UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07619

Nuveen Investment Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kathleen L. Prudhomme

Vice President and Secretary

901 Marquette Avenue

Minneapolis, Minnesota 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: June 30

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Mutual Funds | |

| | | | | | |

| | | | | | | Annual Report June 30, 2017 |

| | | | | | | | | | | | | | | | | | |

| | | | | | | Class / Ticker Symbol | | |

| | | Fund Name | | | | Class A | | Class C | | Class R3 | | Class R6 | | Class I | | Class T | | |

| | |

| | Nuveen NWQ Global All-Cap Fund | | | | NGEAX | | NGECX | | — | | — | | NGEIX | | NGETX | | |

| | Nuveen NWQ Global Equity Income Fund | | | | NQGAX | | NQGCX | | NQGRX | | — | | NQGIX | | NQGTX | | |

| | Nuveen NWQ International Value Fund | | | | NAIGX | | NCIGX | | NTITX | | — | | NGRRX | | NAITX | | |

| | Nuveen NWQ Multi-Cap Value Fund | | | | NQVAX | | NQVCX | | NMCTX | | — | | NQVRX | | NQVTX | | |

| | Nuveen NWQ Large-Cap Value Fund | | | | NQCAX | | NQCCX | | NQCQX | | — | | NQCRX | | NQCTX | | |

| | Nuveen NWQ Small/Mid-Cap Value Fund | | | | NSMAX | | NSMCX | | NWQRX | | NWQFX | | NSMRX | | NWQUX | | |

| | Nuveen NWQ Small-Cap Value Fund | | | | NSCAX | | NSCCX | | NSCQX | | NSCFX | | NSCRX | | NSCTX | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | |

| | Life is Complex. | | |

| | |

| | Nuveen makes things e-simple. | | |

| | |

| | It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. | | |

| | | | |

| | | | | | Free e-Reports right to your e-mail! | | |

| | | |

| | | | | | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your

financial advisor or brokerage account. |

| | | | |

| | | | or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. Must be preceded by or accompanied by a prospectus. NOT FDIC INSURED MAY LOSE VALUE

NO BANK GUARANTEE | | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

Some of the key assumptions driving the markets higher at the beginning of 2017 have recently come into question. Following the collapse of the health care reform bill in the Senate, progress on the rest of the White House’s pro-growth fiscal agenda, including tax reform and large infrastructure projects, is expected to be delayed. Economic growth projections, in turn, have been lowered, and with inflation recently waning, the markets are expecting fewer rate hikes from the Federal Reserve (Fed) than the Fed itself had predicted. Yet, asset prices continued to rise.

Investors have largely looked beyond policy disappointments and focused instead on the healthy profits reported by U.S. companies during the first two quarters of 2017. U.S. growth has remained slow and steady, European growth has surprised to the upside and concern that China would decelerate too rapidly has eased, further contributing to an optimistic tone in the markets. Additionally, political risk in Europe has moderated, with the election of mainstream candidates in the Dutch and French elections earlier this year.

The remainder of the year could bring challenges to this benign macro environment. The debt ceiling looms, with a vote needed from Congress to raise or suspend the nation’s borrowing limit before the Treasury is unable to pay its bills in full or on time (likely in early October). The mechanics of the U.K.’s separation from the European Union remain to be seen, as “Brexit” negotiations develop. A tightening of financial conditions in China or a more aggressive-than-expected policy action from the Fed, European Central Bank or Bank of Japan could also turn into headwinds.

Market volatility readings have been remarkably low lately, but conditions can change quickly. As market conditions evolve, Nuveen remains committed to rigorously assessing opportunities and risks. If you’re concerned about how resilient your investment portfolio might be, we encourage you to talk to your financial advisor. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

August 23, 2017

Portfolio Managers’

Comments

Nuveen NWQ Global All Cap Fund

Nuveen NWQ Global Equity Income Fund

Nuveen NWQ International Value Fund

Nuveen NWQ Multi-Cap Value Fund

Nuveen NWQ Large-Cap Value Fund

Nuveen NWQ Small/Mid-Cap Value Fund

Nuveen NWQ Small-Cap Value Fund

The Funds feature portfolio management by NWQ Investment Management Company, LLC (NWQ), an affiliate of Nuveen, LLC (Nuveen). Jon D. Bosse, CFA, is the Chief Investment Officer of NWQ and manages the Nuveen NWQ Multi-Cap Value and Large-Cap Value Funds. Phyllis Thomas, CFA, and Andy Hwang manage the Nuveen NWQ Small/Mid-Cap Value and Small-Cap Value Funds. Gregg Tenser, CFA, and James T. Stephenson, CFA, manage the Nuveen NWQ Global All-Cap Fund. James T. Stephenson, CFA, and Thomas J. Ray, CFA, manage the Nuveen NWQ Global Equity Income Fund and Peter Boardman serves as portfolio manager of the Nuveen NWQ International Value Fund.

During May 2016, the Board of Trustees approved the reorganization of Nuveen Global Equity Income Fund (JGV), Nuveen Tradewinds Global All-Cap Fund and Nuveen Tradewinds Value Opportunities Fund into the Nuveen NWQ Global Equity Income Fund. During September 2016 shareholders of JGV approved the reorganization and prior to the open of business on October 17, 2016, the assets of JGV were merged into Class A shares of Nuveen NWQ Global Equity Income Fund. The reorganization was approved by the shareholders of Nuveen Tradewinds Value Opportunities Fund and Nuveen Tradewinds Global All-Cap Fund during March 2016 and after the close of business on March 24, 2017, the reorganization of Nuveen Tradewinds Value Opportunities Fund and Nuveen Tradewinds Global All-Cap Fund into Nuveen NWQ Global Equity Income Fund was completed.

Below, the team discusses the economic and financial markets, key investment strategies and performance of the Funds for the twelve-month and/or eleven-month abbreviated annual reporting period ended June 30, 2017.

What factors affected the U.S. economy and financial markets during the twelve-month and/or eleven-month abbreviated annual reporting period ended June 30, 2017?

