UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: August 31

Date of reporting period: August 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Mutual Funds | |

| | |

| | | |

| | | Nuveen Asset Allocation Funds |

| | | | | | |

| | | | | | | Annual Report August 31, 2015 |

| | | | | | | | | | | | | | |

| | | | | | | Share Class / Ticker Symbol | | |

| | | Fund Name | | | | Class A | | Class C | | Class R3 | | Class I | | |

|

| | Nuveen Intelligent Risk Conservative Allocation Fund | | | | NICAX | | NICCX | | NICRX | | NICIX | | |

| | Nuveen Intelligent Risk Growth Allocation Fund | | | | NIGAX | | NIGCX | | NIGRX | | NIGIX | | |

| | Nuveen Intelligent Risk Moderate Allocation Fund | | | | NIDAX | | NIMCX | | NIMRX | | NIMIX | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | |

| | Life is Complex. | | |

| | |

| | Nuveen makes things e-simple. | | |

| | |

| | It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. | | |

| | | | |

| | | | | | Free e-Reports right to your e-mail! | | |

| | | |

| | | | | | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your

financial advisor or brokerage account. |

| | | | |

| | | | or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. Must be preceded by or accompanied by a prospectus. NOT FDIC INSURED MAY LOSE VALUE

NO BANK GUARANTEE | | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

For better or for worse, the financial markets have spent the past year waiting for the U.S. Federal Reserve (Fed) to end its accomodative monetary policy. The policy has propped up stock and bond markets since the Great Recession, but the question remains: how will markets behave without its influence? This uncertainty has been a considerable source of volatility for stock and bond prices lately, despite the Fed carefully conveying its intention to raise rates slowly and only when the economy shows evidence of readiness.

There may be at least one rate hike before the end of 2015. After all, the U.S. has reached “full employment” by the Fed’s standards and growth has resumed – albeit unevenly. But the picture remains somewhat uncertain. Inflation has remained stubbornly low, most recently weighed down by an unexpectedly sharp decline in commodity prices since mid-2014. With the Fed poised to tighten and foreign central banks easing, the U.S. dollar has surged against other currencies, which has weighed on corporate earnings and further contributed to commodity price weakness. U.S. consumers have benefited from an improved labor market and lower prices at the gas pump, but the overall pace of economic expansion has been lackluster.

Nevertheless, the global recovery continues to be led by the United States. Policy makers around the world are deploying their available tools to try to bolster Europe and Japan’s fragile growth, and manage China’s slowdown. Contagion fears ebb and flow with the headlines about Greece and China. Greece reluctantly agreed to a third bailout package from the European Union in July and China’s central bank and government intervened aggressively to try to stem the sell-off in stock prices. But persistent structural problems in these economies will continue to garner market attention.

Wall Street is fond of saying “markets don’t like uncertainty,” and asset prices are likely to continue to churn in the current macro environment. In times like these, you can look to a professional investment manager with the experience and discipline to maintain the proper perspective on short-term events. And if the daily headlines do concern you, I encourage you to reach out to your financial advisor. Your financial advisor can help you evaluate your investment strategies in light of current events, your time horizon and risk tolerance. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

October 26, 2015

Portfolio Managers’

Comments

Nuveen Intelligent Risk Conservative Allocation Fund

Nuveen Intelligent Risk Growth Allocation Fund

Nuveen Intelligent Risk Moderate Allocation Fund

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments, Inc. Portfolio manager James A. Colon, CFA, has managed the Funds since their inception in May 2012. David R. Wilson, CFA, joined the Funds’ management team in December 2013.

Here the management team discusses economic and equity market conditions, key investment strategies and the Funds’ performance during the twelve-month reporting period ended August 31, 2015.

What factors affected the U.S. economy and markets during the twelve-month reporting period ended August 31, 2015?

During this reporting period, the U.S. economy continued to expand at a moderate pace. The Federal Reserve (Fed) maintained efforts to bolster growth and promote progress toward its mandates of maximum employment and price stability by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. At its October 2014 meeting, the Fed announced that it would end its bond-buying stimulus program as of November 1, 2014, after tapering its monthly asset purchases of mortgage-backed and longer-term Treasury securities from the original $85 billion per month to $15 billion per month over the course of seven consecutive meetings (December 2013 through September 2014). In making the announcement, the Fed cited substantial improvement in the labor market as well as sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. The Fed also reiterated that it would continue to look at a wide range of factors, including labor market conditions, indicators of inflationary pressures and readings on financial developments, in determining future actions. Additionally, the Fed stated that it would likely maintain the current target range for the fed funds rate for a considerable time, especially if projected inflation continued to run below the Fed’s 2% longer run goal. However, if economic data shows faster progress, the Fed indicated that it could raise the fed funds rate sooner than expected.

The Fed changed its language slightly in December, indicating it would be “patient” in normalizing monetary policy. This shift helped ease investors’ worries that the Fed might raise rates too soon. However, as employment data released early in 2015 continued to look strong, anticipation began building that the Fed could raise its main policy rate as soon as June. As widely expected, after its March meeting, the Fed eliminated “patient” from its statement, but also highlighted the policymakers’ less optimistic view of the economy’s overall health as well as downgraded their inflation projections. The Fed’s April meeting seemed to further signal that a June rate hike was off the table. While the Fed attributed the first quarter’s economic weakness to temporary factors, the meeting minutes from April revealed that many Committee members believed the economic data available in June would be insufficient to meet the Fed’s criteria for initiating a rate increase. The June meeting bore out that presumption and the Fed decided to keep the target rate near zero. But the Committee also continued to telegraph the likelihood of at least one rate increase in 2015, which many analysts forecasted for September. During the September 2015 meeting (subsequent to the close of this reporting period), the Fed decided to keep the federal funds rate near zero despite broad speculation that it would increase rates. The Committee said it will keep the rate near zero until the economy has seen further improvement toward reaching the Fed’s goals of maximum employment and inflation approaching 2%. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

The U.S. economy proved to be fairly resilient compared to other economies around the globe, boosted by an improving job market, declining gas prices and low mortgage rates. According to the government’s revised estimate, the U.S. economy increased at a 3.9% annualized rate in the second quarter of 2015, as measured by GDP, compared with a decrease of 0.6% in the first quarter of 2015 and increases of 5.0% in the third quarter 2014 and 2.2% in the fourth quarter 2014. The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures, exports, state and local government spending and residential fixed investment that were partly offset by negative contributions from federal government spending, private inventory investment and nonresidential fixed investment. The Consumer Price Index (CPI) rose 0.2% year-over-year as of August 2015. The core CPI (which excludes food and energy) increased 1.8% during the same period, below the Fed’s unofficial longer term inflation objective of 2.0%. As of August 2015, the U.S. unemployment rate was 5.1%, a figure that is also considered “full employment” by some Fed officials. The housing market continued to post consistent gains as of its most recent reading for July 2015. The average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 5.0% for the twelve months ended July 2015 (most recent data available at the time this report was prepared).

Meanwhile, a number of issues weighed on economies across the globe including geopolitical turmoil, weak growth overseas and sharply falling oil prices, which were caused by the faltering global economy and the Organization of the Petroleum Exporting Countries (OPEC’s) refusal to cede market share. Falling oil prices propelled significant appreciation in the U.S. dollar, which hit a multi-year high versus a basket of other major currencies, supported by the confident Fed and weaker data coming out of Europe, Japan and China. In an effort to improve their economic growth, countries across the globe maintained extraordinarily accommodative monetary policies. The European Central Bank (ECB) launched a massive quantitative easing program via a government bond-buying program that pumped more than 1 trillion euros into the weak eurozone economy, while other central banks around the world enacted more than 30 policy easing actions during the first few months of 2015.

