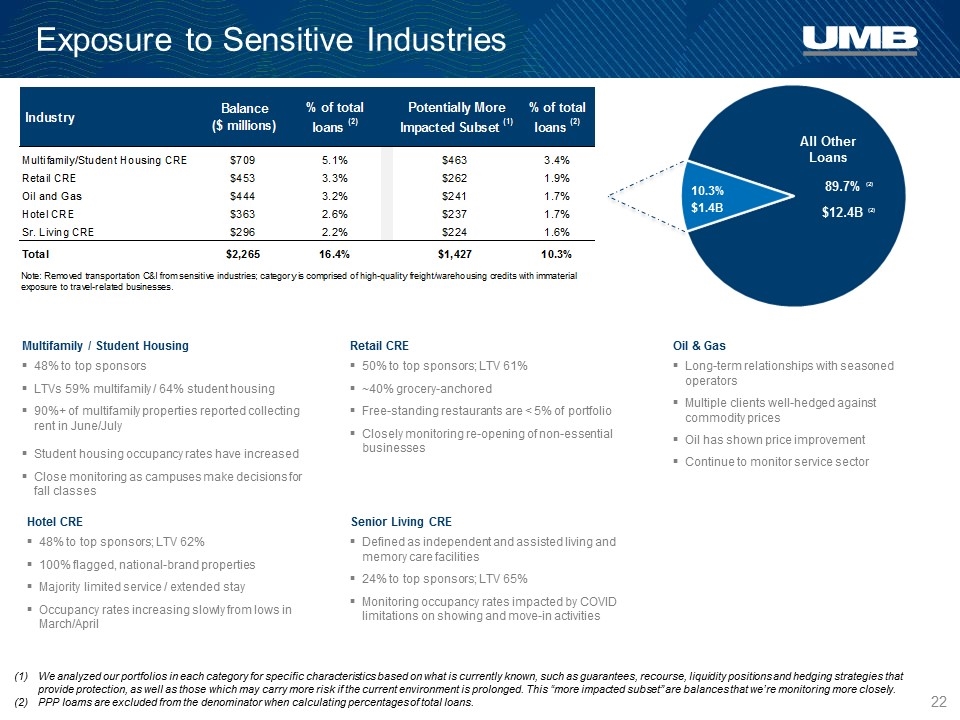

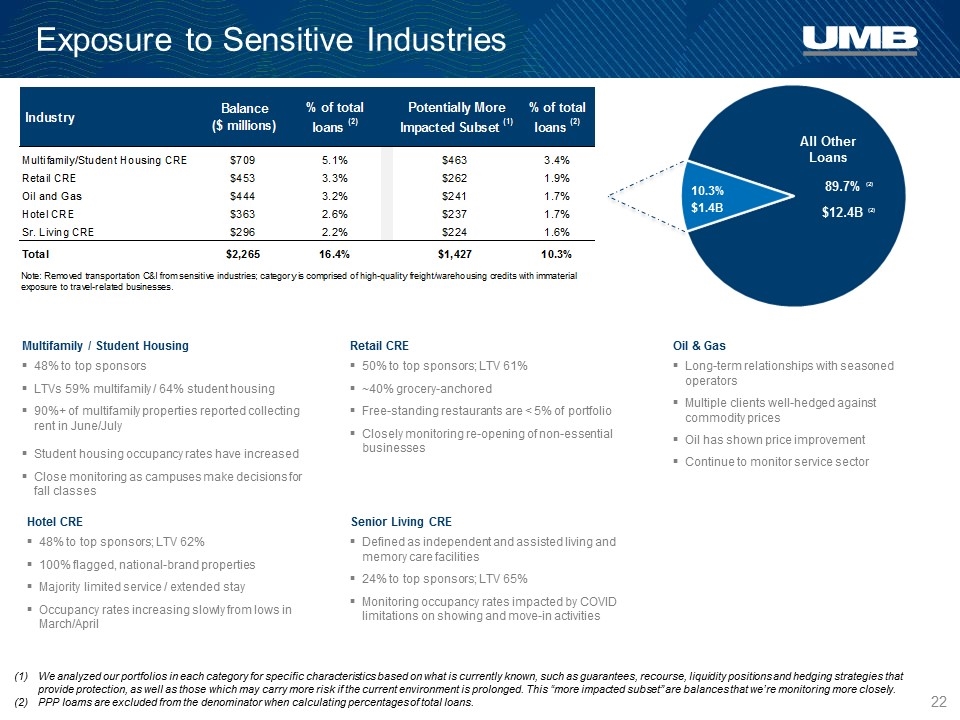

Exposure to Sensitive Industries We analyzed our portfolios in each category for specific characteristics based on what is currently known, such as guarantees, recourse, liquidity positions and hedging strategies that provide protection, as well as those which may carry more risk if the current environment is prolonged. This “more impacted subset” are balances that we’re monitoring more closely. PPP loams are excluded from the denominator when calculating percentages of total loans. Multifamily / Student Housing 48% to top sponsors LTVs 59% multifamily / 64% student housing 90%+ of multifamily properties reported collecting rent in June/July Student housing occupancy rates have increased Close monitoring as campuses make decisions for fall classes Retail CRE 50% to top sponsors; LTV 61% ~40% grocery-anchored Free-standing restaurants are < 5% of portfolio Closely monitoring re-opening of non-essential businesses Hotel CRE 48% to top sponsors; LTV 62% 100% flagged, national-brand properties Majority limited service / extended stay Occupancy rates increasing slowly from lows in March/April Senior Living CRE Defined as independent and assisted living and memory care facilities 24% to top sponsors; LTV 65% Monitoring occupancy rates impacted by COVID limitations on showing and move-in activities Oil & Gas Long-term relationships with seasoned operators Multiple clients well-hedged against commodity prices Oil has shown price improvement Continue to monitor service sector 10.3% 89.7% (2) $1.4B All Other Loans $12.4B (2)