During the twelve-month reporting period, the U.S. economy continued to grow moderately, now ranking the current expansion as the third-longest since World War II, according to the National Bureau of Economic Research. The second half of 2016 saw a short-term boost in economic activity, driven by a one-time jump in exports during the third quarter, but the economy resumed a below-trend pace thereafter. The Bureau of Economic Analysis reported an annual growth rate of 2.6% for the U.S. economy in the second quarter of 2017, as measured by the “advance” estimate of real gross domestic product (GDP), which is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. By comparison, the annual GDP growth rate in the first quarter of 2017 was 1.2%.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives or circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

Despite the slowdown in early 2017, other data pointed to positive momentum as the labor market continued to tighten, manufacturing improved and consumer and business confidence surveys reflected optimism about the economy’s prospects. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 4.4% in June 2017 from 4.9% in June 2016 and job gains averaged around 181,000 per month for the past twelve months. The Consumer Price Index (CPI) increased 1.6% over the twelve-month reporting period ended June 30, 2017 on a seasonally adjusted basis, as reported by the Bureau of Labor Statistics. The core CPI (which excludes food and energy) increased 1.7% during the same period, slightly below the Federal Reserve’s (Fed) unofficial longer term inflation objective of 2.0%. The housing market also continued to improve, with historically low mortgage rates and low inventory driving home prices higher. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.6% annual gain in May 2017 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over-year increases of 4.9% and 5.7%, respectively.

The U.S. economic outlook struck a more optimistic tone, prompting the Fed’s policy making committee to raise its main benchmark interest rate in December 2016, March 2017 and June 2017. These moves were widely expected by the markets and, while the Fed acknowledged in its June 2017 statement that inflation has remained unexpectedly low, an additional increase is anticipated later in 2017 as the Fed seeks to gradually “normalize” interest rates. Also after the June 2017 meeting, the Fed revealed its plan to begin shrinking its balance sheets by allowing a small amount of maturing Treasury and mortgage securities to roll off without reinvestment. The timing of this is less certain, however, as it depends on whether the economy performs in line with the Fed’s expectations.

Politics also dominated the headlines in this reporting period with two major electoral surprises: the U.K.’s vote to leave the European Union and Donald Trump’s win in the U.S. presidential race. Market volatility increased as markets digested the initial shocks, but generally recovered and, in the case of the “Trump rally,” U.S. equities experienced significant gains. Investors also closely watched elections across Europe. To the markets’ relief, more mainstream candidates were elected in the Dutch and French elections in the spring of 2017. However, Britain’s June 2017 snap election unexpectedly overturned the Conservative Party’s majority in Parliament, which increased uncertainties about the Brexit negotiation process. Additionally, in the U.S., legislative delays with health care reform made President Trump’s plans for tax cuts and other fiscal stimulus look less likely to happen this year.

Earlier in the reporting period, macroeconomic uncertainty driven by the economic trouble in emerging economies, falling commodity prices, uncertainty around the Fed’s hiking cycle, culminating with the November 2016 U.S. election all contributed to the significant volatility in both equity and credit markets. Common equity and high yield bonds generated total return of 15.53% as measured by the Russell 1000® Value Index and 15.53% for the BofA/Merrill Lynch U.S. High Yield Index. Global equities performed well returning 18.20% as measured by the MSCI World Index. The preferred market rebounded after a difficult fourth quarter in 2016, with a 5.86% return as measured by the BofA/Merrill Lynch Preferred Securities Fixed Rate Index.

How did the Funds perform during the twelve-month and/or eleven-month abbreviated annual reporting period ended June 30, 2017?

The tables in the Fund Performance and Expense Ratios section of this report provide total returns for the Funds for the one-year and/or 11-month, five-year, ten-year and/or since inception periods ended June 30, 2017. Each Fund’s Class A Share total returns at net asset value (NAV) are compared with the performance of their corresponding market index and Lipper classification average. A more detailed account of each Fund’s performance is provided later in this report.

What strategies were used to manage the Funds during the twelve-month and/or eleven-month abbreviated annual reporting period ended June 30, 2017 and how did these strategies influence performance?

Nuveen NWQ Global All-Cap Fund

The Nuveen NWQ Global All-Cap Fund’s Class A Shares at NAV outperformed the MSCI World Index and comparative Lipper classification average and during the twelve-month reporting period ended June 30, 2017.

The Fund is designed to provide investors with long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities. The Fund may invest in securities of issuers located anywhere in the world. Under normal market conditions, the Fund invests at least 40% of its net

assets in non-U.S. securities and invests in securities of companies representing at least three different countries (one of which may be the U.S.). The Fund may invest up to 20% of its net assets in securities of companies located in emerging markets. The Fund may invest in equity securities issued by companies of any market capitalization, including small- and mid-capitalization companies. The Fund may also utilize derivatives, including currency options, currency futures and options on such futures, and currency forwards.

Geographically, performance benefitted from stock selection in the U.S., Germany and the Netherlands. Investments in Israel, Japan and Sweden lagged and were a headwind for the Fund’s overall return for the reporting period. We no longer continue to hold our investments in Sweden. From a sector perspective, our investments in the financial, technology and industrials sectors were positive, led by overall sector allocation and stock selection, particularly within the financial sector. Conversely, adverse stock selection in the health care and consumer staples sectors were key detractors.

Several investments contributed meaningfully to the Fund’s performance, including technology holding Coherent Inc. The company ended a banner 2016 by completing its acquisition of Rofin Sinar, which Coherent expects will further bolster its product portfolio given its fiber laser offering, as well as improve its margins with $30 million of cost synergies. Also positively contributing to performance was information technology holding Microsemi Corporation. The positive performance of Microsemi was in part a follow-through from the company’s Analyst Day in September 2016, when management raised its operating margin target to 35% from the 30% set at its previous Analyst Day in March 2015. We believe that significant free-cash-flow should be generated as the company moves toward its target. Performance also was bolstered by rumors that Microsemi might be targeted for acquisition. Either way, all indicators are continuing to suggest that the company is executing according to plan. Lastly, positively contributing to performance was health care holding Bio-Rad Laboratories Inc., a global provider of life science research and clinical diagnostic products. The company reported solid earnings during the reporting period.

Several holdings detracted from performance, including health care holdings Impax Laboratories and Teva Pharmaceutical Industries Limited. Impax Laboratories was the largest detractor from portfolio performance during the reporting period. The company missed earnings expectations and lowered guidance for the year. Teva detracted due to a multitude of negative factors. The company’s third quarter 2016 earnings report was not well received as management had to lower guidance it had issued upon the closure of Teva’s $40.5 billion purchase of Allergan’s generic assets just a few months prior and it became more than apparent that Teva had significantly overpaid for the business, leaving the company highly levered and even more exposed to an extremely weak generic drug environment. We believe there will be further margin pressure in the generics space and Teva also faces potential generic competition for its lead drug, Copaxone, which could create additional pressure to cash flows in 2017. We have sold our holdings in both Impax Laboratories and Teva Pharmaceutical Industries Limited. Finally, energy holding Newfield Exploration Company detracted from performance. Energy stocks underperformed during the reporting period. The stocks were hurt by the decline in oil prices despite members of the Organization of the Petroleum Exporting Countries (OPEC) agreeing to keep production cuts in place.