Later in the reporting period, political drama dominated the news including the escalating tensions over Greece’s debt issues and aggressive policy intervention by the Chinese government to deflate the country’s stock market bubble. Greece took front and center in world market headlines with defaults on its payments to the International Monetary Fund and threats of a potential exit from the European Monetary Union (EMU). By mid-July, Greece had agreed to austerity measures in return for more bailout funds. Meanwhile, after skyrocketing for nearly a year, China’s stock market suddenly shifted gears in June and embarked on a massive sell-off that quickly spilled over to the rest of the world. Investors pulled money out of Chinese stocks despite efforts by the country’s central bank to prop up the market by cutting interest rates to a record low. A number of factors helped fuel the sell-off, including weak Chinese economic data and falling commodity prices. By August 2015, oil prices had fallen to their lowest levels of the reporting period with prices for West Texas Intermediate (WTI) crude dipping below the $40/barrel level for a short time.

The environment during the reporting period proved to be challenging for the riskier areas of the bond market with corporate bonds, particularly in the high yield area, falling short of Treasuries and the broader bond market. The high yield segment was down nearly 3% as bonds from energy and commodity-related issuers exhibited significant volatility due to the sharp drop in oil prices and uncertainty about base commodity prices. The broader bond market, as measured by the Barclays Aggregate Bond Index, posted a return of 1.56% for the reporting period.

How did the Funds perform during the twelve-month reporting period ended August 31, 2015?

The tables in the Fund Performance and Expense Ratios section of this report provide total return performance information for the Funds for the one-year and since inception periods ended August 31, 2015. Each Fund’s Class A Share total returns at net asset value (NAV) are compared with the performance of the appropriate Morningstar Index and Lipper classification average.

What strategies were used to manage the Funds during the twelve-month reporting period ended August 31, 2015 and how did these strategies influence performance?

We manage each of the three risk categories of our Intelligent Risk Funds (Conservative, Growth and Moderate) using the same investment process. Our goal with each Fund is to provide investors with a stable level of risk that matches their risk tolerance through changing market conditions. Therefore, each Fund targets its own explicit daily volatility range that we believe to be appropriate for its risk category:

| | | | |

| Fund | | Daily Volatility Target (Annualized) | |

Nuveen Intelligent Risk Conservative Allocation Fund | | | 3.5% to 7% | |

Nuveen Intelligent Risk Growth Allocation Fund | | | 12% to 18% | |

Nuveen Intelligent Risk Moderate Allocation Fund | | | 7% to 12% | |

To keep each Fund’s volatility within its target range, we use our proprietary risk forecasting models to forecast future volatility across asset classes, and in turn, use that information to construct a risk-targeted portfolio. Risk forecasting and portfolio construction processes attempt to limit fluctuations in each portfolio’s volatility primarily by having exposure to a variety of different asset classes and dynamically adjusting exposure to these asset classes. To gain exposure to the various asset classes, the Funds are currently invested in a diverse blend of exchange-traded funds (ETFs) with broad exposures in equities, fixed income, real estate, commodities and cash.

Each Fund’s wide-ranging investable universe gives us the flexibility to reduce exposure to risky assets during periods of high volatility and increase exposure to risky assets during periods of low volatility, while maintaining a stable risk profile. This strategy offers the potential to meet each Fund’s investment objective in a range of economic environments by capitalizing on market upswings, while mitigating risk in down markets. Our goal is to proactively anticipate market volatility to protect investors from unintentionally taking on risk that is inconsistent with each Fund’s respective risk tolerance.

What was the overall volatility environment during the twelve-month reporting period?

Throughout much of the reporting period, annualized volatility remained below historical averages across many asset classes. One notable exception was 20+ year U.S. Treasury volatility, which remained above its historical average for two-thirds of the twelve-month reporting period. Specifically, 20+ year U.S. Treasury volatility averaged 14% and reached as high as 21% during the reporting period, compared to a historical average of 12.6%. Continued and growing debate over the timing and magnitude of future Fed action caused interest rate volatility, which generally translates to total return volatility, especially in longer duration fixed income assets. Aside from a few temporary spikes in high yield fixed income volatility, the volatility of other fixed income asset classes tracked by the investment team remained relatively stable and below their historic averages. By the end of the reporting period, however, the volatility levels of many fixed income asset classes were either close to or above historical averages.

Equity market volatility remained muted for a substantial portion of the twelve-month reporting period until spiking at the end of August due to global growth concerns after China released weak economic growth numbers. Until this point, investors had been experiencing consistently low levels of volatility in equities. For example, U.S. large-cap equity volatility remained below its historical average of 19.6% for 96% of the reporting period, ranging from a low of 8.5% in September 2014 to a high of 33.7% by the end of August 2015. This trend was consistent among the other equity asset classes tracked by the investment team, including U.S. small-cap, international developed and emerging market equities.

In other markets, unstable oil prices affected both the commodities and natural resource markets. Both areas of the market had been well below their historical average volatility levels at the beginning of the reporting period, but saw spikes in volatility in December. After trending back below average levels at the end of February, volatility across real assets spiked at the end of August along with broad equity markets. For example, at the end of the reporting period, natural resource equity volatility stood at 42%, well above its historical average of 27%.

How did the Funds perform and what changes were made to their portfolio allocations during this reporting period ended August 31, 2015?

Nuveen Intelligent Risk Conservative Allocation Fund

During the reporting period, the Nuveen Intelligent Risk Conservative Allocation Fund stayed within its target volatility range 93% of the time. An overweight to more volatile equity asset classes during the first half of the reporting period helped keep the Fund’s volatility within the target range during the low volatility environment. Shareholders should note that the benchmark does not employ the same volatility management strategy as the Fund and therefore the benchmark’s performance was greater than the Fund’s during a period where the Fund had lower exposure than the benchmark to volatile assets that performed well and higher exposure to uncorrelated asset classes such as commodities that performed poorly.

The Fund’s Class A Shares at NAV underperformed the Morningstar index and Lipper average for the twelve-month reporting period ended August 31, 2015. The Morningstar benchmark is heavily concentrated in fixed income and equities, but has very little exposure to real asset categories such as commodities and natural resources. Consequently, when real assets dramatically underperform most other asset classes, as they did during the reporting period, the Fund will tend to underperform the benchmark due to its broader diversification.

Portfolio Managers’ Comments (continued)

As has historically been the case in this Fund, our team allocated slightly more than half of its assets to fixed income securities on average during the reporting period. Gains in 20+ year U.S. Treasuries and municipal bonds outpaced those of U.S. equities; however, international equities and commodity-based investments continued to be a drag on the Fund’s performance. During the reporting period, 20+ year U.S. Treasuries advanced 5.4% as measured by the Barclays 20+ Year U.S. Treasury Bond Index, posting the largest gain of all the indexes tracked for the Fund. Municipal bonds posted a 2.5% gain, as measured by the Barclays Municipal Bond Index, while U.S. large-cap equities finished the reporting period up just 0.4% as measured by the Russell 1000® Index. As previously mentioned, the largest losses were seen in commodities and natural resources due in large part to oil price volatility. Natural resources, as measured by the S&P North American Natural Resources Index, suffered losses of 35.6% during the reporting period. A diversified blend of commodities, as measured by the Bloomberg Commodity Index, fared only slightly better than natural resources and finished with a loss of 28.1% return during the reporting period.

As volatility in real assets increased, we reduced the Fund’s allocations to real estate, commodities and natural resources. By the end of the reporting period, the Fund had no exposure to natural resource equities, but continued to hold approximately 7% in diversified commodity exposure and an additional 7% in dedicated gold exposure. With the proceeds, we initiated and increased its position in high yield bonds and short-term U.S. Treasuries. At the end of the reporting period, the Fund was markedly more defensive than it was at the beginning of the reporting period, with an overall increase in fixed income assets of 22%. As of August 31, 2015, the Fund was positioned with an underweight to equities and an overweight to fixed income relative to historical levels. Real asset exposure in the Fund was in line with its historical average.