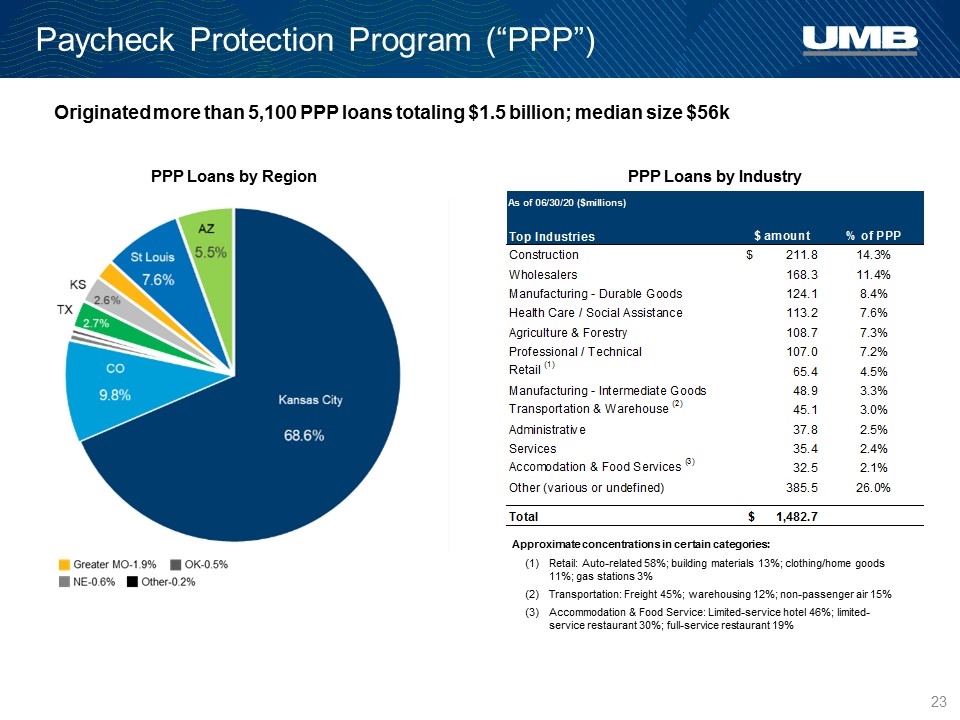

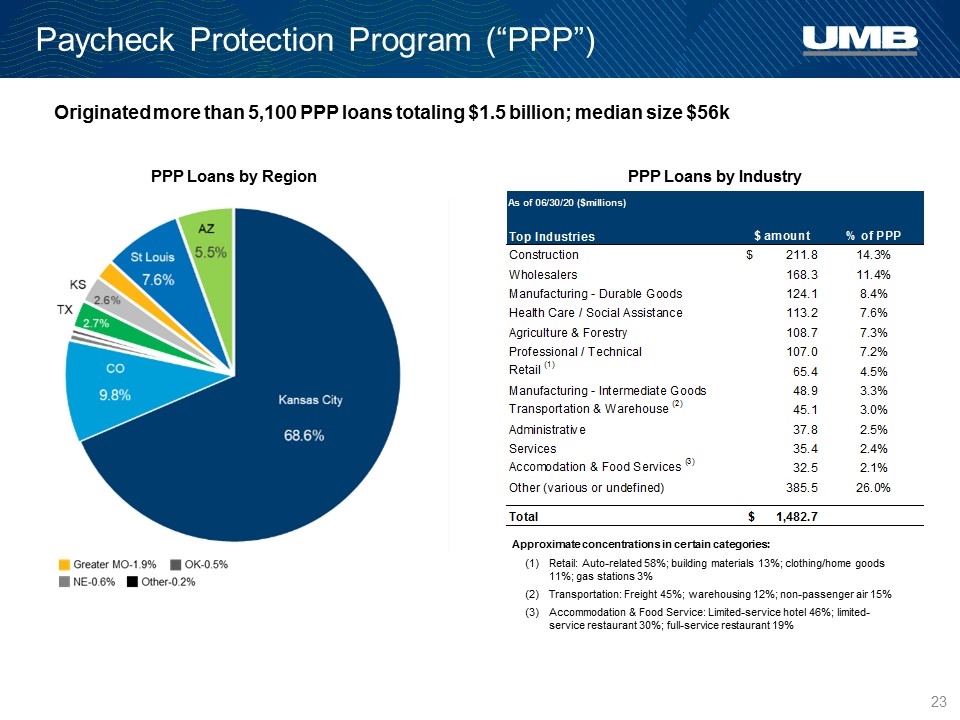

Paycheck Protection Program (“PPP”) PPP Loans by Region PPP Loans by Industry Retail: Auto-related 58%; building materials 13%; clothing/home goods 11%; gas stations 3% Transportation: Freight 45%; warehousing 12%; non-passenger air 15% Accommodation & Food Service: Limited-service hotel 46%; limited-service restaurant 30%; full-service restaurant 19% Originated more than 5,100 PPP loans totaling $1.5 billion; median size $56k Approximate concentrations in certain categories:

Asset Quality

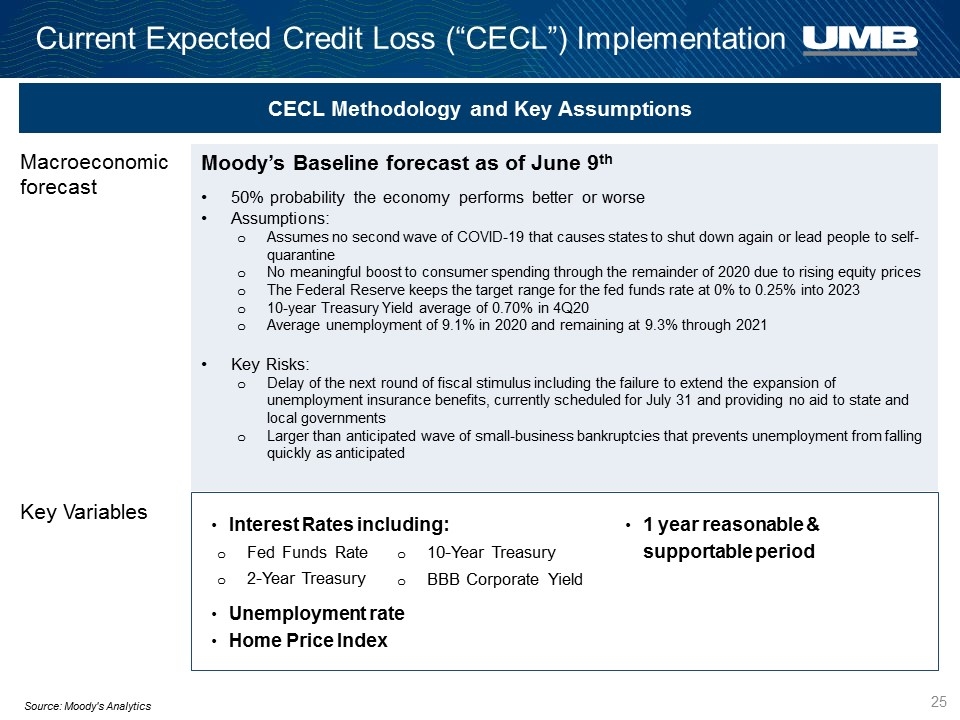

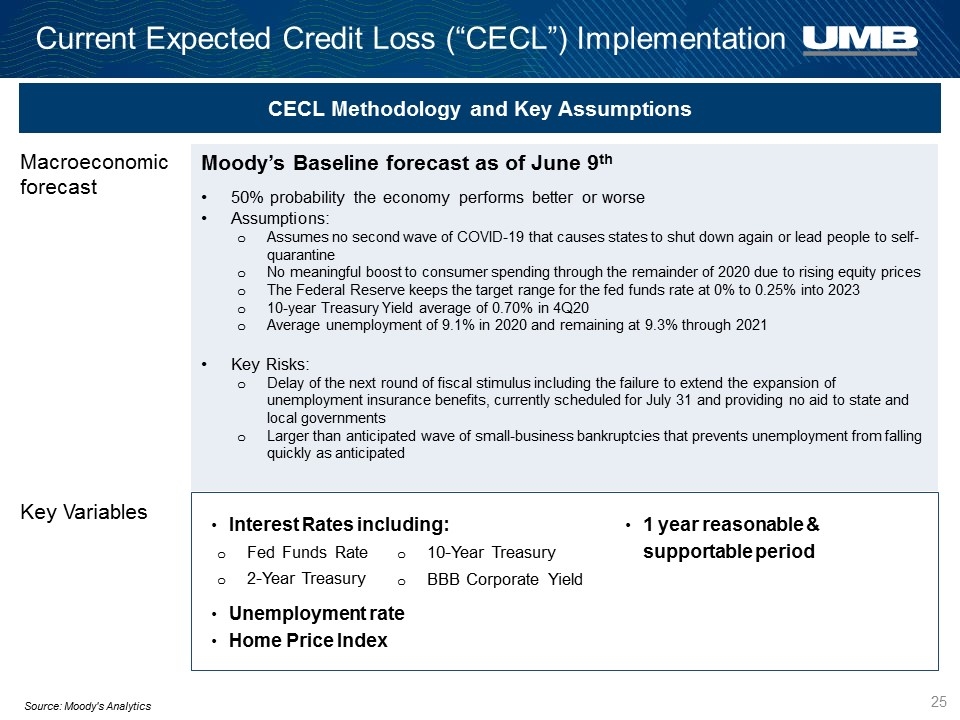

Current Expected Credit Loss (“CECL”) Implementation CECL Methodology and Key Assumptions Macroeconomic forecast Moody’s Baseline forecast as of June 9th 50% probability the economy performs better or worse Assumptions: Assumes no second wave of COVID-19 that causes states to shut down again or lead people to self-quarantine No meaningful boost to consumer spending through the remainder of 2020 due to rising equity prices The Federal Reserve keeps the target range for the fed funds rate at 0% to 0.25% into 2023 10-year Treasury Yield average of 0.70% in 4Q20 Average unemployment of 9.1% in 2020 and remaining at 9.3% through 2021 Key Risks: Delay of the next round of fiscal stimulus including the failure to extend the expansion of unemployment insurance benefits, currently scheduled for July 31 and providing no aid to state and local governments Larger than anticipated wave of small-business bankruptcies that prevents unemployment from falling quickly as anticipated Key Variables Interest Rates including: Fed Funds Rate 2-Year Treasury Unemployment rate Home Price Index Source: Moody's Analytics 1 year reasonable & supportable period 10-Year Treasury BBB Corporate Yield

