UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[Mark One]

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number: 000-32409 (1933 Act)

United Mortgage Trust |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | |

| | Maryland | | 75-6493585 | |

| | (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | |

1702 N. Collins Boulevard, Suite 100, Richardson, Texas 75080 |

| (Address of principal executive offices) |

| (Zip Code) |

| |

Registrant’s telephone number, including area code: (214) 237-9305 |

| |

Securities registered pursuant to section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Shares of Beneficial interest, par value $0.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filero Accelerated filer o Non-accelerated filer x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s shares of beneficial interest held by non-affiliates of the registrant at June 30, 2006 computed by reference to the price at which the common equity was last sold was $141,532,580.

As of March 15, 2007, 6,885,797 of the Registrant's Shares of Beneficial Interest were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

| |

| | |

PART I | Page No. |

| | |

| 1 |

| 4 |

| 8 |

| 8 |

| 8 |

| 8 |

| | |

PART II | |

| | |

| 8 |

| 8 |

| 8 |

| 20 |

| 22 |

| 36 |

| 36 |

| 36 |

| | |

PART III | |

| | |

| 36 |

| 40 |

| 40 |

| 40 |

| 43 |

| 45 |

PART I

GENERAL

United Mortgage Trust (which we refer to in this report as “we,”, “us”, “our” and the “Company”) is a Maryland real estate investment trust formed on July 12, 1996. We acquire mortgage investments from several sources, including from affiliates of our Advisor. The amount of mortgage investments to be acquired from such sources depends upon the mortgage investments that are available from them or from other sources at the time we have funds to invest. We believe that all mortgage investments purchased from affiliates of the Advisor are at prices no higher than those that would be paid to unaffiliated third parties for mortgages with comparable terms, rates, credit risks and seasoning.

We invest exclusively in: (i) first lien secured mortgage loans with initial terms of 12 months or less for the acquisition and renovation of single family homes, which we refer to as “interim loans”; (ii) first lien secured construction loans for the acquisition of lots and construction of single-family homes, which we refer to as “construction loans”; (iii) lines of credit and secured loans for the acquisition and development of single-family home lots, referred to as “land development loans”; (iv) lines of credit and loans secured by developed single-family lots, referred to as “finished lot loans”; (v) lines of credit and loans secured by completed model homes, referred to as “model home loans”; and, formerly we invested in (vi) first lien, fixed rate mortgages secured by single-family residential property, which we refer to as “residential mortgages”. Additionally, our portfolio includes loans to affiliates of our Advisor, which we refer to as “recourse loans.”

The typical terms for residential mortgages, contracts for deed and interim loans (collectively referred to as “mortgage investments”) are 360 months, 360 months and 12 months, respectively. The United Development Funding, L.P. (“UDF”) line of credit in place has a five year term. Finished lot loans and builder model home loans are expected to have terms of 12 to 48 months. The risks to us and the recourse that we have in the event of a default are essentially the same for all three types of security instruments relied upon. The majority of interim loans are covered by recourse agreements that obligate either a third party with respect to the performance of a purchased loan, or a borrower that has made a corresponding loan to another party (the "underlying borrower"), to repay the loan if the underlying borrower defaults. Our loans to UDF are secured by the pledge of all of UDF’s land development loans and equity participations, and are subordinated to its bank lines of credit. In addition, as an enhancement, in October 2006, United Development Funding III, L.P. (“UDF III”), a newly formed public limited partnership that is affiliated with UDF and with our Advisor, entered into a limited guaranty, effective as of September 1, 2006, for our benefit (the “UDF III Guarantee”). Pursuant to the UDF III Guarantee, UDF III guaranteed the repayment of an amount up to $30 million with respect to that certain Second Amended and Restated Secured Line of Credit Promissory Note between United Mortgage Trust and UDF.

We seek to produce net interest income from our mortgage investments while maintaining strict cost controls in order to generate net income for monthly distribution to our shareholders. We intend to continue to operate in a manner that will permit us to qualify as a Real Estate Investment Trust (“REIT”) for federal income tax purposes. As a result of that REIT status, we are permitted to deduct dividend distributions to shareholders, thereby effectively eliminating the "double taxation" that generally results when a corporation earns income (upon which the corporation is taxed) and distributes that income to shareholders in the form of dividends (upon which the shareholders are taxed).

The overall management of our business is vested in our Board of Trustees. UMTH General Services, L.P., a Delaware limited partnership (“Advisor” or “UMTHGS”) is a subsidiary of UMT Holdings, L.P. (“UMTH”), is retained to manage our day-to-day operations and to use its best efforts to seek out and present, whether through its own efforts or those of third parties retained by it, investment opportunities that are consistent with our investment policies and objectives and consistent with the investment programs the trustees may adopt from time to time in conformity with our Declaration of Trust. Our President, Christine “Cricket” Griffin, is a limited partner of UMTH.

In addition to this annual report, we file quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). All documents that we file with the SEC are available free of charge on our website, which is www.unitedmorgagetrust.com. You may also read and copy any document that we file at the public reference facilities of the SEC at 450 Fifth Street NW, Washington DC 20549. Please call the SEC at (800) SEC-0330 for further information about the public reference facilities. These documents also my be accessed through the SEC’s electronic data gathering, analysis and retrieval system (“EDGAR”) via electronic means, including the SEC’s home page on the internet (http://www.sec.gov).

Our principal executive offices are located at 1702 N Collins Blvd, Suite 100, Richardson TX 75080, telephone (214) 237-9305 or (800) 955-7917, facsimile (214) 237-9304.

TERMINATION OF THE MERGER AGREEMENT

On June 13, 2006, the Board of Trustees voted to take no action to prevent the Agreement and Plan of Merger dated September 1, 2005 ("Merger Agreement") between the Company and UMTH pursuant to which the Company would have merged with and into UMTH ("Merger") from terminating for failure to satisfy the condition that the Merger would terminate if the Merger was not consummated by June 30, 2006. On June 13, 2006, the Company received a letter from UMTH in which UMTH also expressed the view that the Merger would terminate on June 30, 2006. On June 30, 2006 the merger terminated and as a result the Company wrote-off approximately $1,040,000 in capitalized merger costs as reflected in the statements of income. The Company believes that it will not incur any termination penalties as a result of the termination of the merger.

RESTATED INVESTMENT OBJECTIVES AND POLICIES

As Amended January 24, 2007

Our principal investment objectives are to invest proceeds from our DRP, financing proceeds, capital transaction proceeds and retained earnings in six types of investments:

(i) first lien secured interim mortgage loans with initial terms of 12 months or less for the acquisition and renovation of single family homes, which we refer to as “interim loans”;

(ii) first lien secured construction loans for the acquisition of lots and construction of single-family homes, which we refer to as “construction loans”;

(iii) lines of credit and secured loans for the acquisition and development of single-family home lots, referred to as “land development loans”;

(iv) lines of credit and loans secured by developed single-family lots, referred to as “finished lot loans”;

(v) lines of credit and loans secured by completed model homes, referred to as “model home loans”; and,

(vi) first lien, fixed rate mortgages secured by single-family residential property, which we refer to as “residential mortgages and contracts for deed”.

We collectively refer the above listed loans as “Mortgage Investments”.

In addition, we intend to generate fee income by providing credit enhancements associated with residential real estate financing transactions in the various forms as recommended from time-to-time by our Advisor and approved by our Board of Trustees, including but not limited to, guarantees, pledges of cash deposits, letters of credit and tri-party inter-creditor agreements, all of which we refer to as “Credit Enhancements”. Mortgage Investments and Credit Enhancements are expected to:

(1) produce net interest income and fees;

(2) provide monthly distributions from, among other things, interest on Mortgage Investments and fees from credit enhancements; and

(3) permit reinvestment of payments of principal and proceeds of prepayments, sales and insurance net of expenses.

There is no assurance that these objectives will be attained.