Nuveen Intelligent Risk Growth Allocation Fund

During the reporting period, the Nuveen Intelligent Risk Growth Allocation Fund stayed within its target volatility range 66% of the time. However, if we were to extend the bottom of its 12% to 18% range to 10%, the Fund would have stayed in its volatility range 94% of the time. This indicates that when the Fund was outside of its target range, it was delivering volatility levels below its target range. Shareholders should note that the benchmark does not employ the same volatility management strategy as the Fund and therefore the benchmark’s performance was greater than the Fund’s during a period where the Fund had lower exposure than the benchmark to volatile assets that performed well and higher exposure to uncorrelated asset classes such as commodities that performed poorly.

The Fund’s Class A Shares at NAV underperformed the Morningstar index and Lipper average for the twelve-month reporting period ended August 31, 2015. The Morningstar benchmark is heavily concentrated in equities with a modest allocation to fixed income securities, but has very little exposure to real asset categories such as natural resources and commodities. Consequently, when real assets dramatically underperform most other asset classes, as they did during the reporting period, the Fund will tend to underperform the benchmark due to its broader diversification.

Due to the persistently low volatility levels across asset classes, our team allocated the majority of the Fund’s assets to equities throughout the reporting period. Also, because of the low volatility environment, we did not hold any fixed income investments in the Fund until the end of the reporting period. Although small-cap U.S. equities and large-cap U.S. equities produced minimal gains, U.S. equities were the main positive contributors to the Fund’s return over the past twelve months. Small caps remained flat, returning 0.0% during the reporting period, as measured by the Russell 2000® Index, while large caps gained only 0.4%, as measured by the Russell 1000® Index. However, international developed market and emerging market equities both posted losses, detracting from the Fund’s performance. For example, emerging market equities lost 21.2% during the reporting period, according to the FTSE Emerging Markets Index. Natural resources were the largest detractor of the Fund’s performance with a loss of 35.6% as measured by the S&P North American Natural Resources Index during the reporting period.

The most notable change we made to allocations during the reporting period was to decrease the Fund’s exposure to international developed equities from 32% to 4%. We reallocated most of the proceeds into emerging market equities, which increased from 1% to 21% during the reporting period. Due to the spike in volatility in late August, we initiated a position in long duration U.S. Treasuries at the end of the reporting period. As of August 31, 2015, the Fund was positioned with overweights to equities and fixed income and an underweight to real assets relative to historical levels. Unless the heightened volatility seen at the end of August remains, we expect to continue allocating a substantial amount of the Fund into global equities to capitalize on the supportive environment for higher risk investments.

Nuveen Intelligent Risk Moderate Allocation Fund

During the reporting period, the Nuveen Intelligent Risk Moderate Allocation Fund stayed within its target volatility range 96% of the time. An overweight to more volatile asset classes helped keep the Fund’s volatility within the target range. Shareholders should note that the benchmark does not employ the same volatility management strategy as the Fund and therefore the benchmark’s performance was greater than the Fund’s during a period where the Fund had lower exposure than the benchmark to volatile assets that performed well and higher exposure to uncorrelated asset classes such as commodities that performed poorly.

The Fund’s Class A Shares at NAV underperformed the Morningstar index and Lipper average for the twelve-month reporting period ended August 31, 2015. The Morningstar benchmark is heavily concentrated in equities followed by fixed income securities, but has very little exposure to real asset categories such as commodities and natural resources. Consequently, when real assets dramatically underperform most other asset classes, as they did during the reporting period, the Fund will tend to underperform the benchmark due to its broader diversification.

We maintained the Fund’s relatively large allocation to global equities and commodities and a reduced allocation to fixed income during the reporting period. By concentrating the Fund’s exposures in more volatile asset classes, we were able to keep volatility consistently within its target range. At the end of the reporting period, volatility spiked due to global growth concerns, and we increased allocations in defensive fixed income assets to keep overall portfolio volatility within its target range.

Our allocations to large-cap U.S. equities and long duration U.S. Treasuries in the Fund benefited investors, while allocations to commodities and natural resources hindered performance. U.S. large-cap equities finished the reporting period up 0.4% as measured by the Russell 1000® Index and long duration U.S. Treasuries gained 5.4%, according to the Barclays 20+ Year U.S. Treasury Bond Index. However, allocations to commodities and natural resources, which we use to help diversify risk in the Fund, did prove to be a drag on performance. The commodities asset class finished the reporting period with a loss of 28.1% return as measured by Bloomberg Commodity Index, while natural resources lost 35.6% during the reporting period, as measured by the S&P North American Natural Resources Index. Although the Fund’s exposure to gold varied throughout the reporting period, that asset class also declined and ended the reporting period down almost 12%, according to Bloomberg.

Our team began increasing the Fund’s exposure to long duration U.S. Treasuries early in the reporting period. By the end of the reporting period, the Fund had a target allocation of approximately 21% to long duration U.S. Treasuries, which benefited investors. While we did decrease overall exposure to real assets, the Fund continued to hold approximately 14% in dedicated gold exposure, 9% in commodities and 4% in natural resources at the end of the reporting period. We maintained the Fund’s meaningful exposure to gold as a hedge against substantial global market declines, geopolitical events and unexpected inflation.

While we prefer to balance risk across the Fund’s asset classes, the low volatility environment suggested that riskier asset classes, such as equities, would perform well and help keep the Fund within its target volatility range of 7% to 12%. Due to heightened volatility at the end of the reporting period, the Fund ended the reporting period positioned somewhat more defensively than it was at the beginning of the reporting period. As of August 31, 2015, the Fund was positioned with underweights to equities and real assets and an overweight to fixed income relative to historical levels.

Risk Considerations

and Dividend Information

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. There is no guarantee that the Funds will achieve their investment objectives and the portfolio managers’ asset allocation decisions may adversely affect Fund performance. Each Fund is exposed to the risks of the underlying derivative instruments, ETFs, municipal bonds, corporate bonds, foreign government bonds, equity securities, commodities, real estate, asset-backed securities, mortgage-backed securities, inflation-protected securities and short-term securities that may be held in the portfolio. These risks include market risk, frequent trading risk, index methodology risk, other investment companies risk, liquidity risk, interest rate risk, and credit risk. As interest rates rise, bond prices fall. The credit risk and liquidity risk is heightened for non-investment grade or high-yield securities. The use of derivatives involves substantial financial risks and transaction costs. Commodities may be highly volatile and foreign investments are subject to additional risks including currency fluctuations, and economic or political instability. These risks are magnified in emerging markets. In addition, each Fund will bear its proportionate share of any fees and expenses paid by the ETFs in which it invests.

Dividend Information for Nuveen Intelligent Risk Conservation Allocation Fund

Nuveen Intelligent Risk Conservative Allocation Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects the Fund’s past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, it may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If the Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if the Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. The Fund will, over time, pay all its net investment income as dividends to shareholders. As of August 31, 2015, Nuveen Intelligent Risk Conservative Allocation Fund had a zero UNII balance for tax purposes and a negative UNII balance for financial reporting purposes.

During the fiscal year end August 31, 2015, market fluctuations caused uneven income flows that in turn resulted in lower-than-expected net investment income for the Nuveen Intelligent Risk Conservative Allocation Fund. As a result, the Fund paid out more in its monthly dividends than the amount of its net investment income; as a further result, the Fund later re-characterized a portion of the regular monthly distributions for each class of the Fund’s shares, as outlined in the following table, as capital gains. The Fund also paid a separate capital gain distribution during the year.

The following table presents the regular, monthly distributions for the Nuveen Intelligent Risk Conservative Allocation Fund for the fiscal year ended August 31, 2015. The final determination of the source and characteristics of all distributions will be made in early 2016 and reported to shareholders on Form 1099-DIV at that time.