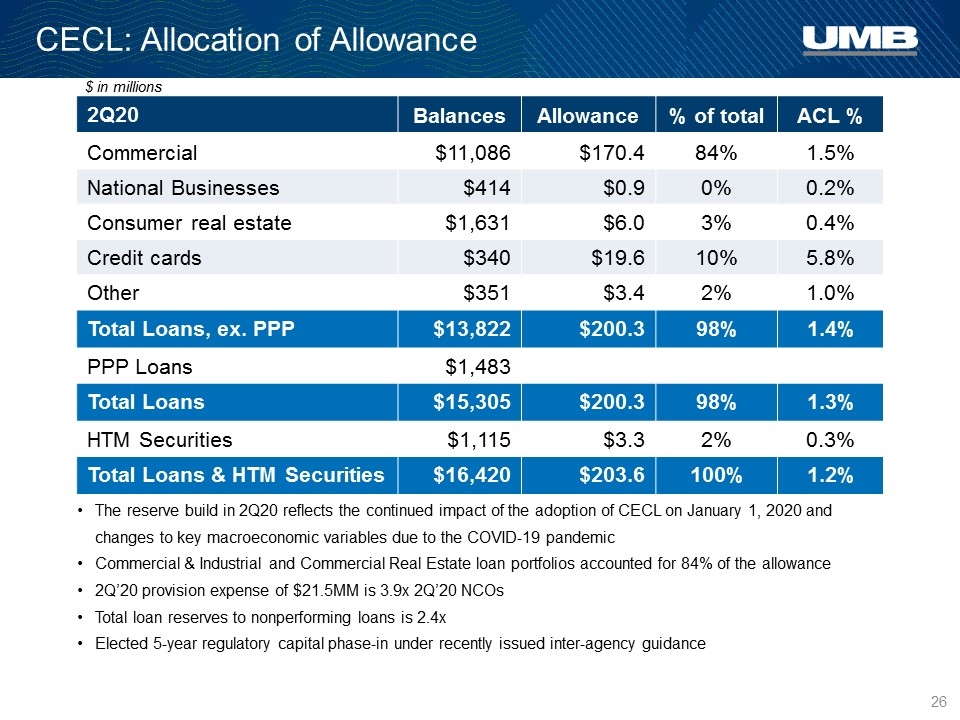

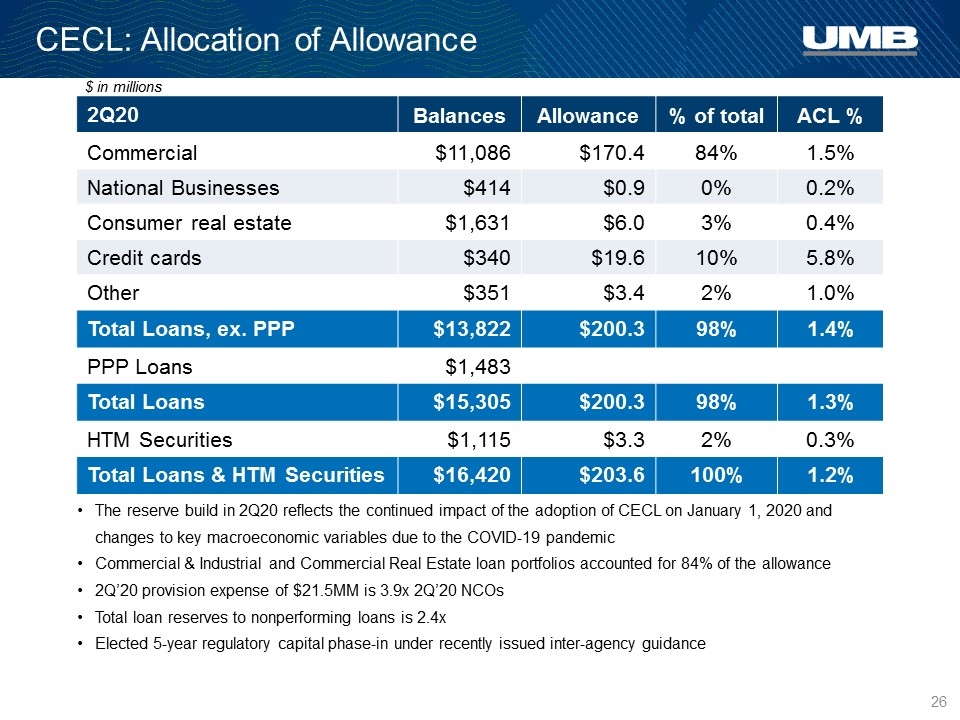

CECL: Allocation of Allowance 2Q20 Balances Allowance % of total ACL % Commercial $11,086 $170.4 84% 1.5% National Businesses $414 $0.9 0% 0.2% Consumer real estate $1,631 $6.0 3% 0.4% Credit cards $340 $19.6 10% 5.8% Other $351 $3.4 2% 1.0% Total Loans, ex. PPP $13,822 $200.3 98% 1.4% PPP Loans $1,483 Total Loans $15,305 $200.3 98% 1.3% HTM Securities $1,115 $3.3 2% 0.3% Total Loans & HTM Securities $16,420 $203.6 100% 1.2% $ in millions The reserve build in 2Q20 reflects the continued impact of the adoption of CECL on January 1, 2020 and changes to key macroeconomic variables due to the COVID-19 pandemic Commercial & Industrial and Commercial Real Estate loan portfolios accounted for 84% of the allowance 2Q’20 provision expense of $21.5MM is 3.9x 2Q’20 NCOs Total loan reserves to nonperforming loans is 2.4x Elected 5-year regulatory capital phase-in under recently issued inter-agency guidance

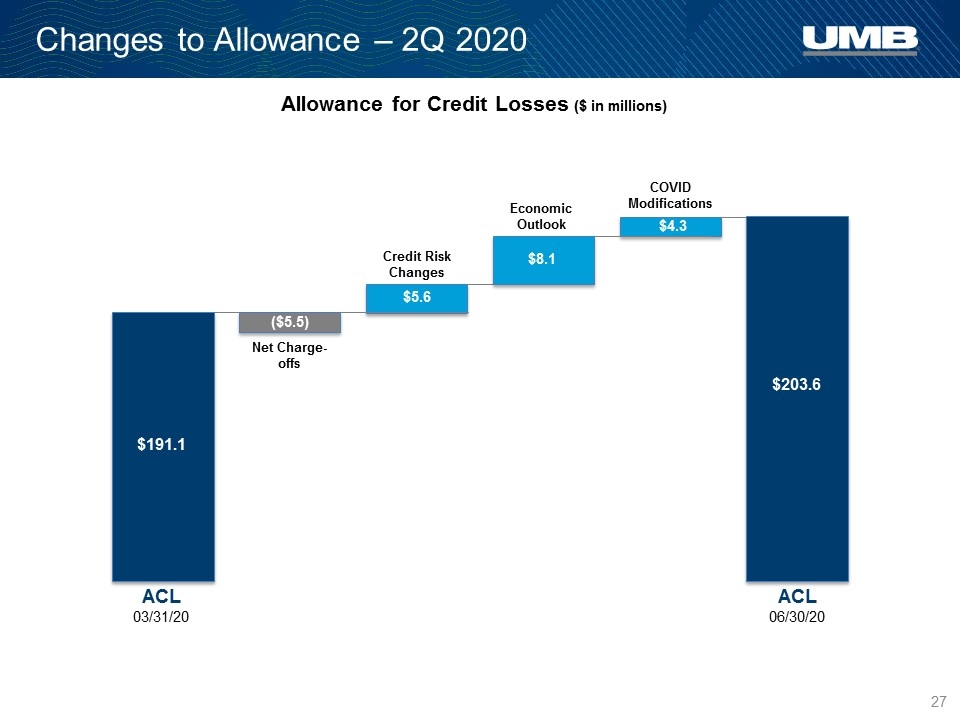

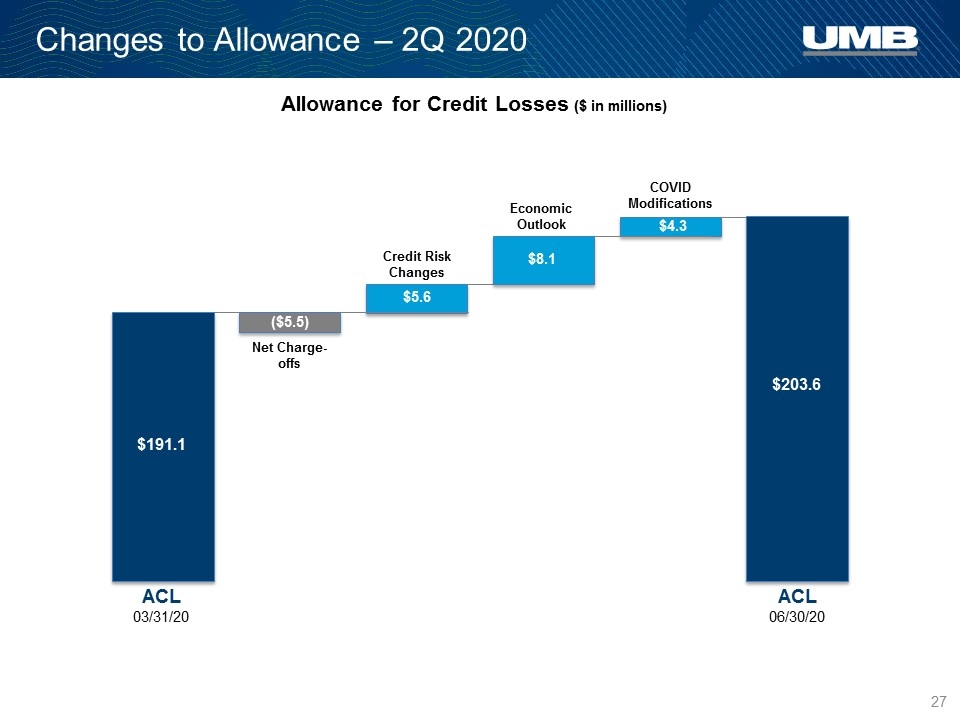

Changes to Allowance – 2Q 2020 Allowance for Credit Losses ($ in millions) $191.1 $203.6 ($5.5) $5.6 $8.1 $4.3 Net Charge-offs Credit Risk Changes Economic Outlook COVID Modifications ACL 03/31/20 ACL 06/30/20