INVESTMENT POLICY

At year end 2006 approximately 59% of the properties securing our Mortgage Investments were located in Texas, 10% in Tennessee, 8% in California, 4% in Missouri, 3% in each of Colorado and Georgia, 2% in each of Illinois, Indiana and Ohio, and 1% or less in 17 other states.

We anticipate that the concentration will continue in the near future, but it is our intention to expand our geographic presence through the purchase of Mortgage Investments in other geographic areas of the United States. In making the decision to invest in other areas, we consider the market conditions prevailing at the time we invest.

As of December 31, 2006, our portfolio was comprised of:

Category | | Percentage of portfolio | |

| Interim loans secured by conventionally built homes | | | 30.61 | % |

| Land development loans | | | 23.87 | % |

| Interim loans secured by modular and manufactured homes | | | 17.22 | % |

| Construction loans | | | 11.89 | % |

| Recourse obligations of affiliates | | | 8.65 | % |

| Residential mortgages and contracts for deed | | | 3.95 | % |

| Cash and other assets | | | 3.82 | % |

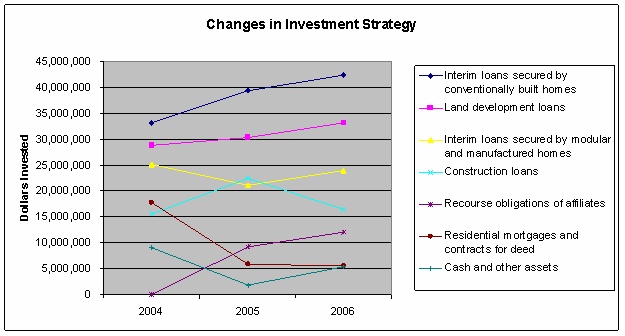

We no longer purchase interim loans that are secured by modular and manufactured homes or residential mortgages or contracts for deed, and we are phasing out of investing in construction loans. We plan to continue to invest in land development loans, finished lot loans, model home loans and interim loans secured by conventionally built houses because 1) land development loans and finished lot loans have provided us with suitable collateral positions, well capitalized borrowers and attractive yields; 2) interim loans have provided us with suitable collateral positions, full recourse from our borrowers and attractive yields; and, 3) model home loans are expected to provide us with suitable collateral positions, well capitalized borrowers and attractive yields. In addition, blended yields for land development loans and interim loans have produced higher returns than those of residential mortgages and contracts for deed. Model home loans are expected to produce higher yields commensurate with land development loans, finished lot loans and interim loans. As we phase out of interim loans secured by modular and manufactured homes and construction loans, we will increase the percentage of our portfolio invested in land development loans, finished lot loans, interim loans secured by conventionally built homes and model home loans, until market conditions indicate the need for an adjustment of the portfolio mix.

UNDERWRITING CRITERIA

We will not originate loans, except to facilitate the resale of a foreclosed property. Funds awaiting investment in Mortgage Investments will be invested in government securities, money market accounts or other assets that are permitted investments for REITs. See “Temporary Investments” below.

The underwriting criteria for Mortgage Investments are as follows:

(1) | Priority of Lien. |

| | |

· | Interim loans purchased must be secured by a first lien that is insured by a title insurance company. We will not purchase second liens or other subordinate or junior lien interim loans. |

| | |

· | Land development loans and finished lot loans must be secured by a first lien, second lien or a pledge of partnership interest that is insured by a title company. Second liens are subject to the loan-to-value (“LTV”) limitations set forth below. |

| | |

· | Model home loans will be secured by a subordinate lien that is insured by a title insurance company. |

| | |

· | Credit Enhancements must be secured by first or second liens or pledges of partnership interests. |

| | |

(2) | Rate and Fees. |

| | |

| | Our Advisor seeks to acquire Mortgage Investments that will provide us with a satisfactory net yield. Net yield is determined by the yield realized after payment of note servicing fees, if any, and administrative costs (estimated to be 1% of our average invested assets). Rates will be either adjustable or fixed. No loans will be purchased at a premium above the outstanding principal balance. Our investment policy allows for acquisition of loans at various rates. Fees charged for Credit Enhancements will be determined by the degree of risk as determined and recommended by our Advisor. Credit Enhancements are expected to range between 0.5% and 3% per annum. |

| | |

(3) | Term and Amortization. |

| | |

· | There is no minimum term for the loans we acquire. |

| | |

· | Land development loans, finished lot loans and model home loans will generally have terms from 24 to 48 months. |

| | |

· | Interim loans will generally have terms of 12 months or less. |

| | |

· | Construction loans will generally have terms of 9 to 12 months. |

| | |

· | Generally, land development loans, finished lot loans, model home loans and interim loans do not amortize. They are interest only loans with the principal paid in full when the loans mature. |

| | |

· | Credit Enhancements will range from 12 to 48 months. |

| | |

(4) | LTV, Investment-to-Value Ratio (“ITV”), Combined LTV Ratio (“CLTV”). |

| | |

· | Land development loans and finished lot loans: except as set forth below, loans purchased may not exceed an 85% ITV. Except as set forth below, land development loans and finished lot loans will not exceed 85% of the value of the collateral securing the indebtedness (the LTV of the loan). The purchase of, or investment in, subordinate liens secured loans or partnership interests securing loans will not exceed a CLTV of 85%, (subject to the exceptions listed below). CLTV will mean the sum of all indebtedness senior to us plus the sum of our investment or loan. |

| | |

· | Model home loans: LTV may not exceed 93% each loan. They will be a part of a pool of model home collateral, all of which will be cross-collateralized. All expenses associated with the model home are borne by the home builder. |

| | |

· | Interim loans: loans will not exceed a 70% LTV without approval by our Board of Trustees. |

| | |

| | The aggregate debt on any loan in our portfolio, other than cited above, will not exceed an amount equal to 85% of the appraised value of the property unless substantial justification exists. Such justification may include: 1) a pledge of partnership equity interest, 2) cross-collateralization by the pledge of other properties from the same borrower, 3) assignment of rents, royalties or other cash flow, and other sound security, including consideration of the net worth of the borrower or guarantor, 4) the credit rating of the borrower or guarantor, and/or historical financial performance of the borrower or guarantor. |

| | |

(5) | Seasoning. |

| | |

· | None of the types of loans we currently purchase, or intend to purchase, are subject to seasoning requirements. |

| | |

(6) | Borrower, Loan and Property Information. |

| | |

· | Land development loans, finished lot loans, model homes loans and Credit Enhancements: borrower, loan and property information will be in accordance with guidelines set forth by the originating entities, UDF and UMTH Land Development, L. P. (“UMTH LD”), a subsidiary of UMTH, including economic feasibility studies, engineering due diligence reports, exit strategy analysis, and construction oversight requirements. Our Advisor will periodically monitor compliance and changes to underwriting guidelines. |

| | |

· | Interim loans: borrower, loan and property information will be in accordance with the guidelines established by the originating company, UMTH Lending Company, L.P. (“UMTHLC”), a subsidiary of UMTH. Our Advisor will periodically monitor compliance and changes to underwriting guidelines. |

| | |

(7) | Appraisals. |

| | |

· | Land development loans, finished lot loans and model home loans: appraisal must demonstrate that the LTV or ITV is in compliance with the above referenced LTV, ITV and CLTV standards. Loans exceeding LTV, ITV and CLTV guidelines must note the criteria on which the exception was based. |

| | |

· | Interim loans: appraisal must demonstrate that the LTV or ITV of not more than 70% (subject to the exceptions set forth in 4 above). |

| | |

· | The appraisals must be performed by appraisers approved by our Advisor. |

| | |

(8) | Credit. |

| | |

· | Interim loans: minimum credit scores and corresponding down payment requirements will be in accordance with the guidelines set by the originating company. Our Advisor will periodically monitor compliance and changes to underwriting guidelines. |

| | |

· | Land development loans, finished lot loans, model home loans and Credit Enhancements: extensions of credit to borrowers will be determined in accordance with net worth and down payment requirements prescribed by the originating companies. Our Advisor will periodically monitor compliance and changes to underwriting guidelines. |