Nuveen NWQ Global Equity Income Fund

The Nuveen NWQ Global Equity Income Fund’s Class A Shares at NAV outperformed its comparative Lipper classification average, but underperformed the MSCI World Index during the twelve-month reporting period ended June 30, 2017.

The Fund is designed to provide long-term capital appreciation and high current income. The Fund will generally focus its investments on income producing securities. Under normal market conditions, the Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities. Up to 20% of the Fund’s net assets may be invested in debt securities, including corporate debt securities and U.S. government and agency debt securities. The Fund may invest up to 10% of its net assets in below investment grade debt securities, commonly referred to as “high yield” securities or “junk” bonds. The Fund may invest in securities of issuers located anywhere in the world. Under normal market conditions, the Fund invests at least 40% of its net assets in non-U.S. securities and invests in securities of companies representing at least three different countries (one of which may be the United States). The Fund may invest up to 20% of its net assets in securities of companies located in emerging markets. The Fund may invest in equity securities issued by companies of any market capitalization, including small and medium market capitalization companies. The Fund may also utilize derivatives, including currency options, currency futures and options on such futures and currency forwards.

Portfolio Managers’ Comments (continued)

Geographically, performance benefitted from superior stock selection in the U.S. and Netherlands, as well as greater exposure to Germany. Investments in the U.K., Israel, and France lagged and were a headwind for the Fund’s overall return for the reporting period. From a sector perspective, our investments in the financial, industrials and energy sectors were positive. Conversely, adverse stock selection in the consumer discretionary, materials and health care sectors were key detractors.

Several individual holdings contributed to performance. The top three performers were all in the financial sector, including Unum Group, Citigroup Inc. and ING Groep N.V. Unum Group provides disability insurance products in the U.S. and the U.K. The accident and health insurer’s two largest operating segments, Unum U.S. and Colonial Life, reported increased operating income and better than expected third quarter results, despite some weakness in its U.K. segment. The company is also expected to significantly benefit from rising interest rates and potential U.S. tax reform. The Fed raised the target level of short-term interest rates three times during the reporting period and reiterated its outlook for higher interest rates going forward. Citigroup Inc. also positively contributed to performance as U.S. bank stocks reacted positively to the results of the U.S. presidential election as investors grew optimistic about the prospect of lower corporate tax rates, looser regulation of financial firms, and other pro-growth policy initiatives that should benefit the company and its banking peers. Additionally, in late-June the CCAR (Comprehensive Capital Analysis and Review) results were announced and capital returns across the board beat high expectations. Citigroup will be returning 125% of its earnings to shareholders in the next four quarters, with a major increase in its share repurchases and a 100% dividend increase. Lastly, Dutch multi-national banking and financial services corporation, ING Groep N.V. reported strong fourth quarter 2016 results, which contributed to performance.

Several individual holdings detracted from portfolio performance, including Teva Pharmaceutical Industries Limited due to a multitude of negative factors. The company’s third quarter 2016 earnings report was not well received as management had to lower guidance it had issued upon the closure of Teva’s $40.5 billion purchase of Allergan’s generic assets just a few months prior. We believe there will be further margin pressure in the generics space and Teva also faces potential generic competition for its lead drug, Copaxone, which could create additional pressure to cash flows in 2017. The company appears to be well positioned for 2018 and beyond as earnings deterioration should abate, allowing a recovery process to begin. Our investment in the preferred stock of telecommunication services holding, Frontier Communications Corporation, also detracted from performance. The company recently acquired assets from Verizon in California, Texas and Florida and the integration has gone worse than expected. We eliminated the position during the reporting period. Lastly, materials sector holding CVR Partners detracted from performance. CVR is a Master Limited Partnership that formed to own, operate and grow its nitrogen fertilizer business. Though we saw a rebound in ammonia pricing during the reporting period, this rally was short-lived due to ramping competitive capacity and a delayed planting season that allowed more product to make its way into the Midwest in time for application. We expect ammonia pricing to remain near trough levels before rebounding in 2018 and beyond.

The Fund wrote covered call options on individual stocks, while investing in these same stocks, to enhance returns while foregoing some upside potential. The effect of these activities on performance was negligible during the period and all covered call options were sold off or expired during the reporting period.

Nuveen NWQ International Value Fund

The Fund’s Class A Shares at NAV underperformed the MSCI EAFE Index and the Lipper classification average for the eleven-month abbreviated annual reporting period ended June 30, 2017.

Our investment strategy remained focused on seeking companies with strong franchises whose shares were trading at a significant discount to what we believed to be their intrinsic value. Under normal market conditions, the Fund invests primarily in non-U.S. equity securities issued in developed countries, but it may invest up to 20% of its net assets in equity securities of companies located in emerging market countries. No more than 35% of the Fund’s net assets may be invested in equity securities of companies located in a single non-U.S. country. The Fund’s investment strategy is not designed to track the performance of any specific benchmark. However, for reporting purposes we use benchmarks for comparison.

The financials, real estate, and information technology sectors were the leading contributors to performance on a relative basis, led by overall sector allocations within the financials sector. The materials, industrials and consumer discretionary sectors were the primary detractors from relative performance, mostly driven by underperforming selections within those respective sectors. On a

regional basis, U.S. equities and emerging markets contributed to relative results while overall selections in continental Europe and the Middle East detracted.

Several individual holdings contributed to relative performance including, financials sector holdings ING Groep N.V., which engages in the provision banking, investments, life and non-life insurance, as one of the larger positions, was also the top individual contributor to absolute results. In the company’s first quarter’s earnings release, they maintained their earnings guidance and we believe they will be one of the better performing names among its peers. Also positively contributing was industrial sector holding ManpowerGroup Inc. ManpowerGroup, a multi-national human resource consulting firm, rallied during the reporting period. We eliminated the position from the Fund as valuations for the company reached our estimated targets and invested the proceeds. Lastly, information technology sector holding Rohm Company Limited contributed to performance. The company is engaged in the manufacture and sale of electronic components. The company overcame difficulties through stabilization of earnings expectations and attendant investor optimism. Currently, we find the company is valued at a discount to book value and also at a discount to enterprise-value-to-sales.

Several individual holdings detracted from relative performance including health care sector holding Teva Pharmaceuticals Industries Limited. Teva Pharmaceutical’s stock performance was influenced by several negative factors. The company’s third quarter earnings report was not well received, as management had to lower guidance it had issued upon the closure of Teva’s $40.5 billion purchase of Allergan’s generic assets just a few months prior. We believe there will be further margin pressure in the generics space and Teva also faces potential generic competition for its lead drug, Copaxone, which could create additional pressure to cash flows in 2017. We believe the company is well positioned for 2018 and beyond as earnings deterioration should abate, allowing a recovery process to begin. Consumer staples holding, Toyota Motors Corporation detracted from performance. Toyota came under pressure as a direct response to the significantly stronger Japanese yen. With greater than 75% of all revenues coming from overseas the currency has a major impact on reported sales and profitability. In addition the continued rhetoric regarding the border adjustment tax, and other anti-trade measures in the U.S. (Toyota’s largest market) affected returns as did increasing concern that the U.S. auto market has finally reached saturation point. Lastly, detracting from performance was information technology holding Ericsson LM. The Swedish telecom equipment maker reported weak earnings and cut its dividend during the reporting period.