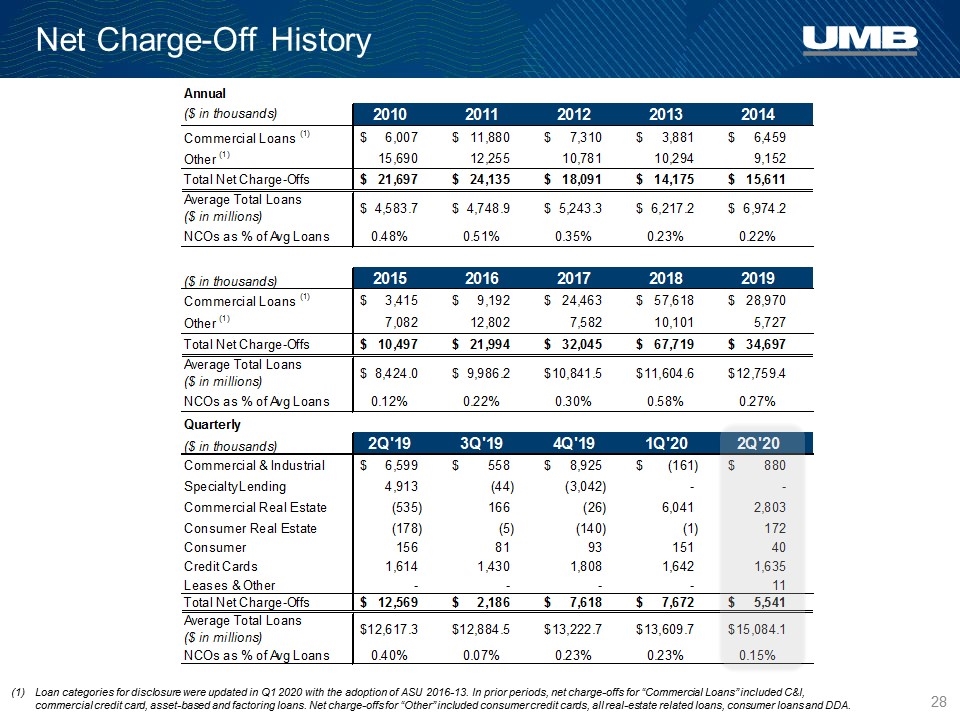

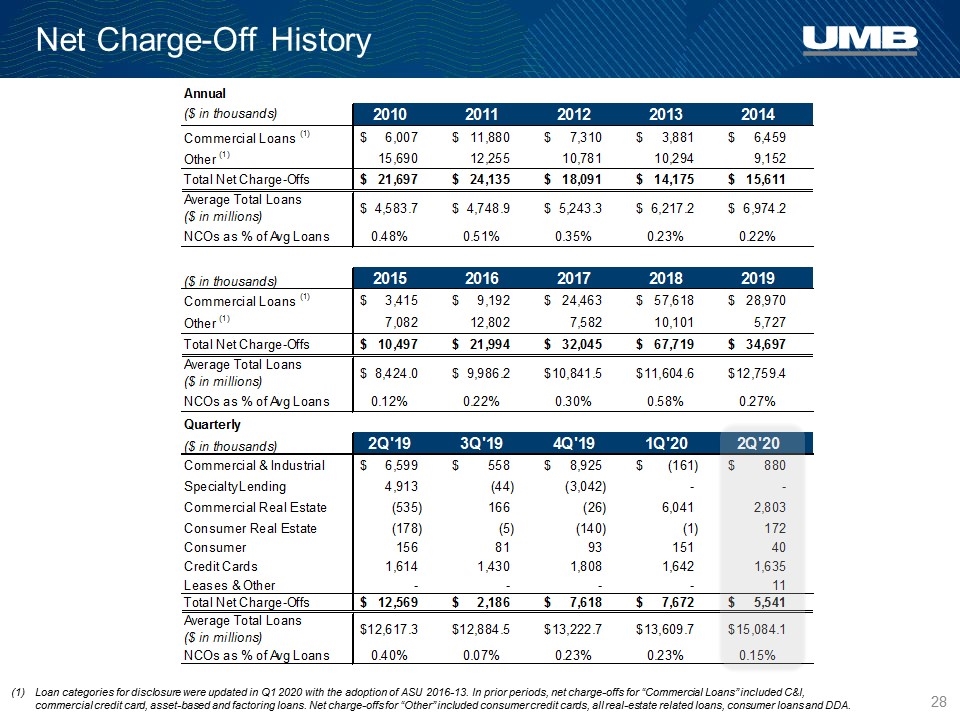

Net Charge-Off History Loan categories for disclosure were updated in Q1 2020 with the adoption of ASU 2016-13. In prior periods, net charge-offs for “Commercial Loans” included C&I, commercial credit card, asset-based and factoring loans. Net charge-offs for “Other” included consumer credit cards, all real-estate related loans, consumer loans and DDA.

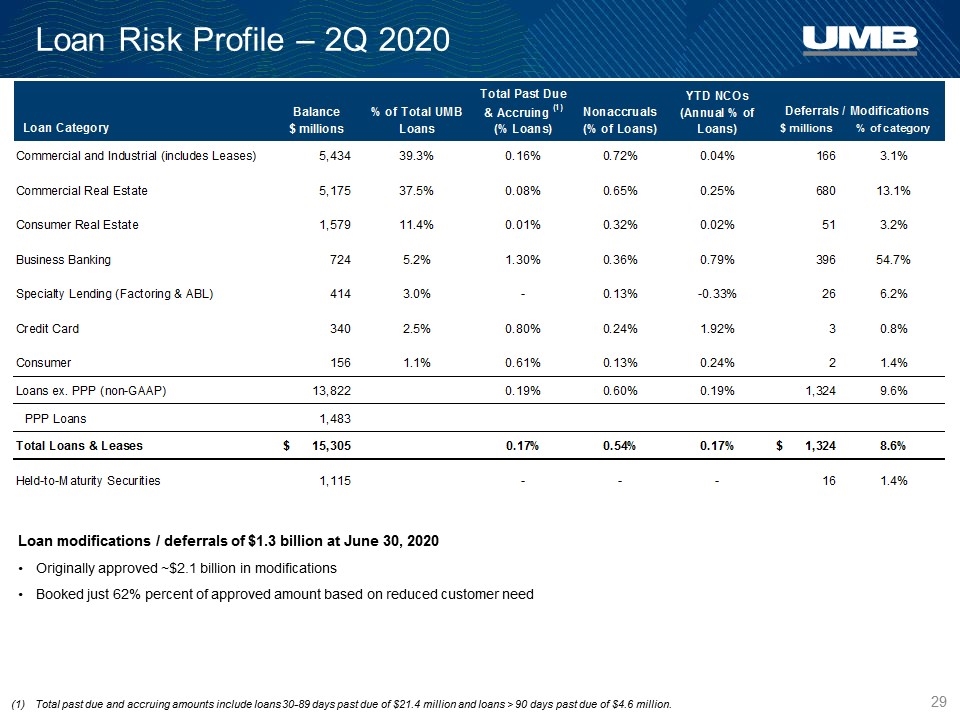

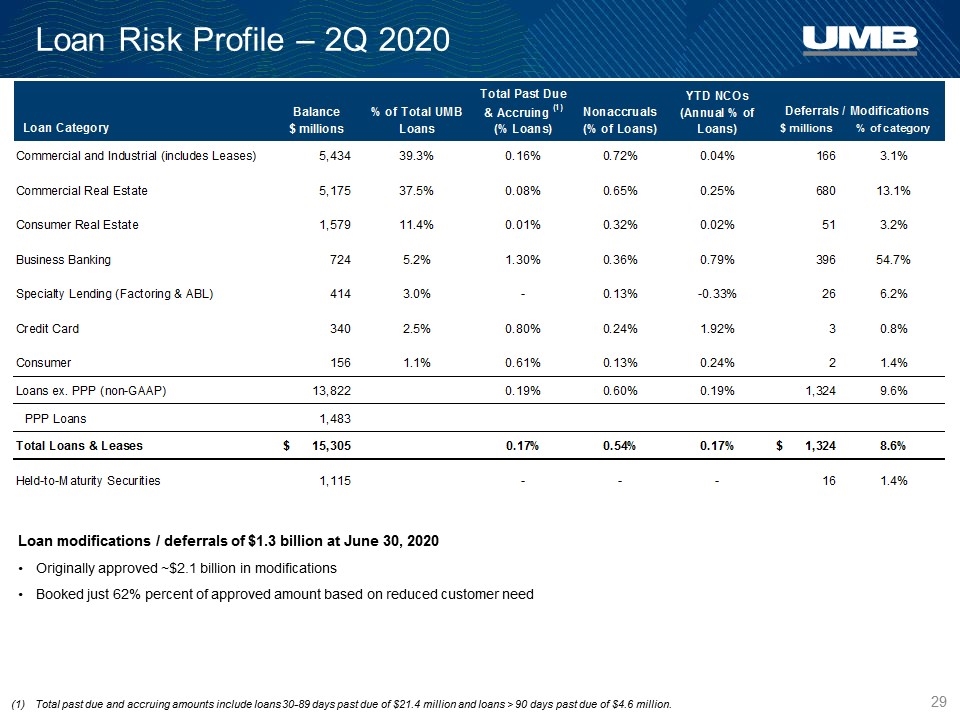

Loan Risk Profile – 2Q 2020 Loan modifications / deferrals of $1.3 billion at June 30, 2020 Originally approved ~$2.1 billion in modifications Booked just 62% percent of approved amount based on reduced customer need Total past due and accruing amounts include loans 30-89 days past due of $21.4 million and loans > 90 days past due of $4.6 million.