| | |

(9) | Hazard Insurance. |

| | |

· | Loans that are secured by a residence must have an effective, prepaid hazard insurance policy with a mortgagee's endorsement for our benefit in an amount not less than the outstanding principal balance on the loan. We reserve the right to review the credit rating of the insurance issuer and, if deemed unsatisfactory, request replacement of the policy by an acceptable issuer. |

| | |

(10) | Geographical Boundaries. |

| | |

· | We may purchase Mortgage Investments and provide Credit Enhancements for real estate projects in any of the 48 contiguous United States. |

| | |

(11) | Mortgagees' Title Insurance. |

| | |

· | Each Mortgage Investment purchased must have a valid mortgagees' title insurance policy insuring our lien position in an amount not less than the outstanding principal balance of the loan. |

| | |

(12) | Guarantees, Recourse Agreements, and Mortgage Insurance. |

| | |

· | Interim loans purchased will contain personal guarantees of the borrower or principal of the borrower. |

| | |

· | Interim loans will afford full recourse to the originating company. |

| | |

· | Land development loans, finished lot loans, model home loans and Credit Enhancements will have guarantees and collateral arrangements as determined by the originating companies. Our Advisor will review guarantees and recourse obligations. |

| | |

(13) | Pricing. |

| | |

· | Mortgage Investments will be purchased at no minimum percentage of the principal balance, but in no event in excess of the outstanding principal balance. |

| | |

· | Yields on our loan portfolio and fees charged for Credit Enhancements will vary with perceived risk, interest rate, credit, LTV ratios, down payments, guarantees or recourse agreements among other factors. Our objectives will be accomplished through purchase of high rate loans, reinvestment of principal payments and other short-term investment of cash reserves and, if utilized, leverage of capital to purchase additional Mortgages Investments. |

The principal amounts of Mortgage Investments, and the number in which we invest, will be affected by market availability and amount of capital available to us from proceeds of our Dividend Reinvestment Plan (“DRP”), retained earnings, repayment of our loans and borrowings. There is no way to predict the future composition of our portfolio since it will depend in part on the loans available at the time of investment.

TEMPORARY INVESTMENTS

We intend to use proceeds from our DRP, retained earnings, proceeds from the repayment of our loans and bank borrowings to acquire Mortgage Investments. There can be no assurance as to when we will be able to invest the full amount of capital available to us in Mortgage Investments, although we will use our best efforts to invest or commit for investment of all capital within 60 days of receipt. We will temporarily invest any excess cash balances not immediately invested in Mortgage Investments or for the other purposes described above, in certain short-term investments appropriate for a trust account or investments which yield "qualified temporary investment income" within the meaning of Section 856(c)(6)(D) of the Code or other investments which invest directly or indirectly in any of the foregoing (such as repurchase agreements collateralized by any of the foregoing types of securities) and/or such investments necessary for us to maintain our REIT qualification or in short-term highly liquid investments such as in investments with banks having assets of at least $50,000,000, savings accounts, bank money market accounts, certificates of deposit, bankers' acceptances or commercial paper rated A-1 or better by Moody's Investors Service, Inc., or securities issued, insured or guaranteed by the United States government or government agencies, or in money market funds having assets in excess of $50,000,000 which invest directly or indirectly in any of the foregoing.

OTHER POLICIES

We will not: (a) issue senior securities; (b) invest in the securities of other issuers for the purpose of exercising control; (c) invest in securities of other issuers, other than in temporary investments as described under "Investment Objectives and Policies - Temporary Investments"; (d) underwrite the securities of other issuers; or (e) offer securities in exchange for property.

We may borrow funds to make distributions to our shareholders or to acquire additional Mortgage Investments. Our ability to borrow funds is subject to certain limitations set forth in our Declaration of Trust. Specifically, we may not incur indebtedness in excess of 50% of our net asset value.

Other than in connection with the purchase of Mortgage Investments or issuance of Credit Enhancements, that may be deemed to be a loan from us to the borrower, we do not intend to loan funds to any person or entity. Our ability to lend funds to a trustee, the Advisor or affiliate thereof is subject to certain restrictions in our Declaration of Trust.

We will not sell property to our Advisor, a trustee or affiliate thereof at terms less favorable than could be obtained from an unaffiliated party.

Although we do not intend to invest in real property, to the extent we do, a majority of the trustees will determine the consideration paid for such real property, based on the fair market value of the property. If a majority of the independent trustees so determine, or if the real property is acquired from our Advisor, as trustee or affiliate thereof, a qualified independent real estate appraiser will determine such fair market value selected by the independent trustees.

We will use our best efforts to conduct our operations so as not to be required to register as an investment company under the Investment Company Act of 1940 and so as not to be deemed a "dealer" in mortgages for federal income tax purposes. See "Federal Income Tax Considerations.”

We will not engage in any transaction that would result in the receipt by the Advisor or its affiliates of any undisclosed "rebate" or "give-up" or in any reciprocal business arrangement that results in the circumvention of the restrictions upon dealings between us and the Advisor and its affiliates contained in the Declaration of Trust and in applicable state securities laws and regulations.

The Advisor and its affiliates, including companies, other partnerships and entities controlled or managed by such Affiliates, may engage in transactions described in our prospectus, including acting as Advisor, receiving distributions and compensation from us and others, the purchasing, warehousing, servicing and reselling of mortgage notes, property and investments and engaging in other businesses or ventures that may be in competition with us.

CHANGES IN INVESTMENT OBJECTIVES AND POLICIES

The investment restrictions contained in the Declaration of Trust may only be changed by amending the Declaration of Trust with the approval of the shareholders. However, subject to those investment restrictions, the methods for implementing our investment policies may vary as new investment techniques are developed. The Board of Trustees will periodically, no less than annually restate our investment objectives and publish same in a public filing and direct mail communication to our shareholders.

COMPETITION

We believe that our principal competition in the business of acquiring and holding mortgage investments is from financial institutions such as banks, saving and loan associations, life insurance companies, institutional investors such as mutual funds and pension funds, and certain other mortgage REITs. While most of these entities have significantly greater resources than we do, we believe that we are able to compete effectively and to generate relatively attractive rates of return for shareholders due to our relatively low level of operating costs, our relationships with our sources of mortgage investments and the tax advantages of our REIT status.

EMPLOYEES

We have no employees however, our Advisor is staffed with employees who possess expertise in all areas required to fulfill its obligation as manager of our day-to-day management. Our President is a limited partner of UMTH. UMTH owns 99.9% of UMTHGS, our Advisor.

The following are certain risk factors that could affect our business, financial condition, operating results and cash flows. These risk factors should be considered in connection with the forward-looking statements contained in this Annual Report on Form 10-K because these risk factors could cause our actual results to differ materially from those expressed in any forward-looking statement. The risks highlighted below are not the only ones we face. If any of these events actually occur, our business, financial condition, operating results or cash flows could be negatively affected. We caution readers to keep these risk factors in mind and to refrain from attributing undue certainty to any forward-looking statements, which speak only as of the date of this report.

Our dividend can fluctuate because it is based on earnings.

The dividend rate is fixed quarterly by our trustees, based on earnings projections. As such, the dividend rate may fluctuate up or down. Earnings are affected by various factors including use of leverage, cash on hand, current yield on investments, loan losses, general and administrative operating expenses and amount of non-income producing assets. We distributed in excess of earnings between 1999 and 2005. The amount of the excess constituted a return of capital.

Our investments are subject to a higher risk of default than conventional mortgage loans.

Most of our Mortgage Investments are not insured or guaranteed by a federally owned or guaranteed mortgage agency. Also, most of our loans involve, directly or indirectly, borrowers who do not satisfy all of the income ratios, credit record criteria, loan-to-value ratios, employment histories and liquidity requirements of conventional mortgage financing. Accordingly, the risk of default by the borrower in those "non-conforming loans" is higher than the risk of default in loans made to persons who qualify for conventional mortgage financing. The default rate recently reported for sub-prime consumer loans for the last quarter of 2006 was approximately 14%. The three year average default rate for our residential mortgages and contracts for deed was 11.77% and for our interim loans was 2.49%.