Nuveen NWQ Multi-Cap Value Fund

Class A Shares at NAV for the Nuveen NWQ Multi-Cap Value Fund outperformed the Russell 3000® Value Index and its Lipper classification average for the twelve-month reporting period ended June 30, 2017.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with small, medium and large market capitalizations that are selected on an opportunistic basis. Generally, we look for undervalued companies where catalysts exist that may help unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

Favorable stock selection particularly in the financial services, technology and producer durables sectors contributed positively to performance relative to the benchmark. Minimal exposure to the weak utility sector also contributed. The Fund’s consumer discretionary, energy and health care sector holdings detracted relative to the Russell 3000® Value Index.

Several investments contributed meaningfully to the Fund’s performance, including technology holding Coherent Inc. The company ended a banner 2016 by completing its acquisition of Rofin Sinar, which Coherent expects will further bolster its product portfolio given its fiber laser offering, as well as improve its margins with $30 million of cost synergies. In the financial services sector, our investments in Unum Group and Citigroup Inc. also helped drive performance. Financials reacted positively to the results of the U.S. presidential election as investors grew optimistic about the prospect of a Republican administration and Congress enacting lower corporate tax rates, looser regulation of financial firms, and other pro-growth policy initiatives that will benefit the broader U.S. banking sector. Unum Group provides disability insurance products in the U.S. and the U.K. The accident and health insurer’s two largest operating segments, Unum U.S. and Colonial Life, reported increased operating income and better than expected third quarter results, despite some weakness in its U.K. segment. The company is also expected to significantly benefit from rising interest rates and potential U.S. tax reform. The Fed raised the target level of short-term interest rates three times during the reporting period and reiterated its outlook for higher interest rates going forward. Citigroup Inc. also positively contributed to performance as the CCAR

Portfolio Managers’ Comments (continued)

(Comprehensive Capital Analysis and Review) results were announced in late-June and capital returns across the board beat high expectations. Citigroup will be returning 125% of its earnings to shareholders in the next four quarters, with a major increase in its share repurchases and a 100% dividend increase.

Several holdings detracted from performance, including health care holdings Impax Laboratories and Teva Pharmaceutical Industries Limited. Impax Laboratories was the largest detractor from portfolio performance during the reporting period. The company missed earnings expectations and lowered guidance for the year. We no longer hold our position in Impax Laboratories. Several issues contributed to the decline in Teva Pharmaceutical. The company’s third quarter 2016 earnings report was not well received as management had to lower guidance it had issued upon the closure of Teva’s $40.5 billion purchase of Allergan’s generic assets just a few months prior and it became more than apparent that Teva had significantly overpaid for the business, leaving the company highly levered and even more exposed to an extremely weak generic drug environment. We believe there will be further margin pressure in the generics space and Teva also faces potential generic competition for its lead drug, Copaxone, which could create additional pressure to cash flows in 2017. We had significantly reduced our position in Teva continually throughout the reporting period at extremely attractive prices and exited our position completely in December 2016 in favor of establishing a new position in Allergan. Finally, energy holding EQT Corporation detracted from performance. Due to its exploration and production operations, EQT’s profit is influenced by commodity price fluctuations. Low realizations affected the company’s revenues and earnings, which declined sharply from previous levels. The company offers an extremely compelling set of assets and an exceptionally strong balance sheet, therefore we continue to hold EQT.

Nuveen NWQ Large-Cap Value Fund

The Nuveen NWQ Large-Cap Value Fund’s Class A Shares at NAV outperformed both the Russell 1000® Value Index and the comparative Lipper classification average for the twelve-month reporting period ended June 30, 2017.

The Fund seeks long-term capital appreciation by investing in equity securities of companies with large market capitalizations that are selected on an opportunistic basis. Generally, we look for undervalued companies where catalysts exist that may help unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation or company restructuring.

The Fund’s results relative to the Russell 1000® Value Index benchmark benefited from favorable stock selection particularly in the financial services, producer durables and technology sectors. Offsetting these gains was the underperformance of our consumer discretionary, energy and health care sector holdings.

Our investments in the financial services sector were the top contributors for the reporting period. Citigroup Inc., Unum Group and JPMorgan Chase & Co. were the top contributors in the sector. Financials reacted positively to the results of the U.S. presidential election as investors grew optimistic about the prospect of a Republican administration and Congress enacting lower corporate tax rates, looser regulation of financial firms, and other pro-growth policy initiatives that will benefit the broader U.S. banking sector. Citigroup Inc. also benefitted as the CCAR (Comprehensive Capital Analysis and Review) results were announced in late-June and capital returns across the board beat high expectations. Citigroup will be returning 125% of its earnings to shareholders in the next four quarters, with a major increase in its share repurchases and a 100% dividend increase. Unum Group provides disability insurance products in the U.S. and the U.K. The accident and health insurer’s two largest operating segments, Unum U.S. and Colonial Life, reported increased operating income and better than expected third quarter results, despite some weakness in its U.K. segment. The company is also expected to significantly benefit from rising interest rates and potential U.S. tax reform. The Fed raised the target level of short-term interest rates three times during the reporting period and reiterated its outlook for higher interest rates going forward.

Several holdings detracted from performance, including energy holdings EQT Corporation and Hess Corporation. Due to its exploration and production operations, EQT’s profit is influenced by commodity price fluctuations. Low realizations affected the company’s revenues and earnings, which declined sharply from previous levels. The company offers an extremely compelling set of assets and an exceptionally strong balance sheet, therefore we continue to hold EQT. During the reporting period, Hess Corporation slightly lowered production guidance. Investors seem impatient waiting for upcoming catalysts that include further delineation on its significant offshore find in Guyana (partnered with Exxon) and production start-ups Stampede (Gulf of Mexico, 2017) and North Malay

(Malaysia, 2018). Lastly, health care sector holding Teva Pharmaceutical Industries Limited detracted due to a multitude of negative factors. The company’s third quarter 2016 earnings report was not well received, as management had to lower guidance it had issued upon the closure of Teva’s $40.5 billion purchase of Allergan’s generic assets just a few months prior, and it became more than apparent that Teva had significantly overpaid for the business, leaving the company highly levered and even more exposed to an extremely weak generic drug environment. We believe there will be further margin pressure in the generics space, and Teva also faces potential generic competition for its lead drug, Copaxone, which could create additional pressure to cash flows in 2017. We had significantly reduced our position in Teva continually throughout the reporting period at extremely attractive prices and exited our position completely in December 2016 in favor of establishing a new position in Allergan.

