Filed pursuant to Rule 433

Registration Statement No. 333-131712

January 26, 2007

| | | Saxon |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Investor Presentation |

| | | January 2007 |

| | |

| | Section 1 | Morgan Stanley’s Acquisition of Saxon |

| |

|

| | Section 2 | Organizational Structure |

| |

|

| | Section 3 | Growth Strategy |

| |

|

| | Section 4 | Saxon - Production |

| |

|

| | Section 5 | Saxon - Servicing |

| | | |

| Saxon | | |

| |

| | | |

| | | Important Notice |

| | | Information as of December 31, 2006 unless otherwise stated |

| | |

IMPORTANT INFORMATION AND IRS CIRCULAR 230 NOTICE

This material has been prepared for information purposes to support the promotion or marketing of the transaction or matters addressed herein. This is not a research report and was not prepared by the Morgan Stanley research department. It was prepared by Morgan Stanley sales, trading, banking or other non-research personnel. This material was not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. Past performance is not necessarily a guide to future performance. Please see additional important information and qualifications at the end of this material.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement(including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the depositor or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-718-1649.

| | | |

| Saxon | | |

| |

| | | |

| | | Important Notice |

| | | Information as of December 31, 2006 unless otherwise stated |

| | |

FORWARD LOOKING STATEMENTS

We have included in this document, and from time to time may make in other public statements, certain statements that may constitute forward - looking statements. These forward -looking statements are not historical facts and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control.

The nature of our business makes predicting future trends difficult. The risks and uncertainties involved in our business could affect the matters referred to in such statements and it is possible that our actual results may differ from the anticipated results indicated in these forward looking statements. Important factors that could cause actual results to differ from those in the forward -looking statements include (without limitation):

| | · | decreases in residential real estate values, which could reduce both the credit quality of our mortgage loan portfolio and the ability of borrowers to use their home equity to obtain cash through mortgage loan refinancings, which would adversely impact our ability to produce new mortgage loans; |

| | · | changes in overall regional or local economic conditions or changes in interest rates, particularly those conditions that affect demand for new housing, housing resales or the value of houses; |

| | · | our ability to successfully implement our growth strategy throughout the various cycles experienced by our industry; |

| | · | greater than expected declines in consumer demand for residential mortgage loans, particularly sub-prime, non-conforming loans; |

| | · | our ability to sustain loan production growth at historical levels; |

| | · | continued availability of financing facilities and access to the securitization markets or other funding sources; |

| | · | deterioration in the credit quality of our loan portfolio and the loan portfolios of others serviced by us; |

| | · | challenges in successfully expanding our servicing platform and technological capabilities; |

| | · | increased competitive conditions or changes in the legal and regulatory environment in our industry; and |

| | · | other risks and uncertainties detailed in this document and in other filings with the Securities and Exchange Commission. Accordingly, you are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any forward-looking statements to reflect the impact of circumstances or events that arise after the dates they are made, whether as a result of new information, future events or otherwise except as required by applicable law. You should, however, consult further disclosures we may make in future filings with the Securities and Exchange Commission. |

Saxon

| | |

| | Section 1 |

| | Morgan Stanley’s Acquisition of Saxon |

| | | |

| Saxon | | Morgan Stanley’s Acquisition of Saxon |

| | | High Growth in Sub-prime and Alt-A segments |

| · | Wall Street is targeting high margin opportunities in sub-prime and Alt-A segments that have scaleable platforms |

| · | Sub-prime and Alt-A have been one of the fastest growing segments in the residential mortgage market- now almost 40% of this market |

| · | Wall Street has been the driver of this segment’s growth |

| – | Competitive holder, trader and distributor of interest rate and credit risk |

| – | Large securitizers of sub-prime and Alt-A loans |

| · | Acquiring origination and servicing platforms allows Wall Street firms to |

| – | Source loans directly and therefore less expensively |

| – | Control credit performance |

| – | Control growth capacity |

| | | |

| Saxon | | Morgan Stanley’s Acquisition of Saxon |

| | | Morgan Stanley’s Acquisition of Saxon |

| | | Synergies Overview |

| | |

- Saxon compliments Morgan Stanley’s overall mortgage business

- A joint platform brings several advantages

| | | |

| Saxon | | Morgan Stanley’s Acquisition of Saxon |

| | | Saxon Compliments Morgan Stanley’s Capabilities |

| | | |

| | | |

- Origination base

- Expand servicing product capabilities

- Seasoned securitization program

- New mortgage product offerings

- Investment in technology

- Ability to add a special servicing platform with sophisticated default resolution capabilities