Nuveen Intelligent Risk Conservative Allocation Fund

| | | | | | | | | | | | | | | | |

| For year ended August 31, 2015 | | Class A Shares | | | Class C Shares | | | Class R3 Shares | | | Class I Shares | |

Cumulative regular monthly distribution, per share: | | | | | | | | | | | | | | | | |

From net investment income | | $ | 0.16 | | | $ | 0.01 | | | $ | 0.11 | | | $ | 0.21 | |

From net realized capital gains | | | 0.10 | | | | 0.10 | | | | 0.10 | | | | 0.10 | |

Return of capital | | | – | | | | – | | | | – | | | | – | |

Total | | $ | 0.26 | | | $ | 0.11 | | | $ | 0.21 | | | $ | 0.31 | |

For financial reporting purposes, the composition and per share amounts of the Fund’s dividends for the reporting period are presented in this report’s Statement of Changes in Net Assets and Financial Highlights, respectively. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6—Income Tax Information within the Notes to Financial Statements of this report.

Dividend Information for Nuveen Intelligent Risk Moderate Allocation Fund

Nuveen Intelligent Risk Moderate Allocation Fund pays quarterly dividends out of its income earned, net of expenses (net investment income). During the current fiscal period, dividend payments earned by the Fund were re-characterized by the ETFs in which the Fund invests as either a capital gain distribution or a return of capital. Due to the ETF re-characterization, the Fund distributed an amount greater than its net investment income, which resulted in the Fund re-characterizing a portion of its regular quarterly distributions for each class of the Fund’s shares as capital gains or a return of capital, as presented in the table below.

The following table presents the regular, quarterly distributions for the Nuveen Intelligent Risk Moderate Allocation Fund for the fiscal year ended August 31, 2015. The final determination of the source and characteristics of all distributions will be made in early 2016 and reported to shareholders on Form 1099-DIV at that time.

Nuveen Intelligent Risk Moderate Allocation Fund

| | | | | | | | | | | | | | | | |

| For year ended August 31, 2015 | | Class A Shares | | | Class C Shares | | | Class R3 Shares | | | Class I Shares | |

Cumulative quarterly distribution, per share: | | | | | | | | | | | | | | | | |

From net investment income | | $ | 0.14 | | | $ | 0.02 | | | $ | 0.10 | | | $ | 0.18 | |

From net realized capital gains | | | 0.08 | | | | 0.08 | | | | 0.08 | | | | 0.08 | |

Return of capital | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.04 | |

Total | | $ | 0.26 | | | $ | 0.14 | | | $ | 0.22 | | | $ | 0.30 | |

For financial reporting purposes, the composition and per share amounts of the Fund’s dividends for the reporting period are presented in this report’s Statement of Changes in Net Assets and Financial Highlights, respectively. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6—Income Tax Information within the Notes to Financial Statements of this report.

THIS PAGE INTENTIONALLY LEFT BLANK

Fund Performance

and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown within this section of the report.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect an agreement by the investment adviser to waive certain fees and/or reimburse expenses during the periods presented. If any such waivers and/or reimbursements had not been in place, returns would have been reduced. See Notes to Financial Statements, Note 7—Management Fees and Other Transactions with Affiliates for more information. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees, and assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (continued)

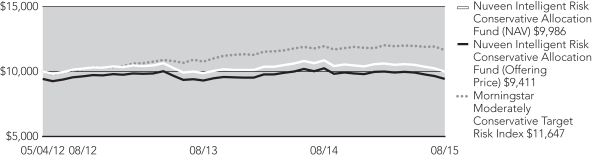

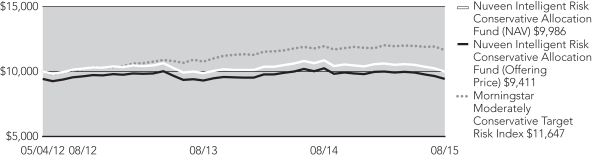

Nuveen Intelligent Risk Conservative Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of August 31, 2015

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | (8.06)% | | | | (0.06)% | |

Class A Shares at maximum Offering Price | | | (13.33)% | | | | (1.82)% | |

Morningstar Moderately Conservative Target Risk Index | | | (2.48)% | | | | 4.72% | |

Lipper Mixed-Asset Target Allocation Conservative Funds Classification Average | | | (2.38)% | | | | 4.20% | |

| | |

Class C Shares | | | (8.75)% | | | | (0.81)% | |

Class R3 Shares | | | (8.32)% | | | | (0.33)% | |

Class I Shares | | | (7.84)% | | | | 0.18% | |

Average Annual Total Returns as of September 30, 2015 (Most Recent Calendar Quarter)

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | (5.19)% | | | | (0.37)% | |

Class A Shares at maximum Offering Price | | | (10.63)% | | | | (2.08)% | |

Class C Shares | | | (5.90)% | | | | (1.12)% | |

Class R3 Shares | | | (5.46)% | | | | (0.64)% | |

Class I Shares | | | (4.96)% | | | | (0.14)% | |

Since inception returns are from 5/04/12. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios* | | | 4.43% | | | | 4.44% | | | | 4.61% | | | | 3.39% | |

Net Expense Ratios* | | | 1.25% | | | | 2.00% | | | | 1.50% | | | | 1.00% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through September 30, 2016 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring September 30, 2016 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | The expense ratios include acquired fund fees and expenses of 0.32%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

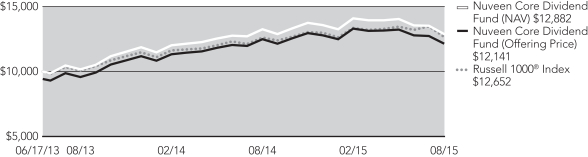

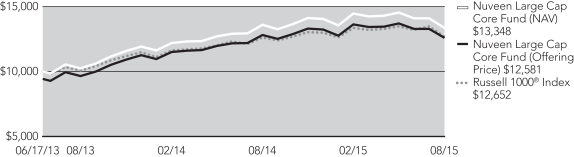

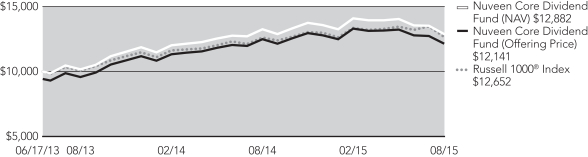

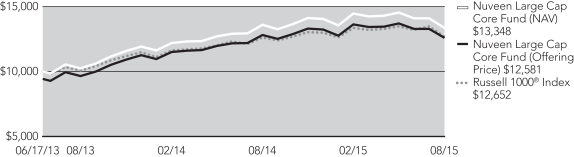

Growth of an Assumed $10,000 Investment as of August 31, 2015 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

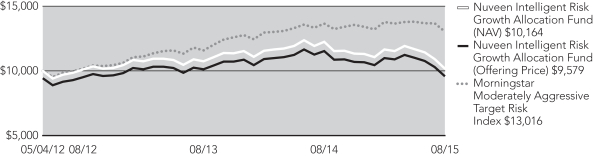

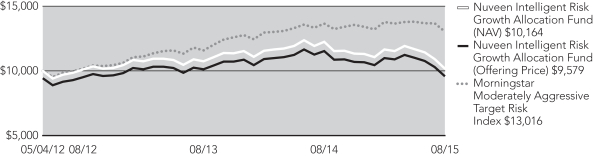

Nuveen Intelligent Risk Growth Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of August 31, 2015

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | (16.88)% | | | | 0.49% | |

Class A Shares at maximum Offering Price | | | (21.67)% | | | | (1.28)% | |

Morningstar Moderately Aggressive Target Risk Index | | | (4.68)% | | | | 8.26% | |

Lipper Mixed-Asset Target Allocation Growth Funds Classification Average | | | (3.51)% | | | | 9.45% | |

| | |

Class C Shares | | | (17.46)% | | | | (0.26)% | |

Class R3 Shares | | | (17.06)% | | | | 0.24% | |

Class I Shares | | | (16.63)% | | | | 0.74% | |

Average Annual Total Returns as of September 30, 2015 (Most Recent Calendar Quarter)