Our loans to UDF are junior to other lenders.

Our loans to UDF are secured by UDF’s interest in mortgages and equity participations that it has obtained to secure its loans to real estate developers. Some of those mortgages are junior mortgages. Accordingly, we face the risk of loss due to defaults by the real estate developers and the potential inability to recover the outstanding loan balance on foreclosure of collateral securing our loans because our rights to this collateral will be junior to the rights of senior lenders.

We purchase mortgage investments from affiliates of our Advisor, which may present a conflict of interest from our Advisor.

We acquire many of our mortgage investments from affiliates of the Advisor. Due to the affiliation between the Advisor and those entities and the fact that those entities may make a profit on the sale of mortgage investments to us, the Advisor has a conflict of interest in determining if mortgage investments should be purchased from affiliated or unaffiliated third parties.

We face competition for the time and services of our officers and the officers and employees of our Advisor.

We rely on our Advisor and its affiliates, including our President, who is a partner of the parent of our Advisor, for management of our operations. Because our Advisor and its affiliates engage in other business activities, conflicts of interest may arise in operating more than one entity with respect to allocating time between those entities.

Our results are subject to market and business conditions.

Results of operations depend on, among other things, the level of net interest income generated by our mortgage investments, the market value of those mortgage investments and the supply of and demand for those mortgage investments. Net interest income varies as a result of changes in interest rates, borrowing costs and prepayment rates, all of which involve various risks and uncertainties as set forth below. Interest rates, borrowing costs and credit losses depend upon the nature and terms of the mortgage investments, the geographic location of the properties securing the mortgage investments, employment conditions, conditions in financial markets, the fiscal and monetary policies of the United States government and the Board of Governors of the Federal Reserve System, international economic and financial conditions, competition and other factors, none of which can be predicted with any certainty.

Fluctuations in interest rates may affect our return on investment.

Mortgage interest rates may be subject to abrupt and substantial fluctuations. If prevailing interest rates rise above the average interest rate being earned by our mortgage investments, we may be unable to quickly liquidate our existing investments in order to take advantage of higher returns available from other investments. Furthermore,

interest rate fluctuations may have a particularly adverse effect on the return we realize on our mortgage investments if we use money borrowed at variable rates to fund fixed rate mortgage investments.

We have a high geographic concentration of mortgage investments in Texas.

A large percentage of the properties securing our mortgage investments are located in Texas, with approximately 40% in the Dallas/Fort Worth area. As a result, we have a greater susceptibility to the effects of an economic downturn in that area or from slowdowns in certain business segments that represent a significant part of that area’s overall economic activity such as energy, financial services and tourism.

We face the risk of loss on non-insured, non-guaranteed mortgage loans.

We generally do not obtain credit enhancements for our mortgage investments, because the majority of those mortgage loans are "non-conforming" in that they do not meet all of the underwriting criteria required for the sale of the mortgage loan to a federally owned or guaranteed mortgage agency. Accordingly, during the time we hold mortgage investments for which third party insurance is not obtained, we are subject to the general risks of borrower defaults and bankruptcies and special hazard losses that are not covered by standard hazard insurance (such as those occurring from earthquakes or floods). In the event of a default on any mortgage investment held by us, including, without limitation, defaults resulting from declining property values and worsening economic conditions, we would bear the risk of loss of principal to the extent of any deficiency between the value of the related mortgage property and the amount owing on the mortgage loan. Defaulted mortgage loans would also cease to be eligible collateral for borrowings and would have to be held or financed by us out of other funds until those loans are ultimately liquidated, which could cause increased financing costs and reduced net income or a net loss.

Bankruptcy of borrowers may delay or prevent recovery on our loans.

The recovery of money owed to us may be delayed or impaired by the operation of the federal bankruptcy laws. Any borrower has the ability to delay a foreclosure sale for a period ranging from a few months to several months or more by filing a petition in bankruptcy, which automatically stays any actions to enforce the terms of the loan. The length of this delay and the associated costs will generally have an adverse impact on the return we realize on our investments.

We are exposed to potential environmental liabilities.

In the event that we are forced to foreclose on a defaulted mortgage investment to recover our investment, we may be subject to environmental liabilities in connection with that real property which may cause its value to be diminished. Hazardous substances or wastes, contaminants, pollutants or sources thereof (as defined by state and federal laws and regulations) may be discovered on properties during our ownership or after a sale of that property to a third party. If those hazardous substances are discovered on a property, we may be required to remove those substances or sources and clean up the property. We could incur full recourse liability for the entire cost of any removal and clean up and the cost of such removal and clean up could exceed the value of the property or any amount that we could recover from any third party. We may also be liable to tenants and other users of neighboring properties for environmental liabilities. In addition, we may find it difficult or impossible to sell the property prior to or following any such clean up.

We face risks from borrowed money.

We are allowed to borrow and aggregate amount not to exceed 50% of our net assets to acquire mortgage investments. An effect of leveraging is to increase the risk of loss. The higher the rate of interest on the financing, the more difficult it would be for us to meet our obligations and the greater the chance of default. These borrowings may be secured by liens on our mortgage investments. Accordingly, we could lose our mortgage investments if we default on the indebtedness.

We rely on appraisals that may not be accurate or may be affected by subsequent events.

Because our investment decisions are based in major part upon the value of the real estate underlying our mortgage investments and less upon the creditworthiness of the borrowers, we rely primarily on the real property securing the mortgage investments to protect our investment. We rely on appraisals and on Broker Price Opinions ("BPO's"), both of which are paid for and most of which are provided by note sellers, to determine the fair market value of real property used to secure the mortgage investments we purchase. BPO’s are determinations of the value of a property based on a study of the comparable values of similar properties prepared by a licensed real estate broker. We cannot be sure that those appraisals or BPO's are accurate. Moreover, since an appraisal or BPO is given with respect to the value of real property at a given point in time, subsequent events could adversely affect the value of real property used to secure a loan. Such subsequent events may include changes in general or local economic conditions, neighborhood values, interest rates and new construction. Moreover, subsequent changes in applicable governmental laws and regulations may have the effect of severely limiting the permitted uses of the property, thereby drastically reducing its value. Accordingly, if an appraisal is not accurate or subsequent events adversely affect the value of the property, the mortgage investment would not be as secure as anticipated, and, in the event of foreclosure, we may not be able to recover our entire investment.

Our mortgages may be considered usurious.

Usury laws impose limits on the maximum interest that may be charged on loans and impose penalties for violations that may include restitution of the usurious interest received, damages for up to three times the amount of interest paid and rendering the loan unenforceable. Most, if not all, of the mortgage investments we purchase are subject to state usury laws and therefore we face the risk that the interest rate for our loans could be held usurious in states with restrictive usury laws.

We face the risk of an inability to maintain our qualification as a REIT.

We are organized and conduct our operations in a manner that we believe enables us to be taxed as a REIT under the Internal Revenue Code (the "Code"). To qualify as a REIT and avoid the imposition of federal income tax on any income we distribute to our shareholders, we must continually satisfy two income tests, two asset tests and one distribution test.

If, in any taxable year, we fail to distribute at least 90% of our taxable income, we will be taxed as a corporation and distributions to our shareholders will not be deductible in computing our taxable income for federal income tax purposes. Because of the possible receipt of income without corresponding cash receipts due to timing differences that may arise between the realization of taxable income and net cash flow (e.g. by reason of the original issue discount rules) or our payment of amounts that do not give rise to a current deduction (such as principal payments on indebtedness), it is possible that we may not have sufficient cash or liquid assets at a particular time to distribute 90% of our taxable income. In that event, we could declare a consent dividend or we could be required to borrow funds or liquidate a portion of our investments in order to pay our expenses, make the required distributions to shareholders, or satisfy our tax liabilities, including the possible imposition of a four percent excise tax. We may not have access to funds to the extent, and at the time, required to make such payments.