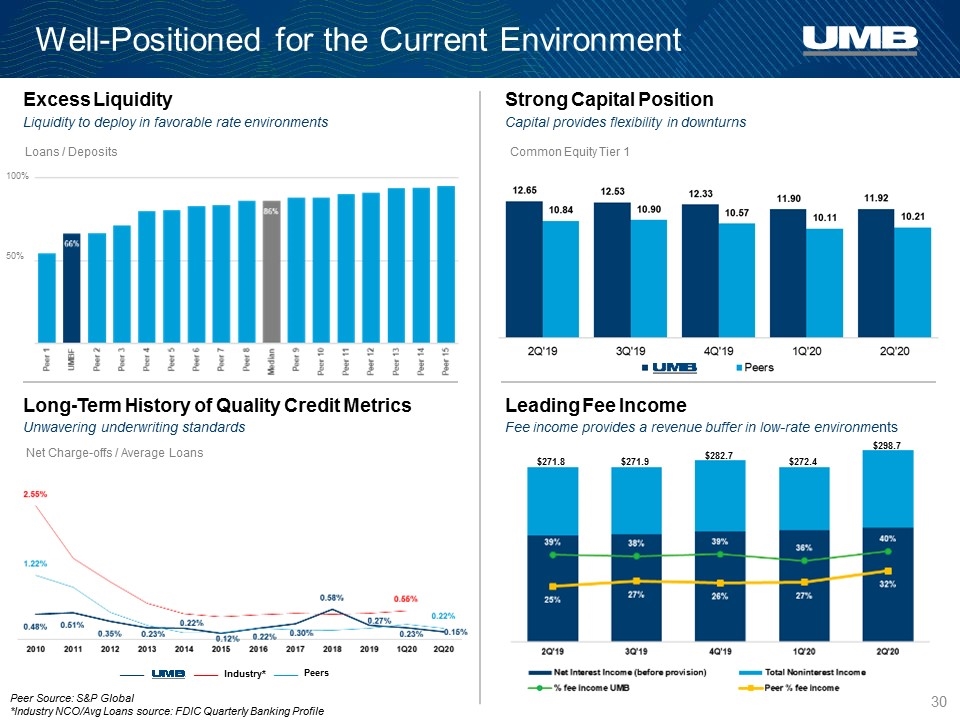

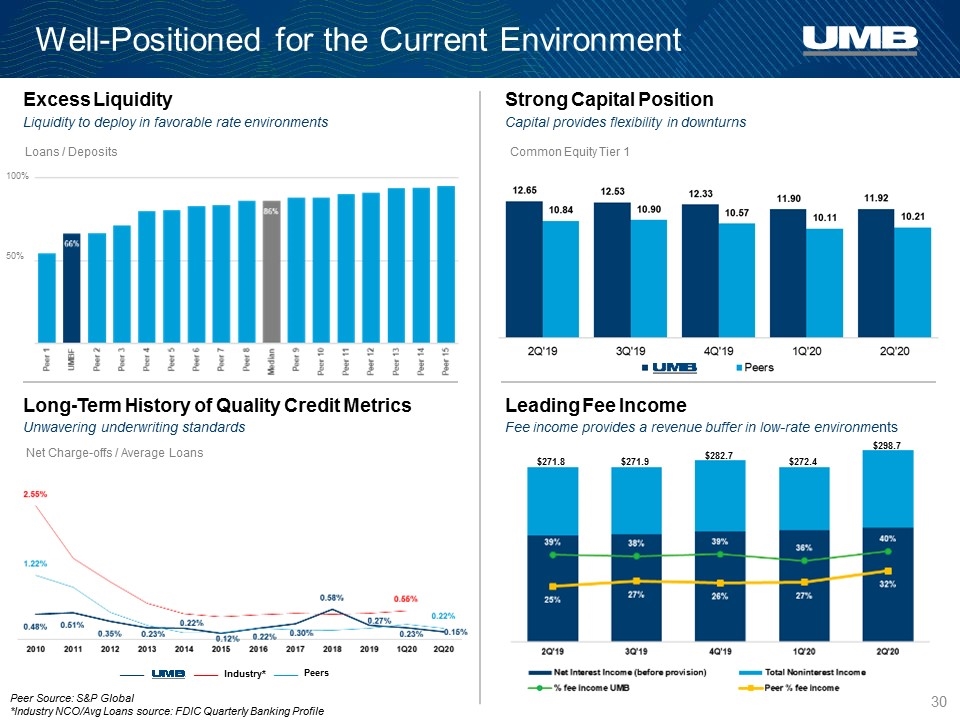

Excess Liquidity Long-Term History of Quality Credit Metrics Leading Fee Income Strong Capital Position Net Charge-offs / Average Loans Liquidity to deploy in favorable rate environments Capital provides flexibility in downturns Fee income provides a revenue buffer in low-rate environments Unwavering underwriting standards Peer Source: S&P Global *Industry NCO/Avg Loans source: FDIC Quarterly Banking Profile Loans / Deposits 100% 50% Common Equity Tier 1 $272.4 $298.7 $282.7 $271.9 $271.8 Well-Positioned for the Current Environment ___ Industry* Peers ___ ___

Appendix

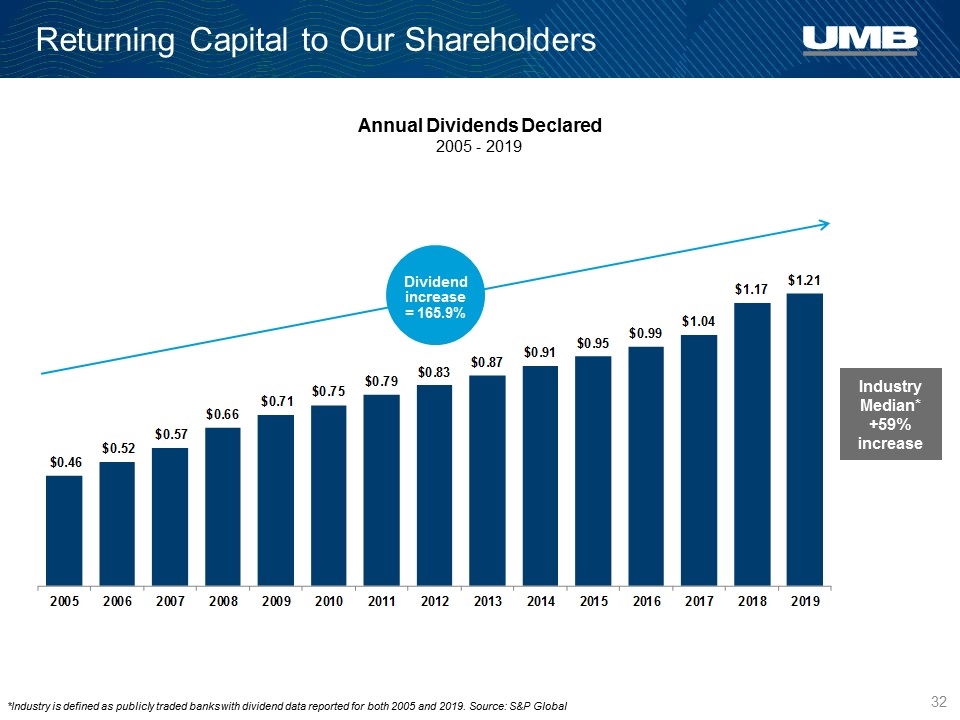

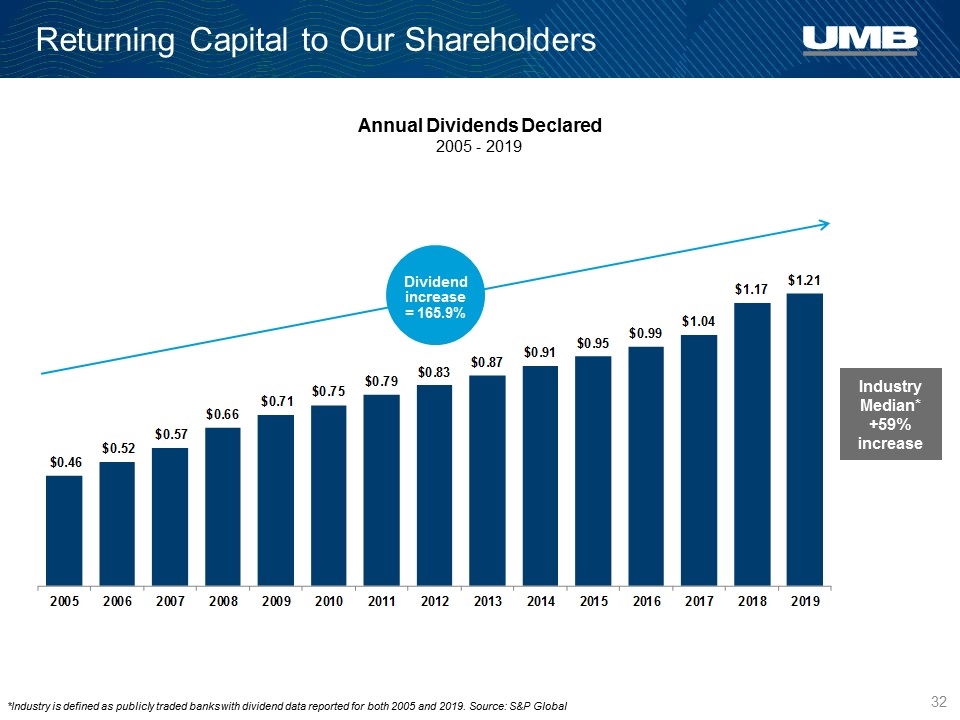

Dividend increase = 165.9% Industry Median* +59% increase *Industry is defined as publicly traded banks with dividend data reported for both 2005 and 2019. Source: S&P Global Returning Capital to Our Shareholders Annual Dividends Declared 2005 - 2019