During the reporting period, the Fund wrote a call option on a stock and covered that position shortly afterwards resulting in a negligible impact to performance.

Nuveen NWQ Small/Mid-Cap Value Fund

The Nuveen NWQ Small/Mid-Cap Value Fund’s Class A Shares at NAV outperformed the Russell 2500® Value Index, but underperformed the comparative Lipper classification average for the twelve-month reporting period ended June 30, 2017.

The Fund continued to follow its disciplined investment approach, which seeks long-term capital appreciation by investing in equity securities of companies with small-to-medium market capitalizations selected using an analyst-driven, value-oriented process. We look for undervalued companies where catalysts exist to unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation, or company restructuring.

For the twelve-month reporting period, strong stock selection in technology, financial services and health care sectors contributed positively to the Fund’s performance. Stock selection in the energy, producer durables and utilities sectors detracted from performance. Our cash position was also a drag on performance.

Several investments contributed to the Fund’s performance, including the technology sector holding of Coherent Inc. The company ended a banner 2016 by completing its acquisition of Rofin Sinar, which Coherent expects will further bolster its product portfolio given its fiber laser offering, as well as improve its margins with $30 million of cost synergies. Also positively contributing to performance was health care holding Bio-Rad Laboratories Inc., a global provider of life science research and clinical diagnostic products. The company reported solid earnings during the reporting period. Lastly, the consumer staple sector holding of John B. Sanfilippo & Son, Inc., a processor, packager and distributor of nut- and dried fruit-based products sold under a variety of private brands, reported strong financial performance and announced a $2.50 per share special cash dividend during the reporting period.

Several individual holdings detracted from performance including energy holdings Newfield Exploration Company and PDC Energy Inc. Energy stocks underperformed during the reporting period. The stocks were hurt by the decline in oil prices despite members of the Organization of the Petroleum Exporting Countries (OPEC) agreeing to keep production cuts in place. Lastly, financial services sector holding Ramco-Gershenson Properties Trust detracted from performance. The fully-integrated real estate investment trust (REIT) owns and manages a portfolio of shopping centers primarily located in large metropolitan markets in the central U.S. Like other income-producing assets, REITs sold off with Treasury yields as markets reacted to the U.S. election.

Nuveen NWQ Small-Cap Value Fund

The Nuveen NWQ Small-Cap Value Fund’s Class A Shares at NAV underperformed its Lipper classification average and the Russell 2000® Value Index for the twelve-month reporting period ended June 30, 2017.

The Fund continued to follow its disciplined investment approach, which seeks long-term capital appreciation by investing in equity securities of companies with small market capitalizations selected using an analyst-driven, value-oriented process. We look for undervalued companies where catalysts exist to unlock value or improve profitability. Such catalysts can be new management, improving fundamentals, renewed management focus, industry consolidation, or company restructuring.

Positive stock selection in technology and materials and processing sectors helped performance, while stock selection in energy and health care sectors detracted from performance. Our cash position was also a drag on performance.

Portfolio Managers’ Comments (continued)

Several investments contributed to the Fund’s performance, including technology sector holdings Coherent Inc. and Novanta, Inc. Coherent Inc. ended a banner 2016 by completing its acquisition of Rofin Sinar, which it expects will further bolster its product portfolio given its fiber laser offering, as well as improve its margins with $30 million of cost synergies. Also positively contributing was Novanta, Inc. Novanta is a leading supplier of core technology solutions for the health care and advanced industrial original equipment manufacturers (OEM). During the reporting period, the company beat earnings and revenues estimates. Lastly, consumer discretionary sector holding Hooker Furniture Corporation contributed to performance as a recent acquisition continued to perform well.

Several individual holdings detracted from performance including energy holdings Carrizo Oil & Gas Inc. and PDC Energy Inc. Energy stocks underperformed during the reporting period. The stocks were hurt by the decline in oil prices despite members of the Organization of the Petroleum Exporting Countries (OPEC) agreeing to keep production cuts in place. We sold our holdings in both Carrizo Oil & Gas and PDC Energy Inc. Lastly, financial services sector holding Ramco-Gershenson Properties Trust detracted from performance. The fully-integrated real estate investment trust (REIT) owns and manages a portfolio of shopping centers primarily located in large metropolitan markets in the central U.S. Like other income-producing assets, REITs sold off with Treasury yields as markets reacted to the U.S. election.

Risk Considerations

Nuveen NWQ Global All-Cap Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Global Equity Income Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as credit, derivatives, high yield securities, and interest rate risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ International Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency, smaller company, and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Multi-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Large-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency, large cap stock, and value stock risks, are described in detail in the Fund’s prospectus.

Nuveen NWQ Small/Mid-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Risk Considerations (continued)

Nuveen NWQ Small-Cap Value Fund

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. These and other risk considerations, such as currency and value stock risks, are described in detail in the Fund’s prospectus.

Fund Performance

and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown within this section of the report.

Returns quoted represent past performance, which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. Total returns for a period of less than one year are not annualized. Returns at net asset value (NAV) would be lower if the sales charge were included. Returns assume reinvestment of dividends and capital gains. For performance, current to the most recent month-end visit nuveen.com or call (800) 257-8787.

Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect fee waivers and/or expense reimbursements by the investment adviser during the periods presented. If any such waivers and/or reimbursements had not been in place, returns would have been reduced. See Notes to Financial Statements, Note 7—Management Fees and Other Transactions with Affiliates for more information.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees, and assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for Class A Shares at NAV only.