If we were taxed as a corporation, our payment of tax will substantially reduce the funds available for distribution to shareholders or for reinvestment and, to the extent that distributions had been made in anticipation of our qualification as a REIT, we might be required to borrow additional funds or to liquidate certain of our investments in order to pay the applicable tax. Moreover, should our election to be taxed as a REIT terminate or be voluntarily revoked, we may not be able to elect to be treated as a REIT for the following four-year period.

We did not have an audit committee in 2006.

During 2006 our Board of Directors did not appoint an audit committee. Typically, an audit committee is responsible for reviewing and discussing with management a company's financial controls and accounting, audit and reporting activities. A typical audit committee will also review the qualifications of the Company's independent registered public accounting firm, select the independent registered public accounting firm and recommend the ratification of the accounting firm to the board, review the scope, fees and results of any audit and review the non-audit services provided by the accounting firm. An audit committee will also be responsible for approving any transactions between the Company and its directors, officers, or significant shareholders. Failing to have a properly

constituted audit committee could expose the Company to a greater risk of error or fraud in the compilation, analysis and reporting of the Company's financial results. In addition, the failure to have an audit committee will prevent the Company from listing its securities on a stock exchange or stock quotation service.

Not applicable.

We do not maintain any physical properties.

We are unaware of any threatened or pending legal action or litigation that individually or in the aggregate could have a material effect on us.

On October 16, 2006, we held our annual meeting of shareholders. At the meeting, Michele Cadwell, Douglas Evans and Christine “Cricket” Griffin were elected as trustees to serve until the next annual meeting of shareholders. The vote for election of the trustees was 52.02% for, 0.25% against, 1.56% abstained and 46.17% did not cast a ballot. The shareholders also ratified the Board of Trustees’ selection of Whitley Penn LLP as the Company’s independent registered public accounting firm by a vote of 51.72% for, 0.34% against, 1.65% abstained and 46.29% did not cast a ballot.

PART II

There is currently no established public trading market for our shares. As an alternative means of providing limited liquidity for our shareholders, we maintain a Share Redemption Plan, (“SRP”). Under our plan, shareholders who have held the shares for at least one year are eligible to request that we repurchase their shares. In any consecutive 12 month period we may not repurchase more than 5% of the outstanding shares at the beginning of the 12 month period. The repurchase price is based on the value of our properties or a fixed pricing schedule, as determined by the trustees' business judgment based on our book value, operations to date and general market and economic conditions and may not, in any event, exceed any current public offering price. We have also purchased a limited number of shares outside of our SRP from shareholders with special hardship considerations.

Share repurchases have been at prices of $16.34 to $20.00 through our SRP. Shares repurchased for less than $20 per share were 1) shares held by shareholders for less than 12 months or 2) shares purchased outside of our Share Repurchase Program.

The repurchase price of $20 was determined by our Board of Trustees based on their business judgment regarding the value of the shares with reference to our book value, our operations to date and general market and economic conditions.

The following table summarizes the share repurchases made by us in 2006:

Month | | Total number of shares repurchased | | Average Purchase Price | | Total number of shares purchased as part of a publicly announced plan | | Total number of shares purchased outside of plan | |

| January | | | 13,858 | | $ | 18.00 | | | - | | | 13,858 | |

| February | | | 1,778 | | $ | 18.00 | | | - | | | 1,778 | |

| March | | | 4,732 | | $ | 18.00 | | | - | | | 4,732 | |

| April | | | 3,480 | | $ | 18.00 | | | - | | | 3,480 | |

| May | | | 8,079 | | $ | 18.00 | | | - | | | 8,079 | |

| June | | | 125,429 | | $ | 20.00 | | | 125,429 | | | - | |

| July | | | 22,217 | | $ | 20.00 | | | 22,217 | | | - | |

| August | | | 20,612 | | $ | 20.00 | | | 20,612 | | | - | |

| September | | | 8,428 | | $ | 16.34 | | | - | | | 8,428 | |

| October | | | 20,433 | | $ | 18.02 | | | 11,005 | | | 9,428 | |

| November | | | 25,585 | | $ | 19.03 | | | 20,093 | | | 5,492 | |

| December | | | 14,430 | | $ | 18.72 | | | 10,406 | | | 4,024 | |

Totals | | | 269,061 | | $ | 19.34 | | | 209,762 | | | 59,299 | |

On December 31, 2006, we had 6,917,443 shares outstanding compared to 7,055,119 and 7,040,743 shares outstanding at December 31, 2005 and 2004, respectively. The decrease in shares is the net between fewer DRP shares issued and more SRP shares repurchased. The shares were held by 2,760, 2,771 and 2,858 beneficial owners in 2006, 2005 and 2004, respectively. No single shareholder owned 5% or more of our outstanding shares.

Under our current distribution policy, we intend to retain up to 10% of our earnings to build share value, Retained Earnings”), and distribute to shareholders at least 90% of our taxable income each year (which does not ordinarily equal net income as calculated in accordance with accounting principles generally accepted in the United States) so as to comply with the REIT provisions of the Code. To the extent we have available funds, we declare regular monthly dividends (unless the trustees determine that monthly dividends are not feasible, in which case dividends would be paid quarterly). Any taxable income remaining after the distribution of the final regular monthly dividend each year, excluding our Retained Earnings, is distributed together with the first regular monthly dividend payment of the following taxable year or in a special dividend distributed prior thereto. The dividend policy is subject to revision at the discretion of the Board of Trustees. All distributions are made by us at the discretion of the Board of Trustees and depend on our taxable earnings, our Retained Earnings, our financial condition, maintenance of our REIT status and such other factors as the Board of Trustees deems relevant.

Distributions to shareholders are generally subject to taxation as ordinary income, although a portion of those distributions may be designated by us as capital gain or may constitute a tax-free return of capital. Although we do not intend to declare dividends that would result in a return of capital, we did so from 1997 through 2005. Any distribution to shareholders of income or capital assets from us is accompanied by a written statement disclosing the source of the funds distributed. If, at the time of distribution, this information is not available, a written explanation of the relevant circumstances accompanies the distribution and the written statement disclosing the source of the funds is distributed to the shareholders not later than 60 days after the close of the fiscal year in which the distribution was made. In addition, we annually furnish to each of our shareholders a statement setting forth distributions during the preceding year and their characterization as ordinary income, capital gains, or return of capital.

We began making distributions to our shareholders on September 29, 1997. Monthly distributions have continued each month thereafter. At year-end 2006 we had paid 112 consecutive monthly dividends. Distributions for the years ended December 31, 2006, 2005 and 2004 were made at a rate of 7.0% ($1.40), 7.5% ($1.50) and 8.6% ($1.72), respectively. The dividend portion of the distribution was 7.0% ($1.40), 6.6% ($1.32) and 6.7% ($1.34), per weighted share for 2006, 2005 and 2004, respectively. The portion of these distributions that did not represent a dividend represented a return of capital.