- Complimentary organizational culture

Saxon

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Section 2 |

| | Organizational Structure |

| | | |

| Saxon | | Organizational Structure |

| | | Saxon Senior Management |

Saxon

| | |

| | |

| | Section 3 |

| | Growth Strategy |

| | | |

| Saxon | | Growth Strategy |

| | | The Next Five Years |

| • | Key benefits of vertical integration include: |

| |

| • | | Strong origination base |

| |

| • | | Scaleable servicing platform |

| |

• Production objectives over the next five years:

–Grow origination volumes

–Offer a broader selection of residential mortgage product offerings

–Reduce origination costs

–Add scale in lower CTP (Cost to Produce) channels, increase loan sizes, etc.

• Servicing objectives over the next five years:

–Improve servicer ratings from rating agencies

–Expand servicing platform

–Expand servicing product capabilities (for example: HELOCs and Option Arms)

–Invest in technology to improve efficiencies

Saxon

| | |

| | |

| | |

| | |

| | |

| | Section 4 |

| | Saxon - Production |

| | | |

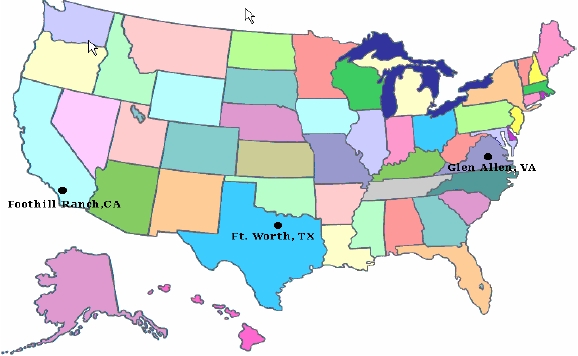

| Saxon | | Saxon – Production |

| | | Current Business Profile |

- Saxon employs over 260 production staff including approximately 117 Account Executives and approximately 143 operations and management staff

- Originate loans in 48 states plus Washington DC

- Top 5 states of loan production (2006:CA, MD, FL, NY, VA)

- Regional Loan production offices in CA,VA & TX

- Eliminated retail branches, will focus on Wholesale, Correspondent and Retail (retention)

| | | |

| Saxon | | Saxon – Production |

| | | Initiatives – Quality Enhancement |

| · | Sales - Implemented a new, performance based compensation plan |

| · | Underwriting - Increased W-2 borrower, stated minimum score from 620 to 660 |

| · | Pricing - added tiered pricing adjustments (higher or layered risk will have add-ons) |

Future Initiatives

| – | Underwriter training, certification program and annual assessments |

| – | Fraud training (borrower and property) |

| – | New purchase transaction and income checklist (alerts require management signoff) |

| – | Greater restrictions on first-time homebuyers—minimum credit history changes |

| – | Enhanced VOE prefunding policies |

| – | Property AVM’s (Including History Pro from Core Logic) and eventual implementation of MARS - a desktop risk review of appraisals considered higher risk by History Pro |

| – | Appraisal checklist completed on properties |

| – | In-house appraisal review group with licensed appraisers |

| · | Fraud & Quality Control |

| – | Updating Appintell DISCO script |

| – | Broker Channel Management |

| – | More targeted pre-funding QC process |

| – | Post funding QC frequency to include a quarterly review of operations center |