The expense ratios shown reflect total operating expenses (before fee waivers and/or expense reimbursements, if any) as shown in the most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (continued)

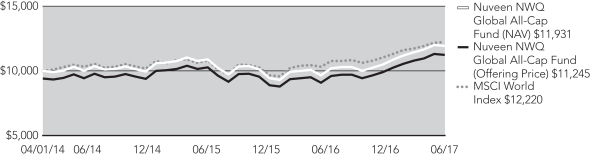

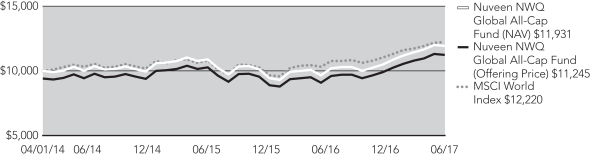

Nuveen NWQ Global All-Cap Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

Class A Shares at NAV | | | 23.50% | | | | 5.58% | |

Class A Shares at maximum Offering Price | | | 16.40% | | | | 3.68% | |

MSCI World Index | | | 18.20% | | | | 6.18% | |

Lipper Global Multi-Cap Value Funds Classification Average | | | 18.58% | | | | 5.71% | |

| | |

Class C Shares | | | 22.51% | | | | 4.78% | |

Class I Shares | | | 23.83% | | | | 5.85% | |

Since inception returns are from 4/01/14. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class I | |

Gross Expense Ratios | | | 11.35% | | | | 11.54% | | | | 10.39% | |

Net Expense Ratios | | | 1.11% | | | | 1.86% | | | | 0.86% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse expenses through October 31, 2018 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.90% of the average daily net assets of any class of Fund shares. The expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

Growth of an Assumed $10,000 Investment as of June 30, 2017 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

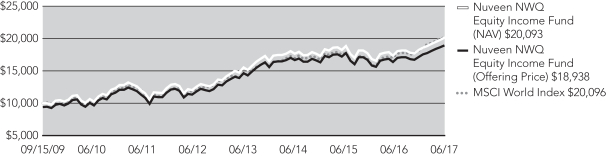

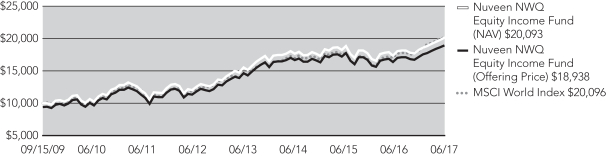

Nuveen NWQ Global Equity Income Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

Class A Shares at NAV | | | 15.75% | | | | 10.59% | | | | 9.37% | |

Class A Shares at maximum Offering Price | | | 9.09% | | | | 9.29% | | | | 8.54% | |

MSCI World Index | | | 18.20% | | | | 11.38% | | | | 9.38% | |

Lipper Global Equity Income Funds Classification Average | | | 11.91% | | | | 8.67% | | | | 7.80% | |

| | | |

Class C Shares | | | 14.87% | | | | 9.77% | | | | 8.55% | |

Class R3 Shares* | | | 15.48% | | | | 10.32% | | | | 9.10% | |

Class I Shares | | | 16.03% | | | | 10.86% | | | | 9.64% | |

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

Class T Shares** | | | 1.74% | |

Class T Shares at maximum Offering Price** | | | (0.80)% | |

Since inception returns for Class A Shares, Class C Shares, Class R3 Shares and Class I Shares, and for the comparative index and Lipper classification average are from 9/15/09; since inception returns for Class T Shares are from 5/31/17. Indexes and Lipper averages are not available for direct investment.

Performance prior to December 13, 2013, reflects the Fund’s performance using investment strategies that differed significantly from those currently in place.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and will only be available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors. Class T Shares have a maximum 2.50% sales charge (Offering Price).

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3* | | | Class I | | | Class T** | |

Gross Expense Ratios | | | 3.73% | | | | 4.69% | | | | 4.18% | | | | 1.29% | | | | 1.79% | |

Net Expense Ratios | | | 1.11% | | | | 1.86% | | | | 1.36% | | | | 0.86% | | | | 1.11% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse expenses through October 31, 2018 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.90% of the average daily net assets of any class of Fund shares. The expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

| * | Effective July 8, 2016, Class R3 Shares became available to the public. |

| ** | Class T Shares are not available for public offering. |

Growth of an Assumed $10,000 Investment as of June 30, 2017 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

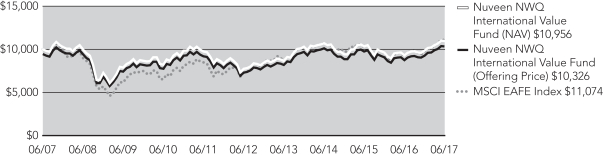

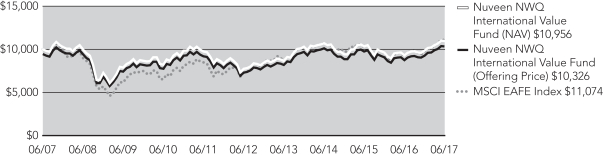

Nuveen NWQ International Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 11-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 14.24% | | | | 18.01% | | | | 7.19% | | | | 0.92% | |

Class A Shares at maximum Offering Price | | | 7.65% | | | | 11.24% | | | | 5.93% | | | | 0.32% | |

MSCI EAFE Index | | | 14.47% | | | | 20.27% | | | | 8.69% | | | | 1.03% | |

Lipper International Multi-Cap Value Funds Classification Average | | | 16.72% | | | | 22.04% | | | | 7.81% | | | | 0.11% | |

| | | | |

Class C Shares | | | 13.47% | | | | 17.12% | | | | 6.38% | | | | 0.16% | |

Class I Shares | | | 14.51% | | | | 18.27% | | | | 7.46% | | | | 1.17% | |

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 11-Month | | | 1-Year | | | 5-Year | | | Since

Inception | |

Class R3 Shares | | | 13.97% | | | | 17.71% | | | | 6.91% | | | | 1.47% | |

Since inception returns for Class R3 Shares are from 8/04/08. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios | | | 1.22% | | | | 1.97% | | | | 1.47% | | | | 0.97% | |

Net Expense Ratios | | | 1.15% | | | | 1.90% | | | | 1.40% | | | | 0.90% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse other Fund expenses through November 30, 2018 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.94% of the average daily net assets of any class of Fund shares. The expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

Growth of an Assumed $10,000 Investment as of June 30, 2017 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

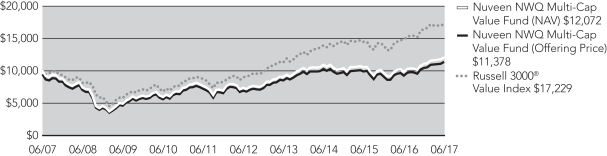

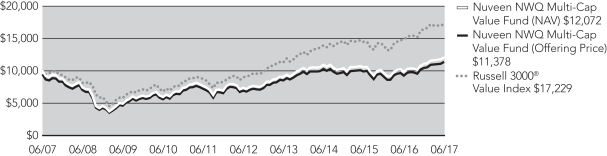

Nuveen NWQ Multi-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 23.08% | | | | 10.44% | | | | 1.90% | |

Class A Shares at maximum Offering Price | | | 15.99% | | | | 9.13% | | | | 1.30% | |

Russell 3000® Value Index | | | 16.21% | | | | 13.89% | | | | 5.59% | |

Lipper Multi-Cap Value Funds Classification Average | | | 17.87% | | | | 13.03% | | | | 5.15% | |

| | | |

Class C Shares | | | 22.17% | | | | 9.60% | | | | 1.14% | |

Class I Shares | | | 23.45% | | | | 10.71% | | | | 2.16% | |

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

Class R3 Shares | | | 22.78% | | | | 10.15% | | | | 5.92% | |

Since inception returns for Class R3 Shares are from 8/04/08. Index and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios | | | 1.26% | | | | 2.01% | | | | 1.51% | | | | 1.01% | |

Net Expense Ratios | | | 1.15% | | | | 1.90% | | | | 1.40% | | | | 0.90% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse expenses through October 31, 2018 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.94% of the average daily net assets of any class of Fund shares. The expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund.