We present below selected financial information. We encourage you to read the financial statements and the notes accompanying the financial statements in this Annual Report. This information is not intended to be a replacement for the financial statements.

| | | Years ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

OPERATING DATA | | | | | | | | | | | | | | | | |

| Interest income from affiliate investments | | $ | 13,180,260 | | $ | 11,242,004 | | $ | 9,140,931 | | $ | 6,252,884 | | $ | 4,519,899 | |

| Interest income | | | 4,030,871 | | | 3,771,731 | | | 4,748,517 | | | 5,823,457 | | | 3,757,843 | |

| Total revenues | | | 17,211,131 | | | 15,013,735 | | | 13,889,448 | | | 12,076,341 | | | 8,277,742 | |

| Total expenses | | | 7,102,911 | | | 5,767,501 | | | 4,423,440 | | | 3,487,222 | | | 901,843 | |

| Net income | | | 10,108,220 | | | 9,246,234 | | | 9,466,008 | | | 8,589,119 | | | 7,375,899 | |

| Net income per share | | $ | 1.45 | | $ | 1.32 | | $ | 1.34 | | $ | 1.47 | | $ | 1.81 | |

| Weighted average shares outstanding | | | 6,993,980 | | | 7,026,311 | | | 7,051,313 | | | 5,859,639 | | | 4,083,488 | |

| | | | | | | | | | | | | | | | | |

| | | December 31, |

| | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

BALANCE SHEET DATA | | | | | | | | | | | | | | | | |

| Cash | | $ | 3,661,724 | | $ | 5,548,421 | | $ | 1,331,798 | | $ | 4,199,455 | | $ | 646,570 | |

| Residential mortgages and contracts for deed | | | - | | | - | | | - | | | 29,780,352 | | | 35,299,701 | |

| Investment in trusts receivable | | | 5,473,508 | | | 5,815,712 | | | 17,749,231 | | | - | | | - | |

| Foreclosed residential mortgage and contracts for deed | | | 359,517 | | | 874,602 | | | 867,591 | | | 3,346,004 | | | 3,676,070 | |

| Interim mortgages, affiliates | | | 64,883,388 | | | 48,411,728 | | | 45,561,688 | | | 45,924,354 | | | 35,652,876 | |

| Interim mortgages | | | 17,825,519 | | | 24,543,944 | | | 28,185,848 | | | 25,622,838 | | | 13,483,445 | |

| Foreclosed interim mortgages | | | 776,643 | | | 1,805,340 | | | 2,025,830 | | | 1,263,350 | | | - | |

| Allowance for loan losses | | | (1,011,975 | ) | | (698,712 | ) | | (921,500 | ) | | (350,000 | ) | | - | |

| Line-of-credit receivable, affiliate | | | 33,056,189 | | | 30,317,037 | | | 28,721,639 | | | 6,093,493 | | | - | |

| Recourse obligations, affiliates | | | 11,975,234 | | | 9,264,233 | | | - | | | - | | | - | |

| Other assets | | | 4,713,499 | | | 4,021,986 | | | 5,676,136 | | | 4,445,972 | | | 2,333,229 | |

| Total assets | | | 141,713,246 | | | 129,904,291 | | | 129,198,261 | | | 120,325,818 | | | 91,091,891 | |

| | | | | | | | | | | | | | | | | |

| Bank loan | | | 27,976,642 | | | 13,808,080 | | | 12,030,000 | | | - | | | 6,245,000 | |

| Other liabilities | | | 810,718 | | | 936,583 | | | 1,012,944 | | | 1,835,145 | | | 1,357,303 | |

| Total liabilities | | | 28,787,360 | | | 14,744,663 | | | 13,042,944 | | | 1,835,145 | | | 7,602,303 | |

| | | | | | | | | | | | | | | | | |

| Total temporary equity | | | - | | | - | | | - | | | - | | | 21,566,181 | |

| Total shareholders' equity | | | 112,925,886 | | | 115,159,628 | | | 116,155,317 | | | 118,490,673 | | | 61,923,407 | |

| Total liabilities and shareholders' equity | | $ | 141,713,246 | | $ | 129,904,291 | | $ | 129,198,261 | | $ | 120,325,818 | | $ | 91,091,891 | |

The following section contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act and should be read in conjunction with our Financial Statements and related notes appearing in this Form 10-K. Such forward-looking statements may be identified by the words “anticipate,” “believe,” “estimate,” “expect” or “intend” and similar expressions. Forward looking statements are likely to address such matters as our business strategy, future operating results, future sources of funding for mortgage loans brokered by us, future economic conditions and litigation against us, each of which are discussed herein under the caption “Factors that may Affect Future Results.”

GENERAL

We invest exclusively in: (i) first lien secured mortgage loans with initial terms of 12 months or less for the acquisition and renovation of single family homes, which we refer to as “interim loans”; (ii) first lien secured construction loans for the acquisition of lots and construction of single-family homes, which we refer to as “construction loans”; (iii) lines of credit and secured loans for the acquisition and development of single-family

home lots, referred to as “land development loans”; (iv) lines of credit and loans secured by developed single-family lots, referred to as “finished lot loans”; (v) lines of credit and loans secured by completed model homes, referred to as “model home loans”; and, formerly we invested in (vi) first lien, fixed rate mortgages secured by single-family residential property, which we refer to as “residential mortgages”. Additionally, we our portfolio includes loans to affiliates of our Advisor, which we refer to as “recourse loans.”

The typical terms for residential mortgages, contracts for deed and interim loans (collectively referred to as “mortgage investments”) are 360 months, 360 months and 12 months, respectively. The UDF line of credit has a five year term. Finished lot loans and builder model home loans are expected to have terms of 12 to 48 months. The risks to us and the recourse that we have in the event of a default are essentially the same for all three types of security instruments relied upon. The majority of interim loans are covered by recourse agreements that obligate either a third party with respect to the performance of a purchased loan, or obligate a borrower that has made a corresponding loan to another party (the "underlying borrower"), to repay the loan if the underlying borrower defaults. Our loans to UDF are secured by the pledge of all of UDF’s land development loans and equity participations, and are subordinated to its bank lines of credit. In addition, as an enhancement, in October 2006, UDF III, a newly formed public limited partnership that is affiliated with UDF and with our Advisor, entered into a limited guaranty effective as of September 1, 2006, for our benefit (the “UDF III Guarantee”). Pursuant to the UDF III Guarantee, UDF III guaranteed the repayment of an amount up to $30 million with respect to that certain Second Amended and Restated Secured Line of Credit Promissory Note between United Mortgage Trust and UDF.

We seek to produce net interest income from our mortgage investments while maintaining strict cost controls in order to generate net income for monthly distribution to our shareholders. We intend to continue to operate in a manner that will permit us to qualify as a Real Estate Investment Trust (“REIT”) for federal income tax purposes. As a result of that REIT status, we are permitted to deduct dividend distributions to shareholders, thereby effectively eliminating the "double taxation" that generally results when a corporation earns income (upon which the corporation is taxed) and distributes that income to shareholders in the form of dividends (upon which the shareholders are taxed).

At the end of 2006, our mortgage portfolio totaled approximately $121,239,000. Approximately 31% of our income producing assets were interim loans secured by conventionally built homes, approximately 24% were land development loans, approximately 17% were interim loans secured by modular and manufactured housing, approximately 12% were invested in the new construction interim loans, approximately 4% were invested in residential mortgages and contracts for deed, owned outright and as part of the Bayview Securitization discussed below.

We no longer purchase interim loans that are secured by modular and manufactured homes or residential mortgages or contracts for deed, and we are phasing out of investing in construction loans. We plan to continue to invest in land development loans, finished lot loans, model home loans and interim loans secured by conventionally built houses because, 1) land development loans and finished lot loans have provided us with suitable collateral positions, well capitalized borrowers and attractive yields; 2) interim loans have provided us with suitable collateral positions, full recourse from our borrowers and attractive yields; and, 3) model home loans are expected to provide us with suitable collateral positions, well capitalized borrowers and attractive yields. In addition, blended yields for land development loans and interim loans have produced higher returns than those of residential mortgages and contracts for deed. Model home loans are expected to produce higher yields commensurate with land development loans, finished lot loans and interim loans. As we phase out of interim loans secured by modular and manufactured homes and construction loans, we will increase the percentage of our portfolio invested in land development loans, finished lot loans, interim loans secured by conventionally built homes and model home loans, until market conditions indicate the need for an adjustment of the portfolio mix.