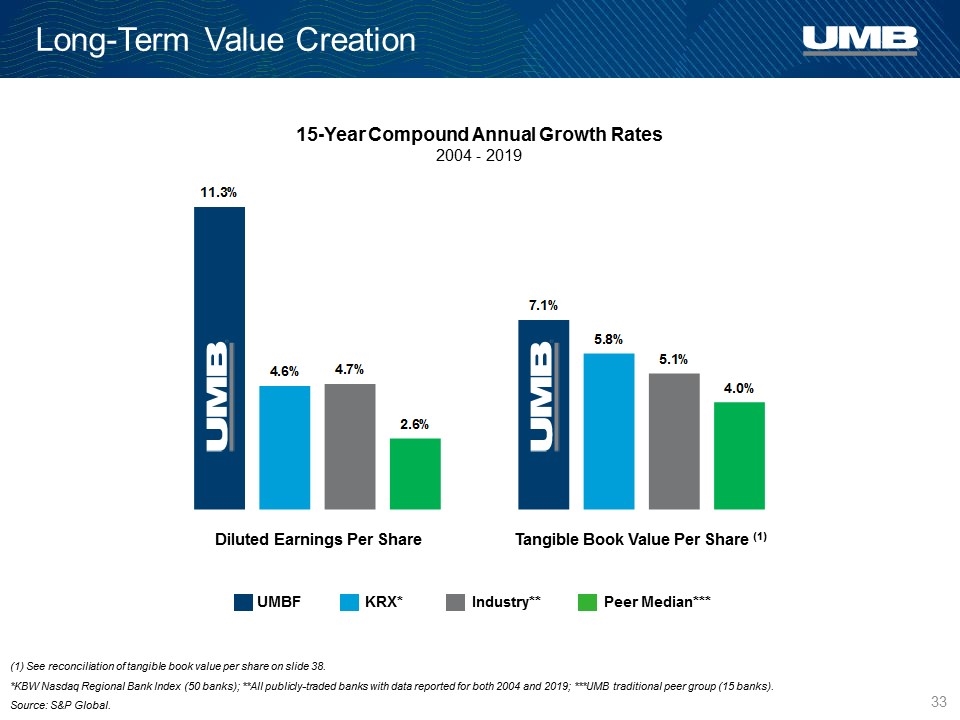

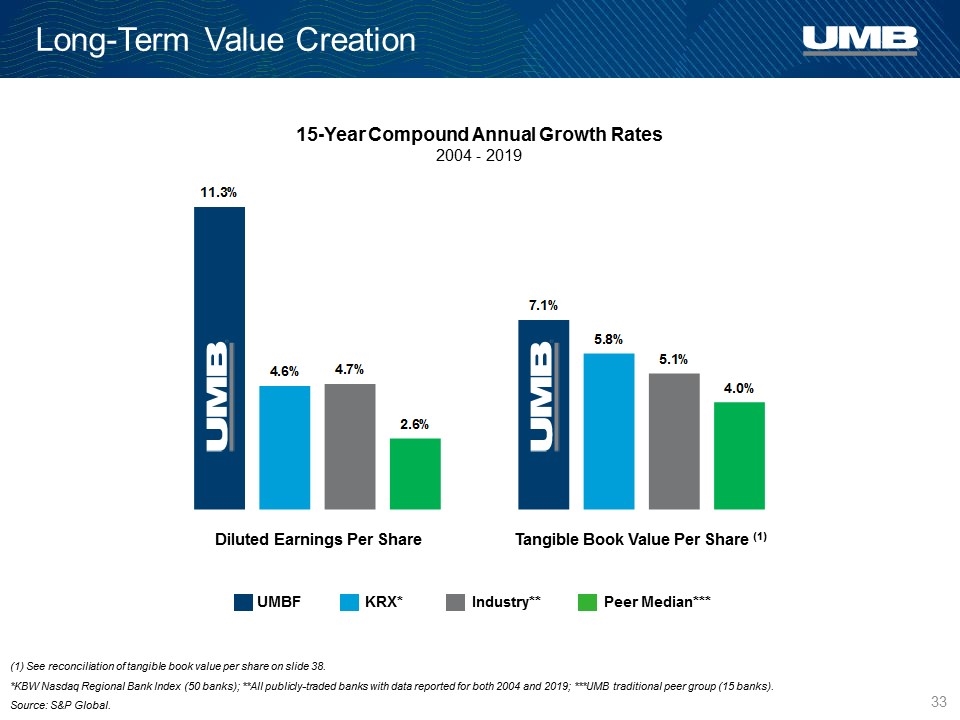

Long-Term Value Creation (1) See reconciliation of tangible book value per share on slide 38. *KBW Nasdaq Regional Bank Index (50 banks); **All publicly-traded banks with data reported for both 2004 and 2019; ***UMB traditional peer group (15 banks). Source: S&P Global. 15-Year Compound Annual Growth Rates 2004 - 2019 Diluted Earnings Per Share Tangible Book Value Per Share (1) UMBF KRX* Industry** Peer Median***