Growth of an Assumed $10,000 Investment as of June 30, 2017 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

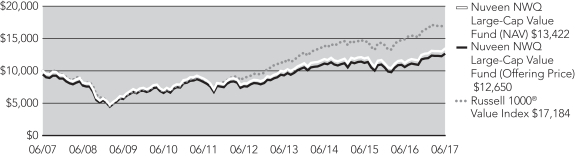

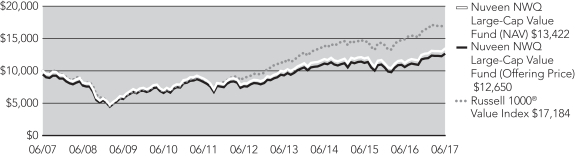

Nuveen NWQ Large-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 19.64% | | | | 10.68% | | | | 2.99% | |

Class A Shares at maximum Offering Price | | | 12.81% | | | | 9.38% | | | | 2.38% | |

Russell 1000® Value Index | | | 15.53% | | | | 13.94% | | | | 5.57% | |

Lipper Multi-Cap Value Funds Classification Average | | | 17.87% | | | | 13.03% | | | | 5.15% | |

| | | |

Class C Shares | | | 18.62% | | | | 9.85% | | | | 2.22% | |

Class I Shares | | | 19.85% | | | | 10.96% | | | | 3.25% | |

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

Class R3 Shares | | | 19.22% | | | | 10.38% | | | | 8.10% | |

Since inception returns for Class R3 Shares are from 9/29/09. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class I | |

Gross Expense Ratios | | | 1.14% | | | | 1.89% | | | | 1.39% | | | | 0.89% | |

Net Expense Ratios | | | 1.00% | | | | 1.75% | | | | 1.25% | | | | 0.75% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse other Fund expenses through July 31, 2019 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.79% (1.35% after July 31, 2019) of the average daily net assets of any class of Fund shares. The expense limitation expiring July 31, 2019 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund. The expense limitation in effect thereafter may be terminated or modified only with the approval of shareholders of the Fund.

Growth of an Assumed $10,000 Investment as of June 30, 2017 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

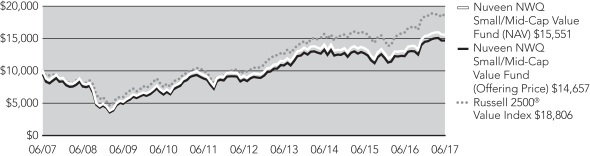

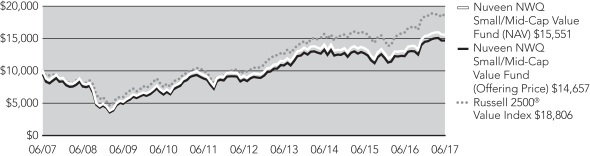

Nuveen NWQ Small/Mid-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 19.62% | | | | 11.10% | | | | 4.51% | |

Class A Shares at maximum Offering Price | | | 12.76% | | | | 9.79% | | | | 3.90% | |

Russell 2500® Value Index | | | 18.36% | | | | 13.69% | | | | 6.52% | |

Lipper Small-Cap Core Funds Classification Average | | | 20.88% | | | | 12.85% | | | | 6.36% | |

| | | |

Class C Shares | | | 18.73% | | | | 10.28% | | | | 3.73% | |

Class I Shares | | | 19.96% | | | | 11.39% | | | | 4.65% | |

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

Class R3 Shares | | | 19.33% | | | | 10.81% | | | | 11.90% | |

Class R6 Shares | | | 20.14% | | | | N/A | | | | 20.14% | |

Since inception returns for Class R3 Shares and Class R6 Shares are from 9/29/09 and 6/30/16, respectively. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class R6 Shares have no sales charge and are available only to certain limited categories of investors as described in the prospectus. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class R6 | | | Class I | |

Gross Expense Ratios | | | 1.42% | | | | 2.17% | | | | 1.68% | | | | 1.02% | | | | 1.17% | |

Net Expense Ratios | | | 1.31% | | | | 2.06% | | | | 1.56% | | | | 0.91% | | | | 1.06% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse other Fund expenses through October 31, 2018 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.10% (1.45% after October 31, 2018) of the average daily net assets of any class of Fund shares. However, because Class R6 Shares are not subject to sub-transfer agent and similar fees, the total annual Fund operating expenses for the Class R6 Shares will be less than the expense limitation. The expense limitation expiring October 31, 2018 may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund. The expense limitation in effect thereafter may be terminated or modified only with the approval of the shareholders of the Fund.

Growth of an Assumed $10,000 Investment as of June 30, 2017– Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

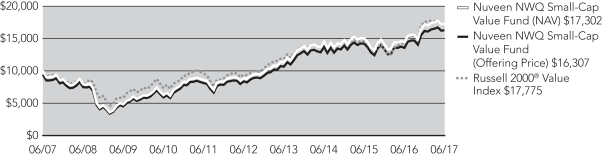

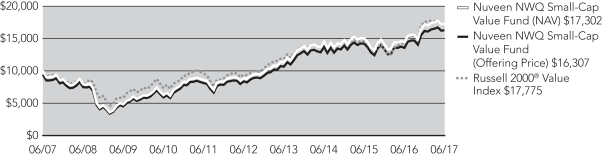

Nuveen NWQ Small-Cap Value Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 20.12% | | | | 14.24% | | | | 5.64% | |

Class A Shares at maximum Offering Price | | | 13.20% | | | | 12.89% | | | | 5.01% | |

Russell 2000® Value Index | | | 24.86% | | | | 13.39% | | | | 5.92% | |

Lipper Small-Cap Core Funds Classification Average | | | 20.88% | | | | 12.85% | | | | 6.36% | |

| | | |

Class C Shares | | | 19.21% | | | | 13.39% | | | | 4.86% | |

Class I Shares | | | 20.43% | | | | 14.52% | | | | 5.90% | |

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

Class R3 Shares | | | 19.82% | | | | 13.96% | | | | 14.02% | |

Class R6 Shares | | | 20.64% | | | | N/A | | | | 12.46% | |

Since inception returns for Class R3 Shares and Class R6 Shares are from 9/29/09 and 2/15/13, respectively. Indexes and Lipper averages are not available for direct investment.