The following table sets forth certain information about our mortgage investments purchased during the periods set forth below.

| | | Years Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | |

Interim Mortgages | | | | | | | | | | |

| Interims funded with affiliates | | $ | 69,812,000 | | $ | 47,442,000 | | $ | 43,442,000 | |

| Interims funded with others | | $ | 18,596,000 | | $ | 33,760,000 | | $ | 34,007,000 | |

| | | | | | | | | | | |

| Number of loans funded with affiliates | | | 1,055 | | | 746 | | | 558 | |

| Number of loans funded with others | | | 137 | | | 277 | | | 367 | |

| Total number funded | | | 1,192 | | | 1,023 | | | 925 | |

| | | | | | | | | | | |

| Affiliate interims paid off | | $ | 48,003,000 | | $ | 42,915,000 | | $ | 43,700,000 | |

| Other interims paid off | | $ | 26,303,000 | | $ | 31,773,000 | | $ | 30,332,000 | |

| | | | | | | | | | | |

| Number of affiliated interims paid off | | | 909 | | | 613 | | | 649 | |

| Number of other interims paid off | | | 206 | | | 346 | | | 467 | |

| Total number paid off | | | 1,115 | | | 959 | | | 1,116 | |

| | | | | | | | | | | |

| Average interim mortgage loan funded during year | | $ | 75,000 | | $ | 75,000 | | $ | 84,000 | |

| Remaining term in months: less than | | | 12 months | | | 12 months | | | 12 months | |

| Yield on investments | | | 13.63 | % | | 12.98 | % | | 12.79 | % |

| Investment-to-value ratio | | | 56.08 | % | | 52.19 | % | | 68.44 | % |

| | | | | | | | | | | |

Line of Credit, Affiliate | | | | | | | | | | |

| Draws funded | | $ | 16,562,000 | | $ | 20,483,000 | | $ | 48,856,000 | |

| Paid down | | $ | 13,823,000 | | $ | 18,888,000 | | $ | 26,228,000 | |

| Term remaining | | | 3 years | | | 4 years | | | 5 years | |

| Yield on investments | | | 14.00 | % | | 13.91 | % | | 13.46 | % |

| | | | | | | | | | | |

Residential Mortgages and Contracts for Deed | | | | | | | | | | |

| UPB of new loans acquired | | $ | 1,721,000 | | $ | 517,000 | | $ | 597,000 | |

| Number purchased from other sources | | | -- | | | 13 | | | 11 | |

| Number reclassified/refinanced/carried back when selling REO (1) | | | 43 | | | -- | | | -- | |

| Aggregate principal balance | | $ | 1,721,000 | | $ | 517,000 | | $ | 597,000 | |

| Average principal balance | | $ | 40,000 | | $ | 40,000 | | $ | 54,000 | |

| Remaining term in months | | | 359 | | | 245 | | | 311 | |

| Current yield | | | 12.76 | % | | 11.70 | % | | 11.61 | % |

| Investment-to-value | | | 74.74 | % | | 86.36 | % | | 85.51 | % |

(1) The 43 loans cited above were a result of reclassification of interim mortgages, refinancing of CFD or a note carried back from the sale of REO. In the case of interim mortgages, we took direct assignment of three notes and one CFD that were in place on the underlying collateral of four interim mortgages. Two CFDs were refinanced and are now notes and deeds of trust. The balance of the activity represents secured 2nd liens notes secured by properties that were security for construction loans. We encouraged one of our unaffiliated borrowers to refinance their maturing construction loans. In doing so, we agreed to subordinate our 1st lien to other institutions. In addition, we required that our borrower execute a 2nd lien note on the portion of our 1st lien that the other institution did not finance. Under the terms of the 2nd lien notes we require both principal and interest payment monthly.

MERGER AGREEMENT

On June 13, 2006, the Board of Trustees voted to take no action to prevent the Agreement and Plan of Merger dated September 1, 2005 ("Merger Agreement") between the Company and UMTH pursuant to which the Company would have merged with and into UMTH ("Merger") from terminating for failure to satisfy the condition that the Merger would terminate if the Merger was not consummated by June 30, 2006. On June 13, 2006, the Company received a letter from UMTH in which UMTH also expressed the view that the Merger would terminate on June 30, 2006. On June 30, 2006 the merger terminated and as a result the Company wrote-off approximately

$1,040,000 in capitalized merger costs as reflected in the statements of income. The Company believes that it will not incur any termination penalties as a result of the termination of the merger.

RECOURSE OBLIGATIONS

Prior to July 1, 2003, we made recourse loans to (1) Capital Reserve Group, Inc. (“CRG”), which is owned by Todd Etter and William Lowe, (2) Ready America Funding Corp. (“RAFC”), which is owned by South Central Mortgage Inc. (“SCMI”), which is owned by Todd Etter and by Eastern Intercorp, Inc., a company owned by Craig Pettit, and (3) SCMI, (we refer to these three companies as the "originating companies"), each of which has used the funds to originate underlying loans that are pledged to us as security for such originating company's obligations to us under the recourse loans to affiliates. When principal and interest on an underlying loan are due in full, at maturity or otherwise, the corresponding obligation owed by the originating company to us under the affiliate loan is also due in full.

In addition, some of the originating companies have sold loans to us, which we refer to as the "purchased loans," and have entered into recourse agreements under which the originating company agreed to reimburse us for certain losses that we incur with respect to those purchased loans.

Before year end 2005, our arrangement was if the originating company foreclosed on property securing an underlying loan, or if we foreclosed on property securing a purchased loan, and the proceeds from the sale were insufficient to pay the loan in full, the originating company had the option of (1) repaying the outstanding balance owed to us associated with the underlying loan or purchased loan, as the case may be, or (2) delivering to us an unsecured deficiency note in the amount of the deficiency.

The owners of the originating companies are among the founders of UMT Holdings. Since July 1, 2003 they have originated interim mortgage loans through UMT Holdings, rather than through the originating companies. As a result, the originating companies do not intend to borrow additional funds from or to sell additional loans to us.

On March 30, 2006, but effective December 31, 2005, each originating company agreed to give us secured promissory notes to consolidate (1) all outstanding amounts owed by such originating company to us under the loans made to such originating company and the deficiency notes described above and (2) the estimated maximum future liability to us under the recourse arrangements described above. Each originating company issued to us a secured variable amount promissory note dated December 31, 2005 (we refer to each of those notes as a “Secured Note”) in the initial principal amounts shown below. The initial amounts represent all principal and accrued interest owed as of such date. The initial principal amounts are subject to possible increases up to the maximum amounts shown below, if losses are incurred upon the foreclosure of purchased loans covered by recourse arrangements. The Secured Notes (including related guaranties discussed below) are secured by an assignment of the distributions on Class C units, Class D units and Class EIA units of limited partnership interest of UMTH held by the originating companies as detailed in the following table and the paragraphs following the table.

Name | | Initial principal amount | | Balance at December 31, 2006 | | Maximum principal amount | | Units pledged as security | | Units remaining at December 31, 2006 | |

| CRG | | $ | 2,725,442 | | $ | 3,456,891 | | $ | 3,372,904 | | | 4,984 Class C | | | 4,573 Class C | |

| RAFC | | $ | 3,243,369 | | $ | 5,091,463 | | $ | 5,274,436 | | | 6,739 Class C and all EIA | | | 5,838 Class C and all EIA | |

| SCMI | | $ | 3,295,422 | | $ | 3,426,879 | | $ | 3,448,643 | | | 4,000 Class C | | | 3,597 Class C | |

The CRG balance at December 31, 2006 exceeded the maximum principal balance by approximately $84,000. The rapid rate of liquidation of the remaining portfolio of properties caused a more rapid increase in the UPB that we originally anticipated and out paced the minimum principal reductions scheduled for the loans. We are analyzing whether this will occur with either RAFC or SCMI. We will ask UMTH to accelerate principal reductions if necessary or we may increase amend the Secured Notes to accommodate the rapid liquidation of properties.

The Secured Notes bear interest at a rate of 10% per annum. The CRG and RAFC Secured Notes amortize over 15 years. The SCMI Secured Note amortizes over approximately 22 years, the average initial amortization of the original loans reclassified as deficiency notes. The Secured Notes require quarterly payments equal to the greater of (1) principal and interest amortized over 180 months and 264 months, respectively, or 2) the amount of any distributions paid to the originating company with respect to the pledged Class C and EIA units.