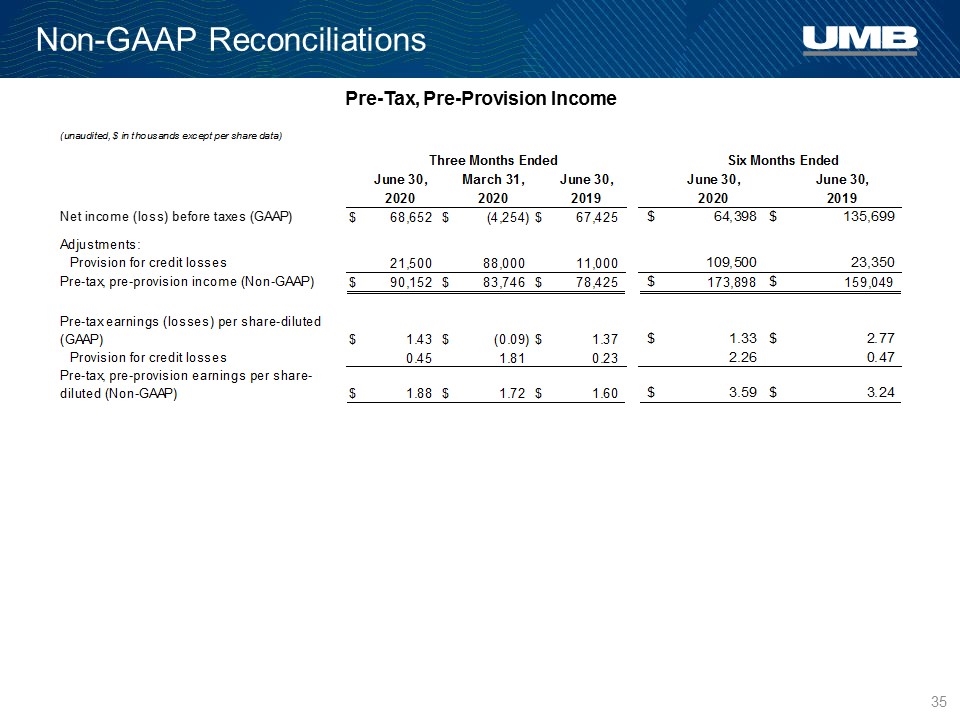

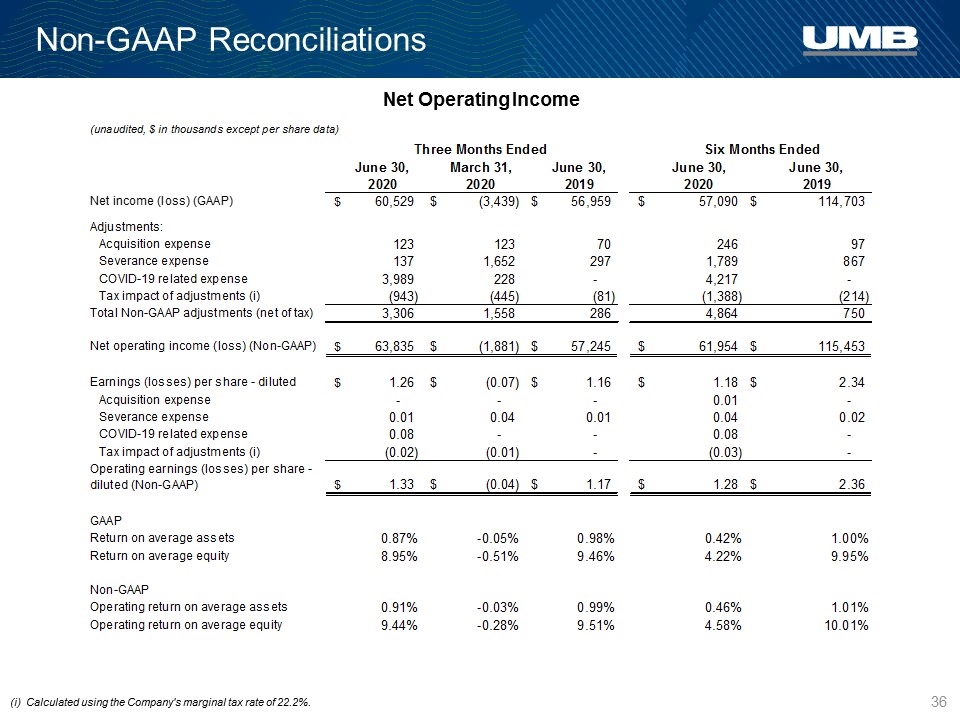

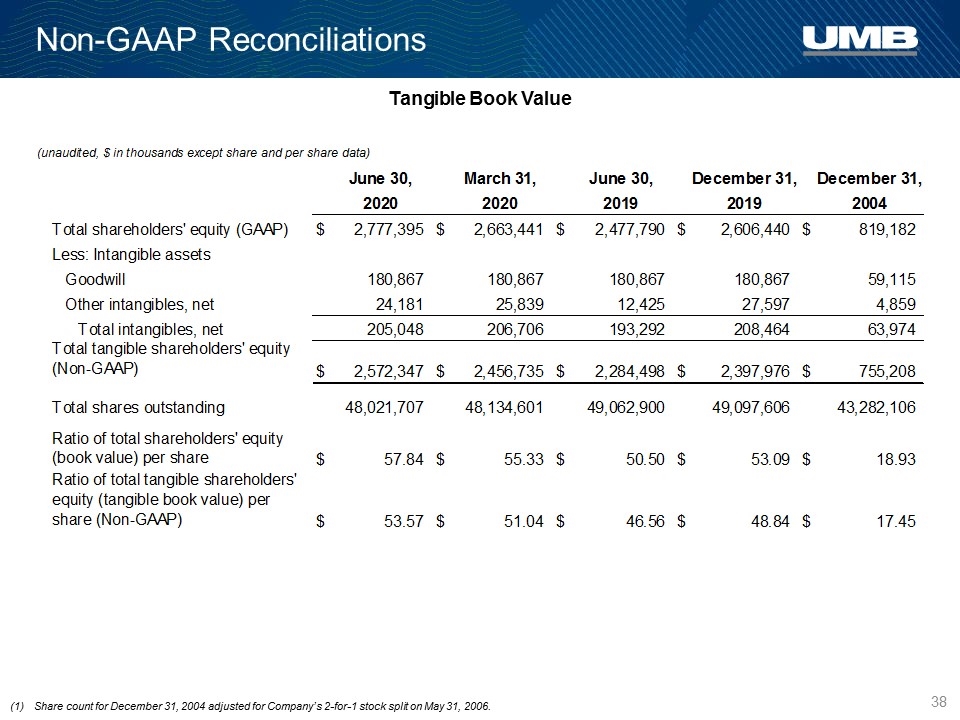

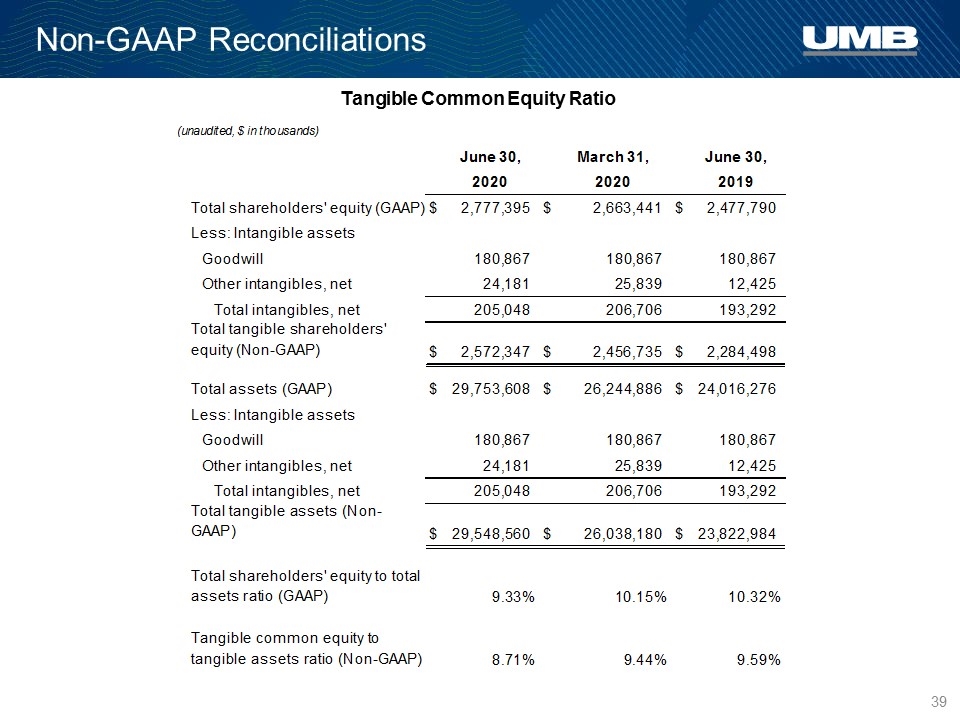

Non-GAAP Reconciliations In this presentation, we provide information about pre-tax pre-provision income, net operating income (loss), operating earnings (losses) per share-diluted (operating EPS-diluted), operating return on average equity (operating ROE), operating return on average assets (operating ROA), operating noninterest expense, operating efficiency ratio, pre-tax, pre-provision earnings per share-diluted (PTPP EPS), tangible shareholders’ equity, tangible assets, tangible common equity ratio and tangible book value per share, all of which are non-GAAP financial measures. This information supplements the results that are reported according to generally accepted accounting principles in the United States (GAAP) and should not be viewed in isolation from, or as a substitute for, GAAP results. The differences between the non-GAAP financial measures and the nearest comparable GAAP financial measures are reconciled on the next 4 slides. The Company believes that these non-GAAP financial measures and the reconciliations may be useful to investors because they adjust for acquisition-, severance-, and COVID-19 related items that management does not believe reflect the Company’s fundamental operating performance. COVID-19 related expense includes hazard pay for branch associates, computer hardware expense to support associates working remotely, and additional equipment, cleaning and janitorial supplies to protect the well-being of our associates and customers while on the Company’s premises. Pre-tax pre-provision income for the relevant period is defined as GAAP net income, adjusted to reflect the impact of excluding income tax and provision expense. Net operating income (loss) for the relevant period is defined as GAAP net income (loss), adjusted to reflect the impact of excluding expenses related to acquisitions, severance expense, COVID-19 related expense, and the cumulative tax impact of these adjustments. Operating EPS-diluted is calculated as diluted earnings (losses) per share as reported, adjusted to reflect, on a per share basis, the impact of excluding the non-GAAP adjustments described above for the relevant period. Operating ROE is calculated as net operating income (loss), divided by the Company’s average total shareholders’ equity for the relevant period. Operating ROA is calculated as net operating income (loss), divided by the Company’s average assets for the relevant period. Operating noninterest expense for the relevant period is defined as GAAP noninterest expense, adjusted to reflect the pre-tax impact of non-GAAP adjustments described above. Operating efficiency ratio is calculated as the Company’s operating noninterest expense, net of amortization of other intangibles, divided by the Company’s total non-GAAP revenue (which is calculated as net interest income plus noninterest income, less gains on sales of securities available for sale, net). Tangible book value per shares is defined as the Company’s total shareholders’ equity, net of intangible assets, divided by the Company’s total shares outstanding. Tangible common equity ratio is calculated as the Company’s total shareholders’ equity, net of intangible assets, divided by the Company’s total assets, net of intangible assets.