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | (15.33)% | | | | (0.71)% | |

Class A Shares at maximum Offering Price | | | (20.19)% | | | | (2.42)% | |

Class C Shares | | | (15.98)% | | | | (1.45)% | |

Class R3 Shares | | | (15.55)% | | | | (0.97)% | |

Class I Shares | | | (15.10)% | | | | (0.47)% | |

Since inception returns are from 5/04/12. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios* | | | 3.77% | | | | 4.62% | | | | 4.16% | | | | 3.15% | |

Net Expense Ratios* | | | 1.18% | | | | 1.93% | | | | 1.43% | | | | 0.93% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through September 30, 2016 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring September 30, 2016 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | The expense ratios include acquired fund fees and expenses of 0.25%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

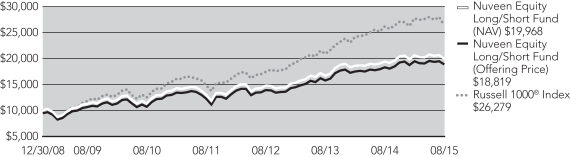

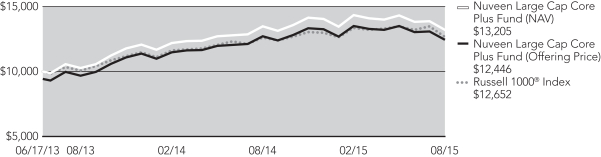

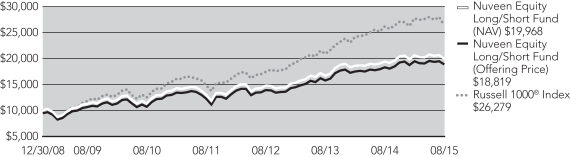

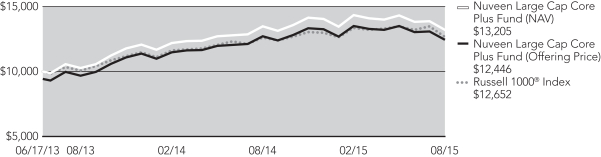

Growth of an Assumed $10,000 Investment as of August 31, 2015 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

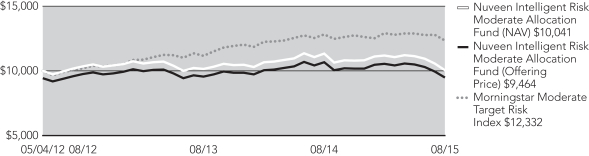

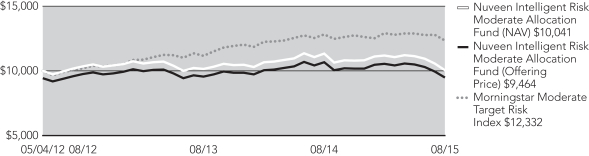

Nuveen Intelligent Risk Moderate Allocation Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of August 31, 2015

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | (11.30)% | | | | 0.12% | |

Class A Shares at maximum Offering Price | | | (16.40)% | | | | (1.64)% | |

Morningstar Moderate Target Risk Index | | | (3.66)% | | | | 6.52% | |

Lipper Mixed-Asset Target Allocation Moderate Funds Classification Average | | | (3.25)% | | | | 6.33% | |

| | |

Class C Shares | | | (11.94)% | | | | (0.62)% | |

Class R3 Shares | | | (11.50)% | | | | (0.14)% | |

Class I Shares | | | (11.02)% | | | | 0.38% | |

Average Annual Total Returns as of September 30, 2015 (Most Recent Calendar Quarter)

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | (7.31)% | | | | (0.40)% | |

Class A Shares at maximum Offering Price | | | (12.63)% | | | | (2.12)% | |

Class C Shares | | | (8.01)% | | | | (1.15)% | |

Class R3 Shares | | | (7.50)% | | | | (0.66)% | |

Class I Shares | | | (7.09)% | | | | (0.17)% | |

Since inception returns are from 5/04/12. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios* | | | 4.20% | | | | 4.72% | | | | 4.23% | | | | 3.21% | |

Net Expense Ratios* | | | 1.26% | | | | 2.01% | | | | 1.51% | | | | 1.01% | |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through September 30, 2016 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.71% of the average daily net assets of any class of Fund shares. The expense limitation expiring September 30, 2016 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | The expense ratios include acquired fund fees and expenses of 0.33%, which reflect the fees and expenses of the exchange-traded funds in which the Fund invests. |

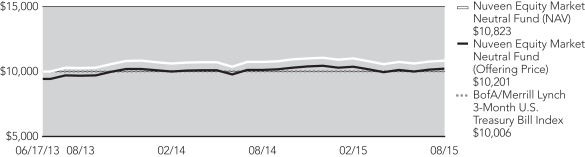

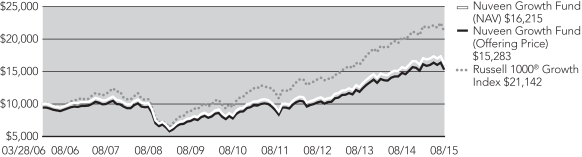

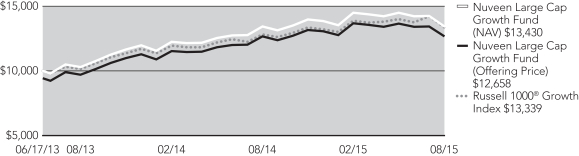

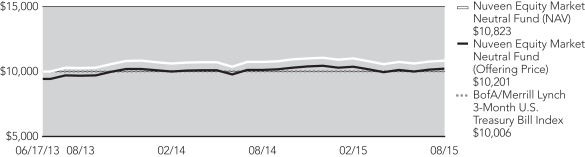

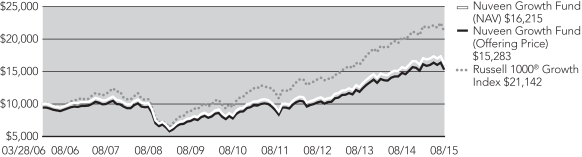

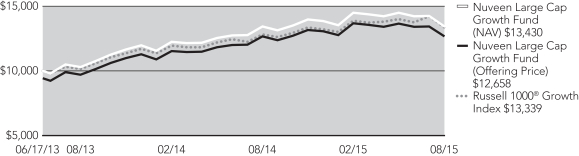

Growth of an Assumed $10,000 Investment as of August 31, 2015 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Holding

Summaries as of August 31, 2015

This data relates to the securities held in each Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov.