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1% if redeemed within eighteen months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class R6 Shares have no sales charge and are available only to certain limited categories of investors as described in the prospectus. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | | | | | | | | | | | | | |

| | | Share Class | |

| | | Class A | | | Class C | | | Class R3 | | | Class R6 | | | Class I | |

Expense Ratios | | | 1.28% | | | | 2.03% | | | | 1.54% | | | | 0.88% | | | | 1.03% | |

Growth of an Assumed $10,000 Investment as of June 30, 2017 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Holding

Summaries as of June 30, 2017

This data relates to the securities held in each Fund’s portfolio of investments as of the end of this reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Nuveen NWQ Global All-Cap Fund

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 99.9% | |

Other Assets Less Liabilities | | | 0.1% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

Cheniere Energy Inc. | | | 2.8% | |

Takeda Chemical Industries | | | 2.8% | |

Coherent Inc. | | | 2.8% | |

Aurelius AG | | | 2.7% | |

Durr AG | | | 2.7% | |

Portfolio Composition

(% of net assets)

| | | | |

Banks | | | 16.2% | |

Pharmaceuticals | | | 8.8% | |

Chemicals | | | 8.0% | |

Semiconductors & Semiconductor Equipment | | | 7.9% | |

Oil, Gas & Consumable Fuels | | | 6.8% | |

Capital Markets | | | 4.9% | |

Household Durables | | | 4.4% | |

Industrial Conglomerates | | | 3.8% | |

Food Products | | | 3.4% | |

Diversified Telecommunication Services | | | 3.1% | |

Electronic Equipment, Instruments & Components | | | 2.8% | |

Machinery | | | 2.7% | |

Life Sciences Tools & Services | | | 2.6% | |

Food & Staples Retailing | | | 2.6% | |

Insurance | | | 2.5% | |

Other | | | 19.4% | |

Other Assets Less Liabilities | | | 0.1% | |

Net Assets | | | 100% | |

Country Allocation1

(% of net assets)

| | | | |

United States | | | 42.2% | |

Japan | | | 11.3% | |

Germany | | | 9.7% | |

United Kingdom | | | 9.0% | |

Spain | | | 4.3% | |

Ireland | | | 4.1% | |

Switzerland | | | 3.7% | |

Netherlands | | | 3.2% | |

Belgium | | | 2.5% | |

South Korea | | | 2.2% | |

Other | | | 7.7% | |

Other Assets less liabilities | | | 0.1% | |

Net Assets | | | 100% | |

| 1 | Includes 4.2% (as a percentage of net assets) in emerging market countries. |

Nuveen NWQ Global Equity Income Fund

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 94.3% | |

Convertible Preferred Securities | | | 3.2% | |

$25 Par (or similar) Retail Preferred | | | 0.4% | |

$1,000 Par (or similar) Institutional Preferred | | | 1.6% | |

Other Assets Less Liabilities | | | 0.5% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

Oracle Corporation | | | 4.2% | |

GlaxoSmithKline PLC | | | 3.6% | |

Dow Chemical Company | | | 3.5% | |

Veolia Enviornment S.A. | | | 3.2% | |

Citigroup Inc. | | | 3.1% | |

Portfolio Composition

(% of net assets)

| | | | |

Banks | | | 16.7% | |

Insurance | | | 10.5% | |

Pharmaceuticals | | | 9.1% | |

Software | | | 6.1% | |

Capital Markets | | | 5.8% | |

Oil, Gas & Consumable Fuels | | | 4.8% | |

Chemicals | | | 4.0% | |

Diversified Telecommunication Services | | | 4.0% | |

Industrial Conglomerates | | | 3.4% | |

Multi-Utilities | | | 3.2% | |

Semiconductors & Semiconductor Equipment | | | 3.0% | |

Tobacco | | | 2.8% | |

Food Products | | | 2.8% | |

Air Freight & Logistics | | | 2.8% | |

Electric Utilities | | | 2.7% | |

Other | | | 17.8% | |

Other Assets Less Liabilities | | | 0.5% | |

Net Assets | | | 100% | |

Country Allocation1

(% of net assets)

| | | | |

United States | | | 42.4% | |

Germany | | | 11.2% | |

United Kingdom | | | 8.6% | |

Japan | | | 6.0% | |

Netherlands | | | 5.2% | |

Ireland | | | 4.6% | |

France | | | 4.4% | |

Switzerland | | | 3.4% | |

Bermuda | | | 3.0% | |

Spain | | | 2.3% | |

Other | | | 8.4% | |

Other Assets Less Liabilities | | | 0.5% | |

Net Assets | | | 100% | |

| 1 | Includes 3.0% (as a percentage of net assets) in emerging market countries. |

Holding Summaries as of June 30, 2017 (continued)

Nuveen NWQ International Value Fund

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 95.1% | |

Repurchase Agreements | | | 5.0% | |

Other Assets Less Liabilities | | | (0.1)% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

Nippon Telegraph and Telephone Corporation | | | 2.7% | |

ING Groep N.V. | | | 2.7% | |

SK Telecom Company Limited, Sponsored ADR | | | 2.6% | |

UBS Group AG | | | 2.6% | |

Royal Bank of Scotland Group PLC | | | 2.5% | |

Portfolio Composition

(% of net assets)

| | | | |

Banks | | | 12.7% | |

Insurance | | | 8.2% | |

Pharmaceuticals | | | 6.7% | |

Food & Staples Retailing | | | 5.9% | |

Diversified Telecommunication Services | | | 4.5% | |

Oil, Gas & Consumable Fuels | | | 4.2% | |

Commercial Services & Supplies | | | 3.9% | |

Capital Markets | | | 3.7% | |

Automobiles | | | 3.6% | |

Professional Services | | | 3.2% | |

Tobacco | | | 3.1% | |

Energy Equipment & Services | | | 3.0% | |

Industrial Conglomerates | | | 2.9% | |

Aerospace & Defense | | | 2.9% | |

Real Estate Management & Development | | | 2.7% | |

Wireless Telecommunication Services | | | 2.6% | |

Technology Hardware, Storage & Peripherals | | | 2.5% | |

Other | | | 18.8% | |

Repurchase Agreements | | | 5.0% | |

Other Assets Less Liabilities | | | (0.1)% | |

Net Assets | | | 100% | |

Country Allocation1

(% of net assets)

| | | | |

Japan | | | 22.5% | |

Netherlands | | | 11.8% | |

United States | | | 9.3% | |

France | | | 7.7% | |