Saxon

| | |

| | |

| | |

| | Section 5 |

| | Saxon - Servicing |

| | | |

| Saxon | | Saxon - Servicing |

| | | Saxon – Ratings |

| | | | | |

| | | Current Servicer Ratings | | |

| Agency | | Category | | Rating |

| |

| Moody's | | Primary Servicer of Sub-prime Loans | | SQ2+ |

| | | Special Servicer of Sub-prime Loans | | SQ2 |

| | | | | |

| S&P | | Residential Mortgage Sub-prime Servicer | | Above Average |

| | | Residential Mortgage Special Servicer | | Average |

| | | | | |

| Fitch | | Residential Mortgage Sub-prime Servicer | | RPS2+ |

| | | Residential Mortgage Special Servicer | | RSS2+ |

| | | |

| Saxon | | Saxon - Servicing |

| | | Geographic Servicing Concentration |

| | Top Five States | | |

| | (approx % of Total Portfolio) | | |

| | 1. California | | 26 | % | |

| | 2. Florida | | 10 | % | |

| | 3. New York | | 5 | % | |

| | 4. Texas | | 5 | % | |

| | 5. Maryland | | 4 | % | |

Top 5 states equal approximately 50% of servicing portfolio

Data as of September 2006

| | | |

| Saxon | | Saxon - Servicing |

| | | Servicing Department Overview |

| | | Data in this section is for third quarter 2006 |

Cure Ratios

1-29 day: 93.82%

30-59 day: 70.60%

| – | History of success on final load from other platforms/servicing systems |

| – | Upload to the MortgageServ system within 48hrs / actual within 24hrs |

| – | Quality checks and Audits via Stewart Mortgage: |

| – | Inventory and image all new and acquired loan files, reconcile and image trailing docs |

| – | Capture 61 critical data fields for data integrity verification (basic loan data, Arm data, prepayment penalty data) |

Customer Service/Early Collections

| – | FTE: 129, Loans per FTE: 1,033 |

| – | Teams of 8-10 representatives, all reps handle inbound and outbound service and collection calls (answer rate: 97.58%) |

| – | Call center resolution desk - to handle customer escalation issues |

| – | Call center operations - statistical analysis (coverage, contacts, success and Early Indicator Scores (EIS) modeling), dialer setup/strategy |

| – | Predictive Modeling - calling campaigns using FHLMC/EIS on entire 0-59portfolio |

| – | Early mitigation/repayment plans - 4 months or less/max 2 in 12 months |

| | | |

| Saxon | | Saxon - Servicing |

| | | Servicing Department Overview |

| · | Cure delinquencies through collection and workout options. |

| · | Target staffing: 135 loans/FTE, Actual staffing: 153 loans/FTE |

| – | 5 loss mitigation teams - delinquencies from 60-120+ |

| – | Workout Team - focus on alternatives to foreclosures (Forbearance/repayment plans, modifications, short sales and assumptions, deeds-in-lieu) |

| – | Loan Recovery Specialist - 2nd lien monitoring, collections and repurchases |

| – | Loan Support Team - supports DRP, BPO orders, property preservation, code compliance and insurance claims |

| – | Admin. Support Team - exception payments, reinstatement letters, repayment plans, imaging |

| · | Predictive Modeling with FHLMC/EIS - focus on higher risk delinquencies delay foreclosure on lower risk borrowers |

| – | EIS below 200 refer at 76 days past due, EIS above 200 refer at 90 days past due |

| · | Titanium Solutions - 3rd party face-to-face contact solution for no contact loans, submission of financial packages (approximately 42% success rate) |

| | | |

| Saxon | | Saxon - Servicing |

| | | Servicing Department Overview |

| REO Performance as of 10/06 | |

| |

| Turn Rate | | 19 | % |

| SP to FMV | | 96 | % |

| Days on Mkt | | 115 | |

REO

| – | Assets are managed from Foreclosure Sale or Deed-in-Lieu through each step of the disposition process: Redemption periods, evictions, available for sale, listed, under contract, liquidation |

| – | Disposal of REO assets outsourced to three national REO asset management companies: |

| – | Fidelity National Asset Management |

| – | NRT Inc., a division of Coldwell Banker |

| – | Assignments based on an even distribution of loan count, UPB and geography |

| – | Delegated authority matrix for establishing value, list price, reductions to price and contract acceptance |

| – | Expenses carried by outsourcer until liquidation |

| – | Performance tracking via outsourcer report cards and annual audits |