Nuveen Intelligent Risk Conservative Allocation Fund

Fund Allocation

(% of net assets)

| | | | |

Exchange-Traded Commodity Funds | | | 14.7% | |

Exchange-Traded Equity Funds | | | 22.7% | |

Exchange-Traded Fixed Income Funds | | | 62.4% | |

Other Assets Less Liabilities | | | 0.2% | |

Net Assets | | | 100% | |

| | | | | | | | |

| Exchange-Traded Commodity Funds | | Weighting

(% of net assets) | | | 1-Year

Average Annual

Total Returns | |

PowerShares DB Commodity Index Tracking Fund | | | 7.4% | | | | (37.01)% | |

PowerShares DB Gold Fund | | | 7.3% | | | | (13.30)% | |

| | |

| Exchange-Traded Equity Funds | | | | | | | | |

iShares® Russell 1000® Index Fund | | | 6.9% | | | | 0.29% | |

iShares® Russell 2000® Index Fund | | | 5.8% | | | | 0.11% | |

Vanguard FTSE Developed Markets ETF | | | 5.2% | | | | (7.99)% | |

Vanguard REIT ETF | | | 4.8% | | | | (0.22)% | |

| | |

| Exchange-Traded Fixed Income Funds | | | | | | | | |

iShares® Barclays 1-3 Year Treasury Bond Fund | | | 8.0% | | | | 0.68% | |

iShares® Barclays 20+ Year Treasury Bond Fund | | | 10.6% | | | | 5.31% | |

iShares® National AMT-Free Municipal Bond Fund | | | 25.8% | | | | 1.88% | |

iShares® TIPS Bond ETF | | | 1.5% | | | | (2.88)% | |

SPDR® Barclays Capital High Yield Bond Fund | | | 16.5% | | | | (5.42)% | |

Nuveen Intelligent Risk Growth Allocation Fund

Fund Allocation

(% of net assets)

| | | | |

Exchanged-Traded Commodity Funds | | | 8.8% | |

Exchange-Traded Equity Funds | | | 83.9% | |

Exchange-Traded Fixed Income Funds | | | 7.7% | |

Money Market Funds | | | 0.0% | |

Other Assets Less Liabilities | | | (0.4)% | |

Net Assets | | | 100% | |

| | | | | | | | |

| Exchange-Traded Commodity Funds | | Weighting

(% of net assets) | | | 1-Year

Average Annual

Total Returns | |

PowerShares DB Gold Fund | | | 8.8% | | | | (13.30)% | |

| | |

| Exchange-Traded Equity Funds | | | | | | | | |

iShares® Russell 1000® Index Fund | | | 9.1% | | | | 0.29% | |

iShares® Russell 2000® Index Fund | | | 29.3% | | | | 0.11% | |

iShares® S&P North American Natural Resources Sector Index Fund | | | 20.5% | | | | (34.22)% | |

Vanguard FTSE Developed Markets ETF | | | 4.0% | | | | (7.99)% | |

Vanguard FTSE Emerging Markets ETF | | | 21.0% | | | | (21.52)% | |

| | |

| Exchange-Traded Fixed Income Funds | | | | | | | | |

iShares® Barclays 20+ Year Treasury Bond Fund | | | 7.7% | | | | 5.31% | |

Holding Summaries as of August 31, 2015 (continued)

Nuveen Intelligent Risk Moderate Allocation Fund

Fund Allocation

(% of net assets)

| | | | |

Exchange-Traded Commodity Funds | | | 22.0% | |

Exchange-Traded Equity Funds | | | 51.5% | |

Exchange-Traded Fixed Income Funds | | | 26.0% | |

Other Assets Less Liabilities | | | 0.5% | |

Net Assets | | | 100% | |

| | | | | | | | |

| Exchange-Traded Commodity Funds | | Weighting

(% of net assets) | | | 1-Year

Average Annual

Total Returns | |

PowerShares DB Commodity Index Tracking Fund | | | 8.5% | | | | (37.01)% | |

PowerShares DB Gold Fund | | | 13.5% | | | | (13.30)% | |

| | |

| Exchange-Traded Equity Funds | | | | | | | | |

iShares® Russell 1000® Index Fund | | | 13.4% | | | | 0.29% | |

iShares® Russell 2000® Index Fund | | | 12.0% | | | | 0.11% | |

iShares® S&P North American Natural Resources Sector Index Fund | | | 3.9% | | | | (34.22)% | |

Vanguard FTSE Developed Markets ETF | | | 10.6% | | | | (7.99)% | |

Vanguard FTSE Emerging Markets ETF | | | 6.7% | | | | (21.52)% | |

Vanguard REIT ETF | | | 4.9% | | | | (0.22)% | |

| | |

| Exchange-Traded Fixed Income Funds | | | | | | | | |

iShares® Barclays 20+ Year Treasury Bond Fund | | | 20.6% | | | | 5.31% | |

iShares® National AMT-Free Municipal Bond Fund | | | 4.0% | | | | 1.88% | |

iShares® TIPS Bond ETF | | | 1.4% | | | | (2.88)% | |

Expense

Examples

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held through the period ended August 31, 2015.

The beginning of the period is March 1, 2015.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

In addition to the fees and expenses which the Funds bear directly; the Funds indirectly bear a pro rata share of the fees and expenses of the exchange-traded funds in which the Funds invest. Because the exchange-traded funds have varied expenses and fee levels and the Funds may own different proportions at different times, the amount of fees and expenses incurred indirectly by the Funds will vary. These exchange-traded fund fees and expenses are not included in the expenses shown in the tables.

Nuveen Intelligent Risk Conservative Allocation Fund

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Actual Performance | | | | | | | | | | | | | | | | |

Beginning Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value | | $ | 941.40 | | | $ | 937.60 | | | $ | 940.10 | | | $ | 942.50 | |

Expenses Incurred During Period | | $ | 4.50 | | | $ | 8.16 | | | $ | 5.72 | | | $ | 3.28 | |

Hypothetical Performance (5% annualized return before expenses) | | | | | | | | | | | | | | | | |

Beginning Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,020.57 | | | $ | 1,016.79 | | | $ | 1,019.31 | | | $ | 1,021.83 | |

Expenses Incurred During Period | | $ | 4.69 | | | $ | 8.49 | | | $ | 5.96 | | | $ | 3.41 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.92%, 1.67%, 1.17% and 0.67% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Expense Examples (continued)

Nuveen Intelligent Risk Growth Allocation Fund

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Actual Performance | | | | | | | | | | | | | | | | |

Beginning Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value | | $ | 872.80 | | | $ | 869.70 | | | $ | 871.70 | | | $ | 873.80 | |

Expenses Incurred During Period | | $ | 4.34 | | | $ | 7.87 | | | $ | 5.57 | | | $ | 3.16 | |

Hypothetical Performance (5% annualized return before expenses) | | | | | | | | | | | | | | | | |

Beginning Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,020.57 | | | $ | 1,016.79 | | | $ | 1,019.26 | | | $ | 1,021.83 | |

Expenses Incurred During Period | | $ | 4.69 | | | $ | 8.49 | | | $ | 6.01 | | | $ | 3.41 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.92%, 1.67%, 1.18% and 0.67% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nuveen Intelligent Risk Moderate Allocation Fund

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Actual Performance | | | | | | | | | | | | | | | | |

Beginning Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value | | $ | 899.20 | | | $ | 895.80 | | | $ | 898.00 | | | $ | 900.80 | |

Expenses Incurred During Period | | $ | 4.40 | | | $ | 7.98 | | | $ | 5.60 | | | $ | 3.21 | |

Hypothetical Performance (5% annualized return before expenses) | | | | | | | | | | | | | | | | |

Beginning Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,020.57 | | | $ | 1,016.79 | | | $ | 1,019.31 | | | $ | 1,021.83 | |

Expenses Incurred During Period | | $ | 4.69 | | | $ | 8.49 | | | $ | 5.96 | | | $ | 3.41 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.92%, 1.67%, 1.17% and 0.67% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Report of

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Investment Trust:

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Intelligent Risk Conservative Allocation Fund, Nuveen Intelligent Risk Growth Allocation Fund and Nuveen Intelligent Risk Moderate Allocation Fund (each a series of the Nuveen Investment Trust, hereinafter referred to as the “Funds”) at August 31, 2015, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2015 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