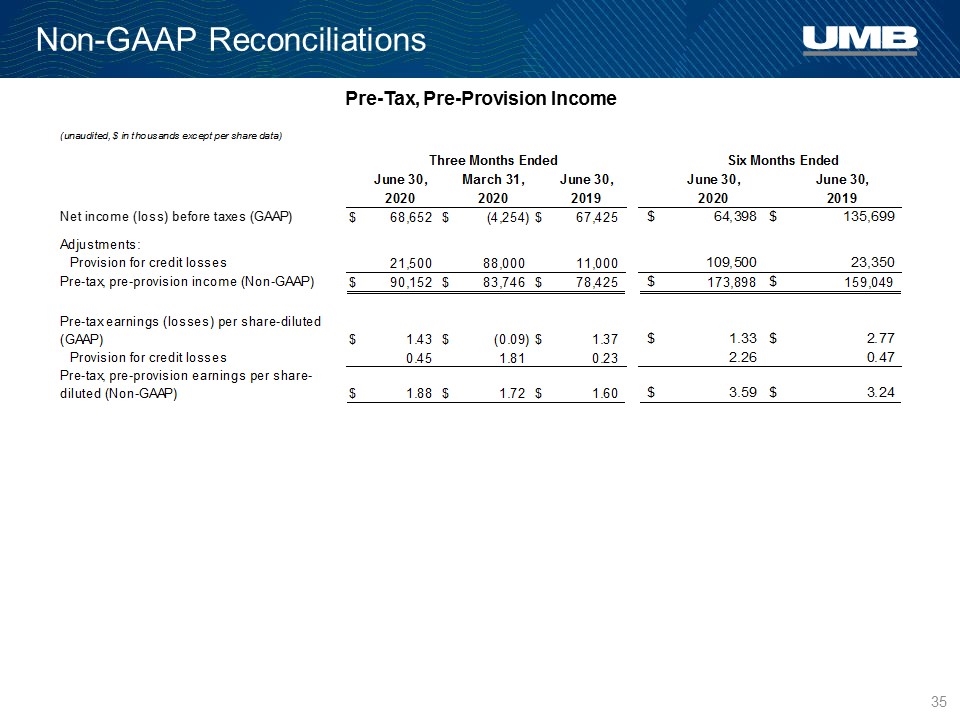

Non-GAAP Reconciliations Pre-Tax, Pre-Provision Income

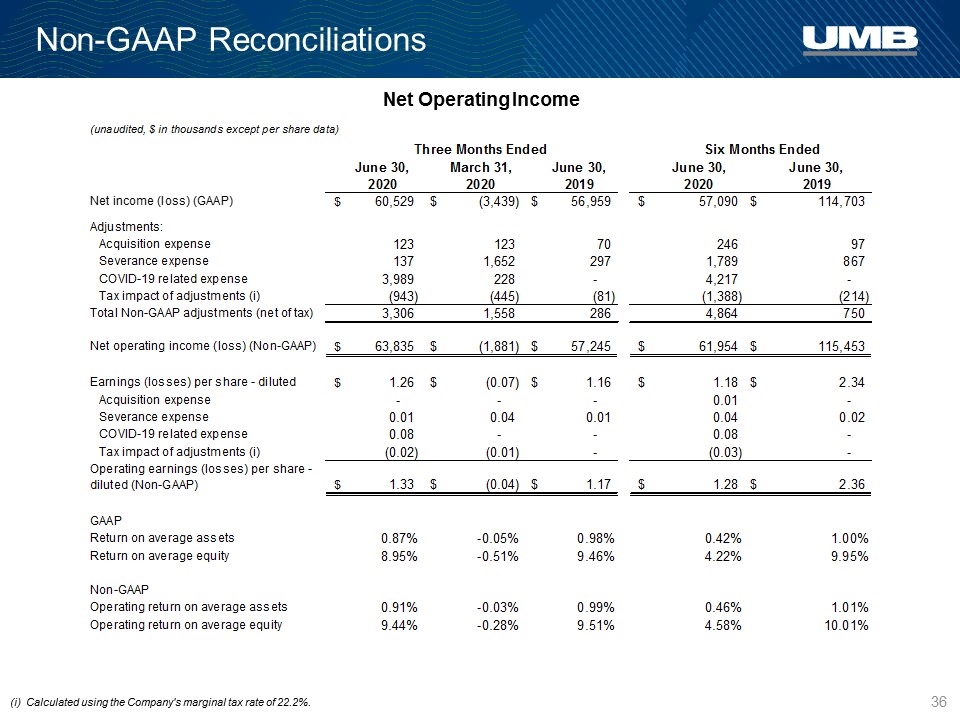

Non-GAAP Reconciliations (i) Calculated using the Company's marginal tax rate of 22.2%. Net Operating Income

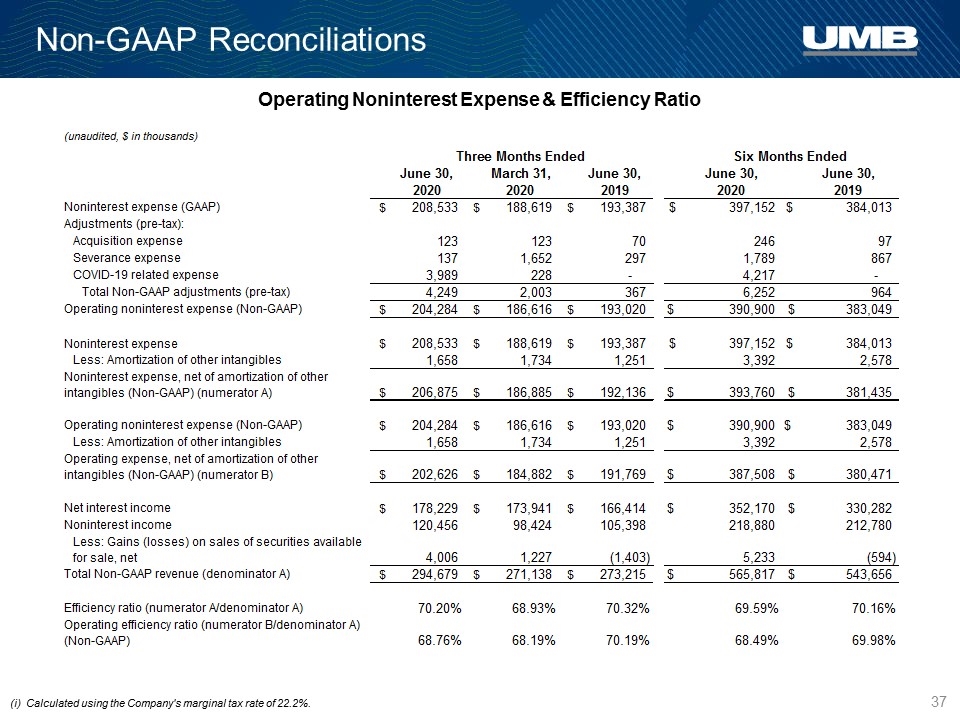

Non-GAAP Reconciliations (i) Calculated using the Company's marginal tax rate of 22.2%. Operating Noninterest Expense & Efficiency Ratio

Non-GAAP Reconciliations Tangible Book Value Share count for December 31, 2004 adjusted for Company’s 2-for-1 stock split on May 31, 2006.

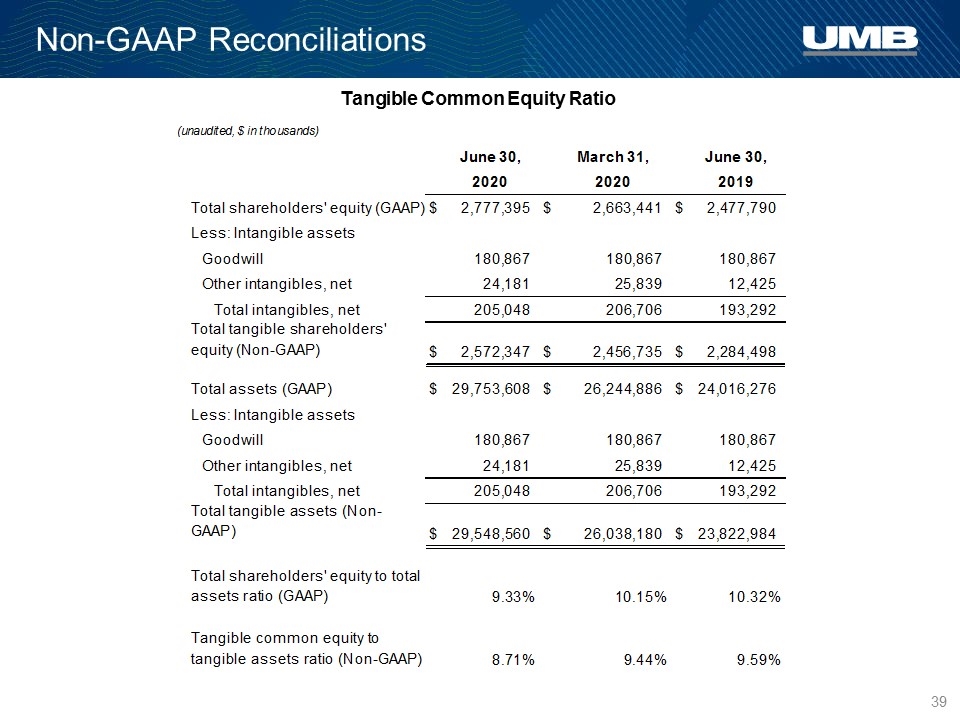

Non-GAAP Reconciliations Tangible Common Equity Ratio