The Secured Notes have also been guaranteed by the following entities under the arrangements described below, all of which are dated effective December 31, 2005:

| | · | UMT Holdings. This guaranty is of all amounts due under all of the Secured Notes and is unsecured. |

| | · | WLL, Ltd., an affiliate of CRG. This guaranty is of all amounts due under Secured Note from CRG, is non-recourse and is secured by an assignment of 2,492 Class C Units and 732 Class D units of limited partnership interest of UMT Holdings held by WLL, Ltd. |

| | · | RMC. This guaranty is non-recourse, is limited to 50% of all amounts due under the Secured Note from RAFC and is secured by an assignment of 3,870 Class C units of limited partnership interest of UMT Holdings. |

In addition, WLL, Ltd. has obligations to UMT Holdings under an indemnification agreement between UMT Holdings, WLL, Ltd. and William Lowe, under which UMT Holdings is indemnified for certain losses on loans and advances made by UMT Holdings to William Lowe. That indemnification agreement allows UMT Holdings to offset any amounts subject to indemnification against distributions made to WLL, Ltd. with respect to the Class C and Class D units of limited partnership interest held by WLL, Ltd. Because WLL, Ltd. has pledged these Class C and Class D units to us to secure its guaranty of CRG’s obligations under its Secured Note, we and UMT Holdings entered into an Intercreditor and Subordination Agreement dated as of December 31, 2005 under which UMT Holdings has agreed to subordinate its rights to offset amounts owed to it by WLL, Ltd. to our lien on such units.

RESULTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2006, 2005 and 2004

Residential Mortgages and Contracts for Deed.

As of December 31, 2006, our mortgage portfolio consisted of 362 residential mortgages (including loans in a securitization), four contracts for deed, one rental property, 34 vacant properties and 1,090 interim loans. The portfolio had an unpaid principal balance (“UPB”) of approximately $88,307,000. The average loan in the portfolio had a current annual yield of 13.57%, an investment-to-value ratio of 59.43%, an average UPB of $59,000, and a remaining term of 245 months for residential mortgages and contracts for deed. Interim loans have terms of 12 months or less, depending on the collateral securing the interim mortgage and the borrower. The more extensive the rehabilitation work on the property or the construction requirements, the longer the term of the loan. The average construction loan has a term of nine months; the average rehabilitation loan has a term of six months.

As of December 31, 2005, our mortgage portfolio consisted of 417 residential mortgages, six contracts for deed (including loans in a securitization), two rental properties, 33 vacant properties and 1,013 interim loans. The portfolio had an unpaid principal balance (“UPB”) of approximately $80,753,000. The average loan in the portfolio had a current annual yield of 12.98%, an investment-to-value ratio of 67.98%, an average UPB of $55,000, and a remaining term of 321 months for residential mortgages and contracts for deed. Interim loans have terms of 12 months or less, depending on the collateral securing the interim mortgage and the borrower. The more extensive the rehabilitation work on the property or the construction requirements, the longer the term of the loan. The average construction loan has a term of nine months; the average rehabilitation loan has a term of six months.

As of December 31, 2004, our mortgage portfolio consisted of 523 residential mortgages, seven contracts for deed (including loans in a securitization), 3 rental properties, 24 vacant properties and 945 interim loans. The portfolio had an unpaid principal balance (“UPB”) of approximately $94,390,000. The average loan in the portfolio had a current annual yield of 12.79%, an investment-to-value ratio of 71.17%, an average UPB of $63,000, and a term remaining of 333 months for residential mortgages and contracts for deed.

MORTGAGE PORTFOLIO TABLE | |

| | |

| | | December 31, | |

| | | 2006 | | 2005 | | 2004 | |

| Residential mortgages owned outright (1) | | | 53 | | | 30 | | | 304 | |

| Contracts for deed owned outright | | | 4 | | | 6 | | | 7 | |

| Rental properties | | | 1 | | | 2 | | | 3 | |

| Loans remaining in first securitization (2) | | | 169 | | | 201 | | | 219 | |

| Loans remaining in second securitization (2) | | | 140 | | | 186 | | | - | |

| Vacant properties | | | 34 | | | 33 | | | 24 | |

| Interim mortgages | | | 1,090 | | | 1,013 | | | 945 | |

| Unpaid principal balance | | $ | 88,307,000 | | $ | 80,753,000 | | $ | 94,390,000 | |

| Annual yield | | | 13.57 | % | | 12.98 | % | | 12.79 | % |

| Investment-to-value ratio | | | 59.43 | % | | 67.98 | % | | 71.17 | % |

| Average Loan UPB | | $ | 59,000 | | $ | 55,000 | | $ | 63,000 | |

(1) The number of loans owned outright increased during 2006 primarily as a result of reclassifying certain REO and interim loans that were refinanced by us.

(2) The 2006 decrease is from REO selling and loans prepaying.

Line of Credit, Affiliate - Land Development Loans.

On June 20, 2006, we entered into a Second Amended and Restated Secured Line of Credit Promissory Note (the "Amendment") with UDF, a Nevada limited partnership that is affiliated with our Advisor, UMTHGS. The Amendment increases to $45 million an existing revolving line of credit facility ("Loan"). The Loan matures on December 31, 2009. The purpose of the Loan is to finance UDF's loans to, and investments in, real estate development projects.

The Loan is secured by the pledge of all of UDF's land development loans and equity investments and is subordinated to certain UDF bank loans and line of credit. Those UDF loans may be first lien loans or subordinate loans.

The Loan interest rate is the lower of 15% or the highest rate allowed by law, further adjusted with the addition of a credit enhancement to a minimum of 14%.

UDF may use the Loan proceeds to finance indebtedness associated with the acquisition of any assets to seek income that qualifies under the Real Estate Investment Trust provisions of the Internal Revenue Code to the extent such indebtedness, including indebtedness financed by funds advanced under the Loan and indebtedness financed by funds advanced from any other source, including Senior Debt, is no more than 85% of 80% (68%) of the appraised value of all subordinate loans and equity interests for land development and/or land acquisition owned by UDF and 75% for first lien secured loans for land development and/or acquisitions owned by UDF. In addition, as an enhancement, in October 2006, UDF III entered into a limited guaranty effective as of September 1, 2006 for our benefit (the “UDF III Guarantee”). Pursuant to the UDF III Guarantee, UDF III guaranteed the repayment of an amount up to $30 million with respect to that certain Second Amended and Restated Secured Line of Credit Promissory Note between United Mortgage Trust and UDF I.

The Loan is subordinate to UDF Senior Debt, which is defined as all indebtedness due and owing by UDF pursuant to (i) that certain loan guaranty to Colonial Bank in the amount of $8,750,000, (ii) that certain loan to OU Land Acquisition, L.P. in the principal amount of $25,000,000, (iii) a line of credit provided by Textron Financial Corporation in the amount of $30,000,000, and (iv) all other indebtedness of UDF to any national or state chartered banking association or other institutional lender that is approved by Lender in writing.

The amendment of the lending facility to UDF represents the further evolution of the Company's investment policy away from its original investment objective of long term residential mortgages to a portfolio which consists primarily of the increase in the Loan to UDF, an affiliate of our Advisor, and interim loans made to affiliates of our

Advisor. The Company's Trustees believe that the interest rate environment, increasing default rates, which have resulted in lower yields from traditional residential mortgage investments and the recent broader deterioration of the sub-prime mortgage market, requires that we seek other investments that are capable of providing superior returns, credit and collateral for our shareholders. Our Trustees were also influenced by the results of our existing loan arrangement with UDF. From June 2003 through December 2006, UDF has funded approximately $261 million in first lien, subordinate loans and equity investments and received approximately $160 million in loan and equity payoffs.

We anticipate the increasing concentration of our investments in the Loan and in interim loans and that residential mortgages will continue to diminish as a significant component of our total investment portfolio.

On June 14, 2006, in connection with the above-described Amendment of our loan to UDF, we entered into a Subordination Agreement with Textron Financial Corporation ("Textron") pursuant to which we agreed to subordinate our existing loan to UDF to the all indebtedness owed to Textron by UDF, including the $45 million credit facility extended to UDF pursuant to the Second Amended and Restated Secured Line of Credit Promissory Note.