October 28, 2015

Nuveen Intelligent Risk Conservative Allocation Fund

| | |

| Portfolio of Investments | | August 31, 2015 |

| | | | | | | | |

| Shares | | | Description (1), (2) | | Value | |

| | |

| | | | LONG-TERM INVESTMENTS – 99.8% | | | | |

| | |

| | | | EXCHANGE-TRADED FUNDS – 99.8% | | | | |

| | |

| | | | Commodity Funds – 14.7% | | | |

| | |

| | 4,741 | | | PowerShares DB Commodity Index Tracking Fund, (3) | | $ | 74,386 | |

| | |

| | 1,973 | | | PowerShares DB Gold Fund, (3) | | | 73,494 | |

| | | | Total Commodity Funds | | | 147,880 | |

| | |

| | | | Equity Funds – 22.7% | | | |

| | |

| | 633 | | | iShares® Russell 1000® Index Fund | | | 70,035 | |

| | |

| | 506 | | | iShares® Russell 2000® Index Fund | | | 58,291 | |

| | |

| | 1,400 | | | Vanguard FTSE Developed Markets ETF | | | 52,248 | |

| | |

| | 660 | | | Vanguard REIT ETF | | | 48,860 | |

| | | | Total Equity Funds | | | 229,434 | |

| | |

| | | | Fixed Income Funds – 62.4% | | | |

| | |

| | 950 | | | iShares® Barclays 1-3 Year Treasury Bond Fund | | | 80,541 | |

| | |

| | 882 | | | iShares® Barclays 20+ Year Treasury Bond Fund | | | 107,092 | |

| | |

| | 2,394 | | | iShares® National AMT-Free Municipal Bond Fund | | | 260,564 | |

| | |

| | 133 | | | iShares® TIPS Bond ETF | | | 14,840 | |

| | |

| | 4,499 | | | SPDR Barclays Capital High Yield Bond Fund | | | 166,508 | |

| | | | Total Fixed Income Funds | | | 629,545 | |

| | | | Total Long-Term Investments (cost $995,501) | | | 1,006,859 | |

| | | | Other Assets Less Liabilities – 0.2% | | | 1,593 | |

| | | | Net Assets – 100% | | $ | 1,008,452 | |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | A copy of the most recent financial statements for these exchange-traded funds can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

| (3) | Non-income producing; fund has not declared a dividend within the past twelve months. |

| REIT | Real Estate Investment Trust. |

See accompanying notes to financial statements.

Nuveen Intelligent Risk Growth Allocation Fund

| | |

| Portfolio of Investments | | August 31, 2015 |

| | | | | | | | |

| Shares | | | Description (1), (2) | | Value | |

| | |

| | | | LONG-TERM INVESTMENTS – 100.4% | | | | |

| | |

| | | | EXCHANGE-TRADED FUNDS – 100.4% | | | | |

| | |

| | | | Commodity Funds – 8.8% | | | |

| | |

| | 3,344 | | | PowerShares DB Gold Fund, (3) | | $ | 124,564 | |

| | |

| | | | Equity Funds – 83.9% | | | |

| | |

| | 1,163 | | | iShares® Russell 1000® Index Fund | | | 128,674 | |

| | |

| | 3,606 | | | iShares® Russell 2000® Index Fund | | | 415,411 | |

| | |

| | 9,164 | | | iShares® S&P North American Natural Resources Sector Index Fund | | | 291,415 | |

| | |

| | 1,531 | | | Vanguard FTSE Developed Markets ETF | | | 57,137 | |

| | |

| | 8,604 | | | Vanguard FTSE Emerging Markets ETF | | | 297,182 | |

| | | | Total Equity Funds | | | 1,189,819 | |

| | |

| | | | Fixed Income Funds – 7.7% | | | |

| | |

| | 896 | | | iShares® Barclays 20+ Year Treasury Bond Fund | | | 108,793 | |

| | | | Total Long-Term Investments (cost $1,445,534) | | | 1,423,176 | |

| | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | SHORT-TERM INVESTMENTS – 0.0% | | | | |

| | |

| | | | Money Market Funds – 0.0% | | | |

| | |

| | 431 | | | First American Treasury Obligations Fund, Class Z, 0.000%, (4) | | $ | 431 | |

| | | | Total Short-Term Investments (cost $431) | | | 431 | |

| | | | Total Investments (cost $1,445,965) – 100.4% | | | 1,423,607 | |

| | | | Other Assets Less Liabilities – (0.4)% | | | (5,645) | |

| | | | Net Assets – 100% | | $ | 1,417,962 | |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | A copy of the most recent financial statements for these exchange-traded funds can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

| (3) | Non-income producing; fund has not declared a dividend within the past twelve months. |

| (4) | The rate shown is the annualized seven-day effective yield as of the end of the reporting period. |

See accompanying notes to financial statements.

Nuveen Intelligent Risk Moderate Allocation Fund

| | |

| Portfolio of Investments | | August 31, 2015 |

| | | | | | | | |

| Shares | | | Description (1), (2) | | Value | |

| | |

| | | | LONG-TERM INVESTMENTS – 99.5% | | | | |

| | |

| | | | EXCHANGE-TRADED FUNDS – 99.5% | | | | |

| | |

| | | | Commodity Funds – 22.0% | | | |

| | |

| | 13,660 | | | PowerShares DB Commodity Index Tracking Fund, (3) | | $ | 214,325 | |

| | |

| | 9,130 | | | PowerShares DB Gold Fund, (3) | | | 340,093 | |

| | | | Total Commodity Funds | | | 554,418 | |

| | |

| | | | Equity Funds – 51.5% | | | |

| | |

| | 3,040 | | | iShares® Russell 1000® Index Fund | | | 336,346 | |

| | |

| | 2,628 | | | iShares® Russell 2000® Index Fund | | | 302,746 | |

| | |

| | 3,125 | | | iShares® S&P North American Natural Resources Sector Index Fund | | | 99,375 | |

| | |

| | 7,143 | | | Vanguard FTSE Developed Markets ETF | | | 266,577 | |

| | |

| | 4,918 | | | Vanguard FTSE Emerging Markets ETF | | | 169,868 | |

| | |

| | 1,649 | | | Vanguard REIT ETF | | | 122,075 | |

| | | | Total Equity Funds | | | 1,296,987 | |

| | |

| | | | Fixed Income Funds – 26.0% | | | |

| | |

| | 4,270 | | | iShares® Barclays 20+ Year Treasury Bond Fund | | | 518,462 | |

| | |

| | 930 | | | iShares® National AMT-Free Municipal Bond Fund | | | 101,221 | |

| | |

| | 301 | | | iShares® TIPS Bond ETF | | | 33,586 | |

| | | | Total Fixed Income Funds | | | 653,269 | |

| | | | Total Long-Term (cost $2,478,369) | | | 2,504,674 | |

| | | | Other Assets Less Liabilities – 0.5% | | | 11,560 | |

| | | | Net Assets – 100% | | $ | 2,516,234 | |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its website at http://www.sec.gov. |

| (3) | Non-income producing; fund has not declared a dividend within the past twelve months. |

| REIT | Real Estate Investment Trust. |

See accompanying notes to financial statements.

Statement of

| | | | |

| | Assets and Liabilities | | August 31, 2015 |

| | | | | | | | | | | | |

| | | Intelligent Risk

Conservative Allocation | | | Intelligent Risk

Growth Allocation | | | Intelligent Risk

Moderate Allocation | |

Assets | | | | | | | | | | | | |

Long-term investments, at value (cost $995,501, $1,445,534 and $2,478,369, respectively) | | $ | 1,006,859 | | | $ | 1,423,176 | | | $ | 2,504,674 | |

Short-term investments, at value (cost approximates value) | | | — | | | | 431 | | | | — | |

Receivable for: | | | | | | | | | | | | |

Investments sold | | | 28,810 | | | | — | | | | 20,657 | |

Reimbursement from Adviser | | | 6,602 | | | | 6,885 | | | | 5,874 | |

Shares sold | | | 295 | | | | 497 | | | | 2,107 | |

Other assets | | | 19,837 | | | | 19,835 | | | | 19,833 | |

Total assets | | | 1,062,403 | | | | 1,450,824 | | | | 2,553,145 | |

Liabilities | | | | | | | | | | | | |

Cash overdraft | | | 23,946 | | | | — | | | | 7,031 | |

Payable for: | | | | | | | | | | | | |

Dividends | | | 1,085 | | | | — | | | | — | |

Shares redeemed | | | 35 | | | | — | | | | — | |

Accrued expenses: | | | | | | | | | | | | |

12b-1 distribution and service fees | | | 113 | | | | 200 | | | | 494 | |

Professional fees | | | 21,190 | | | | 21,205 | | | | 21,219 | |

Shareholder reporting expenses | | | 6,516 | | | | 10,443 | | | | 7,043 | |

Trustees fees | | | 4 | | | | 7 | | | | 10 | |

Other | | | 1,062 | | | | 1,007 | | | | 1,114 | |

Total liabilities | | | 53,951 | | | | 32,862 | | | | 36,911 | |

Net assets | | $ | 1,008,452 | | | $ | 1,417,962 | | | $ | 2,516,234 | |

Class A Shares | | | | | | | | | | | | |

Net assets | | $ | 155,980 | | | $ | 380,562 | | | $ | 881,814 | |

Shares outstanding | | | 9,188 | | | | 21,009 | | | | 47,424 | |

Net asset value (“NAV”) per share | | $ | 16.98 | | | $ | 18.11 | | | $ | 18.59 | |

Offering price per share (NAV per share plus maximum sales charge of 5.75% of offering price) | | $ | 18.02 | | | $ | 19.21 | | | $ | 19.72 | |

Class C Shares | | | | | | | | | | | | |

Net assets | | $ | 67,091 | | | $ | 109,101 | | | $ | 314,340 | |

Shares outstanding | | | 3,954 | | | | 6,054 | | | | 17,054 | |

NAV and offering price per share | | $ | 16.97 | | | $ | 18.02 | | | $ | 18.43 | |

Class R3 Shares | | | | | | | | | | | | |

Net assets | | $ | 42,428 | | | $ | 45,197 | | | $ | 46,361 | |

Shares outstanding | | | 2,500 | | | | 2,500 | | | | 2,500 | |

NAV and offering price per share | | $ | 16.97 | | | $ | 18.08 | | | $ | 18.54 | |

Class I Shares | | | | | | | | | | | | |

Net assets | | $ | 742,953 | | | $ | 883,102 | | | $ | 1,273,719 | |

Shares outstanding | | | 43,764 | | | | 48,677 | | | | 68,385 | |

NAV and offering price per share | | $ | 16.98 | | | $ | 18.14 | | | $ | 18.63 | |

Net assets consist of: | | | | | | | | | | | | |

Capital paid-in | | $ | 1,038,768 | | | $ | 1,519,727 | | | $ | 2,551,457 | |

Undistributed (Over-distribution of) net investment income | | | (1,272 | ) | | | 7,875 | | | | — | |

Accumulated net realized gain (loss) | | | (40,402 | ) | | | (87,282 | ) | | | (61,528 | ) |

Net unrealized appreciation (depreciation) | | | 11,358 | | | | (22,358 | ) | | | 26,305 | |

Net assets | | $ | 1,008,452 | | | $ | 1,417,962 | | | $ | 2,516,234 | |

Authorized shares – per class | | | Unlimited | | | | Unlimited | | | | Unlimited | |

Par value per share | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | |

See accompanying notes to financial statements.

Statement of

| | | | |

| | Operations | | Year Ended August 31, 2015 |

| | | | | | | | | | | | |

| | | Intelligent Risk

Conservative Allocation | | | Intelligent Risk

Growth Allocation | | | Intelligent Risk

Moderate Allocation | |

Investment Income | | $ | 27,312 | | | $ | 37,935 | | | $ | 39,895 | |

Expenses | | | | | | | | | | | | |

Management fees | | | 9,138 | | | | 14,952 | | | | 17,512 | |

12b-1 service fees – Class A Shares | | | 516 | | | | 1,348 | | | | 1,239 | |

12b-1 distribution and service fees – Class C Shares | | | 1,023 | | | | 1,315 | | | | 3,298 | |

12b-1 distribution and service fees – Class R3 Shares | | | 231 | | | | 261 | | | | 256 | |

Shareholder servicing agent fees | | | 929 | | | | 1,116 | | | | 1,053 | |

Custodian fees | | | 7,964 | | | | 7,789 | | | | 7,949 | |

Trustees fees | | | 278 | | | | 301 | | | | 311 | |

Professional fees | | | 26,691 | | | | 26,865 | | | | 26,889 | |

Shareholder reporting expenses | | | 13,227 | | | | 19,488 | | | | 6,459 | |

Federal and state registration fees | | | 58,771 | | | | 58,778 | | | | 58,779 | |

Other | | | 1,916 | | | | 1,918 | | | | 1,927 | |

Total expenses before fee waiver/expense reimbursement | | | 120,684 | | | | 134,131 | | | | 125,672 | |

Fee waiver/expense reimbursement | | | (110,853 | ) | | | (118,017 | ) | | | (105,432 | ) |

Net expenses | | | 9,831 | | | | 16,114 | | | | 20,240 | |

Net investment income (loss) | | | 17,481 | | | | 21,821 | | | | 19,655 | �� |

Realized and Unrealized Gain (Loss) | | | | | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | | | | | |

Investments | | | 25,329 | | | | (38,943 | ) | | | (33,891 | ) |

Distributions from exchange-traded funds | | | 7 | | | | 246 | | | | — | |

Total net realized gain (loss) | | | 25,336 | | | | (38,697 | ) | | | (33,891 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | (147,051 | ) | | | (379,444 | ) | | | (312,519 | ) |

Net realized and unrealized gain (loss) | | | (121,715 | ) | | | (418,141 | ) | | | (346,410 | ) |

Net increase (decrease) in net assets from operations | | $ | (104,234 | ) | | $ | (396,320 | ) | | $ | (326,755 | ) |

See accompanying notes to financial statements.

Statement of

| | | | | | | | | | | | | | | | | | |

| | | Intelligent Risk Conservative Allocation | | | | | Intelligent Risk Growth Allocation | |

| | | Year Ended

8/31/15 | | | Year Ended 8/31/14 | | | | | Year Ended

8/31/15 | | | Year Ended

8/31/14 | |

Operations | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 17,481 | | | $ | 53,103 | | | | | $ | 21,821 | | | $ | 56,824 | |

Total net realized gain (loss) | | | 25,336 | | | | 102,287 | | | | | | (38,697 | ) | | | 145,674 | |

Change in net unrealized appreciation (depreciation) of investments | | | (147,051 | ) | | | 186,352 | | | | | | (379,444 | ) | | | 278,771 | |

Net increase (decrease) in net assets from operations | | | (104,234 | ) | | | 341,742 | | | | | | (396,320 | ) | | | 481,269 | |

Distributions to Shareholders | | | | | | | | | | | | | | | | | | |

From net investment income: | | | | | | | | | | | | | | | | | | |

Class A Shares | | | (1,736 | ) | | | (4,054 | ) | | | | | (14,633 | ) | | | (2,885 | ) |

Class C Shares | | | (67 | ) | | | (616 | ) | | | | | (2,799 | ) | | | (363 | ) |

Class R3 Shares | | | (271 | ) | | | (542 | ) | | | | | (1,429 | ) | | | (378 | ) |

Class I Shares | | | (9,248 | ) | | | (48,098 | ) | | | | | (34,330 | ) | | | (20,312 | ) |

From accumulated net realized gains: | | | | | | | | | | | | | | | | | | |

Class A Shares | | | (29,804 | ) | | | — | | | | | | (39,547 | ) | | | — | |

Class C Shares | | | (11,989 | ) | | | — | | | | | | (8,055 | ) | | | — | |

Class R3 Shares | | | (5,313 | ) | | | — | | | | | | (3,398 | ) | | | — | |

Class I Shares | | | (97,262 | ) | | | — | | | | | | (106,180 | ) | | | — | |

Return of capital: | | | | | | | | | | | | | | | | | | |

Class A Shares | | | — | | | | — | | | | | | — | | | | — | |